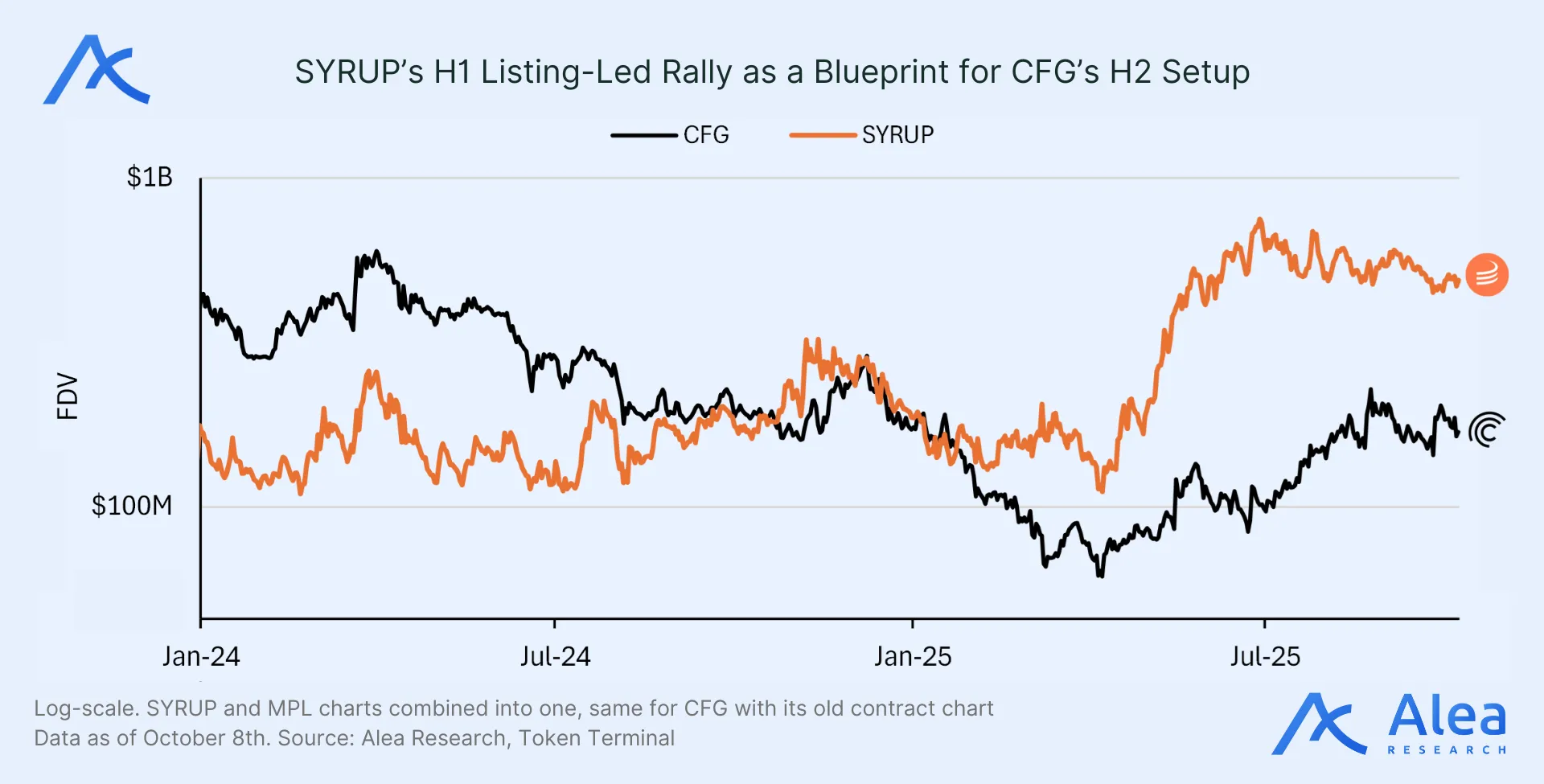

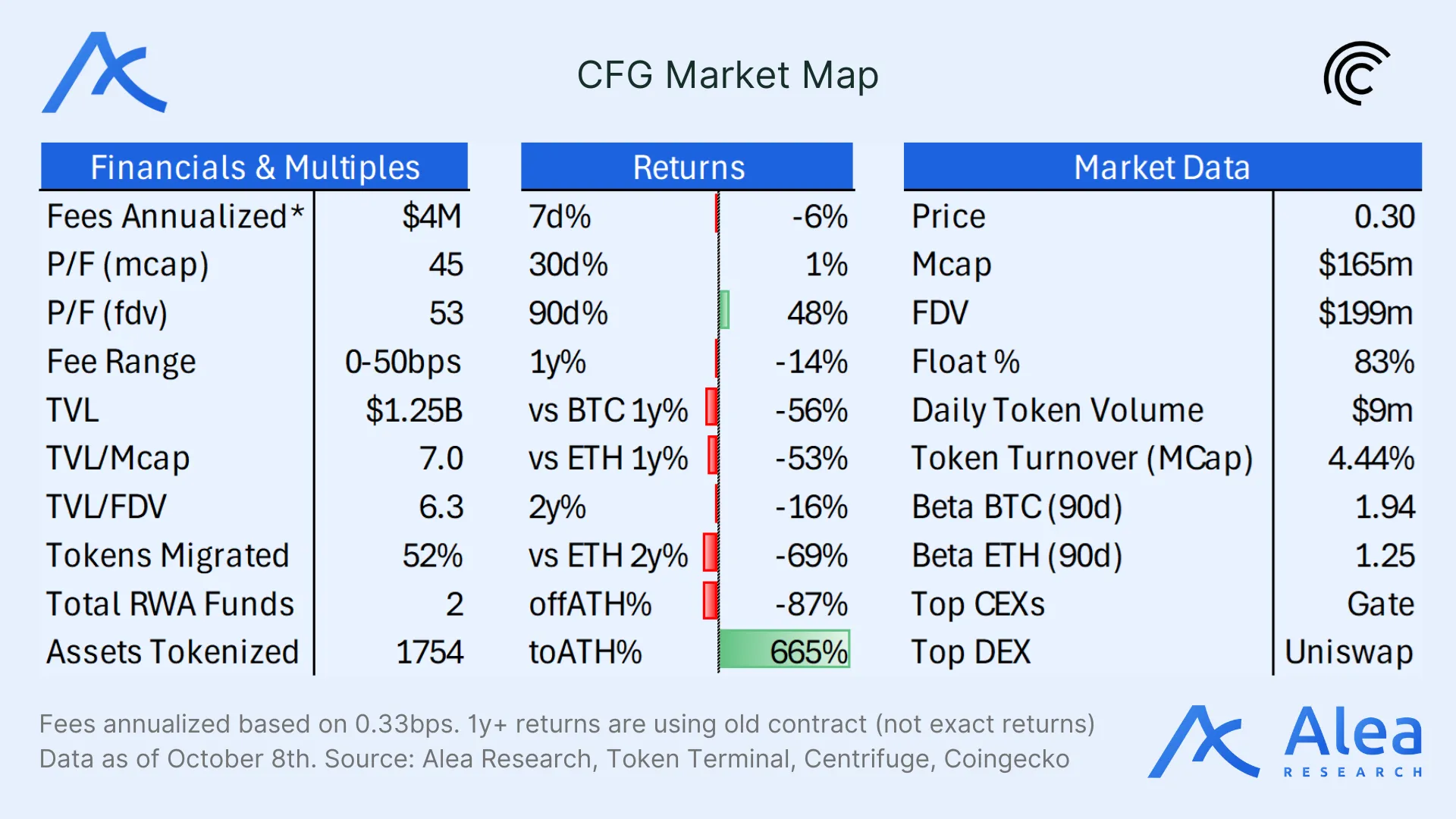

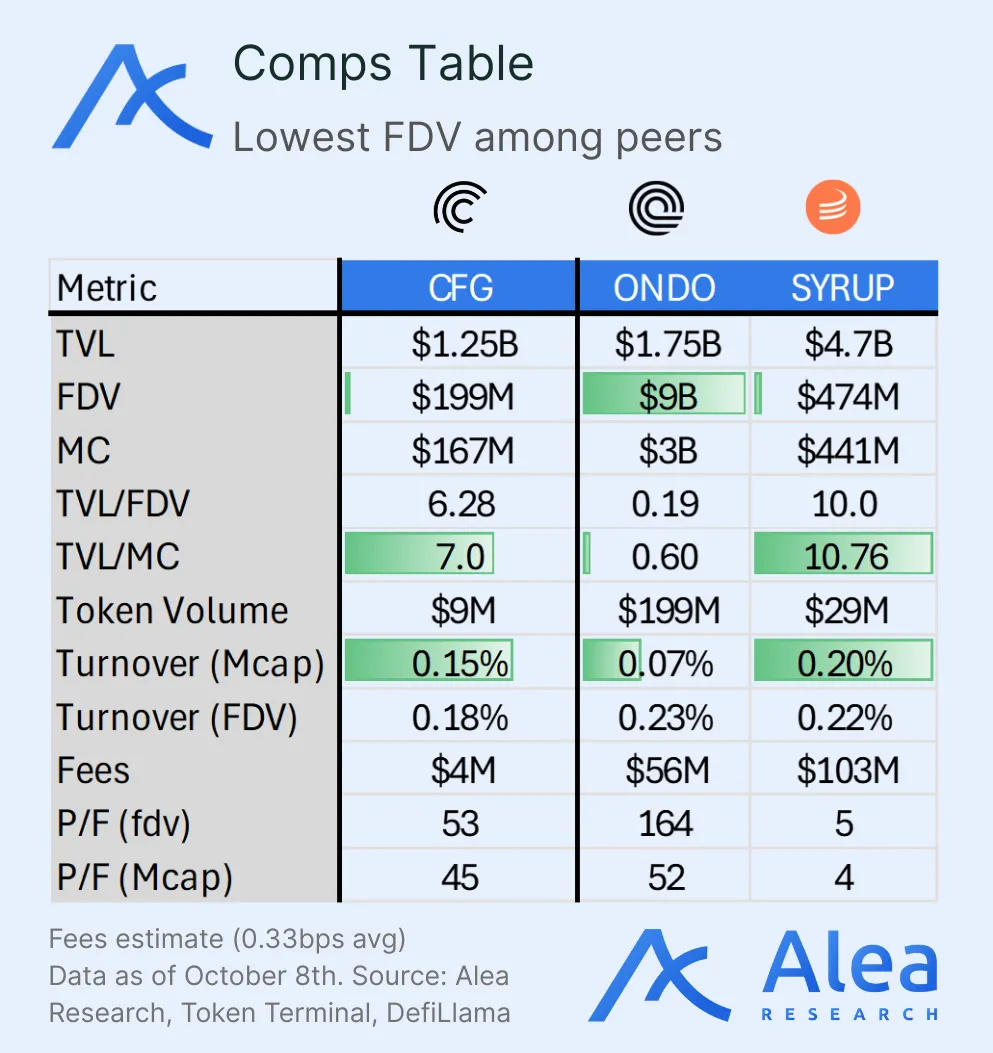

CFG is the highest-beta, all-encompassing, liquid proxy for betting on the growth of RWAs: Securitize and Superstate have no token yet; Ondo screams overvaluation on an FDV basis; and CFG at ~$0.3 market cap (~$200m FDV) with ~$1.25b in TVL (valuation 6x its AUM) offers a pre-Binance Syrup-like entry to capitalize on RWA and tokenization tailwinds.

