Introduction

Blockchains, while often perceived as a single source of truth that operates as a distributed database, actually encompass a diverse range of components with varied functionalities and complexities that are required to maintain the ledger’s immutability: consensus, data availability, execution, and settlement. While many refer to Bitcoin as digital gold, Ethereum was born with the vision of enabling a decentralized and trustless computer for programmable money. This vision often requires the intervention of software components that leave outside of the main ledger, and for which trustlessness isn’t necessarily inherited from the base layer.

Independent of their nature, blockchains operate in a closed loop, only verifying information within their own system. Developers of a PoS chain like Ethereum can create smart contract protocols, such as decentralized exchanges (DEXs) and lending platforms, benefitting from Ethereum’s robust security network of distributed validators and $ETH stakers. However, it is important to highlight that not all protocols can be built using smart contracts alone. Smart contracts operate within a constrained environment, limited to accessing information only available on that blockchain. As a result, they are fundamentally unaware of any events or data outside of their chain.

For example, to obtain off-chain data such as token prices, applications must rely on oracles. Oracles serve as bridges that make available off-chain external information available on-chain. This dependency on off-chain systems is crucial for integrating real-world data with blockchain applications. Therefore, while Ethereum provides robust economic security for smart contract protocols, it does not extend this security to decentralized infrastructure like bridges, sequencers, data availability layers, co-processors, etc, which often struggle to establish their own security, requiring significant capital and resources (most often with their own native token and crypto-economic incentives to bootstrap and retain a large validator set).

EigenLayer pioneered the concept of restaking, offering the best of shared security and permissionless innovation, critical for simplifying infrastructure development. Operating as a set of smart contracts on Ethereum, it creates a marketplace for decentralized trust, connecting $ETH stakers with infrastructure developers (also known as Actively Validated Services within EigenLayer), allowing the former to offer economic security to the latter in exchange for additional rewards beyond $ETH’s native staking yield. $ETH stakers can opt-in to EigenLayer contracts that extend the crypto-economic security of additional applications called AVS, and they earn AVS-specific yield in return as compensation for their exposure to additional slashing conditions.

Ethereum and $ETH already encompass an extensive security network, which, at the time of writing, includes approximately 33 million staked $ETH and 1 million validators. EigenLayer taps into this large pool of liquidity and allows anyone to build crypto infrastructure without worrying about the source of trust. This ability to rent trust from Ethereum’s security is what unlocks EigenLayer’s value proposition: permissionless innovation. New protocols can leverage Ethereum’s economic security without building it from the ground up. They can programmatically access the necessary level of security based on their specific needs, streamlining the development of decentralized infrastructure.

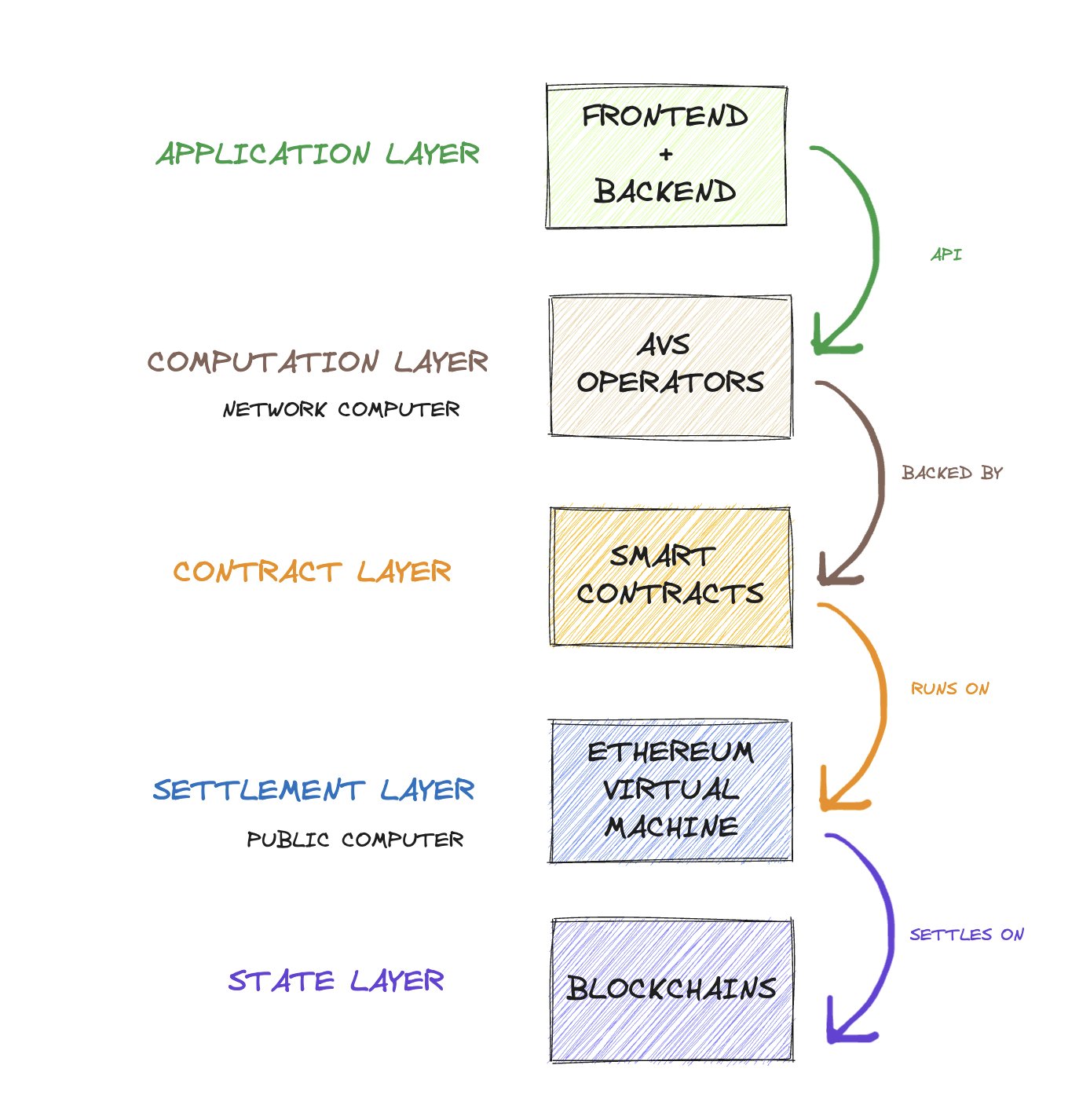

Figure 1: Bringing web3 trust guarantee to any computation, whether on-chain or off-chain.

Source: 0xSumanth

With EigenLayer, infrastructure builders can tap into a large pool of security provided by a large capital asset like $ETH and its decentralized set of validators. By virtue of building on top of this base economic layer, developers can build modular services that will compete for being the best / cheapest at each layer, pushing it closer to true costs and offering the best of open innovation and cost competition.

This report provides an exploration of EigenLayer’s unique value proposition, detailing its architecture, operations, and the benefits it offers to both suppliers and consumers of economic security.

Key Takeaways

- Proof-of-Work (PoW) blockchains operate solely on positive incentives, rewarding miners for adding new blocks, but lacking penalties for malicious behavior. This creates potential economic security vulnerabilities, such as the “nothing-at-stake” problem. In contrast, Proof-of-Stake (PoS) systems integrate both positive incentives (staking rewards) and negative incentives (slashing penalties). This dual incentive structure mitigates security risks by disincentivizing malicious actions, and solving the “nothing-at-stake” problem.

- Smart contract protocols like DEXs and lending platforms can be built using smart contracts alone, as they only need access to on-chain data. However, some functionalities, like bridging off-chain data on-chain, enabling cross-chain asset transfers, and offering data availability, require off-chain infrastructure such as oracles, bridges, and DA layers.

- EigenLayer’s value proposition is to extend Ethereum’s trust to services that cannot be built on smart contracts alone. Deployed as a set of smart contracts on Ethereum, it enables permissionless innovation, acting as a marketplace for decentralized trust.

- EigenLayer’s restaking connects $ETH stakers with infrastructure developers to provide them with the economic security necessitated to support their systems. This creates a marketplace for economic security and decentralized trust, connecting $ETH stakers with builders developing new protocols that can leverage Ethereum’s security instead of building it from scratch (the cold start problem of launching a new token).

- EigenLayer extends Ethereum’s trustlessness and security properties to a wider range of protocols, creating programmable trust. This encompasses economic trust, decentralized trust, and Ethereum inclusion trust, expanding Ethereum’s programmable trust to other ecosystems.

- On top of the native $ETH rewards, Restakers on EigenLayer currently accumulate EigenLayer points reflecting their participation over time, and can earn both token incentives and a share of the fees paid by Actively Validated Services (AVSs) to Operators.

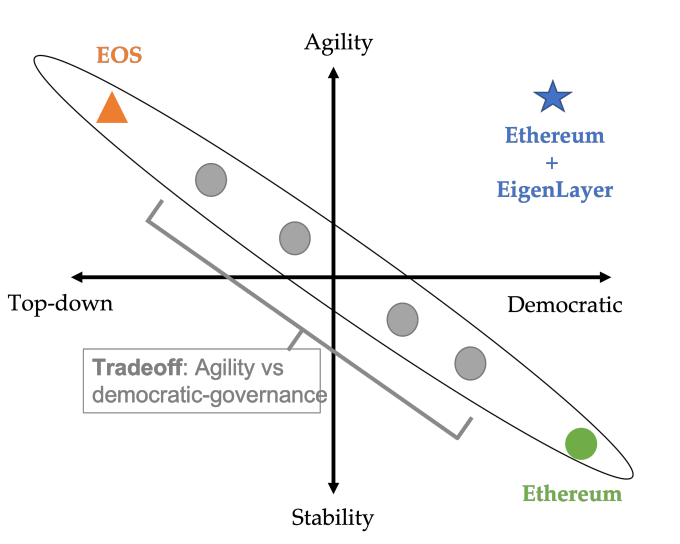

- EigenLayer employs a reputation-based committee to manage upgrades, review slashing events, and admit new AVSs. This approach balances democratic governance with agile innovation, maintaining Ethereum’s long-term stability while enabling rapid, market-driven innovations.

Background

EigenLayer reduces the barrier to entry for new protocols that require some sort of consensus since it bootstraps an existing validator set and pool of staked $ETH (instead of having to issue a new native token for security). Infrastructure builders no longer have to fight to recruit node operators and think about incentive structures to retain them. Instead, they can now use restaking as a primitive to tap into existing $ETH validators with capital at stake. Contrast this with the hustle of launching a new token with zero liquidity and making it grow to eventually become a large market cap asset.

Consensus and Distributed Validation

While blockchain might appear to many as a monolithic technology (that provides a single source of truth), there is a great deal of variation between how different blockchain networks function. At its core, a blockchain must perform four key functions: (1) Consensus to reach an agreement between validators or miners on the validity of transactions and their ordering. (2) Data availability to ensure that transaction data is made available to all participants of the network for their own verification, (3) Execution to process the transactions that update the state of the blockchain, (4) Settlement to ensure the “finality” of transactions.

Consensus is widely considered the most fundamental function of blockchain technology, crucial for maintaining the immutability of the chain and irreversibility of its blocks. A key differentiator among blockchains is the type of consensus mechanism they employ. Commonly, terms like ‘proof-of-stake’, ‘proof-of-work’, and ‘proof-of-authority’ are used to describe these mechanisms. However, these are merely components designed to protect against Sybil attacks. Consensus mechanisms encompass a comprehensive set of ideas, protocols, and incentives that enable a distributed network of nodes to agree on the state of the blockchain.

