DeFi has democratized access to financial markets, but it has done so by replicating only part of the traditional market infrastructure. Automated market makers (AMMs), perpetual DEXs, and options vaults replicate exchange functions, but clearing infrastructure remains largely absent. Clearing is the process that ensures a financial trade is settled properly, meaning the buyer gets their securities and the seller gets paid. A neutral party, called a clearing house, which stands between the buyer and seller, managing and netting all participants’ positions. Clearing exists to minimize counterparty risk and keep markets running smoothly.

In TradFi, clearing houses net exposures across participants, manage collateral and margin calls, and ensure orderly default handling. By contrast, DeFi’s lack of clearing forces each protocol to either underwrite risk itself or outsource it to offchain keepers and/or oracles, leading to inconsistent enforcement of rules and poor comparability across venues, which creates barriers for institutional capital to participate. An asset manager might be interested in onchain futures or options, but not if each trade requires 100% collateral or if a single protocol exploit can lead to cascading liquidations.

Pascal Protocol aims to solve this problem by providing a neutral, onchain clearing layer that any trading venue or product can integrate. So instead of every exchange siloing collateral and performing ad-hoc liquidations, Pascal delivers a unified clearing house where margin requirements are consistent and positions can be netted across platforms, much like central clearing houses (such as LCH or CME) underpin traditional financial infrastructure.

Pascal operates on an Arbitrum Orbit chain (L3) and uses Arbitrum Stylus to run Rust/WASM smart contracts for efficient risk computation. The clearing engine computes portfolio margin (VaR-based), enforces deterministic liquidations via clearance bots, and routes fees and rewards onchain.

Key Takeaways

- Clearing Gap: Clearing houses enable trillions in derivatives trading by netting trades and minimizing bilateral payments, making DeFi markets more efficient and attractive to institutional capital.

- DeFi’s Necessary Primitive: Pascal provides an auditable, onchain clearing layer that standardizes risk management across venues, solving DeFi’s fragmented and underdeveloped risk infrastructure.

- Unified Margin Efficiency: By netting exposures and hedges across products and trading directions, Pascal’s margin system improves capital efficiency and risk-adjusted collateral requirements.

- Tailored Crypto VaR: Pascal uses an options-aware, Student’s-t Value-at-Risk model with dynamic volatility and correlations, promising resilient margining even in high-stress crypto market conditions.

- Deterministic Liquidations: Automated liquidations within price bands, combined with tiered default waterfalls, reduce systemic risk and mirror best practices from traditional clearing houses.

- Broad Protocol Utility: Beyond perpetuals, Pascal infrastructure supports options venues, lending products, and RWAs that can plug into a unified clearing layer.

Clearing in Traditional Markets

In TradFi, clearing houses quietly perform the heavy lifting that keeps markets stable so that traders and exchanges can operate with confidence. Every major exchange or OTC market is supported by a clearing institution that minimizes counterparty risk. This infrastructure is largely invisible until it’s not there.

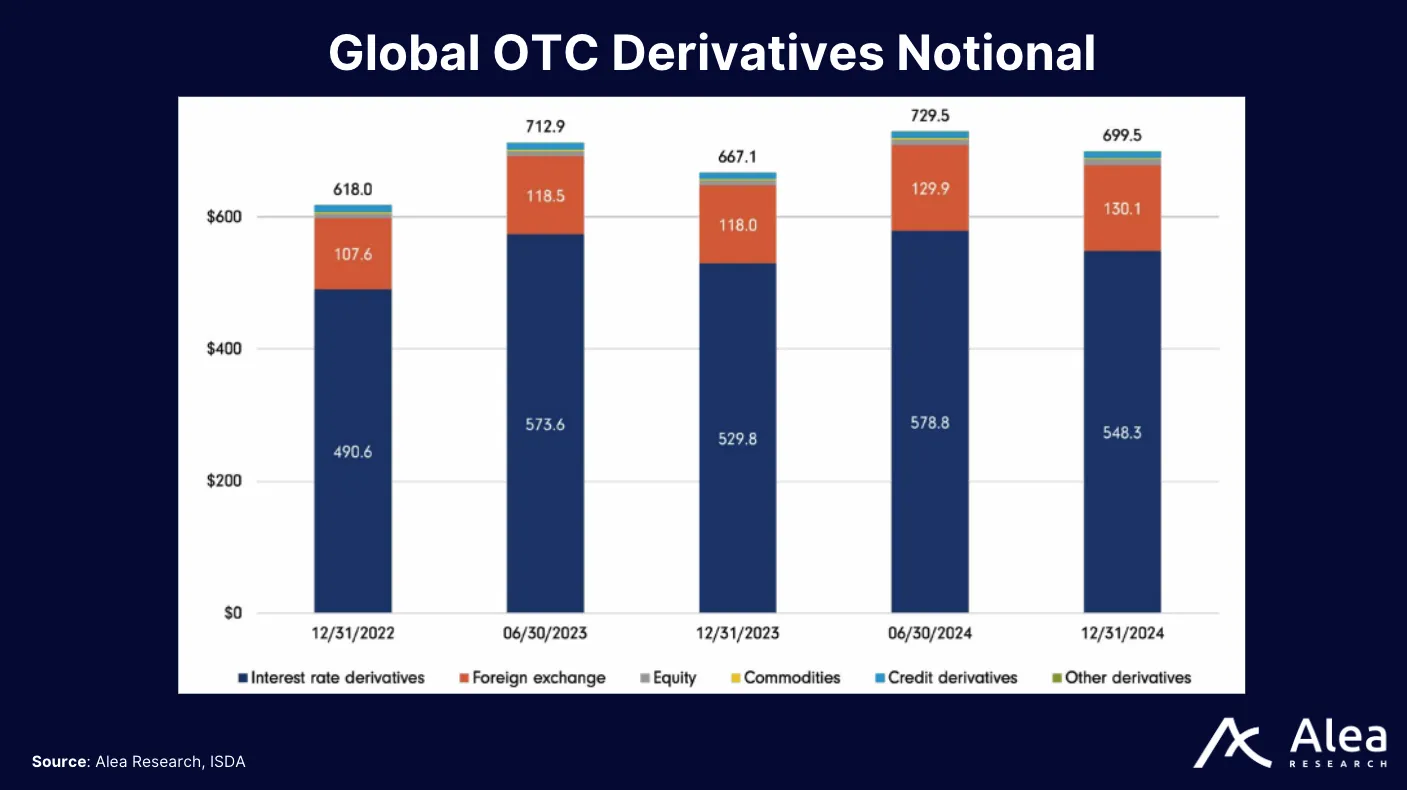

Clearing infrastructure enables scale. By year-end 2024, the notional amount outstanding in global OTC derivatives was approximately $699.5 trillion, a 4.9% increase from year-end 2023, according to BIS-based tallies.

