Bitcoin’s ownership distribution is changing, concentrating at the top. As wealthier holders, ETFs, corporate treasuries, and even nations reshape BTC’s supply dynamics, Threshold is adapting to align its value proposition with the highest institutional standards without sacrificing utility or accessibility.

Spot BTC ETFs have grown fast, now holding ~800k+ BTC with single‑issuer AUM in the ~$90–100B range. Those passive flows, however, are simply warehoused under qualified custody. TradFi-inspired vehicles simply deliver price exposure—the inventory is secure but static. Threshold enhances BTC’s utility, making it redeemable, collateral-ready, yield-bearing, and DeFi-composable across chains.

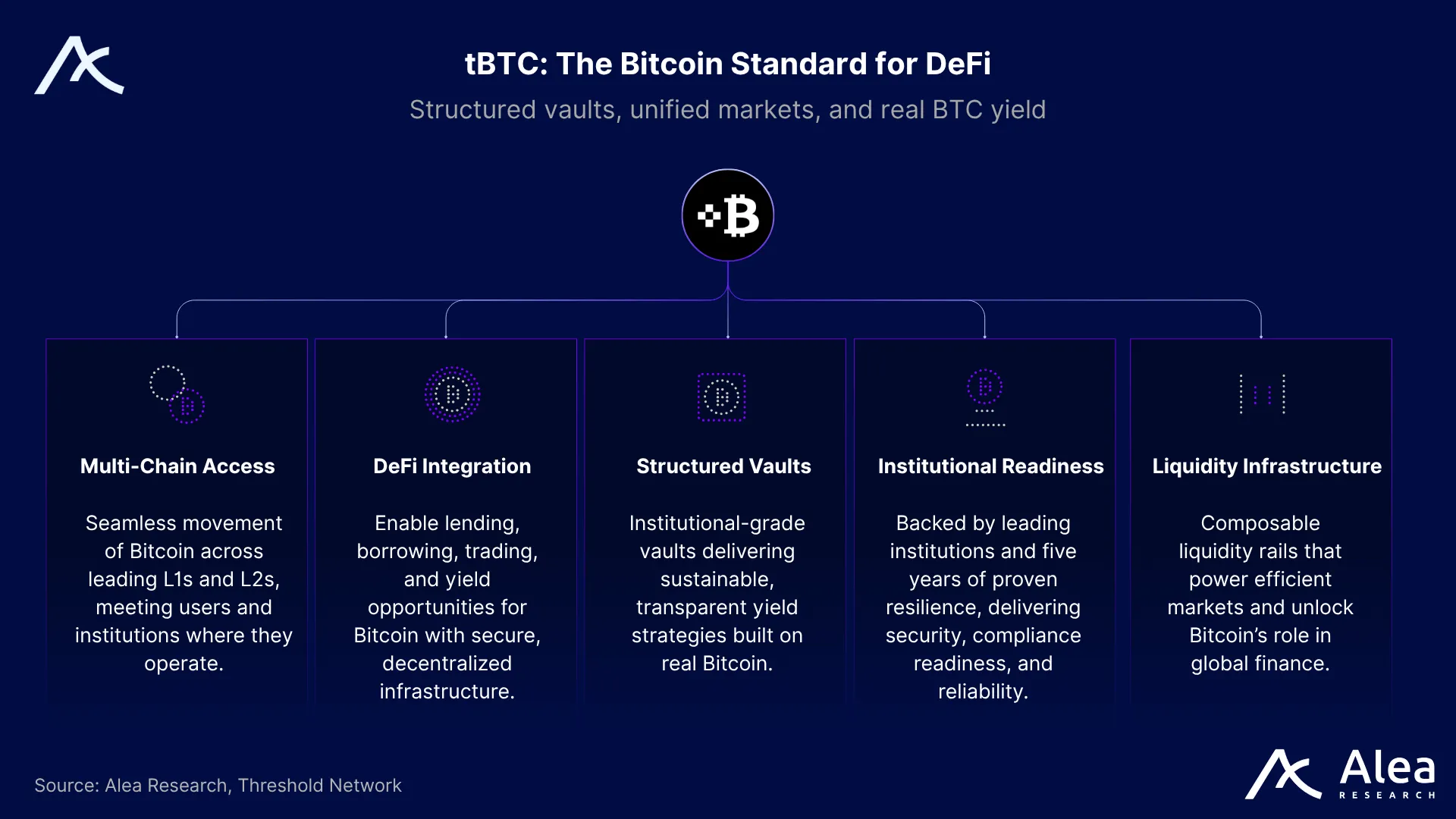

Compliant standards and onchain programmability can coexist; institutional-grade doesn’t preclude utility. Threshold’s tBTC is the leading, trust-minimized BTC wrapper with a threshold-signer model that removes the single-party custody risk of other wrappers. With gasless minting to target venues, native redemptions back to Bitcoin mainnet, and instant deployment into vetted strategies across chains, Threshold aims to become BTC’s institutional bridge—trustless BTC in, programmable transparent collateral out.

Institutions optimize for reliability; individual users for simplicity. Both benefit from BTC’s static price exposure and programmable utility. Threshold’s ambition is to make BTC-to-DeFi flows effortless and bulletproof—mint once, deploy across strategies and chains, and redeem back to mainnet without trusted counterparties, intermediaries, or hidden steps.

Key Takeaways

- Institutional bridge, trustless rails: tBTC turns idle BTC into programmable collateral with gasless minting, native mainnet redemption, and no single-point-of-failure centralization vector.

- Wrappers without trusted intermediaries: Unlike centralized solutions, Threshold mitigates single-custodian risk via 51-of-100 signers. Threshold signatures remove solvency and censorship risk.

