Overview

Velodrome Finance is a DEX built on Optimism. The protocol was designed by building on top of the groundwork laid out by the original version of Solidly created by Andre Cronje. Velodrome addresses all issues of Solidly and seeks to iterate and improve on the original model.

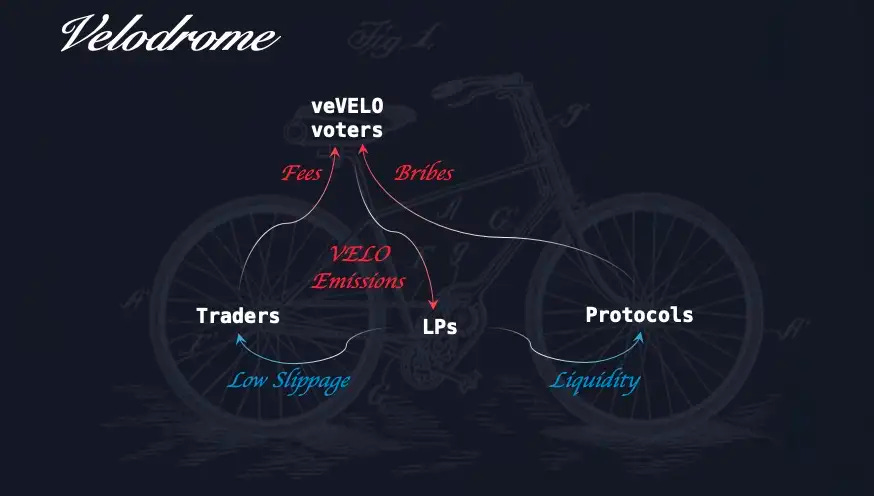

The key innovation and main goals of Velodrome are to align the protocol emissions with the number of fees generated by each pool. This would be achieved by allowing other protocols and large stakeholders to become veNFT holders, who would use their locked voting power to direct future emissions and collect fees from the pools they voted for.

Velodrome Finance was created to solve the problems that most ecosystems face when it comes to liquidity incentivization.

The protocol team realized that most solutions to incentivize liquidity come with a series of significant tradeoffs and pitfalls:

- Pool2 emissions (attaching a reward token for liquidity providers) are costly to maintain and often result in “farm and dump” scenarios (LPs remove their liquidity as soon as the rewards start to dry up).

- Protocol-owned liquidity is hard to bootstrap. Besides, this liquidity is only needed under specific circumstances, instead of on an ongoing continuous basis.

- Bribing tokens while competing with other protocols for gaining market share of CRV or CVX tokens can result in high costs for the protocol since incumbents have already managed to have a sizable lead in accumulating such tokens.

Pool2 refers to liquidity pools that require exposure to the token being farmed, whereas Pool1 yield farming pools don’t. However, most rewards are often allocated to Pool2s.

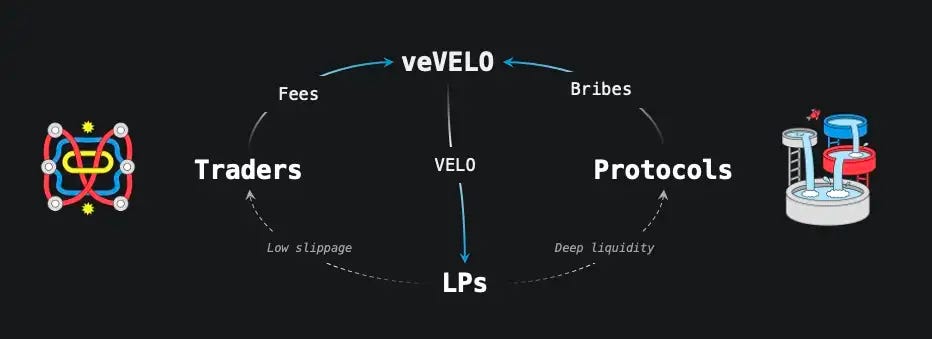

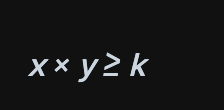

Overall, Velodrome is a public good AMM designed to provide deep liquidity at low fees and slippage conditions. To do that, the protocol rewards liquidity providers and active governance participants through $VELO emissions and the distribution of $veVELO. $veVELO holders accrue the platform’s voting power and make decisions on which pools should receive the emission rewards. In return, voters earn from trading fees and bribes from the external protocols they vote for.

Velodrome V2

Velodrome V2 launched on June 23, 2023.

The goal of Velodrome V2 is to add new functionality to the protocol, including concentrated liquidity, dynamic fees, emission rates, and relay. The goal of these updates is to improve protocol performance as well as boost UX.

A complete list of changes in Velodrome V2 includes:

- UI

- Nightride dApp: Velodrome’s new frontend has been rebuilt from scratch.

- More user-friendly and fully decentralized.

- Deployed and served from a decentralized filesystem without any intermediary caching/API layers.

- UI/UX is designed to provide transparency and intuitive controls for complex operations, including real-time voting stats and reward estimates.

- Nightride dApp: Velodrome’s new frontend has been rebuilt from scratch.

- Pools

- Custom Fees: V2 pools will support a wider range of fees (up to 1%) customizable on a pool-by-pool basis, allowing more dynamic and substantial voting rewards.

- Custom Names and Symbols: V2 pools allow for custom name and symbol changes to differentiate partner pools and reduce confusion.

Zapping into LPs: The new V2 router makes it easier to LP on Velodrome by allowing users to “zap” into a liquidity pool by depositing just one of the pool’s tokens to create a position.

- veNFT

- Artwork and Metadata: The new veNFTs will come with unique on-chain dynamically generated artwork. The underlying balance and unlock dates are provided via metadata that will be indexed by our upcoming integrated veNFT marketplace.

- Permalocked: V2 veNFTs can be set in a (maximum) 4-year lock state. In such a state, veNFTs’ veVELO balance constantly reflects the underlying VELO, no longer decaying..

- Managed: Managed veNFTs operate like a vault and represent a foundation for reward-compounding products like Velodrome Relay. veNFTs can be deposited into a Managed veNFT which is run (not owned) by a partner, with rewards distributed to all depositors. Managed veNFTs aggregate NFT voting power whilst perpetually compounding and locking the underlying tokens.

- Improved Transfers: V2 veNFTs can be reset, transferred, and used to vote on the same epoch, allowing for a more frictionless secondary sale experience.

- Governance

- Velo FED: When VELO emissions fall below 6m per epoch (in ~92 epochs), veVELO voters will automatically gain control of Velodrome’s monetary policy, allowing them to increase or decrease the rate of emissions by one basis point per epoch, unlocking a novel mechanic to collectively manage Velodrome’s economic sustainability.

- Streamlined Voting Rewards: V2 gauges and rewards contracts were rewritten and simplified, resulting in significantly reduced gas costs for claiming rewards. Fees will now accumulate and be delivered similarly to bribes.

- New Governor Functions: veVELO holders will soon be able to control key processes such as token whitelisting.

- Governance Delegation: The delegation for governance voting has been rewritten to accommodate the decentralization needs and the Bedrock Upgrade. Caching layer has been removed and voting allows for a larger number of delegations.

- Opt-In Upgradability: V2 uses a registry with protocol component factories. Factories can be upgraded, and users can opt-in to new factory pool types, gauges or reward contracts. This enables future functionalities like native incentivized concentrated liquidity pools while maintaining protocol decentralization and immutability.

- Tokenomics

- New VELO Token: Onboarding to VELO V2 will be a simple, seamless process. The new VELO token and veNFTs will replace Velodrome’s current governance and utility tokens. V1 VELO and veNFTs will be convertible at a guaranteed 1-to-1 rate to V2. The converter will be registered as a pool, allowing users to simply trade V1 for V2 and aggregators to integrate the conversion pragmatically.

Implementing the desired changes for V2 comes with some issues, as Velodrome is built on Immutable code. This means the properties of the protocol can’t be changed. To work around this, the team designed V2 to interact with Velodrome V1. This requires more protocol maintenance.

One of the primary difficulties in implementing V2 was changing the tokenomics. Because $VELO is immutable, a new token had to be created to reflect the desired changes. This token was then made convertible at a 1:1 ratio. While the new token would experience price action and have all the utility expected of it, holders of the previous token wouldn’t lose value as a result of holding the old version of $VELO. Locked veNFT positions will also similarly be easily convertible to the V2 version.

In addition to $VELO V1 tokens being immutable, the emissions are as well. This means that a mechanism has to be implemented to capture any new $VELO tokens from the original contract and lock them so that they wouldn’t interfere with V2 emissions. The mechanism used to facilitate this process is known as ‘SinkManager’.

Like its predecessor, Velodrome V2 is also immutable. With Velodrome V2, bribes are directed toward the V2 gauges. This is the primary driving force to get people to migrate their $VELO to the new V2 token contract. Emissions will be mostly the same in V2 as in V1 excluding some minor incentives early on in the migration process.

See the chart below for an advanced visual representation of how Velodrome V2 compares to V1.

Velodrome Slipstream

Overview

Velodrome Slipstream was introduced on September 16, 2023.

The primary objective of Slipstream is to add support for concentrated liquidity pools as an additional option on top of the existing sAMM and vAMM models in a way that uniquely leverages the Velodrome flywheel.

It does this by accomplishing the following:

- Encouraging persistent LPing on Velodrome in all market conditions.

- Incentivizing LPers to stake for $VELO emissions, directing fees to veVELO voters.

- Maximize emissions efficiency to driving optimal concentrations and rewards for liquidity providers.

- Maintain full protocol decentralization and transparency (no off-chain gauge computations).

The primary benefit of the Slipstream clAMM is to improve the capital efficiency of stable pools and less volatile assets. Most volatile pools won’t benefit from concentrated liquidity and will likely not transition to it.

Velodrome Slipstream is a novel and fully audited clAMM implementation based on UniV3’s trusted contracts and will fall under the BUSL.

Gauge Rewards

Gauge rewards are distributed over time and only in the active tick. The active tick is the liquidity around the current price that traders trade against.

- Distributing over time is similar to V2 and encourages persistent liquidity that doesn’t move day to day in response to market conditions.

- Incentivizing only the active tick means that Velodrome maximize capital efficiency by only rewarding useful liquidity.

- Gauges accept positions created by the

NFTPositionManager. - Residual emissions (e.g. if there is no liquidity in the active tick for a non-zero amount of seconds in a given epoch) will be rolled over to the following epoch.

- The gauge will have helper functions that will allow users to manipulate their liquidity position while it is in the gauge should the user want to increase or decrease liquidity in response to market conditions.

Fees + Emissions

The pool factory will allow a fee module to be set. The factory can update the fee algorithm being used by the protocol at any time.

- The factory will ship with the custom fee module that exists with V2.

- The maximum fee on this fee module will be set to 3%.

During volatile market conditions, emissions may not adequately compensate LPs for the risk they are taking in CL pools.

To keep liquidity on Velodrome, unstaked liquidity will be able to earn trading fees rather than emissions. However, to encourage restaking of LP’s back into the Velodrome flywheel, the pool factory will allow an unstaked liquidity fee rake/tax (i.e. the fee that is levied on LPers that choose not to stake in the gauge) module to be set. The fees earned by this module will be given to the veVELO voters of that pool.

- The factory will ship with the custom fee module similar to the one described above for pool fees.

- The default value of the rake will be 10%, with the valid values ranging from 0 to 20%.

This fee is designed to incentivize users to stake so that they can participate fully in the flywheel. By not staking, they will still contribute to the flywheel via the small fee that they pay. A small rake should allow Velodrome pools to maintain their TVL advantage meaning LPs will not benefit from moving to a different DEX.

The goal is that Velodrome is able to provide adequate liquidity for baseline market conditions, but also adapt dynamically to volatile ones.

Tick Spacings

Larger tick spacings will make the pools more retail-friendly and reduce the frequency at which ALMs will need to rebalance liquidity. The pools will still be more capital efficient than v2, but potentially slightly less efficient than a UniV3 pool of the same tick size and fee. However, because emissions will be able to attract more liquidity, Velodrome will still offer better trade execution at lower levels of concentration.

In addition, since Velodrome will be using custom fee algorithms, it can still maintain another advantage here (e.g. stable pool depegs and the fees go up, the clAMM pools become more attractive to LP in vs alternatives).

Suggested tick spacings are:

- Stable pairs use 0.05% fee tier, with tick spacing of 10.

- Established pairs (e.g. OP/ETH), .3% fee tier, with tick spacing of 60.

- Volatile pairs, using 1% fee tier, with tick spacing of 200.

Miscellaneous

- The oracle will be updated to add a new observation once every 15 seconds as opposed to once every block a unique optimization enabled by the OPStack.

- Velodrome will provide support for swaps between V2 and V3 pools by adapting Uniswap’s Universal Router for the contracts.

- The routing will provide support for actions across a whole host of different NFT platforms.

- Velodrome may also choose to implement additional support for contracts within the Velodrome ecosystem to make it easier for users to bulk-collect emissions/rewards and swap them.

- Velodrome Slipstream will ship with the ability for automated liquidity management to be offered on top of it. The goal of this is to help non-professional users benefit from concentrated liquidity pools without having to put a lot of effort into re-balancing their positions.

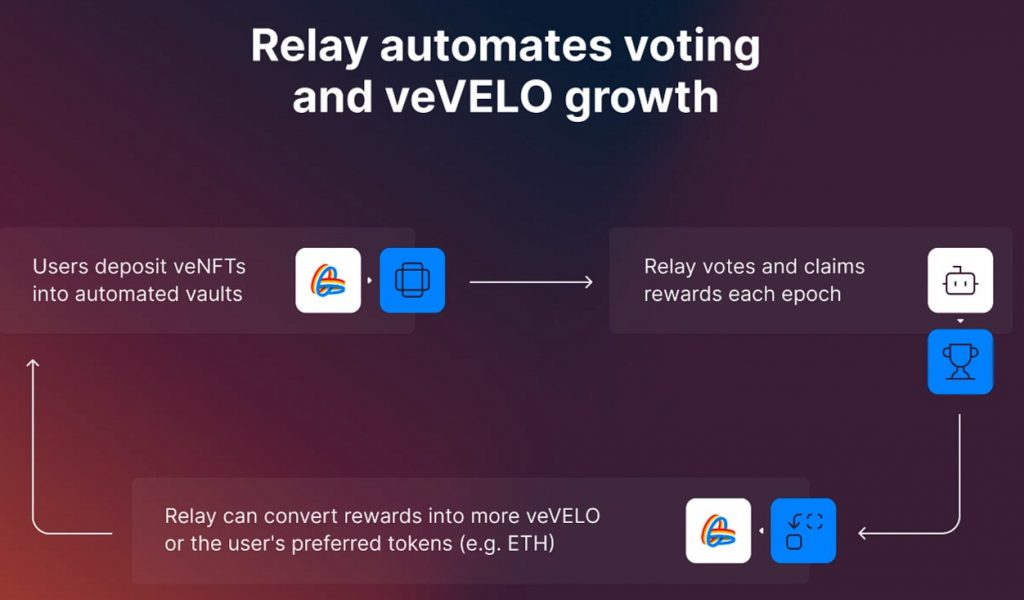

Velodrome Relay

Overview

Velodrome Relay was introduced on October 6, 2023.

It will transform the protocol and user experience by automating the process of managing veNFTs. With Relay, protocols will be able to create personalized voting strategies, select how rewards should be managed, and let the Relay vaults do the work for them.

How Relay works

Velodrome Relay is designed with two primary audiences in mind:

- Protocols seeking liquidity can automatically direct emissions to their preferred pairs and compound any earned rewards into additional veVELO voting power.

- Users seeking rewards can allow Relay to vote optimally to maximize rewards and sometimes convert into veVELO.

In Relay V1 protocols will control Relay auto-compounder vaults, for which they’ll create personalized strategies for voting. Once a strategy is created, protocols can delegate their veNFTs to the vaults and let Relay do the voting and compounding of rewards for them. Protocols may choose, for example, to vote exclusively for their own liquidity pools or split voting across different pairs. This will make it easy for them to grow their veNFT positions passively while continuing to support their pairs.

