Introduction

DeFi lending markets are at a pivotal juncture. Historically dominated by giants like Aave and Compound, the landscape is beginning to shift towards a more flexible, adaptable, and user-centric model. This evolution is marked by the adoption of permissionless money markets built on top of an immutable base layer, with risk management through isolated pools being managed on top by specialized parties, diverging from traditional uniform and one-size-fits-all approaches.

Euler, which has been building and innovating in DeFi since 2020, has demonstrated that it can become a prominent player and innovate upon the original monolithic design of incumbents and established competitors like Aave and Compound. The initial deployment of Euler v1 demonstrated that there is a lot of room for improvement to take decentralized lending to the next level. After an unexpected setback and ~$200M exploit, Euler will introduce its v2 in the second quarter of 2024. This upcoming version, developed with insights from Euler v1, emphasizes a modular structure that is flexible across various elements, including governance and Oracle systems.

This approach allows for unprecedented customization, including the chaining of vaults to explore new opportunities in light of emerging strategies with Liquid Restaking Tokens (LRTs) and basis trades. It introduces a modular architecture with the Euler Vault Kit (EVK) for creating customizable lending markets and the Ethereum Vault Connector (EVC) to enhance interactions between ERC-4626 vaults and other smart contracts. This structure sets a new standard in DeFi lending, promising a platform where builders can innovate freely and securely while empowering users by accommodating their diverse risk preferences.

Key Takeaways

- DeFi lending markets are evolving towards more user-centric models, moving away from the one-size-fits-all approach of giants like Aave and Compound – targeting broader asset support and user preferences.

- Euler v2 is set to launch in Q2, introducing a modular design with the Euler Vault Kit (EVK) for customizable lending vaults and the Ethereum Vault Connector (EVC) for linking vaults and smart contracts, aiming for more adaptability and flexibility.

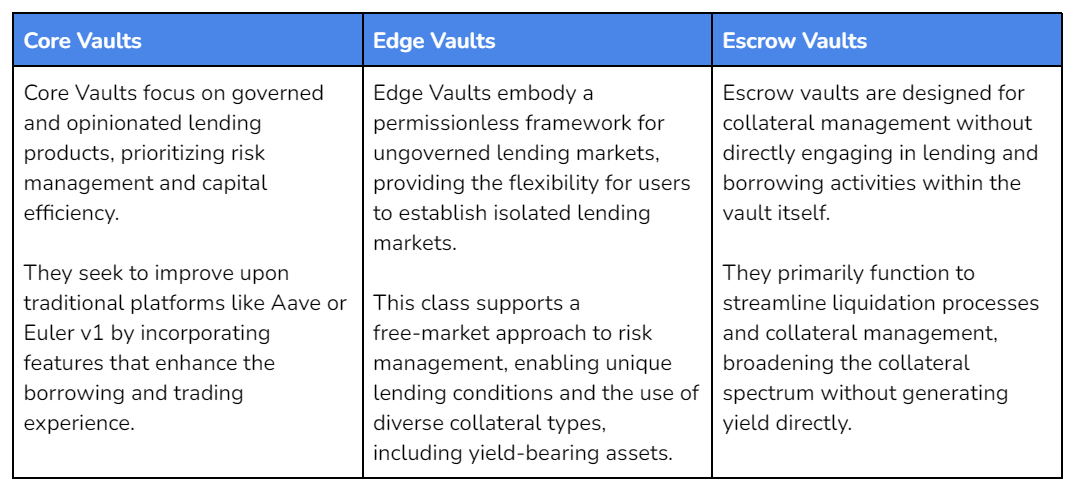

- Euler v2 will feature three main vault classes: Core Vaults for governed lending products, Edge Vaults for permissionless lending markets, and Escrow Vaults for collateral management, each offering distinct benefits and use cases.

- Euler’s introduction of EVC aims to unify liquidity and allow protocols to accept deposits as collateral from other vaults in the network, enhancing interoperability and streamlining liquidity management in DeFi.

- The Euler Vault Kit facilitates the creation of credit vaults with borrowing capabilities, incorporating functionalities like batching operations, simulations, gasless transactions, and flash loans for improved transaction efficiency.

- Euler’s developments draw from lessons learned from Euler v1, aiming to address inefficiencies of existing money markets and offering flexibility with support for synthetic asset creation, RWAs, nested vaults, permissionless reward streams, etc.

Context and Challenges

Aave and Compound’s monopolistic grip on the DeFi lending market is loosening, driven by the sector’s demand for features that cater to a broader array of assets and user preferences. The cornerstone of their success—centralized liquidity and an intuitive user experience—while impressive, masks underlying complexities and trust assumptions that may not align with the future direction of DeFi. The reliance on DAOs for risk management, although historically successful, introduces inefficiencies and potential misalignment of incentives between risk consultants and token holders.

This shift from centralized to distributed risk management and permissionless market creation prompts a reexamination of DeFi’s guiding principles. The challenge encompasses not only the innovation of technologies and frameworks to support a broader asset and preference spectrum but also the maintenance of security, stability, and usability within DeFi.

In the broader context of evolving modularity, EVC resembles Ajna and Morpho Blue in the sense that it offers a permissionless and immutable foundational layer for third parties to build on top. Unlike Morpho’s minimalist strategy, Euler emphasizes its technologically advanced features, including sophisticated risk management tools as a central brand proposition.

Why Euler v2

Euler v2 is conceived to reconcile the dichotomy within the current DeFi lending ecosystem, which is split between monolithic protocols that offer capital efficiency at the expense of governance risks, and isolated markets that provide choice but compromise on capital efficiency. This division underscores the pressing need for a lending platform capable of accommodating varied user preferences while minimizing the intrinsic risks of DeFi lending.

Euler v2’s introduction of customizable lending vaults directly tackles the challenges of adaptability and risk diversification. By empowering users to tailor lending vaults to their specific needs, Euler v2 bridges the gap between the desire for customization and the necessity for security and efficiency in DeFi lending.

