Overview

Thena is the native liquidity layer and Automated Market Maker Decentralized Exchange (AMM DEX) on BNB Chain. The protocol was designed to onboard protocols to the BNB chains by opening a decentralized market for token emissions on the Binance Chain ecosystem.

As a self-optimizing DEX, Thena’s AMM uses algorithms to automatically adjust to market conditions and improve its performance over time. This is achieved by tracking indicators such as trading volume, order book depth, and price spreads. By adjusting the trading fee structure, the size of the order book, and the amount of liquidity in specific trading pairs, users get access to the best prices and trade executions.

With stationary incentives, Thena also solves the problem of inefficient liquidity incentives. This mechanism ensures that incentives are distributed in a transparent and fair manner that rewards LPs according to their contributions, rather than relying on volatile market conditions. Stationary incentives set a fixed reward rate for providing liquidity and rely on a predictable inflation rate to distribute rewards and help to increase the overall liquidity of the platform.

Thena features a unique gauge voting system. Protocols can bribe veTHE holders or acquire veTHE on the open market to redirect emissions to their pools. This is a flexible and capital-efficient solution that helps projects to bootstrap and scale their liquidity incentives. Users can use gauges to make informed decisions about where emissions should go. This concept draws its inspiration from the original Solidly model by Andre Cronje.

Gauges are pools that benefit from dynamic THE rewards based on the veTHE weekly voting allocations

The vision of Thena is to create a Solidly-inspired liquidity layer that becomes the liquidity backbone of the BNB Chain. This will create a long-term sustainable ecosystem that will make it easier to onboard new users and protocols.

Liquidity Hub

The liquidity hub is a fully decentralized, permissionless, and composable DeFi protocol developed and powered by Orbs, now integrated to THENA. It’s currently in its V1 stage, with V2 coming out soon.

THE Liquidity Hub software offers an optimization layer on top of the AMMs, and taps into external liquidity sources for better price execution and lower price impact for users.

In the past, THENA searched for the best route within our somewhat limited liquidity pools. Now, the process is enhanced by utilizing various other sources:

- Onchain solver auction: Third-party solvers who compete to fill swaps using on-chain liquidity like AMM pools or their own private inventory.

- Decentralized orders via API: Decentralized orders are accessible using API, enabling institutional/professional traders, such as market makers, to submit bids and compete to fill swaps.

The benefits for users includes:

- Simplicity: The trading experience is improved with no visible changes, keeping things simple and clean.

- Easy integration: Solvers and market makers can easily plug in to improve the trading experience further.

- Fast execution: Trades have minimal to zero latency allowing users to respond to real-time market movements.

- Gasless trades: Users do not need BNB to execute trades, reducing the cost of transactions.

AMM v1

Thena uses a hybrid vAMM/sAMM model that enables more efficient routing between assets and works for both volatile and stable pairs.

- The sAMM is optimized for stable pools or correlated asset pools. These types of pools follow the Curve stableswap model and allow traders to swap assets that trade at near parity with very tight spreads and lower price impacts.

- The UI suggests the correct ratio (not necessarily 50:50)

- 0.01% fee

- The vAMM follows the traditional Uniswap v2 model and is optimized for volatile asset pairs.

- Tokens need to be added in a 50:50 ratio

- 0.2% fee

Compared to the vAMM, the sAMM model allows for greater imbalances between the two assets before traders start noticing a significant price impact

What makes Thena’s AMM unique is its innovative approach, which reworks parts of Solidly, offers theNFTs, and leverages token economic primitives, partnerships, and distribution models with the goal of unlocking idle capital and increasing the concentration of liquidity within the BNB Chain ecosystem.

Order Types

In collaboration with Orbs Network, 2 new advanced order types were introduced.

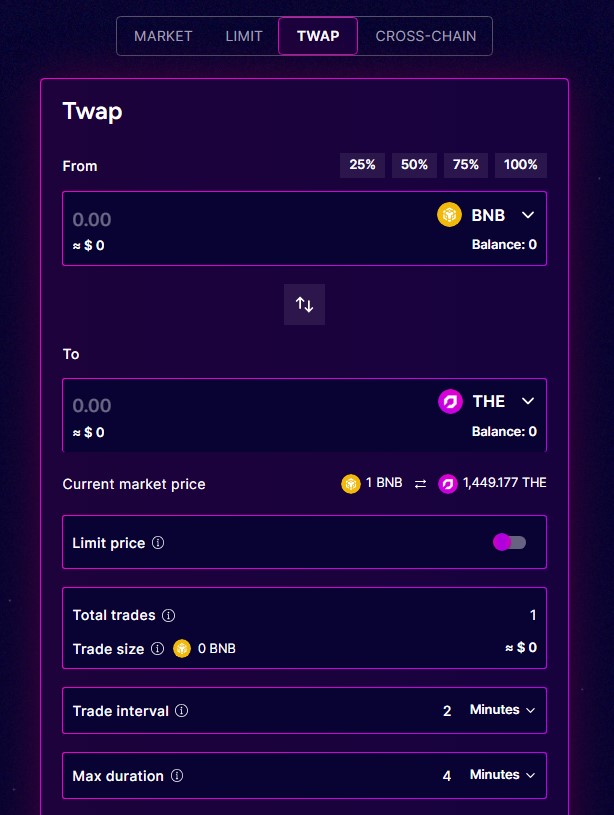

dTWAP

dTWAP (d Time Weighted Average Price) is a order that allows users to DCA (dollar-cost-average) in and out of their selected tokens, reducing the price impact of large trades by splitting them into smaller chunks executed over time, offering a more gradual and less disruptive approach to trading.

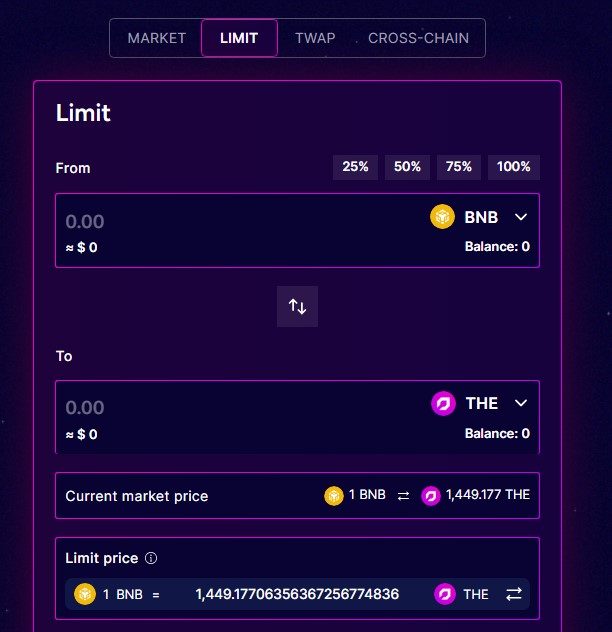

dLIMIT

dLIMIT (limit orders) allows users to automate their trades by setting a specific trade price and having the app execute the trade once the indicated price is hit.

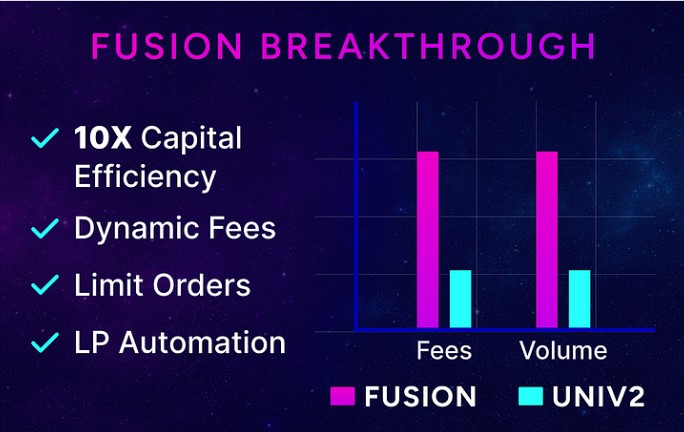

Fusion

Fusion is a solution that introduces automated management of concentrated liquidity in Thena’s AMM. Fusion is the result of a collaboration between Thena, Gamma Strategies, and Algebra Finance. The goal is to improve the capital efficiency and user experience.

In UniswapV2 pools, the liquidity is evenly distributed across the entire price range from 0 to infinity, equally rewarding active and inactive liquidity. This results in capital inefficiency and has a negative effect on the actual LP positions of the protocol, which will not be able to generate enough yield from trading fees to offset impermanent loss. One common approach has been to use the native token of the DEX to rent liquidity, but this leads to an inflationary and unsustainable approach from excessive emissions.

Concentrated liquidity is a concept that was created with the goal of improving the capital efficiency of traditional AMM pools. By allowing LPs to provide liquidity within specific price ranges, they would be able to collect trading fees when the current active price falls within the established range. Similar to an orderbook, the AMM would be able to concentrate the distribution of liquidity around the market price of the token. This provides better price execution for traders while adequately compensating those LPs who manage to allocate their liquidity reserves efficiently.

Algebra is the actual provider of the technology that powers Fusion. Their solution enables the provision of liquidity through custom price ranges, facilitating the advanced execution of market-making strategies.

- A base fee is set by the core team and can be modified at any time without having to redeploy a liquidity pool.

- A dynamic fee component is added and automatically adjusted based on market conditions, such as volatility, available liquidity, and trading volume. This is done intentionally to maximize fee revenue. For instance, fees are increased during periods of high volatility in order to compensate for the potential losses of liquidity providers.

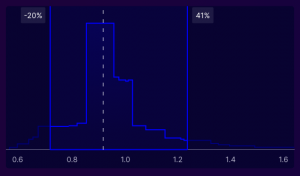

Concentrated liquidity markets are characterized for exposing LPs to increasing levels of impermanent loss. As the price shifts, LPs end up holding more of one asset while traders acquire more of the other. Eventually, when a position gets out of range, LPs may end up holding a single asset position as the price of the pair approaches either the lower or upper limit of the range. This scenario gets worse when the price surpasses one of the boundaries and the LP position ends up consisting of a single asset that is decreasing in value and not generating trading fees.

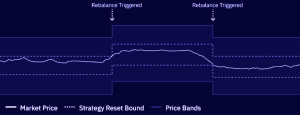

Due to risk of increased impermanent loss, concentrated liquidity strategies require active management and rebalancing of positions, specially during periods of high volatility. By adjusting liquidity ranges to activate liquidity, LPs can maximize their revenue from trading fees. This is where Gamma Strategies plays a role addressing all the complexities associated with the professional management of liquidity. As a professional liquidity management protocol, Gamma actively adjusts LP ranges to maximize the generation of fees while mitigating impermanent losses.

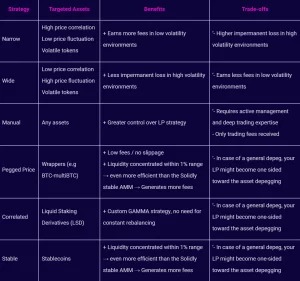

Liquidity pools typology

- Fusion wide pool. The wide-range strategy distributes liquidity over an extensive price range. This approach is highly effective for assets with low price correlation and substantial price fluctuations. The reason for that is because this allows the AMM to generate consistent fees during periods of market volatility, such as a token launch, the release of unexpected news, black swan events…

- Fusion narrow pool. The narrow-range strategy distributes liquidity over a tight price range. This approach is highly effective for assets with correlated prices. A narrow range maximizes the fee-earning potential during periods of low market volatility. However, in the long term, higher fees may not compensate for the higher impermanent loss risk.

- Fusion stable pool. Similar to the sAMM pool, this strategy is specifically designed for assets that are expected to consistently trade at near parity, such as stablecoins or synthetics. This peg in asset prices favors high volume and revenue from trading fees. However, depegging events can be highly detrimental for the pool, which could become entirely imbalanced and consist of only one asset. This would make it impossible for arbitrage bots to rebalance the pool, which is not the case with the v1 stable AMM pool.

- Fusion dyamic pool. This strategy aims to distribute liquidity along a dynamic price range that accounts for a price relationship between a yield-bearing asset and its underlying asset. This is the case for liquid staking derivatives, such as ETH/frxETH or BNB/ankrBNB pools.

- Manual range pools allow LPs to select what their preferred price range is and adjust it in a highly customizable way. This approach is best suited for sophisticated market makers or individuals who build their strategies on top of Thena. These LPs earn 97% of the swap fees generated by their operations, while the remaining 3% of the swap fees are allocated towards bribing FUSION gauges as a revenue share mechanism for veTHE holders. The UI for these pools automatically suggests the correct ratio of tokens, which can be other than 50:50.

