Overview

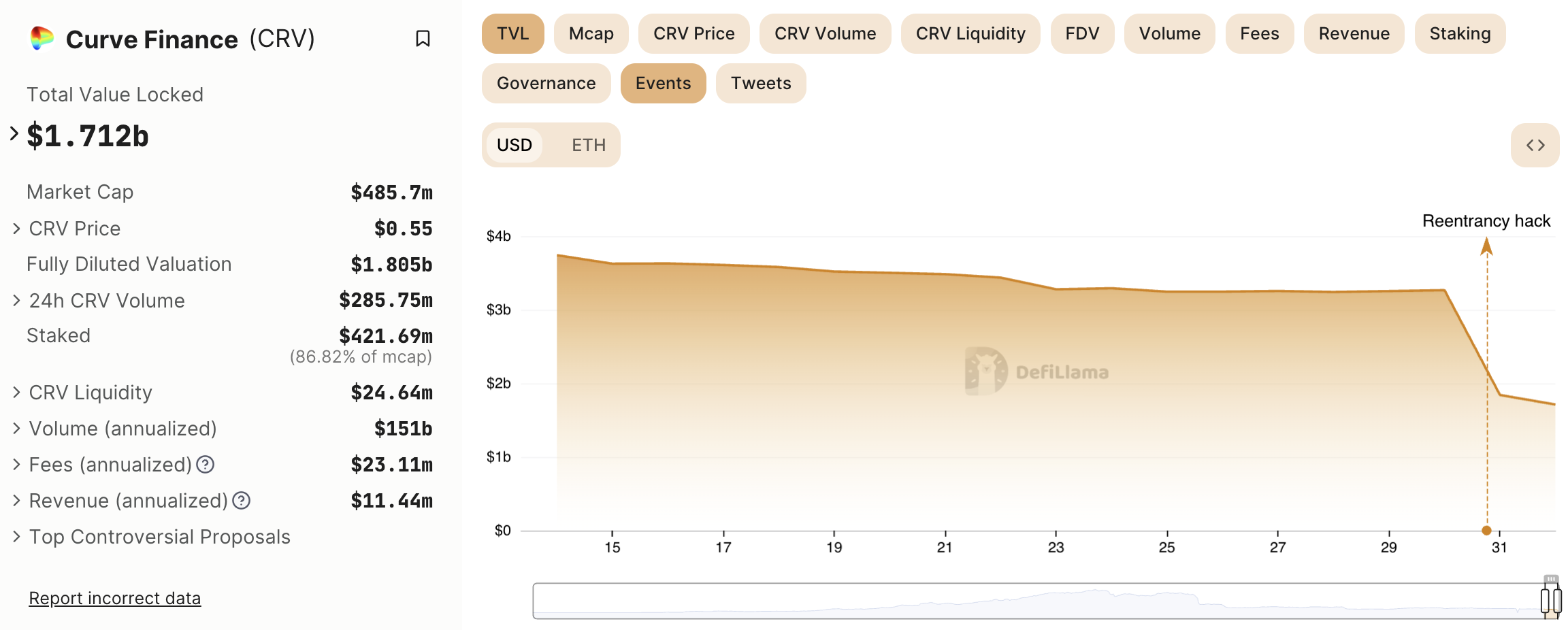

Conic Finance TVL Source: DefiLlama

Primary Chain: Ethereum Mainnet TVL

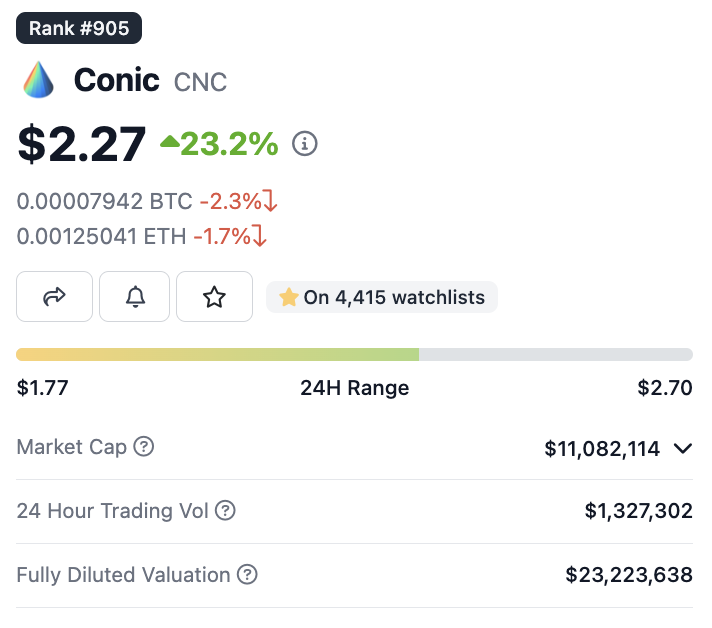

Availability on CEX: Conic Finance’s native $CNC is available for spot trading on MEXC and CoinEX.

