2026 starts with a problem: the U.S. economy is still a five‑stock trade, but the next leg wants breadth. AI remains the dominant capex engine, yet the market demands app monetization and measurable productivity. The main risk isn’t “growth collapse,” but policy volatility, sticky inflation, and too much debt. Expect higher dispersion and periodic air-pockets. Our posture: barbell quality + optionality, trade the dispersion, and avoid hero trades that only work if macro behaves.

Key Takeaways

The Regime: 2026 is a tug‑of‑war between extreme US tech concentration and a late‑but‑real cyclical broadening.

The Trade: AI is the growth engine, but the trade is rotating from “build the roads” capex to “monetize the apps” outcomes.

The Macro Backdrop: Expect more dispersion, more volatility, and fewer “everything up” phases.

The Positioning: 2026 is full of noise. That can be a feature, not a bug. When correlations loosen, single-name bets can finally pay. Until then, keep it tight.

Macro: Breadth Wants In, Policy Adds Vol

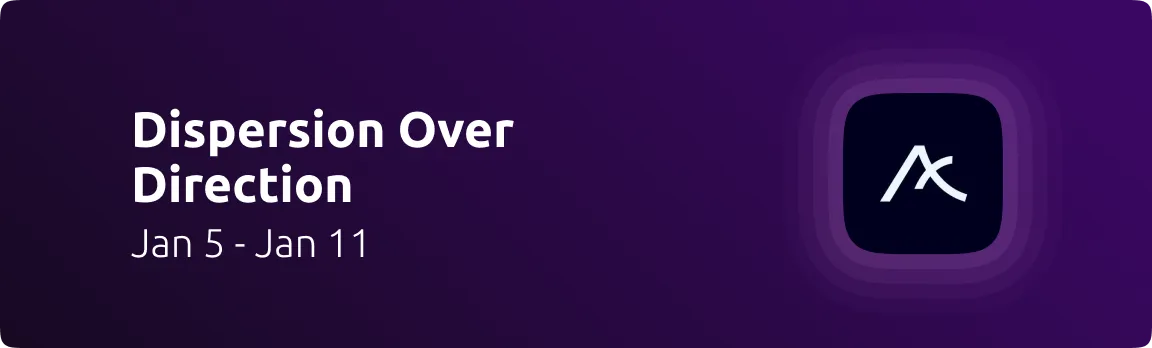

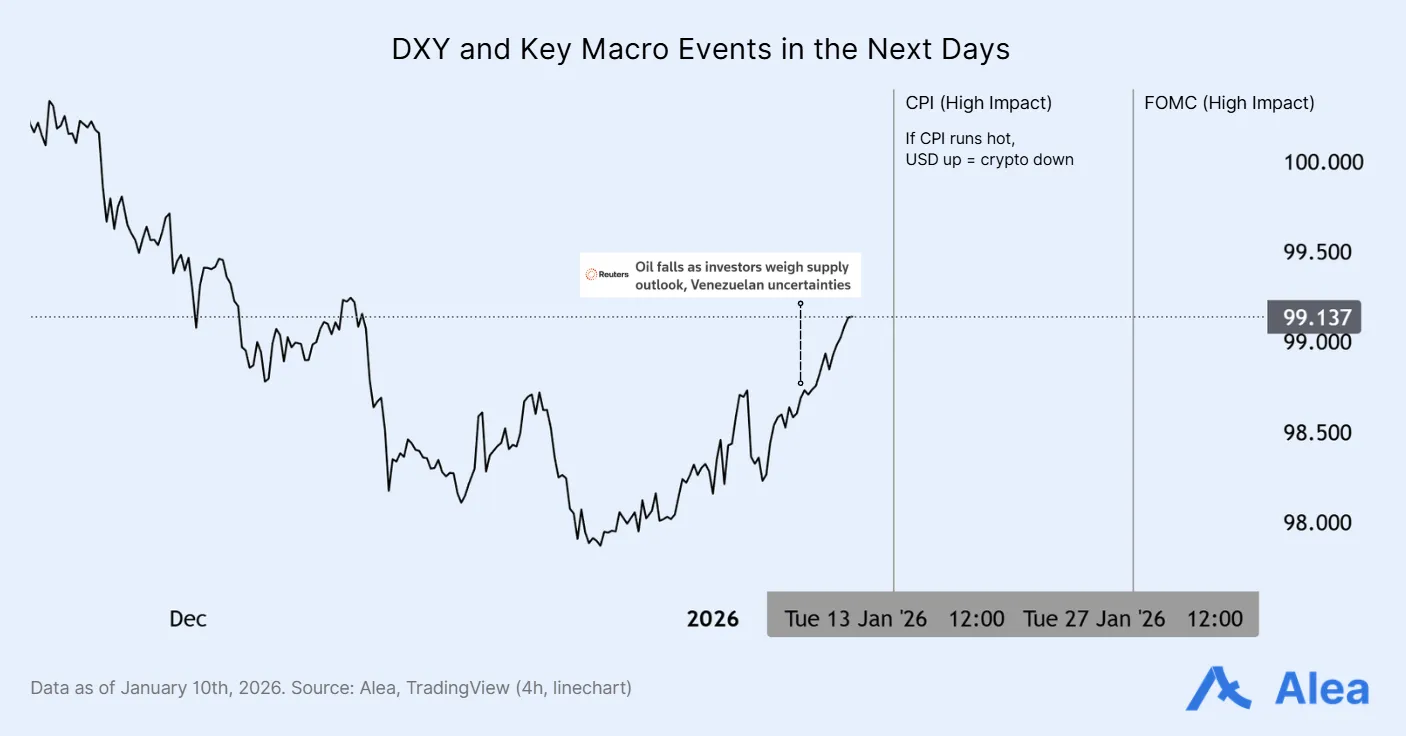

Macro is two‑handed: the Fed already cut in December and is explicitly willing to add reserves, while geopolitics is pushing hedges like gold higher. 2026 consensus is not “recession.” It’s resilient growth with unstable policy. The Fed’s problem: inflation likely doesn’t cleanly go back to 2% quickly, yet growth is too resilient to justify aggressive easing. That keeps rates and FX volatile, not trending. Add a May 2026 Fed chair transition, and you get a market that can swing on policy expectations more than fundamentals. This market will move on what the Fed might do, not what the data just did.

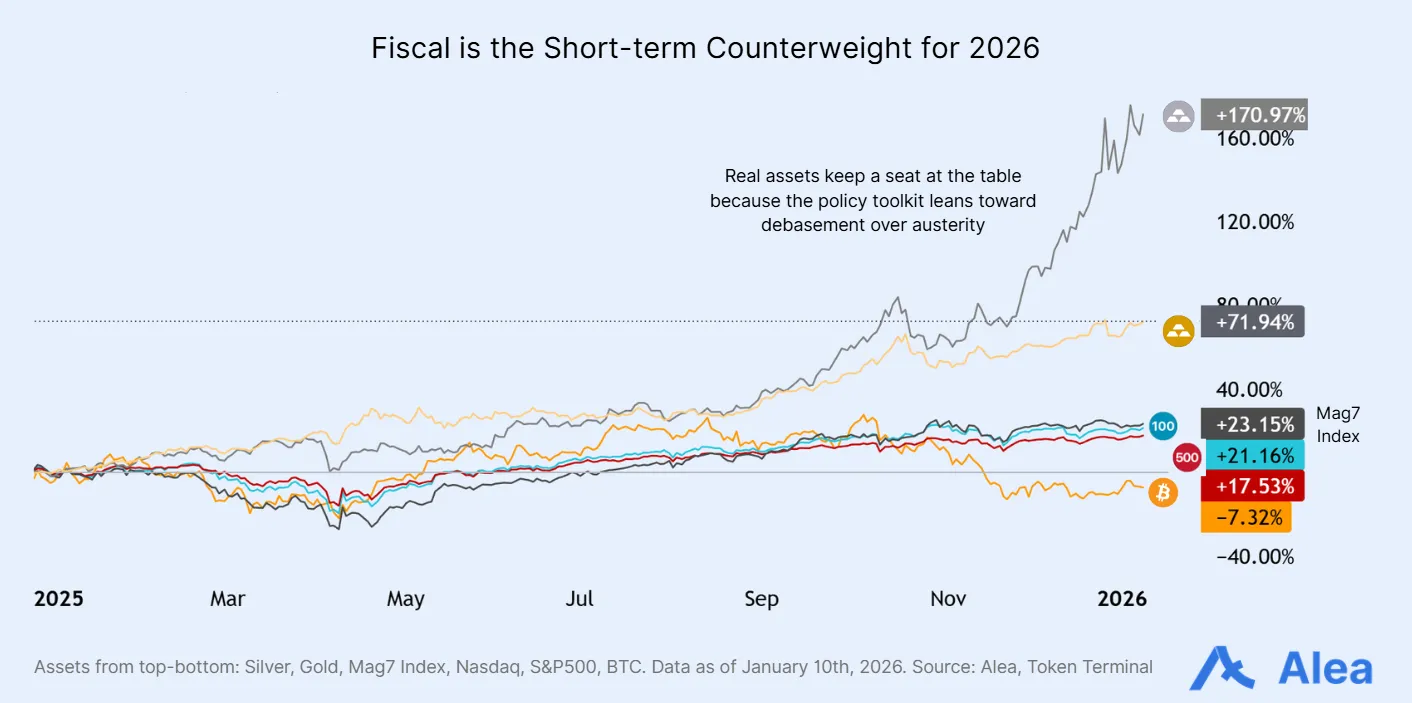

Fed liquidity is supportive, but it won’t save a hot CPI print. USD strength matters again. DXY is around the high‑98s; if it pushes back >99, beta gets sold. If it rolls over, BTC can retest $100K fast. Rates are still restrictive: Fed funds are in the 3.50%–3.75% zone, and the 10‑year ~4.18% prints suggest that the market still demands real yield.

Geopolitics adds noise you can’t model. Maduro’s capture has already proven it can inject fast risk repricing through oil and FX. For most, the only edge there is not being forced to trade it: keep sizes down and exits fast.

Context matters. One plausible read is that oil is the transmission channel: take Venezuela, push crude lower, and temper inflation expectations so policy can stay loose into the midterms. A show of force also plays well domestically while cheaper energy lets Trump claim a win. Another, less tactical but still relevant angle is classic U.S. nation-building logic resurfacing, with Venezuela first and other strategic territories (even Greenland) as longer-dated options.

