Introduction

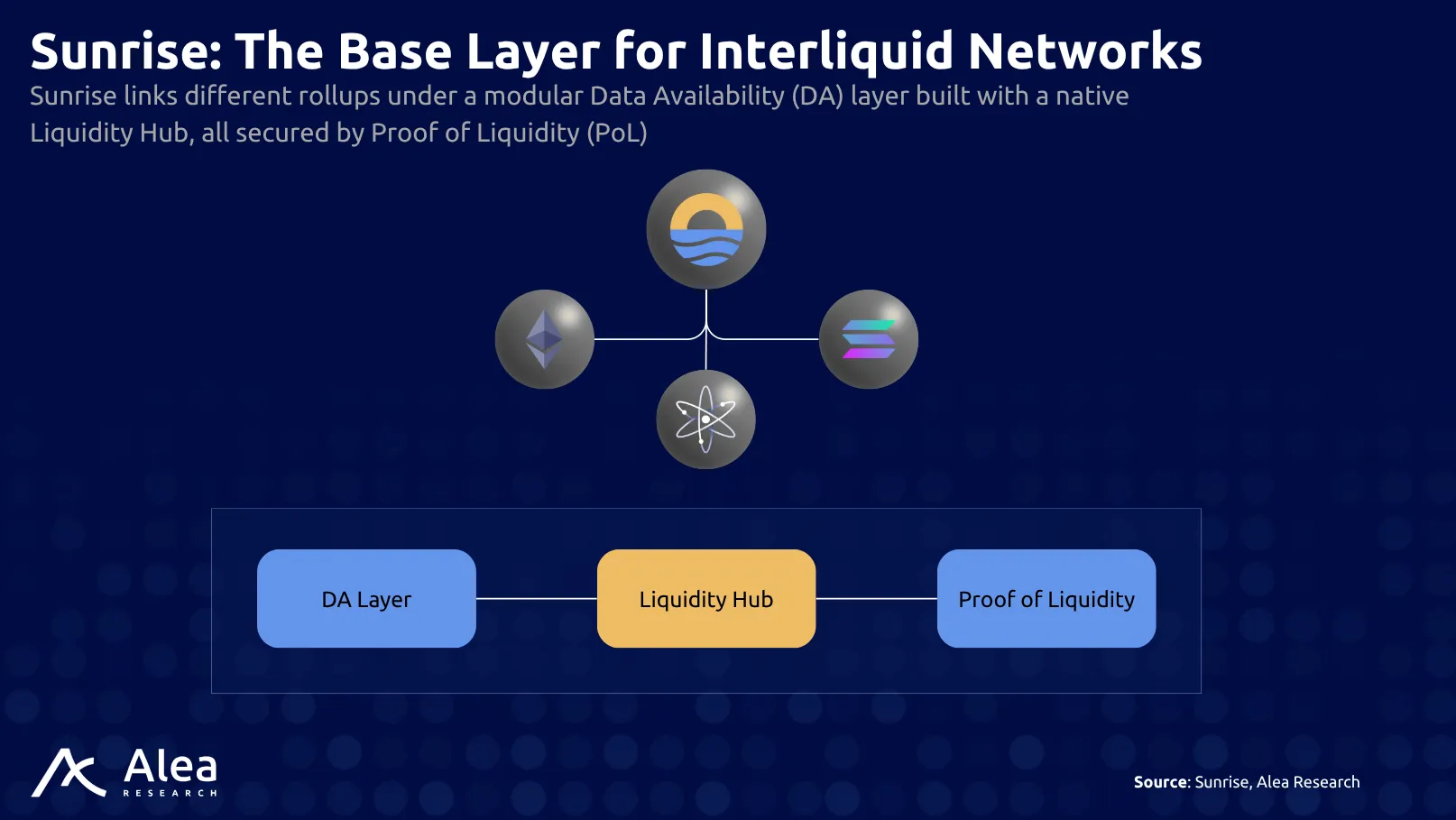

Liquidity, not execution, is the limiting factor for modular blockchains. Rollups that rely on external bridges fragment order flow and add friction for the user onboarding. Sunrise offers a solution with a base layer consisting of two key components: high-throughput Data Availability (DA) and a native Automated Market Maker (AMM) liquidity hub, both secured with Proof of Liquidity (PoL).