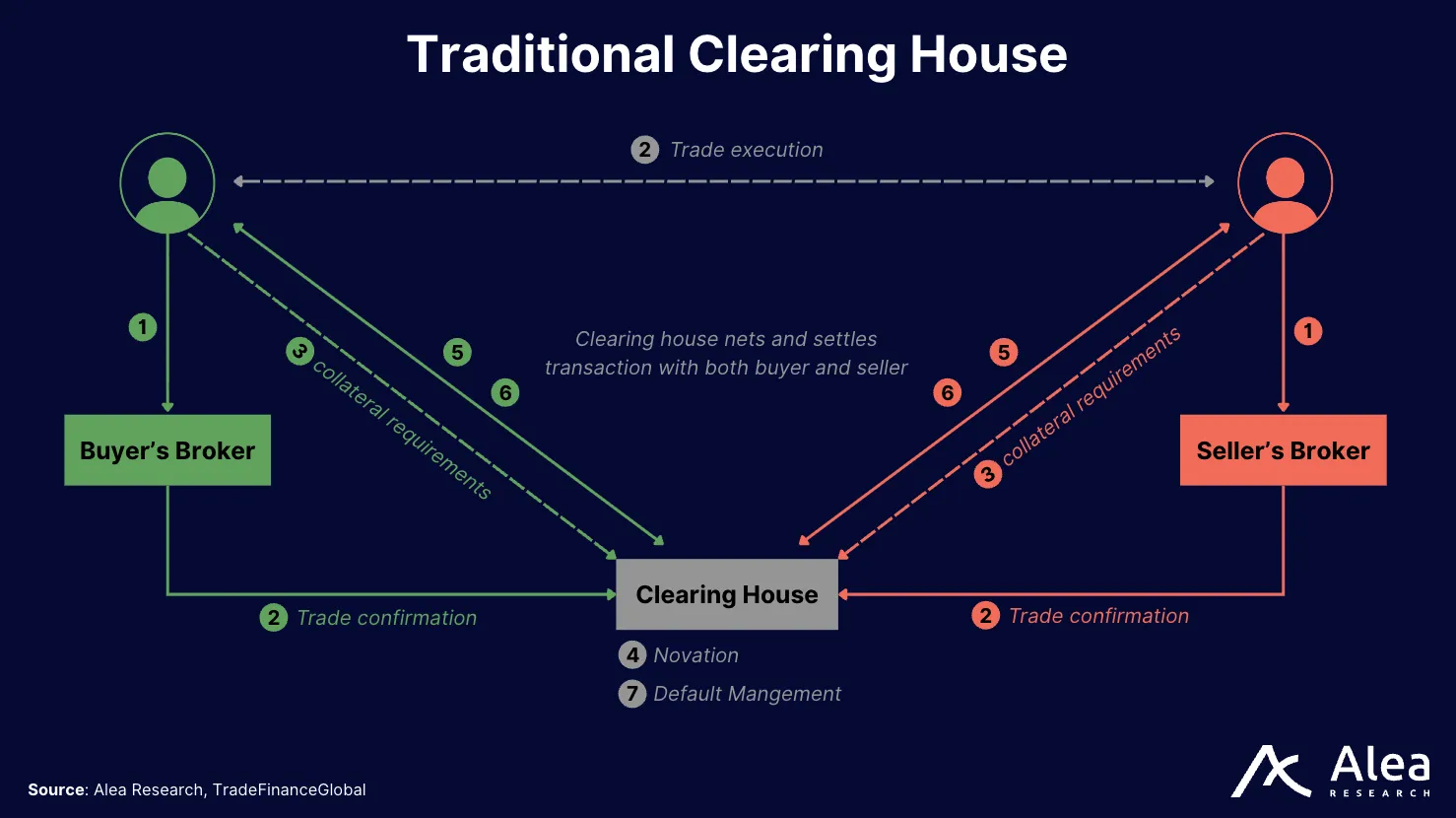

To appreciate why a clearing layer matters, here’s a visual overview of how clearing works in traditional markets.

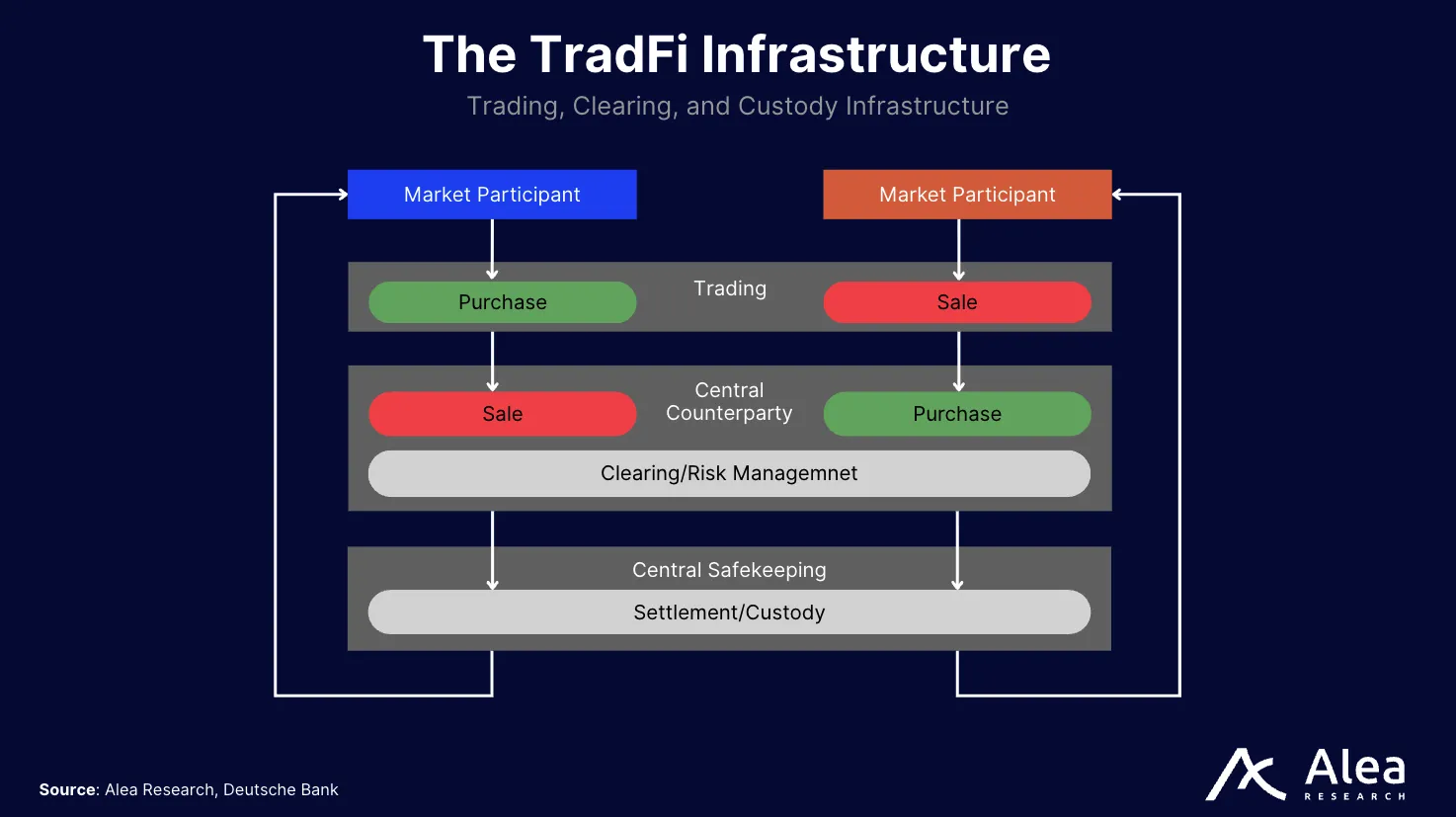

- Trade confirmation: When two parties execute a trade, the clearing house becomes the buyer to every seller and the seller to every buyer, replacing bilateral exposure with exposure to the clearing house.

- Netting exposures: Across all of a participant’s trades, the Central Counterparty Clearing House (CCP) nets the buy and sell obligations into a single delivery and payment for settlement. In LCH SwapClear, a participant’s daily trades across interest‑rate swaps are aggregated into a single net cash flow, rather than dozens of bilateral payments.

