Overview

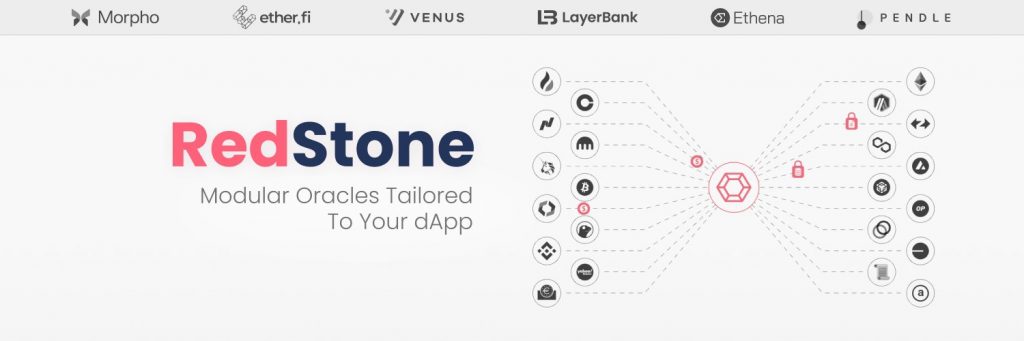

RedStone is a modular oracle platform capable of supporting a diverse range of over 1000+ use cases and assets. Its rapid deployment capabilities are critical for addressing the demanding market needs, particularly in new segments like yield accuring stablecoins (i.e. Ethena, M^0), LST (Liquidity Staking Tokens) and LRT (Liquidity Restaking Tokens). This flexibility allows partners to access exclusive data feeds necessary for developing DeFi applications centered around these innovative assets.

RedStone’s infrastructure is focused on yield-bearing collateral solutions specifically designed for lending markets, ensuring that the solutions it offers are not only tailored to current market demands but are also future-proof. Its operations span across more than 60 different blockchain networks, including all types of rollups, emphasizing its extensive reach and scalability.

Known for its speed in delivering exclusive, highly sought-after assets, RedStone has rapidly become one of the fastest-growing oracles in the sector. Its reliability and efficiency have earned the trust of leading DeFi projects such as Morpho, Venus, EtherFi, and Pendle, further strengthening its position as a leading player in the blockchain infrastructure landscape.

RedStone’s Distinctive Features

RedStone Oracles distinguishes itself within the competitive oracle market by specifically tailoring its features to meet the complex and evolving demands of the DeFi sector. The sections below will go over some of the unique attributes of RedStone.

Exclusive Feed Delivery

RedStone has carved out a niche by specializing in yield-bearing collateral for lending markets, with a particular focus on LSTs and LRTs. The company has developed price feeds for these new asset types that utilize advanced price discovery models, such as slippage-based weighting. This approach ensures that the pricing information remains highly accurate and relevant. RedStone is the first Oracle to deliver both the market rate and the contract rate (referred to as exchange rate too) for the trending assets.

Deployability

A key strength of RedStone is its chain-agnostic design. The oracle’s infrastructure is crafted to function independently of any specific blockchain, enabling it to deliver data across a wide range of EVM and non-EVM ecosystems, including various rollups and appchains. This capability makes RedStone an invaluable partner for Rollup-as-a-Service Providers and Eigenlayer AVSes (Active Validated Services), offering them extensive compatibility and integration options.

Extensive DeFi Support

RedStone’s adaptability extends into its support for a broad spectrum of DeFi applications through its versatile data consumption models. Clients can choose between two most adopted Oracle models: the Classic (Push) and the Core (Pull). The Classic model involves proactively providing data to smart contracts at set intervals, where the oracle operator or another authorized entity continuously updates relevant information, such as price fluctuations, into the blockchain storage. Conversely, the Pull model, also known as on-demand oracles, activates only when a user interacts with a dApp in a way that requires a price feed, i.e. opens or closes a DeFi position. This model ensures that data is fetched and utilized only as needed, which optimizes resource usage, ensures high frequency or updates and reduces unnecessary data transmission costs.

Why the Project was Created

The creation of RedStone Oracles was driven by the explosive growth of the DeFi ecosystem in recent years. As DeFi platforms multiplied rapidly, the demand for reliable financial data feeds which are essential for powering products like synthetic assets and decentralized insurance grew significantly. RedStone identified a gap in the market: the need for more diverse data types to unlock the full potential of Web3 technologies. To address this, RedStone introduced an innovative modular design where signed data packages are transparently accessible in Data Distribution Layer and stored on Arweave for permanent traceability. These data packages are accessible across all EVM-compatible chains, thereby enhancing the utility and reach of RedStone’s data feeds.

Oracles play a critical role as middleware that facilitates communication between blockchains and various off-chain systems, including data providers and IoT devices. These oracles power smart contracts on blockchains such as Ethereum to execute decisions based on external data, which could range from environmental conditions to election results. However, the prevalent centralized nature of existing oracles conflicted with the decentralized ethos of blockchain technology, often leading to issues like data inconsistency and security vulnerabilities, commonly referred to as the Oracle Problem.

To combat these challenges, early blockchain solutions either developed proprietary, isolated oracles or relied on simplistic two-phase data retrieval processes, both of which presented significant drawbacks in terms of security, efficiency, and cost. RedStone’s birth was driven by the need to overcome these limitations by offering a decentralized, secure, and cost-effective oracle solution tailored to the modern demands of DeFi protocols. Their approach not only reduces the latency and cost of data delivery but also supports a wide array of data types, addressing underrepresented areas such as LSTs, LRTs, yield-bearing stablecoins, NFTs, gaming, and insurance within the blockchain space.

What is an Oracle?

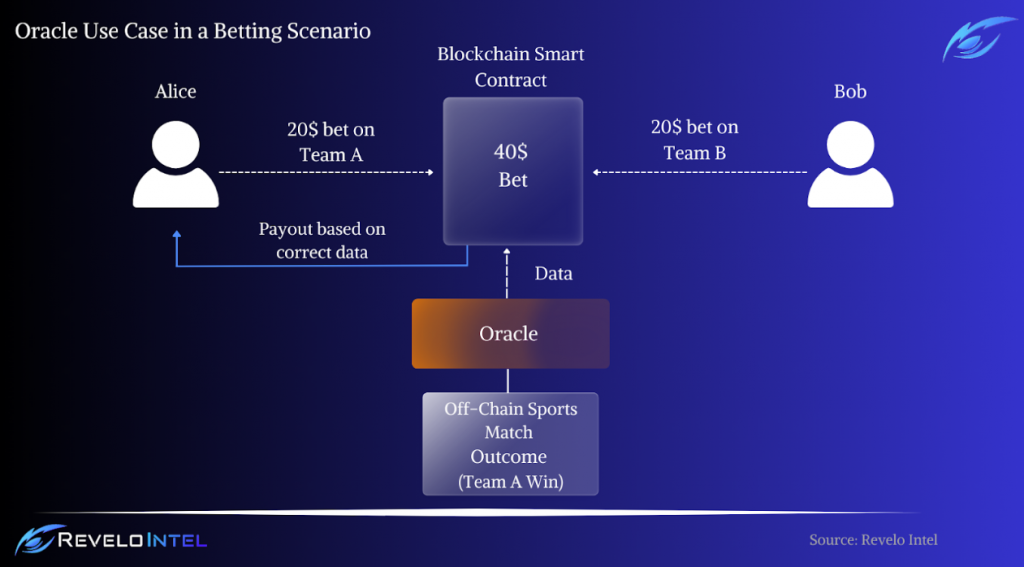

A blockchain oracle serves as a bridge between blockchains and the external world. Oracles enable smart contracts to execute actions based on real-world inputs and outputs, expanding the functionality of blockchains beyond their isolated environment. This connection is crucial for smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, as they can only operate based on the data within their network.

Oracles underpin the transformation of financial markets, global trade, insurance, gaming, and many other sectors by enabling the movement of vast amounts of assets onto blockchain platforms. They are foundational to the development of the verifiable web, a concept where everything within an application is transparent and users maintain control over their assets. Oracles facilitate this by providing access to off-chain data and computational resources, ensuring blockchains can interact with and respond to real-world events.

Oracles are not just single entities but can form networks known as Decentralized Oracle Networks (DONs), which support the creation of hybrid smart contracts. These contracts blend on-chain code with off-chain infrastructure, enabling dApps to respond to real-world events and interact with traditional systems seamlessly.

For example, in a betting scenario, an oracle would fetch the outcome of a sports match from off-chain sources and provide this data to a smart contract, which then autonomously distributes betting earnings based on the game’s result. This capability illustrates how oracles are integral to expanding the scope and utility of blockchain technology into everyday applications.

The Oracle Problem

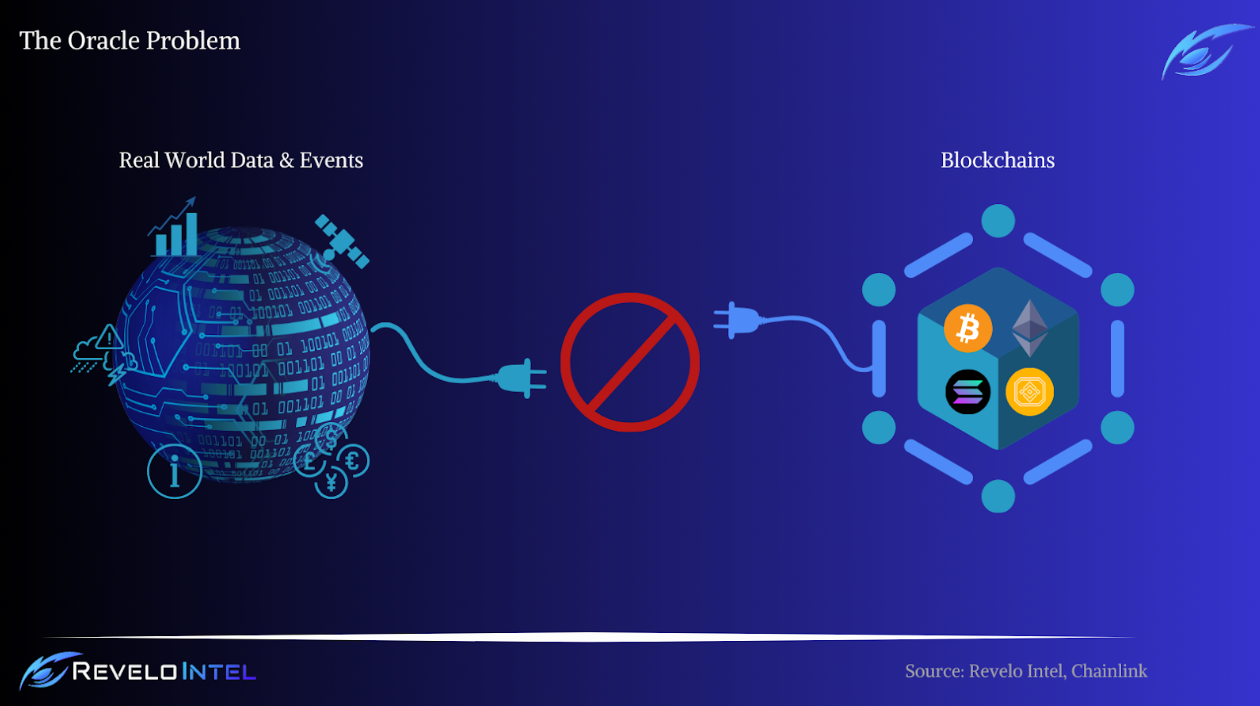

The “Oracle Problem” refers to a fundamental limitation of blockchain technology: its inability to natively access external data. Blockchains are inherently isolated systems, similar to computers without internet connections. This isolation, while bolstering security and reliability by limiting the blockchain to consensus on internal data alone, poses significant challenges for the integration of external information crucial for a wide variety of smart contract applications.