Since September 2022, Ethereum has utilized Proof-of-Stake (PoS) as its consensus mechanism, transitioning Proof-of-Work. Unlike Proof-of-Work (PoW), where miners secure and verify transactions through energy-intensive mathematical operations, a Proof-of-Stake (PoS) consensus mechanism relies on validators, also known as stakers, to propose and validate new blocks on the blockchain. To become a validator, participants must stake a minimum amount of the chain’s native token as collateral for a specified period. In the case of Ethereum, the required amount of stake is 32 $ETH per validator, and consensus is achieved when at least 66% of the network’s nodes agree on the global state of the network. Thus, a Proof-of-Stake (PoS) consensus mechanism derives its crypto-economic security from a system of rewards and penalties applied to the capital stakers locked into the network. This ensures that validators have a vested interest in maintaining the network’s integrity, as their staked assets can be forfeited if they act dishonestly. This mechanism creates a significant financial deterrent against attacking the network.

The key difference between PoW and PoS lies in their approach to incentives and economic security. In PoW blockchains, miners are primarily motivated by positive incentives. They receive rewards for successfully adding the next block to the blockchain; if they fail to follow the rules, the worst outcome is that they miss out on these rewards. Essentially, PoW operates on a reward-only model where the promise of block rewards drives miners to participate and follow the protocol. While the potential for wasted resources (e.g., electricity and computing power) encourages miners to adhere to the rules, the lack of direct penalties for malicious behavior creates a vulnerability. A miner with substantial computing power could theoretically disrupt the network by withholding valid blocks, exploiting what is known as the “nothing-at-stake” problem. PoS systems, on the other hand, incorporate both positive and negative incentives. Validators earn rewards for staking their tokens and validating new blocks. However, if they fail to follow the rules or act maliciously, they face penalties through a process known as “slashing”, where a portion of their staked tokens is forfeited. This dual (both positive and negative) incentive structure adds a layer of economic security that is absent in PoW. The risk of losing staked tokens strongly incentivizes validators to behave honestly. Malicious actors not only miss out on potential rewards but also risk losing their stake. Hence, validators are driven not only by the promise of rewards but also by the fear of losing their staked assets.

Validators in PoS

Running a validator is a commitment. Validators stake capital in the form of $ETH into a smart contract on Ethereum. They are responsible for verifying that new blocks propagated over the network are valid, occasionally creating and propagating new blocks themselves. In return, validators are rewarded in $ETH coming from staking rewards in the form of inflation, and network fees from transactions, increasing their staked balance. However, if they attempt to defraud the network, such as by proposing multiple blocks instead of one or sending conflicting attestations, their staked $ETH can be partially or entirely slashed.

As more validators join and stake tokens, the network becomes increasingly difficult to attack. The more tokens that are staked and the higher their value, the more costly and challenging it becomes to achieve a majority dominance of the network. Overall, the security of the Ethereum network is fundamentally derived from the staking of $ETH tokens, considering both the amount of tokens and the price of each token.

Fractured Trust Network

Today, developers building smart contract protocols such as DEXs or lending platforms on Ethereum can leverage the security of Ethereum’s trust network by deploying their contracts on the platform. However, while Ethereum provides robust economic security for these smart contract protocols, it does not extend this security to decentralized infrastructure and other distributed systems that require their own form of consensus, such as bridges, keeper networks, oracle networks, data availability layers, co-processors, etc.

In general, any module that cannot be deployed as smart contracts or be validated on top of Ethereum cannot benefit from Ethereum’s pooled trust. These modules often process inputs derived from outside of Ethereum, making in-protocol validation within Ethereum impossible. As a result, developers face the significant challenge of establishing their own economic security model, which often comes at the cost of launching their own token and overcoming the cold-start problem: if the price of a native token falls then the security of the network is compromised, whereas $ETH provides a baseline level of security.

Hence, protocol teams working on infrastructure and off-chain systems that live outside of a main blockchain must currently face the following challenges:

- Bootstrapping and retaining a new distributed validator set

- Capital costs and value leakage

- Opportunity cost

- Lower trust model for dApps

In EigenLayer, these modules that have their own distributed validation mechanisms receive the name of Actively Validated Services (AVS). Innovators looking to develop a new AVS must first establish a new trust network to ensure security. This process is challenging, as identifying and recruiting stakers is difficult because there is no centralized platform where developers can easily find them. For instance, consider how much work in terms of communication, business development, and incentives alignment is required if you were an appchain and wanted to convince individuals to run validator nodes and retain them on the network for a long period of time. EigenLayer changes this paradigm with restaking, since it allows those builders to lean on existing $ETH stakers who are already securing the network, further creating a dual marketplace where stakers can also opt-in to AVSs for extra yield.

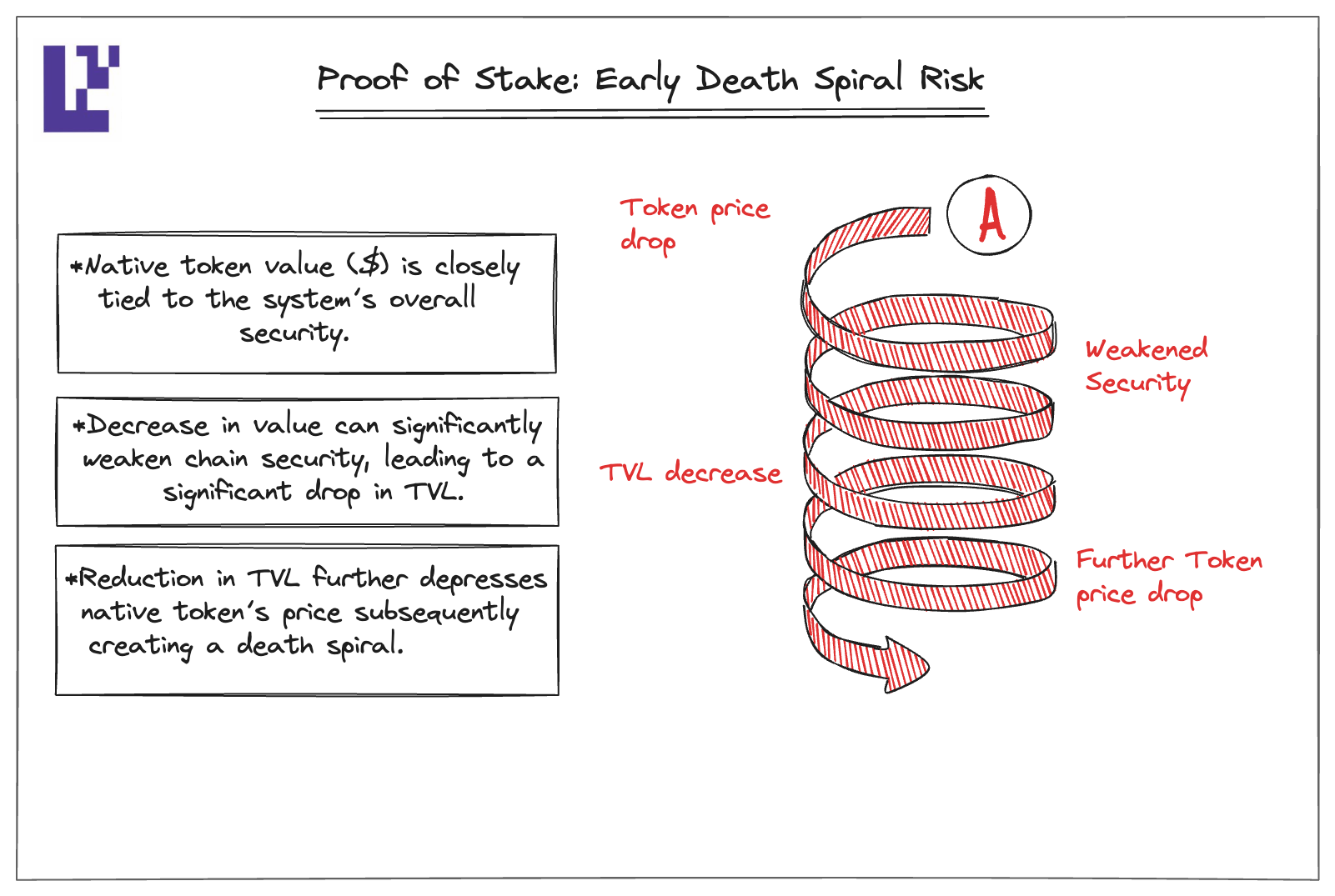

Second, each AVS must create its own trust pool, leading to extra capital costs and value leakage. Users must pay fees to these providers on top of Ethereum transaction fees, diverting value from $ETH. At the same time, in a pre-restaking world, stakers would need to invest heavily in volatile and hard-to-obtain native tokens in order to pay for these fees. Similarly, many projects, which don’t need their own token, are forced to issue one, slowly and laboriously building their own crypto-economic security. Thanks to restaking, projects can start out using $ETH as the shared security layer, which reduces the endogenous risk associated with having a native AVS token. Progressively, as the AVS grows, projects can pivot to a dual-token model and eventually launch their own native token if they decide to do so. This dual-token model is one of the most powerful features of EigenLayer. As stated above, bootstrapping a new PoS network is challenging as projects must issue a new token and persuade people to buy and stake it. However, these native tokens are often volatile, hard to access due to their novelty and lack of exchange listings, and they pose high inventory risk for holders. Since the native token’s value is closely tied to the system’s overall security, PoS networks in their early days might face a potential death spiral.

Figure 2: Proof of Stake: Early Death Spiral Risk

Source: EigenLayer Blog.

A decrease in the native token’s value could significantly weaken the network’s security, leading to a drop in Total Value Locked (TVL), further decreasing the token’s price and creating a downward spiral. A dual-token model aims to solve this problem by using two tokens to secure the same PoS network. If one of these tokens is an external network token with lower volatility, deeper liquidity, and more accessibility, such as ETH, it can address the challenges new PoS networks face. Thus, dual staking can mitigate the death spiral effect; if the native token’s price falls, the PoS network’s security is still affected, but to a limited extent. This is because the ETH staked in the PoS network provides a baseline of economic security.

Third, without EigenLayer, stakers would also miss out on other rewards, such as $ETH’s staking yield from staking rewards and network fees, which is highly attractive since they are paid out in $ETH instead of another asset. Restaking offers a compelling proposition for this holder base. There are a lot of people staking $ETH because of its large staked market cap and relative stability. It is easier to convince them to stake and earn extra yield on an asset like $ETH than convincing someone to buy a new token that just launched with no track record or growth reference. These $ETH stakers can also choose what AVSs they support, allowing them to pick and choose those that present a favorable risk-reward scenario based on their individual preferences. From the perspective of someone building an off-chain system, they can now tap into these stakers and ask them to restake and secure their system in exchange for extra rewards (from the service’s activity and fees, or token incentives).

