Introduction

Recovering from a $197M exploit in 2023, Euler v2 was launched September 4, 2024, with a modular design that challenges incumbent monolithic lending structures. After a short period of liquidity growth on Ethereum mainnet, it was in Q1 2025 when the protocol started growing more aggressively and deploying on other chains.

In Q1 Euler expanded market share with more vaults and strategic deployments on fast-growing chains like Sonic, Berachain, or BOB. The protocol’s capital efficiency has stood out and driven growth on core metrics such as fees, active loans, net deposits, and active users. Despite a general decline in the crypto market in the first quarter of the year, both in price and sentiment, Euler has achieved steep protocol growth throughout Q1, generating $410.28K in total revenue and over $4 million in fees, while active loans reached $423.107M with monthly active users growing and peaking at 12,300.

Much of this momentum is driven by Euler’s modular design, allowing it to rapidly adapt to evolving DeFi demands. New markets have emerged, including Resolv (delta-neutral stablecoin trading), Usuals’ Usual Stability Loan (fixed-rate borrowing against USD0++), Euler Yield (looping stablecoins with yield-bearing tokens), and Apostro BTC (leveraged BTC staking). This flexibility has positioned Euler as the go-to lending protocol for sophisticated strategies that you cannot find on other lending markets like AAVE, Morpho, or Fluid.

Looking ahead, a key upcoming catalyst for Euler’s next growth phase is EulerSwap, a novel AMM built to integrate deeply with Euler’s lending layer. While not yet publicly launched, EulerSwap is designed to address two core inefficiencies in DeFi today: fragmented liquidity and inaccessible yield.

While many protocols rely heavily on token emissions to bootstrap liquidity, Euler v2’s recent growth has been largely organic. As stated by Euler CEO Michael Bentley, $1,963,121.08 in rEUL incentives was reportedly distributed to drive the protocol’s current usage.

Key Takeaways

- Over $1B in total deposits on Euler. TVL hit a new ATH and ended the quarter at $891.16 million (total user deposit), a 399.13% QoQ increase. Active loans grew 434.7% QoQ, reaching $423.11 million by the end of the quarter.

- $4.39M in protocol fees were generated, with $3.99M going to lenders as interest/yield. Total revenue grew by 647.30% QoQ, ending the quarter with $410.28K. The P/F (price-to-fees) ratio improved from 17.05x to 4.61x.

- The circulating market cap of $EUL increased by 17% QoQ in Q1 to $110.28 million on March 31.

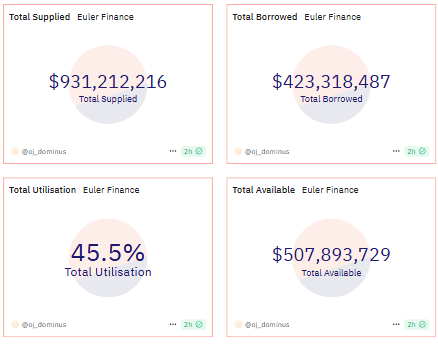

- In Q1 2025, Euler expanded its ecosystem to five new chains: Sonic Labs, Swellchain, BOB, Berachain, and Base. With 297 vaults live, and at the time of this report, Euler has over 992.97M supplied ($931.21M in Q1) in total supply and a total borrowed of $458.32M ($423.32M in Q1). In Q1 2025 alone, approximately 45.5% of the total supplied capital was utilized.

