Overview

Vest is a perpetual futures DEX native to zksync, built to address critical challenges faced by both traders and liquidity providers (LPs) in perpetual futures markets (perps). These challenges stem primarily from inefficiencies in risk management and compensation structures that have not only deterred participation but have also jeopardized the financial stability and attractiveness of existing DEXs.

Both LPs and Traders play pivotal roles that are integral to the functioning and success of a DEX. There is a symbiotic relationship between both parties: LPs need traders to take positions and generate fee revenues, while traders need LPs to provide the liquidity required to execute their trades efficiently.

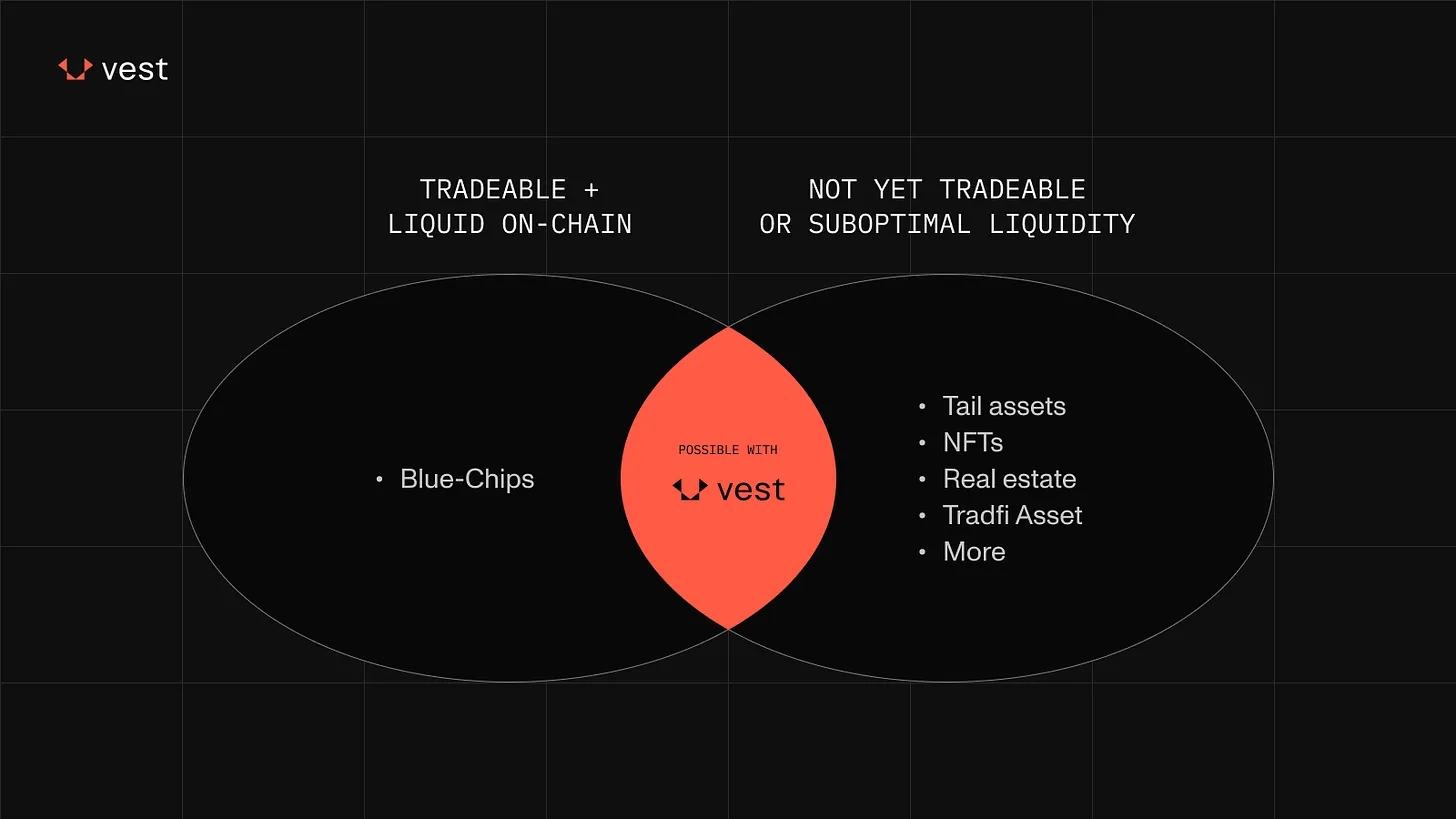

While Vest will initially enter the market as a platform for trading perps, its protocol architecture, vAMM, and risk engine enable more complex use cases such as cross-margin, structured products, and trading for a variety of assets such as NFTs, tokenized Real World Assets (RWAs), real estate, bonds, forex, commodities.

Vest’s core value proposition lies in its dynamic solvency calculation, which determines the minimum capital necessary to ensure the exchange’s solvency with a high degree of probability. This feature is crucial, as it ensures that LPs are appropriately compensated for the risks they undertake. Specifically, Vest’s system dynamically adjusts the charges applied to traders based on real-time solvency assessments. When a trade or market movement increases the exchange’s risk of insolvency, thereby raising the needed capital reserves, this difference is directly charged to the trader in the form of premia or adjustments to the funding rate.

For LPs, Vest calculates the exact amount of capital required to set their expected profit and loss (PnL) to zero. If a trader’s actions reduce this expected PnL, the necessary adjustments in capital are also charged to the trader as premia or via the funding rate. This mechanism ensures that LPs are made indifferent to the risks introduced by traders, significantly enhancing the stability and attractiveness of the platform for liquidity provision.

By integrating these strategic features, Vest not only enhances the trading experience but also strengthens the economic incentives for participation.

Vest Exchange Perps

LPs on many DEXs are frequently exposed to high risks without receiving adequate compensation for these risks. This imbalance can lead to a reluctance among potential LPs to commit capital, which in turn can stifle the growth and liquidity of the exchange. Traders, on the other hand, often grapple with high trading fees that include costs related to slippage and funding rates. These fees do not adjust dynamically based on actual market conditions or the risk levels of the trades. Such inflexibility can result in unnecessarily high costs for traders, especially in less volatile conditions or for less risky trades.

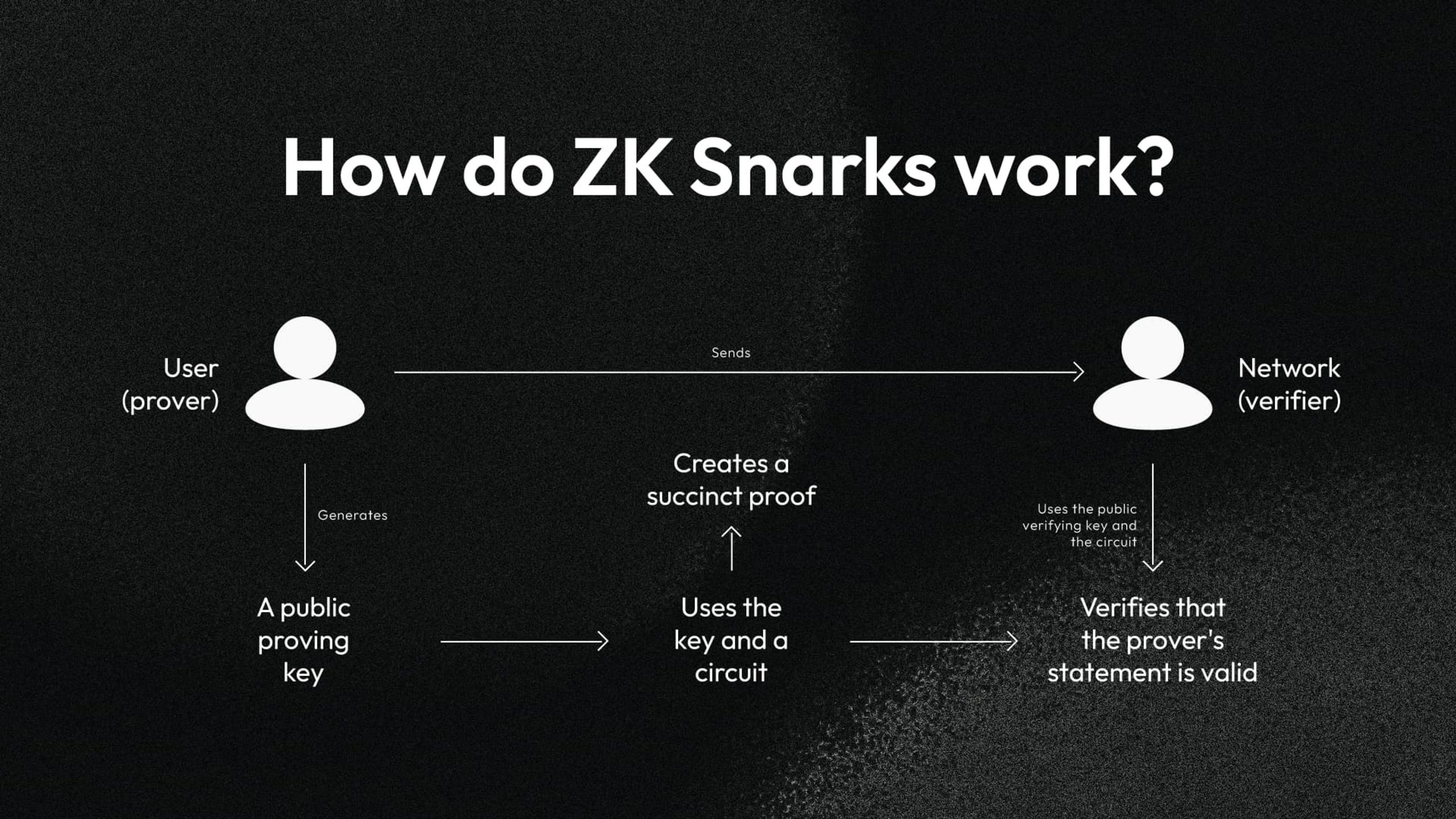

Vest operates on the foundational belief that all aspects of an exchange, from trade pricing to liquidity management, should optimize for efficiency without compromising the safety or fairness to participants. It achieves this through a proprietary risk management system called zkRisk, which employs advanced cryptographic techniques (zk-SNARKs) to calculate and manage trading risks in real time. This system enables Vest to dynamically adjust trading fees and funding rates based on the real-time risk each trader introduces to the system, thereby protecting LPs from excessive risk while enabling lower trading costs for users. zkSnarks computes all this data off-chain but the data is verified on-chain via zkSNARKs which reduces the load, making computation much faster.

Vest Exchange ensures its financial stability by calculating the minimum capital needed to stay solvent. If a trade or market change increases the risk of insolvency, Vest charges the trader an additional fee called premia or adjusts the funding rate to cover this extra risk. Their main goal is to guarantee the solvency of the exchange by

- Continuously calculating risk and pricing for it with dynamic fees (premia), funding rates, and partial liquidations

- Enforcing a risk-indifferent pricing model that accounts for and quantifies the potential for shortfall from any trade

- Using risk measures with Entropic Value-at Risk to determine the probability of protocol insolvency at any given moment

- Calculations associated with this risk measurement are conducted off-chain and submitted to an on-chain verifier. This on-chain verifier can reject the transaction if the proof is incorrect, or accept the transaction.

Similarly, for LPs, Vest calculates how much capital is needed to balance their expected PnL to zero. If a trader’s actions decrease the LPs’ expected PnL, that difference is also charged to the trader as premia or added to the funding rate. This mechanism ensures that LPs are not affected by the trading risks and remain indifferent to fluctuations caused by traders.

