Owning the Full Stack Dollar Economy

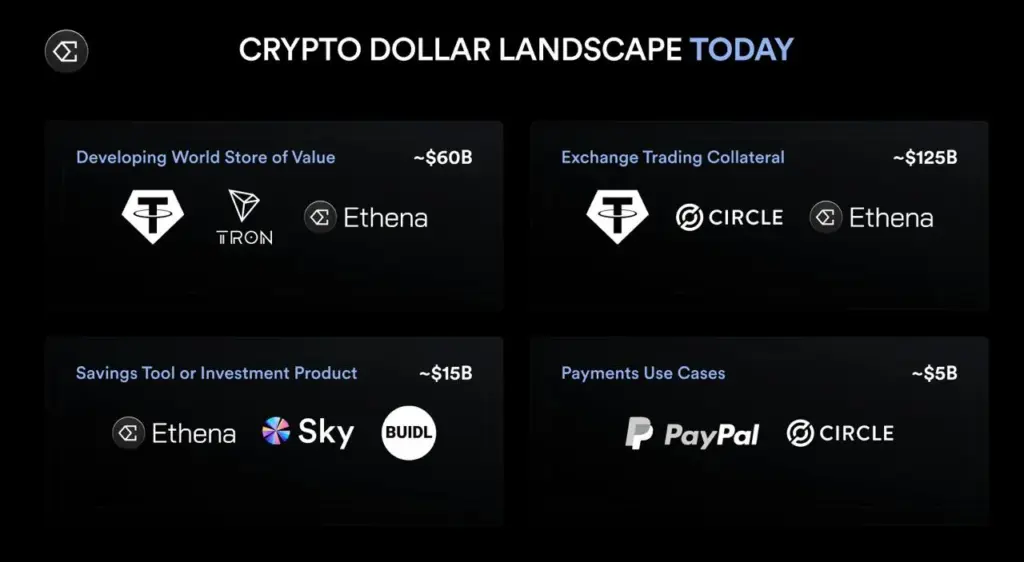

Expecting an aggressive repricing ahead of Convergence mainnet, we find ENA to be one of the most asymmetric opportunities available on the liquid markets. This is a high-conviction bet offering exposure to a Kingmaker in the asset issuance space. As the largest yield-bearing stablecoin, Ethena has already amassed a liquidity moat. Owning the full stack with Converge further strengthens its competitive edge. Riding network effects and purpose-built for value capture, our view is that the path from protocol to full-stack ecosystem demands a monetary premium that will be reflected in token price once institutional flows start coming in. With Converge set to fuse permissionless yields and compliance rails, ENA becomes the clearest trade to wager on billions in dormant TradFi capital finally coming onchain.

Currently trading orders of magnitude below past all-time-highs, Ethena is stacking core primitives under a single economic umbrella where value is captured by ENA. With a market cap over $2B and fully-diluted valuation slightly under $6B, Ethena is about to realize its vision as a full-stack onchain behemoth. Still, this is not being reflected in price action just yet. Bringing crypto-native primitives and TradFi compliance in one venue, this is a playbook that no competitor will bother attempting to replicate. Right now the largest yield-bearing stablecoin float, it is expanding its revenue sources with an appeal to both retail and institutions by meeting them where they are and providing them with frictionless onboarding. This should translate into rising flows and direct value accrual for ENA as it builds deeper ecosystem liquidity and grows the marginal dollar paid per user, whether it is via Telegram payments or compliance SPVs.

Key Takeaways

Converge Mainnet is the Imminent Catalyst: Despite the anticipated launch, this is the actual inflection point that unlocks billions in institutional TVL.

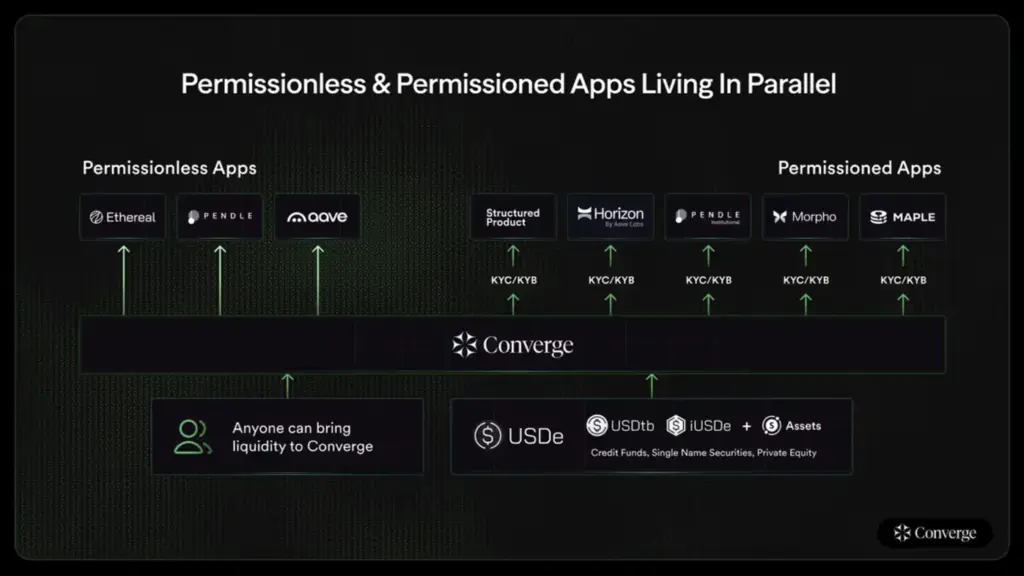

A Full-stack Moat: With Converge, Ethena finally unifies stablecoin minting, yield earnings, a compliance base layer, and an ecosystem of dApps. Pre-arranged integrations with renowned entities give a “cold-start” advantage.

Dual Capital Funnel: Serving both DeFi natives and providing the adequate TradFi rails, Ethena hosts both user bases under the same capital roof.

Multiple Cash Flow Capture: Fees, spreads, and seigniorage all accrue to stakers, translating into a valuation premium. From a governance chip, ENA becomes a monetary asset.

Kingmaking Foundations in Place: Securitize for compliance, Anchorage and Fireblocks for custody, and names like BlackRock validate institutional demand.

Sticky Capital On a Lindy Base: Hosting both permissioned and permissionless environments, blue-chip DeFi protocols like AAVE and Pendle will co-exist with RWAs, Treasuries, and more.

