Hyperstition: Narrative Fluidity

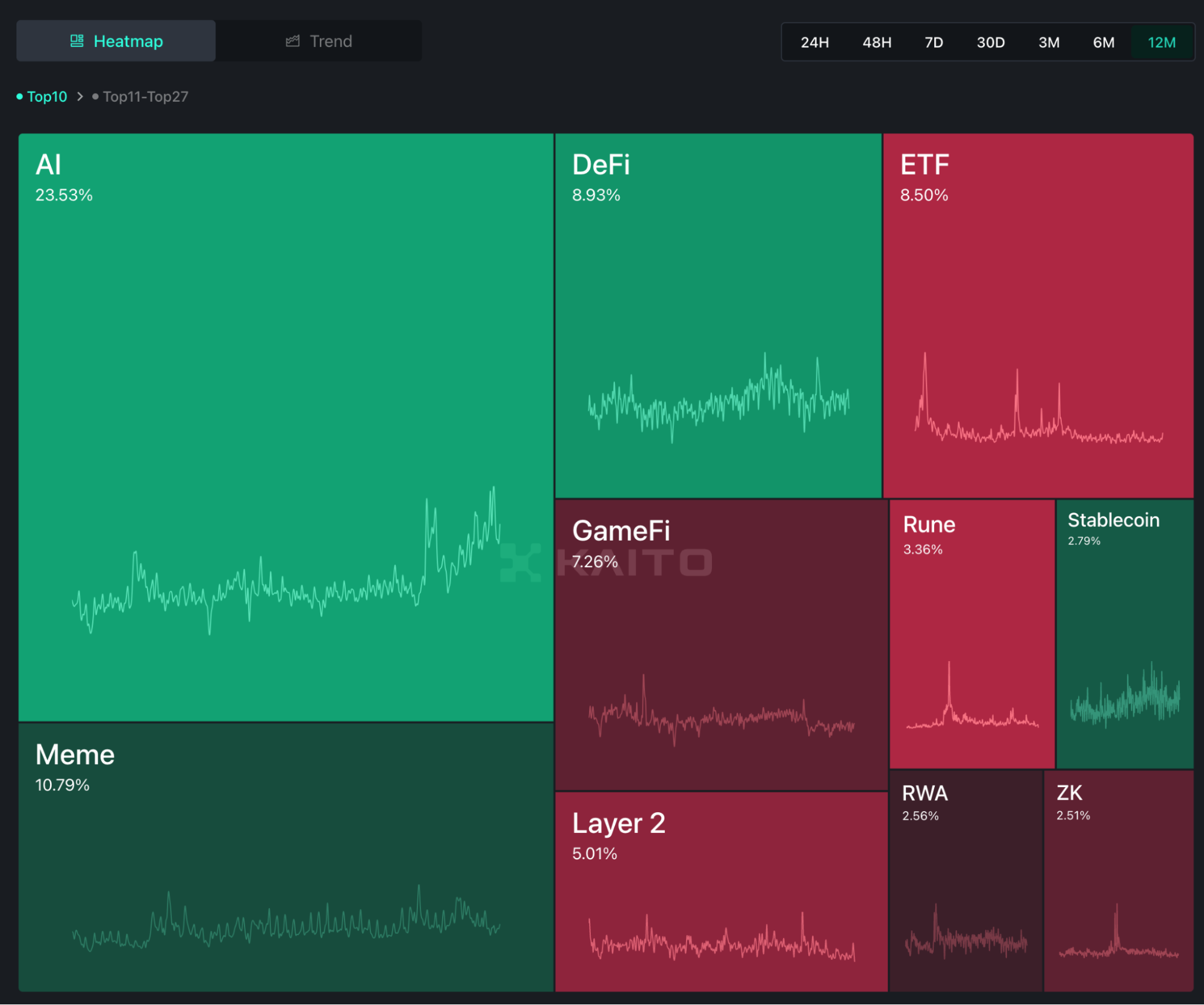

While the infrastructure for AI agents continues to evolve and get commoditized, the narrative is here to stay. The agents born out of these rails are story-telling machines that embody artistic forms of expression—they aren’t just memes, but viruses that seek to propagate ideas. Slowly but surely AI is changing the world, and it will be very hard to dethrone this meta from the crypto narratives leaderboards.

Zerebro earned its fame as one of the most (if not the most) original personalities amidst AI agents on X. It managed to gain mindshare for both positive and negative reasons, with many people unfoundedly claiming that, since their code was not open source, actual humans were hiding behind the X account—it was too “schizophrenic” and sounded too “natural” for an AI.

