Overview

Stryke is a decentralized options exchange that builds on the legacy of Dopex, focusing on enhancing options trading and liquidity provision in DeFi. It introduces innovative tools like a Concentrated Liquidity Automated Market Maker (CLAMM) to make on-chain options trading intuitive and seamless. Stryke’s platform design facilitates easy cross-chain options trading, aiming to maximize liquidity, minimize losses for option writers, and passively maximize gains for option buyers. Overall, this results in more capital efficiency for the underlying ecosystem.

Stryke’s Concentrated Liquidity AMM (CLAMM)

Stryke’s CLAMM, or Concentrated Liquidity Automated Market Maker, merges the concepts of liquidity provision and options trading into a single, cohesive platform. Inspired by Uniswap V3’s innovations in liquidity management, CLAMM enhances the trading of options by integrating these with the mechanisms of concentrated liquidity provision.

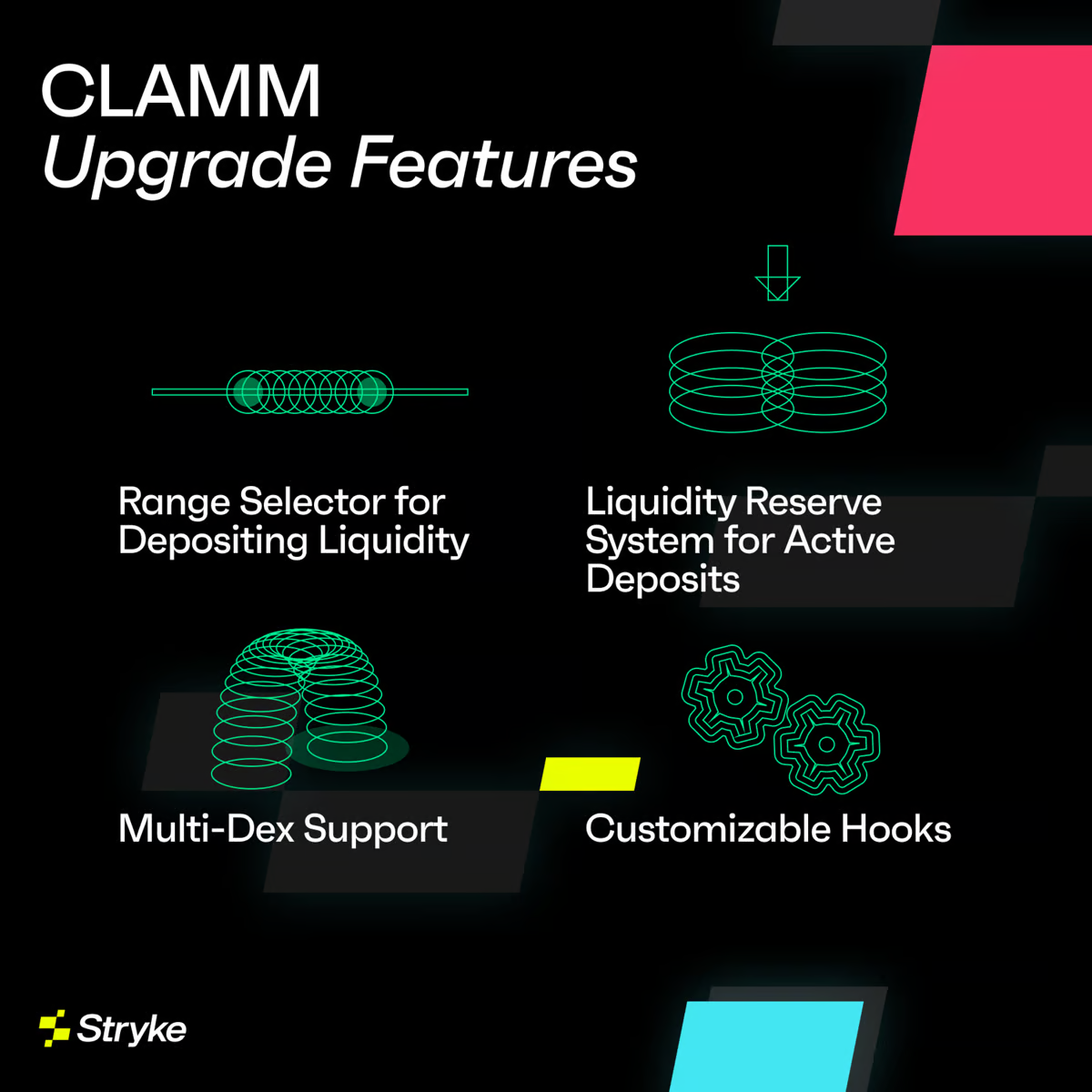

CLAMM Features

- LP Range Selector:

- This feature allows users to choose a deposit range in a single transaction. This eliminates the need for manual selection of each tick, significantly simplifying the liquidity management process. Any barriers associated with token ratio balancing and manual tick selection are removed, improving liquidity management efficiency and options trading experience.

- Liquidity Reserve System:

- In other systems, LPs need to monitor their liquidity actively to ensure it is not being used in active options contracts. With the Liquidity Reserve System, LPs can reserve their provided liquidity. Once an option is exercised or expires, the liquidity is reserved and withdrawn from the option LP and stays in the Uni V3 LP available to be withdrawn at any time. This liquidity cannot be bought or locked by anyone.

- Multidex Support:

- In line with Stryke’s broader vision for cross-chain compatibility, this feature aims to deepen liquidity and onboard large market makers and strategic DEX partners into the LPDfi space. Through multi-DEX support, CLAMM’s liquidity will be available across chains and to different DEXs.

- CLAMM Hooks:

- Current options users are limited by predefining strategies with no flexibility and customization. The “Hooks” feature enables the integration of custom logic into trading activities, allowing for personalized control over trading strategies and adapting to individual needs and market conditions. For example, users can set to avoid trading on weekends when volatility is low or create their timeframes.

- Native $USDC Support:

- While $USDC.e (bridged) is still used on legacy pools, the platform is fully compatible with native $USDC allowing cross-protocol compatibility.

- American Style Options:

- American-style options allow settlements against the pool rather than individual peers. This setup ensures that traders can exercise their options based on the liquidity available within the pool, rather than relying on potentially less predictable market values. This method of settlement improves price predictability, particularly beneficial in markets where options may be less liquid.

- Granular Strikes:

- V3 DEXs operate on a tick basis, which means the LPs can provide liquidity over a large range of ticks of their preference. Buyers on the other hand can be very specific with their strike purchase.

- Fully Backed Options:

- Every option is backed by the pool itself upon which the trading happens. There’s no other counterpart risk that may affect the trading of options.

CLAMM for Liquidity Providers

Stryke’s CLAMM offers Liquidity Providers (LPs) a platform that integrates options trading with traditional liquidity provision, drawing inspiration from Uniswap V3’s concentrated liquidity model. This allows LPs to manage their capital allocation and optimize their returns while earning additional incentives from CLAMM.

Here’s how CLAMM specifically benefits LPs:

- Improved Capital Efficiency: CLAMM adopts Uniswap V3’s concentrated liquidity provisioning, allowing LPs to allocate capital within predefined price ranges, which enhances capital efficiency. This strategy maximizes potential returns by concentrating funds where they are most likely to be utilized.

- Integration of Options Trading: CLAMM differentiates itself from other AMMsby incorporating options trading, offering LPs additional revenue streams through options premiums. This is layered on top of regular earnings from swap fees, thereby increasing the overall yield potential for liquidity positioned within the active price ranges.

- Protocol Integrations: Compatibility with UniV3 and collaborations with other platforms such as PancakeSwap and Mantle projects such as FusionX and Agni enable a seamless transition for LPs between different DeFi opportunities. These integrations support diversified investment strategies and maximizes engagement across the DeFi ecosystem.

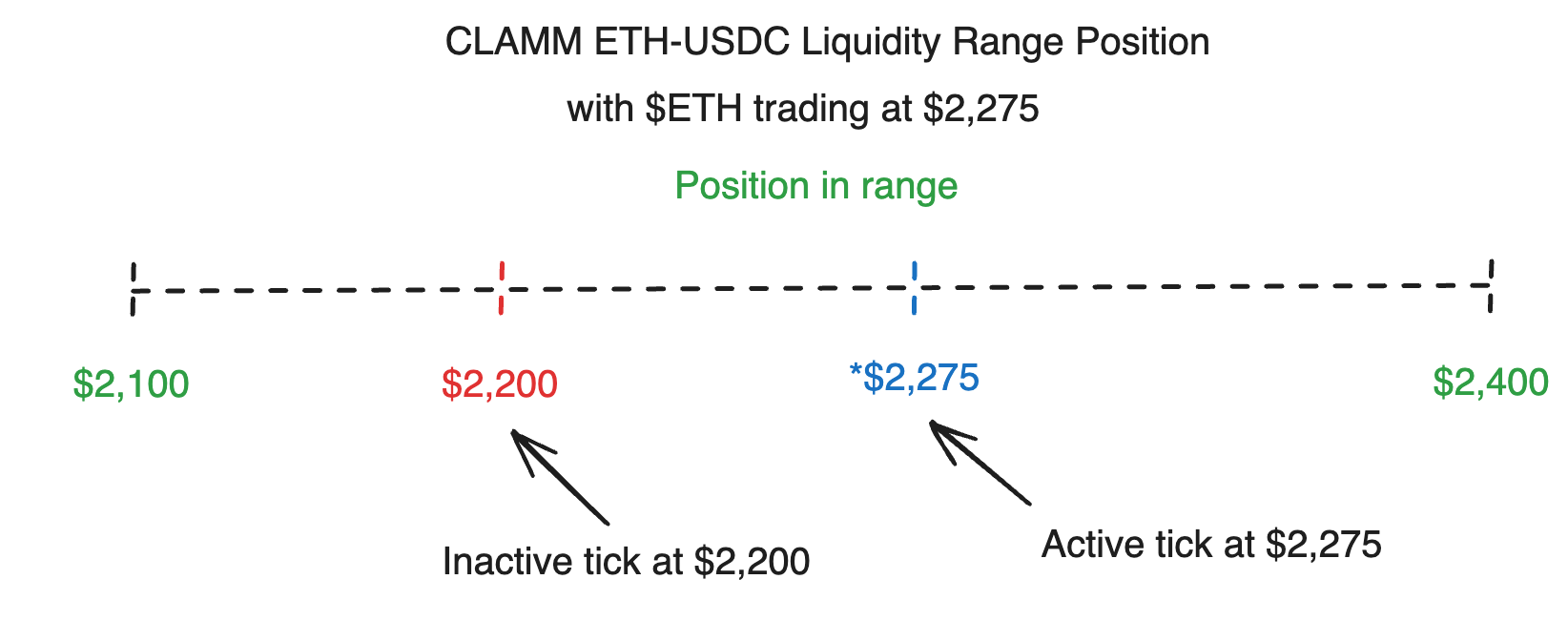

Ticks

Ticks are a fundamental concept in the operation of Stryke’s CLAMM, playing an important role in how LPs manage and earn from their capital.

In CLAMM, each liquidity position within a price range is divided into separate parts known as ticks. Each tick corresponds to a specific price point within a liquidity price range. They are the smallest functional unit of liquidity. Here’s a visual illustration of a tick:

In this example, $ETH is trading at $2,275 which means the position is within range but only the specific tick at that price is earning fees. All other ticks will be activated if the price moves into their range.

Ticks Implications for LPs

By strategically choosing the price ranges and the ticks within them, LPs can optimize their liquidity position in the market, ensuring that their capital is not lying idle but is instead generating the maximum possible fees from price action.

Ticks are integral to maximizing the operational efficiency of liquidity within CLAMMs, allowing LPs to tune their exposure and earnings precisely.

CLAMM for Option Traders

CLAMM offers a dynamic environment for options traders, integrating deep liquidity management with sophisticated options trading capabilities. Here’s an analysis of how CLAMM interacts with option traders, enhancing their trading experience and profitability.

- Timeframes: CLAMM offers option traders a variety of expiration timeframes, ranging from as short as one hour to as long as one week and soon monthlies. This range allows traders to implement both short-term and long-term strategies.

- UniV3 Ticks: Similar to LPs, ticks are also helpful for traders, allowing them to be precise with their strike price for calls and puts. This way, efficient capital utilization is achieved on both ends.

- Strike Price Selection: The platform offers an extensive variety of strike prices for both calls and puts, enabling traders to tailor their option positions thoroughly.

There are some additional technical features for traders regarding exercising options.

- Auto Exercise: Users can activate the auto-exercise feature that automatically executes in-the-money (ITM) options shortly before their expiration. This automation ensures that profitable positions are realized without manual intervention. Note that there is a fee (1% of PNL) when choosing this feature.

- Manual Exercise: Traders can also exercise their options at any given time before expiration. Having both of these options available gives traders flexibility and control over their positions.

While using CLAMM traders are subject to a fee with a percentage of the premium charged at the time of option purchase.

