Introduction

As a nascent industry, crypto moves fast, and builders’ rate of innovation mutates at warp speed. Thousands of projects launch daily, each pushing the boundaries of what’s possible with raw experimentation at scale.

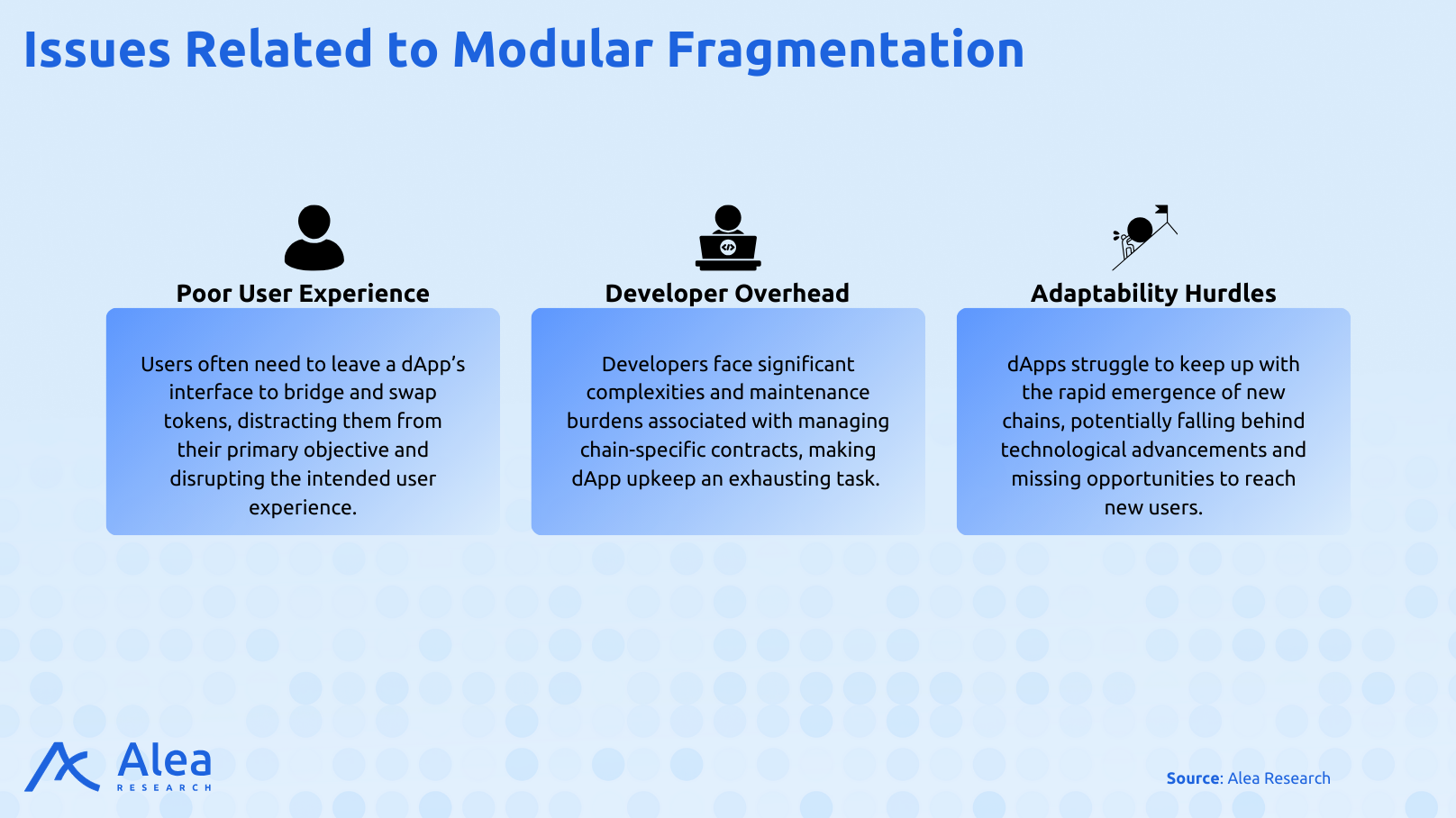

With hundreds of blockchains, millions of smart contracts, and fragmented state data across networks and pools, building and interacting with dApps has become a resource-intensive and inefficient process. Traditional development frameworks can’t keep up, and neither do users. As a result, these challenges have created bottlenecks that now present barriers to innovation and slowed down the adoption of Web3 technologies. When developers need to juggle multiple chains, complex contracts, and fractured data, they get bogged down in technical quicksand instead of building the future.

Enso cuts through this mess and addresses these issues by providing a unified framework that simplifies on-chain development and interactions. Currently live as an API, with the network launch coming soon, Enso is built on a Tendermint-based Layer 1 architecture. Enso enables easy execution across multiple blockchains through a shared network state. By abstracting the complexities of smart contract interactions, it allows developers to focus on building applications rather than managing technical overhead.

With a modular architecture and pre-built shortcuts, Enso offers a practical solution for creating and executing complex workflows. Whether you’re arbitraging across DEXes or managing multi-chain portfolios, Enso handles the heavy lifting while you handle the strategy.

Key Takeaways

- Web3 Usability Challenge: The blockchain ecosystem is fragmented, with developers facing significant challenges integrating multiple blockchains, smart contracts, and siloed data, creating inefficiencies and barriers to adoption.

- Enso’s Solution: Enso simplifies blockchain development through a shared network state and pre-built shortcuts, enabling developers to execute complex workflows without writing extensive custom code or managing integration overhead.

- Enso’s Adoption: Enso’s infrastructure already enables diverse applications, including AI-driven DeFi strategies, cross-chain asset management, and automated liquidity provisioning. A notable example is Enso’s partnership with Boyco Berachain, where its shortcuts powered seamless DeFi interactions (e.g., liquidity operations across multiple protocols), while cross-chain bridging was handled by Stargate and LayerZero.

Background

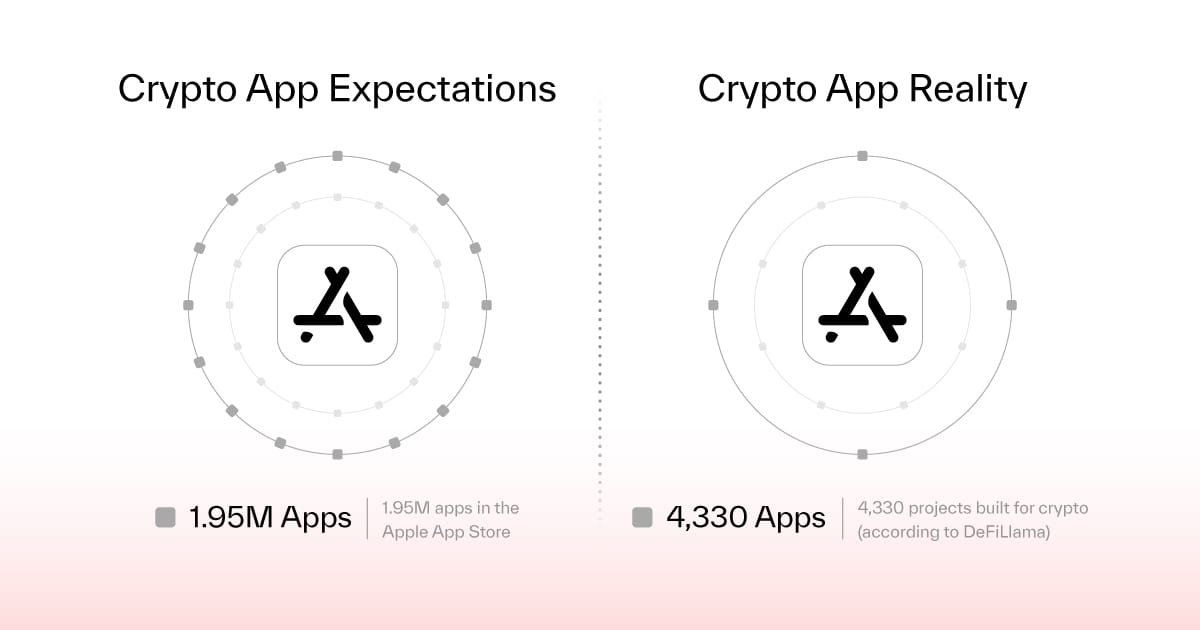

The blockchain industry remains in its infancy compared to the maturity of Web2. For example, while the Apple App Store hosts 1.9 million applications, the entire blockchain ecosystem, as cataloged by DeFiLlama, includes only 4,330 projects. Scaling to mass adoption demands a significant increase in applications. However, building on blockchain remains highly complex, deterring broader participation.

The blockchain ecosystem has evolved from Bitcoin’s straightforward shared network state to an intricate ecosystem comprising thousands of blockchains and hundreds of thousands of smart contracts. As the industry grows, its complexity and fragmentation deepen, posing significant obstacles both for users and developers. Hence, the most significant challenge for Web3 adoption is usability.