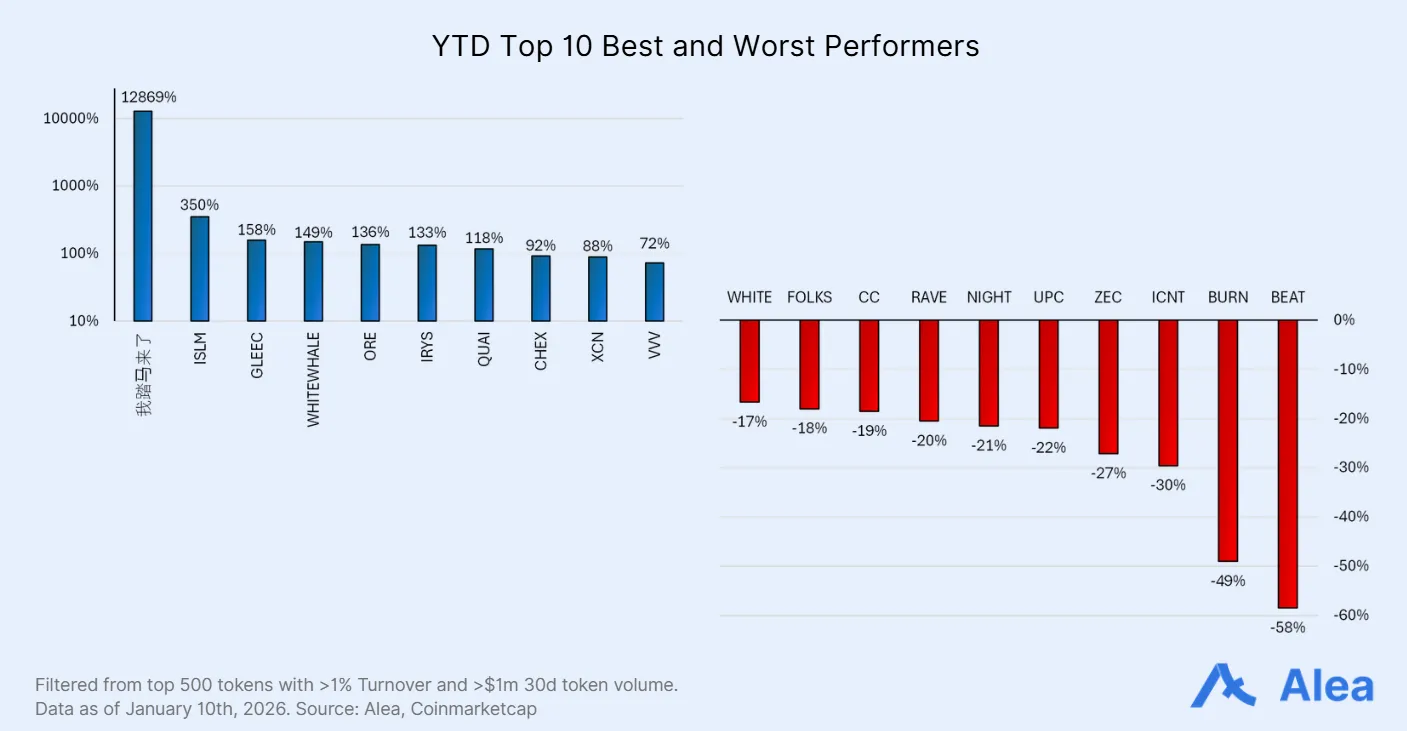

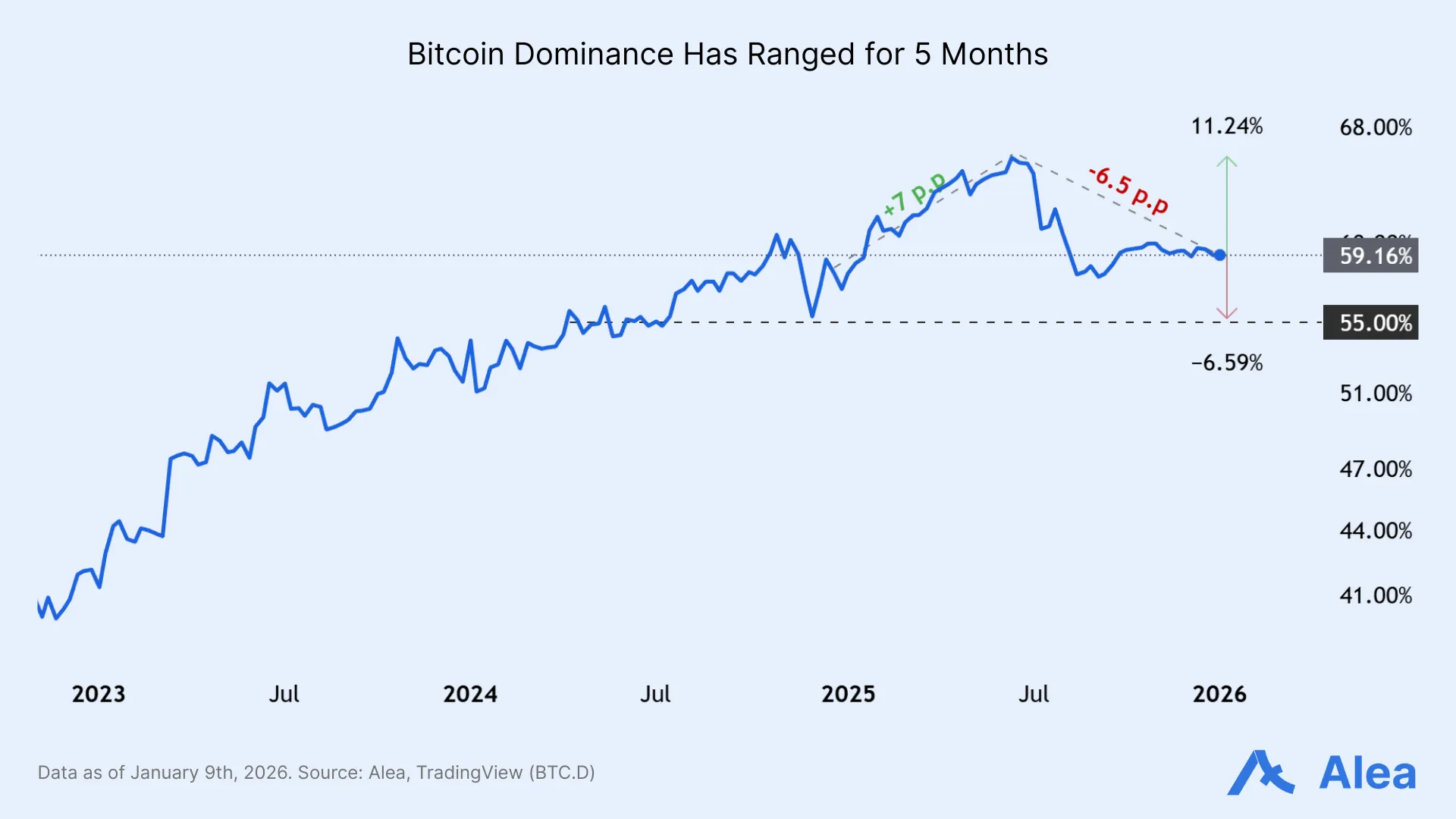

Crypto: A Dispersion Market

Dispersion is back, and the market is paying for cash flow + durability, not “next big narrative.” If equities remain a five‑stock trade, crypto’s reflex is to chase beta. 2026, however, is set up for the opposite: rotation, relative value, and survivability trades. Don’t throw leverage at the headline roulette.

Ubiquitous 24/7 stocks trading may suck liquidity out of crypto, but the lesson from TradFi applies: the winners shift from “hardware and infrastructure worship” to distribution + monetization. Applying that to liquid crypto is straightforward: don’t buy “AI coins” because AI is bullish; buy assets where demand is mechanical (fees, buybacks, structural flow) or where adoption shows up in verifiable usage.