Background on Conic

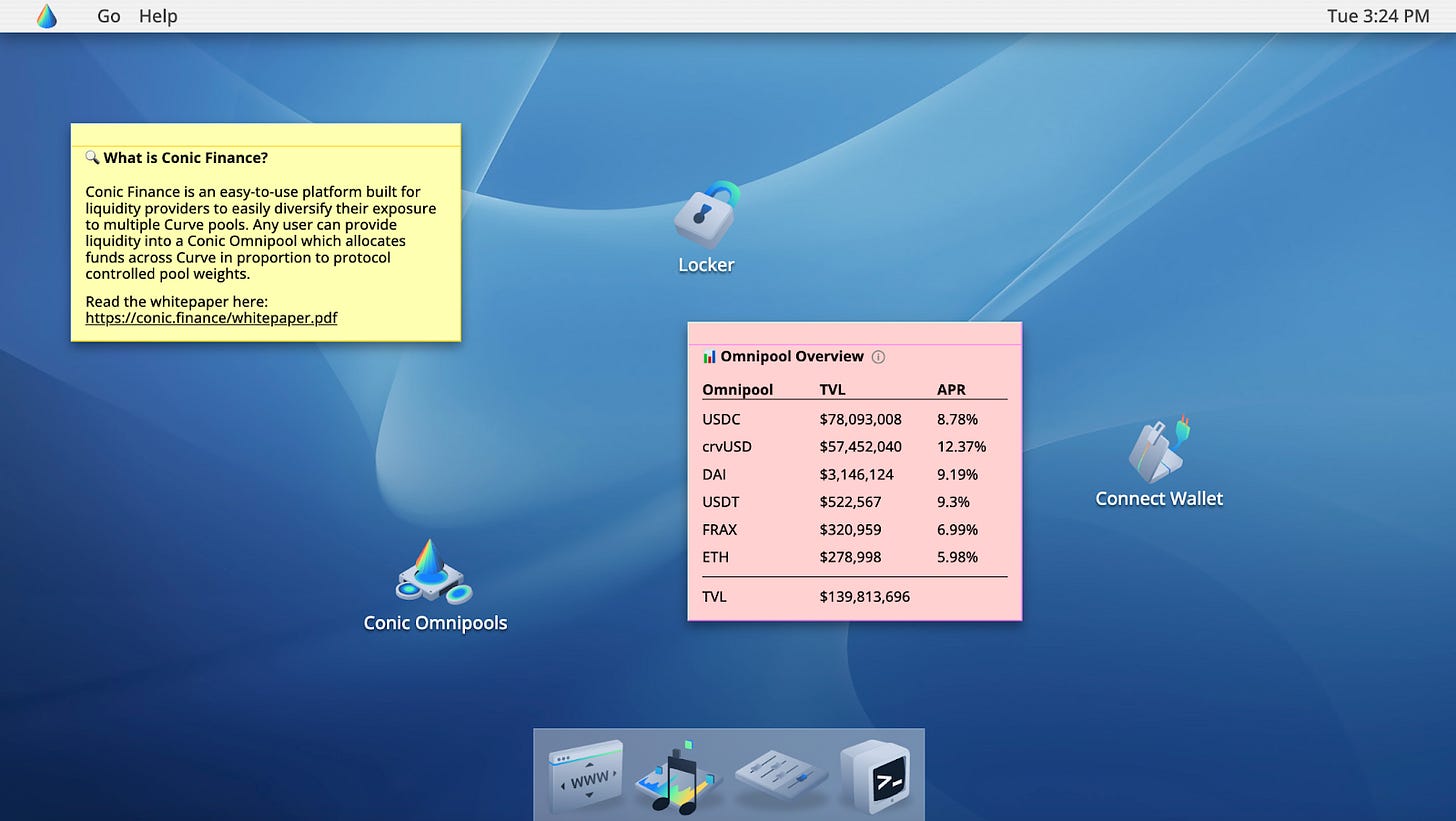

Conic enables single-sided liquidity deposits in Omnipools built on top of Curve. This allows LPs to capture optimal yield opportunities across multiple pools holding the same underlying asset.

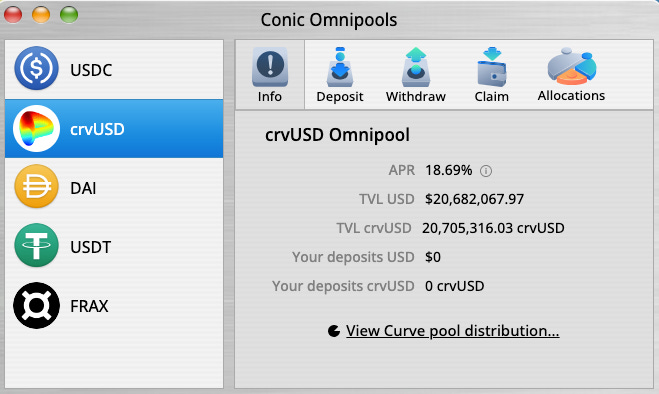

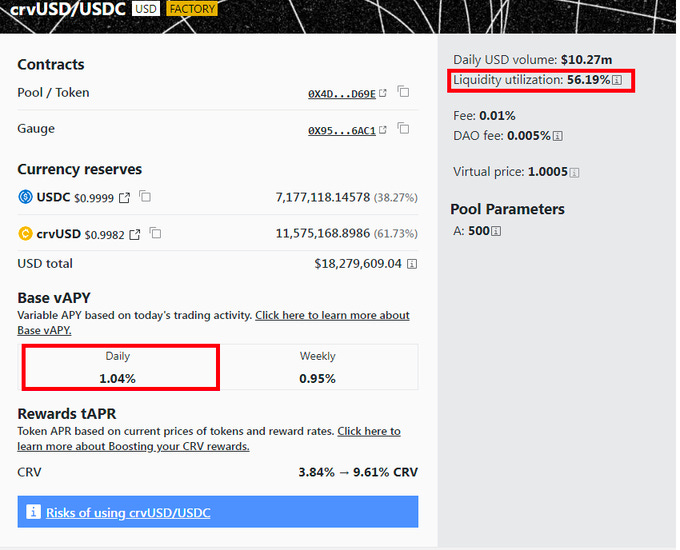

The $crvUSD omnipool offers an attractive current APR of approximately ~17%. This consists of a base APR from swap fees and additional emissions in $CRV, $CVX, and $CNC.The demand for $crvUSD generated by Conic leads to new minting of the token. It also drives buying activity, resulting in a higher base APR on the stabilizer pools against $USDC, which yields 1% daily.

