Overview

Rumpel is a point tokenization protocol that enables secondary market liquidity and price discovery for off-chain loyalty points, unlocking new opportunities for point holders, traders, airdrop hunters, and point issuers.

Loyalty points have become essential in growth strategies across crypto protocols. They serve as mechanisms to reward early adopters, incentivize specific behaviors such as liquidity provision, and grow communities. In Web3, these points convert into monetary value (future tokens), driving user engagement and participation. Currently, most tokenless protocols adopt a point-system airdrop campaign that usually lasts a few months or up to a year in some cases.

Building on this new standard, Rumpel adds functionality to these points before they are converted to actual tokens. This allows various stakeholders, such as traders, LPs, and point issuers, to engage in new strategies by leveraging points.

Origins of Rumpel

Points are proven to boost protocol metrics and increase usage by attracting users who want to be rewarded with future tokens via airdrops. Despite the benefits of loyalty points, the original state of points is leaving multiple stakeholders frustrated, including point farmers, point investors, and point-issuing projects.

Whether it is because of dispersed attention across multiple projects, underwhelming allocations, or surprise changes to the airdrop eligibility criteria, point farmers’ returns are falling far below expectations compared to the time, effort, and capital allocation risks they bear on users. When expectations are unmet, many users feel “farmed,” as they feel they have wasted time and put their capital at risk for minimal reward. As a result, teams often face severe backlash from users expressing their disappointment, leading to negative sentiment around the protocol and making it harder to build a community in the early days.

While projects generally aim for positive responses to their airdrops, wanting to be viewed as loyal, generous, and supportive of their long-term believers, they must also be careful not to give away too much ownership of their protocol and make sure that everyone is fairly compensated based on the future value they may bring.

On the one hand, point investors find it difficult to gain significant benefits from point stacking, especially compared to large holders who dominate the accumulation of points. For instance, eligibility criteria are often based on time and TVL. Some users have no chance to compete against whales, while others feel they’ve missed the optimal window of opportunity to join the points program. As a result, it is common to observe how many investors hesitate to expose their capital to smart contract risks. Similarly, others think the opportunity cost is relatively high compared to farming liquidity mining incentives paid out in liquid tokens. Additionally, the extensive tasks required to earn extra allocations can be overwhelming, hindering user engagement.

Moreover, Point issuers struggle to effectively influence user behavior due to the apathy arising from the challenges collectors and investors face. Project growth and the impact of point programs are restricted when users are disengaged. Points are intended to allow projects to leverage future token liquidity to incentivize current participation in the actions that are most beneficial for the protocol at any given time. However, note that this mechanism relies heavily on users believing in the future value of the points. Delays in airdrop plans or negative experiences with other projects can affect this belief, diminishing the effectiveness of points.

Secondary markets for points have emerged to mitigate and address these issues. These markets are designed to:

- Allow point collectors to sell their points and reduce exposure to uncertain airdrops.

- Enable investors to purchase points and increase their stake according to their preferences.

- Provide issuers with greater transparency regarding the real-world value of their reward programs.

However, current platforms that enable point trading impose restrictions that limit their effectiveness:

- Platforms often require additional collateral from sellers and impose caps on the maximum payouts for buyers.

- Fixed-rate protocols prevent holders from reselling earned points, and sellers face liquidity constraints if they wish to exit early.

- Some markets are not tailored to trade individual point exposures, restricting user flexibility and preference.

Rumpel was developed to overcome these limitations by introducing a point tokenization protocol. Users can encapsulate each earned point into a Rumpel Point Token using a personal Rumpel Wallet, a specialized multi-signature safe. By bringing points on-chain, Rumpel creates a system where all stakeholders benefit:

- Point collectors can sell their points to mitigate risks associated with uncertain future airdrops.

- Investors gain the opportunity to purchase points, allowing them to adjust their exposure according to their investment strategies.

- Issuers continue to distribute points with enhanced transparency regarding their tangible value, strengthening the trust and engagement of their user base.

The Rumpel Oracle verifies off-chain point balances as users accumulate points and updates allowances for minting Point Tokens. When a project announces an airdrop, Rumpel sweeps the reward token from all Rumpel Wallets, and the airdrop can be redeemed for the corresponding share, including future vesting allocations. Additionally, the speculative dynamics of the point token market can serve as a promotional tool for projects, boosting user engagement and key performance indicators.

How it Works

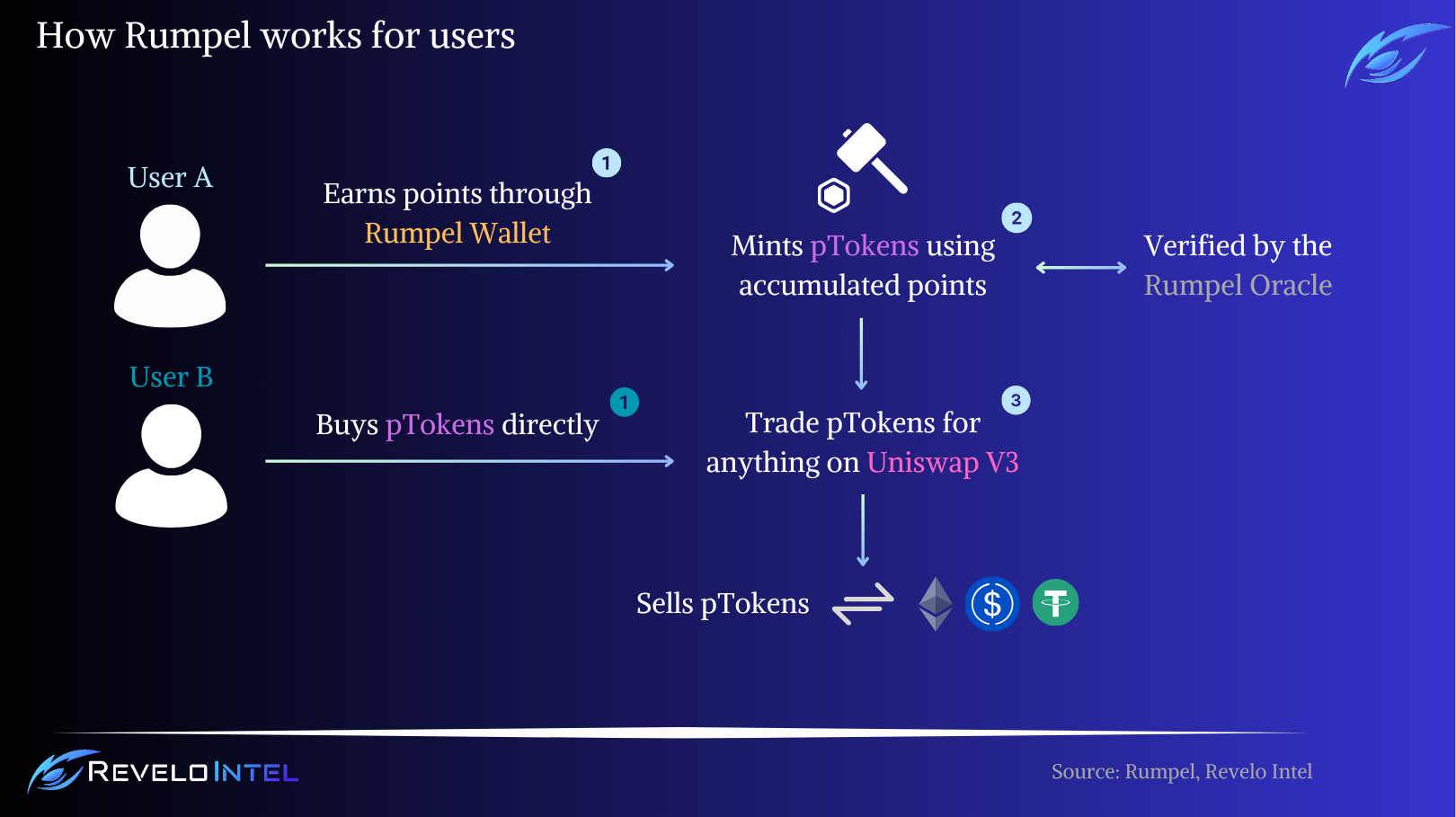

Rumpel allows users to transform their earned loyalty points into Rumpel Point Tokens (pToken) using a personal Rumpel Wallet, a specialized Safe Multisignature wallet. As users accumulate points, the Rumpel Oracle system verifies the off-chain point balances and adjusts the users’ allowances for minting new pTokens accordingly.

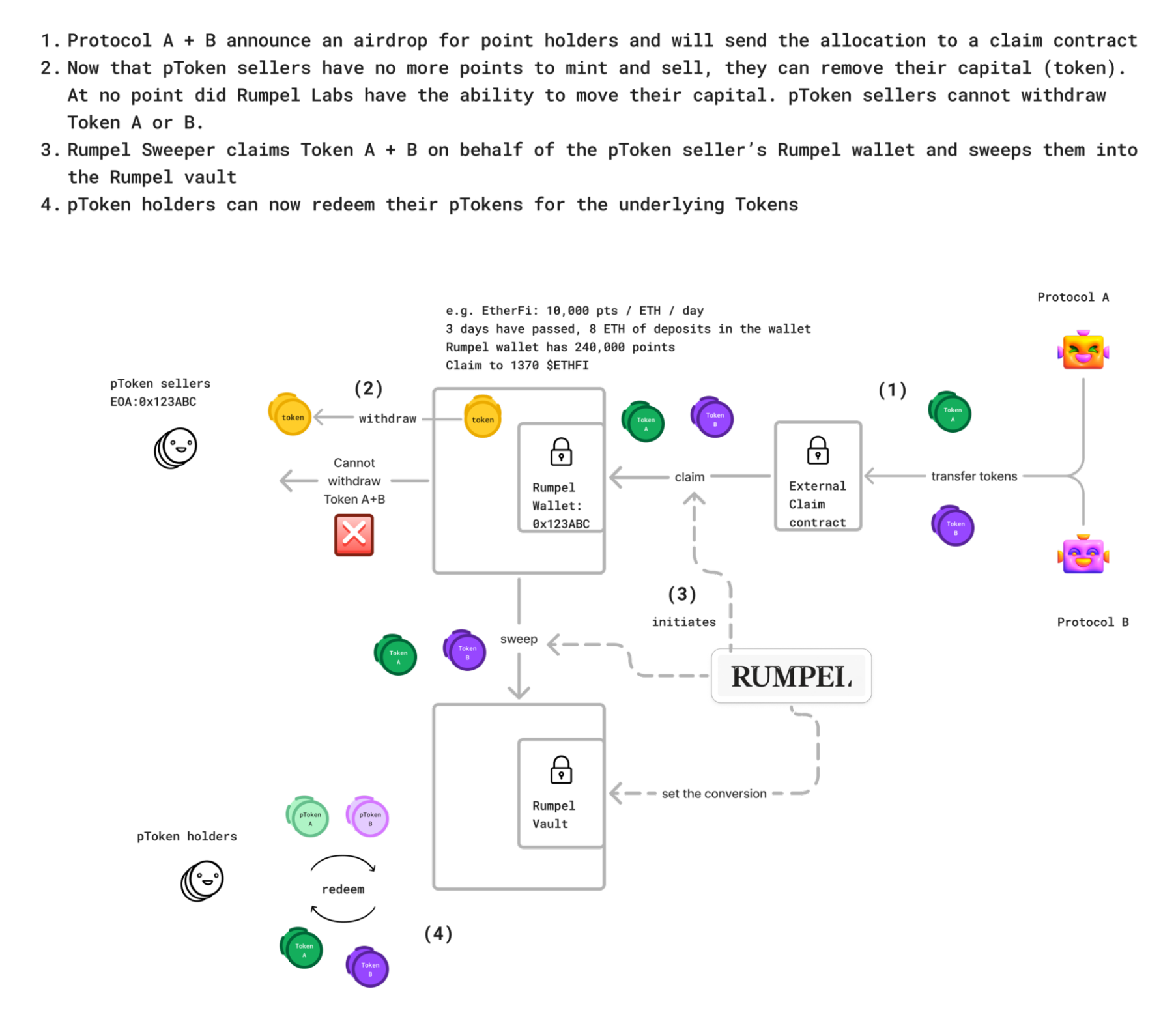

When a project announces an airdrop, holders of pTokens can redeem them for their proportionate share of the airdrop, including any future vesting allocations, through Redemption Rights. This process ensures users can capitalize on their earned points while providing transparency and liquidity within the ecosystem.