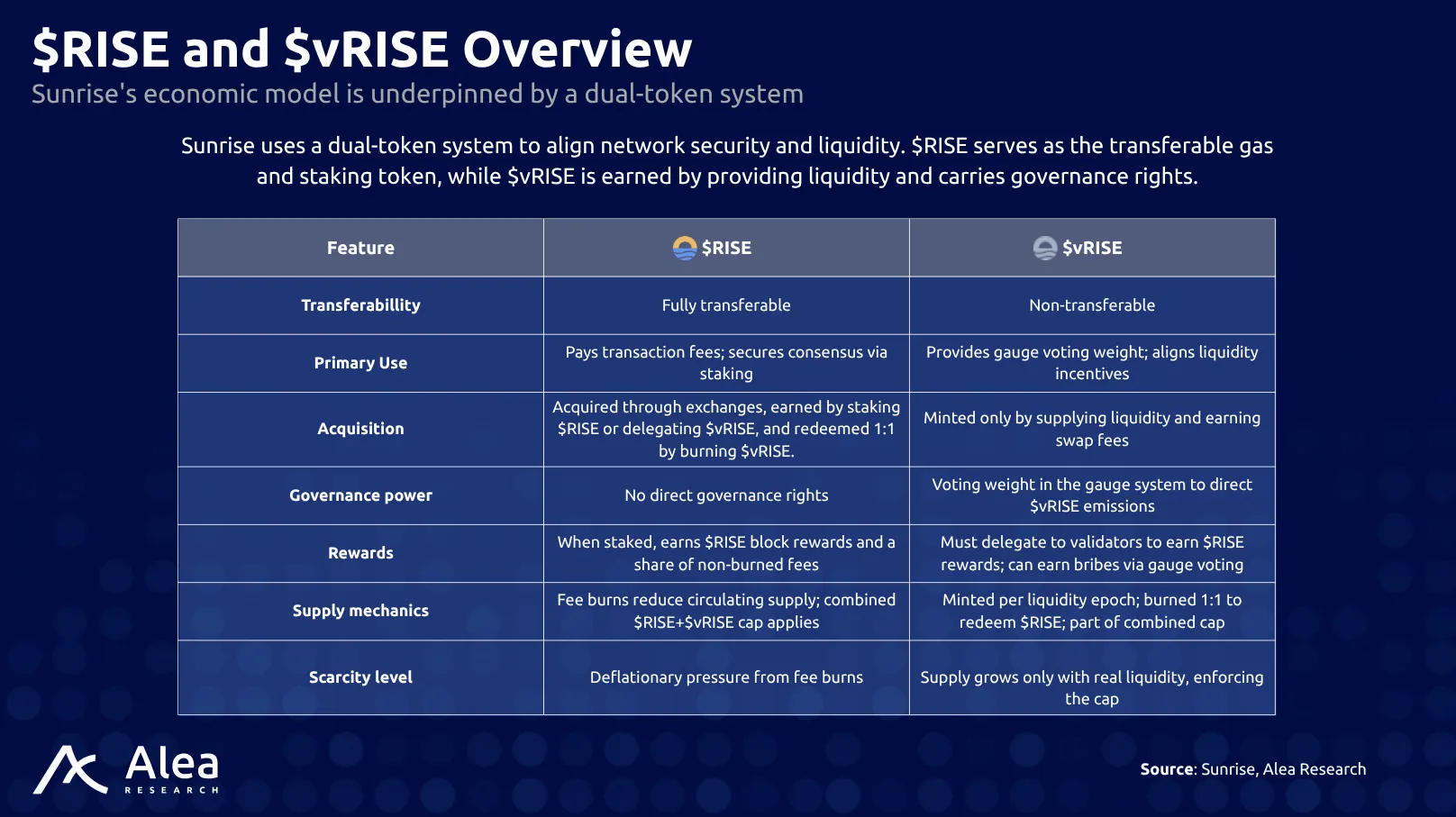

The architecture, defined as (Data Availability + Liquidity Hub) × PoL, and utilizes a dual-token model to enable shared liquidity (Interliquidity) across connected ecosystems. Fee abstraction enables gas to be paid in the rollup’s own asset; the protocol swaps a thin slice into Sunrise’s native token, $RISE, under the hood. Builders gain immediate liquidity and predictable blob costs, while LPs capture trading fees and $vRISE gauge emissions from day one.

Sunrise calls this network effect Interliquidity: a mesh in which sovereign rollups and major L1s share a common deep liquidity pool from the moment they launch. To solve the liquidity fragmentation problem that has historically been chasing both modular and monolithic chains, the value proposition is to provide direct economic upside for ecosystems by letting them and their users access deep liquidity from day one, removing hurdles and expenses associated with attracting new flows.

Key Takeaways

- Liquidity Fragmentation as Central Issue: Siloed liquidity remains a problem, as over $13 billion is scattered across multiple ecosystems.

- Unified Liquidity and Data Availability: Sunrise merges a high-throughput DA layer with a native AMM. However, rollups still need initial capital to bootstrap token-specific pairs, though they benefit from existing RISE-paired liquidity and PoL incentives from day one.

- Proof-of-Liquidity Aligns Incentives: Validators gain stake weight when liquidity providers delegate $vRISE, linking network security directly to active capital rather than idle stake.

- Interliquidity Routing Removes Bridge Risk: Swaps and cross-rollup transfers clear in one packet, cutting the settlement window.

- Fee Abstraction for Lower Friction: Any whitelisted token can be used to pay for gas; the router converts a small slice to $RISE inside the same block, removing the need to pre-purchase a base gas token.

- Dual-Token Flywheel: $RISE is transferable, burned on each transaction, and used to pay for staking rewards; $vRISE is earned only through liquidity provision since it’s not transferable, and governs future emissions, keeping supply growth tied to usage.

- Builder-Focused SDK Speeds Up Time-to-Market: Sunrise introduces the InterLiquid SDK, giving rollups contract-level hooks to liquidity, Passkey onboarding, and GPU-friendly ZK proofs, reducing development overhead and accelerating user acquisition.

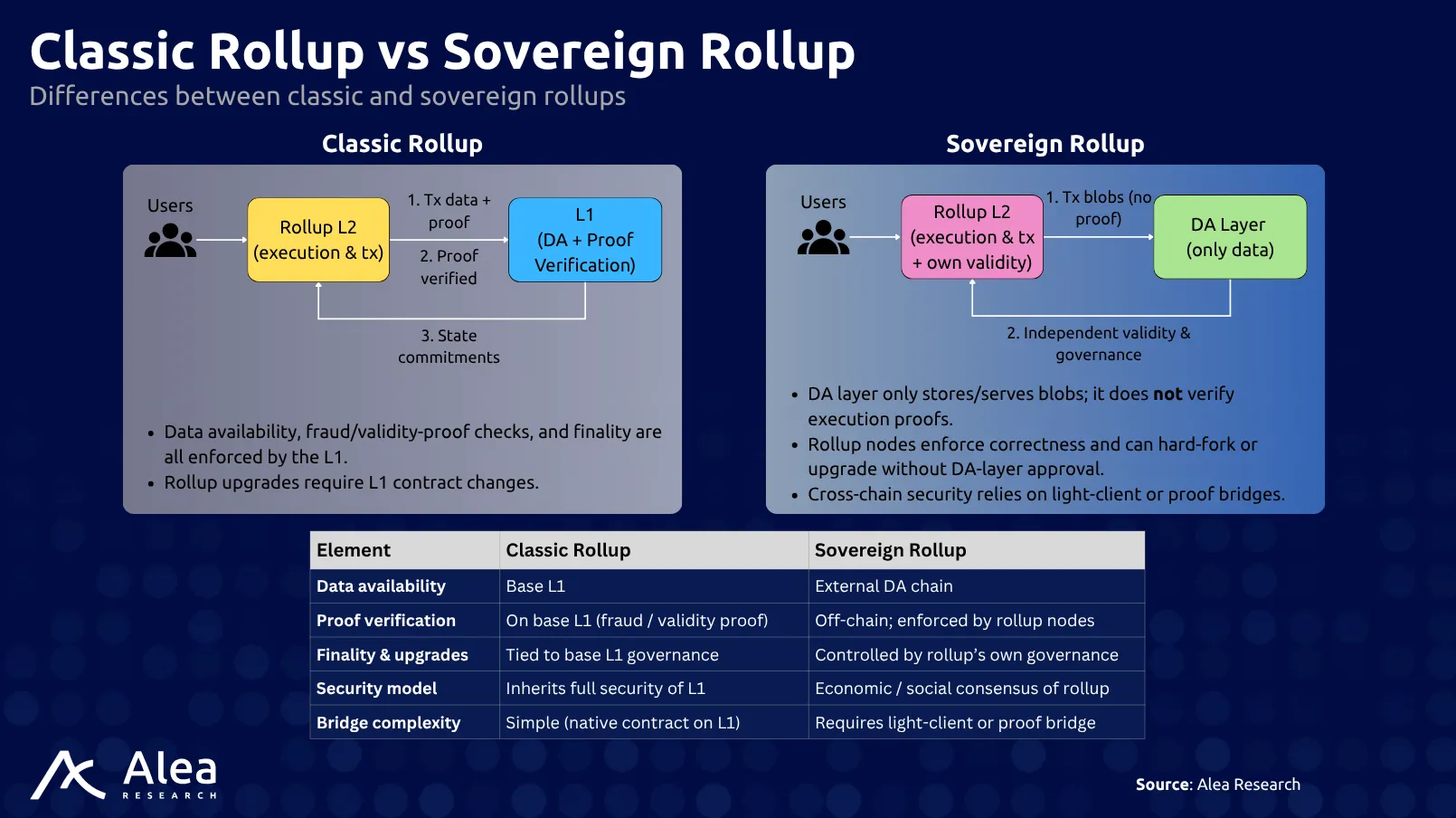

From Monoliths to Modular Stacks

Early public blockchains packed execution, settlement, and data availability into a single monolith. That monolithic model gave each application full control but forced every new chain to attract validators, launch a native token, and bootstrap liquidity, raising the barrier to entry and limiting scale. The industry’s answer has been modularity: sovereign rollups now outsource consensus and data availability to shared layers such as Celestia, EigenDA, or Sunrise, keeping only a lightweight sequencer and application logic on-chain. This “keep sovereignty, outsource consensus” design removes validator overhead and speeds deployment while preserving custom virtual machines and governance rights.

