Overview

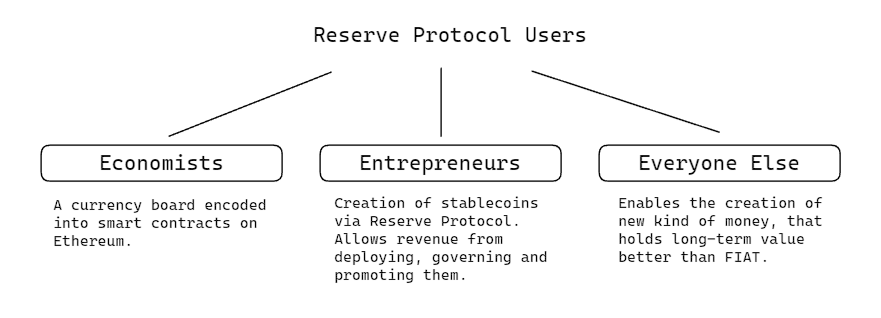

Reserve is a permissionless platform to launch and govern 1:1 asset-backed currencies. It is a decentralized protocol aiming to provide the building blocks for the development of a scalable, decentralized, and stable currency.

The primary goal is to address the need for stable money, in contrast to the inherent volatility of cryptocurrencies like Bitcoin ($BTC) and Ethereum ($ETH). This is achieved through a permissionless monetary system based on asset indexes.

The Reserve protocol allows for the creation of asset-backed, yield-bearing, and overcollateralized stablecoins on Ethereum and other EVM chains, with plans for future interoperability across major smart contract platforms.

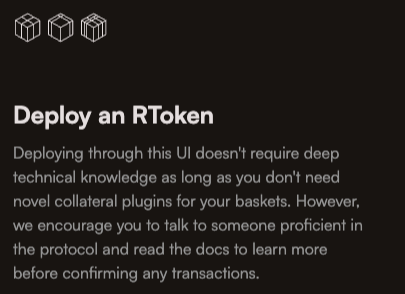

Instead of directly building a stable currency, Reserve has developed a protocol that allows anyone to create a token, known as RToken, which is backed 1:1 by a collection of other tokens. This process can be executed within minutes without the need for coding skills.

RTokens

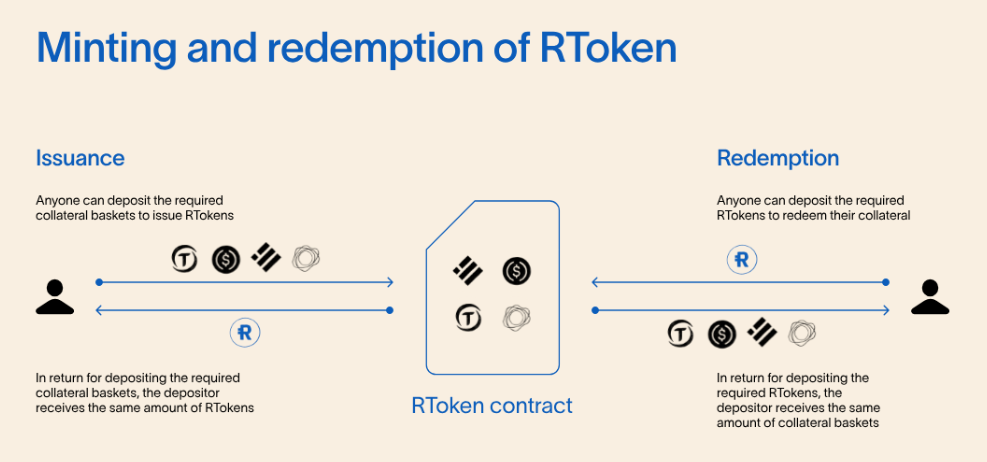

Stable asset-backed currencies introduced through the Reserve protocol are termed “RTokens.” These RTokens are created by depositing the entire basket of backing collateral tokens and can be redeemed for the same basket. Consequently, RTokens tend to maintain a market value equal to the underlying collateral.

RTokens are backed by a combination of ERC-20 tokens and can be protected against collateral default by staking Reserve Rights ($RSR). The process of creating RTokens is completely permissionless: userssimply directly interact with the protocol smart contracts, specifically with a factory contract that allows anyone to deploy their own smart contract instance, in this case an RToken.

When someone creates an RToken they specify a list of assets and asset quantities.. It is also necessary to specify how and by whom the RToken will be governed. This process can be performed by directly interacting with the protocol smart contracts or through the RToken deployer interface. The creator specifies the following parameters, all of which will be explained in upcoming sections of the report:

- Token name

- Ticker

- RToken mandate: describes what goals its governors should try to achieve, providing common ground for governance decisions.

- Primary Basket: The target collateral basket that defines which collateral needs to be deposited for minting new units.

- Emergency Collateral: To replace the base collateral in case of default.

- Revenue distribution: indicates what % of revenue goes to token holders and up to N constituencies and what % of revenue goes to $RSR stakers.

- Backing manager parameters:

- Trading delay: how many seconds should pass after the basket has been changed before a rebalancing trade is opened.

- Warmup delay: how many seconds should pass after the basket regained the SOUND status before an RToken can be issued and/or a trade can be opened.

- Batch auction length: the duration of batch auctions performed via Gnosis EasyAuction

- Dutch auction length: how many seconds long falling-price dutch auctions should be. A longer period will result in less slippage due to better price granularity, and a shorter period will result in more slippage.

- Backing Buffer: how much extra collateral to hold before recognizing revenue. Protects against RSR seizure during rebalance.

- Max trade slippage: maximum deviation from oracle prices that any trade can clear at. Acts as a form of slippage protection.

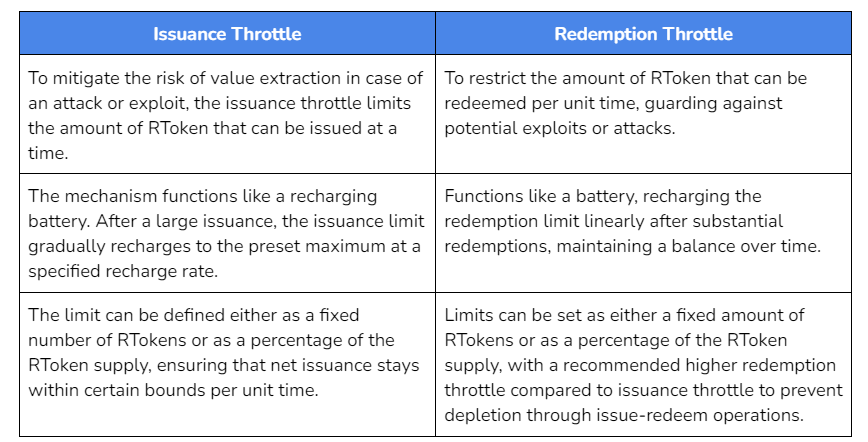

- Issuance throttle rate: allows the issuer to limit the amount of RTokens issued per hour based on a percentage of the current RToken market cap. This matters in the event of an exploit where an attacker tries to issue more RTokens. This buys time for users with pause or freeze permissions to reduce the amount of RTokens that can be issued.

- Issuance throttle amount: allows the issuer to limit the amount of RTokens issued per hour. This matters in the event of an exploit where an attacker tries to issue more RTokens. This buys time for users with pause or freeze permissions to reduce the amount of RTokens that can be issued.

- Redemption throttle rate: allows the issuer to limit the amount of RTokens redeemed per hour based on a percentage of the current RToken market cap. This matters in the event of an exploit where an attacker tries to redeem RTokens. This buys time for users with pause or freeze permissions to reduce the amount of RTokens that can be redeemed.

- Redemption throttle amount: allows the issuer to limit the amount of RTokens redeemed per hour. This matters in the event of an exploit where an attacker tries to redeem RTokens. This buys time for users with pause or freeze permissions to reduce the amount of RTokens that can be redeemed.

- Other parameters:

- Short freeze duration: short freezers have the responsibility of freezing an RToken if anything dangerous or suspicious is happening. This is a one-shot freeze and the role will be revoked after a single use. This field determines how long the RToken will remain frozen until the freeze expires or is extended by another actor.

- Long freeze duration: freeze an RToken’s system for a longer period of time. A long-freezer has 6 charges before losing the ability to freeze any more.

- Reward Ratio: the amount of the current reward amount that should be distributed per block. The default corresponds to a half-life of approximately 15 days.

- Withdrawal leak: the fraction of RSR stake that should be permitted to withdraw without a refresh. When cumulative withdrawals (or a single withdrawal) exceed this fraction, gas must be paid to refresh all assets.

- Unstaking delay: number of seconds that all RSR unstaking must be delayed in order to account for stakers trying to frontrun defaults and needs to be longer than governance for proper incentives for basket changes.

- Minimum trade volume: minimum sized trade that can be performed

- RToken Maximum trade volume: maximum sized trade for any trade involving RToken

Each RToken is governed separately, and once an RToken configuration has been deployed, RTokens can be minted by depositing the entire basket of collateral assets, and redeemed for the entire basket as well. Hence, RTokens will tend to trade at the market value of their respective backing, as any lower or higher price could be arbitraged.

RTokens can be overcollateralized. This way, in the event that any of their collateral token defaults, there is a pool of value available to cover that loss. This overcollateralization is provided by $RSR token holders who can choose to stake their assets on any RToken.

If any of the collateral assets were to default, staked $RSR can be seized mechanically based on the input of price oracles, without depending on any governance votes or human choices.

Additionally, RTokens have the potential to generate revenue or produce yield through mechanisms such as holding tokens from other DeFi protocols which are earning yield through activities such as lending. A portion of this revenue can be directed to $RSR stakers, incentivizing them to stake and thus contribute to the RToken’s overcollateralization. Similarly, without revenue or its distribution to $RSR stakers, an RToken is unlikely to attract $RSR staking and the corresponding overcollateralization benefits.

RTokens Monetary Policy

Note that each RToken operates under its unique governance system, which can evolve over time based on the preferences of its governance participants. Governance is responsible for defining the collateral basket, managing emergency collateral assets, and handling the basket’s regular updates.

A collateral token is considered in default if its value drops significantly and persistently. In such cases, emergency collateral assets predefined by governance can be deployed to the basket.

Governance can regularly revise the basket configuration as well. To do this, the protocol executes on-chain trades to adapt the basket to its new composition, using various trading methods to optimize liquidity and minimize slippage. Refer to the Auctions section below for an explanation on how trades are executed.

Non-Compatible ERC-20 assets

The following types of ERC-20 tokens are not supported to back RTokens:

- Rebasing tokens that return yield by increasing asset balances, instead of using an exchange rate.

- Note that wrapped rebasing tokens are supported (like wstETH or wUSDM)

- Tokens that have a “fee on transfer”.

- Tokens that do not expose their number of decimals on their token interface. The number of decimals should be between 1 and 18.

- ERC-777 tokens, since they could open up the doors for malicious reentrancy attacks.

- Tokens with multiple addresses.

- Tokens that are not compliant with the ERC-20 standard.

However, custom ERC20 wrappers are routinely deployed to overcome these limitations, such as static wrappers for rebasing Aave lending positions.

Use Cases of RTokens

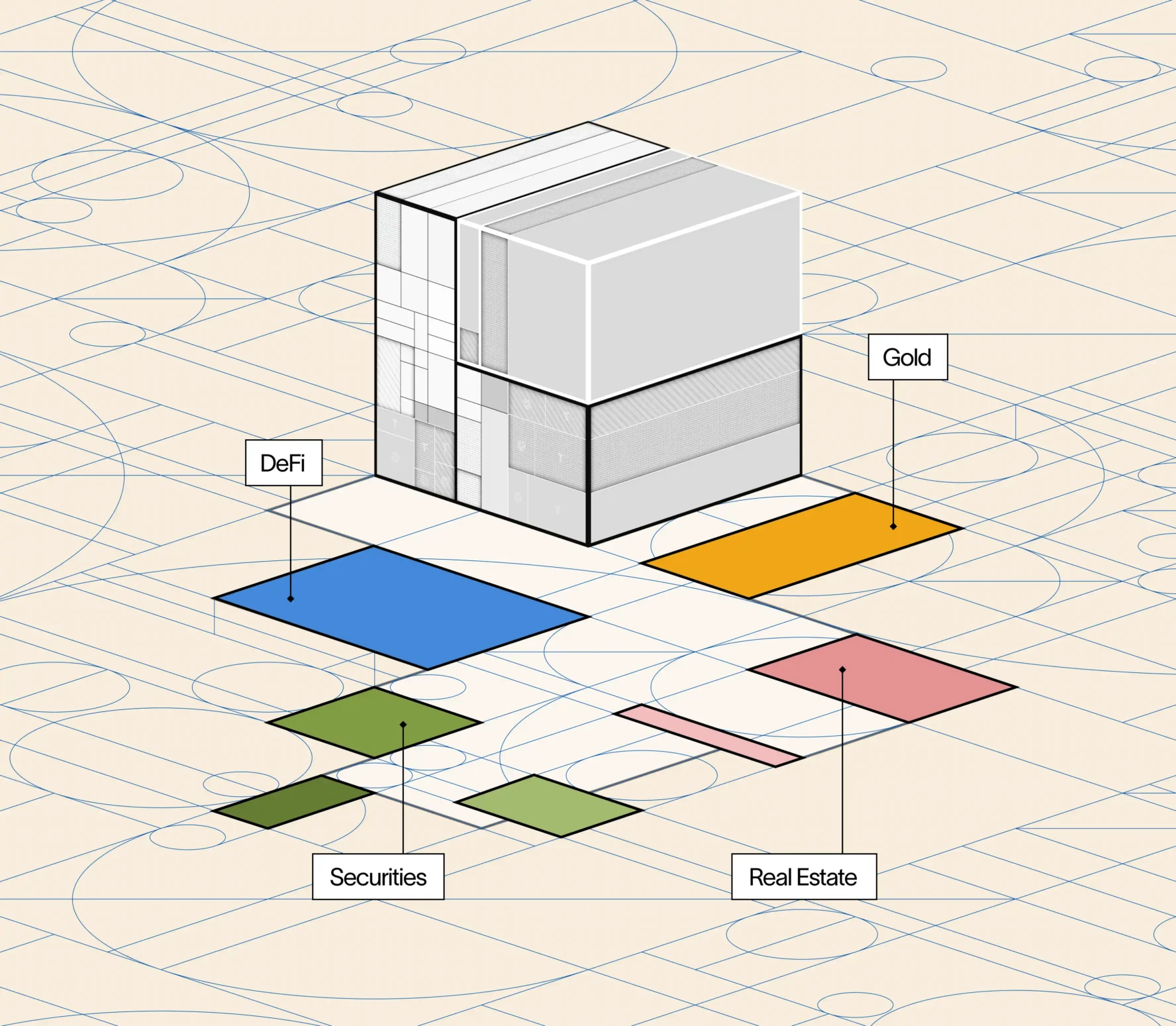

The ultimate goal is to establish an asset-backed currency independent of existing fiat monetary systems, a vision set to materialize with the increasing tokenization of various asset types.

Recognizing that the tokenization of assets is still in nascent stages, the platform is proactively laying the foundation to support a broad spectrum of tokenized assets in the future.

The current use cases include:

- Decentralized USD-Backed Stablecoins: One immediate application is creating a USD-backed coin that reduces reliance on any single fiatcoin issuer, thus enhancing decentralization and resilience.

- Yield-Packing USD Stablecoins: Another use-case is packaging the yields of various DeFi protocols into a single, simplified USD-based coin, making DeFi gains more accessible.

Reserve remains an agnostic protocol, but the community encourages the creation of various RTokens that explore competitive dynamics and a diverse set of governance structures.

While diversity is encouraged, there’s an anticipation that the market could eventually consolidate around a few dominant RTokens. This consolidation is viewed positively, as ubiquity and simplicity are crucial for a currency’s widespread adoption and utility.

Examples of RTokens

Even though the process of deploying RTokens is permissionless, we will use this section to outline some of the working currencies in production to illustrate their utility and use cases.