The platform’s reliance on the Ethereum Vault Connector (EVC) is pivotal, facilitating the seamless integration of various collateral types. This integration not only promotes the composability and interconnectivity among different vaults but also underlines Euler v2’s commitment to creating a more inclusive, resilient, and versatile DeFi lending landscape.

Overview

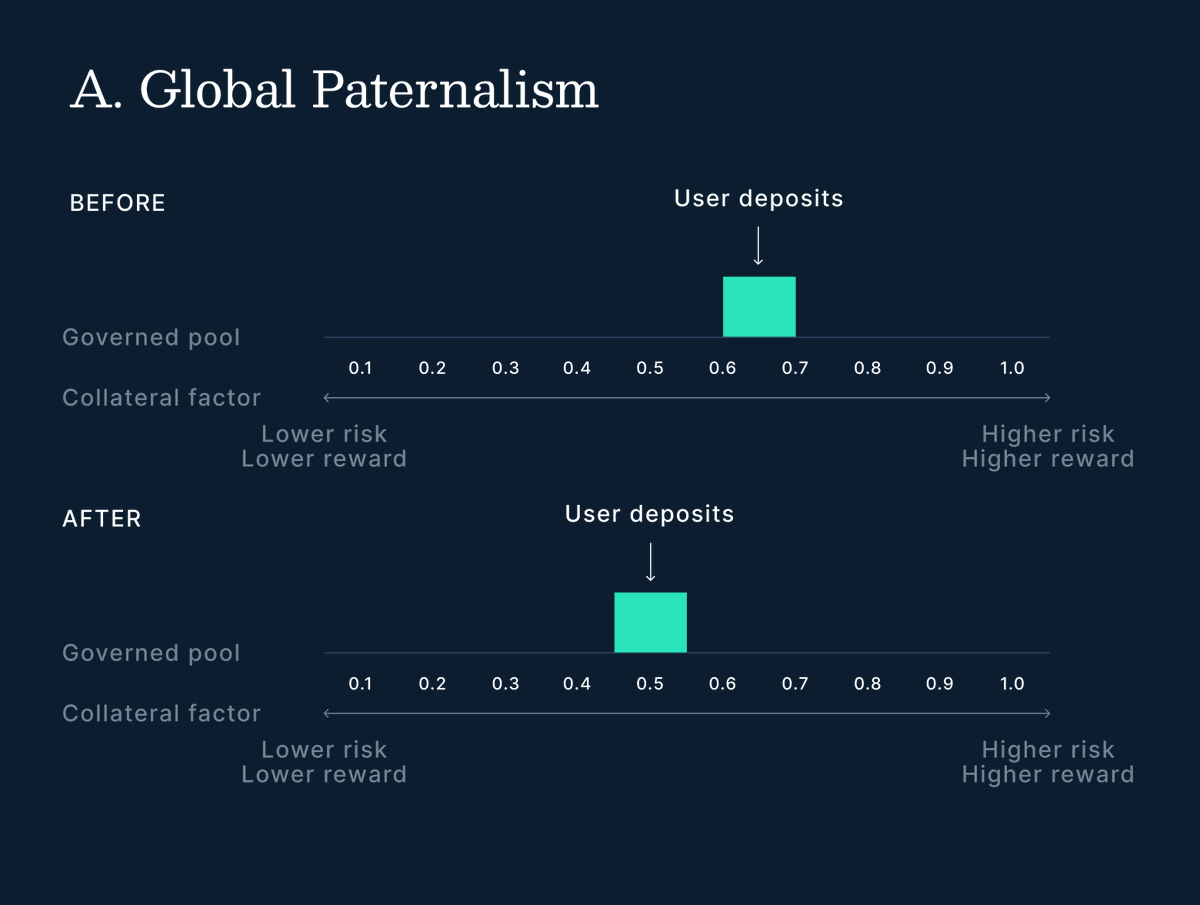

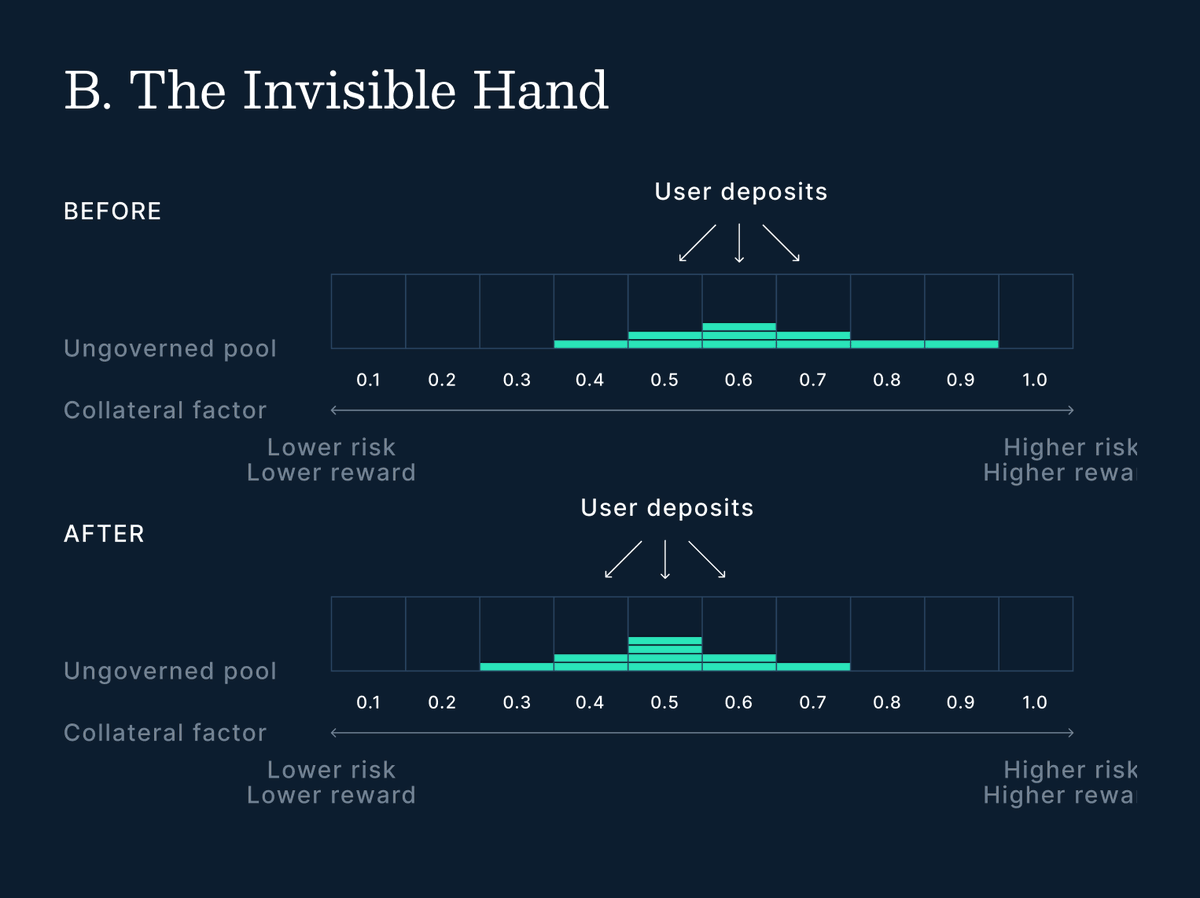

