Float and incentives are the main drivers of a token’s post-launch performance. The post-airdrop arc is often a predictable dynamic. Most headlines don’t move markets after launch. Small floats versus high FDV invite momentum, then fade as unlocks hit. Subsidies can buy a bounce, but only for a while. Most prices drill lower as rewards wind down—funded momentum, unfunded grind.

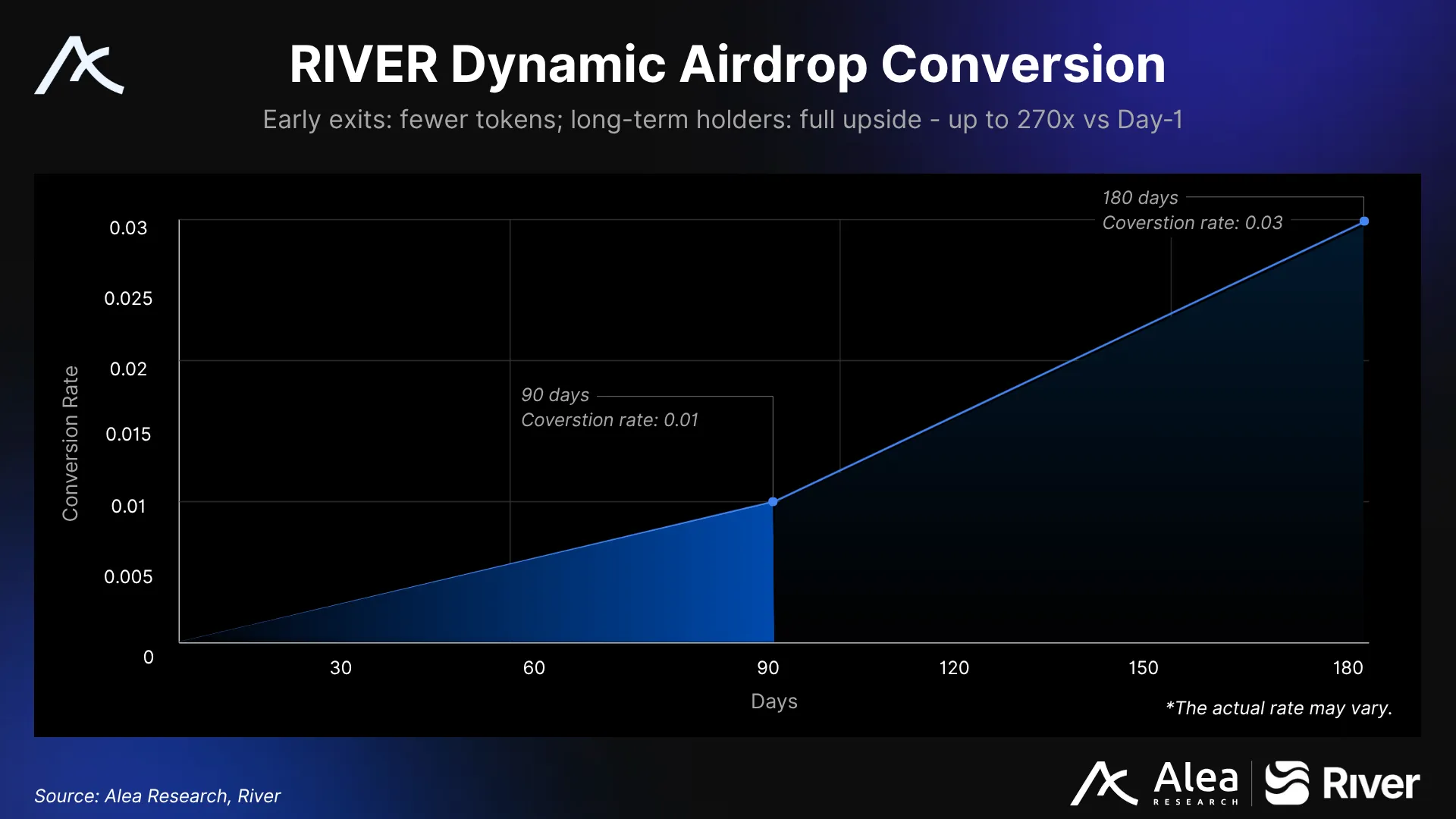

For RIVER, airdrop claims aren’t the end, but the beginning of price discovery. Time governs how River Points (River Pts) convert to RIVER tokens—the clock calibrates distribution as a tradeable market. River’s dynamic airdrop is a time-encoded airdrop: 1B River Pts can convert into up to 30M staked RIVER over 180 days from TGE. The original mechanism used a static time-based conversion curve. Following a November 2025 stress event, River deployed Conversion 2.0, an upgraded system featuring a dynamic integral pricing model, daily conversion caps, and output delivered as Staked RIVER rather than liquid tokens. The core parameters (180-day window, 30% allocation cap) remain unchanged; the mechanics around them were rebuilt.

Think of River’s airdrop like a timer, not a claim. The longer you wait, the better the conversion rate. Under Conversion 2.0, patience is rewarded in two dimensions: the time-based curve still rises over 180 days, and the dynamic rate recovers after periods of heavy activity. Rushing to convert during high-participation windows compresses your rate; waiting for the half-life recovery restores it. The idea becomes: Exit early, leave tokens on the table. Exit during a crowd, leave even more.

River is a chain-abstracted crosschain stablecoin (Omni-CDP). TGE took place on September 22, 2025. The conversion window is now active running for 180 days through April 24,, 2026 (after factoring in the pause). This report will explain the airdrop mechanism, supply dynamics, and how different user profiles can capitalize on the opportunity.

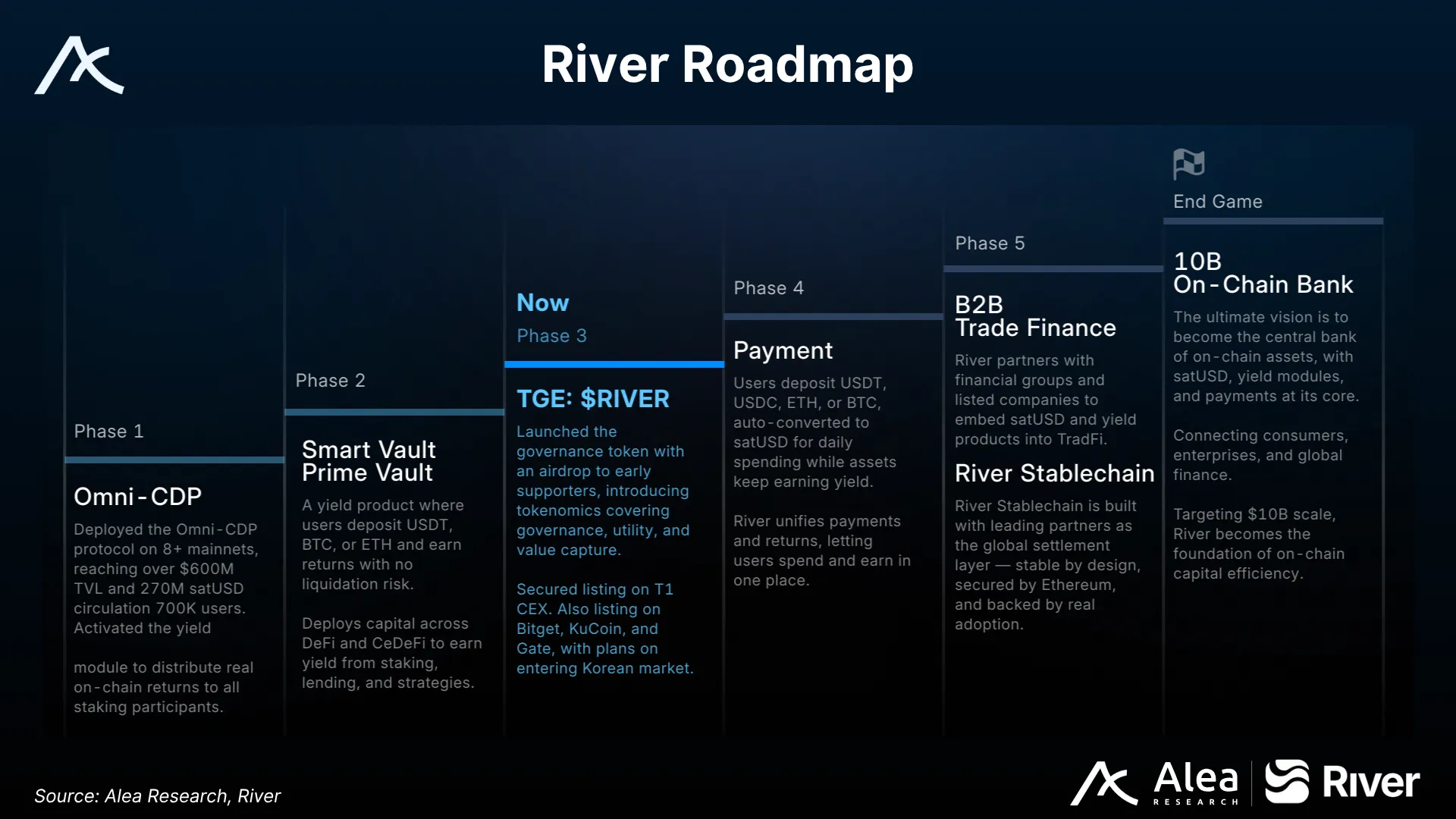

The vision: build a multi-chain onchain neobank that connects assets to opportunities across chains and the real world—earning, investing, and spending while you earn—prioritizing LATAM, emerging markets, and B2B trade-finance. Partnerships with large corporations and institutions in Hong Kong and Vietnam are already in place.

Key Takeaways

- River’s Dynamic Airdrop Thesis: Behavior-driven emissions tame supply overhangs while rewarding conviction and participation.