Key Components of Rumpel

As mentioned above, the key components of Rumpel’s framework are the Rumpel Point Token, Rumpel Wallet, Rumpel Oracle, and Rumpel Vault.

Rumpel Point Token

The Rumpel Point Token (pToken) is a digital asset representing an off-chain loyalty point and its future rewards. These tokens are directly tied to the points accumulated in a user’s wallet, maintaining a ratio of either 1:1 or 1:1000.

Users who have earned points through their Rumpel Wallet can mint pTokens, which are standard ERC20 tokens adhering to widely accepted blockchain protocols. When an airdrop is announced, pToken holders can redeem them for the equivalent reward tokens via the Rumpel Vault. For airdrops that include vesting schedules, Rumpel offers special Redemption Rights to ensure that pTokens remain fully backed, safeguarding their value and the interests of the holders.

Rumpel’s pToken was inspired by Kelp’s DAO $KEP token. $KEP token was introduced to provide liquidity for EigenLayer Points earned by restakers. Each $KEP token represents one EigenLayer Point, allowing users to store, trade, and utilize their accrued points. By tokenizing EigenLayer Points into $KEP, Kelp DAO allowed restakers to mitigate exposure to potential fluctuations in point value before official airdrops, such as those from EigenLayer.

Inspired by $KEP’s model, Rumpel developed pTokens to tokenize off-chain loyalty points, creating a secondary market for these assets. Similar to $KEP, pTokens represent claims on future reward tokens, allowing users to mint and trade them, thereby unlocking liquidity for otherwise illiquid points.

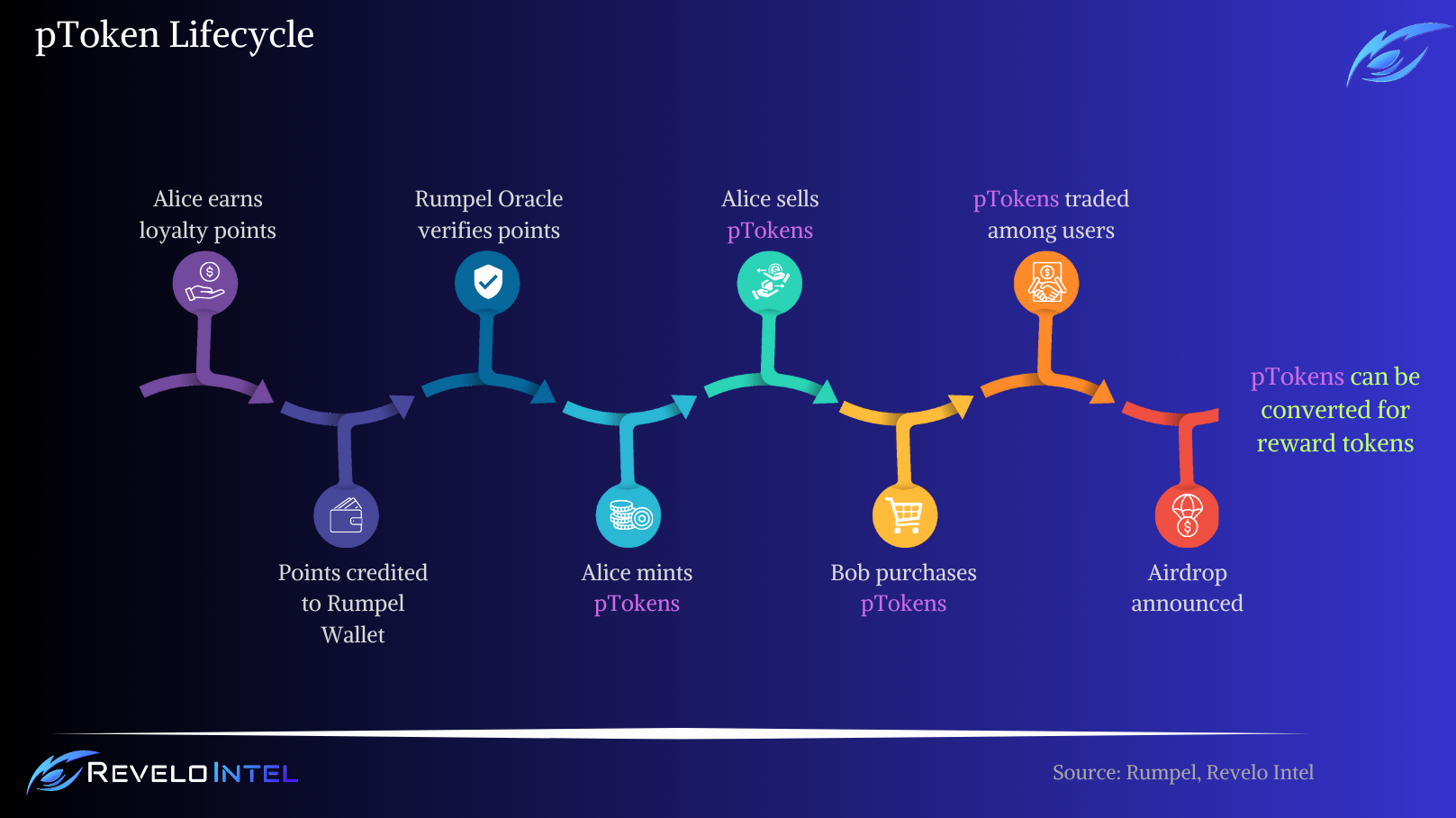

pToken Lifecycle

The lifecycle of a Rumpel Point Token (pToken) includes several stages, illustrating how users can tokenize, trade, and redeem their loyalty points within the Rumpel ecosystem:

- User A starts earning loyalty points by utilizing her Rumpel Wallet, a specialized one-of-one Safe multi-signature wallet designed for secure point management.

- Over time, User A continues to accumulate points through her activities, which are credited to her Rumpel Wallet.

- The Rumpel Oracle system verifies the off-chain point balances and updates User A’s allowance for minting pTokens, reflecting the total points she has earned.

- User A mints Rumpel pTokens based on the points in her Rumpel Wallet. These pTokens are standard ERC20 tokens representing her accumulated loyalty points.

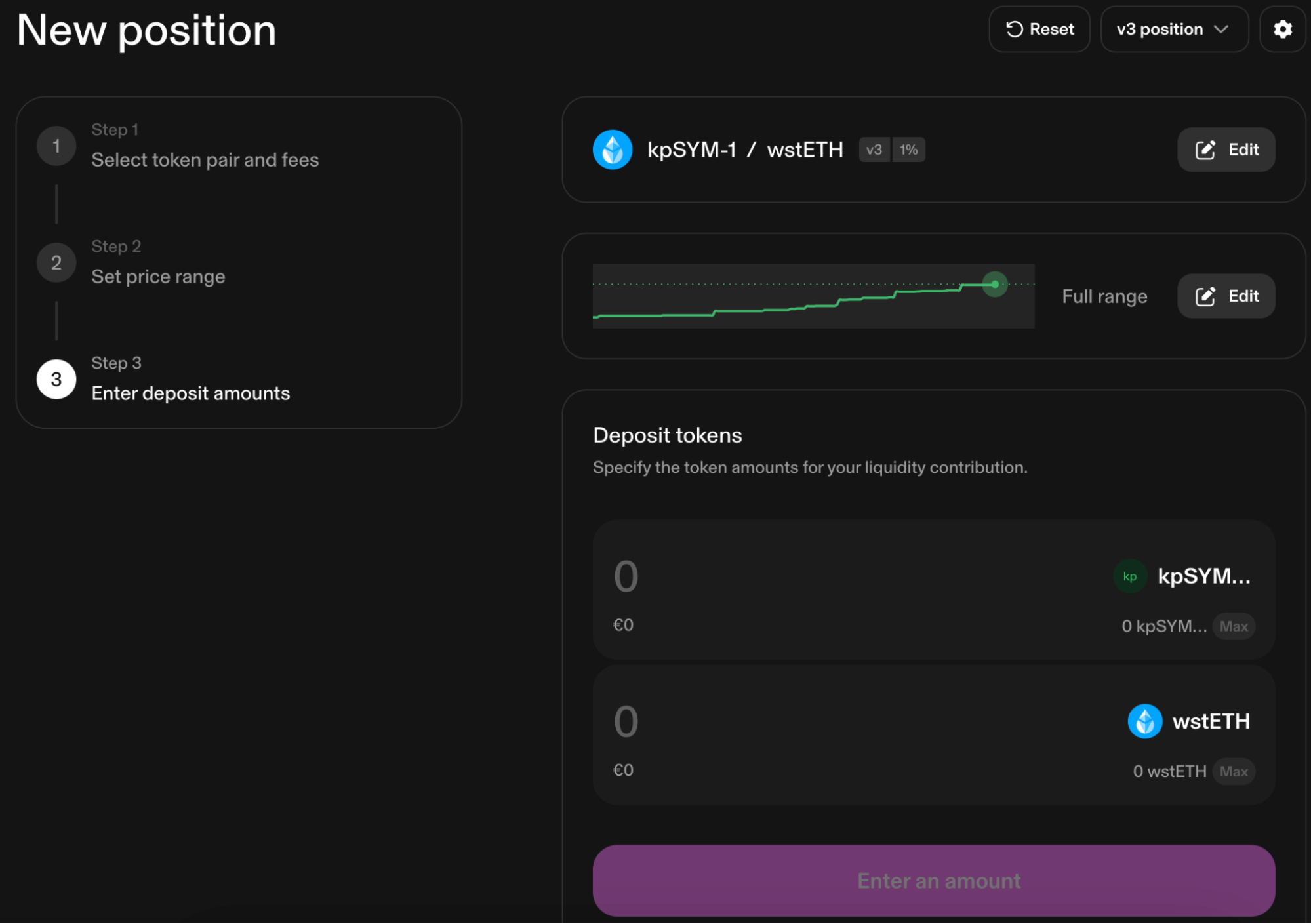

- With her tokenized points, User A can sell her pTokens on decentralized exchanges like Uniswap V3 in exchange for other assets such as $ETH, $USDC, or other cryptocurrencies.

