Introduction

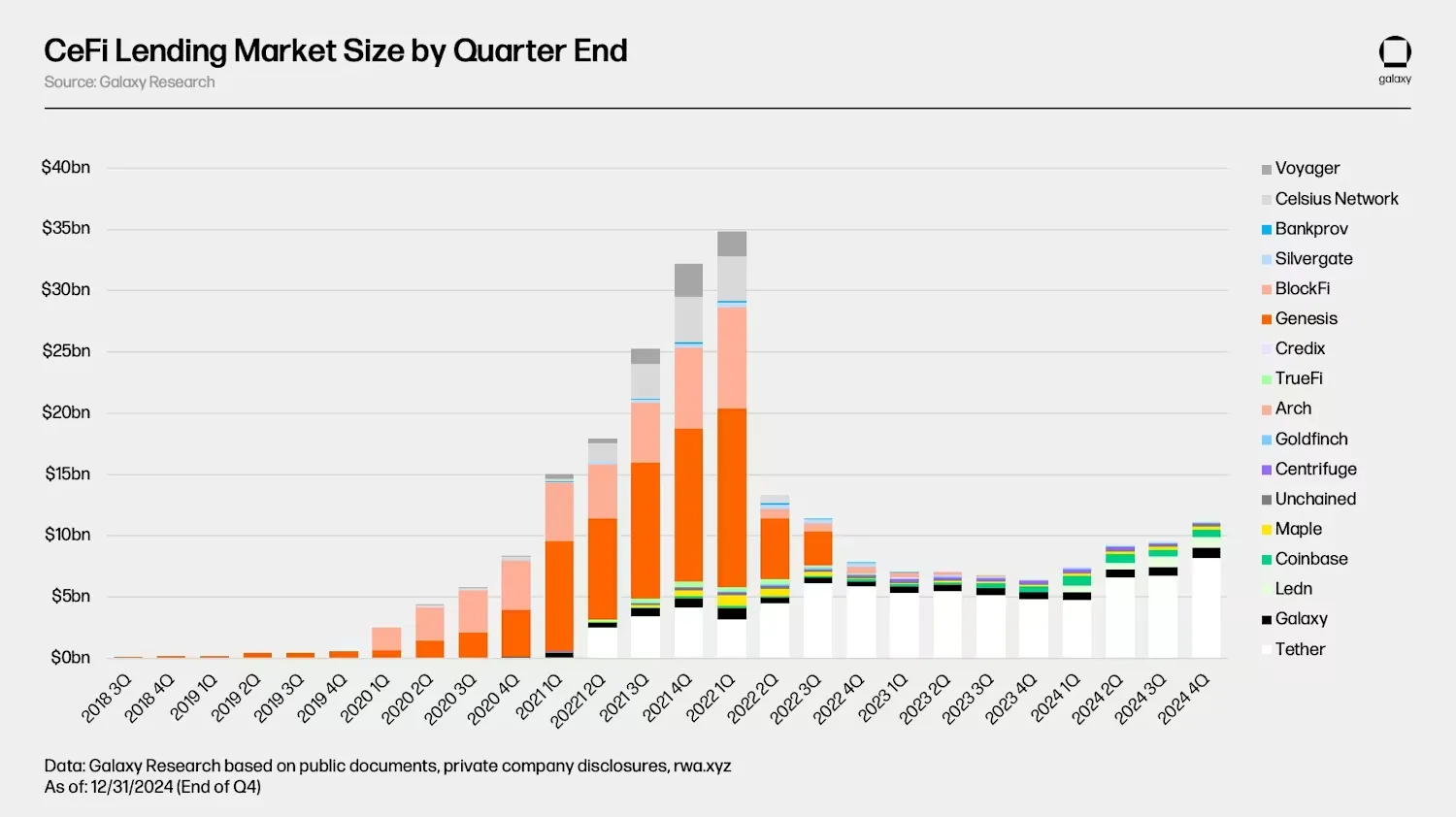

Institutional lending has been an afterthought after the fall of all major issuers in the space, including Silvergate Bank, Genesis, Blockfolio, and Celsius, as well as their high-profile borrowers such as Alameda Research and 3AC. The total market size of institutional lending in crypto today is just a third of what it was at its peak.

