Overview

Pryzm is a Layer-1 appchain in the Cosmos ecosystem, specially crafted for yield trading and interest rate derivatives for any yield-bearing asset on any chain.

Yield trading is a market sector in DeFi that allows investors to trade the expected future returns of their assets, offering a proactive approach for fixed income and risk management. This is particularly beneficial in DeFi where returns can fluctuate widely, providing both individual investors and institutional participants with tools to hedge against these variations. Pryzm facilitates this by tokenizing future yields, allowing users to buy or sell the anticipated returns on their investments before they are realized by a specific maturity date.

This approach for trading yield is achieved via yield stripping, which is the process of splitting a yield-bearing asset into its principal and yield components. The resulting parts can then be traded on an AMM. What makes Pryzm stand out versus other projects is that all of this is achieved on their own application-specific chain, rather than by deploying contracts on an underlying L1 chain. Moreover, another outstanding advantage is the fact that all the maturity dates for a given asset are traded on a unified liquidity pool for that asset (rather than having to deploy one pool for each maturity date) – allowing for the development of a yield curve over time.

Technological Foundation

Pryzm leverages the Cosmos SDK and Inter-Blockchain Communication (IBC) to create a highly flexible, cost-efficient, and interoperable appchain. This foundation enables the support of diverse yield-bearing assets, including tokenized lending positions, liquid staking tokens (LSTs), liquid restaking tokens (LRTs), and even tokenized real-world assets (RWAs) – if it can earn yield, it can be traded on Pryzm’s AMM.

Utilizing IBC, and Interchain Accounts (ICA), Pryzm offers a seamless experience for yield optimization, achieving block times as low as 0.4 seconds. This value proposition is reinforced with the introduction of custom modules for yield trading such as FlowTrade (to facilitate token swaps within a specified timeframe without interacting with the AMM), ICStaking (for liquid staking of Cosmos-based native tokens), Refractor (for yield-stripping), and the Yield AMM (for trading yield) among others, all of which will be presented in their own dedicated section.

An Appchain for Yield

Pryzm’s decision to evolve into an appchain within the Cosmos ecosystem is a direct response to the inherent limitations of deploying DeFi applications on shared, monolithic blockchains. This strategic move allows Pryzm to harness the unique advantages of appchains. These include higher degrees of autonomy, customization, and optimization – free from the constraints of shared computational resources with other protocols, which often results in increased gas fees and limited customization options. By building on top of their own infrastructure the protocol can capture value at every layer of the stack and not be exposed to risks or rent-seeking behavior from external dependencies.

Appchains offer a dedicated blockchain environment specifically designed for a singular application or a set of closely related applications. For Pryzm, this means the ability to implement specialized modules tailored for its core functionalities, such as yield tokenization, liquid governance, oracle support, and a yield-focused AMM. Such specialization ensures that Pryzm can offer optimal performance, scalability, and interoperability, enhancing the ecosystem’s synergy with other projects and chains.

By developing its own Layer 1 blockchain, Pryzm can take full advantage of Cosmos’ interoperability features as well. Furthermore, the support for assets outside of Cosmos allow Pryzm to significantly broaden its tokenization capabilities across a wide array of assets, thereby expanding opportunities for yield generation and trading. Such capabilities are crucial for addressing DeFi’s challenges related to yield volatility, liquidity constraints, and governance complexity, providing users with more control over their investment outcomes and enhancing liquidity in the overall DeFi space.

Some examples of supported assets include:

Proof-of-Stake (PoS) assets from IBC-connected zones like $ATOM, $TIA, $INJ, $DYDX, $OSMO, and more. These assets offer high market caps and staking yields, making them ideal candidates for yield tokenization and trading.

Liquid Staking & Restaking Tokens provided by external providers such as Lido and others. These derivatives enable users to stake their assets while retaining liquidity, creating opportunities for yield tokenization and trading.

Liquidity Provider Tokens (LP tokens) representing shares of liquidity pools on decentralized exchanges like Uniswap, Osmosis, Balancer and more. These tokens generate fees from trading activity and liquidity incentives, allowing users to monetize, trade, or hedge their positions (e.g. hedge against impermanent loss).

Tokenized Real-World Assets with income streams, such as government bonds, corporate bonds, dividend-yielding stocks, and ETFs. Pryzm can tokenize ownership or fractions of these assets, allowing users to access income-generating opportunities from traditional financial markets in a decentralized setting.

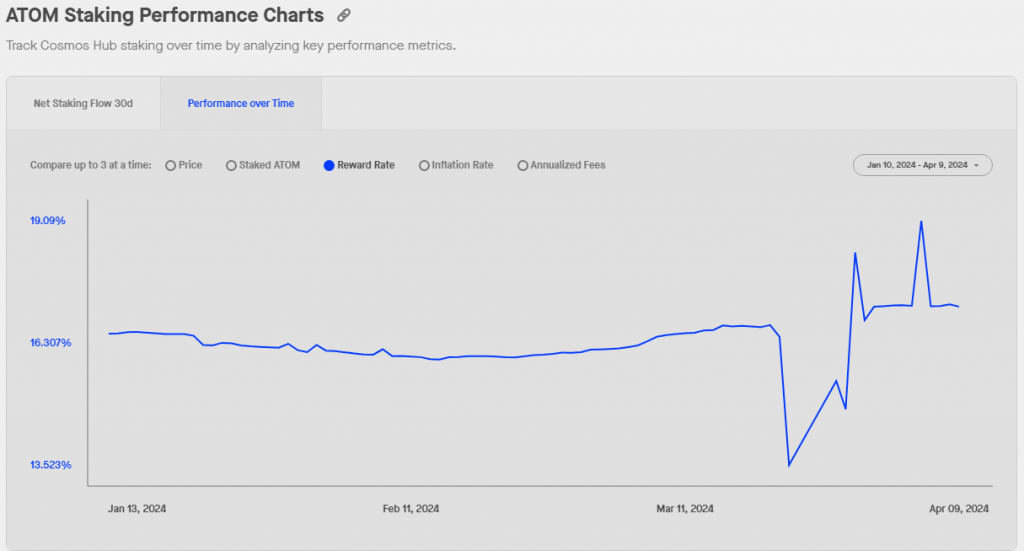

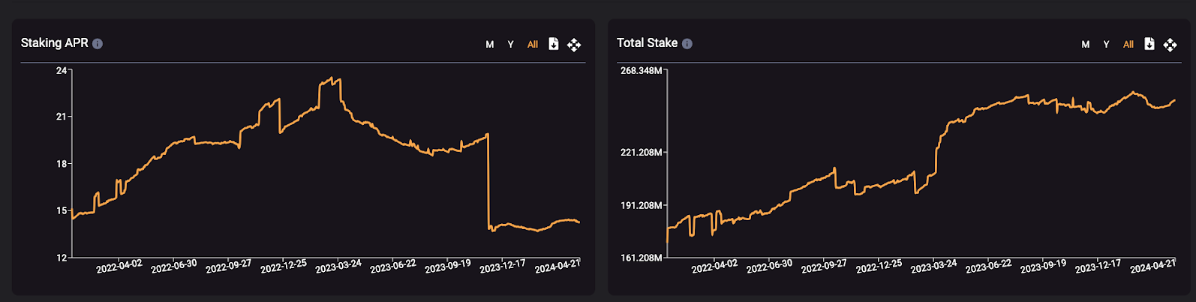

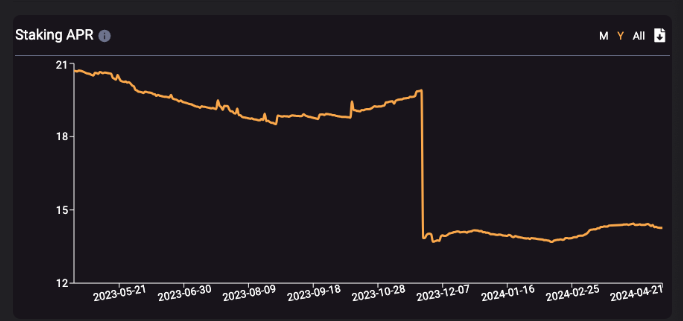

As an example, consider you have been staking $ATOM on Cosmos, aiming to earn passive income from inflationary rewards and network activity fees. However, you’ve noticed that the staking Annual Percentage Rate (APR) has fluctuated significantly, dropping from 23% to 14%. This volatility in yield has left you exposed to uncertain income fluctuations, without the ability to hedge or capitalize on these changes.

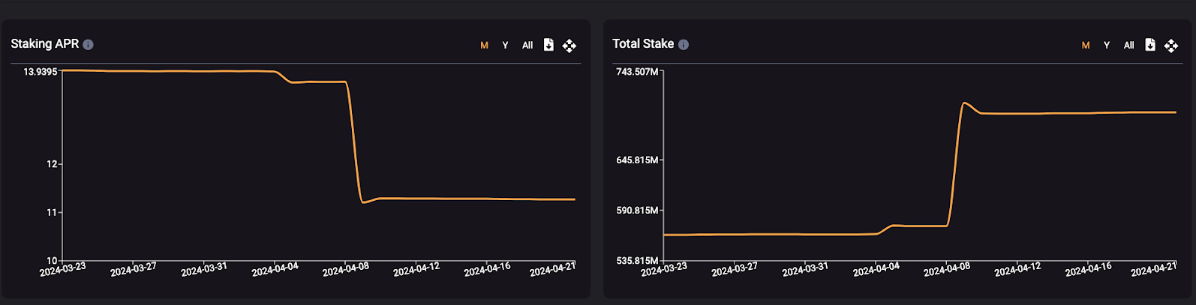

As the amount of assets staked increases, the staking APR tends to go down, as each staker gets diluted. Hence, if you expect an increase in staking participation, you might want to consider locking in a fixed yield before getting diluted.

Cosmos’ $ATOM Historical Staking APR and Total Stake

Celestia’s $TIA Monthly Staking APR and Total Stake

Pryzm changes this paradigm, offering a dedicated platform for yield trading, helping token holders and stakers to mitigate this volatility and access more stable income opportunities. By leveraging Pryzm’s tools, you could have locked in your yield at a higher rate when it was advantageous, providing stability to your returns over the long term.

