A Layer 1 Revival Story

Sonic is a high-speed, EVM-compatible chain that has a track record of building a thriving DeFi ecosystem and that’s now enabling parallel execution. Led by DeFi’s most influential builder, Andre Cronje, Sonic stands to compete face-to-face against highly anticipated launches and overfunded competitors like Berachain, Monad or MegaETH, as well as against others already competing in the liquid market like Hyperliquid’s HyperEVM and Sei v2. Already live and being battle-tested by a sudden flow of DeFi yield farmers, most of the $S supply is fully circulating, currently receiving large inflows that are propelling a fast rate of TVL and on-chain volume growth.

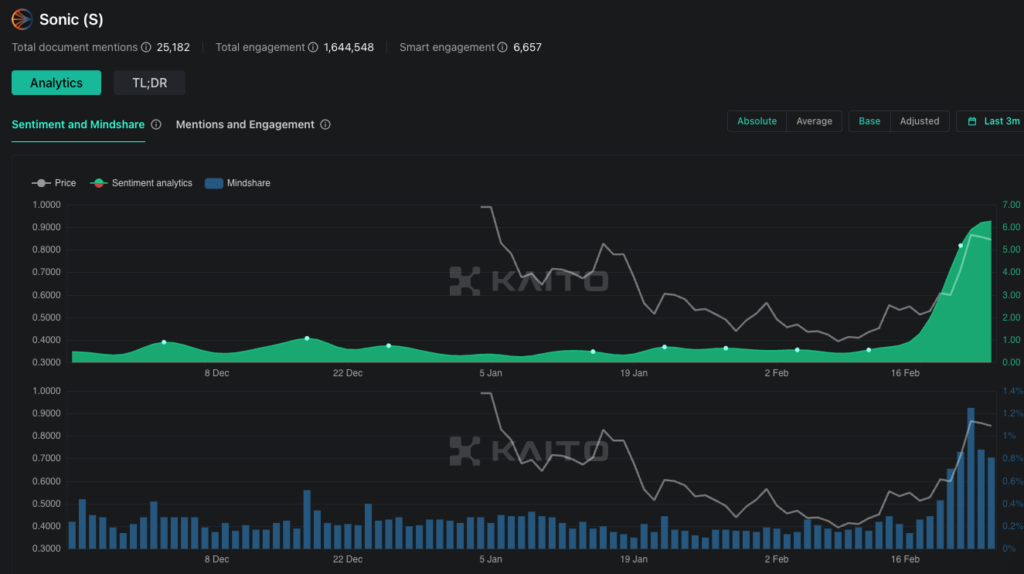

The rebrand has reignited one of the most vibrant DeFi communities, drawing back sophisticated players from the yield farming era who made a name for themselves in the Fantom trenches. Avoiding the massive insider unlock overhang that plagues new entrants, Sonic presents a liquid opportunity that is easy to monitor and track for execution risks. The most recent surge in mindshare highlights an opportunity to capitalize on this ecosystem by both capturing yield on-chain as well as positioning a portion of the portfolio to maintain optionality and get exposure to upcoming unexpected catalysts spearheaded by the Sonic Foundation and its ecosystem teams.

We’re keeping a close eye on this rally, leaning on leadership execution and capital rotation dynamics, until we see signs of outflows or exhaustion. After an initial selloff upon launch, the market now sees Sonic as a rejuvenated project with serious tech credentials and growing usage. The Fantom community has largely reengaged, and new speculators are also joining the wave.

Key Takeaways

- First-mover advantage and live network while competitors are still in testnet or early ecosystem building stages.

- Clean token structure with ~90% of tokens already in circulation, a predictable inflation rate for staking rewards, incentives alignment with developers through Sonic’s Gas Fee Monetization program, and little future dilution attributed to insider unlocks (unlike major competitors).

- Strong liquidity profile ranking in the top 50 by market cap and boasting high volumes on liquid CEXs like Binance.

- Charismatic leader and catalysts spearheaded by Andre Cronje deploying new primitives that will only be available on Sonic first.