Smart contracts on blockchains like Ethereum offer transformative potential for automating and enforcing agreements without intermediaries. However, to unlock the vast majority of their potential applications, these contracts need access to external data. This data might include financial market rates for settling trades, weather data for insurance claims, or even real-time IoT data for logistical operations. Bridging the on-chain world of blockchains with the off-chain world of external data requires an oracle, a specialized infrastructure that fetches and verifies external data for blockchain use.

Challenges

These are the challenges of integrating oracles:

| Security and Reliability | Introducing external data into the blockchain introduces potential security vulnerabilities. Ensuring data quality and reliability is critical, as even basic data requests (like the price of Bitcoin) are susceptible to inaccuracies or manipulation. Traditional methods, such as single-source data feeds or reliance on central services, are at odds with blockchain’s decentralized nature. |

| Scalability and Governance | Scaling an oracle solution involves not just technical challenges but also governance hurdles. Each addition or change to data sources or aggregation methods potentially requires consensus from all network participants, adding complexity and slowing down innovation. |

| Decentralization Trade-offs | Centralized oracles introduce single points of failure, undermining the decentralized ethos of blockchains. These oracles are vulnerable to downtime, cyber-attacks, and even internal corruption, which could compromise the integrity and execution of smart contracts. |

History and Background

RedStone’s journey began in 2020, initiated by a clear mission to improve upon the existing oracle solutions within the blockchain ecosystem. The project was driven by the insights of Jakub, the founder, who utilized his deep background as a smart contracts auditor and a DeFi hackathons winner to address prevalent issues in the field. The project was initially incubated within the Arweave program, which allowed contribution and investments from top tier builders and VCs. Traditional oracles often suffered from high latency and a limited scope in terms of the assets they supported, which constrained their application in a rapidly evolving DeFi landscape.

In response to these limitations, Jakub and his team developed the RedStone Core, a pull-based oracle model. This creation represented a significant departure from the conventional push-based systems that were common at the time. Push oracles typically send data to smart contracts at regular intervals regardless of the contract’s need for new information, which can lead to inefficiencies and outdated data usage. In contrast, RedStone’s pull-based model allows smart contracts to request data as needed, ensuring more timely and cost-effective data retrieval.

Modular Architecture

Traditionally, oracles have placed data directly into storage to facilitate easy access for smart contracts. This method proved adequate when update intervals were large and the number of supported assets was small, across a handful of chains. However, as the DeFi sector has expanded and the number of tokens has increased, this approach has become less viable due to escalating maintenance costs associated with the high frequency of updates required by contemporary derivative protocols. In response, RedStone has devised a modular architecture that initially places data into a data availability layer, broadcasting a large number of assets at high frequencies to a cost-effective layer, and subsequently moving data on-chain only as necessitated by specific protocols.

RedStone’s system architecture features multiple independent components, each capable of being easily modified, replaced, or upgraded to increase system redundancy and operational flexibility. This modularity not only improves the reliability of the system but also allows for notable improvements in gas efficiency, tailored specifically to unique use cases.

The modular architecture offers various methods for dApps to access its data, which are stored off-chain within the secure and decentralized Data Distribution Layer (DDL). This setup enables dApps across different blockchains to consume the same price feed in ways that best suit their specific needs. Currently, RedStone supports three primary data access methods, each designed to cater to different types of dApps and their distinct operational requirements.

The flexibility of RedStone’s modular design is also an important feature for the future of appchains and the proliferation of thousands of rollups. The architecture ensures that RedStone’s data feeds can be seamlessly utilized on any new chain developed using technologies like the OP stack, Arbitrum Orbit, Polygon zkEVM CDK, or zkStack. This capability is applicable whether the platforms are L2 solutions, appchains, or sovereign rollups. Such adaptability guarantees that RedStone’s solutions remain future-proof, ready to meet the evolving needs of the crypto space.

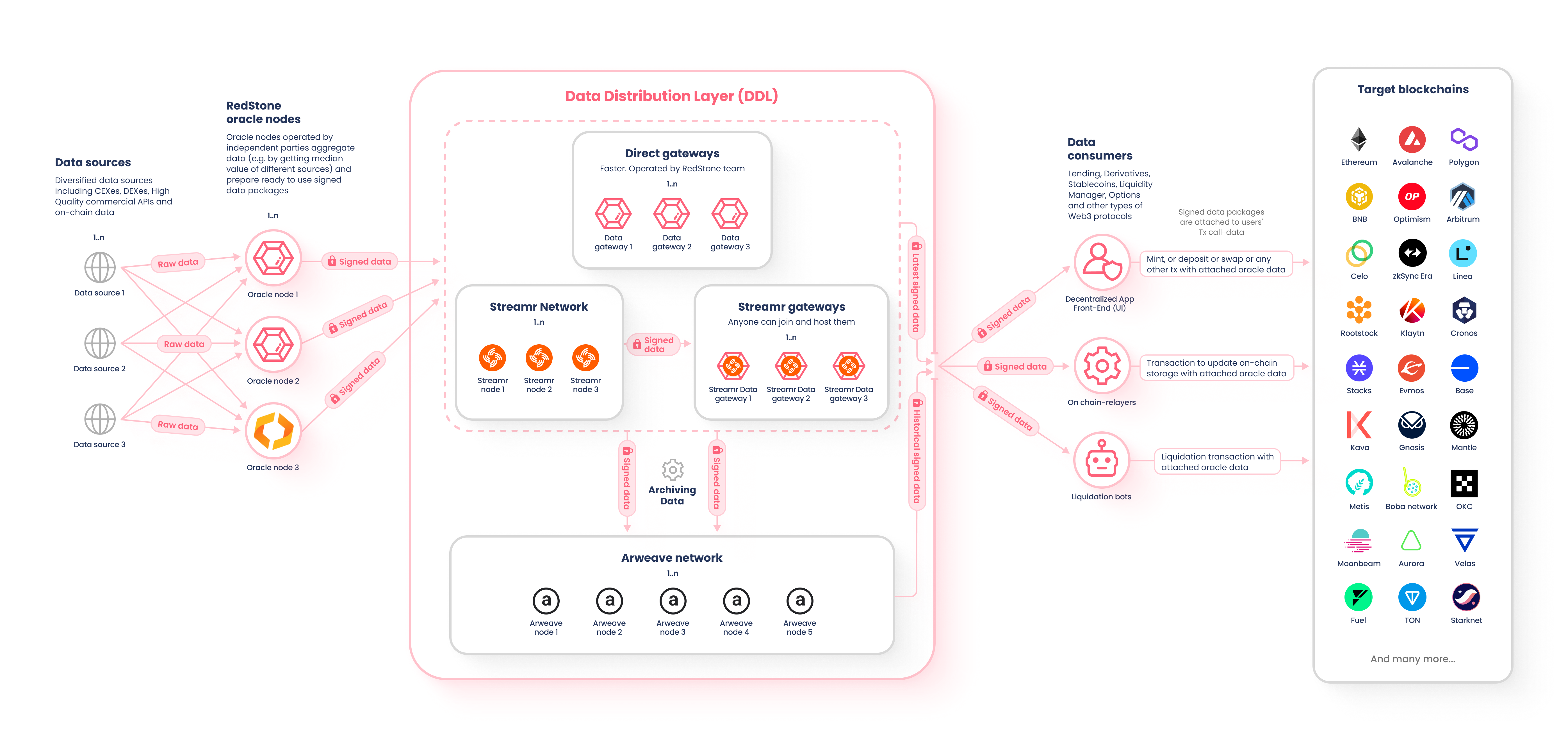

Data Flow

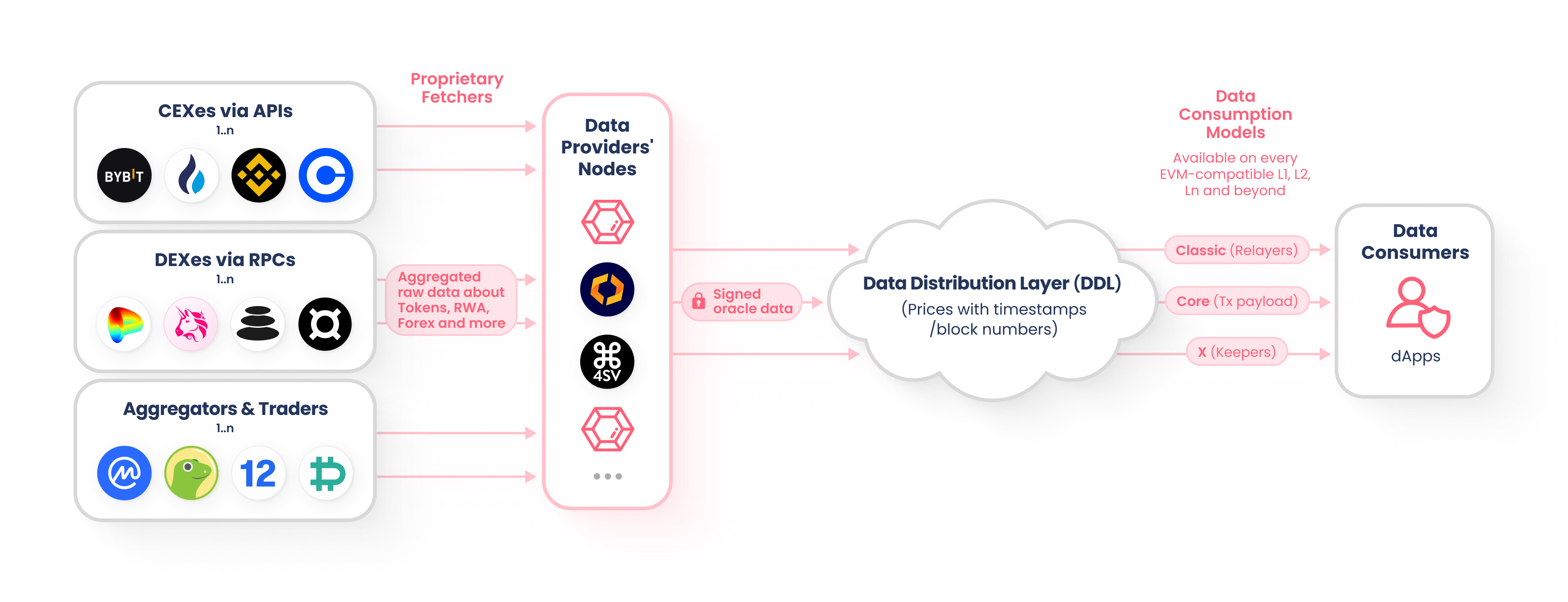

RedStone’s data flow architecture is engineered to manage and process price feeds effectively by drawing on a variety of both on-chain and off-chain sources. This comprehensive approach ensures that the data utilized is not only diverse but also secure and reliable.

