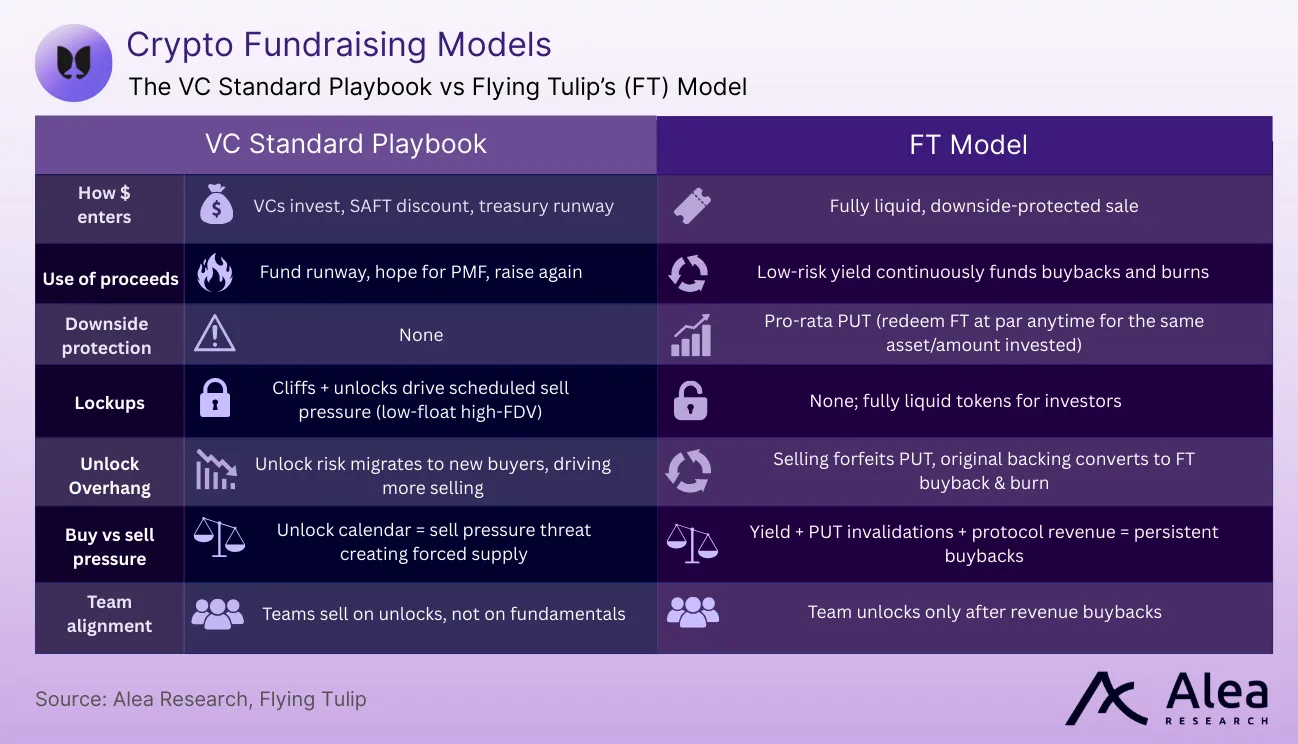

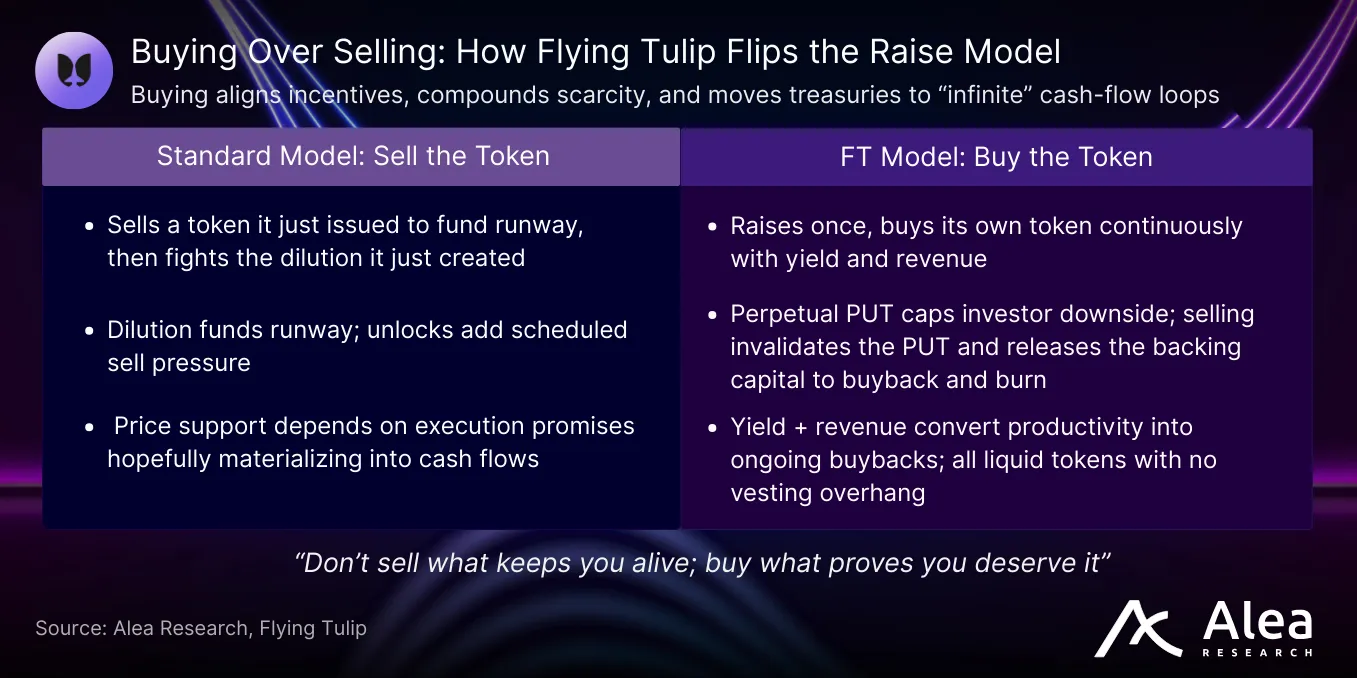

Most projects burn through their capital raise and lose trust; Flying Tulip seeks to earn that trust by design. Where most torch their runway, then beg for more, Flying Tulip’s ambition is to turn the standard crypto fundraising playbook on its head. Instead of selling, it mechanistically buys its own token. FT’s productive raise is all about incentives alignment, protection for investors, yield as performance fuel, and token deflation as profits grow—upside depends on persistent demand. The philosophy: “Don’t sell what keeps you alive; buy what proves you deserve it.”