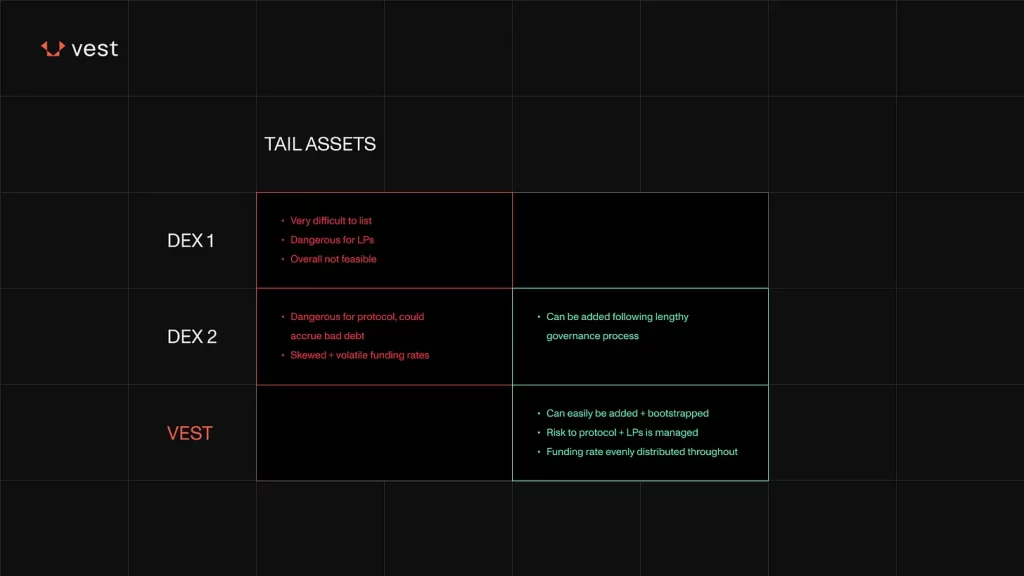

This zkRisk method aims to create a stable and scalable ecosystem for DeFi products, ensuring all operations within the ecosystem can share risks and margins seamlessly. Ultimately, Vest’s goal is to transform traditional financial products into trustless, decentralized versions that operate without relying on intermediaries. This capability also extends beyond traditional crypto to include tail assets, RWAs, and even NFTs.

Role of LPs in DEXs

In traditional DEXs, LPs play a pivotal role in maintaining the operational flow and stability of the platform. Their contributions are crucial for several core functions, which collectively ensure that the DEX operates efficiently and effectively.

Capital Provision: LPs supply the capital necessary for the exchange to operate. This capital is used to facilitate trades, serving as the backbone of the exchange’s liquidity and counterparty to traders’ bids.

Risk Absorption: By providing liquidity, LPs essentially absorb some of the market risks. In typical AMM-based DEXs, LPs contribute to pools from which traders can take positions. The profits and losses from these positions directly affect the pool’s value, impacting LPs’ PnL based on market movements and trader actions.

Earn Returns from Fees: LPs are willing to act as counterparties and underwrite traders’ positions in order to earn returns from the trading fees collected by the exchange. These fees compensate them for the use of their capital and the risks they take by providing liquidity.

Impact on Market Depth and Stability: The amount of liquidity provided by LPs directly influences the market depth and stability of the exchange. Greater liquidity reduces price volatility and allows the exchange to handle larger trades without significant price impacts, fostering a more stable trading environment.

Despite their essential role, LPs on traditional DEXs face significant challenges that can compromise their financial stability and diminish the attractiveness of providing liquidity. LPs are typically exposed to high volatility and the potential for large losses if traders significantly outperform. These risks are compounded by the fact that the fees earned from trading may not always sufficiently compensate for these losses. Additionally, the rigid fee structures and the passive nature of liquidity provision do not dynamically adjust to changing market risks, often placing LPs at a disadvantage when market dynamics shift unexpectedly.

Vest enhances the role of LPs by utilizing the zkRisk engine to balance risk and reward more effectively. This system dynamically adjusts fees and funding rates based on real-time risk assessments influenced by individual traders’ actions. Such adjustments ensure that liquidity providers are compensated fairly for the risks they undertake, aligning their potential returns with actual market conditions.

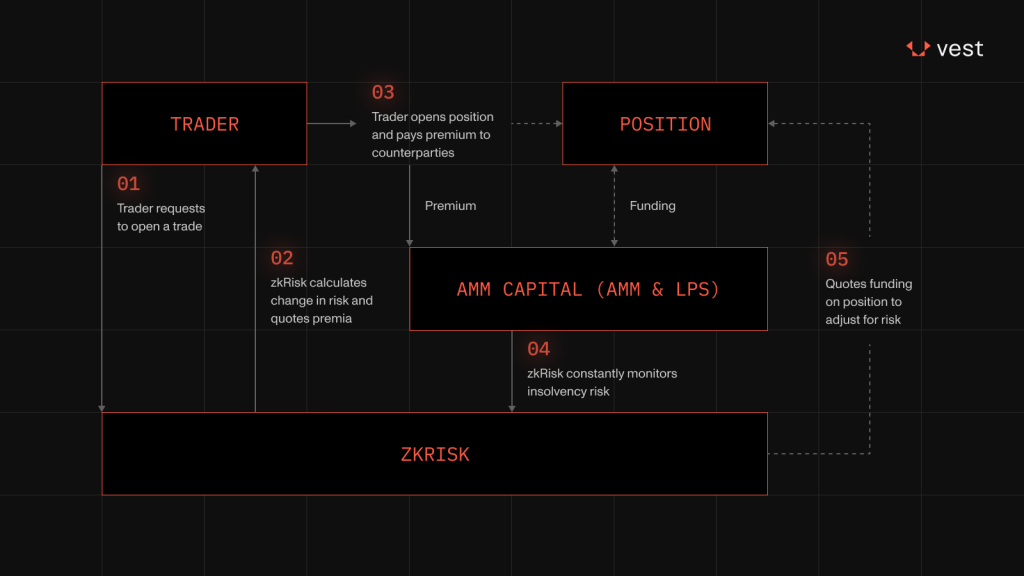

Protocol Design

Vest Exchange’s protocol design is built around its zkRisk engine, which plays a pivotal role in managing risk and liquidity. Before a trade is initiated, zkRisk calculates the potential risk it would introduce and quotes a premium, which the trader pays to LPs. Once a trade is opened, the system continually assesses insolvency risks, dynamically adjusting funding rates and premia to maintain the exchange’s stability. This constant vigilance ensures that LPs are fairly compensated for the risks they bear, while traders benefit from a responsive and secure trading environment.

AMM

The motivation behind the development of a new AMM based off Vest’s zkRisk engine is rooted in addressing the significant trade-offs faced by traditional decentralized exchanges (DEXs) that use mechanisms like Constant Function Market Makers (CFMMs), and Limit Order Books (LOBs). These traditional models often struggle with balancing effective risk management with efficient pricing strategies:

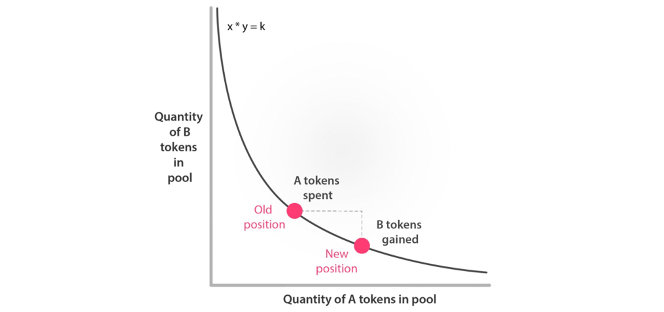

CFMMs employ a predetermined formula to set prices, typically relying on the constant product formula to ensure liquidity pool solvency. This formula ensures that the product of the quantities of the two tokens in the pool remains constant, dictating the asset pricing as traders interact with the pool. While this model provides a stable mechanism to prevent insolvency through automated rebalancing, it often fails to offer competitive or fair pricing reflective of broader market conditions.

The rigidity of the formula means that CFMMs may not react swiftly to market volatility or changes in asset values outside the DEX, leading to price discrepancies between the decentralized and centralized markets. This can deter traders, especially those engaged in arbitrage or those looking for pricing that mirrors the wider financial ecosystem. Moreover, due to the inflexible pricing structure, large trades can disproportionately impact the market price within the pool, leading to significant slippage. This is particularly problematic in pools with lower liquidity, where large orders can shift prices more dramatically, potentially leading to market manipulation where traders could artificially inflate or depress prices through strategic trades.

LOBs enable more dynamic pricing by allowing traders to place orders directly into a market, including various order types like market orders, limit orders, and stop losses. These orders are matched by a sophisticated engine that prioritizes transactions based on price and the order’s entry time, maintaining fairness and enabling efficient price discovery.

However, while LOBs offer a more fluid and competitive pricing environment, they introduce higher insolvency risks. This risk stems from the diverse risk profiles of market makers and the complex management required to maintain equilibrium in the face of market shocks or unusual trading patterns. In decentralized settings, especially in derivatives markets like perpetual futures, these challenges are exacerbated by the leverage and speculative nature of trading. The liquidity required to cover positions on both sides of the market can strain the resources of the DEX, particularly during volatile periods when the alignment of market prices to real-world values is crucial.

In addition, maintaining an LOB requires continuous liquidity and active management, which can be challenging without a steady presence of market makers. These entities provide the necessary liquidity by constantly placing buy and sell orders, but their willingness to participate can fluctuate based on their risk assessment and market conditions. A sudden withdrawal by market makers, driven by adverse market events or shifts in risk appetite, can precipitate a liquidity crisis, making it difficult to execute trades at stable prices. This scenario often leads to increased spreads and may force the exchange to operate at reduced efficiency, potentially causing cascading effects in the broader market.

vAMM and Virtual Liquidity Curve

A well-designed vAMM, leveraging advanced risk management frameworks like the zkRisk engine, can mitigate the insolvency risks common in CFMMs by dynamically adjusting its parameters in response to market conditions, rather than relying on a static formula. This adaptability allows vAMMs to offer more competitive and fair pricing, akin to what traders might expect from LOBs, without compromising the platform’s financial stability. Moreover, vAMMs can alleviate the liquidity issues often seen in LOBs by automating liquidity provision, thus reducing dependence on external market makers and enhancing market depth.

In contrast to CEXs, which are frequently plagued by issues such as system outages, security breaches, and latency problems, vAMMs offer a more robust and secure trading environment. By decentralizing the custody of assets and automating market making, DEXs can provide a trading infrastructure that is not only resistant to single points of failure but also transparent and accountable to its users.

Retail investors can act as liquidity providers which shifts away from the traditional reliance on professional market makers and intermediaries for market liquidity. In a vAMM-powered DEX, anyone can contribute to liquidity pools, earning transaction fees in return, thus playing a crucial role in the market’s liquidity and depth. This approach not only broadens the scope of who can participate in market making but also aligns the incentives of all participants towards the health and efficiency of the platform.

This exchange payoff graph is a representation of the financial outcomes for an AMM and its LP under different scenarios based on the virtual asset price

Black Line (Net PnL): Shows the combined PnL of the AMM and LPs. It usually starts at zero and will decrease as the price moves away from the initial price level s.

Blue Line (Aggregate LP Payoff): Illustrates the PnL for LPs as the price of the virtual asset changes. This line is typically flat up to a certain point because LPs’ profits from fees are generally unaffected by price changes until the AMM’s capital is depleted.

Green Line (AMM Payoff): Depicts the PnL for the AMM alone. It’s usually positive until the AMM’s capital is depleted (at + ), after which it would turn flat because the AMM has no more capital at risk.

Red Line (AMM Shortfall): Represents the losses the AMM incurs when the price of the virtual asset moves beyond its own capital and starts eating into the LPs’ capital. This is where the AMM’s shortfall occurs, and LPs begin to bear the risk.

Vest’s AMM applies a mathematical framework to manage liquidity through a virtual liquidity curve. This vAMM can be conceptualized as a tool that utilizes a pricing function to manage trade risks without actually holding the assets. It adjusts the liquidity based on changes in asset inventory and volatility.

The key concepts of the vAMM are:

- Pricing Function (π(x)): This function determines the cost added to a trade to maintain the risk level of the vAMM after the trade. It uses a risk measure to ensure that the risk before and after the trade remains constant.

- Transformation to Liquidity Function (l(y)): The pricing function is transformed into a liquidity function which shows how liquidity is distributed across different prices. This function is crucial for understanding how the vAMM allocates liquidity at various price levels.

- Indifference Pricing: This specific type of pricing adjusts the premium based on the change in expected value at risk (EVaR), maintaining neutrality to the vAMM’s risk exposure.

Together, this theoretical framework allows for the integration of multiple risk measures, adjusting liquidity based on market conditions. This adaptation can be particularly useful in dynamic markets where asset volatilities fluctuate significantly, such as crypto.

