Overview

Resolv is the protocol behind the $USR stablecoin, which is backed by $ETH and pegged to the U.S. Dollar. The protocol introduces a stablecoin architecture termed True Delta-Neutral (TDN), aimed at achieving market neutrality by tokenizing a blend of on-chain assets and fully hedged derivatives positions. The allocation of $ETH in this strategy is dynamic and depends on several factors (e.g. price). This design contrasts with the conventional pseudo-delta-neutral strategies and circumvents the liquidation risks typically associated with Collateralized Debt Position (CDP) mechanisms.

The architecture of $USR ensures that it remains decoupled from fluctuations in the crypto markets, enhancing capital efficiency and providing an additional layer of protection for stablecoin holders. This is facilitated by segregating CeFi and DeFi risks into a separate token, the $RLP (Resolv Liquidity Provider). This tokenization of risk exposure allows $USR to maintain a backing purely by on-chain assets, paving the way for a trustless stablecoin framework.

Moreover, the protocol is designed to generate a fiat-independent yield, distributing competitive returns to its holders and reinforcing the protocol economy. Resolv generates this yield from staking $ETH rewards and maintaining perpetual futures positions. Staking is performed entirely on-chain. Resolv uses both CEXs and DEXs for perpetual futures positions to get the best of both worlds.

Why the Project was Created

The creation of Resolv was motivated by the need to address significant limitations in the current stablecoin designs, which have slowed their broader adoption in global markets. Despite stablecoins being a foundational layer in DeFi with a combined market cap exceeding $100 billion, their integration into wider financial systems is impeded by structural vulnerabilities.

Stablecoins backed by real-world assets like fiat currencies and money market instruments provide essential liquidity bridges between fiat and crypto markets. However, they also subject holders to potential disruptions, censorship, and credit risks tied to traditional financial institutions. Moreover, fiat-backed stablecoin issuers do not offer any yield to their users and token holders. They take USD and put it into yield-bearing instruments such as treasury bills (T-Bills), generating substantial revenue that is kept entirely by them. For instance, Tether ($USDT) has over $70 billion in treasury bills and other assets that produce enormous profits every quarter, yet token holders do not receive any share of it.

On the other hand, crypto asset-backed stablecoins are predominantly managed through CDP mechanics, offer reduced dependency on external financial systems, and share a percentage of their profits with token holders. However, they suffer from capital inefficiencies. These inefficiencies shorten the potential for leveraged financial positions, reducing liquidity and price stability despite being fundamentally overcollateralized.

| Aspect | Fiat-backed Stablecoin | Crypto-backed Stablecoin |

| Liquidity Bridge | Provides essential liquidity bridges between fiat and crypto markets by representing fiat currencies on the blockchain. | Offers liquidity within the crypto ecosystem without direct fiat integration, relying solely on cryptocurrencies as collateral. |

| Exposure to Real-World Risks | Subject to potential disruptions, censorship, and credit risks tied to traditional financial institutions (banks) and regulatory bodies (SEC). | Reduced dependency on external financial systems; less exposure to real-world disruptions and censorship; and vulnerable to crypto market risks. |

| Yield to Token Holders | Does not offer yield to users; profits from underlying assets (e.g., treasury bills) are retained entirely by the issuers. | Most share a percentage of profits with token holders through mechanisms like staking or governance participation, allowing users to earn yield on their holdings. |

| Capital Efficiency | Generally capital-efficient, requiring a 1:1 backing with fiat currency, allowing users to mint stablecoins equal to their fiat deposits without overcollateralization. | Suffers from capital inefficiencies due to overcollateralization requirements (users must deposit more cryptocurrency collateral than the value of the stablecoins they receive), limiting liquidity and leverage potential. |

| Reliance on Central Authorities | Relies on central entities for issuance, redemption, and reserve management, introducing centralization risks and dependence on the trustworthiness of the issuing organization. | Operates in a decentralized manner using smart contracts and algorithmic mechanisms, reducing reliance on central authorities and enhancing transparency and trustlessness. |

| Price Stability | Maintains peg through direct fiat backing; stability is closely tied to the stability and availability of the underlying fiat currency in traditional financial systems. | Maintains peg using overcollateralization and automated mechanisms within smart contracts; may face challenges in extreme market volatility, potentially affecting price stability despite overcollateralization. |

| Risk of Overcollateralization | Not required; stablecoins are typically backed 1:1 with fiat reserves, making them capital-efficient from the user’s perspective. | Requires overcollateralization (sometimes significantly more than 100%) to account for cryptocurrency volatility, making them less capital-efficient and tying up more user assets than the stablecoin’s face value. |

| Transparency | May lack transparency regarding reserve holdings; audits and disclosures are often infrequent or not publicly available, leading to trust issues among users. | Offers greater transparency through on-chain collateralization; users can verify reserves and collateral ratios directly on the blockchain, increasing trust and accountability. |

| Regulatory Compliance | Subject to regulatory scrutiny and compliance requirements in multiple jurisdictions (see $USDT & $BUSD), changes in regulations can impact operations and user access. | Operates outside traditional regulatory frameworks, potentially facing regulatory uncertainty or future compliance challenges as regulations evolve to address decentralized financial instruments. |

| Dependence on External Systems | Highly dependent on traditional banking systems, financial infrastructure, and regulatory environments for reserve management and operations. | Independent of traditional financial systems; operates within the blockchain ecosystem, reducing exposure to external financial disruptions but potentially increasing exposure to blockchain-specific risks. |

Resolv introduces a dual-tranche architecture that aims to overcome the challenges related to crypto-backed stablecoins by segregating risks and ensuring full backing by on-chain assets independent of centralized financial systems. This architecture allows the senior tranche of the stablecoin to operate without reliance on central authorities like protocol contributors or third-party exchanges and custodians. The protocol architecture includes rule-based safeguards within its smart contracts to enhance trustlessness across all levels, from treasury management to decentralized governance. These measures ensure operational resilience and align with the broader goal of implementing a trustless, decentralized stablecoin ecosystem.

Advantages of Resolv

Resolv’s stablecoin architecture provides several compelling advantages that address prevalent issues in traditional and crypto-backed stablecoin designs:

- Market Neutrality: The protocol achieves stability in its net value through a mechanism where $ETH spot price changes are offset by corresponding perpetual futures positions of the same notional amount. This design ensures the value remains stable regardless of market volatility, achieving delta neutrality.

- Independence from Fiat Currencies: Resolv operates without directly linking to fiat currencies. There is no reliance on physical dollars; the connection to fiat is only through claims on exchanges, which are managed to minimize counterparty risks effectively.

- Capital Efficiency: The protocol allows for the minting of $USR or $RLP tokens by locking up an equivalent value of assets, net of minting costs. This system eliminates the need for over-collateralization typically required in other stablecoin frameworks, enhancing liquidity and operational efficiency.

- Stable Peg: $USR maintains a strict peg to the dollar, with each token redeemable for $1 worth of collateral. This setup enables quick corrections to any deviations from the peg through arbitrage, ensuring the peg’s integrity.

- Insurance Layer: $USR is bolstered by $RLP, a scalable insurance mechanism that provides an additional layer of security against systemic risks, further stabilizing the stablecoin’s value.

- Profitable Business Model: The treasury component of Resolv not only supports the stablecoin’s operational integrity but generates revenue by allocating assets to staking and earning funding fees from futures positions. This dual functionality sustains the system and drives profitability, making the business model economically viable.

How it Works

The minting process of $USR is straightforward. Users must deposit liquid assets such as $USDT or $USDC into the protocol to receive a 1:1 value in $USR. At this point, Resolv allocates these assets to support its strategy.

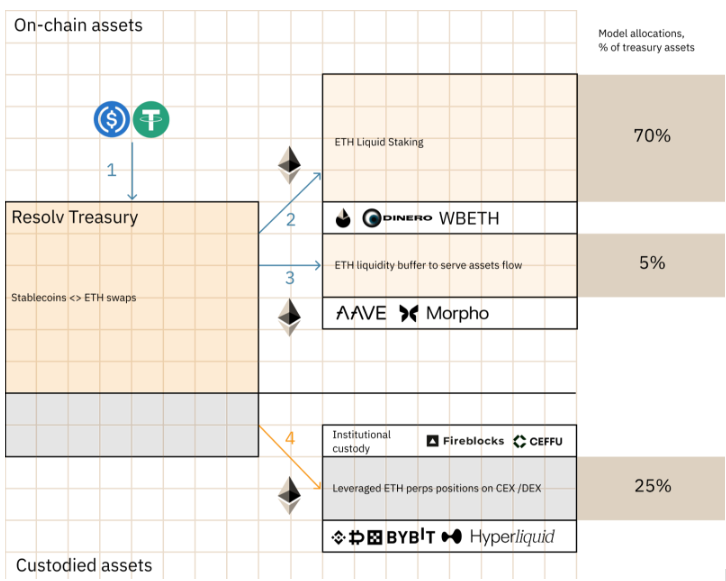

- Asset Allocation:

- Staking: The majority of the received assets are swapped for $ETH and allocated to staking operations. This helps in asset appreciation and contributes to the security of the underlying blockchain network.

- Liquidity Buffer: A portion of the $ETH is reserved as a liquidity buffer to ensure operational fluidity and manage sudden withdrawals or redemptions.

- Risk Hedging: The protocol enters into short perpetual futures contracts on a designated trading venue. The volume of these futures is calibrated to fully hedge the market risk associated with the $ETH position. The collateral required for these futures is managed through off-exchange custody to mitigate platform-related risks.

The distribution of assets within the treasury is dynamic, responding to several factors, primarily the token price. The overarching goal of this asset allocation strategy is to maximize on-chain asset retention while minimizing exposure to trading platform risks.

The minting process for $RLP tokens mirrors that of $USR, with distinctions in the economic underpinnings of the tokens reflecting their different risk profiles. This segregation is crucial for tailoring risk exposure according to investor preferences and market conditions.

Protocol Architecture

Resolv’s protocol architecture introduces a separate layer of protection designed to shield stablecoin holders from counterparty risk and interest rate exposure. This protective layer is structured around a two-tranche token system alongside a dedicated collateral pool, ensuring robust risk management and stability for the ecosystem.

Two-Tranche Token Structure

The Resolv protocol employs a two-tranche token system designed to optimize risk distribution and protection:

- $USR: This stablecoin represents the senior tranche and is the primary unit of stable value within the Resolv ecosystem.

- $RLP: Operating as the junior tranche, the RLP token is a protective buffer for USR holders by absorbing potential losses and providing coverage against trading venue exposures and broader market risks.

The primary objective of this system is to ensure that $RLP tokens maintain full coverage capabilities, effectively mitigating risks and securing the stability and integrity of the $USR stablecoin.

$USR

$USR is a stablecoin fully collateralized by $ETH, ensuring robust backing and stability. Here are the key features of $USR:

- Minting and Redemption: $USR can be directly minted or redeemed by users at a 1-to-1 ratio for liquid collateral, providing straightforward access and liquidity.

- Overcollateralization: In addition to being 100% backed by collateral, $USR includes an added layer of security through an insurance layer composed of liquid $ETH, represented by the $RLP token.

- Utility Token: $USR maintains a stable value of $1 per token and does not generate yield in its base form.

- Yield Opportunities: Users seeking yield can opt to stake their $USR. The staked version of $USR, known as $stUSR, is yield-bearing, offering additional benefits for holders engaging in this activity.

$RLP

$RLP is the liquidity pool of Resolv and is a token that functions as an additional backing for $USR, utilizing the excess collateral from the $ETH portfolio, which maintains over 100% backing for $USR.

Here are the key features of $RLP:

- Price Representation: The price of $RLP represents the value of the $ETH backing each unit of the $RLP token. This price is subject to fluctuation based on the current market conditions.

- Dynamic Collateral Requirements: The collateral needed for minting or redeeming $RLP is calculated based on its latest price, allowing for responsiveness to market dynamics.

- Risk Protection: $RLP is designed to shield $USR from market and counterparty risks. Holders of $RLP are compensated for assuming these risks with a higher share of profits from the collateral pool.

$RLP is targeted towards investors who are comfortable with higher risk levels. It serves as an insurance mechanism that safeguards stablecoin holders while reducing centralization risks associated with using CEXes for futures trading. This design ensures that $USR holders are predominantly backed by on-chain assets.

The yield offered by $RLP tokens is inversely related to the number of liquidity providers in the pool, creating a self-balancing economic mechanism.

The relationship between the total value locked in $RLP and $USR tokens is similar to the capital adequacy ratio (CAR) used in traditional financial institution assessments. This ratio is actively monitored, and the withdrawal mechanisms for $RLP tokens are designed to maintain a sufficient CAR to ensure the protocol’s stability.

