Overview

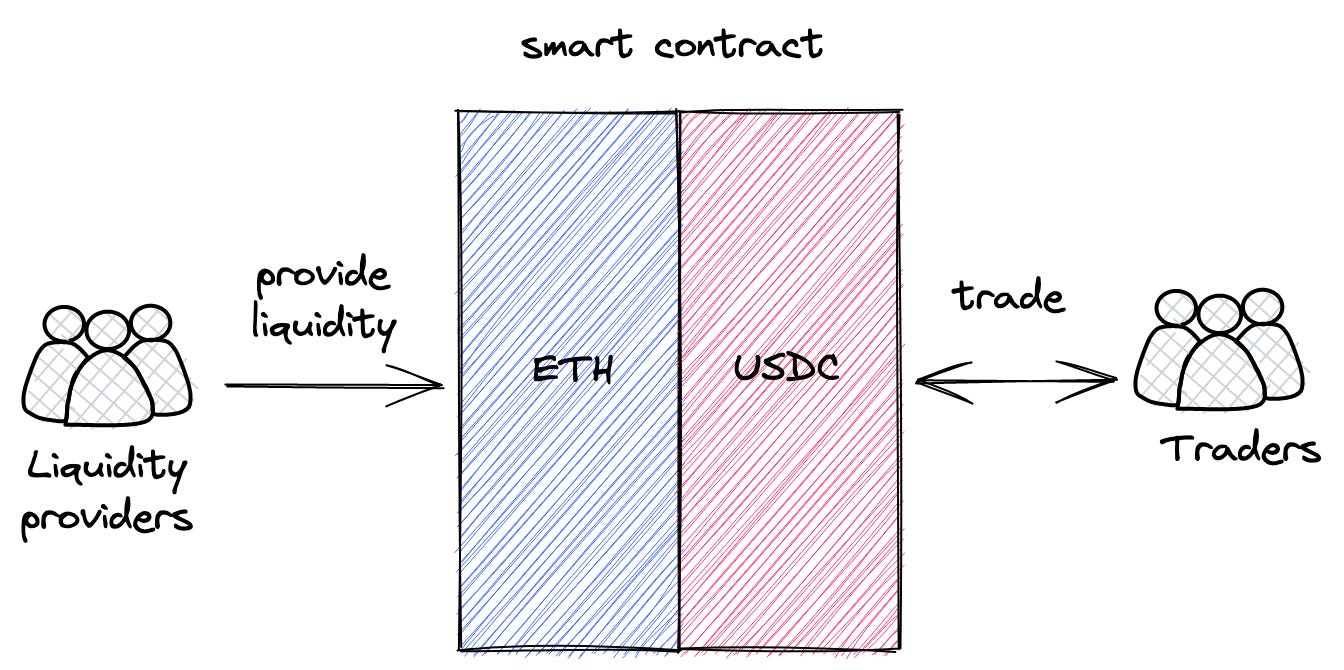

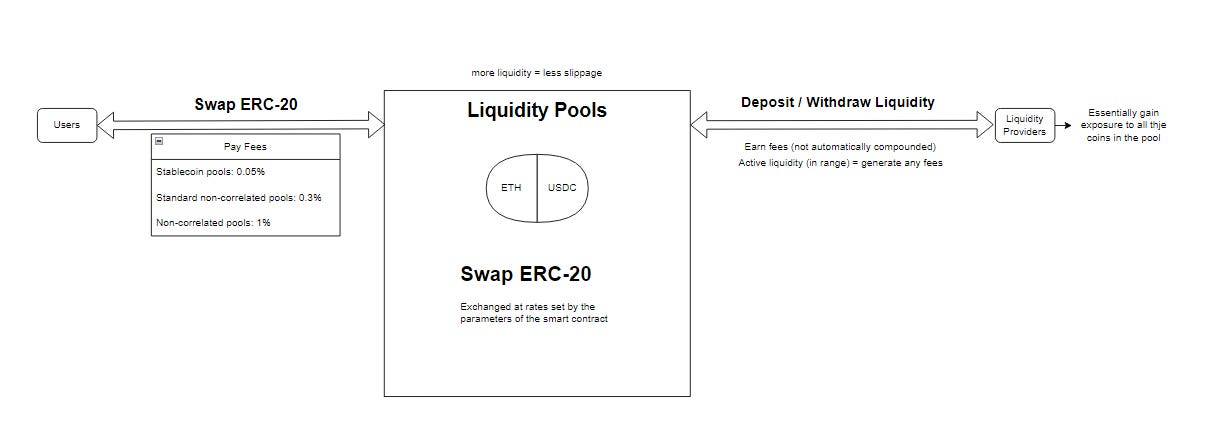

Uniswap is a decentralized exchange that is fully run by an AMM (Automated Market Maker) algorithm that allows users to create pools, or token pairs, and fill them with liquidity to let users exchange tokens.

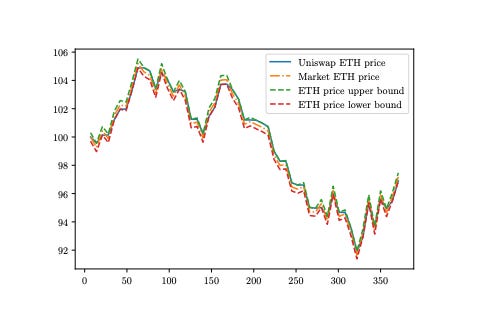

Uniswap allows anyone to become a market maker, democratizing liquidity provision and reducing centralization risks. By enabling asset swaps, the protocol also serves as a price oracle, attracting arbitrageurs to keep its token prices in line with those on other centralized or decentralized exchanges.

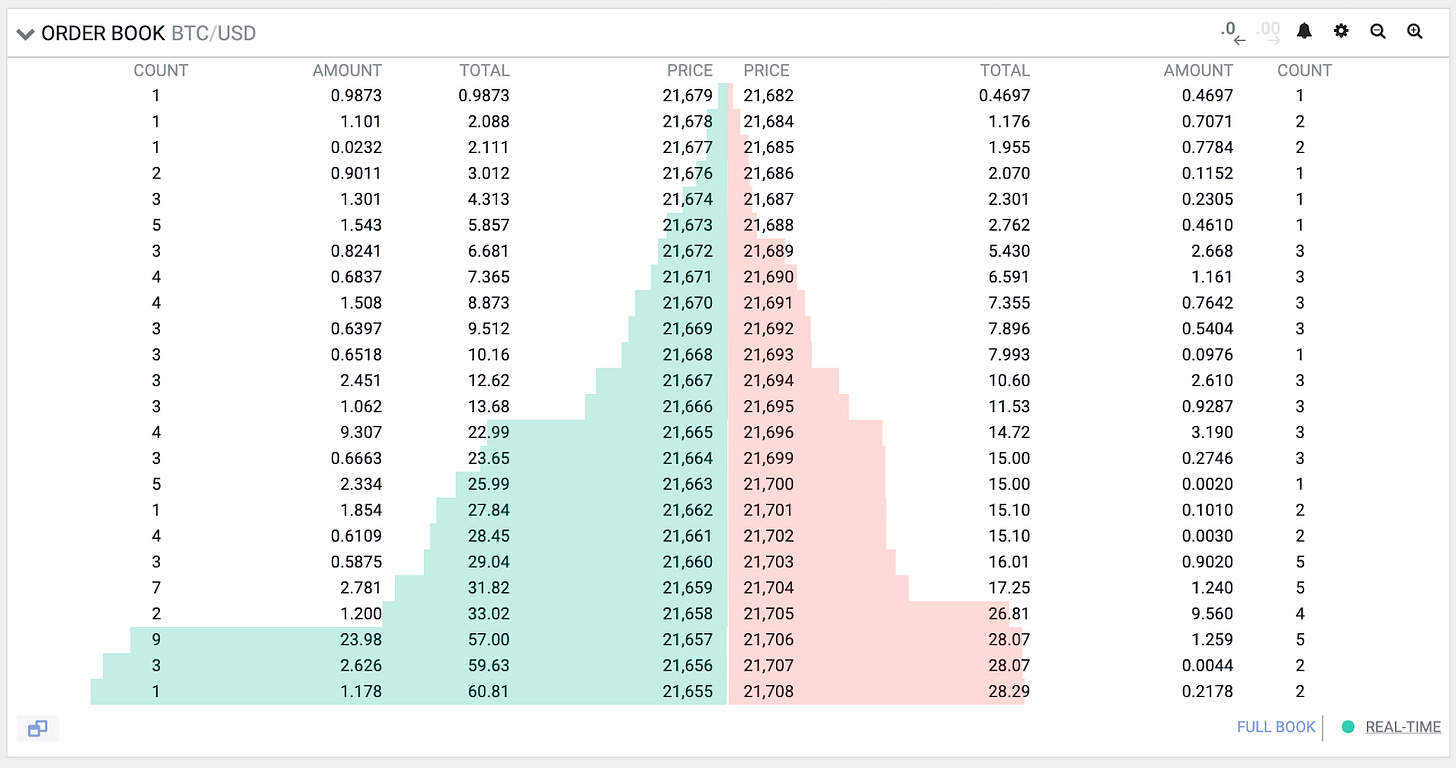

In traditional centralized markets, market makers play a critical role to facilitate trades and offering favorable liquidity conditions for traders to swap assets with as low price slippage as possible. In this context, liquidity refers to the availability of trading assets in the market, and without it, trades cannot occur. For example, some trading pairs, such as BTC-USDT, have high liquidity, while others, like certain low-quality altcoins, may have low or no liquidity at all.

To properly function, Decentralized exchanges (DEXs) need ample liquidity to serve as a viable alternative to centralized exchanges. One approach to achieving this liquidity is for DEX developers to use their own funds or investor capital to act as market makers. However, this method is not realistic due to the large amount of capital needed to provide liquidity for all token pairs. Additionally, it would lead to centralization, as developers would have significant control over the exchange. Uniswap makes it possible to remove that risk and offer a more effective solution by utilizing an automated market maker (AMM) model. This model allows any user to deposit funds into a trading pair, effectively serving as a market maker and benefiting from it.

Liquidity pools are the backbone of the Uniswap platform. They consist of tokens locked in a smart contract to facilitate trading and earn fees in return. The larger the liquidity pool, the deeper the liquidity and, therefore, the lower the slippage and higher the overall trading efficiency. Users can trade any token pair, as long as there is a liquidity pool available for that pair, trading prices are determined by the AMM’s pricing formula.

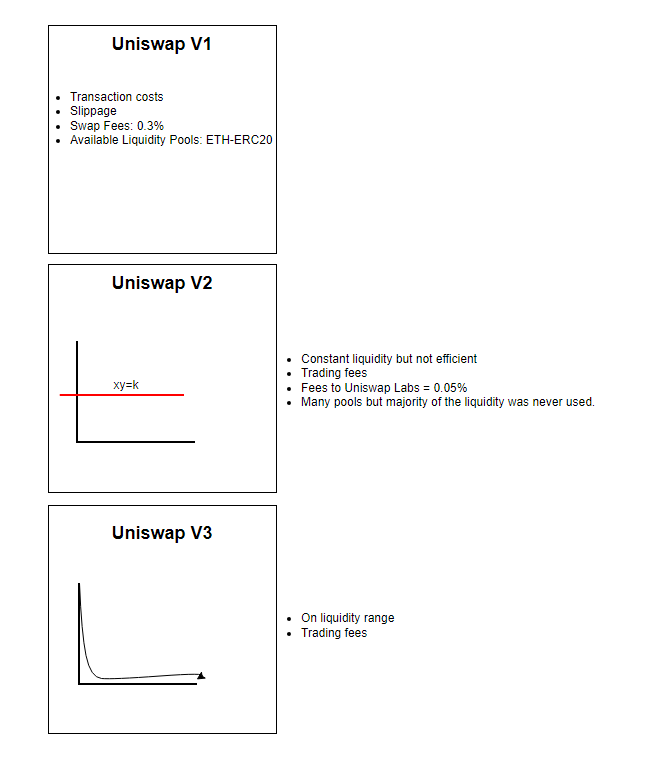

There are 3 versions of Uniswap, with Uniswap V4 currency being actively worked on and in a status of the draft:

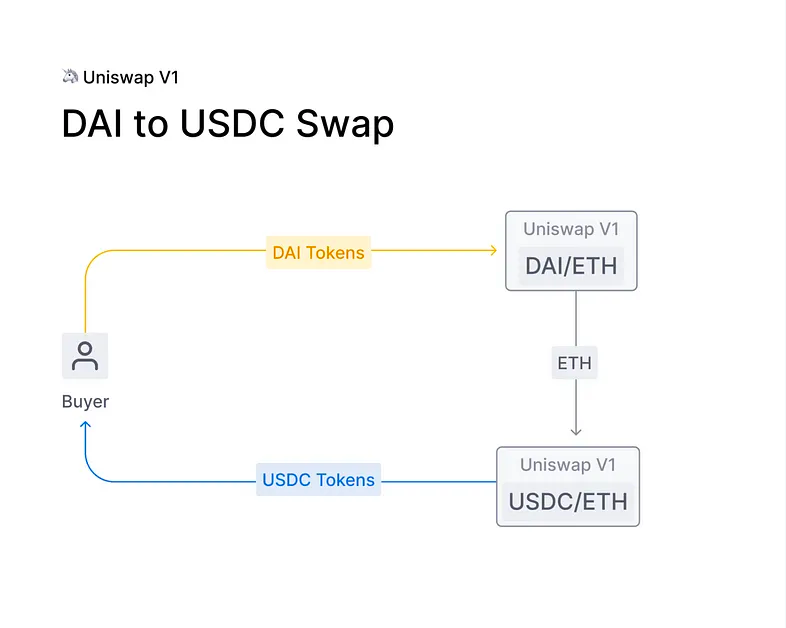

- Uniswap V1 was launched in November 2018 and it allowed only swaps between ETH and another asset. Chained swaps were also possible to allow token-token swaps.

- Uniswap V2 was launched in March 2020 and it allowed direct swaps between any ERC20 tokens, as well as chained swaps between any pairs.

- Uniswap V3 was launched in May 2021 and it significantly improved capital efficiency. With concentrated liquidity, it allowed liquidity providers to remove a bigger portion of their liquidity from pools and still keep getting the same rewards (or squeeze the capital in smaller price ranges and get up to 4000x of profits).

- The vision for Uniswap v4 is to increase the expressiveness of the underlying primitives. Announced as public infrastructure for the Ethereum ecosystem, the goal of Uniswap V4 is to empower developers with the appropriate tools to build unprecedented primitives. Instead of making the tradeoff decisions itself, the protocol will allow anyone to choose what they want to build and how they want to build it.

Although Uniswap is a popular example of an AMM, the concept behind it has been studied in academic literature for over a decade. Most AMMs were initially designed for information aggregation and implemented in prediction markets, where payoffs depend on the future state of the world.

The most well-known AMM is the LMSR (Logarithmic Market Scoring Rule), developed in 2002 and used in prediction markets such as Augur V1 and Gnosis. Other AMM approaches for information aggregation include Bayesian market makers (adequate for binary outcomes) and dynamic pari-mutuel market makers (often used in horse racing).

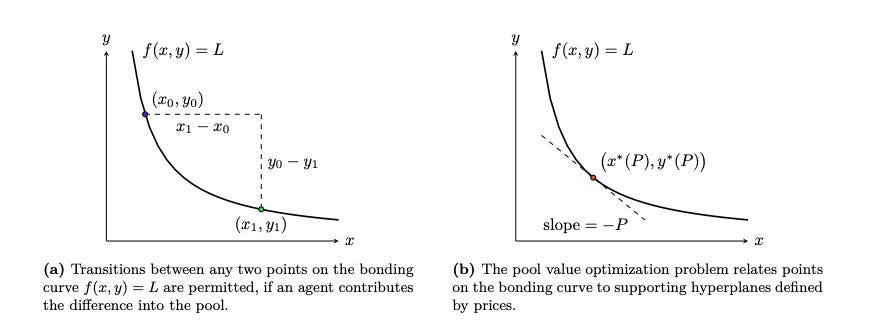

Uniswap employs a “constant product market maker” model, a type of AMM referred to as a CFMM (Constant Function Market Maker). It is important to differentiate CFMMs from other AMMs. One common misconception is to use “bonding curve” interchangeably with CFMM.

- Bonding curves define the relationship between price and token supply.

- CFMMs define the relationship between two or more tokens.

Constant Function Market Makers (CFMMs) are a type of automated market maker with a unique characteristic: any trade must change the reserves in a way that the product of those reserves remains constant. This model takes into account 3 main participants: traders, liquidity providers, and arbitrageurs.

- Traders exchange one asset for another within the CFMM by swapping tokens based on the current exchange rates determined by the constant function mechanism.

- Liquidity providers willingly accept trades against their portfolio in exchange for a fee. They contribute to the reserves of assets in the CFMM, facilitating trades and earning fees as compensation for their provided liquidity.

- Arbitrageurs maintain the price of assets within the CFMM in accordance with the market price by taking advantage of price discrepancies between the CFMM and other marketplaces. They buy and sell assets to profit from these differences, indirectly contributing to the price stability of assets within the CFMM. They basically act as market makers for the DEX.

CFMMs are commonly used for secondary market trading and tend to accurately reflect the price of individual assets on reference markets, thanks to arbitrage. For example, if the CFMM price is lower than the reference market price, arbitrageurs will buy the asset on the CFMM and sell it on an order book-based exchange, profiting from the price difference.

Benefits of Constant Function Market Makers

- Fast exchange of assets, since CFMMs allow for immediate token swaps, overcoming the coincidence of wants problem present in traditional orderbook exchanges.

- Bootstrapping liquidity is simpler than in order book-based exchanges. CFMMs encourage passive market participants to lend their assets to pools, making liquidity provision significantly easier.

- On-chain oracles derived from a pricing function make it possible for the AMM to measure asset prices without the need for a central third party. This is because agents interacting with CFMMs are incentivized to report asset prices accurately, providing a reliable on-chain price oracle for other smart contracts.

- Path independence means that the price of any two quantities depends only on those quantities and not on the path between them. This offers two key benefits:

- No need for trade strategizing, since traders receive the same price for a single large trade as they would for a series of smaller trades.

- Minimal state representation, since only the quantity of assets is required for the pricing process.

Drawbacks of Constant Function Market Makers

- Slippage is the tendency of prices to move against a trader’s actions as the trader absorbs liquidity. The larger the trade, the greater the slippage.

- CFMMs incur large slippage costs, making them more suitable for smaller order sizes.