Key Takeaways

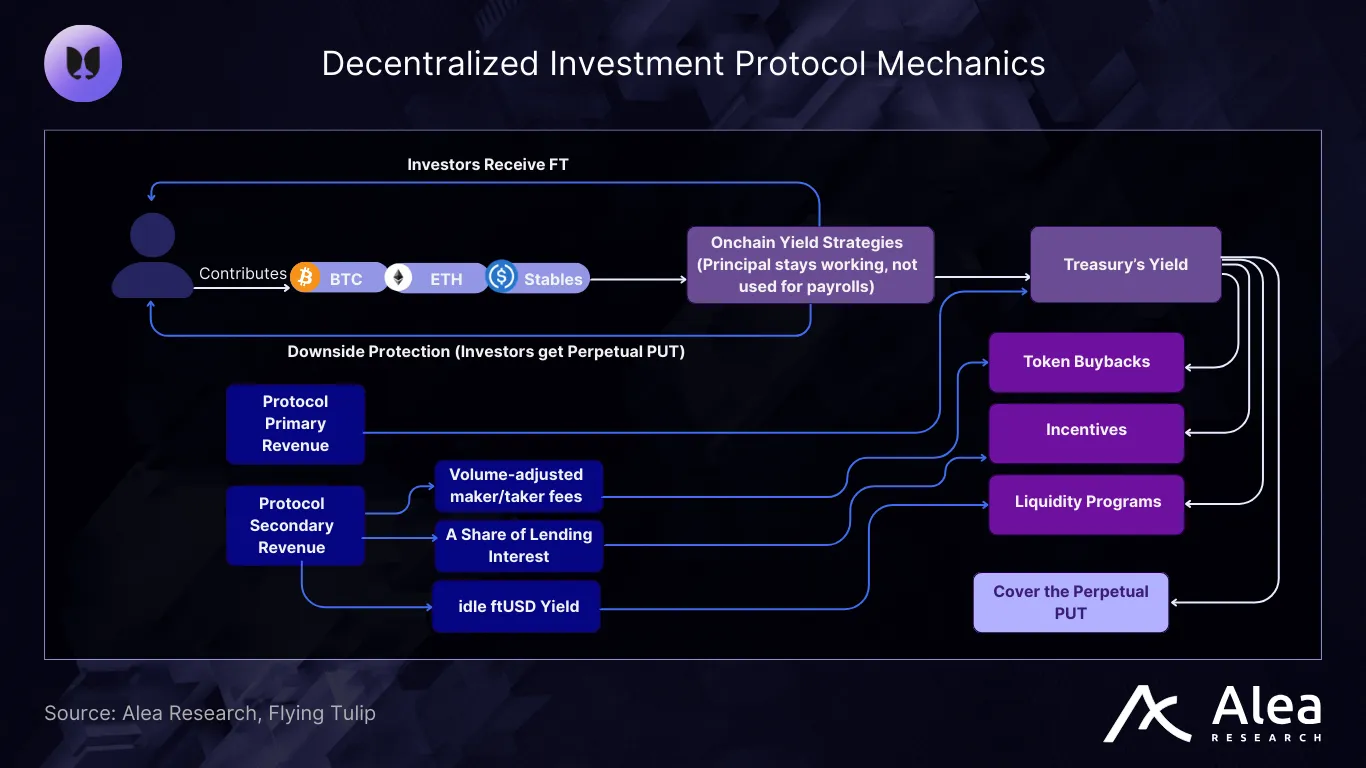

- Why Invest: Downside protected by a perpetual pro-rata PUT while upside compounds via yield-funded, revenue-driven FT buybacks and burns.

- Incentives Alignment: Team/Foundation unlock only as protocol revenue buybacks and burns FT—keeping net supply flat and tying upside to performance.

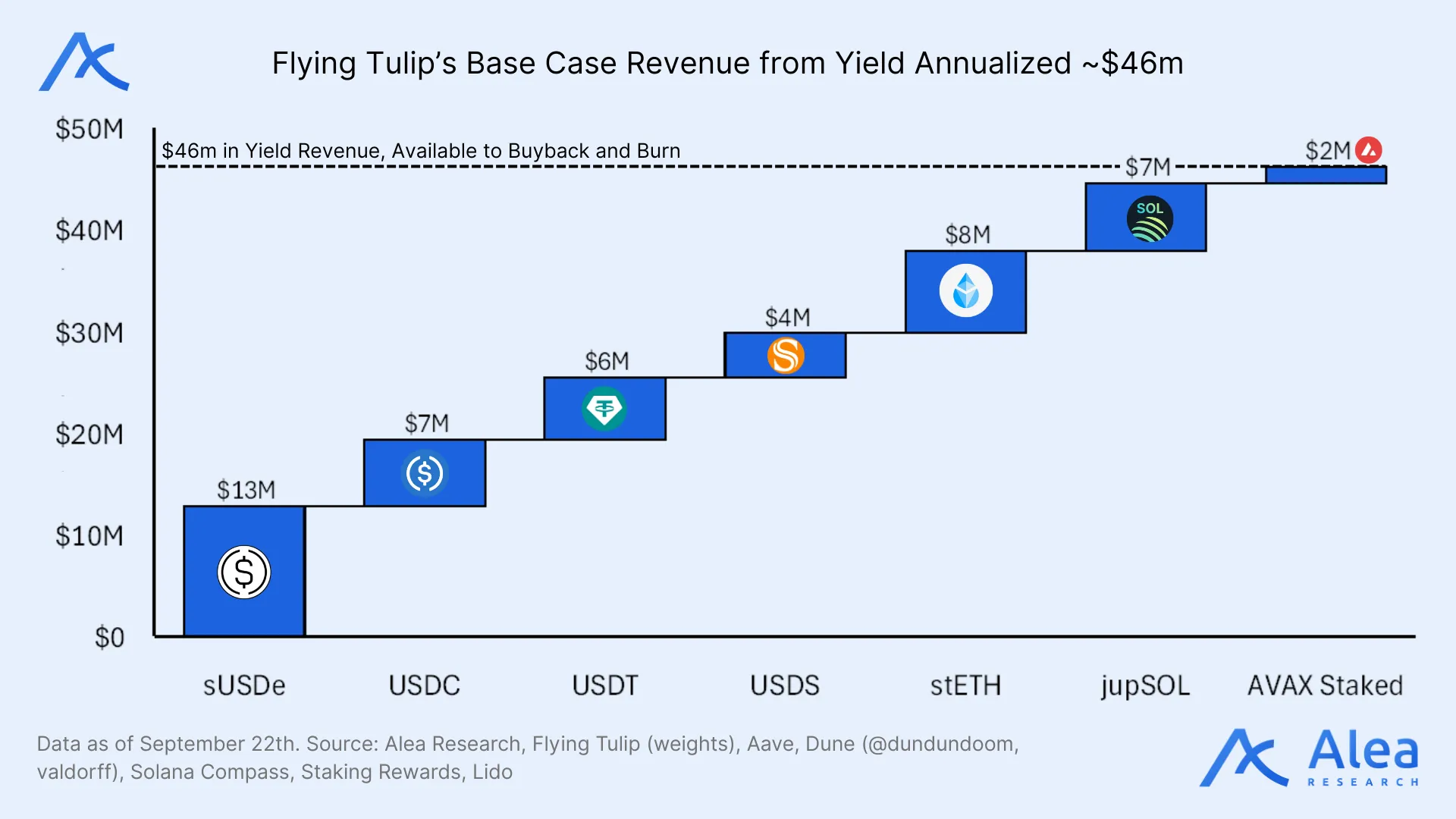

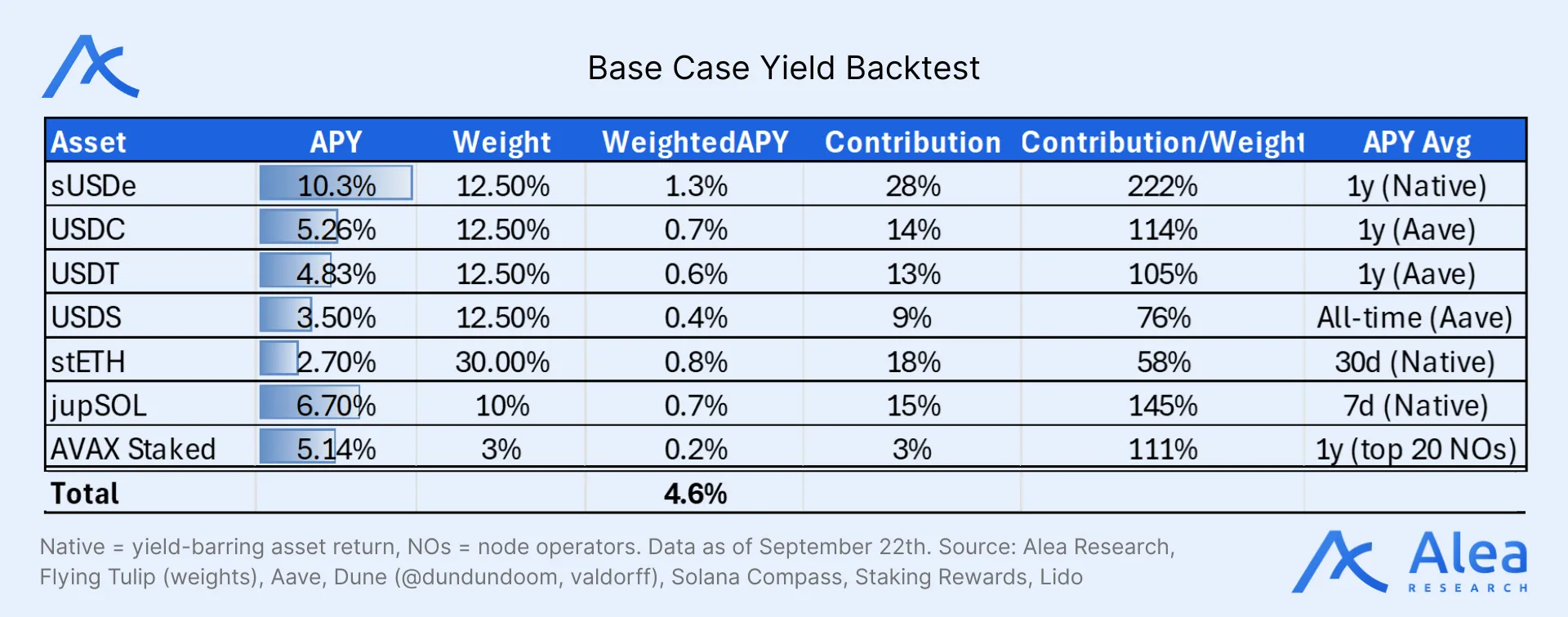

- Use of Raised Funds: Investor deposits are deployed across diversified low-risk DeFi liquid yield strategies (stETH, jupSOL, Aave, sUSDe, etc.) that fund continuous FT buybacks and burns.