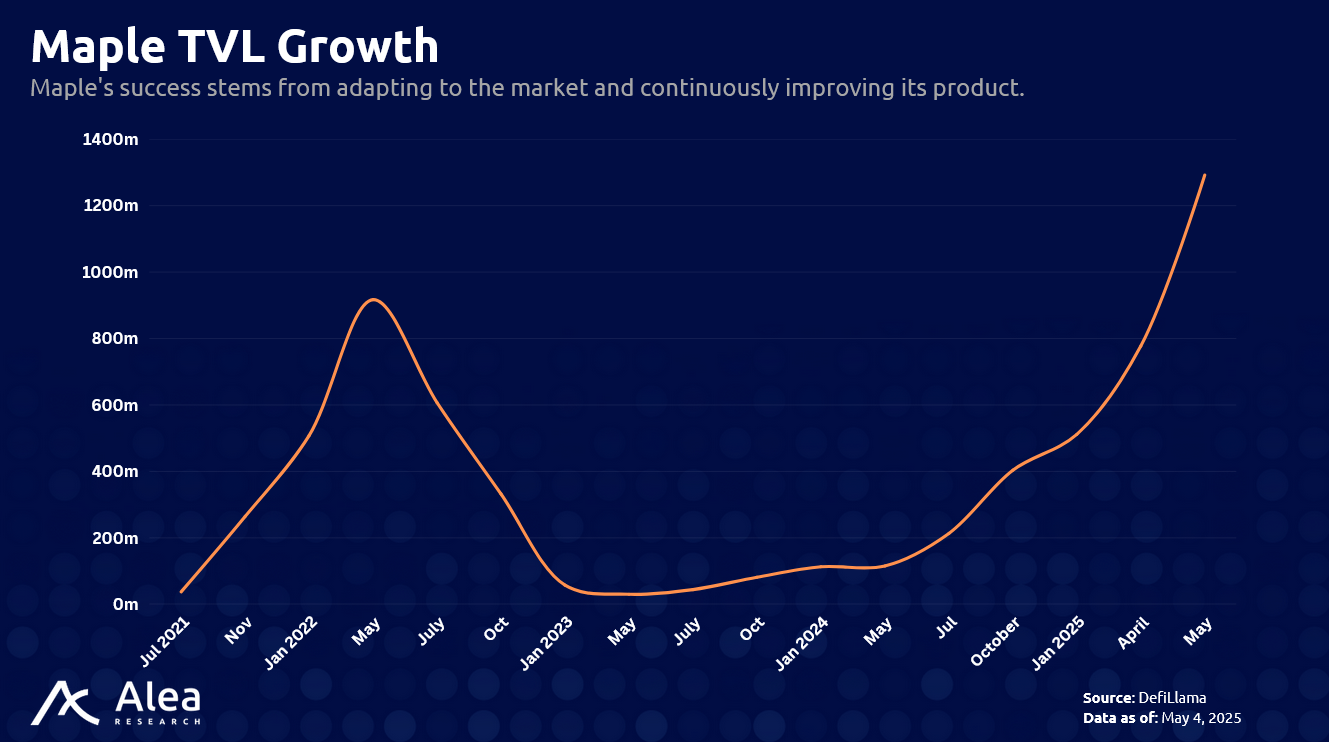

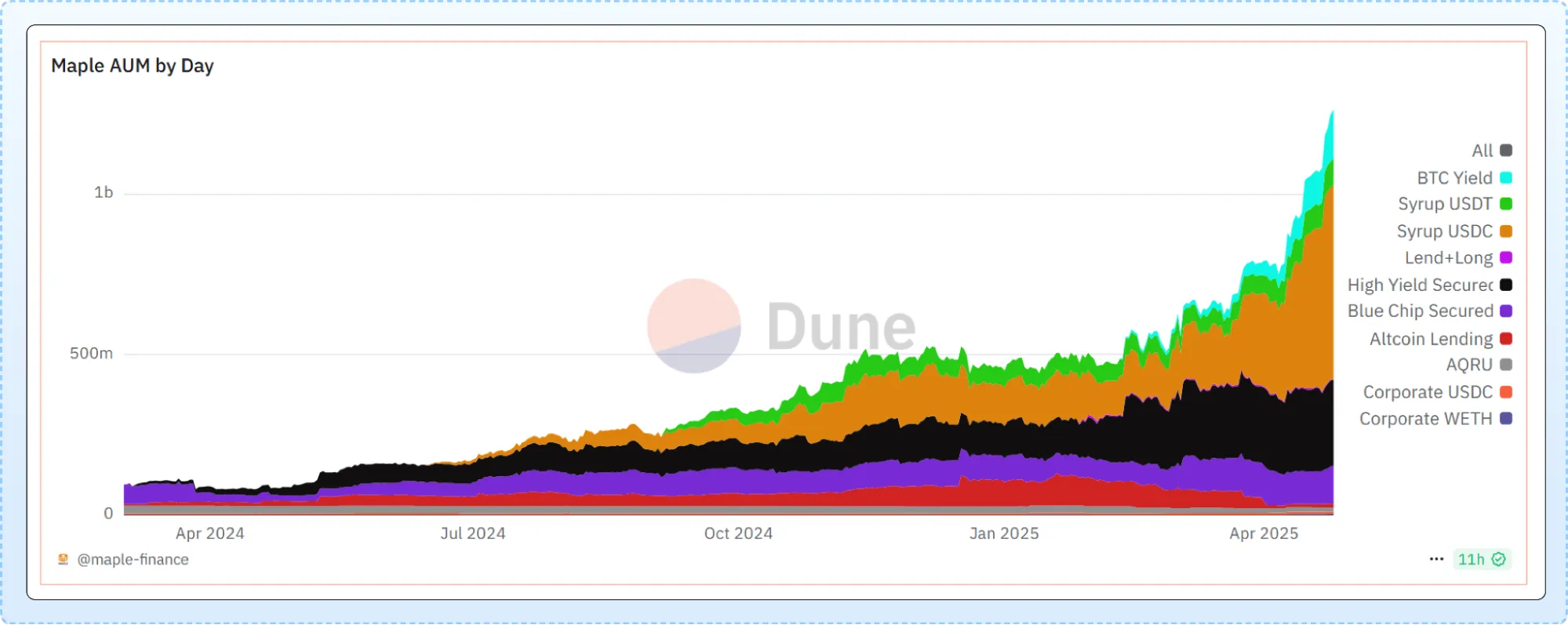

However, momentum is returning, both in terms of actual flows into the sector as well as pledged interest and investment from key institutions outside of crypto. Maple dominates the onchain institutional lending space, but decentralized protocols make up just 7.5% of the total $12B institutional lending sector, leaving a lot of room for growth. $SYRUP, Maple’s native token, stands out as the primary vehicle to get liquid token exposure to onchain institutional lending. Maple has outlived its centralized competition, reaching $1.27B in TVL, the only decentralized institutional lending platform of this magnitude.

The state of institutional lending in crypto is changing, with more attention and capital flowing through decentralized protocols rather than centralized intermediaries.

This is where Maple shines, sourcing capital from retail and institutions alike, while smart contracts facilitate the permissioned borrowing process. Maple’s native token, $SYRUP, is the best option to get liquid exposure to the growth of the decentralized institutional lending sector.

Besides fundamentals, investors must also weigh supply dynamics and tokenomics against the upside of institutional lending and Maple’s strong TVL growth. 9% of the $SYRUP supply has gone unclaimed, reducing the maximum supply and giving $SYRUP a marketcap/FDV ratio of nearly 90%. This leaves annual inflation as the only source of net issuance. Investors also have to consider unclear value accrual mechanisms in their judgment of $SYRUP.

Key Takeaways

- $SYRUP is one of the few liquid bets with the fundamentals to bet on the growth of institutional lending.

- Maple is the largest player in the decentralized institutional lending space, offering both permissioned and permissionless options for sourcing loans.

- With $533M in loans outstanding, Maple is the 5th largest player overall in the institutional lending space, competing with large centralized players like Tether, Galaxy, and Coinbase.

- Maple and Syrup both continue to ink large deals with institutions and protocols alike, including Bitwise and Spark, increasing TVL and building brand recognition.