AMM Pricing Engine

zkRisk

The interaction between LPs and traders determines the risk dynamics on the platform. Traders’ activities can lead to significant profits or losses for LPs depending on market conditions and the traders’ success. The zkRisk mechanic in Vest Exchange is a risk management framework designed to maintain the solvency and stability of the exchange while facilitating a fair and efficient trading environment whose aim is to align incentives and protect both parties from excessive risk.

The zkRisk engine offers several benefits:

Risk-Adjusted Compensation: By utilizing the zkRisk engine, Vest dynamically adjusts the fees (premia and execution fees) based on the real-time risk each trade introduces. This model ensures that traders are charged fees based on the actual risk they introduce to the system. This means that responsible trading behavior is incentivized, as lower-risk trades incur lower fees, promoting a healthier trading environment. Liquidity providers benefit from a risk-neutral environment where their exposure to losses from trader activities is minimized. This is achieved by compensating LPs for taken risks through appropriately calculated premia, ensuring that they are not unfairly disadvantaged by high-risk trader behaviors. The state of the exchange is checked after each trade to assess how much risk it poses to the system (by comparing the state before and after the trade).

Increased Capital Efficiency: zkRisk allows Vest Exchange to operate with higher capital efficiency. It dynamically allocates capital based on actual risk rather than static, over-conservative estimates. This means that more capital is available for trading rather than being held unnecessarily as a buffer against potential insolvencies. The platform can safely scale its open interest beyond its TVL by leveraging accurate risk assessments. This facilitates larger trading volumes and greater liquidity without the traditional constraints imposed by fear of insolvency.

Improved Trader and LP Incentives: Traders are charged fees based on the actual risk they introduce to the system. This means that responsible trading behavior is incentivized, as lower-risk trades incur lower fees, promoting a healthier trading environment. Liquidity providers benefit from a risk-neutral environment where their exposure to losses from trader activities is minimized. This is achieved by compensating LPs for taken risks through appropriately calculated premia, ensuring that they are not unfairly disadvantaged by high-risk trader behaviors.

Coherent Risk Measure

The coherent risk measure in zkRisk is designed to assess and manage the risks associated with the trading activities on the exchange. It is defined through several components:

Market Setup: The risk measure considers n markets, with each market’s prices represented as St which evolves over time within a structured probability space.

Exchange Liability Function Xt(θ):

Xt(θ) = qTSt − (C + P + L)

Here, represents the vector of long-short imbalances, is the cumulative entry notional sizes, is the capital owned by the AMM, and is the capital provided by LPs. This function calculates the net payout to traders if all positions were to be closed at current market prices .

Entropic Value-at-Risk

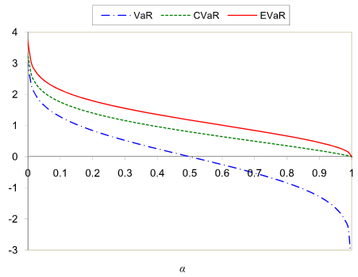

The core concept of zkRisk is that it utilizes advanced risk metrics to calculate the potential financial shortfall that might occur due to trades within the system. It employs a specific risk measurement known as Entropic Value-at-Risk (EVaR).

EVaR is a type of coherent risk measure that quantifies the amount of capital necessary to cover potential losses over a specified period at a certain confidence level. This measure is particularly useful in settings where risk profiles are complex and highly dynamic, as seen in perp DEXs.

EVaR is noted for being the tightest upper bound to Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR), calculated using the Chernoff bound formula:

EVaR1 − α(X) = infz > 0{logMX(z)/z + zlog(α)/z}

Where M X (z) is the moment-generating function of the risk position M, and α represents the confidence level.

The VaR curve would typically start at a higher value and decrease as α increases because as we move towards higher confidence levels, we’re considering more extreme (and thus less likely) losses.

The CVaR curve, representing the average of the losses beyond the VaR cutoff, would usually be above the VaR curve because it includes all the tail losses beyond the VaR threshold.

The EVaR curve represents a risk measure that also takes into account the behavior of the entire tail of the distribution, considering the extreme potential losses weighted by their probability. The EVaR curve may behave differently depending on the distribution of returns and the risk aversion parameter used in the calculation. It is a more complex measure that usually provides higher risk values for lower α due to the exponential weighting of the tail risks.

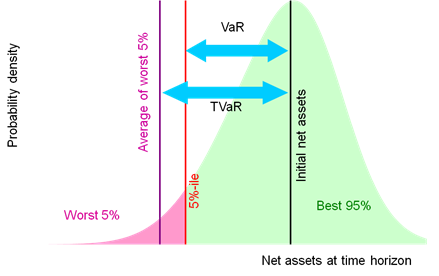

Value at Risk

Value at Risk (VaR) is a statistical measure used to assess the level of financial risk within a firm, portfolio, or position over a specific time frame. It provides an estimate of the potential loss that could be experienced with a certain confidence level (usually 95% or 99%) due to adverse market movements. The confidence level is the probability that the amount of loss will not exceed the VaR estimate.

For example, a 95% confidence level means there is a 5% chance that the loss will exceed the VaR. To illustrate, if a portfolio has a 1-day 95% VaR of $1 million, it means that there is a 95% confidence that the portfolio will not lose more than $1 million in a single day.

The chart above is an illustration of VaR. Here is what each term means:

Worst 5%: This likely represents the 5% VaR, indicating that there is a 5% chance that losses will exceed this value.

Best 95%: This implies that 95% of outcomes will be better (i.e., less loss or more gain) than the 5% VaR point.

Average of worst 5%: This might be referring to the Expected Shortfall (ES) or Conditional Value at Risk (CVaR), which is the average loss in the worst 5% of cases.

VaR Arrow: This line indicates the threshold for the worst-case losses within a given confidence interval. It signifies the maximum expected loss over a given time period with a certain level of confidence (e.g., 95%). The area to the left of this line, labeled “Worst 5%”, represents the tail of the distribution where the 5% of worst-case scenarios fall.

TVaR Arrow: The arrow pointing to the left labeled “Average of worst 5%” indicates the Tail Value at Risk or Expected Shortfall. TVaR/ES is the average loss in the worst 5% of cases. Unlike VaR, which only tells you the threshold that losses are not expected to exceed, TVaR/ES tells you what the average loss could be beyond the VaR threshold.

Here is how to read the chart:

- The green shaded area represents the range of most likely outcomes (best 95% in this case), meaning there is a 95% chance that losses will not exceed the VaR threshold.

- The pink shaded area indicates the portion of the distribution where extreme losses occur (worst 5% in this context), beyond the VaR threshold.

- The VaR threshold is the point at which you move from the green to the pink area. It’s the maximum loss expected not to be exceeded with 95% confidence.

- The TVaR/ES goes beyond just where that threshold lies and averages out all the possible losses that occur in the pink area (the tail), giving a sense of the mean loss in the worst 5% of scenarios.

Premia

Premia is a dynamic trading fee that is charged to traders based on the additional risk their trades introduce to the system. These fees are calculated using the EVaR metric, a risk measure that determines the capital required to keep the exchange solvent should a trade adversely affect its financial standing.

When a trader initiates a trade, Vest’s AMM system evaluates the potential risk increase caused by this trade. It calculates the EVaR before and after the trade is executed. If the trade heightens the risk, a premia fee proportional to the increased risk is charged to the trader. This fee is intended to compensate for the additional capital that the exchange would need to allocate to maintain its solvency if the trade were to go against the market.

The distribution of premia fees serves dual purposes. It not only enhances the capital buffer of the AMM, safeguarding the exchange against potential liquidity issues but also redistributes a portion of these fees to LP. This redistribution acts as a form of risk-adjusted compensation for the LPs, aligning their returns with the risks they are exposed to due to traders’ activities. By doing so, Vest ensures that LPs are compensated fairly for the liquidity they provide, which is crucial for maintaining a stable and liquid trading environment.

For example, a trader wishes to open a large position in a highly volatile asset. This action increases the exchange’s exposure to potential losses. To counteract this risk, the system calculates the EVaR to determine how much additional capital would be required to cover potential losses if the trade moves against the exchange. The resulting premia, charged to the trader, effectively increase the exchange’s resilience against the trade’s volatility, while also ensuring that LPs are appropriately rewarded for the risk undertaken.

Premia can be calculated with:

πρt = (ρ (Xt + τ(θ′) ∣ Ft) − ρ (Xt + τ(θ) ∣ Ft)+

where:

- Before Trade (θ): This state represents the exchange’s risk position before accepting a new trade. It includes the current balances of all trades, the capital owned by the AMM, and the liquidity provided by LPs. The notation for this state is θ = (q, C, P, L) where

- q is the vector of net open positions (long-short imbalances)

- C is the total capital used for open positions,

- P is the capital owned by the AMM,

- L is the liquidity provided by LPs.

- After Trade (θ’): This state reflects the exchange’s risk profile after a new trade has been incorporated. Adjustments are made to reflect the new positions and capital allocation resulting from the trade.

- πρt represents the Premia at time t

- p is the risk measure (EVaR)

- Xt + τ(θ) and Xt + τ(θ′) are the liabilities of the exchange before and after the trade, respectively

- Ft is the filtration representing the information available at time t

- The (+) function ensures that Premia is charged only when the risk increases (non-negative)

Funding Rate

While premia charges for marginal change in risk from the change in liability, zkRisk needs to collect funding from open positions to cover the market risk.

Vest employs Euler Allocation to distribute the calculated funding rates across different markets. Euler Allocation is a risk attribution method that is used to allocate the total risk of a portfolio to its individual components. It is based on the Euler’s Theorem on homogeneous functions. In the context of financial risk management, it can be particularly useful for determining how much each position in a portfolio contributes to the overall risk, especially when dealing with nonlinear risks like those in options or other derivatives. It can be calculated with the formula:

ρEuler (Xi) = Xi × ∂Xi∂ρ(X)

where:

- Xi represents the size of the position or component i within the portfolio

- ρ(X) is the total risk measure of the portfolio

- ∂X i/ ∂ρ(X) is the partial derivative of the risk measure with respect to the position size Xi

- ρEuler(Xi) is the allocated risk to component i according to Euler’s allocation

The process works as follows:

Risk Measure: First, you need a risk measure that is homogeneous of degree one, meaning if all position sizes are doubled, the overall risk measure would also double. A common risk measure used in conjunction with Euler Allocation is Value at Risk (VaR) or Expected Shortfall (ES).

Marginal Risk: Calculate the marginal risk contribution of each position, which is how much each position contributes to the total risk. This is typically done by taking the partial derivative of the risk measure with respect to the position size.

Allocate Risk: The total risk is then allocated across positions based on their marginal contributions. The allocation is such that the sum of the individual risk contributions equals the total risk of the portfolio.

This allocation method takes into account the proportion of long/short open interest that each trader holds within a particular market, ensuring that the funding rates are equitably assigned based on market participation and risk contribution. This system promotes fairness and prevents disproportionate impact on any single trader or group of traders.

Unlike many traditional systems where funding rates are adjusted at discrete intervals (e.g., every 8 hours), Vest applies funding adjustments continuously. This approach not only smooths out the funding rate experience for traders but also enhances the responsiveness of the platform to underlying changes in market dynamics and risk profiles. Continuous adjustment helps mitigate the risk of sudden market shocks and allows traders to operate with a clearer understanding of their cost implications at any moment.

zkSNARKs

To maintain trustlessness, the zkRisk engine and proof of its computation is posted on-chain via zkSNARKs or “Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge”. zkSNARKs are cryptographic proofs that allow one party to demonstrate the truth of a statement without revealing any underlying information beyond the statement’s validity. Within the framework of zkRisk, zkSNARKs are pivotal for ensuring the integrity and privacy of financial transactions on the blockchain.

The first step involves validating the covariance matrix, which essentially predicts how the prices of different assets move in relation to each other. Vest’s system generates this forecast off-chain to ensure quick computations. Once these predictions are made, they use zkSNARKs to create a cryptographic proof, confirming that the data matches the model’s expectations based on actual market behavior.

