Introduction

While Bitcoin was conceived as a pristine monetary asset, its original design did not contemplate a blockchain hosting decentralized applications that would unlock productive use cases for $BTC with yield-bearing opportunities for holders. Despite having the largest market cap in crypto ($2T+), $BTC remains underutilized, as its native scripting limitations prevent meaningful onchain programmability. As a result, the majority of this capital sits idle in wallets, treasuries, and custodial silos. GOAT Network proposes a technical solution to make that idle $BTC productive, and bring it onchain.

GOAT Network is a Bitcoin-Native ZK Rollup purpose-built to unlock yield that is paid in $BTC, without compromising the asset’s security or the network’s censorship-resistance. It introduces smart contract capabilities to Bitcoin’s economic base using zero-knowledge (ZK) proofs and a trust-minimized design that delivers non-inflationary $BTC-denominated yield.

GOAT’s vision is to reframe $BTC utility not just as a passive store of value but also as a productive resource that enables DeFi without synthetic asset issuance, rehypothecation, or custodial risks. Its architecture integrates native Bitcoin compatibility with zkVM infrastructure, enabling an ecosystem of dApps that inherit Bitcoin’s security guarantees while accessing EVM-style composability.

Currently, GOAT sits between two forces: the growing demand for capital-efficient, yield-generating Bitcoin infrastructure and the institutional appetite for trust-minimized, $BTC exposure. The result is a network that aims to scale Bitcoin and enable various applications to operate on top of it.

Key Takeaways

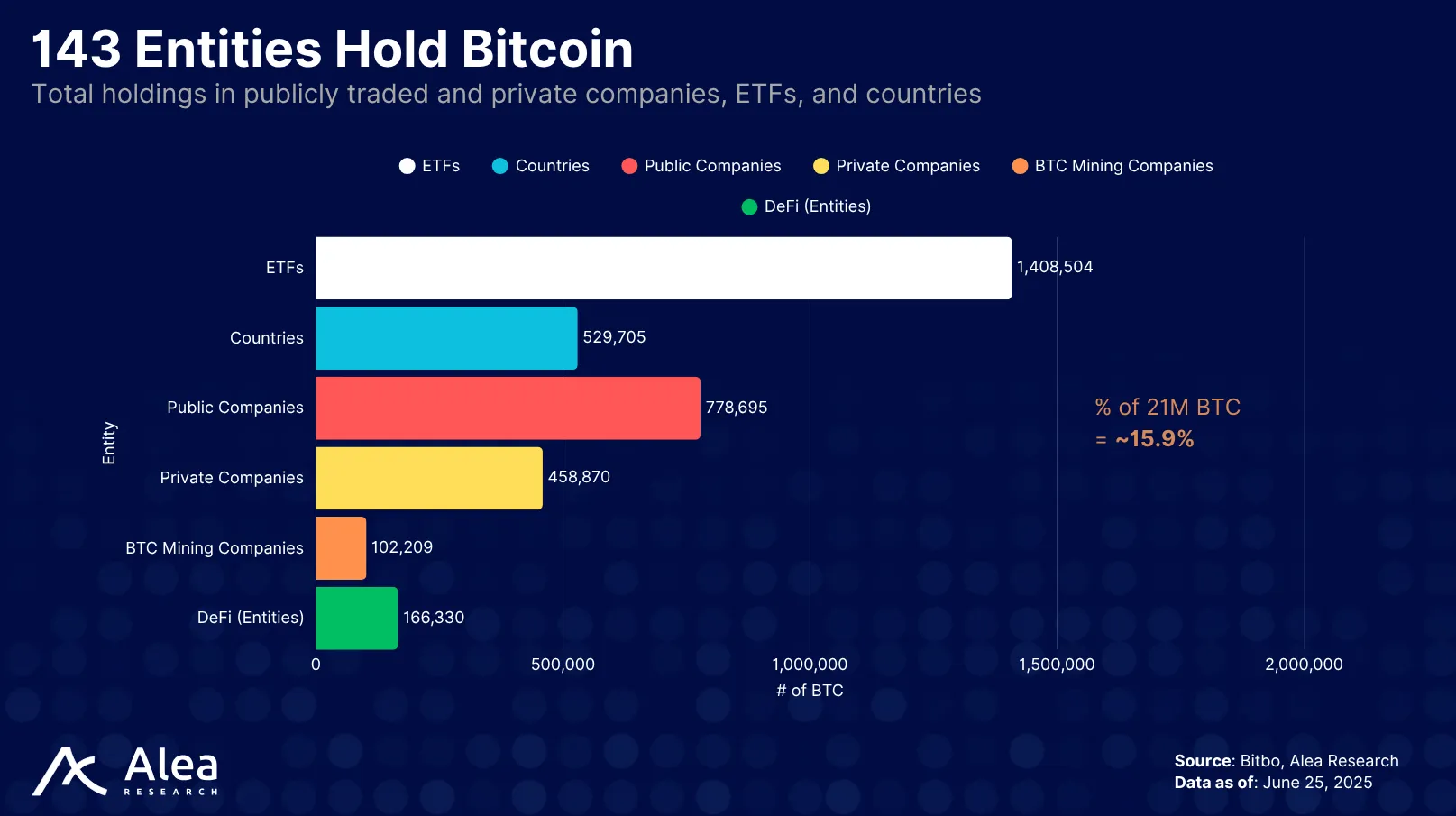

A Trillion-Dollar Market Cap Earning No Yield: GOAT wants to transform $BTC from a passive store-of-value into an active, yield-generating asset, capturing a largely untapped market. ETFs alone hold more than 1.4 million $BTC earning nothing.

$BTC Denominated Yield: All network rewards, such as transaction fees, sequencer MEV, and lending interest, are paid directly in $BTC, with the yield derived from economic activity taking place on GOAT Network using $BTC as the canonical asset for fees.