- Lack of value accrual to $SYRUP acts as a headwind for what is otherwise a strong fundamental bet on a sector monopoly holder.

Maple’s Evolution

In 2019, Maple began being developed by Melbourne-based Co-Founders Sidney Powell and Joe Flanagan, both of whom have strong backgrounds in TradFi and the Fintech space. The idea behind Maple was to provide undercollateralized loans. Manual verification of applying borrowers is what made this all possible.

Both coming from non-technical roles in finance, Maple’s Co-Founders instead looked to outsource core protocol functions, including the development of the protocol. Understanding the level of scrutiny needed to maintain protocol integrity, Maple introduced pool delegates. This would allow experienced institutions with the proper risk management and due diligence departments, including Maven11, among other organizations, to create and underwrite loans on the Maple platform. Due diligence would be conducted off-chain, and money would exchange hands on-chain, an ideal balance which involves human judgment and execution only where necessary.

In May 2021, Maple V1 came to market on Ethereum mainnet. This was nearing the prime of institutional lending in crypto, giving enough runway and demand for capital from institutions, two important ingredients that enabled Maple to find its initial success.

In Q3 & Q4 of 2022, Maple narrowly escaped insolvency during the crypto lending bubble burst, which saw every major centralized lender in crypto go bust. A default involving Orthogonal Trading resulted in over 30% of active loans on the platform being defaulted on. Lessons learned give the leadership and risk management team at Maple Finance, a level of experience that can only be obtained by going through periods of crisis.

In December 2022, the team launched Maple V2, the foundation for the protocol’s success today. V2 builds on risk management pain points felt with V1 during the lending collapse in 2022. V2 introduced several features, including a continuous withdrawal queue instead of 30-day liquidity lockups, as well as the ability for delegates to declare immediate repayment if they suspect a borrower is at default risk.