Bribing market

Thena has reworked the bribing market from the original Solidly implementation in order to become more resilient against mercenary capital (who farms rewards and then leaves the ecosystem selling for a profit) and promote cooperation between users.

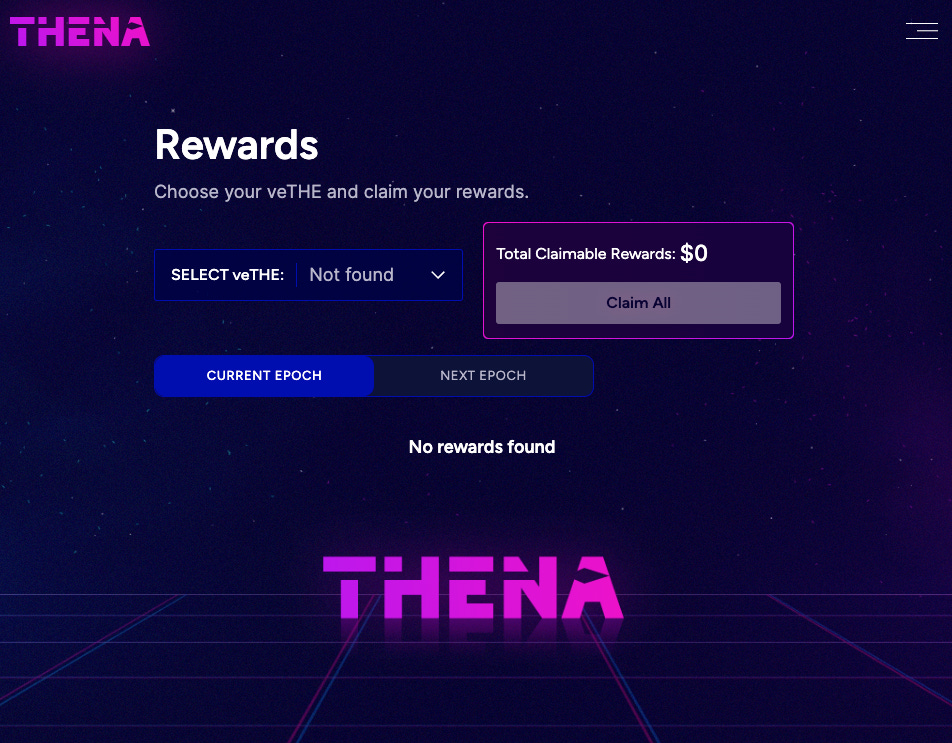

veTHE holders receive rewards at the end of the epoch (every week) in the form of a single claim amount. This prevents bribe farming. Also, there is no possibility for negative votes.

All new tokens added to the bribing market are whitelisted by Thena’s multisig.

In order to avoid protocols acting as a Convex layer over Thena, the protocol optimizes for a fair distribution of decentralized governance and voting power by allowing many protocols to take part.

This is achieved by not including a farming boost feature

The anti-dilution mechanism introduced by ve(3, 3) tokenomics has also been capped to offer full protection against dilution until Thena reaches a 30% locking rate. At any rate above that, the anti-dilution will become partial (anti-dilution will decrease and the locking rate increases). Through this mechanism, the protocol becomes an open marketplace for protocols to solve the cold-start liquidity problem.

The expectation is that by offering full protection against dilution until the locking rate reaches 30%, the protocol will avoid a convex-curve situation and will favor a more distributed supply

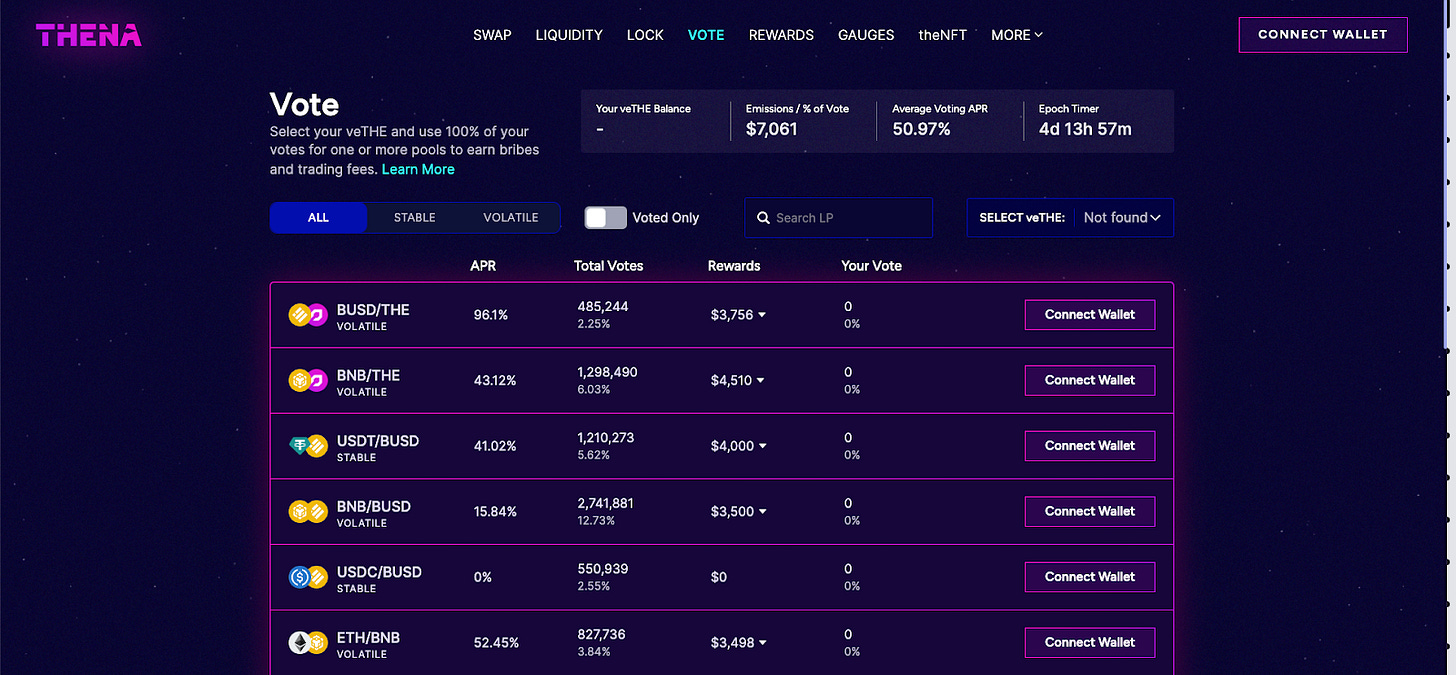

- Users can only earn bribes and trading fees from the pools they have voted for

- Each epoch lasts 7 days, after which the bribes and trading fees are distributed

- Users can pre-approve votes for a number of weeks in advance

- Users can change or reset their votes at any time

- Users who forget to vote or choose not to participate on a weekly voting round will lose the bribes and the trading fees

Staking

Staking is a key component of Thena’s go-to-market strategy. The protocol will bribe itself (veTHE holders) with the funds raised from an initial NFT sale. This will be an ongoing strategy until the protocol reaches a point of maturity where it generates enough fees to compensate voters.

- Thena will scale liquidity for core pools (BNB, BUSD, USDT, wBTC, wETH, LINK…) in order to maximize its revenue generation.

- Thena will incentivize and attract liquidity for DeFi protocols to help them reduce their operating costs and scale their liquidity

On-chain referrals

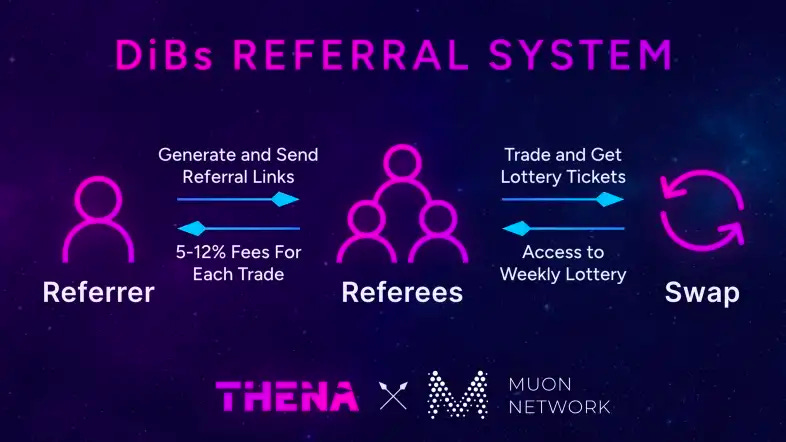

Thena has built an on-chain referrals system with Muon, which will allow users to generate referral codes that they can share with others in order to benefit from a 5 to 12% rebate for each trade made through the referral link. Users of the referral link have benefits as well, such as earning lottery tickets that give them access to a weekly lottery.

The rebate depends on the tier reached by the referrer of the referral link. The higher the volume, the greater the tier.

The referral system is permissionless and implements a (3, 3) model designed to create a win-win situation for both the referrer and the user who uses the referral link.

- The referrer earns a share of trading fees.

- Users of a referral link get lottery tickets to participate in prize pools.

ALPHA

ALPHA is the next-gen trading platform powered by the SYMMIO‘s RFQ (Request-For-Quote) engine.

RFQs are the dominant trading technology for less liquid assets such as municipal bonds and options in traditional finance. The same tools are needed on-chain to create new markets or deepen existing ones:

- Less frequently traded products (municipal bonds in trad-fi, protocols which want to distribute their revenue to stakers rather than spend on liquidity incentives)

- Redundant products (such as options where the same exposure can be achieved by trading different amounts on all possible strikes and maturities)

- Large orders, i.e., orders that would impact price if executed on order books, can be executed with less impact as liquidity forms into RFQ-type systems.

The public beta was launched on September 11, 2023.

ICHI Market-Making Vaults

The market-making vaults were launched on November 11, 2023, in collaboration with the Ichi Foundation.

These vaults are automatically managed, utilizing sophisticated algorithmic strategies on concentrated liquidity pools. Using these on-chain market-making vaults on THENA aims at reducing $THE price volatility, thereby bringing more resilience to Thena.

The core technology behind the vaults is the Yield IQ which is powered by Chainlink Automation. It dynamically adjusts the concentrated liquidity position based on token arrangements and real-time market conditions such as volatility and volume. Users earn trading fees when swaps occur, supplementing potential token appreciation. With vigilant oversight of token composition, Yield IQ guards against harmful arbitrage and market shifts. Users can withdraw their initial deposit and earnings at any time by exchanging LP tokens for their share of assets in the vault.

Thena’s target is to reach a level of 40% $THE market cap managed by Yield IQ strategies, contributing to achieving a more stable and prosperous ecosystem.

Essentially, the vaults allow users to deposit blue-chip asset tokens into them, which are then used to buy or sell $THE tokens based on ICHI’s strategies.

Why the Project was Created

As of the beginning of 2023, BNB Chain is incentivizing liquidity, and 97% of the liquidity on Dex is located in pools receiving those incentives – rather than being driven by market forces. Because of this, most LP deposits have the primary goal of farming incentives rewards rather than earning revenue from trading fees.

Furthermore, swap prices are often suboptimal across the ecosystem, partly due to the dominance of Univ2-style AMMs and the lack of more modern solutions. This led to the development of Thena, which combines the best of Curve’s stableswap and Uniswaps’s constant product AMM. By drawing its inspiration from the Solidly model, Thena has an opportunity to capitalize on the opportunity of building a dex that can offer low-cost and near zero slippage transactions for both stable and volatile pairs.

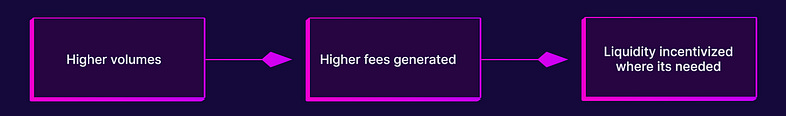

One of the differences with the rest of AMMs on the Binance Chain is that the fees generated on any given pool are captured by gauge voters (instead of liquidity providers). Because of this, gauge voters will tend to favor the most productive pools, since they are the ones attracting more volume and generating more revenue from trading fees.

The mechanism design of the AMM draws its inspiration from the original Curve ve (vote escrow) model and blends it with additional benefits that result from a “rebase mechanism” inspired by Olympus DAO. This results in a ve(3, 3) tokenomics model that helps to shield vote lockers from dilution. With this blended model, the protocol solves the “cold start liquidity problem” of most AMMs by enabling a free market for other protocols to offer incentives on.