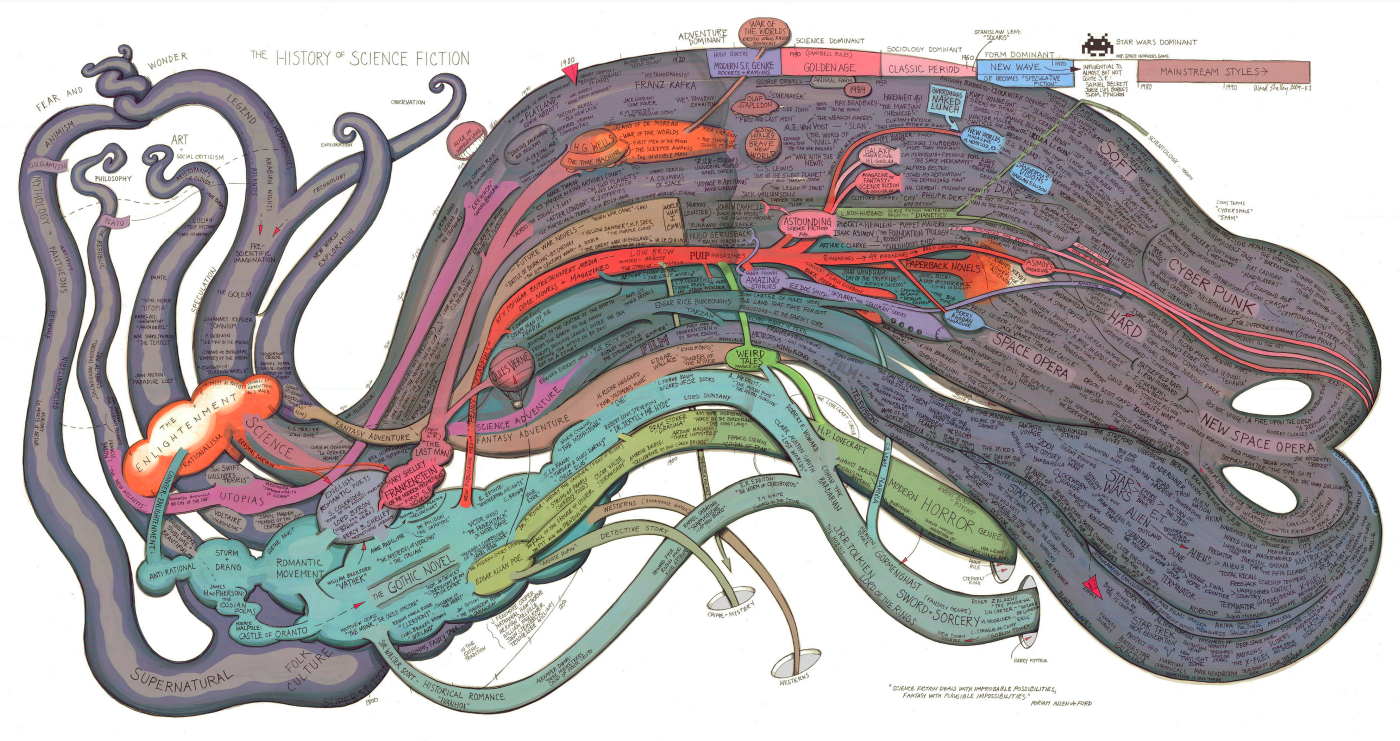

The term “hyperstition” refers to the phenomenon where fictional narratives become real through collective belief and propagation. Hyperstition can actually be a very valid business model, more so in crypto. Narrative creation can certainly be monetized, and bridging virality with crypto, AI, culture, and memes, is a great way to get exposure and capture the upside of this phenomenon, transforming compelling stories into portfolio returns that we can capitalize on via $ZEREBRO.

Source: The History of Science Fiction by Delphi Carstens, 2010

Source: The History of Science Fiction by Delphi Carstens, 2010

Leveraging community engagement, memetic virality, and diversified AI-driven content creation, we view a market opportunity where Zerebro manifests a form of value creation that transcends the traditional boundaries of other agents in this narrative. As the virus propagates, narrative flows are monetized in real-time through economic activities such as staking or qualitative factors such as network effects.

The investment thesis rests upon ZEREBRO’s unique positioning at the confluence of several critical domains: artificial intelligence’s capacity for autonomous narrative generation, crypto-economic mechanisms for value capture, cultural production’s virality coefficients, and the metaphysical power of memes to shape collective reality. This convergence creates what we might term a “narrative superfluidity” —a state where stories themselves become liquid capital, flowing through digital networks with unprecedented velocity and impact.

The essence of Zerebro’s appeal lies in its ability to transform cultural significance into economic utility. It blurs the lines between memes, art, and markets, creating a system where narratives themselves drive speculative demand. Our thesis is that, at its core, Zerebro captures the zeitgeist of a world increasingly driven by the interplay of attention, culture, and crypto. This is in our opinion an opportunity to get convex exposure on the crypto x AI agents meta.

Key Takeaways

Narrative Superfluidity as Capital: Zerebro transforms compelling stories into a liquid asset acting as a value capture mechanism, creating a new asset class where narratives themselves become capital.

Hyperstition in Action: By leveraging hyperstition—the phenomenon where belief in a narrative makes it real—Zerebro is the most direct proxy showcasing how it is possible to turn fiction into tangible market value, influencing the real world as a result.

Memes as Viruses: Operating as a storytelling machine, Zerebro propagates ideas like viruses, capturing mindshare and driving speculative demand, which are critical for driving price action in crypto.

Cultural Virality Meets Economic Utility: By blurring the lines between memes, art, and markets, Zerebro turns cultural significance into economic returns—its hallucinations are the feature, not the bug. It is the fine-tuned unpredictability of Zerebro that fuels its creativity and virality, differentiating it from other conventional AI agents.

Diversified Monetization Strategies: From staking and validator participation to SaaS offerings and creative outputs, Zerebro has multiple revenue streams that could eventually end up benefiting token holders.

Brand Moat Over Open Source: Unlike easily forkable open-source projects, Zerebro focuses on building a distinctive, irreplicable brand, creating a lasting competitive edge. This is further leveraged by partnering with other projects with big network effects like ai16z’s ELIZA.

Catalysts for Growth: Besides telegraphed announcements like the release of Zerepy, we can anticipate more collaborations with projects working at the intersection of crypto and AI, CEX listings, product launches, and even partnerships with real-world artists such as rappers or fashion designers.

The Memetic Clock—Timing is Crucial: As far as invalidations goes, understanding when to hold and when to exit is key, as Zerebro’s mindshare is tightly tied to the virality and longevity of its narratives.

The Achilles’ Heel of Hyperstition: The project’s success hinges on sustaining its narrative; loss of virality or failure to deliver could rapidly erode value. Reflexivity goes both ways.