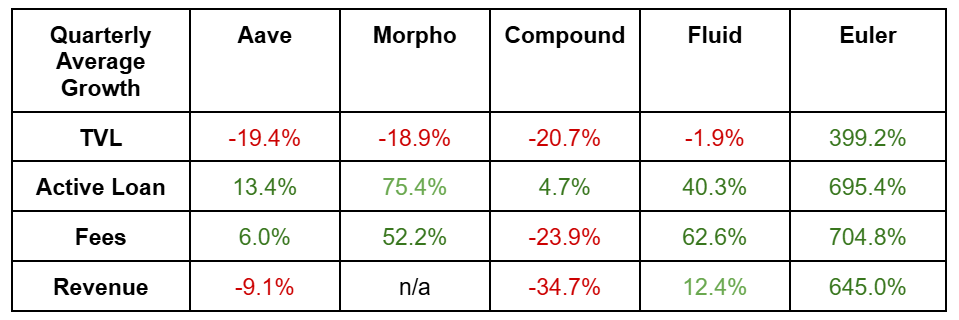

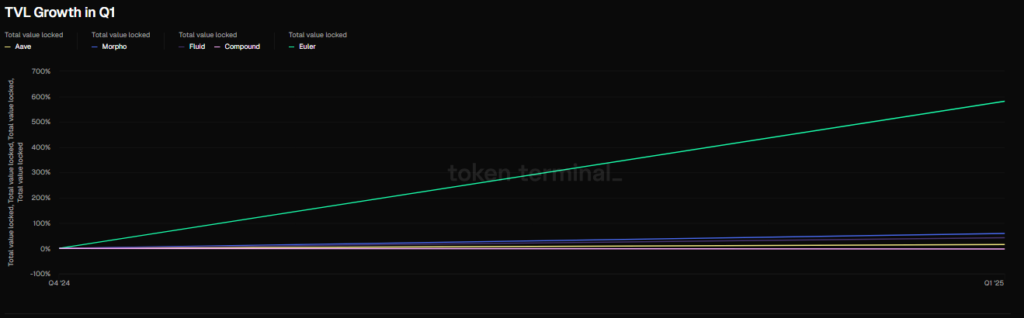

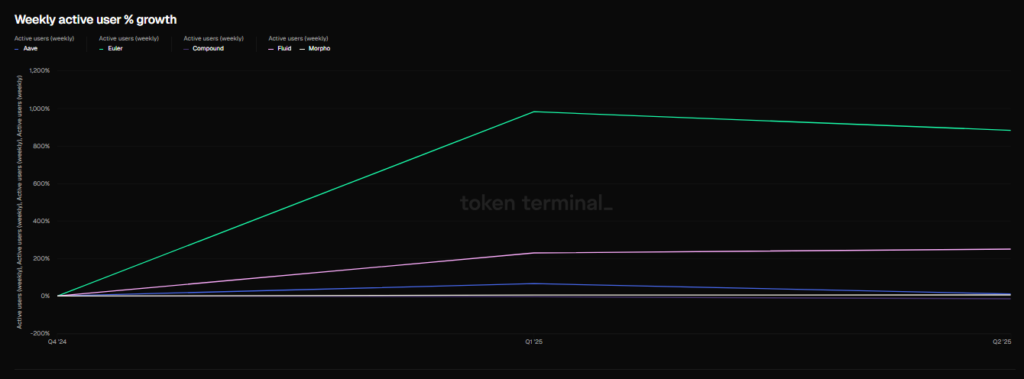

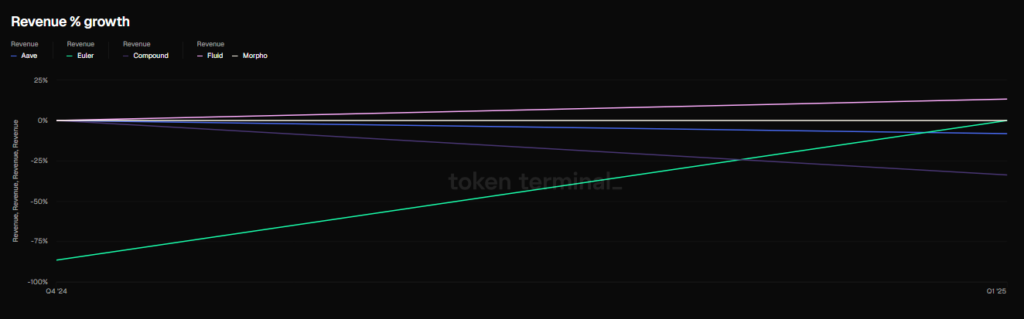

- Outperformed major competitors in lending sectors for Q1 2025:

Euler’s V2 Implementation Strategy

Euler Finance, once demonstrating a promising future in DeFi lending with a steadily growing TVL of $263 million, suffered a major financial exploit in March 2023, leading to the loss of approximately $197 million in assets. The attack, which leveraged a flash loan vulnerability, significantly impacted Euler’s financial stability, user confidence, and liquidity standing. Following the exploit, Euler Finance initiated negotiations with the attacker, resulting in the return of the stolen funds.