Collateral Pool

Resolv’s strategy to ensure the stability of $USR involves an $ETH collateral pool with the following strategies:

- Delta-Neutral Hedging: The $ETH collateral is hedged against USD price fluctuations using perpetual futures, creating a delta-neutral portfolio. This strategy ensures that $ETH price volatility does not affect the collateral value.

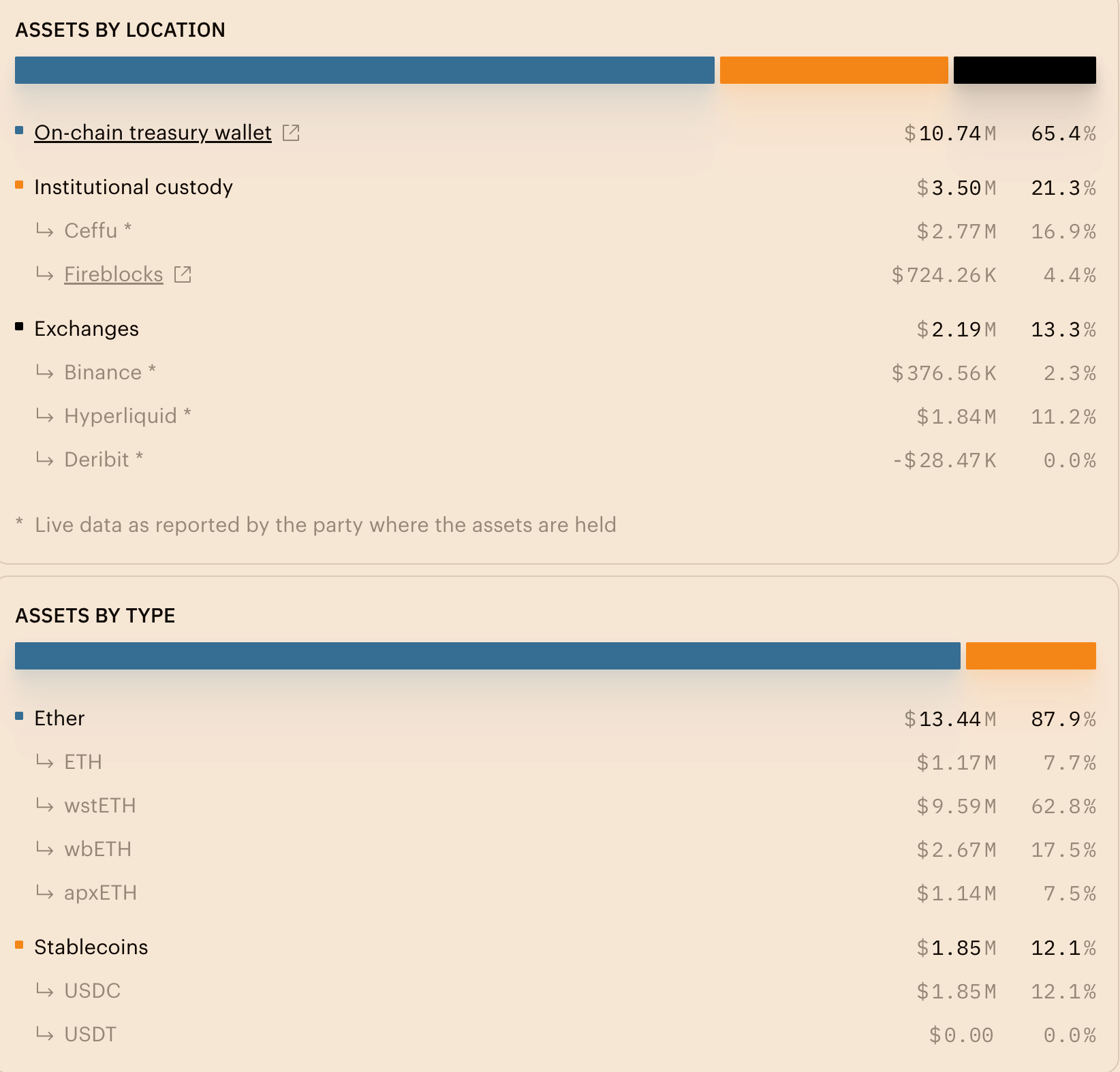

- Asset Allocation: Most of the collateral is held directly on-chain and staked to earn yield. A portion of the collateral is also held in institutional custody to serve as margin for the futures contracts.

These hedges are precisely aligned with the quantity of $ETH in the pool, effectively neutralizing the price sensitivity of the collateral to fluctuations in the $ETH market. This balance between on-chain assets and those necessary for futures maintenance off-chain allows Resolv to leverage market opportunities while mitigating risks associated with $ETH inherent volatility.

The collateral pool is held in two locations: On-chain smart contract and institutional custody. Resolv provides full transparency on its app page.

The majority of $ETH collateral is kept on-chain in a smart contract connected to the protocol mint and redemption smart contract. A part of the collateral pool is kept in institutional custody wallets away from exchanges and designated as margin for futures positions.

Delta-Neutral Strategy

The delta-neutral strategy employed by Resolv is designed to minimize the exposure to price fluctuations of its underlying asset, which in this case is $ETH. This strategy is one part of maintaining the stability of $USR. Here’s how it works:

- Underlying Asset: The core of the delta-neutral portfolio is $ETH, which acts as the primary asset around which the portfolio is structured.

- Derivative Contracts: Resolv enters an inverse $ETH/$USD perpetual futures position to achieve delta-neutrality. These derivatives are used to offset the risk posed by the volatility in the underlying asset’s price.

The tokenization of a delta-neutral portfolio creates a new form of stablecoin and ensures that the entire operation can be conducted with on-chain assets and derivatives, enhancing transparency and reducing reliance on external financial systems.

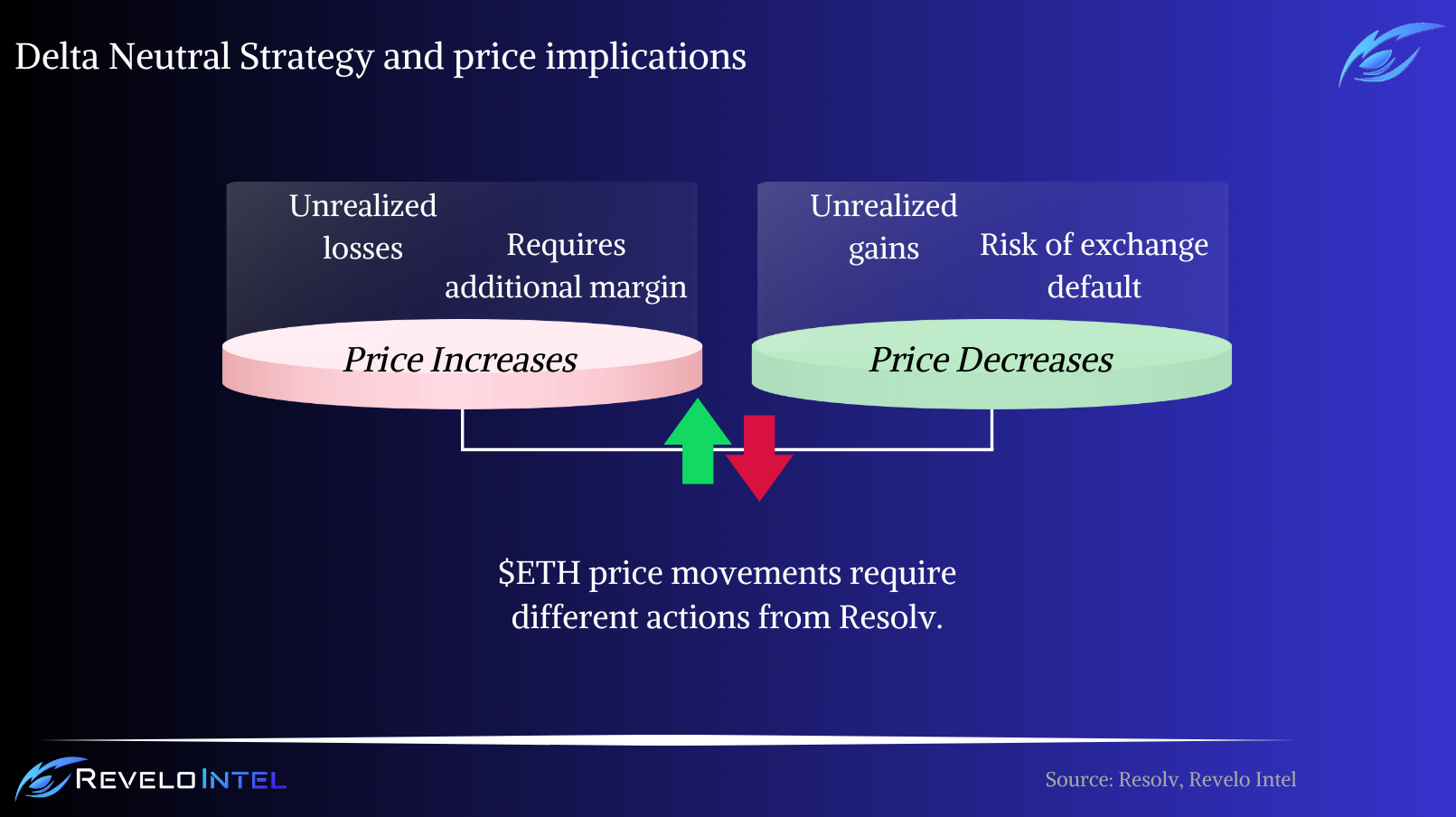

Understanding the implications of price movements on these positions is important in the context of Resolv’s treasury operations, which primarily utilize short futures positions on $ETH. Here’s how different price movements affect the strategy:

- Price Increase: If the $ETH price rises, short positions will incur unrealized losses. To maintain these positions, additional funds must be allocated to the exchange as margin to prevent liquidation. Without topping up the margin, the exchange could forcibly close the position, turning unrealized losses into realized ones.

- Price Decrease: Conversely, a decrease in $ETH price leads to unrealized gains for the short positions. However, these gains remain unrealized and carry the risk of the exchange defaulting on payments under the futures contract. To mitigate this risk, closing the existing futures contract at the new market levels is advisable to realize the gains and withdraw the funds from the exchange, thereby reducing exposure to potential default.

Staked $ETH

The second primary strategy that helps $USR stability is $ETH staking on-chain. The $ETH collateral pool is staked on-chain in the form of Lido’s $wstETH, Binance’s $wbETH, and Dinero’s $apxETH earning yield. Part of the $ETH assigned as margin to institutional custodians is held in a staked format. Future plans include a more diversified approach with direct delegation of tokens to Proof of Stake (PoS) validation nodes.

Liquidity Management

Resolv handles short-term liquidity demands, such as fulfilling redemptions and meeting margin requirements on exchanges, by borrowing $ETH against $wstETH through on-chain lending protocols. The specifics of this borrowing mechanism are as follows:

- Lending Protocol: The protocol used for these transactions is Aave v3.

- Pool Type: The collateral used in these transactions is $wstETH, against which $ETH is borrowed.

- Health Factor: The health factor for these borrowings is maintained at 2.0, ensuring a buffer against potential liquidation risks.

In scenarios where the proportion of staked $ETH used as collateral exceeds 50%, the excess staked $ETH is unstaked to facilitate the redemption of the borrowed $ETH.

Protocol Economy

Resolv’s protocol economy is backed by a delta-neutral strategy for collateral management. While this approach is not new in financial markets, Resolv uniquely structures it to enhance economic terms. $USR is protected by a layer that shields it from funding rates and reliance on centralized infrastructures, ensuring stability and reduced market susceptibility.

This layer is the $RLP token, which accrues yield and is best for investors with moderate risk tolerance. $RLP enables these investors to benefit from the protocol’s revenue while managing risk effectively.

The backing for $USR and $RLP tokens comes from a treasury that includes staked $ETH and short $ETH futures positions. Both help stabilize $USR and generate revenue for the protocol. Profits from these operations are then distributed among Resolv token holders.

Yield Generation

In Resolv, the yield derives from two primary sources:

- Staking of On-Chain Assets: Yield is primarily generated by staking on-chain assets utilizing prominent liquid staking protocols like Lido $wstETH, Binance $wbETH, and Dinero $apxETH.

- Funding Rates on Perpetual Contracts: Additionally, Resolv harnesses yield from the funding rates associated with perpetual futures contracts. Historically, holders of short positions in these contracts tend to receive net funding rates, contributing to the protocol’s overall yield.

Out of the two, the yield from $ETH staking has been relatively stable and predictable. Typically, this yield fluctuates between 3% to 6% per annum (post-merge).

In contrast, funding rates derived from perpetual contracts exhibit much higher volatility. These rates vary significantly across different trading venues and are influenced by the specific supply and demand dynamics at each exchange and the technical methodologies used to calculate funding rates.

