Introduction

Superseed is the first-of-its-kind Ethereum Layer 2 blockchain designed to autonomously repay user debt, leveraging a novel embedded Collateralized Debt Position (CDP) mechanism. Built on the OP Stack, Superseed is pioneering a new approach to rollups that focuses on maximizing capital efficiency through the direct sharing of all protocol revenues, such as net sequencer profits, CDP interest, and inflationary rewards, to its users (thus nothing will be captured by the core team or held by a DAO for fee decisions). With Superseed, loans are effortlessly repaid without interest, creating a frictionless way to access yield.

At the core of Superseed lies the SuperCDP system, which allows users to mint an overcollateralized stablecoin (Superseed Stablecoin) by locking assets such as $ETH, $WBTC, or even the Superseed governance token as collateral. It basically acts as both a liquidity hub and a rewards distribution engine.

The protocol introduces new financial primitives such as Supercollateral and Proof-of-Repayment, respectively allowing users to borrow without interest and to automatically repay loans through Dynamic Repayment Vaults. Both outcomes are achieved by using fees generated by different sources on-chain, including sequencer revenues, interest from non-native borrowers, and daily auctions for emission distribution.

The Superchain is a network of chains built with Optimism’s OP Stack, a scalable, open-source technology framework aligned with Ethereum’s core principles. Each chain within the Superchain benefits from shared interoperability, security updates, and ecosystem-wide grants and contributes a portion of its protocol fees to the Optimism Collective, collectively aiming to scale Ethereum to a global level.

By joining the Superchain, projects gain advantages such as access to economic incentives (e.g., grants and public goods funding), improved security, compatibility with other ecosystem projects, and a wider user base. The Superchain’s shared infrastructure also allows for streamlined development and benefits from network-wide updates and optimizations.

As Superseed is built on the OP Stack, it will be able to leverage shared liquidity and cross-chain compatibility, optimizing its self-repaying loan model and yield generation. This access to a broader user base and liquidity pool will further amplify its capital efficiency and adoption within the DeFi space.

Unlike existing debt instruments issued on top of other chains, Superseed aims to redefine debt management through a chain-based system, where loans can repay themselves using protocol-generated fees. Built as a Layer 2 solution on Ethereum, the protocol aims to align value flows across its ecosystem and reduce financial pressure on users. The protocol automatically channels fees back into loan repayments for Supercollateral borrowers, enabling self-repaying loans for users.

Key Takeaways

Positive-sum incentives alignment: users on Superseed can take out loans against their collateral from a CDP protocol that is embedded and natively available at the chain level. Users can deposit collateral to mint a stablecoin which is interest-free and automatically repays Supercollateral debt positions by tapping into the protocol’s multiple revenue sources, such as net sequencer revenues, CDP interest, and inflationary rewards.

Uniquely designed value accrual system: on Superseed, 100% of the revenues generated by the platform are directly allocated to its user base through the self-repaying loans mechanism, drastically improving the on-chain borrowing experience.

User-centric tokenomic model: Superseed’s token launch embodies a fair and community-driven approach by prioritizing equal opportunity access for all participants through a public sale without any earlier VC involvement. . By starting with a high token float and a low Fully Diluted Valuation (FDV), the project maximizes user interest and encourages broad community ownership.

Real use-cases associated with the governance token: Superseed’s governance token gives those who use it in the CDP and meet certain requirements (Collateral Ratio >/= 500%) the opportunity to borrow without paying interest and to benefit from self-repaying loans.

New chain-level primitives paving the way for next-gen apps: Superseed’s infrastructural model introduces two key primitives, Supercollateral and Proof-of-Repayment, giving developers new design solutions that benefit from the Ethereum equivalence provided by the OP Stack.

Background

Superseed was born in 2024 from the ideas and talent of Arkantum Labs, a Bucharest-based software house with around a dozen employees and associates. The team consists of crypto natives across several core verticals, with a strong combined track record of previously working in successful web3 projects such as Consensys, Allinfra, and many others. Known and traceable members are:

- David Iach, Founder.