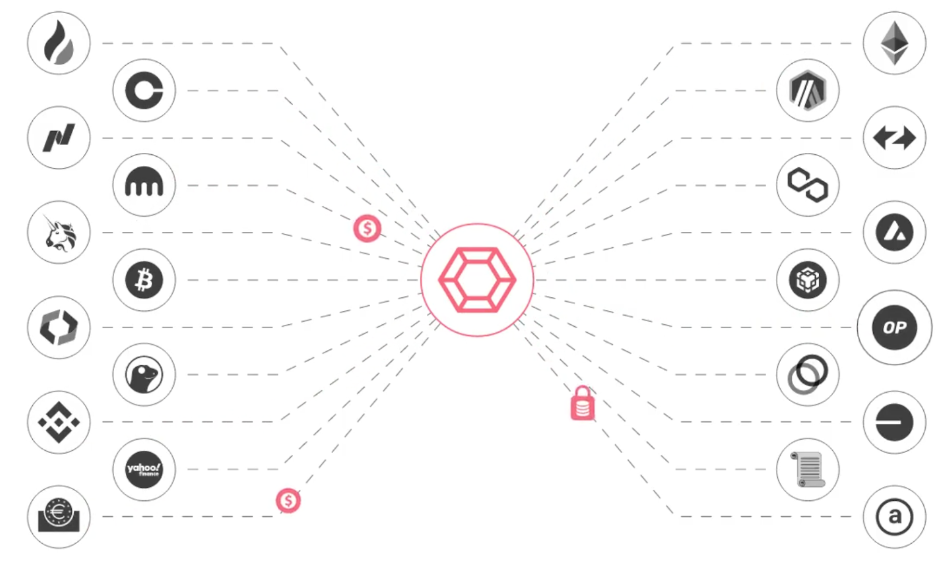

RedStone aggregates its price feeds from multiple sources to ensure a wide coverage and mitigate risks associated with data manipulation or inaccuracies. These sources include CEXes such as Binance, Coinbase, and Kraken, as well as on-chain DEXs like Uniswap, Sushiswap, and Balancer. In addition to these, data aggregators like CoinMarketCap, Coingecko, and Kaiko also contribute to the pool, collectively bringing the total to over 50 integrated sources.

Once collected, the data undergoes a rigorous aggregation process handled by independent nodes operated by various data providers. These nodes employ different methodologies such as median, Time-Weighted Average Price (TWAP), and Last Weighted Average Price (LWAP), along with safety measures including outliers detection to clean and process the data. Following this, the processed data is signed by the node operators, thereby underwriting its quality and integrity.

The verified data feeds are then broadcasted using multiple channels to ensure broad accessibility and redundancy. This broadcasting occurs both on the Streamr network and directly to open-source gateways that can be easily activated on demand. Such a dual approach in broadcasting helps in mitigating the risk of data silos and ensures that the data remains accessible and transparent to all participants in the ecosystem.

Once broadcasted, the data can be pushed on-chain through various mechanisms depending on the needs and the design of the protocol. These mechanisms include a dedicated relayer operating under specific conditions like heartbeat or significant price deviations, automated bots (e.g., those performing liquidations), or even directly end-users interacting with the protocol. This flexibility in the on-chain data pushing mechanisms allows for an adaptive response to changing market conditions and user interactions.

Upon entering the blockchain, the data is unpacked and undergoes a cryptographic verification process that checks both the origin and the timestamps associated with the data. This ensures that the data used within the smart contracts is not only current but also originates from a trusted source, thereby maintaining the integrity and trustworthiness of the entire process.

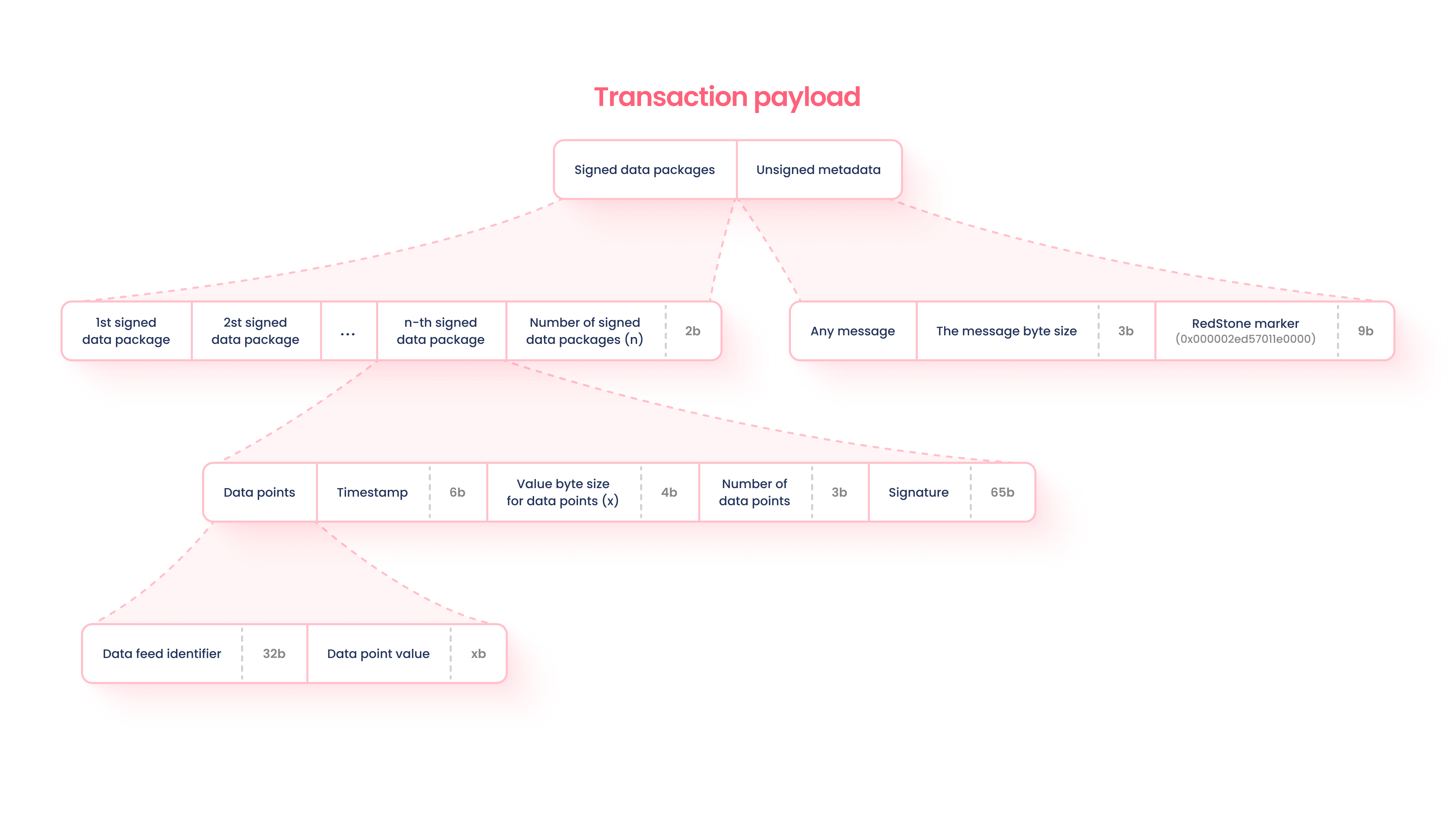

Data Format

The challenge of creating cross-chain oracles lies in their ability to provide consistent data across multiple blockchain networks without engaging in direct information exchanges between those networks. Traditional oracle implementations often focus on a single network due to the high costs and complexity associated with maintaining up-to-date values in storage contracts across multiple chains. This method tends to limit scalability significantly. To address these challenges, RedStone has chosen to bypass the use of storage contracts, thereby enhancing scalability and efficiency.

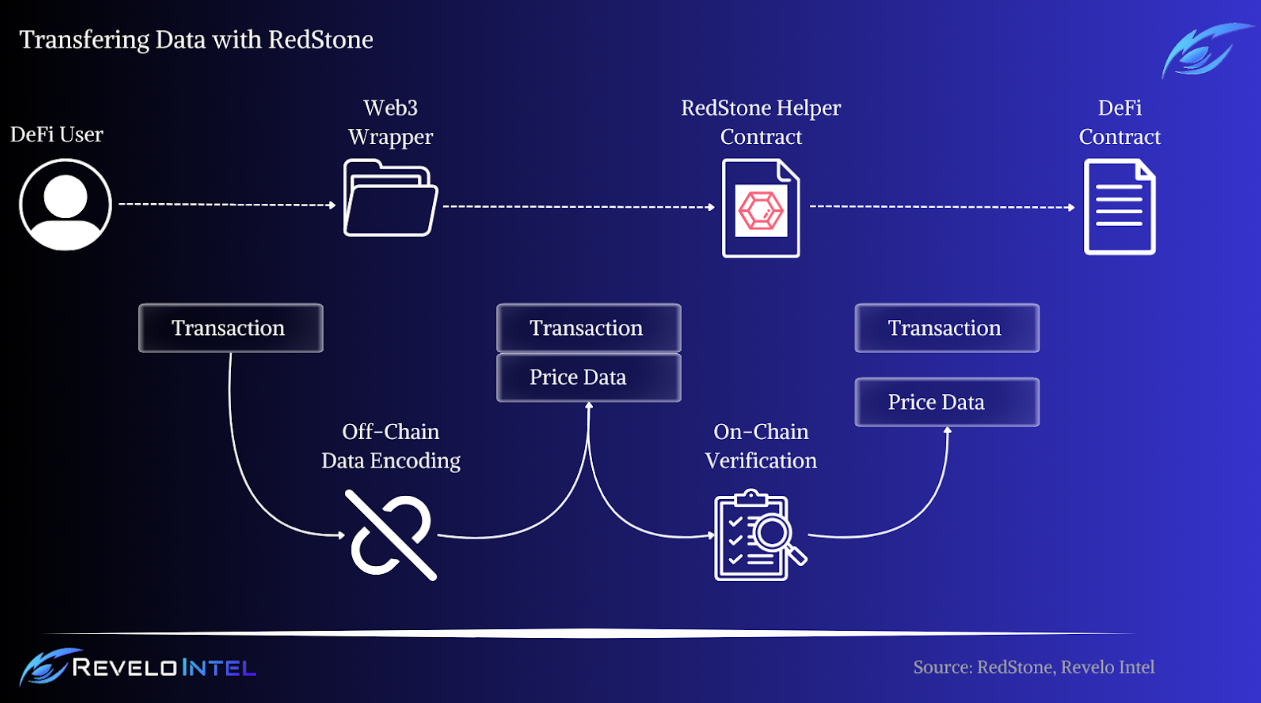

RedStone’s approach involves a unique system that enables the seamless integration of data into smart contracts across different blockchains. This system comprises two main components: a chain-specific connector and a set of functionalities embedded within RedStone’s contract. The contract, which must be inherited by the user’s contract, includes key functions for data extraction from calldata, data provider validation, timestamp validation, and the aggregation of data from multiple providers. These functions ensure that the data utilized in smart contracts is not only accurate but also comes from verified sources.

On the client side, RedStone has developed a library that functions primarily with ethers.js. This library acts as a wrapper for a contract instance, automatically fetching information from the RedStone cache layer and appending it to the transaction calldata. This transaction is then processed by the smart contract which, utilizing the inherited RedStone contract, extracts and employs the data for various on-chain activities.

The process described above can be also seen in the visual below.

Data Packing (Off-Chain Data Encoding)

Data packing is an essential step in RedStone’s off-chain data encoding process that ensures secure integration of data into blockchain transactions. Here’s how it works:

- Fetching Data: Data is retrieved from the decentralized cache layer, powered by the Streamr network and RedStone light cache nodes, ensuring it is current and relevant.

- Data Structuring: The fetched data is organized into a specific message format for consistency and efficient on-chain processing.

- Message Appending and Signing: The structured data is then appended to the original transaction message, signed to verify its integrity, and submitted to the network.

The entire process, executed by RedStone’s ContractWrapper, is automated and transparent, simplifying user interaction with the protocol.

Data Unpacking (On-Chain Data Verification)

On the other side, here’s how the unpacking process goes:

- Extraction and Verification:

- Data packages are extracted from msg.data. Then each package is checked for a signature from a trusted provider and the timeliness of its timestamp.

- Processing Data Feeds:

- Calculate the count of unique signers per data feed.

- Extract and aggregate values (typically using the median) from these signers.

The entire process is optimized with low-level assembly code to minimize gas consumption and reduce operational costs.

RedStone Oracle Models

RedStone offers three oracle models depending on the type of smart contract architecture and business demands of each client. The three models are Core, Classic, and X.

RedStone Core (Pull)

The RedStone Core (Pull) model focuses on dynamic data injection directly into user transactions, ensuring maximum gas efficiency. This model is ideal for maintaining an excellent user experience as it fits the entire process into a single transaction. It features the lowest gas costs and offers a latency of only a few seconds. In this model, dApp users deliver signed data packages on demand to the destination chain, making it highly efficient and user-centric.

