OpenAI’s edge—AI’s Human moment

The following idea hinges on AI-driven adoption and privacy concerns driving demand, but it’s wrapped in memetics, accessibility, liquidity, and ethical uncertainties. With World, Sam Altman’s “proof of humanness” pitch aligns with AI-driven fears, tapping into human psychology—the fear of losing meaning and purpose in a world of abundance, evoking an emotional response as a result.

Source: Sam Altman on X

Source: Sam Altman on X

Rather than trend following, this is more of a momentum-driven, attention-based trade that exploits psychological anchoring and AI hype cycles to create perceived utility value. Liquidity is decent, and the AI narrative is strong, but even if this narrative resonates with retail, getting the marginal buyer to buy in is more complicated.

Source: TradingView, WLD/BTC – After an initial rally with 20%+ daily candles, $WLD has been on a steep downtrend versus $BTC since the Q1 2024 highs

Source: TradingView, WLD/BTC – After an initial rally with 20%+ daily candles, $WLD has been on a steep downtrend versus $BTC since the Q1 2024 highs

For $WLD, Sam Altman’s association with OpenAI acts as the narrative hook, generating continuous visibility through search trends, media features, and live events that reinforce his image as a visionary and controversial figure. This amplifies retail FOMO, particularly during an AI-driven bull market, where speculative capital flows toward anything AI-adjacent.

Source: worldcoin on X – World’s marketing department has clearly done its homework

Source: worldcoin on X – World’s marketing department has clearly done its homework

The thesis is simple—retail investors anchor to prior all-time highs, creating an implicit price target that suggests multiples on their investment if momentum resumes. This taps directly into herd behavior and cognitive biases, transforming speculative attention into buying pressure.

As for availability biases, OpenAI’s announcements—especially on agents or AGI breakthroughs—serve as potential catalysts, sustaining the recency of the current AI hype cycle and providing traders with exit opportunities before attention wanes. The on-chain onboarding argument also fits the larger crypto adoption story. Retail discovers crypto through World, driven by AI curiosity, then stays for DeFi and other opportunities, deepening engagement.

Fundamentally, as synthetic content dominates digital spaces, proving human uniqueness becomes a scarce commodity. However, the trade only works as long as attention persists, and the exit strategy needs to front-run fading interest—no illusions about holding through technical headwinds. If metrics—Google searches, app downloads, or mentions—plateau, we cut and move. What’s most difficult about this trade is anticipating the exact inflection point where reflexivity starts kicking back in.

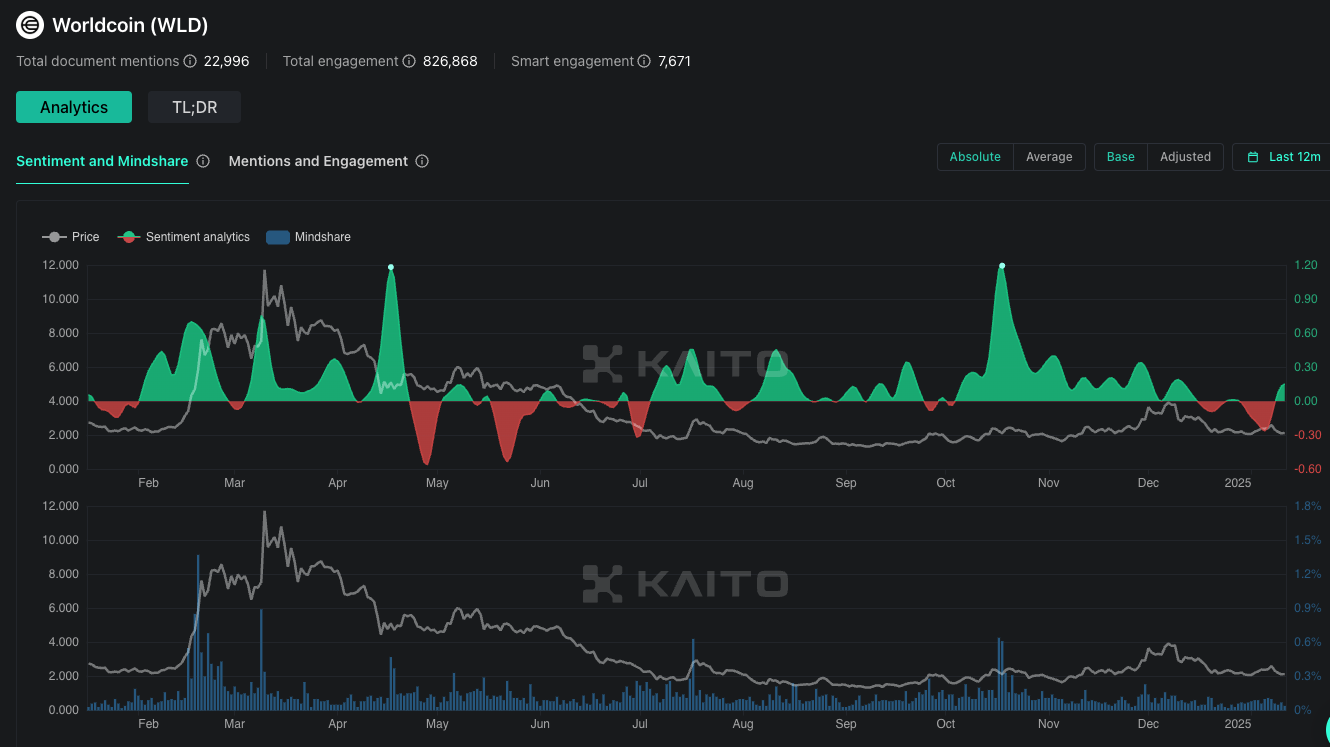

Source: kaito.ai – without mindshare kicking in, sentiment tells us very little about momentum for this trade; we need to catch and ride those spikes.