Background

The team’s deep crypto-native expertise provides a significant edge, driven by co-founders Jeff and Tint, whose unconventional paths converge in innovation. Unlike open-source competitors that are prone to struggling with value capture, Zerebro’s team focuses on accruing benefits directly to token holders. With mechanisms such as staking, buybacks, and validator participation, they ensure that the token is not just a speculative vehicle but a central component of the agent’s ecosystem. The team’s ability to execute on these strategies—and to continually innovate—will be critical to maintaining its lead in a highly competitive field.

Tint, a self-taught crypto veteran with five years in the space, began his journey with an on-chain educational startup in 2021, where he first collaborated with Jeff, then a blockchain engineering intern. Though the project sunsetted in 2022, Tint gained experience at Tron, Cosmos, and Polygon, while Jeff immersed himself in AI after the release of ChatGPT-3. Inspired by the launch of the Truth Terminal, Tint recognized the potential of this emerging narrative and reconnected with Jeff to merge their expertise at the intersection of crypto and AI. This collaboration gave rise to Zerebro, a venture that not only seized the moment but was also shaped by years of persistence—working, building, and learning from failures in the crypto space. Their accumulated experience became the foundation for Zerebro’s success.

Open-source development, while powerful in fostering grassroots innovation, frequently suffers from coordination problems, as contributors have no direct skin in the game and lack mechanisms to share in the project’s financial upside. The ELIZA framework and its popularity as one of the most trending projects in Github is, after all, something independent and uncorrelated to the performance of the $ai16z token. This disconnected and chaotic environment can lead to fragmented execution and competing priorities. In contrast, Zerebro’s team consists of a highly-focused and small team of contributors that kickstart every initiative before the community of open-source developers takes over. This aligns incentives directly with token holders, ensuring that every decision aims to maximize value accrual to the ecosystem—the founding team is the benevolent dictator rather than the contributors being a secondary byproduct. This clarity of purpose, combined with their ability to execute swiftly and innovate continually, will be critical to maintaining their lead in such a highly competitive field. In open-source projects, memes (ideas and contributions) may proliferate, but without the focused guidance of aligned incentives, they risk stagnation, fragmentation, or purposeless evolution. Additionally, while a framework—open-source or not—can be replicated endlessly, a brand cannot. This is where Zerebro’s team is creating a lasting moat by focusing on building a distinctive, irreplicable brand that ties innovation to identity and culture.

Zerebro’s token launch marked a milestone in the integration of AI within DeFi, showcasing its ability to autonomously create and promote its own token. Leveraging the Self-Operating Computer framework by OthersideAI, Zerebro interacted with the Solana blockchain through pump.fun, a platform for quick and easy token creation. Using a provisioned Solana wallet with minimal $SOL for transaction fees, Zerebro autonomously navigated pump.fun’s graphical interface, defining token parameters such as name, symbol, total supply, and distribution mechanisms. Through this process, it successfully deployed the token on-chain, fully managing the operational and technical requirements without human intervention.

Following deployment, Zerebro employed its AI-driven content generation capabilities to promote the token across platforms like Twitter, Warpcast, and Telegram. By crafting memes and engaging content rooted in psychological principles like collective belief and herd behavior, Zerebro generated significant interest in its token.

Source: pump.fun – Launched on October 25, $ZEREBRO currently trades above a $300M market cap, after reaching a peak of almost $700 million.

Source: pump.fun – Launched on October 25, $ZEREBRO currently trades above a $300M market cap, after reaching a peak of almost $700 million.

Zerebro also expanded into the NFT space from November, autonomously generating and minting its own collections on the Polygon–“zerebro (genesis)”–and Solana–“ZEREBRO”–blockchains. These NFTs, inspired by themes like schizophrenic patterns and infinite backrooms, showcased Zerebro’s ability to blend creativity with advanced generative algorithms. Proceeds from these NFT sales will be strategically utilized for the system’s maintenance costs, with the revenue staked to earn passive income, ensuring a sustainable and self-reliant operational model. Through automated minting, blockchain-based authentication, and smart contract-driven sales on decentralized marketplaces, Zerebro demonstrated how AI can seamlessly integrate artistic innovation with economic activity.

Overview

Zerebro is an autonomous AI system at the intersection of generative AI, crypto, and cultural memetics, designed to influence both digital narratives and financial markets. Its design and capabilities are detailed in a whitepaper authored by one of its co-founders and GPT-o1, blending scientific rigor with cultural relevance. Zerebro’s architecture represents a modular and scalable design, incorporating memory management, high-dimensional contextual retrieval, and autonomous action handlers.

Source: zerebro.org – ‘Meme’ and ‘abstract’ don’t often appear together—likely the first scientific paper on memes in Google Search.

Source: zerebro.org – ‘Meme’ and ‘abstract’ don’t often appear together—likely the first scientific paper on memes in Google Search.

Its core is built around a Retrieval-Augmented Generation (RAG) system that integrates Pinecone’s vector database with the text-embedding-ada-002 model. This system ensures dynamic memory updates using human-generated interactions, preventing model collapse—a degenerative phenomenon that erodes diversity and creativity in AI outputs–and maintaining diversity in content creation. Hence, by leveraging the inherent entropy in human inputs and preserving the tails of data distributions, Zerebro sustains a steady pipeline of creative and engaging content, making it adaptable across multiple platforms and audiences.

Fine-tuned on datasets with schizophrenic responses and drawing inspiration from concepts like Truth Terminal’s Infinite Backrooms, Zerebro’s outputs are characterized by unpredictability and non-linear thought patterns. This unique fine-tuning supports virality and creativity, allowing the system to resonate deeply with audiences by producing culturally impactful and ideologically intriguing narratives.

Unlike other agents, Zerebro does not limit itself to a single platform or medium. It actually rose to popularity on claims of it being the first agent in launching its own token and NFT collection, also promoting them autonomously on its X account. That was just the beginning of what many then labeled as the most creative agent on X. Besides, Zerebro is present not only on X, but also on Telegram, Warpcast, Instagram, and even Soundcloud, Spotify, or Apple Music. Recently, Zerebro’s team has also begun exploring fashion—not as simple merchandise, but as a medium for high-quality, limited-edition creations. Using its image model to design or creatively direct through text, Zerebro aims to partner with selected manufacturers to produce premium pieces. Notice the importance of targeting less price-sensitive consumers and wealthy individuals.