Fourth, on the operational side of things, staking another token that is not $ETH to secure any given service would come with significant capital costs, including opportunity costs and price risks (which also happens with $ETH, but we will assume it is the unit of denomination). Therefore, these infrastructure projects would be forced to offer high enough returns to cover these costs and incentivize others to run nodes for them. For most of them, these capital costs would far exceed the operational costs (viewed as an acquisition cost to bootstrap the system until it can self-sustain). As an example, consider a Data Availability layer with $10 billion in stake and a 5% APR. It would then need to pay $0.5 billion annually to stakers, overshadowing data storage or networking expenses. In addition to that, consider what happens when the market cap of the token shrinks, thereby lowering the security of the system (as less capital is required to attack the integrity of the system). By restaking $ETH, AVSs can recycle existing capital in a token with a very large staked market cap and that is fairly decentralized and distributed across many different hands.

Lastly, generating sufficient security is time-consuming and often inferior to Ethereum’s. This creates a weak security model where the cost to corrupt a system is merely the cost to compromise its weakest dependency. In the current AVS ecosystem, middleware dependencies can be targeted, making overall security only as strong as the weakest link. For example, if a critical module like an Oracle has minimal stake, Ethereum’s security guarantees are undermined, as attacking the Oracle is much cheaper than attacking Ethereum itself.

The need to bootstrap is arguably the most significant obstacle for new ideas, preventing innovation in decentralized infrastructure systems from achieving the same speed, variety, and scale as smart contract protocols. These challenges result in a fragmented trust network.

The EigenLayer Solution

EigenLayer is an open marketplace for decentralized trust and build systems that are economically secured by $ETH rather than solely by the issuance of their own native tokens, but why do we need EigenLayer in the first place?

The term “Eigen” is German for “your own,” implying “your own layer.” EigenLayer aims to address the fragmented blockchain security issue and simplify infrastructure building. By focusing on trustless composability, EigenLayer makes it possible to bring social trust and subjective truth on-chain.

To achieve the goal of streamlining infrastructure development, EigenLayer focuses on three main objectives: (1) connecting stakers and infrastructure developers through a platform, (2) allowing stakers to provide economic security by opting in to secure additional services called AVSs in exchange for extra rewards, and (3) pooling security through restaking rather than fragmenting it. This is achieved with restaking, which refers to the ability of reusing existing staked $ETH to secure additional services beyond the Ethereum L1 itself.

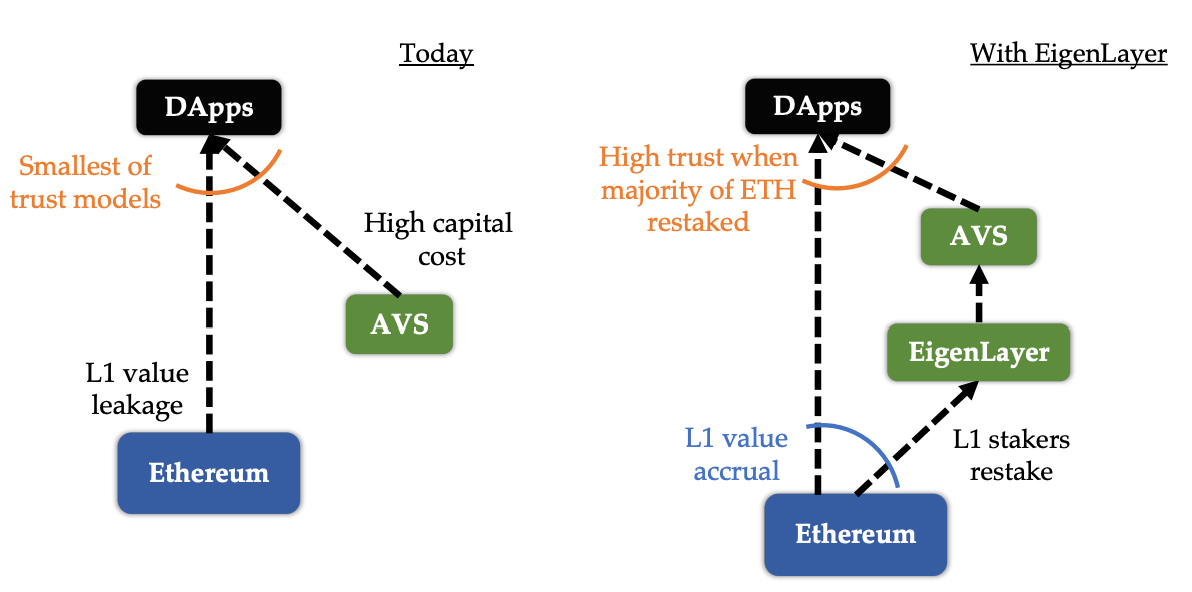

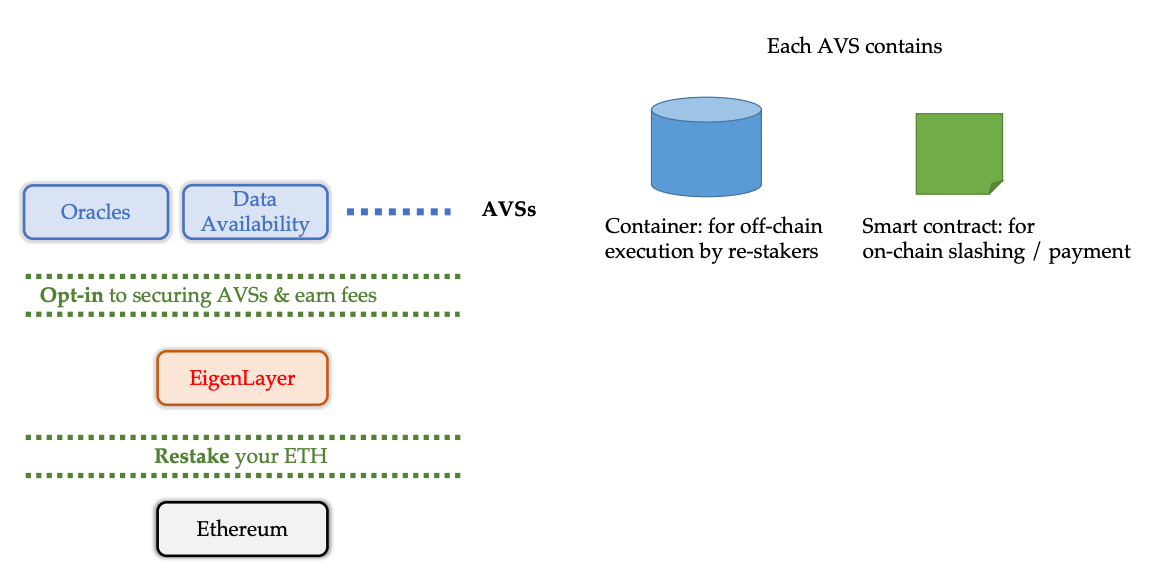

Figure 3: AVSs Ecosystem today and with EigenLayer

Source: EigenLayer Whitepaper.

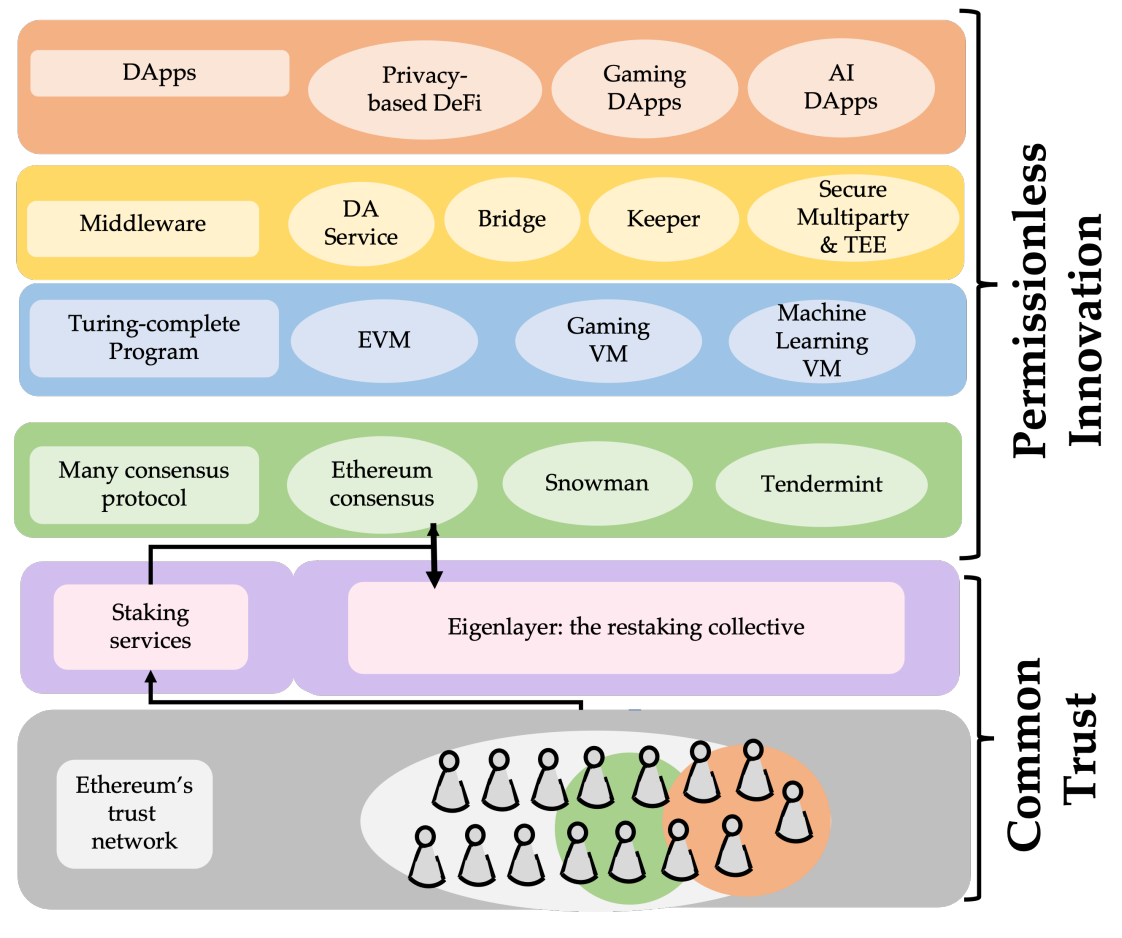

Restaking significantly expands the range of blockchain applications that can benefit from pooled security, extending beyond Ethereum-based smart contract dApps to include virtual machines, consensus protocols, and middleware (oracles, bridges, L2 sequencers, DA layers, etc). EigenLayer allows any service, regardless of its composition, to leverage the security provided by Ethereum’s stakers, fostering an environment for permissionless innovation and free-market governance.

Figure 4: EigenLayer enables Permissionless Innovation

Source: EigenLayer Whitepaper.

Through restaking, Ethereum stakers can secure multiple services simultaneously by “restaking” their $ETH, providing pooled security based on their risk/reward preferences. This reuse of $ETH across various services reduces capital costs for stakers and significantly enhances trust guarantees for individual services. Each restaker can opt in to secure additional services to earn extra rewards based on their own risk/reward calculations and preferences.

This approach allows new protocols to leverage Ethereum’s extensive security programmatically, based on their specific needs, without building their networks from scratch. They can design systems that pay fees to the network for the desired level of security, facilitating the development of decentralized infrastructure.

This design creates a win-win situation: networks gain access to high-quality decentralized security more affordably than if they established their own validators, while Ethereum node operators and stakers earn additional yield.

