Introduction

Collateralized Debt Positions (or CDPs for short) represent a foundational category within DeFi, offering a mechanism to mint stablecoins. This allows for the circulation of new stable units of account that are backed by crypto assets used as collateral. Hence, the actual units of the stablecoin represent debt that has been issued against overcollateralized assets.. A CDP is created when users lock some form of collateral, such as $ETH, $BTC, $USDC or/and other crypto assets into a smart contract, which allows them to generate debt in the form of newly minted stablecoin units.

These stablecoins are managed through a monetary policy that is designed to maintain a peg to a reference asset, typically the U.S. Dollar (i.e. USD), ensuring a stable store of value within a decentralized system. Peg stability is critical for the stablecoin’s utility as a medium of exchange and a store of value. Therefore, the actual design of the CDP must ensure that all units are fully backed at all times, and that the liquidity conditions are optimal for the protocol to dictate how this peg is or should be maintained.

The core challenge in CDP-based systems revolves around balancing collateralization requirements, liquidation mechanisms, and peg maintenance. CDP protocols generally rely on price oracles to continuously assess the value of the locked collateral against the issued debt, triggering liquidations if the collateral value falls below a certain threshold. Many designs, such as MakerDAO’s $DAI (now respectively rebranded to Sky and $USDS) or Liquity’s $LUSD, employ distinct approaches to manage the stability of their debt issuance. These protocols differ in their governance models, stability mechanisms, and risk mitigation strategies, but basically share the fundamental objective of preserving a stable value while ensuring the system’s solvency through over-collateralization. Essentially, the nature of the stablecoin trilemma dictates that every stablecoin strives for balancing three main goals: peg stability, capital efficiency or scalability, and decentralization.

Figure 1: The stablecoin Trilemma

HAI represents an emerging participant in this space, adopting core CDP principles while seeking to address some of the most relevant limitations in existing models. By leveraging an overcollateralized and a control theory driven framework, Let’s Get Hai incorporates proven mechanisms for maintaining stability.

Key Takeaways

Floating Peg System. HAI employs a floating peg system based on market dynamics and a control-theory-based algorithm (the PID controller), which adjusts $HAI price autonomously without being directly tied to a fixed value like $1, unlike traditional fiat-pegged CDP paradigms.

Collateral Backing. The protocol is fully decentralized and backed by a wide range of collateral types, reducing the risk of price volatility associated with any single asset and giving users flexibility in choosing collateral.

Overcollateralization for Security: HAI’s overcollateralized model ensures that the value of locked collateral exceeds the amount of stablecoins issued, providing protection against market downturns and promoting system solvency.

Price Stability Management through Control-Theory. The project uses a PID controller to autonomously adjust its pricing mechanism, correcting price deviations in real-time and promoting stability without centralized intervention.

Solid infrastructural foundations. HAI is based on the GEB framework (a fork of MCD), allowing it to mint stablecoins backed by many collateral sources. Its choice to deploy on top of Optimism also enhances cost-efficiency by significantly reducing gas fees compared to Ethereum.

Background

Hai protocol has been built upon the foundational principles of the Reflexer protocol, aiming to improve the overall design while addressing some of its key limitations. Reflexer is a protocol launched on Ethereum Mainnet in February 2022 which introduced the $RAI stablecoin, a floating-peg based and fully decentralized stable asset backed by $ETH. However, the Reflexer model relies on a single collateral type, $ETH, which led to persistent issues, namely the constantly negative redemption rate. This limitation was seen as a significant drawback in its model, where $ETH’s volatility directly influenced the stability and performance of the $RAI stablecoin.

The HAI Protocol is governed by the HAI Decentralized Autonomous Organization (HAI DAO), which is structured as an unincorporated nonprofit association operating under Wyoming law. The organization is built around principles of decentralized governance, leveraging smart contracts to manage its operations and decision-making processes.

HAI DAO identified these challenges and set out to create a protocol that could overcome the restrictions of relying on a single collateral. Specifically, the HAI Protocol broadens the collateral base by including multiple assets beyond $ETH, such as staked $ETH derivatives and other assets available on Optimism. This shift aims to minimize the opportunity costs associated with using only $ETH as collateral and to improve redemption rates.

By expanding the range of acceptable collateral, HAI aims to reduce systemic exposure to the volatility of $ETH, while optimizing for more stable and favorable redemption rates. This design choice reflects a more flexible and capital efficient approach to managing decentralized stablecoins. As a result, the goal of HAI is to mitigate the downsides of Reflexer’s design while retaining the core principles of decentralization and collateral-backed stability.

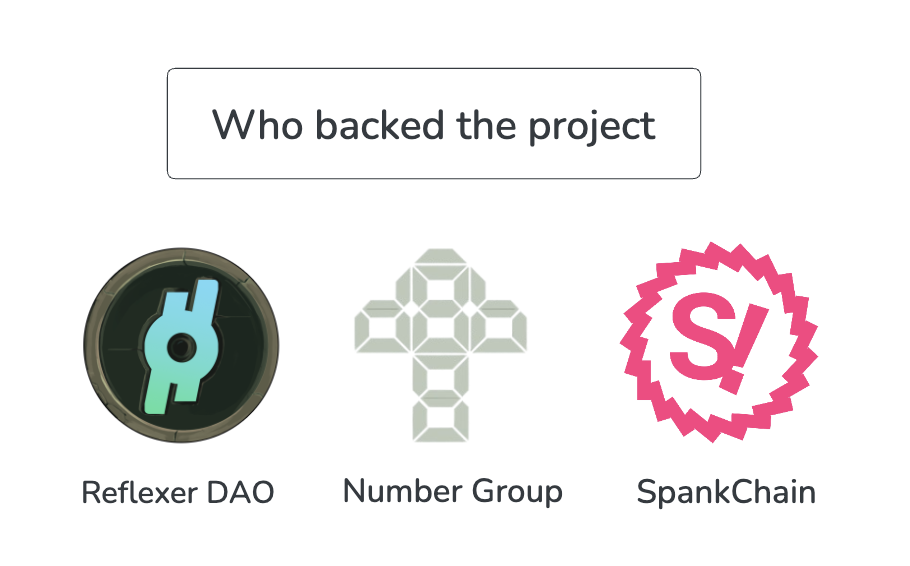

HAI was incubated by Reflexer DAO, SpankChain, and Number Group, and developed in collaboration with DeFi Wonderland. The protocol is a multi-collateral fork of Reflexer, deployed on the Optimism network. As noted by Ameen Soleimani, founder of Reflexer, in his forum post, the goal of HAI is to advance the mission of $RAI by expanding its ecosystem of developers and promoting the concept of controlled peg stablecoins. While $RAI is designed to be ungoverned and unable to adapt to newer regimes such as liquid staking tokens (LSTs), $HAI instead introduces a more flexible model that is more adaptable to changing market conditions and different rates regimes.

Figure 2: The players who funded or contributed to the project’s deployment

Core Team members include:

- Ameen Soleimani (Summoner)

- Reza Jafery (Comms/Ops)

- 0x-Kingfish (Integrations/BD)

- Piesrtasty (Tech Lead)

- DeFi Wonderland (Dev Team)

Figure 3: List of the members who make up the team

The Evolution of CDP Models

The CDP (Collateralized Debt Position) model has been one of the longest-standing frameworks in DeFi, and it has played a crucial role in the development of increasingly accessible and secure decentralized financial services.

By allowing users to generate stable value instantly thanks to crypto asset collateralization through smart contracts interaction, and with the help of efficient algorithms for minting and burning this stable value, CDPs have streamlined asset management within the DeFi space. The progressive improvement of the underlying business models further guarantees the continuity of these services.

In the following paragraphs we will look back over the main stages of the development path of the CDP category to better understand HAIi’s contribution.

MakerDAO (Multi-Collateral Dai – MCD)

MakerDAO was the first major CDP-based stablecoin system, introducing $DAI as a decentralized stablecoin. Initially called SAI, the stablecoin was backed by a single collatral asset, $ETH. The protocol then introduced multi-collateral $DAI, allowing users to mint DAI by locking a series of tokens approved by governance, such as $wBTC or $USDC.