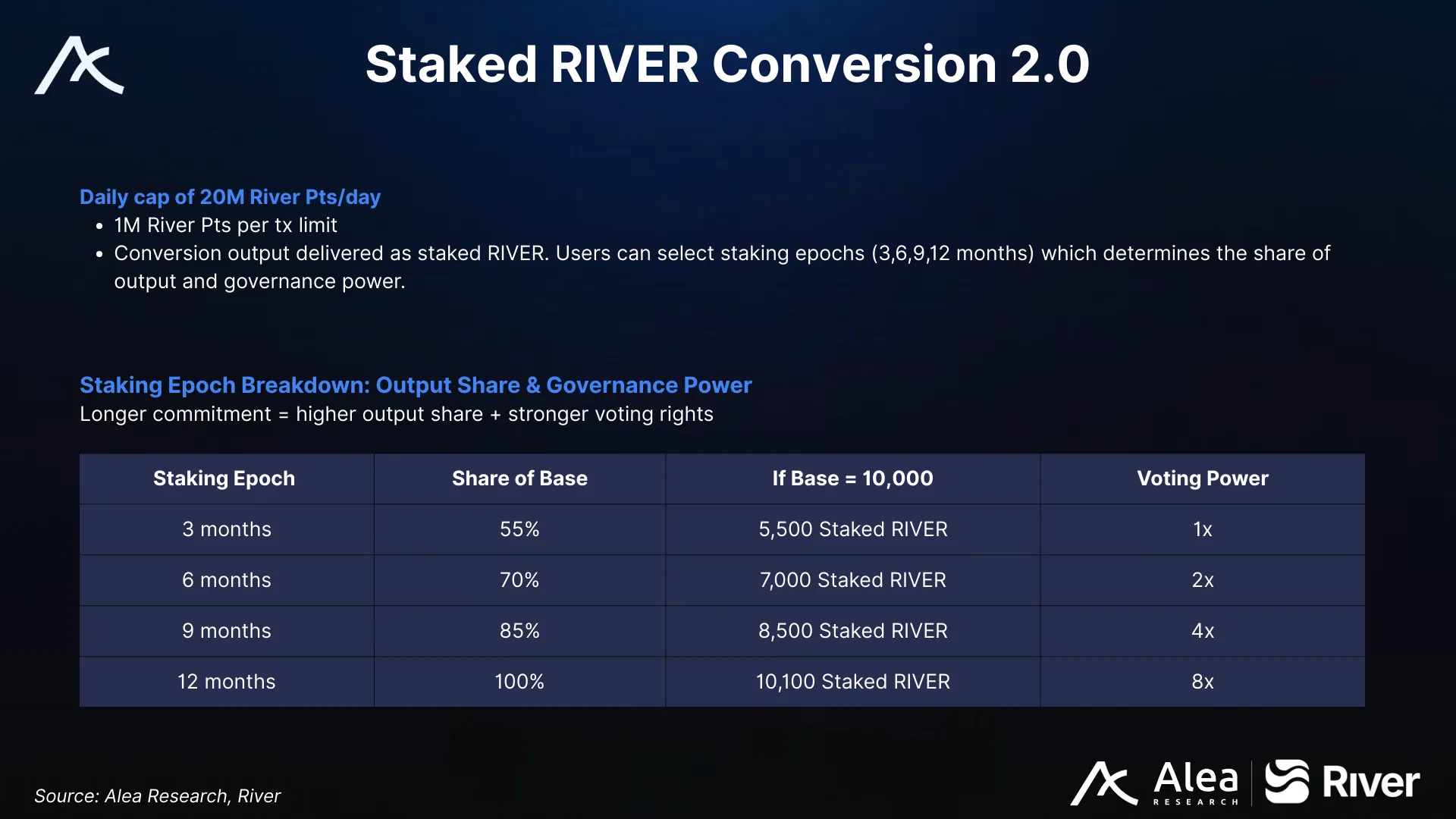

- Conversion 2.0: Following November 2025 stress event, River deployed an upgraded mechanism with dynamic integral pricing, daily caps (20M Pts), per-tx limits (1M Pts), and Staked RIVER output.

- Time Governs Supply: Patience mints more; early conversions and activity cap float and shrink circulating RIVER. Under Conversion 2.0, concentrated participation further compresses rates.

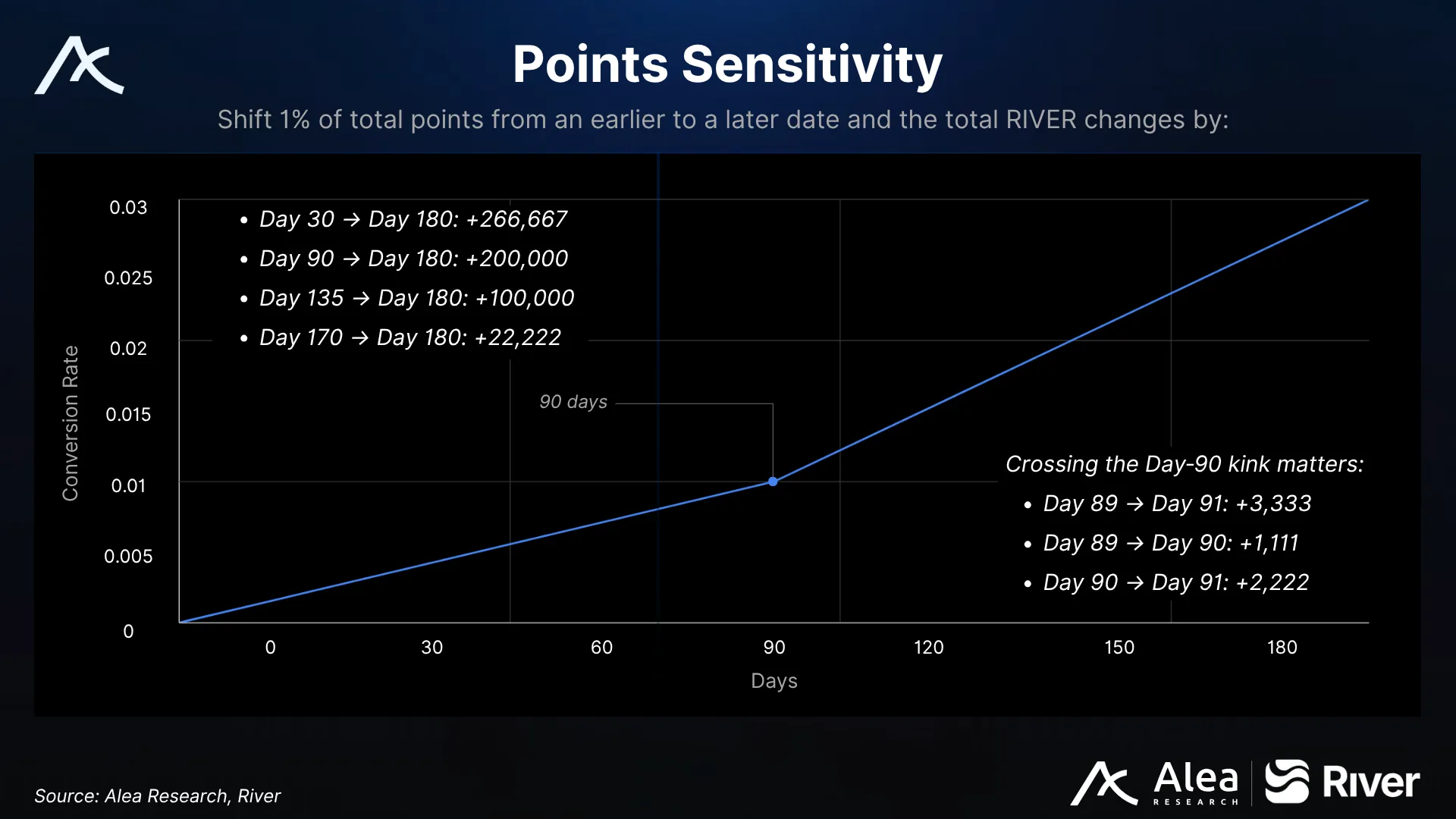

- Day 90 is the Kink: The emissions slope doubles on Day 90; avoid early exits unless liquidity is mission-critical.

- Output as Staked RIVER: Conversions now deliver Staked RIVER with 3/6/9/12 month epochs. Longer epochs receive larger share of base output (55% at 3mths vs 100% at 12mths).

- Use Time-Yield as Your Hurdle: Convert only when expected daily appreciation beats daily yield. Also factor in staking epoch when calculating effective yields.

- Cohort Modeling Matters: Back‑loaded paths smooth price discovery and stack late issuance.

- Exploit Dislocations: track Pts‑to‑RIVER parity, perps funding, rate compression/recovery and curve mispricings for tactical entries.

