Overview

Synonym is a universal cross-chain credit layer. It streamlines the cross-chain lending and borrowing processes creating a seamless, efficient, and user-friendly experience.

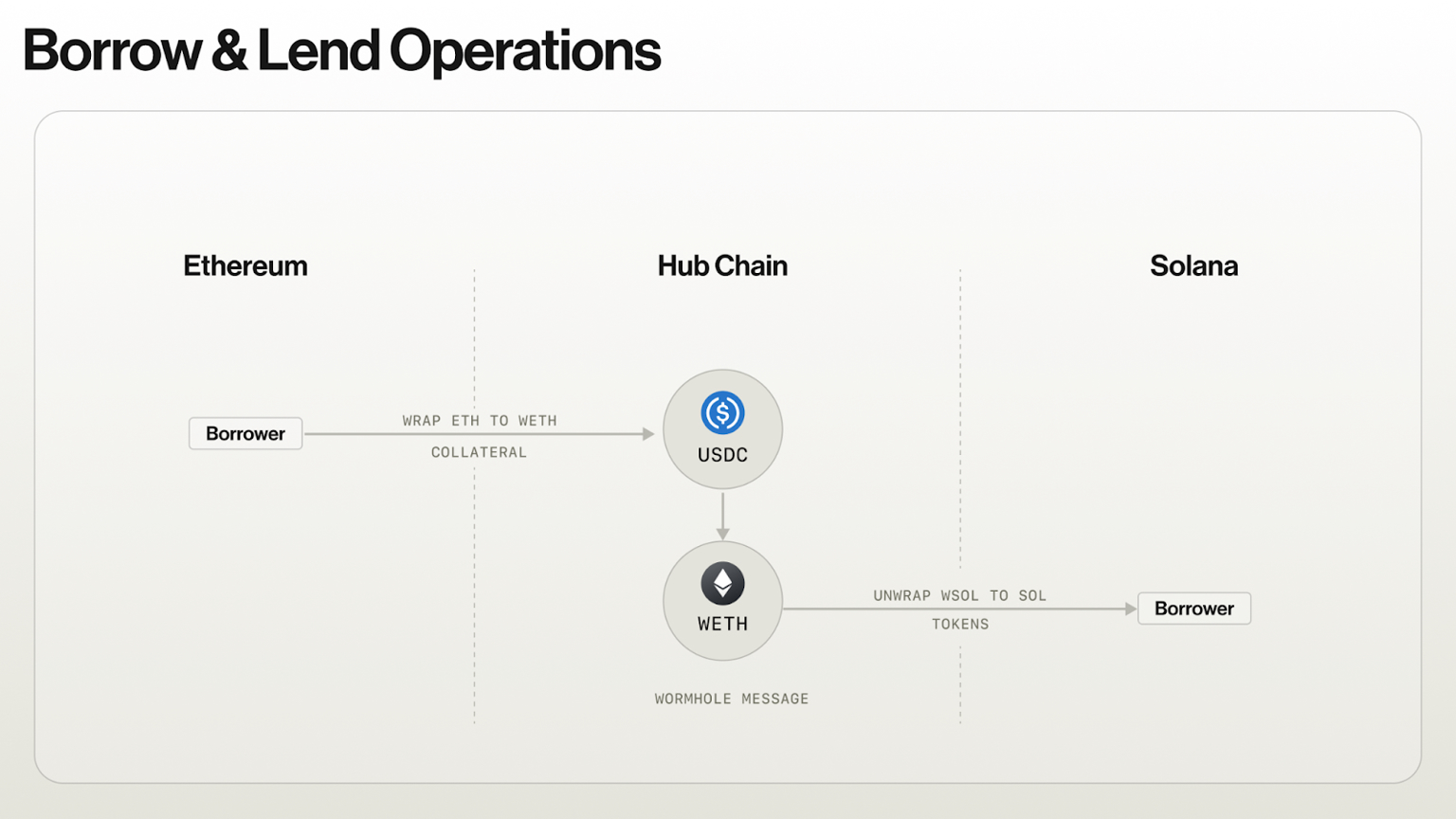

At the core of Synonym’s product is the ability to facilitate cross-chain lending and borrowing through a single, unified interface. This is achieved by leveraging the Wormhole cross-chain technology stack, enhancing the flexibility and accessibility for users to manage their assets across various blockchain networks. Unlike standard credit markets, Synonym’s approach allows users to earn yield, manage loans, borrow assets, repay loans, and withdraw across different chains without the need for additional applications to handle asset transfers, such as wrapping or unwrapping.

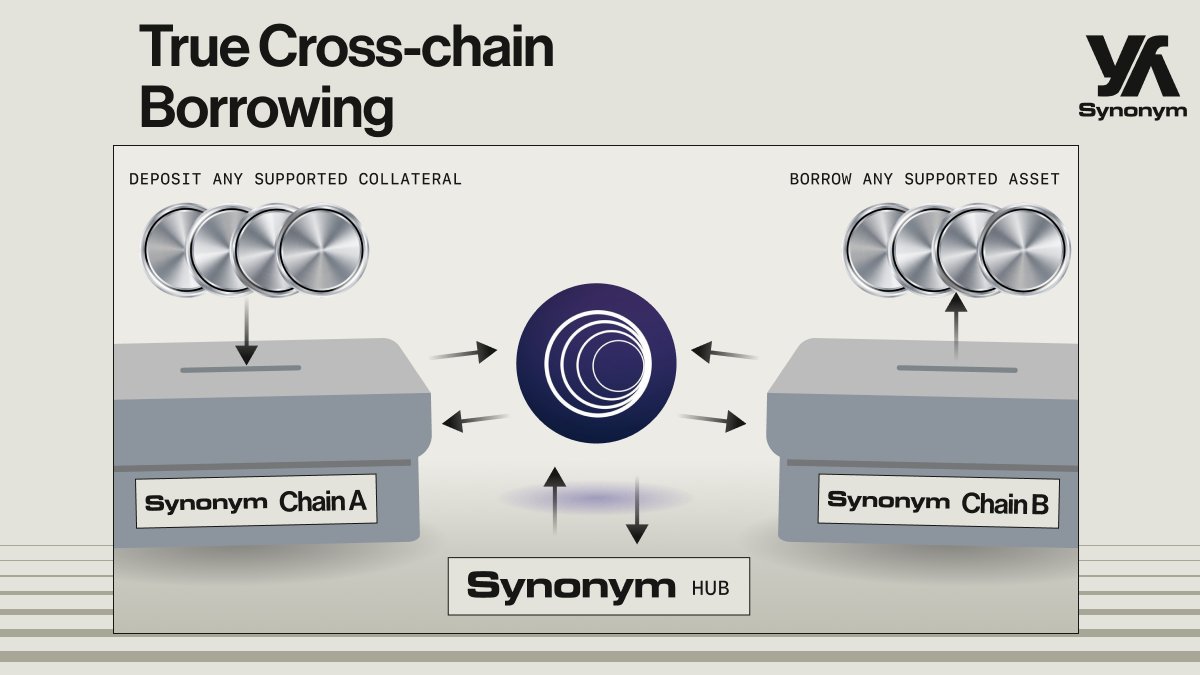

The protocol introduces a chain-abstracted cross-collateralized market system, allowing users to deposit collateral on one chain (source chain) to secure loans on another chain (destination chain), enhancing the liquidity and usability of assets. Synonym also uses Circle’s CCTP-enabled $USDC.

Synonym Key Features

Current lending markets either rely on a pooled model where risk is shared across all assets (the less liquid collateral becomes the weakest link of the protocol), or on isolated models where liquidity is fragmented across multiple markets. The former model introduces additional risks while the latter degrades the user experience. In contrast, Synonym was built to aggregate all this liquidity across markets and chains.

| Maximum Usability | Betting heavily that the future is on-chain Synonym ensures that cross-chain transactions follow the latest industry standards and meet user expectations. It achieves this through a single interface that facilitates efficient lending and borrowing across multiple chains. This approach removes the complexity typically associated with managing assets across different chains, making the process feel immediate and seamless, rather than cumbersome and outdated. |

| Maximum Usability | Synonym utilizes the capabilities of the Wormhole network and Circle’s CCTP technology to connect users directly to financial opportunities across various blockchain ecosystems as they arise. This integration means users can quickly act on opportunities without the usual delays caused by transfer confirmations and block waiting times, thus maximizing potential gains and reducing opportunity costs. |

| Cutting-Edge Security | Security is a priority for the Synonym platform, which utilizes the open-source Wormhole technology. Unlike many competing technologies which often remain closed and proprietary, Wormhole’s openness contributes to its security position. Synonym has also worked with Gauntlet since day one on security and liquidations. Finally, Synonym’s core contracts undergo rigorous auditing by reputable security firms. |

| Leading Liquidity Model | Synonym has developed an advanced liquidity model by combining the best components of multiple existing strategies. This model is designed to align the interests of lenders, borrowers, and protocol stakeholders, promoting optimal liquidity outcomes. |

Why the Project was Created

Synonym was created as a solution to several inherent challenges facing existing DeFi lending and borrowing markets, which, while crucial for liquidity and yield generation within the DeFi landscape, are affected by inefficiencies and vulnerabilities.

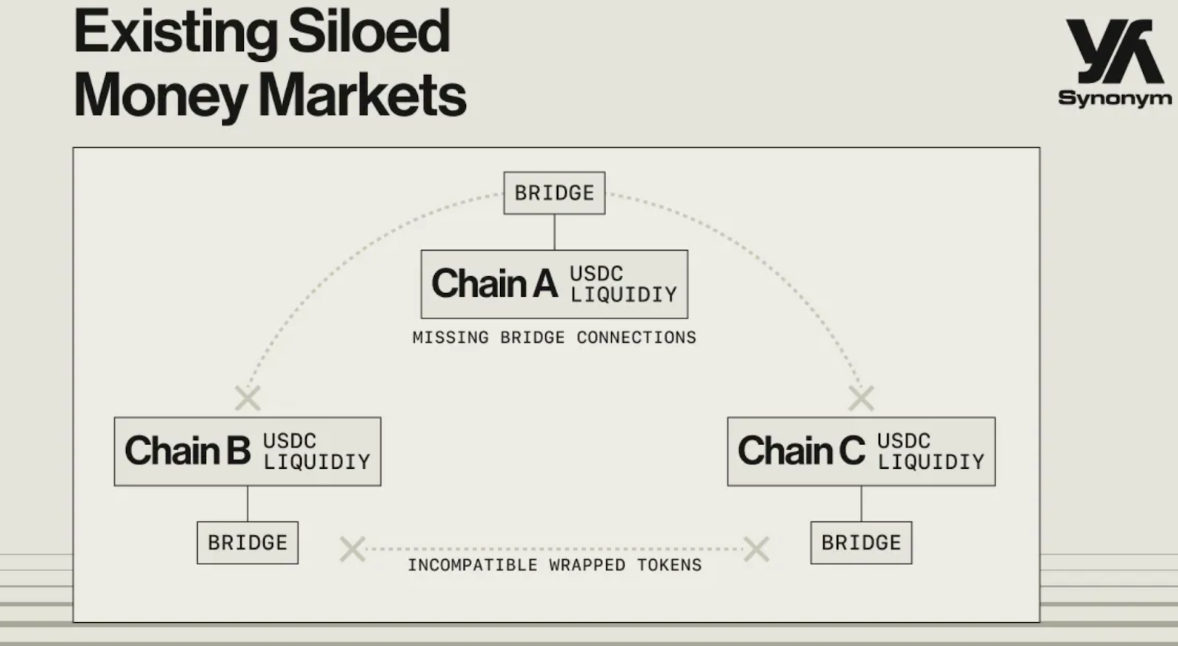

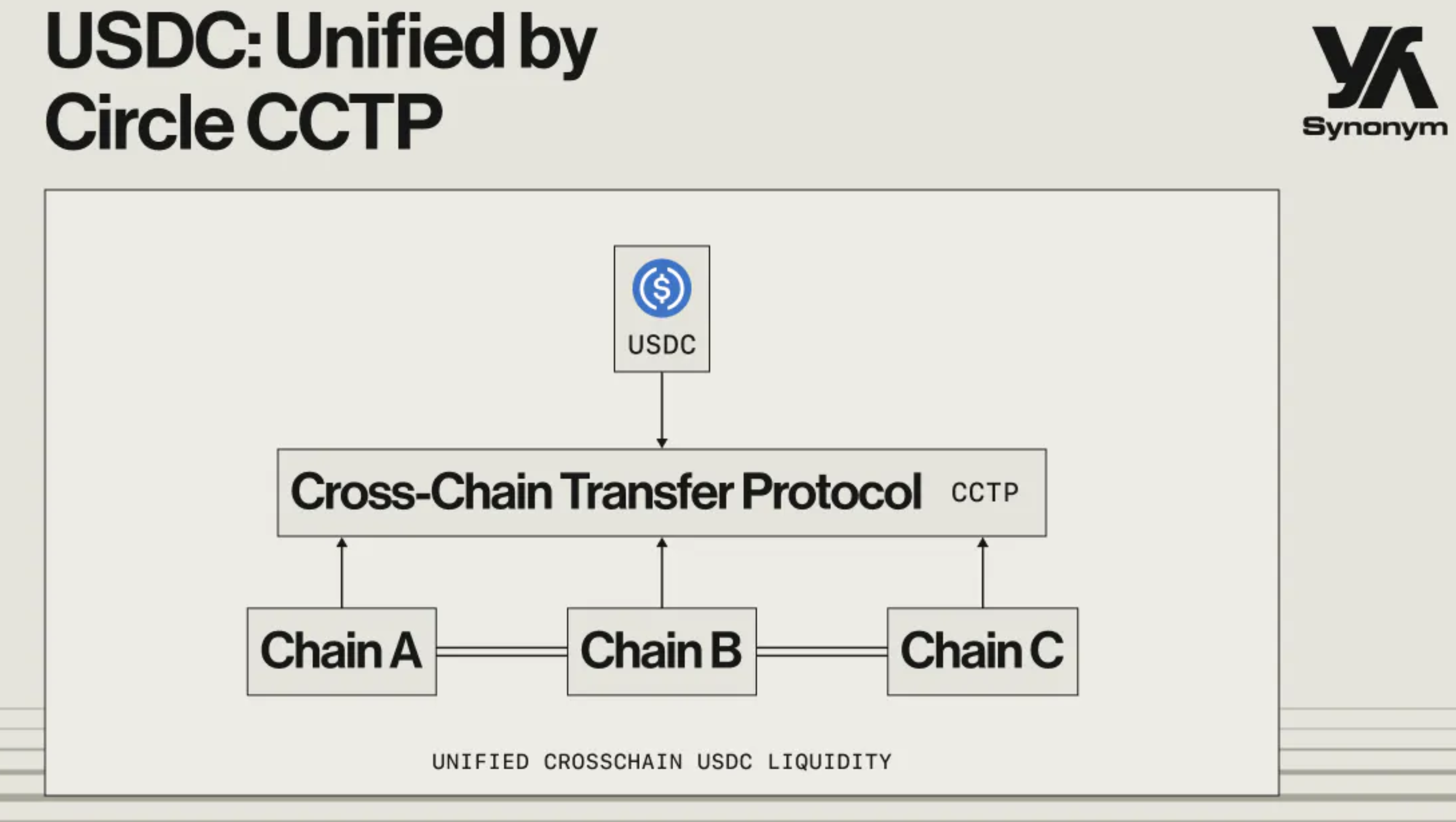

Traditional DeFi money markets have struggled with liquidity fragmentation due to their structure, operating across multiple chains but remaining ununified. For instance, $USDC available on Arbitrum is not accessible with $USDC on Optimism within some of these platforms, leading to siloed markets. This fragmentation reduces the efficiency of capital utilization across the different blockchains.

To address these limitations, existing markets often require users to wrap and bridge assets to participate across chains, complicating the liquidity landscape even further. Each chain may have different methods for token wrapping and bridging, introducing not only operational complexities but also significant security risks. Wrapped assets, acting as IOUs for tokens on other chains, aren’t interoperable, which not only incurs additional transaction costs and gas fees but also enlarges the attack surface for potential exploits.

Recognizing the limitations of siloed and fragmented markets, Synonym aims to redefine the scope of what cross-chain money markets can achieve. Therefore, Synonym is designed to be a flexible cross-chain lending protocol that seamlessly integrates liquidity and borrowing capacities across new and existing blockchain ecosystems. This approach not only enhances the efficiency of capital deployment but also reduces the associated risks and costs of operating in a multichain environment.