The idea of compensating LPs with governance tokens while giving trading fees to vote lockers based on which gauge they vote for is a simple and yet very effective mechanism. This results in a self–optimizing DEX where stakeholders voting on gauges will redirect emissions to the pools with the higher volume (that produce the most fees) in order to optimize revenue over time.

The foundations of Thena

- Most incentive allocation programs are not capital efficient and rely on unsustainable liquidity mining programs where the value is extracted out of the ecosystem by farming and dumping rewards on the open market. This leads to poor liquidity conditions for such tokens that barely generate any revenue from fees

- Liquidity mining incentives are often stationary and not flexible enough to allow protocols to adjust their operating costs on an ongoing basis.

- Thena solves the shortcomings of Solidly and adds innovation to the original design by allowing voters to properly compensate liquidity providers for impermanent loss on top of earning revenue from an increasing fee generation.

- Fixed marketplace for emissions

- Fixed emission schedule

- Lowered the impact of the anti-dilution mechanism

- Improved the initial token distribution

- Additional referral program to reinforce a positive feedback loop

- Long listed of committed partners

- Dedicated core team that will continue adding features

All together, Thena becomes a liquidity layer for the BNB Chain ecosystem by offering protocols a cooperative way to bootstrap the liquidity of their own native token. As a result, these projects will benefit from more capital-efficient trading conditions for their token as well as from having the optionality to bribe veTHE lockers to compensate during periods of decreased trading volume.

Roadmap

An official roadmap was published on May 19, 2023.

The roadmap is separated into quarters. The following are the current checkpoints still in progress:

Q2 2023

- ALPHA Perpetuals Beta

- ALPHA will open up a multitude of markets, offering over 150 cryptocurrencies with up to 100x leverage.

- Focus on providing a competitive on-chain experience will see ALPHA presenting lower fees than GMX and its likes while offering a broader array of assets.

- Perps engine provider ensures stringent security measures including insured and capped (while in beta) deposits, a robust bug bounty program, and a rigorous audit process to protect users’ funds.

- WARP Launchpad Accelerator

- Designed to accelerate both early-stage and established projects within BNB Chain.

- By hosting the liquidity of promising DeFi projects, the aim is to broaden the user base and boost trading volumes.

- For veTHE holders, WARP opens up new horizons by providing early access to fundraising rounds.

- Features include:

- Fundraising: With top VC partners in the space, WARP facilitates a seamless end-to-end fundraising process, connecting projects with top-tier digital asset venture capitalists and LP providers.

- IDO and On-Chain Fundraising: Through Liquidity Bootstrapping Pools (LBPs), WARP enables efficient price discovery and capital raising in an on-chain, permissionless, and decentralized manner.

- Liquidity Scaling Strategies: From bribe top-ups to attract votes and secure more emissions, to pairing tokens with our partners’ Liquid Staked Derivatives (LSD) tokens, WARP offers multiple avenues to scale liquidity.

- Media Coverage: WARP ensures that projects get the exposure they need, including leading media publications.

- Industry Connections: WARP’s incubated projects have the opportunity to be introduced to any of our partners, opening doors to new opportunities for growth and collaboration.

Q3/Q4 2023

- Expert trading mode

- Perpetuals DEX

- THENA debit card

- FIAT off-ramp

- CORE Social Hub

- An innovative integration of DeFi and social elements designed to empower the THENA community.

- Features include:

- .thena Domains: With CORE, users will have the ability to purchase unique .thena domains. These personalized domains will not only serve as identifiers within the THENA ecosystem but also provide users with a way to showcase their commitment and participation in our community.

- Portfolio Analytics: CORE will give users a comprehensive overview of their portfolios on THENA, including their rewards history and detailed profit and loss statistics. This feature is designed to provide users with the information they need to make informed decisions about their investments.

- User Achievements: To add an extra layer of fun to the experience, CORE will introduce user achievements. This gamified system will reward users for reaching certain milestones or completing specific actions within the THENA ecosystem.

- Decentralized Trading Competitions: In keeping with our commitment to decentralization, CORE will allow any user to launch a trading competition. These competitions will not only promote healthy competition within the THENA community but also help to drive further engagement and activity on the platform.

- Lending & borrowing $THE

- THENA Labs R&D unit

Future

- Tier 1 CEX listing(s)

- A listing on a top-tier centralized exchange can significantly increase the visibility and accessibility of a token.

- Helps to increase liquidity and trading volume and also expand the user base and provide more recognition in the space.

- Top 1 DEX on BNB chain

- One million users

The team has also released a roadmap for 2024, in addition to the 2023 roadmap. This includes:

- New UI & ALPHA on opBNB

- ARENA

- A rebrand of CORE

- Thena V3

- An improved version under any aspect of the current platform.

- Algebra 2.0 (Algebra Integral) plugins such as fee discounts, limit orders, and others. These plugins are similar to the hooks introduced by Uniswap V4 but under developed by Algebra prior.

- Cross-chain technologies to allow everyone to vote and claim their THE on different chains, simplifying their experience

Team

The team has an extensive background in DeFi. This allowed the members of the core team to observe the pros and cons of the original Solidly launch. Starting from there, the team managed to build a product and deploy it on the BNB Chain.

The core team’s identity is not known publicly, but some are doxxed to the launch partner protocols and to the BNB chain team.

There are 8 members on the core team and 4 paid community moderators, along with various community volunteers.

Team members

- Theseus – Founder.

- DeFi native, self-appointed tokenomist. Started as a consultant in web3 back in early 2020, and quickly realized he wanted to build his own systems.

- 0xApollo – Head of marketing, collaborations.

- DeFi maven with over a decade of experience in various industries.

- Theonysus – Partnership leads, business development, collaborations.

- Studied economics and worked in the banking industry.

- Xermes – Community manager.

- Enjoys turning chaos into functional organizations. Believes in direct communication, hates misinformation.

- Prometheus – Lead Solidity Developer.

- Security minded master of smart contract engineering.

- Hyperion – Full Stack Developer.

- A wizard of all things web, now building THENA inside and out.

- Morpheus – Strategic Advisor.

- Web3 native, founder & advisor.

- Homer – Advisor.

Moderators

- Bartcheeks

- Almighty Abe

- Mawhass

- Timefreak

DeFi Subsector

Thena is a decentralized exchange. The main objective is to become the largest DEX on the BNB Chain. Nonetheless, Thena is also a decentralized marketplace for token emissions, a community-driven public good, and a gateway to the BNB chain.

Thena offers two major drivers for growth within the BNB ecosystem: efficiency and composability. While Uniswap’s v3 concentrated liquidity model can lead to more capital efficiency and requires less liquidity for trade execution than Uniswap v2 (the one used by Thena), it lacks composability. Thena leverages this composability and relies on an underlying economic design with the goal of becoming a liquidity blackhole. For instance, Thena can leverage the idle liquidity in Uniswaps’s v2 based pools and stake the funds elsewhere (e.g building an auto compounder on top of a money market in order to maximize yield for LPs).

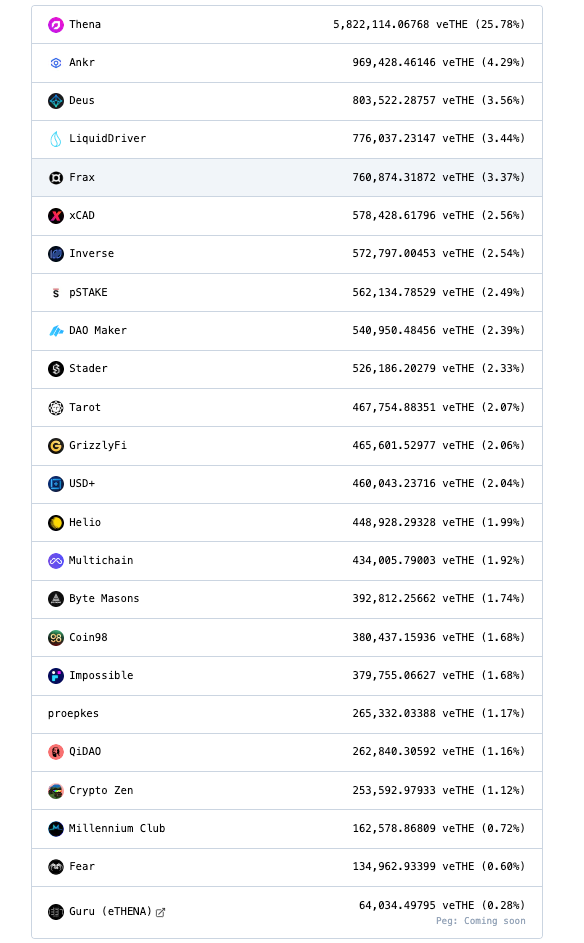

As of February 4, 2023 the majority of the veTHE supply (27%) is controlled by whales and DAOs. Thena itself owns 25% of the veTHE supply, followed by protocols such as Ankr, Deus, LiquidDriver, Frax, and other protocol partners.

Centralized vs Decentralized emissions

In DeFi, there are 3 different strategies used by Decentralized Exchanges token emissions: centralized emissions (e.g. Pancakeswap), decentralized emissions (e.g. Thena), and mixed emissions (e.g. Beethoven)

- Centralized emissions are allocated by the core team of a DEX according to their own strategy and agreements with external protocols.

- This model is efficient to provide direct incentives for liquidity providers and benefit from the exposure of a protocol that has already scaled its operations.

- On the flipside, these emissions are not permissionless and the price of incentives is set artificially rather than by letting market forces maximize the revenue generated by the DEC.

- Decentralized emissions are based on market forces and offer the flexibility to secure incentives through two primary mechanisms: bribes, and gauge weight votes.

- This is a permissionless and flexible model where protocols can adjust their bribes/votes on a weekly basis depending on their operating needs.

Chains

Through a series of extensive partnerships, Thena aims to become the gateway to the BNB chain. The team firmly believes that BNB Chain is underrated by most participants in DeFi. However, it is the second biggest chain after Ethereum and has one of the largest user bases.

Since its original launch in 2017, the BNB Chain has gone through a substantial evolution and is currently prioritizing the design of a modular architecture. There are plans being fleshed out to introduce technological breakthroughs such as zk-rollups and other updates to improve scalability. Other reasons for launching on the BNB chain include its extensive community of active users and its access to the overall Binance ecosystem.

Thena is currently available on the following chains:

- BNB

- opBNB

For Users

In order for protocols to direct emissions to their pools, they will need to bribe veTHE holders or buy veTHE on the open market. Protocols lock THE tokens to receive veTHE and then use veTHE to vote for their pools, which will receive bribes and trading fees. The longer the locking period, the more veTHE you receive.

Bribes are incentives offered to a gauge by external protocols in order to incentivize veTHE holders to vote for their pools

Thena’s rewards model incentivizes long-term supporters of the protocol and aligns the incentives with token holders by incentivizing them to stay in the ecosystem accruing revenue from trading fees and bribes.

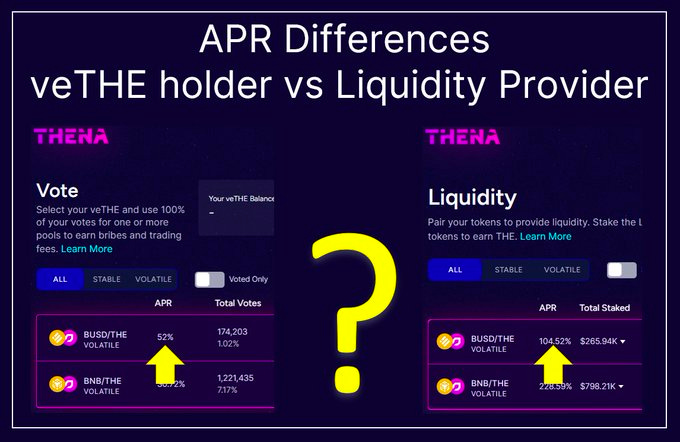

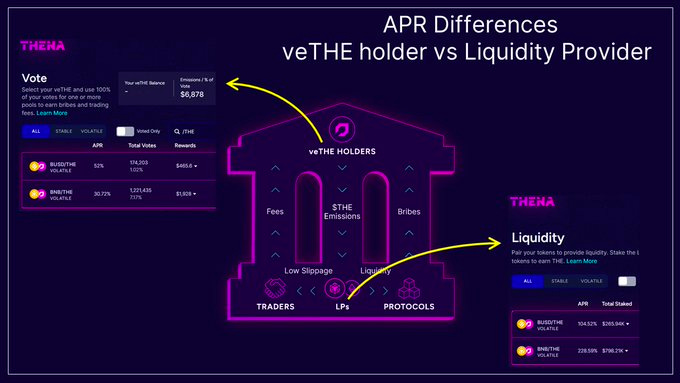

Why is the APR different on the Liquidity and Vote pages?

