Overview

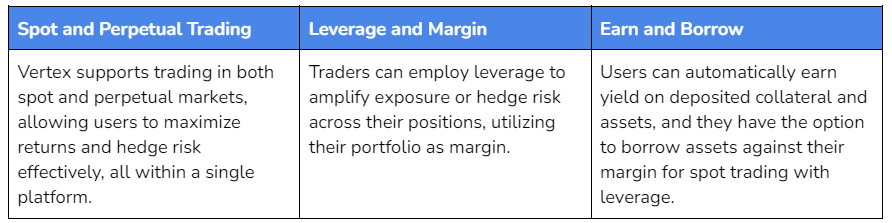

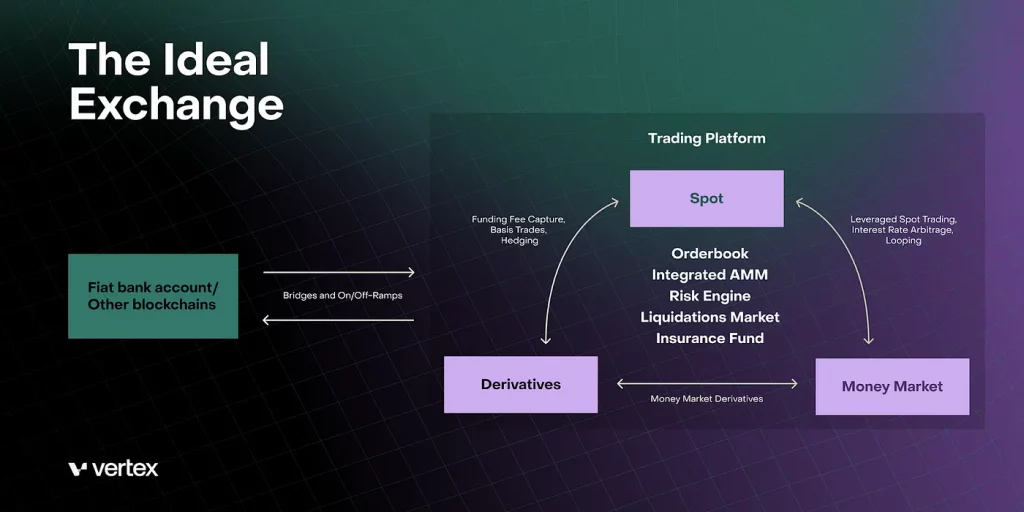

Vertex is a decentralized exchange (DEX) on Arbitrum, offering a versatile platform for spot and perpetual trading with margin capabilities. The defining characteristic of Vertex is its vertically integrated approach, encompassing various trading features within a single application. This includes spot and perpetual contracts as well as an integrated money market.

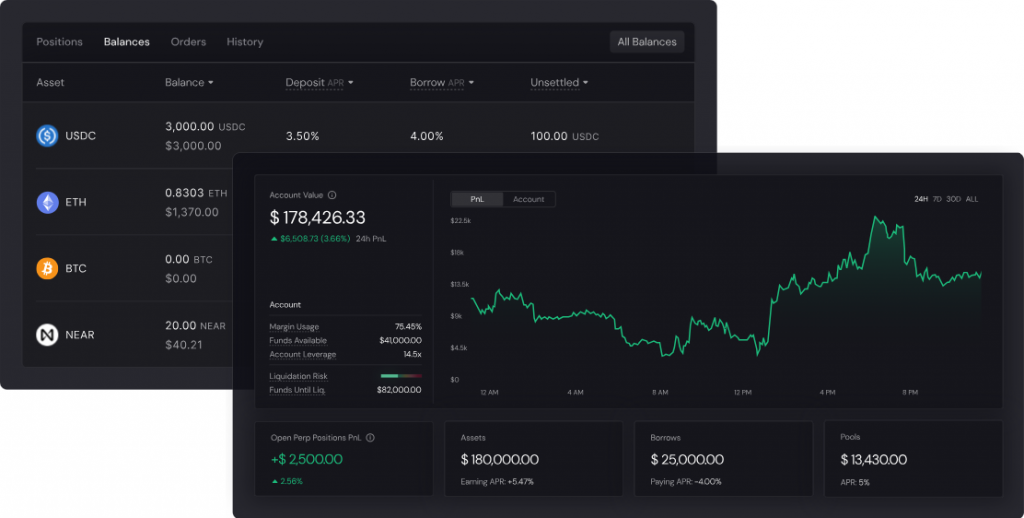

At its core, Vertex provides a Universal Margin Account, enabling users to manage risk effectively by utilizing their entire portfolio as margin. Trading accounts on Vertex are universally cross-margined by default. The platform’s universal cross-margining simplifies trading by combining multiple open positions into a single trading account. This approach optimizes capital efficiency, reduces initial margin requirements, and enhances risk management. Furthermore, Vertex’s integrated money market lets users earn yields automatically on deposits and borrow assets against their margin, supporting various collateral types.

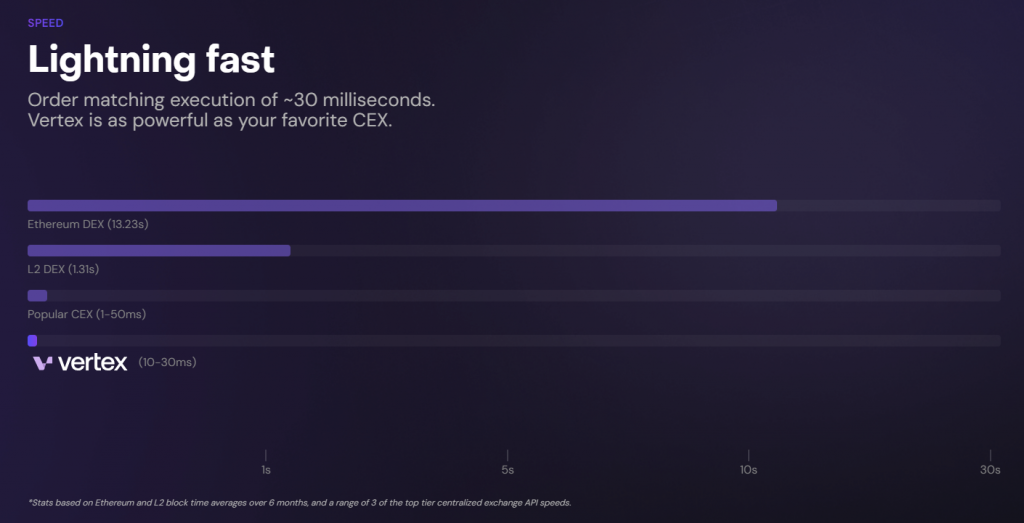

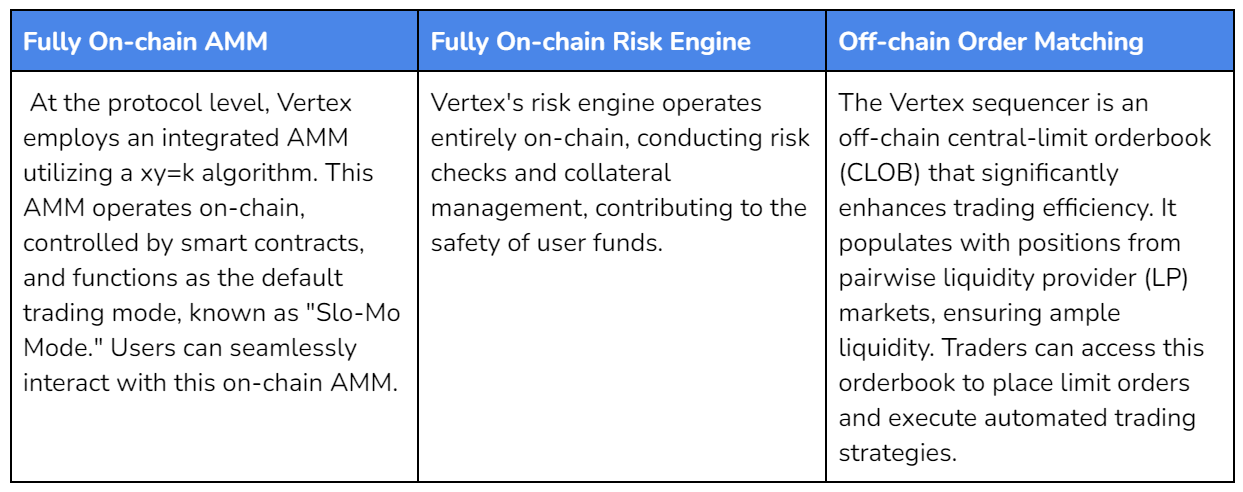

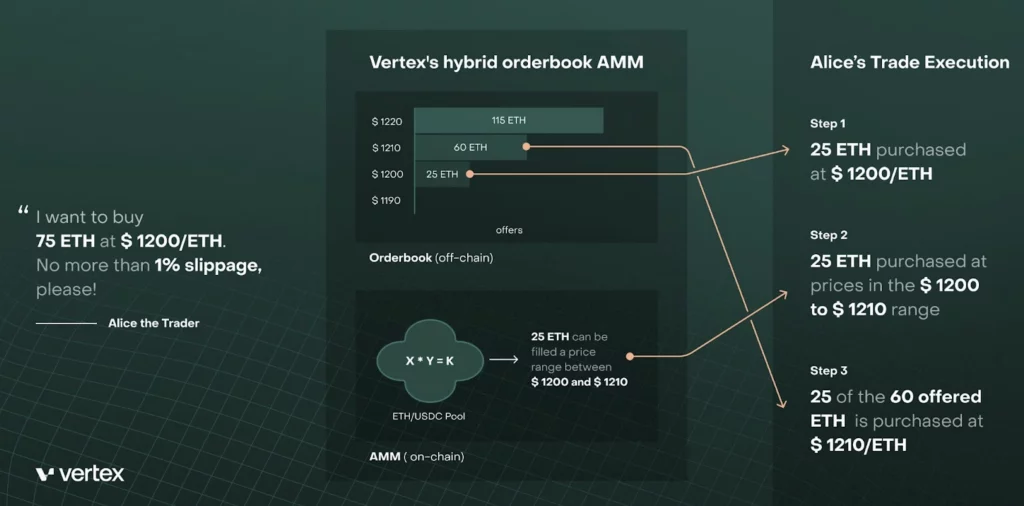

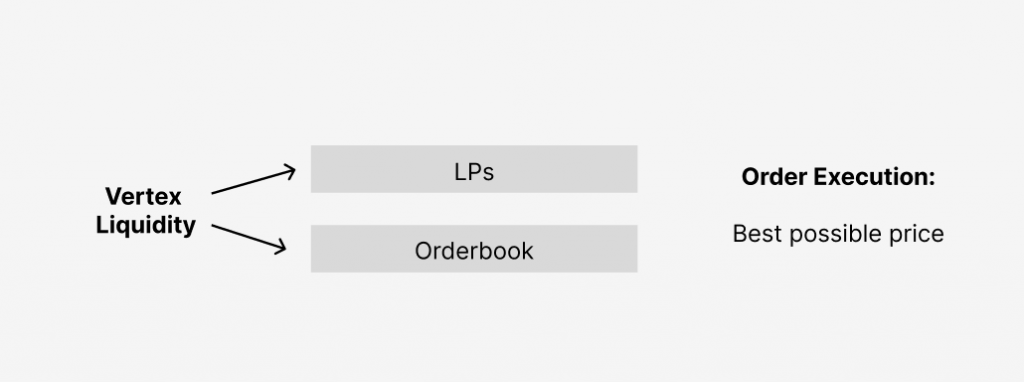

Vertex’s trading system combines a Unified Central Limit Order Book (CLOB) through an off-chain sequencer, and an on-chain Automated Market Maker (AMM). This integration provides users with a user experience akin to centralized exchanges (CEX) while preserving the self-custody advantages associated with decentralized exchanges (DEX). Liquidity from pairwise LP markets enhances the order book, while the specific implementation on Arbitrum helps to reduce Maximum Extractable Value (MEV) and reduces gas fees.

Vertex’s AMM operates on-chain within the protocol layer, constituting the default state known as “Slo-Mo Mode.” Complementing the on-chain AMM is Vertex’s off-chain order book, referred to as the “sequencer.” This approach aims to combine the best of both worlds – the speed and capital efficiency of an orderbook, and the passive liquidity of the AMM.

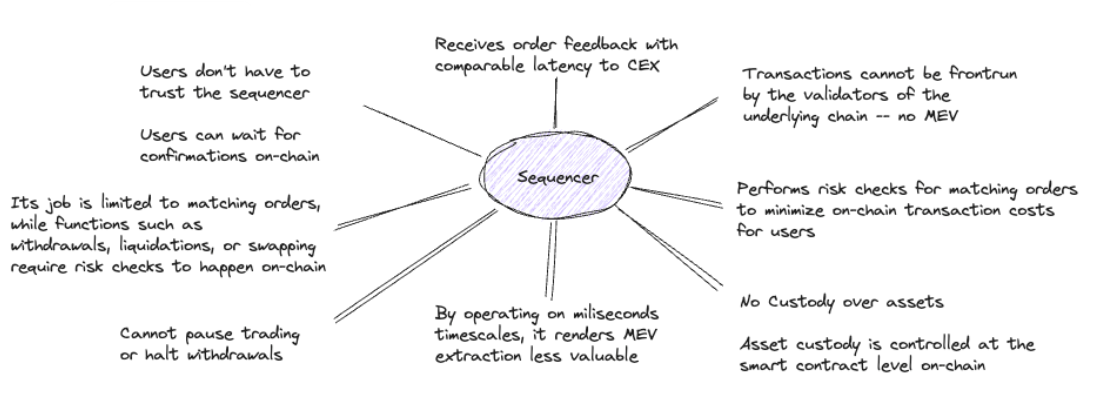

The sequencer operates as an off-chain node layered atop smart contracts within the Arbitrum protocol, delivering order matching at competitive speeds. Nonetheless, Vertex prioritizes user control, ensuring that assets remain under the user’s control on-chain. It also boasts incredibly low-latency trading, with order execution speeds of 10 – 30 milliseconds, competitive with leading CEXs.

With this hybrid design, Vertex pools liquidity from its on-chain AMM and the sequencer, augmenting liquidity through smart contracts rather than relying solely on external APIs. This consolidation creates a unified source of liquidity, fostering an efficient trading environment where users can seamlessly execute orders.

Spot Markets

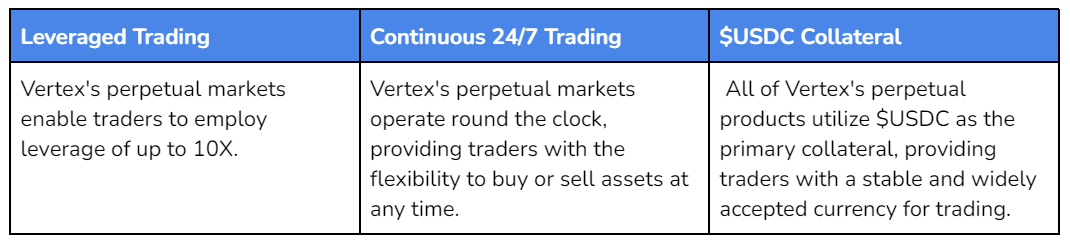

Spot markets enable the exchange of assets with immediate settlement upon trade execution. When you buy or sell a crypto asset on Vertex’s spot market, you receive or deliver the asset instantly. As everything in crypto, Vertex’s spot markets operate around the clock, 24/7, providing you the flexibility to trade crypto assets at any time of day or night. This accessibility caters to traders in different time zones and allows for uninterrupted trading opportunities.

Crucially, Vertex maintains the DeFi principle of self-custody in its spot markets. This means that you always retain full control over your spot assets on-chain. Your assets are never held in a centralized custodial account, ensuring you have complete ownership and transparency.

Vertex’s spot markets pair a selection of assets with USD-denominated stablecoins, simplifying trading and quoting all spot assets in $USDC. It is also worth noting that more assets will be added over time.

Perpetual Markets

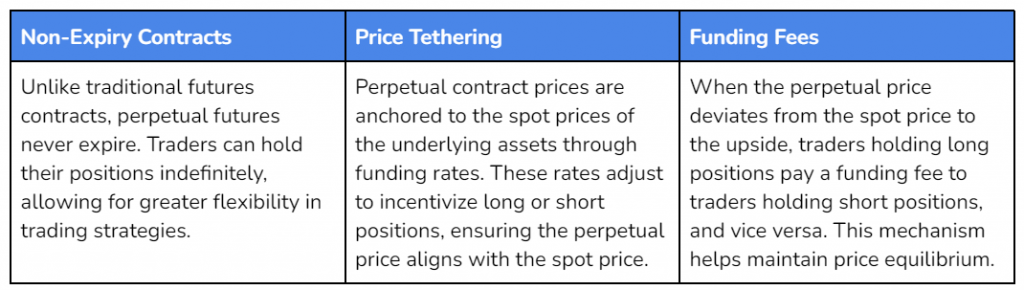

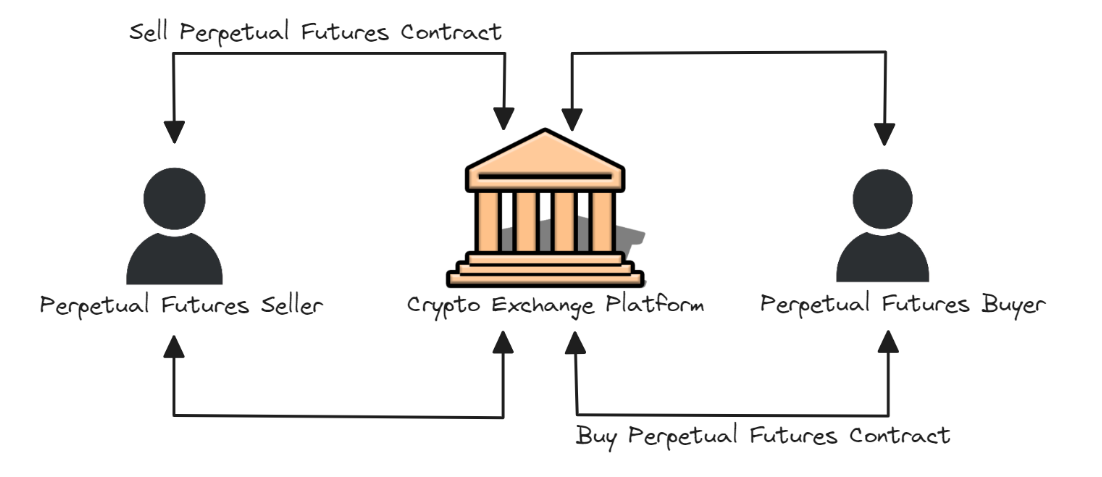

Perpetual futures contracts allow traders to speculate on price movements without the need to take ownership of the underlying assets. They are primarily used for speculation and hedging, and they are one of the most popular derivatives instruments in crypto.