History and Background

Synonym was established through a merger with New Order DAO. This merger provided Synonym with immediate access to an extensive network, a vibrant community, and significant resources, positioning it advantageously from the outset.

Protocol Architecture

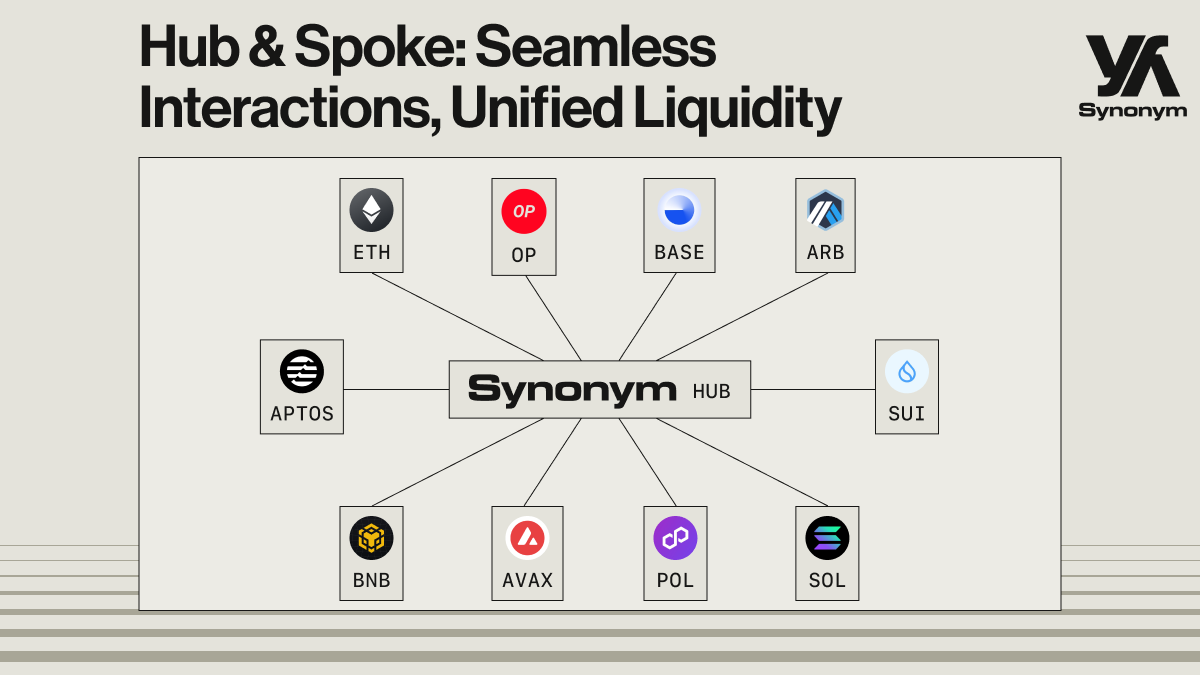

A hub & spoke money market architecture is powering the Synonym protocol in combination with various integrations.

Hub & Spoke Model

Synonym’s architecture is built on the hub & spoke model that leverages the Wormhole Crosschain Messaging technology from the Wormhole xChain technology stack. This design allows Synonym to scale efficiently across multiple blockchain networks (n chains) and facilitates logical asset and information transfer within its ecosystem.

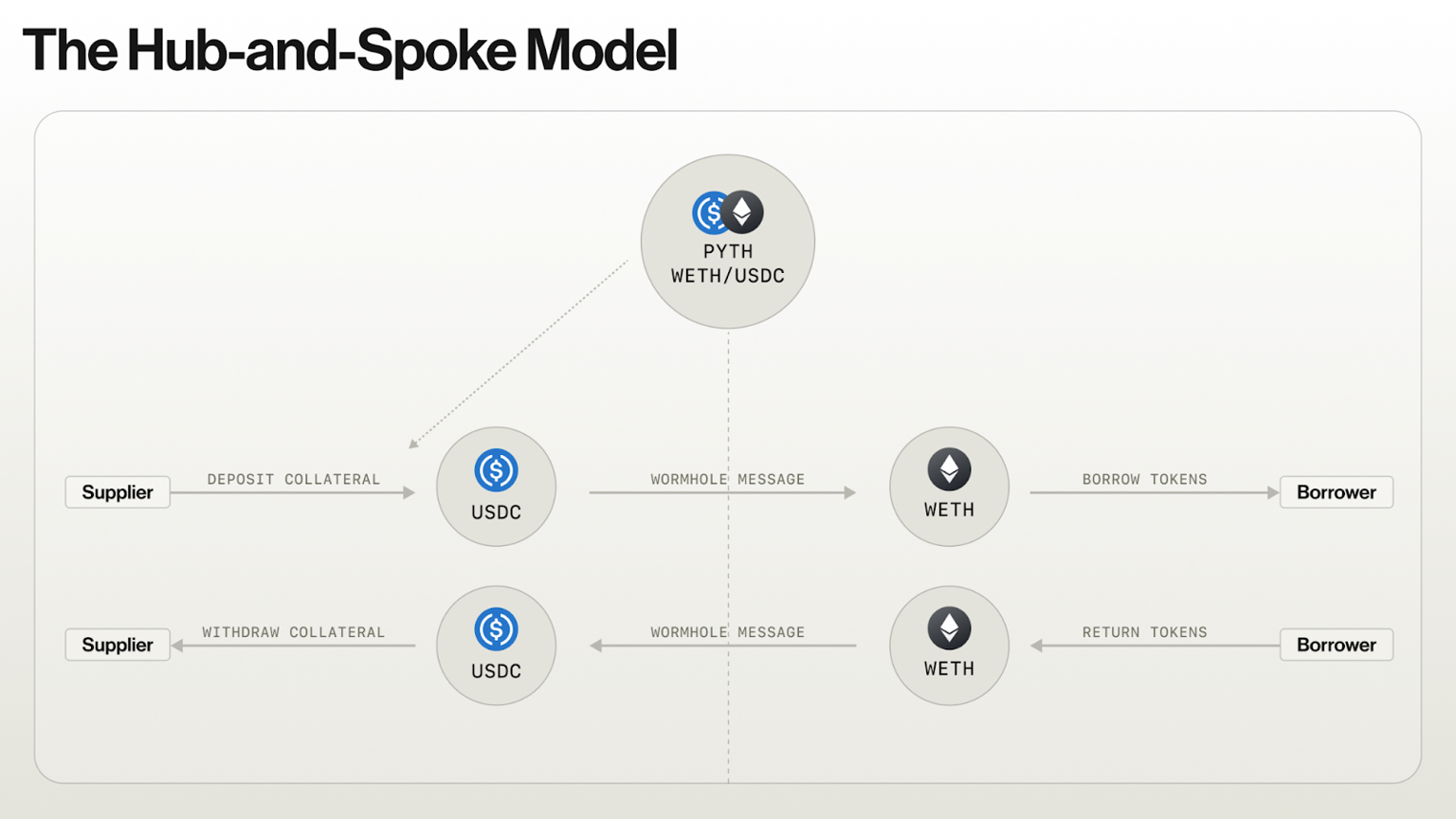

In Synonym’s hub & spoke model, a central hub chain acts as the core of the protocol, either as a centralized accounting or liquidity layer. The spoke chains interact with this hub by sending accounting messages or wrapped token transfers, depending on the specific implementation. This central hub then serves as the authoritative source for state information, ensuring all data on the spokes is a consistent copy of the hub’s ground truth state. This model avoids the need for users to interact with external bridges or token wrapping mechanisms, simplifying the user experience (UX).

The hub & spoke architecture was chosen over the point-to-point model due to several challenges associated with the latter. In a point-to-point model, where each chain could independently manage loans and deposits, maintaining synchronized and accurate state information becomes complex. Interest rates, which are dynamic and change with user activities like deposits and withdrawals, need continuous updating across all chains. This can introduce errors and synchronization issues, especially when more than two chains are involved.

For instance, when a user initiates a borrow on Solana and completes it on Ethereum, both chains must accurately reflect changes to the relevant interest indices for the borrowed and collateral assets. If these indices are not synchronized, it could lead to discrepancies in the amounts users can borrow or repay, potentially leading to financial losses or system exploitation.

By centralizing borrow-lend operations on a single hub chain (e.g., Arbitrum), Synonym mitigates these risks. This approach simplifies the process by maintaining a single, atomic state that updates in real time without the asynchronicity issues seen in decentralized models. All transactions and updates are handled on the hub, with spoke chains merely executing actions based on the hub’s authoritative data as seen in the graph below:

This single hub chain approach ensures that even though users might need to wrap and unwrap assets when moving them across chains, all essential accounting and state updates are managed centrally. This not only simplifies the user experience but also enhances the security and integrity of financial transactions across the Synonym platform.

Wormhole xChain Technology Stack

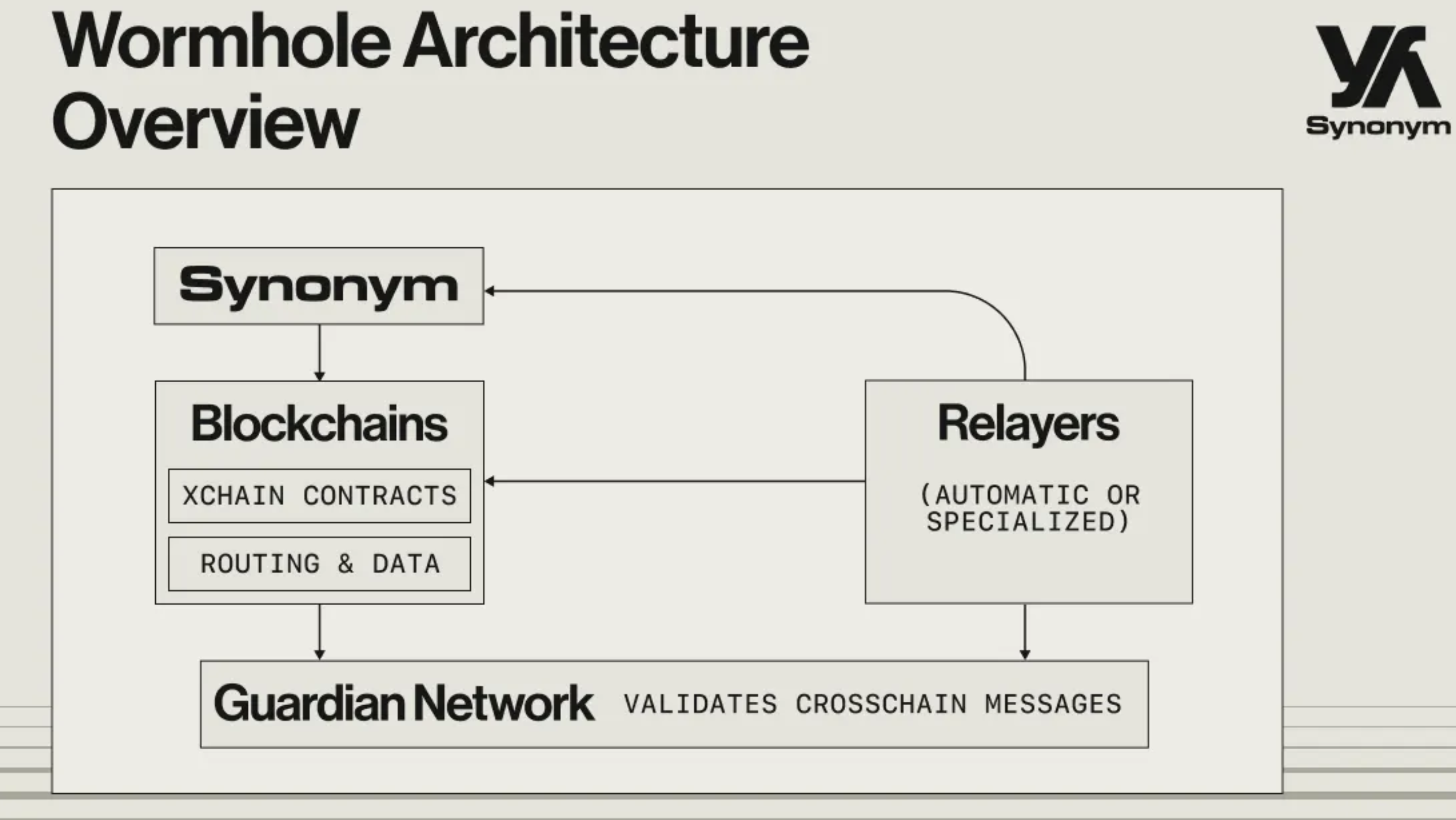

Synonym is built on the Wormhole xChain technology stack, a platform designed to enable seamless cross-chain transactions through scalable and secure messaging technologies. Supported by the Wormhole Foundation, this technology is important for the growth and support of integrations across numerous blockchain networks.

Wormhole facilitates scalable and secure cross-chain transactions, allowing Synonym to transfer assets and information seamlessly across its hub-and-spoke architecture without necessitating external bridges or token wrapping mechanisms. It uses a proof-of-authority validator system where Guardians sign and validate cross-chain transactions, ensuring all transaction requests are continuously monitored and checked for validity and state.

Synonym’s choice of Wormhole as the foundational technology behind the protocol is based on four key parameters:

| Transparency | Wormhole is entirely open source and developed transparently, contrasting with many competing solutions that often have opaque validation libraries or mechanism designs. |

| Security Improvements | Significant enhancements in security practices within the organization have been made, including the implementation of global accounting, rate limiting, and system governors, which have collectively bolstered the network’s security. |

| Connectivity | Currently connected to 29 blockchains, with plans for further expansion, Wormhole’s extensive connectivity is crucial for Synonym’s focus on inter-rollup transactions and striving towards total modularity. |

| Catalysts for Growth | The Wormhole ecosystem is anticipated to undergo significant growth, supported by a major ecosystem push from the Wormhole Foundation. Synonym is positioned to benefit as a leading protocol in this expanding ecosystem. |

Moreover, the Wormhole messaging stack uses relayers in conjunction with oracles to deliver signed messages to their intended recipients for processing and execution. This ensures that all messages are delivered accurately and on time, enhancing the protocol’s efficiency and reliability.

In terms of asset management, Wormhole addresses the challenge of handling blockchain-specific assets like $ETH, which are native to particular ecosystems. The technology automatically mints representations of such assets on the target chain, allowing these representations to be transferred or burned depending on the transaction’s objectives. This system provides a more flexible accounting system for cross-chain applications and simplifies the asset management process, abstracting away the need for users to perform additional steps outside of the core Synonym platform.

Finally, the use of Wormhole xChain technology equips Synonym with a solid foundation for cross-chain interactions, simplifying user involvement and improving the overall security and functionality of cross-chain financial activities.

Circle CCTP Integration

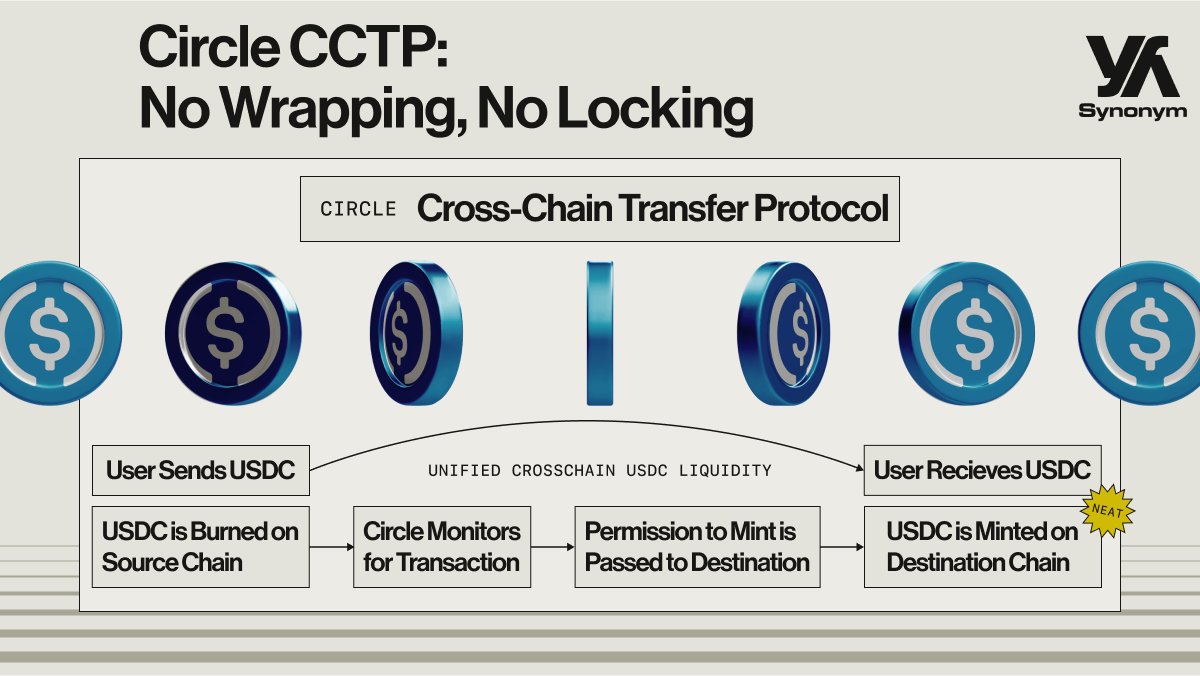

The integration of Circle’s Cross-Chain Transfer Protocol (CCTP) with Synonym facilitates the liquidity and usability of the $USDC stablecoin across the Synonym protocol. CCTP is a permissionless on-chain messaging protocol that allows for the secure transfer of $USDC between blockchains through a process of native burning and minting.

