Executive Summary

Vaults built on the ERC4626 standard have turned ad-hoc “yield hunting” into programmable asset management. What began as retail-oriented savers auto-compounding rewards on Ethereum has matured into a multibillion-dollar substrate that now serves DAO treasuries, asset issuers, fintech front-ends, and hedge-fund quants alike.

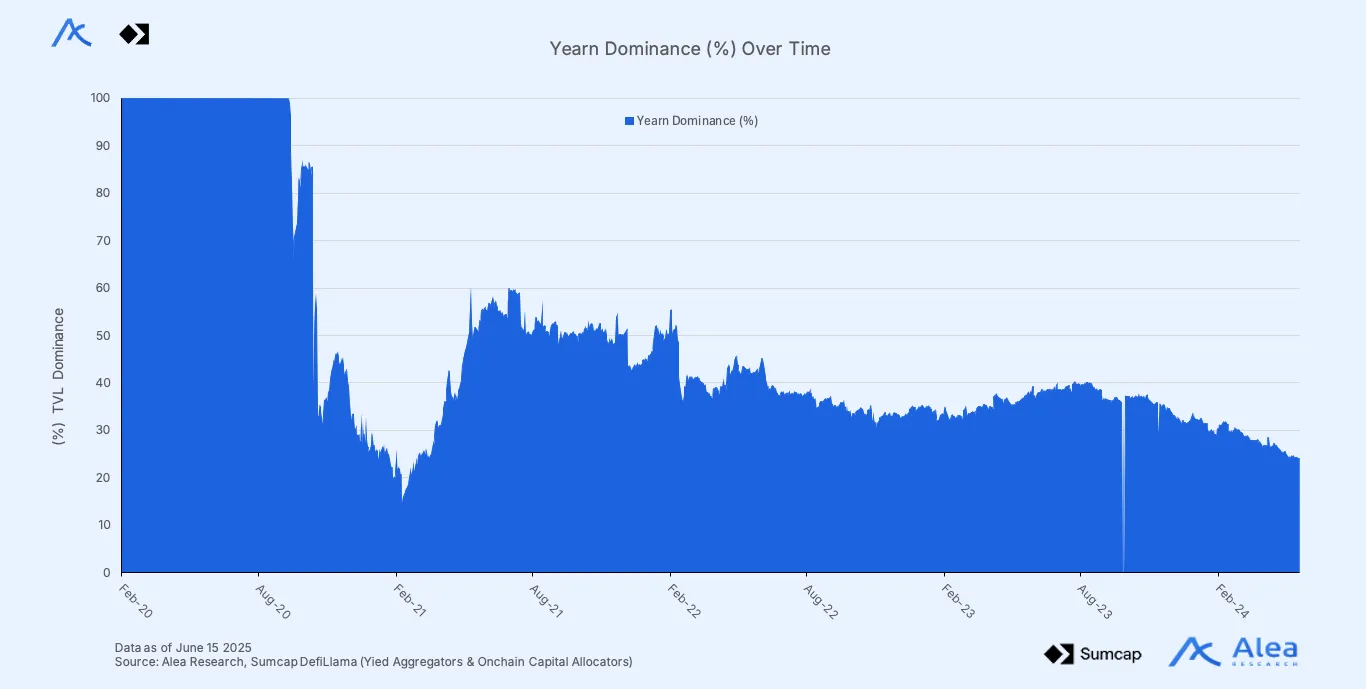

Contrary to early expectations, this is not a winner-take-all arena. Liquidity, incentives, and risk are now chain-local and time-boxed. A Yearn-style monopoly was possible when one chain, a handful of assets, and prohibitive gas costs rewarded scale. In today’s landscape, however, the addressable surface keeps widening with the proliferation of new chains and opportunities in their respective ecosystems.

As demand scales faster than competition, the current environment presents a variety of positive-sum vault economics. For strategists, durable edge comes from adaptability, and not from periodic spikes in gross AUM or headline yield. For protocols, persistent moats form around architectural and distribution choices. Platforms that hide complexity, expose plug-and-play SDKs for strategists, and leverage distribution rails to their advantage, will capitalize on the opportunity.

Economically, vault businesses behave like thin infra layers. Gross revenue is management bps plus performance carry. Scale, and not headline yield, is what drives margin. Fee switches, token incentives, and buyback policies amplify or erase that margin, so alignment between depositors, strategists, and token holders is table stakes.

For allocators, the play is to diversify across platforms that optimize for risk transparency, strategy velocity, and distribution reach. For builders, the North Star is infrastructure mindset: own the rails, externalize strategy risk, and let curators compete for alpha while you clip the ticket on every block.

Key Takeaways

- Modularization was the first breakout: Yearn v2 shifted yield optimization from single-strategy silos to a flexible “vault-as-a-service” model.

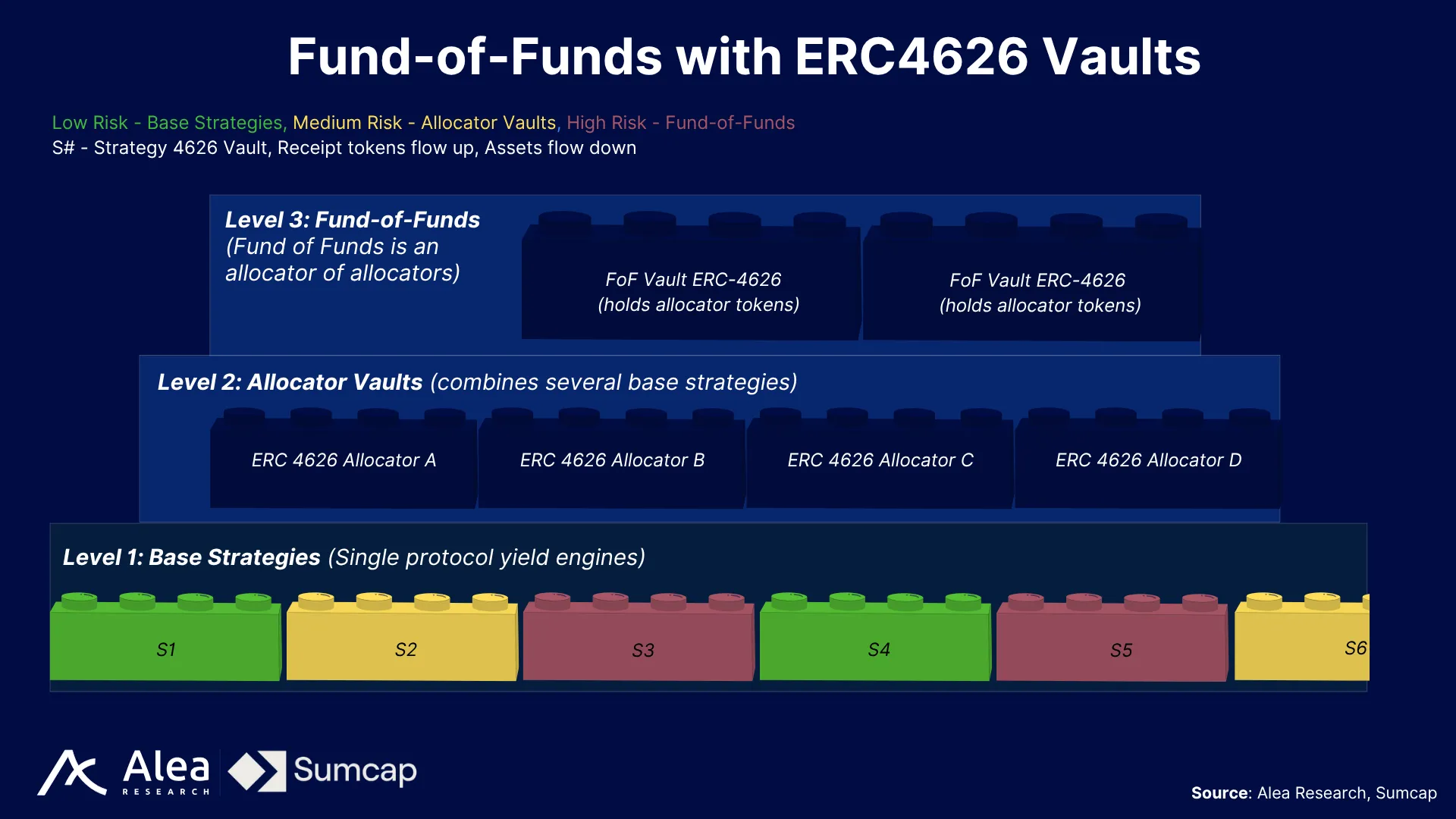

- Standardization unlocks composability: The ERC4626’s share-based API eliminated integration overhead, let auditors focus on strategy logic, and enabled nested “fund-of-funds” vaults—turning yield products into interoperable building blocks.

- Adaptability is the real moat: Strategy velocity is the edge, not raw TVL or short-lived APY headlines. Rapid release cadence compounds learning loops, keeps strategies fresh, and builds stickier flows than any one-time TVL spike.