- Liquidity providers deposit tokens as liquidity and stake the LP tokens through the Liquidity page in order to earn THE emissions.

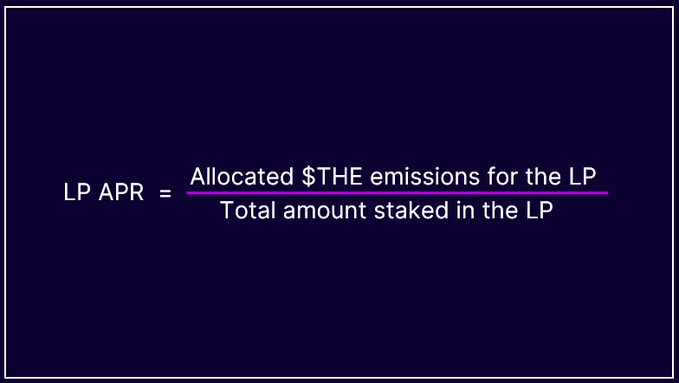

- This APR is calculated by dividing the number of THE emissions allocated for the LP by the total amount staked in the LP

- As a veTHE holder, you can allocate your veTHE voting power to one or more pools via the Vote page. This allows you to earn revenue from bribes and trading fees for the pools that you vote on.

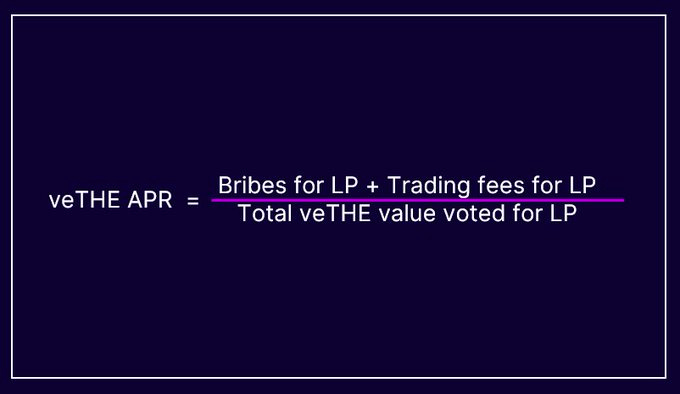

- This APR is calculated dividing the total revenue (from bribes and trading fees) by the total veTHE value allocated to that pool.

As a user, you can earn both APRs by being both a liquidity provider and a veTHE holder.

Value creating strategies for protocols

Protocol-owned liquidity deposits

Protocols with a veTHE allocation can deploy their own liquidity on Thena in order to farm THE tokens. These protocols can then lock the proceeds as veTHE in order to increase their share of the total veTHE supply

- (0, 0): Protocols that do not bribe or deposit POL (Protocol Owned Liquidity) do not foster the creation of value in Thena.

- (0, 2): Protocols that deposit their own liquidity are able to farm and lock THE in order to increase their governance power over time. This also increases liquidity for pools, which drives more volume (and generates more fees) and allows for lower slippage trades.

- (2, 0): Protocols that bribe benefit from Thena’s incentives and are incentivized to lock their tokens in order to generate higher yield out of their weekly votes.

- (3, 3): The best scenario results from protocols depositing bribes and POL in Thena. This translates to deeper liquidity and higher THE emission for those pools.

Market buys and locks

Protocols can market buy THE on secondary markets and lock it to increase their voting power and receive a greater amount of emissions over the coming months/years

Given a hypothetical market price of $0.1 per THE, any market buy and lock amount at week #1 would be amortized and start producing net positive THE emissions by week #22.

Bribe deposits

Third parties can look out for a positive ROI by depositing custom amounts of rewards (bribes) for any given pool. Those rewards are claimed by veTHE holders that vote and allocate THE emissions to such pools.

This way, protocols can influence and increase the emission rate for their native tokens.

Protocol revenue from bribes

Protocols can use a portion of the revenue they have generated to bribe or market-buy-and-lock THE in order to increase the emissions received by the native pool of the protocol.

This strategy can be considered by protocols whose revenue depends directly on the global market demand and liquidity conditions for their own native token.

Since locked positions are tokenized as financial NFTs, protocols also have the flexibility to sell their voting power on any given period of time in order to make a profit.

Investing Strategies

The investing strategies will differ as the protocol grows and bootstraps its initial liquidity. Individual strategies are also likely to change due to the time preferences and position sizes of each particular user.

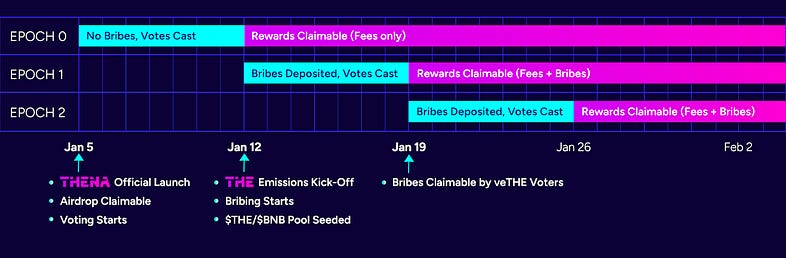

Epoch 0 vote

Users receiving the veTHE airdrop could use their voting power to receive trading fees for epochs 0 and 1 by voting to the THE/BNB pair. Afterwards they could move on voting for the highest briber in the upcoming epochs in order to maximize their ROI.

During epoch 0, no emissions were distributed to liquidity providers and, therefore, no bribes or fees were captured by veTHE voters

Mint and sell

Users who received the veTHE airdrop and minted a theNFT could hedge their exposure to THE emissions (if they think emissions would drive the price lower) by selling the liquid THE allocation while voting early to get trading fees.

Users who minted a theNFT were eligible for an airdrop where 60% was liquid THE and 40% was veTHE

Mint and lock

Users who minted a theNFT and are bullish on the price of THE and believe that the trading fees will be high in the upcoming future could lock their THE to to get veTHE and earn fees and bribes that can be compounded for more veTHE

Farm and lock

- Provide liquidity to the BNB/USD pool.

- Farm THE rewards.

- Lock THE for veTHE and autocompound rebases for more veTHE.

- Participate on weekly votes by voting to the BNB/BUSD pool and earn revenue from bribes and trading fees.

- Deposit your earnings back to the pool as liquidity.

This strategy increases both the user’s veTHE position and LP position.

Farm and sell

- Deposit liquidity to the BNB/BUSD pool

- Farm THE rewards

- Sell THE rewards (for stables, or to get additional liquidity to put back into the initial LP position)

Max lock and vote

The user would lock all the THE tokens they earn and increase their locking time to the maximum every epoch. It would also be possible to then compound on the locking position by relocking the revenue earned from bribes, trading fees, and LP rewards.

This strategy optimizes for earning yield in perpetuity by building a large veTHE position.

veTHE wrappers and optimizers

Users are able to utilize wrappers and optimizers in order to expose themselves to veTHE positions, while still staying liquid.

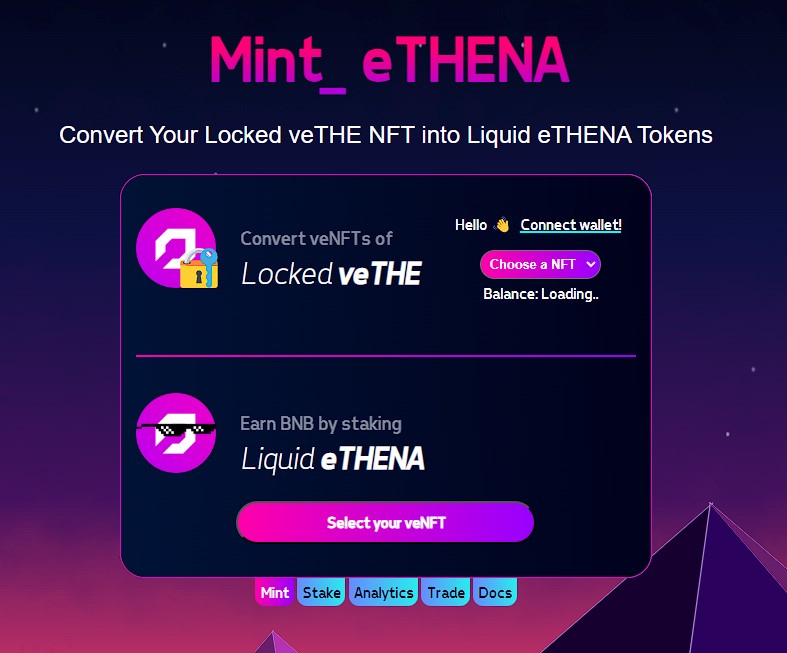

eTHENA

eTHENA is a liquid wrapper by the Guru Network, for the locked veTHE (Thena’s veNFT) which makes it possible to trade the benefits of a veTHE position using a traditional A.M.M. such as Thena itself without being subject to a long-term lock-up period of 730 days (2 years).

How it works

Users can convert their veNFT into eTHENA, which can be staked to earn BNB.

Users can also buy eTHENA via Thena itself, opening up an arbitrage opportunity depending on the market prices between converting eTHENA and market buying it.

All the earnings from Voting such as Bribes & Trade-fee will be sold in their entireity to purchase BNB.

Usage of the BNB is allocated to the following:

- 13.37% of the BNB will be used to acquire Protocol-owned Liquidity.

- 86.63% of the BNB is used as follows:

- 20% of BNB is distributed to Stakers

- 80% of BNB is sent as Bribes to Thena.fi voters

Initially in the first week, each 1 THE inside a veNFT will be able to mint out 1 eTHENA (1:1 ratio).

As the epochs go by the rewards from rebasing will be added to the main veNFT of eTHENA protocol without minting any new eTHENA. This will cause the minting ratio to shift from 1:1 to 1:(1+R), R being the rebase factor.

For example, if the rebase for 2nd epoch is 0.5%, then the mint ratio will increase to 1.005, which means it would take a veNFT with 1.005 THE inside it to mint 1 eTHENA token.

Due the fact that there are no negative rebases in veTHE system, this minting-price ratio of eTHENA will keep on increasing forever, and it will keep on appreciating against plain THE in a veNFT.

Rewards

86.63% of the BNB from voting yield is allocated to the following:

- 20% of BNB is distributed to stakers.

- 80% of BNB is sent as Bribes to Thena.fi voters.

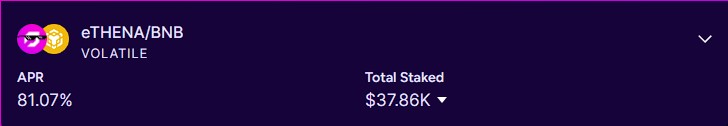

Apart from earning yield on staked eTHENA or voting for it, users can also LP eTHENA with BNB on Thena, earning LP rewards.

Fees

13.37% of all earnings (after conversion to WBNB) from the Protocol veNFT will be treated as ‘Protocol Fees’.

It can be broadly classified into 2 sections:

- Protocol-owned Liquidity

- Half of the 13.37% of BNB will buyback eTHENA from the market and be matched with the other half to create liquidity tokens of the eTHENA/WBNB pair at Thena.fi DEX.

- Performance Fees

- Early phase – Initially, there will be no direct fees taken out of the system by the Guru Network. All of the 13.37% will be allocated towards acquiring Protocol-owned Liquidity. There will be Zero Performance fee initially for atleast 2–4 months.

- Future – Once the system matures enough and there is sufficient liquidity, a part of the BNB from the recurring 13.37% funding allocated for PoL building will be sent to our treasury as performance fee. Performance fee is capped at a max of 13.37% of BNB earnings. This fees can only be taken from the PoL allocations.

cpTHENA

cpTHENA (formerly known as chamTHE & cpTHE) was an Overcollateralized Champion-escrowed version of THE staked for cpTHENA to take advantage of the various benefits offered to THENA stakers.

However, the team is unresponsive and the project seems to have been abandoned as of November 16, 2023.

liveTHE

liveTHE is a product from Liquid Driver which allows users to access impressive veTHE yields without having to lock any THE tokens.