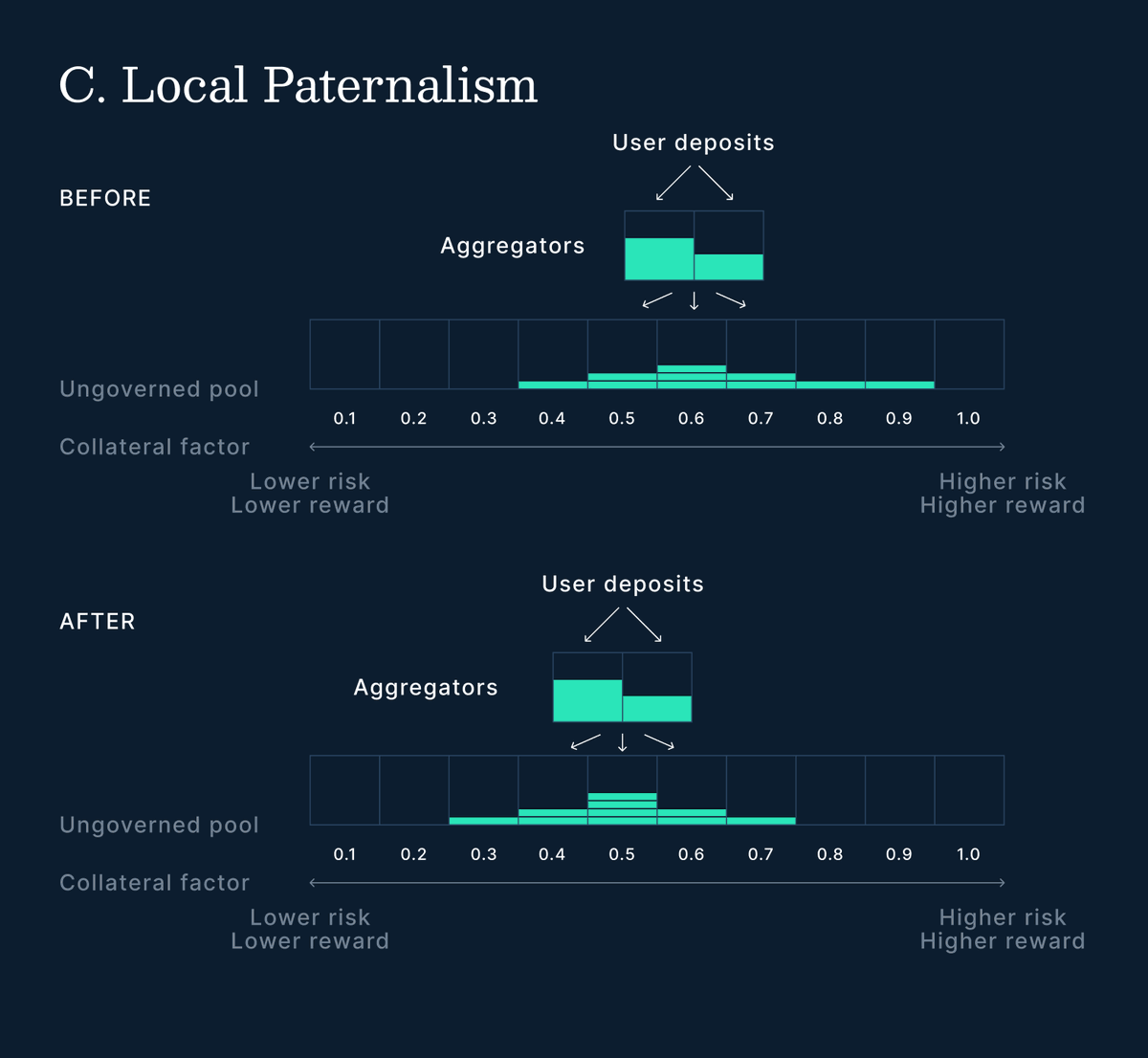

In a recent blog post, Euler presented a framework to present the idea that DeFi lending’s risk assessment is navigated through three distinct models: Global Paternalism, The Invisible Hand, and Local Paternalism. These models represent a spectrum from centralized to decentralized risk management approaches, each with unique implications for flexibility, capital efficiency, and user autonomy.

