The Solana Kingmaker

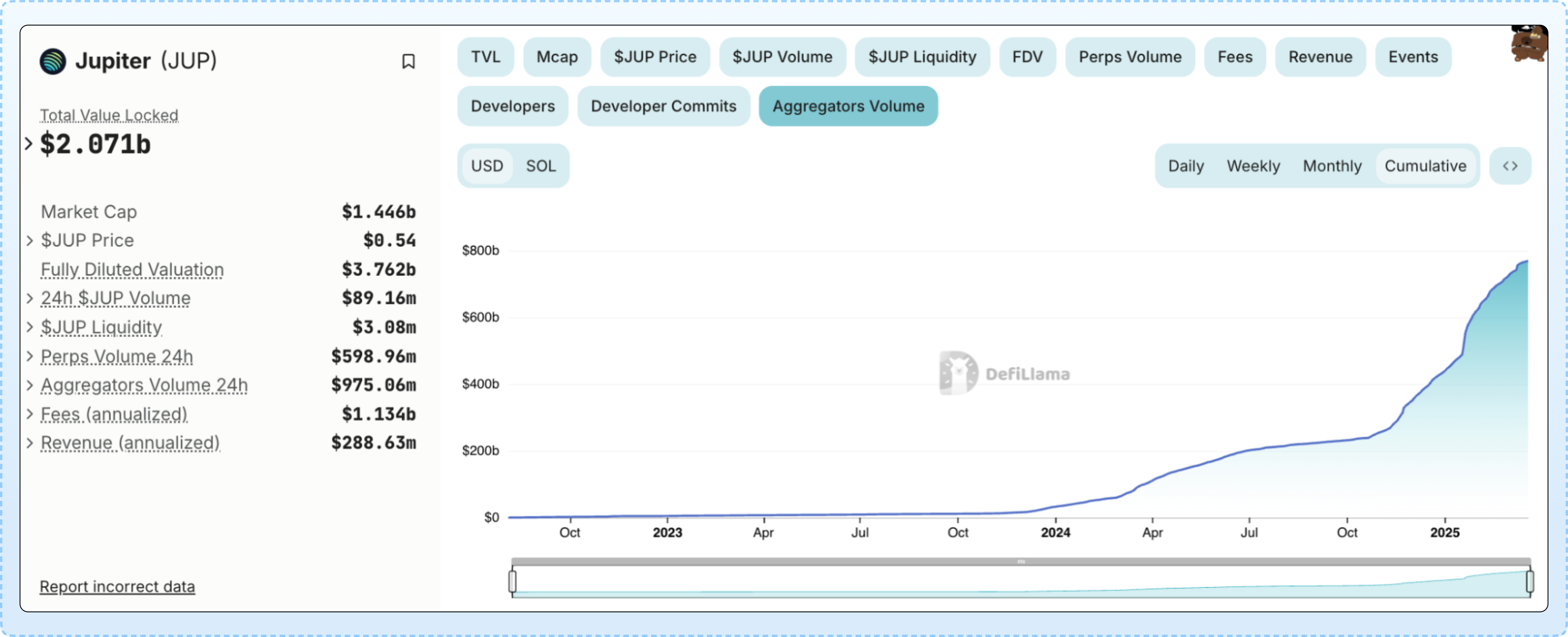

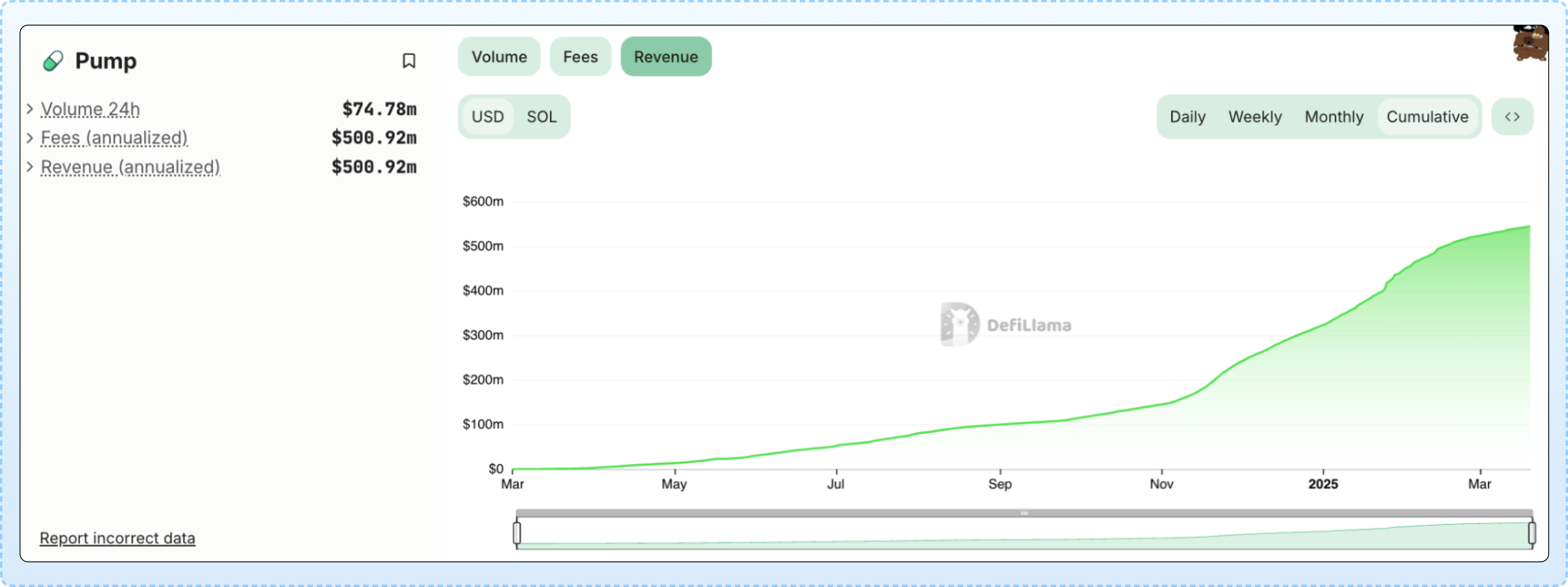

$JUP stands out as the best leveraged play on $SOL, acting as the main proxy for beta to its ecosystem. It is the most used, recognized, and established protocol in Solana, and that’s because it has built a true moat. A combination of market conditions and negative sentiment around a DAO vote over $JUP team allocations has resulted in the $JUP price falling to the lowest price it has ever seen. With upcoming catalysts like Jupiter’s omnichain Jupnet and the Solana ETFs on the way, now is a good time to position at the lows. $JUP’s current depressed price certainly doesn’t represent the broad distribution that Jupiter has been able to build through its intuitive UX and product expansion. With current annualized fees sitting at over $1.2B, Jupiter’s fee-generating capacity now dwarfs that of Pump.Fun ($547M). What’s more is that Jupiter has a liquid token and a buyback program allocating ~$160M in buy pressure annually toward $JUP.