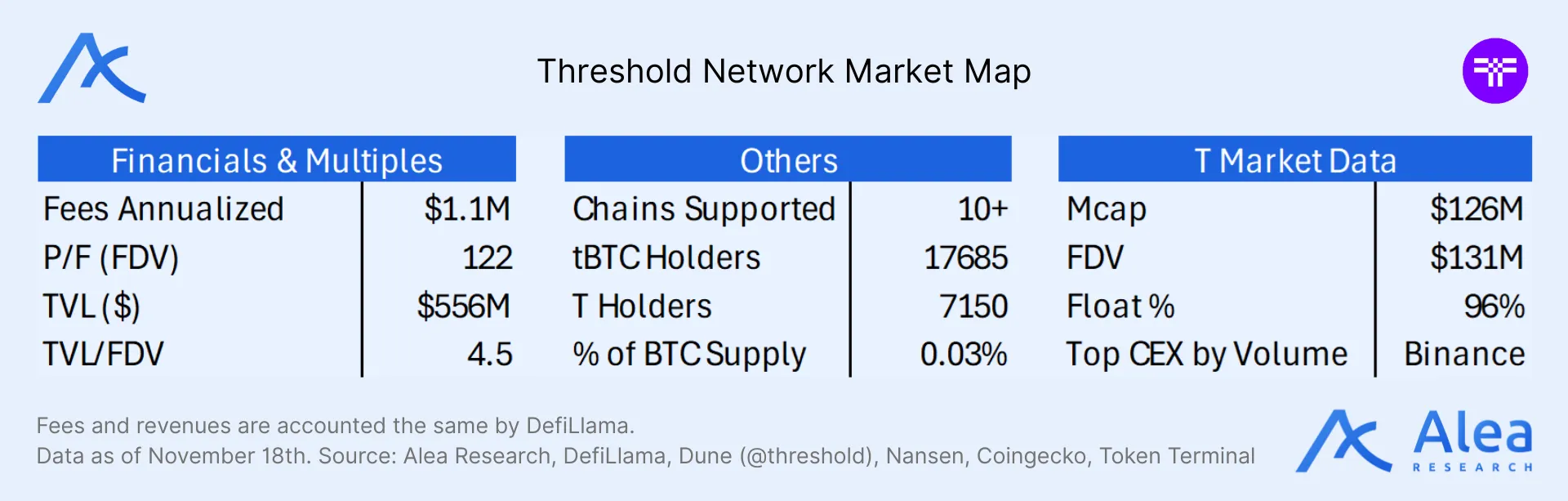

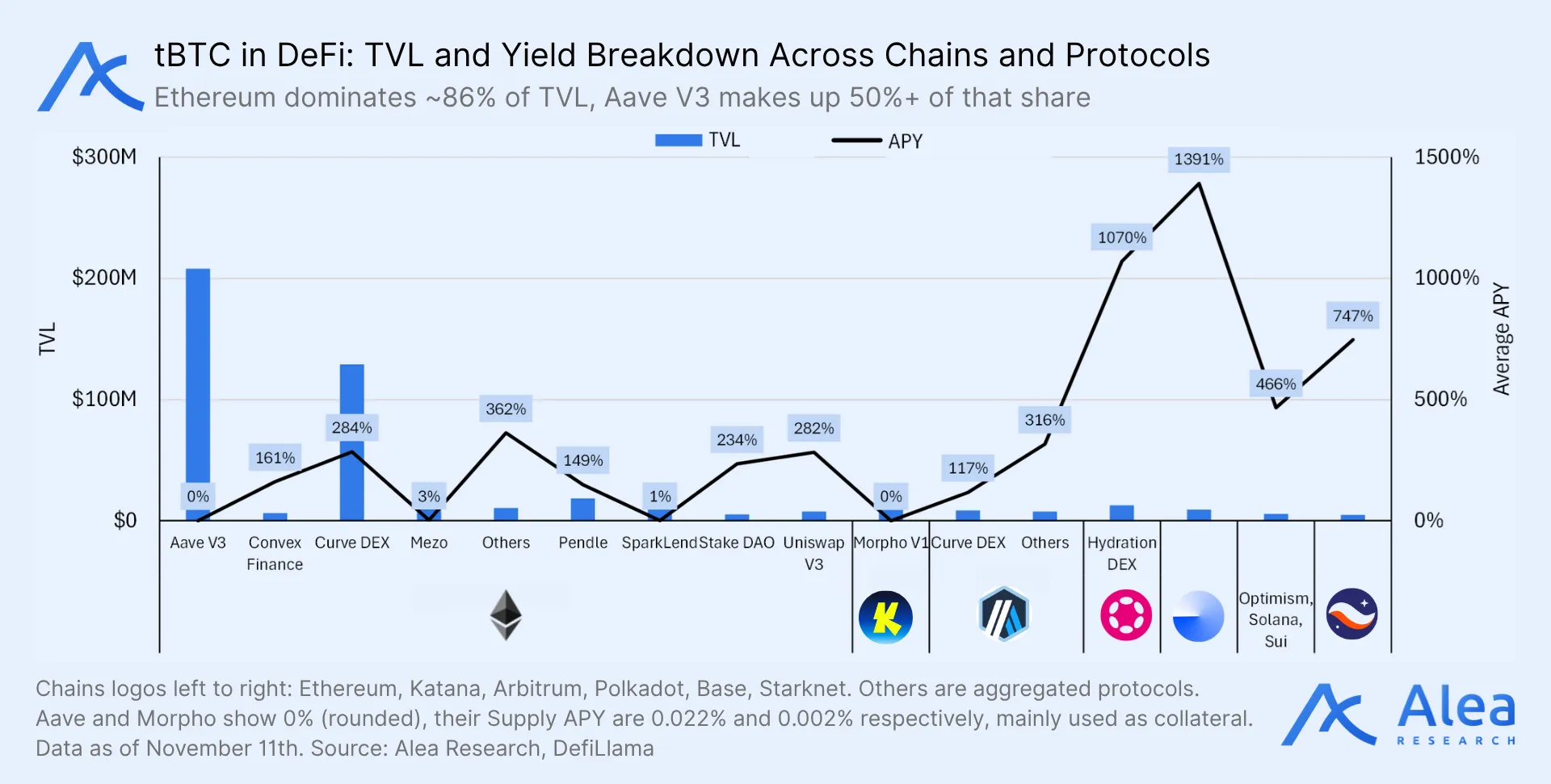

- Deep integration footprint: tBTC is already live on 10+ chains, with key protocol integrations on lending markets like Aave or DEXs like Curve, as well as across chains (Starknet’s BTCFi, Sui, etc).

- Institutional adoption awaits utility: ETFs (~7%), governments (~2–3%), and corporations (~6–7%) hold increasingly larger amounts of BTC while CEX balances fall (>20%) and illiquid supply stands above ~70%.

- Penetration and Market Share: BTC made useful; tBTC upgrades idle BTC balances into a composable asset without custodial fragility.

Why Wrappers, Trust Models & Track Records

Bitcoin mainnet offers monetary finality, base-layer settlement, and censorship-resistance. Permissionless and trust-minimized at the protocol level, it stands out as the most credibly neutral, scarce settlement vehicle for digital ownership. Bitcoin, however, is minimally programmable. As a result, most BTC finds its utility elsewhere, either offchain or on other chains. The demand to earn yield on BTC, use it as collateral, or leverage it across DeFi, explains why BTC wrappers exist.

Bitcoin wrappers are crosschain tokens redeemable 1:1 for BTC on Bitcoin. A BTC wrapper’s degree of trust can be defined as a function of custody and verification—who holds the underlying BTC and what proves backing onchain. Within wrappers, we can differentiate between trust models: centralized custodians (Bitgo’s wBTC, Coinbase’s cbBTC), Bitcoin L2 signer sets (Stacks’ sBTC), federated multisig sidechains (Liquid’s LBTC, Rootstock’s RBTC), or threshold signer networks (Threshold’s tBTC).

Wrappers differ by how they optimize for different tradeoffs in the custody and verification spectrum. Moving BTC off the Bitcoin mainnet chain is a choice that’s expected to bring on additional utility, turning BTC into a productive asset. The real edge comes after the mint, with onchain distribution and yield. Deep protocol integrations across DeFi attract flows, unlocking demand for the use of wrapped BTC as collateral, ensuring deep DEX liquidity, and allowing for a variety of yield opportunities. Wrappers embedded across leading L1 and L2 chains stand to benefit from their DeFi ecosystem’s network effects—that’s where isolated sidechains or single-chain assets fall behind.

Convenience that requires permission is fragile. Bitcoin wrappers should preserve Bitcoin’s properties and security guarantees, adding utility without compromising its trust-minimized nature. Only wrappers that honor Bitcoin’s core—censorship resistance, decentralization, and permissionless access—can turn price exposure into durable utility without adding a single point of failure.

Wrappers should keep BTC’s promise with trustless, permissionless minting and native redemption to Bitcoin mainnet; users should be able to mint, move, and transfer freely across chains; institutions should gain operational clarity via onchain records; L1 and L2 ecosystems should benefit from BTC’s liquidity and composability. That’s how BTC becomes transparent, portable collateral, accessible to anyone, available everywhere.

From first-principles, wrappers must answer 3 questions: is there an underlying unit of BTC backing the token?, who can mint/redeem/move the underlying BTC?, and who can halt/freeze the system? Threshold answers with onchain proofs, a rotating threshold of staked signers (51‑of‑100 threshold‑ECDSA signer groups selected randomly by weighted stake), and permissionless access.

Why Threshold

Most BTC wrappers follow a custodial model, acting as intermediaries issuing IOUs. That model goes against Bitcoin’s trust-minimized, censorship-resistant, self-custody ethos. Custodians replace cryptographic assurances with solvency risk, trading Bitcoin’s guarantees for convenience. IOUs like Bitgo’s WBTC or Coinbase’s cbBTC add single-point-of-failure and censorship risk. Threshold’s tBTC, in contrast, replaces the custodian component by a rotating, majority-controlled signer set.