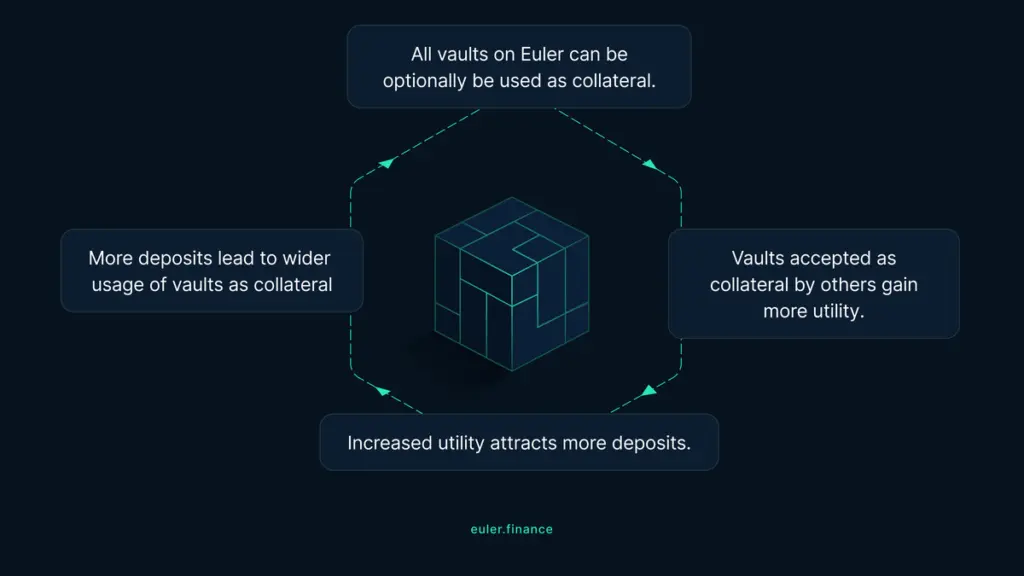

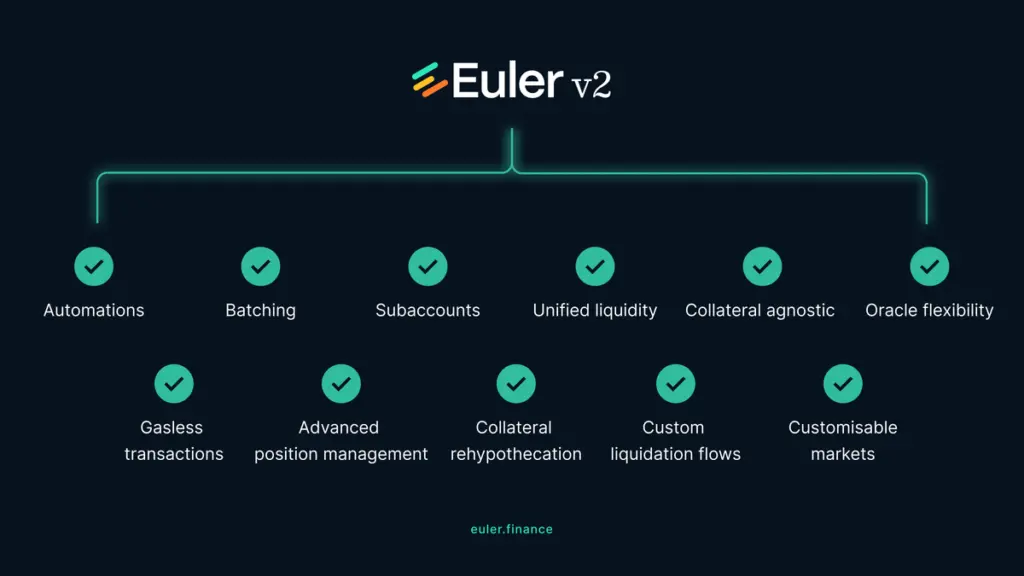

As v1 was sunset, the team spent the next year refining their new version, implementing the lessons they learned in the past to enable a more capital-efficient lending market. Euler introduced v2 in the second quarter of 2024, with a modular design different from its predecessor and from other competitors. Rather than fragmenting liquidity across isolated markets, Euler focused on capital efficiency by tokenizing both collateral and borrowing vaults. This would be enabled by the Euler Vault Kit (EVK), allowing developers to tailor lending vault designs, and the Ethereum Vault Connector (EVC), a tool for linking ERC-4626 vaults with various smart contracts. This would allow the protocol to achieve interoperability within its ecosystem, allowing the use of vaults as collateral for borrowing. With the EVC, the protocol allows vaults to connect and interact seamlessly, acting as a coordination layer without requiring major modifications, making it ideal for integrating with DeFi systems.

EVK is a permissionless vault development kit that allows users to create customized lending vaults using Euler’s framework. It builds on the ERC-4626 standard but extends beyond basic vault functionality to offer more advanced features, where vaults can be deployed as either upgradeable or immutable through a factory contract, providing governance flexibility. The system optimizes gas usage with internal balance tracking and introduces a virtual deposit mechanism to handle precision issues. This approach prevents accounting discrepancies that have historically affected lending protocols due to precision loss.

The EVC has two key layers: (1) authentication to verify identities and permissions and (2) authorization to determine if actions are allowed based on vault rules, ensuring security and modularity. Its core component, the collateral set, consists of vaults users designate as collateral, which must follow the ERC-4626 standard for consistency, while the controller system ensures loans are managed safely by restricting collateral withdrawals until repayment. EVC enhances interoperability, provides standardized liquidation processes, supports diverse assets (including NFTs and RWAs), enables batch operations for efficiency, and allows external operators for automated strategies. Users can create multiple sub-accounts to segregate risks, liquidity checks prevent failures due to temporary fluctuations, and strict security measures ensure vaults only interact with trusted entities.