The Market Opportunity

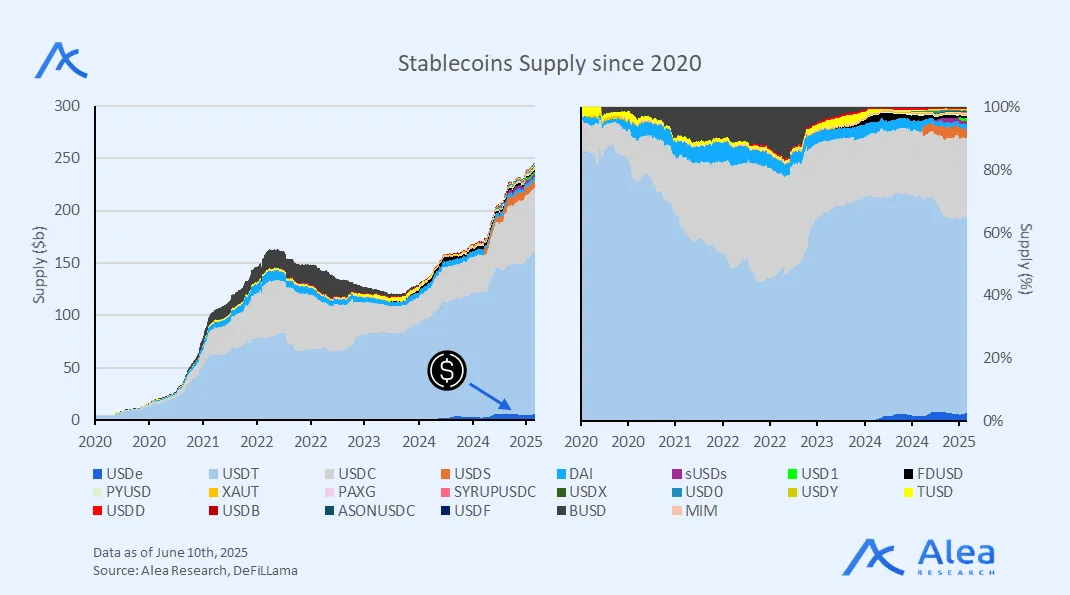

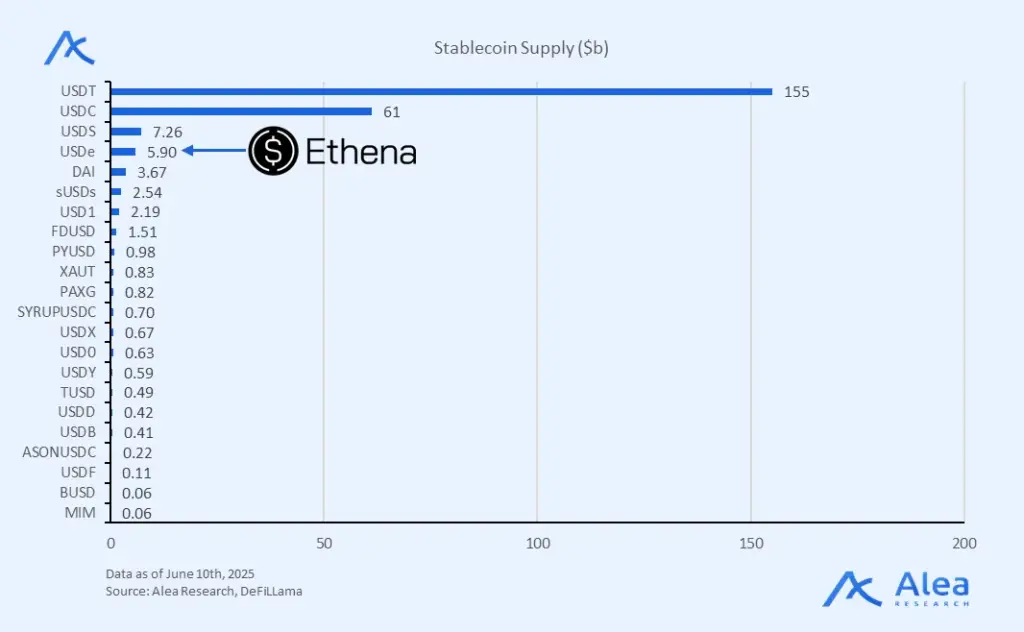

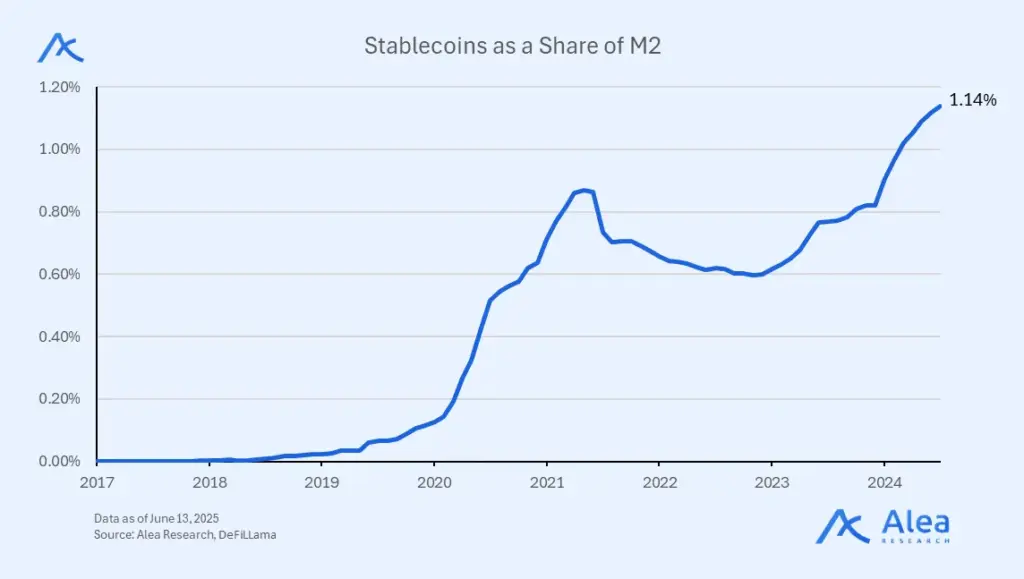

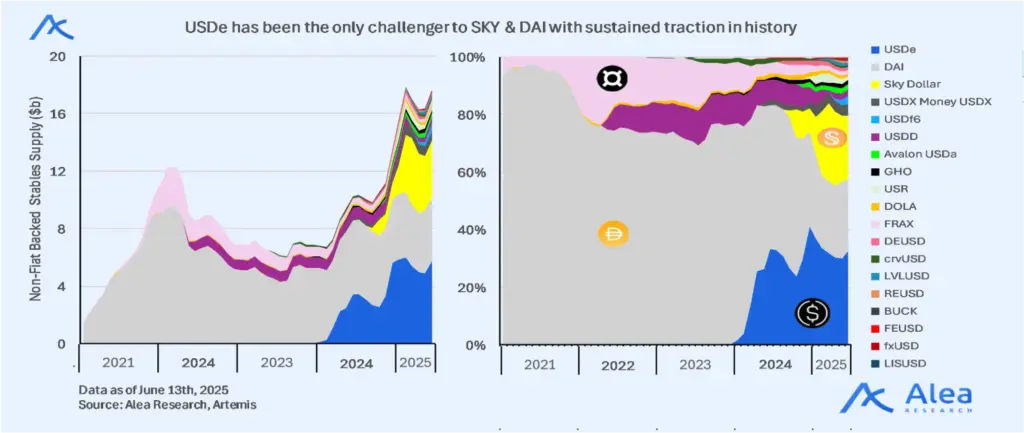

Stablecoins are crypto’s most proven use case, settling trillions onchain and supporting the majority of DeFi’s volume. Turning the stablecoin issuance business model on its head, Ethena led the rise of yield-bearing stablecoins. Today, the total supply of yield-bearing stablecoins is slightly above $6B, with sUSDe (only staked USDe ie sUSDe accrues the basis yield) representing almost $3B and the bulk of the other half being Sky’s sUSDS and sDAI.

Having grown past the initial skepticism, Ethena is now more than just a yield-bearing stablecoin issuer. In fact, with USDtb, it has also demonstrated that it is becoming more antifragile over time. The combination of crypto-native and TradFi yield not only unlocks arbitrage opportunities, but helps the protocol to stay relevant and capture positive perps funding in bull markets while reallocating to T-Bills in bear markets.

