Introduction

Oasys is an EVM-compatible blockchain launched in 2022 by a consortium of game studios, including Bandai Namco Research, SEGA, Square Enix, and Ubisoft. It targets games that need high throughput and frequent small payments. It runs a Layer 1 Hub chain and supports multiple Layer 2 Verse chains, enabling apps to settle transactions quickly without requiring players to pay gas fees.

Oasys is headquartered in Singapore, with a core team in Japan affiliated with doublejump.tokyo. It gained early traction in Asian gaming markets and built partnerships with SBI Holdings, Animoca Brands, and other industry groups.

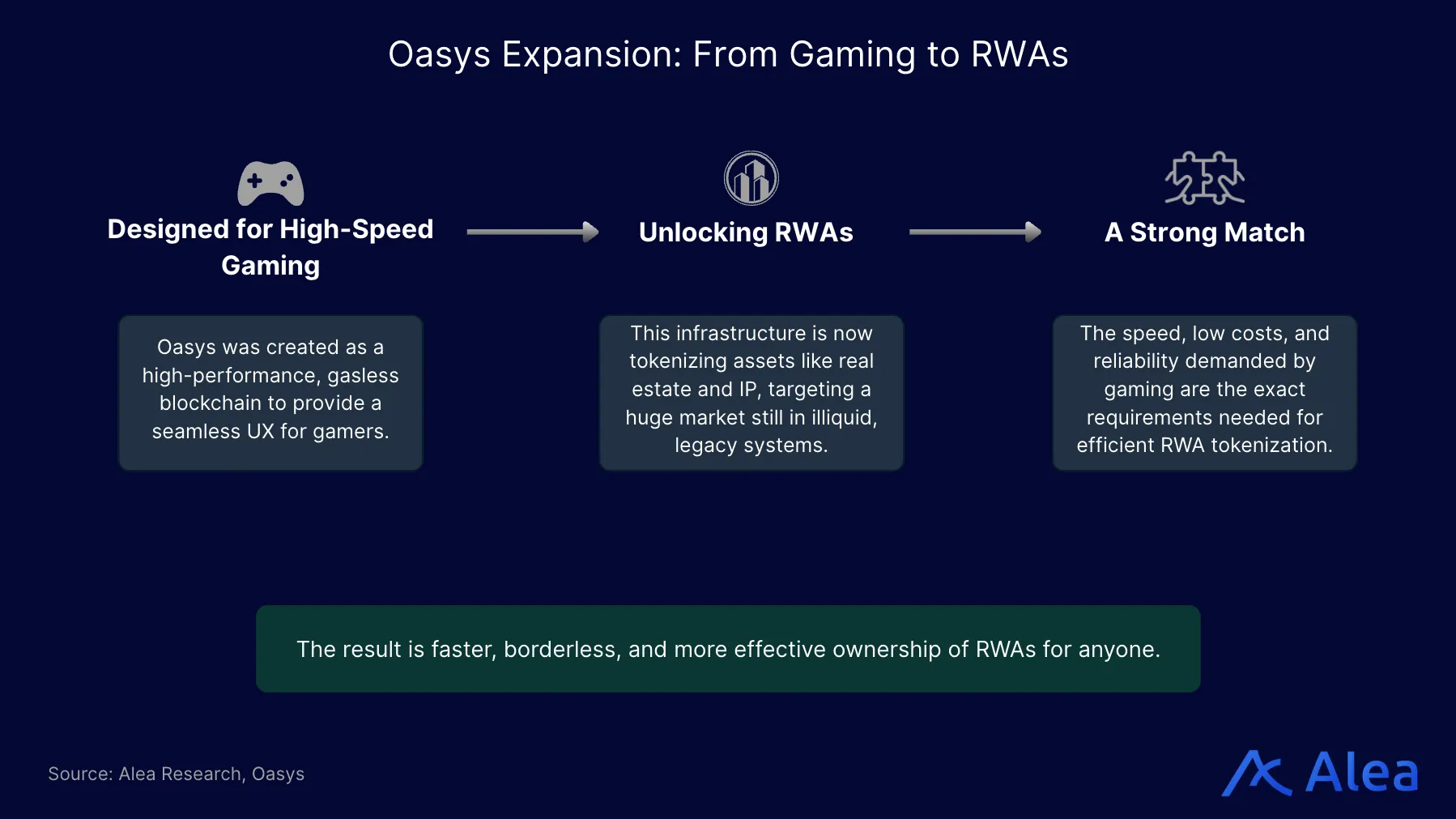

Oasys started as a chain for onchain games and broader user adoption. It is now expanding into RWAs and IP tokenization. It aims to use its existing stack and game-style product design to bring offchain value onchain, with a focus on tokenized assets in real estate, entertainment, and finance across Asia.