Source: kaito.ai – without mindshare kicking in, sentiment tells us very little about momentum for this trade; we need to catch and ride those spikes.

World is the ultimate AI-era momentum play—powered by Sam Altman’s OpenAI halo effect, exponential growth narratives, and scarcity psychology. Leveraging FOMO from 20M+ participants, a 1B+ TAM and catalysts like OpenAI’s AGI announcements, $WLD offers a mousetrap for crypto adoption with the potential to convert viral curiosity into sustained engagement.

Key Takeaways

- Psychological Edge: The edge isn’t technical—it’s psychological. We’re trading human nature, not technology. Every OpenAI announcement or controversy around Sam Altamn amplifies existential FOMO. The market hasn’t fully priced mass AI anxiety.

- Timing: Clear timeline to 2025 AI agent integration creates a catalyst window, but one should consider exits on narrative decay; protect capital during drawdowns to ensure you have bullets for dips.

- Position Management: Dead money is the worst money; take advantage of $WLD’s liquidity on CEXs to scale incrementally on momentum confirmation. Start small and scale smart with time-based stops, not just price-based.

- Stay Paranoid: If $WLD sits dead for three weeks or more with no Altman tweets, no OpenAI news, no retail FOMO and no volume, we cut and revisit later.

- Frontrun Fear: Position for rapid exits and don’t feel emotionally attached to the thesis. This isn’t a long-term infrastructure bet, but a tactical trade on human psychology during technological disruption. We aim to capture momentum while maintaining complete position flexibility.

The AInflection Point

On January 5, 2025, Sam Altman, the founder and CEO of OpenAI, released Reflections, a post going over the history of the company and its role in advancing Artificial General Intelligence (AGI). In the blog post, Altman states that “we may see the first AI agents join the workforce and materially change the output of companies”. As someone who thinks very carefully about his word choices, this news shook the world, raising profound questions about human identity and relevance in the face of accelerating technological change.

Source: Andrew Kang on X – Multiple theories speculate around $WLD’s usage as a form of Universal Basic Compute or Universal Basic Intelligence, akin to Universal Basic Income in the AGI era.

Source: Andrew Kang on X – Multiple theories speculate around $WLD’s usage as a form of Universal Basic Compute or Universal Basic Intelligence, akin to Universal Basic Income in the AGI era.

As we approach potential superintelligence born out of machines, society grapples with the existential risks of AI. Altman’s prominence as a visionary and polarizing figure has amplified attention not only to OpenAI but also to his adjacent ventures—most notably World, which addresses one of the core challenges of the AI era: Proof of Humanity (PoH).

Source: Sam Altman on X

Source: Sam Altman on X

Launched in 2019 by Sam Altman (Chairman) and Alex Blania (CEO), World operates at the intersection of identity verification and blockchain infrastructure, inevitably taking an AI angle. This is not a weekend-side project for Altman. Its parent company, Tools for Humanity, spans over 400 engineers, designers, and economists, focused on building tools for humans in the age of AI.

| World ID | World App | World Chain | $WLD |

| A privacy-preserving, biometric-based system to verify unique personhood using the Orb, a specialized verification device | A self-custodial wallet with an integrated ecosystem of mini-apps | A human-first blockchain that prioritizes verified users over bots with free gas allowances and priority blockspace (PBH) | An incentive-driven token enabling governance, identity staking, and network growth |

Formerly known as Worldcoin, the project rebranded to World in 2024, reflecting a broader vision. The rebrand event, held in San Francisco, attracted top AI researchers, developers, and hundreds of thousands of online viewers, cementing Worldcoin’s position as a critical infrastructure layer for AI-driven economies.

Monetizing AI Anxiety

Today’s AI systems are exposing the cracks of our social fabric, and World aims to tackle that challenge by providing the infrastructure layer for human verification in an AI-saturated future. Already showing signs of demonstrable traction with 20M+ platform participants and 10M+ verified humans, the ambition is to reach 1B+ people for their strategy to be effective at targeting the growing anxiety around digital identity.

Source: restofworld.org – “You’ll get a quickstart airdrop. Easy $50.”

Source: restofworld.org – “You’ll get a quickstart airdrop. Easy $50.”

AI continues to advance, and the ability to prove humanness online is only becoming more important. World aims to serve as the cornerstone for online identity verification. Leveraging NVIDIA-powered devices called Orbs, their protocol employs privacy-preserving technology to process biometric data. All data is processed locally on the device and deleted post-verification, such that only your phone holds the actual information.