All veVELO holders will be able to use the vaults created by protocols. In its next release, Relay will also enable vaults that will vote optimally to maximize the value of rewards each epoch, ensuring that veVELO holders always get the most out of their votes.

Core Features

- Protocols will be “given” a Relay auto-compounder vault that they can control. This means they can control how the managed veNFT votes.

- When depositing into a Relay auto-compounder vault, the veNFT positions are merged and converted into a single managed veNFT. Any user may deposit into these vaults.

- Managed veNFTs are in a permanently locked state, which maximizes voting power and thus rewards and rebases. A veNFT withdrawn from a managed veNFT will have its lock time set to the maximum.

- Rebases will be automatically collected and distributed to depositors.

- Rewards will be automatically collected and compounded into the veNFT position, with the amounts distributed proportionally between depositors.

- The auto-compounder is fee-free in the ordinary case, as Velodrome will run keepers that will do the auto-compounding (cost should be minimal).

- In the event our keepers are down, the keeper functions are openly available for permissionless calls on the last day prior to the epoch flip. The maximum allowed slippage for the swap call is 5%.

Other Details

- In Relay V1, voting follows strategies defined by the owners of the Relay auto-compounder vaults. A version with auto-max reward voting and compounding will follow following the release of Slipstream.

- Relay V1 will only support V2 pools for compounding; support for Velodrome Slipstream pools will follow after its launch.

- The auto-compounder factory has a list of all tokens that Relay will programmatically compound into more vote power. These tokens have been chosen because of their relatively deep liquidity.

- All other tokens — may be swept on the first day of every epoch by auto-compounder owners, by keepers after day 1, and by any user’s last day.

Why the Project was Created

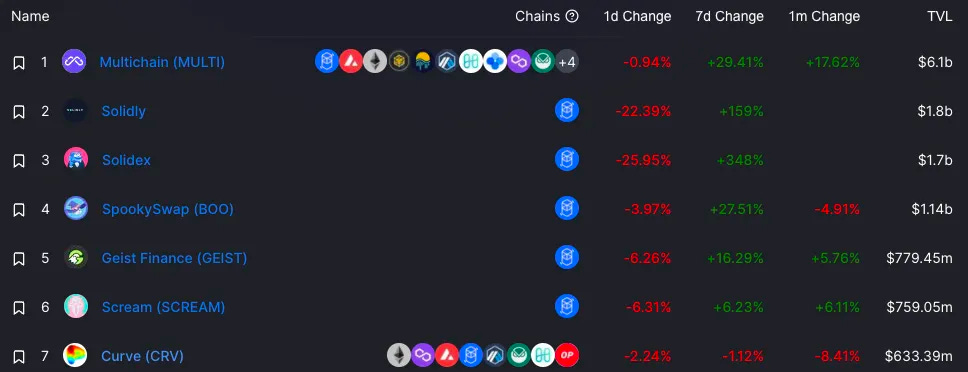

Velodrome launched on Thursday, June 2, 2022. The veDAO core team bootstrapped the protocol from their learning experience after the Solidly wars. Even before Solidly was launched, projects on Fantom started competing against each other to position themselves in the TVL leaderboard.

The concept of DeFi Wars was initiated by Curve, where protocols competed with each other to gain as much CRV emissions as possible.

Similar to the Curve Wars, the Solidly Wars originated after Andre Cronje’s announcement of an airdrop for the protocols that managed to accrue the biggest TVL on Fantom.

During the Solidly Wars to accumulate TVL, many projects emerged for this short-term goal. The general opinion at the time was that these protocols would not know what to do with the NFT they would earn from the airdrop (how to distribute emissions, how to fractionalize the NFT, how to split rewards between pools…).

The original idea was that the locked ve(3,3) tokens would be given out to the top 20 protocols by TVL in Fantom. It would then be up to those protocols to create their own pools and have their communities vote for the initial distribution.

This experience resulted in a veDAO governance proposal that suggested the core team seek opportunities outside of accruing Solidly vote shares on Fantom. This proposal passed and was the beginning of the development of Velodrome.

This took place in a moment where $WeVE represented governance over locked positions of $SEX and $0XD, on top of an ecosystem fund of ~70M $WeVE and a multi-sig with perpetual partner benefit for both Solidex and 0xDAO.

While the DAO was considering a series of alternative paths (playing the Solidly wards, playing the Curve wars, becoming a Farming as a Service DAO…), the final decision was to disband veDAO and disrupt the full treasury to become $VELO airdrop holders. This treasury distribution involved burning $WeVE tokens on Fantom ahead of the Velodrome launch in Optimism.

The initial design architectured the Velodrome flywheel such that:

- Traders and protocols would drive cash flow into the protocol by trading on the AMM.

- Liquidity providers would receive $VELO emissions as reward incentives for supplying the assets necessary for low-slippage swap execution.

- $VELO holders would share the upside in the protocol’s success. Those who locked their tokens would get a veNFT that granted the power to control the trading pairs that would be rewarded with trading fees and bribes in an anti-dilutive manner.

The design choices became apparent when the Curve Wars proved that the emissions were not being directed to the pools that generated more fees. When assessing CRV revenue from fees, it is a function of liquidity such that the deeper the liquidity, the lower the slippage (more aggregators will route trade orders through that pool), and the higher the revenue captured from fees. However, the pools with the most trading volume aren’t always the pools that earn the higher yield, since bribes can influence where the native token emissions should go.

Similar to Solidly, Velodrom’s origin aimed to favor volume over TVL, such that the protocol’s liquidity providers would vote for the pools that drive the most volume and, therefore, generate more fees. Under this model, voters would only get fees from the pools they voted for. This, at the protocol level, meant that veToken holders would vote for the pools that offered them the best price (lower slippage). In theory, these would be the most attractive pools due to their deep liquidity and higher volume.

Roadmap

Over the next 6 months, Velodrome will focus on major protocol upgrades that will improve the user’s experience, optimize the underlying contracts, and implement new automation features for both lockers and liquidity providers. All of this will be part of Velodrome 2.0

UI features:

- Updated light/dark mode support

- Dashboard view of all positions

- Embedded guidance for users

- Custom swap slippage toggles

- Improved and more user-friendly error messages

- Improved wallet integrations

- veNFT artwork and statistics

New features:

- Support for custom pairs (UniV3 + Curve style pair implementations)

- Support for named pairs (Balancer-style pairs)

- Votium-style voting upgrades

- Support for gasless transactions

- Support for LP delegation and voting

- Tradeable veNFTs while staked/voting

- veNFT splitting

Beyond the detailed upgrades in the roadmap, the team also expects to implement the following features:

- Autocompounding LPs

- Concentrated liquidity (Uni-v3 style)

- Multi-pair meta pools

- Integrated veNFT trading

- veNFT lending and borrowing

- Superchain

- Optimism’s Superchain is a horizontally scalable network of chains that share security, a communication layer, and an open-source development stack. A permissionless system for deploying new chains to a shared network opens the door to massive scale, novel applications, and a new revenue model that rewards application developers for the fees their chains generate, and rewards protocol developers for the public goods they create.

- The Superchain will have complex liquidity and infrastructure needs, which Velodrome will evolve to service.

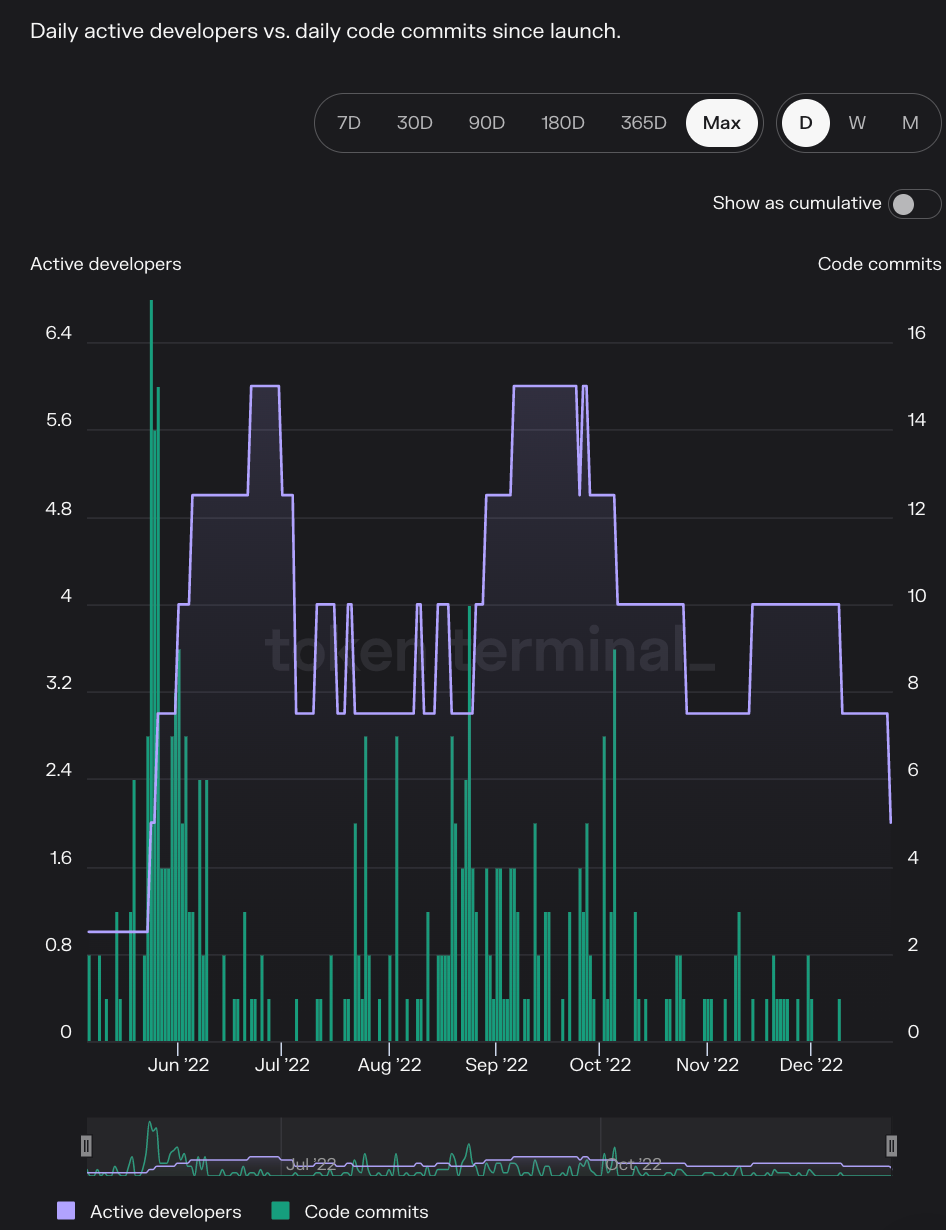

Team

The team behind Velodrome is known for previously launching veDAO, an initiative incubated by Information Token to participate in the original launch of Solidly on Fantom. The knowledge from the early days allowed the team to identify potential points of failure in the economic models of the protocol. This inspired them to build an improved version of Solidly and ve(3, 3) mechanism that culminated in the foundation of Velodrome.

While the ultimate goal is to build a fully autonomous and immutable protocol, Velodrome will ensure its long-term sustainability in a progressive manner over time. Therefore, the team will support the development of the base AMM layer, marketing, and community management… until the optimal performance is reached in a fully decentralized manner.

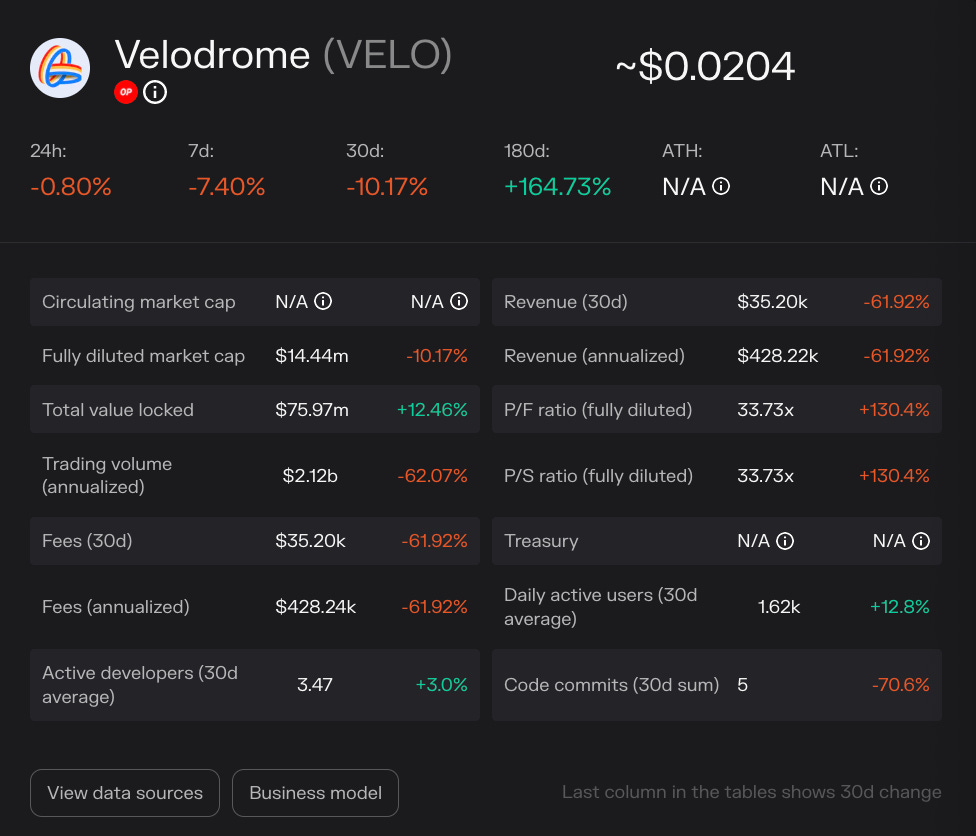

Active developers and code commits since the launch

List of team members

- Alexcutler.eth – Co-founder, comms, and operations

- Tao – Co-founder, tokenomics, and strategy

- Gabagool – Ex-business development – Was fired due to stealing $350k worth of funds from the team, which was returned after.