Key Takeaways

- From gaming to RWAs with high-performance, gasless infrastructure: Oasys delivers ~1,500 TPS and hides gas fees from users, a UX edge when moving high-frequency RWA or IP tokens, retaining the UX advantages of gaming (speed, low cost, ease of use) while targeting a much larger market.

- Modular hub + Verse design: Institutions can create permissioned, EVM-compatible Verses that anchor to the Hub for security. A strong fit for security tokens across fragmented Asian regulatory frameworks.

- First-mover timing advantage in the Asia-Pacific RWA race: With regional regulators currently designing legal frameworks, Oasys has already secured regulatory approvals that could accelerate go-to-market for new partners and use cases.

- Institutional alignment via SBI Holdings: Backing and integrations with institutional players position Oasys as a potential settlement layer for tokenized bonds, REITs, and funds, in a region where institutional RWA pilots are gaining traction.

- Gaming, payments, and tokenized assets in one Ecosystem: Oasys aims to be the ecosystem where video games, NFTs, stablecoins, and tokenized RWAs coexist for retail users, making it easy to play, pay, save, and invest within the same environment.

- Tokenizing intellectual property in Asia: Oasys enables the tokenization and monetization of IP (anime, music, art), focusing on Asia as the primary market.

Opportunities and Challenges of Tokenizing RWAs and IP

RWAs are one of the clearest uses of blockchains. Tokenization can turn illiquid assets such as real estate, commodities, and IP into digital tokens that people can split, trade around the clock, and settle onchain. Smart contracts can also automate payments and other cash flows.

In Asia, Singapore and Hong Kong have already run pilots for tokenized bonds and securities. These pilots show how tokenization can speed up settlement and broaden investor access.

Market data and institutional participation suggest the category is moving from theory to deployment. More than $18 billion in RWAs are already onchain, with private credit and U.S. Treasuries as leading segments. Large banks and asset managers are also participating, which points to growing alignment across infrastructure, capital, and demand.

Some forecasts project a much larger market by 2030 and beyond. If that growth materializes, protocols will still need to solve practical constraints, including interoperability, regulatory requirements, liquidity, and user experience. In that context, Oasys could compete by offering tokenization rails that support compliant issuance and low-friction, gasless transactions for issuers and end users.

The Asia-Pacific region has strong growth and tech-savvy users, so tokenization could scale once builders and regulators remove the key barriers. Platforms still need to do three things well: comply with local regulations, provide real liquidity, and be simple for users.

Asia’s entertainment industries—anime, K-Pop, and gaming—also create a natural fit for IP tokenization. Projects can use it to organize fan communities, and creators can use it to share revenue with holders.

RWA and IP tokenization are gaining traction, but Asia faces practical hurdles. Countries move at different speeds on regulation, and infrastructure remains fragmented. Many products still feel clunky, so users hesitate to trust them. IP adds another layer of risk: generative AI can fuel deepfakes and unauthorized copies. Cross-border trading of tokenized assets is also still early, and weak interoperability limits where assets can move.

Asia’s tokenization market faces four frictions: disconnected rails, shifting rules, poor user experience, and AI-enabled IP abuse. Oasys says it can address these issues through a single integrated stack.

| Challenge | Barriers to Adoption | Oasys’ Strategic Solution |

| Fragmented Infrastructure | Assets live on different chains that aren’t interoperable with each other, and legacy banking systems can’t be plugged in | Oasys’s Hub + Verse architecture lets each institution run a custom, permissioned Verse that still inherits Hub security and bridges many silos |

| Regulatory patchwork | Asset classes are labelled differently across Asian jurisdictions; issuers face duplicative approvals, and investors hesitate | OAS is already listed on Japan-FSA-licensed SBI VC Trade, Rakuten Wallet, OKCoin Japan, Upbit, and more, giving a compliant template for other Verse-level licences |

| User-experience gap | Complex wallet setups, the need to manage private keys, and opaque fees deter mainstream users and institutions alike | Gasless transactions and EVM-compatible wallets reduce onboarding friction |

| AI-driven IP risk | Generative models obscure authorship, making provenance and royalty enforcement more difficult. Laws are not keeping pace with this technology. | Protocols like AnimeChain (not yet launched) on Oasys can hash creative works onchain, time-stamp provenance, and automate royalty splits via smart contracts. |