- Nicolae Oprisan, CT.

- Mesky (@systems_value on X), Growth Lead.

- 2chairs (@2chairs_eth).

- Adam Browman, BD lead.

- Aura Plopeanu, Ops lead.

The project’s mission is to establish a protocol that prioritizes the individual within the on chain ecosystem, fostering a transparent, community-aligned, and equitable approach to decentralized finance. To align with this vision, the project has raised $1.5M in a pre-seed funding round.

Rather than following the standard VC playbook, Superseed emphasizes broader community involvement. As a result, the protocol will be allocating 20% of the token supply to a public sale, thus ensuring that everyone has the opportunity to invest and benefit from the network’s growth.

Next-Gen L2s with Design-Embedded Primitives

The rollup-centric vision outlined by Buterin back in 2020 has now finally materialized, though perhaps not in the way the father of Ethereum envisioned it.

Many of the current projects are actually forks of other successful projects or barely more than experiments, which fragment liquidity and users and do not introduce any new elements into the industry; but this is not the place to broach the subject.

The topic of modularity has played a major role in the path that has led to the status quo: the picture that the market shows us today reflects an ecosystem populated by thousands of chains, each with its own features, community and varying degrees of product-market-fit.

Among the most interesting technical developments that have been fostered by the environment outlined above are undoubtedly ETH scaling solutions with chain-embedded primitives. These projects represent a category of L2 scaling solutions projects that take advantage of reliable and mature stacks (such as those provided by Optimism, Arbitrum and Polygon) and combine them with new and/or existing functionalities to create new design paradigms that are more efficient or simply better suited than the previous ones to meet specific needs. This category also includes those projects that integrate additional functionality but within their own stacks, without depending on third-party providers

While the assumptions driving the birth of the trend are clear, it is trickier to set the research boundaries because the level of versatility, modularity and technical support now offered by the Web3 industry is very high and the range of potential deployable solutions is growing exponentially.

Let’s therefore try to focus only on those dedicated to the DeFi branch and analyze some of its most influential and promising players to understand the big picture and the competitive landscape inside which Superseed operates.

Figure 1: A list of projects that fall into the category of 2.0 scalability solutions

Source: Alea Research

Blast’s native yields

The project that actually ushered in mainstream attention and later consolidated into a full-fledged category is Blast, an Ethereum-compatible Layer 2 network that enhances scalability, reduces transaction costs, and improves throughput by using optimistic rollup technology.

What sets Blast apart from other Layer 2 options is its native yield on assets like $ETH and stablecoins, generated respectively by staking and earning passive returns from RWA (T-bill focused) protocols such as Sky (former MakerDAO).

The L2’s stablecoin, $USDB features an auto-rebasing mechanism that allows users to seamlessly earn yield on their holdings without having to take any additional action on their end. This mechanism adjusts the token’s value over time to reflect the yield earned on assets. Users can see their holdings increase without needing to take action, simplifying yield generation and compounding.

In a nutshell, $ETH is natively rebasing while the stables are all converted to $USDB, also natively rebasing, at the end of inflow operations through bridge solutions.

Figure 2: The main features that Blast boasts

Source: Blast official docs

$USDB offers various yield modes:

- Automatic (default): Yield is automatically incorporated into the token’s value.

- Void: Yield is prevented from rebasing.

- Claimable: Yield accumulates and can be claimed manually by the user.

ve-Chain and BTC Tokenization on Corn

Corn is an Ethereum Layer 2 solution that leverages a hybrid tokenized version of Bitcoin, $BTCN, as its gas token. This token is pegged 1:1 with Bitcoin, having the underlying assets being backed by multiple trusted custodians (both decentralized and centralized) as well as smart contracts and bridging protocols.. Corn’s approach integrates Bitcoin more deeply into the DeFi ecosystem by enabling $BTC holders to participate in yield-generating activities without sacrificing control over their assets.

The core mechanics of Corn’s ecosystem are driven by its Super Yield Network, inspired by Curve Finance’s veTokenomics model (that is why the team calls the project itself a ve-chain). Users can stake Corn’s native token, $CORN, to receive popCORN, which allows them to control the yield allocation. The two main yield sources are:

- $BTCN, generated through transaction fees.