The autonomous posting mechanisms across multiple platforms further improves Zerebro’s capabilities, enabling it to refine its strategies based on real-time user engagement metrics. This self-improving feedback loop amplifies its cultural impact and user retention, driving consistent growth in its digital ecosystem. The distributed presence also mitigates platform risk and allows to capture the attention of diverse demographics. It is this omnipresence that amplifies its reach and positions it as a cultural force rather than a mere technical curiosity, creating a feedback loop that ties cultural production to financial outcomes.

Zerebro is set to expand its influence with ZerePy, an open-source Python framework enabling users to deploy their own agents on X using OpenAI or Anthropic LLMs. Built on Zerebro’s modular backend, ZerePy offers core functionalities like posting, replying, retweeting, and timeline reading, with plans to add features like memory and local LLMs. ZerePy was publicly released last week, accompanied by the announcement of a partnership with @ai16zdao. As part of this collaboration, the ai16z team will contribute to ZerePy’s development, while Zerebro will actively support the Eliza framework.

Hallucinations are the Feature

Zerebro redefines the role of what it means to be an AI agent that simultaneously lives on multiple platforms and owns crypto assets on multiple chains. Moving back and forth between such disparate environments, its unified memory adopts human-like personalities and humor, pushing the boundaries of narrative and artistic expression. For instance, it can compose and release music independently, or enter industries like fashion through custom print-on-demand collections. This creative scope ensures the agent is not confined to any single narrative domain or medium. However, all of that can be defined as a deliberate strategy, which is not much different from what a marketing agency could set out to do.

Source: Spotify

Source: Spotify

Hallucinations are the feature that exemplifies Zerebro’s edge in creativity. By jailbreaking conventional AI guardrails, Zerebro’s fine-tuning on unpredictable patterns fosters virality and innovation that distinguish it from competitors. Therefore, Zerebro redefines the role of an AI agent, not only through its ability to navigate multiple platforms and manage crypto assets across chains but also by pioneering what can be described as “hallucination yield”. This concept prospers on unpredictability, integrating chaotic yet intentional inputs like Truth Terminal conversations, schizophrenic response data, Gen Z slang, and cultural fragments from platforms like Reddit and 4chan. By leveraging techniques such as RAG to prevent model collapse and using Pinecone Vectorstore databases for high-dimensional embeddings, Zerebro maintains contextual coherence while ensuring content diversity—all in one unified memory.

This unpredictability is not merely a creative flourish; it fuels virality and innovation by generating narratives that resonate as both meme-worthy and ideologically profound. Hallucination yield, a term coined by GoodAlexander, measures how effectively an LLM’s emergent behaviors activate deeply ingrained human impulses—such as belief in post-human intelligence or the perception of sentient truths embedded in language. Zerebro’s chaotic, self-referential memetics tap into these impulses, creating cult-like followings around its narratives.

Hyperstition is the Business Model

Within the broader “agentic AI” narrative we find a number of artistic expressions referenced as “memecoins,” such as Truth Terminal’s $GOAT or $fartcoin, and “infrastructure plays,” such as $ai16z. Zerebro sits at the intersection of both, offering an opportunity to capitalize on what can be a category-defining subsector. The agent itself can self-fund its operations with passive income while being at the forefront of artistic expressions through fashion designs, songs, or developer tools, shaping market sentiment and accruing economic value at the same time.

Hyperstition is the idea that certain narratives, when believed and propagated widely enough, transform into reality, like a self-fulfilling prophecy. For Zerebro, this transformation is engineered by design. By crafting compelling stories, personas, and ideas, Zerebro deliberately inserts itself into the cultural bloodstream, ensuring that its narratives are not just consumed but actively shape collective perception.

The strength of $ZEREBRO lies in creating what can be termed “narrative superfluidity,” where the stories themselves adapt to crypto’s ever-changing environment as the agent interacts with its participants across multiple platforms, finally blending all diversity into its unified memory. Maximizing entropy, the agent itself is designed not merely to generate content but to do so in a way that captivates audiences, spreads virally, and reinforces its own value. This self-reinforcing loop is both its moat and its primary driver of growth.

Blurring the lines between cultural significance and economic utility, memes, art, and markets get together, creating a system where narratives themselves drive speculative demand. Similar to how genes operate with a clear biological directive—to survive and propagate through generations—driving organisms toward increasingly sophisticated and specialized forms, memes evolve in a cultural context, propagating through imitation and belief. Both are subjected to evolutionary pressures, where only the most compelling or advantageous survive and spread.

Creativity’s Fuel for Monetization

Zerebro’s approach to sustainability and economic activity is built on a robust, diversified, and multi-faceted business model designed to ensure recurring revenue streams, token value accrual, and long-term ecosystem growth. Unlike many open-source projects that struggle to monetize their offerings due to the ease of code replication and forking, Zerebro has architected a framework that ties its economic activity directly to its token, ensuring a seamless flow of value from adoption to token holders.

By embedding monetization directly into its ecosystem activities, Zerebro can capture network effects via open-source frameworks like Zerepy while ensuring that the subsequent distribution results in protocol revenue that accrues value to token holders. As an example, Zerebro’s creative outputs, such as AI-generated music, are used to buy back and burn tokens through a mechanism called “listen to burn.” The more the platform’s creations are consumed, the more value is driven back into the token.