Global Paternalism relies on DAO governance for centralized risk oversight, as seen in platforms like Euler v1, Compound v2, and Aave v3. This model offers structured risk management but at the cost of user autonomy and flexibility. The Invisible Hand, with examples including Kashi, Silo, Morpho Blue, and Compound v3, champions user-defined risk preferences through isolated pools, enhancing choice but potentially reducing capital efficiency. Local Paternalism, exemplified by Yearn, Idle, and Metamorpho, operates as a hybrid, utilizing aggregators for dynamic asset allocation, balancing flexibility with efficiency.

| Global Paternalism | The Invisible Hand | Local Paternalism |

|

|

|

| Euler v1, Compound v2, Aave v3 | Kashi, Silo, Morpho Blue, Compound v3 | Yearn, Idle, Metamorpho |

Source: Revelo Intel

An ideal approach would enable users to switch between models to suit their risk appetite seamlessly. This adaptability signifies the sector’s evolution, meeting diverse user demands and marking a stride towards maturity. Euler v2 catalyzes this vision by offering customizable lending vaults, thereby merging the strengths of the three models for an optimized DeFi lending experience.

Euler v2

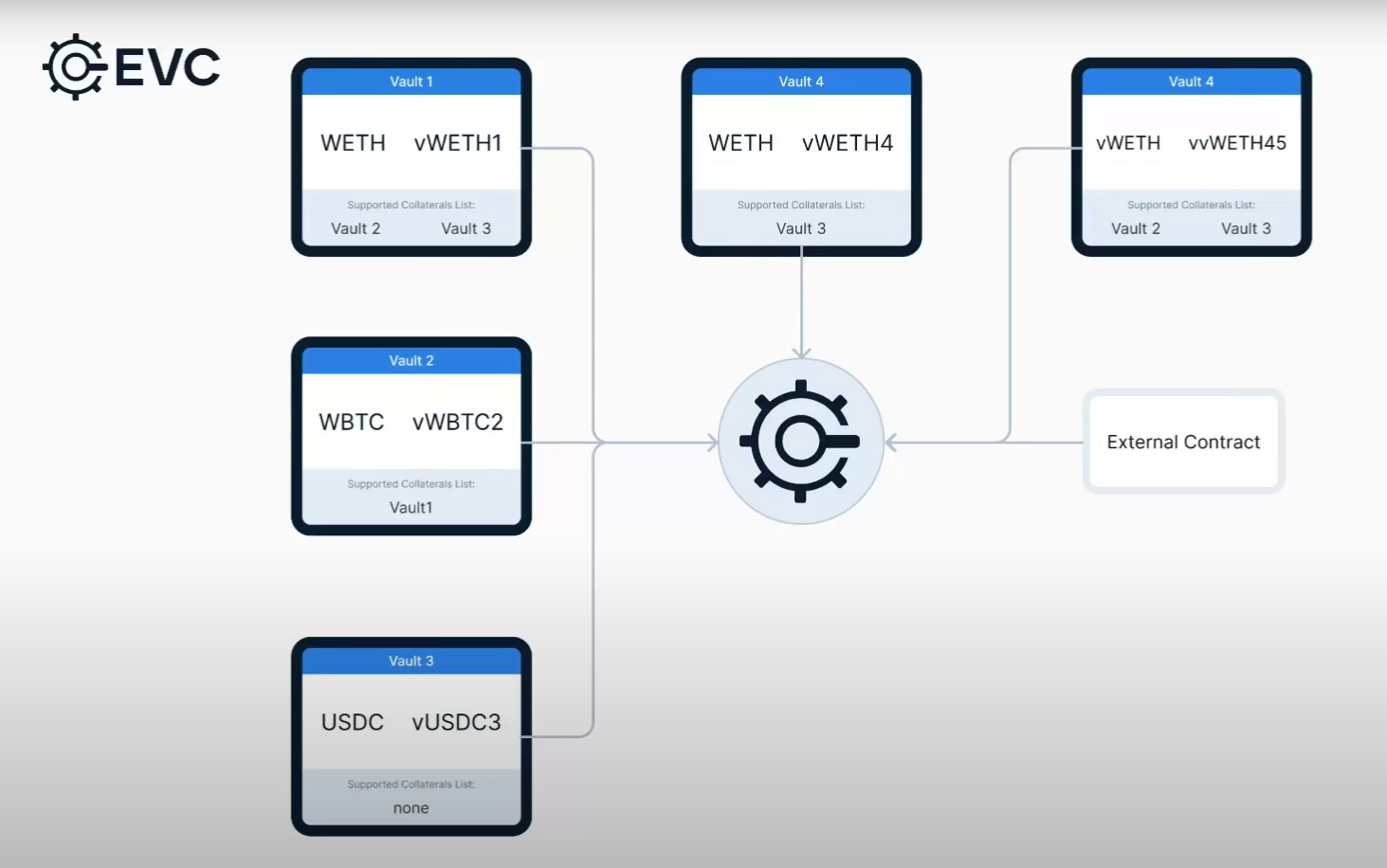

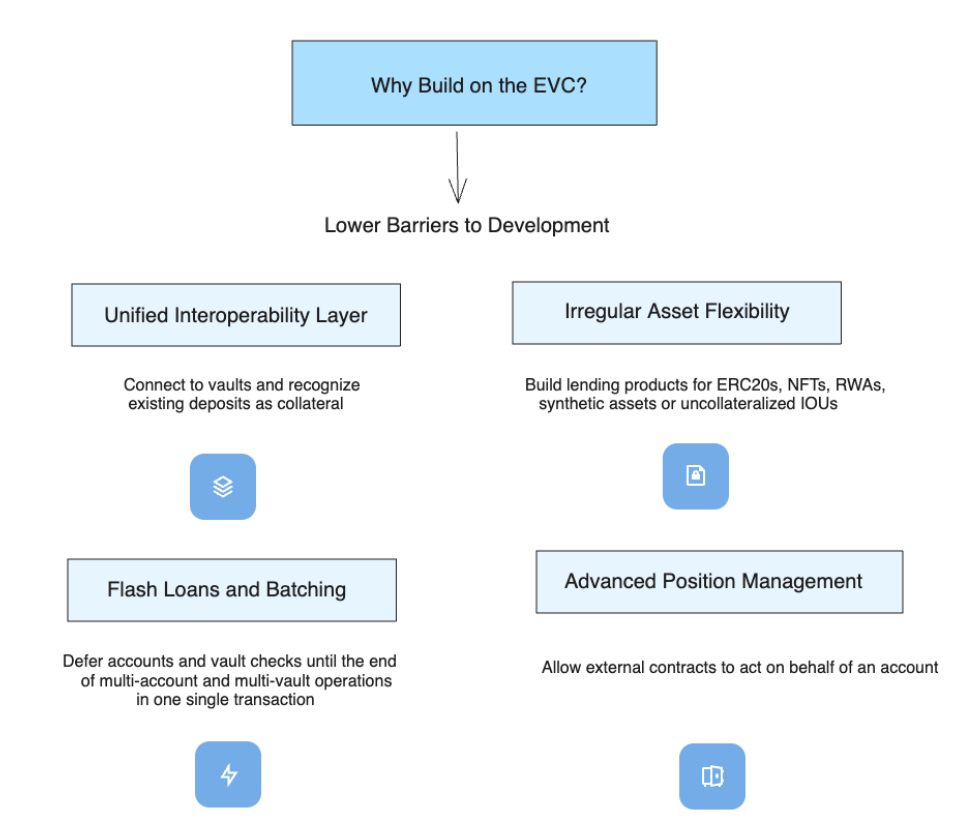

Euler v2 is a modular lending platform characterized by the use of two primary components: the Euler Vault Kit (EVK) for creating custom lending vaults, and the Ethereum Vault Connector (EVC), enabling vaults to use each other as collateral. This modular approach not only fosters the development of a wide array of lending products within the Euler ecosystem but also aims to solve the liquidity fragmentation challenge prevalent in existing DeFi lending protocols by connecting various vault types.

The platform’s architecture is crafted to enhance the lending and borrowing experience, aiming to deliver a superior experience for both lenders and borrowers. This is achieved by offering access to varied risk/reward opportunities, new collateral options, reduced borrowing costs, and advanced risk management tools.

Euler v2 is set to launch with three distinct classes of vaults—Core, Edge, and Escrow—each designed to meet varied user needs and preferences, thereby enriching choice and flexibility.

In addition to these 3 vault classes, the Euler Vault Kit (EVK) underpins the platform’s flexibility, providing a flexible framework for developers and advanced users to develop custom lending vaults that suit their specific needs and risk preferences. It is also noteworthy to mention that all of this is achieved with an agnostic approach to key components such as oracles, interest rate models, governance, and upgradability.

For instance, one could create custom vaults that either mirror the Edge class with additional governance features and unique liquidation strategies, or vaults that resemble the Core class but with alternative interest rate models and governance structures, including options for real-world assets (RWAs) with distinct regulatory requirements.

Ethereum Vault Connector – EVC

The Ethereum Vault Connector (EVC) represents the first building block of Euler v2. As a permissionless, unopinionated DeFi primitive, it paves the way for advanced borrowing and lending dynamics. This is achieved through immutable code, and without fees or governance, embodying a true public good.

