MAX LRTs: Yield Optimization 2.0

Despite grand promises of unlocking new dimensions of capital efficiency, the reality of restaking in 2025 is a fragmented landscape of incomplete infrastructure, misaligned incentives, and unrealized potential. The gap between narrative and execution is wide, yet there is still opportunity.

Rather than chasing theoretical possibilities, YieldNest is taking a more proactive and pragmatic approach that differentiates its value proposition from that of competing projects in this market sector. Recognizing that users demand returns now—and not promises of future efficiency—YieldNest’s architecture favors composability and flexibility such that it can generate risk-adjusted yield for its users today while maintaining optionality for embracing tomorrow’s promising restaking ecosystem.

Through technical innovation, past experience building structured products, institutional-grade risk management, and AI-driven optimization, YieldNest is redefining what’s possible in DeFi capital efficiency in spite of the current limitations hampering the progress of restaking. YieldNest’s MAX LRTs are already delivering risk-adjusted yields through battle-tested mechanisms—bridging the gap between restaking’s promise and DeFi’s present reality.

In this report, we highlight how market evolution requires adaptation. While others remain frozen by ideological commitments to particular technical approaches, YieldNest has built the infrastructure to thrive in both current and future market conditions. This is how innovation actually happens in a fast-moving space like DeFi—not through speculative narratives, but through proven strategies.

Key Takeaways

- Restaking’s execution lags behind its promise: Promised efficiency remains unfulfilled due to fragmented infrastructure, delayed rewards, and weak security enforcement.

- Yield must come now, not later: Instead of waiting for restaking to mature, YieldNest generates yield today while maintaining optionality for future restaking opportunities.

- YieldNest modular approach: YieldNest’s architecture supports an automated strategy layer that dynamically reallocates assets across DeFi opportunities, and that is capable of adapting to any market conditions.

- Liquidity and yield in one token: MAX LRTs, such as ynETHx, fully automate staking, restaking, and DeFi strategies under a single liquid token, providing users with auto-compounded, risk-adjusted returns without the need to manually manage positions or reallocate assets.

- Beyond single-layer rewards: Unlike single-protocol LRTs, YieldNest aggregates multiple yield streams into one token, providing users with optimized returns through automated rebalancing and AI-driven risk management.

- L1 Settlement: L1 settlement ensures real-time synchronization of asset states, NAV tracking, and strategy execution, preventing fragmentation and inefficiencies while maintaining accuracy, security, and transparency across integrated DeFi strategies.

- Built for today, ready for tomorrow: YieldNest is building infrastructure that delivers yield today while still being prepared to take advantage of restaking’s full potential once all promises are delivered.

The Evolution of Restaking: Promise vs. Reality

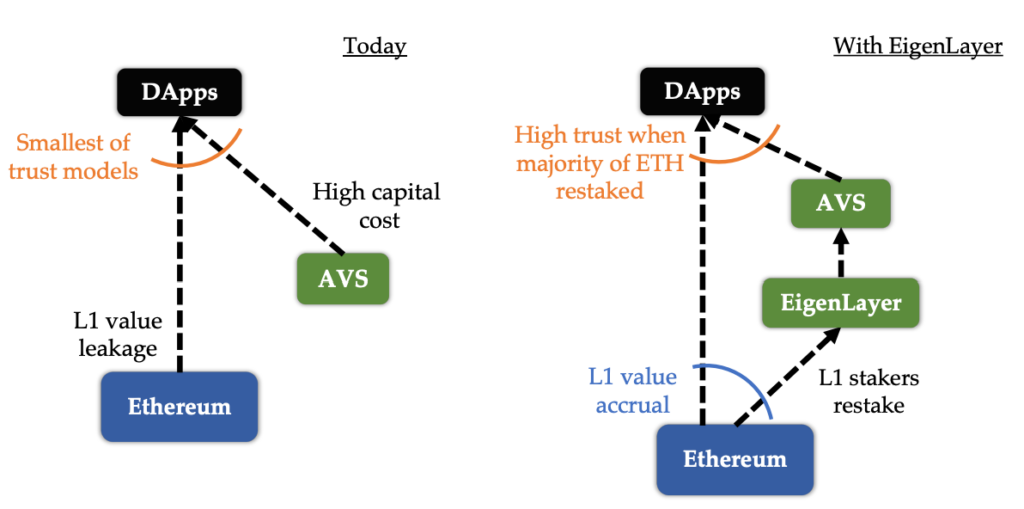

The idea of restaking was born with a seductive pitch: stake once, secure many. Originally, EigenLayer envisioned a world where idle ETH could simultaneously secure multiple protocols, creating a multiplier effect on capital efficiency. By extending Ethereum’s trust layer beyond its core blockchain to secure other off-chain systems, such as bridges, rollups, oracles, DA layers, etc. staked ETH could simultaneously secure multiple services, earning extra yield for stakers while solving the cold-start problem for protocols. On one side, dApps and networks seek security, and on the other, stakers (both retail and institutional) seek to maximize returns on their collateral.

Repurposing the 30M+ of ETH already staked, restaking would make it possible to bootstrap the security of emerging infrastructure while increasing rewards for ETH stakers through additional yield streams. To illustrate the significance of this, consider how, traditionally, staked assets were locked to a single use (securing one network), leaving a vast amount of capital underutilized. Restaking extends the same crypto-economic security across the Web3 ecosystem—from Layer-2 rollups to oracles, bridges, etc—effectively “rehypothecating” staked collateral into multiple productive uses. This means a single stake can simultaneously secure multiple protocols, earning layered rewards and enhancing overall network security through a shared security model.

In DeFi, where yield is king, restaking has been hailed as a way to merge security and yield generation: stakers benefit from extra returns, and new projects gain instant security backed by a large existing stake pool. For instance, one of the most highly anticipated use cases was the use of LRTs as collateral. However, even though the idea was widely embraced, its execution faces hurdles that are still ongoing to this day. The current state of the restaking ecosystem in 2025 reveals significant gaps between vision and reality: basic features like rewards distribution became months-long challenges, slashing mechanisms remained theoretical, and the promised developer tooling stayed perpetually “coming soon”.

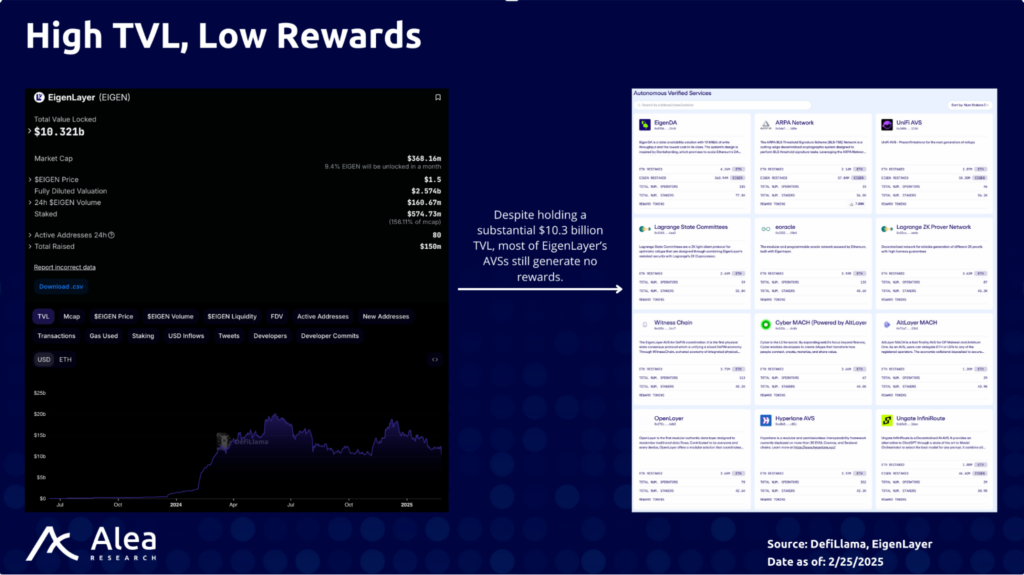

In 2025, the infrastructure gaps have become impossible to ignore. Basic features like rewards distribution—the very engine meant to drive operator participation—were missing at launch. When they finally arrived through EigenLayer’s Rewards V2, they addressed symptoms rather than the disease: a fundamental lack of trust infrastructure. What should have been day-one functionality—operator-directed rewards and variable fees—arrived months into the project. As a result, actual adoption crawled. Developers faced a stark choice: build on shaky infrastructure or wait indefinitely for proper tooling. Unsurprisingly, market adoption has been slower than expected, with many AVSs and LRT providers taking a wait-and-see approach.