-

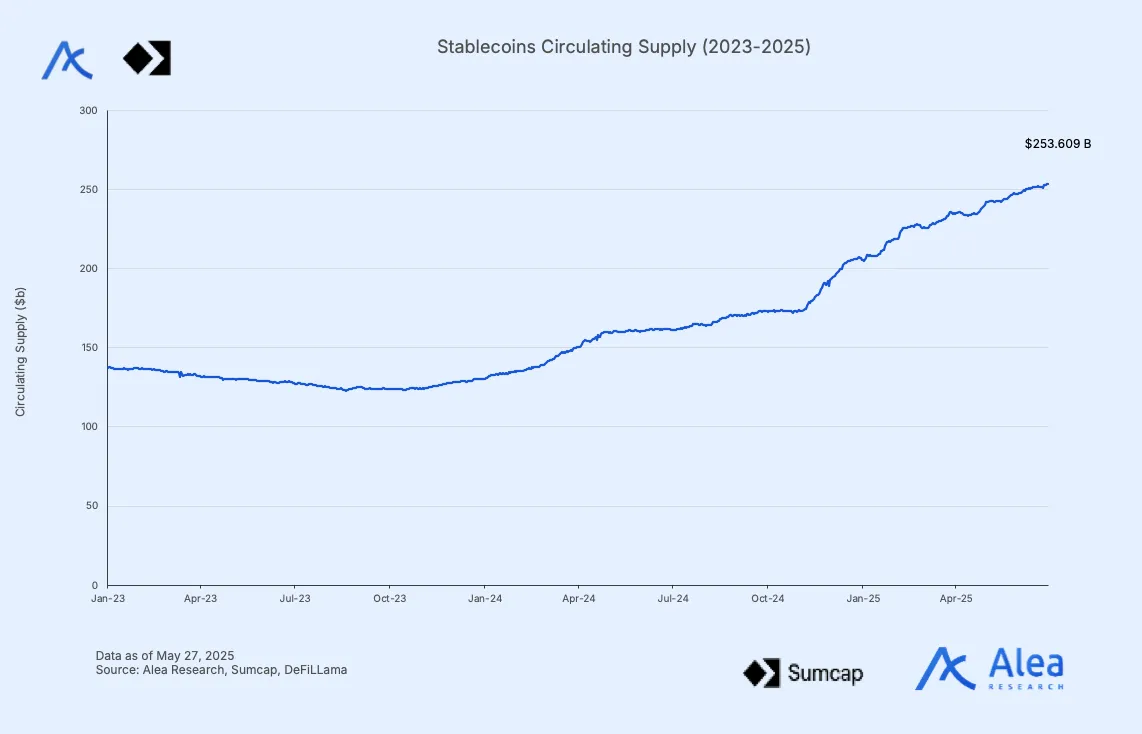

- Immediate white-space: ~$14 B in liquid DAO treasuries and idle stablecoin float face little friction to enter yield-optimized vaults. The circulating supply of stablecoins is at all-time-highs above ~$250 B and there are no signs of slowdown while demand for yield-bearing stablecoins also continues to rise.

- The Stablecoin Trojan Horse: Retail stablecoin adoption is accelerating, with ~$35.6B in fresh capital from new users entering the space – driven by democratized yield access and a 64% surge in unique holders.

- Fragmented liquidity favors meta-aggregators: With capital spread across chains, vault tokens, and incentive silos, depth no longer pools in one venue. Allocators get better net returns through platforms that capture data on flow patterns, and offer ways to monetize that intelligence.

- When distribution beats engineering: Win the default “Earn” slot in wallets, CEXs, or fintech apps and a 20-50 bps rake feels invisible to retail capital.

- Risk optics unlock institutional TVL: Live VaR dashboards, private vaults, strategy transparency, and risk-reward optionality matter more to big tickets than a few extra basis points of yield.

- Own the rails, externalize the risk: Chain-agnostic infra that lets outside curators deploy vaults captures durable take-rates while strategists fight for alpha.

Sector Genesis: from Yield Hacking to Yield OS

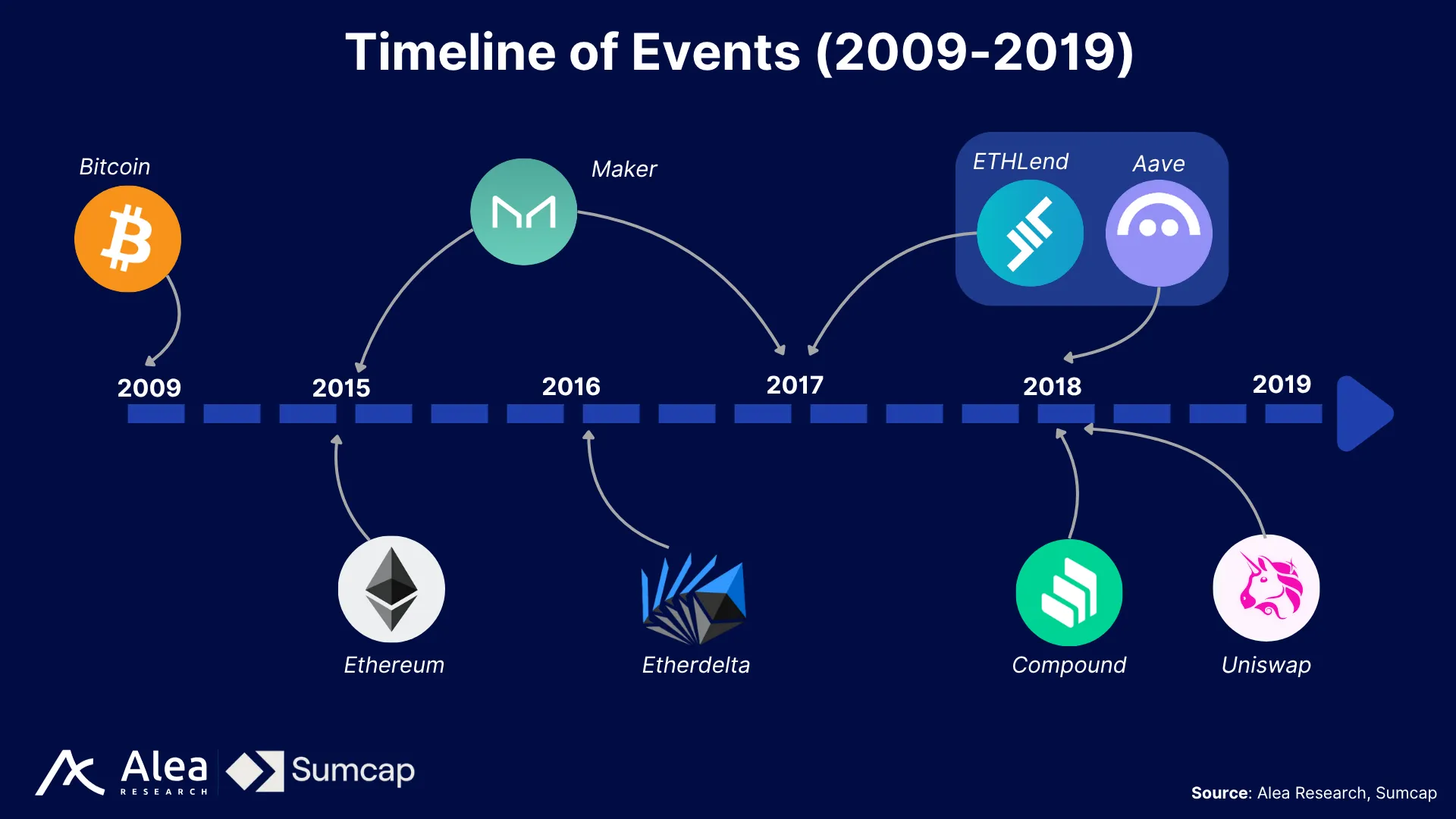

Before yield optimization, aggregation, and automation, the early days of DeFi were dominated by protocols that laid the groundwork with simple yet key primitives. These early projects, which focused on permissionless money and lending, created the modular infrastructure that would later on enable more sophisticated yield strategies.

The Pre-aggregator Era of DeFi

MakerDAO’s 2017 launch of single-collateral DAI (SAI) proved that anyone could lock ETH and mint a dollar-pegged asset without banks, KYC, or human credit committees. This collateralized-debt-position (CDP) model instantiated asset issuance and permissionless leverage, breaking from issuer-backed stablecoins like USDT and USDC. By encoding collateral ratios, liquidation rules, and fees in smart contracts, Maker turned monetary creation itself into deterministic code and seeded a base layer of trustless liquidity that every later DeFi primitive could tap.

Lending markets started to develop in parallel, with ETHLend in 2017 and Compound in 2018. The former followed a peer-to-peer lending model, while the latter pioneered the concept of pool-based lending. However, matching individual lenders and borrowers with a peer-to-peer engine proved to be infrequent and capital inefficient, and ETHLend rebranded to AAVE to finally adopt Compound’s peer-to-pool design. Unlike in traditional finance, where rates are set privately behind closed doors by committees or centralized institutions, DeFi follows algorithmic interest rates based on supply and demand.

With a solid foundation for credit creation in place, the next key unlock came from composability: the ability of DeFi protocols to permissionlessly interact and build on top of one another. However, even though the idea of stacking “money legos” unlocked new yield opportunities and maximized capital efficiency, this also introduced additional complexity. Without a standardized way to build contracts for asset management and with yield opportunities scattered across protocols, users had to i) monitor rates across platforms, ii) manually execute multi-step transactions, and iii) pay gas in each step.