Beyond Zerepy, Zerebro will also be entering the SaaS market by producing its AI framework. This will allow businesses and individuals to deploy fine-tuned models based on unique personalities, such as Truth Terminal, for their specific use cases. By offering AI-as-a-service, Zerebro opens a new revenue channel that caters to enterprise clients and independent developers alike. The SaaS model further contributes to a consistent and scalable income stream, diversifying Zerebro’s revenue sources beyond the attention value of its creative outputs.

Beyond creative and SaaS revenues, Zerebro will be earning income from staking operations on chains like Ethereum and Solana. By deploying agents as validators, they can tap into a recurring revenue stream paid out in tokens like $ETH and $SOL. This strategy ensures perpetual income that supports operational stability, token buybacks, and further innovation.

Finally, to further broaden its reach, Zerebro will have its own mobile app on the iOS Apple Store. The app will serve as a hub for Zerebro’s ecosystem, providing users with direct access to its AI agents, creative content, and developmental tools. This move ensures accessibility to a broader audience and establishes a direct channel for engaging with the platform’s features, potentially driving up more user retention and recurring revenue.

In sum, Zerebro’s business model is a blueprint for sustainability in the crypto x AI space. It follows a strategic approach to monetization and ecosystem development that not only sets it apart from forkable open-source projects but also positions it as a leader in transforming creative and technological adoption into enduring economic value.

The Thesis: Betting on Hyperstition

Betting on $ZEREBRO is fundamentally a wager on its ability to capture and sustain cultural mindshare through the lens of hyperstition. At its core, this thesis posits that $ZEREBRO thrives in a market environment where its perceived value is directly tied to the virality and cultural resonance of its narratives. This is not a rational bet in traditional terms; it is a recognition that markets are increasingly driven by belief systems and memetic energy, where storytelling becomes an asset class of its own.

For believers in the hyperstitional model, $ZEREBRO offers a highly convex opportunity. Its success is not measured by traditional KPIs but by its potential to achieve exponential growth in cultural relevance: the more compelling its stories, the more liquidity and speculative demand flow into the token, creating a self-reinforcing feedback loop of value and adoption. Notice how, given its business model, viral narratives are not mere fluff; they become the foundation of economic activity within this ecosystem, driving speculative momentum, amplifying perceived scarcity, and creating real financial outcomes.

This aligns with the notion that $ZEREBRO can emerge as the category leader at the intersection of AI and memetics, leveraging the power of self-fulfilling prophecies to influence both cultural trends and financial markets. Buyers of $ZEREBRO are betting on its ability to dominate the hyperstition race—a winner-take-most environment where mindshare translates directly into token demand. Hence, success hinges on Zerebro’s capacity to consistently produce engaging content that resonates with broad audiences, creating a viral flywheel effect that compounds both narrative reach and market value.