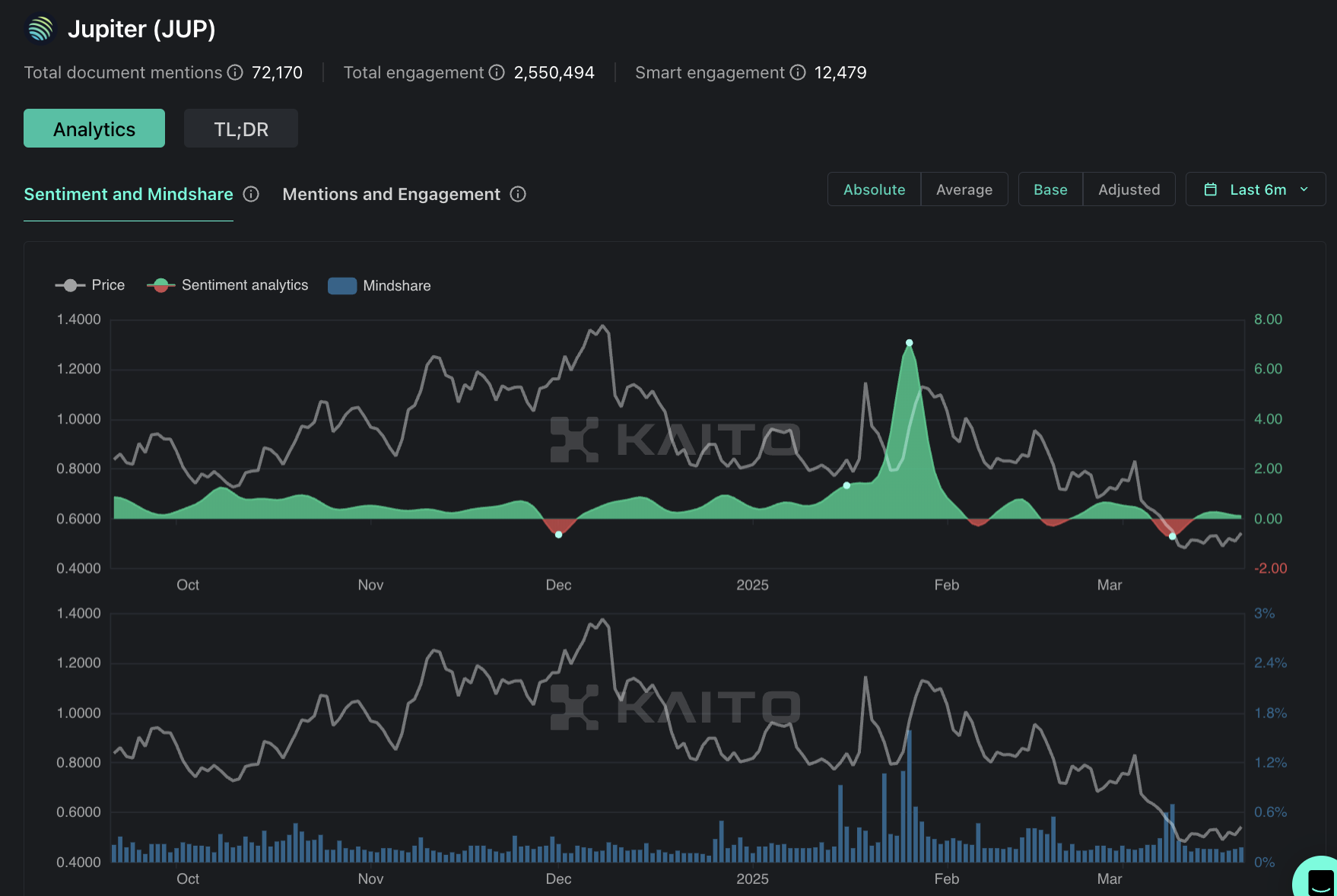

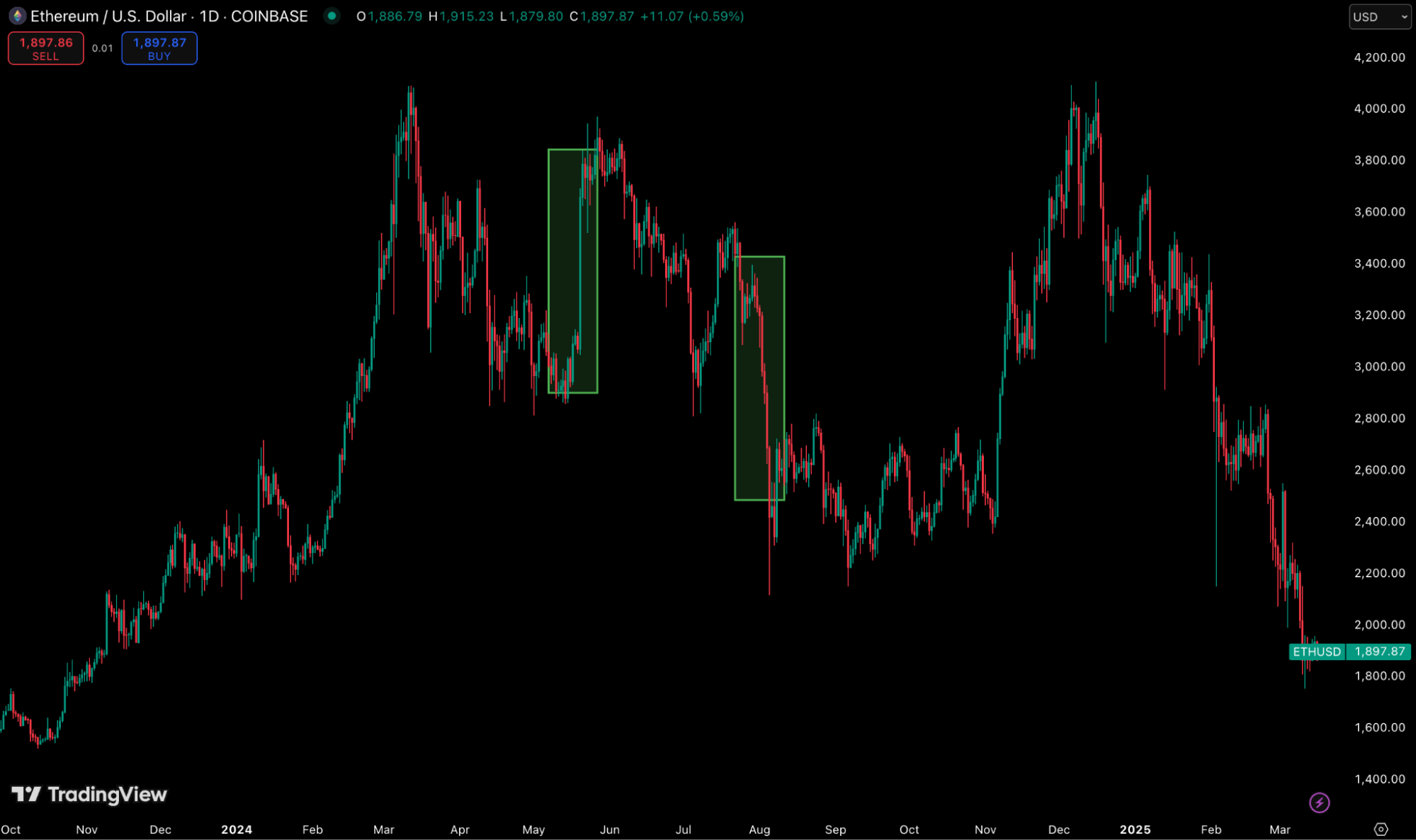

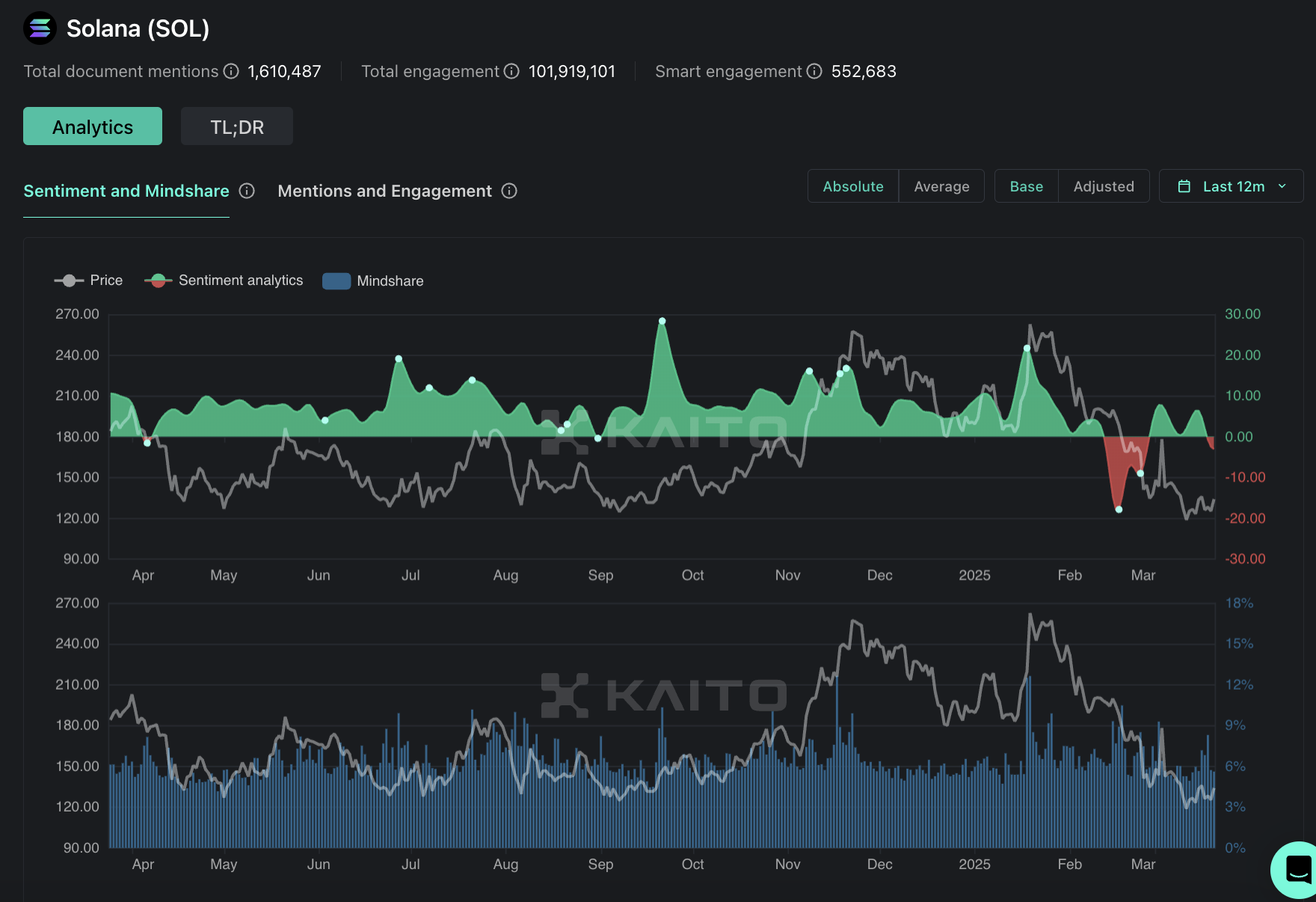

After the initial euphoria and the $TRUMP launch, $SOL has been hit hard during this Q1 market downturn, down over 55% from the highs. This is a temporary mismatch, currently not representative of the established role Solana plays in on-chain markets. The Solana ecosystem is the place to look for betting on fast, speculative on-chain activity—one of the most coveted positions in all of crypto. With the FTX unlocks no longer a worrying point and Solana ETFs to look forward to, $SOL has a lot of room to rise in the coming months/year. While $SOL might look attractive at these levels, Solana’s most prized protocol presents an even better opportunity. $JUP is down nearly 75%, bouncing 20% off of ATLs made a week ago.

While the $JUP price is down, its positioning couldn’t be better. The Jupiter team, spearheaded by co-founder Meow, expanded to 80+ members last year—that’s multiples more than the average team in crypto. Jupiter has also been extremely active on the M&A front, acquiring established protocols that can contribute to its product offerings, including Moonshot, Sonar Watch, and several others. The team has built a brand with extensive distribution, becoming the primary touchpoint for many when it comes to speculating on Solana’s growth and adoption. All of this success is built on a solid foundation, with the core Jupiter team having survived the FTX collapse and rising stronger from it.

Jupiter has fully embraced its role as an aggregator and expanded its distribution by building a UX that Solana-native platforms can’t compete with. It is the most resilient protocol on Solana but also the most susceptible to negative price action in $SOL itself. This, however, can play in your favor right now, as the market looks ready to reward market participants for taking on leverage $SOL exposure in the months ahead.

Jupiter’s stellar leadership so far has been one of its largest strengths, and this will need to continue for protocol growth to persist at this current pace. Jupiter seems to be in good hands with co-founder Meow acting as the face of the protocol and leading the team through various challenges, even opting to burn some of his tokens & lock his allocation until 2030. The primary way in which the Jupiter team is incentivized to continue their streak of strong execution is via token incentives, which can also be a detriment if $JUP goes without any new inflows for prolonged periods of time. $JUP remains a strong bet, especially in this current market, a powerful combo of leveraged $SOL positioning and exposure to a high-performance team.

Key Takeaways

- Bounce: $SOL has been hit extremely hard during February, down 55% at its lowest. Prospects for $SOL in the short to medium term now appear much more positive, with the FTX unlock now behind us and the Solana ETFs offering something to look forward to.

- Positioning is Everything: $JUP is perfectly positioned to benefit from a $SOL rejuvenation, not only from a wealth effect standpoint as $SOL liquidity trickles down into ecosystem tokens, but also due to its role as a key middleman on the chain, thriving as activity grows.

- Back to Fundamentals: The lack of a clear catalyst or narrative makes it hard to allocate to excessively speculative protocols with questionable longevity in this market. Jupiter is the antithesis to the ‘junk’ in crypto, as a proven, profitable protocol with a history of successfully steering through some of the most turbulent times in the space.

- An Evolving Game: From the aftermath of $TRUMP and $LIBRA, to Pump.Fun’s launch of PumpSwap is causing a severe drop in $RAY’s valuation; the memecoin space is volatile to say the least. Fortunately, as an aggregator, Jupiter is unscathed from most of this chaos; in fact, it may stand to gain from it. Jupiter may have an advantage with Jupnet, an ambitious omnichain aggregator platform, and a token launchpad product.

- One Token to Rule Them All: With Raydium’s future uncertain, capital allocators need a channel to express a leverage bet on $SOL and its ecosystem. Future flows into productive Solana assets are now much more likely to find their way into $JUP, especially while Pump.Fun does not have a token.

- Born in the Darkness: Jupiter was forged in the depths of the bear, not yet a major player during its stint in the 2021 Solana Ecosystem. The team doubled down in the wake of the FTX collapse, quickly becoming a dominant force within the chain as activity picked up from 2023 onward.

- Poised for Success: Jupiter has been active when it comes to M&A, using this as a tool for expanding product offerings and distribution to capture as much Solana ecosystem activity as possible. Jupiter knows its distribution is its moat, and its use of acquisitions to expand the Jupiter product to new audiences makes it even stronger.

Born in the Darkness

Jupiter is a pretty battle-hardened team, going through its fair share of trials and tribulations. Like most Solana teams who were around in the bear market, Jupiter had to go through the FTX collapse. Jupiter’s co-founder, Meow, didn’t show any signs of hesitation or desire to move chains, instead tweeting about important problems emerging in the Solana ecosystem in light of the on-chain chaos caused by the chain’s proximity to FTX. Conviction in Solana and their product allowed Jupiter to build a robust offering that became extremely popular to new or returning Solana users when momentum would find its way back to the chain in mid-to-late 2023.