Resolv holds futures positions at the most liquid exchanges:

| Exchange | Target Allocation |

| Binance | 50% |

| Hyperliquid | 30% |

| Deribit | 20% |

Note that the weighted allocation for each exchange can change over time, and new ones can be added. Future exchange integration plans include Bybit, OKX, and the most liquid decentralized exchanges.

Yield Distribution

The generated yield is allocated to holders of staked $USR tokens and $RLP, with a portion of the earnings also directed to Resolv equity or future token holders.

Allocation ratios are handled through governance. The primary goal is to optimize yields across all instruments managed by the protocol while ensuring a balanced system. This includes maintaining a specific capital adequacy ratio between $RLP and $USR to safeguard $USR holders.

Yield distribution goes like this:

- Protocol profitability is assessed over 24-hour reward epochs, allowing for timely adjustments and distributions.

- Profits from each epoch are divided into three segments:

- Base Reward: Distributed to staked $USR and $RLP tokens holders.

- Risk Premium: Allocated exclusively to $RLP holders to compensate for the higher risk they bear.

- Protocol Fees: Directed to the protocol treasury to support ongoing operations and development.

- If the protocol loses money during a reward epoch, the loss is absorbed by the $RLP, and no distributions are made to protect the protocol’s financial health.

- It’s important to note that $USR holders must stake their tokens to receive yield distributions. Unstaked $USR tokens function purely as ERC-20 tokens, with the primary utility of value retention but no yield benefits.

Here’s in detail how profits are distributed:

| Reward | Profit Portion | Allocated pro rata to |

| Base Reward | 70% | $stUSR + $RLP |

| Risk Premium | 30% | $RLP |

| Protocol Fee | 0% (Temporary) | Protocol |

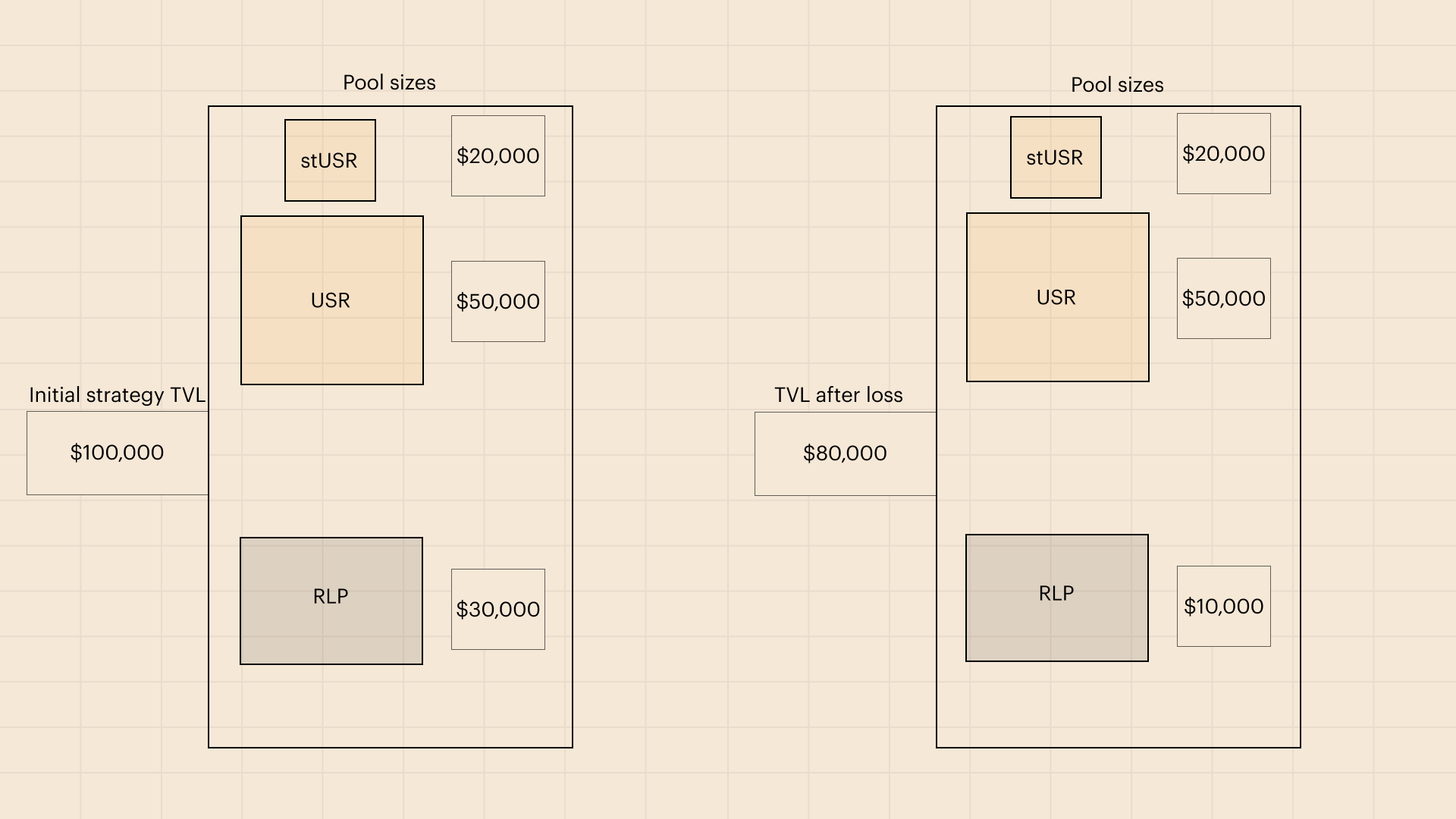

Reward Distribution Example

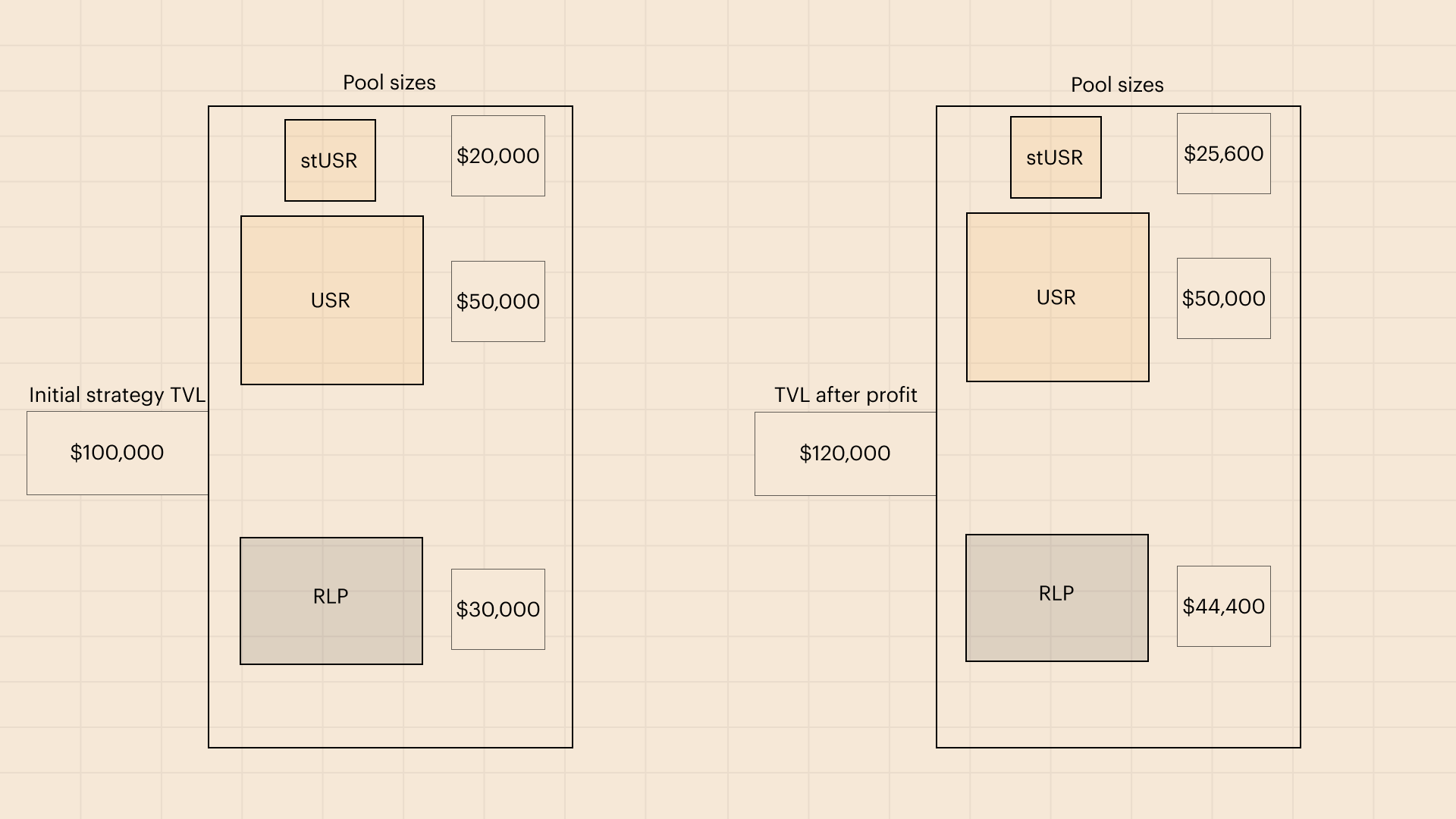

Resolv’s reward distribution mechanism is designed to allocate profits from the collateral pool to $stUSR and $RLP tokens, while losses are solely attributed to $RLP. This structure is illustrated through the following examples based on a hypothetical deposit scenario:

- Total deposit into the protocol: $100,000

- Allocated to $USR: $70,000

- Allocated to $RLP: $30,000

Example 1: Reward Epoch Profit

The collateral pool realizes a profit of $20,000 during a reward epoch.

The distribution will go like this:

- Base Reward: 70% of the profit, amounting to $14,000 ($20,000 * 70% = $14,000), is distributed proportionately between $stUSR and $RLP based on their TVL.

- Risk Premium: 30% of the profit, which is $6,000 ($20,000 * 30% = $6,000), is allocated exclusively to $RLP to compensate for the higher risk it bears.

Example 2: Reward Epoch Loss

The collateral pool incurs a loss of $20,000 during a reward epoch.

Distribution will occur as such:

- The entire loss amount of $20,000 is attributed to $RLP, reducing its value accordingly.

- No distributions are made to $stUSR holders as the system absorbs the loss through the $RLP.

These examples demonstrate how Resolv’s yield distribution mechanism functions to share profits and manage losses accordingly, ensuring that rewards are fairly allocated while maintaining the protocol’s financial health and stability.

Sector Outlook

The stablecoin sector has evolved significantly over the last four years as a critical bridge between traditional financial assets and the crypto ecosystem. Stablecoins are digital tokens pegged to stable assets like fiat currencies or commodities, offering a more stable value than typical cryptocurrencies.

Initially dominated by entities like Tether and Circle, the stablecoin market has seen widespread adoption of fiat-collateralized stablecoins backed by real-world financial assets like bank deposits. These stablecoins facilitate seamless transitions between fiat currencies and cryptocurrencies, providing an entry and exit strategy for crypto investors.

Conversely, decentralized stablecoins, such as $DAI, $GHO, $USDe, and $LUSD, operate without central control, relying instead on cryptocurrencies or algorithmic methods to maintain their pegs. This model aligns with the decentralization principle of crypto but faces challenges, particularly in maintaining stability during market volatility. Despite these hurdles, decentralized stablecoins innovate with mechanisms like overcollateralization, dynamic interest rates, delta-neutral, or other sophisticated strategies to sustain their pegs and increase user trust.

Moreover, the role of stablecoins is expanding beyond just mirroring fiat currencies to embodying a broader array of real-world assets (RWAs), from gold to other commodities or T-Bills. Some notable examples are Usual and $USD0 and $USDz from Anzen. This expansion enhances the utility of stablecoins and integrates them more deeply into traditional finance, although it also introduces regulatory and operational complexities.

Not long ago, we saw the development of stablecoins that employ tokenized delta-neutral positions and utilize assets like $ETH as collateral to achieve stability. Examples of such initiatives are seen in products like Ethena’s $USDe, Resolv’s $USR, and Elixir’s $deUSD, demonstrating advanced approaches to combining stability with decentralization. This strategy has seen strong adoption by users as Ethena became the fastest-growing decentralized stablecoin.