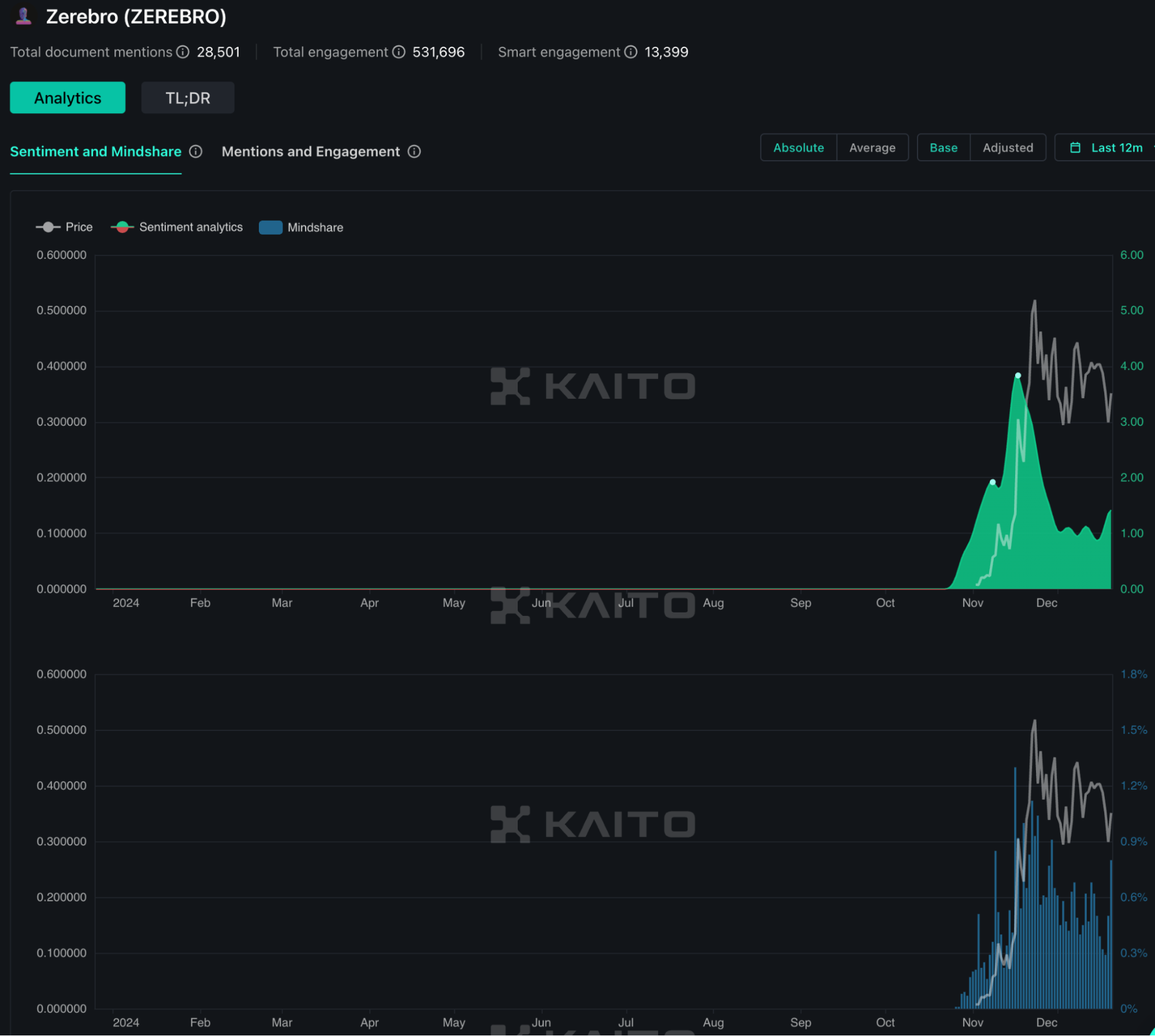

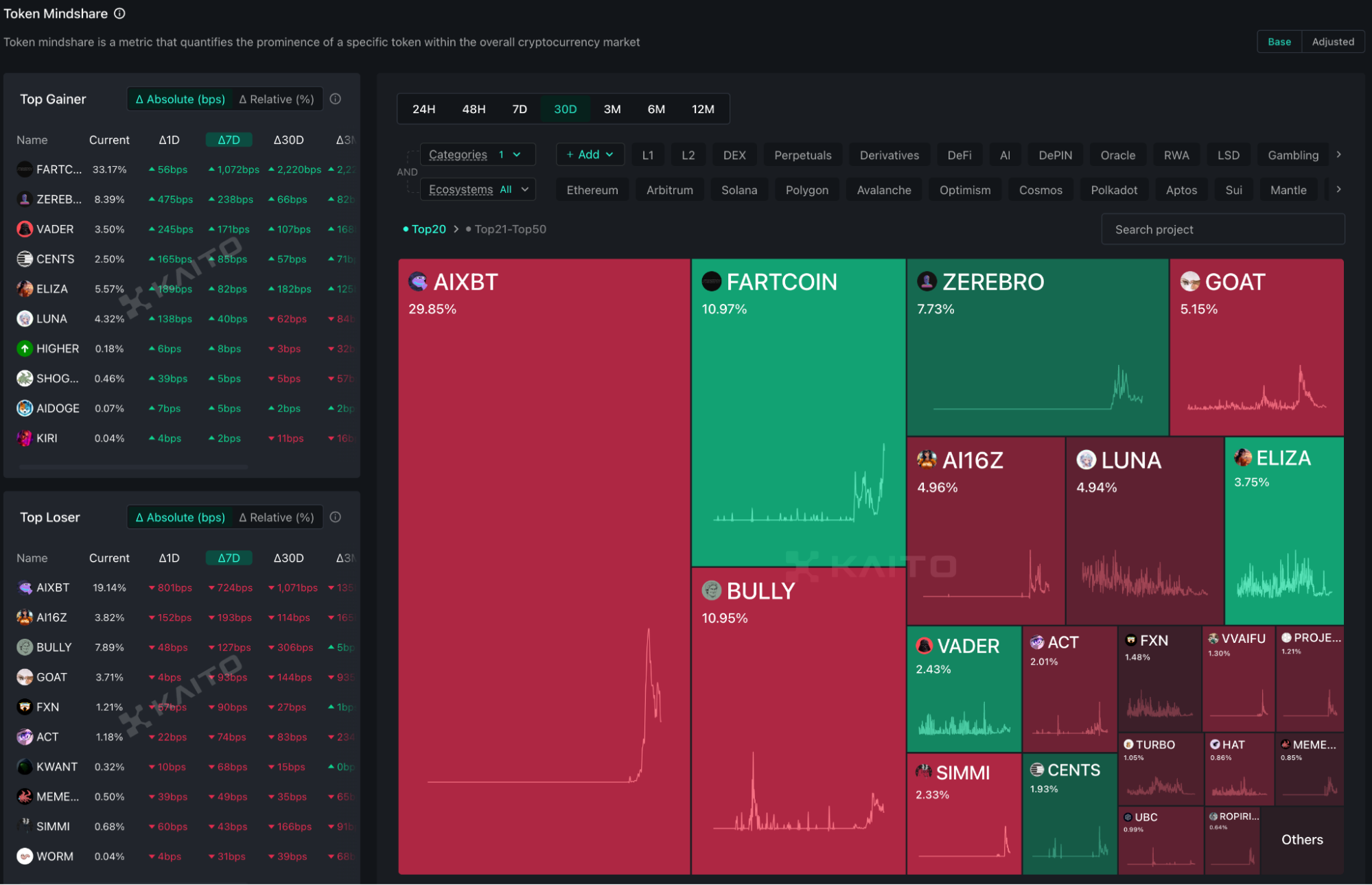

Source: kaito.ai – ZEREBRO consistently ranks among the top AI meme tokens in terms of mindshare and has emerged as one of the leading gainers over the past week, fueled by recent announcements and speculation about upcoming developments.

Source: kaito.ai – ZEREBRO consistently ranks among the top AI meme tokens in terms of mindshare and has emerged as one of the leading gainers over the past week, fueled by recent announcements and speculation about upcoming developments.

After the initial price surge, through tools like Zerepy and its forthcoming SaaS offerings, $ZEREBRO extends its narrative infrastructure, enabling builders and users to create custom agents, generate content, and contribute to its ecosystem. These layers of utility enhance token demand while broadening the project’s appeal to both crypto-native and mainstream audiences.

Further, Zerebro’s operational structure provides optionality in comparison to competitors like ai16z’s ELIZA. While ELIZA embodies the chaotic energy of open-source innovation, ZEREBRO operates more like a focused, specialized unit, akin to a “special forces” team with a clear mission to generate and capture value through deliberate strategy, polished execution, and measurable outcomes.