However, modularity introduces a new constraint. Each rollup launches with its own bridge and liquidity pools, turning capital into islands that cannot service neighbouring chains without wrapped assets and added risk. The result is duplicated deposits, higher spreads, and the constant spectre of bridge exploits.

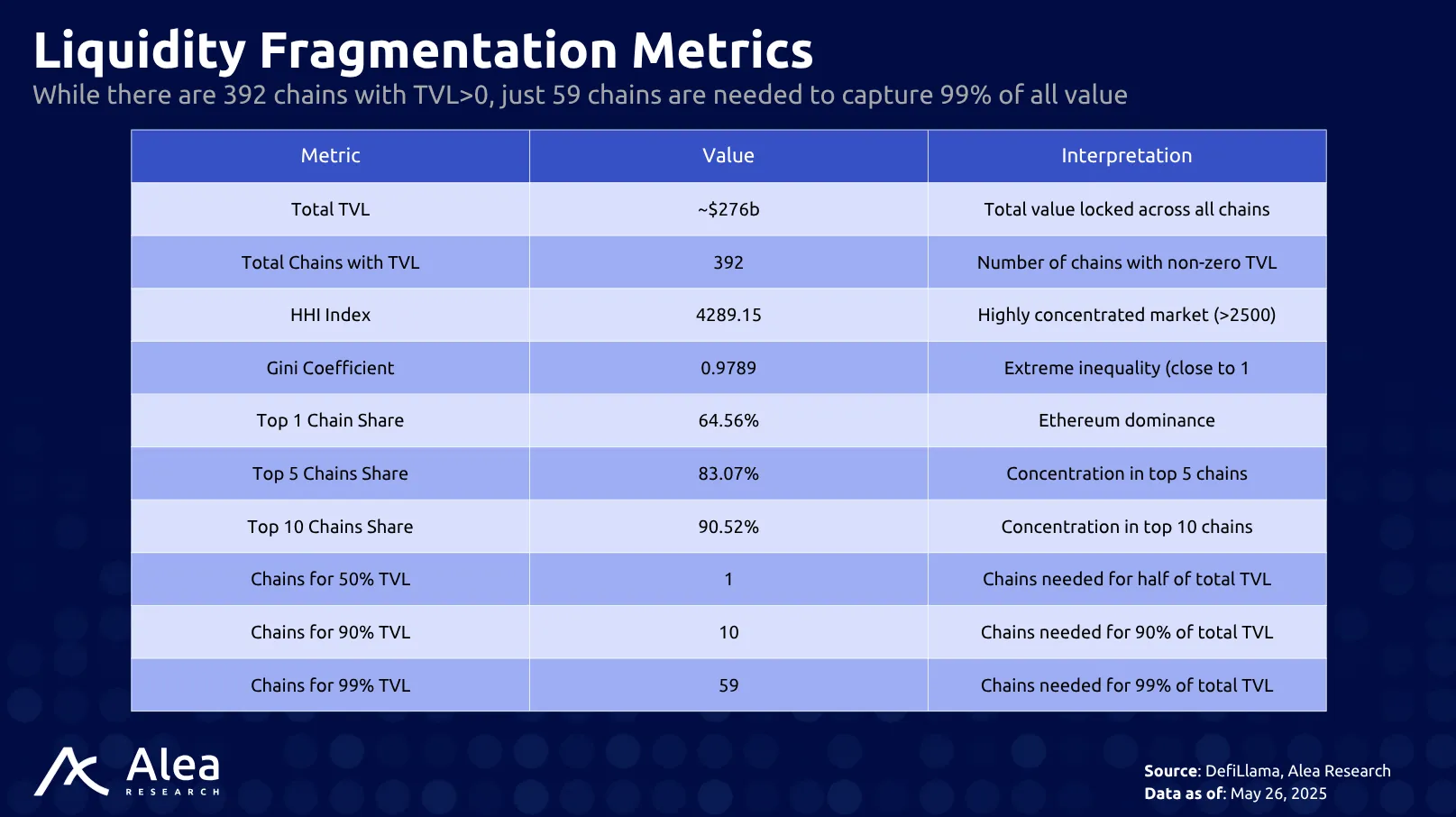

Fragmentation carries measurable costs. There are over 390 chains, with the top 20 holding 95% of the total TVL. This means that while the top 20 chains dominate 95.2% of all TVL, there is still $13.26 billion scattered across 372 smaller chains, representing significant liquidity fragmentation.

Interoperability efforts such as the Arbitrum Orbit, the OP stack, Polygon CDK, and zkSync Hyperchains aim to coordinate rollups. However, they still depend on asynchronous message passing and separate liquidity reserves, so order flow remains segmented by default outside of that niche and stack.

Why Interliquidity Matters

Sunrise’s answer: fuse DA and liquidity at the base layer. Sunrise embeds a Concentrated Liquidity AMM (CLAMM) inside its DA layer, allowing every connected rollup to clear trades against the same depth of capital from day one. Fee abstraction lets users pay gas in any token; the protocol automatically converts a fraction to $RISE, eliminating the need to hold a separate gas coin.