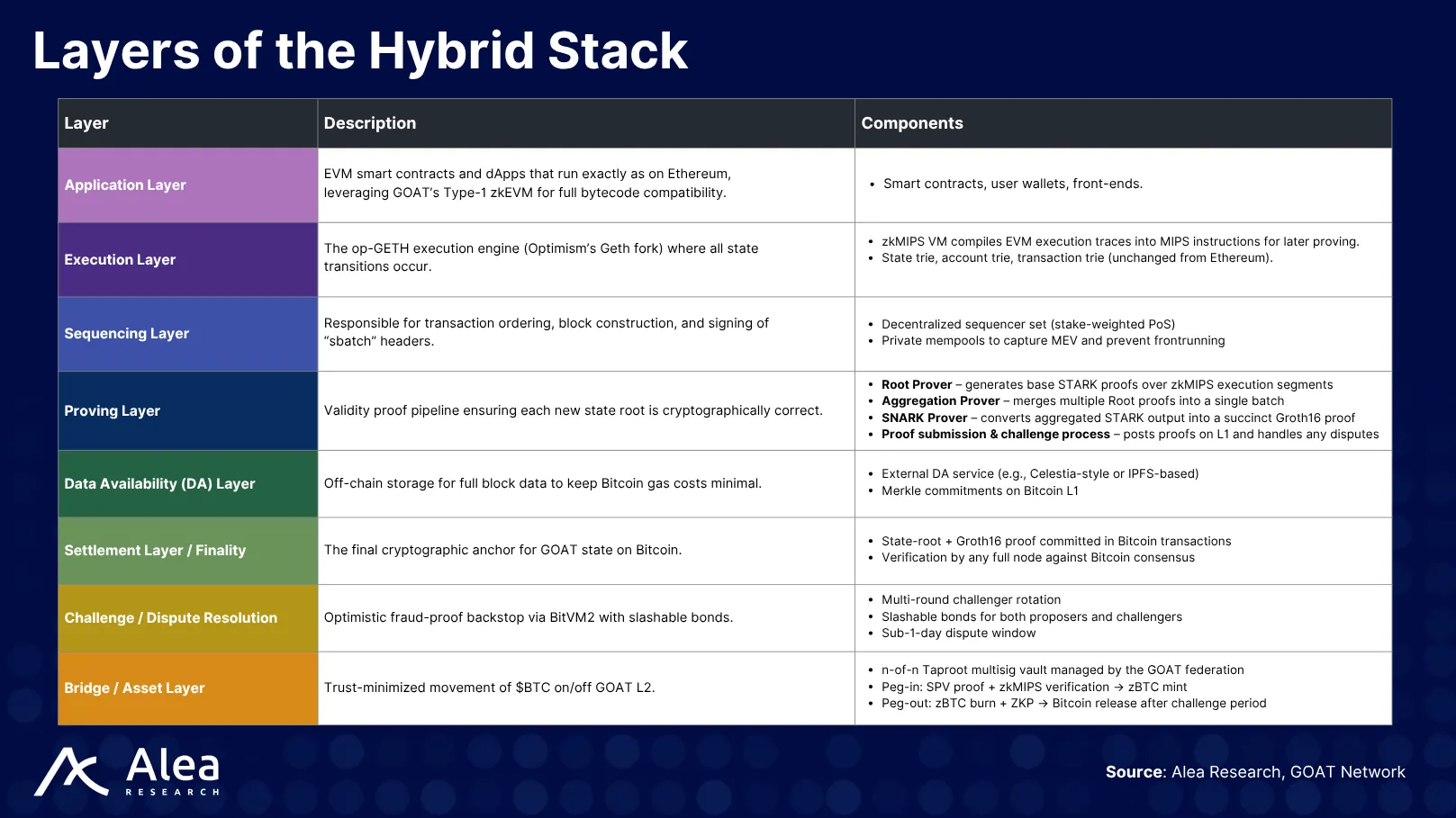

Hybrid Architecture Stack: A stack combining zkVM, Ziren, BitVM2, a decentralized sequencer set, and trust‐minimized bridging, enabling programmability and finality on Bitcoin L1.

Network-Driven Feedback Loop: Multi-asset support, EVM compatibility, and network effects create a feedback loop that grows activity, liquidity, and native $BTC yield.

Macro Tailwinds: ETF inflows, corporate and sovereign $BTC accumulation, and supply squeezes, reinforce demand for non-custodial, yield-bearing infrastructure. A 5-10% APY on a portion of these holdings can earn substantial returns.

Execution Dependencies: Long-term success depends on attracting quality dApps, sustaining deep liquidity, bridging developer communities, and maintaining robust protocol activity.

Bitcoin Security & EVM Flexibility

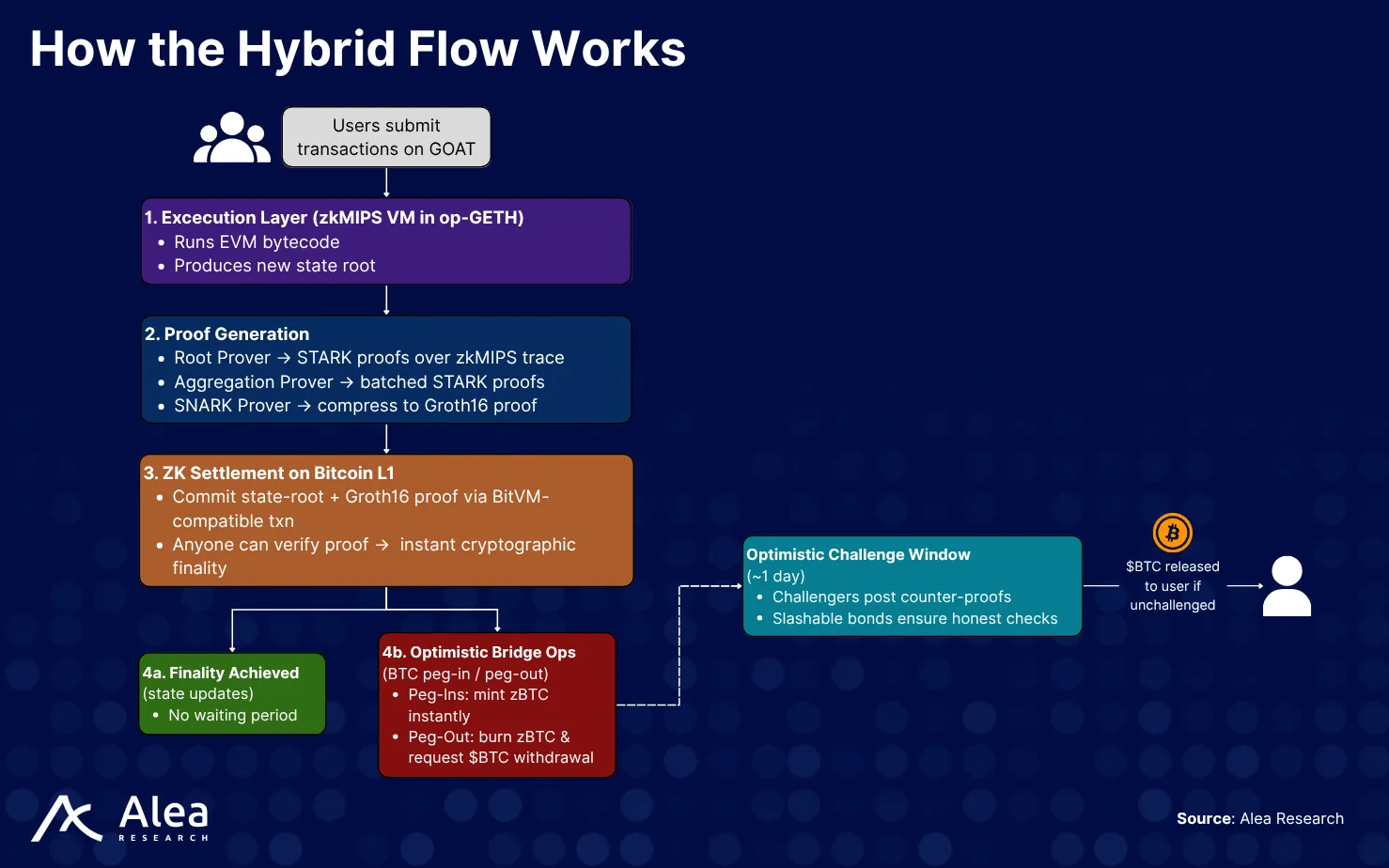

GOAT Network’s architecture is designed to reconcile two traditionally incompatible traits: Bitcoin’s conservative security model and the composability of Ethereum-style smart contracts. To achieve this, GOAT implements a hybrid stack that layers a zkVM execution environment over Bitcoin’s consensus and finality guarantees.

The security model combines zero-knowledge settlement with an optimistic challenge window to deliver both instant, math-based finality for L2 state updates and a crypto-economic backstop for $BTC bridge operations.