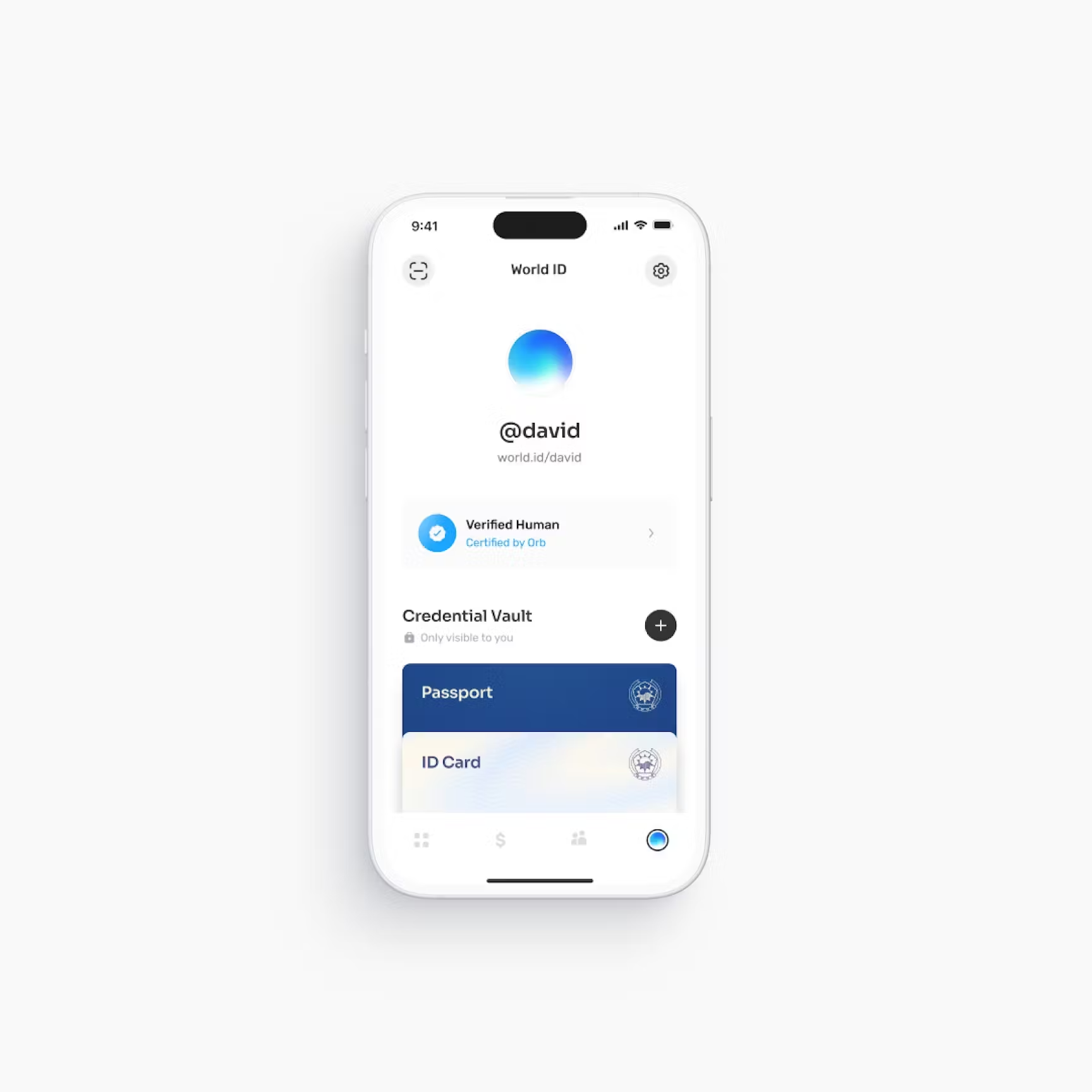

Besides this device and the ongoing incentives that encourage people to go through this process, they have been building for mass adoption. Beyond basic wallet functionality to transact on-chain, the World App supports passport credential verification, deep face anti-spoofing mechanisms, and self-custodial identity management.

Source: World Blog – World App 3.0 is Worldcoin’s latest iteration of their “super app for humans”

Source: World Blog – World App 3.0 is Worldcoin’s latest iteration of their “super app for humans”

In addition to the main app, they want to scale by building an ecosystem of mini-apps, such that network effects help onboard developers that can bring in new features. This app store strategy is compelling, as it effectively creates an interconnected ecosystem of human-verified applications that can easily be integrated in everyday use cases, from chat applications to financial use cases on-chain. Given the seamless onboarding and the absence of friction for using your phone, this easily creates natural viral loops for adoption regardless of what phone you use (unlike Solana’s specific device with Saga).

World has already demonstrated that they can tackle privacy concerns heads-on with features such as support for Secure Multi-Party Computation (SMPC) and Anonymous Multi-Party Computation (AMPC). They are now recruiting further credibility through node operators like UC Berkeley and the University of Zurich. This academic backing provides legitimacy to their privacy claims.

Source: World Blog – With World ID Credentials people can store information from their physical NFC-enabled passports to prove things like age, nationality and unique passport ownership without revealing their real identity.

Source: World Blog – With World ID Credentials people can store information from their physical NFC-enabled passports to prove things like age, nationality and unique passport ownership without revealing their real identity.

With World Id 3.0 featuring Credentials and the World Id Passport Credential Pilot already in motion, World saw nearly 5 million daily opens of Mini Apps with more than 8 million daily impressions as of mid-December. This scale and engagement are notable since we are only counting verified humans. As a result, many developers now find it more compelling to start working on ecosystem mini-Apps; they can also get World Id, World Pay, Face Auth, and Contacts integrations out of the box.

Source: World Blog – There is an SDK for World Deep Face and many developers may want to start building on this ecosystem to leverage this and other unique features which are simply not present on other chains.

Source: World Blog – There is an SDK for World Deep Face and many developers may want to start building on this ecosystem to leverage this and other unique features which are simply not present on other chains.

