Cross-chain Lending Simplified

Syno is a chain-agnostic money market designed to unify liquidity and simplify borrowing across both EVM and non-EVM chains. Utilizing Wormhole’s cross-chain messaging system and Circle’s Cross Chain Transfer Protocol (CCTP), Syno enables seamless transfer of data for cross-chain lending operations. This eliminates the complexities and the resulting cognitive load typically associated with cross-chain activities (deposit collateral on one chain, borrow an asset, swap it and bridge it, etc).

With a hub-and-spoke architecture, Syno ensures efficient management of liquidity while maintaining strong security standards, presenting an answer to the current liquidity fragmentation problem that we observe across chains. What sets Syno apart is its ability to facilitate cross-chain lending and borrowing, allowing users to deposit collateral on one chain and borrow on another with a single transaction. This is achieved through a unified and easy-to-use interface.

To fully appreciate the industry’s shift towards cross-chain lending, this report will delve into the history and evolution of lending markets, looking into the motivations that led to Syno’s development and value proposition.

Key Takeaways

- Extreme Accessibility. Syno provides a unified and intuitive user interface that aggregates DeFi’s liquidity across many chains, simplifying complex cross-chain transactions and enabling seamless interaction with multiple wallets and dApps.

- Prioritizing Security. Syno places a strong emphasis on security, integrating enterprise-grade and open-source solutions such as Wormhole and Circle’s CCTP. The platform’s smart contracts are audited by leading security firms, while its decentralized governance framework empowers the community to take action to safeguard the system’s integrity.

- Promising Design Architecture. Unlike the point-to-point model, which requires maintaining consistent and synchronized state information across chains, the Hub & Spoke model simplifies cross-chain lending by centralizing state management. This approach ensures high performance, lower costs, low latency, and a smoother UX.

- A Catalysts-Rich Present. Even though Syno is already fully operational on several networks (such as Arbitrum, Optimism and Base), the upcoming landing on Solana and the implementation of optimistic finality, which zeroes transaction execution times by anticipating payments to users on destination chains, will give a strong boost to the quality and versatility of their lending service.

Background

Syno Finance was established through a strategic merger with New Order DAO (a DAO-based and community-driven incubation project), which provided an advantageous starting point by granting immediate access to a vast network, active community, and substantial resources. This merger has allowed Syno to position itself effectively from the outset, leveraging the strengths of both entities.

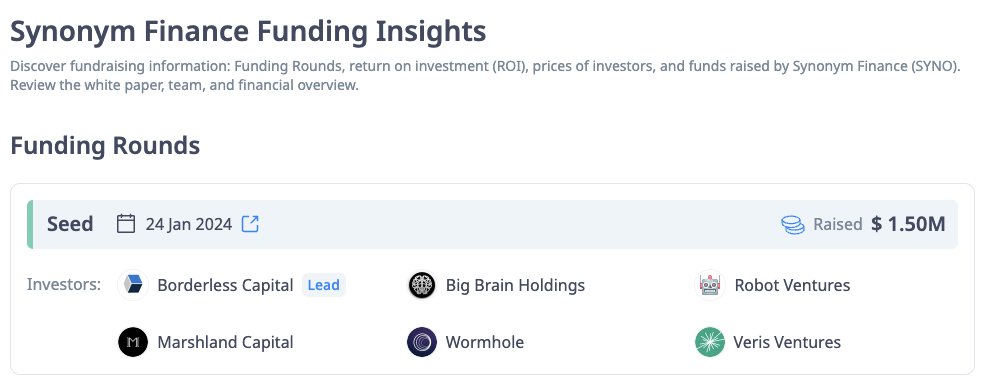

Regarding the investor base, the project secured $1.5m in a funding round (which took place in late January 2024) led by Borderless Capital and with the participation of Robot Ventures, Big Brain Holdings and Wormhole.

Figure 1: Syno’s Funding Round Participants And Capital Raised.

Source: Cryptorank

Source: Cryptorank

In response to community feedback, Syno has enhanced its original merger proposal to better align with the interests of its longest-term supporters, particularly veNEWO lockers, who will benefit from a conversion of their positions into tSYNO (i.e., the staked version of SYNO tokens with an unstaking penalty that decreases linearly over 15 months) and enjoy 10% of the fees generated by the new protocol.

Figure 2: $NEWO → $SYNO Token Migration.

Source: New Order Dao’s Official Blog

Source: New Order Dao’s Official Blog

These supporters are now offered 50% of the revenue generated by yield-bearing projects incubated within the Syno ecosystem. This 50/50 yield-sharing model is designed to reward those who have been committed to New Order from the beginning.

Syno’s core team is composed of seasoned professional devs who bring years of experience from both the crypto world and several other industries. These individuals have made significant contributions to numerous projects and companies, both within and outside the blockchain space. This has allowed Syno to deliver a fully functional (and not forked) platform in a very short period of time, showcasing their ability to execute complex projects swiftly

All its members have maintained anonymity and are known in the crypto industry by their pseudonyms: Beachball, Vladyslav and Sami (Cheguevara).

The Evolution of Onchain Lending

DeFi lending markets are among the oldest and most established sectors in the DeFi space, second only to spot DEXes. This longevity has allowed the field to develop a level of maturity and sophistication that easily outpaces many other crypto areas.

On each chain, a dominant lending protocol usually emerges (such as AAVE on Ethereum, Venus on BNB Chain, or Kamino on Solana) serving as the primary platform for borrowing and lending activities. However, these protocols are confined to their respective chains, limiting their utility. Users face significant friction when they need to interact across different chains, requiring multiple steps to lock collateral, borrow assets, and bridge them to another chain. This process introduces unnecessary complexity, and there is also an opportunity cost where they cannot access yield opportunities available elsewhere.

Technological advancements in DeFi over the years have largely focused on improving the technical and infrastructural aspects of these platforms, such as security, scalability, risk parameters, and capital efficiency. However, while making these markets more robust to economic attacks, they have often neglected the UX. As a result, users must navigate a fragmented and cumbersome landscape. The absence of seamless cross-chain interaction increases the cognitive load on users, hindering onboarding of new users and limiting the engagement of even seasoned players.