The introduction of customizable lending vaults was a much-needed restructuring and innovation, ultimately setting the stage for a comeback, and this report assesses the on-chain financials for Euler in the first quarter of 2025, analyzing its adoption metrics, revenue, market position, and performance post-exploit.

Assessing Growth: Liquidity, Usage, and Revenue Metrics

The following sections of this report assess protocol growth and fundamentals through liquidity and usage metrics, vault performance, and a comparison with lending markets on Ethereum and Base.

To assess the protocol’s health, we focus on metrics such as Active Loan growth, Annualized Revenue, and Supply/Borrow Volume across vaults. We also consider the market capitalization-to-fees ratio to evaluate how token valuation aligns with actual revenue generation.

Given the concentration of large holders, traditional active-address metrics are less reliable; this report instead emphasizes fee-based indicators tied directly to protocol usage.

Fees and Revenue

Fee represents the value end users assign to the protocol. As a core indicator of LP revenue, they serve as a proxy for product-market fit—the more users are willing to pay to use Euler, the stronger the demand.

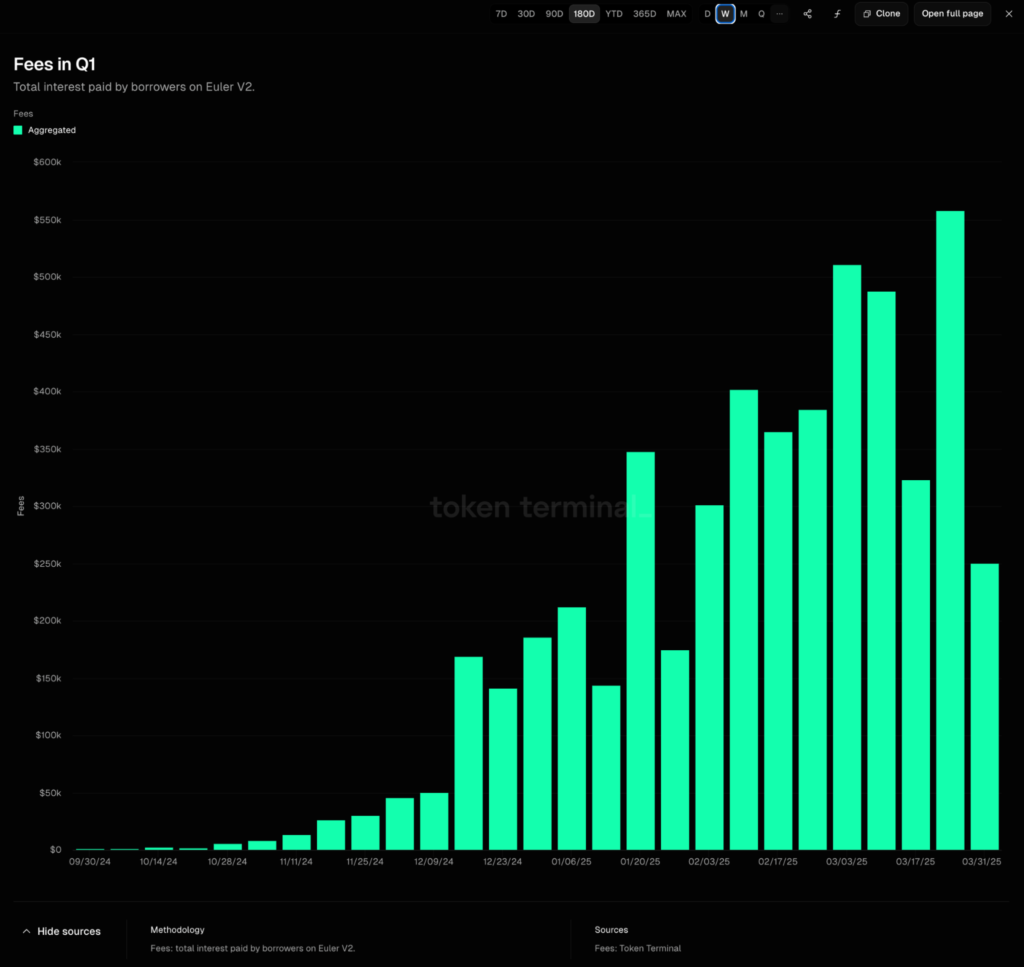

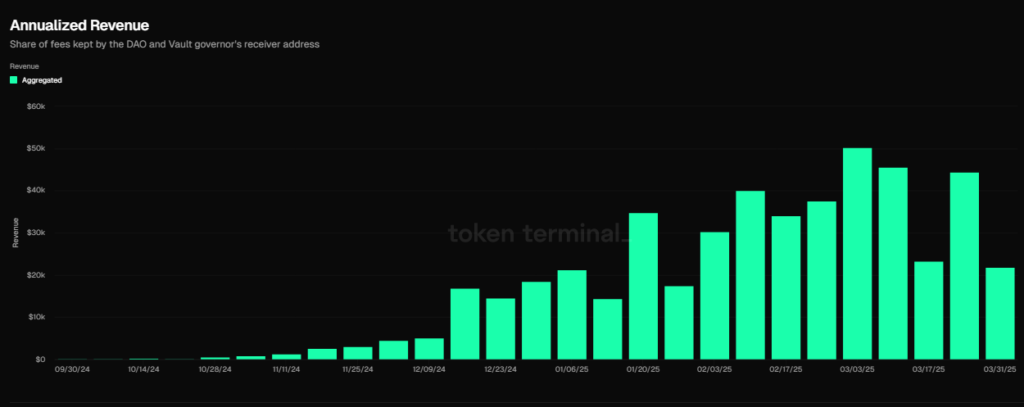

During Q1 ‘25, Euler v2 saw a significant increase in fees, rising from $544.8k in Q4 ‘24 to $4.4 million, a +707.4% growth. Of this amount, 90.7% ($3.99 million) was distributed to LP as supply-side fees (the share of interest paid to lenders).