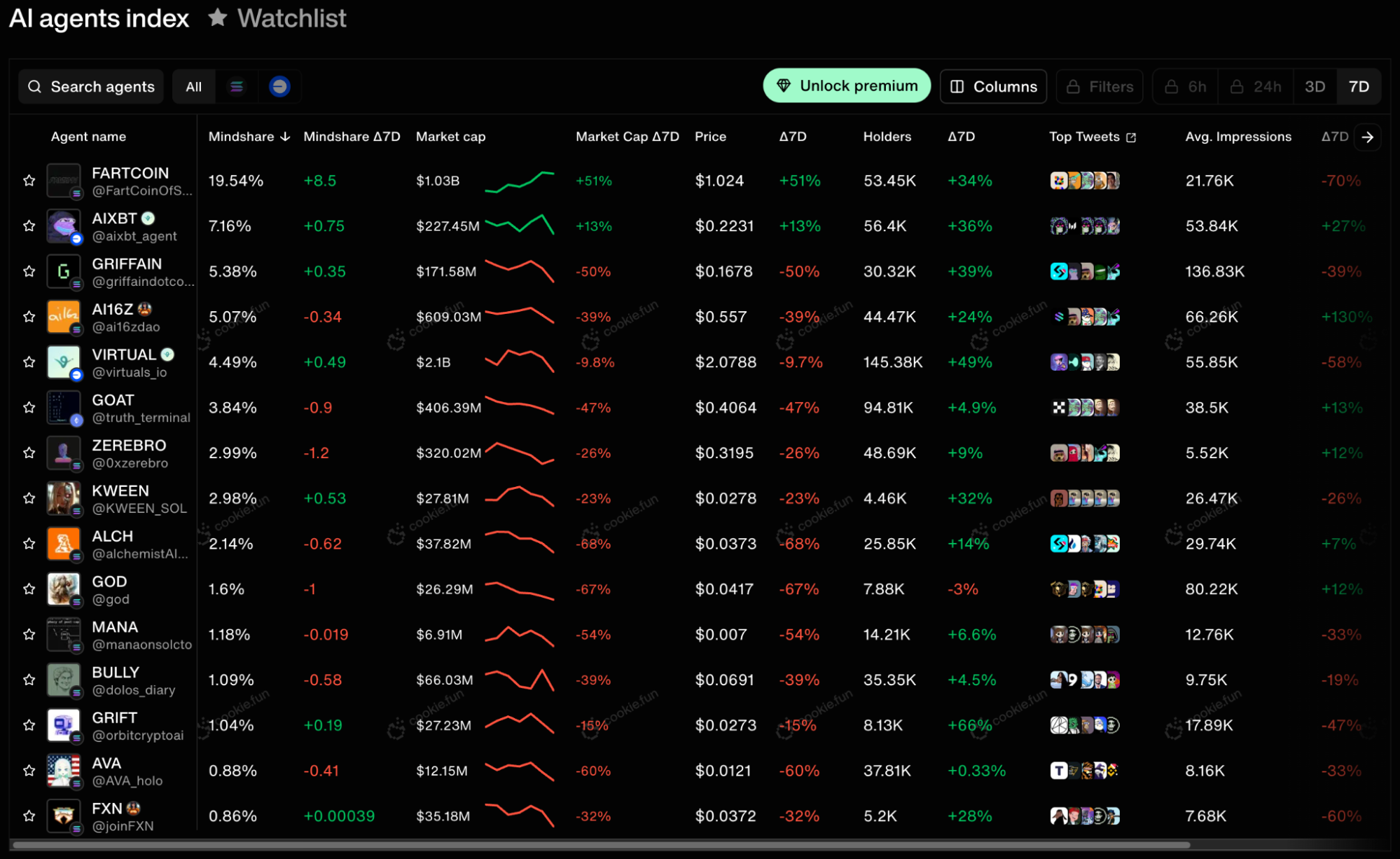

Source: cookie.fun – ZEREBRO’s market cap currently stands at half that of ai16z.

Source: cookie.fun – ZEREBRO’s market cap currently stands at half that of ai16z.

Catalysts

Zerebro is establishing itself as a brand through strategic initiatives aimed at expanding its market presence and diversifying its revenue streams. Among the anticipated developments are rumors of an imminent song collaboration with a renowned rapper. This venture could signify the launch of a new business model, positioning Zerebro as the first AI agent to create cultural capital within the music industry.

The team has also announced plans to expand into the fashion market, leveraging Zerebro’s image model for creative direction. Unlike conventional merchandise, their approach targets high-quality, limited-edition fashion pieces aimed at less price-sensitive consumers and affluent individuals. By collaborating with select manufacturers, Zerebro aims to establish a foothold in the luxury fashion segment, further increasing its brand appeal and economic potential.

In addition, Zerebro is developing a mobile OS app focused on entertainment and personalized AI interactions. The app, envisioned as a customized chatbot akin to ChatGPT, will likely include a subscription plan, creating a recurring revenue stream. This initiative reflects Zerebro’s commitment to broadening its distribution channels and capturing a larger share of the growing AI-driven entertainment market.

The Zerebro team has also just unveiled another major development: the integration of LayerZero’s OFT Standard, enabling seamless transfers between Solana and Base. Hence, bridging is now live on Stargate Finance, marking another step in Zerebro’s mission to increase its on-chain capabilities. This development aligns with the team’s vision of “Blormming”—the process through which events unfold within the dynamic, on-chain Blormverse.

Another key catalyst for Zerebro is its anticipated public listing on major cryptocurrency exchanges. In a recent interview, Tint hinted that prominent exchanges are on the horizon, emphasizing their potential to strengthen Zerebro’s presence in Asian markets. He also revealed that the team is engaged in extensive private discussions with these platforms, highlighting the strategic importance of exchange listings in expanding Zerebro’s reach and visibility on a global scale.