- Operational Expenses Caveat: Yield covers protocol opex and funds incentives until fees exceed opex (<$500k/year). Once fees > opex, 100% of excess fees and all ongoing yield are used for FT buybacks and burns.

- What Triggers Buybacks/Burns: Ongoing yield, PUT forfeitures when investors transfer/sell, and protocol revenue all convert into FT buybacks and burns; PUT redemptions burn FT.

- Token Native All-in-One DeFi Stack: Protocol fees are used to buy back FT, then distributed to users as yield paid in FT.

Ft’s Capital Raise

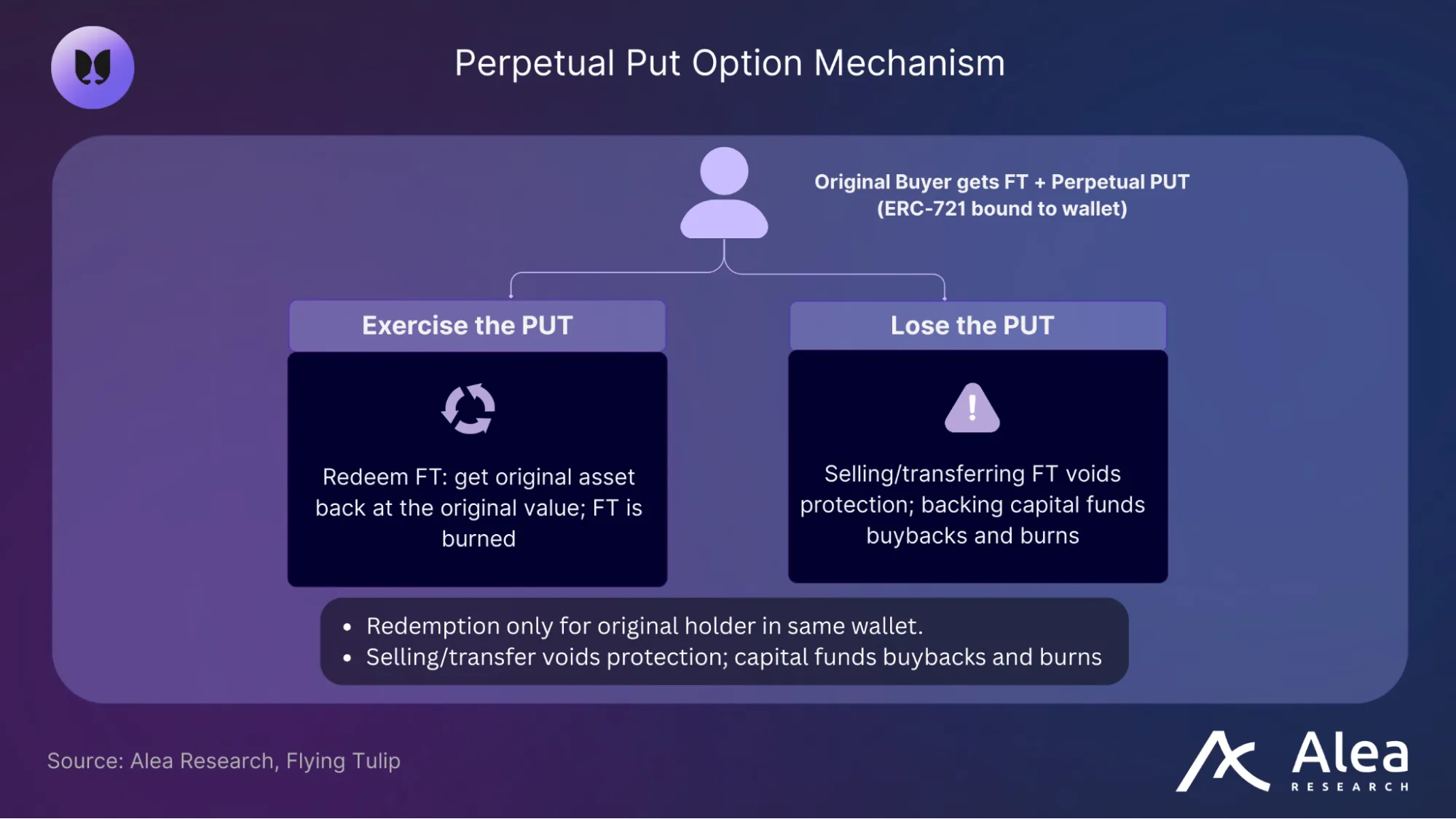

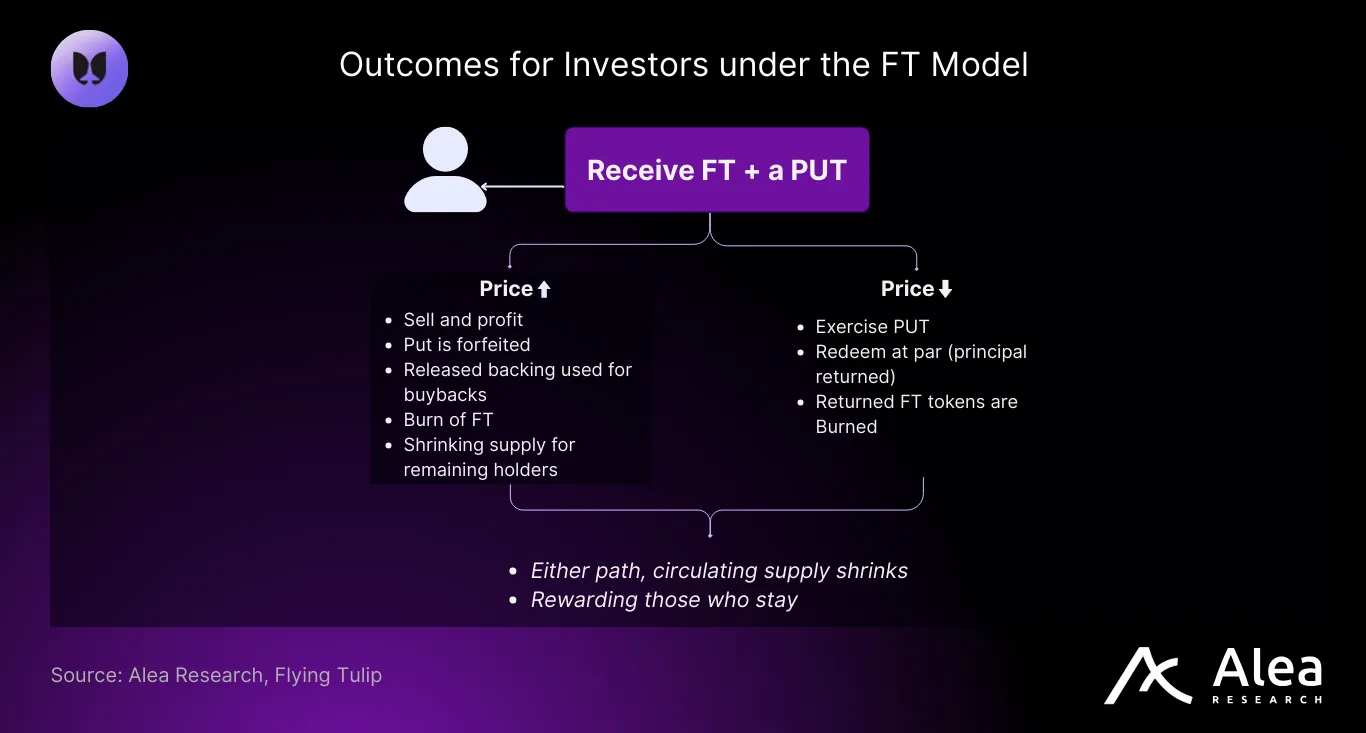

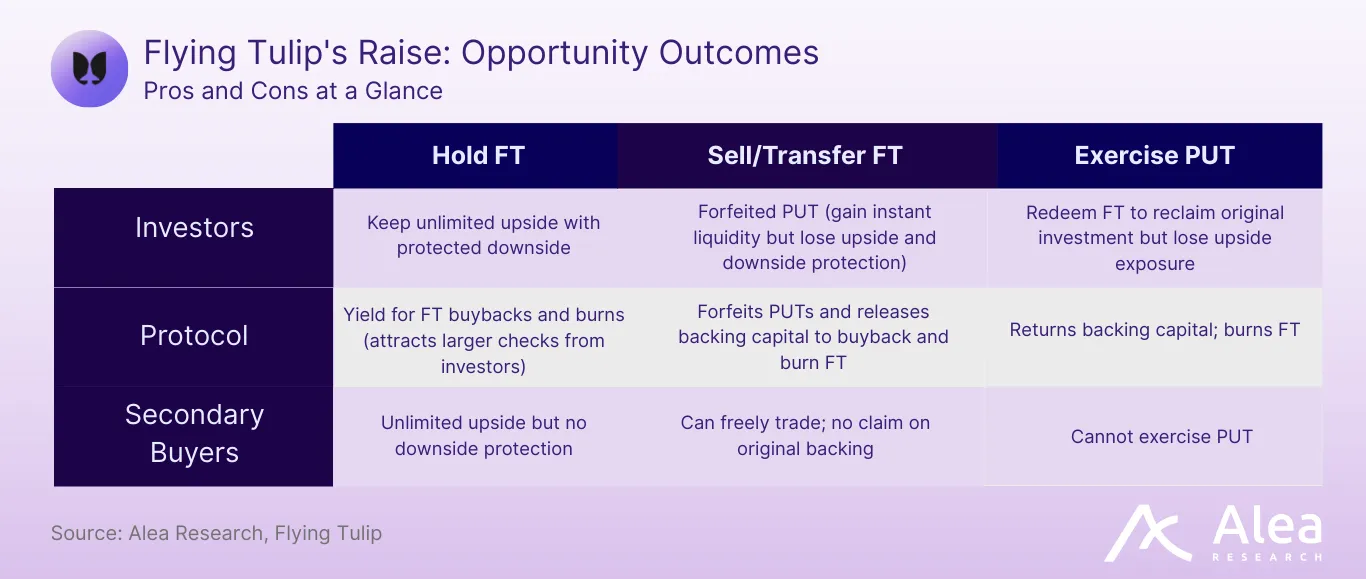

Flying Tulip’s raise sells 10 FT for $1 and gives every investor a standing right (perpetual PUT) to redeem their original investment at the same terms. While that right exists, investors’ money earns yield in low‑risk strategies. If investors transfer or sell, they lose the right to redeem (PUT invalidation: they forfeit the PUT) and the backing capital plus generated yield fund FT buybacks and burns; if they redeem, they recover their original asset 1:1 on the same terms and FT is burned. In addition to that, protocol revenue adds more buybacks—only then do team and Foundation tokens start to unlock.

- Terms: $1B target raise for a total 10B FT supply (50% investors, 50% Foundation) at a $0.10 implied TGE price. Investors receive liquid FT with no locks or vesting.

- Accepted assets: USDC, USDT, USDS, USDe, ETH, SOL, BTC, AVAX, and S, each deployed to the lowest-risk liquid yield source (e.g., stETH, jupSOL, Aave, sUSDe, etc). This yield continuously buybacks and burns FT.

- Perpetual PUT: Each investor gets the right to redeem FT 1:1 for their original asset at any time. FT is burned upon redemption.

- PUT forfeiture: Selling or transferring FT forfeits the PUT. Secondary buyers never receive a PUT. Forfeited backing is used to buy back and burn FT.

- Revenue unlocks: Protocol revenue funds buybacks and burns, subsequently unlocking Foundation / Team / Ecosystem / Incentives tokens in a 40 : 20 : 20 : 20 split without dilution or supply inflation.

