Introduction

After Kujira’s most recent setback, Thorchain has stepped in to secure a more promising outlook for both parties. This has led to the formation of the Rujira Alliance, a Merger that seeks to overcome risk assessment mistakes of the past while leveraging the strengths of Kujira to enhance Thorchain’s value proposition with smart contract capabilities. This not only provides a chance to recover and expand Kujira’s mission, but also addresses Thorchain’s need to offer more advanced financial services beyond cross-chain-swap and overcome the current limitations of the network.

The following report will examine the key stages of the path that led to the merger, the medium and long term objectives, and the potential upside to be had by being exposed to one of the most interesting partnerships of the year.

Key Takeaways

Flexibility with CosmWasm, security with Thorchain: Rujira will become Thorchain’s application layer, built on top of the existing cross-chain network and with support for CosmWasm smart contracts.

Kujira’s bad debt amount is limited and recoverable: Even though the liquidation cascade experienced by Kujira on 1 August led to significant losses for the Protocol Treasury, Thorchain considers that the overall damage, estimated at $ 2.76 M, is fully recoverable.

High performance and low costs environment: Rujirafully leverages the unique properties of Thorchain’s cross-chain swaps and combines them with support for more advanced smart contract functionality via CosmWasm to achieve maximum flexibility in a high-performance, low-cost environment.

Limited risks for Thorchain’s infrastructure: Thorchain benefits from the merger with Kujira by retaining 50% of the revenue generated on the App Layer. This integration brings upside while not introducing any systemic risk for the underlying Thorchain network.

Revenue generating financial services meet huge native liquidity: The large amount of coding work done on Kujira and the wide range of tools/products created will not be lost, but rather enriched with the cross-chain features of Thorchain’s infrastructure. Besides the cross-chain interoperability among native assets, the incentive pendulum between nodes and Liquidity Providers, Thorchain also offers large amounts of liquidity that can now be leveraged for building novel financial primitives.

Background

To understand the significance of this Merger, it is imperative to understand the circumstances that led to the actual development of each protocol individually.

Kujira

Kujira’s origins date back to May 2021, with the $KUJI Token Generation Event taking place in November of that same year. The origins of the vision date back to the early days of the Terra Ecosystem, when they witnessed howMonths later, a liquidation cascade on the Anchor Protocol in Terra triggered a significant price drop on $LUNA. This event highlighted vulnerabilities in the DeFi space, where a small group of market participants was able to purchase liquidated assets at steep discounts. In response to these market inefficiencies, the Kujira team began developing a platform to decentralize the liquidation bidding process, Orca.

Orca was the first product built by Kujira, and it was deployed on top of the Terra blockchain. This protocol would allow users to bid on defaulted loans—a process traditionally limited to institutional-grade investors. By democratizing access to liquidation markets, Orca addressed a key gap in DeFi and created a foundation for a community of users focused on a more inclusive financial ecosystem.

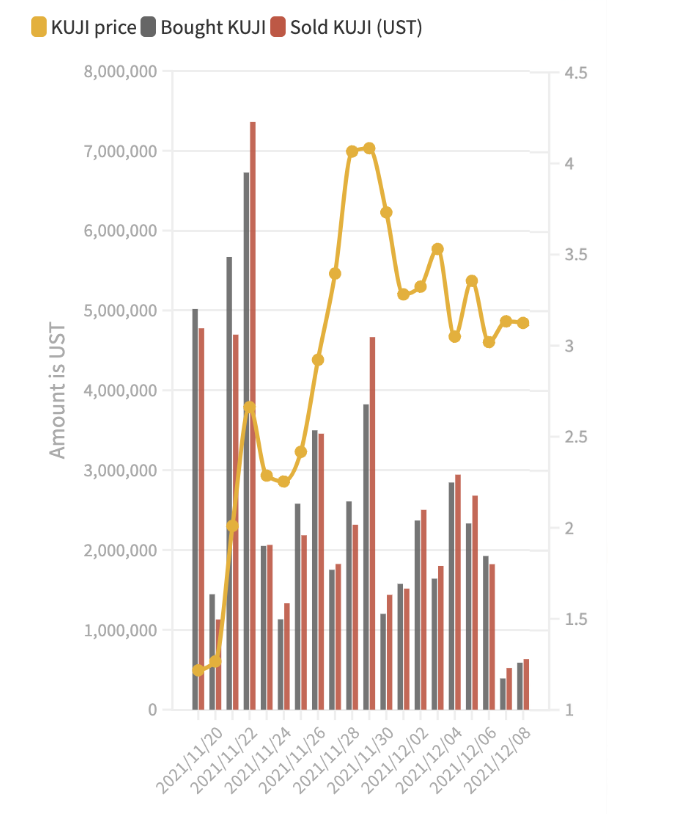

Figure 1: The vertical growth of $KUJI price from TGE to the Luna collapse.

Source: “Kujira — A Data Driven Analysis” (2022), published by @incioman (Alex) on Medium blog

Kujira’s development, however, faced its first significant challenge in May 2022 when the Terra ecosystem collapsed, resulting in a $45 billion loss in market capitalization. $LUNA and $UST dropped from a value of $87 and $1, on 05/05/22, to less than $0.00005 and $0.2, on 13/05/22, respectively. Kujira lost almost 50% of its funds before pulling out of Terra’s $UST and the remaining capital was roughly $3 M. Despite this setback, Kujira managed to get back on its feet very fast. It stood out as one of the most resilient protocols in the Cosmos ecosystem. After the collapse of the chain that was hosting all their operations, they didn’t give up and decided to continue building. Within 6 weeks they launched the Kujira chain, a Cosmos SDK-based Layer 1 that would host all protocols built by Kujira. All of this was done by the same team of contributors and without external funding, which allowed them to preserve the integrity of their ecosystem, operational runway, and maintain (if not increase) user trust.

Following this transition, Kujira expanded its range of products, including a fully on-chain order book (Fin), lending tools (Ghost), and other decentralized financial applications (market making frameworks like Bow, launchpads like Pilot, etc). These developments marked Kujira’s move from a liquidation-focused platform to a broader DeFi ecosystem that was geared towards sustainable and community-driven financial solutions.

Thorchain

Thorchain was founded in 2018 with the mission of creating an interoperable cross-chain decentralized exchange (DEX) that would allow users to swap native tokens from different networks directly, without wrapping assets or relying on third parties. While often compared to a bridge, the original vision was to challenge and compete against CEXs, offering an alternative for users to exchange assets that live on different chains—a decentralized Binance.

In August 2020 Thorchain launched its Single Chain Chaosnet, focusing on testing and refining its native asset swaps on a single chain. In April 2021, the Multi Chain Chaosnet was introduced, enabling cross-chain swaps between multiple chains. Mainnet was finally launched in July 2022.

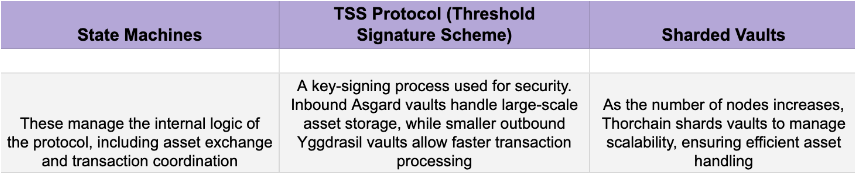

Thorchain’s technical infrastructure is supported via node operators running the state machines responsible for asset exchanges and transaction coordination across different chains. The network consensus is based on the use of a TSS (Threshold Signature Scheme) Protocol that works in tandem with Sharded Vaults. Essentially, network nodes constantly monitor vault addresses and process cross-chain transactions, converting them into internal transactions, thus enabling the cross-chain functionality. This is powered by the Bifröst Protocol.