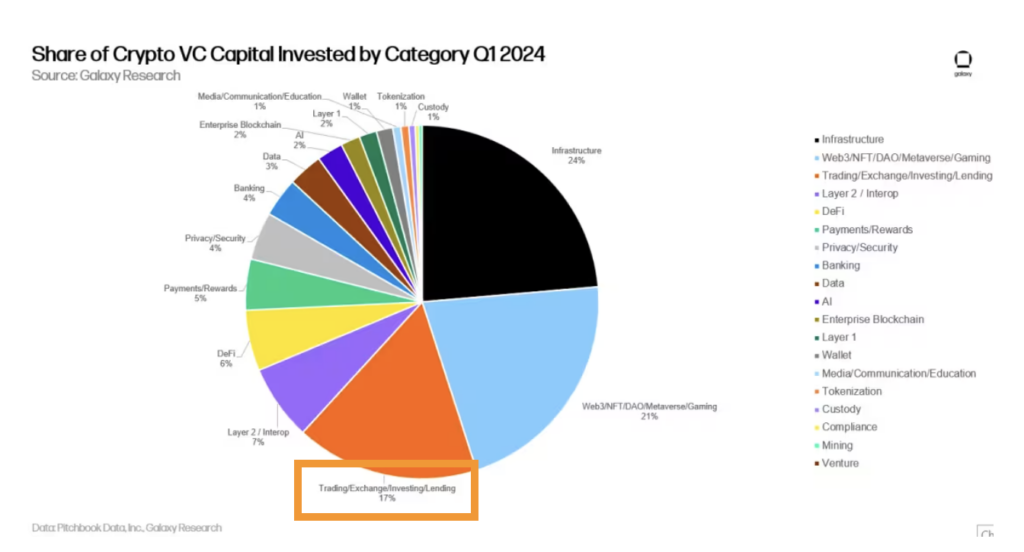

Figure 3: These investments have then culminated in today’s impressive range of products which are lauded for their versatility, capital efficiency, and above all, security.

Source: Galaxy Research

Source: Galaxy Research

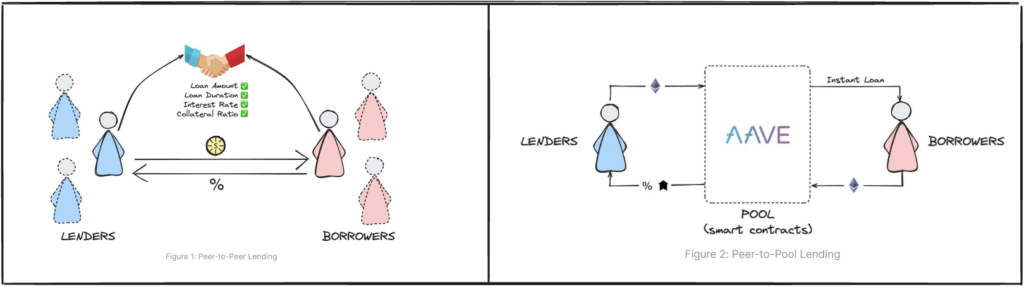

The story of DeFi lending kicked off with the launch of EthLend in 2017. EthLend introduced a peer-to-peer model where lenders posted loan requests, and borrowers had to match them by accepting the terms. However, this system proved to be capital inefficient, as the amount of liquidity in DeFi was quite low back then, making it complicated to match borrowers with lenders. A pivotal moment occurred with the release of MakerDAO and its stablecoin $DAI, which although belonging to a different category (that of CDPs, which is not the subject of this in-depth research paper) has offered several innovation cues to the lending field. Notably, CDPs have introduced a more capital-efficient model that eliminates the need for direct interaction with the counterparty. Unlike lending markets, where lending depends on the availability of a lender, CDPs allow users to mint stablecoins directly against their collateral, effectively functioning as both borrower and lender within the system. This innovation improves capital efficiency by maximizing the use of stablecoin assets and providing constant liquidity without depending on market conditions or third-party intermediaries.

As the landscape evolved, significant developments emerged. Tools like Instadapp and DeFiSaver introduced smart wallets and fee abstraction to simplify user interactions with the underlying lending protocols, and Compound released the second iteration (V2) that improved both user experience and capital efficiency by introducing cTokens for automatic interest accrual and collateral use, implementing dynamic interest rates, optimizing liquidations to minimize losses, and enabling flexible collateral factors for greater borrowing capacity.

The sector witnessed a major shift when EthLend rebranded to Aave and transitioned from a peer-to-peer model to a peer-to-pool model. This new design leveraged smart contracts to create liquidity pools where lenders could deposit assets to earn passive income, and borrowers could take loans out of it by over-collateralizing assets and paying interest.

Figure 4: The Paradigm Shift of Lending Protocols

Source: Shell Finance’s official mirror

Source: Shell Finance’s official mirror

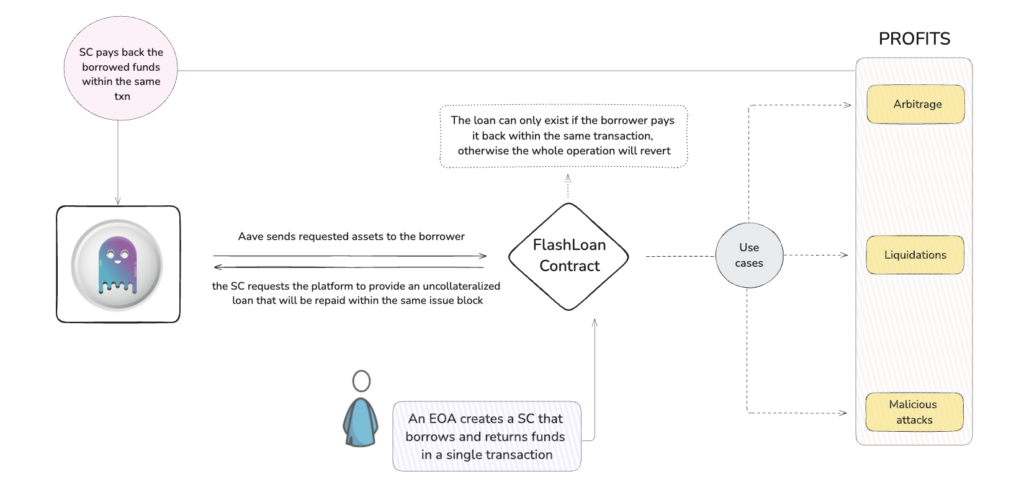

The Peer-to-Pool model dramatically improved the UX by offering flexible loan parameters, reduced friction costs, and instant loan availability. Aave also introduced new features like Flash Loans, which allowed users to borrow assets without collateral as long as the loan was repaid within the same transaction. This significantly expanded the use cases for DeFi lending, particularly in arbitrage, collateral swaps, and liquidation protection.