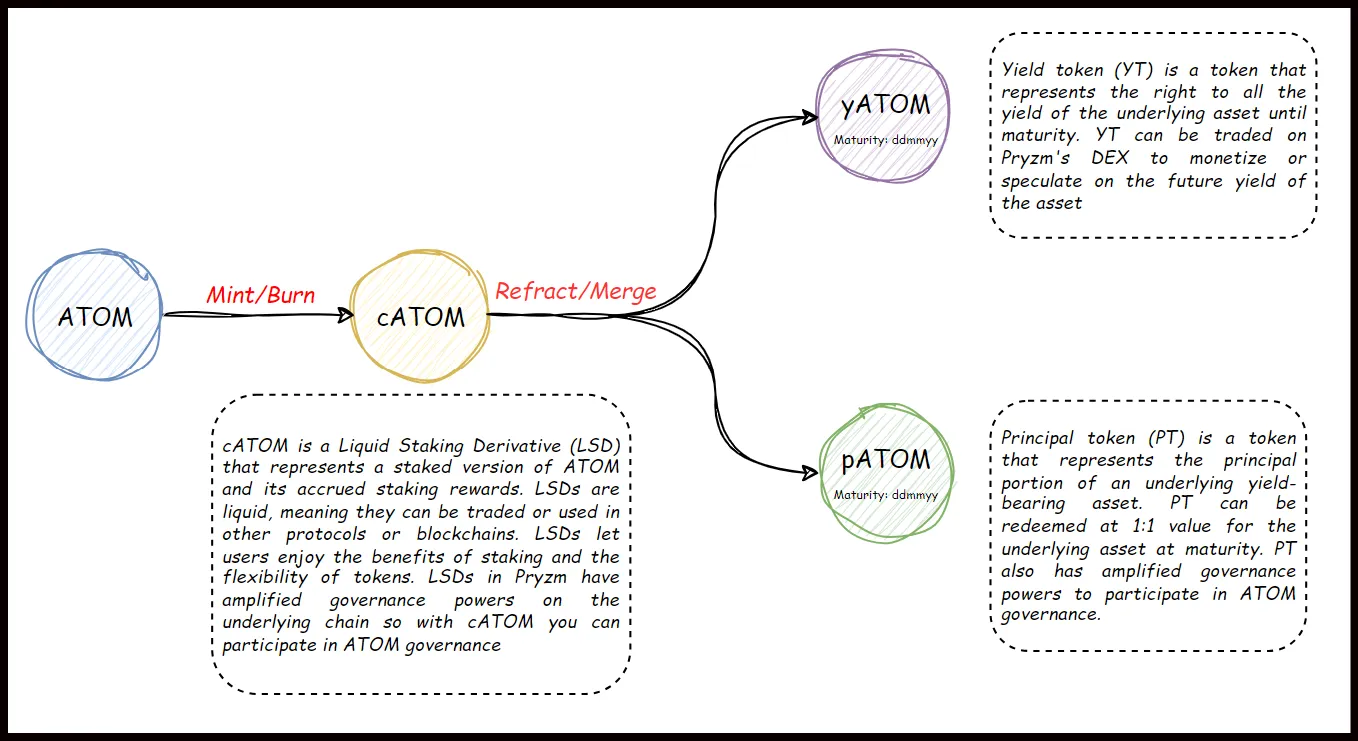

Yield Trading on Pryzm

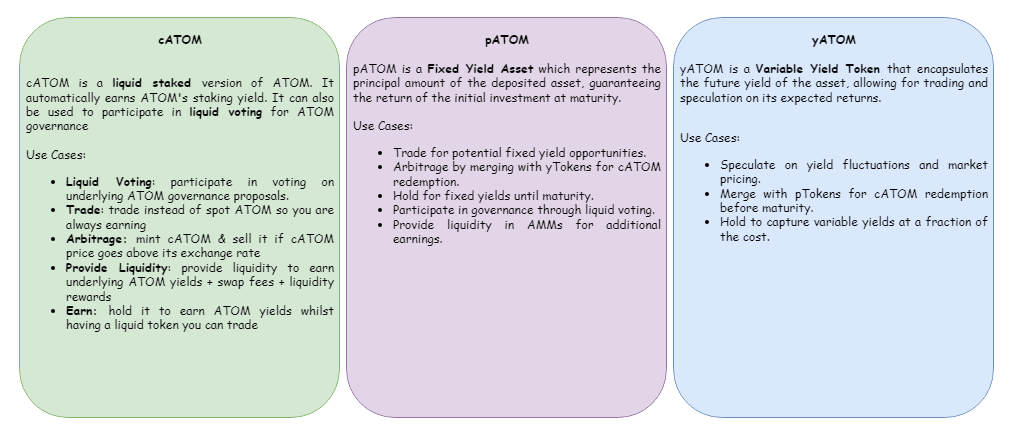

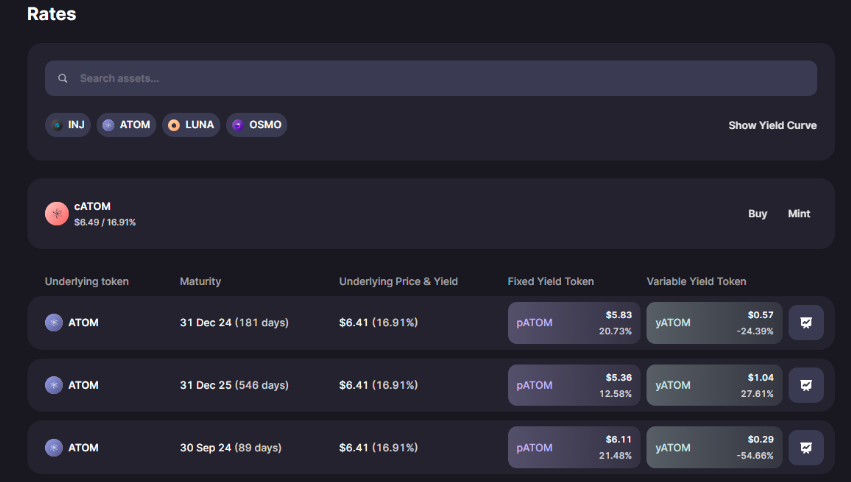

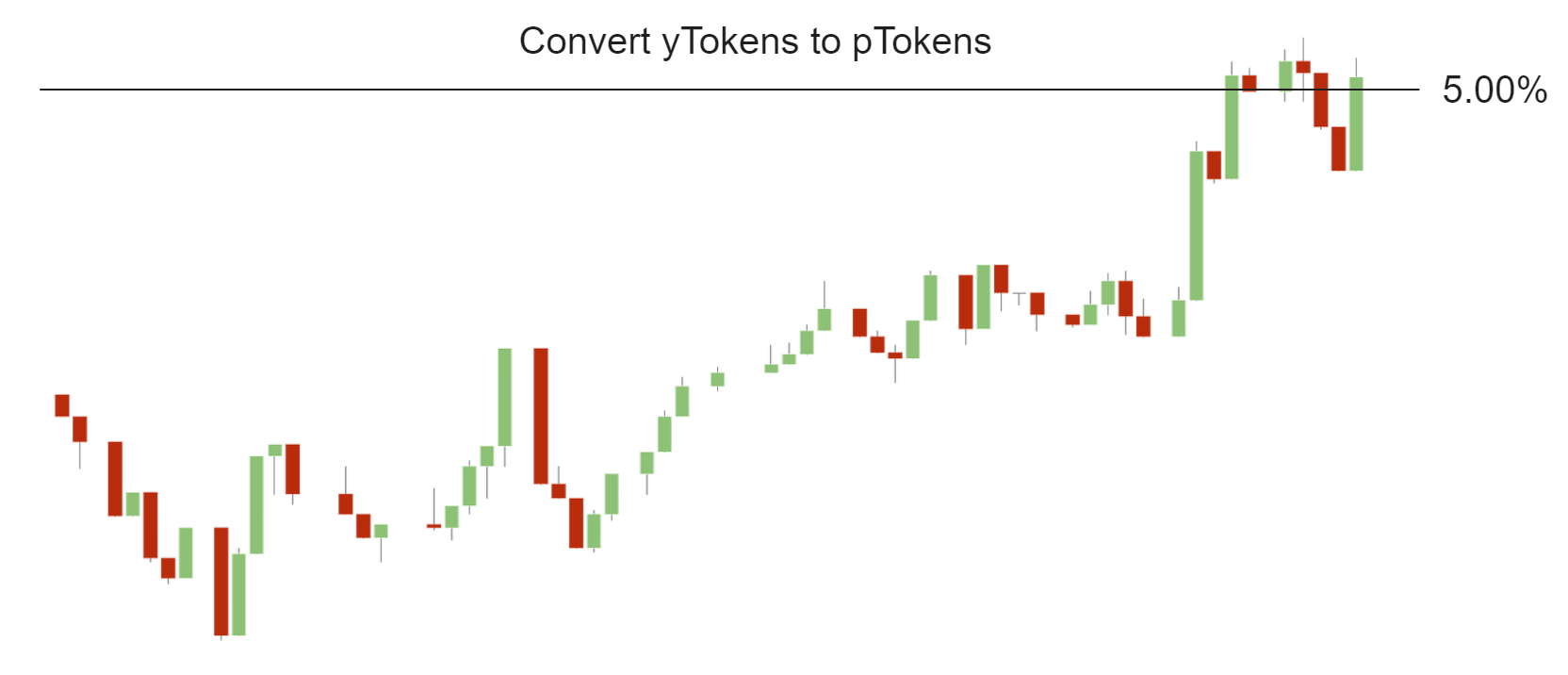

At the core of Pryzm’s functionalities is the tokenization of yield: the process of depositing a yield-bearing asset onto the platform. When users deposit such an asset, Pryzm mints a collateral token (cToken), which is then bifurcated into two distinct components with a maturity date attached: a principal token (pToken) and a yield token (yToken). For instance, cATOM, a liquid staking token of $ATOM within Pryzm, embodies the staked value and the rewards it accrues.

pToken: Represents the principal amount of the deposited asset and holds a 1:1 redemption value with the underlying asset at maturity. Essentially, pTokens guarantee the return of the initial principal invested after a predetermined period.

yToken: Represents the future yield that the deposited asset is expected to generate until maturity. Holding yTokens entitles the owner to the yield earnings, which can be realized without having to wait for the natural accumulation period.

Pryzm splits cTokens into a Principle Token (PT) and the Yield Token (YT), thereby enabling users to trade the future yield of their assets independently of their principal value. This separation allows users to tailor their investment strategies according to their risk appetite and yield expectations.

Yield Tokens (yTokens)

Yield Tokens, or yTokens, represent the future yield of a yield-bearing asset over a specified period. These can include Liquid Staking Derivatives like stETH from Lido, or Proof-of-stake assets from IBC connected zones like $ATOM, $TIA, $INJ, etc.

For instance, if you own $ATOM and it generates a 20% annual yield, you can tokenize this future yield into yATOM. This yATOM then becomes a tradable asset on Pryzm’s AMM, allowing you to sell or buy future yield on a secondary market without needing to transfer the underlying asset. The value of yTokens fluctuates based on market predictions of the asset’s yield and the remaining time to maturity. After the maturity date, yTokens expire, becoming valueless as their yield payout is completed.

This allows investors to directly manage, trade, or hedge the yield component of their assets, independent of the principal value. By tokenizing future yields, yTokens become tradable assets, providing liquidity for what was traditionally a more static return on investment. Investors can buy or sell future yields based on their market outlook or yield management strategies. If investors are concerned about yields depreciating, they can sell it for principal tokens to essentially “lock in” the yields, vice versa if they believe that yields would go up.

Principal Tokens (pTokens)

Principal Tokens, or pTokens, encapsulate the underlying value of an asset, separate from its yield-generating capabilities. By converting assets into pTokens, investors essentially lock in the principal value, allowing for distinct management of asset capital without the yield aspect. pTokens are particularly useful in scenarios where investors wish to secure or hedge against the principal value fluctuations of their investments while engaging separately with yield strategies through yTokens.

Due to its separation from yield, PT can be purchased at a discounted price compared to the original asset. Additionally, PT is freely tradeable at any time, offering flexibility to investors who can buy or sell it according to market conditions. As the investment nears maturity, the value of PT gradually increases until it reaches parity with the original asset’s value, ensuring that holders receive the full principal amount when redeemed.

For example, if an investor has $ATOM with a significant market value, they can tokenize this principal value into pATOM and yATOM. This conversion enables the pATOM to be traded independently of the yield aspect, focusing solely on the asset’s capital value. pTokens provide an avenue for investors to buy assets at a discounted rate or lock in a fixed return by selling their future yield via yTokens. The market value of pTokens is determined by the perceived stability and expected future value of the underlying asset, adjusted for the time until the token’s maturity. Converting yATOM to pATOM essentially means you are shorting yields on the asset and locking in whatever the rate is now.

A Framework for Yield Trading

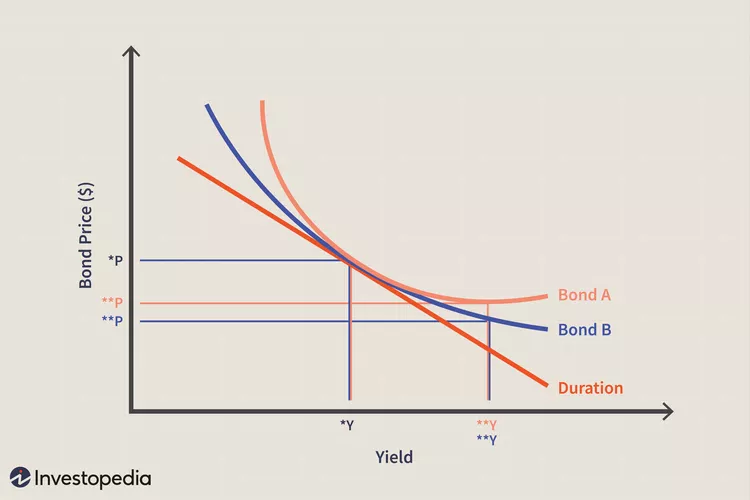

Maturity Assessment and Convexity: Assets with longer maturities might present more substantial yield opportunities but entail greater uncertainty regarding future yield and value. Conversely, assets with shorter maturities offer a more predictable yield landscape but might limit potential gains. This concept is called convexity in fixed income. In TradFi, convexity is a measure to assess how the duration of a bond changes as interest rates change. It provides a more accurate estimate of bond price sensitivity compared to duration alone, which assumes a linear relationship between bond prices and interest rate changes. Convexity accounts for the fact that this relationship is curved, meaning the change in bond price is not proportional across different interest rate levels. For instance, a bond with higher convexity will have larger price increases as interest rates fall, and smaller price decreases as interest rates rise, compared to a bond with lower convexity. This makes high convexity bonds more desirable in volatile interest rate environments as they offer greater protection against rising rates and enhanced gains when rates fall.

Convexity is the curvature in the relationship between prices and interest rates. It reflects the rate at which the duration of a bond changes as interest rates change. As an example, the image below shows how Bond A has a higher convexity than Bond B, which indicates that all else being equal, Bond A will always have a higher price than Bond B as interest rates rise or fall.

- If a bond’s duration increases as yields increase, the bond is said to have negative convexity.

- If a bond’s duration rises and yields fall, the bond is said to have positive convexity.