The network achieves economic security through the Incentive Pendulum mechanism, which is responsible for balancing capital requirements between L1 nodes and the chain’s liquidity pools. Namely, the Incentive Pendulum is a system that balances rewards between node operators and liquidity providers to keep the network secure and efficient. If the balance tips too much in either direction, the network then becomes:

The network achieves economic security through the Incentive Pendulum mechanism, which is responsible for balancing capital requirements between L1 nodes and the chain’s liquidity pools. Namely, the Incentive Pendulum is a system that balances rewards between node operators and liquidity providers to keep the network secure and efficient. If the balance tips too much in either direction, the network then becomes:

- Unsafe (too much in pools, too little in security).

- Inefficient (too much in security, not enough in pools).

The Incentive Pendulum monitors two main components:

- Bonded $RUNE: $RUNE staked by node operators to secure the network.

- Pooled $RUNE: $RUNE added by liquidity providers to enable trading in pools.

If there’s too much in pools compared to what nodes have bonded, the network could be attacked more easily. To counter this, rewards are increased for node operators and reduced for liquidity providers.

This new balance in rewards distribution motivates more people to become node operators (adding more bonded $RUNE) and discourages excess liquidity from piling up in pools. Over time, the network returns to a safer, balanced state.

If too much is bonded by nodes and too little sits within the pools, Thorchain isn’t using resources efficiently. So the system reduces rewards for node operators and increases them for liquidity providers.

This shift encourages more liquidity providers to participate, boosting pool sizes and reducing excessive bonding by node operators.

The Incentive Pendulum aims for an optimal state where the bonded capital (100% $RUNE) and the pooled capital (50% $RUNE / 50% external assets) is roughly equal, and thus bonded $RUNE is roughly three times the value of pooled $RUNE: indeed, in this state, there’s enough bonding to secure assets in pools and those kept in TC’s “vaults” (security pools) for safety.

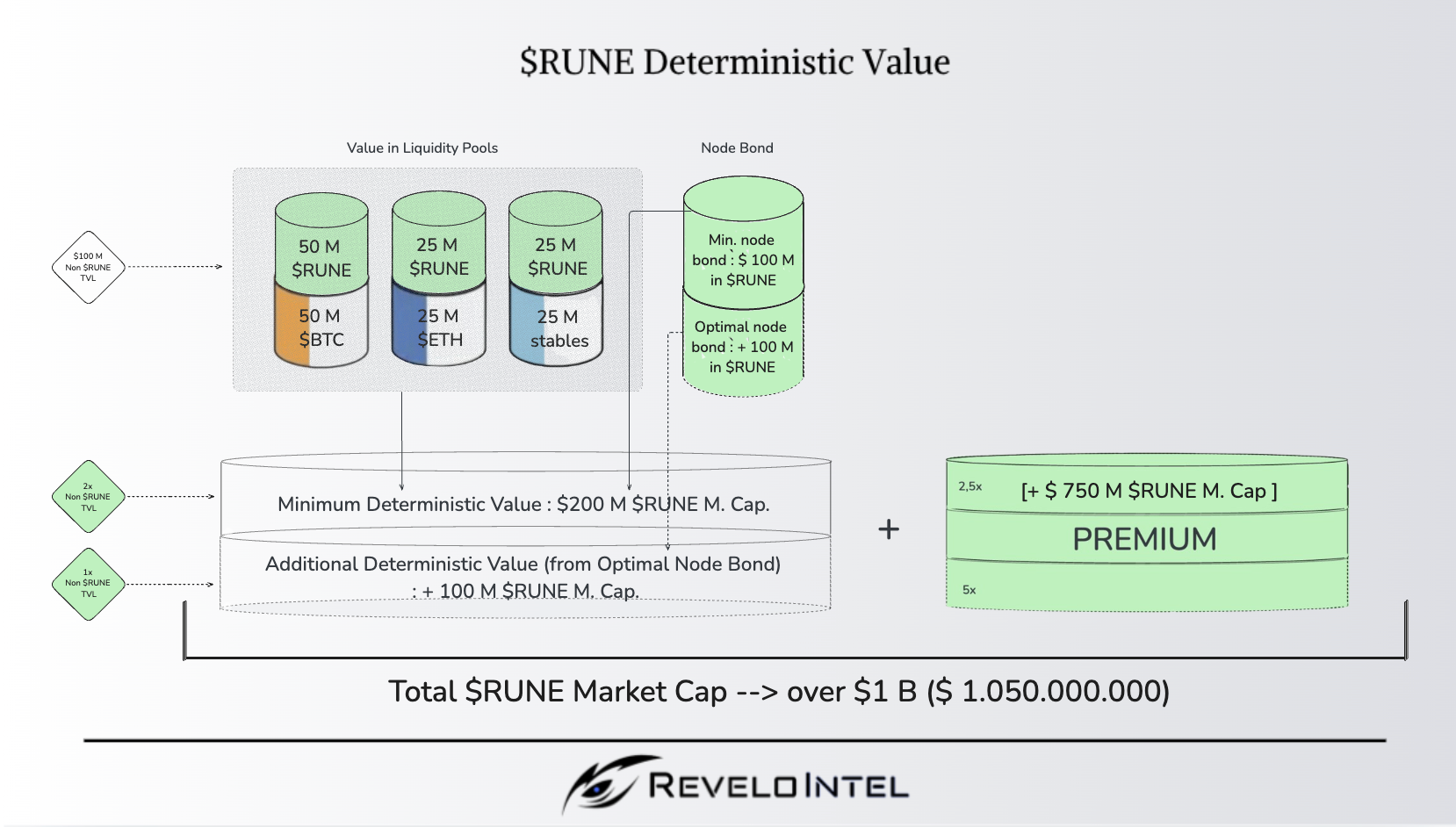

Figure 2: The optimal state to which the incentive pendulum tends is where bonded $RUNE are about equal to 3 times the $RUNE in pools

Source: Thorchain official documentation

Another component playing a crucial role within the system devised by Thorchain is its governance token $RUNE, because it provides security to the network through incentives and its economic design is closely related to the TVL.

The value of $RUNE indeed aims to be deterministic, meaning its minimum value is calculable based on the network’s TVL. For THORChain, the deterministic value of $RUNE is driven by a 3:1 ratio: every dollar of non-$RUNE assets in liquidity pools should be matched by 3 dollars in $RUNE market cap.

$RUNE Market Cap ≥ 3× Non-$RUNE TVL.

To be more specific, for every $1M of multi-chain assets pooled into the liquidity pools $1M of $RUNE is required to be deposited alongside. Because of the Incentive Pendulum powering the network, this also means that $2M in $RUNE are bonded. Therefore, $1 in external assets will cause the total required value in $RUNE to be $3M.

By including circulating supply among the evaluation parameters, we can thus estimate the deterministic value of $RUNE by forecasting market conditions and the Total Value Locked (TVL) in the network. This value is calculated by taking 3x the TVL of non-$RUNE assets within the TC’s liquidity pools and dividing it by $RUNE’s circulating supply.

