Just like ETFs have taken $BTC off the market, our viewpoint is that Bitcoin L2s like Stacks will draw increasing amounts of liquidity into their ecosystems, growing the pie for everyone involved in the success of this upcoming market sector and increasing demand for $BTC.

$STX is the only liquid asset of size that is directly tied to this secular trend, and there are multiple catalysts in the upcoming year that will bring more eyes and attention to Stacks’ emerging ecosystem, enhancing the utility of $BTC and stirring the appetite of passive institutional capital that is currently sitting idle in $BTC as a store of value.

Since the Genesis block in 2009, the Bitcoin network has remained stable and secure, a testament to its robust design. To maintain its core principles of decentralization and security, Bitcoin intentionally limits complexity in its operations. However, the tradeoff is that, as time goes by and more halvings take place, the economic rewards for miners start to go down as well, necessitating an extra incentive in the form of network transaction fees. By leveraging Bitcoin’s security model, Stacks transactions gain an extra layer of irreversibility and trust, making it a more reliable platform with enhanced functionality from smart contracts and improved transaction speeds.

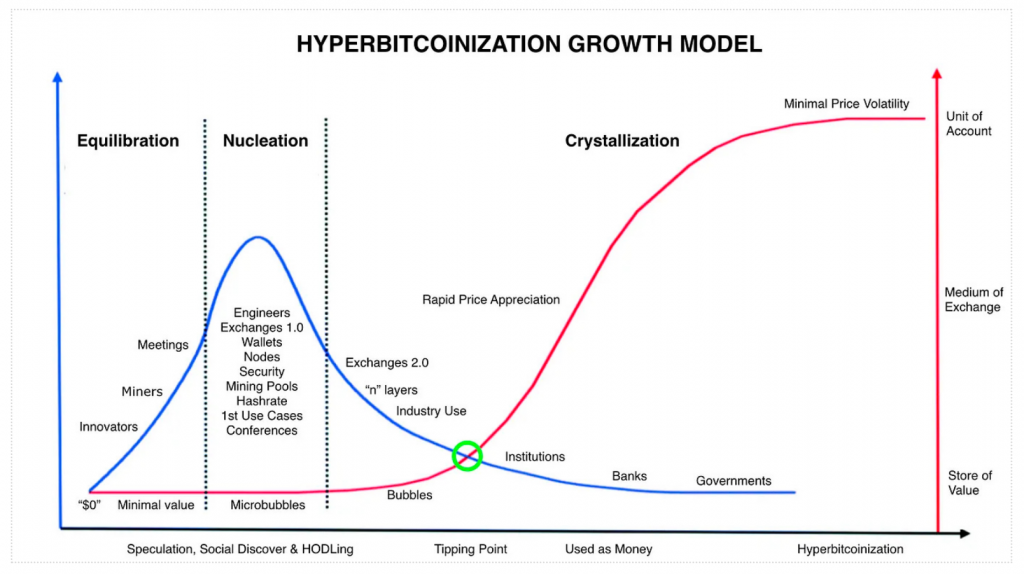

Bitcoin’s inability to natively support complex smart contracts and high transaction throughput is the reason why extra layers like Stacks are needed, offering more productive and innovative use cases for $BTC and increasing network activity on the underlying chain. With the introduction of Ordinals fees and Bitcoin L2 fees, we started seeing the first signs of what a viable solution to address the economic security issue of Bitcoin looks like. This security problem exacerbates with every halving and will be a topic of debate in the upcoming months. The clock is ticking and we are running out of time, and the Bitcoin halving is a great opportunity to drive attention to Bitcoin L2s – of which Stacks has proven to be the fastest horse.

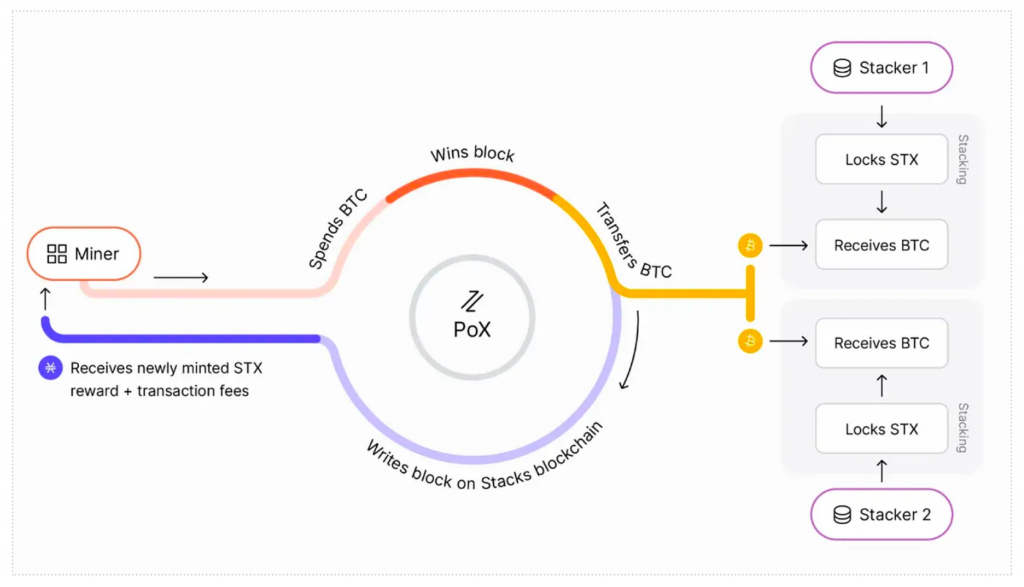

To understand Stacks, it is critical to be familiar with its Proof of Transfer (PoX) mechanism, which aims to leverage the security and capital of an underlying chain, namely Bitcoin, to secure a new network. It’s a variation of Proof of Burn (PoB), where instead of burning a cryptocurrency to participate in the consensus, miners transfer the base cryptocurrency (in this case, $BTC) to existing token holders of the new network (Stacks).

There are two participants involved in this process, miners and stackers. Miners bid $BTC to mine blocks on the Stacks network. Instead of spending computational power, it works in such a way that the more they bid, the higher the likelihood of mining the next block. In return, they are compensated with $STX rewards, coming from both inflation and transaction fees. Stackers are $STX holders who lock their tokens and actively support the network’s security by participating in the consensus. In return, they earn $BTC rewards from the miners’ bids.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free