- Jack-anorak – Strategy, business development

- Coel.eth – DeFi Consultant

- And various others

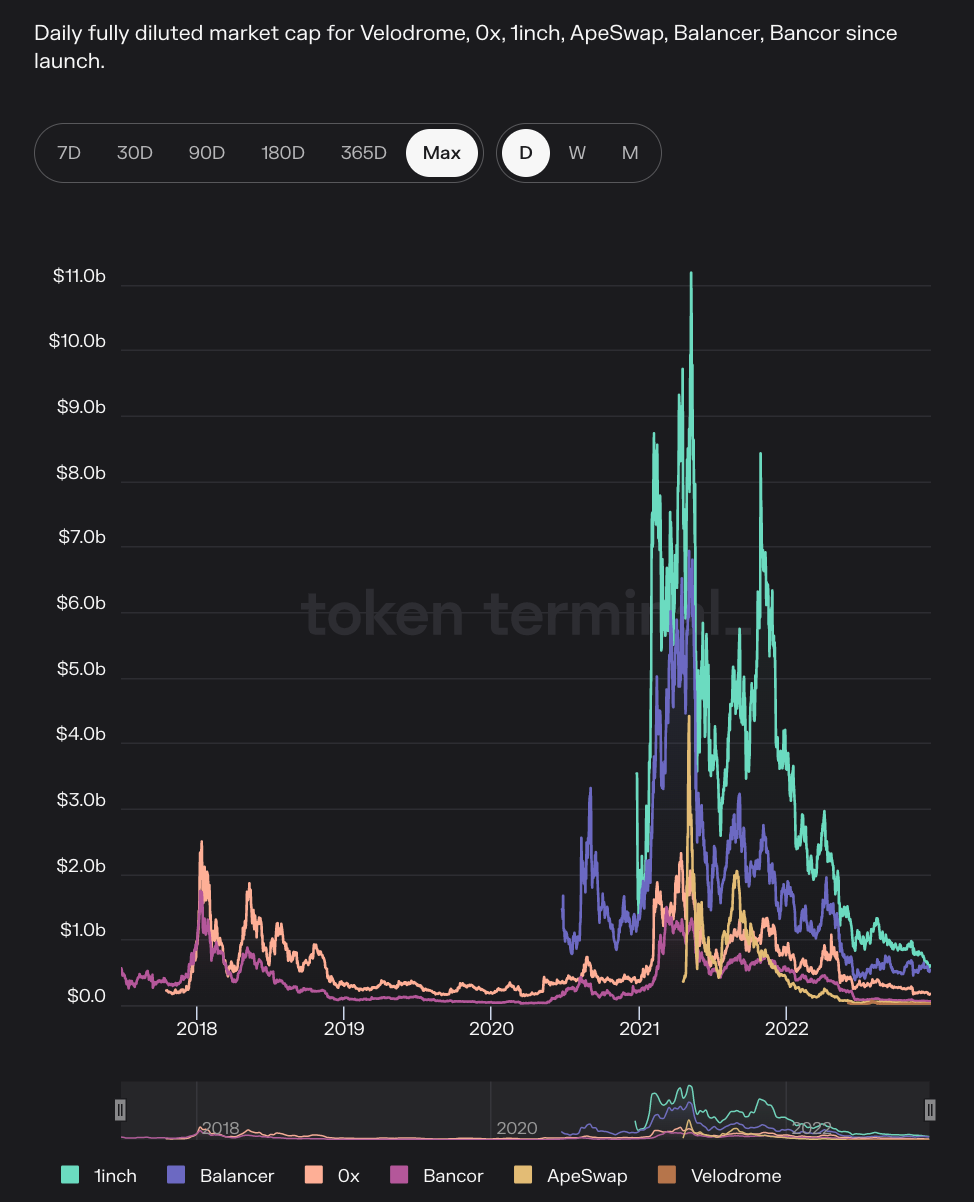

Sector Outlook

Velodrome is a decentralized exchange that seeks to combine the best of Curve, Convex, and Uniswap V2 all in one platform. As such, the project’s objective is to become a premier ecosystem-native liquidity layer and growth engine in Optimism. Velodrome achieves this with a ve(3,3) design that blends vote-escrow, voting rewards (bribes), locked rebases, and constant emissions.

Because of its ve(3,3) inspiration, Velodrome is not an AMM that attempts to compete with other Dexes of the same type. For that reason, the core architecture was built with a protocol-to-protocol design in mind. Thanks to this model, existing AMMs can integrate and adapt its ve(3,3) design to suit their own needs without losing out on any fees, volume, or liquidity.