Oasys uses a Hub + Verse design to link otherwise separate chains. It also allows institutions to run their own permissioned subchains. In Japan, Oasys has listings on FSA-registered exchanges such as SBI VC Trade, Rakuten Wallet, and OKCoin Japan, which gives it a compliance path it can reuse. Its EVM wallets remove gas fees for users and can integrate with Rakuten Points.

Oasys is also working with AnimeChain to register creative works onchain, prove provenance, and automate royalty payments. These pieces support its push beyond gaming into RWA and IP tokenization: it connects fragmented rails through its multi-layer network, leans on licensed exchange partners and marketplace ties for compliance, and reduces user friction with gas-free transactions and familiar interfaces.

Oasys’s Strategic Expansion

Oasys started as a gaming-first chain: a fast, gasless, EVM-compatible network built to keep the player experience smooth. Gaming still matters, but the team sees the same base layer as a fit for RWA tokenization, which also needs speed, low fees, and reliable rails.

Most RWAs still sit in legacy, illiquid systems. Tokenization could make ownership easier to transfer and easier to access across borders. But the blockers are not only technical. Adoption depends on culture, trust, and clear regulation.

Oasys is expanding beyond gaming through partnerships and new programs in finance and IP. It is not rebuilding from zero. It is reusing its gaming stack and community and working with established finance, e-commerce, and media firms so these new products can meet compliance requirements and be simple to use.

Oasys has gained the most traction in Asia, where gaming is mainstream and major companies back digital asset ownership as validators and ecosystem partners. Asia also accounts for a large share of global game developers, player base, and video game revenues, particularly in Japan, South Korea, and China. Clearer rules in places such as Japan and Singapore have also supported blockchain gaming, NFTs, and broader Web3 activity.

In May 2023, SBI VC Trade—an exchange regulated by Japan’s Financial Services Agency (FSA)—listed OAS. That listing placed OAS among the small set of tokens Japanese retail investors can legally trade, as Japan allows retail trading only for tokens that clear a formal screening process.

In May 2024, SBI’s NFT marketplace, SBINFT Market, added support for Oasys L1 and Verse NFTs with yen-denominated trading. That lets local users buy and sell in JPY without first acquiring crypto. The marketplace also limits listings to KYC-verified creators to meet local rules.

In August 2024, Oasys formed a strategic alliance with SBI Holdings and raised capital from the group. The deal gave Oasys fresh funding and a clearer path into Japan’s regulated distribution and on-ramp channels through the SBI network.

Oasys also expanded through Rakuten Wallet, a payments app that has operated as a crypto exchange since August 2019. Rakuten also runs Rakuten Points, a loyalty program that millions of Japanese consumers earn and spend on shopping, travel, and bills.

In February 2025, Rakuten Wallet listed OAS. Users can now convert Rakuten Points to OAS within the same app they use for in-store purchases and online checkouts. That gives Oasys a regulated, low-friction on-ramp for people who have never used crypto, pulls in local liquidity, and turns loyalty points into a live tokenization use case. It also provides Rakuten with a repeatable model for issuing other assets, such as gift cards, branded IP, or even securities, on Oasys’s gasless rails.

In March 2025, Oasys launched Yukichi.fun, a token-creation tool that enables users to mint custom tokens on Oasys via a simple web interface. Users pick basic parameters and deploy a token in minutes, typically using OAS or other supported tokens.

Yukichi.fun matters because it makes token creation cheap and fast. Game teams can use it, but so can creators or small businesses that want to test a token for an asset, access pass, or loyalty program. Even if Oasys markets it for gaming, the tool can also support early experiments in RWA and IP tokenization.

In July 2025, GATES Inc., a Japanese real estate firm, partnered with Oasys to launch a $75 million tokenization of central Tokyo real estate assets. The goal is to open Japanese property investing to a global audience by offering fractional ownership and simplifying common hurdles, including legal processes, language barriers, and fees. Phase 1 targets up to $34 billion in token liquidity. Over time, GATES aims to tokenize more than $200 billion of its holdings—about 1% of Japan’s ~$20.5 trillion real estate market.

