Jumper Exchange is a smart money app enabling movement, deployment and management of capital built on LI.FI’s routing infrastructure responsible for routing $20.2 billion in cumulative bridge volume and $10.7 billion in DEX swap volumes. Today, Jumper is an execution rail aggregating 20+ bridges, connecting 60+ chains, and supporting over 20 DEXs and aggregators on a single interface.

Jumper’s new set of products aims to position itself as a crosschain yield command center where capital doesn’t just move around, but deploys into multichain yields. 2 products are being introduced: Jumper Earn for discovery, and Jumper Portfolio for position management. The thesis is that a swap aggregator with enough distribution can convert into retained flows by owning the deployment and ongoing management of multichain capital.

This Perspective Report is written for allocators who frequently execute crosschain transactions or already use Jumper as a crosschain bridging or swap tool and are deciding whether Jumper warrants attention beyond its current execution utility. This is determined by Jumper’s ability to translate distribution into product leverage through Earn and Portfolio.

Key Takeaways

Distribution is the Wedge – Jumper has routed near $30 billion across 62 chains via LI.FI’s infrastructure representing an untapped yield funnel of users who bridge for opportunity but currently deploy elsewhere.

Aggregator-to-Allocator Pivot – Jumper aims to own the full capital workflow from discovery to execution to management, rather than just a movement leg. Earn surfaces personalized yield opportunities; Portfolio provides crosschain position management.

Personalization as the Differentiator – Earn filters opportunities across DeFi positions, token holdings, chain activity, and risk profile. The goal is to provide curated suggestions rather than a generic APY leaderboard.

Introducing Jumper

Jumper Exchange is a smart money app powered by LI.FI, a crosschain routing protocol founded in Berlin in May 2021 by Philipp Zentner (CEO) and Max Klenk (CTO). LI.FI raised a total of $52M in funding from backers including Coinbase Ventures, Dragonfly, Circle, and 1kx. Recently, they closed a $29M Series A extension round led by Multicoin and CoinFund. Jumper launched publicly in March 2023 supporting only 20 chains and has since become the primary interface for users seeking single-transaction crosschain swaps. They are now headed by CEO Marko Jurina who was previously CMO at LI.FI.

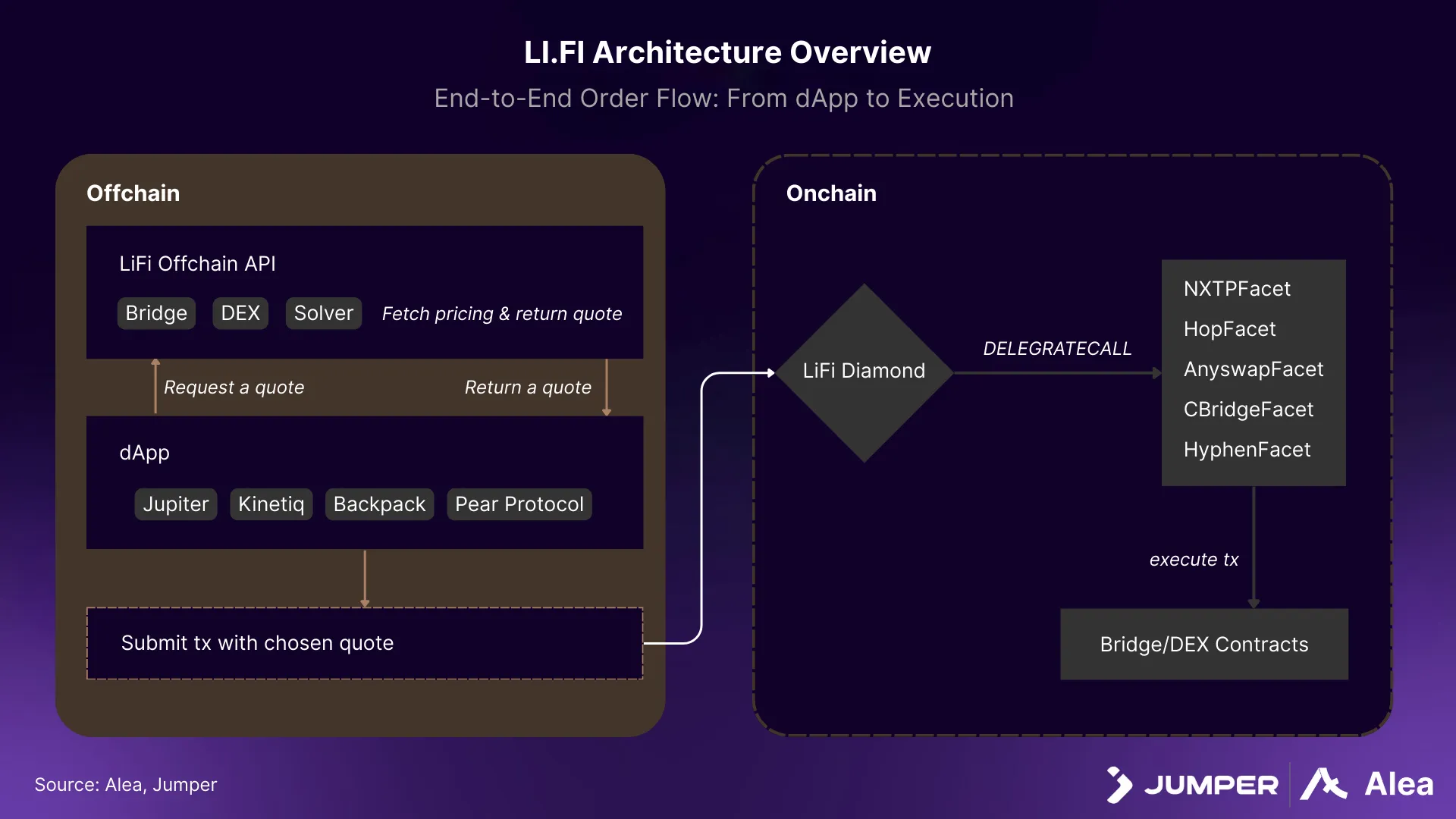

Jumper is an interface built on LI.FI, a backend routing protocol that connects to an extensive network of blockchain bridges and DEX aggregators. Jumper is the user-friendly frontend that allows a user to swap any token for any other on any supported chain, allowing the system to initiate a “swap + bridge + swap” within a single transaction, abstracting what used to be multiple user actions into one.

