Executive Summary

Record-setting filings for crypto ETFs signal true institutional entry, but only purpose-built infrastructure can keep that momentum and bring large amounts of capital onchain. When ETFs fuel institutional flows, social-driven dApps energize retail, and AI agents streamline onchain workflows, the result is a market that is deeper, faster, and culturally sticky.

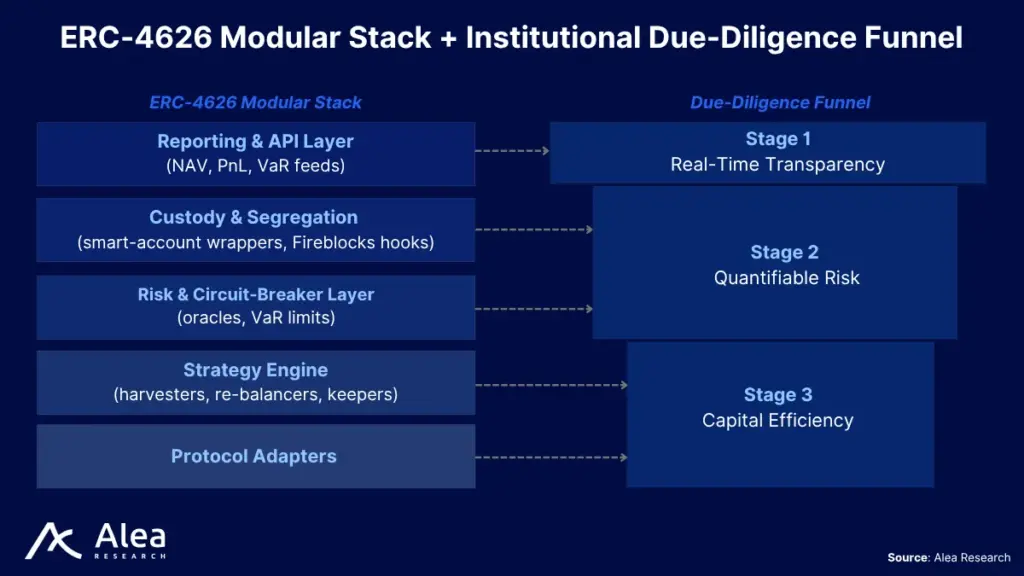

The next phase of DeFi will be defined not by isolated yield aggregators but by modular asset-management stacks that institutions can operate end to end. For capital to flow, three conditions must converge: real-time verifiable data, seamless execution, and risk-aware underwriting that mirrors TradFi credit desks. Anything less leaves allocators blind to counterparty exposure and unable to size positions with confidence.

Institutional decision makers are no longer limited to crypto-native “prop shops”. The cohort now includes multi-strategy hedge-fund complexes, non-US banks running dedicated offshore crypto desks, traditional long-only asset managers like mutual funds, sovereign wealth funds and public pensions, insurance general accounts, endowments, foundations, etc. For these players, full onchain transparency is non-negotiable: live positions, liabilities, and vault-level allocation data must be queryable at block speed.

Key Takeaways

Core Thesis: Sustainable onchain income will accrue to modular ERC4626 vault issuers and marketplaces with a clear strategy to onboard both institutional asset managers and retail depositors through mainstream distribution platforms.

Institutional Non-Negotiables: A full-stack composable yield layer must offer real-time transparency, quantified risk, and capital efficiency via standardized vault wrappers, scalable and adaptable strategy engines, performance tracking APIs, and reporting interfaces.

The Strategy Velocity Moat: SDKs, no-code libraries for easy onboarding, and permissionless curator marketplaces accelerate release cadence; fastest protocols to ship new strategies capture transient alpha first.

The Distribution Flywheel Edge: Yield-by-Default and Vaults-as-a-Service are key for seamlessly embedding DeFi into wallets, exchanges, and fintech apps; every B2B partner compounds AUM, fee revenue, and increases switching costs for competitors.

Strategic Implications for Protocols: Asset issuers and treasury managers should own their yield stack for fee capture and risk alignment; wallets, exchanges, apps should embed yield at the UX level to lift retention while outsourcing complexity.

Untapped Market Opportunities: Pre-Deposit Vaults, the Bitcoin ecosystem, Telegram mini-apps, and ecosystem-level specialization highlight white-spaces for RWA collateral onboarding, retail outreach, or the adoption of crypto-native distribution layers that industrialize incentive pricing and user acquisition.

Token Utility and Value Capture Lens: TVL ≠ value; fee-share, buybacks, or bonded utility must link protocol growth to governance token demand. Bonded collateral for strategists, staking for risk governance, and adaptive fee recycling tighten this loop.

Yield Stacks, Not Yield Farms

Despite functioning infrastructure, institutional allocators continue to sit on the sidelines because the legal enforceability of onchain contracts and token ownership remains unresolved; their mandates prohibit exposure to such uncertainty. As a result, capital behind “institutional-grade” DeFi products—whether money-market tokens, private-credit platforms, or curated lending vaults—still comes mainly from crypto-native firms, hedge funds, and asset issuers, not pensions, insurers, or sovereign funds. The available yields, while higher than traditional markets, do not compensate large institutions for the perceived legal and operational risks. However, the time will come when courts and regulators provide clear, enforceable frameworks that satisfy fiduciary standards.

The Yield Stack Thesis holds that sustainable onchain income will accrue not to single “one-size-fits-all” vaults but to modular asset-management stacks built around ERC4626: a base layer of standardized vault wrappers that lives onchain, an offchain strategy engine that can swap, leverage, or hedge assets in real time, a risk-control layer with circuit breakers and attested VaR, and an API reporting layer exposing Net Asset Value (NAV) and Profit & Loss (PnL).

Unlike the yield aggregators that dominated farming volume in the past, this architecture slashes integration cost and time-to-market, lets allocators compose bespoke risk-return profiles without touching code, and meets institutional non-negotiables—real-time transparency, quantifiable counterparty risk, and capital efficiency—thereby converting latent institutional interest into deployable capital while capturing durable fee flow for the protocols that own each layer.

From Yield Aggregators to Asset Management Stacks

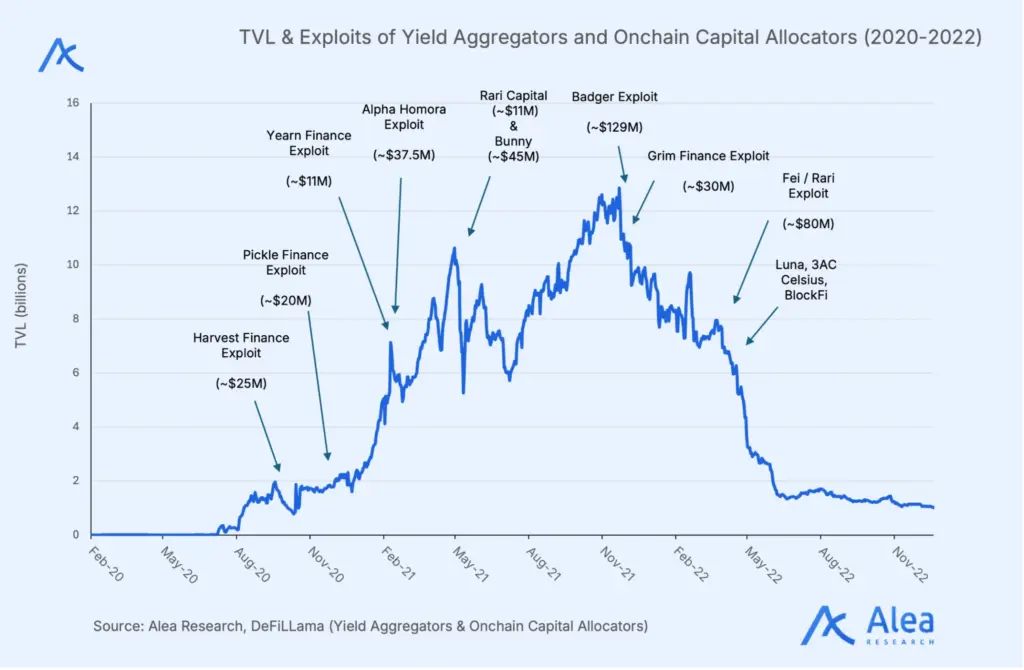

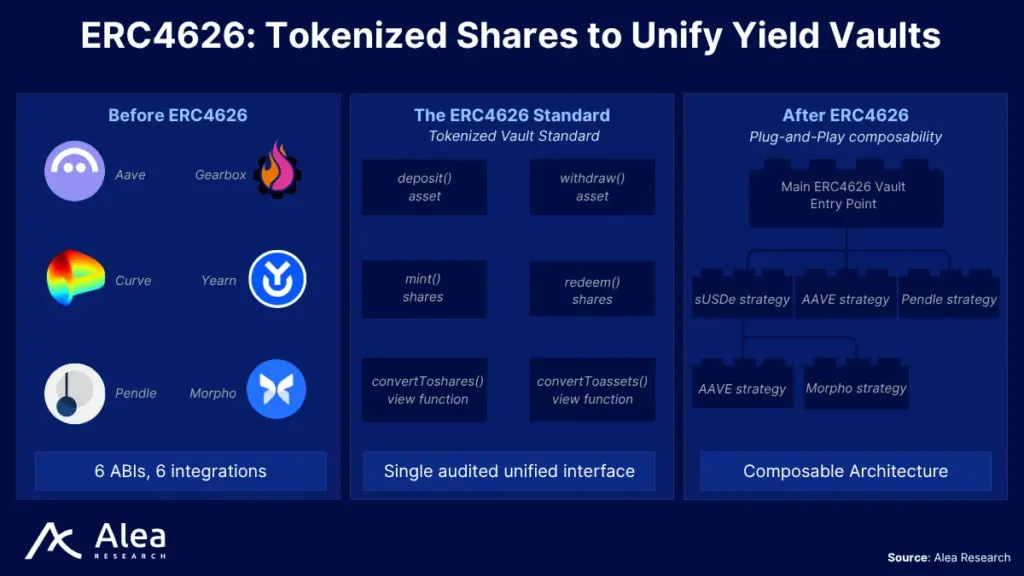

Yield aggregators surfaced in DeFi Summer 2020 as automated vaults that rotated deposits into the highest onchain returns. A succession of exploits in 2020–2021 forced the sector to adopt audits, multisig controls, and bug bounty programs. Builders also discovered that the relentless churn of strategies and protocols made bespoke vault integrations costly and time-consuming. In 2022, the ERC4626 standard gained recognition as the universal answer for unifying vault interfaces and enabling seamless composability across protocols.

With robust security practices and interoperable standards now established, the time-to-market for new vault protocols collapsed. ERC4626 strategy templates let teams launch a wider spectrum of strategies that could suit different risk-adjusted vaults. Yet institutional capital will not deploy on convenience alone.