On IP, Oasys partnered with AnimeChain to reduce copying and misuse linked to generative AI and to tap into Japan’s anime industry. In March 2025, the two announced a partnership in which AnimeChain provides AI-focused production tools, and Oasys provides a gas-free onchain record. In pilots, they plan to hash and timestamp frames and character designs, track how models use the material, and route royalties through NFTs that encode licenses or revenue shares. If it works for anime, the same pattern could extend to music, film, or game IP facing similar AI-driven infringement risks.

These moves target Asia’s strengths. SBI lends financial credibility in Japan. Rakuten adds consumer distribution. AnimeChain ties Oasys to culturally valuable IP.

Together, these partnerships also give Oasys more legitimacy and more support as it moves into RWAs. Listing OAS on regulated exchanges and marketplaces reinforces its compliance posture, which it will need to run RWA products at scale.

Architecture

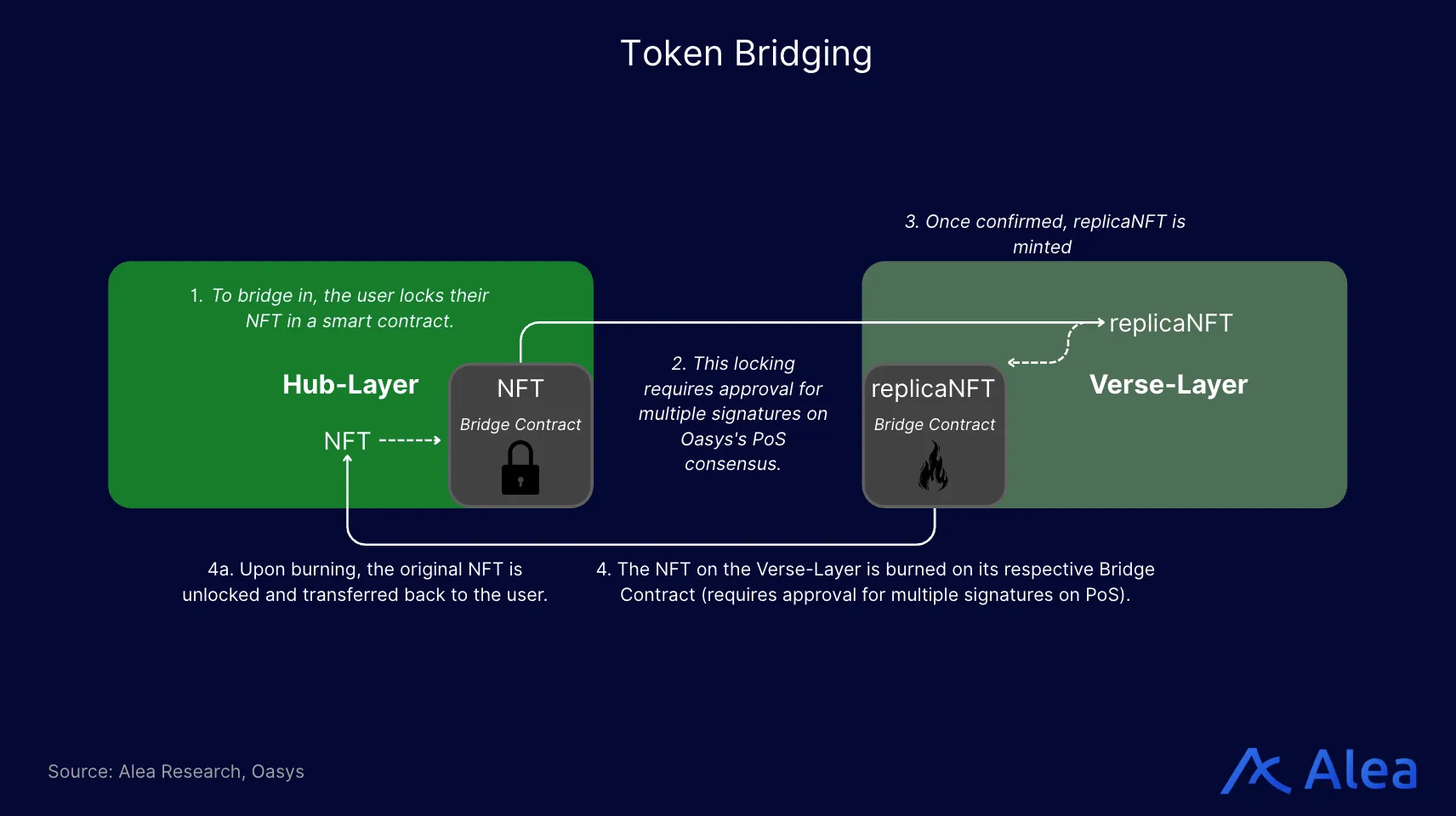

Oasys runs a two-layer design: a Layer 1 Hub chain and multiple Layer 2 Verse chains that use Ethereum-style scaling tech. The network lets projects launch specialized sub-chains for specific use cases. Enterprises can deploy custom Verse chains and anchor them to the Hub for shared security.

Oasys also targets fast, gas-free transactions. It built this setup for games, but the same features can support RWAs by making transfers cheaper, faster, and easier to use across borders.

The Oasys Hub is the Layer 1 backbone of the network. It stores network data and posts the batched transactions that the Layer 2 Verse chains produce. The Hub keeps the network’s shared state. It records token data for both fungible tokens and NFTs, and it maintains the data that supports bridges and cross-chain movement. Because every Verse anchors to the Hub, a Verse can rebuild its full state from Hub data if it loses local records.

The design follows the basic pattern of optimistic rollups, but Oasys tuned it for high-traffic apps like games and enterprise systems. Industry partners such as SEGA, Ubisoft, Nexon, and Rakuten Wallet validate the Hub and help secure the data it stores. Many people still frame Oasys mainly as a gaming and RWA chain, but the ecosystem supports a wider set of use cases.