Figure 5: How Flash Loans Are Structured

Source: Alea Research

Source: Alea Research

The overcollateralized lending primitive then started to spread to other ecosystems through the deployment of Aave and Compound forks.

The overcollateralized lending primitive started to spread to other ecosystems, through the diffusion of Aave and Compound forks.This led to the birth of projects such as Venus on Binance Smart Chain (now BNB Chain) and Benqui on Avalanche, which are still operational. Protocols like Gearbox introduced a leverage farming and trading protocol that allowed users to access leverage in a non-custodial manner, while other projects such as Euler and Rari expanded the addressable market by introducing permissionless markets for long-tail assets. In parallel, the introduction of Real-World Asset (RWA) protocols and uncollateralized lending services, like Ondo and Maple respectively, marked another huge milestone. These protocols bridged the gap between traditional finance and DeFi by allowing real-world assets, especially bonds, to be used as collateral in lending markets. More precisely, Ondo Finance is a project aimed at bringing stable, low-risk, interest-bearing financial products such as US Treasury bonds and money market funds onto the blockchain. This approach offers blockchain investors a safe alternative to stable coins, allowing them to get returns directly from these traditional assets. Meanwhile, Maple developed crypto-native bonds, offering undercollateralized loans to institutional borrowers. These loans are packaged as bonds, allowing lenders to earn fixed income by providing liquidity to creditworthy institutions. This expansion into RWAs attracted institutional investors seeking exposure to crypto yields while leveraging traditional assets.

Projects like Morpho introduced new primitives on top of existing lending markets, optimizing them for better capital efficiency. Morpho Optimizers act as an intermediary (similar to a borrow-lending yield aggregator that offers a better rate to each party) that seamlessly integrates with lending platforms like Aave and Compound, providing users with enhanced interest rates by matching P2P lenders and borrowers directly when possible, while still allowing fallback to the underlying protocol’s pools. This approach improves yields for all parties without compromising the security and liquidity of the underlying markets.

In terms of mechanism design, protocols like Myso, Timeswap, or Ajna pioneered an oracleless approach to lending, eliminating the external price feeds dependency. By using a unique AMM-based model that relies on constant product curves, Timeswap creates a market where interest rates and collateralization levels are determined entirely by the interaction between borrowers and lenders, reducing the risk of oracle manipulation and increasing the protocol’s resilience.

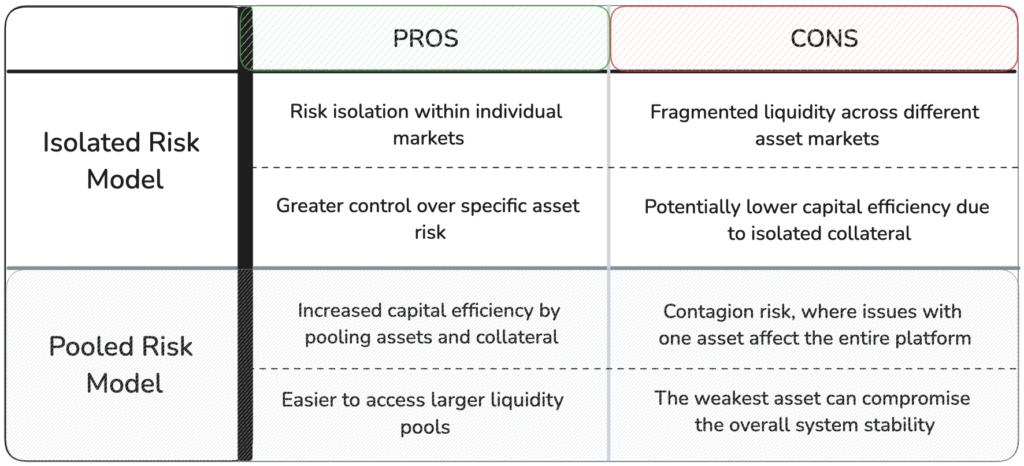

Shortly afterward, DeFi witnessed the introduction of the isolated risk model, with protocols like Silo, and FraxLend pioneering this design architecture. These projects create independent lending markets for each asset pair, isolating risk and preventing the spread of insolvency or other systemic risks across the platform. This approach allows for more tailored risk profiles for each market, offering users greater flexibility and security.

Protocols like Term Finance and Notional helped to increase stability and predictability in DeFi lending through the introduction of Fixed Rates. These platforms allow users to lock in fixed interest rates for specified terms, mitigating the volatility typically associated with variable lending APYs. This kind of model partly met the needs of borrowers and investors seeking more reliable cash flow management in a decentralized environment.

One of the last stages in the development path of the lending markets industry involved derivative products on the interest rates paid by IOUs (i.e. deposit receipts representing the collateral deposited on money markets, such as Aave’s aUSDC), allowing users to hedge against or speculate on future rates movements.

Figure 6: Pros And Cons Of The Isolated-Risk And Pooled-Risk Models

Source: Alea Research

Source: Alea Research

During the bull market, DeFi rates consistently exceeded those of traditional finance (TradFi) due to the high leverage rate and risk premium, also with most projects aggressively incentivizing their users with token rewards. However, the bear market reversed this trend, prompting protocols to explore new strategies to support revenues and on-chain activity in order to avoid a drastic decrease in Total Value Locked (TVL). That ‘s why decentralized stablecoins with increasingly efficient and complex issuance models, like Aave’s $GHO and Curve’s $crvUSD, proliferated, offering new options for stable value storage and liquidity provision.

The latest competitors coming up with new primitives are Instadapp and Euler. The former introduced Fluid, the latest iteration of its platform, featuring smart collateral and smart debt management tools, further enhancing capital efficiency and risk management tools. The latter is a modular lending platform based on two core components, the Euler Vault Kit (EVK) and the Ethereum Vault Connector (EVC). The EVK allows builders to create and chain together custom lending vaults, while the EVC enables vaults to be used as collateral across the ecosystem. Key features include advanced risk management tools, permissionless reward distribution, support for synthetic assets, and customizable liquidation flows, all aimed at enhancing capital efficiency and UX. Both Fluid and Euler have effectively implemented new products and functionalities but their operation is still limited to a single chain, with all the associated consequences.