Institutional allocators evaluating capital deployments onchain demand asset management stacks that satisfy three non-negotiable requirements: real-time transparency, quantifiable counterparty risk, and capital efficiency comparable to top-tier CeFi venues. These entities remain sidelined not for lack of appetite but because few onchain platforms yet deliver the essentials they treat as table stakes:

- Block-level position and PnL feeds exposed through open APIs that power real-time Net Asset Value (NAV) and Value at Risk (VaR) dashboards.

- Continuous code audits and formal-verification pipelines in addition to secure coding and monitoring practices that make exploit probability an observable metric.

- Emergency circuit breakers and time-locked privileged actions to contain tail-risk events.

- Self-custody and strict segregation of client assets within loss-capped accounts.

Building an institutional-grade onchain asset management stack demands specialized blockchain development talent, round-the-clock DevOps, and recurring audit spend. Not all institutions have the time or resources to build their own stack from the ground up. The urgency of capturing these market opportunities pushes them to look for onchain protocols offering the full stack that best fits their needs. That creates a market opportunity for those DeFi protocols that bundle vault engineering, risk analytics, custody hooks, and reporting APIs out of the box.

Plug-and-play ERC4626 stacks offer allocators the exact toolkit they are looking for. That lets them tailor exposure levels and fee budgets on demand while the protocol handles the engineering overhead.

Strategy engines that seamlessly shift capital among RWA collateral, stablecoin carry trades, and leveraged ETH (re)staking loops exemplify the new playbook that professional onchain allocators want to follow: they run multi-strategy mandates, enforce VaR limits at block cadence, and rebalance exposures as basis, funding, or oracle risk changes.

The Capital Deployment Lifecycle

The first generation of DeFi depositors—retail yield farmers, DAO treasuries, and opportunistic whales—moved capital fast predominantly with hot wallets, accepted single-key or multisig risk, and chased token incentives with little ex-ante discipline. The institutional cohort now arriving—registered funds, family offices, and fintechs—treats allocation as a regulated investment process: assets live with secure Multi-Party Computation (MPC) or qualified custodians, every vault clears audit-grade due-diligence gates, real-time NAV feeds flow into portfolio dashboards, and hard stop-loss rules trigger orderly rotations when liquidity, yield, or governance signals deteriorate.

Unlike retail, institutional allocators move through a gated, repeatable sequence that reduces key-loss, smart-contract, and liquidity risk from the moment assets leave cold storage until capital rotates out of a vault. Prospective vaults must clear a checklist of fresh audits, live bug bounty coverage, transparent onchain data APIs, underwritable counterparty and contract risk, and fee-driven “real yield” curves benchmarked against reliable sources of yield.

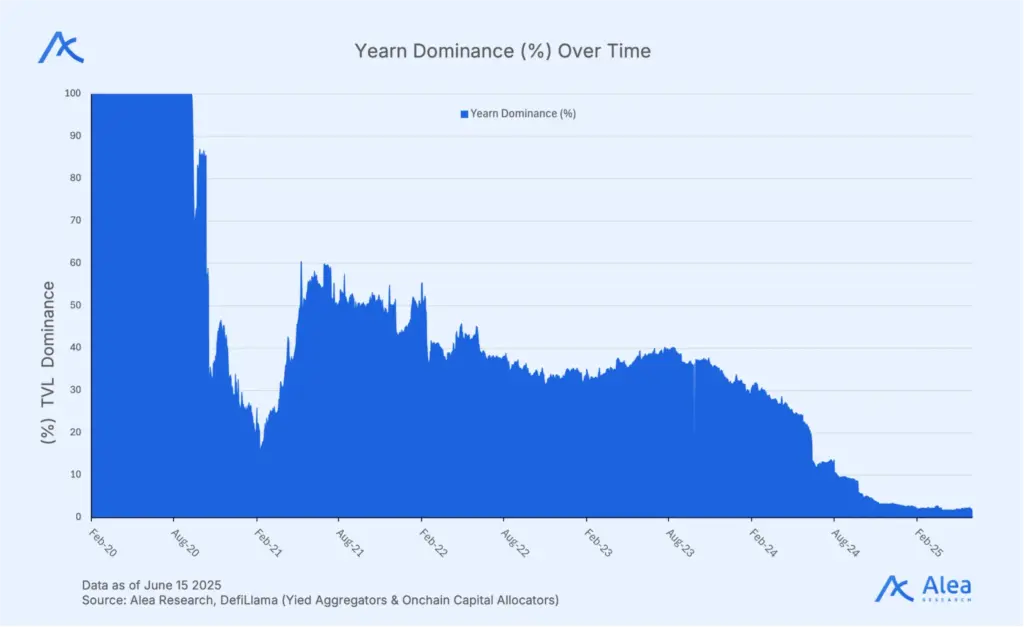

Market Map & Design Patterns

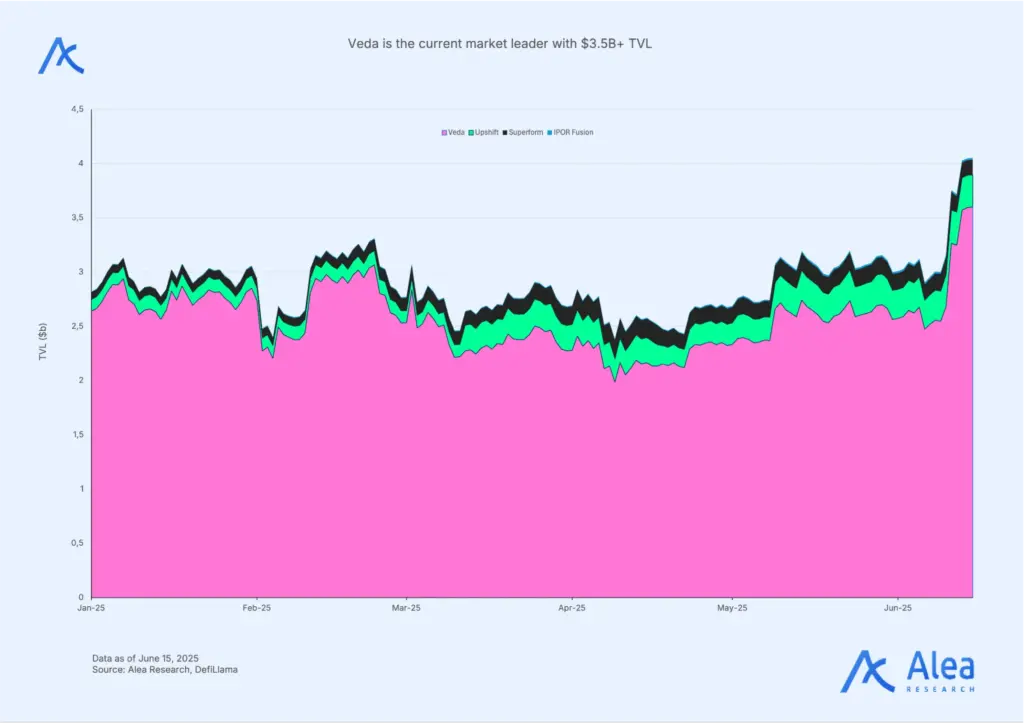

Onchain asset management now clusters into three models: i) trusted or managed vaults, ii) curator marketplaces, and iii) onchain/offchain hybrid structures. In most cases, at least two of those overlap within the same protocol (e.g. Veda offering Yield-as-a-Service but also working on a platform for curators, Upshift’s curator marketplace while also leveraging August’s margin accounts in the backend, or IPOR Fusion complementing IPOR’s interest rate swaps). Each has different tradeoffs in trust, fees, scalability, and strategy customization. However, a trend is starting to become apparent: TVL and strategy diversity are shifting from legacy yield aggregators towards more modular and customizable stacks. Competitive moats increasingly depend on strategy release cadence and market timing to seize opportunities on up and coming chains with a fresh set of users, inflows, and incentives.

- Trusted-manager platforms like Veda offer discretionary oversight but depositors still rely on the allocation decisions made closed-doors by the strategist: Seven Seas.

- Curator marketplaces decentralize strategy creation and allow anyone to start running their own vaults and charge depositor fees, increasing competition and driving market efficiency as a result.

- Hybrid structures require bespoke implementations that centralize accounting while assets are deployed on both onchain protocols and offchain venues.

Trust-permission is a spectrum that runs from fully discretionary managers manually signing transactions to permissionless curated vaults with automation for calling smart contract transactions. Standardized ERC4626 receipt tokens make every vault fungible and composable, unlocking a new layer for capital efficiency and utility such as enabling collateral reuse in lending markets or yield-stripping and trading in Pendle-style markets.

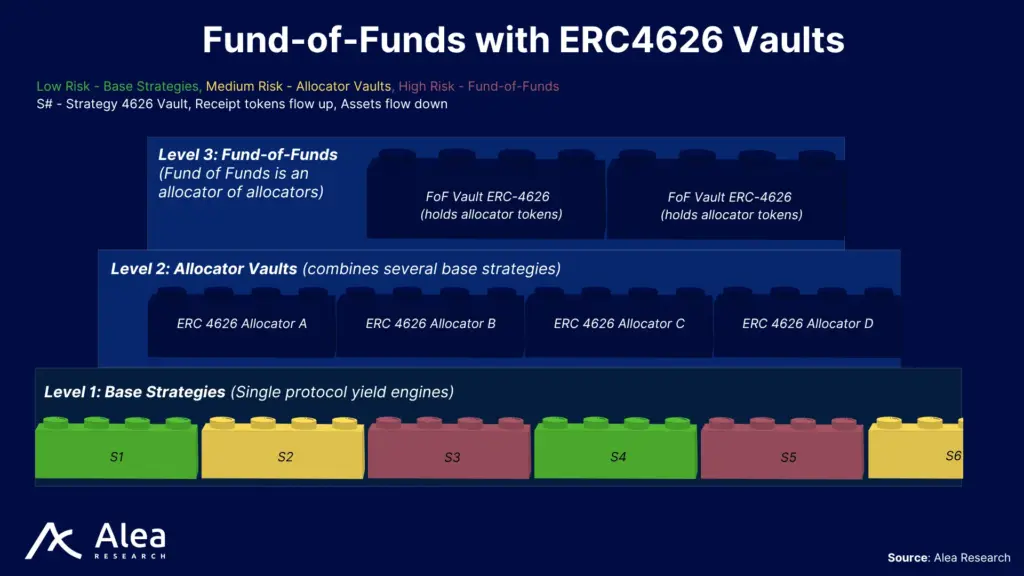

Irrespective of archetype, whether you are dealing with a trusted manager like Seven Seas in Veda or with a curator spinning its own vaults in Upshift or IPOR Fusion, converging on the ERC4626 standard is a key unlock in terms of composability. This turns every deposit receipt and strategy connector into a “money lego”. A single 4626 adapter lets any new protocol plug into the entire universe of existing vaults. Since the actual deposit is also a tokenized receipt in the form of a ERC4626 vault, managers can now stack strategies and vaults: a top-level “fund-of-funds” vault simply adds other 4626 vaults as line-items, and those allocator vaults can nest inside larger allocators.