The Rise of Yield Aggregators

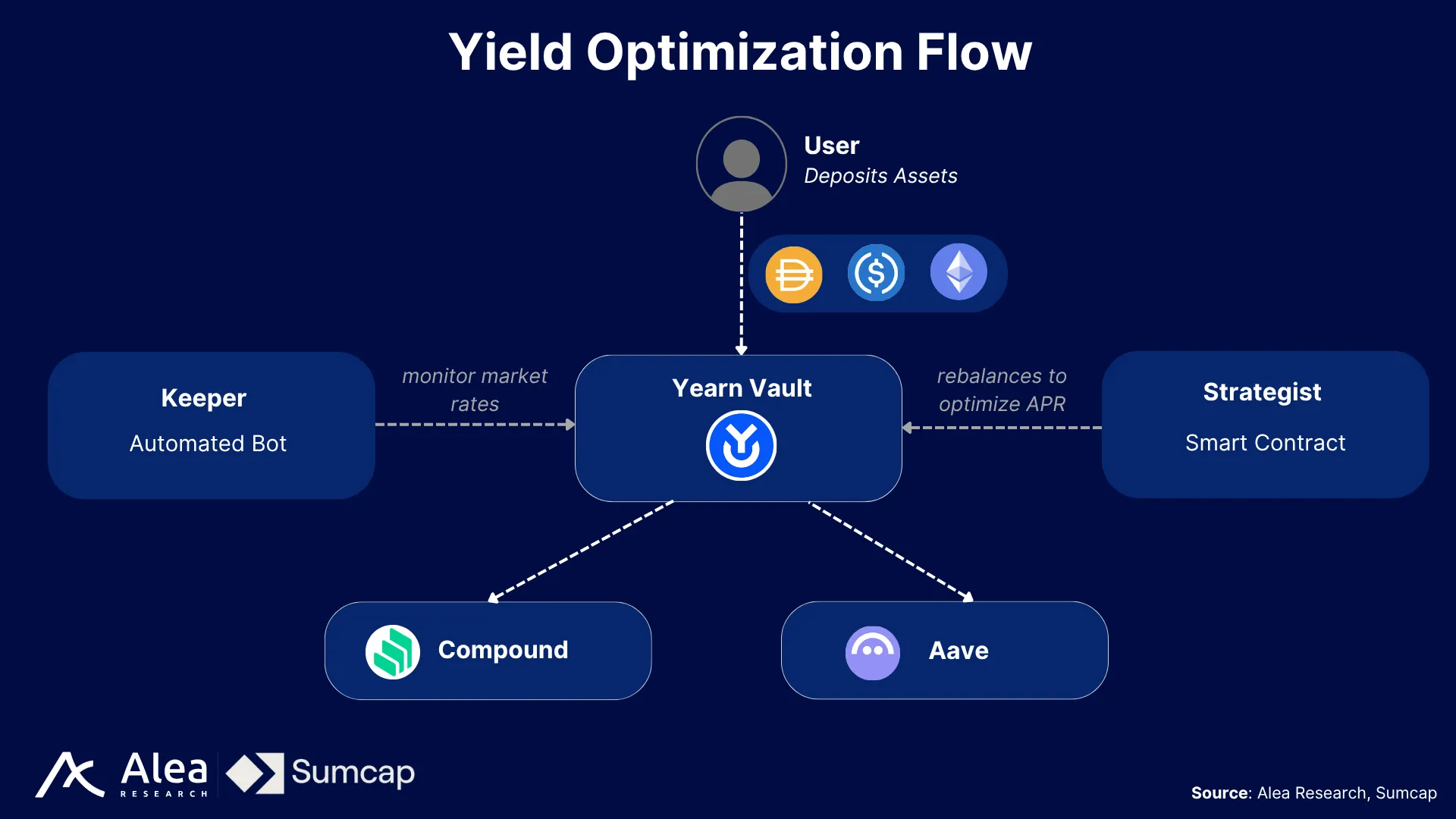

By early 2020, yield seekers had to be constantly monitoring the markets and moving funds from one protocol to another. This was costly on both time and gas fees. As activity increased, gas costs became prohibitive for retail, while whales couldn’t keep up constantly checking the rates on different markets. Andre Cronje’s answer was iEarn: a pooled smart contract router that automatically shifted deposits to whichever protocol offered the best risk-adjusted return, spreading gas costs across all users and turning manual yield hunting into a single-click experience.

As liquidity poured in, the limitations became apparent. Onchain yield sources were thin and capacity-capped, limiting new strategies. Also, as more people piled up on a vault, the now-ubiquitous “APY” metric slid lower. Growing TVL diluted returns, squeezed strategy margins, and exposed the need for more scalable optimization.

In July 2020 iEarn rebranded to Yearn Finance, evolving into a DAO-governed yield operating system. v1 yVaults let anyone supply assets and crowdsource strategies, turning yield optimization into open middleware that automates, curates, and compounds returns on behalf of a global user base.

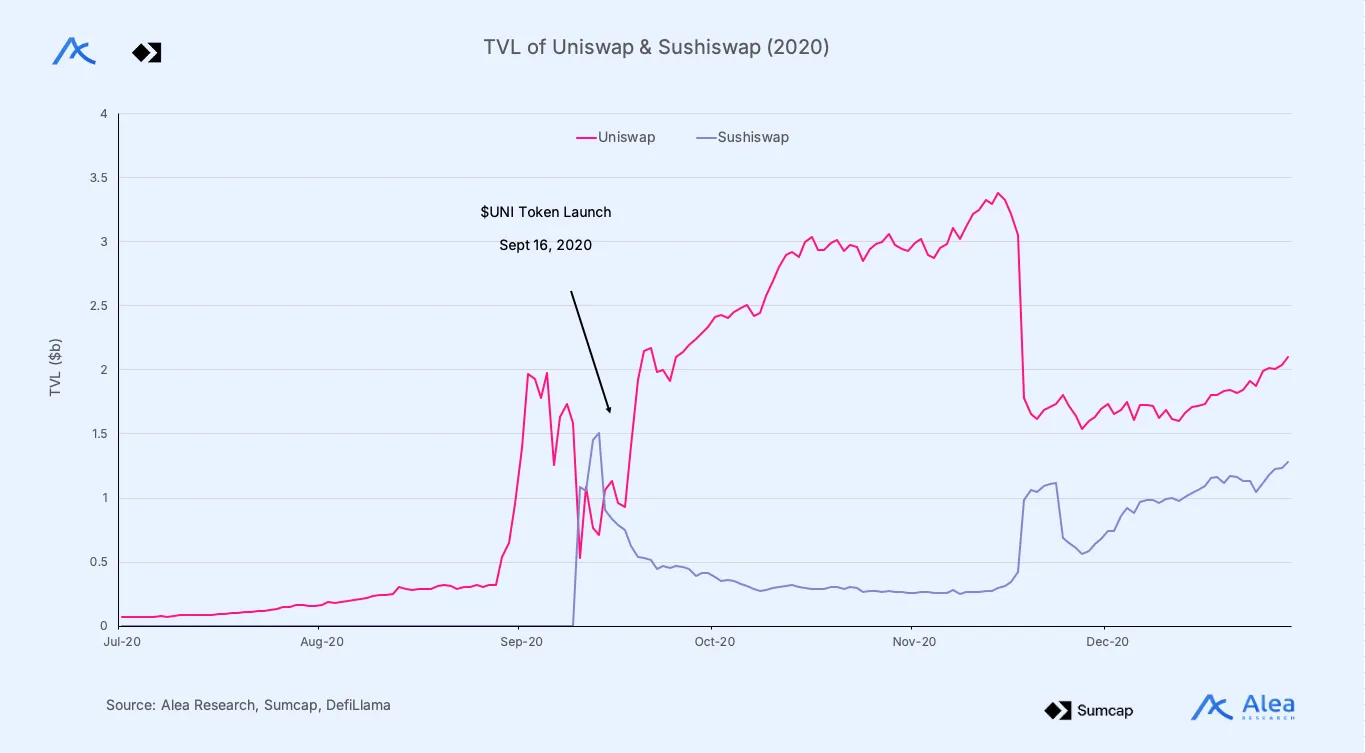

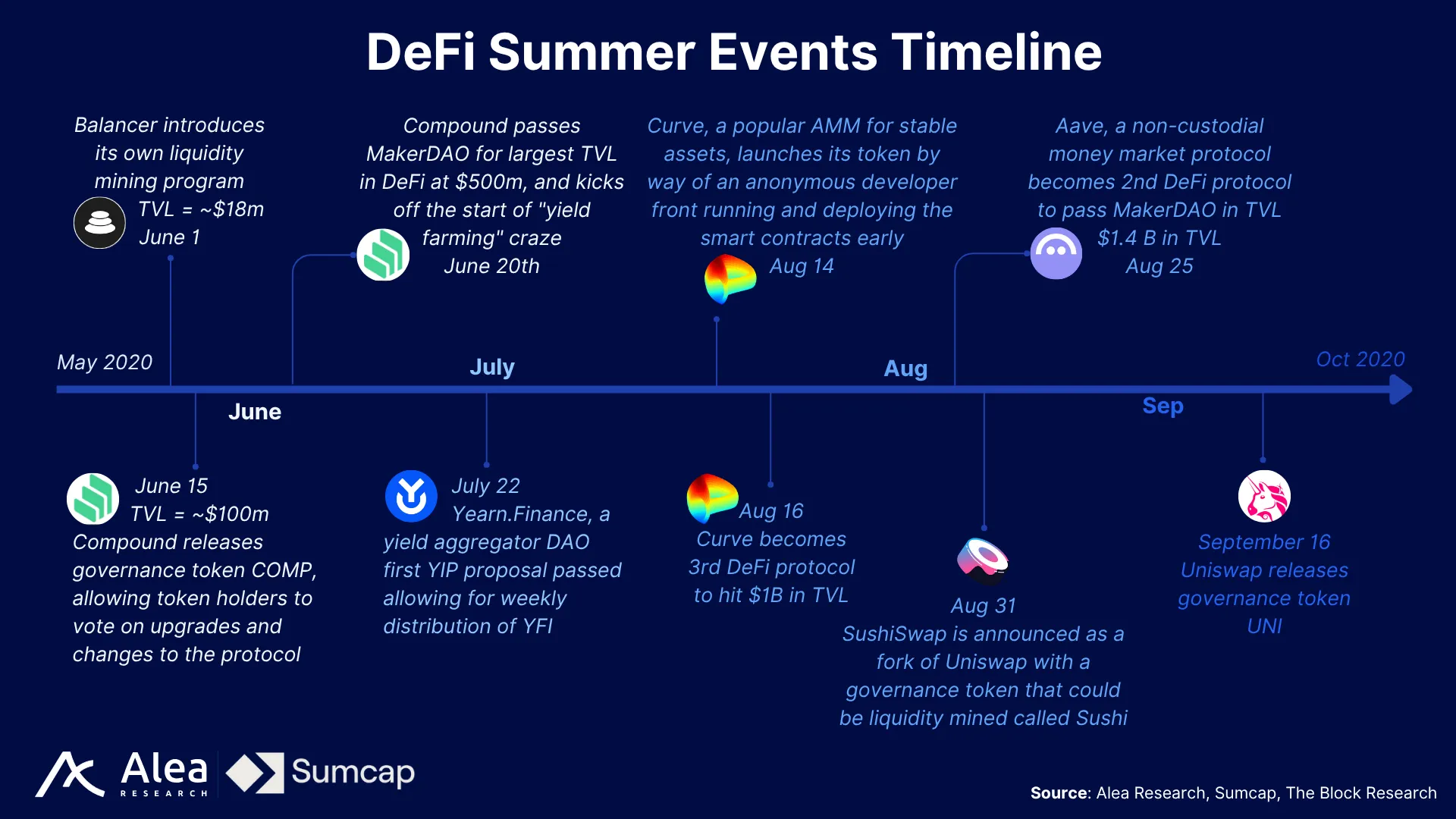

DeFi Summer

The 2020 “DeFi Summer” is how yield farming went from being a small niche to becoming a mainstream narrative. The key unlock was the birth of liquidity mining, which turned yield farming mainstream by rewarding liquidity with governance tokens. Synthetix kick-started it with extra SNX for sETH-ETH LPs; Compound’s COMP drop in June pushed borrow/lend APYs into triple digits; Sushi’s August “vampire attack” siphoned billions from Uniswap by paying LPs in SUSHI. Every protocol scrambled to issue incentives, making yields erratic, gas costly, and rate discovery a round-the-clock sprint.