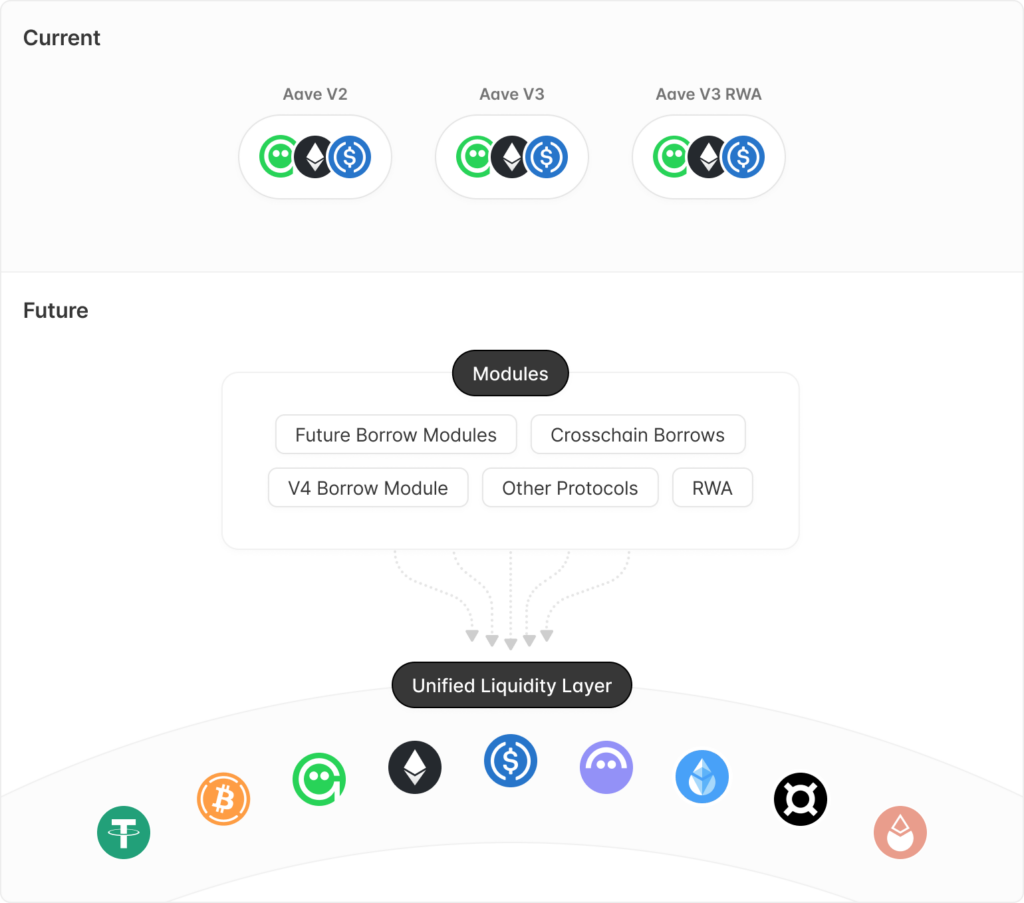

As the ecosystem moves forward, the next big leap for the industry is clearly achieving fully cross-chain interoperability and a unified user experience while maintaining the high security standards already achieved. Cross-chain lending markets have emerged as a promising solution to face these challenges, providing a mechanism for lending and borrowing operations across many blockchain environments. Projects such as TapiocaDAO and Radiant started to explore the ground by introducing cross chain lending services built on LayerZero. Similarly, the launch of Aave’s V4 further underscores the trend towards more interconnected and flexible lending market designs, where they propose introducing a Unified LIquidity Layer.

Figure 7: The new liquidity layer architecture coming to Aave with V4

Source: Aave’s official governance forum

Source: Aave’s official governance forum

Finally, we will cover Syno, which is one of the most recent entrants in this race. With a focus on inter-chain interoperability and a unified user experience, Syno addresses the pressing need for seamless interactions and overall cost reductions between multiple blockchain ecosystems. By integrating features such as cross-chain liquidity aggregation and a framework for managing cross-chain transactions, Syno aims to enhance efficiency, liquidity, and interoperability within the decentralized lending landscape.

Protocol Architecture

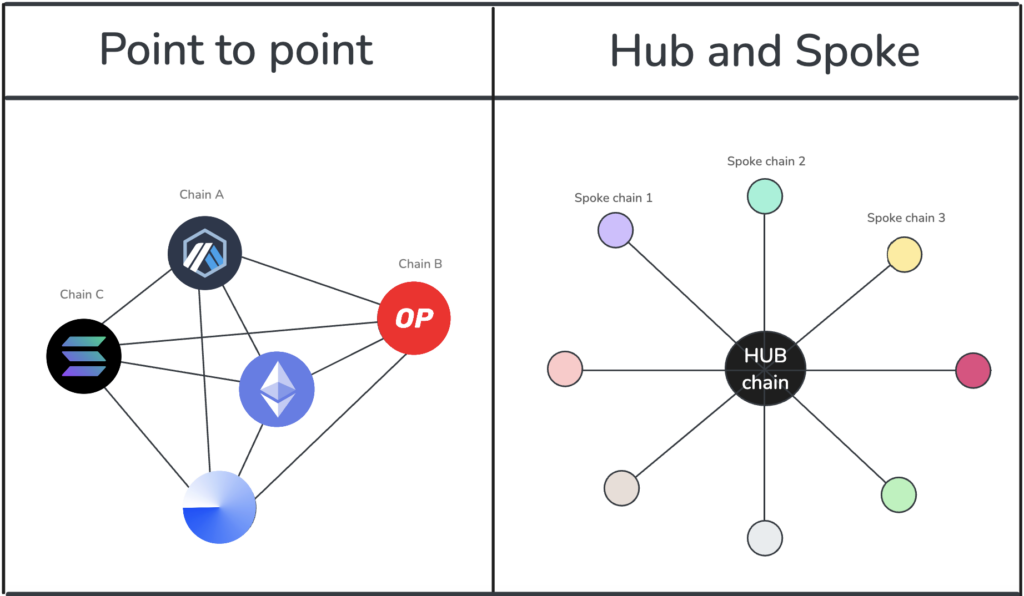

Syno’s architecture is structured as a Hub & Spoke model that leverages Wormhole’s cross-chain Messaging technology. This design allows Syno to efficiently scale across a number of chains while facilitating logical transfers of assets and information within its ecosystem.