The Web3 Usability Challenge

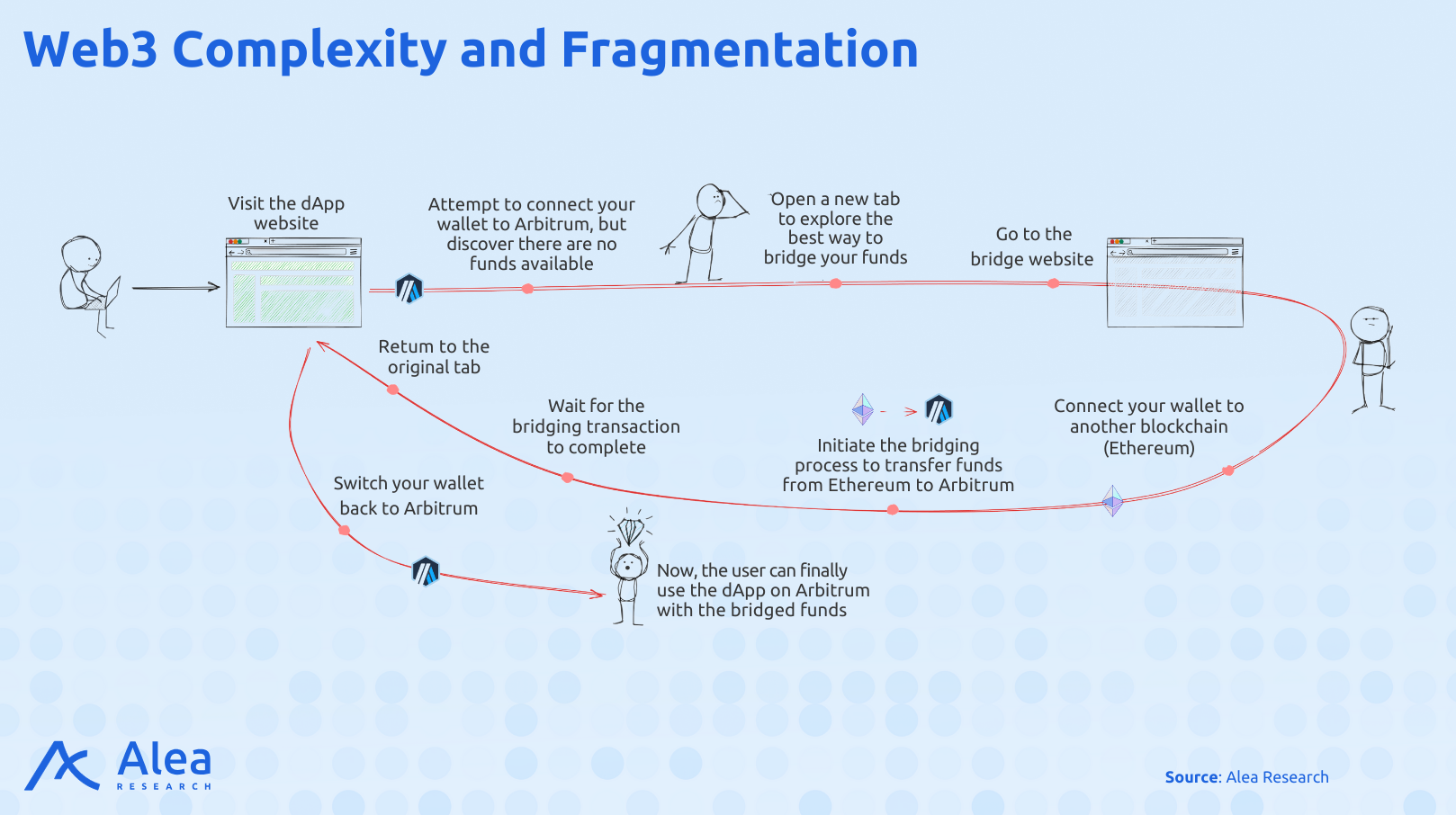

For users, interacting with dApps across multiple blockchains remains a complex and time-intensive process, even for experienced ones. This difficulty comes from the need to manage liquidity across numerous L1 and L2 networks, navigate fragmented on-chain liquidity, and address the technical challenges inherent to these systems. Consider, for example, the case of wanting to use a dApp on the Arbitrum network while holding funds on the Ethereum blockchain.

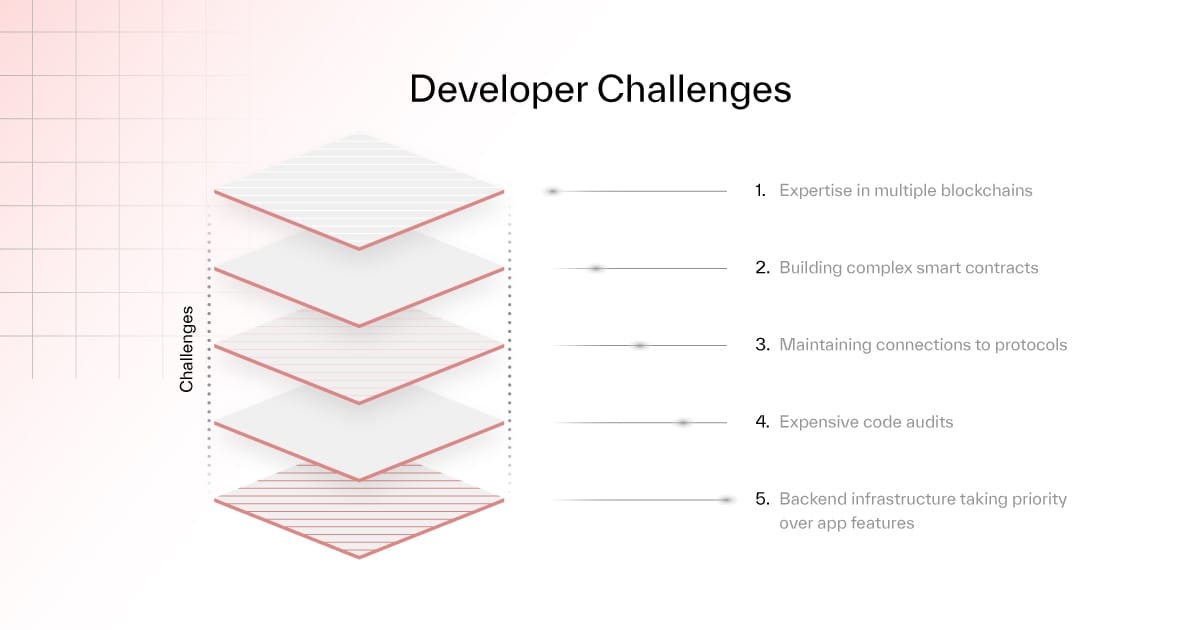

At the same time, developing a dApp involves navigating: (1) over 637.9 million EVM smart contracts deployed across just seven EVM chains since January 2022, (2) 120 L2 solutions, 24 testing tools, and 72 wallet options for Ethereum mainnet alone, (3) 1.4 million tokens on Ethereum, (4) +75 auditing firms to ensure security, and (5) billions of potential connections between smart contracts.

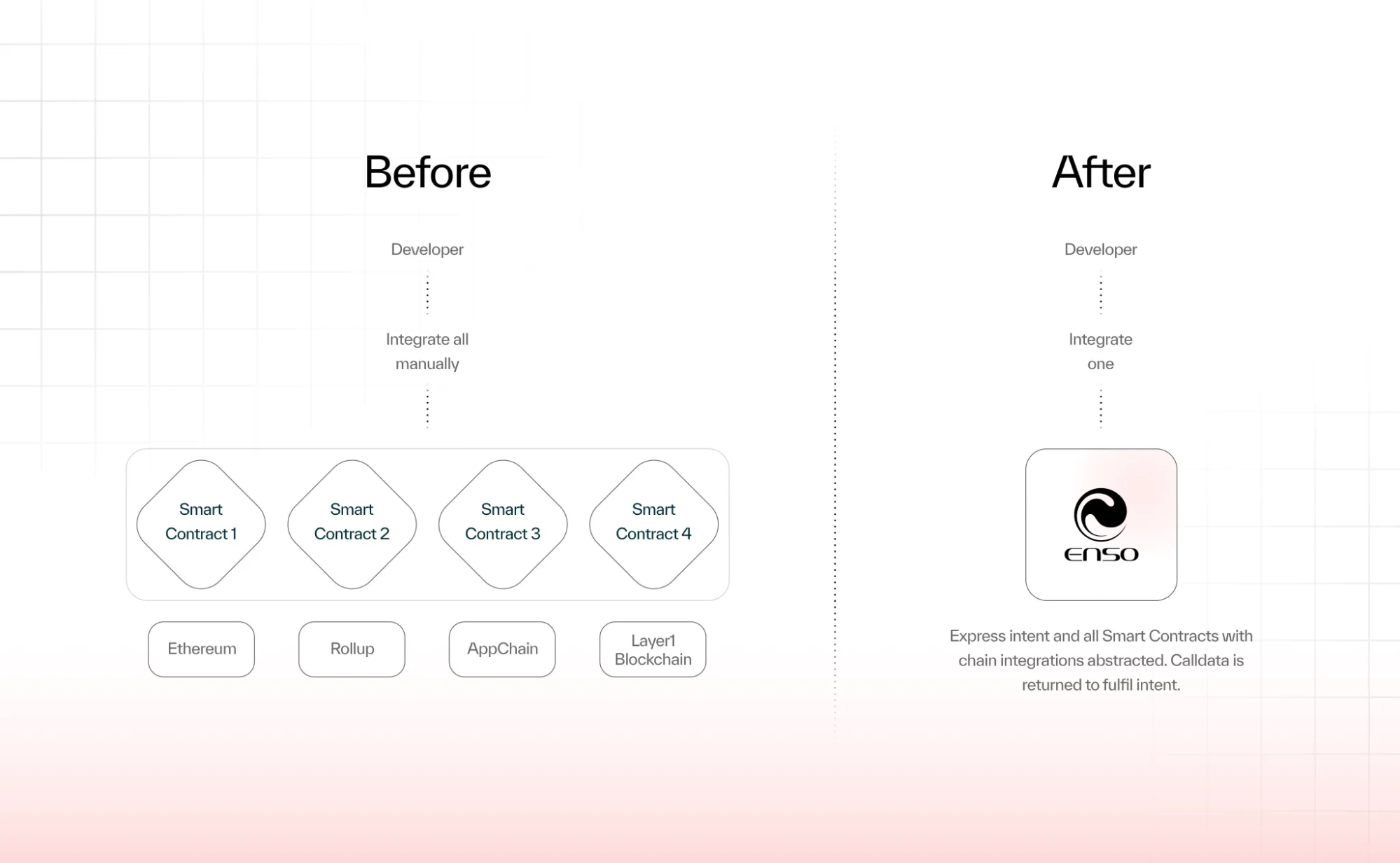

As a result, developers face the daunting task of selecting a chain, understanding its specific architecture, and determining which smart contracts to integrate. Even after selecting a blockchain, they must decode the complexities of smart contract interactions and compose functionalities across multiple contracts. To interact with a contract often requires prior state knowledge, forcing developers to build adapters for all necessary state transitions—an effort-intensive process that consumes substantial resources, promotes vendor lock-in, and necessitates extensive rewrites for integration. And all of this must be done in a secure way that minimizes the attack surface and other risk vectors that may come with external dependencies.

Figure x: Web3 Developers Challenges

This fragmentation locks developers into siloed environments, limiting flexibility while creating long-term dependencies on specific chains. Tokens, liquidity, states, and users are isolated across networks, resulting in massive inefficiencies.

Overall, the expansion of dApps to multiple chains presents challenges for all actors involved, not just the end users. To support innovation and drive mass adoption, simplifying integration and reducing fragmentation are essential steps.