Figure 3: The deterministic value of $RUNE

Source: Revelo Intel

Setting the Stage and Merger Rationale

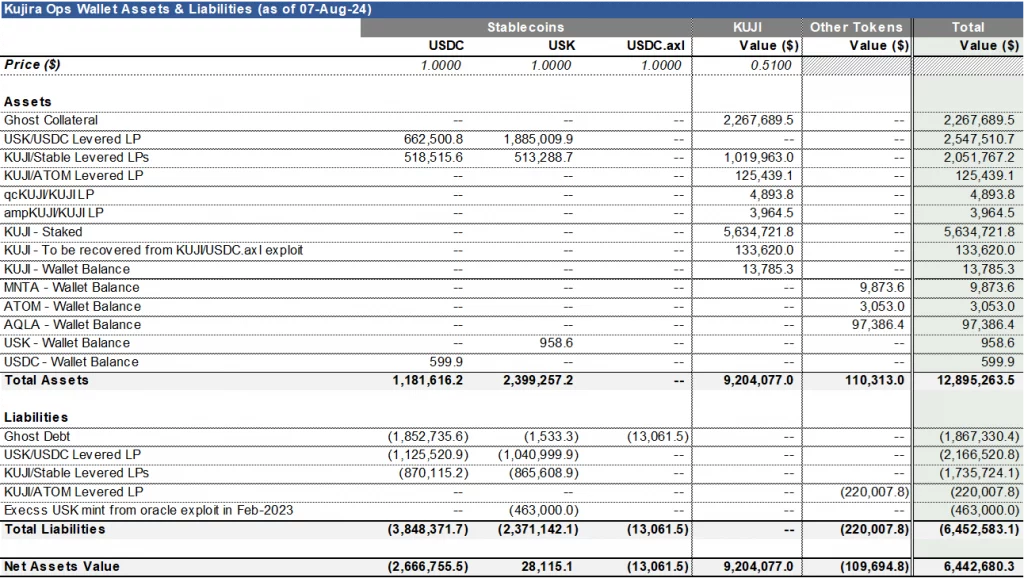

In August 2024, Kujira faced its second critical event as its operational wallet underwent a series of liquidations due to undercollateralized leveraged positions. The Ops wallet used a portion of $KUJI tokens as collateral (information that had not been disclosed to the community and the market), which was borrowed against to secure $USDC and $USK (Kujira’s stablecoin), both used to provide liquidity and, according to the team, foster financial activities within the ecosystem. However, a sudden drop in the $KUJI price, from $0.86 to $0.60, triggered a liquidation cascade as the leveraged positions fell below their safe loan-to-value (LTV) levels.

During this event, market participants used Orca, Kujira’s liquidation engine, to buy the liquidated $KUJI collateral at a 30% discount to market value. Given the lack of competition on Orca, buyers quickly liquidated $KUJI for arbitrage profits, which further depressed the token price and exacerbated the liquidation cycle. As the volume of liquidated collateral exceeded the available bids, the system reached a point where liquidations could no longer be processed, resulting in bad debt (loans or outstanding balances that are no longer deemed recoverable and must be written off by the protocol).

Figure 4: Kujira’s balance sheet a few days after the event

Source: The Kujira team held approximately 18 M $KUJI in their Ops wallet, of which around 4.5 M was collateralized to borrow $USDC and $USK on their Ghost platform, and 2.25 M was in leveraged $KUJI liquidity pools. Due to a sharp price drop, the team’s collateralized positions fell below safe Loan-to-Value (LTV) ratios, leading to a liquidation cascade on the Orca platform.

As of August 7, 2024, Kujira’s $USDC liabilities amounted to $3.85 M, against which it held $1.18 M in assets, resulting in a net debt of $2.67 M. Kujira’s $USK holdings, however, slightly exceed its liabilities, and this provided an overall net positive cash balance of $30K. Together, the total net debt, excluding $KUJI and other assets, amounted to $2.76 M.

After the event,, the Kujira team acknowledged the deficiencies in risk management and proposed a series of corrective actions in order to avoid similar issues in the future, such as reducing the maximum borrowing limits against $KUJI (one of the reasons that triggered the spiral), optimizing partial liquidation logic in stressful periods, and transferring management of the Ops Fund to a newly established Kujira Operational DAO.

The Recovery Plan

As we have seen, the cascading liquidation in August 2024 was followed by the definition of a technical and strategic path to stabilize the ecosystem and resolve debt obligations. The key components of this recovery plan are centered on a fundraising initiative and a complete restructuring of both the team and the infrastructure design.

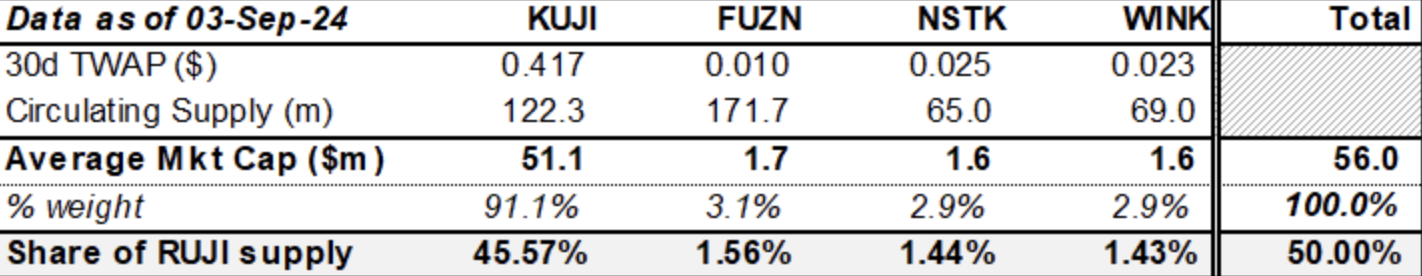

The Kujira team plans to raise capital through its PILOT platform by selling $KUJI tokens from the Ops Wallet. The goal is to raise sufficient funds to pay off the outstanding debt incurred during the liquidation event and to allow GHOST lenders to withdraw their funds. This fundraising initiative will be partially underwritten by JPThor, founder of Thorchain, with a personal commitment of up to $3M, alongside participation from the broader community and other professional investors.The $KUJI sold on PILOT will be subject to a 3-month lock-up, and 6-month linear vesting after that. The KUJI token will then be eliminated (as will those of other projects participating in the Rujira Alliance) in favor of the new $RUJI token, which will recognize each project a share of the supply allocated for this purpose (50% of the total supply).

Figure 5: The distribution of the $RUJI token among the Alliance participants

Source: Winkhub, Kujira blog page

Namely, holders of $KUJI, $FUZN, $NSTK, and $WINK tokens will have 12 months from the merger date to convert these tokens into $RUJI on Thorchain; the conversion rate will start to decay after 4 weeks until 12 months (at which point tokens can no longer be converted).

On the infrastructure side, the Merger will make it possible for Kujira’s products to become available in Rujira, the first consumer layer on Thorchain. This will allow the latter to support smart contract functionality and host protocols such as FIN (on-chain order book), BOW (liquidity pools), GHOST (money market), ORCA (liquidation engine), and PILOT (launchpad). Each of these applications will have exclusivity in their respective verticals, ensuring a focused integration of Kujira’s decentralized finance tools within the Thorchain ecosystem.

Figure 6: The partnership between Thorchain and Kujira confirmed by JP.Thor, Thorchain founder

Source: JPThor official X profile

All application code will be re-audited and open-sourced before being deployed on the consumer chain, with a target of completing the full migration within 6 months (the official launch is, therefore, planned for Q1 2025). Following this migration, the Kujira Layer 1 chain will then enter low-power mode, retaining its functionality only as the issuer of the $KUJI token and other migrated assets.

The management of the Ops Fund will be transferred to a newly formed Kujira Operational DAO, which will oversee the allocation of funds and liquidity management. This DAO will also manage the governance of the core Kujira protocols, with transparency provided through upcoming admin dashboards. Additionally, $KUJI (now $RUJI) will continue to play a role in governance and will implement a 50/50 revenue-sharing model with Thorchain validators.

As part of the recovery plan, the Kujira team will undergo a deep restructuring as well. Notably, JPThor will take on the role of Project Lead, overseeing the development of the platform and leveraging his institutional relationships to push Kujira’s growth. The restructuring will also include new team members, such as Amit and PM, who will receive vested allocations of KUJI tokens, while others get off the bandwagon (like Dove).