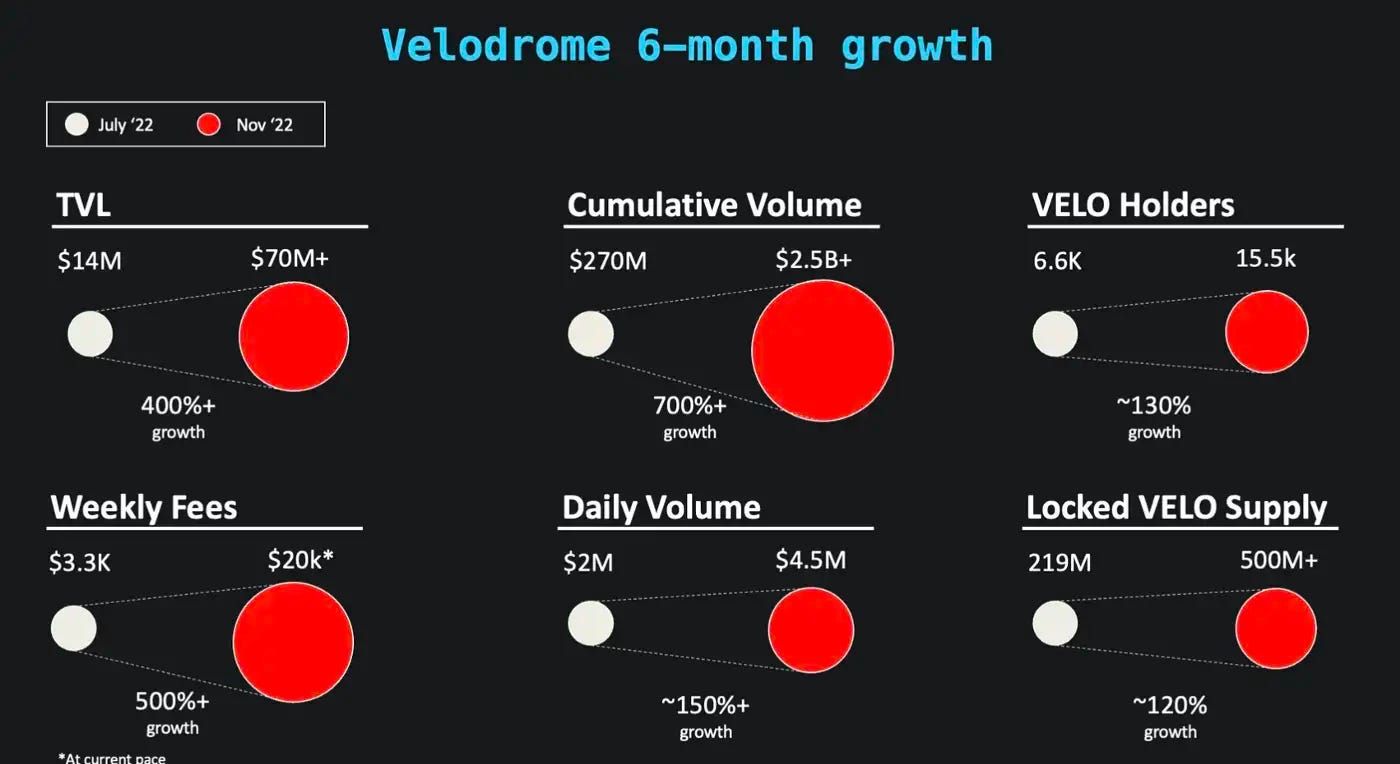

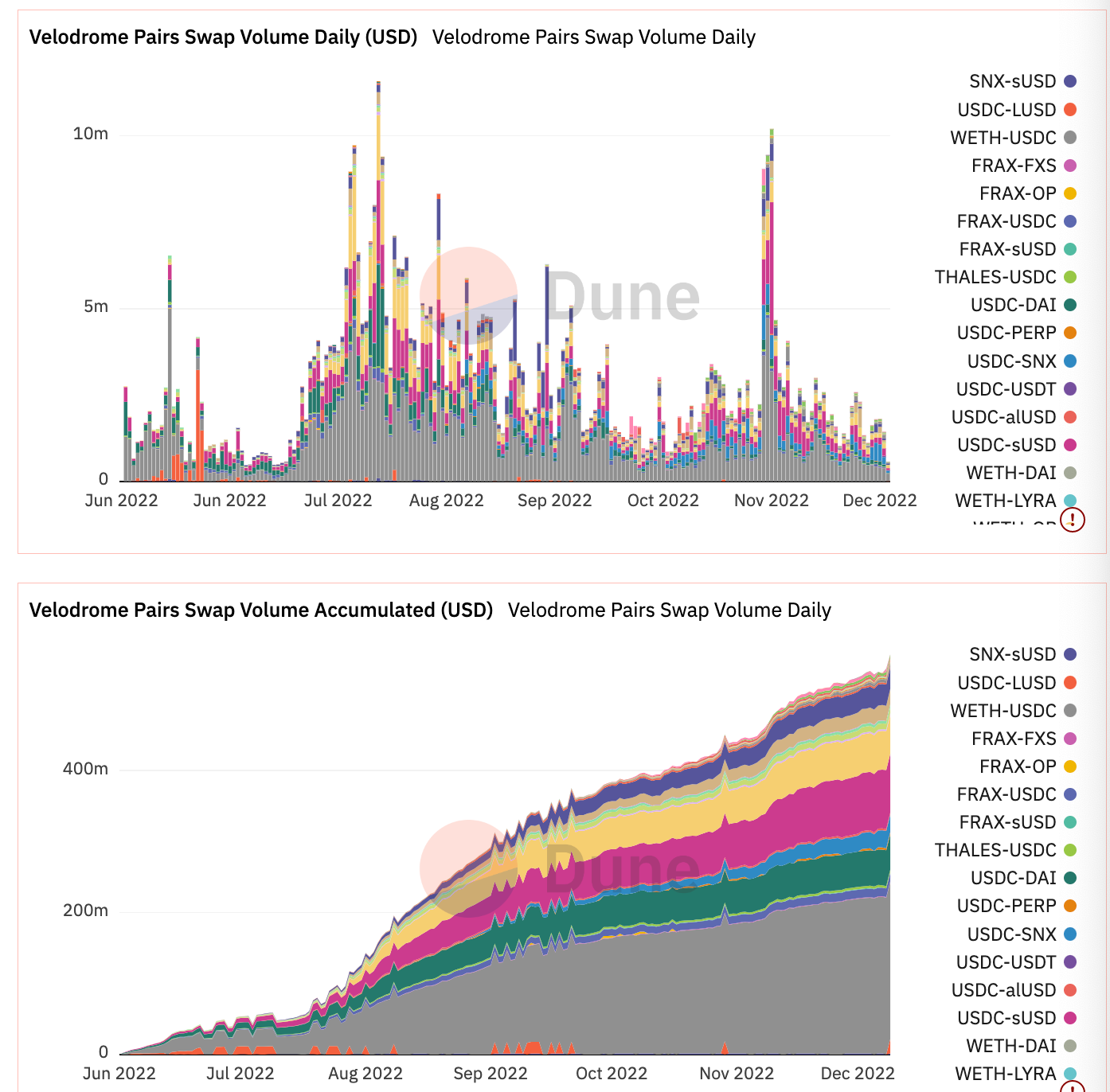

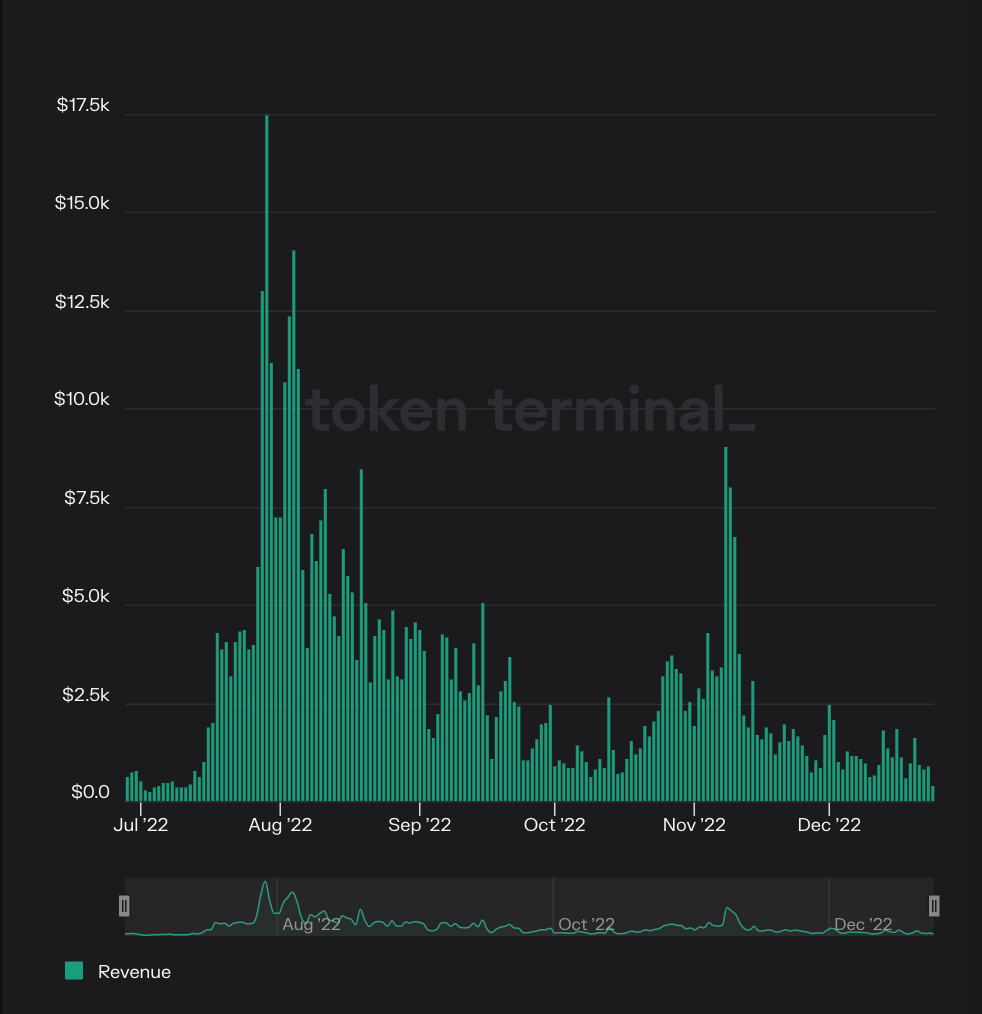

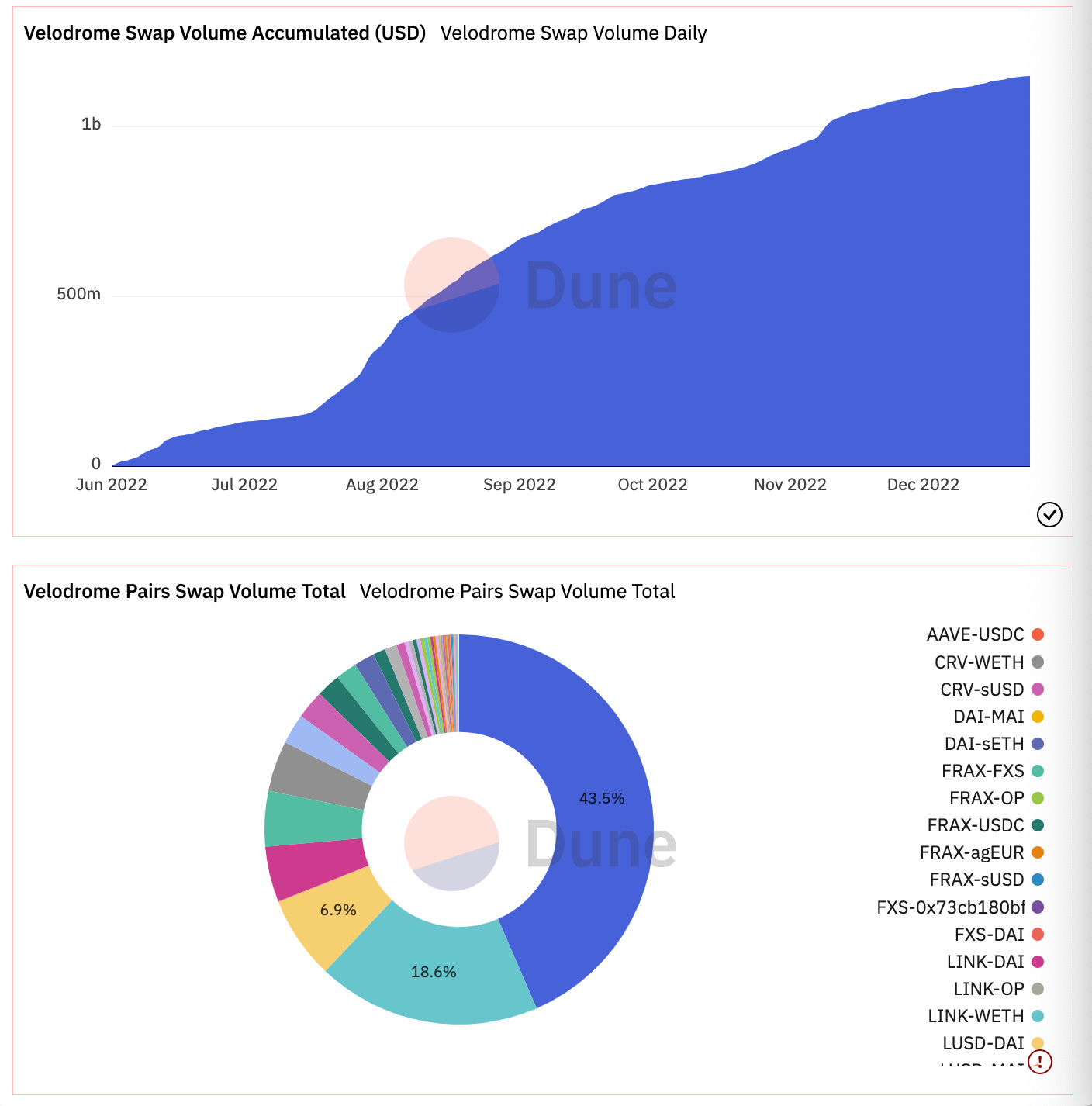

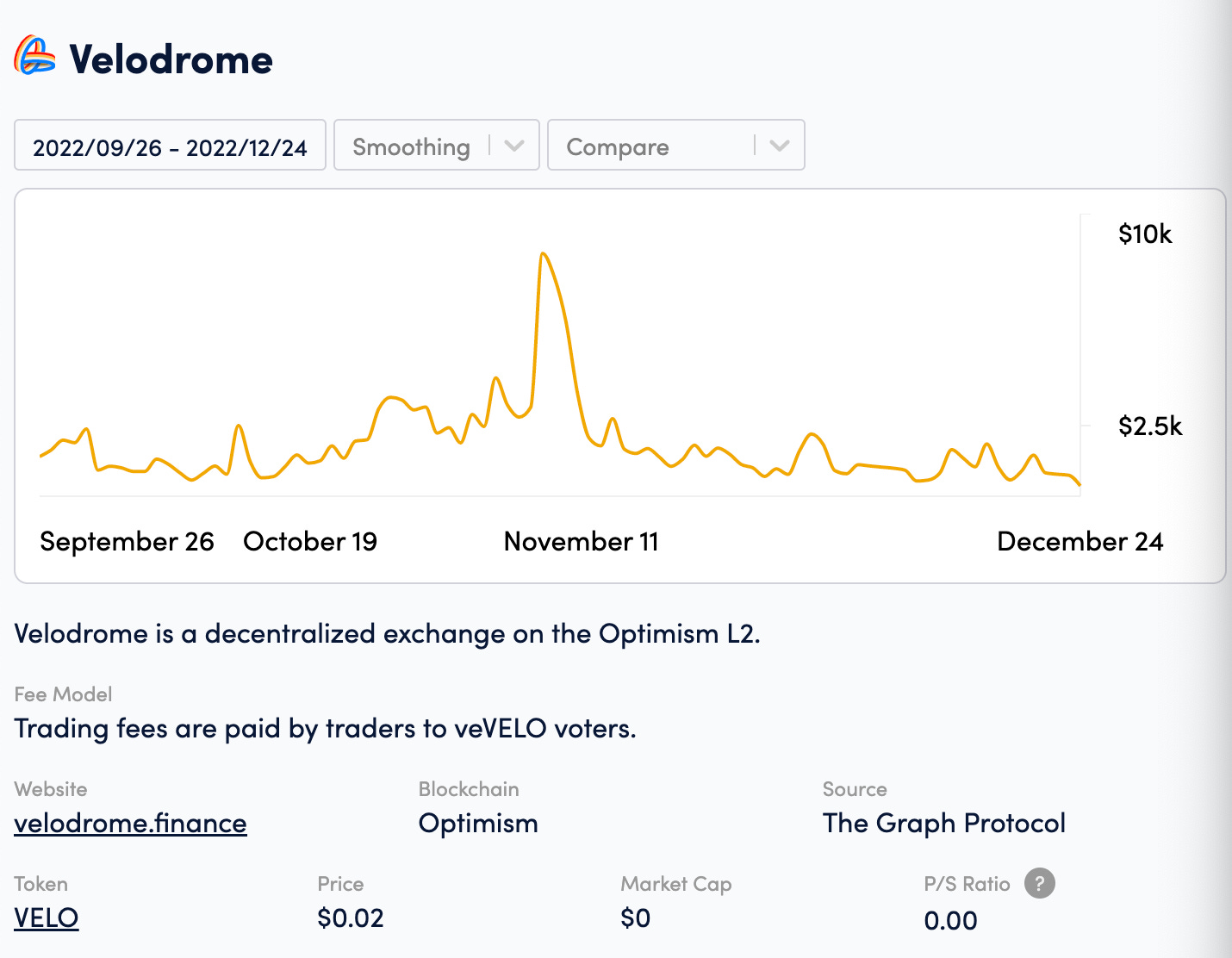

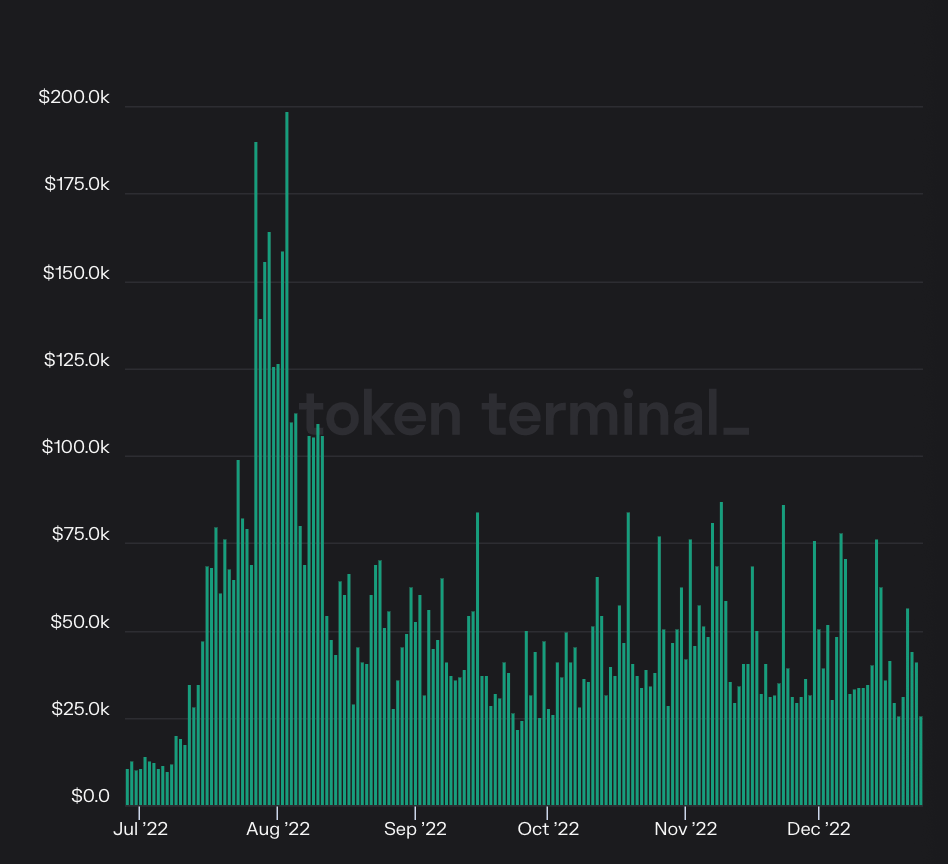

Despite launching in the midst of the bear market, Velodrome has proven to be effective at attracting and rewarding early adopters, offering up to 300% APR for LPs and an extra 200% APR for $veVELO voters. The protocol has managed to create a thriving ecosystem with over 30 protocols, $2.5B in cumulative trading volume, and $2.5M in cumulative transactions.

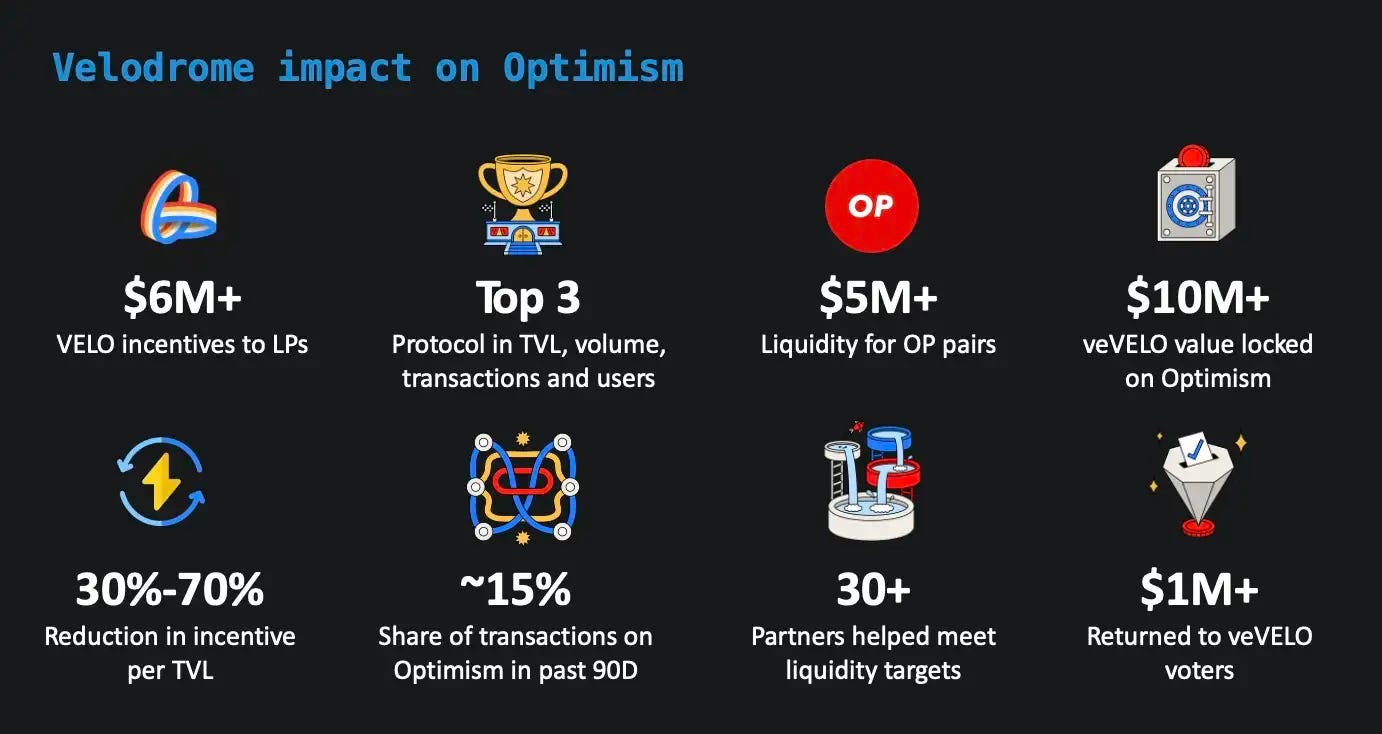

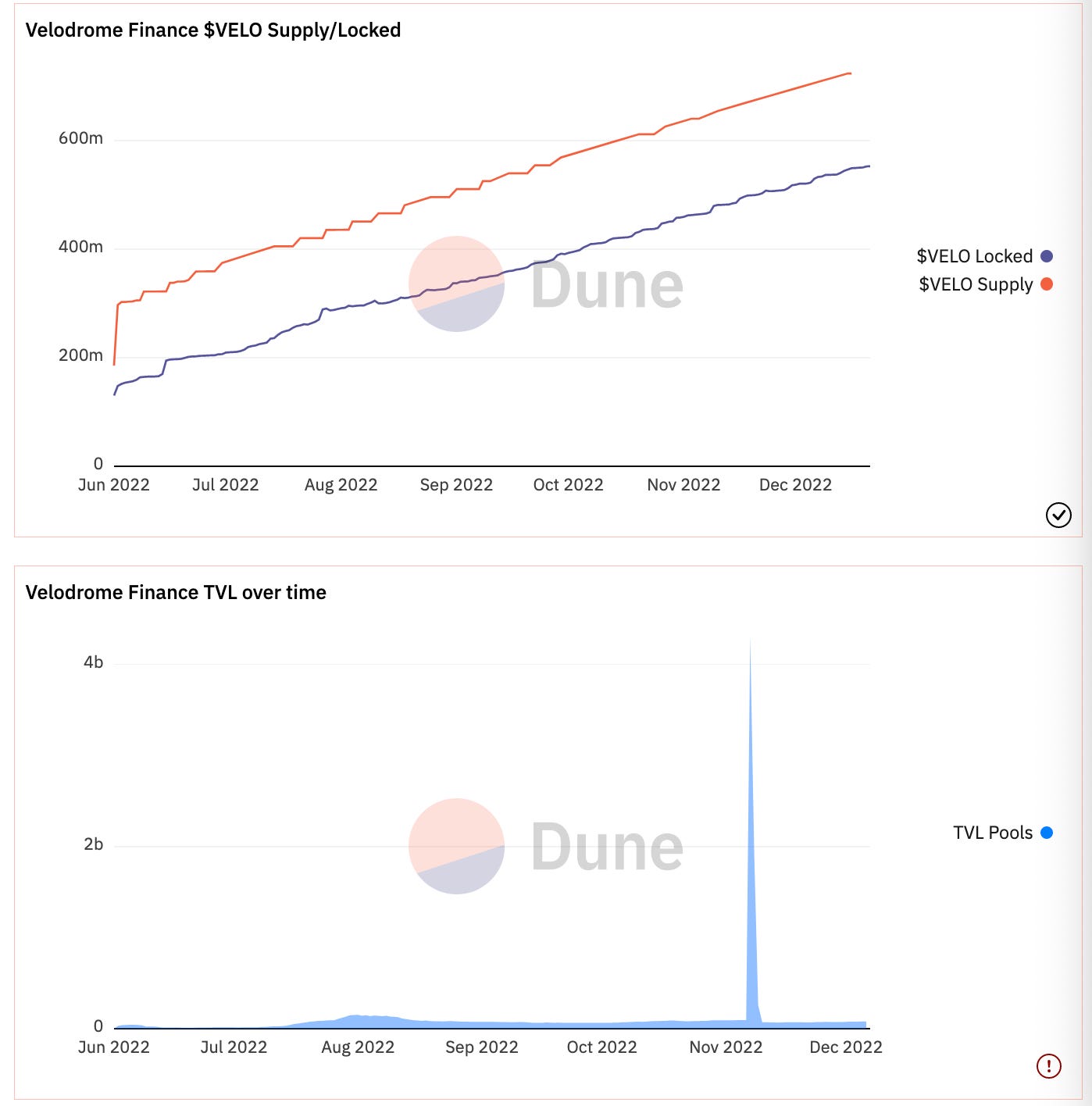

By the end of 2022, the protocol has achieved the following milestones:

- $6M cumulative emissions to LPs

- $4M cumulative in bribes and fees to $veVELO lockers

- $10M value locked as $veVELO (70% of supply)

- Average ~3.5 years locking period

- 8,400 Discord members

- 44,000 Twitter followers

- Consistent ranking placement in the top 3 by TVL, volume, transactions, and users

Growth in the second half of 2022:

Given the growth in the Optimism network, Velodrome has been granted a 4M OP token grant that will support further growth with the Tour de OP.

The Tour de OP is a 6-8 month $OP incentive program that started on November 24th, 2022. The program is focused on incentivizing external protocols and $veVELO lockers through 3 mechanisms:

- Bribe matching, to reduce the costs of supporting liquidity and extending the runway of protocol partners. To do that, Velodrome will match partner bribes at the following rates:

- Public goods ($0.25 in $OP per $1 bribe) for those pairs that benefit the Optimism ecosystem as a whole, like $stETH-$WETH

- Established projects ($0.2 in $OP per $1 bribe)

- Emergent projects ($0.05 in $OP per $1 bribe)

- As of February 16, 2023, every $OP incentive spent delivered a 4.5x multiplier for TVL.

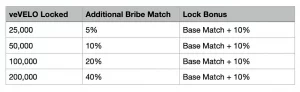

- Lock bonus. Velodrome will distribute a pool of 50,000 $OP tokens to all wallets that lock 5,000 or more $VELO tokens. Before February 13, 2023, it was set to 10,000 $VELO.

- Typically this results in lockers getting an average of 20-25% of their total lock value back in the form of an $OP airdrop.

