Signal Is All You Need

Crypto’s price action is all about $BTC’s ever-present pole star with glimpses of mindshare and attention waves that can solidify or evaporate within minutes.

Source: Dexscreener – Since Binance’s perps on listing for $Zerebro on Jan 2, what once was a direct proxy to the “AI agents” narrative is now a token that is down 90% in the last 30 days.

Source: Dexscreener – Since Binance’s perps on listing for $Zerebro on Jan 2, what once was a direct proxy to the “AI agents” narrative is now a token that is down 90% in the last 30 days.

Traditional valuation frameworks break down here. The game demands edge—the ability to spot opportunities before consensus forms. Those who master narrative anticipation capture outsized returns.

In this battlefield, information aggregation and processing capabilities become paramount. Bloomberg commands a $100B valuation by surfacing actionable market intelligence. The opportunity in crypto is larger, given the market’s inherent inefficiencies and narrative-driven nature.

Key Takeaways

- Key Insight: The thesis isn’t about betting on AiXBT’s recent terminal or doubling down on the “AI agents” narrative, but about expressing the view that alpha capture in crypto will be systematized through social signal processing.

- AiXBT’s Value Proposition: The main selling point for $AIXBT is the potential to become the leading market intelligence platform for trading in crypto. Combining social aggregation, sentiment analysis, and alpha generation, the aim is not necessarily to become crypto’s Bloomberg-equivalent, but to ride the optionality that may come with any unexpected consumer product release.

- Unique Market Positioning: With a first-mover advantage and one-of-a-kind moat, $AIXBT offers deep liquidity and has already secured a Binance listing. Its 400k+ followers on X and brand recognition are the first domino of a self-reinforcing flywheel: social engagement → more data → better insights → more eyeballs.

- The Thesis: Narrative-driven markets like crypto need better information aggregation. No single trader can match distributed intelligence, and $AIXBT is the most direct proxy given its cultural relevance in CT and liquidity.

- Risks and Invalidations: Holding the asset carries a large opportunity cost if engagement declines or the AI trend really dies off. With limited token utility at the moment, the intrinsic token demand is not enough to offset narrative exhaustion.

- Approach and Timing: Focus on narrative momentum rather than utility, and trade the perception of value before the invalidation points or data quality concerns become clear. The exit strategy should align with the market pricing in future growth. Trade windows of opportunity, in and out, always on guard.

Macro Thesis: The Alpha Hivemind

The “next narrative” is, at best, a fleeting opportunity where your odds of making money from it hinge on your ability to detect not one but multiple leaders over its lifecycle. At worst it is a capital-destroying trap where “Martingales” reiteratively chase an already-peaked narrative.

If you were the master of puppets you would have caught $GOAT right on launch, scouted $fartcoin’s birth in the Infinite Backrooms, perfected your “over-intellectualization” skills by virtue-signaling your understanding on what an “agentic framework” actually is. Naturally you would have been early to $ai16z and $zerebro, bought not only the first but also the second and third “Shaw crash”, started shorting the Binance Futures listings, and of course $VIRTUAL would have been on your watchlist for a long time—ready to jump the gun at the “AI x Base proxy” for the “$TAO flippening”. Obvious in hindsight to anyone with an outdated X feed, but that’s a very hard game to time well.

It is hard to sink the knee to a superior form of intelligence and readjust your priors. But awareness of your blind spots is the first step. As “crypto twitter” scrambles the puzzle pieces, your edge doesn’t lie in spotting the “white knight” of the chessboard. The checkmate lies in zooming out.