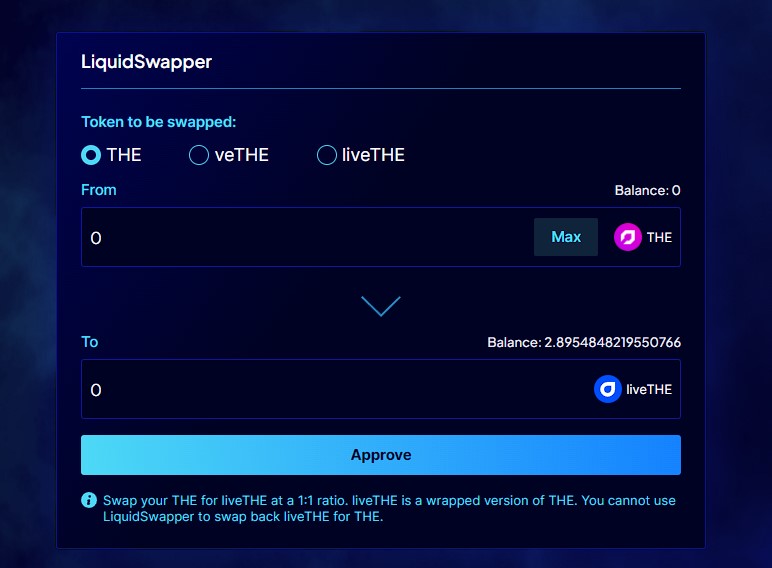

How it works

Users can convert their veNFT or THE into liveTHE, which can be staked to earn liveTHE.

Users can also buy liveTHE via Thena itself, opening up an arbitrage opportunity depending on the market prices between converting liveTHE and market buying it.

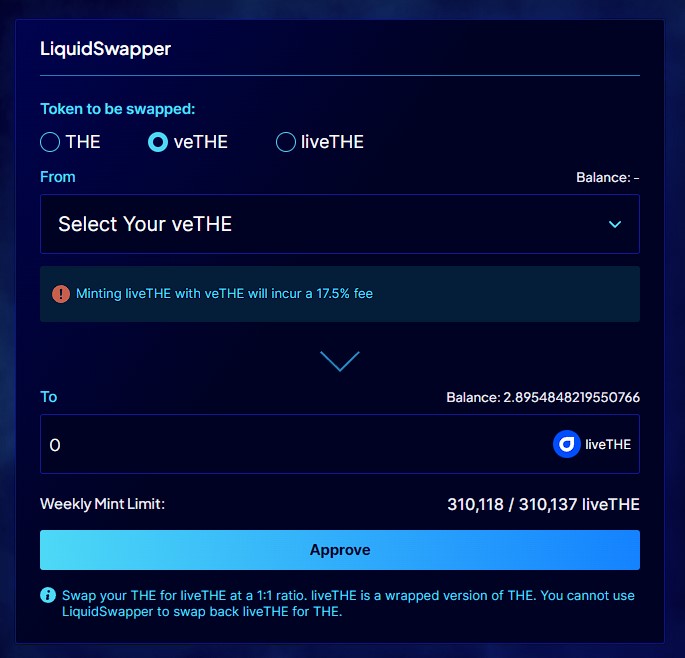

There is a weekly max supply for converting veTHE to liveTHE, and a dynamic conversion fee which is influenced by the balance of the stable LP on Thena may be incurred.

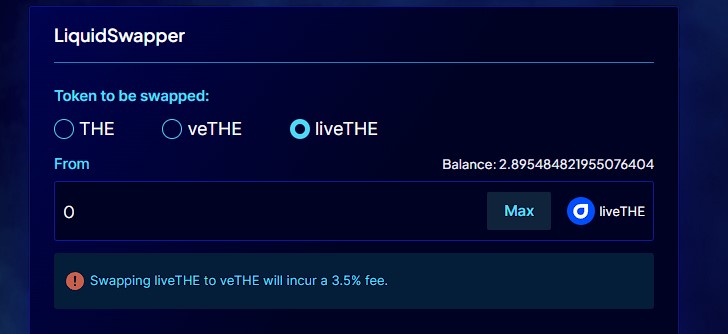

Users can also swap liveTHE for veTHE, incurring a 3.5% conversion fee.

Rewards

By auto-converting fees, bribes, and rebases into liveTHE, the innovative distribution system allocates a staggering 81.5% of the voting rewards to the single staking pool, ensuring higher rewards for stakers.

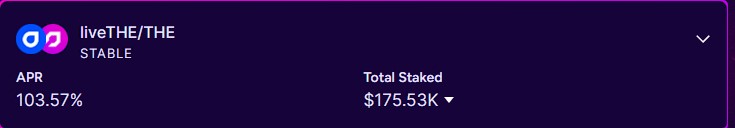

Users can also LP liveTHE with THE on Thena, earning LP rewards.

Fees

There are 2 types of fees for liveTHE.

Dynamic Conversion Fee

- When converting veTHE to liveTHE, a dynamic conversion fee is applied. The fee is influenced by the balance of the stable LP on THENA and ranges from a minimum of 12.5% to a maximum of 70%.

- The dynamic conversion fee formula is:

Dynamic fee = (liveTHE balance / THE balance) * min conversion fee.

liveTHE to THE Fee

- A 3.5% conversion fee.

Byte Masons

The Byte Masons provide a vote optimizing service, generally known as the veVOTER vaults. The veTHE voting vault is hosted on Pain Finance, which is a production testing site for novel Reaper Farm strategies.

How it works

veVOTER Vaults maximize and optimize the growth of a user’s veNFT position by accumulating trading fees, bribes, and rebases, and converting it all into more ve- tokens for distribution to veNFTs.

Vault contracts manage all the claims, swaps (to ve- tokens), and ve- token distribution without needing access to any tokens in your wallet.

These vaults are designed to enable the user to approve voting rights and locking rights for the user’s veNFT position without depositing the veNFT (the veNFT never leaves your wallet). It does so by implementing a Voting Manager contract and Voting Strategies.

- Voting Manager

- This is the main contract that is responsible for interfacing with the user. When a user grants the VM their voting rights, it will distribute voting power to various voting strategies, which will maximize bribes and trading fees each epoch.

- Voting Strategies

- These are designed to manage a subset of the veNFTs under the VM’s management. If a strategy is full, the manager automatically deploys a new one.

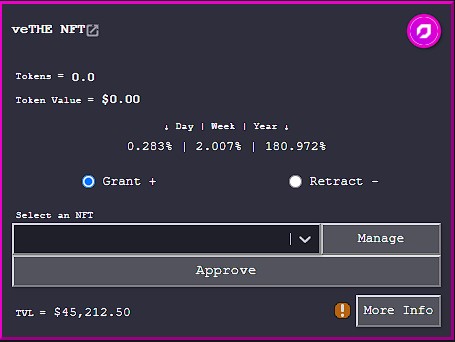

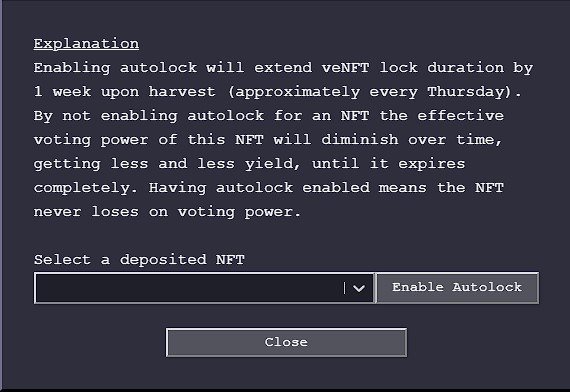

Users can also choose to enable autolock, which extends the veNFT’s lock duration by 1 week upon harvest, ensuring maximum voting power.

Rewards

Rewards are compounded into veTHE.

Fees

Most single strategy vaults incorporate a 0.1% withdrawal fee that is redistributed to vault users. However, there is no indication of any fees for the veTHE voting vault.

DCA

The user would sell THE rewards for USDC with the expectation to buy at lower prices and build up a larger position that can either be locked for the maximum duration, or sold for a profit.

Diversify within the Thena ecosystem

- Mint and stake theNFTs

- Optimize weekly votes for highest APR

This strategy avoids locking all tokens related to the Thena ecosystem and allows the investor to take profit. The user could also provide liquidity, farm THE rewards, lock half of it and sell the other half to rebuy at lower prices.

Similar strategies could allocate ⅓ of the funds to an LP position, another ⅓ to earn yield by lending on a money market like Tarot, and locking the other ⅓.

Business Model

The team is part of the initial token distribution and will have an allocation that incentivizes them to keep building and improving their product. Besides, they can also rely on the funds raised from the theNFT sale as well as the swap collected from fees.

At launch, the fee switch is not activated. Regardless of how these decisions will evolve, Thena aims to become a public good within the upcoming years and expects its treasury to generate revenue from fees.

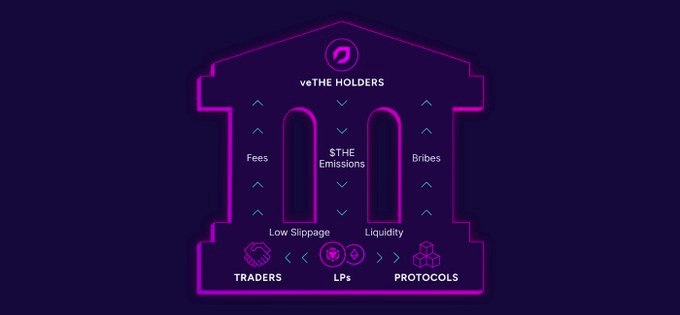

A protocol for protocols

The main stakeholders of Thena are veTHE holders, LPs, users, and protocols – all of which are aligned by ve(3, 3) token dynamics to determine the most efficient allocation for THE emissions. As a result, the underlying pillars of the Thena ecosystem are THE emissions, bribes deposited by protocols, and trading fees generated by liquidity pools.

Revenue Streams

As a decentralized protocol, Thena has been designed to promote long-term sustainable practices so that participants can tailor their own strategies in order to maximize the value they get from the ecosystem:

- Traders benefit from deep liquidity pools (which offer lower slippage trades).

- LPs benefit from bribes deposited in pools in order to drive THE emissions and achieve higher locking rates that lead to greater numbers in terms of APR.

- Protocols can use bribes to lower their operating expenses in order to farm THE emissions and allow for better trading conditions for their native token pairs.

- veTHE holders capture bribes and revenue from trading fees.

- theNFT stakers earn more revenue with higher trading volume.

LPs can earn trading fees (proportionate the share ownership of the pool) without staking their LP tokens and they can remove liquidity at any time.

From epoch 0, the protocol bribes for core trading pairs that are critical to the BNB Chain ecosystem and that will become a source of revenue for the DEX – BTC, ETH, BNB, BUSD, USDT, and USDC.

Economics

- Daily and cumulative swaps volume: https://dune.com/queries/1851533/3065646

- Swaps count and number of unique swappers: https://dune.com/queries/1851533/3065647

- Current liquidity by token: https://dune.com/queries/1861421/3075752

- Daily liquidity: https://dune.com/queries/1861953/3066634

- Lock distribution: https://dune.com/queries/1851523/3046676

- Total lock and cumulative lock: https://dune.com/queries/1845328/3036902

- Cumulative bribes vote count: https://dune.com/queries/1876668/3087994

- theNFT floor price: https://dune.com/queries/1861380/3065645

- theNFT trading volume: https://dune.com/queries/1845292/3036981

- theNFT sales count: https://dune.com/queries/1845292/3036910

- Top traded tokens: https://info.thena.fi/tokens

Fee Breakdown

The fee structure was modified with respect to the original Solidly implementation with the goal to reach a sweet spot between long-term revenue generation and offering highly competitive trading prices.

By increasing the fees, the protocol incentivizes users to lock their tokens and benefit from their veTHE positions earning more revenue. This should act as an incentive that would increase the number of users locking their assets and participating in weekly gauge voting rounds.

veTHE holders can vote for gauges on a weekly basis and access 80% of trading fees(later 90%) and 100% of the bribes associated with a given pool

During periods where there is not enough trading activity on-chain, the protocol cannot offer extremely low fees (such as 1bps). The reason for that is because the token’s value comes from the trading fees and the governance premium. Over time, as the trading volume increases, the transaction fees can be reduced as well.

- LPs earn 100% of trading fees on V1 pools.

- LPs earn 97% of the fees in manual range pools.

- LPs do not earn anything from trading fees in Fusion pools if their positions are not staked.

Operating Expenses

The team pays for its 8 members and 4 moderators via THE token emissions.

Team salary costs about $40K every month, and the team allocation covers their salary adequately.

Tokens

THE

THE is the BEP-20 utility token of the protocol.