Hub & Spoke Model

In this model, a central hub chain functions as the protocol’s core, acting as either a centralized accounting layer or a liquidity layer. The spoke chains communicate with this hub by sending accounting messages or wrapped token transfers, depending on the specific implementation. The hub serves as the ultimate source of state information, ensuring that all data on the spoke chains is a consistent reflection of the hub’s authoritative state. This model eliminates the need for users to engage with external bridges or token-wrapping mechanisms, thereby simplifying the user experience.

Figure 8: Architectural Differences Between The Point-To-Point And The Hub And Spoke Model

Source: Alea Research

Source: Alea Research

The decision to adopt a Hub & Spoke architecture, as opposed to a point-to-point model, was driven by the complexities associated with maintaining synchronized state information in a decentralized chain rich environment. In a point-to-point model, each chain would independently manage loans and deposits, necessitating continuous updates to dynamic interest rates across all chains. This synchronization is particularly challenging when multiple chains are involved, as discrepancies in interest indices could result in inaccurate borrowing or repayment amounts, potentially leading to financial losses or system exploitation that harm users and the protocol’s prestige.

For example, if a user initiates a borrowing transaction on Solana and completes it on Optimism, both chains must accurately reflect the changes to the relevant interest indices for the borrowed and collateral assets. Any misalignment could cause relevant discrepancies, making it difficult to maintain the integrity of the system.

By centralizing borrow-lend operations on a single hub chain through the handling of transactions and updates on the hub, such as Arbitrum, Synomitigates these risks. This approach streamlines processes by maintaining a single, atomic state that updates in real time, avoiding the asynchronicity issues prevalent in decentralized models.

Optimistic Finality

Syno, previously constrained by the Wormhole Token Bridge’s finality constraints in its V1 structure, has undergone significant enhancements with its V2 rollout. The primary bottleneck was the lack of configurability in transaction finality, leading to a poor user experience due to delays in transaction settlement.

The V2 upgrade introduces an efficient change by implementing Optimistic Finality, allowing for sub-1-minute transaction finality across various blockchains beyond just EVM chains. This was achieved by modifying core contract logic to support asset custody at Spoke chains and utilize instant finality messages, reducing dependency on the Wormhole bridge. This mechanism operates on the principle of assuming transactions are valid from the get-go unless someone proves otherwise within a designated time frame.

With deposits, the system credits the user’s account immediately on the spoke chain, assuming the deposit will be final. This means the user can start using their funds right away without waiting for the traditional blockchain confirmation times.

When a user withdraws or borrows, the system processes the request instantly, releasing funds or allowing the user to borrow against their assets, with the transaction being considered final unless challenged.

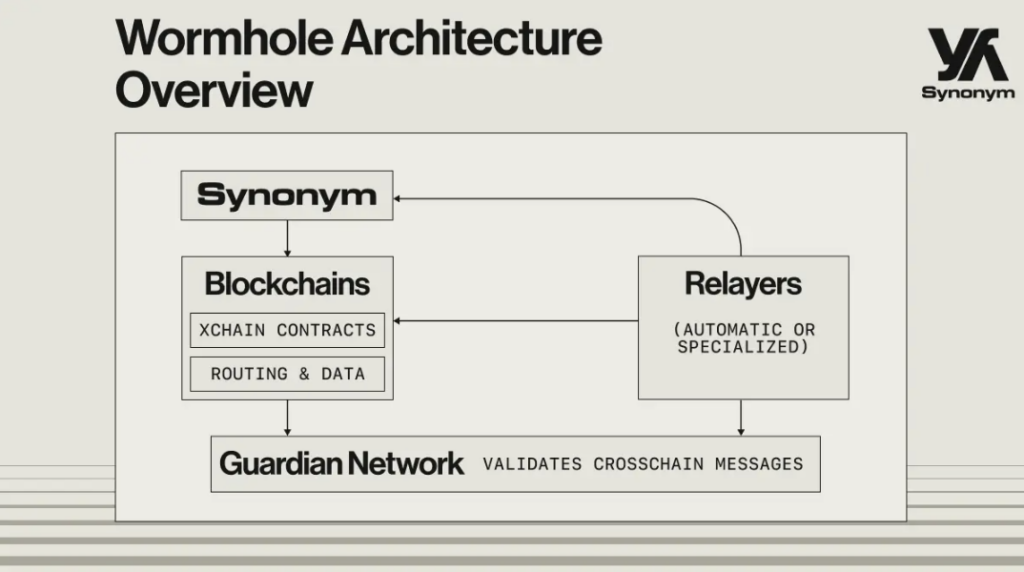

Wormhole xChain Technology Stack

Syno is built on the Wormhole xChain technology stack, which is designed to enable seamless cross-chain transactions through scalable and secure messaging technologies. Wormhole’s architecture supports scalable and secure cross-chain transactions, allowing Syno to transfer assets and information smoothly within its Hub & Spoke model without the need for external bridges or token-wrapping mechanisms. The system relies on a Proof of Authority (PoA) validator framework, where Guardians sign and validate cross-chain transactions, ensuring that all transaction requests are continuously monitored and validated for accuracy and state consistency.

Figure 9: Wormhole Stack: The Backbone of Syno’s Cross-Chain Messaging System

Source: Syno’s Official Mirror page

Source: Syno’s Official Mirror page

Syno’s selection of Wormhole as its foundational technology is based on four critical factors:

- Transparency: Wormhole is fully open-source, developed transparently, and contrasts sharply with many competing solutions that rely on opaque validation libraries or mechanisms.

- Security Enhancements: Significant improvements in security practices have been implemented, including global accounting, rate limiting, and system governance measures, all of which enhance the overall security of the network.

- Connectivity: Wormhole is currently connected to 29 blockchains, with plans for further expansion. This extensive connectivity is vital for Syno’s focus on inter-rollup transactions and its commitment to achieving total modularity.