River In Context

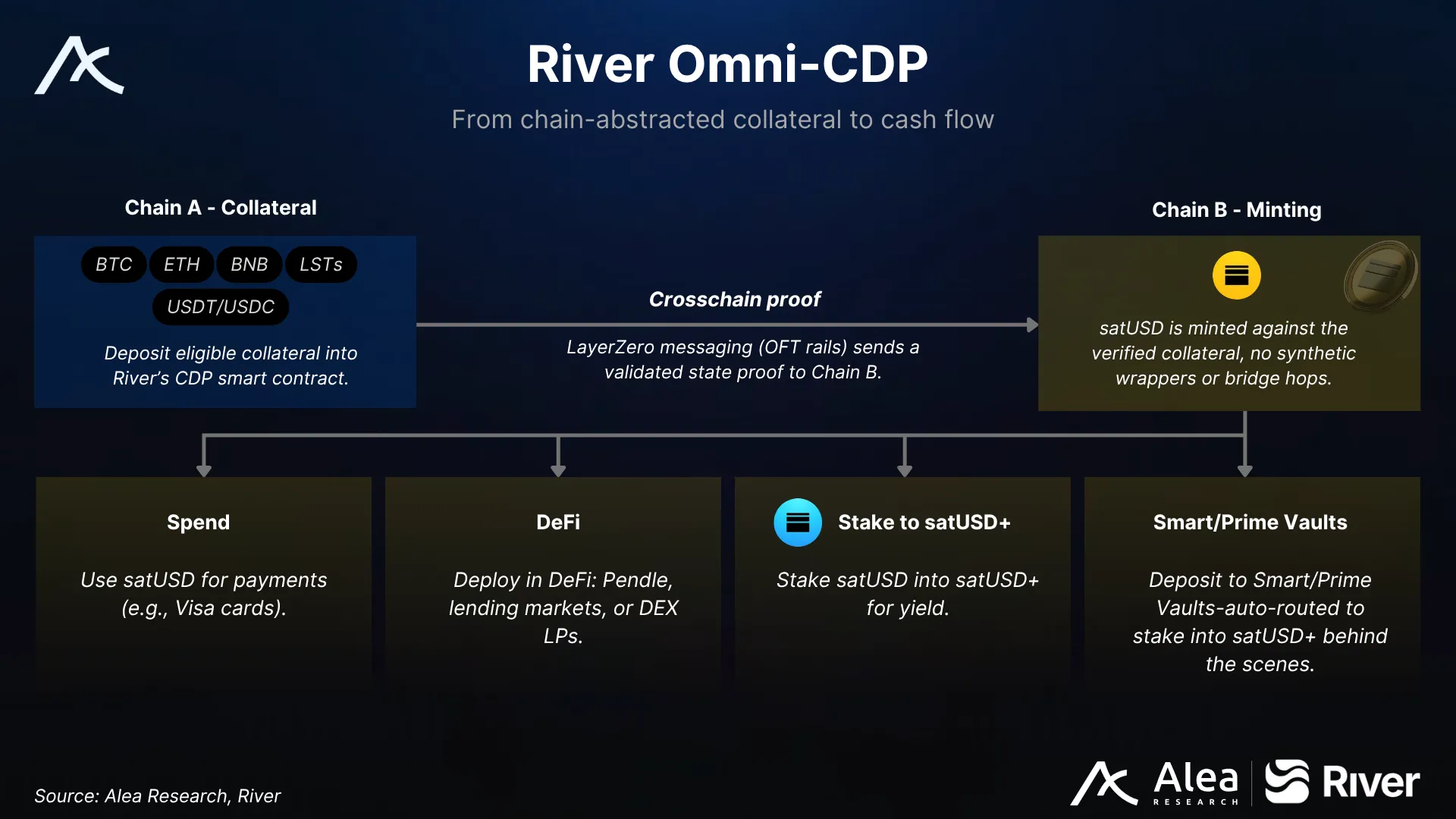

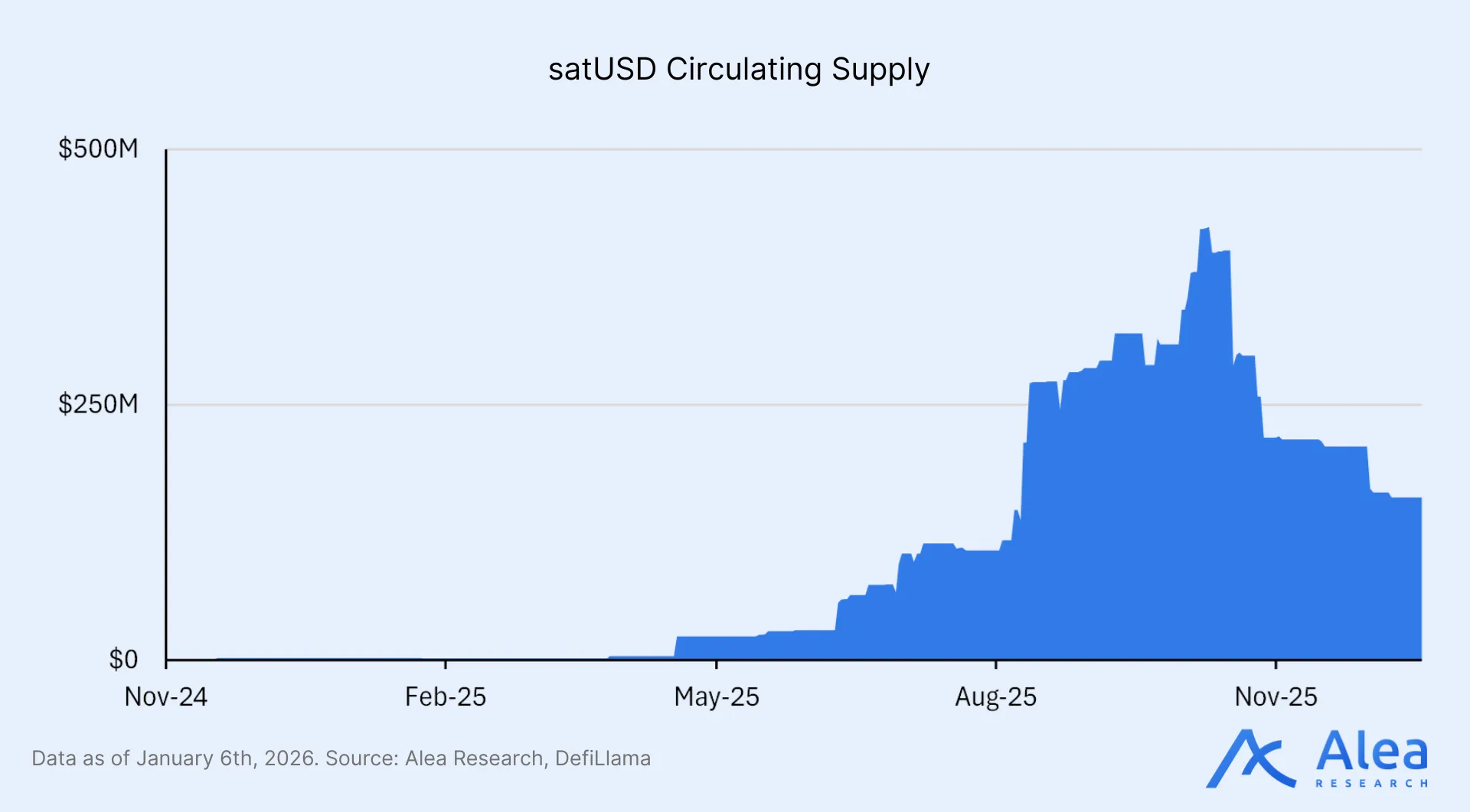

River is building the chain-abstraction stablecoin system that connects assets, liquidity, and yield across ecosystems. It is an Omni-CDP, a crosschain stablecoin issued as a chain-abstracted CDP (Collateralized Debt Position). Users can deposit collateral on Chain A and mint satUSD on Chain B—without bridges or wrappers, using LayerZero’s messaging and the OFT (Omnichain Fungible Token) standard. The system is live on key ecosystems like Binance’s BNB Chain, Ethereum, Base, and is expanding to non-EVM chains like Sui and Solana.

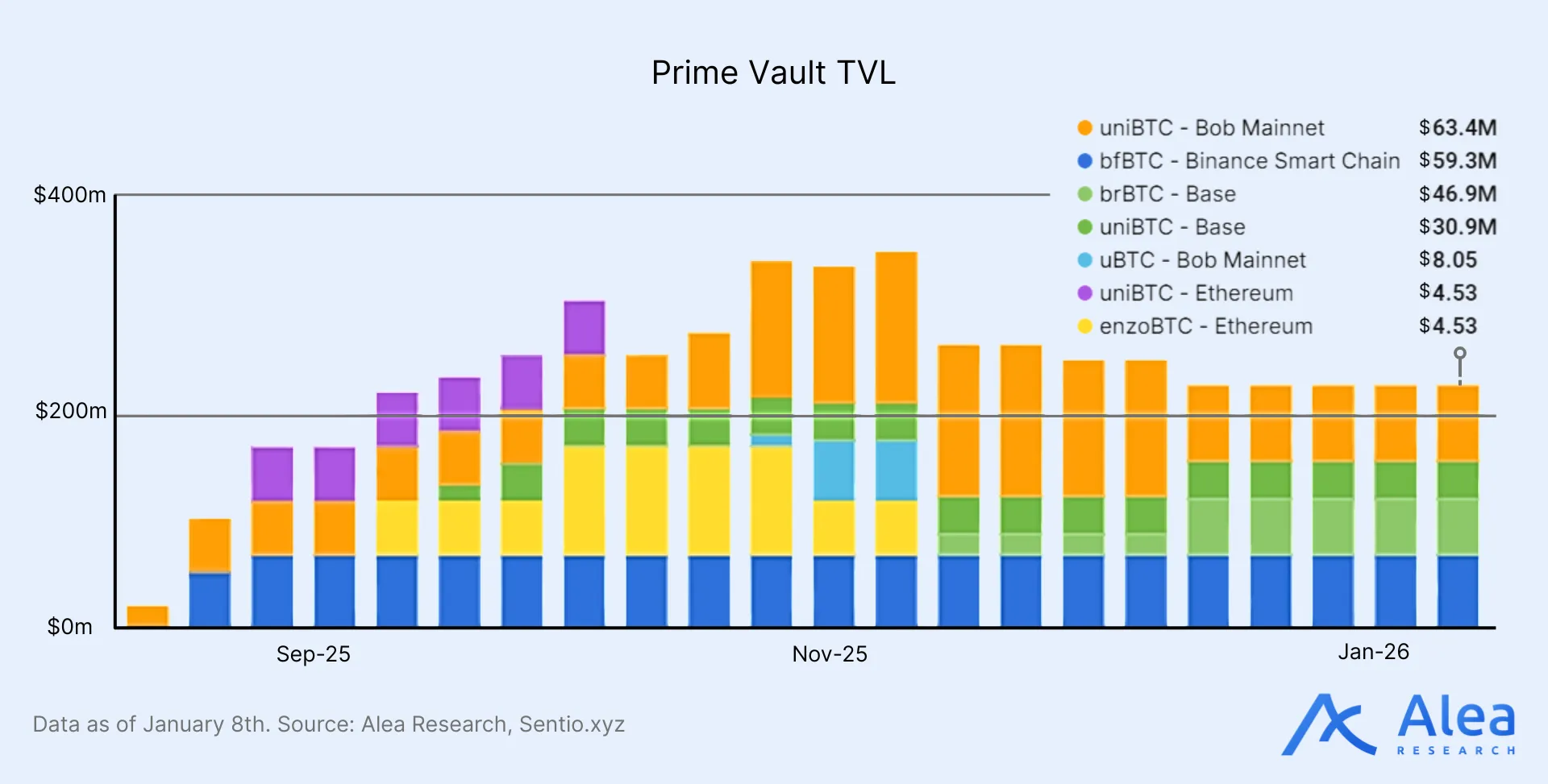

satUSD can be staked into satUSD+ to earn protocol revenue as yield. On top, Smart Vault (one-click, no-liquidation yield) and Prime Vault (custody-friendly) provide access to additional opportunities.

- Smart Vault: deposit once and the system mints and stakes satUSD for you under a pre-set policy, delivering no‑liquidation yield without users monitoring collateral health.

- Prime Vault: custody‑oriented rails that connect River’s yield to external custodians and institutional controls, tailored for larger treasuries.

Most multichain stablecoins bridge or wrap IOUs; River mints satUSD directly on the destination chain via LayerZero, removing bridge hops, wrapper risk, and liquidity fragmentation. From its OApp (LayerZero Omnichain App) users can mint, swap stables 1:1, and stake across chains with low friction, avoiding bridge delays and fees.

Smart and Prime Vaults solve one of the most common bottlenecks other CDPs face—collateral management. Most users, whether they are retail, DAO treasuries, or institutional funds, shy away from CDPs to avoid dealing with liquidations and operational complexity. These Vaults replace CDP micromanagement with a simple “deposit-and-earn” UX.

Smart Vaults no-liquidation feature comes at an opportune time, offering a compelling alternative given the October 10 market crash. Users executing carry trades or dealing with collateral complexities that caused their positions to be liquidated could have avoided the misfortune and continue passively earning yield.

The project raised capital from backers like CMS Holdings, RockTree Capital, Cypher Capital, Outliers Fund, Cogitent Ventures, Metalpha [NASDAQ: MATH] and more. Advisors are tied to blue-chip DeFi protocols like Curve, funds like Maven Capital, and ex-BlackRock. More recently, they closed a $12M strategic round with participation from TronDAO, Justin Sun, Maelstrom (Arthur Hayes’ fund), Spartan Group and other institutions across US and Europe.