- OpEx caveat: Until protocol fees exceed operating expenses (OpEx), estimated to be <$500k/year, the protocol allocates yield to cover costs and fund incentives that support liquidity and usage. Net buybacks occur only from the remaining surplus. After fees surpass expenses, all excess fees and all continued yield are directed to FT buybacks and burns—100% of the net flow.

The design ensures investor protection by issuing onchain, perpetual, pro-rata PUT options. This allows investors to redeem their tokens for their original investment at any time, effectively setting a hard floor on downside risk.

- Investors can always recover their principal as long as they hold FT from the original raise, regardless of market conditions. PUTs are only invalidated when they transfer or sell FT.

- Team and Foundation tokens only unlock as the protocol generates revenue that buys back and burns FT, netting supply growth without dilution.

This raise ensures that the incentives of the team and investors are aligned by linking upside to the protocol’s success and consequent value creation. Investors are protected from an uncapped loss while the team is motivated to drive sustainable long-term growth—both benefit only if the protocol succeeds.

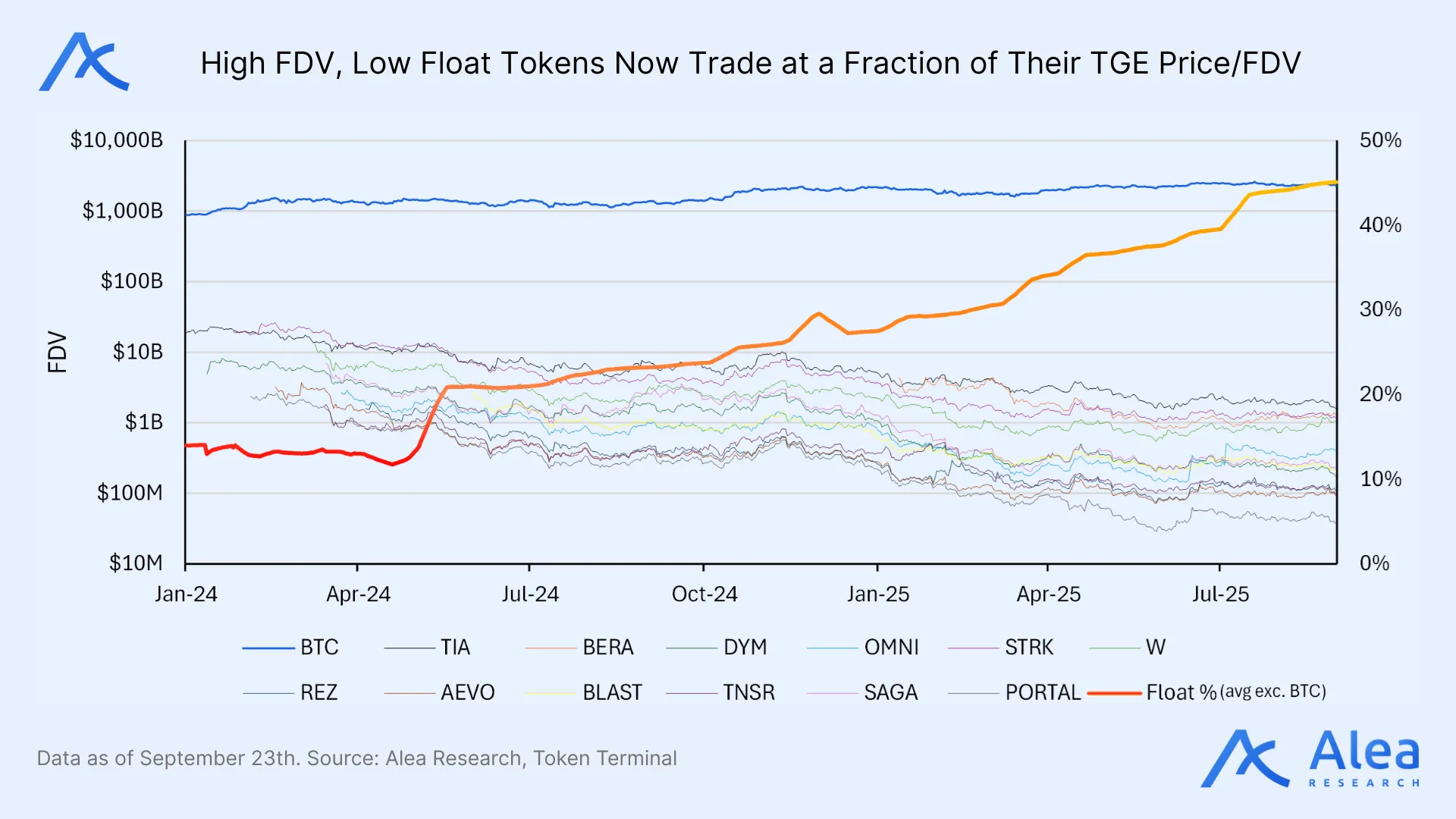

Burn-to-build is Broken

Most crypto raises burn fuel up front. The fire flares (big treasury, big ambitions) then fades. The standard fundraising playbook burns runway to rent growth, but when projects burn the raise, they lose trust, momentum stalls, and backers walk away. Next (hopefully) comes another raise, a new story, and a fresh set of promises, but when dilution and disappointment set in, the pool of committed backers shrinks.

Instead of burning through raised capital, Flying Tulip invests for yield. Performance drives spending. All liquidity, incentives, and buybacks come from output, not input. Investor principal always remains available to honor redemptions. In parallel, yield shrinks supply and supports price—all of yield earnings (revenue minus expenses) buyback and burn FT in perpetuity. Operational expenses (OpEx) are currently estimated at <$500k/year. If they were to increase, that would be a function of infrastructure fees, which would imply more demand and, as a result, also more revenue. In practice, this implies that the reserve yield would fund FT buybacks and burns from day one, with revenue-driven buybacks compounding the effect as activity scales.