Even though the current premise remains powerful, the critical weaknesses emerged: protocols still cannot reliably track or enforce operator behavior, the technical tooling lacks a robust SDK or standardized frameworks, and without proper slashing controls the “shared security” thesis devolves into shared risk without shared responsibility.

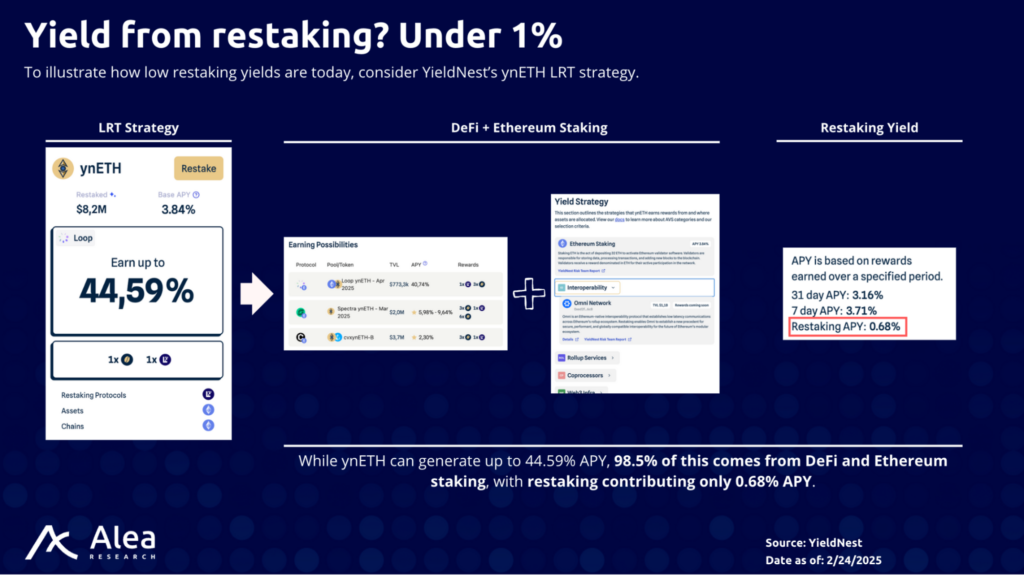

- Sparse Real Yield: Most restaking services are nascent, with limited real usage or fees from the new networks they secure. This has caused protocols to over-rely on emissions of their tokens to attract capital, which undermines sustainability. If the underlying protocols don’t produce revenue, restaking becomes a short-term farming exercise rather than a long-term income stream.

- Supply-Demand Mismatch: Without proven business models and with many protocols launching their own tokens before delivering substantial utility, stakers have been hesitant to commit their assets to AVSs. The absence of real yield from restaked applications (RAs) and high intermediary fees erode net returns for restakers, threatening the long-term sustainability of restaking. At the present, there is a lot of staked capital chasing too few quality opportunities, which has led to speculative TVL accumulation in restaking platforms while genuine demand for security lags.

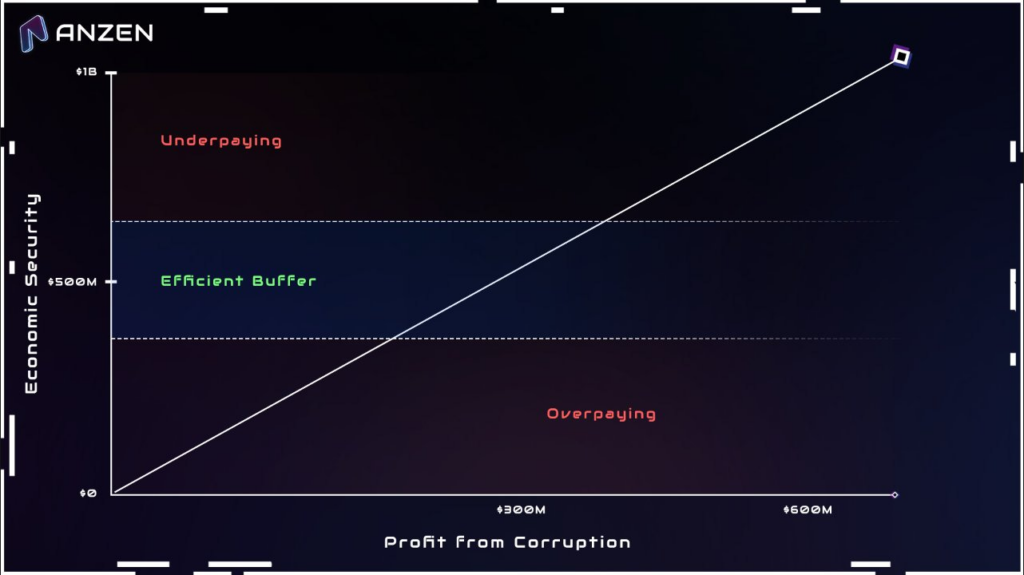

- Compounded Risks: By extending staking to more platforms, restakers inherently take on additional risk. If an underlying AVS fails or is attacked, restakers’ collateral can be slashed across multiple networks instead of just one. There’s also risk of operator misbehavior or collusion. Hence, the cost of an error is higher, and savvy investors factor this into their risk/reward calculus.

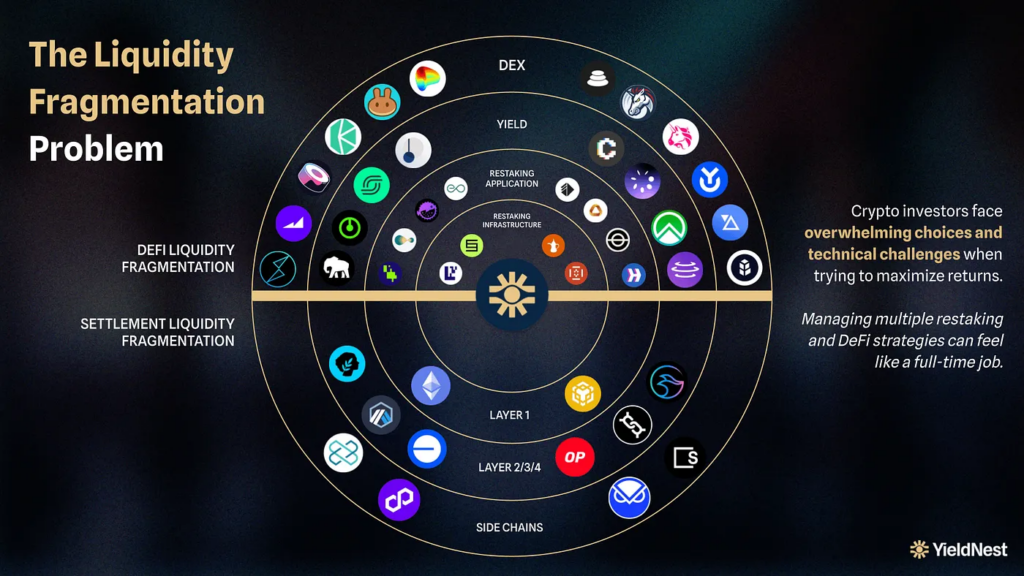

- Growing Complexity: Unlike one-click staking, participating in restaking can be complex. Users (or node operators on their behalf) often must choose which restaking protocol, which AVS, and which operator to delegate to. EigenLayer, for instance, has ~1,500 node operators and a growing list of AVSs – navigating this requires expertise that average stakers may lack. The fragmentation (with at least 10 different restaking protocols available across various chains) further complicates decision-making. LRTs address this issue by issuing fungible tokens that streamline liquidity and simplify participation. Rather than requiring individual users to assess AVS risks and manage allocations manually, LRT protocols collaborate with node operators while their DAOs actively curate which AVSs they are comfortable gaining exposure to.

- Fragmented ecosystem: Restaking is not an Ethereum-only phenomenon. Similar concepts are being implemented on Solana, Bitcoin, BNB Chain, and others. While this cross-chain growth underscores restaking’s appeal, it also means liquidity and innovation are spread across networks. Each focuses largely on its own network security use case so far, and truly interoperable restaking markets are only in early vision stages. DeFi yield opportunities, however, are available in all chains, and also let users earn yield on an underlying asset.