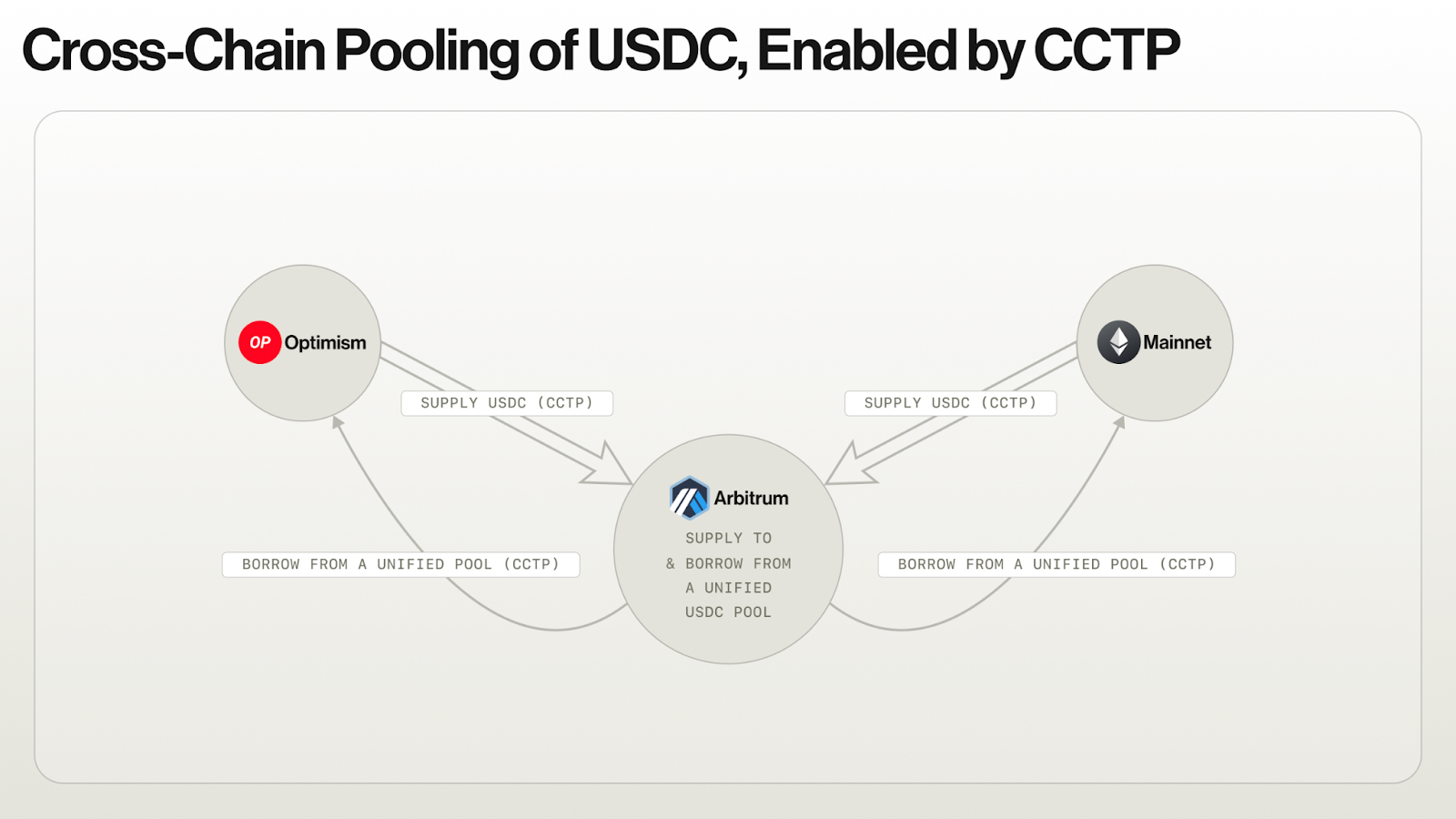

Synonym utilizes the CCTP for native minting and burning of $USDC, facilitating the pooling of liquidity across all supported spokes. This mechanism ensures that $USDC supplied from any network is pooled on the Arbitrum Hub. The unification of liquidity on a central hub directly addresses and mitigates the fragmentation of $USDC across multiple networks.

For example, when $USDC is supplied on the Optimism network (a spoke), it is instantly bridged to the Arbitrum hub. This “centralized” approach allows borrowers on all other supported networks to access funds from this unified pool. The result is more efficient and predictable asset utilization and interest rate management across the platform.

Put simply, the CCTP integration makes financial operations on Synonym more user-friendly. Borrowers can easily repay loans on a different network from where they originally borrowed, eliminating the need to transfer assets across chains manually to settle debts. This simplification reduces the operational complexity for users, making $USDC more flexible and convenient to use within the Synonym ecosystem.

Interest & Liquidation Model

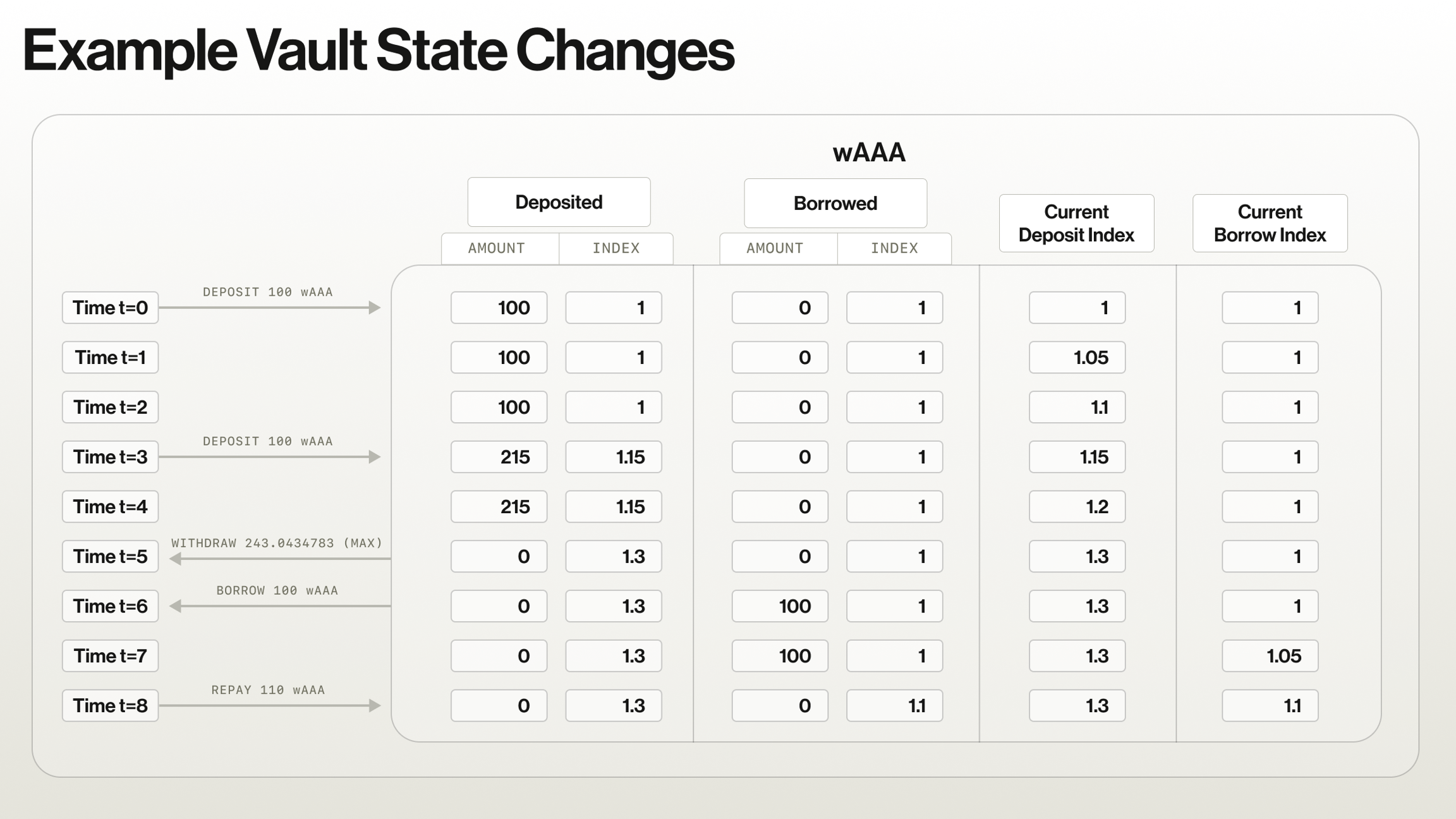

Synonym employs a model for managing interest through two specific indices for each asset: the ‘deposit interest accrual index’ and the ‘borrow interest accrual index’. These indices, starting at 1.0 upon protocol initialization, represent the accumulated interest over time for deposits and loans respectively.

- Deposit Interest Accrual Index: This index indicates how much of an asset that was deposited can later be withdrawn, accounting for accrued interest. For example, if a user deposits 200 units of asset A, and the deposit accrual index rises to 1.05, the user can withdraw 210 units of that asset, reflecting the interest gained over time.

- Borrow Interest Accrual Index: Similarly, this index shows how much a borrower needs to repay over time to cover their loan fully. If a borrower took 200 units of asset A, with an initial borrow index of 1.05, they would need to repay 210 units of asset A to settle the loan.

Interest calculations are updated dynamically with each vault state change, comparing the stored accrual index at the time of the last update to the current index to determine how much interest has accumulated.

This is calculated using the formula:

storedAmount * currentAccrualIndex / accrualIndexAtLastUpdateTime

For each user and asset, Synonym stores:

- The deposit amount with all interest accrued up to the time of the last vault update.

- The deposit accrual index at the time of the last vault update.

- The borrowed amount with all interest accrued up to the time of the last vault update.

- The borrow accrual index at the time of the last vault update.

Let’s give an example:

If a user initially deposits 100 $WETH when the accrual index is 1.0 and wishes to withdraw when the index is 1.05, they would be able to withdraw 105 $WETH. The formula: depositAmount * currentDepositAccrualIndex / depositAccrualIndexAtUpdate = 100 WETH * 1.05 / 1.00 = 105 WETH

A different user borrows 1000 $USDC with a borrow index of 2.75. If the index increases to 3.3 over a year, to fully cover the loan, the user would need to repay 1200 $USDC. The formula: borrowAmount * currentBorrowAccrualIndex / borrowAccrualIndexAtUpdate = 1000 USDC * 3.3 / 2.75 = 1200 USDC

Building on the last example, let’s explore a scenario where further repayment activities occur.

The user previously borrowed 1000 $USDC when the borrow accrual index was 2.75. After some time, due to accumulated interest, the borrow accrual index increased to 3.3, raising the user’s total debt to 1200 $USDC. Suppose the user decides to repay part of their debt. They choose to repay 600 $USDC. To manage this transaction, the system first recalculates the total debt using the current and previously stored accrual indices to confirm the total owed amount is indeed 1200 $USDC.

After the user repays 600 $USDC, the system updates the remaining debt. The new total amount of debt now stands at 600 $USDC. Additionally, the system updates the stored information to reflect the remaining debt and the current borrow accrual index, which remains at 3.3.

The protocol uses a method where both borrowed and deposited funds experience a continuous increase in accumulated interest. This means that the interest added to your debt is influenced by the borrowing rate, and similarly, the interest gained on your deposits is driven by the deposit rate. Essentially, interest is compounded on both your debt and deposits.

The management of interest accrual indices is conducted by the ‘HubInterestUtilities.updateAccrualIndices()’ function.

The APY is derived through the process of second-compounding a yearly rate R. This rate R is determined by a piecewise interest rate function that adjusts based on the current utilization of the pool at the time the accrual index is calculated.

The formula used to calculate the APY is: APY = (1 + R/sec_in_year) ^ sec_in_year – 1

Interest Model

Synonym utilizes a ‘PiecewiseInterestRate’ model, characterized by three distinct thresholds or ‘kinks’. This model integrates two linear functions, where the demarcation between these functions is marked by the second kink. The model is designed such that the borrow interest rate initially increases gradually in response to rising liquidity utilization (total borrows / total deposits). As this ratio approaches the second kink, the rate of interest growth accelerates significantly.

Here’s a practical example explaining how kinks work:

- Segment 1: Up to $1,000 borrowed, interest might be 5% per year.

- First Kink: At $1,000, the first kink occurs.

- Segment 2: From $1,001 to $5,000, the interest rate might increase to 7% per year due to crossing the first kink.

- Second Kink: At $5,000, the second kink changes the slope again.

- Segment 3: Beyond $5,000, the interest rate might jump to 10% per year.

The positions of the kinks, along with the specific borrow rates, are individually tailored for each asset and are dynamically adjusted to reflect real-time market conditions.

Distribution of Borrow Interest

- To Depositors: 40% of the interest collected from borrowers is distributed to the depositors in proportion to their deposits.

- To Treasury and Stakers: The remaining 60% of collected interest is allocated to the treasury, which then distributes these funds as rewards to vlSYNO and TSYNO stakers, and covers protocol fees.

Collateralization Ratios

Synonym has implemented a system of supply and borrow factors to maintain protocol solvency and account for the varying volatility across different assets.

Collateralization ratios for each asset are stored in the ‘AssetRegistry.assetInfos’ within the ‘HubSpokeStructs.AssetInfo’ struct.

Supply Factor

The supply factor decreases the effective power of deposits used as collateral. For example, if the supply factor is set at 0.9, then a $1000 deposit can collateralize up to $900 of a loan. This factor is stored in the code under ‘HubSpokeStructs.AssetInfo.collateralizationRatioDeposit’ and is calculated as: Supply Factor = 1 / collateralizationRatioDeposit

Borrow Factor

Conversely, the borrow factor increases the weight of a loan in terms of portfolio health. For instance, with a borrow factor of 0.8, a $800 loan is considered as $1000 of borrowing in terms of portfolio health calculations. This is defined in the code under ‘HubSpokeStructs.AssetInfo.collateralizationRatioBorrow’ and calculated by: Borrow factor = 1 / collateralizationRatioBorrow

Interaction of Supply & Borrow Factors

The interplay between supply and borrow factors determines how much a user can borrow against their deposits. Using the factors:

- Deposit of $1000 in Token A with a supply factor of 0.9.

- Borrowing in Token B with a borrow factor of 0.8.

- The user can borrow up to $720 worth of Token B ($1000 * 0.9 * 0.8 = $720)

- It’s important to note that such a borrowing arrangement places the collateralization ratio at exactly 100%, any adverse price movement could lead to part of the position becoming eligible for liquidation.

Collateralization Ratio

The collateralization ratio, which varies over time as the $ values of the loans and deposits fluctuate, is the ratio between the effective loan weights and effective deposits power.

For example:

- Deposit in Token A: $1000, supply factor: 0.9

- Deposit in Token B: $500, supply factor: 0.8

- Loan in Token C: $300, borrow factor: 0.75

- Loan in Token D: $400, borrow factor: 0.85

- The effective deposits power is $1300: ($1000 * 0.9 + $500 * 0.8 = $1300)

- The effective loan weight is $870.59: ($300 / 0.75 + $400 / 0.85 = $870.59)

- The collateralization ratio is 149%: (1300 / 870.58 * 100% = 149%)

Liquidations

In Synonym, the entire portfolio of a user acts as a unified entity for liquidations. This means that if the overall collateralization ratio of a user’s portfolio drops below 100%, indicating that the portfolio is underwater, it becomes eligible for liquidation.