At the base layer, yield strategies remain directly accessible to users who want isolated exposure, yet they can also roll up into higher-order more sophisticated structured products. The result is a recursive, capital-efficient design space where liquidity flows seamlessly across protocols.

By letting asset managers themselves nest and remix ERC4626 vaults, it becomes possible to come up with diversified risk-adjusted portfolios that satisfy the needs of different user cohorts. Because every sub-vault shares the same ERC4626 interface (e.g., totalAssets, previewRedeem, converToShares, etc), the allocator vault can track real-time VaR, enforce risk buckets, and seamlessly rebalance weights onchain.

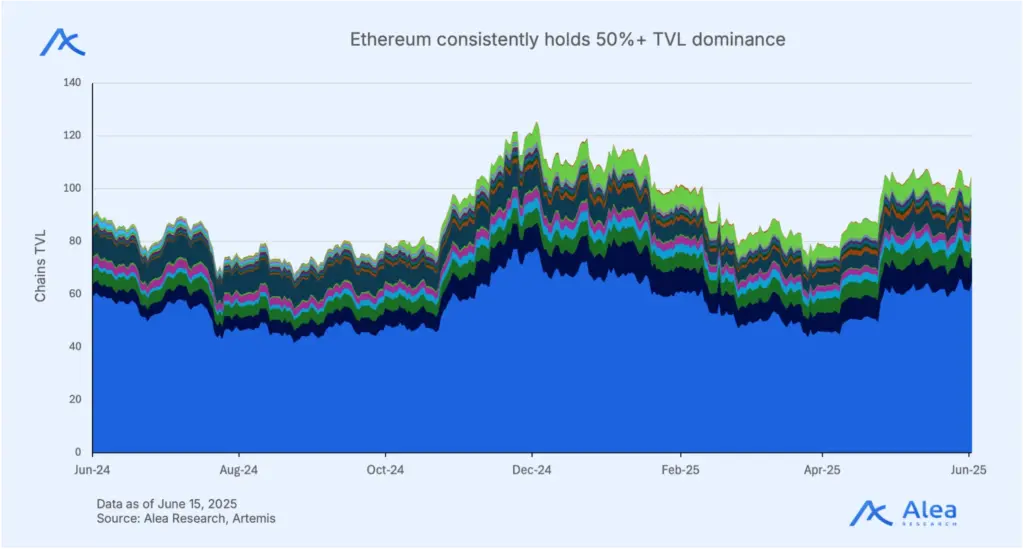

Adaptable platforms with fast upgrade cadence and simple deployments to rapidly onboard asset managers can unlock the greatest network effects on asset-rich chains hosting the majority of share of onchain liquidity, such as Ethereum. This turns those chains into the hub where resilient primitives emerge and compound staying power.

With more than 50% of DeFi’s TVL still parked on Ethereum, asset management platforms find the deepest liquidity and widest asset availability there. That’s where these protocols have an opportunity to meet existing asset managers and onboard them to start deploying vaults and run strategies through them. This is also an opportunity for many family offices and prop funds to become curators, launch their own vaults, open them up to the public and benefit from automation and additional fee income.

Yet the remaining half of the TVL is fragmented, with Solana representing ~7% of the total, Bitcoin ~5%, BSC ~4%, and we observe a similar dynamic in stablecoin dominance with the exception of Tron representing ~30% due to USDT payments. This means that there is still plenty of white-space opportunity for asset management protocols to tackle, such as capitalizing on their first-mover advantage in other ecosystems like Solana or Bitcoin L2s and building Lindy and network effects from a resulting liquidity moat.

Solana, for instance, already has a culture where most protocols feature “vaults”. This is the case for Kamino, Drift, and most recently Jupiter partnering with Fluid. The culture already teaches users that, whatever frontend they visit, they will have the ability to passively deposit assets and earn yield while all complexity is abstracted away from them. The constraint for adoption in this case is not necessarily tooling, but the fact that most liquidity is on Ethereum and additional inflows in valuable assets like stablecoins are needed to achieve that market efficiency. Bitcoin inverts the equation: the balance sheet is massive, yet—excluding wrappers—the thesis can only materialize as L2s harden and start seeing adoption. TON is a third archetype: Telegram’s billion user base can expose yield bots and mini-apps behind the chat interface, offering instant distribution.

Yield-as-a-Service

Asset issuers and DAO treasuries are incentivized to own their yield stack; they are unwilling to fully outsource such a vital function to external protocols and strategists. For scaling their assets, every issuer—stablecoins, liquid staking tokens, RWAs—benefits from sovereign control of the vault architecture that makes their token yield-bearing. Direct ownership secures fee capture, lets issuers codify risk limits and emergency brakes, and shortens reaction time when new opportunities emerge. Relying on third-party aggregators dilutes brand equity and forces issuers to accept risk-reward profiles set by others.

For teams lacking in-house bandwidth to build and maintain all of this onchain and offchain infrastructure, neutral “Vault-as-Infrastructure” platforms offer a middle path. Issuers won’t necessarily trust the discretionary manual actions of a multisig, but they can offload certain automation functions to agnostic vault factories that still let them customize their exposure without the coding overhead. The issuer sets hard parameters (fee splits, drawdown caps, kill-switch logic) along with whitelisted strategies they are comfortable running and everything is enforced within those bounds. This arrangement unlocks a buffet of tranches—from conservative to speculative—that makes an asset yield-bearing and more competitive in the market.

For an asset issuer whose income depends on circulating supply, controlling the yield stack expands the flywheel: higher net APY drives token demand →circulating supply lifts fee revenue → revenue funds deeper liquidity → further lowering the opportunity costs to onboard new holders and allocators.

There is a moat to be fleshed out being positioned as a neutral protocol offering a white-label yield stack that lets any issuer or DAO spin up ERC4626 vaults while they retain full control of fee switches, protocols to deploy on, etc.

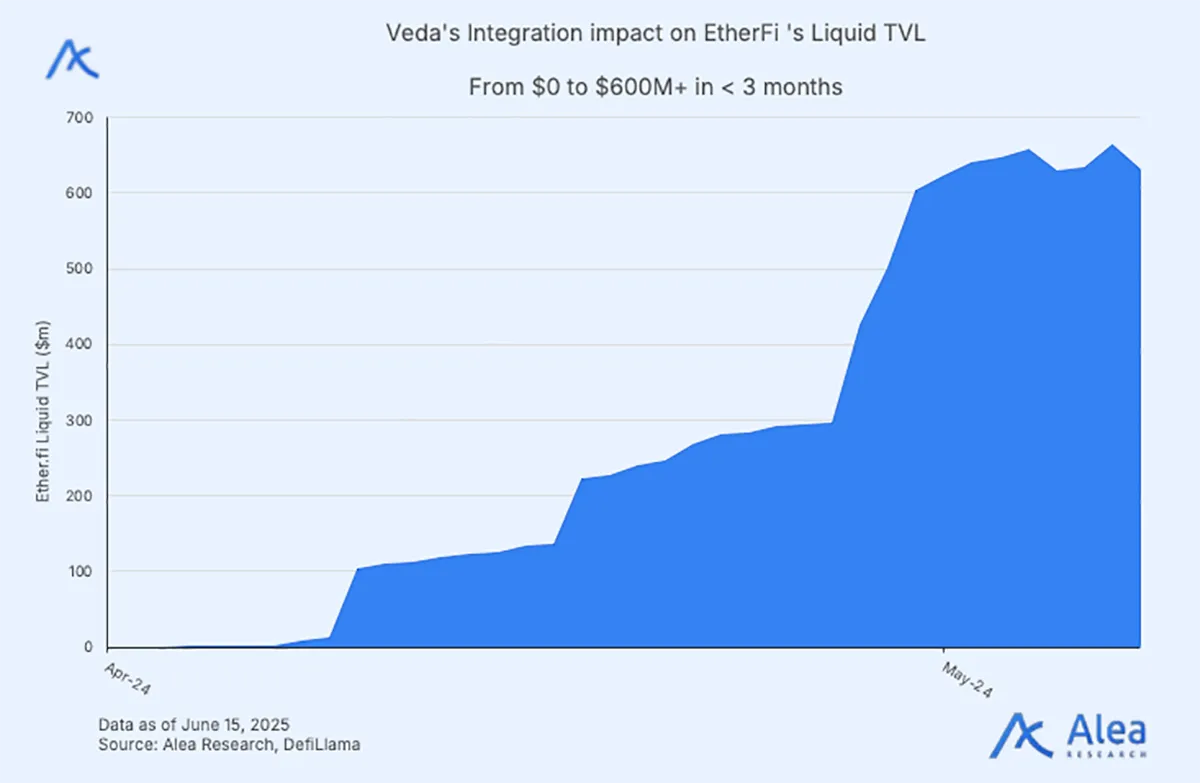

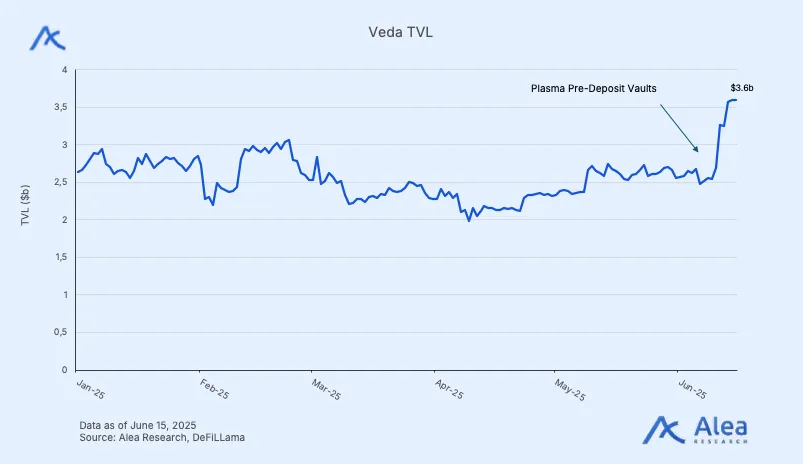

Veda is an example of a protocol that already powers branded vaults for EtherFi, Lombard, Mantle, Bedrock, Plasma Pre-Deposits, and more. Issuers and Veda clip platform and performance fees on AUM while holders earn additional yield on their assets in a passive experience. This creates a B2B SaaS-style revenue stream that scales with partner AUM.

Hybrid Composability

Legacy yield stacks take advantage of DeFi’s composability but also bring about their capital inefficiency and capacity constraints. Standard onchain lending pools require to post excess collateral that, once withdrawn, escapes any protocol-level risk monitoring. Herein lies a market opportunity to build an asset management stack that unifies collateral, debt, and trading accounting in a single margin engine that re-prices exposure block-by-block.

Capital feels expensive in siloed DeFi because every loan is ring-fenced: collateral cannot be netted against offsetting hedges. Stacks that embed lending, execution, and real-time oracle feeds within one account abstraction layer solve both problems, letting allocators recycle collateral across strategies. Overcollateralization alone is not the drag; it is the lack of portfolio-wide visibility with unified health-factor engines that can follow collateral and debt balances as they traverse protocol, bridges, and CEXs.