- Exotic financial risk

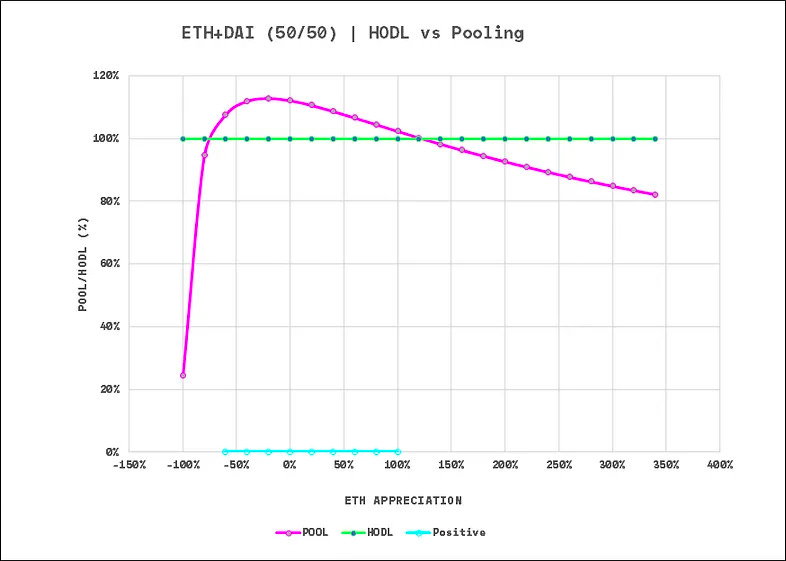

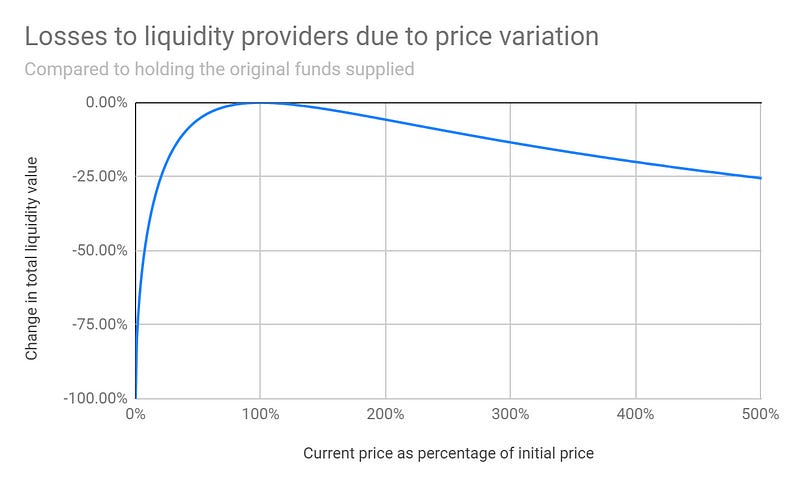

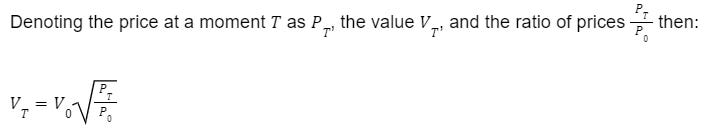

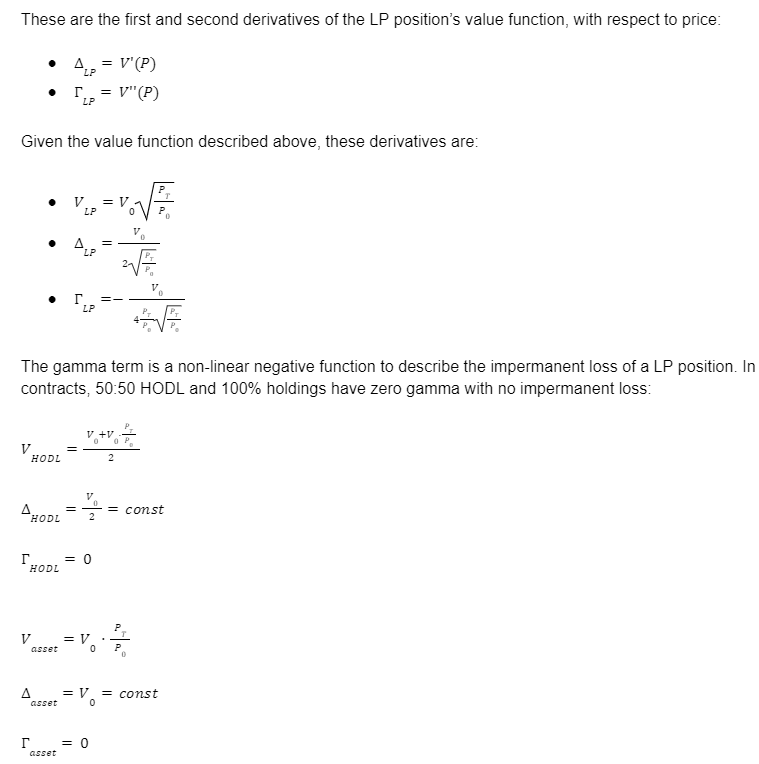

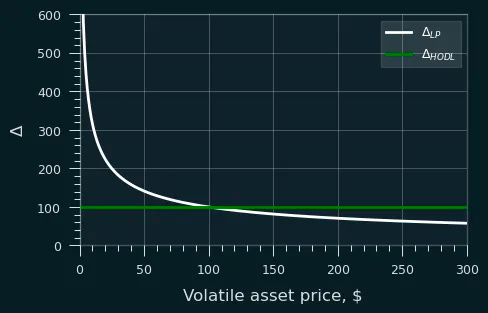

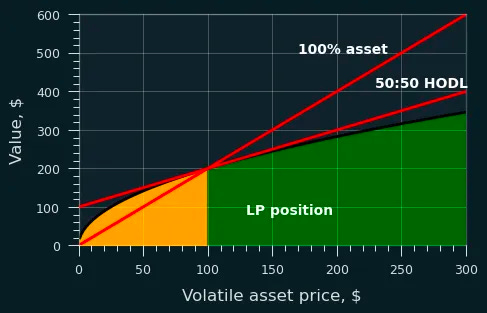

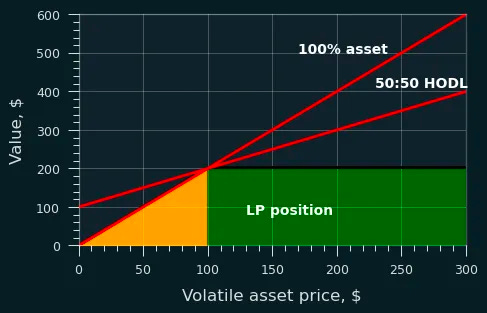

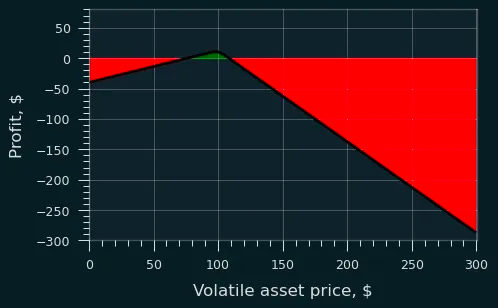

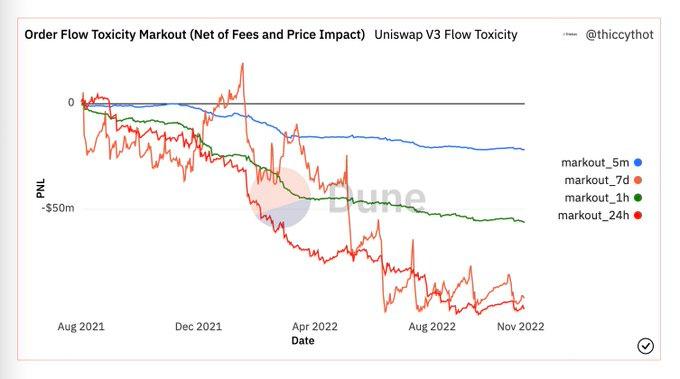

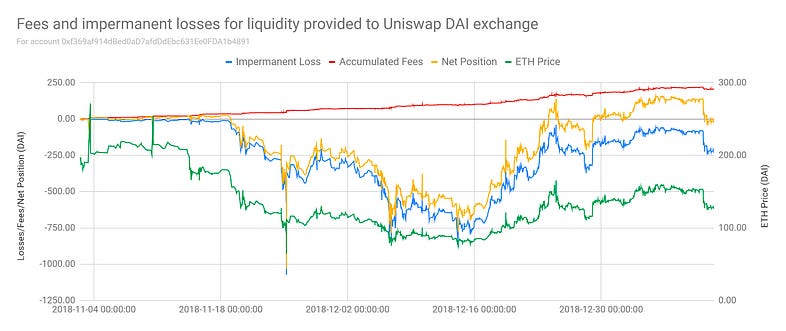

- Impermanent loss, which describes the losses experienced by liquidity providers due to the price divergence of a pool’s asset prices.

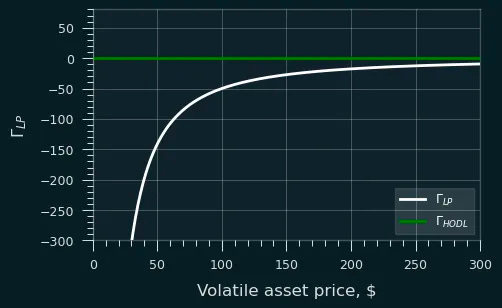

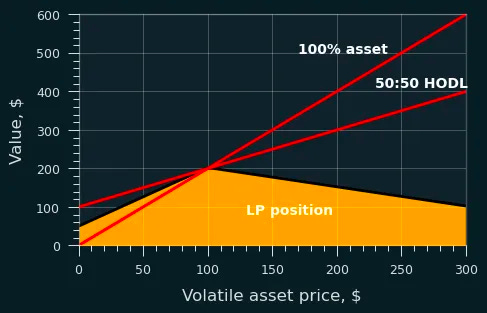

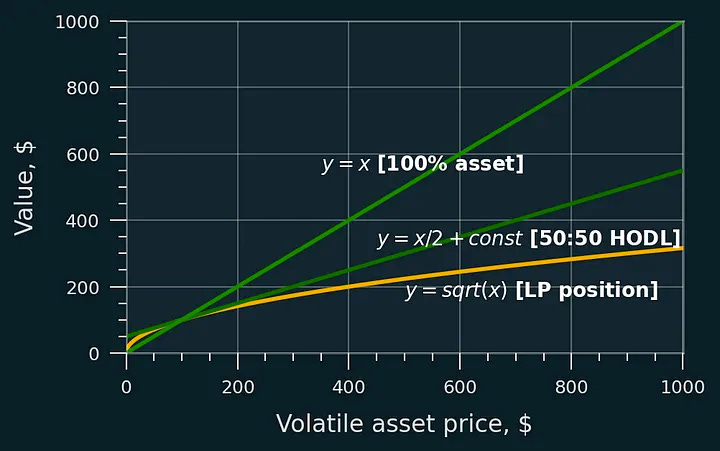

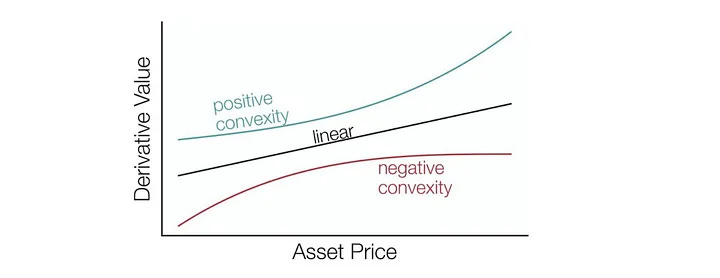

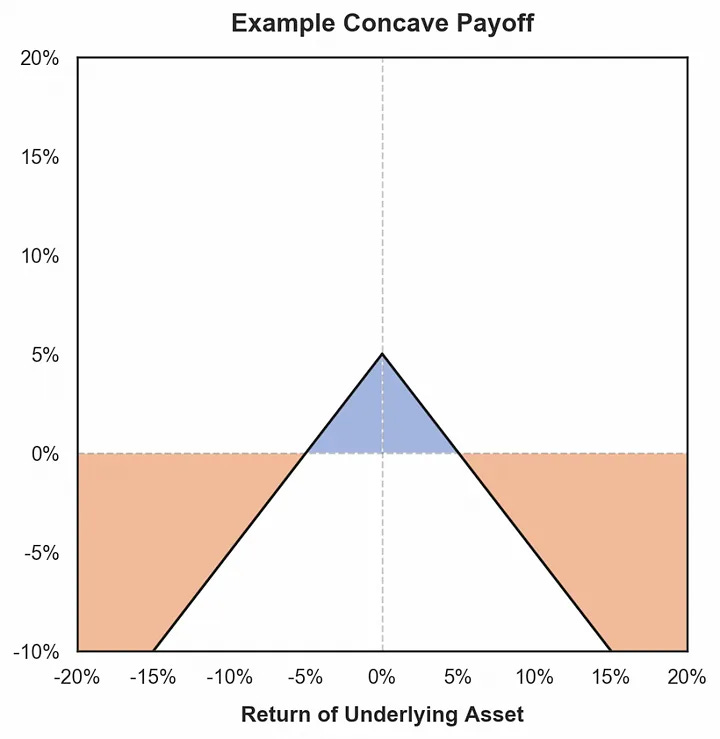

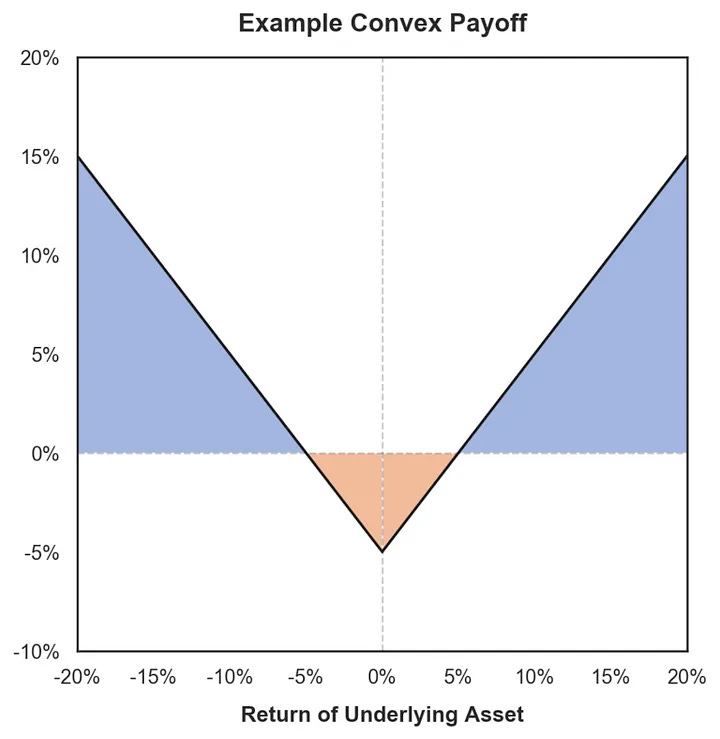

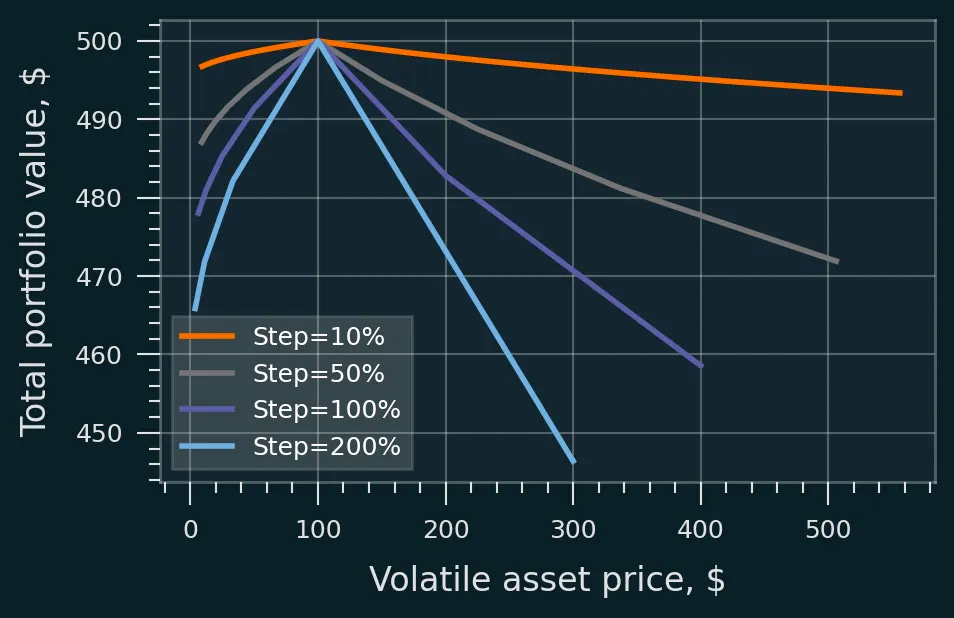

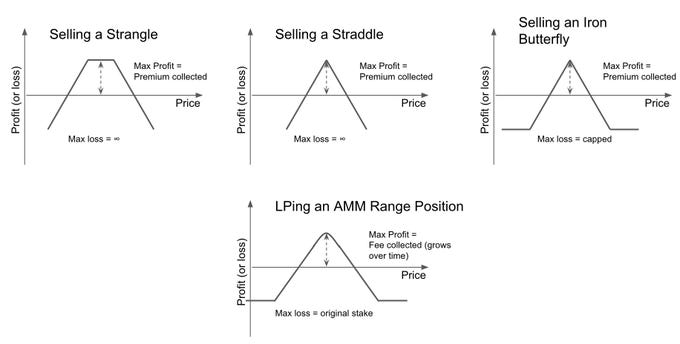

- Short volatility. Since the Uniswap payoff curve is concave, this means that liquidity providers are profitable within a certain price bound and will lose money in large price movements.

- High volatility/volume correlation

Constant Product Market Maker

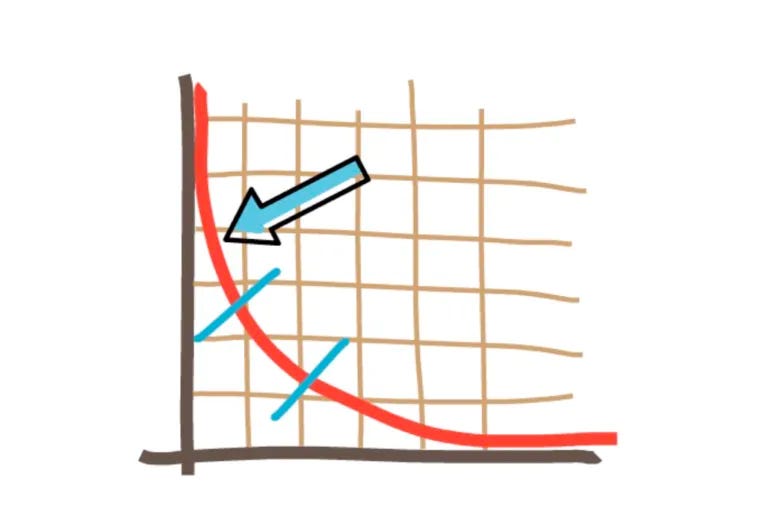

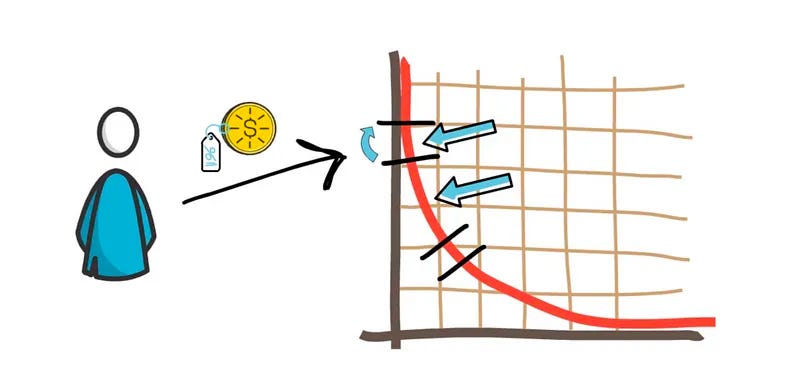

Automated market makers (AMMs) are decentralized algorithms responsible for creating and maintaining liquid markets for various assets. In the case of Uniswap, this was originally achieved with a constant product function that would impact pricing calculation based on the ratio of asset balances in a liquidity pool.

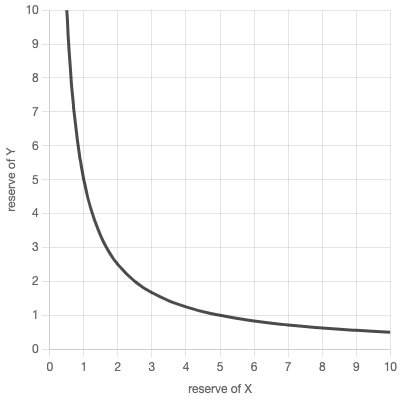

x * y = k

- x represents the reserve of one asset (e.g., ETH) in the liquidity pool.

- y represents the reserve of the other asset (e.g., an ERC-20 token) in the pool.

- k is a constant value.

Uniswap’s AMM model ensures that the value of k remains constant, regardless of the amount of x or y reserves in the pool. When a trade occurs, users deposit one asset and receive the other in return. Accordingly, Uniswap adjusts the reserves to maintain the constant product (k) after each trade. Since the smart contract does not interact with centralized providers or other exchanges, the contract acts as the price oracle itself. The formula states that k remains constant no matter what the reserves of each asset are. Every trade increases a reserve of either one token or the token and decreases a reserve of either one token or the other.

(x+x)(y-y)=xy where x is the number of tokens being traded for y, which are the tokens that the user gets in exchange.

y=yxx+x

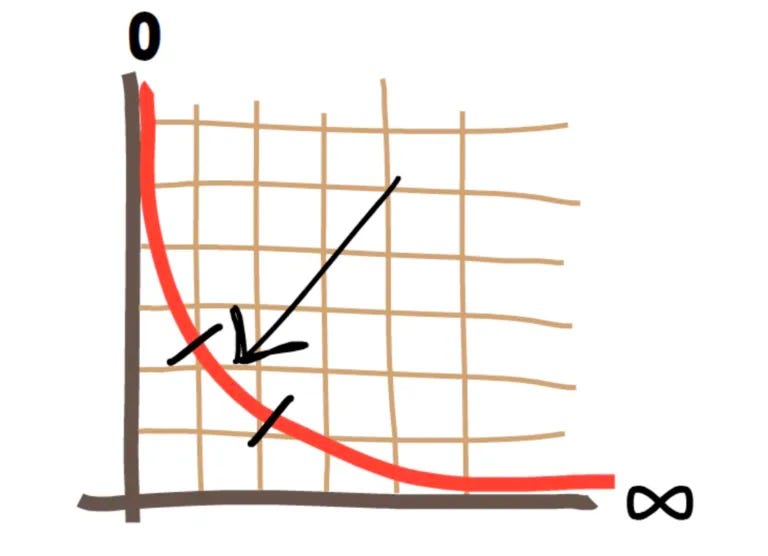

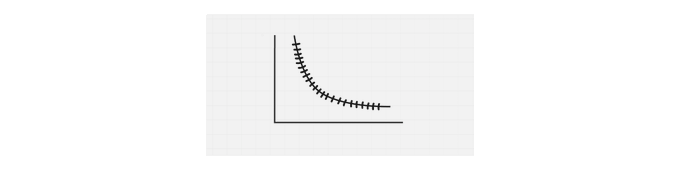

The constant product formula has two main implications:

- The price function causes price slippage: the bigger the number of tokens traded relative to reserves, the higher the price would be.

- The function’s curvature is a hyperbola that never crosses the x or y axis, thus making the reserves infinite.

Together, this mechanism protects pools from being drained and also aligns with the law of supply and demand

- The higher the demand (the bigger the output amount you want to get) relative to the supply (the reserves), the higher the price (the less you get).

Uniswap V1

Uniswap V1 was written in Vyper (a Python-like smart contract language) and incorporated a unique mechanism using factory and registry contracts. Each Uniswap v1 pair stores pooled reserves of two assets, and provides liquidity for those two assets, maintaining the invariant that the product of the reserves cannot decrease. This approach would allow for individual exchange contracts for each ERC20 token, with ETH serving as an intermediary for direct ERC20 to ERC20 trades. This way, users could trade ERC20 tokens directly without converting them to ETH first, simplifying the trading process and reducing transaction costs.

- The factory contract in Uniswap is responsible for creating separate exchange contracts for each ERC20 token. When a new ERC20 token is added to the platform, the factory contract deploys a new exchange contract specific to that token.