Despite the size of the total-addressable market and clear signs of product-market-fit, the current valuation implies minimal institutional adoption; even a growing share of the stablecoin TAM alone could justify rising returns. Nonetheless, co-developed with Securitize and pre-integrated with Anchorage and Fireblocks, Converge’s mainnet is an imminent catalyst that we argue is not yet priced in. With the institutional pipelines already in place and applications being shipped at launch, we expect price to front-run the highly anticipated flows. Even at $100B+ in TVL, the current size of DeFi is trivial next to the trillions that flow around global capital markets.

ENA is no longer the governance token of a stablecoin issuer that only recently entered the market. After proving resilience on multiple occasions, ENA is not just about the Lindyness of its yield-bearing assets on different market regimes anymore. With Converge, the opportunity lies in the convergence of DeFi-native users and institutional capital coexisting on a single, composable base layer. As the native asset of a full-stack DeFi economy that brings together stablecoins, RWAs, and crypto primitives with compliance guardrails, we anticipate a material repricing once Converge’s growth is too hard to ignore. We expect this to happen fast, and at once, as there are pre-agreements on committed capital in place.

We cannot underestimate how broad and large the current user base of Ethena is. Not only is it tapping into the main venues on Ethereum mainnet such as Pendle, Aave, or Curve, but it is simultaneously expanding to new ecosystems ranging from L2s to chains like Hyperliquid, Berachain, and TON. This brings benefits in both distribution and liquidity stickiness. Having bootstrapped all of this demand ahead of Converge is additional leverage that increases the adoption of USDe and amplifies network effects. From a go-to-market perspective, this strategy also serves as a bootstrapping mechanism for Converge. With a larger holder base, Ethena has now established monetary demand and user familiarity, seeding future value flows into its own ecosystem. Ultimately, the multichain presence is not a distraction, but a critical step in building liquidity gravity that will make the eventual consolidation on Converge more organic and high-value.

Simultaneously, we cannot overlook the importance of Ethena to be scaling its retail distribution. For instance, the Telegram integration literally embeds yield-bearing USDe into the chat wallet of 1B+ users. This translates to offering 10%+ USD-denominated APY to large populations in emerging markets, resembling WeChat’s neobank model.

Together with more favorable regulatory conditions in the US with the Trump Administration, Ethena is one of the few projects offering a credible and sticky entry point to onchain finance to both retail users and institutions.

Competitive Landscape

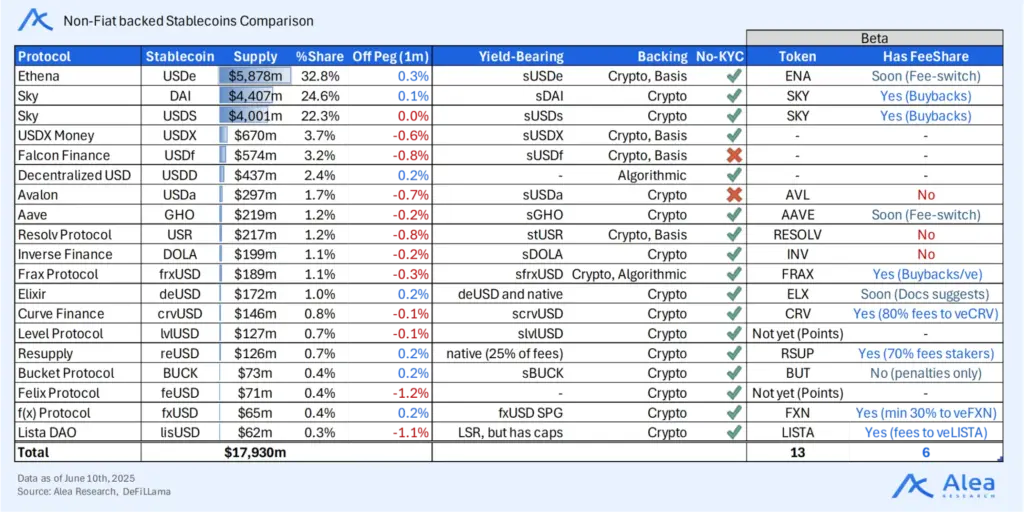

Ethena isn’t alone in aiming to bring decentralized stablecoins to the masses. Within its sector (non-fiat backed), where protocols are backed by crypto, basis, or algorithmic mechanisms rather than traditional fiat, ENA stands out with a clear path to value accrual and a strong moat. Broadly, we identified 18 protocols (top 14 plus 4 honorable mentions with significant fees on DeFiLlama) in the growing competitive non-fiat stablecoin landscape. Of these, only 13 have liquid tokens (2 more upcoming with points programs), and just 6 currently offer fee-sharing systems, with ENA being one of the three soon to implement it.

To gain exposure to this market, we believe liquid funds and larger investors will increasingly favor established players with high growth potential. Sky (recently rebranded from Maker) is a top contender due to its longstanding market confidence as the oldest stablecoin issuer and strong Lindy effects. However, there’s a significant chance it could lose to Ethena, thanks to Ethena’s key partnerships (as exemplified by Converge’s strategy) and its different backing system, which lowers supply growth bottlenecks. Empirical evidence shows that ENA’s USDe has been the only challenger to Sky’s USDs (formerly DAI).