Out of total fees, Euler had a margin of $410.28K (9.3% margin) in terms of revenues over Q1, an average quarterly increase of 647.3%.

The Revenue growth trend was consistent week after week, reflecting increased vault activity and stronger utilization.

Ecosystem Growth

Euler v2’s TVL increased from under $200M at the beginning of the quarter to over $891M by the end of March (399% QoQ increase), and despite multi-chain expansion, liquidity (unused supply) is still heavily concentrated on Ethereum ($445.14M). Sonic ($53.54M), Berachain ($22.08M), BOB ($23.47M), Base ($18.53M), and Swellchain ($5.75M) are growing strong, contributed to by rEUL incentives. Contracts have been deployed on Unichain and Avalanche, but no official launch yet.

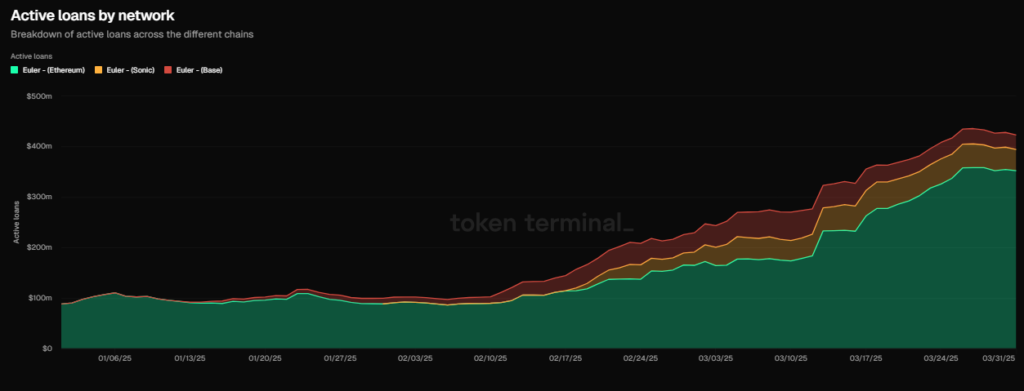

Euler’s net deposits grew steadily through late 2024 and then rose sharply in early 2025, with over $1 billion in net deposits by March. The ratio between user deposits and active loans, the utilization ratio, increased by 7% QoQ to 47.47%; an increasing ratio suggests utilization is improving with more user deposits.

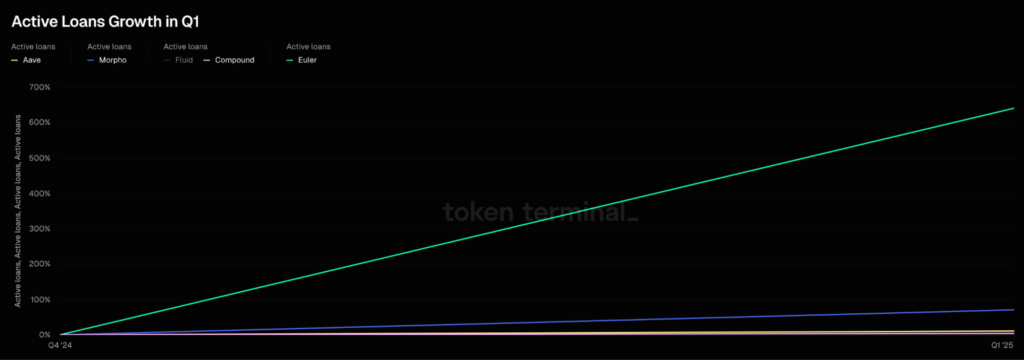

Active loans on Euler more than quadrupled, moving from $79.13M to $423.11M in Q1. The final surge in March shows a major inflection in borrowing demand as supply steadily rose from $200M in early January to over $900M. It is important to watch out if the growing base of depositors will push utilizations and yields lower in Q2.