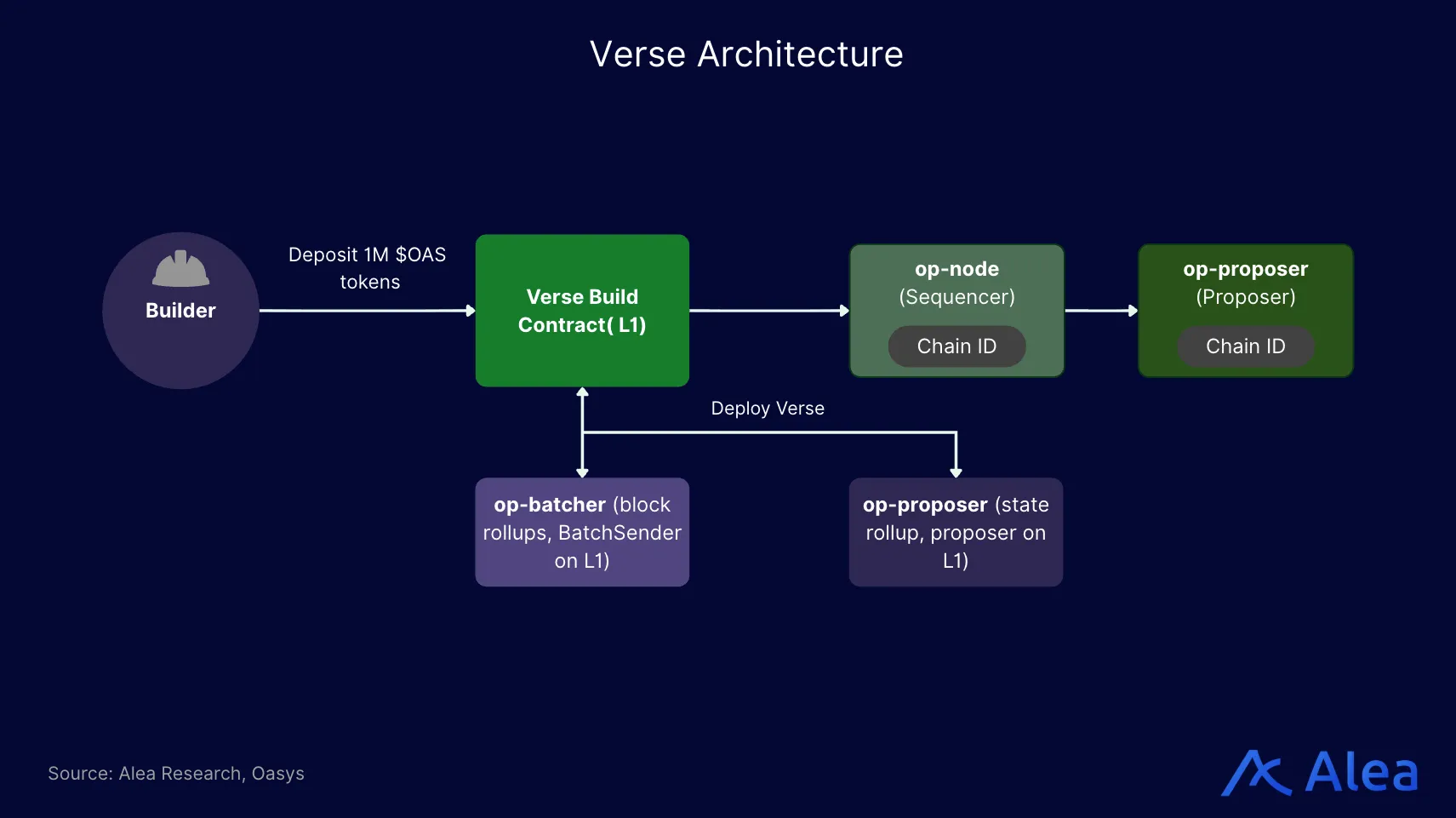

Verses are specialized Layer 2 chains that run application logic, mainly for games. Developers own and operate them as customizable rollups connected to the Hub. Each Verse processes transactions offchain, then bundles the results into blocks. An “Appointed Verifier,” chosen by the Verse, signs those blocks. This setup confirms activity quickly.

Verse builders can tune each chain’s rules, permissions, whitelists, and throughput targets while staying interoperable with the Hub and other Verses. Verses can also keep the user experience fee-free by having the app or validator pay gas, so the flow feels closer to a Web2 product.

Verses serve app teams with specific needs—mostly games, but also marketplaces, trading, and RWAs. A game can run on its own Verse, mint in-game items, then let users verify or trade those items on another Verse or on the Hub. You can also run Verses for value-transfer systems or supply chains that use the Hub as a shared record. This setup keeps the user flow simple: no gas prompts, quick confirmation, and performance that feels like a standard app, even for people new to crypto.

Oasys built this two-layer setup to scale beyond a single chain’s limits. Verses handle execution, and the Hub anchors consensus and shared state. That split lets the network process high transaction volumes—often cited at 1,500+ transactions per second—with a Web2-like feel and roughly 30-second finality. Each Verse can also set its own rules, permissions, and throughput targets while staying compatible with the Hub and other Verses. A validator set made up of known industry partners secures the Hub’s data, which helps Oasys balance speed with a clear security model.

Oasys and its Verse chains support the EVM, so developers can write contracts in Solidity and use standard Ethereum tools. Oasys chose this to make building easier: developers who know Ethereum or other EVM chains can port code with minimal changes.

EVM support also matters to enterprises and institutions because it fits the common industry stack and works with existing wallets and infrastructure. An IP tokenization app can rely on familiar ERC standards—for example, ERC-721 for NFT-based rights or ERC-20 for fungible tokenized assets—so wallets and exchanges can support the assets without custom work. EVM support also makes it easier to bridge assets to and from Ethereum or other EVM networks, which can matter for liquidity if a token needs access to deeper DeFi markets.