More recently, the Jupiter team came under some fire for their alleged mishandling of the $LIBRA memecoin rug. Most of this FUD applies to Meteora, which was co-founded by Meow. While there are previous ties here, this FUD is not anything substantial or noteworthy that should affect the greater thesis for $JUP. In fact, this FUD just wound up presenting another opportunity for the Jupiter team to show a commitment to the protocol.

It is worth remembering, however, that Jupiter plays a pivotal role in facilitating significant events in the Solana ecosystem. This includes high-profile token launches, such as the $TRUMP launch. Jupiter has grown past the bounds of what a decentralized protocol has traditionally been responsible for, adopting some of the duties more associated with CEXs such as verified listings, assistance with token launches, and spurring ecosystem development.

Not a part of the original clan of Ethereum-based OG protocols such as Aave, Uniswap, etc., Jupiter is firmly a part of the next generation of UX-focused, profitable protocols. A case can be made that Jupiter is the most CEX-like of its peers, an example of what the endgame role for decentralized protocols might look like. This is a position of privilege that not every protocol has, but it also comes with a level of responsibility and trust that must be maintained by the Jupiter team. So far, Meow and the Jupiter team have handled any objections and accusations of misconduct regarding high-profile token launches and listings reasonably well, as one would expect from a team of this size and caliber.

Another key point worth mentioning is that Solana ETFs are likely coming this year. The decision deadline for Grayscale and other issuers’ applications is toward the end of the year, in October. Because of this delay, markets may not be pricing in catalysts this far down the line. The October deadline for these ETFs is also just that: a deadline. As was the case with Ethereum, the actual approval can come much earlier. It is likely that there will be rumors related to filings that might give more indication as to when $SOL ETFs might soon be approved.

Whether Solana ETFs can garner as much or more inflows than the Ethereum ETFs is somewhat irrelevant right now. Markets will likely begin anticipating ETF approvals under a new crypto-friendly SEC before they happen. This phase is when it would be optimal to position in $SOL or its ecosystem, with maintained exposure post-approval optional based on inflow expectations and results.

What this all points to is that a bottom has likely formed for $SOL, assuming that $BTC doesn’t follow U.S. equities lower. The FTX unlock took place recently, and whatever range constituted a support for $SOL before then needs to be reevaluated to take this development into account. Fundamentals remain strong and the Solana ecosystem remains intact, ready to reactivate when market conditions stabilize. Solana ETFs may be going under the radar; markets could begin pricing in this catalyst several months in advance during Q2.

While there isn’t much reason to think that ATHs might be imminent, there may not be much for investors to gain from waiting longer before positioning. If market participants begin slowly piling back into $SOL, the entire Solana ecosystem stands to gain.

Mindshare is less relevant for majors as it has less influence on the large buyers and sellers that are collectively responsible for price moves over the course of days and weeks. But unnecessarily low mindshare might reflect that the price has been hit harder than it might have otherwise deserved to.

$JUP: The Casino’s House

There are many stakeholders in Solana who control different areas of the memecoin trading stack, from Pump.Fun, where tokens are created, to DEXs and even trading terminals. As an aggregator that has expanded its offerings, Jupiter is the closest thing to a one-stop-shop for speculation on Solana, perhaps more comparable to a CEX because of its moat and distribution power. This is all part of the greater trend of decentralized protocols eating away at the role of CEXs in the crypto casino. When it comes to the idea of a casino in crypto, there are a few key areas that can be perhaps thought of as different floors within a casino. Spot token trading is what most crypto natives engage in, the most established method of speculation. Memecoins provides a game with an implied randomness and luck component, which players accept in the hopes that they can beat the odds. Perpetuals trading sees much less retail activity, a domain where a small group of institutions and sophisticated individuals are responsible for the majority of the profits.

Jupiter has a foot in all of the known areas of speculation in crypto today:

- Spot Aggregator: This is Jupiter’s bread and butter, its initial product offering since 2021, and the driver of the majority of protocol revenue.

- Trenches: Trenches serves as Jupiter’s answer to the Pump.fun UI and the various trading terminals that have popped up. Users can screen for new tokens and consume information rather than simply use Jupiter as a means of making trades. Consolidating trading and token screening into one platform is a powerful combo in the memecoin space, and one that Jupiter is definitely smart to try and get a foothold in.

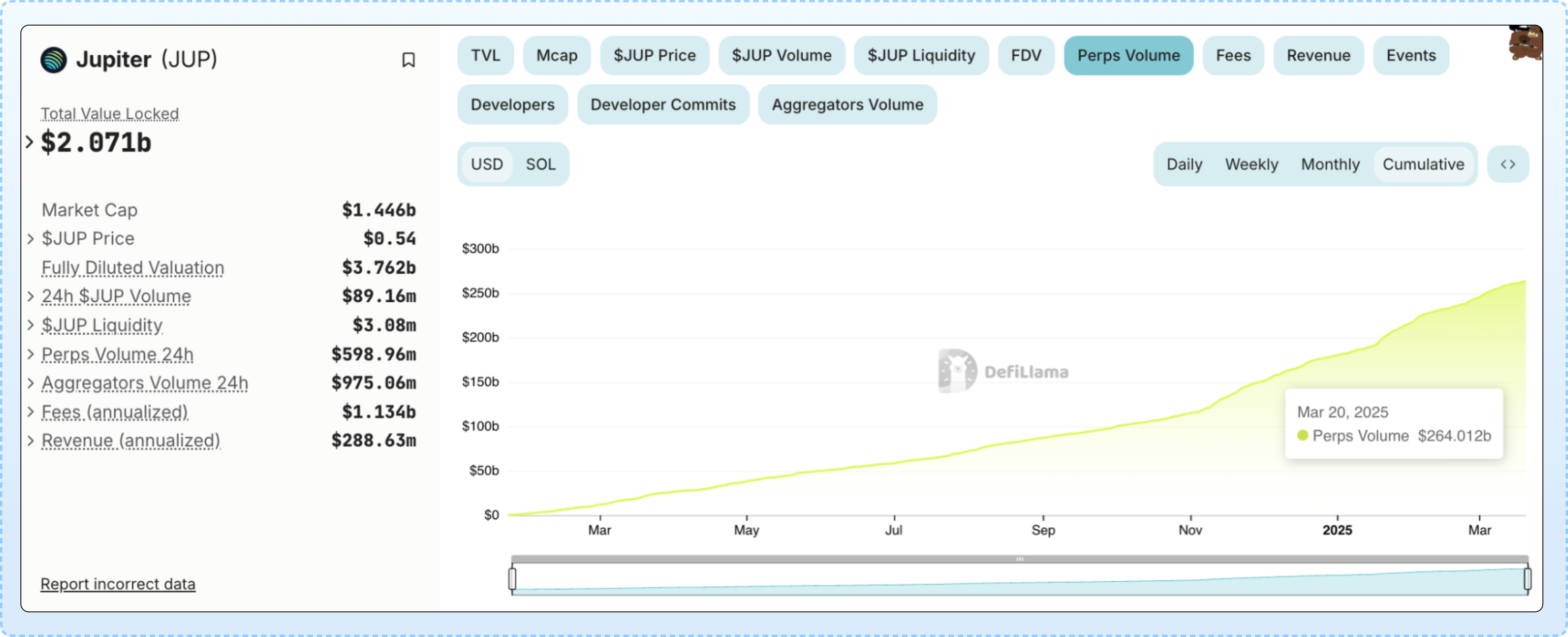

- Perps Exchange: Rolled out to the public in late 2023, Jupiter Perps still only contains 3 markets—$SOL, $ETH, and $WBTC. Still, the product has grown to process a substantial amount of volume. This could be one area where Jupiter could gain from expanding its offerings, especially during a period of drought for the Solana ecosystem relative to peak mania.

Beyond the core areas of speculation, Jupiter also has its passive $JLP vault, which contains over $1.4B in TVL. JLP serves as the liquidity backbone for Jupiter’s perps markets. JLP denominates deposits across all of the assets for which Jupiter provides a perps market: $SOL, $WBTC & $ETH as well as stablecoins. This can serve as something similar to an index that returns 75% of perps trading fees to depositors. There is also the upcoming Jupiter launchpad, which could become a key offering of the protocol.

The main differentiating factor between Jupiter and a CEX in offerings is the fact that Jupiter only operates on Solana. This is fine for now—it has become a consensus that Solana is the place to be for protocols that facilitate trading activity, as this chain is where the largest amount of hot money can be found. Jupiter seems content with dominating on Solana for now, not looking to make the mistake that top DEXs like Uniswap and Sushi have previously made by deploying on numerous chains, many of which were just not worth the effort in the end.