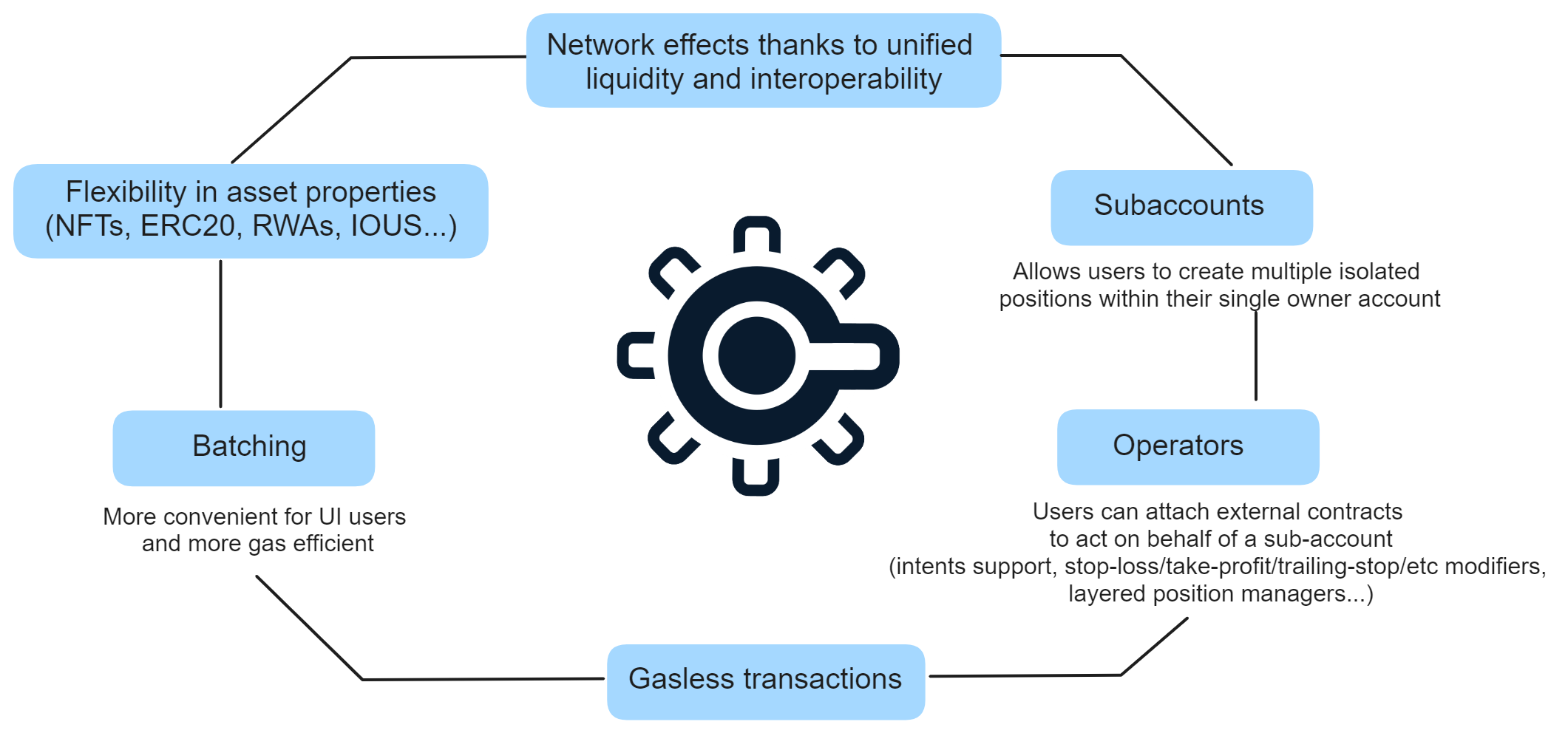

By enabling more granular control and flexibility over collateral and borrowing, the EVC facilitates more intricate interactions between users and vaults. Protocols building on top will be able to offload complexity and benefit from the network effects of other vaults. The EVC mediates between vaults and makes it possible to recognize deposits on other vaults as collateral (no need to move collateral from one protocol to another to refinance loans or get better rates).

EVC empowers developers with a flexible and versatile codebase, facilitating innovation in DeFi vault strategies without starting from zero. Developers can utilize a broad spectrum of collateral types—ranging from ERC-20s, NFTs, and real-world assets to synthetic tokens and uncollateralized IOUs—for creating diverse DeFi solutions, such as stablecoins, margin trading applications, and yield aggregators.

EVC’s design is intentionally modular and unopinionated, allowing for extensive customization. Developers have the liberty to implement specialized risk management strategies, create lending products with or without oracles, and design loans with varying collateralization levels and custom liquidation mechanisms. This opens the door to an endless array of use cases, from simple lending protocols to complex structured products.

As soon as you bootstrap a new vault, you can already start using existing vaults as collateral without any coordination whatsoever. This is the primary purpose of EVC: to connect vaults and mediate between them

One of the pivotal features of EVC is its capacity to serve as a unified liquidity layer. By allowing vaults to accept collateral from other vaults within the network, EVC facilitates the creation and expansion of lending products. This interoperability significantly reduces the operational friction for users, who no longer need to shift their collateral between protocols to access different financial services.

Moreover, EVC enhances DeFi operations by enabling external contracts to act on behalf of accounts. This feature supports conditional orders, automated position management, and custom liquidation processes. The introduction of virtual addresses or “sub-accounts” further enables users to manage diverse positions and strategies efficiently, providing a sophisticated mechanism for risk segmentation.

EVC also incorporates features like multicall batching for executing multiple transactions in a single call, flash loans, and transaction simulation for risk-free outcome forecasting. These capabilities, alongside intent-based EIP-1271 signatures for gasless transactions, enhance the user experience by facilitating more accessible and efficient DeFi interactions.

By serving as the interoperability layer that connects various vaults and yield-bearing assets in DeFi, EVC lays a solid foundation for lending/borrowing protocols, encouraging external protocols to concentrate on innovation.

Your vault, your rules. pic.twitter.com/DVzpIbnHIl

— Euler Labs ️ (@eulerfinance) January 23, 2024

Another minor yet highly significant improvement is ERC20Collateral, which is a token extension for ERC20 tokens that allows using tokens in your wallet as collateral in the EVC ecosystem. Instead of depositing into a vault or lending contract to borrow against your assets, you can now simply borrow whilst not giving up ownership of the asset in your wallet. That way users don’t have to forego governance rights, trigger tax events, or inherit the risks of an underlying contract.

Euler Vault Kit – EVK

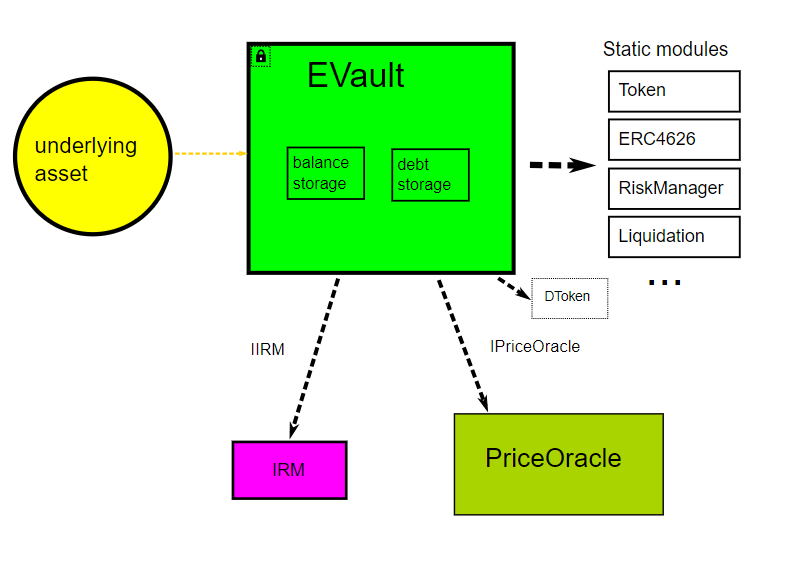

The Euler Vault Kit (EVK) enables the creation of credit vaults, an advancement over typical ERC-4626 vaults by incorporating borrowing capabilities. Unlike standard ERC-4626 vaults which earn yield by actively investing deposited funds, credit vaults represent passive lending pools. Since these vaults are deployed on top of Euler’s EVC, borrowing from these vaults is permitted provided there’s sufficient collateral in other credit vaults.