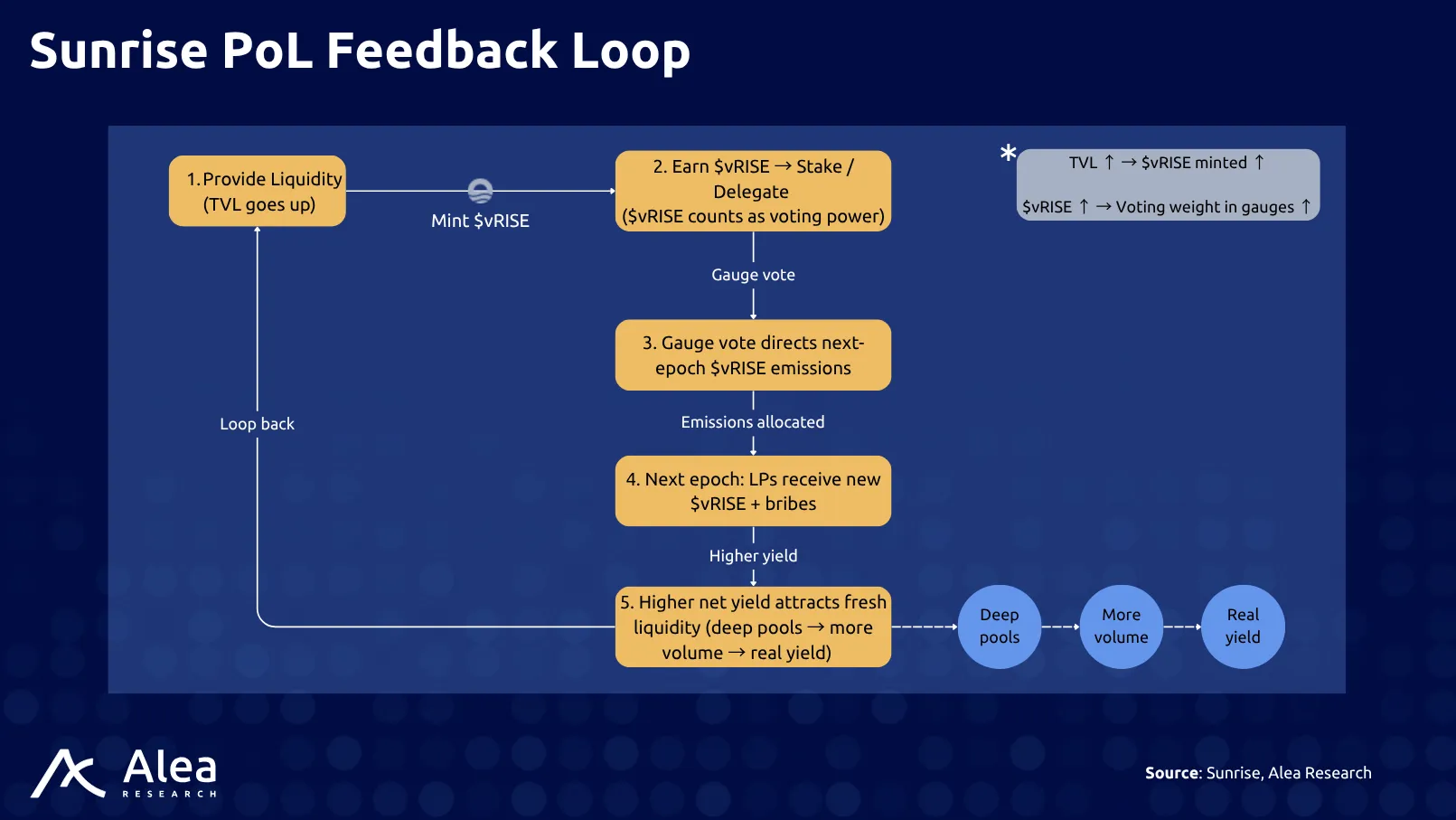

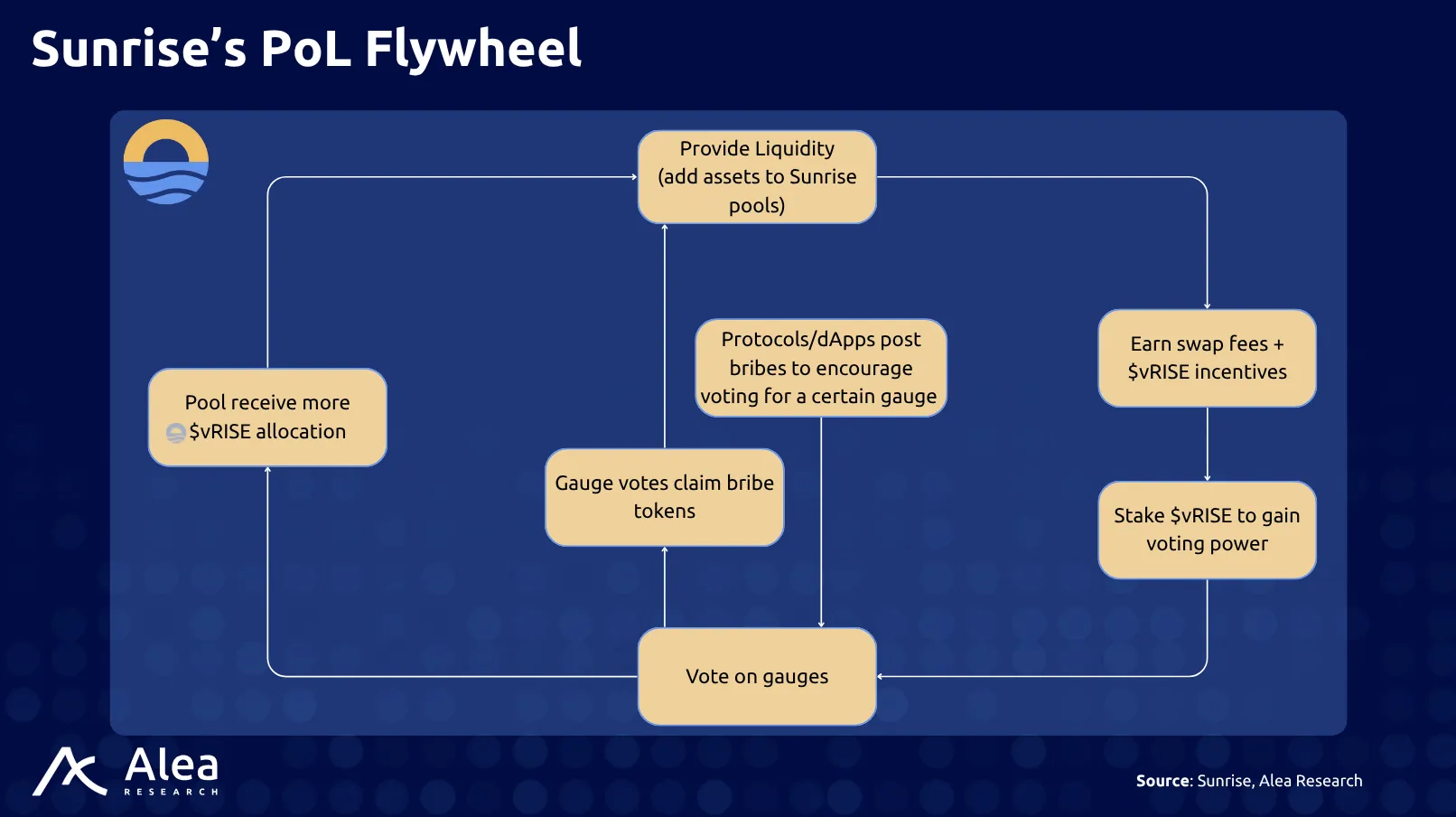

Proof of Liquidity (PoL) aligns security with productive capital rather than dormant assets:

- Validators: stake transferable $RISE or delegated $vRISE and earn $RISE block rewards for producing blocks.

- Liquidity Providers (LPs): supply assets, earn swap fees + $vRISE (non-transferable), then direct future emissions through gauge voting.

Because the validator set’s voting power can include delegated $vRISE, deeper liquidity directly raises network security, with no trade-off between the two—PoL, therefore, ties builders, LPs, and validators into one feedback loop. LPs seed pools earn swap fees plus non-transferable $vRISE, and delegate that vRISE to validators while voting on gauge emissions. Validators stake $RISE, or accept delegated $vRISE to produce blocks and collect a proportional share of fixed $RISE rewards plus commission. Builders and app-chains post bribes to pools to gauge voters, steer emissions and liquidity toward their markets, cutting their capital costs.

*$RISE secures consensus and pays fees; $vRISE is voting power minted only to LPs.

This loop is self-reinforcing:

Note that $vRISE can be burned to redeem $RISE at a 1:1 ratio, but $RISE cannot be converted back to $vRISE, creating permanent $vRISE scarcity and $RISE supply reduction.