This is done through LI.FI’s modular diamond architecture (EIP-2535 multi-facet proxy) that allows a single contract call to handle many types of bridge and DEX integrations. When a user executes a Jumper trade, they are interacting with the LI.FI Diamond contract, which delegates the call to the appropriate facet for each protocol needed (e.g. a Stargate for bridging, Uniswap for swaps, etc.).

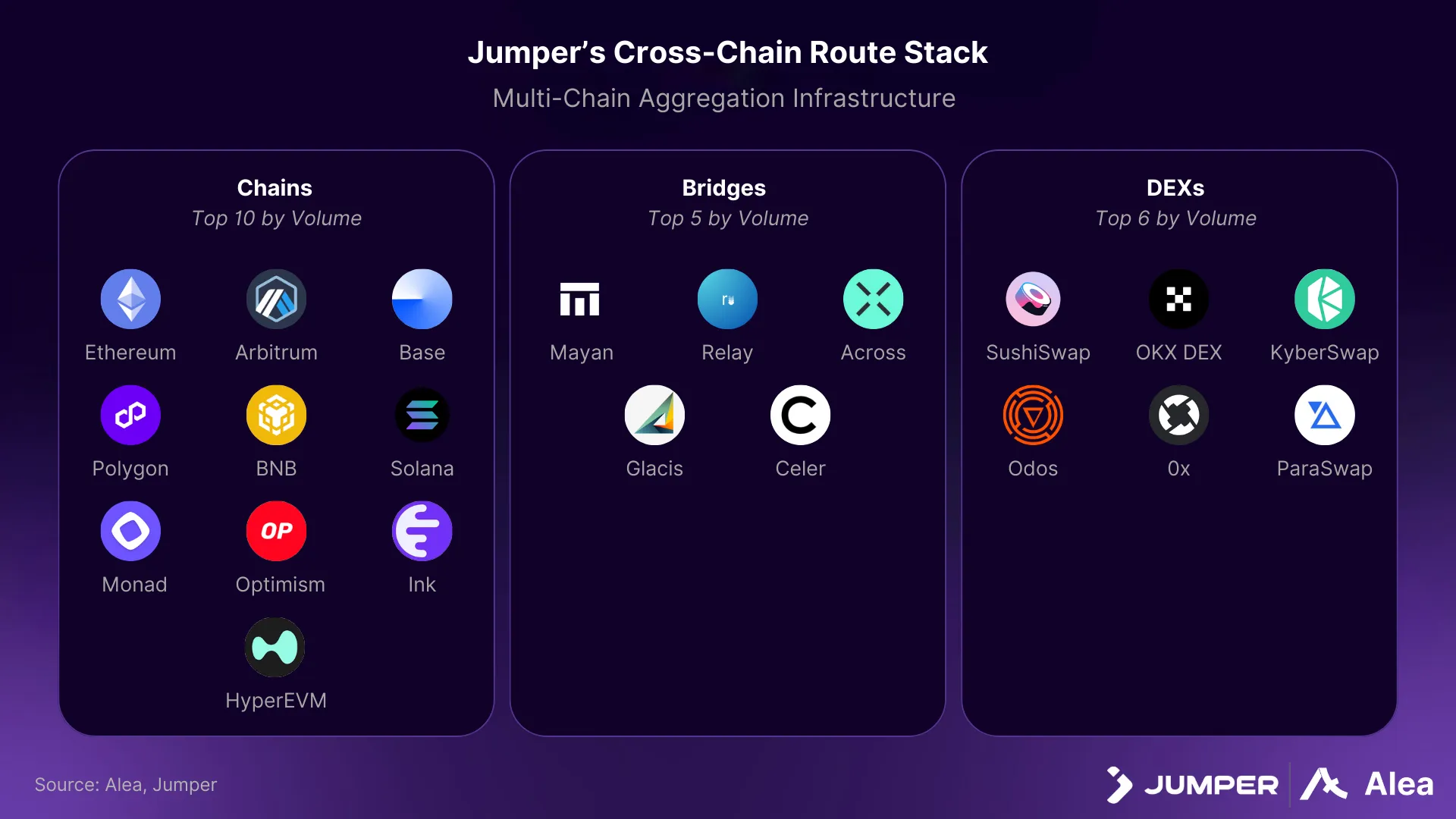

As of Jan 2026, Jumper’s integration depth spans 62 chains, 23 bridges, and 21 DEXs across almost all major chains.