The standard fundraising playbook asks investors to underwrite a future that may never arrive; Flying Tulip protects investors’ principal while investing funds for yield. The old way burns cash for runway while investors wait for an unlock date to come (which secondary buyers eye as a selling pressure threat); the Flying Tulip way ensures that yield—not principal—funds continuous buybacks and burns so long as holders retain their original PUT (if they sell or transfer, the PUT is forfeited and the released backing plus accrued yield converts into FT buybacks and burns, while exercising the PUT returns principal 1:1 and the redeemed FT is burned).

This capital raise optimizes for alignment you can measure: a redeemable floor for buyers, persistent buy pressure from yield and PUT invalidations, and team tokens that unlock only after revenue has done the work.

Long Live Burn-to-build

Flying Tulip raises capital without spending investors’ principal. Investors’ money is reserved for deployment into onchain low-risk yield strategies. Instead of simply funding the team’s runway, private investors get a perpetual PUT—the right to redeem their original deposit back at the same terms (e.g., 1ETH in, 1ETH back). PUTs are issued as ERC721 tokens, allowing for secondary markets to exist.

Accrued yield funds growth—that’s the beginning of the flywheel. Token supply is fixed and split 50% investors, 50% Foundation, subject to milestones.

FT is sold to investors at an implied price of $0.10. For every $1 investors receive 10 FT along with a PUT option—the right to reclaim the original investment denominated in the same asset. That PUT, however, is only valid as long as the tokens aren’t transferred or sold. The moment an investor moves their FT, their PUT is forfeited. Should that happen, the capital tied to that PUT is then released to buyback and burn FT.

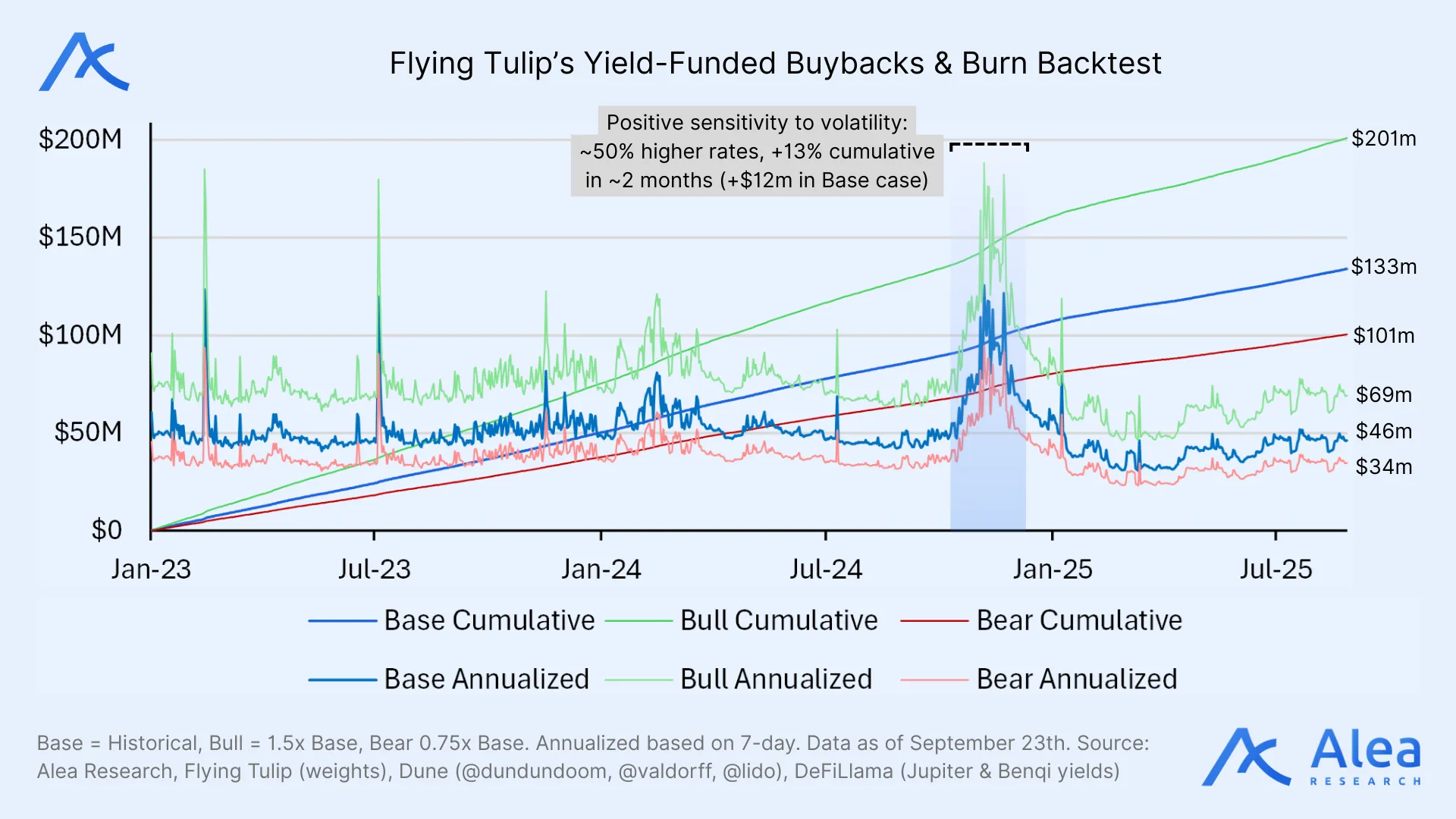

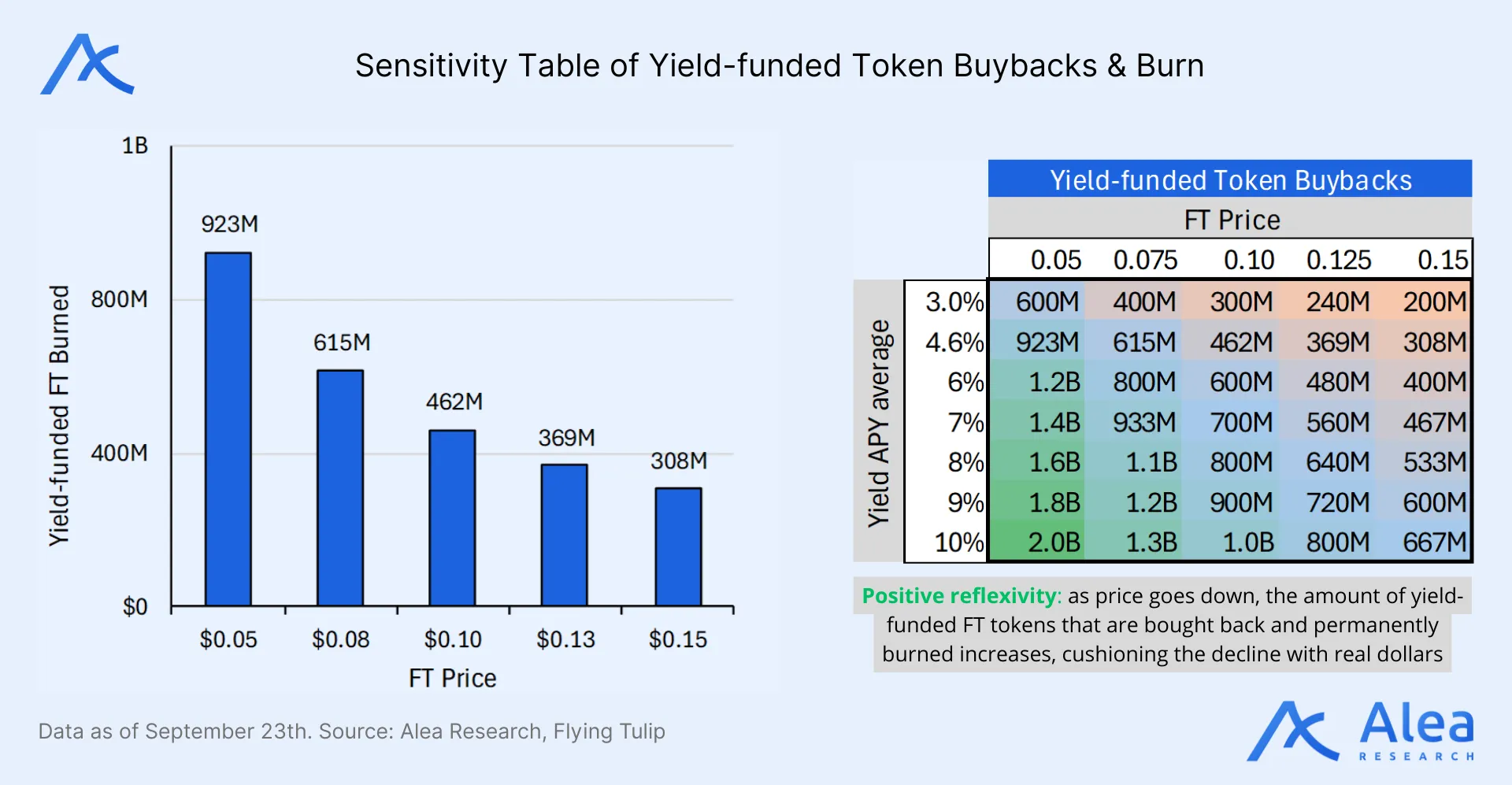

Investor capital is never sitting idle, but deployed into blue-chip protocols and low-risk yield sources (the lowest risk yield source for each asset: Aave for USDC/USDT, Ethena’s sUSDe for USDe, stETH for ETH, jupSOL for SOL, etc.). This yield buybacks and burns FT in perpetuity. A backtest shows that a $1B raise would burn 460M FT at the implied price of $0.10, or a total of ~$46M burning 4.60% of the supply at that price.

