The Abstraction Layer for DeFi Agents

Introduction

DeFi is broken—not the technology but the usability. Its powerful tech is buried under crushing complexity, and users don’t know how to navigate this landscape. In addition, we are entering an era where agents are being onboarded on-chain and will become first-class citizens as well.

INFINIT is the AI layer that makes DeFi more accessible. It is an abstraction layer that paves the way for users to tell AI what they want and achieve an outcome with straightforward commands. Users can use natural language and let AI handle the rest.

Users can chat in plain English and let AI handle the rest, while developers can build in Typescript and forget that Solidity exists. INFINIT teaches AI to speak DeFi so humans don’t have to. The elegance is in what’s missing: No more jumping between protocols, no more technical manuals, no more missed opportunities because you needed sleep.

Key Takeaways

DeFAI: By combining DeFi with AI, INFINIT turns DeFi’s “read the docs” problem into “tell AI what you want.”

Natural Language DeFi: Through the INFINIT Terminal, users can type what they want, and the AI (DeFi agent) will figure out how to complete it.

Three Core Engine: INFINIT’s DeFi abstraction layer consists of 3 core components that power the INFINIT Terminal: the Autonomous DeFi Agent Framework (ADA Framework), INFINIT Data Stream, and INFINIT Cloud Infrastructure. Simple interface up front for users to interact with serious tech under the hood.

DeFi Agent-Based Automation Strategy: INFINIT’s DeFi agents can handle complex multi-protocol strategies while preserving user control. They are AI-powered agents that actually work and can do more than basic swaps.

24/7 Portfolio Intelligence: Markets never sleep, and now, neither does your portfolio manager. Continuous monitoring and instant execution when opportunities arise.

Full-Spectrum Data: INFINIT merges on-chain signals with social sentiment and market conditions. Every response of the DeFi agent happens with complete market context.

Background

DeFi’s first wave introduced so-called “money legos.” These powerful, programmable pieces of code allowed protocols to innovate by building on top of each other. Thus, builders could reuse existing code to enhance the capabilities of a more primitive building block.

However, as more code gets added on top, you end up adding layers of complexity and, eventually, money legos become quicksand. This is the Solidity tax, and every EVM developer paid it. Onboarding Web2 developers meant that they could spend months just to learn how to write Web3 code, then another period of time to get more proficient, and still on top of that, you would then need to refine the original code for security purposes—and audits still couldn’t offer safety guarantees.

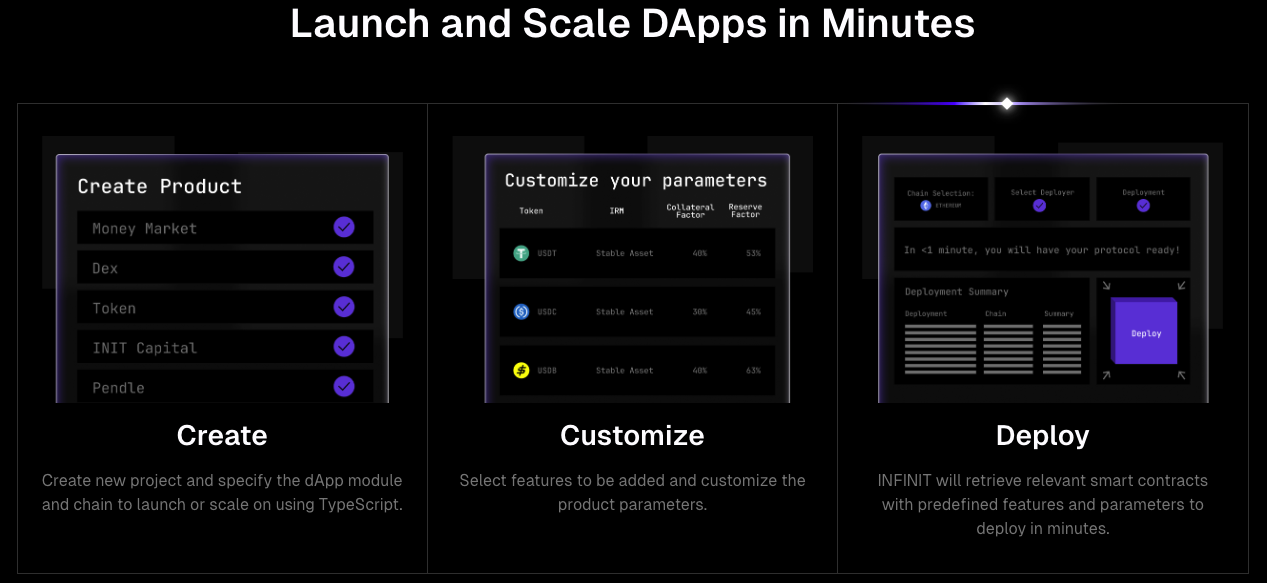

That’s the exact problem that INFINIT set out to solve at inception. Initially focused on simplifying dApp development across EVM chains, it looked to address fundamental barriers in DeFi protocol creation. The traditional requirement for Solidity expertise and deep smart contract security knowledge created significant friction in protocol development and deployment. To tackle these challenges, INFINIT introduced a modular DeFi Abstraction Layer that reduces deployment overhead and supports protocol expansion.

Figure 1: The stages of launching a new project using INFINIT

Source: INFINIT

Source: INFINIT

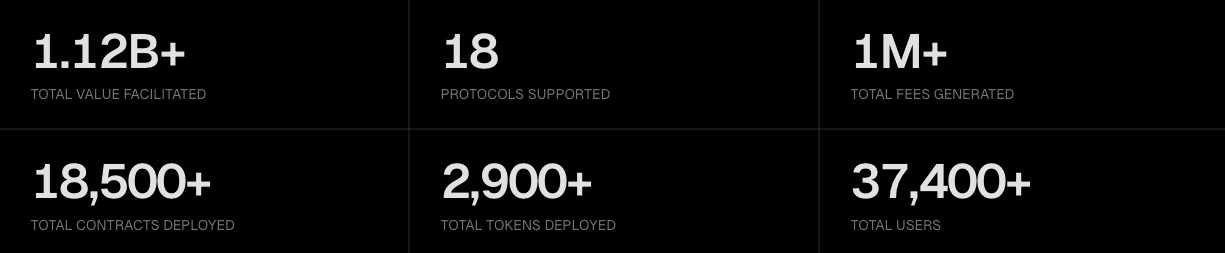

Since its launch, INFINIT has a proven track record as the leading DeFi abstraction layer, successfully enabling developers to launch and scale their DeFi protocols using INFINIT’s infrastructure. Empowering developers to build DeFi dApps in minutes instead of months by using Typescript is a major selling point. Not only does this lower the barriers to entry for new developers who want to build DeFi dApps, but it also speeds up the bootstrapping process for chains to build out their ecosystems.