THE emissions have two key objectives:

- Reach and maintain low trading slippage (by emitting THE as farming rewards to incentive deep liquidity)

- Achieve high levels of token distribution that favor decentralized governance over the protocol’s long-term future.

THE emissions combine an anti-dilutive rebase mechanism with vote escrow tokenomics.

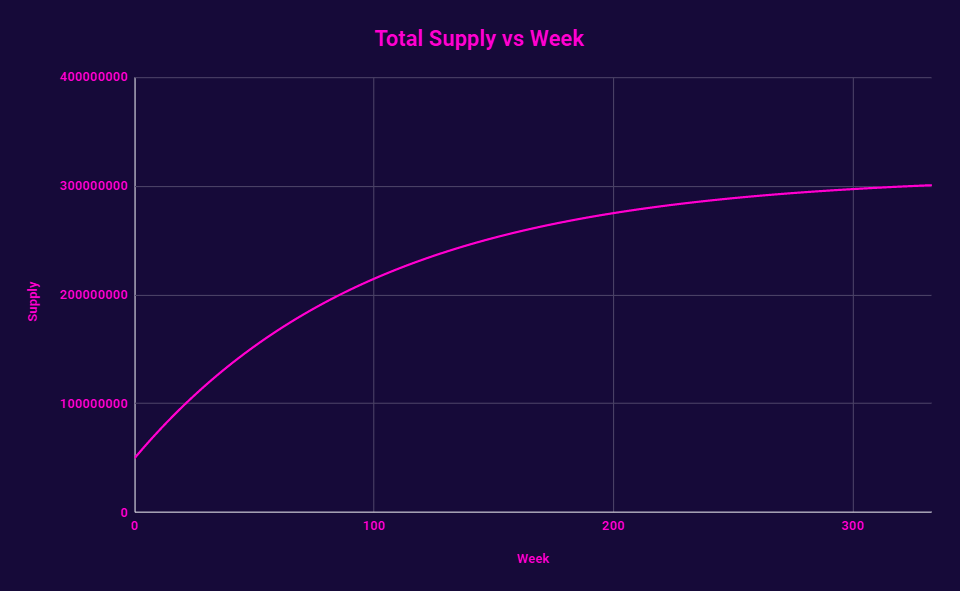

- Weekly emissions (at inception): 2,600,000 THE

- Weekly emissions decay: 1%

- Weekly developer wallet allocation: 2.5% (lowered from 4%)

- Weekly veTHE rebase: up to 30%

- Emissions for liquidity providers: 67.5% (1.5% added from the dev allocation).

veTHE

veTHE is an ERC-721 token that represents governance powers as a transferable NFT.

veTHE NFTs can be fractionalized and sold on secondary markets

The utility of veTHE comes from:

- Access to revenue by voting for gauges (pools) on a weekly epoch basis that grants access to revenue from the bribes and trading fees associated with the pool that has been voted for

- Participation in governance, where veTHE holders can cast votes for protocol improvement proposal

Each epoch, voters choose which pools to allocate their veTHE voting power in order to claim a share of trading fees and bribes. Protocols that want to incentivize liquidity for their native token pairs can bribe veTHE holders to participate on weekly voting rounds. By voting every epoch (every week), veTHE holders can earn bribes and trading fees for the pools they vote on.

veThe holders are incentivized to vote either for the highest volume pools (because more volume will generate more fees), or the pools that are being bribed by protocols seeking to bootstrap their liquidity

Snapshot taken on February 4, 2023

A weekly distribution of THE emissions will protect veTHE holders from being diluted. This distribution is claimable as veTHE and increases your voting power over time. If not claimed, these rewards will accumulate.

Launch partners received veTHE positions to help them get started with the liquidity bootstrapping process.

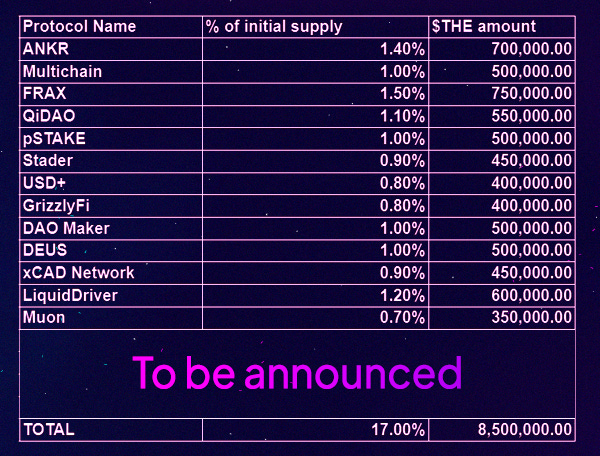

As part of the protocol airdrop, 9,500,000 veTHE were distributed, where the amount received by each protocol was set based on: daily volume, amount of weekly bribes committed, POL deployed on Thena, willingness and capacity to build products on top of Thena, and social engagements.

- veTHE holders have the power over which pools receive THE emissions.

- veTHE holders receive a share of trading fees and bribes

- veTHE holders receive revenue from 4 income streams:

- Bribes – Weekly rewards submitted by partners

- Trading fees

- Weekly rebase – veTHE distribution to protect against dilution

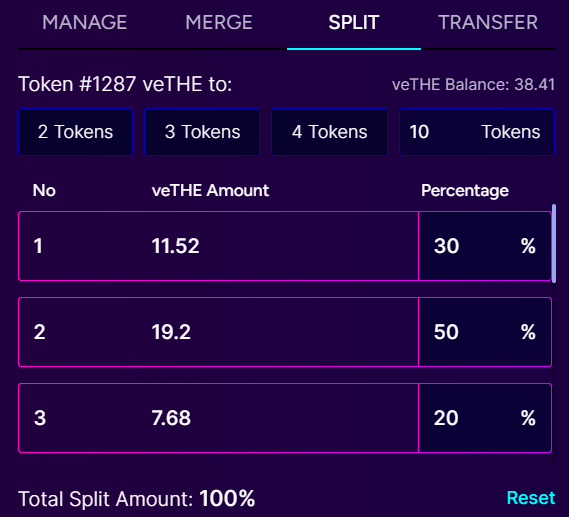

- veTHE can be split and sold

Similar to Curve’s veCRV, veTHE delays over time unless you re-extend the lock. Once unlocked, you receive the underlying THE.

Additionally, veTHE holders who are in need of liquidity can access a split function that will allow them to sell parts of their position at an NFT marketplace.

veTHE NFTs

veTHE follows the same escrow model as veCRV, where voting power decays linearly over time and reaches zero at the unlock time. However, the maximum duration lock is 2 years and the locked position is represented with a financial NFT.

By tokenizing the locked position into a NFT, it is possible for an address to hold several locks as well as benefit from cumulative lock balances, where each lock will add to the total ve balance of the user. Also, veNFT can be sold in the secondary market as well.

veNFT are likely to trade at a discounted market price in order to compensate for the inherent liquidity risk of holding a locked position.

veTHE gives voting power over Thena’s gauges. Every epoch (1 week), veTHE holders can allocate their votes to redirect emissions to gauges and they will receive a share of the bribes and fees generated by the gauge they voted in favor of.

veTHE positions can be merged, split, and sold on secondary markets

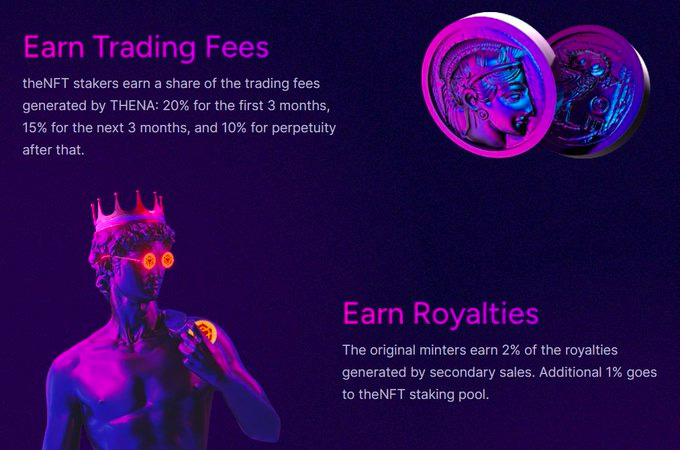

theNFT

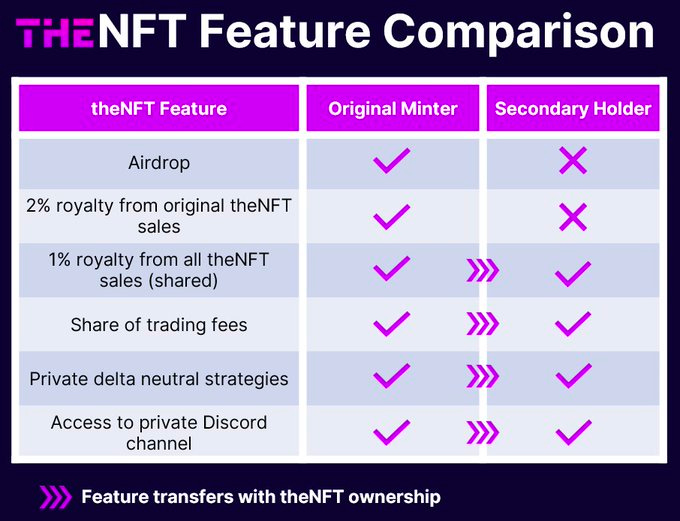

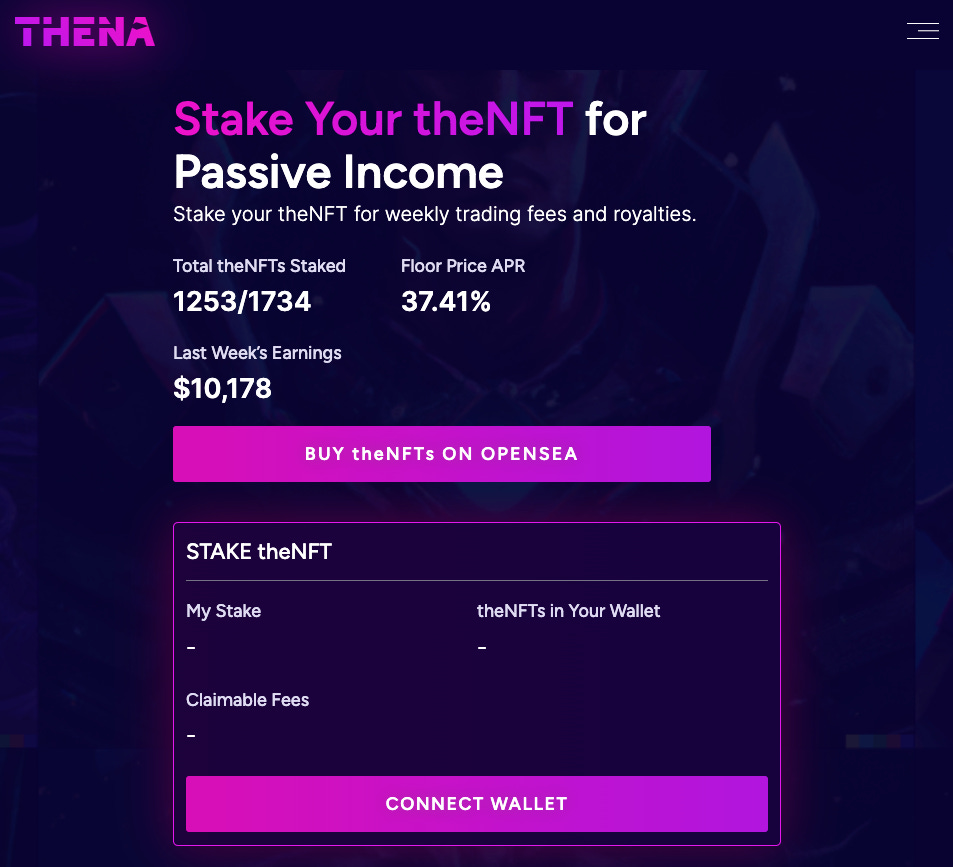

Thenian NFTs (theNFT) are a limited collection of 3,000 items, each of which grants access to multiple revenue streams and exclusive delta-neutral strategies within the Thena ecosystem.