Hybrid composability is all about enabling a single onchain account with cross-venue margin. Instead of juggling separate accounts and margin calls, managers should be able to pledge assets onchain just once and redeploy the resulting leverage across any venue—DEX, CEX, or bilateral OTC—under a consolidated system that nets exposures and flags liquidation risk before it materializes.

Margin management is a pain point. Volatile collateral demands 24/7 monitoring, robust alerting, and reliable automation for large-scale adoption. For instance, the cross-collateralization of DeFi positions (e.g., hedging impermanent loss) plus OTC derivatives in one dashboard not only unlocks capital efficiency but also attracts sophisticated delta-neutral and momentum strategies.

Defi as Backend, Yield as Frontend

For the Yield Stack Thesis to materialize, liquidity grows onchain in tandem with user adoption via standard apps; assets live in smart contracts onchain while users interact with frontends that display APR tiles inside wallets, savings dashboards, or boosted-deal links. Control over the final mile of distribution is the key differentiator between managing millions and billions in TVL.

Embedding yield can turn an app from a mere conduit into an income-generating hub for both users and the platform. When an interface exposes yields directly beside spot balances, inactive assets migrate from “dead money” to productive capital. Users win through higher net returns while platforms harvest a recurring fee stream.

Control of the distribution layer compounds a protocol’s defensibility by gathering user data and increasing the menu of yield opportunities. This creates a two-sided network effect: richer choice attracts more depositors, which attracts more protocol incentives, which in turn deepens user loyalty. Similar to how app stores or payment networks lock in both developers and consumers, these forces turn the distribution layer into a durable moat.

The Ecosystem Frontier

Ethereum remains the liquidity hub. Deepest liquidity and battle-tested protocols keep big funds on mainnet. In the meantime, clear niches are forming on other chains: Berachain’s PoL, Avalanche’s RWA strategy, HyperEVM ecosystem opportunities, etc. Large allocators are generally chain-agnostic, but will only park capital where they can deploy assets in size and not dilute their returns.

Attention is a key driver for liquidity, and alpha pockets exist on other chains that are still in their liquidity formation stage. Whether it’s about a specific asset’s notoriety, such as Hyperliquid’s HYPE, or specific incentive distribution models like Berachain’s Proof-of-Liquidity (PoL), there are multiple angles that incumbent yield aggregators cannot satisfy. For instance, Avalanche excels on the RWA front, Bitcoin hosts $1T+ in unproductive (not earning yield) market cap, and TON secures a direct pipeline to Telegram’s user base. This section will dive into four short case studies—HyperEVM, Berachain, Royco Pre-Deposit Vaults, and Turtle Club’s Distribution Layer—to illustrate how capital and users migrate when economics or UX are superior.

Hyperliquid’s HyperEVM

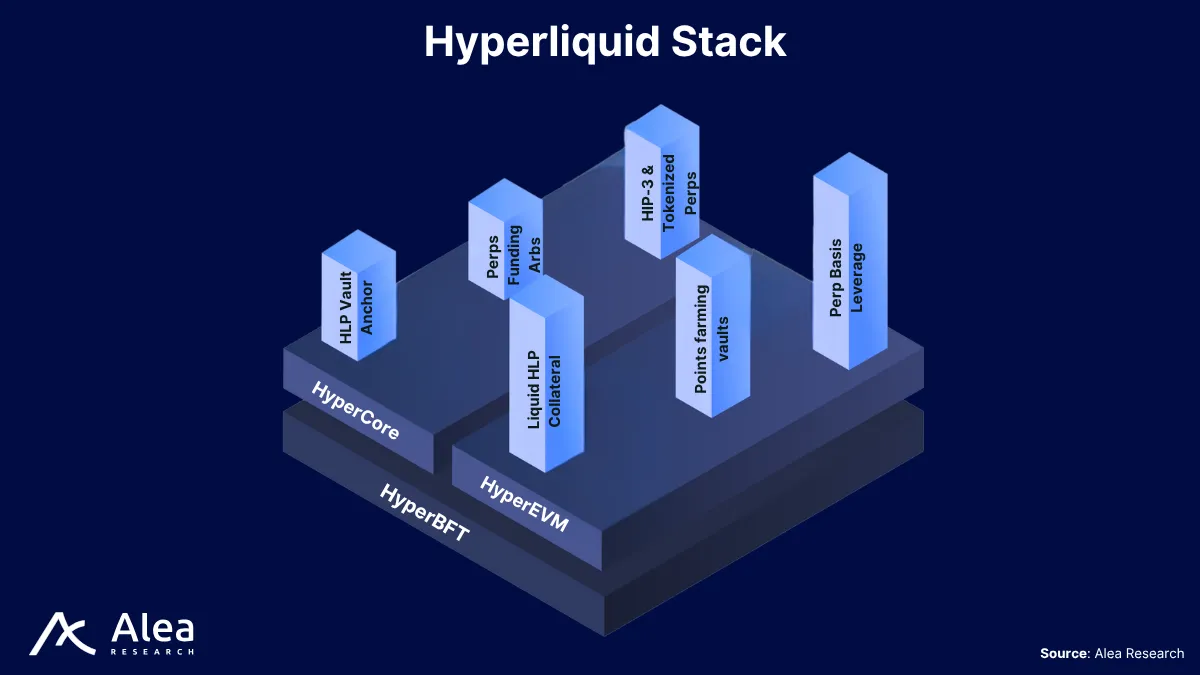

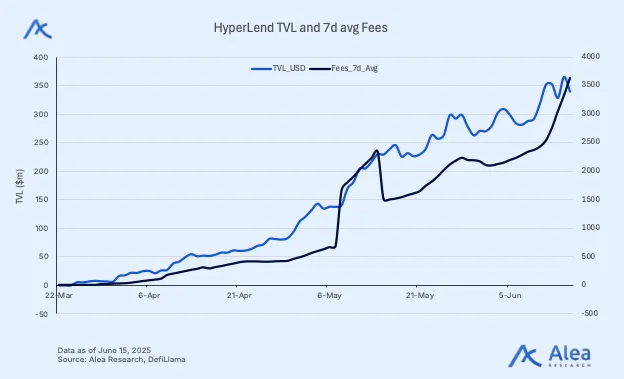

While EVM-based protocols can port their codebases without changes, yield aggregation requires more than just static smart contract code in order to seize the opportunity of a specific ecosystem. Custom-built native protocols that take advantage of Hyperliquid’s dual architecture—HyperCore order-book plus HyperEVM smart contract layer—capture yield mechanics that simple EVM ports leave on the table.

In addition to finding yield opportunities for HYPE, the HLP vault could become the benchmark as the ecosystem’s “risk-free” rate earning trading fees, funding and liquidation proceeds denominated in USD. Because HLP capitalizes on Hyperliquid’s trading volume, this offers an uncorrelated source of yield with respect to DeFi on Ethereum. The key constraint has been composability, but the HyperEVM fixes this. For instance, HyperLend is positioned to unlock that idle collateral. The lending market already accepts yield-bearing receipts such as sUSDe or stHYPE, and the team will be enabling a liquid HLP wrapper. That will allow HLP depositors to borrow against their market-making stake, and use the newly unlocked capital to chase other opportunities.

Low-hanging fruit also includes the tokenization of market-making vaults or delta neutral funding-rate strategies like Ethena. Similarly, as more protocols deploy and the ecosystem starts to grow, points-maximizer vaults become more appealing by capturing airdrops from a large number of HyperEVM-native protocols.

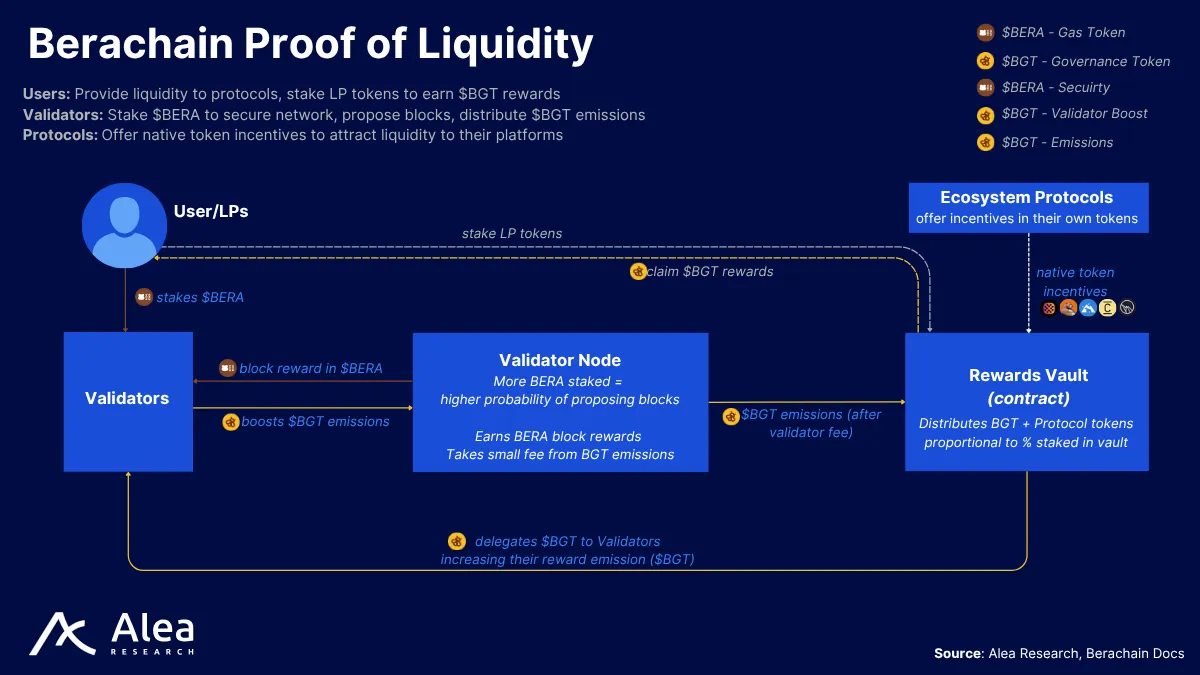

Berachain’s PoL

The Berachain ecosystem revolves around Proof-of-Liquidity (PoL), which unlocks opportunities not available in other chains. Building a protocol specifically to capture this mechanism design is the way to carve a niche and find staying power within the ecosystem. Because PoL rewards accrue to liquidity positions, yields stack in ways rare elsewhere. This deep integration raises a barrier to generic EVM code. Yearn’s decision to incubate a native sub-DAO (Bearn) instead of porting its vaults illustrates the implicit cost.

Berachain’s PoL funnels block rewards in BGT to addresses that provide and lock liquidity rather than to passive stakers. Protocols that aggregate liquidity flows and stake their LP tokens inside Berachain Reward Vaults stand to collect swap fees and streams of BGT reward emissions. These tokens can then be delegated to validators, unlocking yet another opportunity: liquid staking. This base staking income plus delegation bribes creates the BGT wars that a yield aggregator could systematize.