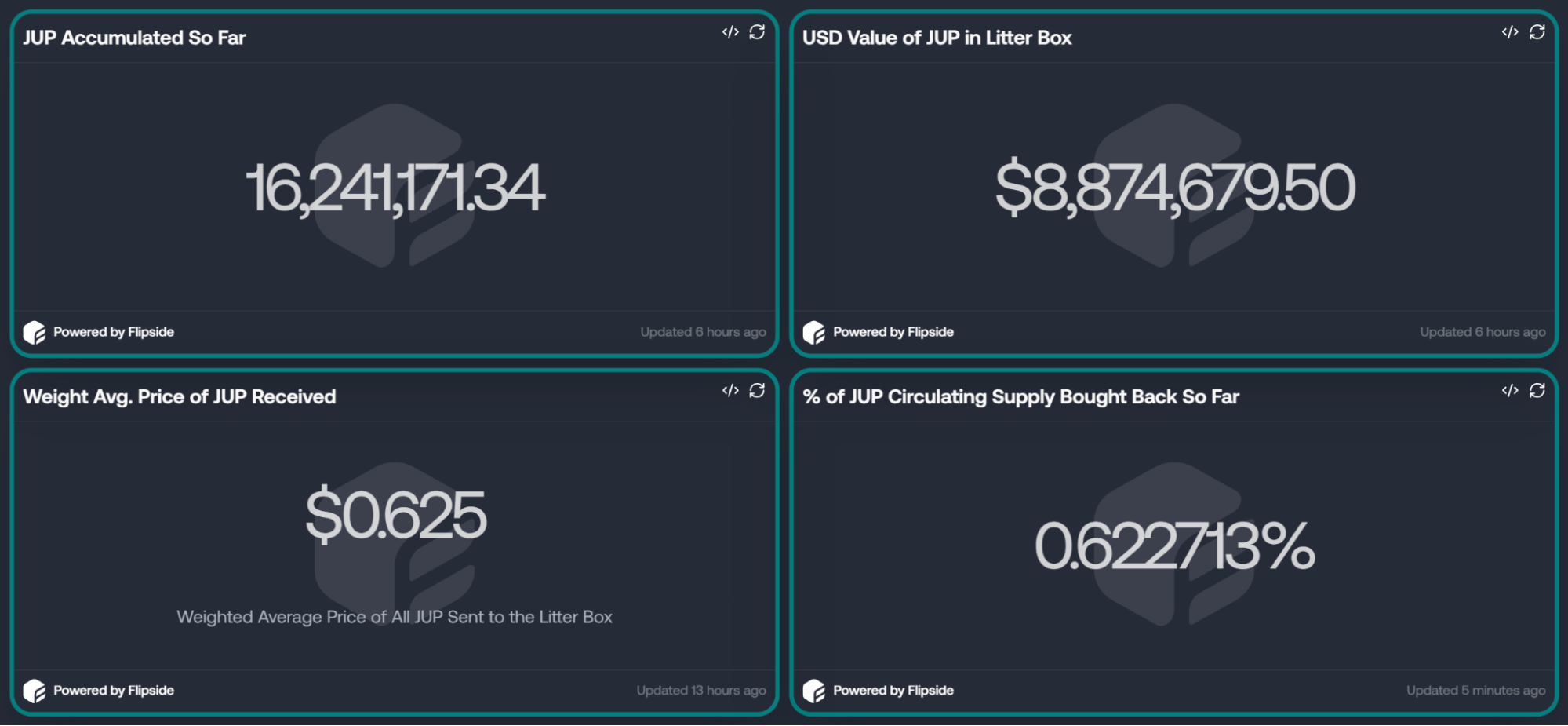

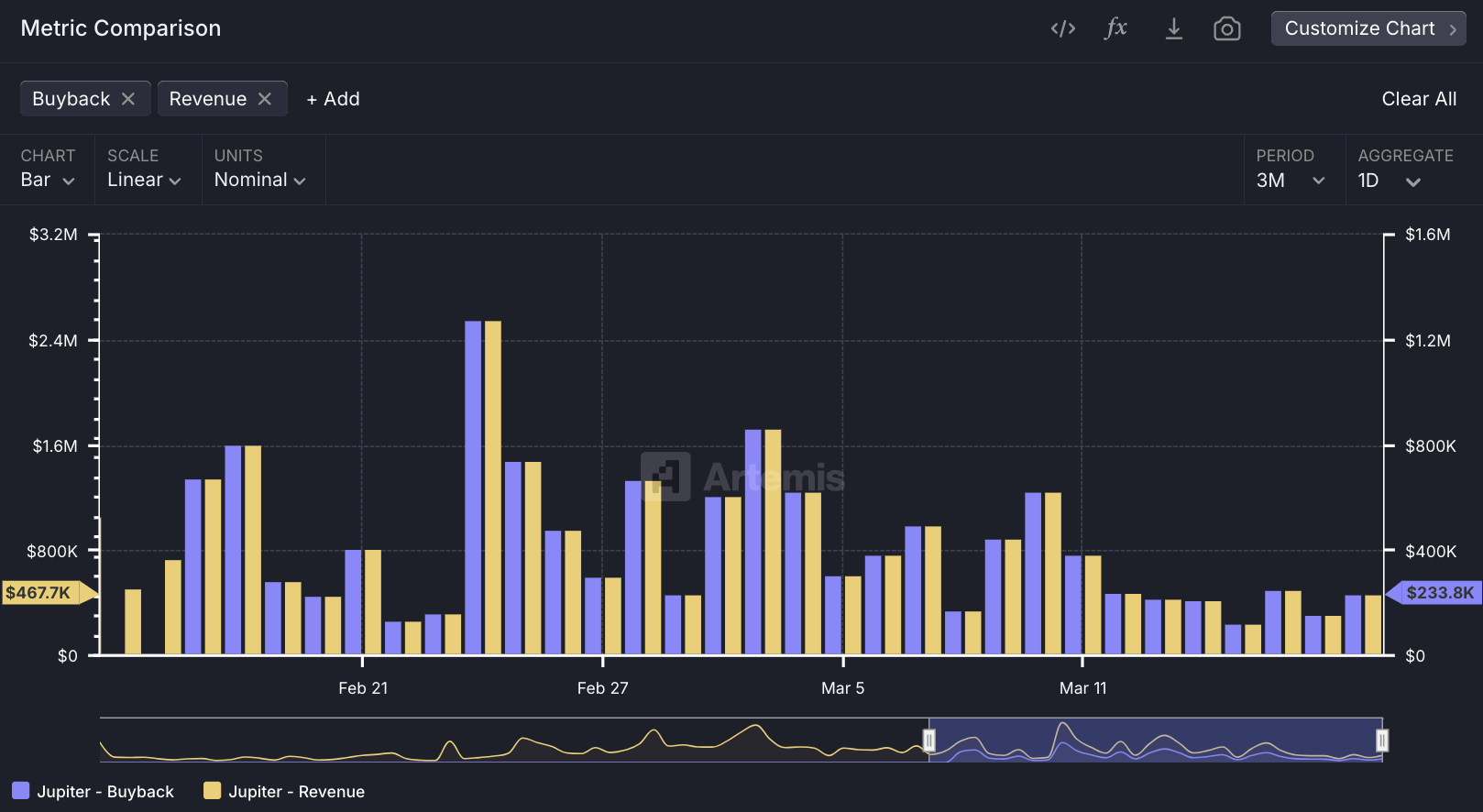

There also aren’t questions as to how speculative activity on $JUP maps to value for token holders. Last month, the $JUP buyback program commenced, which allocates 50% of protocol revenues toward token buybacks. There are more applications today generating serious revenues than there were just a couple of years ago. Many of these protocols, including Hyperliquid, Raydium, Aerodrome, and others, have buybacks or other means of directly funneling protocol fees to token value. Buybacks may be becoming less of a differentiating factor and more of an expected qualifier for those looking for exposure to top revenue-generating protocols. When it comes to the Solana ecosystem specifically, Jupiter’s buyback program solidifies $JUP as the ultimate token for leveraged exposure to $SOL. $JUP is bought back and held in the treasury for at least 3 years, a holding period likely longer than most other buyers in the market.

This is something that can act as a buffer against unlocks. On net, the circulating token supply will still increase and there will be additional sell pressure on the token in the long run. Market participants shouldn’t get it twisted; narrative is still the primary driving factor behind all tokens, no matter if they have buybacks or not. But these buybacks can certainly help to provide a consistent bid for $JUP. Jupiter may see elevated revenues even during times of downside volatility, providing some level of an emergency bid and an implicit floor.

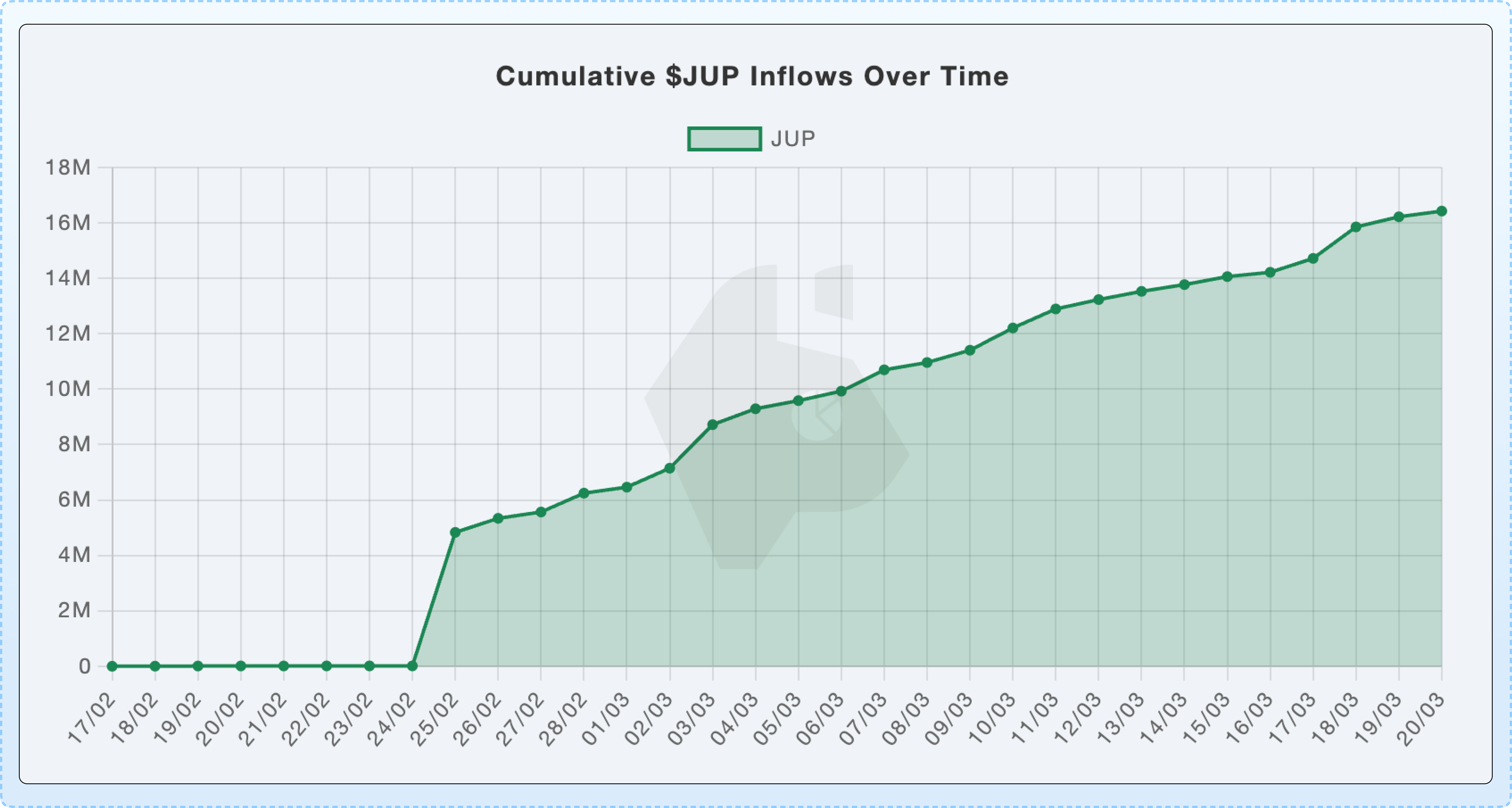

In its current state, these buybacks simply are not enough to move the price of $JUP. But as trading activity returns to highs, these transactions can definitely become much more of a fundamental driver of price action, separate from anything narrative-driven. Since starting on February 18th, roughly 9.5M $JUP tokens have been bought back, right around $6M. This is obviously insignificant relative to $JUP’s $1.7B marketcap, but it’s a good start nonetheless.

As with all token buybacks, this scheme can align incentives between the team and the community. More importantly, it creates a link between protocol performance and token price, which is one of the hardest things to get right for most protocols. With these buybacks, there is a more structural bid behind $JUP that simply works in the background, rewarding token holders as the team pushes updates to increase trading volumes, or just when market conditions dictate more activity.

An Evolving Game

Jupiter’s all-encompassing nature as an application provides a true one-stop shop for speculation on Solana. The major piece of the pie that Jupiter misses out on in the user-facing domain is the actual creation of tokens, which is dominated by Pump.fun. This imbalance is extremely significant considering that, despite all of Jupiter’s offerings and developments, its expansive array of products has netted it roughly the exact same amount in fees earned (not excluding $JUP incentives) as Pump.Fun, which has a much simpler interface and a seemingly far less sophisticated product.

Jupiter has its own launchpad, though it is used for high-profile token launches including $TRUMP and $JUP, not permissionless token creation like Pump.fun. Jupiter mostly sticks to what it does best, ensuring that swaps can be conducted seamlessly on the platform and that the necessary optionality for more sophisticated users is also there. From DCAs and limit orders to slippage maximization, Jupiter has rolled out all the features an aggregator can to ensure the best possible experience for users.

Running the Numbers

While Jupiter doesn’t necessarily compete with Pump.Fun or Raydium at a protocol level, it does in terms of token valuation. In crypto, valuations tend to escape reasonable revenue expectations. But this doesn’t mean that revenue figures should be cast aside, especially not for top-tier revenue-generating protocols like Jupiter.

One way to assess the relative worthiness of $JUP is to analyze its fees compared to competitors. On any given day, Jupiter has the potential to be one of the highest-grossing protocols in crypto, often ranking in the top 5 by fees earned. Its revenue figures have actually proven much stickier than those of Pump.Fun during this recent market downturn. Just a few weeks ago, this might have been difficult to believe.