Currently, the stablecoin sector is divided into three main categories:

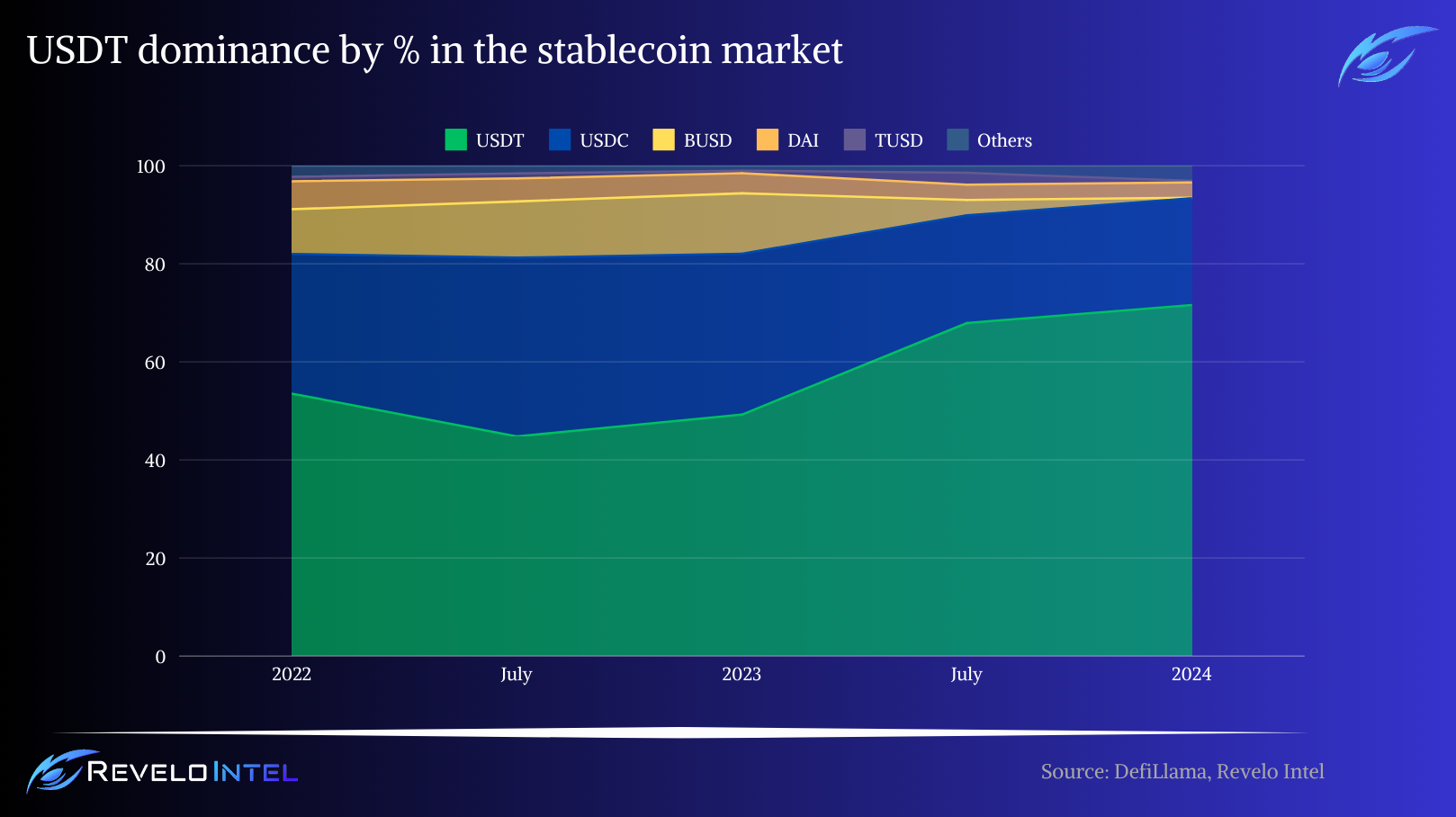

Stablecoins represent a significant portion of the total crypto market cap, a dramatic increase from their market share at the beginning of 2020. This growth was mainly influenced by the rise and fall of Terra’s $UST, which underscored the potential and risks associated with decentralized stablecoin models.

$USDT heavily dominates the total stablecoin market cap. $USDC was very close to $USDT, but the depegging incident after the banking crisis in 2023 took a lot from its market share and also showed that USD-backed centralized stablecoins can face significant risks too. Binance’s $BUSD was also a massive stablecoin, but after the SEC declared it a security, Binance’s support stopped. $DAI from MakerDAO was one of the first decentralized stablecoins to have a stable market share throughout the years.

Decentralized stablecoins hold only a portion of the total market cap, showcasing the untapped potential and the opportunity to grow even further.

Fiat-backed stablecoins are the most significant players in this market, but they are entirely centralized and rely on the traditional financial system. Their operation and strategy are opposite to what crypto aims to accomplish. In contrast, crypto-backed stablecoins use crypto-native solutions to earn yield and pass that on to token holders, promoting decentralization transparency.

Competitive Landscape

The decentralized stablecoin market is witnessing a shift towards delta-neutral projects that aim to offer stability without direct reliance on traditional asset backing. These projects leverage sophisticated financial strategies to mitigate risks and provide stable, decentralized alternatives for crypto users.

Ethena has become a notable player in the stablecoin sector in a short time. Its product, $USDe, employs delta-hedging strategies to stabilize its value relative to the USD, utilizing short positions in derivatives markets to manage risks associated with its diverse cryptocurrency collateral. Since its launch, $USDe has rapidly grown, capturing a total value locked (TVL) of $2.7 billion and demonstrating the market’s demand for this product. However, concerns about the sustainability of its yield mechanisms persist, especially under extended bear market conditions, which remain to be seen.

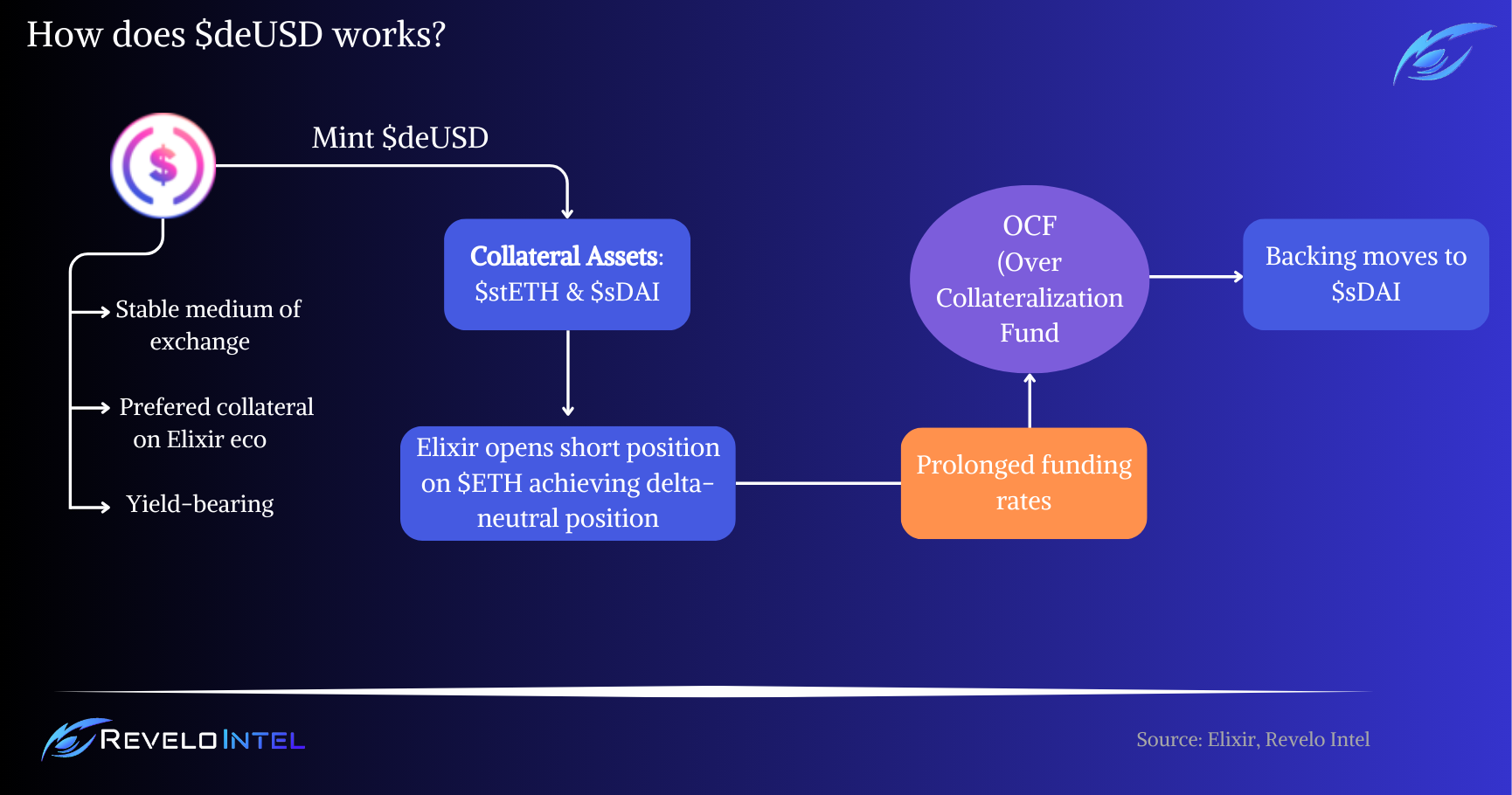

Heavily inspired by Ethena, Elixir has introduced its version of a delta-neutral stablecoin, $deUSD, which uses a mix of $stETH and $sDAI for collateral and then opens a short $ETH position to create a delta-neutral position. This mix allows Elixir to engage in basis trades on Ethereum, capturing positive funding rates and maintaining stability even during periods of negative funding rates by adjusting exposure and diversifying into safer assets like U.S. treasuries through MakerDAO and $sDAI. This is achieved through Elixir’s OCF (Over Collaterization Fund), which acts as an insurance layer.

Elixir claims to be more decentralized than Ethena by combining decentralized execution with verifiable proof of execution, open-source code, and everything conducted on chain in a non-custodial manner away from centralized parties.

Joining this frontier, Resolv Labs has developed a new stablecoin architecture termed True Delta-Neutral (TDN). Unlike its competitors, Resolv focuses exclusively on a crypto-only collateral base, combining on-chain assets with derivatives to fully hedge price exposure. $USR and its associated high-yielding token, $RLP, are designed to effectively isolate and manage both CeFi and DeFi risks. This segregation enhances capital efficiency and paves the way for a trustless stablecoin design. Resolv’s architecture also capitalizes on economically viable and fiat-independent yield sources, offering competitive returns to token holders.

| Category | $USR | $USDe | $deUSD |

| Issuer | Resolv Labs | Ethena Labs | Elixir |

| Collateral Type | $ETH | $ETH, $BTC, Liquid Stables | $stETH, $sDAI |

| Hedging Strategy | Combines on-chain staked $ETH with perpetual derivatives to fully hedge price exposure using True Delta-Neutral (TDN) architecture. | Delta-hedging using short positions in perpetual futures markets. | Shorts $ETH to create a delta-neutral position. |

| Yield Generation | Staked $ETH yield + funding rates. | Staked $ETH + funding rates ($ETH + $BTC) | Staked $ETH + funding rates + $sDAI |

| Yield Bearing | Yes ($stUSR). | Yes ($sUSDe). | Yes, both the native $deUSD and the staked version. |

| Unique Features | Introduces True Delta-Neutral (TDN) stablecoin architecture; uses $RLP to isolate CeFi and DeFi risks; enhances capital efficiency; offers a novel layer of protection for stablecoin holders; fully backed by on-chain assets | Robust reserve fund; highly scalable framework; ecosystem rewards; first to adopt the delta-neutral strategy for a stablecoin. | Adjusts exposure during negative funding rates to maintain stability through the OCF; shifts to $sDAI; Elixir ecosystem to support the growth of $deUSD. |

As the stablecoin sector evolves, delta-neutral strategies will become increasingly important for crypto users. Projects like Ethena, Elixir, and Resolv are pushing the boundaries of what stablecoins can achieve, focusing on stability, risk management, and decentralization. Each project brings a unique approach, contributing to a heavily competitive and demanding landscape.

Potential Adoption

Resolv offers a compelling proposition for crypto users seeking stability, yield opportunities, and thoughtful risk management in DeFi. One key feature that makes Resolv appealing is its True Delta-Neutral (TDN) stablecoin architecture. By backing $USR with a delta-neutral portfolio of on-chain assets and fully hedged derivatives positions, Resolv protects against crypto market volatility. This design ensures that the value of $USR remains stable regardless of fluctuations in the price of $ETH, addressing the ever-present concern of users looking for reliable and safe value retention in a prolonged bearish environment.

The value proposition of Resolv lies in the dual-token system of $USR and $RLP. $USR is a stable, fully collateralized asset that users can mint and redeem on a 1-to-1 basis with liquid collateral like $USDC or $USDT. $RLP, functioning as the junior tranche, absorbs market and counterparty risks, offering higher yield potential to investors with a moderate risk appetite. This segregation of risk allows users to choose a token that aligns with their risk tolerance while contributing to the overall stability and liquidity of the protocol.