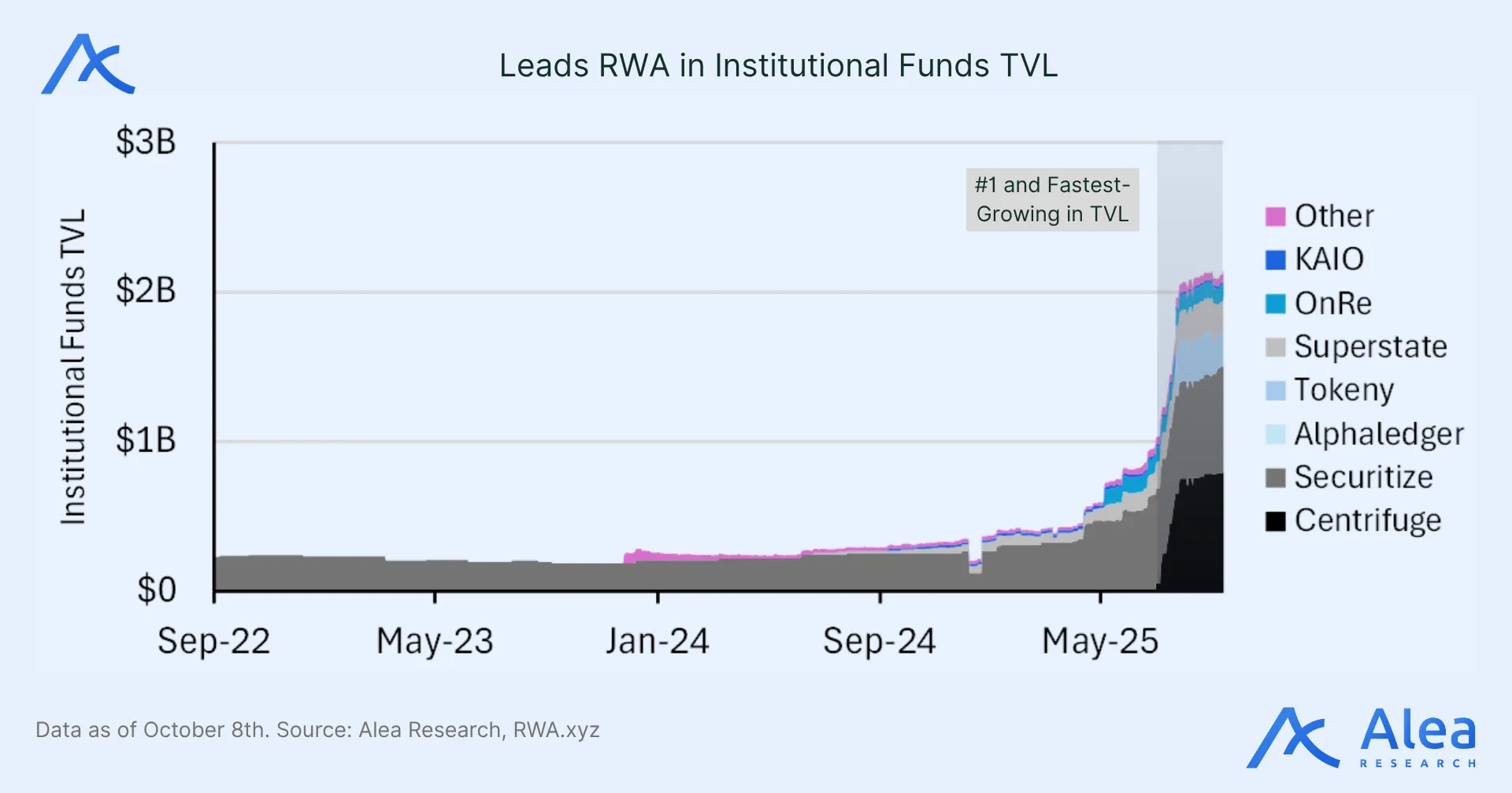

Centrifuge has crossed the institutional chasm: fundamentals and institutional traction are leading price; liquidity is deepening with more CEX listings, making a re‑rating more likely; fees are on; and the team has a credible path to ~$4.5B TVL at an implied ~$15M ARR on AUM charges alone.

From 2017 Polkadot roots, Centrifuge has learned lessons that set it apart: starting where buyers already are (e.g., stablecoin treasuries, institutional anchors, leveraged looping); integrating vertically yet modularly (regulated on‑ramp + deRWA distribution + white‑label SDK); structuring legally durable products and making them ubiquitous across chains; and consolidating token value‑accrual so fundamentals and market expectations align.

Key Takeaways

- CFG: Relative value with institutional proof and a distribution edge—one of the cleanest liquid opportunities for RWA exposure.

- RWAs: Tokenized T-Bills proved scale; now RWAs are compounding via DeFi composability, higher-yield assets, and broader accessibility.

- OG & Lessons Learnt: i) Start from demand, not supply, ii) institutions need a counterparty, not a DAO, iii) chain ubiquity and legal wrappers for scaling.