The second step is about pricing accuracy. zkSNARKs confirm that the charges for trading (premia) and the fees for holding positions (funding) are calculated correctly, as per the system’s risk evaluation. This process of risk evaluation, premia, and funding rates is crucial to maintain financial stability on the platform and avoid insolvency.

For liquidations, zkSNARKs ensures that positions are closed optimally to maintain market health. This means minimizing losses for traders and preventing nukes that could occur from abrupt, mass sell-offs of assets. The use of zkSNARKs ensures that the solutions provided by off-chain solvers are the best ones and that these are carried out without error, thus maintaining fairness and efficiency in the market.

Risk Engine

Vest Exchange’s risk engine, particularly its liquidation protocol, stands out by not only managing the immediate risks associated with trading positions but also by ensuring the long-term solvency and stability of the exchange. By employing real-time calculations and advanced financial modeling, Vest can dynamically adjust to the market conditions, providing a stable platform for traders and LPs alike. This approach reduces the systemic risk typically associated with perp DEXs and enhances the overall robustness of the exchange.

Volatility Forecast

Vest Exchange utilizes its risk engine’s Volatility Forecast component to strategically predict how the prices of various digital assets may fluctuate in relation to one another over time—a vital process for accurately pricing trades and ensuring that the exchange can adequately cover its financial liabilities.

How the Volatility Forecast Works:

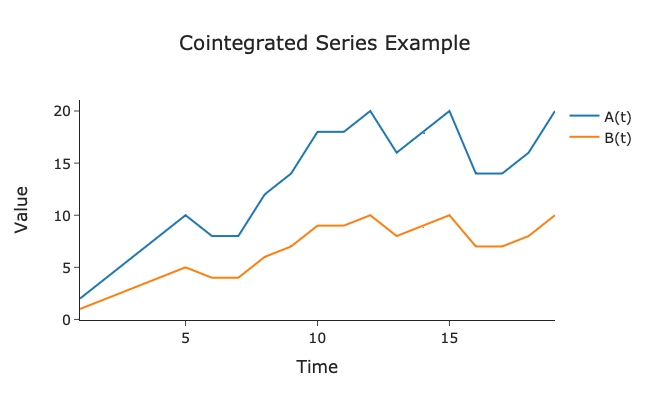

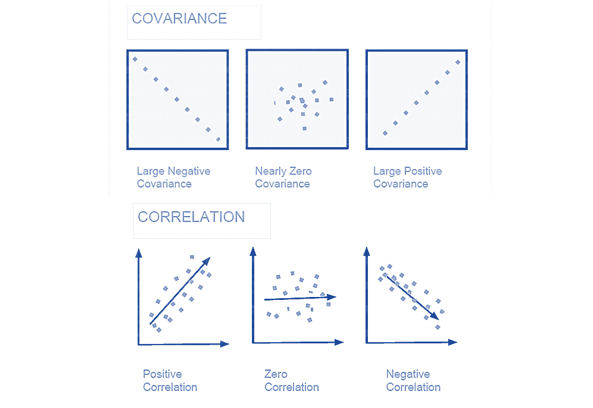

Asset Clustering: Initially, the engine clusters assets based on historical correlations in their price movements. This process leverages the concept of cointegration, a statistical method used to test the correlation between two or more non-stationary time series over the long term or for a specified period. By understanding these relationships, the model can make more informed predictions about how these assets will behave relative to each other in the future.

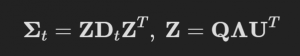

Forecasting Covariance: Once assets are grouped, the engine projects the covariance matrix for each cluster. The covariance matrix Σt quantifies the extent to which the returns of the assets in a group are expected to move in tandem. A positive covariance indicates that asset returns tend to move in the same direction, while a negative covariance suggests opposite movements. A zero covariance implies no relationship, indicating independent movements between the assets. This matrix is fundamental in portfolio theory, aiding in the construction of a portfolio that optimally balances risk and return.

Modeling with GO-GARCH: The forecasts assume that log returns rt adhere to a multivariate normal distribution influenced by latent variables ft representing underlying market forces or trends. These variables are modeled using a Generalized Orthogonal-GARCH (GO-GARCH) model, which is particularly effective for capturing the dynamic volatility and correlation of multiple assets. Unlike simpler models, GO-GARCH disentangles the complex interactions between different assets into more manageable, independently evolving factors.

The Generalized Orthogonal GARCH (GO-GARCH) model is an advanced statistical tool used for understanding the volatility and correlation of multiple financial assets simultaneously. It’s an extension of the well-known GARCH model, which stands for Generalized Autoregressive Conditional Heteroskedasticity.

Here’s what those terms mean in simpler language:

Generalized: It’s a version that’s more adaptable and can be applied in a broader range of scenarios than the original model.

Autoregressive: The model uses past data points to predict future ones.

Conditional: It takes into account the most recent information available.

Heteroskedasticity: This refers to the changing variability or volatility over time.

The GO-GARCH model predicts fluctuations in asset prices, specifically focusing on log returns. Log returns are essentially the percentage changes in asset prices, transformed logarithmically for better mathematical properties and stability in financial models. These returns are assumed to follow a multivariate normal distribution, where most changes are minor, but significant fluctuations are less common, aligning with typical market behavior.

The GO-GARCH model is crucial for understanding the interactions between multiple assets under the influence of latent variables. These latent variables represent underlying market forces or economic trends that affect all assets collectively. Traditional models might find it challenging to understand the complex dependencies between different assets, but the GO-GARCH model excels in this area. It breaks down these interactions into simpler, independent components. This separation allows for a clearer understanding of how each underlying factor influences asset prices, thereby enhancing the precision of risk assessment and trading strategy development in Vest’s platform.

In practice, this model helps Vest Exchange to predict how the prices of different crypto might change together, which is important for managing the risks of offering complex trading products like futures contracts. By understanding these relationships and how volatile the market might be, Vest can set trading fees and safeguards to protect itself and its traders from unexpected market movements.

Cross-Margin

Cross-margining at Vest allows traders to use a single collateral pool across all open positions. This pooled approach provides increased liquidity and flexibility, enabling traders to maximize their trading strategies without needing separate collateral for each position. The mechanism operates by calculating a trader’s total portfolio value, which includes both collateral and all realized and unrealized profits and losses from trades.

The leverage of a trader’s portfolio is defined as the ratio of the total notional value of all positions to the portfolio value. Mathematically, it’s expressed as:

Leverage = Portfolio Value / Total Notional Value

where Total Notional Value is the sum of the products of the sizes of all positions and their respective market prices.

The initial and maintenance margin requirements are pivotal in this setup. They are calculated as follows:

Initial Margin Requirement = ∑i = 1n ∣qi∣⋅ pi ⋅ rinit,i

Maintenance Margin Requirement = ∑i = 1n ∣qi∣⋅ pi ⋅ rmaintenance,i

Here qi is the signed size of the ith position, pi is the index price, and rinit,i and rmaintenance,i are the initial and maintenance margin ratios, respectively. These ratios ensure that the portfolio has sufficient collateral to cover potential losses, calculated across all positions.

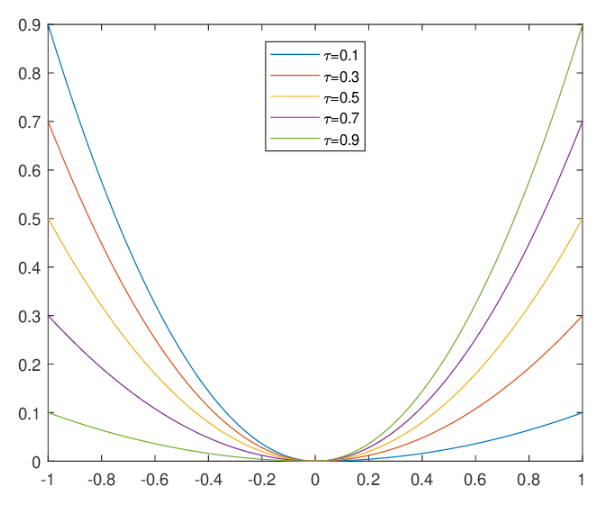

Expectiles

Vest Exchange has developed a sophisticated approach to setting optimal margin requirements, leveraging expectiles—a more nuanced and flexible risk measure—to balance the dual objectives of ensuring prudentiality while minimizing opportunity costs. This method addresses the specific needs of trading contracts on potentially illiquid underlyings, a common scenario in crypto markets.

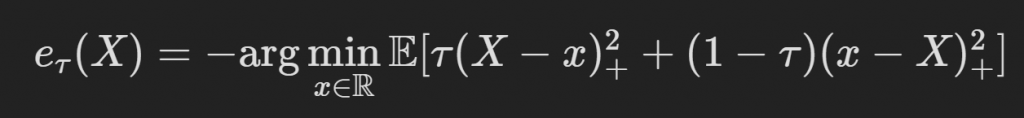

Expectiles, similar to quantiles used in value-at-risk (VaR) calculations, offer a more comprehensive view of the risk distribution. An expectile is a statistical measure similar to a quantile, but instead of focusing purely on the position within a distribution, it assesses the expected value of tail losses or gains around a specified point in the distribution. Expectiles are valuable in financial risk management and econometrics because they provide a nuanced view of risk that incorporates both the likelihood and the impact of potential losses or gains. They are especially pertinent for assessing financial returns and risks because they can describe the behavior of tails (extreme values) in loss distributions more effectively than quantiles. It is calculated as the point that minimizes the weighted average of squared deviations above and below itself, thus providing a more sensitive measure of risk that considers both the magnitude and probability of potential outcomes. They are defined mathematically as:

where

- X represents a random variable (such as returns on an investment).

- eτ(X) is the expectile for the given τ.

- (x) + = max(0,x) ensures that only positive differences are considered in each term.

- τ is a parameter that determines the focus of the expectile. Specifically, it influences how much weight is given to deviations above and below the expectile in the optimization process used to find the expectile itself.

Here, τ is a parameter that dictates the sensitivity of the expectile to tail risks. Lower values of τ focus on extreme negative outcomes (similar to VaR), while higher values provide a broader assessment of potential outcomes, making expectiles particularly useful for managing risks in assets with asymmetric and fat-tailed distributions. τ ranges from 0 to 1.

- When τ<0.5, more weight is given to the losses (values below the expectile). This makes the expectile focus more on downside risk, similar to how Value-at-Risk (VaR) would work for low quantiles.

- When τ>0.5, more emphasis is placed on gains (values above the expectile), making the expectile capture upper-tail risks.

- At τ=0.5, the expectile is essentially the median, providing a balanced view of risks on both sides of the distribution.

The value eτ(X) obtained from the expectile calculation provides a threshold under which a certain τ-proportion of the weighted squared deviations of the distribution fall. For risk management:

- Lower τ: The expectile quantifies lower-end risks, giving insights into potential losses and the worst scenarios at a certain confidence level.

- Higher τ: It captures what happens if things go unexpectedly well, quantifying potential gains.

The curves represent how the expectile, or the balancing point that minimizes the weighted squared deviations, changes across different levels of the distribution for different τ values. This shows how the threshold for potential losses (and gains) shifts depending on τ values

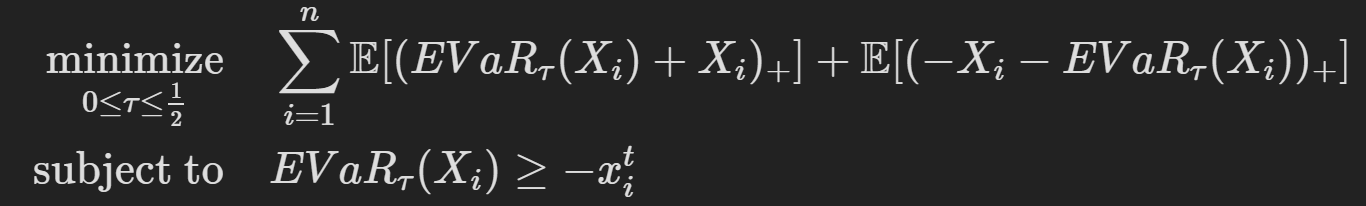

The optimization problem formulated by Vest Exchange for setting margins using expectiles involves a delicate balance. The objective is to minimize the expected margin overcharges and shortfalls. This is done by calculating the difference between actual margins set and the losses realized, thus directly addressing the cost of capital and the risk of insolvency.