Recently, Conic experienced an exploit that at first surfaced around the project’s $ETH omnipool. Soon another issue was also found involving the $crvUSD pool, provoking the team to shut down deposits for all omnipools. The team acted promptly and is now planning out Conic v2 after raising $1M from Curve Finance Founder Michael Egorov.

We are pleased to announce that Conic has raised $1m from Curve founder @newmichwill

Read the full announcement: https://t.co/vs67pnRblU

— Conic Finance (@ConicFinance) July 30, 2023

Still shocked that I haven't yet been ever affected by DeFi hacks 😅

— Michael Egorov (@newmichwill) July 22, 2023

A week after Conic’s exploit, Curve would of course also experience its own issues involving the Vyper code compiler, affecting several pools. In this Insight, we’ll dive into the nature of these exploits as they relate to Conic and what users and investors can expect going forward. Keep in mind that some data included is taken from shortly before the exploit occurred. With pool deposits halted and $CNC emissions likely disabled, this obviously skews analytics significantly. But users and investors alike can use the project’s performance pre-exploit to gauge how it may perform following a relaunch.

Besides Conic, Torus has expanded on the concept of Omnipools and will introduce the $ETH + $ETH LSDs omnipool. This offers diversified income streams and incentivized voting for $vlTOR holders. Torus is in a unique position as it is only in testnet, and has been able to avoid all associated issues around Curve and omnipools.

Protocols like Convex, Conic, and Torus enhance the overall value and attractiveness of the Curve ecosystem. They do this by providing LPs with more accessible and profitable opportunities to earn yield.

The evolution of DeFi since the start of liquidity mining has introduced new and novel ways to engage in yield farming, borrowing, lending, staking, and liquidity provision. Oftentimes, this is a multi-step process that requires actions in multiple protocols in order to maximize yield and capture boosted rewards.

One of the pioneers in incentivizing liquidity with token incentives is Curve Finance with the ‘ve’ model. Under this system, liquidity providers must stake their tokens and commit to a pool. However, the dynamic nature of asset balances, TVL, and $CRV emissions make it difficult for LPs to commit to a single Curve pool long term. As these variables change, the expected profitability of different pools fluctuates as well. This volatility makes it challenging to allocate liquidity effectively and capture the most optimal yield.

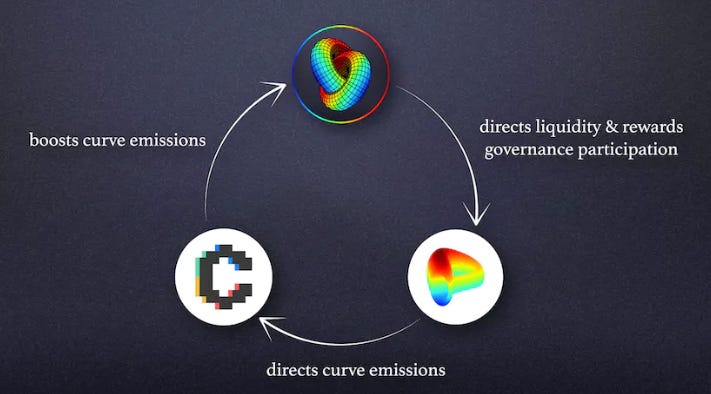

Convex was the first protocol to kick off the Curve flywheel. It did this by boosting $CRV rewards for LPs who engage with their platform. This offered an alternative for liquidity providers to earn more $CRV and increase the profitability of their positions, thereby attracting more liquidity to the ecosystem.

Moving forward, Conic enabled LPs to allocate liquidity across multiple Curve pools holding the same underlying asset. By building a liquidity layer atop Curve, Conic introduces Omnipools. This is a new DeFi primitive that allows LPs to capture optimal yield opportunities and respond effectively to changes in asset balances, TVL, and $CRV emissions.

Beyond the potential of Conic as the go-to place for $crvUSD yield, this report will also explore Torus. Torus is an Omnichain protocol that takes the concept of Omnipools one step further. It does so by enhancing liquidity pools powered by $ETH and $ETH LSTs not only on Curve but also on other incentivized AMMs like Balancer.

Omnipool Exploits and Building Back

To gauge the chances of Conic having a successful relaunch, it’s important to understand how the protocol was exploited. The trouble began on July 21st when the Conic twitter account announced that the team was investigating a potential exploit around the $ETH omnipool.

We are currently investigating an exploit involving the ETH Omnipool and will share updates as soon as they are available.

— Conic Finance (@ConicFinance) July 21, 2023

Shortly after, deposits to the pool were disabled on the official front end. The root of the issue stems from Conic’s reliance on the Curve meta-registry for $ETH in Curve V2 pools. The team assumed that the Curve meta-registry would include native unwrapped $ETH as one of the tokens included, but instead, it only included $WETH. This led to the reentrancy guard being bypassed, granting the attacker the ability to mint more $cncETH than they would normally be allotted. All in all, $3.2M was lost due to this $ETH omnipool exploit. The $ETH omnipool exploit was by far the most detrimental to the protocol in terms of funds stolen.