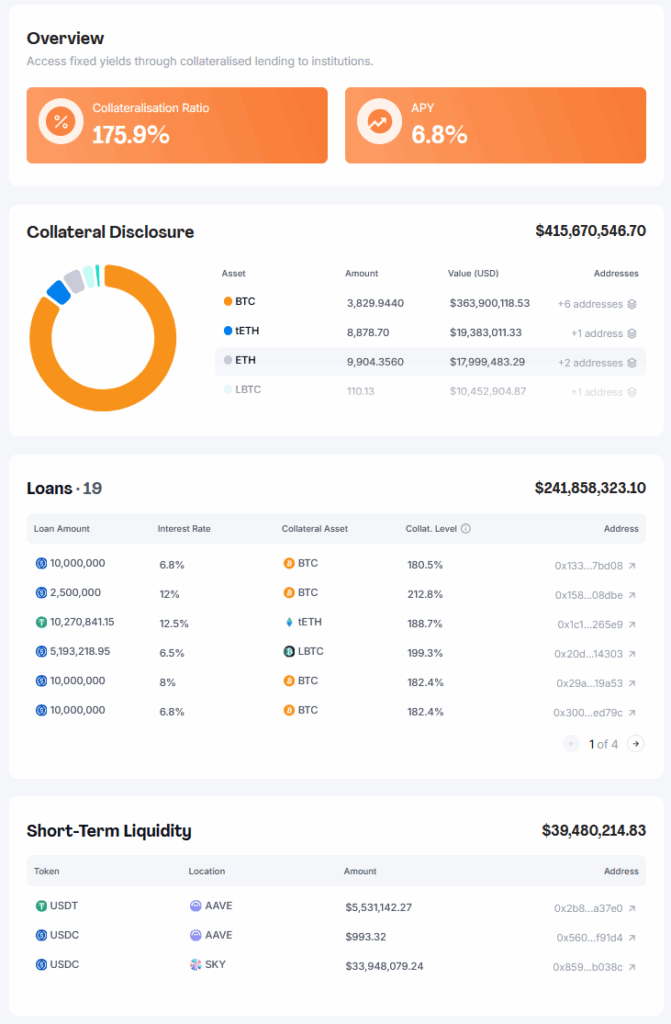

The most important change with Maple V2 is its shift to short-duration overcollateralized lending, a major shift from the undercollateralized model previously used. Partnering with qualified custodians, including BitGo, Anchorage Digital, and other solutions already used by institutions, borrowers are easily able to verify their collateral assets. There is still custodian risk, which impacts most institutional activities in crypto outside of Maple as well. The two largest pools on the platform, the High Yield and Blue Chip overcollateralized pools, hold an average LTV ratio of 244% with ~$250M worth of collateral.

In June 2023, Maple Direct was launched, serving as Maple’s own internal lending arm. This mostly eliminates delegate risk, as seen with several defaults on the platform in 2022 that could have been mitigated with more thorough due diligence. Today, Maple Direct is the delegate for nearly 99% of loans outstanding on the platform.

Introducing Syrup

Syrup funnels capital from onchain lenders who may not meet Maple’s accredited investor qualifications into Maple Direct for loan origination. Syrup was launched on May 28, 2024 as a permissionless way to increase distribution. KYC’d lenders go through Maple while DeFi users are free to lend through Syrup. Both of these distribution channels are united through the native $SYRUP token, a migration from Maple’s original $MPL token.

Maple operates its permissioned lending business as an onshore U.S. entity. A separate protocol with an offshore legal structure was created for permissionless lending, targeting a retail user base through DeFi without KYC. Ideal users would be interested in earning higher yields than what could be earned on Aave and other lending platforms.

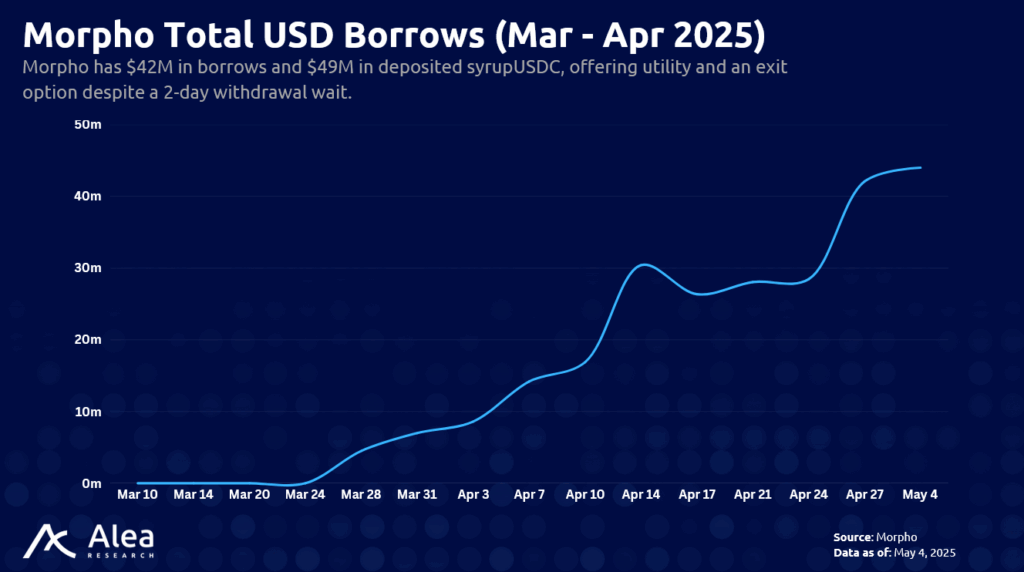

On Syrup, onchain users can access rates of 10%+. Lenders on Syrup also receive syrupUSDC or syrupUSDT, liquid receipt tokens representing their deposits. syrupUSDC is the dominant stablecoin of the two, with $607M in TVL compared to syrupUSDT’s $83M. Users can earn additional yield on syrupUSDC via platforms such as Pendle, Morpho, Uniswap, Equilibria, and Aave.

Besides offering stacked yields, syrupUSDC integrations also provide liquidity for users to manually swap to other assets, rather than being forced to wait in the withdrawal queue. Currently, syrupUSDC trades at a 9% premium. This premium could flip to a discount if the withdrawal queue were to increase; current withdrawal time is 2 days. There is ~$10M in Uniswap’s syrupUSDC – USDC pool for over $600M in syrupUSDC liquidity.