Figure 2: These key metrics showcase the value of INFINIT as an infrastructure layer for DeFi dApps

Source: INFINIT

Source: INFINIT

The protocol’s expansion into DeFAI is a response to limitations in the current DeFi-AI convergence. Existing AI agents demonstrate several constraints: social media agents remain confined to content creation and engagement farming, while DeFi agents handle only basic operations. The inability to execute complex, multi-protocol transactions significantly limits their utility and true capabilities.

This technical limitation intersects with DeFi’s persistent accessibility problem. The ecosystem’s complexity, from wallet setup to funds deposit to blockchain navigation, creates substantial cognitive overhead for users who just want simplicity. The combination of overwhelming information flow and unpolished UI have created a clear market gap: the need for intelligent automation that simplifies DeFi engagement.

INFINIT’s transition to a DeFi abstraction layer for DeFi Agents wants to address this opportunity. By improving AI agents with protocol-level integration capabilities, INFINIT allows autonomous execution of complex DeFi operations. The system transforms basic AI agents into advanced DeFi operators capable of managing complex yield strategies and cross-protocol interactions.

The DeFAI Breakthrough

Enter AI—not as a feature, but as the missing interface layer. INFINIT realized they could teach AI to handle DeFi’s complexity the same way they’d taught TypeScript to handle Solidity’s.

Today’s crypto AI landscape is limited: social bots that farm likes, DeFi bots that execute basic swaps, etc. INFINIT saw the chance to transform these basic bots into financial co-pilots for DeFi.

Instead of teaching users about slippage tolerances and gas optimization, teach AI to handle them. Instead of building better UIs for complexity, make complexity invisible. Let humans declare their intentions while AI handles the Byzantine machinery underneath.

The perfect storm culminated in the convergence of INFINIT’s abstraction layer and the rise of AI. The result? A system where developers can build DeFi agents and DeFi dApps using TypeScript, users interact in plain English, and the DeFi agent will seamlessly bridge the gap between intention and execution.

DeFAI: AI Meets Money Legos

Forget about last cycle’s DeFi 2.0. The market looked at incremental improvements and said: “Not good enough.” Instead, we’ve jumped straight to DeFAI—where artificial intelligence meets autonomous finance. AI is solving crypto’s biggest hurdle: accessibility.

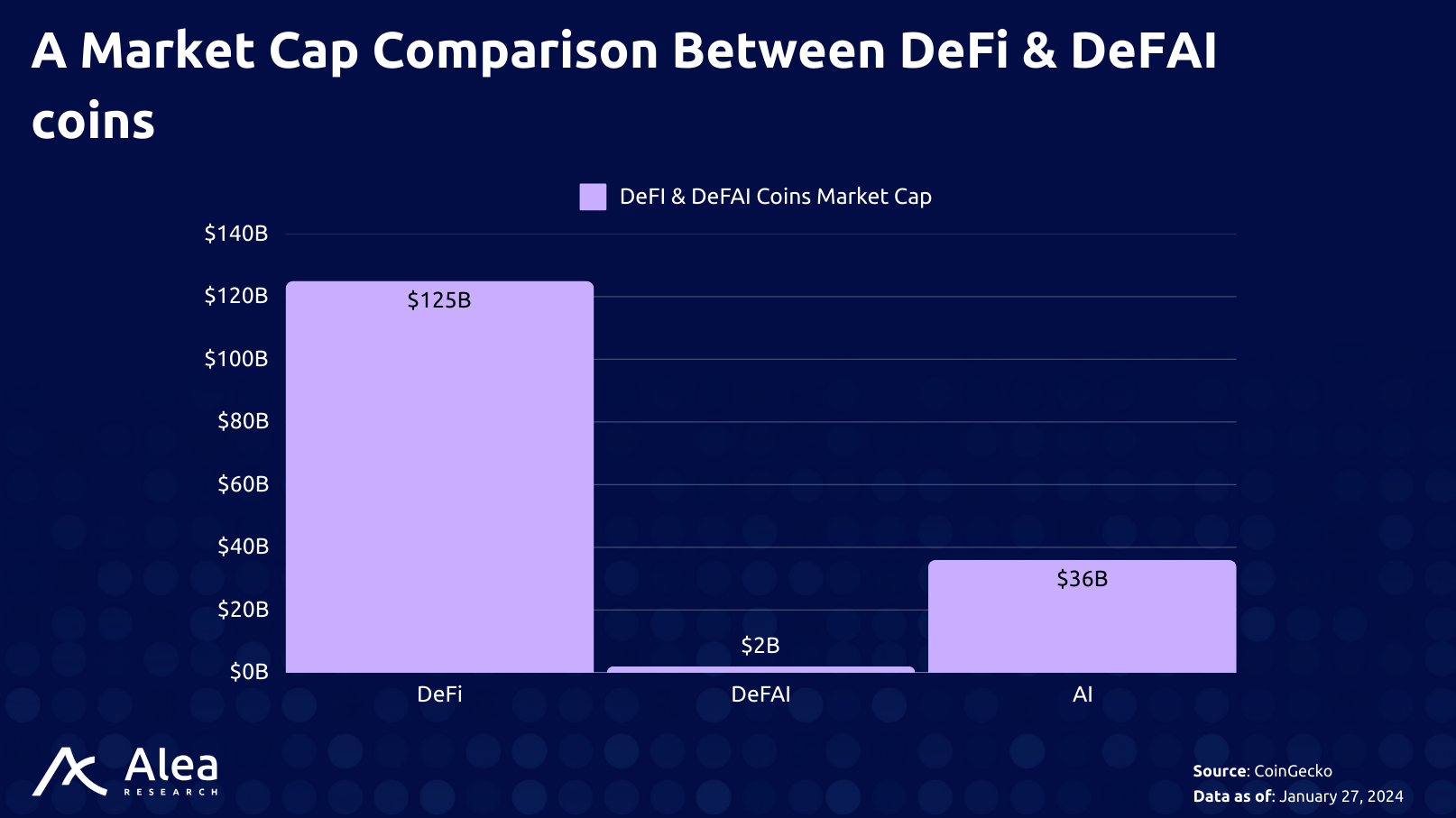

Figure 3: DeFAI coins can grow exponentially compared to DeFi and AI coins

Source: Alea Research (Data: CoinGecko)

Source: Alea Research (Data: CoinGecko)

DeFi promised financial freedom, but it also came with financial engineering homework. Users got direct control of their assets, but that came at the expense of becoming their own bank, trader, and risk manager. Sovereignty became a burden instead of a benefit.

This is where DeFAI changes the game. Instead of teaching humans to think like protocols, we’re teaching AI to think like humans. By offloading DeFi complexities to AI agents, users can easily access and manage their on-chain finances. Where traditional DeFi just moved buttons around, DeFAI eliminates them entirely. DeFAI’s transformation works on three levels:

First, it frees users from technical jargon. “Slippage tolerance” becomes “make sure I get a fair price.”