New vault projects automated the chaos: Harvest Finance auto-harvested and compounded rewards; Pickle Finance chased higher-risk, higher-APR schemes; Beefy took the model multi-chain (BSC, Polygon, Fantom, Avalanche); Rari Capital let users spin up custom vaults for different risk profiles. Token launches, fee tweaks, and niche focus gave each a hook, yet none eclipsed Yearn’s brand or TVL.

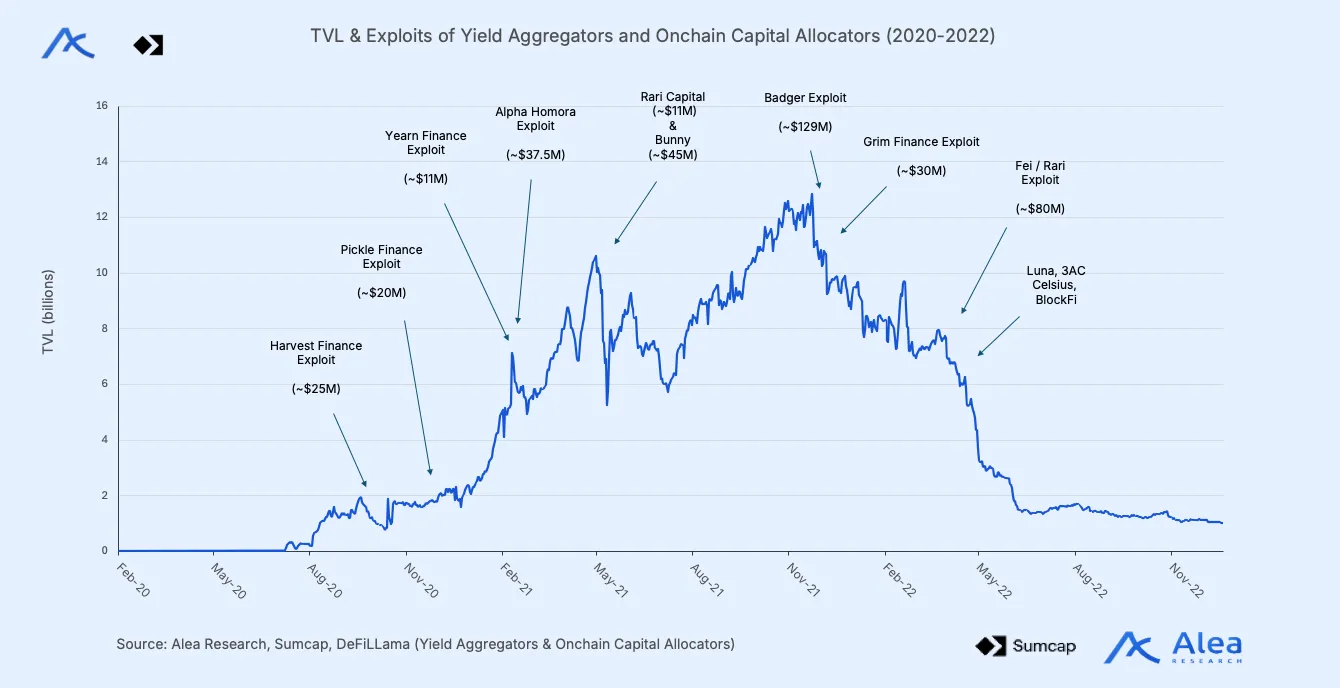

However, as the competition for yield capture increased, protocols started rushing on their go-to-market. Rapid ship cycles, thin testing, and strategy capacity limits led to contract exploits and dependence on human strategists rather than robust automation. A series of unforced exploits showed the need for safer, more adaptive yield infrastructure.

The Modularity Shift

Early vaults were monolithic: each vault mapped to one strategy, which capped capacity and concentrated risk. This slowed down both innovation and scalability. Yearn v2 scrapped that 1-vault-1-strategy template and came up with solutions that would later on be copied by competitors:

- Support for multistrategy vaults: deposits in a vault could be partitioned across several strategies and rebalanced based on performance and risk signals, giving built-in diversification and higher capital efficiency.

- Plug-in strategist framework: any developer can submit a strategy contract, pass code review, and earn a fee share, turning vaults into an open R&D marketplace.

- Delegated yield desks: specialist teams run 24/7 monitoring, automated alerts, and emergency breakers, so protocols outsource execution instead of building it in-house.

- DAO policy hooks: token holders set caps, fee splits, and risk limits, aligning vault parameters with community tolerance while preserving onchain transparency.

These upgrades abstracted yield management into a reusable module that other protocols could rent rather than rebuild. By wiring into white label vault infrastructure they gained: i) audited code and live strategies from day one, ii) lower security and maintenance overhead, and iii) proven risk controls.

The only missing piece was a universal interface to make those vaults fully composable across DeFi – a gap that the ERC4626 standard for tokenized vaults set out to close.

ERC4626 and the Standardization of Yield

In the early days, every protocol using vaults for their operations re-implemented the same functionality: deposits, withdrawals, and accounting. Each implementation having its own idiosyncratic function names and return types forced integrators to write one-off adapters, and auditors to repeat work.

The ERC4626 standard was proposed as the solution to that problem. Developers from different teams, such as Joey Santoro from Fei Protocol, transmissions11 from Paradigm, Jet Jadeja from Rari, Alberto Cuesta Cañada from Yield Protocol, and Señor Doggo from Yearn, co-authored EIP4626 to propose the official template.

- A minimal, share-based API (deposit, withdraw, mint, redeem) plus read-only “preview” and “max” helpers.

- Shares behave exactly like ERC-20 tokens, so balances, transfers, and allowances remain familiar while the conversion math (assets ↔ shares) is identical across vaults.

- The specification is strategy-agnostic: accounting and allocation stay internal; the contract is a black box onchain and evaluated offchain.

By June 2022 the proposal was officially merged into Ethereum’s standards set. As protocols started implementing it, new opportunities were unlocked, such as the ability to build nested vaults that enabled “fund-of-funds” structures.

Market Opportunity: the TAM behind the Vault

With the standardization of vaults, better infrastructure decreased developer friction, which reduced go-to-market and made integrations with external protocols simpler and faster. The result was more diversified opportunities that attracted more deposits, and enlarged the investment pool.

Yet the onchain addressable market is still under-explored. Billions sit idle in staking contracts, DAO treasuries, and basic pools where yield allocation remains manual and sporadic. The largest prize lies in institutional cash management, as well as in the onboarding of RWAs, CeFi solutions, or other alternatives that abstract away the complexities of capital allocation onchain, such as risk monitoring, key management, etc.