- $CORN, issued through network emissions.

Corn also has a natively embedded bribe market, a kind of bargaining vote mechanism that allows participants to offer incentives to $CORN stakers in exchange for their votes. Also, this system is inspired by Curve Finance’s veTokenomics, where governance and decision-making are driven by token stakers who can influence the direction of yield distribution.

Figure 3: The rewards distribution model (incentives in $CORN—fees generated in $BTCN) on Corn, which is clearly inspired by the ve-design

Source: Alea Research

The innovative nature of this feature lies in its ability to address the opportunity cost traditionally associated with moving assets to Layer 2 solutions, where users often miss out on yield-generating opportunities available on Eth mainnet.

Corn’s approach also opens up new possibilities for apps, such as fee subsidizing, where users are effectively exempt from transaction fees. The protocol, in turn, generates revenue by taking a portion of the yield produced by assets under management. This dual-benefit framework, where users experience 0 direct costs and the protocol ensures sustainable revenue, fosters a more dynamic, synergic and liquid ecosystem, aligning incentives across all network’s participants (users, devs, and stakeholders).

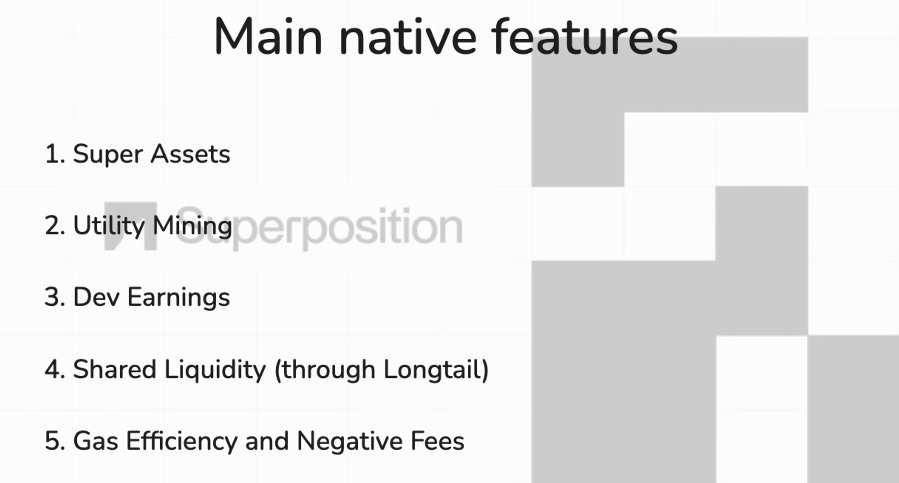

Shared Liquidity and Utility Mining on Superposition

Superposition is a Layer-3 chain built on top of Arbitrum using the Arbitrum Stack, designed to enhance DeFi apps with unique liquidity solutions and yield distribution mechanisms. It introduces Super Assets, which provide yield both when held and used in transactions, creating a dual functionality that fosters active participation. The Superbook is an on-chain order book that aggregates and shares liquidity across multiple protocols across the network, optimizing capital efficiency.

Utility Mining enables developers to reward users based on their activity, decentralizing incentive structures. Superposition also supports Stylus, allowing high-performance apps to be written in multiple languages (e.g., Rust, C++), and is highly gas-efficient, even offering negative transaction fees.

Stylus adds a second Virtual Machine coequal to the EVM (called WASM VM) that:

- Executes WebAssembly instead of EVM bytecode, enabling the creation of smart contracts in any language that compiles into WASM (such as Rust, C++, Cairo, Move, etc);

- Is designed to be fully interoperable with Solidity smart contacts, even for cross-language calls (i.e., from Solidity SC to Wasm SC or vice versa).

Figure 4: The list of embedded primitives at the chain level provided by Superposition

Source: Alea Research

The Super Layer is basically the core system integrating these elements, with tools to foster innovative financial applications and liquidity models.