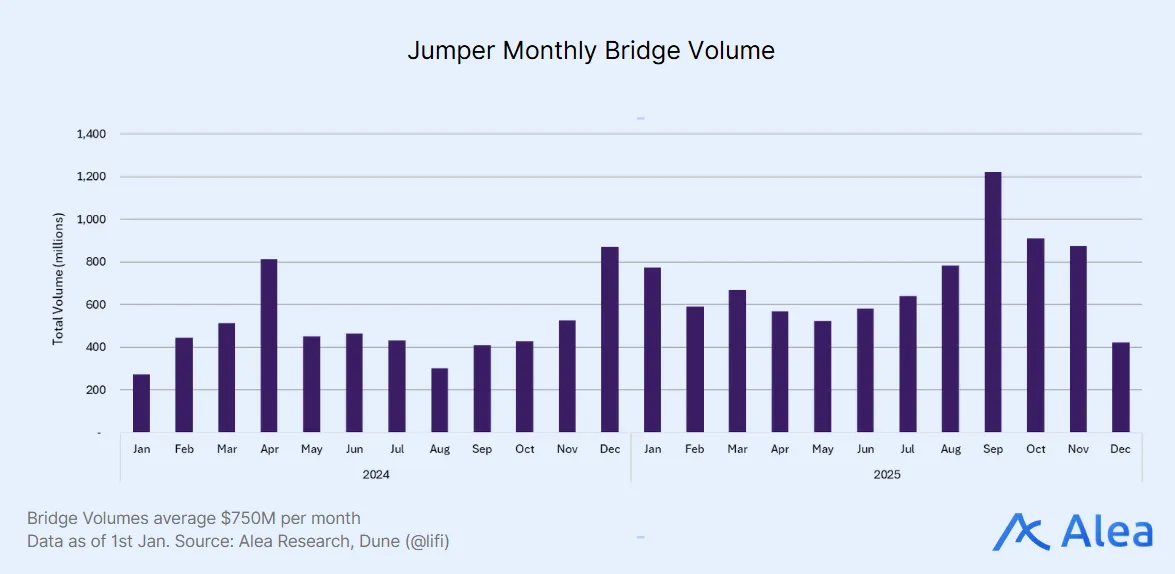

Since launch, DefiLlama reports cumulative volumes of roughly $20.2 billion bridged (~$1 billion/month over 2025) across Jumper’s bridge aggregator.

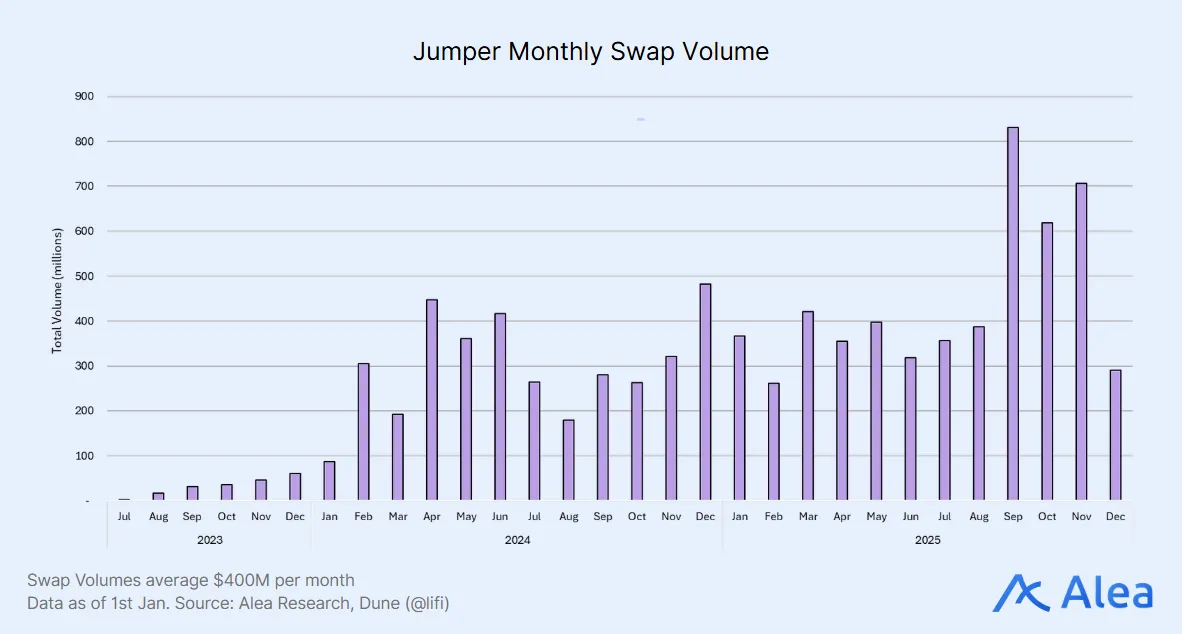

Jumper’s DEX aggregator sees around $10.7 billion swapped (~$500 million/month over 2025).