Applied to yield trading we can infer that as the yield produced by an asset decreases, then yTokens become less valuable (since you would be receiving lower amounts as coupon payments). Hence, decreasing yield rates cause the price of pTokens to go up. As an investor you could realize a profit just by the price move caused by yield changes alone, meaning that you would not have to wait to get the fixed yield. Hence, we can see how longer dated maturities would return higher profits due to convexity, as those opportunities have more sensitivity to changes in interest rates.

Stability through Fixed Yield: For investors prioritizing stability, selling yTokens while retaining pTokens can lock in a fixed yield, providing a safeguarded return on investment.

Maximizing Yield Potential: Investors with a bullish outlook on asset performance might consider acquiring additional yTokens. This strategy leverages optimistic market predictions, aiming to capitalize on higher-than-anticipated yields.

Mitigating Asset Value Fluctuation Risk: To counteract risks from volatile asset values, selling pTokens while holding yTokens can isolate yield benefits, divorcing yield generation from potential depreciation in the underlying asset’s value.

Discounted Asset Acquisition: Purchasing pTokens can equate to acquiring future asset ownership at a discount, particularly when the market appears to undervalue the asset’s potential or overvalue its yield prospects.

Market Sentiment and Yield Impact: Keeping abreast of market trends and sentiment is crucial, as these factors can significantly influence pTokens and yTokens valuations. An informed strategy allows for timely entry and exit decisions, optimizing the investment based on current and anticipated market conditions.

Diversification as Risk Management: Relying on a single strategy in the dynamic DeFi yield market may expose investors to undue risk. Diversifying investment approaches across various assets and maturity horizons can balance potential returns against risk, ensuring a more resilient investment portfolio.

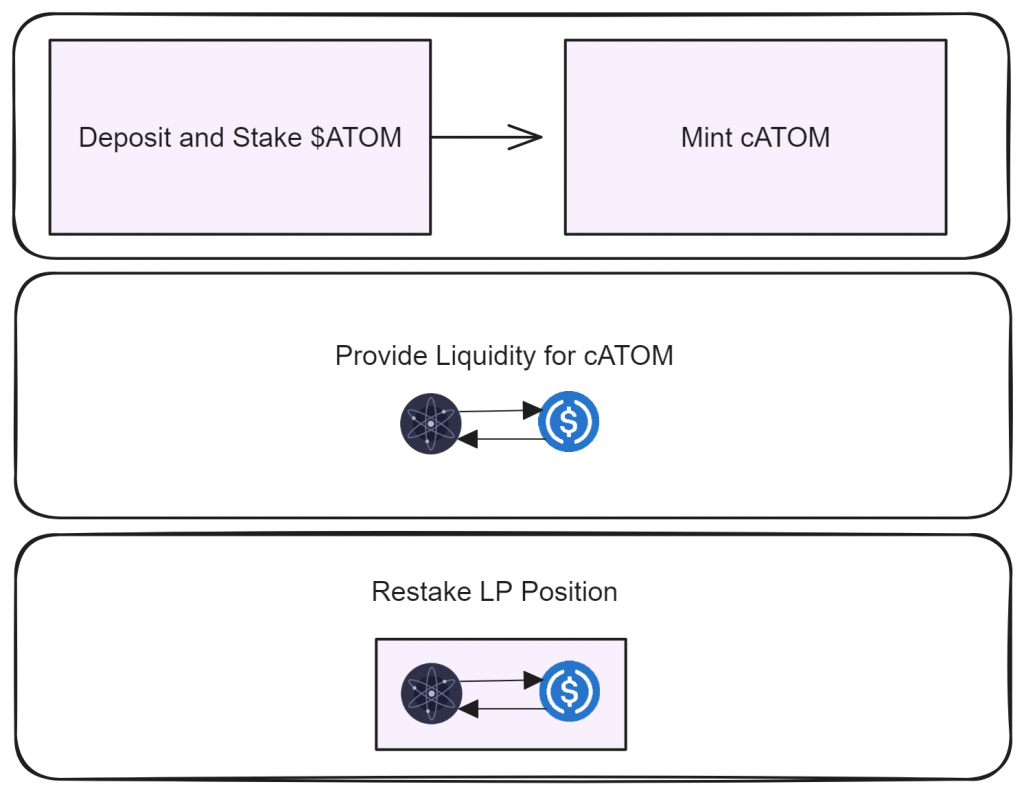

Restaking or “Yield on Yield” Opportunities on Pryzm

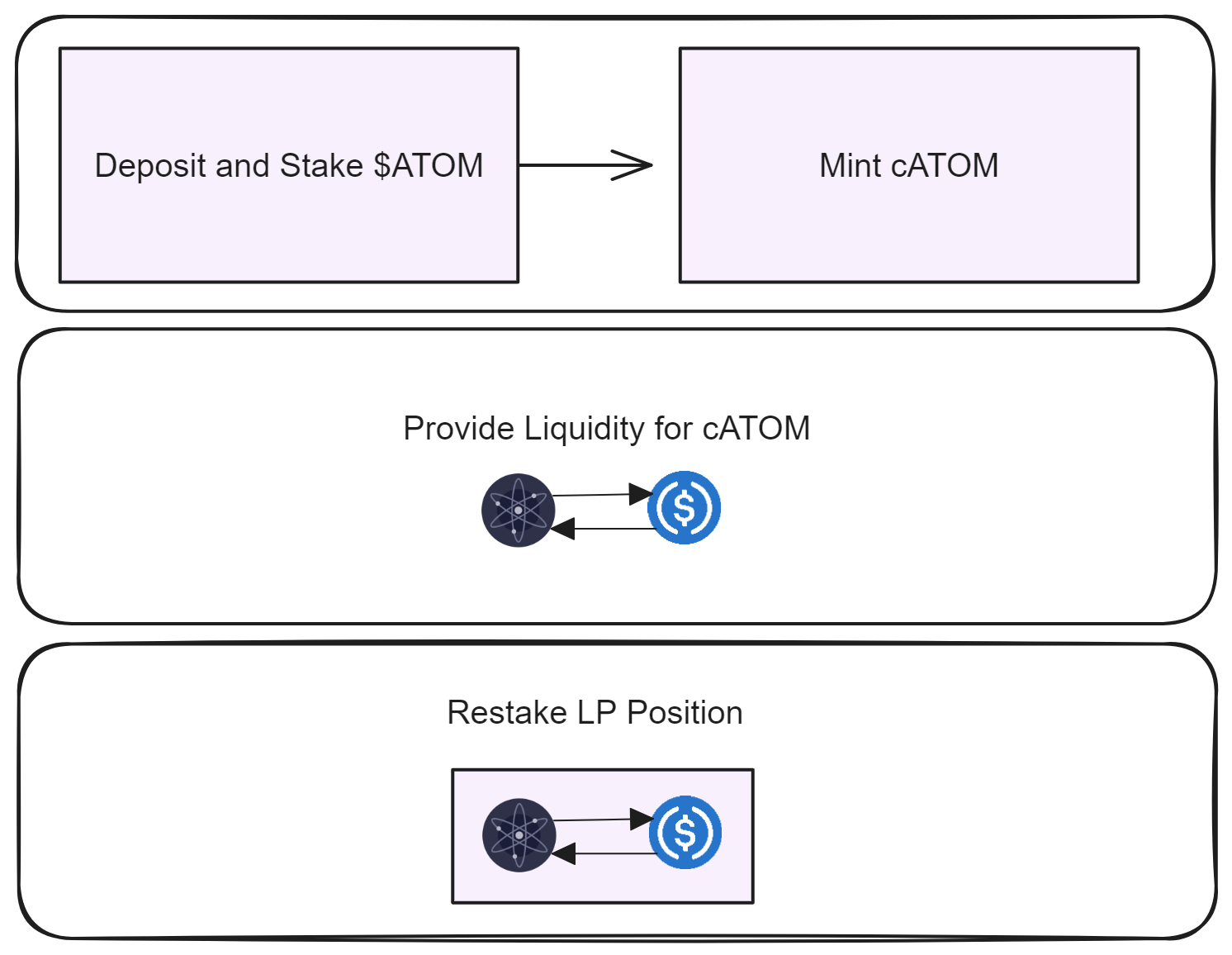

Pryzm allows you to restake Liquidiy Provider tokens, which are collateralised themselves by LSTs, similar to Eigenlayer. By restaking these LP positions on the Przym blockchain, you essentially engage in a secondary layer of yield generation.

This restaking process contributes to the security and operability of the Pryzm network, similar to how staking works in other Proof of Stake or Delegated Proof of Stake systems. However, in addition to contributing to network security, restaking in Pryzm uniquely positions your LPs to earn further rewards. Restaking rewards come from two main sources:

Pryzm Block Rewards: Similar to block rewards in traditional PoS systems, Pryzm generates block rewards that are distributed to participants who help secure the network by staking (in this case, restaking LP positions).

Chain Revenue: Pryzm generates revenue through various mechanisms like trading fees on dApps built on it. A portion of this revenue is allocated to restakers, providing an additional layer of yield on top of the standard LP fees and LST yields.

The allocation of rewards and the decision on which assets can be restaked are governed by Pryzm’s integration of The Alliance Module. This module acts as a decentralized governance framework that allows token holders to participate in the decision-making process (explained further below). The Alliance Module creates a dynamic marketplace where different assets compete for the attention and support of Pryzm governance token holders so they can earn a share of chain inflation and chain revenue. This is based on the perceived value and utility that different assets bring to the Pryzm ecosystem. Assets that are deemed more valuable or have a higher utility in securing the network or attracting liquidity may be allocated higher rewards. This is similar to the “governance wars” concept on most DeFi protocols where different protocols compete for governance tokens to influence the allocation of rewards.

Protocol Architecture

Cosmos Modules

Cosmos modules are pre-built, customizable components that developers can use to create blockchains using the Cosmos SDK. These modules abstract common blockchain functionality and provide developers with a set of tools and functionalities that are essential for building dApps. They are crucial for the Cosmos ecosystem as they enable rapid development, interoperability, and scalability of blockchain applications.

Modules cover various aspects of blockchain technology, including governance, staking, token issuance, and inter-blockchain communication (IBC), among others. By leveraging these modules, developers can focus on building their unique application logic instead of reinventing the wheel for common blockchain operations. This accelerates the development process, reduces potential for errors, and enhances the security of blockchain networks.

Rapid Development: Modules offer pre-designed templates and functions that handle complex blockchain features, allowing developers to quickly bootstrap new projects and focus on their specific application needs.

Interoperability: Through IBC, Cosmos facilitates seamless communication and transfer of assets between different blockchains within the Cosmos network, promoting a network of interconnected blockchains.

Customizability: Although modules provide standard functionalities, they are designed to be customizable. Developers can modify existing modules or create new ones to suit their specific requirements, offering flexibility and control over their blockchain’s features.

Scalability: Modules are designed to be efficient and lightweight, contributing to the scalability of applications built with the Cosmos SDK. They allow for the creation of application-specific blockchains that can scale independently, preventing congestion and maintaining high performance.

This is not to be confused with modules that Pryzm has specifically built for its protocol (which will be presented in their own dedicated section).