When trading perpetual futures, the price of the contract is tethered to the underlying asset via funding rates, which modulate the incentive to go long or short by assigning a positive or negative carry cost to a specific perpetual position.

- When the price of the perpetual contract is higher than the spot price, traders with long positions must pay a funding fee to traders with short positions.

- When the price of the perpetual contract is lower than the spot price, traders with short positions must pay a funding fee to traders with long positions.

This funding fee helps to bring the price of the perpetual contract back in line with the spot price by incentivizing traders to open positions on the underweight side.

It is also worth noting that Vertex’s cross-margin system leverages spot assets held in the Money Market to back perpetual positions, offering a seamless and efficient margining process.

Similar to spot markets, more assets will be added over time.

Money Market

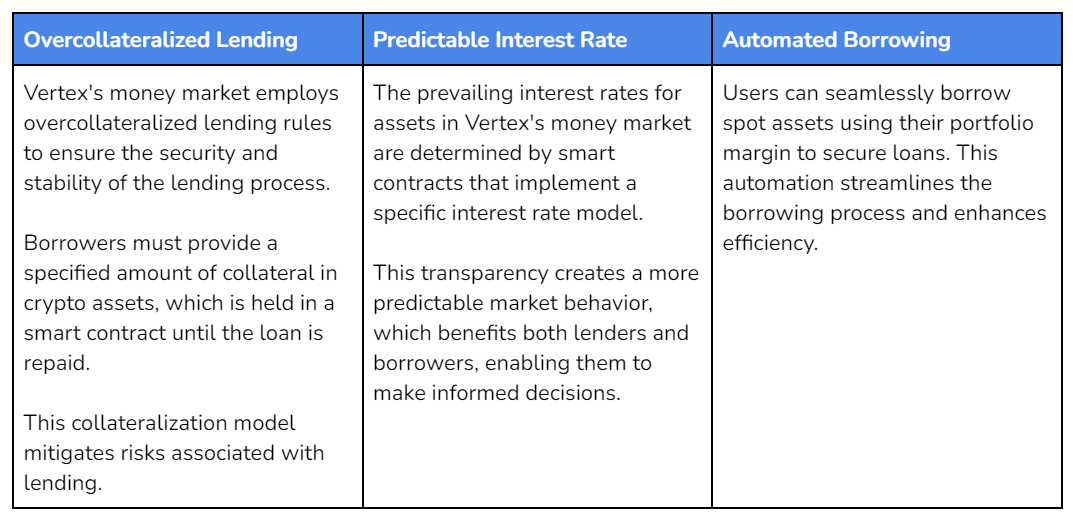

Decentralized money markets allow users to borrow and lend crypto assets without the need for intermediaries. Vertex takes this a step further by integrating a money market directly into a DEX.

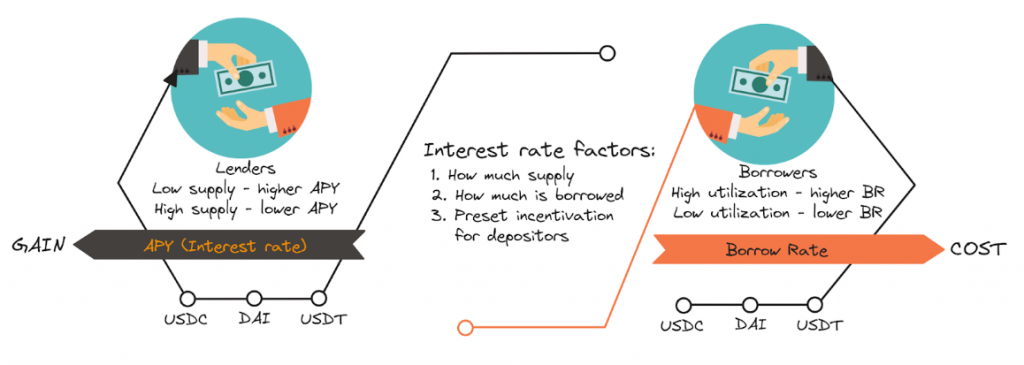

Interest Rates

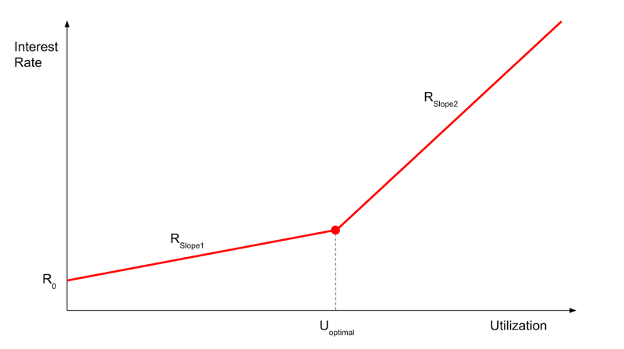

Similar to other decentralized money markets, interest rates are a dynamic function of supply and demand. Depositors act as liquidity providers (LPs) to the pool and earn a proportional share of the prevailing interest rates paid by borrowers. This mechanism enables passive yield on idle assets for users.

Vertex uses a dynamic interest rate model that adjusts in real time based on the demand within collateral pools. If more borrowers enter the market, increasing loan demand, the interest rates will rise to incentivize lending. Conversely, if there are more lenders than borrowers, interest rates will decrease to encourage borrowing.

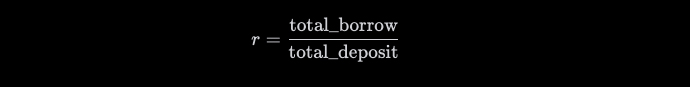

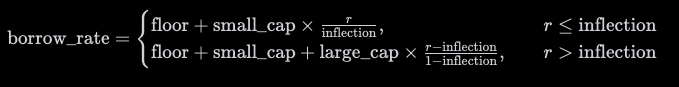

Vertex’s money market introduces spot rates for each spot product, defined by attributes such as small_cap, large_cap, floor, and inflection. Borrow rates and deposit rates are calculated based on these parameters and the utilization ratio, with adjustments made approximately every 15 minutes.

- small_cap is the peak interest rate in the first part of the utilization curve.

- large_cap is the peak interest rate at 100% utilization.

- floor (R0) is the minimal rate for borrowing.

- inflection (kink) (Uoptimal) is the utilization rate where the slope of the interest rate curve steepens.

- interest_fee is the protocol fee taken from borrow/lending markets

Utilization Ratio Formula:

Borrow Rate:

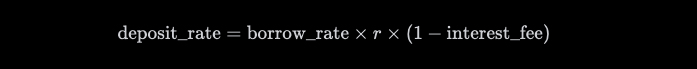

Deposit Rate:

To ensure the integrity of the lending process, Vertex’s smart contracts are programmed to execute predefined rules and conditions automatically. If a borrower fails to maintain the required collateral level, keepers step in to liquidate the collateral and use it to repay the lender. This automated loan management is integrated into the cross-margin function associated with each subaccount, simplifying and streamlining the loan management process.

As with spot and perpetual markets, the list of available assets is expected to grow over time.

Hybrid Orderbook AMM

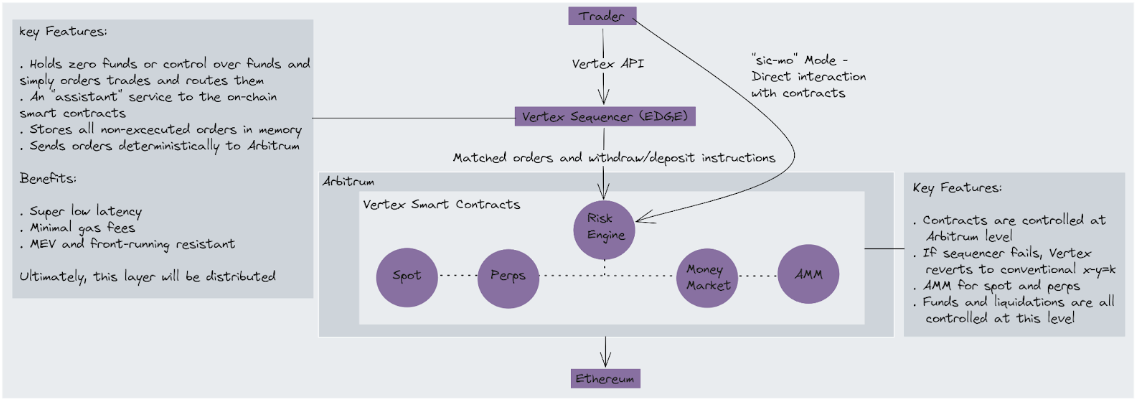

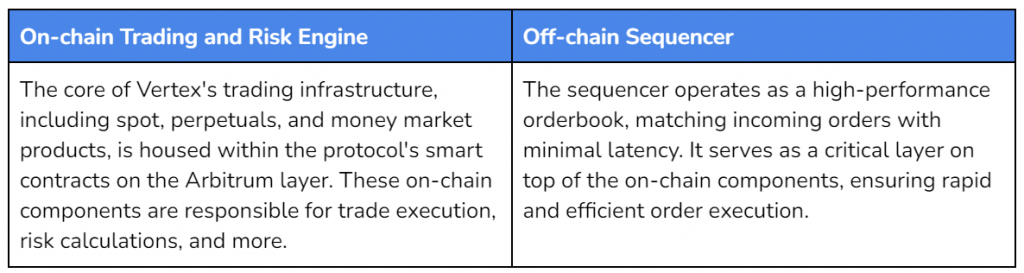

Vertex’s exchange model aims to combine the best of both worlds by merging a fully on-chain trading venue and risk engine at the protocol level with an off-chain sequencer. This hybrid approach forms the backbone of Vertex’s decentralized exchange (DEX).

The on-chain trading and risk engine contains Vertex’s core products, including spot, perps, and money market – operated by smart contracts deployed on Arbitrum.

The sequencer lives off-chain and enables a high-performance orderbook that matches inbound orders fed from the protocol layer with extremely low latency.

Vertex’s on-chain clearing house operates as the hub combining perps and spot markets, collateral, and performs risk calculations within a single integrated system.

The combination of an on-chain AMM and an off-chain orderbook forms a unique trading stack with benefits such as:

- High performance, achieving impressive speed comparable to CEXs, with average order-matching execution speeds between 10 and 30 milliseconds.

- Flexible liquidity deposits. By combining an AMM and orderbook, Vertex maximizes liquidity advantages. Users can trade directly on-chain using the AMM, benefiting from passive liquidity provision and access to long-tail DeFi assets.

- Diverse product suite by incorporating DeFi primitives including spot and perpetuals trading, and an integrated money market, catering to different trading strategies and preferences within a single platform.

Besides the advantages mentioned above, this hybrid model is key to enable a more efficient trading experience that resembles CEXs.

- Trades always execute at the best available price, as the sequencer sources liquidity from limit orders and LP positions concurrently.

- Some liquidity will always be available to clear trades. Markets can be seeded with more passive liquidity while still allowing for more flexibility through limit orders – benefitting both illiquid and liquid assets.

- Vertex minimizes Miner Extractable Value (MEV) risks, thanks to its fast execution and the use of Arbitrum, which periodically submits batches of transactions to Ethereum L1.

- Users can trade directly on-chain without relying on the sequencer if they choose to do so.

- The existence of the AMM empowers users with two of their core value propositions:

- The ability for users to provide passive liquidity to asset pools and start earning trading fees in a permissionless way.

- Support for long-tail illiquid assets.

Combined with the off-chain orderbook, Vertex can offer a more performant trading engine than standard DEXs. Liquidity is augmented as positions from pairwise LP markets populate the orderbook as well.

Additionally, an HFT-friendly API enables programmatic traders to plug their strategies into the orderbook and trade against the combination of AMM and orderbook and high speed.

Initially run by the Vertex team, the sequencer operates with a TPS of 15K and latency between 10 – 30 ms. It is important to note that the use of Arbitrum prevents any kind of transaction reordering or front-running. Also, the sequencer has no custody over the user’s assets, and it cannot pause trading or halt withdrawals.

As Vertex evolves, the idea is for the sequencer to become decentralized via governance. Meanwhile, in the case of maintenance, downtime or any other unforeseen circumstance, the AMM layer functions as the backstop of the protocol, enabling users to trade solely against the AMM, without needing the orderbook. As a result, instead of getting a CEX-like experience, you would get a UX closer to Uniswap but with cross-margined accounts for spot, perps, and an integrated money market.

Slo-Mo Mode

Slo-Mo Mode represents a foundational aspect of Vertex’s hybrid orderbook-AMM design, offering users an alternative trading mechanism during instances when the off-chain sequencer might be unavailable or when users prefer to engage directly with on-chain mechanisms. This mode is characterized by increased transaction execution times and potentially wider spreads compared to the high-speed, low-latency trading experience facilitated by the off-chain sequencer. However, it upholds the core principles of decentralization and self-custody, emphasizing the autonomy and security of user assets.

In Slo-Mo Mode, Vertex users can still execute swaps, manage perpetual positions, and interact with the platform’s diverse financial products, albeit with the nuances typical of traditional AMM-based DEXs like Uniswap. This includes experiencing slippage, which is the difference between the expected price of a trade and the executed price, and facing wider bid-ask spreads, especially in less liquid markets. Despite these limitations, Slo-Mo Mode ensures that trading on Vertex remains uninterrupted, maintaining user access to the platform’s liquidity pools and trading pairs.

This mode leverages the xy=k algorithm for AMM functionality, enabling users to provide liquidity and trade directly on-chain. It serves as a critical safety net, ensuring that even in the absence of the sequencer, Vertex’s market dynamics remain operational, safeguarding against downtime and maintaining continuous market access. The on-chain risk engine and liquidity pools continue to function, albeit with the inherent on-chain constraints of higher gas costs and slower transaction speeds compared to the sequencer’s capabilities.

Slo-Mo Mode also plays a vital role in preserving the decentralized ethos of Vertex, allowing users to retain full control over their assets without reliance on the sequencer. It exemplifies the platform’s commitment to offering a seamless transition between high-speed trading and the traditional on-chain DEX experience, ensuring that Vertex remains adaptable to various market conditions and user preferences.

Slo-Mo Mode is an essential component of Vertex’s hybrid model, offering a reliable and decentralized trading option that complements the high-performance features of the off-chain sequencer. It ensures that Vertex users can enjoy the benefits of both centralized exchange-like efficiency and decentralized, permissionless trading, embodying the platform’s innovative approach to merging the best of both worlds in the decentralized trading landscape.