- Immediate competition incoming will test Sonic’s ability to retain liquidity, developers, and mindshare.

- Rotation risk and immediate incoming competition could jeopardize growth down the road—EVM compatibility means near-zero switching costs for developers and capital.

- Strategic timing window where opportunity exists until the main competitors launch—then it becomes harder to predict winners.

Speed, Liquidity, and the First-Mover Edge

Sonic’s 720ms finality places it among the fastest EVM-compatible Layer-1s, rivaling direct competitors on the high-performance EVM parallelization front like Sei V2, Hyperliquid’s HyperEVM, Monad, and MegaETH, as well as other L1s building liquidity moats for DeFi, such as Berachain. However, Sonic’s track record and first-mover advantage give it a critical edge that opens a window of opportunity for the weeks to come—while competitors are in testnet or bootstrapping liquidity, Sonic is already live and growing. Sustaining this growth will be key, but the current trajectory suggests it is securing a foothold before the next wave of competition arrives.

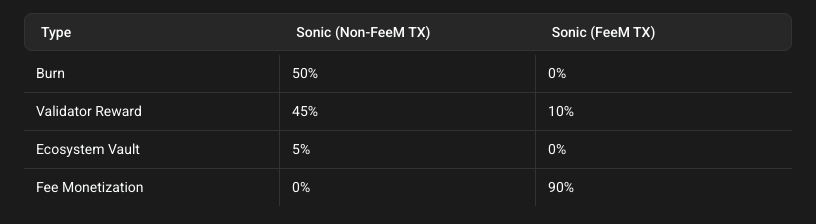

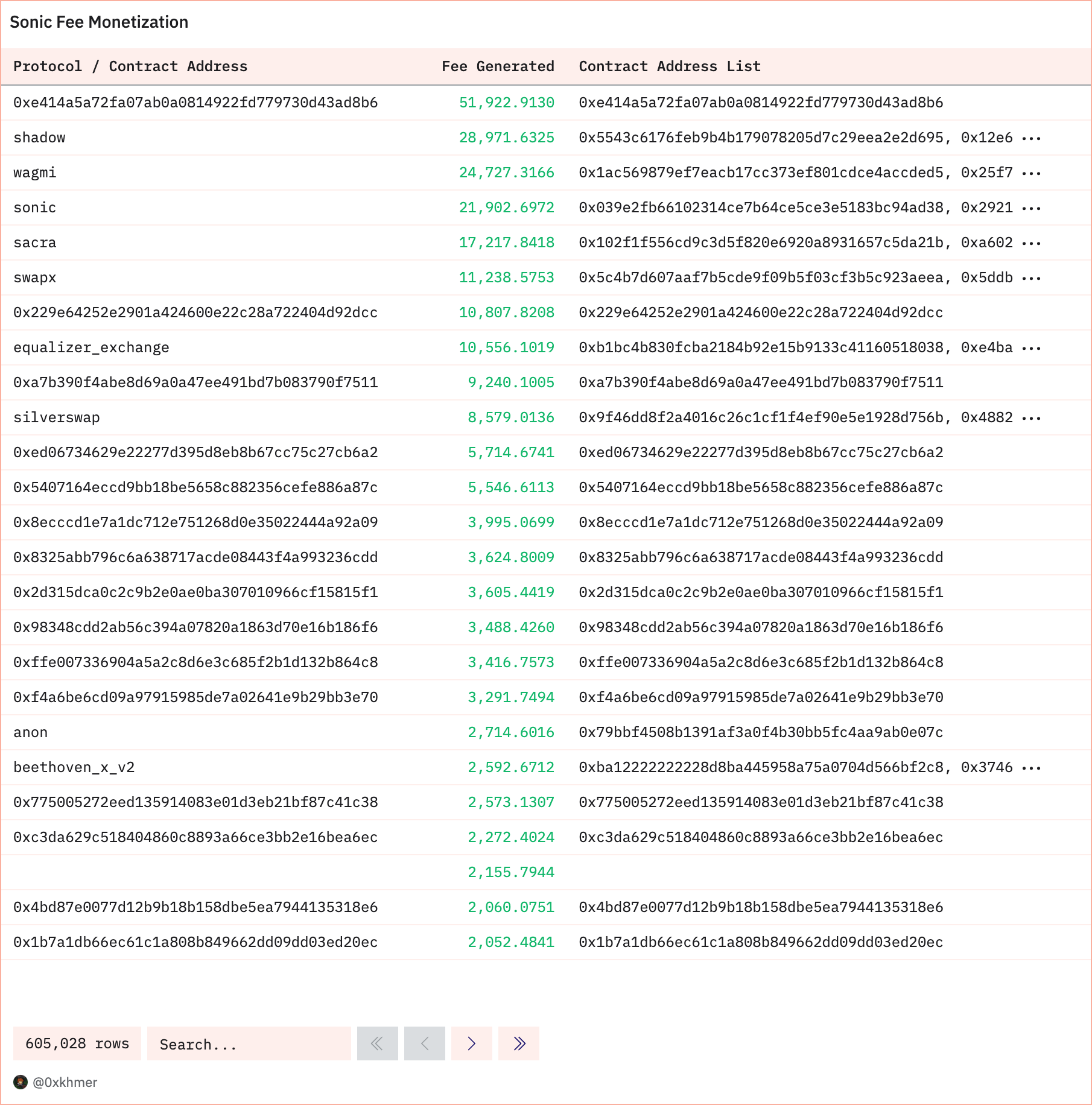

One of Sonic’s most differentiating features is its Gas Fee Monetization program, which shifts value accrual toward dApp builders by rewarding them with up to 90% of the gas fees their users generate. This creates an ecosystem that directly incentivizes applications with real usage, attracting serious builders who believe in their product-market fit. While this comes at the expense of automatic token burns (reducing deflationary pressure), it aligns network expansion with token demand—the more transactions, the higher the demand for $S as gas. The bet is that rising on-chain activity will offset lower fee burns, creating long-term value accrual for an asset that will have little dilution in the long run, just coming from predictable staking rewards.