Simplifying Web3 Usability

Lately, efforts to simplify dApp user experience and development have made significant progress.

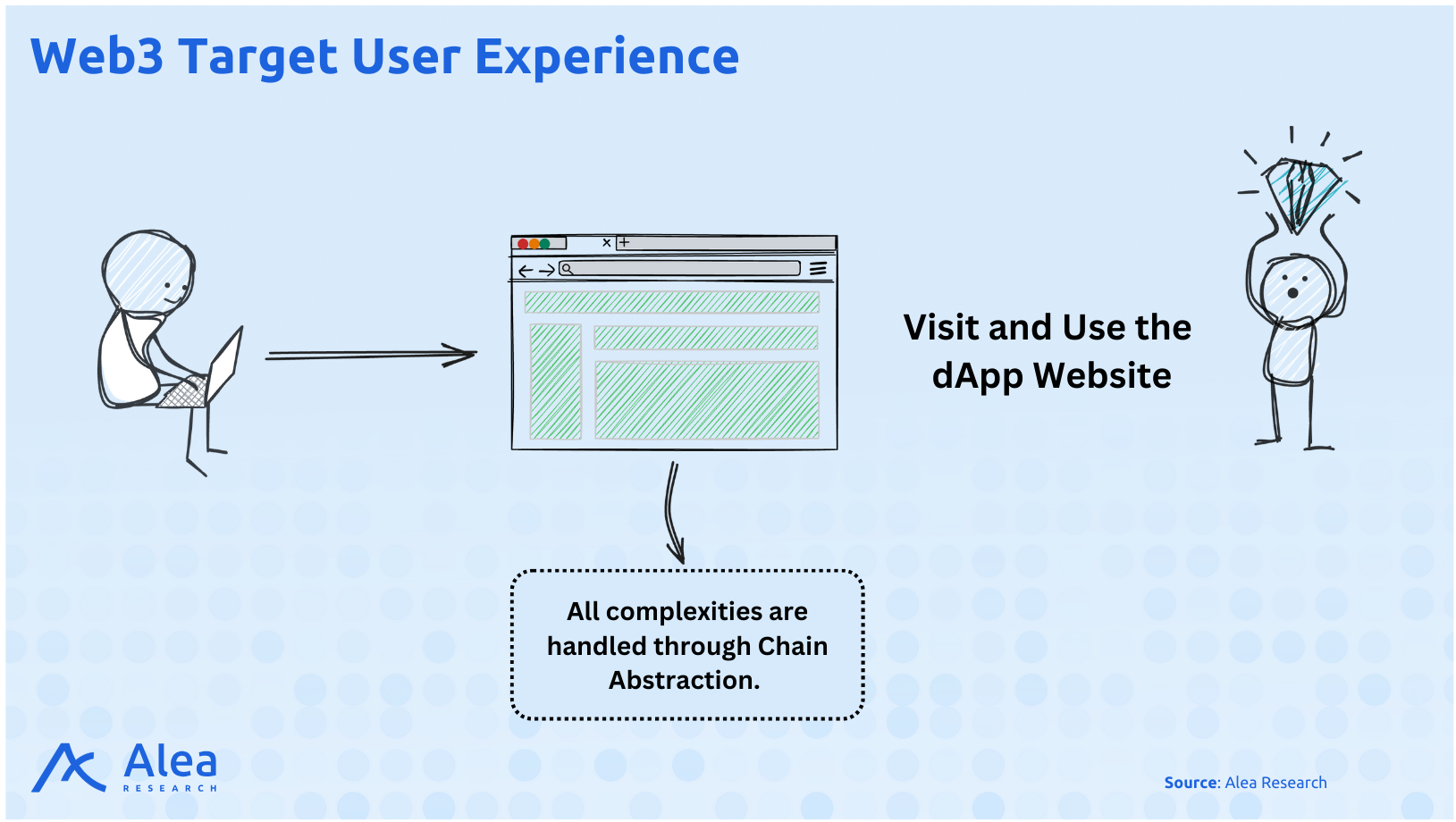

A key advancement lies in the concept of Chain Abstraction, which aims to hide chain-specific information from the user, simplifying interactions and improving the overall user experience. In essence, the goal of Chain Abstraction is to enable users to interact with any dApp from any chain using any token, all within a single, unified user interface (UI).

Referring to the user journey example from the previous chapter, the simplified user journey with Chain Abstraction would be as follows:

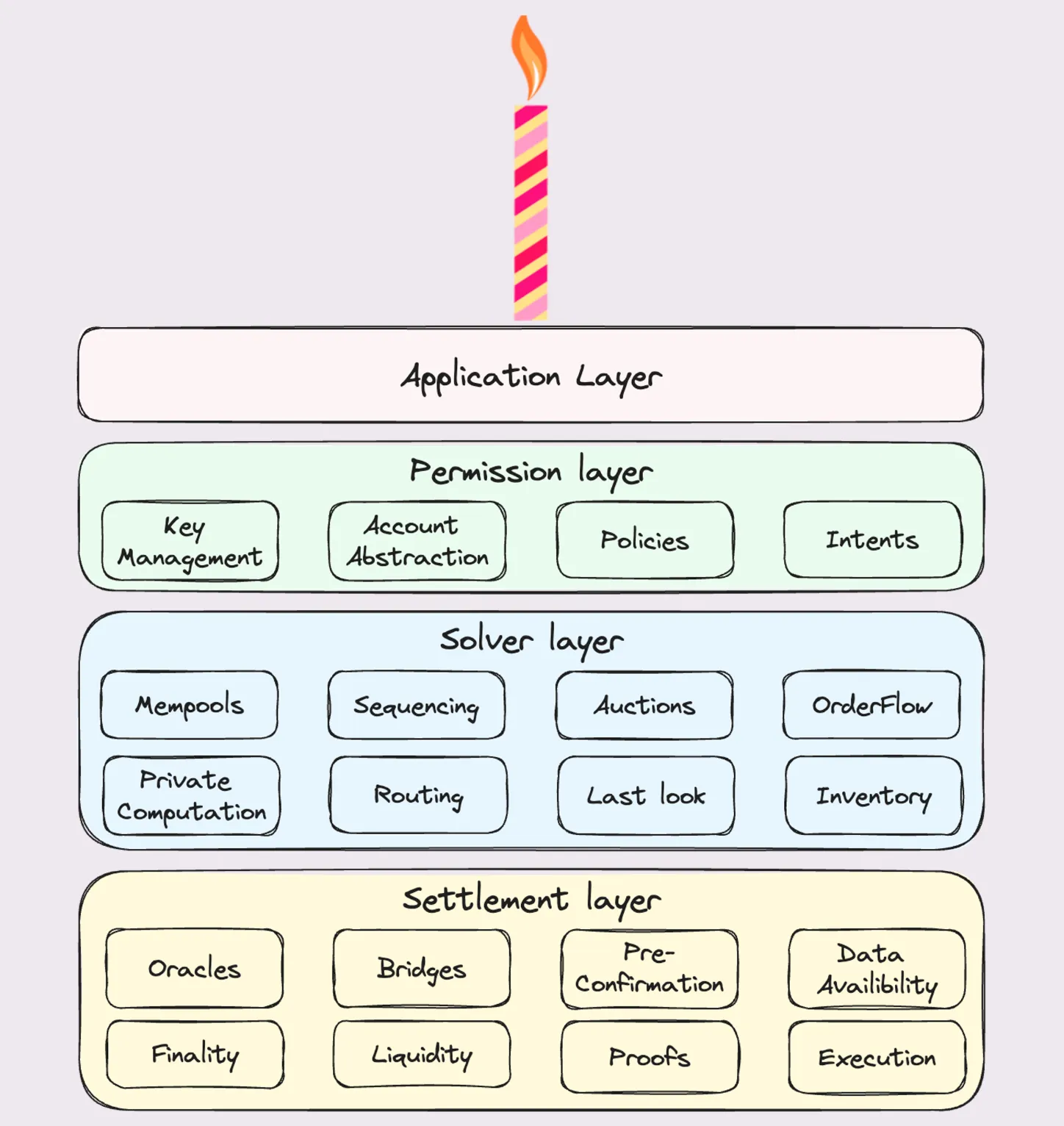

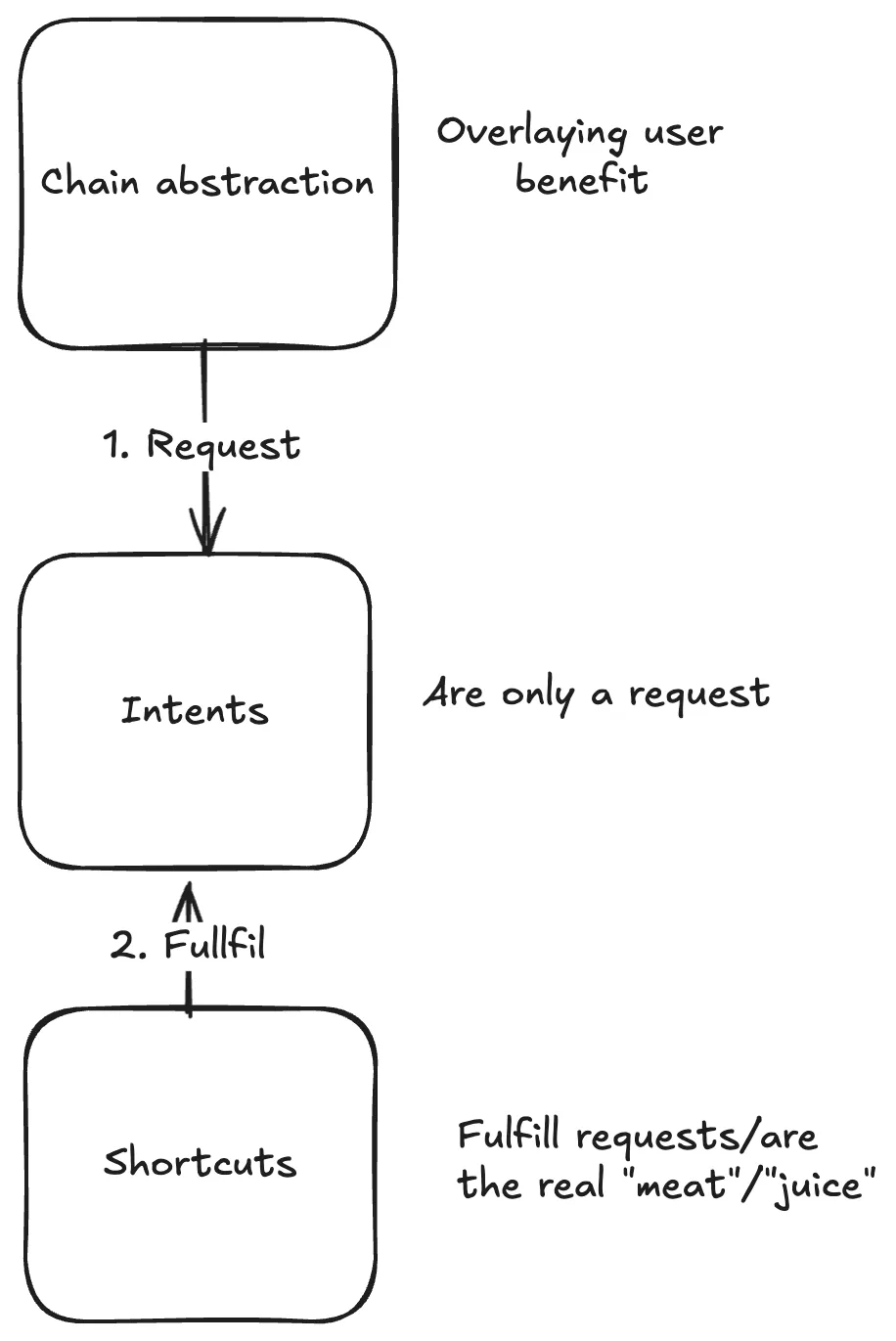

From a technical point of view, Chain Abstraction is the permission layer that acts as the interface between users and blockchains. This layer enables users to interact with dApps, connect wallets, and initiate actions—referred to as “intents”—through a consolidated interface.

However, it’s important to note that Chain Abstraction is not a singular product or solution but the result of various projects across different layers working in tandem to deliver this seamless experience. While the permission layer facilitates user asset management across chains, the underlying complexity of fulfilling these intents still requires direct blockchain interaction.

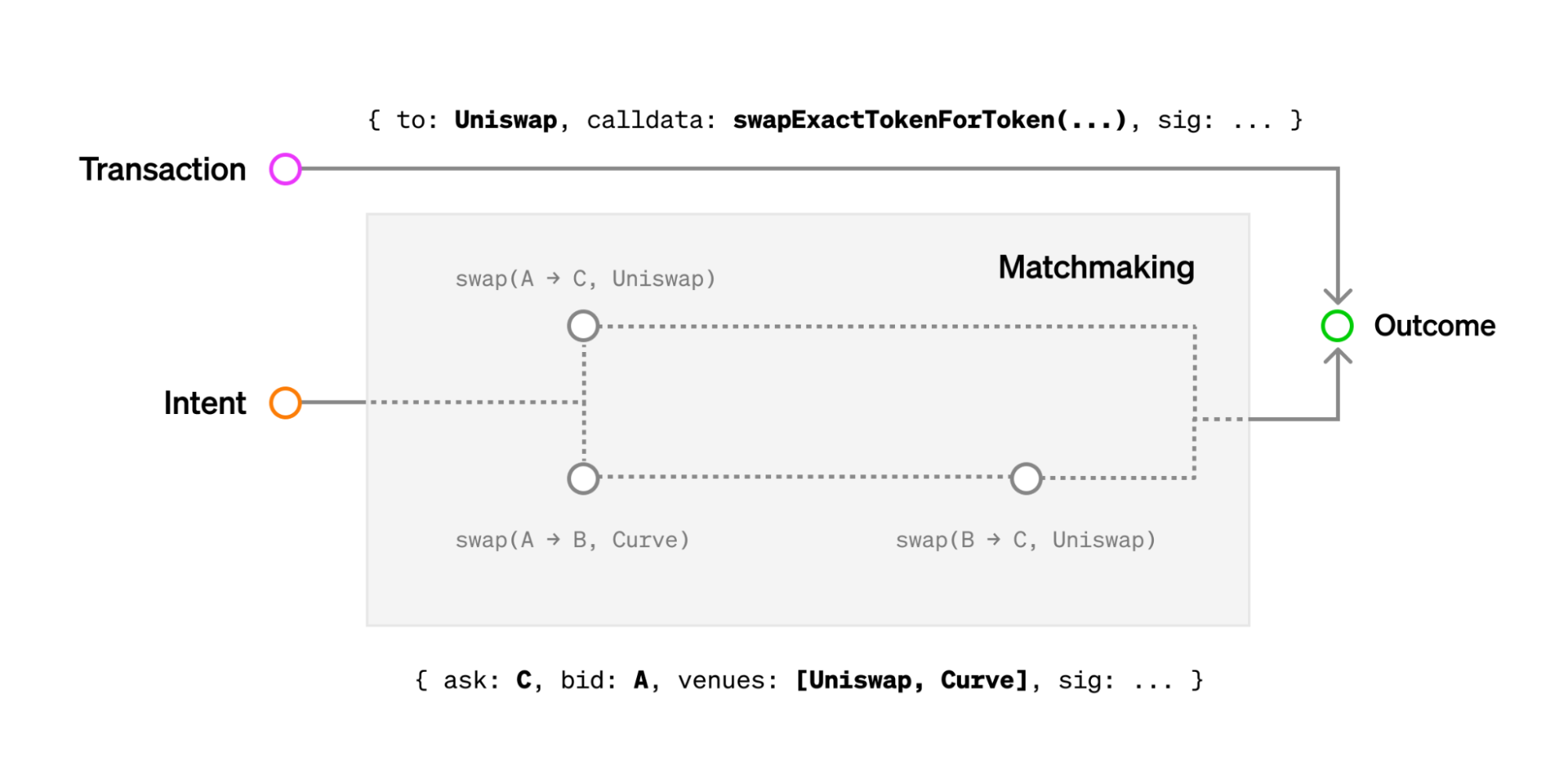

In the traditional transaction-based model, users specify each step of a process, such as: “Swap 100 $USDC for $ETH on Uniswap with a 0.5% slippage tolerance”. The emerging intent-based model simplifies this by allowing users to define desired outcomes instead: “Swap 100 $USDC for the maximum $ETH at the lowest cost”.

Transactions and intents both involve users delegating the construction of the ultimate computational path (the journey) to a third party. The key difference lies in who defines this path. In a standard transaction-based flow, a transaction signature authorizes the validator to follow a specific computational path against a certain state, with a tip incentivizing the validator to execute this path. In contrast, an intent does not specify a particular computational path but rather permits any path that satisfies certain constraints. By signing and sharing an intent, a user effectively grants recipients the authority to choose the computational path on their behalf.

This distinction allows for a more precise definition of intents as signed messages that authorize a set of state transitions from a given starting state. Transactions, a special case of intents, allow for a unique transition.

The responsibility to fulfill users’ intents is addressed by the Solver Layer through the so-called solvers. These are off-chain agents tasked with managing several operations, such as: (1) route optimization across chains and dApps, (2) fee estimation to identify the most cost-efficient path, (3) execution speed estimation for timely settlement, and (4) intent execution, handling transactions on behalf of the user. Hence, the Solver Layer bridges this gap by interpreting user intents and executing the required transactions.

While Chain Abstraction and Intents are fundamental in simplifying Web3 usability, they alone are not enough. Without pre-built actions and defined execution paths, intent-based networks rely heavily on solvers to dynamically determine how to execute requests. This reliance introduces inefficiencies and potential inconsistencies.

Additionally, while solvers play a critical role in simplifying cross-chain operations, they face significant challenges, particularly centralization. Solver networks today are often centralized due to two primary barriers: the high financial cost of participation and the steep learning curve. Becoming an effective solver requires months of preparation—typically 5–6 months—to master protocol intricacies and develop the algorithms necessary for efficient routing and bid optimization.

Enso directly addresses these challenges by providing verified, ready-to-use execution paths, known as shortcuts. These shortcuts eliminate the need for users to navigate complex processes, such as providing liquidity and staking LP tokens across multiple interfaces. Instead, Enso consolidates these operations into a single, seamless transaction. To further decentralize and democratize its solver network, Enso has modularized the Solver Layer into distinct roles—Action Providers, Graphers, and Validators. This modular architecture lowers the barriers to entry for solvers, promoting a more accessible and decentralized network architecture.

Enso’s Answer: Shortcuts To Build On-Chain

Enso’s journey began in 2021 with the vision of creating a social trading app. However, after raising funds and dedicating over a year to development—including over $500k in audits—it became clear that the product lacked market fit. The long development timeline, caused by integration overhead and extensive audits, delayed the launch and ultimately hindered its success. This challenge led the team to pivot, focusing on solving the exact problems they faced: the inefficiencies of integrating and interacting with DeFi protocols. But here’s the thing: dozens of teams hit this same wall. Each failure is a datapoint. Each pivot is a lesson. The winners won’t be the first to try—they’ll be the first to synthesize what worked.

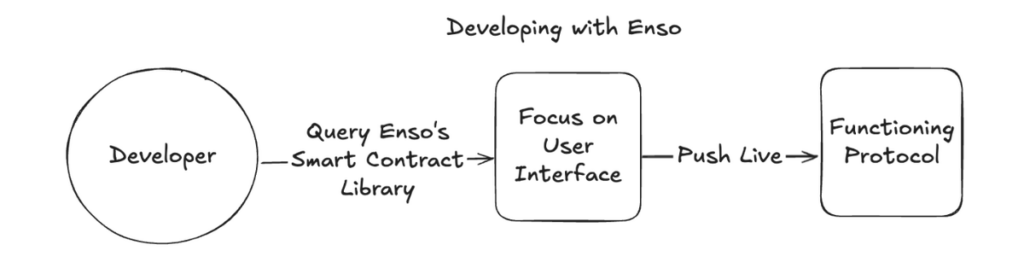

By 2023, Enso had evolved into a DeFi app with over 50 protocol integrations. Its approach attracted interest from other teams, curious about how Enso achieved so many integrations so quickly. In response, Enso launched an API just two weeks later, enabling other developers to leverage its infrastructure to interact easily with DeFi.

This evolution highlights Enso’s core purpose: to turn ideas into reality by providing a single integration that opens access to the entire on-chain ecosystem. Enso simplifies what was once a slow and complex process, serving as a shortcut for developers to build on-chain. With Enso’s middle-layer DeFi API, developers can embed DeFi functionality into their products without manually integrating protocols, understanding complex smart contracts, or incurring high audit costs.