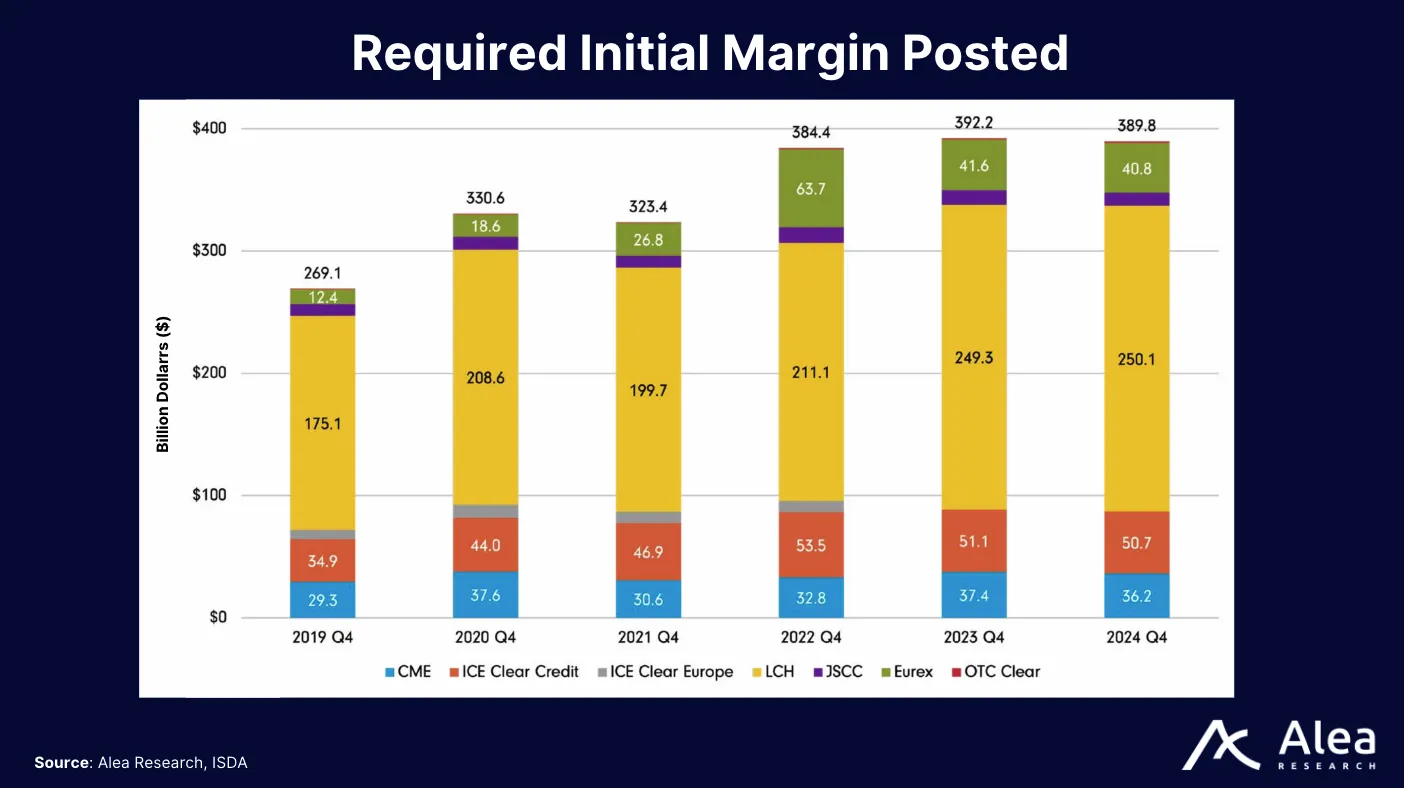

- Margining: The clearing house calls initial margin to cover potential future losses and variation margin to realise daily mark‑to‑market gains and losses. Participants post cash or securities, which the CCP invests in this collateral and pays interest. BIS/ISDA statistics show that clearing members posted $389.8 billion of required initial margin for cleared interest rate and credit default swaps at end‑2024.

- Default Waterfall: If a member defaults, the CCP liquidates the portfolio using defined steps to ensure that counterparties are made whole and systemic contagion is contained: a) First, the defaulter’s margin and contributions, b) then the mutualised default fund, c) lastly, the CCP’s own capital or unfunded commitments.

- Settlement (DvP): On the settlement date, the clearing house delivers securities versus payment through a central securities depository (CSD). The process is largely invisible to end users as they see timely settlement and stable markets, not the machinery underneath.

Pascal as the DeFi Clearing Layer

Despite strong growth in DeFi trading volumes, there is no onchain analogue to a CCP. Each DEX or lending protocol sets its own margin rules and uses bots or offchain keepers to liquidate positions, which tend to be conservative because they lack cross‑product visibility.

Most DeFi derivatives venues today either:

- Use an isolated margin where each position stands alone with its own collateral, or

- Offer limited cross-margin within their platform but without true portfolio risk modeling.

Without netting, capital efficiency remains poor. A trader long $BTC and short $ETH on separate venues must post collateral for both legs; a VaR-aware clearing house would recognize offsets and set lower, portfolio-level requirements. (This is standard practice in CCP margining, which nets exposures across a member’s book).

Additionally, if a protocol’s liquidation bots fail or an oracle feed is manipulated, positions may not be closed in a timely manner, leading to incidents or insolvency events (see MakerDAO’s Black Thursday). The result is a fragmented landscape where users must over-collateralize positions on every platform, and systemic risk remains opaque and unmitigated.

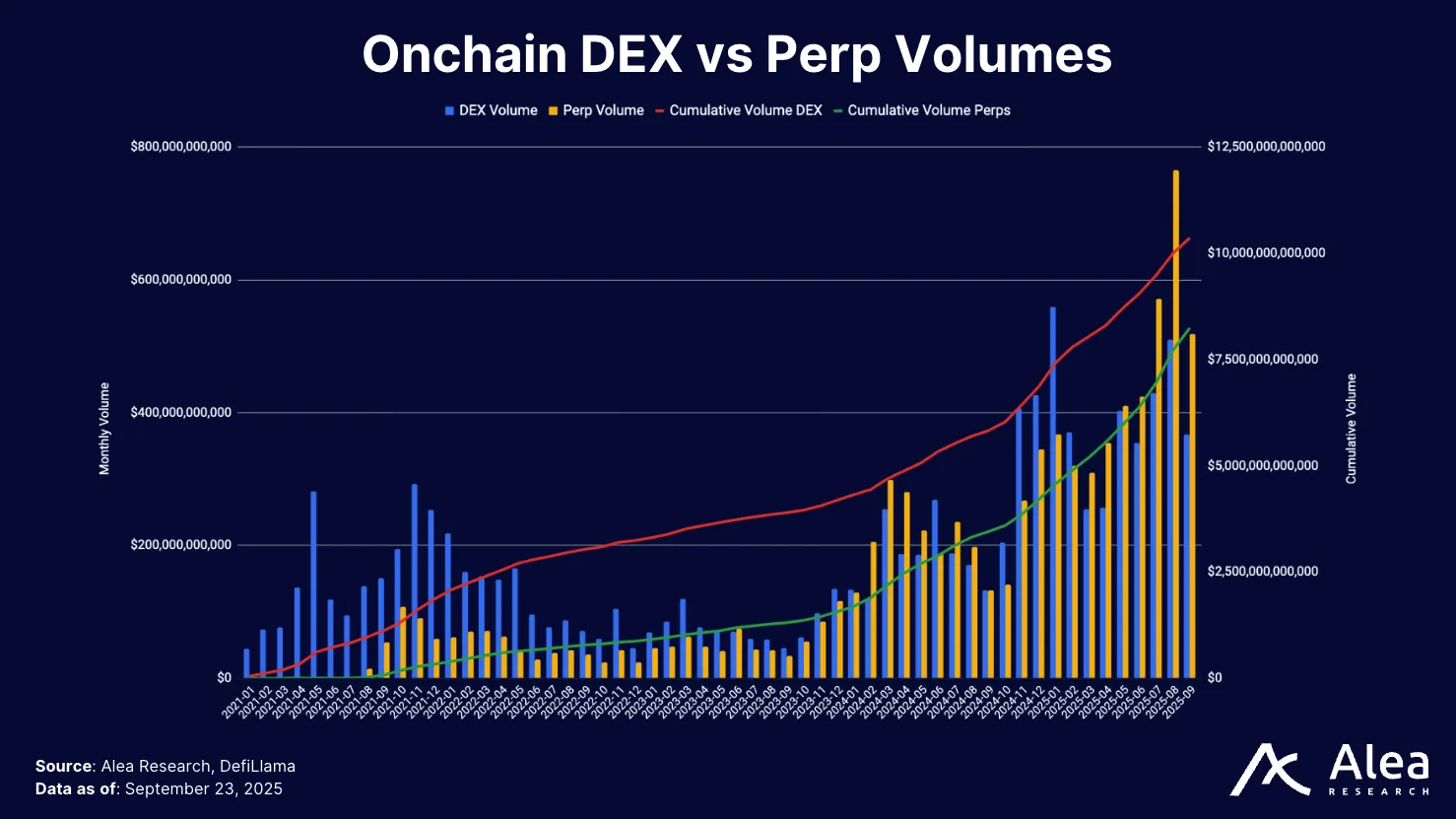

In DeFi, perpetual DEX volumes have reached a cumulative $8+ trillion and continue to rise at an exponential rate, surpassing spot DEX volumes ($765 billion in perpetual volume vs $510 billion in spot volume in August). Onchain interest‑rate derivative products (e.g., fixed‑rate lending markets like Ipor, Term Finance, etc.) are also poised to grow. The combination of growing onchain trading flow and lack of credible risk infrastructure presents an opportunity for an onchain clearing layer to capture significant value.