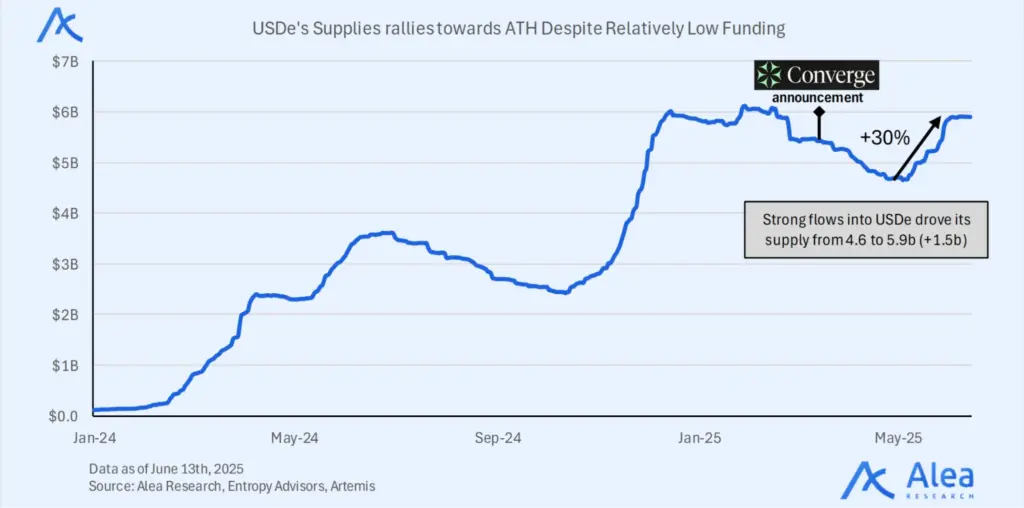

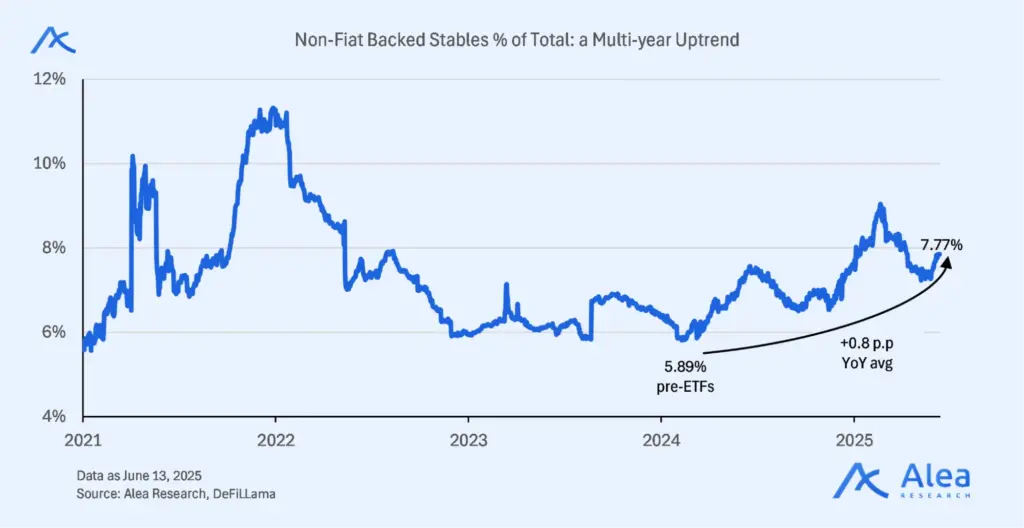

The data speaks for itself, Ethena’s killer product has seen huge growth due to the higher yields and DeFi integrations. One key trigger that we should note for the above chart going forward is the launch of retail stablecoins now that the GENIUS bill act has passed the senate in the US, which should open the door for several more issuers in the coming months. WIth this new inflow of users, we should see a similar rise in the search for yield (higher mindshare with network effects to create a positive feedback loop), which we think only goes higher from here as most stablecoins today are used by business and not necessarily touching DeFi.

Ethena is operating in a “growing-the-pie” market on two fronts—gaining share against both decentralized and centralized peers. This dual trend suggests that Ethena can continue increasing its market share regardless of new entrants, as long as these dynamics persist. In a later section (Valuation), we outline different scenarios for how Ethena’s trajectory might evolve.

Growing the Moat

Pre-integrated partners and ample liquidity solve the cold-start problem of new chains entering the market, and the combination of a permissionless layer with compliance wrappers further accelerates the bridge between TradFi and DeFi capital. Meanwhile, UX and monetization moats start to form around the use of stablecoins for gas payments, embedding fee flows and validator incentives at the ENA staking level. This cohesive stack not only sets the Ethena ecosystem apart, but also unlocks signs of reflexivity in network effects as stablecoin adoption translates to rising TVL and increased protocol revenue. The demand sinks of those forces will eventually be very hard to ignore.

As Converge goes live with various DeFi protocols, (Aave, Pendle, Maple, Morpho, Ethereal, etc.), one can expect incentive programs to be introduced to attract TVL onto the new chain. This might skew TVL projections temporarily but also signals opportunity. Both liquidity and points incentives should attract flows and the idea is that Ethena’s ongoing seasons keep them hooked until the end of the year to create stickiness. Since there will be multiple protocols entering the market at different points in time, we expect this to be a trend rather than a short-term fleeting contingency window.

With several major DeFi protocols announcing support for Converge (Aave, Pendle, Morpho, Maple, etc.), one might wonder if existing TVL from Ethereum will simply migrate over to Converge. The more likely scenario is that Converge’s growth will come from incremental new capital and unique use-cases, rather than wholesale migration of existing liquidity. The key point is that introducing a dedicated chain can create a new venue optimized for certain activities, but liquidity is already “sticky” on Ethereum and other chains. For that reason we argue that Converge grows the pie, and not just shifts liquidity.

Take Aave’s RWA instance (Horizon) as an example. The deployment of Aave Horizon on Converge will be an institutional market that is KYC-gated and that focuses on tokenized RWAs and iUSDe. This does not replace Aave’s massive existing pools on mainnet. Instead, it’s a new market segment. Institutions that were not using Aave on public chains due to compliance can now participate via Horizon on Converge. The same applies to Pendle facilitating yield trading and enabling new yield products not available elsewhere.

Of course, if Converge doesn’t offer sufficiently compelling benefits, it could struggle to attract any substantial liquidity. But given the unique RWA angle and backing by Securitize and major protocols, it seems positioned to tap into growth areas. Converge’s upside comes from being a specialized hub for dollar-based DeFi and TradFi assets, driving incremental growth (the “convergence” of new TradFi money with DeFi). For that reason, the expectation is not for existing TVL to simply migrate overnight. Instead, the support from big DeFi names is more about validating the ecosystem and ensuring key building blocks (lending, yield markets, etc.) are in place for those new flows, rather than pulling their entire user bases over.

ENA & Value Flows

Up until now minting and redemptions of USDe don’t enforce holding an ENA balance. Now with Converge the utility value from staking will introduce a new demand sink. With Converge, ENA becomes the monetary and coordination layer of the Ethena ecosystem. USDe and USDtb are gas, and ENA is the staking token, with the latter capturing value via fee payments in stablecoins and via ownership of ecosystem app tokens through airdrops. Spanning stablecoins, yield-bearing products, RWAs, and core infrastructure hosting both DeFi apps and TradFi capital, we are looking at a wealth of value-accrual opportunities. Similar to the BNB model, or how HYPE accrues value via vertical integration. ENA is positioned to capture flows not only from asset issuance but also from network activity catalyzed by ecosystem dApps.

Gas payments in stablecoins—USDe and USDtb—simplify UX and flow directly to stakers without directional exposure to a volatile token. This is a form of continuous cash flow directly correlated with network activity. On top of that, Ethena has reiterated on multiple occasions the deliberate choice to imitate the BNB model. This implies that, in addition to the stablecoin revenue from onchain fees, ENA stakers should expect to be rewarded with co-incentives and airdrops from partners and ecosystem protocols. Ethereal has already set a precedent with a 15% of the total supply allocation, and the same can be expected from other partners such as Symbiotic or Converge-native protocols. New protocols launching on the chain have a clear incentive to allocate a portion of their token supply for Ethena stakers to bootstrap liquidity and attract early users. This feedback loop is free marketing that is amplified as the number of competing projects increases, with all of them trying to get support from the core team and gain mindshare versus competing projects.

That being said, the revenue projections of such a stake-to-earn model is uncertain. There is a reliance on extrinsic reward streams and these airdrop decisions are at the discretion of their teams. The fact that there are no contractual agreements in place means that the rules can change anytime and we should expect moving goal posts; there are no hard-coded fee flows to ENA yet.