It is not just on-chain volume and TVL. Developer activity is also on the rise, thanks to a native USDC integration (Circle/Wormhole) and the Sonic Gateway, an Ethereum bridge with a 14-day fail-safe that addresses concerns about unreliable bridging solutions from the past. These upgrades de-risk DeFi liquidity flows, making Sonic a more attractive settlement layer. It also shows that the team can execute on their roadmap almost impeccably, confronting past criticism and shadows of the past, such as the Multichain exploit and lack of native stablecoins on-chain.

Andre Cronje’s return is a double-edged sword—his leadership and reputation are a magnet for developers and liquidity, but Sonic’s success still hinges on execution. We anticipate that Andre’s new primitives will revitalize the ecosystem and enable new teams to build upon it. This adds some exclusivity to the chain in the short term, as it will take some time for other EVM ecosystems to fork and replicate the code elsewhere. At the same time, unlike many rivals weighed down by investor unlock overhangs, Sonic has a cleaner token structure from its ICO-era distribution.

However, competition will escalate in the coming months with the launch of Monad and MegaETH, requiring continued innovation to defend its positioning. We maintain a bullish outlook but will exercise caution as these new players enter the market. Sonic’s token supply structure presents minimal future dilution risk, with approximately 90% of its 3.175 billion maximum supply already in circulation. The token maintains strong liquidity as a top-50 market cap asset, supported by substantial daily trading volume. These are favorable conditions for liquid funds to build up a position that they can exit easily on Binance and other CEXs.

Convexity and Liquidity in a Crowded EVM Market

Developers choosing where to deploy face three main tradeoffs: General-purpose L1/L2s offer built-in infrastructure and composability but capture most of the value via gas fees, often pushing dominant apps to seek their own chain despite the high costs and operational complexity. Custom rollups provide more control but come with vendor lock-in, expensive setup, and fragmented composability across ecosystems like the OP Stack or Arbitrum Orbit. Sonic presents a new alternative—an ultra-fast, EVM-equivalent chain with up to 90% fee-sharing for dApps, no infrastructure overhead, full composability, and backing from figures like Andre Cronje.