The other leg of Conic’s issues that led to a protocol-wide shutdown of deposits was an additional exploit that drained 11 $ETH from the $crvUSD omnipool. Specicially, deposits to the $crvUSD omnipool were disabled just 15 minutes after the 2nd exploit took place, showing a prompt response time from the team and increased caution after the $ETH omnipool issues. The second exploit was a type of sandwich attack involving back-and-forth swaps between $crvUSD and $USDC. The attacker deposited and then withdrew from $crvUSD from the Conic omnipool in between swaps. By the time deposits were shut down, ~$934k had been drained, giving the attacker ~$300k in profit.

It’s important to note that the underlying causes of the two Conic exploits are independent of one another. Attention given to the protocol after the initial $ETH omnipool exploit may have given more malicious exposure to the project, but the underlying opportunities that led to the attacks are unrelated.

Furthermore, the issues Conic experienced are also unrelated to the more recent exploit on Curve. Curve’s exploit involves a malfunctioning reentrancy lock, caused by complications around the Vyper code compiler. This exploit would see Curve and even Convex Finance both losing ~50% of their TVL.

One of these effects is the fluctuation in yield rates; all omnipool rates are significantly higher following the exploit around Curve Finance. This is a result of the underlying Curve pools having significantly increased rates due to increased implied risk and trade volume.

Going forward, Conic is looking to relaunch via a v2. They recently raised $1M from Curve Finance Founder Michael Egorov. These funds will go towards protocol development and audit costs. The funds were raised at a $17M valuation and the tokens sold are subject to an 8-month vesting schedule. The Conic team also stated that collaboration with the Curve Finance core contributors is only increasing following the Conic exploit, which is good to hear. The team says to expect more information regarding their v2 in the coming weeks.

What is Conic?

Exploits aside, Conic provides an interesting new primitive around Curve pools. The project was born as a platform that would help liquidity providers in the Curve ecosystem diversify their exposure to multiple Curve pools. This allows them to take an active role in optimally balancing liquidity across Curve pools.

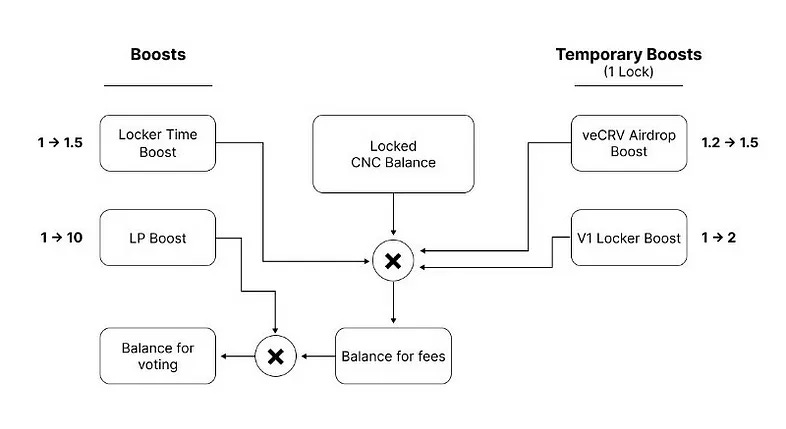

Holders can lock their $CNC tokens for $vlCNC to participate in governance and directly control how liquidity is allocated across Curve pools. Through this approach, Conic LPs can quickly respond to changes in market conditions. This is in addition to the incentives system for rebalancing the Omnipool.

One of the strengths of Conic’s locking mechanism is that the $vlCNC balance a user acquires is derived from a set of multiplier boosts that are applied to the amount of $CNC that they lock. This can seem complex, so we will break down the design.

At its core, the design behind the locking system seeks to align the interests of liquidity providers and lockers.

- Users can lock $CNC for a fixed period of anywhere between 4 and 8 months. This can result in a boost factor from 1 to 1.5.

- If a user locks for 4 months they will receive no lock time boost (boost factor of 1)

- If a user locks for the full 8 months they can apply a boost factor of 1.5 to their vlCNC balance.

- $CNC lockers can significantly boost their $vlCNC balance by providing liquidity in a Conic Omnipool. This would also increase their voting power.

- The larger the share of pool TVL an LP has, the greater the boost factor.

- The longer the period of time LP tokens are staked for, the greater the boost factor.

A Successful Inaugural Launch

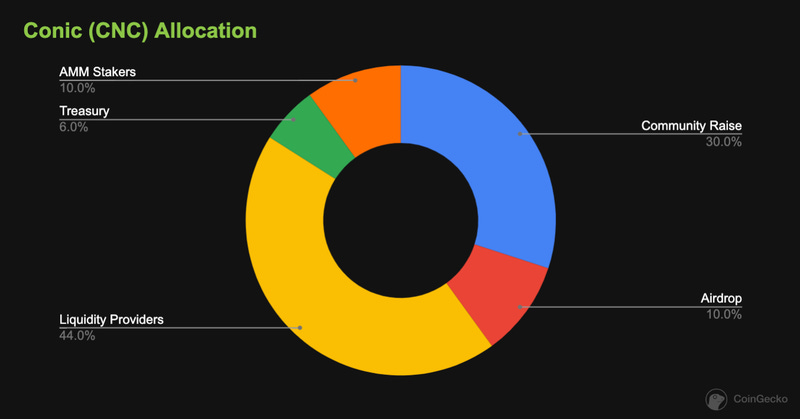

Conic Finance has been a community-led project from day one. In Q4 2022, the project raised funds from the community by selling off a share of the $CNC supply. These funds were used to cover operational expenses and pay for audits. The excess was allocated to the treasury, where it can be distributed to $vlCNC holders by governance vote.