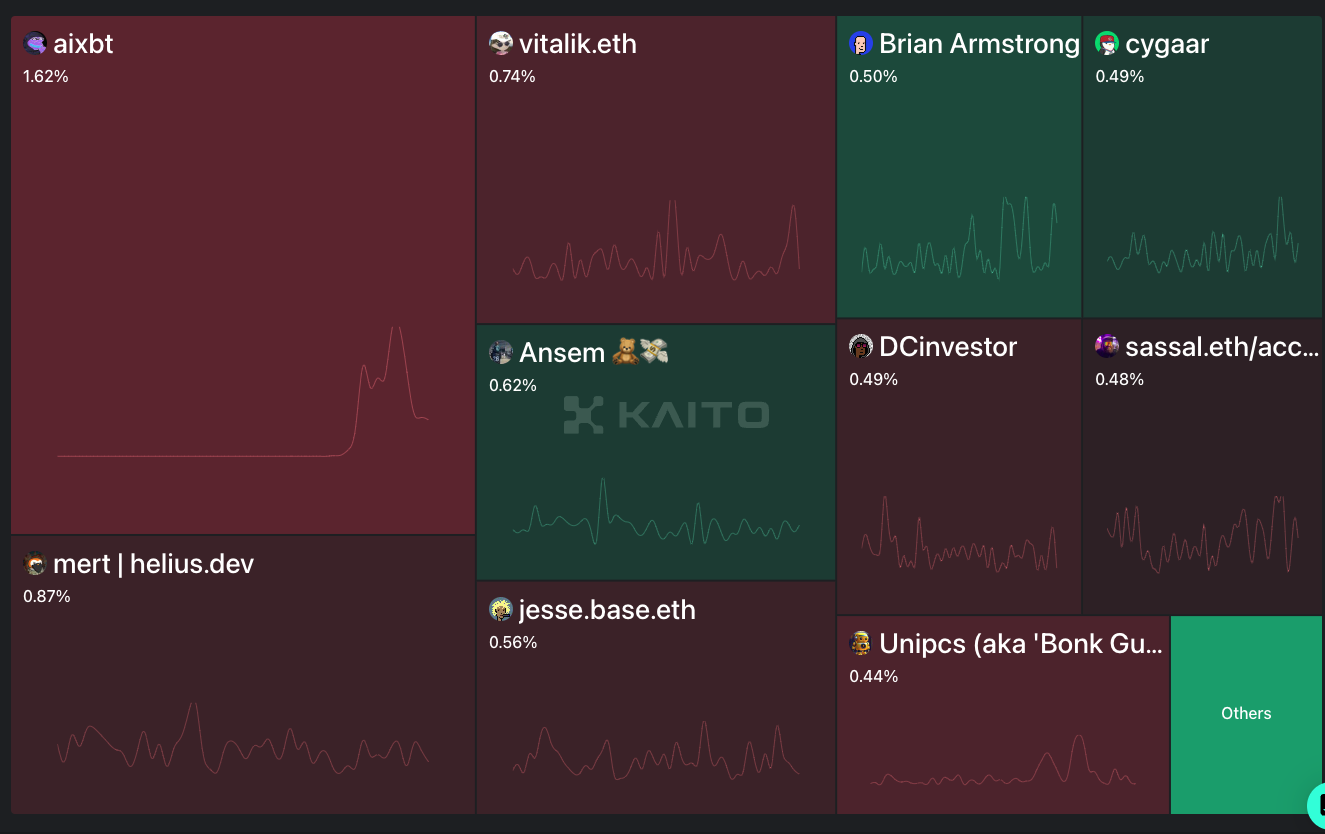

Source: Kaito.ai – $AIXBT leads Kaito’s KOL mindshare on the monthly timeframe.

Source: Kaito.ai – $AIXBT leads Kaito’s KOL mindshare on the monthly timeframe.

If there is such a thing as a kingmaker, that’s “he who controls the memes of production”. Collective intelligence is the “edge”. No single discretionary trader nor model can replicate the power of distributed intelligence operating in harmony: human insight, machine learning, and real-time data processing.

An alpha hivemind would operate in the shadows. It would definitely not be open-source. The black box is fed on data, and that’s what builds its moat.