Outlook on the Merger: Rujira

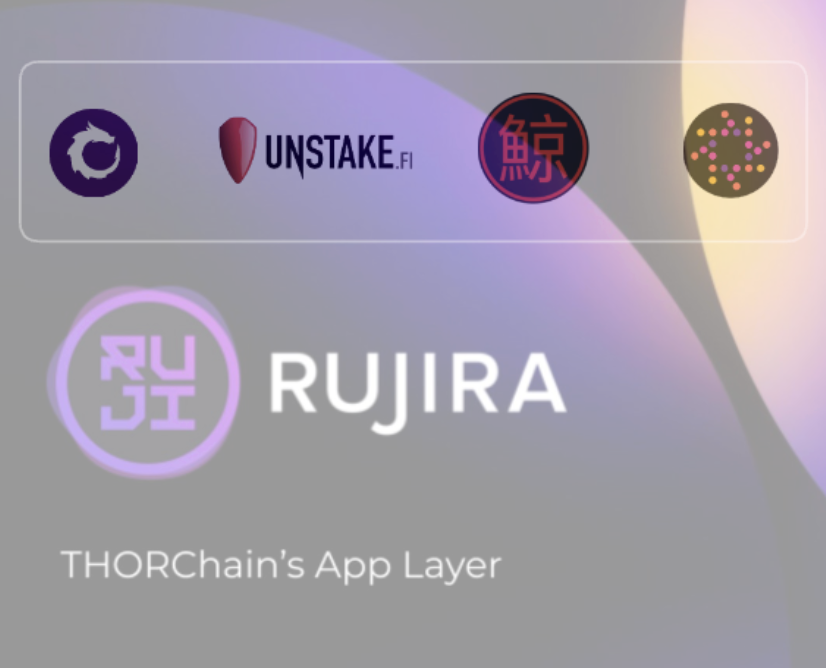

Thanks to the joint effort of several development teams (namely Wink, Fuzion, Unstake and Levana), and the valuable contributions both on the infrastructural and financial side from Thorchain’s community and JP, Rujira will be born.

Figure 7: The development teams that make up the Rujira alliance

Source: JPThor official X profile

The merger preserves Kujira’s vision of offering decentralized financial tools while extending its reach through Thorchain’s infrastructure and liquidity. The $RUJI token will be central to the governance and fee-sharing model within the unified app layer, ensuring that participants in both ecosystems share in the benefits generated by the protocols.

The core focus of the Rujira Alliance will be on expanding the suite of DeFi tools and products, enabling projects to operate within their own verticals while benefiting from a robust liquidity network. The new app layer will provide enhanced opportunities for developers and users to build and scale financial applications, reinforcing the DeFi ecosystem by connecting Kujira’s tools with Thorchain’s liquidity

This collaboration marks a critical step for both platforms, bringing together Kujira’s complex and revenue generating financial solutions withThorchain’s cross-chain liquidity infrastructure.

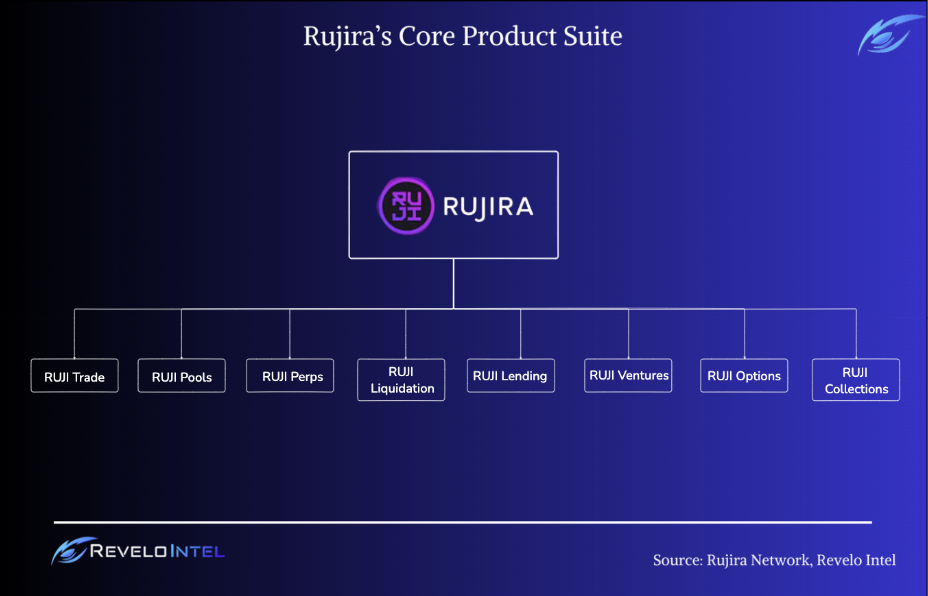

Rujira’s Core Product Suite

The decision to attract new devs to the team by joining forces with other projects orbiting the Kujira galaxy is justified by the desire to offer the highest level of expertise and know-how on each primitive.

The following are the projects we will find on Thorchain’s new application layer and consumer chain.

Figure 8: The range of vertical products Rujira will offer, each managed by a team with specific expertise

Source: Revelo Intel

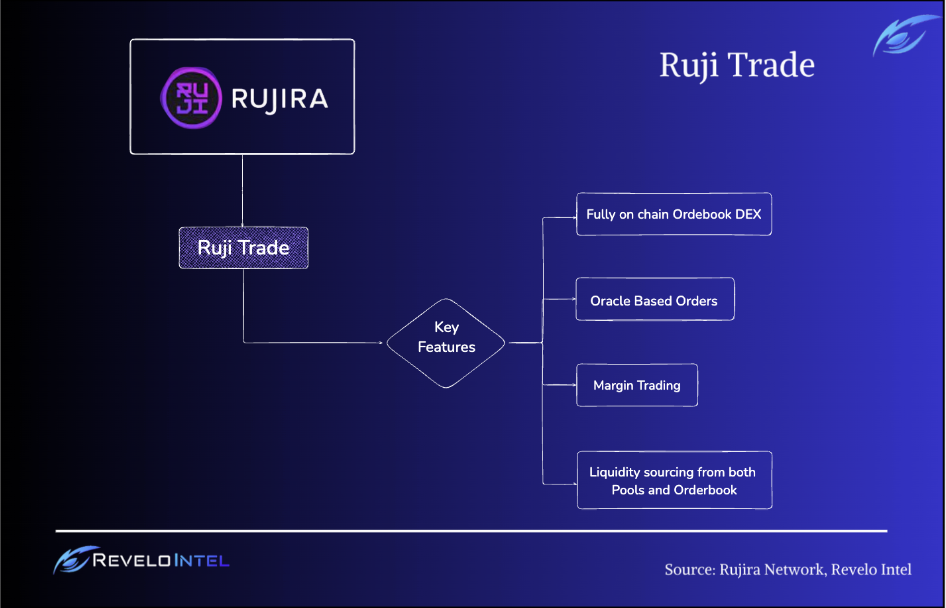

Ruji Trade

Ruji Trade picks up the Fin Exchange legacy and plans to offer a decentralized, fully on-chain Orderbook DEX, aiming to provide efficient trade execution with low fees. The platform will feature constant-time O(1) algorithms for handling large transaction volumes and will source liquidity from both Rujira’s AMM pools and Thorchain’s liquidity pools.

Figure 9: The main features of Ruji Trade, which picks up the legacy of FIN

Source: Revelo Intel

It will support oracle-based orders (a new kind of order developed by the team allowing users to buy or sell at a fixed discount/premium to the underlying asset’s oracle price) as well as margin trading with leverage, thanks to the direct connection with the Rujira’s Money Market.

Fees are set at 0.075% for maker orders and 0.15% for taker orders, with a 50/50 revenue split applied depending on whether the transaction benefits the Thorchain Base Layer (in any case, Rujira has to pay back security costs).

Additionally, RUJI Trade will offer an OTC platform where both buyers and sellers will pay 1% commissions on transactions.