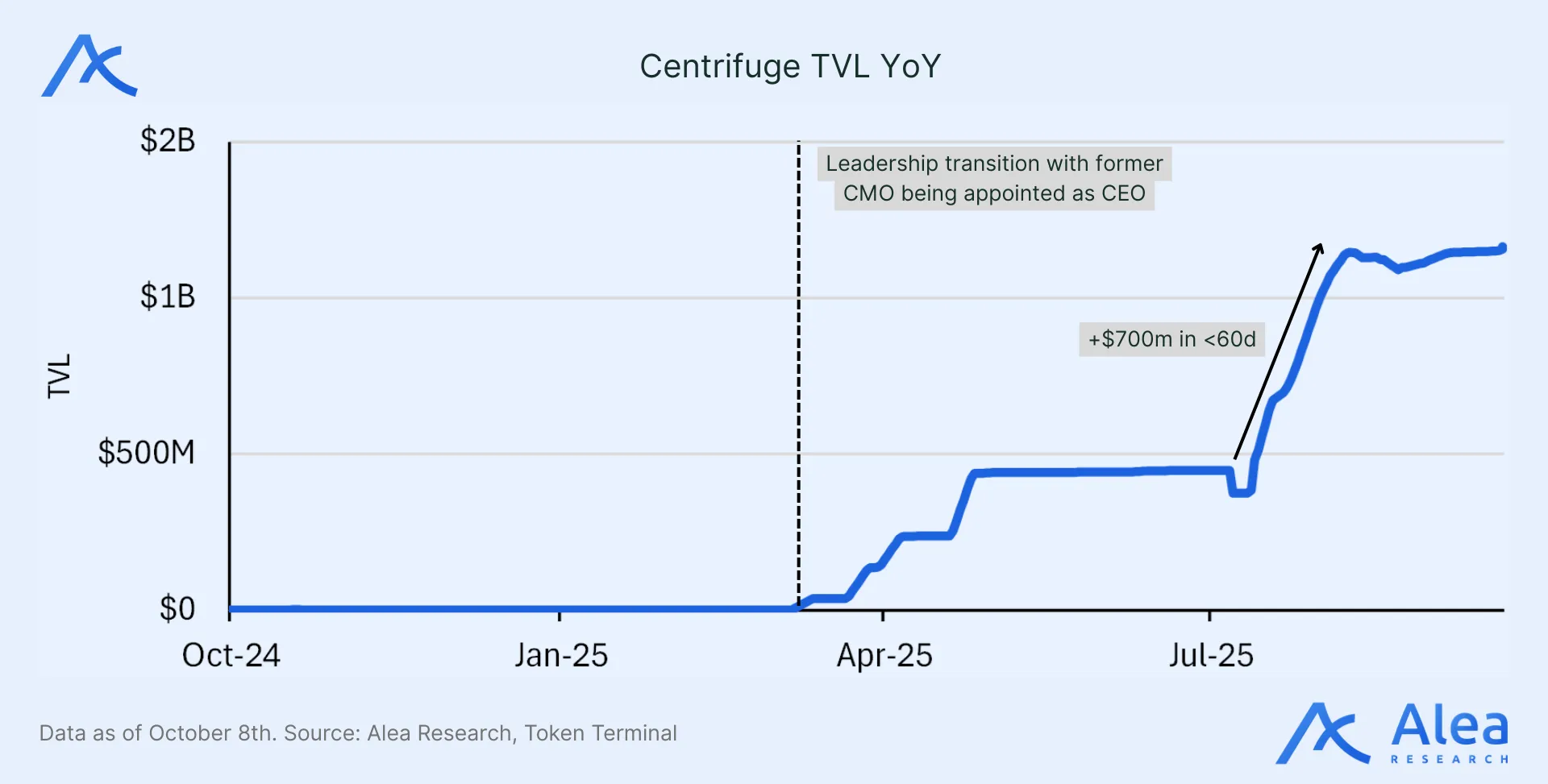

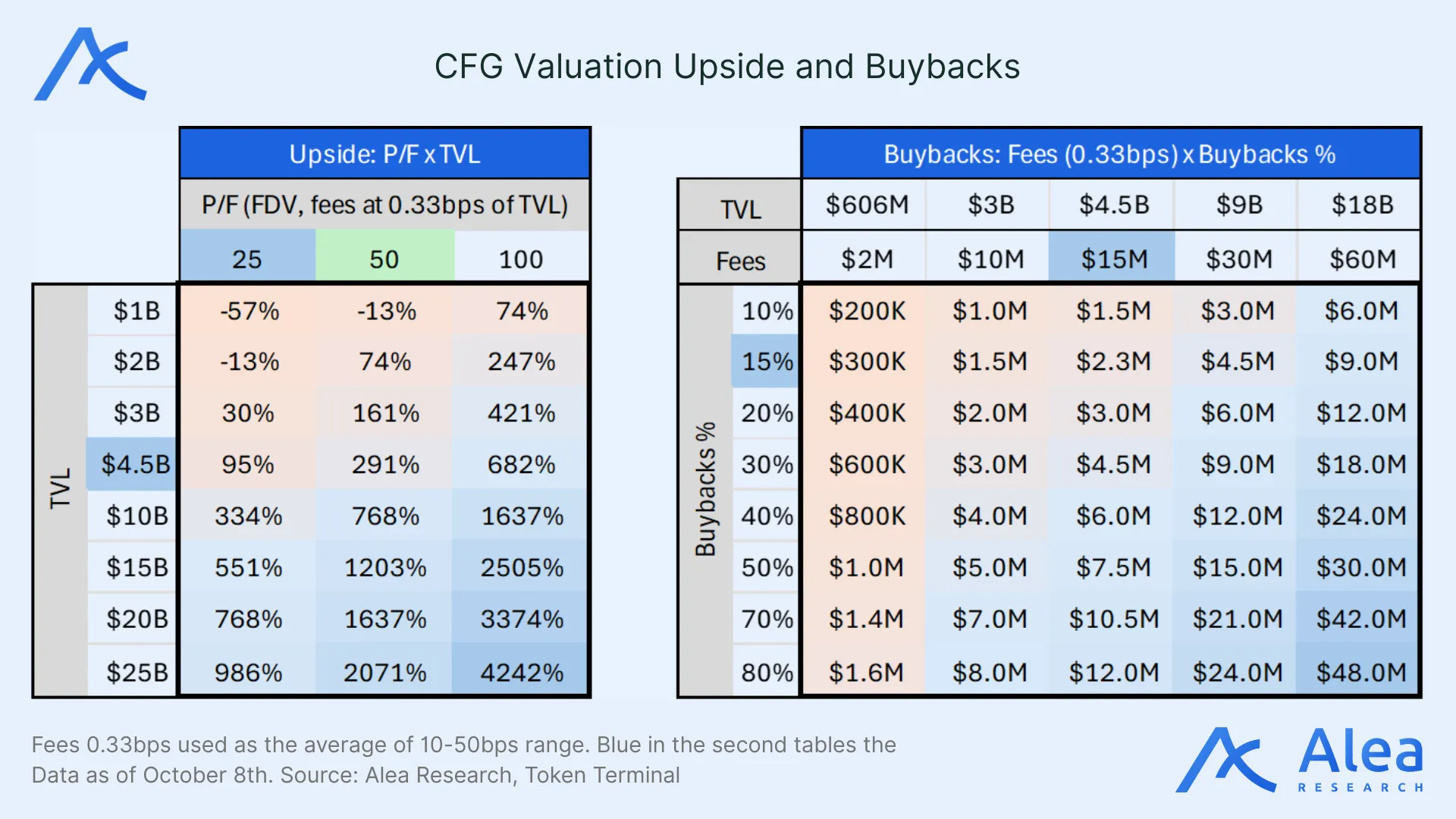

- Fee Switch On: TVL has expanded from ~$80M to >$1B in months. A credible path to ~$4.5B TVL implies ~$15M ARR at ~33 bps (20-50 bps on AUM fees) on funds management alone.

- Two-way Revenue Track: Today it’s AUM fees; tomorrow it’ll be expanded with SaaS-style recurring revenue from its white-label vault tokenization SDK.

- Token Alignment: All value will accrue to CFG; Anemoy has no separate equity claims—it’s a vertically integrated operational arm.

- Rerating Window: As liquidity deepens and listings expand, we expect CFG to rerate regardless of actual buyback-and-burns in place—the expectation alone can be enough.

- Ambitions: i) deRWA ERC‑20s for secondary trading and collateral use across chains, ii) more funds and index expansion, iii) convert the SDK into recurring revenue adding up to AUM-backed fees.

- Delayed Value Capture: The most recent fee switch activation proposal didn’t pass quorum, signaling low interest and/or participation in accelerating CFG’s revenue pipelines.

Crossing the Institutional Chasm

Centrifuge was founded in early 2017 with the ambition of building RWA infrastructure even before DeFi existed. This involved the development of the Centrifuge Chain and an associated smart contract system for direct RWA lending called Tinlake—both now considered legacy and effectively deprecated. The goal was to build an onchain securitization stack that collapsed legal, data, and custody functions.

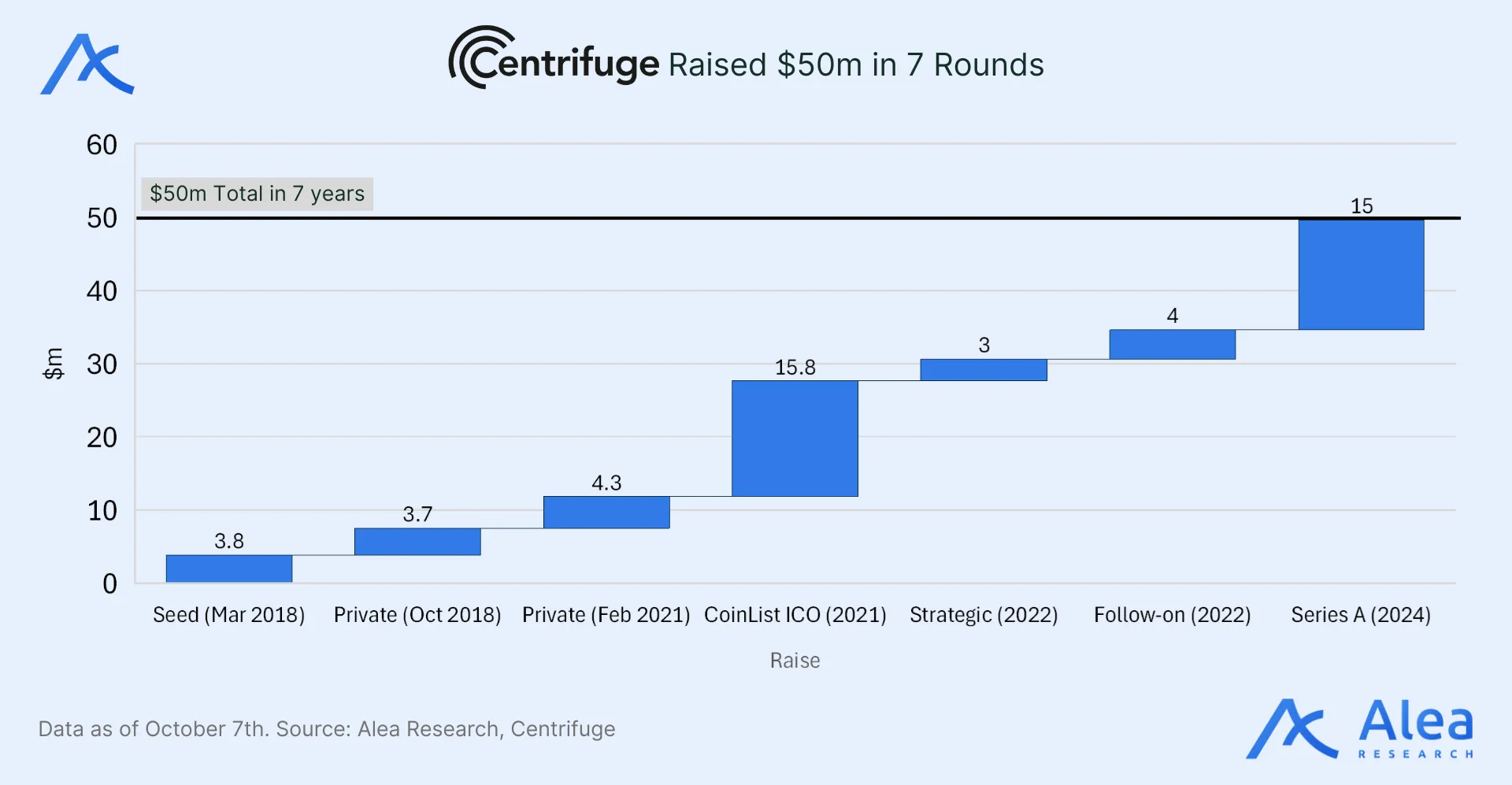

CFG was launched in a 2021 Coinlist ICO (two tranches; ~34M CFG sold at $0.55 and $0.38) that raised ~$15.8M in addition to previous rounds ($3.8M in March 2018, $3.7M in October, and $4.3M in February 2021). Strategic investments came later from former Blocktower, Strobe Ventures ($3M) in 2022, which doubled down again alongside Coinbase Venture, Scytale and L1D ($4M). The $15M Series A in 2024 was led by ParaFi, with commitments from Circle, IOSG, Arrington, and others—totaling ~$50M funding. With runway through 2026–2027, they are well capitalized to execute.

Originally issued in Polkadot, CFG has now become an Ethereum ERC20 (ongoing 1:1 token migration ends November 30, 2025). Post‑migration supply targets 680M CFG (from ~564.6M pre), with 115M newly minted under CP149—15M unlocked immediately and 100M linearly vesting over four years from May 20, 2025. The 15M unlocked and vested streams are earmarked for exchanges, market makers, and targeted DeFi incentives, while the team is subject to 48-month lockups with a 1-year cliff. Interestingly, while late migration dynamics can create short‑term dislocations, only ~52% of the supply has migrated to date, which reduces the circulating float despite the supply increase (supportive for growth).

All these changes are part of a strategic pivot, which is also reflected in a leadership transition that took place earlier this year in February 2025. Centrifuge appointed Bhaji Illuminati (former CMO) as CEO, with the original founder Lucas Vogelsang moving to a board role. The rationale is to align leadership with the company’s next phase: institutional distribution. The skills that mattered eight years ago aren’t the same skills that will make Centrifuge’s tokenized assets ubiquitous across chains and DeFi as it pursues an institutionally-oriented go-to-market strategy.

The team has leveled up accordingly, with Anil Sood as Chief Strategy & Growth Officer and Jürgen Blumberg as COO. Anil’s résumé stands out with experience across Cantor Fitzgerald (Head of EMEA ETF Sales), Knight, and Barclays, while Jürgen’s track record includes former leadership at Goldman Sachs, Invesco, and BlackRock. Execution quickly followed: Centrifuge launched the Real‑World Asset Summit in September 2023 and co-founded the Tokenized Asset Coalition with Aave, Base, Circle, and Coinbase to set shared standards, educate buyers, and normalize tokenized funds as an asset class.

The information asymmetry underneath this opportunity stems from being early, perhaps too ahead of its time. Everyone in the RWA space knows the Centrifuge brand, but not many liquid investors can tell what CFG is today after so many years of iteration. What’s pertinent now is that they speak the TradFi language, have the DeFi connections, and everything is in place for the narrative to take off with institutional scale. They spent years prioritizing growth with zero fees, but now the fee switch is on.

Demand-first Tokenization

As Centrifuge started focusing on tokenizing funds, they reversed the typical RWA playbook. Instead of tokenizing assets hoping for buyers to show up, they started with demand: identify buyers first, then build products for them. That’s where Anil’s and Jürgen’s addition significantly strengthened the sell side—building a pipeline of institutional clients requesting funds to support their needs. Ultimately, credibility drives adoption. This competitive edge turns distribution into a moat—and the experience of the team keeps it durable. That track record shows up in outcomes.

Anemoy is the execution vehicle for Centrifuge’s “demand‑first” RWA strategy: partner with established TradFi players to design portfolios, originate and tokenize funds, and distribute them where liquidity lives. By professionalizing the asset management offchain layer while keeping the distribution onchain, Anemoy closes the gap between institutional requirements and crypto’s benefits (liquid, programmable, 24/7 RWA rails).

Investors onboard with Anemoy in the Centrifuge app, complete KYC, and subscribe. They receive fund shares with full legal recourse and access to the underlying assets. Redemptions can be in kind, with protections matching traditional funds. Rather than being the wrapper-of-a-wrapper, the difference here is that investors can own a fund in a token format if they want.

- Identify demand: stablecoin reserves, collateral, treasury yield, etc.

- Design the fund: partner with TradFi managers to define mandate, asset, risk, and redemption policies.

- Legal and operations: Anemoy acts as the regulated issuer, taking care of wrappers, custody, KYC/KYB, and fund management.

- Tokenize shares: issue funds onchain, seed liquidity, integrate with lending markets for collateral use, onboard investors and automate portfolio rebalancing, reporting, and compliance.