Due to its unique architecture, RedStone can provide 1000+ price feeds for various types of data, including crypto, stocks, forex, commodities, ETFs, and more

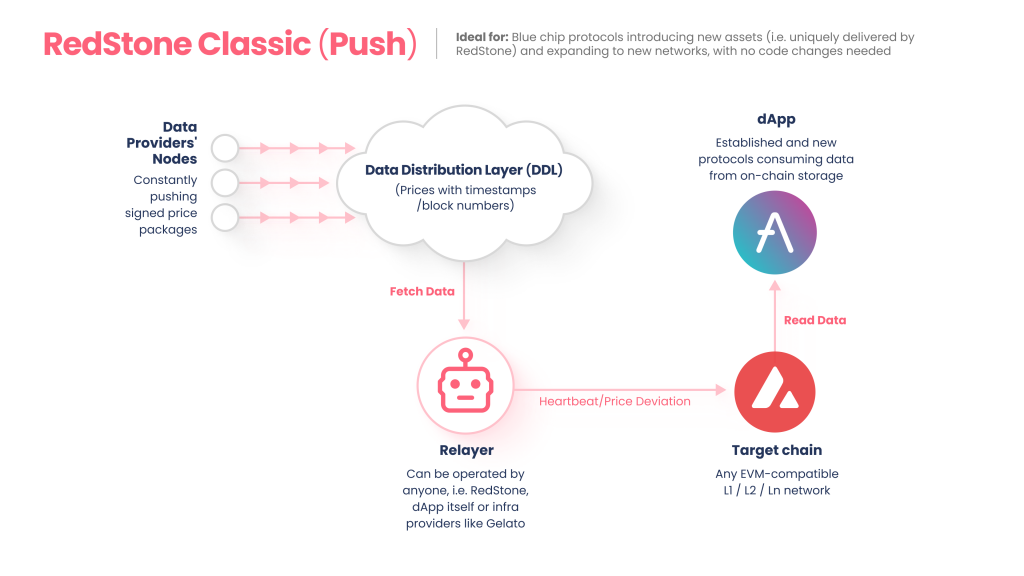

RedStone Classic (Push)

Designed for protocols that adhere to the traditional oracle model, the RedStone Classic (Push) model pushes data into on-chain storage via a relayer. This model is best suited for applications that require full control over the data source and update conditions, such as heartbeat intervals and deviation thresholds. It provides compatibility with traditional oracle setups, offering dApps complete governance over how and when data is updated and stored.

This model is particularly suited for scenarios where:

- There is an existing well-audited codebase, and the team prefers to avoid making even minor amendments.

- The protocol operates on a private network or a blockchain where gas costs are minimal.

- Price updates are not required frequently.

RedStone Classic builds on the principles of the RedStone Core model, maintaining rigorous on-chain validation of data providers and timestamps to ensure security. The model integrates two main components:

- Relayer:

- This off-chain service is customizable based on environmental variables. It periodically checks a defined set of conditions and pushes prices onto the blockchain when these conditions are met. Conditions can include a time-based interval (UPDATE_PRICE_INTERVAL) and a value-deviation threshold (MIN_DEVIATION_PERCENTAGE). This allows for dynamic and responsive data updates according to the needs of the protocol.

- Contracts:

- The on-chain functionality is managed by the PriceFeedsAdapter contract, which handles storing and updating price feed values and symbols, managing update rounds and timestamps, and allowing batch updates. For protocols that require compatibility with Chainlink’s PriceFeed architecture, additional contracts can be deployed to mimic this setup.

RedStone Classic offers significant improvements over traditional push-based oracles. Its modular design allows protocols to dictate when and how prices are updated, providing more control compared to other oracles where parameters are often fixed and inflexible.

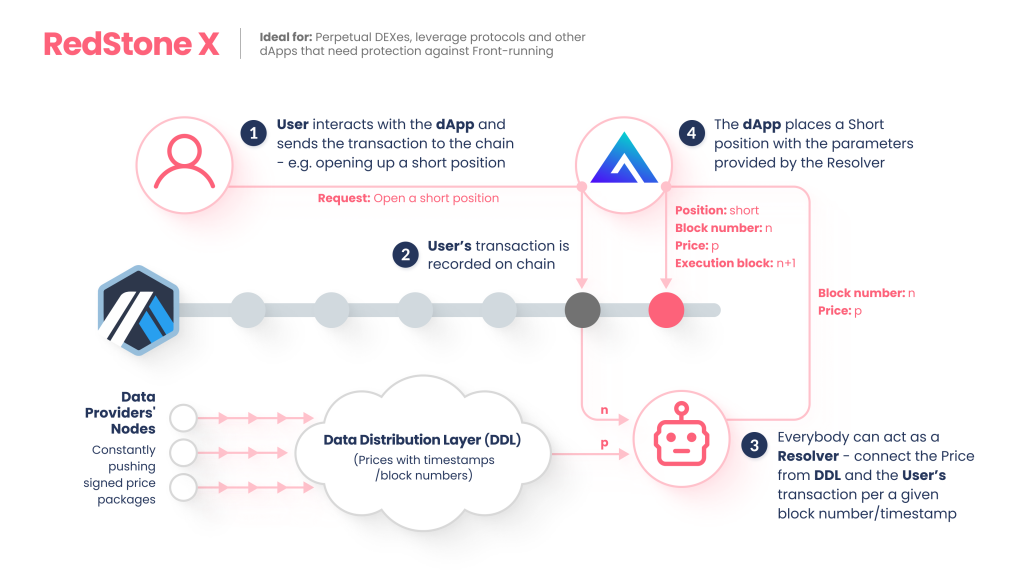

RedStone X (Perps)

RedStone X is specifically crafted for advanced financial protocols like perpetuals, options, and other derivatives, which are sensitive to front-running risks. This model ensures that price feeds are updated in the very next block following users’ interactions, thereby eliminating the possibility of front-running. It is tailored for sophisticated protocols and is based on the GMX design, providing highly secure and timely data for complex financial instruments.

The RedStone X model employs a two-step process to safeguard against front-running:

- Transaction Initiation:

- Users initiate transactions by recording an intention to interact with the protocol on-chain (e.g., opening a perpetual position) without knowing the exact price at which the transaction will ultimately execute. This first step effectively conceals the transaction details, mitigating potential arbitrage opportunities by front-runners.

- Price Delivery and Execution:

- The actual price is pushed to the blockchain only in the subsequent step, usually occurring in the very next block. This price can be pushed by anyone, including the user, ensuring that it remains democratic and transparent. The integrity of this price is validated on-chain according to predefined protocol constraints. Once the price is established, it is used to settle the transaction definitively.

To effectively utilize the RedStone X model, protocols must do these things:

- Adjust contracts to handle price-sensitive transactions in two phases: a request phase and an execution phase.

- Deploy a keeper service that automatically fetches the latest price data and triggers the execution phase of the transaction.

RedStone ERC7412

The RedStone ERC7412 model is a combination of the Classic and Core models, encapsulated within the ERC7412 standard. This hybrid approach, popularized by the perpetual protocol Synthetix, integrates the strengths of proactive data delivery and dynamic data injection for enhanced efficiency and flexibility.

To effectively integrate the RedStone ERC7412 model into a DeFi protocol, two primary actions are required: Deploy price feed and update the client to interact with the ERC7412 standard.

Here’s the detailed guide.

Sector Outlook

The oracle sector within blockchain technology has become increasingly vital as dApps proliferate across various industries. Oracles act as bridges between blockchains and the external world, enabling smart contracts to interact with data and systems outside their native platforms. This capability is crucial for the broader adoption of blockchain technology, as it allows blockchains to extend their utility beyond simple transactional capabilities to more complex financial instruments, insurance products, supply chain management tools, and more. The growth of the oracle sector is primarily driven by the need for reliable and secure data sources as these applications cannot rely solely on internal blockchain data to execute most of their functions.

Despite their importance, oracles introduce unique challenges, primarily around the areas of security and data integrity. The central issue is the oracle problem, which concerns the trust and reliability of the data oracles provide to smart contracts. A compromised or faulty oracle can lead to significant losses, incorrect execution of contracts, or other serious consequences. To address these challenges, the sector has seen innovations such as DONs that aim to distribute the data sourcing and verification process across multiple nodes to reduce the risk of tampering or single points of failure.

Types of Blockchain Oracles

Given the wide array of offchain resources, blockchain oracles vary significantly in form and function. Hybrid smart contracts require diverse types of external data and computation, necessitating various delivery mechanisms and security levels. Typically, each type of blockchain oracle encompasses a mix of activities, including fetching, validating, processing, and ultimately delivering data to its intended destination. The following is a non-exhaustive classification method, and it should be noted that some oracles can belong to more than one category.

| Type | Description |

| Cross-Chain Oracles | Cross-chain oracles allow for the seamless transfer of data and assets between blockchains, thus expanding the capabilities and reach of smart contracts beyond a single blockchain environment. This type of oracle is fundamental in creating a more connected and efficient blockchain landscape, facilitating multi-chain strategies for decentralized applications. |

| Input Oracles | They are specifically designed to fetch external data from various sources and deliver it onto the blockchain for smart contract use. This type of oracle is crucial for applications that require real-time, accurate data to function correctly. For instance, Chainlink Price Feeds utilize input oracles to provide DeFi smart contracts with access to up-to-date financial market data. This enables functions such as pricing assets or executing trades based on current market conditions, ensuring that DeFi platforms operate with the necessary precision and reliability. |

| Output Oracles | Conversely, output oracles function oppositely to input oracles. They enable smart contracts on blockchain networks to interact with and trigger actions in the external world. This is accomplished by sending commands from smart contracts to off-chain systems. Examples of output oracle applications include initiating payments through banking networks, commanding storage providers to secure data, or interacting with Internet of Things (IoT) devices, such as unlocking a car door once a blockchain-based rental payment is processed. |

| Software Oracles | Software oracles interact with internet-connected data sources, pulling information from websites, servers, and other digital infrastructures to feed into smart contracts. This type is indispensable for applications that require real-time data, such as currency exchange rates or stock prices, enabling smart contracts to operate with current and relevant data. |

| Human Oracles | Human oracles involve individuals who provide specialized knowledge or data verification before the data is fed into a smart contract. They play a crucial role where automated systems might fail, providing a layer of human oversight to ensure data accuracy and reliability. The use of cryptographic methods to authenticate these human inputs minimizes the risks of fraud. |

| Hardware Oracles | These oracles gather data from the physical world, such as measurements from electronic sensors or barcode scans. Hardware oracles translate real-world physical data into digital form that smart contracts can interpret and act upon, critical for industries like logistics, manufacturing, and agriculture. |

| Compute-Enabled Oracles | Focused on performing computations off-chain, compute-enabled oracles handle complex calculations that are impractical to perform on-chain due to cost, speed, or technical constraints. These oracles are particularly useful for applications that rely on intensive data processing, such as those using advanced algorithms for financial modeling or AI-driven analytics. |

Centralized vs Decentralized Oracles

Centralized oracles operate under the control of a single entity and generally rely on a single data source. This approach introduces significant risks, as it becomes a single point of failure. If a centralized oracle is compromised, it can lead to catastrophic failures in smart contract execution. For instance, if an oracle providing football match results for a betting smart contract is manipulated, it could incorrectly distribute funds based on the false data, and due to blockchain’s immutable nature, these transactions cannot be reversed, resulting in irreversible financial loss.

Furthermore, the reliability of data from centralized sources can vary greatly depending on the type of information required. While financial data like cryptocurrency and stock prices may be abundantly available, sourcing consistent and reliable data for other parameters like weather conditions can be more challenging.