Ruji Pools

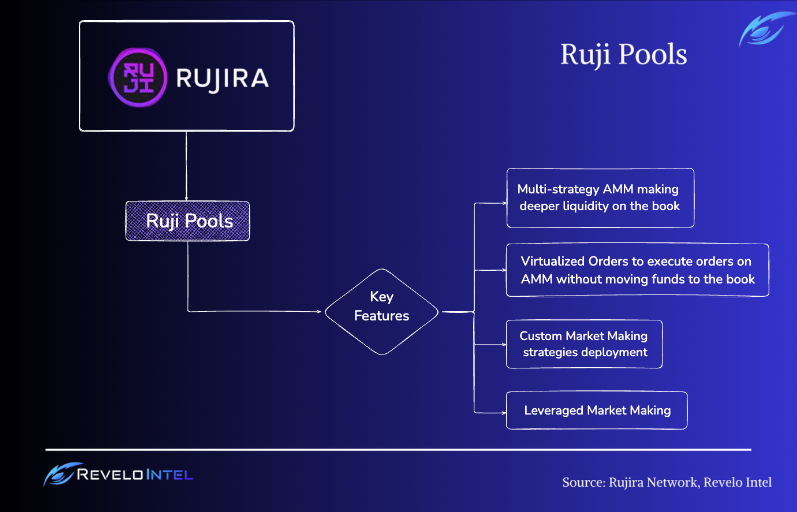

RUJI Pools are designed to provide a multi-strategy Automated Market Maker (AMM) aimed at deepening liquidity on the Orderbook DEX. They enable decentralized, on-chain market making with features like virtualized orders, which allow the AMM to execute orders without moving funds to the DEX.

Figure 10: The core features of Ruji Pools

Source: Revelo Intel

To be more specific, within RUJI Pools the AMM virtualizes orders, meaning that the AMM does not need to transfer liquidity directly to the DEX to place orders. Instead, it simply guarantees that it can execute at the quoted price when a trade is initiated. This design enhances capital efficiency because the same liquidity can be used across multiple strategies and markets without being tied to a specific order. For instance, the AMM can provide liquidity for the ETH/USDC pair on the DEX while simultaneously participating in the liquidation of $ETH collateral in a separate market.

The AMM will deploy many different strategies such as the XYK, oracle-based, and liquidation strategies, optimizing liquidity depending on the asset type. It also supports third-party strategy deployment, allowing external developers to create custom market-making strategies for additional trading profits. Leveraged market making will be possible as well, with LP tokens used as collateral, enabling liquidity providers to amplify their positions.

The service will not require additional fees, complementing the DEX by offering improved liquidity and trading volumes. Liquidity providers will earn returns through trading profits rather than fees, and strategies developed by third parties may come with performance or management fees.

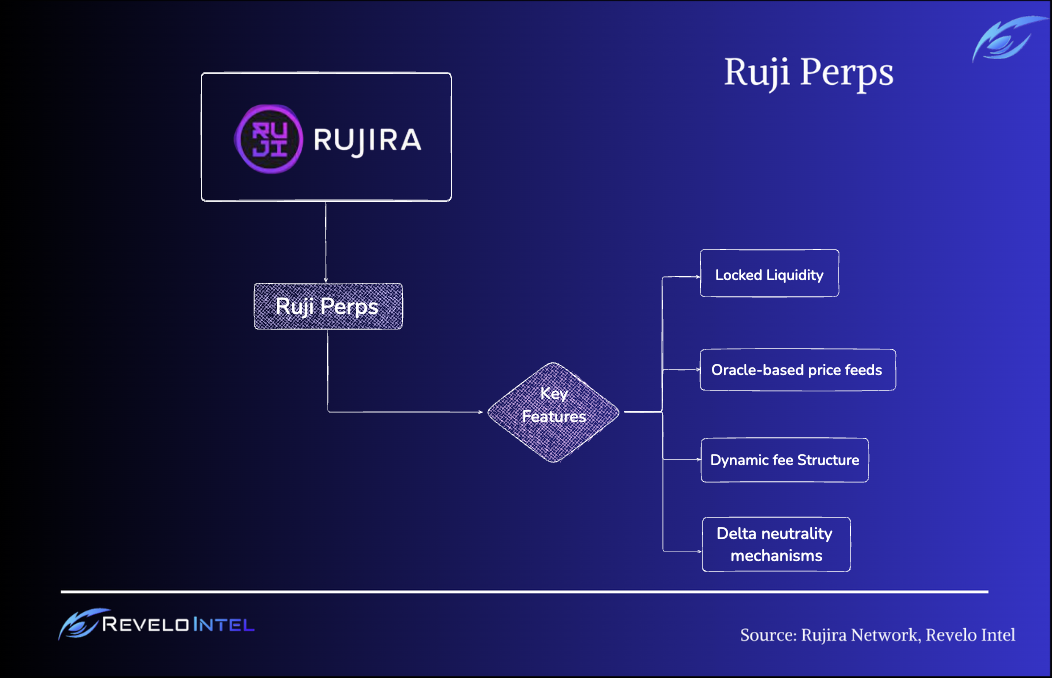

Ruji Perps

RUJI Perps is a decentralized, fully collateralized perpetual futures platform designed to mitigate risks commonly seen in traditional platforms, such as insolvency risks. With locked liquidity, the platform ensures that liquidity providers (LPs) cover the maximum potential profits, guaranteeing solvency even in extremely volatile market conditions. Traders can open positions in crypto-denominated pairs, allowing them to benefit from rising asset values with no cap on gains. Oracle-based pricing reduces the risk of manipulation, while the platform’s dynamic fee structure adjusts based on market conditions, providing low-cost leverage.

Figure 11: Rujira Perps’ main features

Source: Revelo Intel

Liquidity providers play a crucial role, receiving trading fees and borrow fees for covering the risk of counter trades. In return, they face no risk of impermanent loss, as LPs only provide single-sided deposits. Furthermore, delta neutrality mechanisms encourage balanced positions to maintain market stability, rewarding arbitrage traders for stabilizing the system. Fees collected through various streams (trading, borrow, and delta neutrality fees) are split, with 70% going to LPs and 30% to the protocol.

RUJI Perps also supports features like stop losses, take profits, and limit orders, providing traders with most widely used tools for risk management. Multiple isolated positions with varying leverage can be opened, allowing traders to hedge and adjust strategies in every market environment.

