Introduction

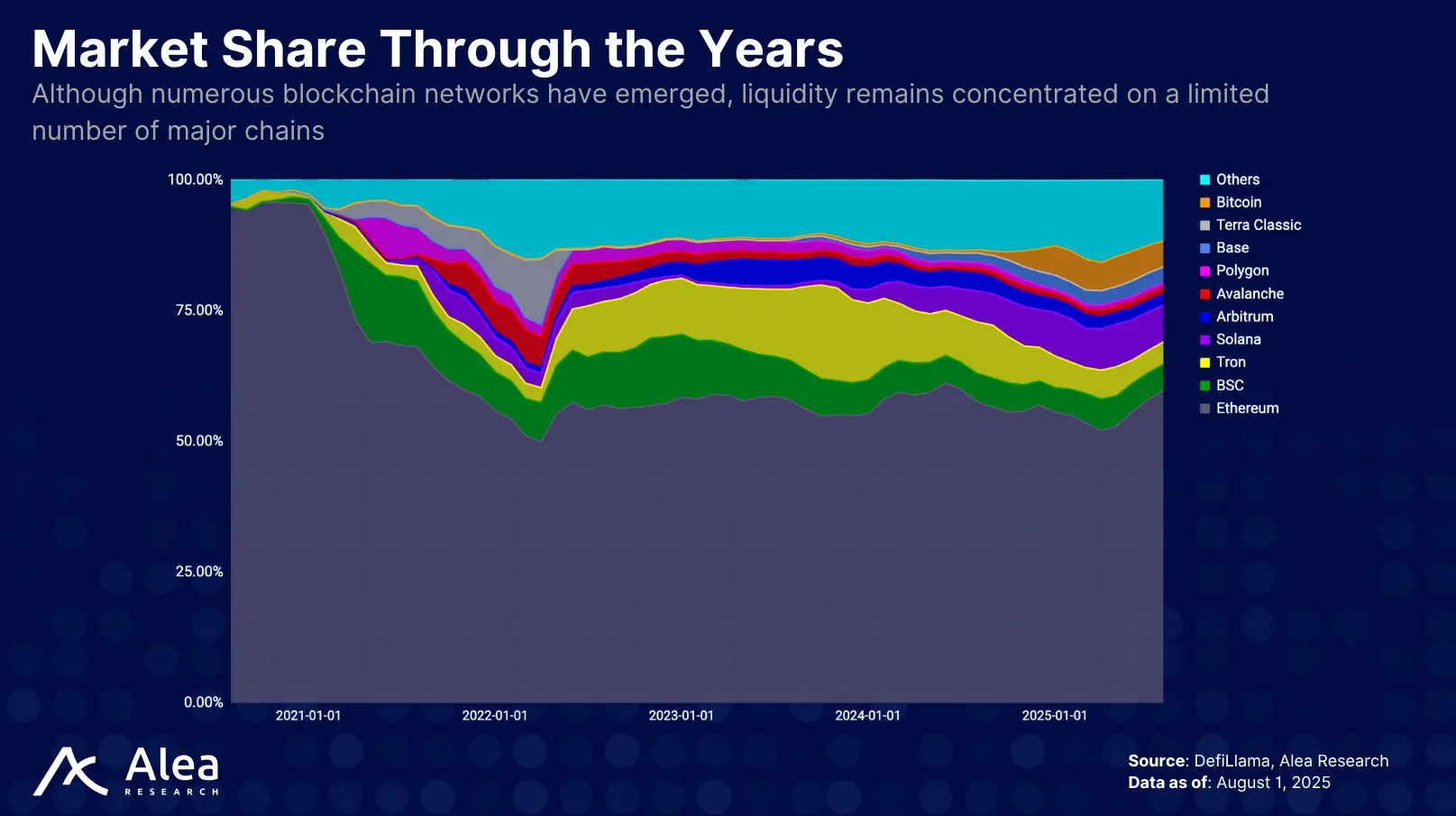

The crypto industry has grown exponentially over the past few years, with almost 400 active networks and more than 180 holding at least $1 million in TVL. Each blockchain is built on a technical foundation and unique substrates that enable ecosystems to be developed on top. While this diversity reflects the growing specialization of blockchains, it has also introduced significant fragmentation across multiple dimensions: users, assets, and developer efforts. As a result, most applications remain confined to individual chains, and users are forced to navigate complex workflows and manual bridging to move between ecosystems.

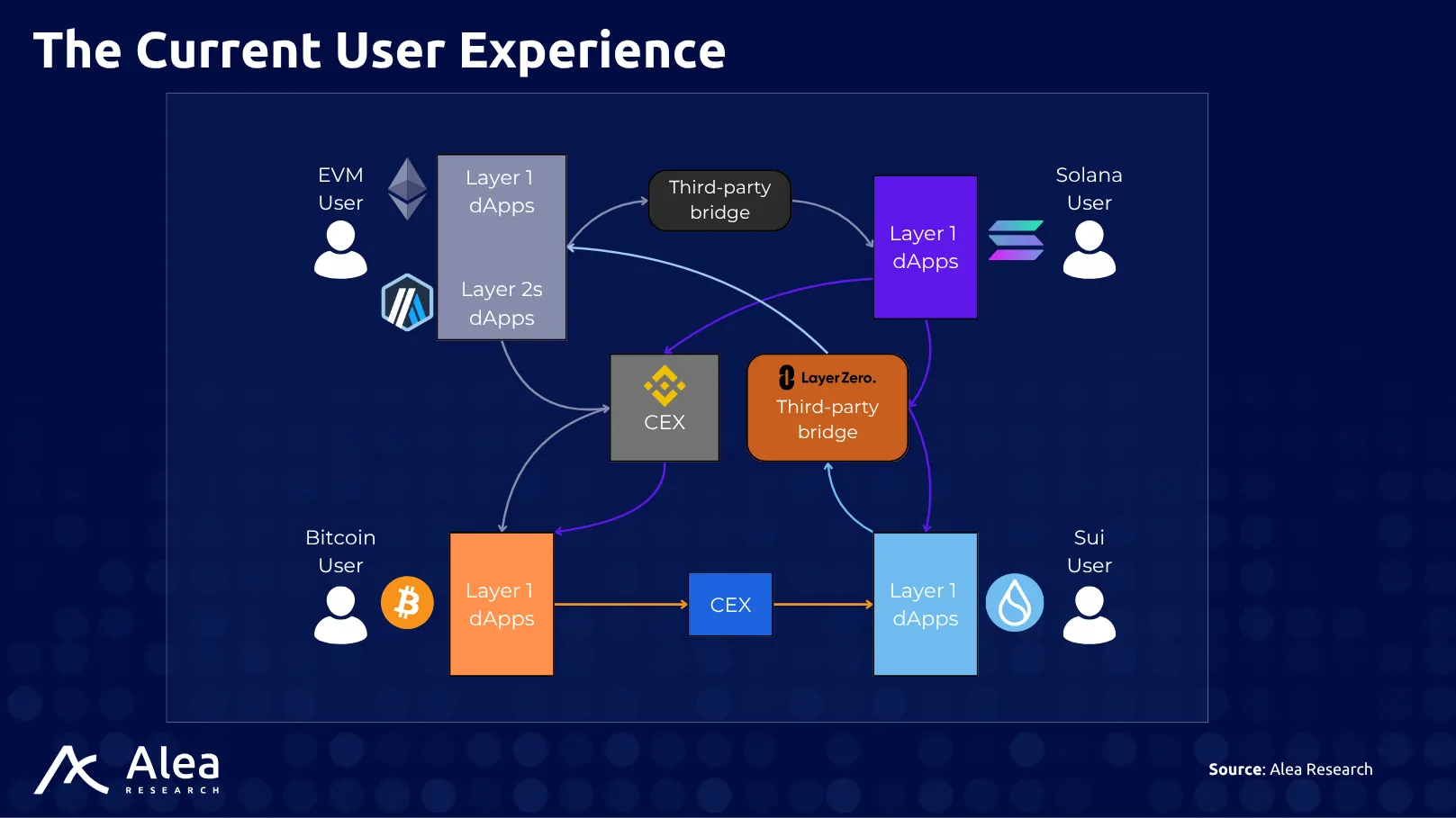

Existing interoperability solutions range from asset bridges to general messaging protocols, and although they attempt to connect chains at different levels, they still fall short of enabling true crosschain composability. Under such a paradigm, liquidity remains siloed, wrapped assets multiply, and complex workflows are required just to execute basic actions across chains. The result is a fractured user experience and a high barrier to innovation.

To break past limitations, ZetaChain introduces a fundamentally new model. As the first universal blockchain, it enables developers to deploy dApps that are inherently chain-agnostic and that can natively interact with assets and contracts across any connected chain from a single interface, including EVM chains, Bitcoin, Solana, and Sui. A Universal App on ZetaChain lets any user connect with any wallet, from Metamask to Phantom to a Bitcoin wallet, and use their native assets, with no wrapping or third-party bridges, as if everything took place on a single chain.

Key Takeaways

- Crosschain fragmentation: The rise of specialized blockchains has created significant fragmentation across users, assets, and developer ecosystems, making interoperability a critical requirement.

- Limitations of current solutions: Bridges and crosschain messaging protocols introduce security risks, liquidity fragmentation, and operational complexity, and they cannot support more advanced crosschain applications.

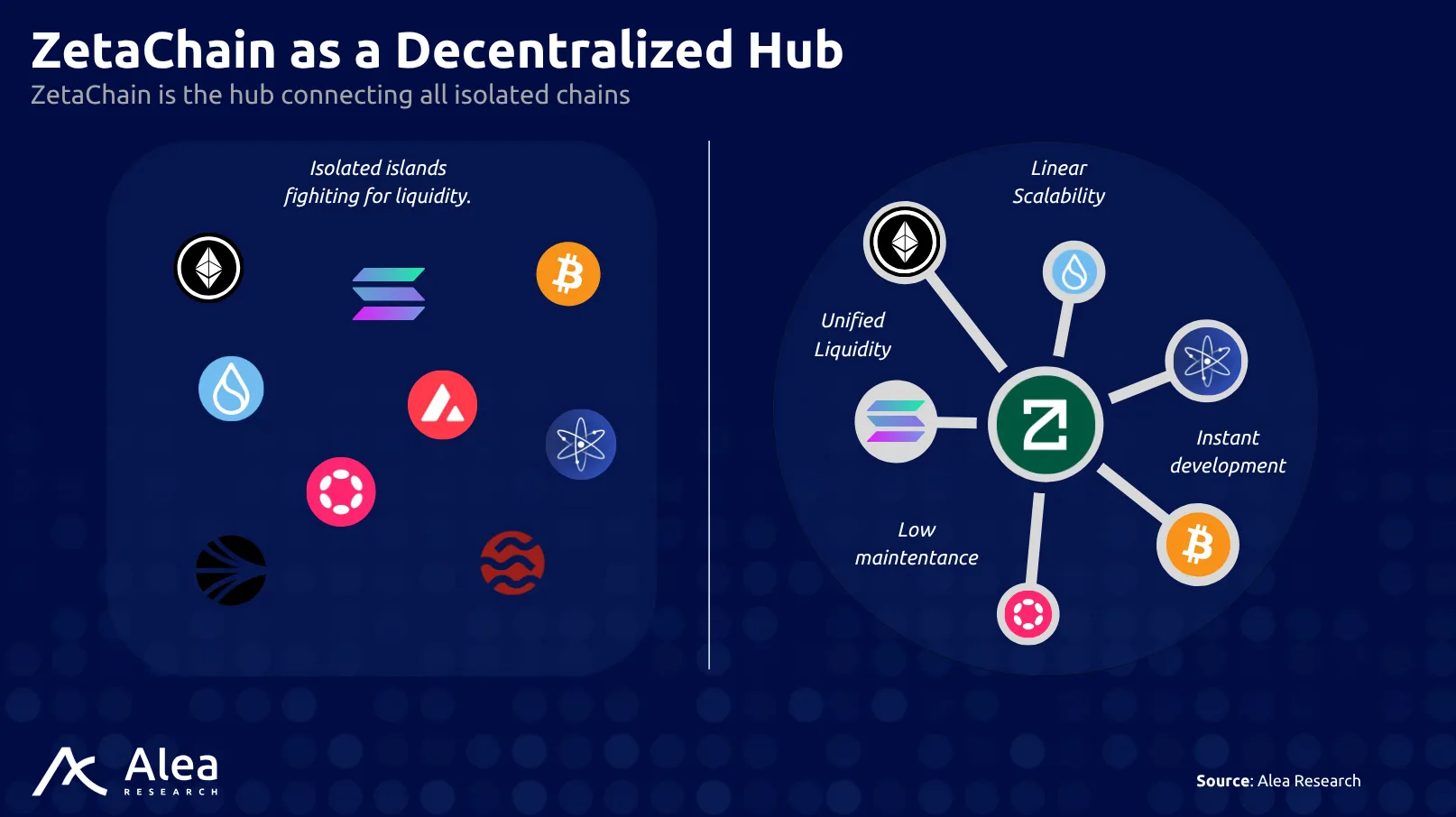

- ZetaChain’s hub-and-spoke model: ZetaChain simplifies interoperability by acting as a single, universal hub, enabling any chain to connect through a single integration and reducing the need for multiple redundant bridges.