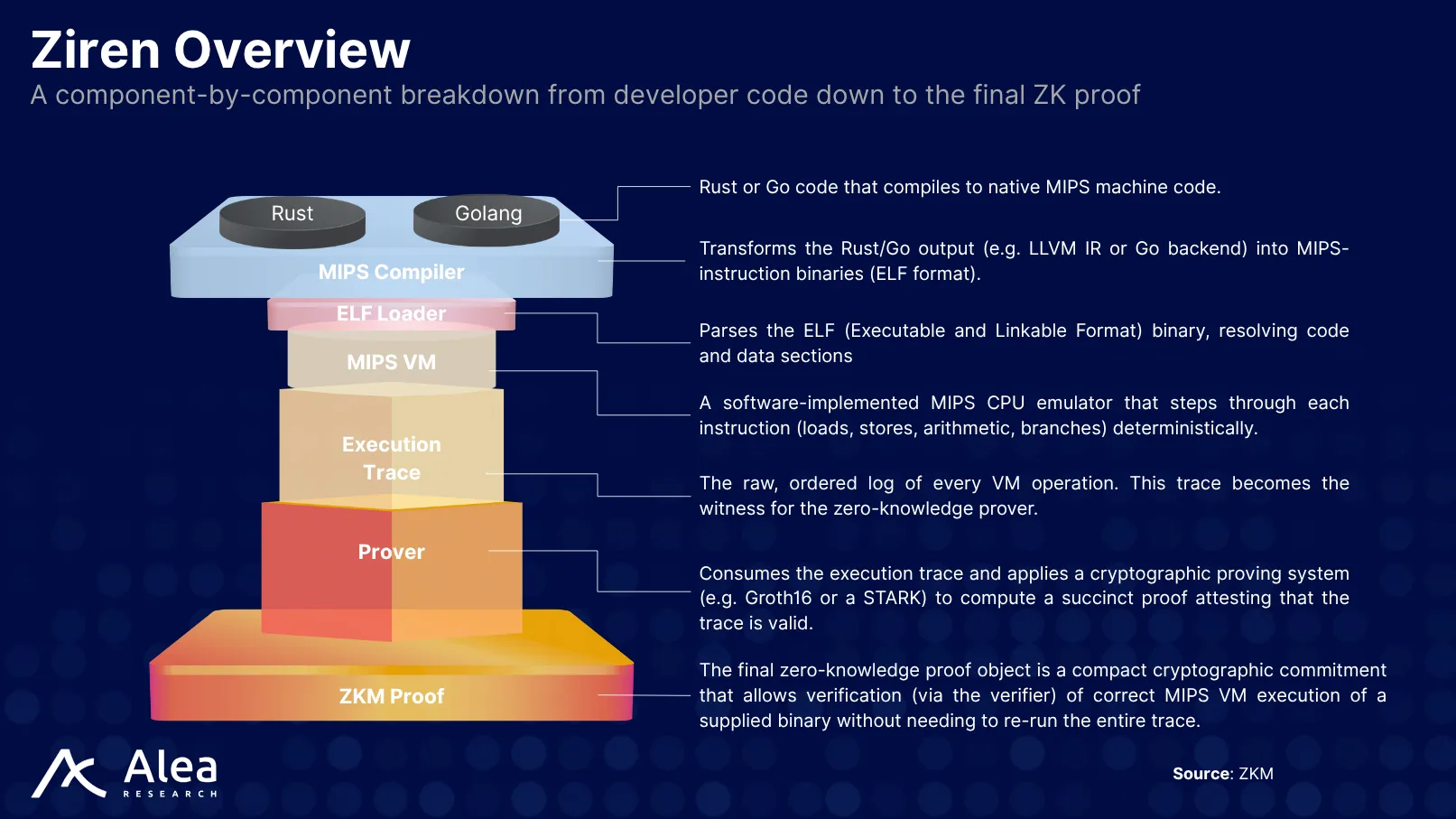

The core component is a Type-1 zkEVM: a bytecode-compatible ZK virtual machine that mirrors Ethereum’s execution logic while enabling fully provable computation. This allows for seamless deployment of existing EVM contracts without modification, while retaining fully ZK-proven state transitions. To enable execution between Bitcoin and the zkVM layer, GOAT incorporates Ziren (formerly zkMIPS), a ZK prover designed to verify computations made under the MIPS architecture. This acts as a critical compatibility layer with BitVM2, an emerging Bitcoin-native computation framework that enables offchain programmability verifiable via Bitcoin Script. BitVM2 allows GOAT to anchor settlement logic directly to Bitcoin L1, while its Optimistic Challenge Protocol (OCP) ensures dispute resolution with minimal overhead, optimizing both speed and finality assurance.

GOAT’s design includes a Dual Slashing Model, which combines Bitcoin-level slashing with its own consensus slashing, making attacks exponentially more expensive. The system employs economic incentives and bonding to ensure participants act honestly, as misbehavior leads to a slashing of their stake.

- Bitcoin-level Slashing: Via BitVM2 fraud proofs on L1, any malicious operator’s $BTC collateral in the kickoff transaction locked by the operator is forfeited and awarded to the successful challenger. In other words, if an operator misbehaves, it cannot finish its reimbursement to the specific UTXO it chooses.

- GOAT Consensus Slashing: On GOAT, sequencers, provers, and challengers stake bonds that are instantly seized for misbehavior (e.g., double-block proposals or missed challenges). Therefore, a single instance of fraud triggers slashing on both chains, making attacks exponentially more costly.

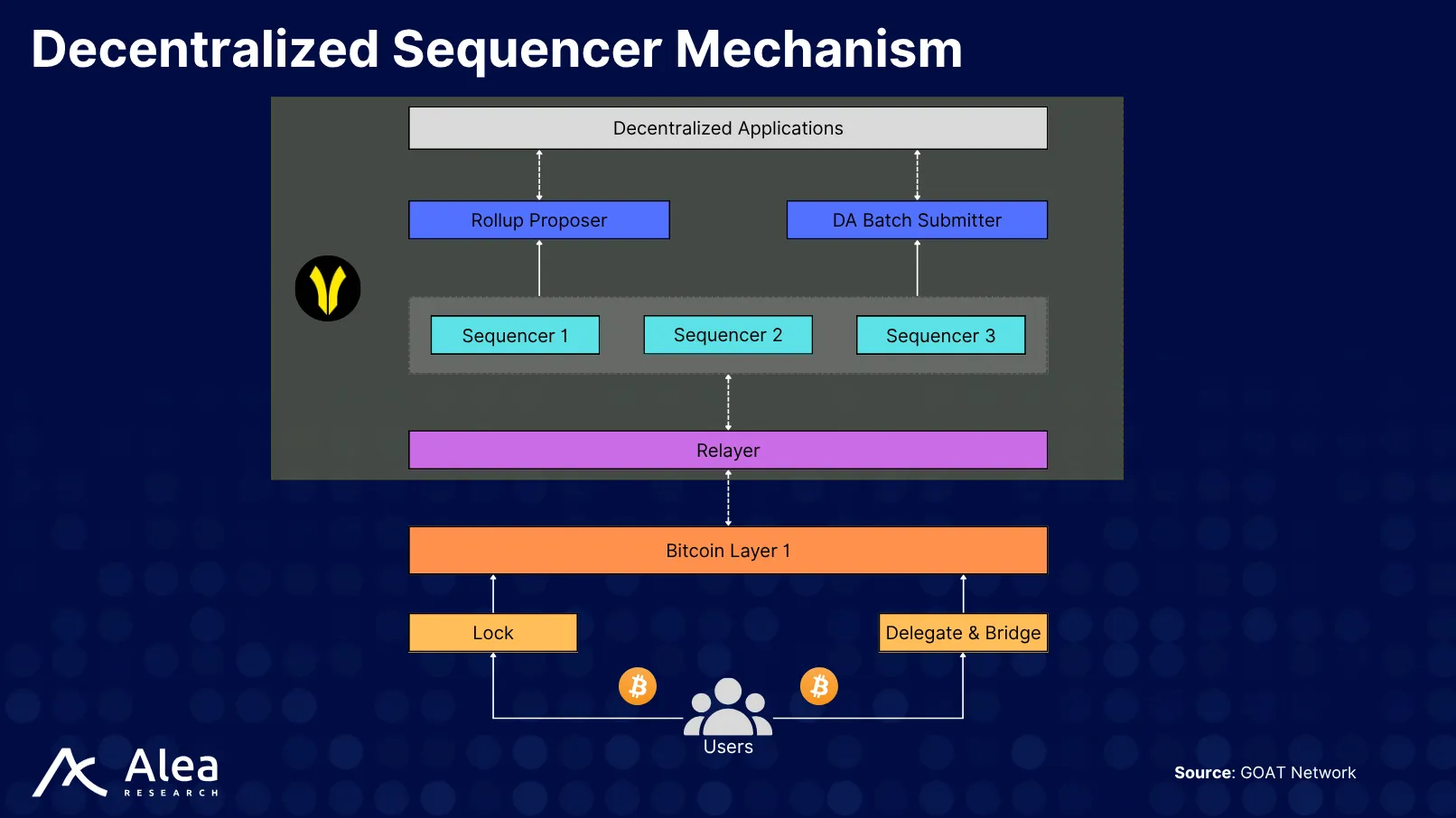

For execution and censorship resistance, GOAT uses a Decentralized Sequencer Network, eliminating the need for centralized ordering mechanisms. Sequencers submit transaction batches to the zkVM, generate validity proofs, and coordinate cross-domain messages. Importantly, this design aims to reduce the concentration of sequencing power and associated MEV centralization risks, which are common problems in rollup ecosystems.

Key features and benefits of GOAT’s decentralized sequencer network include:

- Trustlessness: It ensures no single party can manipulate transaction order for profit, relying on a distributed consensus mechanism.

- Censorship Resistance: Transaction sorting occurs through a globally distributed network of nodes, preventing any single party from censoring or hindering network operations.

- Improved Liveness: By eliminating single points of failure, the network remains operational even if some nodes fail, boosting its resilience.

Unlike centralized sequencers, GOAT uses a multi-operator PoS model. Entities wishing to act as sequencers must stake $BTC (0.5 $BTC on Alpha Mainnet) and be whitelisted (as of now) to earn the right to produce blocks and earn $BTC gas rewards. After TGE, sequencers will also be able to earn $GOATED mining rewards.