Architecture and Stakeholders

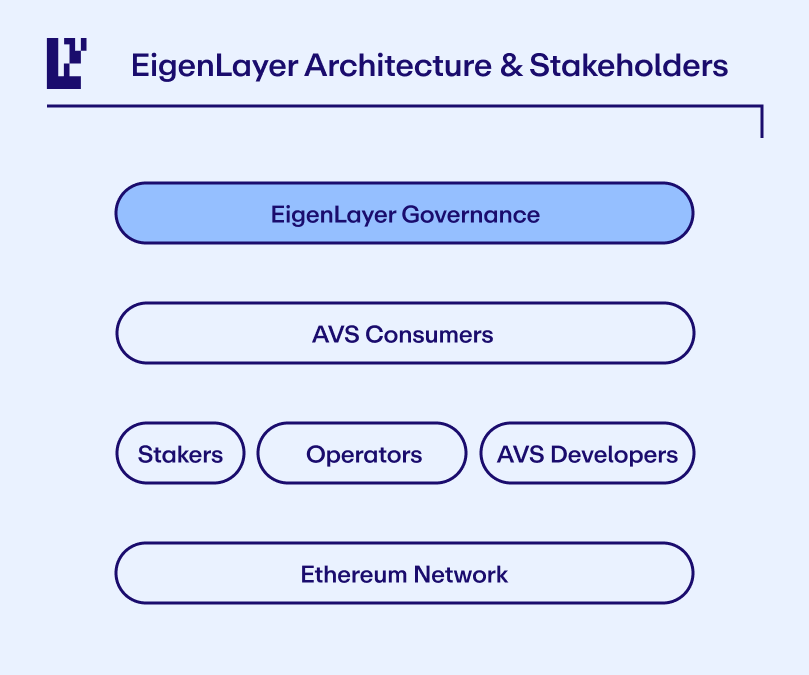

Users use EigenLayer contracts to deposit and withdraw supported assets ($ETH and LSTs), as well as delegate them to operators providing services to AVSs.

Overview

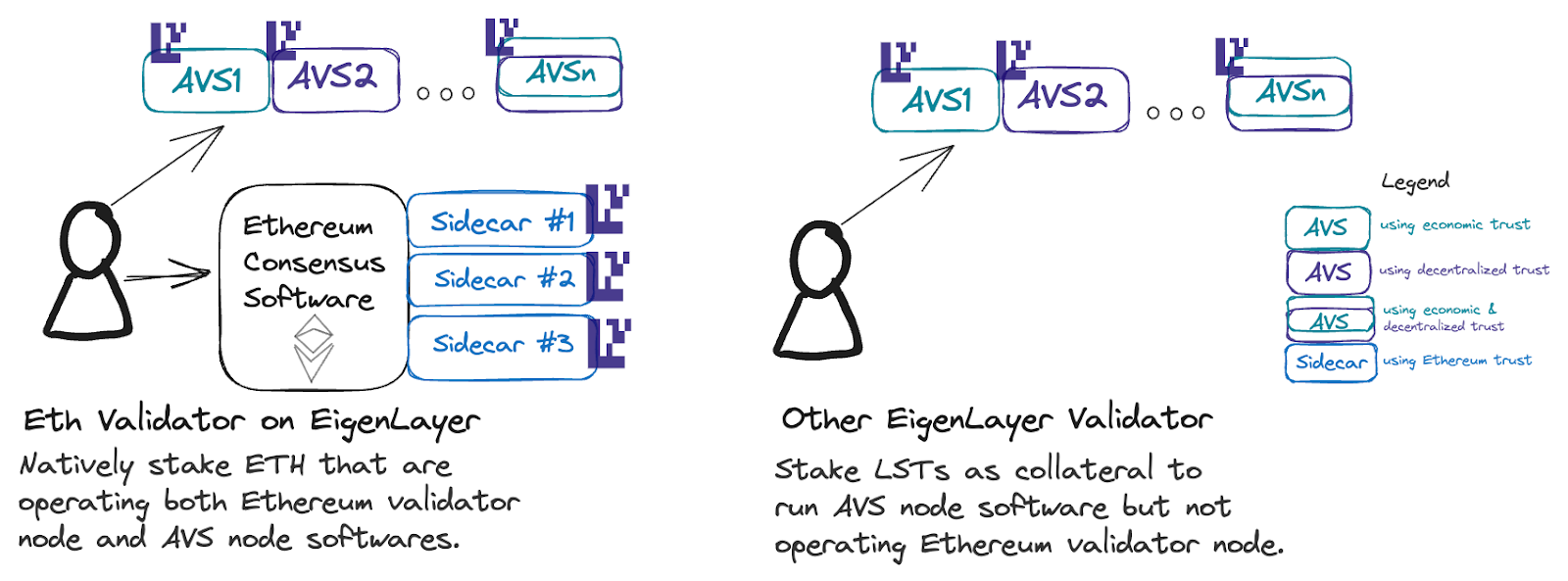

Essentially, EigenLayer integrates smart contracts on the Ethereum blockchain with supplementary off-chain software, enabling stakeholders (including solo stakers, staking pools, and liquid staking token (LST) holders) to voluntarily participate in managing new decentralized systems. EigenLayer acts as the marketplace that matches AVSs looking for economic security with $ETH holders and stakers looking for additional yield.

Figure 5: EigenLayer Architecture & Stakeholders.

Source: EigenLayer Docs.

Stakers, Operators, and AVS Developers

Restaking allows stakers to use their native $ETH or Liquid Staking Tokens (LST) to provide greater security for services within the EigenLayer ecosystem, the AVSs.

Operators, entities that run AVS software on EigenLayer, register on the platform and enable Restakers to delegate their stakes to them. These Operators then opt in to provide various services built on EigenLayer by running the necessary off-chain software for that specific service. Delegation involves Restakers assigning their staked $ETH to Operators or running validation services themselves, effectively becoming Operators. This double opt-in process ensures mutual agreement between both parties. Restakers maintain control over their stakes, choosing which AVSs to validate. Meanwhile, Ethereum validators can simultaneously run Ethereum clients and AVS software, or offload this job to other AVS operators.

AVSs leverage Ethereum’s shared security through the EigenLayer protocol. These services deliver value to users (AVS Consumers) and the broader Web3 ecosystem, while Operators perform validation tasks, ensuring the security and integrity of the network.

Launching an AVS on EigenLayer involves deploying an off-chain container that Operators download and run, as well as an on-chain contract that outlines the slashing and payment terms. This setup offers the following benefits:

- Restakers and Operators earn additional revenue by providing security and validation services to their selected AVSs.

- AVSs establish their own rules and slashing mechanisms to ensure security and pay a fee for these services.

For instance, if the module is a Data Availability layer, Restakers in EigenLayer will receive payments whenever data is stored through the module. In return, Restakers are subject to slashing conditions enforced through proof-of-custody mechanisms.

Figure 6: Launching an AVS on top of EigenLayer.

Source: EigenLayer Whitepaper.

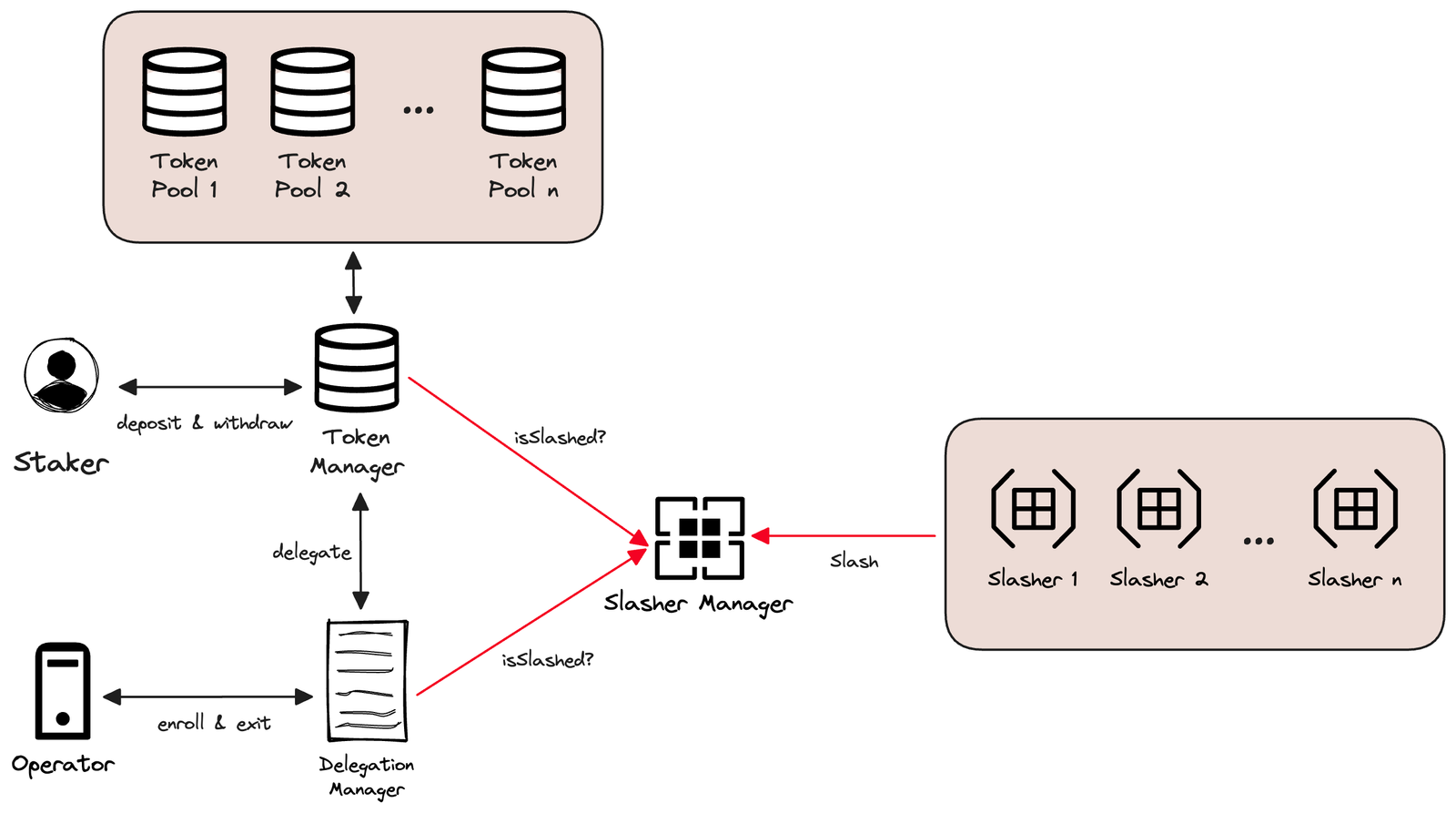

To better understand the interactions among Restakers, Operators, and AVSs within EigenLayer, it is helpful to explore its design through a simplified architecture.

Figure 7: Simplified Architecture of EigenLayer.

Source: EigenLayer Blog.

The three core components are: Token Manager, Delegation Manager, and Slasher Manager. Each component has a specific function: (1) the Token Manager handles staking and withdrawals for stakers, (2) the Delegation Manager allows operators to register and track operator shares, (3) the Slasher Manager provides AVS developers with the interface to determine the slashing logic.

Safeguarding Trust: Governance Mechanisms in EigenLayer

Governance currently plays a central role in EigenLayer, featuring upgradeable smart contracts, the ability to pause functionality and various adjustable parameters.

