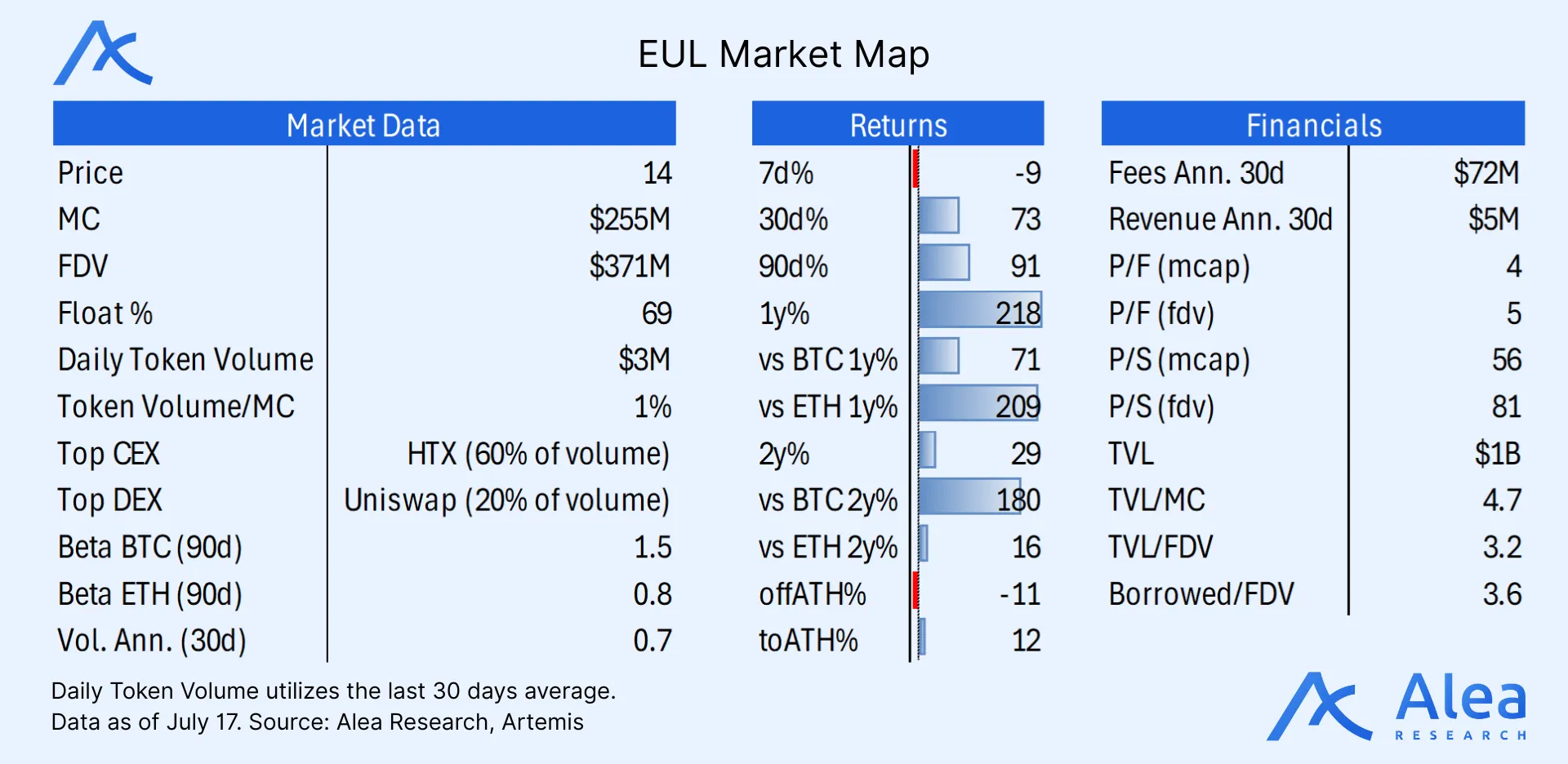

$EUL has broken into fresh price‑discovery, tagging $15.0 (+20 % vs. the September‑2022 past all-time-high). Our thesis: Euler is positioned to become the DeFi operating system that welds trading, lending, and leverage onchain. We believe it’s a misunderstood meta-protocol improperly labeled as a hybrid money market with a DEX. The unfair advantage for their competitive edge stems from an intricate modular design consisting of key primitives that combined together result in critical and highly sticky infrastructure for token issuers and asset managers. With over $1.3 billion borrowed and a FDV shy of $400 million, we are looking at a Borrowed/FDV ratio of >3x (114% greater than Maple’s $SYRUP and 150% greater than $MORPHO) for the credit market with the highest utilization rate globally and the highest number of vault combinations.

Building with intentional optionality is in the DNA of the team, and this flexibility is also embedded in the buybacks fueling $EUL token economics. Fundamentals are accelerating at an opportune moment as ownership becomes increasingly dominated by liquid funds. Because upcoming emissions are modest, transparent and tied to growth incentives, the float is effectively hard-capped while activity scales. The result is sticky TVL, versatile growth strategies across ecosystems, widening fee capture, and a moat that strengthens as markets diversify across stablecoins, RWAs, LSTs, PTs, and other exotic pairs. This has started to materialize in price appreciation, up 91.2% in the last 90 days and 72.9% in the last 30.