- She can liquidate her loyalty points, reducing her exposure to potential uncertainties associated with future airdrops and obtaining immediate value at a fair market price.

- User B, interested in increasing his exposure to a particular project’s loyalty points, purchases pTokens from the market.

- He can quickly increase his stake in the loyalty points without fulfilling the original earning criteria or investing additional capital in the point-issuing project.

- Over time, pTokens continue to be traded among users, allowing the market to determine their value based on supply and demand dynamics.

- The point-issuing project announces an airdrop, initiating the conversion of loyalty points into their native reward tokens.

- Rumpel facilitates the conversion of the underlying loyalty points into the project’s reward tokens and holds these tokens on behalf of the pToken holders, ready for redemption.

- User B redeems his pTokens through the Rumpel Vault to receive his proportional share of the reward tokens, including future vesting allocations.

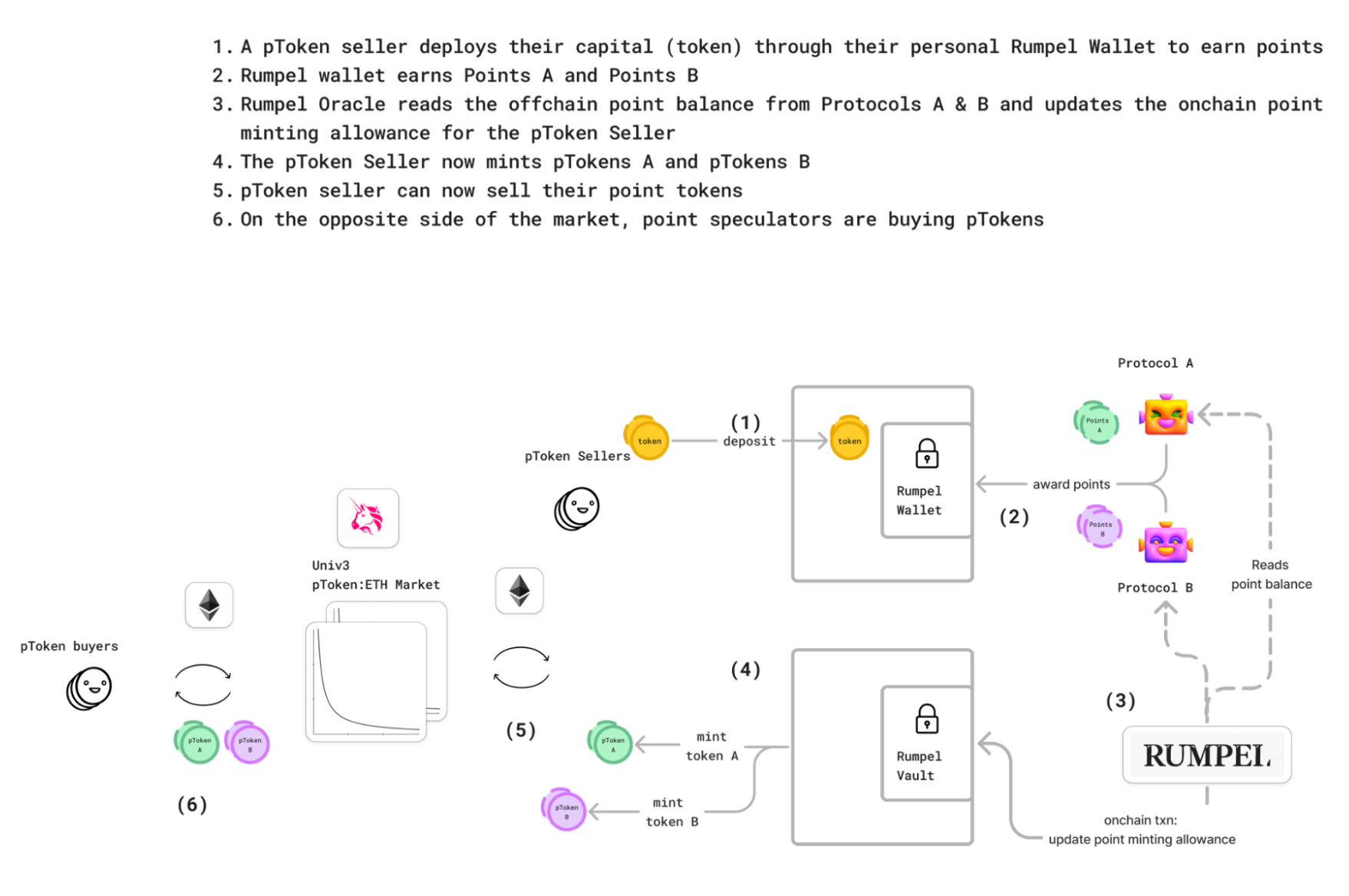

Unabridged Point Token Lifecycle

Below are visual illustrations of the lifecycle of unabridged pTokens in two different functions.

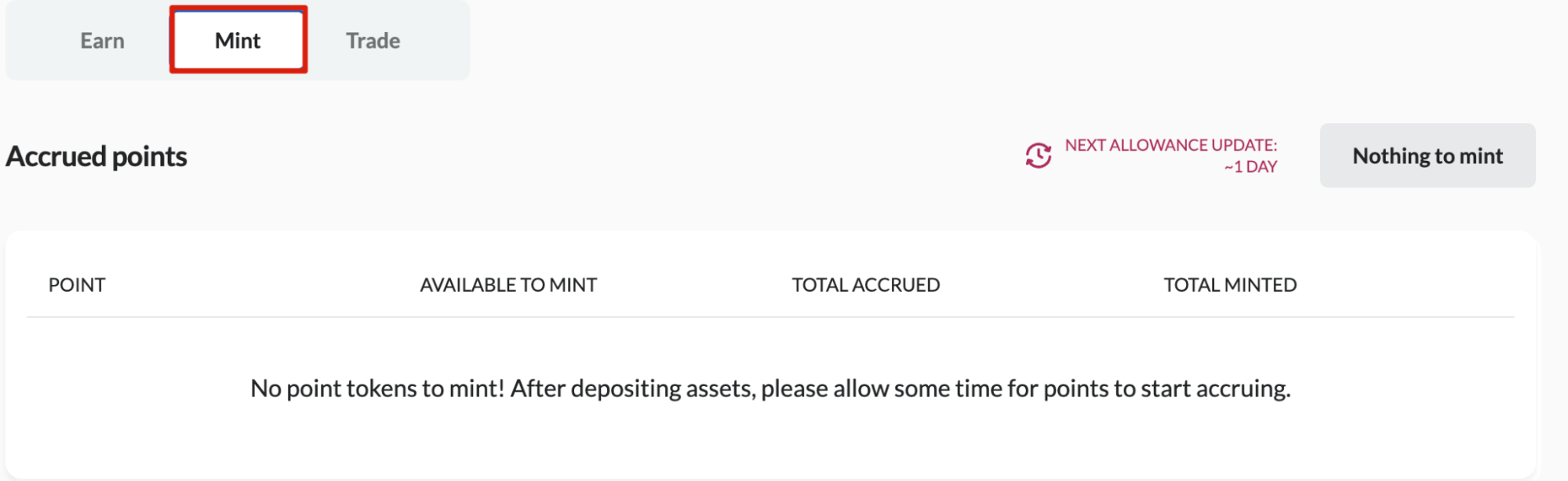

Minting

Burning – Redemptions

Rumpel Wallet

The Rumpel Wallet is a customized, secure multi-signature wallet (Safe) designed for users to accumulate loyalty points directly. Amplified with specialized components like the Rumpel Module and Rumpel Guard, users can create and manage pre-approved strategies within their wallets. Points earned through these strategies are deposited directly into the Rumpel Wallet.

As users accrue points, the Rumpel Oracle system verifies the off-chain point balances and updates the minting allowances within the Rumpel Vault. This verification process ensures that users can mint pTokens corresponding to their accumulated points whenever they choose. Once minted, these pTokens can be sold on the open market, providing users with liquidity and flexibility.

1. Rumpel Guard

To maintain integrity, the Rumpel Guard prevents users from double-claiming rewards for points they have already sold as pTokens. It does this by restricting all wallet actions except those previously whitelisted.

Additionally, the Rumpel Guard can permanently allow certain actions to ensure users always have access to essential functions within their Safe.

2. Rumpel Module

The Rumpel Module empowers the administrator to perform specific actions on behalf of a user’s wallet:

- Claiming Reward Tokens: After external protocols release reward tokens, Rumpel can claim them on behalf of the user.

- Transferring to the Vault: The claimed reward tokens are then transferred to the Rumpel Vault, enabling pToken holders to redeem their share.

These actions are typically executed atomically to prevent reward tokens from remaining idle in the user’s wallet, thereby reducing risk and improving efficiency.

The Rumpel Module also features an irreversible blocklist that specifies actions that cannot be performed on behalf of the user’s Safe, such as “USDC.transfer.” This blocklist provides additional assurances about the limitations of administrative access, ensuring that certain operations are strictly off-limits for the administrator.

Rumpel Oracle

The Rumpel Oracle is an off-chain system that verifies the point balances accumulated in Rumpel Wallets and updates the minting and redemption allowances for pTokens within the Rumpel Vault. To ensure accuracy and minimize the risk of errors, the Oracle disseminates pToken minting allowances through a Merkle root every three to five days, with a deliberate delay of more than three days. This delay helps mitigate the impact of any potential faulty data from the Oracle.

Rumpel operates multiple distinct Oracle clients to diversify implementation risks and enhance reliability. Plans are also in place to progressively decentralize the Oracle component.

Rumpel Vault

The Rumpel Vault is the smart contract that manages all activities related to the minting and burning of pTokens. It receives continuous updates from the Rumpel Oracle concerning minting allowances and redemption details for pTokens. Upon the announcement of an airdrop by a point-issuing project, the Oracle adjusts the redemption logic within the Vault accordingly. Next, Rumpel acts on behalf of the users to claim all eligible reward tokens and transfers them into the Vault while not interfering with users’ capital at any time, ensuring their security. Depending on the specific terms of redemption, holders of pTokens can then exchange their tokens for the underlying reward assets.

Rumpel Straw Program

The Rumpel Straw Program is Rumpel’s native point system that rewards users for contributing to the platform’s growth. Participants earn Straw points through activities such as tokenizing points via Rumpel, providing liquidity in designated Uniswap V3 pools, and engaging with Rumpel’s social initiatives. These points reflect each user’s involvement and support within the Rumpel ecosystem.

By actively participating in these activities, users accumulate Straw points, which may offer benefits within the Rumpel platform.

This program is vital to Rumpel because it incentivizes user engagement, liquidity provision, and ecosystem growth. By rewarding participants for activities such as tokenizing points and providing liquidity, the program aligns user incentives with the platform’s objectives, fostering a strong and active community. It also attracts early adopters and experienced participants from similar platforms, enhancing network effects and driving sustainable adoption.

The Rumpel Straw Program unfolds in multiple “Chapters,” each incentivizing specific activities related to Rumpel pTokens and ecosystem development with additional boosts and rewards.