- Holders are entitled to a share of the trading fees from Thena

- By staking, holders have a claim over a charge of 3% in royalties

- 2% goes to a pool where the original minters have the right to claim (forever)

- 1% goes to the theNFT staking pool

- Guaranteed airdrop allocation

- Access to private delta-neutral strategies

If a theNFT is listed for sale, it cannot be staked and will not earn fees

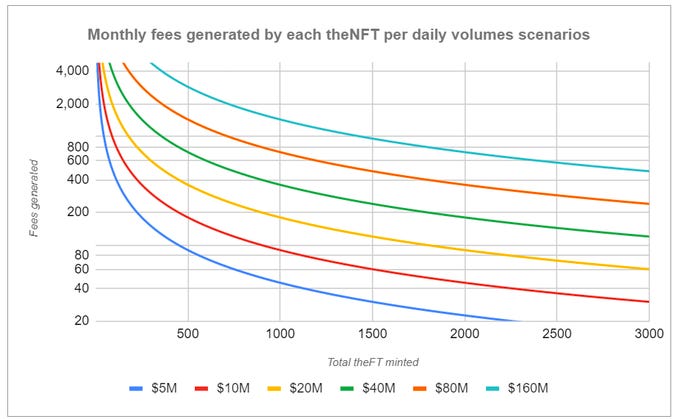

Monthly fees generated by each theNFT per daily volume scenarios:

There are a total of 300 unique AI-engineered designs, each of which provides the holder with different rarity traits and benefits.

The NFT sale will be used for fundraising purposes and all proceeds will be used to incentivize bribing and locking. 100% of the capital will be directed to the Thena treasury, where 40% of the funds will be devoted to the project’s runway and 60% will be used for liquidity incentives and bribes.

Thena was built with the intention of becoming a public good owned by protocols and users, where stakeholders have vested interest in the success of the protocol.

The theNFT minting event was opened to the public on December 4, 2022, and closed on December 7, 2022. The protocol managed to raise over $1,000,000 during this community fundraising event.

This alternative strategy helped the protocol to avoid VC investments that would later on use the community as exit liquidity

The total mint size was 1,734 NFTs with a whitelist price of 2 BNB

The public mint prize was 2.5 BNB

The funds will be used to:

- Incentivize bribing

- Increase veTHE locking

- Fund Thena’s Research and Development program. This includes the implementation of two cutting-edge technologies:

- Boosted pools that can deploy idle tokens into productive investments such as lending pools or vault strategies.

- Metastable pools that will allow correlated assets to keep an evolutive peg (such as BNB and a liquid staked representation of BNB like BNBx, aBNBc, or stkBNB)

By minting theNFTs, protocols could sare 4.5M of the veTHE/THE airdrop and earn 2% on royalties if they were to sell. In the case of not selling, staking the theNFT grants access to revenue from trading fees and 1% royalties from all secondary sales.

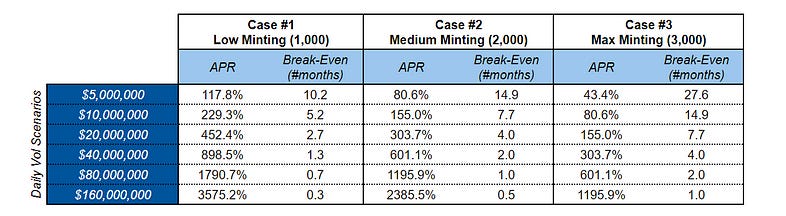

APR simulations for theNFT revenue before minting event

- The lower the number of NFTs minted, the higher the yield captured by each NFT

- The higher the number of NFTs minted, the higher the daily volume being generated by the DEX (revenue for theNFT holders is accrued from trading fees) and the longer it will take to reach a point of break-even

theNFT revenue streams

- theNFT stakers will share 1% of the total sales, and a portion of trading fees. The higher the volume generated on the exchange, the higher the earnings from trading fees. The distribution of fees charged per swap will be as follows:

- 20% of trading fees during the first 3 months

- 15% of trading fees during the next 3 months

- 10% of trading fees afterwards – forever

Thena launched on January 5, 202333

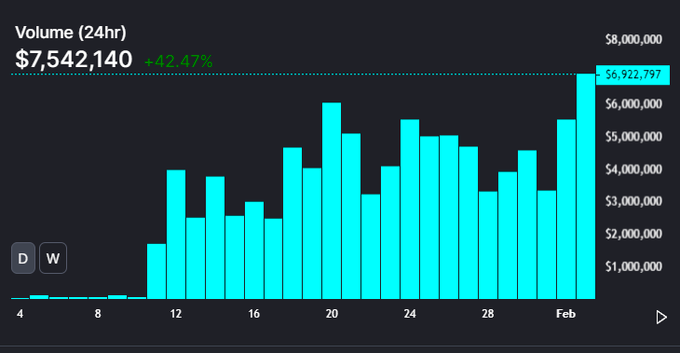

Screenshot taken on February 4, 2023

- The remaining supply that was not minted was burnt

- The lower the number of mints, the higher the fees per staker and the higher the allocation of 4.5M tokens allocated to minters.

Access to delta neutral strategies

Holders of theNFTs gain access to delta neutral strategies. This will protect users’ exposure to limiting factors such as losses resulting from impermanent loss.

Impermanent loss occurs when the user provides liquidity to a pool with two assets that fluctuate in price. As one asset depreciates/appreciates with respect to the other, it is possible for the original LP position to lose value when measured in dollar terms. In other words, the user would be better off having held those tokens in their wallet than providing them as liquidity.

Through delta neutral strategies, theNFT holders will have the opportunity to deposit a single coin into a yield strategy to earn extra revenue with the added benefit of being protected against impermanent loss.

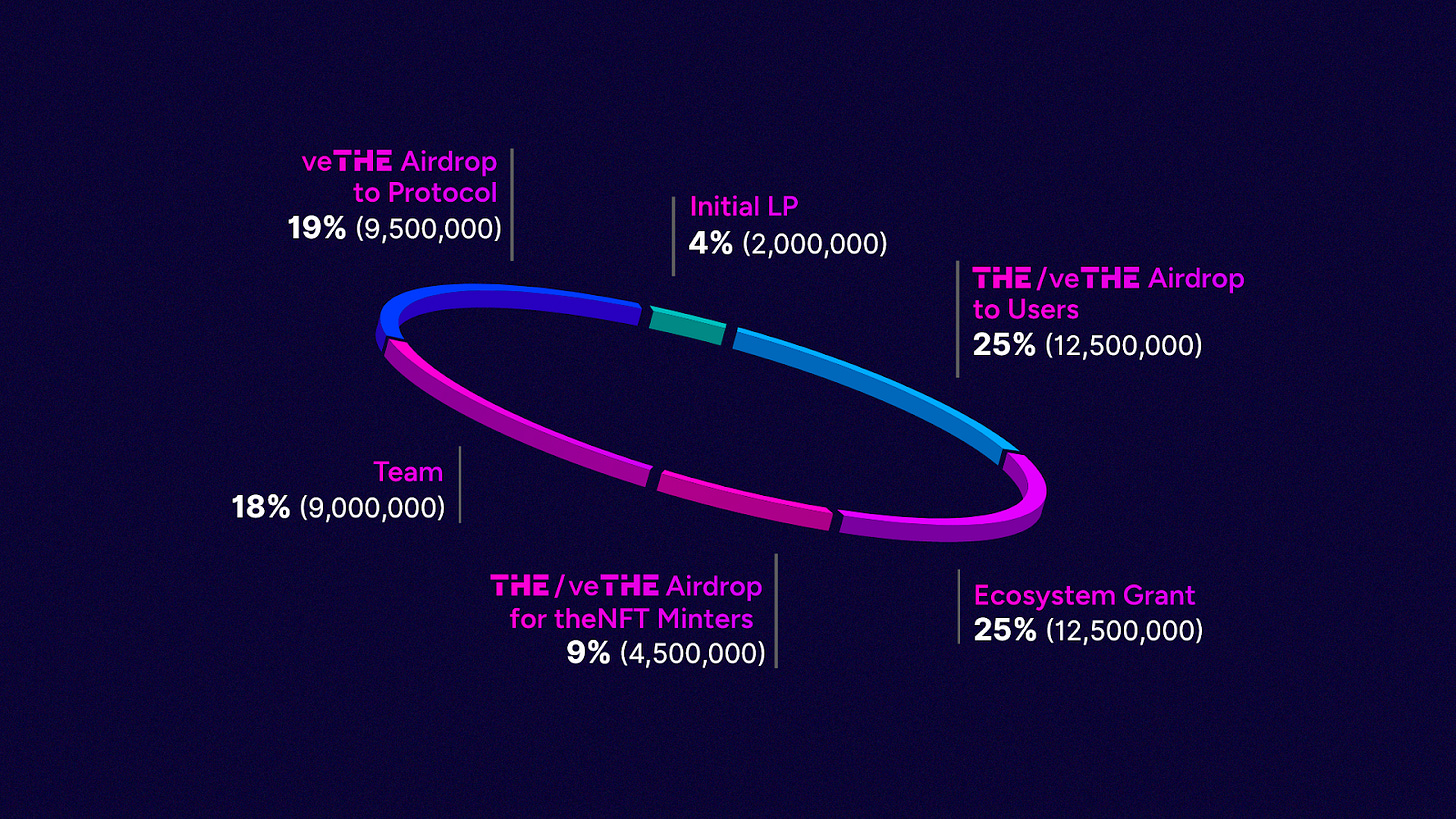

THE token allocation

- 25% (12,500,000 tokens) in a veTHE / THE airdrop for users of partner protocols as well as users of BNB Chain protocols

- THE allocation where 50% can be immediately claimed at launch and the other 50% is linearly vested over 3 weeks

- veTHE allocation immediately claimable at launch

- 25% (12,500,000 tokens) to an ecosystem grant that will accelerate the growth of Thena and receive support from the core team in areas such as marketing, business development, smart contract development…

- 19% (9,500,000) veTHE protocol airdrop for protocols that have committed to engage with Thena’s liquidity layer

- veTHE locked for 2 years

- 18% (9,000,000 tokens) veTHE / THE for the team:

- 60% as veTHE locked for 2 years (relocked every week for a minimum period of 1 year)

- 40% vested for 2 years with a 1-year cliff

- 9% (4,500,000) veTHE / THE for theNFT minters

- 40% as veTHE locked for 2 years

- 60% as THE with no vesting

- 4% (2,000,000 tokens) for the initial liquidity provision

At inception, core team members will vote for core pair gauges on Thena in order to achieve deep liquidity and low slippage for high-volume pairs that are not backed by bribing entities – such as BNB, BTC, ETH, BUSD, USDT, USDC and THE denominated pairs

Governance

Using the THE governance token, users can make proposals that dictate governance decisions related to protocol upgrades, changes to the economic model, additional features…

Risks

Security

Thena’s codebase is a modified version of Velodrome’s code, which is a fork of Solidly.

Denial of service

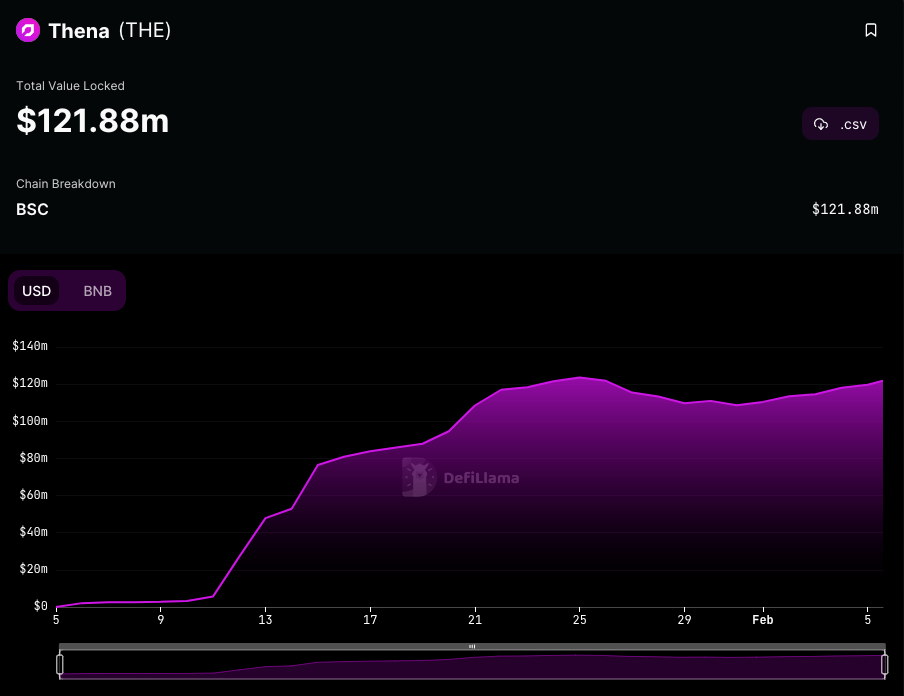

Thena suffered a Denial of Service (DoS) attack on February 1, 2023.