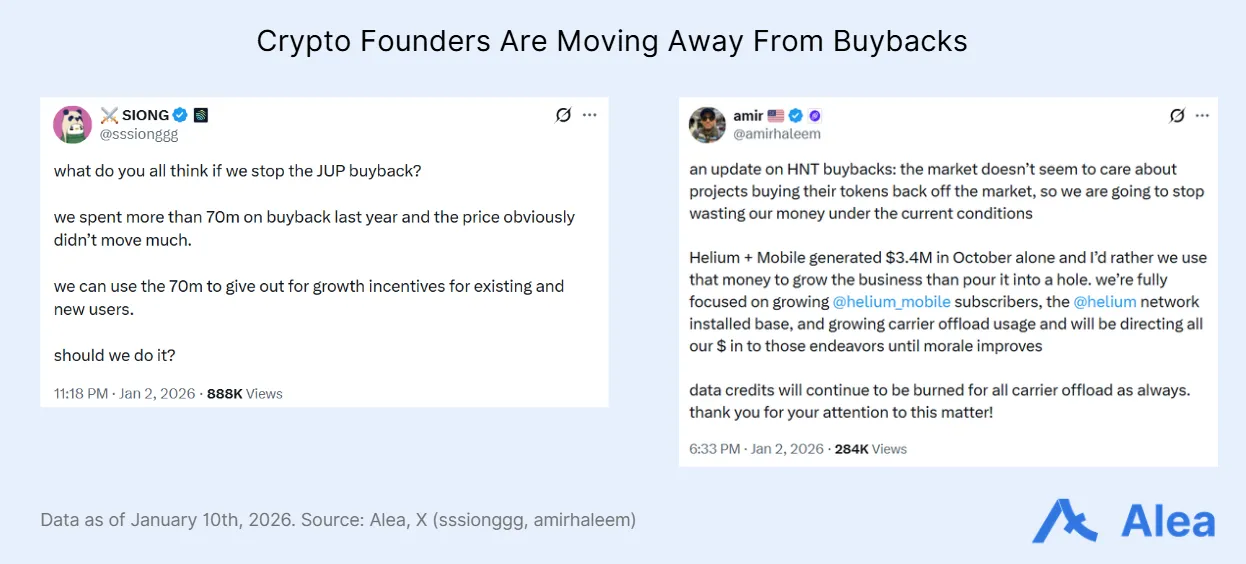

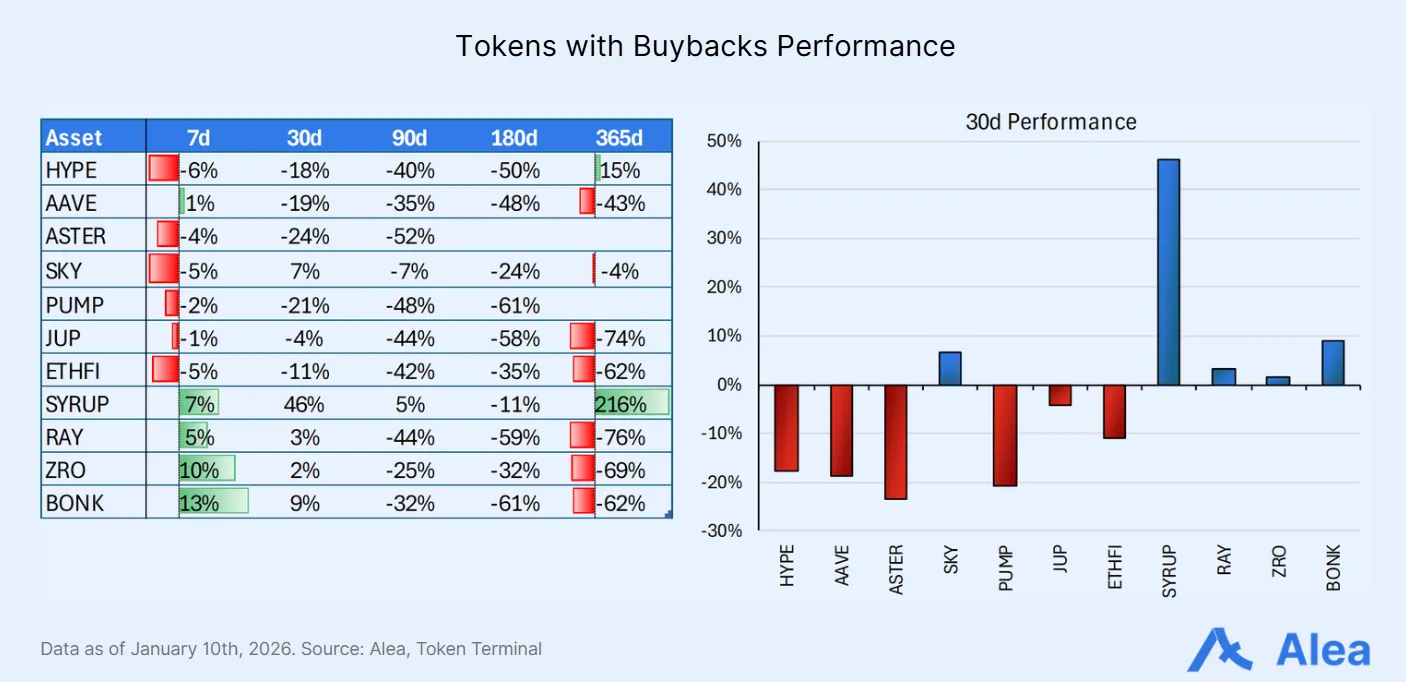

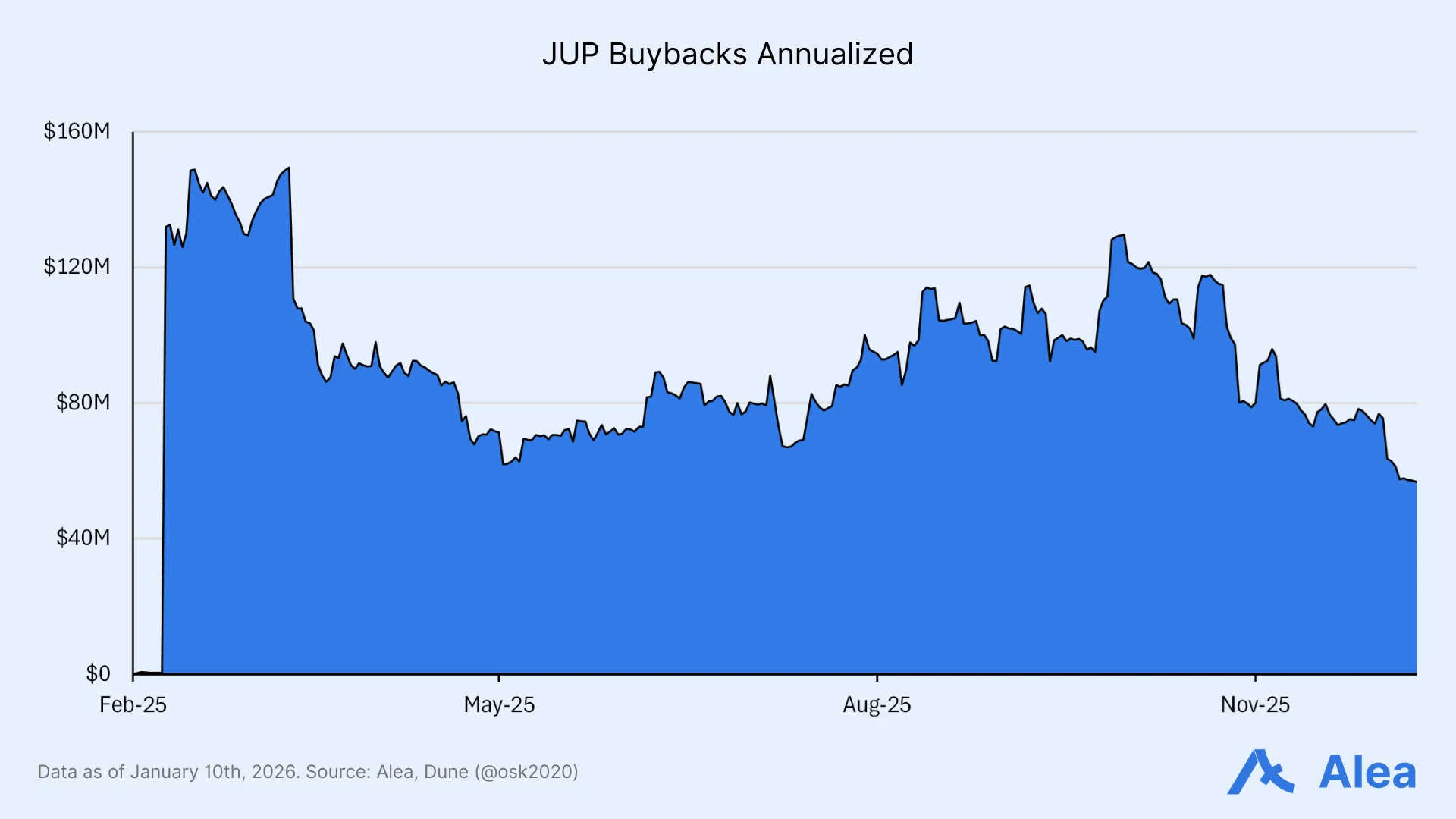

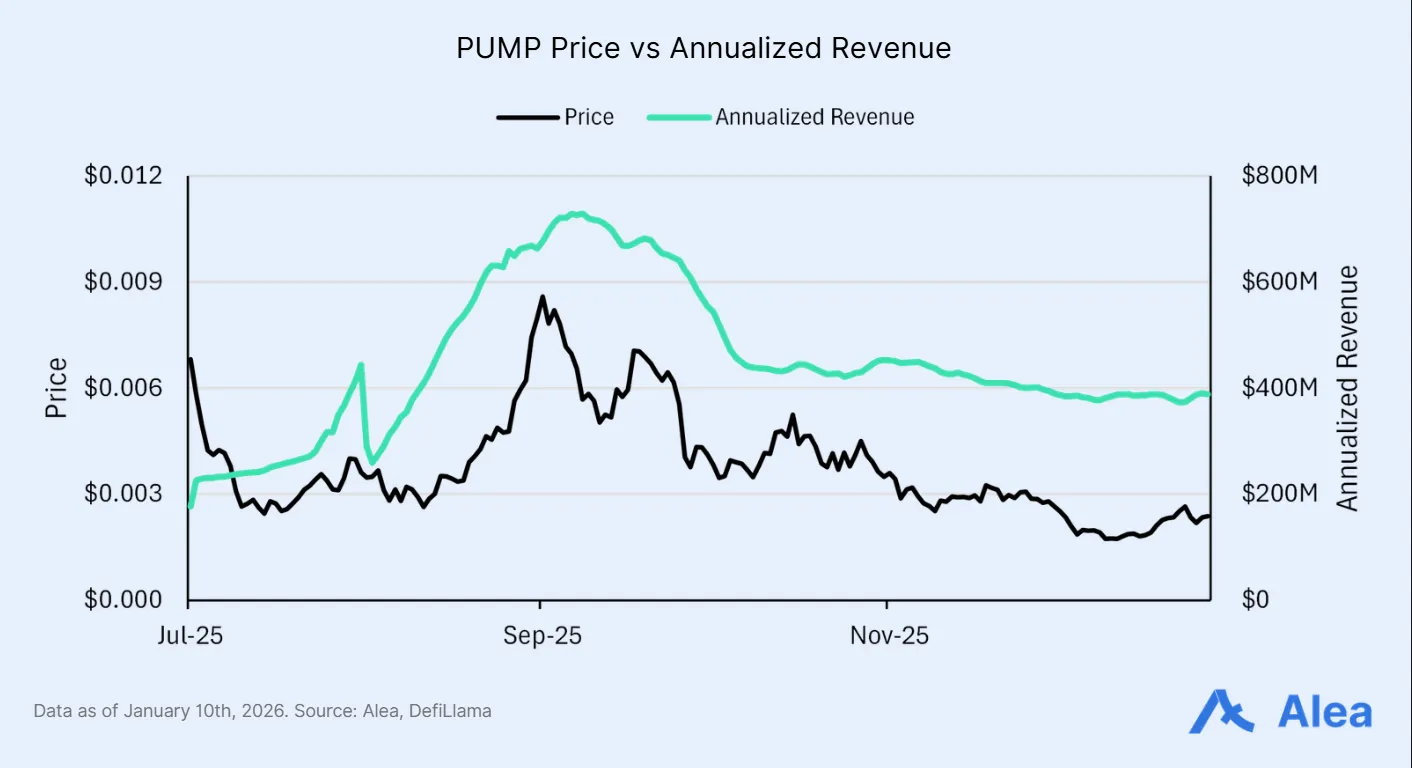

In a surprising turn of events relative to 2025, buybacks are now in the crosshairs. Helium’s Amir Haleem killed their buyback program Jan 2: “The market doesn’t seem to care about projects buying their tokens back off the market, so we are going to stop wasting our money.” Jupiter followed within 24 hours: Siong Ong publicly asked whether to halt JUP buybacks after spending $70M in 2025 with the token down 88% from highs. Pump.fun, who has been running aggressive buybacks, also sees PUMP’s price muted. The counter-examples—HYPE and AAVE—worked during positive sentiment, but that’s the point: buybacks amplify existing momentum, they don’t create it.

The problem isn’t buybacks; it’s automated buybacks at any price. Many founders bought their own hype on stretched multiples, then faulted buybacks when price reverted. They mistook narrative for fundamentals. If you’re buying back at a PE of 50 with the same intensity as a PE of 5, you’re destroying value, not creating it. The fix, therefore, isn’t abandoning buybacks; it’s price-sensitive execution: buy aggressively when the token is cheap; slow down when over-extended. By default, buybacks signal a lack of better uses for cash, dressing up the chart instead of the business. When founders call their own buybacks a “waste,” they are acknowledging that demand for their tokens was shallow and mercenary (and they didn’t expect that).