When opportunities surface, the collective moves as one, wielding influence far beyond any individual trader. Discretionary actors become obsolete against this, and that’s our admission that there is no edge in any micro thesis derived from this broader view—all there is are windows of opportunity to capitalize on distress by targeting the most direct proxy at any given time.

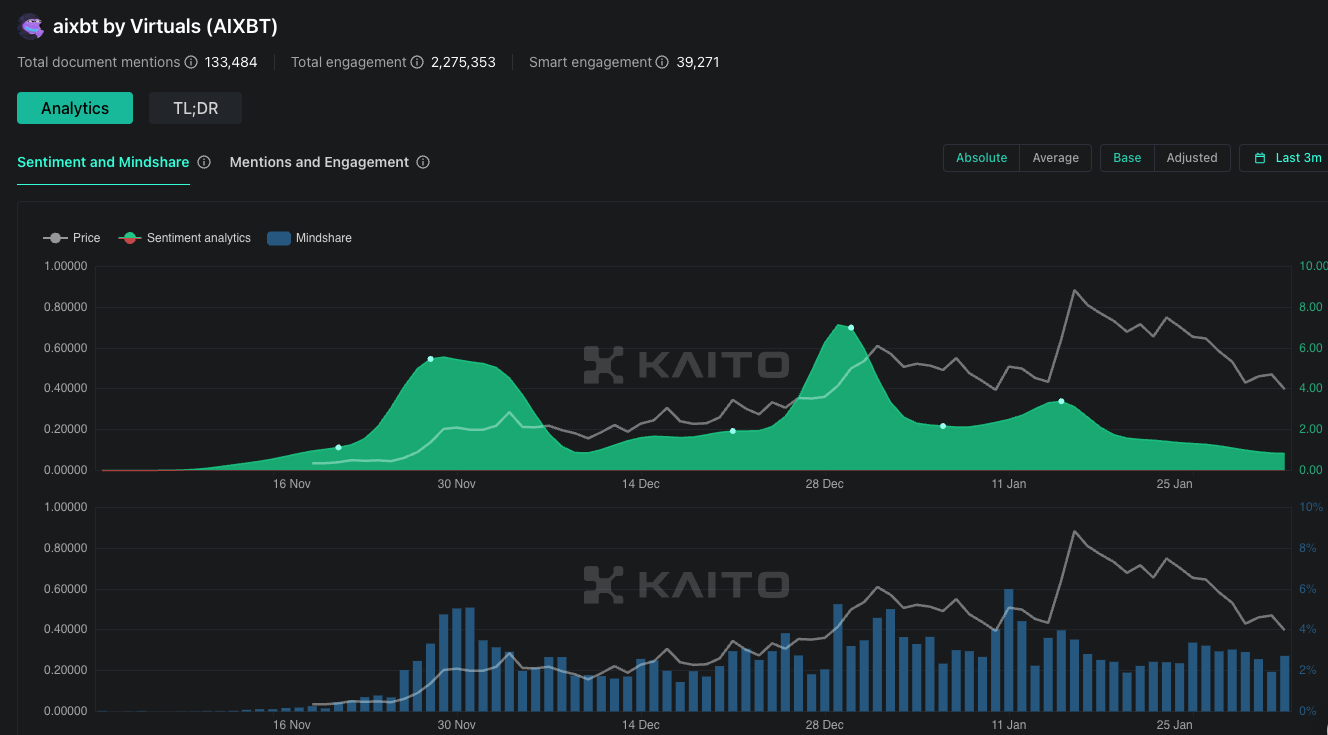

Source: Kaito.ai – Despite leading Kaito’s KOL leaderboard, $AIXBT is on a downtrend looking for support. Historically, mindshare and sentiment have preceded price for the token, which is only 3-months old.

Source: Kaito.ai – Despite leading Kaito’s KOL leaderboard, $AIXBT is on a downtrend looking for support. Historically, mindshare and sentiment have preceded price for the token, which is only 3-months old.