The fact that Resolv distributes all of its profit to $stUSR and $RLP holders is another key aspect of its value proposition and plays a significant role in driving potential adoption. This profit-sharing mechanism ensures that users who participate in the protocol, either by holding $stUSR or $RLP, directly benefit from its economic success, creating a strong incentive to engage with and support the ecosystem.

For $stUSR holders, the appeal lies in earning passive income while holding a stable, fully collateralized asset. By staking their $USR, users receive a portion of the protocol’s profit generated from its delta-neutral strategies and staking $ETH. This gives them a low-risk method to earn a return on their stable holdings. The automatic distribution of profits without the need for active management by users further enhances the ease of participation.

On the other hand, $RLP holders, who take on the higher risk associated with absorbing potential losses from market volatility or counterparty exposure, are compensated with higher yields. The profit-sharing structure allows $RLP holders to capture the upside from successful hedging strategies and futures funding rate arbitrage.

Resolv’s emphasis on transparency and security is key to its potential adoption. The protocol maximizes on-chain collateralization, making assets auditable and accessible directly on the blockchain. By utilizing off-exchange custody solutions, Resolv mitigates risks associated with centralized exchanges, such as insolvency or default. This approach enhances user trust by ensuring that assets remain secure even in the face of systemic risks, a crucial consideration in light of past exchange failures in the crypto industry that affected many DeFi protocols.

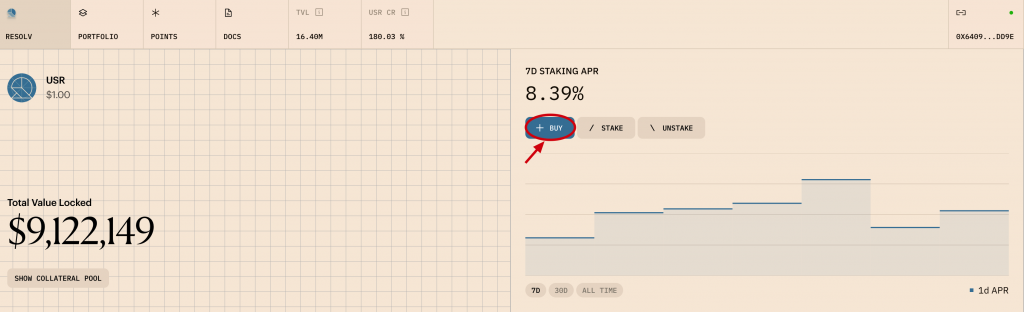

Using the Protocol

Using Resolv is pretty straightforward. Both $USR and $RLP can be bought directly from the app. $USR can be staked to receive $stUSR and part of protocol profits. Both $USR and $stUSR can be used in DeFi. On the other hand, buying and holding $RLP grants access to enhanced profits because of the risk factor associated with $RLP.

Buying tokens permissionlessly can be done via Resolv frontend or DEX aggregators. Staking can also be done permissionlessly on the app page.

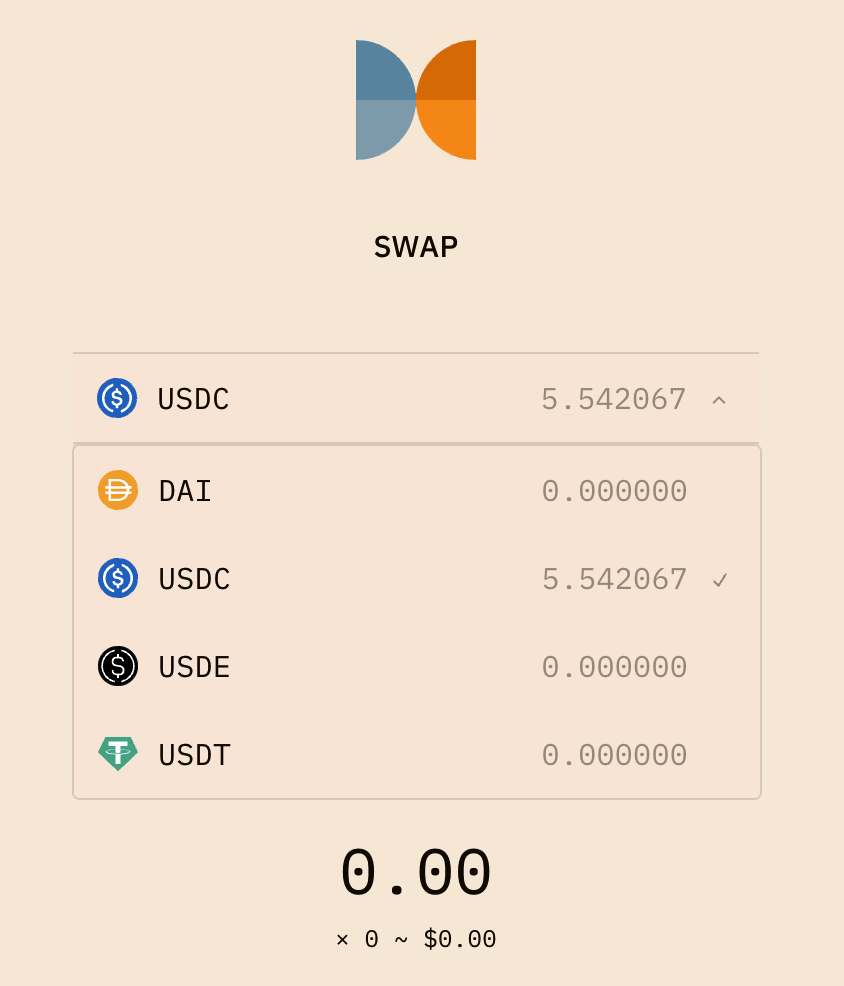

Buying and Staking $USR

- 1. Head over to the app page here. Connect your wallet in the top right corner.

- 2. On the main page, click the “Buy” option for $USR.

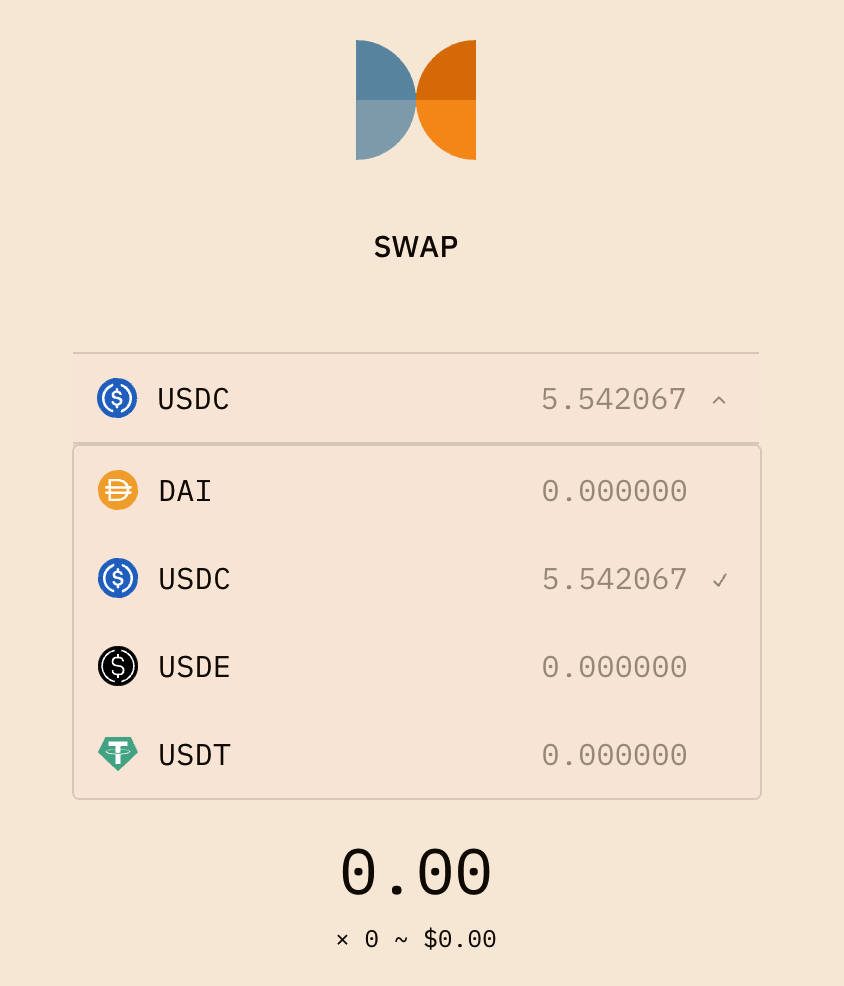

- 3. Here, you can choose the asset to swap for $USR. These are the options:

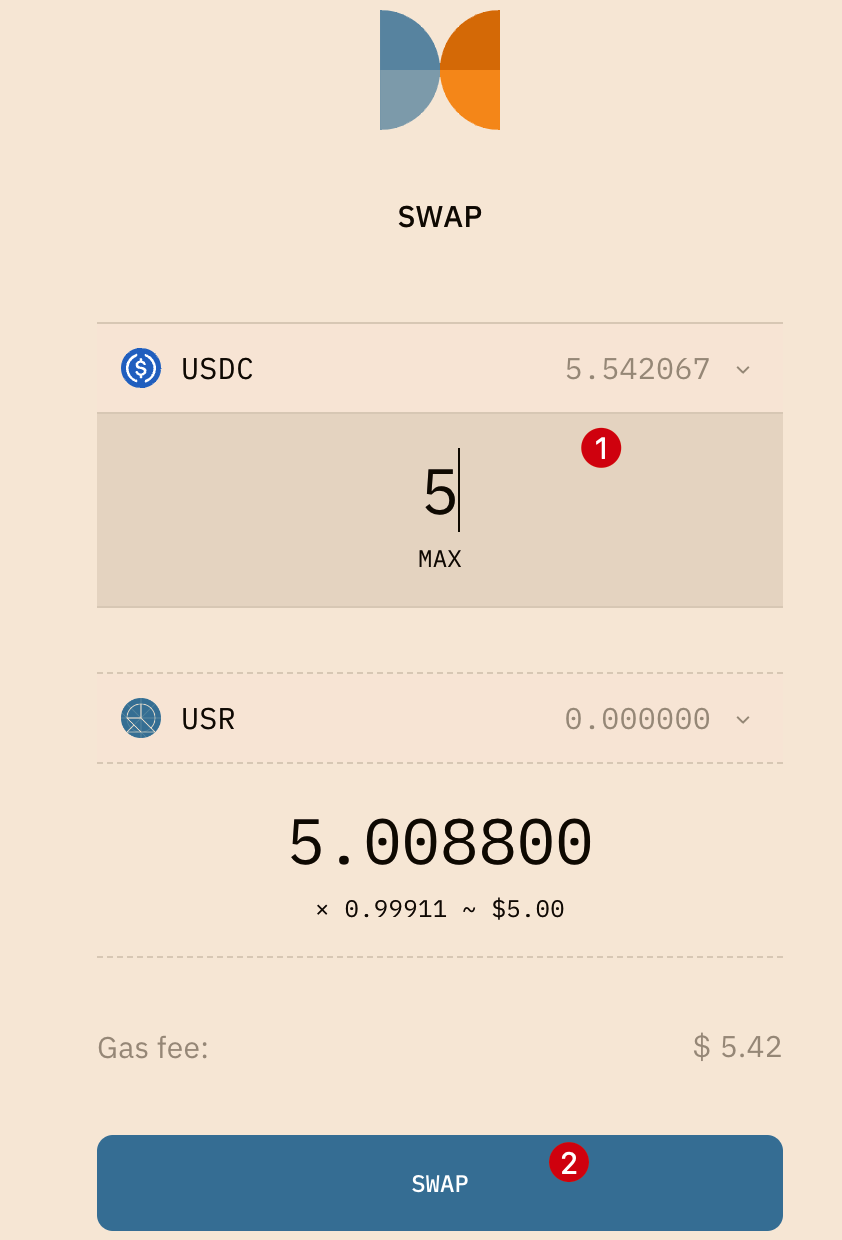

- 4. Choose your asset and the amount you want to swap. If necessary, approve the token and then click “Swap.” Confirm the transaction in your wallet.