The current reality is that restaking is still in its “bootstrapping” phase, ironing out risks and proving its value. These growing pains set the stage for platforms like YieldNest, which aim to address many of the above challenges by automating complexity and optimizing for risk-adjusted returns.

YieldNest’s Adaptive Strategy

Recognizing the shortcomings of current restaking protocols, YieldNest has adopted a dual-focus strategy: adapt to enable current yield opportunities by using DeFi while simultaneously building for when the golden age of restaking comes. This way, YieldNest has strategically positioned itself to create immediate value while maintaining optionality for future more advanced restaking integrations once all infrastructure is live and AVSs go live.

To be exact, YieldNest recognizes restaking as more than just a security enhancement—their vision is to go beyond the original building blocks laid out by EigenLayer with the concept of shared security; YieldNest views this opportunity as an opportunity for them to build a capital efficiency engine for DeFi.

While early restaking efforts (e.g. EigenLayer) focused on the shared security aspect, this covers only a fraction of what restaking could achieve. The team behind YieldNest believes restaking can be leveraged to optimize liquidity and ROI by actively redeploying staked assets into multiple on-chain strategies—all without sacrificing the base layer’s security guarantees. This perspective informs YieldNest’s mission to deliver risk-adjusted, high-yield strategies on top of restaking. In other words, YieldNest treats restaking as one component of a broader DeFi yield strategy rather than a standalone effort.

In particular, YieldNest focuses on three key objectives that guide its approach to asset management: (1) risk-adjusted returns, (2) security and flexibility, and (3) innovation in capital efficiency. First, YieldNest targets risk-adjusted returns by prioritizing not just higher yields but also sustainability and resilience across diverse market conditions. These strategies are designed to adapt and protect assets over time. The code has been built with modularity in mind so that it is easy to add/remove strategies as market conditions change. Second, the platform emphasizes security and flexibility. Through continuous 24/7 monitoring powered by HyperNative, an AI security monitoring platform, and advanced AI agents, the protocol aims to ensure that assets remain safeguarded and are dynamically managed to address emerging risks in real-time. Finally, by leveraging AI-driven parameter tuning and strategic reallocation, YieldNest aims to maximize the productivity of every asset without exposing users to unnecessary risks. All positions can be tracked in real-time, as the vault monitors the market and rebalances the portfolio to accrue risk-adjusted returns optimally.

Rather than using outdated DeFi infrastructure or fork other yield aggregators, in order to ensure readiness for future restaking integration, YieldNest adopts a forward-looking technical framework built on an in-house modular architecture, allowing it to leverage future restaking protocols beyond EigenLayer and supports multi-layer LRT staking/DeFi strategies. This design enables seamless integration, robust security, and the agility to adapt quickly to future opportunities.

MAX LRTs: Bridging Present and Future

YieldNest initially launched LRT strategies like ynETH, which provided exposure to a curated basket of AVSs across different industry verticals, and ynLSDe, which optimized yield by restaking LSTs into EigenLayer. However, as restaking rewards remained low, it became evident that additional yield sources were necessary. This led to the creation of MAX LRTs—a new layer designed to unify and optimize yield aggregation, maximizing capital efficiency beyond conventional shared security models.

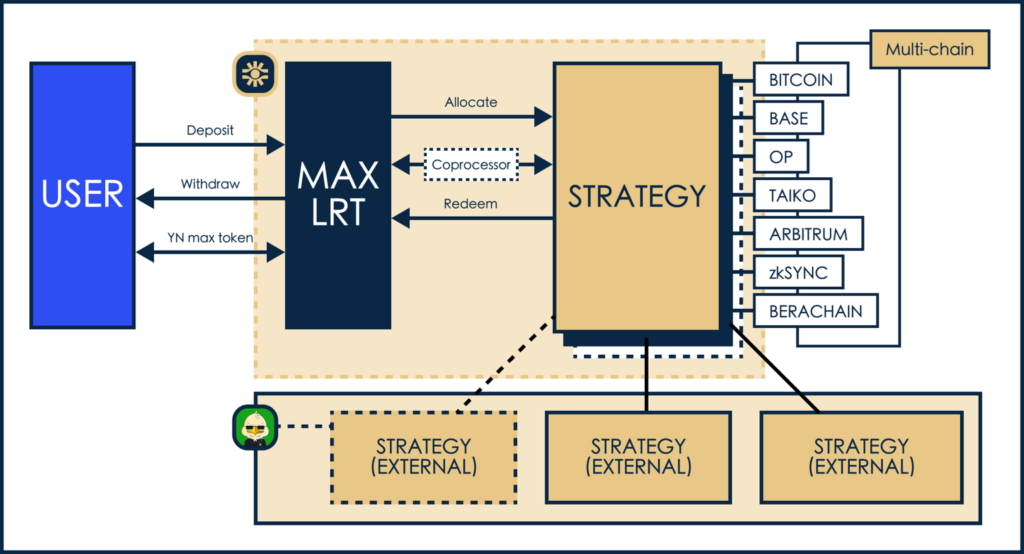

While LRT strategies act as the foundational components executing specific yield optimization techniques, MAX LRTs function as top-level vaults that dynamically rebalance across multiple strategies and DeFi products, consolidating diverse yield sources into a single token. This is possible thanks to YieldNest’s architecture, which marries the security of Ethereum staking with a flexible, automated strategy layer that deploys assets for maximum yield across multiple on-chain opportunities.

YieldNest’s architecture employs a modular design with interchangeable components, ensuring maintainability and the flexibility to evolve. At its core, the protocol is independent of any single restaking provider, and it can deploy assets on-chain into any protocol that can generate yield. This enables seamless integration with DeFi yield opportunities, allowing YieldNest to aggregate and optimize returns across multiple strategies while maintaining flexibility to incorporate new yield sources as they emerge.

Smart contracts on Ethereum handle user deposits through ERC-4626 vaults that tokenize a set of strategies into a yield-bearing asset that increases in value as rewards are accrued (e.g., ynETHx). At the same time, an off-chain co-processor orchestrates automated function calls. This setup pools assets into DeFi protocol strategies, continuously compounding yields and rebalancing allocations based on factors such as liquidity depth, correlation risks, and other real-time health metrics.

The off-chain rebalancing logic is where AI plays a crucial role in optimizing capital deployment. Instead of simply chasing the highest yield, the system evaluates multiple factors, including price impact, yield sustainability, and rebalancing costs, before reallocating assets. AI-driven automation continuously adjusts allocations across different strategies—such as EigenLayer AVSs when rewards are live, a liquidity pool on an L2, or a lending protocol—all based on shifting risk-reward metrics. Over time, as the AI learns from more data and refines its strategies, YieldNest envisions MAX LRTs evolving into fully autonomous yield optimizers, operating under broad governance oversight while minimizing the need for manual intervention.

The design also supports capturing yield on L2 networks while preserving Ethereum’s settlement guarantees by keeping a unified ledger on L1. This real-time view of net asset value (NAV) helps the protocol quickly rebalance or halt strategies if needed, mitigating cross-chain discrepancies. The result is a composable, future-focused infrastructure that integrates new yield sources as they emerge while maintaining robust risk management.

YieldNest’s dual focus manifests in its product suite, particularly its MAX LRTs. These tokens represent claims on actively managed yield strategies while maintaining the capability to integrate with restaking protocols as the ecosystem matures. For example, while ynETH serves as YieldNest’s base Ethereum restaking token, ynETHx (“x” representing MAX LRTs) is an enhanced version that allocates assets across multiple yield sources (L2 yield farms, LSDFi strategies, etc.) in addition to EigenLayer. The goal is to simplify DeFi by offering tokens that deliver risk-adjusted, auto-compounding returns without requiring users to manage allocations manually.