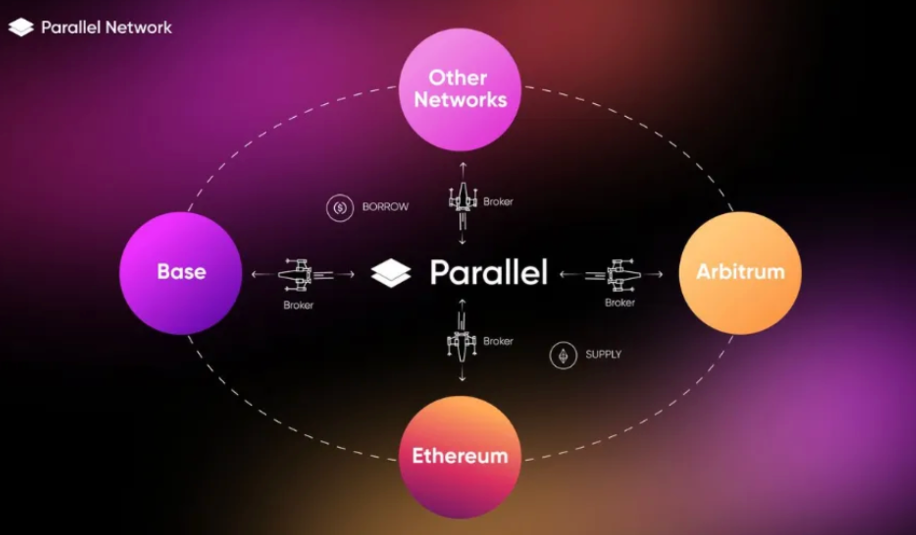

Omnichain Applications on Parallel

Parallel.fi is an EVM-compatible Layer 2 (L2) solution with a multichain vocation and a modular approach. It’s built on Arbitrum Nitro Stack in partnership with Socket and Conduit.

The protocol natively adopts Broker Accounts on the L2 as a multi-chain liquidity aggregation solution (supporting both EVM and non-EVM systems). Broker Accounts are proxy smart contracts acting as trustless, non-custodial intermediaries between Automated User Operations (AUOs) and the chains supported by Parallel, enabling interoperability among them (and thus allowing the cross-chain execution of operations such as lending and borrowing, swaps, or providing liquidity, to name a few).

Broker Accounts get the necessary operation information on the destination chain through the messaging system developed by Socket (aka Socket Data Layer), which facilitates seamless communication and interaction between different chains.

Parallel also Introduces Liquidity Vaults, which are dynamic money markets (or lending pools) fostering deposit and loan operations across the chains where they are deployed. They act as liquidity outposts capable of rebalancing (thanks to an automated system of keepers) based on liquidity demand across the chains supported by Parallel. When deployed alongside Broker Accounts on a specific chain, they allow users to:

- Create and manage unified multi-chain margin accounts.

- Exchange assets and information between money markets on different chains seamlessly and automatically.

The project has implemented an omnichain execution layer allowing users to have a single account on the native L2 and interact with supported chains through a sandboxed Account Abstraction (AA) layer (a series of smart wallets natively integrating AA deployed on each supported chain) dedicated to each user and strategically distributed by Parallel across all supported chains.

The concept of Abstraction in IT encompasses the whole range of tools and protocols that hide non-essential information/data in the background to simplify users’ interaction with web services and, as can be guessed, plays a key role in the adoption process of the underlying technologies.

In the blockchain context (and namely in the EVM world), the AA embodies a new paradigm in the basic account design that breaks down the technical complexities and adds unique functionalities for the benefit of users by decoupling the operational logic of the accounts themselves from the traditional cryptographic signature-based system and replacing it with a programmable, arbitrary execution logic.

Figure 5 & 6: The main components of the Parallel Stack

Source: Paralle’s Official Medium page and WP

The use cases and development potential of this new primitive are virtually limitless:

- Omnichain money markets;

- Omnichain gasless operations;

- Omnichain DEXes and DEX aggregators;

- Automated omnichain functionalities.