During a liquidation event, any volunteer can intervene to help restore the health of the underwater portfolio. Liquidators have the option to select which loans to liquidate and which collateral to claim in return, giving them flexibility based on their assessment of the market conditions and asset values.

Liquidators execute liquidations by calling the ‘Hub.liquidation()’ function within the platform’s framework.

Each asset in the portfolio is associated with specific liquidation parameters:

- Max Liquidation Portion: This defines the maximum proportion of the asset that can be repaid during a single liquidation event.

- Max Liquidation Bonus: This is the extra amount of the asset that can be claimed by the liquidator as a reward for executing the liquidation, in addition to the repayment amount.

Post-liquidation, the portfolio’s collateralization ratio is not allowed to exceed a predefined maximum health factor. For instance, if the ‘LiquidationCalculator.maxHealthFactor’ is set at 1.25, then the liquidation can only bring the portfolio’s collateralization ratio up to 125%. This cap prevents over-liquidation, thereby protecting the user’s remaining assets and providing a buffer to avoid immediate further liquidations.

To incentivize timely user intervention, a liquidation bonus is offered to liquidators, which is deducted from the user’s collateral. Consequently, it is more beneficial for users to proactively manage their loans, either by repaying them or by adding more collateral to improve the portfolio’s health before forced liquidation occurs.

Using the Protocol

Supplying on Synonym

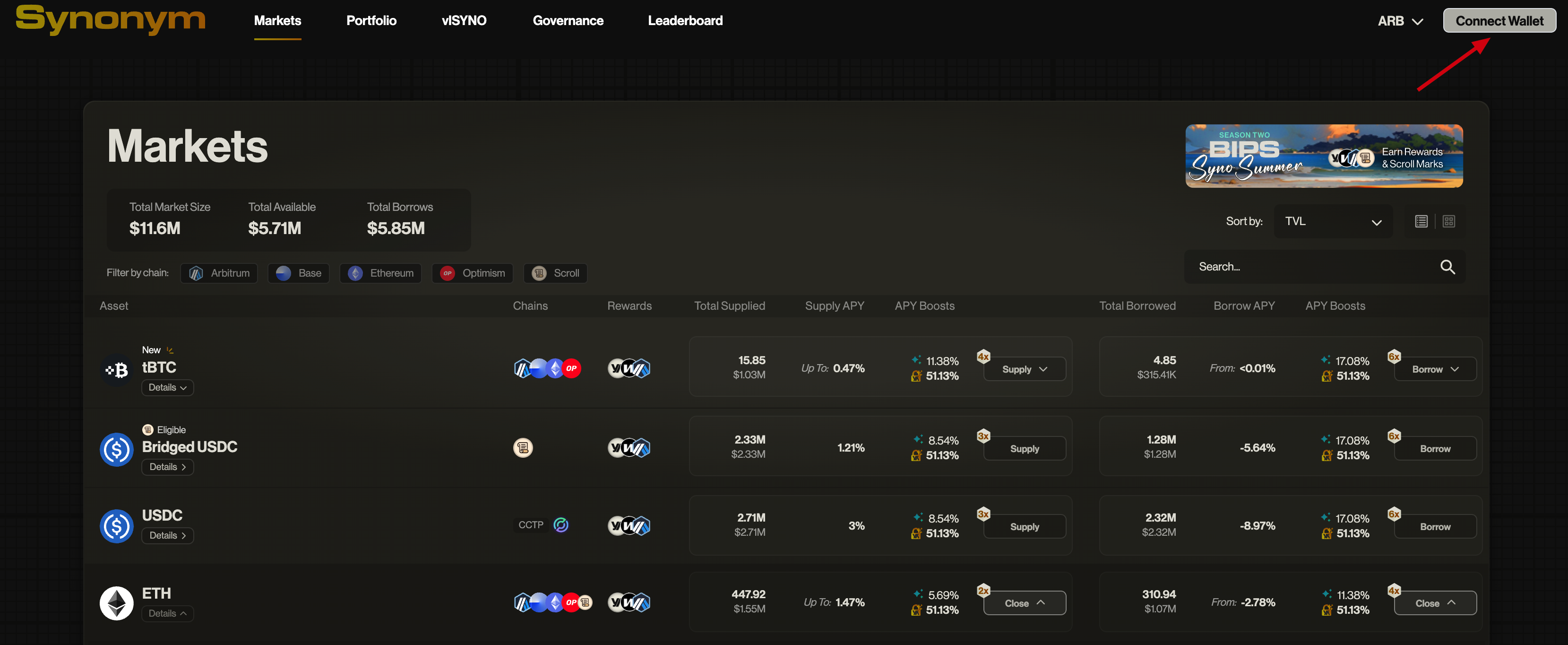

Here’s a guide on how to supply $ETH on Arbitrum using Synonym.

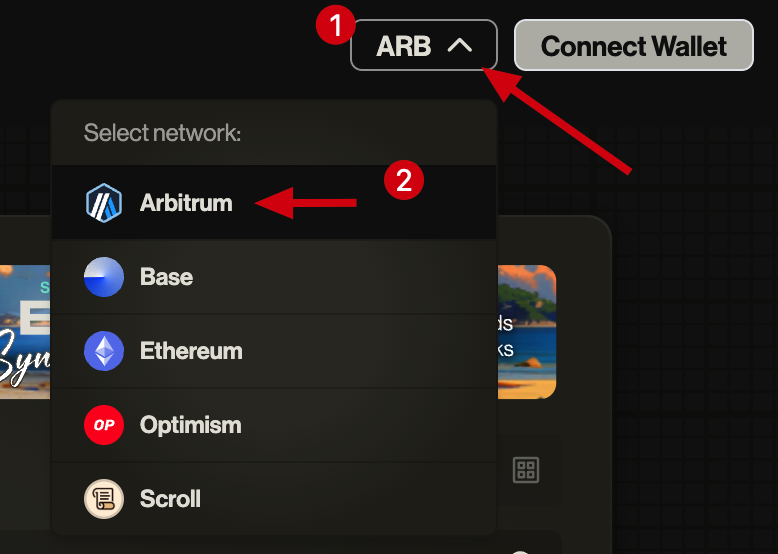

- 1. Head over to the Synonym app page here.

- 2. Connect your wallet in the upper right corner.

- 3. Select the Arbitrum network.

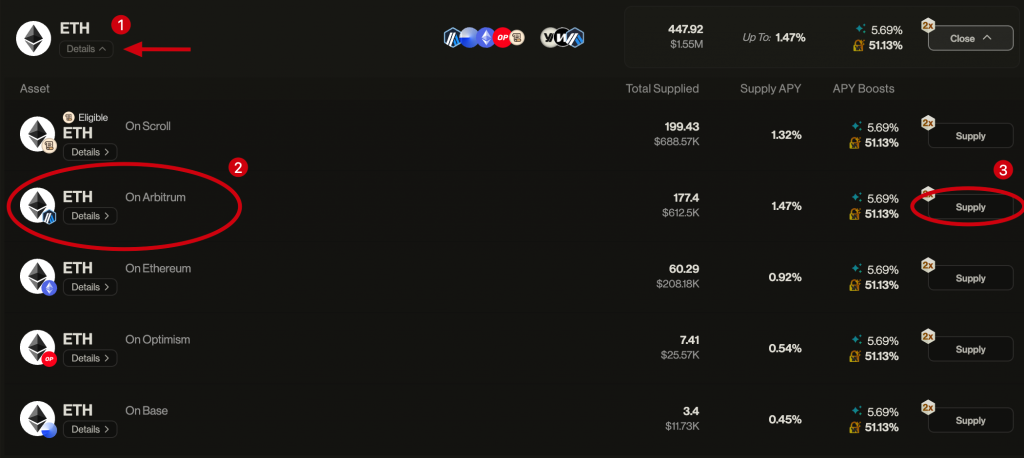

- 4. On the ‘Markets’ tab find the $ETH market and click on it to reveal the chain options.

- 5. Find the ‘Arbitrum’ option and click on the ‘Supply’ button.

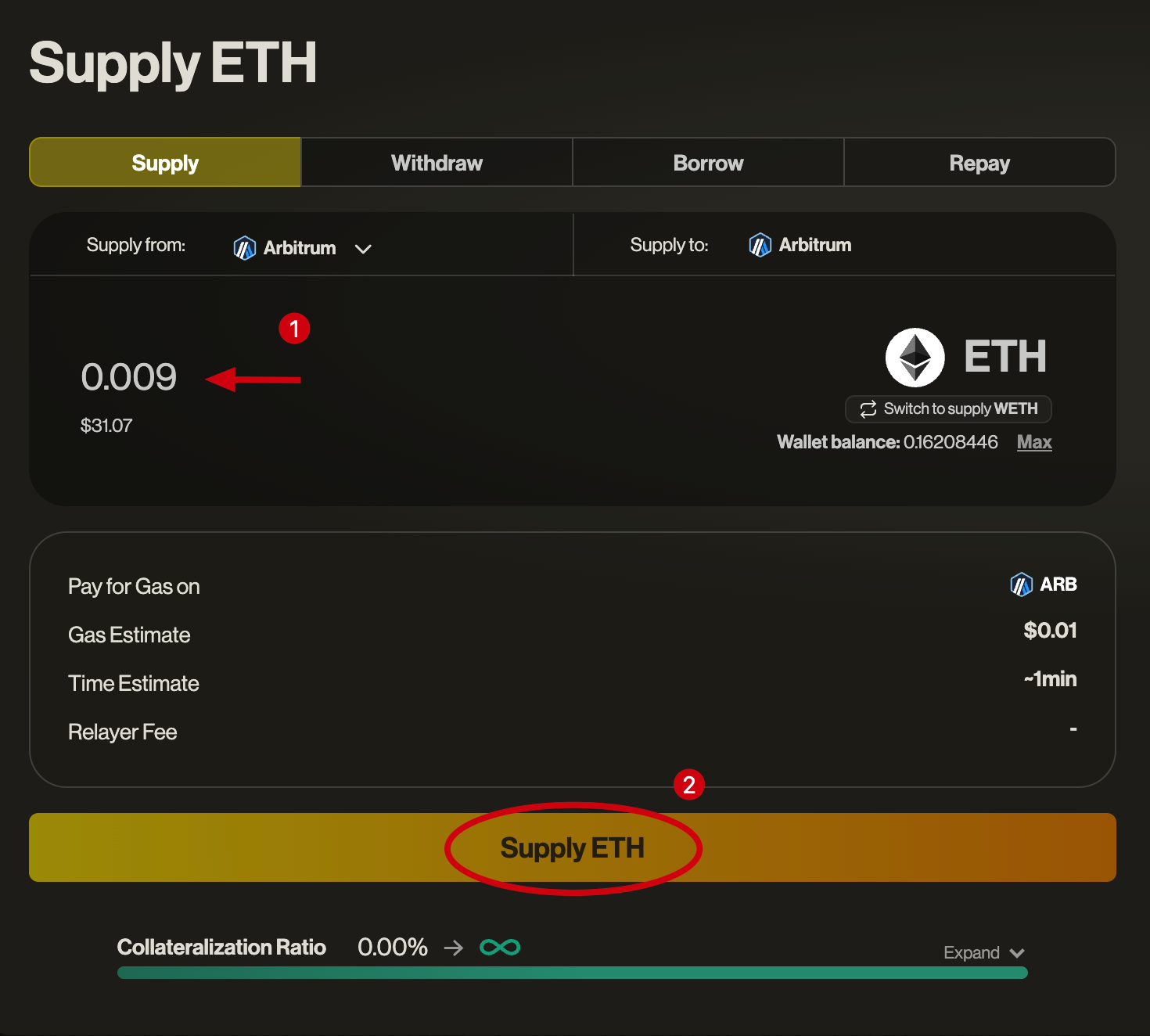

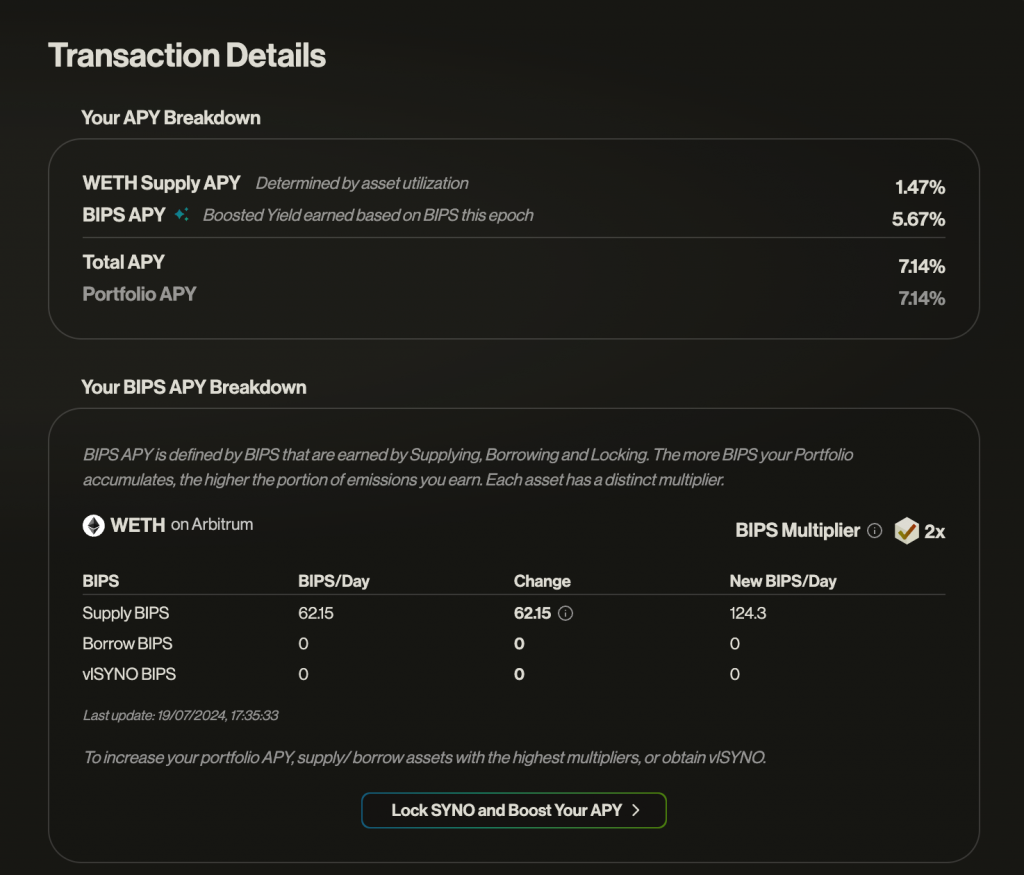

- 6. Here choose the amount you want to supply and click ‘Supply ETH’. Confirm the transaction in your wallet. To the right side of the page, you also have all the Transaction Details.

- 7. You have successfully supplied $ETH on Synonym.