Vesting & Redemption Rights

Rumpel supports different vesting schedules. Certain loyalty point programs distribute rewards based on a vesting schedule, where users receive their rewards gradually over time instead of all at once. Rumpel is equipped to handle these programs through a feature called Redemption Rights, which caters to various types of vesting arrangements.

While straightforward point systems that permit immediate conversion of all points to rewards do not require Redemption Rights, more intricate programs with different vesting formats make this feature particularly important.

To facilitate Redemption Rights, Rumpel employs Merkle roots and proofs. This approach controls the number of pTokens a user can redeem anytime, ensuring compliance with the specific vesting schedule.

The main vesting scenarios supported include:

- Standard Vesting: All users adhere to the exact vesting timetable, uniformly receiving their rewards.

- Whale Vesting: Vesting conditions apply exclusively to large-scale users, commonly known as “whales,” who may have different schedules due to their substantial holdings.

- Minimum Balance Vesting: Large holders must maintain a minimum balance of the deposited asset to continue receiving linear vesting payments after an initial waiting period (cliff).

The objective is to enable the trading of pTokens while ensuring that the distribution of vested reward tokens remains fair and proportional to all pToken holders over the vesting period.

Vanilla Vesting

In this scenario, all users follow an identical vesting schedule. For example, a point issuer may permit half of the points to be redeemed on the first day, with an additional 10% becoming redeemable at the beginning of each subsequent month until the whole amount is redeemed.

Rumpel’s Approach:

- Initial Redemption: When redemption begins, Rumpel claims the maximum allowable rewards from all Rumpel Wallets and pools them in the Rumpel Vault.

- Snapshot and Allocation: At the time of redemption, an off-chain snapshot of all pToken holders is taken. Redemption Rights are granted to these holders, corresponding to 50% of their pToken balance at the snapshot moment.

- Ongoing Vesting: As additional reward tokens vest, Rumpel allocates new Redemption Rights to these initial pToken holders based on their original holdings.

- Token Retention: Holders are encouraged to retain their pTokens to receive future rewards. Transferring pTokens means they must reacquire them to redeem upcoming vesting allocations.

- Market Liquidity: The pToken market may experience reduced liquidity after vesting commences, as holders are incentivized to keep their tokens.

Whale Vesting

Some projects selectively apply vesting schedules to large holders, commonly called whales.

Rumpel’s Approach:

- Application: If any Rumpel Wallets are subject to whale vesting, the vesting schedule is uniformly applied to all pToken holders to maintain equitable treatment.

- Identification and Distribution: Rumpel identifies which points are affected by whale vesting and uses a strategy similar to vanilla vesting to distribute rewards over time.

- Shared Impact: The effects of whale vesting are socialized among all pToken holders, even if individual users do not meet the criteria for whale status.

For instance, if whales holding 10% of pTokens are under a vesting schedule allowing 50% reward claims on day one and 10% monthly after that, Rumpel adjusts the redemption process so that each pToken holder can claim a proportional amount, preventing any rush to redeem that could disadvantage others.

Minimum Balance Vesting

This vesting type requires users to maintain a certain minimum balance of the deposited asset to continue receiving vesting rewards.

Rumpel’s Approach for Known Minimum Balance Vesting:

- Limited Minting: For projects with confirmed minimum balance vesting requirements, Rumpel allows users to mint only a specific percentage (e.g., X%) of their points, aligning with the initial share available on day one.

- Redemption Post-Airdrop: After the airdrop announcement, users can redeem their pTokens for the corresponding percentage of the airdrop.

- Liquidity Considerations: Following the airdrop, liquidity in the pToken market may decrease. Wallets subject to vesting must decide whether to keep their principal locked to earn ongoing rewards.

- Interim Mechanism: The pToken serves as an intermediary towards obtaining rewards, with the market potentially becoming less active after the initial redemption phase.

- Final Minting for Smaller Wallets: Rumpel will mint the remaining pTokens for smaller wallets not subject to the vesting schedule once it is confirmed they can claim their full rewards, ensuring fair distribution.

Rumpel’s Approach for Surprise Minimum Balance Vesting:

- Lock-up: Any wallets that meet the minimum balance can optionally lock up their wallets to ensure compliance with the minimum balance requirement.

- Volatility: The pToken’s price may experience volatility if the market isn’t expecting the vesting schedule.

This is not an ideal scenario, but Rumpel provides a workable solution.

Surprise Snapshots

For non-vesting airdrops announced with sufficient notice, redemption rights aren’t needed, as all pTokens redeem at a fixed rate. Nevertheless, for retroactive snapshots, such as marking a transition between reward seasons, Rumpel uses redemption rights to ensure pTokens are valid for both the previous and current seasons.

In such cases, Rumpel takes its own snapshot of pTokens holders and allocates redemption rights for the earlier season based on the proportion of tokens in circulation at the time. For example, if 70% of current tokens existed during a past snapshot, 70 redemption rights are issued to current holders for the prior season’s airdrop.

This dual representation of pTokens covering prior and current seasons may cause temporary market volatility. As holders use up prior season redemption rights, token values will stabilize, reflecting only the current season. To avoid this complexity, teams are encouraged to clearly announce season transitions to reduce market uncertainty.

Protocol Stakeholders

Rumpel categorizes four groups of users: Point farmers, Point investors, Liquidity providers, and Point issuers.

Point Farmers

These users accumulate loyalty points but may wish to reduce their exposure to specific points before an airdrop event. For example, if a protocol announces a second season of points and delays its airdrop, potentially diluting users, point farmers may decide to sell their points. They aim to sell their points, earn tangible returns, and mitigate risks associated with these kinds of risks. By converting the points they prefer not to keep into tokens, they can sell them on secondary marketplaces like Uniswap V3.

Point Investors

Investors interested in increasing their exposure to particular protocols and their points can purchase tokenized points on platforms such as Uniswap V3. This approach allows them to boost their holdings without completing a series of tasks or exposing their principal capital to significant smart contract risks from new protocols.

Liquidity Providers

Anyone can supply liquidity to designated Uniswap V3 Point Token pools. By doing so, they earn trading fees and receive Rumpel Straw (Rumpel’s point program) points as incentives. Passive participants can offer bid-side liquidity, and passive sellers can ask-side liquidity, supporting the market’s depth and stability.

Point Issuers

Projects that distribute loyalty points continue their rewards programs while leveraging secondary markets to demonstrate the tangible value of their points. This can also help capture new users if the points are valuable (in terms of $).

Using the Protocol

When using Rumpel, users can sell points, buy points, provide liquidity, or issue points (protocols).

Create a Wallet

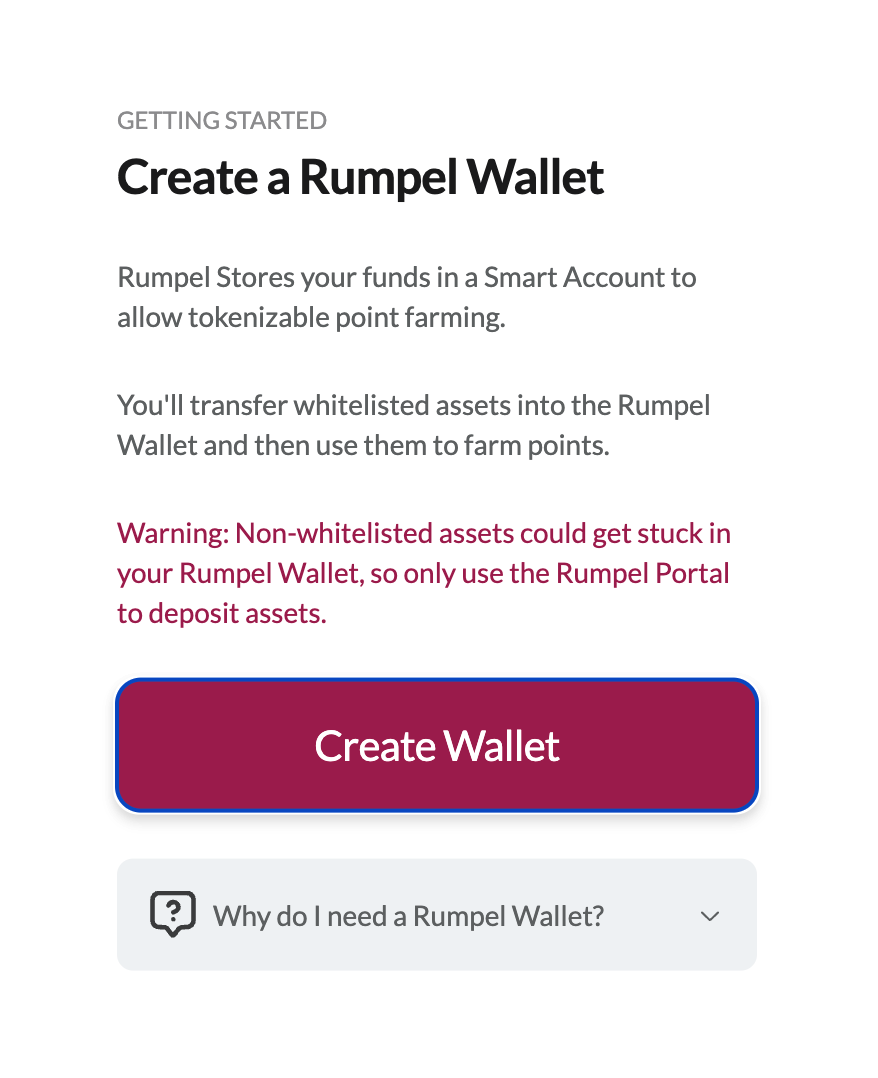

To create a Rumpel wallet, follow these steps.