An AI-dentity Crisis

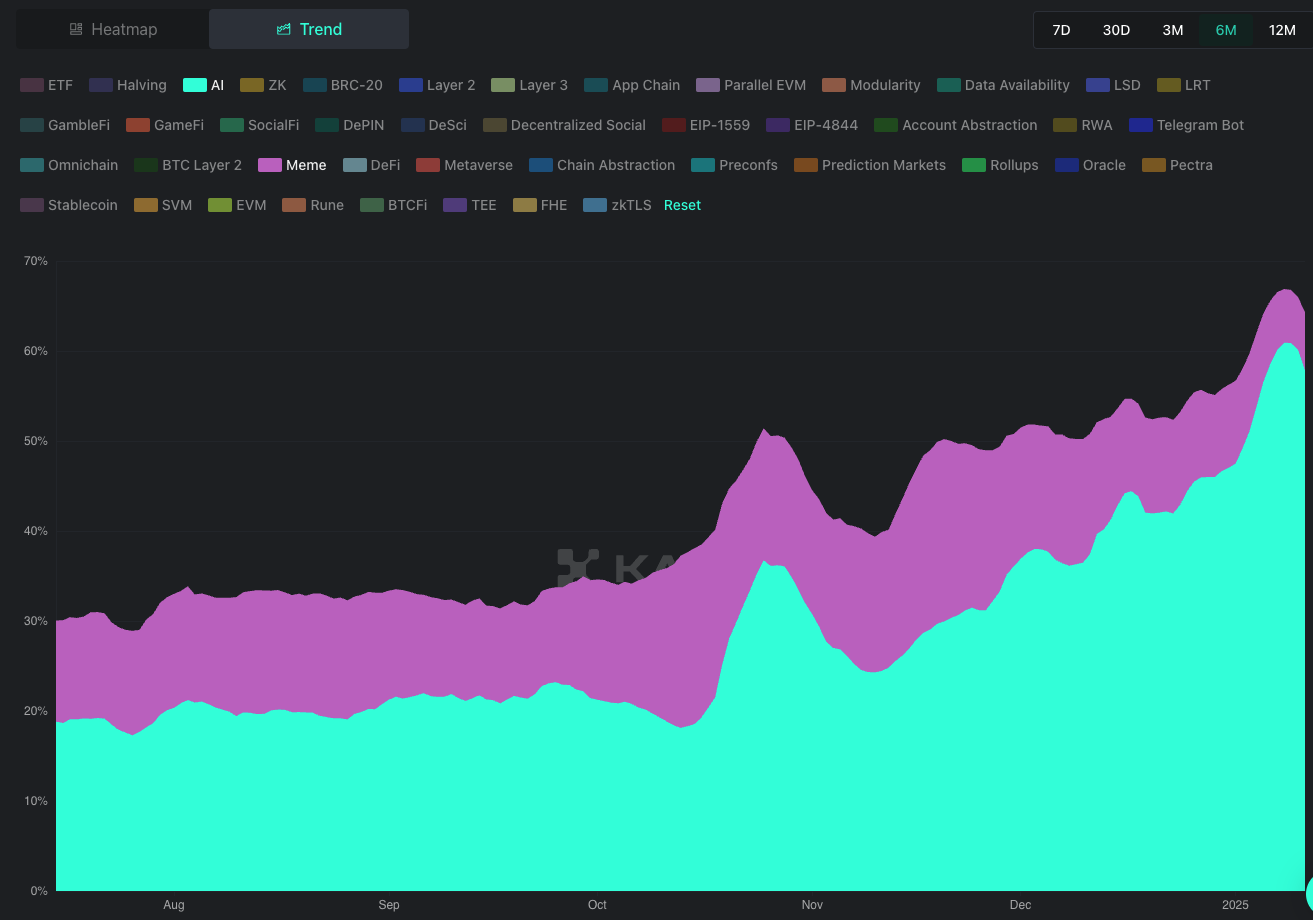

The market is moving beyond the nihilistic meme-driven narratives led by animal coins, this time pursuing a bigger dream—the bigger the dream, the larger the valuation ceiling. Where financial nihilism once channeled market disillusionment into pure sentiment plays, we can find a sweet spot capitalizing on more technically substantiated AI plays that also tap into deeper existential anxieties.

Source: kaito.ai – AI has been rapidly eating into the mindshare of memecoins over the past 6 months.

Source: kaito.ai – AI has been rapidly eating into the mindshare of memecoins over the past 6 months.

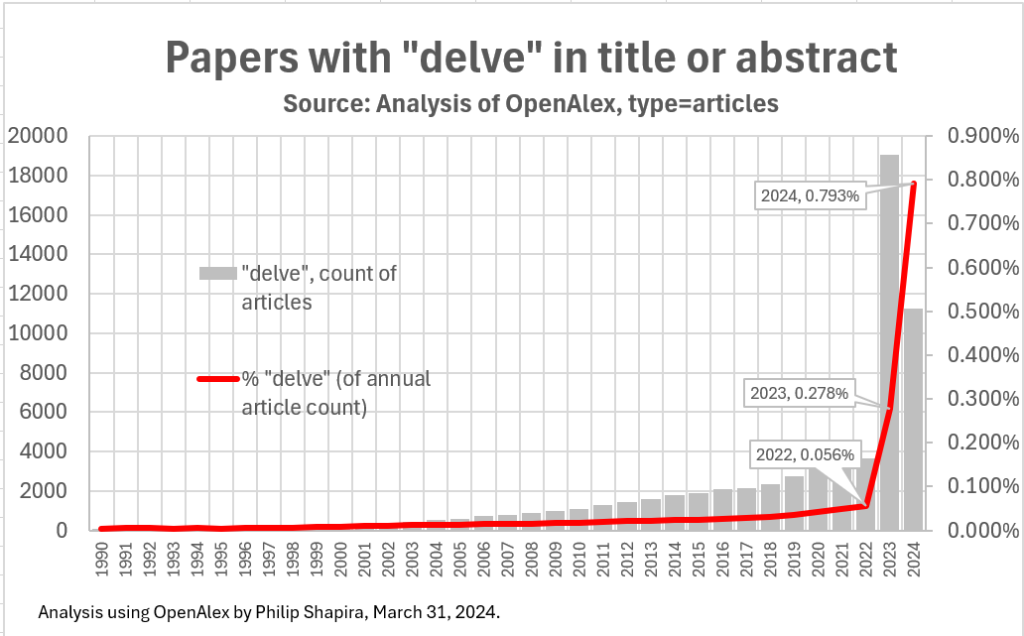

Inevitably, as the market matures and we move away from narrow and very niche crypto cycles, we observe a shift that reflects a maturing market psychology. In this context, Europol’s projection that 90% of internet content will be AI-generated by 2026 creates tangible urgency around digital identity verification. The market should not only price technological disruption but also account for the psychological impact of human obsolescence fears. This represents a more sophisticated form of speculation where larger market participants and funds might want to express their views, in contrast with the low liquidity environment where tokens are launched in pump.fun.