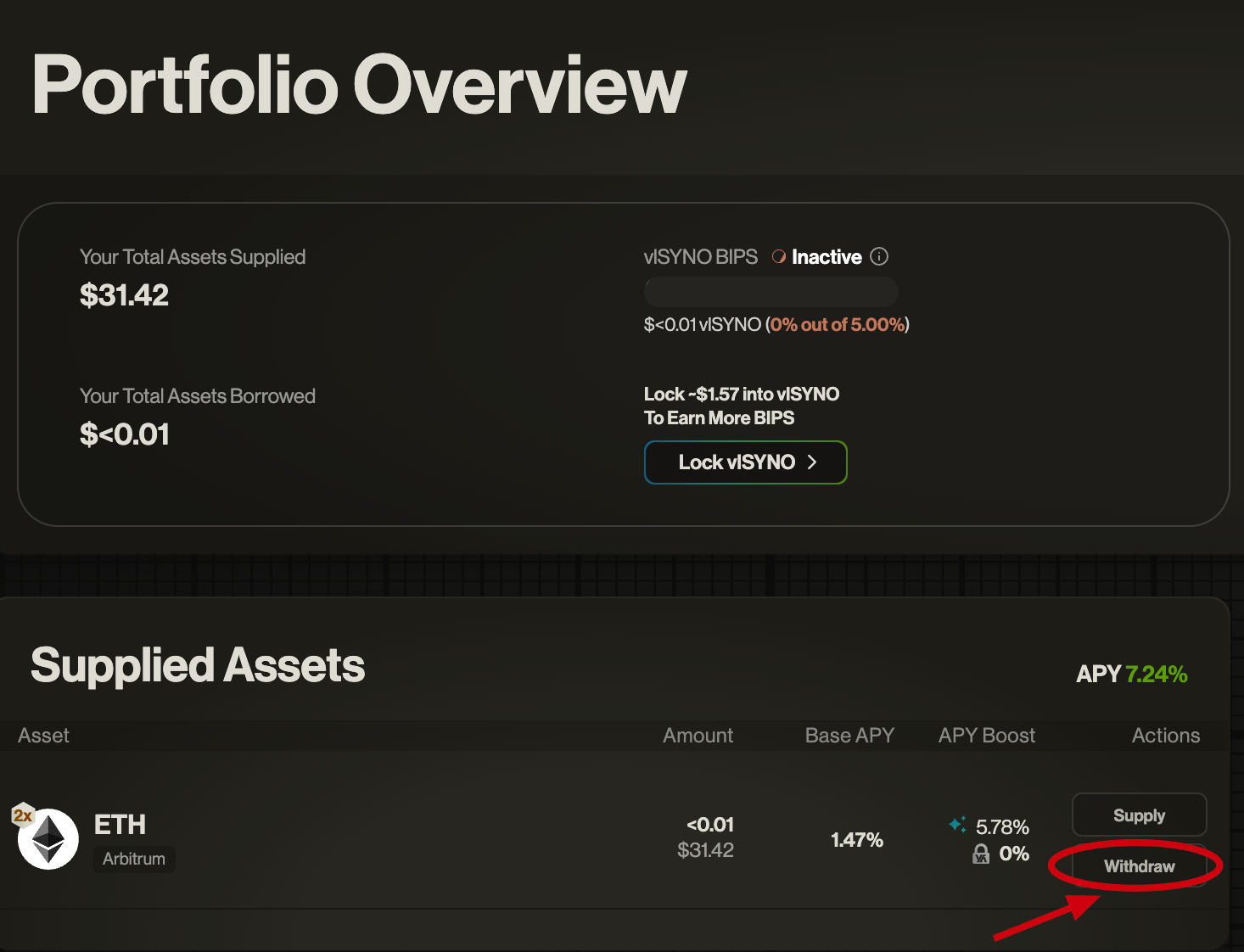

- 8. To withdraw, make sure that all your loans are repaid. Then, head over to the ‘Portfolio’ tab, and under the ‘Supplied Assets’ click on the ‘Withdraw’ option.

Supplying $USDC

The CCTP integration allows users to seamlessly facilitate supply transactions from any supported chain without needing separate bridge and deposit actions. For instance, a user can supply $USDC on Arbitrum directly from their Ethereum balance, combining bridging and supplying into a single transaction.

Collateral

By default, all supplied assets in Synonym are automatically utilized as collateral. Currently, the platform does not support selective collateralization; therefore, if users prefer not to use certain assets as collateral while still supplying them, they should use a separate wallet.

Collateralization Ratio

The collateralization ratio represents the safety of deposited assets relative to borrowed assets and their underlying value. A higher ratio indicates greater security against liquidation. Notably, a collateralization ratio of 100% signifies a threshold where liquidation occurs, underscoring the importance of maintaining a healthy buffer in the ratio to avoid such scenarios.

Earnings from Supplying

Suppliers in Synonym earn through interest payments streamed from loans. The interest shared by suppliers is calculated based on the average borrow rate multiplied by the utilization rate of the reserve. Therefore, the greater the utilization of a reserve, the higher the potential yield for the supplier. It’s important to note that each asset within the platform has its own supply-demand dynamics and thus its own APY, influenced by its unique interest rate curve and asset utilization. Details on specific interest rates and APYs can be accessed on the Markets Page.

Supply Amount Limits

There are no minimum amounts required to supply, though users should consider gas and relay costs which could exceed the value of small supplied amounts. However, there are maximum supply amounts for each asset, set for risk management purposes. Suppliers intending to contribute large amounts should check these limits on the Markets Page to ensure compliance and optimize their investment strategy.

Borrowing on Synonym

After supplying $ETH let’s borrow some $USDC on Base.

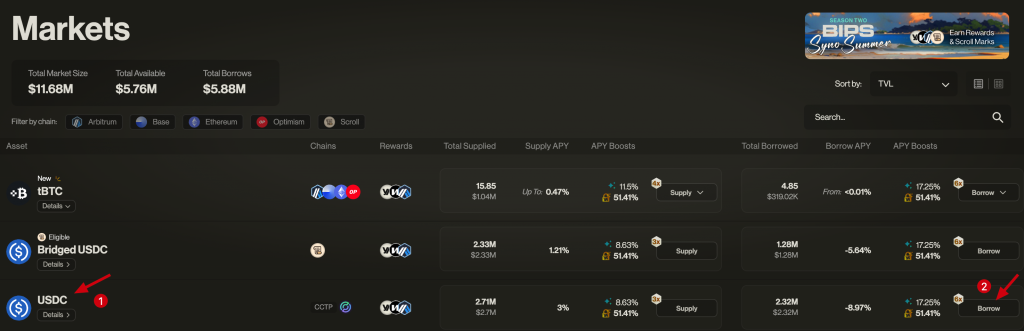

- 1. On the ‘Markets’ page find the $USDC market and click the ‘Borrow’ option.

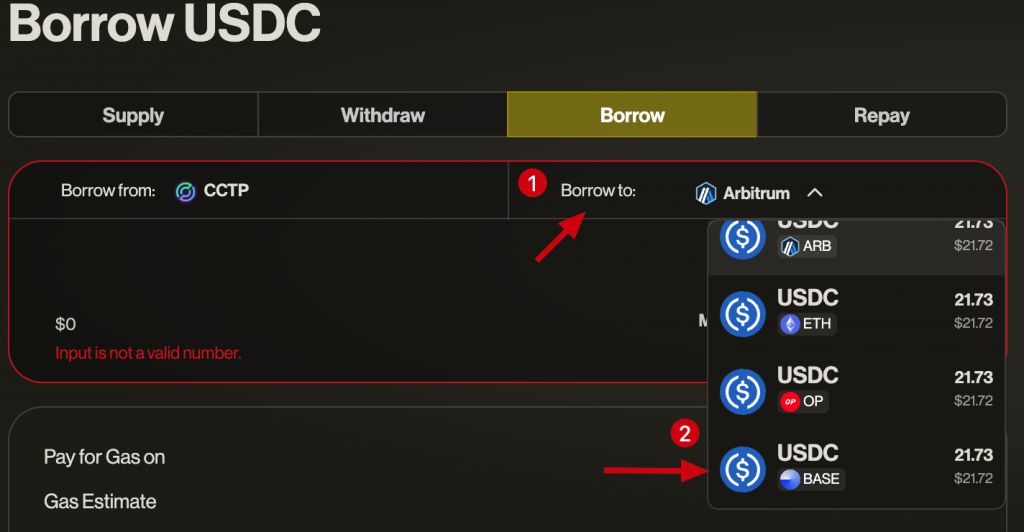

- 2. Change the borrow chain to Base. You’ll be prompted to change the chain to your wallet as well. Make sure you have $ETH for gas.

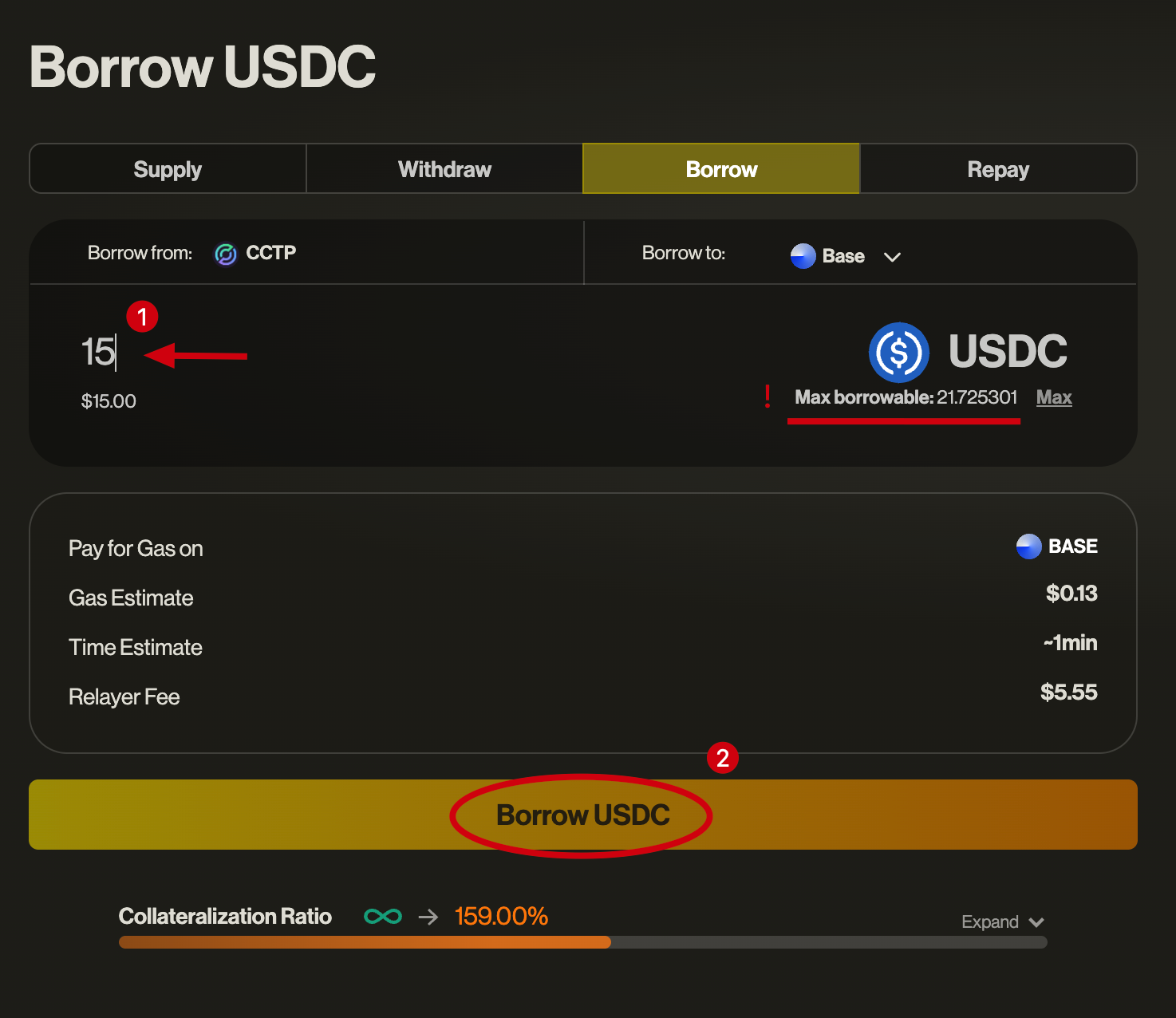

- 3. On the interface, you can see the maximum amount you can borrow. Always avoid maxing out your borrowing amount to avoid liquidations and loss of funds. Select the amount you want to borrow and click ‘Borrow USDC’.

- 4. Confirm the transaction in your wallet. Wait until the transaction is confirmed.

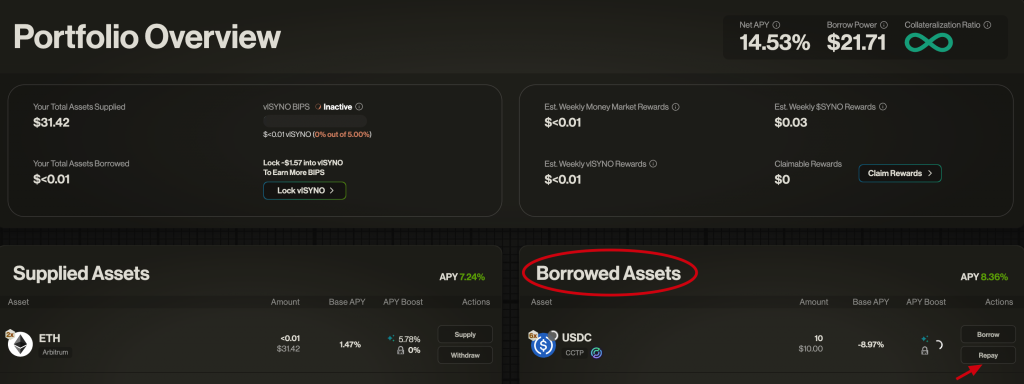

- 5. You successfully borrowed $USDC on Base using Synonym.

- 6. At any time you can repay your loan using the ‘Repay’ function on the ‘Portfolio’ tab.

Collateralization Ratio

If there is a fluctuation in the market value of either the supplied assets or the borrowed assets, the collateralization ratio will adjust accordingly. An increase in the ratio signifies a stronger borrow position, decreasing the likelihood of reaching the liquidation threshold. Conversely, a decrease in the ratio increases the risk of liquidation if the value of the collateral drops relative to the borrowed assets.

Repaying a Loan

Repayment must be made in the same asset and on the same chain from which the asset was borrowed. For instance, if $ETH was borrowed on the Optimism chain, it must be repaid in $ETH on Optimism.

Repaying $USDC

Synonym’s integration with CCTP simplifies the repayment of $USDC loans across different chains. For example, if a user needs to repay a $USDC loan on Arbitrum but their $USDC balance is on Ethereum, the CCTP allows for the bridging and repayment transaction to be bundled into a single action, eliminating the need for separate bridging and repayment steps.

Interest Rates on Loans

The interest rate for borrowing is influenced by two main factors:

- Utilization Rate: This is determined by the supply and demand ratio of the asset.

- Interest Rate Curve: Each asset has a unique interest rate curve that affects the borrowing cost. Detailed information about interest rates for each asset can be found on the Markets page.

Roadmap

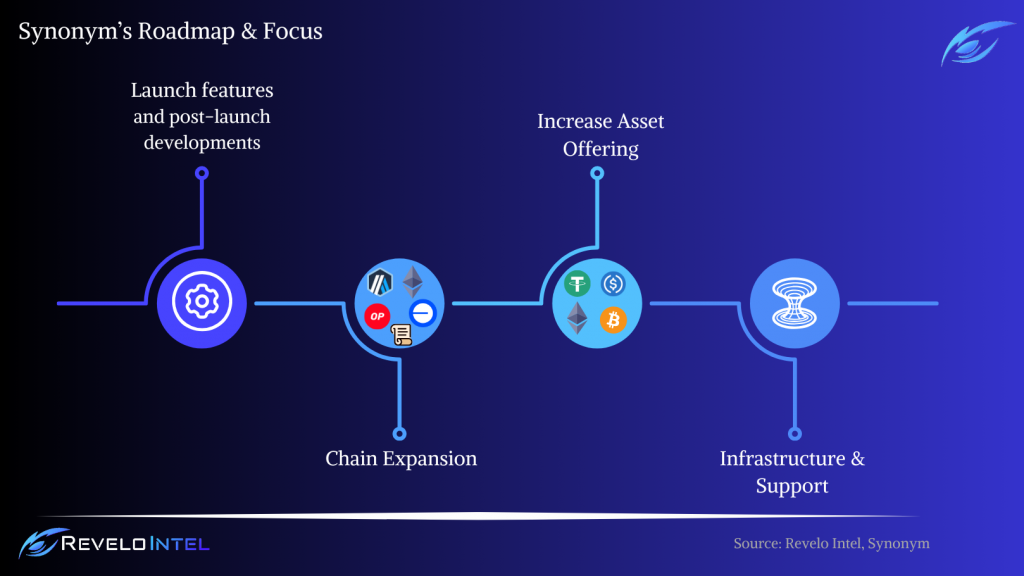

Synonym’s development trajectory is planned across four key categories: Features, Chains, Assets, and Infrastructure. Each category contains specific goals and targets that align with Synonym’s strategy to develop its cross-chain lending and borrowing platform.

Features

At launch, Synonym will enable users to perform key financial actions through a single user interface powered by the Wormhole cross-chain messaging stack, including:

- Deposit & Lend: Earn yield by lending assets or borrowing against them.

- Borrow: Access competitive cross-chain borrowing rates.

- Withdraw: Transactions are enhanced by Circle CCTP-enabled $USDC.

- Repay: Simplified repayment, also enhanced by Circle CCTP-enabled $USDC.

Post-launch, the roadmap includes significant feature additions such as:

- Enhancements to security and performance that reflect advances in the Wormhole stack.

- Introduction of tokenized debt and internal collateral swaps to limit the impacts of liquidations.

- Development of unified multi-asset borrowing and factory isolated markets with customizable LTVs and market parameters.

- Support for intents-based architectures, adapting to user and market needs dynamically.