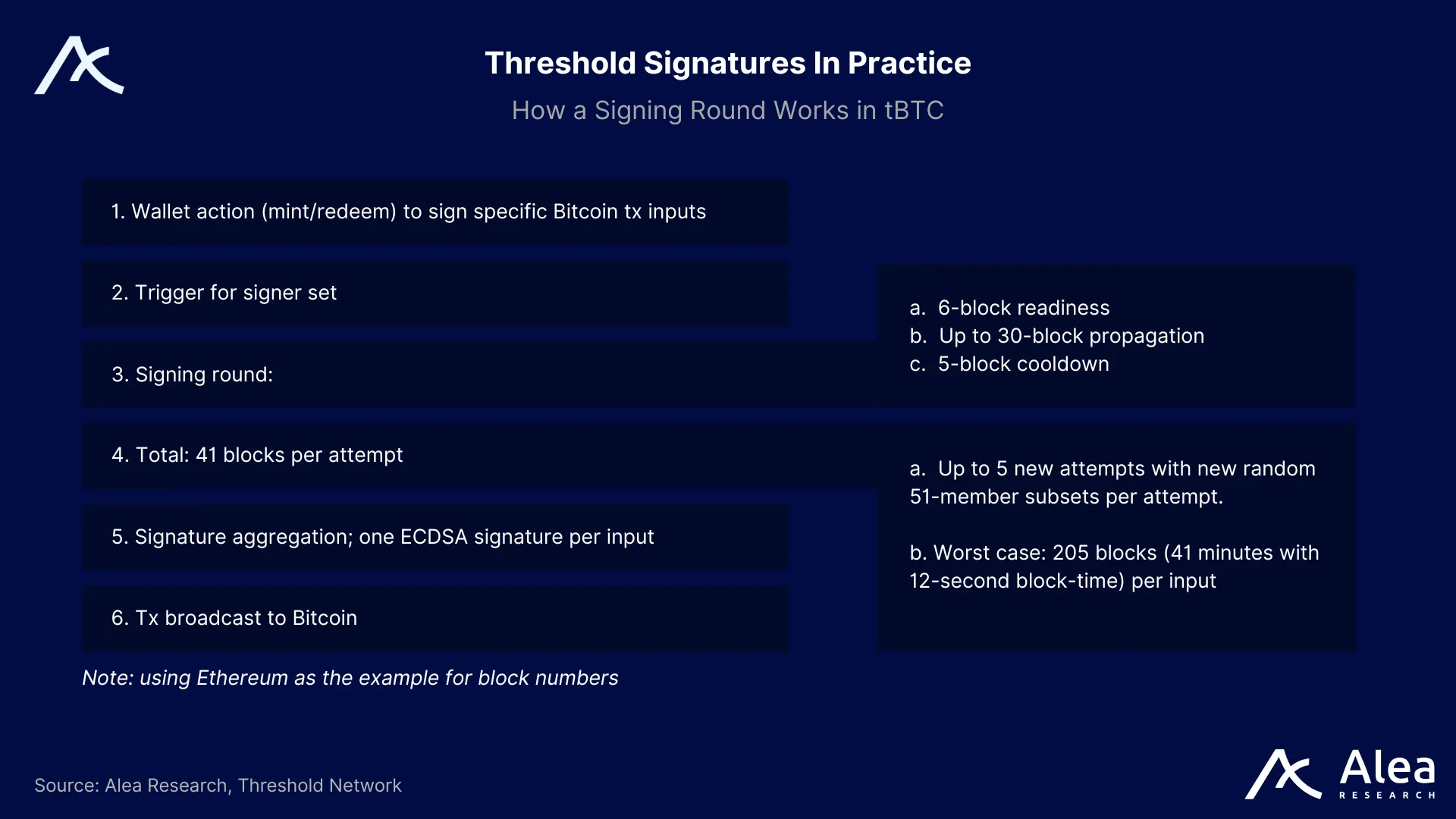

Threshold’s tBTC stands out as the only 1:1 BTC-backed token issued across chains through a threshold-cryptography model rather than full reliance on a single custodian. Importantly, Threshold is not a multisig; it’s a decentralized network consisting of a set of nodes where each active Bitcoin wallet is controlled by a randomly selected group of ~100 operators. Any action (mint/redeem) requires a threshold signature (currently 51 of 100) and the signer set is rotated every two weeks (schedule determined by governance) to limit capture risk.

Where Bitgo’s WBTC and Coinbase’s cbBTC concentrate risk in a single custodian stack, tBTC decentralizes custody and operations to remove single-point failure across many signers and chains. tBTC is trust-minimized and permissionless; WBTC/cbBTC are custodian-gated and require KYC for mint/redeem flows.

Trust dynamics reprice in real-time—when confidence breaks down, supply shrinks. This is observed on the WBTC supply bleed and accelerated burns outpacing new mints. Centralized wrappers are distribution plays, not defensible moats.

Unlike Bitcoin multisigs, which post multiple keys and signatures onchain, threshold signatures let a group jointly produce a single valid signature without revealing who signed. A threshold signature splits a private key into secure shares across many participants. To authorize an action, only a minimum subset—say m out of n—cooperates offchain to generate partial signatures. These are then combined into a single signature under one public key.

Threshold signatures deliver one private onchain signature from a resilient m‑of‑n group. The key is split across a number of members (n); any predefined aggregate number of members (m) can sign. A fewer number than that threshold (m) cannot forge or rebuild the key. Even if some members out of the entire set (n) fail to sign, the remaining members (m) can proceed.

This setup makes it possible to scale by having a large set of signers (like Threshold’s 100 members) without the onchain overhead of multisig scripts. Minimal coordination is required to set up a group, and no single member of the group has to be trusted.

tBTC holds bitcoin (BTC) in Bitcoin wallets whose private keys never exist in one place. Each wallet is controlled by a signer set of 100 nodes, and any 51 of them can jointly produce a standard ECDSA (Elliptic Curve Digital Signature Algorithm) signature to move the coins. On the destination chain, Threshold verifies the Bitcoin transactions with SPV (Simple Payment Verification) proofs that confirm when the network can mint/burn tBTC.

Unlike other bridges or models where there is a fixed federation or central party orchestrating operations, node selection in Threshold is random and stake-weighted. Many nodes participate over time, with signer groups periodically rotating (bi-weekly). This disperses custody continuously over time, making collusion improbable.

Threshold’s Footprint: Supply, Growth & Integrations

Operationally, Threshold leverages threshold cryptography to turn single points of failure into majority-controlled services. One advantage of this system is that it can adaptively secure signatures and their encrypt/decrypt methods by distributing trust across servers. As a result, liveness is preserved while resisting minority corruption.