Users are incentivized to lock up their deposits for longer to earn more Drips, which are basically points that can be converted to liquid $SYRUP tokens. This can add up to 3.5% in additional rewards, depending on whether users opt to lock their deposits or not.

While specific lending practices and procedures differ and are segmented from the capital provided on Maple, liquidity on Syrup is also managed by Maple Direct. Retail users are able to get access to the underwriting and risk management of Maple in a permissionless manner, without the manual KYC and signup process required for the institutional platform.

Comparing Maple & Syrup:

| Feature | Maple Institutional | Syrup |

| Who can lend? | Accredited Investors & institutions | Anyone |

| APY | 6-12% depending on pool | ~7% base excluding <3.5% Drips earnings & additional yield |

| Withdrawal | Continuous Withdrawals | Queue (currently 2 days) |

| Overcollateralized? | Varies by pool | Yes (~175%) |

| Delegate? | Maple Direct & Others | Maple Direct |

Maple and Syrup serve as different funnels for liquidity, which is lent out to borrowers after undergoing due diligence and presenting collateral. These borrowers are made up of institutions and funds like Circle, Blocktower, and others. They are able to source loans with sufficiently low repayment rates. At ~5-10%, depending on the pool, these rates are low enough to give a sizable buffer for generating returns and repayment. Firms can potentially earn double or triple the rate paid with borrowed capital, and these borrowing rates are lower than what is available on other lending protocols.

Maple and Syrup provide optionality for different types of lenders, allowing the protocol and the institutions it serves to source yield from two separate pools of capital. This is a win-win for all parties involved: Maple is able to facilitate more loans, borrowers can access more capital, and all interested lenders are able to earn yield.

Tokenomics

SYRUP’s biggest overhang is net token issuance that still exceeds protocol buy-backs. The main drawback with Maple is its tokenomics, which were sacrificed in a bid to survive during the 2022 crypto lending crisis. $SYRUP came about as a way to get around the fixed supply of Maple’s original token, $MPL, and provide funding for the team. 100 $SYRUP was minted for every $MPL, with additional tokens added on top according to an inflation schedule.

$SYRUP has a circulating supply of ~936M tokens and a maximum supply of ~1.2B. ~88.5% of $MPL migrations have taken place, with the migration window recently closing, on April 30. Taking this into account, the maximum $SYRUP supply was reduced by 9%, leaving only token inflation. $SYRUP has a 5% annual inflation rate, ending in September 2026.

Token buybacks assist in netting out some of the anticipated sell pressure from $SYRUP supply increases. Currently, 20% of protocol revenues are directed toward $SYRUP buybacks.

$SYRUP tokens acquired via buybacks are distributed to stSYRUP stakers. There is no lockup for $SYUP stakers and no vesting for $SYRUP staking rewards. Compared to a buyback-and-burn mechanism or a buyback program that accrues purchased tokens to the team’s treasury, $SYRUP’s buyback system rewards active stakers more than token holders.

This current buyback mechanism was chosen by the community and can potentially be revised for Q2, 2025. The team has also vaguely discussed the possibility of distributing revenues in stablecoins or some other vehicle, but nothing can be assumed at this point in time.

There is roughly 45M new $SYRUP (5% inflation) minted annually. Current annualized revenues come out to $7.9M, 20% of which ($1.58M) would go toward buybacks. At current prices, this comes out to just 9.1M $SYRUP tokens. In Q1, token buybacks from revenue share amounted to just $235K. Even assuming revenue growth and continuation of the Q1 20% buyback mechanism, these buybacks are not sufficient to be a core pillar of the thesis for $SYRUP.

Increasing revenues allows the team to pay their expenses, which are reported as ~$6M per year. With current annualized revenues after accounting for buybacks coming out to $6.3M, the team is able to operate without having to sell $SYRUP, assuming revenue doesn’t contract. This can eliminate internal sell pressure entirely, making $SYRUP much more attractive, especially now that $MPL migrations are complete. With a marketcap/FDV ratio of 89%, and decreasing sell pressure, $SYRUP’s supply dynamics are not perfect but improving with time.

Right now, 50% of the circulating $SYRUP supply is staked, earning 2.5% APY currently, consisting of $SYRUP buyback distribution as well as 20% of new issuance. There is no lockup, users can withdraw their staking rewards and their principal $SYRUP position at any time.