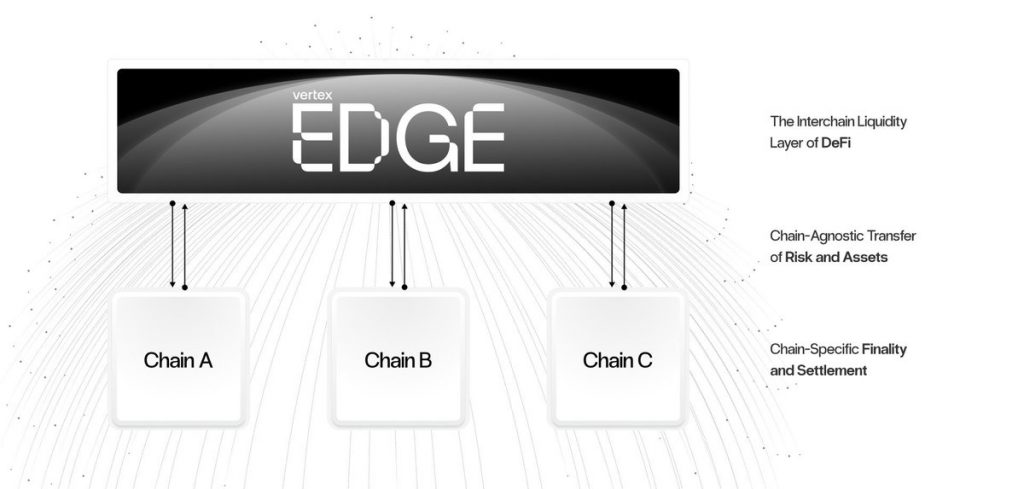

Edge

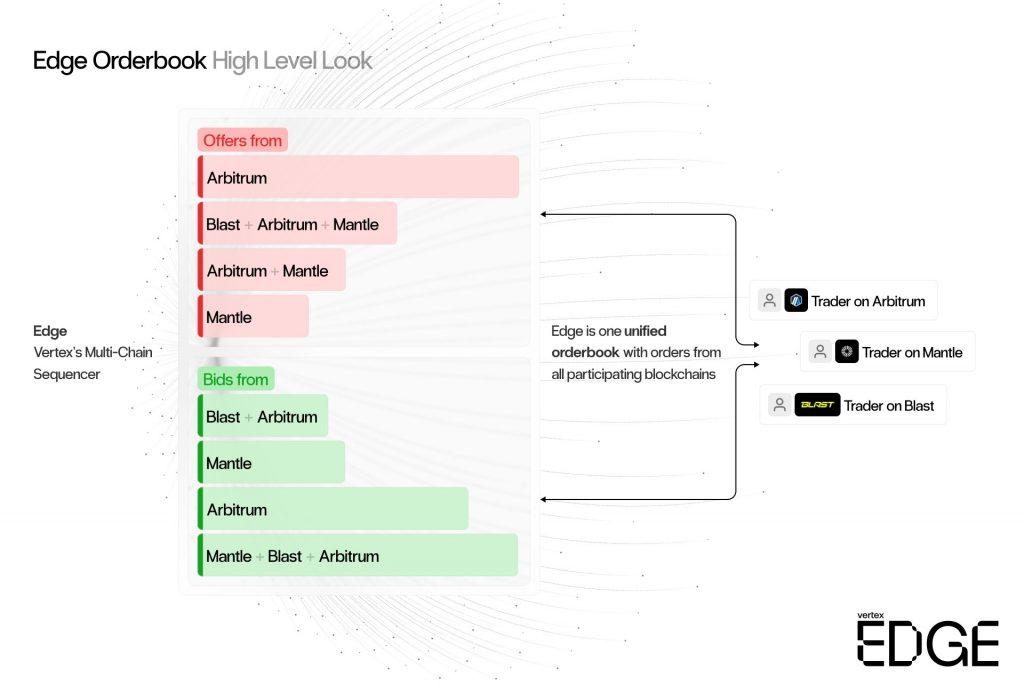

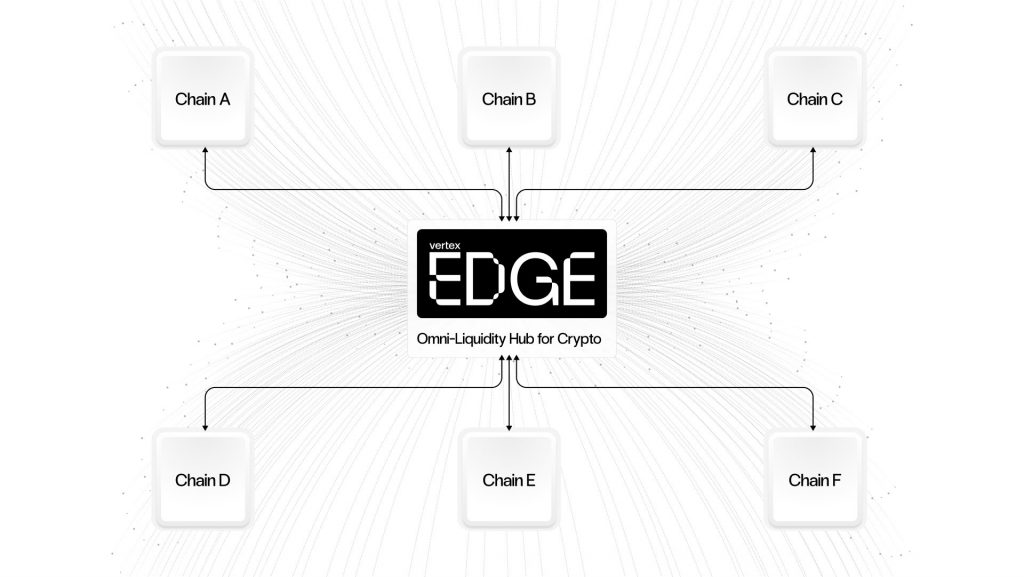

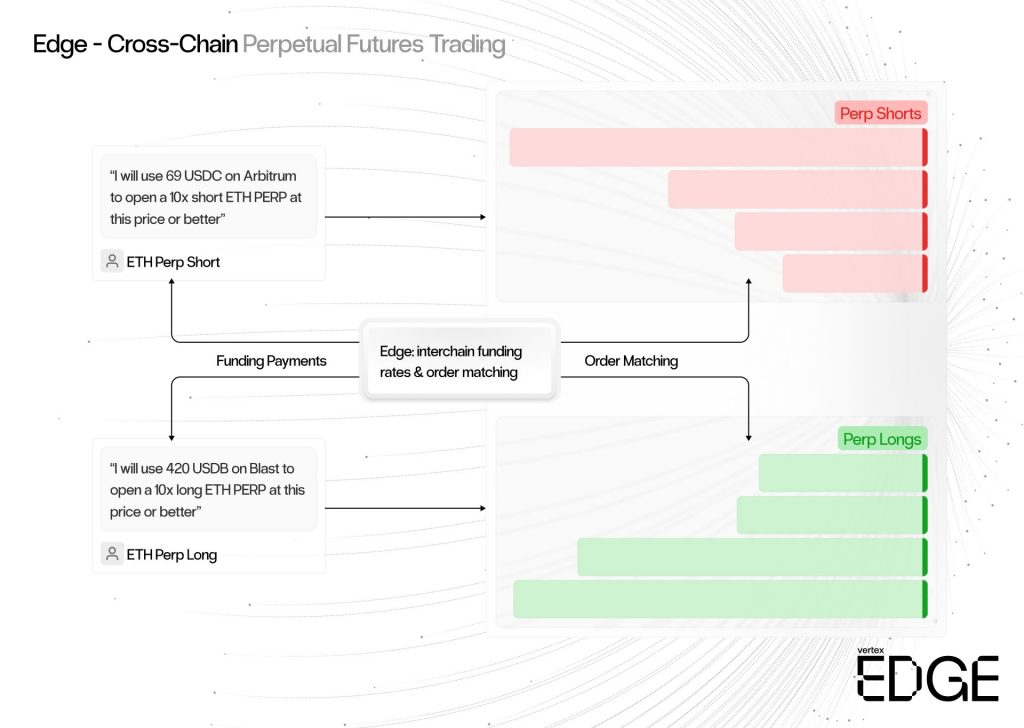

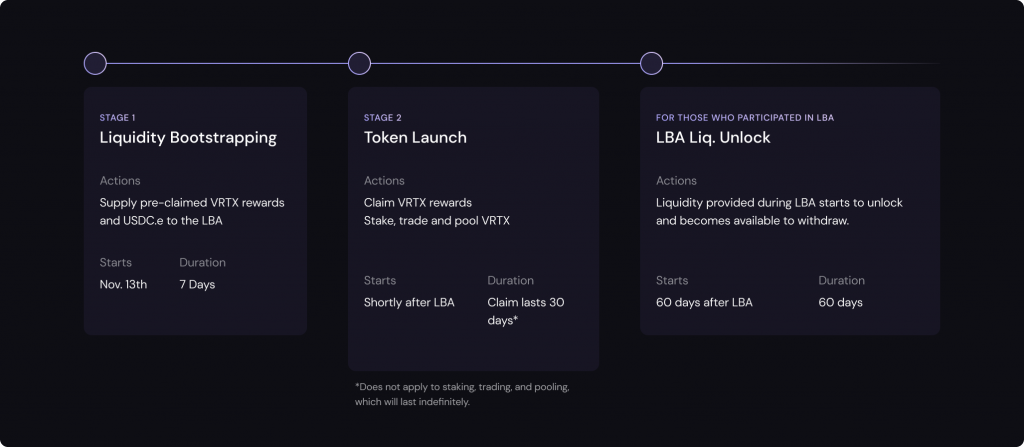

Edge is a Synchronous Orderbook Liquidity layer created to unify liquidity across multiple chains. It is an upgrade to the existing Vertex sequencer, extending its capabilities to support cross-chain functionality. The idea behind this is to forge the path for the sequencer to run on multiple chains simultaneously without fragmenting liquidity between them.

Edge operates as a virtual market maker between DEXs on different chains, matching inbound orders from one chain with the combined orderbook liquidity of all the base layers plugged into the sequencer. This solves for the liquidity fragmentation problem, allowing users to trade against unified cross-chain liquidity on a single DEX without having to move from Chain A to Chain B.

This works by sharding (splitting) the state of the sequencer between support chains in a concurrent manner, intaking and cloning inbound orders from each chain. This way independent orders from one chain can be matched against liquidity from multiple chains. Both sides of a trade would be filled out, and the sequencer (Edge) takes the opposite side of the inbound trade – automatically hedging and rebalancing liquidity on the back end between chains.

This is achieved by having the sequencer only mirror resting liquidity (e.g. maker order) across the sharded states of the Vertex instances on different base layers. Meanwhile, taker orders remain unchanged and are submitted directly from an independent Vertex instance to the sequencer’s unified liquidity layer.

Note that order matching between chains occurs concurrently, and the liquidity profile consolidated on Edge is propagated to each Vertex instance. This makes it possible to match inbound orders from one chain with the combined orderbook liquidity of all the base layers plugged into the sequencer.

The end goal is to unify liquidity and become a foundational building block for other ecosystems. This aggregated liquidity is accessible to all users of any cross-chain Vertex instance (e.g. non-Arbitrum). Settlement of matched orders still occurs locally on-chain on the original source chain of the user, ensuring that there is demand for blockspace and all transactions are made available in a transparent way.

Each inbound order from a Vertex instance can be considered as a request to modify a balance on-chain and, therefore, settlement occurs on those specific chains by updating the corresponding balances.

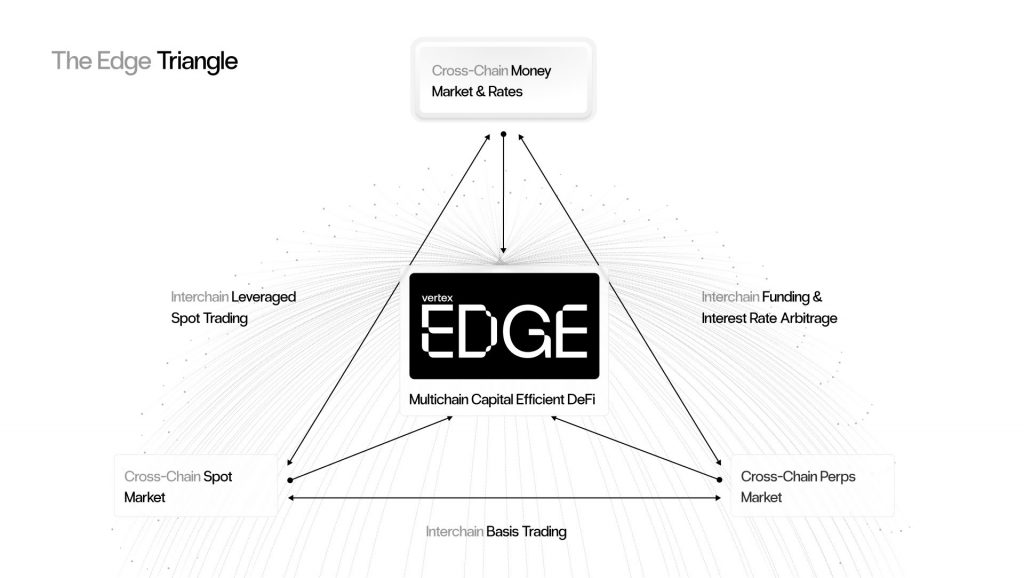

Additionally, Edge unlocks unique features by empowering its core products and tying them together in a unified liquidity environment. At the same time, the aggregated liquidity via Edge is accessible by any user of a cross-chain Vertex instance (e.g., non-Arbitrum), displayed as a single, synchronous orderbook on the corresponding app’s interface.

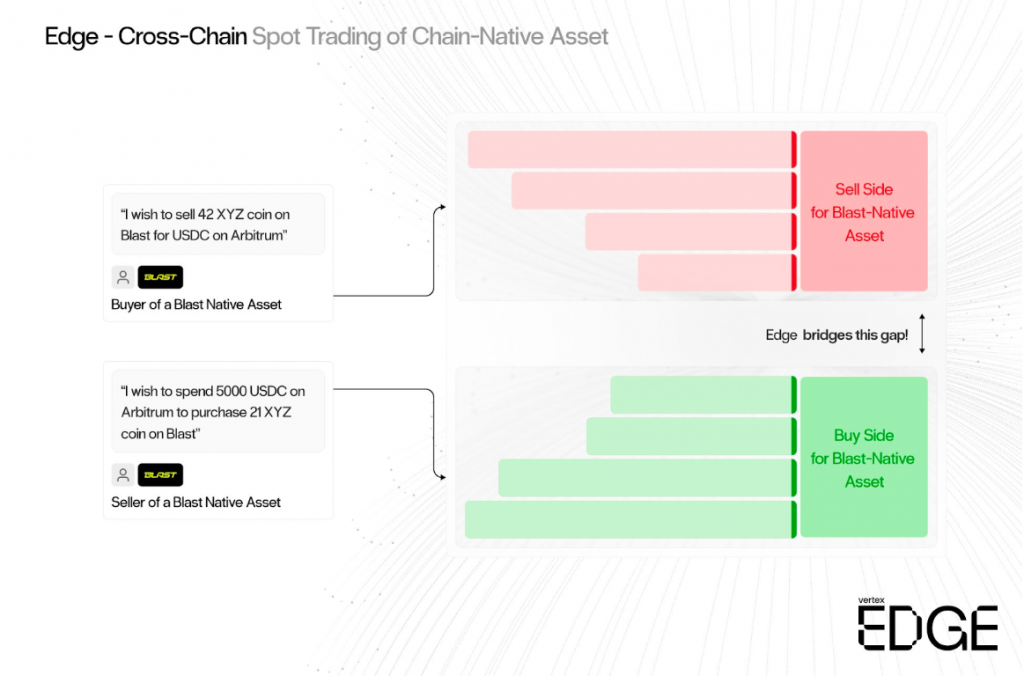

The spot market can perform cross-chain asset swaps of native assets without the requirement to hold the underlying base token of a given native asset they want to trade. Users can access a consolidated order book that aggregates liquidity from multiple chains, allowing for better price discovery and improved execution. Whether trading assets on Arbitrum, Blast, or other supported chains, users benefit from a unified liquidity pool that minimizes slippage and maximizes trading opportunities.

For example, if Alice on Blitz (in Blast) wants to sell $XYZ coin for $USDC on Arbitrum, Vertex Edge matches her order with resting bid liquidity on both Blast and Arbitrum, optimizing market depth and potentially reducing slippage. This synchronized orderbook aggregates liquidity, providing sellers on one chain access to buyers across multiple chains.

With Vertex’s perpetual markets traders can access deep liquidity pools across different chains, enabling orders from various chains to be matched simultaneously, optimizing order execution. This streamlines trading by eliminating discrepancies in funding rates across protocols on different chains due to liquidity fragmentation, enhancing overall market efficiency and trading experience.

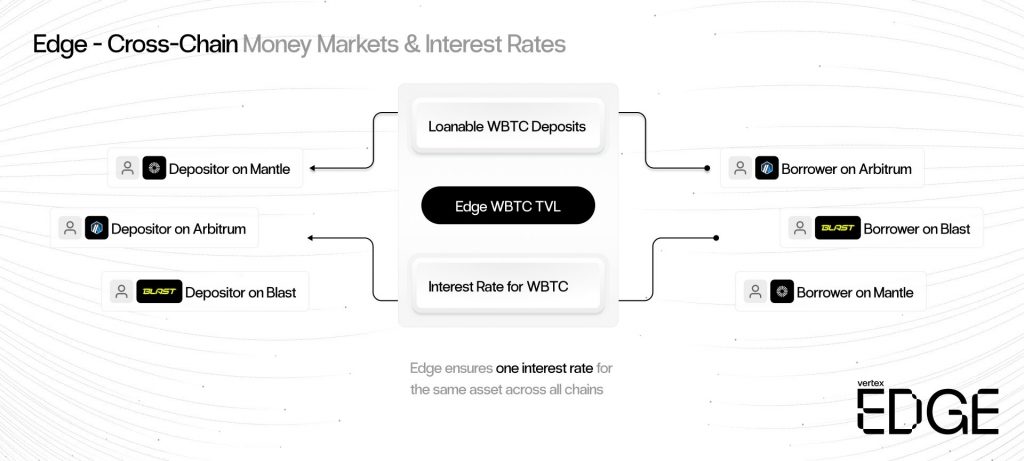

Vertex’s money market will allow for multi-chain collateral and unified interest rates, enabling users to benefit from reduced cross-chain friction and borrow/lend in a seamless way while being able to access increasing amounts of liquidity. Users participating in the money market can benefit from a unified liquidity pool, which increases the availability of assets for lending and borrowing activities. Consistent interest rates across Vertex Edge instances on different chains also promote capital flow between ecosystems, optimizing yields for passive capital allocators and providing cheap loans for active traders.