AI Digest

Four major developments matter to start 2026. Two set the M&A benchmark. Two signal where the capability frontier is headed. All three have tradeable implications for crypto.

- NVIDIA licenses Groq for $20B. Christmas Eve surprise. Structured as “non-exclusive licensing” to dodge FTC scrutiny on what’s effectively an acqui-hire of the world’s fastest inference chip team. Groq was valued at $6.9B in September—NVIDIA paid 3x. Training capex dominated 2023-24; inference dominates 2026+. NVIDIA is no longer just defending GPU dominance, but also preemptively killing inference competitors before they scale..

- Meta buys Manus for $2B+. This sets the stage for where the puck is going, with AI labs doubling down on agent orchestration frameworks. Absent a Codex or Claude Code equivalent, this is Meta’s play to flex its distribution muscle. The premium isn’t for the LLM, but for the orchestration layer and execution environment (and the 2M+ users who pay to automate tasks, now onboarded onto the Facebook, Instagram, and WhatsApp ecosystems).

- Prime Intellect ships Recursive Language Models (RLMs). RLMs let a model manage its own context persistently (inspecting, transforming, and delegating to sub-LLMs) without loading the full input into the transformer. For context, GPT-5-mini via RLM outperforms base GPT-5 on long-context benchmarks by 2x, handles 10M+ token contexts without degradation, and is cheaper per query.

- Physical world agency arrives. Anthropic’s Claude successfully grew a tomato plant via autonomous monitoring and environmental control. First demonstration of an AI agent managing a real-world system end-to-end.

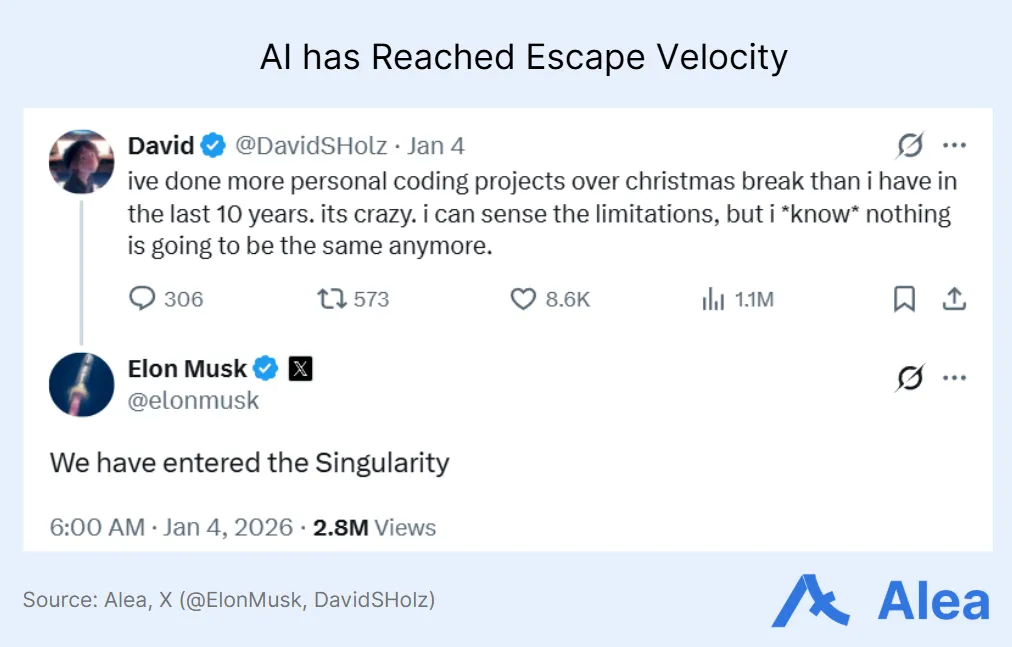

Knowledge work, starting with software, is changing extremely fast. Since the release of Gemini 3, GPT5.2, and Opus 4.5 coders have normalized multi‑agent coding; the edge now is orchestrating AI workflows at scale, not writing code.

- Steve Yegge—30 years at Amazon, Google, Sourcegraph—now writes 12,000 lines of production code per day. He runs 3-4 coding agents simultaneously, spends $300/day (~$80k/year) on tokens, and co-authored a book with Gene Kim titled Vibe Coding: Building Production-Grade Software With GenAI. He is one of the most vocal proponents that traditional coding is dead.

- Jeffrey Emanuel—known for his NVDIA short thesis back in January 2025—operates 9 agents in parallel (three Claude Opus 4.5, three GPT-5-codex-max, three Gemini 3) communicating via a custom mail-like messaging protocol he vibe-coded, and released his entire stack open-source at agent-flywheel.com. Non-coders are now orchestrating 24/7-running agents non-stop.

- Boris Cherny—who created Claude Code at Anthropic—stated Dec 27: “In the last thirty days, 100% of my contributions to Claude Code were written by Claude Code.”

- DHH—Ruby on Rails creator, longtime skeptic—has crossed over to heavy AI usage. “You can’t let the slop and cringe deny you the wonder of AI. This is the most exciting thing we’ve made computers do since we connected them to the internet”.

- Andrej Karpathy—one of the most prominent AI researchers known for leading Tesla’s Autopilot computer vision efforts and for co-founding early teams at OpenAI, as well as for coining the term “vibe coding”—posted Dec 26 that he’s “never felt this much behind as a programmer,” describing a “magnitude 9 earthquake” hitting software engineering with a new abstraction layer of agents, prompts, memory, tools, and protocols—”some powerful alien tool was handed around except it comes with no manual.”

Google reports 30%+ of new code is AI-generated, Anthropic claims 90%. The debate isn’t whether AI replaces human coding—that’s settled among practitioners—but how fast it diffuses to enterprise, how many engineers get fired to fund AI tools for the rest, and how wide the gap grows between those who can orchestrate multi-agent workflows and those who can’t.

The coding collapse is the canary. If AI can write, test, debug, and ship production software autonomously—a task that requires logical reasoning, error correction, iterative refinement, and domain expertise—then every knowledge task with similar structure is on the clock: research synthesis, financial modeling, legal document review, strategic analysis, content production, data interpretation, etc.

The pattern is identical: humans shift from doing to orchestrating, the bottleneck moves from execution to taste and judgment, the leverage goes to those who can prompt effectively and verify output quality, and the labor market bifurcates between orchestrators and the displaced.

Signals Radar

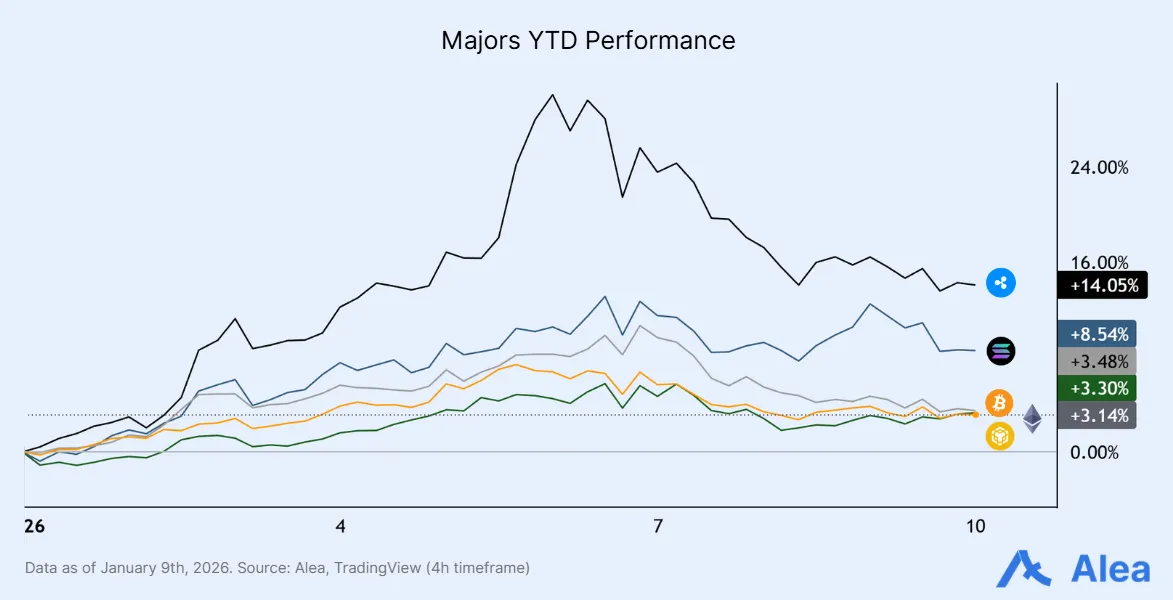

BTC — Core long and main proxy for the broader market, but not a trend until $95K/$100K flips. Adding on $95K reclaim; sizing up above $100K; caution around CPI. On the downside, $88k is the line-in-the-sand for spot risk. Below it, alts don’t deserve size.

