Restaking has emerged as a novel solution to address the economic security challenges faced by new decentralized protocols that require consensus mechanisms but that live fundamentally off-chain. By allowing previously staked assets to be utilized again, restaking allows protocols to borrow trust from a decentralized and credible-neutral layer, such as Ethereum. This makes it possible for restaking protocols to borrow slashing rights from the original validator set in order to leverage the economic weight of already staked assets. This primitive was pioneered by EigenLayer and originally conceived the use of existing staked assets, such as $ETH staked in the Ethereum Beacon PoS chain, to be used to secure multiple services and applications. This would allow users to earn enhanced yield (from both Ethereum PoS rewards and AVS yield) while simultaneously reducing the bootstrapping costs for new protocols, which would no longer have to create their own economic security from scratch by relying on a native token from day 1.

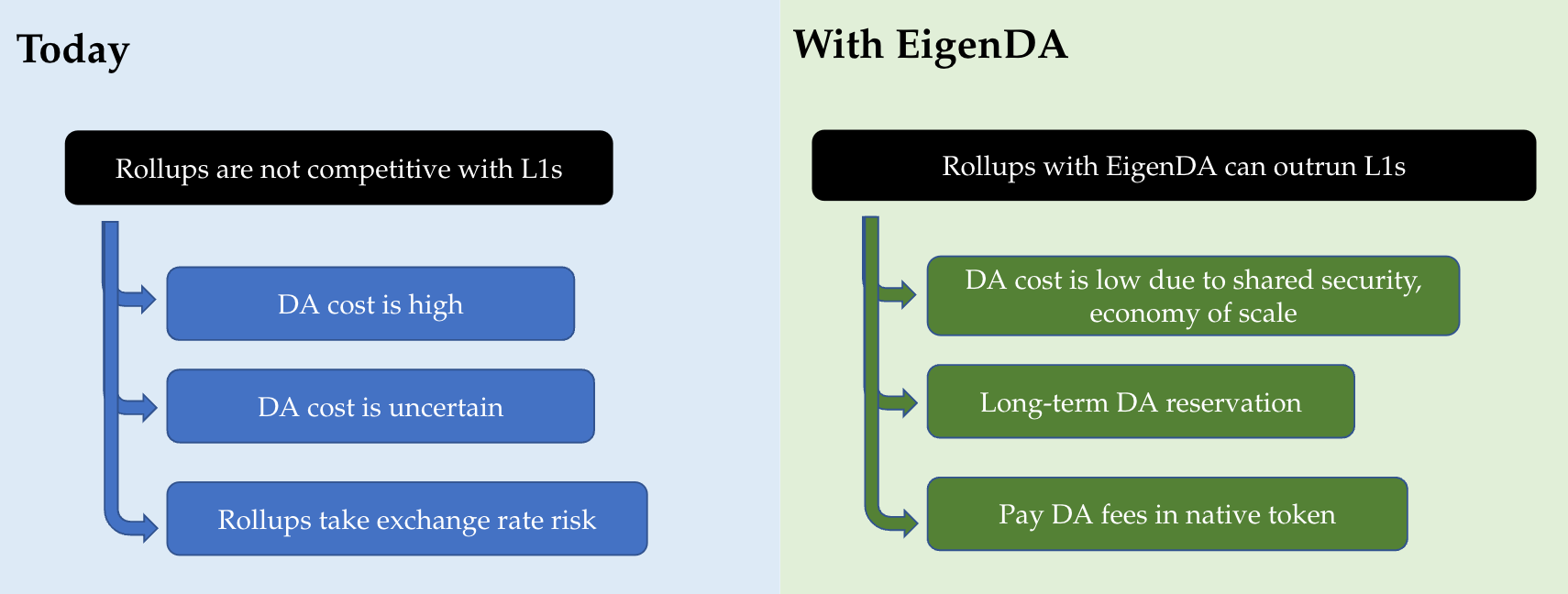

Figure 1: Transforming rollup economics through restaking

Source: EigenLayer Presentation

Since the original thesis and conceptualization, many protocols have joined this market vertical, ranging from Liquid Restaking Tokens (LRTs) to marketplaces for decentralized trust. The latter will be the focus of this report, which will expand on the unique selling points of the 3 main market leaders in the Ethereum ecosystem: EigenLayer, Symbiotic, and Karak. This report will explore the rapid growth of this market sector, emphasizing the tradeoffs and mechanism designs put in place by different protocols in order to connect stakers with node operators and protocol developers.

Over the past year, these protocols have advanced from relying solely on $ETH-backed collateral to supporting multi-asset collateral and offering more flexible security solutions. For many, this flexibility creates an incentive for risk-taking, but others view this as an opportunity for every token to have the potential opportunity for being restaked, capturing additional value as a result. Expanding support to other assets allows for a more diversified risk profile, but the additional revenue streams also carry extra risks. The report will also analyze the main factors that should be considered for asset selection and the key considerations to account for from a DeFi user’s perspective.

This report is reserved for our Elite members. Upgrade your plan to gain access to in-depth analysis, actionable insights, and the tools you need to stay ahead in the crypto space.

Not ready for Exclusive Content? Sign up for free