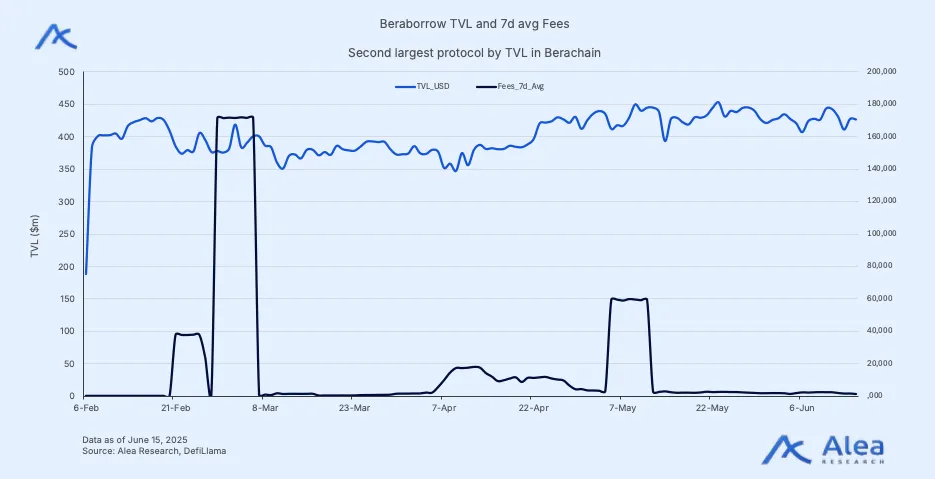

While liquid wrappers for BGT are an obvious use case, it’s important not to underestimate the composability benefits. For instance, the Nectar stablecoin (NECT) lets users mint against iBGT while the collateral’s yield covers the loan’s cost. Beraborrow also simplifies leverage strategies and looping with additional benefits such as supporting LP tokens as collateral.

While nascent, this is an ecosystem that stands out because of its diversity and deep liquidity thanks to PoL, hosting a broad range of protocols from classic auto-compounders to structured products or BGT-centric flywheels leveraging PoL’s emissions. It has also attracted notable asset managers that are also active on other EVM chains, like Veda or Concrete.

Royco’s Pre-Deposit Vaults

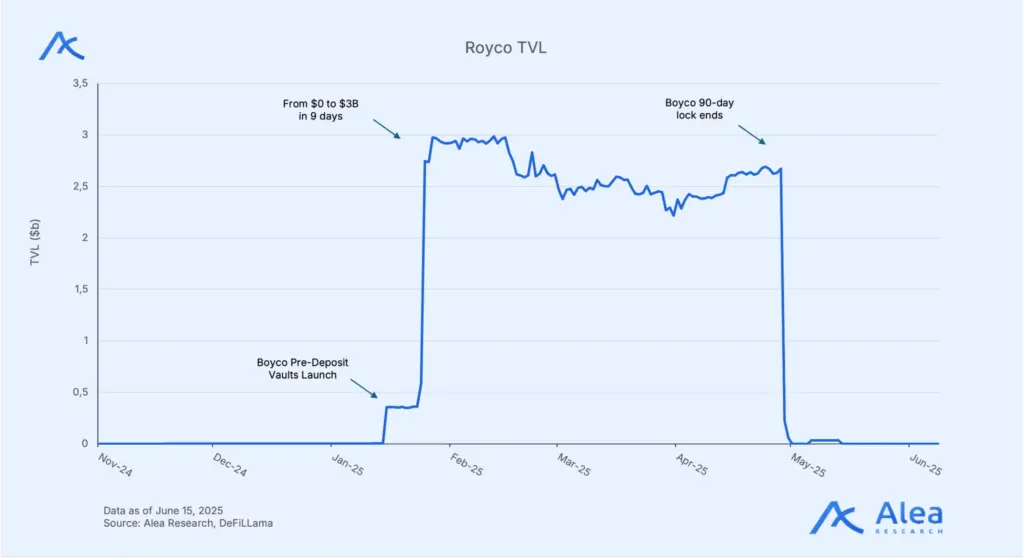

Early-stage chains with immature ecosystems and few dApps suffer a classic cold-start loop: low liquidity deters users, yet users are needed to attract liquidity. Royco is an example of a protocol that seized that opportunity and now has a first-mover advantage in the Pre-Deposit Vaults space. We expect this primitive to become increasingly relevant for upcoming L1 and L2s.

Pre-Deposit Vaults let LPs commit capital before a chain is live, providing an ecosystem with the guarantee of capital availability from day one. The best example of this practice was Royco aggregating roughly $3 billion in committed TVL ahead of Berachain’s mainnet, guaranteeing deep pools the moment the chain went live. Even if capital flies away after a lock period with incentives expires, the primitive still shows how fast capital migrates when a superior bootstrapping mechanic appears.

More than just Pre-Deposits Vaults, Royco is a marketplace for incentives: protocols can provide incentives by posting bids, and LPs can negotiate deal terms with asks. This helps protocols not to overshoot incentives and empowers LPs with the ability to negotiate deal terms that would otherwise happen behind closed doors and without them having any input whatsoever.

Furthermore, many asset management protocols are likely to be issuing a token in the near future. One way for them to bootstrap their TVL is via their own Incentives Market in Royco. That allows them to post their emissions and let LPs negotiate, replacing blunt liquidity mining with pay-what-the-market-demands pricing.

Without a live token (or announced plans) yet, Royco is a protocol to keep a close eye on. Both Pre-Deposit Vaults and Incentive Marketplaces are enablers for the Yield Stack Thesis to evolve the narrative from “find the highest APR” to “negotiate, execute, and prove best-price across chains in one transaction.”

Turtle’s Distribution Layer

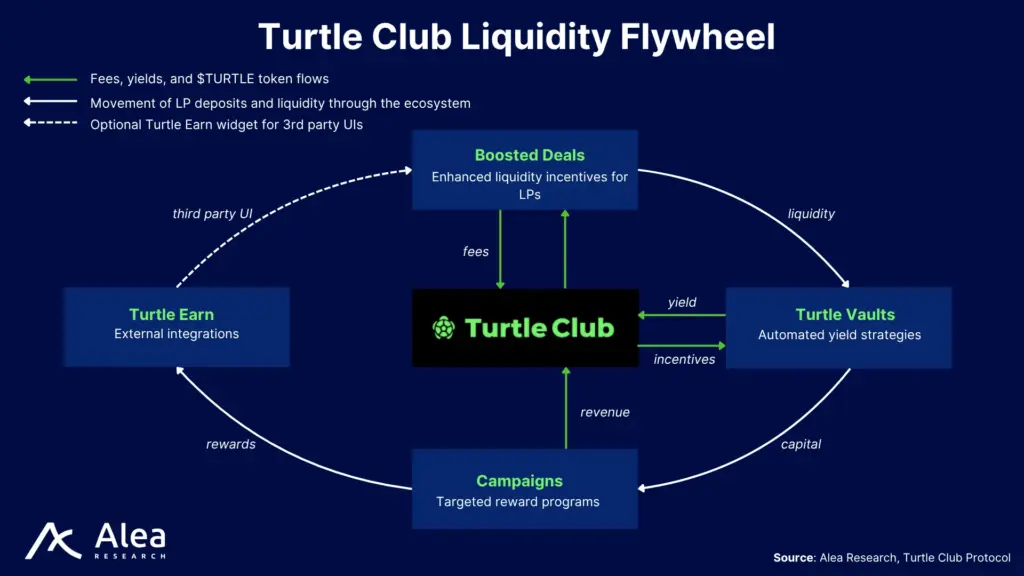

Turtle Club shows how a protocol can become ubiquitous across DeFi by monetizing coordination and aligning incentives between LPs and protocols. Unlike other protocols helping users to capture yield opportunities, Turtle’s ambition is to become the default add-on for protocols to extend their distribution layer and match them with strategic depositors. This is achieved by ingraining itself into the token distribution strategy of other projects, turning fragmented yield opportunities into a single deal flow and improving capital-deployment efficiency across the stack.

- Partner Protocols open “Boosted Deals” or vault campaigns and pledge 5-50 % of extra token emissions to Turtle’s treasury in exchange for LP flow.

- Liquidity Providers (LPs) supply capital to partner protocols and earn native rewards plus boosted rewards later redeemed from the $TURTLE treasury.

- Turtle DAO accumulates retained earnings from protocol boosts to eventually distribute the value to $TURTLE holders.

For a new DeFi project, working with Turtle is attractive because Turtle brings a ready user base and a proven mechanism to attract liquidity. For Turtle, every new partner increases its value proposition to users (more places to earn boosts) and expands its treasury (via the partner’s contributed rewards). This aggregated wallet flow gives Turtle a “DeFi ad-tech” angle: campaigns can be tuned to wallets with the highest marginal propensity to deposit.

Essentially, Turtle Club operates as an onchain Group Purchasing Organization (GPO) for DeFi liquidity: users sign a one-time wallet message to join, then earn higher rewards that Turtle Club’s BD team has pre-negotiated with protocols. The club aggregates buying power and market knowledge, setting the terms and matching each protocol with the funds most likely to supply TVL. This removes the need for founders to cold-pitch investors with one-pagers, cuts weeks of distraction, and ensures depositors interact with protocols exactly as before but with boosted yields. Membership is free; Turtle Club’s revenue comes solely from the incremental reward spread it secures.

Investable Opportunities

Protocols that endure and dominate in market share follow a core playbook: uncompromising security, modular design that lets strategists ship fast, and infrastructure that scales without leaking yield at size. Capital sticks to platforms that build Lindy and keep performance intact when large flows arrive. Trust, resilience, and curator diversity sit at the top of the scorecard, followed by strategy breadth, speed to market, and cost discipline. We picked a series of diverse protocols in this vertical as case studies that expose different edges. Even if battling for the same capital, each of them comes with their own peculiarities and exemplifies how cloning Yearn and lowering fees is not enough. The idea is to analyze each protocol’s strategy from different angles so each lens reveals how their future governance token value may or may not be able to keep up with protocol growth.

To capitalize on the success of these protocols on liquid markets, carefully evaluating their token design is non-negotiable. Without clear utility and a pathway for protocol revenue to reach the token, AUMs and fee growth is predominantly noise. Investors must trace protocol utility that drives demand, as well as value capture and accrual to holders. Protocols that recycle fees into buybacks or staking dividends are expected to trade at richer multiples than peers whose tokens are governance stubs. Liquidity is likely to leak when this pipeline is broken. The key question to answer is: how deliberately do tokenomics convert operating success into holder upside?