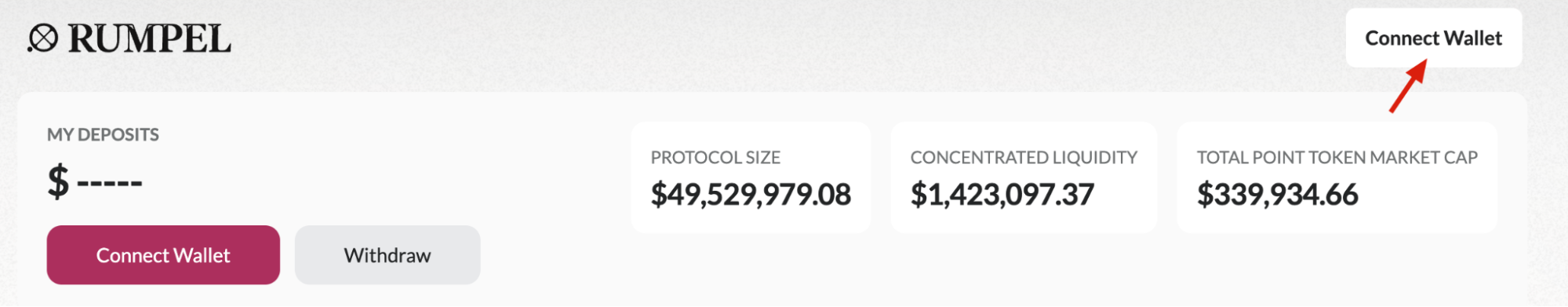

1. Visit the app page here.

2. Connect your wallet in the top right corner.

3. Then click the “Deposit” button.

4. You’ll be prompted to create a Rumpel wallet. Click “Create Wallet”.

5. Confirm the transaction in your original wallet. You now have a Rumpel wallet.

Selling Points

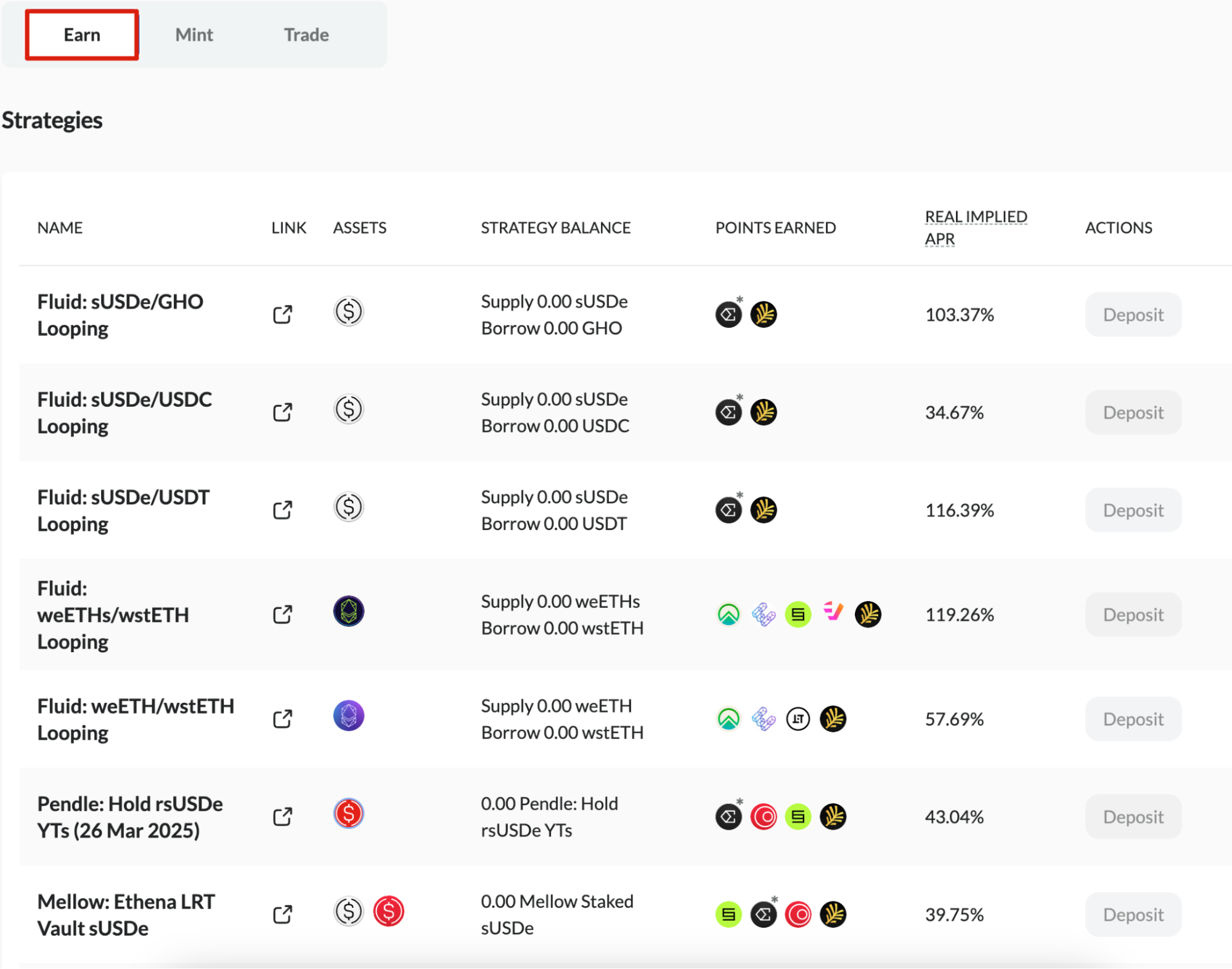

Selling your accumulated points within the Rumpel ecosystem is a straightforward process centered around pTokens. Here’s how the process works:

- Accumulating Points: Users earn loyalty points using their Rumpel Wallet and depositing their preferred asset for their strategy.

- Point Accrual Period: Users continue their activities over time, and points accumulate in their Rumpel Wallet.

- Oracle Update: The Rumpel Oracle updates their allowance for minting pTokens based on their earned points. The Oracle pushes updates every Monday, Wednesday, and Friday, but it will update daily in the future.

- Minting pTokens: Users mint pTokens equivalent to the points held in their Rumpel Wallet.

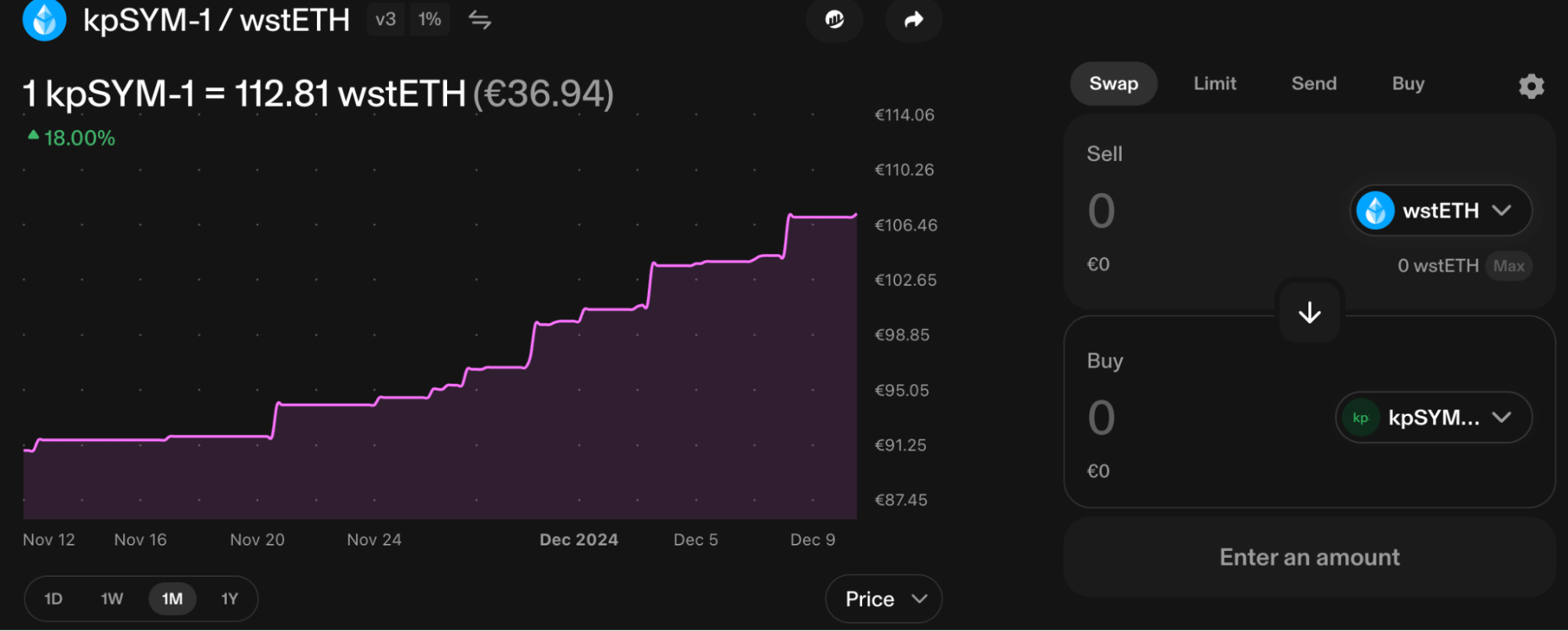

- Selling pTokens: With their points now tokenized, users sell their pTokens on decentralized exchanges like Uniswap V3 for other assets such as $ETH, $USDC, or similar.

By converting and selling their points, users can:

- Reduce Exposure: Minimize the risk associated with holding specific point assets.

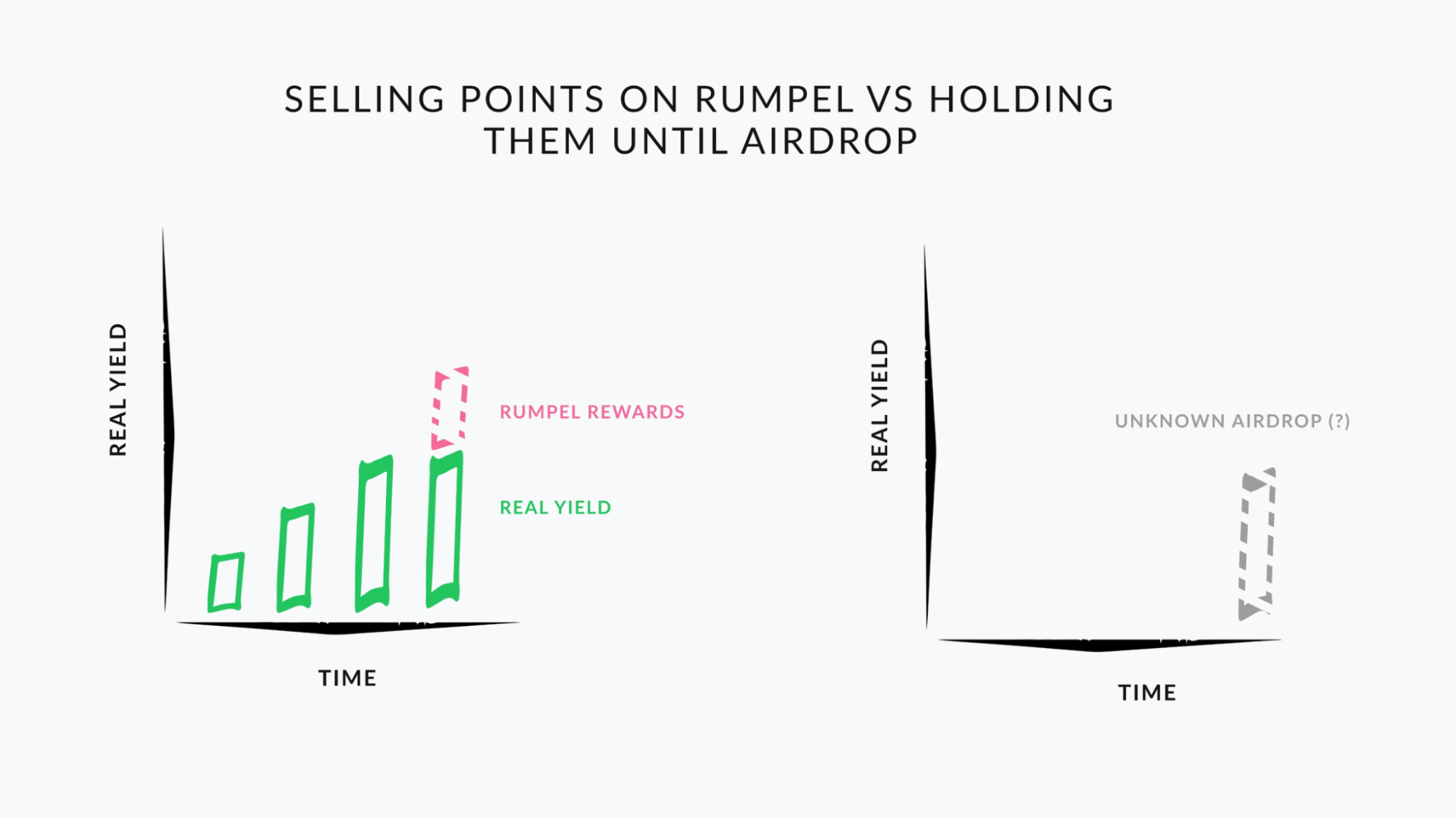

- Gain Liquidity: Obtain immediate access to other assets at competitive market prices. Consider this example: Users who sold their EigenLayer points via $KEP between a certain period earned approximately 38% APR on $ETH. In contrast, those who held onto their $EIGEN likely achieved only low single-digit returns. Rumpel allows the same function but for numerous point programs and airdrops.