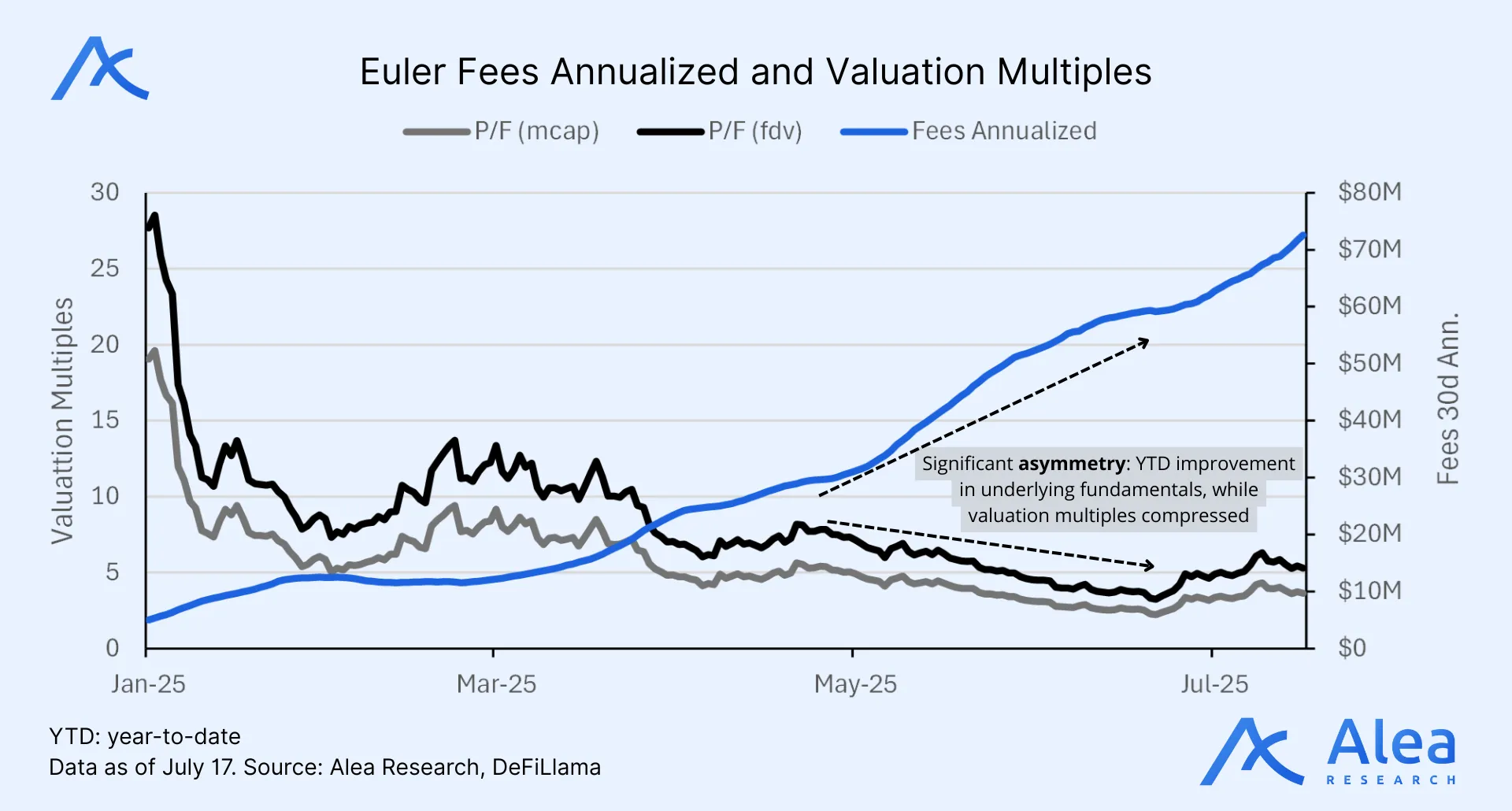

The $EUL token price just cleared its historical ceiling, and even though the asymmetric profile is not the main driver anymore, we see a rare blend of technical leap, favourable tokenomics, and an experienced team that has rebuilt credibility into a stronger brand. In price discovery, building a position here is a bet that market structure matters: when a protocol lets the same collateral power swaps, loans and leverage, liquidity deepens, fee revenue rises, and Euler becomes a more attractive foundation to build structured products and protocols on top. The cap-table no longer having oversized VC blocks reduces potential sell pressure, and $EUL currently stands out with a P/F (fully-diluted) multiple of ~5.2x, in contrast versus that of peer protocols like AAVE (8.2x), Morpho (18x), or Maple (40x).

Supply is known and strategically allocated, revenue is compounding, and the rails for capital efficiency and yield strategies are unattainable to isolated monolithic entrenched competitors. We see this flywheel turning Euler into the indispensable liquidity backbone for Ethereum, L2s, and EVM chains. With EulerSwap going live and growing dominance in market-share KPIs, we see in $EUL an opportunity to bid not only on the most versatile powerhouse for strategy creation onchain but also on a relative-value basis that looks underrated relative to both peers and proxies in fleeting narratives across the board.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free