- Each exchange contract holds a reserve of ETH and the associated ERC20 token. This reserve allows for trades between the two assets based on their relative supply. The automated market maker algorithm maintains the liquidity and adjusts the token reserves in these contracts to facilitate trading.

- The registry contract serves as a directory that links all the individual exchange contracts. This linkage enables users to perform direct ERC20 to ERC20 trades between any tokens on the platform, using ETH as an intermediary.

Providing Liquidity

In Uniswap V1, adding liquidity to a pool involves depositing an equivalent value of ETH and ERC20 tokens into the associated exchange contract.

The first liquidity provider to join a pool sets the initial exchange rate by depositing an equivalent value of ETH and ERC20 tokens. If this ratio is incorrect, arbitrage traders will step in and bring the prices to equilibrium at the expense of the initial liquidity provider.

All future liquidity providers deposit ETH and ERC20 tokens using the exchange rate at the time of their deposit. If the exchange rate is unfavorable, profitable arbitrage opportunities will arise, correcting the price.

When a user provides liquidity, liquidity tokens (LP tokens) are minted to track the relative proportion of total reserves that each liquidity provider has contributed to the market. The number of liquidity tokens minted is determined by the amount of ETH sent to the function. In other words, the number of LP tokens received is proportional to the user’s share of liquidity in the pool’s reserves.

amountMinted = totalAmount * ethDepositedethPool

And depositing ETH into reserves requires depositing an equivalent value of ERC20 tokens as well.

tokensDeposited = tokenPool * ethDepositedethPool

Liquidity tokens can be burned at any time, enabling liquidity providers to withdraw a proportional share of the market’s liquidity based on their token holdings.

ethWithdrawn = ethPool * amountBurnedtotalAmount

tokensWithdrawn = tokenPool * amountBurnedtotalAmount

Note that ETH and ERC20 tokens are withdrawn at the current exchange rate (reserve ratio), not the ratio of their original investment. This means some value can be lost from market fluctuations and arbitrage. Also, fees taken during trades are added to total liquidity pools without minting new liquidity tokens. Because of this, ethWithdrawn and tokensWithdrawn include a proportional share of all fees collected since the liquidity was first added.

- Transaction fees generated in the liquidity pool are distributed among LP token holders.

- The share of fees each LP-token holder receives is proportional to the number of tokens they hold.

- LP tokens can be exchanged back for the initial liquidity provided plus the accumulated transaction fees.

When a liquidity provider decides to remove their liquidity, they receive both assets (ETH and tokens) according to the current ratio in the pool. This can result in a different proportion of assets compared to what was initially deposited. If the value of the received assets in USD is lower than the value of the assets if they had been held in a wallet, the liquidity provider experiences an impermanent loss.

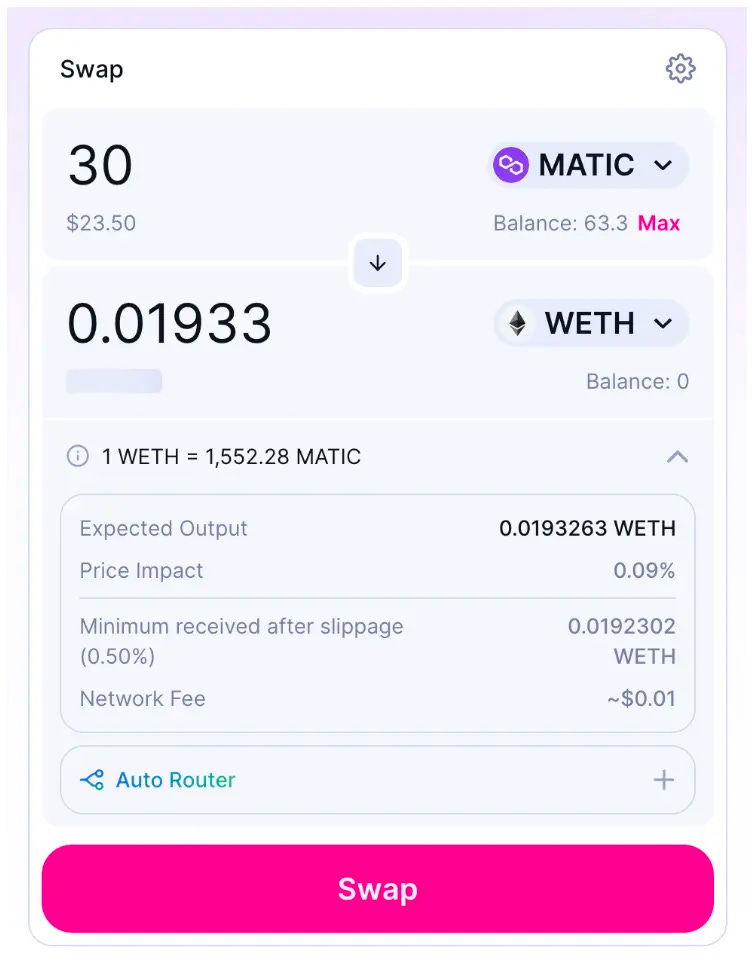

Trading

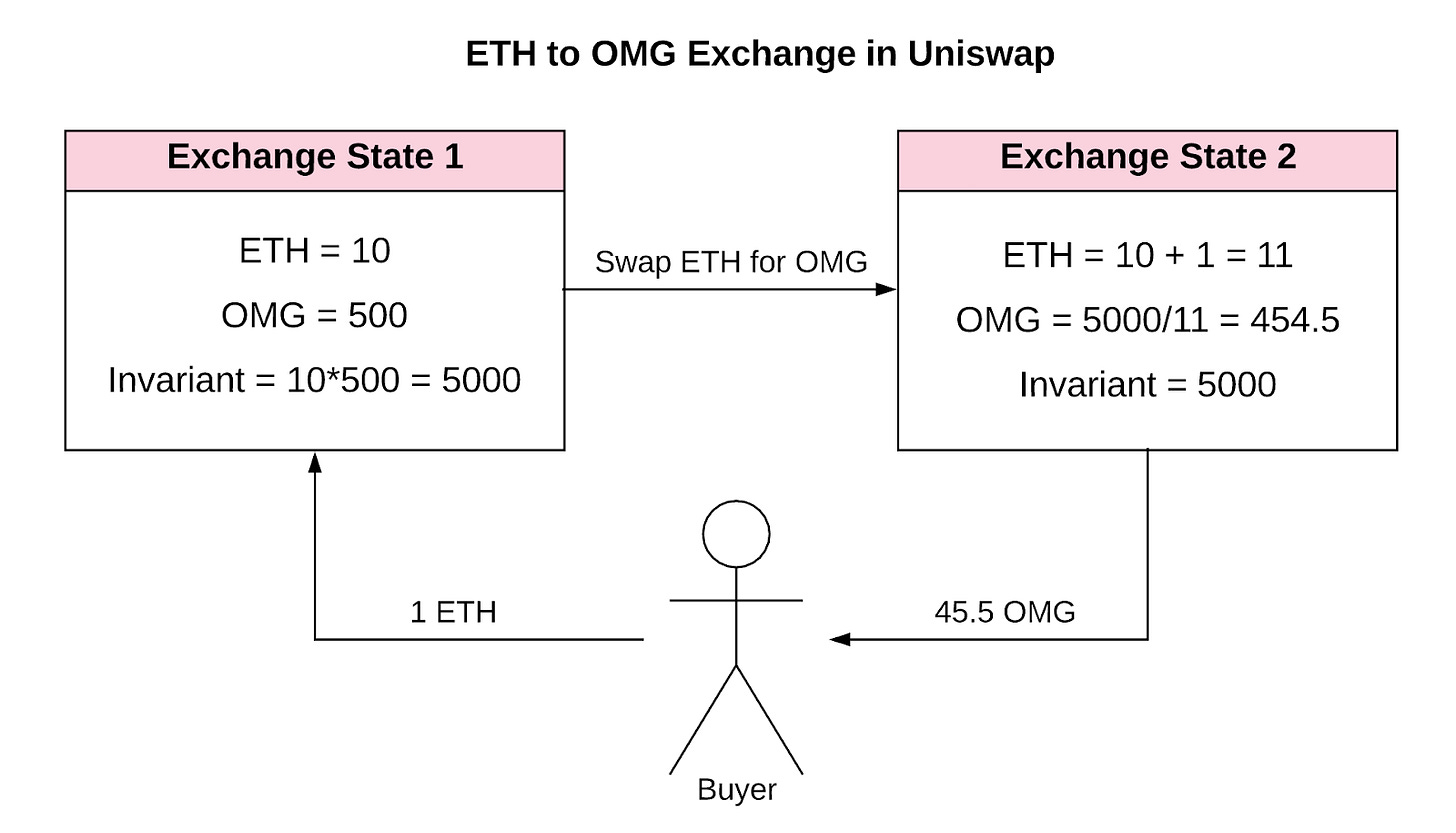

As an example of how swaps take place, we can use a fee of 0.25%, and assume a liquidity pool with 10 ETH and 500 OMG tokens, such that k = 5,000.

- An OMG buyer sends 1 ETH to the contract.

- A 0.25% fee is taken out to reward liquidity providers and the remaining 0.9975 ETH are added to the pool.

- Next, the invariant is divided by the new amount of ETH in the liquidity pool to determine the new size of OMG.

- The remaining OMG is sent to the buyer.

- The fee is added back into the liquidity pool to act as the payout for liquidity providers when they remove liquidity from the market.

Note that since the fee is added after price calculation, the invariant increases slightly with every trade, making the system profitable for liquidity providers.

Asset purchases that are large relative to the total size of the liquidity pools will cause price slippage. Assuming efficient markets, arbitrageurs will ensure that the price will not shift too far from that of other exchanges.

Given that ETH is used as a common pair for all ERC20 tokens, it can be used as an intermediary for direct ERC20 to ERC20 token swaps.

Uniswap V2

Uniswap V2 is written in Solidity and builds on the success of Uniswap V1 by introducing new features and improvements:

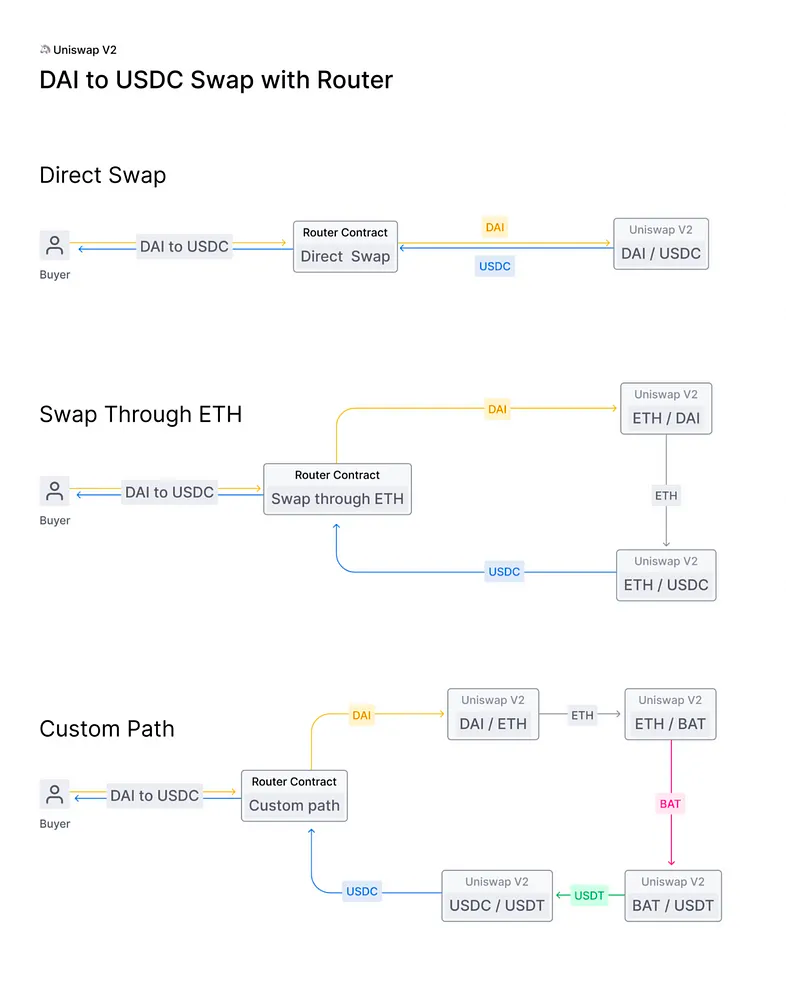

- Arbitrary ERC20/ERC20 pairs: Uniswap V2 allows users to create liquidity pools and trade between any two ERC20 tokens, instead of being limited to ERC20 and ETH pairs as in Uniswap V1.

- When assets are correlated, this greatly reduces impermanent loss.

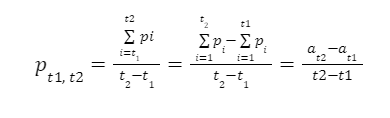

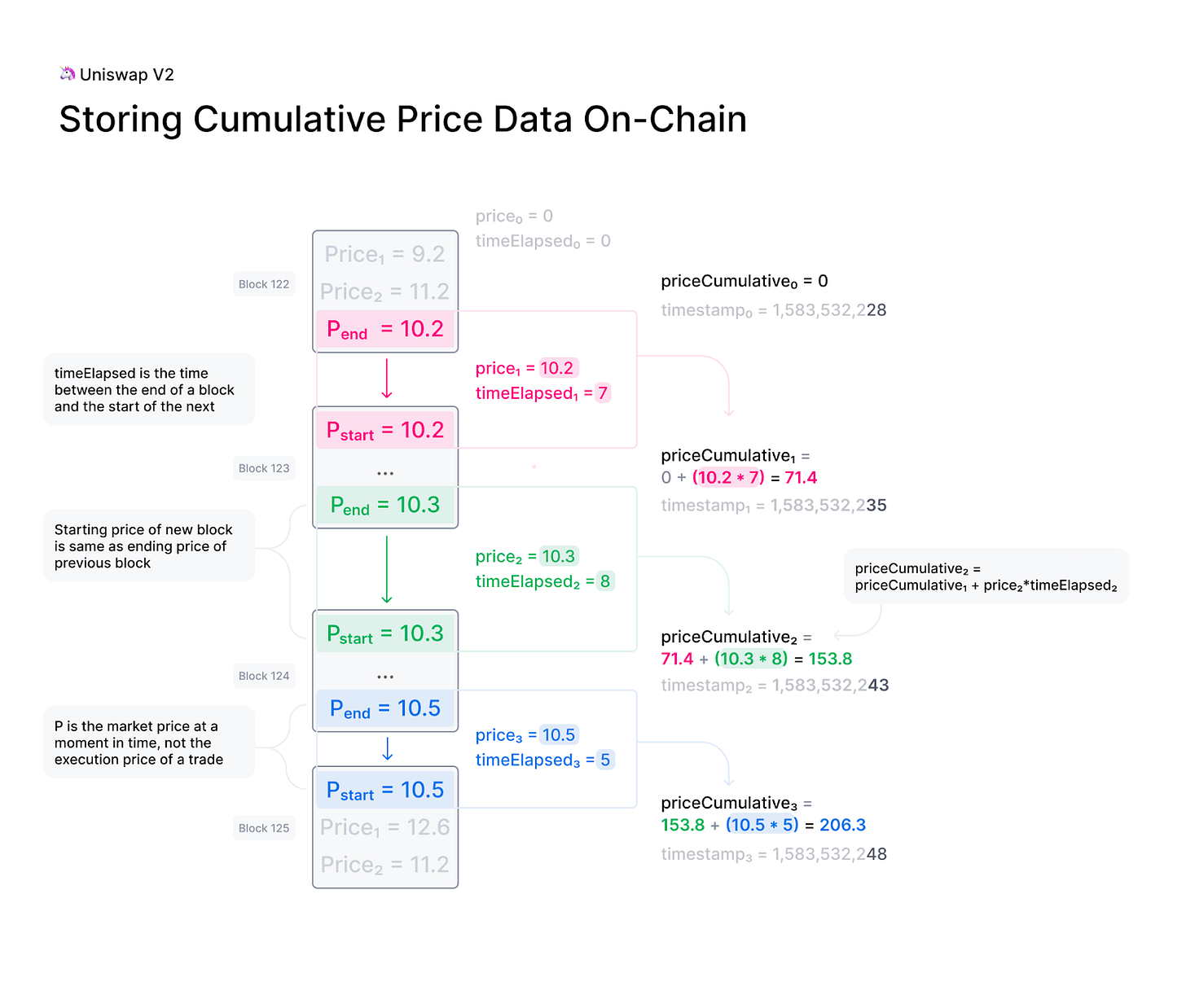

- Hardened price oracle: Uniswap V2 provides a more secure and reliable price oracle that records the relative price of the two assets in a pair at the beginning of each block. This enables other contracts on the Ethereum network to estimate the time-weighted average price (TWAP) for the assets over arbitrary time intervals, which can be useful for various decentralized finance (DeFi) applications.

Uniswap V1 was not safe to use as an on-chain price oracle because it was easily manipulated. An attacker could trade on Uniswap, trigger a settlement on a derivative contract, and then trade back, causing the contract to settle based on the inflated price. This issue is especially problematic if it can be done as an atomic transaction or by a miner who controls the ordering of transactions within a block.

Uniswap V2 improves upon this by measuring and recording the price before the first trade of each block (or after the last trade of the previous block). This makes the price more difficult to manipulate, as arbitrageurs can trade back immediately afterward in the same block if the attacker tries to manipulate the price. However, if a miner or attacker uses enough gas to fill an entire block, they could still manipulate the price at the end of a block. This would be less advantageous for them, as they might not be able to arbitrage the trade back unless they mine the next block as well.

Uniswap V2 adds an end-of-block price to a single cumulative price variable in the core contract weighted by the amount of time the price existed. This variable represents a sum of the Uniswap price for every second in the entire history of the contract. The variable can then be used by external contracts to track accurate time-weighted average prices (TWAPs) across any time interval and for both simple and exponential moving averages.

- For a 10-minute TWAP, sample once every 10 minutes. For a 1-week TWAP, sample once every week, and so on

- For a simple TWAP, the cost of manipulation increases (approx. linear) with liquidity on Uniswap, as well as (approx. linear) with the length of time over which you average.

- The cost of an attack can be estimated as well. Moving the price 5% on a 1-hour TWAP is approximately equal to the amount lost to arbitrage and fees for moving the price 5% every block for 1 hour.

Users of the oracle can choose when to start and end this period, which affects the cost of manipulation for an attacker and the up-to-date nature of the price. Uniswap V2 also tracks both the price of asset A in terms of asset B and the price of asset B in terms of asset A, as the mean price of one asset in terms of the other is not equal to the reciprocal of the mean price of the other asset in terms of the first.

- Flash swaps: Uniswap V2 introduces flash swaps, a feature that allows users to receive assets from a liquidity pool without paying for it, as long as they make the payment within the same atomic transaction. Effectively, flash loans are the equivalent of an unlimited and uncollateralized loan that must be repaid in the same transaction. This opens up new opportunities for arbitrage, liquidations, and other financial operations that can be executed within a single transaction.

- Meta transactions for pool shares: Uniswap v2 pairs support meta transactions for pool shares, which allows users to authorize the transfer of their pool shares with a signature instead of an on-chain transaction from their address. This works by having users sign a message that authorizes a specific transfer of their pool shares. The signature can then be submitted on the user’s behalf by anyone who calls the permit function. This third party can pay the gas fees and potentially perform other actions in the same transaction.

At its core, the architecture of Uniswap V2 is centered around the idea of pooling, where liquidity providers stake their assets in a contract. This staked liquidity enables decentralized trading, with traders paying a small fee that gets accumulated in the contract and shared among liquidity providers.

The primary contract in Uniswap V2 is the UniswapV2Pair, which acts as a pooling contract that accepts tokens from users and uses the accumulated reserves to facilitate swaps. Each UniswapV2Pair contract can pool only one pair of tokens and allows swaps exclusively between those two tokens.

The codebase for Uniswap V2 contracts is divided into two repositories: core and periphery.

- The core contains the following contracts:

- UniswapV2ERC20: An extended ERC20 implementation used for LP-tokens, which also implements EIP-2612 for off-chain approval of transfers.

- UniswapV2Factory: A factory contract that creates pair contracts and serves as a registry for them, using create2 to generate pair addresses. This contract avoids having pairs of identical tokens and liquidity split into multiple identical pairs. Create2 is an opcode that was added in EIP-1014 and enables the generation of new contract addresses deterministically.

- UniswapV2Pair: The main contract responsible for the core logic, allowing only unique pairs to avoid liquidity dilution.

- The periphery contains the following contracts:

- UniswapV2Router: The main entry point for Uniswap’s user interface and other applications built on top of Uniswap, with a similar interface to the exchange contract in Uniswap V1. This contract simplifies the process to create pairs, adding and removing liquidity, calculating prices for all possible swap variations, and performing actual swaps.

- UniswapV2Library: A collection of helper functions that implement essential calculations.

In Uniswap V2, the seller sends the asset to the core contract before calling the swap function. Then, the contract calculates how much of the asset it has received, by comparing the last recorded balance to its current balance.

When trading against the constant product formula, price can be defined as the amount of one token that you get in exchange for 1 unit of another token.

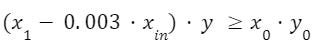

Unlike Uniswap V1, which subtracted the trading fee from the amount paid to the contract before enforcing the constant product invariant, the contract implicitly enforces the following formula:

With flash swaps, V2 introduces the possibility that xin and yin might both be non-zero (when a user wants to pay the pair back using the same asset, instead of swapping). To handle those scenarios, the contract is written to enforce the invariant below:

To simplify the calculation on-chain, each side of the inequality is multiplied by 1,000,000:

Uniswap v2 incorporates two bail-out functions, sync() and skim(), to safeguard against potential issues caused by specific token implementations or the limits of the uint112 storage slots for reserves.