Sonic’s greatest strength—its position as a high-speed EVM-compatible L1 with a fully circulating token—is also its biggest challenge. The race for the fastest and most liquid EVM chain is heating up, with Sei V2, Hyperliquid, Monad, MegaETH, and Berachain all fighting for developer mindshare and liquidity. While Sonic currently holds an advantage with a live mainnet, growing TVL, developer incentives, and the credibility of Andre Cronje, it must sustain momentum in the face of aggressive competition and new token incentives drawing capital elsewhere. In addition to those chains, we cannot ignore other EVMs in the Ethereum L2 ecosystem (Arbitrum, Optimism, Base, etc), or other L1s like Avalanche.

Sei V2 boasts ~28,300 TPS and 390ms finality through “optimistic parallelization,” making it one of the most technically impressive challengers. However, it faces adoption hurdles due to its Cosmos roots—Cosmos-native projects historically struggle with lower liquidity and fragmented communities. Sonic, with its established EVM base and deeper DeFi penetration, has the advantage here, provided it continues attracting capital and builders before Sei V2 gains more traction.

Hyperliquid’s success story currently revolves around its use as a trading platform with a UX that can rival CEXs with all the benefits of non-KYC trading, and a very generous community allocation and $HYPE airdrop. The team’s background in high-frequency trading led them to design an L1 that operates on the custom HyperBFT consensus, allowing for 200ms block times and up to 200,000 tps—an order of magnitude beyond Sonic’s targets. Currently ongoing a process of progressive decentralization, the focus is now to build an ecosystem on the HyperEVM that will enhance the value proposition of Hyperliquid as the only infrastructure provider of a highly liquid vertically integrated exchange and L1. This, however, is already priced in its valuation—more than 10x that of Sonic. Since $HYPE’s price already reflects premium expectations, one could argue that valuation convexity favors Sonic when it comes to upside returns. Similarly, if the HyperEVM disappoints in onboarding dApps, it could face a short-lived “sell-the-news” event similar to Sonic’s initial dip right after launch. Hyperliquid’s community strength, driven by its founder Jeff, is another wildcard—while it has strong trader loyalty post-airdrop, Sonic could still differentiate by becoming the hub for novel DeFi primitives launched by Cronje.

Another chain and direct competitor that recently went live is Berachain. With its cult-like following and Proof-of-Liquidity model, it is proving that community-driven ecosystems can attract billions in TVL even before the chain is active. With $3B+ TVL and 200+ dApps, it is the liquidity leader among emerging EVM chains. Nonetheless, this is also driven by VC backing and future dilution. Sonic, by contrast, must rely on organic ecosystem growth rather than deep VC subsidies. The question is whether Berachain’s yield-fueled TVL is sustainable or if it will taper off when incentives inevitably decline. Sonic’s Fantom-era DeFi veteran base and focus on real utility could give it an edge in value accrual to the native token while both compete for long-term liquidity and user base retention.

Paradoxically enough, the main project that kickstarted the “high-performance parallel EVM meta”, Monad, is still in testnet (only recently launched, and it will take some time until they can go live and dApps can be deployed on-chain). With 10,000 tps and 1s time-to-finality, it is Sonic’s most direct L1 competitor. As with Berachain, Sonic holds the advantage of optionality and lack of dilution. Monad’s heavily VC-backed model means future token unlocks will introduce selling pressure—an overhang $S does not have. Similarly, we retain a lot of flexibility with $S by being able to freely enter/exit positions on the liquid market to adjust exposure based on $BTC moves and other potential macro risks and concerns. Therefore, while Monad remains in testnet, Sonic is already live with active DeFi adoption. One could also take advantage of a tactical pair trade down the road if $MON dips on launch and there is a chance to take advantage of the initial low float. That said, the market’s tendency to chase the “new shiny thing” could challenge Sonic’s lead unless it continues to execute aggressively. It is key to monitor this timeline to avoid being trapped in a position—the idea is to front-run capital rotation, not lag behind once competition is fierce and predicting winners gets harder.