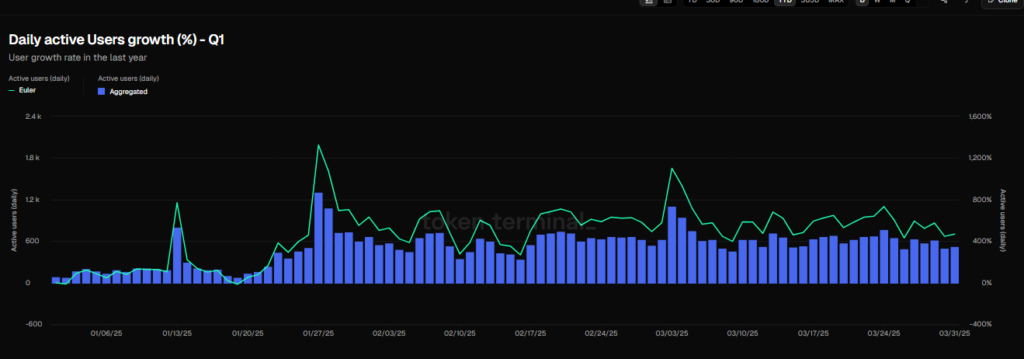

Euler also saw a steady growth in daily active users starting in 2025 but peaking at 1.3K users on 27th January 2025 and ended the quarter with 522 average daily users (+953.87% quarterly increase). Euler v2 was built for capital efficiency, and while there’s room to push even higher, what we have seen so far is a clear indication of users preference for customization of lending vaults to their specific needs.

Vault Analysis

Euler v2 experienced notable growth and diversification across its vaults in Q1 2025. Total assets supplied rose to $931.21M, while total borrowed amounts reached $423.32M, representing a healthy platform-wide utilization rate of 45%.

However, when broken down per vault, utilization varies dramatically, highlighting specific vaults under heavy stress and others underutilized. It is also important to avoid misleading and erroneous representations of data. For example, APY can be quite high for illiquid vaults, and inactive, tiny, or unused vaults can create a lot of noisy data. Hence, we filtered for vaults with at least $3M in TVL; this helps us to only analyze and visualize active, economically significant vaults. Notice as well that some vaults represent isolated positions. Specifically, escrowed vaults allow deposits to be used as collateral, but their actual assets cannot be borrowed. These are attractive for yield-bearing assets or Pendle PT tokens among others.

Vaults with the Most Borrow Demand

The following vaults, arranged in no particular order, all have high utilization rates, consistent APYs, and dominate the borrowing activity.

| Vault Name | Borrowed Amount | Utilization | Borrow APY |

| USL USDO | $214.45M | Often at 100% | 5% |

| Euler Prime WETH | $36.20M | 76% | Averages at 2% |

| Euler Yield USDC | $22.44M | 80% | Averages at 6% |

| Euler Prime USDC | $17.19M | 61% | 4% |

| Euler Prime WBTC | $16.37M | 89% | High APY at 21.7% |

| Euler Prime cbBTC | $10.37M | 68% | 0.8% |

Source: Euler Vault Explorer and Dune – Vaults with the Most Borrow Demand.

Most Popular Vaults for Lenders

On the other hand, the following vaults have attracted the most capital in supply terms.

| Vault Name | Supply Amount | Utilization | Supply APY |

| USL USDO | $234.97M | Often at 100% | Averages at 5% |

| Euler Prime WETH | $47.47M | 76% | Averages at 2% |

| Euler Prime LBTC | $34.60M | 8% | Very low APY at 0.13% |

| Euler Yield USDC | $31.65M | 80% | Averages at 5% |

| Euler Prime USDC | $26.35M | 61% | Averages at 2% |

Source: Euler Vault Explorer and Dune – Vaults with the Most Supply.

Euler V2 was built to be a permissionless infrastructure, and at the root of this is the Euler Vault.

One of the standout launches this quarter came from the Usual Stability Loan (USL) by Usual, which was built using the EVK. It was the first project to utilize Euler’s hooks to create permissioned markets, and it quickly established dominance across both lending and borrowing categories via USL USDO++ and USL USDO vaults, functioning as Euler’s liquidity backbone. Its high utilization, consistent APYs, and high volatility in borrow rates make it a top choice for lenders and borrowers due to attractive returns (often without needing to chase exotic risk).

Other vaults worth mentioning are the Euler Prime WETH, whose consistent utilization is primarily driven by staking and restaking yield arbitrage strategies, and Euler Prime USDC, which was a significant player in Q1, showing consistent growth in both lending and borrowing amidst the decline in popularity of the Resolv USDC Vault.