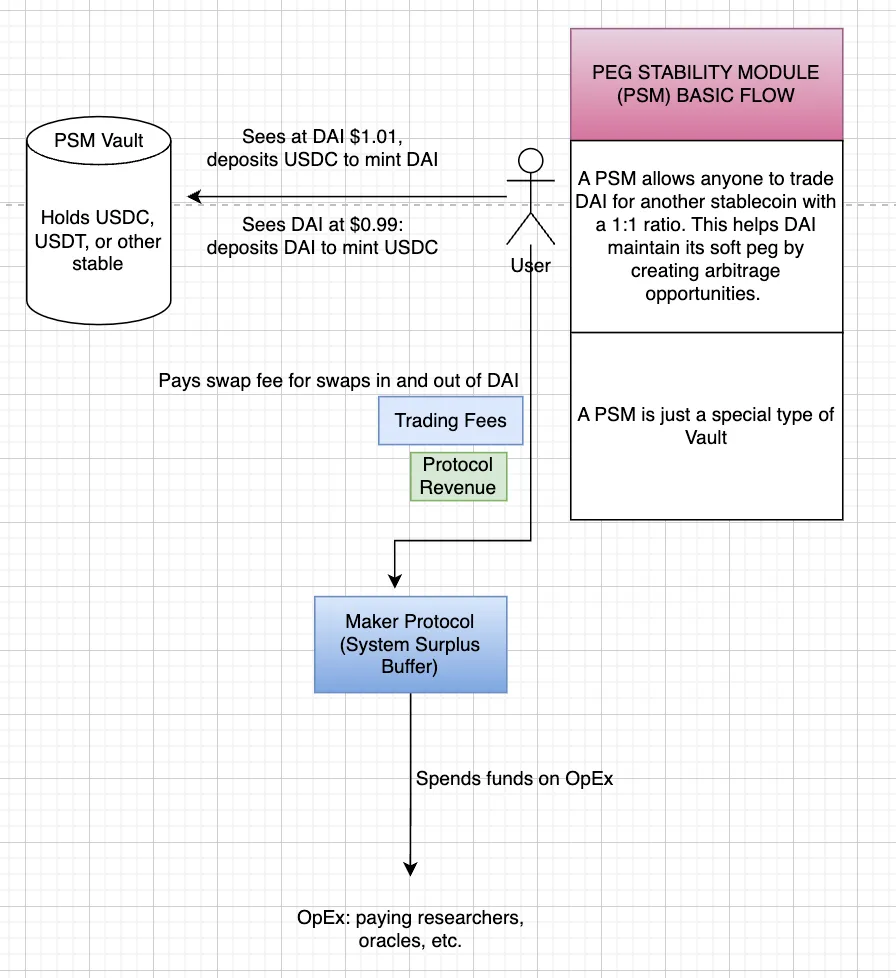

DAI maintains its price stability throughMaker governance by adjusting its monetary policy with mechanisms such as stability fees or the DAI Savings Rate (DSR) rate in order to balance supply and demand dynamics. The protocol also uses an additional Peg Stability Module (PSM) for 1:1 USDC conversions, enabling tight peg management.

Figure 4: The peg-keeping mechanism developed by Maker

DAI’s stability is reliant on governance intervention to adjust interest rates. However, decentralized coordination ultimately slows down the system’s response to market conditions. While Maker sets the baseline for CDP systems, it shares some of the same limitations seen in traditional interest rate management (akin to central bank governance).

Frax (Fractional Algorithmic model Turned Fully Collateralized)

Back in the day the initial version of Frax introduced a fractional algorithmic stablecoin model, where the issued stablecoin ($FRAX) was partially collateralized, with the remainder governed by algorithmic supply mechanisms. This model attempted to balance decentralization and capital efficiency by reducing the reliance on over-collateralization while maintaining stability through an adaptive supply mechanism.

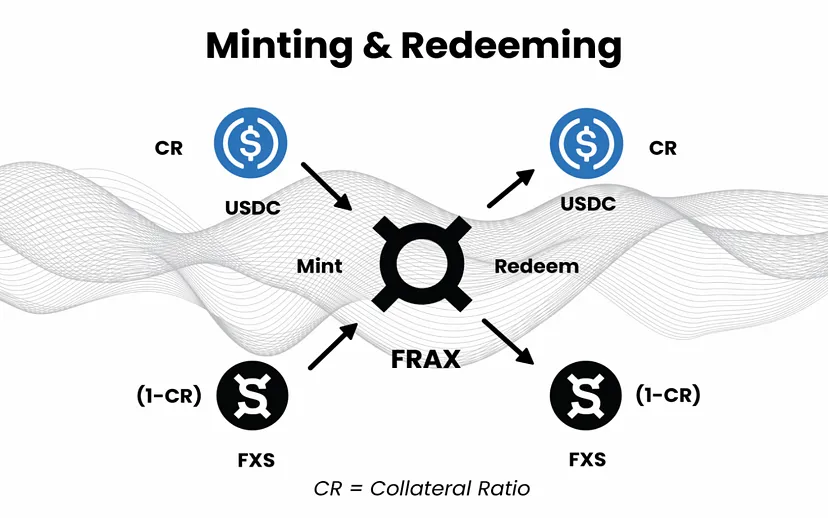

Figure 5: How FRAX’s minting and redeeming mechanism worked when the fractional algorithmic model was in place

A portion of each $FRAX token was backed by real collateral assets like $USDC or other cryptocurrencies. The collateral ratio (CR) indicates how much of the stablecoin was backed by these assets. This collateral served as a safeguard to ensure stability.

The remaining portion of the stablecoin supply was governed algorithmically. The protocol adjusted the supply of $FRAX based on its market price. If the price was above $1, the algorithm reduced the collateral ratio, allowing more tokens to be minted with less backing. For example, if a user wants to mint 100 FRAX and the CR is 80%, he would need to provide 80 USDC (80%) as collateral, while the remaining 20% would be backed by burning or locking an equivalent amount of $FXS. Conversely, if the price falled below $1, the algorithm increased the collateral ratio, reducing supply and raising the stablecoin’s value. This structure allows $FRAX to remain partially collateralized, relying on market demand for $FRAX and the value of FXS to maintain its peg.

When $FRAX traded above $1, users could mint new $FRAX at a lower collateral ratio, sell it at a premium, and reduce supply. If $FRAX traded below $1, users could buy it cheaply and redeem it for collateral, effectively reducing supply and raising the price back to the peg.

The key innovation of $FRAX was its dynamic collateral ratio. Over time, if the system proved stable, the protocol could gradually reduce the amount of collateral backing each token, making the system more capital efficient while maintaining stability.

However, this model has been overcome in favor of a paradigm based on full collateralization to increase the confidence of the user base and avoid potential future clashes with the regulator.

As of February 2023, $FRAX is now fully backed 1:1 by assets like $USDC. This means FRAX stablecoins are collateralized by assets equal to or greater than their supply.

To maintain the stability of $FRAX and give the protocol access to the extractable yields from Protocol Owned Liquidity (POL), Frax Finance introduced Algorithmic Market Operations (AMOs). These are smart contracts that autonomously manage FRAX’s peg without minting new $FRAX, ensuring stable value by deploying collateral (like $USDC) across DeFi protocols/strategies.

AMOs are basically automated modules designed to manage liquidity and stabilize $FRAX in a decentralized and chain rich ecosystem. They operate by dynamically adjusting $FRAX’s collateral ratio and deploying collateral efficiently. The key AMOs include:

- Collateral Investor AMO: Invests idle collateral in DeFi platforms.

- Curve and Uniswap v3 AMOs: Provide liquidity on DEXs like Curve and Uniswap to maintain $FRAX’s peg.

- Frax Lending AMO: Deploys $FRAX into lending markets.

- FXS1559 AMO: Manages profits, buying and burning FXS tokens above a targeted collateral ratio.

Each AMO has four key properties:

- De-collateralize: Lowers the collateral ratio.

- Recollateralize: Increases the collateral ratio.

- Market Operations: Maintains equilibrium without affecting the collateral ratio.

- FXS1559: Formalizes how excess profits buy back and burn $FXS.

Through these mechanisms, Frax tries to ensure long-term stability, liquidity, and capital efficiency, while also distributing profits to $FXS holders.