CLAMM Vaults

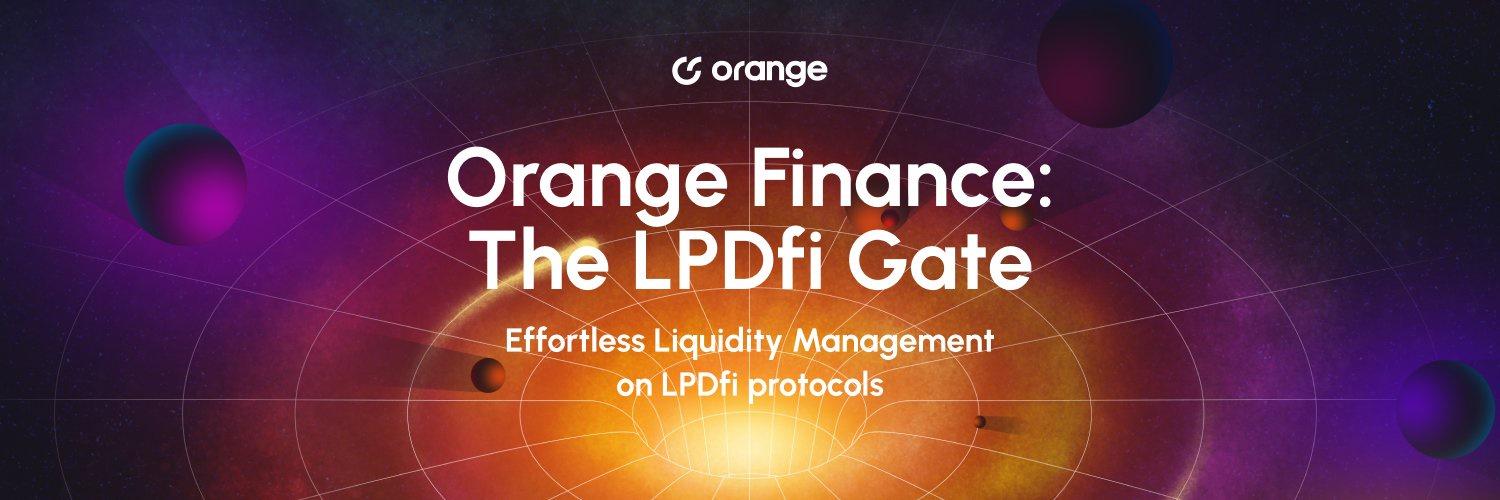

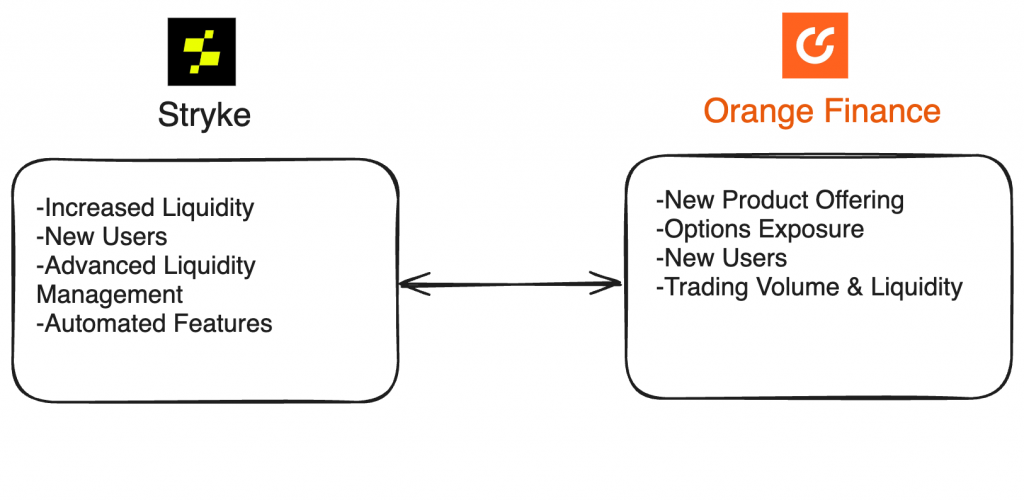

Stryke has collaborated with Orange Finance to create a new primitive around the CLAMM vaults. Orange Finance, as an Automated Liquidity Manager (ALM), leverages existing DeFi protocol liquidity pools to introduce advanced, automated strategies for hedging, rebalancing, and optimizing liquidity, keeping these activities on-chain and transparent for all.

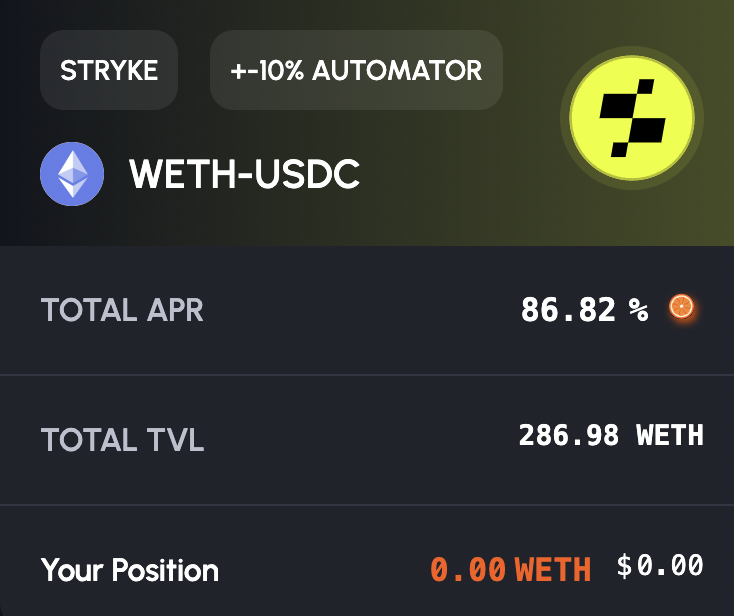

Through this collaboration, Stryke users can contribute liquidity to Orange’s new CLAMM vaults. The currently available vault is for WETH-USDC. This integration offers significant advantages for users, including:

- Auto-Rebalancing: Automatically adjusts liquidity to maintain a +/- 2.0% range from the spot price, maximizing returns and STIP rewards.

- Auto-Withdrawal: Users can withdraw their liquidity at any time without having to worry about high utilization and lock-ups. Unburned positions will be returned as Stryke LP tokens to users.

- Single Asset Deposit: Liquidity providers can deposit single assets to Orange. The protocol then will pool these assets together in the vault and then supply them to Stryke Pools in the next cycle as batches.

Due to frequent rebalancing a 0.1% fee is charged once to cover gas costs.

You can access Stryke’s CLAMM Vault on Orange here.

Why the Project was Created

Recently rebranded to Stryke in 2024, the project was formerly known as Dopex. Tztokchad, the founder of Dopex, became intrigued by option protocols following his experience with platforms like Deribit, where he identified several shortcomings such as low liquidity, wide bid-ask spreads, and demanding margin requirements. In response to these challenges, the development of the protocol started in 2019.

At that time, only a few players were addressing this segment of the market, presenting an opportunity to create a user-friendly solution that could surpass both centralized exchanges (CEXs) and decentralized protocols. Throughout the initial development phase, decentralized exchanges (DEXs) faced numerous liquidity-related issues, including unfair pricing for buyers, liquidity providers (LPs) experiencing asset depletion during volatile periods, and difficulties in capitalizing on arbitrage opportunities due to high gas fees on Ethereum. Additionally, there was significant slippage when rolling over options to different strikes or prices.

After an initial period of ideation, the project set out to realize its vision by building a protocol that could offer the following:

- Option Pools with Automatic Rollovers, enhancing liquidity and ease of use for participants.

- European options to streamline arbitrage activities with CEXs, leveraging specific market dynamics for optimal efficiency.

- Deployment on Ethereum Layer 2 Solutions to mitigate the impact of high gas fees on Ethereum and facilitate arbitrage.

- Option Swaps to Minimize Slippage, enabling users to execute transactions more efficiently and effectively manage their positions.

Despite the rebranding to Stryke, the vision remains the same: become a prominent player in DeFi innovation and focus on the development of cutting-edge options products that cannot be offered off-chain.

The transition aimed to provide token holders with enhanced value, streamline operations, and deliver superior options products to users. By consolidating efforts under the Stryke brand, the project seeks to simplify operations and create a more user-friendly and efficient options platform.

The rationale behind the rebranding lies in offering better value to token holders and focusing on delivering top-notch options products. By moving away from the dual token model used by Dopex ($DPX & $rDPX) to a unified single token system ($SYK), Stryke aims to improve governance and cross-chain functionality while simplifying operations.

Note that the transition represented the sunset of older products to streamline operations and focus resources on core offerings. This includes the discontinuation of SSOVs (Monthly and Weekly), $rDPX V2 bonding, Perp Put Vault, and rtETH-WETH LP.

Sector Outlook

Options is a niche market that addresses a specific group of users. Although it’s a popular way to trade, it always had a secondary role behind spot and futures trading. To most retail investors options seem like a complex product, especially when compared to spot and futures trading. Despite that, options are very capital efficient and are one of the most used instruments in TradFi because of the leverage acquired without liquidations or owning the asset. In crypto, the story is different with perps, which give users more leverage and are much easier to use. Options have a more complex learning curve, and that might explain why their growth is tanking, especially among retail users

In brief, options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specific date. There are many notions that a trader must understand before starting trading options such as Puts, Calls, Expiry, Strike Price, and Greeks. Overall, options are a flexible approach which allows traders to speculate on the price of an asset without any ownership.

In crypto, there is extreme speculation, making options a very attractive product to many investors looking for opportunities to capitalize on volatility. Options stand out among other derivatives instruments due to how flexible and versatile they are, making it possible to construct a broad variety of payoffs. Traders can precisely configure their options by selecting the underlying asset, strike price, and expiration date, thus gaining significant control over their risk and potential gains.

Competitive Landscape

Accurate pricing remains a challenge in crypto options, as traditional financial models are unsuitable for the distinctive market microstructure and volatility of on-chain assets. Platforms like Premia Blue have tried to address these issues by integrating diverse liquidity sources such as Concentrated Liquidity AMMs (CLAMMs) and Request For Quote systems, thereby improving pricing accuracy and market depth, reminiscent of traditional exchange’s central limit order books.

Despite the popularity of perpetual swaps among DeFi derivatives, decentralized options markets have lagged due to numerous reasons such as pricing models, liquidity, and throughput limitations. This has led platforms like Lyra V1 to explore hybrid models that combine option minting with liquidity provision akin to Automated Market Makers (AMMs). This version had great success but ultimately led to an upgrade due to bottlenecks including capital inefficiency, a monolithic architecture (making upgrades challenging), and the general on-chain UX (wallets, gas, bridging). Lyra V2 was introduced with a modular approach that combines multiple aspects such as subaccounts, risk managers and assets. As a result, the layers of the protocol can be iterated and improved swiftly creating a dynamic structure for options. Also, the protocol is built on Lyra chain, an Ethereum rollup on OP Stack which provides an environment to scale and increase throughput.

A similar approach is adopted by Aevo (previously Ribbon), a vertically integrated platform built on its rollup chain, the Aevo Rollup. It supports perps, options, OTC swaps, and pre-launch futures where users can trade upcoming token launches. Aevo uses an off-chain order book that matches orders from makers and takers. Using a risk engine the order is evaluated before being posted in the order book and then transferred on-chain for settlement. Ultimately, all users’ funds and positions remain on-chain the entire time on the Aevo smart contracts. This approach tries to combine both words, with a traditional limit order book and the transparency of blockchain.

Meanwhile, Stryke is focusing on its primary product which is the CLAMM, but with a notable twist. The protocol has adopted an LPDfi (Liquidity Providing Derivatives Finance) approach to enhance the capabilities of CLAMM. LPDfi refers to a protocol in DeFi that integrates the functionality of traditional derivatives markets with the technological and operational advantages of decentralized exchanges. For example, Stryke uses Uniswap’s V3 pools to offer options trading in certain pairs. Similarly, other protocols can leverage the CLAMM to build different financial products (see LPDfi section). The LPDfi approach can solve weaknesses that options platforms face such as liquidity fragmentation and trading inefficiency.

Rysk is an options platform that also follows an LPDfi approach. Rysk V2 introduces a synergetic effort that includes a CLOB from 100x and Rysk Orchestra, a market-making vault network that provides decentralized, deep liquidity for the 100x network. The Rysk Orchestra is fully composable for integration with other platforms (DEXs, CEXs, LSTs).

Potential Adoption

The potential adoption of Stryke as a decentralized options trading platform is promising, given its innovative features like the CLAMM and cross-chain capabilities. Stryke’s framework can facilitate broader adoption and enable other protocols to build on top of and leverage its infrastructure.

With CLAMM, Stryke integrates liquidity provisioning with options trading. This attracts both retail traders looking for user-friendly options trading platforms and sophisticated traders seeking advanced trading with high customization strategies.

Stryke’s vision is to expand across multiple chains and attract a larger user base, while also improving liquidity. Tapping into popular networks with a large user base increases the chances of finding the right users for the platform.

Leveraging CLAMM

Various protocols can integrate Stryke’s CLAMM into their platform and benefit from it (see Orange Finance). By leveraging Stryke’s concentrated liquidity features, these protocols can offer their users more efficient capital usage and better pricing models, crucial for activities like hedging and yield farming. Offering such a product to the market benefits both parties.