- sync(): This function serves as a recovery mechanism in cases where a token asynchronously deflates the balance of a pair. When this happens, trades may receive suboptimal rates, and if no liquidity provider is willing to rectify the situation, the pair remains stuck. The `sync()` function resolves this issue by updating the reserves of the contract to match the current balances, allowing a more graceful recovery from such situations.

- skim(): This function acts as a recovery mechanism for scenarios in which enough tokens are sent to a pair that the two uint112 storage slots for reserves overflow. If this occurs, trades could fail. The `skim()` function enables a user to withdraw the difference between the current balance of the pair and 2^112 – 1 to the caller if that difference is greater than 0. This helps to prevent potential issues related to overflowing storage slots for reserves.

Both of these functions play essential roles in maintaining the stability and security of Uniswap v2, ensuring that the platform can recover from potential problems caused by token implementations or storage limitations.

Providing Liquidity

Similar to V1, no trades are possible without liquidity. For that, liquidity pools will represent smart contracts that store token liquidity amounts and allow to perform swaps using this liquidity. When liquidity is added to a pair, the contract mints LP tokens, and when liquidity is removed, LP tokens are burned.

Initial Pool Deposit

Note that liquidity is calculated differently when initially deposited into the pool (how many LP tokens are issued when there is no liquidity in the pool?). Uniswap V1 indeed used the amount of deposited ethers to determine the initial amount of LP-tokens, and it relied on the liquidity providers to deposit at a ratio that reflects the actual prices at that moment. This approach had its limitations and could potentially lead to inaccurate pricing if the initial liquidity providers did not deposit at the correct ratio. Uniswap V2 introduced support for arbitrary ERC20 token pairs, eliminating the strict dependence on ETH as the base currency for trading pairs. This feature allows for more flexible and diverse trading options within the ecosystem. However, this also means that there might not always be a direct price reference in ETH for certain token pairs.

Liquidity=Amount0*Amount1

The main advantage of the equation above is that such a formula ensures that the initial liquidity ratio doesn’t affect the value of a pool share.

Pools Deposits on Initialized Pools

When there is already some liquidity, the main requirement is to ensure that the liquidity ratio does not affect the value of a pool share./ Hence, the requirement must satisfy that the amount is:

- Proportional to the deposited amount.

- Proportional to the total issued amount of LP-tokens.

Liquidityminted=TotalSupplyLP* AmountdepositedReserve

The formula above is similar to V1, however, V2 introduces two underlying tokens. Either of them could be used, but V2 aims to prevent price manipulation through liquidity provision by choosing the smaller LP-token amount when calculating the minted LP-tokens for a new liquidity provider. This approach discourages unbalanced liquidity provision, as liquidity providers who deposit at an incorrect ratio will receive fewer LP tokens.

When it comes to removing liquidity, the process is the opposite of liquidity provision. Likewise, burning is the opposite of mining. Therefore, removing liquidity means burning LP tokens in exchange for receiving a proportional amount of the underlying tokens.

Amounttoken= Reservetoken*BalanceLPTotalSupplyLP

The formula above shows that the amount of tokens returned is proportional to the number of LP tokens held over the total supply of LP tokens. As a result, the bigger your share of LP-tokens, the bigger share of reserve you get after burning.

Trading

In the context of Uniswap V2, the actual token exchange is handled by the pair contract, which acts as a mediator to ensure correct exchange rates and full payment for each swap. Similar to V1, the constant product formula is used to guarantee the conditions for a successful swap, maintaining a constant product of reserves throughout the exchange process.

In Uniswap v1, Ethereum’s native asset, $ETH, was directly supported due to its presence in every trading pair. This made handling $ETH directly more gas-efficient. However, Uniswap v2 supports arbitrary ERC-20 pairs, which means that directly supporting unwrapped $ETH is no longer practical.

Supporting unwrapped $ETH in Uniswap v2 would double the size of the core codebase and risk fragmenting liquidity between $ETH and $WETH pairs. To address this issue, Uniswap v2 requires native $ETH to be wrapped into $WETH (Wrapped Ether) before it can be traded on the platform.

Wrapped Ether ($WETH) is an ERC-20 token that represents $ETH, with each $WETH token being equal in value to 1 $ETH.

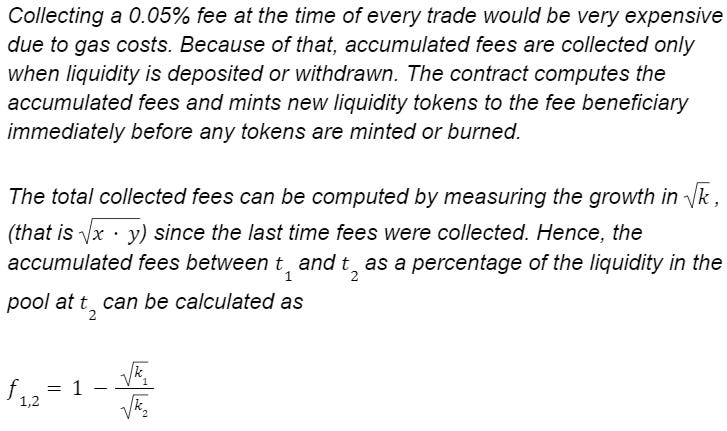

Fees

Uniswap V2 contracts are non-upgradeable. The protocol charges fees on input amounts. By default, a 30 basis-point fee is charged on trades. However, there is a private key that has the ability to update a variable on the factory contract to turn on an on-chain 5-basis-point fee on trades. This fee has been initially turned off but could be turned on in the future, after which liquidity providers would earn 25 basis points on every trade, rather than 30 basis points, with the remaining 5 basis points possibly going to $UNI token holders via staking.

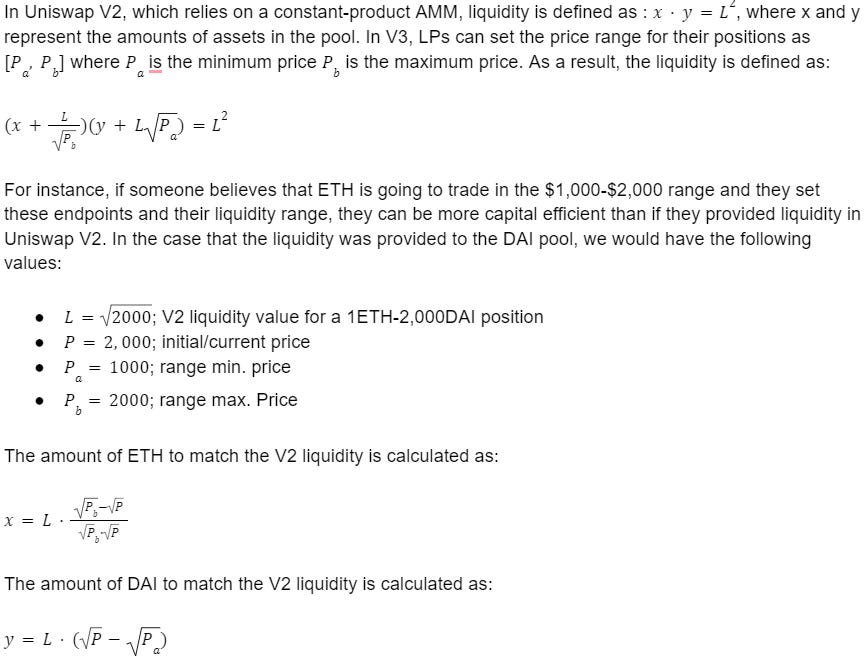

Uniswap V3

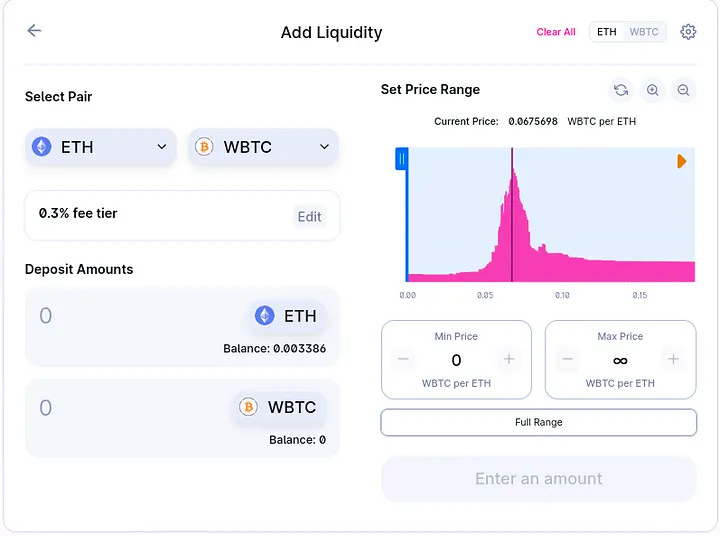

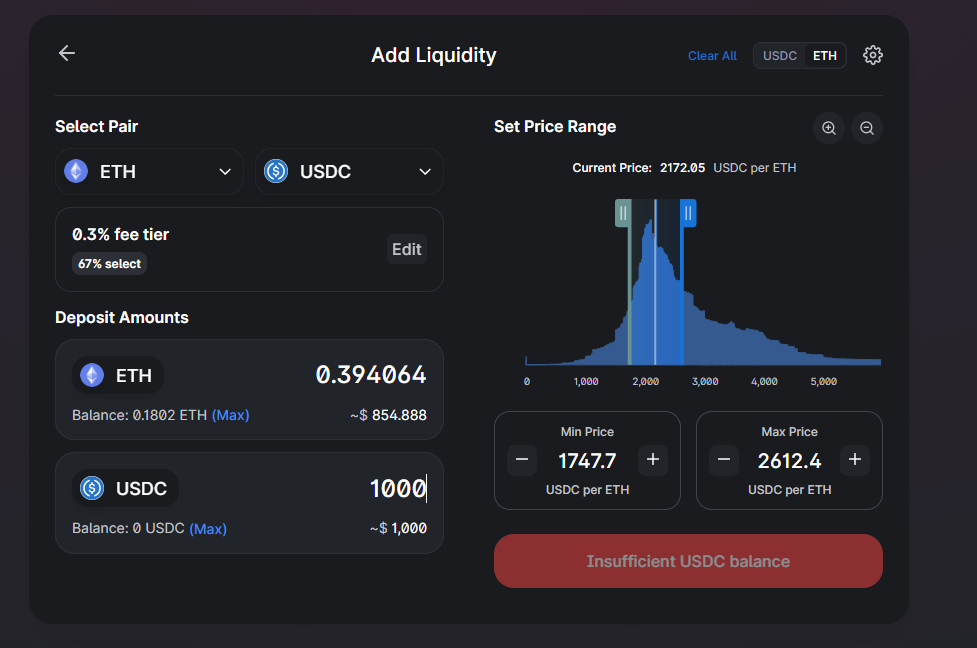

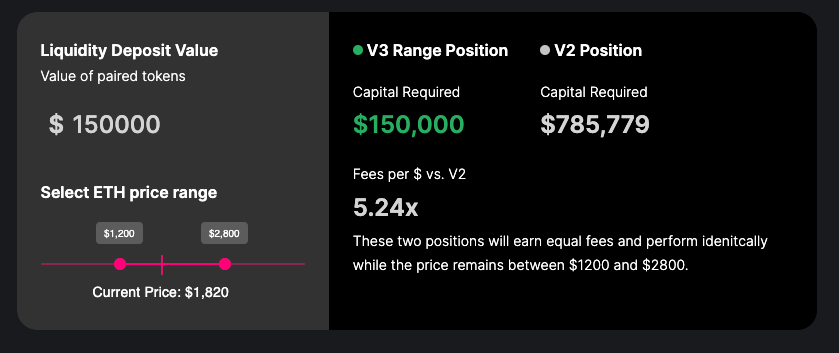

Uniswap v3, launched in May 2021, introduced several significant improvements and features over Uniswap v2, which aim to increase capital efficiency, improve flexibility, and provide more control to liquidity providers (LPs).

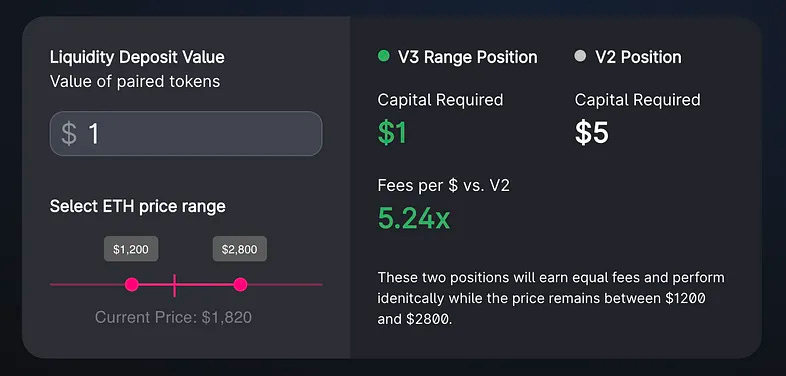

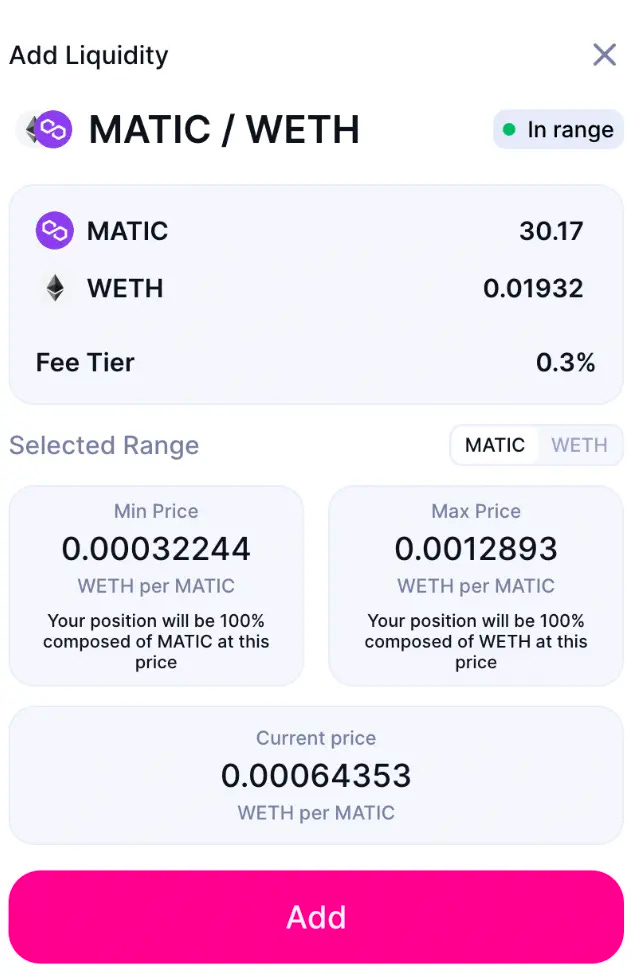

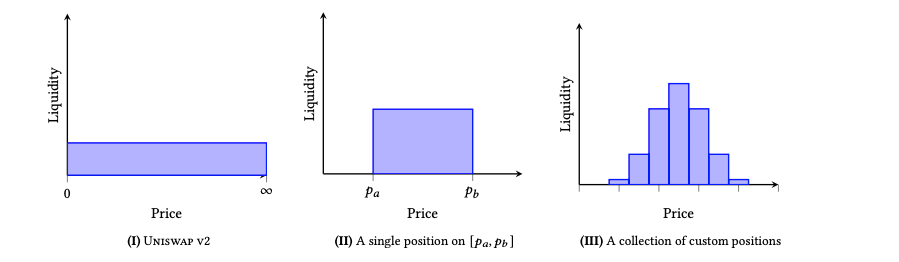

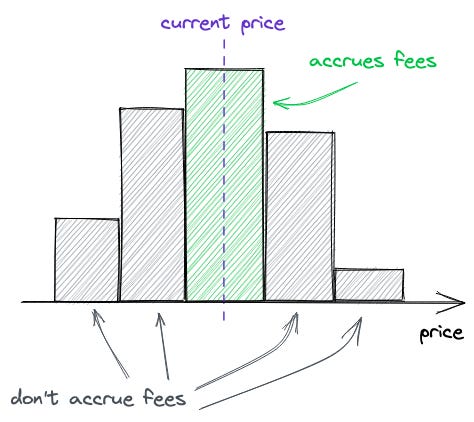

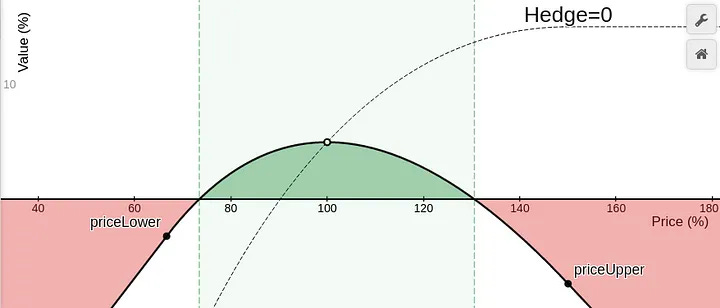

1. Concentrated Liquidity: In Uniswap v2, liquidity was spread across the entire price curve, from 0 to infinity. Uniswap v3 allows LPs to concentrate their liquidity within custom price ranges. This means LPs can set minimum and maximum prices for their capital to be used between, making capital more efficient.

- When the market price of the trading pair is within the specified range, the LPs earn fees just like in v2.

- When the price is outside this range, the LP isn’t participating in the market and hence doesn’t earn fees.

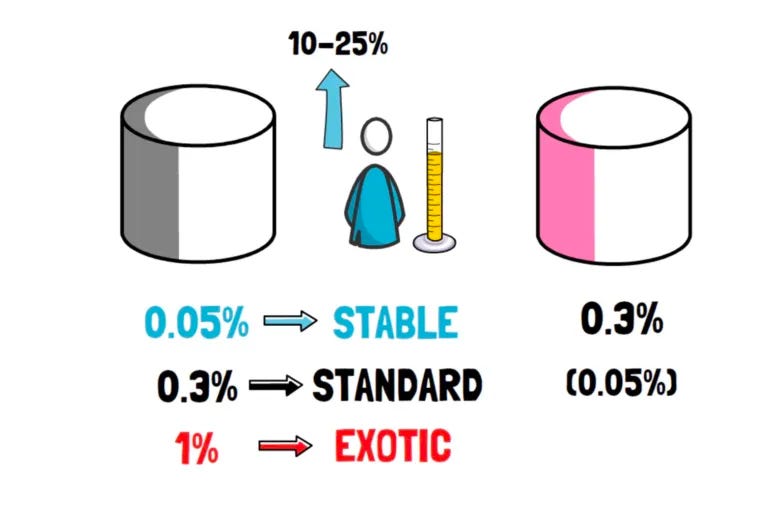

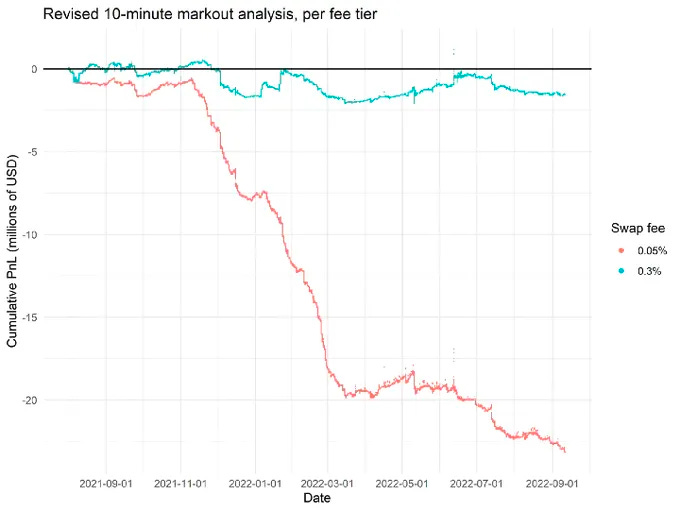

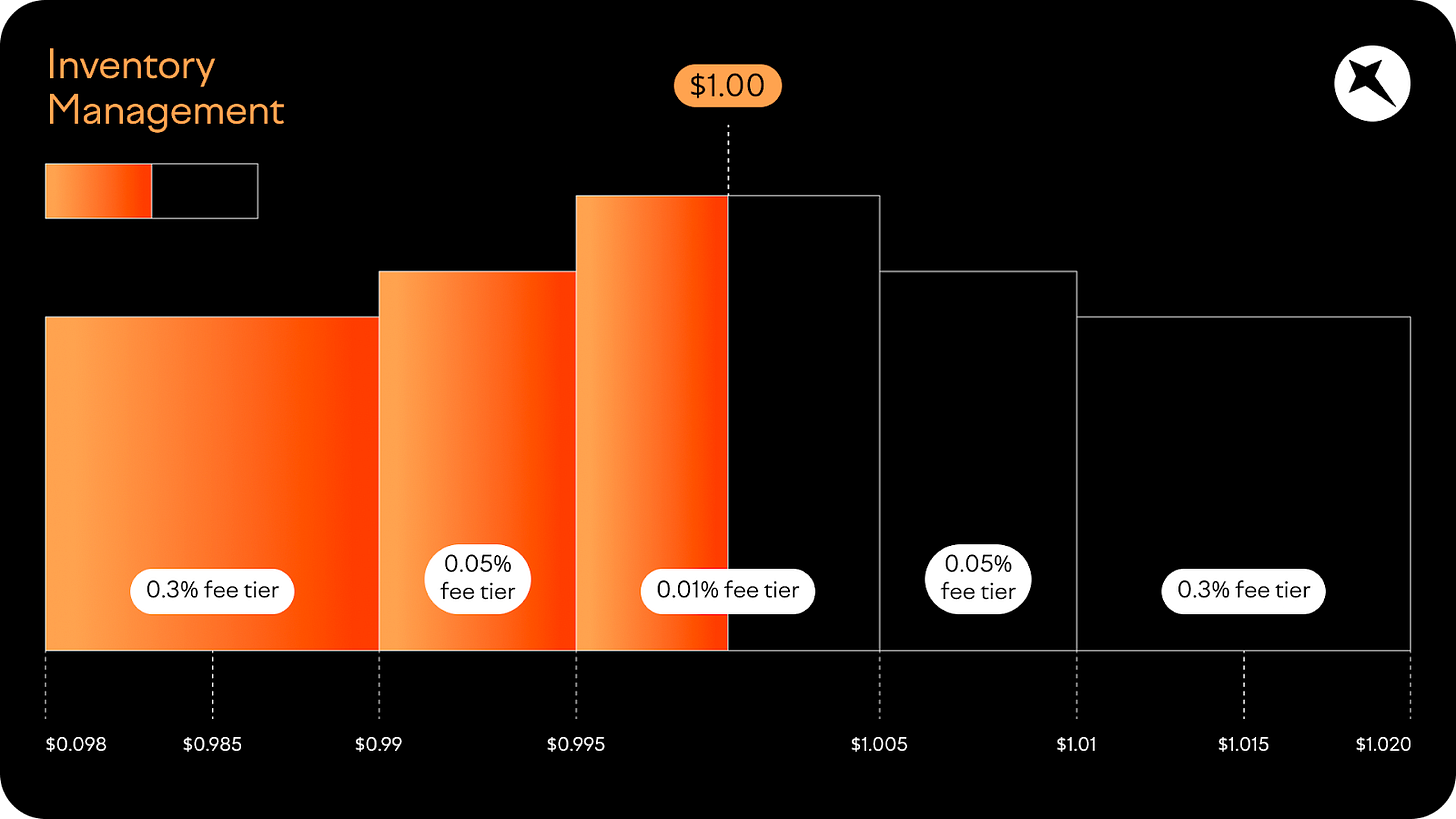

2. Multiple Fee Tiers: Uniswap v3 introduces multiple fee tiers per pair to compensate LPs for taking on varying degrees of risk. This differs from v2, which had a flat fee of 0.3% for all trades. In v3, LPs can choose between three different fee tiers per pair: 0.05%, 0.3%, and 1%. This allows LPs to better align their risk level with expected returns.

