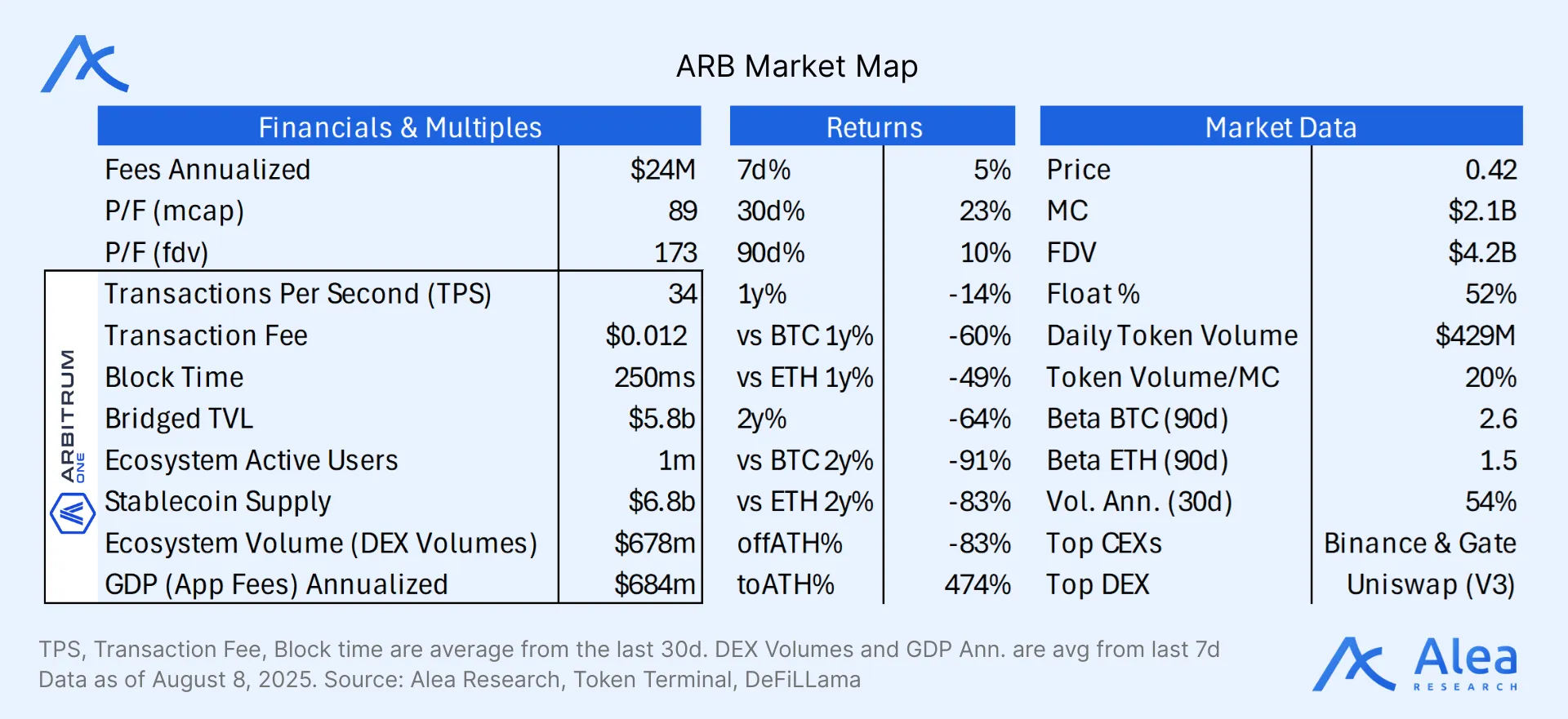

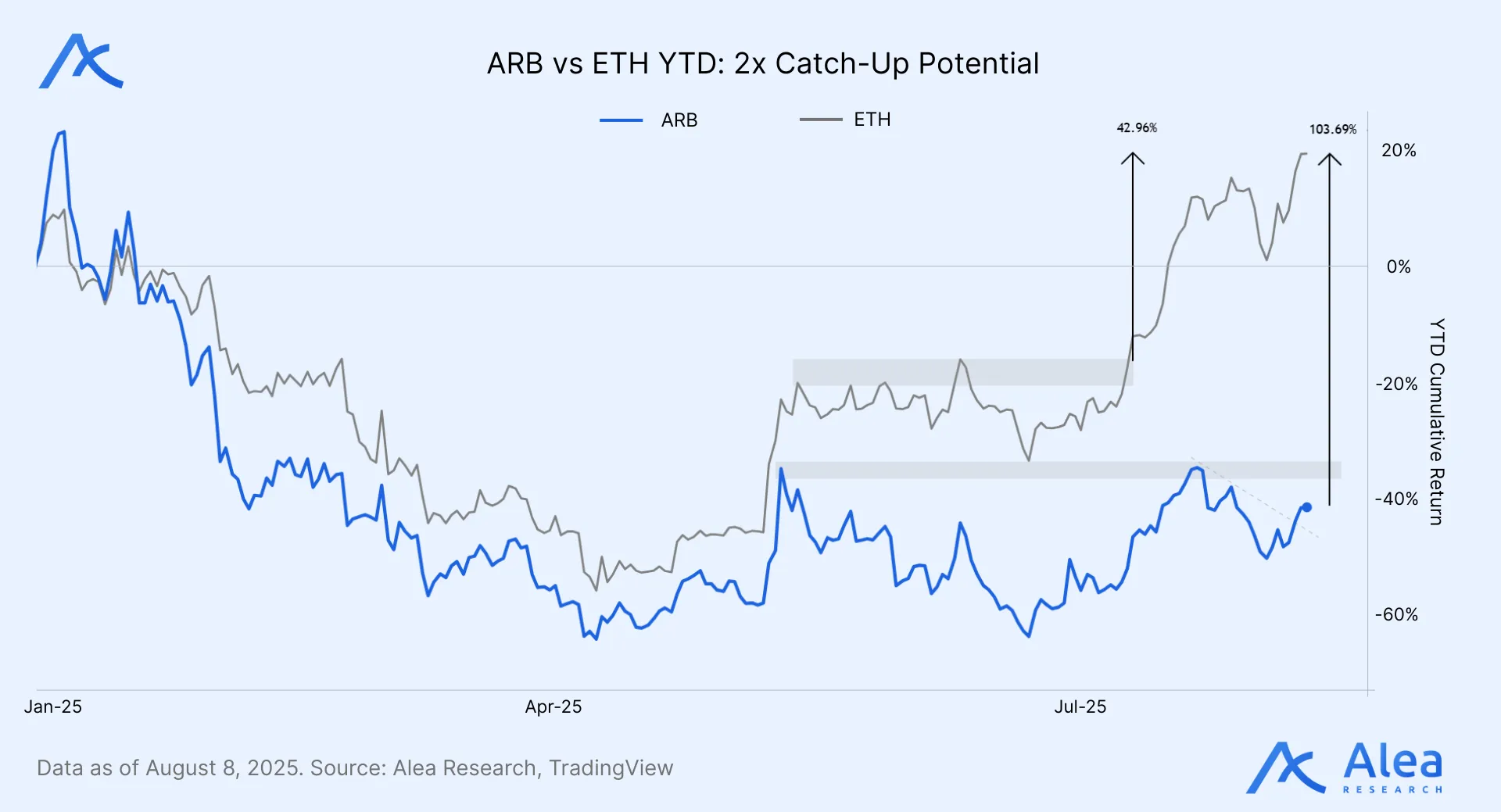

The market chases $ARB’s numbers and activity metrics, but misses the silent surge of cash flows pouring into the DAO. Arbitrum’s strategy—free L3s, profit-sharing L2s, and Stylus’ multiVM engine—ignites rising adoption and thicker margins. Appealing to developers and enterprises, the model provides a repeatable onboarding playbook that has already locked in big players such as Robinhood and Converge.

Arbitrum is no longer—and shouldn’t be priced as such—just another EVM-compatible L2; it leverages early network effects in combination with a technical edge that allows for protocol-level cash flows, SaaS-level gross margins, and a contractual royalty stream from blue-chip partners and institutional players. Orbit chains, Stylus, and TimeBoost are engineered for high-margin sustainable revenue streams, and the DAO treasury accumulation signals a credible path for $ARB value accrual.

Some of Arbitrum’s most important advances—like Stylus, BoLD, and TimeBoost—don’t make headlines, yet allow us to anticipate a window of opportunity to capture a unique risk/reward skew. The downside is cushioned by the DAO’s treasury and $ETH exposure, while the upside grows as the ecosystem matures. As Arbitrum’s revenue potential becomes clearer, we expect the market to recognize this and price in a higher premium.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free