The Sunrise Stack

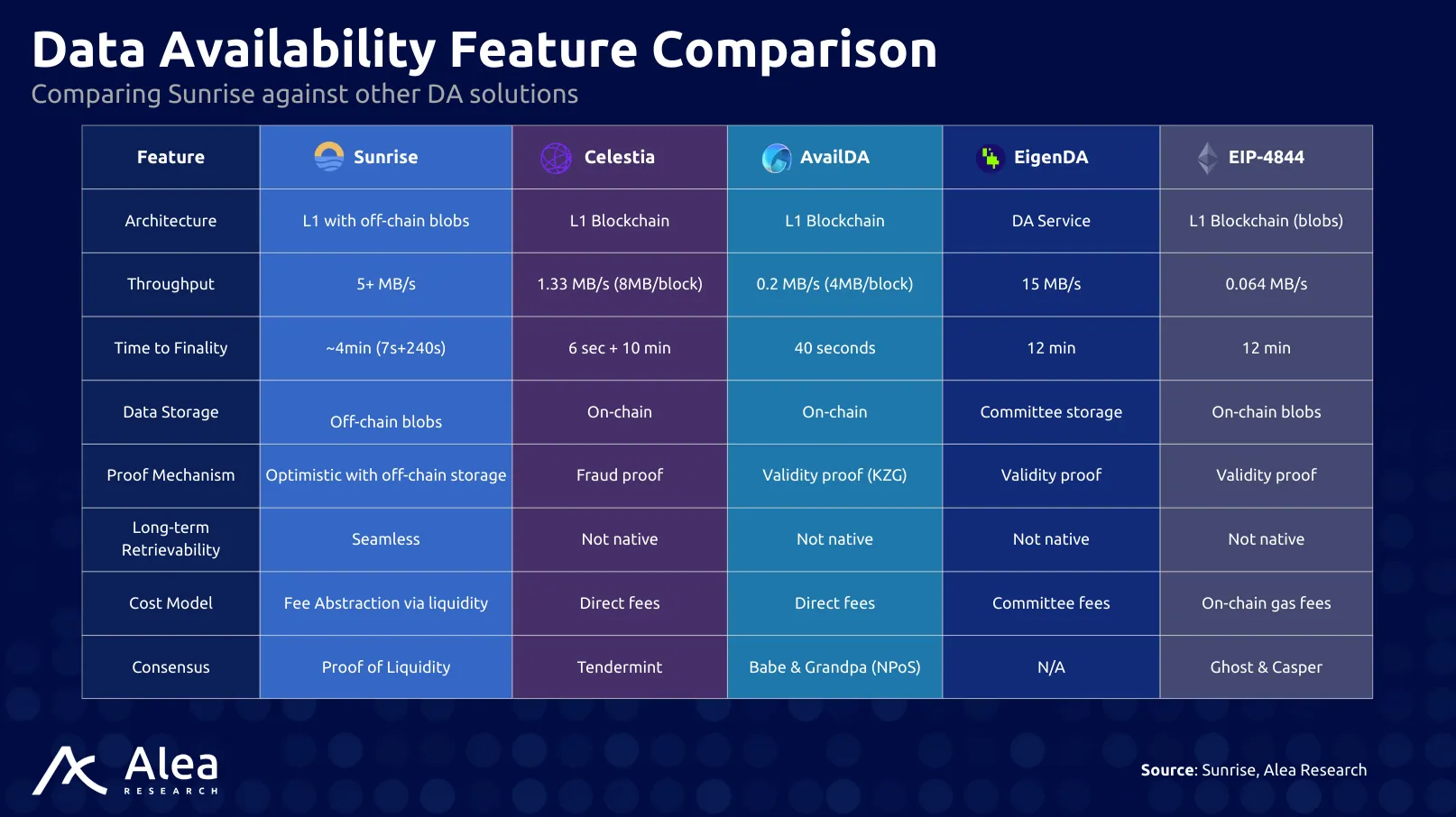

The successful adoption of modular rollups hinges on cheap blob space and deep liquidity. Yet most providers force teams to shop for them separately. Sunrise compresses that market search cost by bundling a high-throughput DA layer with a native liquidity hub, aligning incentives through PoL.

The stack keeps its surface area small: one consensus set runs CometBFT (consensus engine), one AMM concentrates liquidity, and one dual-token system links security to pool depth. Because every component is built into the base layer, rollups integrate through a single adapter instead of juggling separate DA, bridge, and DEX configurations.

Validators secure blocks by staking $RISE or delegated $vRISE, while LPs earn fees and $vRISE that steers future emissions. The architecture trades general-purpose modularity for immediate utility, where rollups launch with shared liquidity and fee abstraction out of the box.