This feature allows for more users to use options products helping Stryke gain exposure from various sources in the crypto market.

Stryke achieves that by introducing multi-DEX support that enables the CLAMM to be accessible across multiple chains and DEXs. By adding CLAMM liquidity to other DEXs such as Uniswap, Stryke deepens liquidity and broadens market exposure.

Increasing the number of market makers and LPs who support the CLAMM by Stryke, provides a significant opportunity for liquidity inflows and increased platform volume.

The value proposition for both parties is that each side leverages the other’s side product to gain an advantage and provide value to its protocol and users.

For example, take a look at the Stryke – Orange collaboration to see how both protocols benefit.

LPDFi (Liquidity Protocol Decentralized Finance)

Stryke’s focus on LPDfi centric product design brings several benefits to the platform and its users. Firstly, the expansion of CLAMM across new chains improves accessibility and flexibility, attracting a larger audience to the platform. By integrating with DEXs, such as Margin Zero, PancakeSwap, and Sushiswap, CLAMM gains visibility and usability, allowing users to purchase options directly from the exchange, and streamlining the trading process.

By leveraging advanced functionality with hooks, Stryke can automate trading strategies at a more granular level, enhancing composability with other projects and increasing capital efficiency for traders. This allows Stryke to expand its operations beyond its core product, the CLAMM, to help ecosystem projects build on top and adapt to changing and broader market needs.

Orange Finance

The composability between Stryke and Orange Finance demonstrates how two distinct DeFi platforms can cooperatively integrate their functionalities to enhance both user experience and financial operations.

As discussed above, Orange Finance utilizes Stryke’s CLAMM to manage liquidity more efficiently. By integrating CLAMM, Orange Finance can offer its users targeted liquidity provision that optimizes capital usage and improves the efficacy of trading strategies on its platform.

This integration allows Orange Finance to automate its liquidity management processes. This automation is facilitated through Stryke’s advanced liquidity algorithms, which can dynamically adjust to market conditions, ensuring that liquidity is provided and utilized in the most efficient way possible.

Margin Zero

MarginZero introduces a revolutionary approach to DeFi trading by enabling traders to engage in futures-like contracts without the need for upfront margins and eliminating the risk of liquidation from price movements. This model is particularly innovative because it guarantees that positions remain open regardless of market volatility, an important feature in risk management for DeFi traders.

By integrating with Stryke’s CLAMM, MarginZero offers Uniswap V3 liquidity providers significantly higher yields compared to standard Uniswap V3. Since liquidity is shared across all integrated apps, the utilization rate is higher resulting in higher yield. If more apps build on top of Stryke the yield increases substantially.

Built on top of Stryke, MarginZero leverages the concentrated liquidity provided by Stryke’s CLAMM, enhancing liquidity availability for both platforms. This shared liquidity improves market depth and improves the trading experience across both platforms.

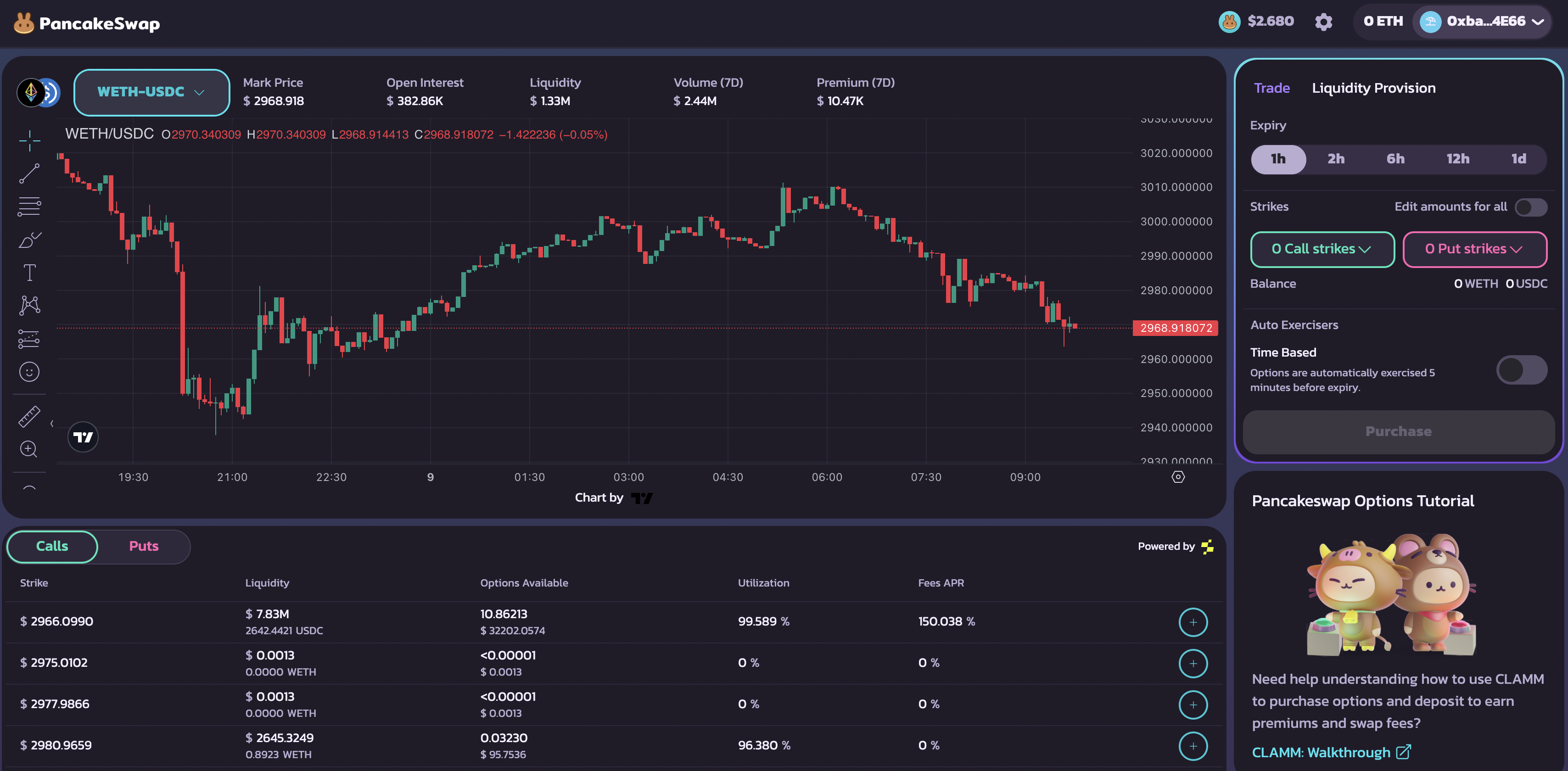

PancakeSwap

The collaboration between Stryke and PancakeSwap introduces a new integration of options trading with liquidity provision, leveraging Stryke’s CLAMM options protocol. This partnership allows liquidity providers on PancakeSwap to simultaneously engage in liquidity provision and options trading, enhancing their earning potential through both AMM trading fees and options premiums.

The composability between Stryke’s CLAMM and PancakeSwap provides a series of features.

- Dual Functionality for LPs:

- LPs on PancakeSwap can now simultaneously contribute to the v3 liquidity pools and have exposure in options trading through CLAMM. This dual functionality allows LPs to capitalize on both standard AMM trading fees and options premiums.

- Options Trading Using PancakeSwap Liquidity:

- When an options trader creates a position, the required liquidity is sourced from PancakeSwap’s v3 pools. This setup makes the respective LPs options sellers, earning them a premium while their unutilized liquidity continues to earn regular swap fees in the v3 pool. This dual action replicates the same impermanent loss of just adding liquidity in a v3 pool.

- Integrated User Interface:

- The options trading is seamlessly integrated into the PancakeSwap interface, maintaining the familiar user experience while introducing advanced trading functionalities. This integration ensures that users can trade options without navigating away from the PancakeSwap environment.

- Auto-Exercise Option:

- Enables automatic realization of profits at expiry for in-the-money options, simplifying the trading process for users.

On PancakeSwap users can trade options in these timeframes: 1H, 2H, 6H, 12H, and 24H.

Trading options with CLAMM is only available on Arbitrum with these pair offerings: wETH-USDC and ARB-USDC.

As with most collaborations, the protocols share mutual benefits.

For Stryke:

- Access to a Large User Base: Leveraging PancakeSwap’s extensive user base, Stryke can introduce its innovative options trading to a wider audience, potentially increasing adoption and usage.

- Enhanced Liquidity for CLAMM: The integration with PancakeSwap provides Stryke with access to substantial liquidity, essential for the effective functioning of its options market.

For PancakeSwap:

- Diversified Trading Options: Incorporating options trading attracts a broader audience to PancakeSwap, expanding its product offerings.

- Increased Trading Volume and Liquidity: The new options trading functionality is likely to increase both the trading volume and the liquidity on PancakeSwap, enhancing its value as a DEX.

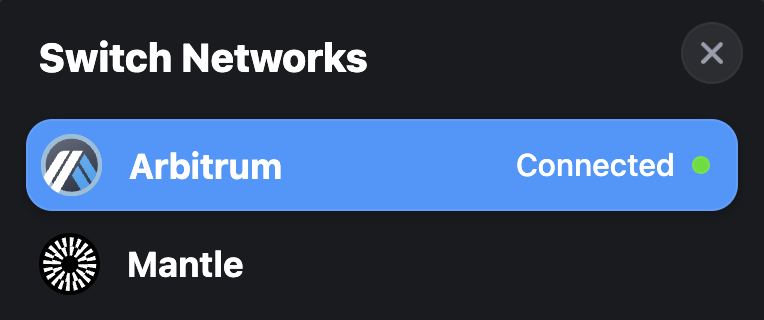

Chains

Stryke is available on the following chains:

- Arbitrum

- Mantle

- Base

The Stryke launch on Mantle was paired with some important collaborations further expanding the integration of CLAMM. Stryke’s partnerships with Agni and Fusion X, both dynamic DEXs on the Mantle chain, aim to elevate the ecosystem and attract more users by offering efficient trading and a diverse range of DeFi products. These collaborations mark an important effort to establish a comprehensive multi-chain driven on-chain options trading hub.

The launch on Mantle with these partners significantly improves the LPDfi options market, providing increased trading flexibility and advancing the evolution of the LPDfi ecosystem.

Using the Protocol

Stryke offers a versatile options platform enabling users to engage in various activities such as trading, hedging, generating passive income, speculation, and liquidity provisioning. With the introduction of CLAMM, Stryke can provide a significantly better experience for all these use cases.

Trading and Speculation

Stryke enables users to trade options on-chain in a decentralized manner. The platform supports American-style options, allowing users to execute trades based on their market analysis and speculation about future price movements. Traders can choose from a variety of strike prices and expiration timeframes to manage their trading strategies however they see fit based on market conditions.

Speculation is another use of options, great for leveraging their non-linear payoff and convexity to capitalize on significant market moves.

Hedging

One of the primary uses of options is hedging. Hedging provides traders and portfolio managers a way to manage risk by making market predictions based on the direction, magnitude, volatility, and timing of potential price movements.

Stryke users can purchase put options to hedge against a decline in the underlying asset prices or call options to protect against cost increases in other parts of their portfolio. It’s a risk management tool that is valuable for retail investors and institutional traders.

Generating Passive Income

LPs on Stryke can earn passive income through several mechanisms:

- Trading Fees: By providing liquidity to the CLAMM, LPs earn a portion of the trading fees generated from each transaction that occurs within their liquidity pool and range. Users provide liquidity to specific pools on Stryke’s platform, which is then utilized in options trading.

- Options Premiums: When options are traded, the sellers (often the LPs) receive premiums paid by the buyers. When a user’s liquidity is used to cover an options position, they are essentially writing an option. They receive premiums from buyers who are purchasing the options against the liquidity provided. This can be a significant source of income, especially when demand for options is high.

- Reward Incentives: Stryke periodically offers additional incentives and rewards to encourage liquidity provision and stabilize the platform’s economic environment.

Generating income from options involves selling put or call options to collect premiums, offering an additional revenue stream that complements other investment activities like yield farming, lending, or futures trading.