Here, Xi represents the portfolio returns or losses for trader i, and EVaRτ(Xi) = −eτ(Xi) denotes the expectile value-at-risk.

Setting margin requirements in a trading environment involves managing the trade-off between restricting risk exposure and allowing traders enough leverage to capitalize on market opportunities. Traditional methods like VaR and expected shortfall might not adequately address the nuances of crypto assets, which often exhibit non-linear and unpredictable behaviors. Expectiles allow Vest Exchange to tailor margin requirements that are responsive to real-time market conditions and trader behavior, thus enhancing the platform’s stability and attractiveness to traders.

By using expectiles, Vest Exchange can set margins that are stringent enough to protect against market downturns without overly restricting traders’ ability to participate in the market. This balances the safety of the platform (prudentiality) with the need to keep trading attractive and viable (minimizing opportunity costs).

Liquidations

If a portfolio’s value falls below the maintenance margin requirement, Vest triggers a liquidation process. This process is designed to realign the portfolio’s health by reducing exposure or closing positions entirely. Vest utilizes a unique liquidation solver that optimizes which positions to liquidate with minimal market impact, while ensuring the maintenance margin is met post-liquidation.

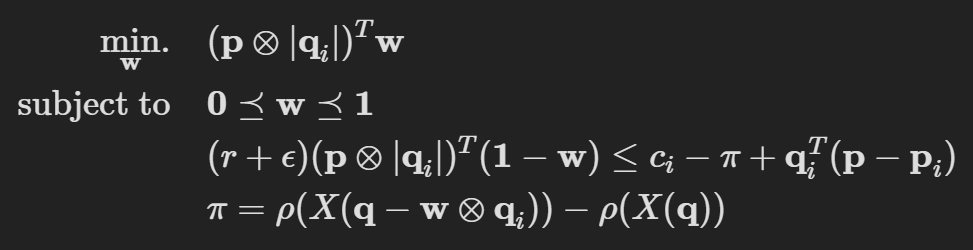

The liquidation is modeled as a convex optimization problem:

where

- w represents the fraction of each position to liquidate.

- p is the vector of current prices, and ∣qi∣ the absolute sizes of positions.

- ci is the collateral, and π is the liquidation penalty

- pi is the price at which positions were entered.

By using convex optimization, the system can find the optimal way to liquidate large positions without causing significant price movements or market disruptions. This is critical in maintaining market stability and ensuring that liquidations do not lead to nukes in asset prices

Why the Project was Created

Vest Exchange emerged as a response to a critical gap in the DeFi landscape, specifically within the realm of AMM-based perpetual futures exchanges. Traditionally, these platforms are constrained by open interest (OI) caps, which serve as a precaution against insolvency but simultaneously restrict the market’s ability to cater to growing trader demand and undermine capital efficiency. Historically, OI caps are implemented to prevent the system from taking on more liability than it can handle, especially important in environments where market conditions can change rapidly and margin calls or liquidations might be necessary.

The prevalent limitation is that the total OI is often only as high as the TVL within the platform, leading to a bottleneck that affects scalability and profitability for both traders and LPs. The level of TVL directly affects how much liquidity is available on the platform for initiating and settling trades. Higher TVL means more liquidity, allowing for larger or more numerous positions to be opened. However, if OI were to exceed TVL, it would imply that the platform is over-leveraged, increasing the risk of liquidity crises where the exchange cannot cover all trades, particularly during rapid market movements.

Addressing this, Vest introduces a risk engine that adjusts trading costs in real-time, according to transparent and quantifiable risk metrics. This dynamic approach eliminates the necessity for static OI caps, enabling the platform to scale OI beyond the limits of TVL, thereby amplifying capital efficiency without compromising on the safety of the exchange or its users. Such a dynamic system not only nurtures a safer trading environment but also enhances the earning potential for LPs and the AMM, as a more extensive OI translates directly to increased fee generation.

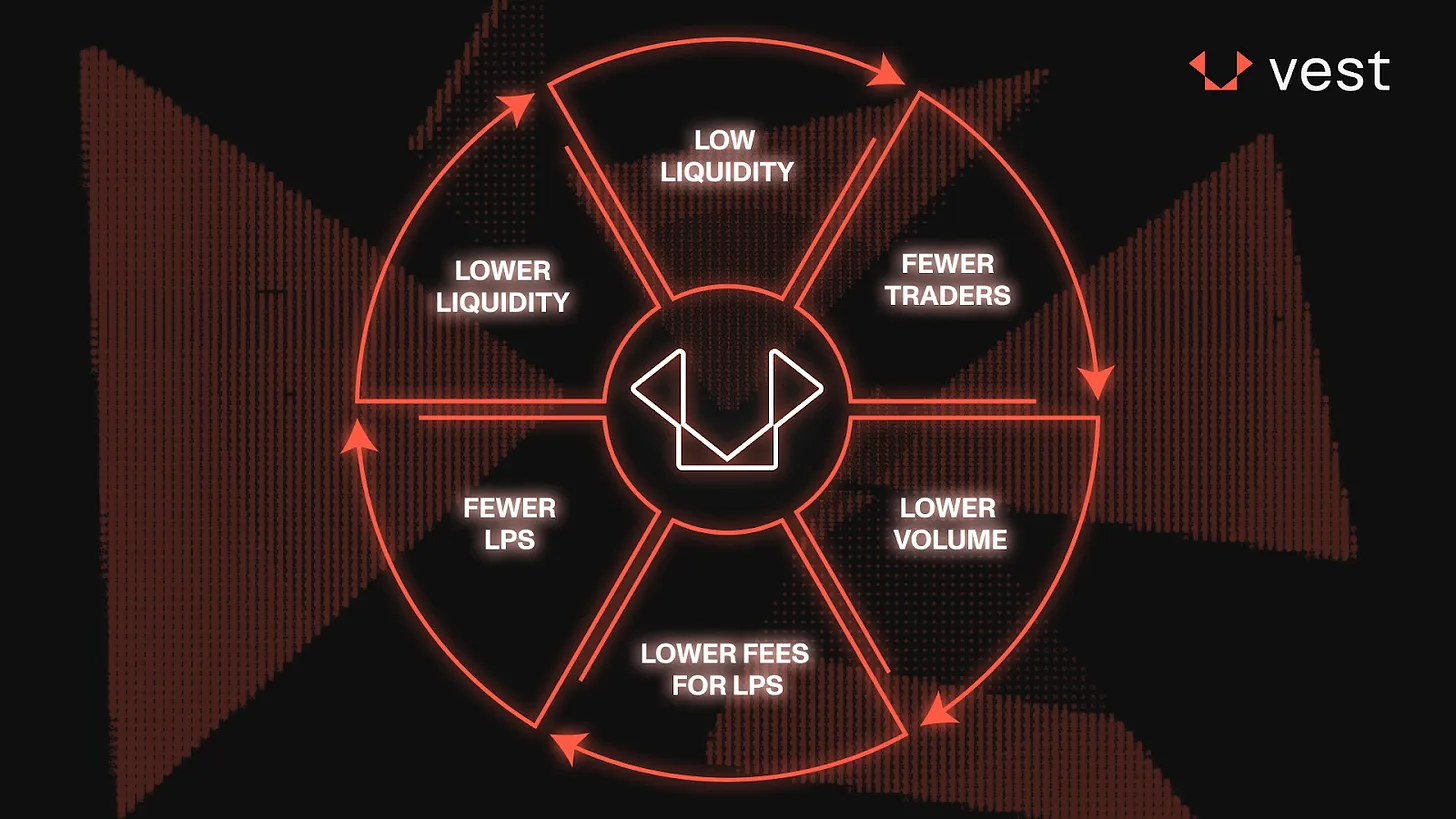

Moreover, Vest’s risk management infrastructure combats the pervasive chicken-and-egg problem that most perp DEXes face regarding liquidity. This predicament arises when a platform experiences low trading activity, which in turn leads to diminished fees for LPs. Consequently, this discourages LPs from committing more capital, which further exacerbates the issue of low liquidity—creating a vicious cycle that hampers market efficiency and growth.

Sector Outlook

Perpetual futures, commonly referred to as “perps,” are a DeFi financial instrument that allows traders to speculate on the future price of an asset without an expiry date. Unlike traditional futures, perps do not settle on a specific date, which means traders can hold positions indefinitely as long as they can maintain the necessary margin. This flexibility makes them particularly appealing for long-term price speculation and hedging in the crypto markets.

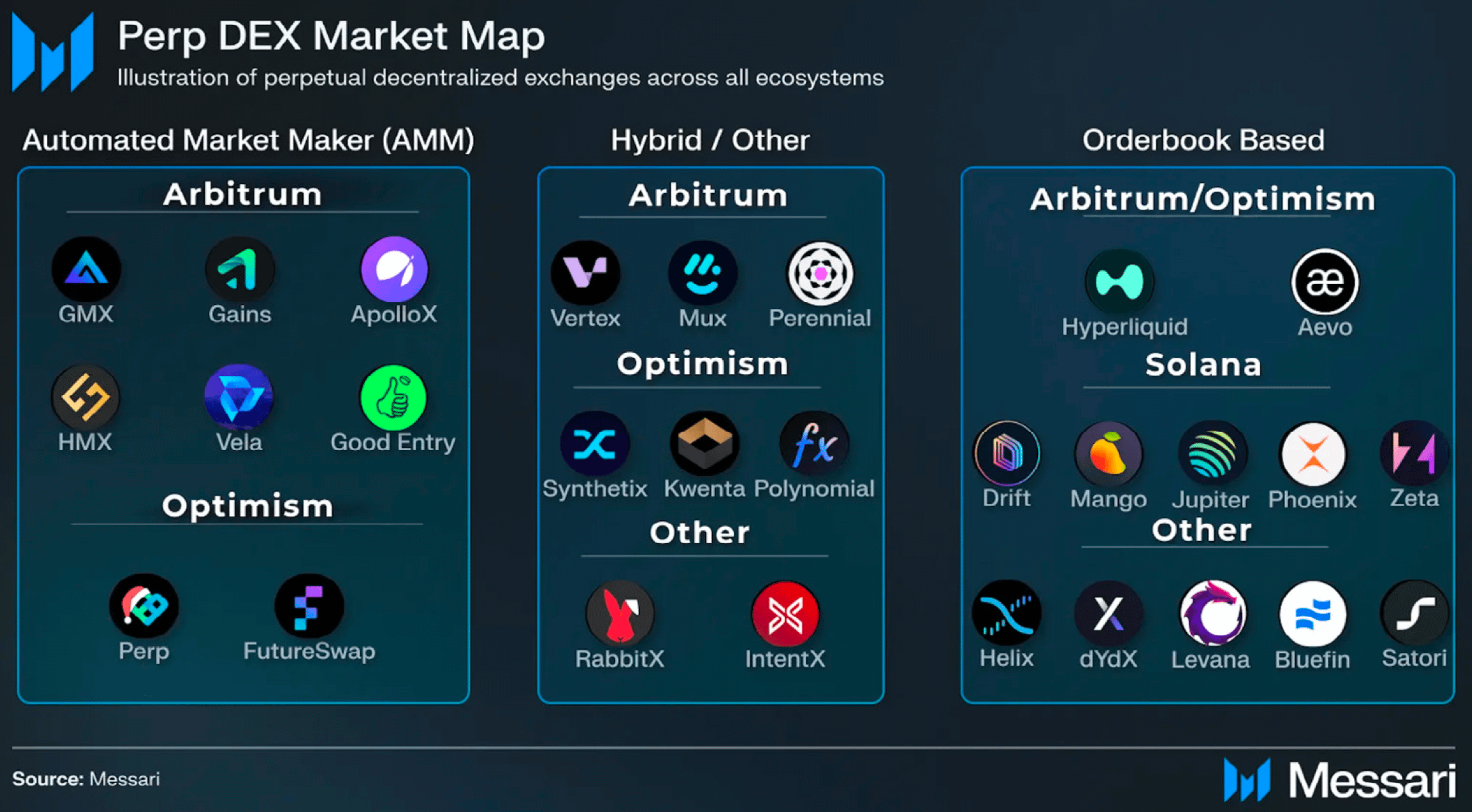

The DeFi sector has innovated several models to accommodate perpetual futures trading, each with unique mechanisms to manage trades, liquidity, and risks. Here’s an overview of the prominent models:

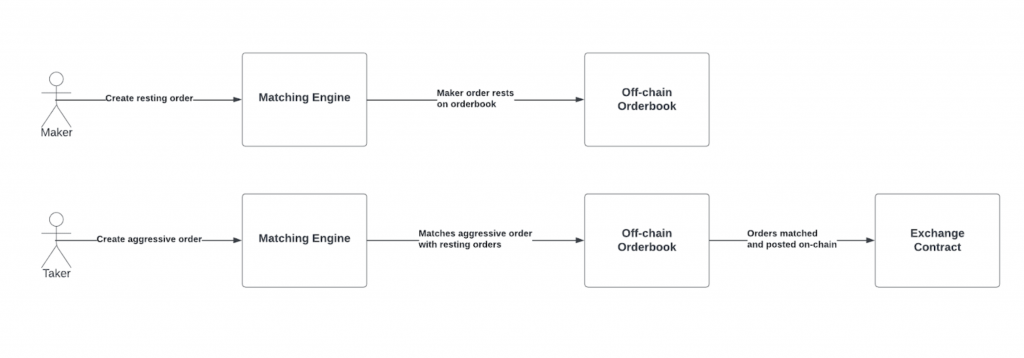

- Off-Chain Order Book with On-Chain Settlement: This model leverages the speed and scalability of off-chain systems for order matching while maintaining the security and transparency of on-chain settlements. Exchanges like dYdX operate under this model, where trades are executed off-chain but finalized on the blockchain. This approach reduces transaction costs and improves trading speeds but may introduce some degree of centralization risk due to the off-chain components.