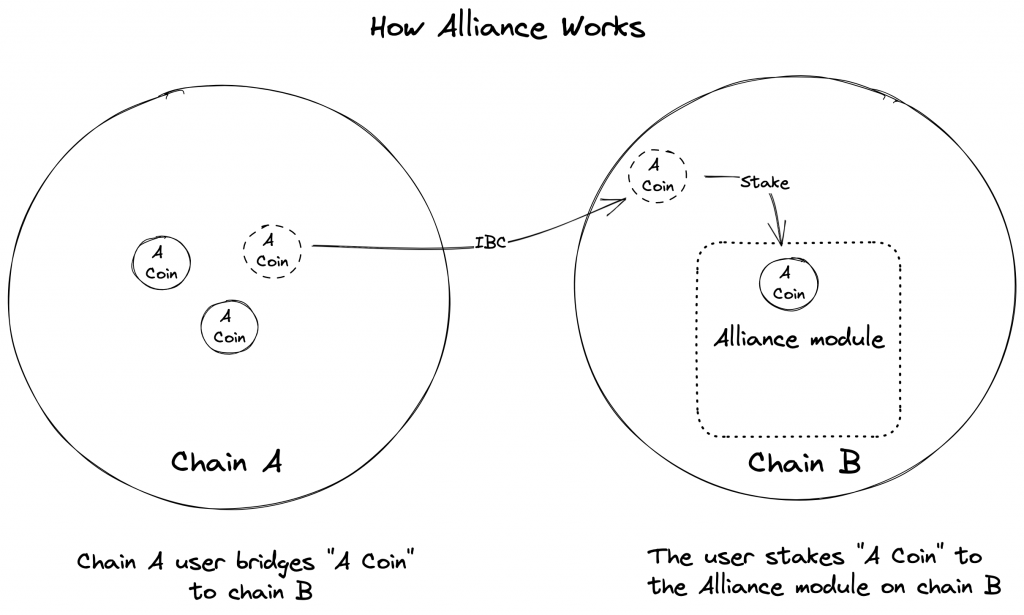

Alliance Module

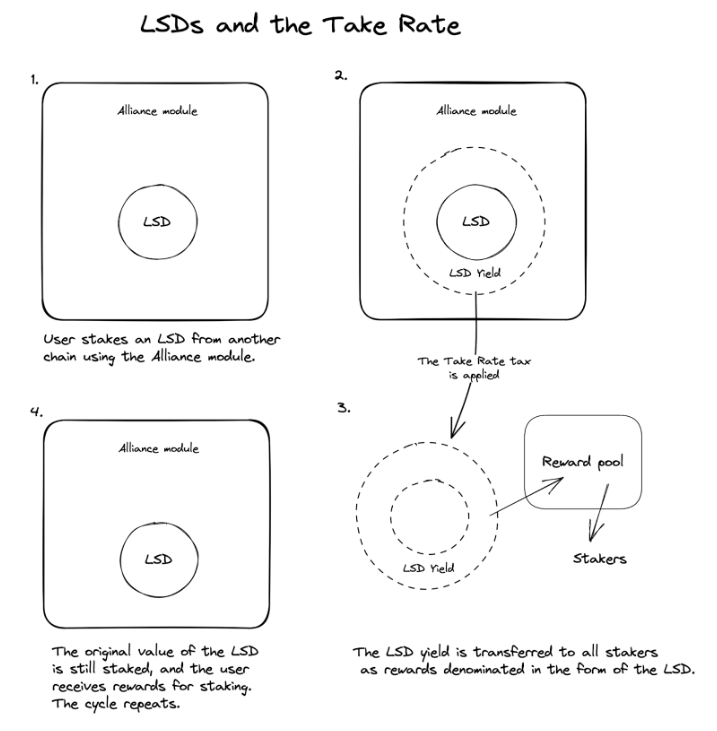

Alliance is an open-source Cosmos SDK module that enables a broad spectrum of assets to be staked on participating blockchains across the Cosmos ecosystem. Pryzm uses it to enable LP tokens on its AMM to be restaked for network security, offering an extra source of yield for depositors.

Key components of the Alliance module include:

Alliance Assets: Tokens designated through governance to be stakable on the chain that has integrated the Alliance module. These can encompass a wide range of assets, including liquid staking tokens from other chains, liquidity provider tokens, receipt tokens from deposits into applications, and even stablecoins.

Take Rate: A percentage specified for each Alliance asset that dictates the portion of staked Alliance assets to be redistributed to native token stakers of the chain. This mechanism allows for the sharing of economic activities generated by Alliance assets with the chain’s native ecosystem. The Take Rate can be set to zero, but when applied, it serves as an additional incentive for native staking and enriches the reward pool for native token stakes. For instance, if the Take Rate is set to 5% on a particular Alliance asset, 5% of the staked amount of that asset is periodically converted into the native token and distributed among its stakers.

Reward Weight: This parameter determines the share of native staking rewards allocated to stakers of an Alliance asset, effectively deciding the distribution of total rewards among different staked assets. For example, if an Alliance asset is assigned a Reward Weight of 0.3, and the total staking rewards available in a given period are 100 units, then stakers of that Alliance asset would share 30 units of rewards proportionally, based on their stake. The remaining 70 units would be distributed among the stakers of the native token or other Alliance assets, according to their respective Reward Weights.

Unlike traditional staking, which is limited to a blockchain’s native asset, the Alliance module expands staking capabilities to include a variety of assets. This includes, but is not limited to, Liquid Staking Tokens (LSTs), IBC assets, LP tokens, and even stablecoins. This means assets from one chain can be staked on another, creating a cross-chain economic web that benefits both the staked asset’s origin chain and the receiving chain. The Take Rate is then paid to the Pryzm treasury.

Implementing the Alliance module is a governance-driven process, requiring a proposal and approval by the community. Once integrated, the community then decides which assets to whitelist as stakable Alliance assets, effectively allowing the ecosystem to tailor the module to its unique economic strategies and needs.

Note that the reference to LSD on the image below is synonymous with LST, which stand for Liquid Staking Derivatives and Liquid Staking Tokens respectively.

This is a very advantageous feature for an appchain like Pryzm, as it allows for the restaking of LP tokens to secure Pryzm’s chain. In doing so LPs can enhance their return and earn native yield, swap fees, chain inflation and chain revenue – whilst paying the take rate to Pryzm’s treasury.

Pryzm Modules

Pryzm has developed dedicated modules in order to enable yield trading on its own appchain.

Asset Module

The Asset Module within Pryzm is designed to manage the lifecycle and characteristics of refractable assets. Refractable assets are assets that can be broken down into principal and yield components, typically through a process known as refracting. These assets are registered in the system with specific identifiers and attributes, such as the token denomination and host chain ID for staked assets, or simply as external assets with unique identifiers.

Each refractable asset in Pryzm is characterized by:

- ID: A unique identifier for each asset, used within the platform for tracking and operations.

- Token Denom: The specific denomination of the token, which may represent internal tokens or IBC transferred tokens for external assets.

- Host Chain ID: Identifies the blockchain where the asset is originally staked; this field is left blank for external assets.

- Disabled Status: Indicates whether the asset is active or has been disabled through governance, affecting its participation in new refracting operations.

Maturity Parameters and Fee Ratios

Each refractable asset comes with maturity parameters that define how often new maturities are introduced and for how long they are available before they reach their expiration. They’re governed by two parameters: the number of maturities per year and the number of years in advance that maturities are available. The former can be discrete values of 1, 2, 4, or 12 – representing annually, semi-annually, quarterly, or monthly maturities. The latter can be any number from 1 to 10. This is crucial for managing the lifecycle of refracted assets, ensuring that users can plan and execute their investment strategies effectively.

The fee ratios associated with each asset operation (such as refract, merge, or redeem) are also defined within the Assets Module. These fees are critical for the economic sustainability of the platform, compensating for the operational costs and incentivizing the maintenance of the ecosystem.

ICStaking

The ICStaking Module in Pryzm enhances the utility and accessibility of native tokens by allowing users to stake them in exchange for LSTs, commonly referred to as cAssets. The ICStaking module significantly automates and optimizes the staking process by batching user stakes and delegating them at predefined intervals, and by automatically compounding staking rewards to maximize returns.

The core functionality of the ICStaking module revolves around integrating with the Cosmos interchain accounts feature, facilitating staking-related operations on supported chains. This integration ensures seamless and efficient management of staking processes across different blockchain networks.

The Host Chain plays a crucial role in this setup. It is the blockchain where native tokens are staked to earn rewards. Each host chain is uniquely identified and integrated with specific parameters that dictate how assets are handled and staked. These parameters include:

- Id: A unique identifier for each host chain used primarily in cToken denominations.

- ConnectionType and ConnectionId: Unique identifiers that establish and manage the interchain connection.

- BaseDenom: The native token denomination of the host chain.

- TransferChannels: Channels that facilitate token transfers between Pryzm and the host chain.

Users engage with the ICStaking module by staking their native tokens and receiving cAssets in return. These cAssets represent their staked interest and can be traded or utilized within the Pryzm ecosystem. The staking process involves several key elements:

- Validators: Tokens are staked with whitelisted validators as per their specified weights.

- Batching: Stakes are batched and delegated at intervals to optimize transaction efficiency.

- Compounding: Rewards are automatically restaked to maximize users’ earnings.

The ICStaking module also handles undelegation, where users can request to unstake their assets. This process is tightly regulated through epoch management, ensuring that assets are returned to users after the host chain’s unbonding period.

Importantly, this feature gives users in Cosmos the ability to unstake instantly without having to wait for the full unbond period of 21 days.

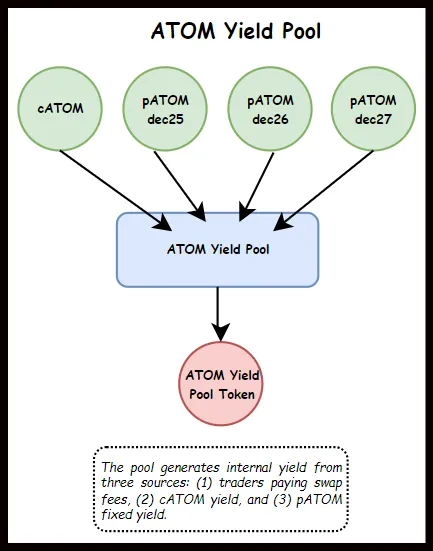

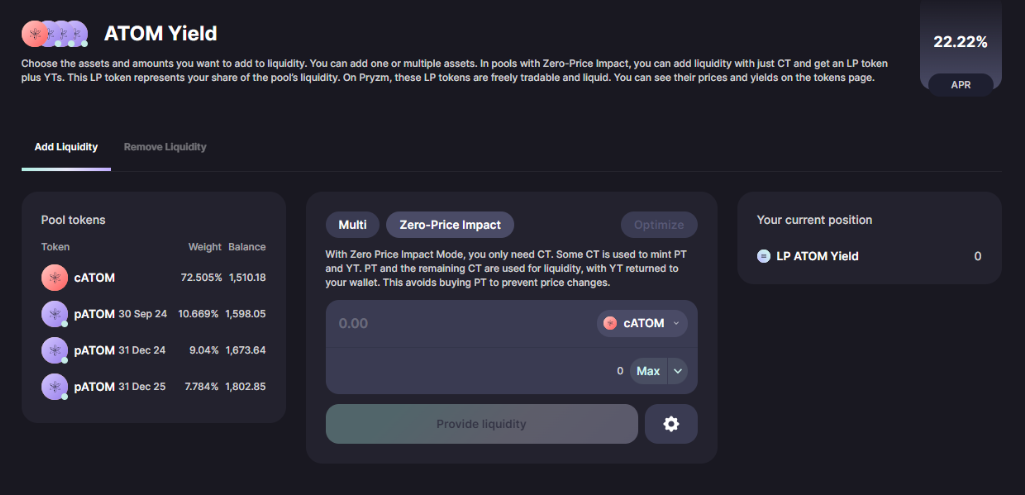

Yield AMM – YAMM

The YAMM is an AMM tailored to the unique needs of trading principal and yield tokens. This specialized AMM model features pools for each asset, incorporating both collateral assets (cAssets) and all active principal asset (pAsset) maturities as liquidity in the yield pool. The YAMM automatically handles asset maturities, seamlessly adding new and removing expired maturities, thereby offering liquidity providers (LPs) a passive and hassle-free experience.

Trading yAssets within the YAMM does not require their own liquidity pool due to a sophisticated combination of flash loans and the refracting process. This mechanism enhances LP yields by routing all yAsset trades through the YAMM pool. Here’s an outline of how it works:

- When a user wants to trade yAssets, the system initiates a flash loan to provide the initial capital needed for the trade. This is a temporary borrowing of assets from the YAMM pool that must be repaid within the same transaction block.

- The borrowed capital (in the form of cAssets) is then refracted. Refracting is the process of splitting a cAsset into its principal (pAssets) and yield (yAssets) components. This process creates yAssets corresponding to the future yield of the cAsset and an equal amount of pAssets representing the principal.

- Once the refracting process is complete, the system then trades the pAssets obtained through refracting back into cAssets in the YAMM pool. This step is crucial for repaying the flash loan and can also adjust the composition of the liquidity pool to maintain balance.

- The yAssets generated through the refracting process are provided to the user executing the trade. The flash loan is repaid using the cAssets obtained from trading the pAssets back into the pool. If there are any surplus cAssets after repaying the flash loan, they are also returned to the user.

This approach offers several advantages including capital efficiency by maximizing the use of the pool’s capital by enabling the trading of yield components without requiring additional capital allocation to separate pools for yAssets. Since all yAsset trades utilize the YAMM pool, LPs benefit from increased trading volume and fees associated with both the flash loan and the refracting process. This ultimately leads to higher yields for LPs than if the system had one pool for each maturity date.

The system automatically adjusts the assets in the pool as they reach new maturity levels or expire, ensuring the liquidity remains relevant and up-to-date.

- Exchange Rate Calculation: The exchange rate between cAssets and pAssets is dynamically determined by their total supply and amount in the vault. This helps in the conversion and understanding of asset values over time.

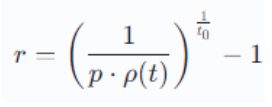

- Yield Calculation: The yield to maturity for pAssets is calculated using a formula that considers the market price of the pAsset, its maturity timeline, and the refractor exchange rate.

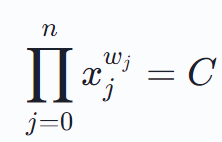

- Weighted Pool Design: Utilizing Balancer’s constant weighted geometric mean formula, YAMM adjusts the weights of the assets in the pool over time, ensuring balance and fair valuation as assets approach maturity.