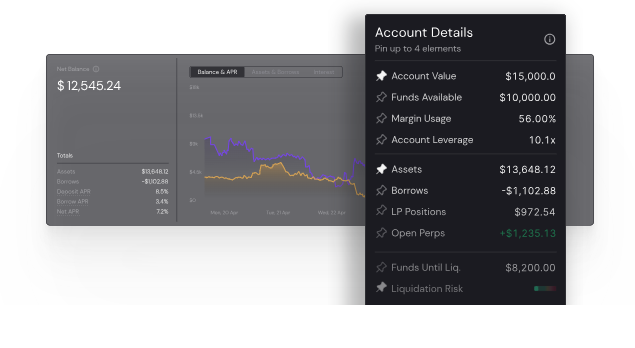

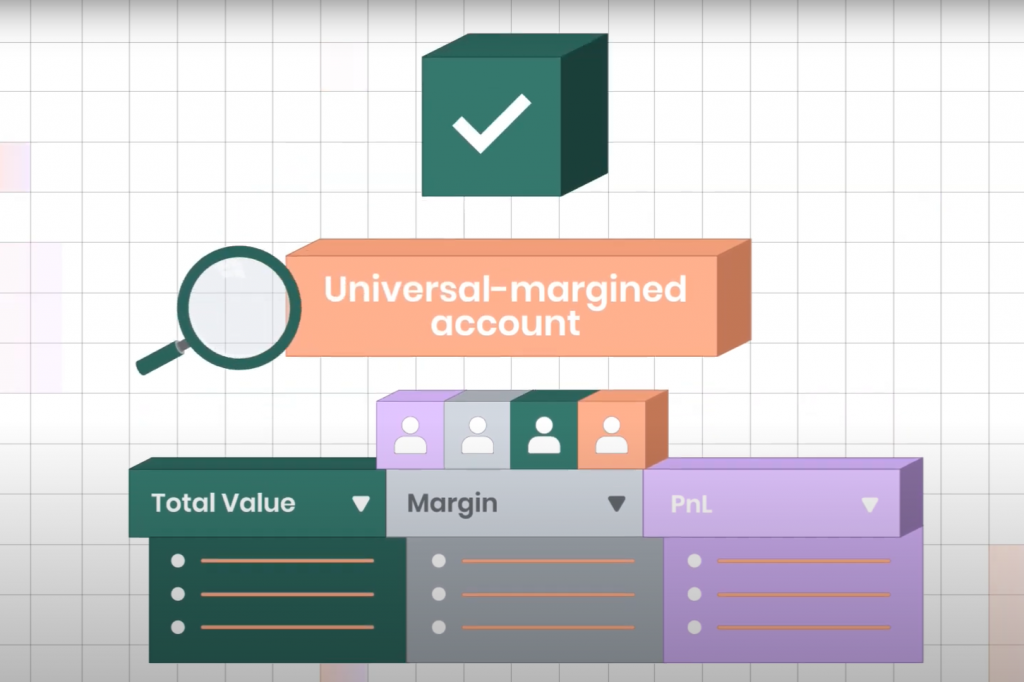

Universal Cross Margin

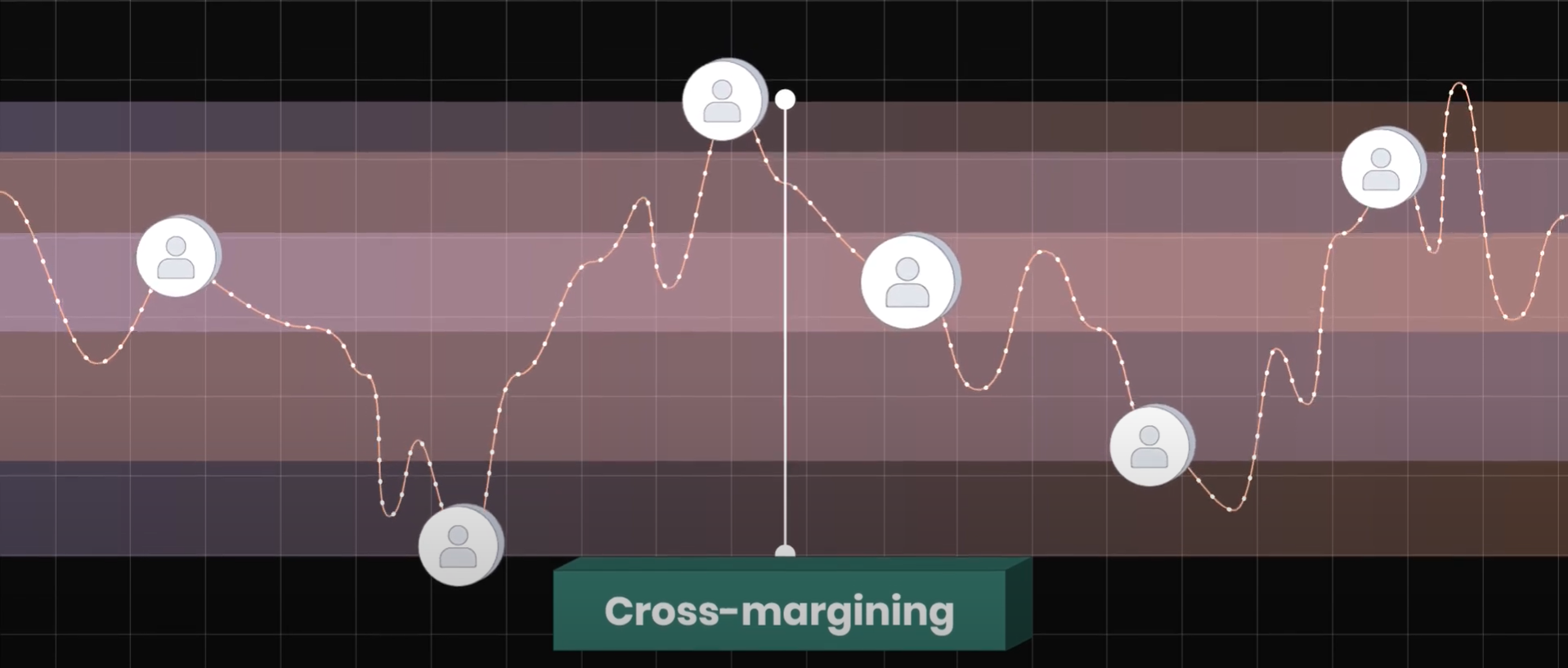

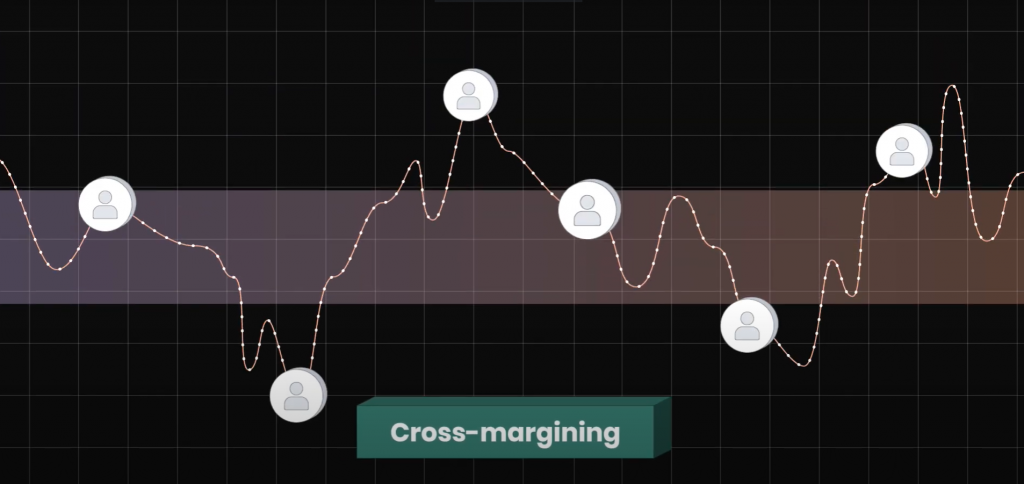

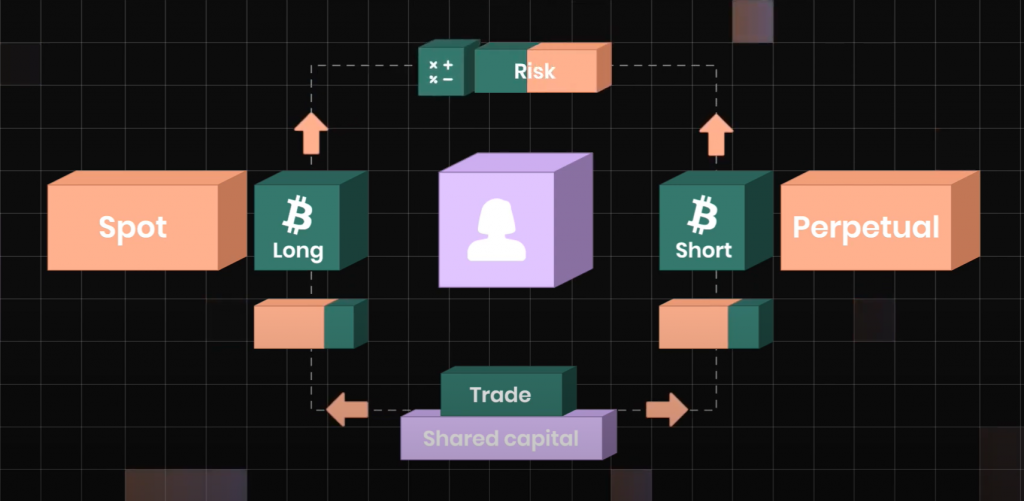

Vertex offers a trading feature called universal cross-margining, which consolidates liabilities across multiple open positions, enhancing capital efficiency and simplifying portfolio management.

Vertex employs cross-margining as the default mode, which means that a user’s trading account combines liabilities from various positions. This consolidation allows a user’s entire portfolio to serve as collateral across multiple positions, fostering capital efficiency.

On Vertex, your portfolio is your margin – your portfolio serves as collateral across multiple open positions.

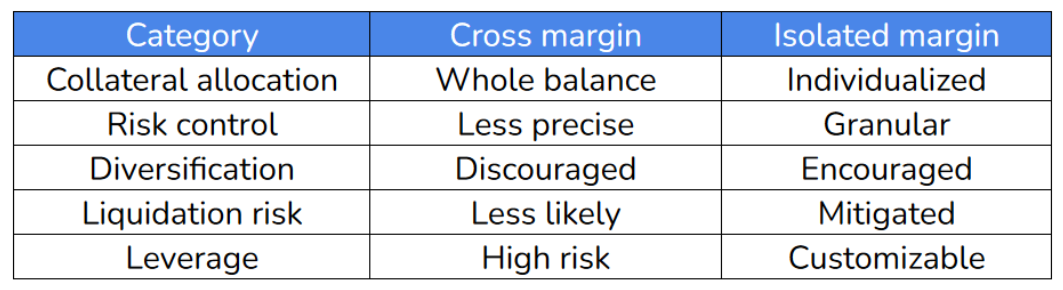

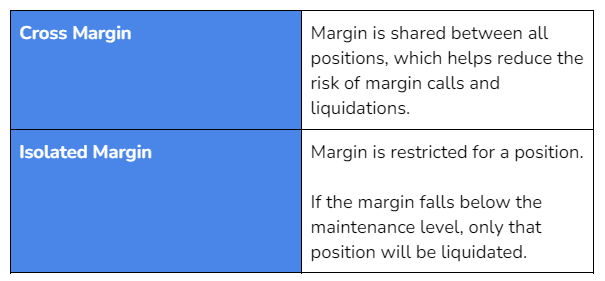

Cross Margin vs Isolated Margin

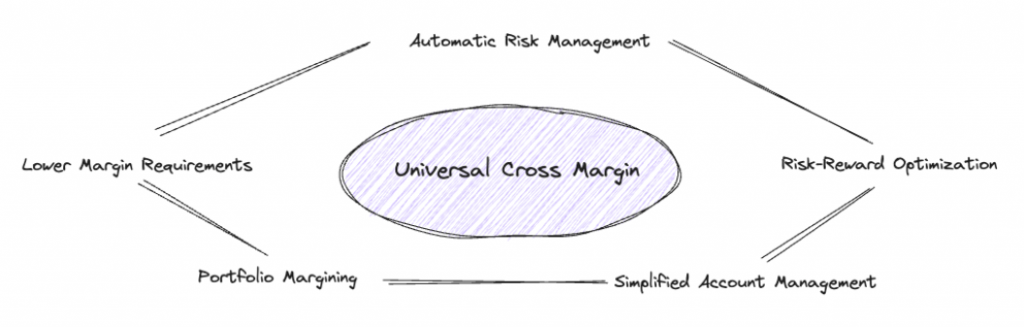

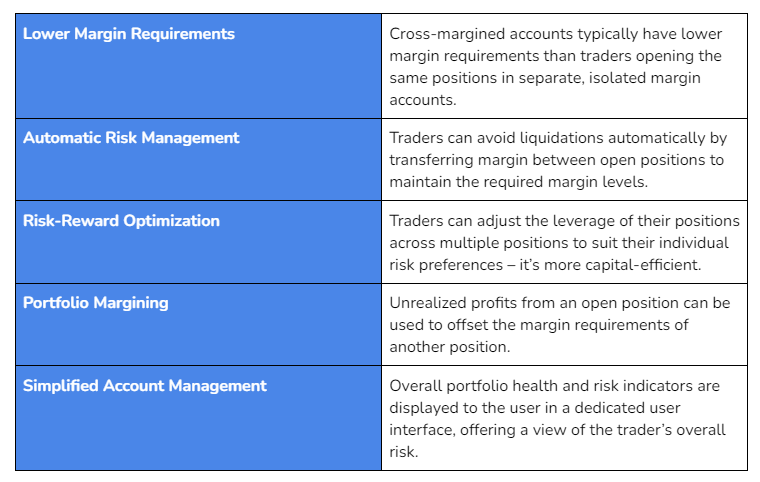

Universal cross-margin offers multiple advantages:

- Lower Margin Requirements: Cross-margining typically demands lower margin requirements compared to trading the same positions in isolated margin accounts. This means users can trade more capital efficiently.

- Automatic Risk Management: Vertex automates margin transfers between open positions to maintain required margin levels, minimizing the risk of liquidation. This automation is especially valuable during volatile market conditions and when executing complex trading strategies.

- Risk/Reward Optimization: Traders can adjust leverage across multiple positions to align with their risk preferences. This flexibility enhances capital efficiency and risk management.

- Portfolio Margining: Vertex’s cross-margin design incorporates portfolio margining, allowing unrealized profits from one position to offset margin requirements for another. This feature optimizes the use of available capital.

- Simplified Account Management: Vertex’s trading accounts provide a comprehensive view of a user’s overall risk, linking and managing all open positions in one interface. This simplifies portfolio management and risk monitoring.

Cross-margin enables users to reduce their margin requirements since the portfolio’s risk is calculated across multiple positions. This way, open positions share capital toward each position’s margin requirements – reducing the risk of single-position liquidations while requiring a lower initial margin for each position. In Vertex, all your open positions across spot, perps, and the money market contribute to your account’s portfolio margin. This gives greater flexibility to traders and helps them reduce the risk of margin calls and forced liquidations from single position declines.

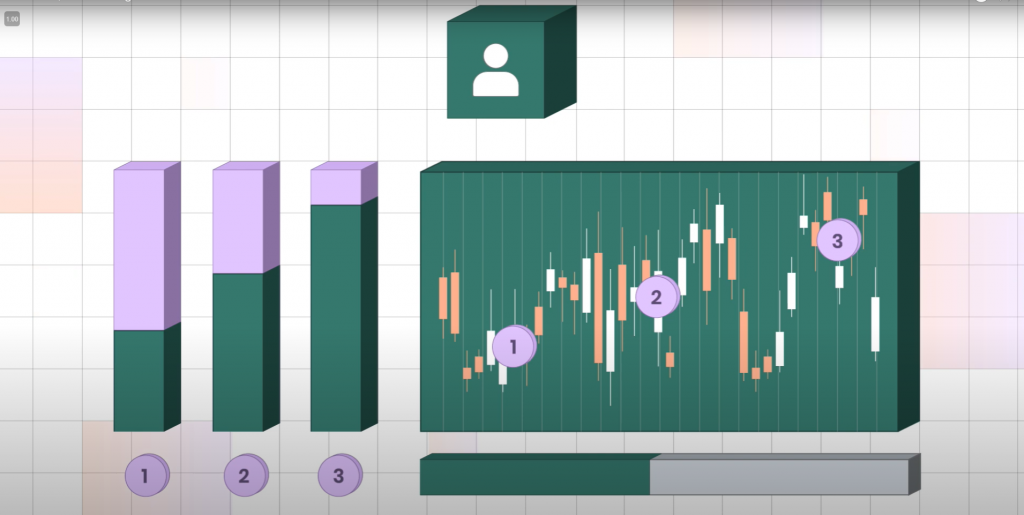

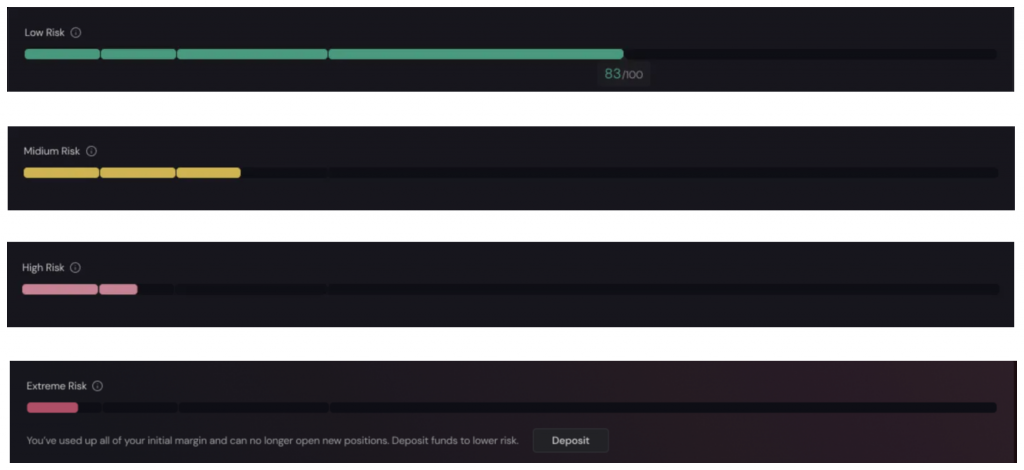

Vertex offers a clear view of your cross-margined trading account’s portfolio, including specific risk tiers. These risk tiers indicate your portfolio’s health and alert you to fluctuations in its weighted value.

The cross-margin design also allows for portfolio margin. This is similar to regular cross-margin with the difference that unrealized profits can be used to offer unrealized losses or deployed as margin for existing positions.

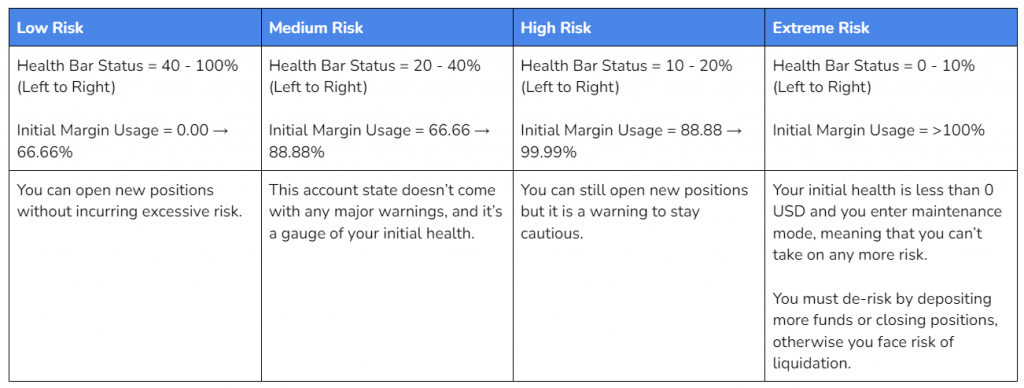

The portfolio health is categorized into different risk tiers, ranging from “Low Risk” to “Extreme Risk,” based on parameters like Initial Margin Usage and Health Bar Status.

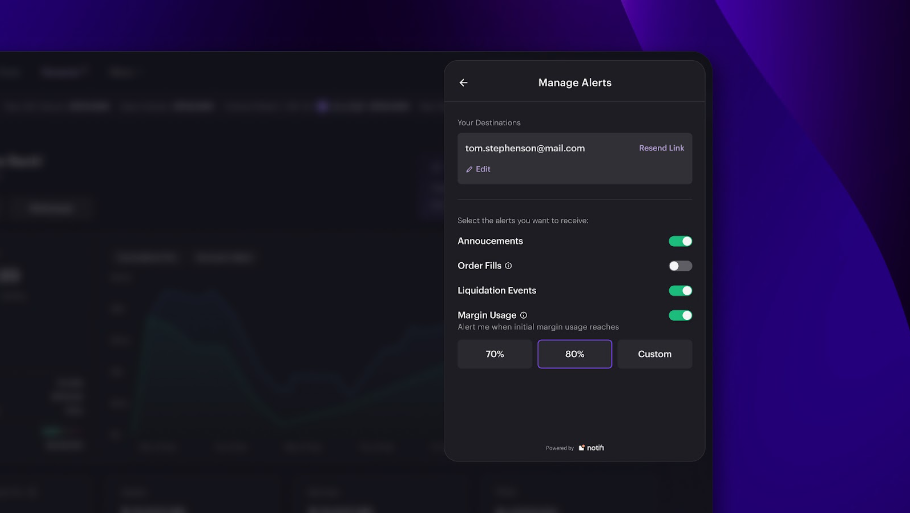

Users are encouraged to monitor their portfolio’s risk status closely. The interface will notify users as their accounts approach higher levels of risk, prompting them to take action to reduce risk or close positions. An integration with Notifi also allows users to set notification settings and get their alerts via email.

Basis Trades and Capital Efficiency

Spot and future prices are not necessarily the same and they eventually converge at maturity. It is standard among TradFi derivative trades to capture this spread and realize a profit calculated as the difference minus fees.

In crypto, perpetuals are the most common type of derivative. They are futures with no expiration and that maintain price parity with the underlying spot asset via funding rates. This mechanism balances the market such that the overweight side pays a fee to the underweight side as an incentive to bring price back to parity. Because of the absence of maturity, spot and perp prices don’t necessarily have to converge completely and can deviate for extended periods.

Perpetuals often trade at a premium compared to spot. This means that basis trades of long spot/ short perps are typically profitable positions while remaining delta neutral. For example, this means that when traders are going long and funding is positive, arbitrageurs can buy spot and short the asset on perps to earn funding.

Vertex’s universal cross-margining enhances capital efficiency for basis trades. Basis trades involve capturing spreads between spot and futures prices. Vertex provides native markets for basis trading, simplifying the process.

On other platforms, basis trades often require separate markets for spot and perpetual positions, leading to capital inefficiencies. For instance, if Alice is long ETH spot and short an ETH perpetual contract on another exchange, she must maintain the full margin requirement for the perpetual position, even if she has an offsetting spot ETH position.

Vertex recognizes the inefficiency and reduces the margin requirement for the ETH perpetual position. This capital-efficient approach allows traders to execute profitable basis trades with lower margin requirements. As a result of integrating a money market and spot trading right into the same protocol, Vertex offers cheaper, easier, and better arbitrage opportunities. For instance, when funding is positive, traders can now borrow $USDC, buy spot (and loop), and short the perp to capture funding and make a profit as long as the funding rate is greeted than the borrow rate.