Reality of Multichain Yields

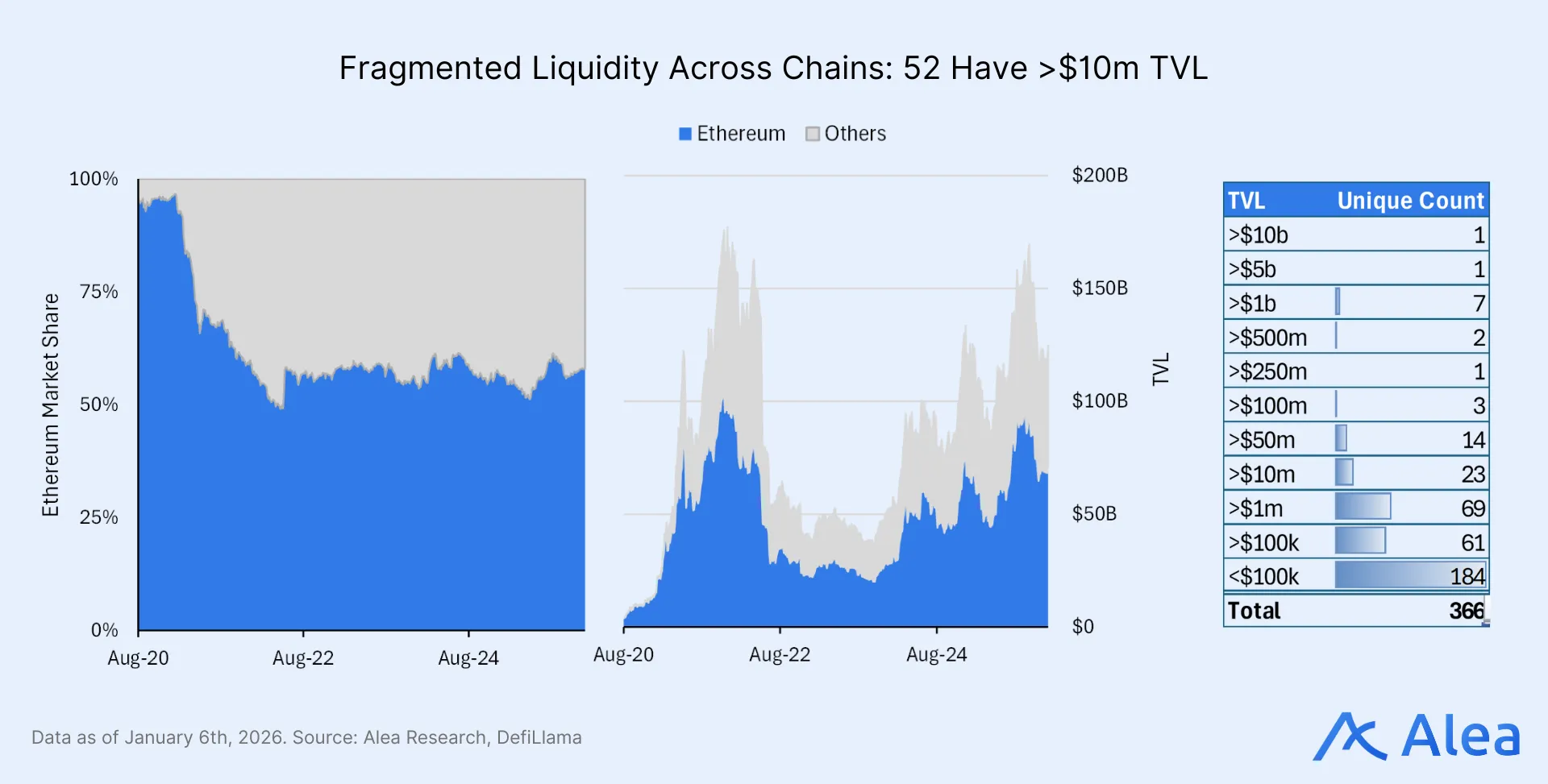

DeFi TVL has grown from $50 billion in 2023 to over $120 billion as of Jan 2026 with over 100 active chains. Ethereum’s share of DeFi TVL has shrunk from over 90% in its peak DeFi summer days to just over 50% as capital is dispersing to Arbitrum, Base, Solana, and newer chains like HyperEVM.