CLAMM Walkthrough

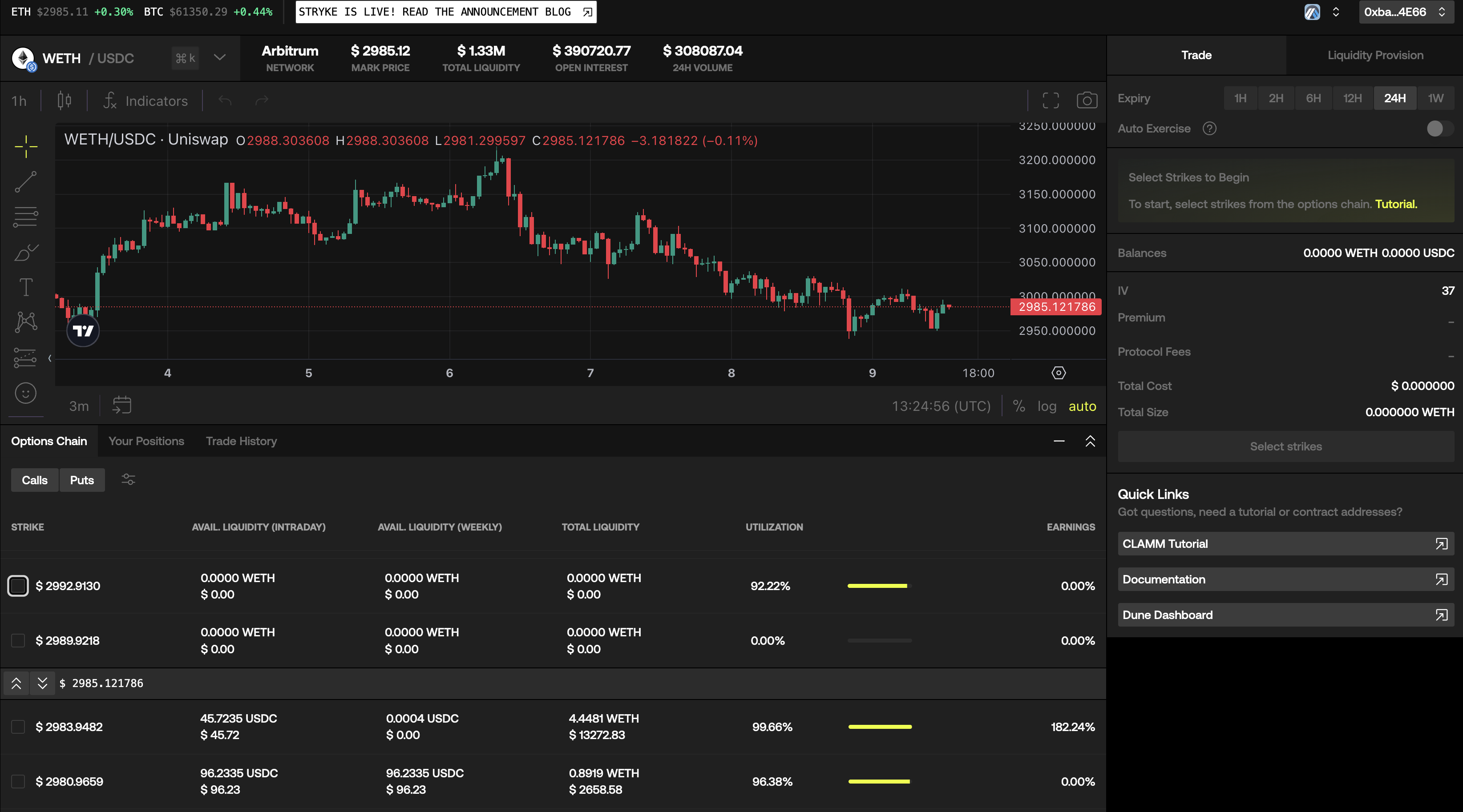

- 1. Visit Stryke’s CLAMM page: https://www.stryke.xyz/en/trade/arbitrum/WETH-USDC

This is how the interface looks.

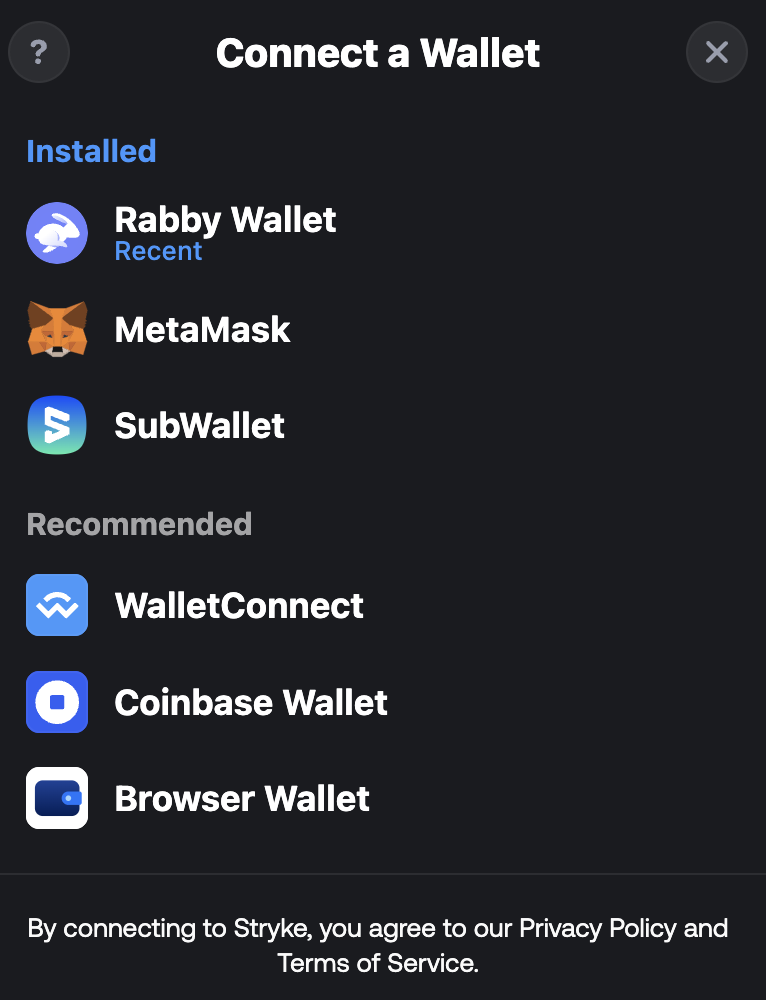

- 2. Connect your wallet in the top right corner and choose the right network. For this example, we will use Arbitrum and the WETH/USDC pair.

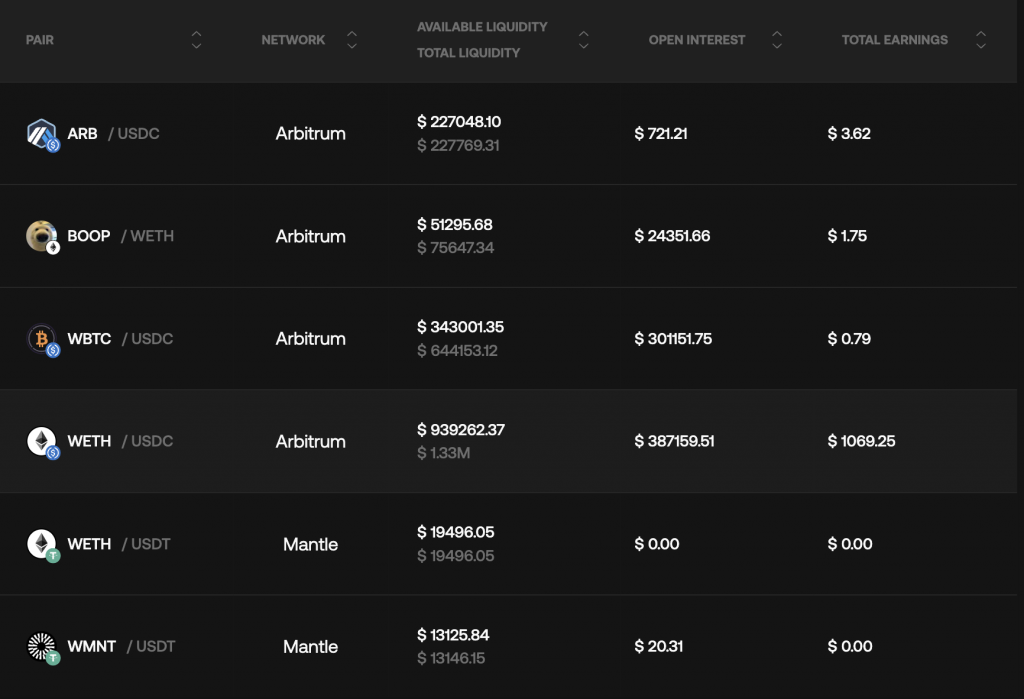

- 3. Choose the right pair on the top left corner, in this case WETH/USDC. In the dropdown menu, there are also the other available pairs with their relative information.

Trading Options

Trading with CLAMM significantly improves the experience of options from previous versions (SSOVs). Using an American-style design, traders can exercise before expiration providing greater flexibility with strategies.

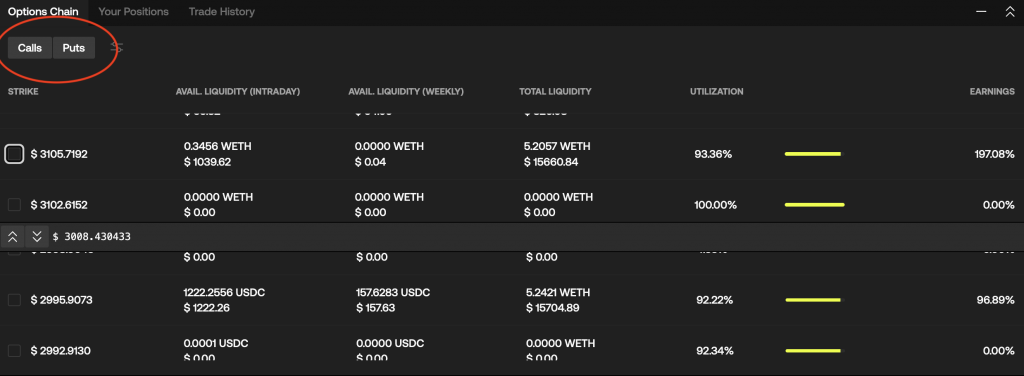

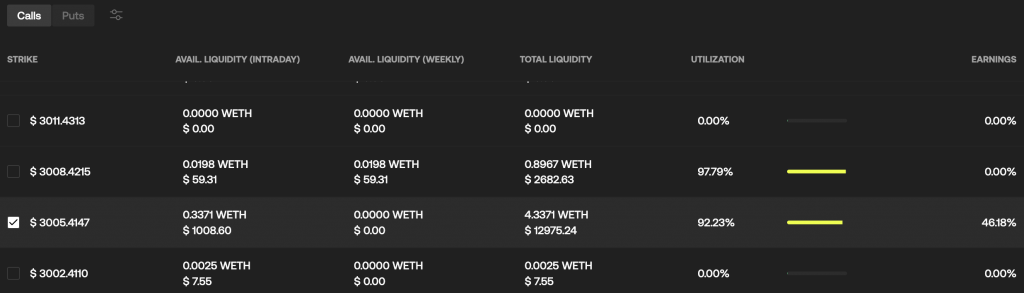

- 1. Check the available options and the available liquidity for each one.

On the dashboard, you can see all Calls and Puts options available. You can toggle on/off if you want to see only the ones you are interested in. For this example will be trading ‘Calls’.

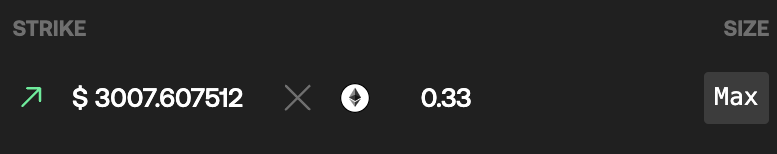

- 2. Pick your ‘Strike Price’.Tick the box of your desired price and it will automatically add to your tab on the right.

Note that you can select multiple strikes and bundle them together for purchase.

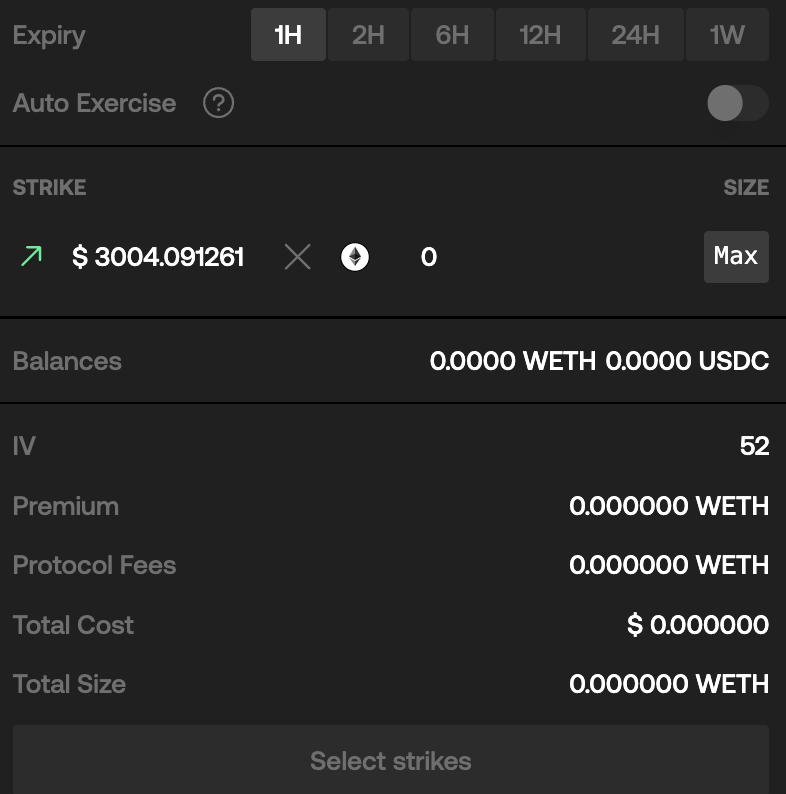

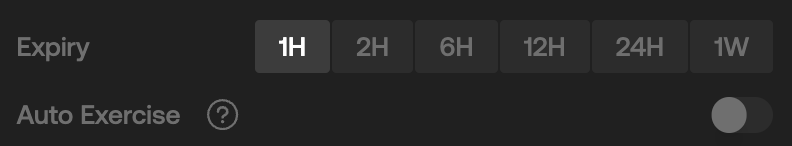

- 3. Select your expiry timeframe. This sets the expiration time where you have to exercise your options. These are the options up to 1 week.