Pascal wants to fill this gap by offering a neutral, onchain clearing layer analogous to LCH or CME Clearing, but implemented through smart contracts. Pascal is the clearing house that nets the exposure, computes portfolio-level margin, enforces deterministic liquidations, and mutualizes default risk. Exchanges, options vaults, structured products, and other protocols can integrate Pascal as a back-end clearing service, with collateral held primarily in $USDC and other stablecoin options.

Architecture: Built for Throughput & Cost Control

Clearing requires compute‑heavy risk models, high throughput for batching orders, and predictable gas costs for liquidations. On general‑purpose chains, each risk recalculation is expensive, and latency can spike during congestion. Pascal solves this by running its clearing engine on a dedicated Arbitrum Orbit L3 chain.

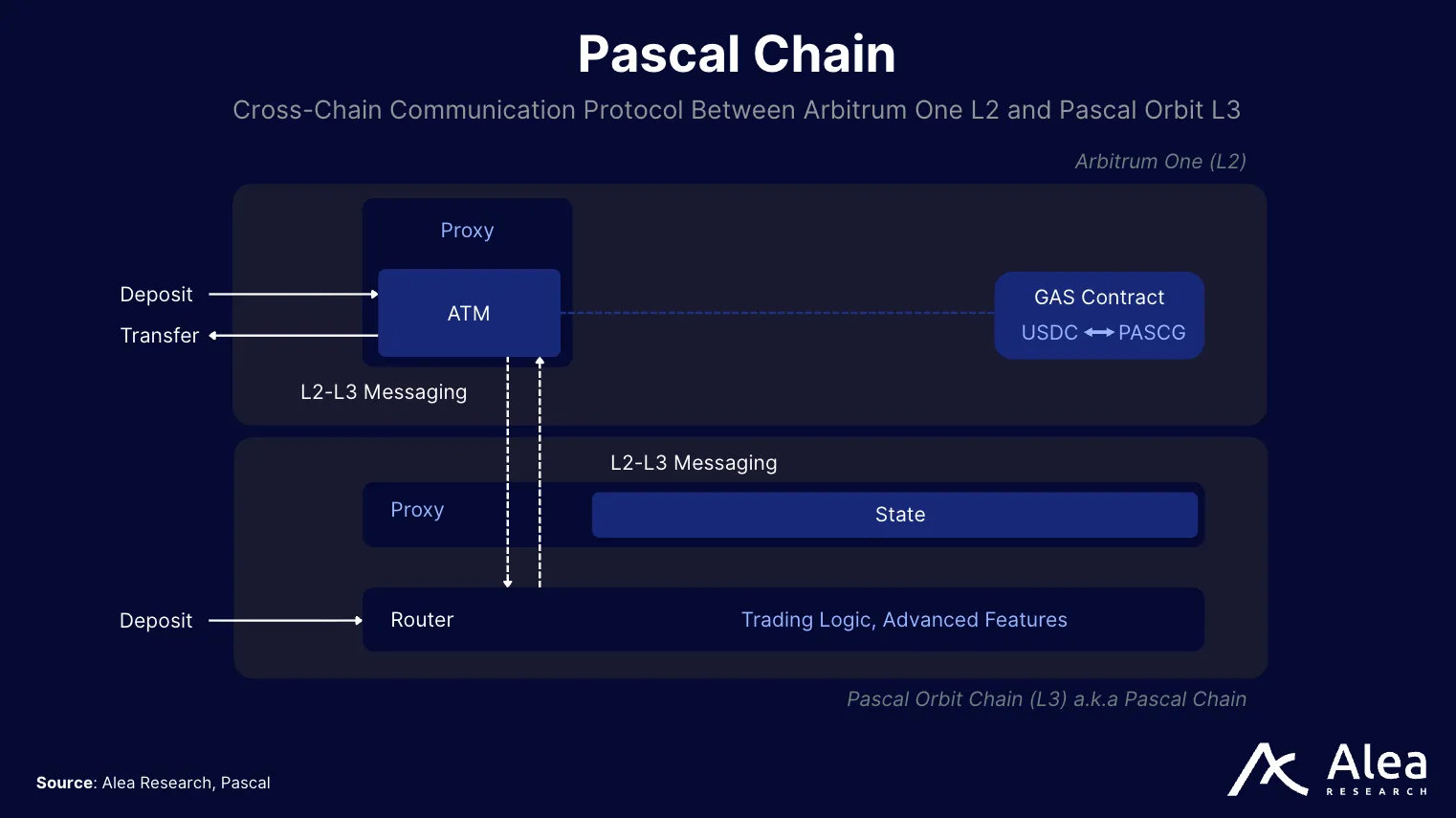

Users deposit $USDC on Arbitrum One via an Asset Transfer Manager (ATM) contract. This contract mints a $USDC‑pegged gas token to pre‑pay L3 fees and sends a message to the L3, crediting the user’s account. Because gas on the L3 is paid in $USDC, traders do not need $ETH to trade and can withdraw unused gas back to L2. Withdrawals are the reverse, where the L3 checks margin conditions, then sends an L3→L2 message to release $USDC from the ATM contract. This design separates custody from clearing and simplifies institutional integration as funds never leave the security of the L2.

Orbit is a custom rollup environment that settles to the Arbitrum L2 but allows the application to control block times, gas limits, and execution environment. User funds live on the L2 custody contract while the L3 executes risk logic. According to Pascal, this split delivers very low and predictable gas for clearing operations and reserves dedicated capacity for recalculating portfolio VaR, batching matches, and processing liquidations even under significant stress, so margin updates track price moves without lag..

Pascal’s clearing layer depends on reliable data fees, portfolio-wide unified margin, and automated execution via their Clearance Bots, which all work together to deliver deterministic risk management.

Wasm-Based Clearing Engine

Pascal’s smart contracts are written in Rust and compiled to WebAssembly (Wasm) via Arbitrum’s Stylus. Unlike the EVM, which is constrained to 24 KB per contract and limited opcodes, Stylus allows up to 96 KB, enabling the inclusion of complex math libraries such as Black-Scholes for options pricing, covariance matrix algebra, and gamma adjustments. Wasm is built to be fast, portable, and human-readable. When compared to Solidity, Wasm programs are much more efficient for memory-intensive applications.