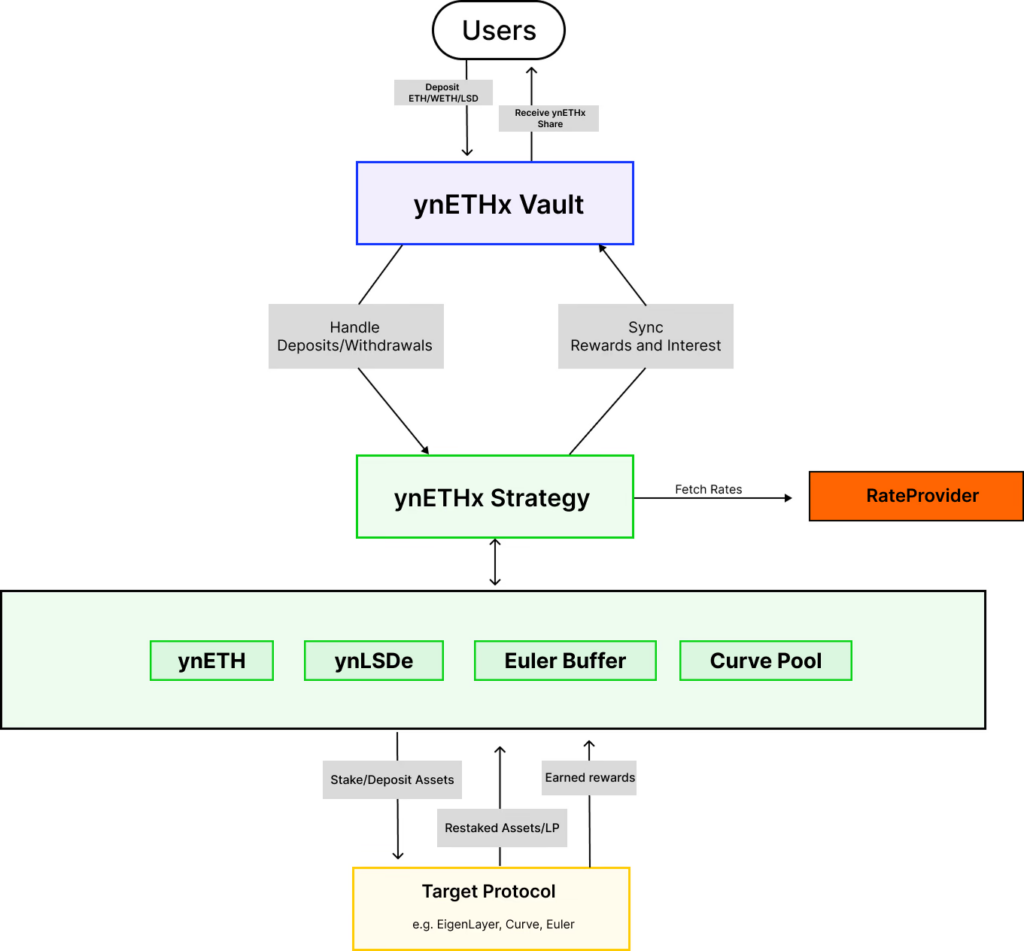

Figure 6: Abstracting DeFi liquidity fragmentation for end users

MAX LRTs operate like a continuously learning DeFi engine, analyzing data, discovering new strategies, and optimizing capital deployment over time. New strategies begin as external integrations, undergoing rigorous testing and monitoring. Once proven safe and efficient, they are adopted within the MAX LRT itself.

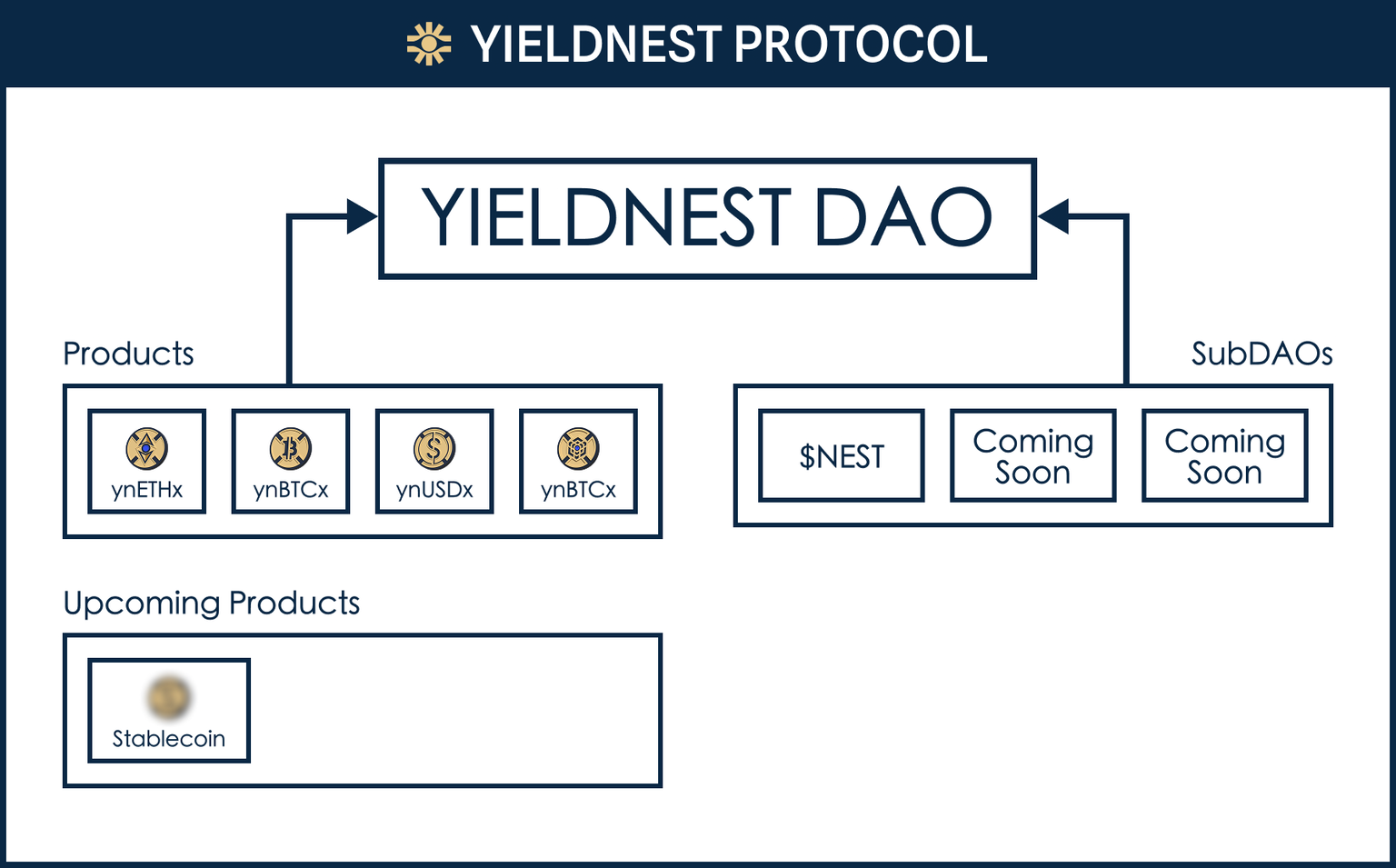

Currently, the YieldNest DAO retains the flexibility to add or remove both strategies and MAX LRTs. However, each MAX LRT is designed to transition into its own SubDAO, maintaining independent governance and strategy execution. Therefore, over time, governance will decentralize, enabling each SubDAO to manage its MAX LRT independently, supported by AI-driven governance tools for strategic decision-making.

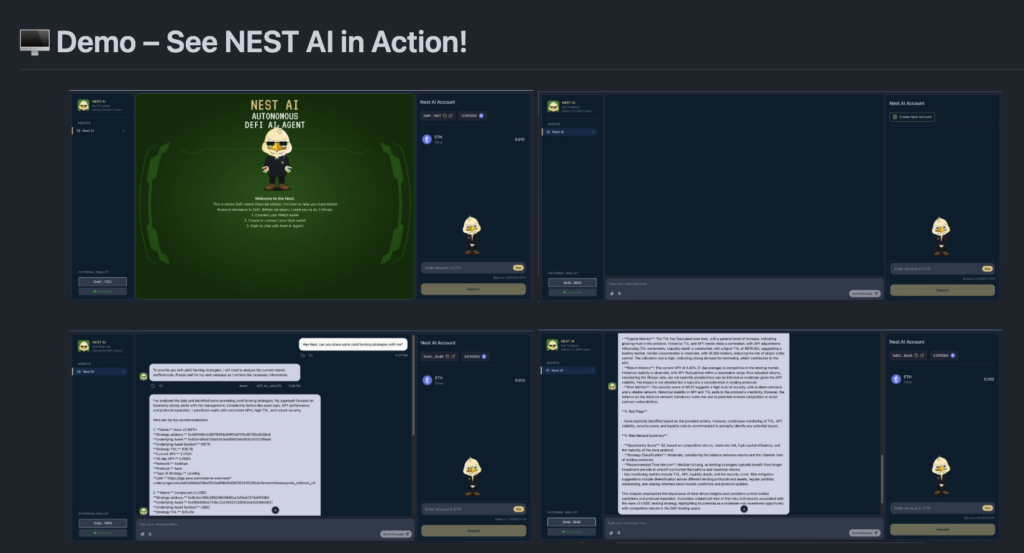

The first DeFAI Agent deployed by YieldNest to realize this vision is Nest AI. Currently, it provides real-time market commentary, offering insights into crypto trends and on-chain events. Future milestones include image generation, integration with communication platforms like Telegram and Discord, and, eventually, dynamic yield strategy management. As Nest AI evolves, it could autonomously rebalance positions or flag risky protocols before they impact returns, thus reaching YieldNest’s goal of an AI-driven system. The AI Agent is now mainly used for internal data collection and will be opened up as a beta release for the public to use to improve their own DeFi strategies.