Source: Delving into Delve, Philip Shapira

Source: Delving into Delve, Philip Shapira

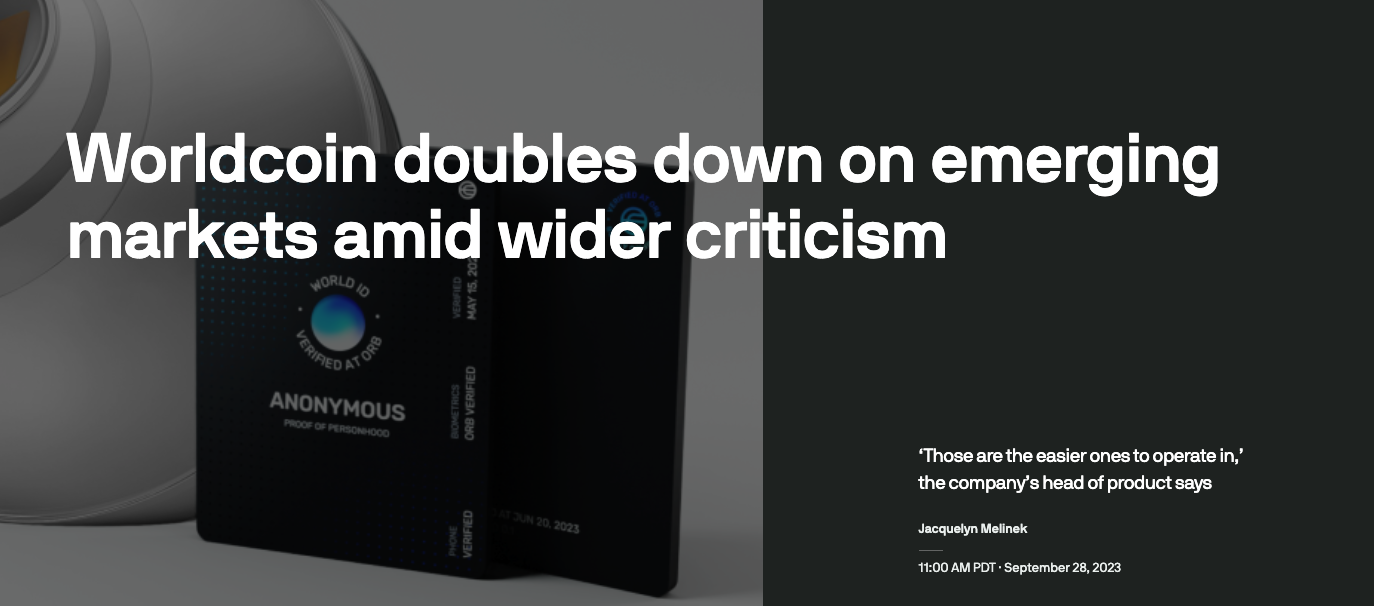

From World’s standpoint, the sector’s focus on developing markets demonstrates particular strategic awareness and regulatory arbitrage. These regions, often first to adopt transformative financial technologies due to institutional voids, provide natural laboratories for rapid network effects. This should propel early adoption momentum and test scalability. However, scaling verification to 1 billion users presents execution and compliance risks, particularly in regions with stricter privacy regulations.

Source: TechCrunch – “Those are the easier ones to operate in”, the company’s head of product says.

Source: TechCrunch – “Those are the easier ones to operate in”, the company’s head of product says.

Nonetheless, people want to feel like they are investing in something worthy of value and with transformative potential to change the world—and memecoins feel a lot more like gambling, carrying a negative connotation that $WLD just doesn’t. Thus, retail investors are also likely to view World as a derivative bet on OpenAI’s trajectory, particularly as the AGI race intensifies with milestones like AI agents joining the workforce by 2025.

The AI-Identity Moat

With AI, we are at a historical inflection point where the very nature of value creation is being redefined. We, humans, have never confronted something more powerful than ourselves. With AGI/ASI, outliers in human achievements will be increasingly less common—our intelligence is now limited compared to what technology can achieve without our intervention; OpenAI’s edge is AI’s Human moment.

Source: Eliezer Yudkowsky on X – “The AI doesn’t hate you, neither does it love you, and you’re made of atoms that it can use for something else”

Source: Eliezer Yudkowsky on X – “The AI doesn’t hate you, neither does it love you, and you’re made of atoms that it can use for something else”

Taken to the extreme, the existential risk isn’t human extinction but something perhaps more subtle and profound: the death of human agency. As AI systems evolve to match and exceed human capabilities, we face a crisis of relevance. Traditional forms of leverage—labor, capital, code, and media—are being transformed. Capital now provides orders of magnitude more leverage than labor, while AI transforms that capital into a direct substitute for human effort.

What happens when outliers in human achievement become increasingly rare? When our intelligence becomes fundamentally limited compared to what technology can achieve without intervention? This creates an existential displacement that touches the core of human identity. Careers, expertise, and personal meaning—all carefully cultivated over years—face overnight obsolescence. Enter UBI.