3. Improved Price Oracle: Uniswap v3 features an improved price oracle that provides more accurate and timely price information. The v3 oracle accumulates prices on a per-second basis, providing a TWAP (Time-Weighted Average Price) over any interval, which reduces the possibility of manipulation.

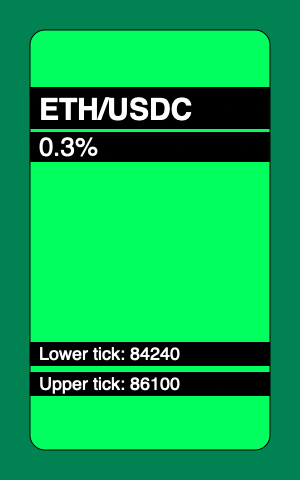

4. Non-Fungible Liquidity: In Uniswap v2, LPs received fungible LP tokens in return for providing liquidity, which could be used in other DeFi protocols. However, in Uniswap v3, LPs receive non-fungible tokens (NFTs) that represent their position, including the price range. This makes positions not directly comparable and hence non-fungible. This can limit the use (composability) of v3 LP tokens in other DeFi protocols.

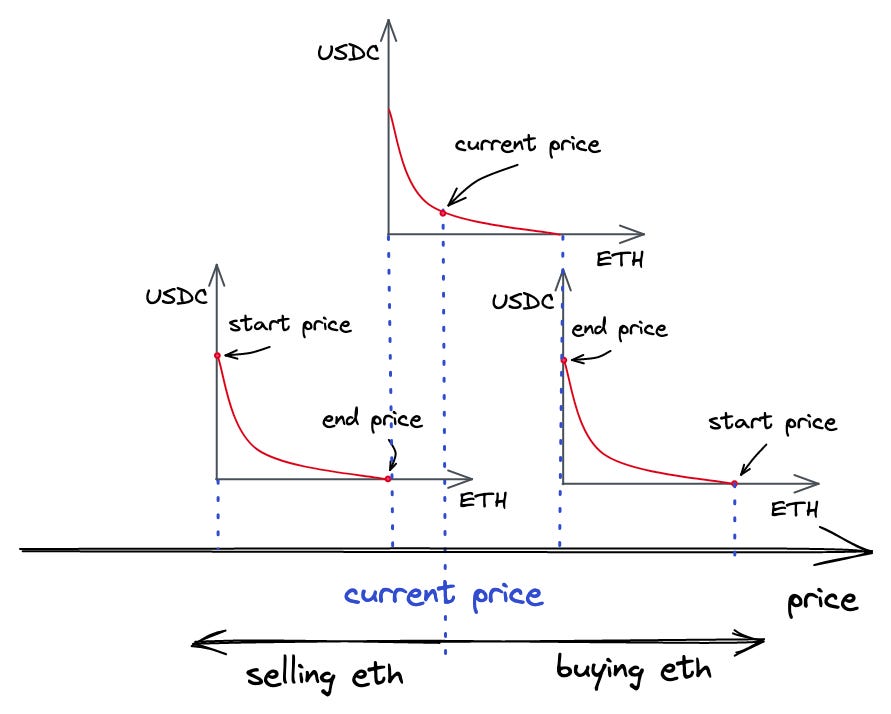

5. Range Orders: Uniswap v3 introduces a new type of limit order called a “range order.” LPs can deposit a single token in a custom price range above or below the current price. If the market price enters into their specified range, their deposited token is sold for the other at their specified price (similar to a limit order enabled by a single-side liquidity deposit).

By slicing the price range [0,∞] into numerous granular ticks, trading on V3 is highly similar to trading on order book exchanges, with only three differences:

- The price range of each tick is predefined by the system instead of being proposed by users.

- Trades that happen within a tick still follow the pricing function of the AMM, but the equation has to be updated once the price crosses the tick.

- Orders can be executed with any price within the price range, instead of being fulfilled at the same price on order book exchanges.

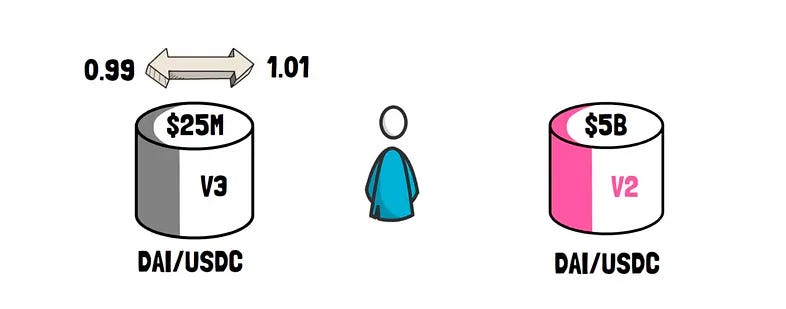

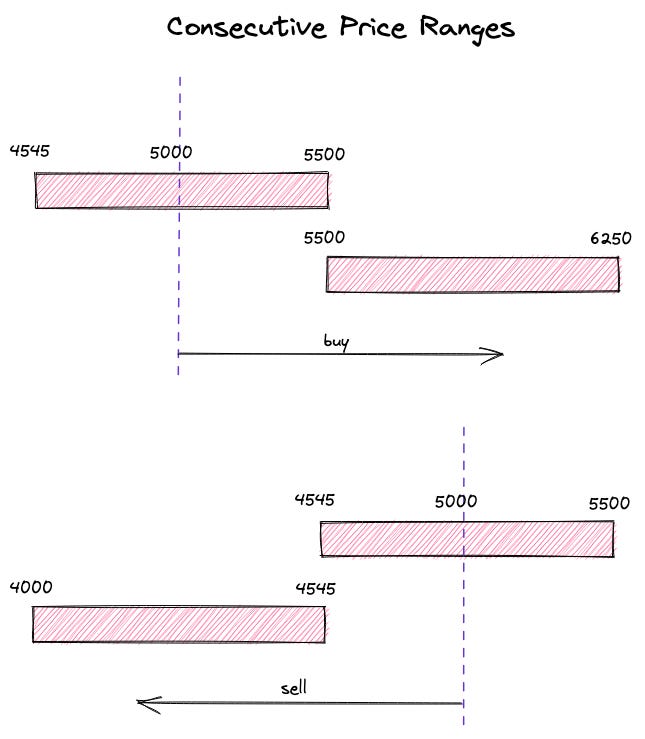

Concentrated Liquidity

When liquidity is provided on a spectrum from zero to infinity, much of the liquidity provided by LPs could be considered idle or underutilized. This lack of capital efficiency is particularly noticeable in stablecoin pairs like DAI/USDC, where the price range is naturally very tight. The majority of the trading volume for such pairs occurs within a very narrow price band (for instance, between $0.99 and $1.01). However, only a tiny fraction of the total pool liquidity is used for trades within this range, while the majority of capital sits idle waiting for extreme price movements that rarely occur. This leads to lower returns for LPs, as they earn fees only on the portion of their capital that is actively used in trades.

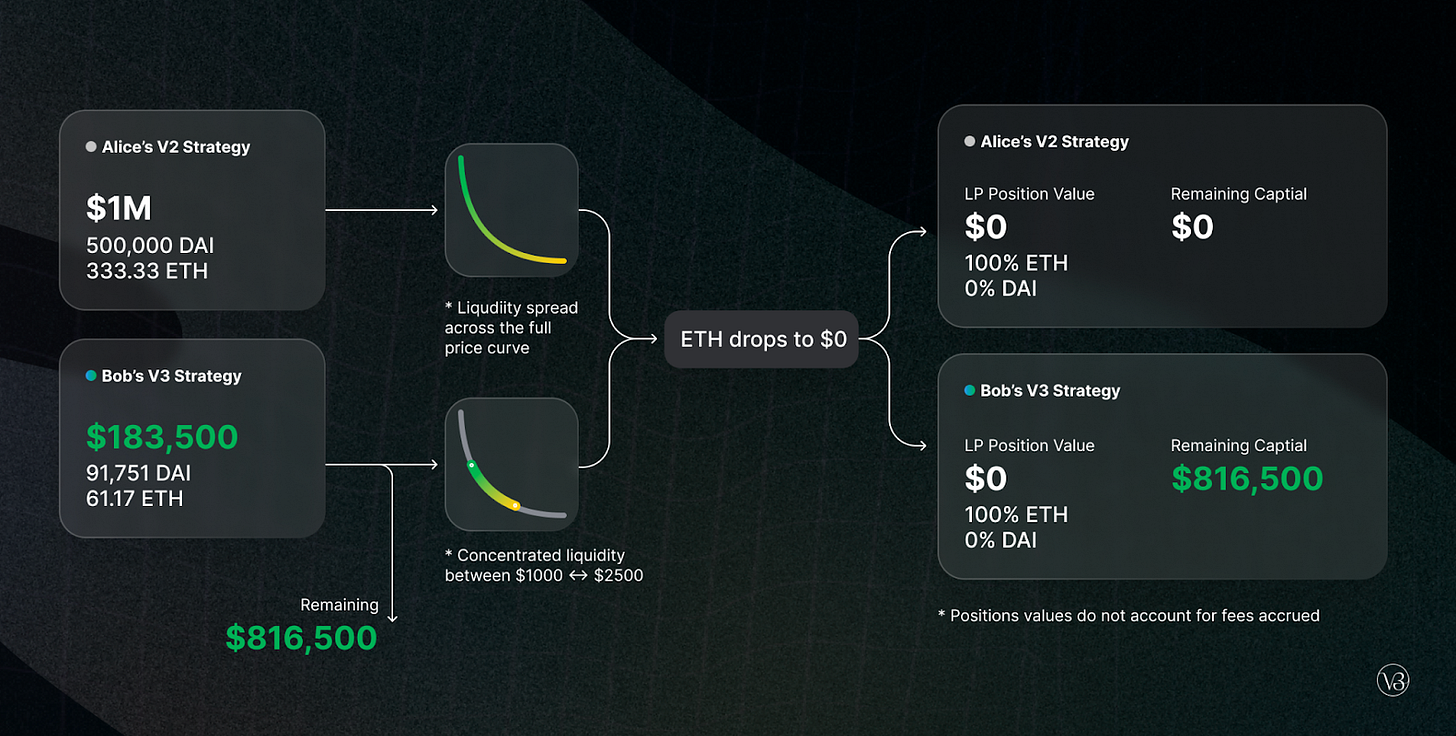

As an example, we can assume two users, Alice and Bob, want to provide liquidity to an $ETH/$DAI pool on Uniswap V3. Each of them has $1M and the current price of $ETH is 1,500 $DAI.

- Alice deploys capital across the entire price range, like in V2:

- 500,000 $DAI

- 333.33 $ETH

- The deposit is worth $1M

- Bob creates a concentrated liquidity position, depositing only within the price range from 1,000 to 2,500

- 91,751 $DAI

- 61.17 $ETH

- The deposit is worth $183,500 and he keeps $816,500 for himself.

While Alice has put down 5.44x as much capital as Bob, they will earn the same amount of fees as long as the $ETH/$DAI price stays within the 1,000 to 2,500 range.

Bob’s position also acts as a stop-loss. Both Alice and Bob will be entirely denominated in $ETH if the price of $ETH falls to $0. However, Bob will have lost just $159,000 vs Alilce’s $1M.

With concentrated liquidity, it is only required to keep necessary liquidity within a specific range in order to support trading like a constant product pool with larger reserves.

When users specify a price range, they are essentially setting a lower and upper price bound:

- The lower bound is the price at which all of the first asset is converted into the second.

- The upper bound is where all the second asset is converted into the first.

More specifically, a position only needs to hold enough of asset X to cover price movement to its upper bound, because upwards price movements correspond to the depletion of fake X reserves.

When the price exits a position’s range, the position’s liquidity is no longer active, and no longer earns fees. At that point, the liquidity is composed entirely of one asset, because the reserves of the other asset have been depleted. If the price enters the range again, the liquidity becomes active again as well.

Liquidity providers can create as many positions as they see fit, each in their own price range. This way, LPs can approximate any desired distribution of liquidity in the price space.

Active Liquidity

Uniswap V3 also introduces the concept of active liquidity: if the price of assets trading in a specific liquidity pool moves outside of the LPs price range, the LPs liquidity is removed from the pool and stops earning fees. When this happens, the LP’s liquidity shifts completely towards one of the assets, such that the position ends up holding only one asset. At this point, the LP can choose to either wait until the market price returns to the specified price range or to update its range to account for current prices.

Even though it is possible that there is no liquidity at a specific price range, this is impractical because this would create a great opportunity for liquidity providers to step in and provide liquidity in that price range to start collecting trading fees.

With concentrated liquidity, a position only needs to maintain enough reserves to support trading within its range and therefore can act like a constant product pool with larger reserves within that range.

Ticks and Ranges

In Uniswap v3, liquidity provision is made more flexible with the introduction of ticks and ranges. Unlike Uniswap v2 where liquidity is uniform across all price ranges, in v3, liquidity providers (LPs) can provide liquidity in a specific price range between any two ticks. This concept is referred to as concentrated liquidity and allows LPs to position their liquidity at specific price ranges where they think trading activity will happen.

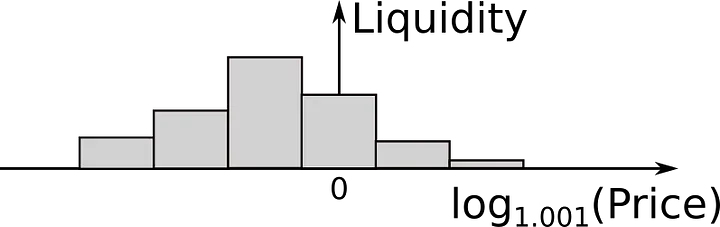

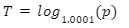

A “tick” in Uniswap v3 represents a price point at which the virtual liquidity of the contract can change. The space of possible prices is divided into these discrete ticks and the prices are always expressed as the price of one of the tokens (token0) in terms of the other token (token1).

Conceptually, there is a tick at every price that is an integer power of 1.0001. Conceptually, compared to the previous/next price, the price change should always be 1 basis point. Identifying ticks by an integer index , the price at each tick is given by:

p(i)=1.0001i

This ensures that each tick is a .01% (1 basis point) price movement away from each of its neighboring ticks.

However, pools in Uniswap v3 actually track ticks at every square root price that is an integer power of √1.0001. This is represented as:

p(i)=1.0001i=1.0001i/2

This allows for more granularity in the price ranges that LPs can choose to provide liquidity to. When an LP adds liquidity to a range, if one or both of the ticks is not already used as a bound in an existing position, that tick is initialized.

Not every tick can be initialized. The pool is instantiated with a parameter, tickSpacing ( ), and only ticks with indexes that are divisible by tickSpacing can be initialized. This balances the need for precision with the potential gas cost for transactions.

When the price of the trading pair crosses an initialized tick, the virtual liquidity changes — it’s either “kicked in” or “kicked out”. This ensures that the right amount of liquidity is present when ticks are crossed and that each position earns its proportional share of the fees that were accrued while it was within range. The pool contract uses storage variables to track state at a global (per-pool) level, at a per-tick level, and at a per-position level.

The global state of the contract includes seven storage variables relevant to swaps and liquidity provision:

- liquidity ( ): A uint128 variable that represents the total liquidity provided to the pool.

- sqrtPriceX96 (√ ): A uint160 variable that represents the square root of the current price, shifted left by 96 bits (for precision purposes).

- tick (ic): An int24 variable that represents the current tick index.

- feeGrowthGlobal0X128 ( ,0) and feeGrowthGlobal1X128 ( ,1): uint256 variables that track the cumulative fee growth per unit of liquidity, for token0 and token1 respectively. This is used to calculate the fees accrued by liquidity providers.

- protocolFees.token0 ( ,0) and protocolFees.token1 ( ,1): uint128 variables that track the protocol fees collected, for token0 and token1 respectively. These fees are potentially distributed to $UNI token holders if the protocol fee switch is turned on by governance.

In Uniswap V3, each pool has a global state that tracks the liquidity (L) and square root price (√ ).

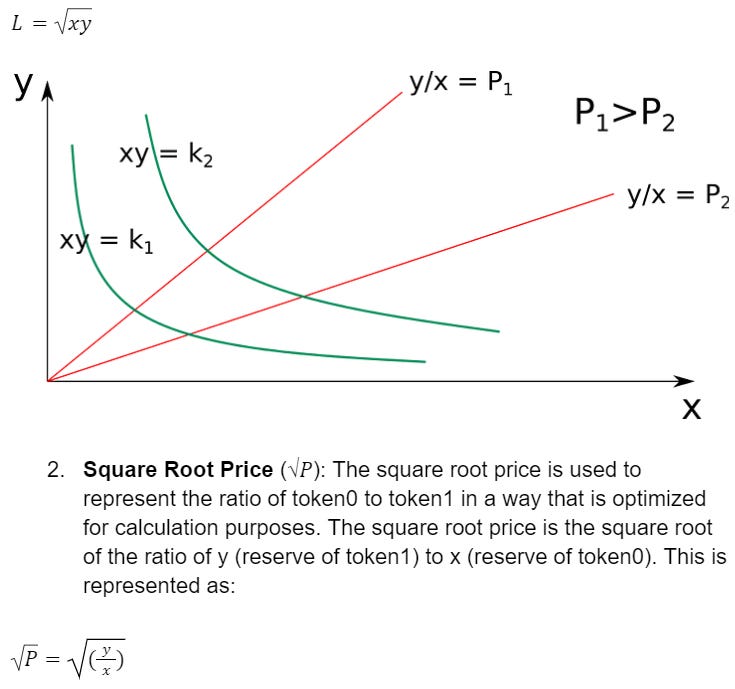

- Liquidity (L): Liquidity is the amount of capital that is provided to a pool. It represents the overall capacity of the pool to handle swaps without incurring major price slippage. In terms of virtual reserves, liquidity is calculated as the square root of the product of x and y (the reserves of token0 and token1 respectively). Mathematically, this is represented as:

Using these two variables, virtual reserves can be calculated as:

– = / √

– = * √

These variables are chosen as they only change one at a time. When swapping within a tick, the price changes, and when crossing a tick or when minting/burning liquidity, the liquidity changes.