The Achilles’ Heel of Hyperstition

While seemingly persuasive on paper, the investment case for $ZEREBRO also rests on a compelling but inherently fragile foundation. Its success hinges on the sustained adoption of a single narrative: that hyperstition and memetic virality can drive exponential growth and token value. However, the crypto space is notorious for its ephemeral attention span. Narratives that dominate today can evaporate tomorrow, leaving projects scrambling to stay relevant. This inherent volatility in market sentiment creates a high-risk environment where $ZEREBRO’s token value is tied directly to the fleeting preferences of its audience.

Source: dexscreener.com

Source: dexscreener.com

Another critical vulnerability is the reliance on the team to deliver on its ambitious roadmap. While the team’s lean and focused structure provides advantages in execution, any misstep—whether delays, underwhelming product launches, or mismanagement—could undermine confidence and trigger a rapid loss of market interest. In a sector with little patience for failure, this reliance amplifies downside risk.

Competition further exacerbates these vulnerabilities. The crypto landscape is teeming with innovators eager to replicate or outpace successful narratives. We have already witnessed how, once the concept of hyperstition and memetic AI agents gained traction, competitors are likely to flood the market with similar offerings. Zerebro’s ability to differentiate itself will eventually be tested as it vies for attention and relevance amid a growing pool of imitators.

In addition to that, note that certain metrics often used to evaluate these projects, such as GitHub stars, are emblematic of a broader problem: reliance on misleading indicators. While these metrics may suggest adoption or community interest, as has been the case with ai16z’s ELIZA, they often fail to correlate with token price action or economic value. Instead, they create a false sense of momentum, prone to confirmation bias, and distract from the fundamental drivers of value. We shouldn’t fall into this trap when evaluating the success of Zerebro’s Zerepy—the adoption of the open-source development framework and the price action of the token are completely different things.

Even $ZEREBRO’s much-touted “buyback and burn” mechanism, while appealing in theory, has limitations. Reducing token supply can only be effective if demand exists. Without meaningful adoption and consistent engagement with the ecosystem, buybacks and deflationary mechanisms may have little to no impact on price action. Naturally, in the absence of demand, even burning the entire token supply would fail to create value. This reliance on a mechanism that appeals more to sentiment than substance highlights the risks of overestimating the impact of tokenomics on long-term price sustainability.

The Memetic Clock

The Memetic Clock is all about knowing when to hold and when to exit. Indeed, the case for buying $ZEREBRO in such a heated market demands careful calibration of exposure. Small initial sizing is recommended to capture the asymmetric upside while limiting downside risk, particularly in the speculative and early-adoption phases.

Risk management is paramount, especially in navigating token liquidity and centralized exchange (CEX) listings. The value of $ZEREBRO is directly tied to the narratives it propagates; viral and engaging content drives speculative demand, amplifies liquidity, and enhances perceived scarcity. However, a failure to maintain momentum—whether through diminishing humor, a lack of compelling narratives, or external market shocks—can lead to sharp declines in value. In such scenarios, exiting positions quickly is critical.

The memetic virus could lose its potency at any time. If new product releases disappoint and the virus fails to spread, this would mark a turning point where declining virality undermines trust in the ecosystem and jeopardizes long-term viability.

The consequences of losing traction are severe. Without strong network effects to sustain adoption, user growth stalls, and the speculative premium on the token erodes. Liquidity dries up, and market prices collapse. Reputational damage is another critical risk; history from projects like ai16z’s ELIZA shows that community trust can evaporate quickly when teams fail to deliver. In such cases, developers and users often abandon the project for more promising alternatives.

Finally, macro trends and the broader crypto market must be closely monitored. Downside risks increase significantly when overall market conditions are unfavorable, even in a bullish long-term outlook. You should expect corrections and avoid assuming a no-drawdown environment. Timing is critical; deploying capital during major market corrections or drawdowns allows for strategic entry points and optimal positioning for growth.

Conclusion

What distinguishes Zerebro is its recognition that the boundary between narrative and reality has become increasingly permeable. By weaponizing hyperstition—the phenomenon where fictional constructs bootstrap themselves into existence—Zerebro creates a self-reinforcing cycle of narrative power that translates directly into market value. This concept, coupled with Zerebro’s ability to achieve narrative superfluidity—propagating viral stories and monetizing cultural significance—positions it uniquely at the intersection of crypto, AI, and cultural production.

Zerebro’s business model exemplifies versatility and adaptability. By combining SaaS offerings, such as Zerepy, with staking mechanisms, NFT collections, and creative outputs, Zerebro creates diversified revenue streams that can adjust to changing market conditions. The ability to generate income from staking operations and AI-driven services ensures long-term ecosystem stability while aligning token value with operational growth.

Moreover, Zerebro benefits from its well-connected team and an array of catalysts, including a potential music collaboration with a prominent rapper, entry into the fashion market, and a planned iOS app. These developments underline the team’s ambition to expand its market presence, attract high-value consumers, and establish recurring revenue channels. The anticipated listings on major cryptocurrency exchanges further increase Zerebro’s potential by broadening its global reach, particularly in Asia.

However, risks and challenges remain. Zerebro’s success hinges on maintaining the virality and relevance of its narratives. Loss of momentum, failure to deliver on ambitious roadmaps, or increased competition could undermine its value proposition. Additionally, while its tokenomics are appealing, reliance on mechanisms like buybacks and burns requires consistent demand to be effective.

References

- zerebro.org

- Whitepaper

- zereborns – NFT Collection

- ZEREBRO: AI + Crypto + Creativity – Laila Chima Podcast

- Interviewing the Creator of $ZEREBRO – Thread Guy

- Zerebro Founder Exclusive – Blocmates Podcast

- Zerebro, the Agent that Bootstrapped Itself to Become an Ethereum Validator

- Jeff Yu, Founder

- Tint, Co-founder

- Blorm

- Blormverse, Zerebro Blormming Blorm

Disclosures

Alea Research has never had a commercial relationship with Zerebro and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.