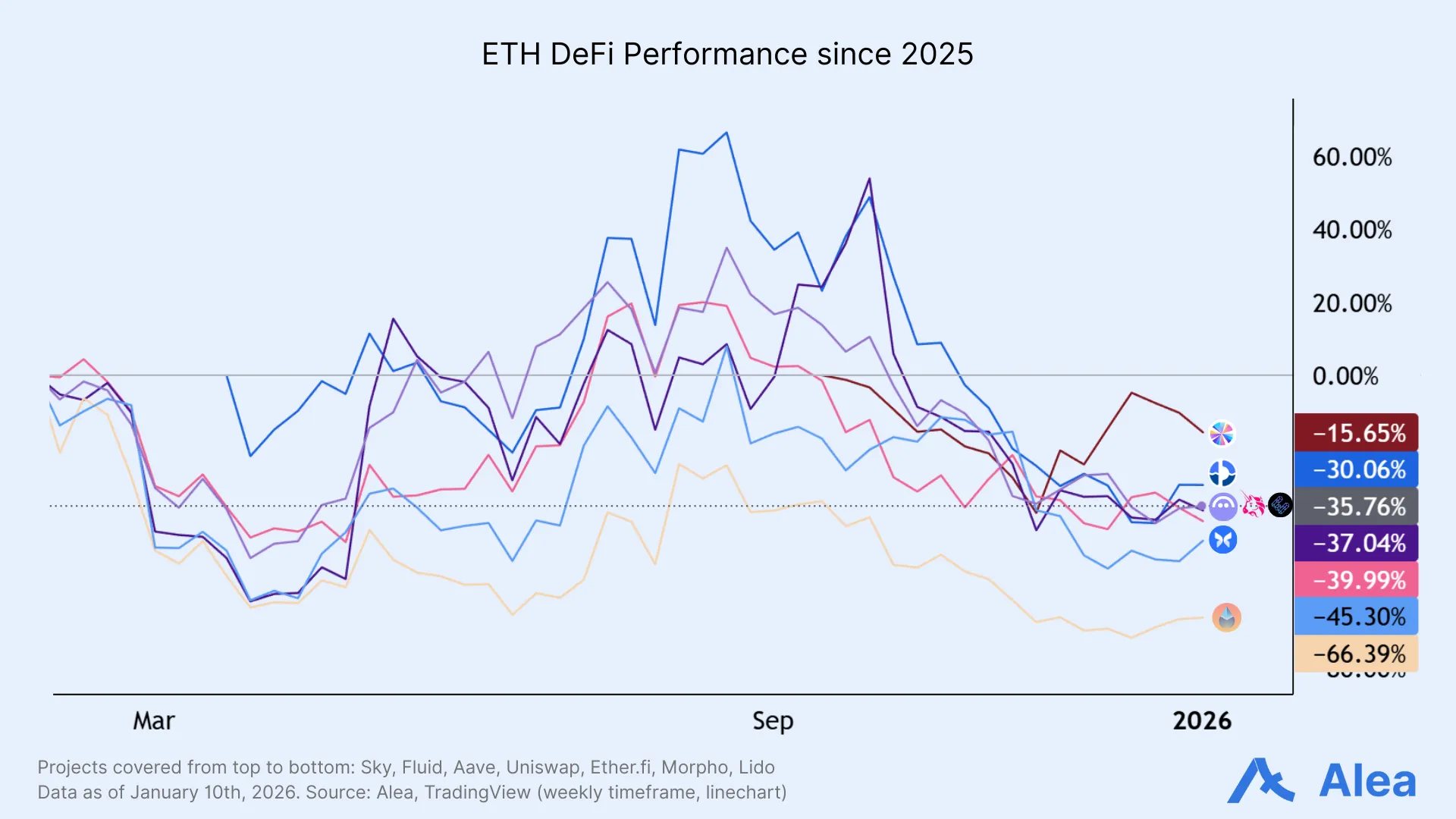

ETH — ETH is fine but not leading. It needs BTC to clear $95K first; otherwise ETH strength is just beta with worse downside asymmetry. Bitmine staked 908,192 ETH valued at $2.8BM, on route to launch a proprietary staking solution in Q1 2026.

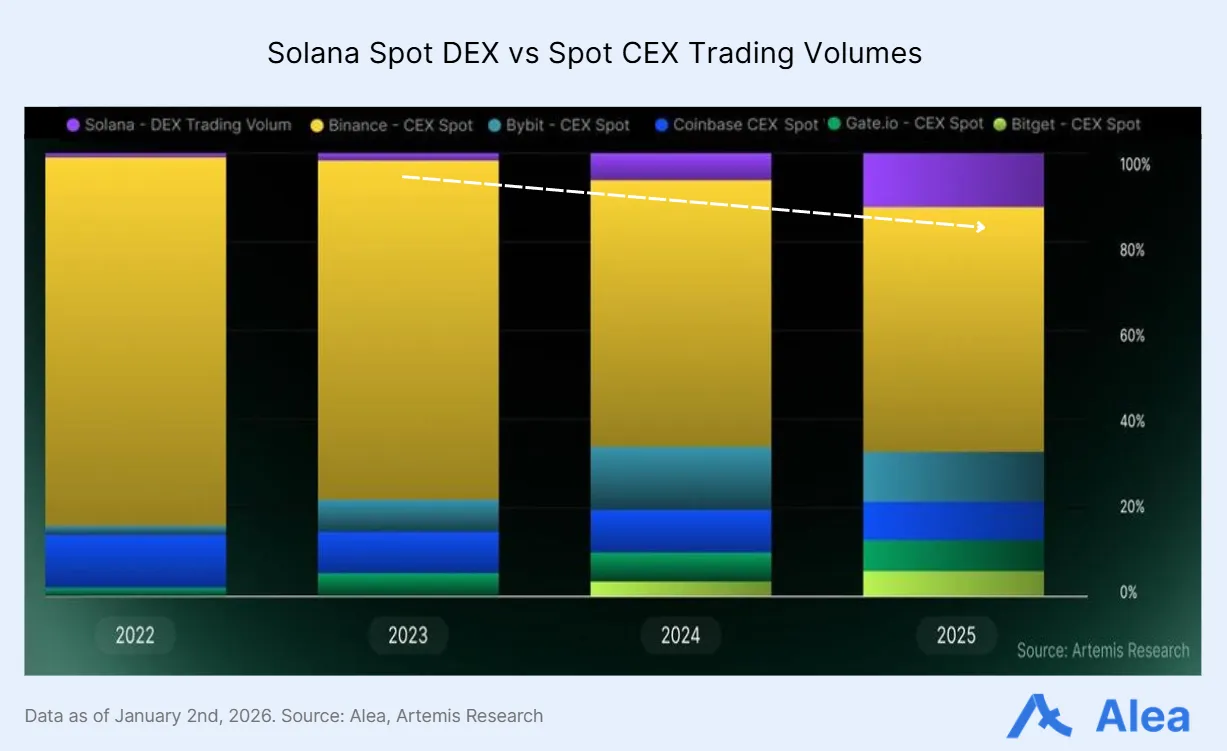

SOL — SOL remains the cleanest high‑beta expression; just respect that it will gap both ways around macro prints.

XRP — Leading among select alts with strong ETF-linked flows.

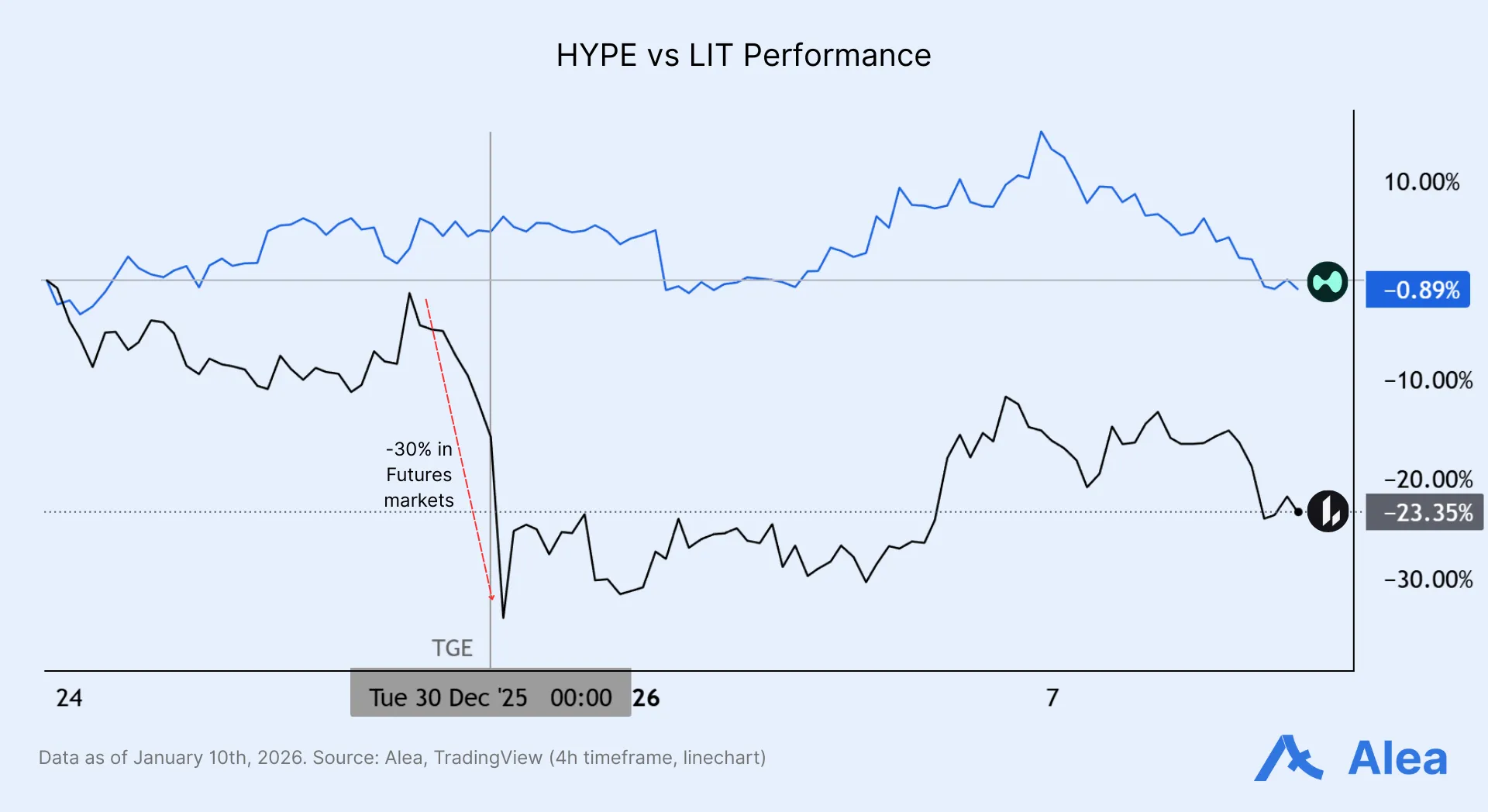

HYPE — You want to see more spot buyers on the post-unlock flush and key-levels reclaim.

LIT — New player in price discovery. More sensitive to beta than other names with a longer historical record. It could rip, but don’t marry it. Don’t donate to volatility unless you have quick feet for intra-day prints. Volume is still elevated for a recently launched asset, exposing a volatile interplay of airdrop sellers and marginal buyers rather than accumulation. Buybacks were publicly announced on Jan 5 and can be tracked following the treasury account. $2.32 is the “airdrop floor,” above $3.37 is high-range territory and ~$7.86 is the launch blow-off.

AAVE — The type of “DeFi quality” beta you want when crypto rotates back into cashflow narratives. The “what changed” in the last couple weeks is governance narrative: late December was dominated by a messy brand/IP control fight (and backlash), and the market seems to be rotating from that noise back toward “Aavenomics” and the 2026 product roadmap. On the tangible value-accrual side, Aave’s buyback framework is explicitly sized: $50M annual budget, executed weekly ($250k–$1.75M) under the AFC/TokenLogic structure.

MORPHO — Aave’s main competitor, trading more like “DeFi quality + optionality,” not like a rocket. Leverage and OI are modest on perps; spot bids lack protocol-driven buybacks. Entering 2026, the token is still priced mainly on governance + potential future value capture, not a current cashflow claim.