Second, it enables true cross-protocol automation. Your agent orchestrates complex strategies across DeFi’s fragmented landscape.

Third, it turns static positions into dynamic portfolios. Your agent adapts to market conditions in real time, like a 24/7 fund manager that never sleeps.

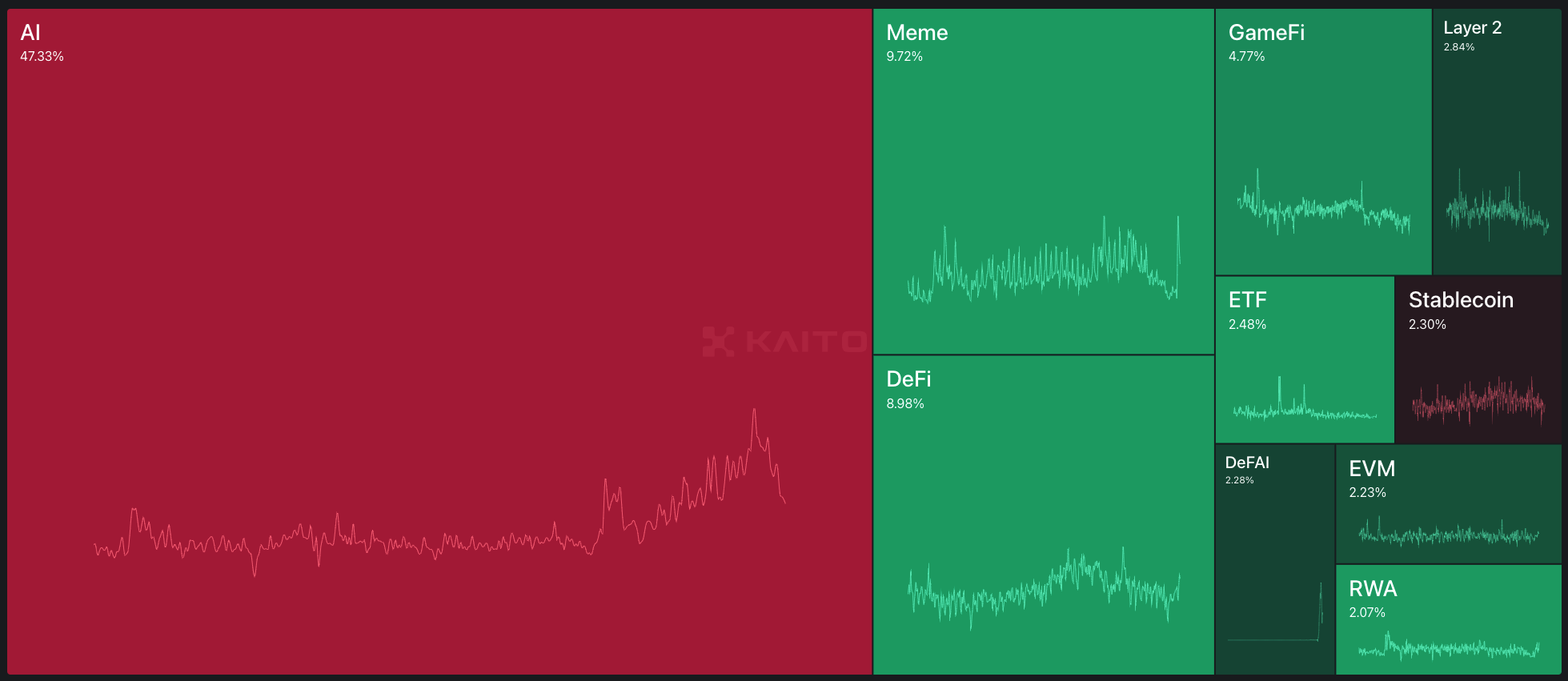

Figure 4: The DeFAI sector is still in its infancy compared to other crypto sectors but is gaining traction as the AI narrative continues to dominate.

Source: Kaito

Source: Kaito

DeFi started with a promise to give users direct control over their assets and bypass traditional intermediaries. Yet many people found it overwhelming, thanks to confusing interfaces, countless protocols, bridges, blockchains, and high-stakes decisions. The result was stagnation, as most users wanted convenience instead of full sovereignty. DeFAI turns this around by delegating complex tasks like swaps, wallet management, and capital deployment to autonomous agents.

This is where INFINIT changes everything. Their abstraction layer makes DeFi complexity invisible. Developers can deploy DeFi agents to onboard more users to their protocols. Users execute strategies without needing a deep understanding of the underlying processes. The machinery of DeFi keeps running, but humans no longer need to operate it manually. This becomes a moat offering a unique value proposition to chains for bootstrapping their ecosystems.

DeFAI goes beyond older abstraction layers, which reduced the friction of DeFi development but didn’t address users’ overall sense of complexity. It uses advanced agents that gather data, negotiate deals, and communicate more naturally with users. DeFAI effectively reduces DeFi to a simple conversation: You ask for a task to be done and let the AI figure out how best to do it.

By removing direct user interaction with fragmented liquidity or complicated dashboards, DeFAI makes decentralized finance accessible to a broader audience. This approach doesn’t eradicate friction altogether; it shifts it to AI entities that operate behind the scenes without caring about friction.

Through INFINIT, even the most inexperienced user can delegate complex tasks to dedicated DeFi agents and receive crypto payouts without struggling through perplexing steps.

INFINIT: Where AI Meets DeFi

The synergy between AI agents and a DeFi abstraction layer reduces the pain points that have long kept DeFi from broader adoption. Offloading the grunt work to AI means users aren’t forced to parse complex dashboards or jump across fragmented protocols, wasting time and capital. At the same time, users can retain the final say over transactions, preserving a measure of control. This approach has a real shot at broadening DeFi’s user base, especially for new users intimidated by technical complexities.

Upgrading the DeFI Abstraction Layer for DeFAI

Initially, INFINIT addressed the challenges developers face when launching and scaling dApps in DeFi. With this upgrade, INFINIT focuses on the end user and their challenges in navigating the DeFi ecosystem through DeFi agents.