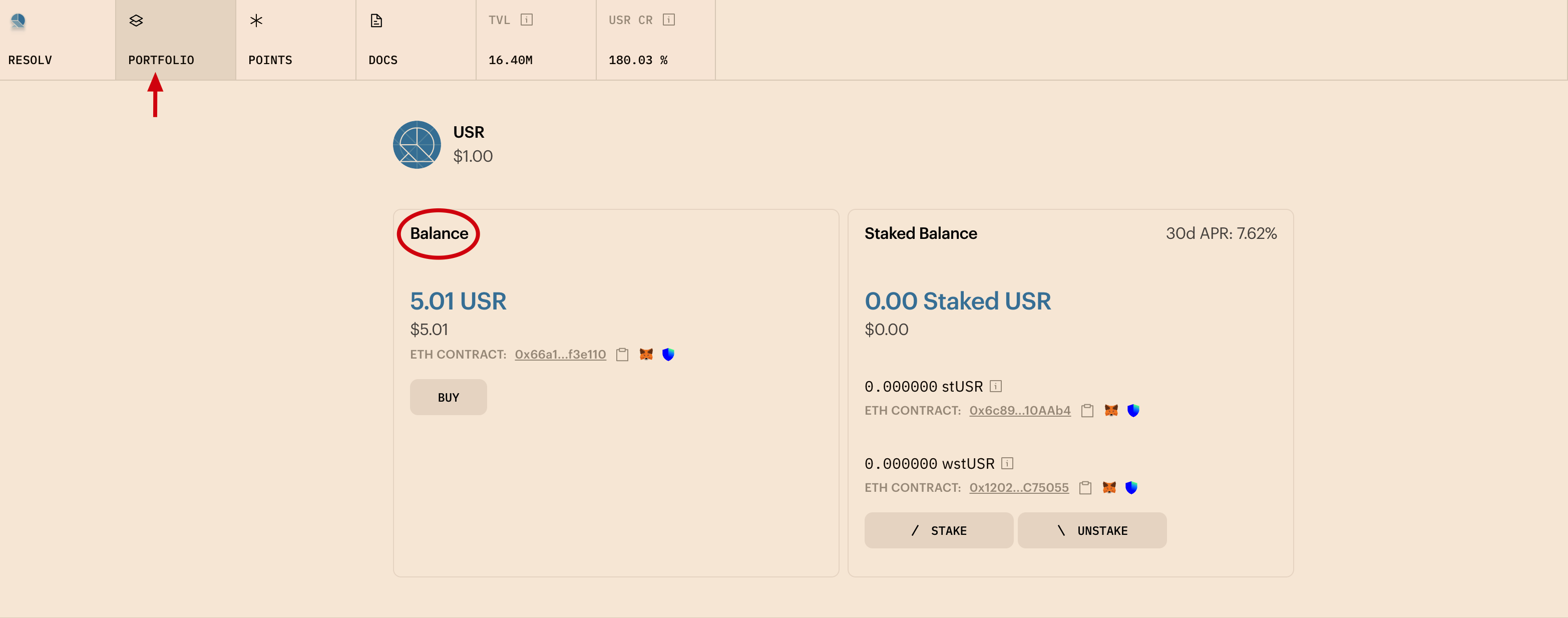

- 5. You can check your $USR on the “Portfolio” page.

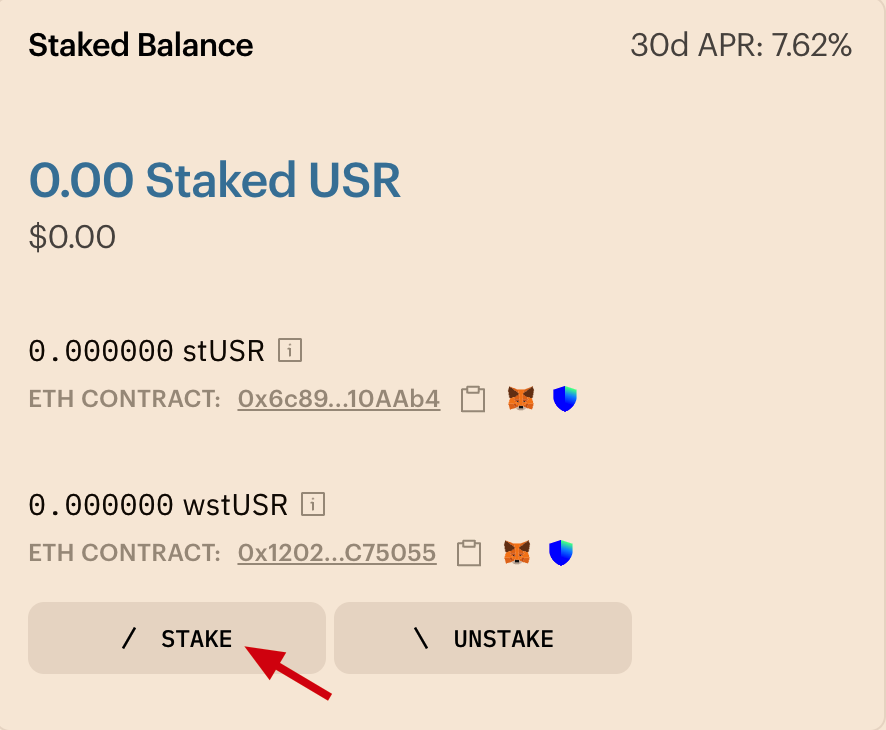

- 6. If you want to stake your $USR, click “Stake.” You’ll receive $stUSR, the yield-bearing version of $USR. $stUSR can be wrapped into a non-rebased ERC-4626 token, the $wstUSR. This version can be used more effectively on DeFi as it is more integrable.

Since its inception, $USR has maintained a stable peg with only minor fluctuations during periods of high volatility and when Resolv was actively bootstrapping liquidity in its early phases, resulting in low aggregated depth. After gaining traction, Resolv expanded aggregated liquidity to $3.5 million, enhancing market stability and enabling larger swaps with lower slippage.

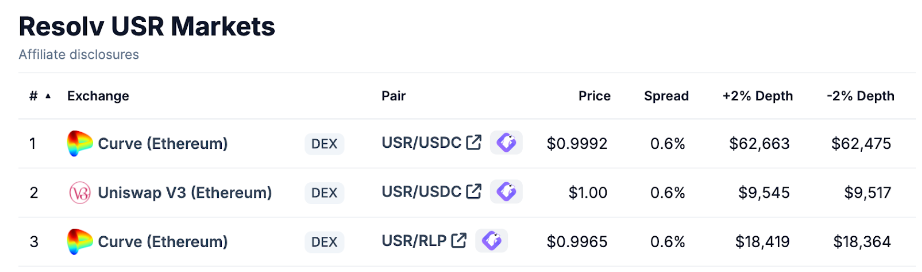

Currently, $USR is available in the following markets, with plans to add new ones.

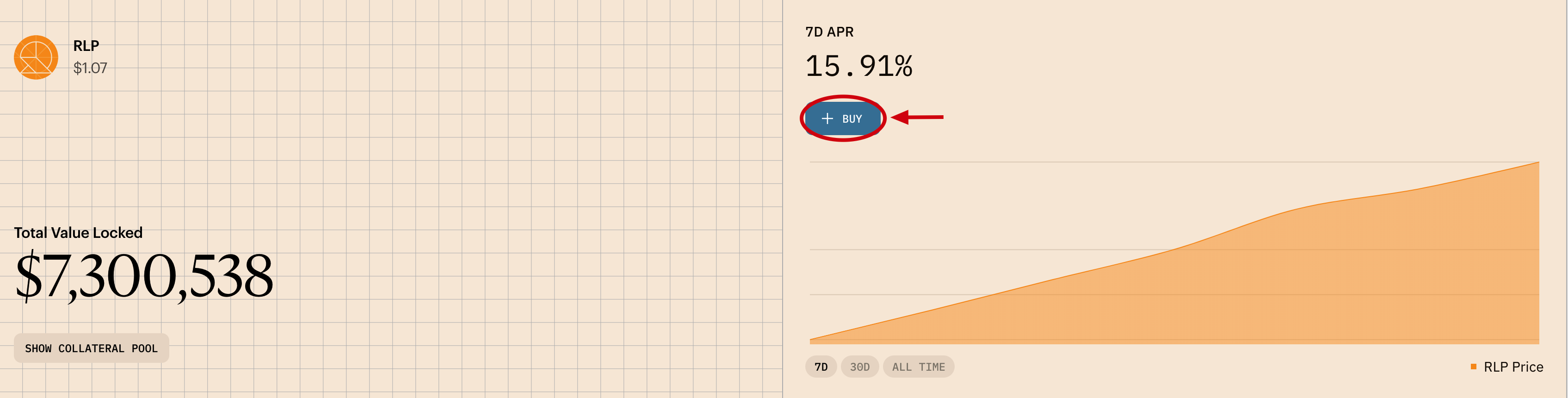

Buying $RLP

Buying $RLP follows the same process as buying $USR.

- 1. Revisit the main page. This time, click the “Buy” option for $RLP.

- 2. Similarly to buying $USR, you can swap with these assets:

- 3. Choose the amount you want to swap for $RLP and click “Swap.”

- 4. Confirm the transaction in your wallet.

You can check the price and the APR % of $RLP on the main page.

Note that $RLP can be cheaper to buy on exchanges than minting directly on the app page.

Investing Strategies

There are strategies for users who want to use $USR in DeFi. Here’s one using $USR and Spectra to provide liquidity on a stable pair and earn double-digit APY%. You will need $USR (see guide above) and $ETH for gas on the Ethereum chain for this strategy.

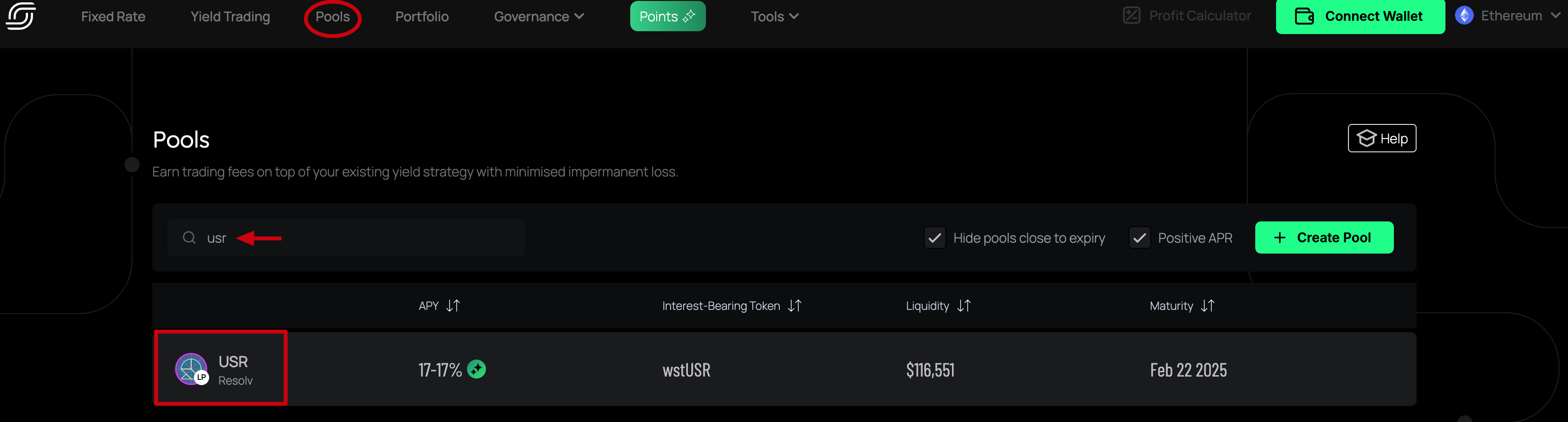

- 1. Visit the Spectra app page here. Connect your wallet in the top right corner.

- 2. Choose the “Pools” tab and search for the $USR pool.

- 3. By clicking on the $USR pool, you’ll see the tab below. On this tab, you can Add or Remove your liquidity. Go ahead and choose the amount you want to add to the pool. The “Balanced” feature balances your liquidity between the pair.

- 4. Approve the token and then click the “Add Liquidity” button. Confirm the transaction in your wallet.

- 5. You can check your position on the “Portfolio” tab. You can also remove your liquidity anytime by following the same steps.

- 6. That is all for this strategy.

Note that APY % is subject to change as liquidity fluctuates.