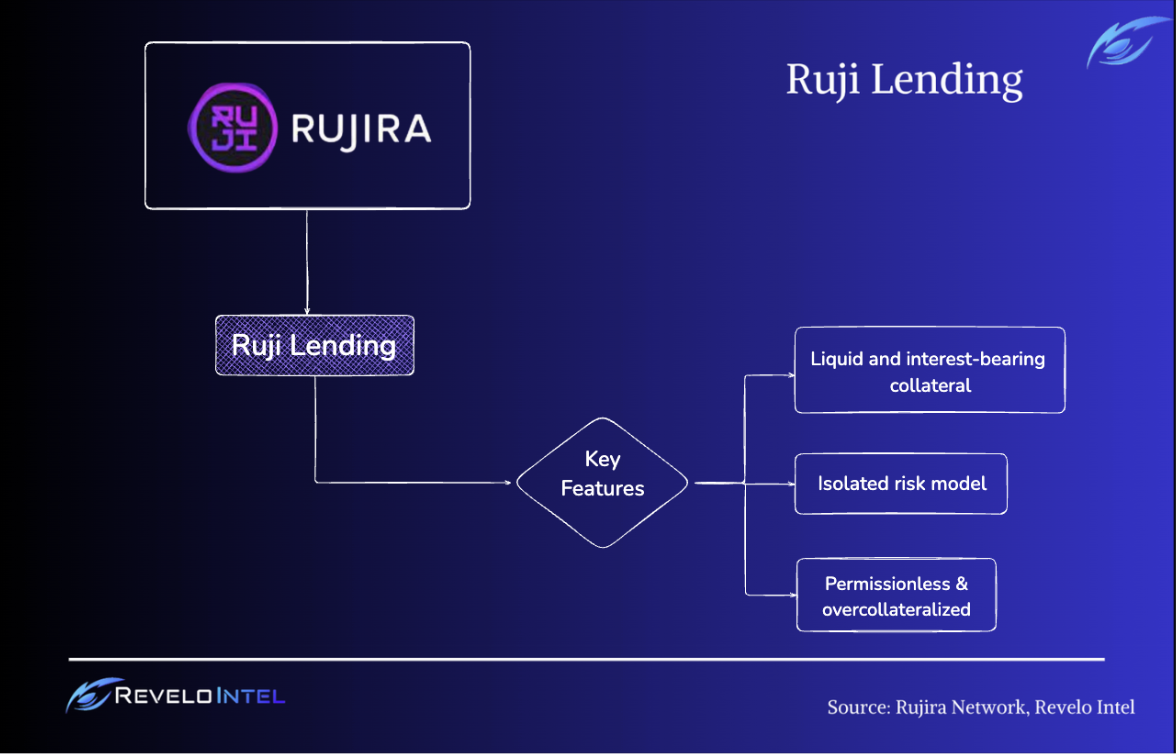

Ruji Lending

RUJI Lending is a decentralized platform that will allow users to lend and borrow crypto assets in a permissionless and overcollateralized environment. The platform’s design intends to cater to both lenders, who would earn interest on their deposited tokens, and borrowers, who would secure loans without the need for traditional credit checks.

Lenders would be able to deposit their tokens and receive xTOKEN, which accrues interest over time and can be used across decentralized apps or redeemed for the original assets plus interest. Borrowers could secure overcollateralized loans without credit checks, using their crypto as collateral, with flexible repayment options and no fixed loan duration.

Figure 12: The main features of the Lending service developed by Rujira

Source: Revelo Intel

The platform plans to use an isolated risk approach and, therefore,there will be an isolated market for each collateral-debt pair, each with its own risk parameters to minimize systemic risks. Borrowing rates would be dynamic, starting at 2% and increasing as market utilization rises, ensuring balance between supply and demand.

Liquidations would be handled by the Rujira Liquidation Engine, using a Dutch auction based mechanism to sell collateral fairly if a borrower’s loan exceeds its safe limit. It is also worth noting that RUJI Lending would support native assets like $BTC and $ETH through Thorchain, avoiding the need for wrapped tokens. Fees would be shared between lenders and the protocol, with 90% going to lenders and 10% kept as protocol revenue, which is shared 50/50 with Thorchain.

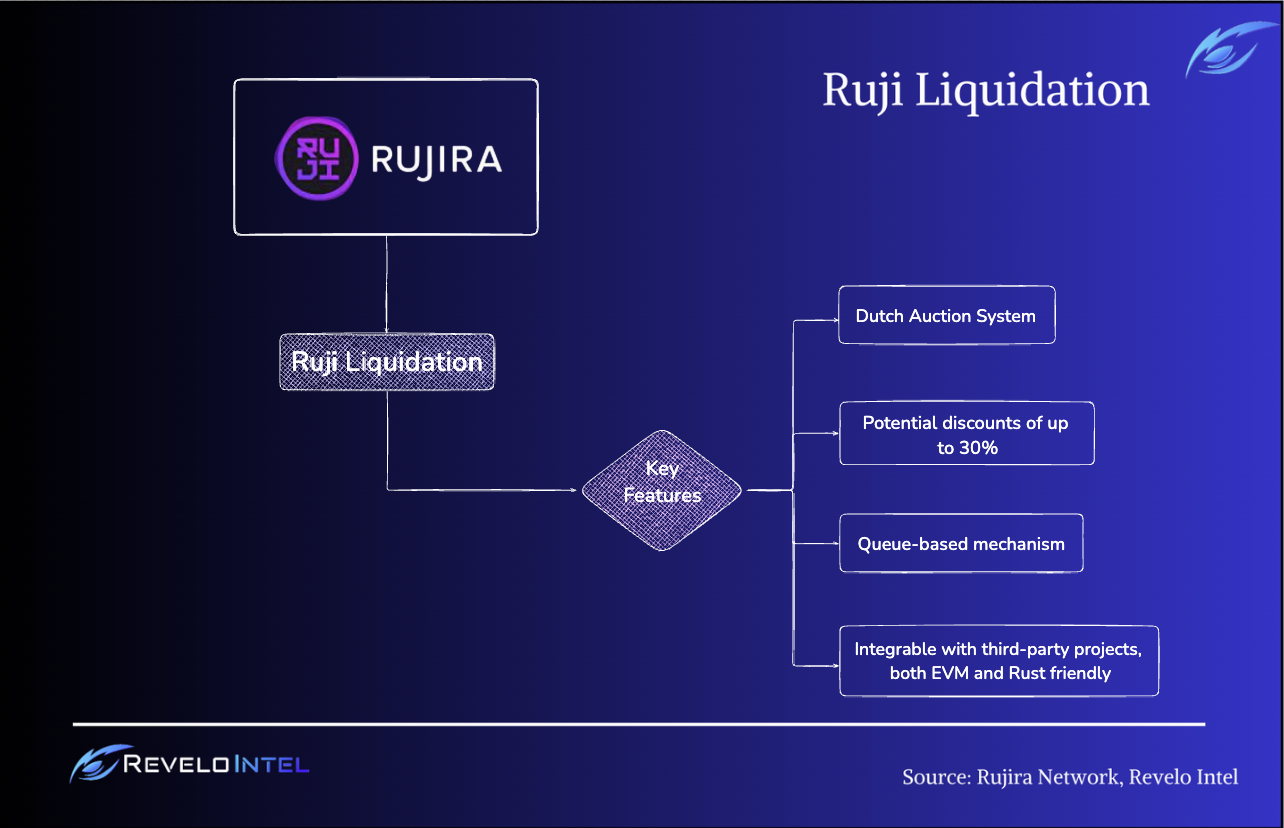

Ruji Liquidation

Ruji Liquidation builds on Kujira’s cumulative experience (with Orca) on democratic access to liquidation bidding processes and it shows up as a future public marketplace for users to bid on at-risk collateral within the Thorchain App Layer. Once live, it will allow participants to purchase liquidated assets through a Dutch auction system, offering potential discounts of up to 30%. This marketplace aims to simplify the liquidation process, eliminating the need for bots or coding, while contributing to the stability of the Rujira protocols.

Figure 13: The features of Ruji Liquidation, which represents the new version of Orca on TC.

Source: Revelo Intel

The system will operate on a queue-based mechanism, prioritizing bids with smaller discounts to optimize the liquidation price. Unlike traditional liquidation systems that prioritize speed, Ruji Liquidations uses a delay period to prevent front-running by bots. If bids are insufficient, this delay will be lifted to maintain system solvency. Users will also have the option to bid using yield-bearing tokens, allowing their capital to earn interest while waiting for liquidations.

Ruji Liquidations is designed to maintain the solvency of the ecosystem by efficiently managing liquidations for products like Ruji Lending and leveraged market positions. In the near future the team will provide basic analytics to help users monitor liquidation opportunities, with plans for more advanced tools. The system will also be integrable with third-party DeFi projects, supporting both EVM and Rust-based environments.

One of the key goals of Ruji Liquidations is to address flaws in standard DeFi liquidation mechanisms, which often favor fast-acting bots and apply fixed discounts. Standard liquidation mechanisms in fact operate on a first come first served basis and at fixed discounts, thus rewarding the fastest actors. By allowing users to bid for collateral, it aims to create a fairer system and reduce liquidation costs for borrowers. Additionally, the platform’s structure will help prevent the market volatility often caused by bot-driven liquidation cascades.