- Distribution and alignment: deploy across chains, integrate with DEXs and lending markets, and maximize utility and composability.

RWA success comes from tuning two systems in parallel. Offchain requires a regulated manager, clear legal structures, and disciplined fund operations. Onchain requires liquidity and integrations to make those tokenized assets useful across DeFi. Both need to be tight for AUM to grow at institutional scale, which translates into sticky liquidity with compounding predictable fee income for the protocol.

- Permissioned fund shares (KYC, non-transferable) for institutions: collateral utility in whitelisted markets with compliance upfront and gated composability.

- Permissionless deRWA wrappers for open DeFi: freely transferable security tokens for non-US users; market makers seed DEX liquidity; lending markets support as collateral while yield strategies optimize for leverage looping; and mint/redeem functions stay at KYC endpoints.

To become a market leader in RWAs, a protocol needs to be built for compliance but also wired for distribution—it needs to bridge institutional trust with open-market reach. Centrifuge’s edge is full‑stack issuance + distribution with credible managers and DeFi composability. This is why the parallel offchain and onchain rails are so important: professionally managed KYC fund shares deliver legal recourse for institutions, while their onchain wrappers allow for portability and collateral utility.

To win this race, you need to be early, be reliable, and be well connected. This allows Centrifuge to aggregate demand and supply, controlling the relationship even if the underlying issuance stack is commoditized.

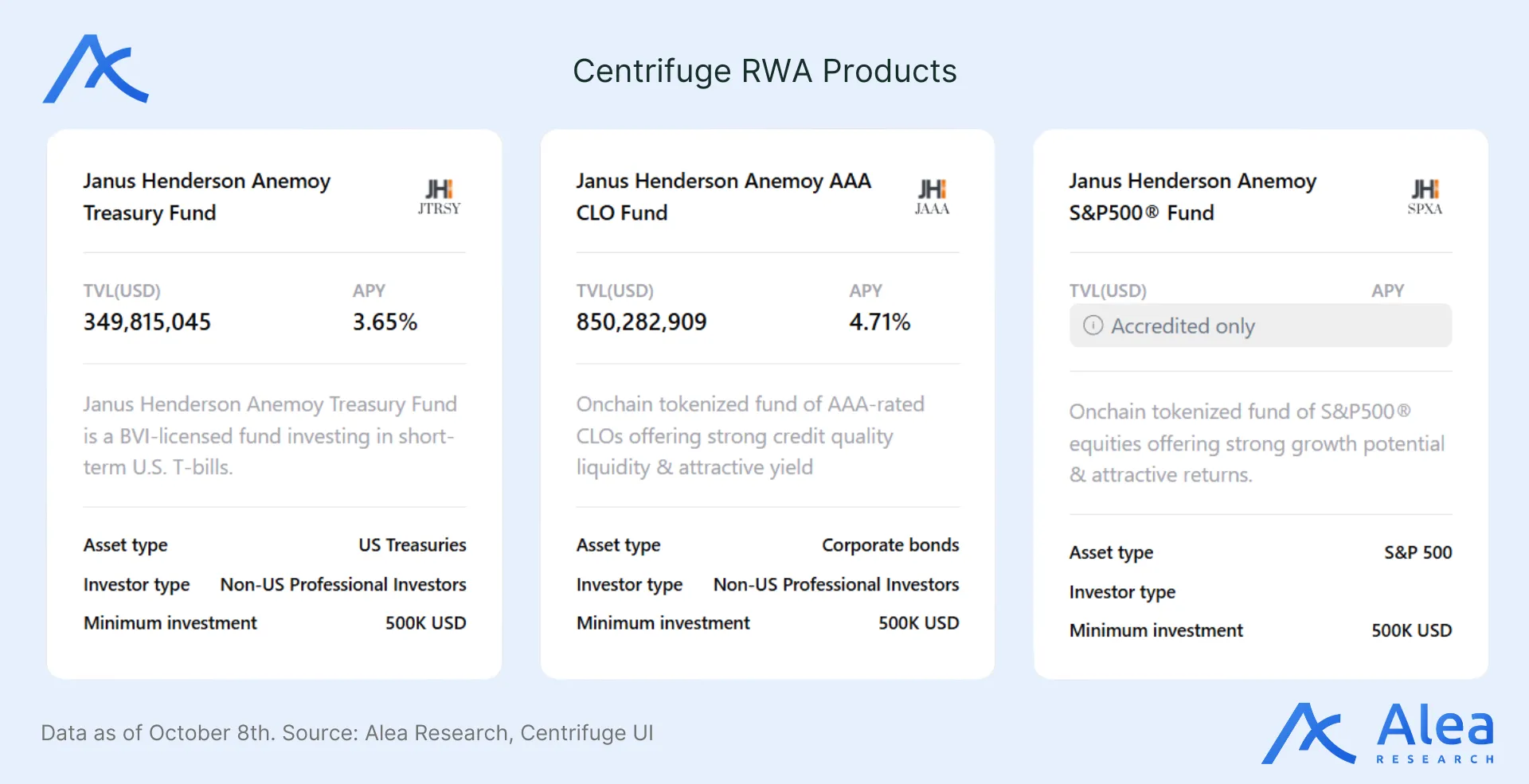

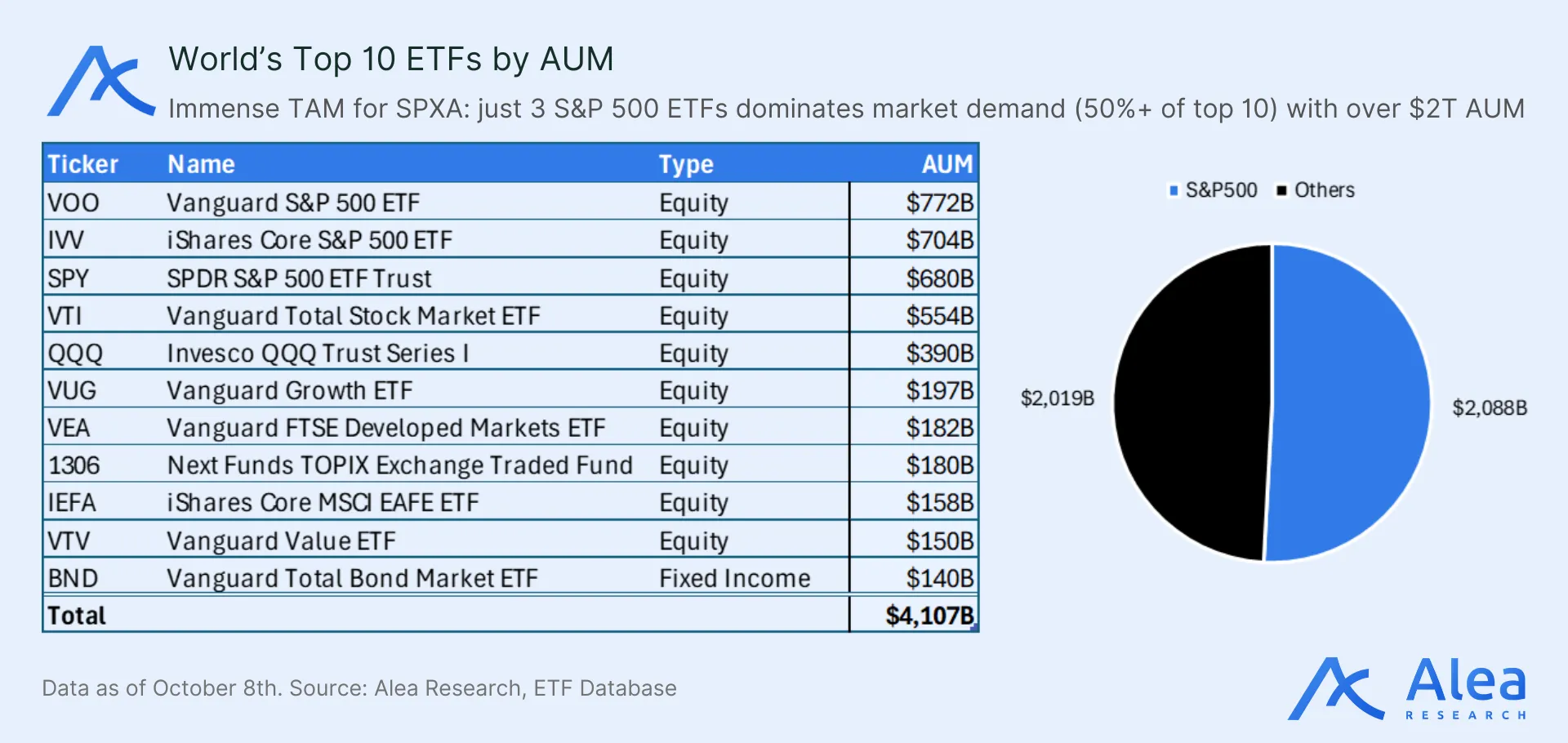

- SPXA: First licensed onchain S&P500 index fund token, using a “Proof-of-Index” feed to track index weights onchain. Brings the world’s most followed equity benchmark onchain with continuous primary issuance/redemption, instant composability (e.g., as collateral or in structured vaults), and verifiable index replication versus opaque wrappers. Announced in July 2025.