Furthermore, the integrated money market on Vertex further enhances the basis rate, closely tethering it to borrowing rates for stables and tokens. This synergy creates profitable arbitrage conditions, attracting higher volumes and liquidity to the platform.

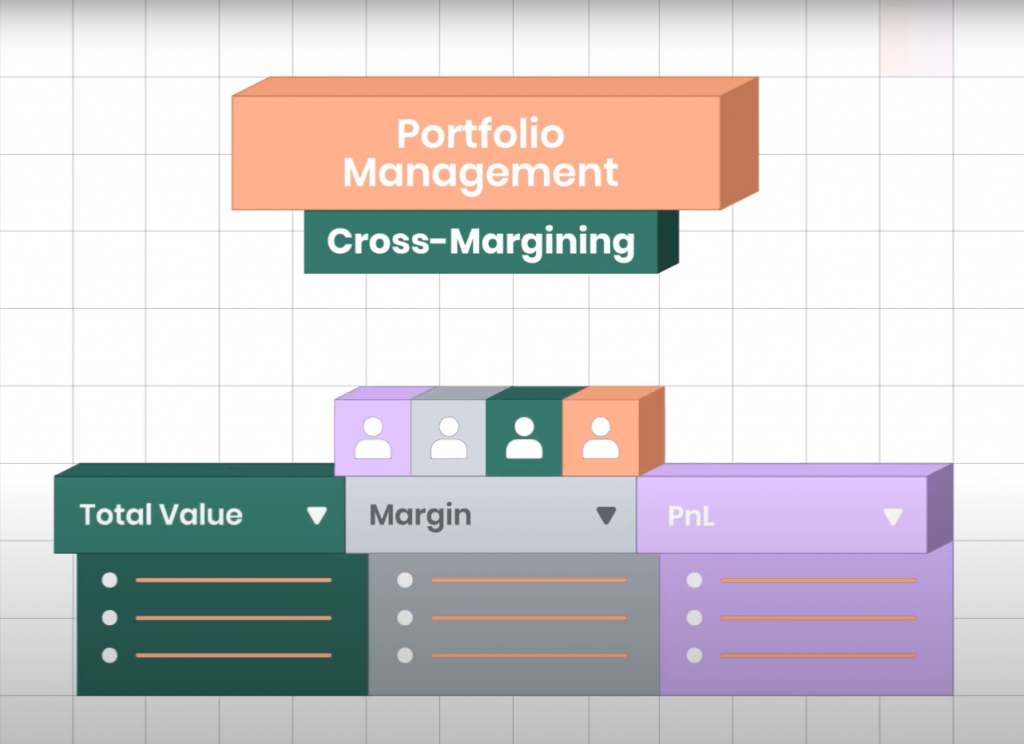

Portfolio Margining

With Vertex’s universal cross-margin feature, users can manage one account comprising all balances and positions, eliminating the need to switch between accounts. This streamlined approach simplifies portfolio management and optimizes capital efficiency.

Subaccounts, Isolated Margin, and Health

In Vertex, several key features play a crucial role in managing risk and optimizing capital efficiency.

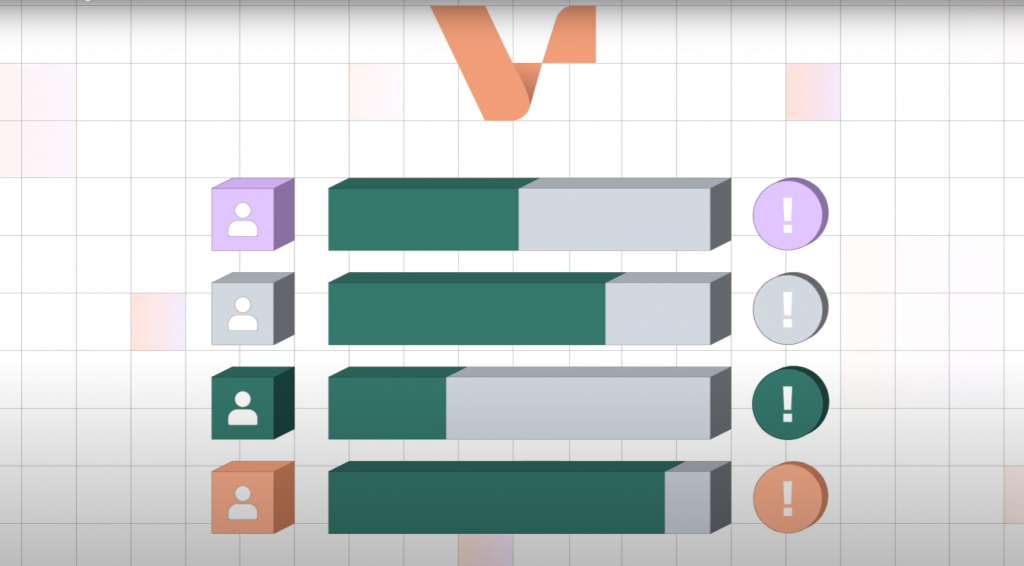

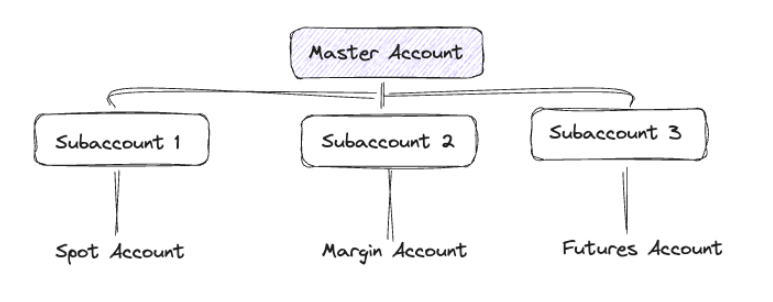

Subaccounts

Vertex allows users to create multiple subaccounts, each treated as an independent trading account. These subaccounts have their margin, balances, positions, and trade histories. Importantly, if liquidation occurs, only the assets within a subaccount are at risk, and risk is not shared between subaccounts.

By default, all subaccounts on Vertex utilize cross-margining. This default setting offers several advantages, including enhanced capital efficiency, reduced risk of liquidation for individual positions, and the ability to compound profits seamlessly.

Isolated Margin

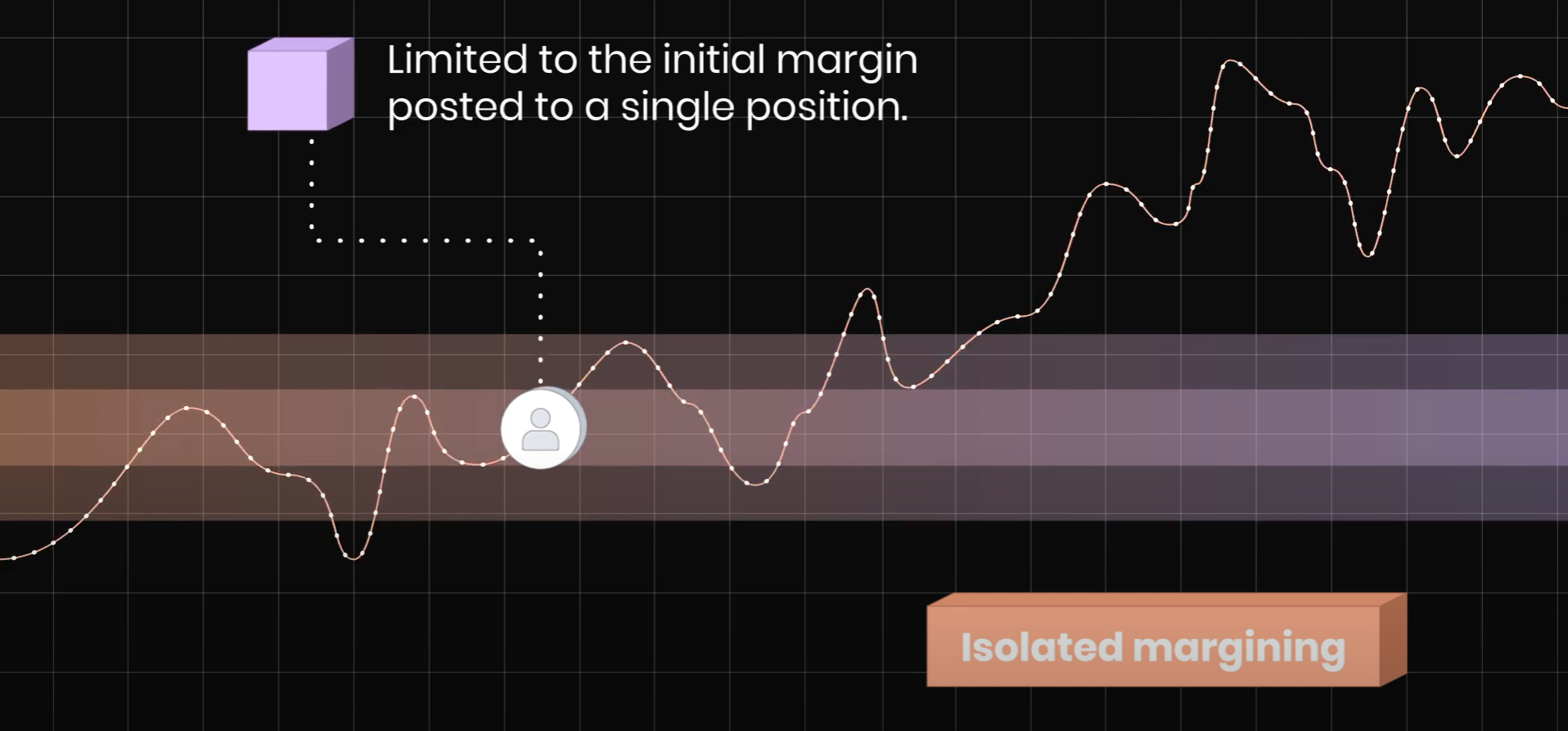

Isolated Margin is a feature on many exchanges that allows traders to assign unshareable margin to a single leveraged position. This isolation ensures that only the capital associated with that particular position is at risk.

On Vertex, users can achieve similar risk isolation by creating new subaccounts for specific positions. This allows traders to compartmentalize and manage the risk associated with individual positions effectively.

Health – Weighted Margin

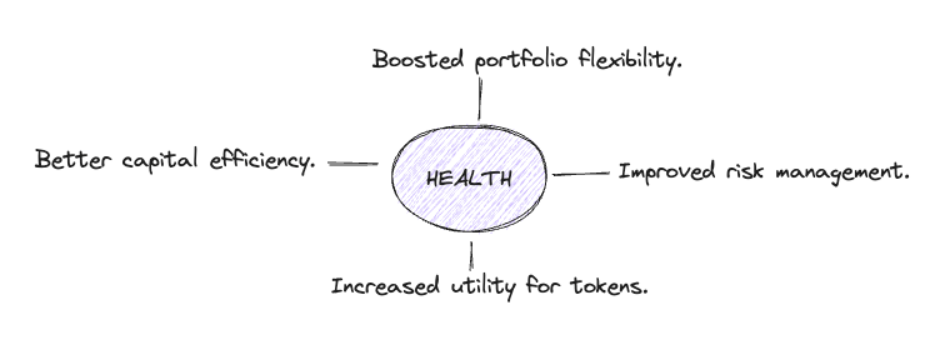

Vertex employs a concept called “Health,” which represents weighted margin calculations. This is a critical metric used to determine whether an account can open new positions or faces the risk of liquidation in adverse price movements.

The purpose of Health is to allow all positions in a user’s account to contribute to their margin and trading activity. This approach offers several benefits, including improved capital efficiency, enhanced risk management, greater portfolio flexibility, and increased utility for tokens.

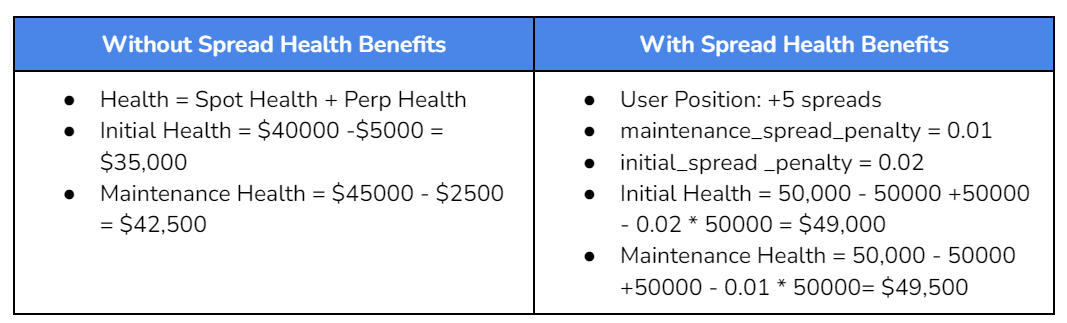

There are two types of Health:

- Maintenance Health: When Maintenance Health falls below zero, accounts become susceptible to liquidation.

- Initial Health: Accounts cannot open new positions if Initial Health falls below zero.

In simpler terms, Maintenance Health refers to the amount of $USDC needed to avoid liquidation, while Initial Health refers to the free collateral that is available for trading.

To account for different assets’ characteristics, including collateral quality, volatility, and liquidity, Vertex assigns “weights” to all products. These weights are essential for calculating both Maintenance and Initial Health.

Each product has four weight parameters:

- maintenance_asset_weight

- maintenance_liability_weight

- initial_asset_weight

- initial_liability_weight

Maintenance health is computed using maintenance weights, and initial health is calculated using initial weights.

Spot Health

Spot assets are used as collateral on the platform and can be used to trade other assets. Their contribution to Health is calculated as follows:

For instance, consider a trade with 5 $BTC in their account and the spot price of $BTC being $10,000. This would result in the following:

- maintenance_asset_weight = 0.9

- maintenace_liability_weight = 1.1

- initial_asset_weight = 0.8

- initial_liability_weight = 1.2

Therefore:

- Initial Health = 5 * 10,000 * 0.8 = $40,000

- Maintenance Health = 5 * 10,000 * 0.9 = $45,000

Hence, since this is the only open position in the account, the user has $40,000 of collateral value available for new positions.

Perps Health

Given the embedded leverage in perps, they have a similar but slightly different calculation:

As an example, consider a user going short 5 $BTC in perps, with the price being $10,000.

- maintenance_asset_weight = 0.95

- maintenace_liability_weight = 1.05

- initial_asset_weight = 0.9

- initial_liability_weight = 1.1

Therefore:

- Initial Health = -5 * 10,000 * 1.1 – (-5 * 10,000) = -$5000

- Maintenance Health = -5 * 10,000 * 1.05 – (-5 * 10,000)= -$2,500

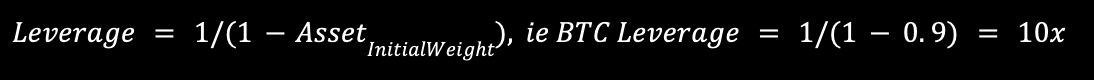

As a result, Vertex’s perpetuals weightings function similarly to leverage calculations on other platforms:

Special Cases: Spreads, LPs, and Large Positions

Spreads

Spreads represent offsetting positions on the same underlying asset, specifically:

- Long Spread = Long Spot + Short Perpetual (i.e., +10 BTC vs. -10 BTC-Perp)

- Short Spread = Short Spot + Long Perpetual (i.e., -10 BTC vs. +10 BTC-Perp)

For instance:

- User Position: +15 BTC, -10 BTC-Perps

- Vertex Definition: +10 BTC Spreads, +5 BTC

Given this definition, spreads are considerably less risky than the spot and perp positions on their own. As such, Vertex has the facility to attribute some health benefits to these positions.

The spread penalty is defined as a separate parameter in the system, and the spread weights for longs and shorts are defined (respectively) as:

1 – spreadpenalty and 1 + spreadpenalty

In most scenarios where the perp and spot are close to offsetting each other, the health of the spread will be roughly equivalent to the value of the spot component minus a small penalty to account for liquidity conditions.

The spread health calculation is presented below:

Continuing with the example above:

- User Position: +5 BTC, -5 BTC-Perps

- Spot + Perp Price = $10,000

LPs

LPs provide liquidity to the AMM, which follows a constant product xy=k formula. Orders can be matched against the liquidity pool or the orderbook, and takers get whichever is the best available price.

The health of a LP position is determined following the steps below:

- Assume the LP is at equilibrium (i.e. the price implied by the LP is the same as the oracle price). This is done to prevent economic attacks that manipulate the price of the LP.

- Decompose the LP into its respective components (continuing to assume an equilibrium state), and add up the health factors from there.

- Apply an additional penalty to Health.

Additional LP Penalty = (1 – LONG_WEIGHT) * AMOUNT_IN_LP * ORACLE_PRICE

This accounts for the additional risk in LPs represented by “impermanent loss” (i.e., the negative convexity). In practice, it means one’s leverage with LPs is halved.

For instance, using the asset weights from previous examples, using 5 $BTC at a price of $10,000, the initial health is $40,000.

- initial_asset_weight (wBTC) = 0.4

- initial_asset_weight (USDC) = 0.9

- LP Health = $40,000 * 0.6 = $24,000

Note that LP components are not considered in spread balances. For example, for a user who owns a $BTC LP and is short the $BTC perp, there wouldn’t be any spread balance benefit.

Liquidations and Insurance Fund

As with any other derivative platform, liquidations are a critical process to ensure the integrity and solvency of the platform. They also protect traders from excessive losses and maintain fairness in trading.

Liquidations are an automated process that closes leveraged positions when a trader’s account balance (margin) falls oto low to cover potential losses. Their primary purpose is to prevent traders from incurring debts that exceed the balance of their initial investment.

Each exchange has its own liquidation mechanisms, often defined by unique maintenance weights specific to each market. These maintenance weights determine the risk profile of a market and influence when liquidations occur.