Trusted by over 60 projects and facilitating over $13 billion in on-chain settlements, Enso has proven its value as a transformative infrastructure solution. Backed by $9.2 million in funding from leading investors such as Polychain Capital, Multicoin Capital, Cyber Fund, Spartan, and prominent angel investors, Enso today is trusted by 60+ projects, 160+ protocols, and has already facilitated more than ~$13 billion in on-chain settlements.

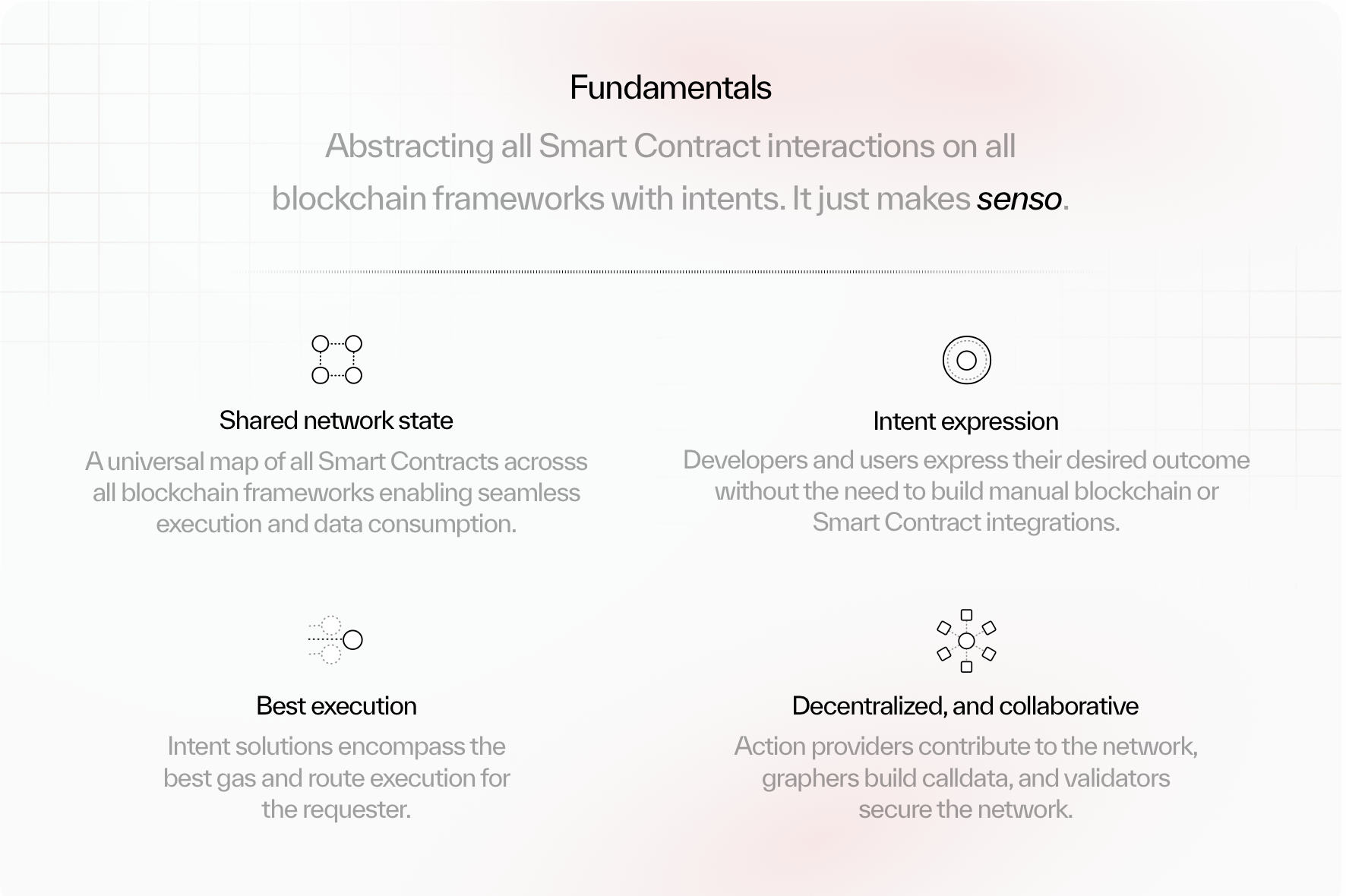

The Shared Network

Enso is a Tendermint-based L1 blockchain built using the Cosmos SDK, designed as a non-custodial aggregation middle layer between users, DEXes, and DeFi protocols. Its architecture stores state data from EVM, SVM, and MVM blockchains, enabling seamless execution across diverse blockchain frameworks. By acting as a shared network state, Enso abstracts the complexities of blockchain interactions, simplifying development and unlocking new possibilities for developers and users.

In traditional blockchain ecosystems, developers must integrate with individual blockchain frameworks and smart contracts, each with isolated state data. For instance, Aave’s state on Ethereum is inaccessible from Arbitrum, requiring developers to create manual integrations for every protocol and chain. Enso addresses this inefficiency by introducing a shared network state aware of all supported blockchains.

This shared state enables developers to submit intent requests, which define desired outcomes without specifying the exact steps to achieve them. The Enso Network processes these requests by building transactable bytecode that takes into account prior states, protocol-specific requirements, and pre-requirement fetchers. For example, an NFT mint abstraction might validate the number of NFTs minted versus the cap before generating executable bytecode. The result is a solution tailored to the developer’s needs, delivered as fully executable code.

Intents Settlement

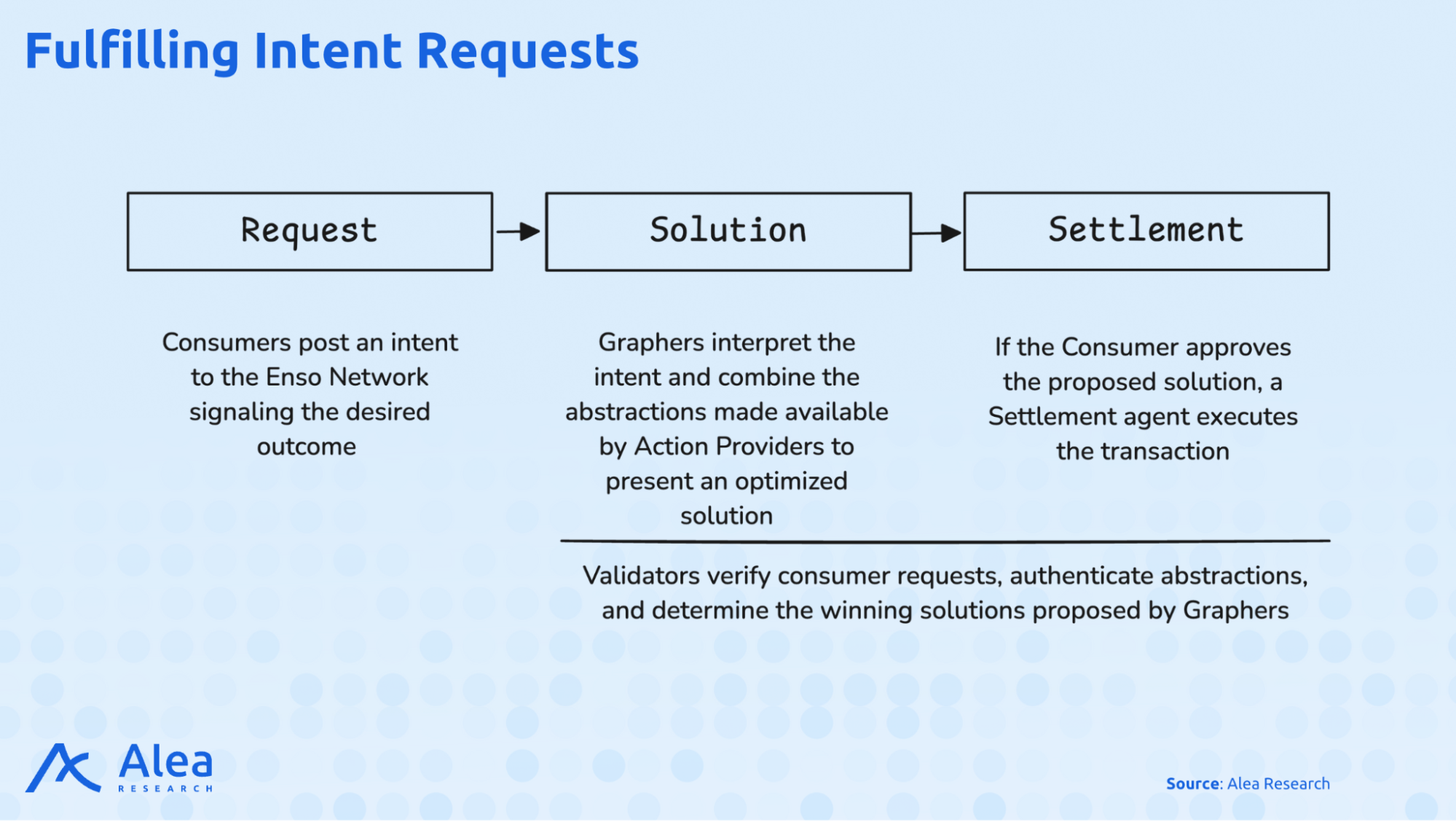

The Enso Network relies on three key participants to function: (1) Action Providers, (2) Graphers, (3) Validators.

Action Providers are developers who publish smart contract abstractions to the network. These abstractions act as playbooks for interacting with specific protocols, covering actions like swaps, staking, claims, and more. Action Providers are incentivized to build these abstractions as they earn fees based on how frequently they are used.

Graphers are experts that build algorithms that combine abstractions to generate optimal solutions for intent requests, thus abstracting this difficulty away from the user. They are incentivized to continuously find the most optimal solution, as only one can be chosen to fulfill a request.

Validators are those participants who secure the network by verifying consumer requests, authenticating abstractions, and determining the winning solutions proposed by Graphers.

These participants interact among them to fulfill the intent requests submitted by Consumers—users or applications—based on the following components: (1) the Request, (2) the Solution, and (3) the Settlement.

The process begins with the Request, an announcement from the Consumer specifying the task they wish to complete and any associated requirements. This request, known as an intent, is posted to the Enso Network and signals the desired outcome.