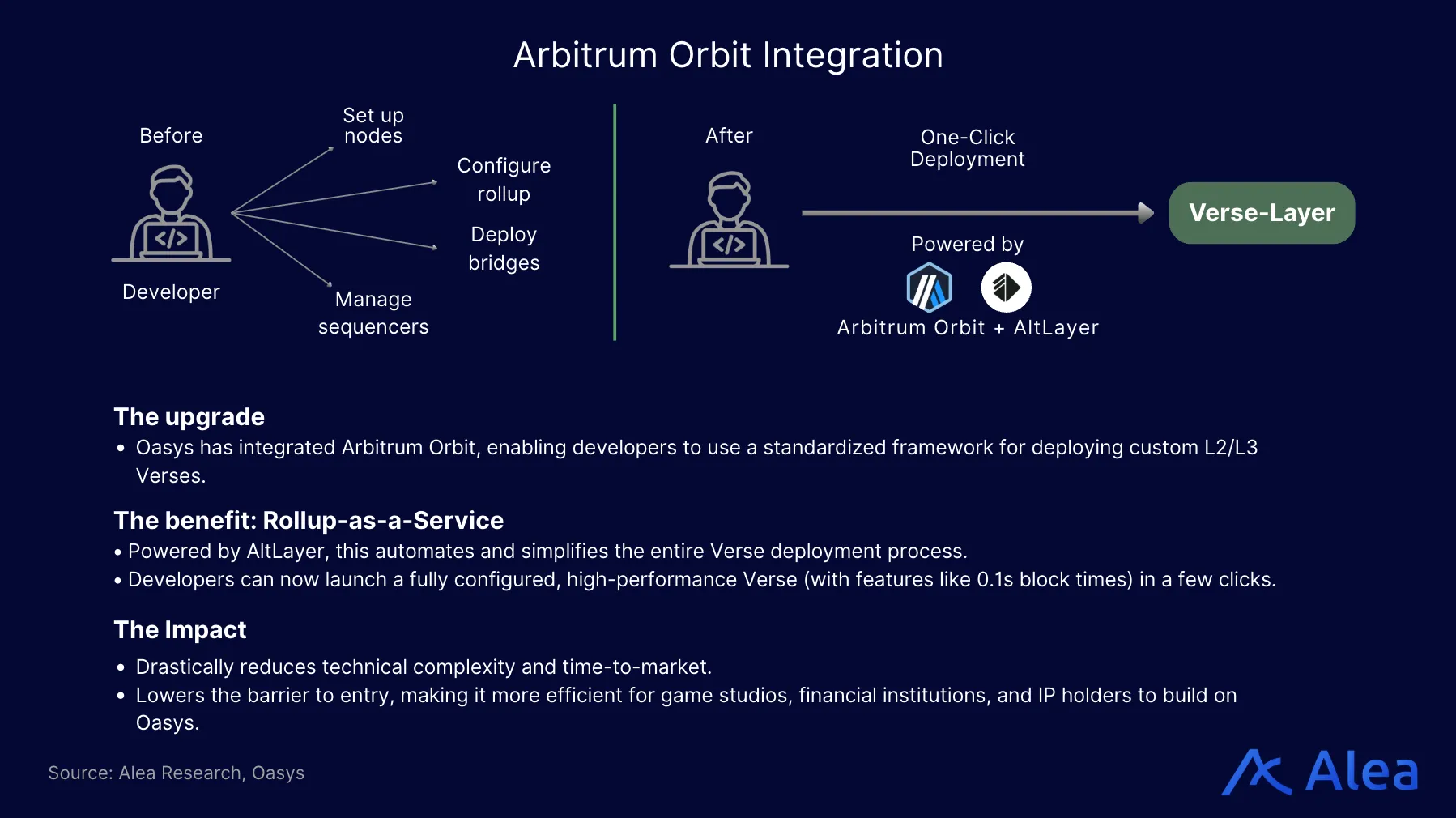

Oasys recently integrated Arbitrum Orbit into its Verse layer. Before this, Verse chains ran only on Oasys’s in-house stack. Now developers can launch custom L2 or L3 Verses with Orbit, including 0.1-second block times and rollup-as-a-service support through AltLayer.

Orbit also lets Verse builders tune latency, throughput, and permissions while keeping Verses interoperable with the Hub + Verse system. This gives Oasys more options for how teams design and run Verse chains.

Investors are betting that teams need strong rails before they can ship scalable, high-quality onchain games. Oasys already fits that thesis. It offers a gaming-first Hub + Verse setup, zero gas fees for users, and EVM support that matches the tooling most teams already use.

Today, launching a Verse still takes work. Teams must set up nodes, rollup settings, bridges, sequencers, and permission systems. Arbitrum Orbit changes the workflow by giving Verse builders a standard rollup framework. AltLayer adds rollup-as-a-service that automates much of the setup. With both in place, studios can launch an Orbit-based Verse on Oasys with preset choices for block time, permissions, and Hub connectivity. That cuts setup time, lowers the skill required, and helps teams ship games faster.

Implications and Potential Use Cases

Oasys is turning from a gaming-focused chain into a broader platform, which could matter to both institutions and retail users. It still targets games, but it is also building for finance, IP, and tokenized physical assets.

If it succeeds, Oasys could show how a niche chain can grow into shared infrastructure without giving up performance or compliance. Many general-purpose chains struggle to balance those goals. Oasys is trying to stay a strong home for games while also supporting tokenized RWAs, copyrights, loyalty points, and financial securities. It also aims to connect with both Web2 systems and other blockchains.