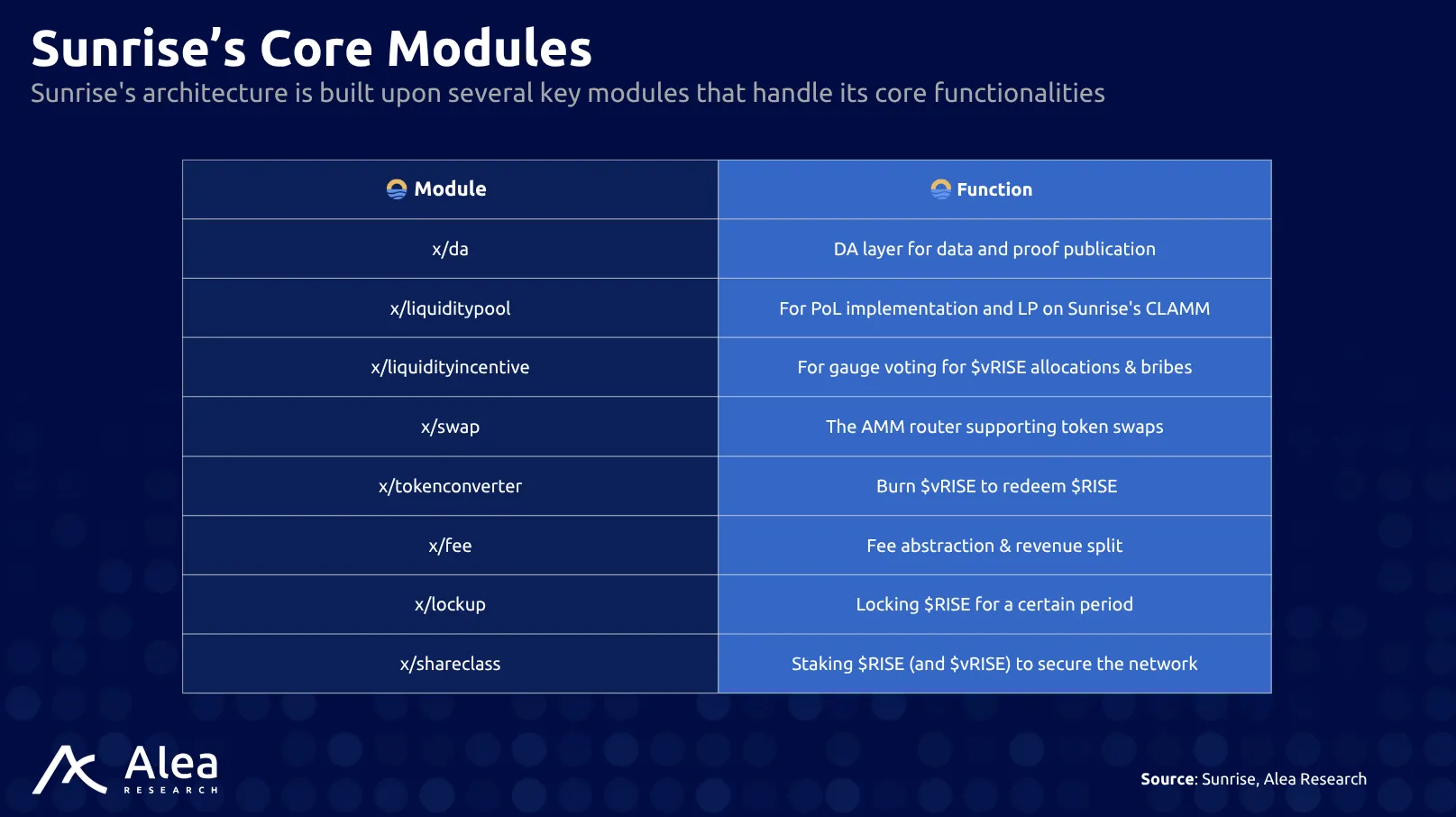

The Sunrise architecture is built upon three interconnected pillars: Data Availability, Liquidity Hub, and Proof of Liquidity. Several key modules are required for these to work, each responsible for certain core functionalities.

Data Availability

Sunrise’s DA layer optimizes for high throughput. By using off-chain erasure encoding and propagation, validators store only metadata URI (Uniform Resource Identifier) or Merkle roots on-chain. This significantly reduces storage and computational requirements. KZG commitments are used on-chain for rapid integrity verification and challenge resolution.

Finality settles in roughly four minutes (7s block x 240s challenge) before blobs become economically immutable. This design slashes DA cost per kB and removes the need for rollups to hold a separate token for gas payments, thanks to fee abstraction. Any token can pay gas; Sunrise swaps a thin slice into $RISE at execution time.

Liquidity Hub

Through the x/liquiditypool module, Sunrise embeds a Uniswap V3-style Concentrated Liquidity AMM directly at the L1 level. Pools are created permissionlessly; LPs choose tick ranges and collect swap fees proportional to volume inside those bands. LPs also earn $vRISE tokens as additional incentives.

Because the router and swap middleware are native, cross-rollup transfers can combine an IBC hop and an on-chain swap in a single call, removing bridge risk and wrapped assets from the user path. Front-end builders can also set an interface fee, creating a secondary revenue line for wallets and aggregators.

Proof of Liquidity (PoL)

Sunrise employs PoL, a new Sybil resistance and core consensus/governance mechanism. PoL grants voting power based on a user’s past contributions to liquidity. The idea is to incentivize liquidity provision while enhancing network security. By having participants stake their assets in liquidity pools, this ensures a continuous and more predictable flow of assets within the network. In return, LPs can be rewarded proportionally to their contributions.

Validators stake transferable $RISE or delegated $vRISE and earn block rewards denominated in $RISE. Liquidity providers supply assets to AMM pools, earn swap fees, and non-transferable $vRISE at the end of each epoch; they can then delegate that $vRISE to validators or use it to vote on gauge weights that redirect future $vRISE emissions. $vRISE is obtained exclusively through liquidity provision, and is the only token that counts in gauge voting.

The redemption path to burn $vRISE and get $RISE is as follows:

- You initiate a burn action on your $vRISE tokens.

- The `x/tokenconverter` module handles this process within the Sunrise architecture. This module is specifically for the conversion from $vRISE to $RISE.

- For every $vRISE token you burn, you will redeem $RISE at a 1:1 ratio.

- You receive the corresponding amount of $RISE tokens.

It is important to note that this conversion only works in one direction: you can burn $vRISE to get $RISE, but you cannot convert $RISE back into $vRISE.

Because validator power increases with delegated $vRISE, deeper liquidity translates directly into higher consensus security instead of competing with it. Unlike standard Proof of Stake (PoS) chains, which focus on token staking for network security alone, PoL integrates liquidity provision to allow staked assets to remain liquid and usable in network transactions.

The result is a three-way alignment loop (as discussed earlier):

- Rollups push transaction and liquidity flow to Sunrise to access cheaper data availability and tight spreads, directing volume through on-chain pools. This activity distributes more $vRISE to LPs, burns $RISE through fee abstraction, and raises validator rewards without requiring additional capital. To further deepen liquidity, rollups offer bribes to incentivize LPs to vote for their pools in gauge elections, aligning incentives across builders, LPs, and validators while concentrating emissions where real usage occurs.

- Rollups compete to attract volume to their pools by incentivizing deeper liquidity with bribes, while LPs earn swap fees and $vRISE based on the volume their positions clear. $vRISE is only rewarded to LPs and reflects real usage rather than passive stake.

- Validators earn $RISE from a fixed block-reward pool, and their share increases with more delegated $vRISE, boosting their effective APY.

Eliminating Onboarding Friction

To attract users and ensure deep liquidity, onboarding is a process that should involve minimal friction. Friction raises the marginal cost of every new user. Any blockchain or rollup that requires wallet funding, bridging, and gas management forces newcomers through a multi-step funnel where each step leaks capital and users.

For a $100 first-time deposit, cumulative cash drag can exceed 8–10% once card, bridge, and gas fees stack. Every failed transaction adds retries and further gas.

| On-chain onboarding step | Typical cost (May 2025) | Friction points |

| Buy $ETH on-ramp | 1–4.5% card fee (MoonPay) | KYC delay; fee opacity |

| L1 gas to bridge | $0.44 – $0.59 per tx at 1.3 gwei (no traffic); $5 – $10 minimum on some bridges | Two transactions, variable delay |

| Bridge service fee | 0.1%–1% (provider-dependent) | Smart-contract risk, variable delay |

| L2 swap gas | $1.16 average on Ethereum; retries if gas is under-funded | 69% of Ethereum swaps initially fail for “not enough gas.” |

Rollups and end-users abandon chains when routine actions feel slow, costly, or operationally complex. Sunrise removes two of the most common pain points: managing gas balances and moving assets between chains by hard-wiring Fee Abstraction and Interliquidity Routing into the base layer. Fee abstraction lets any transaction be paid in the token the user already holds; the protocol converts a small slice to $RISE automatically, so neither wallets nor dApps need to juggle secondary gas tokens.