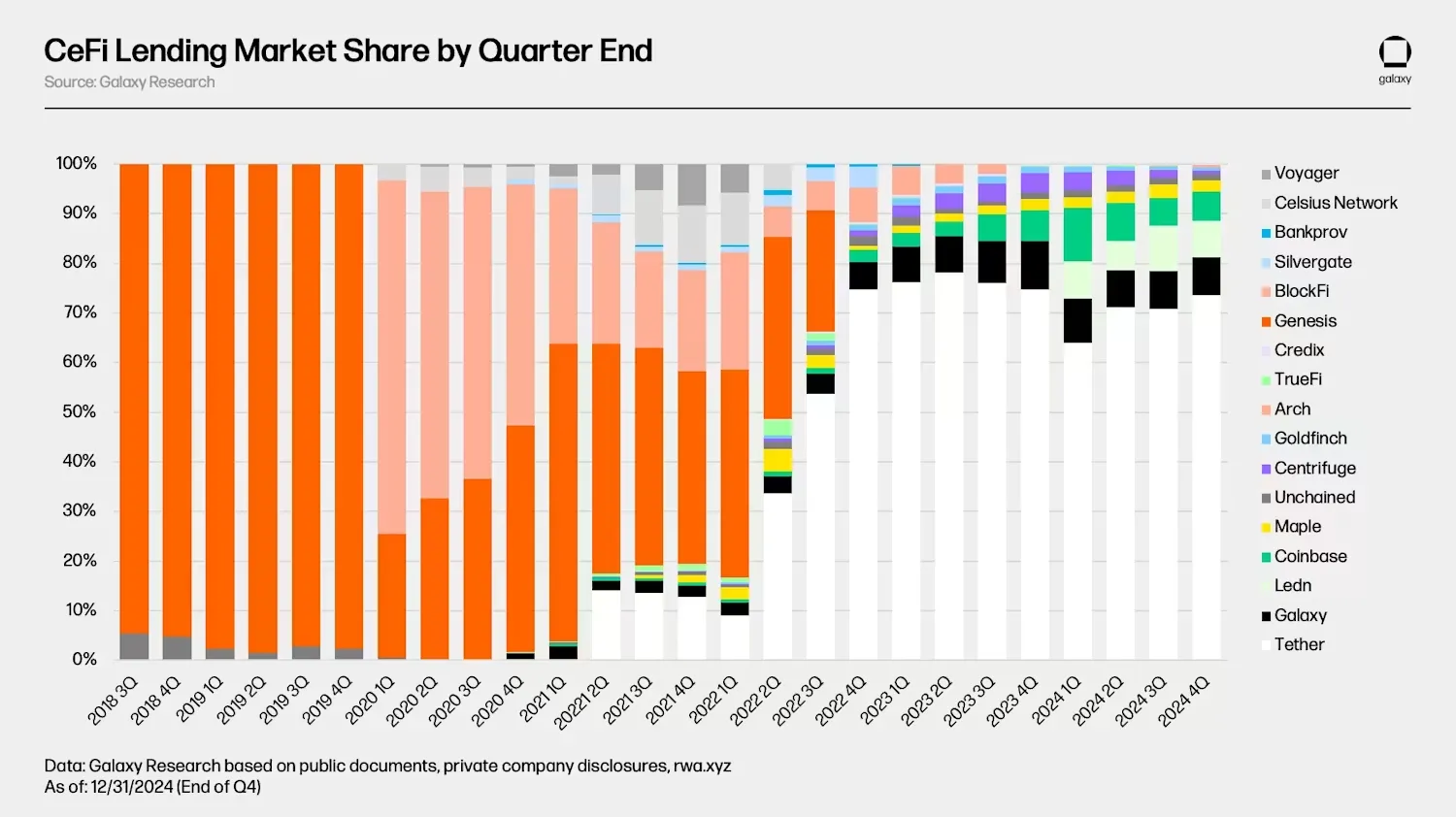

State of Institutional Lending

After the 2022 wipe-out, crypto credit shrank from $35B to just $6B. Virtually every major lender in crypto went bust, including Silvergate Bank, Celsius, BlockFi, and Genesis. The CeFi lending space has since undergone a drastic transformation.

The top three lenders in the space today, Tether, Galaxy, and Led, account for 89% of market share, with Tether alone accounting for 73% of the market. This concentration is greater than what existed in Q1, 2022 between Genesis, BlockFi, and Celsius (76%). Maple is by far the dominant decentralized lender in the space, while onchain peers like Goldfinch ($65M TVL) and Clearpool ($52M TVL) are an order of magnitude smaller.

While institutional lending still stands at just ⅓ of its ATH market size, a clear trend upward over the past several quarters can be observed. Lending is very sensitive to market conditions; growth halts when markets are choppy and range-bound, as observed in Q2 and Q3, 2024, and Q1, 2025. Monitoring this market, which is distinct from and less transparent than the DeFi lending market, will be crucial for forecasting Maple’s success.

Even while Q1 was rocky for crypto, RWAs and the institutional lending space in particular were able to see momentum from TradFi giants that may be less sensitive to monthly or even quarterly drawdowns compared to their crypto counterparts. On January 30, Apollo Global Management recently launched a tokenized private credit fund in partnership with Securitize, the protocol also responsible for rolling out BlackRock’s BUIDL fund. The Apollo Diversified Credit Securitize Fund (ACRED) basically offers tokenized access to the pre-existing Apollo Diversified Credit Fund, which contains ~$1.2B in managed assets.

Securitize x Apollo – Tokenizing Private Credit & Expanding On-Chain Finance

Today, we’re announcing a major milestone in on-chain private credit.

Securitize has partnered with @apolloglobal to launch the Apollo Diversified Credit Securitize Fund $ACRED, bringing tokenized… pic.twitter.com/DuM6yvADRC

— Securitize (@Securitize) January 30, 2025

Apollo’s reasoning for making this move comes down to facilitating an efficient and more timely redemption process and increasing accessibility to both institutional and accredited investor capital. This same logic applies to most firms that would be interested in these sorts of products.