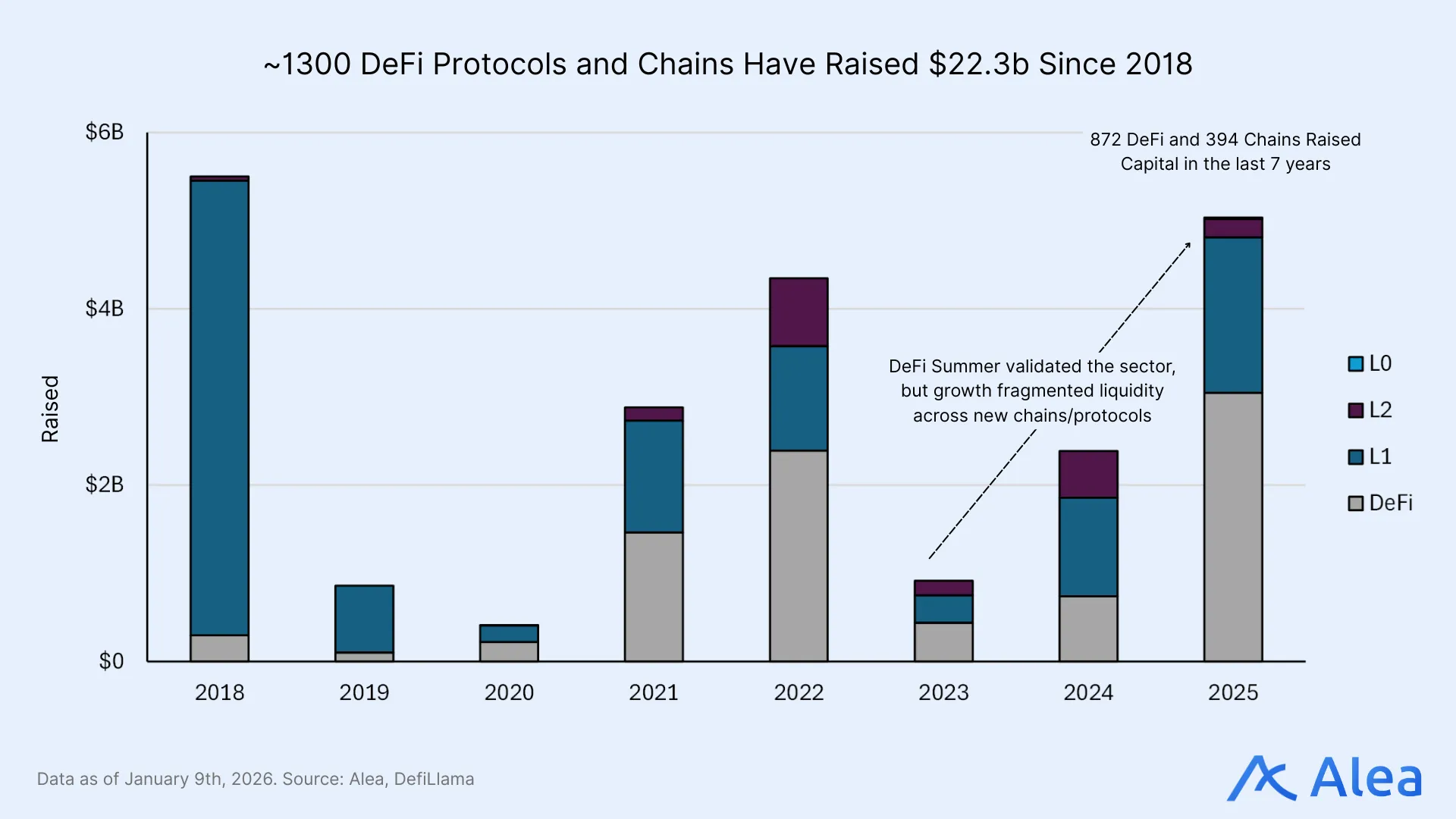

There has been over a 5x growth in the number of DeFi protocols and chains over the past 3 years that have raised money, and even a rise in crosschain activity which sees TVL move to where yields are highest.

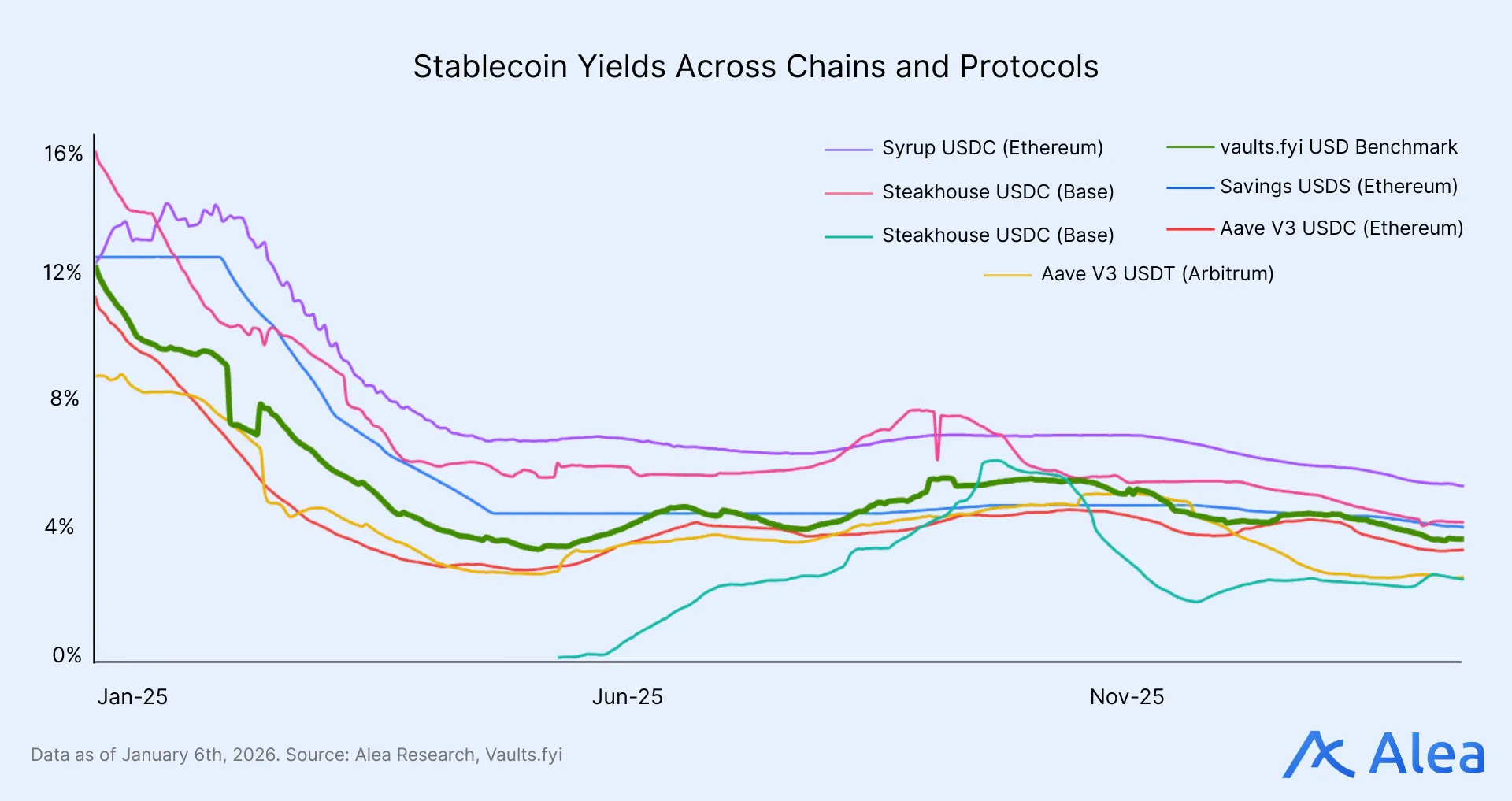

For example, USDT yields on Aave on Ethereum offers a base 2.45%, Arbitrum offers 3.06%, but on Plasma its 3.78% + 0.72% of XPL rewards. Also depending on the protocol and strategies deployed, yields can go upwards of 6% on Maple or in the double digits with Morpho loops. The spread exists because borrowing demand, liquidity depth, and incentive programs differ by chain — and those conditions shift constantly.

The workflow today to chase yields on a new chain hasn’t really changed. Yield farmers still have to:

- Discover the opportunity via X or yield sites.

- Bridge/Swap into the target chain or asset using a dedicated bridge UI, then a DEX on the target chain.

- Deposit capital into the yield protocol’s own UI.