Below are some mathematical formulas and terms relevant to the YAMM:

Yield Rate to Maturity (r): Determines the expected yield from holding a pAsset until its maturity, based on its market price and time until maturity.

Balancer’s Constant Weighted Geometric Mean Formula: Used to manage liquidity in the YAMM pool, ensuring proper distribution among cAsset and pAssets.

Leverage Parameters: Amplifies liquidity for specific yield ranges within the YAMM pool, affecting the pool’s ability to handle trades.

The use of leverage parameters in Pryzm’s YAMM to amplify liquidity within certain yield ranges:

- Weights in the pool are not static; they adapt based on the asset’s time to maturity and other factors, enhancing pricing accuracy and replicating the yield curve dynamics typically seen in traditional financial markets.

- To manage liquidity adjustments smoothly, YAMM uses virtual balances that increase or decrease as assets are added or removed from the pool. This mechanism helps in preventing market distortions during significant liquidity events.

- YAMM focuses on providing instant and continuous liquidity without locking up assets. This design not only facilitates immediate trade execution but also enhances the flexibility for users to engage with the platform without the constraints of waiting for trade completion or potential adverse impacts from other ongoing trades.

Lambda Parameter (λ): A leverage parameter for cASSET, influencing the balance curve’s flattening for the asset.

λ≥1

Parameter L: Reflects the pool’s liquidity, equating to the number of LP tokens in circulation.

Virtual Adjustment Balances: Used to adjust the pool’s virtual balances smoothly when adding or removing pAssets.

Dj(t) = dj(t)⋅L

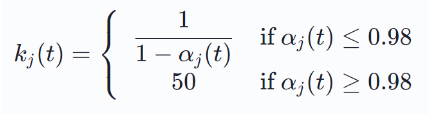

Trading Fee: A variable fee based on the yield rate, suitable for transactions involving yield-bearing tokens.

ϕ = max {ϕi(t), ϕj(t)}

Zero Impact Join: Allows users to join the pool with cAssets while minimizing price impact, involving refracting and trading steps to balance the pool.

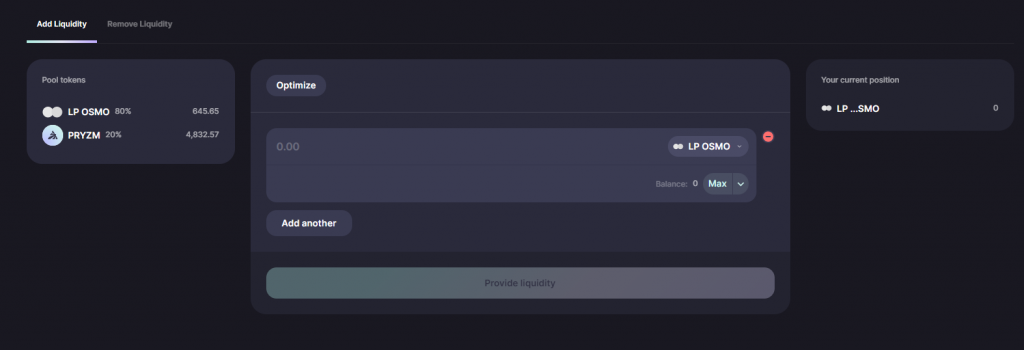

Weighted AMM – WAMM

Pryzm uses a Balancer inspired Weighted Automated Market Maker (WAMM) which is an evolution of the traditional constant product model used by most automated market makers (AMMs), such as the xy=k formula found in Uniswap. The main difference between a WAMM and a traditional AMM lies in how assets are weighted within the liquidity pool.

In a conventional Uniswap AMM, liquidity pools are structured to maintain a 50-50 value ratio between the two assets. This means that for a pool consisting of two tokens, A and B, the AMM requires liquidity providers (LPs) to add equal value of both tokens. The xy=k formula then ensures that the product of the quantities of tokens A and B in the pool remains constant, enabling price discovery as trades are executed.

A Weighted AMM allows for pools with customized weight ratios between the assets, diverging from the strict 50-50 requirement. For instance, a pool might have an 80:20 weight ratio, indicating that 80% of the pool’s value is in one asset and 20% in the other. This flexibility in setting weight ratios allows for a broader range of strategic liquidity provision and trading strategies.

The benefits of a WAMM over a traditional AMM are:

Reduced Impermanent Loss: By deviating from the 50-50 ratio, WAMMs can potentially reduce the impact of impermanent loss by allocating more weight to the asset you believe would perform better. When assets in a pool are more closely aligned with their market volatility through weighted ratios, the disparity between holding assets in the AMM versus holding them outside is lower.

Enhanced Yield Exposure: WAMMs allow liquidity providers to have increased exposure to yield-bearing assets. For example, by favoring LSTs like Pryzm cTokens in the pool composition, LPs can earn higher yields from staking rewards in addition to trading fees.

Efficient Capital Allocation: Weighted pools allow for more efficient capital allocation, as LPs can choose to provide liquidity in proportions that reflect their market outlook or risk appetite. This means LPs can preferentially provide liquidity to assets they are more bullish on or that offer higher yields.

Multi-token Pools: Unlike traditional 50/50 liquidity pools which equally divide liquidity between two tokens, multi-token pools allow liquidity providers (LPs) to configure pools with multiple tokens in customizable ratios. This ensures that liquidity isn’t fragmented across numerous pools. This eliminates the need for pairing each pASSET with a cASSET in separate pools.

The entire yield curve can be traded within a single pool, which enhances capital efficiency, reduces price impact, and ensures that LPs earn swap fees from trades involving any maturity. This addresses key challenges and limitations of standard AMMs, allowing LPs to set their preferred allocation ratios among various tokens in a single pool. This flexibility lets them tailor their exposure according to risk preference.

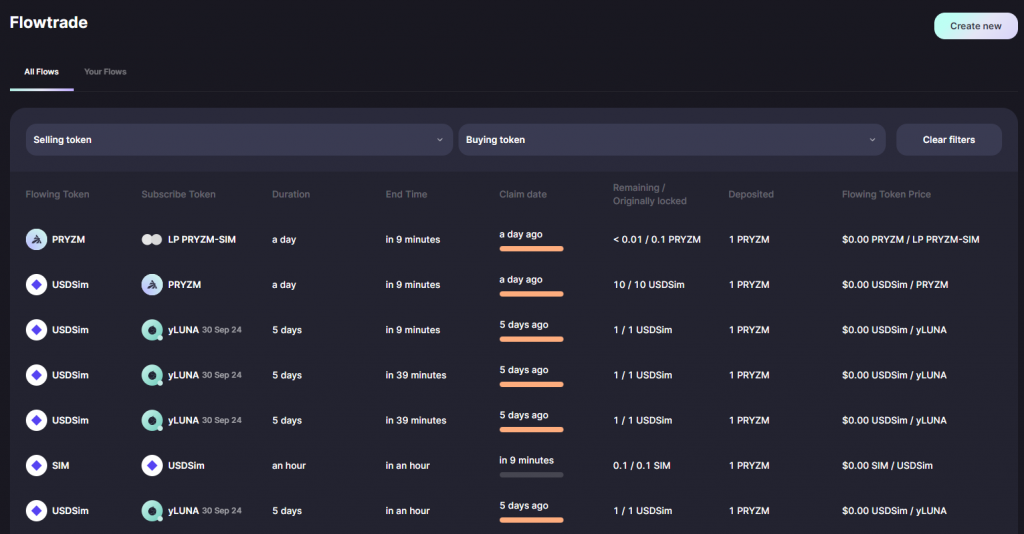

FlowTrade

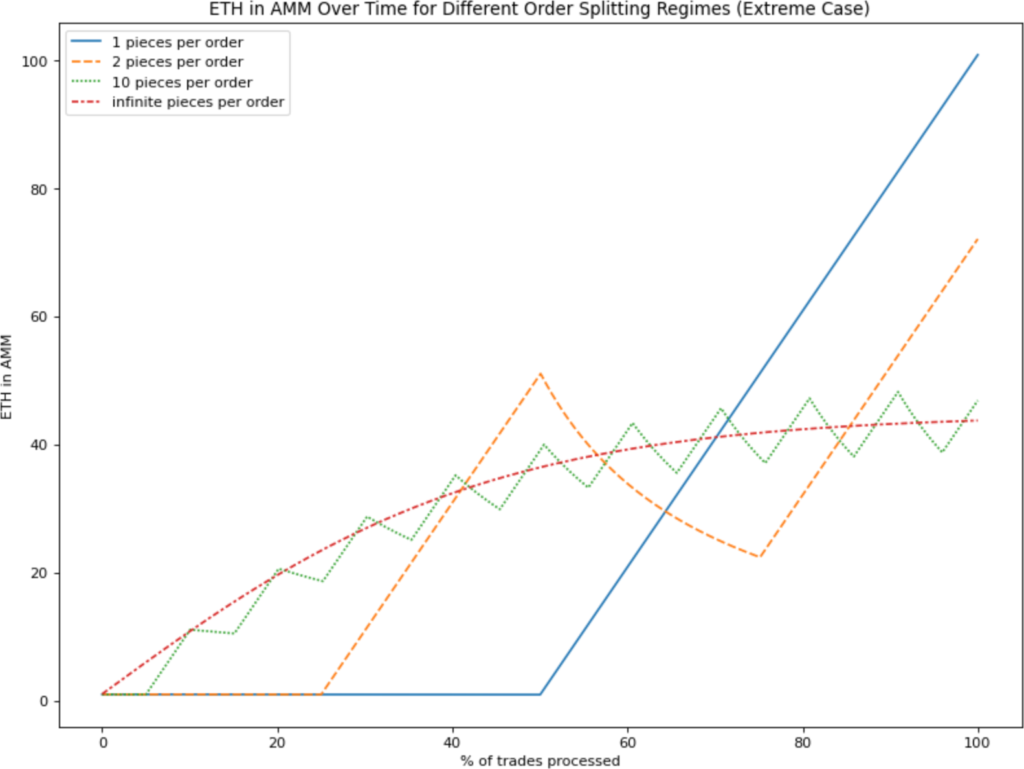

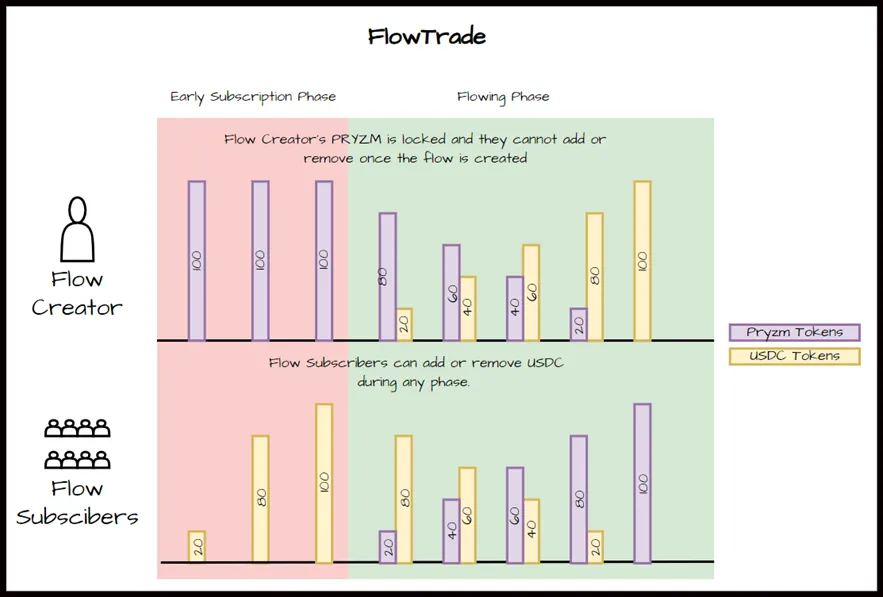

FlowTrade is a trading solution designed to address the challenges of executing trades in token pairs or routes with low or no liquidity on AMMs. This scenario is common in situations where liquidity is distributed across different chains, during the launch phase of new tokens, or when there is no straightforward AMM route between two tokens that offers ample liquidity and reasonable fees. FlowTrade operates akin to an auction system, where tokens are exchanged gradually over time. This can occur continuously at every blockchain block or at predetermined intervals.