The protocol rotates and randomly selects sequencers in proportion to their stake, preventing any single party from monopolizing block production. The cap weight for a single sequencer is 33%. GOAT extends this same stake-weighted random selection and frequent rotation across all operator roles, not just sequencers. Under this Universal Operator Model, every prover, publisher, and challenger must stake and is periodically chosen by the protocol to perform their assigned role.

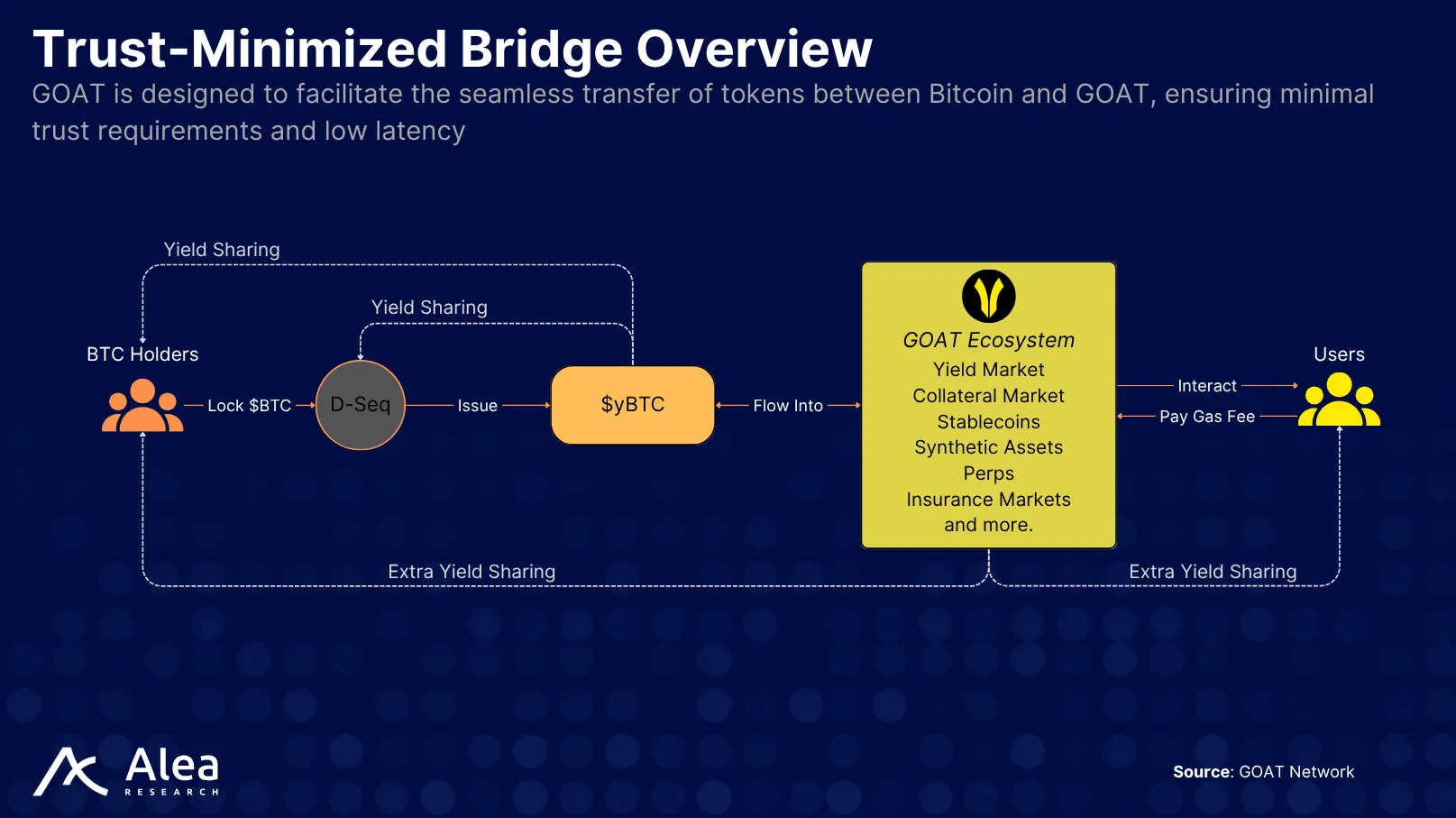

Finally, GOAT’s Trust-Minimized Bridge facilitates two-way asset movement between the Bitcoin network and the zkVM layer without relying on custodians or federations. By leveraging BitVM2 fraud proofs and MIPS-based verification, GOAT achieves Bitcoin-native bridging that aligns with Bitcoin’s ethos and minimizes trust assumptions, critical for institutional and long-term holders.

Bitcoin Yield Engine

GOAT Network’s value proposition centers on enabling sustainable, non-inflationary yield paid directly in $BTC. Unlike staking models in proof-of-stake ecosystems, which typically rely only on token emissions to bootstrap returns, GOAT’s yield is derived from real economic activity within the network and distributed to participants in native $BTC.

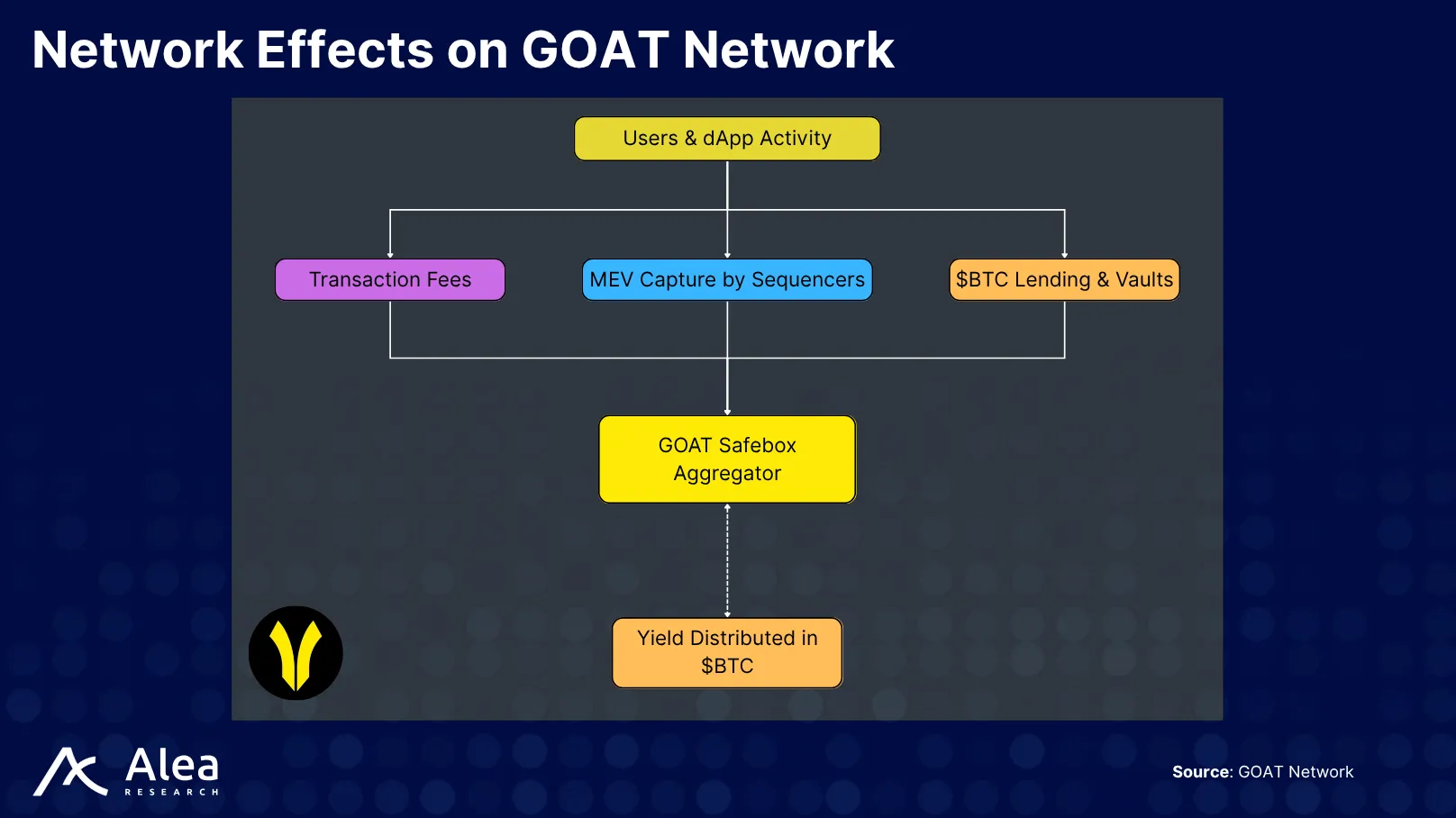

The yield comes from three primary sources:

- Transaction Fees: Gas fees are paid in $BTC, and all activity generates $BTC-denominated fees. These are routed through GOAT’s zkVM and ultimately settled on Bitcoin L1, ensuring transparent and verifiable fee accrual. Fees are redistributed to validators, sequencers, and stakers.