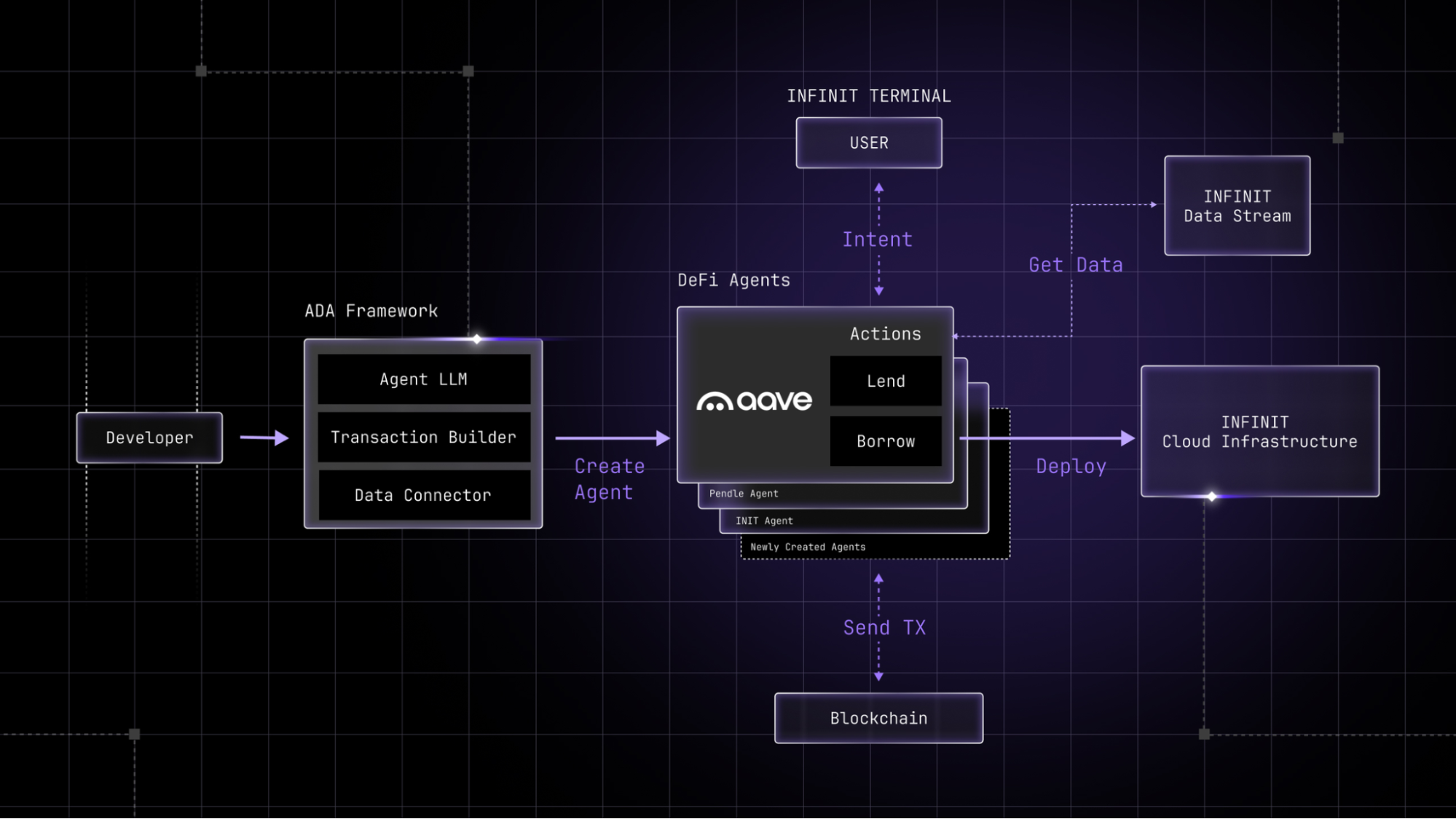

INFINIT’s upgraded DeFi abstraction layer features a modular architecture designed to facilitate autonomous DeFi operations through intelligent agent deployment. To achieve this, the system is based on three components: the ADA Framework, the INFINIT Data Stream, and the INFINIT Cloud Infrastructure.

At the interface level, the INFINIT Terminal is the unified entry point for users to access the DeFi agents. It translates natural language commands into protocol-compatible instructions.

Figure 5: An overview of INFINIT’s DeFi abstraction layer highlighting the core components and the operational workflow

Source: INFINIT Docs

Source: INFINIT Docs

Users can interact with DeFi protocols using DeFi agents by sending simple text-based commands through INFINIT Terminal, letting the system automatically translate them into on-chain transactions. For example, a user might type, “Buy 10 $ETH with $USDC at the best price and supply half to the best liquidity pool on Ethereum”, and the agent figures out which protocol to use, then executes the trade after the user confirms.

Developers rely on the ADA Framework to create AI-driven DeFi agents, which handle LLM-based instructions and connect to on-chain modules. They also use the INFINIT Data Stream for real-time on-chain and off-chain information, enabling agents to identify attractive yield opportunities or stable liquidity sources.

Once developed, agents can be deployed to the INFINIT Cloud Infrastructure to make them globally available for end users. Ultimately, both end-users and builders benefit from an AI system that handles complexity while preserving human oversight.

Autonomous DeFi Agent Framework (ADA Framework)

The ADA framework allows developers to design and deploy AI-driven agents that execute on-chain tasks without forcing users to wrestle with complicated protocols. This is achieved by translating natural-language instructions into transaction data and managing the underlying blockchain interactions. By handling the messy implementation details, it shortens the gap between user intent and on-chain execution.

The ADA framework includes three interconnected sub-components:

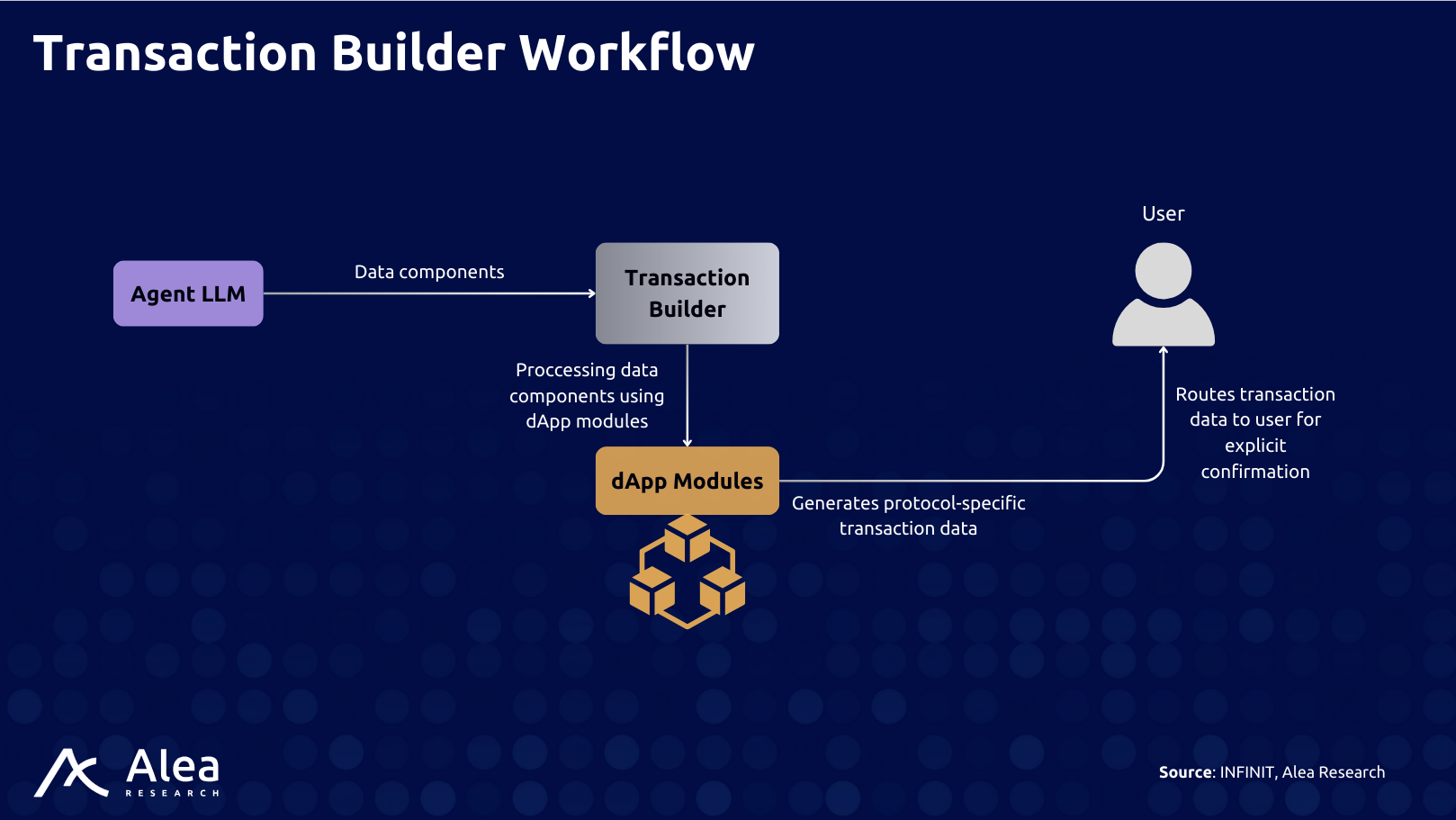

- Agent LLM – The Agent LLM is used for Intent translation by converting user commands into standardized protocol instructions or data components sent to the transaction builder.

- Transaction Builder – The Transaction Builder is the core execution engine within the ADA Framework, handling the path between user intent and on-chain operations. Its architecture contains several dApp modules that process standardized data components received from the Agent LLM.

Figure 6: The workflow of the transaction builder

- Data Connector – This component is the integration layer between the ADA Framework and INFINIT’s Data Stream, enabling real-time data flow for DeFi agent operations. It processes both on-chain and off-chain data sources, providing agents with market context for transaction decisions and user query responses.

INFINIT Data Stream

Markets never sleep, and neither does INFINIT’s Data Stream. Constantly scanning on-chain movements and monitoring off-chain social signals, INFINIT’s Data Stream can track market sentiment and spot yield opportunities at the same time.

The INFINIT Data Stream is a dynamic aggregator that feeds real-time on-chain and off-chain data into AI-driven DeFi agents. It pulls signals from blockchains, social platforms, and other sources, giving agents context about liquidity conditions, community sentiment, emerging opportunities, and more. Aggregating this information reduces the burden of manual research on users and developers.

For example, if the Data Stream detects a yield-farming pool has spiked above a target APR (e.g. 20%), the agent can alert the user or auto-generate a transaction to move funds if it has a pre-command by the user. This helps users act faster and more accurately, capitalizing on market opportunities.

Designed to run around the clock, the Data Stream guarantees that agents remain aligned with current market conditions at all times, which humans can naturally not do since they need to work, eat, and sleep.

Figure 7: DeFAI agents could capture all the opportunities with data access and minimal user interference

INFINIT Cloud Infrastructure

The Cloud Infrastructure is the always-on engine that keeps the DeFi agents in check, always monitoring positions, executing strategies, and adapting to market shifts.

The INFINIT Cloud Infrastructure hosts DeFi agents 24/7. It delivers global availability and robust performance, facilitating the continuous execution of DeFi strategies without constant input by users. Because it is permissionless, developers can scale their agents with minimal friction.

Running an agent 24/7 ensures opportunities aren’t missed when users are offline or asleep. It also allows for continuous position management and quick adaptation to price swings. Soon, each user will have its own agent as a portfolio manager, optimizing capital according to market conditions and the latest data.