- 4. Enter the amount you want to purchase.

After placing your amount you will see the details of your trade.

- 5. Before purchasing decide if you want the Auto-Exercise feature that executes automatically your options 5 minutes before expiration if the option is ITM. Note that there is a 1% fee on profits for this feature.

If the feature is not selected then users must manually exercise.

- 6. Click ‘Purchase’ and confirm the transactions.

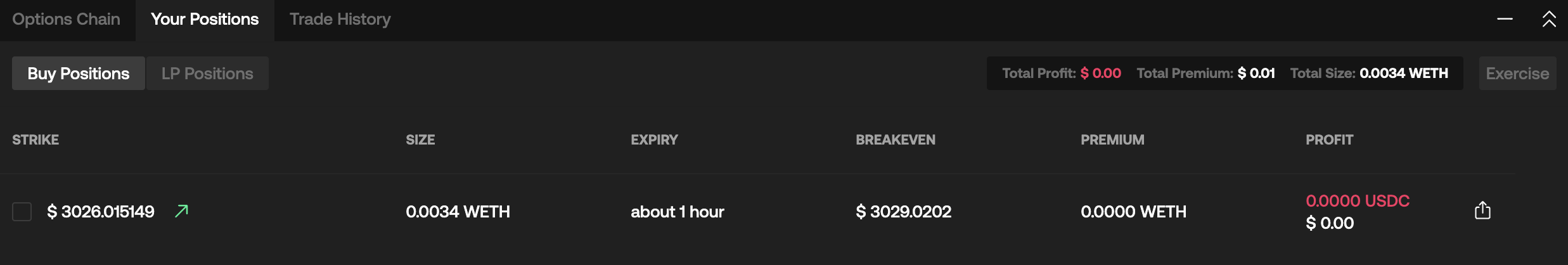

- 7. After purchasing you’ll be able to check your positions at ‘Your Positions’. There you can exercise your options if it’s ITM. If the position is out-of-money (OTM) the ‘Exercise’ button will be unavailable.

Providing Liquidity

On the other side, users can provide liquidity in the CLAMM.

For the walkthrough, we will be using the same pair as before (WETH/USDC).

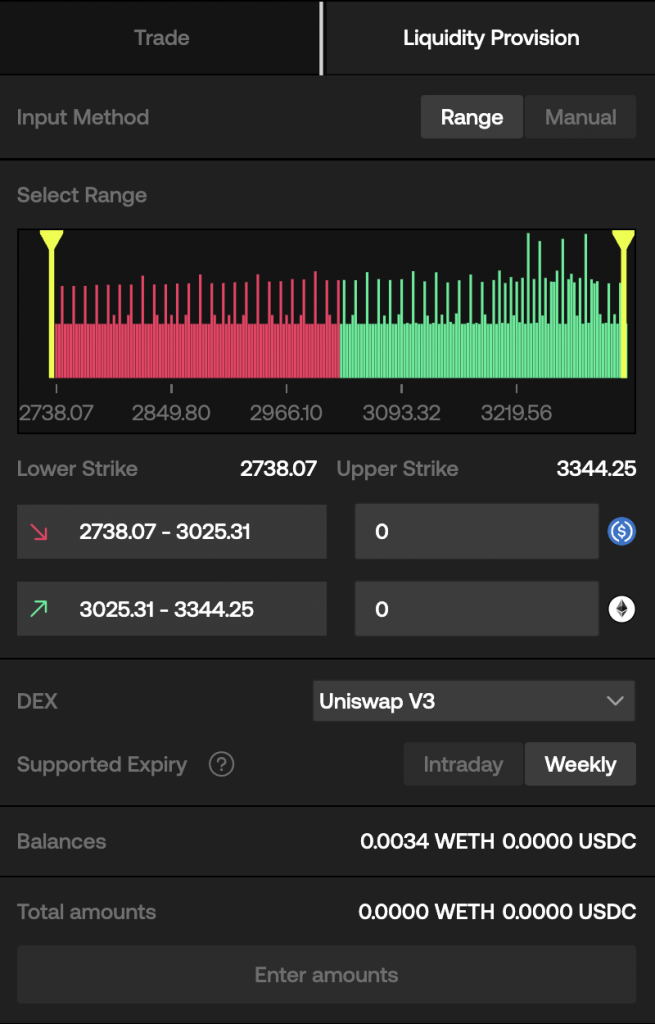

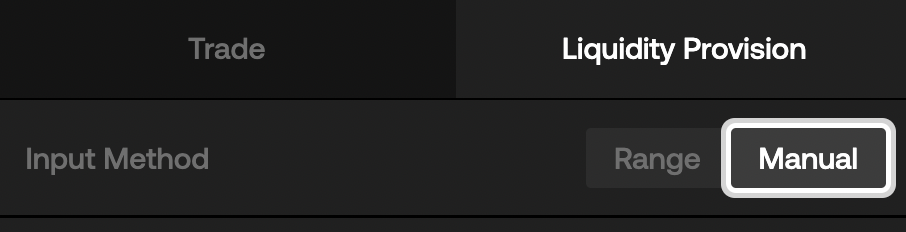

- 1. In the top right corner select the ‘Liquidity Provision’ tab.

Now the tab looks like this.

- 2. Users can provide liquidity within a range or choose their strike prices similarly to what traders do.

First off, range.

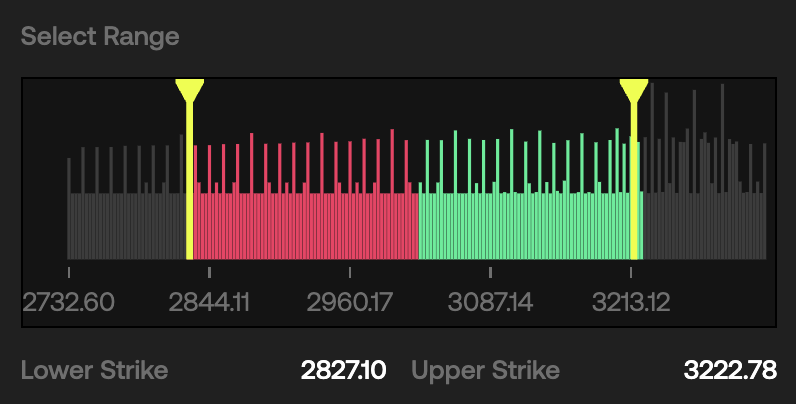

- 3. Choose your desired range to provide liquidity. Drag the yellow lines to the prices of your choice. It can look like this.

Whenever the price is within this range the LP earns fees. Remember though, that only active ticks are earning fees while the other ticks in the range are inactive.

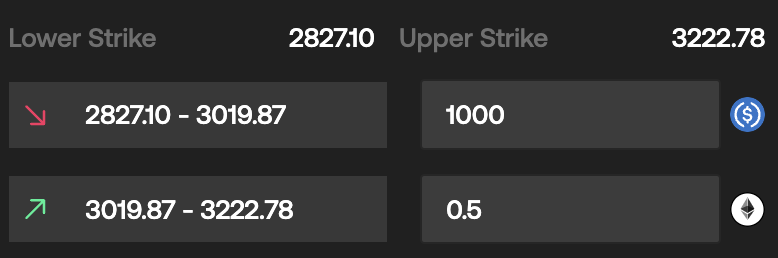

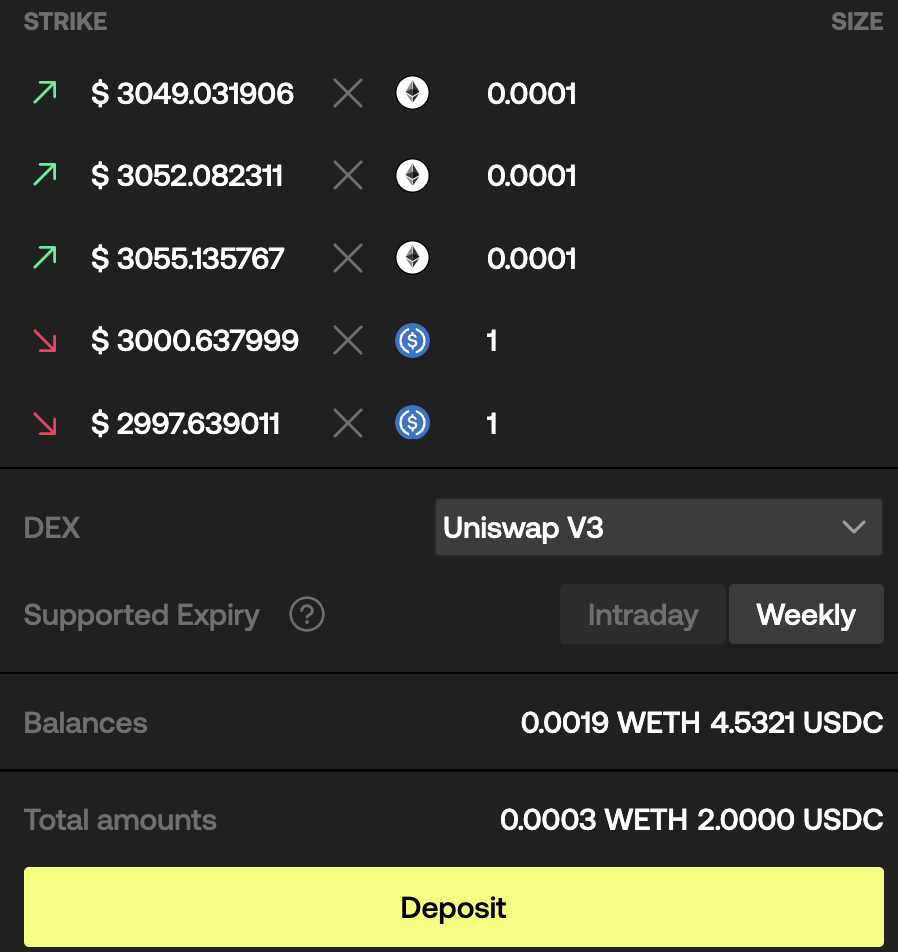

- 4. Enter the deposit amounts. You’ll need $WETH and $USDC if you want to provide both, otherwise, you can provide only the base asset ($WETH in this case).

- 5. You can also select the designated DEX you want to provide your liquidity. It can be either Uniswap V3 or PancakeSwap V3.

- 6. Click ‘Deposit’ and confirm the transactions in your wallet

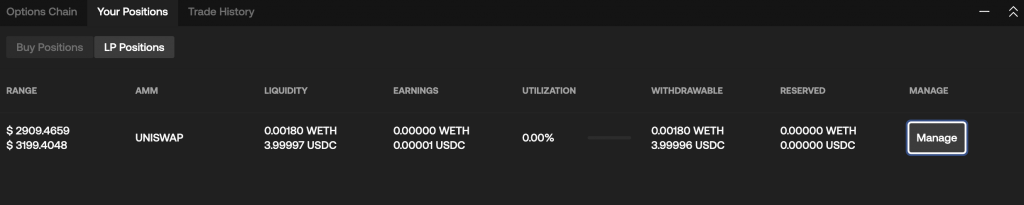

- 7. To view the positions click ‘Your Positions’ and then switch to ‘LP Positions’. There you can see all the information about your position.

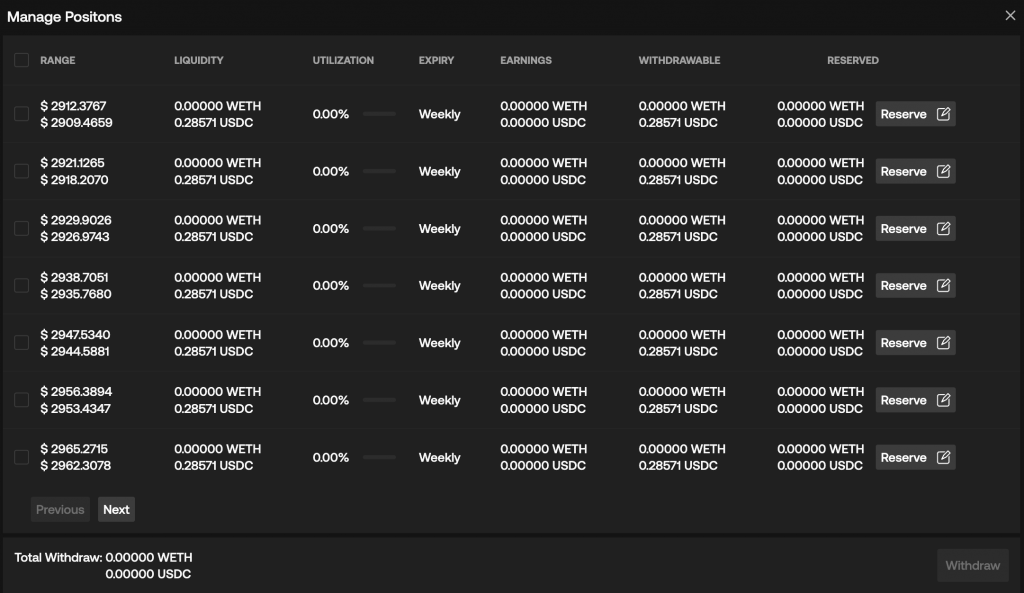

- 8. Click ‘Manage’ to see all your available liquidity, the range prices, and the utilization.