In contrast, decentralized oracles mitigate the risks associated with single points of failure by not relying on a single node or data source. They integrate data from multiple independent oracle operators and various sources, aggregating it to derive a consensus output that is fed into the blockchain. This method significantly improves the reliability and integrity of data used in smart contracts and also removes the risk deriving from a single data source.

Decentralized oracles address many of the vulnerabilities of their centralized counterparts. If one oracle node fails or provides inaccurate data, the system can still function correctly by relying on other nodes’ data, thus maintaining the continuity and accuracy of data feeds. This is important for smart contracts, which operate automatically based on the data they receive. Faulty or manipulated data from a single source in a centralized system could lead to incorrect contract execution, known colloquially as the “garbage in, garbage out” problem, where poor inputs result in erroneous outputs.

Moreover, DONs offer a solid solution by combining multiple data sources and oracle nodes, ensuring data accuracy and guarding against downtime and manipulation. This decentralized approach is essential for maintaining the trustless, automated, and immutable nature of smart contracts on blockchain networks, thus truly embodying the decentralized ethos of blockchain applications.

Push vs Pull and the Hybrid Model

Push oracles operate on a proactive basis, automatically sending data to smart contracts when predetermined conditions are met. This model is useful for scenarios where continuous monitoring and immediate reaction to specific events are necessary. For example, a push oracle could automatically transmit weather data to an agricultural insurance smart contract once the recorded temperature falls to a frost point. The key advantage of push oracles is their ability to facilitate real-time data interactions without requiring initiation from the smart contract.

Contrary to push oracles, pull oracles function based on explicit requests from smart contracts. In this model, a smart contract must first send a query to the oracle, specifying the exact data needed. The oracle then retrieves this data from its external sources and relays it back to the smart contract. This mechanism is essential for use cases where data is needed at specific points rather than continuously, such as fetching the latest price of a cryptocurrency. Pull oracles provide flexibility and control to the smart contract developers, allowing them to dictate when and what information is pulled, based on the needs of the application.

A hybrid oracle model blends the proactive features of push oracles with the on-demand capabilities of pull oracles. This integration can optimize both the delivery of data and the scalability of services. By combining elements of both models, hybrid oracles can serve a broader spectrum of use cases. For example, a hybrid oracle could regularly update a cache of frequently requested data (push mechanism) while also allowing for occasional on-demand requests for less common data (pull mechanism).

Competitive Landscape

The oracle sector has seen significant growth and innovation, driven by the need to improve the functionality, reliability, and security of dApps. Key players in this field have developed a variety of solutions to meet these needs, each bringing something new to this sector. The newest oracle protocols are pushing the boundaries of innovation even further by offering solutions that match the current environment and its products. The monopoly of the previous years does not exist anymore and the competitive landscape looks more promising than ever before.

Chainlink is considered by most the OG oracle platform having the first movers advantage and being present for many years in the crypto space supporting a plethora of applications and protocols. Its robustness and history of being a reliable oracle have established Chainlink as the leading player in this sector. Chainlink has managed to build a cult through the years with many tokenholders of $LINK and supporters of the network. On the technical side, Chainlink supports cross-chain communication and offers various data services like data feeds for commodity prices and sports outcomes, and CCIP for asset transfers between blockchains. Chainlink’s architecture includes data streams for low-latency data and automation services to facilitate smart contract scalability. It also features Chainlink VRF for adding verified randomness in applications like gaming. As a pioneer in the field, Chainlink significantly impacts the crypto ecosystem by enabling blockchain applications to utilize external data, fostering a broader range of dApps such as prediction markets and insurance protocols.

In the last few years, we saw many new oracle projects launching and bringing a whole new set of solutions to the market.

Pyth Network distinguishes itself with real-time market data dissemination across multiple blockchains, leveraging direct inputs from over 90 first-party publishers from the global financial market. It offers unique features like high-frequency updates, confidence intervals, and a diverse data range, ensuring high accuracy and reliability. Pyth’s pull model, in contrast to traditional push-based oracles, reduces operational costs and enhances the timeliness of data updates, making it a compelling choice for DeFi applications requiring rapid and precise data.

Another oracle solution is the Band Protocol. Band Protocol operates on BandChain, using a Cosmos-SDK-based blockchain, designed to efficiently fetch and aggregate data from external sources. It supports a variety of data types, including on-chain metrics and real-world events, making it versatile for different dApps. Band Protocol emphasizes decentralization with a network of validators and is notable for its Phase 2 upgrade which improves its payment systems and cross-chain oracle requests. The platform stands out for its scalability, decentralization, and cost-effectiveness, making it a robust competitor in the oracle market.

Uma stands out for its Oracle Extractable Value (OEV) solution called OVAL, allowing integrating protocols to capture value when prices are updated. The way this works is that price oracle updates create opportunities for OEV. MEV (Maximum Extractable Value) searchers, block builders, and validators profit by working together to extract this value. That’s where OVAL comes in, wrapping existing oracles to capture up to 90% of the OEV created by protocols. This is achieved by using Flashbots’ MEV-Share to auction off the right to conduct liquidations.

Finally, API3 is advancing the oracle landscape with the launch of the OEV Network, aimed at recapturing oracle extractable value for lending protocols. This network creates an efficient market for oracle updates, enhancing the liquidation processes in lending markets. API3’s integration across multiple networks and its ability to secure significant transaction volumes showcases its capacity to support extensive and reliable oracle services, thereby creating new revenue streams for dApps and expanding the functional scope of smart contract applications.

Traditionally, these networks have relied on their own native tokens to achieve and maintain economic security. This method ensures that the network operations are decentralized and that stakeholders have a vested interest in the network’s success and security.

However, in a world where restaking models like EigenLayer become prevalent, bootstrapping these off-chain networks could become significantly more efficient. Restaking allows these networks to leverage the security and economic weight of established blockchain systems, thereby simplifying the process of achieving the necessary economic security to perform their operations effectively.

In the context of improving economic security for off-chain networks, a prime example can be seen in the collaboration between RedStone Oracles and Ether.fi. This collaboration enables over 20,000 node operators from Ether.fi to manage RedStone’s AVS using Ether.fi’s native liquid restaking token, eETH. The restaked Ether will protect against liveness failures and crypto-economic attacks within RedStone’s network, providing reliable crypto collateral and validation from one of the industry’s most diverse sets of validators.

Potential Adoption

RedStone is positioned exceptionally for market adoption as an oracle platform. DeFi platforms, which rely heavily on accurate and timely information for functions like asset pricing, risk assessment, and automated trading, can benefit greatly from RedStone’s secure data feeds. By integrating with RedStone, these platforms can expand their offerings to include more complex financial products such as dynamic staking pools, derivative trading, yield-bearing assets, LSTs and LRTs, and other real-time opportunities, all of which require a high degree of data integrity and latency sensitivity that RedStone is equipped to provide.

RedStone has already achieved significant adoption operating across over 50 blockchain networks, including all major Layer 1 and Layer 2 solutions. Being deployable everywhere, this cross-chain functionality addresses a critical need in the blockchain ecosystem which is interoperability. By facilitating seamless data exchange across different blockchains, RedStone can help unify fragmented blockchain infrastructures, enabling a more integrated network where dApps can communicate and operate across blockchains without compromising on security or efficiency.

The protocol’s approach to building models that suit all use cases and applications is a feature that can serve the majority of the market now or in the future. Offering multiple models makes RedStone accessible to a wider range of developers and projects. This inclusivity can significantly drive adoption, as projects can choose an oracle model that aligns with their specific needs and budget without needing to seek alternative providers. Being one step ahead and taking into account the dynamic environment of crypto in terms of technological changes increases the chances of widespread adoption.

Chains

RedStone Oracles are available on all EVM chains (L1s & L2s) with the potential to be used on any chain with a bit of custom development.

RedStone also supports numerous non-EVM-compatible chains such as TRON, Stacks, StarkNet, Near, Fuel, TON, and Casper.

Data Sources

Here are some of the sources that contribute data to RedStone:

Participants in the Protocol

Users of RedStone include blockchain developers, dApps, and DeFi projects looking for dependable, low-latency data for their apps. These are some major participants for RedStone:

- DeFi Protocols: RedStone’s oracles provide critical data feeds for DeFi platforms which rely on timely and accurate information for operations like lending, borrowing, and trading. These protocols require data for pricing assets, determining interest rates, and managing liquidity, making RedStone’s rapid and reliable data delivery essential.

- LST & LRT Protocols: Platforms offering Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) represent a significant portion of RedStone’s user base. These platforms allow users to stake cryptocurrency assets and maintain liquidity through tokenized stakes, transforming staked assets into liquid assets that can still earn staking rewards.

- Accurate real-time data is essential to correctly value the underlying staked assets and their tokenized forms. This data affects everything from trading prices to redemption values.

- In addition, reliable data feeds help these platforms monitor and manage the risks associated with changes in asset value, market volatility, and liquidity conditions.

- Finally, calculating and distributing staking rewards depends heavily on data regarding asset performance and market conditions, which must be both current and highly accurate.

- Financial Derivatives Platforms: Platforms dealing with financial derivatives such as options, futures, and synthetic assets benefit significantly from RedStone. These applications need precise and immediate data to manage contracts and mitigate risks associated with price volatility, especially given the model’s protection against front-running, as seen in the RedStone X model.

- Insurance dApps: Decentralized insurance platforms use RedStone to obtain trustworthy external data crucial for claims processing and risk assessment. Data like weather conditions, flight statuses, or crop yields can be integral in automating and resolving claims.

- Developers and Innovators: Developers looking to build new applications or integrate existing ones with advanced oracle solutions form a significant part of RedStone’s user base. RedStone’s modular and scalable infrastructure supports developers in customizing data feeds and ensuring compatibility with a range of blockchain protocols.

- As long as there is an off-chain data feed available, RedStone can support any type of DeFi dApp through its oracle models.