Upon receiving the request, Graphers analyze it and propose the most efficient solution. Their role is to interpret the intent, consider the consumer’s guidelines, and combine available abstractions to present an optimized solution. It is worth noting that Enso supports any type of smart contract interaction across the blockchains it integrates, as long as an Action Provider has submitted an abstraction for that action.

Finally, once the Consumer approves the proposed solution, a Settlement agent executes the transaction. Leveraging Enso’s abstractions, the agent ensures the user’s desired result is achieved in a single transaction.

How it Works

Currently, Enso’s infrastructure is accessible via a centralized API, allowing interaction with DeFi protocols on EVM-compatible chains. While the decentralized network remains in its testnet phase, the existing infrastructure enables developers to execute transactions and retrieve all relevant metadata for seamless integration and enhanced user experiences.

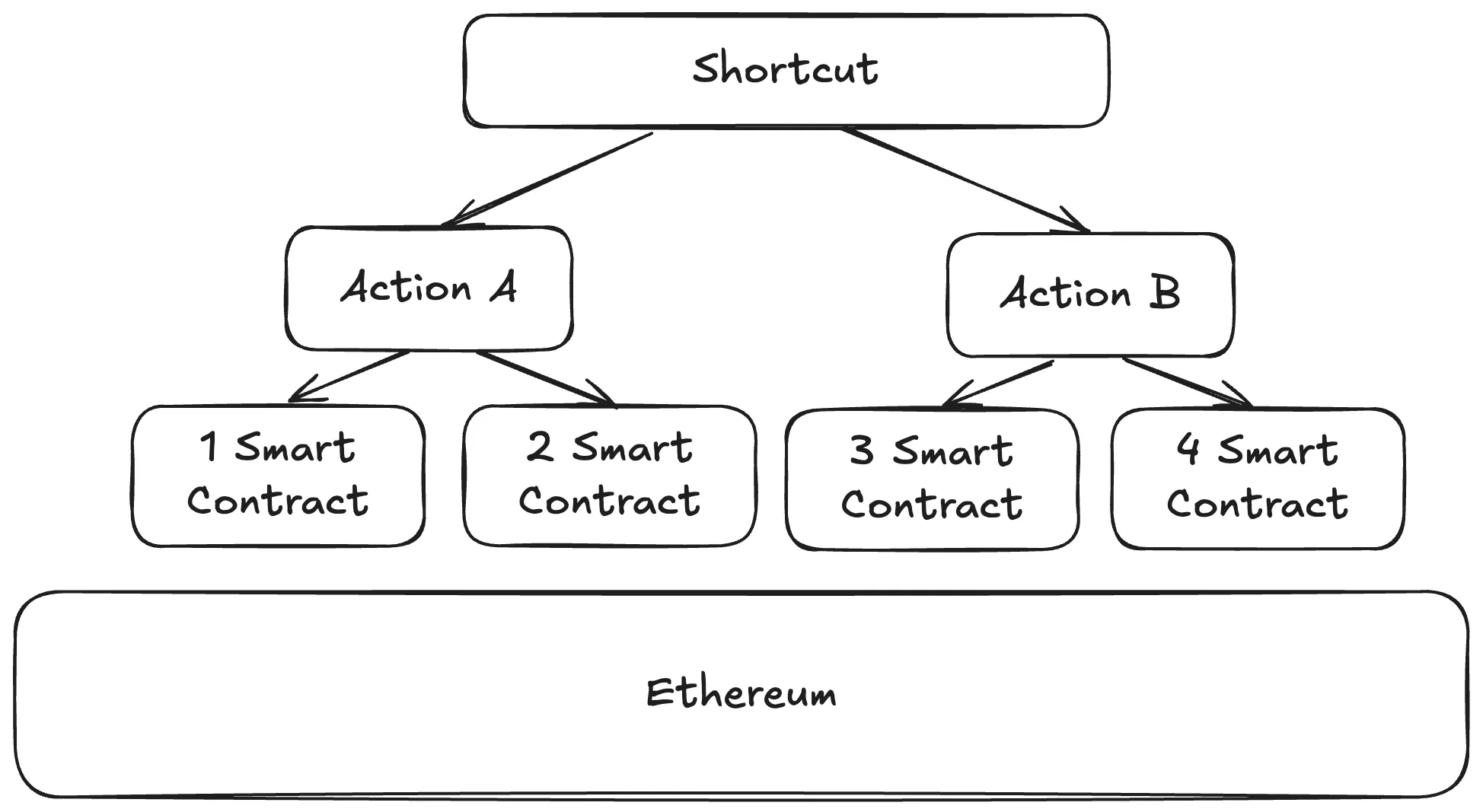

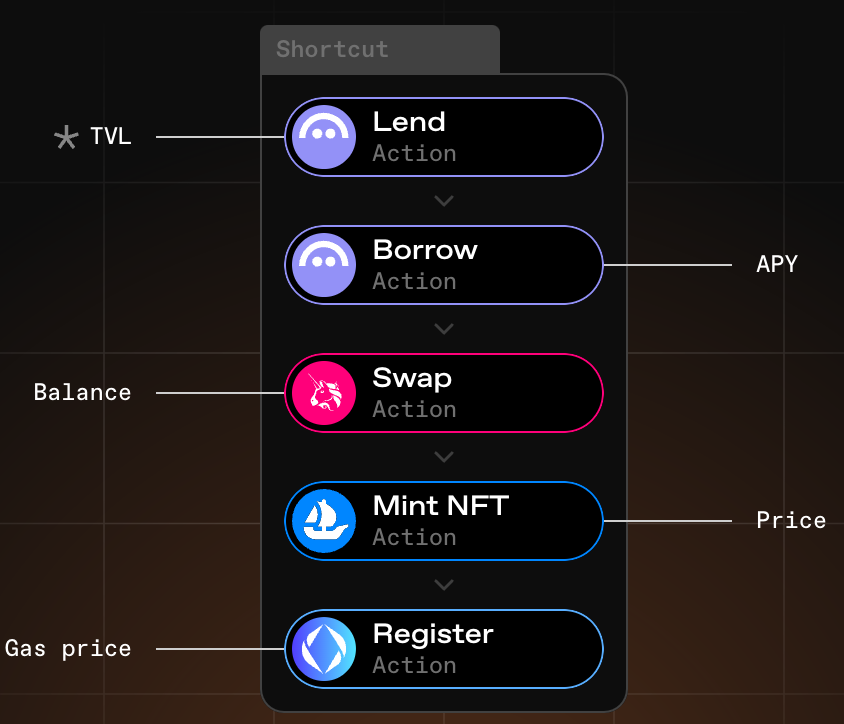

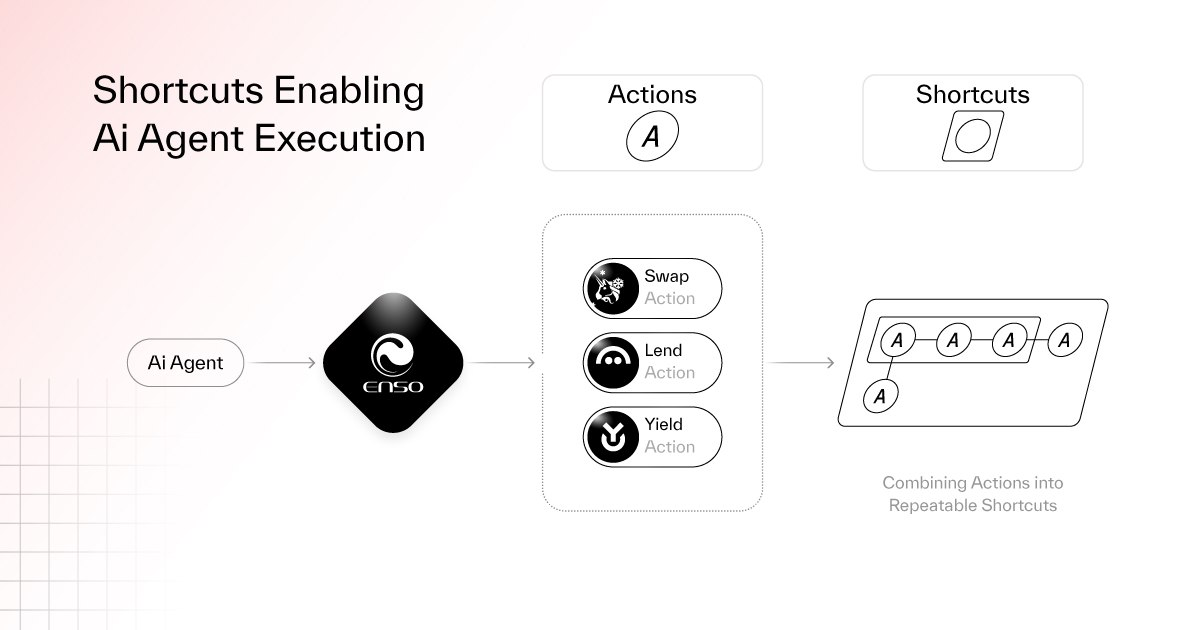

Enso functions as an intent engine that simplifies and abstracts the complexities of blockchain development by introducing actions and shortcuts. Actions are isolated transactions or combinations of transactions designed for common workflows. For example, approving a token and entering a vault can collectively be defined as a deposit action.

Shortcuts, on the other hand, are combinations of actions bundled together to perform more complex operations. For instance, a shortcut might combine a deposit action with a leverage action, enabling seamless execution of a multi-step process. These shortcuts are pre-built, verified, and reusable on-chain building blocks that developers can effortlessly integrate into their projects, significantly reducing development time and complexity.