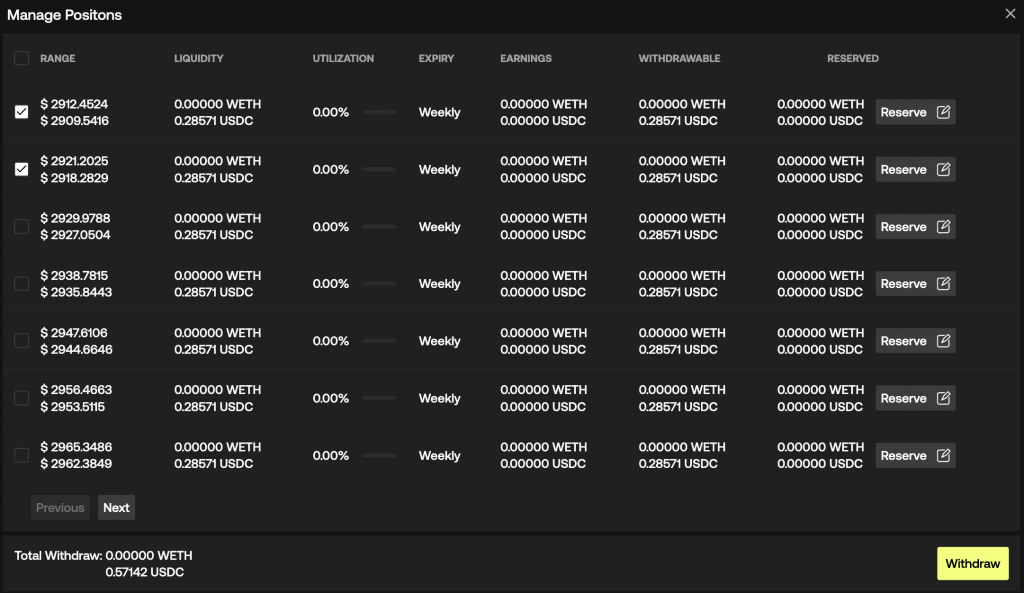

- 9. Finally, if the positions are not utilized you can withdraw them by choosing them and clicking ‘Withdraw’. You can withdraw multiple positions at once.

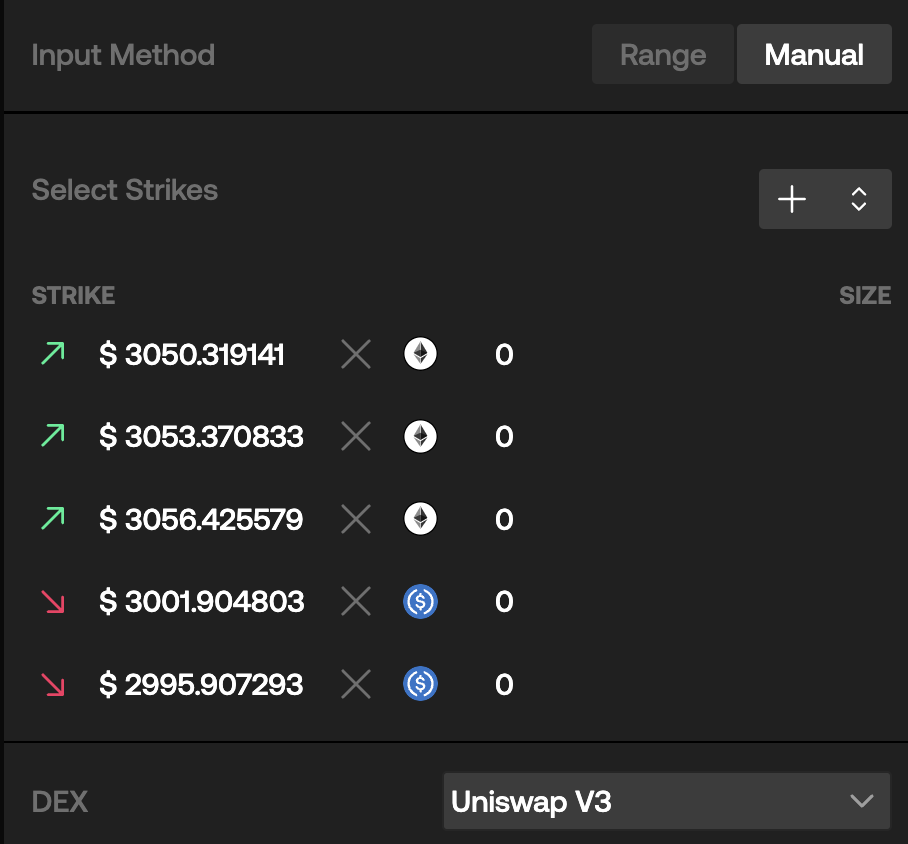

Users can add liquidity manually by selecting the desired strike prices.

- 1. On the input method choose ‘Manual’.

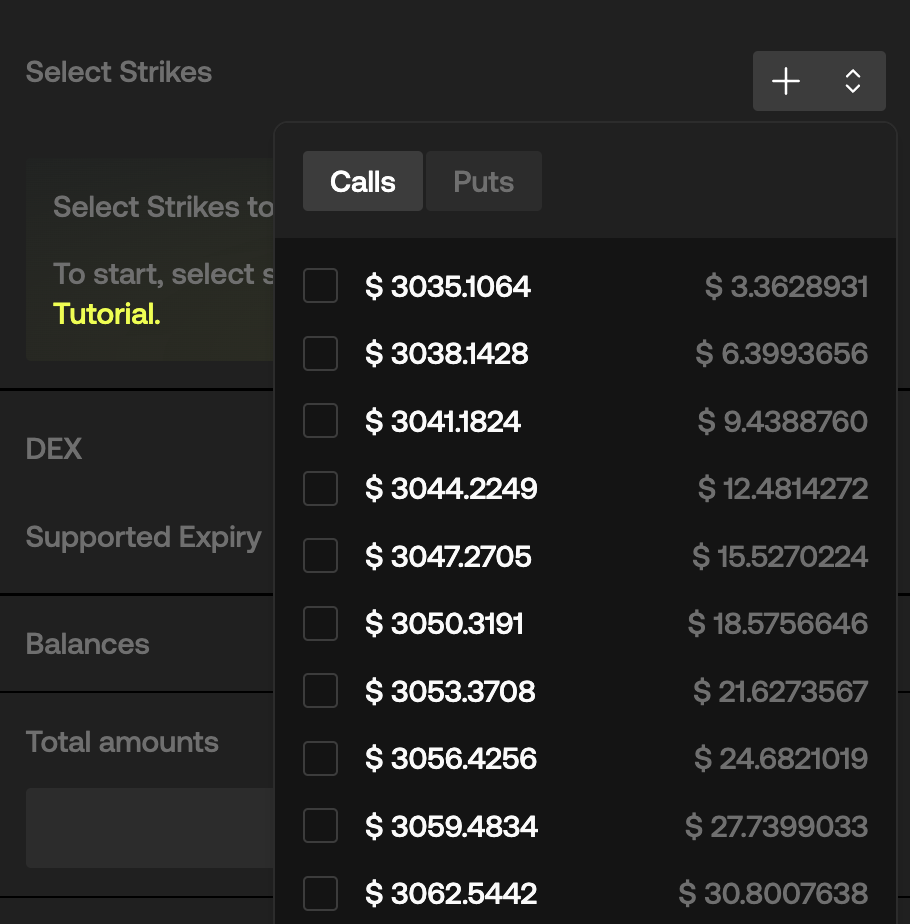

- 2. Click the ‘+’ next to `Select Strikes’ to view strike prices. There you will see two options, ‘Calls’ and ‘Puts’.

- 3. Select a strike price or multiple ones from the two tabs. Again, you can also choose the AMM of your choice.

- 4. Enter your deposit amounts for each position and click ‘Deposit’.

*Intraday = Utilized within the day. *Weekly = Utilized across a week.

- 5. Similarly to the previous steps, in ‘Your Positions’ you can manage your positions and withdraw.

Users and Investing Strategies

As a decentralized options trading exchange, Stryke appeals to a wide range of users within the DeFi ecosystem. Each group of users is attracted to Stryke’s unique features and can utilise different strategies based on their investment goals and risk tolerance. Here’s an overview of the primary user types and the strategies they might follow on Stryke.

Cryptocurrency Traders and Speculators

Profile: These users are actively involved in trading and are typically looking for opportunities to profit from short-term price movements in the cryptocurrency market.

Strategies:

- Directional Trading: Using Stryke to speculate on the direction of cryptocurrency prices by buying calls or puts based on their market predictions.

- Premium Collection: Writing options to collect premiums, benefiting from the decay of options as they approach expiration if they remain out of the money.

Hedgers

Profile: Typically, institutional investors, miners, or even long-term holders who seek to protect their portfolios from adverse price movements.

Strategies:

- Protective Puts: Buying put options to hedge against a decline in the value of their crypto holdings.

- Covered Calls: Selling call options against holdings to generate income, which provides a buffer against price drops, albeit at the potential cost of capping the upside potential.

Liquidity Providers and Yield Seekers

Profile: These users are primarily interested in generating passive income from their cryptocurrency assets without taking on excessive risk.

Strategies:

- Liquidity Provision: Providing liquidity to Stryke’s CLAMM and earning transaction fees from trades executed within their liquidity pools.

- Yield Farming and Staking: Participating in Stryke’s incentive programs that reward liquidity provision and staking with additional tokens or higher yields.

Institutional Investors

Profile: These include hedge funds and other entities that manage large portfolios and seek advanced trading tools to manage risk and enhance returns on the crypto market. Many institutions are turning to DeFi and its applications.

Strategies:

- Complex Options Strategies: Using complex options strategies to maximize returns and control exposure to market movements. Stryke offers that customizability and complexity.

- Diversified Liquidity Provision: Strategically allocating liquidity across different assets and options strategies to balance risk and return.

Tokenomics

$SYK

$SYK is the native token of the Stryke platform, introduced as part of a strategic shift to consolidate the previously used $DPX and $rDPX tokens into a single, more efficient token system. This transition is designed to simplify the token structure and improve the economic operations within the Stryke ecosystem, facilitating transactions, governance, and incentive mechanisms.