- Sequencer MEV: GOAT’s decentralized sequencer set captures Maximal Extractable Value (MEV) from transaction ordering. Rather than privatizing this revenue, GOAT introduces an MEV-sharing mechanism where profits are redistributed to the network.

- Lending & Vault Yield: Native DeFi primitives such as lending protocols and $BTC vaults generate yield from user deposits, collateralized borrowing, and structured products. These applications are built directly into GOAT’s zkVM and return $BTC-denominated yield without introducing intermediary tokens or rehypothecation risks.

-

-

- GOAT Safebox: According to GOAT’s economic beigepaper, it targets a ~2% APY in $BTC by timelocking (90 days) $BTC on Bitcoin L1.

- BTCB/DOGEB Vault: Has a target of ~5% APY in $BTC for users who supply $BTCB or $DOGEB (wrapped forms of BTC/DOGE on BNB Chain). Yield comes from sequencer rewards and L2 gas fees.

- Sequencer PoS Staking: Aims for ~10% APY in $BTC for users staking native $BTC or wrapped tokens to secure GOAT’s decentralized sequencers, as well as rewards paid in $GOATED tokens. Yields are generated from $BTC gas fees, sequencer block rewards, and MEV.

-

These sources are integrated into GOAT sequencer nodes, enabling a native vaulting and staking system that aggregates rewards from across the protocol. Users can stake $BTC, $BTCB (from BNB Chain), or $DOGEB (from BNB Chain) into GOAT sequencers to receive proportional shares of network-wide rewards, with full transparency and no synthetic exposure.

Institutional investors seeking to retain custody of their assets in their wallet at all times may use GOAT Safebox, enabling a fixed-term, onchain Bitcoin timelock: users deposit $BTC into an L1 contract for a three-month term, during which they earn a predetermined slice of the network’s decentralized sequencer rewards comprising transaction fees, block-submission incentives, and captured MEV. It’s algorithmically set aside and then distributed pro rata to Safebox participants at maturity to deliver a target guaranteed ~2% APY in $BTC without diluting principal.

Because GOAT’s yield is sourced from user-driven economic activity (fees, MEV, lending), it scales with adoption and doesn’t rely on subsidies. This makes it resistant to the “APY decay” observed in other ecosystems once token incentives are exhausted. It does, however, rely on network activity and ecosystem development to generate competitive APYs.

This structure enables a compounding effect: as protocol activity increases, so does fee volume and MEV capture, driving more yield, attracting more $BTC deposits, and reinforcing participation. Importantly, because all rewards are settled in $BTC rather than volatile governance tokens, the yield remains economically meaningful and attractive to long-term holders and institutions.

Network Effects & BTCFi Flywheel

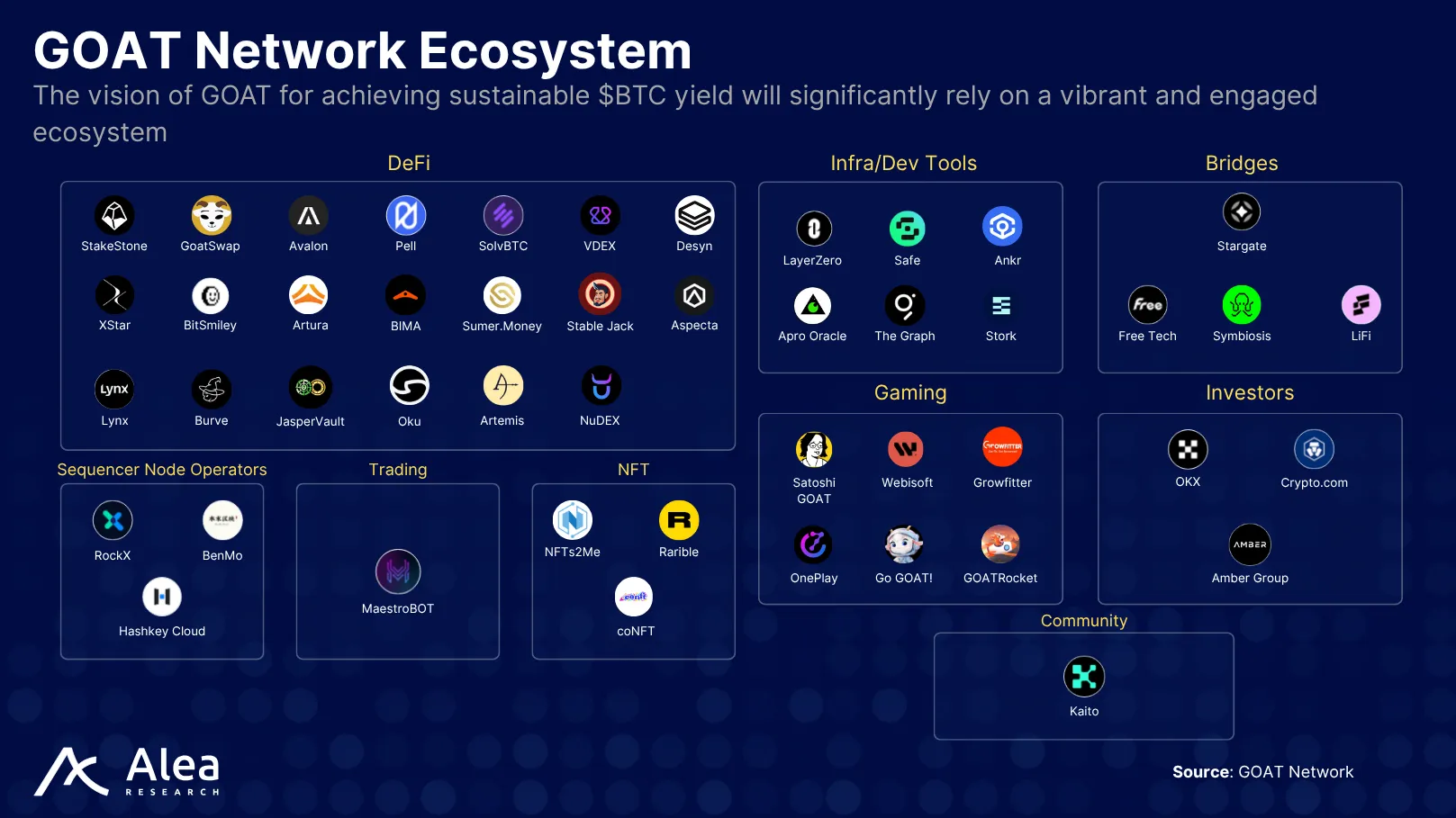

GOAT Network’s design intentionally aligns technical infrastructure with economic incentives to create a compounding network effects loop, which can be described as the BTCFi Flywheel. As more users bring idle $BTC to the network, yield opportunities increase, driving higher activity, more protocol revenue, and ultimately more real $BTC yield. When adopted, higher onchain activity attracts additional capital seeking to earn those returns, as well as developers coming to a thriving ecosystem with users and liquidity.

This dynamic is supported by the multi-asset support within GOAT’s zkVM. While GOAT is Bitcoin-native at the security and settlement layer, its execution environment supports wrapped assets, stablecoins, and synthetic primitives, enabling composable DeFi applications traditionally only accessible on EVM chains. This includes $BTC-backed lending markets, leverage vaults, structured products, liquidity provisioning, and various other applications. To ensure these applications generate real demand, GOAT aims to integrate sustainable yield mechanisms into the core protocol infrastructure, encouraging protocol-native applications to monetize usage and not emissions.