Unified Margin Accounts

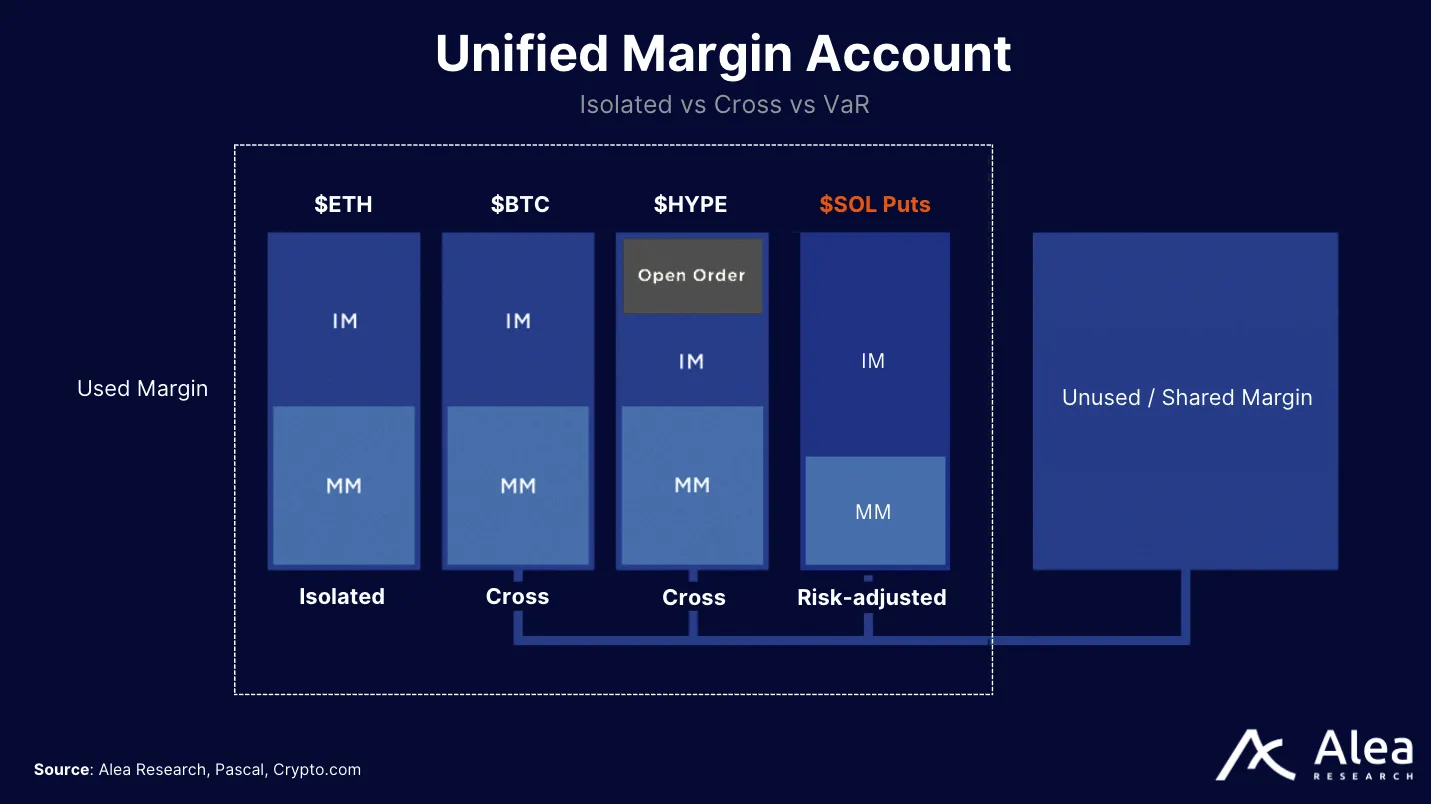

To see why unified margin matters, consider how margin systems evolve:

- Isolated Margin: Each position funds its own risk buffer, and losses can only consume that position’s margin. An isolated margin has poor capital efficiency because offsets are ignored: a long $BTC perp and a short $BTC perp each post full margin, even though they hedge each other.

- Cross Margin: Collateral is pooled across positions in an account that can cover multiple positions. Margin calls consider total equity with profits/losses netting continuously, but this still assumes all positions are equally risky and ignores correlations.

- Portfolio (or Risk-Based) Margin: This margining model computes the risk of the entire portfolio, not just the individual line items, using Value-at-Risk(VaR), incorporating volatilities, correlations, and (for options) Greeks to estimate worst-case loss over a horizon at a stated confidence level. That enables a precise, risk-proportional margin.

Pascal offers unified margin accounts, which are a single collateral pool where all positions across products such as spot, futures/perps, and options on the same (and related) underliers are margined as one portfolio. It reduces total required collateral when hedges are present, while still charging for the risks that remain.

The engine recognizes:

- Positions in Opposite Directions (Long vs Short): Gains on one leg offset losses on the other; margin deficits on one side can be covered by excess on the other, with charges applied to residual risks (basis, liquidity, jump risk).

- Offsets Across Product Types: The same underlying (e.g., $BTC) can be held as spot, futures/perps, and options. A unified account converts everything to risk-equivalent exposures (delta/gamma/vega for options, basis/jump risk for futures vs spot) and nets them:

- Basis Trade: long spot $BTC + short $BTC perp → close to delta-neutral, so the margin reflects basis/jump risk rather than full legs with materially lower liquidation probability for a hedged book.

- Covered Call: long spot $BTC + short call → margin reflects downside delta and short-call gamma rather than sum-of-legs.

- Protective Put: long $BTC + long put → downside capped, hence required margin drops sharply because the worst case is the put premium + residual gap.

Price & Risk Oracles

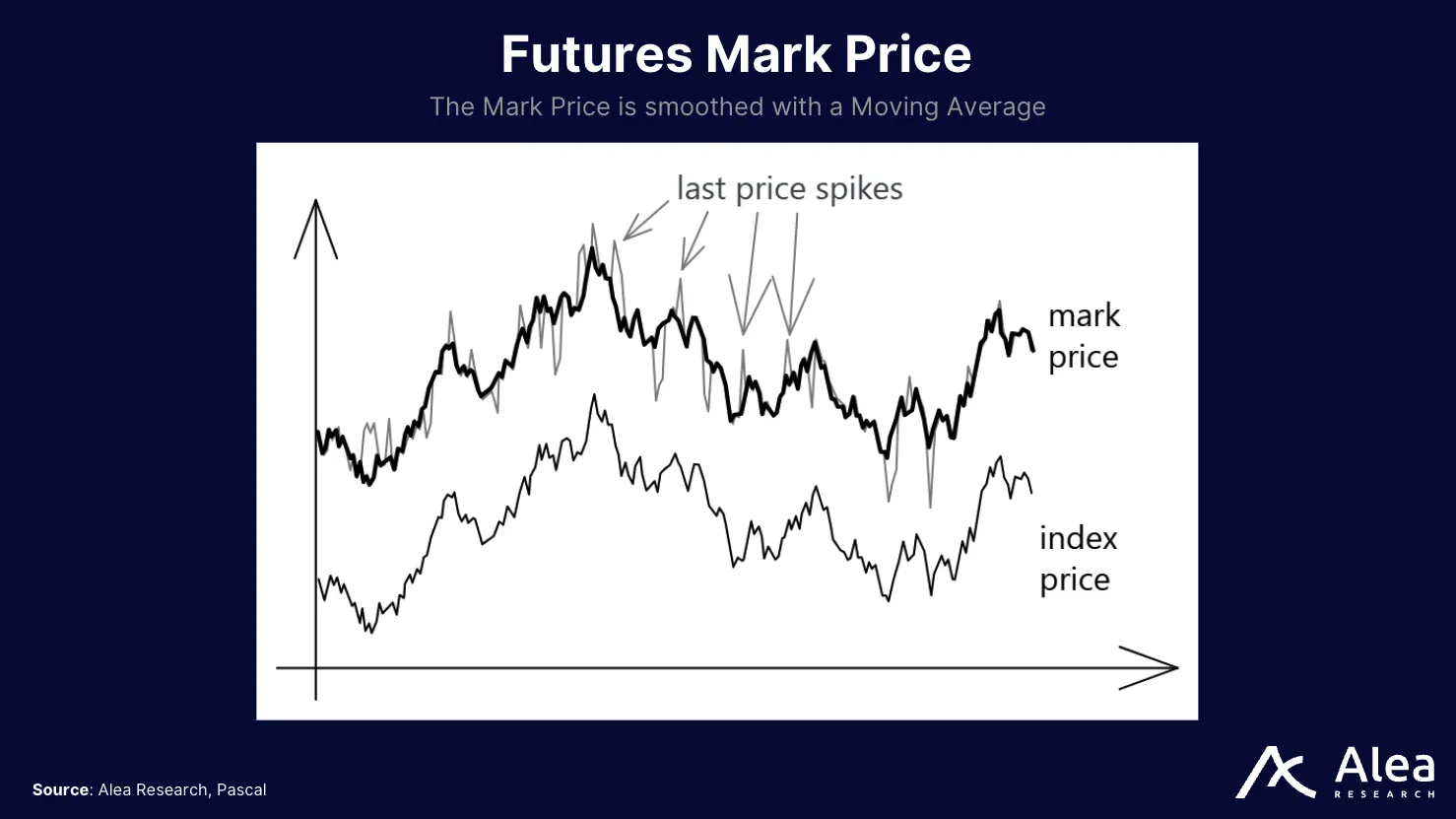

Price oracles help to mark positions to market, while risk oracles set the VaR parameters. For perpetual futures, the mark price uses an external index price (e.g., Chainlink or other trusted feeds) plus the mid‑point of Pascal‑powered order books, smoothed via a moving‑average basis. This design ties the mark to the broad market but adjusts for persistent premiums or discounts (e.g., funding), dampening wicks and making price manipulation much harder.