- Monitor the position using a third party portfolio tracker since it won’t show alongside positions on other chains in a single view.

- Rebalance or Exit by reversing the steps, again across multiple UIs.

very one of these steps is a tax on the user in terms of time, effort and risk so users either stick to 1 ecosystem or accept suboptimal yields because the operational overhead is too high. Automated vaults have partially solved this within chains. Yearn pioneered auto-compounding in 2020, Beefy extended it to multiple L1s and L2s. But these vaults optimize after the user chooses where to deploy. They don’t answer the prior question of “which chain?”, “which protocol?”, and “which opportunity?”.

What’s clear is that the status quo workflow has many points of friction which invites drop-offs. Jumper’s bet is that a unified workflow: discover > swap/bridge > deploy > monitor, will attract users who value speed and execution simplicity in a single integrated UI.

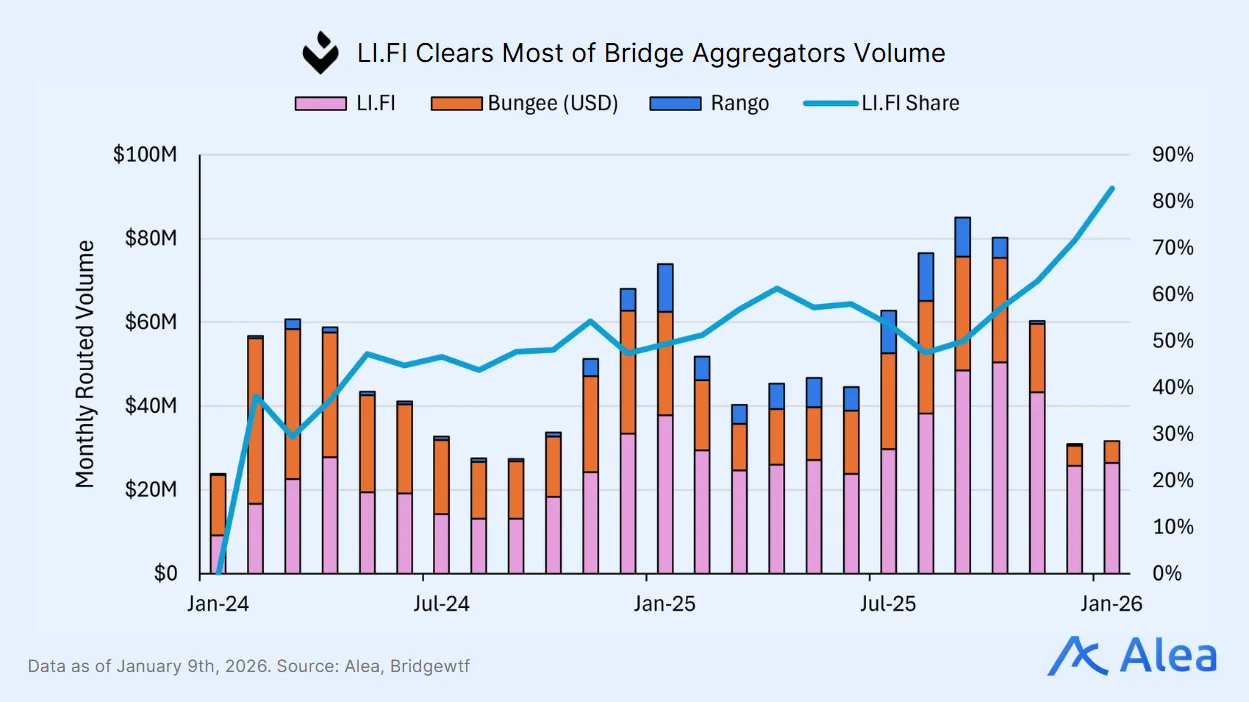

Lifi has demonstrated product market fit, going from <50% in aggregator market share to now >80%.

Where Smart Money Moves

Jumper’s ~$30 million daily asset flow represents a significant yield opportunity currently going untapped. Today, users must separately discover and deposit into yield farms after their assets are bridged. That step happens outside of Jumper. Owning this workflow end-to-end captures yield-seeking capital that bridges for higher rates, liquidity incentives, or farming programs.

Earn surfaces personalized yield opportunities and executes deposits, while Portfolio provides a unified command center for monitoring positions. Together, they transform Jumper from a pure execution tool to a yield-optimization platform where smart money moves, deepening engagement and delivering potentially better outcomes with less friction.

Jumper Earn: Personalized Yield Discovery

Jumper Earn aims to become more than a traditional yield aggregator by adding personalized yield discovery with one-click execution. The discovery phase tailors suggestions based on wallet holdings and activity:

- A wallet holding primarily USDC and ETH might see stablecoin lending and ETH staking opportunities prioritized.

- A user with farming history on Arbitrum might see new programs on that chain highlighted.

The goal is to avoid the yield aggregator pitfall of overwhelming users with hundreds of pools. Instead, Earn’s personalization engine operates across four dimensions: DeFi positions (protocols used), token holdings (assets in wallet), chain activity (networks frequented), and risk profile (conservative, normal, or degen). Opportunities surfaced on the “For You” tab represent the intersection of these signals, filtering for the best available returns within users’ demonstrated risk tolerance, rather than dumping a generic leaderboard.

At launch, Earn supports a curated set of blue-chip strategies including lending via Aave and Fluid, liquid staking and restaking through Lido and EtherFi, and vault strategies across Morpho, Euler, Gearbox, Spark, and curated vaults from Veda (EtherFi) and Mellow (Lido). Pendle PT positions are also planned within the first two months post-launch while perps LP tokens are also included within the roadmap. The initial set of protocols prioritizes depth over breadth that are better to execute reliably on ten integrations than partially on more.