Participants can earn returns on their principal assets by acquiring liquid external points and receiving Rumpel Straw points as additional incentives.

Rumpel Labs has implemented safeguards to protect users’ deposited capital by restricting its ability to transfer or lock assets within users’ Rumpel Wallets. This design choice minimizes risks from capital to smart contract risks only.

Buying Points

Purchasing points with Rumpel involves acquiring pTokens from decentralized exchanges like Uniswap V3. Here’s how the process works:

- Acquisition of pTokens: A user aims to increase his exposure to a particular points program. They buy pTokens on Uniswap V3, representing the project’s loyalty points.

- Benefit: This method allows the user to augment his stake in the points program without needing significant capital investment or engaging in the original point-earning activities.

- Awaiting Airdrop Announcement: Over time, the point-issuing project announces an airdrop, converting accumulated points into their native reward tokens.

- Conversion and Custody: Rumpel facilitates the conversion of the underlying points into reward tokens and holds these tokens in the Rumpel Vault on behalf of pToken holders.

- Redemption of Rewards: The user redeems their pTokens through the Rumpel Vault, receiving their proportional share of the reward tokens based on their holdings.

By holding pTokens, users gain a long position in the points program, allowing them to benefit from the project’s success and the anticipated value of the reward tokens.

There are some risks associated with buying points, such as:

- Price Volatility of pTokens: The market value of pTokens can fluctuate, and there is a risk that their price may decline after purchase. Factors that can aggravate this volatility:

- Oracle Risk: Dependence on the Rumpel Oracle for accurate and timely updates of point balances.

- Malicious Administrator Risk: The potential for administrators to act in ways that could negatively impact pToken holders.

- Point Deletion Risk: The possibility that the point issuer might invalidate or delete points, affecting the underlying value of pTokens.

- Redemption Risk: pTokens may be redeemed for fewer reward tokens than the off-chain points they represent. Factors that can aggravate this risk:

- Airdrop Claiming Risk: Challenges in successfully claiming the airdropped reward tokens.

- Airdrop Diversion Risk: The risk that the airdropped tokens might be diverted away from pToken holders, possibly due to errors or malicious activities.

Providing Liquidity

Participating as a liquidity provider (LP) in the Rumpel ecosystem allows you to earn returns by facilitating the trading of pTokens. Here is how you can provide liquidity on Rumpel:

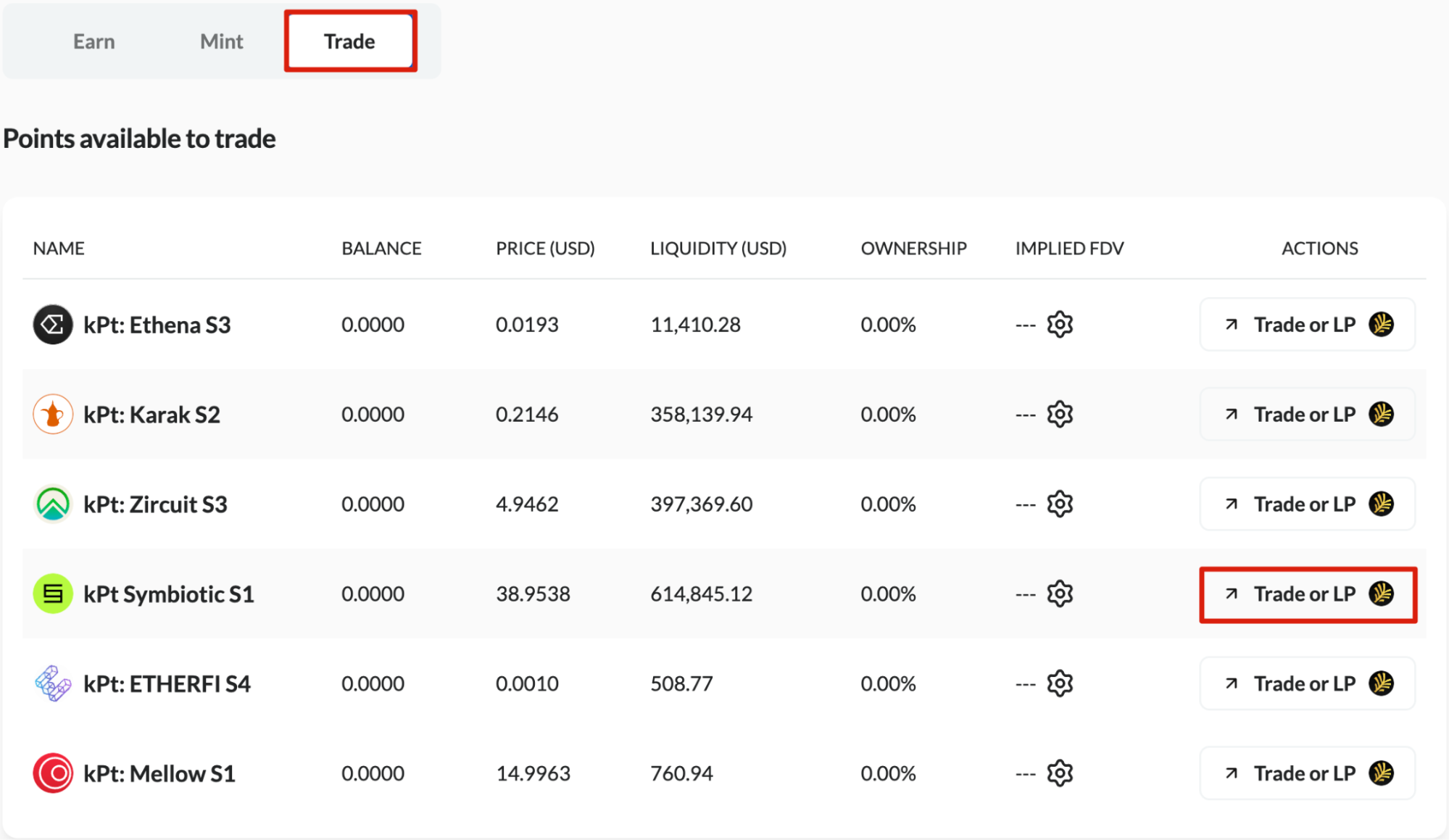

- Access the Rumpel Portal: Visit the “Trade” section on the Rumpel Portal to get started.

- Choose a Liquidity Pool: Select the appropriate pool for the pToken you are interested in.

- Supply Liquidity via Uniswap V3: Use Uniswap’s interface to deposit assets into the chosen pool.

- Withdrawing Liquidity: When you decide to exit your liquidity position, any remaining pTokens can be sold back into the pool or held until they are eligible for redemption into reward tokens.

LPs Earn a portion of the fees generated from trades within the liquidity pool, benefiting from the pToken’s market activity. They also receive additional incentives like Rumpel Straw points for contributing liquidity to the ecosystem.

The risks related to LPs are:

- Impermanent Loss: Exposure to potential losses resulting from pToken fluctuations relative to the paired asset while your funds are locked in the pool. Factors that can aggravate this risk:

- Oracle Risk

- Malicious Administrator Risk

- Point Deletion Risk

- Airdrop Claiming Risk

- Airdrop Diversion Risk

Issuing Points

Point issuers can interact with Rumpel and showcase the tangible value of their points on secondary markets. This allows the market to speculate on airdrops through the monetary value of points, thus helping point issuers reach more users and refine their strategy.

Before integrating with Rumpel and connecting liquidity to a points program, there are some requirements:

- Access to a public API endpoint is needed to read point balances for a particular address.

- The airdrop must be claimable by users (pull-only).

- The airdrop is claimable on-chain by a smart contract or through ERC-1271 signatures only.

- The reward token’s permit function should not allow ERC-1271 signatures (like $USDC). Solmate and OZ token implementations are allowed.

- The airdrop needs to be announced seven days before claiming.

Sector Outlook

The airdrop landscape of Web3 is experiencing a shift, marked by the rise of point programs. Since point programs were introduced by Tensor and Blur in 2022, this new incentive mechanism has quickly been adopted across the industry. Each subsequent program has expanded the design space of incentives, unveiling new reward structures and behaviors to attract users. As of 2024, a diverse ecosystem of point programs has emerged, each contributing unique elements to the evolving meta of loyalty points. This progression has crafted a complex array of reward mechanics and targeted behaviors, offering unique opportunities for user engagement and retention.

Points are digital units of reward valued for their utility or potential conversion into tangible benefits—such as exclusive access, product discounts, or direct financial value. In Web2, points convert to a discount on future purchases. In Web3, points are converted to tokens that reward users for using a protocol and being early adopters. Protocols implement point programs with a mission to cultivate loyalty, drive product adoption, amplify network effects, and influence user behavior in ways that accelerate growth. Point programs establish a mutually beneficial relationship between protocols and users: protocols gain loyalty, growth, and valuable data, while users receive rewards for their continued engagement and participation in the ecosystem.

Blur’s introduction of point systems in 2022 ignited a chain reaction within the crypto industry. Numerous projects have since adopted similar programs, achieving significant scale and impact on their growth. Notable examples include Tensor, FriendTech, Blast, EigenLayer, most LRT protocols, and Hyperliquid.

Hyperliquid distributed 310 million $HYPE tokens to its community, representing 31% of its total 1 billion token supply after a 12-month point program. This allocation is notably higher than the typical 5% to 15% range seen in other airdrops. With the $HYPE price surging after TGE, the Hyperliquid airdrop became the most valuable ever.

Another great example of a successful points program was Ethena. The first season only lasted 40 days before the airdrop. As a result, $USDe became the fastest-growing stablecoin in crypto and retained most of its traction. The users were not diluted from a prolonged point campaign, and $ENA rewards were satisfactory for most users. Points are not limited only to pre-TGE. Ethena has allocated at least 15% of its total token supply to its points program, indicating that more seasons will occur with additional rewards and incentives.

In contrast, there are cases of protocols that extend their airdrop campaigns and the number of points that are distributed to users. In other words, they “farm” their users extensively to retain high protocol metrics and attract investors. By the time the token was launched, users were diluted on a level that their points had lost most of their tangible value, and the rewards were below expectations.