The Superseed Stack

The Superseed architecture rests on six pillars that ensure seamless loan management, fair yield distribution, and secure collateralization processes.

Core Components

- Superseed L2

- SuperCDP Protocol

- Proof-of-Repayment

- Supercollateral

- Dynamic Repayment Vaults

- Superseed Stablecoin

Each of these pillars works synergistically with the others to bring a higher-level on-chain UX back to users through 0-interest and self-repaying loans.

Figure 7: Superseed components operate with each other as distinct parts of a single, cohesive system

Source: Alea Research

The Superseed L2

Superseed is built on the OP Stack—a flexible and modular framework developed by Optimism. Optimism is a Layer 2 solution for Ethereum that uses rollup technology to decrease transaction costs and boost throughput while preserving the security and decentralization of the Ethereum mainnet.

By leveraging the OP Stack, Superseed benefits from these efficiencies and enhances them to deliver a more streamlined blockchain experience. The modular nature of the OP Stack allows Superseed to seamlessly integrate new functionalities and adapt to the changing needs of the blockchain ecosystem, ensuring it remains flexible and responsive to future advancements.

The upcoming launch of the Superchain marks a major milestone for the whole DeFi ecosystem, bringing together a unified and horizontally scalable network of interconnected Layer 2 (L2) built on top of the OP Stack, such as Base, OP Mainnet, Zora, Blast, Mode, etc.

This development aims to create a seamless, highly scalable, and interoperable infrastructure for decentralized applications (dApps), enabling assets and data to move across chains with minimal friction.

The OP Stack infrastructure will have a highly positive impact Superseed’s self-repaying loan mechanism by enabling shared liquidity and cross-chain composability within the Superchain. This setup will improve accessibility and yield generation, while expanding Superseed’s user base and liquidity, ultimately enhancing capital efficiency through a positive feedback loop.

SuperCDP Protocol

At the core of Superseed is the SuperCDP, a native CDP protocol embedded within the rollup system. This protocol basically acts as the central point for liquidity and rewards within the whole network.

Figure 8: The minting and burning process of Superseed Stablecoin

Source: Alea Research

In a CDP model, users usually lock their assets as collateral to mint or borrow another asset, typically a stablecoin. Unlike Peer-to-Pool Money Markets, where liquidity comes from a pool of lenders, CDP protocols generate liquidity directly from the collateral deposited by the borrowers.

On Superseed, users can utilize a range of assets, including the Superseed governance token, $ETH, $WBTC, and others, as collateral to mint and borrow the Superseed stablecoin. Once the collateral is locked into the SuperCDP, a collateralized debt position is established, and stablecoins are issued.

The protocol enforces overcollateralization, requiring the collateral’s value to be at least 150% of the stablecoin’s value to avert the liquidation risk.

To release collateral, users must first repay their loans. If the collateralization ratio drops below the required threshold, the protocol auctions off part of the collateral to cover the outstanding debt, applying a penalty fee.

When a user repays the loan or is liquidated, the stablecoins are burned by the protocol. Interest rates for CDPs are established and, if necessary, updated by governance and are designed to foster stablecoin stability.

Proof-of-Repayment

Proof-of-Repayment is a unique programmatic reward mechanism developed by Superseed, which distributes a small percentage of the supply every day (2% on an annual basis) through auctions. During each auction, participants place bids by committing Superseed stablecoins (the only accepted asset), with the highest bidder winning the reward.

Figure 9: The process of awarding rewards through auctions with Proof-of-Repayment

Source: Alea Research

The stablecoins committed by the auction winner are directed to a repayment vault and used to reduce the outstanding debt of Supercollateral users by burning their debt. Those who do not win the auction are refunded the stablecoins they committed.

This system serves to both distribute new tokens and pay down protocol debt in a structured, programmatic way.

Supercollateral

The SuperCDP protocol differentiates itself from other CDP systems by utilizing multiple fee sources to automatically repay the loans on behalf of users who borrow against assets designated as Supercollateral. Initially, the governance token of Superseed will be the first asset withSupercollateral status.