The architecture of MAX LRTs is designed to maintain a seamless connection with their primary settlement layer. For example, an ETH-based MAX LRT (ynETHx) settles on Ethereum L1 but can deploy and coordinate strategies on L2s or any chain capable of feeding trustless data back. Real-time settlement on the base chain is critical to avoid fragmented data, asynchronous state updates, or other security vulnerabilities. This stands in contrast to traditional finance, where funds typically reconcile their NAVs and settle trades within set timeframes. At the same time, in DeFi’s 24/7 environment, continuous, real-time settlement mechanisms are essential to ensure accuracy and reliability.

Therefore, by keeping a unified source of truth on the base chain, MAX LRTs ensure that all associated strategies, asset states, and accounting remain synchronized, verifiable, and constantly updated across their respective networks. While manual oversight is still necessary for now, the long-term vision is for this hybrid model—merging AI-driven automation with governance oversight—to evolve into fully autonomous MAX LRTs.

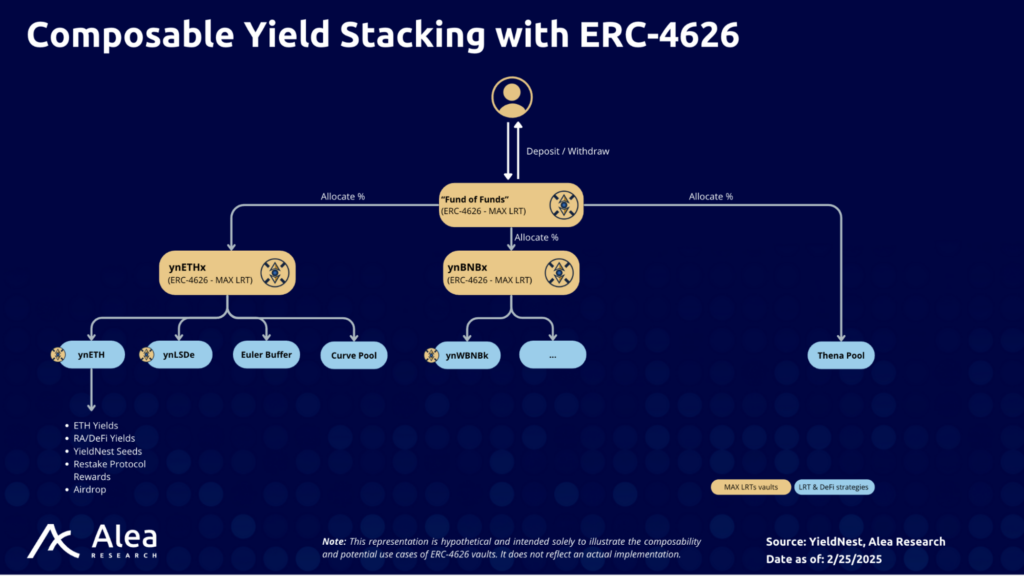

Being designed with composability at their core, MAX LRTs allow seamless tracking and accounting of all underlying strategies within a single liquid token. As these vaults fully adhere to the ERC-4626 standard—an extension of ERC-20 designed for yield-bearing vaults—it allows interoperability with DeFi protocols for liquidity provision, lending, and structured yield strategies.

This flexibility is a key advantage of MAX LRTs. While LRT strategies, like ynETH, serve as a base liquid restaking token, they come with the inherent withdrawal constraints of protocols like EigenLayer, requiring a minimum of a seven-day queue before assets can be redeemed. In contrast, MAX LRTs, like ynETHx, remove these limitations by aggregating yield across multiple DeFi strategies, ensuring that positions remain liquid. To further guarantee smooth exits, even under volatile conditions, the protocol integrates a built-in liquidity buffer, significantly reducing users’ liquidity risk and providing immediate access to funds.

This Buffer Strategy sets aside a portion of underlying assets in readily accessible, yield-generating positions, ensuring immediate withdrawals without delays. If the buffer experiences strain, it is replenished through LPs or a queue system—allowing participants to benefit from ongoing withdrawal flows and preserving stable liquidity management. In cases where the buffer needs a larger refill, assets are shifted from other strategies. This approach aims to maintain deep liquidity across MAX LRTs while minimizing risk in fluctuating markets.

Technical Architecture

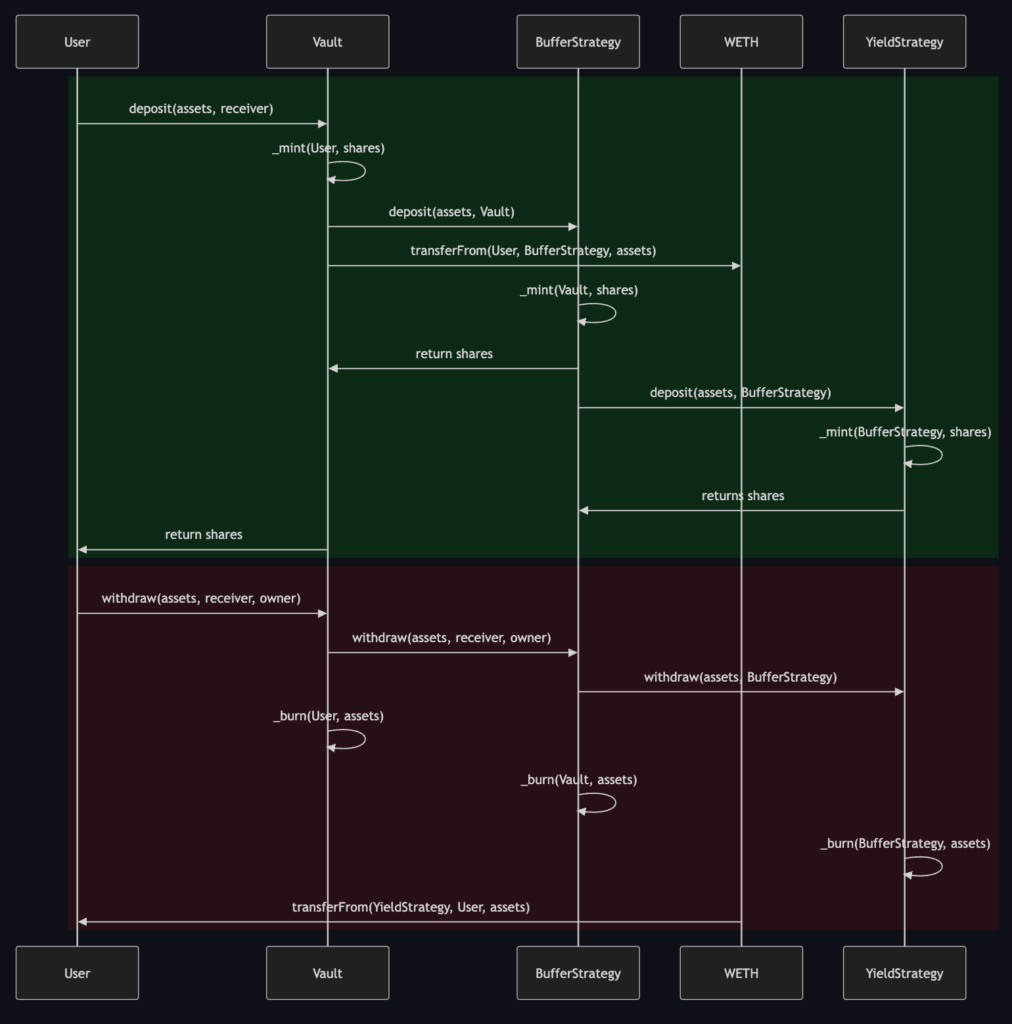

The core infrastructure enabling MAX LRTs to support multichain strategies is built around two types of vaults: the Deposit Vault and the Strategy Vault. Strategies operate downstream of these vaults, handling integrations with DeFi protocols such as EigenLayer, Symbiotic, and Aave. When users deposit assets into the Deposit Vault, funds are allocated to Strategy Vaults, which then interact with restaking/DeFi protocols through dedicated connectors, ensuring efficient capital deployment and yield optimization.