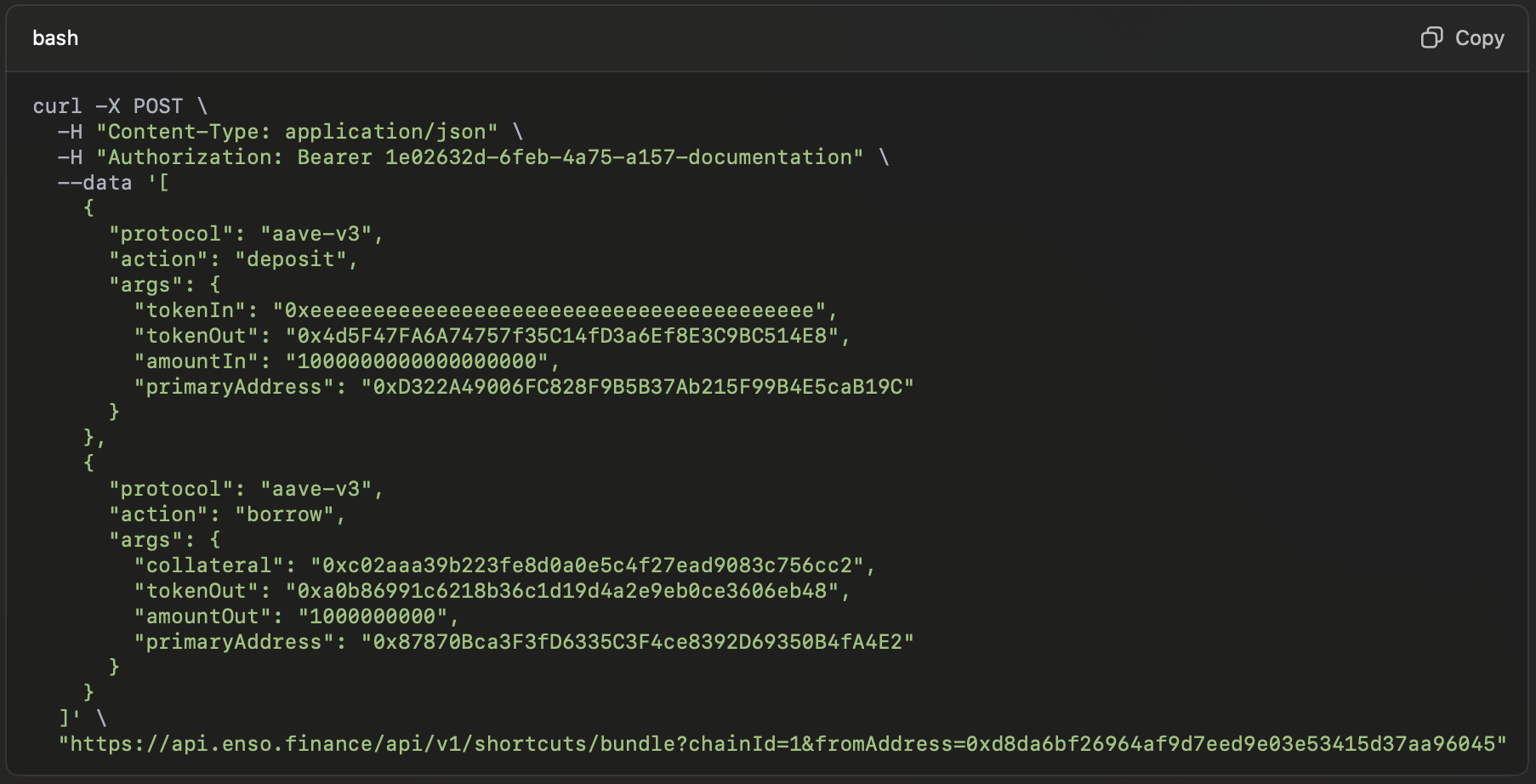

To illustrate how straightforward it is to build a shortcut with Enso, consider the following code snippet that combines the deposit and borrow actions on Aave V3. This simplicity contrasts sharply with the effort required to write the entire integration code from scratch.

Enso’s vision is that shortcuts are the foundation of both Intents and Chain Abstraction, and without them, these concepts would not exist. Intents are essentially requests to perform actions, and Enso fulfills these requests by leveraging its infrastructure of pre-built actions and shortcuts.

Without reliable execution paths, intent-based systems merely mask complexity rather than resolving it. For instance, an interface might simplify liquidity provisioning and staking by presenting a single “Add liquidity and stake” button. However, without pre-built actions and paths, the execution burden shifts to solvers, who must figure out the liquidity addition and staking processes on the fly. This approach introduces inefficiencies, risks, and reliance on ad-hoc solutions.

It’s akin to having a beautifully designed train station but needing to rebuild the tracks every time you want to travel. While the surface may look polished, the underlying infrastructure fails to deliver reliable and efficient results. Just as trains require defined and tested tracks, chain abstraction demands more than solvers with smart routing algorithms—it requires robust, pre-built execution paths that are ready to use.

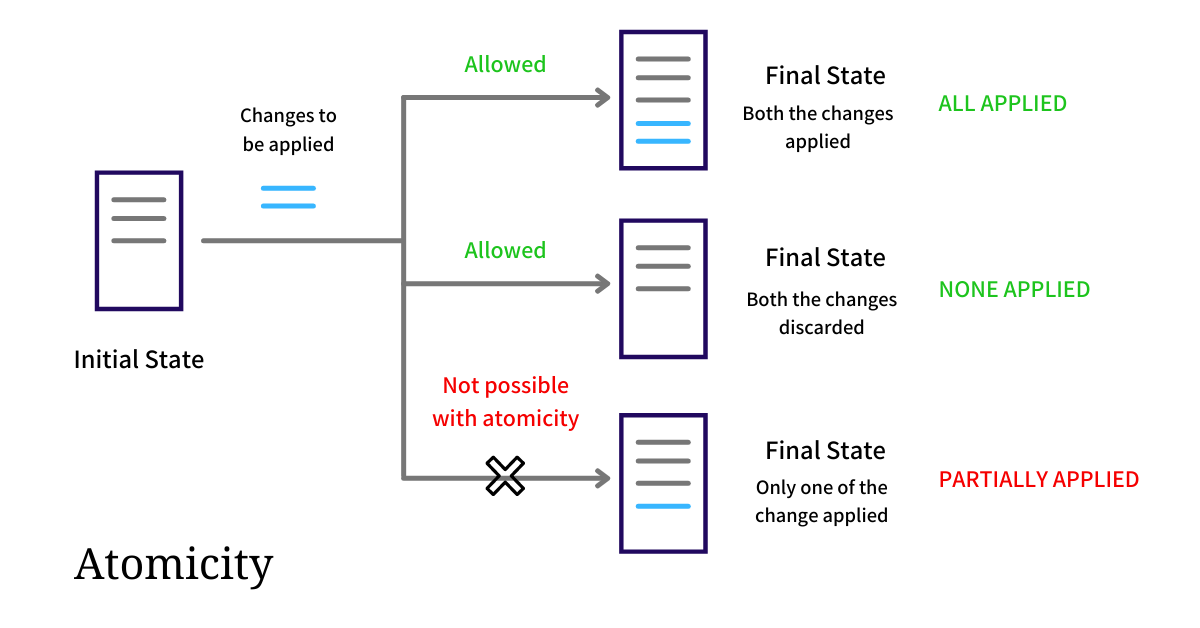

Building on the foundation of robust execution paths, atomicity is a central part of DeFi’s efficiency and reliability. In simple terms, atomicity ensures that transactions are either executed in full or not at all, removing the risk of partial execution and its associated losses.

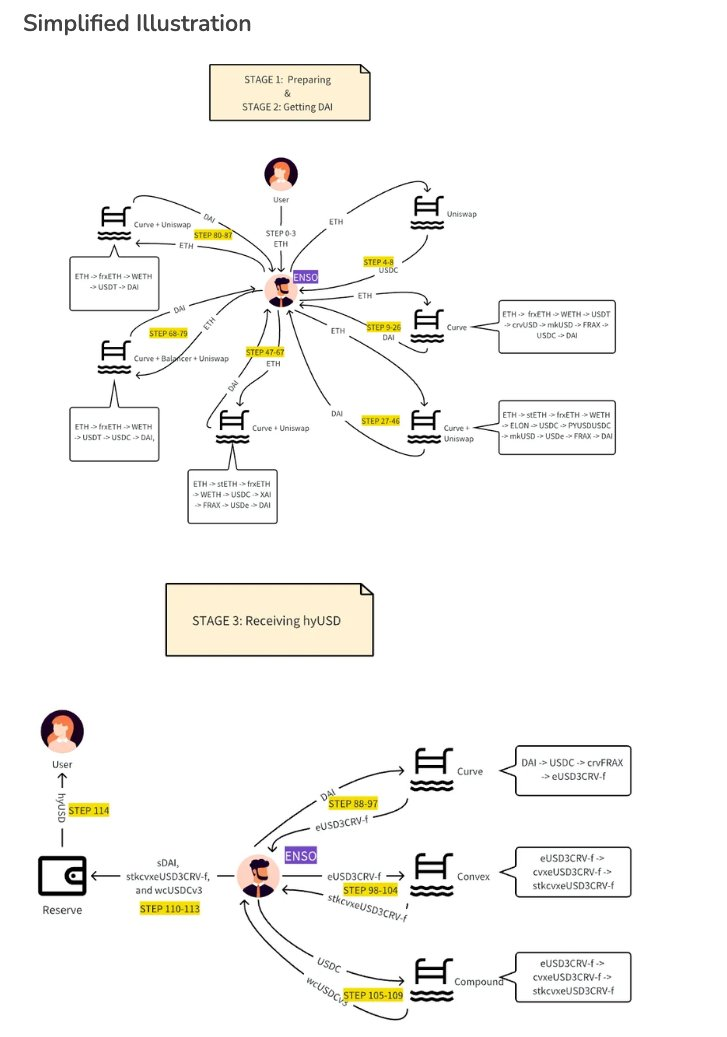

To better understand how Enso leverages atomicity to handle highly complex transactions seamlessly, let’s take a look at the following example. Here, Enso facilitates a 117-step transaction across more than 40 trading venues using 25 different assets, ensuring precise execution without any failures or inefficiencies. Acting as a solver, Enso simplifies hundreds of operations by swapping 73.5 $ETH into multiple tokens—216,661.863807 hyUSD, 276.533490 wcUSDCv3, and 80.362625 sDAI—through platforms like Curve.fi, Compound, Balancer, and Uniswap. In doing so, it optimizes exchange rates and gas costs.

All these multi-step operations are executed through Enso shortcuts as a single transaction. Below the token flow chart to get an idea of the complexity and the main coins/tokens involved: $ETH, $WETH, $USDC, frxETH, $USDT, crvUSD, mkUSD, crvFRAX, $FRAX, $DAI, stETH, $ELON, $PYUSDUSDC, $USDe, $XAI, eUSD3CRV-f, $CRV, $CVX, eUSD3CRV-f-gauge, cvxeUSD3CRV-f, stkcvxeUSD3CRV-f, cUSDCv3, wcUSDCv3, hyUSD, sDAI.