The space is getting even more competitive as L2s enter the race, like MegaETH, which also remains a structural threat to Sonic’s positioning. Offering 1–10ms block times and 100,000+ TPS, it capitalizes on Ethereum’s security and liquidity, giving Ethereum-native projects a reason to stay within its ecosystem rather than migrate to a new L1. MegaETH is also cultivating a series of MegaETH-only projects that won’t be available on other EVMs, as they seek to take advantage of the chain’s real-time processing capabilities. On this topic, Cronje has openly advocated for a single, fast L1 over fragmented L2s, and Sonic’s unified app environment with native incentives is its counter-strategy. The challenge is whether Sonic can convince developers that a standalone L1 provides more long-term value than an ultra-fast Ethereum rollup.

So far there are a lot of unknown “unknowns”, but also a window of opportunity to use this uncertainty to our advantage. While Sonic faced a “sell-the-news” retrace post-rebrand, sentiment is rebounding as TVL continues its upward trajectory. If Sonic can sustain TVL growth while incentives normalize, it will indicate genuine stickiness, reducing its reliance on short-term liquidity boosts. The next 3–6 months will be crucial—Sonic must continue executing to solidify its market position before competitors like Monad and MegaETH fully launch. In the meantime, any sign of TVL erosion could signal trouble, as yield farmers are quick to rotate capital to new chains as soon as the rewards dry up.

Last Bullet Tradeoffs and Value Accrual Shifts

Sonic’s $S, formerly $FTM, underwent a 1:1 token migration and has a fixed max supply of 3.175 billion tokens, with roughly 90% already in circulation. Unlike many competing L1s that still face years of unlocks for early investors and team allocations, Sonic’s remaining emissions come almost entirely from staking rewards. By late 2025, token emissions will be minimal, removing concerns about dilution. This is one of Sonic’s biggest strengths: there is no large VC overhang or upcoming supply cliffs—what’s circulating today is essentially what the market must work with.

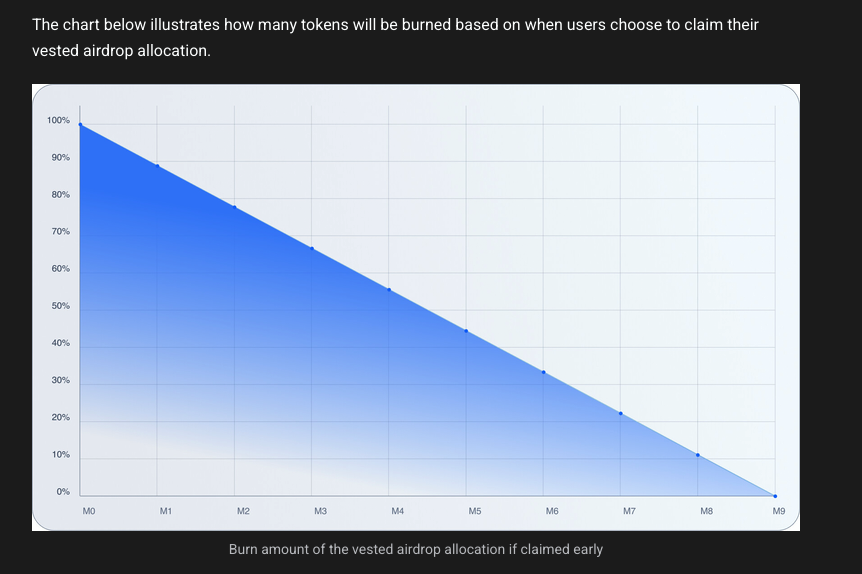

This might raise a critical point if there wasn’t much room left for major incentive programs. Many chains fuel their growth with aggressive token emissions, but Sonic is near full circulation. If this represents the ultimate solution for incentives, the ecosystem must now rely on organic growth to sustain itself. This would put pressure on Sonic’s ability to drive real adoption and on-chain activity rather than relying on artificial bootstrapping. Nevertheless, the current airdrop program allocates an additional 6% of the 3.175 billion supply to be minted and distributed 6 months after launch. After that, 47,625,000 tokens can be minted annually for 6 years to grow the team responsible for driving adoption, as well as implement onboarding and robust marketing campaigns. To guard against inflation, any unused tokens will be burned, ensuring that 100% of all newly minted tokens from this initiative are allocated toward network growth rather than being held by the treasury for later use.