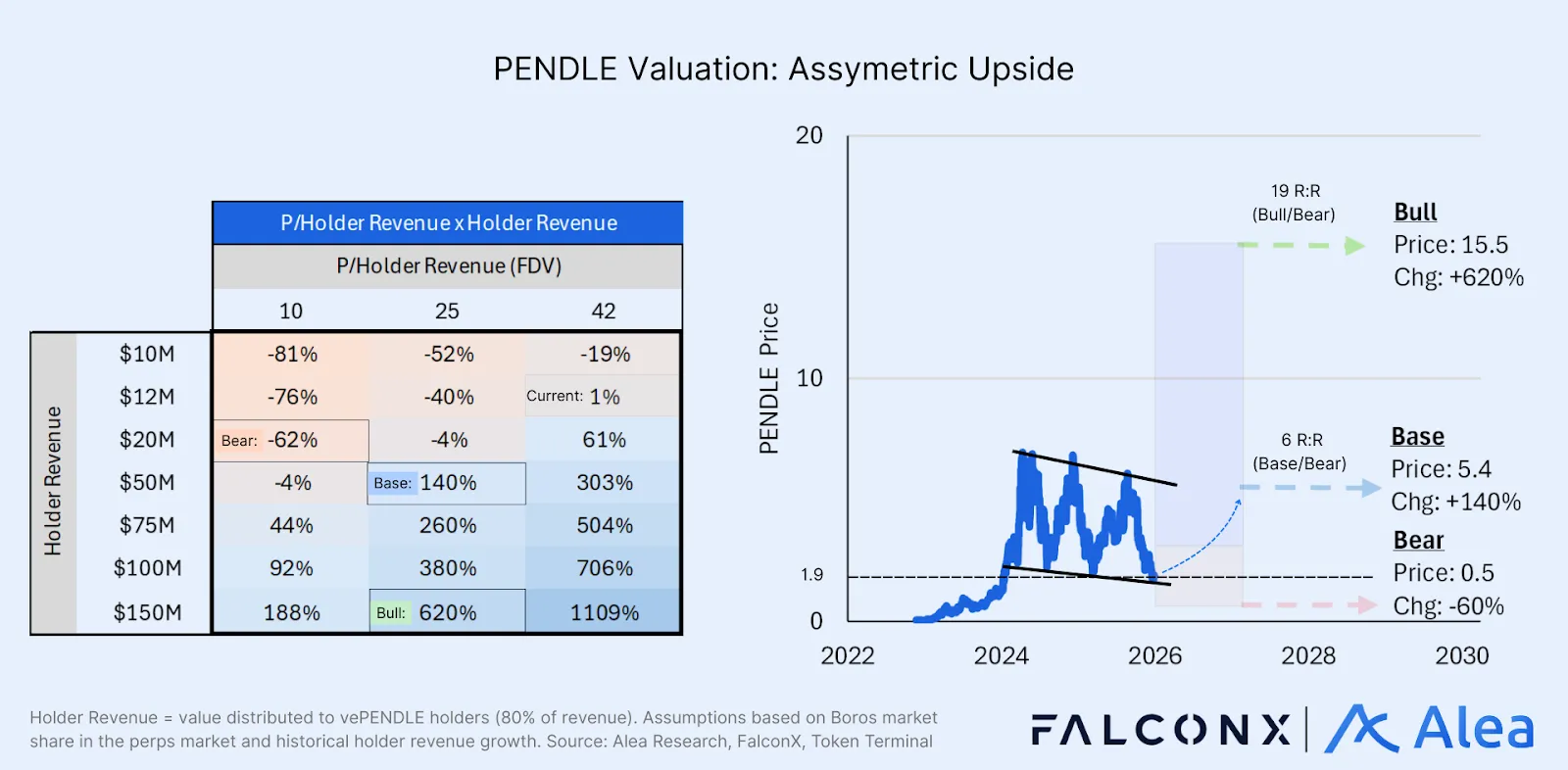

PENDLE — Our latest thesis in collaboration with FalconX, “One Venue, All of Fixed Income,” went over Pendle’s 2025 performance: $5.7B average TVL, $44.6M fees (+134% YoY), top-20 DeFi by TVL, yet PENDLE trades -62% YoY, below its April 2025 Trump-tariff lows. One drawback is that, unlike buybacks, the vePENDLE model forces liquid buyers to lock for up to two years to access cash flows. This shrinks the marginal buyer set, as many liquid funds can’t afford to take that illiquidity risk and, therefore, prefer to stay sidelined. The bull case rests on three underpriced vectors: Boros (funding-rate derivatives targeting a ~$63B perps OI market where Pendle holds just 0.1% penetration—10x OI growth implies ~15% incremental fees), diversified fee sources across two distinct business lines (TVL-driven yield fees and volume-driven trading fees), and potential tokenomics changes (buybacks or governance tweaks) that could re-open the door to liquid buyers.

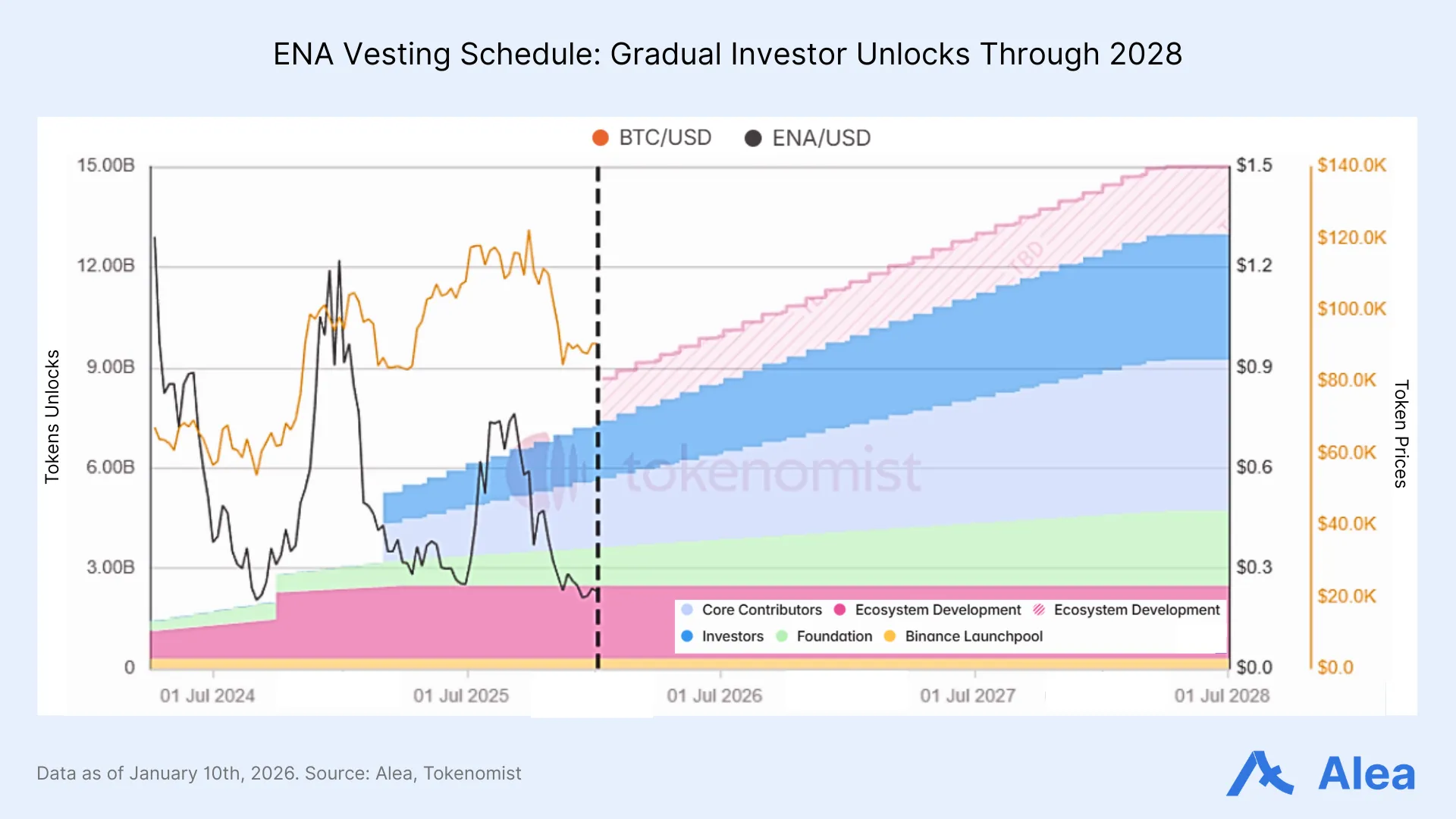

ENA — Bouncing off late-December lows while unlocks keep hitting it. The supply overhang is not “one and done,” yet we expect a new wave of fresh catalysts being announced over the coming weeks. What to watch during downturns: can ENA hold ~$0.25 when sentiment turns negative and unlocks keep coming in. A clean hold there turns this into a “sellers exhausted” setup; losing it and you’re back in chop-with-downside where rallies cannot be fully trusted.