Institutional Finance: Asset-Backed Tokens and Marketplaces

With its partnerships in traditional finance (SBI) and exchange integrations, Oasys is well-positioned to host asset-backed token issuance for institutional players in Asia. Think of a regulated issuer using Oasys to mint tokens that represent ownership in an RWA. A REIT could tokenize shares. A commodities fund could tokenize claims on barrels of whiskey or kilograms of gold.

Oasys could route these tokens through compliant channels. Investors could trade them on licensed venues such as SBI VC Trade. Or an issuer could run a permissioned Verse that only admits KYC-verified investors. Onchain settlement would clear trades in minutes or seconds instead of the multi-day cycle that many traditional markets use. Tokenization also makes fractional ownership straightforward.

Institutions could also hide the crypto complexity. A custodian can hold keys or manage wallets for clients, so users interact with a familiar account model. Oasys’s throughput reduces the risk that trading activity clogs the network. Multiple Verses also let issuers isolate products by venue or asset class—for example, one Verse per bank, exchange, or fund.

If Oasys keeps focusing on Asia, it can align with regulators such as Singapore’s MAS and Hong Kong’s SFC, which have explored tokenized securities. Combined with Oasys’s partnerships in real estate and finance, that focus could make it a common infrastructure choice for regional pilots and production deployments.

Retail Finance: Unified Gaming and Financial Services

Oasys could integrate gaming and finance into a single network. It plans to keep hosting game assets such as NFTs, in-game currencies, and virtual items while adding real-world tokens. That could let users hold and move entertainment assets and financial assets in the same wallets and apps.

For instance, a user in Tokyo who uses Oasys. In a single Oasys wallet app, they could hold:

- Some OAS tokens

- A few NFT characters or skins from an Oasys-based game

- A tokenized share of a music royalty from an anime song

- Perhaps a stablecoin or tokenized yen that’s used for day-to-day transactions

- And even a fraction of a real estate asset or a bond that was offered on an Oasys marketplace

This setup could make Oasys a one-stop network for digital assets with a user flow that feels simple and familiar. A player could earn loyalty points in a game, swap them into a stablecoin, then buy a tokenized asset—all in the same ecosystem.

It could also narrow the gap between playing and investing. Games could reward time and skill with assets that carry real-world value. In the other direction, people could manage real-world investments with the same ease as in-game inventory. Oasys’s gaming roots push it to treat user experience and engagement as core product work, which many financial apps still neglect.

This mix of GameFi and regulated finance may fit younger users in Asia who already interact with mobile games, digital collectibles, and personal investing.

IP Monetization and Fan Engagement

Through AnimeChain and similar programs, Oasys could host platforms that tokenize IP. Think an anime launchpad on Oasys. A studio could raise funding by selling tokens tied to a new series. Fans would buy them to back the project and, in return, get a claim on future royalties or access to exclusive content.

Smart contracts could then pay token holders automatically when the project earns revenue from streaming licenses, merchandise, or other deals. That structure already has a place in industry conversations. Oasys could make it easier to run it inside a compliant wrapper, such as restricting access if the tokens look like securities.

IP holders could also mint licensed collectibles that carry real rights, not just images. An NFT could grant permission to make certain derivative works or use a character in a fan game, with the terms written into the token. Onchain records would also help track ownership history and licensing terms across transfers.

Conclusion

Oasys has built a strong stack and a clear Asia-first strategy. Its modular Hub + Verse design, gas-free user flow, EVM support, and regulated integrations in Japan give it an advantage in markets where rules and local partners decide who can scale.

It still faces competition in Web3 gaming from Immutable, Ronin, Polygon, and Avalanche. Its clearer angle is to run gaming and tokenized RWAs on the same network. With SBI Holdings as a backer and distribution partner, Oasys could draw a meaningful share of institutional interest in tokenized assets across the region.

To make that case real, Oasys needs to deepen its foothold in Japan, bring in more globally recognized IP, and connect its assets to wider DeFi liquidity and marketplaces. If it can expand without losing its compliance posture and partner support, Oasys could become a common reference point in a space that still splits across many chains.

References

RWA.xyz – Global Market Overview

Statista – Real Estate – Japan

Disclosures

Alea Research is engaged in a commercial relationship with Oasys as part of an educational initiative, and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.