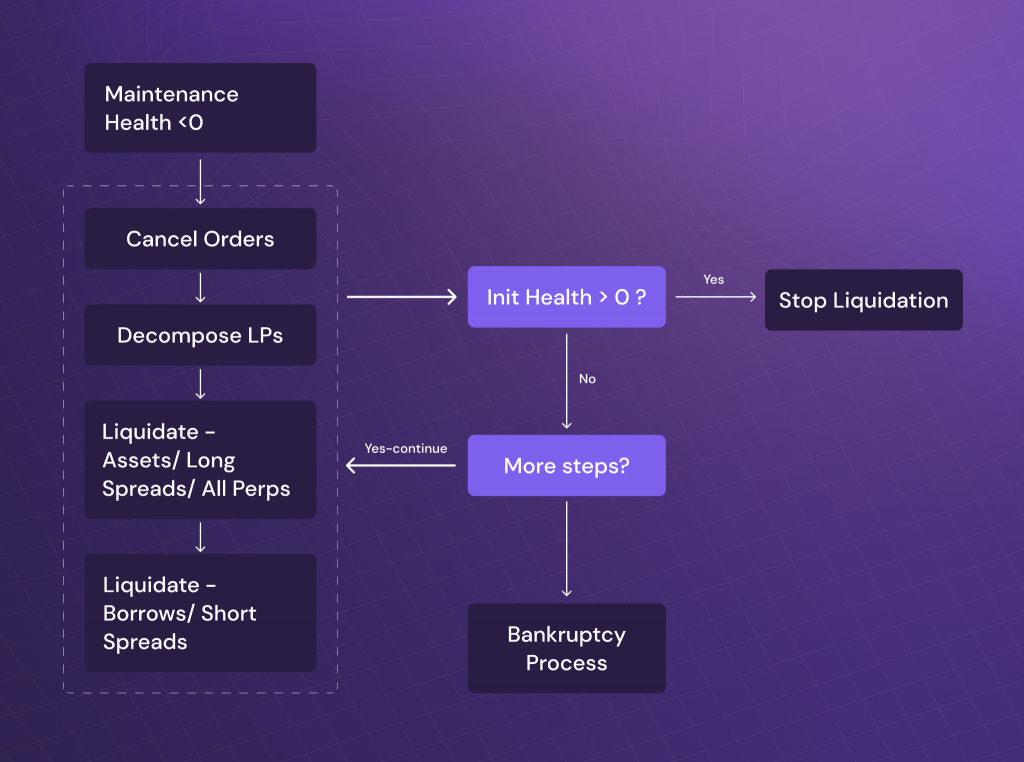

Liquidations on Vertex are executed at the mark oracle price, derived from a third-party oracle called Stork. When an account’s maintenance health falls below zero, it enters liquidation. Next, the liquidation process takes place following a specific order:

- Orders are canceled.

- Liquidity Providers (LPs) are decomposed.

- Assets are liquidated (Spot Balances/Long Spreads/Perps).

- Liabilities are liquidated (Borrows/Short Spreads).

During liquidation, any user can purchase assets from the liquidating account at a discount or pay off its liabilities at a markup. This process continues until the underwater account’s Initial Health rises above zero.

Liquidation Price Calculation

Liquidators aiming to liquidate a subaccount specify the product and amount they want to liquidate. The liquidation price for assets is set halfway between the oracle price and the price determined by the maintenance weight. In addition to that, the net price at which the product is liquidated is calculated differently for long and short positions, taking maintenance weights into account.

Long: oracle_price * (maintenance_asset_weight + 4) / 5

Short: oracle_price * (maintenance_liability_weight + 4) / 5

Liquidators generate a gross profit from liquidation, but Vertex receives 25% of this profit as fees, which are deposited into the insurance fund to protect the protocol’s health. Thus, the net profit for liquidators is adjusted accordingly.

Long: oracle_price * ((1 – maintenance_asset_weight ) / 5) * 0.75

Short: oracle_price * ((maintenance_liability_weight – 1) / 5) * 0.75

Liquidation Outcomes

Liquidators can specify any product and amount, but the total can be rounded down to minimize the impact of liquidations on users. Liquidations aim to bring the liquidatee’s Initial Health back to zero.

As a result, liquidations can result in two outcomes:

- Liquidatee receives $USDC for positive spot balances and positive PNL perps.

- Liquidatee spends $USDC to pay back negative spot balances and negative PNL perps.

Vertex ensures that the liquidatee’s USDC balance cannot go below zero to prevent incorrect assignment of losses to $USDC holders. If all liquidation options result in Outcome 2, the account is considered insolvent.

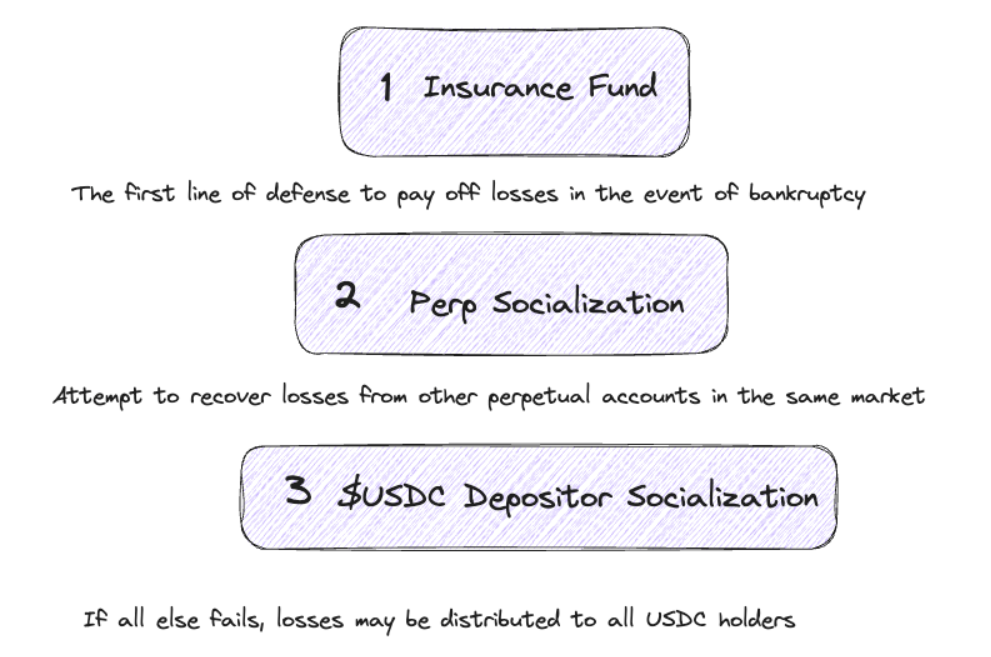

Insurance Fund

Vertex maintains an Insurance Fund that is initially seeded with funding from the core team and progressively topped up with a percentage from liquidations.

The Insurance Fund serves the purpose of being an aggregated pool of funds denominated in $USDC that are used to cover shortfalls in the event of an account going bankrupt. This helps to pay off losses and avoid socialization.

However, in cases where bankrupt accounts cannot be fully covered by the Insurance Fund, the system will attempt to socialize losses against other perpetual accounts in that market. If the account has already been settled, its losses will be socialized against all $USDC holders.

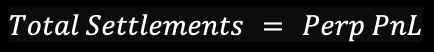

PnL Settlements

“PnL” stands for “Profit and Loss,” representing the current market value of a position minus the cost to open that position.

PnL = Market Value – Costopening

- Perp PnL: The user’s PnL across all open perps positions.

- Position PnL: The PnL of a specific position.

Traders on the platform can monitor their Perp PnL on the Portfolio Overview, and they can find the Position PnL in the Perp Positions table.

It is also possible to pin the PnL to the top of the screen on the UI, making it easy to monitor PnL across different page views.

Account Value Calculation

The value of an Account does not equate to Assets – Borrows ± Perp PnL

Instead, the Account Value is calculated as:

Account Value = Assets – Borrows ± Unsettled $USDC

This way, balances are subject to constant changes as $USDC is automatically settled on the backend from perpetual trading into balancers.

In Vertex, settlement occurs continuously, but this has no impact on the economic state of traders. However, Assets and Borrows will change over time as PnL is settled.

Perpetual Settlements – Settled & Unsettled USDC

On Vertex, open positions fall into two categories within the context of settlement: Winners and Losers.

- Winners are open positions with positive PnL.

- Losers are open positions with negative PnL.

The settlement involves a transfer of USDC from Losers to Winners, leading to corresponding balance adjustments.

Similarly, the PnL of a perpetual contract can be divided into two parts:

- Unsettled $USDC: This represents $USDC that is yet to be transferred between accounts.

- If it’s positive, it will be deposited into your $USDC balance.

- If negative, it will be deducted from your $USDC balance.

- This process is automatic and continuous.

- Settled USDC: This is PnL that has already been transferred to your current $USDC balance on the Portfolio Overview page in the Vertex app.

It’s important to note that Unsettled $USDC can fluctuate based on the volatility of positions and may not necessarily relate to the lifetime PnL of positions. Positive PnL can have negative settlements, and negative PnL can have positive settlements, depending on position duration and movements.

When closing a trade, settlements happen automatically, and any remaining unsettled $USDC will be realized into your $USDC balance. Typically, this settlement occurs within a few minutes.

You can review your settlement history on Vertex by navigating to Portfolio → History → Settlements Table on the Vertex app UI.

Users with open positions may notice changes in their $USDC balances over time. These changes occur due to PnL settlements happening on the backend. This is a normal behavior and does not affect your ability to trade.

If users have negative PnL and no $USDC in their accounts, PnL will continue to settle. However, users with positive account health will automatically borrow $USDC to cover these settlements.

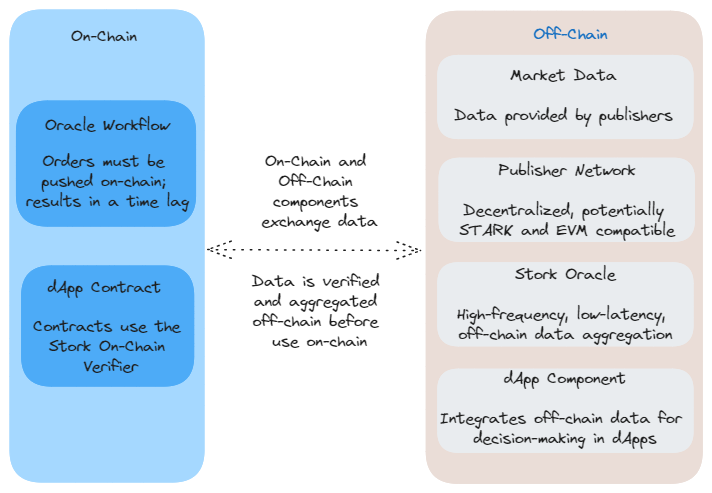

Pricing – Oracles

Pricing and oracles ensure an efficient and reliable trading experience. In Vertex, oracles serve as the bridge between Vertex’s on-chain AMM and off-chain CLOB, providing pricing data that is essential for conducting on-chain operations with accuracy and speed.

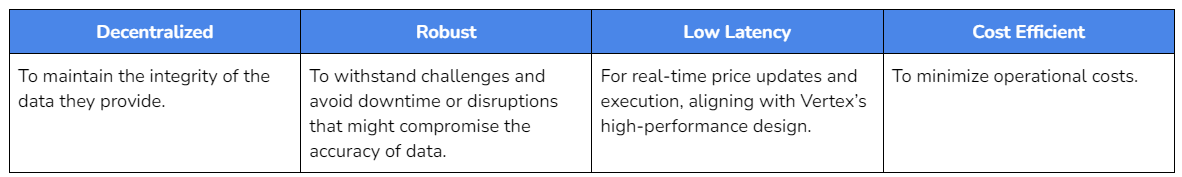

Oracles in Vertex must have the following properties:

Vertex uses a multi-oracle approach such that price data is sourced from different providers.

Stork Oracle

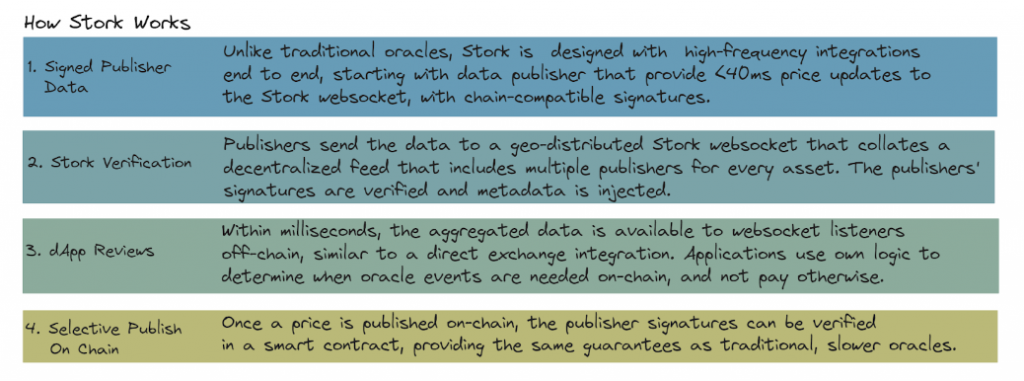

Stork is an oracle provider designed for ultra-low-latency and high-performance price feeds compatible with the EVM.

Stork utilizes ultra-fast WebSockets across multiple regions and node providers to provide millisecond-level reference prices, similar to traditional centralized exchanges. It also enables off-chain initial processing and subsequent on-chain price updates, which reduces computational complexity and costs.

Publishers in the Stork network are chosen based on their ability to provide low-latency price updates reliably. Also, each publisher can contribute an index price for the markets supported by Stork, although not all publishers may converge their price calculations.

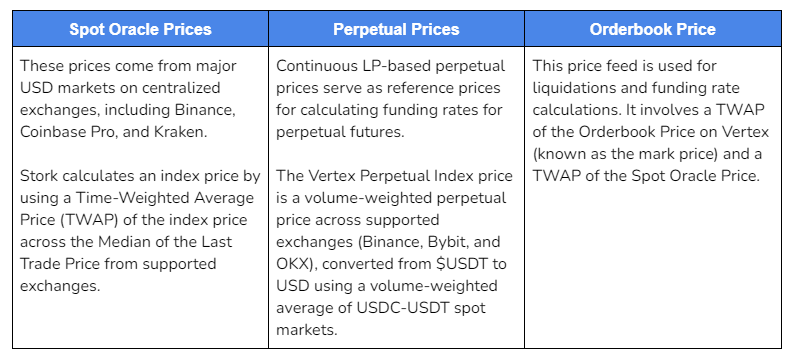

Vertex uses 3 different price feeds via Stork:

- For liquidations, Vertex utilizes the Spot Oracle Price (#1) and the Perp Oracle Price (#2) to calculate a trader’s account value.

- For funding rate calculations, Vertex uses a TWAP of the Orderbook Price on Vertex (#3), known as the mark price, and a TWAP of the Spot Oracle Price (#1).

- An independent oracle price also exists for $USDC, ensuring functional trading behavior even if USDC’s peg to USD is disrupted.

Note that Vertex displays prices quoted against $USDC, not USD. Besides, the protocol does not assume a 1:1 peg between $USDC and USD.

Chainlink Data Streams

Chainlink Data Streams are used to deliver sub-second resolution data, allowing users to access high-fidelity market information quickly and accurately.

Chainlink Data Streams are known for their robust performance and security. They are designed to maintain their reliability even during unexpected events such as exchange downtime, flash crashes, and data manipulation attacks via flash loans. This ensures that Vertex Protocol users can trade with confidence.

Chainlink Data Streams use conflict-of-interest-free data sources and a commit-and-reveal architecture to protect traders and liquidity sources against malicious price manipulation and information arbitrage. This adds an additional layer of security.

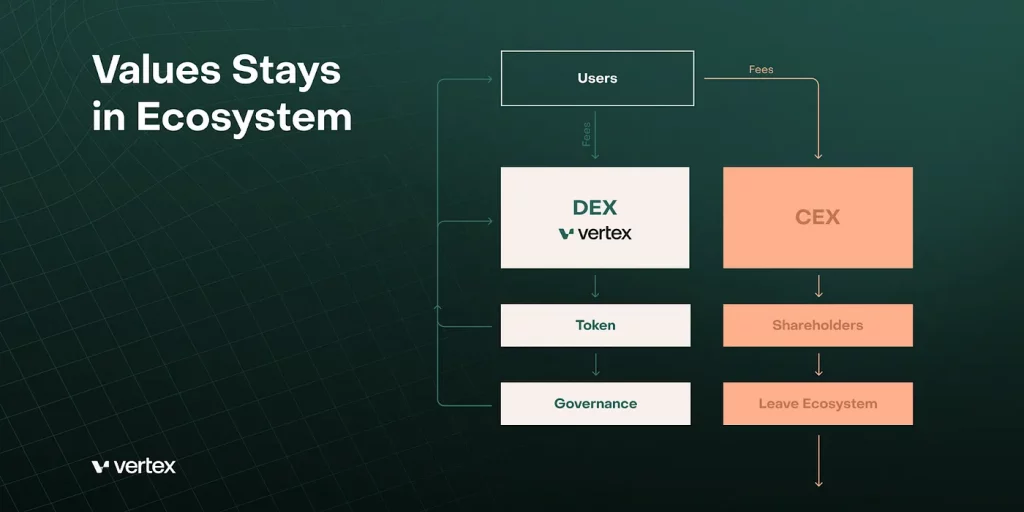

Why the Project was Created

Vertex’s mission is driven by the recognition of centralization risks that continue to plague the cryptocurrency market. The contagion events of 2022 exposed vulnerabilities in the traditional financial system’s influence over the crypto industry. The series of insolvencies and misaligned incentives between third-party custodians and their customers served as a stark reminder of the moral hazard present in traditional finance.

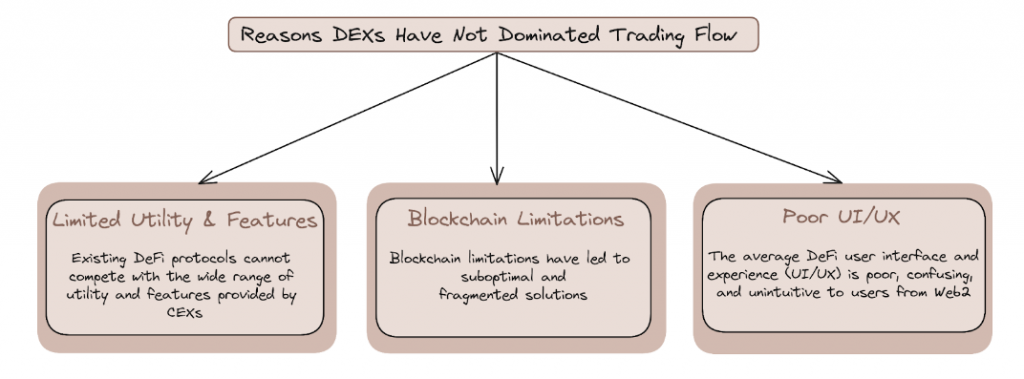

DEXs have long been championed for their ability to empower users with control and autonomy. They mitigate the principal-agent problem posed by centralized actors and eliminate the need for trust in third parties. However, DEXs have faced obstacles hindering their broader adoption.

Despite the revelations of centralization risks, centralized exchanges (CEXs) have continued to dominate crypto trading. They offer additional features, smoother fiat on/off ramping, lower latency, and superior liquidity. Incumbent DEXs have struggled with scalability, user experience, and capital efficiency barriers, limiting their appeal to the average trader.

It is against this backdrop that Vertex emerged with a clear and transformative vision. The project seeks to redefine the narrative by eliminating the trade-offs users face between control and performance when choosing between CEXs and DEXs.

Vertex’s mission is to bring the performance and features of centralized exchanges on-chain while preserving the core benefits of self-custody, transparency, and decentralization inherent to DeFi. The project achieves this by offering a vertically integrated DEX on the Arbitrum network, incorporating spot trading, perpetual contracts, and an integrated money market into a unified platform.