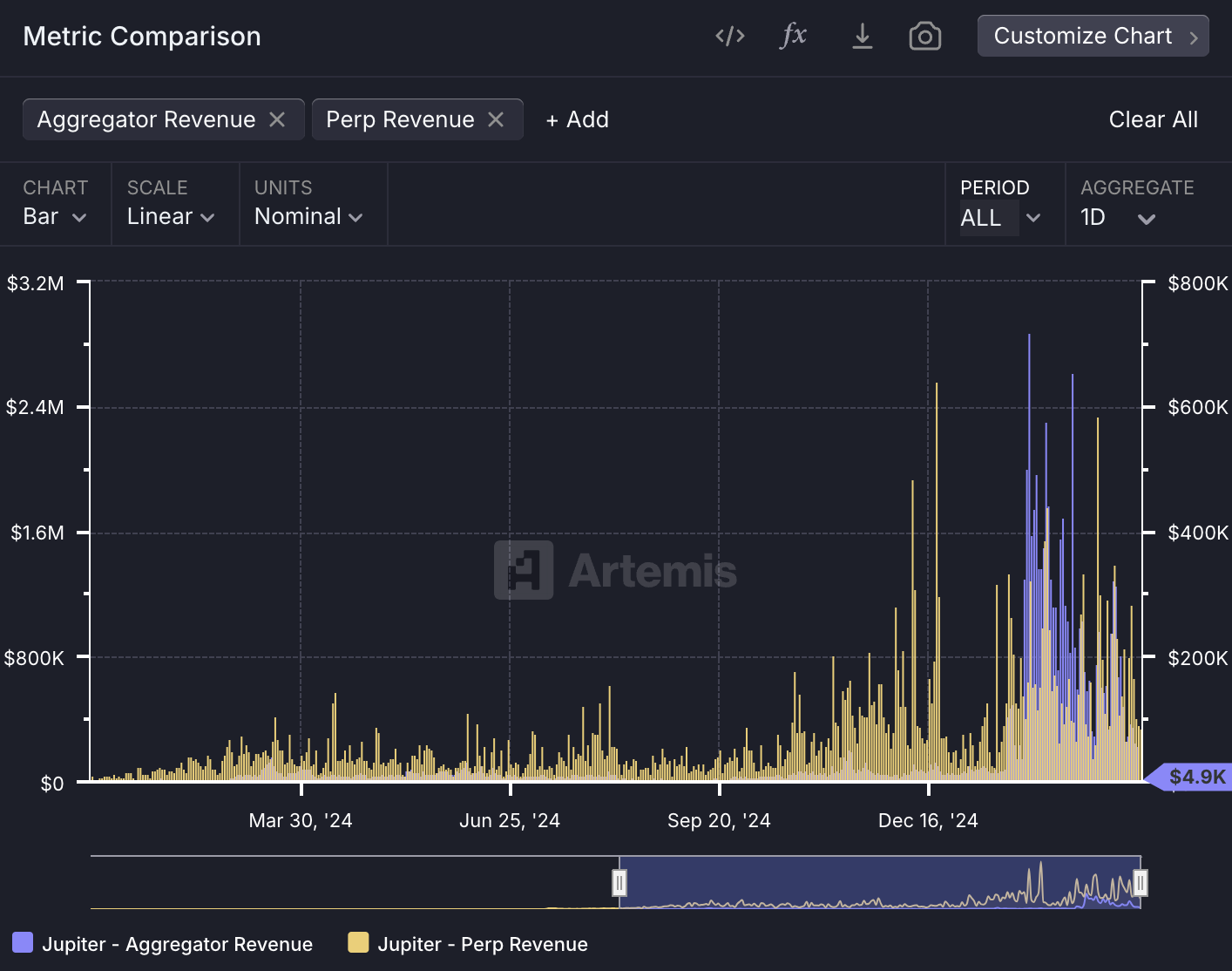

Since Jupiter’s perps and aggregator volumes are responsible for nearly all protocol fees, it’s important to understand how these products can accrue value to $JUP. The structural way in which protocol success fundamentally affects $JUP price is via token buybacks, implemented less than a month ago.

The revenue split for Jupiter aggregator revenue is as follows:

- 50%: $JUP Buybacks

- 50%: Protocol Revenue

Jupiter Perps has its separate fee split:

- 75%: Distributed to $JLP Depositors

- 12.5%: $JUP Buybacks

- 12.5%: Protocol Revenue

What might surprise some is that Jupiter perps is responsible for the vast majority of protocol fees. Despite this, perps and spot swaps are of roughly equal importance for $JUP buybacks. Jupiter aggregator has a 4x higher buyback share of fees compared to perps (50% vs 12.5%), making up for its much smaller nominal amount of fees earned.

After ~3 weeks, Jupiter has bought back ~14M $JUP tokens, worth ~$7.5M. This isn’t too much given $JUP’s large market cap ($1.4B). Note that these buybacks occurred while the $JUP price was falling. Still, it’s a decent start at a time when protocol activity is depressed compared to just weeks prior to when buybacks began being executed.

Based on the past month, Jupiter’s estimated annual revenue is ~$320M. If we assume roughly the same split between perps and aggregator share of revenue, then ~50% of projected revenue would go toward buybacks, resulting in ~$160M of buy pressure for $JUP.

This is a somewhat conservative figure, and it’s reasonable to assume that $160M in annual buyback pressure is an appropriate floor for buybacks. The actual figure has the potential to be much larger if activity picks up. As seen with $TRUMP, Jupiter can directly work with teams that can provide massive catalysts for Solana trading activity.

At the current $JUP price and protocol revenue figures, annual buybacks would account for over 10% of supply. As the $JUP price stabilizes and moves higher, this share of supply acquired will be lower. This is likely to happen as the $JUP price is more sensitive than protocol revenue. In some ways, negative price action can be a good thing for long-term longevity, as this means a higher amount of the $JUP supply will be bought and taken offline for 3 years.

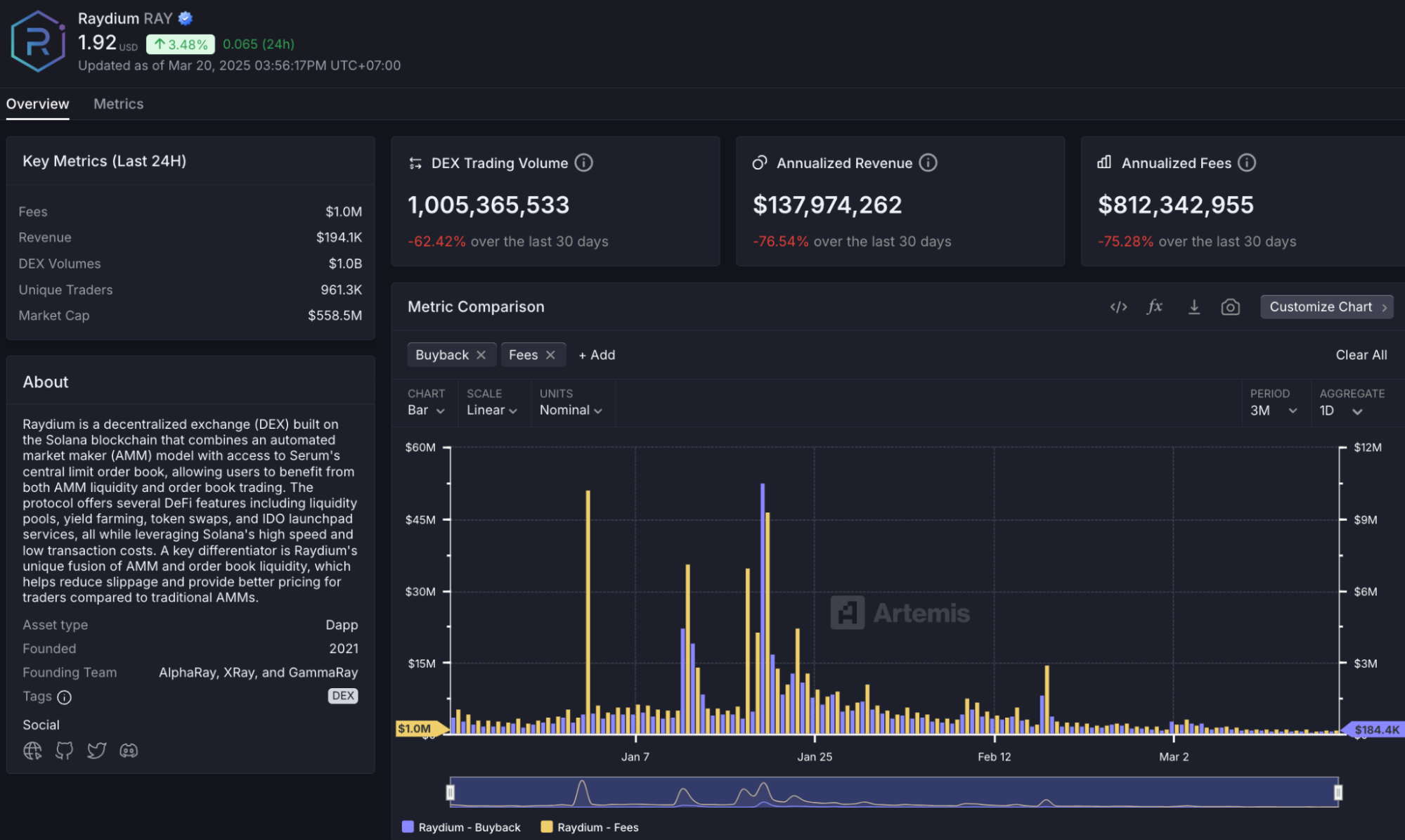

Another way to consider the value of $JUP’s buybacks is to compare the buy pressure relative to Raydium’s $RAY. At the current $JUP price ($0.51) and protocol revenue (~$320M/year with roughly half going toward buybacks), Jupiter has a forward P/E ratio of 8.64. Raydium, on the other hand, has a forward P/E less than half as high at 3.49. These multiples reflect only the amount of revenue allocated toward buybacks.

From a P/E standpoint, $JUP is valued much more than $RAY, and rightfully so. But compared to some other top-grossing protocols, $JUP’s valuation remains low. Take Uniswap for example; if a 20% fee switch for buybacks is assumed, $UNI’s forward P/E comes out to 23.8. Ultimately, P/E values should be viewed as a guideline in crypto, whether they bode positively or negatively for a protocol.

The Gateway to the Solana Ecosystem

As a frontend, first and foremost, Jupiter serves as a user hub for speculating on Solana. This gives Jupiter a leg up in some ways, as they are not overly dependent on any one niche like Pump.Fun.

When analyzing $JUP compared to other Solana ecosystem tokens most linked to the chain’s trading activity, there is one main competitor: $RAY. Raydium ($RAY), until recently, would be thought of as the other major way to play the Solana ecosystem. Raydium is the leading DEX in cumulative DEX volumes. Raydium has a much less polished UX than Jupiter; in many ways, Raydium previously stood to gain as Jupiter enhanced its UX and rolled out more features, as some of the increases in swaps that these improvements looked to create would find their way to the Raydium AMM.