- Protocol partners will also be eligible for an extra 10% lock bonus, as well as higher Bribe Matching rewards as long as they hit the following $veVELO milestones on a weekly basis. Combined, these incentives could result in partners receiving up to a 65% bribe match on top of their lock bonus.

- One of the best ways for protocols to grow their $veVELO positions is to deposit protocol-owned liquidity so as to farm and lock $VELO.

- Thus protocols that add protocol-owned liquidity to Velodrome qualify for additional boosts on their bribes:

- 10% Bribe Boost: $250,000 (volatile) or $500,000 (stable)

- 20% Bribe Boost: $500,000 (volatile) or $1,000,000 (stable)

- This allows protocols (at no additional cost) to grow their potential bribe match to up to 85% while simultaneously growing their voting power.

These incentives seek to encourage protocols to take a long-term stake in the Optimism ecosystem instead of relying on short-term bribing incentives to attract liquidity.

- Vote boosting:

- Every protocol that locks at least $1M $veVELO will qualify to receive a $1M $veVELO voting boost to the pool of their choice for 2 weeks (potentially doubling their APRs)

- Every bribe over $4,000 will qualify for a 1M voting boost from the Velodrome Team for the epoch on which it is deposited

- New incentives example

Competitive landscape

Chains

Velodrome Finance operates exclusively on the Optimism network, an optimistic-rollup layer-2 chains on top of Ethereum.

Optimism has spent significant resources in improving its developer experience which, combined with its EVM equivalent platform, highly improves the development process. This is reinforced by the strong technical and support capabilities of Optimism’s Retroactive Public Goods Funding.

For Users

Velodrome was born from the thesis initiated by Andre Cronje’s version of Solidly. However, soon after discovering some potential problems with the original design, the Velodrome team went on to make several improvements to the Solidly codebase. All of these initiatives were intended to compensate voters for the impermanent loss they might suffer.

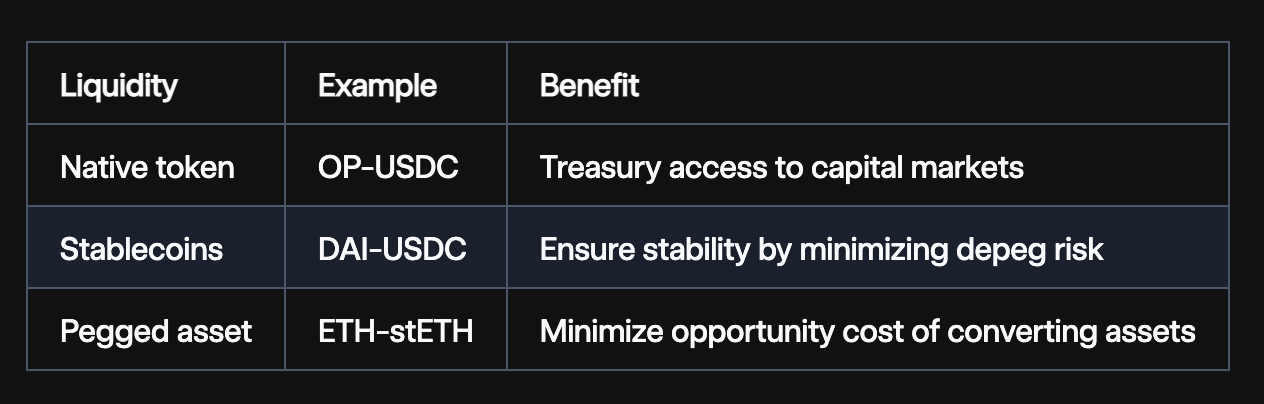

Liquidity Pools

As a Decentralized Exchange (DEX), Velodrome pools allow users to trade digital assets with low fees and slippage.

Slippage is the difference between the current market price of an asset and the price at which an actual trade transaction is executed. This difference could result in a lower or higher amount being paid/received by the trader when compared to the expected amount.

Velodrome classifies its liquidity pools into two separate categories:

- Correlated asset pools are designed for assets with low volatility, such as stablecoins ($USDC, $DAI…).

- The pricing formula optimizes for low slippage trades:

- Uncorrelated asset pools are designed for volatile tokens ($LINK, $CRV…) and use a generic AMM formula

The protocol router evaluates the desired trade submitted by traders and determines the most efficient price quote for executing that trade. For instance, the router will use 30-minute TWAPS (time-weighted average prices) to protect against flash-loan attacks.

An asset’s time-weighted average price (TWAP) is the measure of its average price over a predetermined period of time. This indicator is often used by traders as an algorithmic trading indicator that allows them to minimize the impact of large orders on the market (by dispersing the large order into smaller quantities that are executed at regular intervals over time).

Flash loans allow users to get a loan without upfront collateral since their loan must be repaid in the same transactions. Flash loan attacks consist in borrowing lots of funds to manipulate price oracles and cause illegitimate price fluctuations on a Decentralized Exchange.

Many protocols have been impacted by flash loan attacks in the past:

Ve(3,3)

Velodrome Finance uses a ve(3,3) model that combines two DeFi mechanisms:

- Vote-escrow seeks to strengthen the incentives for long-term token holders

- Fees earned by the protocol should go to ve(3,3) lockers

- Emissions by the protocol should go to the pools with the highest fees

- ve(3,3) lockers decide which pools should receive emissions

- Staking/Rebasing/Bonding (3,3) rewards behaviors that benefit the protocol in the long-term

- Incentives for the trading pairs that generate more revenue from fees result in higher payouts for ve(3,3) lockers

- Emissions promote the highest fee-earning pools, which in turn attract more liquidity and allow for better pricing conditions with lower slippage

- The token emissions and protocol incentives are aligned while still allowing participants to self-optimize the system

Vote escrow is a DeFi primitive pioneered by Curve that consists in locking tokens for a pre-set period of time. The lock period is then used to determine the weight assigned to each vote, such that the longer the liquidity remains in the protocol, the higher the voting power is attributed to that liquidity provider. Besides, protocols often entitle to these users extra incentives such as boosts on their yield, staking rewards…

Vote-escrowed positions are represented with veTokens that attempt to align the incentives of the protocol and the token holders of that protocol’s native token. By locking tokens, DAOs encourage users to participate in Governance and earn from token emissions.

$VELO FED

- Replace existing tail emissions and allow $veVELO holders to set the $VELO emission rate within a key set of parameters.

- Starts when weekly emissions drop below 5M (~0.3% of total supply).

- $veVELO holders will vote each epoch on 1 of 3 options, decided by majority votes:

- Increase emissions by 0.01% of the total supply (0.52% annualized).

- Decrease emissions by 0.01% of the total supply (0.52% annualized).

- Maintain emissions fixed.

- The emission rate will change if any, one full epoch after the vote.

- The max emission rate will be set at 1% of the total supply per week and the min rate at 0.01% per week.

Max-Unlock Mode

Max-Unlock Mode was introduced on July 25, 2023. It enables users to keep their $veVELO max locked automatically, meaning no need to increase lock time weekly to maintain max vote power.

Tying rewards with emissions

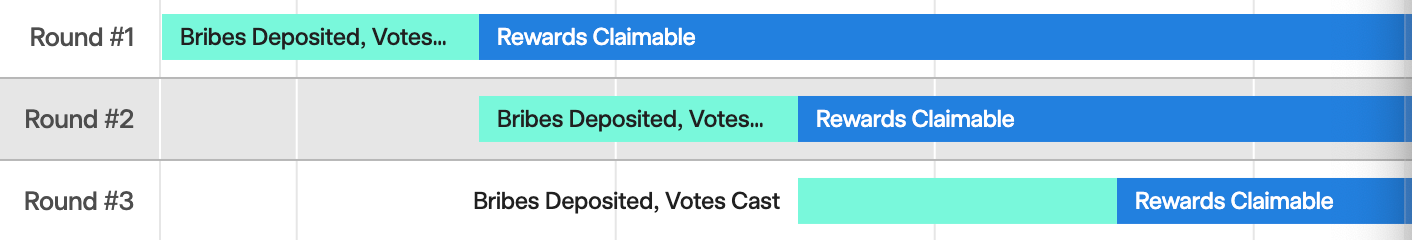

In Solidly, voting rewards (i.e. bribes) were claimable before the emissions from the voting round were fully committed. Velodrome addresses this issue by:

- Allowing voters to only make one active voting decision every epoch

- Treating bribes from fees (internal) and bribes from external sources in a different manner:

- Internal bribes are streamed to the voters who vote for them.

- External bribes are rewarded per epoch, rather than being streamed, and are claimable only after the next epoch starts.

The goal of these changes is to reach a healthy equilibrium and incentives alignments between internal protocol voters and external voters (bribers).

- Voters face a dilemma between voting too early (they might be forgoing more lucrative bribes that come later), and voting too late (they will be forced to vote with a lower $veVELO balance)

- Bribers benefit from voting later to have information about competing bribes but, at the same time, not getting the bribes early prevents them from attracting early voters.

Velodrome achieves this by treating external bribes differently from internal bribes. The difference between the InternalBribe and ExternalBribe contracts is that the external bribes ensure that rewards can only be claimed after the epoch ends while also making sure that rewards are eligible to be claimed by any voter who votes for the underlying gauge during the epoch (instead of only voters who vote after the rewards are sent).

Ensuring productive gauges

In Solidly, exploitive voters could direct emissions towards unproductive gauges. This is prevented in Velodrome:

- There is an on-chain governor role that is responsible for whitelisting the token pairs used in gauges.

- Voters will need at least 0.02% of voting power to submit a proposal, and 4% to reach a quorum.

- By removing the whitelisting fee, protocols, and large stakeholders cannot whitelist the pools of their choice by paying an extra fee.

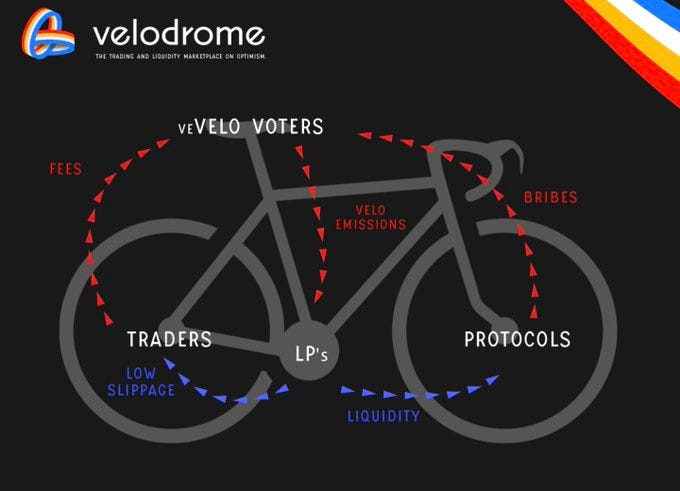

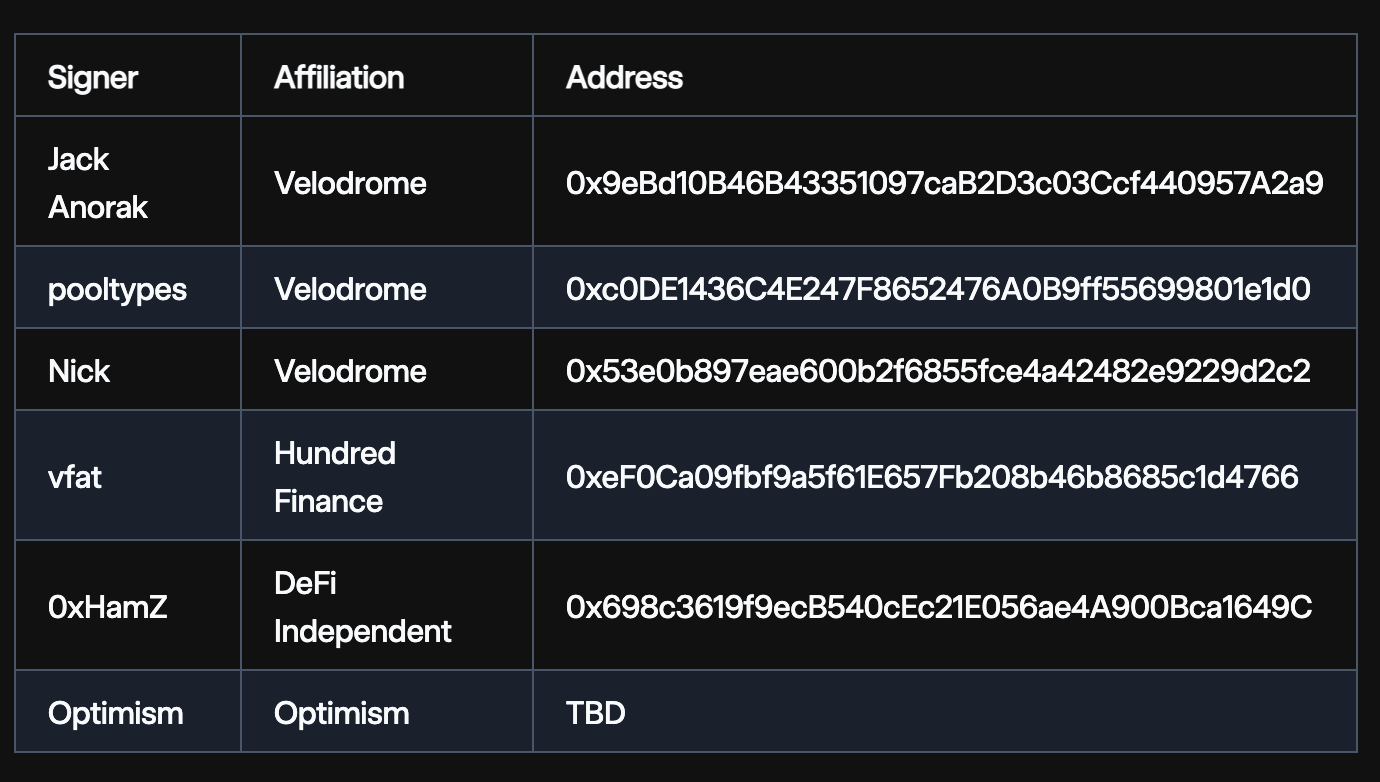

- There is an Emergency Commissaire that can deem any gauge unproductive. Currently, this role consists of people from Velodrome’s core team and the broader Optimism and DeFi ecosystems.

- The swap fee has been increased from 0.01% to 0.02% to ensure that votes have more than twice the incentive to direct emissions toward the pool where liquidity is productive.

- Stable and volatile pairs have different fees, both modifiable up to 0.05%.

- Fees for volatile pairs were increased to 0.04% on 31 January 2023.

Prolonged Emissions Decay

Solidly, the decay of protocol emissions occurred too quickly, which led to lower incentives for late entrants. While it can be argued that early entrants should receive more rewards due to the increased risks they are taking, slowing down the decay of rewards would offer attractive opportunities for future protocols.

- The emissions growth function was modified.

- Negative voting was reduced.

- LP emission boosts were removed for voters. Instead, those emissions are reallocated to LPs regardless of their veNFT ownership status.

- This ensures that voters are able to incentivize outside liquidity.

- This removes the need for a veNFT aggregator.

- The initial distribution was adjusted and skewed in favor of retail. This prevents a race for TVL between participants.

White Glove Support

Andre’s attempt to decentralize the protocol from day 1 meant that there was no support post-launch by the core development team. Solidly uses a more active approach that ensures that its team has enough resources to pay contributors and expand on its product offerings. As such, 3% of perpetual emissions are reserved for the team’s multi-sig.

For Investors

Investing Strategies

Business Model

- Velodrome liquidity providers earn $VELO emissions.

- $veVELO holders vote on which liquidity pools receive the $VELO rewards (pools earn in proportion to the voting power they accrue per epoch, i.e. each week).

- $veVELO holders earn from trading fees generated by the pools they voted for in proportion to their voting power.

- $veVELO holders also earn from the bribes paid out by the pools they are for, as well as from non-dilutive $veVELO rebases (meaning that $veVELO holders earn $veVELO rather than $VELO).

Revenue Streams

There are 4 types of rewards on Velodrome Finance:

- $VELO emissions are distributed to liquidity pool stakers.