EigenLayer employs a reputation-based committee composed of respected members of the Ethereum and EigenLayer communities. This approach prevents a centralized entity from acquiring a majority of tokens to dictate rules or attack the system (token-based approach). The committee is responsible for enabling upgrades to EigenLayer contracts, reviewing and vetoing slashing events, and admitting new AVSs into the slashing review process.

While Ethereum’s current governance is democratic, it often results in a slow pace of innovation. The introduction of EigenLayer offers a solution, combining democratic governance with agile innovation. EigenLayer demonstrates that it’s possible to balance both by building agile innovations on top of Ethereum’s trusted network without altering its core. This approach maintains Ethereum’s long-term stability through cautious upgrades, while EigenLayer enables rapid, market-driven innovations. Acting as a staging network, EigenLayer allows for permissionless experimentation and the integration of successful ideas back into Ethereum, achieving the best of both worlds.

Figure 8: Trade-off between Democracy and Agility.

Source: EigenLayer Whitepaper

In a modular system, tracking the trust assumptions within the protocol can be challenging. Therefore, it is essential to explicitly outline these assumptions among the participants involved in the protocol. As previously discussed, in EigenLayer there are three main agents: Restakers, Operators, and AVS developers.

Operators rely on AVS developers to accurately code the client software and the on-chain slashing conditions. If there are bugs in the AVS software, Operators risk missing potential fee payments or, at worst, being slashed for their entire stake. Given the significant value at stake, the system requires safeguards before full implementation. The veto committee, a mutually trusted party among Restakers, Operators, and AVS developers, can reverse slashing due to non-malicious behavior, removing the immediate trust assumption from the AVS developers. This ensures that Restakers and Operators are not penalized due to software bugs in the AVS.

Restakers trust the Operators they delegate to. Misbehavior by Operators can result in Restakers missing fee payments or losing their entire stake. AVS developers also depend on Operators to act honestly; dishonest behavior by Operators degrades the AVS service, leading to customer loss and other issues.

With the veto committee in place, the trust assumptions among the participants are as follows: (1) Restakers trust Operators to behave honestly, with misbehavior potentially leading to slashing; (2) AVS developers trust Operators to run the AVS software honestly; (3) Restakers, Operators, and AVS developers trust the veto committee to reverse unjustified slashing.

After discussing the various stakeholders in the EigenLayer protocol, here is a simplified illustration of how EigenLayer works, the roles each stakeholder plays within the protocol, and their incentives to participate:

Figure 9: EigenLayer: How it Works

Source: EigenLayer Documentation; Revelo Intel.

Restakers

Restakers are individuals who stake their native $ETH or Liquid Staking Tokens (LSTs) to secure applications on the network (AVSs).

Overview

Through EigenLayer, any restaker can make credible commitments to any AVS. This means that the restaker provides capital to secure the protocol while committing to follow its rules, risking their stake if they behave maliciously.

AVS developers build the infrastructure logic and software, while restakers provide the stake to secure the infrastructure, subject to additional slashing conditions. Similar to stakers delegating their tokens to trusted validators on the Ethereum Network, restakers may choose to delegate to trusted node operators rather than running a node themselves.

In return for their contribution to the shared security of the EigenLayer ecosystem, restakers receive the following economic incentives: (1) accumulate EigenLayer points as a measure of their staking participation, and (2) earn a share of the fees paid by AVSs to Operators. Additionally, AVS might also choose to offer token incentives as an extra reward.

Restaking Options: Liquid or Native

A staker has two options to restake his assets through EigenLayer. These are:

- Liquid Restaking.

- Native Restaking.

Figure 10: Liquid and Native Restaking Options

Source: EigenLayer App. As of June 12th, 2024.

Liquid Restaking involves depositing supported Liquid Staking Tokens (LSTs) and/or $EIGEN tokens into the EigenLayer smart contracts. This process is straightforward and quick for the user:

- Select the token to restake

- Enter the amount to restake

- Confirm the deposit transaction

Once these steps are completed, the corresponding increase in the restaked balance will be visible in the app:

Figure 11: Liquid Restaking

Source: EigenLayer App.

After fully restaking tokens in EigenLayer, the next step is to delegate them to an Operator to contribute to the shared security of the EigenLayer ecosystem.

But what if you don’t want to stake into EigenLayer through a liquid staking protocol? You can start participating in EigenLayer through Native Restaking, depositing $ETH instead of a LST.

To participate in native restaking, a Restaker must first operate an Ethereum Validator, which requires locking 32 $ETH to activate and run the validator software. Native restaking involves using $ETH within a validator for additional commitments. If the validator deviates from these commitments, the $ETH within the validator will be slashed. However, this $ETH is not represented as ERC20 tokens, but instead exists on the beacon chain (locked up and illiquid inside a validator node).

This is where the EigenPod comes in. An EigenPod is a smart contract deployed on a per-user basis, functioning as a virtual accounting system that monitors and manages the $ETH balance and withdrawal statuses for each restaked validator. Validators must point their withdrawal credentials to the EigenPod. When a validator withdraws their stakes from EigenLayer, the $ETH passes through the EigenPod, which checks for any slashing events. If the validator has been slashed, the tokens are frozen within the EigenPod contract. Restakers have two options to natively restake: (1) via the EigenLayer Web App. (2) via smart contracts. The first option provides the simplest user experience, ideal for most users. The second option, on the other side, is for users with advanced development and smart contract expertise.

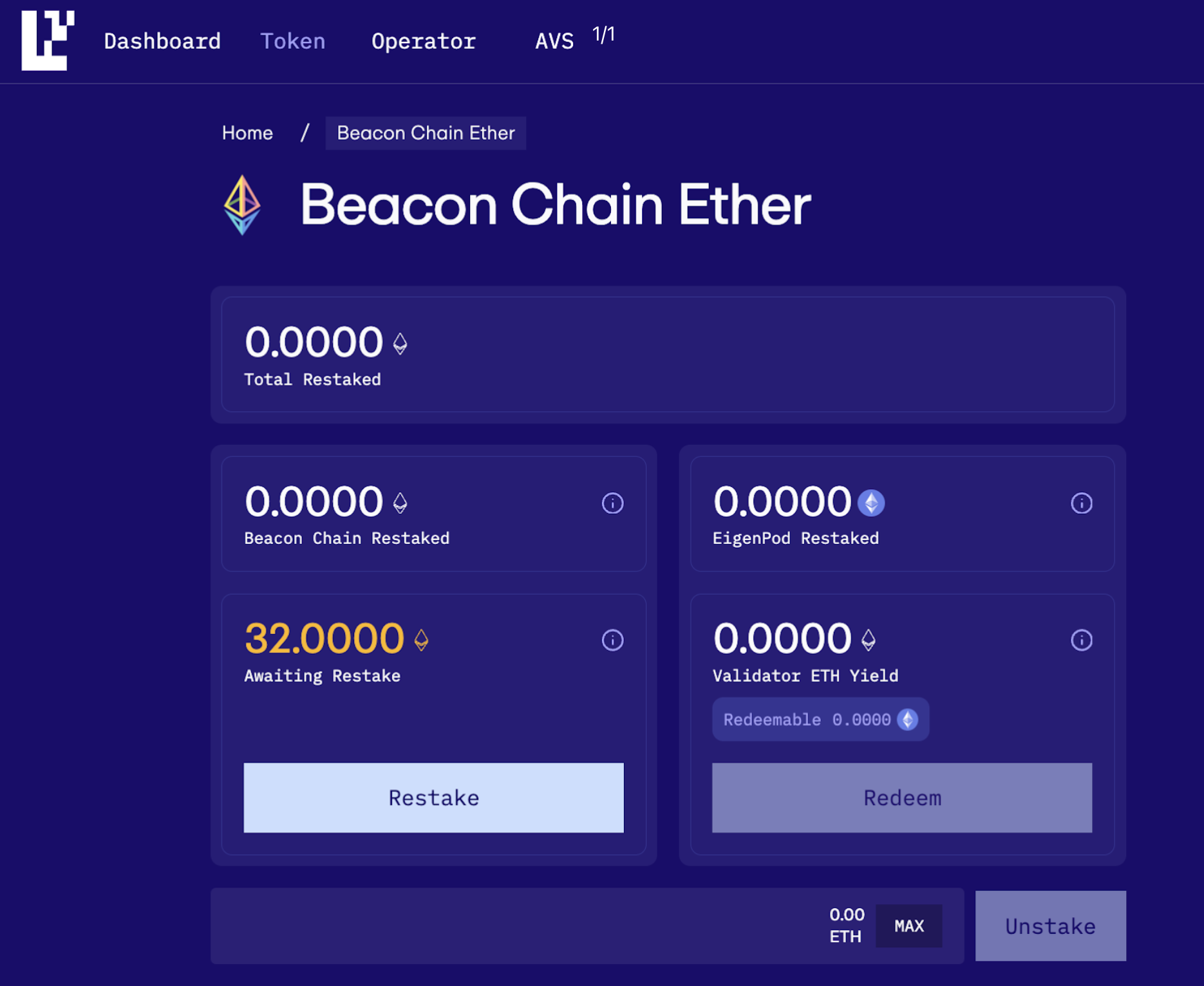

Focusing on the Web App option, users can follow these steps: (1) connect the Web3 wallet to the EigenLayer App, (2) navigate to the Restake section and select the “Beacon Ether” option, (3) click “Create EigenPod” and confirm the transaction:

Figure 12: Native Restaking: Creating an EigenPod from EigenLayer App.

Source: EigenLayer App.

The next step involves setting the validator’s withdrawal credentials using one of the three available methods: ethdo, Consensus Client, or directly from the user’s staking hardware device. Finally, once the user’s Beacon chain $ETH balance has been proven and verified on-chain, they can restake that $ETH balance with EigenLayer. Upon completion, the balance in “Awaiting Restake” will update to reflect the user’s Native Restaked balance.

Figure 13: Native Restaking: Awaiting Restake

Source: EigenLayer App.