The flywheel is further reinforced through developer tooling and composability. By supporting EVM-compatible contracts and ZK-native tooling, GOAT lowers the barrier for Ethereum-native builders to deploy into BTCFi dApps such as DEXs, money markets, perps, vault protocols, and others.

On the user side, community incentives, including $BTC-denominated rewards, participation in validator sets, and access to curated yield products, align capital providers with long-term network growth. Rather than speculate on a token, users stake actual $BTC into productive roles across the network.

The more users deposit $BTC → the more activity flows through dApps → the higher the yield and MEV → the stronger the $BTC-denominated incentives → the more $BTC is drawn in.

A key determinant of GOAT’s success will be its ability to attract and integrate proven applications from other ecosystems. These integrations are essential, as they provide familiar interfaces and known risk profiles that reduce the onboarding friction for users and capital. GOAT’s developer-centric design makes these migrations feasible, but their realization depends on sustained engagement, incentive alignment, and ecosystem-level coordination. The breadth of options will make the network stickier, encouraging users to keep their funds within GOAT rather than moving them out, as they can hop to other ecosystems.

This feedback loop is the protocol’s economic engine and vehicle for growth. GOAT aims to create a self-sustaining ecosystem where $BTC capital, smart contract infrastructure, and protocol-aligned incentives reinforce each other over time. Yet for this flywheel to operate as intended, network activity is needed on a large scale, hence the need for noteworthy integrations and the creation of a rich ecosystem. GOAT’s reliance on user-driven yield, while a strength from a sustainability perspective, means that early adoption is sensitive to application quality, optionality, and liquidity depth.

GOAT Network’s Role in the Bitcoin Landscape

For a long time, the Bitcoin community has struggled with the idea of turning $BTC into a productive asset and generating yield. This goal has sparked the development of various protocol architectures, leading to the emergence of BTCFi. These include sidechains, rollups, virtual machines, and various bridging models, each aiming to extend $BTC’s utility beyond its current passive storage capabilities. GOAT Network enters this landscape as a zkVM-based Bitcoin Native Rollup that bases its security and finality on Bitcoin L1 while enabling Ethereum-style smart contract execution. In terms of architecture, this places it in close proximity to other peers, which also leverage ZK proofs, EVM compatibility, and trust-minimized bridges to extend Bitcoin’s functionality.

From a purely technical perspective, GOAT pushes the boundaries by taking the lead on the latest developments in Bitcoin technology, such as rotating sequencers, tokenization of sequencer rewards, BitVM2, and the latest BitVM3 initiative. Similarities to other projects include the ZK proofs posted to Bitcoin L1 and the EVM. Many employ some form of ZK rollup architecture with a goal of preserving Bitcoin’s security guarantees while expanding its programmability. While implementation details differ (e.g., Ziren in GOAT, validium vs. volition models elsewhere), the core design logic follows a similar path: enhance $BTC utility without altering its base layer.

Where GOAT differentiates and increases its value proposition is in its integration of a native, non-inflationary $BTC yield layer. Unlike peers that rely on application-level incentives or governance-token emissions, GOAT integrates yield generation into the protocol itself via multiple sources. These flows are aggregated and redistributed in $BTC through the Safebox mechanism, offering capital allocators direct exposure to yield on $BTC without relying on synthetic assets or offchain infrastructure.

This distinction is especially relevant in the context of institutional adoption. For allocators seeking low-trust, $BTC-denominated returns, GOAT offers a structurally simpler path with its design. At the same time, its support for EVM contracts and zkVM tooling lowers the barrier for developers migrating from Ethereum, facilitating a composable, $BTC-settled DeFi ecosystem.

The Macro Bitcoin Tailwinds

As $BTC transitions from a retail-dominated asset to one increasingly held by institutions and sovereign nations, the demand for low-risk, yield-bearing infrastructure tied to $BTC is accelerating. This macro context provides a favorable backdrop for BTCFi protocols designed to unlock $BTC’s economic utility without compromising its neutrality or security, providing the necessary infrastructure for these entities to park their $BTC.

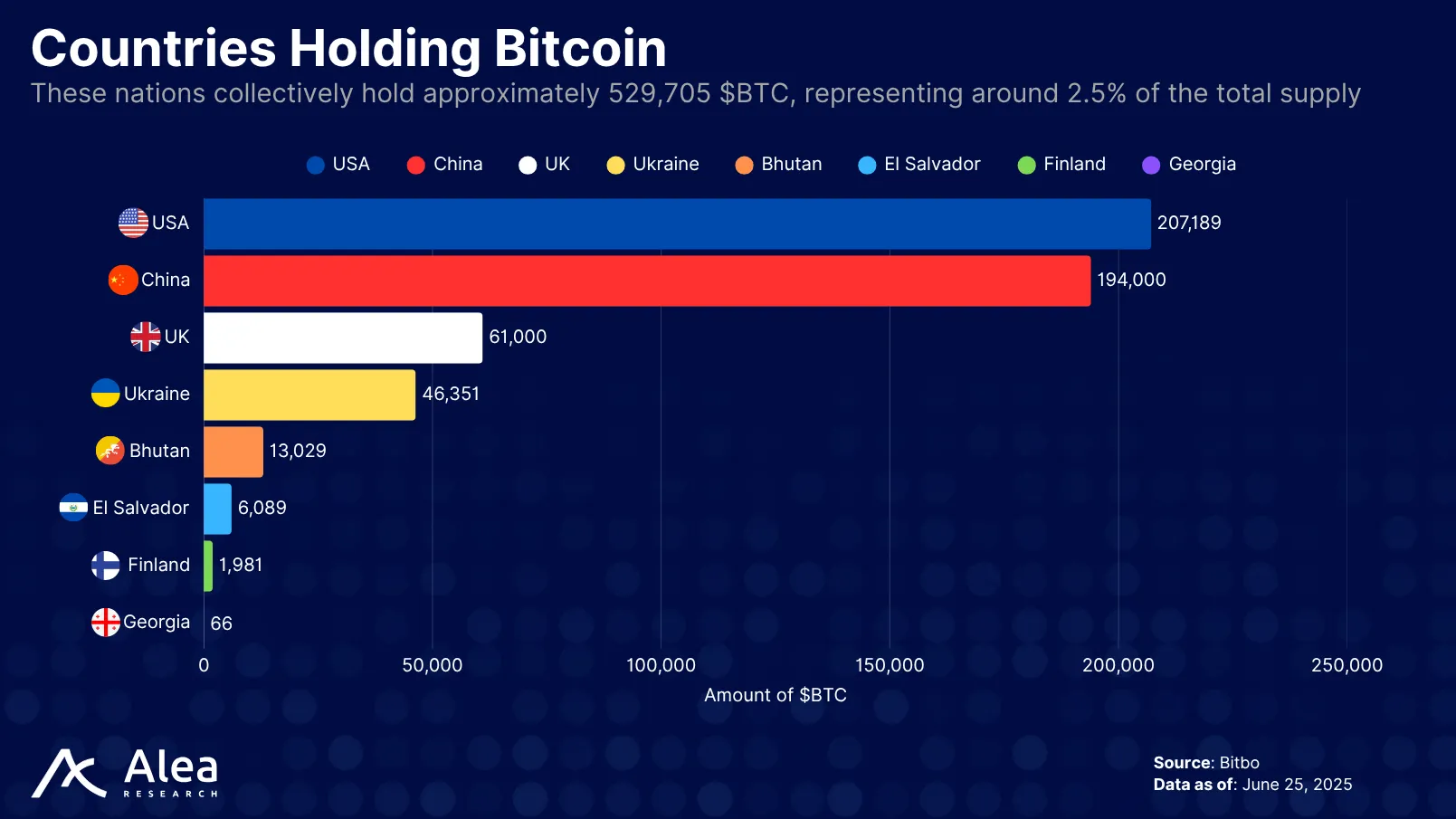

Public filings and fund flows confirm that institutional entities—ranging from ETFs to corporate treasuries and sovereign wealth funds—are steadily accumulating $BTC. As of mid-2025, spot $BTC ETFs in the U.S. alone have amassed more than 1.4 million $BTC, representing ~6.6% of the total circulating supply (Bitbo). This capital is largely idle, held in cold storage or parked in passive vehicles. For capital allocators managing $BTC on behalf of long-term stakeholders, access to $BTC-denominated, low-trust yield is increasingly attractive.