Sector Outlook

Vertex strives to provide a seamless, decentralized trading experience that combines the performance and features of CEXs with the benefits of self-custody, transparency, and autonomy inherent to DeFi.

Traders can execute spot and perpetual trades, manage portfolio margins efficiently, and participate in the integrated money market, all while maintaining control of their assets. The idea is that users no longer compromise control for performance and features.

Vertex stands out as a DEX that not only offers a versatile trading experience but also bridges the gap between centralized and decentralized exchanges. Its use of Arbitrum’s L2 scaling and innovative on-chain AMM, combined with off-chain order book technology, positions it to deliver lightning-fast performance while preserving the user-centric principles of DeFi.

Unlike other projects focused on derivatives, Vertex aims to simplify the trading experience. Users no longer need to switch between various decentralized applications (dApps) for different trading functions. Instead, they can trade, earn, and borrow all within the Vertex DEX, offering a seamless and comprehensive trading ecosystem.

The Flaws of Centralized Exchanges

Differences between Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) revolve around trade-offs that impact trading performance, particularly concerning spreads and slippage. Both types of trading venues aim to provide liquidity through tight spreads and low slippage, but they do so within their respective limitations, allowing users to choose the platform that aligns with their preferences.

Currently, CEXs hold a significant advantage in terms of user adoption and volume. They offer a familiar and efficient trading experience that caters to a broad audience. However, recent incidents like the FTX debacle have triggered a shift in user preferences. Factors such as self-custody, transparency, and autonomy in DeFi have gained traction, prompting users to explore decentralized alternatives.

anced security, and innovative trading options. These integrations play a crucial role in Vertex’s mission to provide a comprehensive and user-friendly DeFi platform.

CEXs typically offer more significant liquidity, making it easier for traders to execute large orders without significant slippage. They also provide a wide range of trading options, including perpetual contracts, spot markets, and cross-margining, catering to different trading preferences. Additionally, high-frequency traders find CEXs attractive due to their infrastructure and speed, allowing for algorithmic trading strategies.

DeFi, on the other hand, introduced innovative financial products and autonomy, attracting users interested in self-custody and transparency. Automated Market Makers (AMMs), in particular, gained widespread attention, enticing retail users with passive liquidity provision and the ability to trade long-tail assets.

However, AMMs faced challenges, including gas fees and the erosion of liquidity provider profits due to arbitrage and Miner Extractable Value (MEV). These issues prompted users, especially high-frequency traders, to seek alternatives on CEXs, which offered better infrastructure and capital efficiency.

While efforts have been made to improve DEXs, including the development of central limit order book (CLOB) exchanges and off-chain order books to minimize MEV and enhance trading execution, CEXs still dominate. In fact, most DEXs prioritize either spot or perps, but not both.

Vertex gains a competitive advantage by offering spot, perps, and a lending market all in one platform. Additionally, it bridges the gap between CEXs and DEXs, offering self-custody, MEV mitigation, integrated products, cross-margining, liquidity, HFT-friendly APIs, and fast order execution. It seeks to provide users with the benefits of both worlds, making it a potential solution to the challenges faced by DEXs.

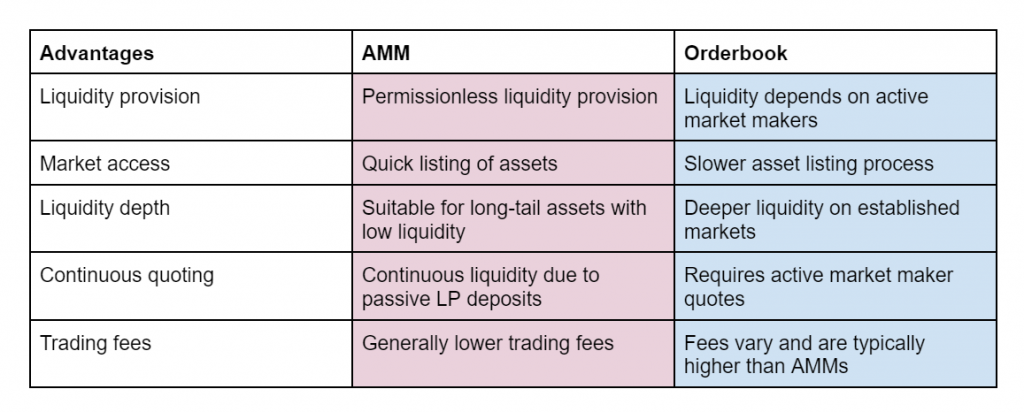

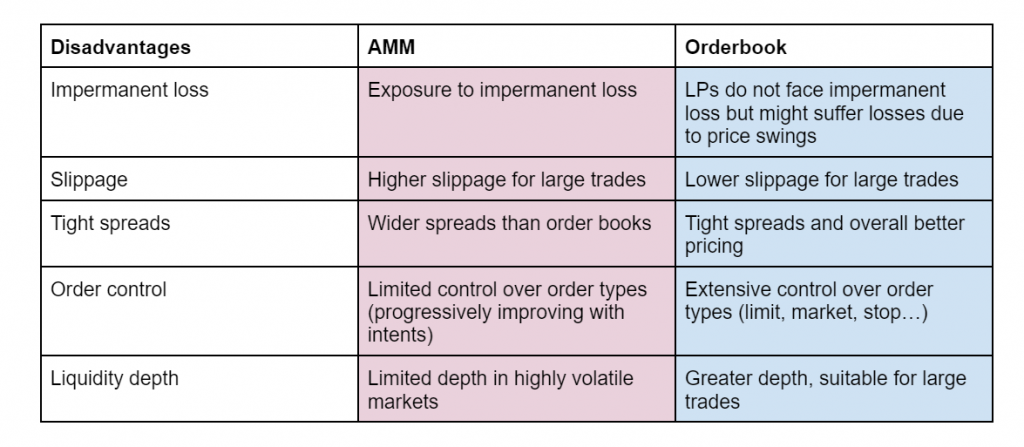

Orderbooks and AMMs

Vertex introduces a Hybrid Orderbook-AMM. This represents a solution that bridges the gap between the limitations of Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs).

In crypto and on-chain environments, liquidity is a paramount concern, defined by tight spreads and minimal slippage. Both DEXs and CEXs strive to provide liquidity to users, but their approaches differ significantly. Vertex’s design, however, seeks to harmonize the best features of both worlds.

Central to this design is the consideration of three core technical factors: speed and performance, flexible liquidity expression, and easy access to market information. The Continuous Limit Order Book (CLOB) structure emerges as the most effective exchange model, a model that dominates both CEXs in the crypto world and traditional finance exchanges.

Despite its advantages, on-chain order book solutions in DeFi face scalability issues due to the inherent limitations of blockchain technology. Scalability, low latency, and the threat of Miner Extractable Value (MEV) pose challenges to the effective operation of on-chain order books.

In response to these challenges, DEXs have gravitated toward two main approaches. The first involves Automated Market Makers (AMMs), which offer passive retail trading venues but often suffer from latency and scalability issues. Despite their limitations, AMMs remain dominant in the DEX space due to their popularity among traders.

The second approach seeks to bypass on-chain limitations by utilizing off-chain order books for trade matching. However, this approach still maintains on-chain execution and asset custody to preserve DeFi’s self-custodial advantages while avoiding performance and MEV issues.

Vertex’s solution takes a unique approach by combining the benefits of an on-chain constant product AMM with an off-chain order book known as the “sequencer.” The risk engine remains entirely on-chain, ensuring transparency and trustlessness. In the default state, trades occur on the on-chain AMM, but traders can access the Vertex API to execute trades directly from the off-chain order book, achieving impressive speeds of 10 – 30 milliseconds, competitive with most CEXs.

This hybrid model offers several advantages to Vertex users. It enhances execution quality by allowing market makers to provide tighter prices with less risk, resulting in reduced slippage. It accommodates retail users, enabling them to provide passive liquidity and engage in market-making and yield farming strategies. Importantly, it ensures trustlessness, as the AMM provides an alternative trading pathway even if the sequencer order book experiences issues.

Furthermore, Vertex’s AMM design leverages the x*y=k pools architecture for both spot and perpetual markets. Traders can contribute liquidity to different pools, and this liquidity combines with automated trader liquidity via the sequencer. Trades are executed at the best possible price, taking advantage of both limit orders and liquidity provider positions. This approach ensures continuous liquidity availability and benefits both illiquid and liquid assets.

In summary, Vertex’s Hybrid Orderbook-AMM design offers the best of both worlds: the performance and features of popular CEXs and the on-chain advantages of DeFi. By addressing the limitations of existing exchange models, Vertex aims to provide traders with an unmatched trading experience, bringing liquidity, flexibility, and trustlessness to the forefront of cryptocurrency trading.

Appchains and Latency Challenges

Building appchains for decentralized platforms involves a tradeoff between achieving low latency and maintaining the core principles of blockchain technology. Appchains serve as an intermediate execution environment within a decentralized ecosystem. While distributed blockchains offer unparalleled security and decentralization, they inherently introduce latency due to the need for consensus among globally distributed nodes. This latency can be a significant challenge when it comes to high-frequency trading, where speed is of the essence.

To address the need for low latency, one approach is to collocate servers in a single location. However, this approach raises questions about decentralization, as it can concentrate control and undermine the fundamental ethos of being a blockchain—a globally distributed network.

When it comes to building a DEX, Vertex acknowledges that faster blockchains can empower market makers by allowing them to place orders at the top of the order book with greater confidence, resulting in better prices and execution for users. For instance, appchains like Hyperliquid still operate with latencies ranging from 200 to 900 milliseconds, which are more than 10 times what Vertex can offer. In comparison, their setup aims for super-low latency, emphasizing the importance of an optimal user experience, particularly for achieving deep liquidity in trading.

However, there’s a notable tradeoff involved. While faster execution is vital for traders, running a decentralized appchain on top of a L2 solution may compromise overall performance and speed. This tradeoff suggests that the need for speed could outweigh the security benefits typically associated with a distributed execution environment.

In the case of Vertex, their setup prioritizes order book security. Real-time transactions are closely monitored by professionals, contributing to the trust users place in the order book’s integrity. Trust in orderbook security is further reinforced through social enforcement mechanisms and open liquidations, ensuring that users have confidence in the trading environment.

This way, market makers would immediately notice any manipulation or reordering of transactions, leading to a loss of liquidity. Lower latency also enables market makers to provide better pricing by taking more risk. This would prioritize time preferences on the market and ensure fair execution for all traders. Similarly, by being fast, consistent, and predictable, liquidity providers can offer better liquidity and pricing to traders.

Unifying Cross-chain Liquidity

With Edge, Vertex addresses the pressing issue of fragmented liquidity across various chains, serving as a synchronous orderbook liquidity layer that seamlessly integrates liquidity from multiple chains. By fusing liquidity from supported Edge chains and aggregating it at the Vertex sequencer level, Vertex Edge eliminates the fragmentation of liquidity pools seen with traditional cross-chain solutions.

The Vertex sequencer, enhanced by Edge, functions as a virtual market maker between exchange venues on different chains. It matches inbound orders from one chain against liquidity from multiple chains concurrently, optimizing order execution and enhancing trading efficiency for users. This approach ensures that users can access deep and liquid markets without the need to navigate between different chains.

As Vertex instances proliferate across ecosystems and usage grows, a mutually beneficial scaling of liquidity manifests, benefiting all participants in the Vertex ecosystem, whether they are trading spot, perps, or borrowing liquidity from the money market.

Contrast this with other DEXs that rely on deposit contracts or appchains. Those DEXs are effectively taking activity off other chains. However, unlike such competitors, Edge maintains all activity on the host chain, offering a win-win scenario for all parties involved: users get the experience they want, liquidity improves everywhere, and chains improve their user retention. This results in alignment between protocols and chains, instead of competition and endless pressure to capture users and liquidity through unsustainable incentives.

Potential Adoption

Vertex’s core value proposition lies in delivering the performance and usability that centralized competitors offer while maintaining on-chain and self-custodial principles. It empowers users to take control of their assets, facilitating lightning-fast trades, universal cross-margining, and a customizable, user-friendly trading interface.

With Vertex, users no longer need to switch between multiple DeFi applications (spot AMMs, perpetual DEXs, money markets…) to perform actions such as buying and selling, going long or short derivative contracts with leverage, borrow or lend assets…

Even though some of the perp DEXs have already gained their first users and managed to retain them, Binance still holds more than half of the market share. Projects like Vertex aim to reduce their share of the pie and bring more users on-chain by offering a similar UX that also allows for unique offerings thanks to their architecture and suite of products.

Besides being a more convenient place to perform on-chain actions, offering multiple products from a single platform reduces costs for users and offers increased capital efficiency, aggregating liquidity conditions and offering better pricing with narrower spreads.

Each component of the Vertex stack coalesces into a single unified platform that solves the limitations of siloed DEX models and allows for each of the core products to amplify the strengths of each other. The resulting hybrid AMM and orderbook DEX maximizes performance, improves liquidity conditions, and offers a more diverse product suite.

Universal-margined accounts are one of the most demanded and popular features in CEX, but they have not been offered to DeFi users up until now. This first-mover advantage can simplify Vertex’s job to onboard new traders who are already used to trading on a CEX.

Universally cross-margined trading accounts can be beneficial for both sophisticated and retail traders for several reasons, including:

When it comes to competing versus other DEXs, the goal is to establish a moat around more capital efficiency, low latency, better liquidity conditions for trading, and more flexible ways to optimize for portfolio management.

Even though Vertex is not currently offering very high levels of leverage such as the 50 allowed on different platforms, the vertically integrated product suite enhances their value proposition versus other competitors like GMX or similar clones which rely on external oracles for pricing.

It is also worth noting that Vertex does not aim to increase the amount of revenue generated from trading fees by setting high numbers that might deter traders from using the platform. Instead, the long term goal is to attract different market segments and clients while maintaining low fees. Because of that, Vertex attempts to charge fees as low as possible to increase market share making it more appealing for institutions and professional trading firms.

Chains

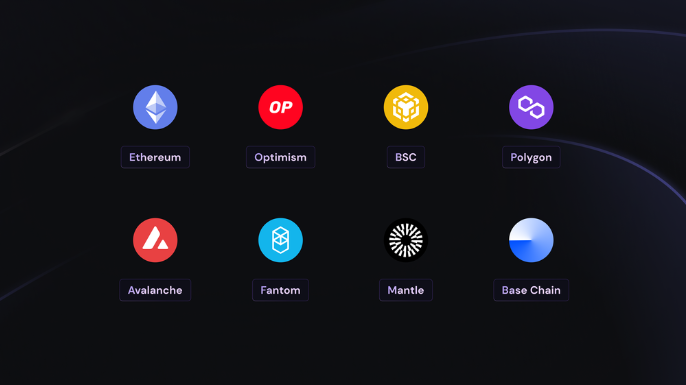

Vertex is currently live on Arbitrum and has plans to deploy on other chains in the future.

One notable feature is the introduction of cross-chain deposits through a partnership with Axelar, utilizing Axelar’s Squid Router to allow users to seamlessly deposit assets from various chains such as Ethereum, Optimism, BNB Chain, Polygon, Fantom, Mantle, Base, and Avalanche, directly into their Vertex accounts. The process is swift, averaging around 2 minutes, and does not require users to leave the Vertex app, ensuring a seamless user experience.

As an example, the graphic above illustrates the Vertex Protocol’s cross-chain deposit flow, where users can easily transfer $wBTC from Ethereum and receive $USDC on Arbitrum, which is then automatically deposited into their Vertex account.

Additionally, Vertex Edge ensures that liquidity across different chains can be unified in a single unified layer orchestrated by Vertex’s Synchronous Orderbook powered by its sequencer.

Using the Protocol

Customizable Experience

Users can customize the trading interface based on their preferences, adjust the trading terminal layouts, set custom notifications, risk management signals…

Spot Trading

Spot trading on Vertex is straightforward and efficient, allowing traders to buy and sell actual assets against $USDC.

Traders can opt to trade with or without leverage and choose between market or limit orders. The platform also offers the option to borrow $USDC or the asset being sold, enabling traders to trade sizes larger than their current holdings.

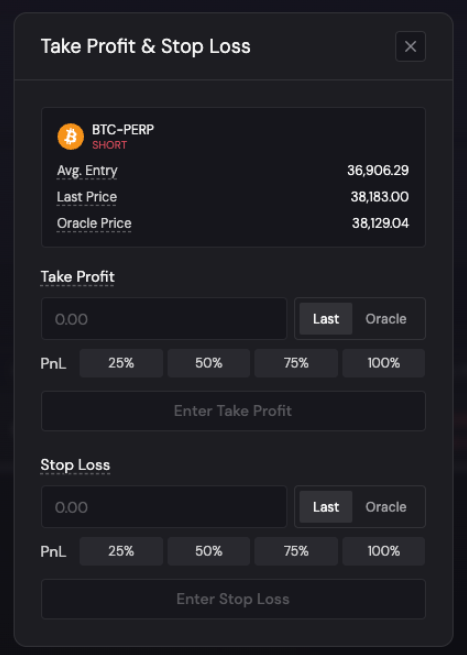

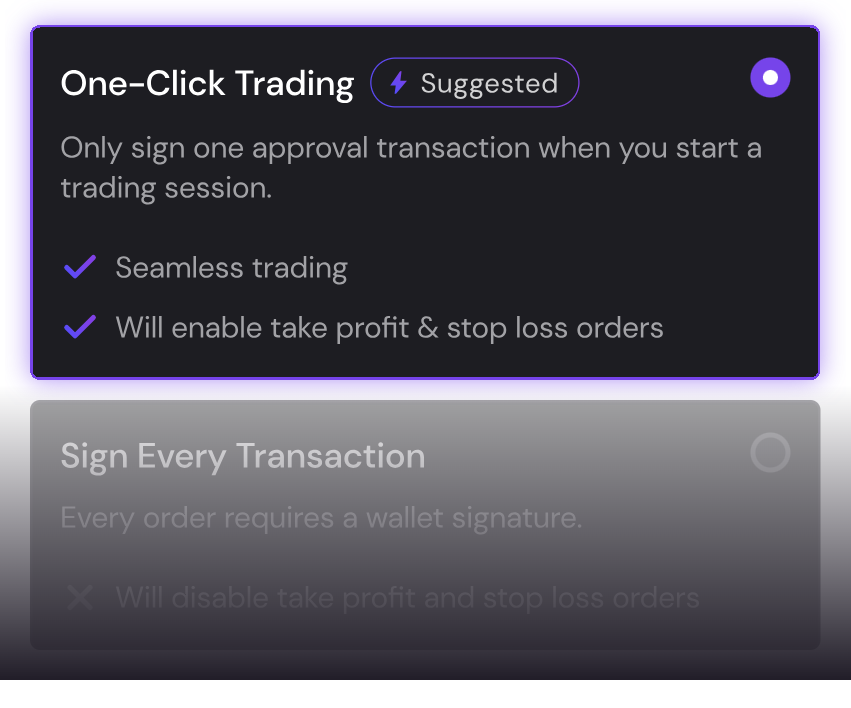

After placing a trade, traders can manage their positions or cancel open orders easily. Vertex does not currently support Trigger order types like Take Profit (TP) and Stop Loss (SL) without 1CT enabled. However, traders can manually approximate a Take Profit by placing a limit order against existing positions. The platform plans to introduce Stop Loss orders at a later date.