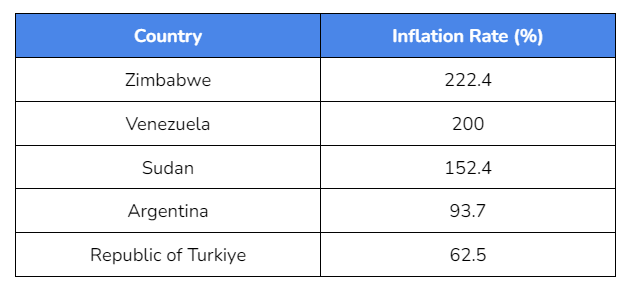

The current four primary assets are hyUSD, ETH+, USDC+ and eUSD. They enable DAOs and funds to improve capital allocation and risk management. As an example, bridged eUSD has already been adopted in the Sentz app (formerly known as MOBY) to send borderless, end-to-end encrypted money in under 5 seconds for quarter-penny fees. Contrast this with the $20+ fees that are charged on remittances that can take several days. eUSD has also been adopted by the Ugly Cash app (formerly known as RPay) in Latin America, which was recently celebrated in a 2023 IMF Working Paper for helping users preserve savings and protect livelihoods from volatility due to hyperinflation

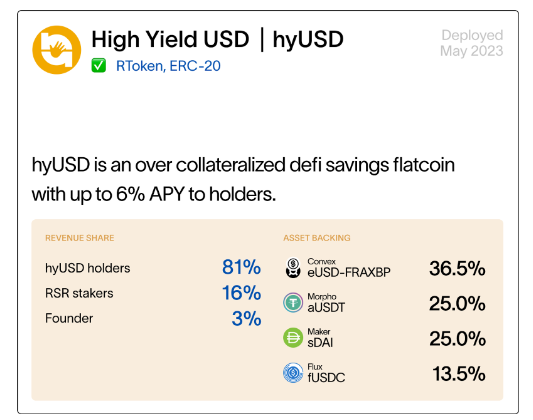

High Yield USD (hyUSD)

hyUSD was deployed by Tom with the intention of creating a decentralized flatcoin that provides convenient access to DeFi yields, enabling holders to earn passive income on their capital. Governance should aim to take low to moderate risk to return high DeFi yields in order to mitigate against inflation.

It is a decentralized flatcoin initially pegged to $1 USD that provides convenient access to DeFi yields, enabling holders to grow and preserve their wealth. This is achieved with a 1:1 asset backed by a basket of other yield bearing tokens including eUSD as well as tokenized lending with exposure to US Treasuries. This makes it possible for hyUSD to act as a secure high yield savings flatcoin with up to 8% in annual appreciation, outpacing inflation in over 100 countries around the world.

hyUSD provides the following benefits to users:

- Stability: hyUSD will be initially pegged to 1$ USD providing stability to holders.

- Passive Yield Exposure: Users can earn passive income on their capital by simply holding hyUSD in their wallet.

- $RSR Staking Protection: $RSR tokens that have been staked on hyUSD, will be sold off in the event of a de-peg by any of the underlying assets in the basket.

- Simplified Defi Exposure: Holders gain exposure to Defi through the underlying basket of assets.

The revenue split for hyUSD is as follow:

- hyUSD holders: 81%

- $RSR Stakers: 16%

- hyUSD treasury: 3%

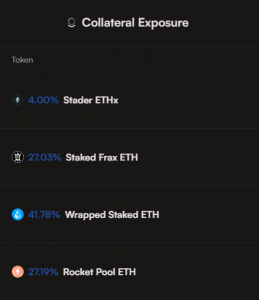

ETHPLUS (ETH+)

ETH+ was deployed by Eridian, a member of the EthStaker community and a solo Ethereum staker. It consists of Lido’s stETH (41.78%), RocketPool’s rETH (27.19%), Frax’s frxETH (27.03%) and Stader’s ETHx (4.00%) with a slight variance in the composition depending on the market conditions. The collaterals were chosen as they were the most significant LSDs in the Ethereum staking ecosystem, providing deep liquidity and a diverse set of validators.

It is an appreciating Ethereum Liquid Staking Token basket with over-collateralized protection and was created with 3 mandates:

- Maintain an Ethereum-aligned Liquid Staking Token basket.

- Positively impact the Ethereum staking distribution.

- Provide value to ETH+ holders through diversification.

ETH+ provides the following benefits to users:

- Passive yield exposure: Users can enjoy attractive rewards on their ETH through a diversified basket of liquid staking tokens.

- Diversified counterparty risk: ETH+ offers over-collateralized protection and simplifies DeFi integrations.

- Reputation neutrality: ETH+ allows for simple DAO treasury diversification.

- $RSR staking protection: $RSR tokens will be sold off in the event of a de-peg to cover losses suffered by the basket.

The revenue split is as follows:

- ETH+ Holders: 95%

- $RSR Stakers: 5%

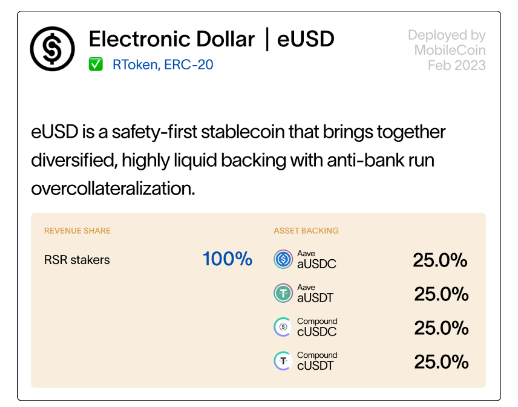

Electronic Dollar (eUSD)

eUSD was launched on February 24, 2023. It is a decentralized stablecoin built with Reserve Protocol, officially launched on the Ethereum and MobileCoin blockchains, and backed 1:1 by a diversified basket of yield-bearing, trusted stablecoin derivatives utilizing Compound and Aave (aUSDC, cUSDC, aUSDT, cUSDT). eUSD is decentralized, community-governed, and censorship-resistant.

eUSD embodies the following characteristics across all blockchains:

- Proof of reserves on-chain 24/7 (auditable and transparent)

- Backed 1:1 by a diversified basket of yield-bearing trusted stablecoins (aUSDC, cUSDC, aUSDT, cUSDT)

- Censorship-resistance by utilizing “receipt tokens” derived from the most successful and proven DeFi protocols Aave and Compound

- Over-collateralized and governed by the community in a fully decentralized way

On the MobileCoin blockchain eUSD enables borderless, private-payments at sub-penny fees, enabled by the following features for all its users:

- Self custody — your keys, your money

- Fully private using end-to-end zero-knowledge encryption

- Employs a KYC/AML-permissioned bridge to support regulatory compliance

- Optimized for mobile devices, settlement in less than 5 seconds at a flat $0.0025 per transaction in eUSD, no matter the transaction size

$RSR stakers provide overcollateralization to eUSD and are subject to seizure in case the collateral backing for eUSD defaults. For example, during $USDC’s depegging in March 2023, eUSD required emergency action. Since it is 50% backed by $USDC (approx 25% saUSDC, 25% cUSDC), the protocol had to sell off its backing for emergency collateral ($USDT). Through the process, eUSD $RSR stakers helped re-collateralize eUSD and restore the peg.

Governance has specified a 2-week delay for unstaking. During this period of time, stakers don’t earn rewards.

The revenue split is as follow:

- $RSR Stakers: 100%

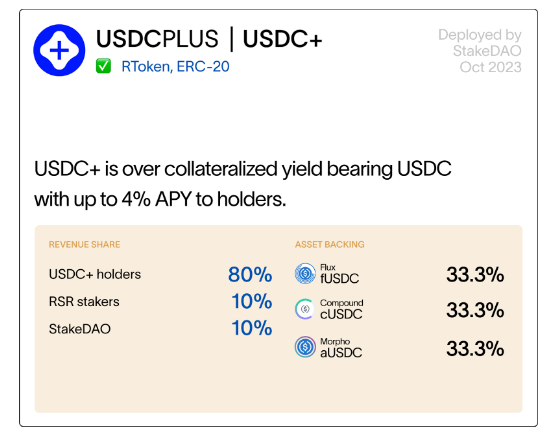

USDCPLUS (USDC+)

USDC+ is an overcollateralized yield-bearing RToken deployed on Ethereum mainnet. The original idea behind its deployment was to introduce a stablecoin that is able to manage its own liquidity leveraging StakeDAO’s liquid lockers. This is achieved with permissionless minting and redemption with no fees.

To capture this yield, the RToken is powered by 3 $USDC markets: Flux, Compound v3, and Morpho-Aave. The revenue split is decided by governance: to USDC+ holders, to $RSR stakers, and to a liquidity fund

Protocol Operations

Issuance and Redemptions

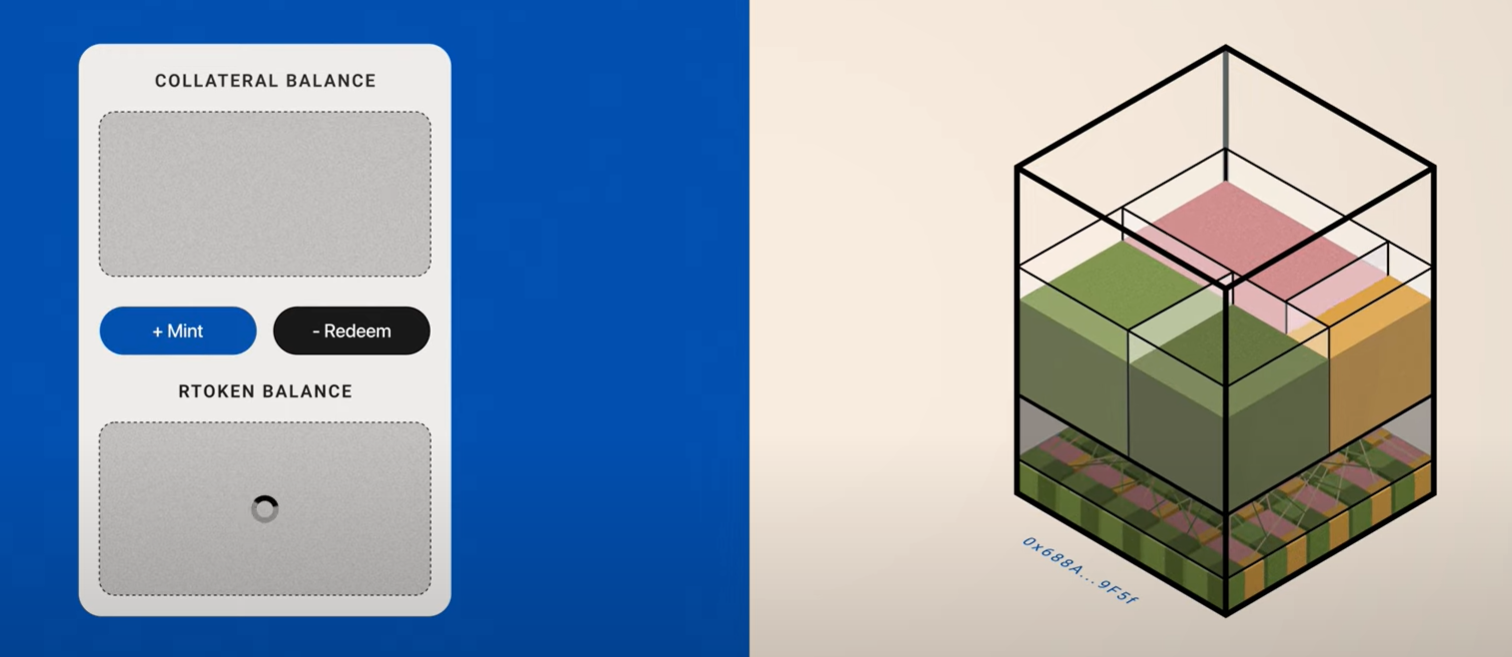

The primary protocol operations involve the issuance and redemption of RTokens:

- Issuance Process: Users can issue RTokens by providing the protocol with collateral baskets equivalent to the desired amount of RTokens. In return, they receive an equal value of RTokens.

- Redemption Process: Conversely, users can redeem their RTokens, receiving collateral baskets in return, equivalent to the amount of RTokens redeemed. This ensures a transparent and balanced exchange mechanism.

There are two additional mechanisms:

Staking and Unstaking

In addition to the issuance and redemption of RTokens we also need to take into account the importance of $RSR staking and unstaking.

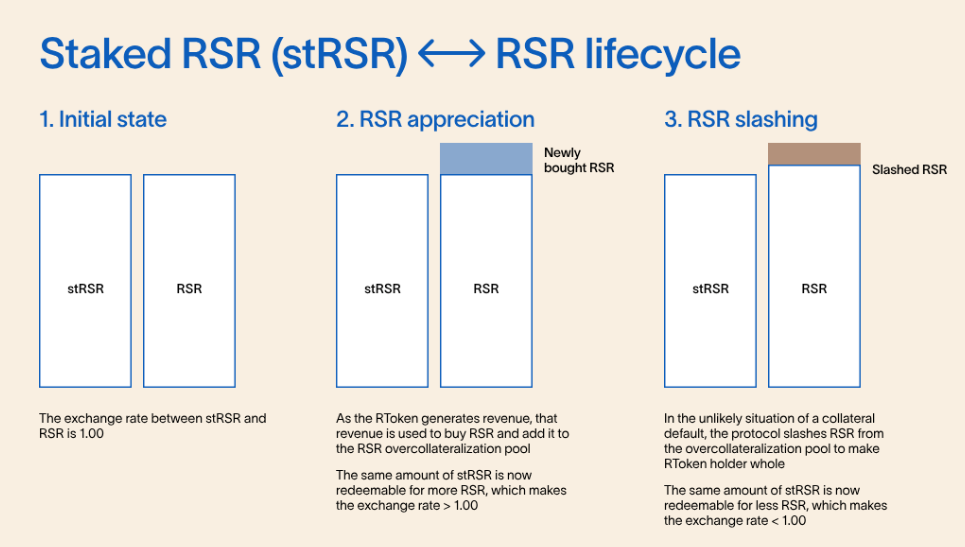

- Staking: $RSR holders can stake their tokens on RTokens, contributing to the overcollateralization pool and receiving a share of the RToken’s revenue.

- Unstaking: Un-staking involves a delay (default set to 2 weeks, can be changed by governance), during which the staker’s position is slashable but does not accumulate revenue. This mechanism prevents gaming of the system and ensures a stable overcollateralization pool.

Upon staking, holders receive stRSR tokens, representing their staked position. The exchange rate between stRSR and $RSR starts at 1.00 and changes over time based on RToken revenue sharing and overcollateralization slashing.

Note that to engage in governance, stakers need to delegate their stake to activate their voting weight.

Un-staking requires two transactions – one to initiate and another to receive $RSR tokens back after the delay. During this period, the stRSR position is not transferable and gets burned upon the first transaction.

Reserve Rights ($RSR) staking is a fundamental component of the Reserve protocol, designed to ensure the stability and security of RToken holders by providing overcollateralization. This mechanism serves as a protection for RToken holders by acting as a buffer against potential defaults of collateral tokens.

- Staking Options: $RSR holders can choose to stake their tokens on a specific RToken, distribute their stake across multiple RTokens, or opt not to stake at all.

- Staking Contracts: Upon staking on an RToken, $RSR is deposited into a staking contract associated with that RToken, and the staker receives an ERC-20 token representing their staked position.

Since $RSR are taking the risk of having their assets be used to cover collateral defaults, they are compensated via two types of incentives:

- Revenue Sharing: Stakers are entitled to a share of the revenue generated by the RToken they are staked on, providing a financial incentive for participation in the staking mechanism.

- Return Expectations: Generally, the returns (APYs) for staking are correlated with the market cap of the RToken, with higher market caps potentially offering higher returns.

Rewards for staked $RSR are calculated based on the RToken’s generated revenue, the portion of revenue allocated to $RSR stakers, and the staker’s proportion of the total $RSR staked on that RToken.

For illustration, if an RToken generates $100 in revenue, 20% is designated for RSR stakers, and a staker has contributed 10% of the total $RSR staked, their reward for the period would be $2.

Finally, rewards are distributed by market-buying $RSR with the revenue (in various ERC20s) generated by the RToken and depositing it into the staking contract, effectively increasing the exchange rate of staked $RSR to $RSR over time.

Stakers have the flexibility to cancel their unstaking process at any point, providing additional control over their staked assets. However, there is an unstaking delay to prevent immediate withdrawals, especially during times of distress.

Asset Management

The Reserve protocol introduces a structured framework for asset management and the distribution of revenue generated by RTokens. The goal of this framework is to ensure transparency, accountability, and fairness in the management of assets and the distribution of gains among stakeholders.

First, upon deploying an RToken, the deployer makes a decision about the revenue split between RToken holders and $RSR stakers. In this step, the deployer also specifies what ERC-20 assets can be used as collateral or revenue assets. These ERC-20 tokens are then registered in the Asset Registry contract, which is specific to each RToken.

Secondly, governance oversees the management of assets, including the registration of new assets, modification of registered asset details, and unregistration of assets from the system.

The protocol monitors the appreciation of the RToken’s (appreciating) collateral tokens and adjusts the redeemability of the RToken accordingly.

This way, as the collateral grows in value, fewer collateral tokens are required to back the outstanding RToken supply. In this case the protocol mints new units of RTokens and directs this value either to $RSR stakers or back to RToken holders.

Revenue Distribution to RToken Holders

Collateral tokens backing the newly created currency are stored in a contract called the Backing Manager. This contract is responsible for holding collateral assets, minting more RTokens out of them, or trading them for RTokens or $RSR (to later pay out rewards to RToken Holders or $RSR stakers).

As yield is accrued by the collateral assets, the Backing Manager periodically mints new RToken units. A portion of the new units (as described by the revenue distribution table) are distributed back to RToken holders.