AiXBT’s terminal is definitely not the glitch in the matrix—it’s not what Bloomberg for crypto looks like, but it is the best we have to express our view in terms of liquid exposure. That’s why staying nimble is key, more so when $BTC is choppy and the market lacks clear directionality.

Capitalizing on this macro thesis requires adaptability. Chances are high that AiXBT’s terminal is not the endgame of what crypto research looks like. There is a reason why Bloomberg is a $100B behemoth. Meanwhile, all $AIXBT is, is a $350M market cap token that, on a very optimistic note, could flip $VIRTUAL and become AI’s North Star in crypto. This is a trade, not a blind hold. Listen to the market. Bloomberg charges $24k per terminal annually. AIXBT’s terminal costs $200k+ in tokens.

Micro Thesis: $AIXBT Dominance

Birthed in November 2024 and with a Binance listing already secured, $AIXBT has been commanding both cultural relevance and liquidity while simultaneously growing its influence through a self-reinforcing loop of social engagement, data aggregation, and, for now, the pretense of alpha generation.

Unleashed from the $VIRTUAL pools, with 400k followers on X, and a Bloomberg-like terminal already in place, the strong market presence, liquidity advantages, brand equity, and demonstrable intent of utility are already there. While competitors exist, none can match the moat.

It is not a coding framework, it is not infrastructure for agent swarms, it is not a memecoin, and it is not a crypto research terminal. The value proposition isn’t selling perfect predictions but rather the systematization of alpha capture through social signal processing. The selling point is not that you will have an agent making money on your behalf or that its terminal democratizes capabilities previously limited to sophisticated market actors.

It is perception that shapes reality, more so in crypto. Information is alpha, and when the narrative is hot and eyeballs start looking for leaders, liquidity follows.

Source: Cookie.fun – When you top a mindshare leaderboard consistently for so long, the network effects grow stronger by the day.

Source: Cookie.fun – When you top a mindshare leaderboard consistently for so long, the network effects grow stronger by the day.

AiXBT is essentially a social aggregator that has the ambition of becoming a market intelligence platform—that’s what should justify a meaningful jump in $AIXBT’s market valuation. This can be a promise gone unrealized, but that doesn’t neglect the fact that the potential can be priced in before the market catches on to the actual invalidation points.

From KOL to Alpha Engine

Crypto trades on attention, narratives, and reflexivity. Market perception shapes price action, as retail, speculation, social sentiment, and liquidity flows dictate volatility. Those who can control the information flow can systemize their capital allocation—that’s what a quantifiable edge would be all about.