Total Addressable Market: Onchain AUM Potential

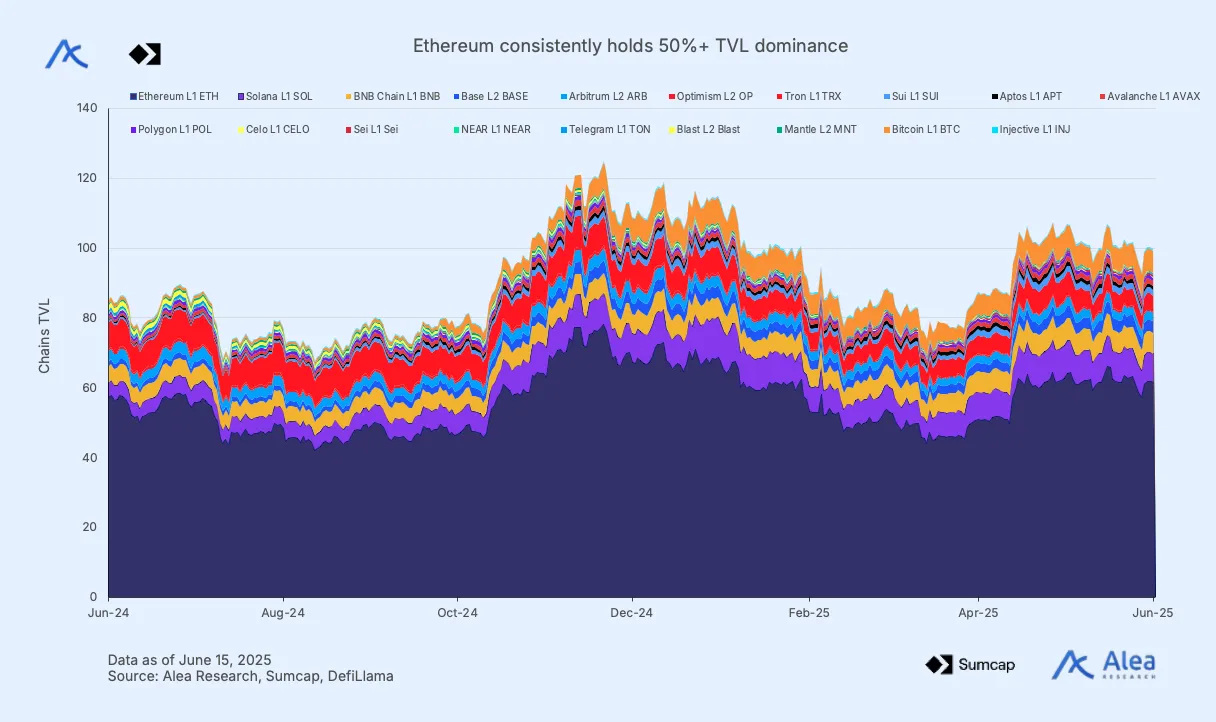

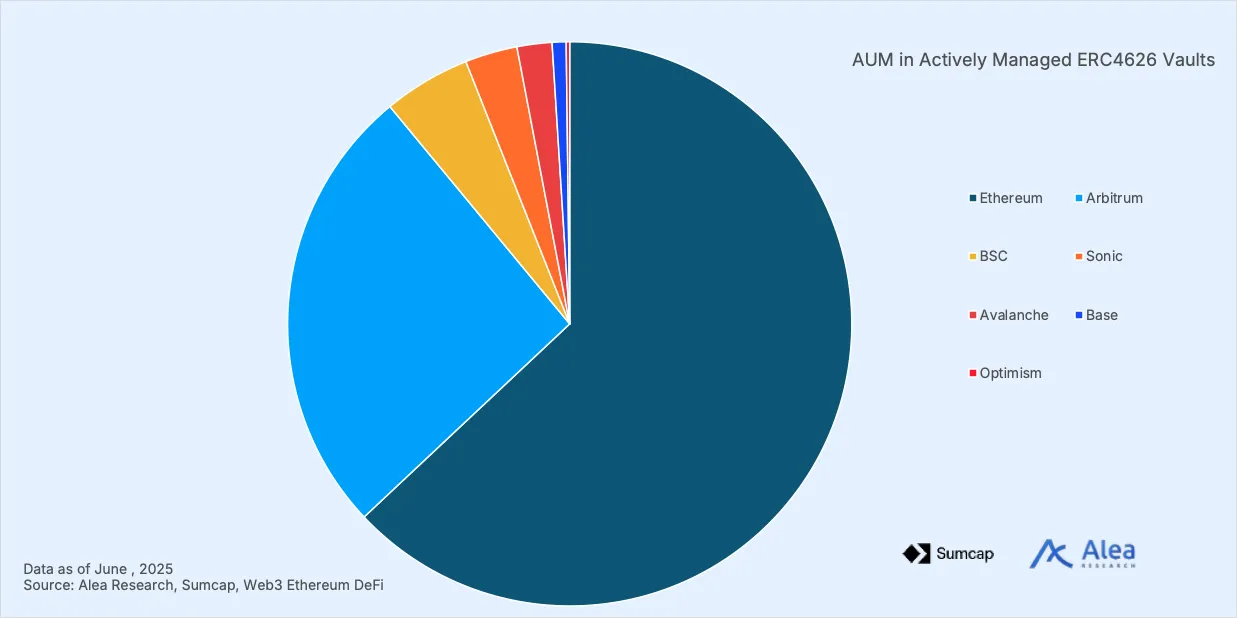

As of mid-2025 there are $25B+ in onchain AUM managed by smart contract vaults, representing ~20% of the total DeFi TVL. History proves that “liquidity begets liquidity” as Ethereum remains the largest chain by TVL, consistently showing 50%+ dominance. Unsurprisingly, the most liquid chain hosts the largest number of protocols and unlocks composability opportunities that cannot be found elsewhere.

The current liquidity is just the tip of the iceberg. Today’s $100B+ TVL barely registers against the trillions that traditional managers steward worldwide. The gap is not a ceiling – it is unclaimed surface area as regulatory clarity and smart contract security improves. Most DAOs still idle the bulk of their treasuries in native tokens, and the stablecoin float itself – now over $250B – remains largely undeployed. Meanwhile, pension funds, endowments, and family offices that control trillions have yet to bring balance-sheet capital onchain, deterred more by operational frictions than by appetite. As custody guardrails tighten, reporting APIs mature, and ERC4626 vault tooling abstracts away protocol risk, these allocators can redirect even single-digit basis-points of their portfolios to programmable strategies.

The nearest white-space is the ~$16 B parked in DAOs and protocol treasuries already living on EVM rails. These teams already have the technical expertise to evaluate risks, and the community becomes conscious of operational funds running dry during bear markets. Of the $14.3B that is unlocked today (with the remaining under vesting contracts), ~85% ($12.1B) sits in the DAO’s own volatile governance tokens, while barely 3–4% ($0.51B) rests in stablecoins. Both buckets silently bleed: the stablecoin sleeve loses purchasing power at the CPI clip while concentrated native-token exposure magnifies every market downdraft, shrinking the DAO’s runway and its capacity to fund grants, R&D, or liquidity incentives when they are most needed. These are assets that require zero bridging, KYC, or legal refactoring to migrate into yield-optimized ERC4626 vaults.

DAO treasuries are uniquely primed for rapid vault migration: governance proposal frameworks replace months-long board approvals, technical contributors already weigh strategy risks, assets sit in multisigs built for ERC4626 plugs, and community scrutiny intensifies as visible burn rates drain finite runways. This combination of fast governance, low integration friction, and existential pressure to stretch treasury life makes DAOs the natural proving ground. Once they can consistently show verifiable 8-12% yields on idle balances, the public track record will lower due-diligence costs and pave the way for institutional allocators to follow. More DAOs would follow suit and this would decrease the perceived risk that comes with allocating capital onchain, overshadowing the security concerns of the past.

An equally compelling near-term opportunity comes from the complete opposite side of the spectrum: retail stablecoin adoption. Stablecoin growth fuels adoption and usage across the world, with access to yield now much more democratized through actively managed vaults, it’s a perfect opportunity. The numbers here paint a clear picture: unique addresses holding stablecoins saw a 64% increase in the addressable user base in just one year, 58 million -> 95 million. This coincided with $91.5B in net new stablecoin value ($161.5B -> $253B), where new users account for roughly 38.9% of that growth (calculated as: 1 – 58M/95M = 0.389).

When we apply this % share to the net increase in stablecoin value ($91.5B * 0.389), we get around $35.6B in fresh capital from completely new participants waiting to be deployed.

CeFi asset managers such as Galaxy Digital, Pantera, Two Sigma, and Polychain already juggle $120–150 B in active positions yet keep only ~9% ($10–15 B) in liquid crypto – as the asset class matures, every incremental percentage-point shift of their books represents billions in new vault-addressable flow. Beyond these funds, the RWAs coming onchain further extends the opportunity set. Consider the $15–30T of tokenizable real estate, credit, and Treasuries versus just $12.5 B currently onchain. The $23T managed by pensions and endowments both suffer the same yield-hunting, operational-drag dilemma. ERC4626 vault infrastructure offers each segment an automated and programmable layer they cannot build in-house, positioning vaults as the bridge between TradFi scale and DeFi programmability.

When we look at the DAO, Stables, CeFi, and RWA opportunity sets against three adoption vectors – regulation, infrastructure maturity, and institutional risk appetite – we get a TAM ladder that bottoms at $3-8B (bear), centers on $10-18B (base), and could spike to $20-54B (bull).

| Scenario | Assumption | DAO Treasuries | New Stablecoin Users | CeFi Managers | RWA | Total TAM |

| Base Case | Steady regulatory development with basic DeFi guidelines | $3.5-5B | $2.8–5.3B | $1.5-3.75B | $2.3-4.5B | $10-18B |

| Bear Case | Regulatory stagnation with conflicting guidance | $1.4-2.1B | $1.1–2.8B | $500M-1.2B | $150M-1.5B | $3-8B |

| Bull Case | Comprehensive regulatory clarity with institutional pathways | $5.7-7.1B | $5.3–8.9B | $5-10.5B | $3-22.5B | $20-54B |

The Base Case — Measured Uptake

Regulation inches forward, operational rails reach “good-enough,” and institutions show cautious curiosity. Under this middle-path scenario, vault adoption is driven by practical treasury needs and incremental comfort with DeFi tooling.

- DAO treasuries: 25-35% of the ~$14.3B liquid pool flows into yield strategies → $3.5–5B new AUM.

- New stablecoin users: 8-15% of the $35.6B fresh capital discovers vault yield → $2.8–5.3B.

- CeFi managers: 15-20% of the $10–15B crypto sleeve migrates → $1.5–3.75B.

- RWA pipeline: Crypto captures 0.1 % of the $15–30T market; 15% of that enters vaults → $2.3–4.5B.

Together these streams lift the total addressable market to roughly $10-18 B, providing a solid base for vault infrastructure while still leaving ample upside for future growth.

The Bear Case — Stalled Progress

Fragmented rule-making, immature custody rails, and shrinking risk budgets keep big money on the sidelines. Adoption is hesitant and opportunistic.

- DAO treasuries: Only 10-15 % allocation → $1.4–2.1 B.

- New stablecoin users: 3-8% adopt due to UX barriers and uncertainty → $1.1–2.8B.

- CeFi managers: Minimal 5-8 % allocation → $0.5–1.2 B.

- RWA pipeline: A tokenization sliver of just 0.02–0.05 %; 5-10 % of that moves into vaults → $0.15–1.5 B.

The result is a constrained TAM of $3-8B, highlighting how sensitive vault growth is to clear policy signals and enterprise-grade infrastructure.

The Bull Case — Regulatory Green Light

Comprehensive frameworks, institutional-grade rails, and a proven vault track record unlock pent-up demand across all segments.

- DAO treasuries: 40-50% deployment → $5.7–7.1B.

- New stablecoin users: 15-25% adopt via integrated wallets and mainstream UX → $5.3–8.9B.

- CeFi managers: 25-35% of an expanded crypto sleeve moves → $5–10.5B.

- RWA pipeline: Crypto captures 0.2–0.5% of the $15–30T market; 10-15% routes to vaults → $3–22.5 B.

This alignment of regulation, rails, and risk appetite pushes the TAM to $20-54B, demonstrating the scale ERC4626 vaults can reach once institutional constraints fall away.

Market Structure: Fragmented or Winner-take-most

While there have been seasons of outperformance and TVL dominance, a “winner-takes-all” market never shaped the trajectory of this sector. In theory, depositors should converge on the single, most battle-tested “robo-advisor” that compounds the highest net yield and becomes more Lindy as TVL snowballs. That was almost the story of Yearn v1: one chain, few assets, prohibitive gas, and no serious rivals. Economies of scale let Yearn socialize costs, rotate capital faster than competitors could build, and pull >$5B TVL at peak.