Terra UST (Fully Algorithmic Paradigm)

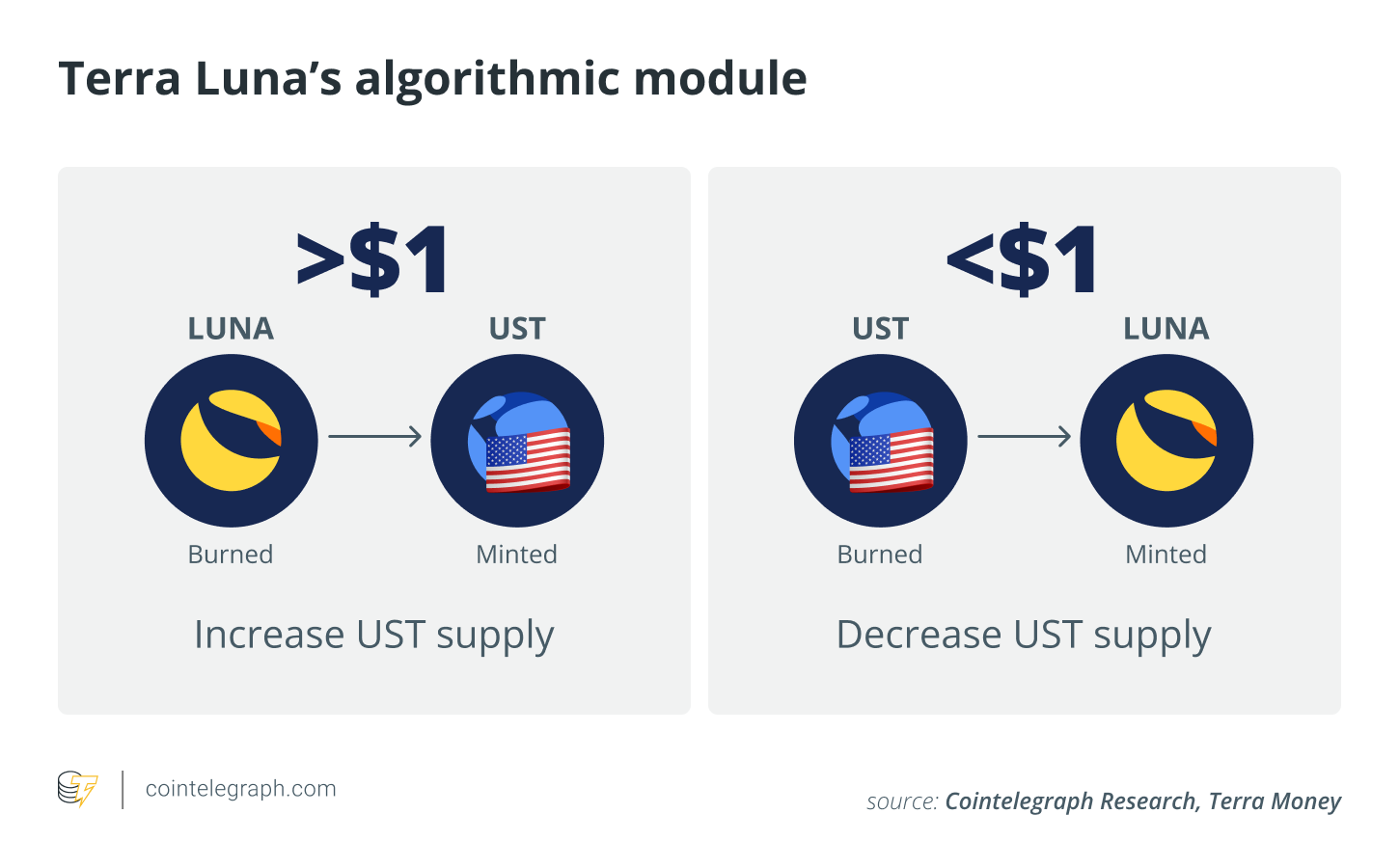

Terra UST was an algorithmic stablecoin that operated without collateral backing, relying instead on an arbitrage mechanism between $UST and $LUNA. The minting and burning of $UST and $LUNA maintained the stablecoin’s peg.

Figure 6: the fully algorithmic model adopted by Terra Luna

However, UST’s collapse in 2022 occurred when the algorithmic mechanism was overwhelmed by rapid market sell-offs, revealing the limitations and vulnerabilities of purely algorithmic stablecoins without sufficient collateral reserves. Terra UST’s failure led to the destabilization of the whole Terra ecosystem and spurred industry-wide discussions on stablecoin minting/burning design and collateralization.

To be specific, the $LUNA and $UST death spiral occurred when $UST, the algorithmic stablecoin, lost its peg to the US dollar. $UST relied on a mechanism where users could swap 1 $UST for $1 worth of $LUNA, and vice versa, to maintain its peg. When $UST de-pegged, mass redemptions of $UST for $LUNA increased $LUNA’s supply, causing its price to plummet. This, in turn, reduced confidence in both assets, leading to more redemptions and further drops in the price of $LUNA, creating a vicious cycle that ultimately collapsed both $UST and $LUNA’s value.

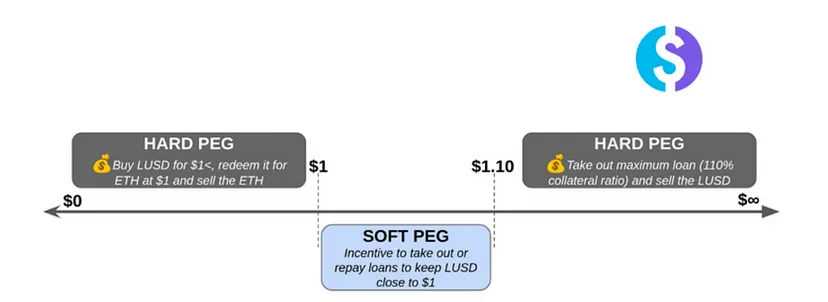

Liquity V1

Similar to the original vision of MakerDAO, Liquity V1 introduced $LUSD, a decentralized stablecoin, minted against $ETH collateral. However, it would differentiate itself from the former by being an immutable protocol with no governance. Liquity V1 is notable for offering zero-interest loans, making it attractive in a low-interest-rate environment. However the service is not entirely cost-free: there is a one-time borrowing fee that is set at 0.5%. To maintain peg stability, Liquity V1 employs a unique redemption mechanism, where users can redeem $LUSD for the underlying $ETH at a 1:1 value when the price of $LUSD falls below $1. Conversely, if it goes over $1.10, arbitrageurs profit by minting and selling LUSD, creating a hard peg. The system worked well when interest rates were low, but it struggled as global interest rates increased, leading to capital inefficiencies and reduced supply. For instance, as MakerDAO increased the DSR to the rates of T-Bills, users started moving their positions to $DAI in order to deposit and earn over a 5% yield. Hence, as Liquity only charged a one-time fixed fee, the model couldn’t adapt well to high-interest-rate environments due to fixed collateralization ratios and lack of dynamic borrowing costs.