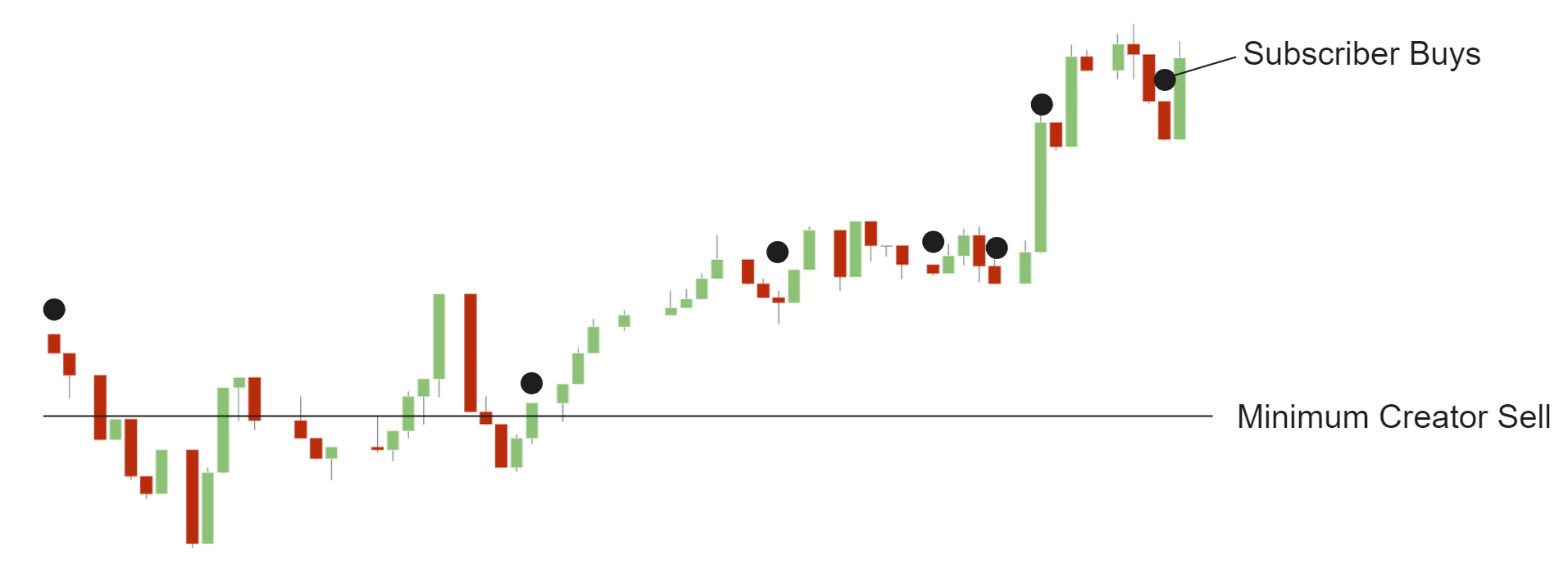

In FlowTrade, two main participant groups are identified: “creators” and “subscribers.”

Creators: Individuals or entities that possess or generate the tokens intended for sale.

Subscribers: Those looking to purchase tokens from the creators.

The mechanism of exchange, termed “flow,” involves creators sending their tokens to subscribers, who in return send their tokens to the creators. A critical aspect of this system is the locking of creators’ tokens within the flow, ensuring that these tokens cannot be withdrawn or altered post-deposit. Conversely, subscribers’ tokens remain unlocked, allowing for adjustments in their contribution amounts based on evolving trading strategies or market conditions.

The unique pricing mechanism within FlowTrade is directly influenced by the volume of subscribers’ tokens participating in a flow. As more tokens are added by subscribers, the price of the creators’ tokens increases, reflecting heightened demand. Conversely, a reduction in subscribers’ tokens leads to a decrease in the creators’ tokens’ price, mirroring a drop in demand. This pricing dynamic ensures fairness within the platform, as all participants are subject to the same price fluctuations without advantage or disadvantage. Additionally, creators have the option to set a minimum price for their tokens, providing a safeguard against significant price drops and ensuring a baseline return on their offered tokens.

Let’s imagine a scenario where an entity or individual, referred to as the “creator,” wants to sell 10,000 $ATOM tokens using FlowTrade, aiming for a gradual sale over a 30-day period to avoid a significant impact on the market price. Here’s how the process might unfold:

Start Date: The auction begins on April 1, 2024.

Duration: The sale is set to last for 30 days, concluding on April 30, 2024.

Token Offered: The creator offers 10,000 $ATOM tokens.

Auction Mechanics:

- The creator locks the 10,000 $ATOM tokens into the FlowTrade system.

- Subscribers can bid on the $ATOM tokens by offering their own tokens (e.g., $USDC) in exchange.

- The price of $ATOM in this auction is dynamic. While the internal mechanics set the price based on bids within the system, participants’ bidding behavior can be informed or influenced by external market conditions. Subscribers might adjust their bids in response to $ATOM’s price movements on the open market, aiming to secure a favorable position within the auction. However, the auction’s price mechanism itself operates independently of the open market, calculating $ATOM’s price based purely on the bids placed within the FlowTrade system. This creates an environment where prices are shaped by the auction participants’ collective actions, although these actions may be indirectly influenced by broader market trends and sentiments. The more $USDC is bid, the higher the price of $ATOM; conversely, lower total bids result in a lower $ATOM price.

- To protect the creator’s interests, a minimum acceptable price for $ATOM is set at the beginning of the auction. For example, the creator might set this minimum at 20 $USDC per $ATOM to ensure they don’t incur losses if the market price drops below this level.

- Subscribers can increase or decrease their USDC bids at any time during the auction, adjusting their purchase price based on the current flow of $ATOM and USDC within the system. The $ATOM tokens are gradually released to subscribers as the auction progresses, based on the dynamic pricing mechanism and the total USDC committed by subscribers.

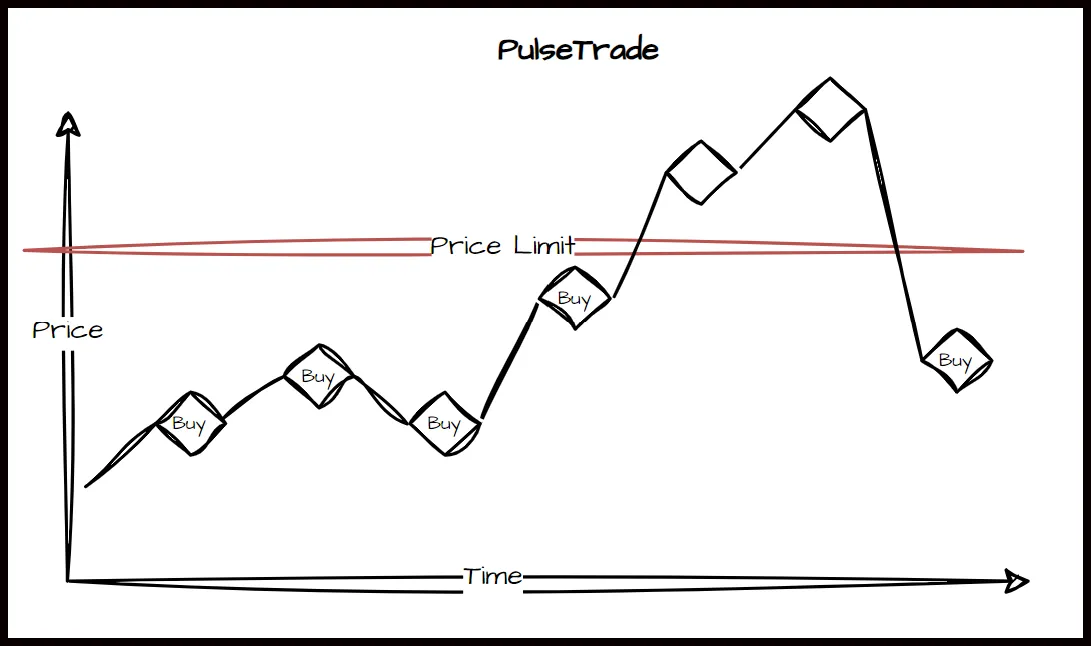

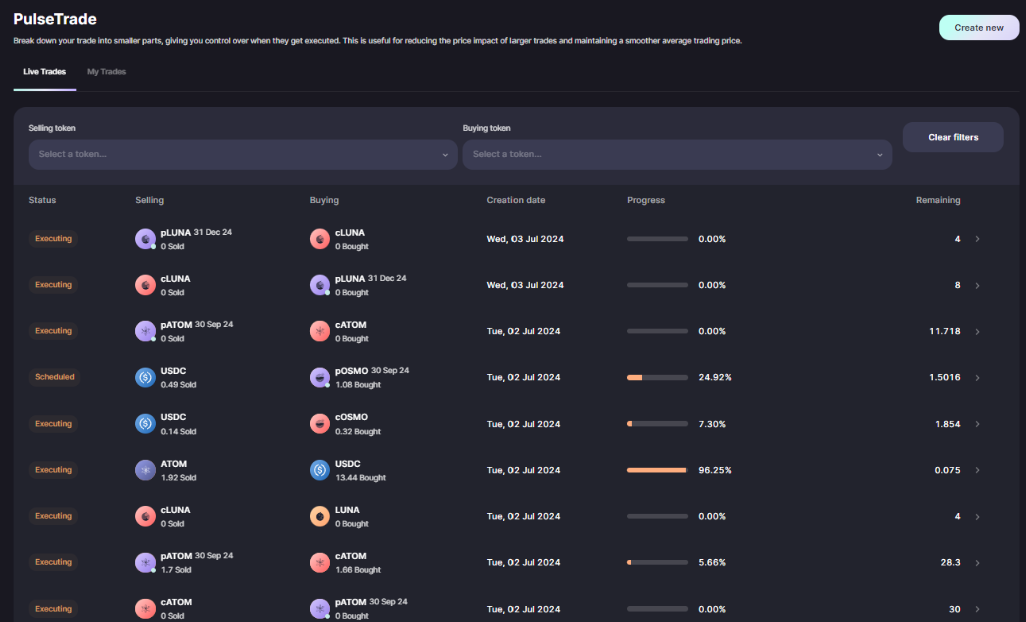

PulseTrade

PulseTrade is a Dollar-Cost Averaging (DCA) module that helps invest, or swap, small amounts at regular intervals to reduce price impact. Users simply need to set up their plan by specifying a total amount to invest in a specific time interval and the system handles the rest for them. For example, you could specify to swap 1 $USDC for $ATOM every minute over 100 minutes, and even specify an execution price limit to take advantage of price fluctuations. This would allow users to stipulate that if the price of the asset drops below a specific level, they would like to take advantage of the dip and complete the remaining amount all at once.

PulseTrade and the TWAMM (outlined by Paradigm here) share a foundational concept in managing the execution of trades over time to mitigate price impact and provide more predictable trading outcomes. Both mechanisms allow for the incremental execution of large orders, spreading the trades out over a period to avoid significant market disruption.

Here’s how PulseTrade relates to the TWAMM concept:

Long-term Order Execution: Breaks down large trades into smaller, incremental orders to be executed over time. This strategy reduces the immediate impact on the market price, which is particularly beneficial for large volume trades that could otherwise move the market unfavorably.

Minimizing Price Impact: The core aim of both systems is to minimize the price impact of trades. By stretching the execution of a trade over time, both mitigate the risk of adverse price movements that can occur when large orders are placed all at once.

Efficiency and Flexibility: Both mechanisms introduce a level of efficiency and flexibility for traders. PulseTrade’s incremental execution and the possibility for off-chain matching provide traders with options for how their orders are filled, while TWAMM’s approach of breaking orders into infinitely many infinitely small pieces executed over time offers a smooth and efficient market interaction.

Solver/Arbitrageur Involvement: PulseTrade involves solvers to propose matches for orders, potentially providing immediate execution at efficient prices. Similarly, TWAMM relies on arbitrageurs to keep its embedded AMM’s price in line with the market, ensuring that long-term orders achieve good execution prices relative to the broader market.

Oracle Module

The primary function of the Oracle Module is to collect, verify, and implement data from external sources into the blockchain. It achieves this through a structured voting process among validators, where data is not only gathered but also validated through consensus to ensure its authenticity and relevance.

Data Integration Process

Data Submission: Validators, or designated feeders on their behalf, submit data points to the Oracle Module. This data pertains to various external conditions that might affect chain operations, such as asset prices, external system states, or any other relevant external data.

Voting Mechanism: Submitted data undergoes a voting process where validators confirm the accuracy of the data by submitting their votes. This mechanism ensures that only data verified by a majority of the network’s validating power is accepted.

Data Utilization: Once validated, the data is made available to other modules within the blockchain. This is facilitated through a callback interface where modules that require external data register their interest and utilize the validated data to perform necessary operations, such as adjusting protocol parameters or triggering specific actions based on external conditions.

The Oracle Module comprises several key components:

Oracle Votes

The structure of an oracle vote is designed to accommodate a variety of data types and sources. Each vote includes:

- Validator: Identifier of the validator submitting the vote.

- Module Votes: Contains votes pertaining to specific modules that require the data.

- Namespace Votes: Detailed breakdown of votes within a module, categorized by namespace, which organizes data under specific categories or sources.

Voting Process

The Oracle Module employs a two-phase voting process to enhance security and data integrity:

- Pre-vote: Validators commit to a hashed version of their data, preventing premature disclosure and ensuring commitment to their data before revealing it.