- Growth-oriented development potential: The Wormhole ecosystem is expected to experience significant growth, driven by a major ecosystem push from the Wormhole Foundation, and Syno can benefit from it.

The Wormhole stack is structured as a cross-chain messaging protocol that enables seamless interoperability between different chains. At its core, the system relies on a network of validators, known as Guardians, who monitor events on supported blockchains and validate cross-chain messages. These messages are then relayed through smart contracts, called Portal Contracts, deployed on each supported chain. The whole process ensures secure and trustless communication between chains, allowing assets and data to move freely across different ecosystems.

In terms of asset management, Wormhole also addresses the challenges associated with handling blockchain-specific assets like $ETH, which are native to specific ecosystems. The technology automatically mints representations of these assets on the target chain, allowing for their transfer or burning depending on the transaction’s objectives. This process provides a more flexible accounting system for cross-chain applications, simplifying the asset management process and removing the need for users to perform additional steps outside of the core Syno platform.

Ultimately, the use of Wormhole xChain technology equips Syno with a robust foundation for cross-chain interactions, enhancing user involvement while improving the security and functionality of cross-chain financial activities.

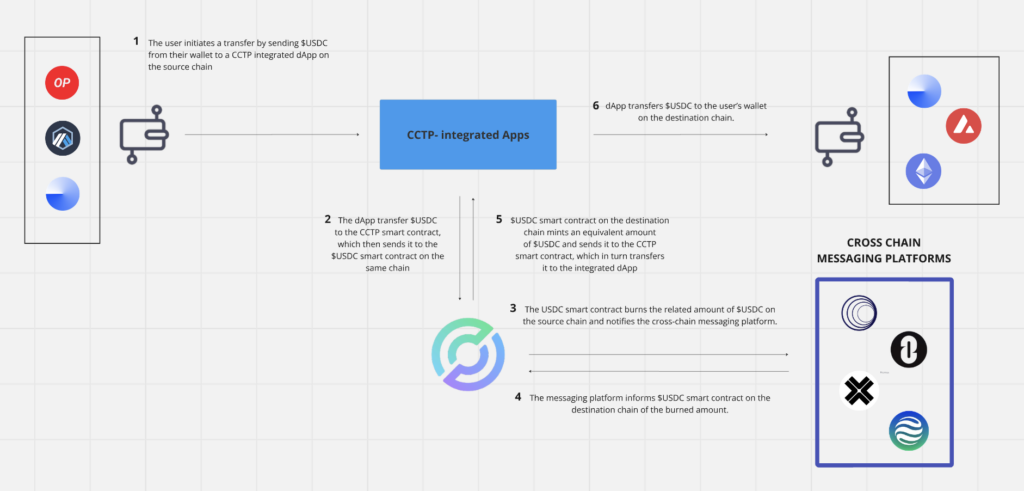

Circle CCTP Integration

The integration of Circle’s Cross-Chain Transfer Protocol (CCTP) with Syno enhances the liquidity and usability of the $USDC stablecoin within the Syno protocol. CCTP is a permissionless on-chain messaging protocol that enables the secure transfer of $USDC between blockchains through a native burning and minting process.

Figure 10: How Circle’s Cross Chain Transfer Protocol (Cctp) Works

Source: Alea Research

Source: Alea Research

Syno leverages CCTP for the native minting and burning of $USDC, facilitating the pooling of liquidity across all supported spoke chains. This mechanism ensures that $USDC supplied from any network is pooled on the Arbitrum hub, directly addressing and mitigating the fragmentation of $USDC across multiple networks.

For instance, when $USDC is supplied on the Optimism network (a spoke), it is instantly bridged to the Arbitrum hub. This centralized approach allows borrowers on all supported networks to access funds from this unified pool, resulting in more efficient and predictable asset utilization and interest rate management across the platform.

In other words, the CCTP integration simplifies financial operations within Syno, allowing borrowers to repay loans on a different network from where they initially borrowed, without the need to manually transfer assets across chains. This reduces operational complexity and makes $USDC more flexible and convenient to use within the Syno ecosystem.

Interest Rates & Liquidations

Syno adopts a new model for managing interest through two specific indices for each asset: the Deposit Interest Accrual Index and the Borrow Interest Accrual Index. These indices, initialized at 1.0 when the protocol launched, represent the accumulated interest over time for deposits and loans, respectively.

- Deposit Interest Accrual Index: This index tracks the growth of deposited assets, reflecting how much of an asset can be withdrawn after accounting for accrued interest. For example, if a user deposits 200 units of Asset A and the index rises to 1.05, the user can withdraw 210 units, indicating the interest gained over time.

- Borrow Interest Accrual Index: This index shows how much a borrower needs to repay over time to fully cover their loan. For instance, if a borrower takes out 200 units of Asset A with an initial borrow index of 1.05, they would need to repay 210 units to settle the loan.

Interest calculations are dynamically updated with each vault state change, comparing the stored accrual index at the time of the last update to the current index to determine the accumulated interest.