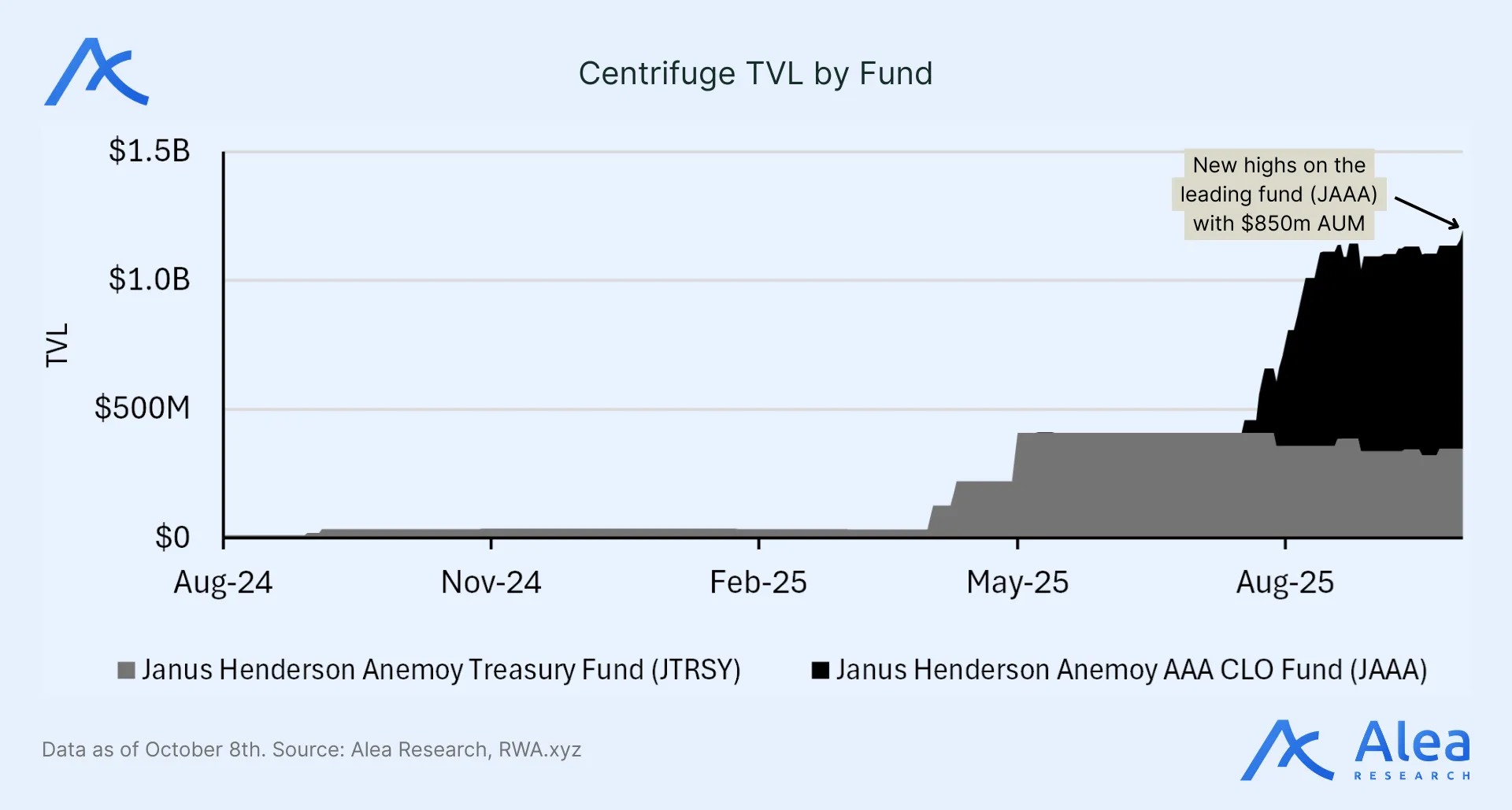

- JTRSY (TBills): First institutional on-ramp with top‑tier ratings (AA+/S1+ by S&P; Aa by Moody’s; A+ by Particula) led by Janus Henderson (a ~$400B AUM asset manager), already receiving inflows from DeFi blue-chips like Spark (~$200M deposit earning yield on reserves as part of the Grand Prix initiative). Announced in September 2025.

- JAAA (AAA CLOs): Regulated open‑ended BVI fund for non‑U.S. professional investors, with transparent on‑chain NAV and stablecoin flows. It allocates to AAA-rated senior tranches of collateralized loan obligations managed by Janus Henderson. For treasuries seeking yield over T-bills, JAAA adds uncorrelated carry and offers high-quality collateral diversity for onchain loans.

- ACRDX: Apollo’s Diversified Credit Fund investing across direct corporate lending, asset-backed lending, and performing and dislocated credit. It unlocks fractional access to private credit with better transparency and programmable eligibility controls for qualified investors.

- deRWA Wrappers: Freely transferable DeFi-native wrappers around regulated fund shares that preserve 1:1 backing while still being usable on DEXs, lending markets, etc. They extend institutional‑grade yield instruments to consumer‑facing apps and non‑custodial rails.

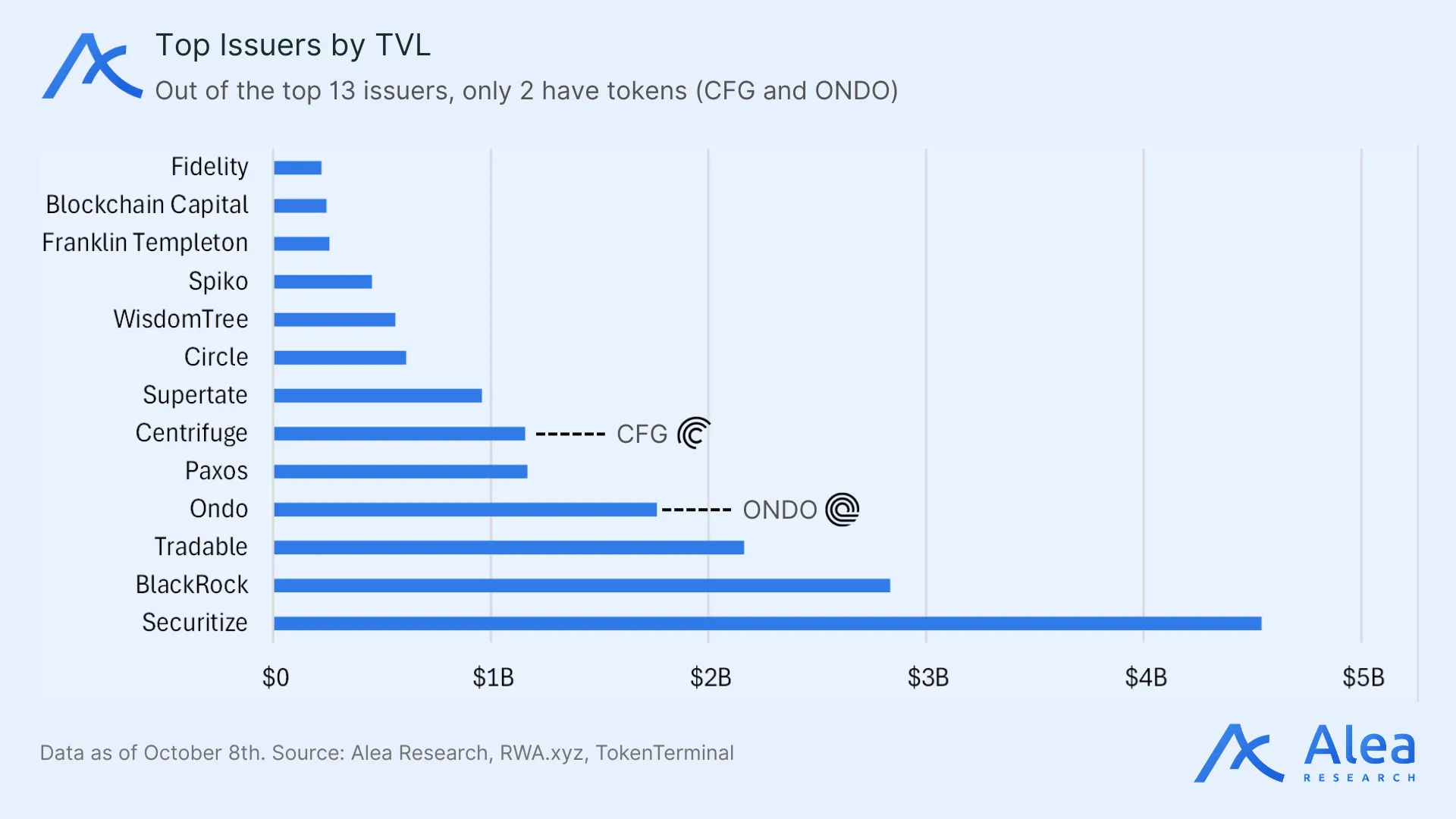

Heavyweights like Securitize, Franklin Templeton, WisdomTree or Superstate don’t have a token. That makes CFG one of the most direct liquid proxies for RWA exposure across not one, but multiple subverticals (U.S. T-Bills, private credit, and alternative institutional funds). This versatility, combined with active collateral routes while expanding distribution, is key for scaling AUM across products and trigger a re-rating as the leading full-stack RWA platform with a liquid token and very little dilution ahead.

Centrifuge wins by starting from buyers (stablecoin reserves, lending markets, DAO treasuries, etc) and building the exact funds they need, not tokenizing supply in search of demand. Its SDK makes that strategy scalable by turning bespoke wins into a repeatable playbook that partners can adopt. This is the distribution lever that diversifies revenue streams and converts protocol fees into durable ARR (Annual Recurring Revenue). The end goal is to make Centrifuge the default stack for self-serve tokenization.

To simplify onboarding, Centrifuge has made a series of decisions that reflect their ambition to design for scale. One example of that is CP151, which overrides CP83 to lower issuer friction and standardize economics. The idea is to scale permissionless pools with a simplified 50bps flat-fee pool onboarding that can later on be adjusted through governance. Self‑serve pools cut launch friction and the uniform 50 bps aligns issuers. Doubling down on the permissionless nature of the protocol allows for RWA breadth while the UI/offchain layer is still able to curate and optimize for quality. The payoff is predictable economics, faster launches, and fee revenue that compounds as distribution expands.

Turning Bottlenecks into Moats

RWA is shifting from talk to flow, but the seemingly overnight success has been years (almost a decade) in the making. Private credit, T-Bills, and tokenized funds are now scaling with real assets, real yield, and real adoption. Today, cross‑domain consensus (crypto + institutions) reduces narrative risk. The market finally wants proof of compliant issuance with DeFi distribution. The giants are here—BlackRock, WisdomTree, Franklin Templeton, Securitize—but you can’t buy their tokens. If you want liquid exposure to the tokenization wave, you need the players that have both products and tradable tokens. Success means not only tokenization, but also portable shares that can be used as collateral and are easy to trade across DeFi.

Centrifuge is not a narrative-chaser, but a long-standing operator with a battle-tested track record of execution. They survived bear and bull markets when RWAs weren’t a crowd‑pleaser. They moved slowly by design to stay safe. Still, there were some early structural blockers:

- Institutions wouldn’t negotiate with a DAO or build directly on a protocol.

- KYC-only fund shares were non-transferable, so they had no wallet/DEX/lending utility.

- Supply-first issuance left products idle; demand needed to lead.

- Polkadot isolation and a wrapped token fragmented distribution and access.

- Confusion over Anemoy vs. Centrifuge created perceived incentive misalignment.

- Zero-fee growth under-monetized the platform and capped fundamentals.

- No loopable, liquid yield meant weak pull from DeFi money markets.

- Distribution was B2B2C-light; inflows were slow and lumpy.

They answered with Anemoy as Centrifuge’s regulated asset manager to onboard institutions, transferable wrappers, a multichain strategy, demand-led products, unified incentives, AUM fees, and a B2B2C distribution motion with partner-driven scale:

- Anemoy is the regulated counterparty to institutions; Centrifuge runs the tokenization onchain operations. This unlocked legal recourse, in-kind redemptions, and Janus Henderson–type deals.

- deRWAs (wrappers) to make professional fund exposure freely transferable for DEXs, lending, and savings.

- Leadership pivot and strategy towards demand-first deal sourcing (stablecoin reserves, leverage loops, treasury diversification, T-Bills, CLOs via JAAA, Apollo private credit, index exposure, etc).

- Chain agnostic approach to meet buyers where they are and opportunities where they arise.

- Incentives alignment: there is no value extraction to Anemoy/Centrifuge equity; value accrues to the CFG token.

- Fee switch charges (25–50 bps AUM) to establish a path to profitability and enable buyback readiness.

- B2B2C distribution strategy (stablecoins, wallets, perps, vaults) + a white-label SDK (ERC-4626/7540, hub-and-spoke) for programmatic invest/redeem and reporting.

- Partner flows aggregation to scale in big clips: Spark +$200M to JTRSY, Grove ~$1B, SPXA launch—driving TVL from ~$80M (March) to >$1B in a matter of months.