- The amount of $VELO distributed towards every pool is proportional to the voting power received from the voters every epoch.

- These rewards are streamed and available for claiming as soon as they accrue.

- Fees are distributed to liquidity providers in the form of pool tokens (e.g. the fees for the $VELO/$USDC pool are distributed in $VELO and $USDC tokens

- These rewards are streamed and available for claiming as soon as they accrue.

- Bribes allow external whitelisted protocols to distribute token rewards to the users who vote for their pool.

- These rewards are only available to claim after the next epoch starts (every Wednesday at 23:59 UTC).

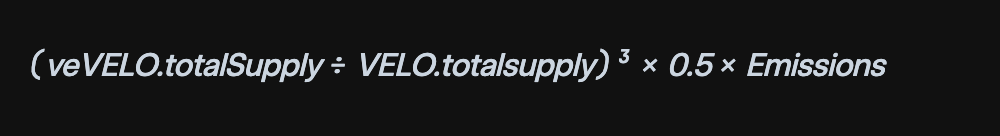

- Rebases represent $veVELO (voting power) distributed to $veVELO holders in order to reduce dilution in their voting power.

- These rewards are streams and available for claim as soon as they accrue.

Economics

The origin of the protocol development imposed a redemption process where $WeVE tokens would be burnt on the Fantom Network in exchange for a redemption of $USDC and $VELO on Optimism (all unclaimed tokens would be sent back into the treasury). This process was facilitated by using LayerZero.

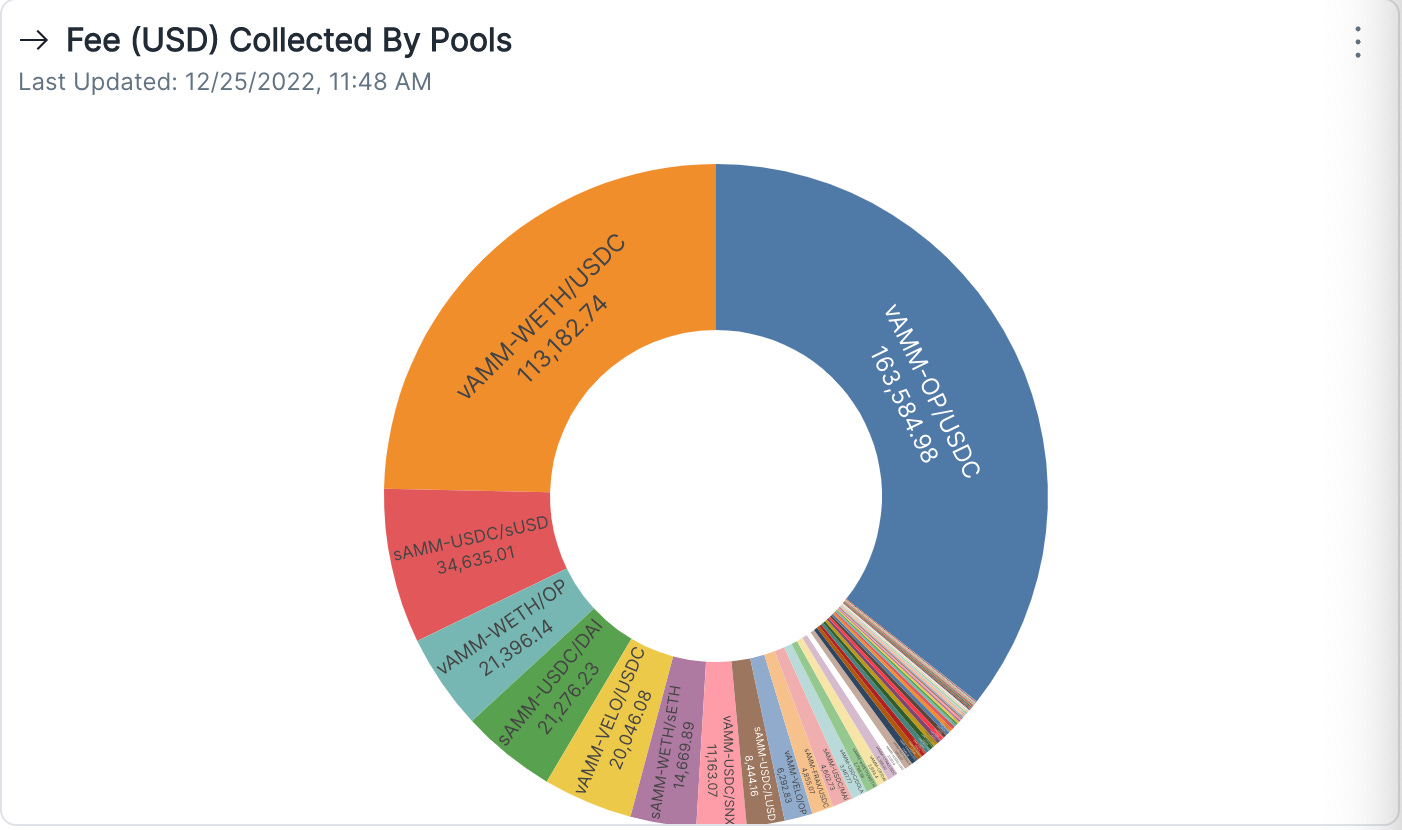

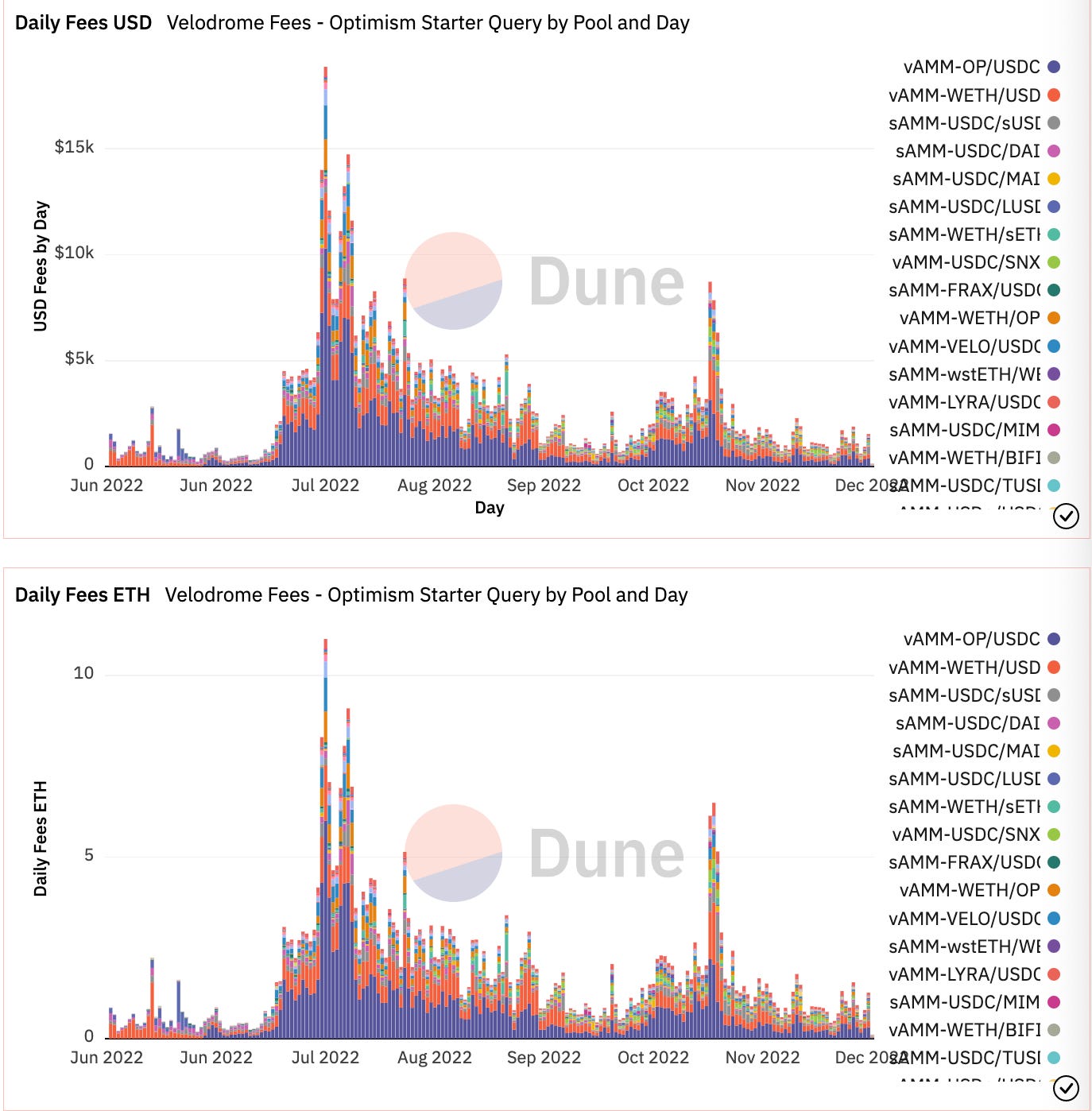

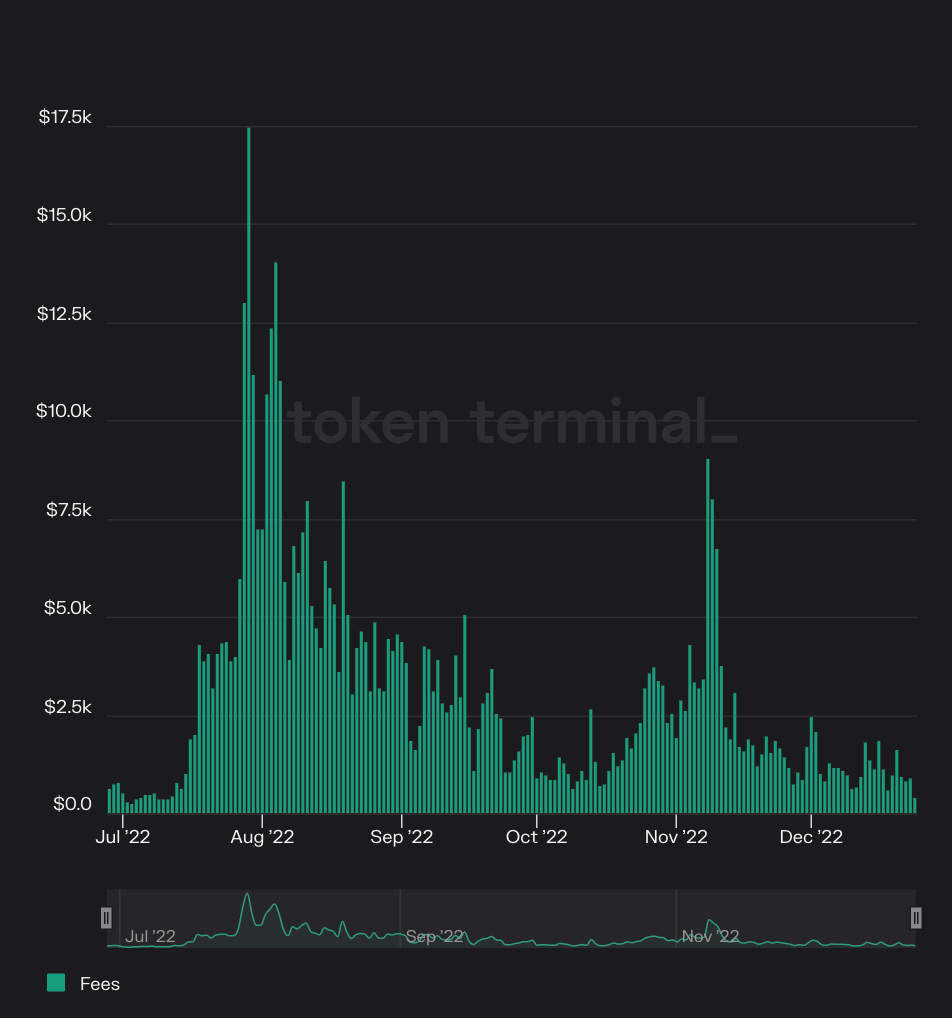

Fee Breakdown

On Velodrome Finance the trading fees are charged in the originally traded tokens (e.g. if you trade $USDC and $VELO, the fees will be charged in those tokens).

The trading fees for both liquidity pool types (correlated and uncorrelated assets) are set at 0.02% and can be adjusted for up to 0.05%.

On 31 January 2023, the trading fees for volatile pools were increased to 0.04% as the team was confident of the liquidity growth and wanted to capture higher fees for $veVELO voters.

As Velodrome liquidity grows, its ability to capture a higher fee for $veVELO voters while still delivering the best execution for top pairs grows too.

Protocols bribing on Velodrome 2.0 will be able to choose the fee level for their liquidity pools, which will also make it easier for pairs to “self-bribe”, generating more fees to attract more voters and emissions.

Operating Expenses

Token incentives

Emissions data

Tokens

To deal with protocol governance, Velodrome uses a two-token model:

- $VELO is the ERC20 utility token of the protocol

- $VELO is used for rewarding liquidity providers through emissions.

- $veVELO is an ERC721 NFT that acts as the governance token of the protocol

- $veVELO is used for governance, where any $VELO holder can vote-escrow their tokens to receive a $veVELO NFT in exchange.

The vote-escrow mechanism requires a lock period that will dictate the amount of voting power that is returned to $VELO lockers

- 100 $VELO locked for 4 years becomes 100 $veVELO

- 100 $VELO locked for 1 year becomes 25 $veVELO

The longer the vesting time, the higher the voting power and the greater the rewards that a $veVELO holder receives.