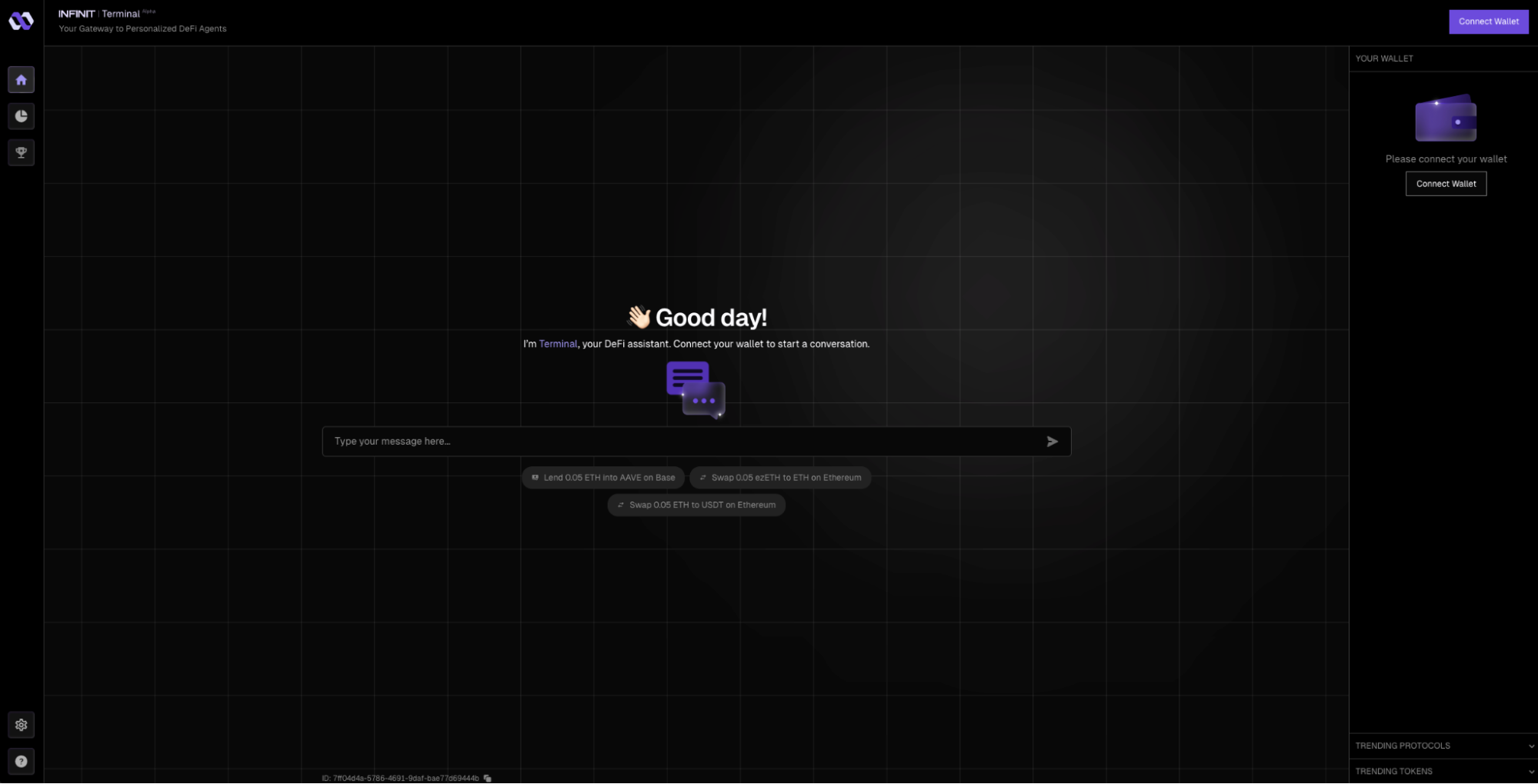

INFINIT Terminal: Express Intent, Confirm, Execute

The Terminal is INFINIT’s ChatGPT moment, akin to a Bloomberg Terminal that understands both DeFi and plain English.

It is a single interface for users to access DeFi agents and ask questions using natural language. You can picture the INFINIT Terminal as a well-organized console; it streamlines the chaos behind the scenes, letting users focus on the results, not the wiring.

Figure 8: INFINIT Terminal

Source: INFINIT Terminal

Source: INFINIT Terminal

In the alpha launch, INFINIT offers three agents assigned to each protocol available on Ethereum and Base: a Pendle agent, an AAVE agent, and a Uniswap agent.

The Pendle agent facilitates trading yield-bearing assets (such as YT/PT Pendle tokens) to generate either stable or variable returns. The AAVE agent lets users supply assets to earn interest and withdraw funds at will. The Uniswap agent executes token trades across Uniswap V3.

Consider the current state: users juggle between Uniswap for trading, AAVE for lending, and Pendle for yield strategies, each with its own learning curve and interaction process. The INFINIT Terminal replaces this fragmented approach with a conversational interface where specialized agents handle the technical complexity. Users simply express their intent, and the appropriate agent executes the required protocol interactions.

INFINIT will add new DeFi agents to the Terminal, supporting more lending and liquidity protocols, such as Morpho, Fluid, and Aerodrome. Gradually, all agents will gain extra features to handle increasingly complex tasks. The roadmap also includes expanding to additional chains like Solana to increase the Tterminal’s capabilities.