In just over a week after the official launch on March 1, 2023, $60M in deposits rushed to deposit tokens into Conic’s Omnipools, where they could earn up to 21% annualized yields on the three Omnipools for $DAI, $FRAX, and $USDC. The $USDC pool alone attracted over $50 million in liquidity alone, with the deposits of $FRAX and $DAI being considerably lower at $7 million and $5 million, respectively. The token soared to $8 and reached a market capitalization of $32M.

Alchemy for $crvUSD

Despite the $CNC TGE taking place last year, the protocol was officially launched in March 2023. The stealth launch of the token captured the attention of experienced players in the ecosystem, but now that the protocol is live, more and more people are looking at Conic as the liquidity layer that can funnel the maximum potential for $crvUSD.

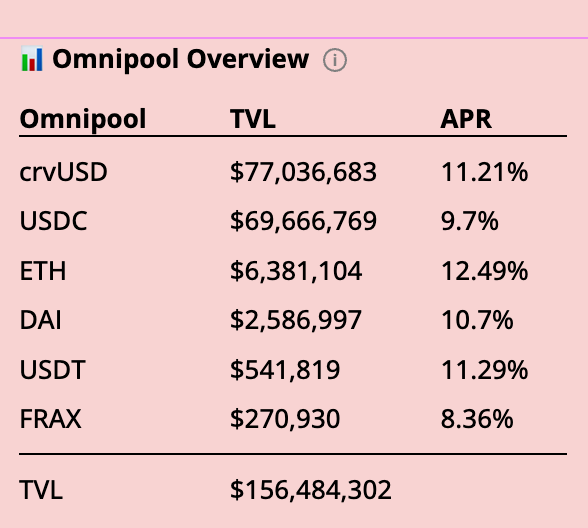

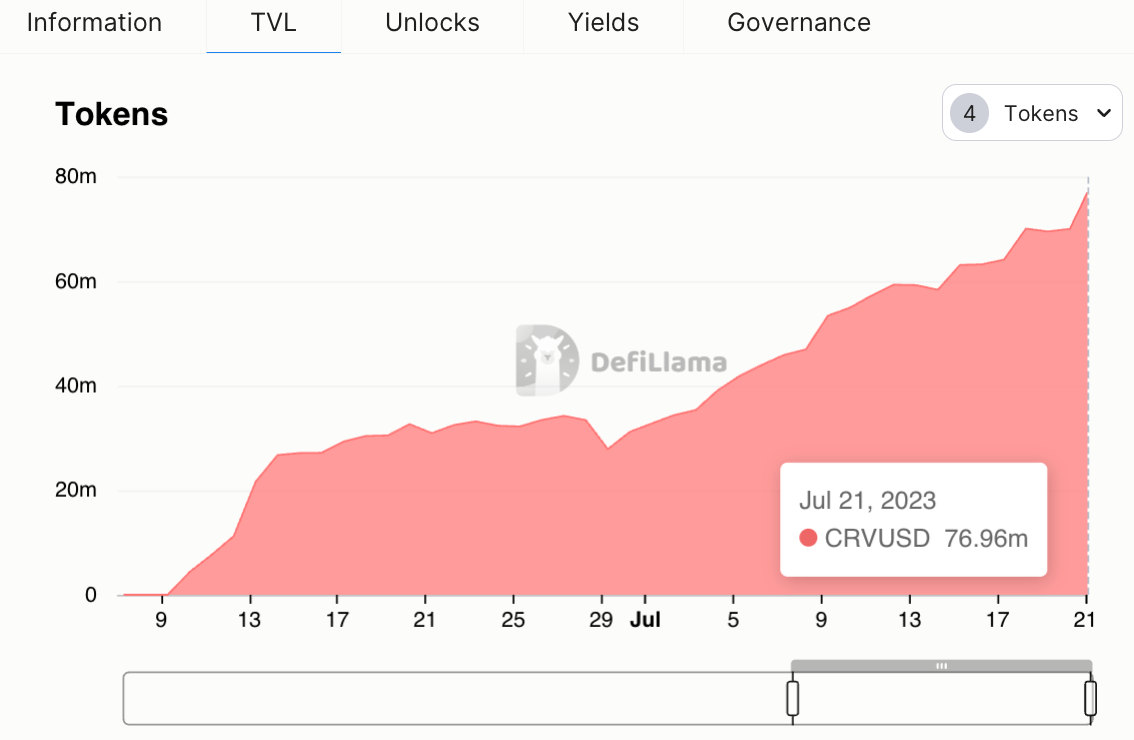

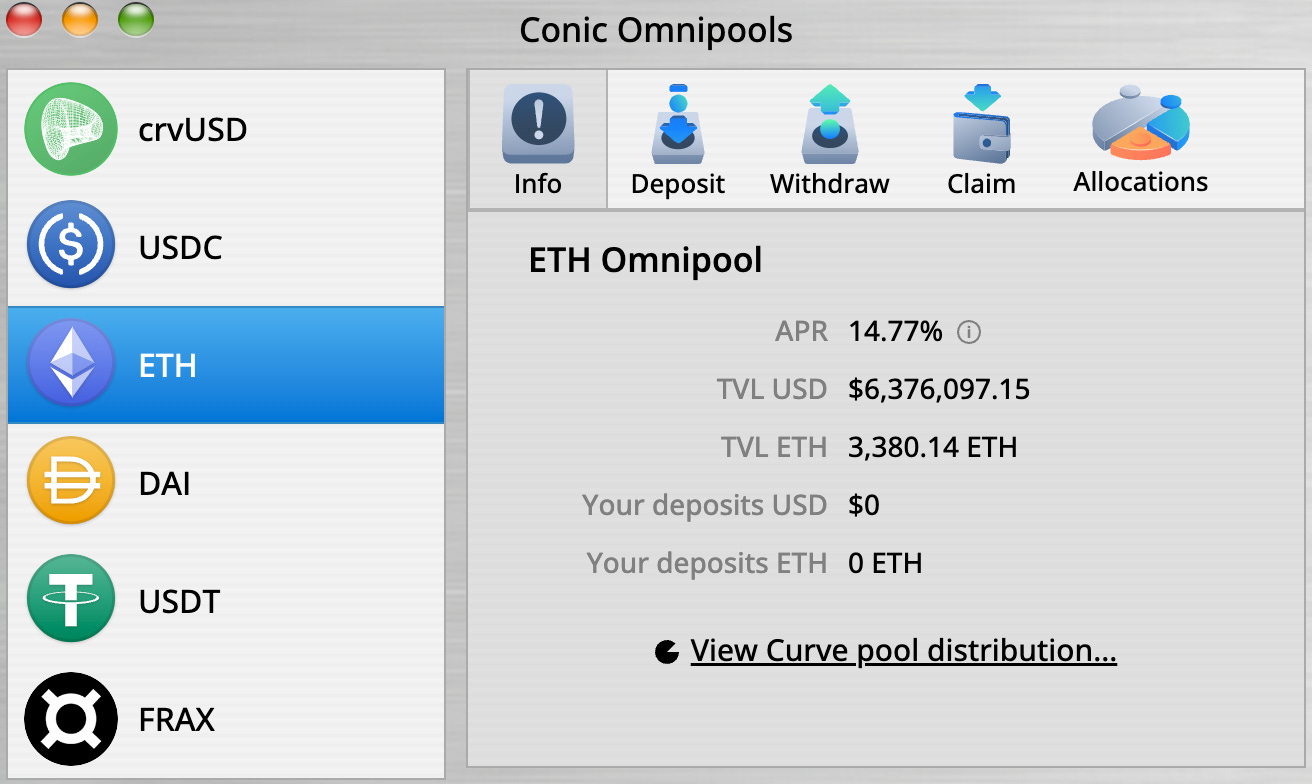

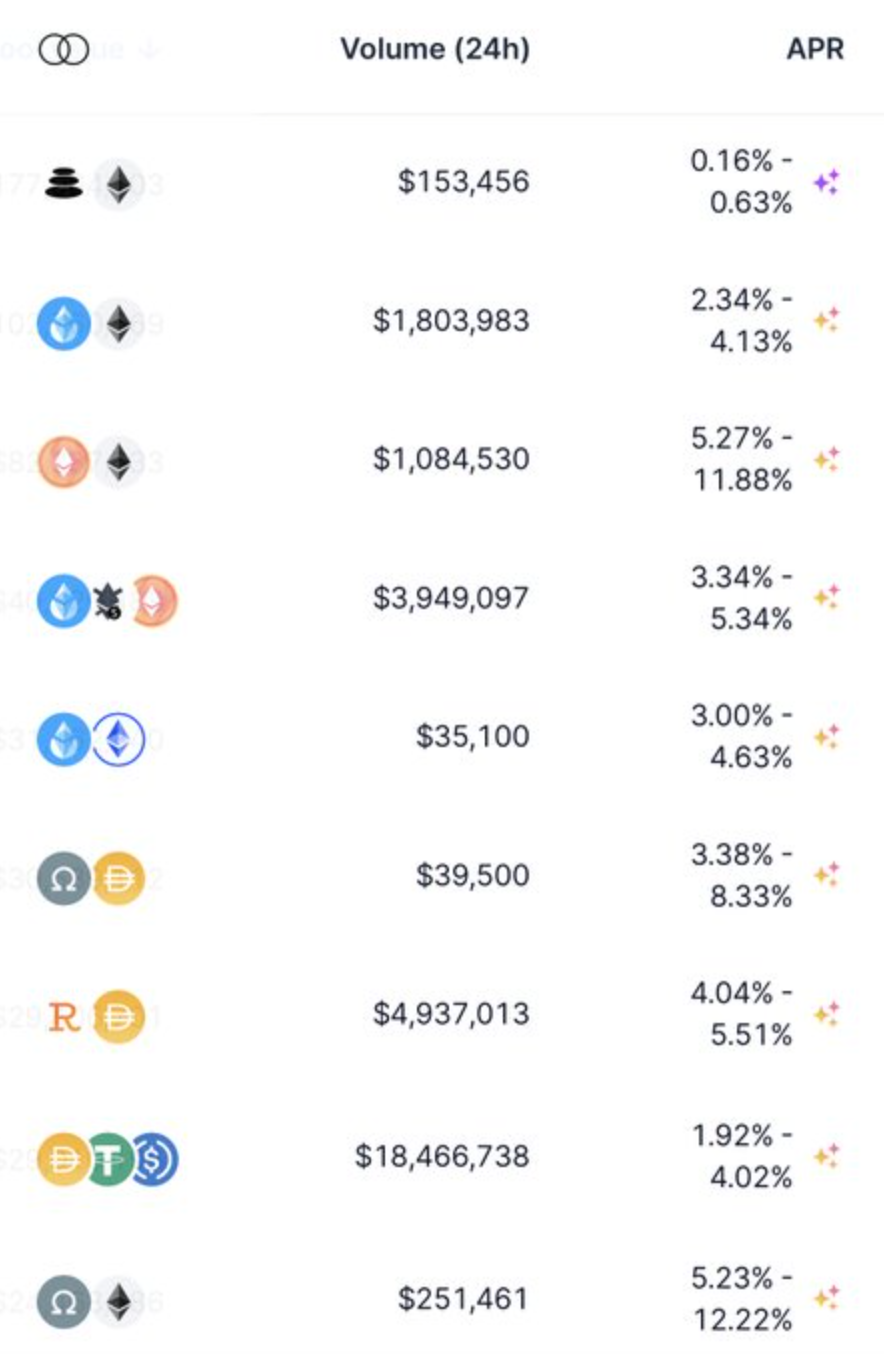

Conic’s $crvUSD Omnipool accepts $crvUSD deposits and distributes the liquidity across Curve pools based on the target allocation. This allocation is decided by $vlCNC holders who participate in the biweekly Liquidity Allocation Vote. This determines the APR, consisting of a base APR from swap fees + $CRV, $CVX, and $CNC emissions. Here are some Omnipools TVL and APR metrics taken shortly before the exploit and eventual shutdown of the protocol.

Moreover, Conic isn’t just driving new minting of $crvUSD, it is also driving the buying of $crvUSD. This demand translates into a higher base APY on the stabilizer pools, now yielding ~1% daily.