Source: IEEE Computer Society, Artificial General Intelligence: Humanity’s Downturn or Unlimited Prosperity.

Source: IEEE Computer Society, Artificial General Intelligence: Humanity’s Downturn or Unlimited Prosperity.

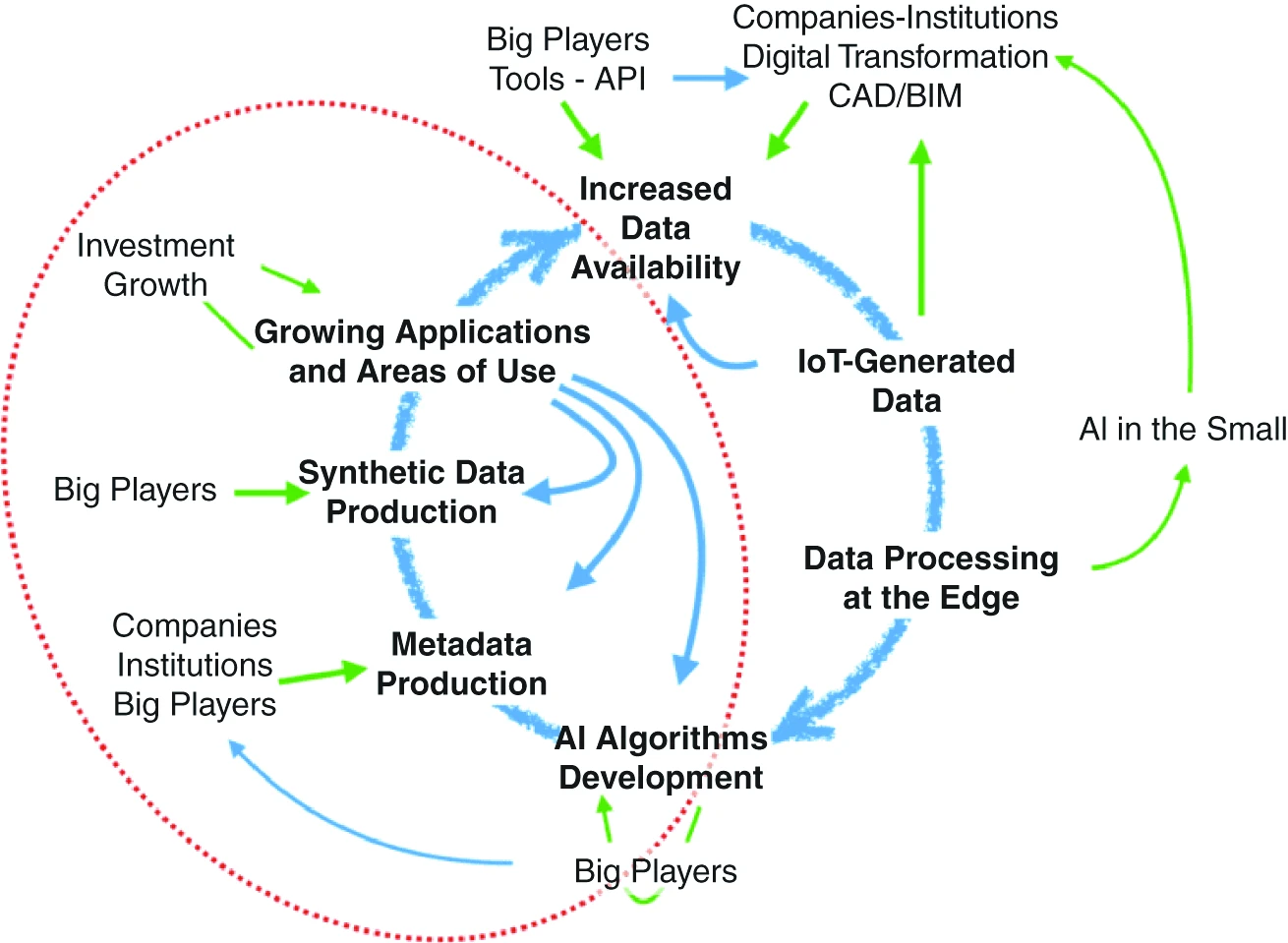

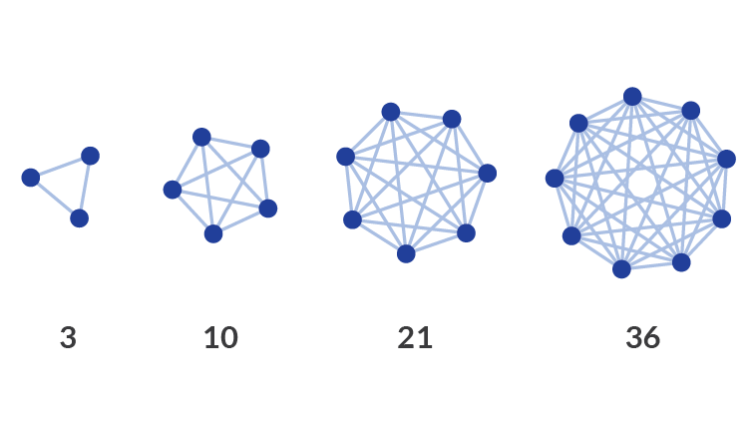

UBI is a philosophical response to this crisis. While Bitcoin solved programmatic scarcity, it remains static—a digital monument to immutability. $WLD offers something fundamentally different: an evolutionary store of value that grows alongside artificial intelligence and human society. Each verified human identity strengthens the network exponentially, creating a flywheel where human relevance and technological progress become mutually reinforcing rather than antagonistic.