To be successful, tokens must align every actor’s incentives—asset managers, institutional LPs, token holders, DAO treasury—while scaling TVL and AUM from zero to billions without reflexive sell pressure. For instance, it is undesirable to have asset managers allocating capital provided by others without them having skin in the game when things go wrong but clipping fees otherwise. For instance, protocols may want to have those managers post a bond that is slashed when losses go beyond a preset VaR trigger. Similarly, supply discipline is non-negotiable to set clear expectations and prevent stealth dilution from inflation.

Protocol fees allocated to the DAO should be routed adaptively. In the bootstrap phase the expectation is that most revenue recycles into liquidity and user incentives to hit depth and stickiness targets. As TVL scales up, the split tilts toward direct distributions to stakers or buybacks that compress free float. Governance should also be proactive and not get stuck in politicized debates every market cycle.

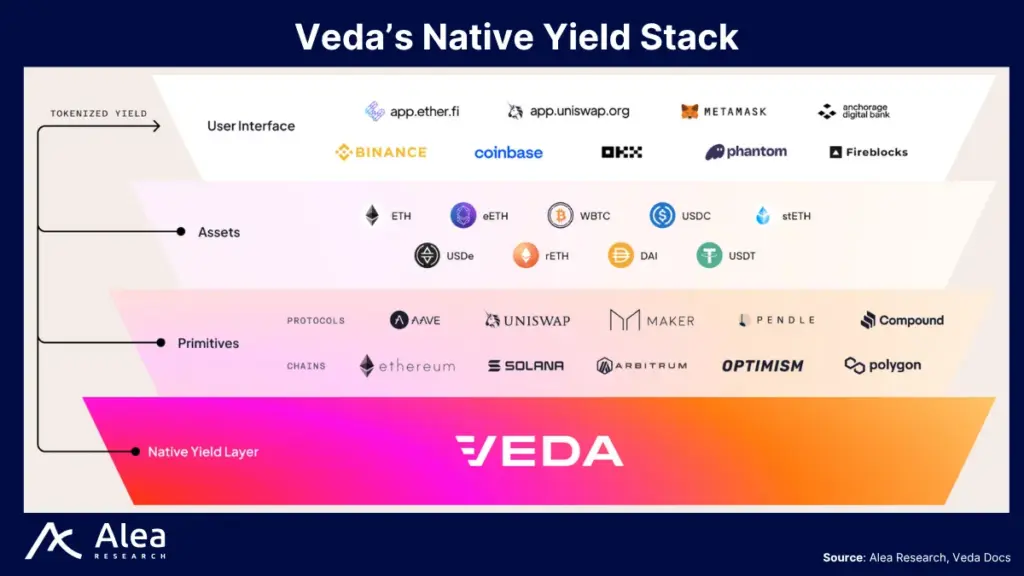

Veda

Veda is a proponent of the “invisible yield” thesis: by default, wallets, exchanges, L1s, L2s, etc should hold assets where yield accrues passively without user intervention. The mission is to make DeFi yields accessible by abstracting away complexity and embedding yield generation directly into user experiences.

- Black-box yield engine: The strategy layer is a sealed “black box,” swappable between human quants, discretionary managers, or autonomous AI agents without touching the vault.

- Onchain risk guardrails: Merkle-verified caps on assets, protocols, and leverage give provable capital protection.

- Modular, upgrade-friendly stack: Vault core plus swappable modules let Veda onboard new assets or integrate new protocols in days instead of weeks.

- Unified crosschain execution: OmniYield routes one vault’s liquidity to multiple chains, seamlessly earning from opportunities available elsewhere at once.

The protocol positions itself as a backend yield service. Similar to how Blast pioneered the concept of “native yield” by auto-staking, Veda embeds strategy yield directly into user experiences. With a “native yield” stack, Veda sits at the base as an infrastructure layer that tokenizes yield and connects to other chains, exchanges, or DeFi primitives to make every asset yield-bearing.

Today, Veda stands out as the largest protocol offering yield-as-a-service to partners that range from L1s and L2s to asset issuers or wallet providers. The business model operates like Stripe for crypto yield: monetizing by skimming a fee on yield earnings and licensing its infra to large partners. For instance, consider a wallet provider partnering with Veda to offer their users extra yield on their assets. This creates a win-win scenario where users earn on idle tokens, increasing loyalty and stickiness, while the wallet earns recurring revenue from a fee that is split with Veda. With zero balance-sheet risk for the wallet provider, Veda gains distribution and AUM, creating a mutually reinforcing loop of higher yield, higher retention and higher fees.

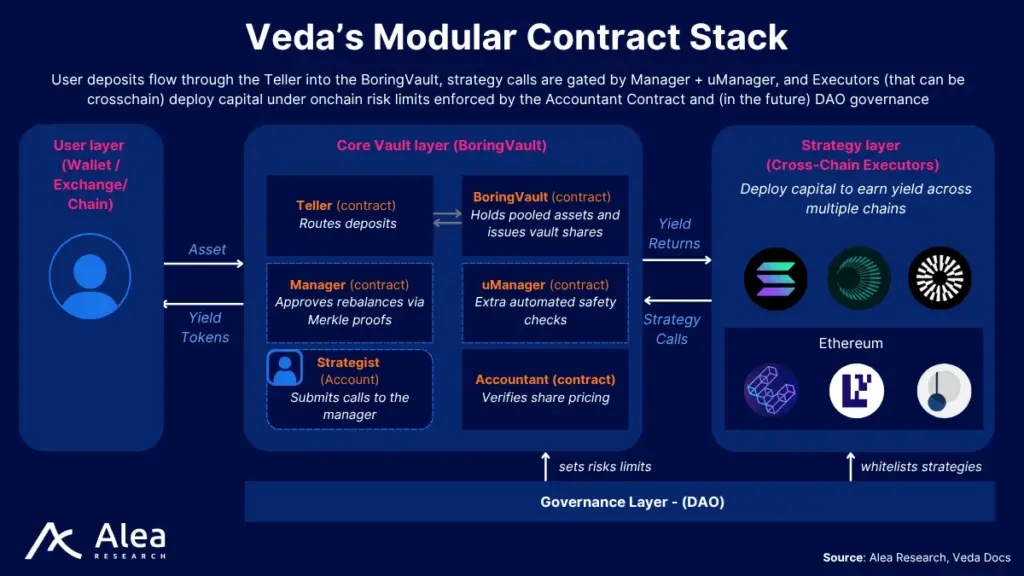

Veda stays adaptable and relevant by design: it was built from the ground up as a modular, extensible yield infrastructure. Instead of building a factory for deploying and hosting a series of vaults, Veda’s approach is fundamentally different. The foresight comes from the experience of the founding team, Seven Seas, running strategies for the Sommelier Cosmos-based appchain for yield aggregation. Cutting their teeth building and rebalancing strategies, they discovered first-hand how brittle one-off integrations and monolithic vault designs can be. Those lessons drove them to engineer Veda around the minimalist BoringVault for holding and rebalancing assets, a Manager contract for orchestrating strategy execution via Merkle-proof authorization, a Teller for user deposit/withdrawal interactions, and more.

The protocol capability is instantiated as a “black-box” framework that lets any authorized strategist—or even an AI agent—push yield-seeking rebalances into the BoringVault while keeping the strategy logic itself offchain, opaque and upgradeable. Every transaction is forced through the Manager’s Merkle-proof whitelist and optional uManager safety scripts, which impose hard limits on assets, leverage, and slippage. This ability to isolate strategy code from the actual vault holding the assets allows Veda to plug in new protocols, chains, and strategies extremely fast while still ensuring that those changes don’t violate deterministic onchain-enforced guardrails.

Veda’s architecture is also crosschain; capable of deploying capital across multiple networks from a single vault. An offchain oracle aggregates opportunities from multiple ecosystems while abstracting the bridging and multichain strategy execution. There is a vault on Ethereum and the Manager contract dispatches rebalances to remote executors, while vault shares stay on mainnet, unifying liquidity that would otherwise be fragmented. This lets users earn “multichain yield” from a single deposit, gives strategists a larger capital base to deploy, and lets partner apps tap one pooled treasury instead of maintaining chain-specific vaults.

Veda is currently running a points system that has been ongoing for almost a year. A DAO is expected to be introduced soon to offload the centralization and trust currently placed in Seven Seas as the main strategist. A token launch should be coupled with a deliberate initiative to convert Veda’s growing multi-asset fee stream into non-dilutive income. The indispensability of the token could be made explicit with mechanisms such as i) onboarding more strategists and curators that must bond VEDA as slashing collateral in order to manage assets, ii) staking to govern vault listings and set risk limits as well as earning a portion of the fee income, or iii) buybacks that ensure a permanent demand sink that grows with TVL.

Upshift

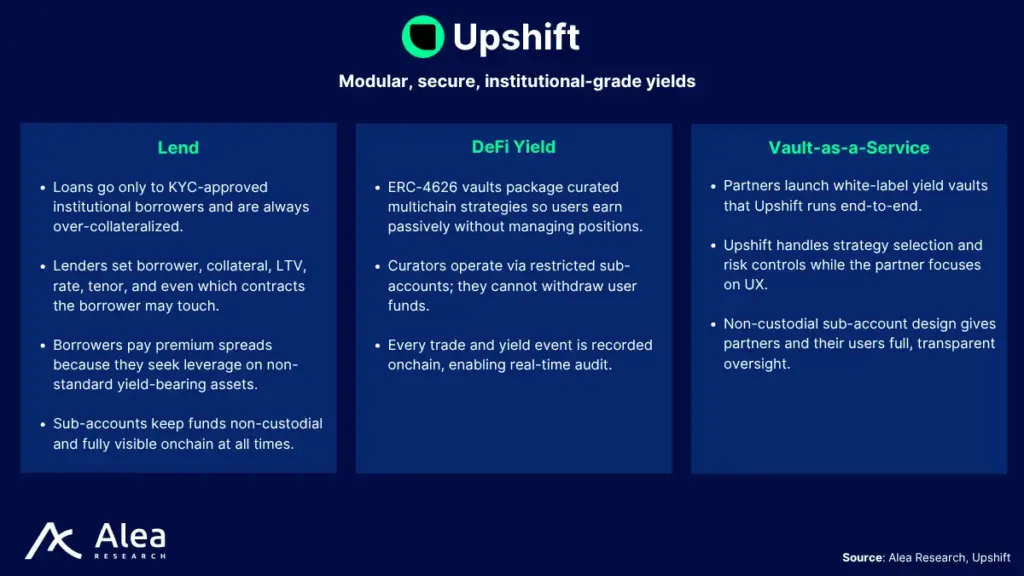

Powered by the prime broker August, Upshift democratizes institutional-grade yield opportunities. August provides the core infrastructure; Upshift packages it into permissionless vaults.

The thesis driving Upshift is that yield can be the “Trojan Horse” for onboarding masses and traditional assets onchain. Powered by August’s battle-tested infrastructure, Upshift offers a marketplace for strategy curators to expose managed ERC4626 vaults where users deposit and the capital is deployed into various DeFi strategies by approved institutional curators behind the scenes.