- Universal Apps and developer UX: ZetaChain allows developers to build applications that interact with native assets and contracts across chains from a single smart contract, improving composability and reducing overhead.

- Native and non-EVM support: Unlike most protocols, ZetaChain supports non-EVM chains like Bitcoin, Solana, and Sui natively, allowing users to interact with real assets without wrapping or custodians.

- Emerging use cases: Applications like Beam, Amana, and others demonstrate how ZetaChain enables real-world omnichain use cases, while future models may include crosschain money markets, multichain yield aggregation, and universal governance and DAOs.

The Challenge of Crosschain Interoperability

The blockchain industry has evolved and will continue to evolve further into a multichain universe with specialized networks for smart contracts, payments, stablecoins, and more. DefiLlama currently tracks more than 392 chains, with ~180 holding over $1 million in TVL.

While this diversity enables use-case-specific optimizations, it has resulted in fragmentation of users, liquidity, and developer effort. A dApp on one chain typically cannot directly interact with assets or contracts on another. As a result, users who want to move value or data across chains must rely on external bridging solutions or complex manual processes.

The lack of a universal interoperability layer has been a major hurdle to broader adoption and composability. To put things in perspective, consider that while the Apple App Store hosts 1.9 million applications, the entire blockchain ecosystem includes less than 4.5k projects.

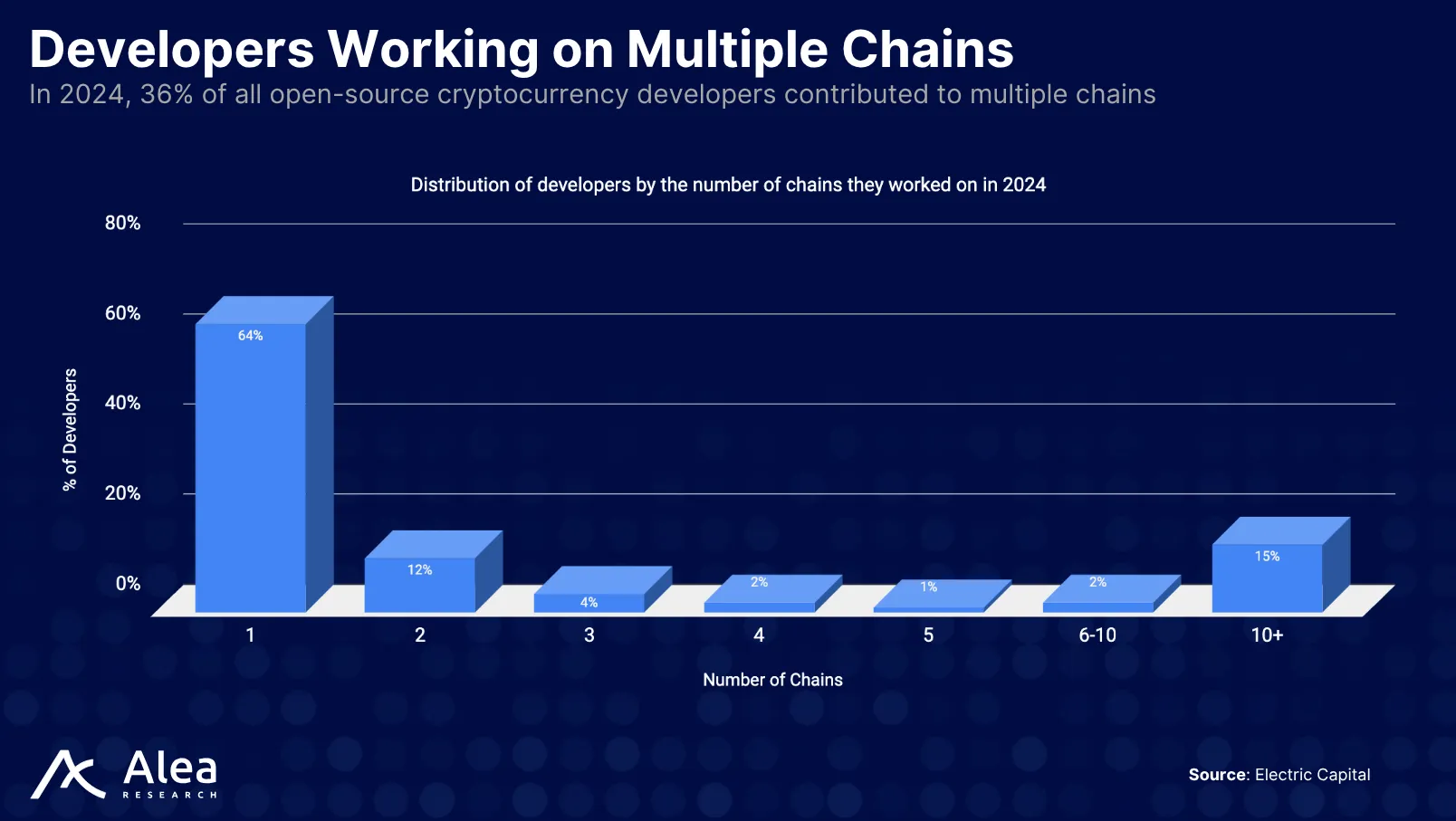

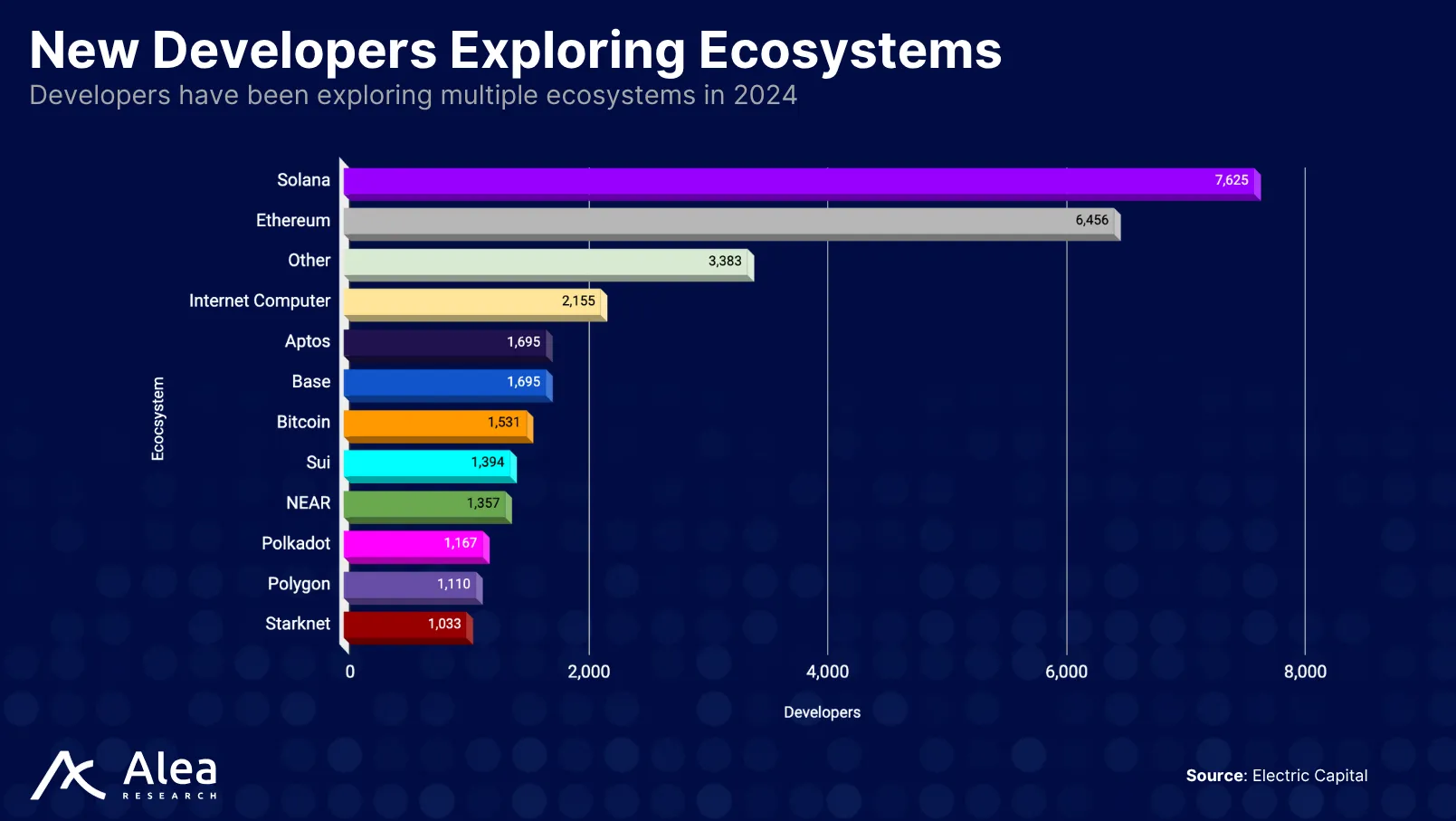

This rapid proliferation of chains catalyzes growing demand for blockchain interoperability, which is the process of connecting two isolated systems. As 36% of all developers are now working on multiple blockchains, and within that group, 41.6% are engaged in development on ten or more chains, the need for effective cross-chain communication becomes increasingly critical.

Interoperability has evolved from basic token bridges to general message passing (GMP) protocols and modular interop stacks like DVNs (Decentralized Verifier Networks) and ISMs (Interchain Security Modules). While these solutions represent progress, they still face critical limitations.

Standard messaging protocols often lead to additional liquidity fragmentation by creating wrapped versions of native assets across multiple chains. For example, the proliferation of tokens like USDC.e via asset wrappers. This adds complexity to the user experience and limits composability. Consider a user who wants to swap $SOL on Solana for $PEPE on Ethereum. With legacy messaging protocols, the $SOL must first be bridged to Ethereum and wrapped, requiring a secondary swap from wrapped $SOL to $PEPE.

Messaging protocols also fall short when it comes to enabling advanced crosschain applications. Most current use cases are restricted to simple value transfers or basic NFT verification. Complex dApps, such as true crosschain lending, where users supply collateral on one chain and borrow on another, are not feasible using messaging alone, especially when bridging non-EVM and EVM environments.