Figure 7: $LUSD pegging mechanism

GHO

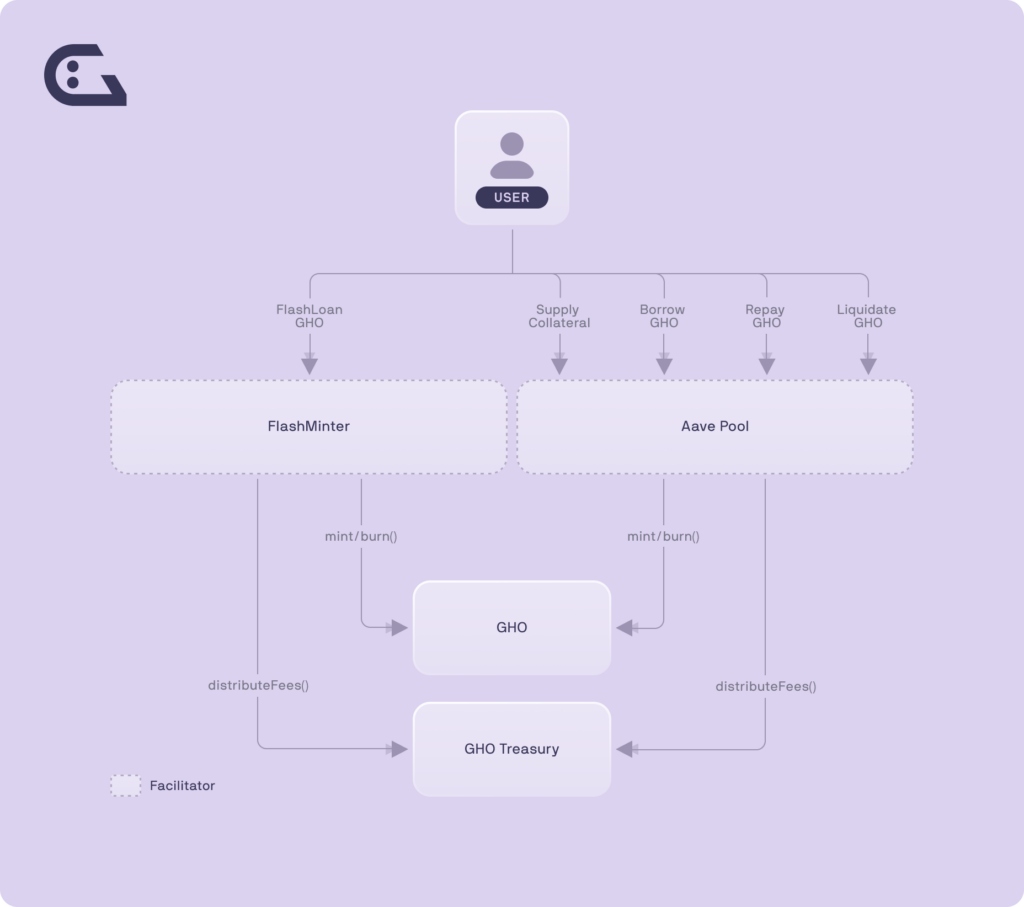

GHO is a decentralized, collateral-backed stablecoin integrated into the Aave protocol. It allows users to mint $GHO against their collateral supplied to the Aave Protocol, similar to MakerDAO. However, $GHO has a more scalable and dynamic interest rate model, governed by Aave’s on-chain governance system. When borrowers repay or are liquidated, the $GHO they minted is burned. Interest payments from $GHO minters are directed to the Aave DAO treasury, bypassing the usual reserve factor applied to other asset borrowings.

The $GHO system also introduces “Facilitators,” which are entities or protocols authorized to mint and burn $GHO trustlessly. Facilitators must be approved by Aave Governance, and each of them can employ different strategies for $GHO generation. Aave Governance will also approve a “bucket” for each facilitator, representing the maximum amount of $GHO they can mint.

The creation of $GHO represents Aave’s response to the chronic, albeit temporary, liquidity crunches within the protocol. By introducing a protocol-owned stablecoin, Aave ensures that liquidity can be sustained within the lending pools. A key advantage of $GHO over Maker’s $DAI is that users earn on the performance of their collateral while borrowing $GHO, improving capital efficiency and providing more predictable lending rates.

From the protocol perspective, $GHO generates more revenue for Aave than assets like $USDC, since there’s no need for liquidity providers (LPs). The reserve factor for $GHO is 100%, which means that Aave captures all revenue, unlike the current $USDC markets, where only 10% is collected. For example, minting $100 million of $GHO brings the same revenue as $1 billion in $USDC, highlighting the wide financial gap.

Figure 8: The minting and burning process of $GHO employed by Aave

Although the integration within the Aave markets potentially increases the use cases and the user base of $GHO across DeFi, its reliance on governance (which votes for adjustments to the global interest rate) introduces lag, making responses to market changes slower than desired, leading to potential periodic depegs.

crvUSD

Curve’s crvUSD employs an adaptive interest rate system, where the rate adjusts based on the price of $crvUSD and a variable called sigma. This sigma value, controlled by the Curve DAO, dictates how quickly interest rates rise or fall as $crvUSD deviates from its $1 peg. A lower sigma makes interest rates react more quickly to price changes, while a higher sigma slows the rate of adjustment.

The main feature of $crvUSD is definitely its soft-liquidation system, LLAMA (Lending Liquidating Automated Market Maker Algorithm), which dynamically liquidates or de-liquidates collateral based on market conditions and thus on the health rate of the debt position, primarily through arbitrage traders. Each specific market has its own AMM, holding both the collateral and the borrowable asset. For example, the ETH-crvUSD market’s AMM contains both $ETH and $crvUSD. The algorithm basically optimizes liquidation by adjusting collateral in real-time to maintain loan health and market stability.

The system has been in place since August 2023, so its response to major market changes has not been fully tested yet. However, it has shown promise in maintaining $crvUSD close to $1, and its borrowing interest rates remain competitive.

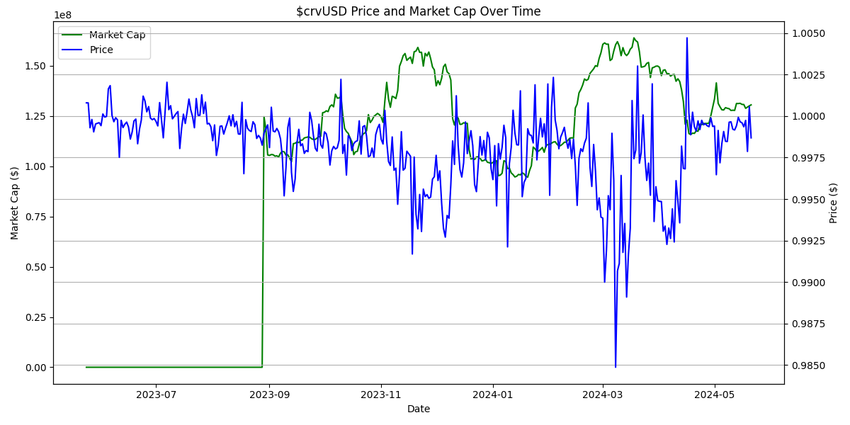

Figure 9: The solidity of the $crvUSD peg is quite evident even if the historical data is still limited

Despite its strengths, the $crvUSD system has limitations. It relies on debt caps to manage the DebtFraction parameter, which affects the interest rate calculation. These caps can restrict scalability and create artificial utilization signals, potentially leading to price offsets from the peg. While the sigma variable can mitigate this, it requires governance intervention, leading to delays similar to those in Aave’s GHO system. Currently, $crvUSD also lacks an automatic mechanism to correct wide price deviations.

The PegKeeper system also helps stabilize $crvUSD by performing algorithmic arbitrage. When crvUSD’s price rises above $1, PegKeepers mint and deposit uncollateralized $crvUSD into pools, lowering the price. Conversely, they withdraw $crvUSD when the price falls below $1, helping increase the price. However, PegKeepers provide only a limited buffer since they cannot mint $crvUSD indefinitely.

Overall, Curve’s stablecoin system has functioned effectively over recent months, as reflected in its stable market capitalization and $crvUSD price stability.