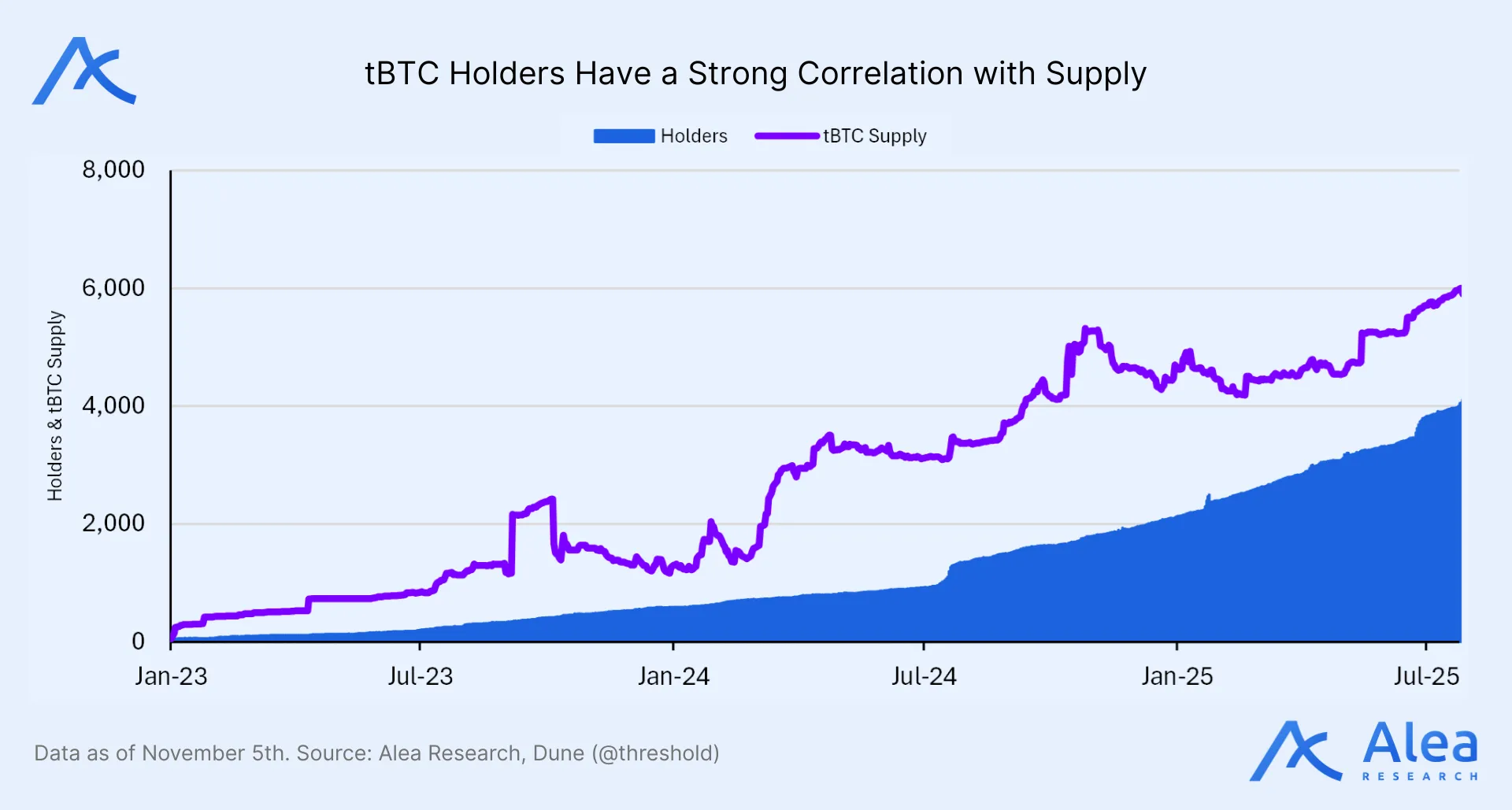

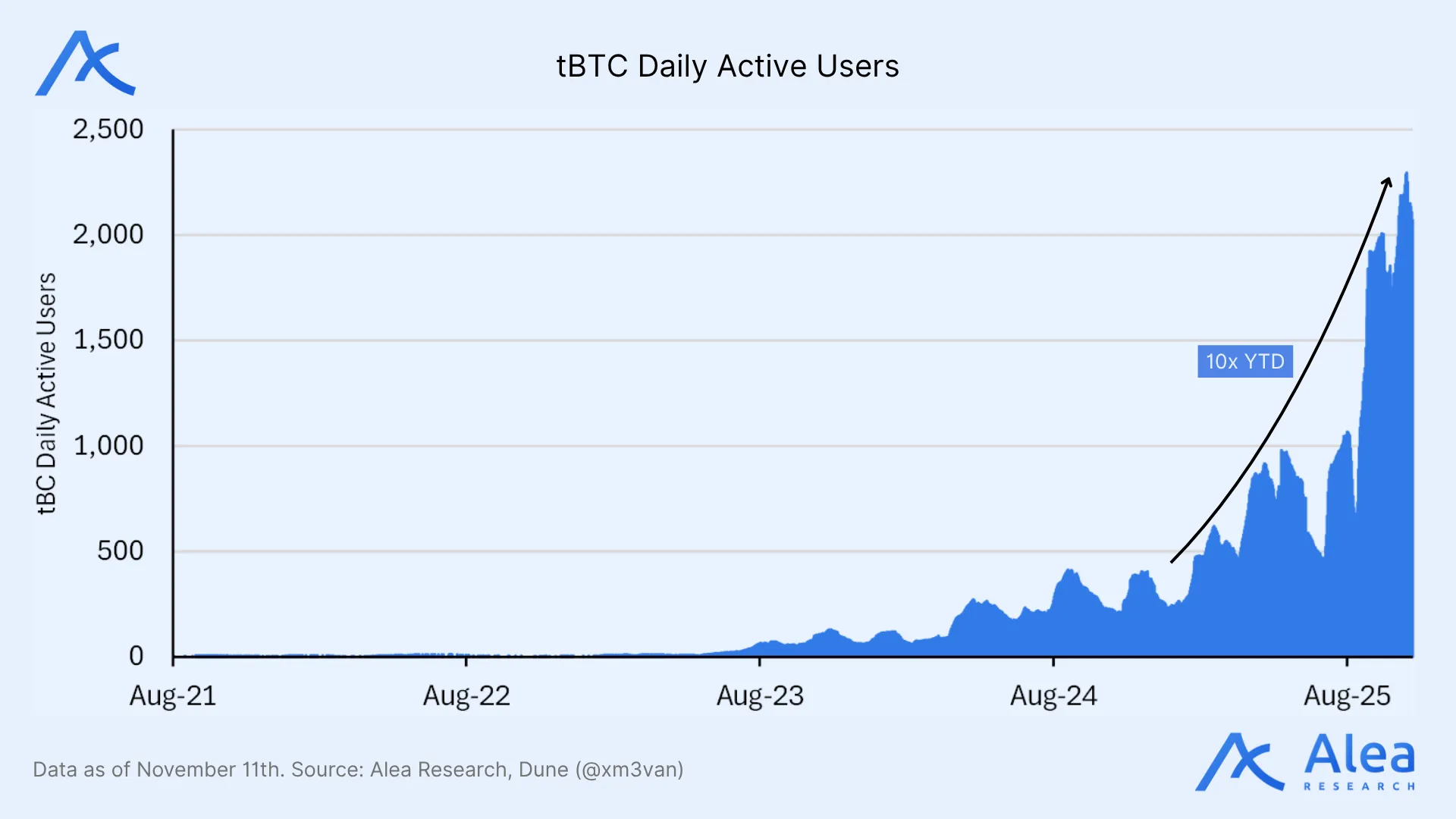

Majority‑controlled signing is step one; step two is deep, crosschain tBTC composability. Security is the foundation, but adoption acceleration requires tBTC integrations across leading DeFi protocols. As DEX liquidity builds up and more lending protocols start accepting tBTC as collateral, practical utility starts to materialize.

Threshold wrapper, tBTC, is present on 12 chains, with more to come. That includes Ethereum, Base, Sui, Solana, Ethereum L2s like Arbitrum, Optimism or Starknet, Bitcoin L2s like Mezo or BOB, and more.

Ethereum is the most dominant chain (~85% share of TVL share; ~$370M), as it’s where most of DeFi liquidity is and, therefore, most yield opportunities are found at scale. On Ethereum, Aave v3 and Curve make up for most of the TVL (~70% between the two; ~$200M in Aave and ~$135M in Curve).

The fact that custodial wrappers centralize risk means that they propagate liabilities as their supply expands. Threshold’s scaling strategy seeks to overcome solvency hazards by offering utility that asset allocators can comfortably underwrite—signer set size, operator, rotations, etc. In addition to verifiable and real-time onchain flows, tBTC is an open-source protocol.