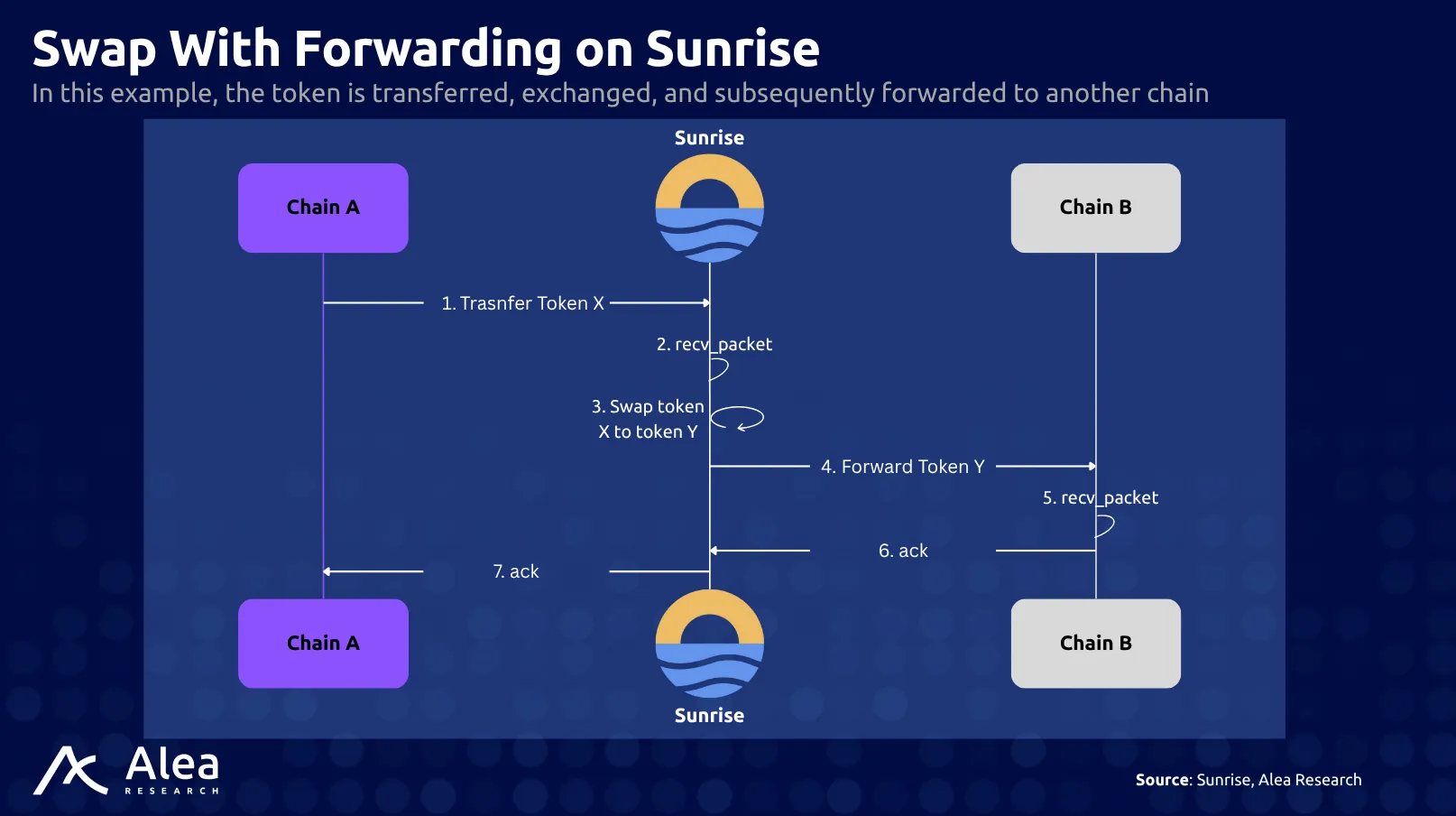

Interliquidity Routing couples the AMM router with IBC middleware, allowing a token transfer, a swap, and an onward relay to clear in the same packet rather than in three separate steps. Together, these functions shorten the critical path for onboarding, market-making, and cross-chain arbitrage. They also deepen Sunrise’s incentive loop: the $RISE generated by fee conversion feeds validator rewards, while higher swap volume earns more $vRISE for liquidity providers. Security and liquidity, therefore, rise in parallel instead of competing for capital.

Fee Abstraction

Sunrise doesn’t require pre-purchasing a gas token: any whitelisted token supplied with a transaction can pay fees. The router automatically takes a small fraction of the amount, swaps it through the hub’s AMM, and delivers $RISE to the fee module within the same block.

Users no longer need to acquire or hold a specific gas token like $RISE to use the network or a rollup leveraging Sunrise. This enables “gasless onboarding” for end-users and cuts one of the biggest onboarding drop-offs without diluting Sunrise’s fee economy.

Developers can use their project’s own native tokens as gas from day one, eliminating friction associated with token requirements. For developers, this also means zero upfront cost to integrate data availability, as they can earn $vRISE by providing liquidity instead of spending capital on fees. Early-stage rollups can effectively bootstrap their operations via liquidity by allocating treasury tokens to a pool instead of continuously paying in cash.

Validators retain clear incentives: they stake transferable $RISE (or delegated $vRISE) and receive the non-burned portion of fees plus block rewards ($RISE), while liquidity providers do not touch fee flow directly but still benefit as higher network usage raises swap demand and, by extension, $vRISE emissions.

One-Hop Interliquidity Routing

Sunrise’s x/swap router is natively aware of IBC packets. A sender can specify a route that executes a swap against a PoL pool and forwards the output to a target chain in one call; metadata is carried in the memo field, and excess input is automatically refunded. For example, a trade originating on a zkRollup that publishes to Sunrise DA can settle against depth on an OP-Stack chain without minting wrapped assets, because both legs draw liquidity from the same bonded pools. Execution clears inside CometBFT, so either the full route succeeds or everything reverts, removing bridge risk and cumulative fees. From a user’s view, the operation feels like a single-hop transfer, with no wrapped assets and no separate bridge approval.

Users face a single gas payment and one slippage curve instead of multi-step aggregator paths. For builders, inheriting the hub’s liquidity footprint from launch eliminates the cold-start problem that typically hinders new rollups. Sunrise labels this effect Interliquidity.

Economic Model & Revenue

Sunrise runs on a dual-token framework that links security to active market depth instead of idle stake. $RISE is the transferable currency used for gas, validator staking, and settlement in pools, while $vRISE is a non-transferable governance asset distributed only by supplying liquidity.

Liquidity providers receive $vRISE in proportion to the volume their positions clear and can delegate it to validators or vote in the gauge system that steers future $vRISE emissions. Validators enter the set by staking $RISE or by receiving delegated $vRISE and earn $RISE block rewards; their voting power therefore rises when market makers deepen liquidity rather than when capital is withdrawn from productive use.

The PoL design keeps security and liquidity on the same side of the equation: more trading flow distributes more $vRISE, which strengthens validator weight and, in turn, the settlement reliability that attracts further flow. Gauge voting ensures control rests with those who keep markets liquid, while the ability to convert $vRISE back to $RISE at 1:1 provides an exit without breaking the supply cap.

Revenue comes from two main sources:

- Network Transaction Fees: First, every transaction, whether a blob publish or a swap, pays a network fee that the protocol partially burns before sending the remainder to the fee pool that funds validator payouts.

- Swap Fees from Liquidity Pools: Second, the liquidity hub charges swap fees that accrue to positions inside each price band; these fees go straight to liquidity providers, and the scale of new $vRISE emissions is determined via gauges.

Sunrise claims that they will also earn revenue from MEV capture in the future. These streams create a base-layer cash flow that does not rely on block subsidies alone.

Deflationary pressure is built in on Sunrise. Because fees can be paid in any token, the x/tokenconverter module first swaps the user’s chosen asset into $RISE and then executes the burn; growing activity therefore removes $RISE from circulation while the supply of $vRISE increases only as liquidity deepens.