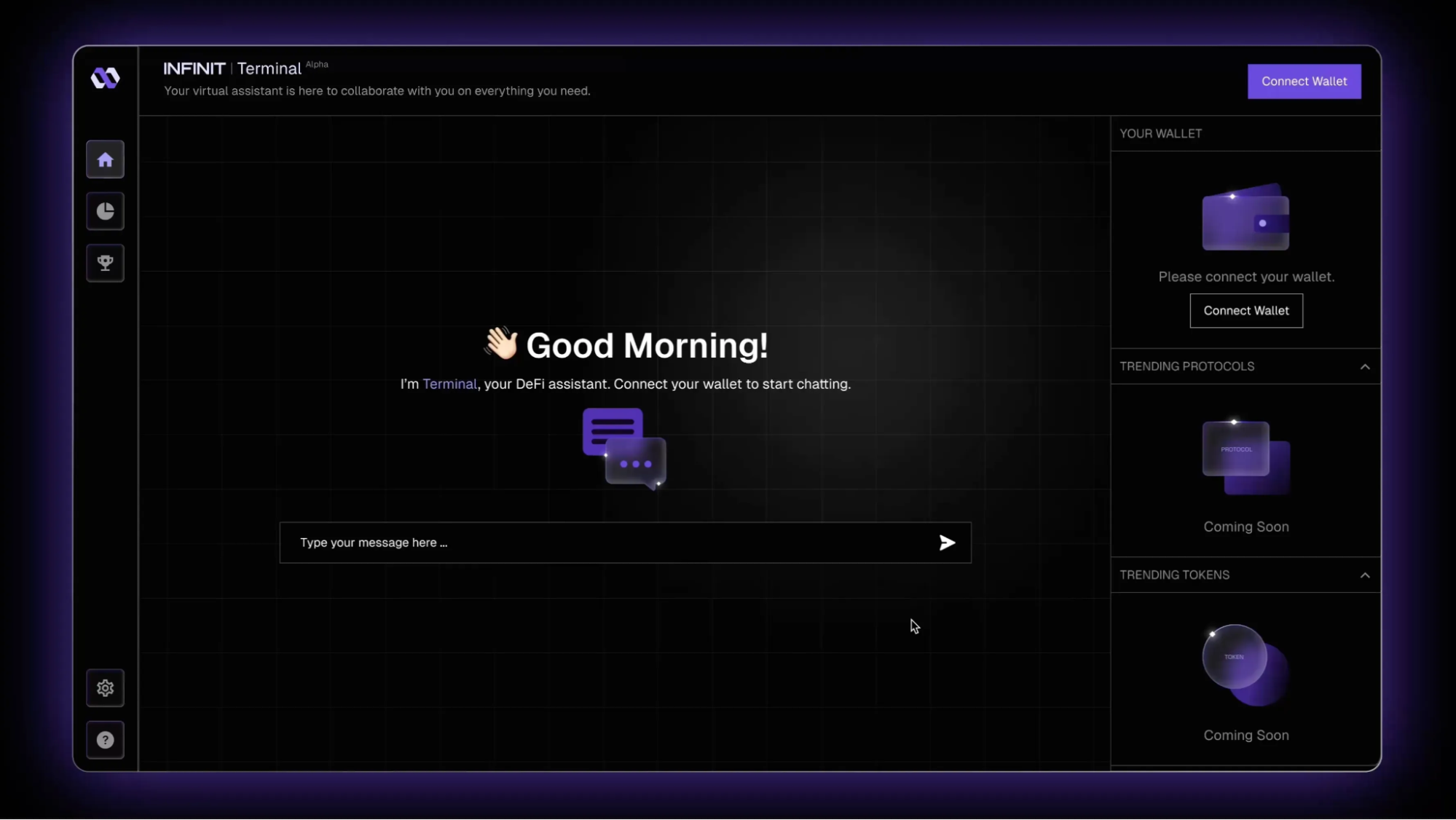

How to Use the INFINIT Terminal

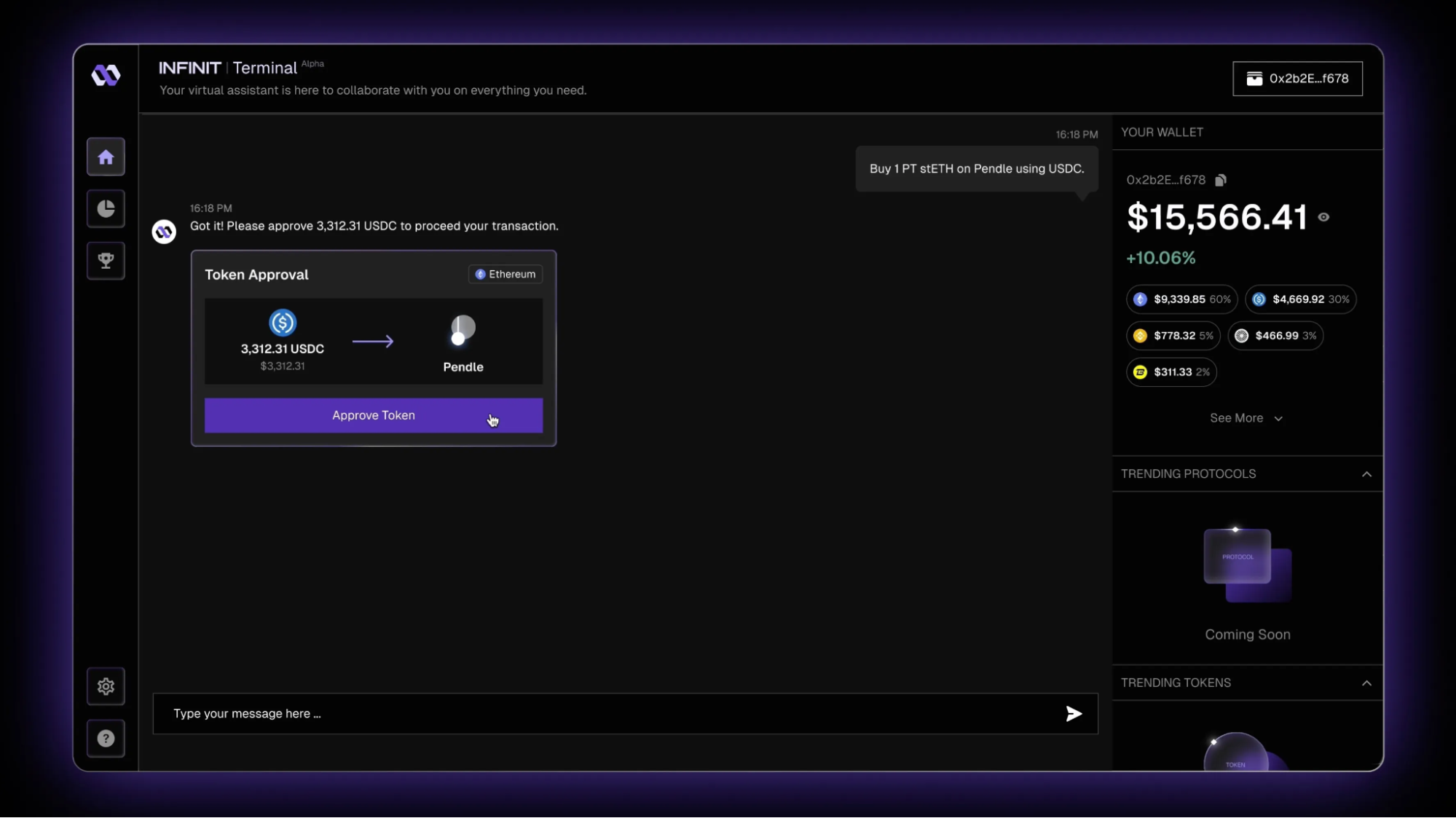

Here’s a guide provided by INFINIT on how to use the INFINIT Terminal with the Pendle agent.

- Visit the INFINIT Terminal page https://terminal.infinit.tech/ and connect your wallet in the top right corner.

Figure 9: INFINIT Terminal

Source: INFINIT Blog

Source: INFINIT Blog

2. Simply express your intent in a text to the DeFi agent, specifying the following: protocol name, asset, action, token amount, and the chain you wish to execute. For example, “I want to buy 1 PT $stETH using $USDC on Pendle on Ethereum chain. Make sure that you have sufficient funds in your wallet.