A lot of what is driving demand from institutions to roll out onchain products comes down to access to capital. Just last week, the Fed removed some of its previous guidance for how banks should treat crypto. Previous guidance in place advised TradFi institutions to seek approval from regulators and approach crypto with caution. Monitoring interest from large TradFi institutions and any regulatory easing will be important to assess the growth potential of onchain institutional lending.

The onchain environment provides a means of getting access to capital that is more efficient than traditional finance rails. This demand driver expands beyond the tokenization of existing funds and into the realm of procuring new capital through DeFi, exactly where Maple Finance operates.

Maple Thesis

$SYRUP is the primary vehicle to get liquid exposure to institutional credit, with strong fundamentals and growth. Large firms that are much more well-capitalized than Maple are not currently looking to compete in the institutional lending space. Maple is by far the largest onchain institutional lender, making up 85% of this market compared to other Goldfinch and Clearpool.

Maple is continuing to grow its market share, competing with centralized crypto lenders while TradFi institutions focus on tokenized funds and other onchain products. If this pace continues, Maple will be able to position itself so that by the time TradFi eyes onchain institutional lending, Maple is able to leverage its existing relationships and brand value to sustain growth.

On March 6, Maple announced a partnership with Bitwise, a top crypto asset manager with $12B+ in AUM. The size of Bitwise’s allocation into Maple is unknown, but this marks Bitwise’s first institutional DeFi allocation, looking for onchain exposure to flexible credit. This highlights Maple’s position, serving as the primary point of contact for institutions, crypto-native or not, looking to access onchain credit while maintaining strict compliance standards.

Institutional adoption of on-chain credit is here.@BitwiseInvest, a premier asset manager with $12B+ in client assets, has made its first institutional allocation leveraging DeFi through Maple.

The future of finance is on-chain. Full press release below ⬇️ pic.twitter.com/vmr6D1yOLt

— Maple (@maplefinance) March 6, 2025

Recently, Maple announced the onboarding of another large player, Spark. Spark deployed $50M and was impressed with Maple’s quick turnaround time to get the capital lent out, leading to Spark allocating another $50M into the protocol. The Maple team places an emphasis on being able to quickly onboard institutional borrowers and large lenders.

Spark is expanding to institutional lending.

With the allocation of $50M into @maplefinance's SyrupUSDC giving Spark access to overcollateralized offchain & onchain lending.

And making it one of the largest DeFi allocations with the potential to scale to $100M.

Dive in 👇 pic.twitter.com/UiOdcfHef3

— Spark (@sparkdotfi) April 15, 2025

If demand for institutional credit grows, more partnerships like the two mentioned above will crop up. Besides driving protocol TVL and revenues higher, this can build brand reputation for Maple.

On March 12, Maple announced its BTC Yield product. This product earns yield for depositors not through lending but via staking, powered by Core DAO’s $BTC PoS layer. Just as multiple products have emerged to serve demand for generating yield with idle stablecoins, this can be done with $BTC. $BTC is held in large quantities by institutions and crypto company treasuries and is often used as a benchmark for funds.

The Maple team’s self-stated goal is to reach $ 1 B+ in $BTC AUM by the end of 2025. As of April 17, the protocol disclosed nearly 1,000 $BTC in allocations to the Core staking strategy, closing in on $100M in deposits. Maple is currently expanding on this $BTC yield product, tokenizing it in the form of an LST. For depositors, this process will look similar to using the existing yield product, but investors will be able to mint a tokenized representation of their staked Bitcoin, lstBTC. lstBTC provides more optionality for institutional Maple depositors and more opportunities for DeFi protocols to integrate lstBTC, similar to syrupUSDC.

Of the tier-1 exchanges, $SYRUP is currently only listed on Coinbase. More tier-1 token listings for $SYRUP can serve as a catalyst. Programs like Binance’s vote-to-list might make it more likely for an established and in-demand protocol like Maple to have its token listed.

Timing & Positioning

With $MPL to $SYRUP migrations having closed on April 30, the circulating supply drops 9% overnight. This supply reduction leaves ~120M in scheduled emissions through Sept 2026, presenting an opportunity to take a position now that the largest source of supply overhang has been removed.