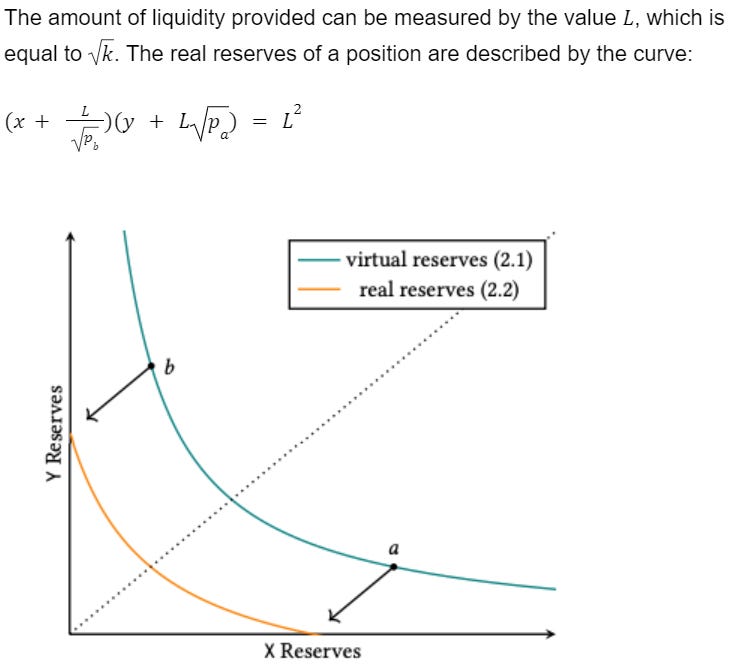

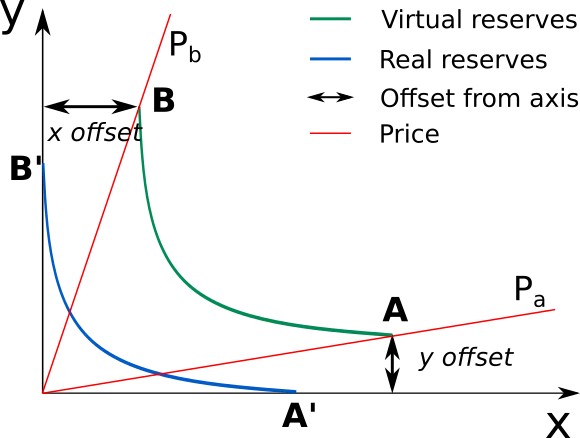

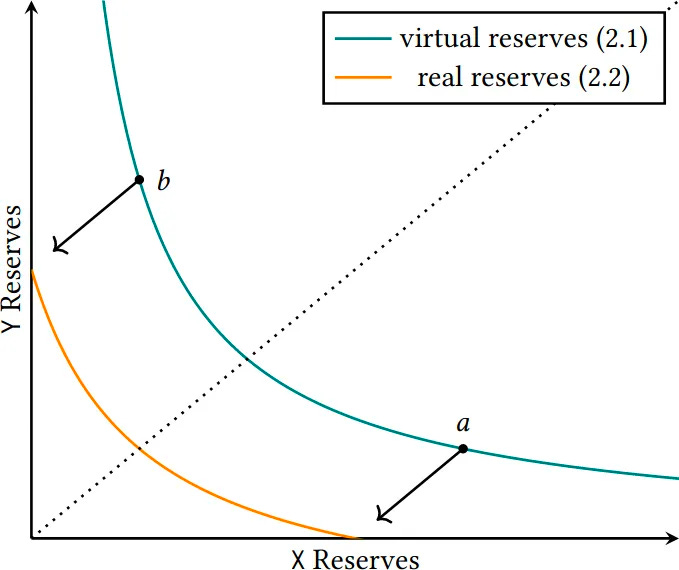

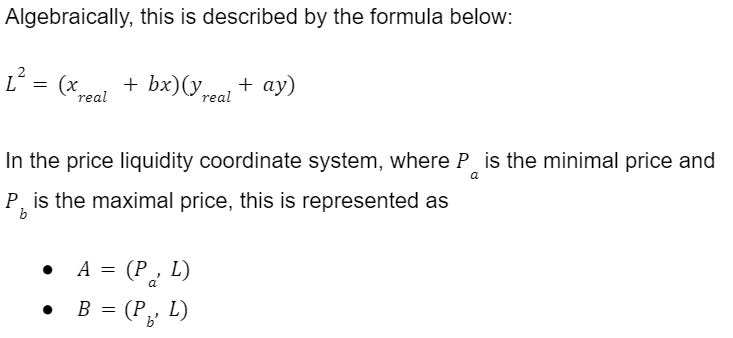

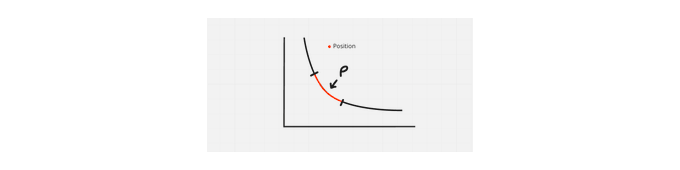

- In a “price/liquidity coordinate system” system, a Uniswap v3 concentrated liquidity position is represented as a single bar, because liquidity is concentrated between two specific prices.

- In contrast, the “amount of tokens” coordinate system represents the number of each type of token in the pool, again with the price on the x-axis but this time the number of tokens on the y-axis. In this system, the position is represented as a segment of a hyperbola between two points (A and B), where A and B represent the lower and upper prices at which the liquidity provider is willing to trade.

The shape of this hyperbola is invariant to liquidity, meaning it does not change as liquidity changes. This is because the shape of the curve is determined by the mathematical properties of the constant product formula (x*y=k) used in Uniswap, rather than the amount of liquidity in the pool.

Consequently, any position in the same price range will have the same shape as the hyperbola, regardless of the amount of liquidity it has. Essentially, this characteristic allows a liquidity provider to precisely specify their risk and reward by setting the range of prices (A and B) at which they are willing to provide liquidity. This is the fundamental advantage of Uniswap v3’s concentrated liquidity feature: it allows liquidity providers to be much more capital efficient by focusing their liquidity at the price ranges where it is most likely to be needed.

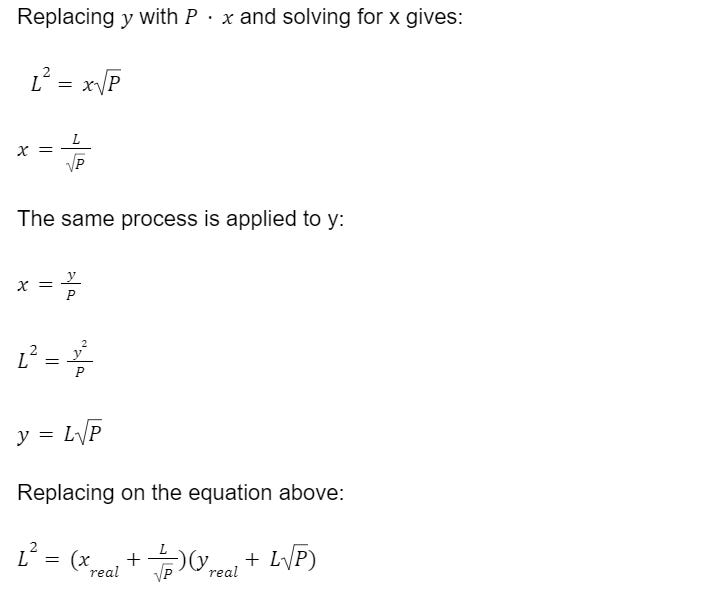

In the concentrated liquidity approach, a liquidity position has only a single token x or y if the price range of the position does not cover the current price. This means that, when translated to real reserves, the goal is to move the curve segment between points A(ax, ay) and B(bx, by) to points A’ and B’.

And the goal is to translate the coordinates to the “token balances” coordinates system.

- The price P of y in terms of x corresponds to the slope of the line y=Px on which the point sits

- The liquidity L of the position determines the distance from the coordinate center on that pice line.

As an example, assuming a point (P, L) in the price/liquidity coordinate system, the coordinates in the “token balances” system can be found by looking at the intersection between the price line and the liquidity curve, which is expressed by the system of equations below:

- y=P*x

- L2=x*y

Fees: Each pool has an associated fee ( ) which is the fee paid by swappers. There is also a protocol fee ( ) which is the fraction of the fees paid by swappers that currently go to the protocol rather than to liquidity providers. Fees are paid by users who swap tokens, where a small amount is subtracted from the input token and accumulated on the pool’s balance.

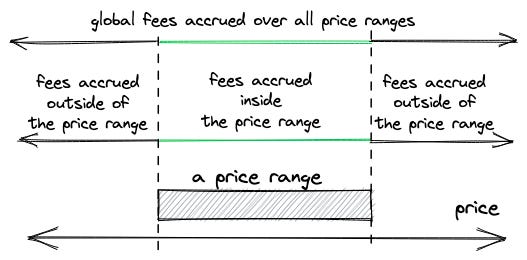

Fee Growth: The global state tracks feeGrowthGlobal0 ( ,0) and feeGrowthGlobal1 ( ,1). These represent the total amount of fees that have been earned per unit of virtual liquidity ( ), over the entire history of the contract.

Protocol Fees: The global state also tracks the total accumulated uncollected protocol fee in each token, protocolFees0 ( ,0) and protocolFees1 ( ,1). These can be collected by UNI governance.

- Each pool has state variables that track the total amount of fees accumulated per unit of liquidity (fee amount divided by the pool’s liquidity).

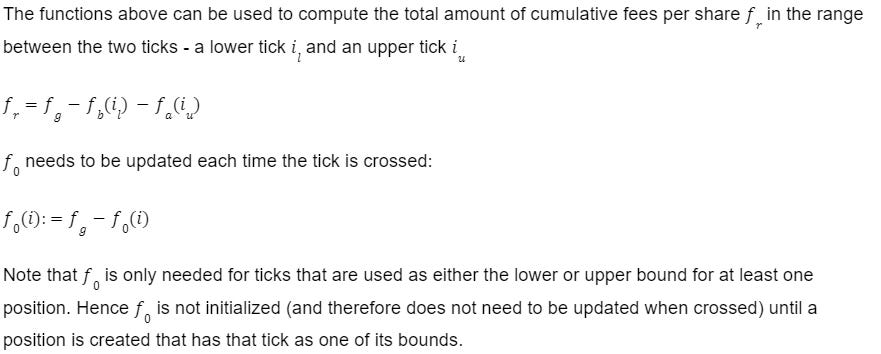

- Ticks keep records of fees accumulated outside of them. When creating a new position and activating a tick (adding liquidity to a tick that was empty before), the tick records how many fees were accumulated outside of it.

- When a tick is activated, the fees accumulated outside of the tick are updated as the difference between global fees accumulated outside of the tick since the last time it was crossed.

- Having ticks that know how much fees were accumulated outside of them makes it possible to calculate how much fees were accumulated inside of a position (where a position is a range between two ticks)

- Knowing how much fees were accumulated inside a position makes it possible to calculate the shares of fees that liquidity providers are eligible for. For instance, a position that has not been involved in swapping will have zero fees accumulated inside of it and, therefore, its liquidity providers will have no profits from it.

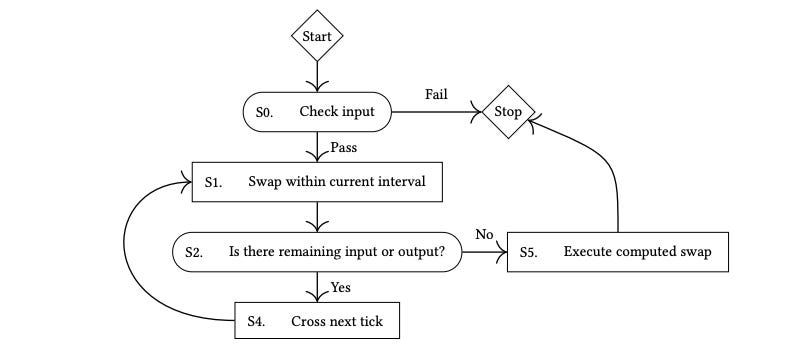

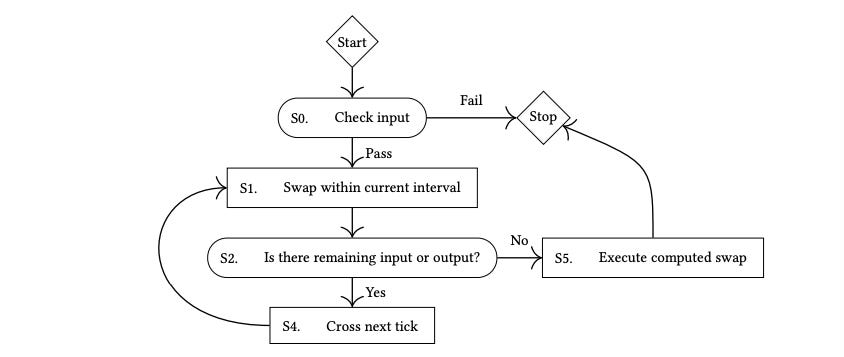

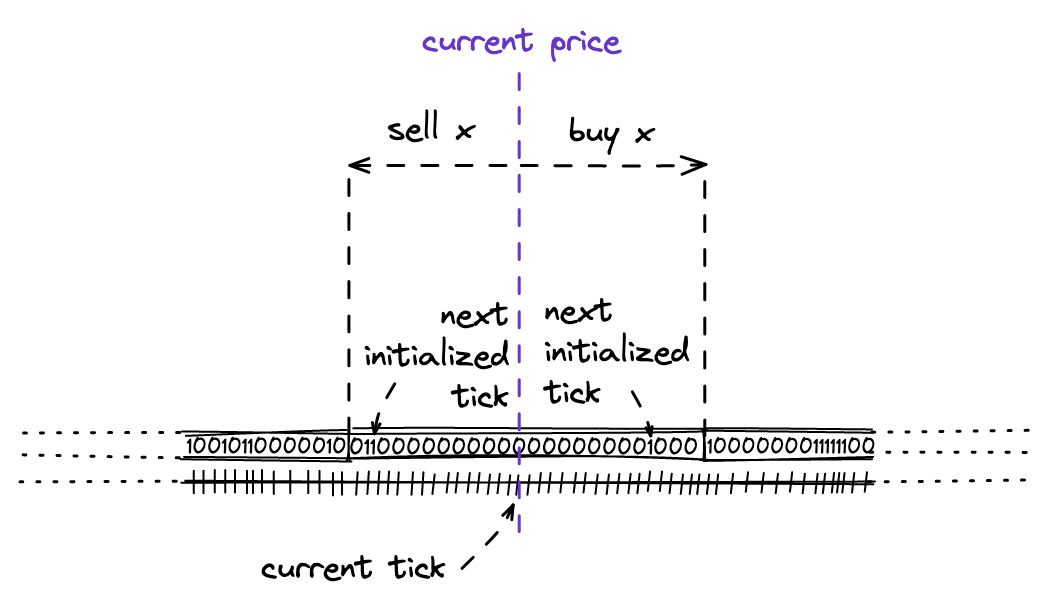

Swapping Within a Single Tick

In Uniswap V3, when a swap occurs that does not move the price past a tick (i.e., the price movement is small), the contracts behave like a constant product model ( · = ), which is characteristic of Uniswap V2.

The formulas below are only applicable for swaps that do not push √ past the price of the next initialized tick. If the swap would cause √ to move past that next initialized tick, the contract must only go up to that tick, then cross the tick, before continuing with the rest of the swap.

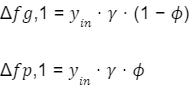

Assuming is the fee, typically 0.003, and yin is the amount of token1 sent into the pool.

When a swap occurs, the global fee growth (feeGrowthGlobal1) and the protocol fees (protocolFees1) are increased:

Here, Δ ,1 and Δ ,1 denote the changes in the global fee growth and the protocol fees respectively. is the protocol fee fraction.

Δ , which is the increase in (after the fee is taken out), is calculated as:

Δ = · (1 − )

In Uniswap V3, the contract tracks liquidity ( ) and the square root of price (√ ) instead of and . Therefore, to compute the amount of token0 sent out, the following formula can be used:

xend = · / ( + Δ )

However, since the contracts track and √ , the formulas that describe the relationship between Δ√ and Δ , and between Δ1/√ and Δ can be used instead:

Δ√ = Δ /

Δ = Δ√ *

Δ1/√ = Δ /

Δ = Δ1/√ *

Thus, when a swap occurs, the contract first calculates the new √ , and then it calculates the amount of token0 or token1 to send out.

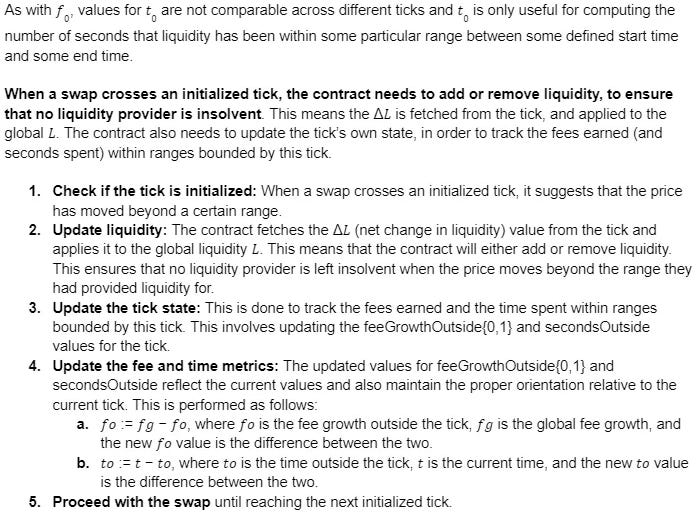

Tick-Indexed State

With concentrated liquidity, the Uniswap V3 contract needs to store information about each tick in order to track the amount of net liquidity that must be added or removed when the tick is crossed, as well as to track the fees earned above and below the tick.

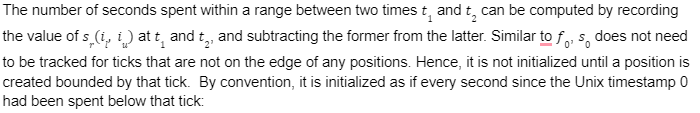

The contract stores a mapping from tick indexes (int24) to the following seven values:

| Type | Variable name | Notation |

| int128 | liquidityNet | ΔL |

| uint128 | liquidityGross | Lg |

| uint256 | feeGrowthOutside0x128 | f0,0 |

| uint256 | feeGrowthOutside1x128 | f0,1 |

| uint256 | secondsOutside | so |

| uint256 | tickCumulativeOutside | io |

| uint256 | secondsPerLiquidityOutsidex128 | sl |

- liquidityNet (Δ ): This is the net change in liquidity at a particular tick index due to liquidity events (minting/burning).

- liquidityGross ( ): This is the total amount of liquidity that was added at this tick.

- feeGrowthOutside0X128 ( ,0): This tracks the total fees collected in token0 for all liquidity that is outside of the current tick range.

- feeGrowthOutside1X128 ( ,1): This tracks the total fees collected in token1 for all liquidity that is outside of the current tick range.

- secondsOutside ( ): This is the cumulative seconds that the pool price has been outside this tick.

- tickCumulativeOutside ( ): This is the cumulative tick value when the pool’s price was outside this tick.

- secondsPerLiquidityOutsideX128 ( ): This is a measure of the time-weighted liquidity outside this tick, which is used for calculating fees.

Each tick tracks Δ , which is the total amount of liquidity that should be added or removed when the tick is crossed. The tick only needs to track one signed integer: the amount of liquidity added (or, if negative, removed) when the tick is crossed from left to right. This value does not need to be updated when the tick is crossed but only when a position with a bound at that tick is updated.

A tick can be uninitialized when there is no longer any liquidity referencing that tick. To track this, liquidityGross is used. This value allows the protocol to know if a tick is referenced by at least one underlying position or not, which tells us whether to update the tick bitmap.

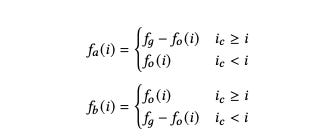

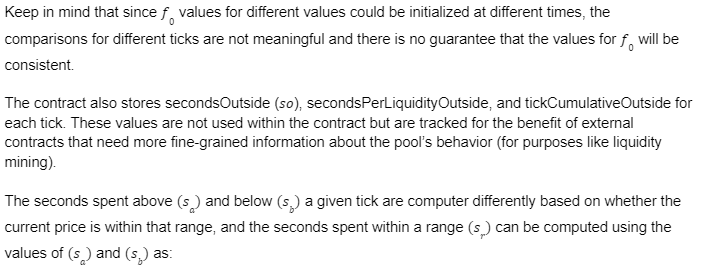

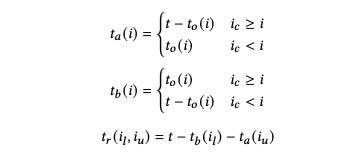

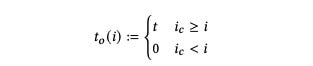

feeGrowthOutside{0,1} are used to track how many fees were accumulated within a given range. This value needs to be updated each time the tick is crossed. The fees earned per unit of liquidity in token 0 above (fa)and below (fb) a tick i can be calculated with a formula that depends on whether the price is currently within or outside that range (that is, whether the current tick index ic is greater than or equal to i)

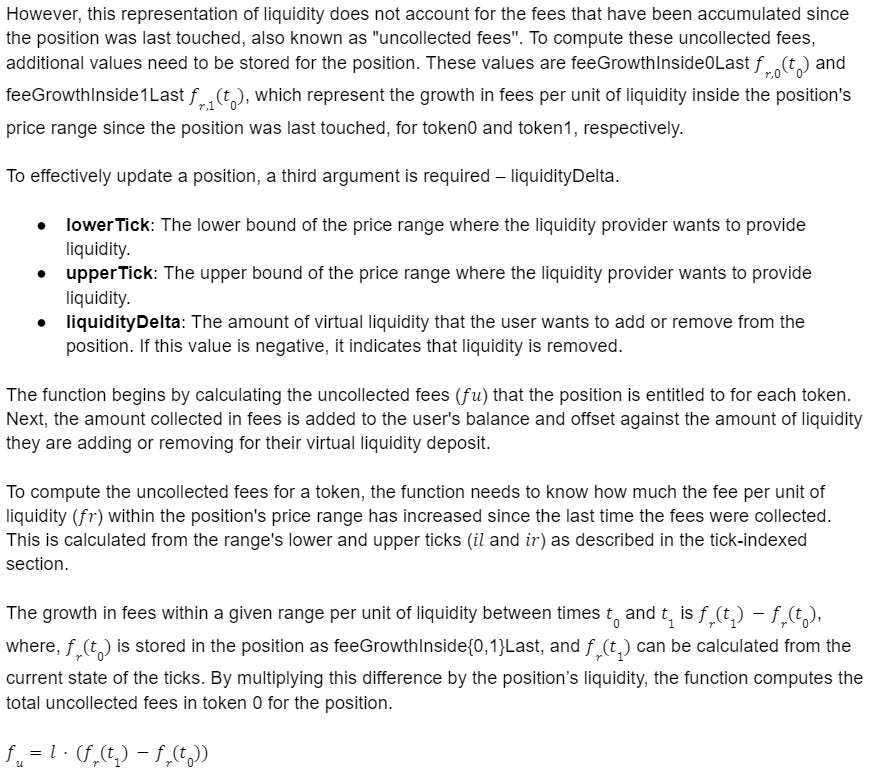

Position-Indexed State

Two main arguments are required to call the setPosition function —lowerTick and upperTick— when combined with the msg.sender. This allows Uniswap to map a user’s position with a lower bound and an upper bound.