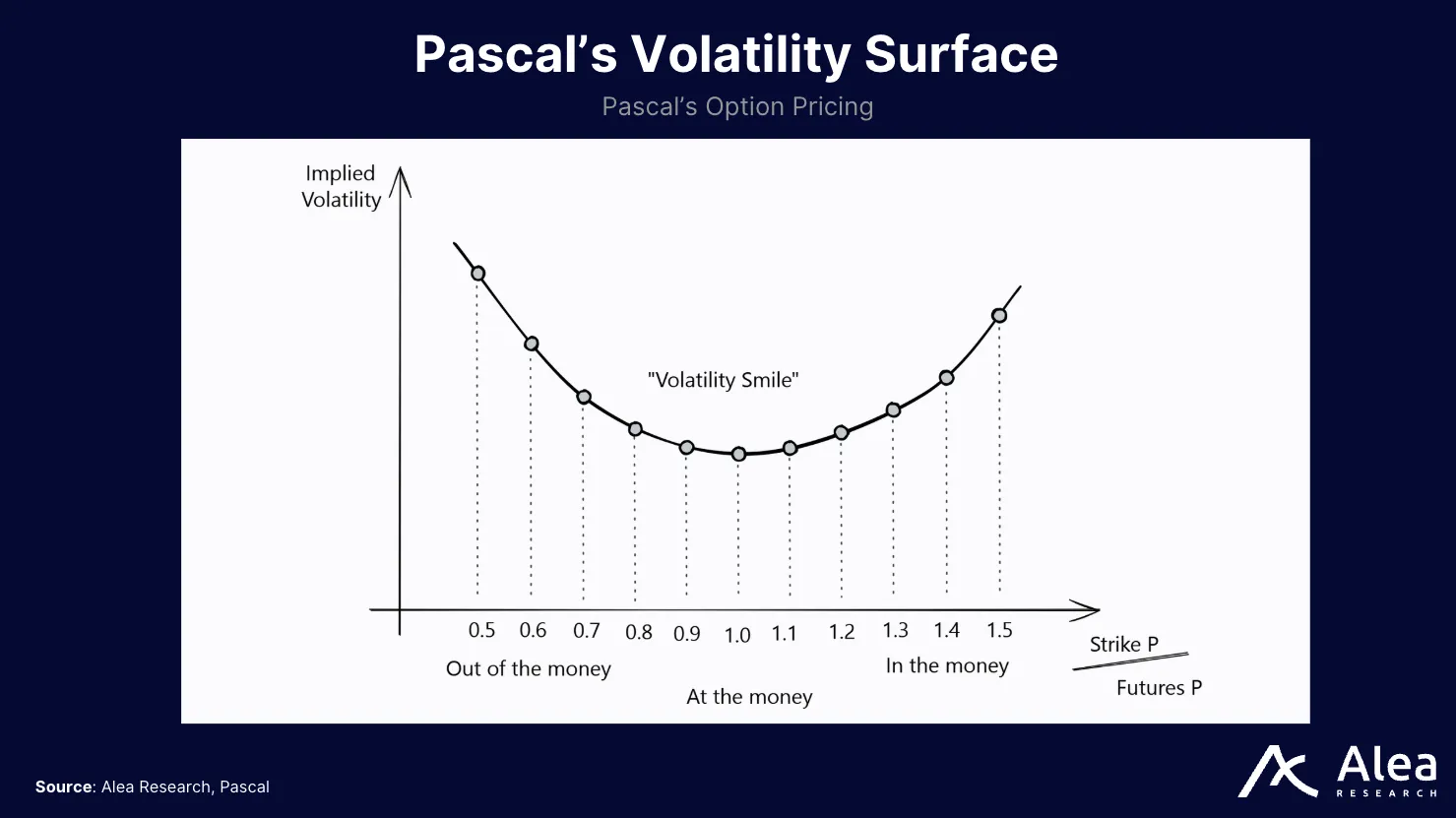

For options, platforms price contracts off an implied‑volatility surface as oracles publish volatility for each strike/expiry, and Pascal computes theoretical premiums using the Black-Scholes model. By marking options to model rather than last trade, the protocol avoids liquidating users in thin markets and adjusts margins when volatility spikes.

Risk oracles feed the VaR engine with live data by updating asset volatilities, correlations, gamma floors, and the IV surfaces used to price options. Today, these oracles are run by platform operators or trusted partners; however, over time, the goal is to decentralize data providers and allow governance to establish methodologies.

Clearance Bots

Pascal introduces Clearance Bots: a network of offchain agents that perform protocol‑defined tasks in a permissionless yet incentivized manner. Bots are needed because constant monitoring of margin ratios, timed events (contract expiries), and batching of order settlements would be gas‑prohibitive if embedded in every user transaction.

The bots carry out several operations:

- Order Clearing and Settlement: When a taker trade fills many resting orders, the smart contract moves the matched orders into a clearance queue. A bot processes this queue, settling each order with minimal gas so the taker doesn’t pay for everyone’s settlement. This makes deep order books feasible onchain.

- Periodic Tasks: Bots execute scheduled events like futures or options expiry, automatically closing positions at settlement price and canceling residual orders, and triggering funding rate payments or fee distributions.

- Margin Monitoring and Liquidation: Bots monitor margin ratios and call the liquidation function once an account reaches 100%. They also implement Default Prevention by canceling limit orders that would breach margin if filled. In liquidation, bots compete to trigger the process and earn a 0.5% share of the liquidation fee.

- Auto‑Deleveraging: If the default fund cannot cover residual losses, bots process the ADL queue by reducing profitable counterparties’ positions in a deterministic order. All bots follow the same queue logic, so the outcome is uniform regardless of who calls the function.

- Conditional Orders: Bots monitor price feeds to execute or cancel stop‑loss and take‑profit orders at the right time.

What makes clearance bots effective is determinism. The smart contracts verify that each bot call works according to the protocol rules, so if a bot tries to liquidate a solvent account, the call will revert. Anyone can run a bot, and the protocol’s operational fund pays gas and a premium for successful actions. In effect, bots turn Pascal into a permissionless clearing house, implementing margin and settlements 24/7 without a central operator.