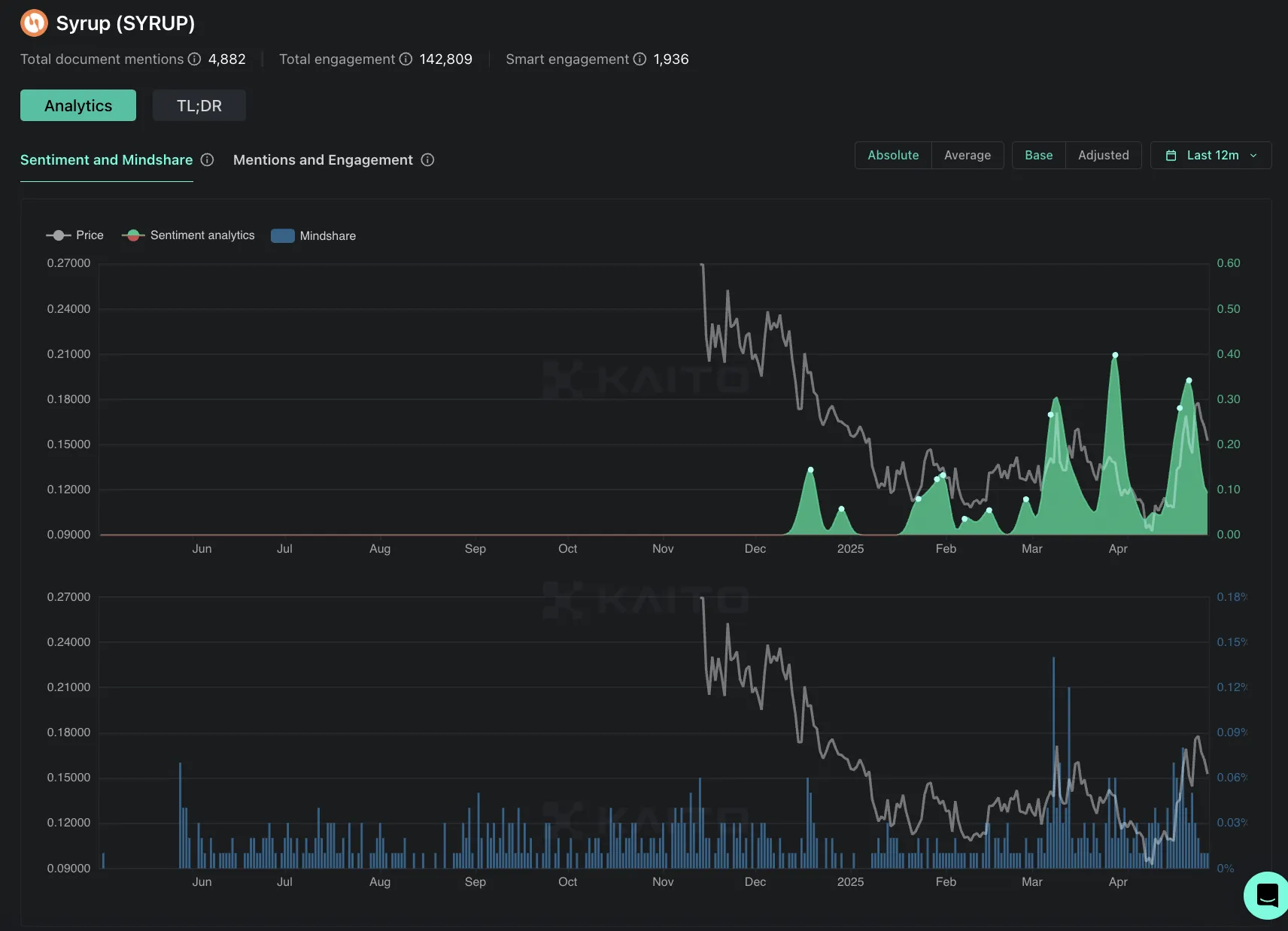

Throughout its short history, $SYRUP has mostly traded in a relatively tight range in terms of marketcap (~$80 – $120M), with price grinding lower due to increasing supply. Recently, $SYRUP broke out of this range, reaching a peak marketcap of $185M.

Prior to this breakout, $SYRUP’s price held up well while market tumbled in Q1. $SYRUP has held up very well since tariffs began to weigh on markets. The token is up 45% since Trump’s Inauguration Day, which marked the Q1 top of the market.

$SYRUP’s price action in 2025 shows an increase in demand at the previous range, while price action hasn’t gotten frothy yet. This strength also provides somewhat of a cushion, as it can be inferred that macro conditions might have to meaningfully worsen for $SYRUP to break below its lows of ~$0.09.

In 2022, $SYRUP reached a peak marketcap of $300M, when the protocol was about to break the $1B TVL milestone.

Having reached nearly $1.3B in TVL today and with the team inking key partnerships and rolling out new products, there may be more momentum this time around. $SYRUP trading past $300M could be a sign to reevaluate the protocol and make sure that price has not become disconnected from performance.

Markets have rallied recently, but a broader reversal is always possible. $SYRUP dipping significantly below the ~$80M marketcap range (~$0.085) might suggest that there is more than just simple unlock sell pressure. This would be a good place to derisk. Should macro factors indicate that there might be several months before a meaningful recovery can be found in TradFi and crypto markets, it might be wise to derisk and avoid further pain, looking to re-allocate further down the line.

Additionally, there is only ~$5M in daily trading volume

Conclusion

Maple’s edge lies in its in-house underwriting desk (Maple Direct) and multi-channel distribution targeting both institutional and retail lenders. After $MPL to $SYRUP migrations halted on April 30, $SYRUP’s maximum supply has decreased ~9%, providing an opportune time to take a position. The fundamentals behind $SYRUP are strong, with the token now representing an ecosystem competing with the largest centralized lenders, including Tether, Galaxy, and Coinbase. With token value accrual still unclear, monitoring the institutional lending landscape and Maple’s role within will be key while maintaining a position in $SYRUP.