- Oracle-Based Models: These models depend heavily on oracles to fetch off-chain price data for assets being traded on-chain. This setup is crucial for ensuring that the trading instruments are pegged accurately to their real-world values. However, reliance on oracles introduces a layer of risk, as price manipulation or oracle failure can lead to significant discrepancies in pricing and potential financial losses.

- Virtual Automated Market Makers (vAMMs): Unlike traditional AMMs used in spot trading, vAMMs do not hold the actual assets but instead use mathematical formulas to simulate trading environments. Platforms like Perpetual Protocol utilize this model to offer high leverage and deep liquidity without the actual reserves typically required. vAMMs adjust their pricing dynamically based on a pre-set formula, which reacts to market conditions without needing actual asset reserves.

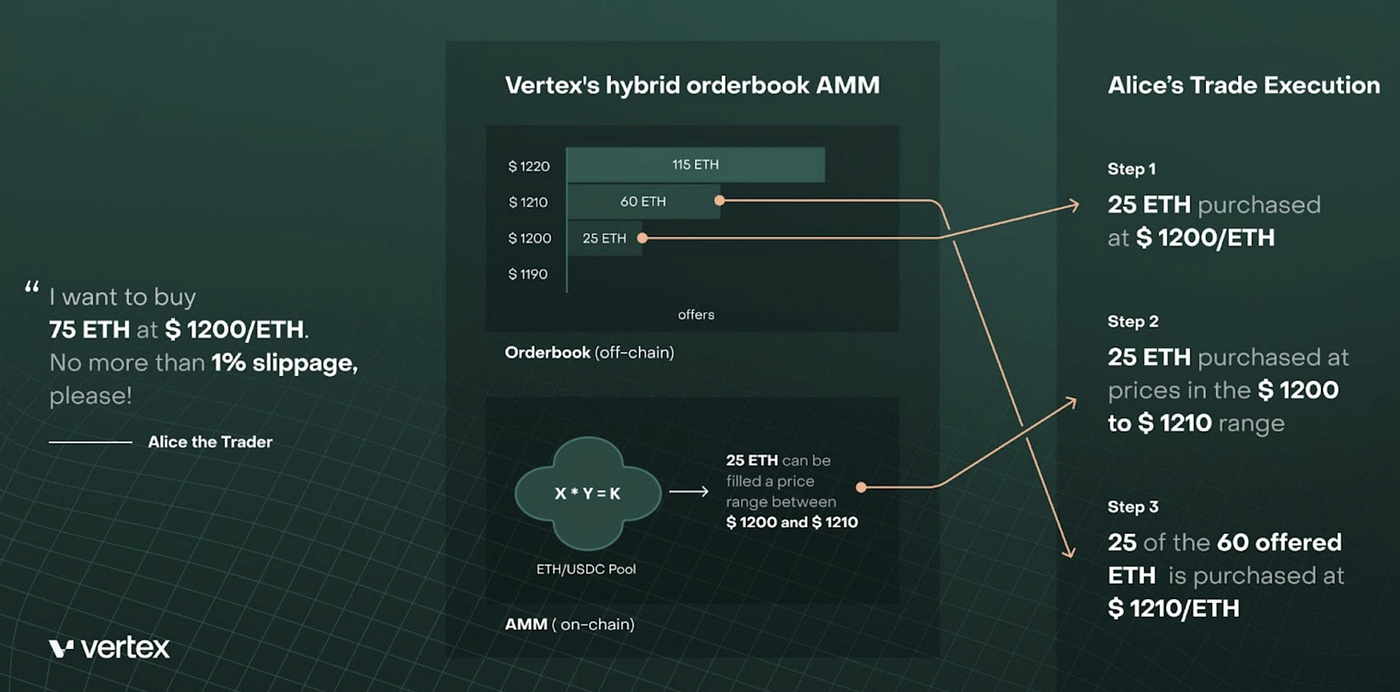

- Hybrid Models: Some platforms combine features from different models to optimize performance, liquidity, and security. For instance, Synthetix uses a mixture of oracle feeds and vAMMs to manage its synthetic assets and futures trading. This hybrid approach allows for more stable pricing and reduces reliance on any single point of failure. Vertex uses both an AMM and an orderbook.

vAMM vs Orderbooks

Market makers play a critical role in perp DEXes ensuring there is liquidity for trades to be carried out, as with those seen on CEXes. But in the context of a DEX, 3 principal models have emerged for facilitating the exchange of perpetual contracts:

Traditional Role: On some perp DEXs, market makers function similarly to their traditional counterparts in centralized exchanges, manually setting orders based on their market-making algorithms and risk assessments. These are Centralized Limit Orderbook (CLOB) models.

Automated Role: On others, especially those utilizing vAMMs, market makers contribute liquidity to pools from which trading prices are algorithmically determined. This method typically involves less direct control over price setting but can also involve less intensive management.

Hybrid Systems: Some perp DEXs may implement hybrid systems where aspects of AMMs and traditional market making are combined, attempting to capitalize on the strengths of both approaches.

Each embodies a different philosophical and technical approach to creating liquid, efficient markets for digital assets, particularly those with derivative-like features such as perpetual contracts.

vAMMs rely on algorithmic pricing mechanisms to provide liquidity. At the heart of vAMMs is a mathematical model that determines prices based on the ratio of assets in a liquidity pool like the popular Constant Formula Market Maker x*y=k.

This structure is designed to ensure that there is always a counterparty for trade execution. vAMMs ensure constant availability for traders to enter and exit positions.

| Pros | Cons |

|

|

Orderbooks

Orderbook perp DEXes maintain a ledger of buy and sell orders for various assets. These orders specify the amount of the asset the trader wishes to buy or sell and the price they’re willing to accept. Unlike AMMs, in Orderbooks, Market makers on these platforms continuously place buy and sell orders to provide liquidity. Their orders are matched with those of other traders based on the orderbook’s rules, usually following a price-time priority — this means that the earliest order at a particular price gets executed first. Market makers earn the spread between buy and sell prices and may receive additional incentives from the exchange for providing liquidity.

| Pros | Cons |

|

|

Within orderbooks, there are also on- and off-chain orderbooks. In an on-chain orderbook, every order and transaction is recorded directly on the blockchain. This approach offers a high level of transparency and decentralization, as all trading activities are publicly visible and verifiable by anyone. However, it comes at the cost of potentially higher transaction fees and slower transaction speeds. With each trade requiring on-chain validation, the underlying network’s throughput can become a bottleneck, thus affecting the overall efficiency of the exchange.

Off-chain order book DEXs take a different route by moving much of the trading activity off-chain, only settling the final trades on the blockchain. Off-chain matching allows for rapid trade execution, similar to traditional centralized exchanges, and can significantly reduce costs associated with on-chain transactions.

DEX Comparisons

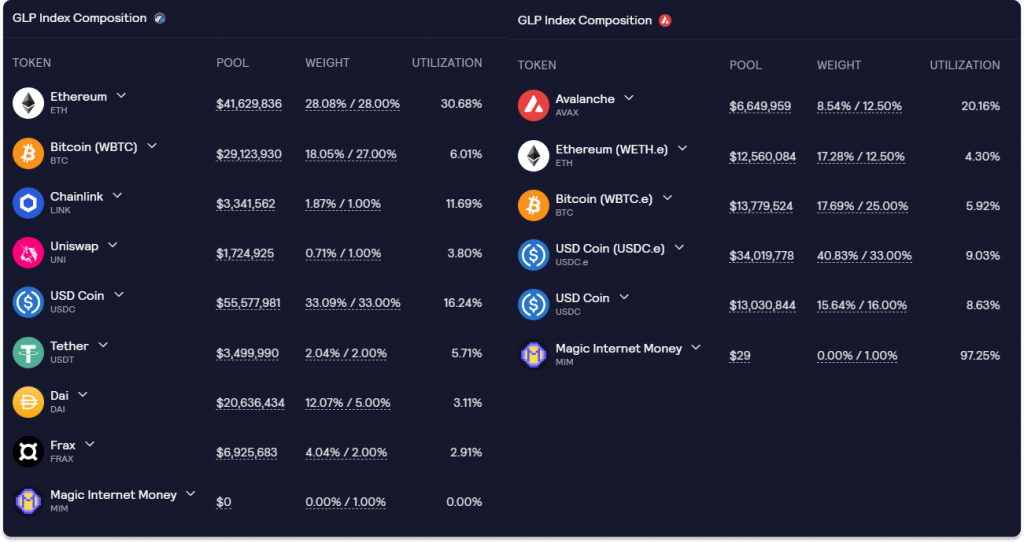

GMX (GLP based Perpetuals)

GMX perps leverages an index model using their GLP Pool, which provides liquidity for traders to open leveraged positions without direct token exchange.

Liquidity providers contribute to the GLP pool and receive GLP tokens, which stake automatically, with traders paying premiums for exposure to asset upside. However, the range of assets and markets available on GMX is directly tied to the composition of the GLP pool, which may limit trading options. And while individual risk is mitigated, systemic risk may be increased. If a significant market event occurs, the entire GLP pool could be affected, potentially leading to substantial collective losses for LPs.

Synthetix (Oracle-based)

Synthetix is a pioneering platform in the DeFi space, offering a unique approach to trading synthetic assets. Unlike traditional perpetual DEXs like GMX, Synthetix relies on risk management strategies like the Price Impact function which promotes market neutrality and protects LPs.

Synthetix incentivizes traders to maintain positions that help balance the system, ensuring that liquidity providers remain neutral and are not directly affected by individual trades that is too long or short skewed. This setup minimizes counterparty risk and allows for a broader range of trading strategies.