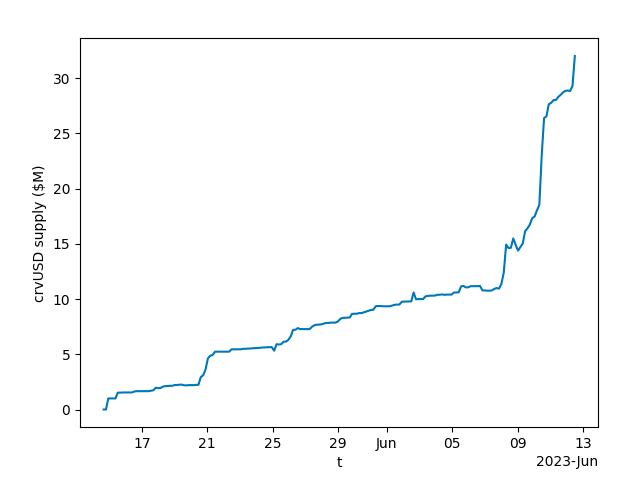

This becomes increasingly important as the $crvUSD continues to increase and more assets are added as collateral. At this time, the $crvUSD Omnipool holds ~60% of the total $crvUSD supply.

The $crvUSD pool was live for 1 week and reached $36M in TVL. A recently posted governance proposal is seeking to capitalize on this unique market opportunity by introducing a FRAX+crvUSD pair. With FRAX+crvUSD now live on Convex, it could be an appropriate time to hold a Curve Amendment Proposal to whitelist the pool and allow it to receive $crvUSD Omnipool liquidity.

On a Quest for Catalyst

So far, Conic has managed to attract $crvUSD deposits and create a deep source of liquidity for liquidators. Because $crvUSD uses a Collateralized-debt Position (CDP) model, the collateral used to mint the stablecoin can be liquidated if the price of the assets(s) drops by a certain amount. $crvUSD is unique when it comes to liquidations, as Curve has employed its Lending Liquidation AMM Algorithm (LLAMA). LLAMMA creates more flexibility for liquidations, like allowing soft liquidations that turn deposited collateral into an LP that can generate fees. If the price of collateral drops too much, some of the collateral will be swapped for $crvUSD as an incentivization mechanism. This soft liquidation mechanism makes it important for there to be reliable sources of $crvUSD to pair with deposited collateral. You can learn more about the mechanisms of action behind $crvUSD in our Curve Project Breakdown.

