The current market keeps getting saturated with new tokens that often enter the market with a low float and building infrastructure rather than innovating at the application level. This infrastructure naturally commands a premium because the Total Addressable Market (TAM) is larger and it operates as a substrate for the applications that will build on top.

However, it is important to not miss the forest through the trees and complain that the market is inefficient. The reason for that is because VCs and investors want to bet on what has proven to work and, in addition to infrastructure projects and their tokens yielding the highest returns to their funds, the majority of market participants would agree that the killer applications of crypto have already been identified.

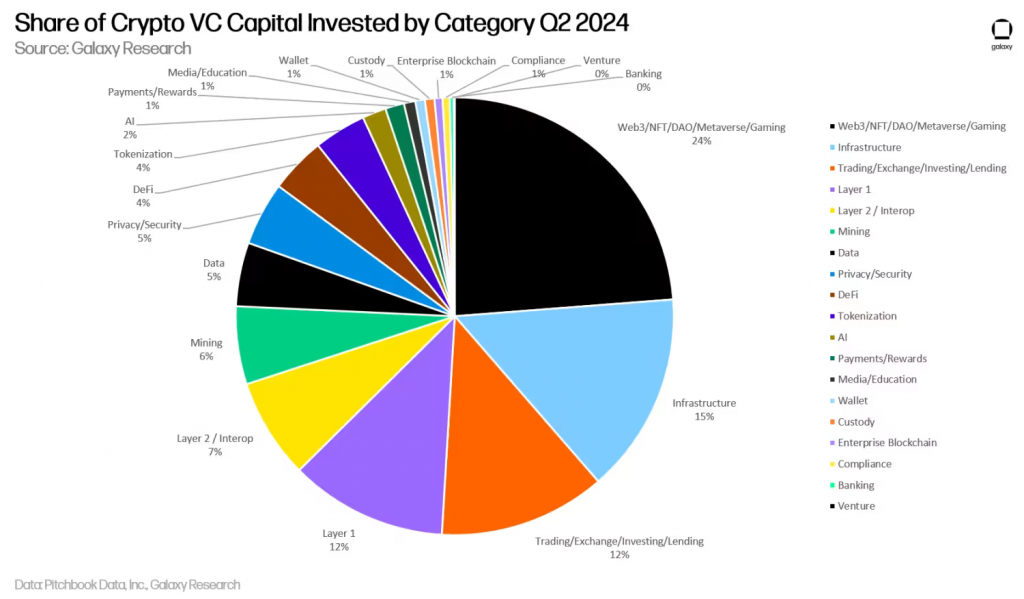

Source: Galaxy Research, VC Capital Q2 2024 – Only 4% of the capital invested in crypto in Q2 2024 has gone into DeFi, with 7% going into L2s and Interoperability solutions, and 15% into infrastructure

One example of a use case that has found product-market-fit in crypto is decentralized lending, which consists in using smart contracts to ensure solvency via overcollateralization and allow anyone to take out a loan at any time and from any part of the world without asking for permission. Within that market sector, Aave is the clear winner and category leader with almost $20B in Total Value Locked (TVL). That makes it the second largest dApp by TVL (only behind Lido’s $30B in TVL) and also one of the largest by fees and revenue generated.

This report is reserved for our Pro members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free