Risk Methodology, Liquidations, & Bankruptcy Handling

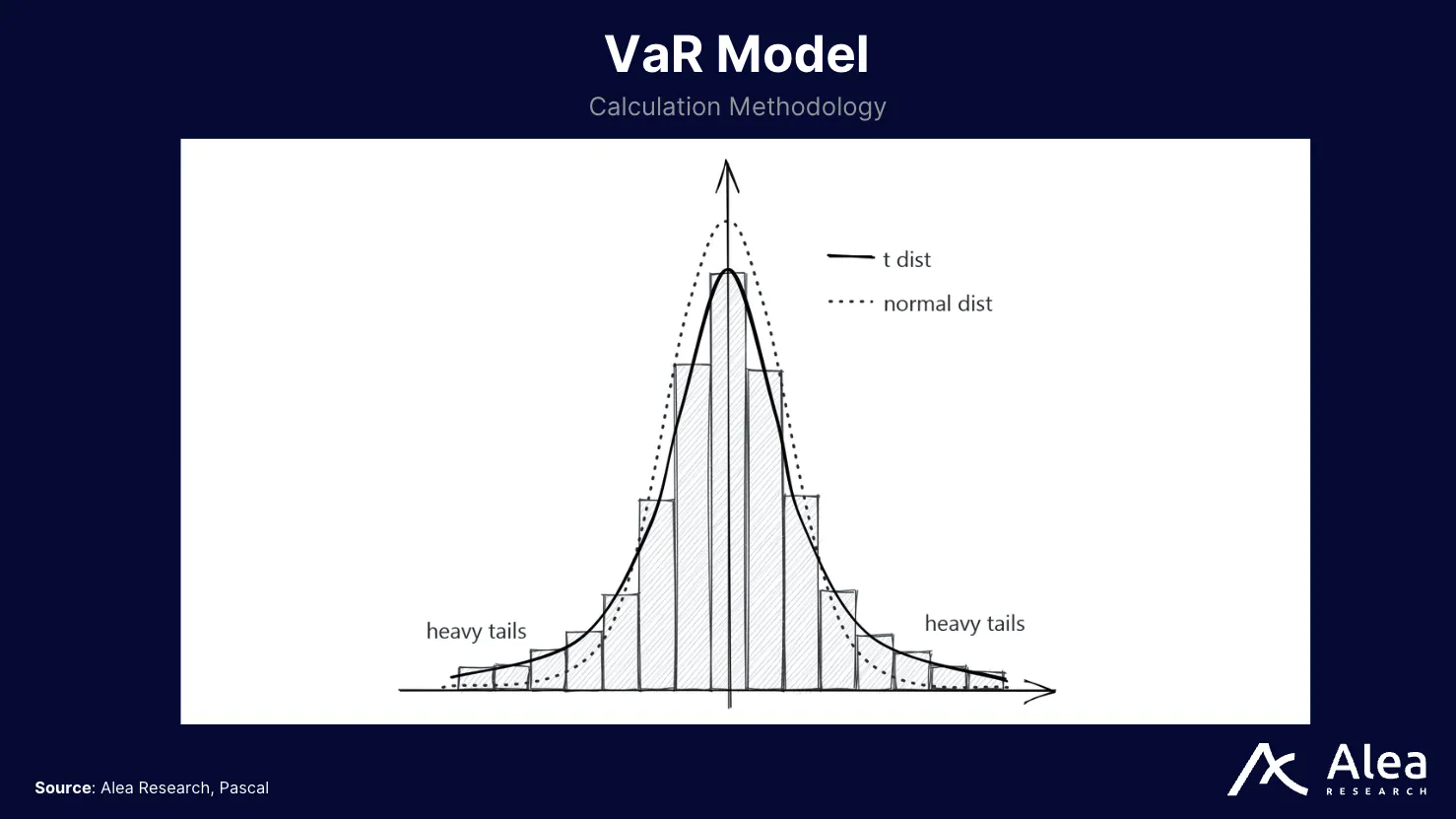

The core of Pascal’s risk stack is the portfolio VaR engine that prices tail risk explicitly (heavy-tailed distributions), refreshes volatility and correlations so diversification credit shrinks in stress, and applies options-adjusted guardrails (a gamma floor and concentration add-ons) to keep “delta-flat, risk-short” books honest. Losses are managed in a structured way by flowing through a transparent default waterfall, mirroring CCP best practices but enforced by code and fully observable onchain.

Portfolio Value-at-Risk Model (VaR)

Pascal’s margin considers the worst expected portfolio loss over a defined horizon and confidence, but the edge comes from how the engine has different risk parameters so that collateral requirements for hedges don’t underestimate tail exposure. In practical terms, Pascal’s margin model establishes that, with 99% confidence, losses over the next day will not exceed X. The value of X serves as the margin anchor for all positions.

Traditional VaR models assume returns follow a normal distribution, but crypto markets exhibit fat-tailed (leptokurtic) behavior, meaning they have a higher likelihood of extreme outcomes. This is due to persistent factors like 24/7 trading, leverage reflexivity, and thin order books. Gaussian VaR frameworks consistently miss these extremes, often allocating excess collateral in quiet periods and pulling back sharply during market stress.

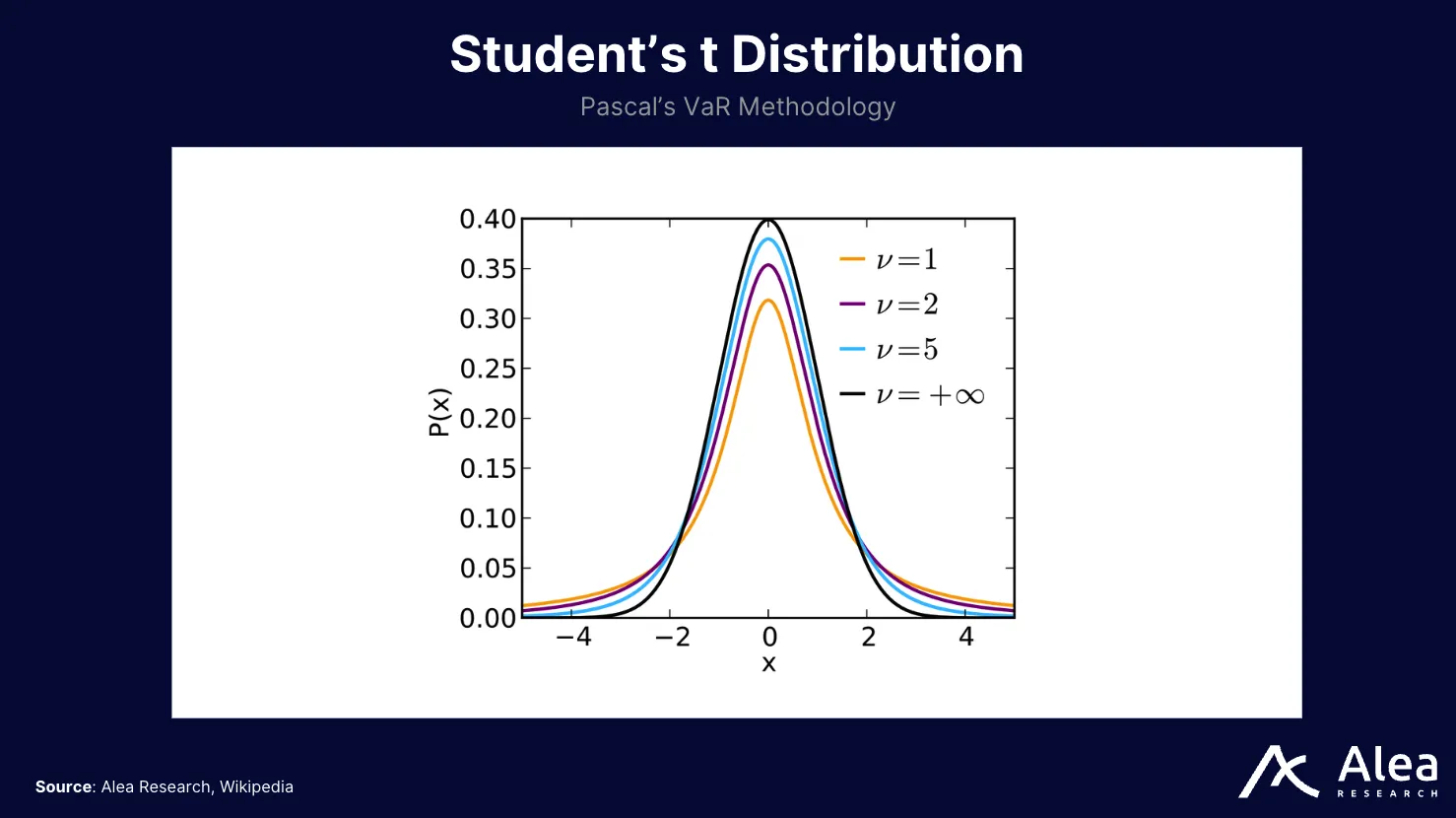

Pascal tackles this by introducing a Student’s t distribution, where the degree of freedom (v value) parameter directly controls the heaviness of the tail-end. This alone captures most frequently observed extremes in crypto without over-fitting the risk model to recent or outlier data.

Overall, this produces a safer and more reasonable margin as it front-loads tail risk rather than adjusting it as a crash happens, allowing portfolios that are genuinely hedged to have lower margin requirements as the engine recognizes the directional offsets and product types.