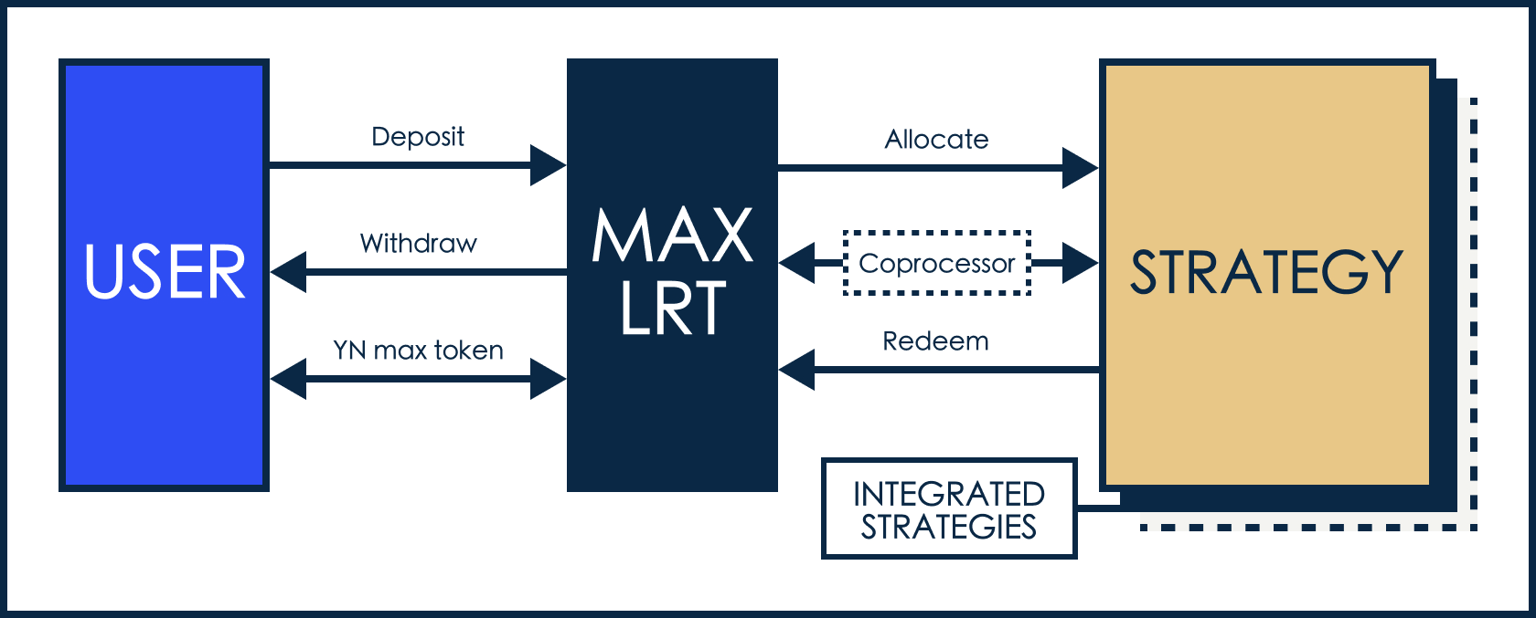

Users begin by transferring their assets to the MAX LRT vault, which supports multiple deposit assets, and in return, they receive YN MAX share tokens representing their proportional stake in the vault. The vault then coordinates with the Coprocessor, an off-chain module designed to track deposit events and determine optimal allocation strategies. From there, the Strategy Vault receives and distributes assets according to a predefined plan, while a Rate Provider ensures accurate conversion rates throughout the process.

Coprocessors, increasingly adopted across DApps, play a crucial role in YieldNest’s architecture by enabling advanced data processing, real-time strategy execution, and cost-efficient decision-making. Since Ethereum’s on-chain environment is constrained by high gas fees and limited computational capabilities, performing complex calculations directly on-chain is impractical. Coprocessors increase blockchain capabilities by providing specialized processing power for position management, vault rebalancing, and dynamic asset allocation.

YieldNest leverages an off-chain coprocessor that acts as a Strategist layer to handle computationally intensive tasks to determine optimal asset allocations and trade routes across restaking and DeFi strategies. These off-chain computations rebalance vault strategies based on predefined parameters such as market volatility, liquidity conditions, and yield opportunities. By automating these processes, YieldNest ensures that MAX LRTs dynamically adjust allocations without requiring manual intervention. Additionally, coprocessors aggregate oracle sources to determine accurate share exchange rates, moving complex calculations off-chain to reduce costs and mitigate potential manipulation risks.

By offloading these tasks to a trust-minimized off-chain system, YieldNest can analyze deeper on-chain data, automate complex decision-making, and optimize capital deployment without incurring excessive costs. The coprocessor continuously evaluates factors such as yield fluctuations, liquidity depth, and risk exposure, ensuring that MAX LRTs dynamically adjust allocations across strategies. This approach enhances efficiency, improves responsiveness, and enables more sophisticated yield optimization techniques that would be impractical in a purely on-chain system while still keeping accounting and settlement on-chain. This contrasts with other vaults, which keep everything off-chain or operate entirely on-chain. YieldNest MAX LRTs solve this issue by combining the best of both worlds.

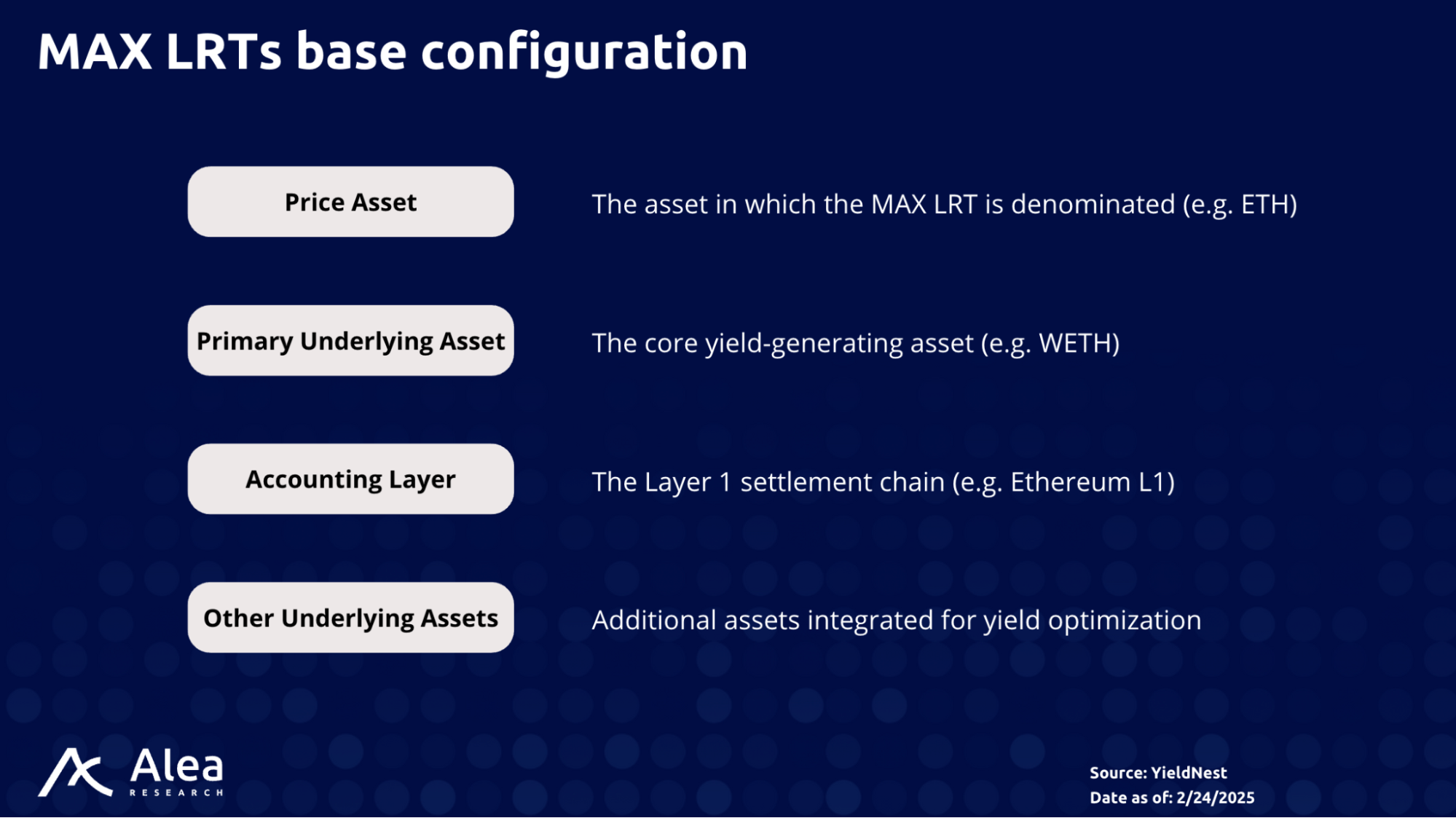

Each MAX LRT adopts a unique strategy composition and management framework. Its base configuration specifies:

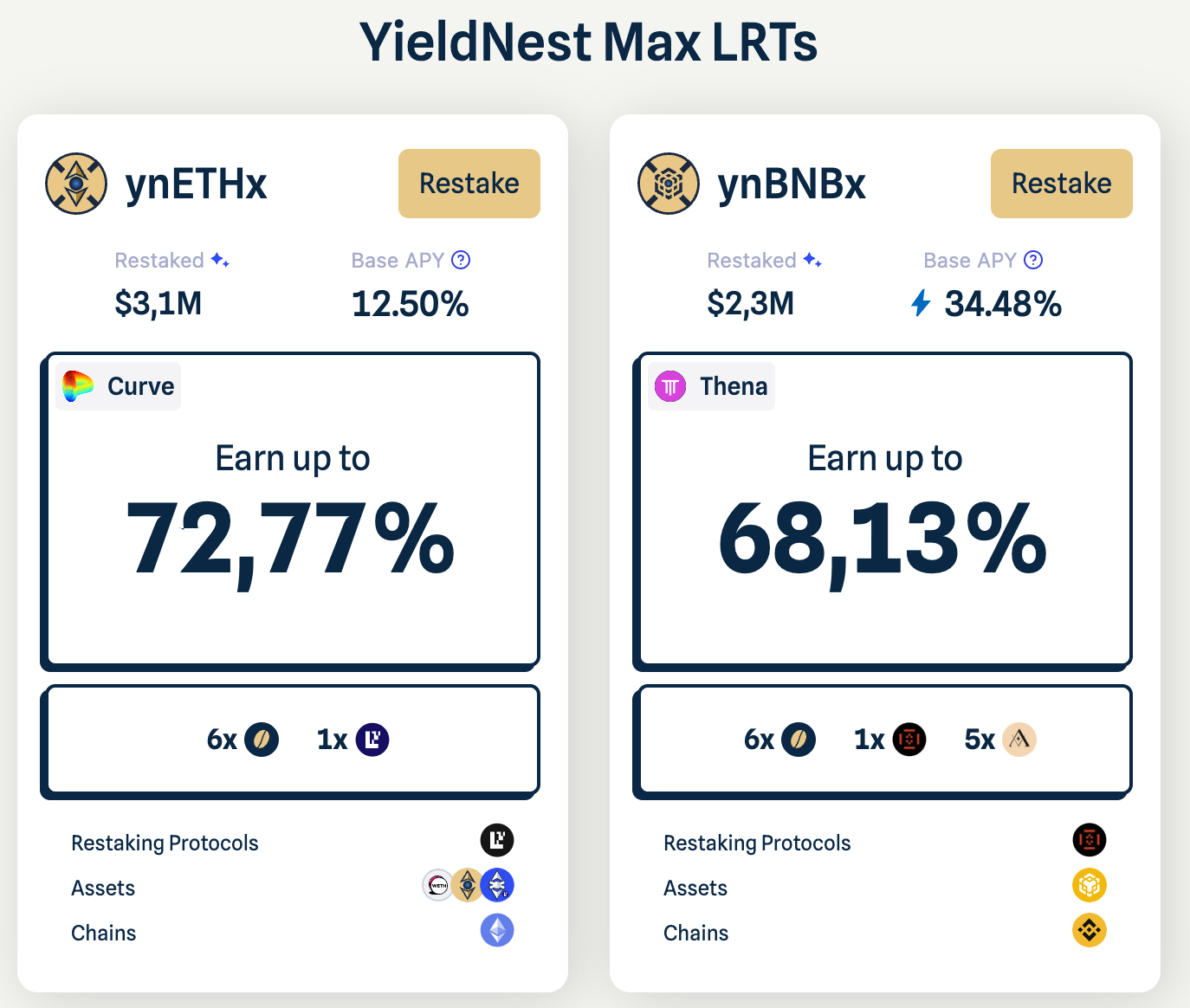

Currently, YieldNest offers two MAX LRTs—ynETHx and ynBNBx—and plans to introduce ynBTCx and ynUSDx in the near future. This demonstrates YieldNest’s ability to transform any asset into a yield-bearing instrument by aggregating and optimizing yield opportunities across DeFi.

Using ynETHx as an example, users deposit underlying assets (e.g., ETH, wETH, ynETH, or ynLSDe) and receive ynETHx share tokens denominated in ETH. ynETHx maximizes capital efficiency by aggregating ETH and LSTs into one liquid instrument. It does so by optimizing the exposure across restaking and DeFi strategies, continuously generating yield, thus capturing staking rewards, DeFi yields, and additional incentives such as airdrops and governance rewards.

Assets associated with ynETHx are staked or deposited into target protocols such as EigenLayer, Curve, and Euler. The rewards generated from these strategies are then synchronized with the ynETHx vault, ensuring continuous compounding and accurate accounting.

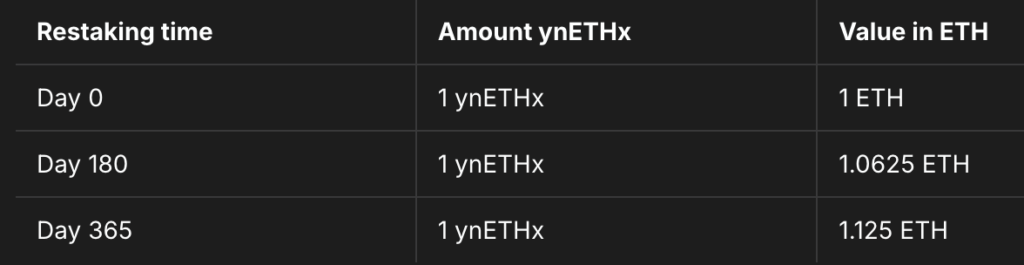

MAX LRTs automatically compound rewards, increasing token value over time (Number goes up). For ynETHx, which is denominated in ETH, the number of tokens stays the same, but their ETH value grows. For example, assuming a constant 12.5% APY, 1 ynETHx—initially worth 1 $ETH—would appreciate to 1.125 ETH after one year.