Anemoy + deRWA turned “safe but slow” into scalable distribution—legal counterparty + transferable exposure—as a demand‑first sourcing model that aligned products to buyers’ use‑cases. With unified leadership and proactive communication, the perceived misalignment between Anemoy and Centrifuge has also been addressed head-on.

Now that the protocol has started charging fees and Centrifuge carries both institutional and DeFi validation across chains, we can expect herd behavior to follow. Once Janus Henderson, Apollo, Aave, Spark, and Grove are in, the floodgates open. Especially in RWAs, credibility compounds fast and begets inflows. Once validated, capital arrives fast, liquidity moats build up with more integrations, and it eventually becomes a matter of time until market leadership is recognized.

Investment Thesis

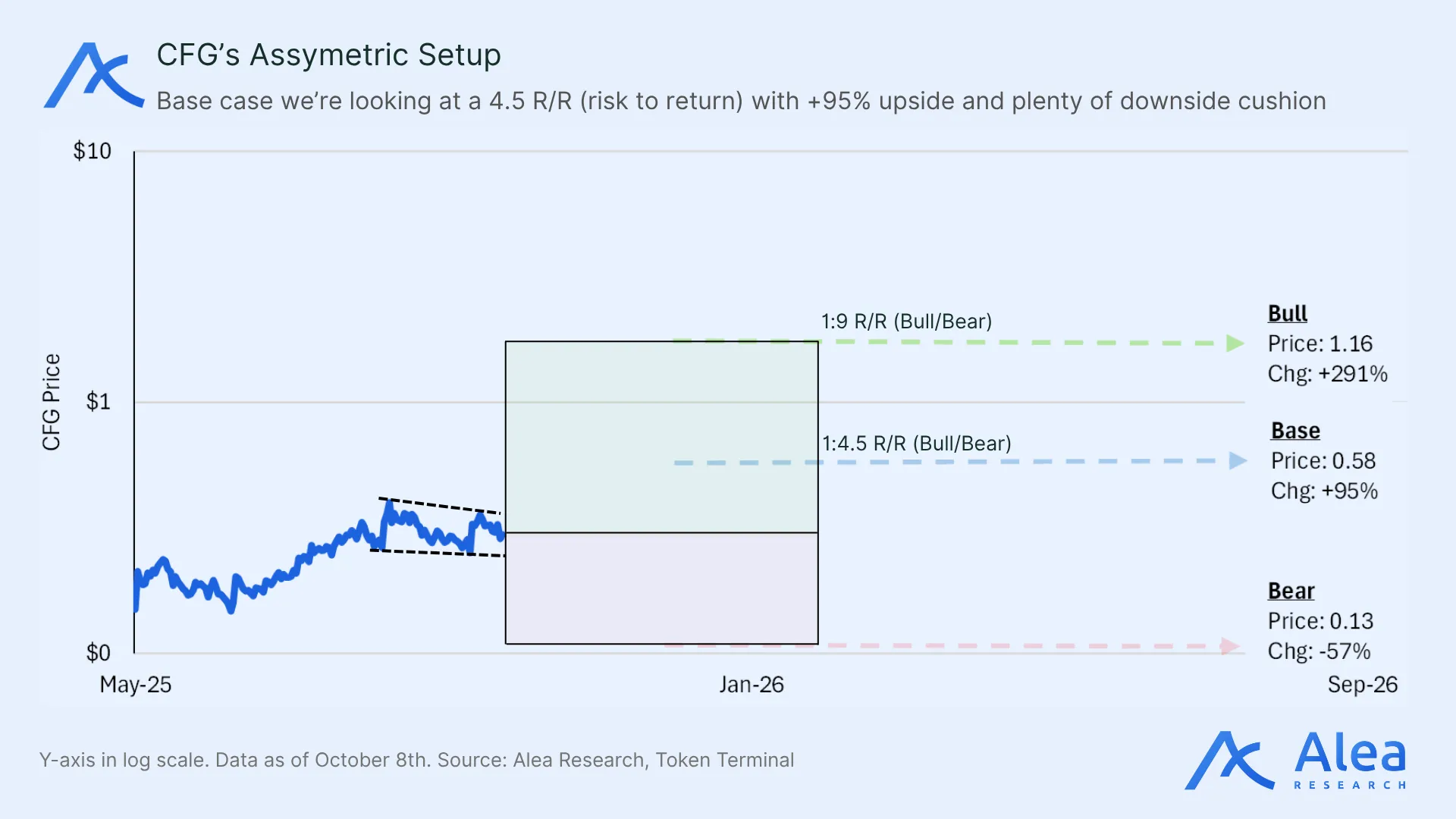

CFG represents one of the cleanest, liquid levers on tokenized funds. Already capturing fees and with solid institutional pillars in place, the next step is execution—make the most out of their connections, onboard them with a clear DeFi strategy, and let the subsequent distribution moat do the work. There are few liquid proxies for getting exposure to institutional funds on the market, and CFG presents one of the most relatively undervalued plays in RWAs as a whole.

The TAM for RWAs is massive and gets larger with asset‑class diversity, while traction is proven and growth is visible. Few competitors have a liquid token, which concentrates narrative flows in CFG. SYRUP has already re‑rated to the top, while ONDO screams overvaluation and supply concentration. That makes CFG an attractive catch-all narrative bid.

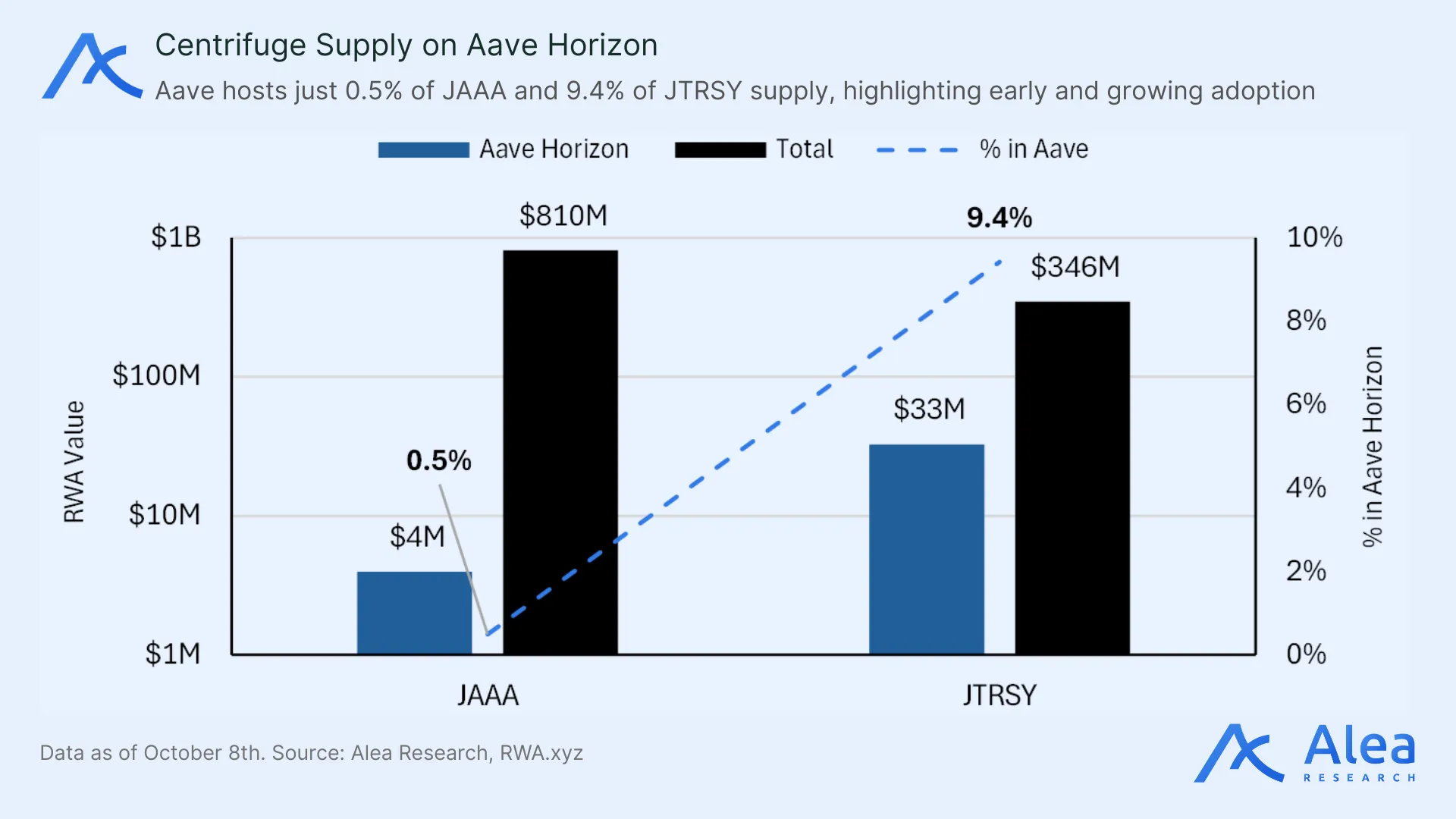

Having solved the institutional bottleneck—regulated issuance through Anemoy with deRWA distribution onchain—CFG captures value across both funds and ecosystems. CFG is the liquid way to own full-stack RWA infrastructure while also getting exposure to the RWA arm of blue-chip protocols, such as Sky or Aave Horizon.

Centrifuge is the only RWA protocol that pairs a regulated issuer (Anemoy) with deRWA ERC-20 wrappers to serve stablecoin treasuries, lending markets, and index products across chains. Not only does it lower a key barrier for TradFi capital, but it also compounds network effects with DeFi integrations. On top of that, asset class diversity (T‑Bills, CLOs, private credit, SPXA) makes it stand out in terms of TAM. DeFi brings on additional utility, with protocol integrations driving sticky liquidity.

- Spark (Sky/Maker): Programmatic DAO reserves channel 9-figure sticky TVL into JTRSY.

- Grove (Sky credit): Institutional credit lines push large, recurring tickets into JAAA/ACRDX.

- Aave Horizon: Permissioned Aave markets turn JTRSY/JAAA into borrowable collateral.

- Plume Network: RWA-native integration lowers issuance cost and embeds distribution at the chain level.

- Wormhole (interop): Chain-abstraction for seamless liquidity transfers and distribution density.

- deRWA wrappers: ERC-20 transferability for DEX pairs, lending utility, and DeFi composability.

- Fireblocks: Institutional custody/ops rails de-risk workflows involving large allocations.

- Chronicle oracles: Onchain reporting for real-time credible oversight and compliance monitoring.

- Multichain (Ethereum, Base, Arbitrum, Solana, Avalanche, Stellar, Plume): Meet buyers where they are—more venues, lower CAC per dollar of AUM.

The importance of integration depth can’t be understated, as that’s the main ingredient for making RWAs ubiquitous across chains. From stablecoin and DAO reserves to credit lines or collateral utility, Centrifuge makes exposure portable and liquid. These workflows are key for lengthening capital half-life, driving sticky, durable deposits that scale AUM management fees—while competitors without a token, or reliant on heavy incentives, struggle to match Centrifuge’s now‑organic reach.