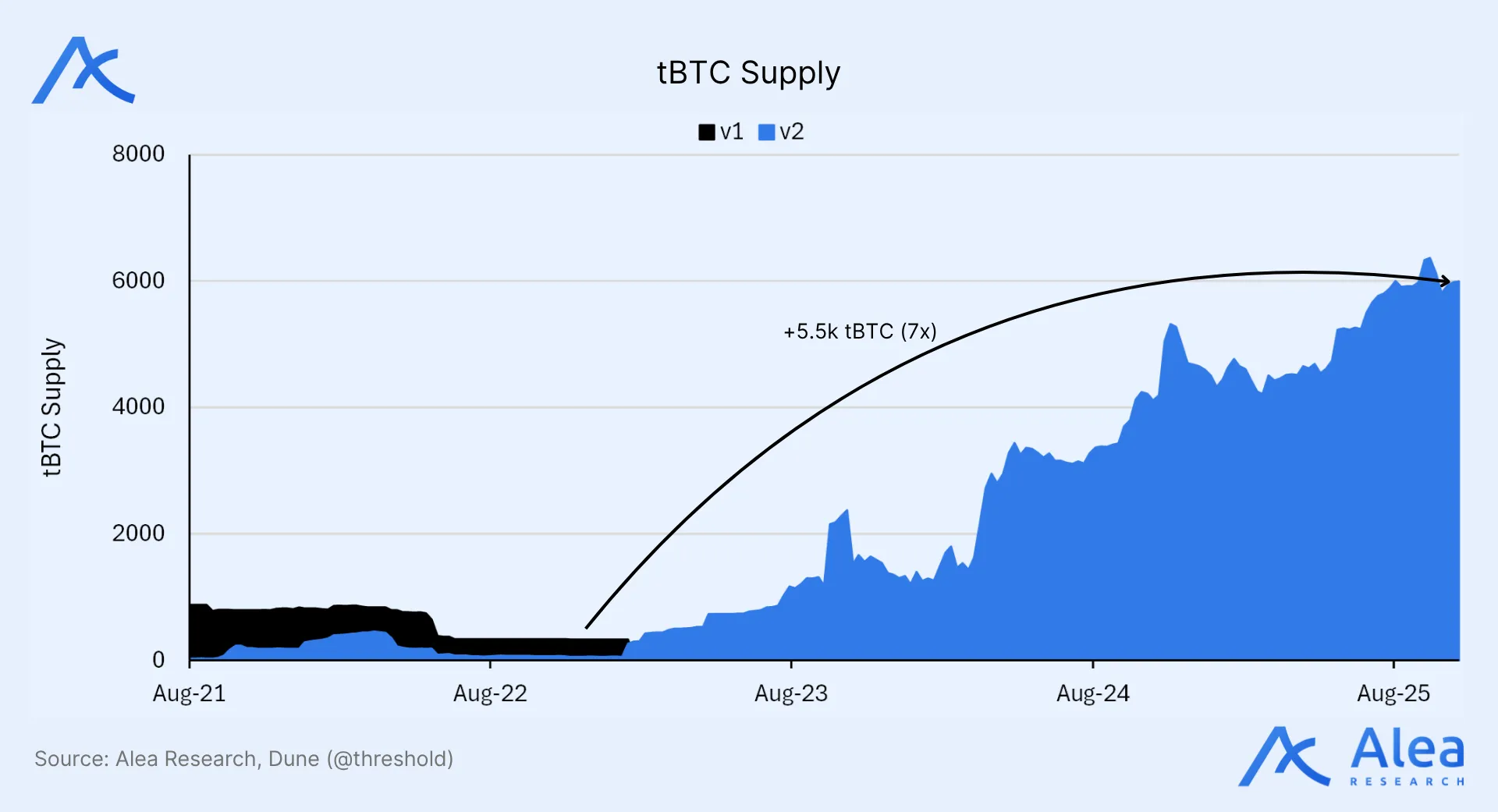

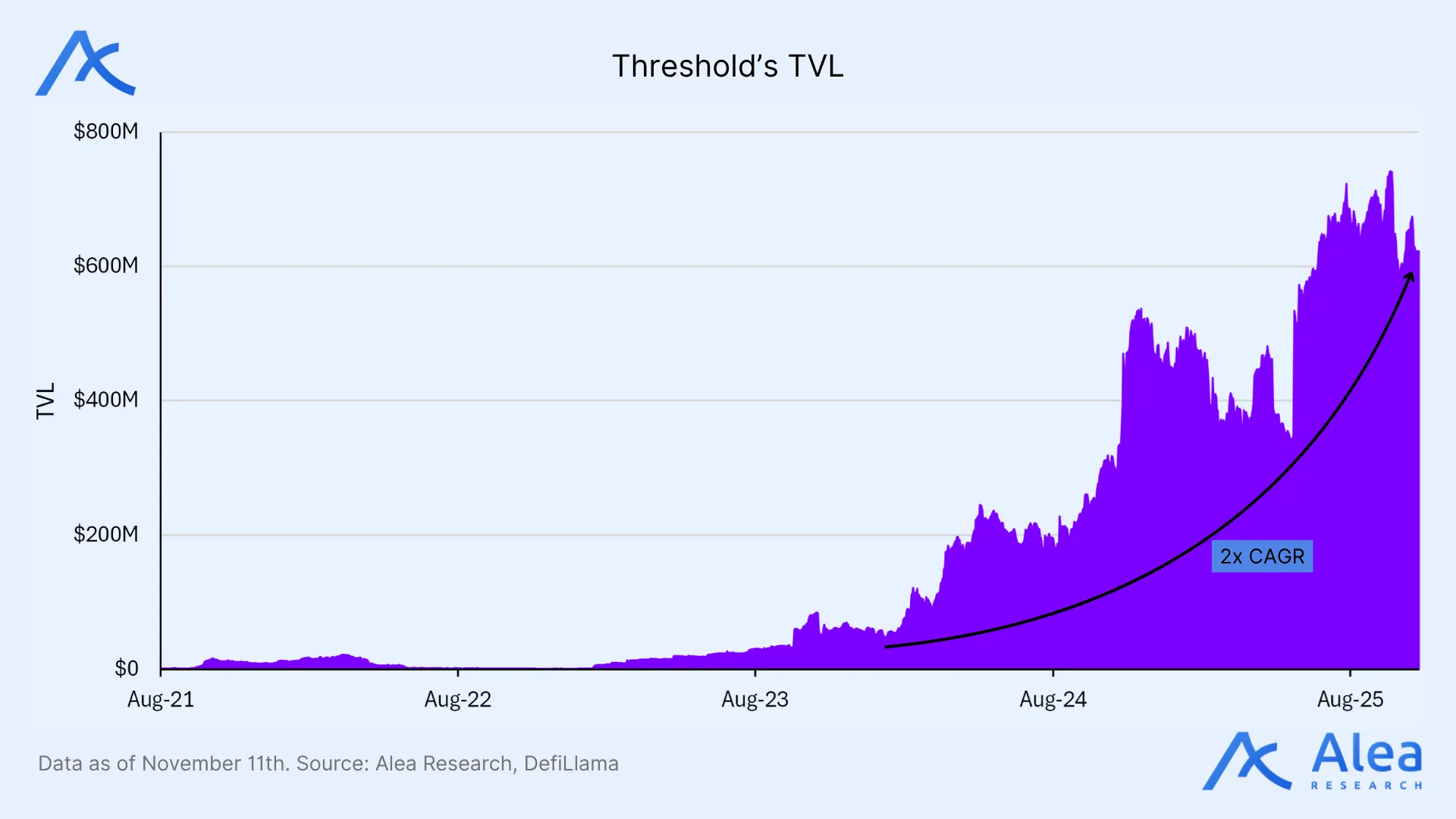

The project’s origins go all the way back to 2017-2018, with tBTC’s v1 launched in 2020. A protocol upgrade to tBTC v2 took place in 2022, signaling the beginning of a new growth stage focused on scalability and capital efficiency. With so many lessons learned and years of experience under their belt, Threshold is one of the few protocols in crypto with a 5+ year track record.

Threshold contributors have endured multiple bear markets and Black Swans. That resilience, time-in-the-market, and battle-tested operations have helped Threshold build a durable advantage over time. All of that facilitates protocol integrations that compound utility, boosting tBTC’s supply with more yield opportunities across venues, collateral use, and crosschain access that unlocks BTC utility wherever new demand shows up.

The same praise cannot be attributed to other solutions. Projects like renBTC didn’t manage to decentralize on time—Alameda’s collapse exposed that single-actor risk. This is a prime example of a project that promised decentralization but, in practice, the team still controlled the network. That’s the cost of “halfway decentralization.”

Worth reminding as well, there is a precedent of WBTC temporarily depegging during the FTX collapse. Even though there were no reported reserve shortfalls, confidence was shaken and WBTC temporarily traded at ~0.98 BTC. That small spread still matters in DeFi, where basis trades and leveraged yield strategies are common.

Threshold’s Mission & North Star

Bitcoin can’t run DeFi natively; wrapped BTC brings Bitcoin to DeFi: real BTC is custodied, a 1:1 token is issued on another chain, and that token can earn yield, serve as collateral, and trade. The result is portable Bitcoin liquidity that earns yield, underwrites loans, and trades seamlessly. Instead of a passive store of value sitting idle on a non-programmable chain, wrapping mints a 1:1 claim usable on Aave, Morpho, Curve, Pendle, etc earning yield, backing loans, and capturing trading fees among other use cases.