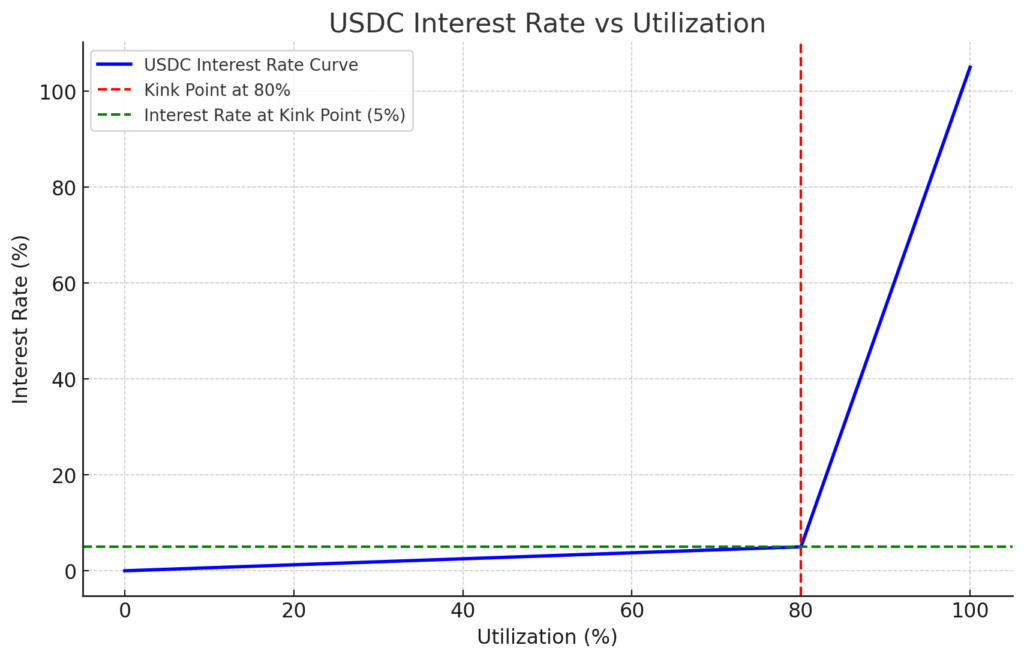

Figure 11: a graphical representation of the interest rate curve on USDC (Ethereum network) according to the utilization rate change and the eventual reaching of the kink point.

Source: Alea Research

Source: Alea Research

Syno also maintains detailed records for each user and asset, including the deposited amount with accrued interest, the deposit accrual index at the last update, the borrowed amount with accrued interest, and the borrow accrual index at the last update.

The protocol uses a continuous interest compounding model, where both borrowed and deposited funds accrue interest based on dynamic rates. The APY is calculated using a second-compounding method, with the annual rate (R) determined by a piecewise interest rate function that adjusts based on the pool’s current utilization at the time the accrual index is calculated.

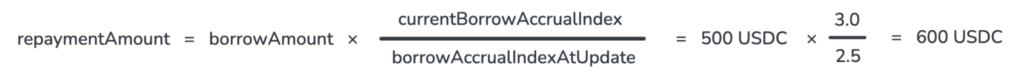

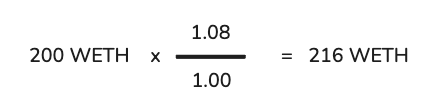

Let’s consider a scenario where a user deposits 200 $WETH when the accrual index is 1.0. Later, when the index rises to 1.08, the user decides to withdraw. Using the formula:

The user would withdraw:

In another case, a different user borrows 500 $USDC with a borrow index of 2.5. Over time, the index increases to 3.0, meaning the user now owes:

Interest Rates Model

Syno’s interest model is based on a ‘Piecewise Interest Rate’ system characterized by three distinct thresholds or ‘kinks.’ This model integrates two linear functions, with the transition marked by the second kink. The borrow interest rate increases gradually as liquidity utilization rises, but once the second kink is reached, the interest rate growth accelerates sharply.

For example, in a scenario:

- Segment 1: Up to $1,000 borrowed, interest might be 5% per year.

- First Kink: At $1,000, the interest rate increases to 7% per year.

- Second Kink: Beyond $5,000, the interest rate might jump to 10% per year.

These kinks and borrow rates are tailored for each asset and dynamically adjusted to reflect real-time market conditions.

Distribution of Borrow Interest

Syno distributes the interest collected from borrowers as follows:

- 40% of the interest collected is distributed to Depositors in proportion to their deposits.

- The remaining 60% is allocated to the Treasury, which then rewards vlSYNO and TSYNO Stakers and covers protocol fees.

Collateralization Ratios

To maintain protocol solvency and account for asset volatility, Syno uses supply and borrow factors.

- The former reduces the effective power of deposits used as collateral. For example, with a supply factor of 0.85, a $1500 deposit would effectively collateralize up to $1275 of a loan.

- The latter increases the weight of a loan in portfolio health calculations. For instance, with a borrow factor of 0.75, a $1000 loan would be treated as a $1333.33 loan when calculating portfolio risk

The interplay between these factors determines the maximum borrowing capacity against a user’s deposits. For example, if a user deposits $1500 with a supply factor of 0.85 and borrows with a borrow factor of 0.75, they can borrow up to $956.25, with the collateralization ratio exactly at 100%, making the position vulnerable to any adverse price changes that could trigger liquidation.

The collateralization ratio changes over time as the values of loans and deposits fluctuate. It is calculated as the ratio of effective loan weights to the effective deposit power.

For instance, if a user deposits $2000 in Token A (supply factor 0.8) and $800 in Token B (supply factor 0.9), with loans of $500 in Token C (borrow factor 0.7) and $600 in Token D (borrow factor 0.8), the effective deposit power would be $2360, and the effective loan weight would be $1235.71. The collateralization ratio would then be calculated as approximately 191%.

Liquidations

On Syno, the user’s entire portfolio is treated as a unified liquidation entity. If the overall collateralization ratio falls below 100%, indicating the portfolio is underwater, it becomes eligible for liquidation.

Liquidators can intervene to restore the portfolio’s health by choosing which loans to liquidate and which collateral to claim. Each asset within the portfolio has its own liquidation parameters.

- Max Liquidation Portion: Defines the maximum portion of an asset that can be liquidated in a single event.

- Max Liquidation Bonus: The additional amount a liquidator can claim as a reward for executing the liquidation.

After liquidation, the portfolio’s collateralization ratio is capped at a predefined maximum health factor (e.g., 130%), preventing over-liquidation and providing a buffer to avoid further immediate liquidations.

Liquidators are incentivized with a liquidation bonus, which is deducted from the user’s collateral, encouraging users to proactively manage their loans by repaying or adding collateral to maintain their portfolio’s health and thus prevent forced liquidations.