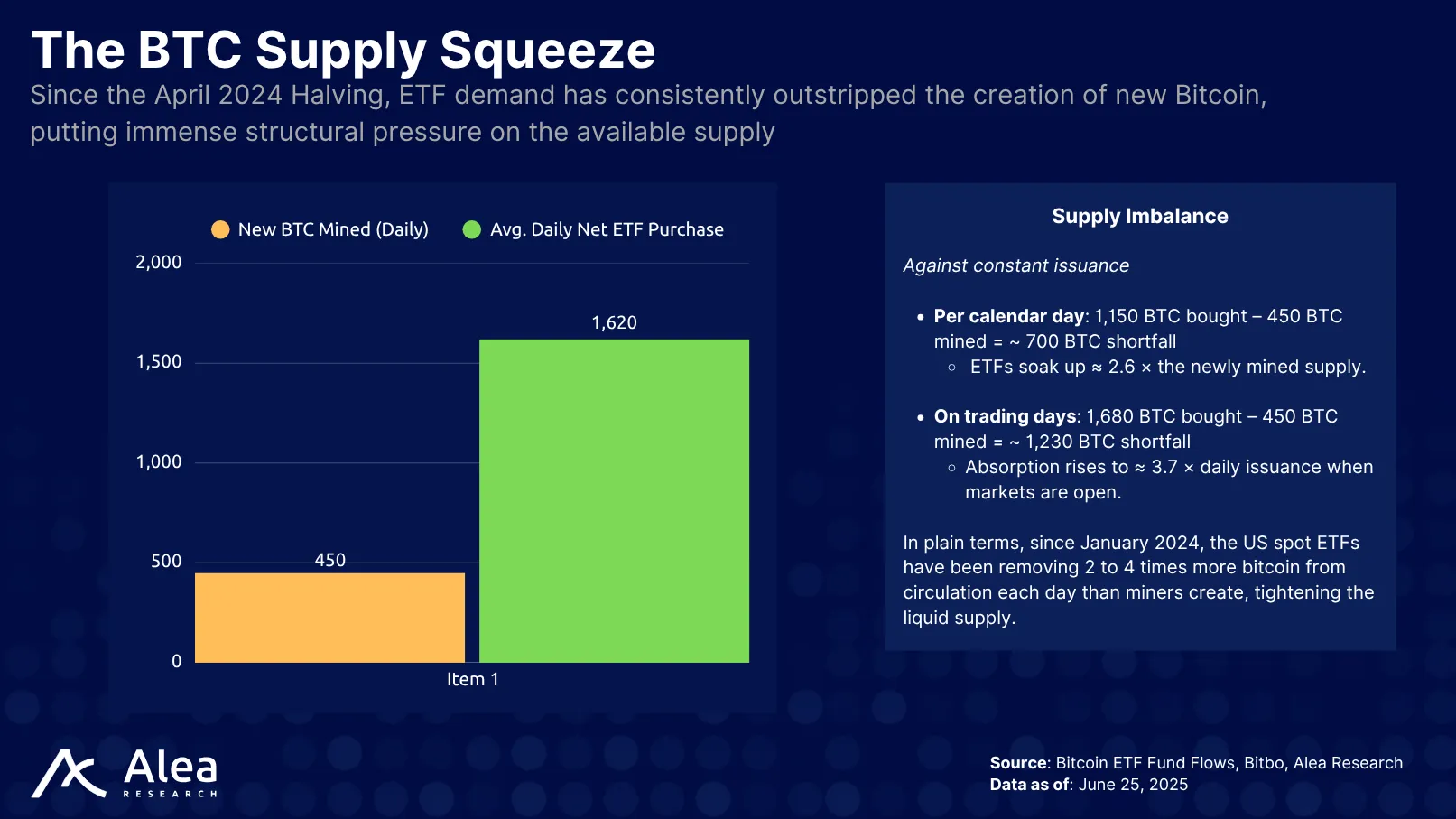

Simultaneously, $BTC’s supply dynamics are becoming more restrictive. The 2024 halving cut block rewards to 3.125 BTC per block, further limiting new issuance. Layer this with long-term holders’ growing share of supply and the operational constraints of custody, and the result is a capital base that is large, static, and economically underutilized. For example, the average net daily ETF purchase since launch is ~1600 $BTC while the daily mined $BTC is 450, creating a significant imbalance. In this environment, protocols offering native yield on $BTC, without requiring token wrapping or rehypothecation, can address a clear market inefficiency.

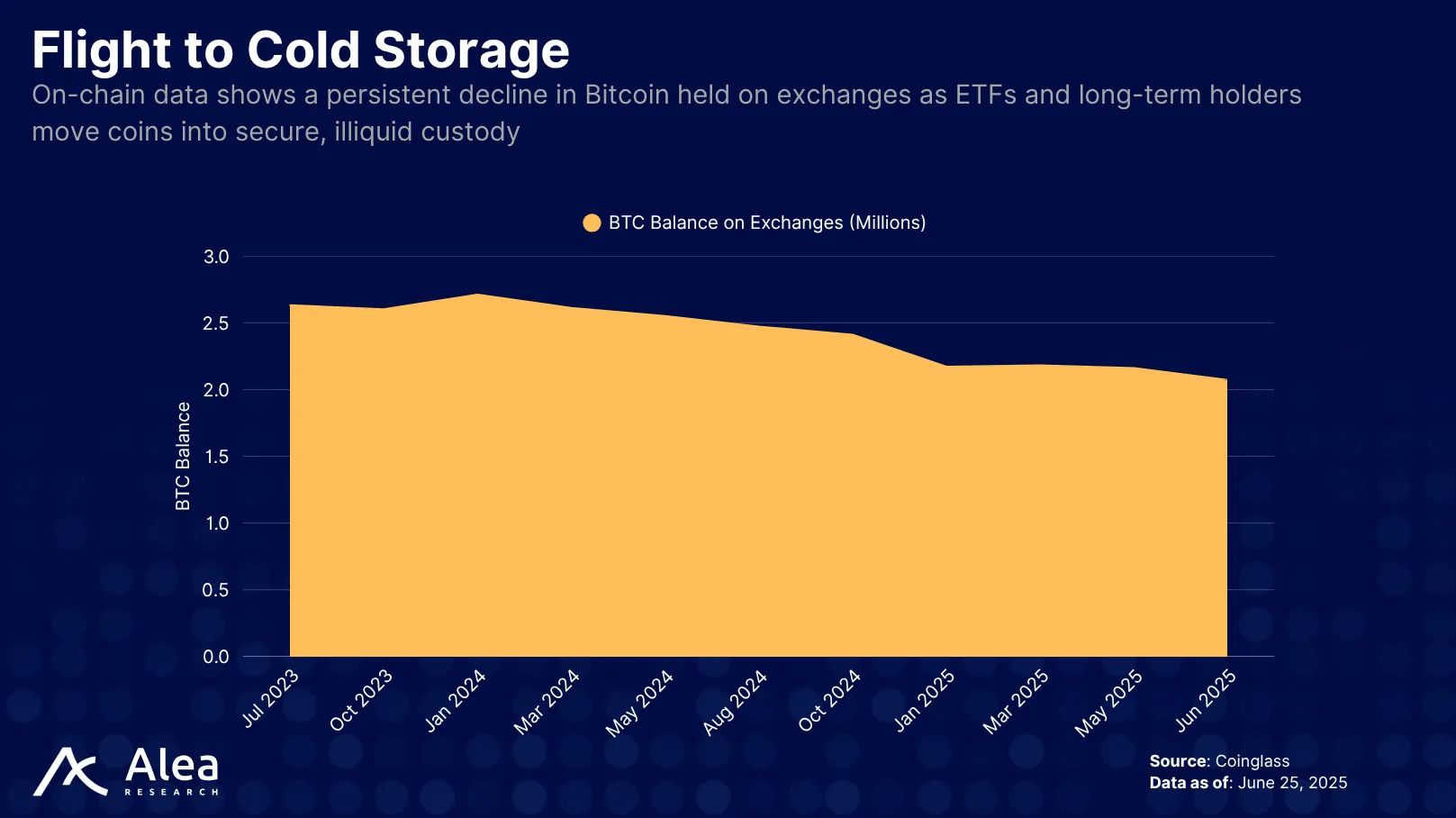

The great accumulation of $BTC by all these parties affects exchanges, whose balances have declined to ~2.1 million $BTC (Coinglass), their lowest level since 2017. Capital is migrating into long-term custody, ETFs, cold wallets, and corporate vaults. This trend reflects growing institutional preferences for regulated exposure and low-custody risk, but it also reduces onchain liquidity. The implications are twofold: on one hand, it limits circulating supply; on the other, it increases the relevance of onchain yield-generating mechanisms that don’t rely on token emissions or intermediaries.