However, note that each collateral asset will earn yield at its own pace. The portion of collateral that uniformly appreciates (represented in brown in the image below) is used to mint new RTokens. The remaining grown collateral that cannot be evenly minted into RTokens is then sent to the RToken Trader contract, which trades them directly for more RTokens through auctions.

Once the uneven portion of the yield is swapped for RTokens, both the newly minted RTokens and the newly traded RTokens get consolidated in a contract called the Furnace. This contract is responsible for “melting” (slowly burning) these new RTokens, which incrementally increases the exchange rate between the RToken and its collateral basket.

To summarize:

- The protocol will hold all collateral tokens in the Backing Manager.

- As yield is accrued, it will mint new RTokens for the even yield portion shared by all collateral assets, and trade the excess via the RToken Trader.

- Once the newly minted and traded RTokens are collected, the Furnace will slowly burn RTokens to increase their exchange rate – making the RToken more valuable, allowing each unit to be redeemed for more collateral tokens over time.

Revenue Distribution to $RSR Stakers

The section above explained how the Backing Manager holding collateral assets leads to the production of new revenue RToken which can be returned to RToken holders in a melting process. Similarly: this revenue RToken can also be used to market buy RSR to distribute to $RSR stakers.

Newly minted revenue RToken as well as the unevenly-appreciated collateral is sent to the RSR Trader, which sells all tokens it holds for RSR which it forwards to the stRSR pool.

Next, the protocol will transfer all the newly acquired $RSR to the stRSR pool, where another melting process will take place in order to increase the stRSR/RSR exchange rate

To summarize:

- The protocol will hold all collateral tokens in the Backing Manager.

- As yield is accrued, it will trade excess collateral for $RSR through the RSR Trader.

- Before handing out rewards, each unit of $RSR can be exchanged for 1 stRSR. But as $RSR are handed out, each stRSR is now redeemable for $RSR at a ratio that is greater than the previous 1:1.

Revenue Distribution Example

Assume a scenario where 40% of the revenue is allocated to RToken holders and 60% is directed to $RSR stakers.

Out of the newly minted revenue RToken, the protocol allocates 40%to RToken holders. Excess collateral which cannot be minted into RTokens directly, is sent to the RToken Trader for conversion into more RTokens. The newly minted and traded RTokens are then consolidated in the Furnace, where they undergo a melting (slow burning) process. This incrementally enhances the exchange rate of RToken relative to its collateral, thereby appreciating the value of each RToken held by investors.

Similarly, out of the 60% revenue allocated to $RSR stakers, the protocol again mints as many RTokens as feasible. These newly minted RTokens, along with the remaining collateral, are then sent to the RSR Trader for conversion into $RSR tokens. Next, the acquired $RSR tokens are transferred to the stRSR pool, where they are gradually distributed to stRSR holders. This distribution process effectively elevates the stRSR/RSR exchange rate, increasing the value of the staked $RSR.

Altogether, the protocol manages and leverages all accrued revenue in the Backing Manager, ensuring that the growth of the collateral is distributed accordingly between RToken holders and $RSR stakers.

This dual-pathway distribution mechanism ensures that both parties—investors in RTokens and $RSR stakers—benefit from the appreciation of the underlying collateral.

Recapitalization

Recapitalization is the process that ensures that RTokens remain stable and can be redeemed in the face of volatile market conditions or any other unforeseen disruptions. By systematically managing collateral assets and leveraging $RSR in emergency situations, the protocol ensures that RTokens remain a reliable and stable asset for holders.

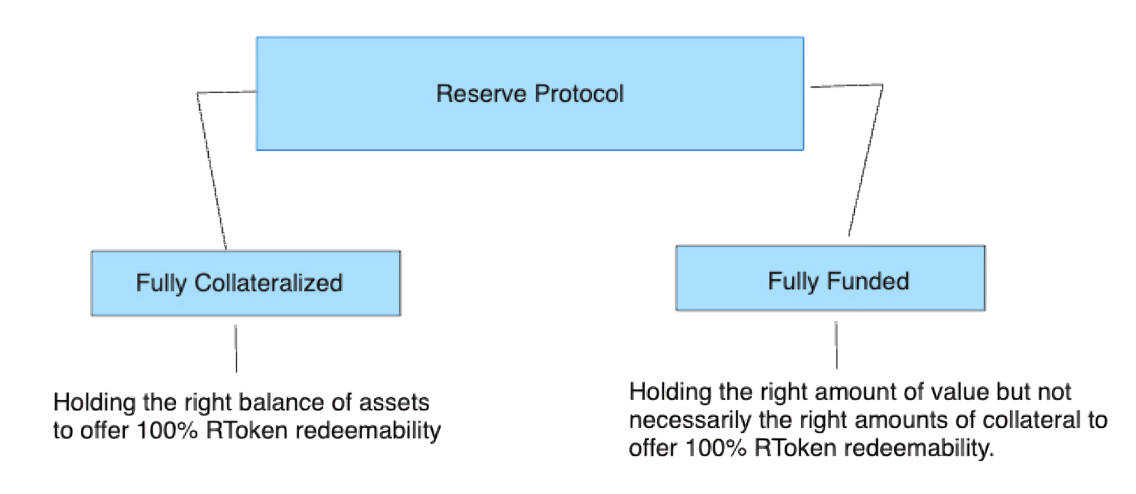

To conduct this operation, the protocol distinguishes between being “fully collateralized” and “fully funded,” and has a structured approach to manage recapitalization, primarily through Reserve Rights ($RSR)

Even though the protocol aims to be fully collateralized at all times, there are two situations that can lead to a transition between the two states:

- Following governance decisions that alter the collateral basket, the protocol may temporarily shift from being fully collateralized to fully funded as it adjusts its holdings to match the new basket composition.

- In the event of a collateral default, the protocol might remain fully funded (thanks to excess collateral or RSR overcollateralization) but will not be fully collateralized until proper recapitalization actions are taken.

When not fully collateralized, the protocol initiates the sale of assets not part of the proper collateral basket. This process continues until the protocol either becomes fully collateralized again or requires intervention through $RSR liquidation.

If a collateral default occurs, the protocol immediately flags the default and begins liquidating the faulty collateral. The proceeds, along with any excess collateral, are used to acquire predefined emergency collateral.

If the proceeds from liquidations and excess collateral are insufficient, the protocol seizes the required amount of $RSR from the stRSR contract. These $RSR tokens are then sold through auctions to purchase the necessary emergency collateral, resulting in a proportional reduction in value (haircut) for all $RSR stakers.

Auctions

Reserve uses auctions as a method for trading assets. This is required for operations like 1) revenue distribution, and 2) recollateralization following basket changes or collateral defaults. Anyone can participate in auctions, and frequent revenue auctions ensure that stakers receive a constant reward stream.

Presently, the protocol integrates two types of auctions: Dutch Auctions and Batch Auctions.

Dutch Auctions

Dutch auctions start with a high price for the auctioned asset, gradually reducing until a buyer accepts the current price or a preset minimum price is reached. This method ensures rapid price discovery and prevents bidding wars.

The process is conducted in 4 stages (as currently implemented):

- Initial Drop: The asset price decreases from 1000x its expected price to 1.5x. This phase is primarily a safeguard against price manipulation.

- Approaching Expected Price: The price lowers from 1.5x to 1x the expected price, accommodating potential natural price movements during the auction.

- Expected to Worst Price Range: The price drops from the expected price to the worst-case price, factoring in oracle errors and maximum trade slippage. Most bids are anticipated in this phase.

- Final Static Price: The price remains fixed at the worst-case price, allowing for manual human bidding if bots are not active.

A Dutch auction concludes when a user places a full-lot bid or when the auction time expires without bids, leading to the possibility of initiating a new Dutch or Batch auction for the assets.

Batch Auctions

Reserve utilizes Gnosis’ Easy Auction for batch auctions, a market mechanism that matches limit orders of buyers and sellers at a fair clearing price. It executes all “batch” bids above the minimum acceptable price, satisfying the number of assets available for sale.

For example, consider the following scenario:

- Bidder A: Orders 5 tokens at $10/token.

- Bidder B: Orders 4 tokens at $9/token.

- Bidder C: Orders 4 tokens at $5/token.

- Outcome: Bidder A receives 5 tokens, Bidder B receives 4 tokens, and Bidder C receives 1 token, with all bids clearing at $5/token, the next-lowest price at which all assets can be sold.

Smart Contracts Architecture

Many of the core contracts used by the protocol follow a proxy pattern. This means that users interact with contracts that store data but do not contain business logic. This logic is delegated to implementation contracts that can be swapped in order to apply changes to the business logic if/when required.

The architecture differentiates between core contracts and plugins:

- Core Contracts: Include ‘Main’ and other contracts directly registered by ‘Main’. These contracts share governance, pausing status, are upgradable, and form a single security domain.

- Plugin Contracts: Serve as individual, static contracts that can be registered with core contracts. This category includes Asset and Collateral contracts registered in AssetRegistry, and Trade contracts created by the Broker. Plugins are not individually pausable or upgradable; if an upgrade is needed, they can simply be replaced.

Any ERC20 token is wrapped and modeled in an Asset or Collateral contract. An Asset models an ERC20 token and offers a price view against the unit of account, while a Collateral is an Asset with additional information required for its use as RToken backing.

- Main.sol serves as the central hub, coordinating interactions between other functional contracts.

- RToken.sol is an ERC20 token contract with elastic supply. Its primary functions involve minting and redemption of units.

- AssetRegistry.sol provides the mapping from pertinent ERC20 tokens to Asset contracts, allowing the rest of Main to think in terms of both ERC20 tokens and the protocol accounting standard.

- BackingManager.sol holds and manages the backing for an RToken, applying the monetary policy by rebalancing collateral assets, forwarding revenue and settling trades as needed.

- Broker.sol is the contract that handles trading. It requires deploying a customized disposable trading contract that will execute a Batch or Dutch Auction.

- Distributor.sol is responsible for sharing revenue in RTokens or $RSR with RToken holders (furnace) or $RSR stakers.

- Furnace.sol is a helper contract that “melts” (slowly burns) RTokens continuously to realize apprecation after processing revenue.

- FacadeRead.sol and FacadeAct.sol provide a stateless, generic interface for external interactions and app development with any RToken. FacadeWrite.sol simplifies the deployment and configuration of an RToken.

- StRSR.sol is where users can stake their $RSR in order to provide overcollateralization for RAssets and benefit from their expansion and revenue-sharing.

- Deployer.sol deploys clones of implementation contracts as needed for a new RToken. It requires specifying the name of the token to deploy, along with a symbol (ticker) and an IPFS link or direct string to a mandate, describing what the RToken governors should take into account for making their decisions.

Monetary Units

In order to fully understand the system, it is important to note that there are 3 internal financial units used to perform different functions pertinent to RTokens.

- Unit of Account: This is the standard numerical unit that is used to compare the value of different assets. This is helpful for deciding when there is sufficient revenue to initiate an auction, determine what assets are at a surplus, detect collateral defaults…

- By default, the unit of account for all RTokens is USD. This setting is primarily for internal calculations, such as converting price feeds, and is not intended to be changed by an RToken deployer.

- Target Unit: The target unit refers to the exogenous currency against which a collateral token in an RToken basket is expected to remain stable or appreciate. It acts as the benchmark for the expected stability or growth of the collateral tokens.

- In many RTokens, all collateral tokens are expected to have the same target unit, allowing for a unified understanding of the RToken’s stability or appreciation against this target unit.

- Reference Unit: The reference unit is the base token for a collateral token that is expected to appreciate over time. This appreciation is typically due to the dynamics of a DeFi protocol that produces a “receipt token” redeemable for the base token at a rate that is expected to increase monotonically.

For instance, consider the following:

- Compound Collateral Token (e.g., cUSDC): Unit of account is USD, reference unit is $USDC, and target unit is USD.

- Aave Collateral Token (e.g., aUSDP): Unit of account is USD, reference unit is $USDP, and target unit is USD.

- Pure-Stable USD Basket (e.g., USDC, USDP, DAI): Unit of account is USD, each collateral token serves as its own reference unit, and their target units are USD.

This is relevant because the protocol operates on the premise that collateral tokens maintain a known and predictable relationship with their reference units, and that these reference units, in turn, maintain a known and predictable relationship with their target units.

The protocol actively monitors these relationships. It flags a collateral token as defaulting if any of these relationships appear to be broken, ensuring the stability and reliability of the RToken system.

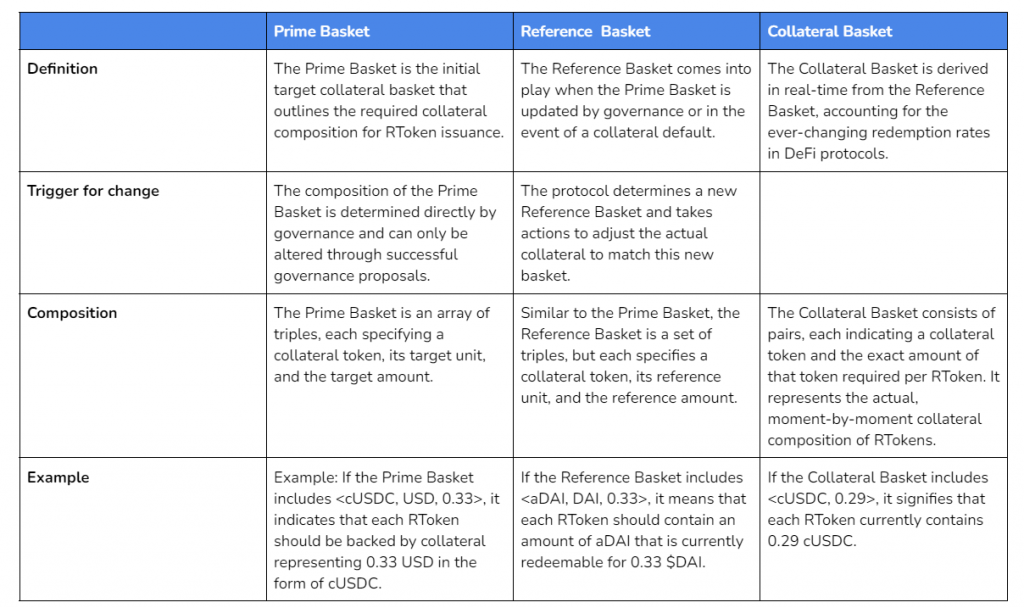

Basket Dynamics

In Reserve, “baskets” are fundamental constructs that represent collections of financial values crucial for maintaining the full collateralization of RTokens at all times.

The protocol differentiates between three main types of baskets: Prime Baskets, Reference Baskets, and Collateral Baskets. Each plays a specific role in ensuring the stability and redeemability of RTokens.

System States and Roles

Reserve features a governance structure comprising different roles that can interact with the system. These roles are designed to respond swiftly and effectively in the event of attacks, exploits, or bugs.

- OWNER: The ultimate authority, typically a decentralized governance smart contract. The OWNER can manage roles, set governance parameters, and upgrade system contracts.

- PAUSER: Can pause and unpause the RToken system, ideally positioned to respond rapidly to off-chain events. Multiple PAUSERS can exist for redundancy, and their role can be automated or managed by a multisig for swift response.

- SHORT_FREEZER: Can freeze the RToken system for a short period, useful for immediate response to detected bugs or vulnerabilities. This role requires quick action but allows some margin for error. The SHORT_FREEZER role is relinquished upon activation and must be reassigned by the OWNER.

- LONG_FREEZER: Can freeze the RToken system for an extended period, optimizing for accuracy and absence of false positives. This role acts as a safeguard against zero-day exploits, allowing for deliberate action. It has limited “charges” for activation, after which the role must be re-granted or recharged by the OWNER.

- GUARDIAN: Can reject proposals even if they pass. This role acts as a final backstop and should be assigned to a trusted entity, capable of considered and potentially slower response. Only one GUARDIAN should be defined.

Similarly, there are different states that the system can be in at any given time.

- Paused state: This state is activated by any PAUSER by calling the pause() function. In this state, the RToken system only allows for redemptions, $RSR staking, and rewards payouts. All other interactions are disabled until normal activity is resumed by unpausing the functionality.

- Frozen state: The system can be frozen for a long or short period of time, activated by any SHORT_FREEZER or LONG_FREEZER respectively.

Why the Project was Created

Reserve was built under the belief that access to a stable currency is considered a fundamental human right. The protocol was built with the ambitious goal of achieving a world where a currency can maintain its purchasing power over time. The ultimate vision for Reserve is to create a new approach to currency that can be used by the majority of people in the world, providing stability and equal purchasing power over time.

The motivation behind the Reserve Protocol is to combat the inflationary nature of traditional currencies like the USD while avoiding the extreme volatility associated with cryptocurrencies like Bitcoin ($BTC) and Ethereum ($ETH). Reserve achieves this by bundling various assets into an index, which serves as the basis for its stable currency.