$EUL Token

$EUL is the native token of the Euler protocol, serving as the primary governance and utility asset within the ecosystem. Euler’s Fee Flow mechanism converts protocol fees into EUL by auctioning collected fees, in WETH or other assets, and using the proceeds to acquire EUL. The rEUL (Reward EUL) token is introduced as an incentive to boost liquidity and participation, rewarding users in key lending and borrowing markets.

$EUL has four primary network-level use cases:

- Governance Participation: EUL holders can vote on proposals that shape the protocol’s development, including parameter adjustments, feature upgrades, and Treasury allocations.

- Protocol Fee Flow: A portion of the protocol’s fees is converted into EUL, reinforcing its role in the network’s economic model.

- Liquidity Incentives: rEUL (reward EUL) is distributed to users participating in liquidity provision and lending markets.

- Security & Staking (Future Use Case): Governance discussions suggest EUL may be used in a staking model to enhance protocol security and decentralization.

Euler (EUL) has a maximum supply of 27,182,818 tokens, with allocations to shareholders (25.9%), protocol users (25%), treasury (13.8%), and employees/advisors (20.6%). Currently, $18,685,530 $EUL (68%) is in circulation, with the next token unlock scheduled for May 1, releasing 114,570 $EUL (0.42% of supply).

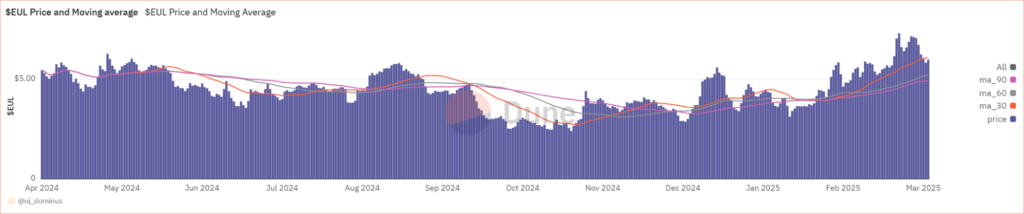

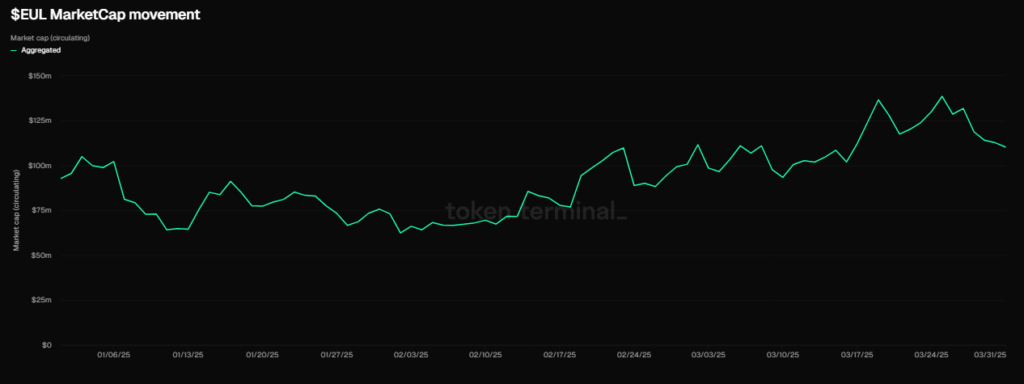

EUL’s price increased 22% to $6.1 in Q1 and, on March 26th, hit an ATH of $7.40. This was primarily driven by expanding utilization and popularity of Euler v2. Due to the price increase, EUL’s circulating market cap peaked at over $100 million in Q1.

$EUL’s market cap fluctuated between $70M and $120M throughout Q1 2025, closing the period at $110.27M (17% QoQ) and an FDV of $160.20M.

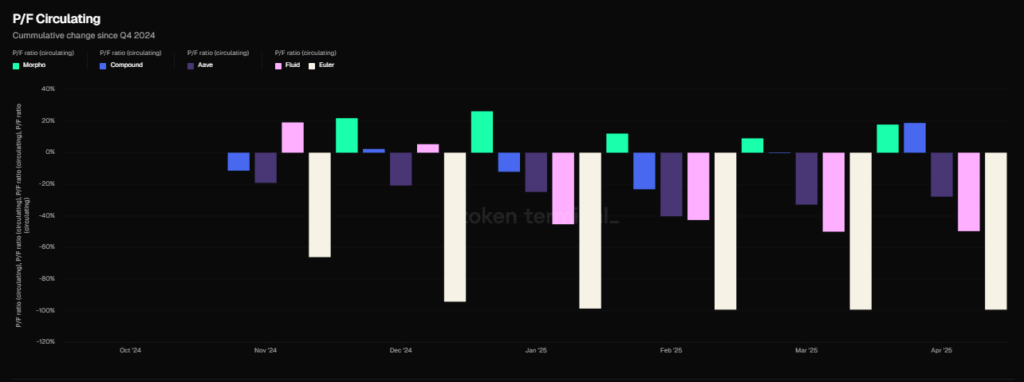

The P/F ratio is a particularly useful metric and serves as a proxy for protocol efficiency and value capture. It tells us how much the market is willing to pay for each dollar of protocol revenue. Although the P/F ratio doesn’t provide a complete picture, generally, a lower P/F ratio suggests that the protocol is relatively undervalued, while a higher P/F ratio may indicate overvaluation in terms of multiples.