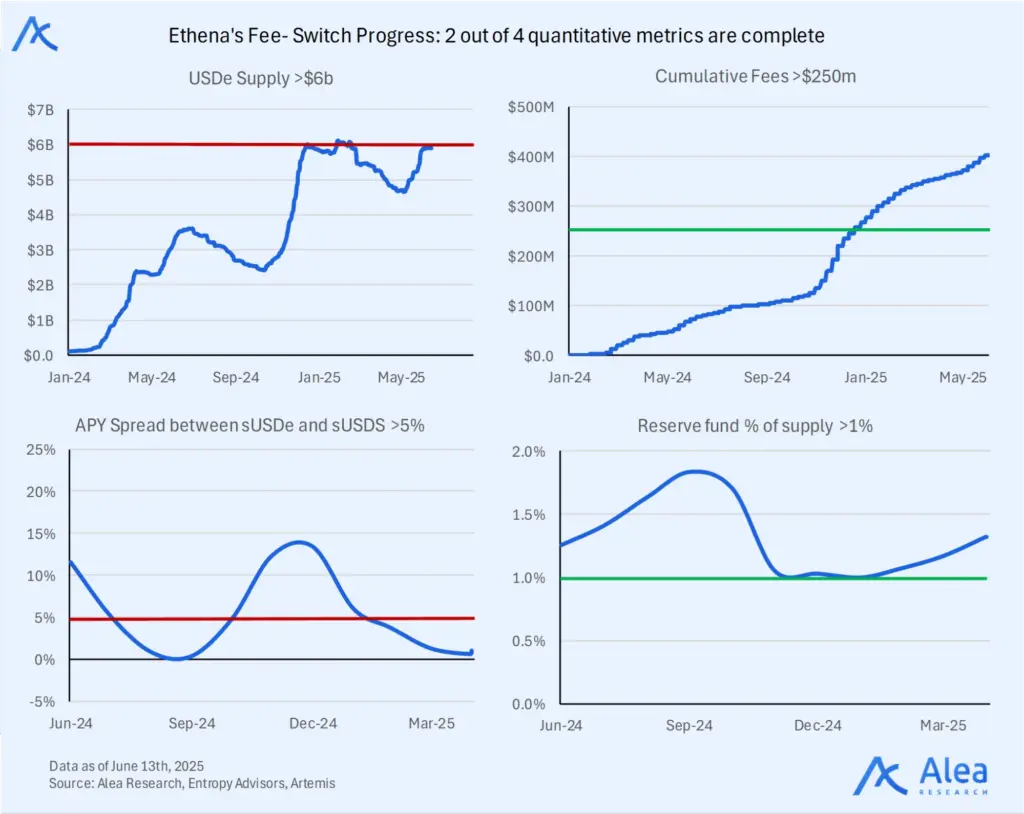

For the short term, the ecosystem carrot may lift demand, and this is a positive-sum dynamic while we await more clarity on revenue share terms after a fee switch activation. On that front, Wintermute submitted a proposal on November 2024, urging Ethena’s Risk Committee to pave the way for a “fee-switch” that would direct a yet-to-be-determined share of protocol revenue to sENA holders, thereby realigning token incentives with Ethena’s proven revenue growth. The Risk Committee subsequently set three success metrics to be met first:

- USDe circulating supply > $6 B

- Cumulative protocol revenue > $250 M ✅

- USDe listed on 4 of the largest derivatives CEXs ✅

At the time, the idea was for these targets to be reached and then maintain two risk metrics on an ongoing basis (both reviewed monthly):

- sUSDe must yield 5.0–7.5% above a benchmark rate

- Reserve Fund must stay adequately capitalized (>1% of USDe supply) ✅

Once these milestones are achieved, the regulatory roadblocks should be de-risked under the new U.S. administration. It will be key to keep an eye on the governance forum to evaluate the valuation scenarios we present below.