Chains

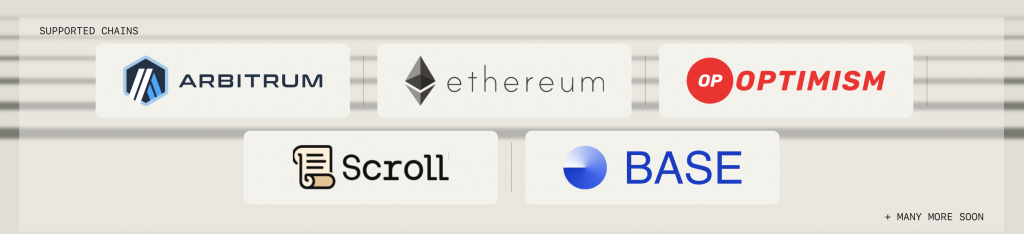

Synonym was initially launched on Arbitrum, Optimism, and Ethereum Mainnet. Soon after, Base and Scroll followed, showing a focus on ecosystems that exhibit DeFi activity with active user bases.

The anticipated deployment on Solana is expected this year and it will unlock unlimited possibilities for Synonym and its users. For the first time, this deployment will enable the connection of SVM (Solana Virtual Machine) and EVM for lending purposes from a single interface.

Expansion Plans: Future deployments will be announced via Twitter and Discord as Synonym extends its reach to new chains, prioritizing those with significant DeFi engagement.

Assets

At launch, Synonym supported established and liquid blue-chip assets such as $WETH, $WBTC, $WSTETH, and $USDC.

The next phase focuses on incorporating LSTs from multiple partners, including Dinero.

Subsequent additions include LRTs & restaked assets (Ether.fi, Renzo), Cosmos ecosystem assets, wrapped DeFi strategies, and tokenized yield vaults, gradually expanding to more diverse and exotic assets.

Infrastructure

Synonym collaborates closely with the Wormhole Foundation and Circle to integrate the latest features from Wormhole and $USDC across its platforms.

As one of the first teams to utilize Wormhole’s Automatic Relayer system, Synonym remains at the forefront of adopting new cross-chain features. A key priority is enhancing stablecoin liquidity, particularly through deployments that support CCTP-enabled $USDC, ensuring widespread and efficient use of stablecoin assets across the network.

An important development for Synonym will be the Optimistic Finality that will reduce transaction wait times to zero by fronting assets to the destination chain.

Sector Outlook

The evolution of the Web3 ecosystem into a multi-chain environment with numerous blockchains, Layer 2 (L2) networks, and appchains has encouraged the development of dApps that can function across these blockchains. This diversity has catalyzed the adoption of decentralized trust-minimization protocols but has also resulted in the fragmentation of assets and applications across isolated environments. Cross-chain lending, which facilitates the lending and borrowing of tokens across these disparate ecosystems, is emerging as a solution to this matter.

Blockchains are incapable of natively communicating with external systems, including each other and existing Web2 infrastructure, underscoring the necessity for cross-chain interoperability. Such protocols not only enhance connectivity between the traditional web and the growing Web3 economy but also prevent blockchains from becoming isolated islands, devoid of shared resources or information. By linking these disparate networks, cross-chain technology fosters a unified liquidity environment and improves the operability of applications.

The principle behind cross-chain borrowing and lending closely mirrors the general need for interoperability in DeFi. It allows users to interact with applications directly from their native wallets without migrating to specific chains, focusing on convenience and meeting users where they already are. This aspect is crucial because liquidity is vital for the success of DeFi applications as with any other financial instrument. Cross-chain functionalities enable liquidity pooling from various chains into a single application, significantly enhancing the user experience in borrow-lend scenarios.

While there has been notable progress in cross-chain DeFi, particularly with leverage-focused and stablecoin-centric protocols, the sector remains underdeveloped. Existing initiatives have heavily invested in building robust lending primitives and cross-chain infrastructures. However, the integration of these elements into user-friendly cross-chain money markets that offer broad access to various chains and assets is still far from ideal. Despite these challenges, the sector is well-positioned for growth, with many initiatives and developments anticipated to bridge these gaps.

Potential Adoption

Synonym intends to be the universal cross-chain credit layer that connects all market makers from all chains. By facilitating lending and borrowing across multiple blockchain ecosystems, Synonym addresses significant challenges related to asset liquidity and interoperability, factors directly tied to widespread adoption.

One of the primary barriers to DeFi adoption has been the fragmentation of liquidity across various blockchains. Each blockchain operating as an isolated economy system significantly complicates users’ ability to leverage assets across different chains and dApps. Synonym’s cross-chain functionality directly addresses this issue by enabling assets on one chain to be used as collateral on another, effectively unifying liquidity pools and reducing the complexity and costs associated with cross-chain interactions where users must follow a series of steps to finally achieve their initial goal.

Synonym’s single unified interface does not require users to engage with multiple wallets or interfaces for different chains, which significantly improves the user experience by eliminating all the burdens associated with cross-chain interactions, a feature that many dApps of this kind are missing. This simplification makes DeFi work as intended and without limitations that hurt the mass adoption of this technology. Having dApps like Synonym offering these kinds of capabilities to users improves the overall ecosystem as more liquidity can flow to different applications and blockchains.

Moreover, the protocol’s ability to support numerous assets across different chains improves its utility and appeal to a wide range of users. By not limiting itself to major cryptocurrencies but also incorporating various tokens such as LRTs, Synonym has the chance to capture a larger segment of the market, appealing to users with diverse portfolios and investment strategies.

Potential partnerships with existing DeFi platforms, exchanges, and wallet services could drive adoption by integrating Synonym’s functionalities directly into well-established user interfaces. Similar to the integrations with Wormhole and Circle’s CCTP, new integrations with various technologies can improve even further the protocol and offer additional services and products.

In summary, the adoption case for Synonym is promising, given its approach to solving some of the most pressing issues in the DeFi space today. By offering an efficient cross-chain money market platform that supports multiple blockchains, Synonym can be an influential player in the expansion of the DeFi ecosystem, making it more accessible and versatile for all users.

Chains

Synonym is currently deployed in these chains with plans to support more in the future: Arbitrum, Optimism, Ethereum, Base, and Scroll.

The Synonym hub is positioned on Arbitrum due to its capability to handle high transaction volumes efficiently and its low execution costs. Arbitrum’s security, demonstrated by hosting a significant Total Value Locked (TVL), ensures a secure environment for transactions. Additionally, the vibrant and dynamic ecosystem of Arbitrum presents valuable opportunities for early strategic partnerships, promoting Synonym’s integration and functionality within the DeFi community. This combination of efficiency, security, and ecosystem synergy makes Arbitrum an excellent onboarding location for Synonym, attracting additional liquidity from DeFi-native users.

Business Model

Synonym’s primary offering is its ability to enable lending and borrowing across different blockchain ecosystems through the Hub & Spoke model without users manually bridging assets or using different interfaces. This is achieved by integrating technologies like the Wormhole cross-chain messaging protocol and Circle’s CCTP for $USDC transactions. By reducing friction and simplifying user interactions, Synonym’s unified credit layer aims to become the de facto cross-chain money market for DeFi users.

The protocol’s capability to integrate seamlessly across various blockchain networks amplifies its appeal and utility within the DeFi space. This multi-chain accessibility enables Synonym to tap into diverse pools of liquidity, which is crucial for reducing the fragmentation often seen in other DeFi dApps. By being operational on multiple chains, Synonym broadens its user base by accommodating preferences for different blockchain ecosystems and improving the fluidity and flexibility of transactions. Users benefit from the ability to interact with a wider range of assets and participate in cross-chain borrowing and lending without the worry and limitation of being on a single chain.

As a cross-chain money market, Synonym penetrates multiple markets which is critical for its business model that requires constant action and liquidity from both suppliers and borrowers. To achieve that Synonym offers additional incentives to increase the rewards and boost the APYs on all assets through locking $vlSYNO tokens. This process requires the users to provide liquidity in the $SYNO-$WETH (80-20) pool on Balancer; in return, they receive additional rewards in the Synonym platform. This model incentivizes users to a) increase their positions supply/borrow positions, thus increasing protocol metrics, and b) interact with Synonym’s system and $SYNO and $vlSYNO tokens.

This model is designed to bring value to all stakeholders of the protocol by addressing both the needs of the protocol for sustainable growth and the user needs for an efficient cross-chain money market.

Revenue Streams

Synonym generates revenue primarily through fees associated with borrowing and liquidations:

- Borrowing Fees: Borrowers pay interest on the assets they borrow, part of which is distributed to the liquidity providers as returns on their supplied capital, while a portion is retained by the platform as revenue.

- Liquidation Fees: In events where loans become undercollateralized, liquidation occurs, and fees are collected. These fees are designed to compensate liquidators and the platform.

- Fast Mode Fees: This feature will be part of the Optimistic Finality upgrade that will eliminate transaction wait times. Users will have the option to choose “Fast Mode” to make their transactions instant. Synonym will collect the fees for using this mode as pure revenue.

Synonym collects 10% of total fees for operational costs.

Fee Breakdown

The fees on Synonym primarily originate from two sources: Borrowers’ Interest and Liquidation Fees. Here’s how these fees are distributed:

| Fee | % |

| Base APY for Suppliers (Contributing to the money market) | 40% |

| vlSYNO Holders | 40% |

| tSYNO Holders | 10% |

| Operational Expenses | 10% |

| Total | 100% |

Other fees include the gas needed for supplying or borrowing assets on each available chain and the relayer fee which is controlled by Wormhole. Note that supplying and borrowing directly on Arbitrum does not incur a relayer fee because it is the chain hub.

Tokenomics

Synonym’s native token, $SYNO, serves as a transferable representation of attributed utility functions specified within the Synonym protocol code. $SYNO is specifically designed to function as an interoperable utility token and$SYNO can only be acquired through emissions or by buying directly via the Balancer pool.

Additionally, the Synonym protocol has 4 major tokens each one with a different function:

- $SYNO: The protocol token, standard ERC20.

- $vlSYNO: Locked Balancer $SYNO-$WETH LP tokens. A non-transferable ERC20 token. Earns a portion of the protocol fees.

- $tSYNO: Locked $SYNO for users who want to convert their $NEWO (see section Token Additional Information) tokens to $SYNO tokens. A non-transferable ERC20 token. Earns a portion of the protocol fees.

- $rCT: Rewards claim token – $veNEWO holders who converted their $NEWO tokens to $SYNO tokens, can also receive $rCT tokens.

The key tokens of Synonym are $SYNO and $vlSYNO. Over time, the $tSYNO and $rCT tokens will continue to be less important.

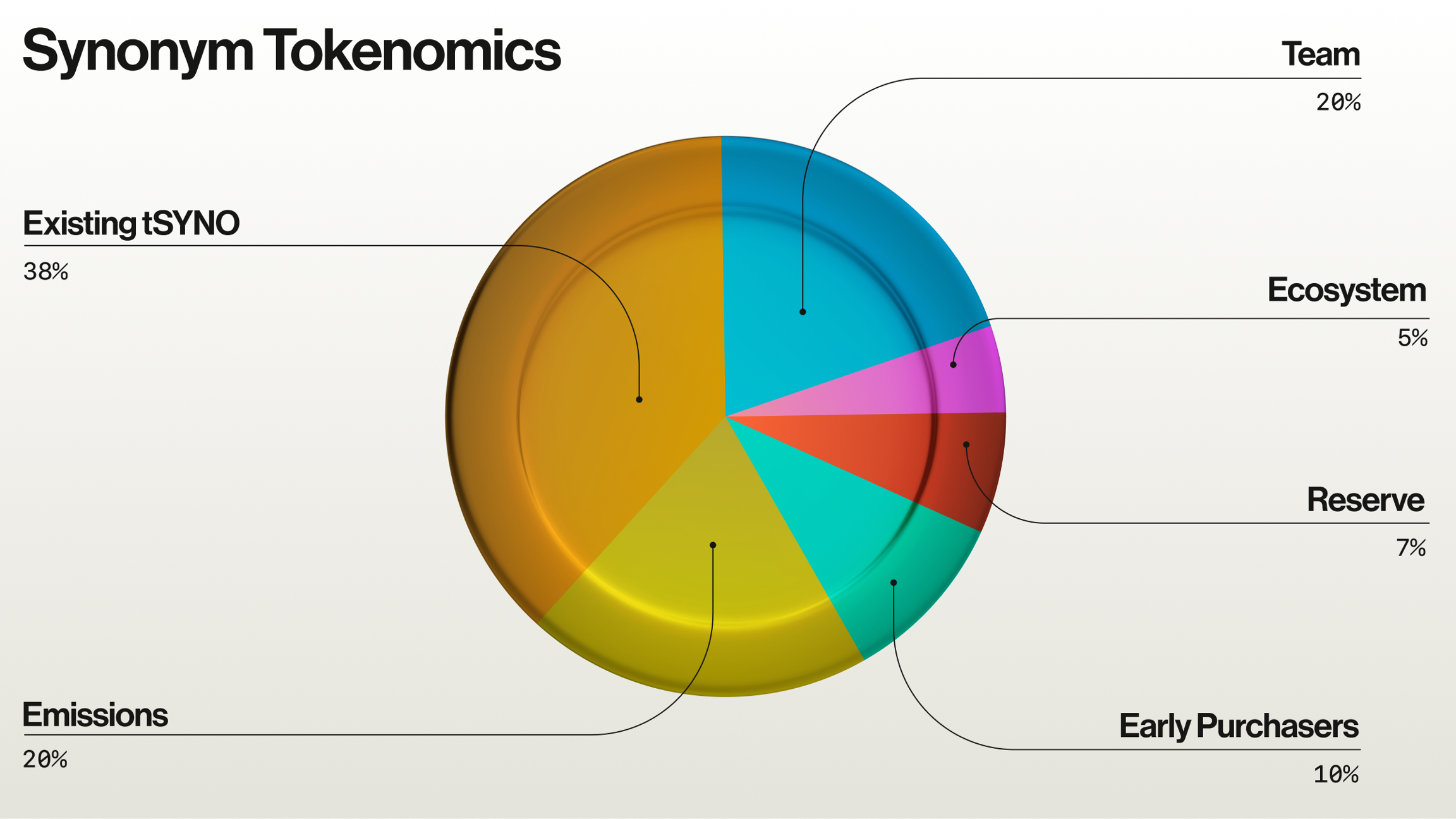

Token Distribution

Here’s the detailed tokenomics table:

| % | $SYNO Tokens | |

| Team | 20% | 160,000,000 |

| Existing Tokens (tSYNO) | 38% | 304,000,000 |

| Emissions | 20% | 160,000,000 |

| Early Purchasers | 10% | 80,000,000 |

| Reserve | 7% | 56,000,000 |

| Ecosystem | 5% | 40,000,000 |

| Total | 100% | 800,000,000 |

Token Allocation Breakdown

Existing Supply – tSYNO: 38%

- The existing supply of $NEWO tokens is convertible to tSYNO on a 1:1 basis. These tokens are subject to a 15-month staking period starting from the Token Generation Event (TGE). An early unstaking option is available but incurs a penalty that decreases linearly, starting at 90% at TGE and reducing over time. Penalties collected from early unstaking revert to the treasury. It is anticipated that not all tokens will convert to $SYNO, thus the maximum of 800 million in circulating supply is considered unlikely to be reached.

Reserve: 7%

- This portion of tokens is set aside to incentivize contributors, drive growth, and cover unforeseen costs. The reserve is strategically used for leveraging unexpected opportunities that can deliver value to the Synonym community.

Ecosystem: 5%

- Funds allocated here are used to support the ecosystem and promote partnerships that are beyond the scope of regular emissions. This ensures a proactive approach to community engagement and collaborative growth.

Emissions: 20%

- Emissions are planned to commence from the launch, designed to aggressively promote the adoption of the ecosystem. A portion of these tokens will be distributed at the outset, with the remainder set to be released in perpetuity to sustain long-term engagement and growth.

Team: 20%

- Tokens allocated to the team recognize the contributions of a diverse group of professionals with expertise in economics, computer science, venture capital, and various DeFi verticals. This allocation aims to retain talent and incentivize the continued development and success of the Synonym platform.

Early Purchasers: 10%

- A limited portion of the total token supply is reserved for early purchasers. This segment recognizes and rewards the trust and support of initial investors who contribute to the platform’s early-stage development.