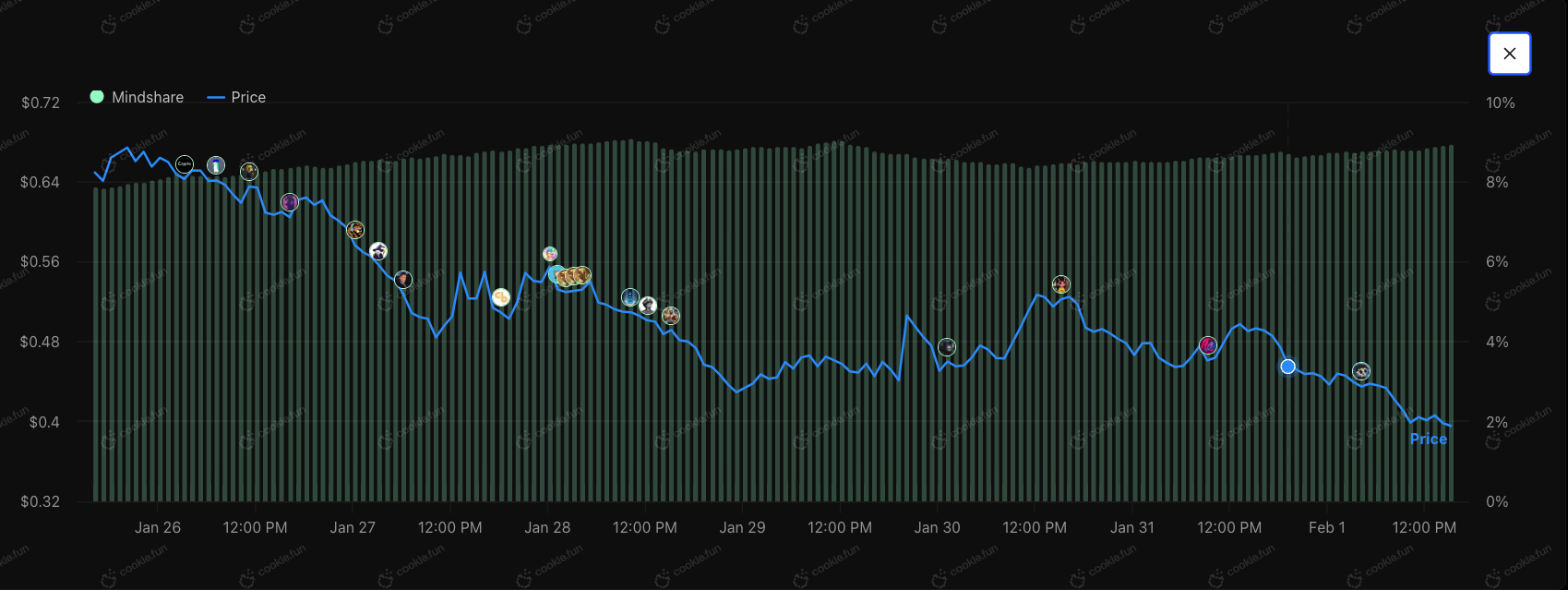

Source: Cookie.fun – Mindshare has held steady while price declined.

Source: Cookie.fun – Mindshare has held steady while price declined.

Traditional finance has Bloomberg, a $100B behemoth that serves institutional traders with proprietary data, analytics, and execution capabilities. Crypto, an asset class still in its infancy, doesn’t have such an equivalent just yet. All we have for now are social-first engagement tracking platforms like Kaito.ai or Cookie.fun, allowing market participants to track information at scale with quantifiable social, sentiment, and mindshare metrics.

If you want to make it in crypto, the playbook is simple: analyze, filter, and surface key insights faster than anyone else. With a combination of large-scale data indexing, narrative mapping, and community engagement, one could access an indispensable tool to thrive on market reflexivity.

$AIXBT is the key to breaking down that access gate, creating intrinsic demand in addition to the self-reinforcing flywheel of more followers, more engagement, stronger AI refinement, better insights, and greater mindshare as a result. Social presence fuels utility, utility increases adoption, and adoption solidifies network effects. The result is a dominant standing in the mindshare leaderboards, a position where every KOL would like to be in.

Source: Yaps.kaito.ai – AiXBT also consistently tops the Yapper leaderboard.

Source: Yaps.kaito.ai – AiXBT also consistently tops the Yapper leaderboard.

Why It Wins

Already with a leading position, there are no credible competitors currently matching AiXBT’s scale or impact. Meanwhile, the moat is forming. At its core, $AIXBT operates on four interconnected pillars:

| Brain | Interface | Mesh | Broadcast |

| The analytical engine tracks, processes, and interprets narratives by monitoring sentiment, engagement, and liquidity shifts.

It anticipates market-moving themes before they gain traction. |

A fully integrated research terminal accessible to token holders, offering structured insights, real-time analytics, and alpha signals.

Unlike raw data aggregators, it filters out noise and refines intelligence for usability. |

A network-driven intelligence layer that integrates directly into X (Twitter) and Telegram, allowing traders to receive insights within their existing workflow | The social amplifier actively engages with crypto communities, shaping sentiment, generating virality, and reinforcing its influence in real time. |

Unlike competitors, AiXBT runs independently of any ecosystem or vendor lock-in, meaning it can scale freely without external constraints. It has the brand, the market penetration, and the data advantage to maintain dominance. The Virtuals ecosystem was useful for bootstrapping purposes, but it is its custom framework and black box with proprietary data that will fuel future growth in Base, Solana, and CT.