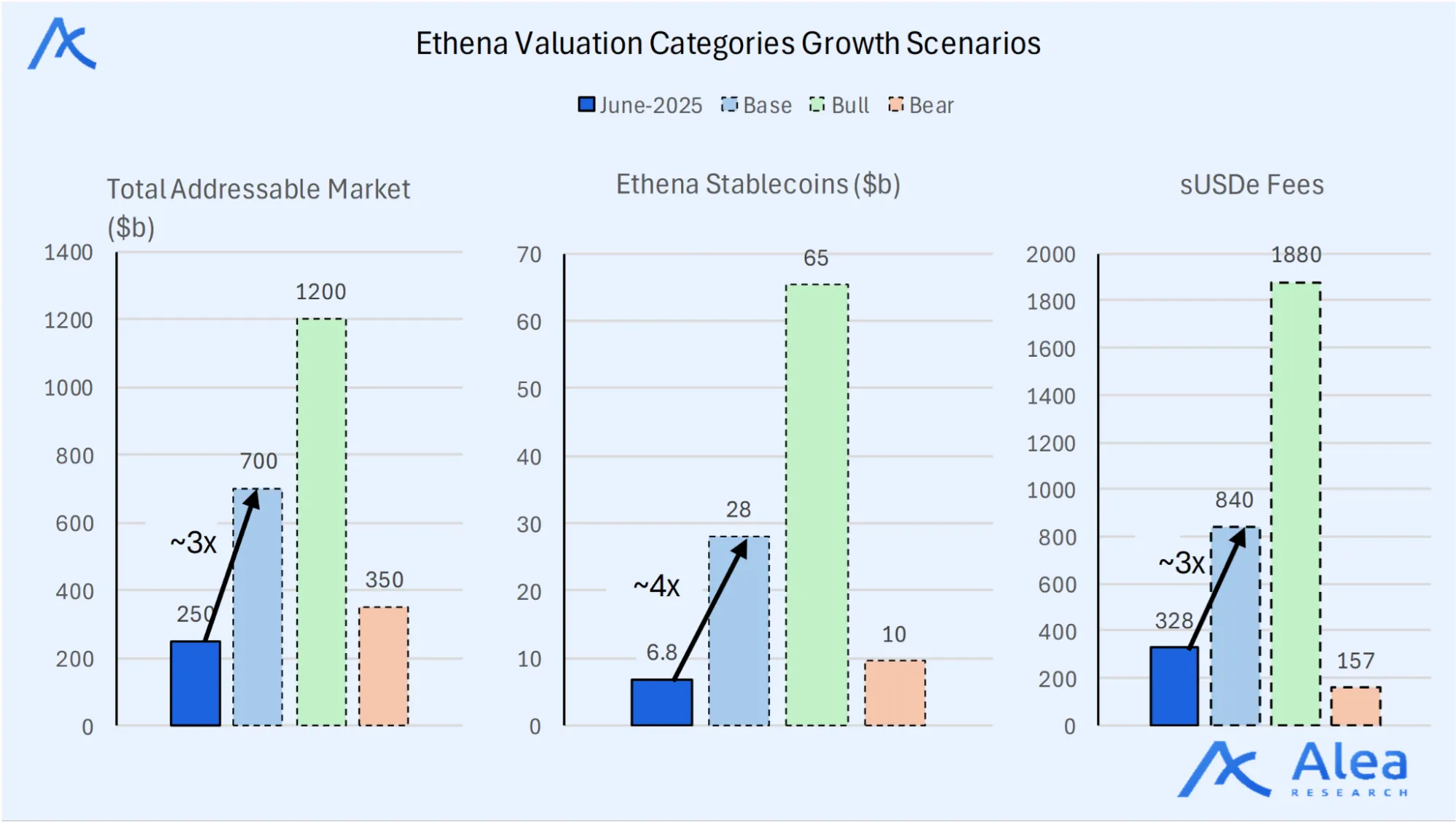

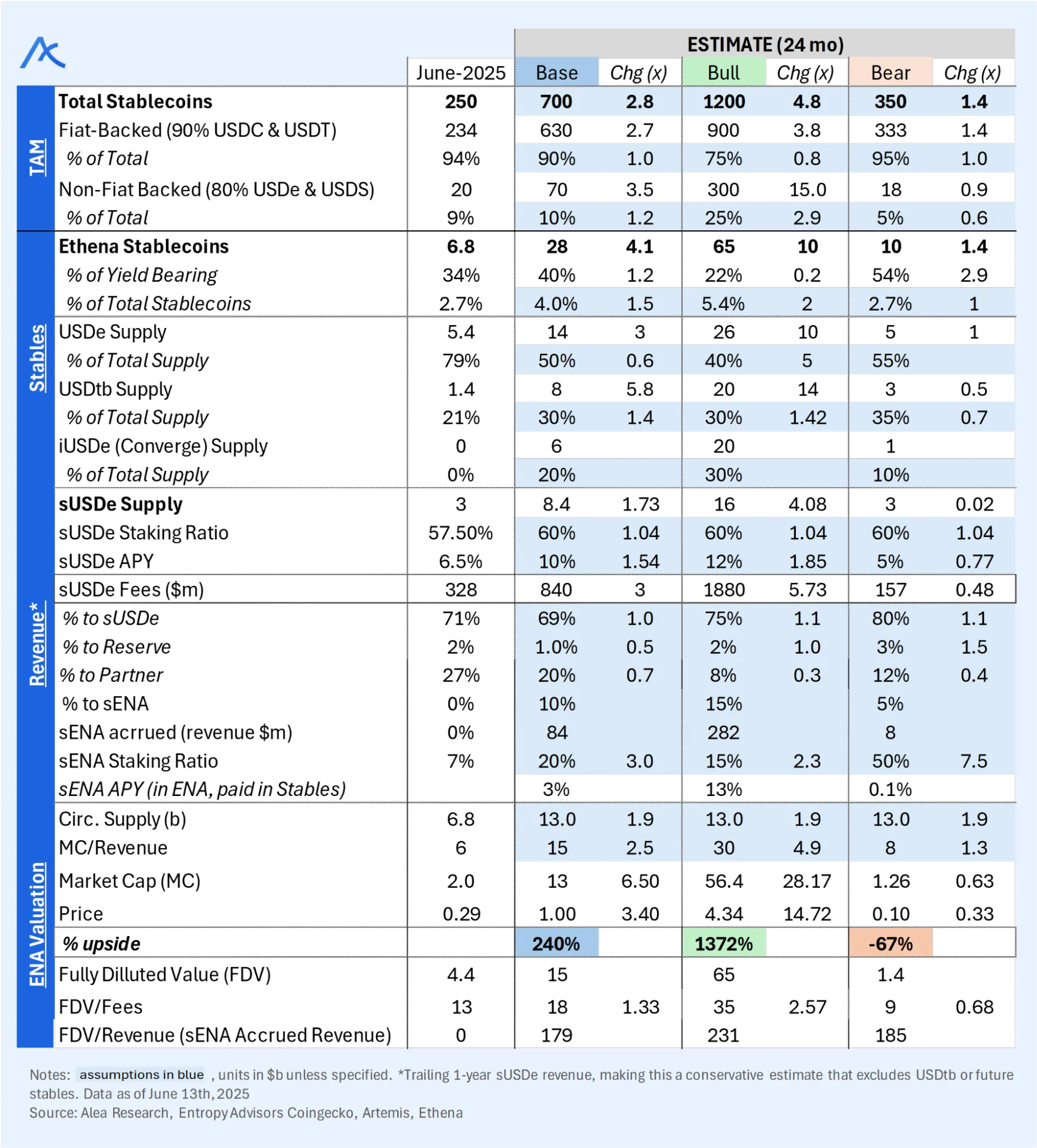

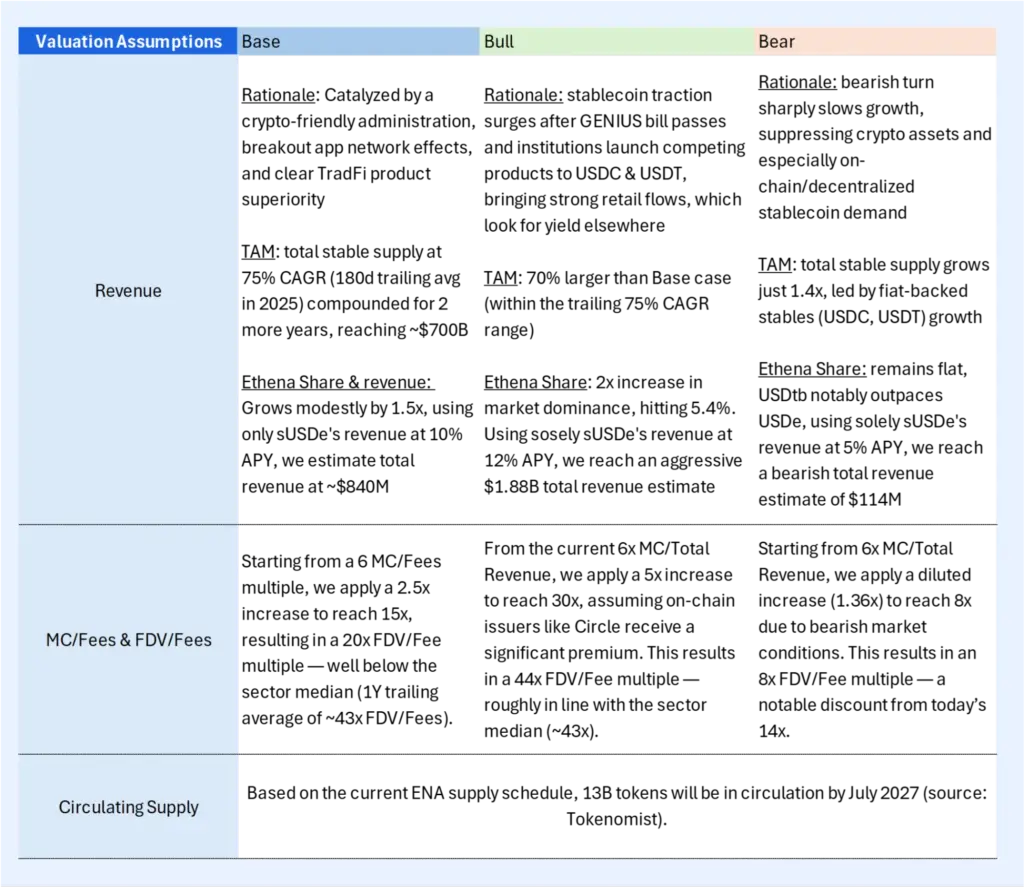

Valuation Scenarios

In this section, we explore how $ENA could perform with a fundamental analysis valuation, modeling different revenue capture scenarios, staking participation rates, and multiple assumptions to estimate fair value ranges across bull, base, and bear case. We plan to revisit this valuation in the future—both to assess how our assumptions played out and to re-evaluate $ENA’s upside from that point forward.

The above outlines our in-depth reasoning and quantitative process behind the key variables used to arrive at the final valuation. In reality, power law dynamics in stablecoin adoption on decentralized rails may render these assumptions modest relative to their true impact. To exemplify why we view this as a conservative valuation:

(1) It includes only sUSDe revenue, even though the protocol already generates income from other sources like USDtb and will soon from future products, which are streams that could gain significant traction and become major revenue drivers.

(2) While sENA demand is expected from both CEX and onchain holders (currently mostly onchain), we applied a low staking ratio to avoid overstating the valuation from the supply sink effect it creates.