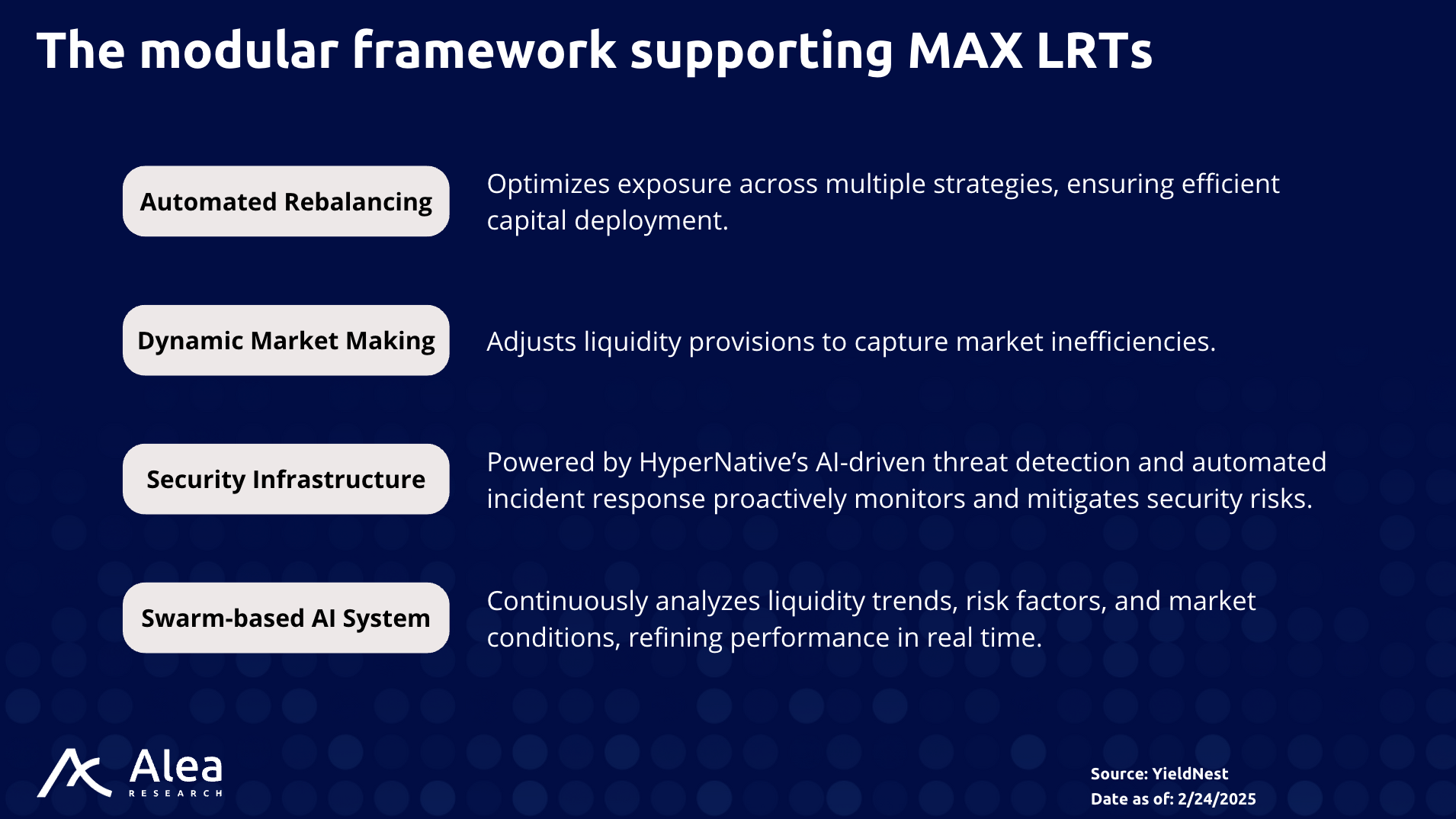

The modular framework supporting MAX LRTs like ynETHx is designed to go beyond yield maximization, placing equal emphasis on protecting capital and preserving system integrity to achieve robust, risk-adjusted returns. To ensure this, robust risk management is integrated at both the contract and strategy levels.

This approach is implemented through four key mechanisms: (1) automated rebalancing, (2) dynamic market making, (3) security infrastructure, and (4) swarm-based AI systems.

So, for example, an LRT strategy (e.g., ynETH) may diversify restaking allocations across a curated set of approved targets to prevent overexposure to any single high-risk AVS. This diversification extends across different categories, such as rollups, interoperability networks, and Web3 infrastructure. In addition to predefined risk management parameters, the system relies on continuous 24/7 monitoring through tools like HyperNative and AI-driven analytics. Hence, if an AVS exhibits signs of instability—such as an exploit or a sharp TVL decline—the protocol can swiftly intervene by pausing allocations or reallocating funds to mitigate potential slashing or losses this same process applies to DeFi strategies where any strategies that show concerning sings can get ejected back into the top lvl MAX LRT vault.

YieldNest’s Competitive Edge

YieldNest differentiates itself through aggregation, automation, and risk-managed yield. Unlike a single-protocol LRT, YieldNest’s MAX LRT approach means a token like ynETH can encapsulate multiple yield sources – e.g., Ethereum staking + EigenLayer + An Curve LP + Lending/Borrow etc… all under one asset, and this can be one of the many destinations for a vault to deploy assets in.

For instance, consider an ERC-4626 vault where ETH is the underlying asset. This ETH can be deployed to an LP in Curve, lent on a lending market like Euler, or restaked into ynETH. In this case, ynETH is one of the many possible destinations, and the vault will dynamically allocate capital among the available strategies (Curve, Euler, and ynETH in the example above) to maximize yield.

The YieldNest approach provides a level of capital efficiency and convenience that a user would otherwise have to replicate by manually juggling several platforms and tokens. Moreover, YieldNest emphasizes risk-adjusted returns over pure yield. Through controlled exposure (only whitelisted AVS, position limits, etc.) and monitoring, it aims for sustainable yield where others might chase APY at the cost of safety.

Where many LRT issuers provide a single layer of yield on a specific asset, YieldNest’s competitive strength is providing a stack of yields across layers and protocols in one package. With relentless focus on automation (AI-driven rebalancing) and governance-driven security measures, YieldNest optimizes for the best risk/reward at any given time. The following image provides a hypothetical representation of the vast possibilities enabled by ERC-4626 composability. Imagine a fund-of-funds structure where one vault (e.g., ynETHx or ynBNBx) serves as a strategy within another vault. This setup allows an ERC-4626 multistrategy vault to incorporate another ERC-4626 vault as a strategy, demonstrating how composable yield aggregation can be achieved.

Thus, YieldNest can also be viewed through the lens of general DeFi yield aggregators with built-in protection, offering a set-it-and-forget-it approach for passive earnings. Users deposit one asset and receive a tokenized vault (yield-bearing asset) that automatically earns yield from multiple sources through an actively managed, AI-optimized portfolio. This simplicity is key for broad adoption—busy investors and institutions prefer a single instrument that optimizes itself.

YieldNest believes in open-source development, as it fosters collaboration and enhances security. This architecture is designed to be fully open and composable, enabling third-party retail investors, institutions, and AI agents to build seamless, interoperable strategies that work efficiently together.

Conclusion

To overcome restaking’s execution failures, YieldNest is building tomorrow’s restaking infrastructure while enabling yield generation through DeFi’s current optimization capabilities. The fundamental thesis is: build sustainable yield infrastructure that works today while maintaining strategic optionality for tomorrow’s opportunities.

By making restaking the centerpiece of a broader yield aggregation framework, YieldNest is unlocking new levels of capital efficiency. The protocol transforms passive staked assets into actively managed portfolios that capitalize on both security incentives and DeFi opportunities, all through a single user-facing asset.

As more yield strategies offer meaningful fees to restaked collateral, the yield ceiling for staked assets will rise. YieldNest is well-positioned to capture and deliver those gains to users, given its already extensible architecture (ready to plug in new sources as they mature).

No longer just about shared security, restaking is poised to become a cornerstone of high-yield, automated DeFi infrastructure. YieldNest’s architecture and strategy demonstrate how this can be achieved in practice—by merging AI, smart contract automation, and prudent risk controls to continually adapt in pursuit of optimal returns.

The long-term outlook is that restaking will become an integral part of DeFi. Just as yield farming, liquidity mining, and liquid staking were major themes of past cycles, restaking and meta-yield aggregation could define a future where every unit of crypto collateral simultaneously secures networks and earns yield, all managed by autonomous protocols like YieldNest—ultimately making DeFi more efficient and rewarding for all participants.

The ultimate goal is to bring price discovery and volume on-chain, move away from centralized structures, and transition to an open, permissionless, and self-sovereign settlement layer where commerce can flow freely across the world.

References

Asset Risk Assessment: YieldNest ynBNBx (January 2025). Llama Risk | Link

Asset Risk Assessment: YieldNest ynBTCk (January 2025). Llama Risk | Link

Beyond Shared Security: The Evolving Role of Restaking in DeFi. Llama Risk (February 2025) | Link

Coprocessors Overview. Llama Risk (November 2024) | Link

EigenLayer Documentation | Link

ELIP-001: Unlocking flexibility in EigenLayer rewards. X (January 2025) | Link

Introducing: Rewards v2. EigenLayer (December 2024) | Link

Intro to AVS Evaluation. Llama Risk (May 2024) | Link

Memorandum on YieldNest Initial AVS & Operators Selection. Llama Risk (July 2024) | Link

YieldNest General Protocol Assessment (February 2025). Llama Risk | Link

YieldNest Website | Documentation | Medium

Disclosures

Alea Research is engaged in a commercial relationship with YieldNest as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose.

Alea Research is a research platform and not an investment or financial advisor.