Enso has already developed a suite of shortcuts that encapsulate the most common DeFi operations, including lending, borrowing, swapping, liquidity provisioning, vault interactions, LSTs, LRTs, NFT operations, and more. Each component within a shortcut is verified, each execution path is proven, and the entire solution is ready for immediate use.

The impact of Enso’s shortcuts is evident in their rapid adoption. After opening its infrastructure to other developers, Enso processed $11 million in transactions within the first week alone. Today, the platform has facilitated ~$13 billion in transactions.

Before Enso, developers faced the complex task of manually writing smart contracts to interact with other contracts, deciphering the nuances of each protocol, and building custom infrastructure to manage integrations.

Now, Enso transforms this process by providing a single source that abstracts all the complexities of smart contract interactions.

Enso’s Adoption

By allowing seamless interaction with any type of smart contract, Enso’s agnostic design enables a virtually unlimited range of applications.

Main Use Cases

A prime example lies in AI-driven on-chain solutions. In DeFi, AI Agents can identify arbitrage opportunities, develop yield farming strategies, and anticipate market trends. Yet, there remains a significant gap between the strategies AI can conceptualize and their practical execution on-chain. For instance, an AI agent may identify an optimal yield farming opportunity across three protocols, knowing precisely which tokens to swap and which positions to take. However, implementing this strategy is daunting due to the complexity of interacting with multiple protocols, bundling transactions, and coordinating operations.

Enso addresses this complexity by giving developers access to over 180 pre-built integrations. Some real-world examples of projects using Enso behind the scenes include: Brian, SphereOne, and Velvet Unicorn. Brian executes transactions, retrieves on-chain data, and searches resources using natural language prompts. SphereOne converts conversational commands like “Send”, “Swap”, or “Bridge” into executable transactions. Velvet Unicorn implements AI-driven portfolio management.

Beyond AI, Enso simplifies other use cases such as automation of on-chain processes to eliminate manual intervention (e.g. Plug and Glider), intent-based execution (e.g. CowSwap), and asset management (e.g. Velvet).

Enso’s Role in DeFAI

Lately, the rapid advancements in AI and crypto have given rise to numerous experiments and a new meta called DeFAI, which introduces customized AI agents for individuals. These agents master everything on-chain—from sourcing information to executing transactions—but require integration with protocols to function. As mentioned earlier, manually integrating each protocol is a slow, costly, and error-prone process. On the other hand, by integrating a solution like Enso, AI projects gain instant access to 180+ protocols and on-chain actions through a single integration, eliminating the complexity of manual integrations and accelerating development and go-to-market.

The significance of building for AI agents lies in their potential to dominate the on-chain economy. Unlike human users, AI agents can manage endless permutations of token swaps, liquidity provisioning, and staking strategies across protocols in real-time. This is why AI agents are rapidly becoming the most active participants on-chain, handling complex workflows and interactions far beyond the capacity or willingness of human users.

However, when executing transactions on-chain, AI agents give their best on clear and deterministic logic. Given the non-deterministic nature of AI, without pre-built actions and proven paths, AI systems are forced to “invent” their own solutions, leading to risks such as hallucinations, unpredictable behavior, and potential execution failures. For this reason, Enso Shortcuts are well positioned to eliminate these risks and support this future by providing the deterministic, pre-built paths that AI agents require for efficient, reliable, and scalable on-chain operations.

A recent example of Enso’s impact is the integration with Hey Anon as part of the AUTOMATE framework. Showcasing Enso as its latest integration partner, this collaboration enables DeFAI users to execute tasks across over 180 DeFi protocols seamlessly.

As AI agents become the primary interface between users and blockchains, solutions like the Enso Shortcuts will only grow, offering an efficient way to support the next generation of decentralized agent-driven economies.

Enso x Boyco Berachain

An important upcoming milestone is the launch of Boyco on Berachain, where Royco has partnered with Enso to enable seamless and efficient DeFi execution. As the first incentivized action market (IAM) protocol, Royco introduces a decentralized marketplace for efficiently incentivizing crypto transactions. IAMs enable transactions between Incentive Providers (IPs) and Action Providers (APs), allowing them to negotiate and complete actions that were previously complex, opaque, and often predatory.

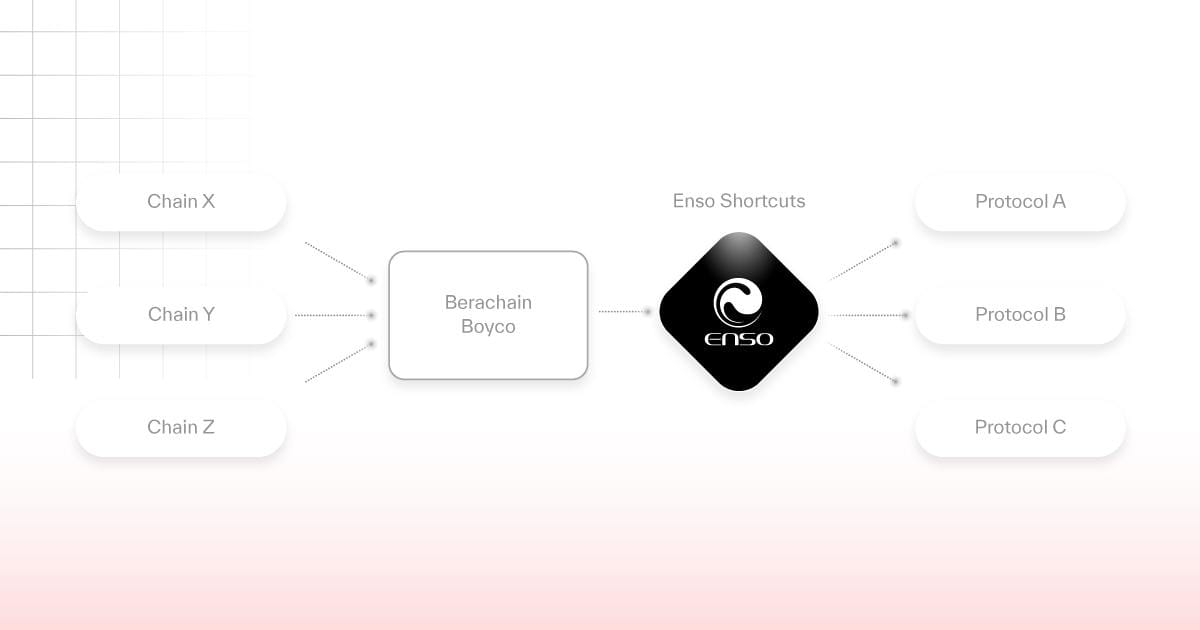

Boyco, developed in collaboration with Berachain, Royco, Enso, LayerZero, and Stargate Finance, is a liquidity platform tailored to the Berachain ecosystem. Its primary goal is to help dApps secure liquidity before the mainnet launch, enabling them to bypass years of capital-building. By creating pre-launch liquidity markets, Boyco allows users to deposit assets into dedicated pools that support a dApp’s launch while earning rewards, with the initiative live until February 3. This approach to liquidity generation has attracted over $2.3 billion in deposits before the Boyco launch.

The Boyco Bootstrapping campaign leveraged Enso’s infrastructure to create custom IAMs, enabling LPs to contribute capital on day one of the new chain. While cross-chain bridging was handled by LayerZero and Stargate, Enso facilitated DeFi execution, with liquidity flowing from Boyco to protocols via 84 custom Shortcuts. These markets span four or more chains and involve over 20 protocols. Enso’s role was to address this by streamlining liquidity operations across three critical areas: (1) day-one DeFi execution, (2) native asset routing within Boyco, and (3) pre-pre-deposit routing.

First, Boyco’s markets provide various functions ranging from single-token deposits to multi-token strategies. Instead of writing custom code for each market’s requirements, Enso enabled protocol integrations and pre-defined shortcuts from day-one. Each interaction with a protocol, such as a swap or deposit, is abstracted into a single-step action. These actions are further bundled into shortcuts to execute even more complex workflows.

Second, Enso simplified the process of acquiring deposit assets, which traditionally involved multiple steps and significant friction for users. Previously, tasks like converting USDT to USDC required users to exit Boyco, navigate a swapping interface, submit multiple transactions, and then return to the platform to complete the deposit. Enso eliminates these complexities by enabling users to perform the entire process within Boyco through a single transaction.

Third, Enso extended its native asset routing capabilities to Boyco’s pre-pre-deposit vaults. Meaning that users were able to route any asset natively through the platform’s interface, eliminating the need for external tools or manual operations.

In summary, Enso’s infrastructure enabled Boyco to drastically reduce the time and cost associated with building from scratch, while simultaneously improving the user experience and lowering barriers to participation.

Conclusion

Enso addresses the challenges of blockchain development by simplifying integration and execution. Developers are no longer required to manually build infrastructure for interacting with smart contracts or navigate isolated blockchain ecosystems. Enso’s shared network state enables seamless interaction across multiple chains, significantly reducing development complexity.

Shortcuts provide pre-built and verified execution paths for common DeFi operations, streamlining workflows and minimizing time spent on repetitive tasks. These tools allow developers to focus on delivering functionality while ensuring efficient and reliable execution.

With ~$13 billion in transactions facilitated and adoption by more than 60 projects, Enso provides a scalable and practical solution for Web3 development. Its approach reduces inefficiencies and promotes accessibility, contributing to the broader usability and scalability of dApps.

References

Bedrock Integrates Enso: One-Click Deposits (January 2025) | Link

Building on Blockchain is Broken (December 2024) | Link

Chain Abstraction & Intents Need Shortcuts (January 2025) | Link

Enso Documentation | Link

Enso Website | Link

Enso White Paper (July 2024) | Link

Enso x Boyco – Powering the Largest ever Chain Bootstrapping Event with Intents (january 2025) | Link

From AI Strategy to Onchain Action: DeFAI (January 2025) | Link

Introduction to Enso Network | Link

Royco Integrates Enso to Power Boyco Berachain Launch (December 2024) | Link

Shortcut to Enso (January 2025) | Link

Solvers: The Backbone of Intent-Based Transactions (September 2024) | Link

The Unified Developer Journey: Blockchain Needs Shortcuts (January 2025) | Link

Disclosures

Alea Research is engaged in a commercial relationship with Enso as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.