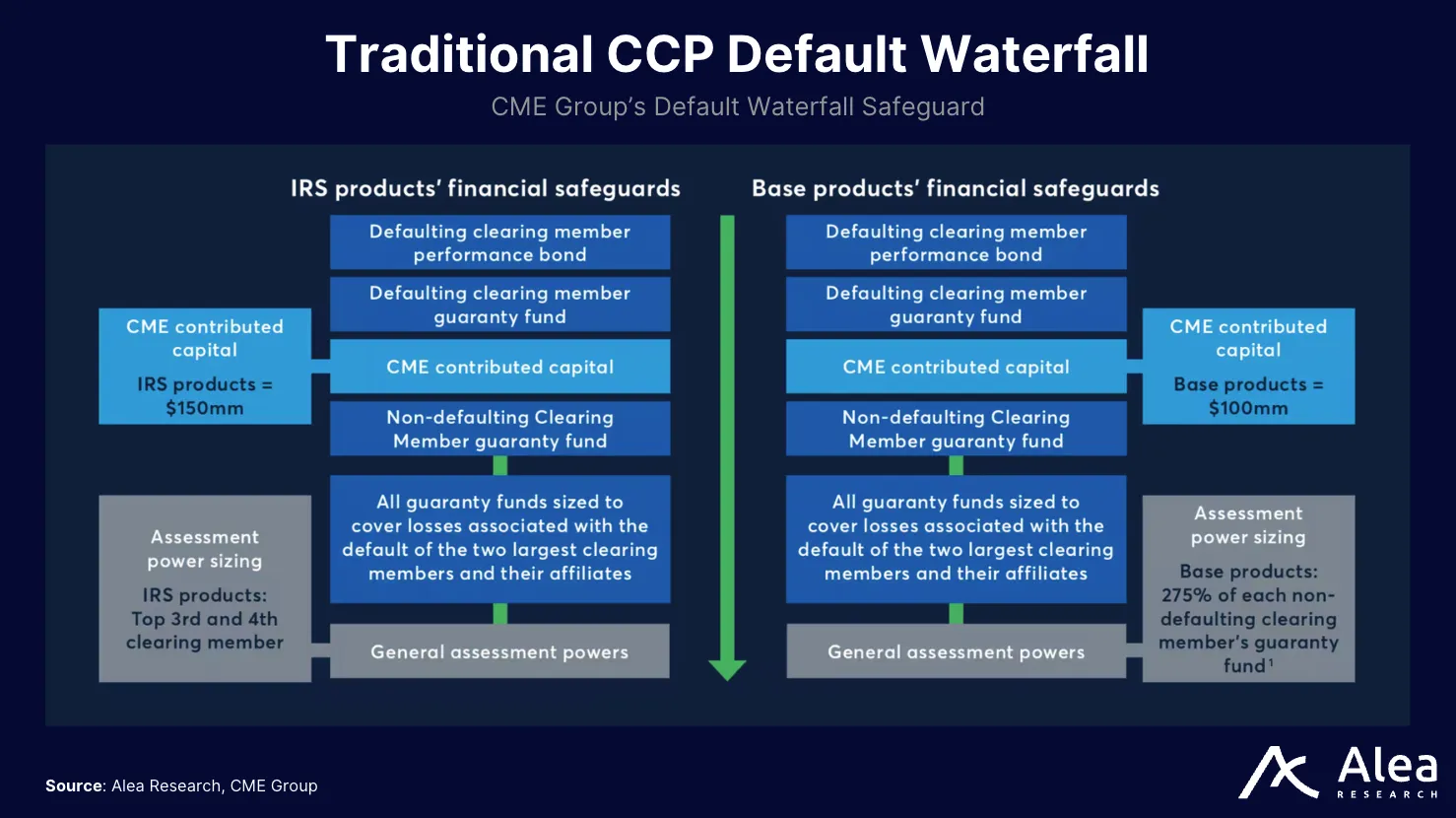

Default Waterfall & Bankruptcy Safeguards

TraditionalCCPs use a default waterfall to absorb losses from a clearing member’s default in various structured tiers to protect the market and other non-defaulting members. In practice, this often starts with the defaulter’s resources, including their margins or any default fund contributions.

Once those are exhausted, the CCP goes a tier down to tap into mutualized resources. Many CCPs place their own capital ahead of non-defaulting member funds to align incentives. For example, CME states it “takes the first loss via its own contributions… prior to using any resources of non-defaulting clearing members,” before moving to mutualized guaranty funds and assessments. After the CCP’s capital, mutualized default funds (risk-based contributions from all members) absorb remaining losses.

Pascal implements the same logic onchain:

- Tier 1: Defaulter Equity + Liquidation Proceeds: When an account’s margin ratio hits 100%, clearance bots initiate liquidation under deterministic rules. The system first attempts to fill-or-kill market orders within a price band (within 2% of the mark price) to contain slippage. Proceeds and any remaining collateral are applied to losses.

- Tier 2: Default Fund (mutualized, capped): If liquidation proceeds are insufficient, the platform’s onchain Default Fund pays the residual, so solvent counterparties receive their full P&L. Each integrated platform (e.g., perps DEX vs. options) maintains a separate fund, so incidents are siloed. Usage caps (~10% per liquidation event, ~25% per 24h) prevent a single blow-up from draining coverage and preserve capacity for subsequent events.

- Tier 3: Auto-Deleverage (ADL)( last resort backstop): If the fund’s caps are reached (or exhausted), Pascal closes risk against opposite positions in an ordered ADL queue at mark price, prioritizing the most in-the-money/risky counterparties. Traders deleveraged by ADL can re-enter immediately with their deleverage rank surfaced in front ends for transparency.

Use Cases & Integration Paths

Pascal’s neutral clearing layer enables advanced trading and hedging in DeFi that were previously impractical due to capital and infrastructure constraints. By providing unified portfolio margining and cross-asset netting, builders can create offerings that mirror TradFi risk handling onchain.

Perpetual and Futures DEXs

Traders take offsetting positions in highly correlated or related perpetual contracts to exploit price differentials or hedge exposures. Examples include spread trades (long $BTC-PERP vs short $ETH-PERP), basis trades (long spot/short perp to capture funding rates).

On existing platforms, even if cross-margin is offered, these positions often require margin almost as if they were separate from each other. For instance, long $BTC and short $ETH on different platforms would each need full margin, which is highly inefficient since $BTC and $ETH are highly correlated. Even on the same platform, many systems wouldn’t substantially reduce margin for the pair or might not even allow cross-asset offset.

Pascal’s VaR-based engine margins the portfolio, not each leg in isolation, so correlated pairs receive offset credit rather than duplicative requirements. The design explicitly supports portfolio-level netting and can materially reduce collateral for hedged books.

Options Venues

DeFi options sellers typically must over-collateralize; for example, selling 1 $ETH call often requires locking 1 $ETH (for a covered call) or equivalent stablecoin margin, which may approach the underlying’s value if the position is naked. That erodes much of the yield potential. Complex strategies are hard to execute because each leg is treated separately, which requires a lot of collateral and transactions.

Pascal treats options and futures/spot on the same underlying as one risk book. In a covered call, your long $ETH and short call are directly offset. The required margin would essentially be the small gamma risk of that position, which is practically the risk that $ETH mooned so fast that your short call lost slightly more than your long $ETH gained in the short term. This amount is modest (reflecting maybe a 1-2 day extreme move).

Thus, a covered call writer under Pascal can free up nearly the entire value of their $ETH to use elsewhere, versus having it idly sitting as “cover.” This could drastically boost the return of options vaults (like those run by protocols selling weekly options for yield).

Structured Vaults

DeFi vaults combine derivatives to produce specific payoffs such as principal-protected notes, yield enhancement notes, or automated delta-neutral strategies. This includes things like Ribbon’s theta vault (options selling), Yearn-style vaults that farm yields and hedge, or more exotic products like “tranching” vaults that offer leveraged upside vs downside protection.

Many of these structured products need either very high collateral to assure outcomes or cannot operate continuously due to margin constraints. For example, a vault that sells perps to generate yield and uses the proceeds to buy upside options (to cap risk) would find it hard to do on separate platforms without manual balancing and lots of capital.

Pascal’s unified margin account means the vault can hold a mix of perps, options, spot (tokenized as perp positions or collateral), and Pascal will margin it collectively. This reduces redundant capital and makes multi-leg strategies operable onchain.

Conclusion

In TradFi, markets only scaled when clearing houses standardized risk by netting exposures, setting portfolio margin, and handling defaults in a structured manner. Pascal brings that onchain as a neutral layer that prices tail risk properly, unifies margin across perps, options, and spot, and enforces deterministic liquidations.

A transparent default waterfall mutualizes residual losses and caps contagion, giving allocators something DeFi rarely offers: predictable loss paths and cash flows that can be underwritten. If DeFi wants to graduate from isolated exchanges to truly integrated markets, it needs clearing. Pascal introduces the very primitive method to turn fragmented collateral into capital efficiency at scale.

References

Trade Finance Global: Clearing House

ISDA: Key Trends in the Size and Composition of OTC Derivatives Markets in the Second Half of 2024

Deutsche Bank: Central Securities Depositories – Clearstream

Kantox: Central Counterparty Clearing House (CCP)

LCH: LCH SwapClear

ISDA: Required Initial Margin for Cleared Interest Rate and Credit Default Swaps

Deutsche Boerse: Central Securities Depositories

Glassnode: What Really Happened to MakerDAO

DefiLlama: DeFi Perpetuals and Spot Volume, DEX Volume

Pascal: Dual-Chain Architecture

Arbitrum: Stylus MultiVM

Crypto.com: What is Smart Cross Margin?

Pascal: Futures Mark Pricing

Pascal: Implied Volatility Surface

Wikipedia: Student’s t-distribution

CME Group: Clearing Financial Safeguards Waterfalls

CME Group: Risk Management Financial Safeguards

Disclosures

Alea Research is engaged in a commercial relationship with Pascal Protocol and receives compensation for research services. This report has been commissioned as part of this engagement.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.