Reserve is offering a solution to the people who suffered a decrease in their quality of living because their currency was not working for them and devaluing more and more every day. Up until now these people had no choice, but thanks to tokenization and the advent of stablecoins, they now can rely on a permissionless tool that can help them maintain their purchasing power or increase their wealth through asset-backed currencies.

The vision of Reserve is to remove barriers to entry and decrease transaction costs around the world. All of this is achieved without excluding the most vulnerable ones or unlucky ones who have been born in hyperinflationary countries where they don’t have freedom to access the whole spectrum of financial services.

Addressing the Challenges of Stable Currencies

Building stablecoins involves navigating a complex landscape of design choices and trade-offs. Each decision carries implications for stability, trust, and adoption.

The first issue comes from the choice of choosing between a pegged or floating exchange rate. While some national currencies are relatively stable, creating an independently stable cryptocurrency without a peg presents numerous hurdles. Central banks stabilize currencies by managing supply, demand, and purchasing power, often with considerable resources at their disposal. For a tokenized asset, replicating such a centralized system’s functions is feasible but unattractive, making pegging to a stable currency or asset the more practical approach initially.

Secondly, pegging a currency’s value requires collateral. While self-referential collateral (where the collateral’s value is tied to the currency’s success) can theoretically create a positive feedback loop of stability, it’s inherently risky. Any decrease in the currency’s demand can devalue the collateral, leading to a downward spiral. Conversely, exogenous collateral, with its independent value, provides a more stable and reliable backing, insulating the currency from its own market fluctuations.

Thirdly, while fiat currencies can be attractive for pegging due to their liquidity and simplicity, this approach introduces the fiat’s inflationary tendencies and geopolitical risks into the stable cryptocurrency. Pegging to a diversified asset basket can offer long-term stability but is more complex and may be susceptible to short-term value fluctuations.

Fourth, the backing ratio is crucial for maintaining a currency’s stability. While partial backing could theoretically suffice, it introduces risks of bank runs and speculative attacks, especially given the high competition and low switching costs in the cryptocurrency market. A 100% collateral backing or overcollateralized design, although more capital-intensive, ensures robustness against such destabilizing events.

There are also issues that come when deciding between off-chain and on-chain assets being used as collateral. This has an effect on the degree of centralization and censorship resistance. For instance, the high volatility of assets like $ETH makes overcollateralization or hedging necessary, both of which are costly strategies. Off-chain collateral, despite introducing centralization, offers lower volatility and, therefore, economic viability.

Centralizing collateral with a single issuer also concentrates counterparty and third-party risks, including mismanagement and intervention by external forces like governments. A multi-collateral system, spread across various jurisdictions, can mitigate these risks by distributing the collateral, though it may increase the complexity and the chance of partial defaults.

Reserve’s Strategic Vision

The strategic vision behind the Reserve protocol is to enable anyone to create RTokens, which can eventually be detached from the USD peg.

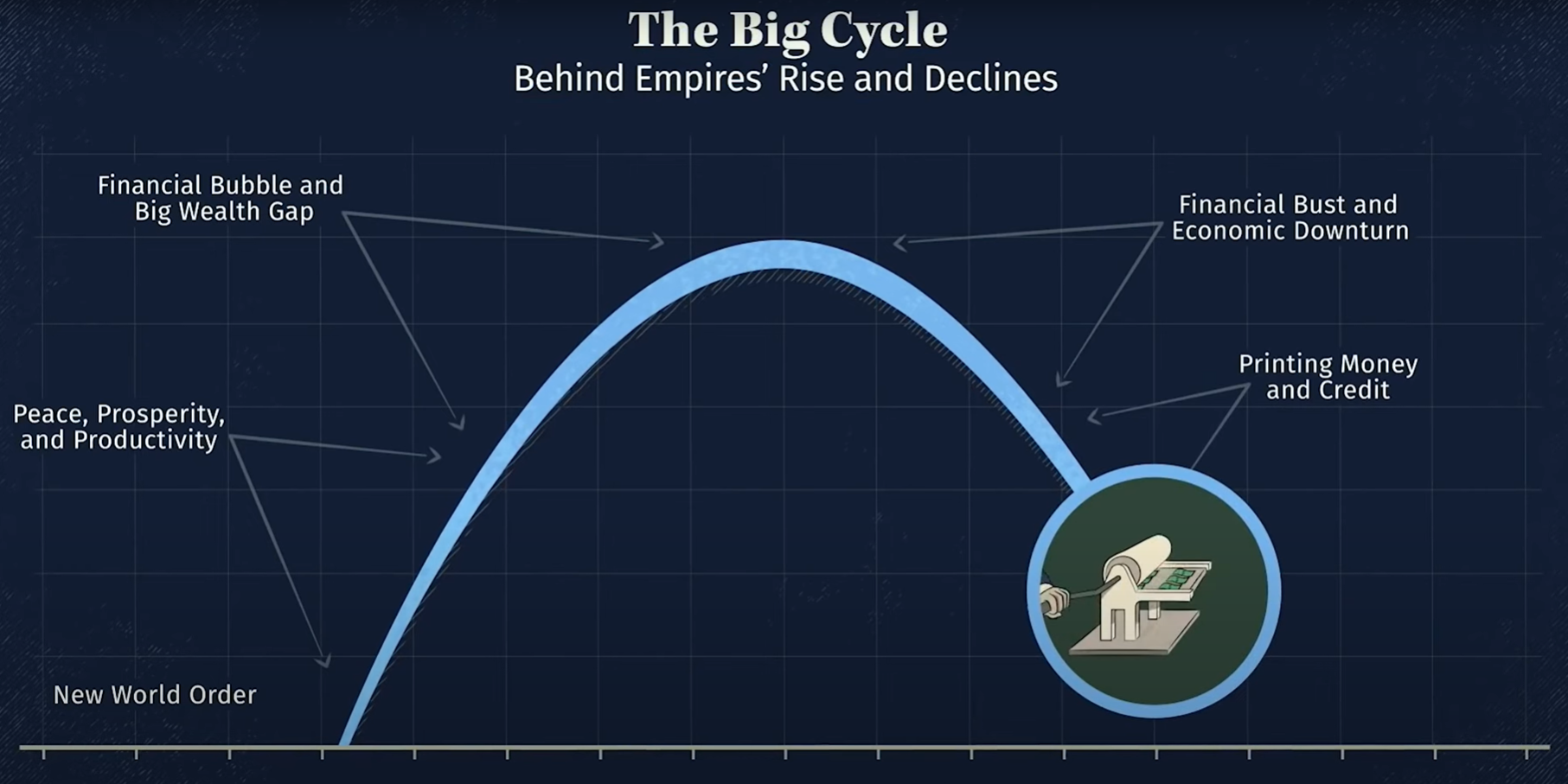

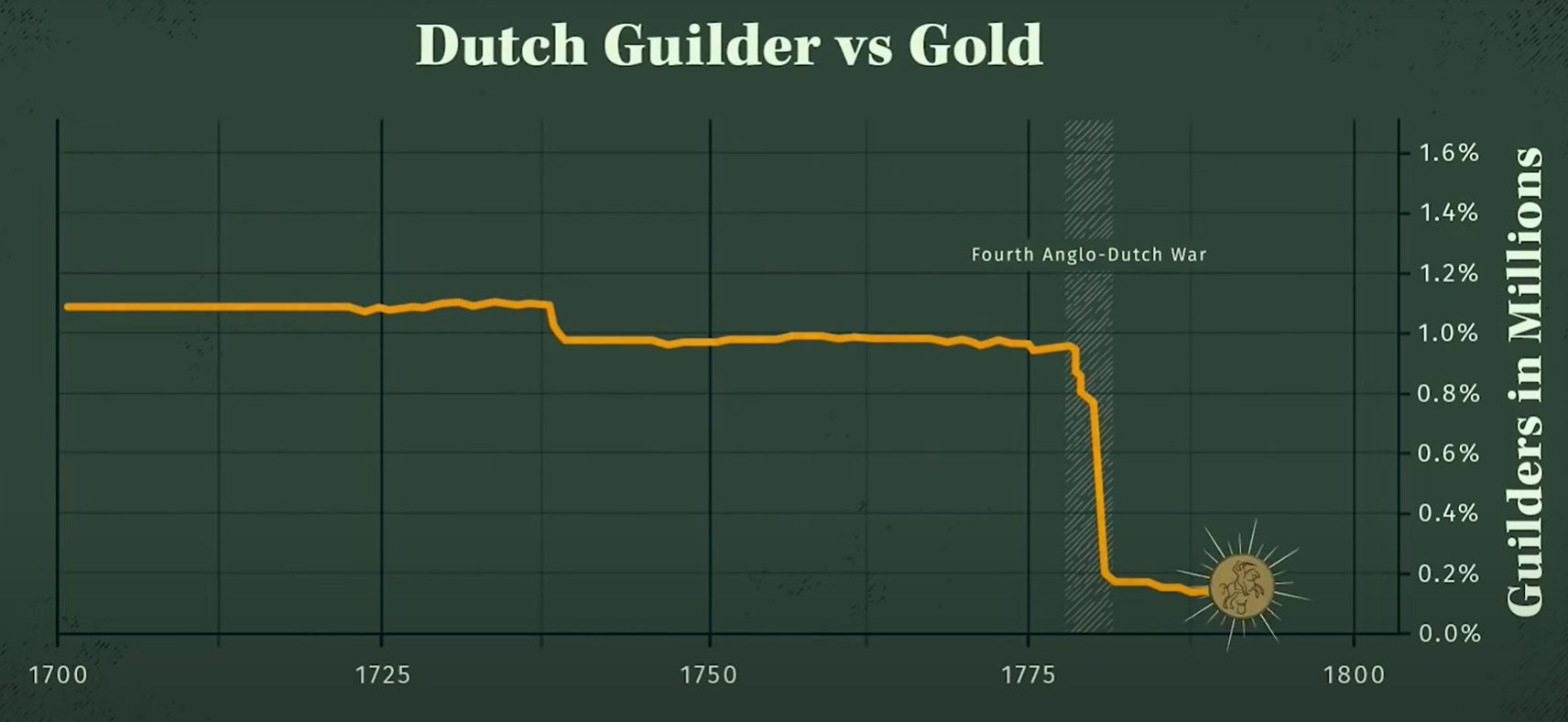

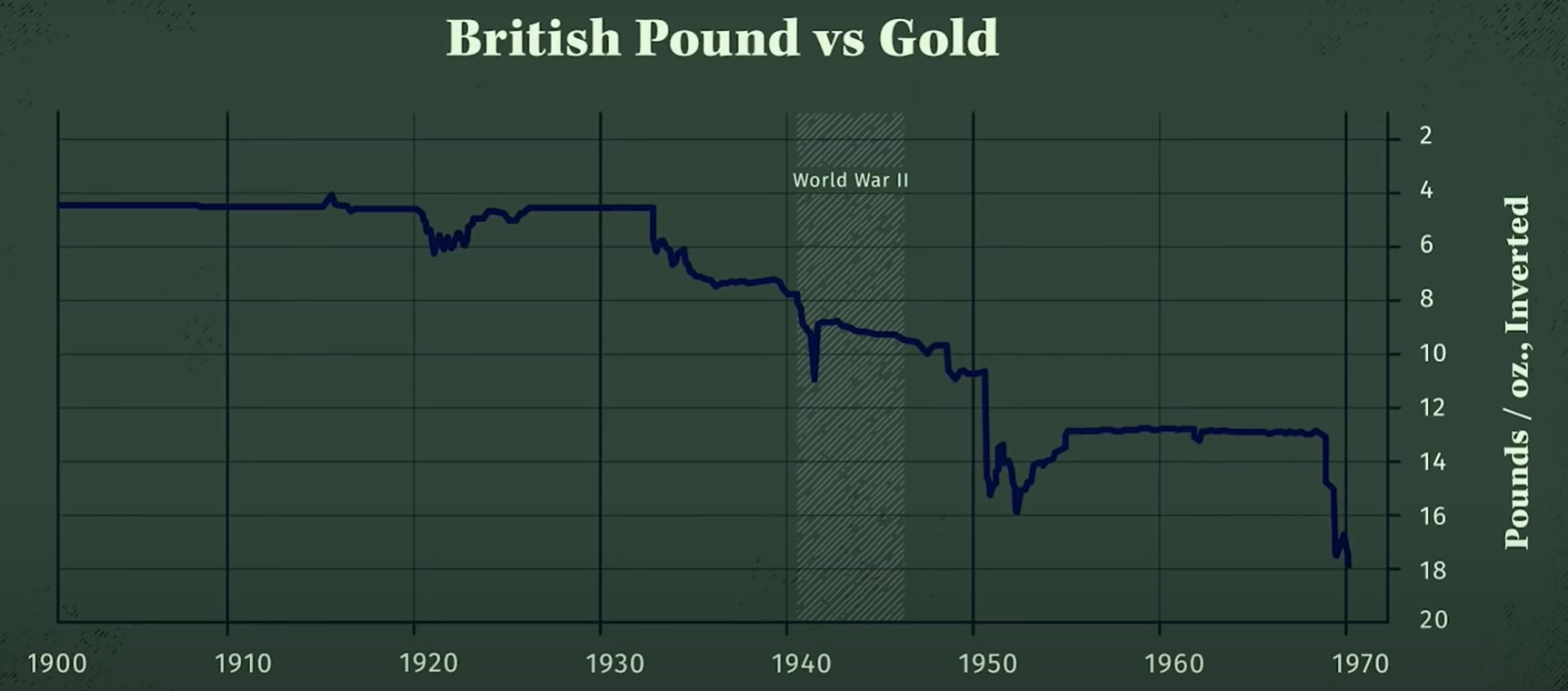

History has shown that dominant world currencies, associated with major empires or economic powers, tend to lose value and status as reserve currencies when those powers wane. Notable examples include the Dutch Guilder and the British Pound.

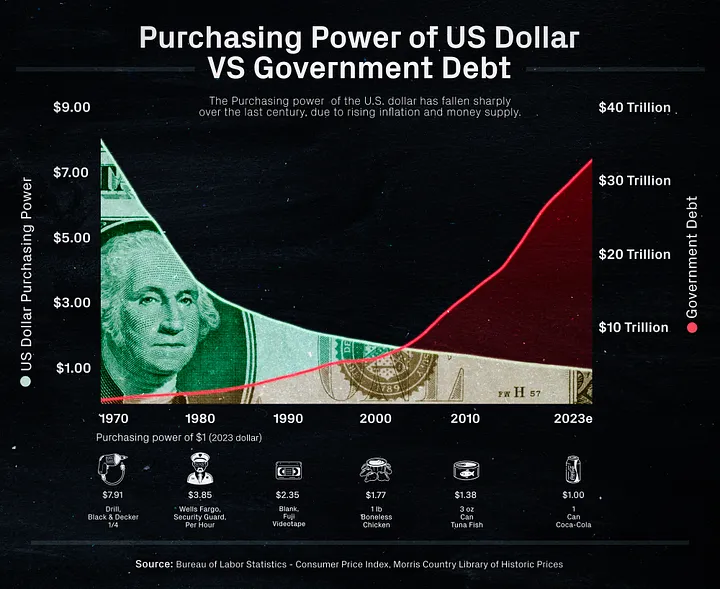

On that note, prominent figures like Ray Dalio and Larry Fink have expressed concerns about the US dollar’s future as the world’s reserve currency, citing factors like burgeoning national debt and potential policy responses that could devalue the currency.

Because of that, it is important not to overlook the debt monetization concerns associated with the USD. The Federal Reserve’s potential to monetize the burgeoning national debt raises worries about significant depreciation of the US dollar, possibly up to 30%. These concerns highlight the inherent vulnerabilities in relying on a single fiat currency as a global standard, especially in the context of shifting geopolitical and economic landscapes.

In anticipation of potential instability and depreciation of the US dollar, the Reserve community aims to create a stablecoin (RToken) that initially pegs to the US dollar but is designed to transition away from this peg in the long term.

The goal is not merely to mirror the stability of existing asset classes but to innovate a novel stablecoin that maintains short-term stability while offering enhanced long-term stability and resilience against the vulnerabilities of traditional reserve currencies.

Reserve Ecosystem

Rpay

Rpay allows users to escape currency inflation & save in a more stable currency, eg USD.

Rpay initially utilized $RSV, but transition to $eUSD after depeg events on major stablecoins like $USDC and $USDT showed that there would be risks.

However, on May 2, 2023, it was mentioned that Rpay had lost its main US banking partner as result of the reverberations from the FTX scandal and the general loss of willingness for banks to serve crypto companies. As a result, they had to shut off most of their USD liquidity services for Rpay users.

Since many use cases include moving money in from one currency and then out to another currency in order to e.g. pay a supplier abroad, send a remittance to someone in another country, etc., the loss of USD liquidity means less depositing/withdrawing in USD as well as in other currencies., leading to a drop in total transaction volumes on Rpay.

As a result, the team behind Rpay pivoted to Best Friend Finance, and its successor app Ugly Cash.