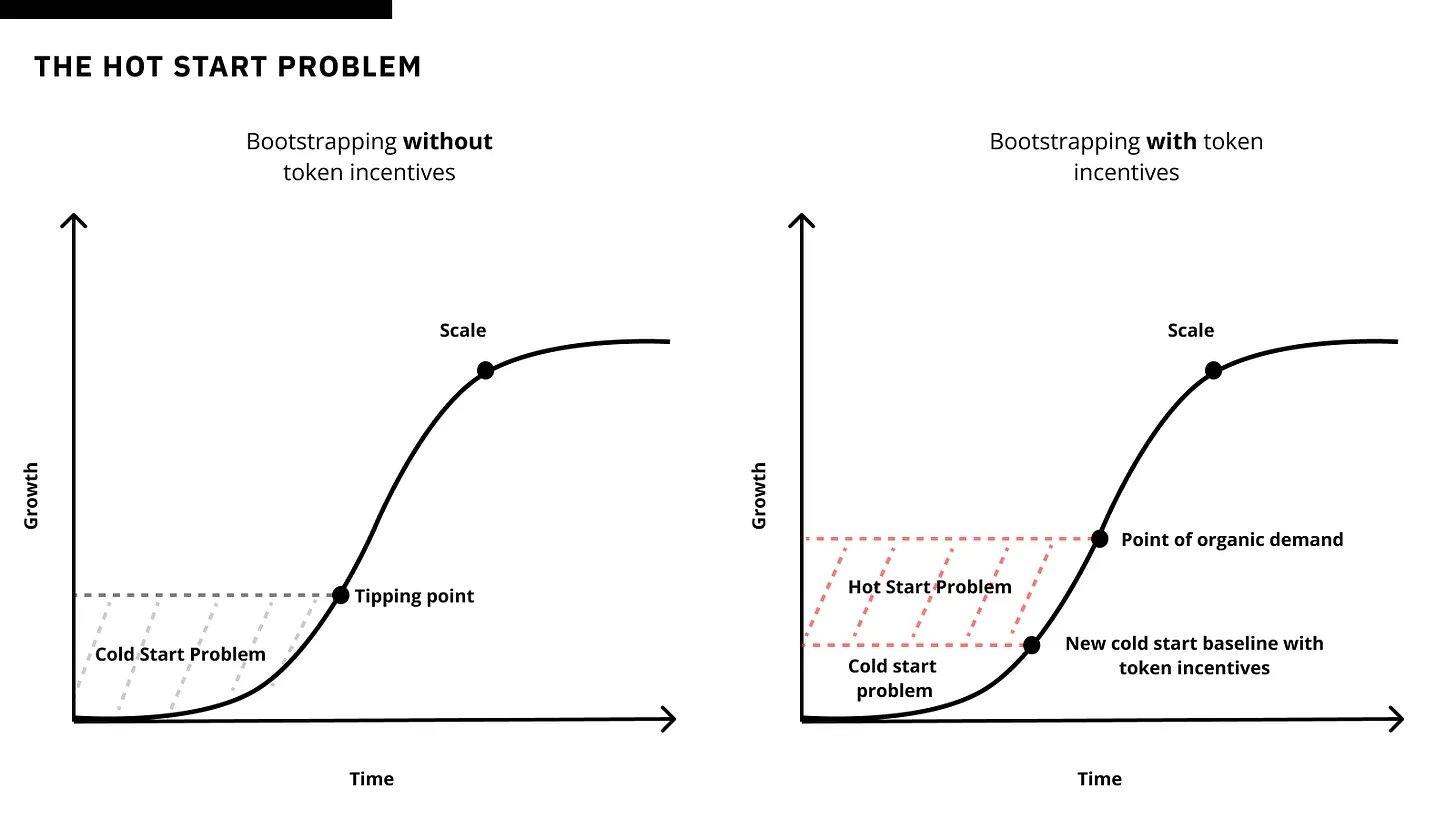

Point programs in Web3, while effective for incentivizing user engagement and boosting protocol metrics, have notable flaws. These programs are often centralized and lack transparency, with point accrual methods, data storage, and program criteria hidden from users in off-chain databases. This opacity can erode trust, as users often doubt the fairness and value of the points they earn. Additionally, reliance on point incentives can mask a product’s proper market fit by artificially boosting engagement metrics. This leads projects to prioritize superficial growth indicators like TVL, fees, and volume over genuine user satisfaction and retention. Mayson Nystrom refers to this challenge as the “Hot Start Problem.” Even after validating product-market fit, teams must grow sufficient organic traction to achieve sustainability for their protocols before reducing reliance on incentives. However, this strategy often conflicts with investors’ expectations for immediate investment returns.

The challenges above showcase the need for protocols like Rumpel and secondary markets for points. Protocols like Rumpel address these shortcomings by tokenizing loyalty points, bringing them onto the blockchain to provide transparency, liquidity, and market-driven valuation. By converting points into tradable tokens, Rumpel allows point holders to realize immediate value and mitigate risks associated with uncertain future rewards due to protocols’ strategies. This tokenization creates a fair and open market where point values are determined by supply and demand dynamics, rebuilding user trust. It also helps projects gauge authentic user interest without the distortions caused by opaque incentive systems, supporting sustainable growth and a clearer understanding of product-market fit.

Competitive Landscape

The current loyalty points industry lacks a crypto-native secondary marketplace that effectively addresses the needs of all stakeholders. Such a marketplace would enable point farmers to sell their points and reduce exposure before uncertain airdrops, allow point investors to acquire points and adjust their exposure efficiently, and provide point issuers with a transparent platform to demonstrate the real value of their rewards programs. Current solutions solve aspects of the general issue, such as point fatigue, but are not designed to handle complex scenarios.

Whales Market was among the first protocols to enable users to trade points. It offers a decentralized OTC trading platform where users can directly exchange assets across multiple blockchains. Transactions are secured and settled through smart contracts, providing trustless and efficient exchanges. However, Whales Market requires point sellers to provide collateral as a safety measure, and settlements occur only after the TGE. This approach may limit liquidity and delay access to funds for point sellers or point buyers.

Bubbly introduces an AMM-based DEX that utilizes liquidity pools to offer a trading experience similar to Uniswap. Like Whales Market, Bubbly requires point sellers to lock collateral, allowing them to claim their funds only after the TGE. This requirement can restrict sellers who wish to liquidate their points promptly and may discourage participation from those unwilling or unable to lock additional assets.

Protocols such as Pendle, Spectra, and Hourglass provide fixed-rate services, enabling users to gain leveraged exposure to points and boost their stack. While these platforms allow significant exposure to point programs, they do not permit yield token (YT) holders to resell earned points. Additionally, point sellers’ principal is subject to liquidity constraints if they wish to withdraw early, potentially limiting flexibility and accessibility for users needing immediate liquidity.

Pichi employs a different model by utilizing ERC-6551 token-bound accounts through its Michi Wallet NFTs. Users deposit tokens that earn points into wallets owned by NFTs. Once points accumulate, users can withdraw the point-earning tokens and sell the Michi Wallet NFT, effectively transferring ownership of the associated wallet and any accrued points. This method does not require collateral from either party. However, Pichi is not designed for trading individual point exposures, which may limit user preference and flexibility, especially for those interested in specific point programs and more liquid options than an NFT.

Stacks provides a platform for creating and managing point systems using the Points Protocol, a Solidity smart contract. It offers a flexible and modular approach for point issuers to implement and understand their point-based systems, helping them improve their point programs. Stacks allows users to redeem their rewards based on their points but focuses more on point system management rather than facilitating a secondary marketplace for trading points.

Rumpel sets itself apart by offering a comprehensive point tokenization protocol that enables deep secondary market liquidity and price discovery for off-chain loyalty points without requiring user collateral. Through the Rumpel Wallet, users can wrap their earned points into pTokens and sell them anytime, providing immediate liquidity and reducing exposure to specific point programs.

Rumpel provides a valuable solution in the market by simultaneously addressing the needs of point farmers, investors, and issuers. It facilitates immediate liquidity, flexible trading options, and transparent valuation of loyalty points, differentiating from other offerings in the sector.

| Protocol | Pros | Cons |

| Rumpel | – No collateral is required from sellers.

– Allows trading of individual points. – Provides immediate liquidity before TGE. – All stakeholders are satisfied. – Supports complex vesting schedules. – Implements comprehensive risk mitigation strategies. |

– New protocol with potentially limited initial adoption.

– Initial market liquidity may be lower. |

| Whales | – Enables trading across multiple blockchains.

– Secure, trustless transactions via smart contracts. – Available markets to trade points. |

– Requires collateral from point sellers.

– Settlement occurs only after TGE, delaying sellers’ access to funds. |

| Bubbly | – AMM-based DEX offering a Uniswap-like trading experience.

– Utilizes liquidity pools for trading. |

– Requires collateral from point sellers.

– Sellers can claim funds only after TGE. |

| Fixed-Rate (Pendle, Spectra, Hourglass) | – Allows users to gain leveraged exposure to points.

– Enhances point stacks for investors. |

– Does not allow resale of earned points.

– Sellers’ principal is subject to liquidity constraints if they wish to withdraw early. |

| Pichi | – No collateral is required from sellers.

– Innovative use of ERC-6551 accounts and NFTs for trading points. |

– Does not support trading of individual point exposures.

– Points are bundled within NFTs, limiting flexibility. – May add complexity due to the use of NFTs and token-bound accounts. |

| Stacks | – Provides tools for creating and managing point systems.

– Helps point issuers understand and improve their programs. – Allows users to redeem rewards based on their points. |

– Focused on point system management rather than facilitating trading.

– Does not provide a secondary marketplace for point trading. – Does not specifically address liquidity or enable trading of points among users. |

Potential Adoption

As the ecosystem progresses, the limitations of traditional point systems—such as lack of transparency, liquidity constraints, and centralized control—have become more apparent. Users and projects alike are seeking solutions that address these flaws. Rumpel’s protocol offers a decentralized approach to point tokenization, enabling secondary market liquidity and price discovery for off-chain loyalty points, directly aligning with the market’s current needs and reducing friction overall.

Rumpel provides tangible benefits to all stakeholders in the loyalty point market. Point farmers can tokenize and sell their points, mitigating risks associated with uncertain or prolonged airdrops and reducing their exposure before TGE. This flexibility allows them to realize immediate value from their accumulated points without relying on valuation models and complex calculations. Point investors gain easier access to various point programs without the need for significant capital or exposure to smart contract risks inherent in earning points traditionally. By purchasing pTokens on secondary markets like Uniswap V3, they get immediate exposure based on their investment thesis. Finally, point issuers benefit from increased transparency and a market-driven valuation of their points, which can increase user engagement and validate their reward programs’ effectiveness.

The rapid adoption of point programs by numerous Web3 projects indicates a shift towards this kind of incentive mechanism behind airdrops. Projects like Tensor, Blur, Ethena, Ether.fi, Hyperliquid, and others have demonstrated the effectiveness of point systems in driving user engagement and growth. However, these programs’ centralized nature, opacity, and uncertainty over the actual value of points have led to user dissatisfaction, as seen with issues like undisclosed claim criteria, perceived unfairness in airdrop allocations, and subpar expectations over rewards. Rumpel addresses these concerns by bringing points onto the blockchain, providing transparency, and enabling fair value assessment through market dynamics. This alignment with the core principles of decentralization and user empowerment in Web3 makes Rumpel an attractive option for existing and new projects aiming to improve their loyalty programs and take ultimate advantage of Rumpel’s mechanisms.