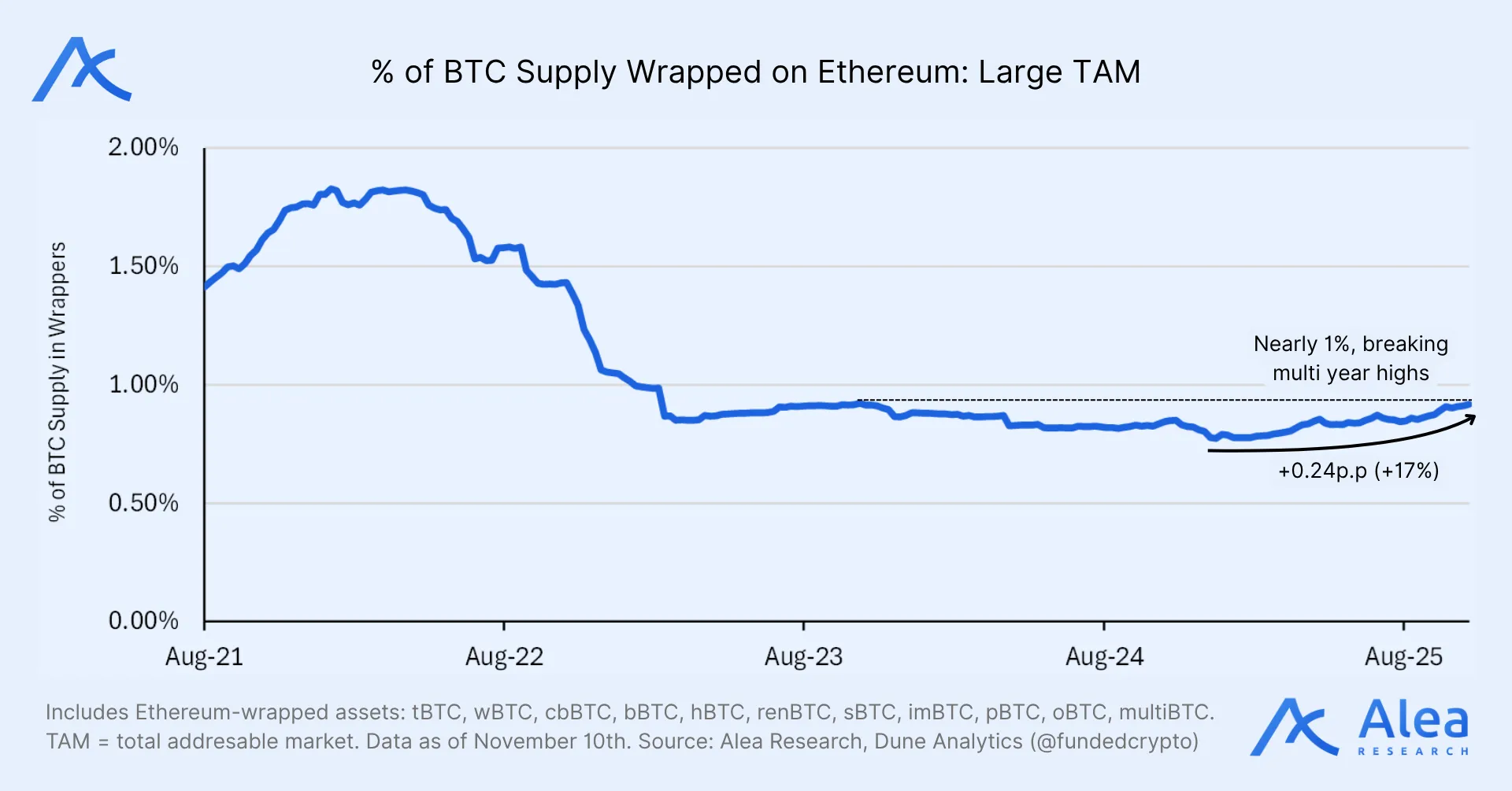

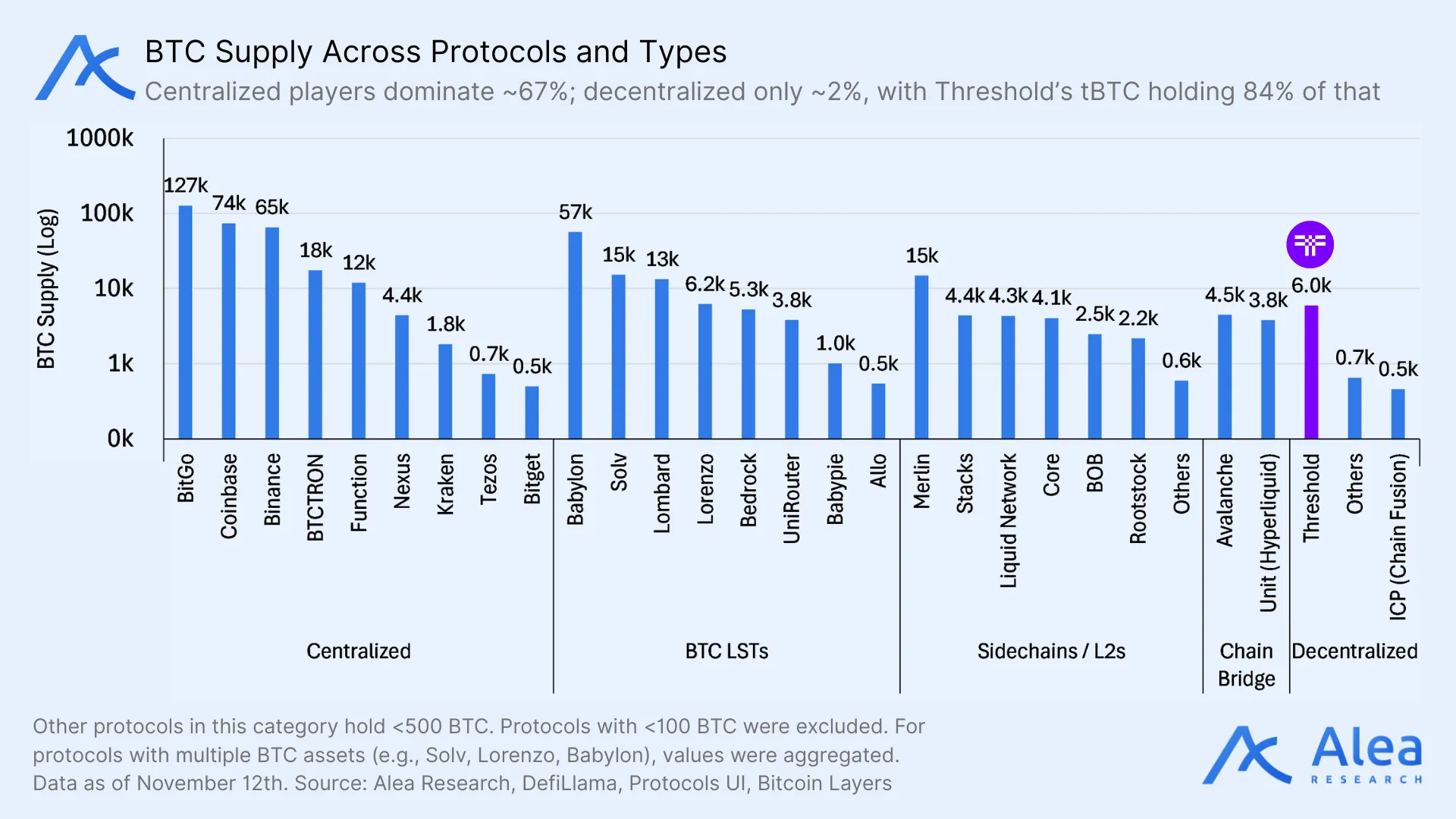

With ~376k BTC, BTC wrappers represent ~1.8% of the total 21M BTC supply. More than 95% of that consists of BTC held in reserves, with the remainder representing liquid staking and yield-bearing versions (Lombard LBTC, Bedrock uniBTC, Solv xSolvBTC, etc).

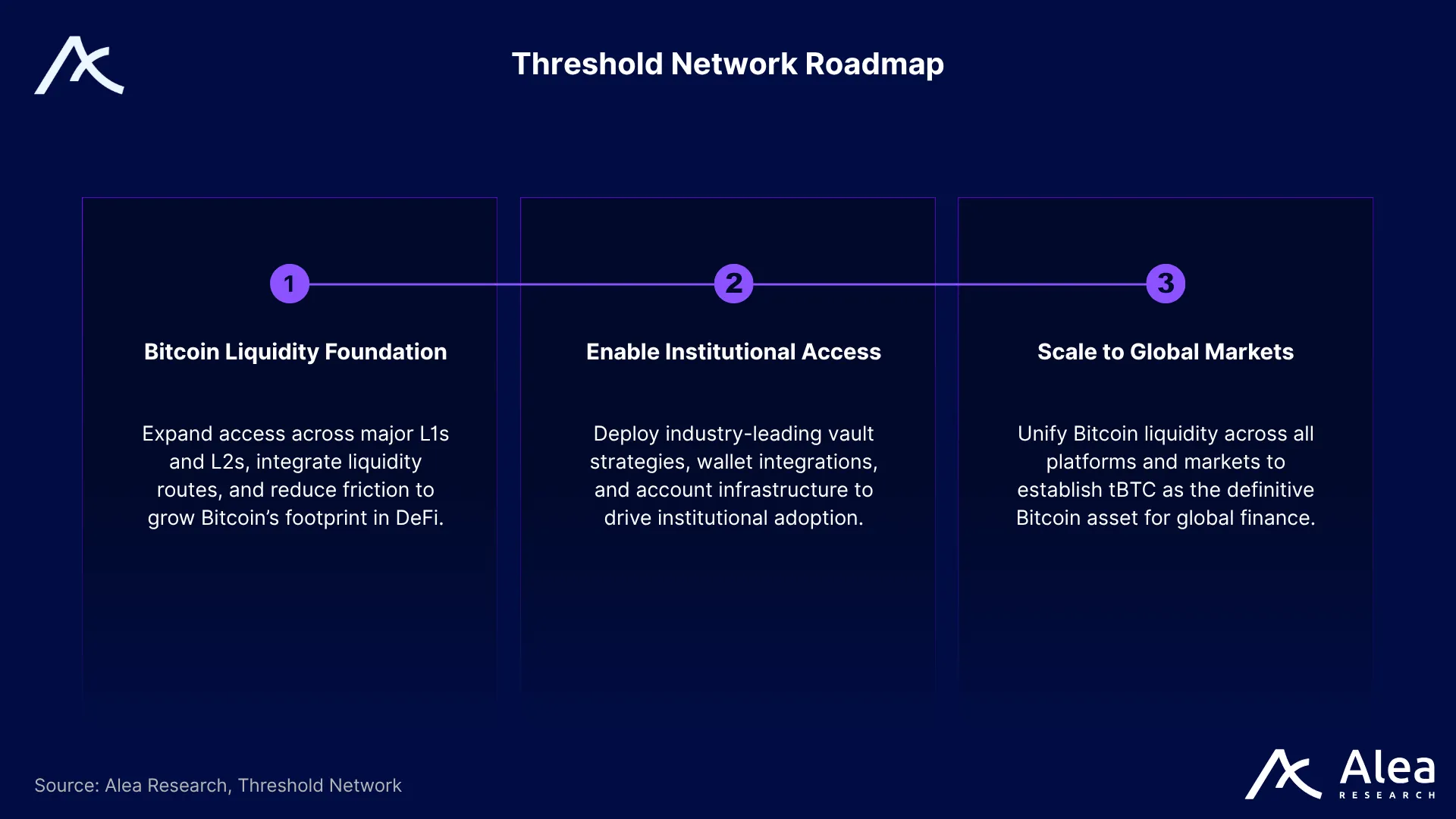

Threshold’s North Star hasn’t changed: Bitcoin should move freely across markets while staying trustless and grounded in its permissionless-access and censorship-resistance principles. Those values have been shaping how decisions are made since launch. Today, while the core tenets won’t be reformed, Threshold will be widening the funnel, focusing on institutions while still empowering individuals—broader participation and deeper scale across onchain markets with the same degree of security and transparency.