Ultimately, crosschain messaging protocols provide short-term fixes to long-term UX and composability challenges. They allow tokens to move across chains, but they don’t unlock the full potential of dApps that can truly operate across chains as one unified system.

The Fragmentation Issue

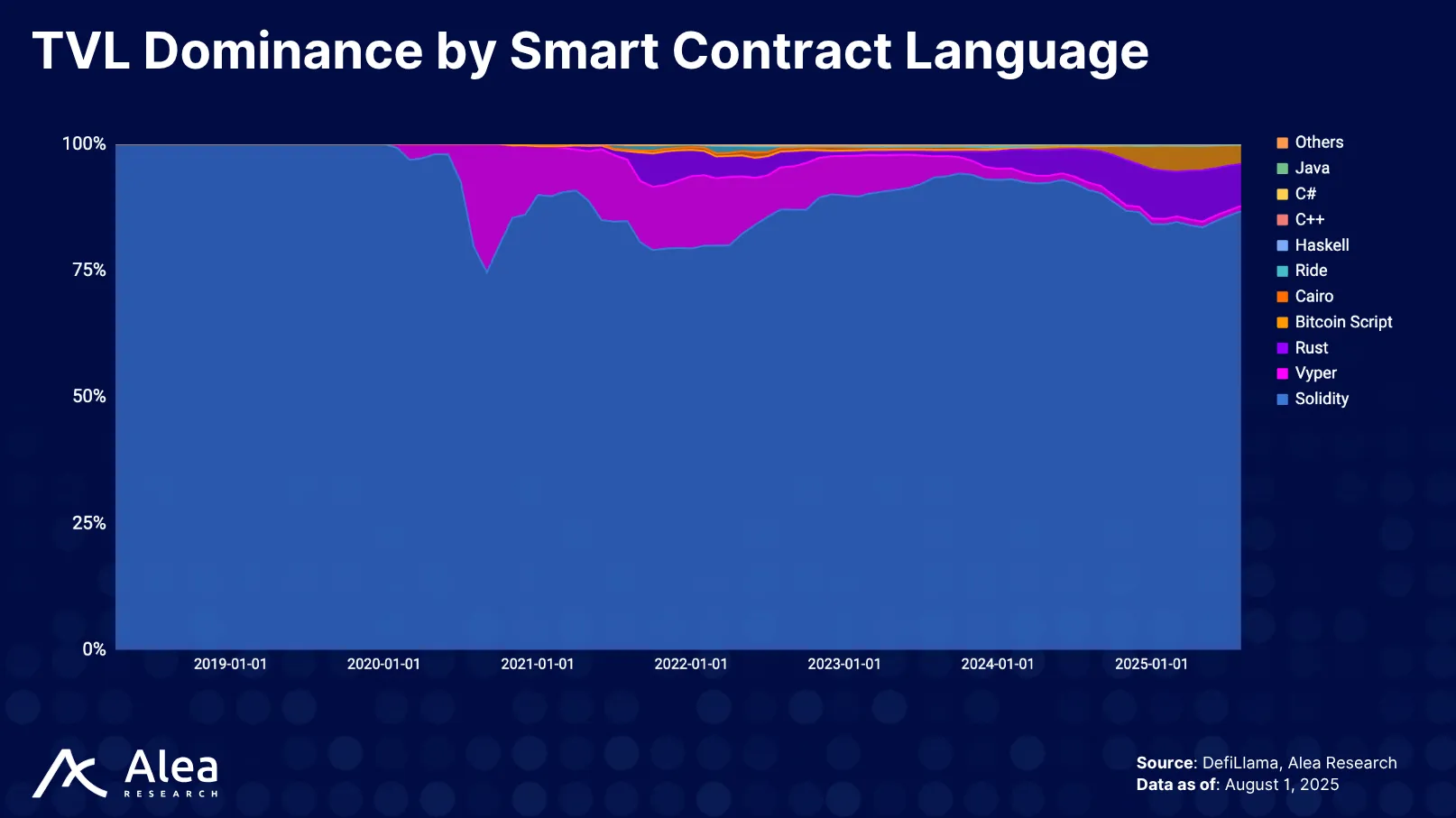

When each blockchain is sovereign, maintaining its state and security implies differences in programming languages (Solidity, Move, Rust, etc.), consensus mechanisms, and account models that make interoperability complex. Early solutions to connect chains often involved trusted custodians or federations that hold assets on one chain and issue representations on another, the classic “lock and mint” bridge model.

Dozens of independent bridges now connect various chain pairs in an ad-hoc manner, but there’s no single standard. Ethereum–Solana might use one bridge, Ethereum–Sui another, each with separate tokens and trust assumptions. This patchwork approach has led to multiple versions of the same asset (e.g., there are numerous “wrapped BTC” and “bridged USDC” tokens on different chains), confusing users and splitting liquidity into many buckets. It’s common to see the liquidity of a popular asset like $USDC subdivided among native $USDC and several bridged forms on a chain, reducing overall market depth and efficiency.

Limitations of Bridges and Point-to-Point Messaging

Bridges have not only fragmented liquidity but also introduced major security risks. By design, they concentrate large reserves of tokens as collateral for wrapped assets, creating attractive “honeypot” targets for attackers. In recent years, vulnerabilities in bridge smart contracts and multi-signature setups have been exploited, leading to nearly $3 billion in losses, representing ~25% of all crypto stolen through hacks.

Aside from hacks, even when functioning as intended, bridges usually require users to perform multiple transactions and wait periods for finality or validation. The user experience is notoriously poor: switching wallet networks, acquiring gas fees in the target chain’s token, and trusting that the bridge will maintain redeemability. Crosschain messaging protocols, used for passing data or instructions between chains, improve trust assumptions, as some, like LayerZero and Hyperlane, use decentralized validator sets to verify messages. However, they still face a complex problem: each new chain added requires integration, and specialized contracts are often deployed on that chain. In a point-to-point model, connecting N blockchains may require on the order of N^2 connections or at least custom adapters between each pair. This complexity grows quickly and becomes hard to manage or secure as more networks join.

Another limitation is that bridges typically only transfer assets, not arbitrary smart contract interactions. If a dApp on Chain A wants to trigger logic on Chain B, there isn’t a straightforward way in most cases aside from passing a message and relying on a corresponding contract on Chain B to execute it. Protocols like LayerZero, Wormhole, Axelar, etc., have introduced crosschain messaging. Nevertheless, developers using them still have to deploy and maintain contracts on every chain involved and handle the intricacies of each environment.

There’s no shared state or single source of truth. State is siloed per chain with messages as a sync mechanism. This means truly atomic crosschain operations (e.g., a single transaction that swaps an asset on Chain A then uses the output on Chain B) are extremely difficult.

Liquidity Fragmentation and Wrapped Assets

From a liquidity perspective, the bridging paradigm has led to the fragmentation of capital across multiple chains.

For example, a DEX on Polygon might have a pool for “bridged USDC (Wormhole)” and another pool for “bridged USDC (Polygon’s official bridge)”, each smaller than if all $USDC liquidity were unified. The same fragmentation happens, for example, for $BTC: there is no native Bitcoin on Ethereum, so users choose between WBTC, tBTC, etc., each with different trust assumptions. This reduces capital efficiency and adds both risk and complexity for users who must understand what wrapped asset they hold and whether it’s fully collateralized.

Furthermore, traditional bridges and messaging require one-to-one links between each chain’s contracts or assets, resulting in a convoluted mesh.

A New Paradigm: the Hub-and-Spoke Model

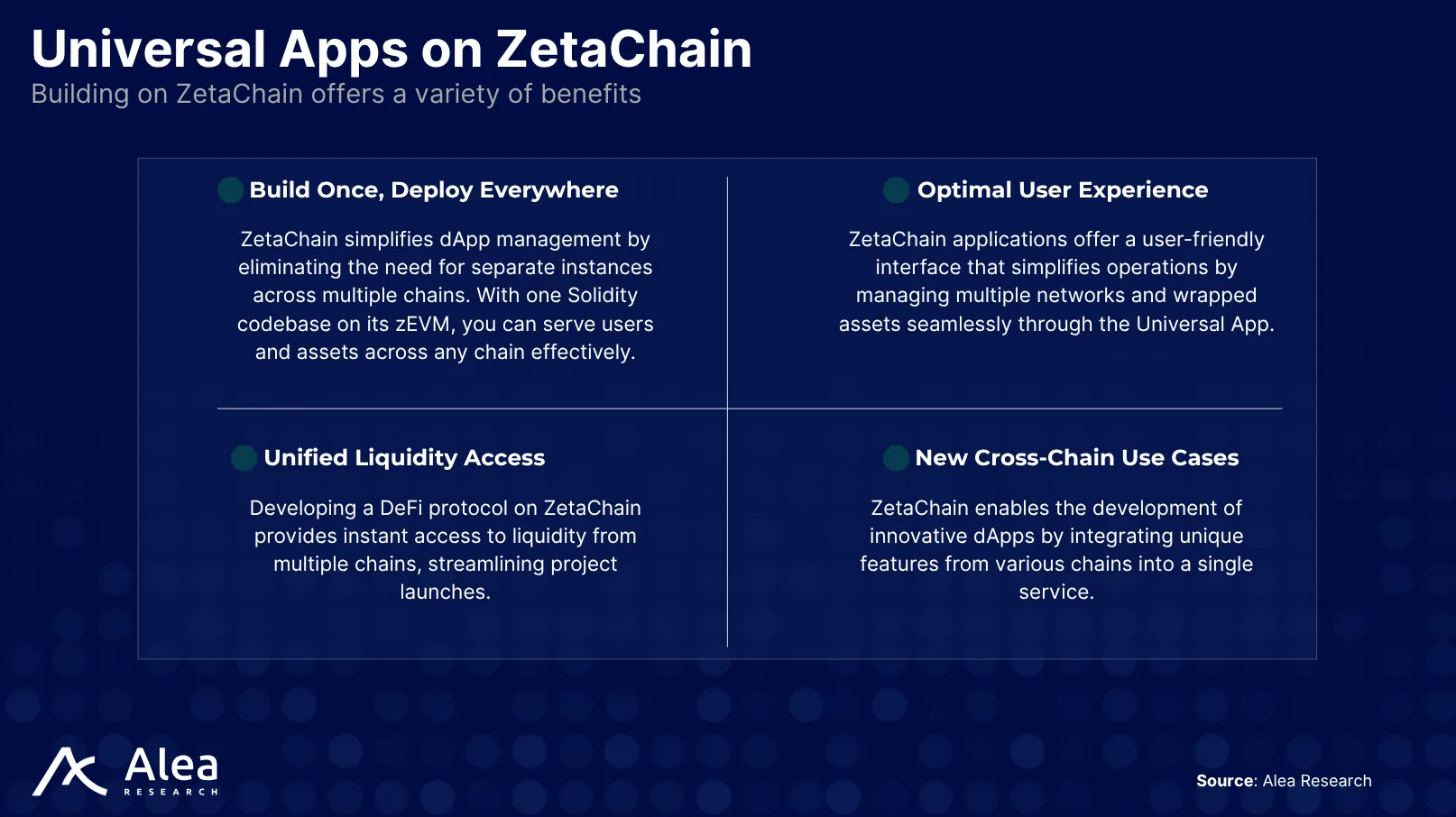

To address these challenges, ZetaChain adopts a hub-and-spoke architecture, so that instead of every chain connecting, all chains connect to a single hub chain, which acts as a routing layer. This enables chain-agnostic dApps (Universal Apps) that manage native assets and data from a single contract, thus significantly simplifying crosschain interactions.