Figure 10: Expressing the intent

Source: INFINIT Blog

Source: INFINIT Blog

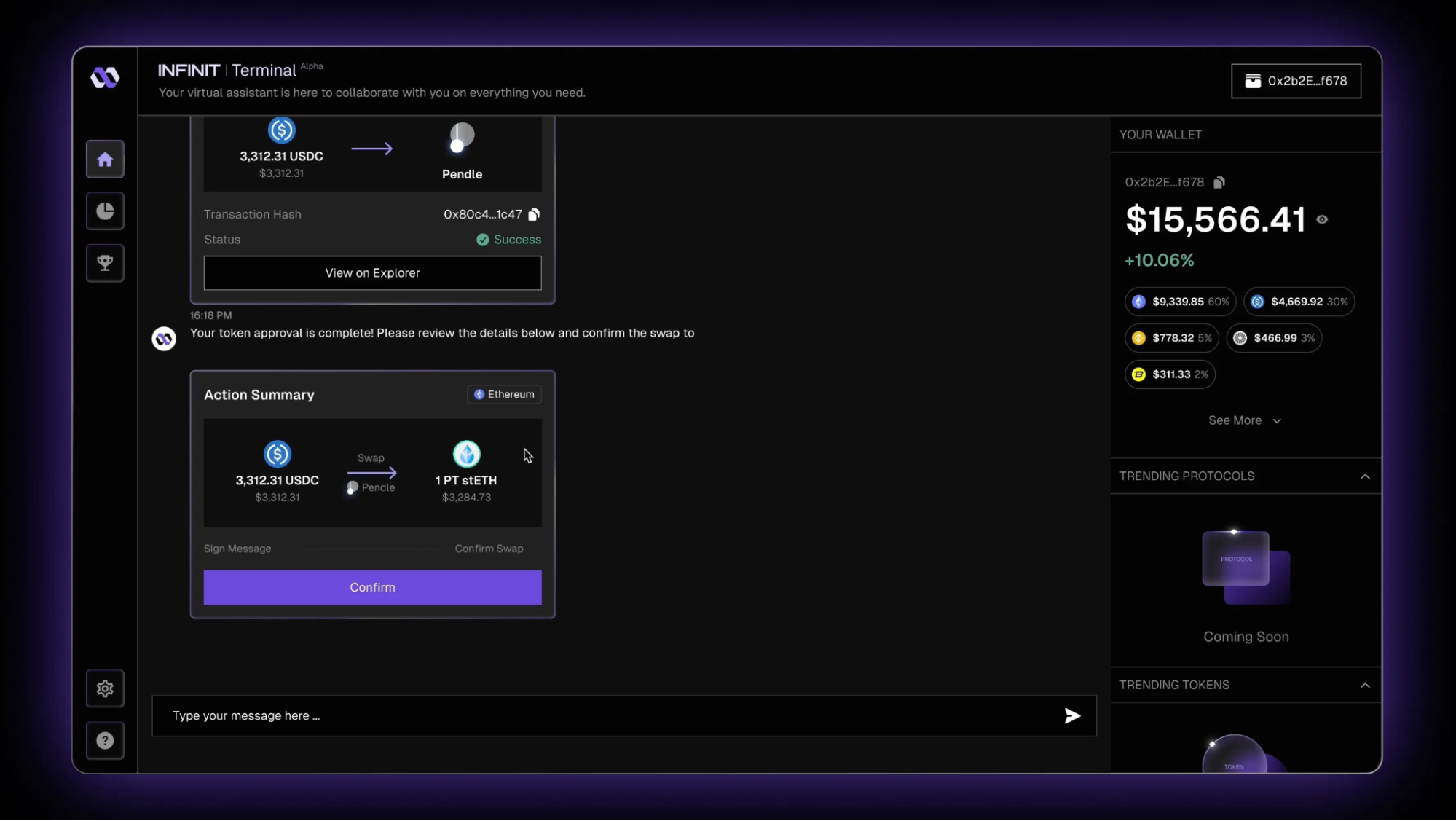

3. After going through the transaction builder and the dApp modules, the Pendle Agent will translate the expressed intent into data components and send it back to users for confirmation before execution.

Figure 11: Confirming the transaction

Source: INFINIT Blog

Source: INFINIT Blog

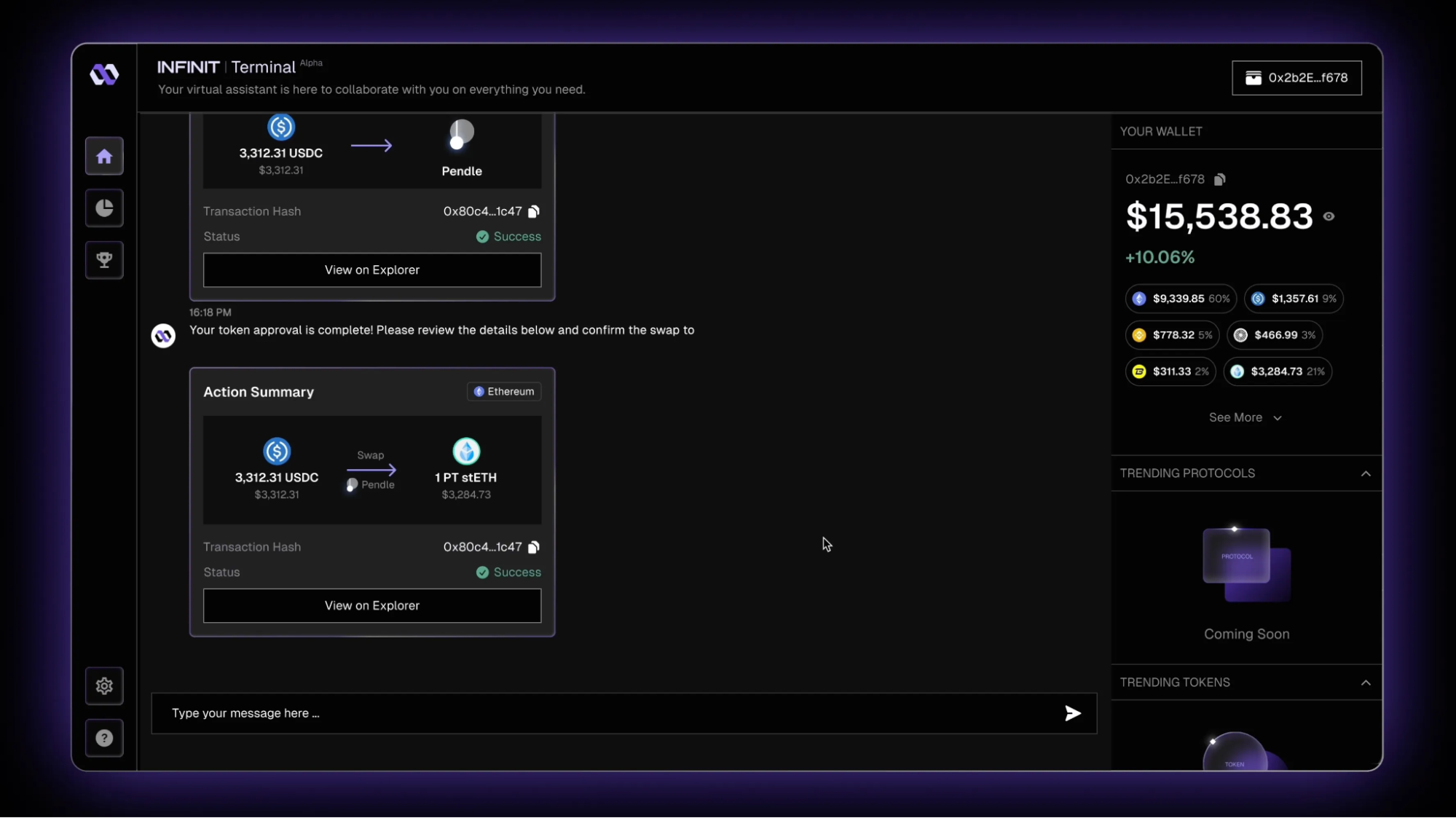

4. Once the intent is confirmed, the Pendle Agent will initiate the execution and provide confirmation when it’s completed.

Figure 12: The transaction is completed

Source: INFINIT Blog

Source: INFINIT Blog

If the user had handled this process manually, it would have required multiple swaps, approvals, and potentially other transactions, such as bridging. Using the INFINIT Terminal, users can express their intent to the DeFi agent, confirm once, and execute their transaction almost instantly.

Conclusion

INFINIT’s DeFi abstraction layer addresses a critical friction point in DeFi adoption: the cognitive overhead required to navigate multiple protocols and complex interactions. By introducing DeFi agents to handle technical complexity while preserving user control over final execution, the platform creates a more accessible entry point for mainstream users.

The infrastructure of INFINIT’s abstraction layer combines natural language processing at the interface level with modular protocol integration underneath, representing a pragmatic approach to DeFi accessibility that leverages the latest developments in DeFAI. Rather than attempting to simplify the underlying protocols, INFINIT’s design accepts DeFi’s inherent complexity but shields users from it through AI autonomy.

The emergence of DeFAI points to a broader pattern in crypto adoption where decentralization merges with AI to prioritize user experience. While early DeFi emphasized direct protocol interaction as a feature, user behavior suggests this imposes too high a technical barrier for widespread adoption. Abstraction layers can preserve the benefits of decentralized finance while delegating its operational complexity to automated agents.

Disclosures

Alea Research is engaged in a commercial relationship with INFINIT as part of an educational initiative, and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose.

Alea Research is a research platform and not an investment or financial advisor.