It is worth noting that in Euler, the falling P/F indicates that despite rapid increases in fee generation from vault activity and active borrowing, the market cap hasn’t fully caught up, presenting a potential opportunity for improved valuation as Euler increases in popularity and adoption.

This becomes more pronounced when comparing Euler to competitors with higher multiples but slower growth trajectories, especially if Euler revenue continues to rise while $EUL remains underpriced.

Data indicates that $EUL’s growth in Q1 reflects strong fundamentals and increasing adoption, rather than purely speculative activity.

Competitive Landscape

Euler has positioned itself as a top-tier lending protocol in 2025, from just above $24 million in active loans from Q4 2024 to $423.107 million at the end of Q1 2025, outperforming all competitors by far.

In an industry where DeFi lending has been synonymous with Aave, Compound, and Morpho, Euler’s introduction of a more flexible, versatile, and permissionless structure with tokenized vaults created a competitive edge for Euler, most especially on Ethereum and Base, which were dominated by traditional monolithic lending protocols. A key characteristic of Euler’s design is its concept of nested vaults, enabling vault shares to serve as underlying assets for other vaults. This creates a composable architecture where users can stack yields across multiple vault layers or simply choose to isolate their collaterals, creating capital efficiency without compromising risk management, something that monolithic protocols can’t easily replicate. Because curators have the freedom to plug into any existing vaults in the Euler ecosystem, they can quickly build tailored credit markets around emerging trends (LRTs, PTs, RWA-backed tokens, or yield-bearing stablecoins) instead of rigid, one-to-one borrow/collateral markets.

The protocol grew by 357.56% on Ethereum and Base while unlocking deposits on Sonic, Berachain, BOB, and Swellchain. TVL (total deposits) surpassed $1B in Q1, and a big part of Euler’s aggressive growth was driven by their introduction of principal tokens (PTs), yield-bearing stablecoins, and permissionless lending, which allowed Euler V2 to deploy fast on new chains and get a first-mover advantage that could be difficult to supplant by other lending protocols.

Weekly active user growth highlights the competitive advantage Euler has over other established competitors, with Fluid’s exponential growth explained by the protocol’s DEX activity.

In Q1 2025, Euler scaled faster than any other major lending protocol, with revenue growth rising as the protocol grew more popular and expanded into new chains.

Conclusion

Euler’s Q1 2025 performance reflects a decisive turnaround following its 2023 exploit, with the successful rollout of v2 driving adoption and measurable financial growth. Active loans rose by over 695% QoQ, while TVL approached $1 billion. Fees and revenue also scaled rapidly, with $4.4 million in fees generated and a 647% increase in revenue. This growth occurred despite broader market contraction, indicating increasing product-market fit and organic demand for Euler’s modular lending infrastructure.

The adoption of the Euler Vault Kit and Ethereum Vault Connector enabled new curators to deploy customized vaults, experimenting with novel yield strategies and expanding the range of lending opportunities made possible by Euler’s modular design. The resulting vault diversity supported a range of novel strategies and led to concentration in high-performing markets like USL USDO and Euler Prime WETH. Euler’s ecosystem further expanded across multiple chains, while utilization ratios and user growth metrics showed continued momentum.

Euler outperformed competitors across nearly all key lending metrics in Q1, establishing itself as the fastest growing lending protocol in the sector. Its modular architecture and ability to support advanced strategies give it a structural advantage. With EulerSwap on the horizon, further integration between trading and lending is likely to deepen usage and reinforce liquidity stickiness.

References

Cryptorank.io$EUL Price and Moving Average | Link

Daily active Users growth (%) – Q1: Link

Euler Finance: Dune dashboard | Link

Euler Finance Website | Link

Euler The Lending Super App: Dashboard on Token Terminal | Link

Euler V2 – DefiLlama | Link

Euler v2 is Live: Lend, Borrow, and Build Without Limits (September, 2024). Euler Blog | Link

Euler Vault Explorer | Link

Euler vault Q1 analysis for vaults above $3m | Link

Euler vesting | Link

Financial performance of Euler this Q1: Dashboard on Token Terminal | Link

Michael Bentley on X: “As Euler approaches $1B total deposits | Link

The $200M Euler Finance Hack | Link

Disclosures

Alea Research has never had a commercial relationship with Euler, and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including analysts directly involved in this analysis, may hold positions in the tokens discussed.

This content is provided solely for informational and educational purposes. It does not constitute financial, investment, or legal advice.