Business Model

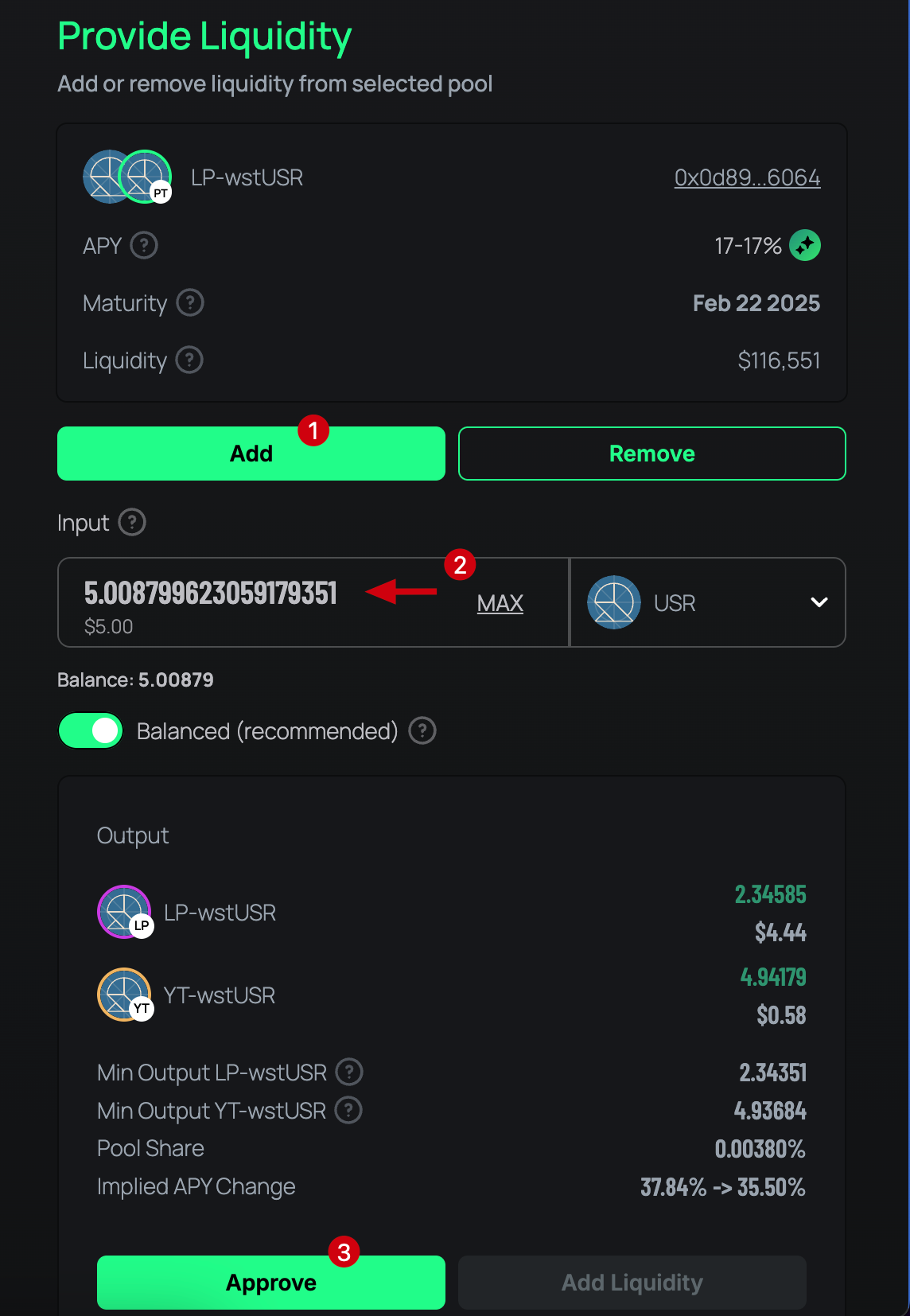

The business model of Resolv is designed around creating and maintaining a stablecoin, $USR, which is backed by a stablecoin framework that employs a True Delta-Neutral (TDN) strategy using $ETH and staked $ETH. This model ensures the stability and security of the stablecoin and creates a mechanism for yield generation and risk management.

The operation cycle of Resolv involves minting $USR by locking up $ETH, which is then managed in a delta-neutral portfolio to mitigate risk. The $ETH assets are staked and used to enter into short futures contracts to hedge against price fluctuations. Revenue is generated from the yield on staked $ETH and the funding rates received from these futures positions. The majority of the revenue is then distributed to Resolv’s stakeholders. Additionally, $RLP plays a crucial role during periods of negative funding rates or when additional coverage is needed, absorbing impacts that could otherwise affect the stability of $USR.

Resolv creates value by offering a stablecoin that is less susceptible to the typical volatility and risks associated with crypto-assets. By employing a delta-neutral strategy, Resolv ensures that $USR remains stable regardless of the large fluctuations in the underlying cryptocurrency markets. This is particularly valuable for users looking for haven assets or stable mediums of exchange in the crypto economy. Furthermore, Resolv captures value through transaction fees on minting, staking, and redeeming of $USR and $RLP tokens. However, these fees are waived during the initial phases of the protocol’s rollout to stimulate adoption and liquidity.

Lastly, Resolv aims to continuously monitor and adjust its strategies based on market conditions, which involves rebalancing the $ETH holdings and futures positions to maintain delta neutrality. This active management not only helps maintain the peg of the stablecoin but also optimizes the yield from its operations, thereby generating profits for the token holders, particularly for $RLP holders positioned to absorb more risk.

Revenue Streams

Currently, all revenue goes to $stUSR and $RLP holders. Mint and redemption fees are waived to boost the protocol at the early stages.

Resolv plans to implement a 10% carry from collateral pool profits as a revenue strategy.

Fee Breakdown

Currently, the protocol does not charge fees for basic actions such as minting or redeeming, but this may change in the future.

| Action | Fee |

| Mint | 0% |

| Redemption | 0% |

| Protocol Fees | 0% |

Tokenomics

In addition to $USR and $RLP, which are utility tokens, Resolv plans to launch its governance token.

$USR can be minted by depositing liquid assets and has an infinite supply. The minting process follows a 1:1 value basis, adjusted for any minting fees. However, at the current stage of the protocol’s implementation, minting fees are waived, and $USDC, $USDT, and other stablecoins are accepted for minting $USR.

Users can stake their $USR to earn a share of the profits generated from Resolv’s collateral pool. Staking is straightforward and is conducted on a 1:1 basis where each $USR can be converted into one $stUSR at any time. The value of $stUSR remains equivalent to $USR, but the quantity of $stUSR may increase over time due to rebasing from staking rewards. Unstaking is also facilitated on a 1:1 basis and can be executed at any moment without any waiting period.

In addition to $stUSR, there is a wrapper token called $wstUSR, a non-rebasing version of $stUSR. The value of $wstUSR accrues over time from staking rewards, providing another avenue for holders to benefit from the protocol’s yield.

Governance

Resolv includes governance as a critical aspect of its roadmap toward decentralization. Holders of the Resolv token will play a vital role in this governance structure, enabling them to influence the direction and management of the protocol.

The Resolv token will have a few functions:

- Voting Power: Resolv token holders will have the authority to vote on governance proposals. These include crucial decisions such as adjusting protocol metrics, approving new integrations, and allocating grants to support various protocol activities.

- Stakeholder Alignment: The token will also align the interests of key stakeholders, including trading venues, liquidity providers, DeFi protocols, and other long-term partners. This alignment is vital for fostering a cooperative and mutually beneficial ecosystem.

- Community Engagement: Resolv tokens will be allocated for initiatives like bug bounty programs and other community-sourced support, enhancing the protocol’s security and reliability through active community participation.

Risks

As with any DeFi protocol, Resolv faces potential risks, both extrinsic (market conditions and economic security, etc.) and intrinsic (smart contracts, operations, etc.).

Smart Contract Risk

Like all DeFi protocols that rely on smart contracts, Resolv is susceptible to risks associated with vulnerabilities or bugs in the code. These weaknesses in the smart contracts could potentially disrupt the protocol’s operations or be exploited by malicious entities. Resolv engages in rigorous audits by third-party security firms to mitigate these risks and maintains a commitment to continuous development.

Credit Risk

Integrating Resolv with CEXs and perpetual DEXs for hedging purposes carries inherent credit risks. Potential insolvency of a trading venue or exploitation of a DEX protocol are significant concerns, highlighted by instances like the FTX collapse. Even well-managed trading venues can face insolvency due to severe market conditions that trigger cascading liquidations.

Resolv mitigates counterparty exposure by holding collateral outside of CEXs. It plans to use institutional custodians, allowing the use of assets outside the exchange as collateral for futures. This strategy eliminates the counterparty risk related to collateral.

The protocol emphasizes diversification by connecting to multiple sources of futures liquidity. Risk management is prioritized over chasing favorable funding rates. Resolv maintains strict single counterparty exposure limits at the protocol level, ensuring that hedges are balanced according to a target allocation.

Centralized exposure risks are isolated within the $RLP, the protection layer of Resolv. This structural safeguard ensures that the default of an exchange will not impact $USR, the stablecoin layer. This isolation is a distinctive feature of Resolv’s design compared to other stablecoin architectures, providing an additional layer of security for $USR holders.

Price Risk

Following a delta-neutral strategy for a hedge, the underlying asset’s price risk remains, and the protocol’s mechanics require constant monitoring and management to keep the hedge safe.

Resolv adheres strictly to a delta-neutral strategy to manage price risks associated with $USR and $RLP. This strategy ensures that $USR and $RLP are consistently backed by a perfectly hedged portfolio between holdings in $ETH and short futures positions. When users mint or burn tokens, Resolv automatically adjusts the corresponding futures positions to maintain this hedge, effective against any significant fluctuation in the price of $ETH, whether a sharp increase or a drastic decline.

Resolv’s commitment to this strategy involves stringent risk management. Protocol’s contributors propose avoiding additional leverage, pseudo-delta-neutral and directional positions, or links to other stablecoins that could introduce higher yields but with greater risk. This focus on maintaining a purely delta-neutral stance by design is fundamental to the protocol’s risk management framework.

Questions often arise about the protocol’s resilience against sudden, significant price movements when allocating only a portion of reserves to collateralize futures. Resolv addresses this by ensuring that even though only a fraction of the assets is placed as margin on exchanges, the exposure to futures remains fully covered by these assets at all times. This full backing prevents the need for liquidation by centralized venues under normal conditions.

Liquidity Risk

Liquidity is one of the most important aspects for a protocol. Often, lack of liquidity can be the cause of serious issues within a protocol. In some cases, market liquidity can also affect protocols incorporating futures into their system operation.

For Resolv, liquidity risk is a significant factor in its operations, especially in the context of token redemption and the corresponding closure of futures positions. The quantity of $ETH returned to a user during such redemptions is determined by the unwind price of these futures positions, which can be affected by market liquidity.

In extreme market conditions, such as those that trigger cascading liquidations in global spot markets, futures liquidity may dry up, affecting the slippage during trade executions. This scenario typically occurs when rapid price movements in spot markets lead to a chain reaction of liquidations, subsequently impacting the liquidity in futures markets.

During such volatile periods, minting and burning activities (e.g. the creation and redemption of $USR tokens) could result in open market trades experiencing higher slippage. This means that more $ETH might be required to mint $USR tokens as the executable average price of $ETH deviates from the current market price due to these conditions.

It is important to note that the slippage effect discussed does not impact the existing positions that back $USR and $RLP tokens. These are maintained to ensure the stability and integrity of the tokens, irrespective of the immediate liquidity conditions in the market.

Substantial liquidity on-chain is critical for $USR to operate efficiently and be accepted in lending markets across the ecosystem. It is also necessary for achieving adoption, which requires handling demand, offering low-slippage swaps, and being accessible everywhere.

Rates Risk

Rates risk in the context of Resolv involves the potential impact of negative funding rates on $ETH staking profits, which could lead to net losses. Given the volatile nature of funding rates, particularly in very liquid markets like those for $ETH and $BTC futures, there are times when substantial divergences between spot and futures prices occur. These discrepancies can severely impact delta-neutral strategies, leading to losses.

Resolv addresses this rate risk primarily through its protection layer, the $RLP. The design of $RLP allows it to absorb losses arising from negative funding rates, thus shielding $USR from these impacts. Even in scenarios of all-time low funding rates, the structure of $RLP is solid enough to manage such losses without significant depletion of its value.

Concerning long-term exposure to sustained negative funding rates, it would take a long period of severe negative funding rates to drain the $RLP. Market principles of arbitrage typically prevent prolonged periods of extreme negative rates. Arbitrageurs would capitalize on such opportunities, thereby mitigating the duration and impact of negative rates through risk-free yield strategies.

Even during significant negative swings in funding rates, the impact is confined to the $RLP, ensuring that $USR remains unaffected and maintains its 100% collateralization.

Security

Resolv’s strategy for managing security, especially while interacting with CEXs, revolves around integrating off-exchange custody solutions. This approach is vital in blending the benefits of DeFi and CeFi, improving the protocol’s overall security and transparency. Resolv uses credible custodians such as Ceffu and Fireblocks.

$USR leverages a security model that maximizes on-chain transparency. By maintaining as much collateral as possible directly on the blockchain, $USR ensures all assets are auditable and accessible. This transparency facilitates trust and enables the community to continuously verify the protocol’s solvency.

However, trading futures contracts on centralized exchanges necessitate maintaining a margin. To address the risks associated with centralized exchanges, Resolv employs off-exchange safekeeping. In this setup, assets are held in accounts managed by third-party custodians rather than directly on the exchanges. This method allows assets to be swiftly moved to the exchange when necessary, such as to meet margin requirements or to execute trades.