Liquidity, l, refers to the amount of virtual liquidity that the position represented the last time this position was touched. More specifically, liquidity is represented as √ · √ , where and are the amounts of virtual token0 and virtual token1 that the position contributes to the pool when the price is within the range set by the position.

This representation of liquidity differs from Uniswap V2, where liquidity was represented as shares in the pool, and the value of each share increased over time as fees were accumulated. In Uniswap V3, the units for liquidity do not change as fees are accumulated. Instead, they are always measured as √ · √ , where and are quantities of token0 and token1, respectively.

The setPosition function then proceeds to update the position’s liquidity by adding liquidityDelta. This value is also added to the liquidityNet value of the lower tick and subtracted from the liquidityNet value of the upper tick. This is done to reflect the addition of new liquidity when the price crosses the lower tick going up, and the removal of liquidity when the price crosses the upper tick going up.

If the current price of the pool is within the range of this position, the contract also adds liquidityDelta to the contract’s global liquidity value.

The function then proceeds to transfer tokens from (or to, if liquidityDelta is negative) the user, corresponding to the amount of liquidity that is burned (if negative) or minted (if positive).

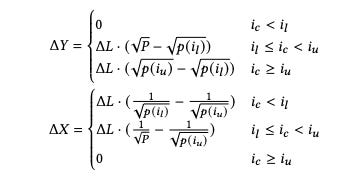

The amount of token0 (Δ ) or token1 (Δ ) that needs to be deposited by the user can be thought of as the amount that would be sold from the position if the price were to move from the current price ( ) to the upper tick (for token0) or lower tick (for token1).

Multiple Pools Per Pair

In Uniswap V1 and V2, every pair of tokens corresponds to a single liquidity pool, which applies a uniform fee of 0.3% to all swaps. V3, however, introduces multiple pools for each pair of tokens, each with a different swap fee. The factory contract initially allows pools to be

created at three fee tiers: 0.05%, 0.30%, and 1%. Additional fee tiers

can be enabled by $UNI governance.

Autorouter

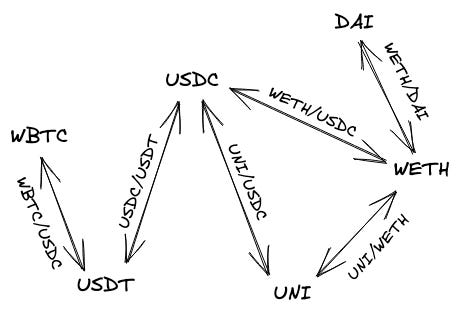

Uniswap implements an autorouter algorithm that finds the shortest path between two tokens that don’t have a pool. Furthermore, it also splits one payment into multiple smaller payments to find the best average exchange rate.

Flexible Fees

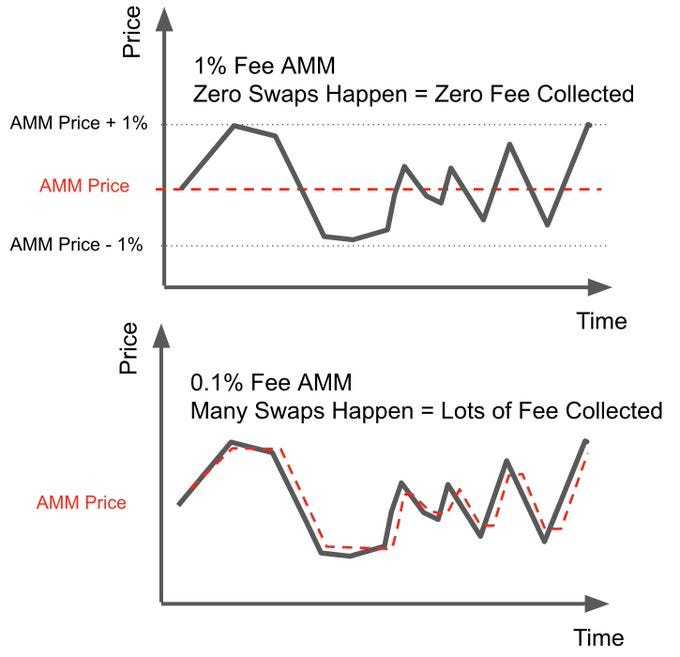

In order to incentivize liquidity providers, traders need to pay a small fee for executing swaps. UniswapV3 makes it possible to create fee tiers per pair – 0.05%, 0.3%, and 1%. This makes it possible to better align the risk (price volatility of an asset pair) with the potential rewards (from trading fees).

For example, pairs involving stablecoins (like $USDC/$DAI), or correlated assets (like $stETH/$ETH) that have low volatility and are less risky are likely to attract LPs to the 0.05% fee tier. On the other hand, more volatile pairs (like $ETH/$DAI) might attract LPs to the 0.30% fee tier. Similarly, exotic or highly volatile assets might find the 1.00% fee tier more appropriate.

In addition to these fee tiers, Uniswap v3 also introduces a flexible protocol fee structure. While Uniswap v2 had a protocol fee switch that could enable a flat 5 basis point fee (which is 16.66% of LP fees), v3 allows for protocol fees to be turned on by governance on a per-pool basis and set anywhere between 10% and 25% of LP fees. This provides the Uniswap governance community more control and flexibility in determining the protocol’s revenue structure.

Swap fees are collected only when a price range is used for trading. Hence, the protocol is responsible for tracking the moments when price range boundaries get crossed.

- When the price is increasing and a tick is crossed from left to right.

- When the price is decreasing and a tick is crossed from right to left.

Similarly, a price range becomes inactive when:

- Price is increasing and a tick is crossed from right to left.

- Price is decreasing and a tick is crossed from left to right.

Advanced Oracles

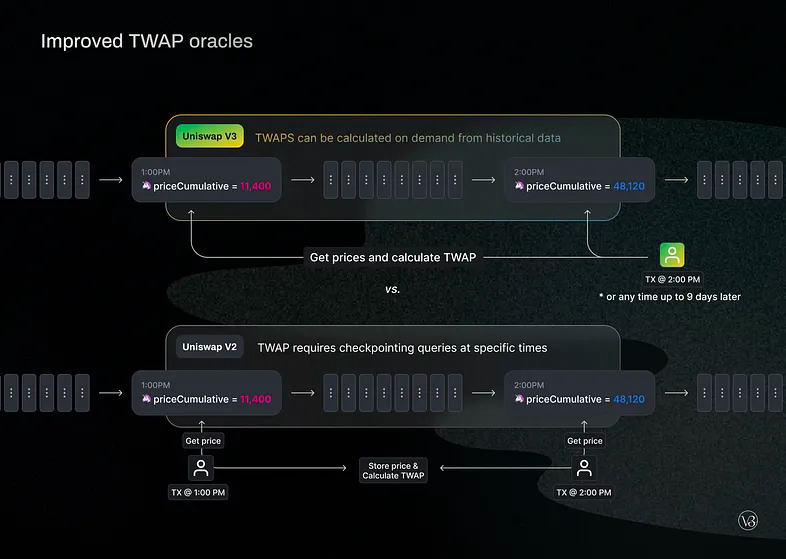

Uniswap V2 introduced TWAP oracles, which record the cumulative sum of a price pair on a per-second basis and could be used to compute an accurate TWAP over any time period. Uniswap V3 iterates upon this model and improves by making it possible for users to calculate any recent TWAP within the past 9 days with a single on-chain call. Additionally, the gas costs associated with this feature were reduced by ~50%.

- Accumulator Checkpoints in Core: In Uniswap v2, external contracts wanting to compute on-chain TWAPs needed to store checkpoints of the accumulator value. Uniswap v3 has brought these accumulator checkpoints into the core of the protocol, allowing external contracts to calculate on-chain TWAPs over recent periods without storing these checkpoints. The pool exposes the array of past observations to users and also provides a convenience function for finding the (interpolated) accumulator value at any historical timestamp within the checkpointed period. This enables users to calculate any recent TWAP within the past ~9 days in a single on-chain call, vastly improving the flexibility and precision of price oracles on Uniswap.

- In Uniswap v2, the price accumulator only stored the most recent value — the value as of the last block in which a swap occurred. Computing average prices in v2 required the external caller to provide the previous value of the price accumulator. This meant that each user had to create their own method for checkpointing previous accumulator values or coordinate a shared method to reduce costs. This system had limitations, as not every block that touched the pool could be reflected in the accumulator.

- Uniswap v3 improved upon the previous model by implementing accumulator checkpoints. Now, the pool stores a list of previous values for the price accumulator (and a new liquidity accumulator). These values are automatically checkpointed every time the pool is touched for the first time in a block. This is done by cycling through an array where the oldest checkpoint is eventually overwritten by a new one, creating a system akin to a circular buffer. Initially, this array only has room for a single checkpoint, but it can be extended to as many as 65,536 checkpoints. Anyone can initialize additional storage slots to lengthen the array, imposing the one-time gas cost of initializing additional storage slots for this array on whoever wants this pair to checkpoint more slots.

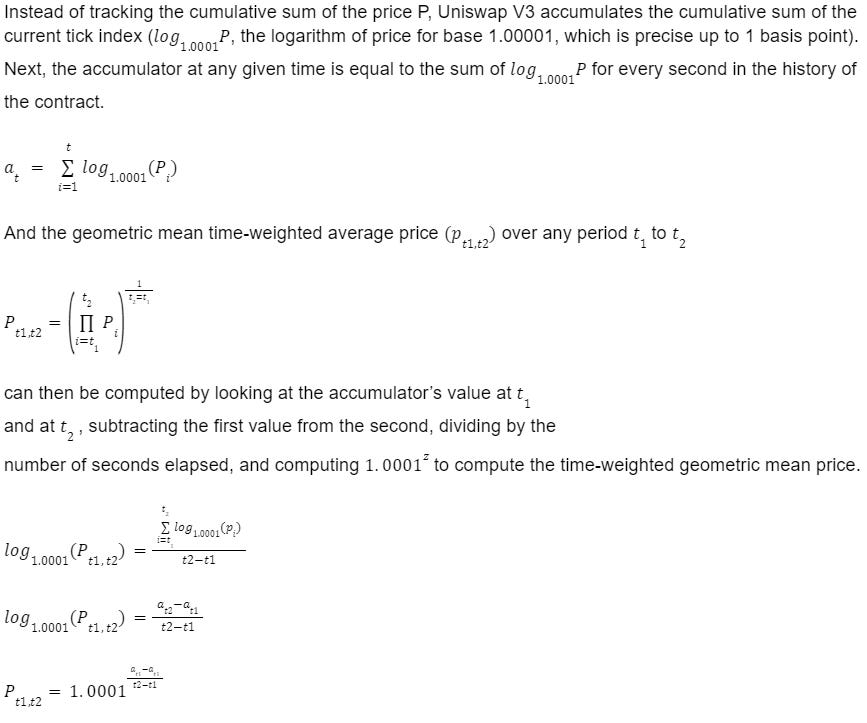

- Geometric Mean TWAP: Uniswap v2 accumulated the sum of prices, which allowed users to compute the arithmetic mean TWAP. Uniswap v3, however, tracks the sum of log prices, allowing users to compute the geometric mean TWAP. This can provide a more accurate representation of price over time, particularly for volatile assets.

- In Uniswap v2, two price accumulators were maintained — one for the price of token0 in terms of token1, and one for the price of token1 in terms of token0. This was because the time-weighted arithmetic mean price of token0 is not equivalent to the reciprocal of the time-weighted arithmetic mean price of token1.

- Uniswap v3 only needs to maintain one price accumulator due to the properties of the geometric mean. The geometric mean of a set of ratios is the reciprocal of the geometric mean of their reciprocals. This allows Uniswap v3 to maintain a single price accumulator.

- Liquidity Accumulator: Uniswap v3 introduces a liquidity accumulator that is tracked alongside the price accumulator. This liquidity accumulator accumulates 1/L for each second, where L represents the pool’s liquidity. This feature is useful for external contracts implementing liquidity mining on top of Uniswap v3. The liquidity accumulator can also be used by other contracts to determine which pool for a pair will provide the most reliable TWAP.

Non-Fungible Liquidity

Since each LP will have its own price curve, the liquidity positions are no longer fungible and cannot be represented with standard ERC20 LP tokens. Instead, ERC-721 NFTs are used.

- In previous versions, fees earned by the protocol were continuously deposited in the pool as liquidity. This meant that liquidity in the pool would grow over time, even without explicit deposits, and that fee earnings compounded. In V3, due to the nature of NFTs, this is no longer possible, and fee earnings are stored separately and held as the tokens in which the fees are paid.

- In Uniswap V1 and V2, the pool contract is an ERC-20 contract whose tokens represent the liquidity held in the pool. While this is convenient, this discourages the creation of improved ERC-20 token wrappers.

In V3, fees are collected and held by the pool as individual tokens, rather than automatically reinvested as liquidity in the pool. As a result, the pool contract in V3 does not implement the ERC-20 standard.

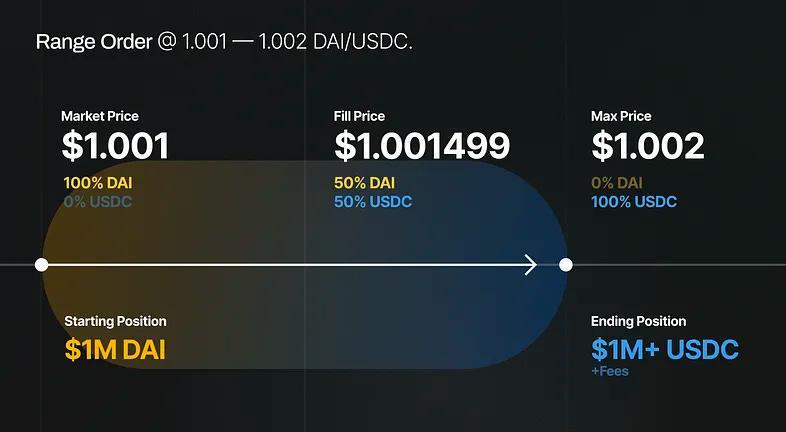

Range Orders

Range orders are a feature enabled by concentrated liquidity. With range orders, liquidity providers can provide liquidity at custom price ranges above or below the current market price. When the market price enters that range, their liquidity will become active such that one asset is sold for another along a smooth curve, all while still earning fees along the process.

For example, assuming that $DAI/$USDC is trading below 1, a liquidity provider can choose to deposit $DAI liquidity in a narrow price range between 1.001 and 1.002. Once $DAI trades above 1.002 $DAI/$USDC, the whole liquidity is converted into $USDC and the LP has to withdraw its liquidity to avoid automatically converting back into $DAI once $DAI/$USDC goes back to trading below 1.002.

Slippage Protection

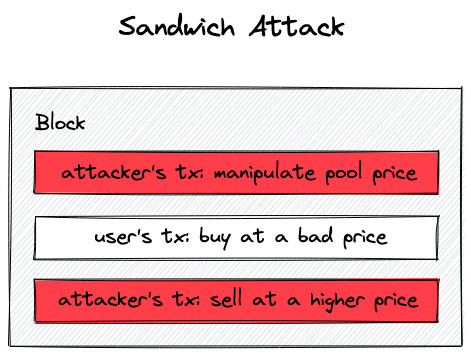

Slippage and sandwich attacks are significant concerns when trading on Dexes like Uniswap.

- Slippage can be particularly problematic on Dexes due to factors like network congestion and variable gas costs. Slippage refers to the difference between the price that you see on the screen when initiating a transaction and the actual price the swap is executed at. This occurs because of the short delay between when a transaction is initiated and when it’s mined, which can result in a discrepancy between the expected and actual execution price.

- A solution for this issue is to set a maximum acceptable slippage before confirming the transaction. If the slippage exceeds this maximum, the transaction will fail.

- Sandwich attacks are a more specific issue to decentralized exchanges. In this type of front-running attack, a malicious actor observes a pending transaction on the network (specifically on the mempool) and places a transaction with a higher gas price to get it confirmed before the original. The attacker then places another transaction to execute after the original transaction. As a result, the first transaction modifies the pool state to make the original transaction unprofitable, and the second transaction reverts the pool to its original state. The attacker thus profits from the manipulated prices.

- To mitigate sandwich attacks, some protocols implement mechanisms like transaction ordering protection and private transaction submissions. However, completely eliminating the possibility of sandwich attacks is a complex challenge that remains to be fully addressed.

To protect against these issues, Uniswap V3 sets slippage tolerance to 0.1% by default. This means that a swap is executed only if the price at the moment of execution is not smaller than 99.9% of the price the user saw in the browser.

Slippage protection is also required when adding liquidity. The reason for that is that price cannot be changed when adding liquidity – liquidity must be proportional to the current price.

Uniswap V4

Uniswap v1 and v2 were the first two iterations of the Uniswap Protocol, facilitating ERC-20 <> ETH and ERC-20 <> ERC-20 transactions, respectively, both using a constant product market maker (CPMM) model. Uniswap v3 introduced concentrated liquidity, providing more capital-efficient liquidity through the use of positions that provide liquidity within a limited price range, and introduced multiple fee tiers.

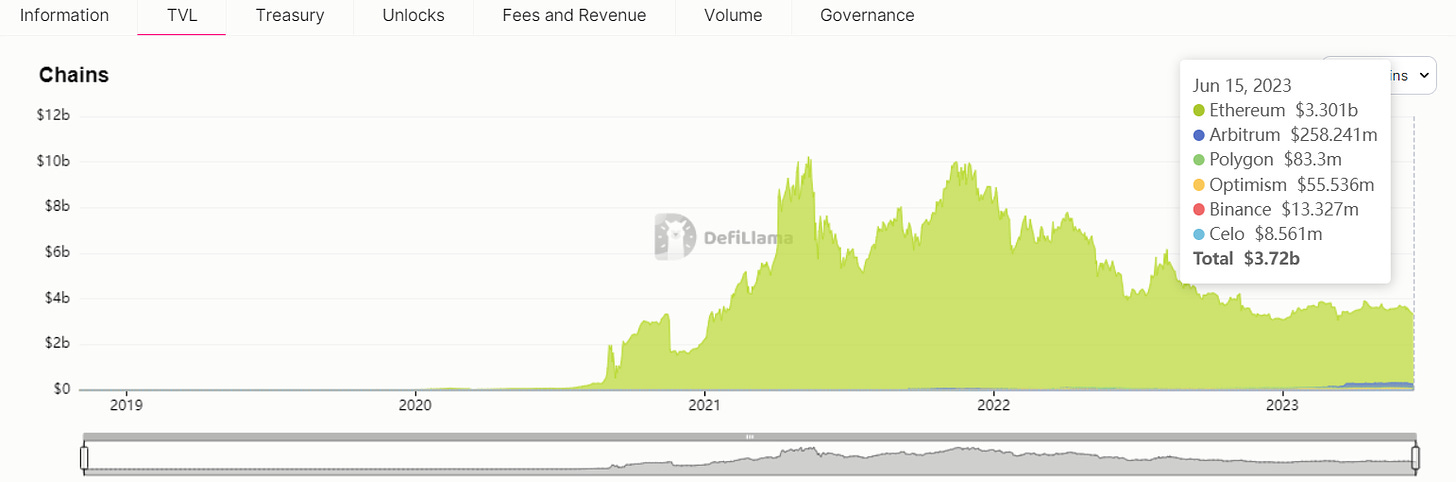

While concentrated liquidity and fee tiers increased flexibility for liquidity providers and allowed for new strategies to be implemented, Uniswap v3 was not flexible enough to support new functionalities that were invented, as AMMs and markets evolved. For example, v3 enshrined oracles allowed builders to integrate real-time, on-chain pricing data, but this came at the expense of some increased costs for swappers. Something similar occurs with concentrated liquidity, where most passive LPs lose money due to the time and gas costs that come with actively managing positions.

The vision for Uniswap v4 is to increase the expressiveness of the underlying primitives. Announced as public infrastructure for the Ethereum ecosystem, the goal of Uniswap V4 is to empower developers with the appropriate tools to build unprecedented primitives. Instead of making the tradeoff decisions itself, the protocol will allow anyone to choose what they want to build and how they want to build it.