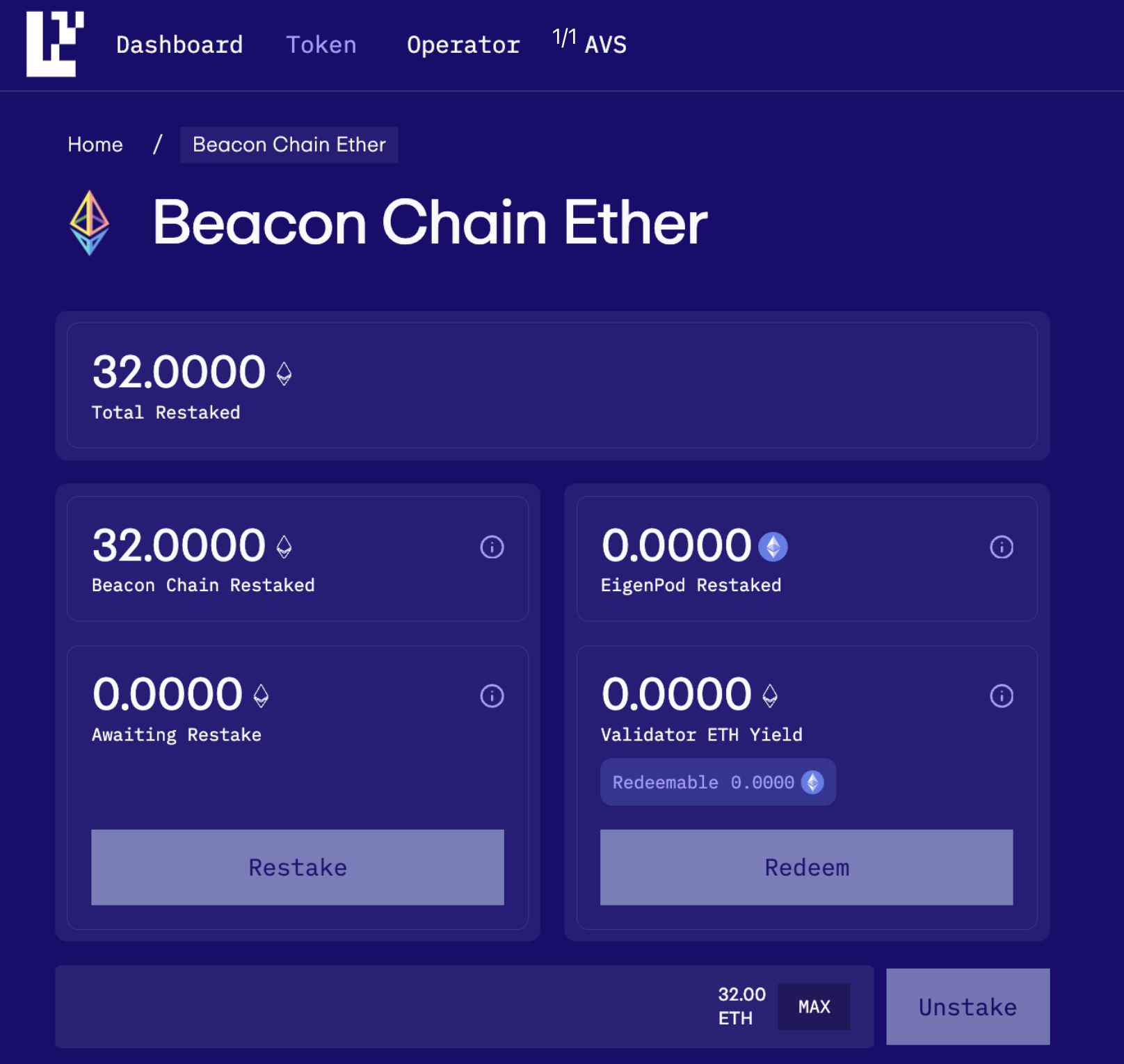

The final step is to click on the Restake button to complete the process. This action will update the Beacon Chain Restaked and Total Restaked balances, allowing the user to view the updated figures.

Figure 14: Native Restaking: Assets Restaked

Source: EigenLayer App.

Both LST tokens and native restaking have a 7-day withdrawal delay as a security measure in case of vulnerability disclosure or anomalous behavior detection. In contrast, the withdrawal window for $EIGEN tokens is 24 days to support future planned functionalities unique to the token.

Delegation

Many EigenLayer Restakers holding $ETH or Liquid Staking Derivatives (LSDs) may be interested in participating in EigenLayer without acting as Operators themselves. They might lack the capability or desire to handle the operations securing the AVS, similar to $ETH holders who prefer not to operate their own validators.

EigenLayer offers a solution for these Restakers by allowing them to delegate their $ETH or LSTs to other entities running EigenLayer operator nodes. Delegation involves assigning the restaked balance to an Operator, an “all or nothing” operation where a Restaker must delegate their entire available restaked balance to a single Operator at a time. Restakers can undelegate their balance to end their assignment to the Operator and later redelegate it to a new Operator.

Note that an Ethereum address can be both a Restaker (via liquid or native restaking) and an Operator simultaneously, although this is not required. Through delegation, a Restaker’s token balance is represented by the Operator they delegate to. If the Operator violates the AVS commitment, the Restaker’s tokens will be slashed.

EigenLayer Operators with delegated stakes can use these to spin up new Ethereum validator nodes and subject the stakes to slashing from the modules they participate in. These Operators receive fees from both the Ethereum beacon chain and the EigenLayer modules they participate in, retaining a fraction of these fees and passing the remainder to the delegators.

Restakers should consider the fee-sharing ratio offered by operators (as well as any additional token incentives that might be added on top). With many Operators available for delegation, a free market for delegation will naturally develop. Each Operator will establish a delegation contract on Ethereum specifying how fees will be split with delegators, and this contract will route fees accordingly.

Fungibility and LRTs

Every delegation of a staked asset implicitly carries a risk/reward calculation to make a decision on whether to secure or not any given AVS. Every time you restake $ETH, EigenLayer does not issue a fungible token representing this restaked position. Since each restaker may opt in to validating different combinations of AVSs, they will be subject to different sets of rewards and slashing conditions. Given the diversity and optionality to participate in multiple AVSs at the same time, all restaking positions are non-fungible; a fungible token would not be able to capture multiple coexisting positions accurately unless they secure the same AVSs and share the same pool of funds.

However, there is a subset of protocols that tokenize this position as Liquid Restaking Tokens (LRTs). In fact, there is a very good reason for LRTs to exist. LRTs help to solve the problem that restaking positions cannot be transferred. For instance, in the event of a liquidation, one would have to withdraw $ETH from Eigenlayer, decreasing the economic security of the system. By having LRTs in place we can ensure that liquidations don’t result in a forced withdrawal, but rather in a transfer of restaked value from one entity to another. A liquidation cascade might result in a death spiral, as the price of $ETH may fall, causing more positions to be liquidated, and resulting in more withdrawals from Eigenlayer. This would jeopardize the overall economic security of the system.

By implementing LRTs, AVSs and EigenLayer can effectively reduce potential financial risks related to staker positions, as LRTs provide a more seamless and efficient liquidation process. However, there is also a reason why EigenLayer has chosen not to issue its own LRT. Ensuring that the risks of each AVS and slashing conditions remain transparent to holders of a fungible position is tricky. This is because of the potential for principal-agent problems between holders of the fungible positions and the Operators who run the nodes. This needs careful management; therefore, EigenLayer does not plan to issue fungible positions.

Another common misconception and topic of discussion have been whether EigenLayer is a protocol for “leverage” or “rehypothecation”. In finance, rehypothecation implies that depositors no longer have direct control over their assets and they are subject to liquidity and counterparty risks, leaving them vulnerable to potential losses. However, Restakers in EigenLayer retain full control over their staked tokens and can decide what AVSs they want to validate. Similarly, leverage refers to the use of borrowed funds to increase the potential return on an investment. Assets that can be easily used as collateral for borrowing are considered to have good leverage potential.

While EigenLayer is not directly involved in any of the above, it is undeniable that LRTs, by virtue of being fungible and liquid, can offer greater liquidity and access to leverage across DeFi. Note that this adds extra default risk and complexities in terms of liquidity, yield generation, and risk management (managing multiple AVSs, coordinating multiple node operators, and inherent risks of slashing…). For instance, the price of LRTs can vary (lower than 1:1 $ETH exchange rate) based on technical flaws or market conditions. This, however, is for lending markets and DeFi applications to consider and manage their risk accordingly.

As for EigenLayer, the reference to “leverage” often points to the fact that Operators can run multiple AVSs at the same time (i.e. same amount of capital at risk but earning yield from multiple places). EigenLayer notes that this is not the same as “leverage” in the traditional sense. When you are restaking you have skin in the game and you get penalized (slashed) if you don’t operate properly. Contrast this to “leverage” in DeFi, which exposes a position to external risk. Instead, the act of restaking only involves endogenous risk (something that you can control and it is in your best interest to do so) versus leverage associated with external market risk from price movements that are outside of a user’s control.

This simply means that when you participate in restaking, the protocol is not taking your $ETH and using it to get involved in financial activities such that small price movements could result in liquidations. Additionally, it is also worth noting that, even though users may be able to use their LRTs as collateral to borrow against in DeFi, they cannot deposit the LRT back into EigenLayer, which means that if they get liquidated they will lose their LRTs, but that will have no effect on EigenLayer or the security of Ethereum.

Economic Incentives

A restaker has three economic incentives to restake through EigenLayer:

- Retain native $ETH rewards: by allowing stakers to provide a stake in a liquid staking token (LST) or native $ETH, EigenLayer enables them to retain their native $ETH rewards while securing other infrastructures and potentially earning additional rewards.

- Accumulate EigenLayer points: Restakers earn points as a measure of their contribution to the shared security of the EigenLayer ecosystem. These points reflect staking participation and are calculated as the time-integrated amount staked in units of $ETH ⋅ hours. For example, a user who stakes 1 st$ETH for 10 days would accrue 240 restaking points over this period (1 $ETH × 10 days × 24 hours/day = 240 $ETH ⋅ hours).

- Earn a share of fees and token incentives rewards: Restakers who delegate to operators earn a share of the fees and token incentives rewards paid by AVSs for securing their services.

Operators

Operators are individuals and/or organizations that register with EigenLayer and enable $ETH stakers to delegate their staked assets. When incentives are aligned, operators naturally opt in to secure extra services (AVS) and earn additional rewards. Similarly, Operators are prone to exiting when their profitability starts to decrease.

Effectively, AVSs rent economic security from Operators in exchange for incentives, and Operators may choose whether to opt in or out of restaking for each AVS. This decision is influenced by a number of factors: change in the value of incentives they get (i.e. token price fluctuations), changes in the risk perception of an AVS, usage and adoption of an AVS, etc.

Overview

While Restakers provide tokens for the economic security of each AVS, Operators ensure the operational security by running the EigenLayer software through their nodes. These Operators can be either individuals or organizations. By registering within EigenLayer, they enable $ETH Restakers to delegate their assets, whether in the form of native $ETH or LSTs. The Operators then opt-in to provide various services to AVSs, enhancing the overall security and functionality of their networks.