Flying Tulip defies the standard convention by setting transparent expectations: the put option protects downside; the yield powers upside. Every dollar raised is put to work immediately. Investor capital is allocated to the safest available yield sources for each asset. Yield generated from these blue-chip protocols funds ongoing FT buybacks and burns, reducing supply over time.

This is an approach that scales with size. The larger the raise, the more capital earns yield from day one. There is no wasted runway. That yield compounds, driving buybacks and burns. More capital means more momentum. Bigger reserves drive resilience during market downturns instead of diluting discipline—they create a flywheel that rewards patience fueling long-term growth.

Variable‑rate yields rise with market activity. When borrowing, perps, or onchain activity increasing staking rewards spikes, yields rise. FT captures those yields—without leverage or bridges—before any protocol revenue. Original investors’ PUT creates two actions: redeem (burn FT) or sell (forfeit PUT; backing buys and burns FT). Both paths shrink supply and add buy pressure. Market volatility fuels a built‑in bid; the PUT ensures exits tighten supply rather than swell it.

Skin in the Chain

The Foundation is allocated 50% of the supply, but those tokens unlock only after revenue-funded buybacks and burns. There is no time-based vesting and the unlocks don’t inflate the token supply. Unlike other models enforcing vesting schedules that pay out on a clock, whether the protocol succeeds or not, Foundation unlocks are directly tied to performance: unlocks occur only when protocol revenue funds FT buybacks and burns.

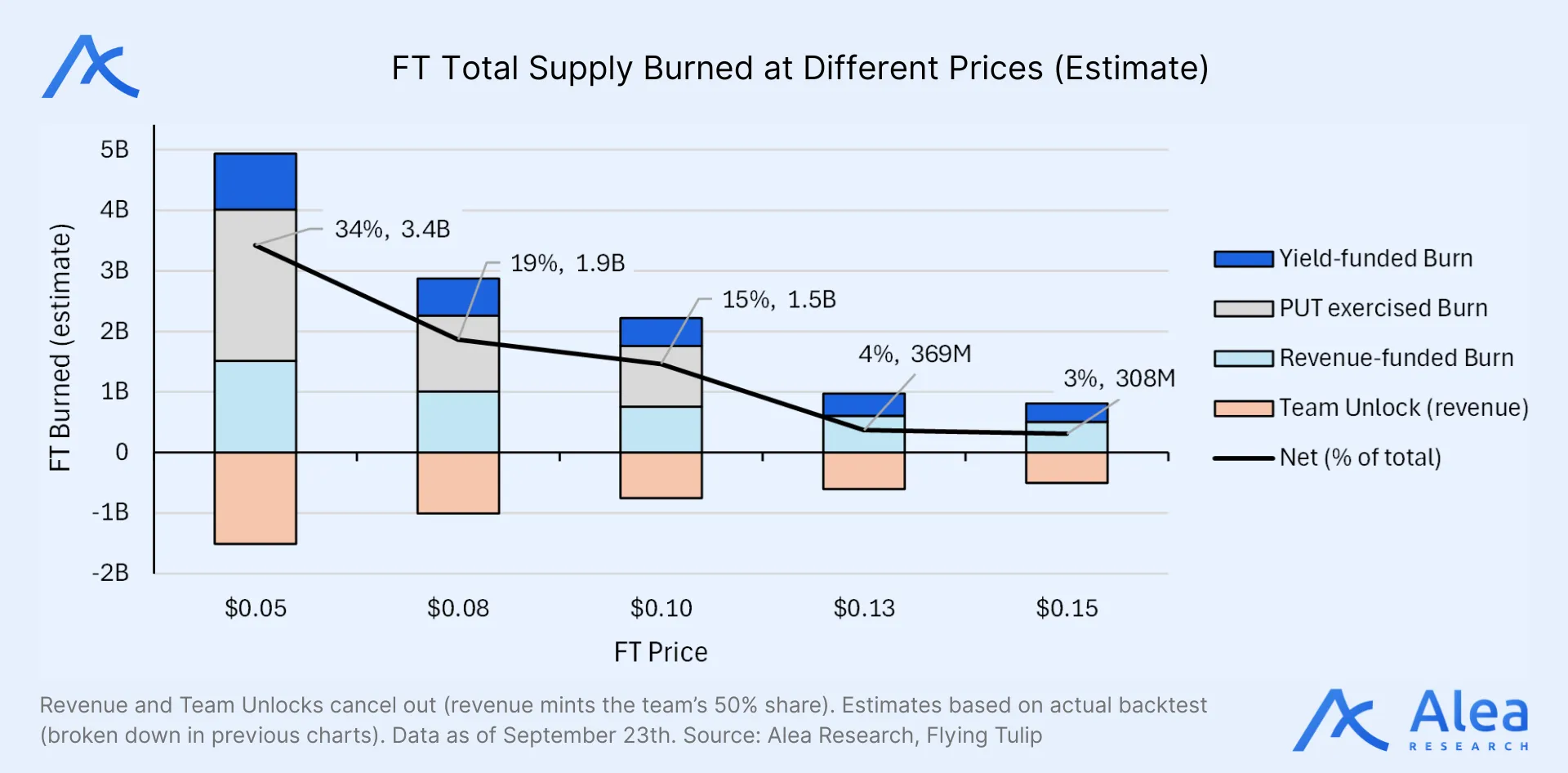

The team earns only after existing holders win. For every 10 tokens burned from protocol revenue, 4 unlock to the Foundation, 2 to the Team, 2 to Ecosystem Growth, and 2 to Incentives. Because each unlock is matched by a burn, the net circulating supply stays flat.

- Investors PUT: Capped downside; unlimited upside.

- Investors PUT Invalidation: Sellers forfeit their floor. Their backing capital buys back and burns FT.

- Yield: Perpetual deflationary buyback shrinking FT supply.

- Revenue: Foundation/Team unlocks only as the protocol earns and uses its revenue to buyback and burn, keeping the supply flat.