- Vote: Validators reveal their previously committed data. The system verifies the hash from the pre-vote phase to ensure the data was not altered.

This process mitigates risks such as validators altering their submissions based on other validators’ votes, thus preserving the integrity of the data and the fairness of the voting process.

Oracle Vote Callback

Modules that depend on external data implement the OracleVoteCallback interface, which includes methods to handle incoming validated data and compute hashes for data verification. This interface ensures that the Oracle Module can operate generically with any module without needing specific knowledge of the data being processed.

yStaking Module

This module incorporates functionalities such as bonding, unbonding, and reward claims, which are essential for managing yield-generating assets effectively. Each of these functions plays a critical role in optimizing user engagement and maximizing reward potentials from staked assets.

Bonding:

Bonding is the process where users stake their yASSETs into a specific MaturityYAssetPool. This process is critical as it represents the user’s commitment to locking their assets into the pool to earn rewards over time. When a user bonds an amount to the pool, several updates occur:

The ‘bondedAmount’ for both the MaturityYAssetPool and the overall YAssetPool increases by . The user’s ‘pendingReward’ is updated based on the difference between the current ‘globalIndex’ of the pool and the user’s last recorded ‘userIndex’. This ensures that rewards are accurately distributed based on the amount and duration of the stake.

When rewards are distributed to a pool, the globalIndex is updated using the formula:

Inewg = Ioldg + R/B

Here, Ioldg and I newg are the old and new global indices, is the reward amount, and is the total bonded amount in the pool.

Upon bonding, unbonding, or claiming rewards, the user’s pendingReward is updated based on the accumulated value from the global index:

P new u =P old u +(I g −I old u )×B u

This formula ensures that rewards are proportionally allocated based on the user’s share of the pool and the duration of the stake.

Unbonding:

Unbonding allows users to withdraw a portion or all of their staked yASSETs from a pool. This function is particularly useful when users need liquidity or wish to reallocate resources. Upon initiating an unbonding request:

The bondedAmount in both the MaturityYAssetPool and the YAssetPool decreases by the unbonded amount .

Rewards accrued till the point of unbonding are computed and transferred to the user, updating the pendingReward to zero post transaction.

Claim Rewards:

Users can claim accrued rewards based on their staked assets. This function calculates the rewards by considering the user’s bonded amount and the time during which the assets were staked, utilizing the globalIndex for precise calculations.

Exit from Pool:

This function is used for withdrawing from pools with expired maturities. It allows users to exit the pool, claiming any remaining rewards. It is similar to the unbonding function but specifically tailored for handling expired assets.

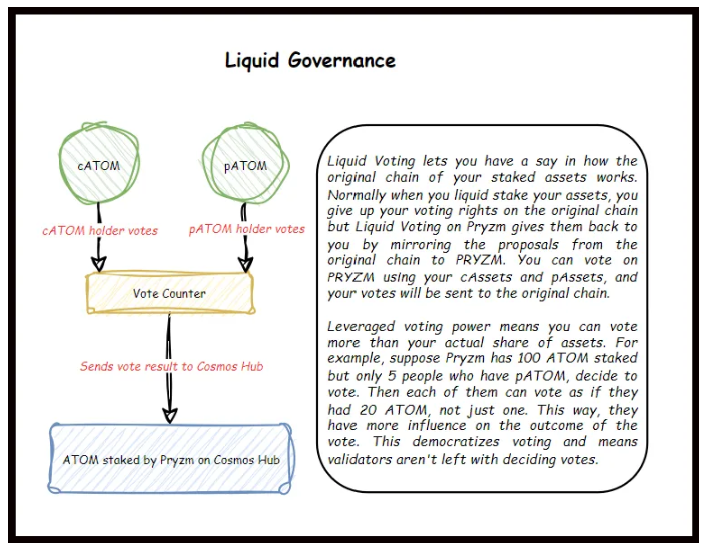

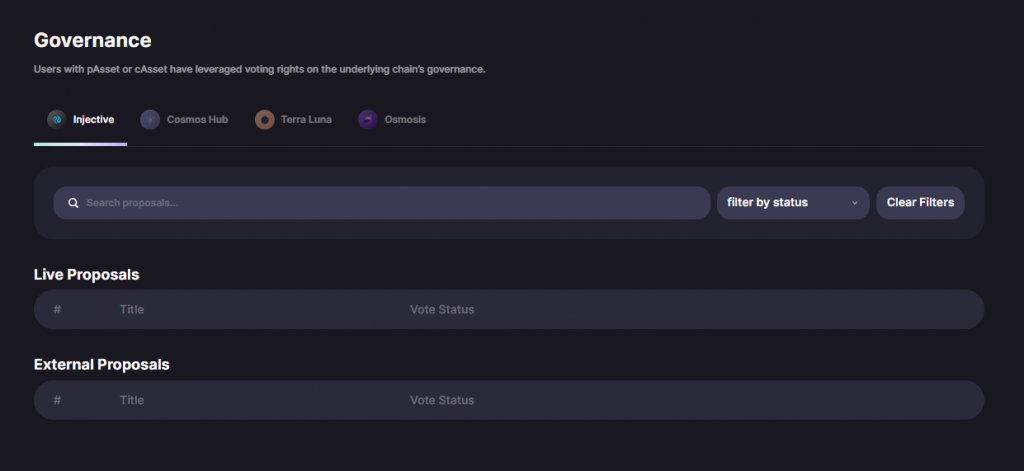

Liquid Governance

Liquid Governance is Pryzm’s approach to governance, and enables token holders to participate in the governance decisions of the underlying protocols without needing to lock up or immobilize their holdings.

This model allows for a more fluid and dynamic engagement in governance processes, making it easier for investors to lend, sell, or trade their governance rights. The concept enhances the democratization of decision-making in DeFi projects by broadening the base of participants who can influence the direction and policies of decentralized organizations or protocols.

pATOM, as a principal token, represents the underlying value of the staked $ATOM, separate from its yield-generating component. However, what sets pATOM apart is that the governance rights that come with pATOM can be traded. pATOM holders can directly engage in the governance of the Cosmos network (in this example) without sacrificing liquidity. This flexibility means that investors can reallocate, trade, or leverage their governance rights as they see fit.

Leveraged Voting further democratizes the process, amplifying the influence of active voters and ensuring a more equitable representation in decision-making processes. Leveraged Voting means you can vote more than your actual share of assets. For example, suppose Pryzm has 100 $ATOM staked but only 5 people who have pATOM, decide to vote. Then each of them can vote as if they had 20 $ATOM, not just one. This way, they have more influence on the outcome of the vote. This democratizes voting and means validators aren’t left with deciding votes.

pGov Module

In Pryzm, principal tokens (pAssets) represent the underlying value of the staked tokens ($ATOM, $INJ, $TIA, etc.), separate from its yield-generating component. However, what sets pAssets apart is that the governance rights that come with pAssets can be traded. pToken holders can directly engage in governance without sacrificing liquidity. This flexibility means that investors can reallocate, trade, or leverage their governance rights as they see fit.

Pryzm users, holding cAssets or staked pAssets, can participate in voting. All users are eligible to vote on proposals, but their voting power is calculated at the time of vote tallying. The voting power is determined using the following formula:

voting_power = totalStakePAssets + (cAssetBalance * assetExchangeRate)

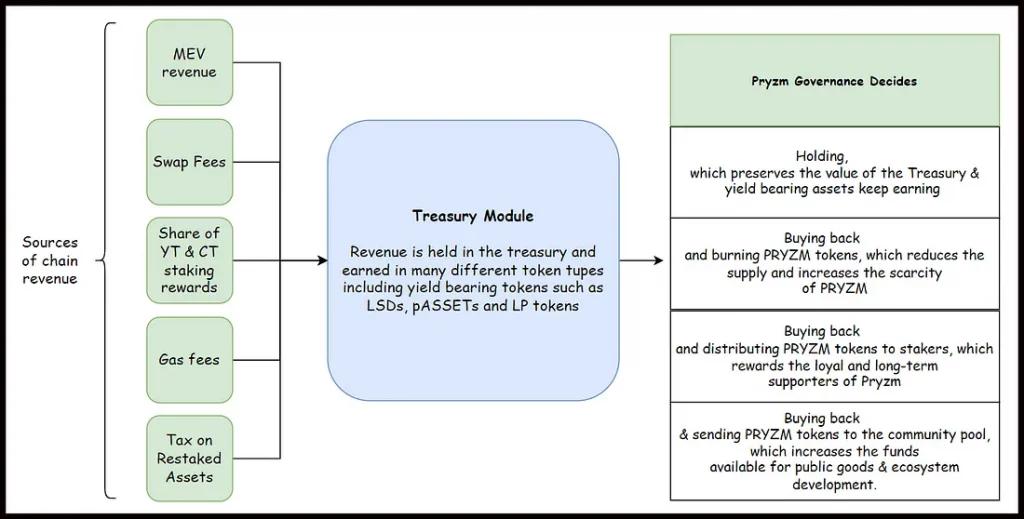

Treasury Module

The Treasury module in Pryzm serves a dual role: it acts as a centralized account for aggregating protocol fees collected across various operations within the network, and provides a framework for managing these accumulated funds through scheduled actions.

The concept revolves around collecting fees from different modules within the Pryzm ecosystem, each specifying the amount and type of fee. The Treasury Keeper then offers methods for fee collection, either based on a fixed ratio of the transaction amount or as a collection from the sender’s account. This process involves several methods to efficiently collect fees, which are then categorized by type, allowing for nuanced tracking and application across different module operations.

CollectFeeByRatio: Targets fee collection based on a predetermined ratio of the transaction amount, facilitating proportional fee deduction.

ComputeFeeByRatio: Similar to CollectFeeByRatio but only computes the fee without actual collection, useful for estimation purposes.

CollectFee: Directly collects specified fees from an account, transferring them into the treasury pool.

This module is extremely relevant for the protocol and its token holders, also highlighting the benefits that come with building a protocol on top of a dedicated appchain.

The Pryzm Treasury is a module designed to collect and manage the revenues generated by the Pryzm network. This treasury plays a crucial role in the strategic management of assets, aligning with the governance decisions of PRYZM token holders.

The treasury accumulates revenue in various forms of tokens, including yield-bearing assets and LP tokens. This collection of diverse tokens enables Pryzm to hold protocol-owned liquidity, which can be managed by token holders, ensuring that the governance of the network directly influences its financial strategies.

$PRYZM token holders have significant control over how the treasury’s funds are utilized, and they can propose and vote on various strategic actions regarding the treasury’s assets:

- Holding Funds: The treasury can simply hold onto its assets to preserve their value, which may be beneficial in times of market volatility or when conserving capital for future large-scale projects.

- Token Buyback and Burn: One of the more aggressive uses of the treasury involves buying back $PRYZM tokens from the market and permanently burning them. This reduces the overall supply of $PRYZM, potentially increasing its scarcity and value.

- Distribution to Stakers: Another option is to buy back $PRYZM tokens and distribute them to stakers. This rewards those who are actively contributing to the network’s security and operations through staking, reinforcing loyalty and long-term commitment.

- Funding Community Pool: $PRYZM tokens can also be redirected to a community pool. This pool serves as a funding mechanism for public goods and ecosystem development, supporting projects that enhance the Pryzm network and its community.

When the decision is made to sell non-PRYZM tokens for such activities as token buybacks, the sales are conducted through FlowTrade in order to mitigate market impact and ensure that token conversions are done efficiently and potentially at better prices.

Why the Project was Created

Yield tokenization and trading can tap into the vast potential of fixed-income markets on-chain. By creating a marketplace for yield and governance, Pryzm not only enhances DeFi’s value proposition but also addresses inherent market challenges such as yield volatility revolving Fixed Income products.

Challenges in Translating Fixed-Income Products to DeFi

DeFi yields are notoriously volatile due to changing protocol incentives, fluctuating demand in lending and borrowing markets, varying rewards for liquidity provision, and even governance decisions that impact network inflation. This volatility makes it challenging to create products with fixed returns over time.

The valuation of fixed-income products on-chain requires understanding not just the future cash flows (like interest payments and principal return) but also the risk factors specific to DeFi, such as smart contract risks, platform solvency, and the underlying asset’s volatility. These factors introduce additional considerations for the creation and management of fixed-income products, affecting their safety and attractiveness to investors. But these can also be an opportunity for pricing of those risks. For example a long dated yield token where there is high smart contract risk over the yield source might trade at a discount.