ZetaChain serves as this hub. It is a blockchain that is purpose-built to connect with external chains natively. All cross-chain messages or token movements are routed via ZetaChain, significantly simplifying the network topology. Adding a new blockchain to the network only requires integrating it with ZetaChain, in one connection rather than building bridges to dozens of others.

The hub-and-spoke model offers several advantages, such as: (1) linear scalability, (2) unified liquidity, and (3) simplified development and maintenance.

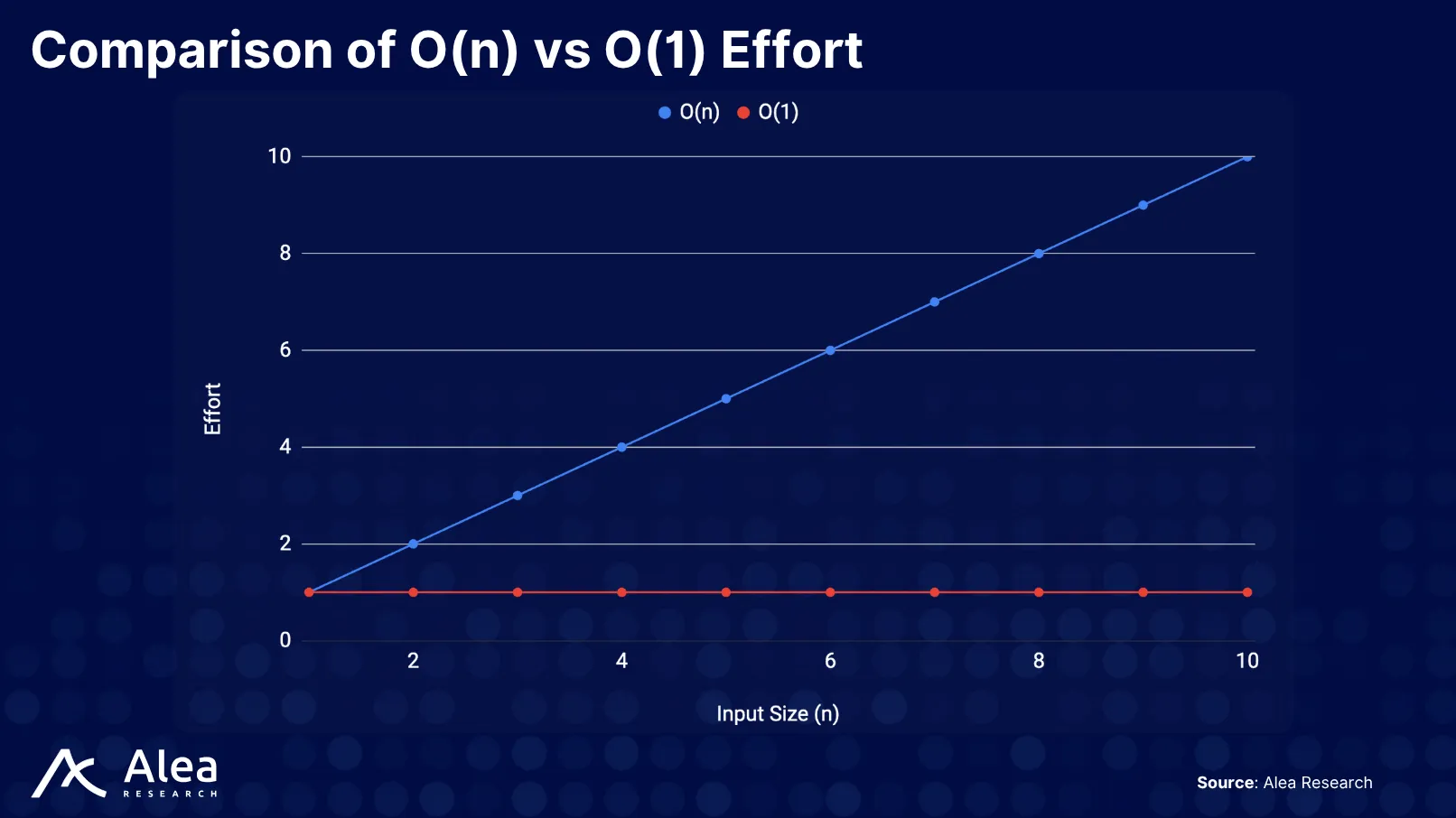

First, as mentioned, onboarding a new chain is O(1) effort—just connecting to the hub—rather than O(N) pairwise integrations, where the complexity grows linearly with chains.

Second, because ZetaChain can hold assets from all connected chains and allow contracts to operate on them, liquidity can be aggregated across these chains. For instance, LPs could pool tokens on ZetaChain that are redeemable 1:1 on any chain, rather than splitting funds across instances on many chains. ZetaChain’s design allows assets from different chains to be represented as a single token standard (ZRC-20) on the hub, and swapped or used in one place. This liquidity consolidation reduces inefficiency as assets from different chains can be pooled and exchanged centrally, thus reducing fragmentation.

Third, developers can focus their logic on the hub (e.g., one smart contract on ZetaChain) instead of writing and deploying code on every chain. Crosschain interactions become function calls to the hub’s API, rather than custom bridge transactions. Upgrades or bug fixes are made in one place. This can significantly lower the barrier to creating crosschain applications. ZetaChain’s approach essentially abstracts away individual chain differences. By routing through a single universal contract, devs don’t need to manage multiple connection protocols or maintain sync logic across chains. Instead, they write their dApp as if interacting with one big blockchain, and ZetaChain handles the under-the-hood calls to others.

As far as tradeoffs go, the hub model must be highly secure and scalable to support the potentially high volume of crosschain transactions. However, when executed successfully, it unlocks a new layer for crosschain development. Several major enterprises have recognized this potential and joined ZetaChain’s ecosystem as validators, including Coinbase, Google Cloud, Deutsche Telekom, stc Bahrain, and Alibaba Cloud.

ZetaChain’s Vision: One Network to Connect Them All

ZetaChain’s core vision is encapsulated in its branding as “the first universal blockchain”. Rather than being just another L1 competing for dApp deployments, ZetaChain is built to be a neutral interoperability layer that natively connects many heterogeneous chains. The idea is to make interacting with multiple blockchains as simple as interacting with one.

Connecting Diverse Ecosystems

ZetaChain is designed to integrate with virtually any type of blockchain, whether it’s an EVM chain (e.g., Ethereum, Binance Smart Chain, Base, etc.), a non-EVM smart contract chain (e.g., Solana), or even non-smart contract chains (like Bitcoin).

This broad compatibility is a key differentiator. For example, Bitcoin cannot run smart contracts or be easily controlled by Ethereum logic. However, ZetaChain integrates Bitcoin by having its validators jointly control a Bitcoin wallet through threshold signatures, thereby mirroring $BTC as an asset on ZetaChain. Therefore, a ZetaChain dApp can hold and move actual $BTC, not a wrapped IOU, but real Bitcoin settled directly on the Bitcoin L1.

For users, this means previously incompatible worlds can now interact seamlessly. A Bitcoin user could, for instance, directly engage with an Ethereum DeFi app through ZetaChain without ever giving up custody of their $BTC to a centralized custodian or needing to swap for $ETH first. Similarly, an Ethereum user can initiate a crosschain transaction, like converting $ETH on Ethereum to $BNB on BNB Chain, all with a single signed transaction.

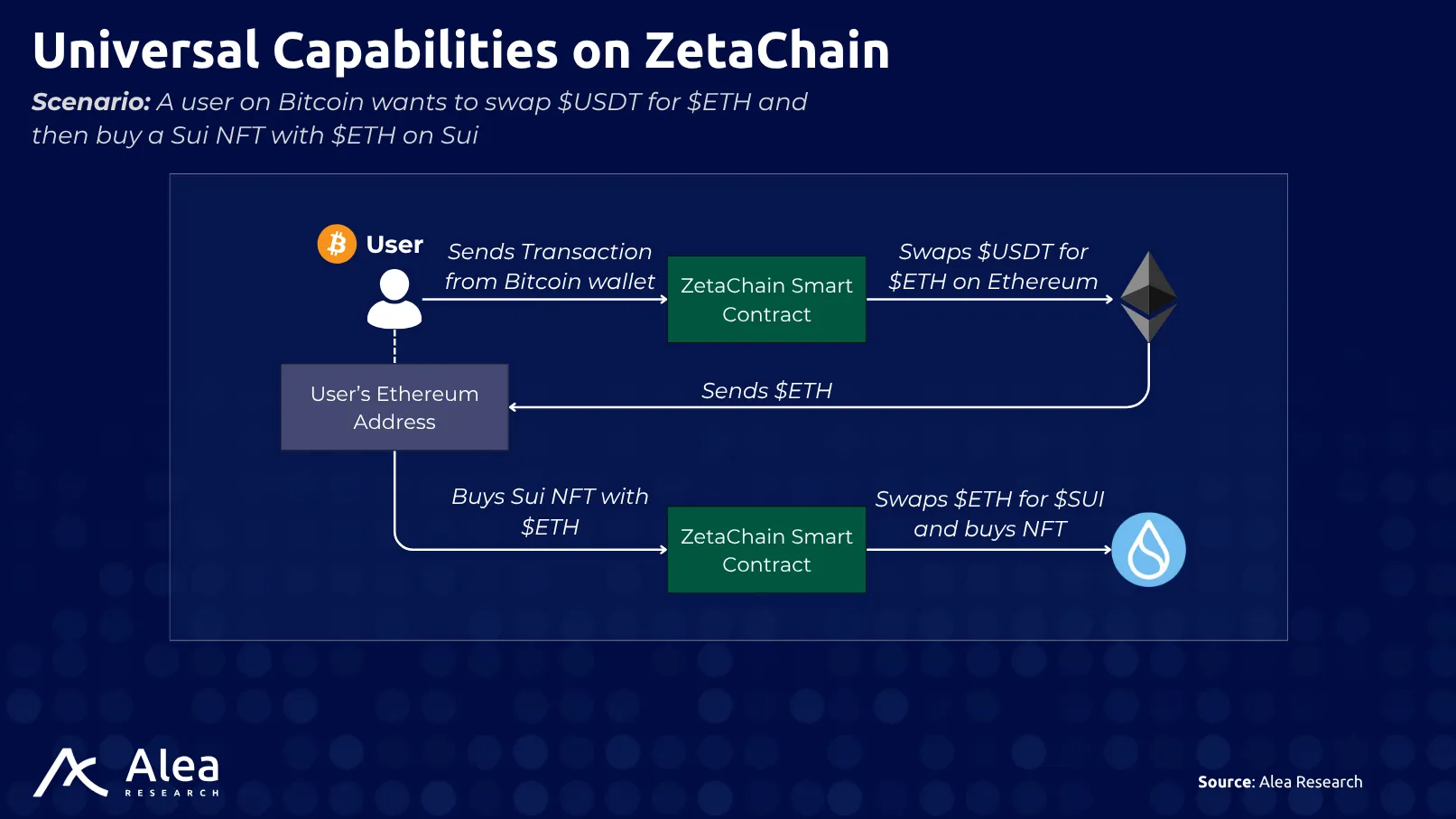

With ZetaChain, the Ethereum user sends $ETH to a ZetaChain contract with the intent to swap it for $BNB; the contract sees the $ETH deposit and triggers a swap of $BNB on BNB Chain to the recipient. The process is orchestrated by one Universal App contract. This example illustrates the power of abstraction: the user’s intent, to send money to X on the Y chain or buy an NFT on Z and deliver it to the W chain, is executed without manually touching multiple chains.

Universal Apps and Seamless UX

The lynchpin of ZetaChain’s user experience is the concept of Universal Applications. These are smart contracts that live on ZetaChain but can be invoked from any connected chain and can, in turn, invoke contracts on any connected chain.