There is also the Sonic Labs Innovator Fund, which allocates up to 200M $S to accelerate app adoption and support new ventures, focusing on infrastructure, compliance, cross-chain tech, and strategic partnerships, with backing from top industry investors and VCs such as Michael Egorov (Curve), Stani Kulechov (Aave), Robert Leshner (Compound), Tarun Chitra (Gauntlet), and Sam Kazemian (FRAX), as well as venture partners like Hashed, Signum Capital, and UOB Venture Management.

A key factor in Sonic’s tokenomics is its Gas Fee Distribution Model. Originally, 20% of transaction fees were burned, creating a direct link between network usage and token scarcity. However, with the Gas Monetization Program, up to 90% of fees can now be redirected to dApp developers. While this rewards builders and incentivizes application growth, it also reduces direct value accrual for passive token holders. Instead of burning supply aggressively, Sonic’s model redistributes value to developers in hopes of compounding adoption.

For investors, this means $S is not purely a deflationary asset like ETH post-EIP-1559. Instead, its success is directly tied to transaction volume and dApp usage. If Sonic attracts high-quality applications that drive sustained demand for gas, this model could lead to strong network effects and long-term price appreciation. But if adoption stalls, the token lacks a built-in mechanism to sustain value purely from supply-side reductions.

Regardless, Sonic employs three key burn mechanisms to counterbalance inflation and enhance token value over time. First, the Fee Monetization Burn permanently removes 50% of gas fees from transactions on dApps that don’t participate in the developer rewards program. Second, the Airdrop Burn reduces the circulating supply when users opt for early airdrop claims, forfeiting a portion of their tokens. Third, the Ongoing Funding Burn ensures that any of the 47.6M $S tokens allocated annually for growth but left unused are automatically burned instead of retained. These mechanisms help offset emissions, creating a deflationary effect that strengthens $S’s long-term supply dynamics.

Another optimistic note is that Sonic not only inherits the existing Fantom ecosystem, but also augments it with new projects drawn to its improved execution model. The upcoming launch of Andre’s new primitives can prove to be inspirational and unlock new innovation by building on top of his projects. At present, the rebrand has reignited developer interest and capital inflows, making Sonic an increasingly attractive base for DeFi innovation. Our viewpoint is that the momentum can persist without further major emissions at the L1 level. Most foundations distribute token incentives and grants to incentivize builders, but Sonic already has those incentives built-in at the chain level with the gas monetization program. As more projects enter the ecosystem, each with its own token, that already leads to yield opportunities that don’t necessarily require oversized emissions at the L1 token level.

Ultimately, buying $S is a bet on ecosystem growth rather than tokenomics-driven scarcity. The near-complete circulation of supply eliminates major unlock risks, but Sonic must now prove it can generate sustainable usage to onboard builders. Success will depend on whether developers stick around, whether liquidity remains, and whether Sonic can maintain its competitive positioning in the increasingly crowded high-performance EVM market.

Yield-Dependent Sentiment and Fleeting Loyalty

The Layer-1 premium that once existed is no longer a given. Even less so if you are an EVM-compatible chain. “Ethereum but cheaper and faster” is no longer a unique selling point. New chains, whether they are L1s, appchains, or L2s, must now fight harder to justify their valuations. Sonic’s biggest challenge is retaining liquidity and attracting developers to foster a resilient ecosystem—the switching costs of moving code from one EVM to another are very low, and bridging assets is now a frictionless process for the end user.