Figure 10: $crvUSD Market Cap grew steadily over time

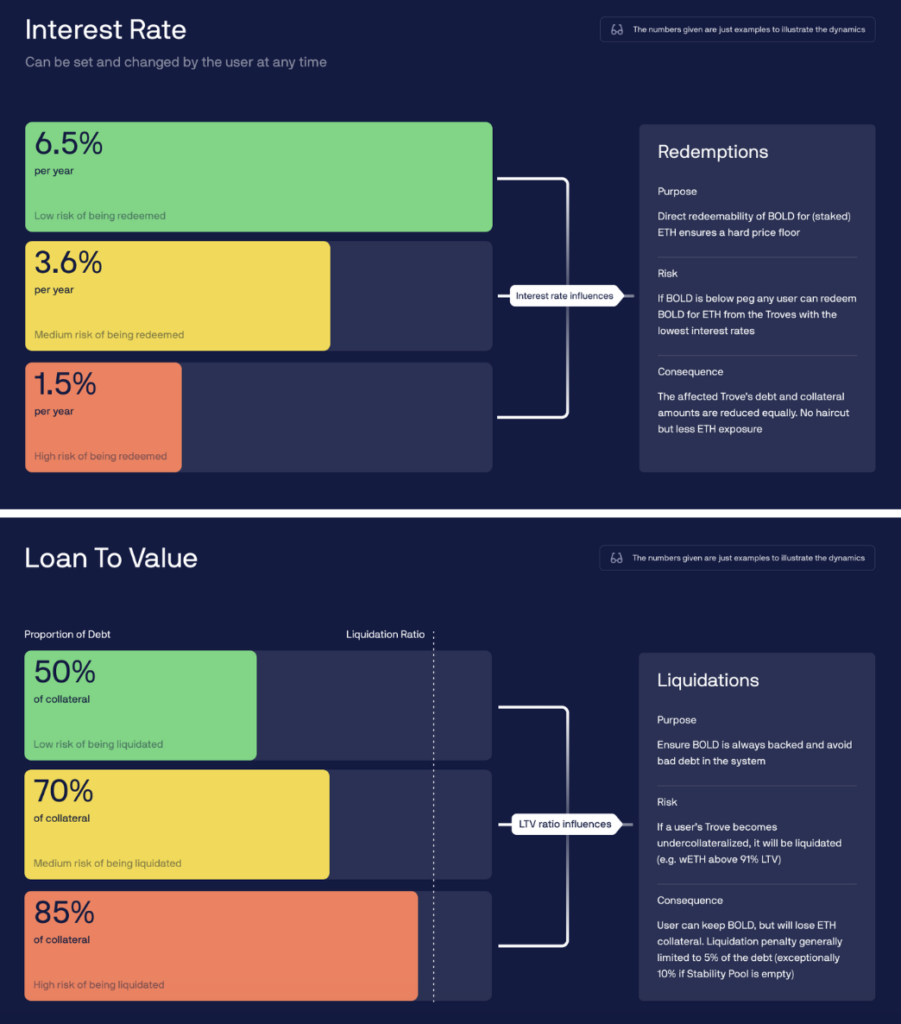

Liquity V2

Liquity V2 seeks to overcome the limitations of V1 by introducing user-adjustable interest rates, making the system more adaptive to changing market conditions. Instead of relying solely on collateral ratios, V2 allows users to set their own interest rates.

Figure 11: The main innovations introduced with VC2

However, the V2 model still has several flaws that are worth listing:

- Interest Rates vs Redemption Risk: Higher interest rates do not shield users from redemption risks, as larger redemptions can still impact them. Borrowers must monitor potential redemption sizes and manage interest rates, adding complexity and inefficiency to debt management.

- Dependency on Third-Party Interest Rate Managers: Delegating interest rate management to third parties can automate adjustments but introduces dependencies. Users still need to monitor positions to avoid paying unnecessary interest, making third-party management not a perfect solution.

- Market Response Delays and System Inefficiency: Liquity V2’s response to market changes is slow. Users tend to delay increasing interest rates until threatened by redemption, leading to overshooting rates. Conversely, they pay more than necessary when rates fall, creating inefficiencies in the system.

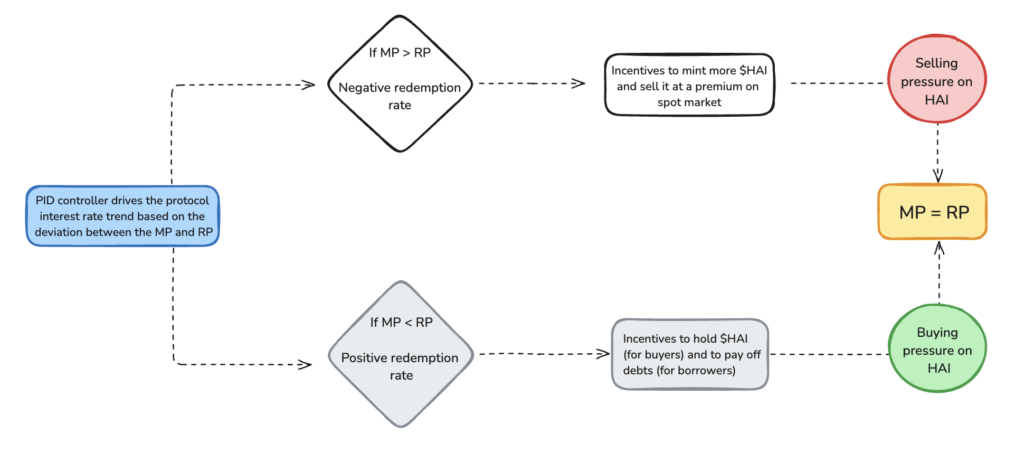

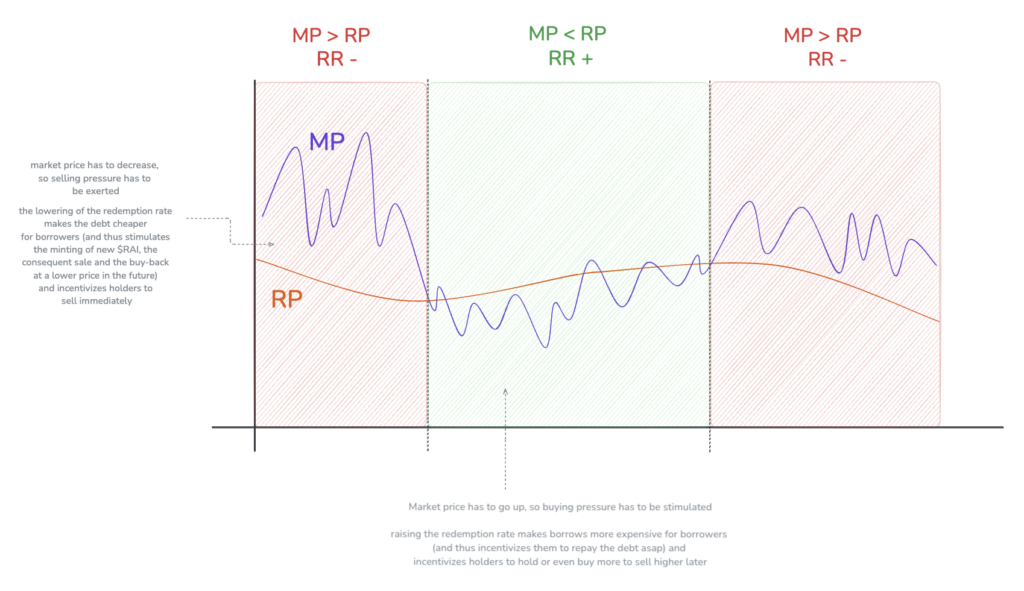

Rai – Hai (floating peg based model)

The last model we will be examining is what was implemented by Reflexer. As stated above, $HAI is a fork of Reflexer’s $RAI and, therefore, operates in a floating-peg paradigm, which stabilizes the stablecoin price by adjusting the redemption rate while securing its value through overcollateralization.

Figure 12: Diagram showing the behavior of the PID controller when market conditions change

- If $HAI’s (market) price rises above its target, the redemption rate is decreased. This makes holding $HAI less attractive, encouraging more users to borrow $HAI just in order to sell it now and buy it back at a lower price in the future. This increases the supply of $HAI and pushes its price back down.

- If Hai’s price falls below its target, the redemption rate is increased. This makes holding $HAI more attractive, reducing borrowing (borrowers are in fact incentivised to close their positions) and encouraging more users to hold $HAI, which increases demand and pushes the price back up.