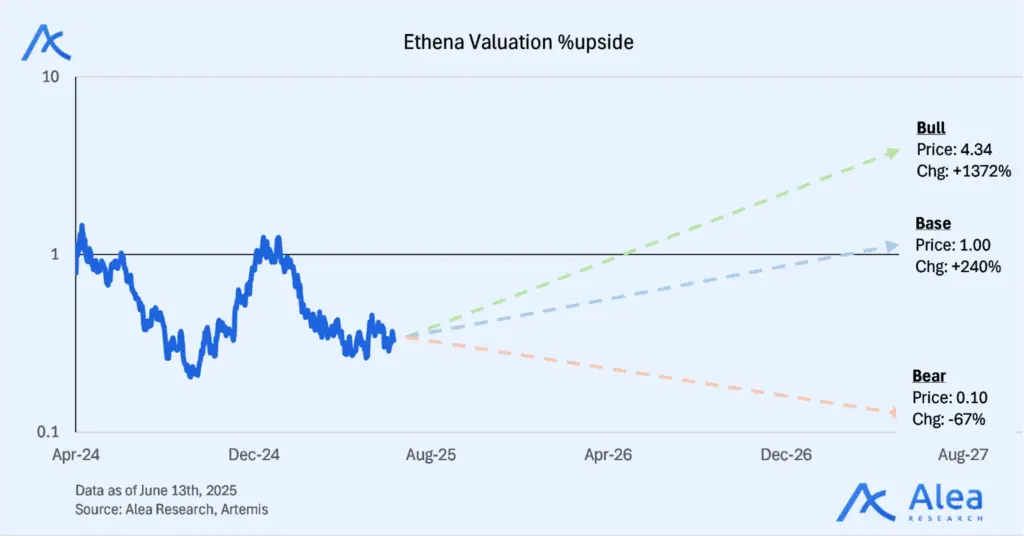

We’ve modeled a straight-line path to the targets, which doesn’t reflect how markets actually behave. In live trading, taking partial profits leads to better risk-adjusted returns, especially in high-volatility periods where sharp price spikes can occur intraday even in highly liquid tokens like ENA.

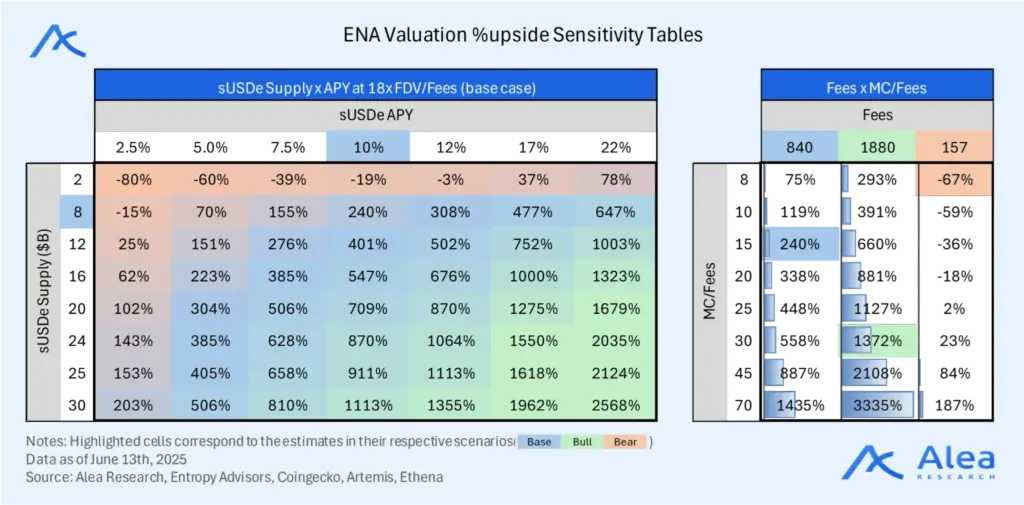

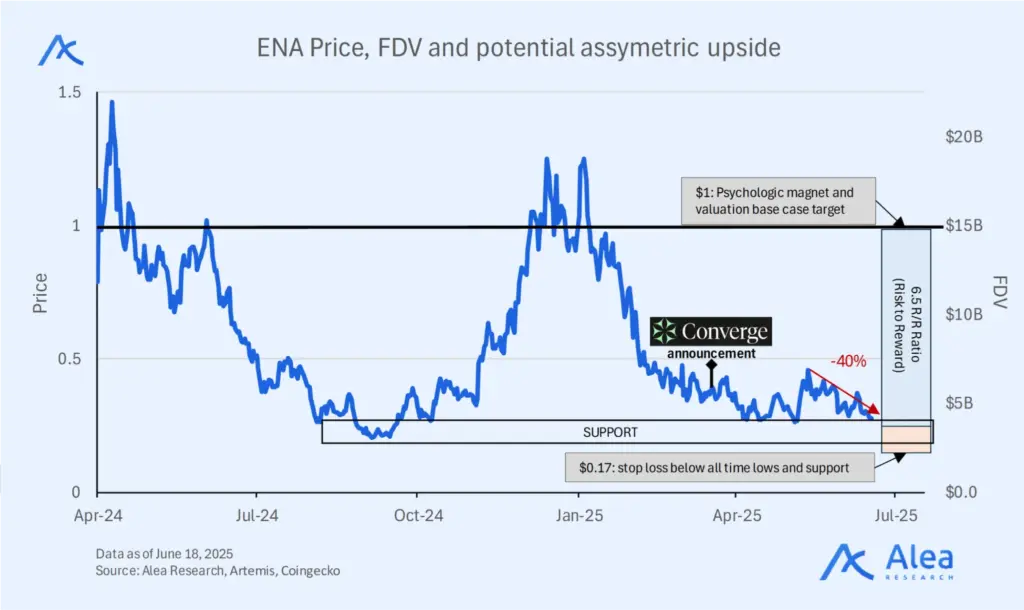

The 2-year base case target price is $1.00, with the bear case at $0.10 and the bull case at $4.34. This wide price range highlights the asymmetry of the opportunity, with the following Reward-to-Risk (R/R) ratios calculated as the absolute % upside of one scenario over another:

- Base/Bull: 3.6

- Bull/Bear: 20.4

- Bull/Base: 5.7

In the table on the left, the base case FDV/Fees outcomes show a wide price range from -80% downside (0.2x) to 2568% upside (27x), giving ballpark figures for a “moonbag” (Buy and hold, not selling early) or where the largest drawdown could be.

On the right, our estimates place the base case near the lower end of MC/Fees multiples, which could be increased to 70x and capture up to 15x upside. Given a market full of value traps, especially in crypto where price often follows narrative rather than fundamentals, applying a margin of safety is our preferred approach. We would rather be pleasantly surprised on the upside than caught off guard on the downside. ENA is currently part of the bid book on Market Pulse, a weekly letter that updates on portfolio rebalances and protocol coverage every 7 days.

The opportunity cost of a late ENA entry rises as Converge and fee-switch milestones approach, therefore positioning before the end of Q2 offers a well-timed entry ahead of these catalysts.

Risks & Invalidations

As the circulating supply grows and more holders pile up on the carry trade, that decreases the over-dependence on USDe’s yield prints on a weekly basis. In a bullish market, and from a price action standpoint, all eyes are on ENA itself. Thus, the main risk for our thesis not playing out as we expect is if in fact the news is already priced in and we fell prey to over-estimating the size and growth of Converge. Simply put, if expectations peak and ENA underperforms, the market is signaling that the Converge catalyst is indeed imminent and fully priced in.