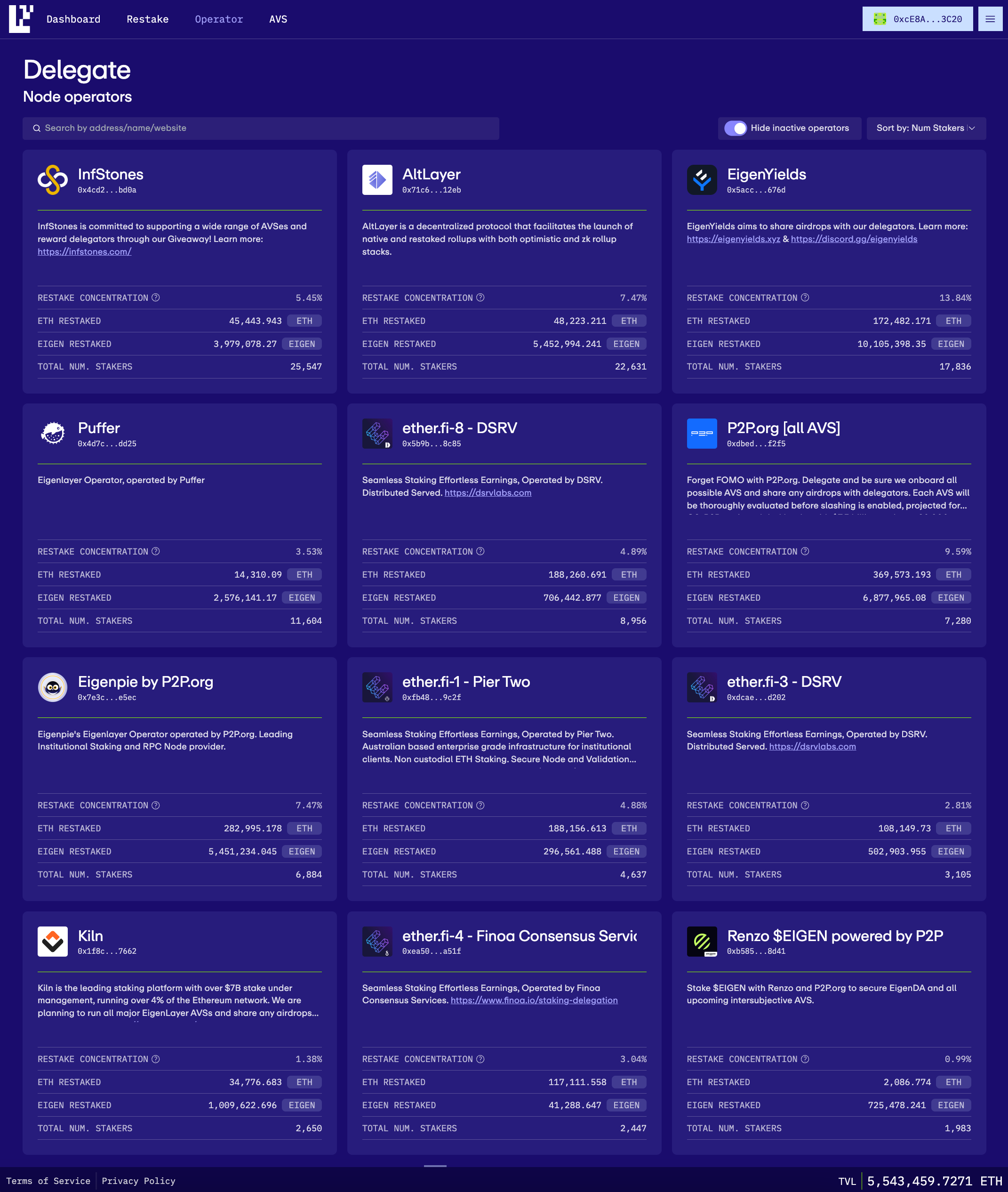

Figure 15: EigenLayer’s Operators available for delegation

Source: EigenLayer App. +280 node operators as of June 13th, 2024.

Becoming an Operator in the EigenLayer ecosystem does not require a specific amount of delegated restaked TVL. Any Ethereum address can serve as an Operator, and an address can simultaneously function as both a Restaker and an Operator, though this dual role is not mandatory. Besides, an Operator can participate in the EigenLayer network without holding any restaked tokens.

To allow Restakers to choose which AVSs to secure, an Operator can maintain different addresses for various AVS combinations. Each address represents a specific combination of AVSs supported by the Operator.

For instance, if an Operator supports two AVSs, they can have three addresses: one for AVS 1, another for AVS 2, and a third for running both. A Restaker who trusts the Operator and wants to secure only AVS 1 can delegate to the appropriate address. This approach enables Restakers to maintain full control over their stake while delegating off-chain responsibilities to Operators.

Most Operators will receive token delegations from other Restakers within the network, although Operators can also choose to self-delegate by allocating their own restaked token balance.

Economic Incentives

Node Operators can gather delegated stakes, spin up an Ethereum node, and earn fees from Ethereum PoS. Additionally, they can increase their yield by securing various protocols with their stake. For their services, Operators retain a portion of these fees and distribute the remainder to their delegators (Restakers). If an Operator misbehaves in relation to the EigenLayer modules they participate in, their deposited stake, along with the delegated stakes, will be subject to slashing.

Actively Validated Services (AVSs)

Actively Validated Services (AVS) are applications, protocols or infrastructure providers that require economic security to perform certain functions. Their modules impose a set of conditions under which a validator may be slashed (but not necessarily).

Overview

An AVS is any system built on top of EigenLayer that requires its own distributed validation semantics for verification. Examples include coprocessors, data availability layers, new virtual machines, keeper networks, oracle networks, bridges, threshold cryptography schemes, trusted execution environments, and more. They are analogous to verifiable SaaS (Software as a Service), providing specialized services on top of EigenLayer. Essentially, AVSs consume decentralized trust from EigenLayer and provide validation services for new protocols.

Each AVS has its own set of contracts that maintain state relevant to the service’s functionality, such as which Operators are running the service and the amount of stake securing it. The goal of each AVS is to attract Restakers to help them with security.

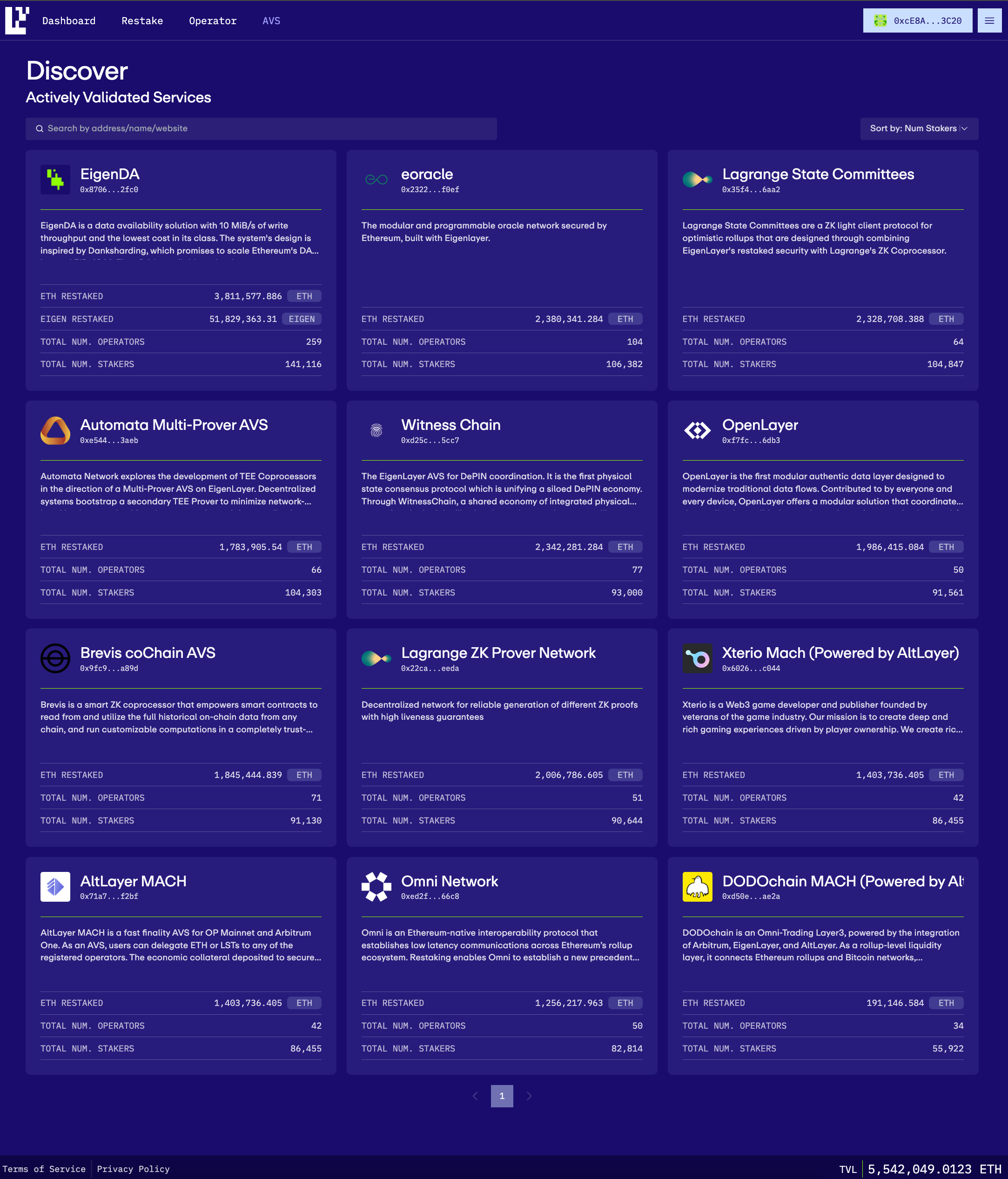

Figure 16: EigenLayer’s Actively Validated Services (AVSs)

Source: EigenLayer App. 12 AVSs as of June 13th, 2024.

Programmable Trust

Beneath the structure of any blockchain lies an intangible asset far more significant than any other: trust. It is this asset that encourages users to engage with the platform, providing them with the confidence that their transactions will not only proceed but also achieve their intended outcomes.

Trust is a currency as valuable as any cryptocurrency, yet far more complex to establish and maintain. Programmable trust is the concept of encoding trust parameters within blockchain networks, enabling developers to build on top of distributed systems.

Today, developers creating smart contract protocols like DEXs or lending services on Ethereum can leverage the platform’s established trust network for security by deploying their contracts directly onto Ethereum’s network. However, this trust only extends to smart contracts that fully operate within Ethereum’s network. Interacting with off-chain data requires developers to bootstrap their own trust networks to ensure security.

EigenLayer extends Ethereum’s trust capabilities to a wider range of protocols, creating programmable trust. These new use cases and decentralized systems (AVSs), function under the umbrella of trust provided by Ethereum but operate independently, handling tasks beyond the scope of traditional smart contracts.

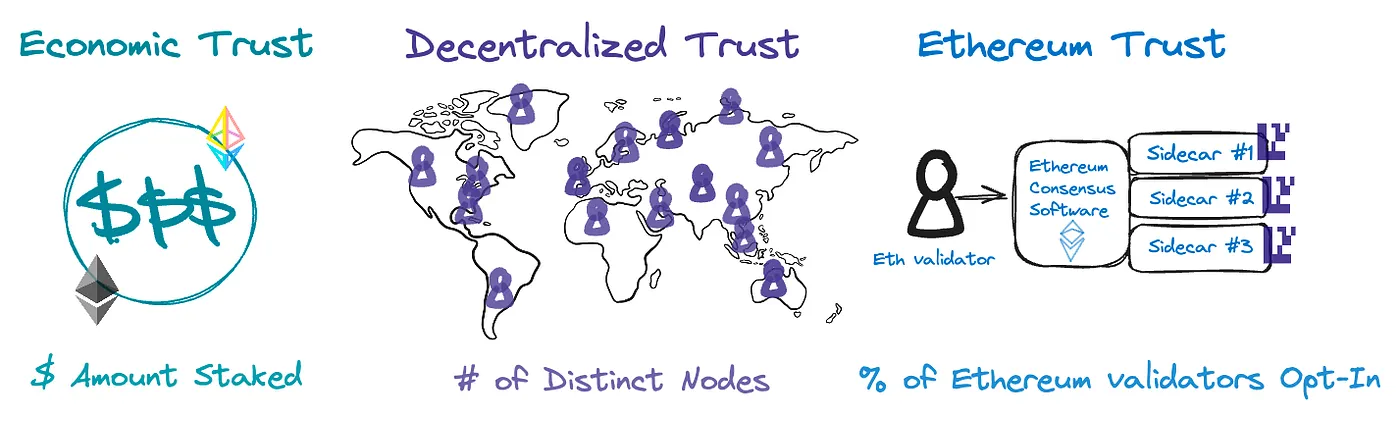

The EigenLayer solution encompasses three models of trust that can be programmatically acquired from Ethereum via the available AVSs, thereby expanding Ethereum’s programmable trust to other ecosystems:

Figure 17: The three models of Programmable Trust

Source: EigenLayer Blog.