Best Friend Finance

Best Friend Finance, or BFF, was introduced on August 31, 2023.

BFF is a new company from the creators of Rpay, focused on global financial inclusion. The Rpay team had realized that it was virtually impossible to offer a stablecoin wallet with reasonable pricing in the US banking climate, and hence the decision to develop BFF was made. US users will not touch any crypto balances, including RTokens, while international balances will still be in RTokens.

BFF will start off by providing comprehensive banking services in the US and seamless cross-border money transfers and financial solutions across Latin America (LATAM). Its name was chosen in order to fulfill the need of being able to speak to the zoomers who run the streets and the boomers who run the banks, and this name works for that.

BFF intends to get users equal access to what they deem the six essential financial functions, being:

- Earning Money

- Saving Money

- Moving Money

- Insurance

- Lending/Borrowing Money

- Investing/Raising Money

Their first product is Ugly Cash.

It was introduced on December 11, 2023 and is intended to be a financial center designed for Latinos from all over the American continent with a focus on those living in the US, offering banking to U.S. customers, access to a USD balance with a card to customers in Latin America, and allowing the movement of money between them at no cost.

Ugly Cash went live on the Apple App Store and Google Play on December 23, 2023, in the early access stage.

MobileCoin / Sentz

MobileCoin is an encrypted-focused L1 blockchain designed for use in everyday transactions, and addresses 4 fundamental issues:

- Security

- Transaction Speed

- Energy Consumption

- Optimization for Mobile devices.

No one except for the sender and receiver can see the details of the transaction. The public blockchain is encrypted to ensure security, and is designed to be fast and secure enough to be used for mobile transactions. At the consumer level Sentz offers extensive geographical coverage while ensuring local withdrawal convenience via Visa cards or bank accounts.

The Sentz app allows anyone to send and receive payments globally from anyone you can text. This allows for instant cross-border money transfers that cost a fraction of a cent. Payments can be done via debit card, ACH, stablecoins, or MOB. Some use cases include paying freelancers or international payments for businesses. All customer data is secured end-to-end to safeguard confidential information.

By focusing on reducing friction in blockchain-based payments, Sentz ensures a superior user experience compared to traditional financial rails without the drawbacks of existing blockchain solutions. Payments between individuals are processed in less than five seconds. As another example applied to cross-border payments, Sentz can transfer funds from a US bank to a Mexican bank in under 10 minutes, a significant improvement over traditional banking timelines.

Additionally, the Sentz wallet empowers you with total control over your funds without intermediary oversight, underscoring the importance of personal responsibility in managing digital assets. Your public key accounts like your digital account number, allowing others to send funds to your wallet, maintaining privacy while facilitating transactions. With your wallet you are also the owner of your private key, which is your unique digital signature, akin to traditional banking PINs or check signatures, proving ownership and controlling access to funds tied to these keys.

Sentz has innovated transaction simplicity by associating public keys with familiar identifiers like phone numbers or emails, streamlining the user experience without compromising security. In addition to that, Sentz offers a cloud-based vault service, leveraging iCloud and Google Cloud, to securely store your encryption keys, providing an accessible yet secure backup solution.

- Utilizes AES256-GCM encryption with a unique, device-generated random key.

- Encrypts the 24-word recovery phrase on your device before storage.

- Splits data storage between Sentz servers and your Apple/Google account, requiring both for recovery.

- Adheres to a multi-party design, preventing any single entity from accessing your wallet without your consent.

For those preferring manual backups or additional security layers, Sentz supports:

- Using trusted password managers.

- Physically writing down the recovery phrase for safe storage.

- Opting out of cloud backup for a completely manual approach.

Overall, the Sentz wallet is more than just a tool for digital transactions; it’s a comprehensive solution for modern financial management, blending the convenience of digital payments with the security and privacy essential in today’s digital age.

Curve Ecosystem

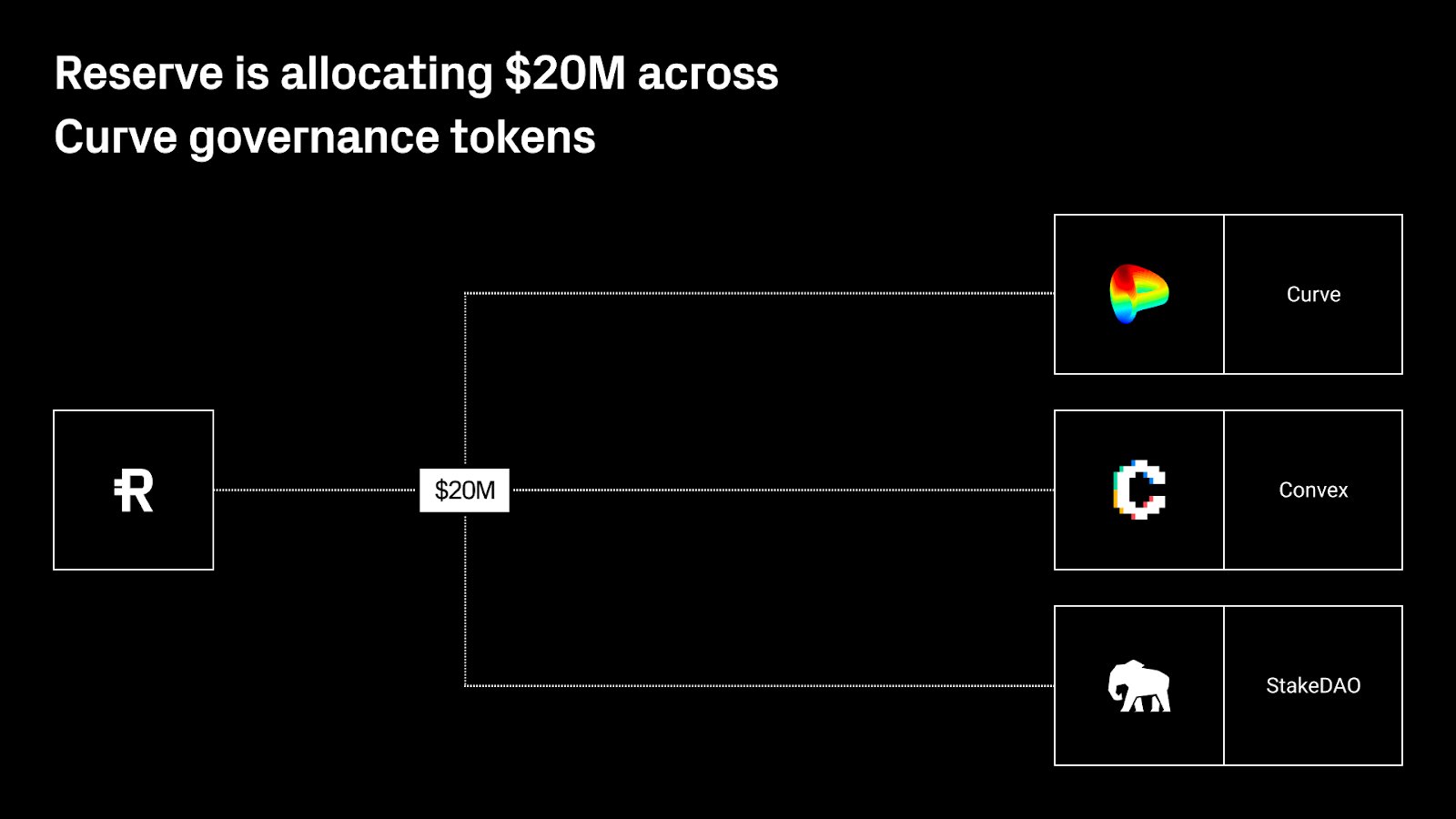

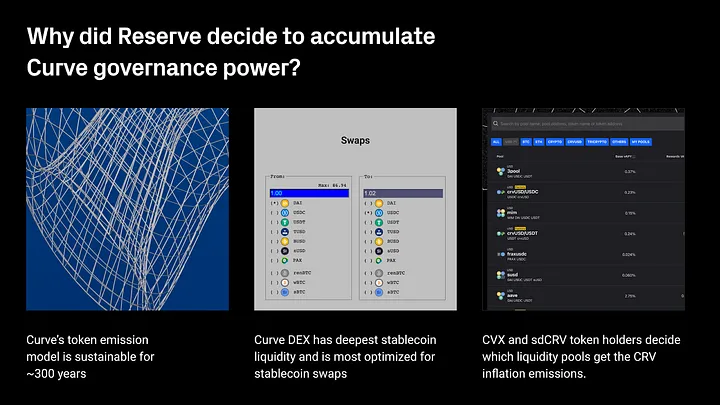

In June 2023, Reserve strengthened its relationship with the Curve ecosystem by allocating $20M investment across $CRV, $CVX, and $SDT governance tokens.

RTokens can be a store of value and unit account, but in order to be a medium of exchange, they can benefit from improving their liquidity conditions on DEXs like Curve. This strategy fosters a wider supply distribution and adoption.

The investment primarily supports the liquidity of the first three RTokens – High Yield USD (hyUSD), ETHPlus (ETH+), and Electronic Dollar (eUSD). These RTokens are intricately designed to offer high yield, safety, and resilience, backed by a diversified portfolio of yield-bearing assets.

Nonetheless, while the initial focus is on the first RTokens, the investment strategy is flexible and may extend to additional assets as the Reserve ecosystem matures, ensuring sustained growth and stability.

Enhanced liquidity and stability will make RTokens more attractive to a broad array of market participants, including DAOs, entrepreneurs, protocols, and institutions, fostering a more integrated and expansive DeFi ecosystem.

Sector Outlook

Reserve is a protocol that facilitates the creation of yield-bearing USD stablecoins and composite assets. Its use cases can expand to supporting real-world assets (RWAs) that are tokenized, potentially replacing fiat currencies in the future.

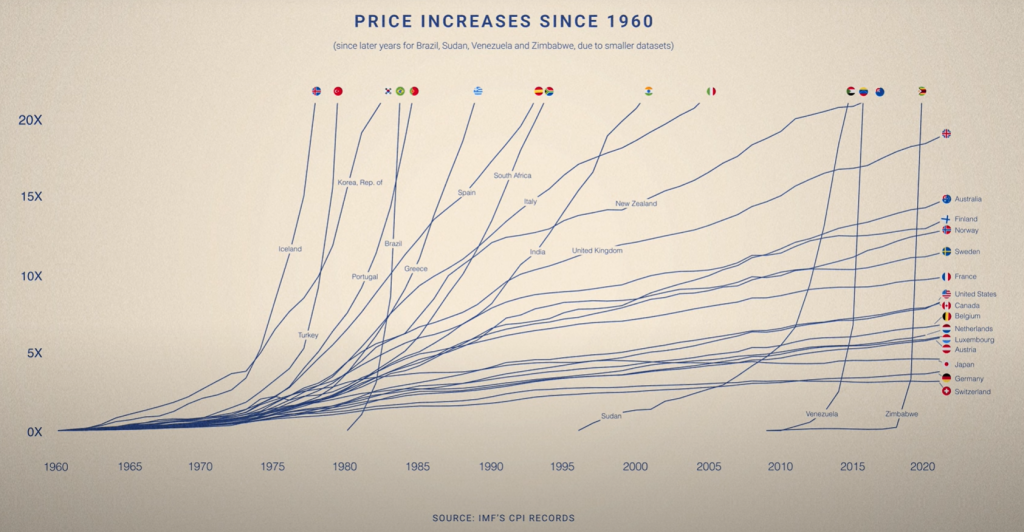

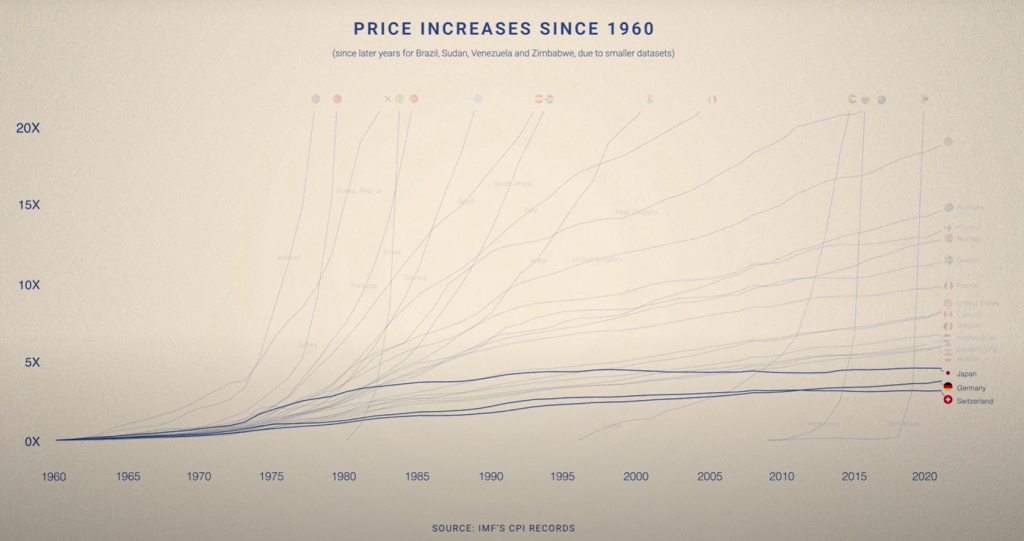

The primary issue addressed is inflation, a common problem worldwide, causing prices to rise consistently over time. Currency inflation is linked to excessive money printing by central banks, which devalues sovereign currencies, as the economy cannot absorb the extra money at the same rate.

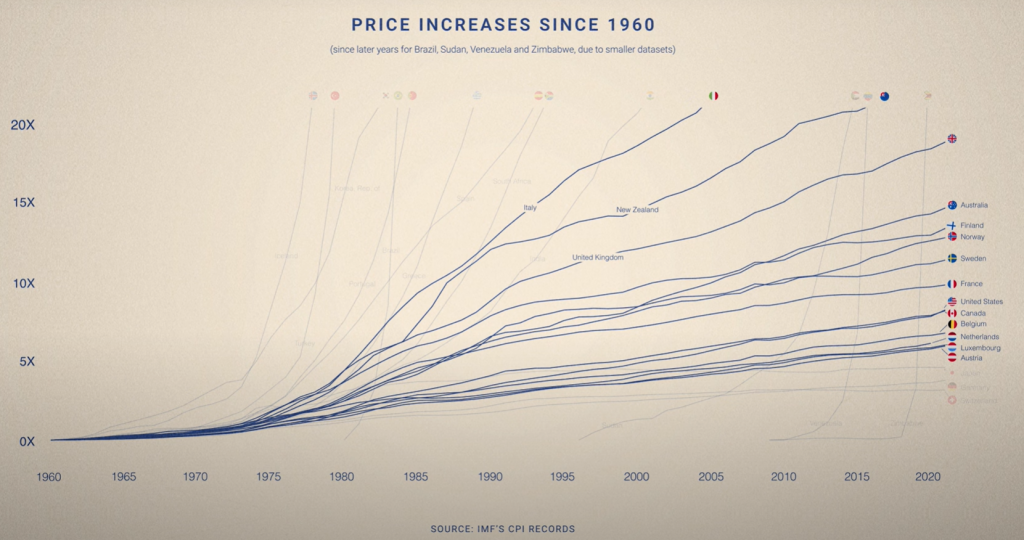

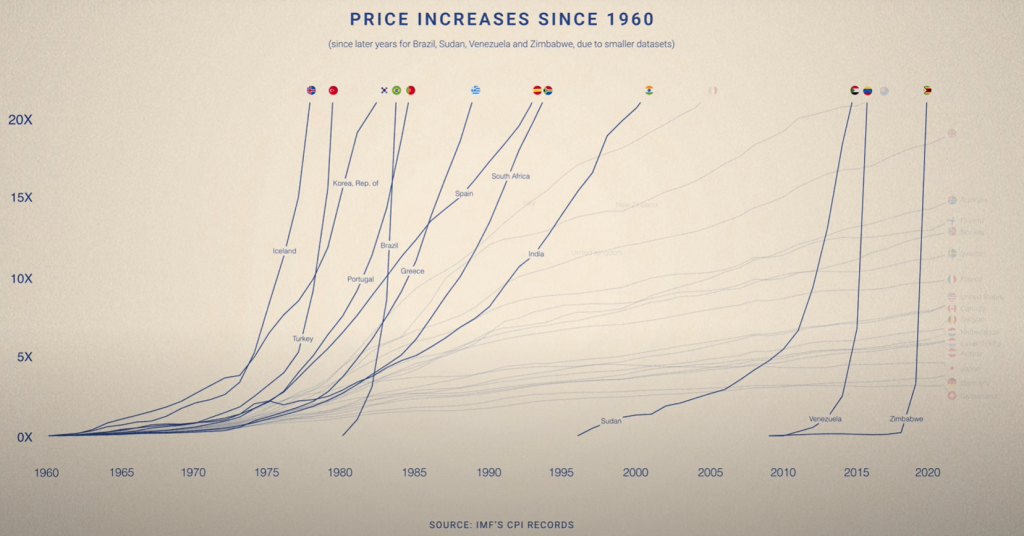

The outcome of poor monetary policy leads to prices increasing over time across the globe. Money is printed at a faster rate than the economy can handle the extra supply

Even though this process can start taking place slowly…

…it can also happen very fast…

…and even at an almost exponential rate.