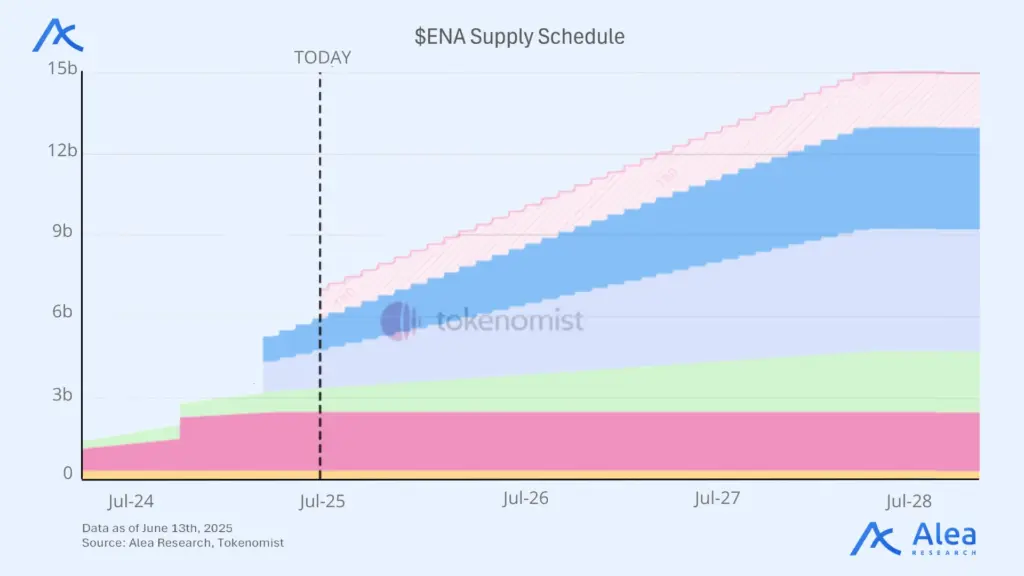

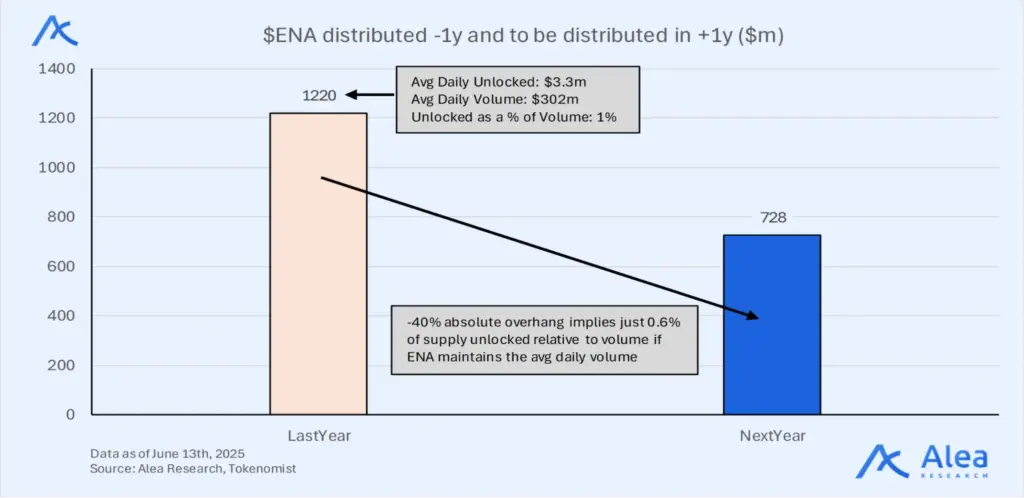

Outside of that, even though token unlocks or profit-taking could put the brakes on during certain time windows, we foresee most setbacks being induced by unexpected delays or disappointments on Converge’s degree of adoption if allocators aren’t onboarded as planned. Since we are past 1 year since TGE, core contributors and investors have already received their 25% allocation of tokens, with the remaining unlocking monthly for 3 years.

The final significant cliff, set for Ecosystem Development which is likely to be used for Converge incentives, is approaching on July 1st. After that, no further cliffs will happen, which implies that any selling pressure will likely shift from large lump-sum unlocks to smaller, more gradual daily sales. This would reduce the risk of sudden market dumps or heavily discounted OTC deals that force market makers to aggressively clear bids, leading to sharp price drops.

Since last year, we’ve seen substantial unlocks in dollar terms, largely due to major cliffs for investors and core contributors. As a large and liquid token, we can monitor the cadence of token unlocks, as well as OTC sales. Similarly, we can observe liquidity depth to estimate buy/sell pressure at different points in time and on different exchanges. For now, those aren’t necessarily top of mind for liquid buyers.

What’s pertinent, though, is tracking the staking ratio to measure demand for sENA in the context of organic cash flows that may be skewed by incentives. This metric should be watched carefully along with inflation.

For those that put a premium on liquidity and would rather hold ENA, technical invalidations are pertinent on key levels determined by EMAs or the $0.25 support. This should be coupled with other information as well. For instance, if you expect downside from the current price but also anticipate a return to or above the $1 psychological level, then we are still looking at a highly bullish asymmetric setup. In such an event, one could as well get bigger on the way up as confidence on price appreciation increases.

Another way is to position with a stop loss at -40% ($0.17) and a take profit at +240% ($1.00), offering a strong risk-reward setup for the base case (6.5 R/R). If the stop is hit, we wouldn’t immediately be interested at the bid side without first looking at the overall market. Instead, one might as well wait for a 50% rally from the post-stop-loss low before considering a new position. Once that threshold is met, one would look to scale in on any retracement from that move.

The Bybit hack showcased the protocol’s strong resilience to custody-related risks. Overall, the counterparty risk of the CEX short (basis trade) strategy remains low due to Copper Clearloop’s off-exchange custody solution. However, a prolonged depeg—especially if triggered by a hack involving one of the custodial counterparties—could erode user confidence. Even if the underlying assets remain intact, extended instability might push USDe below $1 for longer than most holders would tolerate, risking a loss of trust that is difficult to recover. A historical parallel is the USDC depeg to $0.88 in Q1 2023 following the collapse of Silicon Valley Bank. We believe that if a similar event were to impact USDe, the outcome could be catastrophic. As such, our valuation targets are intentionally conservative and remain below all-time highs.

Another concern is the relatively small reserve backing USDe. Although the current fee-switch requirement is set at 1% of circulating supply, this is minimal in the face of large-scale liquidations—especially across Pendle and other DeFi protocols—that could generate systemic bad debt. While this risk is not yet significant, it could grow over time.

If we are right and our thesis plays out, bullish sentiment would pile up after breaking resistance at $0.5, as ENA has been trading in the $0.25 to $0.5 range since the start of the year.

Conclusion

Our thesis is that ENA presents a reflexive call option to capitalize on the growth of the Converge ecosystem. In a risk-on market, we see little downside but asymmetric convexity on the way up. Despite the Q2 launch of Converge being pre-announced, we argue that now is the best time to position, as the market may be discounting Ethena’s execution abilities (with no good reason for doing so other than unexpected delays). Even though this may be seen as a path dependent trade, the yield-bearing stablecoin sector alone already presents a solid foundation for future growth that we don’t think has been exhausted yet. While the valuation may already be expensive, we don’t think it is likely to get many buying opportunities much lower than current levels if $BTC continues to show strength in a risk-on market.

References

CoinGecko. Ethena (ENA) Price, Market Cap, and Data Overview.

Converge. Converge Tech Specification & Roadmap

Ethena. Ethena Ecosystem Overview.

Ethena. Ethena Official Website.

Ethena. (2025, January). Ethena 2025: Convergence. Mirror.

Ethena Foundation. Ethena Governance Portal.

Ethena Foundation Governance. (2024). Wintermute Governance Proposal for ENA Fee Switch.

Ethena Foundation Governance. (2024). ENA Fee Switch Parameters.

Ethena Labs. Official X Account.

Ethena. The Size of the Opportunity.

Ethena. Transparency Dashboard.

Tokenomist. Ethena Overview and Analysis.

Symbiotic. (2024). Ethena × Symbiotic.

Entropy Advisors. (2024). Ethena Protocol Metrics Dashboard.

Disclosures

Alea Research has never had a commercial relationship with Ethena and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.