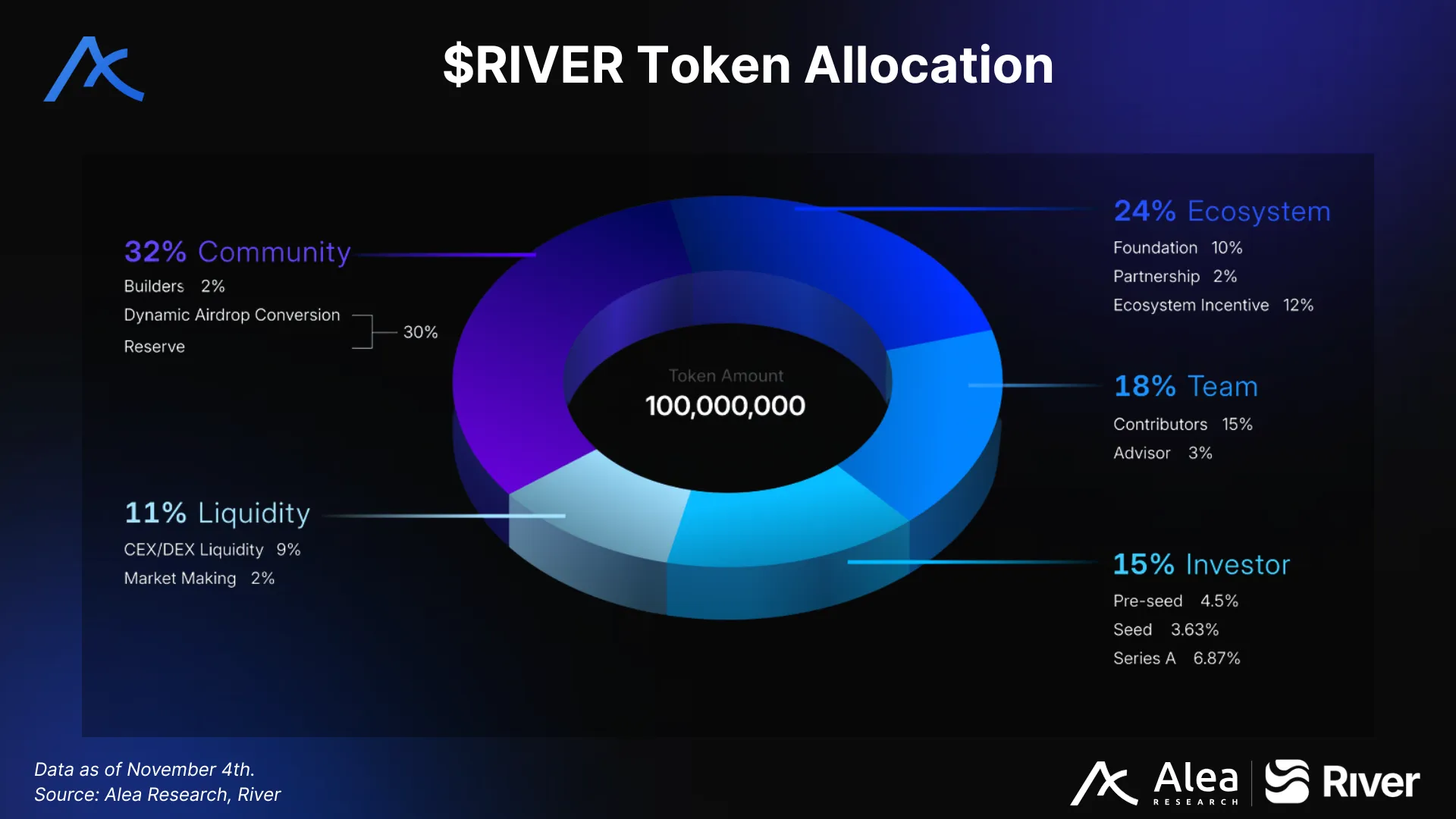

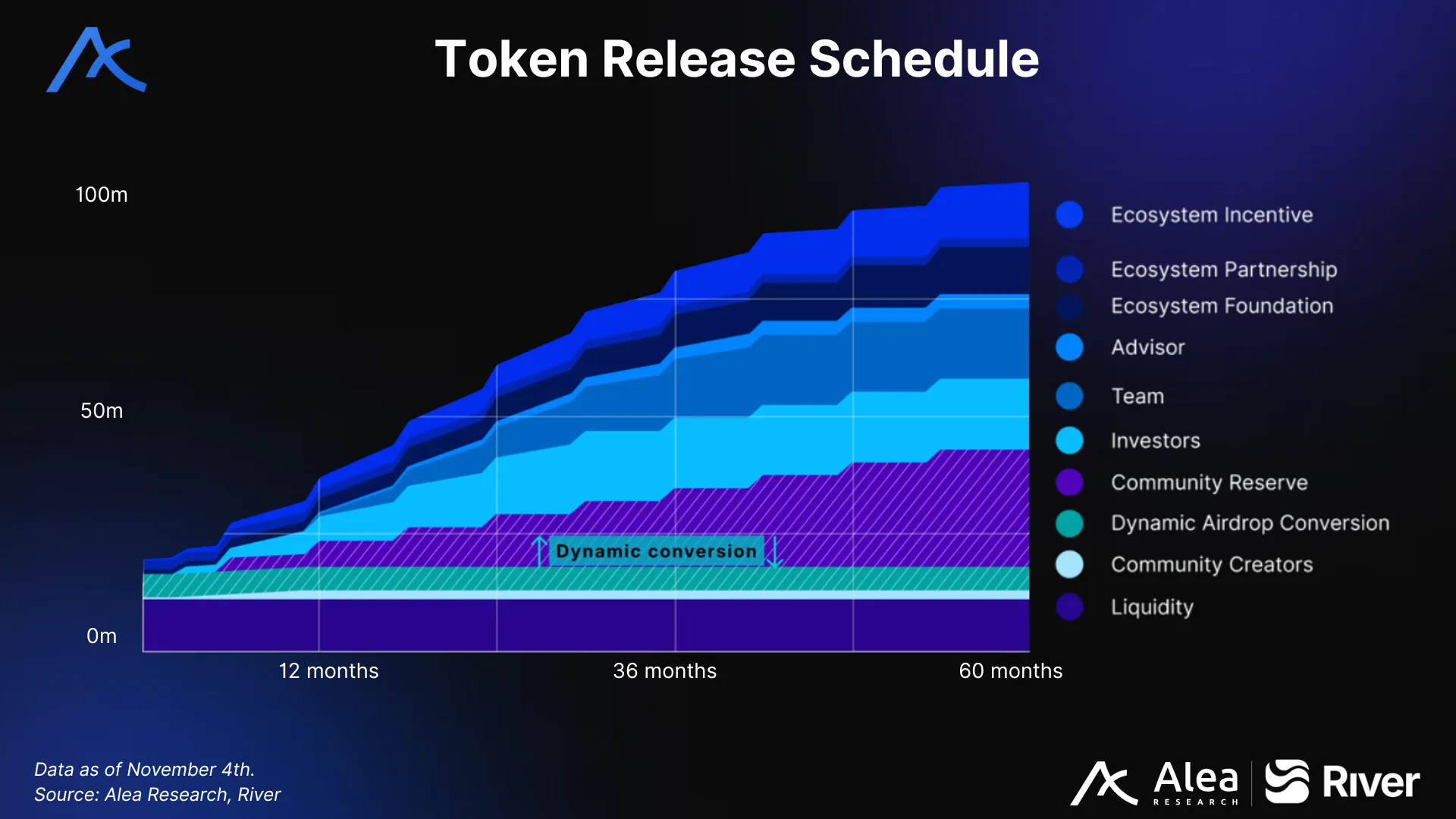

RIVER is a 100M fixed-supply token. The amount of units in circulation is determined by a 30% time‑encoded airdrop over 180 days, 11% TGE liquidity, and investor/team cliffs that stagger unlocks across 24–60 months.

At launch, River allocated 1B River Pts, representing up to 30M RIVER (30% of supply) subject to Conversion 2.0’s dynamic rate adjustments and staked RIVER as the output.