One Stack to Rule Defi

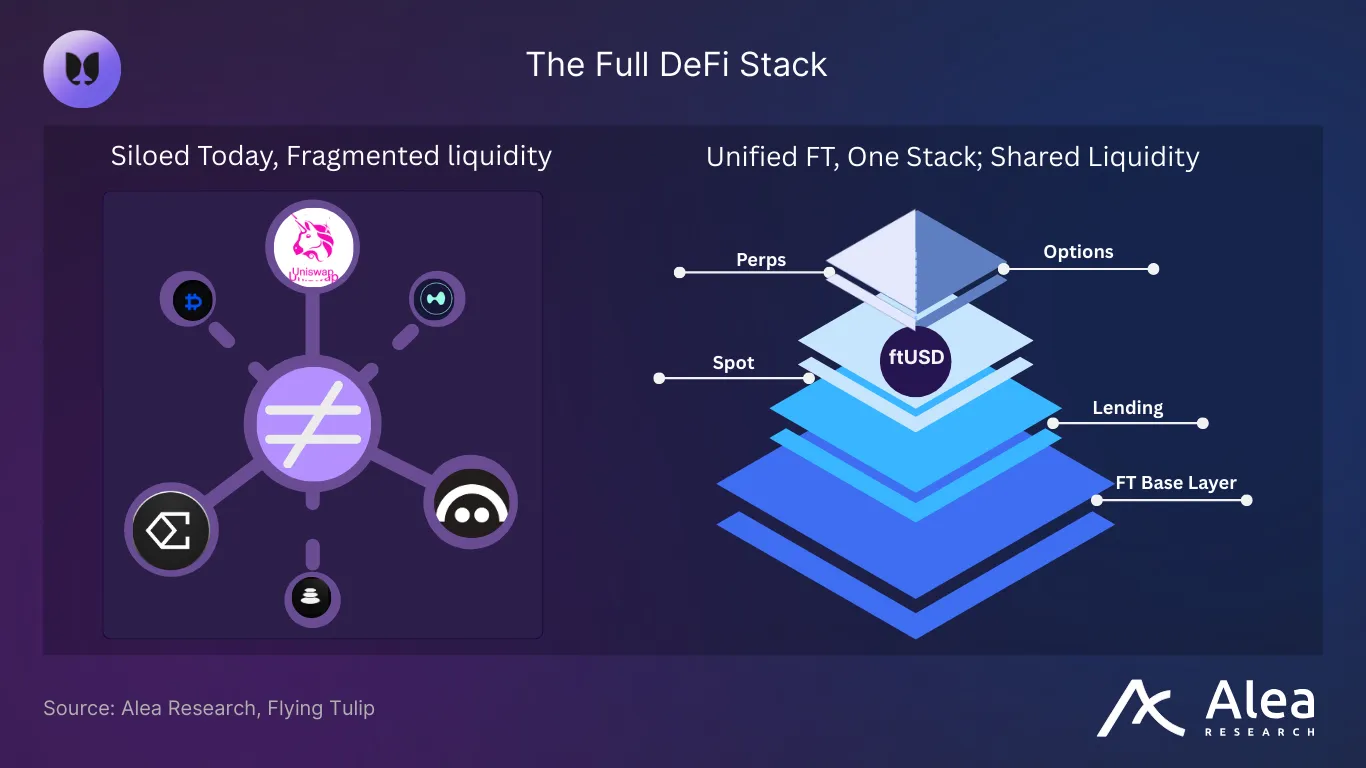

Flying Tulip’s hybrid AMM+CLOB is a bet to host all DeFi in a single stack—spot, lending, perps, options, delta-neutral stablecoins, and even insurance. One venue, one liquidity layer, and a token-first design where FT is natively required for protocol operations.

Flying Tulip’s PUT-backed raise supports pro-rata exits for investors; secondary buyers can get exposure to the upside, but get no downside protection (the original PUT issued as an ERC721 is address-bound and forfeited on sales). The incentives structure allows the protocol to raise more capital than other models, since investors’ downside risk is capped. This property also lets the protocol access deeper diversified liquidity from day one while issuing a fixed-supply token that investors receive liquid with no vesting or lockup.

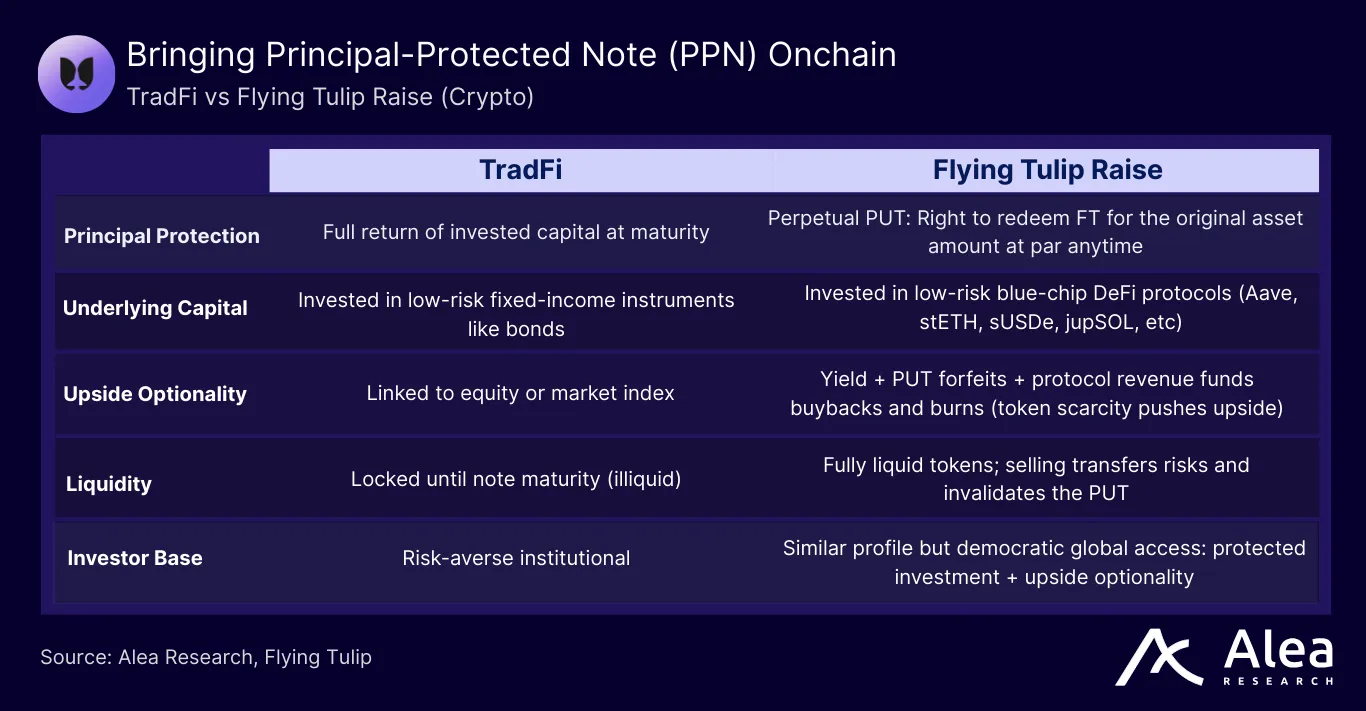

This model draws inspiration from TradFi’s Principal-Protected Notes (PPNs), which are favored by risk-averse institutional investors. Similar to FT’s PUT model, PPNs guarantee the return of the original investment (the principal) while leaving the doors open for additional upside. A bank issues a principal-protected note, invests in low-risk assets like bonds, then uses a portion of the yield for derivative exposure that offers equity-like upside.

- Floor at par: Investors can always get back what they put in.

- Upside optionality: Investors can hold while expecting appreciation from buybacks, burns, and protocol revenue.

- Risk-aligned capital: The structure aligns incentives in a way that attracts larger, risk-averse checks.

The protocol and the token are inseparable: fees from protocol operations are used to buyback FT that is then distributed to users. Fees fund FT buybacks; users receive their yield paid out in FT.

The Infinite Game Plan

The default fundraising model sells tokens in exchange for runway. Raised funds go to teams’ pockets not only to fund operations, but also marketing, partnerships, exchange listings, and other initiatives that can often be described as wasteful. The modus operandi sells tokens, which strikes in contrast to the recurrent theme of this report: Flying Tulip is intentional about its preference for buying FT instead of selling it.

- Selling pushes short‑term runway at the expense of holders; buying credibly signals confidence and ties the team’s upside to holder outcomes.

- Selling tokens is short‑term runway; earnings‑funded buybacks sustain demand without new issuance.

- Selling tokens buys time, then pressure returns. Token sales are finite games.

- Infinite games can be played when treasury sustainability is independent of new token issuance.

- Buybacks start the flywheel: burns cut float and increase upside convexity; selling postpones float expansions that raise the price hurdle.

- Price, trust, and signaling are tightly coupled: buying converts revenue into a visible, confident bet; selling implies weakness that signals runway stress.

- Buybacks and burns allow for game theoretical equilibriums achievable with fully liquid tokens, avoiding lockups and vesting overhangs that increase perceived sell pressure risk.

To fuel growth, most projects sell their own tokens, arguably draining value for short-term gains (masqueraded as growth) that ultimately dilute holders. Flying Tulip offers a contrasting alternative: buy the project’s own token, compound scarcity, and bet on itself. This single difference changes everything: incentives, trust, and sustainability. A buyback‑heavy treasury is re‑price risk (beta) rather than issuance risk (alpha dilution)—it compresses the number of ways the treasury’s strategy can go wrong and aligns treasury drawdown with holder drawdown.