Execution is equally critical. Jumper offers one-click Zaps powered by LI.FI Composer by handling swaps (into the required deposit asset), bridging (if needed), and calling the target protocol’s contracts which are all bundled into a single transaction hidden on the backend. This leverages the same diamond contract architecture that made crosschain swaps possible, extended to protocol interactions.

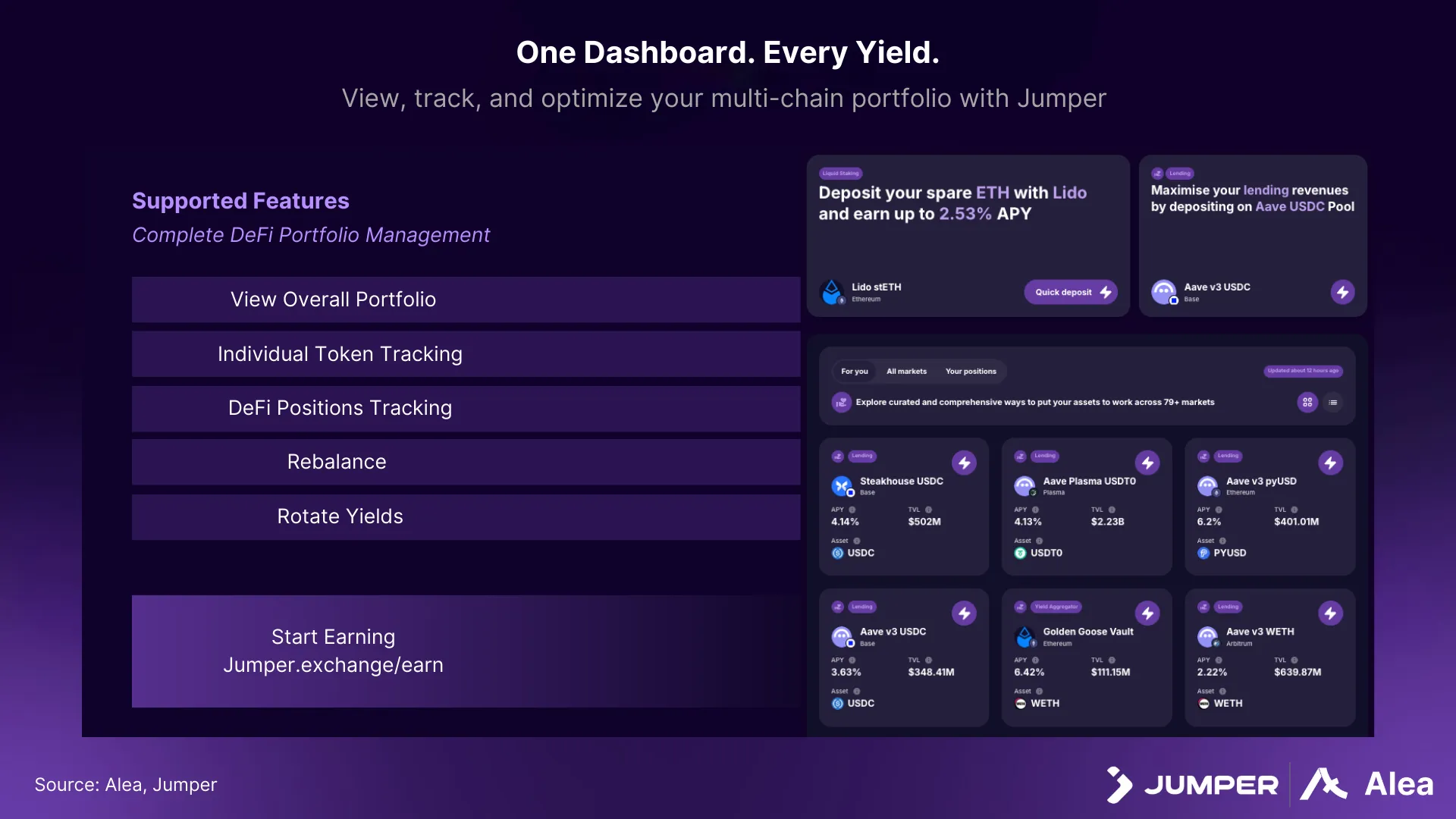

Jumper Portfolio: All-in-one Management UI

While Earn provides users with discovery and execution, Portfolio post-execution management and monitoring.

The problem is familiar. A user deploys capital across multiple chains on Earn: stablecoin lending on Optimism, LP farming on Arbitrum, staking on Base. A week later, yields shift and users want to rebalance. Without Portfolio, they have to check each position in a separate dashboard (Debank, Zapper), navigate to each protocol’s native UI, execute withdrawals and deposits manually, bridge between chains. The friction that Earn eliminated on entry returns on exit.

Jumper Portfolio isn’t trying to be another read-only portfolio dashboard like Debank or Zapper. Instead, Portfolio is an action-oriented dashboard that lets users monitor positions across chains, rebalance, and rotate yields without leaving the platform, thus closing the loop. Portfolio needs integration breadth (top protocols across chains), action depth (withdrawals, claims, rebalancing), and diverse execution (multi-step operations in single flows). Anything less is a dashboard. Done right, it is the retention engine that makes Earn sustainable.