Moreover, Rumpel’s ability to handle complex vesting scenarios through features like Redemption Rights positions it well for adoption by projects with any kind of incentive structure. As protocols continue to introduce new point system designs with diverse reward mechanics and user incentives, a solution like Rumpel becomes increasingly valuable.

Business Model

Rumpel provides a platform that tokenizes off-chain loyalty points, enabling users to trade these points on secondary markets. The protocol has turned off the protocol fees for minting and burning pTokens, and it won’t be generating any revenue in the early phases. This is a strategic decision to boost protocol engagement and gain traction in its early stages, but it is subject to change in the future.

Rumpel creates value by addressing the flaws of crypto point systems. It allows point holders to convert their accumulated points into tradable tokens, providing liquidity and reducing exposure to uncertain future rewards. Point investors benefit by accessing various point programs without typical barriers, such as significant capital requirements, complex earning processes, or prolonged campaigns. The protocol delivers this value through its own infrastructure: the Rumpel Wallet for secure point accumulation, the Rumpel Oracle for accurate point verification, and the Rumpel Vault for minting and redeeming pTokens.

Rumpel is designed to be a critical part of the loyalty point ecosystem by facilitating liquidity and market-driven pricing for loyalty points. This attracts users, investors, and point issuers to the platform. Increased activity enhances the utility of Rumpel, further embedding the protocol within the current incentive environment that revolves around points and their connection to rewards.

Risks

Rumpel is dedicated to maintaining transparency and considers it essential to outline the potential risks associated with the protocol, the measures taken to mitigate them, and plans to manage them further.

| Risk | Description | Mitigation |

| Point Oracle Risk | A point distribution might allow users to claim points they have not legitimately earned. This could occur if teams temporarily publish incorrect point balances and adjust them later or due to a bug in Rumpel’s distribution scripts. |

|

| Malicious Admin Risk | There is the risk that a malicious actor could gain control of Rumpel’s administrative multisignature wallet and either mint an unlimited amount of pTokens or attempt to misappropriate assets held in users’ Rumpel Wallets. |

|

| Smart Contract Risk | Vulnerabilities or bugs in the smart contracts could lead to exploits or draining of funds. |

|

| Point Deletion Risk | Point issuers might delete points, affecting all point holders, including those using Rumpel. |

|

| Airdrop Claiming Risk | Rumpel may be unable to claim the airdrop through Rumpel Wallets due to incompatibilities with the point program’s airdrop infrastructure provider or if the point’s reward token is one of the whitelisted principal assets that the administrator cannot transfer. |

|

| Frontrun Risk | Users might delegate to a secondary account via a non-ERC1271 signature to receive their reward tokens instead of the Rumpel Wallet, potentially diverting the airdrop from the intended process. |

|

Security

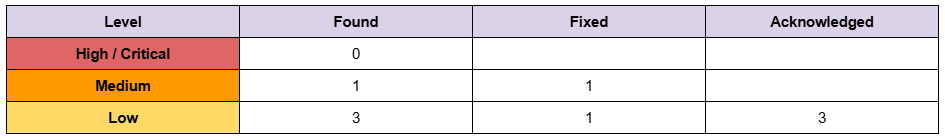

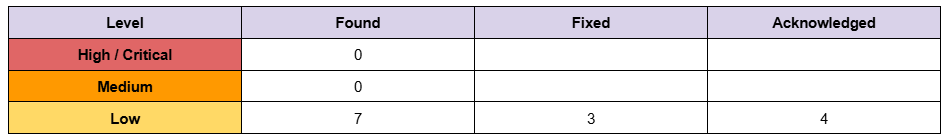

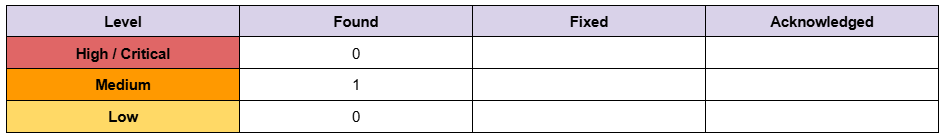

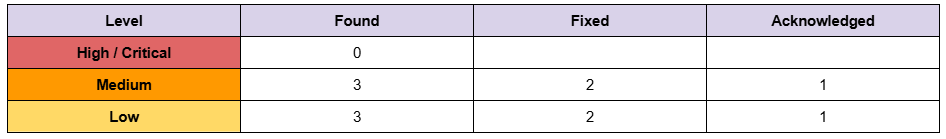

Rumpel has thoroughly identified potential internal and external risks with its platform. This allows the protocol to be proactive against possible risks and security threats and have mitigation plans for each, as seen in the above Risks section. In addition, Rumpel has undergone rigorous audit reviews by third-party security firms.

Audits

Rumpel’s Security Model

Rumpel safeguards point sellers and their principal assets, including all funds deposited into Rumpel Wallets. The Rumpel Wallet is built on top of Safe, a wallet that provides top-notch security using advanced measures. Every user wallet is a Safe with two specialized components: the Rumpel Module and the Rumpel Guard. Since each user wallet is essentially a standard Safe enhanced with these additions, much of the security framework is taken from Safe. To comprehend the extent of administrative capabilities, it’s important to understand these two components:

- Rumpel Guard: This feature restricts user actions to specific calls included on an allowlist.

- Rumpel Module: This allows the administrator to perform specific actions on behalf of the user, except for functions listed on a blocklist.

An administrator’s involvement is necessary because Rumpel’s pTokens represent claims on future reward tokens. When these reward tokens are distributed, the administrator must be able to collect them from user wallets and transfer them to the Point Token Vault for pToken redemption. If users could withdraw the rewards independently before this process, the pTokens would lose their backing, undermining the system’s integrity.

The system permanently enables user actions and disables administrative access for assets that are certain not to become reward tokens. The smart contracts are designed with this balance in mind to ensure both security and user autonomy.

How it Works

Users are the sole owners of their one-of-one Safe wallets. By default, the Guard prevents all actions to protect users from making unintended or harmful contract calls. Only functions on the allowlist are executable by the user, ensuring that all permitted actions are secure and intentional.

The Rumpel Module controls the actions that administrators can perform on behalf of users. It utilizes a blocklist to restrict specific function calls. When a call is added to the module blocklist, the administrator is prohibited from executing that function on the user’s Safe. This blocklist is immutable—once a call is added, it cannot be removed—preventing administrators from regaining access to blocked functions.

By adding critical functions like enableModule and disableModule to the blocklist during deployment, Rumpel ensures that administrators cannot alter the module to circumvent security measures. This step is crucial in maintaining a secure environment where users’ assets are protected from unauthorized access.

In summary:

- Blocklist: If a function related to an asset is on the module blocklist, the administrator cannot withdraw or use that asset from the user’s Safe.

- Allowlist: If a function related to an asset is on the guard allowlist, users can interact with that asset, such as withdrawing it.

- Permanent Allowlist: When a function is marked as PERMANENTLY_ON in the allowlist, the administrator cannot remove it.

For more information about Rumpel’s security framework, visit this page.

Dependencies and Access Controls

Rumpel leverages decentralized exchanges like Uniswap V3 to trade pTokens. These platforms’ liquidity and functionality are essential for users to buy and sell tokens efficiently. Adding additional exchanges where users can trade pTokens will decrease the reliance on just Uniswap for this part of the operation.

The functionality of Rumpel also depends on point issuers continuing to support their loyalty programs and honoring the conversion of points into reward tokens. If a point issuer alters or discontinues their program, deletes points, or refuses to recognize tokenized points, it could negatively impact Rumpel users and the value of their pTokens. Rumpel mitigates this dependency by actively engaging with point issuers to demonstrate the benefits of secondary markets, including increased transparency and liquidity. Building solid relationships and aligning interests help reduce the likelihood of adverse actions by point issuers.

Moreover, Rumpel’s ability to claim airdrops and facilitate token redemption relies on compatibility with the airdrop infrastructure provided by point issuers or third-party services. Incompatibilities or technical issues could prevent successful airdrop claims, affecting users’ ability to receive their rewards. Rumpel proactively collaborates with multiple airdrop infrastructure providers to address this dependency and ensure smooth integration and compatibility with various distribution systems.

Lastly, Rumpel relies heavily on its Oracle to provide accurate and timely off-chain data, such as point balances and redemption allowances. The integrity of the Oracle directly affects the system’s correct functioning. Any failure or manipulation could lead to incorrect token minting or redemption processes, undermining user trust and the protocol’s credibility. Currently, Rumpel’s Oracle is a centralized component but aims to become fully decentralized as part of its security measures.

Team

Rumpel was created by a team with significant experience and contributions in crypto and other domains, including protocols and companies such as MakerDAO, SpaceX, and EY. Kenton Prescott (Co-founder & CEO) leads the team alongside Josh Levine (Co-founder & CTO) and 0xsteven (Founding Engineer).

Project Investors

Notable venture firms like Dragonfly and Variant back Rumpel. Funding rounds are undisclosed.

FAQ

What is Rumpel?

Rumpel is a point tokenization protocol that enables users to convert off-chain loyalty points into tradable tokens called Rumpel Point Tokens (pTokens). This allows for secondary market liquidity and price discovery of loyalty points, benefiting point holders, investors, and issuers.

What is Rumpel pTokens?

pTokens are ERC-20 tokens that represent off-chain loyalty points and their future rewards. They maintain a ratio with the original points (e.g., 1:1 or 1:1000) and can be minted by users who have earned points through their Rumpel Wallets. pTokens give instant exposure to a specific points program and faster stacking of points.

What can I do with pTokens?

If a project announces an airdrop, pTokens can be redeemed through Rumpel for the reward token equivalent to the shares held.

Can I sell my pTokens whenever I want?

Yes. pTokens can be sold on Uniswap V3 anytime before and after the airdrop.

What kind of points does Rumpel support?

Rumpel can support any points program in coordination with the point issuer. Some notable ones include Symbiotic, Karak, Ethena, and Zircuit.

How does the Rumpel Wallet work?

The Rumpel Wallet is a personalized, Safe multisignature wallet enhanced with the Rumpel Module and Rumpel Guard. Users can earn points directly through their Rumpel Wallets and manage whitelisted strategies. The wallet interacts with the Rumpel Oracle to validate point balances and allows users to mint pTokens based on their accumulated points.

How can investors buy points through Rumpel?

Investors can purchase pTokens on decentralized exchanges like Uniswap V3. This allows them to gain exposure to specific loyalty points without engaging in the original earning activities or exposing significant capital to smart contract risks.

How does Rumpel address the flaws of traditional point systems?

Traditional point systems often lack transparency and liquidity and can mask true product-market fit. Rumpel addresses these issues by tokenizing loyalty points and bringing them onto the blockchain for transparent trading and valuation.

Does Rumpel have a token?

No, Rumpel does not have a token.