Each asset originator and DeFi integration increases the value of others, creating a self-reinforcing lead. Competitors without similar network effects face a steep climb and high switching costs to attract the same flows—give investors places to use the product and they show up. More venues increase utility and demand, driving AUM and fees with it.

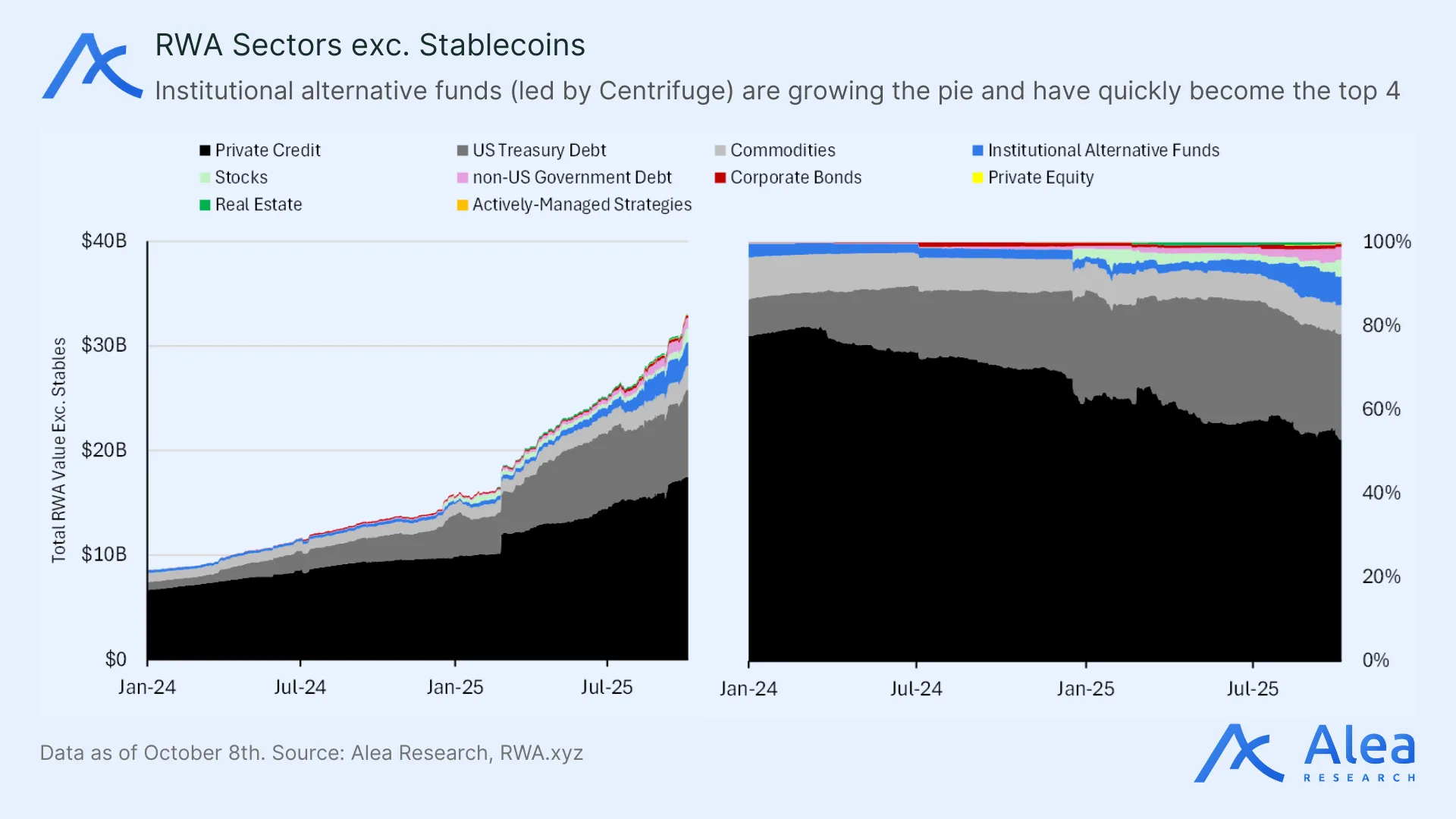

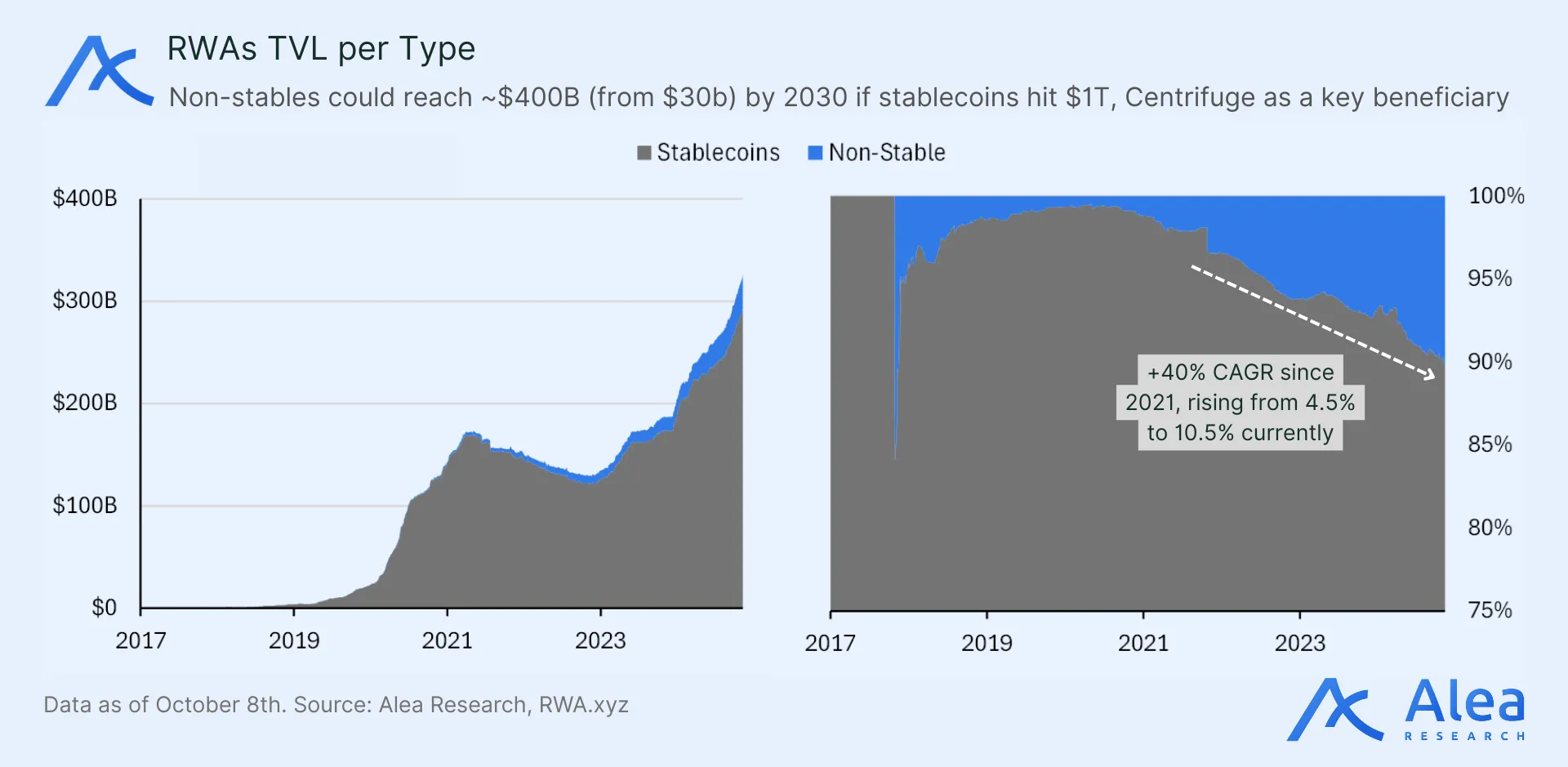

Still, the market treats asset tokenization as simple wrappers on legacy funds. Such claims are wildly out of touch with reality. Centrifuge issues natively onchain with direct shares, programmable compliance, and asset‑level proofs, then distributes across chains. That combination of legal enforceability, transparent 24/7 collateral, and composability, is what fuels the growth of this asset class as liquidity scales. Like stablecoins, RWAs are tracing its own S-curve. From a near-zero base in 2020 to ~$30B today, they are up from ~$5B in 2022 and ~$25B by June 2025—while stablecoins climbed from $27B (Dec-2020) to ~$300B now.

We notice a clear trend where demand is moving past commoditized T‑Bills to higher‑yield RWAs. T‑Bills set the floor during the 2022 bear market, but they lose appeal with upcoming rate cuts. Protocols offering these now face a race to the bottom versus competition—it’s a value proposition with limited upside in both yield and adoption.

Institutions now want carry and diversification they can use as collateral, with gateways like JAAA or SPXA as well as AAA CLO exposure. Centrifuge offers all of these with a first-mover advantage that, as liquidity deepens and distribution expands, captures more predictable value—first through AUM fees, then through recurring SaaS-style deals where their connections and SDK come into play.

- CFG is the single value accrual vehicle; no leakage to Centrifuge or Anemoy equity.

- Targeting ~$15M in revenue at ~$4.5B TVL in AUM-based fees.

- Buybacks expected to come rather soon (first proposal failed to meet the quorum).

- The operational budget covers runway until end-2026 even in a no-revenue scenario.

- The path to profitability is conservatively heading into 2026-2027 as fees and TVL scale.

- Growth is expected to come from stablecoin reserves, protocol treasuries, a chain-agnostic expansion, and demand for leverage (looping in lending markets with high-yield RWA collateral).

- The CFG token migration can create a supply shock (only ~52% migrated so far; deadline Nov 30, 2025).