Figure 13: the money supply control mechanism developed by Reflexer and improved by HAI

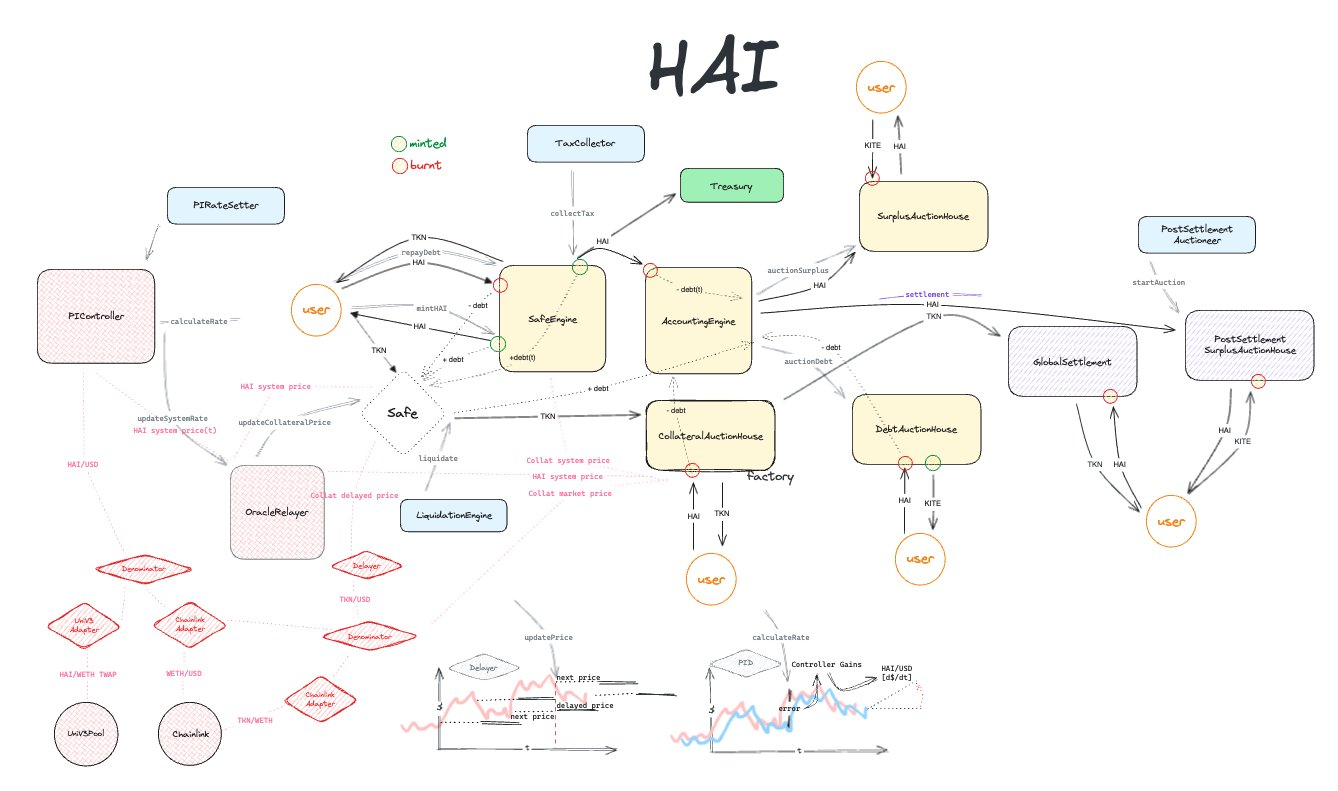

Stack Architecture

HAI is based on the GEB (Godel, Escher, Bach) framework, which is a modified version of the Multi Collateral Dai (MCD) system. It is designed to issue stablecoins like $HAI, which are backed by a multitude of collateral types instead of being pegged to the US dollar with a single collateral asset alone. The protocol improves upon the GEB framework by incorporating features such as advanced system parameter controls, enhanced deployment and upgrade capabilities, and a robust testing and simulation environment to mitigate risks. It emphasizes multi-collateral support and includes pre-built factories for common contract types to simplify collateral management and reduce the devs’ workload when integrating the framework.

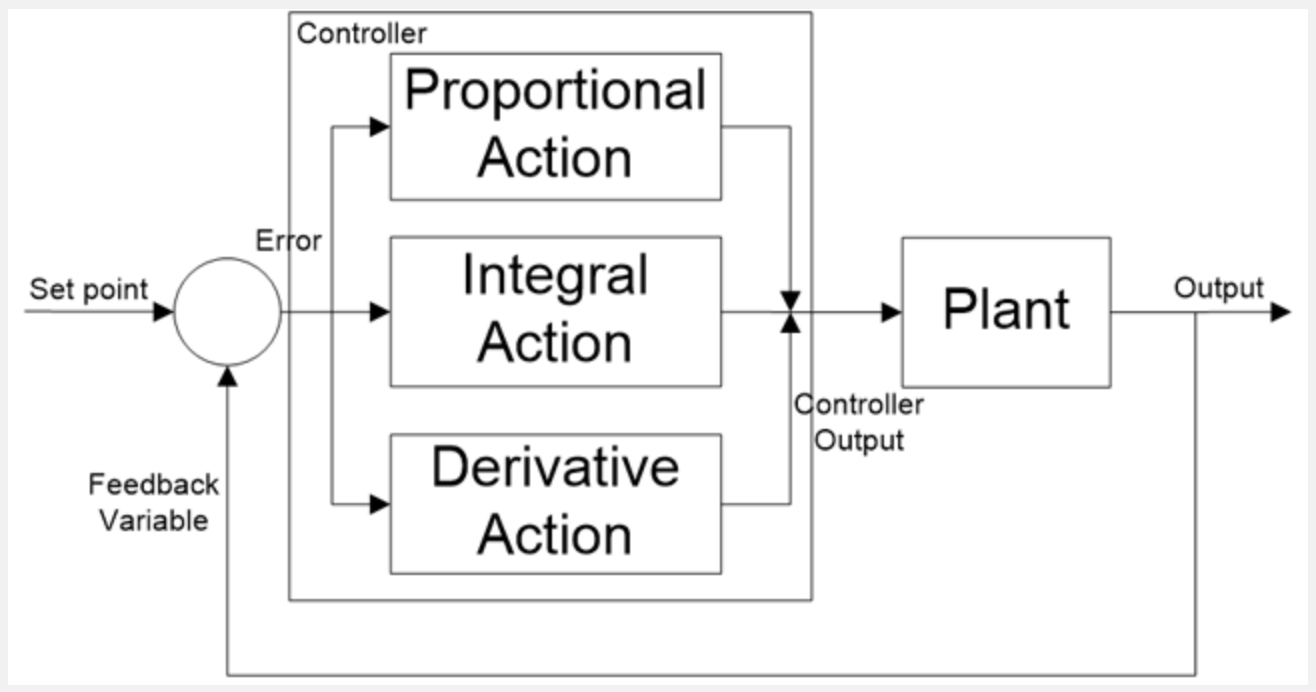

Control theory is a field of study that focuses on how to influence the behavior of dynamic systems using control inputs. It is concerned with developing mathematical models and strategies to ensure that a system responds to external inputs or changes in a desired and stable manner. The goal of control theory is to regulate system outputs by making adjustments to its inputs in real time, often through feedback mechanisms.

Control systems can be either open-loop, where the control action is independent of the output, or closed-loop (feedback systems), where the system continuously monitors its output and adjusts its inputs to minimize errors between the desired outcome (setpoint) and the actual output. This branch of engineering and applied mathematics is essential in various applications like robotics, electronics, process control, and economic systems, where stability, accuracy, and efficiency are critical.

A common approach in control theory is the PID (Proportional-Integral-Derivative) controller, which adjusts a system’s output based on the current error, the cumulative past error, and the predicted future error, helping to fine-tune the system for optimal performance.

Figure 14: The PID controller is a feedback mechanism used in control theory-based systems

In the HAI Protocol, this concept is applied to stabilize the value of its stablecoin, $HAI. The PID controller continuously monitors market deviations from a target price and dynamically adjusts the stablecoin’s price in response. By leveraging the proportional, integral, and derivative components of the controller, $HAI can fine-tune its reactions to price fluctuations, maintaining stability without relying on centralized or high-risk collateral types. This mechanism ensures that $HAI remains stable while being adaptable to changing market conditions.

Core components

The HAI Protocol incorporates several key components that handle functions such as collateral management, stablecoin issuance, governance, and global settlement. These contracts form the core infrastructure, ensuring the protocol’s stability, scalability, and security.