From a developer’s perspective, it’s like having a super-powered contract with a presence everywhere. A Universal App is a smart contract on ZetaChain’s EVM that is natively connected to any other blockchain (Bitcoin, EVM, non-EVM, etc.), allowing it to accept calls and assets from any chain and initiate actions on any chain.

For users, Universal Apps translate into unified workflows that feel chain-agnostic. Rather than performing a series of manual steps, the user interacts with a single interface or clicks one button. Behind the scenes, the Universal App coordinates all steps across chains. Thanks to this approach, you no longer need to switch networks in your wallet, hold multiple gas tokens, wrap or unwrap assets, or wait on slow bridges.

Consider a Solana user with only a Solana wallet and $SOL for transaction fees. He can still use an Ethereum-based DeFi service via a Universal App, with ZetaChain invisibly handling the in-between.

Removing Bridging and Swapping Burdens

A critical part of smoothing UX is handling swaps and bridges at the protocol level. ZetaChain’s architecture includes the concept of ZRC-20 tokens, which are representations of native assets from connected chains, managed by the protocol.

When a user deposits a token from a connected chain (e.g., $ETH from Ethereum) into ZetaChain, the validators observe it and mint a corresponding ZRC-20 (e.g., ZRC-20 ETH) on ZetaChain for contract use. If the user later withdraws, the ZRC-20 is burned, and real $ETH is released back on Ethereum.

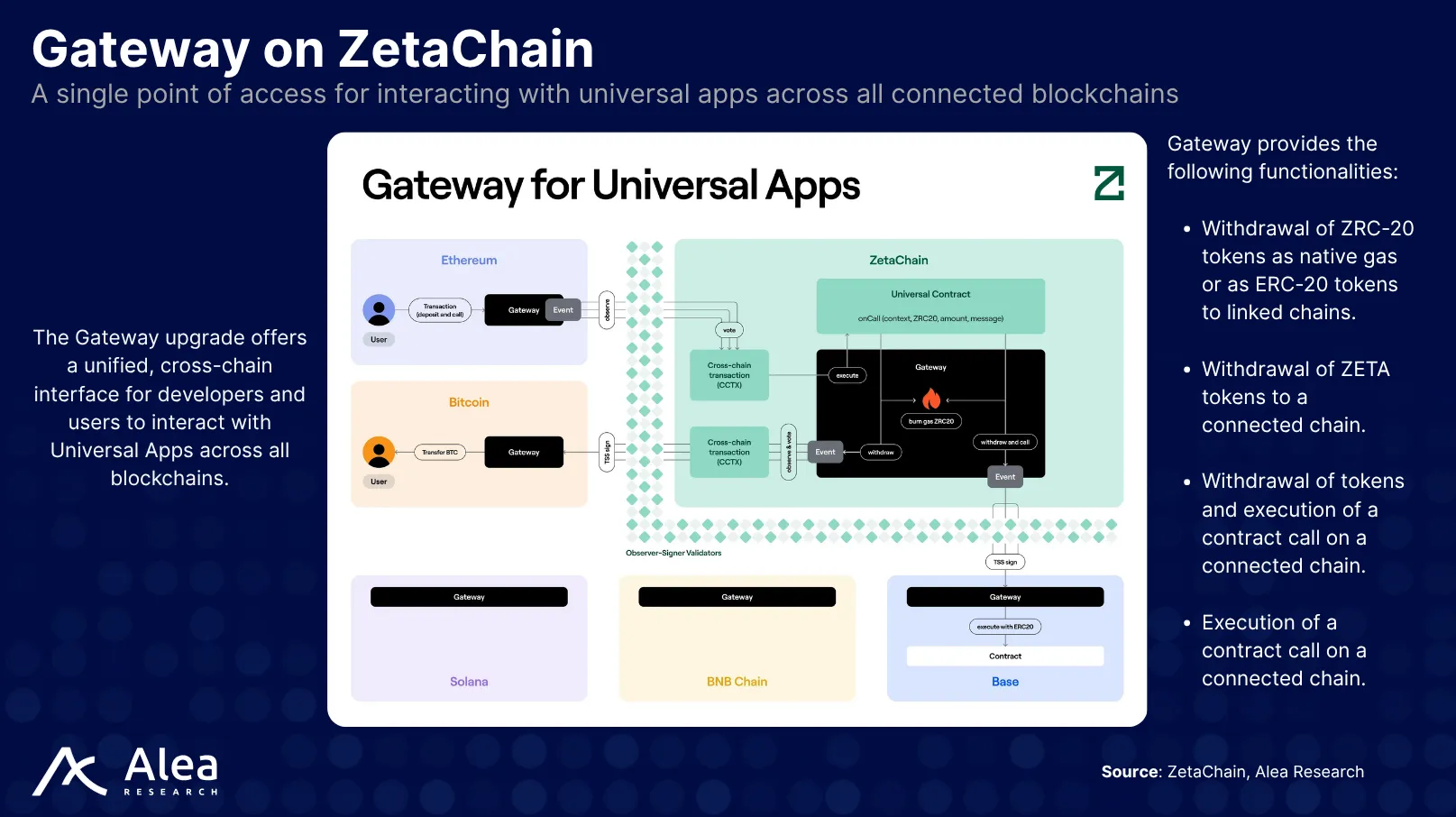

This mechanism is similar to how custodial bridges work, but fully decentralized and built into the chain’s logic. For UX, this means that moving assets between chains becomes a simple deposit/withdraw call to the Gateway contract. The user doesn’t have to visit an external bridge UI or manage two transactions. ZetaChain also tracks gas balances and facilitates gas payments on destination chains, so users can’t pay fees after a transfer.

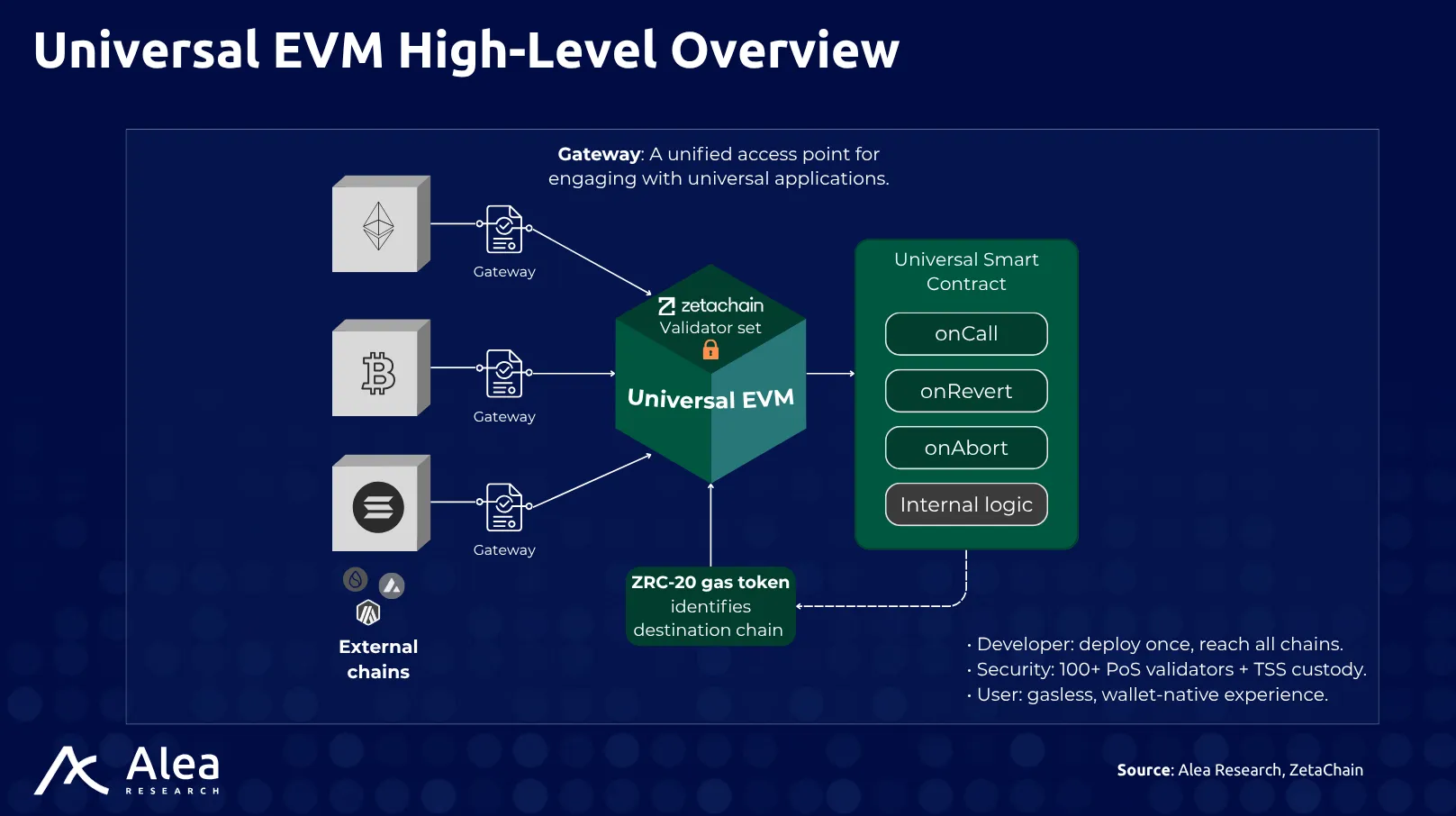

From a developer’s perspective, ZetaChain’s Gateway API standardizes how contracts on any blockchain interact with ZetaChain and how ZetaChain communicates back. It acts as a universal interface for cross-chain operations, enabling seamless integration.

ZetaChain’s Unique Value Proposition

ZetaChain’s differentiation comes from its architecture as a vertically integrated interoperability stack. At the consensus layer, it runs a Tendermint-based, delegated-proof-of-stake chain whose single validator set secures local blocks and cross-chain operations. On the connectivity layer, those validators operate full nodes for every connected network and collectively control threshold-signature (TSS) wallets for non-smart-contract chains such as Bitcoin, so proofs and custody stay ‘in-house’ rather than outsourcing to guardian committees or oracles.

Above that sits ZetaEVM, a modified EVM whose pre-compiled cross-chain op-codes let a single Solidity contract lock native BTC, swap ERC-20 liquidity, and mint tokens on Solana in one atomic call; no other shared-security hub couples direct Bitcoin custody with on-chain execution in this way. The developer layer preserves familiar tooling: Hardhat, Foundry, MetaMask, and a TypeScript SDK wrap the cross-chain primitives, while Gateway contracts on each external chain let users initiate omnichain transactions from their home network and pay fees in that network’s native gas token instead of requiring a ZETA balance or network switch on the wallet.

Versus competitors, ZetaChain stands out because it collapses the entire interoperability stack—messaging, execution, liquidity custody, and developer tooling—into a single L1 that already speaks the dominant smart-contract language (Solidity) while natively verifying foreign chains. Where intent-centric networks outsource routing to off-chain solvers, ZetaChain lets the contract itself own the full flow: one Solidity file can pull BTC, swap ETH, and settle USDC across three chains under a single commit-or-revert transaction. Where sovereign-rollup frameworks hand every app its chain and then re-bridge them, ZetaChain concentrates economic security in one validator set and thus delivers synchronous composability that other frameworks can only approximate with asynchronous proofs. And where bridge-first protocols deliver messages but not state coordination, ZetaChain’s validators let the chain prove remote facts on-chain before acting.

Taken together, these design choices position ZetaChain as a one-stop full-stack execution venue: developers gain synchronous composability across heterogeneous chains; users experience Web2-level simplicity; and security assumptions collapse to a single validator majority rather than a chain of bridges, relayers, or solver markets.