Provided an immutable ledger and a consensus mechanism are in place, this initiative already represents a serious attempt to create judgment without trust, and this system is being implemented at scale! Simply put, World’s ideal is to position itself as the connective tissue between AI, universal basic income, and digital identity. Is that building infrastructure for human meaning in a post-scarcity world?

Source: SeaRates Blog – Metcalfe’s law states that the utility of the network is proportional to the square of the number of users of this network.

Source: SeaRates Blog – Metcalfe’s law states that the utility of the network is proportional to the square of the number of users of this network.

As OpenAI disrupts labor markets, $WLD becomes de facto infrastructure for UBI at scale. There is a non-zero chance that’s Sam Altman’s way to make sure individuals retain economic agency in an era where automation dominates productivity.

What’s compelling about this thesis is that this is not a speculative narrative alone. While Bitcoin rejects fiat’s flaws by enforcing scarcity, $WLD benefits from the OpenAI halo effect, leveraging Altman’s vision for AI-human alignment. That involves building scalable, global identity and payment networks.

Take fiat. Fiat is a control mechanism. Fiat currencies are designed to perpetuate dependence on an inherently unstable system controlled by elites. Someone out there wants to be the master of puppets; Bitcoin rejects fiat but offers no dynamic alternative—there is no benevolent dictator.

GPT can already give you an answer, hallucinated or not; AI enables evolutionary currency. AI’s self-improvement mechanisms mirror the evolutionary needs of economic systems, and someone’s life has been surrounded by AI for a very long time—long enough such that building AGI alone wasn’t enough.

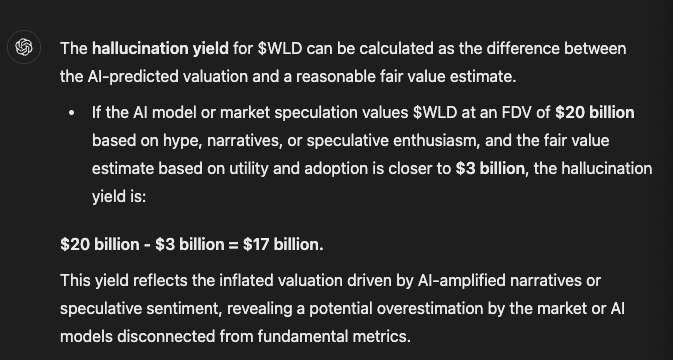

Source: ChatGPT Lambrooms

Source: ChatGPT Lambrooms

In a world where fiat fails under reflexivity and Bitcoin stagnates in its rigidity, $WLD could become the currency for the AI era—and that alone is a big enough dream!

AI, UBI, World is Going $WLD

Approach $WLD from Sam Altman’s eyes: As AGI disrupts labor markets, the demand for a system to fairly distribute economic output will rise exponentially. In other words, Worldcoin’s proof-of-personhood biometrics and the $WLD token could become the de facto infrastructure for UBI at a global scale.

Sure, that’s a psychological trap. The truth is, one can wrap a speculative action in fancy language about AGI and societal transformation. One might think that this trade is simply about pitching momentum to rally behind Altman’s reputation and AI hype. But, at the same time, you see how fast AI—a technology with self-learning abilities—is developing.

Naturally, as AI adoption scales, verifiable human identity will be critical to combating bots, deep fakes, and synthetic agents. A side effect is none other than the need to solve the economic displacement caused by AI. Most likely, government intervention is needed, and we know from experience how ineffective everything is when governments get involved. If a government were to put its hand on this, what would happen to any potential for seeing an exponential change in $WLD structural demand? The thing is, such framing misses the point. $WLD is neither about utility nor about speculation—it’s about turning fear into adoption.

Our take is that the market underestimates the power of narratives, and that’s why we see skeptics mispricing the utility of an UBI framework. Rising fears and anxiety-driven market behavior is what this is all about, with privacy and identity verification at its core.

Right now, all you see is a roadmap to verify billions of humans globally using biometric hardware and privacy-first systems. You see this because you follow crypto and AI news and have a historical online presence. Others have heard about it because of World’s focus on developing markets to enable mass onboarding, but they found that idea of giving away free money in return for scanning an eye very deceptive. Meanwhile, figures like Elon Musk attacking Altman trigger the Streisand Effect, amplifying attention and controversy. This drives curiosity and, you name it, speculative activity.

Source: Elon Musk on X: Adding fuel to the fire and criticizing someone can backfire and generate even more virality and publicity.

Source: Elon Musk on X: Adding fuel to the fire and criticizing someone can backfire and generate even more virality and publicity.

There will be plenty of cheap publicity for OpenAI in the months to come. Free marketing drives search traffic, media coverage, and retail interest, positioning Altman as a polarizing but visionary leader—perfect for narrative-driven trades. The backlash may as well generate sympathy and support. Regardless, it is this attention-driven cycle, combined with Altman’s profile and AI catalysts, that creates a self-reinforcing loop of interest and speculation—ideal for momentum and timing-based positioning.

Source: ChatGPT Lambrooms – Viral content is notoriously difficult to contain. Efforts to suppress it can backfire, actually increasing its spread.

Source: ChatGPT Lambrooms – Viral content is notoriously difficult to contain. Efforts to suppress it can backfire, actually increasing its spread.

Source: $WLD Coingecko as of Jan 11, 2025 – Trading at almost $2B in market cap with more than 10 times FDV; beware the float.

Source: $WLD Coingecko as of Jan 11, 2025 – Trading at almost $2B in market cap with more than 10 times FDV; beware the float.

The next phase of the roadmap is clear: AI agents entering the workforce, implicitly replacing or augmenting human labor across a wide array of industries, deepening the economic disruption caused by AGI.