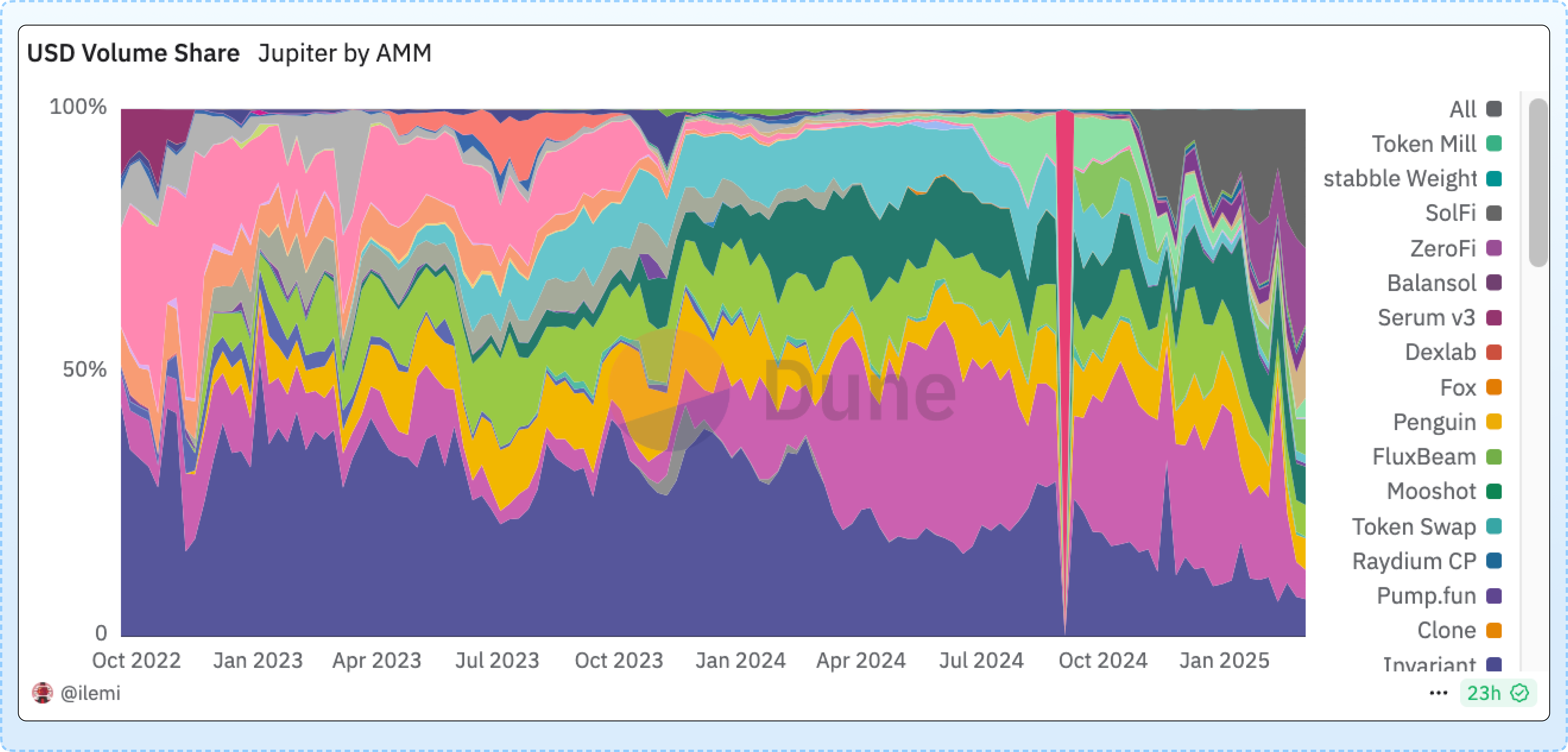

The main driver of $RAY’s dominance last year was its integration with Pump.Fun, where graduated tokens on the platform would bond to a Raydium AMM pool. This is the structural reason behind Raydium’s dominance in 2024. The DEX had an inherent advantage and ability to be guaranteed the closest position to trading flows from Pump.Fun tokens.

Now, $RAY has seen a capitulation after it was revealed that Pump.Fun was developing PumpSwap. This would be extremely disruptive to Raydium’s business model; during memecoin mania, Raydium would routinely make up 30-40% of Jupiter AMM volume share.

With Pump.Fun opting to graduate tokens to its own AMM, the case for using Raydium pools over another DEX becomes much less clear. Prior to Pump.Fun, Raydium’s market share was often in the single digits, with $ORCA being the primary leader. This is not inspiring for Raydium; $ORCA’s market cap lies at just ~$90M today. The implications of all these developments have seen $RAY fall nearly 75% to a market cap of ~$640M, though some of this decline is simply due to $SOL’s own price action and broader market conditions.

Just recently, it was announced that Raydium would be building out its own version of Pump.Fun. All is not saved, as Pump.Fun has been completely dominant when it comes to memecoin generation on Solana; it’s not a given that Raydium will attract sufficient attention. It’s easier for an app with a distribution moat like Pump.Fun to build out the AMM infrastructure than vice versa. These back-and-forth exchanges between Pump.Fun and Raydium also make $JUP more attractive, since Jupiter will benefit from increased activity regardless of who it comes from.

As an aggregator, Jupiter is not necessarily affected by developments from Pump.Fun or Raydium, though it’s worth noting that Pump.Fun launching PumpSwap allows it to capture more of the memecoin stack, just as Jupiter has expanded its operations to other areas of trading over time instead of just focusing on one thing. Jupiter would integrate Pump.Fun’s AMM, though Pump.Fun’s role in creating tokens makes it more attractive for users to bypass aggregators and trade directly on the DEX itself, more so than Raydium or Orca.

Overall, Raydium remains the recipient of a lot of structural flows from Pump.Fun, volume that it would receive more or less by doing nothing. In comparison, Jupiter can be seen as processing a much larger share of ‘earned volume’, not overly reliant on a single integration. Instead, its moat is in its enhanced UX and now its distribution.

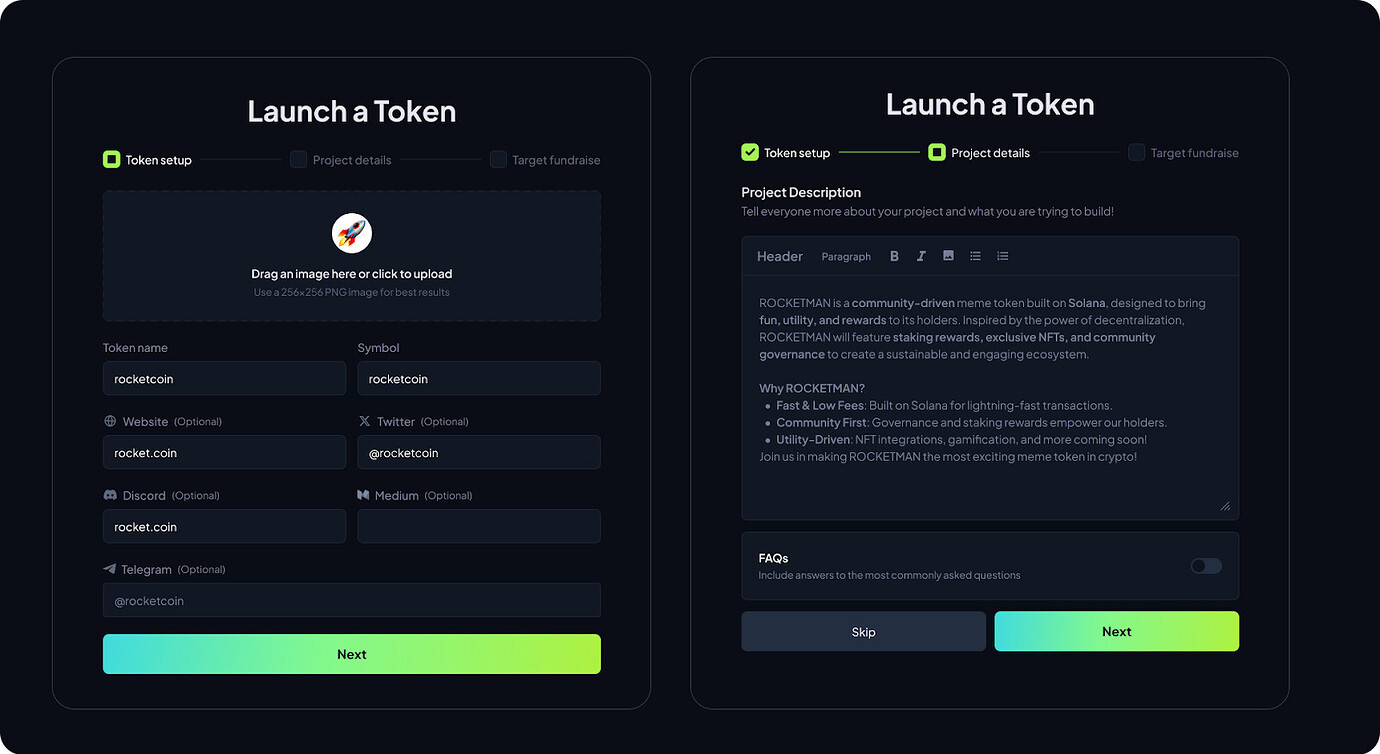

As an aggregator, Jupiter builds upon the volumes of Pump.Fun and Raydium rather than directly competing with them. However, Jupiter is looking to branch out into the token launchpad space, potentially brushing heads with Pump.Fun. Jupiter’s current launchpad iteration is reserved for high-profile token launches like $TRUMP, not a point of emphasis for the protocol compared to its other products. With CATPad, this will change.

CATPad is a permissionless token launching platform, initially modeling itself after Kickstarter. Users can essentially fundraise for their token within a set amount of time, providing a minimum amount of funds to raise for the token sale to go through. The maximum time to raise is relatively short, just two days. In the event of a successful sale, the creator receives nearly 90% of the token supply, vested over 2 years. This is the first mode for token generation on the launchpad, with more potentially being introduced later on. More details are set to be revealed next month.

It’s hard to predict how much traction CATPad might receive and whether or not it can realistically serve as a solid alternative to Pump.Fun. There is a gap in the market when it comes to being able to permissionlessly launch tokens while ensuring some level of price stability for early buyers and automatically allocating supply to the token creator. Pump.Fun in its current form falls short here, and there is room for new players.

An Onchain Conglomerate

As an aggregator, Jupiter’s business model is dependent on its ability to attract attention, focusing a lot on optimizing UX and distribution to provide a reason for users to choose Jupiter over the core DEXs. When it comes to the creation of tokens and how liquidity is managed, there is a lot that is out of Jupiter’s hands, and the protocol serves to maximize what already exists on-chain. Jupiter needs to maintain relevancy and expand its services to as wide a user base as possible. could include existing crypto users, both in and outside of Solana, or even onboarding new users to crypto entirely.

We’ve seen CEXs, including Binance, Coinbase, and others, expand their offerings over the years beyond their core business. As price action moves on-chain and decentralized protocols begin generating massive revenues themselves, it’s only natural that they begin taking steps to invest in their future success as well.

Jupiter pushes the envelope, expanding an on-chain business in new ways than what we’ve previously seen before from the juggernaut-sized protocols on Ethereum. Jupiter has engaged in targeted M&A activity, responsible for the new products they have been able to roll out.

- ApePro – September 20, 2024: Jupiter acquired Coinhall, the leading DEX aggregator on Cosmos, primarily interested in their ape.pro product. This product, which was integrated as its own terminal within the Jupiter platform, has now merged with Jupiter to create “Trenches”, the revamped interface for memecoin trading.

- Moonshot – January 25, 2025: Jupiter acquired Moonshot shortly after the $TRUMP token launch, which saw 200K new users onboarded via the app in a single day.