The Universal EVM

The key difference is that ZetaChain offers a stateful execution environment that can manage cross-chain interactions. In contrast, most messaging protocols simply deliver messages and leave execution to each chain’s local contracts. With ZetaChain, a developer deploys a contract on ZetaChain that can orchestrate logic across chains. There’s no need to deploy contracts on every chain or handle message verification manually because ZetaChain’s validators take care of that by observing external chains and reaching consensus on events. This leads to what ZetaChain calls “Universal EVM”, meaning smart contracts that inherently work across multiple chains.

Competing messaging solutions require trust in an offchain network as well, often a subset of nodes or oracles, to carry messages, and those solutions don’t have a base chain to provide atomicity or shared state.

ZetaChain’s approach provides a single composable environment for crosschain operations, which can simplify development and enable features like built-in rollback: if any part of a multichain operation fails, the ZetaChain transaction can revert as a whole, akin to a database rollback, something hard to do when actions are split across chains.

Universal EVM and Developer Familiarity

ZetaChain’s execution layer is an EVM derivative, but it remains fully Solidity-compatible, allowing developers to write contracts in Solidity or Vyper as usual. This is important because it lowers the barriers to entry and learning curve, as a huge developer base already knows EVM development.

Additionally, ZetaChain provides EVM extensions for crosschain functionality. For example, it can initiate transactions on external chains directly from a contract and read external chain states via consensus observations. Think of it as Ethereum but with built-in functions like deposit (receiver, amount, asset) or depositAndCall (receiver, amount, payload). The contract doesn’t magically run on the other chain, but it commands ZetaChain’s validator network to perform those actions via the Gateway Validators.

The result is that developers get an “out-of-the-box omnichain SDK”. In contrast, if one uses crosschain messaging on, say, Avalanche and Ethereum without ZetaChain, they would need to write two contracts (one on each chain) and set up a relayer or pay a protocol to deliver messages, handle nonce management, and so on. ZetaChain consolidates all that into a single codebase. This not only significantly speeds up development but also ensures that the crosschain logic sits in one place.

Native Asset Support

One of ZetaChain’s key features is its support for native assets, most notably, its integration with Bitcoin. Many solutions exclude Bitcoin or treat it specially because Bitcoin doesn’t support smart contracts or quick finality. ZetaChain, however, treats Bitcoin as just another connected chain, albeit a UTXO-based one. Its TSS (Threshold Signature Scheme) mechanism gives the network an address on Bitcoin from which it can send transactions, and the Gateway Validators can read Bitcoin blocks to see deposits.

This means that $BTC can be directly used in smart contracts without wrapping. This is a huge deal for DeFi: $BTC is the largest crypto coin by market cap, yet it’s mostly been siloed regarding DeFi utility. Alternatives like Wrapped $BTC ($WBTC) provide a bridge, but involve central custodians (BitGo, etc.) and require users to leave the Bitcoin network. ZetaChain brings Bitcoin into the DeFi universe in a decentralized manner.

Beyond Bitcoin, ZetaChain also supports other non-EVM chains natively, such as Solana, Sui, and Ton. This native integration is crucial because it allows ZetaChain to treat all chains with equal functionality. In contrast, crosschain messaging protocols often face limitations when interacting with non-EVM chains or require custom adapters. ZetaChain’s uniform approach works with any chain that can be externally observed and supports signature-based control, which includes most major blockchains.

Unified Liquidity and One-Stop User Engagement

Another facet of ZetaChain’s value proposition is unified LPs. Because all assets can be held on ZetaChain as ZRC-20, developers can create LPs or lending pools on ZetaChain that accept deposits from any chain, thus concentrating liquidity.

For example, an AMM on ZetaChain could have a pool of “ZRC-20 USDC” vs “ZRC-20 ETH”, representing liquidity from multiple chains. For example, $USDC might be deposited from Ethereum, $ETH might be deposited from Arbitrum or Base, etc. Traders from any connected chain could tap into this pool via a single contract, rather than many fragmented pools across chains.

From the user’s perspective, ZetaChain also introduces a unified incentive layer. Users who provide liquidity or interact with Universal Apps on ZetaChain can be rewarded in $ZETA tokens and other chain-agnostic rewards. This is different from, say, using an app on Polygon and only getting rewarded on Polygon. With ZetaChain, the engagement spans all chains, as do the rewards.

Real-World Use Cases

Let’s briefly look at some real examples of dApps built on ZetaChain and covering different use cases: (1) Beam DEX, (2) Amana, and (3) a Unified Stablecoin Protocol.

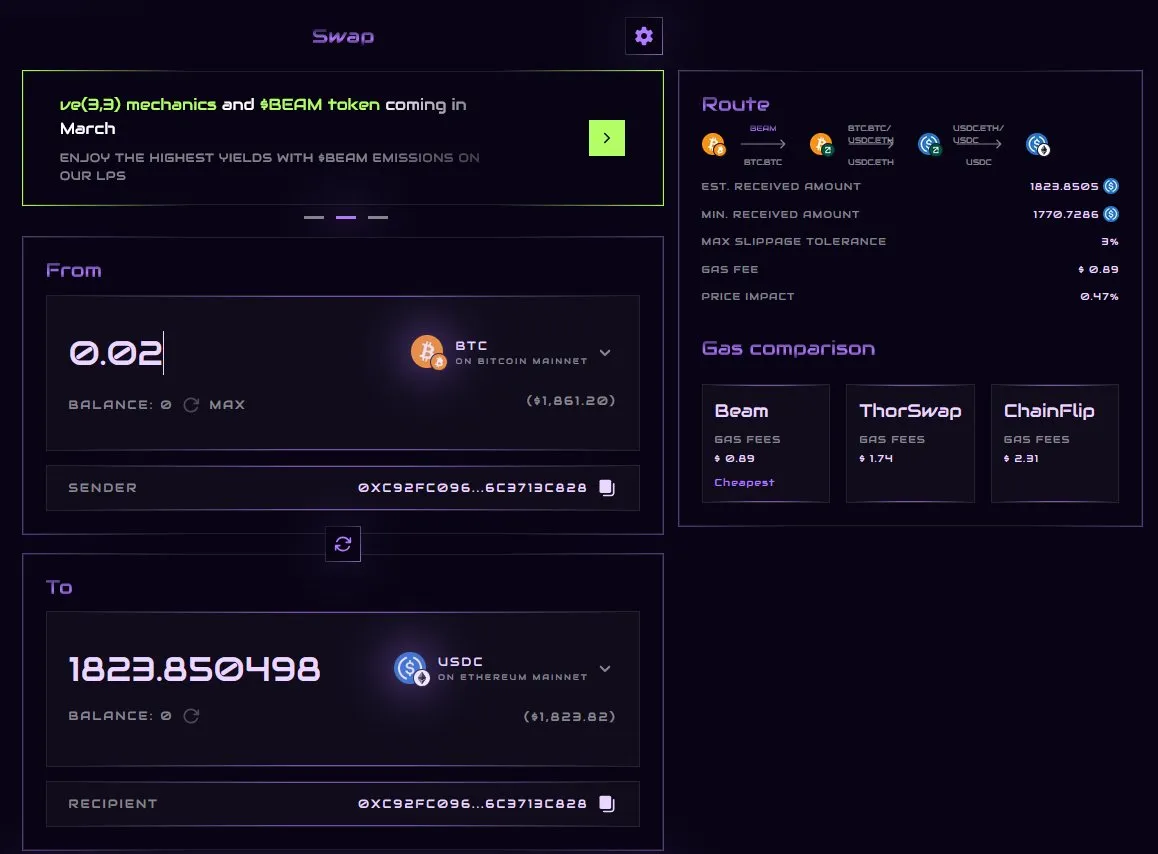

Beam DEX: Unified Liquidity and Native Asset Swaps

Beam is the first omnichain ve(3,3) DEX that allows users to swap assets and unify liquidity across native blockchains, including Bitcoin, Solana, Ethereum mainnet, and other EVM chains. It achieves this by leveraging ZetaChain’s ZRC-20 tokens to enable crosschain swaps without relying on wrapped assets.

For example, a user can swap $BTC for $ETH directly through Beam. ZetaChain handles the transaction by transferring $BTC from a Bitcoin address and releasing $ETH on Ethereum to the user, without any wrapping involved.

Beam’s integration of ve(3,3) tokenomics with native multichain liquidity is only possible because ZetaChain coordinates assets across blockchains. It validates the idea of a truly unified DEX for all chains.

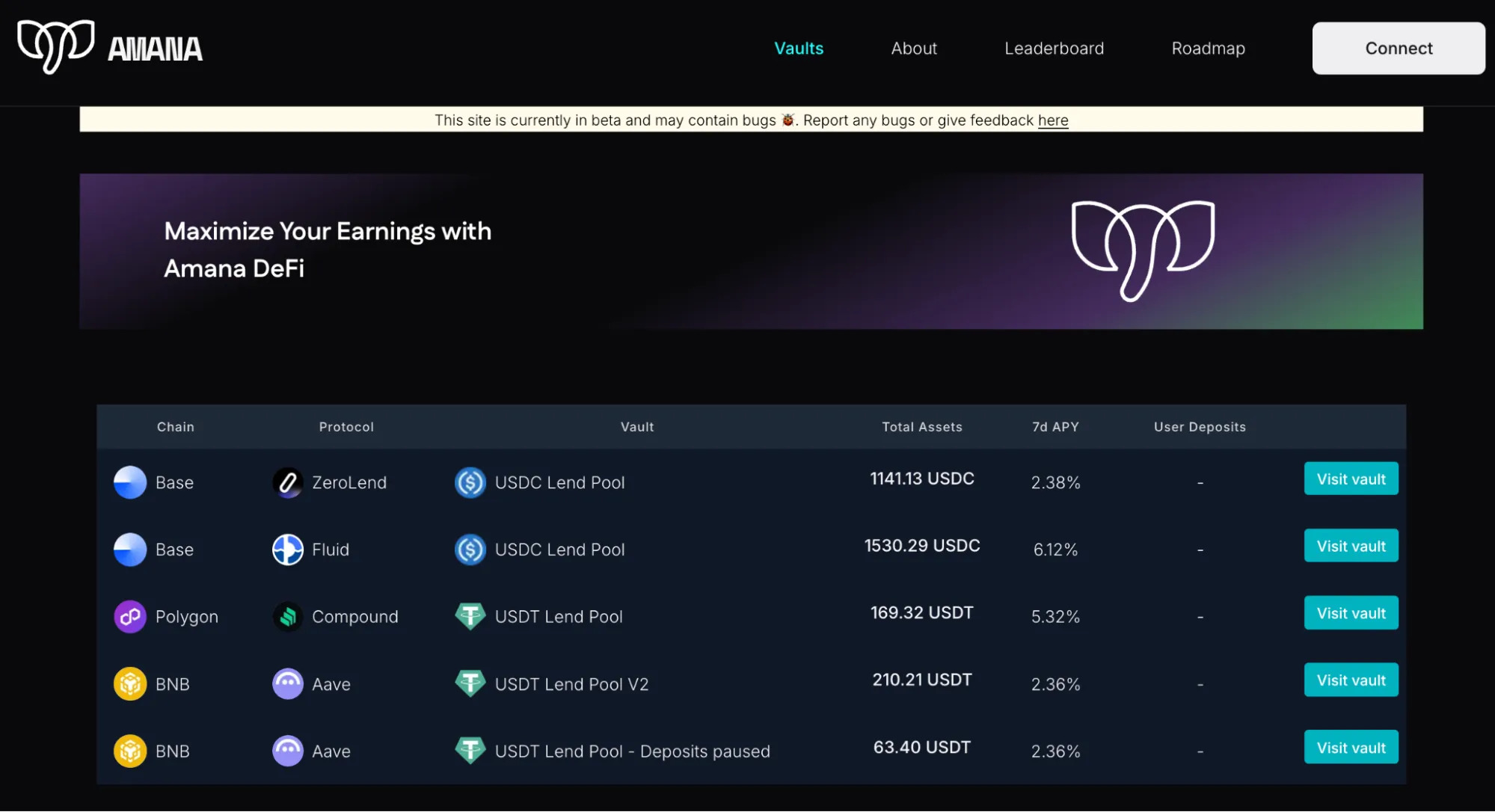

Amana: Universal Yield Aggregator

Amana is a Universal Yield Aggregator that aims to simplify the fragmented and complex world of crosschain yield farming. It automatically allocates user deposits to the highest-yielding opportunities across DeFi protocols, whether through lending, liquidity provision, or staking.