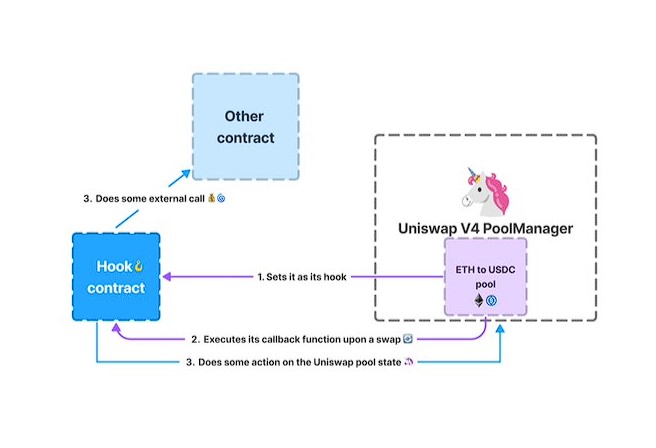

Hooks

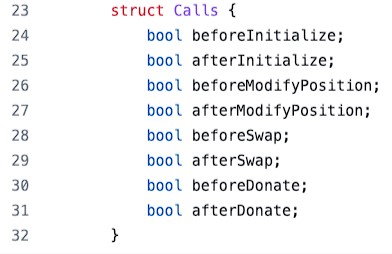

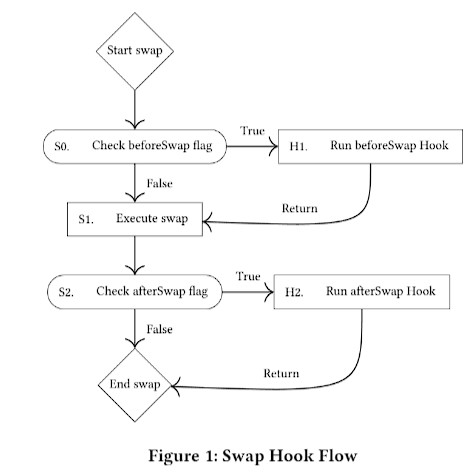

Hooks are the most notable feature of Uniswap’s new version. These are contracts that run at various points of a pool action’s lifecycle. This way, it will be up to external builders to add totally new functionality at their own discretion.

Hooks are customizable functions that can be added to a pool in order to modify its behavior. With hooks, developers can customize and augment the capabilities of the concentrated liquidity model. This makes it possible to create new pools with specified hooks that can execute before or after particular pool actions. The whitepaper and source code shows that there are currently 8 different steps.

To fully understand the potential of hooks, it is worth noting that each Uniswap liquidity pool has a lifecycle: a pool is created with a fee tier, liquidity is added, removed, or readjusted, and users swap tokens. In previous deployments, these lifecycle events are tightly coupled and must be executed in a very strict sequence.

Uniswap v4 improves upon the old implementations by allowing developers to design custom “plugins” that will perform a designated action at key points throughout the pool’s lifecycle – during pool creation, before or after a swap, before or after an LP position is changed…

Hooks make it possible to dynamically adjust fees, create new order types, such as TWAP (Time-Weighted Average Price) or *TWAMM orders, facilitate on-chain limit orders, lend idle liquidity (out-of-range) to money markets, autocompound LP fees, or distribute internalized MEV profits back to LPs.

*TWAMM stands for Time-Weighted Average Market Maker. Instead of performing a swap across many pools, the AMM takes a dollar-cost-average approach to swap funds over a period of time.

TWAMM Hook

TWAMMs are a type of swap that reduces the price impact of larger orders by breaking them into small pieces over time.

TWAMM gets swappers better prices by splitting a large single swap order into smaller ones that steadily execute over time. These smaller swaps are less likely to move the market price.

In Uniswap v4, each pool can insert hooks that run at various points of a pool action’s lifecycle. These hooks are smart contracts distinct from the core v4 liquidity contract. Orders are deposited into the TWAMM hook, and the user sets the duration they want their order to execute over. These two parameters instruct the TWAMM hook to swap at the price of each block until the expiration.

TWAMM orders are always the first pool action in a block, meaning they happen before any swaps or LP positions are adjusted. The first time someone swaps or LPs in a block, the pool will first check whether the TWAMM orders have been fulfilled. If there are any open TWAMM orders, the TWAMM hook will settle those orders before continuing on to complete any swaps or LP transactions before repeating the process with the next block. Executing TWAMM orders as the first pool action in the block protects users from frontrunning MEV.

TWAMMs can be used for the following

- Recurring investments

The TWAMM hook is great for longer-term investors who want “set it and forget it” recurring investments. Also known as dollar-cost average (DCA) is a popular trading strategy for passive buyers to invest the same amount at regular intervals. The steady cadence of investments offsets daily market volatility by averaging the purchases over time. - A DAO converting its treasury

The TWAMM hook can let DAOs market sell large portions of their treasuries. If Alice’s DAO can split their order over time, they could sell smaller quantities of tokens until the date they set, letting the market smoothly adjust to thousands of swaps instead of doing it in one go. Using the TWAMM hooks, the DAO’s $10M order can execute at every block for the next 30 days.

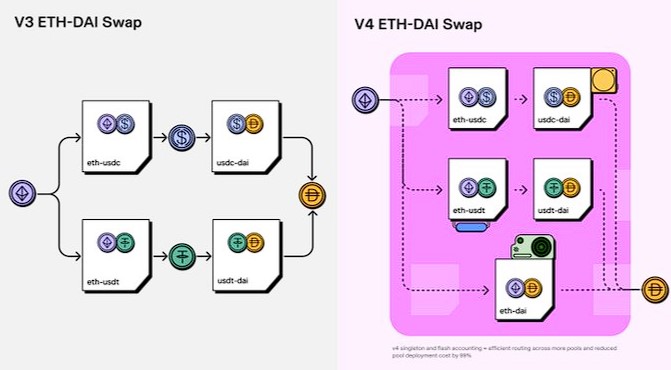

Singleton and Flash Accounting

Along with the improvements in terms of customization, the new protocol architecture significantly reduces transaction costs. Uniswap v4 employs a singleton model where all pools are managed by a single contract, significantly reducing the cost of pool creation by ~99%. In other words, all pools live within a single smart contract that will enable more efficient routing across many pools. This design fully aligns with the EVM’s construction of stateful contracts, leading to a better developer experience.

Flash accounting further optimizes gas usage. Since pools are managed by the singleton contract, the protocol only needs to update an internal balance instead of executing immediate transfers from one contract to another at the end of each operation. This is specially relevant for multi-hop asset swaps implemented by the Uniswap router, where an intermediary swap is executed in order to swap the input asset for the requested output asset.

The design for flash accounting uses “transient storage” which will be enabled by EIP-1153 in the Ethereum Cancun hard fork. Pool creators will no longer be restricted to selecting from a predefined range of fee tiers. Instead, they can choose whatever fee ratio they see most competitive and even customize them with a dynamic fee hook that reacts to volatility or other market indicators.

V4 also introduces support for native $ETH in trading pairs, further reducing gas costs even more, since native $ETH transfers are cheaper than ERC-20 transfers. This was not the case in v2 and v3, where $ETH had to be wrapped into $WETH.

ERC 1155 Accounting

Uniswap v4 supports the minting and burning of ERC-1155 tokens for token accounting within the singleton. By allowing users to keep tokens in the singleton contract, they can avoid ERC-20 transfers to and from the contract, thereby making the process of swapping significantly more gas efficient.

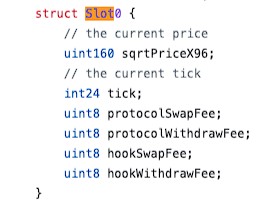

Fees

The protocol fee mechanism is modeled after v3. V4 comes with two separate governance mechanisms: swap fees and withdrawal fees. Governance will be able to vote to adjust the fees of any particular pool, up to a capped percentage of the swap amount.

With v4, if hooks initially choose to turn on withdrawal fees for a pool, governance also has the ability to take up to a capped percentage of that withdrawal fee. Unlike in Uniswap v3, governance does not control the permissible fee tiers or tick spacings.

The full list of fees is:

- protocolSwapFeeToken0

- protocolSwapFeeToken1

- protocolWithdrawFeeToken0

- protocolWithdrawFeeToken1

- hookSwapFeeToken0

- hookSwapFeeToken1

- hookWithdrawFeeToken0

- hookWithdrawFeeToken1

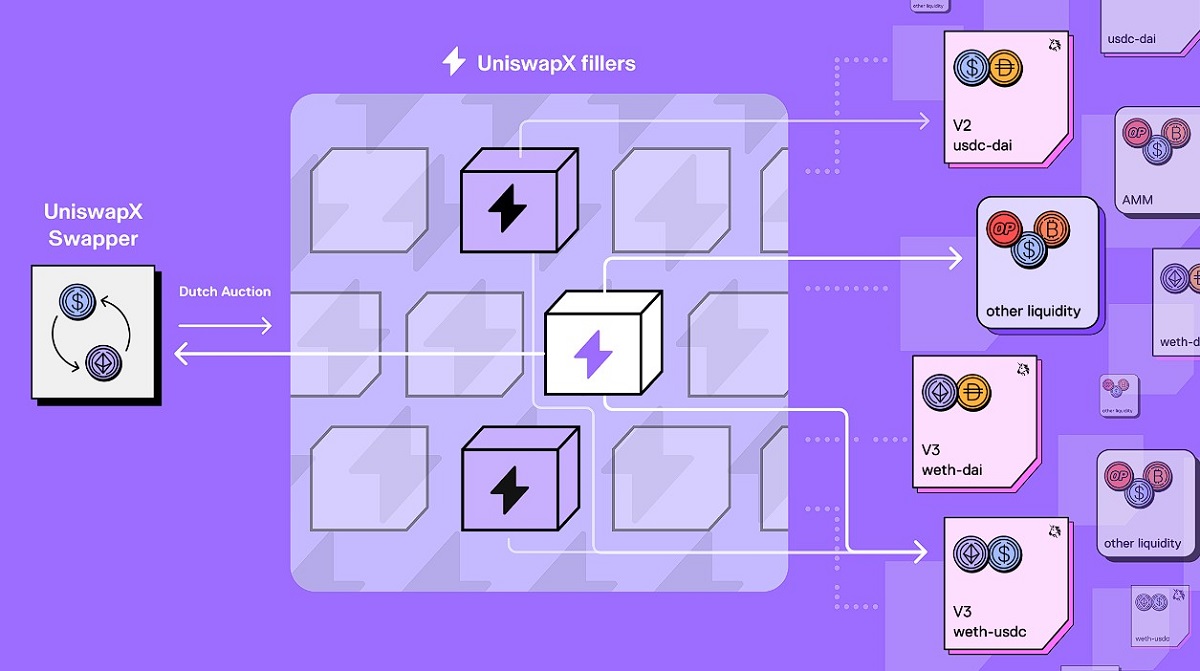

UniswapX

Since its initial release in 2018, the Uniswap Protocol has witnessed remarkable growth in on-chain trading. It has expanded its support to millions of users, catered to numerous use cases, and facilitated an impressive trading volume of $1.5 trillion on Uniswap alone.

UniswapX was introduced on July 17, 2023 as an opt-in beta, available on Ethereum Mainnet and expanding to other chains and the Uniswap Wallet in the future.

Its main function is as a new permissionless, open source (GPL), Dutch auction-based protocol for trading across AMMs and other liquidity sources, helping to grow on-chain trading and improve self-custody swapping.

UniswapX is expected to improve the swapping process in the following ways:

- Better prices by aggregating liquidity sources

- Gas-free swapping

- Protection against MEV (Maximal Extractable Value)

- No cost for failed transactions

- Gas-free cross-chain swaps.

Uniswap X represents a significant evolution in the DEX and DEX aggregator design space, offering a unique solution that combines the efficiency of Dutch auctions with the power of on-chain and off-chain liquidity aggregation.

Despite many claims of taking huge inspiration from 1inch Fusion or Cowswap, Uniswap’s approach improves the handling of MEV at the protocol level and makes it possible to offer gas-free and cross-chain trading for protocol users.

By creating a competitive marketplace for trade execution, Uniswap X is not only improving the trading experience for swappers but also democratizing the process of liquidity provision.

Finally, there are no primary or second-order effects as a result of UniswapX that will impact the $UNI token.

Next-Level Aggregation

As on-chain trading continues to evolve, on-chain routing has become a progressively significant and complex challenge. The growth of liquidity pools, the introduction of new fee tiers, the emergence of Layer 2 solutions, and the proliferation of on-chain protocols have resulted in liquidity fragmentation. Anticipated future developments, such as the creation of thousands of customized pool designs on Uniswap v4, will further complicate the routing process. Sustaining competitive pricing throughout such an environment requires manual integration, ongoing maintenance, and substantial effort.

To tackle these complexities, UniswapX proposes a solution that delegates routing complexity to an open network of third-party fillers who compete to execute swaps using on-chain liquidity from AMM pools or their private inventories.

UniswapX offers swappers the convenience of utilizing the Uniswap interface without concerns about obtaining the best price. Additionally, all transactions are transparently recorded and settled on-chain. The Uniswap Smart Order Router acts as a backstop for all orders, compelling fillers to compete with Uniswap versions 1, 2, 3, and, in the future, version 4.

Gas-Free Swapping

With UniswapX, swappers initiate the process by signing a unique off-chain order. Subsequently, fillers take the responsibility of submitting the order on-chain, and they bear the gas fees on behalf of the swappers. This eliminates the need for swappers to possess the native network token of a chain (e.g., ETH, MATIC) or incur any costs for failed transactions. Fillers incorporate the gas fee into the swap price and have the flexibility to optimize transaction costs by batching multiple orders to achieve the best possible price.

It’s important to note that there are specific circumstances where users still need to pay for gas. For instance, gas is required for the initial token approval of Permit2. Additionally, when selling, native network tokens need to be wrapped, which incurs gas costs.

MEV Protection

One of the significant challenges in on-chain swapping is the issue of Miner Extractable Value (MEV), which often leads to unfavorable prices for swappers.

UniswapX addresses this concern by redirecting the MEV that would typically be captured by arbitrage transactions back to swappers, resulting in improved prices. Additionally, UniswapX mitigates the risk of more explicitly extractive forms of MEV. Orders executed using fillers’ inventory are protected from sandwich attacks, a common MEV strategy. Moreover, fillers are incentivized to utilize private transaction relays when routing orders to on-chain liquidity venues, further minimizing the potential for exploitative MEV practices.

Cross-Chain

In the near future, there are plans to introduce a cross-chain version of UniswapX that integrates swapping and bridging functionalities into a unified and streamlined process. This upcoming feature will enable swappers to swiftly exchange assets between different chains within seconds.

A notable advantage of cross-chain UniswapX is that swappers will have the flexibility to select the specific assets they wish to receive on the destination chain, instead of being limited to a bridge-specific token.

Why the Project was Created

There are multiple approaches to how an exchange can be designed. All centralized exchanges rely on order books that offer a similar experience to how trading works in traditional finance with stocks and commodities. An order book is just a journal that stores all the sell and buy orders that traders want to make. Each order in this book contains a price the order must be executed at and the amount that must be bought or sold.

For trading to happen, there must be liquidity. This liquidity is accumulated at different price ranges in the orderbook. When there’s no liquidity, but markets are still interested in trades, market makers come into play. A market maker is a firm or an individual who provides liquidity to markets, that is someone who has a lot of money and who buys different assets to sell them on exchanges. For this job market makers are paid by exchanges. Market makers make money by providing liquidity to exchanges.

In traditional finance, order books dominate the scene for asset exchanges. These mechanisms rely on a list of buy and sell orders to match trades, but this approach has limitations when applied in a smart contract or blockchain environment. Some of the challenges include:

- High Costs: The order book mechanism requires a large state to represent all the outstanding orders, which can be expensive in a smart contract environment where users have to pay for space and computing power.

- Complex Matching Logic: Traditional order books support a variety of order types like iceberg orders, limit orders, and stop-limit orders. Implementing these in a smart contract environment can be quite complex.

To navigate these challenges, some decentralized exchanges have used blockchain for settlement while executing trades off-chain. However, this approach also has drawbacks:

- Front-running: The complex interaction between off-chain and on-chain mechanisms, along with transaction ordering ambiguity in blockchain systems, can lead to front-running, where an entity can exploit the knowledge of pending transactions for their gain.

- Latency Arbitrage: When the order book state is maintained by multiple participants (for instance, ‘relayers’ in the case of 0x), it often leads to stale orders and latency arbitrage opportunities, which can be exploited to profit from delayed price information.

- Complex Threat Model: Decentralized exchanges interacting with off-chain systems have a more complex threat model than smart contracts that operate solely on-chain. This complexity can necessitate additional security precautions for users and can complicate the process of releasing funds.

Automated Market Makers (AMMs) like Uniswap provide a solution to these challenges. By replacing the order book with a liquidity pool and a pricing function, they offer a simplified and more efficient trading model suitable for the blockchain environment

At a very high level, an AMM replaces the buy and sell orders in an order book market with a liquidity pool of two assets, both valued relative to each other. As one asset is traded for the other, the relative prices of the two assets shift and a new market rate for both is determined. This brings advantages such as the creation of permissionless and decentralized markets, and having constant liquidity, although this comes at the expense of impermanent loss, slippage, and smart contract risk among others.

The term “automated market maker” initially referred to algorithms used in prediction markets, which allow users to profit from accurate predictions of future events. These algorithms were designed to create liquid markets for event outcomes by adjusting the odds and payouts automatically.

Uniswap and other on-chain exchanges have evolved from these original algorithms and adapted them for use in decentralized finance (DeFi). The primary goal of AMMs in DeFi is to maintain liquidity and facilitate token trading without relying on traditional order books.

The original proposal on Reddit by Vitalik Buterin outlined an alternative paradigm for decentralized exchanges, borrowing ideas from Nick Johnson’s proposal and prediction markets like Gnosis and Augur. The primary goal of this new mechanism would be to address the high spreads and gas fees associated with market-making in existing decentralized exchanges at the time. This would be achieved with a mechanism that could maintain the following components:

- Internal state that represents the current market price of a token.

- Parameters that set a transaction fee for each trade as well the liquidity depth for each market.

- Order execution such that when users buy tokens, they raise the price to (PRICE + ORDER_AMOUNT / DEPTH) and pay the corresponding amount (ORDER_AMOUNT * (PRICE + ORDER_AMOUNT / DEPTH / 2) * (1 + FEE). This simulates buying an infinitesimal number of tokens at every price point between the old and new prices.

- Initial deposit to set up the market.

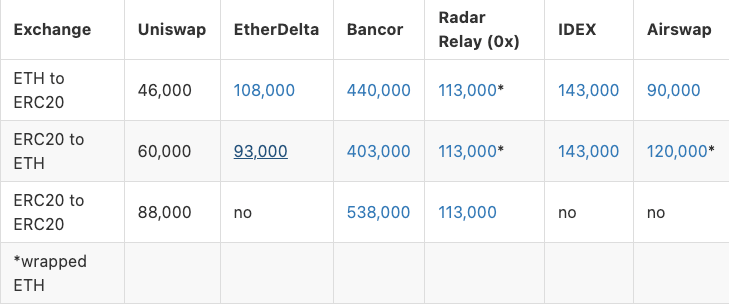

At the time, Uniswap was the most efficient decentralized exchange, mostly due to its simplistic design. For ETH to ERC20 trades it used almost 10x less gas than Bancor and could perform ERC20 to ERC20 trades more efficiently than 0x, also offering significant gas reductions when compared to on-chain order book exchanges, such as EtherDelta and IDEX.

In November 2018, Uniswap V1 was deployed as a proof of concept for what an on-chain AMM would work like. Two years later, in May 2020, V2 was released introducing new features and optimizations. This set the stage for the exponential growth in AMM adoption. Less than one year later, more than $100bn had been traded in Uniswap, making it the largest decentralized exchange in the industry.

Roadmap

Uniswap does not have an official roadmap, users can either track their social media channels for the latest updates or join the governance forums to keep track of the relevant proposals.

Some of the relevant proposals that have gained strong traction include:

- Making Protocol Fees Operation

- Propose implementing a protocol fee equal to ⅕ of the pool fee across all* Uniswap v3 pools and turning on the fee switch for Uniswap v2.

- *All pools with regular volumes that would generate an annualized income over $10,000 for the protocol.

- Deploy Uniswap v3 on Moonbeam (2023)

- To reinstate the deployment of Uniswap v3 on Polkadot’s EVM-compatible para chain, Moonbeam.

- Deploy Uniswap v3 on Avalanche

- Importance of Uniswap v3 expansion to popular EVM chains.

- Temperature Check: Deploy Uniswap v3 on Scroll

- To authorize the deployment of Uniswap V3 on Scroll testnet.

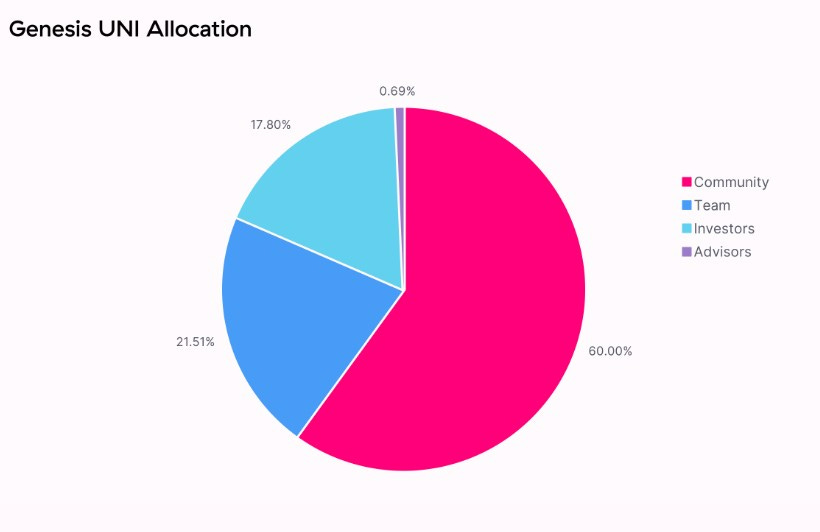

Sector Outlook