The Internal Monetary Fund (IMF) offers data that goes back to the 1960s for multiple countries. We can observe that for some counties prices have increased by 20x. But historical data also shows that even strong currencies like the US dollar have significantly lost purchasing power over decades, resulting in price increases of approximately 8x. In other words, even if you had been saving money since the 1960s, nowadays you could only buy 1/8th as much now as you could back then – or an 87% loss in purchasing power.

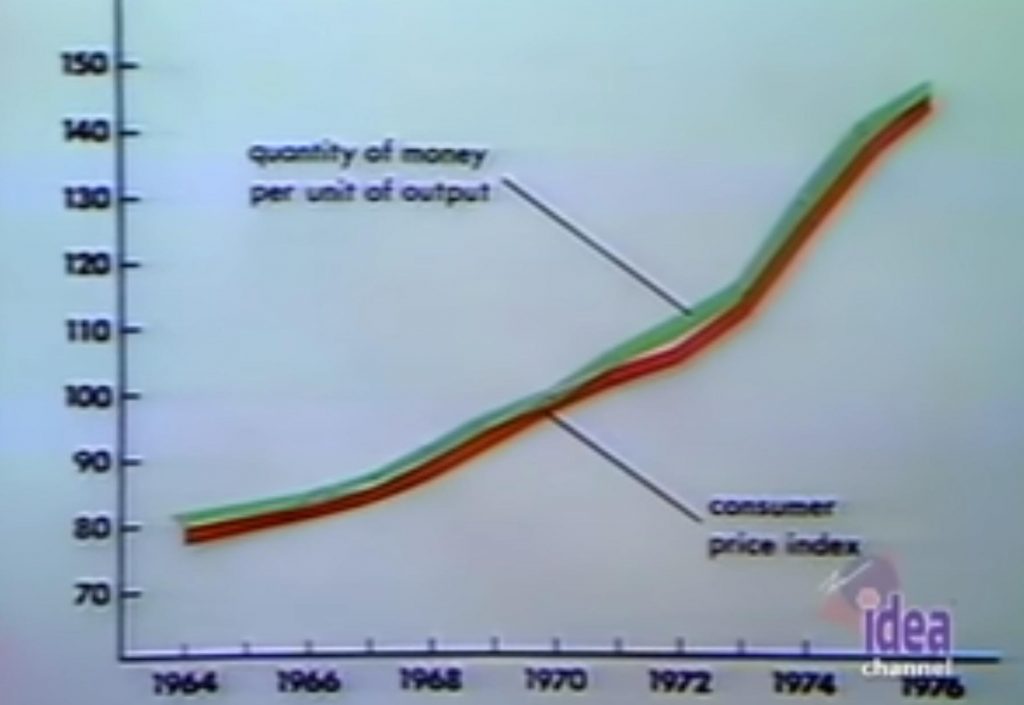

It is a well-known monetary phenomena that printing money over time leads to price inflation. Economists like Milton Friedman have stated that “inflation is always and everywhere a monetary phenomenon”, in the sense that price increases are produced as a result of significant increases in the amount of money supply. According to this theory, inflation occurs because, with more money available, people are willing to spend more, leading to price increases.

For example, the image below shows a green line that represents money being printed and a red line that shows prices. We can observe that as more money is printed prices go up proportionally. This happens because the USD is being diluted and that decreases its value. In fact, the green line is not just showing the amount of money in circulation, but the money supply divided by the size of the economy – hence why the chart illustrates “quantity of money per unit of output”.

What this means is that if the money supply was growing at the same rate as the economy, the green line would actually be flat. Therefore, when the line is steeper than flat, that indicates that money is being printed faster than the economy is growing.

Why Printing More Money Decreases Its Value

Printing more money tends to decrease its value because it increases the supply of money relative to the goods and services available for purchase, a concept known as inflation.

When there’s more money circulating in the economy but the quantity of goods and services remains constant, the value of each monetary unit diminishes. This happens because each unit of currency now represents a smaller portion of the total goods and services. As a result, more units of currency are required to purchase the same amount of goods and services as before, leading to an increase in prices.

This devaluation of currency reduces the purchasing power of money, meaning consumers can buy less with the same amount of money. This concept is foundational in monetary economics and underscores the importance of prudent monetary policy to maintain the value of currency.

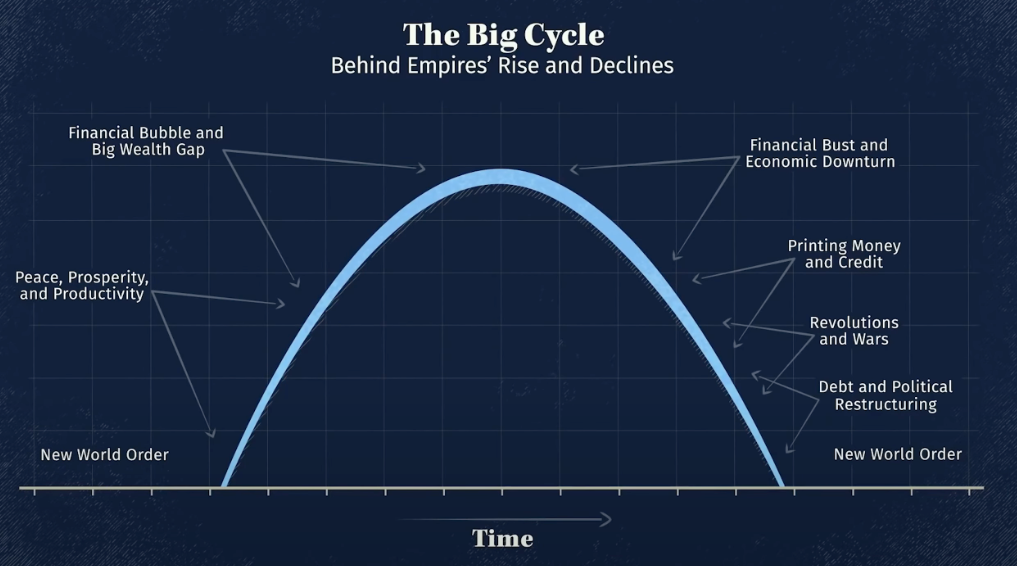

This phenomena has been illustrated by Ray Dalio’s Principles for Dealing With The Changing World Order.

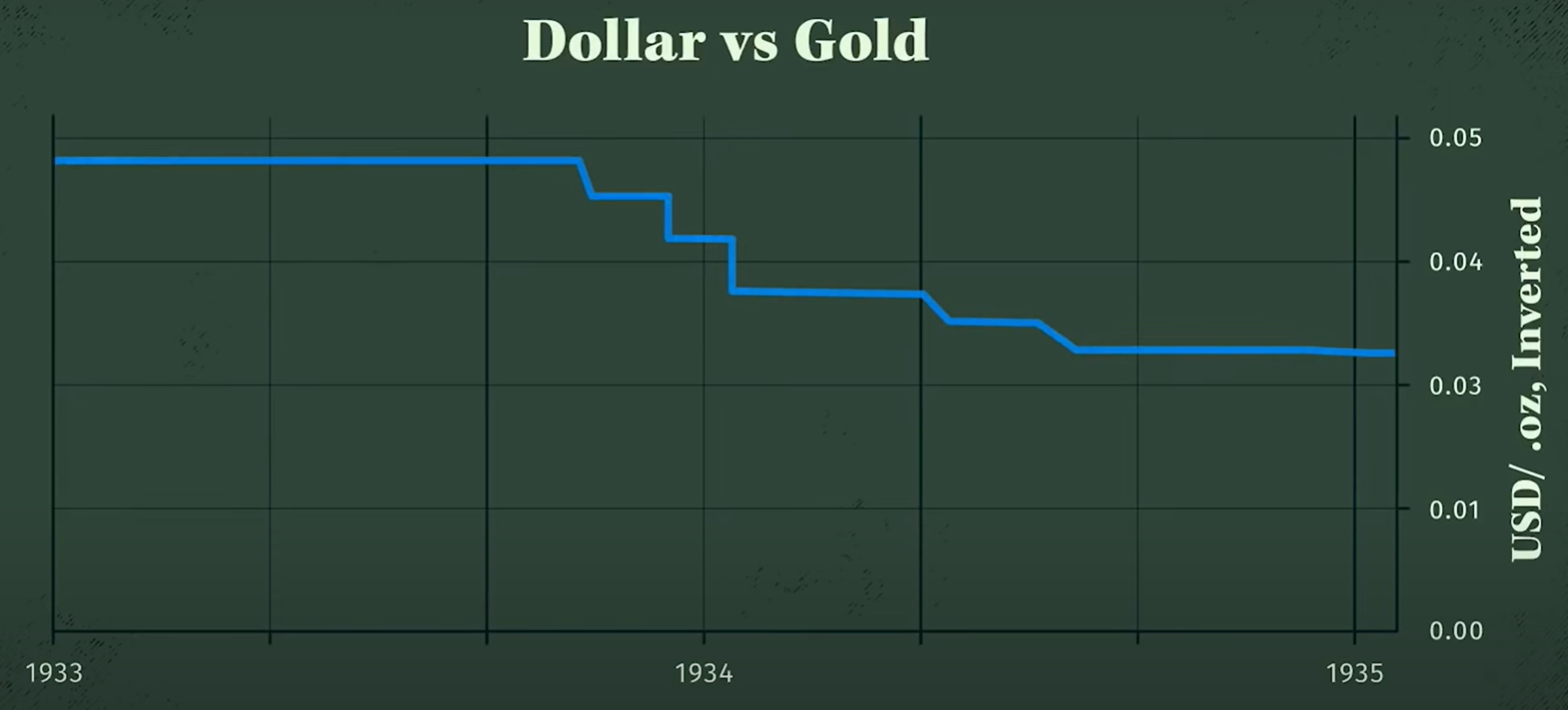

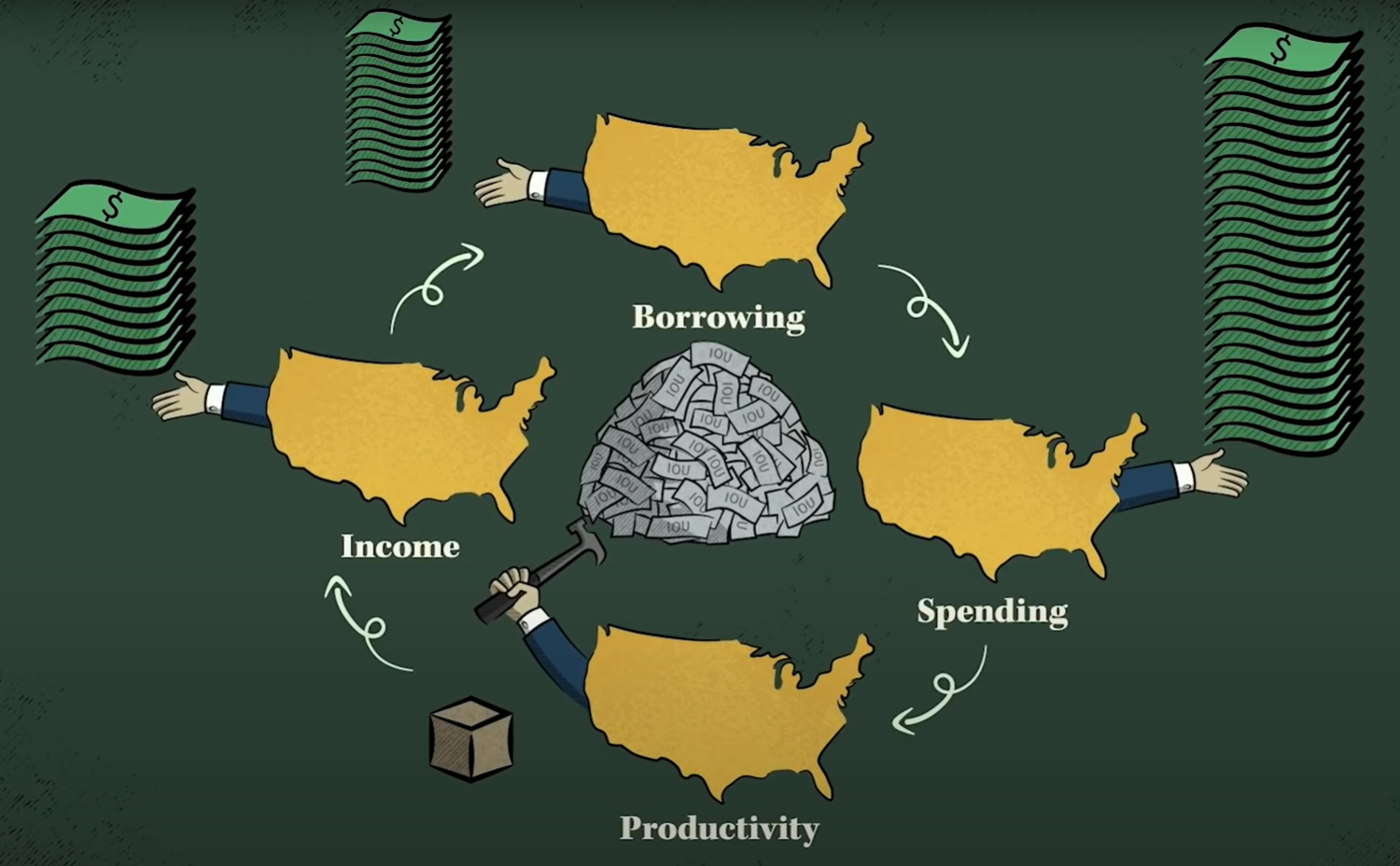

As an example, breaking the link to gold allowed the US to continue spending more than it earned. By issuing debt they managed to increase the number of dollars. Consequently, as there was an increase in the number of dollars without an increase in the country’s wealth, the value of each USD unit fell.

|

|

As these new dollars entered the market without a corresponding increase in productivity, they were used to buy lots of stock, gold, and commodities, causing their prices to rise.

This pattern has repeated in history multiple times. When governments spend much more than they take in taxes, they eventually run out of money and end up printing more. This causes the prices of stocks, gold and commodities to rise.

As a matter of fact, out of the roughly 750 currencies that existed since the 1700, less than 20% exist now and all of them have been devalued.