Traditionally, yield aggregators are limited to a single ecosystem or require users to manually bridge assets across chains. Amana leverages ZetaChain’s native crosschain capabilities and taps into multiple ecosystems and protocols. Specifically, ZetaChain can call smart contracts on multiple chains on behalf of the user, without wrapped assets or manual bridging.

This enables true chain abstraction: users deposit into Amana from any supported chain, select a strategy, and the platform handles the rest, allocating funds across chains like Base, BNB, and more to maximize yield.

Amana is a key use case that goes beyond simple swaps. It showcases ZetaChain’s ability to execute complex workflows across chains: performing a swap, withdrawing assets, and then calling a function to deposit into a supported LP on any chain.

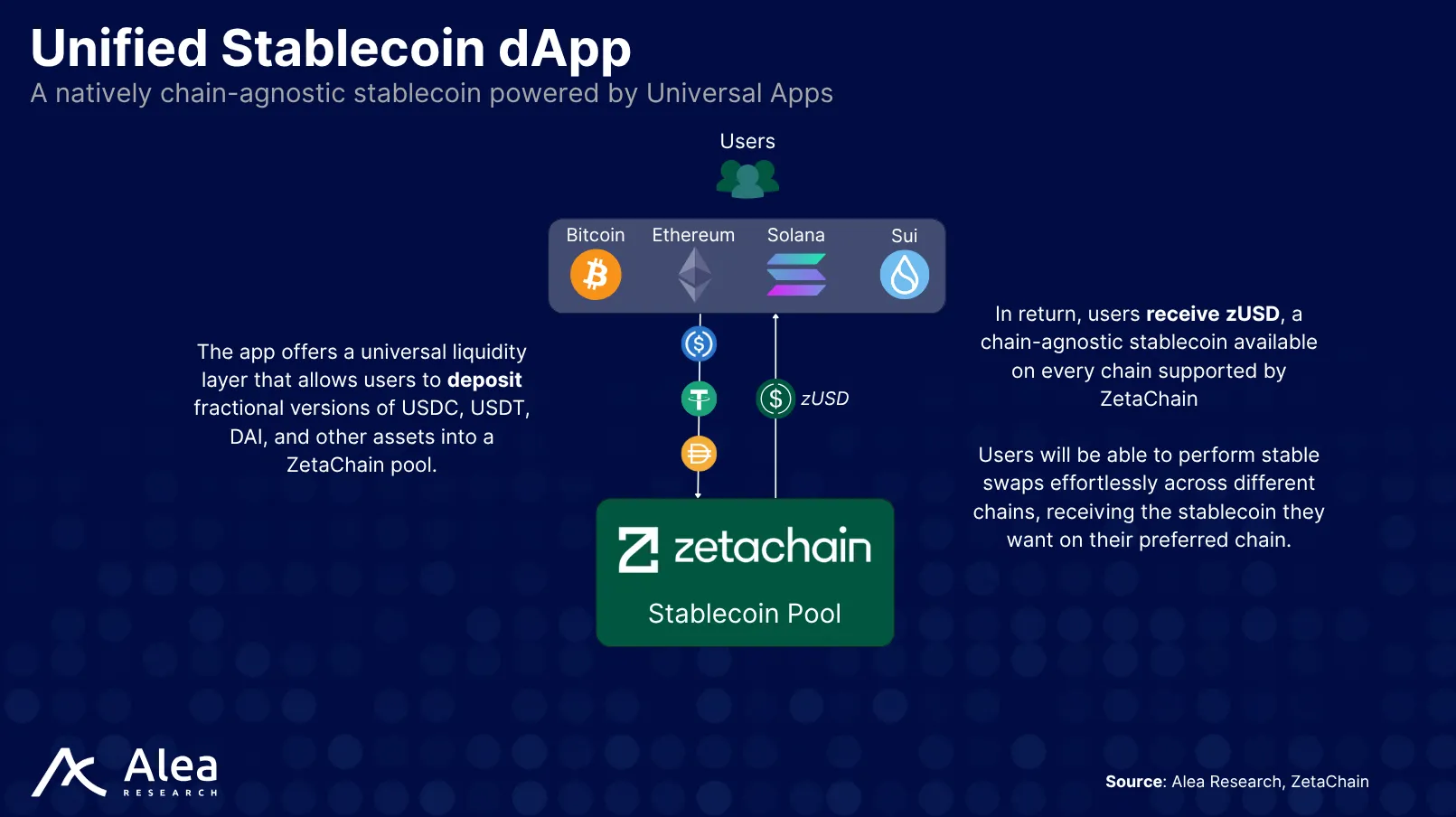

Unified Stablecoin Protocol

Soon, users will be able to deposit assets such as $USDT, $USDC, $DAI, and more in a pool to receive a native, chain-agnostic stablecoin that supports use cases across the whole ZetaChain ecosystem. zUSD removes a lot of friction that exists among isolated chains and adds a unified liquidity layer to help users be more intuitive on those chains with their stablecoin use cases.

For use cases, imagine supplying $USDT or $USDC to ZetaChain’s stablecoin pool that earns anywhere from 10% to 15% on various strategies, and receive zUSD to explore further yield opportunities on every available chain.

Universal App Ideas

If ZetaChain’s vision materializes, it could give rise to a new class of dApps that are universal by design. In this section, we explore forward-looking use cases and application models enabled by ZetaChain, going beyond basic token transfers or swaps.

All the following rely on a core capability: composability of native assets and contracts across chains. Developers benefit by being able to build dApps that tap into the strengths of multiple chains from a single interface. For users, the experience becomes seamless, as they no longer need to think about whether they’re interacting with Ethereum, Sui, or any other chain. There’s no need to manage multiple wallets or learn new interfaces. With ZetaChain, they simply use a Universal App that connects to the necessary network behind the scenes.