Business Model

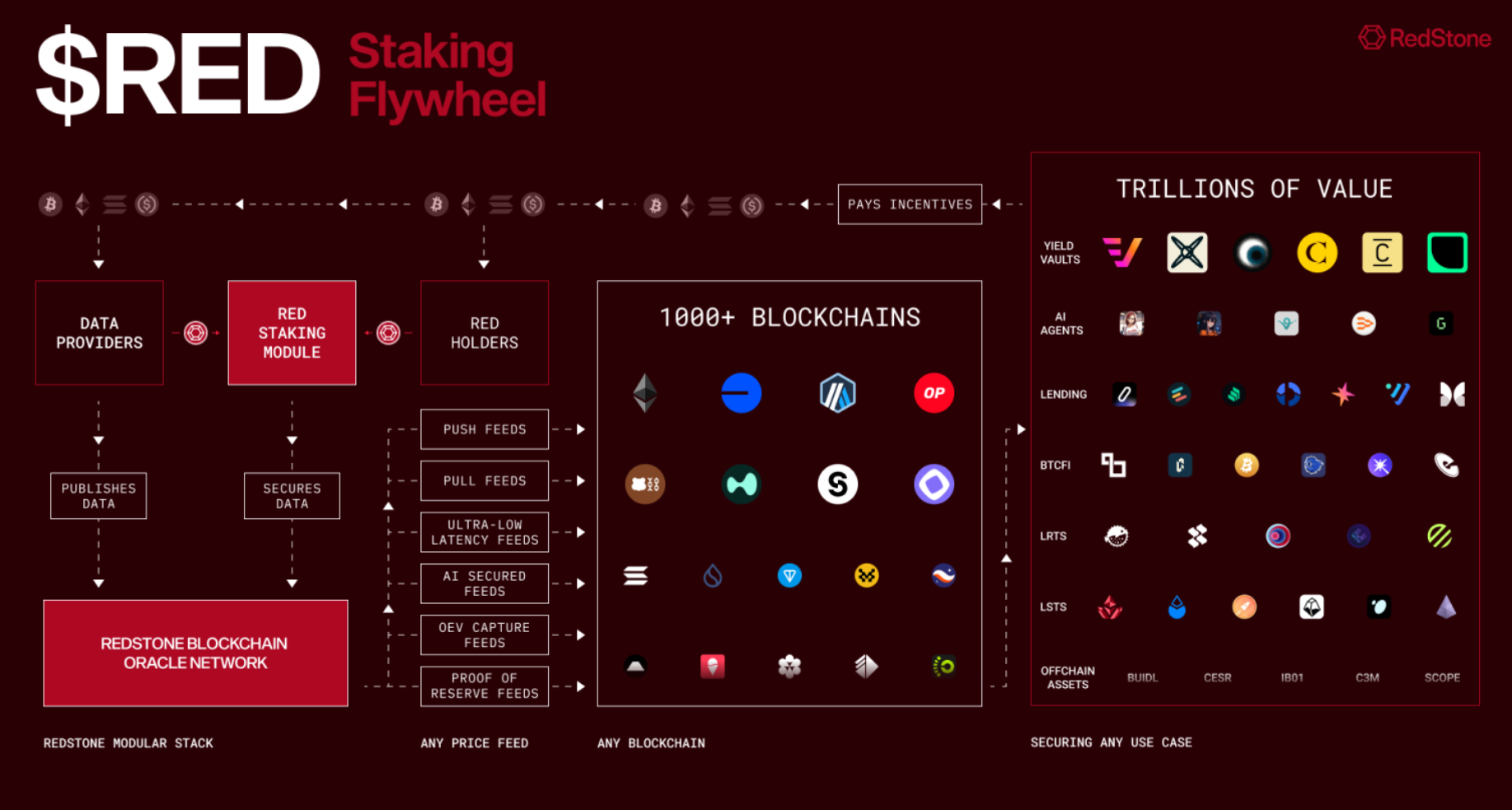

RedStone Oracles operates as an important infrastructure provider, offering data verification and delivery services to dApps across multiple blockchain networks. dApps and other clients pay fees in assets like ETH, BTC, SOL, or stablecoins whenever they access RedStone’s oracle data. Instead of flowing to a centralized entity, these fees are distributed to stakers—the node operators and community members who secure and deliver accurate data by staking $RED (and also re-staking ETH through EigenLayer).

Because real revenue (in major cryptocurrencies) goes directly to stakers, the network does not rely on high inflation of the $RED token to reward participants. As more protocols adopt RedStone’s oracles and pay for the data, the pool of fees grows, boosting rewards for honest stakers. This in turn incentivizes more token holders to stake, increasing the total economic weight securing the oracle. By aligning usage fees with staking incentives, RedStone establishes a cycle of growing demand, higher security, and sustained ecosystem value—grounded in real-world payments rather than purely inflationary rewards.

Tokenomics

$RED

$RED is an ERC-20 standard token designed to enhance both the decentralization and economic security of oracle services within the Redstone Ecosystem. The $RED token enables data providers and token holders to stake and provide economic security. In return, stakers receive tokens from the dApps that pay fees to utilize Redstone data feeds.

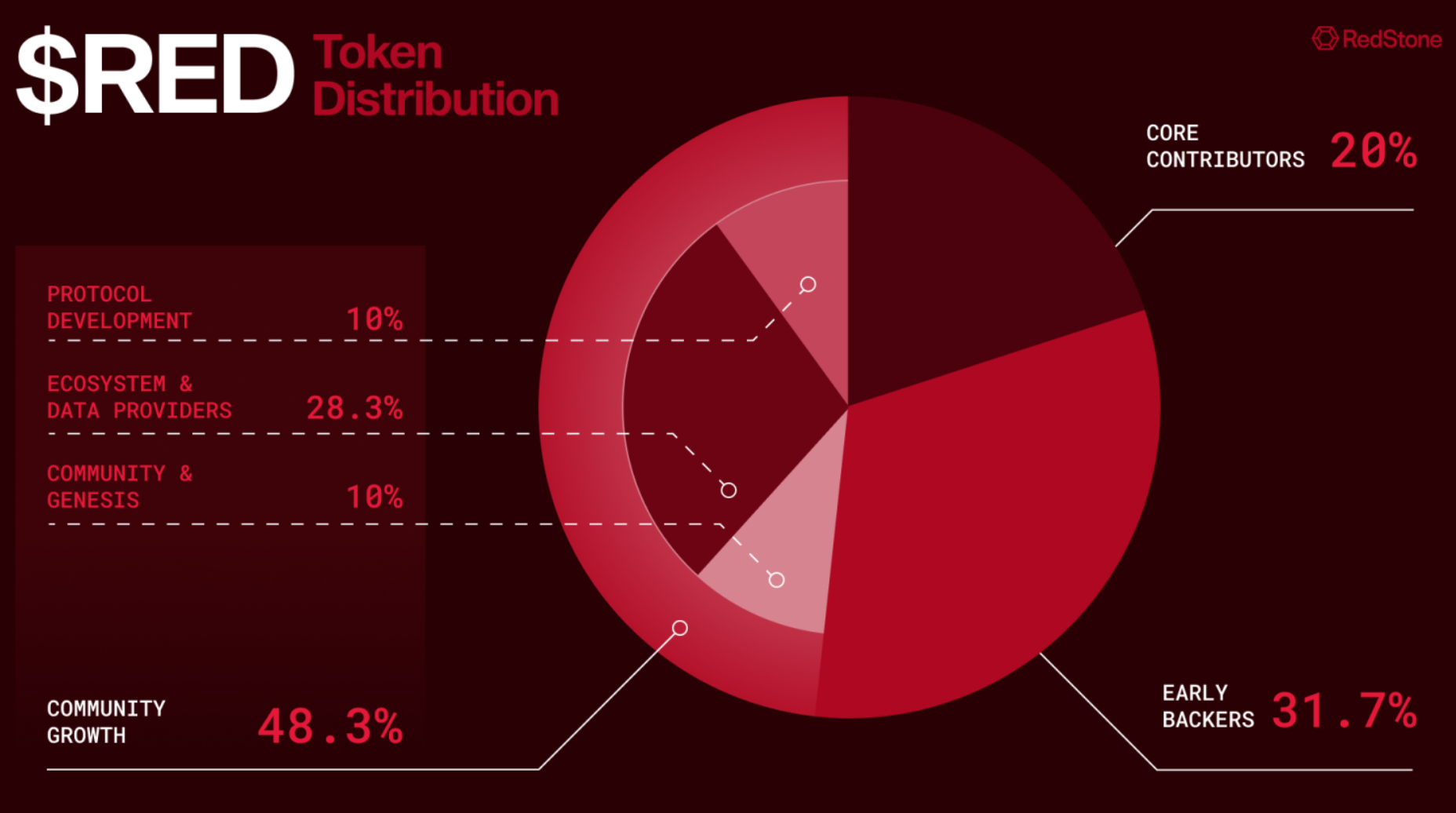

Token Distribution

The total supply of 1,000,000,000 RED will be apportioned across five major categories. Each category is designed to further specific objectives within RedStone’s long-term roadmap.

Nearly half of all $RED tokens (48.3%) will be allocated to the Community Growth of the Redstone Ecosystem across the following categories: Community & Genesis, Ecosystem & Data Providers, and Protocol Development.

Community & Genesis: 10%

- Distributed through carefully designed airdrops and claim activities, ensuring early supporters and protocol participants are fairly represented.

Ecosystem & Data Providers: 28.3%

- Incentivizing builders, developers, and data providers. Grants and rewards for sustaining reliable data feeds.

Protocol Development: 10%

- Funding ongoing research & development, developer resources, and operational expenditures for protocol sustainability.

Core Contributors: 20%

- Allocated to founding team and key stakeholders. Locked with a vesting schedule to align contributor incentives with long-term success.

Early Backers: 31.7%

- Allocated to strategic investors who supported RedStone’s early development. Vested to ensure long-term alignment.

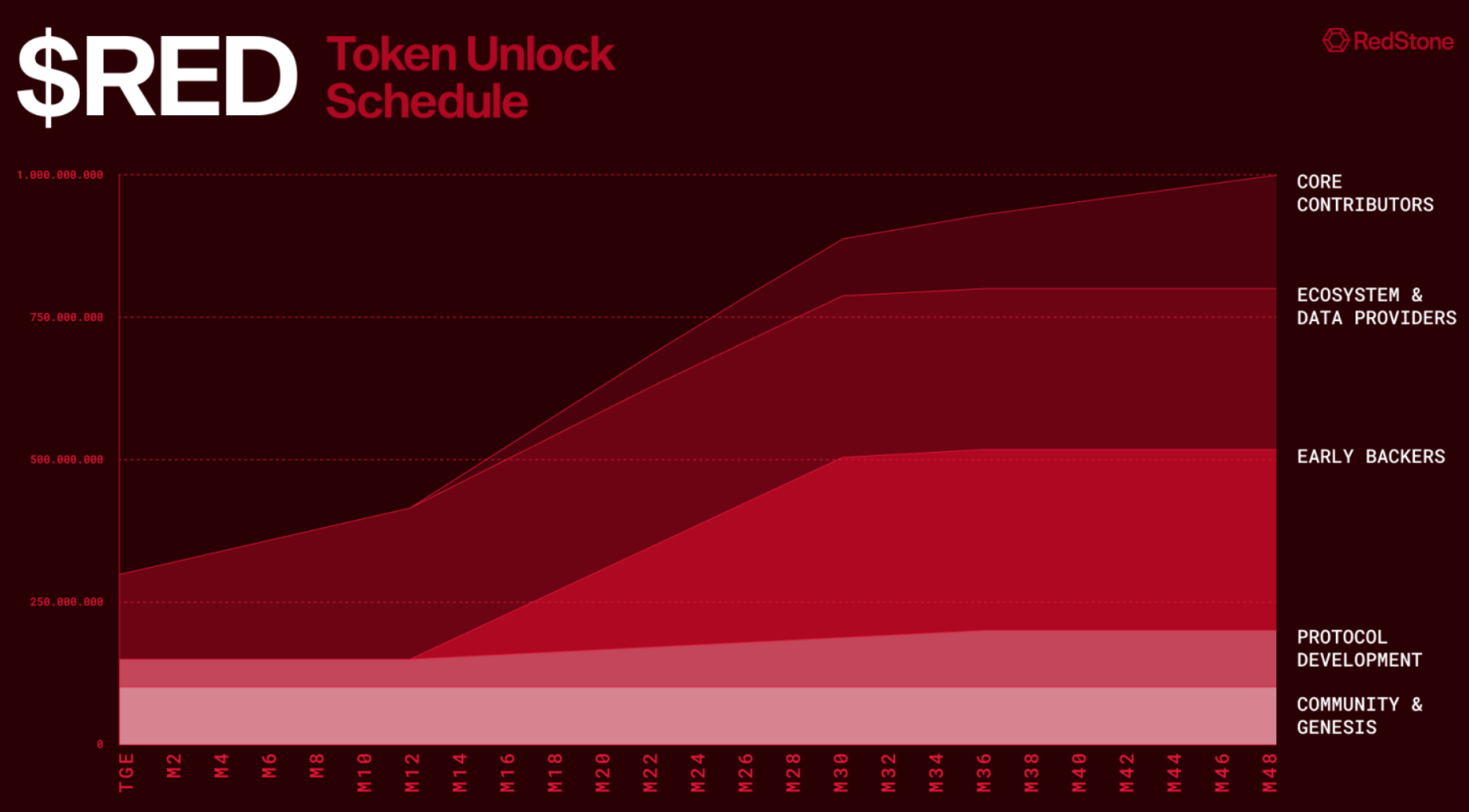

Token Unlock Schedule

- Community & Genesis (10%): Mostly available at TGE for airdrops/claims.

- Protocol Development (10%): Unlocks linearly to fund ongoing research and operations.