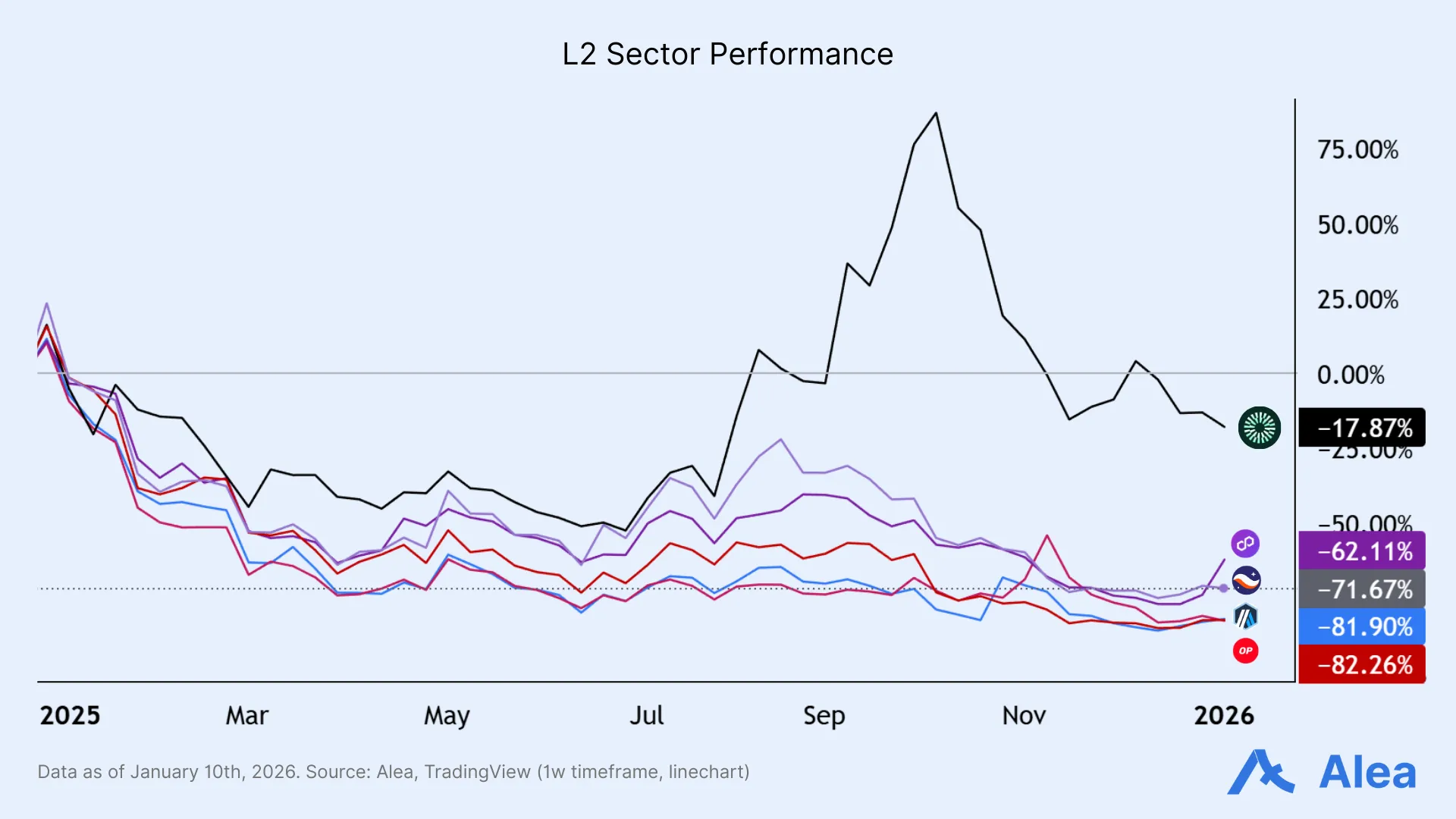

OP — A governance proposal hit on Jan 8 proposing to route 50% of incoming ETH revenue into OP monthly buybacks for 12 months starting February. Last year’s run‑rate implies ~2.7k ETH of buybacks (~$8M in OP at prevailing prices). The catch (or alpha): execution is OTC, in a pre-set monthly window “without regard to price,” and it pauses if monthly revenue is <$200k. Voting starts Jan 22. If it passes, the market will front-run probabilities (not realized buy pressure) and speculate on whether they will accumulate for future burns or staking rewards. The bull case is Superchain revenue scaling across leading chains like Ink, Base, Unichain, World, etc; the bear case is that unlock gravity keeps winning, since only ~45% of the supply is unlocked and the overhang doesn’t disappear just because the treasury is buying OP OTC.

JUP — Jupuary 2026 has a defined window. Eligibility runs from Dec 6, 2025 to Jan 30, 2026; claims open Feb 4, 2026. JUP is a cash flow token, far from a routinary airdrop dump. Mobile V3 just shipped and the Coinbase integration has also gone live, making millions of Solana assets accessible through the Coinbase app. Despite $70M spent on buybacks last year, price did not move. The team is now asking: buyback or build? This is the exact moment where capital discipline either emerges or does not.

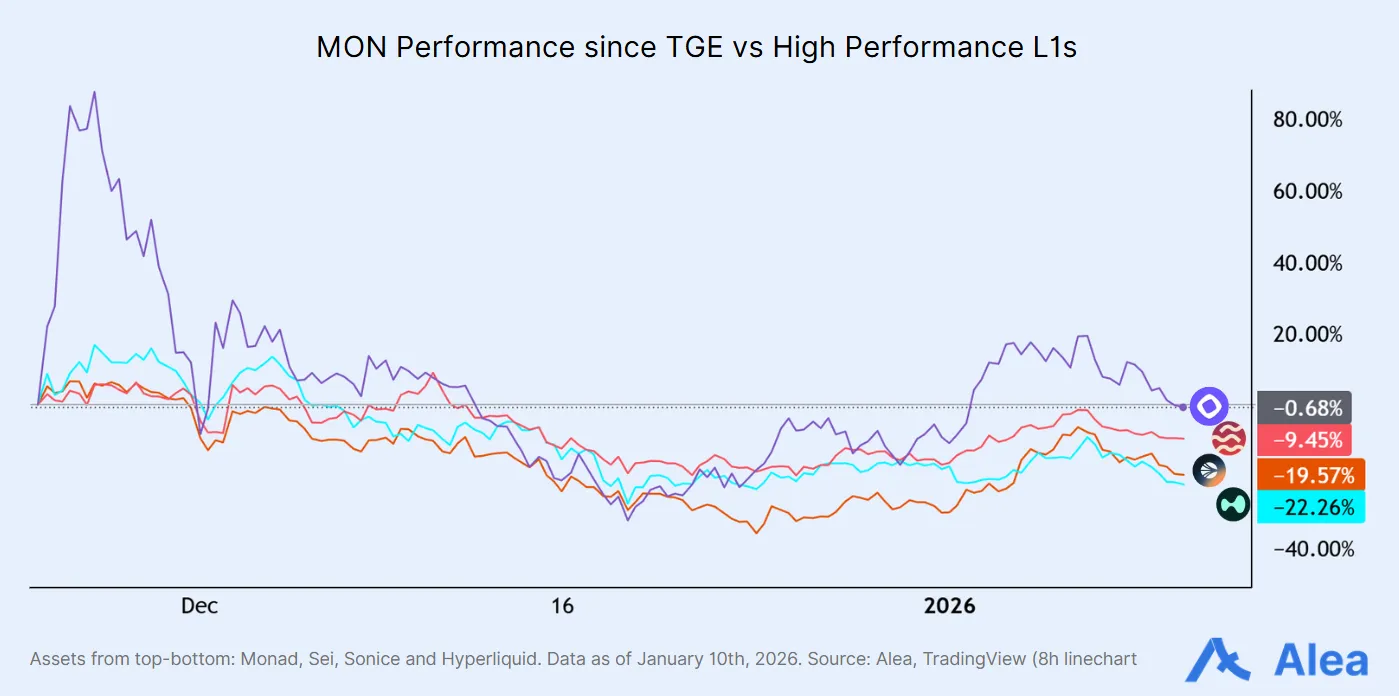

SEI — SEI is back on the radar because “Sei Giga” is being pitched as a step‑change in EVM performance. This is a two‑handed trade: upgrade narrative can bid for it, but competition from Monad and MegaETH is something to keep in mind.

PUMP — Does the market care about buybacks? Yes, but so far everything indicates that they help more to set a floor than to attract narrative buyers. PUMP can route ~$1M/day into buybacks and still chop/down if the market thinks the business is a fad (or legally toxic). This is the perfect example of how buybacks are only as good as forward revenue. And revenue is attention-cyclical. Additionally, since there is no contractual claim, the market discounts the “yield.”

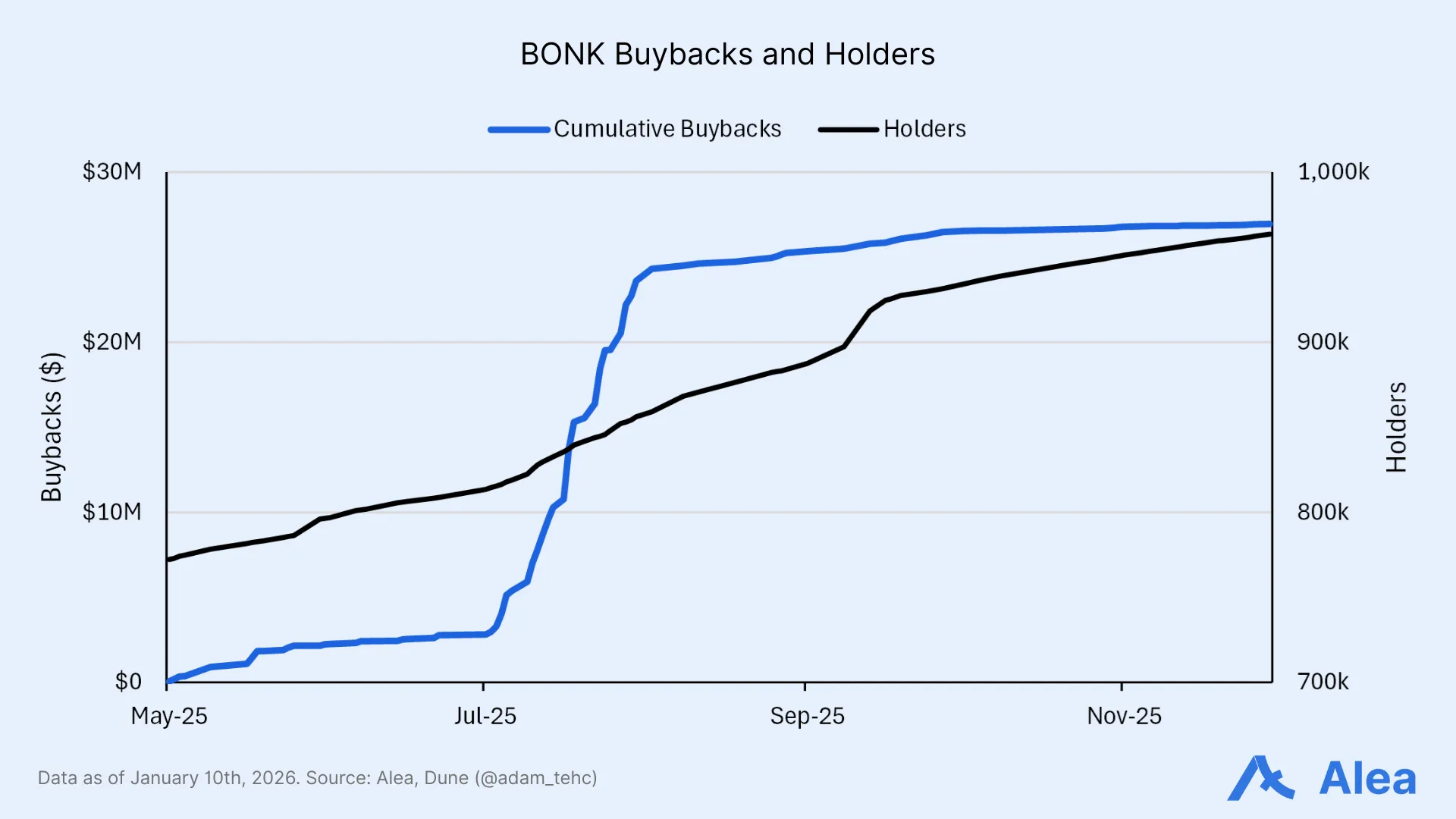

BONK — Momentum long and not a “zero-fundamentals memecoin”. Very reflexive on risk-on flows. Buybacks are the structural bid; convexity comes from a milestone burn the market is watching: a 1T BONK burn (~1% supply) once holders hit 1M.