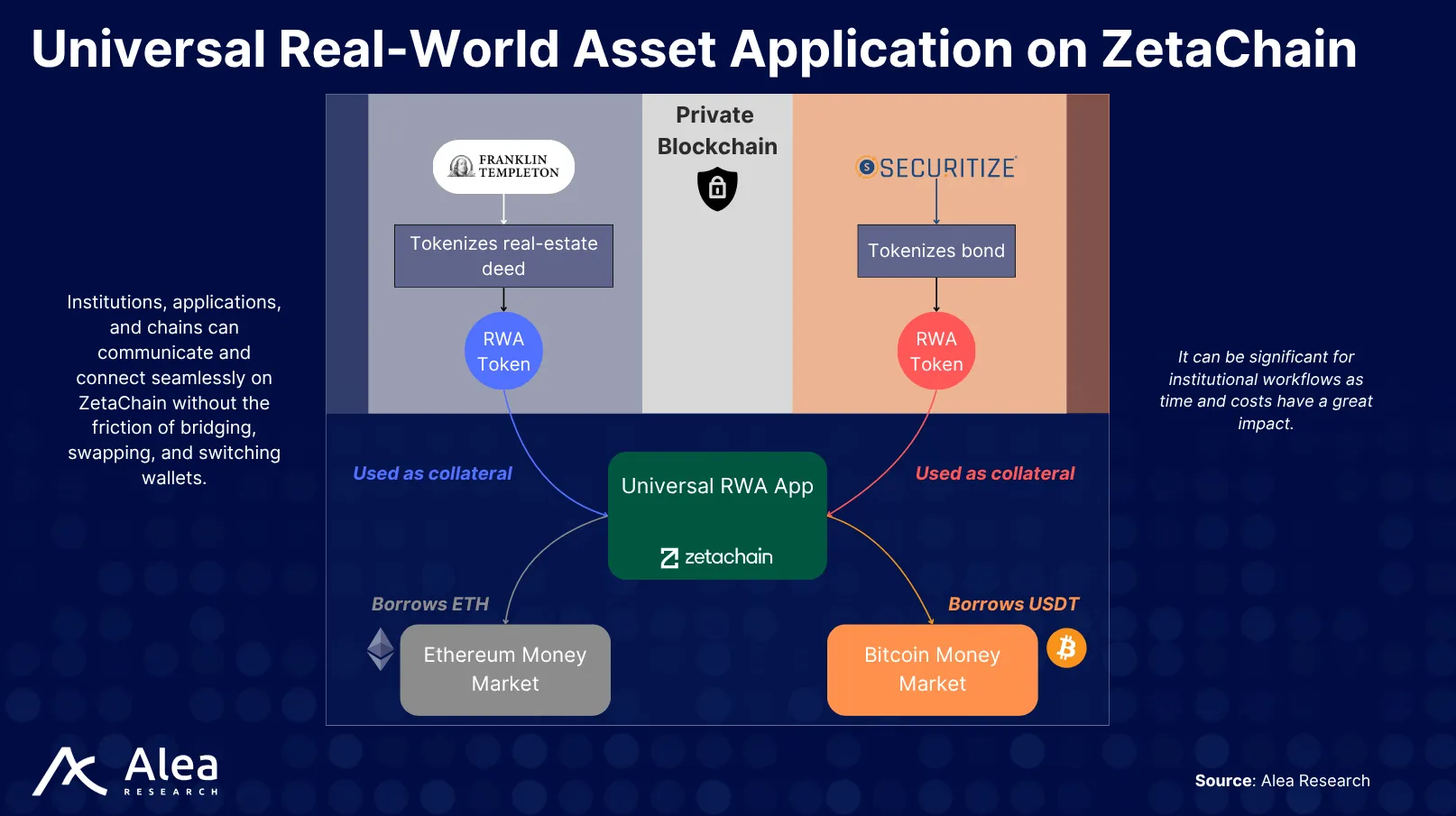

Universal App Idea #1: Universal RWA App

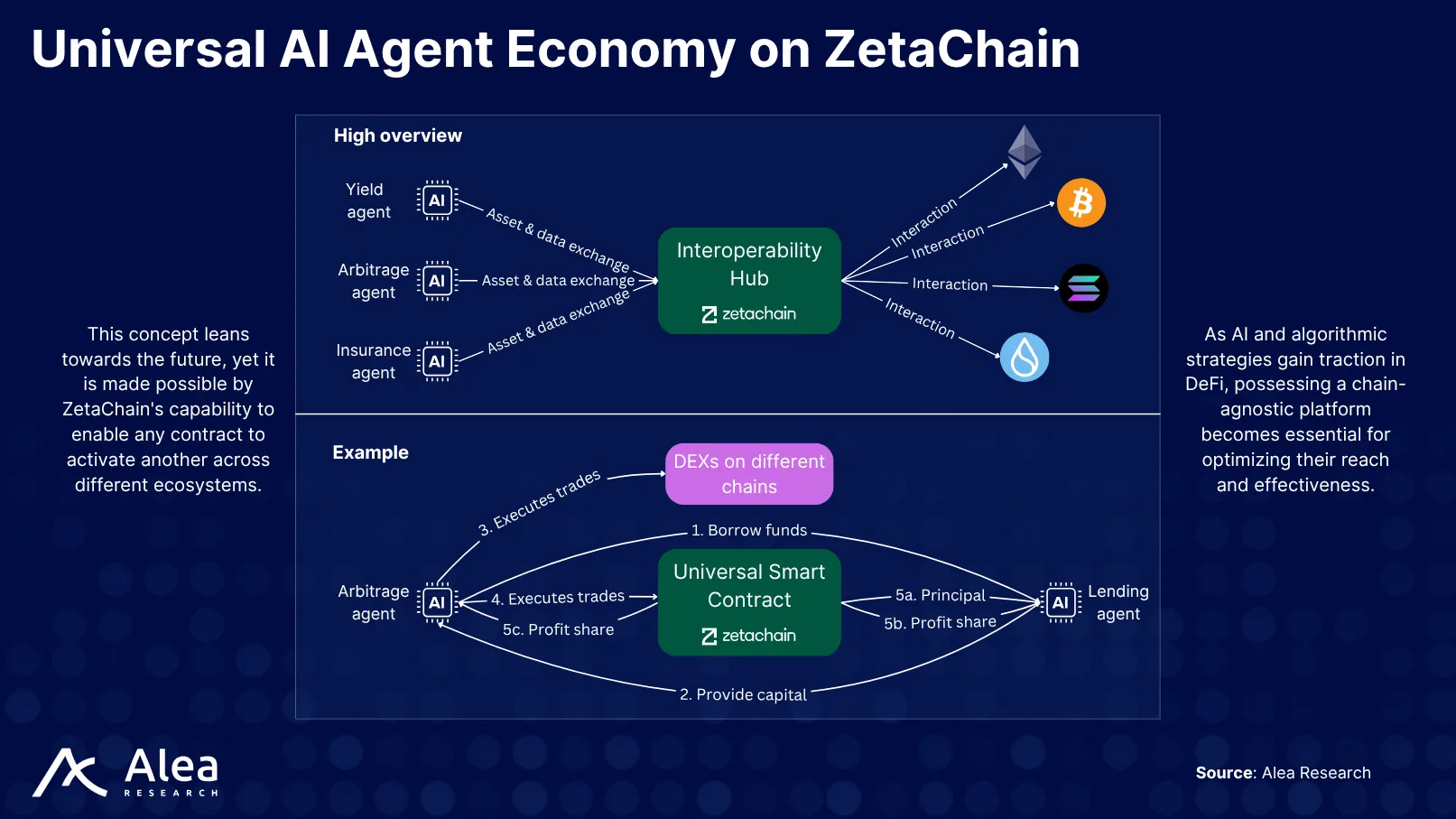

Universal App Idea #2: Universal AI Agent Economy

Why Sui? Strategic Integration and Native Support

ZetaChain is rapidly expanding its chain support, with Sui now live on testnet and mainnet integration. Developers can already build and test Universal Apps that connect Sui with any other chain, including native Bitcoin, through a single smart contract. Looking ahead, ZetaChain’s roadmap includes upcoming mainnet support for TON.

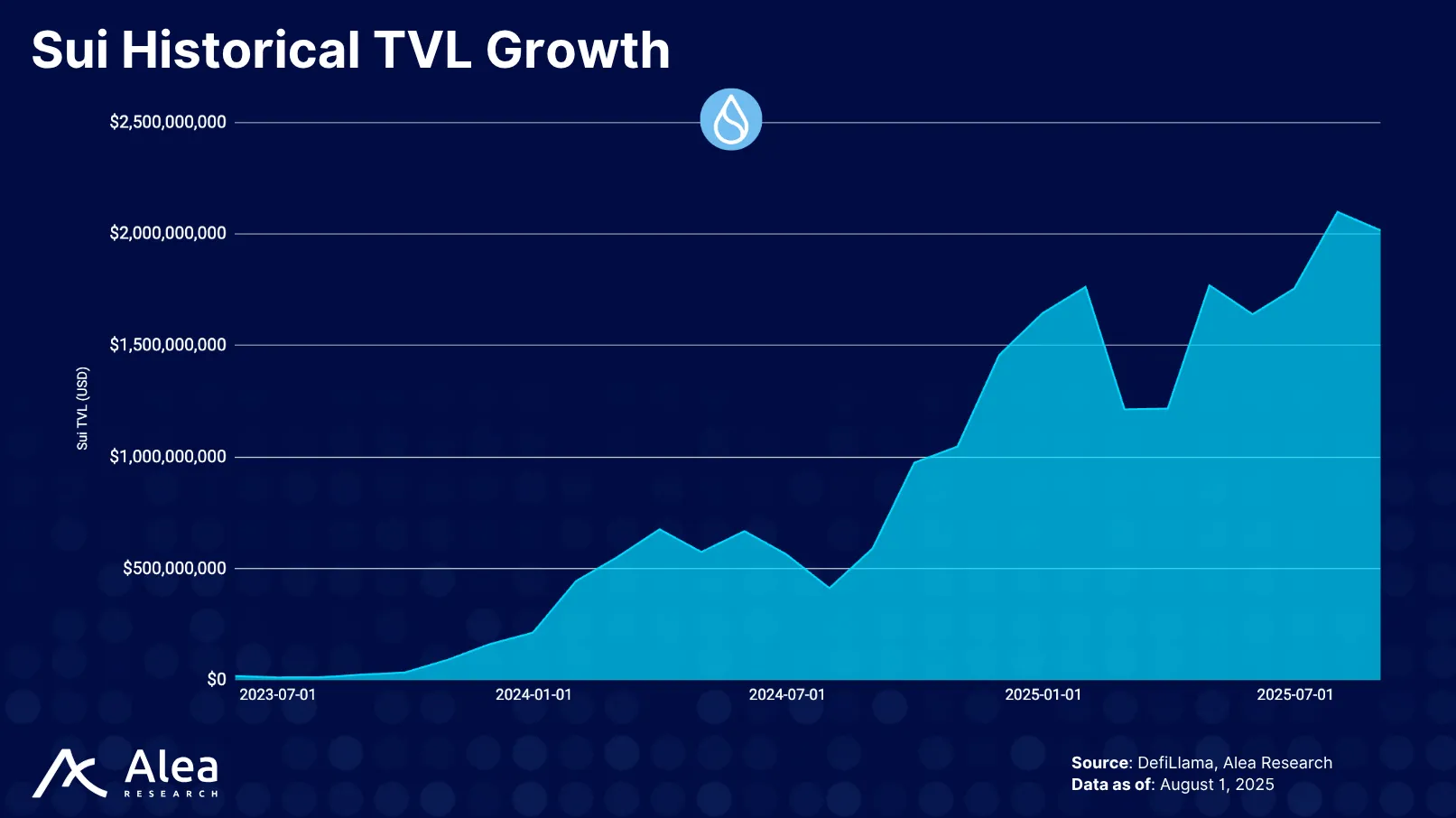

Sui is one of the newest L1 blockchains to gain significant attention, distinguished by its Move programming language and high-throughput architecture. Launched in May 2023, Sui was designed to offer “internet-scale” performance and a safer smart contract environment. So why is integrating Sui a strategic milestone for ZetaChain, and what unique value does ZetaChain bring to Sui’s ecosystem?

Sui’s Technical Differentiation

Sui runs on the Move VM, built on the Move language originally developed at Facebook. It offers three core advantages: (1) scalability through horizontal scaling, where adding validators increases parallel processing capacity; (2) safety, thanks to Move’s strict semantics that reduce bugs; and (3) support for rich onchain assets, enabling features like dynamic NFTs and composable objects that are difficult to implement on EVM-based chains. These capabilities have drawn a strong developer community with Sui being one of the few chains to attract over 1,000 new developers in 2024 alone.

Sui also launched massive incentive programs, including hundreds of millions of $SUI tokens for developers and liquidity programs, which bootstrapped a growing DeFi ecosystem. As of today, Sui is among the top 10 chains by TVL, having a growing DEX volume and user base.

However, Sui’s ecosystem remains relatively isolated. As a Move-based chain with its own unique address format and VM, it isn’t directly compatible with Ethereum or other networks. To transfer assets in and out of Sui, users must currently rely on the native Sui Bridge or Wormhole, which are limited to moving tokens. This lack of generalized interoperability means that Sui dApps cannot easily call contracts on Ethereum or other chains, and vice versa, forcing users to explicitly move liquidity from other chains, thereby limiting Sui’s reach.

Current Interoperability Gap for Sui

ZetaChain’s integration with Sui is both timely and significant. It positions ZetaChain as a bridge of bridges for Sui, not only enabling token transfers but also unlocking broader crosschain interactions. While the initial focus will be on swaps and 1:1 bridging, the integration effectively connects Sui to the wider ZetaChain network, linking it with Ethereum, Bitcoin, BSC, Base, Solana, and more.

This opens up many possibilities:

- Sui dApps can access external assets/users: A DeFi dApp on Sui could accept collateral from other chains via ZetaChain or offer its services to users who don’t natively hold $SUI tokens. For example, a Sui lending protocol could allow an Ethereum user to supply $ETH without bridging manually. This could bring more liquidity into Sui’s apps seamlessly.

- Crosschain functionality involving Sui: Developers on Sui can expand their reach. Imagine a game on Sui where in-game items, such as Sui NFTs, could be used as collateral or traded on Ethereum, all coordinated by ZetaChain.

- Sui as part of multichain dApps: Conversely, developers on Ethereum, Solana, Base, and other chains can access Sui’s unique capabilities through ZetaChain. For example, an Ethereum-based DAO could use ZetaChain to trigger complex asset minting via Sui’s Move modules, then bring those assets back to Ethereum. By abstracting away differences in interaction models, signature schemes, and consensus protocols, ZetaChain allows developers to interact with Sui contracts using familiar APIs, without needing to learn Move.

Another challenge for Sui developers is attracting users from other chains, as users tend to stay within the ecosystems they’re familiar with, like Metamask for Ethereum or Phantom for Solana. ZetaChain addresses this by enabling users to interact with Sui applications directly from their home chain wallets. For example, an Ethereum user could access a Sui-based DEX without switching networks, while ZetaChain handles asset bridging and executes the necessary Sui transactions behind the scenes.

From ZetaChain’s perspective, supporting Sui also validates its agnostic approach. It already handles EVM and non-EVM (Bitcoin, etc.), and now adding a Move VM chain shows that ZetaChain truly can be universal.

Conclusion

ZetaChain introduces a new approach to interoperability by embedding crosschain capabilities directly into its protocol. Its L1 architecture allows developers to build applications that can interact with native assets and contracts across multiple chains, such as Bitcoin, Ethereum, Solana, and others, through a single smart contract. This removes the need for wrapped assets, third-party bridges, or redundant contract deployments across networks.

The hub-and-spoke model simplifies development and improves capital efficiency by consolidating liquidity and reducing operational overhead. Instead of managing fragmented pools and adapting to multiple environments, developers can focus on a single deployment on ZetaChain. Users benefit from a unified experience, where assets and interactions across chains are abstracted away behind a consistent interface.

With support for additional networks, such as Sui and TON, on the roadmap, ZetaChain is positioned as a general-purpose interoperability layer. Its design enables a broader range of applications, such as fully crosschain money markets, multichain DEXs, and yield aggregators, to operate more efficiently and with less complexity than existing models.

References

Build for any blockchain with Universal Apps (July 2024). ZetaChain Blog

Sui vs. Aptos: Competitive Analysis (March 2025). VanEck

ZetaChain White Paper (February 2023)

Disclosures

Alea Research is engaged in a commercial relationship with ZetaChain and receives compensation for research services. This report has been commissioned as part of this engagement.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.