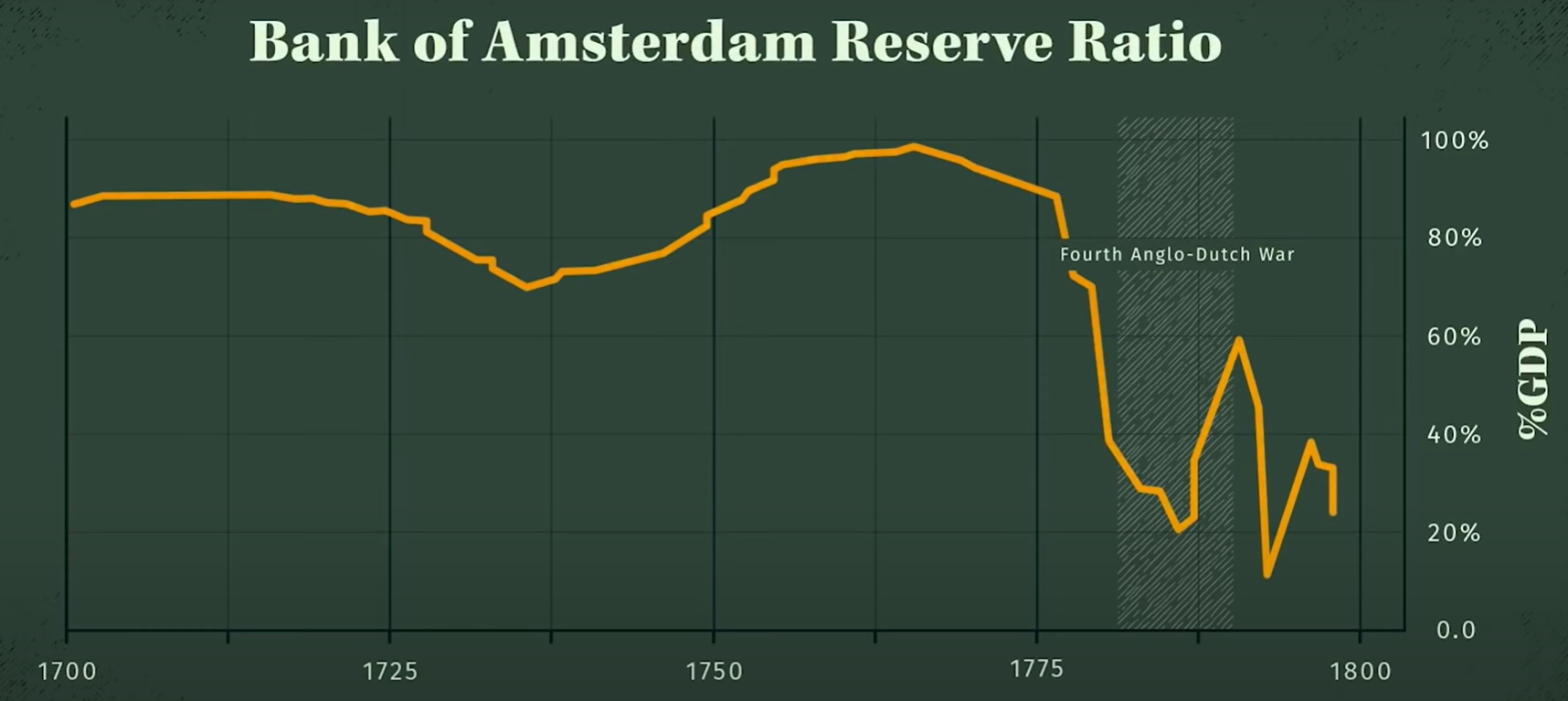

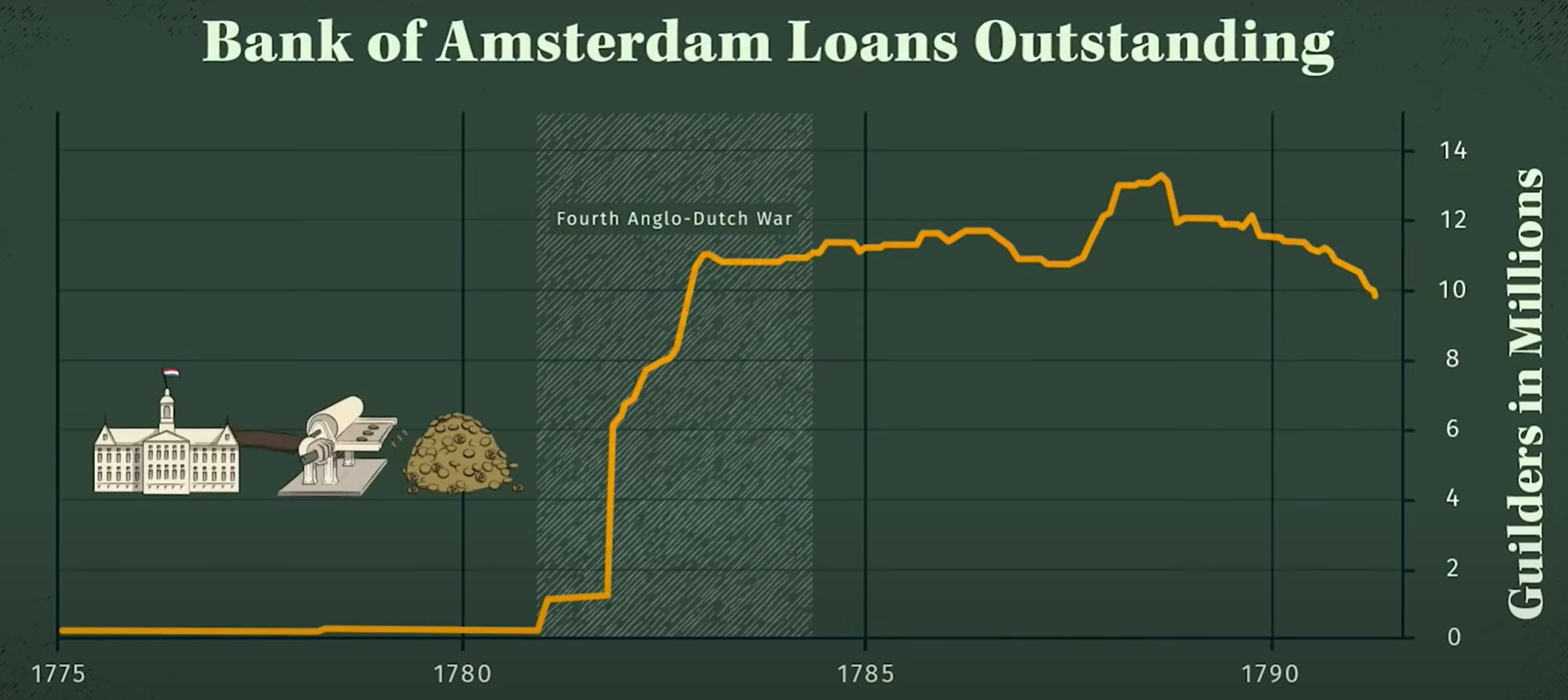

For the Dutch this happened after their defeat in the 4th Anglo-Dutch War when they weren’t able to repay the massive debts they built up during the conflict. This led to a run on the bank of Amsterdam.

The bank run was followed by a desperate sell-off, forcing massive money printing.

This devalued the currency and led the empire into irrelevance.

For the British this happened after World War II. Despite their victory, they could not repay their debt to cover the funds they borrowed to fund their war efforts.

Afterwards, the British Pound lost its dominance, and created a New World Order dominated by the USD as the default Reserve Currency.

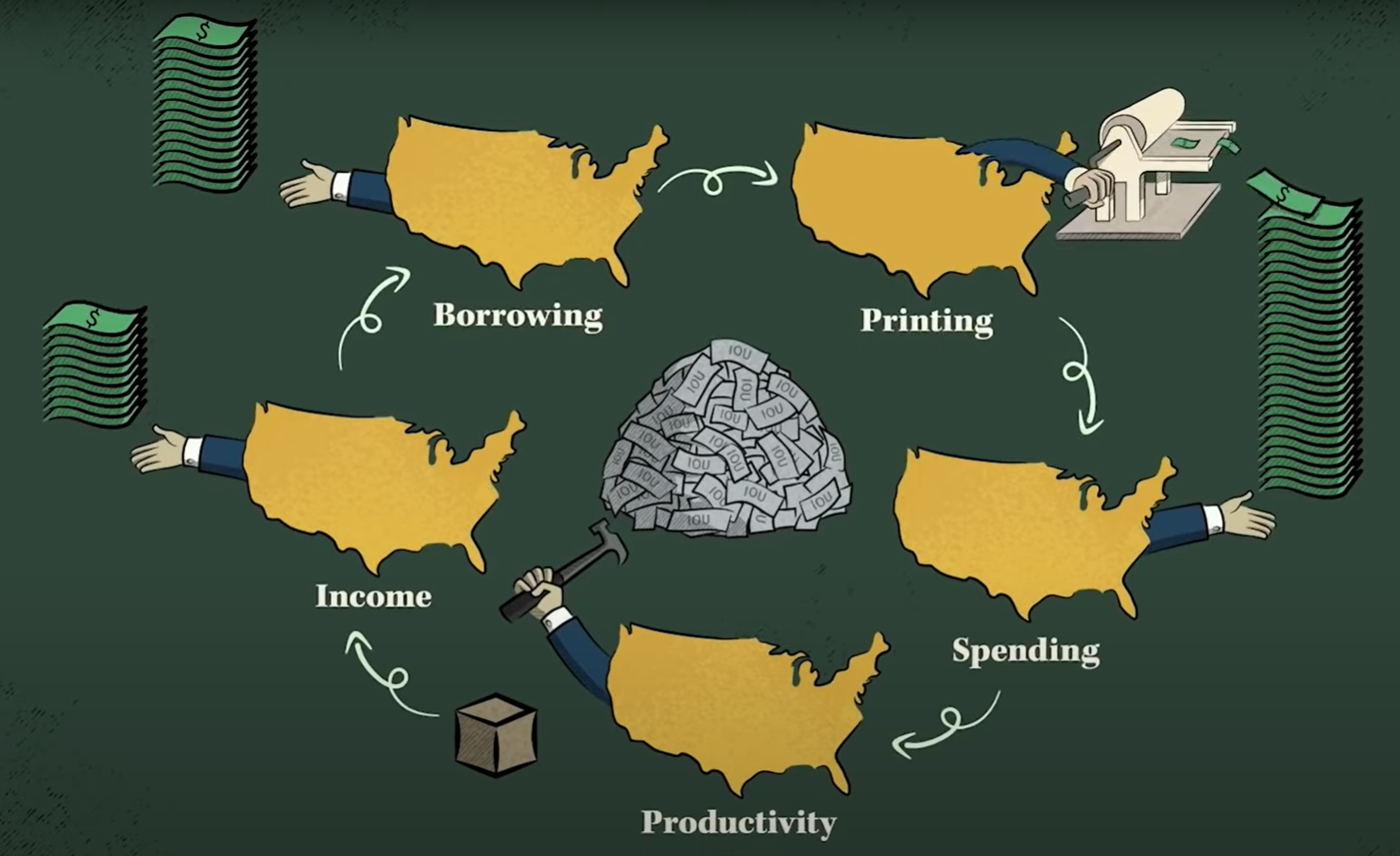

Even though the United States still retains its dominance, its debt continues to increase, spending more than it earns.

Essentially, it is funding its deficit with more borrowing and printing huge amounts of money.

Even though the big sell-off in USD and USD-denominated debt hasn’t yet begun, the point is that we don’t only need to worry about the constant slow inflation of the USD, but about the potential massive devaluations we might see – just like it happened to the two previous Reserve Currencies at the end of their reign.

A New Approach to Currency

Reserve presents a new approach to currency, aiming for global adoption by individuals, businesses, banks, and governments. The Reserve protocol distinguishes itself from other stablecoin designs by advocating for an exchange rate peg to a fiat currency initially, with a subsequent transition to a basket of assets. This approach may involve using off-chain foreign collateral that has been tokenized by various issuers.

One notable feature of the Reserve protocol is its commitment to openness, exploration, and competition. It embraces a permissionless ethos, enabling anyone to deploy an asset-backed currency (RToken) with their chosen collateral basket, governance system, and revenue distribution model.

The Opportunity for Stable Asset-Backed Currencies

Cryptocurrencies inherently offer substantial improvements over fiat money, including near-instant global transactions, protection against dilution or devaluation by governments, and programmable features for complex financial contracts.

Despite their potential, major cryptocurrencies like Bitcoin and Ether face significant adoption challenges due to their volatility. This volatility undermines their utility as a medium of exchange, store of value, or a standard of deferred payment. The inherent risk and unpredictability discourage their use in everyday transactions, savings, or contractual agreements.

Stable cryptocurrencies can address these volatility issues, unlocking the full potential of blockchain technology. For instance, a stable cryptocurrency can serve as a reliable medium of exchange, a secure store of value, and a viable unit of account for contractual obligations, without the speculative risks associated with traditional cryptocurrencies.

Furthermore, stablecoins hold the potential to revolutionize money, which is the most basic platform for commerce. This potential comes from its inherent characteristics of stability and censorship-resistance, coupled with programmability that may enable new solutions to age-old problems in capitalism.

There is a large market opportunity for stablecoins to globalize commerce by removing barriers to cross-border transactions, allowing anyone to transact with anyone else, anytime, anywhere. This could enable businesses to scale internationally without having to build new infrastructure to interface with local banking institutions in each region.

Even though the industry has largely adopted fiat-backed stablecoins like $USDT and $USDC, as evidenced by their large market capitalization and transaction volumes, a trusted and decentralized stablecoin could broaden this demand opening more use cases and markets, offering a de-risked means of exchange and a reliable store of value. As of 2024 crypto MAUs are about the same as the Internet MAUs in 1994. Furthermore, $USDC and $USDT are first-generation stablecoins, similar to how AOL was a first-generation Internet company. This comes to show that crypto is a nascent industry and there is a lot of room for expansion.

Supporting Emerging Markets

In many emerging markets, fiat currencies can lose significant value rapidly, mirroring the volatility seen in crypto assets during certain periods, but with much more dire consequences for the local population. For individuals in these markets, being forced to hold a rapidly depreciating currency can lead to substantial economic hardship.

In developing countries and emerging markets, stablecoins present a viable solution to this problem. By offering a stable value, they can serve as a reliable store of value and medium of exchange, independent of the local currency’s instability.

Consider a scenario where, if a local currency’s demand begins to decrease significantly, governments might be incentivized to manage their monetary policy more responsibly to keep their currency competitive. Alternatively, if mismanagement continues, the local fiat currency might eventually be replaced by a more stable tokenized asset. While the latter outcome might be more disruptive in the short term, it could lead to long-term benefits by liberating the populace from chronic inflation and economic instability.

Potential Adoption

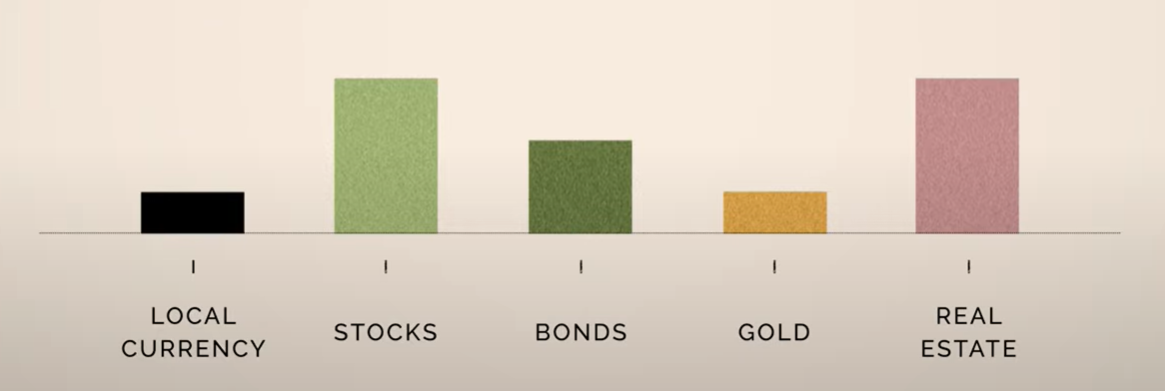

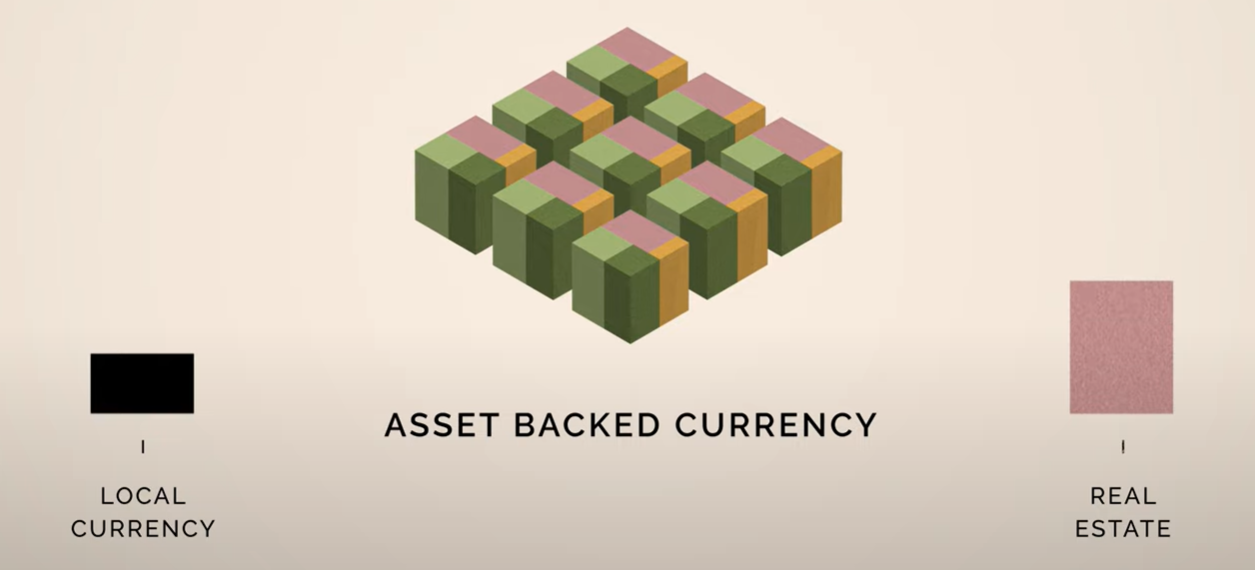

In the pursuit of achieving a currency that can maintain its purchasing power over time, Reserve takes inspiration from the fact that most wealthy individuals keep their net worth in a diversified basket of assets, such as their local currency, stocks, bonds, gold, or real estate.

The proposition of Reserve is to take those assets that people already own to protect their wealth and aggregate them altogether such that it is possible to mint a currency out of it. This results in an asset-backed currency.

These asset-backed currencies are Reserve’s RTokens, which can be permissionlessly minted by anyone as long as every unit is backed one to one by the appropriate basket of assets. This means that, unlike fiat currencies, its supply can’t be artificially inflated and each unit can be redeemed for the underlying at any time.

Just like wealthy individuals diversify their assets, Reserve aims to expand this vision to offer this opportunity to anybody who interacts with the smart contracts of the Reserve protocol.