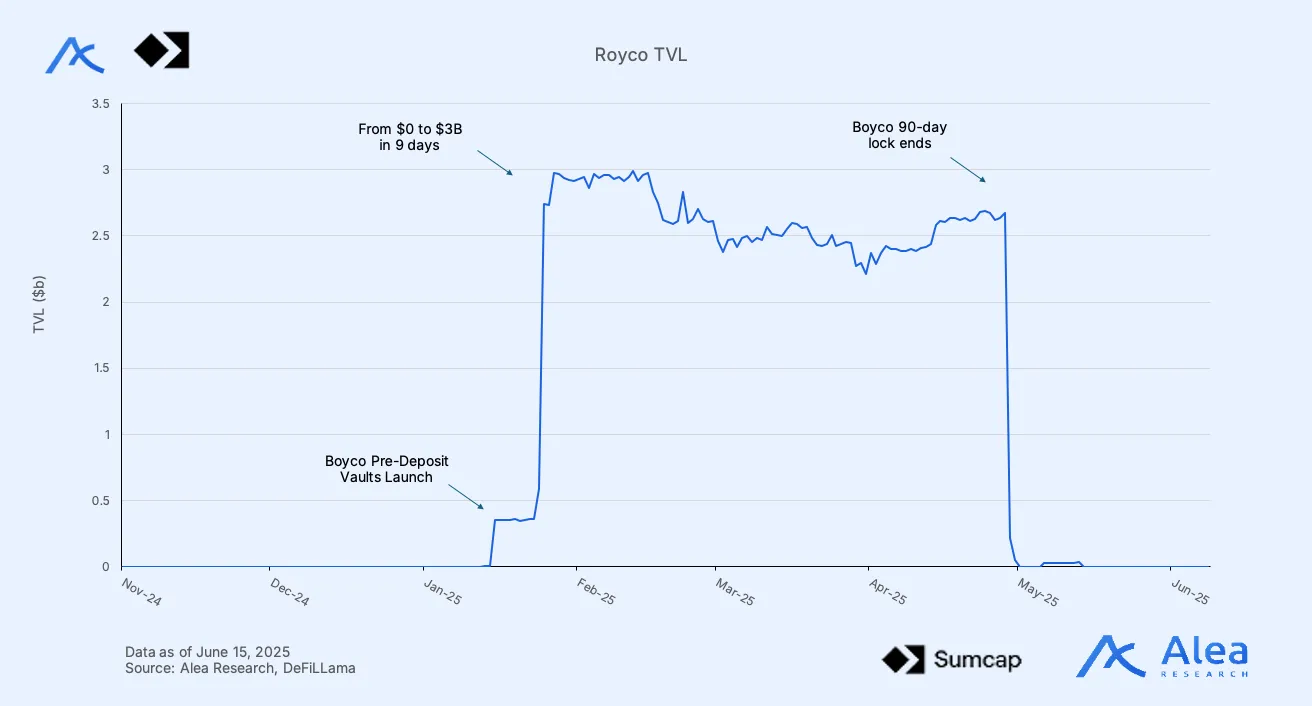

Fast-forward to 2025 and the game board is way different: multi-asset treasuries, alternative L1s, rollups, appchains, RWAs, points farming, ecosystem incentives, pre-deposit vaults, etc. Liquidity is now scattered across hundreds of liquidity pools and a dozen execution layers, each with idiosyncratic rates and risks. Opportunity cost is chain-local; “best” yield is time-boxed. The result is short-lived windows of opportunity conquered by one protocol carving its own niche at a time. Royco’s pre-deposit Berachain vaults are one example. Because of this, there is no fertile ground for the emergence of a sector-wide monopoly. Instead, the market rewards speed, specialization, and locality.

Today, strategies chase heterogeneous payoff curves, and allocators optimize for diversification and optionality, e.g. carry trades, Pendle coupons, lending rates arbitrage, airdrop farming, etc. For depositors, the switching costs are low, and capital flows opportunistically. The proliferation of new chains and frequent incentives programs prevent durable lock-in. Any platform that narrows the scope of strategists or custodies assets monolithically simply pushes innovators elsewhere.

Still, aggregation pockets can form where network effects compound faster than users churn. For this to materialize in practice, there are some credible choke-points, such as DeFi protocols providing institutions with the compliance and risk management tools they require. Outside of that, it gets harder to scale network effects and build a liquidity moat across assets and chains.

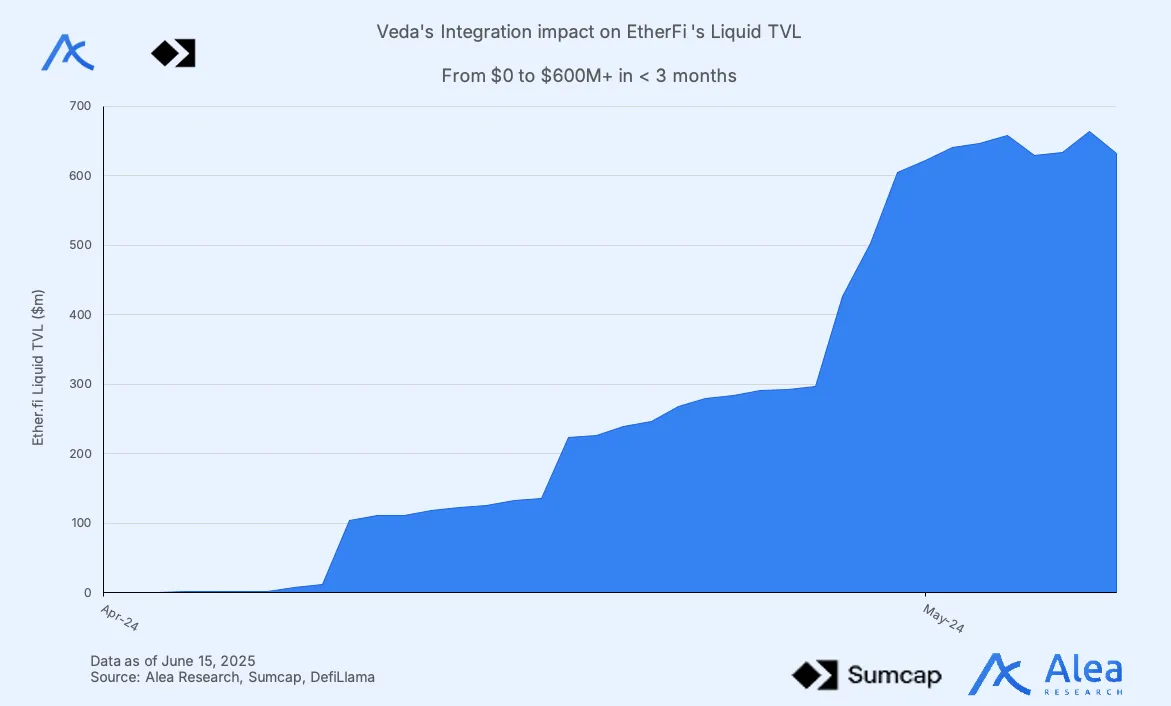

Escape velocity and distribution dominance could be found in those protocols that embed their contracts as the backend for CeFi apps. For instance, consider a protocol smart contracts powering CeFi or Fintech frontends that package a Savings app for their users. In that scenario, whatever gets integrated first most likely becomes the default. Similar to Veda’s playbook invisibly powering EtheFi’s Liquid and being instrumental to the rapid take-off in eETH’s supply, CEXs might want to pick their winners among the current crop of onchain asset management protocols.

Technically, that competitive advantage would be enabled by developer-friendly SDKs and APIs, as well as by BD and partnership efforts with centralized giants. Yield arbitrage exists onchain, and that’s attributed to market inefficiencies that stem from liquidity fragmentation. Meanwhile, distribution pipes largely sit in regulated on-ramps. Expect a “DeFi in the back, CeFi in the front” pattern: Coinbase, Revolut, Telegram, or a regional super-app offers a one-click “crypto savings” product while ERC4626 factories run unseen in the back. Even though a decentralized protocol could capture that opportunity and win a substantial portion of market share, the franchising power still sits with whoever owns the fiat bridge and KYC rails.

Aggregation at the chain-level is also a big lift. For this to materialize in practice, the most likely scenario is protocols picking a specific environment, like the EVM, and keeping the base protocol chain-agnostic and permissionless, then letting external curators deploy vaults and launch strategies that plug into that substrate. Similar to Morpho Blue, this model of “one infra layer, many strategists” scales surface area without bloating core governance or development bandwidth.

This is a market sector that is fragmented by design, but won by execution. Persistent fragmentation is the default, and the winners will be the platforms that:

- Mask multi-chain and multi-asset complexity behind single-step deposit UX.

- Offer plug-and-play UI command centers or SDKs so asset managers can design and start running strategies in hours, not weeks.

- Leverage distribution rails (CeFi and Fintech apps, wallets, bridges, etc) to surface vaults and yield opportunities.

- Optimize for strategy velocity with fast back-test and deploy loops that allow managers to exploit fleeting edges across cycles and ecosystems.

Long story short: create a competitive marketplace and distribution platform for vaults with diverse risk-reward profiles, and let managers compete on alpha as depositors maximize their yield while the protocol clips platform fees.

Business Models and Margins; Moats and Incentives

Fee structures for vault platforms are fairly standardized. Vaults usually charge an annualized management fee that can range from 50 bps to 2% annualized. On top of that, when a strategy realizes a profit, the contract routes a performance cut that tends to range between 5% and 20%. Usually there are also exit or withdrawal fees designed to deter mercenary exits or gaming incentives, but this is often a negligible amount. As for protocol themselves, they monetize by skimming a take rate off management and performance fees. This segmentation allows protocols to capture recurring cash flows without running and collecting carry on strategies themselves.

| Stack Layer | What it Taxes | Typical Range | Purpose |

| (a) Vault-level Management Fee | Time-weighted deposit value | 0-2% annualized | Funds core devs & auditors |

| (b) Performance Fee | Net profit per harvest | 5–20% | Aligns strategist & depositors |

| (c) Withdrawal / Exit Fee | Principal on exit | 0-50 bps one-off | Discourages mercenary TVL |

| (d) Platform Take Rate | Takes slice of (a)+(b) | 10-50% | Pays infra, token buyback, etc |

Once fees are defined, the economics hinge on how quickly gross revenue outruns operating drag. Gross revenue equals management basis-points on assets under management plus performance percent on realized profit. Against that top line sit semi-fixed costs: gas to execute rebalances, keeper tips, oracle calls, offchain analytics servers, and the amortized spend on audits among others that could be strategy-dependent such as interest rate dynamics or price impact for entering and unwinding positions.

Gross Revenue = (Mgmt bpsTVL) +(Perf %Realized PnL)

Gross Margin = Gross Revenue-(Gas+Keeper+Oracle+Offchain Infra+Audits)

Scale is far more important than headline APY: a low-yield vault with one hundred million in stable deposits may throw off more cash than a high-yield niche vault that never climbs past a few million. Cash flow is framed as Capital × Yield, and those exotic high-APY opportunities are usually capacity-constrained. As an allocator looking at a vault marketplace, you want some degree of consistency and predictability on yield generated, as well as the ability to retain optionality as market conditions change.