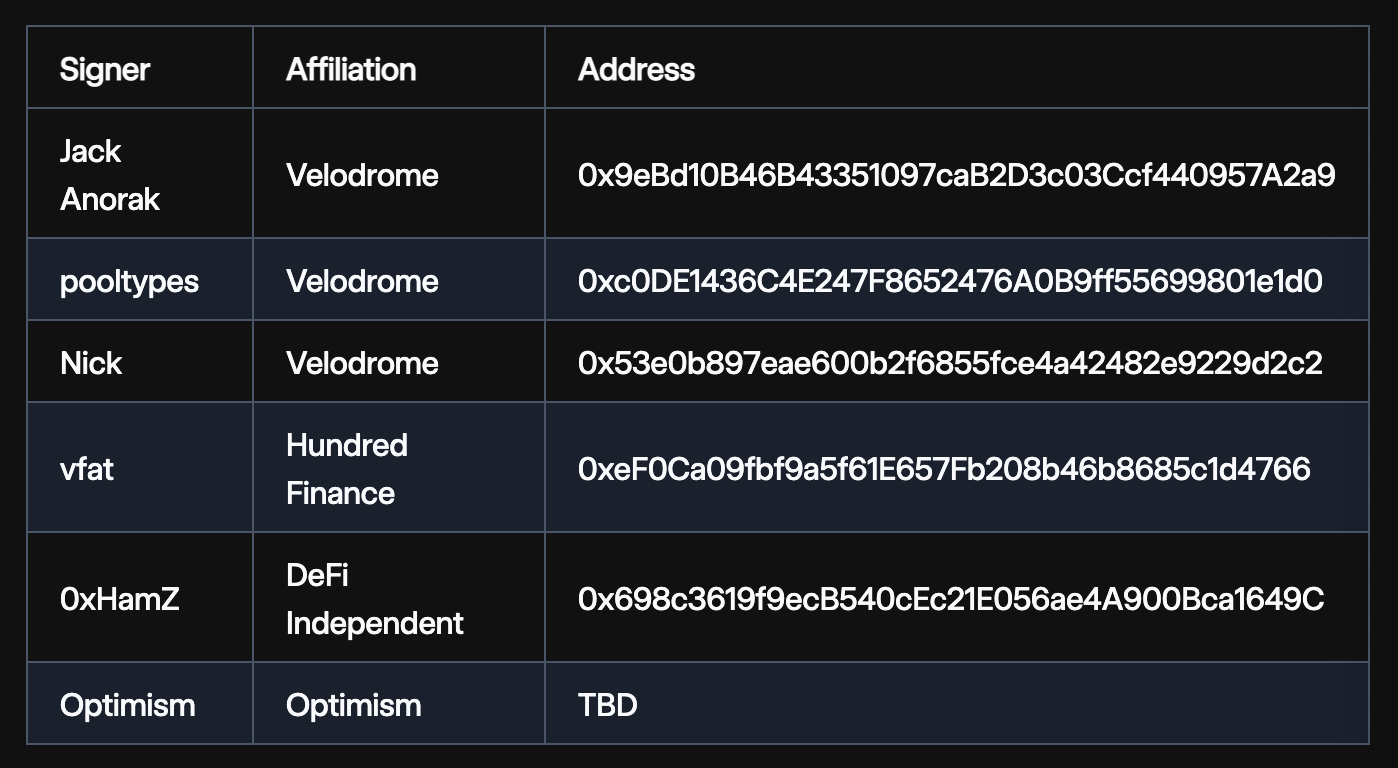

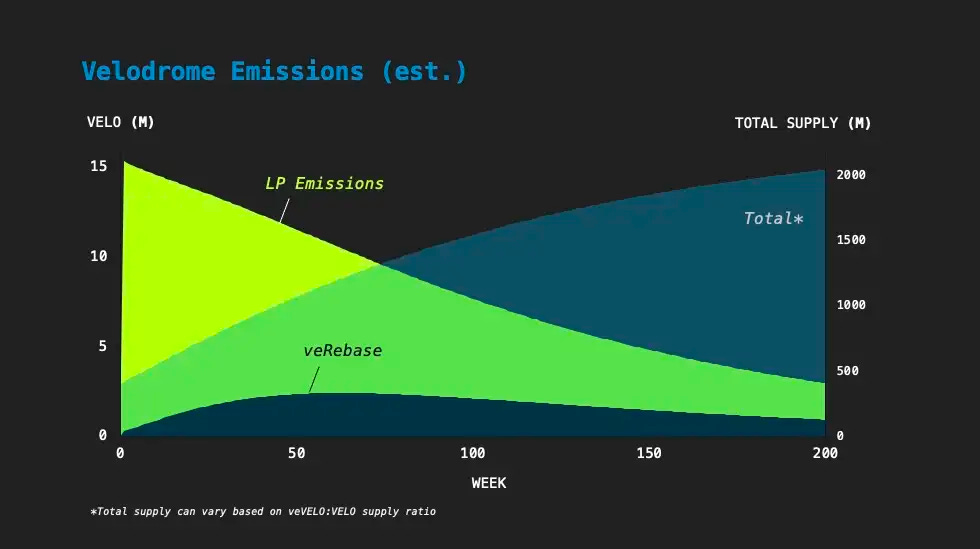

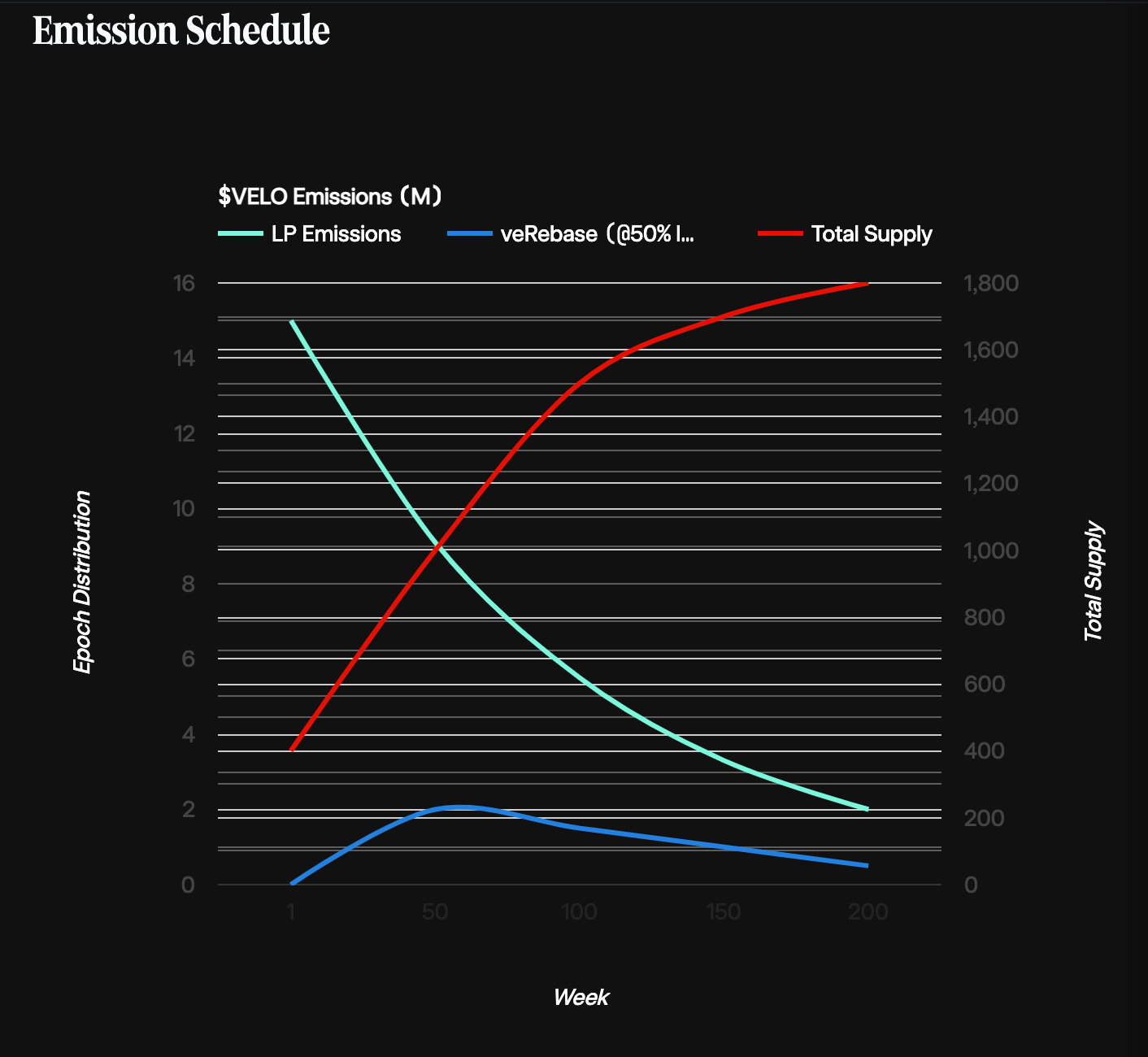

Emissions started high and rapidly declined soon after.

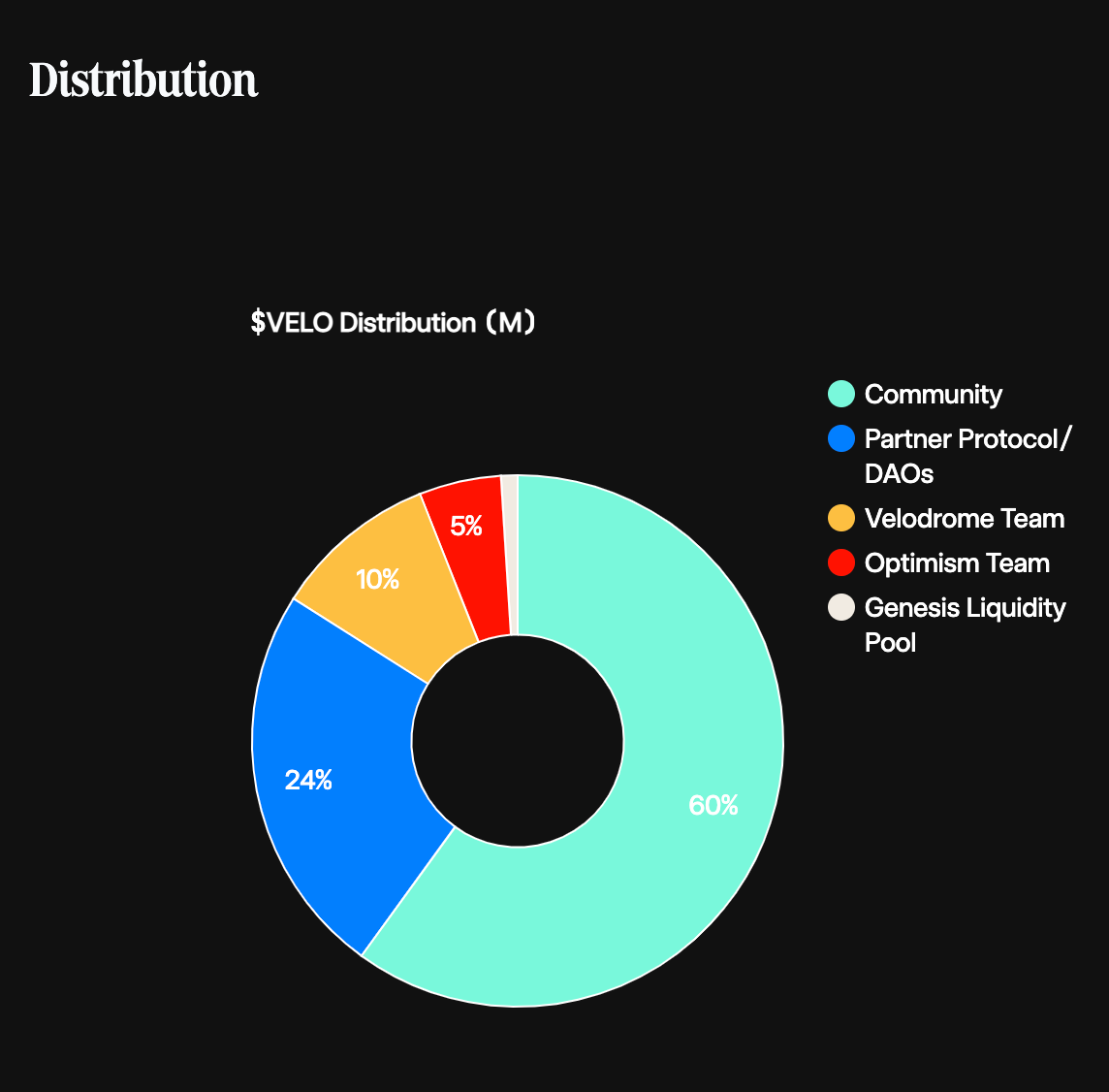

An initial distribution of 400M $VELO tokens was airdropped to community members, protocols, and DAOs that would play an active role in the Optimism ecosystem.

60% (240M $VELO) distributed to key community members that played a big role in incubating the protocol:

- 27% (108M $VELO) to $WeVE holders

- 18% (72M $VELO) to users of the Optimism network:

- 3755 $VELO/wallet to users that qualify as Repeat Optimism users. This amount will provide enough voting power to familiarize protocols with the ecosystem and give them a head start.

- 15% (60M $VELO) to cross-chain DeFi users:

- 3500 $VELO/wallet to Curve Protocol users with a 1,450+ days $veCRV lock time

- 3000 $VELO/wallet to Convex Protocol lockers of $vlCVX

- 3000 $VELO/wallet to Treasure DAO Genesis Mine MAGIC stakers for 1-3 month periods

- 2000 $VELO/wallet to Platypus Protocol stakers with a $vePTP and $PTP balance

- 500 $VELO/wallet to Redacted Cartel participants in the Genesis Dutch auction who did not sell their $BTRFLY tokens

- 500 $VELO/wallet to Eminence Finance wallets affected with EMN, $eAAVE, $eLINK, $EYFI, $eSNX, or $eCRV

6% (24M $veVELO) to distribute to partner protocols after launch

10% (40M in $VELO and $veVELO) for the team to keep working on the protocol (development, community, documentation, ecosystem…)

- 15,520,816 $VELO vested over 12 months, 6-month lock in a $veVELO position followed by a linear 6-month unlock period

- 7,200,000 $VELO vesting for 24 months, 12-month lock in a $veVELO position followed by 12-month linear unlock

- All ongoing payments to team members in $VELO are vested over 6 months with a 3-month lock in $veVELO followed by a linear 3-month unlock

5% (20M $veVELO) for the Optimism team

1% (4M $VELO) to liquidity providers of the foundational token pairs to provide better liquidity and user experience from launch day.

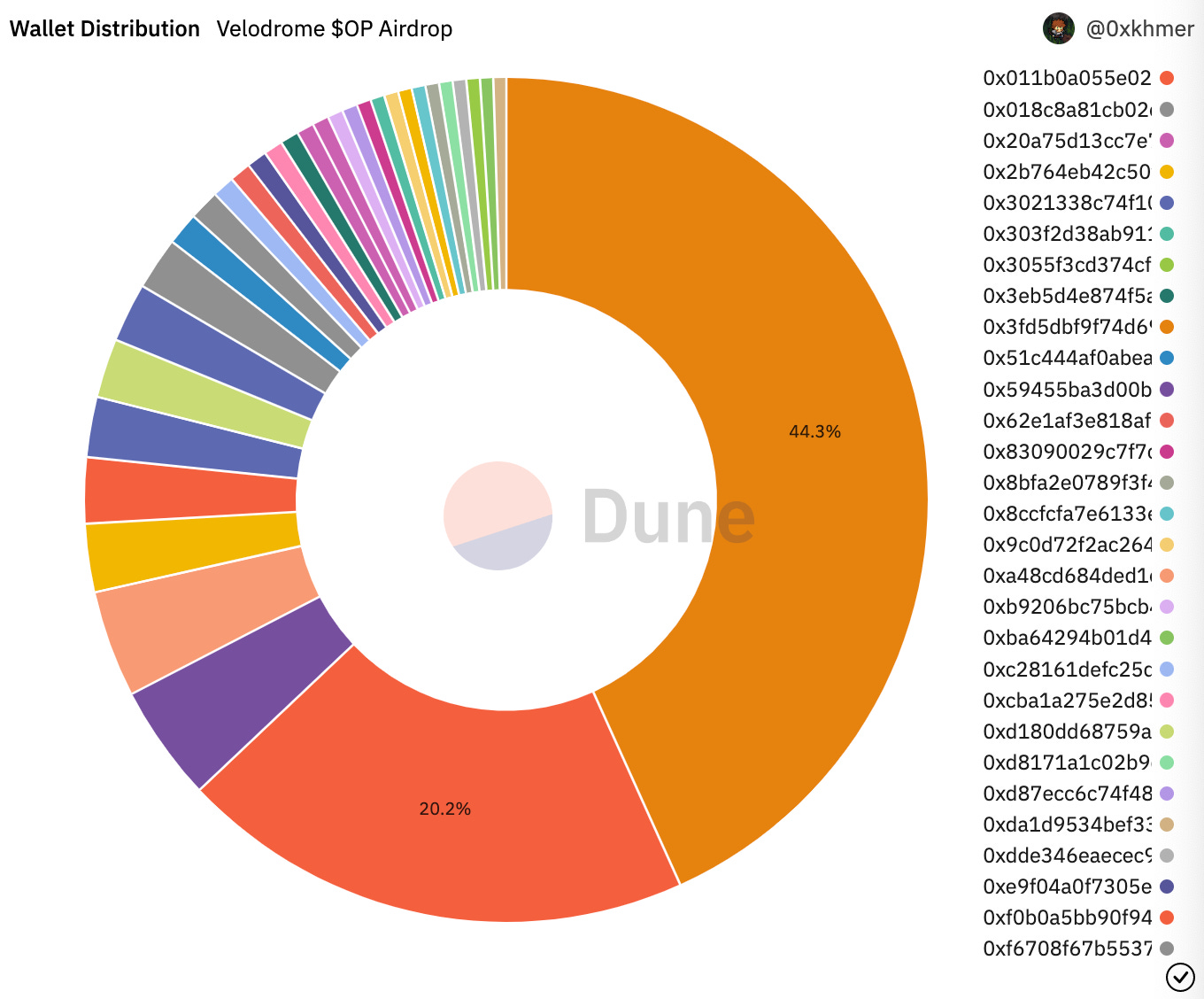

Wallet distribution after airdrop

The initial supply is 400M $VELO tokens and weekly emissions start at 15M $VELO (3.75% of the initial supply) and decay at 1% per week.