EVC’s integration is pivotal, enabling collateral tracking across vaults, facilitating liquidations when necessary, and streamlining operations with features like batching, simulations, gasless transactions, and flash loans. This integration removes the need for specialized adaptors, making refinancing and interactions more efficient.

Authentication is managed by the EVC, ensuring actions are initiated by legitimate users, while authorization of transactions, such as redemptions, is managed by the vaults, verifying users’ claim amounts. Additionally, vault creation is streamlined through a factory contract, offering the choice between upgradeable or immutable vaults. After creation, the vault’s governance is initially set to the creator, who can then configure the vault or transfer governance if desired.

The EVK adheres to ERC-4626 standards while adding borrowing features. Because ERC-4626 vaults are a superset of ERC-20s, they are also tokens themselves, called vault shares or ETokens, which represent a proportional claim on the vault’s assets, and are exchangeable for larger amounts of the underlying asset over time as interest is accrued.

Vaults manage a single token type, with ETokens representing a claim on the vault’s assets. These ETokens, accruing interest over time, are based on a model that compounds interest every second, ensuring consistent accrual regardless of interaction frequency.

Key components include:

- EVault: The central interface for vault interactions, overseeing deposits, borrows, position health, and liquidations.

- PriceOracle: Ensures real-time valuation of collateral and liabilities, crucial for maintaining vault integrity and solvency.

- IRMs (Interest Rate Models): The rates are adjusted to incentivize or disincentivize borrowing, based on the current economic conditions and the vault’s objectives.

- ProtocolConfig: A global contract dictating protocol-wide settings like fee distribution and protocol governance.

Before the establishment of a new vault, it’s necessary to either create or select existing PriceOracle and IRM contracts. These components are integrated into the EVault, ensuring that the vault operates within the defined economic and operational parameters.

Additionally, vaults are equipped with mechanisms to ensure the safety of both lenders and borrowers. This includes setting maximum loan-to-value (LTV) ratios for different collateral types and monitoring the health of accounts and the vault itself.

EVK relies on external price oracles to accurately value collateral and liabilities in real-time. These oracles provide both one-sided and two-sided price quotes, allowing the system to adjust LTVs and manage liquidations effectively.

The system also includes a reverse Dutch auction mechanism for liquidations, where the LTV of collateral assets is gradually reduced to ensure fair value recovery. This process minimizes losses for borrowers while ensuring that lenders are adequately protected.

In terms of fee capture and revenue sharing, a FeeFlow module gives the Euler DAO greater control over the platform’s fee generation. It utilizes a reverse Dutch auction mechanism to systematically allocate accumulated fees, enhancing the DAO’s financial flexibility. Fees can also be converted into various assets.

Besides enhancing transaction efficiency through support for gasless transactions, multicall batch operations, and flash liquidity, the EVK also enables a feature called “nested vaults”, which makes it possible to deploy interest-bearing assets as collateral across vaults.

Sector Outlook

The on-chain lending sector’s reliance on over-collateralization, in contrast to traditional finance’s uncollateralized loans, highlights the crucial role of collateral due to the lack of traditional enforcement mechanisms. Starting with ETHLend in 2017, the evolution from peer-to-peer to peer-to-pool models like Compound marked a significant shift, simplifying the lending process through asset aggregation and dynamic interest rates.

Despite these advancements, the current DeFi ecosystem is characterized by siloed protocols, resulting in fragmented liquidity, cumbersome integration for developers, and less-than-optimal user experiences. This fragmentation underscores the need for a unified framework facilitating efficient interactions across lending and borrowing protocols to address capital allocation inefficiencies, high transaction costs, and limited innovation.

Euler v2’s modular lending framework aims to disrupt the status quo by blending the capital efficiency of monolithic protocols with the flexibility and risk management offered by isolated pools. Incorporating ERC-4626 vaults and the Ethereum Vault Connector (EVC), it supports a diverse range of assets, including NFTs and real-world assets, striving for a balance between flexibility, capital efficiency, and risk management.

The introduction of EVC revolutionizes the sector by serving as a central facilitator for DeFi lending, simplifying interactions between vaults and contracts. This reduction in complexity allows developers to focus on innovation, creating financial products beyond traditional money markets. EVC’s framework encourages interoperability, streamlined liquidity, and a cohesive DeFi ecosystem, positioning Euler as a versatile platform with features like subaccounts, fee flow, and simulations, surpassing competitors.

Furthermore, Euler’s strategy encompasses multiple market opportunities: leveraging the DAO for market creation and fee capture, offering infrastructure as a public utility for third-party curators and risk managers, providing a foundational layer for protocol development, and enabling permissionless markets.

What To Expect

Euler v2’s modular framework can potentially redefine the opportunity set for DeFi applications and use cases, offering a rich array of features such as synthetic asset creation, nested vaults, permissionless reward streams, and enhanced liquidation processes. This versatility paves the way for a diversity of financial products, ranging from yield aggregators to stablecoins or collateralized debt positions (CDPs) to mint synthetic assets.

One of the most powerful features to leverage the platform’s capital efficiency is the concept of nested vaults. This allows for the tokenization of vault shares, which can then be lent or borrowed. For instance, lenders in the Core vaults can lend out their vault shares to borrowers seeking exotic collateral assets, earning additional yield. This mechanism facilitates access to diverse collateral types and lending configurations without increasing the overall risk of the platform.