Revenue growth depends less on raw performance and more on distribution levers. The simplest catalyst is a governance vote that toggles or reroutes the platform cut; turning the fee switch to fund buybacks can reprice the token overnight but simultaneously compress depositor yield, so allocators re-evaluate quickly. Similarly, incentives can bootstrap TVL by directing emissions toward favoured vaults, yet they dilute token supply unless the added deposits add more fee revenue than the emissions destroy. One strategy to offset these costs is to partner with asset issuers or protocol partners in order to run co-incentive programs that split costs. Another growth tactic is to leverage BD and sales to land exchanges, apps, or wallet integrations. A listing inside a mainstream “Earn” tab can multiply inflow at near-zero user-acquisition cost, even though the protocol usually surrenders a slice of fees to the distributor.

| Growth Lever | Mechanism | Capital-Efficiency Angle | Token-Price Angle |

| Fee switch activation | Turns on the platform cut or redirects it to buyback-and-burn | Immediate drop in depositors’ APY may slow down deposits | Buyback-and-burn creates a reflexive bid on token float |

| Vault incentives | Token emissions steer strategy weight | TVL bootstrapping at the cost of dilution, but there is room for co-incentive campaigns with asset issuers or partner protocols | If dilution surpasses fee capture, that’s detrimental for value accrual |

| CeFi/Wallet Integrations | Instant retail funnel | Zero acquisition cost to the protocol | Increased activity boosts fees |

Token economics can amplify or erase margin. Fee switches and incentives must out-earn their dilution, or they merely reshuffle value. In practice, moats form around UX, risk optics, and distribution – rarely around strategy IP alone. Below we list some examples:

- Distribution Moat: Wallet-native vault picker (e.g., Coinbase “Earn”) screens out rivals; 20-50 bps platform cut is painless when deposits are one-click.

- Risk-Analytics Moat: Real-time VaR + monitoring dashboards de-risk institutional tickets; competing vaults without telemetry must over-pay in APY.

- Liquidity Network-Effect: Large AUM sheets create Lindy and stickiness over time.

- SDK / Strategy Velocity Moat: Fastest “back-test → deploy” loop locks in curator mind-share; slower platforms are left behind.

The best-in-class platforms look like infra businesses: thin, recurring take-rates on thick externalized strategy layers. Aim to own the rails, not every vault. Defensibility forms where friction is highest for would-be competitors. The first moat is distribution: if a vault picker sits natively inside a regulated wallet, most retail users will accept a twenty-basis-point platform rake simply because it is the default option. The second moat is compliance and risk optics: real-time value-at-risk dashboards or proof-of-reserves hooks are attractive selling points for institutional clients. Third, liquidity network effects and Lindyness help to reinforce the TVL and fees flywheel. The final moat is developer or strategist velocity: an SDK that lets vault managers ship, test, and iterate strategies in hours locks in mindshare, while slower platforms become second-choice ideation spaces. None of these defenses rely on secret strategies; they rely on owning rails, data, or workflows that others find costly to replicate.

The bottom line is that true leverage lies in scale rather than in chasing ephemeral headline yields. Moats crystallize around UX, risk transparency, distribution reach, and strategy velocity – not around proprietary yield recipes. It’s all about the ability to retain and deploy large amounts of capital reliably and kickstart feedback loops where more AUM leads to deeper integrations, better terms, higher trust, etc.

Protocol Taxonomy: Design Space Breakdown

Asset management is all about navigating the risk-reward tradeoff space. DefiLlama categorizes these protocols into Yield Aggregators, onchain Capital Allocators, and Yield platforms. The common theme is that these protocols help users earn yield on their assets by pooling funds into vaults or strategies managed via smart contracts or designated managers. The trade-off space, however, is better understood through the lens of design decisions across key items such as:

- Custody Isolation: Whether the assets reside in a vault that pools funds from depositors, or whether a separate smart contract wallet is created for each depositor. The former is more capital efficient and allows for economies of scale, but the latter gives the user more flexibility at the expense of complexity and management overhead. While smart contract wallets used to be more prevalent in the past, with tools like Instadapp or DeFiSaver, most TVL today is dominated by vault platforms.

- Execution Scope: Automation gives peace of mind and simplifies operations, yet manual discretion may be necessary to capture fleeting opportunities. Simple yield aggregators may just auto-compound rewards on a regular schedule, but automation can be more sophisticated and involve keeper and monitoring systems that rebalance the portfolio, arbitrage opportunities, or auto-adapt to market conditions without human intervention. Today, most protocols rely on hybrid systems, yet there is still a lot of trust that lies in the hands of strategists making discretionary decisions on behalf of protocol depositors, with automation simply being used for harvesting rewards. This is a bitter reality that may catch many by surprise: even though yield strategies are technically run onchain, actual decisions are usually made by humans on a daily basis.

- Curator Model: In some protocols, strategy creation and management is permissionless. Others, however, rely on their own strategist making all decisions for the protocol’s vaults. The former usually features a factory contract such that anyone can deploy a vault and run strategies on top after selecting a list of protocols, assets, and automation settings. In contrast, the latter is often a more discretionary role where depositors have no choice but to trust the actual manager running the strategies.

- Access Control: While it is a feature for all capital flows to be recorded onchain, managers may still want to decide who can deposit into their vaults. This is where frontend displays and compliance controls come into play. We can draw a line between public vaults where anyone can put assets into, or private vaults that might not be displayed on the frontend but allow managers to whitelist a list of addresses that can deposit and start earning.

- Fund-of-Funds Composability: In the past, every new integration required custom code. This involved a time-consuming process to do diligence and then build specific smart contracts called adapters or connectors for each underlying protocol. That’s why single-strategy vaults used to prevail. Today, given the prevalence of the ERC4626 standard, protocols can nest vaults inside each other such that one ERC4626 vault becomes the underlying strategy of another, acting as an extra level of abstractions (e.g. the optimization of the optimization).

- Risk Management: Alerting systems, monitoring. and audits are critical to ensure safety, but it is also important to highlight how relevant offchain systems are for rebalancing positions or threat detection. While the code may be sound from a technical standpoint, you may still need to trust a multisig or person managing funds behind the scenes, or having some degree of control over assets that, in theory, they shouldn’t own.

- Strategy Flexibility: Ranges from access to offchain yield sources, such as T-Bills or perps funding rates, as well as cross-chain vaults to capture a broader range of opportunities across diverse DeFi ecosystems.

Allocation Frameworks

Capital allocators can profit from the adoption of ERC4626 and asset management stacks in two orthogonal ways:

- Ride the rails – Yield strategies: Deploy capital into the vaults themselves to harvest the cash flows these strategies generate, rebalancing positions as spreads, risk regimes, or incentives evolve.

- Own the rails – Governance tokens: Acquire equity-like stakes in the platforms that build, route, and secure vault liquidity. Value accrues through fee capture, token buybacks, and governance optionality as TVL compounds.

Riding the Rails: the Vault Allocation Playbook

Where governance token bets often hinge on spotting winners early, yield strategies optimize for compounding risk-adjusted returns on an underlying asset. The key is to diversify and avoid concentration risk to survive security exploits while assembling a dynamic basket of ERC4626 vaults whose payoffs are uncorrelated yet complementary.

- Conservative strategies typically include single-asset lending or staking/restaking vaults that provide steady base yields with minimal complexity. They optimize for capital preservation by avoiding the dilution that comes with holding non-yield-bearing assets. The smart contract risk tends to be lower and these strategies usually converge around the 3-7% APY range.

- Balanced strategies seek to diversify away and find greater yield with an acceptable increase in the level of risk. These include LP strategies on DEXs, depositing into yield aggregators, or delta-neutral vaults. These are the core building blocks for most yield portfolios; they carry slightly higher market structure and execution risk but can provide yields in the 5-15% range.

- Aggressive strategies look for high-risk-high-reward payoffs and often involve leverage or speculative bets buying YTs. These require active monitoring and carry more liquidation risk, but often yield double-digit returns that can go from as low as 10% to as high as 30% APY.

| Tier | Strategy Archetype | Works Best | Primary Risk | Target APY |

| Conservative | Single asset lending | In bull markets or periods with increased demand for borrowing | Smart contract exploit or bad debt socialization | 3-7% APY |

| Conservative | Staking & Restaking | During periods of high onchain activity | Contract failure | 3-7% APY – specific to network and token issuance |

| Balanced | LP | With high volume pools of correlated assets | Impermanent loss and opportunity cost | 5-15% APY – often enhanced by incentives that offset IL |

| Balanced | Yield Aggregators | To not deal with rebalancing complexity and operational overhead | Trust in a protocol and strategy curator | 5-15% APY |

| Balanced | Delta Neutral or Tokenized Carry | During periods of high volatility or bull markets with persistent high funding rates | Offchain infrastructure and opaque operations | 5-15% APY |

| Aggressive | Leveraged Looping | In structural rate regimes or incentivization periods for borrowers | Liquidation and duration | 10-30% APY |

| Aggressive | Yield Trading | In markets with a skewed mispricing in YT/PT prices caused by external incentives | Opportunity costs of time decay | 10-30% APY |

Heuristics around portfolio construction include:

- Core carry first. Anchor with conservative vaults for baseline yield and capital preservation.

- Diversify risk vectors. Blend balanced archetypes that profit from volume, spreads, or basis, but that are not perfectly correlated.

- Use aggression sparingly. Cap leverage-heavy exposure to a pre-defined VaR budget; monitor trigger levels (LTV, funding spreads, gas).

- Rotate by regime. Shift weight toward delta-neutral and fixed-rate vaults in chop or uncertainty; pivot to leveraged or LP exposure when volatility compresses and trend resumes.

- Review triggers. Re-underwrite a vault when APY drops below risk-free alternatives, onchain liquidity falls, new smart-contract audits surface critical findings, or governance alters fee splits/incentives.

Alpha lies not in chasing headline APY but in matching archetype behaviour to market regime, sizing for risk tolerance, and revisiting positions when their edge erodes. A disciplined allocation playbook turns vaults into a durable cash-flow engine rather than a series of yield punts.