Perps Trading

Perpetual contracts on Vertex offer a way to trade derivative contracts on underlying spot assets with leverage. This function amplifies both profits and losses and is suited for experienced traders. Vertex’s perpetual markets allow traders to long or short contracts against $USDC, providing a dynamic trading environment. Users can select their trade leverage, place market or limit orders, and manage their positions with ease. Although Vertex currently doesn’t offer trigger order types like Take Profit and Stop Loss without 1CT enabled, the platform is actively working on introducing these features.

One-Click Trading

One-Click Trading (1CT) on Vertex significantly enhances the trading process and user experience by eliminating the need for repeated approval transactions.

A single approval transaction at the beginning of a session enables traders to perform any subsequent action within the Vertex app without additional approvals.

This feature, which improves the platform’s efficiency and security, closely aligns the trading experience with that of centralized exchanges. Importantly, when 1CT is enabled, it facilitates the setting of TP and SL orders for both Spot and Perpetual trading, ensuring a seamless and efficient trading process. The feature includes a ‘Remember Me’ option for session continuity and offers the flexibility to switch modes based on trader preferences.

Mobile

Vertex mobile allows users to keep track and monitor their positions on the move.

Notifications

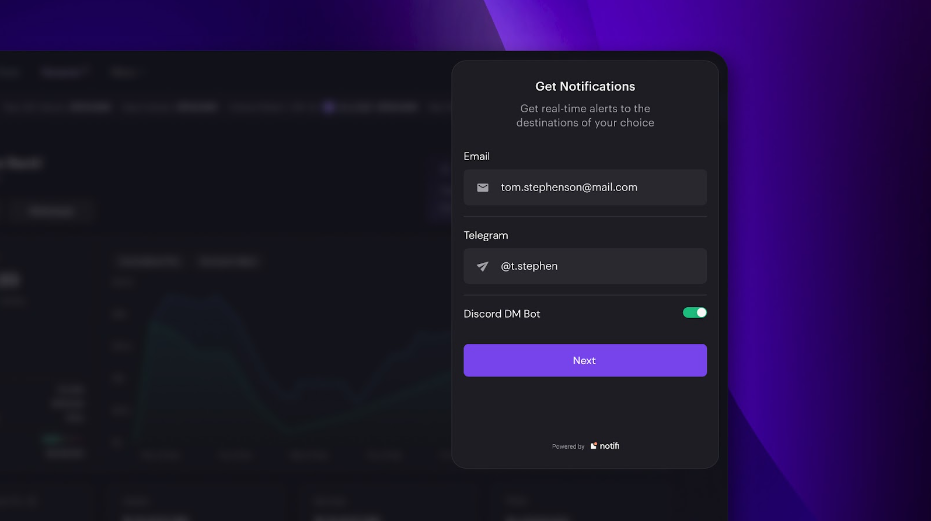

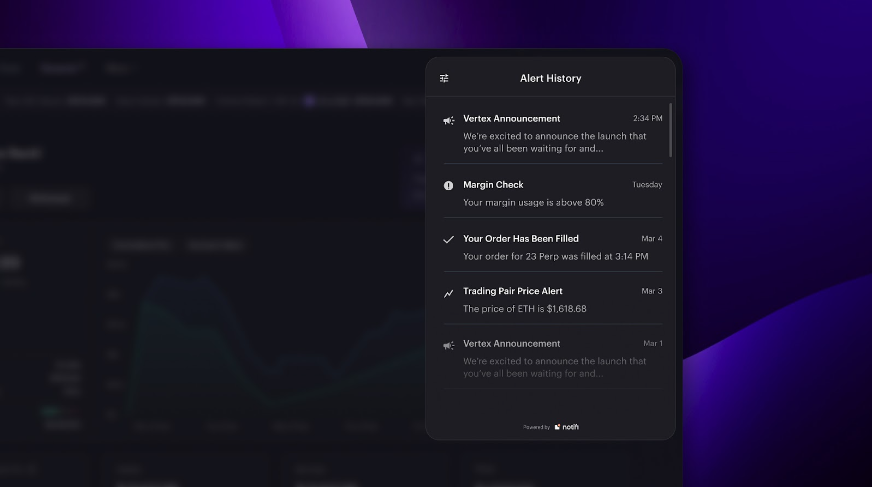

Vertex has introduced notifications feature through its partnership with Notifi, bringing push notifications directly to traders. This integration marks a significant step forward in enhancing the trading experience on Vertex, providing real-time updates and alerts that keep users abreast of vital account activities and market movements.

Getting Started with Notifications

Setting up notifications on Vertex is a straightforward process, designed to integrate seamlessly with users’ preferred communication channels. Here’s how to activate this feature:

- Activation: Users can initiate the setup by clicking the notification bell icon located at the top right corner of the desktop interface. (Note: Mobile functionality is under development and will be available soon.)

- Channel Selection: Users are prompted to enter the accounts where they wish to receive notifications, such as Discord, Email, and Telegram.

- Approval Transaction: A transaction is required to authorize the chosen notification settings.

- Alert Preferences: Users can then select the types of alerts they wish to receive, tailoring the notification experience to their specific needs.

Available Alerts

Upon launch, Vertex users can opt-in to receive a variety of alerts:

- Vertex Announcements: Stay updated with the latest features, market additions, special events, reward programs, and partnerships.

- Order Fills (Partial & Full): Receive instant notifications when your orders are partially or fully executed.

- Liquidation Events: Get alerted promptly on any liquidation events affecting your positions.

- Margin Usage: Monitor your initial margin usage, with alerts sent out when it reaches a specified percentage. Users can choose from pre-set options or set a custom percentage threshold.

Viewing Alert History

Vertex also provides an easy-to-access history of past alerts. By clicking on the notification icon, users can view a scrollable page of their alert history, ensuring they never miss an update or alert.

Real-Time Updates

The Notifi integration ensures that alerts are processed on a 1-minute polling schedule. This means that notifications, whether they pertain to order fills, margin thresholds, or any other specified alert, will be delivered within 1 minute of the event occurring. This timely delivery ensures that traders can react swiftly to market changes and account notifications, enhancing their trading strategy and portfolio management.

Cross-chain Deposits

Vertex simplifies the process of depositing assets from various chains through its native integration with Axelar’s Squid Router, allowing users to seamlessly deposit assets from various chains such as Ethereum, Optimism, BNB Chain, Polygon, Fantom, Mantle, Base, and Avalanche, directly into their Vertex accounts.

The process is swift, averaging around 2 minutes, and does not require users to leave the Vertex app, ensuring a seamless user experience.

As an example, the graphic below illustrates the Vertex Protocol’s cross-chain deposit flow, where users can easily transfer $wBTC from Ethereum and receive $USDC on Arbitrum, which is then automatically deposited into their Vertex account.

This way, traders can seamlessly bridge and deposit assets from supported chains directly into their Vertex trading accounts. This feature eliminates the need for multiple steps and interfaces, offering a straightforward and time-efficient deposit process.

Deposits and Withdrawals

Vertex simplifies the process of depositing and withdrawing assets, ensuring that users can manage their funds with ease.

When depositing, users initiate the process through a user-friendly interface, selecting their desired asset from a dropdown menu and specifying the amount they wish to deposit. The system may require approval for certain assets, establishing a spending cap for future transactions without additional approvals. Once approved, the deposit is confirmed in the user’s wallet, reflecting immediately in their Vertex account.

Withdrawing follows a similar intuitive process. Users select the ‘Withdraw’ option associated with the asset of their choice and specify the amount they want to withdraw, up to the maximum amount available. After confirming the withdrawal in their wallet, the transaction is executed swiftly, ensuring that users have full control and quick access to their funds.

Borrowing and Repaying

Vertex’s integrated Money Market allows traders to borrow assets against their portfolio, enabling the withdrawal of borrowed assets from Vertex’s smart contracts. Traders can easily manage their borrowed assets and repay their loans through the platform’s intuitive interface.

Portfolio Management

Vertex’s Portfolio Management offers a comprehensive overview of the user’s entire portfolio, including high-level insights and specific metrics like account value, PnL, and performance charts. Detailed insights into margin usage, available funds, and liquidation risks provide a clear understanding of the portfolio’s health. Activity tables display account totals for balances, open positions, and LP positions, allowing users to manage their assets and positions effectively.

Margin Manager

The Margin Manager of Vertex Protocol serves as an advanced tool, offering users a holistic overview of their account’s margin influence. It consolidates information about users’ balances and positions, clarifying their contribution to overall margin requirements.

This comprehensive view is vital for maintaining robust risk management strategies, as it assists users in steering clear of liquidation by providing a clear understanding of initial and maintenance margin levels.

The feature also facilitates quick actions for balance and position management, enhancing the user’s trading strategy and risk management capabilities.

Developers and Integrations

Vertex understands the importance of catering to high-frequency traders (HFT) and automated trading strategies. To this end, it offers a powerful Vertex API and SDK, enabling HFTs and automated traders to operate effectively. Notably, Vertex optimizes gas efficiency by excluding low-value and extraneous transactions, making it adaptable across various EVM-compatible chains.

Trigger Orders

Vertex offers sophisticated trigger orders, including Stop-Loss (SL), Take-Profit (TP), and Stop-Market Orders, providing traders with advanced risk management tools. These conditional orders automatically trigger a buy or sell action once the market reaches a specified price, known as the trigger price, allowing for predetermined entry and exit points without the need for constant market monitoring.

Types of Trigger Orders on Vertex:

- Stop-Market Orders enable traders to set a trigger price, executing a market order once the price is reached. These orders are particularly useful for capitalizing on market trends without the need for continuous price tracking. However, it’s important to note that stop-market orders are not linked to existing positions and are executed as new buy/sell orders, subject to full execution or cancellation (Fill or Kill). Traders can customize slippage tolerance to ensure the order is executed within an acceptable price range.

- Take Profit (TP) Orders are set to automatically close or exit a profitable position once it reaches a certain price level. These orders are linked to existing positions and are executed in the opposite direction of the open position. TP orders are classified as “Taker” orders, meaning they take liquidity from the order book. Similar to stop-market orders, TP orders are also subject to the Fill or Kill rule, ensuring full execution or cancellation.

- Stop-Loss (SL) Orders are designed to limit potential losses by automatically executing a market order when the asset price hits a predetermined level. These orders are beneficial for managing risk and defending a position from liquidation. Like TP orders, SL orders are linked to open positions and executed in the opposite direction to manage exposure effectively.

To utilize these trigger orders on Vertex, the One-Click Trading mode must be enabled, streamlining the trading experience by reducing the need for multiple approvals. Vertex ensures that traders have a wide array of tools for effective risk management and strategy implementation.

Guide on Utilizing Trigger Orders:

Setting Up TP/SL Orders:

- Navigate to the Perp Positions table.

- Use the ‘+ Add’ option to set up a TP/SL order for a specific position.

- Choose the trigger price, based on either the Mark Price or the Last Price.

- Confirm and place your TP/SL order. The system automatically reflects the new TP/SL in the positions table.

Placing Stop-Market Orders:

- Select ‘Stop’ as the order type in the trading form.

- Input the trigger price and the order size.

- Confirm the order. Vertex supports Fill or Kill (FoK) execution, meaning the order must fill entirely or be canceled.

Managing Orders:

- TP/SL orders auto-cancel if users want to modify the size of the associated position.

- Stop-market orders do not auto-cancel and must be manually canceled if no longer needed.

While trigger orders are a powerful tool for risk management, it’s crucial for traders to understand that these orders do not guarantee execution at the trigger price, especially in volatile markets. Traders are advised to regularly monitor their orders and manage their positions proactively to align with their trading strategy and risk tolerance.

Vertex API and SDKs

- EIP-712 executes (place/cancel orders, withdraw collateral, liquidate subaccounts, mint/burn LP…)

- Queries (contracts, nonces, orders, subaccount info, market liquidity, symbols, market prices, max/min order size, max withdrawable, max LP mintable, fee rates, health groups, linked signers, insurance…)

- Subscriptions (authentication, available streams, events, rate limits…)

Business Model

When users execute trades on the platform, they are charged a fee, which is typically a percentage of the transaction amount. These fees contribute to the platform’s revenue.

Similarly, Vertex also generates revenue through the interest charged on borrowed funds.

Vertex also takes a cut out of liquidations to grow an Insurance Fund to cover losses in the event of liquidations and defaults.

Revenue Streams

As a DEX, Vertex generates revenue from trading fees. The protocol also earns by capturing a portion of the interested paid out by borrowers on the money market

Fee Breakdown

Vertex offers a fee model designed to cater to various market participants, from price makers and takers to liquidity providers and borrowers.

Here’s a breakdown of the fee structure and its impact on trading on Vertex:

Trading Fee Model:

Vertex’s trading fee model is multifaceted, applying to various aspects of the platform including AMM Liquidity Pools, Borrow/Lend Pools, and the Central-Limit Orderbook (CLOB) operated by the sequencer.

Vertex employs a role-based fee model to cater to different market participants:

- Price Makers: These participants enhance liquidity by placing limit orders, thereby playing a pivotal role in narrowing spreads and reducing slippage.

- Price Takers: These traders execute trades against the liquidity provided by makers and pay a fee for the immediacy of trade execution.

- Liquidity Providers (LPs): They supply liquidity to AMM pools, earning a share of trading fees while also facing risks such as Impermanent Loss.

- Borrowers & Lenders: Participants in Vertex’s money market, either borrowing assets and paying interest or providing liquidity and earning interest.

Incentivization:

- To encourage liquidity provision and compensate for risks like Impermanent Loss, Vertex offers incentives such as competitive maker/taker fee models, fee-based rebates for market makers, and $VRTX token incentives.

Trading Fees:

Vertex has a competitive fee model with respect to industry standards, charging minimal fees for takers and zero fees for makers on major pairs like BTC/USDC and ETH/USDC for both spot and perpetual trades. The trading fee model is designed to foster an efficient trading environment by incentivizing market makers through rebates and token incentives, ensuring liquidity and low trading costs.

Taker Fees: Subject to a minimum fee upon order execution, calculated as minSize × maker.price × feeRate. Additional standard fees apply to any portion of the order exceeding minSize.

Maker Fees: Vertex provides competitive incentives to Makers, including rebates and token rewards, to encourage liquidity provision.

Maker / Taker Trading Fee Model

Fee Denominations & Distribution:

Vertex ensures a clear and transparent fee structure, with all trading fees paid in $USDC. This approach simplifies fee payment and collection, providing consistency across various trading pairs. Initially, all pairs on Vertex are denominated in $USDC, such as BTC/USDC for both spot and perpetuals. The collected fees serve multiple purposes:

- Protocol Revenue: A portion of the trading fees contributes to the protocol’s revenue, ensuring ongoing development and maintenance.

- Insurance Fund: Trading and liquidation fees contribute to Vertex’s insurance fund, safeguarding the platform against unexpected market events and ensuring stability.

- Operational Expenses: Fees are used to cover the essential costs of running the platform, including marketing, development, and other operational expenses.

- $VRTX Liquidity: Part of the fees is allocated to seed the initial liquidity pool for the $VRTX token, enhancing its market stability and availability.

Over time, the revenue generated from trading fees is intended to drive value back to the $VRTX token, aligning with the tokenomics and incentivizing long-term platform growth and user participation.

Sequencer Fees:

Vertex charges a flat sequencer fee for interactions with its sequencer, which matches orders and handles high-speed interactions like deposits, withdrawals, and LP token minting. The fees, denominated in $USDC, aim to balance the cost of gas on the underlying blockchain and ensure a swift trading experience. The sequencer fees are as follows:

- Deposit: 0 $USDC

- Submitting a Liquidation: 1 $USDC

- Withdrawing Collateral: Fees vary based on the asset (e.g., $BTC, $ETH, $USDC).

- Placing an Order that Takes Liquidity: Reduced from 0.1 $USDC to 0 $USDC for specific epochs as part of a promotional incentive.

It’s important to note that Vertex adjusts its fee structure periodically to align with market conditions and the protocol’s operational requirements. All fees are aimed at ensuring the platform’s sustainability, rewarding participants appropriately, and maintaining a competitive and efficient trading environment.

For the most accurate and up-to-date information on Vertex’s fee structure, users are encouraged to refer to the official documentation and announcements.

Funding Rates

Funding rates are integral to the mechanics of perpetual contracts, also known as perpetual swaps. Unlike traditional futures contracts, perpetuals don’t have an expiration date and can theoretically be held indefinitely. However, this unique feature necessitates a mechanism to tether the price of the perpetual contract to the underlying asset’s spot price over time – this is where funding rates come into play.

Function of Funding Rates:

- Price Convergence: In traditional futures markets, the futures price converges with the spot price as the contract approaches expiration. Perpetual contracts, lacking an expiration date, use funding rates to ensure their prices don’t deviate significantly from the underlying spot price.

- Incentive Balancing: Funding rates are used to balance the market by providing incentives for traders. A positive funding rate indicates that the price of the perpetual contract is higher than the spot price, leading long position holders to pay short position holders. Conversely, a negative funding rate suggests the perpetual price is lower than the spot, causing short position holders to pay those holding long positions. This mechanism helps in keeping the perpetual contract price in line with the underlying asset’s spot price.

How Funding Rates Work:

Funding rates are calculated based on the difference between the perpetual contract’s mark price and the underlying asset’s spot index price. Vertex calculates funding rates using the following inputs:

- Spot Index Price: Provided by Stork, a decentralized oracle network.

- Perpetual Contract Mark Price: Determined by the time-weighted average price (TWAP) of the orderbook price.

- Funding Interval: The period over which funding rates are applied. On Vertex, this interval is set to one hour.

The funding index is derived from the difference between the TWAP of the perpetual mark price and the TWAP of the spot index price. The funding payment, a transfer between longs and shorts, is then calculated as a fraction of the funding index, and it’s capped at 10% per day.

Impact of Funding Rates on Trading:

Funding rates influence the profitability and cost of maintaining open positions in perpetual contracts. Traders holding positions in a market with a positive funding rate will pay funding fees if they are long, and receive funding fees if they are short. The opposite is true for markets with a negative funding rate.

Example of Funding Rate Impact on Trading:

Consider a scenario where Alice is trading Ethereum (ETH) perpetual contracts on Vertex. The current spot index price of ETH is $1,000.

- Positive Funding Rate Scenario: If the perpetual contract’s mark price is $1,010 (higher than the spot index price), the funding rate might be positive. Suppose the funding rate is +0.1%. Alice holds a long position of 10 ETH (notional size = $10,100). If she maintains this position over the funding interval, she will pay a funding fee to the short position holders, adding a cost to her trade. For instance, her hourly funding payment might be ($10,100 * 0.1%) / 24 = $0.42.