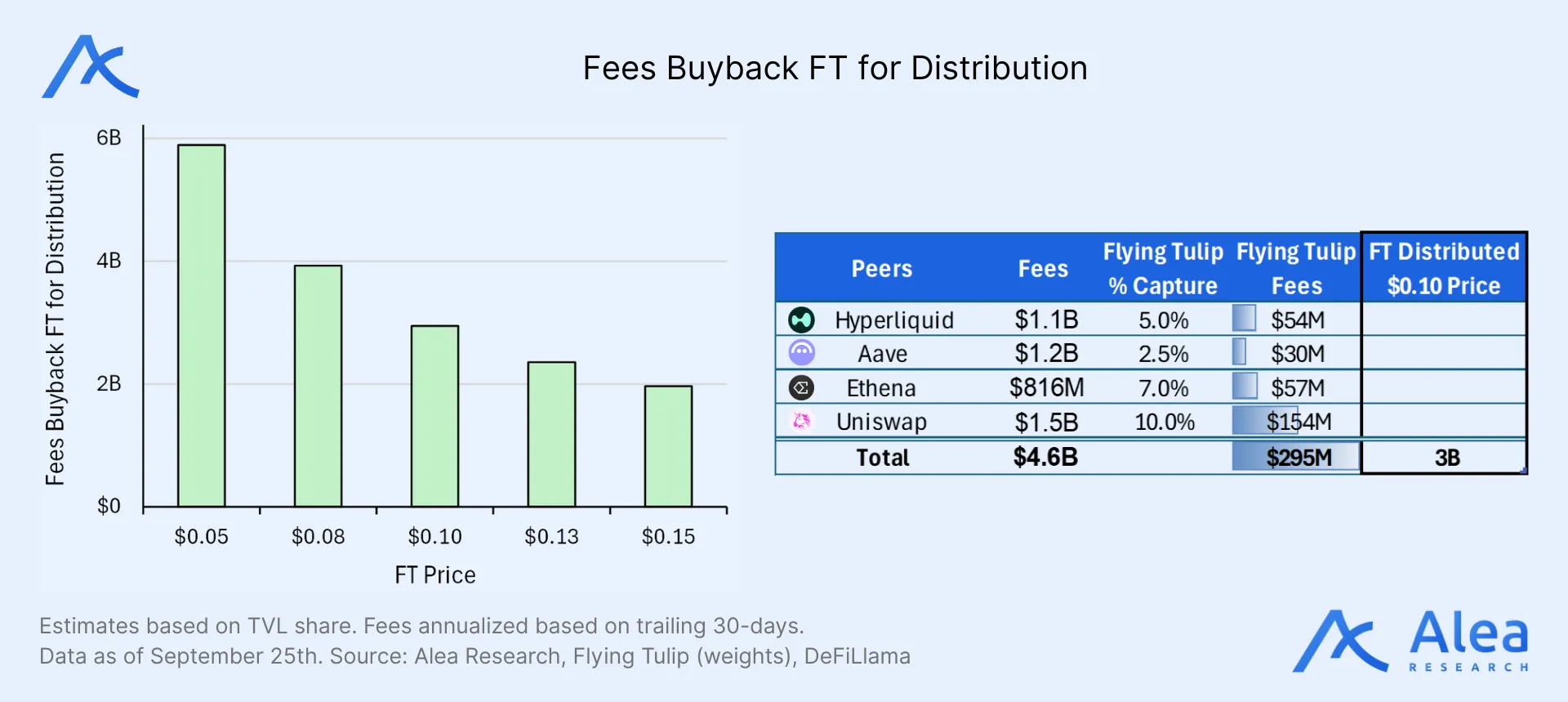

To illustrate the net impact of FT’s mechanism, using a $0.10 FT price and a 1B FT supply as the base case:

- Yield-only burns: $46M, or 460M FT burned (4.60% of supply).

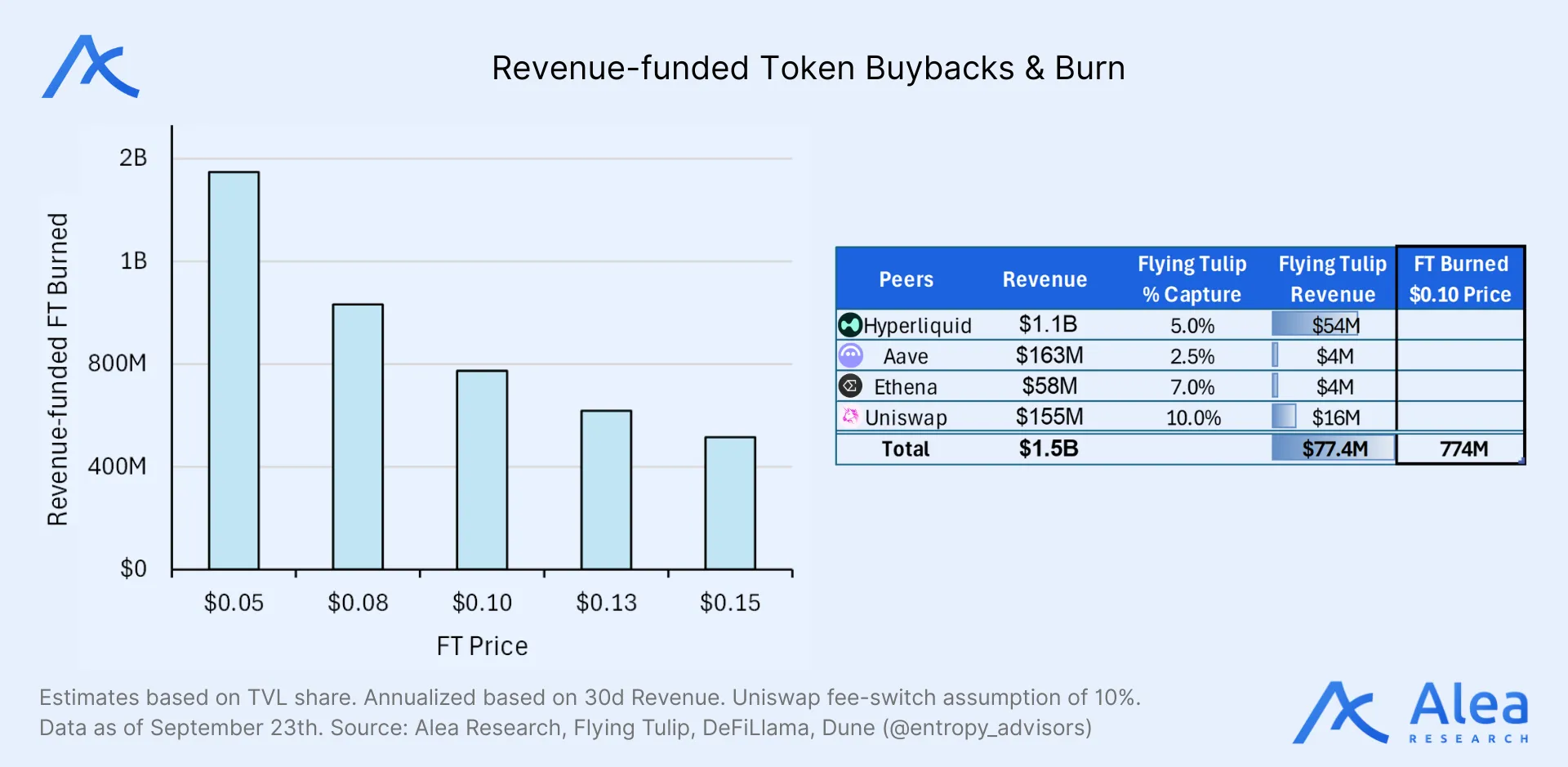

- Revenue-capture: $61.8M, or 618M FT burned (6.18% of supply)

- Fee-capture: $295M, or 2.95B FT bought back and distributed to users (29.5% of supply)

- PUT invalidation: 25% of investors selling and getting their PUTs forfeited would result in $250M of backing converting into 2.5B FT buybacks and burns.

- PUT exercises: 25% of investors redeeming would burn 1.25B FT (12.5% of supply).

One common objection is that buybacks are just financial engineering. While valid, this claim misses the point that, when buybacks are funded from organic yield and protocol activity, they convert protocol productivity into token scarcity. Revenue-funded buybacks tackle this common critique and, in addition to that, Flying Tulip’s raise model removes issuance/dilution risk overhang. Further avoiding pure optics, the Foundation claims are gated behind revenue bars as well; growth spend is downstream of production, not pre-funded dilution.

Conclusion

FT is a downside-protected, yield-powered sale. Every dollar invested earns yield that funds continuous buybacks and burns. Backing capital is used productively as a token-aligned cash-flowing reserve. Yield and fees are the input to the flywheel; deflation is the output.

- Investors get downside protection; unlimited upside from scarcity created by yield and revenue-funded buybacks.

- Secondary buyers don’t inherit the PUT, but benefit from sellers’ invalidated PUTs that release more capital for buybacks and burns.

- The protocol gains credibility and capital efficiency. Instead of burning through the runway, a big raise unlocks a self-sustaining engine with no supply overhang.

- The team only unlocks when revenue has already funded buybacks and removed tokens from the circulating supply. They win only if their protocol delivers value first.

FT spends only what it earns. Capital earns trust before it earns returns. Supply contracts before upside expands. Investors get protection, holders get scarcity, and the team builds trust before it reaps rewards.

References

Flying Tulip (Coingecko; FT not live yet)

DefiLlama: Revenue by Protocol

Disclosures

Alea Research is engaged in a commercial relationship with Flying Tulip and receives compensation for research services. This report has been commissioned as part of this engagement. Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed. This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.