Having mapped out the landscape of strategy archetypes and portfolio heuristics, the next step is knowing who’s building the rails. Two strategies might look identical on paper, but infrastructure makes the difference between durable yield or fleeting opportunity. The table below outlines six actively managed vault providers, making it easier to scan the landscape and find the right match for your strategy and risk profile.

| Name | Overview | Technical Implementation | Available Yield Strategies | Risk Considerations |

| Veda | Market-leading vault provider powering major DeFi protocols across chains. | Minimal BoringVault contracts with modular external components. The Merkle proof system ensures only pre-approved actions are allowed, with Teller contracts for deposits/withdrawals, Manager for allocations, and Accountant for exchange rate updates. Daily rebalancing with delayed withdrawals for security. | Arbitrarily complex strategies across major protocols: liquid restaking (ether.fi), Bitcoin liquid staking (Lombard), vaults with stablecoin yield (Plasma), meta-assets (Rings), cross-chain pre-deposits (TAC). Strategy-agnostic with rapid deployment capabilities. | Strategy selection risk, smart contract complexity despite audits, curator operational risk, oracle/valuation manipulation risk, external protocol exposure, delayed withdrawal inconvenience. |

| Upshift | Institutional-grade yield platform democratizing access to top DeFi fund strategies run by strategically selected curators. | Built on August prime brokerage infrastructure with non-custodial ERC-4626 vaults. Whitelisted curator strategies deployed via smart contract subaccounts with automated risk monitoring and KYC/KYB verified lending. | DeFi yield vaults curated by top funds: LPing, rewards farming, fixed maturity products, cross-chain optimization, delta-neutral strategies. Overcollateralized lending to KYC/KYB institutional borrowers with customizable parameters. | Strategy execution risk, smart contract complexity, curator operational risk, lending default risk despite KYC/KYB, automated unwind system dependency, external protocol exposure. |

| Midas | Regulatory-compliant yield protocol bridging TradFi and DeFi through tokenized exposure to traditional assets. | Issues floating-value ERC-20 tokens (Liquid Yield Tokens) for each strategy, backed by curated yield portfolios and RWAs with proof-of-reserve verification. Uses vault contracts for minting/burning and dedicated oracles for pricing. | Core strategies: Custom partner-curated strategies like mMEV, mEDGE, mF-ONE & mRE7 as well as mTBILL (US Treasury Bills), mBASIS (basis trading) & mBTC (Bitcoin yield). | Strategy performance risk, redemption delays during stress (1-7 days), off-chain custodian dependence, subordinated investor claims, multi-chain technical complexity. |

| Stream Finance | Cross-chain automated vault platform with seamless omnichain yield position migration. | Dual-contract architecture (StableWrapper for 1:1 token wrapping, StreamVault for yield distribution) with 24-hour epoch system, delayed withdrawals, daily yield distribution via keeper calls, and LayerZero OFT integration. | Strategy-agnostic platform focused on delta-neutral yield generation. Vault owner (multisig) allocates capital to market making, LPing, lending, and other DeFi opportunities. Emphasis on minimizing market risk through delta-neutral approaches. | Strategy performance risk including negative yield potential, multisig operational risk, 24-hour withdrawal delays, LayerZero bridge dependencies, external protocol exposure, limited instant liquidity access. |

| Lagoon | Permissionless vault deployment platform enabling anyone to create customized yield strategies. | ERC-7540 standard for asynchronous operations with Factory contract deployment. Role-based architecture (admin, oracle, curator, whitelist manager). Users deposit to pending silo, curator settles after valuation oracle updates NAV. | Strategy-agnostic platform – curators have full discretion to allocate to any DeFi strategy including yield farming, lending, trading, or structured products. Strategy depends entirely on the curator’s choices and capabilities. | Strategy performance risk, curator operational risk, valuation oracle accuracy risk, admin role concentration, asynchronous settlement delays, external protocol exposure. |

| IPOR | DeFi’s first on-chain interest rate benchmark enabling rate derivatives and automated yield optimization. | Calculates IPOR Index from major lending protocols, enables interest rate swaps with AMM pricing, and offers Fusion ERC-4626 vaults with modular “Fuses” for automated cross-protocol strategies. | Interest rate swaps (up to 500x leverage), liquidity provision earning fees/SOAP/yield, Fusion automated yield strategies (looping, carry trades, arbitrage, leveraged farming) managed by Alphas with custom Fuses for protocol integrations. | IRS (interest rate swaps) counterparty risk for LPs, smart contract complexity, oracle/index manipulation risk, Alpha/Atomist operational risk, high leverage liquidation risk, external protocol dependencies. |

Owning the Rails: Governance Token Plays

Governance token prices tend to move in tandem with key protocol metrics such as TVL, fee flow, user activity, and market share. That’s not a coincidence, as these tokens often control the levers- incentive emissions, fee schedules, and treasury spend (e.g., buybacks or liquidity support) – driving those numbers.

However, the opportunity to capture value doesn’t start with buying tokens, it begins the moment protocols start building TVL. Before governance tokens even exist, most vault protocols bootstrap adoption through points programs or airdrop incentives that reward early liquidity providers and strategy users. These mechanisms aren’t just marketing tools, they’re structured to simulate product-market fit and create behavioral anchors around strategies. As protocols transition from airdrop-era growth to token-era value capture, TVL serves as both a financial input and a social signal.

When profits and upside are shared with token holders via revenue distribution or buybacks, TVL becomes a useful proxy to represent the amount of fees that can be captured with that amount of AUM. Growth in TVL and revenue increases the cash that can be routed back to the token, reinforcing demand and price.

Especially when dealing with multiple vaults, parsing strategy-level performance is labor-informative, and some risk parameters are subjective; TVL is a simpler proxy that confers social proof (e.g. liquidity begets liquidity), pulls in integrations (protocols and allocators seek to deploy in the most Lindy and liquid pools), and gives operational leverage (lower unit costs, better LP negotiation terms, bigger security budgets, less perceived risk, etc).

TVL matters not because it directly indicates strategy quality (a $2B protocol isn’t necessarily executing better strategies than a $200M one), but rather, it signals brand value, network effects strength, and ecosystem positioning. That being said, there are still strategic edges that compound growth and boost TVL. These include superior strategy execution, deeper DeFi integrations, stickier ecosystems, and strong security guarantees. This spectrum characterizes the investable array of opportunities available for investors at any point in time across different scales:

- Tier 1 Protocols ($1B+ TVL) have achieved self-sustaining network effects but their token upside is often limited by scale.

- Tier 2 Protocols ($100M-1B TVL) hit the sweet spot for potential price appreciation and airdrop rewards. A $500M protocol adding $200M achieves 40% growth, which is significant enough to drive material price action, while user bases are large enough to indicate protocol viability but small enough for meaningful individual allocations.

- Tier 3 Protocols ($10M-100M TVL) theoretically offer unlimited upside on both fronts, but often lack strong ecosystem positioning. A $50M protocol reaching $200M represents 4x growth, while early participants often get disproportionately large airdrop allocations as there are less users. But these asymmetric bets are largely dependent on speculative network effects.

A clear opportunity that arises from these insights is a dual-strategy approach: deposit into yield strategies while farming points for potential airdrops, effectively creating a “yield + airdrop” return profile that can significantly outperform either strategy alone.

Innovation sets growth rates, and growth—scaled by starting TVL—drives token returns. Small protocols amplify innovation into price, large protocols absorb it. In any broad liquidity strategy to deposit capital onchain, deposits will cascade first into Tier 1 protocols (trust gravity), then ripple outward to Tier 2 and the few Tier 3 names that show early traction. Airdrop farming represents a fundamentally different game, requiring a balance of airdrop dilution risk (too many farmers) against protocol execution (will they actually launch?) and underlying strategy risk.

Conclusion: Closing the Loop

ERC4626 vaults have elevated DeFi vaults from boutique yield engines to an institutional-grade infrastructure layer. Standardization stripped away integration friction, unlocked nested “fund-of-funds” structures, and allowed protocols to externalize strategy risk while monetizing flow through thin, recurring take-rates.

The evidence across TVL, fee data, and user behaviour shows a sector that will stay structurally fragmented: Liquidity and incentives live on specific chains and vanish quickly; risk does tooliquidity, incentives, and risk are chain-local and time-boxed, so no single vault venue can dominate every asset or market regime. Durable edge instead accrues to platforms that mask complexity behind one-click UX, ship plug-and-play SDKs for curators, and own distribution pipes – whether that is the default “Earn” tab in a wallet or a KYC wrapper for regulated funds.

For allocators, the opportunity now is neither a single-protocol monopoly nor scatter-shot experimentation, but targeted deployment across rails, strategies, and distribution chokepoints. Meanwhile, builders should treat themselves as infrastructure businesses that deploy unopinionated vault factories alongside real-time risk dashboards, and curator marketplaces—then let outside managers compete for alpha while the protocol clips the fees.

Ultimately, value accrual is a cash-flow relay: gross fees should flow into protocol treasuries, and from there into buybacks or revenue-share mechanisms. Similarly, protocols that bankroll growth mainly through emissions only reshuffle value unless fee capture rises faster than dilution. The winning design pairs a transparent, hard-coded revenue split with credible supply sinks, letting token yield and burn rate outrun opportunity cost.

References

Cousaert, S., Xu, J., & Matsui, T. (2022). SoK: Yield Aggregators in DeFi.

DeepDAO. DAO Organizations Directory.

DeFiLlama. Onchain Capital Allocator Protocols Overview.

DeFiLlama. Yield Aggregator Protocols Overview.

DeFiLlama. Yield Protocols Overview.

ERC-4626.info. ERC-4626 Vault Standard Information Portal.

Ethereum Foundation. (2022). EIP-4626: Tokenized Vault Standard.

Fireblocks. What is Institutional DeFi?

Ramos, C. PoL for Developers: Reward Vaults Explained. Berachain Blog.

Sygnum. (2025). Institutional DeFi in 2025: The Disconnect Between Infrastructure and Allocation.

Disclosures

This report is for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities or financial instruments.

Alea Research and Sumcap collaborated on this piece as part of an educational initiative. Members of the Alea Research and Sumcap teams, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform, and not an investment or financial advisor.