Figure 15: Mind map describing how the protocol works and the interactions between users and the different modules

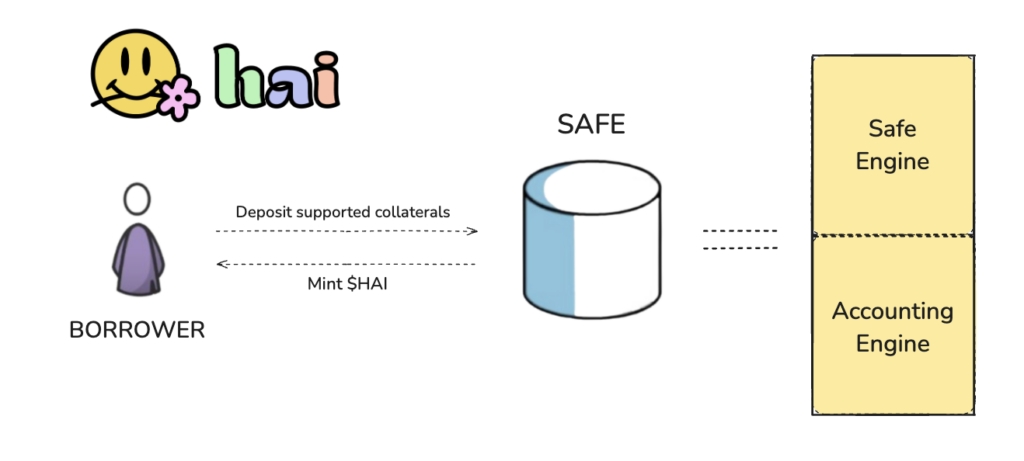

SAFE Engine

The SAFE Engine is central to the HAI framework and manages user-owned SAFEs (Simple Agreements for Future Equity) and interest rates for various types of collateral. It performs several critical functions, namely:

- Debt Monitoring: Tracks system-wide debt, individual collateral types, and specific SAFEs.

- Transaction Facilitation: Manages transfers of coins, collateral, or debt between accounts.

- Collateral Seizure: Seizes collateral during liquidation events to cover outstanding debts.

- Permission Management: Controls account permissions for secure access to system functionalities.

- Debt Management: Enforces debt caps globally and for individual SAFEs to maintain system health.

Figure 16: Interaction between the borrower and his SAFE

The SAFE Engine differentiates between ACCOUNTs and SAFEs. ACCOUNTs can hold coins, collateral, and multiple SAFEs associated with the related collateral types. SAFEs are linked to an account’s address and collateral type, containing locked collateral and generated debt, with each SAFE characterized by its account, collateral type, generated debt, and locked collateral. SAFEs are deemed healthy as long as locked collateral multiplied by the safety price remains greater than or equal to the generated debt multiplied by the accumulated rate.

Accounting Engine

The Accounting Engine is responsible for managing the protocol’s financial activities. Its main tasks include:

- Surplus and Deficit Tracking: Monitoring system-wide surplus or deficit to ensure operational balance.

- Debt Management: Initiating and managing auctions to recover bad debt.

- Handling Surplus: Conducting auctions or direct transfers to manage excess assets.

- Debt Offset: Using system coins to balance accumulated debt.

The Accounting Engine manages the overall debt balance, dividing it into three parts: queued debt (awaiting auction), on-auction debt, and unqueued-unauctioned debt (not engaged in auctions). Once the unqueued-unauctioned debt reaches a threshold, debt auctions are triggered. Throughout the process, the classification of debt changes as it moves into auction, ensuring the system effectively handles fiscal responsibilities.

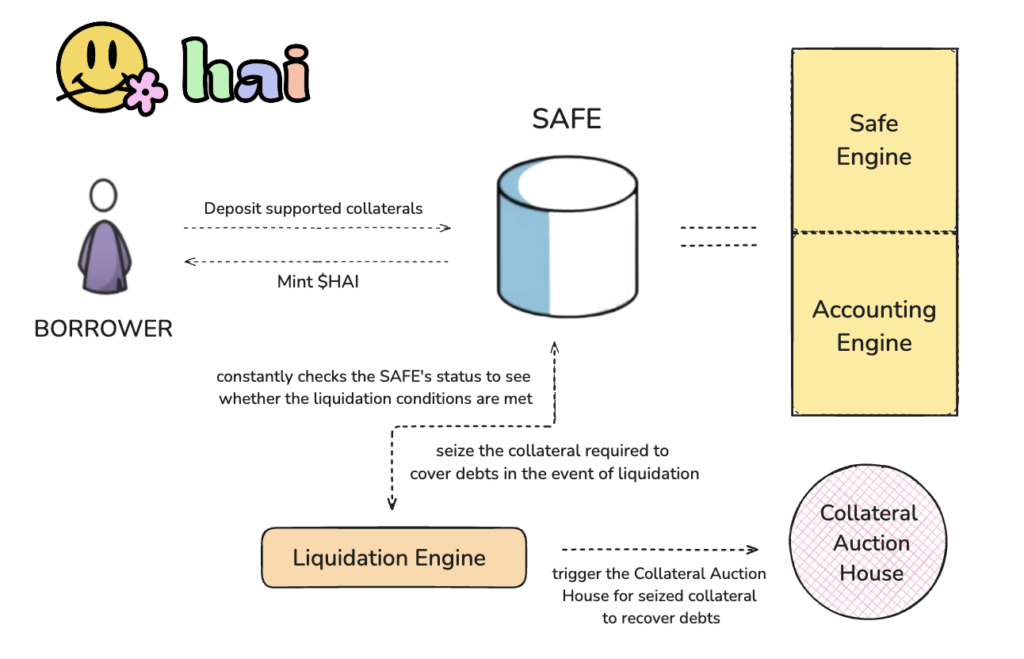

Liquidation Engine

The Liquidation Engine manages the liquidation of SAFEs when required. Its key functions include:

- Assessment of Liquidation Status: Continuously evaluating SAFEs to determine if they qualify for liquidation.

- Collateral Seizure: Seizing collateral to cover debt.

- Collateral Auction: Initiating auctions for seized collateral to recover debts.

Figure 17: The main functions performed by the liquidation engine

Liquidation follows the application of a Liquidation Penalty, which increases the debt that must be covered during an auction. If the debt surpasses a predefined liquidation volume, only part of the debt is liquidated. The remaining debt stays in the SAFE until liquidation conditions are met.

Oracle Relayer

The Oracle Relayer handles the quoting mechanism for the HAI system, managing two primary tasks:

- Oracle Addresses: It stores the addresses of oracles that provide price data for every collateral type.

- Price Updates: It fetches and updates collateral prices and adjusts the redemption price based on the redemption rate to maintain the overall system stability.

The Oracle Relayer uses a formula to adjust collateral prices by dividing the oracle-reported price by the redemption price. It also calculates safety and liquidation prices by applying specific collateralization ratios to the collateral price. These prices determine whether a SAFE is secure (the former) or subject to liquidation (the latter).

Tax Collector

The Tax Collector manages the system’s tax collection, including:

- Interest Rates: It stores the interest rates for each collateral type.

- Tax Revenue Management: It keeps track of the addresses where tax revenues are distributed.

- Tax Calculation and Distribution: It calculates the amount of tax due and distributes it to primary and secondary tax receivers.

Taxes are based on a global stability fee and can also be customized per collateral type, thus offering devs further discretion in design choices. The system calculates the effective tax by multiplying the global fee by the specific per collateral fee. The Tax Collector updates the stability fee regularly, ensuring accurate and transparent tax obligations.

Stability Fee Treasury

The Stability Fee Treasury manages protocol fees without directly impacting the financial surplus or deficit. Its key responsibilities include:

- Reward Distribution: Disbursing rewards for maintenance tasks.

- Debt Management: Addressing unbacked debt to maintain system health.

- Payment Management: Handling payments for operational needs.

- Surplus and Deficit Management: Using excess funds to balance the system’s financials by offsetting deficits or boosting surpluses.

This component plays a crucial role in the financial structure of the HAI Protocol, serving as a reserve that can be accessed when necessary. By maintaining liquidity and keeping these funds distinct from the system’s main operational accounts, the Treasury basically acts as an essential financial management resource. This arrangement enables quick responses to urgent financial requirements or emerging opportunities, ensuring the protocol remains flexible and responsive in its economic management.