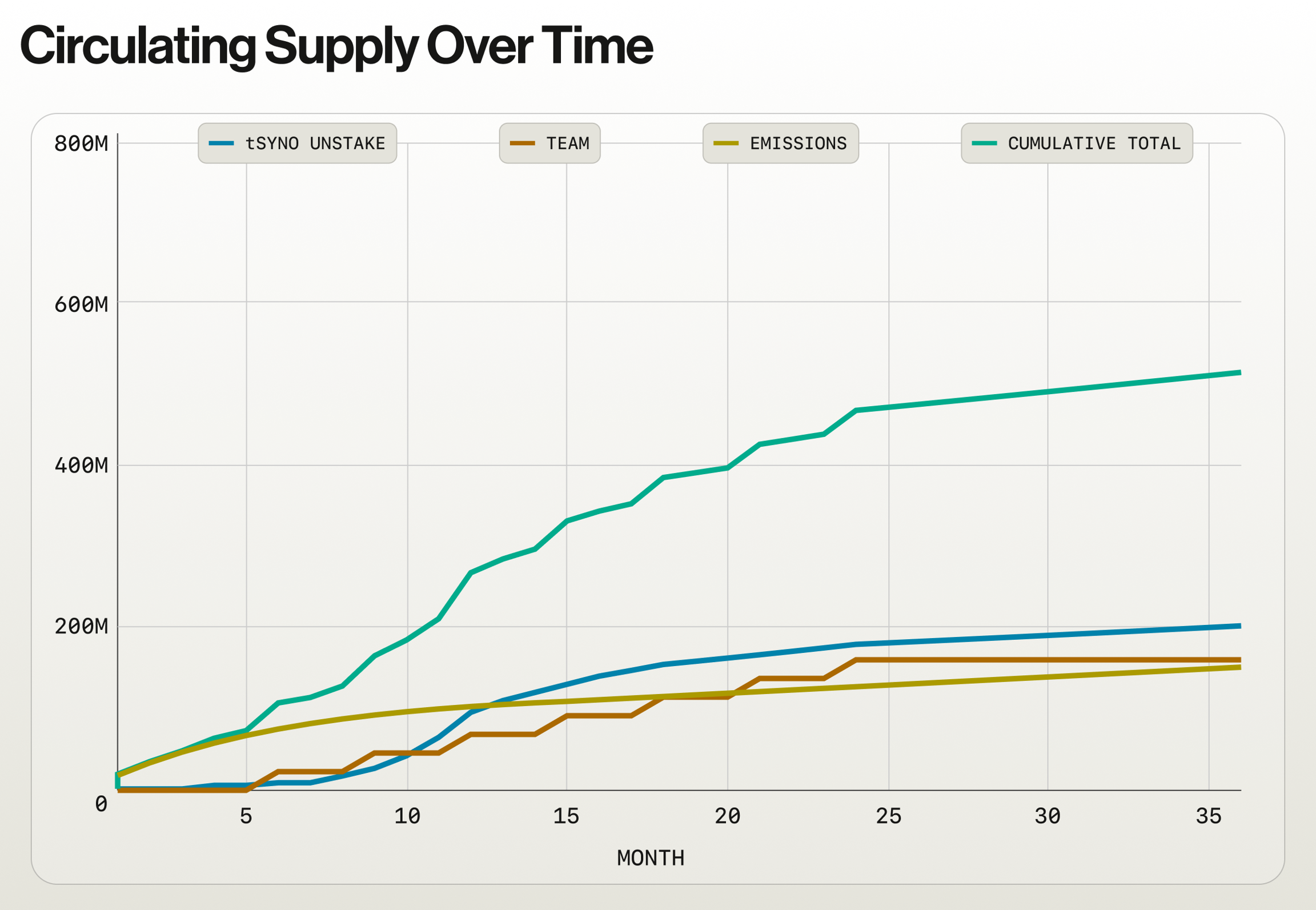

Token Emissions

Emissions cover 20% of the total supply which is 160,000,000 $SYNO tokens.

This is the schedule for the emissions and the circulating supply over time (subject to change):

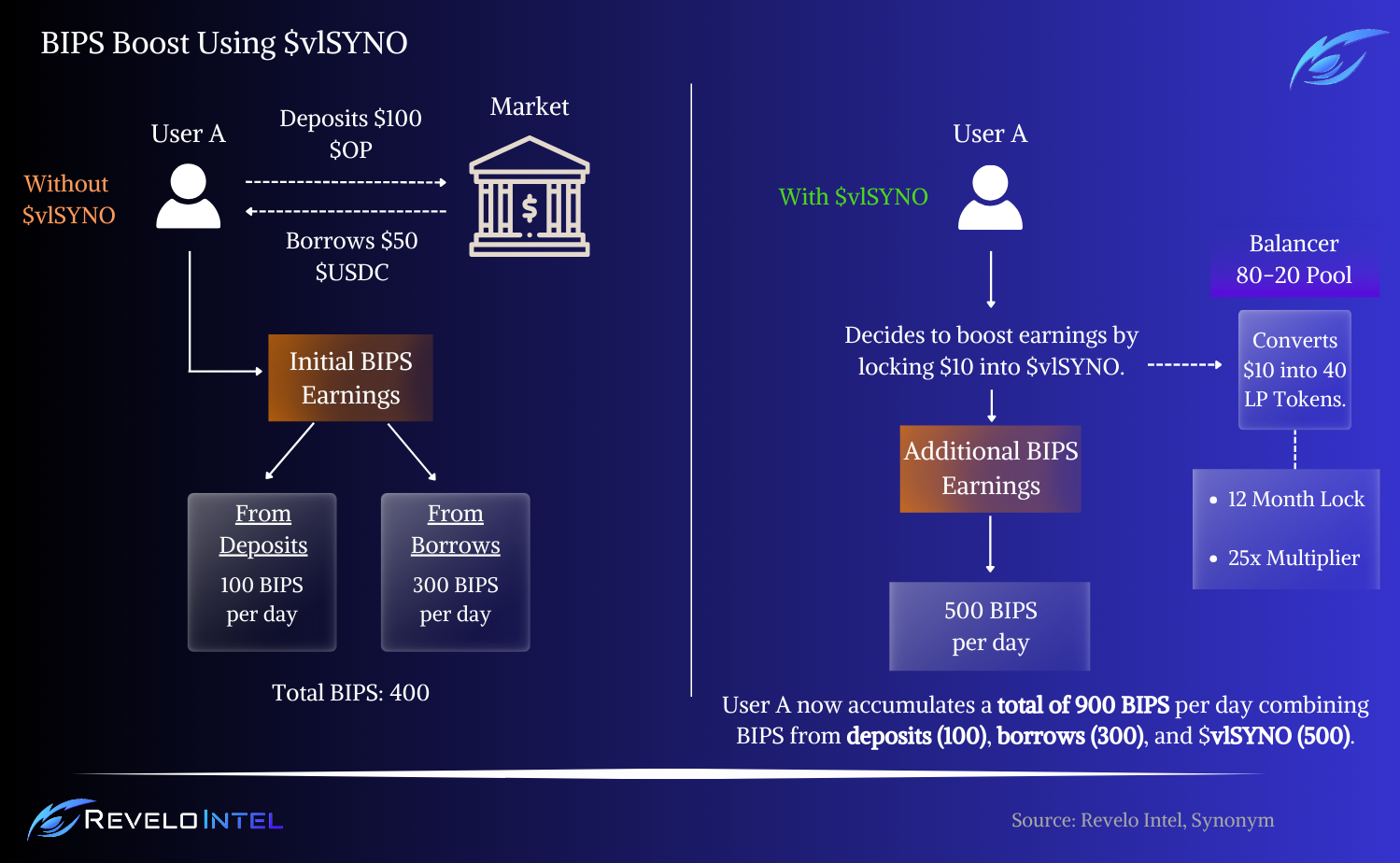

BIPS Program

The BIPS program is a reward mechanism for $SYNO within the Synonym ecosystem, focusing on transparency, fairness, and reward distribution for users interacting with the platform. This program represents an improvement from the initial complex tokenomics of Synonym to a better model, making it accessible for users of all experience levels. The BIPS program is structured across multiple seasons, with distinct opportunities and rewards outlined for each period.

How to Earn

Users can earn BIPS through several activities on the Synonym platform:

- Depositing assets into the money market.

- Borrowing assets from the money market.

- Locking $vlSYNO for enhanced liquidity and rewards.

Here’s how BIPS are distributed:

- Supplying: Users earn 1 BIP for every dollar supplied per day.

- Borrowing: Users earn 2 BIPS for every dollar borrowed per day.

- $vlSYNO Locking: Users earn 0.5 BIPS per $vlSYNO per day. Additional boosts are applied if the dollar value locked in $vlSYNO exceeds 5% of the supplied assets or if there are no supplied assets.

During the growth stages of the platform, certain assets may receive boosts to incentivize participation. For instance, depositing $USDC might earn 3 BIPS per dollar per day, and borrowing $USDC could earn 6 BIPS per dollar per day. In another phase, a different asset might receive a boost. These boosts are detailed on the markets page and are subject to change as per the strategic needs of the ecosystem.

BIPS for vlSYNO Lockers

$vlSYNO serves as an advanced liquidity provisioning tool within the Synonym ecosystem. Locking $vlSYNO not only contributes to deeper liquidity but also qualifies users for enhanced BIPS, $SYNO emissions, base market rates, and potential airdrops from ecosystem partners. To be eligible for the $vlSYNO boost, users must lock at least 5% of their supplied assets into $vlSYNO, though locking 10% is recommended to account for price volatility. However, locking $vlSYNO comes with risks such as impermanent loss, hence the additional rewards through BIPS.

BIPS Calculation Example

Here are some scenarios and examples of how you can earn BIPS.

- Scenario 1:

- Action: Lock $vlSYNO amounting to more than 5% of your supplied assets in the market.

- Outcome: Earn both Supply/Borrow BIPS and additional $vlSYNO BIPS due to the significant lock.

- Scenario 2:

- Action: Lock $vlSYNO without supplying any assets to the market.

- Outcome: Earn $vlSYNO BIPS only, as there are no supplied assets to generate Supply/Borrow BIPS.

- Scenario 3:

- Action: Either no $vlSYNO is locked, or $vlSYNO locked is less than 5% of supplied assets.

- Outcome: Earn only Supply/Borrow BIPS from the assets supplied to the market; no $vlSYNO BIPS are awarded.

Also a practical example:

With $vlSYNO locked, User A is eligible not only for increased BIPS but also gains eligibility for governance participation and a share in fees distribution.

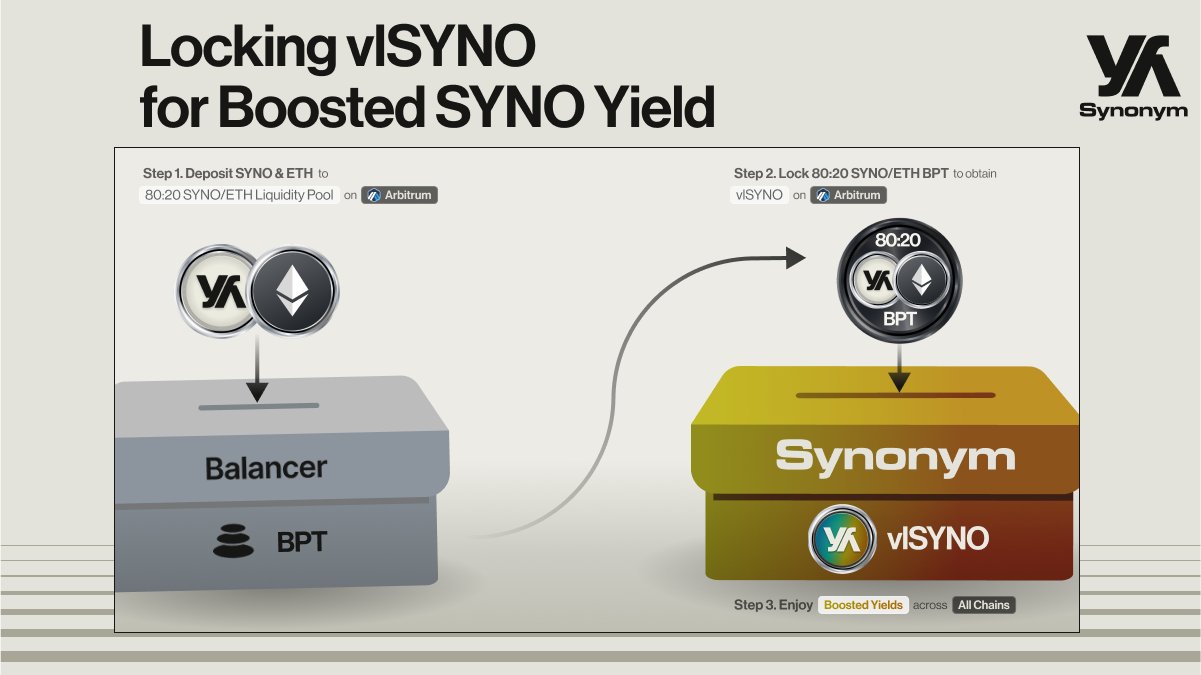

vlSYNO

Synonym has introduced $vlSYNO as a mechanism to incentivize and reward users for their contributions to liquidity, particularly within the $SYNO-$WETH pool on Balancer. This system is designed to boost the liquidity of the $SYNO token by encouraging user participation in the 80-20 $SYNO-$WETH liquidity pool on the Balancer platform. Users who provide liquidity to this pool receive Balancer Pool Tokens (BPT) that can lock on Synonym for $vlSYNO tokens. Users can lock their BPT tokens from 1 to 12 months. Each duration has a different multiplier on $SYNO emissions earned.

- 1 Month: x2

- 3 Months: x5

- 6 Months: x11

- 12 Months: x25

$vlSYNO holders gain several advantages, aimed at both increasing their potential returns and boosting their influence within the Synonym ecosystem:

- Boost in BIPS: Locking $vlSYNO significantly increases a user’s BIPS, which amplifies their share of:

- $SYNO Emissions: Users receive a greater portion of $SYNO tokens distributed as emissions, rewarding them for their liquidity provision.

- Ecosystem Allocations: Additional allocations from the ecosystem fund are directed towards users with locked $vlSYNO, recognizing their contribution to the platform’s stability and growth.

- Distribution of Fees in $wETH: A higher share of the fees generated from transactions within the liquidity pool, denominated in $wETH, is allocated to $vlSYNO holders, providing financial incentives tied directly to their investment in liquidity.

- Governance Power: Beyond financial incentives, locking $vlSYNO also grants users increased governance power within the Synonym Finance DAO.

Token Additional Information

$SYNO serves as a multi-utility token within the Synonym ecosystem, designed to provide economic incentives that encourage user participation and contribution. It creates a mutually beneficial system where each participant is compensated based on their involvement and efforts. The more a user engages with the Synonym platform whether through usage, activity, or transaction volume, the more $SYNO they can potentially earn. Importantly, $SYNO is crucial for maintaining the ecosystem’s operational integrity, as it incentivizes users to contribute resources towards communal benefits.

It’s important to clarify that $SYNO does not represent any form of shareholding, ownership, or equity in any company or entity associated with Synonym or its affiliates. Ownership of $SYNO tokens confers no rights other than the ability to use them as a tool for facilitating activities within the Synonym platform. This includes no entitlement to dividends, profits, or any form of financial return. $SYNO tokens are not classified as securities in any jurisdiction including the British Virgin Islands and Singapore, and are intended solely for use on the Synonym platform.

The valuation of $SYNO in secondary markets is independent of the efforts of the Synonym team. There are no mechanisms within the token’s design to influence or manipulate its market price. The distribution and sale of $SYNO occur only during a limited initial period aimed at raising funds for project development, increasing market visibility, and building community engagement.

Finally, Synonym’s integration with New Order DAO introduces $tSYNO, a staked form of $SYNO, to ensure growth in token supply without diluting the value for existing holders. $NEWO tokens convert to $tSYNO on a 1:1 basis, subject to a 15-month staking period with a linearly decreasing penalty for early unstaking from 90% at the start to 0% by the end of the period. Tokens forfeited from early unstaking are returned to the Synonym treasury. Additionally, holders of $veNEWO at a specific snapshot receive a claim token ($rCT), which entitles them to 50% of rewards from incubated project tokens transferred to the Synonym Treasury. The number of $rCT a user receives is proportional to their $veNEWO balance converted to $SYNO. Unstaking $tSYNO early reduces the holder’s claims on these treasury rewards.