Some clients of August even deposit into Upshift vaults instead of running their own strategies. This is an example of operational simplicity outweighing direct oversight and full control. Upshift sits one layer above that infrastructure, repackaging the same tooling into permissionless, audited vaults that automate sophisticated yield and hedging strategies.

In practice, August gives funds direct, bespoke access to liquidity and leverage, while Upshift offers the same clients—and any wallet address—a turnkey “one-click” product set that leverages August’s risk controls and composability. The two platforms therefore form a vertically integrated stack: August supplies institutional-grade infrastructure; Upshift commercializes it in easily consumable yield vehicles.

With Upshift we start to see a recurrent theme where protocols are carving their own niche embedding yield infrastructure. Similar to Veda’s Liquid Vaults for EtherFi or Pre-Deposit Vaults for Plasma, Upshift competes by offering Vaults-as-a-Service to asset issuers, wallets, or fintech apps. Partners gain instant, non-custodial yield products that raise retention and liquidity efficiency out of the box; Upshift enlarges its vault marketplace and liquidity; and users enjoy one-click access to curated strategies, keep custody of their assets, and avoid the gas, bridging, and strategy churn that normally blocks mainstream adoption. Every integration drives more deposits and fee revenue, and raises the switching cost for future competitors.

The protocol is currently ongoing a milestone-based points system with a multiplier that encourages deposits until the $750 million TVL target is reached. Converting those points into a token would open up the doors for holders to govern protocol parameters or earn a share of the performance/management fees charged by the platform. A mandatory bond could be enforced for onboarding external curators as well.

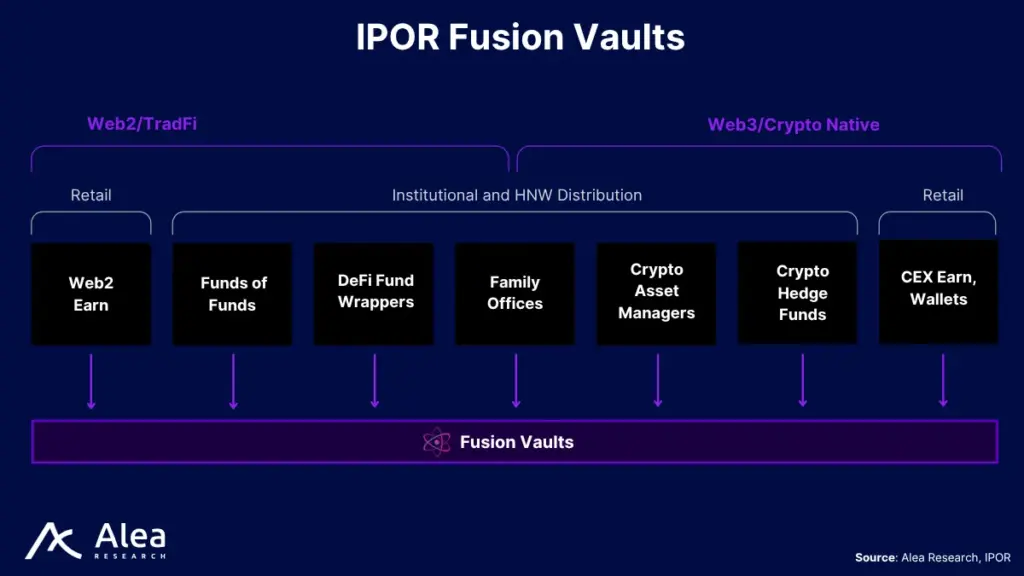

Ipor Fusion

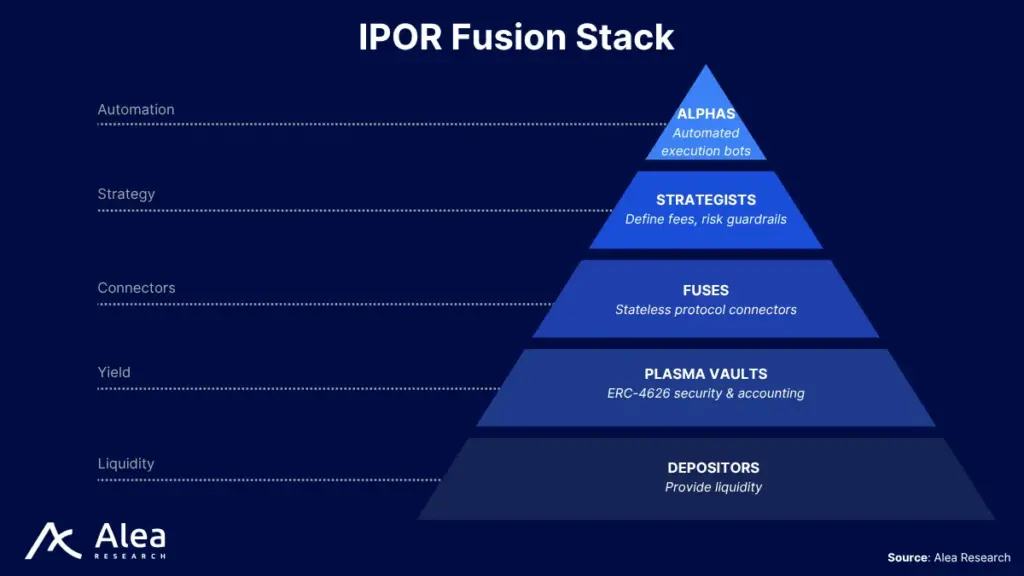

Originally an onchain interest rate swaps protocol, IPOR has now opened its vault architecture to the public. This was one of the first protocols to realize that collateral sitting idle was an untapped profit centre. Rather than let LP capital and trader collateral languish, the protocol built a module that would route assets into money markets to earn yield while traders waited for their positions to be closed. That insight evolved into a full upgrade—IPOR Fusion—where the same optimization engine is now offered through ERC4626 vaults.

What differentiates IPOR Fusion is the design decision to atomize every onchain move—depositing collateral, borrowing, leverage-looping, hedging—into simple, stateless “fuses.” Each fuse is nothing more than a single-purpose conduit (technically referred to as connector or adapter) that knows how to interact with one external venue and holds no balances of its own (the vault does).

Depositors supply a single asset to the vault and start earning yield. They have no active duties but can monitor every allocation transparently onchain.

Plasma Vaults are the ERC4626 vaults that hold user deposits and enforce strategy rules

Strategists configure vaults:

- Decide the base asset

- Define the risk guardrails

- Set the fees

- Whitelist the strategies

Alphas run offchain logic and automate onchain execution to run the strategies

- Monitor market rates, gas costs, and risk events

- Call vault functions to rebalance, open/close hedges, or unwind positions under emergency conditions

- Cannot redirect funds to non-whitelisted strategies

Fuses are the conduits through which assets flow. They are stateless non-upgradeable contracts with no internal balances and their sole function is to connect vaults to external protocols

Strategists snap Lego-like adapters into Plasma Vaults to build flexible strategies while an offchain Alpha bot routes funds through the fuse mix with the best current risk-adjusted return. The result is a yield engine that treats liquidity as a programmable flow, able to hop between protocols in real-time, yet always within the hard guardrails codified in the vault.

IPOR Fusion is the closest to a build-your-own fund kit: launch a vault, pick the asset, set fees and risk limits, plug in only the protocol adapters you trust, and you’re ready to take deposits, deploy capital, and start charging fees. Because each adapter (“fuse”) is a detachable, stateless link to an external venue, you can swap tactics or add new ones anytime without touching the core. That makes it trivial for anyone—from solo quants to DAOs—to roll out a strategy tailored exactly to their rules while keeping every guardrail enforced and transparent onchain.

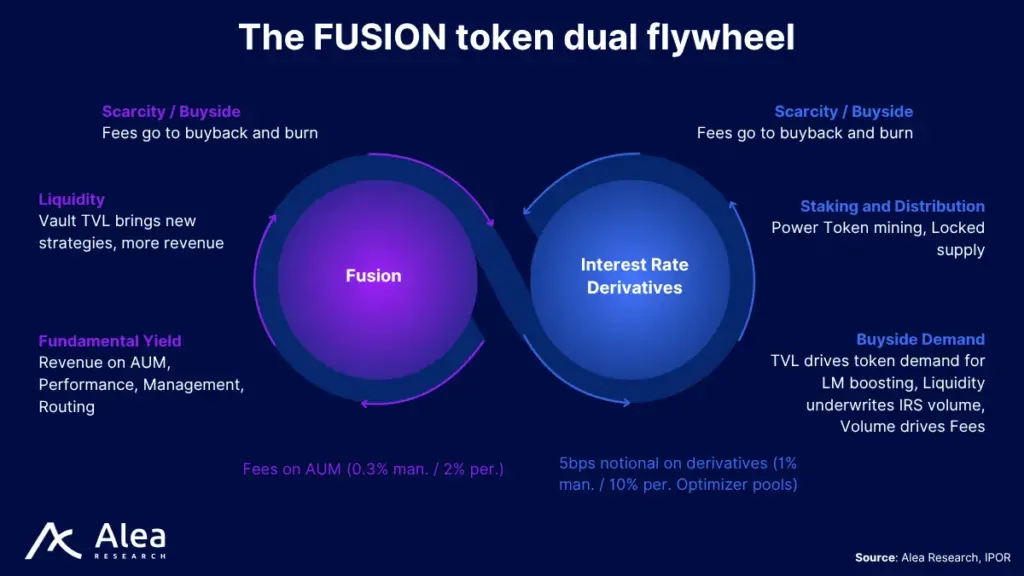

A competitive advantage comes with the integration of IPOR’s interest rate swaps: the same platform that stitches fragmented lending venues into a single yield-routing layer also embeds its own interest rate swap engine. Strategists can therefore arbitrage rate dislocations and instantly hedge variable borrow costs inside one permissionless stack, turning volatile floating yields into predictable fixed coupons.

FUSN will be launching with a hard-capped 100 M supply, inherited 1:1 from the legacy IPOR token. The expectation is that as Fusion vaults TVL and interest swap volumes rise, the portion of the fees allocated to the DAO would be used for buybacks that either improve token liquidity on DEXs or remove circulating tokens. Preliminary discussions also involve token utility for fee discounts and liquidity mining boosts.

The DAO currently holds a large portion of the token supply and new funding rounds may be announced involving token sales. Other tailwinds would include strategic partnerships while the DAO continues to onboard a growing number of asset managers (Clearstar, Tau Labs, etc) and protocols (Harvest Finance, Reservoir, Falcon USD, etc).