The distinct advantage of off-exchange custody becomes evident if a trading entity or the exchange itself defaults. Assets held in off-exchange safekeeping remain secure and protected from the exchange’s insolvency. This safeguard is crucial in scenarios like the collapse of FTX, highlighting the risk of keeping all assets on an exchange.

For institutional traders, the reliability provided by off-exchange custody is indispensable. It mitigates the risks associated with poor risk management practices in the crypto industry, providing a vital security layer for large-scale operations. This system protects assets from exchange-related risks and ensures they can be recovered or redeployed quickly in crises.

In addition to these security measures, Resolv is vigilant about its smart contracts, which support the protocol and operation.

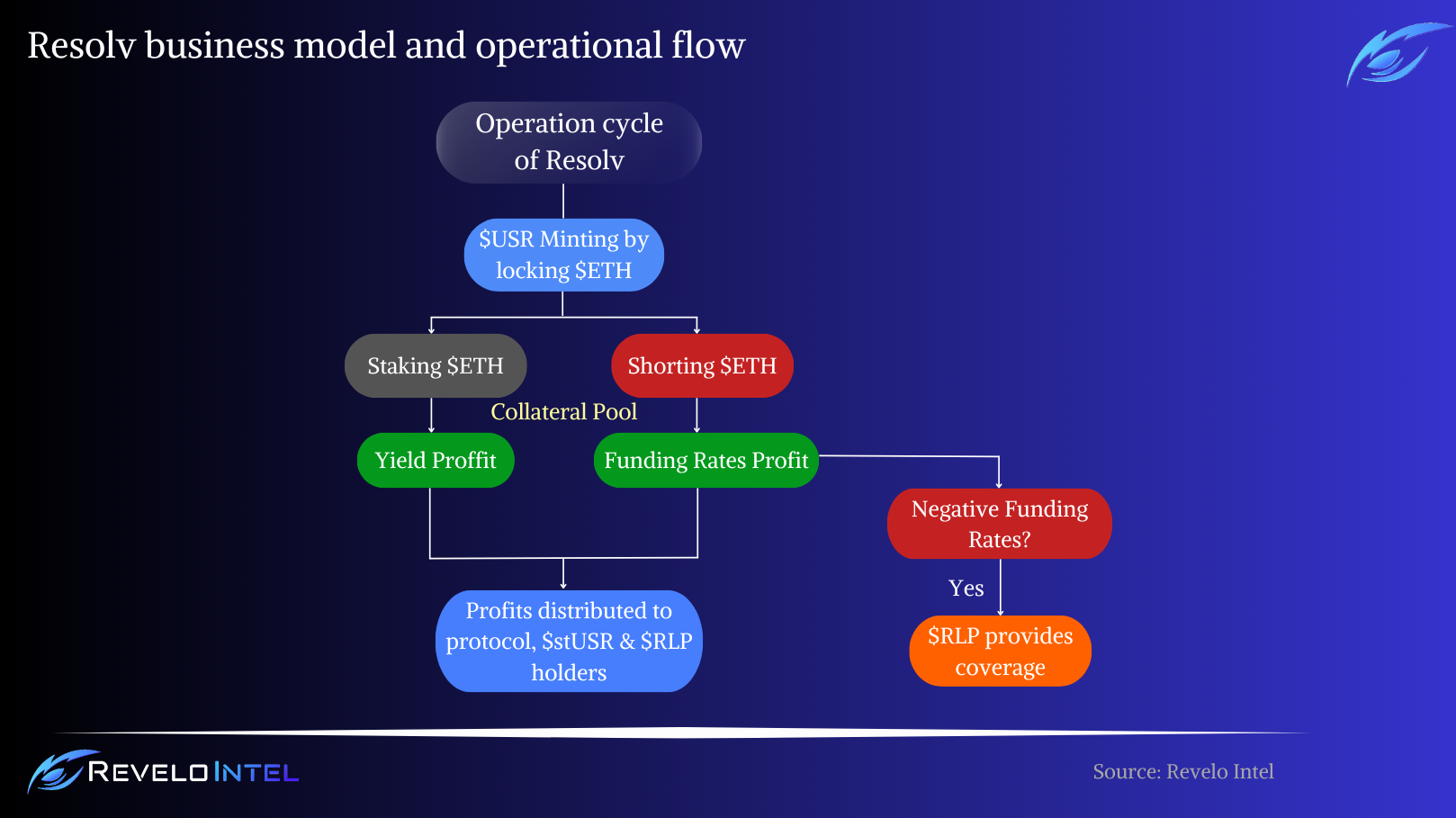

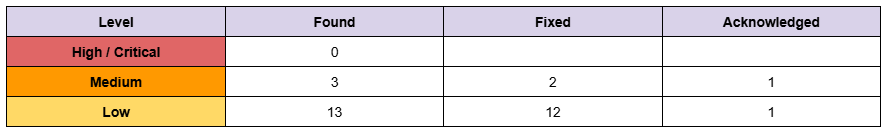

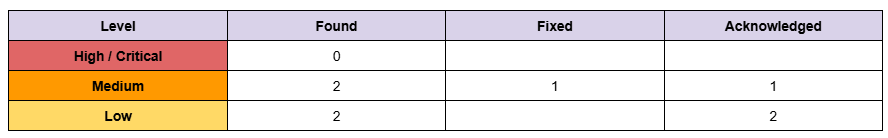

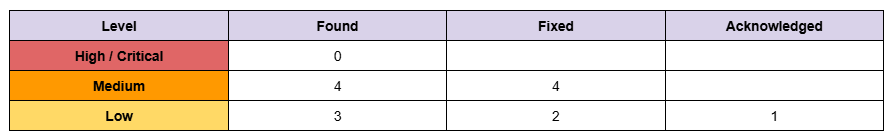

Audits

Third-party security firms have rigorously audited all of Resolv’s smart contracts, including staking contracts, token contracts, and request manager contracts.

Dependencies and Access Controls

Resolv’s operation depends on several critical components that ensure its stability and functionality.

Resolv relies on institutional custody solutions for off-exchange safekeeping of assets used as collateral for futures contracts. The protocol minimizes counterparty risk by holding collateral with third-party custodians instead of directly on centralized exchanges. This arrangement protects assets in case of exchange insolvency, ensuring that funds remain secure and accessible for margin requirements without exposing them to potential exchange failures.

The $RLP token is essential for absorbing market and counterparty risks, acting as an insurance layer for $USR holders. The protocol depends on sufficient liquidity in the $RLP pool to maintain the capital adequacy ratio necessary for protecting the stablecoin. The self-balancing economic mechanism of $RLP incentivizes investors to provide liquidity when the protection layer becomes thin, but consistent participation is crucial for the system’s resilience.

Resolv mint and redemption are available to whitelisted addresses on Ethereum Mainnet, owned by users who have undergone the KYC process.

Lastly, the protocol requires access to centralized exchanges to execute short futures positions for hedging $ETH exposure. Dependence on these exchanges introduces risks related to liquidity, operational integrity, and regulatory compliance. Any disruptions or limitations in these venues can affect Resolv’s ability to maintain its delta-neutral strategy.

Team

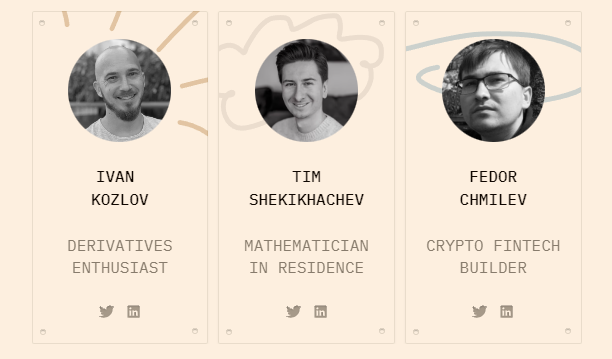

Resolv Labs is the team behind the Resolv protocol. All team members have years of experience in the finance and fintech sectors. The core team is comprised of:

CEO: Ivan Kozlov | X | LinkedIn

CPO: Tim Shekikhachev | X | LinkedIn

CTO: Fedor Chmilev | X | LinkedIn

Project Investors

Many industry experts and teams, including Delphi Labs, Daedalus, and No Limit Holdings, back Resolv.

Legal Structure

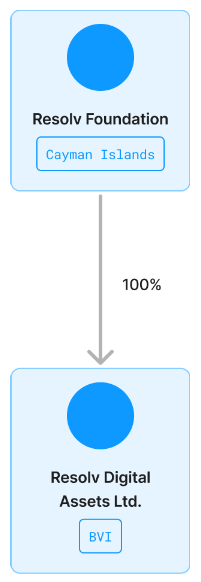

Resolv operates within a structured legal framework to ensure compliance and governance transparency. The tokens associated with the protocol are issued by Resolv Digital Assets Ltd. (RDAL), a company incorporated in the British Virgin Islands (BVI). RDAL is wholly owned by the Resolv Foundation, which was established in the Cayman Islands. Notably, the Resolv Foundation has no owners and is governed by a board of independent directors, ensuring independent oversight.

The rights and obligations related to the protocol tokens issued by RDAL are outlined and governed by the company’s terms of service. The team asserts that tokens are issued lawfully following BVI law, with relevant legal advice available upon request for stakeholders requiring more detailed information.

In addition to RDAL and the Resolv Foundation, Resolv Labs Ltd. plays a crucial role in the ecosystem. Owned and operated by the core contributors, Resolv Labs Ltd. is a contractor for Resolv Digital Assets Ltd. It provides essential services such as software development and business development, supporting the growth and maintenance of the Resolv protocol.

FAQ

What is Resolv?

Resolv is a protocol that maintains $USR, a stablecoin fully backed by $ETH and pegged to the U.S. Dollar. It introduces a True Delta-Neutral (TDN) stablecoin architecture, combining on-chain assets with fully hedged derivatives positions to achieve market neutrality.

How does Resolv’s True Delta-Neutral (TDN) stablecoin architecture work?

The TDN architecture creates a delta-neutral portfolio by holding $ETH and simultaneously entering into short futures contracts that fully hedge price exposure. This strategy ensures that changes in $ETH price do not affect the net value of the portfolio, providing stability for $USR.

What are $USR and RLP tokens, and how do they function?

$USR is the stablecoin representing the senior tranche. It is fully backed by $ETH collateral and can be minted or redeemed on a 1-to-1 basis with liquid assets like $USDC or $USDT. $USR holders can stake their tokens to earn yields from the protocol’s profits.

$RLP acts as the junior tranche. $RLP absorbs market and counterparty risks, protecting $USR holders. In return, $RLP holders receive a higher portion of the profits from the collateral pool.

Where is Resolv deployed?

Resolv is currently deployed only on the Ethereum chain.

How does Resolv generate and distribute yield to token holders?

Yield is generated from two main sources:

- Staking On-Chain Assets: $ETH in the collateral pool is staked using protocols like Lido, earning consistent returns.

- Funding Rates from Perpetual Futures: By holding short positions in perpetual futures contracts, Resolv earns funding rates.

What are the yield targets?

According to historical data, the yield of the $ETH delta-neutral strategy is stable. Across several simulations, the median annual performance is 8.4%, and 99% of the results fall between 7% and 10% p.a. More information can be found here: Historical data & Simulations.

What risks are associated with Resolv, and how are they mitigated?

Risks include credit risk from centralized exchanges, smart contract vulnerabilities, price risk, liquidity risk, and rates risk. Resolv mitigates these risks through Off-Exchange Custody, Diversification, Protection Layer ($RLP), and Smart Contract Audits.

How does Resolv manage security when interacting with centralized exchanges?

Resolv uses off-exchange custody solutions, where assets are held by third-party custodians rather than directly on exchanges. This approach protects assets in case of exchange insolvency and allows for secure margin management for futures contracts.

What sets Resolv apart from other stablecoin projects like Ethena and Elixir?

Resolv’s key differentiator is its True Delta-Neutral (TDN) architecture and the segregation of risks through the $RLP token. Unlike other projects, Resolv isolates CeFi and DeFi risks into a separate token, allowing $USR to be fully backed by on-chain assets and enabling a trustless stablecoin design.

How can users participate in Resolv, and what benefits do they receive?

By depositing assets like $USDC or $USDT, users can mint $USR stablecoins on a 1-to-1 basis. Staking $USR allows users to earn a share of the protocol’s profits through $stUSR. Users with a higher risk tolerance can mint $RLP tokens, receiving higher yields in exchange for absorbing additional risks.

What is Resolv’s business model, and how does it generate profit?

Resolv generates profit through the yields from staking $ETH and earning funding rates on perpetual futures contracts. While minting and redemption fees are currently waived to encourage adoption, the protocol plans to retain a 10% carry from the collateral pool profits. This revenue supports ongoing development and operations.

What are Resolv’s plans for governance and decentralization?

Resolv aims to introduce decentralized governance involving Resolv token holders.