Within wrappers, centralized custodians are leading—Bitgo’s WBTC represents ~33% market share, Coinbase’s cbBTC ~20%, Binance’s BTCB ~17%. Since launch, Coinbase has been putting a dent in WBTC’s market share—a read-through on institutional preferences (Proof-of-Reserves is the minimum requisite, and distribution matters). Still, the trust model hasn’t changed—both rely on centralized custody.

BTC’s onchain future demands a tighter balance between liquidity and decentralization; centralized wrappers shouldn’t keep the crown. Crypto has proven multiple times that custodial wrappers aren’t the safest path; onchain BTC should meet institutional reliability with decentralized custody. Threshold optimizes for that sweet spot—bridging BTC to other ecosystems should deliver deeper liquidity and more opportunities, but not at the expense of corrupting its ethos.

Since U.S. spot ETF approvals in 2024, institutional adoption has grown significantly. Such growth in BTC demand requires trustless, scalable infrastructure aligned with the highest ranks of professional performance standards. Beyond holding, institutional participation demonstrates readiness for onchain expansion. Threshold’s objective: convert passive ETF/Treasury holdings into compliant, productive, yield-ready, onchain collateral—all without additional operational friction.

- Frictionless Entry: Direct gasless minting from a single BTC transfer to Ethereum, L2s, and non-EVM chains—no need to bridge, wrap, or deal with gas.

- Native BTC Exits: Deterministic unwind back with direct redemptions to Bitcoin mainnet.

- On-arrival Rollout: tBTC portfolio deployment at the destination across DeFi integrations.

- Managed Vaults: Curated interface with externally managed vaults and asset management strategies.

- Auditability & Compliance: End-to-end onchain logs of mints, redemptions, and vault allocations for performance tracking.

- Multichain Distribution: Diversity of opportunities across ecosystems—Ethereum, Arbitrum, Base, Sui, Starknet, etc (and growing).

Threshold’s forward-looking mission is to let BTC move trustlessly across chains with unified and standardized institutional-grade rails. tBTC can be minted, routed across ecosystems, exited natively, and allocated via managed vaults with policy controls and reporting. The goal is to make BTC behave consistently everywhere, allowing for capital deployments at scale without operational drag.

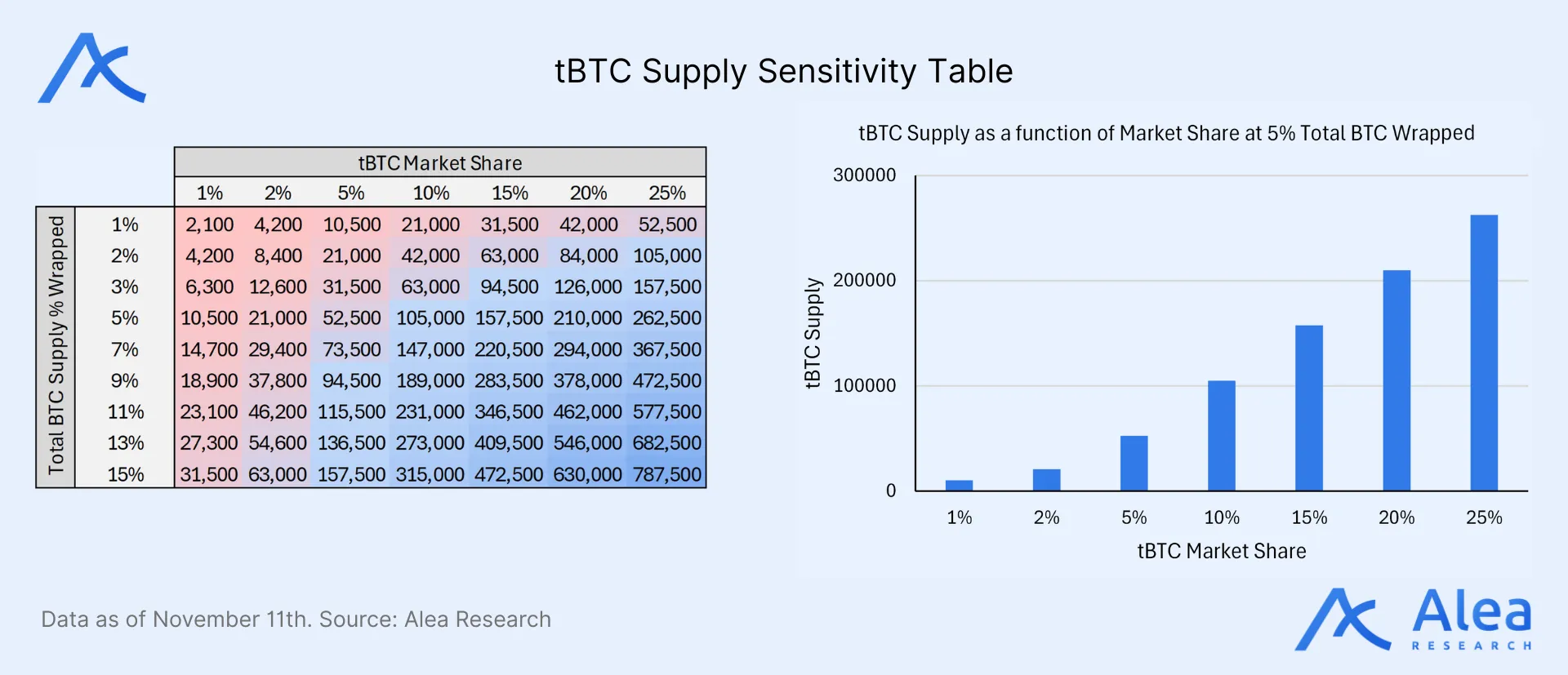

The upside for tBTC depends on two primary drivers: wrapper penetration (% of total BTC supply) and winning wrapper market share (% share of wrappers). Institutions have already proven that they are comfortable with BTC’s price exposure. Now they want yield with a high degree of operational efficiency: faster mint/redeem cycles, live reserves, and listings in key DeFi protocols.

Institutions won’t deploy size if access is narrow or liquidity fragmentation quietly taxes returns. Operational simplicity and broad market coverage must go hand-in-hand. Example workflow: you have BTC on the balance sheet, move it onchain without trusted intermediaries by minting tBTC straight to the target venue, allocate into vetted strategies for credit, capture basis, or liquidity provision, and track every step’s returns transparently onchain. Threshold’s institutional strategy is all about removing entry/exit friction, and putting BTC to work across chains, wherever opportunities emerge, without compromising custody or control.

How Threshold Wins

Threshold’s playbook for dominance seeks to reduce operational drag with frictionless UX, turning BTC-to-DeFi into a single, auditable, default rail accessible to institutional liquidity. Less like a bridge, and more like a base layer, tBTC aims to standardize how BTC flows across chains and DeFi venues.

The central idea: eliminate every operational barrier that prevents institutions from putting Bitcoin to work—without intermediaries, manual signatures, or complex bridging. Unlike centralized wrappers holding reserves in the hands of trusted counterparties, Threshold doesn’t have the ability to freeze reserves (tBTC v2 contract). Besides, native minting allows for accelerated adoption across chains, allowing tBTC to become an omnichain layer for BTC flows across networks.

ETFs, Governments, and Corporate Treasuries now warehouse a big slice of BTC; individuals still own the majority. Since 2024, spot ETFs have amassed ~7% of the total BTC supply, with governments ~2–3% and corporate treasuries ~6–7%. There is a clear shift toward institutionalization in the ownership of BTC. Marginal demand suggests that the bottleneck has shifted from “can they buy BTC?” to “can they deploy BTC onchain without reputational, compliance, or operational risk?” That’s the utility gap Threshold is aiming to solve.

While ETF flows rise, CEX balances have been on a sharp decline, down >20% since January 2024. The illiquid BTC supply exceeds 70%, implying most coins sit with long-term individuals. This outlook suggests concentrated custody with broadly dispersed ownership. Less float on exchanges increases sensitivity to marginal demand from institutional players.

The market’s supply concentration has become tighter. Institutions now hold meaningful chunks, even if individuals and long-term holders still control most units in circulation. The time has come for Threshold to reposition tBTC as the default vehicle for institutional access while keeping the retail adoption path intact. ETF-led inflows and expanding corporate reserves prove that the constraint is no longer BTC exposure, but access to onchain utility with institutional-grade infrastructure.

A big opportunity awaits for converting passive, regulated flows into safe, productive onchain collateral. ETFs deliver exposure but leave BTC inert; tBTC delivers utility: minting, redeeming, and deployment of the underlying—preserving exposure with additional optionality.

For Threshold, the next step is distribution combined with a moat that lets capital allocators mint, redeem, and deploy faster than centralized wrappers. Threshold is already present on 10+ chains, covering both the liquidity-heavy and innovation-leading end of the spectrum. This multichain footprint is key for becoming universal BTC collateral across ecosystems while other competitors remain siloed.