Both of these acquisitions are important as they allow Jupiter to control a piece of the memecoin and trading stack that was otherwise out of reach, held by centralized or semi-centralized applications and trading terminal platforms. While Jupiter is firmly a decentralized protocol, acquisitions of this nature push Jupiter more toward CEX status when it comes to its distribution.

Other acquisitions include:

- Ultimate Wallet – April 23, 2024: This acquisition was actually incredibly important; it paved the way for Jupiter to launch its mobile app, which climbed as high as #5 in the U.S. app store rankings immediately after the launch of $TRUMP.

- Sonar Watch – January 25, 2024: This acquisition was used to push out Jupiter Portfolio.

- SolanaFM – September 20, 2024: This acquisition boosted Jupiter’s internal data infrastructure & analysis capabilities.

There is no other decentralized protocol in crypto that has been as active in the M&A markets as Jupiter. More importantly, no other protocol has made multiple acquisitions and successfully used them to expand offerings in areas that are productive to the core protocol.

Some examples of questionable acquisitions include Uniswap’s acquisition of Genie in an attempt to grow a presence in the NFT space. This ultimately never really panned out, and neither has Uniswap’s acquisition of Crypto: The Game, a crypto-themed on-chain survival game. There is also Polygon, which spent hundreds of millions acquiring multiple ZK-related protocols and solutions, which have mostly gone unrecognized by the market today.

Jupiter fills in gaps in its product stack by any means necessary. The team has also made a profound shift toward ‘building in public’ and marketing, something that was not prioritized early on in the protocol’s lifespan. The results of Jupiter’s M&A activity have definitely paid off when it comes to gaining traction and drawing attention to the Jupiter product suite. The Jupiter team can be seen leaving its comfort zone if there is a chance to expand reach.

New Horizons

Jupiter is a prime example of a protocol that knows its niche and is doubling down on it. Fortunately for Jupiter, they couldn’t have picked a better niche than speculative activity on Solana to commit to. But this doesn’t mean that there isn’t room for the team to expand their product further. Jupiter now consists of a team of ~80 members, 65 of whom were just hired last year. This provides ample resources for slowly expanding Jupiter’s reach, in addition to the protocol’s revenue generation of hundreds of millions of dollars.

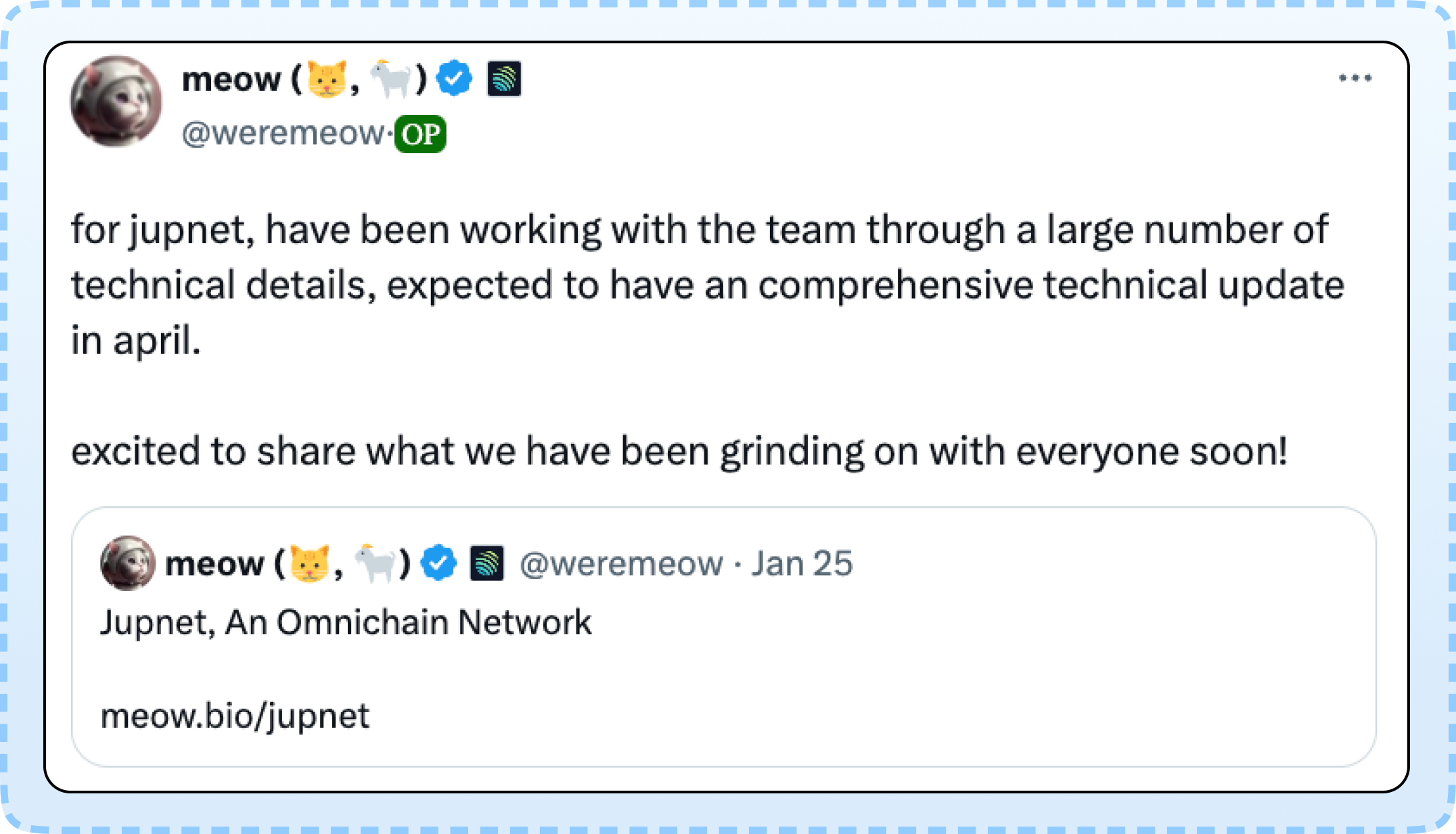

Jupnet is arguably Jupiter’s most ambitious step, that we know of. Yet to launch, Jupnet will function as an omnichain aggregator. There is a lot of liquidity that flows both to and from Solana. Jupnet is Jupiter’s attempt to keep more of this value within its ecosystem, even after it leaves Solana.

But Jupnet goes beyond an aggregator that can route across chains; this initiative is better understood as an attempt at establishing the closest thing to an on-chain CEX. What Jupnet looks to achieve from the users’ perspective is, in some ways, similar to Particle Network, and other protocols under the chain abstraction banner.

This is all part of Jupiter’s Global Unified Market (GUM) vision, which basically foresees a world where on-chain markets are as united as CEX trading with almost no differentiation between chains or assets. This vision sees past crypto, also referencing real estate and forex, and making them interoperable with crypto.

To achieve its omnichain goals, Jupnet introduces three new infrastructure components:

- DOVE Network – Decentralized Oracles that Validate and Execute. This is the oracle infrastructure behind Jupnet, allowing the protocol to validate and execute transactions across a variety of chains. DOVE accomplishes the task of settling on a single source of truth for pricing and other information across different chains.

- Omnichain Ledger Network – Hosting a custom omnichain ledger allows Jupnet users to transact freely between chains. To put it simply, trades can be made across chains with someone keeping score, similar to the experience associated with a CEX. The ledger network accounts for settlement and bridging times, largely abstracting this away for users. The technology will also enable developers to build apps for more complicated DeFi functions on top of this infrastructure.

- Aggregated Decentralized Identity (ADI) – The ADI will abstract the need for wallet interfacing and private key storage. Instead, multi-factor authentication and account recovery are available, and a new 100% on-chain identity system is in the works to allow for “wallet-less” transacting. This is perhaps the most crucial step to get right for Jupnet to separate itself from other protocols in the chain abstraction category, by providing a world-class UX. ADI isn’t something exclusive to the Jupiter protocol either; developers can also incorporate this into their projects.

Jupnet’s validator implementation uses Jupiter SVM, Jupiter’s own extension of the Solana chain. Jupiter SVM will basically be an addition to Solana, with some changes made to prioritize omnichain features, the DOVE Network, and other features that are unique to Jupnet.

There aren’t too many details available right now regarding Jupnet. More are expected to come in April, which could present a small catalyst in the short term for $JUP. Jupnet provides some level of diversification and independence beyond $SOL. This makes $JUP potentially viable even for those who cast a pessimistic view of Solana as a whole, likening the ecosystem to one big casino that has since dried up.

Jupnet is one piece of a broader GUM vision, which is very ambitious and is not a 0-1 catalyst that can occur randomly. Instead, Jupnet will likely roll out slowly, probably gaining significant traction along the way.

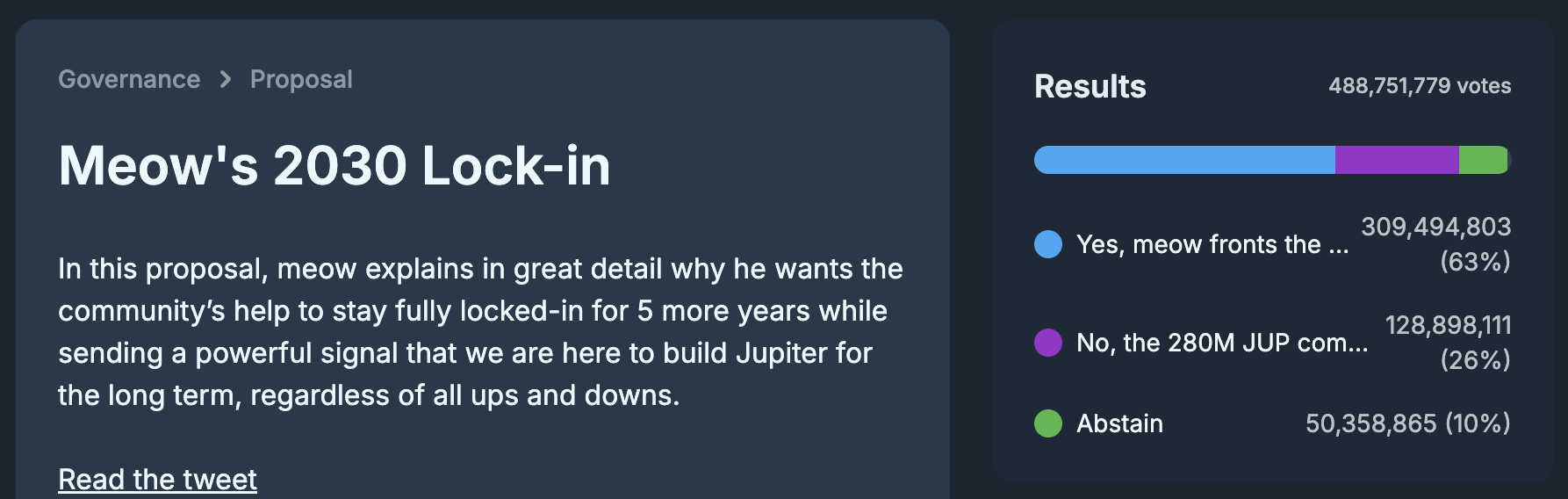

Locked in

Recently, the Jupiter DAO held a successful vote (63%) pertaining to team allocations. It had already been established that the non-core members of Jupiter were to be rewarded with 2.8% of the $JUP supply. Where the controversy lied was in the motion for Jupiter Co-Founder Meow to fund this initiative with his entire $JUP allocation, as opposed to using the Jupiter strategic reserve. In return, Meow would receive his initial allocation with an additional 80% bonus in 2030. This modification significantly increases Meow’s allocation but locks it for several more years than it otherwise would have been subject to.