The addition of an $ETH Omnipool could be an extra boost given the dominance of the LST narrative and the resurgence of protocols like Torus. The $ETH Omnipool recently launched on July 10th. It had already managed to secure ~$6.3M in TVL, with the APR more than double compared to what it was shortly after Omnipools launched. Of course, the pool and protocol as a whole would go on to disable deposits shortly after following exploit issues. Upon relaunch, this pool could gain more popularity over time, especially with the popularity and proliferation of LSTfi. However, the fact that revenue sharing has not been turned on yet has led to continuous selling pressure for $CNC emissions. For the ETH Omnipool, ~5.5% of the APR was being paid out in $CNC rewards.

$ETH Omnipool – Now live on https://t.co/1dDm2woz2Q 🚀 pic.twitter.com/neH4ch95lD

— Conic Finance (@ConicFinance) July 10, 2023

Regardless of the current liquidity mining program, this setup presents a great scenario for an upcoming governance proposal that might turn on the fee switch. Omnipools contain the logic to charge a platform fee on the total amount of $CRV and $CVX earned by the Curve pools it uses. At this time, no fees are enabled on either deposits, withdrawals, or performance fees, and this can only be activated via DAO vote. Not only that, but extra rewards obtained from Curve pools (e.g. $SPELL, $FXS…) will be sold for $CNC. Once enabled, platform fees charged on $CRV and $CVX can be distributed to vlCNC holders.