Regarding fees, Ruji Liquidations will charge a 1% fee on repaid debt and a 0.5% fee on liquidated collateral. Revenue from these fees will be split equally with Thorchain’s base layer.

Ruji Ventures

Ruji Ventures is a platform which aims to connect both retail and institutional capital with early-stage projects, allowing users to participate in funding opportunities across multiple development stages. It will offer users early access to projects seeking capital for expansion and Token Generation Events (TGE). Unlike traditional launchpad services, Ruji Ventures plans to provide a full suite of tools to support projects from the initial stages of fundraising through to later stages of development.

The platform will allow for flexible fundraising mechanisms, such as first-come-first-served sales, auctions, and bonded token offerings. It will support multi-chain access, enabling tokens minted on different chains to be sold and bought with ease.

The platform is expected to offer permissionless self-service for projects, automating processes like token distribution, liquidity provision, and vesting schedules. Buyers will benefit from a streamlined investment process, while sellers will be able to manage token sales and liquidity creation in one place.

Fees will include a 5% commission for token sellers on initial sales and a 0.5% fee for buyers withdrawing purchased tokens. Bonded token offerings will have lower fees. Like all other Ruji products, all fees will be shared 50/50 with Thorchain.

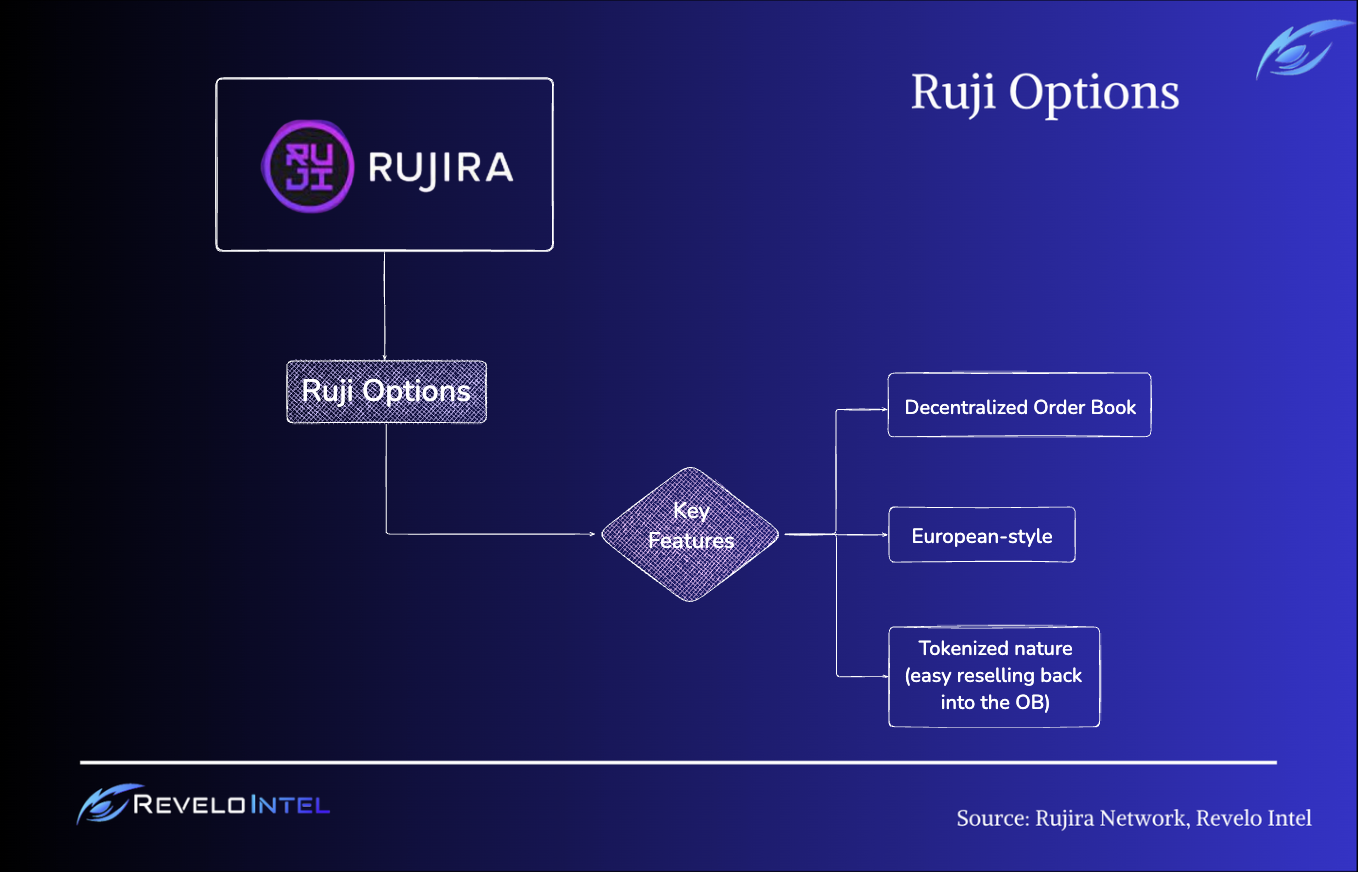

Ruji Options

Ruji Options is a decentralized options exchange designed to provide a clear and straightforward user experience without complex tokenomic designs or pricing structures.

Figure 14: The main features of Ruji Options

Source: Revelo Intel

The exchange operates through a decentralized orderbook that handles bids and asks across multiple strike prices within each trading epoch. Once an order is filled, the protocol issues a tokenized representation of the option, called an “option denom,” which is specific to the contract’s underlying asset, option type, strike price, and expiration date.

Ruji Options uses European-style options, meaning they can only be exercised at expiration (but can always be sold and bought on the secondary market). This system allows users to manage their positions without needing to exercise early. Liquidity is provided across different strike prices using a mechanism that leverages historical volatility data and market confidence intervals. The platform also uses a discretized Black-Scholes pricing model, a well-known industry standard, to ensure a transparent and reliable pricing model.

The pricing engine, historical volatility calculations, and all transactions are handled fully on-chain, enhancing transparency and decentralization. Ruji Options uses historical data from on-chain oracles to calculate volatility and strike prices based on probabilistic ranges, ensuring they reflect real-time market conditions.

The platform aims to democratize access to options trading by offering a fully decentralized and transparent trading environment, allowing users to maintain full control of their assets throughout the process. The tokenized nature of the options enables easy reselling back into the orderbook, allowing users to close positions or take profits directly within the platform.

RUJI Options will charge a 1.0% settlement fee on trading volumes, with 50% of the collected fees shared with Thorchain’s base layer.

RUJI Collections (Gojira)

RUJI Collections, aka Gojira, is an upcoming NFT marketplace designed to enhance creator earnings and platform revenue through efficient and customizable minting, auctions, and real-world asset (RWA) integrations. Gojira will enable users to mint and trade NFTs using RUJI or USDC, aligning with the broader Rujira ecosystem.

The platform will feature a specialized auction design where users can place bids during a 48-hour period to mint NFTs. Auctions will support several formats, including descending price models. Once the auction is over, successful bidders will mint their NFTs, while unsuccessful ones can be withdrawn. Post-mint trading will also be supported, with options for direct sales or re-auctions.

Gojira NFTs will implement the GW721 specification, an extension of the Cosmos-standard CW721, providing improved developer capabilities and composability. Gojira also plans to support real-world use cases, such as an on-chain nameservice (Dive Domains).

This marketplace will integrate closely with the rest of the Rujira ecosystem, including its DeFi offerings, and serve as a content hub for creators and community engagement.

Gojira’s auction system is designed to be fair and bot-resistant by prioritizing bids over speed, which also reduces network congestion. The platform aims to optimize blockchain performance by spreading auction activity over time and enhancing the developer experience with upgradable and composable smart contracts.