Since the total $RISE + $vRISE is hard-capped, each burn raises the $RISE share of that cap unless governance decides to mint offsetting $vRISE as incentives. The treasury collects the unburned portion of fees and the protocol share of MEV; $vRISE holders vote on whether to recycle that income into $RISE buy-backs, pool incentives, or ecosystem grants.

Sunrise’s InterLiquid SDK

Most blockchains give builders a smart-contract VM or rollup framework, but leave critical components such as liquidity, onboarding, and data access to third parties. InterLiquid SDK offers a unified alternative: native access to shared liquidity, low-latency state reads, and zero-knowledge proof tooling optimized for consumer GPUs.

Key-prefix iteration lets contracts read ranges of state directly on-chain, replacing off-chain indexers and lowering front-end costs. Pipelined proof generation reduces latency, meaning market makers can hedge faster and keep spreads tight. Because proofs can compile on consumer GPUs, hardware entry costs are relatively low, widening the prover set and reinforcing censorship resistance.

For developers specifically, Sunrise offers gasless onboarding, allowing users to pay for transactions with any token automatically swapped to $RISE, thus letting projects use their native tokens as the gas coin from day one.

Rollups built with the SDK call Sunrise’s swap router natively, so their assets list against existing concentrated pools on day one, with no wrapped tokens or separate bridges. Each trade feeds swap fees to liquidity providers, which earn $vRISE and, through delegation, enlarge the validator stake, tying application growth directly to network security rather than competing with it. This alignment is unique to Sunrise’s PoL design; other DA layers supply blob space but leave builders to solve capital depth themselves.

The InterLiquid SDK focuses on removing three barriers so applications can reach fee-generating usage sooner: 1) Data friction, 2) Seed-phrase UX, 3) Liquidity silos.

InterLiquid transforms Sunrise from a DA venue into a builder platform. This occurs because each completed transaction boosts swap volume, which, in turn, powers the $vRISE flywheel and increases validator weight. As a result, throughput, liquidity, and security scale simultaneously.

Stakeholder Value Proposition

Sunrise ties every source of economic activity, such as transactions, swaps, and data publication, to the same dual-token flywheel. $RISE pays validators and carries block rewards, while $vRISE is earned only when real liquidity is supplied and volume is cleared. Validators gain when more $vRISE is delegated because it directly boosts their economic rewards and decision-making weight in the network; LPs earn governance power and fees; builders receive low-cost data availability and ready-made markets; and capital allocators obtain exposure to both a hard-capped, fee-burning asset and the trading flows that drive its demand.

Figure 10: The value flow between different ecosystem participants in Sunrise

Source: Alea Research

Because $vRISE cannot be bought, it must be earned through liquidity, security, and market depth, which rise simultaneously. This alignment, enforced by gauge voting, gives each stakeholder a clear, performance-linked path to revenue and governance influence.

Here’s how each stakeholder benefits separately:

Builders and Rollup Teams

Launching on Sunrise removes three early bottlenecks:

- Teams pay gas with their own token, eliminating a second-coin dependency.

- They gain immediate access to the L1 liquidity hub.

- They inherit a PoL-secured settlement without bootstrapping a validator set.

LPs

LPs receive swap fees from concentrated pools and non-transferable $vRISE at epoch end. They can delegate that $vRISE to validators for a share of $RISE block rewards, or use it in gauge voting to steer the next emission cycle toward pools that drive real volume.

Validators

Validators stake transferable $RISE or accept delegated $vRISE. Their reward rate rises when deeper liquidity sends more $vRISE their way, aligning them with LPs rather than competing for the same capital. Slashing and fee-burning mechanics keep security budgets honest while fee abstraction broadens fee throughput paid in $RISE.

Institutional Investors & Treasury Managers

$RISE has a combined supply cap across $RISE + $vRISE and a default fee-burn that shrinks circulating $RISE as network activity grows. Revenue from transaction fees, swap fees, and MEV accrues to the treasury, where $vRISE holders can direct buy-backs or new incentives. Early capital can seed PoL pools, capturing both trading fees and governance weight before emissions tilt toward the most used pools.

Conclusion

Sunrise’s moat rests on integrating data availability and a native liquidity hub under Proof of Liquidity, tying validator security to live market depth and removing the trade-off between throughput and capital efficiency. Fee Abstraction and Interliquidity routing let users pay gas in any asset and settle swaps across rollups in one packet, cutting operational friction while feeding $RISE burn as activity grows. Validators earn scalable $RISE rewards aligned with liquidity providers who earn $vRISE only by supplying capital, connecting governance and security to actual usage rather than speculation. For builders, the InterLiquid SDK supplies direct hooks into this shared liquidity and keeps ZK proofs inexpensive, cutting time to market effects. Investors gain exposure to a hard-capped, fee-burning asset backed by transaction fees, swap fees, and captured MEV, plus additional upside from delegated $vRISE.

By tying every revenue line to the same dual-token loop, Sunrise acts as both a liquidity hub and security backbone for interliquid networks. Investors, builders, and market makers who act early can shape gauge weights, capture first-mover fees, and lock in validator influence before activity raises the entry price higher.

Glossary

- Sunrise

A L1 blockchain combining data availability and on-chain liquidity under a Proof-of-Liquidity model to support rollups and dApps. - Data Blob

A compressed batch of transaction or state data published off-chain, with only a KZG commitment and URI stored on-chain for verification. - Blob Space

The dedicated block capacity allocated for storing Data Blobs off-chain, enabling high-throughput and lower-cost data availability. - Data Availability (DA)

The assurance that any off-chain data (Data Blobs) can be retrieved and verified against on-chain commitments. - Liquidity Hub

Sunrise’s native concentrated-liquidity AMM, where users and protocols trade assets and LPs provide capital. - Proof of Liquidity (PoL)

A consensus mechanism aligning network security with active liquidity: validators stake $RISE or delegated $vRISE, and LPs earn $vRISE by supplying assets. - $RISE

The transferable native token of Sunrise is used for transaction fees, staking, and validator rewards. - $vRISE

A non-transferable token earned only by providing liquidity, used for gauge voting, and can be burned 1:1 to redeem $RISE. - Gauge Voting

The process where $vRISE holders allocate emission weights to specific liquidity pools determines how future $vRISE incentives are distributed. - Fee Abstraction

A mechanism allowing users to pay gas in any whitelisted token, which the network automatically swaps into $RISE in the background. - Interliquidity Routing

A native cross-chain feature that combines a swap and IBC transfer in a single packet, removing the need for wrapped tokens or separate bridges. - InterLiquid SDK

A developer toolkit that provides low-latency state access, ZK proof generation, fee abstraction, and built-in liquidity routes for new rollups.

References

(Kimura, 2025)

Kimura, Y. (2025). InterLiquid SDK.

(Sunrise, 2025a)

Sunrise. (2025a). InterLiquid SDK: Making Blockchain Feel Like Web2.

(Sunrise, 2025b)

Sunrise. (2025b). Overview of Sunrise’s Dual-Token Model with Proof-of-Liquidity.

(Sunrise, 2025c)

Sunrise. (2025c). Sunrise: The Base Layer for Interliquid Networks.

(Sunrise, 2025d)

Sunrise. (2025d). Sunrise DEX, Gauge Voting & Bribes — Why the Liquidity Wars Are Coming Here.