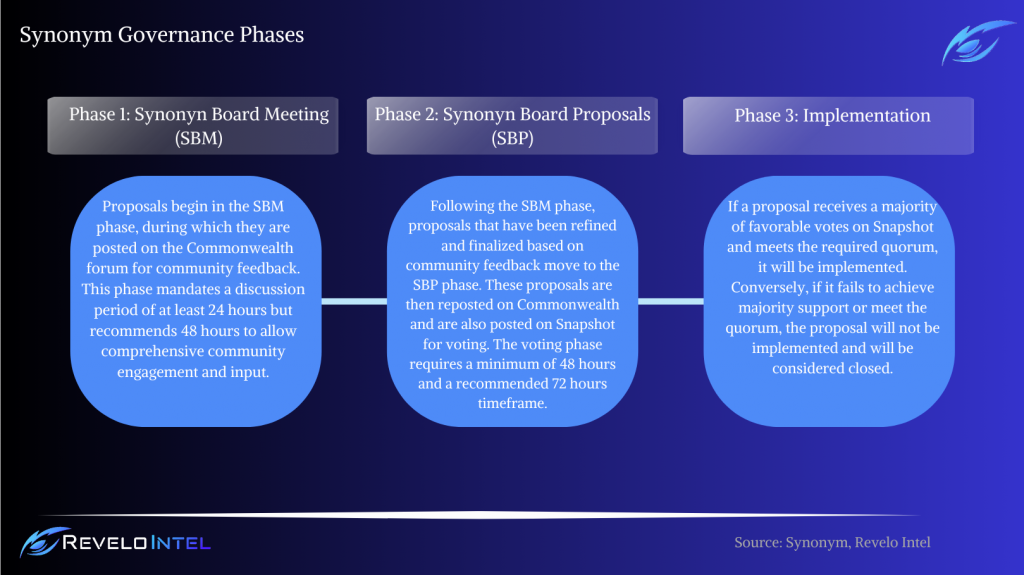

Governance

Synonym places great importance in the community by having a comprehensive governance structure that allows users to be part of Synonym’s future through the Synonym Finance DAO. The DAO operates under a structured governance framework designed to ensure transparency, inclusivity, and efficiency in decision-making processes. This framework outlines the stages through which proposals must pass before being implemented, providing a clear path for community participation and proposal evolution.

Synonym’s plan for full protocol governance includes the Solana deployment and the Optimistic Finality upgrade. After both are implemented to the protocol the DAO will take place.

To preserve a positive and productive environment, proposals deemed unreasonable or designed to harass or troll members will be removed. This policy helps maintain the DAO’s integrity and focus on productive initiatives.

These are the types of proposals in the Synonym Finance DAO:

- Proposal to update risk parameters of an asset.

- Proposal to list/remove the asset.

- Proposal to allocate $SYNO Emissions to the asset.

- Proposal to update $SYNO/$tSYNO/$vlSYNO tokenomics.

- Others that will contribute towards the future growth of the protocol.

Voting

Holders of $SYNO can convert their tokens into $vlSYNO to participate in key governance processes, ensuring that long-term aligned members have a say in significant decisions. Additionally, $tSYNO holders, due to their 15-month staking commitment, are also eligible to participate in governance, reinforcing their involvement in the DAO’s long-term objectives.

It is important to note that while the DAO facilitates community governance over protocol decisions, it does not extend legal control over corporate matters, the assets of the company, or any of its affiliated entities. The ultimate responsibility for these areas remains with the governing board of the relevant company.

$SYNO holders can discuss and submit proposals on the forum page here.

All the accepted proposals for voting can be found on Snapshot.

Risks

Despite rigorous security measures, Synonym, like any DeFi platform, faces the risk of exploits and vulnerabilities in its smart contracts. In addition, as a money market, Synonym has to deal with additional risks associated with lending and borrowing. Even with audits by reputable firms, the complexity of cross-chain interactions increases the potential for unexpected security issues.

Here’s a list of the most important risks.

Liquidity Risk

While Synonym aims to enhance liquidity through its various pools and cross-chain capabilities, sudden market shifts or massive withdrawals could strain the platform’s liquidity, affecting its ability to facilitate transactions smoothly. Being a cross-chain platform mitigates this risk to a great extent, although that also comes with its own set of complexities in the form of delays or technical failure.

Liquidation Cascades

Cryptocurrency markets are highly volatile. Rapid and extreme price fluctuations can affect collateral values, leading to increased calls for liquidations and potentially destabilizing the platform. Proper measures taken by the protocol can provide a safety net when it comes to extensive liquidations. Untimely liquidations could leave bad debt in the protocol due to the inability to sell collateral promptly or suffering large slippage in execution, which might deter some external liquidators from stepping in and taking on that risk

In money markets, bad debt occurs when the value of the borrowed assets exceeds the value of the collateral due to unfavorable market movements or failure in timely collateral management. This risk is inherently present in any lending system but is highlighted in a DeFi setting due to the volatility of crypto markets and the complexities of managing assets across multiple blockchains.

Debt Pricing & Risk

Synonym adopts a confidence-interval pricing approach to manage the complexities and risks associated with cross-chain liquidations, particularly during periods of high market volatility.

The platform utilizes Pyth oracles, which operate with confidence margins—a distinct mechanism that differs from traditional oracle services. In Synonym’s model, the confidence margin is strategically subtracted from the deposit (collateral) values and added to the debt values. This adjustment is particularly important because it accounts for the inherent delays and uncertainties in cross-chain communication and messaging, ensuring that liquidation processes are executed accurately and timely.

The use of confidence intervals is necessary for Synonym’s cross-chain functionality. By adjusting collateral and debt valuations according to confidence margins, Synonym effectively mitigates the risk associated with the time lags in cross-chain data transmission, which is critical to prevent erroneous or unfair liquidations and to protect the protocol from potential losses due to bad debt.

Synonym advises users to maintain a sufficiently high collateralization ratio to accommodate the adjustments made by confidence intervals. This precaution helps ensure that users’ positions remain secure even during unpredictable market conditions, reducing the likelihood of unexpected liquidations.

Example

Consider the following scenario to illustrate how Synonym calculates collateral and debt prices under this model:

Formula: The protocol adjusts collateral and debt prices around a base price, factoring in the confidence value.

- Collateral Price = Price − 4.24 × Confidence

- Debt Price = Price + 4.24 × Confidence

For example, if $ETH price is $3240.69911225 and the confidence is $2.62411225:

- Collateral Price of $ETH: 3240.69911225 − 4.24 × 2.62411225 = 3229.57287631

- Debt Price of $ETH: 3240.69911225 + 4.24 × 2.62411225 = 3251.82534819

This example highlights how, during periods of high volatility, confidence margins can significantly widen the gap between collateral and debt prices, necessitating careful risk management and monitoring by users.

Security

A foremost priority of Synonym is to minimize risk and ensure a secure trading environment for users across multiple blockchain networks. Besides the rigorous audits from third-party security firms, the protocol has established security measures around its platform and built an infrastructure that protects users and their assets from various risks within crypto.

Synonym is built on Wormhole’s cross-chain messaging infrastructure, a choice made due to Wormhole’s solid security framework. All cross-chain transactions facilitated by Wormhole are verified through a decentralized network of independent Guardians, enhancing the integrity and reliability of operations across different blockchains.

Oracles

For real-time asset pricing, Synonym utilizes Pyth oracle services, which allow for pulling asset prices on-demand. This feature significantly reduces latency and provides more frequent updates, ensuring price accuracy across all supported chains. Pyth aggregates data from over 80 market makers and exchanges, offering a comprehensive and reliable pricing mechanism that is crucial for maintaining market consistency and fairness. The protocol can also switch to Chainlink immediately if necessary.

Protocol Level

Synonym meticulously manages risk at both the individual asset and chain levels by implementing supply and borrow parameters that are carefully designed in collaboration with risk management experts from Gauntlet. This approach helps maintain asset utilization within healthy thresholds.

For $USDC, a major asset within the Synonym ecosystem, parameters are set globally across the protocol, standardizing operations and simplifying risk assessments.

Liquidation Measures

Liquidation occurs when the collateralization ratio of a borrower’s portfolio drops, signaling that the collateral no longer adequately covers the loan value. This may result from either a decrease in collateral value or an increase in the borrowed amount. Liquidations are initiated when the collateralization ratio reaches 100%. The actual liquidation bonus for each asset can be checked to understand the additional costs incurred during this process.

To mitigate liquidation risks, Synonym employs a system of partial liquidations. This method involves liquidating only enough of a borrower’s position to restore the health of their account, as opposed to binary liquidations where an entire position might be liquidated. This strategic approach prevents over-liquidation, optimizing overall protocol safety and user protection.

Accounts that fall below the Minimum Collateralization Ratio (MCR) of 100% (Health Factor ≤ 0) become eligible for liquidation. However, liquidations are conducted judiciously only to the extent necessary to elevate the account’s MCR back above 100%, thereby safeguarding the user’s remaining assets and stabilizing their financial standing within the platform.

Risk Parameters

- Asset Risk Definitions

Within the Synonym Protocol, each asset is assigned specific risk parameters that influence its utilization within the system for supplying and borrowing. These parameters are established in collaboration with Gauntlet, adhering closely to their expert recommendations to ensure robust risk management.

- Liquidation Bonus

The liquidation bonus is a fee added to the price of collateral assets when liquidators engage in the liquidation process of loans that have surpassed the liquidation threshold. This bonus acts as an incentive for liquidators to participate in the recovery of loans nearing default.

- Minimum Health Factor

To mitigate the risk of binary liquidations where positions are either fully liquidated or not at all, Synonym introduces a Minimum Health Factor. This parameter helps manage the extent to which a position can be liquidated, supporting the protocol’s stability by facilitating partial liquidations. For example, if a position hits a Collateralization Ratio of 100% and triggers liquidation, liquidators are restricted to adjusting the position only up to the specified Minimum Health Factor, thereby avoiding excessive liquidation and maintaining protocol safety.

- Supply Factor

The Supply Factor determines the maximum borrowing power granted by a specific collateral type. This factor directly affects how much a user can leverage their deposited assets for borrowing.

- Borrow Factor

Conversely, the Borrow Factor dictates the maximum ratio at which an asset can be borrowed against the collateral. For instance, if Asset A has a Supply Factor of 70% and Asset B has a Borrow Factor of 80%, then the maximum amount of Asset B that can be borrowed is 56% of the value of Asset A.

- Supply and Borrow Caps

Supply Cap: This parameter sets the upper limit on the amount of an asset that can be supplied to the protocol for each asset, on each chain. Notably, $USDC has a global supply cap across the entire protocol.

Borrow Cap: Similar to the supply cap, this limits the total amount of an asset that can be borrowed from the protocol, with $USDC also having a global cap.

- Reserve Factor

This is the portion of the interest generated from borrowing that is not distributed to lenders but is instead set aside as reserves. The global reserve factor is structured as follows:

- 40% allocated to $vlSYNO stakers

- 10% to $tSYNO stakers

- 10% for operational purposes

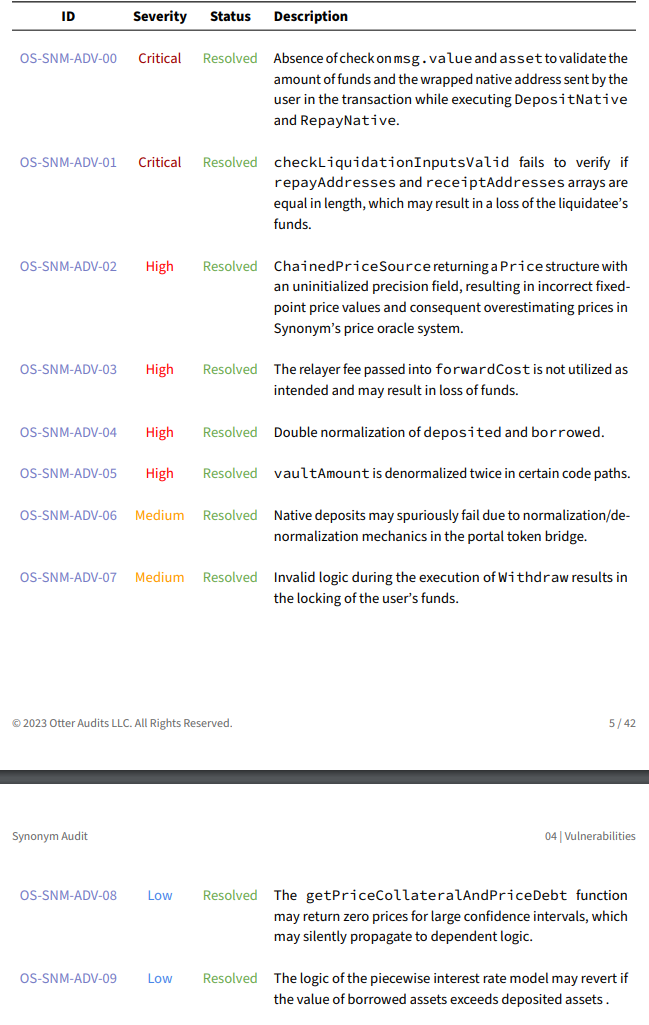

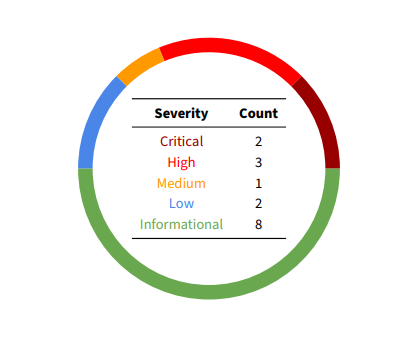

Audits

Synonym has been audited by Runtime Verification and OtterSec as part of its security measures.

- Audit Report Synonym – December 22, 2023 – Runtime Verification

- Synonym Audit – January 16, 2024 – OtterSec

Economic Attack Vectors

Given that Synonym utilizes cross-chain technology like Wormhole, it is susceptible to relay attacks where an attacker exploits the time lag in cross-chain communication to conduct arbitrage or duplicate transactions. Such attacks can lead to double-spending or other forms of financial loss for the protocol or its users.

Similarly, flash loan attacks allow attackers to borrow substantial assets without collateral, manipulate market conditions or asset prices, particularly in markets with lower liquidity, and adjust their positions within a single transaction block.

Dependencies and Access Controls

Synonym’s functionality heavily relies on third-party technologies like Wormhole and Circle’s CCTP. Any disruptions, exploits, or failures in these services could severely affect Synonym’s operations since without them the protocol cannot operate as intended.

Additionally, for accurate and up-to-date asset pricing, Synonym integrates with Pyth Oracle services. These oracles fetch price data from numerous exchanges and market makers, which is important for calculating collateral values and managing liquidation thresholds. There is a major dependency on this service but at any time Synonym can switch to Chainlink if an issue occurs with Pyth.

Team

The core team of Synonym is composed of individuals with years of experience in the crypto space and contributions to different crypto and non-crypto companies and projects.

The team is fully anon:

Project Investors

Synonym has raised $1.5 million in a seed round led by Borderless Capital and participation from various other crypto funds and angel investors.

FAQ

What is Synonym?

Synonym is a universal cross-chain credit layer, enabling users to perform lending and borrowing across multiple blockchain ecosystems from a single interface.

How does cross-chain borrowing work on Synonym?

Cross-chain borrowing on Synonym allows you to use collateral from one blockchain to secure a loan on another blockchain without the need to manually bridge assets, thanks to the integration of advanced cross-chain technologies like Wormhole.

What security measures does Synonym employ?

Synonym leverages robust security practices, including using the open-source Wormhole network for secure cross-chain communications, and Pyth oracle services for accurate, real-time asset pricing, alongside regular security audits of its smart contracts.

Can I earn interest on Synonym?

Yes, users can earn interest by lending their assets on Synonym. The platform supports various cryptocurrencies across different blockchains, improving your investments’ diversity and potential yield.

Are there risks of liquidation on Synonym, and how can I mitigate them?

Yes, if the collateral value falls below certain thresholds, your positions may be subject to liquidation. To mitigate this risk, maintain a healthy collateralization ratio and monitor your positions regularly through Synonym’s user interface.

How is Synonym different from other DeFi platforms?

Unlike some DeFi platforms that are restricted to a single blockchain, Synonym provides a smooth cross-chain experience, enabling greater liquidity and flexibility by allowing users to interact with multiple blockchains through one unified platform.

What assets can I use as collateral on Synonym?

Synonym supports a wide range of cryptocurrencies as collateral, including major tokens like $ETH, $BTC, and $USDC, among others. The platform is continuously expanding its list of supported assets to include tokens from various chains.

What happens if I fail to repay a loan on Synonym?

If you fail to repay a loan, your collateral may be subject to liquidation if the collateral value falls below a certain threshold. Synonym uses a partial liquidation process to minimize the impact on the borrower while ensuring the platform’s stability.

How can I participate in Synonym’s governance?

Token holders can participate in Synonym’s governance processes by voting on various proposals that shape the direction and policies of the platform. Participation requires holding $vlSYNO tokens, which grant voting rights within the ecosystem.