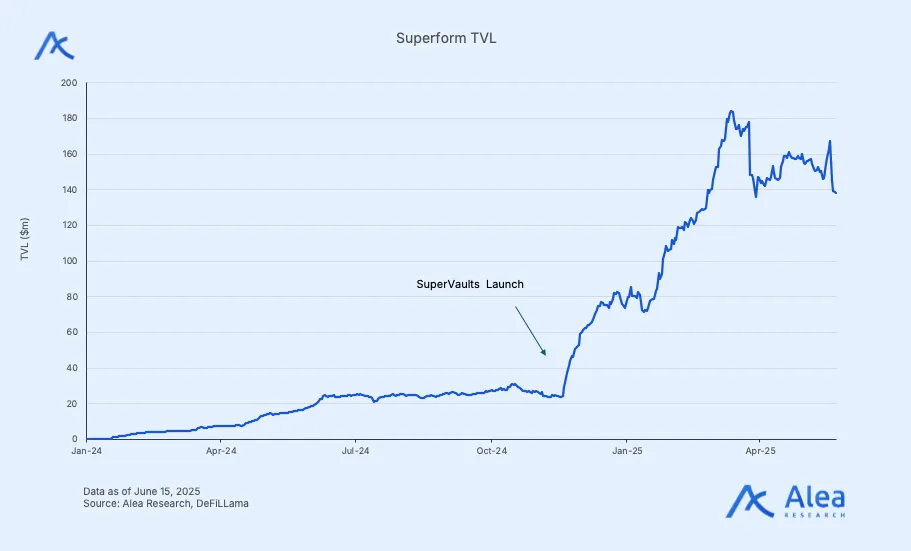

Superform

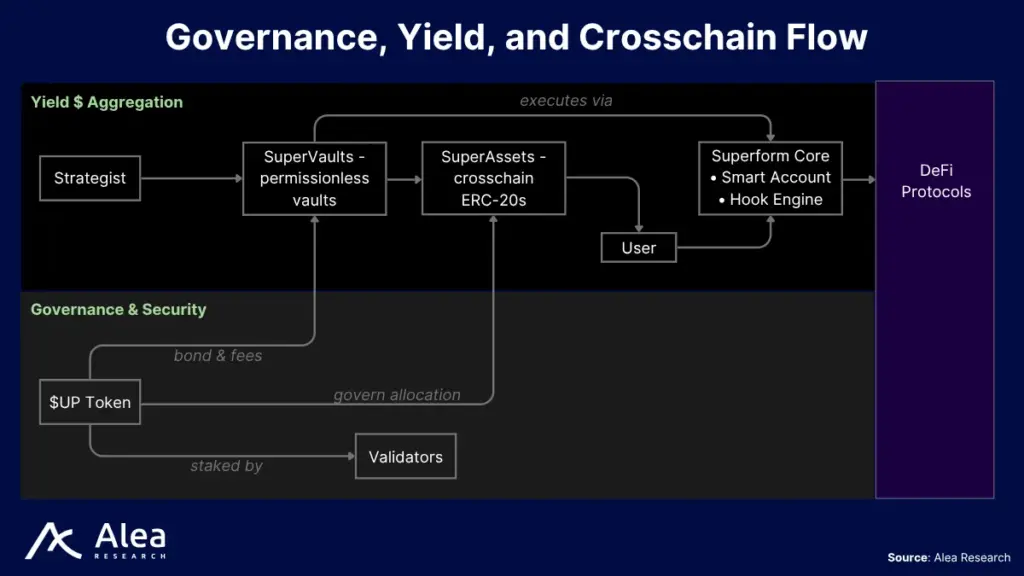

Superform is a “universal yield marketplace” and distribution platform for ERC4626 vaults. Vaults can be listed permissionlessly and users can deposit with any asset from any chain. This unified crosschain access is enhanced with access to aggregation Superform vaults.

From a technical standpoint, the protocol is a suite of smart contracts that serve as a central yield repository and intent-based transaction router for moving assets across chains in a single transaction. The architecture of v2 represents a notable upgrade over the previous version. While v1 proved that earning crosschain yield was possible, the new protocol upgrade introduces smart accounts with the ambition to remove friction and reach a broader market of users while improving the developer experience for strategists.

ERC-7579 smart accounts let any EOA or pass-key login sign one intent, behind which Superform bundles every required bridge, swap, lend, or stake step into an atomic, Merkle-verified execution flow. This collapses what used to be multiple transactions into a single signature and receipt. In addition to that, the platform will replace bespoke developer integrations with a hook engine to orchestrate permissionless single-purpose modules (bridge, swap, lend, stake, KYC check, etc) that can be chained together and validated onchain.

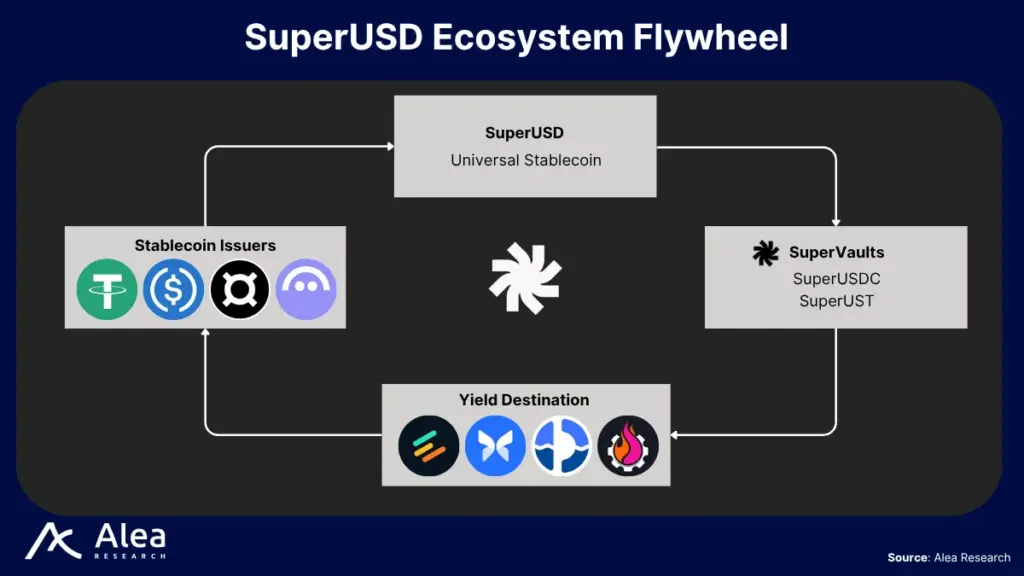

On the product side, the motivation is to package durable, diversified yield strategies for mainstream capital. SuperVaults break the “vault trilemma” by splitting logic, custody, and escrow, allowing fully onchain yet flexible strategies. SuperAssets, like SuperUSD, roll many SuperVault positions into a single ERC20 that continuously rebalances, enforces circuit-breakers, and streams multichain yield back to users, turning complex yield management into a one-click savings token.

Finally, v2 introduces the yet-to-be-launched UP token as a coordination asset: strategists must burn it for vault upkeep, validators bond it for accountability, and stakers (sUP) steer parameters such as fee caps, circuit-breaker thresholds, and SuperAsset weights.

| User Benefits | Strategist Benefits | Chains and Issuer Benefits |

| One-click, crosschain yield (SuperAssets) | Permissionless launch of vaults-as-a-service (SuperVaults) to launch strategies and earn fees | Spin up a vault or create a SuperAsset to boots

trap liquidity from day one |

| Gas-abstracted smart accounts with social recovery and passkey authentication (ERC-7579) | Hook engine + SuperBundler = one signature for any multichain workflow | Stake sUP to influence SuperAsset allocation and bootstrap TVL |

| All actions routed through a single, Merkle-verified flow | Instant distribution via SuperAssets and access to mainnet liquidity | Sticky liquidity as incentives flow through the broader Superform basket |

Token utility and demand will come from mandatory UP burns for price-per-share updates and bonding to secure data feeds, while emissions and unlock schedules remain unconfirmed. A portion of the fees could be swapped to buy UP, but this value capture remains unguaranteed. At the beginning the validator set is likely to be thin, but this is expected to change as the protocol engages in progressive decentralization and the economic security increases with more UP bonded and automated slashing.

Conclusion

Modular yield stacks stand as the only architecture that can satisfy institutional requirements for transparency, risk limits, and capital efficiency. Sophisticated desks won’t route capital through opaque engines even if yields are higher; they are willing to pay a premium for Lindy, trust, transparency, and security.

Modular yield remains multi-winner because each ecosystem prizes different edges, yet distribution tilts winner-take-most. Wallets and embedded-yield super-apps are becoming the default entry point for consumers. For allocators, position sizing should migrate from raw TVL heuristics to favor those protocols offering real-time risk monitoring, customization of the stack, automation and circuit-breakers, and standardized reporting.

Protocols and asset issuers should own at least one layer—vault factory, strategy engine, or distribution rail—then plug permissionlessly into the rest. SDKs and no-code rails that cut deployment time from weeks to hours convert first-mover alpha into a durable release-velocity moat.

On the liquid market, when estimating the fair value of yet-to-launch tokens, assess whether fee capture is structural; supply, unlock, and emission schedules keep fully diluted value within plausible convergence to protocol cash flow; token utility is indispensable to core functions such as strategy whitelisting, manager accountability, or execution rights; and governance design gives holders power over fee switches.

References

Cousaert, S., Xu, J., & Matsui, T. (2022). SoK: Yield Aggregators in DeFi.

DeFiLlama. Onchain Capital Allocator Protocols Overview.

DeFiLlama. Yield Aggregator Protocols Overview.

DeFiLlama. Yield Protocols Overview.

ERC-4626.info. ERC-4626 Vault Standard Information Portal.

Fireblocks. What is Institutional DeFi?

Hyperliquid. Hyperliquid Documentation.

IPOR. IPOR Fusion Documentation.

Ramos, C. PoL for Developers: Reward Vaults Explained. Berachain Blog.

Sommelier. Sommelier Documentation.

Superform. Superform Documentation.

Superform. Superform’s Official Mirror Blog.

Superform. Superform: Redefining Access to Yield. Mirror.

Superform. (2025). Superform V2 Whitepaper.

Sygnum. (2025). Institutional DeFi in 2025: The Disconnect Between Infrastructure and Allocation.

The Edge Podcast – August & Upshift. Why DeFi’s Next Trillion Will Come From Institutions.

Turtle Club. Turtle Club Documentation.

Upshift. Upshift Documentation.

VEDA. (2024). Introducing VEDA.

Yearn Finance. Yearn Finance Documentation.

Yearn Governance. YIP-82: The BIP-YIP (bEarn Finance).

Disclosures

This report is provided by Alea Research for informational purposes only and does not constitute investment, legal, accounting, or tax advice.

The analysis herein reflects Alea’s views as of the publication date and is subject to change without notice. All data are drawn from sources believed to be reliable; however, Alea makes no representation or warranty, express or implied, as to the accuracy, completeness, or timeliness of the information.

Forward-looking statements, projections, and scenario analyses are inherently uncertain and may differ materially from actual results; past performance is not indicative of future outcomes.

Alea, its affiliates, employees, and contributors may hold positions—long or short—in digital assets, tokens, or securities discussed and may trade them for their own account.

No part of this report may be reproduced, redistributed, or posted on any public or private website without prior written consent from Alea. By reading this report, you agree that Alea shall not be liable for any direct or indirect loss arising from any use of the information contained herein.