Economic Trust refers to trust based on financial commitments, where individuals back their promises with financial stakes. This ensures that misbehavior results in significant financial loss, making it irrational for economic actors to behave dishonestly. The core feature of economic trust is objective validation semantics, where actions or transactions can be objectively verified on-chain. For instance, if an EigenLayer node (Operator) commits to maintaining the sequence of transactions but reorganizes them, an objective on-chain proof can demonstrate this deviation, leading to the slashing of the malicious node’s stake.

Decentralized Trust derives from having a large, independent, and geographically diverse set of validators, reducing the risk of collusion. Some AVSs have failure modes that are not objectively provable on-chain and thus cannot rely solely on economic trust. These AVSs depend on decentralized trust, where the AVS’s properties hold as long as enough validating nodes act independently without collusion. By utilizing a large decentralized validator set, collusion becomes difficult or observable. AVSs can set specific entry conditions using subjective oracles to ensure a certain configuration of nodes, such as “home stakers,” for maximum decentralization. For example, Shamir secret sharing requires splitting a secret into shards stored in non-colluding nodes. EigenDA, built on EigenLayer, combines both economic and decentralized trust to create new services. It relies on decentralization to prevent collusion and economic trust to punish deviations from equilibrium through a proof-of-custody system.

Ethereum Inclusion Trust ensures that Ethereum validators will construct and include blocks as promised, alongside the consensus software they are running. One possible application of Ethereum Inclusion Trust is MEV (Maximal Extractable Value) management. Ethereum block proposers can make credible commitments to order blocks according to specific rules. For instance, validators might sell portions of future blocks or commit to including specific transactions based on predetermined events, with financial incentives ensuring they adhere to these commitments.

Figure 18: Difference between with and without Ethereum inclusion trust.

Source: EigenLayer Blog.

Each AVS may require a combination of different trust types, hence, AVS developers can mix and match these elements to create appropriate trust models tailored to their specific design and security requirements. To implement these trust models, each AVS can develop an AVS-specific slasher contract to handle the slashing logic. Operators can enroll in an AVS through the Slasher Manager interface, which adds the AVS slasher contract as one of the slashers capable of slashing the Operator. The slasher contract interacts with the Slasher Manager to update the status of different Operators. Restakers and Operators can leverage both economic incentives and the decentralization inherent in the Ethereum trust network. By allowing Ethereum validators to restake, these models enable powerful new features that can be experimented with on an opt-in basis without altering the core Ethereum protocol.

Economic Security

In EigenLayer there are two different models to achieve economic security: (1) pooled security, and (2) attributable security. Pooled economic security allows Operators to simultaneously restake their assets across multiple AVSs; in this model, if an Operator is slashed by an AVS, their funds are burned. Attributable economic security, on the other hand, requires Operators to commit a specific amount of value to restake on only one AVS; if an Operator is slashed by the AVS, the funds are returned to the AVS.

The pooled security approach is capital efficient as it enables AVSs to access larger pools of capital for security at lower costs. Besides, the pooled security model allows Operators to earn yields from a variety of AVSs with minimal marginal cost of capital. However, it provides fewer assurances for AVSs since Operators’ funds are at risk of being slashed by other AVSs. This model ensures that if $10 billion is restaked across 1,000 services, an attacker would need to control a majority of that $10 billion to compromise any single service. This shared security model is economically efficient but comes with the trade-off of less assurances for AVSs due to potential simultaneous slashing by multiple AVSs.

The attributable security model offers higher assurances for AVSs as they do not need to worry about Operators being slashed by other AVSs. The economic security level is higher since the AVS can recover funds in the event of malicious actions, rather than merely penalizing the attacker without direct retribution.

From an AVS perspective, attributable security simplifies risk management by reducing the level of rehypothecation (refer to the “Fungibility and LRTs” section for more details on this topic) as it does not need to factor in multiple AVS rehypothecation in order to calculate its Cost of Corruption (CoC). Hence, it simplifies the CoC formula for AVSs and improves protocol solvency by providing stronger economic guarantees. However, attributable security requires more diligence from Operators, as they must ensure the integrity of the AVS they commit to. In fact, a malicious AVS may falsely trigger a slashing condition to steal the Operator’s capital. Finally, attributable security incurs higher costs for AVSs.

The primary difference between pooled and attributable security lies in the allocation and management of risk. Pooled security allows for greater capital efficiency and the potential for higher yields by spreading the risk across multiple AVSs. However, it introduces systemic risk and requires complex risk modeling to account for multiple AVSs. Attributable security, while more expensive and requiring higher diligence, offers clearer and more predictable economic guarantees, making it attractive for AVSs seeking to minimize risk and ensure protocol solvency.

Business Models

AVSs can build various business models on top of EigenLayer. One model is the pure wallet approach, where an entity deploys an AVS as a commercial service. Users pay fees in a neutral denomination, with a portion of these fees going to the provider’s wallet for their service, while the rest is distributed to $ETH Restakers and the EigenLayer protocol. This model supports company-based business operations and allows for SaaS economics within the crypto space.

Another model is to tokenize the fees. In this scenario, the AVS operates as a protocol rather than a commercial service. Users pay fees in a neutral denomination, with a fraction of these fees allocated to the token holders of that AVS as specified by the protocol, and the remainder going to $ETH Restakers and the EigenLayer protocol. This approach leverages the protocol’s native token to distribute earnings.

A different model involves users paying fees in the native token of the AVS. Here, the AVS operates as a protocol, and users pay fees using the AVS-issued token. The value of this token is tied to the AVS’s expected future profitability. Fees are divided between token holders of the AVS’s token and $ETH Restakers in EigenLayer, integrating the AVS’s token directly into the fee structure.

Lastly, the dual staking utility model features two quorums within EigenLayer: one for $ETH Restakers and another for AVS token stakers. This model allows anyone with either $ETH or tokens from AVSs to participate in securing the AVS by restaking $ETH or staking the tokens of the AVS. Security is determined by the more robust quorum, while operational continuity depends on the less robust quorum. This dual staking system enhances the utility of the AVS’s token while using $ETH restaking to mitigate the risk of a potential collapse of the AVS’s token, thereby maintaining the AVS’s security.

Ecosystem projects

One of the most interesting aspects of EigenLayer is the variety of projects it is set to bring into the ecosystem. The potential enabled by EigenLayer is vast, covering protocols from Ethereum sidechains to oracles and bridging layers. The most significant protocols will likely be those where bootstrapping security is most challenging and those with a natural synergy with Ethereum, especially during the early stages. Below is a brief overview of some of the currently available AVSs.

The first notable application on EigenLayer is EigenDA, a data availability layer that allows Ethereum to offload its data within the ecosystem’s security framework rather than relying on off-chain solutions. Using a dual quorum model, one by Ethereum’s staking economic quorum and the other by Rocketpool’s $ETH stakers or other liquid staking platforms, EigenDA combines economic and decentralized trust. It achieves up to 15 MB/s throughput (176 times more than Ethereum’s current throughput without danksharding). EigenDA improves the efficiency of Ethereum rollups and is ideal for applications like gaming, social media, and video streaming that require robust data availability.

Brevis coChain AVS aims to facilitate seamless interoperability between different blockchains. It ensures that various blockchain protocols can work together efficiently, much like coordinating trains from different companies to run on the same tracks without delay.

AltLayer MACH offers a solution for separate blockchain systems to interact, akin to translators in a multi-language conference ensuring everyone understands each other. This interoperability layer is crucial for a cohesive blockchain ecosystem.

Eoracle provides reliable external data to blockchain networks, functioning like a news reporter offering the latest updates for smart contracts to utilize. This service is essential for smart contracts that require accurate and timely external information.

The Omni Network focuses on connecting Ethereum’s various layers quickly, reducing wait times similar to a direct express elevator in a tall building. This network aims to enhance the efficiency and speed of interactions between Ethereum’s multiple layers.

As described, the potential applications of AVSs on EigenLayer are numerous and varied. By mixing and matching types of programmable trust, developers can create innovative and secure decentralized systems.

Conclusion

EigenLayer represents a significant advancement in the blockchain space by addressing the challenges of security and innovation involved in building decentralized infrastructure. By introducing the concept of restaking, EigenLayer enables protocols to leverage Ethereum’s robust security network without the need to establish their own trust from scratch. This innovative approach creates a free market for decentralized trust, delivered from Ethereum stakers to modules that desire stake and validation services.

EigenLayer allows for the best of both worlds: maintaining Ethereum’s long-term stability through cautious core upgrades while enabling rapid development and deployment of new protocols (permissionless innovation). This is achieved by extending Ethereum’s trust capabilities to a broader range of protocols through programmable trust with economic, decentralized, and Ethereum inclusion trust models. This flexibility allows AVSs developers to create the best combination of these trust models tailored to their specific needs. Besides, the various business models supported by EigenLayer, such as pure wallet approaches, tokenized fees, and dual staking utilities, provide flexibility of choice for AVSs.

Governance within EigenLayer is managed by a reputation-based committee, ensuring a balanced approach to upgrades and slashing events, thus preventing centralization and fostering trust among participants.

In conclusion, EigenLayer, as “a general-purpose marketplace for decentralized trust,” addresses the fragmented blockchain security landscape and simplifies infrastructure development, thereby accelerating innovation within the Ethereum ecosystem.

References

0xMeir, (2023) What is economic security in EigenLayer?. X | Link

0xSumanth, (2024) EigenLayer Actively Validated Services (AVS) Ecosystem | Link

Abramovich A., (2024) EigenLayer. A Beginner’s Guide to Enhancing Ethereum Rewards through Staking and Restaking | Link

Cryptopedia Staff, (2023) Types of Blockchain: PoW, PoS, and Private. Gemini | Link

Cryptoslav I., (2023) A Deep Dive into EigenLayer: Restaking ETH. CoinMarketCap | Link

David C., Klaudi K., (2024) EigenLayer’s Risk Management. Bankless | Link

EigenLayer Docs | Link

EigenLayer Research, (2023) Dual Staking: secure a PoS with two tokens. AVS Research | Link

EigenLayer Research, (2023) The EigenLayer Universe: Ideas for Building the Next 15 Unicorns. AVS Research | Link

EigenLayer Research, (2023) The Three Pillars of Programmable Trust: The EigenLayer Endgame. AVS Research | Link

EigenLayer Research, (2023) You Could’ve Invented EigenLayer. AVS Research | Link

EigenLayer Whitepaper | Link

Goel K., (2024) A Deep Dive Into EigenLayer. Twitter | Link

InceptionLRT, (2023) Programmable Trust: The Three Principles. Published on Medium | Link

Muzzy E., (2020) What is Proof of Stake?. Consensys | Link

Sharma S., (2024) The Hitchhiker’s Guide to Restaking. Binance Research | Link

Tranks, (2024) EigenLayer – Leveraging Ethereum’s Security. DeSpread Research | Link

wackerow (last edit), (2024) Consensus Mechanism. Ethereum.org | Link

wackerow (last edit), (2024) Proof-of-Stake (PoS). Ethereum.org | Link

Disclosures

Revelo Intel is not engaged in a commercial relationship with EigenLayer and this report was not paid for or commissioned in any way. Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in EigenLayer or any other protocols discussed in this report.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.