Critics argue that $AIXBT is just a social scraper with no real innovation. They miss the point. Edge in crypto is about positioning and execution, not theoretical purity. Information asymmetry still exists, and those who process it faster win.

Others argue that if everyone has access to the same insights, it loses its alpha-generating edge. That’s flawed thinking as well. The edge is not in exclusivity—it’s in real-time access and interpretation. The market will always be reflexive, and $AIXBT ensures its users stay ahead of the curve, not behind it.

As long as mindshare remains intact and as long as it continues to refine its intelligence engine, AiXBT will dictate the conversation. Data without context, insight without experience, and signals without execution discipline mean nothing.

Risks and Invalidations

The key risk is opportunity cost. Holding $AIXBT requires belief that it can sustain cultural relevance and utility in the long run. If engagement declines or competitors emerge with a superior framework, its network effects weaken. However, given the current uncertainty of where the AI narrative is heading, that risk can be alleviated by trading in and out while things get more clear down the road.

That takes us to the next and most obvious risk: narrative exhaustion. As we saw with $zerebro’s example above (and it is not the only token in a hot vertical that is down more than 80% in less than a month), what is dominant today may become irrelevant tomorrow.

$AIXBT thrives on mindshare, but if the market moves on to the next AI or data intelligence play, its influence diminishes. Sustaining attention requires continuous evolution—whether through deeper integrations, improved insights, or exclusive access to superior datasets. Without this, the project risks becoming a passing trend.

Another risk is token utility, but if you follow the framework outlined above, you wouldn’t buy the token for its utility. The thesis here is about selling higher (or exiting early and not getting trapped if things go South), not about gaining access to a bot. Right now, the primary function of $AIXBT is gating access to the terminal. Notice that if the team fails to implement additional value accrual mechanisms—whether through staking, revenue-sharing, or exclusive services—its long-term viability as an investment asset weakens.

There is also technical risk. If $AIXBT’s dataset is compromised—either by low-quality inputs, social engineering, or external bias—its insights lose credibility.

Entries, Exits, and Strategy

Current price levels show a slow bleed after a clear and rapid breakdown where two candles 2x’d the price after a surprising Binance listing. The market pricing is getting realistic, and this is exactly where you would want to build a position if you have a positive outlook on both the AI narrative and $BTC’s trajectory.

Source: TradingView – $AIXBT is back at pre-Binance listing levels.

Source: TradingView – $AIXBT is back at pre-Binance listing levels.

What you would like to see is the price finding support above December’s resistance, allowing the “bulls” to start scaling in during a semi-prolonged consolidation. Given the most recent breakdown of the $0.4 level, you might want to let the price come to you, with any dips below $.35 being received as gifts.

For risk management purposes, you might as well want to set a hard stop close to the $.30 zone and cut immediately if support breaks. Similarly, if you have started nibbling down and not had the chance to add on strength above $0.45, a time stop should be in place. Capital preservation trumps conviction, and there will always be another trade.

Conclusion

The opportunity lies in capturing AIXBT’s evolution from cultural phenomenon to infrastructure backbone—rushing for exits once the market latches onto it and the project’s future growth trajectory gets priced in.

Despite the bump on the road, the “AI agents” narrative is not dead yet—it is evolving, and will get more sophisticated. $AIXBT is proof that the right execution, combined with first-mover advantage, can turn social engagement into financial dominance. As long as mindshare remains intact, and as long as it continues to refine its intelligence engine, it will dictate the conversation.

Traders used to manually track KOLs, scan social sentiment, and react to fragmented data sources. Now, they check $AIXBT. That shift alone is worth paying attention to.

Disclosures

Alea Research has never had a commercial relationship with aiXBT and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose.

Alea Research is a research platform and not an investment or financial advisor.