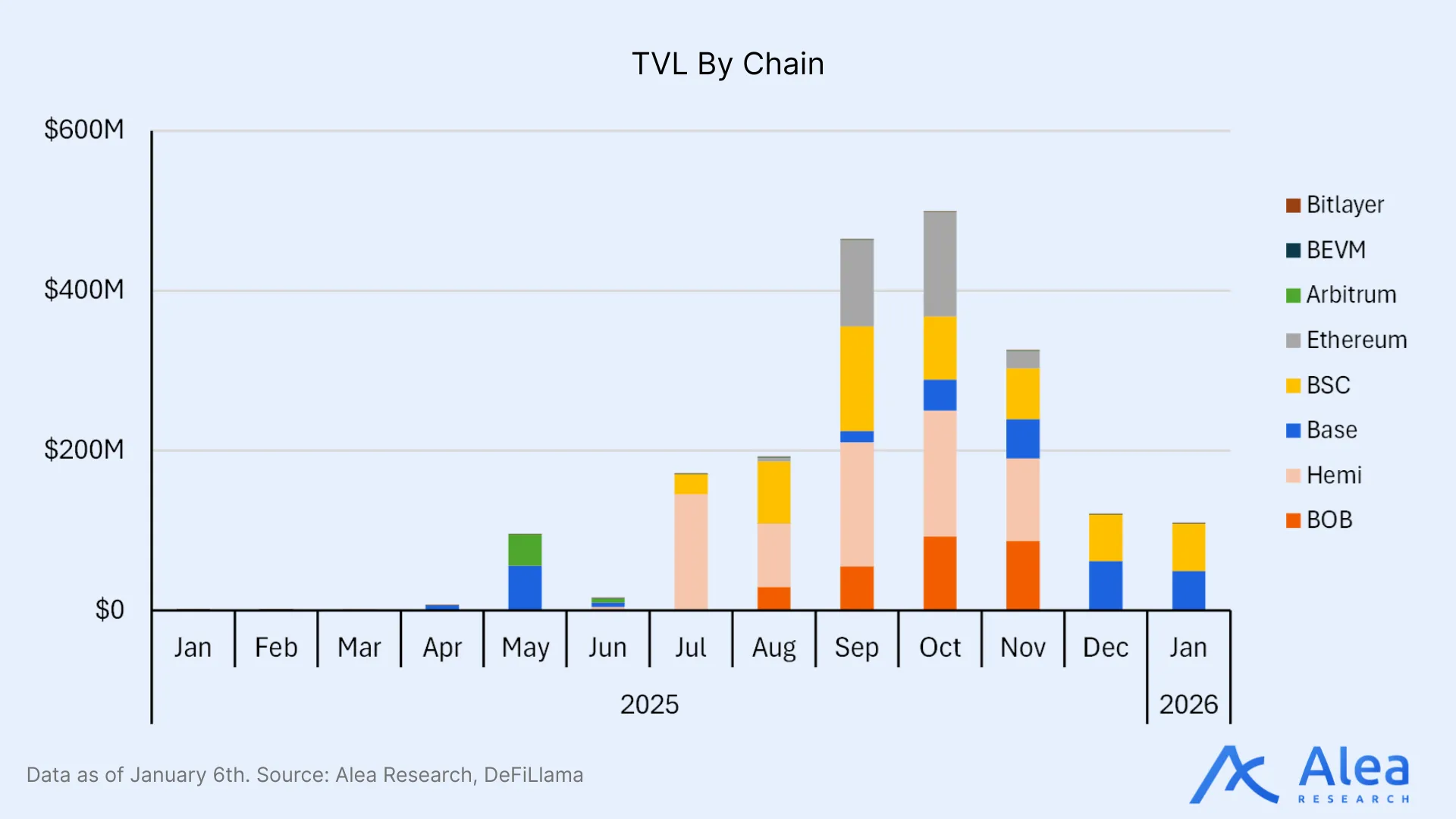

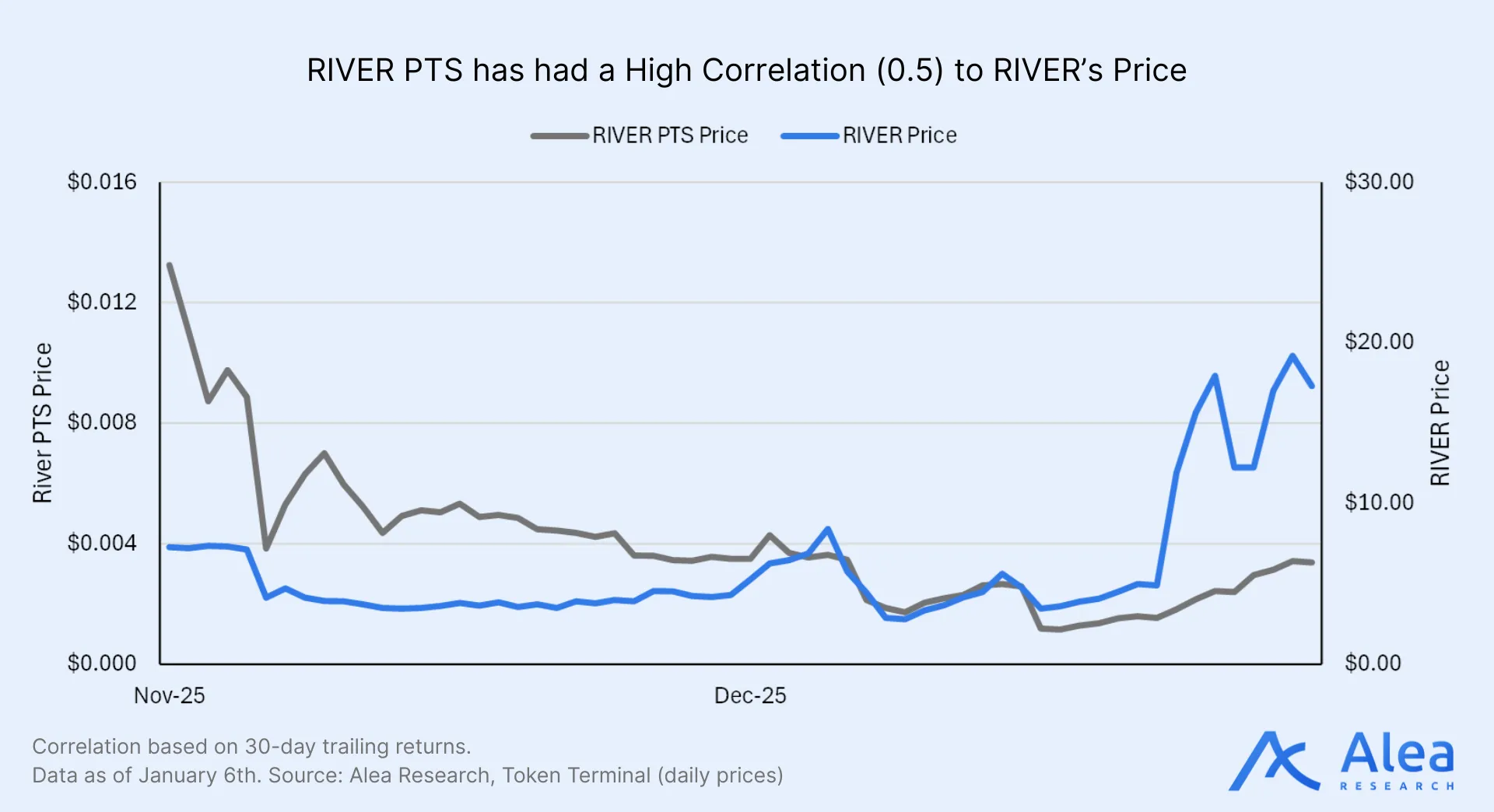

River has secured Tier-1 CEX listings and Binance perps, OKX perps and boost, and Kraken spot, operates across 8+ chains, and sustains $320M+ in TVL with 200M satUSD in circulation across integrations such as Pendle and MEV Capital curated vaults. They also recently listed on XLayer. Following Conversion 2.0 activation in mid-December, RIVER rallied from post-pause lows to all time highs of over $20. The moat: chain-abstracted protocol architecture and a liquidity flywheel with satUSD+ yield and Vaults in addition to broader ecosystem and DeFi integrations.

Billions across the globe lack reliable banking access. River’s pitch: satUSD, a stablecoin minted against eligible collateral (BTC, ETH, stablecoins) connecting every asset to its optimal opportunity across chains; yield-bearing deposits through satUSD+ and spendable with Visa-backed credit cards. Long-term, the vision is to build a billion-dollar scale onchain bank where users can earn, invest and spend, making their digital assets productive, liquid, and usable across both chains and the real world.

The BuildKey TGE in Binance Wallet set a new record in its IDO history—$100M in BNB committed in less than 2 hours from 30k+ users (993x oversubscribed). Smart Vault deposits reached the initial $10M cap in 12 hours; Prime Vault surpassed $100M in two weeks. The Public Sale sold out in 2.5 hours, raising ~$3.2M selling 50M River Pts, whose value will be dynamically adjusted over time with River’s Dynamic Airdrop.

River earns fees and captures yield by banking crypto collateral for borrowers, savers, and institutions. Borrowers mint satUSD against BTC, ETH, USDT/USDC and other eligible collateral assets (with high capital efficiency up to 90% loan-to-value), savers park satUSD+ for yield or deposit into Smart Vaults to earn with no liquidation risk, and institutions pledge assets with KYB custody guarantees and no smart contract risk.

River’s business model stacks multiple cash flows—borrow/mint/redemption and fixed interest fees, on/offchain arbitrage, market-making yield, CeDeFi strategies, POL (Protocol Owned Liquidity)—differentiating itself versus other stablecoin systems that rely solely on CEX-based delta-neutral strategies or operate on single chains with narrower market reach.

Incentives: Alignment By Design

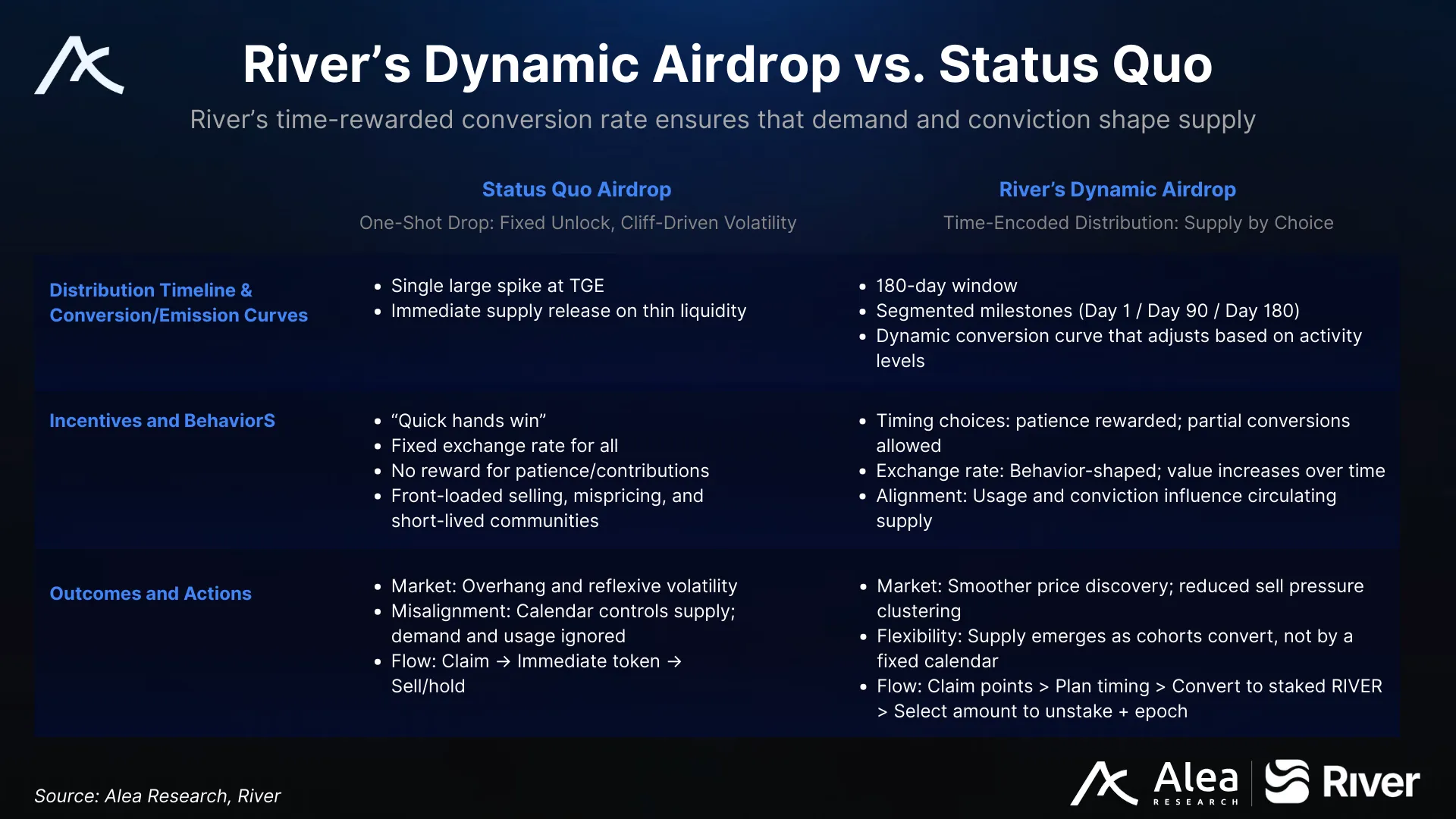

Most airdrops create a one‑time wealth transfer that ends at claim, concentrates supply in sybil or low-conviction hands, and invites immediate churn. River’s time-encoded airdrop ties emissions to holder behavior, reducing reflexive sell pressure while offering yield arbitrage opportunities across points, spot, and perps. The mechanism rewards patience and participation, releasing tokens as users earn them rather than on a fixed calendar.

In November 2025, concentrated River Pts conversions during a low-liquidity environment exposed vulnerabilities in the original conversion model. River responded with countermeasures: a full buyback for Public Sale participants at original price (completed within 10 days), and a comprehensive mechanism upgrade. Conversion 2.0 activated on December 13, 2025, resuming from Day 48 on the original 180-day schedule.

The core parameters remain unchanged: 180-day conversion window and 30% maximum allocation. Conversion 2.0 introduces a dynamic integral pricing model that adjusts rates based on participation density, daily conversion caps (20M River Pts) and per-transaction limits (1M River Pts) to smooth activity over time. Staked RIVER output with selectable epochs (3/6/9/12 months) that align incentives toward longer-term holding.

The following section details how the upgraded mechanism works.

Conversion 2.0 activated on December 13, 2025. In the weeks following:

- RIVER recovered from post-pause lows.

- The token reached a new all-time high of >$20 with volumes averaging >$30M daily.I

- TVL stabilized at ~$318-350M.

- S4 Airdrop and RIVER staking activated.

RIVER Dynamic Airdrop

River Pts track engagement and count toward your convertible token balance. This includes actions like minting and using satUSD, staking, or engaging through River4FUN. They are tokenized as River Pts ERC20 tokens that can be converted into staked RIVER at the prevailing exchange rate or traded on secondary markets—opening up arbitrage opportunities as a result.