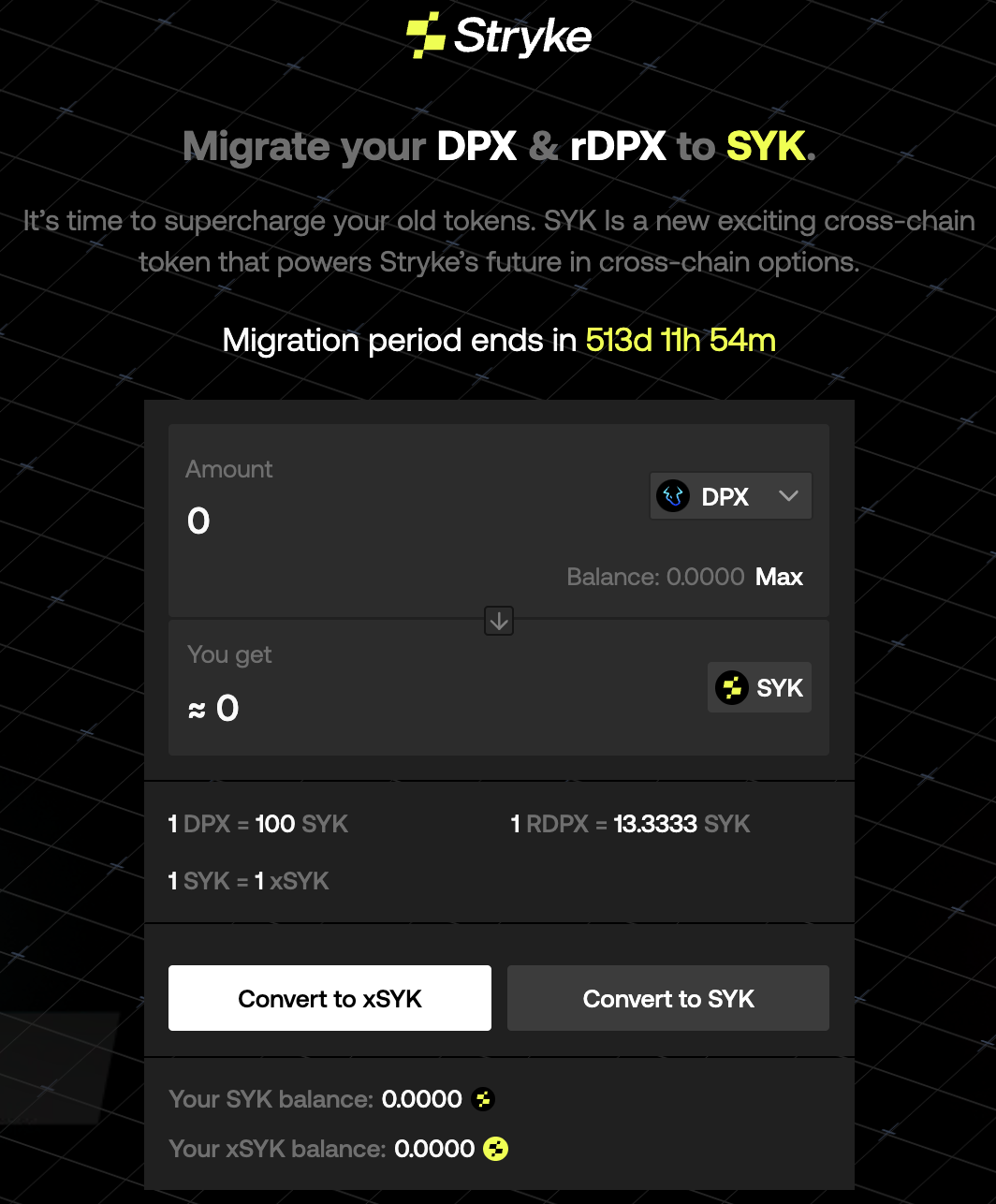

Migration

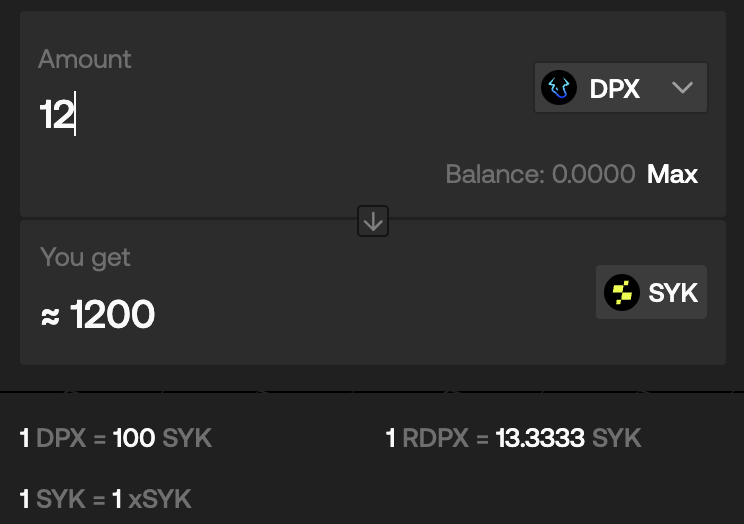

The migration to $SYK involves transitioning from $DPX and $rDPX tokens to $SYK based on predefined conversion ratios to ensure a seamless changeover for existing stakeholders. The conversion rates are as follows:

- 1 $DPX = 100 $SYK

- 1 $rDPX to 13.333 $SYK

This process was implemented through a smart contract, enabling the automatic minting of $SYK tokens. The migration contract will be available for 1.5 years post-deployment for all $DPX holders to convert their tokens.

How to Migrate

Stryke has set up a straightforward process for previous $DPX & $rDPX holders to migrate their tokens to the new ecosystem. The process was carefully designed so that previous holders would retain the same value of their tokens but at the same time, the team would accomplish its new vision for the protocol by providing better value and token utility to users.

Here’s a step-by-step guide on how to migrate on Stryke if you holding $DPX or $rDPX tokens:

- 1. Visit the Stryke migration page here.

- 2. Connect your wallet and make sure you are on the Arbitrum network.

- 3. Choose the token you want to migrate.

- 4. Click “Max” if you want to migrate all your tokens. You’ll see the exact amount you will receive based on the predefined conversion rate.

- 5. Users have the option to convert to $SYK or directly to $xSYK.

- For $DPX or $rDPX conversion to $SYK you need two steps: Approve and Migrate to complete the migration.

- For $DPX or $rDPX conversion to $xSYK you need four steps: Approve and Migrate, then Approve and Convert to complete the process.

- Confirm all transactions in your wallet.

- 6. After successfully following these steps, your $SYK/$xSYK should be in your wallet.

Token Distribution

Total Supply: 100,000,000 $SYK tokens

Circulating Supply at Merge: 47,800,000 $SYK tokens (reflecting the conversion from $DPX and $rDPX circulating tokens)

Token Allocation: 12.2 million tokens of the total supply is directed to Protocol Treasury. 40 million tokens are set for future emissions and strategic initiatives.

Token Emissions

Total Un-emitted Tokens: 52.2 million $SYK. 40 million $SYK are set for direct emissions.

Annual Inflation Rate: Set at 3%. This steady increase in token supply helps maintain economic stability and supports ongoing development and community incentives.

Distribution of Emissions:

- 60% for reward gauge emissions.

- 30% to bonding mechanisms for protocol-owned liquidity.

- 10% to grants for protocols.

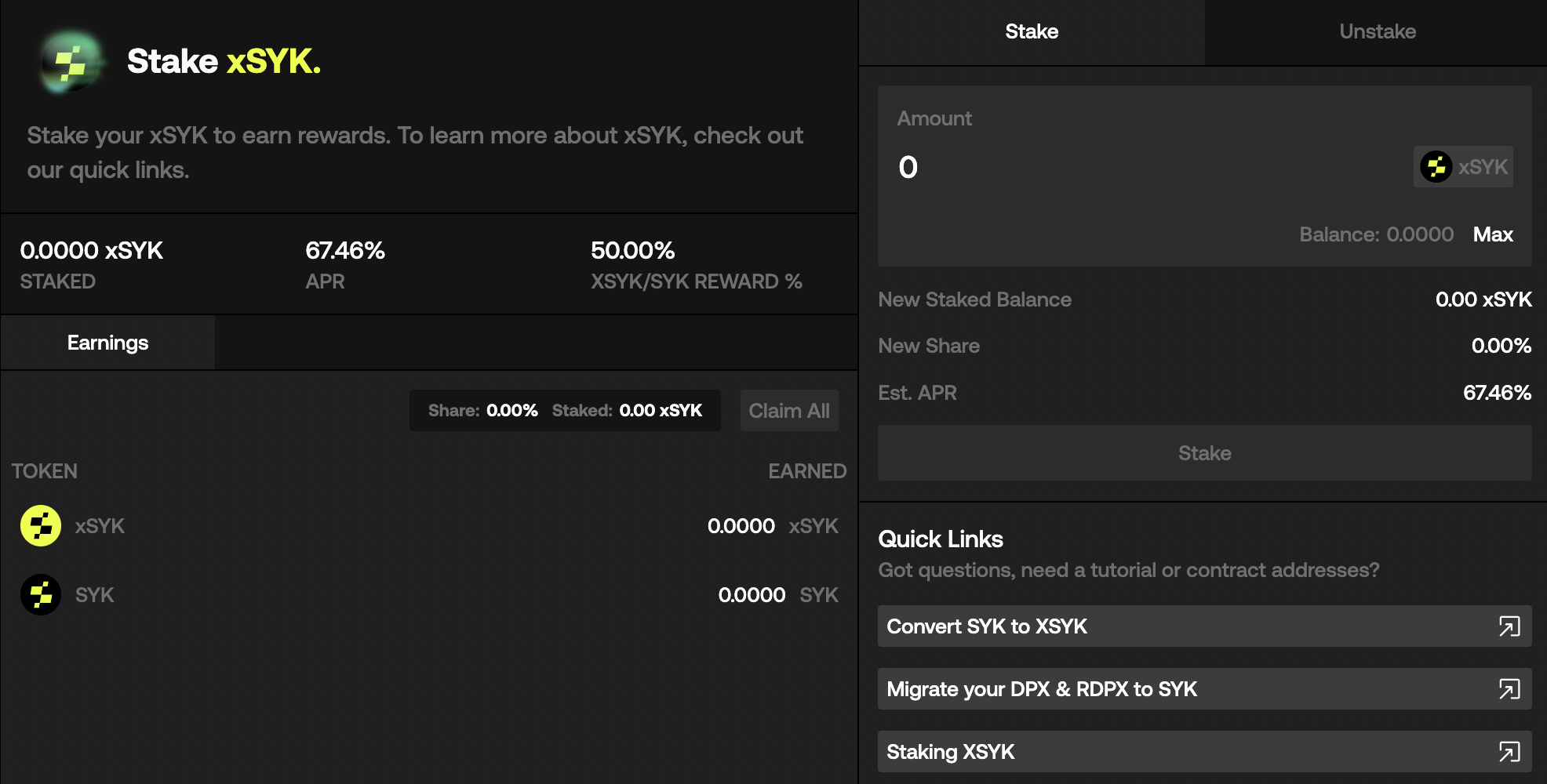

Staking and $xSYK

The $xSYK token is an escrowed version of $SYK, designed to promote longer-term holding and governance participation among holders. Staking $SYK to receive $xSYK allows users to engage more deeply with the ecosystem, influencing decisions such as reward distributions and protocol updates. The structure of $xSYK staking aims to incentivize sustained engagement and stability within the Stryke platform.

The conversion rate is 1:1 meaning that for every $SYK users can receive one $xSYK.

To stake $xSYK visit: https://www.stryke.xyz/en/xsyk/staking.

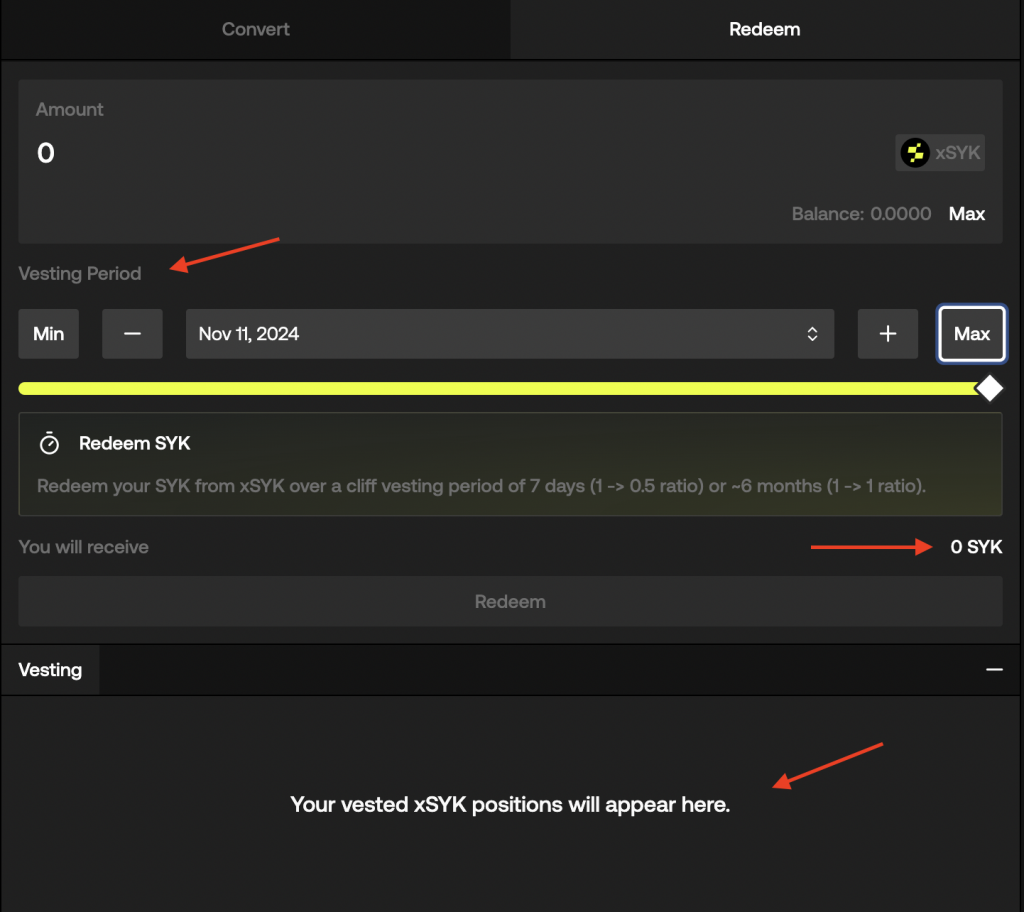

Redemption Process

The $xSYK framework features a unique redemption mechanism that balances immediate liquidity needs with long-term ecosystem benefits.

Holders of $xSYK that choose to lock their tokens will receive yield. Redeeming $xSYK requires a vesting period. Stryke offers two options. Holders can choose to lock their $xSYK for a minimum of 7 days or up to 6 months.

- Min Vesting: Redeeming $xSYK after the minimum vesting period of 7 days allows holders to reclaim 50% of their $SYK.

- Max Vesting: Opting for the maximum vesting period enables holders to reclaim 100% of their $SYK at the end of the 6 months.