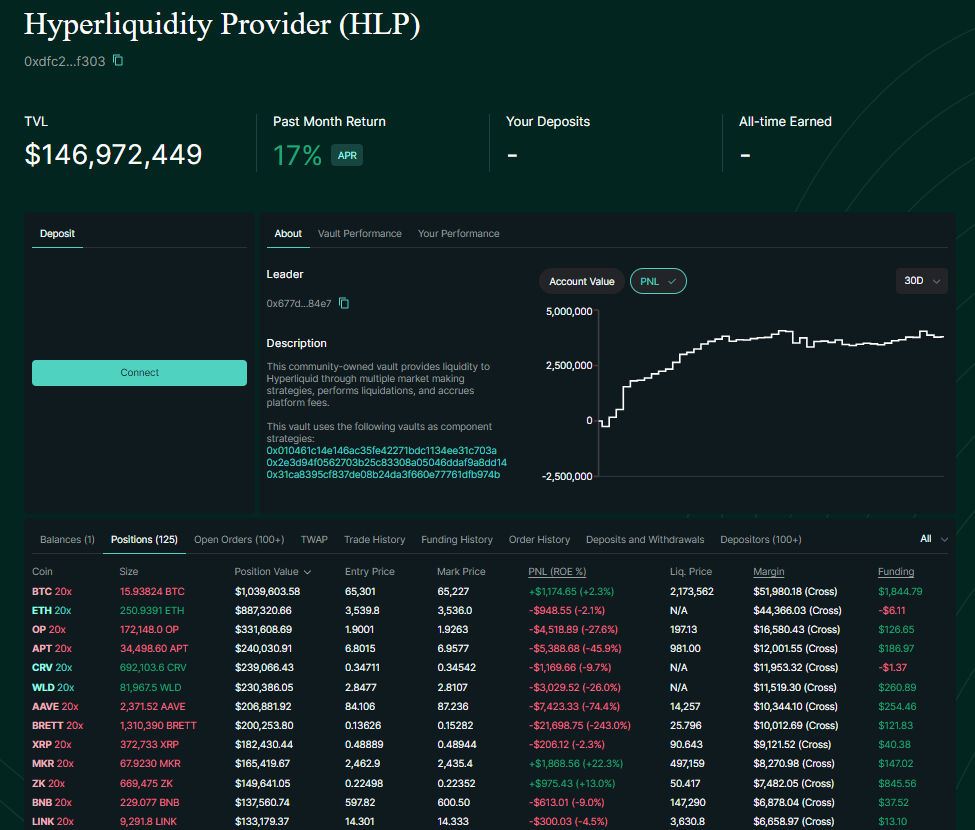

HyperLiquid: (L1 OrderBook. Fully on-chain)

HyperLiquid operates on a dedicated Layer 1 blockchain with an on-chain order book, ensuring high transaction throughput and low latency. This architecture allows for all trading actions, including order placement and cancellation, to be recorded on-chain.

Traders and LPs interact directly with the on-chain order book called the HLP, which requires substantial liquidity to minimize slippage. HLPs are market makers that facilitate trading by providing ample liquidity for various assets, helping to narrow the bid-ask spreads and improve overall trading efficiency. Unlike traditional market-making strategies, HLPs benefit from favorable funding rates.

Off-Chain Orderbooks with On-Chain Settlement

Platforms like Aevo and Lyra combine the efficiency of off-chain orderbooks with the security of on-chain settlements. In these systems, the orderbook is maintained off-chain, meaning that the collection and matching of buy and sell orders happen outside the blockchain.

This setup allows for rapid order execution, as the need to write every transaction to the blockchain in real-time is eliminated. The primary advantage here is the significant reduction in latency and network costs, enabling a trading experience akin to that of CEXs without compromising the decentralized nature of asset custody.

Once orders are matched off-chain, the actual exchange of assets is conducted on-chain. This ensures that the final settlement is transparent and verifiable by all network participants, maintaining trust in the integrity of trades. The settlement process is typically automated through smart contracts on a Layer 2 solution, which helps in scaling the transactions while keeping gas costs minimal.

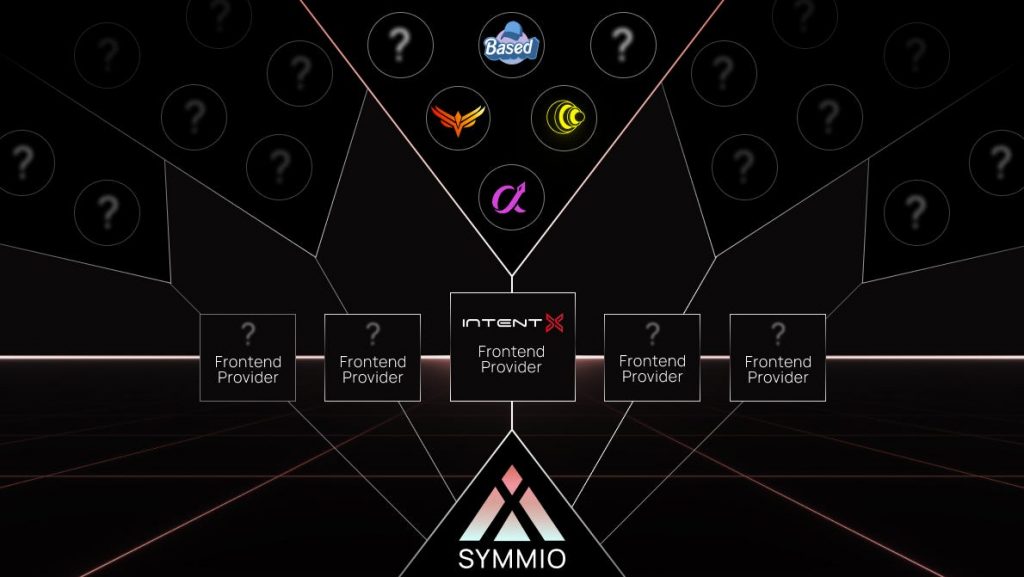

Intent-based

Intent-based trading is possible through an integration with Symmio, connecting traders on one side with market makers on the other. This is achieved by entering bilateral agreements between both parties, who post collateral into an escrow contract.

The core of Symmio’s architecture is built around Symmetrical Contracts, inspired by traditional finance’s bilateral agreements but adapted for the decentralized world. These contracts allow for peer-to-peer over-the-counter (OTC) deals, effectively sidestepping the liquidity fragmentation seen across numerous DEXes and blockchains. Through an Automated Market for Quotation (AMFQ), it allows users to request quotes, reducing the complexity of on-chain orderbooks in a trust-minimized way.

Front-ends like Pear Protocol, Intentx, Thena, Based markets use the symmio engine to power intent-based trading.

RFQ DEXs offer a distinctive approach to handling trades and liquidity compared to the more common LP-based models seen in platforms like GMX. Unlike traditional LP models where liquidity is pooled, in RFQ systems, designated MMs respond to these requests with tailored quotes. These MMs are typically professional trading firms or algorithmic traders who have the capital and expertise to quote prices for various assets quickly.

Vertex Protocol (Hybrid AMM OrderBook Exchange)

Vertex Protocol integrates the advantages of both AMM and order book models, offering a pooled liquidity mechanism alongside a traditional order book.

This means the pooled liquidity typical of AMMs is available alongside the precise order matching of traditional order books. Liquidity providers can contribute to the AMM pool, while traders can place limit orders or market orders directly on the order book. Vertex uses a smart order routing system that automatically determines whether an order should be filled by the AMM or matched with another order in the order book. This ensures that orders are executed at the best available prices, whether that comes from the AMM pool or direct counterparty orders on the order book.

Competitive Landscape

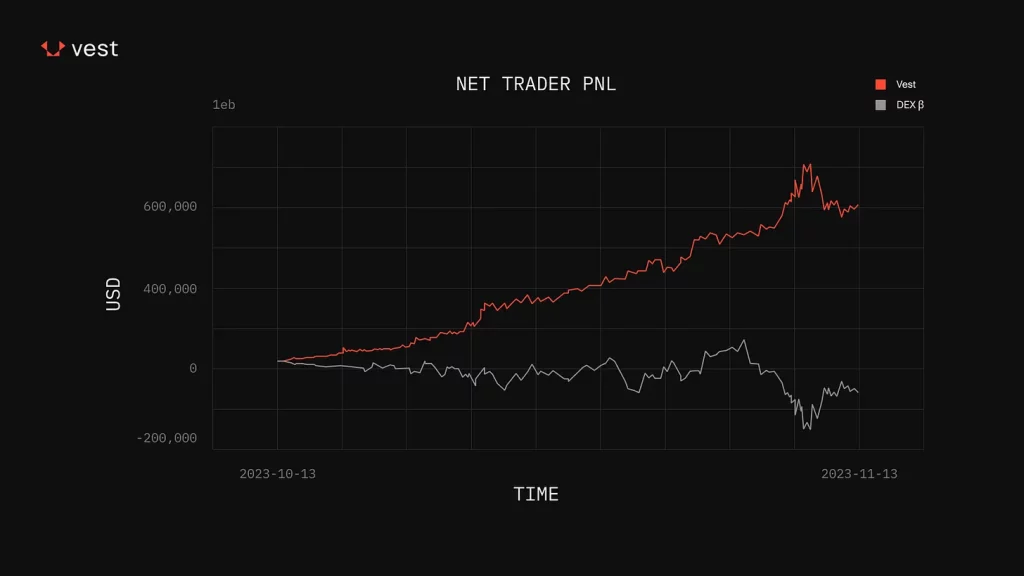

Disadvantaged LPs to Highly-skilled Traders

In many models, LPs serve as the counterparty to traders, which ostensibly places them in a position of advantage, akin to the “house” in a casino, as traders pay fees that typically benefit the LPs. Fees are typically a few basis points per transaction.

However, in traditional AMM-based DEXs, LPs are required to contribute capital which is used to cover both profits and losses from trading activities. While this mechanism ensures that trading can continue fluidly, it also exposes LPs to significant risk, especially when facing highly skilled traders. This setup can create scenarios in which LPs inadvertently subsidize the gains of these traders, potentially eroding their capital over time, particularly in consistently profitable trading environments. This dynamic, while seemingly offering LPs an upper hand, can often result in financial vulnerability due to the inherent risks of providing liquidity.

While these fees can provide attractive yields in stable or neutral market conditions, they are often insufficient in volatile or bullish market scenarios. In such environments, the accumulated fees can quickly be wiped out by a few days of heavy losses, as the fee structure does not adequately compensate LPs for the high risk of providing liquidity.

For example, this is a scenario on GMX where LPs are at a loss. These were the fees paid during the month of February.

In the same period, cumulative Trader PnL came out to $4.2M.

Insolvency Risks in Undercollateralized Systems

Another significant issue is the risk of insolvency, particularly in undercollateralized systems. This risk arises when the liabilities (i.e., the amounts owed to winning traders) exceed the assets or the available liquidity within the AMM. Such situations can lead to a freeze on withdrawals for LPs and traders, causing substantial financial losses and eroding trust in the platform.

Open Interest Caps

Traditionally, perp DEXs have grappled with balancing the trade-offs between speed, decentralization, liquidity, and security. These platforms face inherent challenges, notably in managing OI due to constraints imposed by the TVL on the platforms.

OI caps are a common feature in traditional perp DEXs, serving as a critical risk management tool to prevent insolvency by limiting the total amount of open contracts to the liquidity available within the platform, for example on Hyperliquid or Intentx. This linkage of OI to TVL inherently restricts the platforms’ scalability and liquidity by capping the maximum trading volume they can support. Such limitations can hinder the ability of these exchanges to meet growing trader demand, especially during market surges, thereby affecting their competitive edge against centralized counterparts.

Additionally, the funding rate mechanisms in traditional perp DEXs often struggle to equitably balance the costs of leverage among participants, particularly in volatile market conditions. These rates, which are intended to keep the perpetual contracts anchored to their underlying spot prices, can fluctuate significantly. The adjustments are typically made at discrete intervals and may not reflect real-time market dynamics, potentially leading to scenarios where traders face unexpected costs or benefits from holding positions.

Potential Adoption

Vest’s zkRisk system opens up several potential adoptions that extend beyond traditional trading frameworks:

New Markets and Asset Classes: Vest can quickly integrate new assets, including less liquid ones like NFTs, real estate, and various real-world assets (RWAs), into its trading platform. This capability is due to the zkRisk engine which facilitates the listing of these new assets by calculating the risks associated with each trade without needing direct asset backing. This capability is crucial for assets with less liquidity, where large capital reserves are impractical. By enabling trades based on price feeds and managing risks through calculated premiums, Vest ensures that liquidity providers are not unduly burdened by volatile market conditions.

Structured Products: Given the high potential returns and stable yield opportunities on Vest, LPs can engage in more sophisticated investment strategies. For example, structured products that blend long/short positions with high-yield LP stakes could attract investors seeking both high returns and exposure to specific market movements.

Cross-Product Margining: The flexibility of the zkRisk engine allows it to support a wide array of financial products. Developers can build options, money markets, and spot trading platforms that leverage Vest’s deep liquidity and advanced risk assessment capabilities, enabling a highly integrated and capital-efficient ecosystem. The zkRisk engine ensures that risks are appropriately managed no matter how complex the product relationships become. This holistic oversight is critical when assets involved in one market segment are used to collateralize positions in another, maintaining system integrity and solvency.