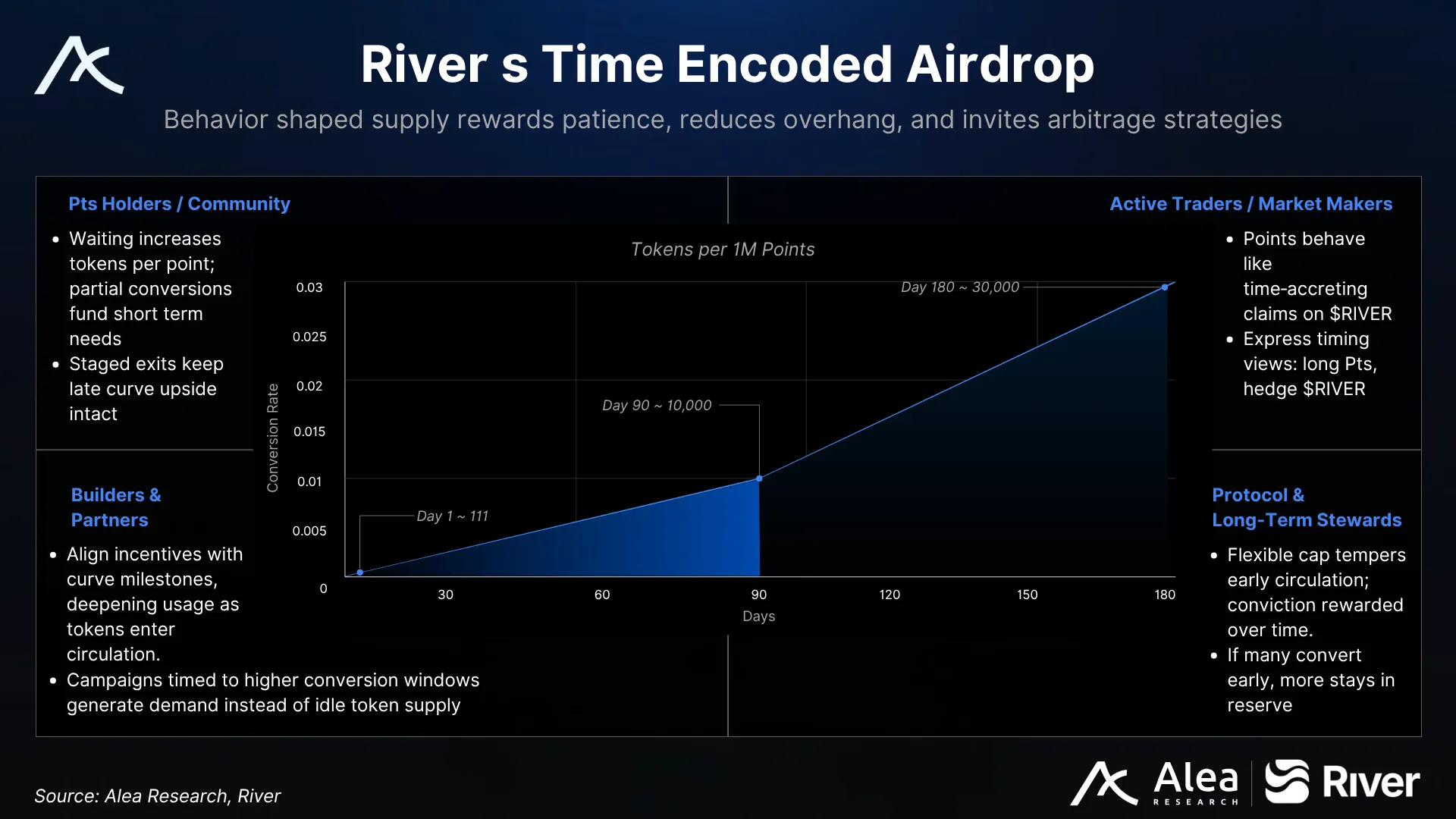

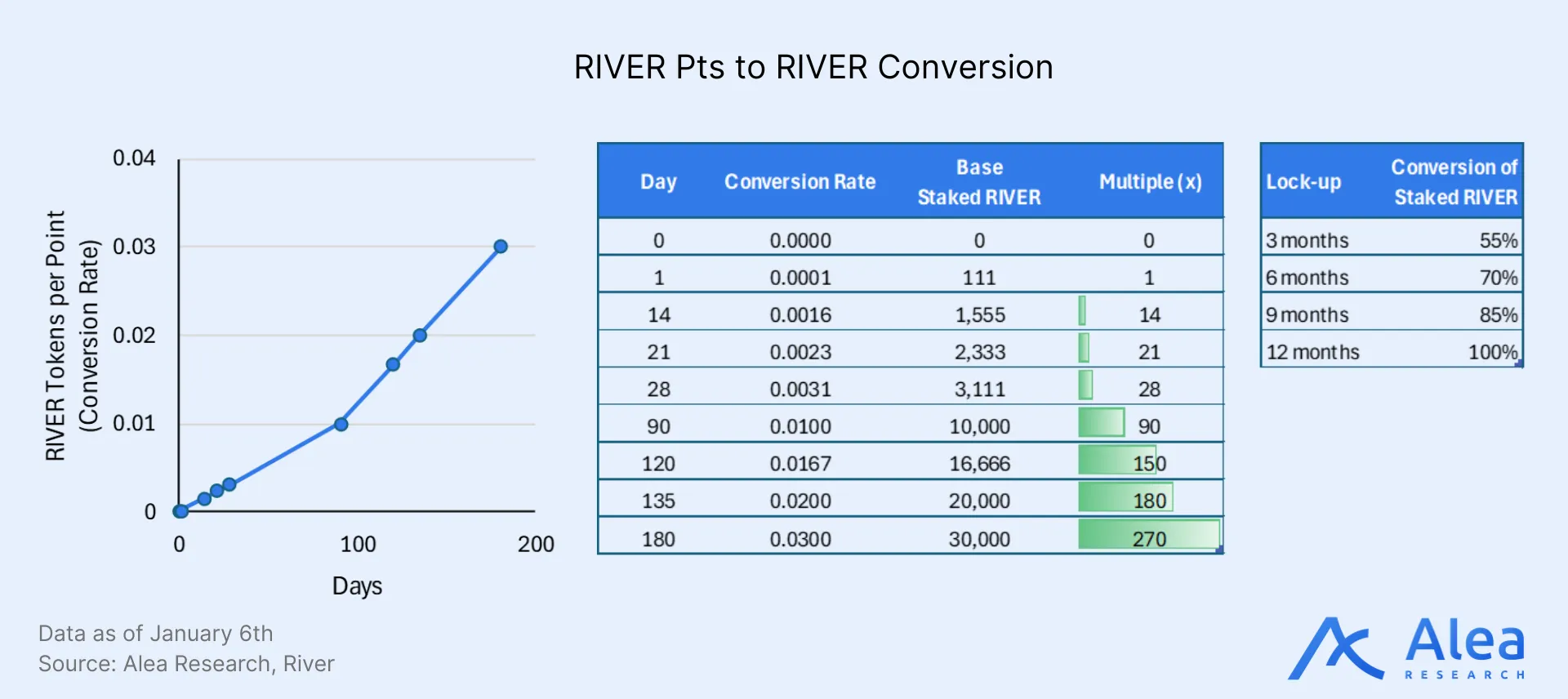

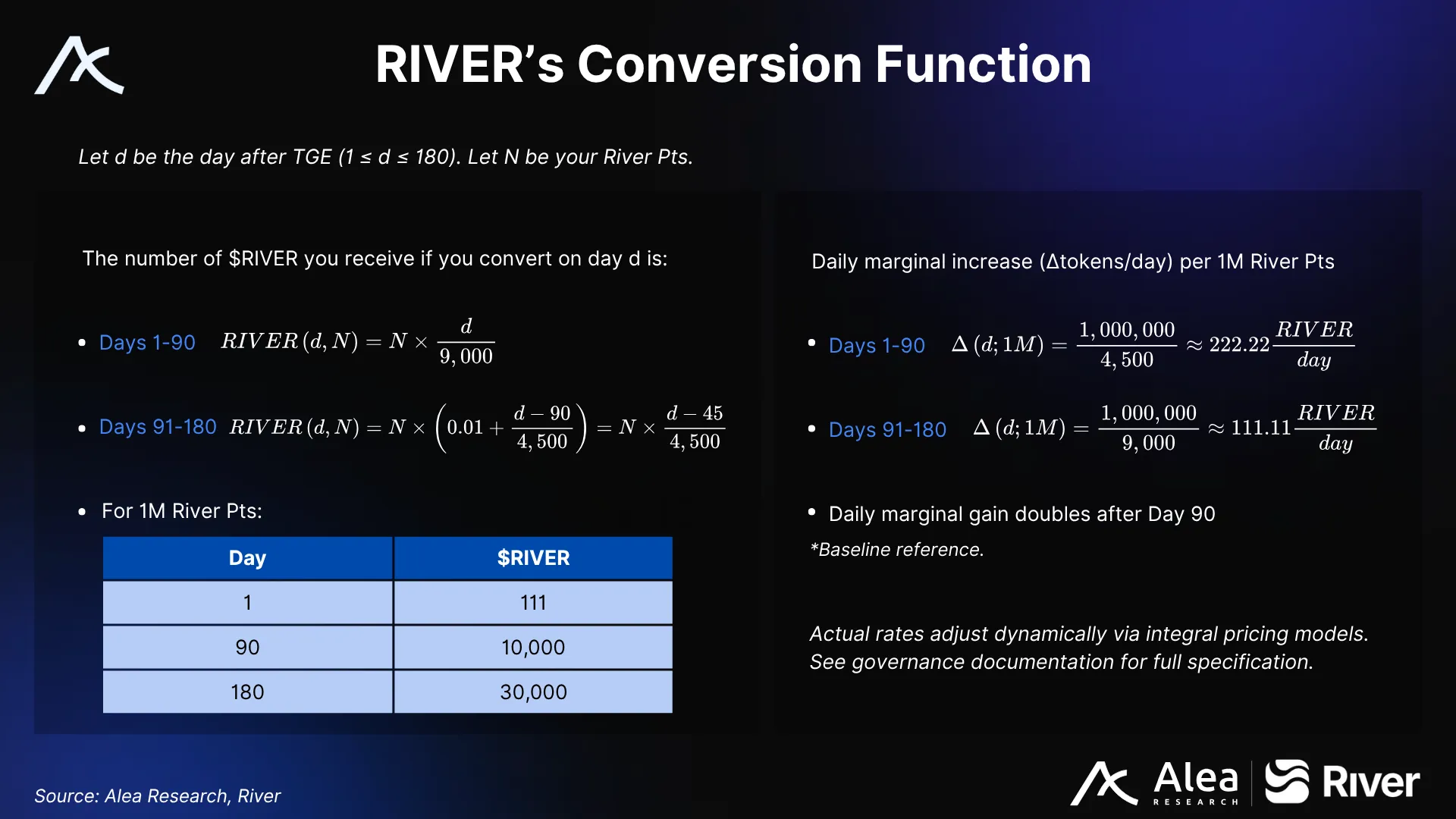

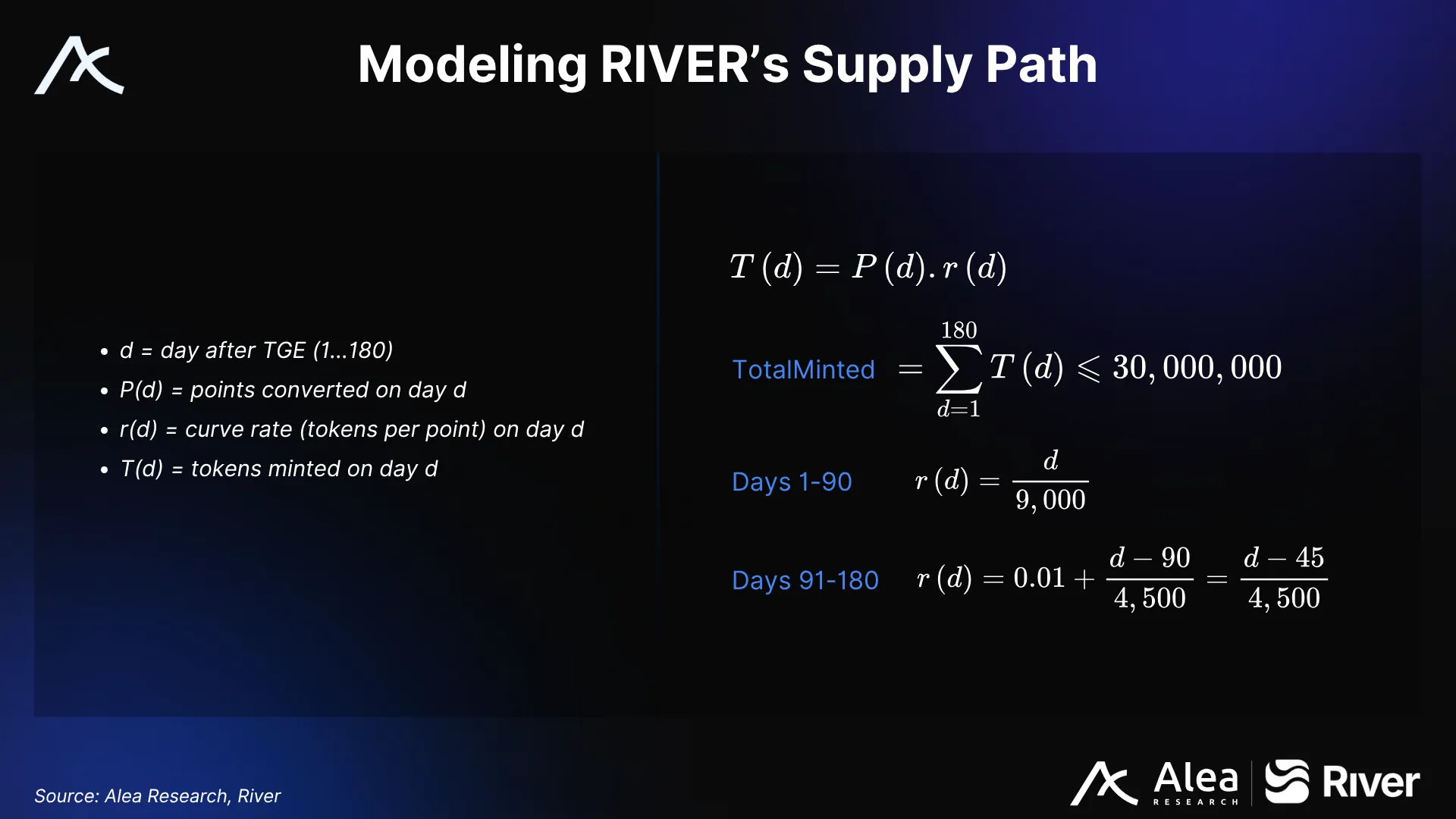

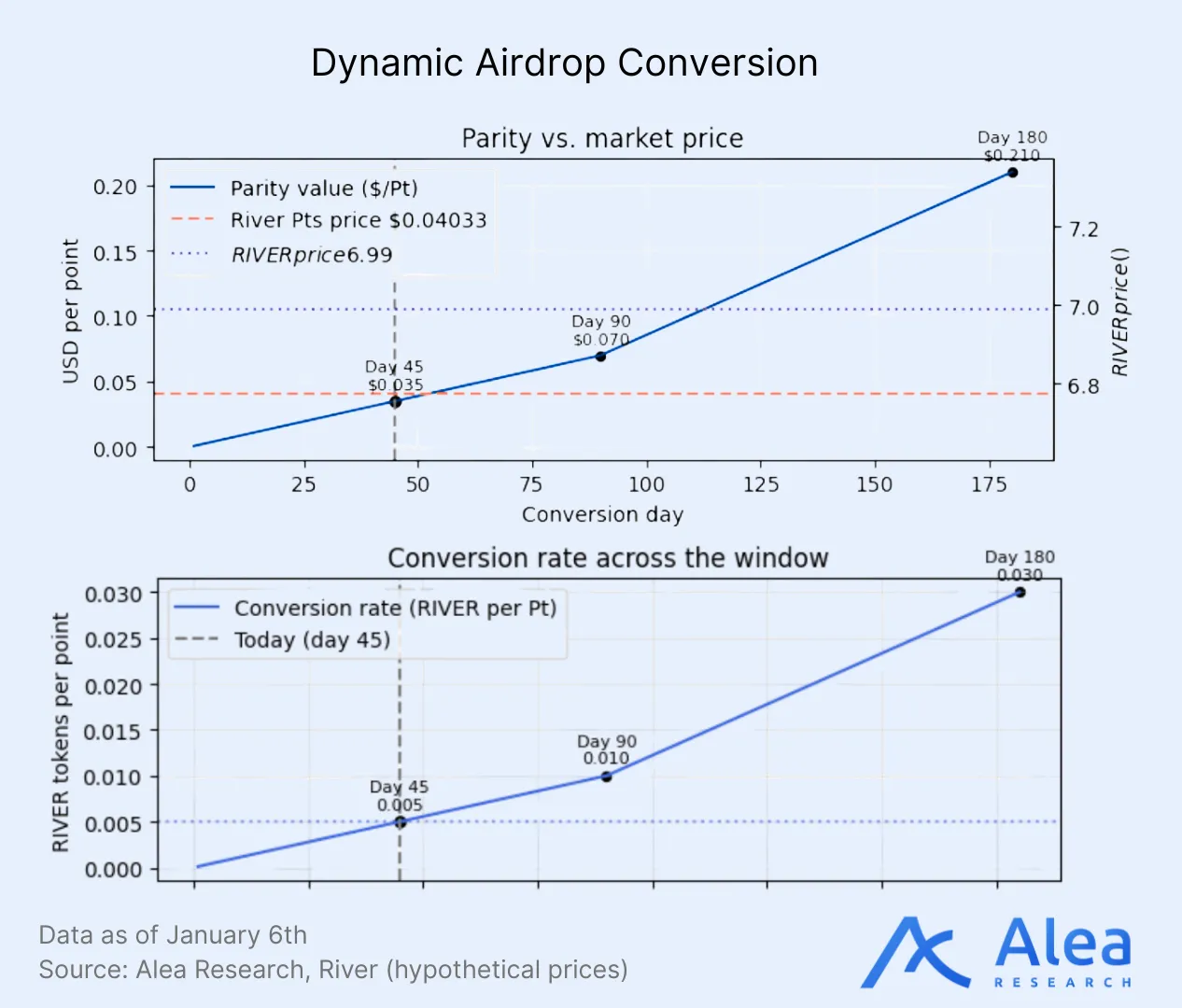

The later points are converted, the greater the exchange rate. A total of 1B River Pts correspond to up to 30M staked RIVER over the 180-day window. If many participants convert early at lower rates, fewer tokens are emitted and the remainder stays in the Community Reserve. Under Conversion 2.0, the baseline curve retains the original structure (Day 90 kink at 10,000 staked RIVER per 1M Pts), but the actual rate adjusts dynamically based on participation density.

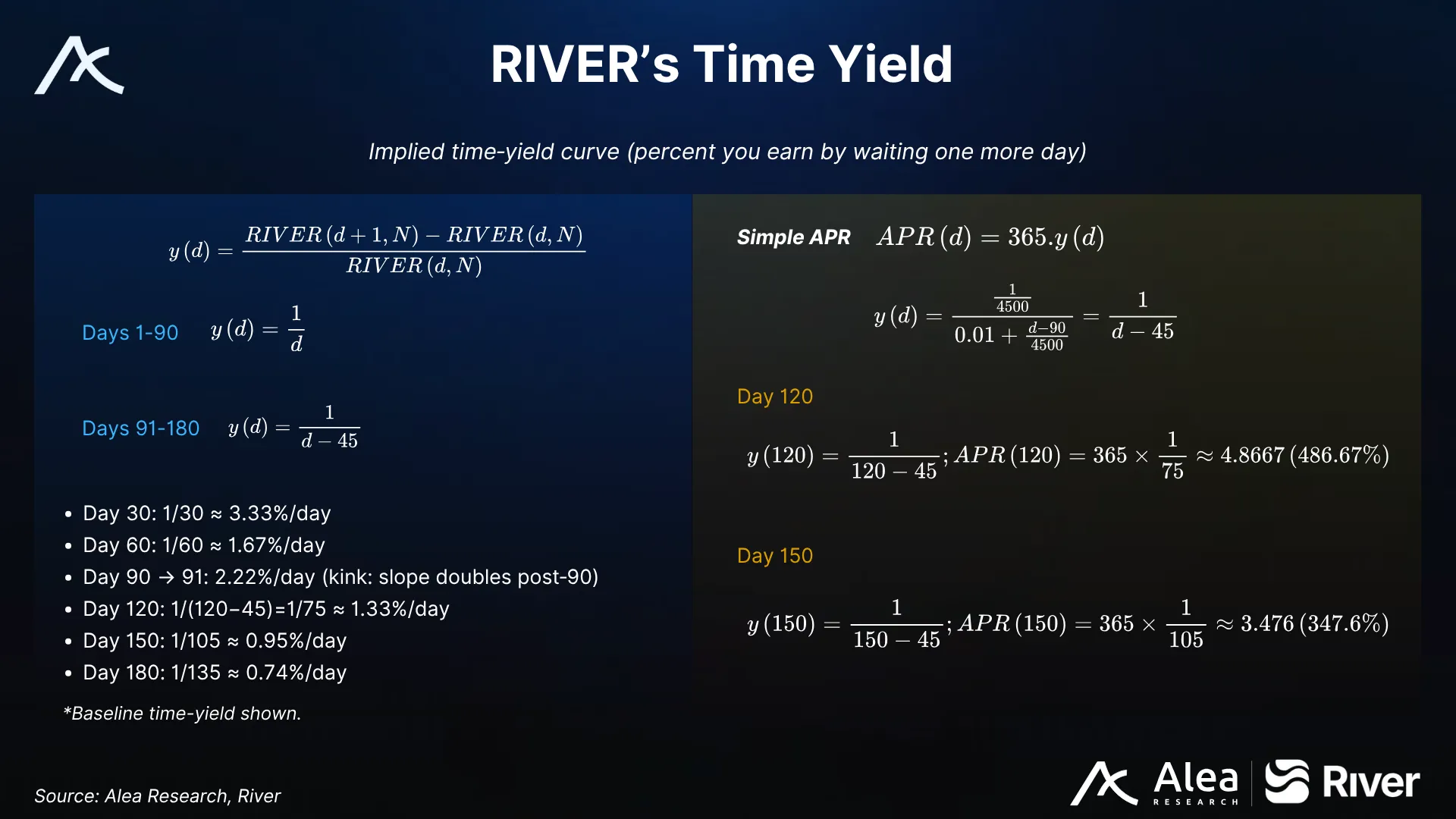

The daily marginal gain doubles the moment you cross the 90-day threshold: between Days 1-90 you are earning ~111.11RIVER/day; ~222.22 RIVER/day Days 91-180 per 1M Pts. Assuming RIVER’s price is unchanged while waiting, token-denominated and USD-denominated yields are the same. Within each segment, the per‑day time‑yield declines as you move to the right. Still, because the slope doubles at Day 90, there is a clear incentive to make it past that point. By Day 120 you would be earning a 487% simple APR; 348% by Day 150. However, it is important to consider the actual rates may differ from baseline depending on participation density, and that the output is now in Staked RIVER, meaning yields must also factor in epoch duration and share-of-base multiplier.

Since price will fluctuate over time, the expected return calculations need to account multiple factors:

- Baseline time-yield: Waiting improves the baseline rate (especially crossing Day 90)

- Activity-based recovery: Converting during low-activity windows avoids compression.