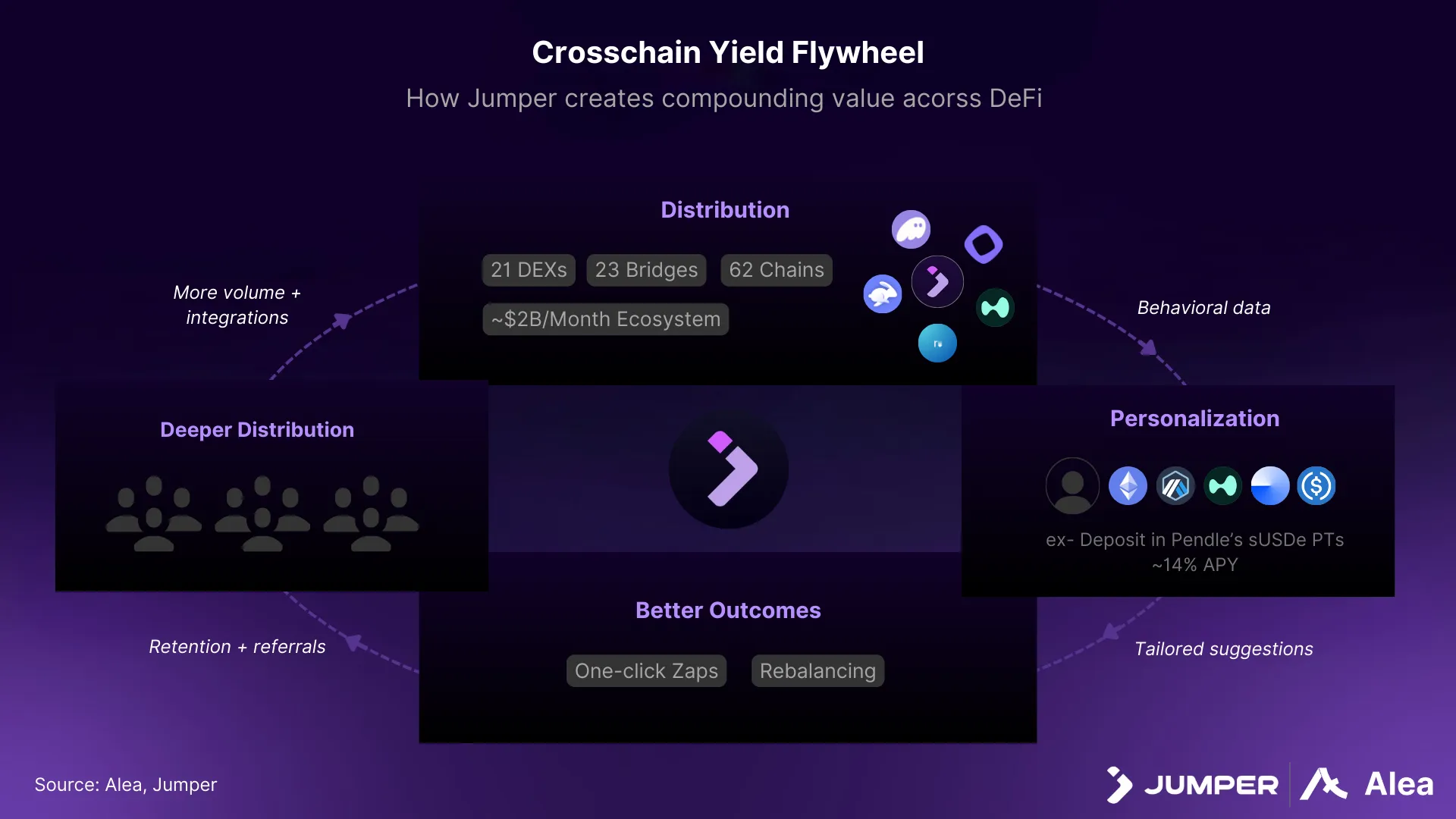

Growth Flywheel

Behind Jumper’s product evolution is a bet on a flywheel effect which starts with distribution. Jumper already handles significant traffic in crosschain swaps (over $1 billion in monthly volumes). It also indirectly reaches users through B2B partners; LI.FI’s tech (and by extension Jumper as the flagship app) is integrated into major products like Rabby, Phantom, Jupiter, Hyperliquid, and others.

Every wallet connection gives Jumper behavioral data: which chains a user frequents, which tokens they hold, which swaps they execute. Earn is designed to apply that data to surface personalized yield opportunities that match the user’s actual portfolio and rush profile. If the personalization is accurate, users find suitable investments faster.

If the execution is smooth, users save time and potentially capture yields they would have missed during manual sequencing. Better outcomes should drive retention where instead of dropping off after a swap/bridge, users return via Portfolio, rotate positions when yields compress, and concentrate activity on the platform that keeps working for them.

More usage generates more behavioral data, which improves personalization. Better personalization attracts more volume. More volume attracts more yield providers wanting integration into Earn. More integrations expand the opportunity set, which improves outcomes further. The endgame is that Jumper becomes the default front-end for crosschain capital allocation where smart money moves, not easily displaced because switching means losing the personalization built on users’ transaction history.

Conclusion

As a battle-tested crosschain router built on LI.FI’s aggregation infrastructure, Jumper has already moved tens of billions across chains and applications. Now, Jumper is clearly trying to play the aggregator-to-allocator pipeline game to capture the next clicks after the bridge/swap.

Jumper is betting that in a fragmented multichain environment, the app that owns the full loop (move assets > find yield > manage positions) compounds user stickiness in ways a pure routing utility never can. This is the same playbook metamask tried (and mostly fumbled) with swaps and staking. Jumper has a real shot because they are starting from actual aggregation infrastructure, and the already established backend means they’re not rebuilding the plumbing from scratch.

Execution risk however remains real with Earn and Portfolio being freshly launched on Jan 13. Validation will come from real uptake with retention on the new features mattering more than launch volume. If Jumper can show that bridge users convert to yield users at meaningful rates, the thesis is validated. If not, they remain a very good crosschain exchange.

References

Defillama – Crosschain USDT Yields

LiFi Blog – Crypto’s Everything Exchange

Disclosures

Alea Research is engaged in a commercial relationship with Jumper and receives compensation for research services. This report has been commissioned as part of this engagement.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.