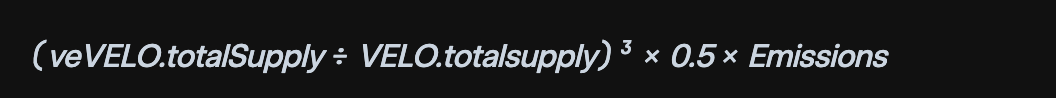

$veVELO holders receive a rebase proportional to the weekly LP emissions and the ratio of $veVELO to $VELO supply. This reduces the voting power dilution for $veVELO, since the $veVELO supply does not affect the weekly LP emissions.

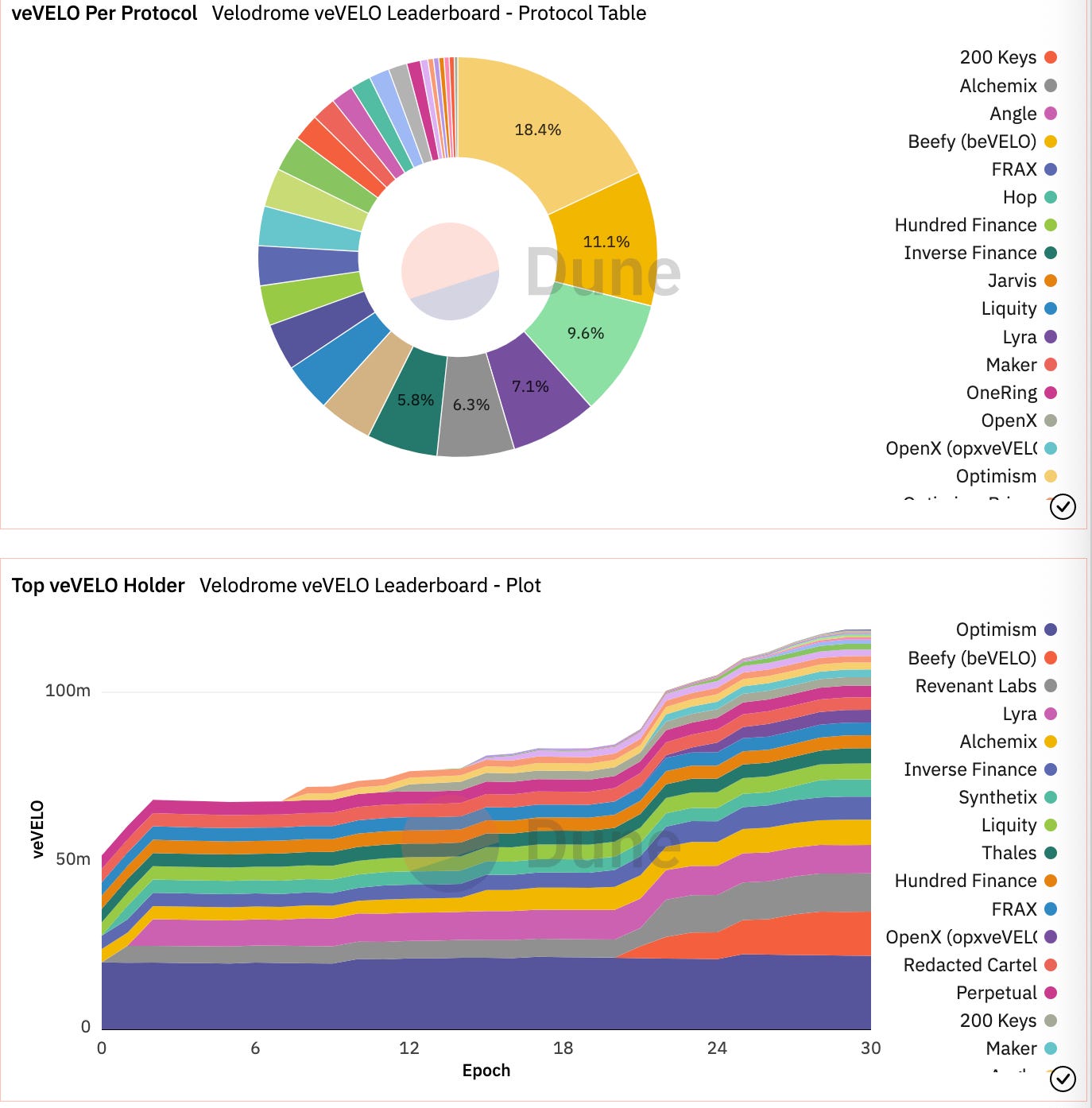

Top $veVELO holders

Governance

Due to the protocol’s nature, governance is concentrated on where token emissions should go. As such, $veVELO holders are the decision-makers when it comes to voting on their preferred liquidity pool gauges. Every epoch (weekly), $VELO emissions are distributed proportionally to the total number of votes received by a pool. In return, voters receive 100% of the trading fees and bribes collected by the pool they have voted for.

Voting for gauges is an action that can only be performed by $veVELO holders once per epoch. While this might an inconvenience for some $veNFT holders, this protects the protocol emissions from exploitative behaviors.

Whitelisting

Velodrome supports the permissionless creation of liquidity pools and their associated gauges. However, these pools and gauges can only contain whitelisted tokens. Upon launch, tokens from protocol partners were whitelisted. Over time, other protocols can request to whitelist their tokens.

To handle protocol-wide decisions on-chain, such as what tokens become eligible, Velodrome introduces an on-chain Governor with Tally

Commissaire

To ensure that the whitelisting process cannot be exploited to the detriment of the protocol, Velodrome’s Commissaire has the right to impose a series of requirements and to disable hostile gauges.

The Velodrome Commissaire also reserves the right to dissuade emissions exploitation via “bad gauges”.

Initially, the Commissaire consists of 7 members from the Velodrome team as well as prominent figures within the Optimism ecosystem.

Risks

Security

Velodrome Finance started developing by adapting Solidly’s open-source codebase (the repository was made private in March when Andre Cronje publicly announced he would stop developing the protocol). Since the official release in February 2022, no security incidents have been reported.

Peckshield audit of Solidly AMM: https://github.com/velodrome-finance/contracts/blob/master/audits/Solidly.pdf

Audits

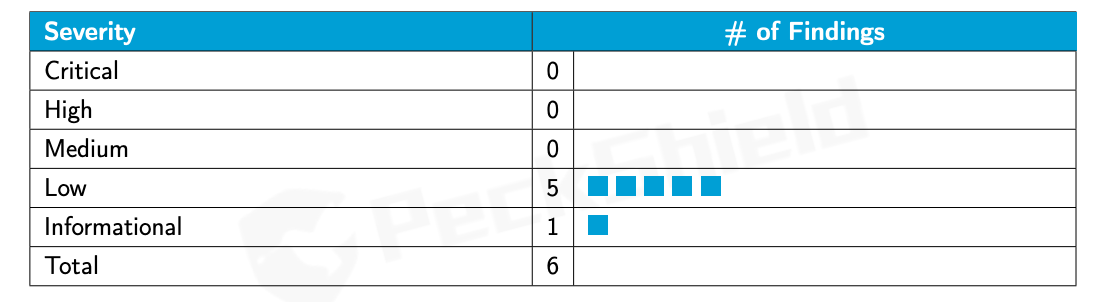

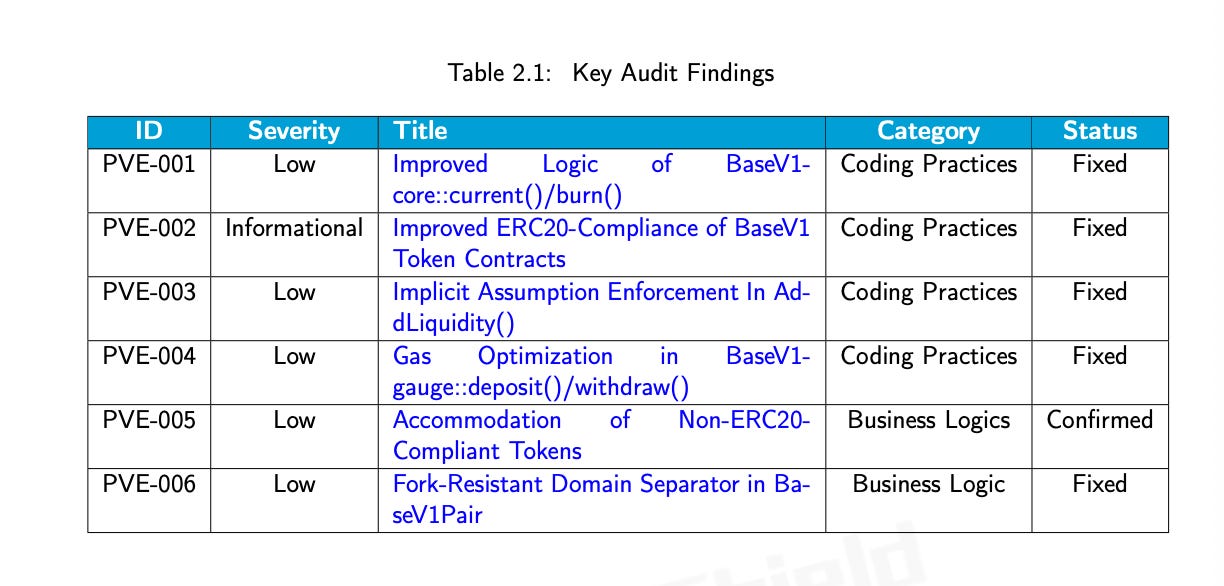

Solidly’s code went through a partial audit (only the AMM was covered) on January 30, 2022. The audit was done by Peckshield and revealed 5 low-severity and 1 informal finding. Besides, the codebase was also reviewed as part of a Code4rena bug bounty contest.

When it comes to Velodrome’s version, Mythx performed a deep scan of the protocol contracts that revealed low-severity issues. Coelacanth (@ImpossibleNFT) also engaged in an informal full audit.

All high or medium-risk issues were resolved pre-deploy except for one known issue being currently addressed (users can claim eligible rewards from ExternalBribe contracts more than once. This vulnerability does not put any user assets at risk.

Bug Bounty Programs

Velodrome ran a bug bounty contest on Code4rena that ran from March 23 to May 30 2022 with awards up to $75,000. The Code4rena report found a total of 23 vulnerabilities, out of which 6 were deemed “high severity” and 17 received a risk rating of “medium severity”.

Code4rena report main takeaways:

- Users can get unlimited votes -> Fixed in mainnet deployment.

- Attacked can block the LayerZero channel -> This was fixed to ensure that no more $WeVE tokens than eligible are burned to claim the airdrop on Optimism.

Velodrome also launched a bug bounty in February 2022 on Immunefi, where none of the $200,000 rewards were claimed.

Economic Attack Vectors

On June 9, 2022, a community member identified a vulnerability that allowed attackers to infinitely claim external rewards from bribes under specific conditions.

The funds were returned and, therefore, the exploit was considered a ‘white-hat’ report whose exploiter was compensated for collaborating with the protocol team.

In order to prevent further losses of funds, the core team drained the outstanding rewards from the relevant bribe contracts (~95% of bribes were secured and the rest was appropriately claimed). The code at risk had been modified after Code4rena’s review.

As soon as the attack occurred, the team scheduled an AMA with the community to share all the details and announce the remuneration plan.

To compensate $veVELO voters, the team manually airdropped rewards for the $THALES-$USDC and $VELO-$USDC gauges:

- $THALES-$USDC: 0.00259 $THALES per $veVELO vote (20,000 $THALES bribe / 7.713M $veVELO tokens)

- $VELO-$USDC: 0.02656 $VELO per $veVELO vote (1M $VELO bribe / 37.651M $veVELO votes

Requirements to qualify:

- Have voted for $THALES-$USDC and/or $VELO-$USDC

- Have voted before the June 8 2022 snapshot

- Have not fully claimed bribe rewards

Dependencies and Access Controls

On August 4, Velodrome announced on Twitter that one of the team member’s wallets had been hacked, resulting in a $350,000 loss.

10 days later, Velodrome’s team member Gabagool.eth admitted to having stolen funds from the project’s treasury in order to recover his personal trading losses from May’s market crash. The funds were transferred to Tornado Cash to obscure the origin of the capital. Gabagool himself claimed, “I did this in a pathetic attempt to solve my own problem, to get out of a trap of my own making”. He claimed to have returned most of the funds after being proven guilty.

The Velodrome team announced that they were cutting off ties with Gabagool and that they were working with attorneys on the next steps to follow. It is still unclear whether the ex-contributor will face criminal charges as a result of his actions.

Additional Information

Partnerships

Launch Partners

- Perpetual Protocol

- Frax Finance

- Thales

- MakerDAO

- Alchemix

- Hundred Finance

- Optimism

- Liquity

- Redacted Cartel

- Lyra Finance

- Hop Protocol

- Synthetix

- Inverse Finance

Post Launch Partners

- Matcha, a DEX aggregator, integrates Velodrome

- 0x Project, a DEX infrastructure, integrates Velodrome.

- 1inch, a DEX aggregator, integrates Velodrome.

- QiDao onboards with Velodrome

- OpenOcean, a DEX aggregator, integrates Velodrome.

- Matrix Farm, a yield optimizer, partners with Velodrome.

- dForce onboards with Velodrome.

- Aelin Protocol onboards with Velodrome.

- Angle Protocol, an over-collaterized stablecoin protocol, onboards to Velodrome.

- Lido partners with Velodrome to bring deep stETH liquidity to Optimism.

- BarnBridge onboards to Velodrome.

- Velodrome announces partnership to be one of the first protocols to create an active pool on Resonate, a yield futures protocol developed by Revest Finance.

- Abracadabra bootstraps $MIM liquidity on Optimism.

- Stargate Finance – Fully composable liquidity transport protocol that lives at the heart of omnichain DeFi.

- 0xProject – 0xProject enables powerful APIs to build financial apps on crypto rails.

- MetaPools – Liquid staking protocol.

Additional Information

FAQ

Who is behind this project?

- The team behind Velodrome Finance previously launched veDAO, an initiative incubated by Information Token. See the Team section for more info.

How do epochs work?

- A new epoch starts Thursday (00:00 UTC).

- Bribes are deposited at any point in the epoch.

- A snapshot of votes cast is taken at the end of Wednesday (23:59 UTC).

- Rewards are available 24–48 hours after the snapshot.

How do I reset my veNFT?

- 1. Go to the voter contract and connect your wallet.

- https://optimistic.etherscan.io/address/0x09236cfF45047DBee6B921e00704bed6D6B8Cf7e#writeContract

- 2. Input your veNFT ID number in 19. reset() function.

- 3. Hit Write and approve the transaction on your wallet.

How do I merge my veNFTs?

- If you’ve voted in the past, first RESET your votes.

- Go to the veNFT contract and connect your wallet.

- https://optimistic.etherscan.io/token/0x9c7305eb78a432ced5c4d14cac27e8ed569a2e26?a=0xe247340f06fcb7eb904f16a48c548221375b5b96#writeContract

- Go to function “13. merge”, input the veNFTs IDs you’d like to merge and click Write.

- Approve the transaction on your wallet.

Why are there 2 different pools? (sAMM/vAMM)

- Stable pools are designed for assets that have little to no volatility.

- Variable pools are designed for assets with high price volatility.

- Fees and formulas for both pools differ as a result.

Has Velodrome been audited?

- Solidly went through a partial (only the AMM part was sent for audit) security audit on January 30, 2022. The audit was done by PeckShield and did reveal 5 low-severity and 1 informal finding.

- Velodrome Finance went through a security audit and a peer review as part of the Code4rena bug bouncy contest.

- Finally, a full MythX deep scan on Velodrome contracts found just a handful of false-positive, low-severity issues reported.

- Lastly, they also engaged with Coelacanth for an informal full audit.

Community Links

- Website: https://app.velodrome.finance/

- Dapp: https://app.velodrome.finance/swap

- Twitter: https://twitter.com/VelodromeFi

- Discord: https://discord.gg/velodrome

- Blog: https://medium.com/@VelodromeFi

- Docs: https://docs.velodrome.finance/

- Guides:

- How to use the Optimism Bridge: https://youtu.be/pR31stuRejg