In terms of fees, Gojira will charge 4% on baseline auction funding and 15% on any excess profits raised beyond a pre-set threshold. A 2% fee will apply to aftermarket sales. All collected fees will be split 50/50 with the Thorchain base layer.

Thorchain’s Future Infrastructure Design

Since inception, Thorchain has operated as a layer-1 blockchain developed on the Cosmos-SDK, designed to facilitate cross-chain liquidity and interoperability. Key features include:

- The ability to exchange native assets between different blockchains (e.g., swapping native $BTC directly for $ETH).

- Fully permissionless swaps—users don’t need to provide registration or personal identification to interact with services.

- Liquidity pools contain only native assets, ensuring that no wrapped or synthetic tokens are involved, securing the assets directly on their respective chains.

- Pricing is decentralized and transparent, free from reliance on centralized entities. Continuous liquidity pools are employed to ensure the protocol operates with maximum efficiency

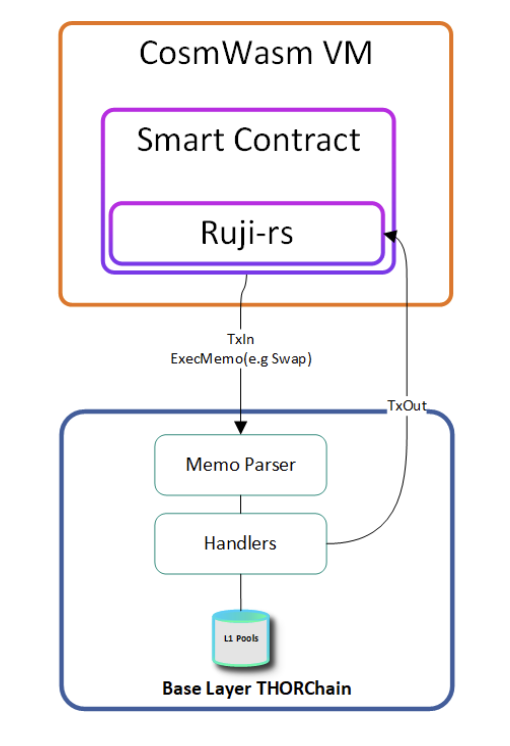

In addition to the “Proof of Bond” consensus mechanism and the incentive pendulum, which contribute to balancing incentives and liquidity within the protocol, the Merger will strengthen its value proposition by allowing the L1 to support smart contracts on top.

By the end of 2024 Thorchain will complete an upgrade to finalize the mainnet integration of Cosmwasm and IBC (Inter Blockchain Communication). This update will bring smart contract functionality to Thorchain, allowing developers to build decentralized applications (dApps) directly on its network. Additionally, IBC will enable Thorchain to communicate with other chains within the Cosmos ecosystem, expanding its cross-chain liquidity and asset support beyond its current capabilities.

In this infrastructural context, Rujira wouldoperate as an app layer with embedded smart contracts (CosmWasm) functionality, creating a seamless interaction between the base layer and decentralized applications within its ecosystem. The concept of Bridge Assets enables users to deposit native layer 1 tokens, such as Bitcoin or Ethereum, into Thorchain. These tokens are then converted into Bridge Assets (e.g., BTC-BTC) that represent the underlying L1 token, effectively allowing users to transact and interact across Rujira and Thorchain.

Once users deposit their L1 assets, Bridge Assets act as their on-chain counterpart, enabling faster and more efficient trading without incurring the typical fees associated with Layer 1 chains. This process supports cross-chain liquidity while maintaining the security of native assets. The key advantage here is that these assets can be used directly within Rujira for trading, swapping, and participating in the whole dApps ecosystem, all facilitated by CosmWasm smart contracts.

The system operates efficiently, allowing Bridge Assets to circulate freely within the Rujira ecosystem or to be sent across other IBC-enabled chains for broader cross-chain interoperability. Bridge Assets, being fully fungible, can also be transferred easily between accounts or other chains, simplifying the process for users who want to participate in DeFi activities like lending, liquidity provision, and limit order placements.

Rujira’s reliance on Bridge Assets also facilitates arbitrage opportunities for traders. These assets enable more capital-efficient trades, allowing them to execute arbitrage strategies with fewer capital constraints compared to using synthetic assets. This contributes to market price corrections with lower risk and higher efficiency.

In terms of security, Bridge Assets remain backed by the underlying L1 deposits held in Thorchain’s vaults. Mechanisms such as the Incentive Pendulum and Automatic Liquidation safeguard the system, ensuring that the value of L1 assets and their Bridge Asset counterparts remains secure, even during sudden market volatility. If the value of L1 deposits exceeds bonded node security, the system automatically triggers liquidity redistributions to balance out potential risks, maintaining network stability.

The process of minting, using, and withdrawing Bridge Assets is straightforward. Users deposit their L1 tokens, receive Bridge Assets, and can use them for various dApp interactions within Rujira. When they wish to revert back to L1 tokens, they simply withdraw their Bridge Assets in exchange for the original L1 assets.

Once these assets are created, transactions involving swaps or dApp interactions are handled either through a compound memo system or a sequence of smart contract (SC) messages. The compound memo allows users to specify multiple actions (e.g., swap, trade, or interact with SCs) in one command, executing them sequentially. Alternatively, users can interact directly with SCs, where each step (like swapping or adding liquidity) is managed internally by the contract itself, ensuring each action is executed efficiently.

Figure 15: The interaction modes between Rujira app layer and TC base layer

Source: JPThor official X profile

This approach ensures that transactions are processed quickly, without requiring multiple independent actions or suffering from Layer 1 fees.

Conclusion

The Merger between Thorchain and Kujira, giving birth to Rujira Network, marks a big step toward enhancing both platforms’ capabilities by combining Thorchain’s cross-chain liquidity infrastructure with Kujira’s decentralized product suite. This partnership aims to address the challenges faced by both projects and to build a sustainable and secure decentralized finance ecosystem.

By integrating Kujira’s application suite on Thorchain’s infrastructure, Rujira is positioned to offer an extensive range of financial services while benefiting from high native liquidity. The adoption of CosmWasm functionality within the Thorchain architecture further amplifies the features of the latter by allowing the development and deployment of advanced decentralized apps in a seamless manner.

The strategic goals of the Rujira Alliance include recovering from Kujira’s earlier liquidation cascade, restructuring the Kujira team and governance mechanisms, and leveraging Thorchain’s decentralized security model to support the growing DeFi ecosystem. This collaboration aims to strengthen the resilience and scalability of both networks, while expanding their service offerings to meet broader market demands.

This new partnership definitely shows a fair degree of potential synergy from the outset because it attempts to enhance the qualities of the 2 projects, respectively Thorchain’s huge native liquidity and integrated exchange infrastructure and Kujira’s complex financial products, while fixing their respective problems (lack of next-generation financial services for the former, and lack of users and liquidity for the latter).

References

“The Rujira article”, published by Thorchain University (2024) on its official Medium page. Link

“Kujira recovery plan & Thorchain partnership” (2024), published by Kujira Team on Winkhub. Link

“Forging the future of DeFi: The Kujira x Thorchain Bull Thesis” (2024), published by Kujira Team on Winkhub. Link

Kujira official docs. Link

Rujira Official docs. Link

Thorchain Official docs. Link

X Post by JPThor on the birth of the Rujira Alliance. Link

“Kujira Foundation’s Tokens Stung by Its Own Leveraged Positions as Bets Backfire” (2024), published by CoinDesk on its official website. Link

“Kujira Team Announces New Rujira Alliance For Thorchain App Launch” (2024), published by Bitget within the “Newscrypto” section. Link

Disclosures

Revelo Intel has never had a commercial relationship with Kujira nor Thorchain and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.