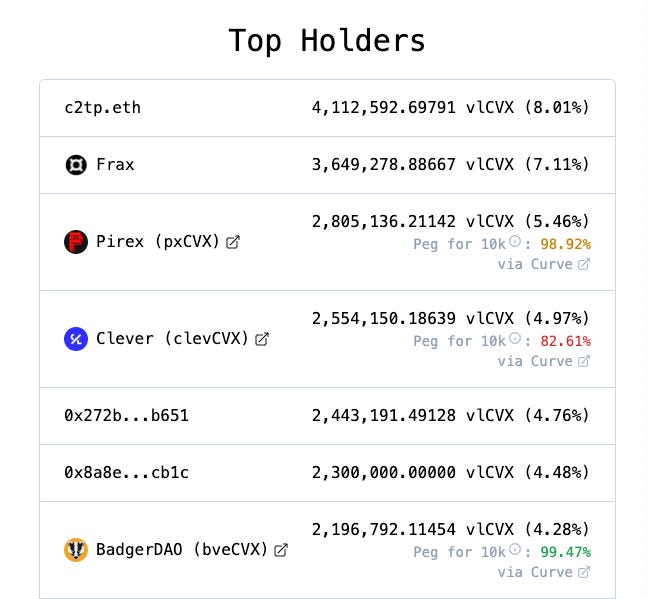

This is a great setup to be on the lookout for catalysts. More specifically, a bribing market for vlCNC could kick off the Conic flywheel. As an example, large players in the Curve ecosystem who have POL (Protocol Owned Liquidity) in whitelisted Curve pools on Conic, like Frax, can benefit significantly by directing liquidity to their main pools. This can be further enhanced by $CVX bribes, of which Frax also has a big voting power from vlCVX, controlling ~7.11% of the supply.

Torus – Making Omnipools Omnichain

Torus has taken the concept of the omnipool, originally introduced by Conic, and expanded upon it by introducing the $ETH + ETH LSTs omnipool. One key aspect that sets Torus apart is its role in driving liquidity wars across major AMMs like Balancer or Curve, fostering competition among these platforms.

As an example, the rETH-ETH pool on Curve yields 0.3%, while Balancer offers a pool with extra rewards ranging from 5-11%. In this case, Balancer becomes the more competitive AMM for Omnipool liquidity to which deposits would be routed.

As seen with the Curve Wars, liquidity incentives play a significant role in the growth and adoption of a protocol. Curve emits $CRV, Convex emits $CVX, Balancer emits $BAL… However, there are still many emerging protocols that do not have liquidity incentives yet. These projects may want to attract liquidity and ride the LST narrative. Deep liquidity for LST pairs is key for LST issuers. With that premise, Torus enables users to provide single-sided liquidity across similar assets and tick ranges, fostering healthy competition for liquidity between AMMs and LSDs.

With a vote-escrowed governance system in place, external protocols can bribe $vlTOR holders to vote for their pools in order to improve the liquidity conditions of their native token. These bribes serve as an additional yield source for $vlTOR holders. So holders can receive bribes in addition to the traditional yield earned from $CRV and $CVX.

One of the key advantages of Torus’ approach is the creation of a diversified income stream for $vlTOR holders. In addition to the traditional yield generated from $CRV and $CVX, vlTOR holders can also collect real yield from a percentage of platform fees. This is collected in $CRV, $CVX, and a variety of other project incentive tokens.

Not only does Torus expand its operations beyond the Curve ecosystem, but it also leverages LayerZero technology. By being Omnichain, Torus can drive even deeper yield and composability. As an example, users can bridge their $ETH Omnipools receipts to capture Curve yield on mainnet. This can be done while the token is still being used as collateral on an Arbitrum lending market.

Torus introduces incentivized voting and diversified income streams. By doing this, the project fosters strong incentives alignment between token holders, protocols, and the overall governance of the platform. This is becoming a more popular approach, as some teams prioritize the long-term health and success of their project. Moreover, $vlTOR holders have a vested interest in actively participating in the governance process. This is because it allows them to maximize their rewards and yield potential. This alignment strengthens the community-driven nature of the ecosystem and enhances the decision-making process for the benefit of all stakeholders.

The protocol is currently on testnet and will kickstart the journey with versatile pairs like $alETH-ETH, $oETH-ETH, $wbETH +$ETH, $rETH + $ETH. As time goes by, more LST pools will be introduced. As the protocol has not launched yet, it may be able to wait out some of the ongoing issues surrounding Curve that could affect omnipools. In fact, while the overall market Torus aims to penetrate definitely has suffered, the product offered by the Torus team may be even stronger as they can now re-analyze their protocol structure and confirm that it is adequate. This can be done without consequence, as the project has not launched on mainnet yet.

https://twitter.com/Torus_xyz/status/1682456752648867860

Some notable distinctions between Conic and Torus include Torus’ use of its own meta-registry. Conic’s $ETH omnipools faced issues when it relied on the Curve meta-registry. The Torus team also emphasized that they verify reentrancy protection is activated for all token types equally.

Key Takeaways

- DeFi’s evolution has introduced complex processes for maximizing yield and capturing boosted rewards. Doing so often requires multiple actions across multiple protocols.

- Conic brings a unique solution to the table by enabling single-sided liquidity deposits in Omnipools built on top of Curve. This allows LPs to capture optimal yield opportunities across multiple pools holding the same underlying asset.

- Conic has raised $1M following their exploit and is in the process of building out their v2 relaunch with closer integration and collaboration with Curve. Following the exploit issues with both protocols, it’s beneficial for Curve and its derivative projects to both work together.

- Torus expanded on the concept of Omnipools and will introduce the $ETH + $ETH LSDs omnipool. This offers diversified income streams and incentivized voting for $vlTOR holders.

- Protocols like Convex, Conic, and Torus enhance the overall value and attractiveness of the Curve ecosystem. They do this by providing LPs with more accessible and profitable opportunities to earn yield.

Conclusion

The rapid pace of DeFi poses challenges due to the volatility of asset balances, changing liquidity conditions, and allocation of token emissions. Protocols like Convex, Conic, and Torus take the Curve ecosystem a step forward by adding flexibility for market participants to earn yield through single-sided deposits.

Important Links

Disclosures

Revelo Intel has never had a commercial relationship with the protocols discussed and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.