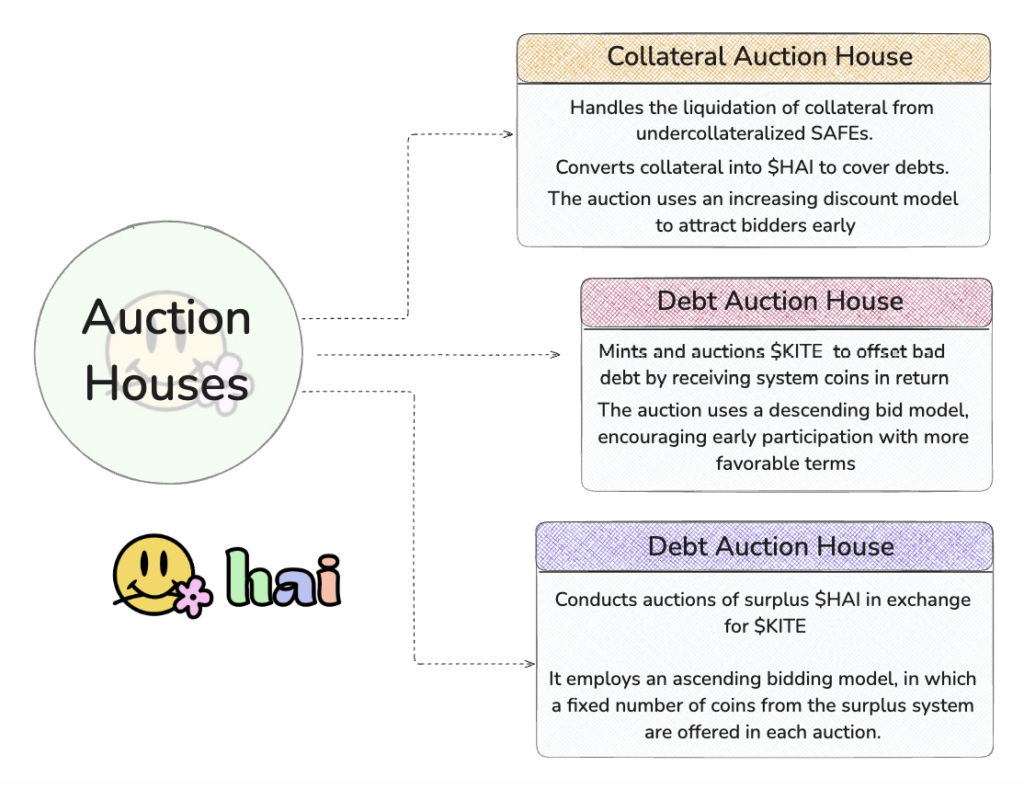

Auction Houses

The protocol utilizes three types of auction houses to manage collateral, debt, and surplus respectively:

- Collateral Auction House: Manages the liquidation of collateral from undercollateralized SAFEs. It converts collateral into system coins ($HAI) to eliminate debt. The auction uses an increasing discount model to attract bidders early, with discounts increasing over time until a maximum cap is reached.

- Debt Auction House: Mints and auctions protocol tokens (on HAI, $KITE) to offset bad debt by receiving system coins in return. The auction uses a descending bid model, encouraging early participation with more favorable terms.

- Surplus Auction House: Conducts auctions of surplus system coins in exchange for protocol tokens. The Surplus Auction House applies an ascending bidding model, in which a fixed number of coins from the surplus system are offered in each auction. Participants compete by bidding higher quantities of protocol tokens to acquire the coins. A portion of the tokens from the auction is burned to control token supply and ensure implicit support for its market value, while the rest is used for operational needs.

Figure 18: Types of Auctions on Hai Protocol and related properties

Settlement and Global Settlement

The Settlement Module ensures the orderly redemption of $HAI tokens for collateral in case of system shutdown due to technical vulnerabilities, critical bugs or governance decisions. It manages the fair and orderly unwinding of positions and enables token holders to redeem $HAI for collateral.

The Global Settlement Contract acts as an emergency mechanism to halt the system safely. It processes SAFEs, ends ongoing auctions, and calculates the redemption price. The contract ensures a fair and secure shutdown, allowing users to exchange system coins for collateral.

Post-Settlement Surplus Auction House

This auction house operates after a global settlement in order to manage surplus system coins. It burns all protocol tokens from these auctions (thus distinguishing itself from the normal Surplus Auction House) to prevent market effects post-settlement, ensuring a clean sunset of the protocol.

Settlement Surplus Auctioneer

The Settlement Surplus Auctioneer ensures that the system remains balanced during the settlement process. It manages surplus auctions to ensure the total coin supply covers outstanding debts, preventing imbalances that could affect the redemption price. This helps maintain fairness and integrity during the unwinding of the protocol.

Performance Evaluation

Assessing the performance of CDP protocols is always very tricky because there are so many factors influencing it.

This is probably even more difficult for a framework such as HAI, with its floating peg based asset $HAI.

Monitoring the number of circulating units can generally help gauge a stablecoin’s liquidity and adoption, as higher circulation typically suggests increased trust in that stable. However, this metric alone is not sufficient to assess overall stability or health and it doesn’t necessarily reflect the stability of the peg, collateralization health, or liquidity management.

To get a complete picture, other parameters must also be taken into account like the redemption rate, collateralization type, and the volatility of backing assets, which are critical to ensuring the stablecoin’s peg and overall operability remain stable.

About Tokenomics

As we can guess from the previous paragraphs, the framework created by the team revolves around 2 tokens, which are distinct but complementary to each other.

$HAI: This is the primary stablecoin within the HAI Protocol, backed by collateral deposited by users. The price stability is maintained by two factors:

- Market Price (MP): The trading price of $HAI on centralized/decentralized exchanges.

- Redemption Price (RP): Set programmatically based on internal mechanisms aiming to stabilize $HAI around a target value, like collateral performance and overall market conditions.

$KITE : This token mainly acts as the governance token for the HAI Protocol, allowing holders to vote on key protocol parameters and decisions (e.g., changes in system parameters, supported collateral types, etc).

The two primary functions of $KITE in the HAI Protocol are:

- Backstop Mechanism. $KITE stakers serve as the first line of defense during financial shortfalls, absorbing impact through staking. In severe cases, the protocol mints and auctions new $KITE tokens in exchange for $HAI to cover debts and maintain system integrity.

- Ungovernance. As the protocol moves toward decentralization, $KITE holders gradually reduce governance layers, enhancing decentralization while retaining limited control over critical elements like oracles.

Conclusion

The framework developed over time by the Reflexer and HAI teams offers an interesting decentralized alternative to the monopoly exercised over the industry by Circle and Tether giants.

The paradigm based on floating pegs is objectively more difficult to digest for the DeFi public, which is used to stablecoins pegged to the US Dollar (and thus tolerates zero volatility on stable assets, whatever their design), but it represents an excellent trade-off in light of the strong decentralized connotation it has.

The flexibility granted to developers to fine-tune the protocol’s parameters makes it highly attractive to builders. This includes adjusting the operation of the PID controller, setting governance permissions, and choosing oracle providers or assets to integrate as collateral. Devs also benefit from a dedicated testing environment and a wide availability of modular factory contracts, which further drive adoption of the protocol.

Additionally, the dynamic money supply control system has proven resilient, even during periods of high market volatility. The decision to adopt multiple collaterals for $HAI minting addresses a key limitation of the original GEB model pioneered by Reflexer upstream, providing a more robust and flexible framework.

References

Let’s Get Hai’s Official Medium blog. Link

Let’s Get Hai’s Official Docs. Link

“Non-pegged Stablecoins #01: On the Current State of HAI” (2024), published by Gokhan.eth on his Substack page. Link

Reflexer Finance’s Whitepaper. Link

“RAI — one of the coolest experiments in crypto” (2023), published by Dankrad Feist on his blog page. Link

“Maker – A Deep Dive Into The World’s First Unbiased Global Financial System” (2024), published by Artemis on their Substack page. Link

“Two thought experiments to evaluate automated stablecoins (2022)”, published by Vitalik Buterin on his official blog. Link

“Liquity V2: Enhancing the borrowing experience (2024)”, published by Liquity team on their official blog. Link

Disclosures

Alea Research is engaged in a commercial relationship with HAI Protocol and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.