Currently a major risk is Sonic’s reliance on DeFi yields to sustain sentiment. For instance, consider how certain chains like Berachain have built their entire model around liquidity. If users find better risk-adjusted yields elsewhere, Sonic could struggle to maintain capital inflows. The ease of migrating between EVM-compatible chains makes it frictionless for users and builders to chase the next best incentive structure. Many of the builders who once backed Fantom in 2021 pivoted to Ethereum L2s—there’s no guarantee they won’t do the same again if incentives fade.

For many, another concern is the key-man risk around Cronje’s charismatic figure. While Sonic now has a more structured leadership team (Sonic Labs, Sonic Foundation), the market still sees Cronje as the key figure. Currently, high expectations surround his new projects, but failure to meet these expectations can lead to disappointment.

Nonetheless, the primary concern is that Sonic faces the risk of becoming outdated in crypto’s fast-moving narrative cycle. Right now, Sonic has a “first-mover” advantage in the high-performance EVM category, but chains like Monad and MegaETH will soon launch with massive incentives and flashy tech claims. As the broader market shifts its attention, Sonic could quickly be seen as “yesterday’s trade.” This is particularly dangerous in a space where hype and liquidity rotate aggressively.

Finally, Layer-1 rotation remains a persistent risk. Capital and users frequently chase the highest incentives and trendiest narratives, then move on. If Sonic fails to maintain momentum, it could suffer the fate of many past L1s—initial excitement, short-lived TVL spikes, and then gradual decline as liquidity migrates elsewhere. We already saw this in the $FTM chart.

A Strong Narrative, But Can It Last?

Sonic’s price action in early 2025 tells a familiar story: initial excitement, a “sell the news” retrace, followed by a strong rebound as sentiment improves. We saw the same thing with $BERA. Liquidity conditions are favorable—$S is a top-50 market cap asset, with hundreds of millions in daily trading volume and listings on major exchanges, making it easy to scale in or out of positions. For now, that’s a critical advantage in a market where liquidity dictates opportunity.

Andre Cronje is a double-edged sword, but for now we lean into the side of believing that his new primitives will serve as a positive catalyst. Meanwhile, we will closely monitor liquidity rotations and anticipated market launches. This makes having a clear exit strategy essential—whether it’s TVL trends, ecosystem adoption, or a shift in sentiment, knowing when to take profits is as important as the entry.

Structurally, Sonic’s ecosystem is in a strong growth phase, reminiscent of early Fantom but with a more strategic approach. Key DeFi infrastructure (DEXs, lending, stablecoins) is live and gaining traction. TVL and trading volume suggest that liquidity isn’t just coming from incentives—it’s finding real usage. Developer activity is robust, fueled by a mix of improved technology, financial incentives, and Sonic’s fast-execution edge.

However, this is a race, not a guaranteed success story. Sonic must compete with Sei, Monad, Hyperliquid, and Ethereum’s L2 stack—each offering their own innovations and aggressive incentive programs. The burn mechanics and gas incentives help differentiate $S, but ultimately, Sonic’s success depends on sustained developer adoption and growing transaction volume.

Sonic has momentum—a strong rebrand, Cronje’s return, rising TVL, and deep liquidity. But competition is relentless, and developer loyalty is fragile. This is a high-upside trade if adoption continues, but watch for signs of exhaustion—if growth stalls or sentiment shifts, liquidity will rotate elsewhere fast.

Execution on this position can make or break how much juice you extract out of it. You don’t want to find yourself in a position chasing green candles, but the most recent strength shouldn’t be ignored. It seems reasonable to expect a retrace and small correction, giving an opportunity to scale in while sentiment is warming up but not as euphoric. Once in, the key is to track ecosystem metrics and use any sign of liquidity rotation or TVL erosion as the exit alarm. Strength can symbolize validation of the thesis, but strength also attracts crowded positioning. This is a trader’s market, not a holder’s paradise. Extract your value before narrative rotation does it for you.

Disclosures

Alea Research has never had a commercial relationship with Sonic and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.