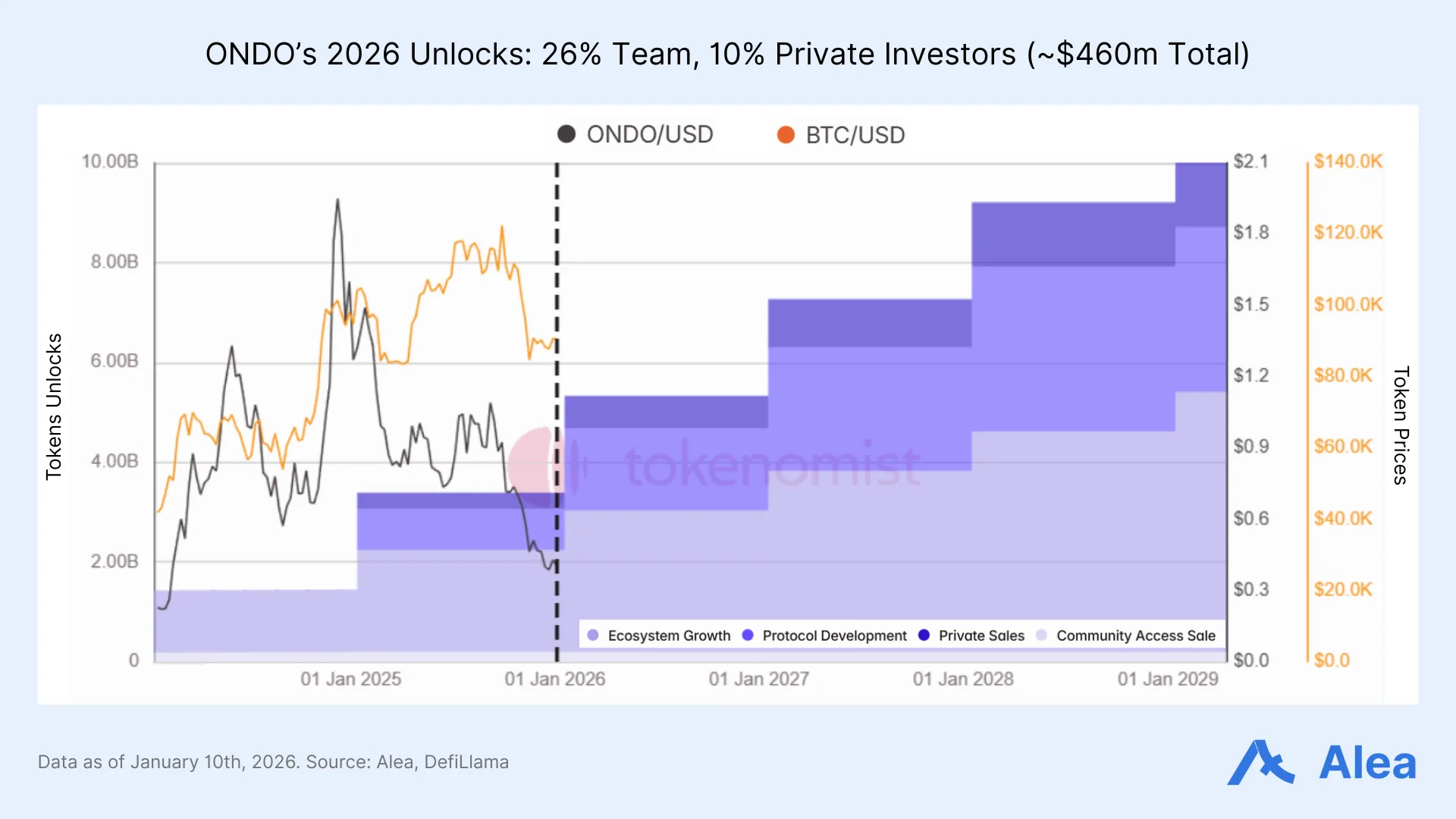

ONDO — This is the biggest supply grenade on the list. Jan 18, 2026: 1.94B ONDO unlock; ~57.23% of released supply. Avoid being the marginal buyer into that; if you want RWA beta, pick a smaller cap instead. Past that date, the Ondo Summit will be taking place Feb 3, 2026 in New York City.

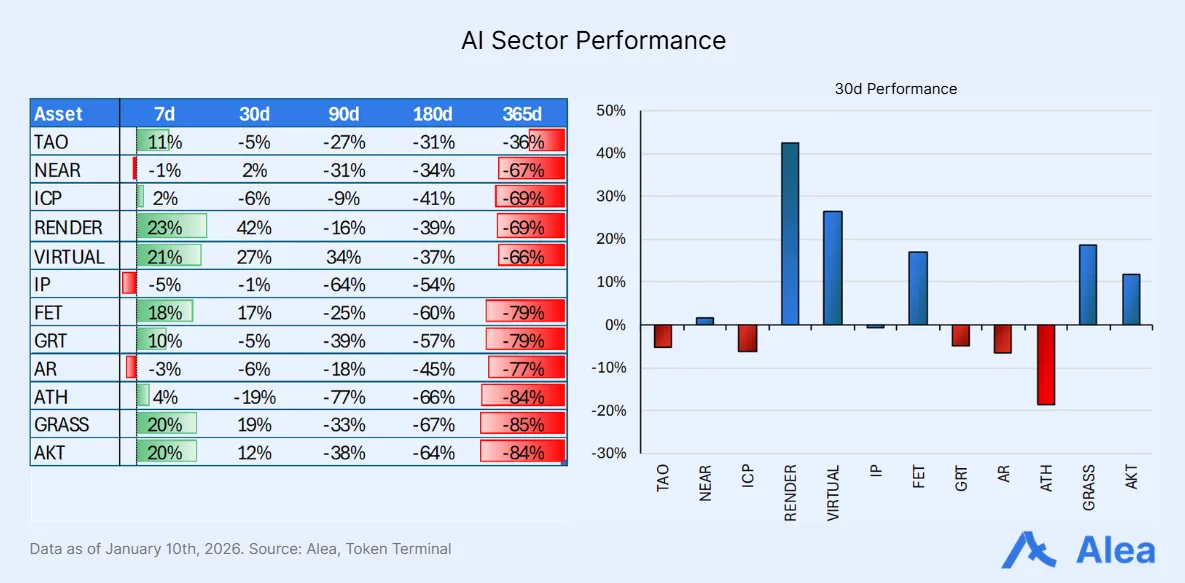

TAO — Post-halving, Bittensor trades as AI beta that trades without clearly defined catalysts. The dTAO mechanism was modified so TAO holders can rotate more easily into subnet “alpha tokens,” making TAO closer to an index of productive AI subnets than a single-chain L1 coin. That’s your “who pays me” story: capital chasing real AI/compute output and crypto use cases, not just narrative.

VIRTUAL — Heading into 2026 VIRTUAL remains the most liquid robotics play and one of the few projects at the intersection of robotics and AI.

RENDER — Reminder of what a squeeze looks like in bullish conditions (OI in the ~$60M range with significantly more perps volume than spot). The catalyst is Dispersed, which is an AI/general compute platform aggregating distributed GPUs. They are citing pilot usage/plans from OTOY Studio and Scrypted, and explicitly flagging a plan to add up to ~1,000 enterprise GPUs (H100/H200, MI300, etc.) plus ongoing node-operator onboarding.

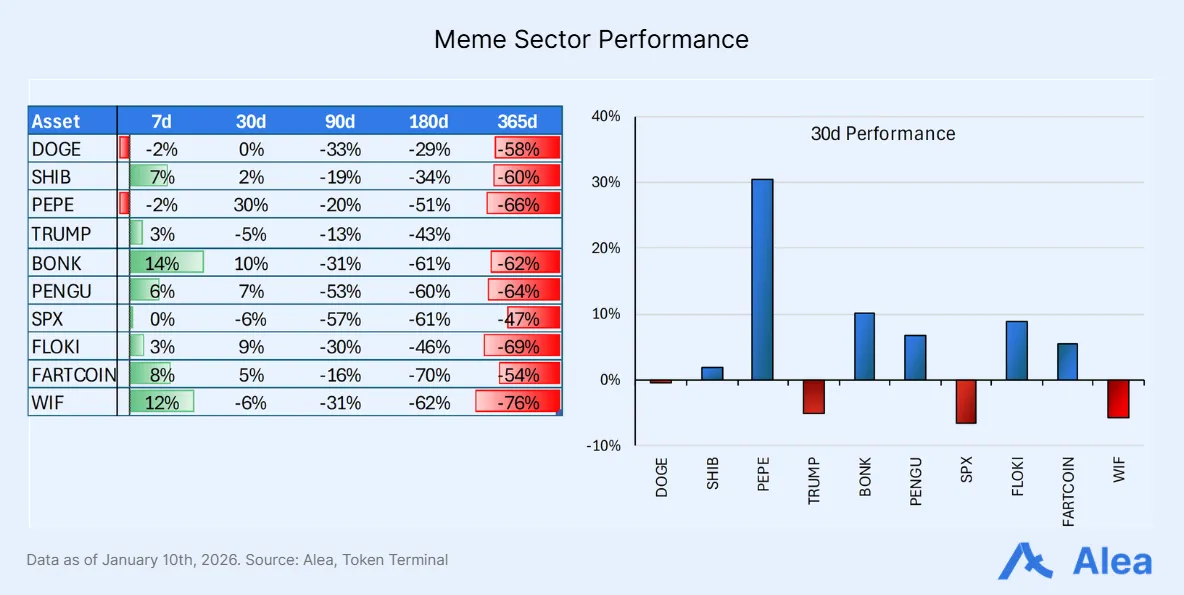

Memes — Memes are back on top when BTC smiles, printing green candles cheering BTC’s move. That’s exactly what memes do: they are the fastest bet when risk-on kicks in. Memes don’t need a “fundamental catalyst,” they need participants and leverage. The risk profile hasn’t changed: memes are a liquidity thermometer, not an investment thesis. They will outperform on upside days and get smoked on downside days because positioning is fragile and exits are crowded.

Conclusion

2026 is not a “buy everything” year; 2026 is about fast exits and time stops. Chop regime with meme froth means one thing: liquidity and stops matter more than narratives. Exit before you are right. Crypto’s rhythm is now dictated by chop, froth, and bluffs. Add on strength, cut on time.