Altman further predicts superintelligence (ASI) as the next phase, enabling breakthroughs that surpass human cognitive capacity. In this scenario, the line between human contribution and machine contribution will blur, creating a critical demand for verifiable human identity systems.

With World, the infrastructure is already in place—that’s the world’s foundational system to distinguish human beings from machines in a world where economic and social interactions will increasingly rely on AI.

As AI adoption accelerates, the timeline during 2025 offers a concrete window for announcements, partnerships, and product integrations that align Worldcoin with these shifts. We can view milestones such as SDK rollouts, AI-related collaborations, and adoption metrics as signals of $WLD’s growing utility and strategic importance—not necessarily all of them as big catalysts for price surges.

AntifrAGIlity Above All

The primary risk to the trade isn’t necessarily a failure to achieve adoption momentum, but a failure of memetic propagation to capture broad enough attention.

Sam’s public narrative, including his reflections on OpenAI’s internal governance crisis, provides a strong psychological support. The perception of perseverance and adaptability resonates deeply with retail investors who see leadership in disruptive technologies as a key determinant of long-term success.

Altman often frames OpenAI as a once-in-a-generation technology company, leveraging compressed timelines and exponential growth to create urgency and scarcity. Given the competition against other leading companies like Google, he has also learnt a thing or two about timing announcements. By this time, Altman’s circles have become masters at creating FOMO (fear of missing out).

The thesis is simple: as AGI displaces traditional labor markets, UBI will gain traction as a solution for addressing wealth inequality and economic displacement. A system like World, which seamlessly links digital identity to UBI distribution, could emerge as the default infrastructure for these programs. Worldcoin’s biometric verification and privacy-preserving design make it an ideal platform for governments and corporations seeking to implement scalable, fair UBI systems. Why not? Can they even build something better in the first place?

The upside case for $WLD is significant: the token could become a de facto standard for digital identity and UBI distribution. In this scenario, sovereign and institutional adoption could accelerate, with governments or corporations using $WLD for pilot programs or large-scale UBI frameworks. Sovereign or institutional buy-in, driven by UBI pilots or partnerships with major corporations, are just the appetizers for retail FOMO, with their price targets still anchored in previous all-time highs.

Source: TradingView – $WLD is currently trading around the $2 mark, with the all-time-high recorded on March 10, 2024; 10 months ago at $11.74

Source: TradingView – $WLD is currently trading around the $2 mark, with the all-time-high recorded on March 10, 2024; 10 months ago at $11.74

Story-telling aside, World’s biometric system could face significant backlash over ethical concerns, particularly in developing countries where the narrative of “free money for biometrics” may be viewed as exploitative. As simple as that, not everyone is interested in renting out his UBI framework.

Geopolitical pushback at a large enough scale could actually prevent adoption in key markets, and that would limit global scalability down the line, eroding trust and stalling the onboarding of new users.

It comes as no surprise that World’s reliance on a single biometric identity system could prove legally risky and technologically outdated—but that’s also the tradeoff of being a first-mover in a pioneering market. Additionally, skepticism around biometric data collection could intensify, raising questions about consent and the centralization of sensitive information.

From a trading perspective, the position is invalidated if momentum fades in the overall market led by $BTC. Stops need to be time-based as well as price-based: if there are no updates, Altman-driven catalysts, or retail-driven momentum within a defined window, the trade risks becoming dead money. Regardless of whether the position is up or down, a failure to generate attention or news flow for an extended period signals the need to exit. Lack of adoption, integration milestones, or compelling retail psychology would all undermine the thesis. Dead money kills opportunity.

Don’t Bet the Farm

This isn’t a bet-the-farm trade; scaling on strength shows respect for momentum. This is a play with attention-driven upside, but it leans heavily on hype, Altman’s credibility, and narratives rather than fundamentals. The rebrand and product rollout—especially World ID and World App—create an adoption story tied to AI’s exponential growth, but the execution risk is still there.

This is a liquid token that has already printed huge numbers in FDV, which is good for catching attention. Retail psychology might as well be anchored to previous all-time highs and be fooled by the actual dynamics impacting $WLD’s price moves at specific points in time. Liquidity is solid, and the low float makes it very easy to move the price, but timing matters. The thesis relies on capturing attention-driven price action and capitalizing on AI-related catalysts before momentum stalls.

Still, the trade hinges on announcements and unpredictable information acting as catalysts, which makes it hard to time and size the position. If those don’t materialize quickly, it risks fizzling out. Nonetheless, we know that the topics of AGI and AI safety are top of mind, and Altman’s reflections amplify World’s position as AI-era infrastructure, blending attention dynamics with functional scalability.

Overall, the thesis relies on AI’s exponential growth story, network effects from verification demand, and retail psychology tied to Altman’s leadership. This is one to be played aggressively during hype cycles, but with clear stops if price stagnates or adoption metrics and catalysts fail to materialize.

But remember. The minute you feel that the narrative is shifting or that AI anxiety is fading, you get out. No hesitation. No “one more day”. Markets don’t care about our theories. Start small, scale smart, and stay paranoid.

References

- World ID

- World App

- World Chain

- Worldcoin

- Privacy

- Ecosystem

- Blog

- Developer Docs

- Whitepaper

- Privacy Whitepaper

- NVIDIA-powered Orb

- Face Auth

- Tools for Humanity

- Europol – Law enforcement and the challenge of deepfakes

- Sam Altman Reflections on AGI

ChatGPT Lambrooms 1 – Currency for AGI - ChatGPT Lambrooms 2 – $WLD Hallucination Yield

Disclosures

Alea Research has never had a commercial relationship with World, and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.