Broader DeFi Ecosystem: Vest has the potential to anchor a larger DeFi ecosystem that includes everything from stablecoins backed by perp contracts to more traditional banking services like loans and savings accounts, all benefiting from the security and efficiency of Vest’s platform.

Chains

Vest Exchange is currently deployed on zkSync Era.

Market participants in Vest

We can differentiate between two types of market participants in Vest: traders and liquidity providers.

Traders

Traders on conventional perpetual DEXs often face high trading fees, which include costs associated with slippage and funding rates that do not dynamically adjust according to the actual risks or prevailing market conditions. This inflexibility can lead to unnecessarily high costs for traders, particularly in less volatile market conditions or for less risky trades.

Traditional DEXs often have limited asset offerings and shallow market depth, primarily due to the high risk and capital requirements for listing new assets. This limitation restricts traders’ ability to diversify their trading strategies and hampers the overall market liquidity, making it difficult to enter and exit positions without significant price impact.

Vest enhances the trading experience by providing a more equitable fee structure. Thanks to the zkRisk engine, the platform dynamically adjusts trading fees in real-time, aligning them more closely with the actual risk that each trader brings to the market. This means that in less volatile conditions or for less risky positions, traders can enjoy lower fees compared to the standard fixed rates.

The design of Vest’s protocol also allows for a broader asset offering and deeper market depth. The zkRisk engine facilitates the listing of new assets without the typical constraints tied to the risks of illiquid markets. By effectively managing risk, Vest can provide a diverse range of trading opportunities while maintaining market depth, which benefits traders by allowing for smoother entry and exit from positions, even in sizable trades.

Liquidity Providers

LPs on Vest are positioned to benefit from a more sustainable and risk-adjusted return profile. The premiums calculated and charged by the zkRisk engine for trades that add risk to the system are redistributed to LPs, compensating them more fairly for the risk they bear. This system discourages risky positions that could otherwise lead to large losses for LPs and ensures that their returns are not undermined by the gains of successful traders.

Moreover, Vest’s model promises to provide a more stable liquidity environment. The zkRisk engine’s continuous risk assessment and insolvency checks work to prevent scenarios where LPs might be left holding the bag after market downturns or trader wins, which is a common concern in traditional LP models.

Risks

Modeling and Algorithmic Risks

The zkRisk engine relies on financial models that make certain assumptions about market behavior. If these assumptions are incorrect, risk measures could be improperly evaluated, leading to systemic underestimation or overestimation of risk.

The mathematical complexity of the zkRisk engine could have undiscovered bugs or logical errors that might not become apparent until they are exploited or cause a system failure. The risk of overfitting to historical data is also a threat, as it could limit the model’s responsiveness to new market conditions. The engine must continuously evolve to reflect the dynamic crypto markets.

Data quality is another critical factor. The engine relies on accurate inputs to assess risk correctly, so any data inaccuracies could significantly affect outcomes. Timely updates and rigorous data validation processes are necessary to maintain the integrity of the system.

The engine’s algorithmic stability and convergence are also vital for providing reliable risk assessments. Failures in these areas can lead to systemic mispricing of risk, affecting both the platform’s solvency and user experience.

Funding Rate Volatility

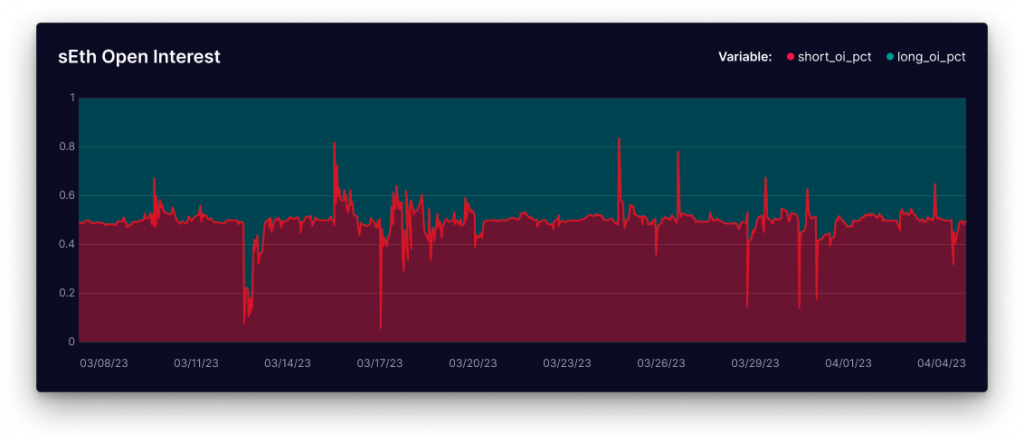

Perpetual futures contracts on DEXs use a mechanism called the “funding rate” to ensure that the price of the perpetual contract remains anchored to the underlying asset’s market price. This rate is paid between longs and shorts depending on the position they hold. If the perpetual contract trades at a premium to the spot market, longs will pay shorts, and vice versa. These are typically calculated at intervals like 1 hour, 4 hours or 8 hours.

However, Vest’s protocol utilizes its zkRisk engine to dynamically adjust funding rates based on real-time market conditions and risk assessments. While this approach aims to more accurately reflect market dynamics, it introduces the risk of funding rate volatility which can be exacerbated by market manipulation or extreme volatility. Sudden swings in funding rates can lead to unexpected trading costs, potentially discouraging trading activity or leading to unplanned liquidations. If the algorithm fails to accurately predict or respond to rapid market changes, it could misalign funding rates, causing further dislocation between the perpetual prices and the underlying market prices.

Security

Audits

Vest Labs Smart Contract Audit by Ottersec

- Critical risk – 1 (Resolved)

- Medium Risk – 1 (Resolved)

- Low Risk – 2 (1 Acknowledged, 1 Resolved)

- Informational – 1

Oracle Risk

Vest requires real-time asset prices to compute the values of positions, manage collateral requirements, and determine the potential exposure of the liquidity pools. The pricing function within the vAMM depends on accurate market prices to calculate trade costs and manage the liquidity curve.

The zkRisk engine uses market data to calculate risk metrics like the Entropic Value-at-Risk (EVaR). These calculations require current and historical price data to forecast potential market movements and assess the probability of adverse outcomes. This risk metric directly influences the calculation of premia and funding rates that are charged to traders to cover the risks they introduce into the system.

Market data from oracles help determine when a trader’s position no longer meets the maintenance margin requirements, triggering liquidations to preserve the health of the liquidity pool and protect the platform from insolvency.

Given these critical dependencies, oracle manipulation poses a significant threat to Vest. If an oracle were to feed incorrect price data into the system—whether due to external market manipulation or a direct attack on the oracle itself—it could lead to inaccurate risk assessments. This scenario could cause traders to be unfairly liquidated or not liquidated soon enough, which might endanger the liquidity providers’ capital. Additionally, incorrect pricing could result in traders and liquidity providers receiving incorrect premia or funding rates, potentially skewing the economic incentives designed to balance risk across the platform.

Team

Vest Exchange was created by the Vest Labs Research team. Many of them come from backgrounds in Finance or Engineering, with experience at Morgan Stanley, Goldman, Point72, Ascendex, Blackrock, Amazon, LinkedIn, Robinhood and a bunch more. Some notable members include Perpyv2 (Founder), Maxfundingrate (CTO), Riquidate, and Billie among others.

Project Investors

Vest Exchange raised an undisclosed amount in a Seed Round from Jane Street, QCP Capital, Big Brain Holdings, Ascendex, Builder Capital, Infinity Ventures Crypto, Robert Chen (Ottersec), Pear VC, Cogitent, Moonshot Research, Fugazi Labs and other angel investors.

FAQ

What is the main value proposition of Vest?

Vest’s primary value proposition is its integration of the zkRisk engine, which uses zero-knowledge proofs to dynamically adjust trading fees and funding rates based on real-time risk assessments. This approach allows Vest to offer more equitable trading conditions by aligning fees with the actual risks traders introduce to the system. Additionally, the platform provides a framework for trading a diverse range of assets, including cryptocurrencies, NFTs, and tokenized real-world assets, with an emphasis on maintaining solvency and protecting liquidity providers LPs from excessive market volatility.

Are LPs counterparties to traders where traders’ losses are gains for LPs and vice versa?

In Vest, the relationship between LPs and traders is structured to be less directly adversarial than the traditional casino model where the counterparty is the house. While it is true that in many trading scenarios, losses from traders can result in gains for LPs (and vice versa), Vest’s system is designed to mitigate undue risks for LPs through its risk management framework. This framework adjusts fees and funding rates to manage the exchange’s overall risk exposure, making LPs less dependent on trader losses for gains. Instead, the focus is on sustaining a stable and fair trading environment where fees and risks are systematically managed to protect both traders and LPs from extreme market volatilities.

What is Vest’s zkRisk engine, and how does it benefit traders?

Vest’s zkRisk engine is a proprietary system designed to calculate and manage trading risks in real-time. It uses advanced cryptographic techniques to ensure that all trading fees and funding rates are dynamically adjusted based on the actual risk each trader introduces to the platform. This approach ensures fairer pricing, reduces potential overcharges, and enhances the financial stability of the exchange.

How are LPs protected from market volatility on Vest?

LPs on Vest are protected through a combination of the zkRisk engine and a dual-fee structure comprising premia and flat execution fees. These mechanisms are designed to compensate LPs adequately for the risks they assume by providing liquidity. The zkRisk engine dynamically adjusts fees based on market conditions, ensuring that LPs are not excessively exposed during high volatility.

Can traders use leverage on Vest, and if so, how is it managed?

Traders can use leverage on Vest to magnify their potential returns. The platform manages leverage through its vAMM system, which automatically calculates the maximum allowable leverage based on the current liquidity and the trader’s risk profile as determined by the zkRisk engine. This ensures that leverage is used within safe limits to prevent systemic risks.

What happens if a trader’s position becomes undercollateralized?

Vest implements a sophisticated liquidation process that is triggered when a trader’s position becomes undercollateralized. The system uses a fair price marking method, influenced by the vAMM and external oracles, to determine the market value of positions accurately. If liquidation is necessary, it is executed in a way that minimizes impact on the market and maximizes the recovery of funds, using both the platform’s liquidity and the positions of the trader in a manner that aims to be as non-disruptive as possible.

How does Vest handle extreme market conditions or flash crashes?

Vest is equipped to handle extreme market conditions through its advanced risk management protocols which include monitoring liquidity levels, adjusting leverage and margin requirements in real-time, and employing automated safeguards to pause trading if needed.

How can someone become a liquidity provider on Vest, and what are the expected returns?

Becoming an LP on Vest involves staking assets into the platform’s liquidity pools. Returns for LPs vary based on the trading volume, the volatility of the market, and the risk profile of the assets involved. Vest’s dynamic fee model aims to offer competitive returns that compensate LPs adequately for the risks they undertake.

What is a Virtual AMM (vAMM) and how does it work on Vest?

A Virtual Automated Market Maker (vAMM) on Vest is a novel mechanism that uses a mathematical model to facilitate trading without actually holding the assets. Instead of real assets, the vAMM uses a pricing function to simulate trading activities and manage liquidity. This allows Vest to offer high liquidity and rapid trading without the typical capital constraints of traditional AMMs, enhancing both market efficiency and security.

How does Vest utilize zk-SNARKs within its trading platform?

Vest leverages zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs) to ensure the privacy and integrity of trades. zk-SNARKs are used to verify transactions and complex operations like the execution of trades and the calculation of fees without revealing any underlying data. This technology enables Vest to maintain a high level of security and trustlessness, as proofs are verified on-chain, ensuring all computations are correct and tamper-proof.

What is the role of the zkRisk engine in risk management on Vest?

The zkRisk engine is a core component of Vest’s protocol, designed to dynamically assess and manage risks associated with trading activities in real-time. It calculates the potential financial shortfall that might occur due to trades and adjusts trading parameters such as fees, margins, and leverage accordingly. This proactive risk management helps maintain the platform’s stability and ensures it can operate effectively under various market conditions.