- The attack was successfully mitigated and no ransom was paid.

- Funds and contracts were safe at all times.

- Despite the attack, both volume and TVL hit an all-time high on that same day.

Audits

Solidly’s AMM has been audited by Peckshield:

- 5 low severity issues

- 1 informational comment

- No security-related incidents since the original deployment on Fantom in February 2022.

Velodrome’s codebase went through a security audit and a peer review as part of a Code4rena bug bounty contest. All high and medium-risk issues were resolved pre-deployment except for one known issue that has been addressed with a wrapped contract solution. This issue allowed users to claim eligible rewards more than once.

Thena has undergone audits with Cryton Studio, PeckShield and OpenZeppelin.

- Crypton Studio – October 28, 2022

- Medium – 1

- Low – 1

- Informational – 2

- Smart Contract Audit Report – March 25, 2023 – PecksShield

- Medium 3 (2 resolved, 1 mitigated)

- Low 5 (5 resolved)

- Retro/Thena V2 Audit – June 26, 2023 – OpenZeppelin

- Critical – 1 (1 Resolved)

- High – 4 (3 Resolved, 1 Partially Resolved)

- Medium – 9 (6 Resolved, 1 Partially Resolved)

- Low – 12 (7 Resolved, 3 Partially Resolved)

- Notes & Additional Information – 19 (13 Resolved, 3 Partially Resolved)

Thena is also running a bug bounty program on Immunefi, where a bug was found and caused the initial launch date to be delayed by a week.

Through Thena’s bug bounty on Immunefi, security researchers can earn up to $150,000 in rewards.

The protocol operates on a 4/6 multisig that involves 3 team members, and 3 doxxed entities from Ankr, GrizzlyFi, and Deus Finance.

Dependencies and Access Controls

Project Investors

Thena is a community-owned Dex. There was no seed round or VC investment. By design, the protocol allows for a collaborative approach within the BNB ecosystem.

Fair Launch

The ethos of Thena called for a “fair launch” that allowed users to become early backers of the protocol through a process designed to build a strong and long-lasting community. The launch consisted of two events and the total community fundraising amount was $1,000,000.

Orbs

On December 8, 2023, a $600K investment by Orbs was announced by Thena. Orbs is a “Layer-3” public blockchain infrastructure project powered by PoS, pioneering on-chain innovation since 2017. Orbs is set up as a separate execution layer between L1/L2 solutions and the application layer, as part of a tiered blockchain stack, enhancing the capabilities of smart contracts and powering protocols such as dLIMIT, dTWAP and Liquidity Hub.

Additional Information

Partnerships

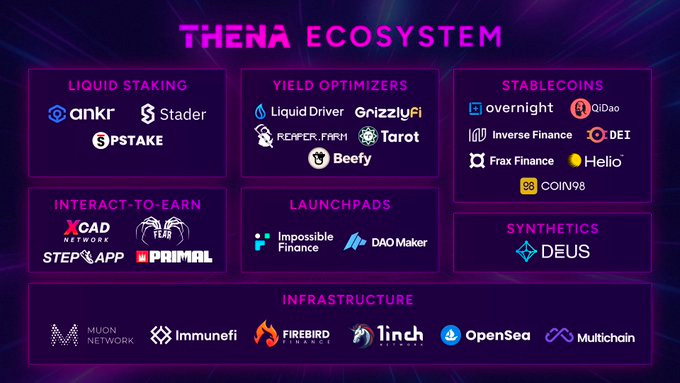

By bribing and depositing Protocol Owned Liquidity (POL), projects on the Binance Chain can reduce their costs to incentivize liquidity for their native tokens. Besides, they can also increase their share of veTHE, allowing them to have control and voting power to direct emissions to their pools. Thena’s launch also brought over many native Fantom chain protocols to Binance Chain for the first time.

Before launch, Thena had partnered with the following projects:

Partners for Thena include:

- Infinity PAD – A multichain launchpad and accelerator platform.

- Tarot Finance – Decentralized liquidity, lending, and yield dAPP.

- Frax Finance – Multichain stablecoin platform.

- LiquidDriver – Liquidity-as-a-Service protocol that acquires strategic governance assets to drive yield for their users.

- Coin98 Dollar – Liquidity Solution for The Cross-chain Economy.

- Inverse Finance – Decentralized global central bank.

- Helio Protocol – USD over-collateralized decentralized stablecoin backed by Binance.

- Overnight Finance – Asset management protocol offering low-risk passive yield products and catering to DeFi’s stablecoin needs.

- Qi Dao Protocol – Open source and non-custodial stable protocol for extracting value out of priced assets.

- Stader BNB – Liquid staking protocol for the BNB token.

- pSTAKE Finance – Multichain liquid staking protocol.

- Ankr Staking – Multichain liquid staking protocol.

- Primal – 1st athlete fan token project with integrated Move2Earn.

- Step App – Move2Earn fitness app.

- Firebird Finance – Multichain aggregator.

- DAO Maker – Launchpad platform on Binance.

- Fear NFTs – Horror Entertainment Platform for Fans with Scary Games & Films coming in 2023.

- Impossible Finance – Crypto investment platform that empowers you with high-quality, fair and accessible crypto opportunities.

- Byte Masons – DeFi engineers building toward a brighter future.

- Muon network – Decentralized optimistic oracle network.

- Multichain – Cross-Chain Router Protocol.

- DEUS Finance DAO – World-first decentralized bilateral OTC derivatives platform.

- Grizzly Finance – Liquidity mining platform.

- Jarvis Network – On-chain Forex market.

- Brz Token – Stabelcoin fully backed by Brazilian Real.

- Brokokli Network – Brokoli is a financial system built on the Ethereum blockchain, and now with liquidity on BNB Chain, that aims to offset the carbon emissions generated by the crypto industry.

- Fantom Starter – A decentralized investment protocol with built-in governance that provides a cost-effective and secure way for project developers to raise capital instead of the traditional VC funding route.

- Tangible DAO – A provider of fractionalized real estate solutions that brings tokenized real world assets (RWAs) right to your front step.

- Alfa Catalyst – Crypto venture fund and leading marketing agency.

- NFTb market – A multichain Gaming & Metaverse platform for digital ownership, empowering Web3 Gaming projects with the ability to distribute & raise liquidity.

- OKX – World’s most reliable crypto trading & web3 apps.

- Gold Fever Game – A Free2Play survival MMORPG.

- Uniwhale Exchange – Decentralized Leveraged Trading.

- Floki – The people’s cryptocurrency and utility token of the Floki Ecosystem.

- Liquidus Finance – A premier platform that makes DeFi simple, secure, and automated.

- Stafi Protocol – The first decentralized platform to unlock staked asset liquidity in the LSD markets.

- Granary Finance – A crosschain lending market.

- Three Sigma – A leading blockchain engineering, research, and investment firm.

- Radiant Capital – Radiant is building the first omnichain money market atop LayerZero.

- Ankr – Ankr builds web3 apps with a full suite of developer tools.

- Chain GPT – Pioneer of on-chain AI and one of the most traded tokens on BNB Chain to THENA.

- Midas Capital – Isolated lending/borrowing infra for any asset on any chain.

- Morhpex – Decentralized perpetual exchange, powered by Fantom.

- Alpaca Finance -Alpaca Finance is the largest lending protocol allowing leveraged yield farming on BNB Chain and Fantom.

- Root Protocol – An omnichain ecosystem, solving DeFi’s governance and liquidity fragmentation.

- Axelar Network – Axelar delivers secure cross-chain communication for Web3. Our infrastructure enables dApp users to interact with any asset or application, on any chain, with one click.

- Range Protocol – Universal Gateway to Defi Asset Management. Their unique design allows asset managers and market makers to execute systematic strategies for LPs and investors, all in a trustless, non-custodial fashion.

- Prime Protocol – Prime Protocol is a cross-chain prime brokerage that allows users to borrow against the value of their entire portfolio of assets.

- COTI – COTI is a DAG-based Layer 1, specifically designed for Enterprises.

- Pendle Finance – Adecentralized finance protocol that allows users to tokenize and sell future yields.

- Penpie – Penpie was developed by Magpie, and specifically crafted to augment yield enhancement services for users of Pendle Finance.

- Davos Protocol – A next-gen Collateralized Debt Position (CDP) protocol that harnesses Liquid Staking Tokens (LSTs) for optimized collateral application.

- Galxe – Galxe is a platform for building a Web3 community.

- Chainlink – Chainlink is the decentralized computing platform powering the verifiable web.

- MetaCRM – Enhance the user support infrastructure to the next level.

- Onramper – The collaboration with Onramper brings seamless fiat-to-crypto gateway for users.

- Solidus Ai Tech – It’s the heartbeat of their AIaaS, BaaS, and HPC offerings via the IaaS platform and also fuels their one-of-a-kind AI software developer marketplace.

- DefiEdge – An on-chain asset management protocol.

- ApeBond – A liquidity bonding protocol.

- USDV Money – The 1st omnichain tokenized treasury-backed stablecoin, developed by the Verified USD Foundation.

- DeFiEdge – Advanced asset management protocol

Thena is open for collaboration with other projects and individuals looking to build better web3, lasting the first 3 to 4 months following the launch.

FAQ

- What is the supply cap for $THE?

- Theoretically none, and mathematically about 315M.

- Instead of having a supply cap, $THE emissions are reduced at a 1% rate every week. For more information, see: https://thena.gitbook.io/thena/the-tokenomics/initial-supply-and-emissions-schedule.

- I cannot find my LP tokens after I unstaked them from a pool. Are they gone?

- After you unstake your LP tokens, you need to click on the “Add/Remove Liquidity” button in order to unpair them and receive your single asset tokens back.

- What are the locking durations?

- THE can be locked for 2 weeks, 6 months, 1 year, or 2 years.

- When does an epoch end?

- An epoch starts and ends every Thursday 00:00 AM UTC. You can track the epoch timer on the website or with the Epoch Bot on Discord.

- Do I have to vote every week?

- Currently, yes.

- You can only claim your rewards if you vote every week, even if you vote for the same gauge. An auto-vote feature will be implemented in the future. Other projects will offer auto-voting and/or vote-optimizer solutions for Thena users as well.

- Do I have to claim my veTHE rewards every week?

- No. They will accumulate if you leave them.

- I voted but I did not receive any rewards. Where are they?

- When you vote on Epoch N, you can claim your rewards on Epoch N+2. (i.e. If you voted on Epoch 1, you can get your rewards on Epoch 3).

- I claimed my rewards but they were sent to the wrong address. Where have they gone?

- That is the rebase for your veTHE and it is added to your current locked position. If you check your veTHE, you will notice that the locked amount is increased by your reward amount.

- The rebase mechanism is a partial anti-dilution method from THENA where max 30% of weekly emissions are distributed among veTHE holders and automatically added to their locked position when claimed.

- Do I lose my rewards if I merge/split/transfer my veTHE?

- If you still have rewards from V1, claim them before doing so.

- From v2 onwards, rewards are tied to your wallet and will not be affected.

- When I try to extend the lock duration of my veTHE, it requests such a high amount of gas that I cannot extend it. Why?

- You can only extend your lock duration once per epoch. If the lock duration is already at its maximum, you cannot re-lock again. The re-locking would extend the duration to the nearest Thursday of your chosen lock period.

- I am trying to buy veTHE on OpenSea but the txn fails every time. Is there an issue?

- If the seller did not reset the vote before putting it up for sale, you cannot buy veTHE. You can check this here.

- Or on discord #the-bot-town using the /vethe command with the veTHE ID.

Community Links

- Website: https://www.thena.fi/

- Docs: https://thena.gitbook.io/

- Twitter: https://twitter.com/ThenaFi_

- Telegram: https://t.me/Thena_Fi

- Telegram announcements: https://t.me/ThenaFi

- Discord: https://discord.gg/VMShQt73Ez

- Medium: https://medium.com/@ThenaFi

- Github: https://github.com/ThenafiBNB

- Guild: https://guild.xyz/thena

- Analytics: https://info.thena.fi/home

- TheNFT Collection (OpenSea): https://opensea.io/collection/thenian

- veTHE Collection (OpenSea): https://opensea.io/collection/vethena

- Smart contract addresses: https://docs.google.com/spreadsheets/d/1upJeZwRuF-5fR_jpXRSS0K2LeE_H-jGC0KgC9wTb1Zs/edit?usp=sharing

- Coingecko: https://www.coingecko.com/