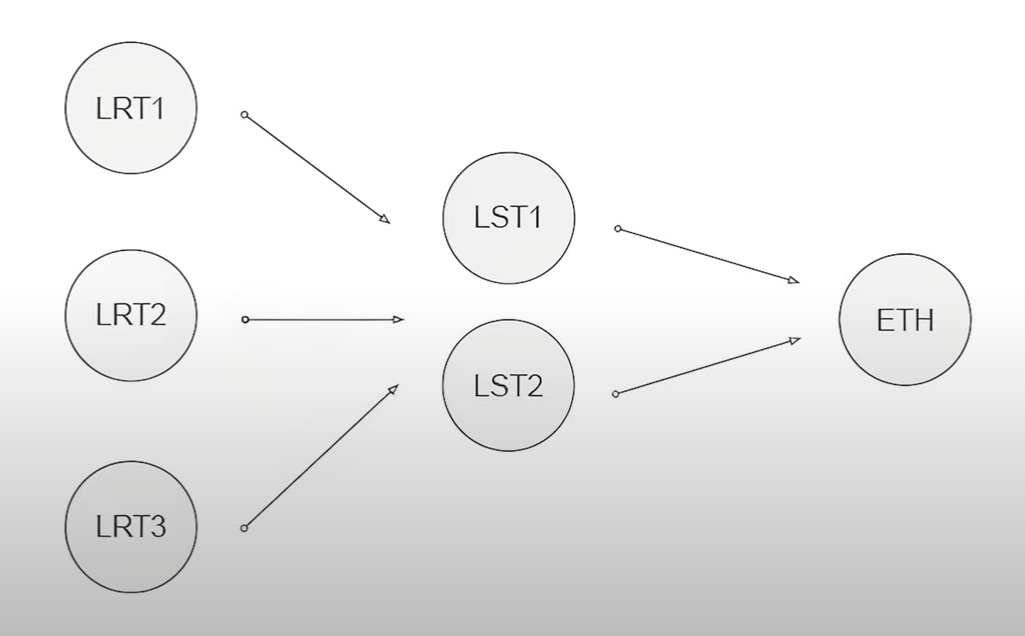

Furthermore, the strategic use of liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) for leverage and yield strategies underscores Euler v2’s unique capability to integrate evolving DeFi trends, such as restaking.

Currently, a widely adopted strategy in DeFi involves leveraging liquid staking tokens (LSTs) as collateral to borrow $ETH, which can then be restaked or swapped for more LSTs, enabling users to recursively leverage their positions. As the DeFi ecosystem evolves, we anticipate a rise in the use of liquid restaking tokens (LRTs) as collateral. This shift is driven by the growing abundance of LSTs not currently being lent out and the desire to leverage these assets further.

Euler v2 stands at the forefront of this trend, offering a platform where users can use LRTs as collateral to borrow both LSTs and $ETH, facilitating a new layer of financial strategies.This leveraged trade flow from higher-yielding assets down to base assets like $ETH is realized through the chaining of LRT, LST, and $ETH vaults. Within this framework, $ETH lenders emerge as significant beneficiaries due to the flow of leverage from higher-yielding assets down to base $ETH vaults. This cascading leverage effect highlights the efficiency and capital efficiency of Euler v2’s system, enabling $ETH depositors to capitalize on the demand for leveraging strategies across different asset types.

Another notable feature is the “FeeFlow”, which allows for setting reward streams that can be paid in a specific asset of choice. This is a module that enables projects to stream rewards to users in a permissionless manner, eliminating the need for users to stake their vault shares in a separate contract to earn rewards. This also allows for more dynamic and efficient user engagement by enabling suppliers to earn rewards while also taking out loans.

Altogether, this can result in a suite of practical applications that are likely to include:

- Leverage by Chaining LRT/LST/ETH Vaults, allowing users to create Edge vaults for liquid staking tokens (LSTs) and liquid restaking tokens (LRTs). Users can then borrow $ETH against these assets, enabling a loop of reinvestment to amplify yield. This approach underscores a high demand for $ETH Edge vaults, benefiting both borrowers, who gain leverage, and lenders, who receive higher interest rates.

- Leveraged Liquidity Provision by accepting liquidity provider (LP) tokens as collateral in Edge vaults. Euler v2 enables users to borrow additional assets to augment their positions in automated market makers (AMMs). This functionality enhances liquidity provision strategies, allowing users to increase their exposure and potential yield within AMMs.

- Impermanent Loss Hedge by accommodating strategies to mitigate impermanent loss or establish short positions by enabling borrowing against WETH/USDC LP tokens. This offers liquidity providers additional yield opportunities and sophisticated risk management tools.

- USD Carry Trades through the creation of custom vault pairs for stablecoins, facilitating carry trade strategies by leveraging differences in APY between stablecoins. This strategy allows users to navigate stablecoin volatility and engage in interest rate arbitrage, exploiting yield differentials for profit.

- Long Positions on Long-tail Assets, enhanced by the nesting of Edge Vaults, which permits borrowing of stablecoins against less liquid, longer-tail assets. This provides an avenue for users to leverage their holdings in such assets, enhancing their yield potential while offering Core market depositors opportunities to engage with riskier collateral types selectively.

- Margin-trading Real-world Assets (RWAs) by supporting RWAs as collateral and enabling users to borrow against these assets for margin trading strategies. This application not only broadens the asset base within DeFi but also facilitates greater market participation and diversity.

Overall, this composability puts Euler at the forefront of a new paradigm in DeFi lending, addressing critical inefficiencies that have slowed down the growth and maturity of decentralized credit.

Conclusion

By empowering both users and developers, Euler v2 aims to overhaul the lending and borrowing landscape by integrating the flexibility of isolated lending markets with the capital efficiency of monolithic protocols.

Euler’s modular architecture does not just promise enhanced liquidity and efficiency; it also ensures robust security and risk management.

The platform’s integration with the Ethereum Vault Connector (EVC) paves the way for new yield opportunities and the development of novel financial products, including those involving real-world assets, non-fungible tokens, and oracle-free lending.

References

- Euler v1 breakdown by Revelo Intel

- Euler v2 Litepaper

- EVC – Github

- EVC Playground – GitHub

- Euler Vault Kit Whitepaper

- ERC4626 – Tokenized Vaults

- ERC20Collateral.sol

- Make Euler Great Again

- Paternalism Versus the Invisible Hand in Risk Management

Disclosures

Revelo Intel has never had a commercial relationship with Euler and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.