While this DAO disagreement attracted criticism from those outside of the Jupiter community, it has since been resolved positively. Ultimately, the amount of tokens at stake here is 2.8% of the max $JUP supply, with Meow’s 2.2% bonus locked until 2030.

Depending on how you look at it, this proposal could leave tokenomics and unlocks in better shape than they were previously. Instead of meow’s ~280M $JUP supply unlocking in June 2026, an equal amount is distributed across dozens of team members over the course of 3-4 years. There will likely be more selling pressure before June 2026, but less afterward, assuming meow would have sold some $JUP shortly after it became available to him.

With this DAO vote wrapped up, there is more certainty around $JUP supply dynamics and unlocks. Resolving this proposal and reaching finality also builds up the reputation for Jupiter, showing that it can easily handle disputes within its community.

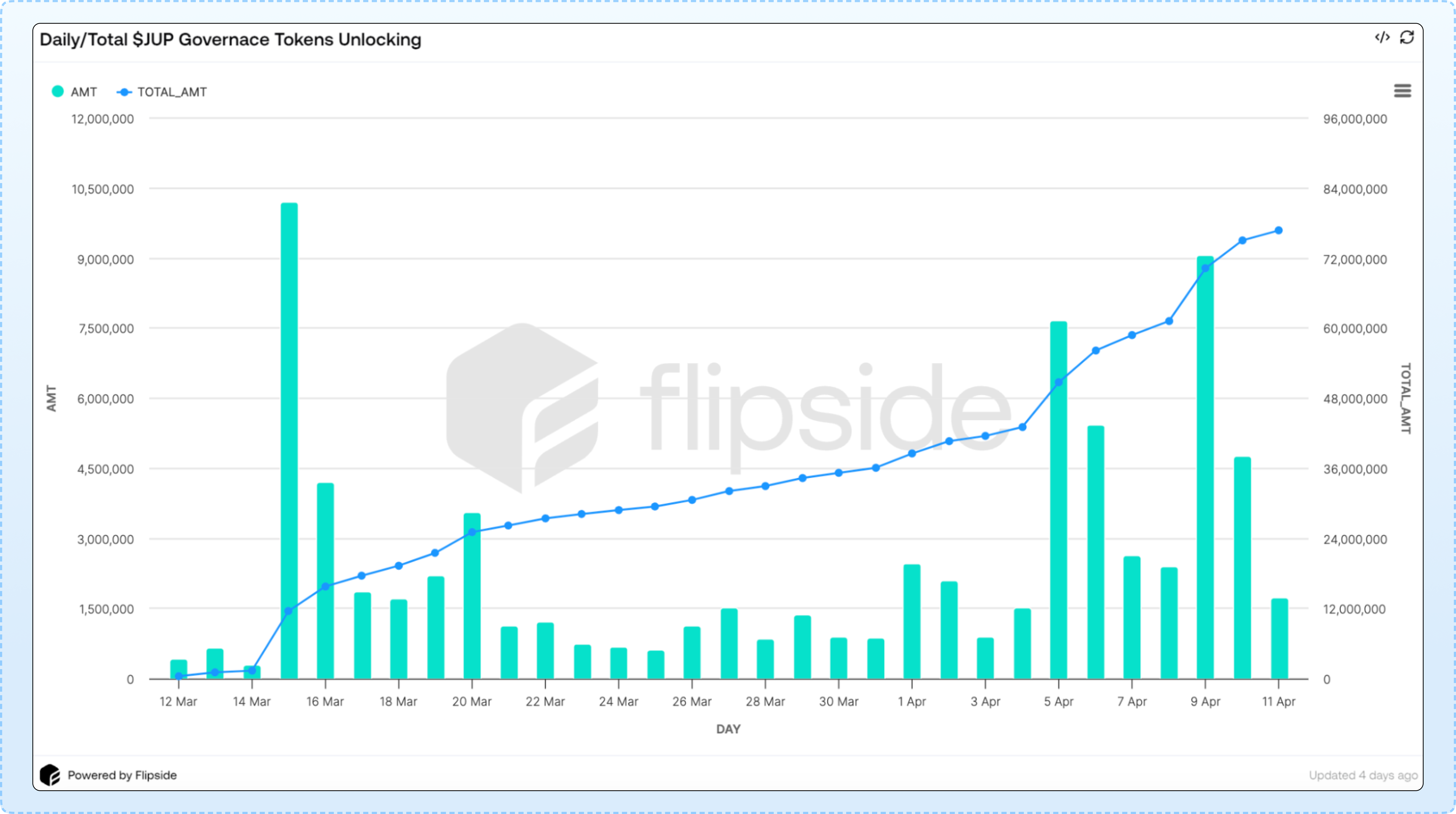

Unlocks

Unlike $JUP buyback buy pressure, not all token unlocks result in sell pressure. Jupiter also has a history of changing unlock schedules to lock tokens up much longer than initially planned for. However, it is crucial to monitor these unlocks for the purpose of entering and exiting positions.

There are a total of roughly 4.7B $JUP tokens that have not been distributed yet, 1.8B allocated toward the community, and 2.56B allocated toward the team. Not all of this supply has been allocated yet, especially on the team side; much of it remains in the strategic reserve with no clear vesting plans yet. Below are the most significant and pressing unlocks. The most significant ongoing issuance is the team allocation of 466M $JUP throughout 2025.

- OG Team Allocation – 1.4B $JUP (20% of supply). OG Jupiter team members are rewarded with 20% of the $JUP supply, vested linearly over three years.

- 466M $JUP (~33%) began circulating but is now relocked until 2027.

- 466M $JUP (~33%) currently vesting monthly, transitioning to quarterly vests on May 1st.

- 466M $JUP (~33%) to begin vesting February 2026.

- Mercurial Stakeholders – 350M $JUP (5% of supply): Mercurial was a previous Solana project that the Jupiter team was first involved with before fully pivoting toward Jupiter and Meteora. Supply allocated toward original Mercurial token holders is a significant monthly allocation, with ~13M $JUP being vested per month until the end of 2026.

- Jupuary – 1.4B $JUP (20% of total supply): Jupuary is the single biggest source of unlocks. Fortunately, the next Jupuary airdrop is months away, coming up in January 2026. ~700M $JUP tokens will be distributed to protocol users and stakers. Another Jupuary airdrop is planned for 2027, though this is not yet confirmed. Jupuary constitutes the vast majority of the community $JUP allocation.

- ASR (Active Staking Rewards) – 200M $JUP (~2.8% of supply): Active Staking Rewards rewards unlock on a quarterly basis; the next date for these rewards to come online will likely be over 2 months from now, some time in mid-May. The previous ASR unlock saw an immediate price increase afterwards, as did the Jupuary airdrop. More could be allocated toward ASR in the future.

- Meow Allocation – 500M $JUP (7% of supply): This allocation is locked for five years, representing Meow’s entire allocation.

- New Team Allocation – 280M $JUP (4% of supply): The exact first cliff and vesting schedule for these funds is not yet available. They will be distributed over the course of 3-4 years.

Governance Unlocks: These unlocks cannot be tracked more than one month in advance, which is the time it takes for $JUP voters who initiate the unlock process to have full access to their tokens. These unlocks can amount to tens of millions per month and may be elevated following significant DAO votes.

Currently, there is nearly 54M $JUP (0.7% of supply) being unlocked on the 1st of each month. This sell pressure from these unlocks is greater than any buying pressure from buybacks (~$10M monthly buyback pressure), assuming most of these tokens are immediately sold. This is an important consideration as it makes $JUP prone to bleeding lower during market droughts. Bearish market conditions result in a lower $JUP price, decreased buyback amounts, and a higher likelihood that team members and other unlock recipients will dump tokens. However, this is predictable and one can position accordingly.

Overall, $JUP’s ongoing supply unlocks present a crucial reason to be selective when it comes to market timing and duration of a trade for $JUP. Beyond the ongoing token vesting, the remaining $JUP. Bearing that in mind, the Jupiter team has done a lot to show solidarity with the community, including Meow locking up his allocation for 5 years, as well as the choice to burn 3B $JUP (30% of total supply). It’s possible that there will be more voluntary token locks from the team in the future or more rewards for the community beyond what is already allocated to them. It’s important to monitor news and governance votes around unlocks.

Invalidations and Timing

The thesis for $JUP is better suited for more of a long-term buy-and-hold or swing trade strategy, as opposed to trying to play any short-term narratives or catalysts. Part of the reason for this is that the team often works in stealth and we cannot predict when the actual surprise comes; it pays to have some exposure and be positioned. Jupiter has made a number of spontaneous announcements at conferences, such as the recent acquisition of Moonshot, which occurred just days after the app’s crucial role in the $TRUMP launch.

Simply put, Jupiter’s status as one of the top fee-generating protocols on any given day can make it much more comfortable to hold this risk; this goes for several of the tokens representing top-grossing protocols, not just $JUP. This can provide a buffer against getting timing exactly right, as it’s less likely that $JUP, $HYPE, and other large market cap tokens with buyback programs would be hit as hard as other sector tokens should a trader be caught offsides as the market moves against them.

Timing is still important even if there is some comfort in the fact that $JUP has decent tokenomics and demand for the token. Right now still presents a good opportunity to position within the Solana ecosystem, without getting too far out on the risk curve. A return to the mean for $SOL could be in order, and what level constitutes a ‘mean’ for Solana has changed post-FTX unlock. Anything above the $200 level is definitely much closer to fair value for $SOL, with future upside for $SOL, and ecosystem tokens, becoming more limited unless new catalysts present themselves.

When it comes to invalidations for $JUP, it’s hard to think of any that haven’t already come up in the past. $JUP’s correlation to $SOL and just basic execution risk are the most likely causes for a downturn. The team has already been through the FTX collapse. It’s hard to imagine a more catastrophic event for a Solana protocol to go through, though obviously, Jupiter did not yet have a liquid token at that time. Events like this provide some reassurance to the protocol’s ability to handle large drawdowns in $SOL price and properly handle execution during bearish seasons.

Jupiter, has grown to become one of, if not the most important protocol for Solana’s success, though the interdependence is somewhat mutual at this point. A sustained downturn in Solana activity, which would probably coincide with a downturn in $SOL price, is the biggest invalidation for $JUP. A trend of this magnitude would likely take months, if not years, to play out. Right now, the place with the most activity and the highest trading volumes for applications to take advantage of is Solana; should something catastrophic happen to the chain, Jupiter is one of the most capitalized and experienced teams to pivot elsewhere. Still, speculating on this sort of thing is mostly a fool’s errand. Buybacks are nice, but at this mcap and FDV they aren’t moving the needle, so they shouldn’t be incorporated into timing a trade.

Conclusion

$JUP represents a true on-chain conglomerate. In this current market environment, there may be heightened demand for exposure to less speculative, established, and, most importantly, profitable protocols. This is accentuated at a time when $SOL looks to have bottomed, with the FTX unlock having just passed and the asset’s inclusion within a U.S. Crypto Reserve weighing on investors’ minds. While the tailwinds for Solana will benefit Jupiter immensely, the thesis behind $JUP is in its proven ability to execute, expand its operations, and generate fees. Solana is simply the chain with the users and active liquidity to create the best environment for revenue generation, $JUP remains one of the top user-facing protocols capable of consistently generating fees.

Disclosures

Alea Research has never had a commercial relationship with Jupiter and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.