In addition to that, not all financial assets are currently tokenized, but this trend is gaining more and more traction over time. Tokenization is the process through which real-world assets or rights are represented by digital tokens on a blockchain. These tokens can represent a wide range of values, from real estate and art to stocks and commodities. The beauty of tokenization lies in its ability to allow for fractional ownership, enhance liquidity, and facilitate easy asset transfers. All of this can be further optimized by minting a stable unit out of them.

What makes this value proposition powerful is the fact that the protocol smart contracts are permissionless. Anybody can deploy a new currency on Reserve without asking for permissions and even get paid out of the revenue that is generated by currencies backed by yield-bearing assets like tokenized T-Bills, liquid-staking yield…

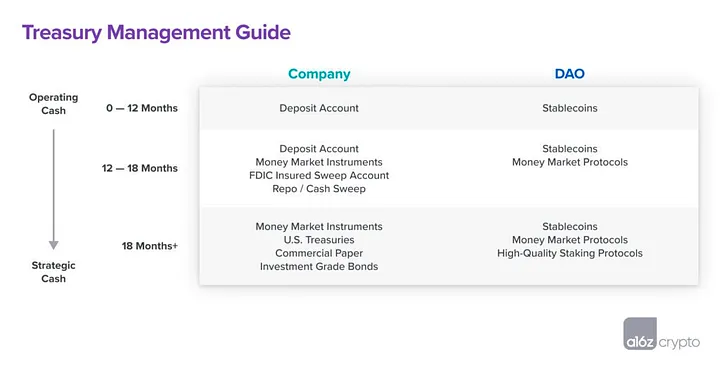

RTokens and Treasury Management For DAOs

As DAOs mature and their ecosystems expand, efficient treasury management becomes crucial to sustain growth and stability. Traditional treasury strategies, while adequate in the past, no longer suffice in the dynamic DeFi landscape.

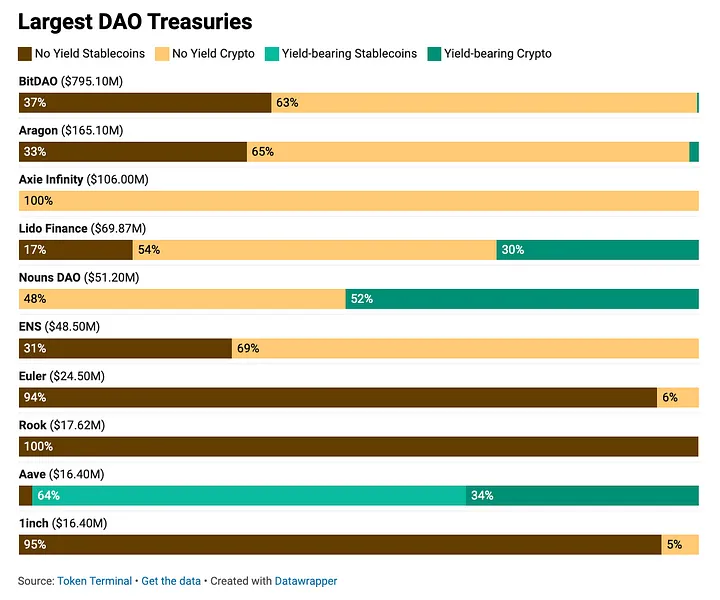

Traditionally, DAO treasuries have adopted a conservative approach, primarily holding native tokens and liquid assets to ensure operational liquidity. While prudent, this strategy often leads to unproductive asset allocation.

As a result, a significant portion of DAO treasuries remain in non-yield-bearing assets, representing missed opportunities for growth and capital appreciation. A strategic shift towards yield-bearing assets could unlock substantial treasury expansion.

By introducing RTokens as a new asset class backed by yield-bearing assets, Reserve could redefine treasury management for DAOs:

- Permissionless and Transparent: RTokens allow for permissionless minting and redemption on-chain, offering a high degree of transparency and autonomy. This eliminates reliance on intermediaries and enhances the verification of protocol activity.

- Overcollateralization for Security: Backed by diverse assets and overcollateralized by $RSR stakers, RTokens provide a robust safety net. This mechanism is designed to protect against depegging events and maintain stability even during market turbulence.

- Yield-Bearing Nature for Growth: RTokens like High Yield USD (hyUSD) and ETHPlus (ETH+) offer attractive yields, turning treasuries into productive assets. This not only preserves capital but also ensures growth, aligning with the long-term objectives of DAOs.

- Capital Preservation and Autonomy: The diversified nature of RTokens’ backing assets, combined with the self-healing properties demonstrated by assets like eUSD, ensures capital preservation. DAOs can confidently allocate part of their treasury to RTokens, benefiting from both security and growth.

- Instant Liquidity and Control: RTokens provide instant redeemability and liquidity, essential for DAOs to meet operational demands swiftly. This feature empowers DAOs with immediate access to their funds, ensuring operational agility.

The above features demonstrate that RTokens can offer multiple advantages for DAOs, addressing core needs such as:

- Liquidity: Since RTokens are instantly redeemable for the underlying assets.

- Capital Preservation: RTokens offer diversified exposure to blue-chip assets with extensive on-chain liquidity, thus mitigating risk.

- Growth: As yield-bearing assets, RTokens enable DAOs to earn passive income on their holdings.

Challenges and Future Prospects

Two significant challenges lie ahead for the Reserve protocol. Firstly, the tokenization of various financial assets, such as equities, commodities, and derivatives, remains an ongoing multi contributor process. Secondly, regulatory constraints on the use of tokenized assets worldwide are uncertain. The protocol aims to adapt to these changes as the ecosystem evolves.

At this point in time, most financial assets are not yet tokenized, posing temporary constraints to the realization of the Reserve vision. Note that the original vision entails a world where a broad spectrum of assets are tokenized and incorporated into the Reserve stablecoin baskets, with the Reserve protocol facilitating the creation of new stablecoins with varied baskets.

On a similar note, the timeline and extent of asset tokenization, and the regulatory frameworks governing the use of tokenized assets globally, are uncertain and largely beyond the direct control of the Reserve protocol.

In addition to that, present decentralized governance systems are primarily based on simple token voting mechanisms, which are adequate for managing a world reserve currency due to issues around fairness and centralization.

Chains

The protocol is written in Solidity smart contracts that have been deployed to Ethereum mainnet and Base.

Deployments can take place on other EVM-compatible chains without requiring any significant code changes.

Using the Protocol

RTokens are the pivotal component of the Reserve protocol, functioning as stablecoins fully collateralized by a dynamic basket of assets. The issuance, redemption, and over-collateralization processes of RTokens are designed to ensure stability, reliability, and responsiveness to market dynamics

- Issuance and Redemption of RTokens

- Minting RTokens: Users can mint RTokens by depositing a specified basket of collateral tokens. This process ensures that the value of the RToken is fundamentally backed by tangible assets.

- Redemption Process: Conversely, RTokens can be redeemed for the underlying basket of collateral tokens. This ensures that RTokens maintain a value equivalent to the market value of the entire collateral basket, with arbitrage mechanisms acting to correct any deviations.

- Dynamic Basket Composition

- Reference Basket: The composition of the issuance/redemption basket is dynamically defined based on a reference basket. This basket is a linear combination of reference units, reflecting the composition and value of the collateral at any given block.

- Appreciation and Unit of Account: While internal calculations within the RToken system are often denominated in a single unit of account (like USD), appreciation is determined relative to the reference basket, ensuring that RTokens accurately represent the value dynamics of the underlying assets.

- Overcollateralization Mechanism

- Protection Against Defaults: RTokens can be over-collateralized, meaning that in the event of a collateral token default, there is a reserve pool of value available to compensate for the loss.

- Role of Reserve Rights (RSR): $RSR holders contribute to this over-collateralization by staking their $RSR on an RToken instance. In the event of a default, staked $RSR can be seized through a mechanistic process based on on-chain price-feeds, ensuring a fair and transparent resolution without reliance on governance decisions or human judgment.

- Incentivizing Overcollateralization. To incentivize $RSR holders to stake and provide over-collateralization, RToken instances can allocate a portion of their revenue to the $RSR over-collateralization pool. This creates a financial incentive for $RSR staking, aligning the interests of RToken holders and $RSR stakers.

Business Model

The business model of the Reserve protocol centers around creating a scalable and decentralized financial infrastructure that enables the creation, governance, and usage of stable, asset-backed currencies known as RTokens.

The core value proposition lies in offering a stable and scalable alternative to traditional and digital currencies, addressing the volatility and inflation issues commonly associated with them.

RTokens can be permissionlessly created by anyone anywhere in the world. The deployer will set a revenue-sharing allocation for RToken holders and $RSR stakers respectively.

Revenue Streams and Fee Breakdown

There are no protocol fees and revenue participation is derived by staking $RSR, which is done on the same terms as any other community participant.

Stakers earn rewards based on 3 factors:

- Amount of revenue generated by the RToken (yield from collateral assets).

- Portion of revenue that is allocated to $RSR stakers for each RToken.

- Proportion of the total stake that an individual position represents on a specific RToken.

Tokenomics

Reserve Rights, $RSR, is the governance token for the Reserve protocol.

$RSR tokenholders can stake their assets on any RToken, providing stakers with the ability to participate in governance, earn staking fees, and provide over-collateralization.

- Staked $RSR receives a portion of the RToken collateral’s revenue in exchange for being the first capital-at-risk in the event of a collateral default.

- Staked $RSR proposes and votes on changes to the RToken’s configuration.

Token Distribution

$RSR has a fixed supply of 100 billion token, with more than 50 billion already in circulation

| Category | Amount |

| Circulation | 50.6B |

| Slow Wallet | 49.4B |

| Slower Wallet | 0 |

The Slow Wallet created in 2019 is a locked wallet controlled by the Reserve project team, used to fund RToken adoption initiatives. It has a hard-coded 4-week delay after initiating each withdrawal transaction on the blockchain.

In January 2024, organizational changes and a new Slower Wallet were announced. As part of these changes, Confusion Capital is a new entity who will manage funding for the Reserve Ecosystem, including Best Friend Finance, and ABC Labs (who focuses on core protocol development). The Slower Wallet will be a wallet that is administered by Confusion Capital (receiving a portion of funds from the Slow Wallet), which imposes additional withdrawal restrictions.

The Slower Wallet maintains the 4-week withdrawal delay and adds a further limitation that no more than 1% of the total supply of $RSR can be withdrawn in any 4-week period. The reason for the change is merely to reduce the degree of trust that anyone needs to place in Confusion Capital. Following is an illustrative example of how this works:

- No withdrawals are made for a while

- Throttle limit (max available): 1,000,000,000 $RSR

- Withdrawal initiated for 1 billion $RSR

- Throttle limit: 0 $RSR

- 2 weeks pass

- Throttle limit: 500,000,000 $RSR

- Withdrawal initiated for 250,000,000 $RSR

- Throttle limit: 250,000,000 $RSR

- 1 week passes

- Throttle limit: 500,000,000 $RSR

This reduces the degree of trust that needs to be placed in the core team that administers the Slower Wallet.

Token Emissions

As the $RSR supply is capped and fully minted, there are currently no token emissions.

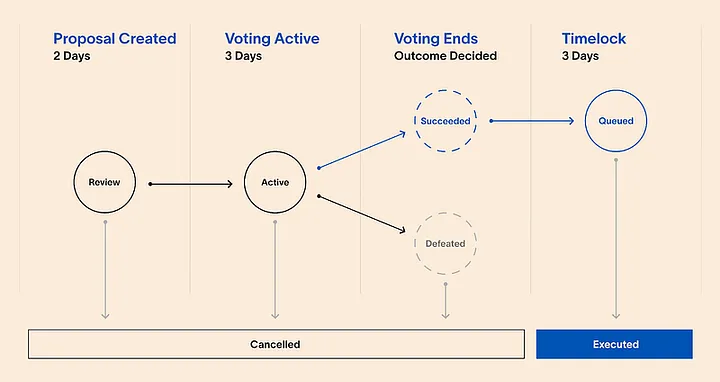

Governance

Each RToken can feature its unique governance system, although a default configuration is provided for consistency and ease. In most RTokens, the governance system is configured such that the amount of $RSR tokens a participant holds determines their voting weight.

$RSR token holders, who also provide overcollateralization, are incentivized to ensure the safety and prudent management of the RToken, as their funds are at risk in the event of collateral default.

The community-driven governance process follows two steps:

- Proposal Initiation: Any community member can propose changes to an RToken, initiating a transparent and democratic decision-making process.

- Voting and Execution: $RSR holders who staked on that RToken vote on proposals. Successful proposals, after meeting required criteria and passing through a predefined delay period, are executed, leading to the implementation of the proposed changes.

Governor Alexios, a modified version of the OpenZeppelin Governor, is the suggested governance system for RTokens, facilitating proposal submission, voting, and execution.

It is worth noting that $RSR holders can delegate their voting power to other addresses, promoting active participation and higher voter turnout.

Furthermore, various aspects of the governance process, such as proposal threshold, quorum, voting snapshot delay, voting period, and execution delay, are configurable.

Additional roles like Pauser, Short Freezer, Long Freezer, and Guardian can be assigned to addresses to manage the RToken in case of attacks, exploits, or bugs.

Similarly, the system can be in two following two states as an extra protective measure:

- Paused State: Limits RToken interactions to essential functions like redemption, ERC20 functions, staking of $RSR, and rewards payout.

- Frozen State: Further restricts interactions, allowing only ERC20 functions and staking of $RSR.

Risks

Interacting with smart contracts inherently involves exposure to various risks that users must be aware of, such as smart contract vulnerabilities, oracle risks, market and governance-related threads, collateral asset uncertainties…

- Vulnerabilities and Exploits: Despite multiple security audits, the inherent complexity of smart contracts means undiscovered bugs or vulnerabilities could be exploited, potentially leading to the loss of user funds.

- Reliance on External Data: The protocol uses oracles like Chainlink to fetch real-time price data. Inaccurate or failed data delivery can disrupt the protocol’s functioning, such as misidentifying a collateral default or causing inappropriate swaps to emergency collateral.

- Sandwich Attacks and MEV: MEV searchers scan the blockchain for profitable transaction reordering opportunities. Interactions with AMMs could expose users to potential value extraction if not managed properly, e.g., by adjusting slippage settings or using MEV protection services like Flashbots RPC.

- On-Chain Governance Vulnerabilities: The broad powers of the governance system could potentially be exploited by attackers, especially if they accumulate sufficient governance power. It’s crucial for users to understand the governance structure and the individuals or entities holding special roles within the system.

- Collateral Asset Risks:

- Issuer/Custodian Trust: The behavior of stablecoin issuers or custodians, from imposing transferability restrictions to managing real-world asset reserves, can introduce risks. It’s essential to understand the specific practices and risk profiles of each asset issuer.

- Price Fluctuations: The value of RTokens is subject to the price stability of their underlying assets. Price deviations, especially in volatile collateral, can affect the RToken’s aggregate price. The effectiveness of $RSR overcollateralization also depends on the market dynamics and the mark-to-market price of $RSR.

- Underlying Protocol Dependencies: RTokens depend on external protocols like Compound and Aave. Users, therefore, inherit the risks associated with these underlying protocols, including their smart contract and governance frameworks.

- User Interface Related Risk: Interfaces like Register, operated by third parties, introduce additional layers of risk, from potential technical vulnerabilities to front-end bugs. Users must stay vigilant and ensure they are interacting with authentic and secure platforms.

Utilizing yield-bearing assets from external protocols like Compound and Aave introduces compounded collateral risk. This risk needs to be carefully managed to prevent systemic vulnerabilities within the broader Reserve ecosystem.

$RSR Staking Risks

- Risk of Seizure: Staked $RSR is at risk and can be seized by the protocol in the event of a collateral token default, ensuring RToken holders are protected.

- Unstaking Delay: To prevent immediate withdrawal of staked $RSR, especially in times of distress (e.g., collateral default), an unstaking delay is imposed, typically ranging from 7 to 30 days.

- Reward Forfeiture During Unstaking: During the unstaking delay, stakers do not earn rewards, deterring frequent deposits and withdrawals that could undermine the system’s stability.

Security

Audits

Recognizing that one audit is not enough, the Reserve protocol undergoes rigorous and repeated smart contract audits by reputable firms such as Trail of Bits, Solidified, Ackee Blockchain, Halborn, Code4rena, and Trust Security, coupled with ongoing reviews and updates to ensure contract security and resilience.

Trail of Bits Security Assessment – August 11, 2022

- High – 5

- Medium – 2

- Low – 3

- Informational – 5

Solidified Audit Report – October 16, 2022

- Critical – 3 (3 Fixed)

- Major – 3 (1 Fixed, 2 Acknowledged)

- Minor – 11 (6 Fixed, 3 Acknowledged, 2 Pending)

- Note – 8 (7 Fixed, 1 Pending)

Ackee Blockchain Security Report – October 7, 2022