- Early Backers (31.7%): Subject to a moderate cliff, then vesting ramps between months ~12–30.

- Ecosystem & Data Providers (28.3%): Gradual unlock for ongoing incentives, grants, and data-provider rewards. Subject to a moderate cliff, then vesting ramps between months ~12–30.

- Core Contributors (20%): Longest vesting period, starting around months ~12–30 and completing by month 48.

RedStone’s design encourages consistent participation from core contributors, ecosystem builders, and data providers.

Utility

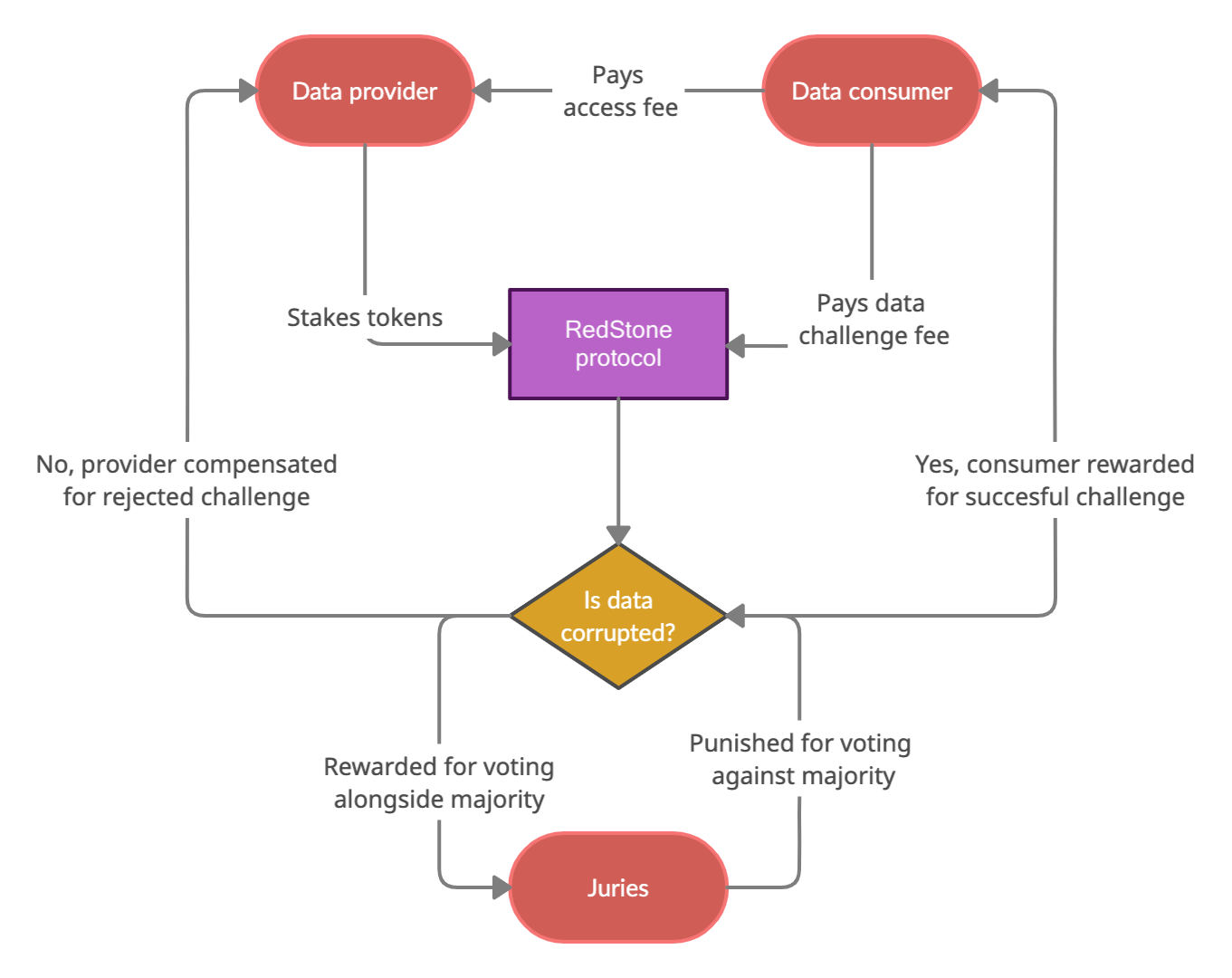

RedStone’s $RED token introduces a crypto-economic layer to secure data provision, transforming what was once a trusted (centralized) model into a decentralized oracle service. Under this new system, data providers stake $RED to back the accuracy of the information they deliver. If a provider reports incorrect data, their stake can be slashed, creating a powerful deterrent against wrongdoing. Token holders also stake $RED to earn incentives from Dapps that pay to use Redstone’s Oracle services.

Beyond staking with $RED, RedStone leverages EigenLayer for “re-staking” ETH. This dual-staking approach means an attacker must overcome not just RedStone’s native token economy but also the vast capital base of the Ethereum network, making malicious acts dramatically more expensive. Honest providers are rewarded with fees paid by the DeFi protocols that depend on RedStone’s feeds (in ETH, BTC, or stablecoins), reinforcing a positive feedback loop of security and reliability. The result is a robust, multi-layered defense model that aligns incentives, promotes honest behavior, and scales with the growth of both the RedStone and Ethereum ecosystems.

Data Access Fees

A token also plays a role in the economic model of data access within the ecosystem. End users who benefit from the data pay tokens to the providers who publish the data. The fee structure and subscription terms are determined by the data providers based on the effort required, demand for the data, and market competition.

Locking Mechanism

Data providers are required to publish a Service Level Agreement that details the data scope, information sources, and update frequency. Should a provider fail to meet the agreed terms, a penalty denominated in tokens is imposed. To ensure claims can be fully covered, providers must lock a specified number of tokens for a predetermined period. This locking mechanism reassures users of the reliability of the providers they choose.

Dispute Resolution

Given the diversity of information provided, disputes over data quality are inevitable. The platform incorporates a token-facilitated dispute resolution process where jurors are compensated for aligning with the majority decision and penalized for dissenting, ensuring integrity and fairness in data validation.

Bootstrapping the Market

In the early stages of the platform’s development, tokens may be distributed to providers as incentives for their participation and to stimulate the market before sufficient demand materializes from data users.

Governance

On-chain governance is a major part of RedStone’s vision. The release of the RedStone token will lay the ground for a governance structure.

Risks

This is a list of possible risks associated with oracles.

Single Data Source Risk

One of the primary risks associated with the use of oracles in dApps is the reliance on single or limited data sources. For applications requiring price data, especially in the highly volatile and liquid cryptocurrency market, using data from a single exchange can be particularly risky. Price discrepancies across different trading platforms are common, and relying on one source increases the vulnerability to price manipulation and exploitation. This is exacerbated by the ability of large-volume traders or malicious actors to use mechanisms like flash loans to temporarily manipulate prices, potentially leading to incorrect data being fed into smart contracts.

Inadequate Data Redundancy Risk

The lack of redundancy in data sources can lead to significant issues in price accuracy and oracle reliability. If an oracle mechanism does not adequately cover the market by aggregating data from a comprehensive range of exchanges, it may fail to reflect true market values. This issue is compounded when market volumes shift rapidly between platforms, which can happen without warning. An oracle that does not account for such shifts may provide data that is not only outdated but also dangerously misleading, leading to poor execution of smart contracts based on this data.

Centralization Risk

Even the most accurate and timely data can be compromised if delivered through a centralized oracle. Reliance on a single node for data delivery introduces a significant point of failure. Issues such as downtime or manipulation at the node level can lead to severe repercussions for dApps relying on this data, given the irreversible nature of smart contracts. Furthermore, centralized nodes offer potential avenues for targeted attacks, including data tampering and denial of service, which could disrupt the entire dApp operation. Blockchain oracles eliminate this risk through support by many nodes in their network.

To mitigate these risks, RedStone implements strict data validation processes, ensures high redundancy across data sources, and maintains a decentralized network of reliable and transparent oracle nodes. Continuous monitoring, regular audits, and open communication about network performance and security practices are essential to uphold the integrity and reliability of the RedStone Oracle Platform.

Security

Web3 developers recognize security as a paramount concern, yet many overlook the integral role of oracles in ensuring the overall security of a blockchain application. Oracles act as bridges between the blockchain and the external world, providing smart contracts with necessary data that isn’t inherently available on-chain. This data is crucial for the execution of contracts whose operations depend on real-world information, computations, or interactions.

Integrating off-chain data within smart contracts dramatically broadens the capabilities of dApps. However, this integration introduces significant security vulnerabilities. The security of a smart contract is not limited to its code or the blockchain it operates on; it also extends to the reliability and integrity of the data inputs it receives from oracles. If these inputs can be tampered with, or if they are not delivered securely and promptly, the entire contract could be compromised.

A smart contract is only as secure as its weakest link. If an oracle that supplies critical data is compromised, the consequences can be severe, potentially rendering the smart contract’s defenses useless against attacks. For example, if an oracle feeding pricing data to a financial dApp is manipulated, it could lead to incorrect trades, financial losses, or the unintended triggering of contract clauses.

Ensuring the security of the oracle mechanism is as crucial as securing the smart contract code itself. Poor oracle security may expose smart contracts to a variety of exploits and hacks. Both the data quality and the security infrastructure of the oracle must be robust. This includes employing secure data transmission channels, implementing stringent data validation and verification processes, and ensuring that the oracle service itself is resistant to tampering and manipulation.

As a decentralized oracle, RedStone places security as a top priority ensuring that all the information that it provides to dApps is correct and reliable continuously. To achieve that the protocol implemented certain security aspects to its oracles.

On-Chain Aggregation

To boost the security of the RedStone Oracle system, an on-chain aggregation mechanism has been implemented. This security feature is designed to ensure the reliability and accuracy of data by requiring a robust verification process before data is used within consumer contracts.

The system mandates that each data feed must receive at least ‘X’ signatures from different authorized data providers. This requirement helps mitigate the risk of data tampering or corruption by individual providers.

Once the required signatures are collected, the values provided by these different signers are aggregated. By default, RedStone uses a median value calculation for aggregation, which helps neutralize the effect of outliers or potentially corrupt data from a minority of providers.

RedStone’s consumer base contract includes several functions to facilitate the aggregation process:

- getUniqueSignersThreshold

- getAuthorisedSignerIndex

- aggregateValues

- aggregateByteValues

By employing this on-chain aggregation mechanism, RedStone significantly enhances the security and integrity of the data feeds used across DeFi platforms, ensuring that even if a small subset of data providers is compromised, the overall data integrity remains intact and reliable. This approach is crucial for maintaining trust and operational stability in decentralized finance applications.