Together, these macro factors—constrained supply and rising institutional exposure—create strong tailwinds for networks that can unlock the productive use of $BTC capital in a trust-minimized manner. GOAT does not compete with ETFs, companies, or sovereign nations; it complements them by offering direct $BTC yield and programmable utility without requiring offchain intermediaries.

Institutional capital allocators can engage with productive Bitcoin infrastructure through GOAT. Its architecture and incentive design enable multiple modes of exposure, depending on the risk profile, operational capabilities, and strategic intent. GOAT allows institutions to generate yield in native $BTC through exposure to Safebox staking, lending vaults, or sequencer infrastructure. Safebox locks $BTC for 90 days and sources rewards from sequencer fees, targeting a treasury-style coupon near 2% APY. Vault strategies add a fee plus block-reward exposure and target about 5% APY; they suit cash-management mandates that tolerate smart-contract but not slashing risk. Sequencer PoS pools collateralize network nodes, sharing MEV and fees, which lifts returns toward 10% APY.

For treasuries or funds seeking low-volatility $BTC-denominated returns, these instruments offer a risk-adjusted profile tied to GOAT’s transaction throughput and dApp activity. More dApps launching on GOAT means new yield sources, amplified network effects, and increased attractiveness for capital allocation.

Addendum for Sovereign Nations

Sovereign wealth funds and central bank investment arms already collectively hold more than 2% of the total $BTC supply. For these actors, GOAT Network offers a way to transform dormant strategic reserves into productive, $BTC-denominated assets while preserving full self-custody and onchain auditability.

A sovereign wealth manager can allocate part of its strategic $BTC reserve to GOAT’s Safebox and validator pools to convert dormant holdings into programmatic yield. For illustration, consider a mid-sized nation that controls 10,000 $BTC in its treasury. By depositing 5,000 $BTC into Safebox and staking another 500 $BTC as sequencer collateral, the treasury could earn roughly 2% annual yield on the Safebox tranche and about 10% on the staked position. Under current network conditions, this translates to approximately 200 $BTC of aggregate yearly income, which can be routed back to the reserve or used to finance public initiatives without selling core holdings. The move would also signal long-term confidence in $BTC’s productive capacity, potentially attracting foreign direct investment and positioning the nation as an early participant in $BTC-settled financial rails. Key considerations include operational custody arrangements, parliamentary oversight on staking risk, and clear guidelines for repatriating yield into the main treasury account.

Because yield accrues in native $BTC and proofs are based on Bitcoin L1, reserve managers gain transparent accounting, straightforward policy reporting, and no exposure to third-party inflation or governance tokens. Should liquidity be needed for macro-stabilization, peg-out proofs unlock the underlying $BTC directly from Bitcoin Script, bypassing custodial gatekeepers.

The sovereign path complements the earlier institutional pathways by addressing the unique mandate of sovereign actors: capital preservation, geopolitical optionality, and transparent audit trails, all of which align with GOAT’s native-BTC, trust-minimized design.

Conclusion

Bitcoin has crossed a structural threshold. With ETFs absorbing over five times the daily issuance, and corporate and sovereign entities locking up vast reserves, idle $BTC capital rapidly consolidates into long-term holdings. Yet the infrastructure to deploy that capital productively, without sacrificing Bitcoin’s core principles, remains limited. GOAT Network does not attempt to alter Bitcoin’s network base layer; instead, it activates its economic potential by anchoring programmability, yield, and composability directly to Bitcoin L1 finality using ZK infrastructure.

GOAT’s principal differentiation is not technological novelty alone, as many peers are exploring zkVMs and trust-minimized bridges, but its deliberate alignment with Bitcoin-native capital. By redistributing all protocol revenue in $BTC, GOAT offers a yield structure that suits balance-sheet allocators: it is non-custodial, inflation-resistant, and denominated in the very asset institutions are accumulating and want in their balance sheets.

For sovereign funds, the value proposition is strategic: transform inactive reserves into yield-bearing instruments without foreign custody or synthetic wrappers. For funds and corporates, GOAT creates a pathway to generate $BTC cash flow that complements ETF-based exposure while maintaining onchain control. And for developers, it offers a fully EVM-compatible canvas to build new financial primitives for a Bitcoin-native user base.

Network effects rely on the timely integration of marquee applications that will drive activity; without them, fee throughput could undershoot the levels required for attractive APY, reversing the flywheel. Liquidity fragmentation across competing Bitcoin rollups, validiums, and sidechains may slow capital formation. Finally, sovereign and institutional guidelines on MEV income and smart-contract risk are still fluid, implying that due diligence overhead will persist. If GOAT can meet these execution thresholds, it has the potential to scale $BTC and make it a productive asset.

Glossary

| Term | Definition |

| Aggregator | Component that combines multiple partial ZK proofs into a single succinct proof for onchain verification. |

| BitVM2 | Bitcoin-native computation framework enabling offchain programs to be verified via Bitcoin Script and contextual fraud proofs. |

| Decentralized Sequencer Network | Set of independent nodes responsible for ordering transactions, generating validity proofs, and submitting state commitments without centralized control. |

| Execution Trace | Ordered record of every VM instruction execution (register updates, memory reads/writes) used as the witness for ZK proof generation. |

| Groth16 Proof | A succinct zkSNARK proving system that produces compact proofs and fast verification, used by GOAT’s prover layer. |

| MEV (Miner/Maximal Extractable Value) | Value captured by transaction-ordering strategies (e.g. arbitrage, frontrunning) that GOAT sequences and redistributes to network participants. |

| MIPS Compiler | Toolchain component that translates high-level Rust or Go code into MIPS machine instructions (ELF binaries) for Ziren execution. |

| MIPS VM | Software emulator of a MIPS CPU that deterministically executes MIPS instructions and emits an execution trace. |

| Optimistic Challenge Protocol | Dispute-resolution mechanism for BitVM2 where challengers submit fraud proofs on Bitcoin L1 to contest incorrect offchain computations. |

| Request Pool (Stage Service) | Task queue that normalizes and prioritizes heterogeneous proof requests before dispatching them to distributed prover instances. |

| Safebox | Native vault and staking system that aggregates protocol fees, MEV revenue, and lending interest, then redistributes BTC rewards to participants. |

| SNARK Proof Publication | onchain transaction that commits a zkSNARK proof (e.g. via OP_RETURN) to Bitcoin L1, anchoring GOAT’s state root and ensuring cryptographic finality. |

| Staking / PoS Pools | Mechanism by which participants lock BTC collateral to run sequencer or prover nodes in exchange for fee and MEV-based rewards. |

| Transaction Fees | BTC-denominated fees paid by users and dApps for transaction inclusion and execution on the zkVM layer, redistributed via Safebox and node rewards. |

| Trust-Minimized Bridge | Non-custodial mechanism leveraging SPV proofs, ZK proofs, and Bitcoin Script logic to transfer BTC between L1 and the zkVM layer without federations or third-party custodians. |

| TVL (Total Value Locked) | Aggregate amount of BTC (or equivalent) locked in GOAT Network’s smart contracts and vaults, representing onchain capital committed to protocol activities. |

| zkVM (Zero-Knowledge Ethereum Virtual Machine) | Type-1 ZK rollup execution environment that is bytecode-compatible with Ethereum, enabling existing EVM smart contracts to run under ZK proof settlement. |

| Ziren | ZK prover framework for MIPS-architecture binaries, enabling arbitrary Rust/Go applications compiled to MIPS to be proven correct without exposing sensitive data. |

References

GOAT Network. GOAT Network Economic Beigepaper 2.0

GOAT Network. GOAT BitVM2 White Paper

Coinglass. Bitcoin Exchange Balance

Disclosures

Alea Research is engaged in a commercial relationship with Goat Network and receives compensation for research services. This report has been commissioned as part of this engagement.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.