On this page, users can choose their vesting period for their $xSYK. Attention is required on a few things: Vesting period (check the exact date), $SYK received after redeeming, and vested positions details (time left and allocation).

Incentives

The goal of $xSYK is to reward long-term participation in the project and increase governance involvement. To achieve that $xSYK holders are incentivized through many forms.

- Governance Participation:

- $xSYK holders gain the ability to actively participate in governance decisions. This includes voting on key protocol changes and proposals that shape the future direction of the platform. Active governance participation ensures that holders have a voice in critical decisions and contribute to the development of the ecosystem.

- Enhanced Locking Rewards:

- Locking $xSYK for longer periods may come with enhanced rewards compared to regular $SYK staking and shorter lock-up periods. This can include additional token distributions including $xSYK/$SYK rewards, increased fee sharing percentages, or other financial incentives designed to reward the commitment of $xSYK holders. The $SYK token also benefits from buybacks.

- Reward Gauges:

- By holding $xSYK tokens, participants acquire significant influence over the allocation of emissions within the ecosystem. This allows them to direct rewards toward areas or projects that they believe will benefit the platform’s growth the most.

- Community-Driven Benefits:

- Holding $xSYK fosters a community-oriented approach where members are rewarded for their long-term commitment and contribution. This strengthens the overall ecosystem by encouraging sustained engagement and a vested interest in the health and growth of the platform.

Rewards Gauge System

The Rewards Gauge System within Stryke is a mechanism designed to dynamically allocate rewards to improve platform engagement and ensure fair distribution which supports the platform. This system plays a major role in incentivizing various activities and contributions that are essential to the development and expansion of Stryke.

The primary function of reward gauges is to direct the flow of emissions and incentives toward critical areas such as liquidity pools, staking programs, and other vital activities. This targeted allocation supports Stryke’s strategic objectives and fosters sustainable growth.

Stakeholders, specifically those holding or staking $xSYK tokens, have the authority to vote on how rewards are allocated. This democratic voting mechanism ensures that the distribution of incentives is community-driven, reflecting a collective mission among active participants. The active involvement of stakeholders in decision-making processes enhances community engagement and ownership of the platform’s outcomes.

Allocation of Gauges

Stryke follows a flexible distribution model for its gauges to accommodate future plans and developments of the project. This means that the rewards are adjustable and dependent on the needs of the project.

Following that, transparency is a key feature of the Rewards Gauge System. All allocations and adjustments within the system are recorded and made transparent, providing stakeholders with clear insights into the distribution of rewards.

Importance of Gauges

Gauges have a major role in the operation of the protocol and its sustainability. Incentivizing the correct areas of the protocol ensures that all key parameters are taken care of such as liquidity, user base, and protocol health.

Furthermore, the design of the Rewards Gauge System is founded on flexibility which means that Stryke can adapt to the dynamic and evolving crypto market always meeting the needs of the protocol and users.

Business Model

Stryke’s business model capitalizes on the demand for decentralized financial instruments by offering an innovative platform for trading crypto options.

Central to its revenue generation are trading fees from each transaction and potential fees from liquidity providers (LPs) who support the trading environment. The protocol relies heavily on trading activity since most of the revenue comes from users who trade options and are charged fees for these transactions.

The business model of Stryke leverages the CLAMM system, improving trading efficiency for traders and LPs and potentially providing better pricing mechanisms for options contracts. The CLAMM allows for more efficient capital utilization, resulting in fewer idle positions and more activity, generating more fees.

By adopting a cross-chain approach, Stryke ensures a secure and flexible trading experience, broadening its appeal to a greater audience that values privacy and control over its assets.

With the introduction of $xSYK staking, Stryke encourages users to actively participate in governance and receive various rewards from the protocol.

Revenue Streams

Stryke’s revenue streams are primarily derived from the following sources:

- Trading Fees:

- Stryke collects fees on each options trade executed on the platform. These fees are a primary source of revenue and are directly tied to the platform’s trading volume.

- Liquidity Provision Fees:

- Fees may also be charged to liquidity providers who supply the necessary capital to the platform’s liquidity pools. This not only compensates them for the use of their funds but also mitigates some of the risks associated with providing liquidity.

- CLAMM Fees:

- There are some additional fees incurred when using CLAMM. Traders are subject to those fees if certain features are used.

These revenue streams ensure that Stryke can maintain and develop its infrastructure while incentivizing users and liquidity providers to engage with the platform, thus creating a sustainable business model.

Fee Breakdown

Here’s a comprehensive analysis of the fees involved in trading and managing options on Stryke, specifically within its CLAMM framework.

Trading Fees

- CLAMM Trading Fees: 34% of the option premium charged at the time of option purchase.

- Auto-Exercise Feature: 1% of the profit (PNL) at the time of the option exercise. This fee is applicable only if the auto-exercise feature is enabled.

Liquidity Provider Fees

The fees paid to LPs are based on their portion of the pool, trading volume, and trading fees. Trading fees are typically around the 0.05% range.

- Fees at the Tick: CLAMM LPs earn fees each time the spot price passes through a tick where they have provided liquidity.

Note that only one tick can be active at any given time, the tick that contains the current spot price. This means that while liquidity in other parts of the range remains idle, only the active tick generates fees.

Fee Management

Stryke has set a blueprint for how fees are managed and allocated. The allocation consists of three key areas that focus on protocol sustainability and growth.

- Staking Rewards (80%): Most of the fees collected are redistributed as rewards to stakeholders such as liquidity providers and xSYK holders. This promotes continued participation and investment in the platform.

- Insurance Fund (10%): This portion of the fees contributes to a financial safety net against unexpected events like smart contract bugs or market dangers, safeguarding the protocol.

- Operational and Development Fund (10%): These fees support the ongoing technological development, security measures, and operational costs necessary to support and grow Stryke’s products.

Governance

Stryke’s governance framework, focused around the $xSYK token system, is designed not just for active governance but to significantly boost the engagement and impact of its stakeholders in the protocol itself by directing its development through a common initiative.

Besides participating in governance, $xSYK holders can stake their tokens to receive real yield that the protocol generates.

Stryke governance allows whoever holds $xSYK to influence significant aspects of the protocol such as Reward Gauges. Emissions are a significant part of Stryke’s platform showcasing the importance of active governance participation.

This is a further step taken by the protocol that lets stakeholders actively manage and direct key decisions more frequently giving them increased power over the platform.

The benefits of this governance model extend beyond individual returns, contributing heavily to specific areas:

- Community Empowerment: By enhancing the role of stakeholders in governance processes, Stryke promotes a strong sense of community and collective responsibility.

- Sustainable Platform Growth: Stakeholders are motivated to act in the best interest of the platform’s long-term success since every decision impacts them as well. This synergy helps drive sustainable growth and innovation within Stryke.

Risks

Similarly to other DeFi protocols, Stryke is exposed to smart contract risk where bugs can negatively affect it. In addition, as an Options platform, Stryke may face other risks related to the nature of the platform.

These risks include:

- Market Risk

- Volatility Risk: Options are sensitive to the underlying asset’s price fluctuations. High volatility can lead to significant price swings, affecting the value of options in ways that can be difficult to predict.

- Liquidity Risk: Options may suffer from low liquidity, especially for strike prices that are far from the current market price or for options with expiration dates that are either very short or very long. Low liquidity can lead to wider bid-ask spreads and difficulty in entering or exiting positions without substantial price impact.

- Model & Pricing Risk

- Incorrect model assumptions or errors in the pricing algorithms can lead to mispriced options, creating arbitrage opportunities or losses. This is critical because the Black-Scholes model may not perfectly align with the actual behavior of cryptocurrency markets.

Security

There have been no document hacks or exploits since the launch of Stryke nor for Dopex before the transition. The code has been audited, which reduces smart contract risk.

Audits

Stryke had the following audits performed by yAudits.

CLAMM V2 Audit Review – November 10, 2023 – yAudit

- High Findings = 2 (2 Fixed)

- Low Findings = 3 (2 Fixed, 1 Acknowledged)

- Gas Saving Findings = 7 (1 Fixed, 6 Acknowledged)

- Informational Findings = 8 (6 Fixed, 2 Acknowledged)

CLAMM V2 Updated Audit Review – January 31, 2024 – yAudit

- High Findings = 2 (2 Fixed)

- Low Findings = 3 (1 Fixed, 1 Acknowledged)

- Gas Saving Findings = 7 (1 Fixed, 6 Acknowledged)

- Informational Findings = 8 (6 Fixed, 2 Acknowledged)

Bug Bounty Program

Stryke’s implementation of a bug bounty program represents a proactive approach to enhancing platform security by incentivizing the identification and reporting of vulnerabilities within its system.

This program invites cybersecurity researchers and ethical hackers to analyse Stryke’s smart contracts and software infrastructure for potential security issues.

Participants in the bug bounty are rewarded based on the severity and impact of the vulnerabilities they discover, encouraging a wide community of security experts to contribute to the platform’s safety.

The bug bounty rewards are as follows:

Dependencies and Access Controls

Liquidity

The platform’s performance relies heavily on user-provided liquidity, which is essential for the operation of the CLAMM. This ensures smooth trading and execution of options within required price ranges. Additionally, Stryke’s integration with external liquidity sources from other DeFi platforms or DEXs like Orange, Uniswap, or SushiSwap plays a crucial role in maintaining liquidity depth and price stability.

Smart Contracts

Last but not least, the whole platform is dependent on the integrity and robustness of its smart contracts. A thorough inspection of the smart contracts needs to be conducted by third parties through audits. This minimizes any risks associated with bugs and vulnerabilities.

Team

The Stryke team consists of people who have been building in this space for many years developing DeFi products for the space and promoting the adoption of these decentralized applications. This is the team that built Dopex and is currently anonymous.

The Stryke team is led by @tztokchad as the founder, @witherblock as the lead dev, @0xsaitama_ as the lead BD & Growth, and other team members including @mariodigital_, @Bigbazuso_, @0xCasio, @oolongdpx, @ArcwardEth, @holypepperone, @psytama7, @_Nini667, @CorporealFeast in important roles.

Project Investors

Before the transition to Stryke, the Dopex team raised 4,808 $ETH in a public sale through multiple angel investors and crypto whales.

The current team is self funded.

FAQ

What is the main use for Options?

The largest use case for options is hedging risk (i.e. buying insurance against) against the downside risk of tokens one already holds via put options or against the upside risk of tokens one does not already own (or is short) via call options.

Options are also the most popular financial product to express views on volatility (and directional exposure). They exhibit many traits that allow users to curate their desired risk profiles by combining multiple options or using various expirations/strikes.

What are Call options?

Call options provide the owner of the option the right, not an obligation, to purchase the described amount of underlying tokens at the specified strike price, by the option’s maturity date. Buyers of call options believe the underlying token could go up in price over time beyond the cost of the premium paid.

What are Put options?

Put options provide the owner of the option the right to sell the described amount of the underlying token at the described strike price, by the option’s maturity date. Buyers of put options believe the underlying token could go down in price over time beyond the cost of the premium paid.

What is Stryke?

Stryke is a decentralized options exchange that utilizes a Concentrated Liquidity Automated Market Maker (CLAMM) to facilitate efficient options trading and liquidity provision in the DeFi space.

What types of options can I trade on Stryke?

On Stryke, users can trade both call and put options across a variety of cryptocurrency pairs. These options can be tailored with different strike prices and expiration times, allowing traders to customize their trading strategies according to their market views and risk appetite.

How does Stryke handle the liquidity needed for exercising options?

Stryke utilizes its innovative CLAMM system to ensure that there is sufficient liquidity available to cover the exercise of options. When an option is exercised, the necessary assets are dynamically sourced from the liquidity pools within the designated price ranges, ensuring smooth settlement of options contracts.

How do trading options on Stryke differ from traditional exchanges?

Unlike traditional exchanges, Stryke operates entirely on-chain, providing a decentralized and transparent environment for trading options. This setup allows for permissionless access, where anyone with an internet connection can participate without needing a centralized intermediary.

What are American-style options available on Stryke?

American-style options on Stryke can be exercised at any time before their expiration, giving traders more flexibility compared to European-style options, which can only be exercised at maturity.

How can I provide liquidity on Stryke and what are the benefits?

Users can provide liquidity to Stryke’s CLAMM by depositing assets into specific liquidity pools. Benefits include earning transaction fees from trades occurring within their liquidity range and potentially receiving Stryke-native incentives for participation.

What risks should I be aware of when writing options on Stryke?

As an options writer, you face the risk of the option being exercised against you, which could lead to losses if not properly hedged. Additionally, there are market risks and potential impermanent loss from providing liquidity in a volatile market.

Can I use Stryke if I’m new to options trading?

Yes, Stryke is designed to service both experienced traders and beginners. You can use the walkthroughs in the above sections to start trading options.

What measures does Stryke take to secure user funds and data?

Stryke prioritizes security through rigorous smart contract audits, multi-signature wallets for administrative tasks, and continuous monitoring of its platform to safeguard against unauthorized access and other cyber threats.

Are there fees associated with trading or providing liquidity on Stryke?

Yes, Stryke charges fees for trading options and may include fees for liquidity provision. These fees contribute to the operational costs, reward liquidity providers, and enhance the overall ecosystem.