Security Considerations

In deploying RedStone’s Oracle solutions, several key security considerations must be addressed to safeguard the integrity and functionality of the decentralized systems relying on this data. Here are essential practices to ensure optimal security:

| Action | Description |

| Function Overrides | Exercise caution when considering overrides to the ‘getUniqueSignersThreshold’ function. This function is critical for determining the number of unique data signers required for validation and should only be modified if you are fully confident in the implications and security of the changes. |

| Timestamp Validation | Pay close attention to the logic for timestamp validation. For specific applications like synthetic DEXs, it’s advisable to cache the latest values in your contract storage. This practice helps prevent arbitrage attacks by ensuring that the data used in transactions is both recent and accurate. |

| Contract Upgradability | Implement a secure mechanism for contract upgrades, ideally one that involves multi-signature or decentralized autonomous organization (DAO) approvals. This step ensures that any changes to the contract are thoroughly vetted and agreed upon by multiple parties, thereby reducing the risk of malicious alterations. |

| Monitoring and Adaptation | Regularly monitor the RedStone data services registry for any updates or changes. It’s crucial to adjust the signer authorization logic in your contracts swiftly if necessary. RedStone also commits to notifying paying clients of any significant changes, aiding them in maintaining security and functionality. |

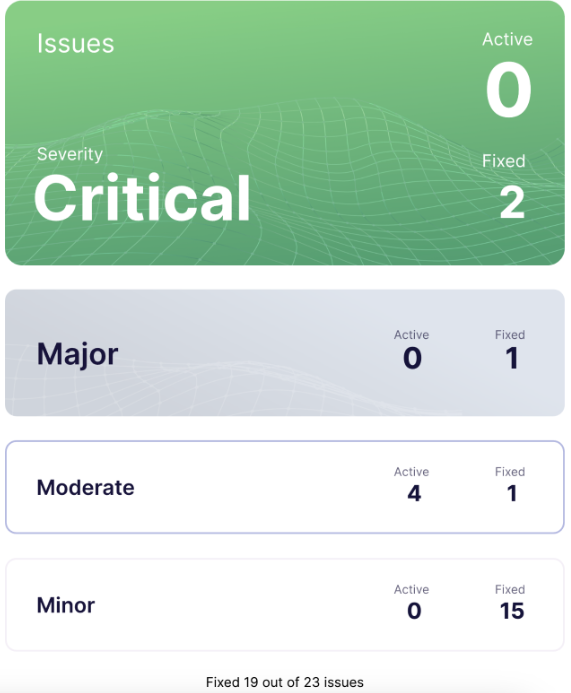

Audits

RedStone has undergone numerous edits from credible third-party auditing firms showcasing their focus on security. The audits below were focused on some core components of the protocol.

Economic Attack Vectors

Oracles provide the critical service of linking external data sources to blockchain-based smart contracts. This role, however, also makes them targets for market manipulation. Market manipulation involves the intentional distortion of asset prices for profit, often at the expense of other market participants. The susceptibility of an asset to manipulation typically inversely correlates with its liquidity; more liquid assets are generally harder to manipulate.

Some common techniques:

| Spoofing | This involves placing a large number of trade orders to create a misleading impression of market demand without any intention of executing them, often automated through bots. |

| Ramping | Artificially inflating an asset’s market price to spur demand. |

| Bear Raid | Intentionally driving down an asset’s price through heavy sales or short sales. |

| Cross-market Manipulation | Engaging in trades within one market to affect prices in another, capitalizing on the discrepancies. |

| Wash Trading | Simultaneously buying and selling the same asset to create misleadingly high trading volume. |

| Frontrunning | Executing trades based on advance, non-public information about upcoming transactions. In the crypto world, this often relates to exploiting pending transactions visible in the public mempool, a practice also known as maximizing extractable value (MEV). |

Another form of economic attack that utilizes oracles is the flash loan attack. These attacks leverage the characteristics of flash loans being uncollateralized and immediate to manipulate market prices drastically. Here’s how a typical flash loan attack unfolds:

- Borrowing: The attacker takes out a flash loan, which allows them to borrow a substantial amount of cryptocurrencies instantaneously without collateral from a DeFi platform offering such services.

- Execution: The borrowed funds are then used to create large buy or sell orders on DEXs. These significant orders artificially alter the price of an asset, either inflating or deflating it according to the attacker’s strategy.

- Repayment: Before the loan’s short duration ends, the attacker completes their intended market manipulation and repays the loan with fees, usually having executed trades that capitalize on the artificially altered prices.

Both attacks can be avoided by improving the verification processes for data integrity, diversifying data sources to avoid reliance on single points of failure, and possibly integrating algorithms that can detect unusual trading patterns indicative of manipulation tactics.

Team

RedStone’s team is filled with individuals with similar backgrounds and several years of experience in blockchain technologies and related subjects primarily engineering.

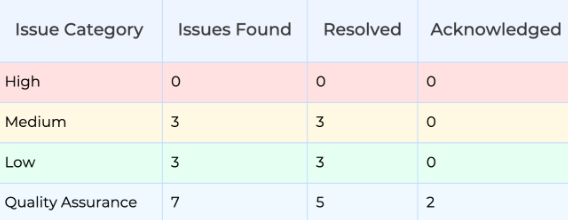

The founding members of RedStone are:

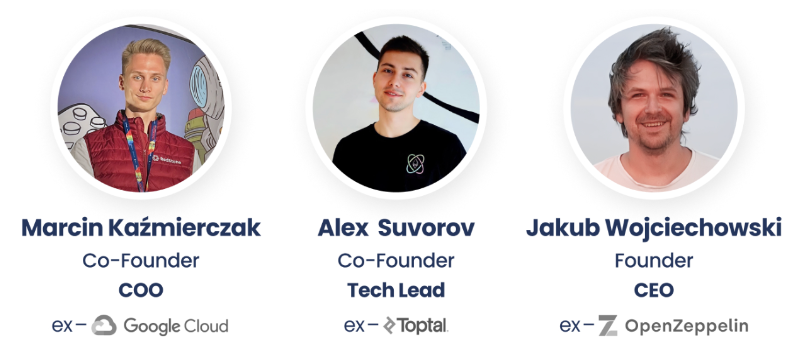

The rest of the team is made up of these members:

Project Investors

RedStone Oracles has achieved significant financial backing through various funding rounds, each of which has played a significant role in its development and expansion.

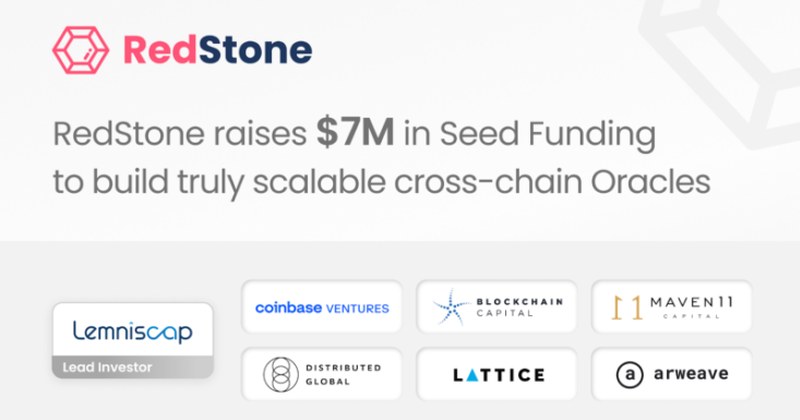

Seed Round

In August 2022, RedStone raised $7 million in a seed funding round led by Lemniscap. This initial raise of capital was aimed at boosting the development of RedStone’s decentralized oracles and modular data-processing smart contracts on the Arweave network, known as Warp. This funding round was critical in laying the foundational elements for RedStone’s novel approach to on-chain data storage and oracle services.

Angel Round

In 2023, RedStone conducted an exclusive angel round that saw participation from notable Web3 pioneers such as Stani Kulechov, Sandeep Nailwal, Alex Gluchovski, and Emin Gün Sirer. This round underscored a strong market conviction that dApps benefit from having a range of oracle options beyond a single provider. The contributions from these angel investors supported RedStone’s mission to disrupt the oracle space with its modular design, customizable data feeds, and comprehensive coverage across all EVM-compatible L1 and L2 networks.

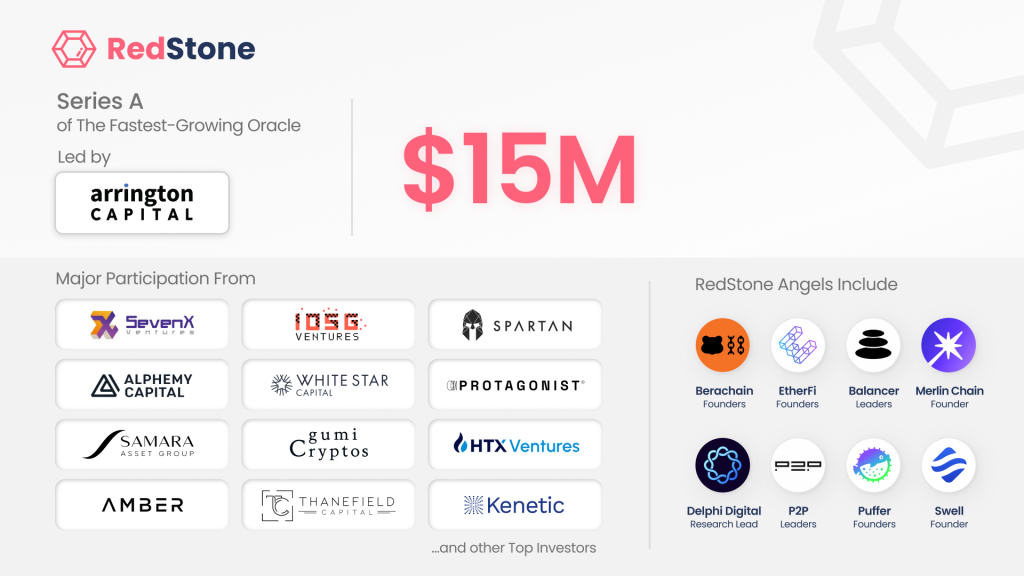

Series A Funding

The momentum continued into 2024 with a $15 million Series A funding round led by Arrington Capital. This round attracted a diverse group of investors, including SevenX, IOSG, Spartan Capital, Alphemy Capital, and many others, reinforcing RedStone’s position in the market. The funds from this round are earmarked for advancing RedStone’s modular architecture, which is crucial for powering the next wave of dApps with gas-optimized and secure oracle solutions. This phase also marked the beginning of “Season 2 Warm-up of The RedStone Expedition,” signaling a new stage of growth and innovation.

FAQ

What is RedStone Oracles?

RedStone Oracles is a blockchain oracle service that provides frequently updated, reliable, and diverse data feeds for decentralized applications (dApps) across multiple Layer 1 (L1) and Layer 2 (L2) blockchains.

How does RedStone ensure the reliability of its data feeds?

RedStone utilizes a combination of decentralized data sources, rigorous validation mechanisms, and a network of independent node operators to ensure the accuracy and reliability of the data it provides to blockchain networks.

Can RedStone Oracles be used for any type of blockchain project?

Yes, RedStone Oracles is designed to support a wide variety of blockchain applications, including DeFi, insurance, gaming, and cross-chain interactions, thanks to its versatile and scalable infrastructure.

How much does using RedStone cost?

The pricing model is published in each Data Provider’s manifest

What makes RedStone different from other oracle services?

RedStone stands out due to its ability to support over 1000 use cases and assets, its operation across more than 50 chains, and its tailored oracle solutions that include specialized models for different needs and scenarios.

Are there any specific blockchain networks that RedStone supports?

RedStone operates across all major blockchain networks, including Ethereum, Binance Smart Chain, Polygon, and many others, providing versatile support for dApps regardless of the underlying blockchain technology.

What are the main oracle models offered by RedStone?

RedStone offers three main oracle models: RedStone Core, RedStone Classic, and RedStone X, each designed to cater to different operational needs and application requirements.

Is there a RedStone token?

Currently, RedStone does not have a token but has plans for it in the future that will reward early adopters and data providers.

How does RedStone handle cross-chain data transfers?

RedStone utilizes cross-chain oracles to facilitate data and asset transfers between different blockchain networks, enhancing interoperability and enabling more complex interactions across the blockchain ecosystem.

Is RedStone suitable for applications requiring real-time data?

Yes, RedStone is particularly well-suited for applications that require real-time data, such as trading platforms and dynamic pricing engines, thanks to its low-latency data streams and high-frequency update capabilities.

What measures does RedStone take to ensure the security of its data feeds?

RedStone employs multiple layers of security, including cryptographic data signing, consensus-based validation among multiple nodes, and robust data source diversification to mitigate risks and ensure the integrity of the data provided.

How can developers integrate RedStone into their projects?

Developers can integrate RedStone by connecting their smart contracts to RedStone’s APIs or using the RedStone SDKs provided for various blockchain platforms. RedStone also offers comprehensive documentation and developer support to facilitate integration.