Tokenomics Design

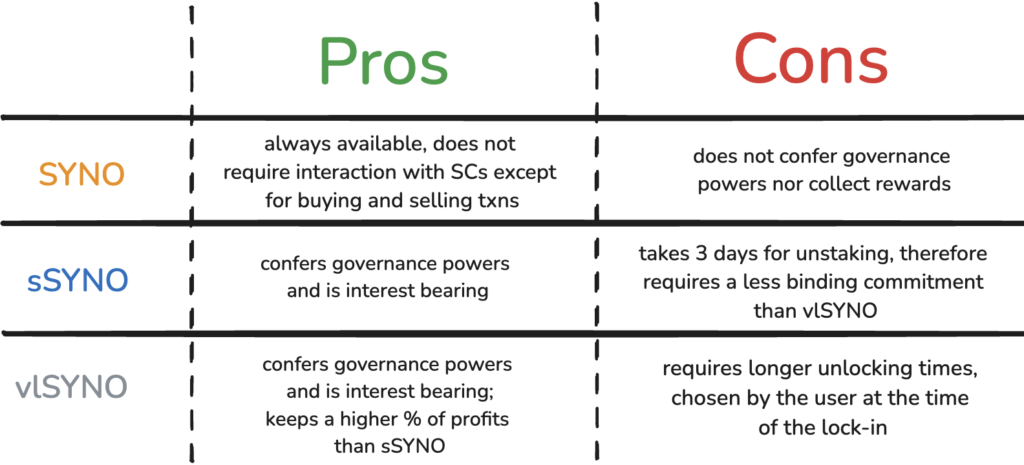

Syno’s native token, $SYNO, serves as a versatile utility token within the protocol, designed for seamless interoperability across the Syno ecosystem. $SYNO can be acquired through emissions or directly via the Balancer pool. Even after the recent shift to tokenomics V2, the protocol still features four tokens, each with distinct functions:

- $SYNO: The primary protocol token, following the ERC20 standard.

- $vlSYNO: Represents locked Balancer $SYNO/$WETH (80/20) LP tokens. This non-transferable ERC20 token earns the bigger portion of both protocol’s fees (70% of the overall 35% awarded to all kinds of stakers) and emissions (70%).

- $sSYNO: Represents staked SYNO, which benefits from reduced fees and accrues both revenue (30% of the overall 35%) and emissions (30%) although to a lesser extent than $vlSYN due to the less binding unstaking mechanics (only 3 days of cooldown).

- $rCT: The rewards claim token, granted to $veNEWO holders who convert $NEWO to $SYNO.

Among these tokens, $SYNO, $sSYNO, $vlSYNO are the primary ones, while $rCT is expected to diminish in importance over time.

Figure 12 : Prof And Cons Of The Main Tokens Within The Synonym Ecosystem Source: Alea Research

Source: Alea Research

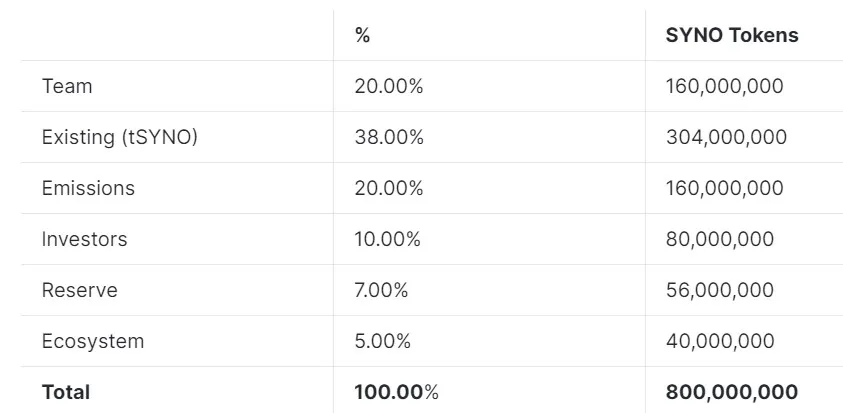

Token Allocation

- Existing Supply – tSYNO (38%): $NEWO holders can convert their tokens to $tSYNO on a 1:1 basis, with a mandatory 15-month staking period. Early withdrawals are penalized, with fees decreasing over time and reverting to the treasury.

- Reserve (7%): Allocated for incentivizing contributors, supporting growth, and covering unexpected costs.

- Ecosystem (5%): Funds are reserved to support ecosystem development and strategic partnerships.

- Emissions (20%): Tokens are released gradually to drive ecosystem adoption, with an initial distribution at launch followed by perpetual releases. The emission schedule will dictate the circulating supply over time, which will be subject to potential adjustments based on the platform’s needs.

- Team (20%): Allocated to the team to reward contributions and retain talent, ensuring the platform’s ongoing development and success.

- Early Purchasers (10%): Reserved for early investors, recognizing their support in the platform’s initial stages.

Figure 13: Token Allocation Details

Source: Icodrops – Syno Finance

Source: Icodrops – Syno Finance

As we said, the team recently updated the tokenomics model to simplify the staking structure and make the reward mechanics clearer.

The BIPS program has been completely removed as well as the governance power to $SYNO and the rule of locking 5% of lending deposits in $vlSYNO.

The emission distribution mechanism has also been changed, as well as that of fees.

- 50% of fees are distributed back to money market suppliers;

- 15% of fees are distributed to treasury for operational expenses;

- 35% of fees are distributed among vlSYNO and sSYNO.

For fees distributed to vlSYNO and sSYNO:

- 30% are distributed among sSYNO;

- 70% are distributed among vlSYNO tSYNO & rCT.

The new staking model implemented by Syno is now simple and intuitive and strives to reflect and align the interests of all stakeholders by driving protocol growth, improving liquidity, and promoting active participation.

Conclusion

In conclusion, Syno seeks to carve its own niche in the lending space by enabling cross-chain functionality, unifying liquidity, and overall offering a more streamlined and friendly user experience. By integrating technologies like Wormhole and Circle’s CCTP, Syno provides a unified credit layer that improves efficiency and reduces overall costs in an increasingly chain-rich DeFi environment. With a Hub and Spoke architecture, Syno seeks to differentiate itself from other competitors with point-to-point systems, ultimately making design decisions that seek to benefit all protocol users.

References

- “Crypto & Blockchain Venture Capital – Q1 2024”, Galaxy Research, published on its website. Link

- “Peer-to-Pool: the Paradigm Shift of Lending Protocols in the Bitcoin Network (2024)”, Shell Finance, published on its Mirror page. Link

- Syno’s Official Documentation. Link

- A deep dive into economic risk and risk parameters in DeFi (2023), Apostro.xyz, published on its official blog. Link

- “From banks to DeFi: the evolution of the lending market (2022)”, Jiahua Xu and Nikhil Vadgama, academic paper published on Arxiv. Link

- A Brief History of Crypto Lending Markets (2024), Maple Finance, published on its official blog. Link

- “What is Cross-Chain Transfer Protocol (CCTP)? Circle’s Ambition to Capture Market Share (2024)”, published by Pulse Wallet team on their official medium blog. Link

Disclosures

Alea Research is engaged in a commercial relationship with Syno Finance and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.