- Epoch selection: Longer lock-ups capture more of the base output.

- Lock-up opportunity cost: Staked RIVER is illiquid for 3-12months.

Converting early makes sense if expected RIVER price appreciation exceeds the combined benefit of waiting for better baseline + recovery + longer epoch share.

Every extra day you wait, your River Pts convert into slightly more RIVER. That “extra” is the time‑yield, y(d). Converting today means you forgo that incremental gain to get liquidity sooner. Users can also convert in tranches, pacing their own curve. For instance, all at Day 30 gives ~3,333 staked RIVER; all at Day 170 gives ~27,778. Splitting—40% early, 60% late—lands ~18,000 staked RIVER.

Post-Launch Dynamics

In River’s launch, tokens accrue when points convert. The baseline conversion rate follows the curve; actual rates adjust dynamically based on participation density. Circulating supply is set by when holders choose to convert and which staking epoch they select. A total of 1B River Pts can turn into up to 30M RIVER over 180 days, but if participants convert earlier, then fewer tokens will enter circulation and stay in the Community Reserve.

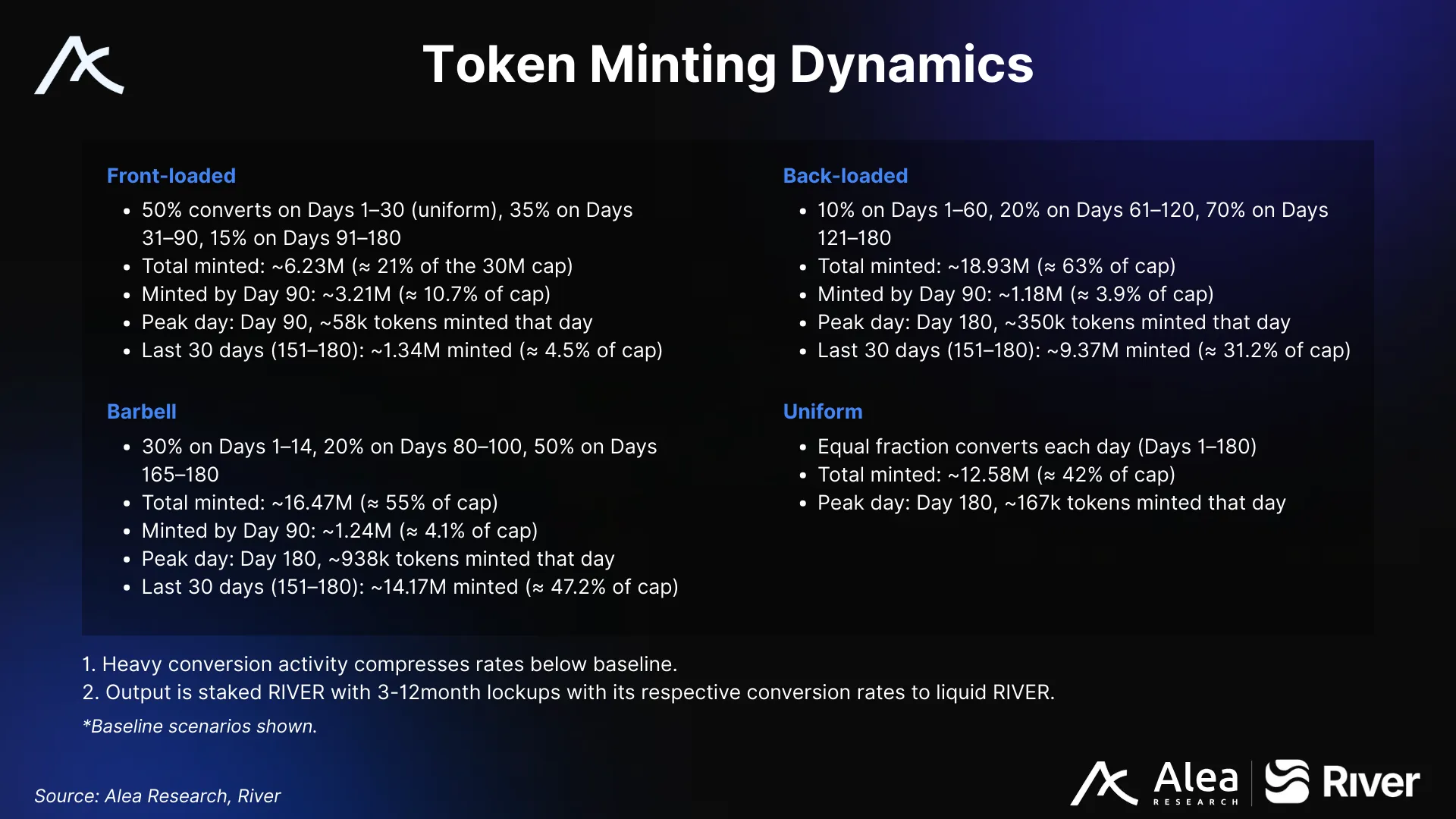

Timing drives the total RIVER that will enter circulation: late conversations mint more tokens; early conversions mint fewer. We can quantify how different behaviors shape emissions. The main takeaway: River Pts offer asymmetric optionality given the dynamic built-in conversion floor.

At a high level, this is a coordination and optionality game. From the perspective of a River Pts buyer, you are acquiring optionality with accelerating time-value (unlike standard options, which carry a time-decay) under the uncertainty of a given float and future price action. When trading points, what’s being traded is a claim whose payoff improves as time passes—there is a positive carry by design (and you can track the market premium in real-time) that lets early buyers capture more convexity. That is key for game theory, since both flows and narrative can push price well beyond a static “fair value.”

Useful bounds for one-day thought experiments:

- All on Day 30: ~3.33M minted (~11% of cap).

- All on Day 90: 10.00M minted (~33% of cap).

- All on Day 180: 30.00M minted (100% of cap).

The later the move, the smaller the marginal gain—because balances are larger and the per‑day percentage increase declines inside each segment. As a participant, you aren’t forecasting exact prices, but can buy River Pts exposure where upside grows with time. If enough traders believe the claim is undervalued, their buying shifts the equilibrium. Similarly, adverse price moves in River Pts would still preserve attractive ratios that sustain participation and reduce the likelihood of forced exits. A shorter path to break-even, for example, is a common-knowledge signal of mispricing.

River Pts are currently trading at a steep discount to epoch-adjusted parity (~96% below 3-month parity at current prices), suggesting the market is heavily discounting for rate compression risk, Staked RIVER illiquidity, or residual mechanism uncertainty post-Conversion 2.0. This could represent either warranted skepticism or a significant mispricing for patient capital willing to accept lock-up periods.

With conversion now past Day 70, the key milestones ahead are:

- Day 90 (~Jan 24, 2026): The baseline slope doubles. Holding past this threshold yields ~222 RIVER/day per 1M Pts vs ~111 RIVER/day before.

- Days 120-150: Post-kink accumulation zone. By Day 120, baseline APR exceeds 480%.

- Days 166–180: Back-loaded behavior can mint hundreds of thousands to 1M+ tokens per day.

- Day 180 (~Apr 24, 2026): Window closes. 20% converting on Day 180 mints 6M; 50% mints 15M.

The design rewards patience, but each user profile should optimize for different needs. With Day 90 approaching, users who haven’t converted face a decision: convert now at ~8,000 RIVER per 1M Pts baseline, or wait 2-3 weeks to capture the post-kink slope at 10,000+ RIVER per 1M Pts. Those with near-term liquidity needs may convert smaller tranches now while reserving the rest for post-Day 90 windows. Traders could hedge Pts to harvest remaining time-yield, though the Staked RIVER lock-up complicates exit timing. Monitor rate compression and daily cap utilization when planning conversion timing.

One common mistake is treating conversion terms as a static daily snapshot. Under a dynamic system, realized terms depend on when you convert and how crowded conversion is at that moment. Avoid forcing large conversions into congested windows and instead, tranching execution across days (and across epoch choices where appropriate) can reduce adverse timing and capacity risk.

Arbitrage & Execution

River’s Dynamic Airdrop is a time-yield arbitrage opportunity. Users can act under three variables: time (carry), flow (supply/demand), and narrative (attention). For instance, enter River Pts when time-to-break-even is low and attention is building; reduce when that inverts. The meta-game is to harvest convexity while avoiding crowding at obvious exits.

With conversion past Day 70 and approaching the Day 90 slope inflection, the baseline rate continues climbing (~8,000 RIVER per 1M Pts currently, rising to 10,000 at Day 90). Yet River Pts trade at a >95% discount to epoch-adjusted parity. The discount may reflect: (1) thin Pts liquidity amplifying sell pressure, (2) market expectation of severe rate compression if conversions cluster, (3) heavy penalization of Staked RIVER illiquidity, or (4) sellers exiting ahead of potential volatility. Regardless of cause, the gap between market price and conversion floor is unusually wide.

For those looking to avoid price exposure, the traditional arbitrage (long Pts, short RIVER perps) requires modification under Conversion 2.0. The net carry is no longer simply time-yield minus funding—it must also account for Staked RIVER lock-up duration. Traders must either:

- Maintain the perp short through the staking period (accumulates funding cost)

- Sell points on secondary markets instead of converting

- Stagger conversions across epochs to create rolling liquidity.

The inability to immediately monetize conversions changes the hedge calculus significantly with conversion 2.0.

At current discount levels, the math shifts. If Pts trade at $0.0034 and 3-month epoch parity is ~$0.088, the implied upside is ~25x to parity but that parity value is locked for 3 months minimum. Hedging via perps for 3+ months accumulates funding costs (positive or negative depending on market conditions). To breakeven, the discount-to-parity spread has to exceed cumulative funding plus opportunity cost of locked capital.

Alternatively, if Pts liquidity improves, selling Pts directly (rather than converting) may offer cleaner exit without lock-up. Monitor both conversion activity and Pts secondary volume to determine optimal execution path.

Conclusion

River’s Dynamic Airdrop turns token distribution into a live market event. Over the 180-day window that began on September 22, 2025, the community’s collective timing choices will define how much of the 30 million RIVER cap actually enters circulation, and when. What happens next is measurable in real time. These five metrics—claims, conversions, timing patterns, Pts pricing, and emissions vs cap—let you read participation, pace, and mispricing.

Following the pause, conversion resumed from Day 48 on December 13, 2025. At Day 90 (~January 24, 2026) the baseline slope doubles; Day 135 (~March 10, 2026) gauges momentum; and Day 180 (~April 24, 2026) marks the window closing, fixing float and allocating unconverted points. In the meantime, watch out for rising but paced conversions, Pts-to-RIVER parity, and market timing.

For holders, RIVER ensures alignment between governance, yield, and protocol growth. Staking grants voting power (veRIVER) via time-based multipliers and boosted returns—longer terms, i.e. 12 months, grant up to 4x voting power; the minimum lockup, i.e. 3 months, a 1x multiplier; 2x and 3x for 6 months and 9 months respectively. veRIVER boosts satUSD+ yield, amplifies LP rewards, and provides fee-driven utility with reduced mint/redemption costs.

The next months are a live test of behavioral economics, each conversion impacting the game theory. Track claims, conversions, timing, value, and emissions. Read the feedback loop in action—River’s time‑based alignment could become a template for future launches.

References

Disclosures

Alea Research is engaged in a commercial relationship with River and receives compensation for research services. This report has been commissioned as part of this engagement. The content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.