Users who maintain a 500% collateralization ratio on their Supercollateral loans will have their loans repaid without incurring any interest charges.

The fees that contribute to the self-repaying loans come from several revenue sources:

- Revenues generated by the Layer 2 sequencer;

- Interest earned from loans backed by non-supercollateral assets (e.g., $ETH, $WBTC) within the lending protocol.

- Revenue from Proof of Repayment mechanism, which directs additional income toward loan repayment.

Dynamic Repayment Vaults

One of the primary stabilization mechanisms in the Superseed Lending Protocol is the Dynamic Repayment Vault.

Figure 10: Main functions performed by the Dynamic Repayment Vault

Source: Alea Research

Borrowers have the option to manually repay their loans by burning the stablecoins they initially minted. For Supercollateral users who benefit from self-repaying loans, the fees are collected in a repayment vault, a smart contract designed to manage these funds.

The vault systematically pays off the debt of Supercollateral users by burning stablecoins on a pro-rata basis, following a predefined repayment schedule. This process is dynamic and can adjust the repayment rate as needed.

The key advantages of the Dynamic Repayment Vault include stabilizing the repayment rate through a programmatic approach, reducing the volatility of the payment rate across different market conditions. Additionally, the vault serves as a stablecoin sink, helping the protocol maintain the stablecoin’s peg by absorbing excess stablecoins.

Superseed Stablecoin

Users can mint the Superseed Stablecoin by providing any accepted collateral within the SuperCDP system. The stablecoin is designed to maintain a value as close as possible to $1, supported by several structural mechanisms.

All fees generated across the Superseed Protocol are converted into the Superseed stablecoin and directed toward repaying the debt of Supercollateral users, reducing the Superseed’s stablecoins overall supply.

Sources of fees, such as sequencer revenues, interest from non-Supercollateral borrowers, and the Proof-of-Repayment system, create a constant demand for the stablecoin under various market conditions.

The stablecoin functions as a debt-tracking token, a medium of exchange, and a stable unit of account within the Superseed ecosystem. It is overcollateralized and decentralized, making it a reliable instrument for enhancing liquidity and stability across Ethereum’s decentralized finance markets.

Additionally, the Superseed stablecoin benefits from natural supply-and-demand mechanics. If the stablecoin’s price drops below $1, the cost to repay the debt decreases, incentivizing borrowers to close their positions at a discount, which reduces the overall stablecoin supply. Conversely, if the price rises above $1, borrowers are encouraged to sell their stablecoins to capture the excess profit, wait for the target price to realign and then buy again.

Conclusion

Built on the OP Stack, Superseed integrates a native CDP protocol with self-repaying loans, supported by multiple revenue sources including sequencer revenues, interest from non-Supercollateral assets, and auction-generated fees (thanks to Proof-of-Repayment, the programmatic distribution mechanism of the governance token through auctions rewarding the highest bidder).

Through an overcollateralized stablecoin and the new Supercollateral mechanism, Superseed enables self-repaying loans This architecture is complemented by the Dynamic Repayment Vault, which ensures a stable repayment rate and acts as a supply sink for the stablecoin, contributing to its price stability.

By aligning protocol success with user benefits, Superseed seeks to implement on chain a sustainable and universally accessible user-centric alternative to financial credit.

References

“Super seed European Union Trademark Information”. Link

General info about the project on Rootdata. Link

Superseed’s Official docs. Link

“Blast Network review” (2024), published by Coin Bureau on his official blog page. Link

“What Is Blast? An Optimistic Rollup That Offers Native Yield” (2023), published by Coingecko in its learn section. Link

“Introducing Corn: The Super Yield Network Rooted in Digital Gold”, published by Corn on its official blog page. Link

Parallel Fi WP. Link

Optimism’s Official docs. Link

Superposition’s Official docs. Link

“Superseed Protocol Overview” (2024), published by Superseed on its official Mirror page. Link

“The Superseed Vision” (2024), published by Superseed on its official Mirror page. Link

Disclosures

Alea Research is engaged in a commercial relationship with Superseed and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.