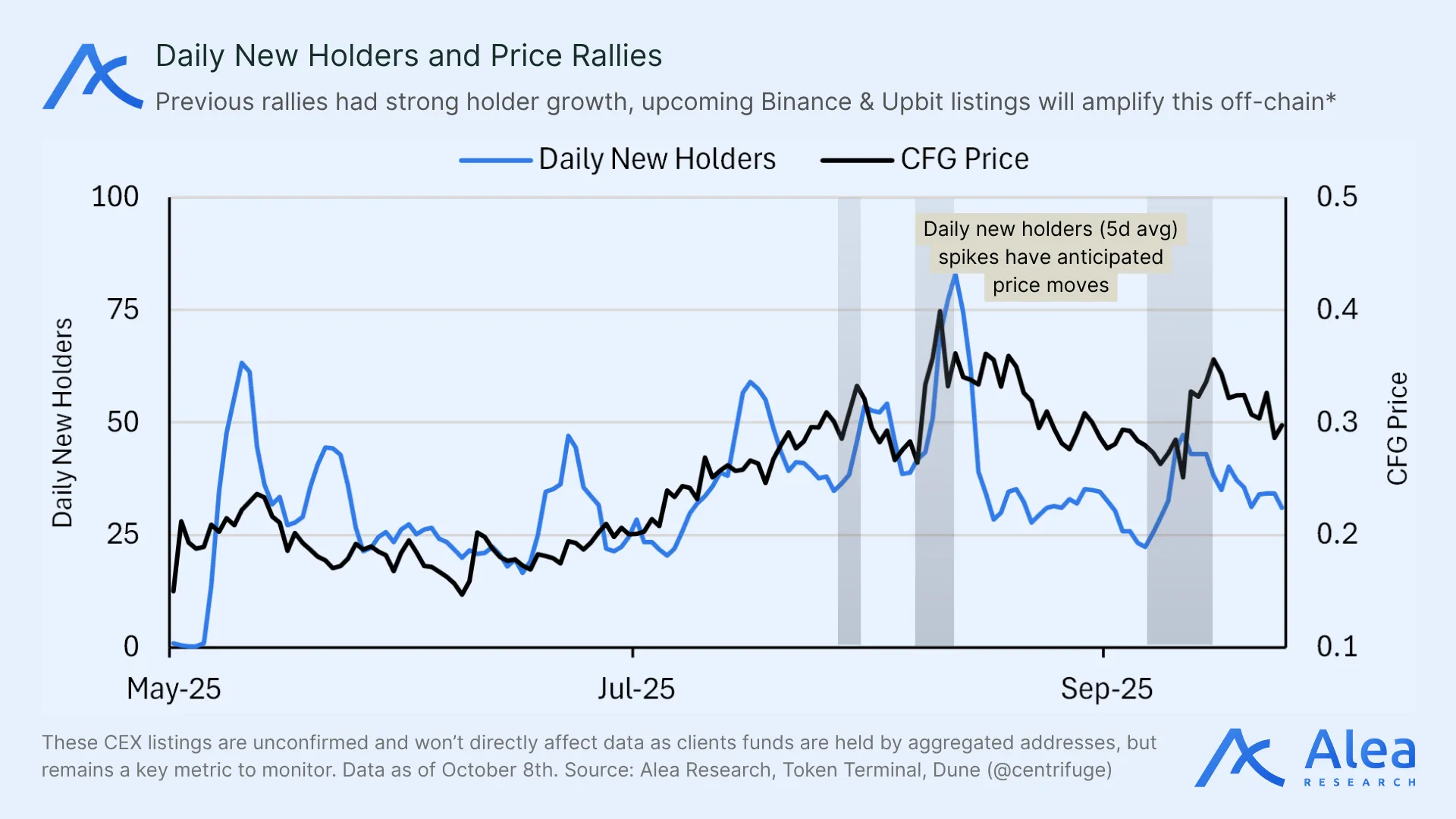

Bybit listed CFG on Aug 26, and Coinbase followed on Sep 25, improving accessibility for liquid investors; Binance and Upbit remain in the back pocket for future upside. Like SYRUP, CFG price has historically been held back by thin liquidity for liquid buyers. For Centrifuge, CFG liquidity is a bigger hurdle than its onchain fundamentals, as evidenced by the AUM vs FDV gap (~$1.2B TVL vs ~$190M FDV).

Compounder on Sale

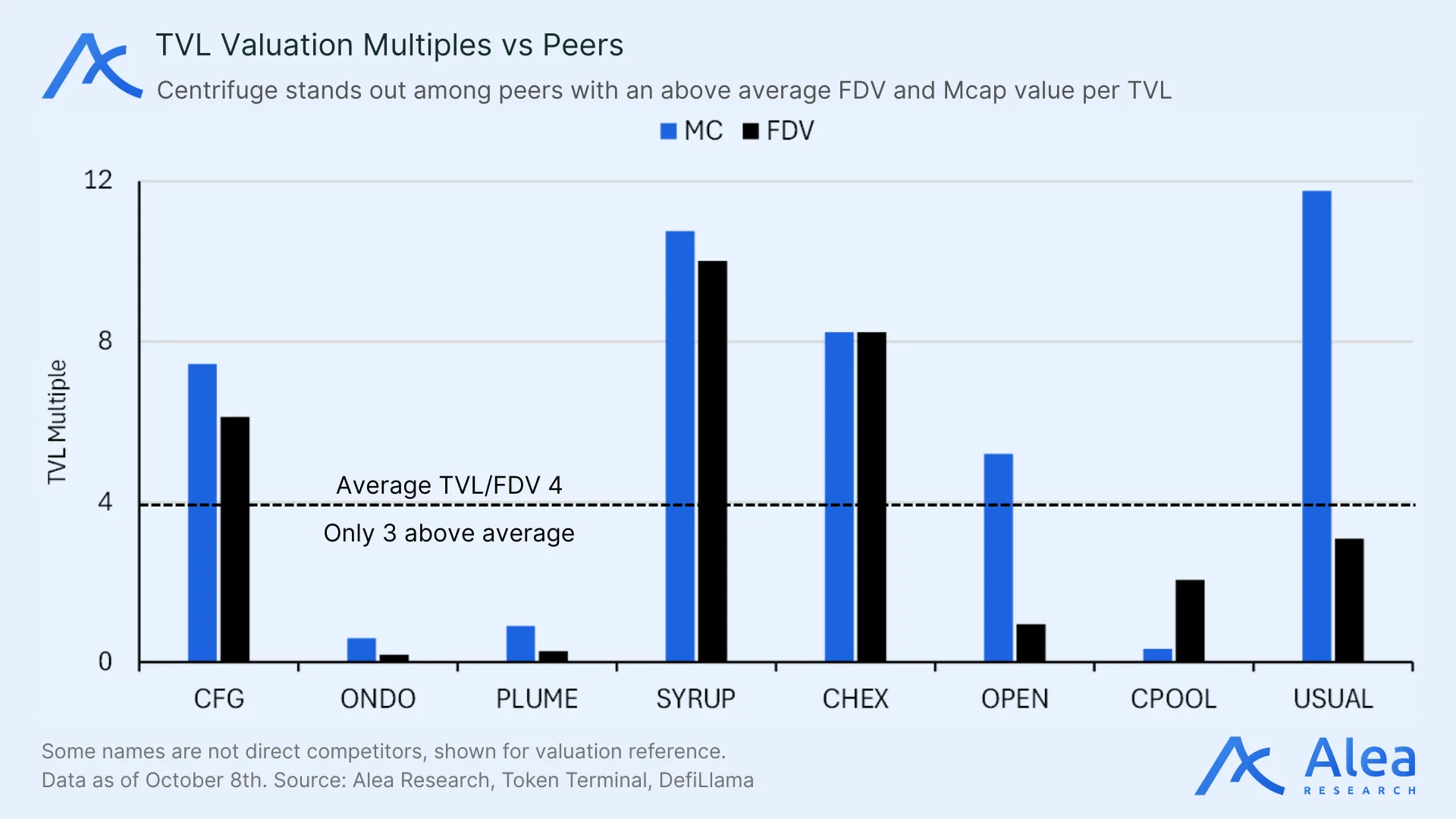

From a relative value perspective, CFG stands at ~6.28x TVL/FDV vs ONDO’s ~0.2x TVL/FDV. Just optically, ~$600M FDV seems like a fair value zone (still severely undervalued if we keep AUM and growth projections in mind)—that’s ~3x from current levels.

Among peers, Centrifuge stands out with a well-above-average TVL multiple, significantly outperforming ONDO, its closest comparable. Of the eight protocols analyzed, only three trade above the average multiple, forming a “liquidity staircase” (SYRUP->CFG->CHEX) where CFG stands as relatively undervalued. Liquidity is a bottleneck for large funds to express their bullish RWA view with large CFG positions. Take CHEX as an example, which we’ve covered previously. It differs from projects tokenizing assets on public chains as it operates on a private, permissioned chain, serving a niche market that, despite growth, continues to see token depreciation.

To gain conviction, price should respond relatively fast to net new demand. Markets move when new buyers show up—persistent inflows require a rise in holder growth. Three lines should climb together to reflect how price can actually follow sustained buy pressure: persistent net inflows into CFG assets, expanding holder base, and upward price action. Not seeing all those is likely indicative of trades “renting the rally” but not “owning the narrative” for the parabolic breakout move that can take CFG past $1B FDV.

Given crypto’s historical premiums to asset valuations, we may be looking at a compounder on sale that is likely to reprice as fundamentals surface. Protocol revenue and future buybacks hinge on two levers: fee rate and buyback allocation percentage. At 4.5B TVL, 33–50 bps yields roughly $15M–$22.5M; buyback impact scales linearly with allocation. Assuming price follows cash flows, higher fees and buyback share drive compounding.

Risks & Invalidations

The most recent fee switch activation proposal diverting flows to CFG holders failed to reach the minimum quorum. This suggests low governance participation and, by extension, lack of interest or truly committed holders. Similar apathy is also evidenced by how slow old CFG holders are being to migrate their holdings from the old Polkadot chain to the Ethereum deployment. This reinforces the point that upside reflexivity is likely to be highly dependent on net new buyers stepping in with size—leaving behind the old holder base and seeing the migration as a bullish supply shock. Currently, 3% of annual inflation is routed to the DAO treasury, which could hit the market as the team announces incentives or pursues other growth campaigns.

Depending on how much decision weight you assign to CFG value accrual, the thesis fails if/when adoption slows down or competition squeezes margins. Similarly, any token value capture delays would weaken the marginal bid. It’s also worth keeping an eye on both asset class and business lines diversification. An optimistic case would contemplate recurring SaaS-like revenue beyond AUM fees and less T‑Bill dependency. Competitors with broad distribution can compress fees and crowd flows—even without a token—while Centrifuge’s DeFi playbook is “copyable”.

The rerating story accelerates if cash reaches the token and demand compounds. Missing the activation of revenue for CFG holders or letting fund flows stall would undermine confidence at this point. Many of Centrifuge’s competitors don’t need a token to win; they already have the distribution and only need speed of execution and lower fees for Centrifuge’s edge to fade. Alternatively, a bullish case would see these projects as Centrifuge’s allies, driving flows to its funds instead of leaking market share away from them. RWA deposit centralization risk from crypto-native (Spark & Grove) protocols should diminish as products mature, but if these funds move elsewhere, the protocol could see a sharp drop in TVL and price.

Conclusion

RWAs are a structural sector that can take the industry from zero to one. Winning the RWA race means owning the rails that connect the efficiency and programmability of DeFi with the scale and trust of TradFi. Similar to stablecoins, the prize for becoming the default stack for issuance and distribution can be in the scale of take rates on the order of trillions. Tokenization follows the path of least resistance and greatest trust. Centrifuge has a first-mover advantage and many lessons learnt under its belt. Over the long run, RWAs crown whoever sets the standard. Standards outlast sprints. Today, on a risk-reward basis, Centrifuge’s CFG presents one of the most attractive liquid opportunities to back the fastest horse riding the full-stack that binds DeFi’s speed to TradFi’s scale.

References

Bidcast. (2024). CFG’s Institutional Leap [Video]. YouTube.

Centrifuge Developers. Legacy Developer Documentation.

Centrifuge Docs. Token Summary.

Centrifuge Dune Analytics. CFG Migration Stats Dashboard.

Centrifuge Dune Analytics. Centrifuge Protocol Dashboard.

Centrifuge Governance. Governance Forum.

CryptoRank. Centrifuge ICO Overview.

RWA Report. RWA 2025 Dashboard.

RWA XYZ. App rwa.xyz Dashboards.

Disclosures

Alea Research has never had a commercial relationship with Centrifuge and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.