Value Accrual & Upside Levers

Current market share distribution is the result of a legacy artifact—WBTC’s first-mover advantage—and a misread of distribution as merit—cbBTC’s and BTCB’s exchange convenience. Incumbency and access explain the leaderboard. Long-term, however, safety comes first. So does preserving Bitcoin’s ethos. Threshold’s mission is to become the most trust-minimized and DeFi-integrated wrapper, offering a credibly-neutral alternative for institutional allocators.

The dominance of custodial players looks durable because of how fast they managed to scale their distribution on the most liquid venues, seizing the opportunity to use BTC as collateral on leading markets like Aave or Morpho (often with incentives favorable to looping strategies). Even if today’s leaders benefit from path dependence, concentration risk cannot be overlooked. Once liquidity clears the bar across chains, trust-minimized solutions offer a more compelling solution for institutions.

Threshold’s live integrations, scaling supply on leading money markets and DEXs like Aave and Curve, pave the way for network effects. A single asset, tBTC, present across chains and venues, offers a clean go-to-market for institutions, letting them choose where it’s most optimal for them to deploy their holdings based on their preferences. The opportunity set doesn’t end with lending markets and DEXs. Supply can scale with tBTC-backed stablecoins and yield products, supporting asset issuance, credit lines, managed strategies, rate arbitrage, perps margining, pendle-style yield tokenization, and more, while preserving native BTC redemptions.

Vault integrations are key for widening the “deposit once, earn anywhere” path for BTC holders. In September, Ember Protocol on Sui launched its BTC vault with tBTC as collateral, letting users earn yield while abstracting away all complexities associated with onchain strategies. In just 48 hours the vault attracted ~$2.5M in deposits, consistently offering double-digit % APY. This strategy (eBTC vault), for instance, supplied 60% of the deposits to Bluefin Lend, 20% to Bluefin’s auto-LP AMM, and borrowed against 20% for added capital efficiency. It serves as a perfect example of composability—lend‑borrow‑LP all in one strategy managed end-to-end.

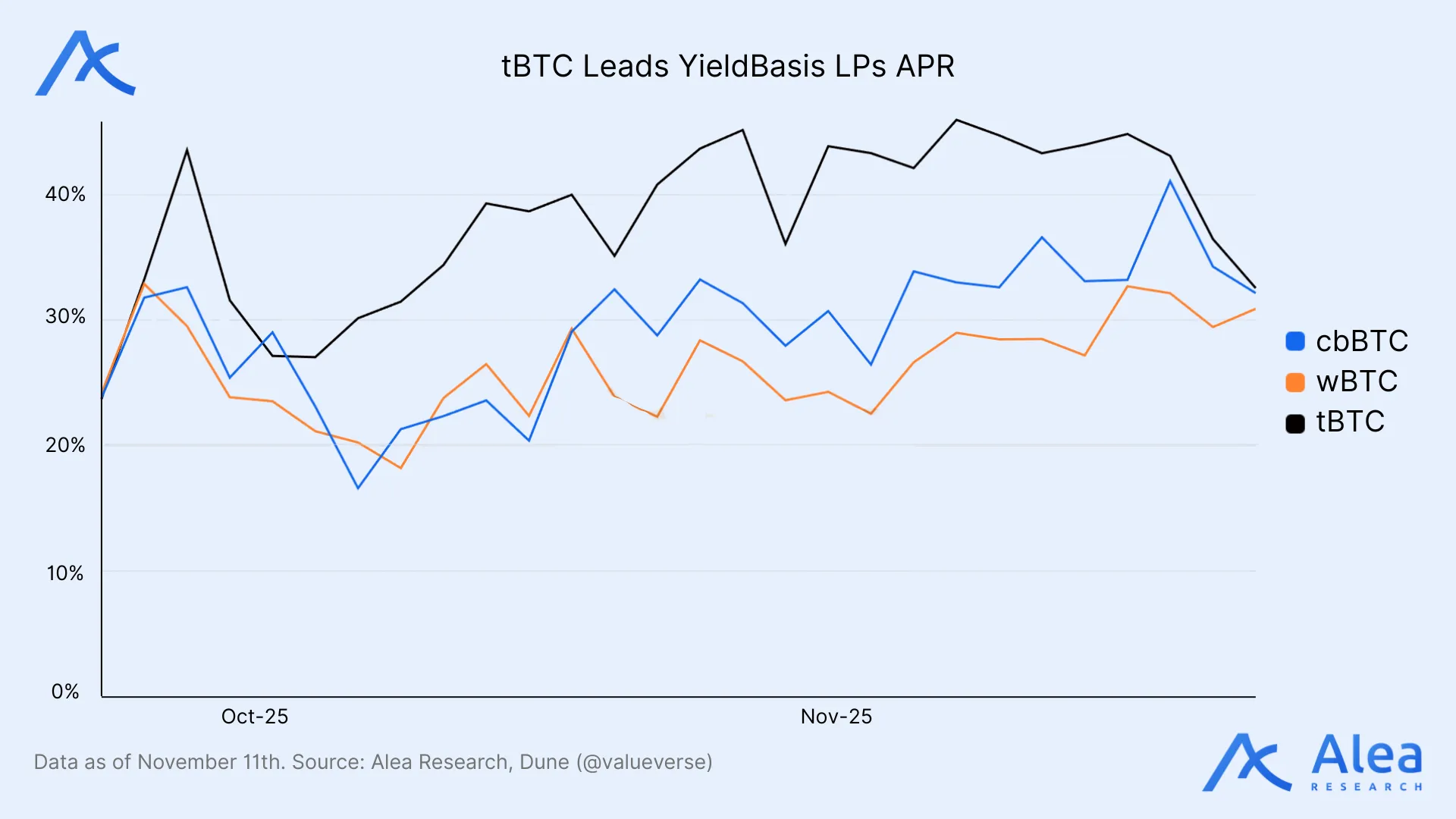

Other examples of current strategies include providing and staking liquidity on YieldBasis ($50M deposited in record time, caps filled under 1 hour), lending/borrowing on leading Ethereum money markets like Aave or Spark, providing DEX liquidity against WBTC and cbBTC on Curve, looping via AlphaFi on Sui, on Starknet’s BTCFi campaign protocols like Vesu, EndurFi, or Ekubo, or used as collateral for stablecoin minting on projects like Nerite.

Unlike in 2021, when people had to send their BTC holdings to opaque “black-box” strategies run by trusted intermediaries like BlockFi or Celsius, institutions, retail, family offices, and onchain funds can now safely deposit and track the flow of their assets onchain. With so many balance sheets filled up with idle BTC, treasury management won’t ignore a safer path to productive BTC. Once one major allocator commits, others follow.

Threshold hosts a unified dashboard aggregating all tBTC opportunities. This view provides an end-to-end catalog of strategies that span multiple protocols across chains. The set is expected to increase as Threshold strengthens its network with partner curators. The app also provides easy onboarding for Thresholds Vaults, such as tBTC’s Mezo strategy on Upshift.

The primary source of protocol revenue comes from mint/redeem fees. Mint fees have been waived in favor of growth, while the 0.2% redemption fees remain in place (charging for exits, similar to how GBTC or ETFs charge management fees).

Conclusion

Threshold’s tBTC is all about making BTC useful and productive across chains without adding custodial fragility. By replacing centralized trust assumptions with majority-controlled threshold signatures, it cuts counterparty risk at the root. Every mint/redeem operation is permissionless and traceable onchain.

tBTC is built for institutions and individuals alike. Recognizing how BTC’s ownership distribution has changed since the approval of spot ETFs, Threshold’s strategy—gasless minting straight to target venues, native redemptions back to Bitcoin, and instant deployment into DeFi strategies—now prioritizes frictionless workflows that still stay true to Bitcoin’s trust-minimized ethos. From ETFs, corporate treasuries, long-term holders, and even governments, Threshold’s ambition is to convert passive holdings into onchain collateral.

Looking ahead, the mission is to win share as wrappers expand beyond price exposure toward useful collateral. From lending markets like Aave to DEXs like Curve or yield-trading protocols like Pendle, Threshold seeks to expand BTC’s utility while keeping custody decentralized—meeting allocators where liquidity lives, anywhere across chains.

References

Bitcoin ETF Flows – Farside Investors

Bitcoin ETF Tracker – Blockworks Analytics

Bitcoin Treasuries – bitcointreasuries.net

Bitcoin Treasuries – The Block

tBTC Scan (Proof of Reserves) – tbcscan.com

Threshold Network – Governance Forum

Threshold Network – Snapshot Voting

Threshold Network Token – Coingecko

Threshold Network T Token Holders – Etherscan

Threshold Staking Contract – Etherscan

Disclosures

Alea Research is engaged in a commercial relationship with Threshold Network and receives compensation for research services. This report has been commissioned as part of this engagement. The content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.