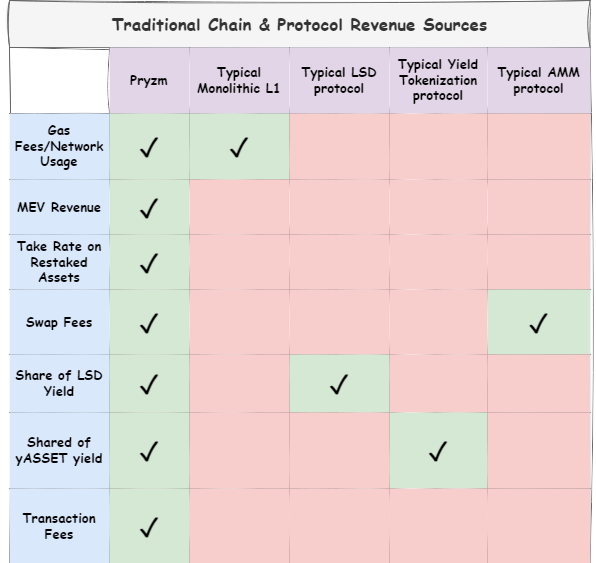

Furthermore, yield tokenization protocols in the broader DeFi space lack vertical integration as it cannot capture revenue streams from application-level fees to blockchain-level transaction fees and MEV. Traditional yield tokenization platforms operating on existing Layer 1/2s are confined to generating revenue solely from their application-specific activities. This limitation restricts their economic model to a narrower scope, omitting the potential revenues from the underlying blockchain activities, such as transaction processing and ordering.

Pryzm’s Opportunity for On-Chain Fixed-Income Products

The volatility is the opportunity for people to speculate and hedge these risks. The potential for fixed-income products in DeFi is immense, driven by the desire for more predictable investment outcomes and the need to cater to a wider range of risk appetites among crypto investors.

Yield Tokenization: With Pryzm, Alice (previous example) could have tokenized her future yield from the staked ETH when the APR is favorable, say at 5%. By doing so, she creates a yield token (yToken) representing the expected returns on her investment at the current APR. This yToken can then be sold or traded on the Pryzm platform, allowing Alice to realize the value of her future yield immediately, hedging it rather than waiting and potentially facing a decrease in APR.

Diversification and Risk Management: On-chain fixed-income products offer DeFi investors tools for portfolio diversification and risk management. Investors seeking stability can invest in products that offer fixed yields over time, complementing the typically more volatile equity-like returns from other crypto investments.

Pryzm’s Vertical Integration: Pryzm facilitates yield tokenization through its unique modules but also captures a broad spectrum of revenue streams. By operating as its own Layer 1 blockchain, Pryzm can collect transaction fees, participate in MEV opportunities, and implement a variety of fee mechanisms across its DEX. This vertical integration allows Pryzm to benefit from every layer of transaction and interaction on its network.

Sector Outlook

Yield Tokenization Market

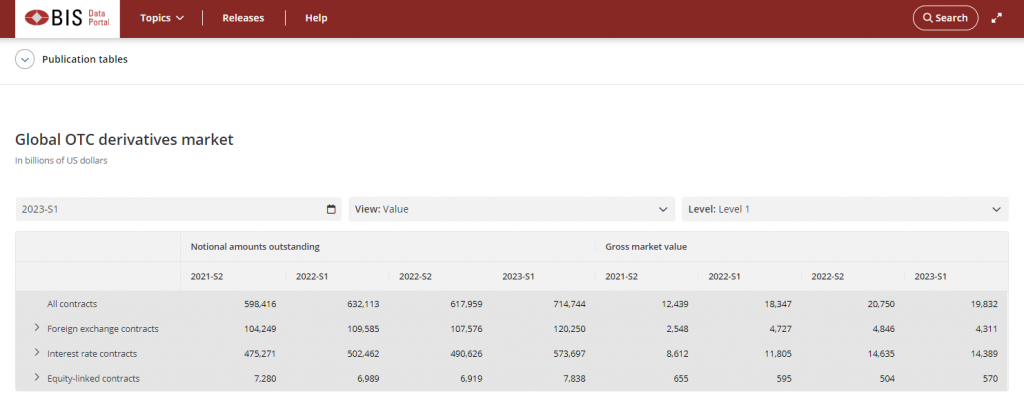

The sector outlook for yield tokenization and trading is highly promising. While the FX market is significant, it pales in comparison to the interest rate swap (IRS) market. Fixed income represents the largest asset class globally and yield derivatives are the biggest derivative market. First, interest rates are a great vehicle for expressing a view on the market, since they are extremely reflexive to changes in supply and demand. Second, sophisticated players consistently demand tools for managing their risk, such as locking in rates or using derivatives to insure against unfavorable rates movements.

Institutions and hedge funds have historically profited from yield trading, but Pryzm aims to democratize access to this lucrative market, making yield trading available to everyone. Tokenizing yield opens up endless opportunities, allowing users to sell future income for immediate cash, lock in guaranteed income, or capitalize on expected yield increases.

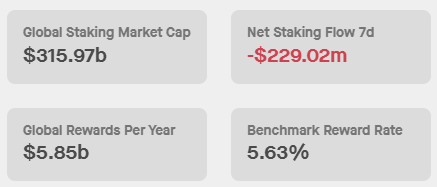

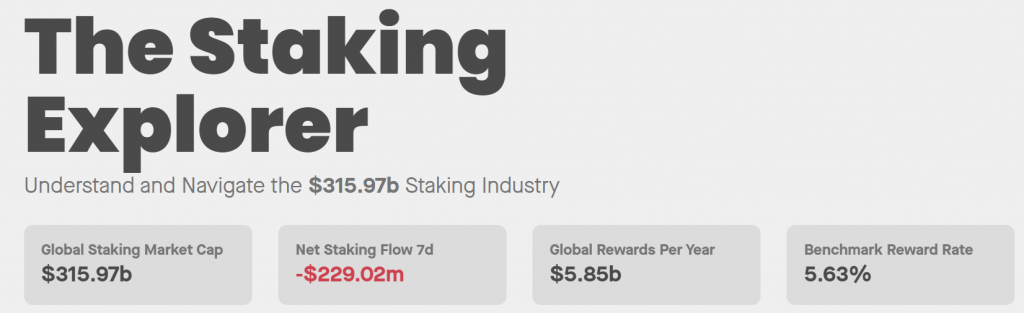

Unlike traditional models that depend solely on asset price, Pryzm’s Total Addressable Market (TAM) is >$300B with Total Annual Yield available for trading at $5.85B.

This means that any chain with a bridge can bring an increased number of assets and Liquid Staking Tokens (LSTs), the TAM is set to expand correspondingly. And in addition to Cosmos, Pryzm can also add assets like AAVE USDC or JitoSOL.

Therefore, the TAM is the global staking market cap, which is over $305B in all of crypto. Note that Pryzm is not restricted to the Cosmos ecosystem, as they can also support assets from other chains, like $wstETH, Aave’s $aUSDC, or jitSOL among others.

Furthermore, the model benefits from both token prices and yields appreciating, which together drive overall growth in the TAM. This approach not only enhances Pryzm’s attractiveness but also its utility by eliminating the conventional unstaking periods and allowing instant redemption of underlying tokens. This is done through netting off people waiting to liquid stake against those looking to redeem and so only the residual is staked/redeemed, thereby mitigating common pain points for yield-seekers.

Pryzm leverages market-driven volatility not merely as a challenge but as a strategic asset. This inherent volatility is crucial as it spurs more frequent trading activities. For a platform like Pryzm, increased trading volume is beneficial as it translates directly into higher transaction fee revenue. By embracing volatility, Pryzm capitalizes on the natural market movements to enhance its value proposition, ensuring that every fluctuation is an opportunity for both the platform and its users to gain from increased trading activities and the resulting fee accruals. This approach not only aligns with the market’s dynamics but also serves as a core component of Pryzm’s operational strategy.

Bear and Bull Cases for Pryzm

Bull Case

Pryzm is strategically positioned to capitalize on the sector of yield tokenization, tapping into a market with a potential value exceeding $300 billion in TAM. The primary driver of Pryzm’s market opportunity is the rapidly growing global staking market, currently valued at over $305 billion. Unlike traditional financial systems, Pryzm enables the tokenization and trading of yield, which not only democratizes access but also enhances liquidity and flexibility in financial management.

A significant advantage for Pryzm is its ability to operate across multiple blockchain ecosystems. This is not restricted solely to the Cosmos network; Pryzm supports assets from a variety of chains, such as Ethereum’s $wstETH, Aave’s $aUSDC, and Solana’s jitSOL. This interoperability significantly widens Pryzm’s potential user base and available assets for yield trading.

Moreover, Pryzm’s innovative approach to handling volatility as a feature rather than a drawback encourages increased trading volumes during market fluctuations, thereby escalating transaction fee accruals. This model not only aligns with the core dynamics of DeFi’s market-driven nature but also ensures Pryzm benefits directly from periods of high market activity.

Bear Case

There are considerable risks and challenges that could impact Pryzm’s growth and adoption. The complexity of yield tokenization and the inherent risks associated with liquidity and smart contracts could deter average users and even some institutions from fully engaging with the platform. That being said, concerns are more likely to come up from slashing events rather than from shrinkage of the TAM. Liquid staking is here to stay and this proposition has only gotten stronger with the advent of restaking.

Potential Adoption

Pryzm’s value proposition lies in its comprehensive ecosystem designed for yield optimization, providing users with unprecedented control over their earnings across a diverse range of assets. Unlike other DeFi projects in other chains that focus solely on wrapping yield-bearing assets into principal tokens (PTs) and yield tokens (YTs), Pryzm offers a multifaceted approach to yield management.

As a Layer-1, Pryzm not only tokenizes and facilitates the trading of future yield earnings but also grants PT and LST holders liquid governance power, implements a Time-Weighted Average Price (TWAMM) mechanism to reduce price impact, and introduces the concept of “restaking” or “proof of liquidity”, allowing users to stake their LP tokens to secure the chain and earn additional yield (from $PRYZM inflationary emissions,network activity fees, chain revenue, swap fees, yield commissions, MEV and more).

Unique as a Layer-1 chain, Pryzm unlocks access to fixed-income and derivative markets, establishing itself as a versatile platform for yield-related across all chains, not just limited to Cosmos (since Pryzm features their own oracle module and leverages interoperability beyond IBC with Axelar and Wormhole integrations). Users benefit from the ability to navigate yield volatility across various activities—such as earning interest, collecting LP fees, and participating in staking and restaking—to secure yields, purchase assets at a discount, and engage in governance.

- Stake the native asset of a Cosmos chain and wrap this position into an LST, allowing you to continue earning staking rewards while unlocking liquidity for further use in DeFi.

- Use the LST to provide liquidity to Pryzm’s Yield AMM, contributing to the platform’s liquidity and earning extra yield from swap fees in exchange for facilitating yield trading between fixed and variable rate takers.

- Finally, stake the LP token obtained from providing liquidity into the yield AMM in order to earn block rewards and chain revenue from staking and securing the Pryzm chain itself, providing you with additional yield.

By following these steps users can effectively leverage 3 different sources of yield: LST rewards, swap fees from providing liquidity to Pryzm’s YAMM, and Pryzm’s block rewards and chain revenue earned from staking the LP token as a PoS asset.

The Pryzm Yield AMM equips users with the tools needed to manage risk and capitalize on yield volatility. Loan takers on money markets can fix their borrowing costs, arbitrageurs can capitalize on rate differences of underlying assets, and speculators can long/short the future income produced by yield-bearing assets like LSTs. This system not only maximizes return potentials but also stabilizes investment outcomes, accommodating both conservative investors seeking fixed yields and those pursuing higher returns through variable yields.

This creates a marketplace that meets the needs and preferences of users with different risk profiles: liquidity providers earn additional yield from swap fees, YT buyers get leveraged exposure to the yield produced by the underlying, and PT buyers can get a fixed rate or buy assets at a discount.

For Users

One thing to note is that Pryzm pools consist of cTokens and pTokens, still allowing users to trade yTokens. This is key because users can trade yTokens and pTokens in a single pool of liquidity, instead of having a separate pool to trade each component (the yield and the principal) of a yield-bearing asset. It is important to highlight this feature because of how important it is for capital efficiency. A single pool, even if it consists of cTokens and pTokens can still allow for trading yTokens. Therefore, the liquidity providers (LPs) of that pool earn fees from all the yToken, cToken, and pToken trades that take place in it. Besides, all maturities are also traded in that same pool, allowing LPs to be exposed to fees from all of them, unlike other yield stripping that require one separate pool for each maturity date.

Since YAMM pools only contain cTokens and pTokens, yTokens cannot be directly traded against the pool’s equations. That problem is solved by using flash loans that interact with the refractor module, necessitating a two-step batch swap.

For instance, buying yTokens involves the following steps:

- The buyer sends cTokens to the YAMM

- The YAMM borrows more cTokens from the liquidity pool vault

- pTokens and yTokens are minted from the total amount of the buyer’s cTokens and the borrowed cTokens

- The buyer receives yTokens

- The pTokens are sold for cTokens to repay the amount borrowed in step 2.

Similarly, the process for selling yTokens would be:

- The seller sends yTokens to the YAMM

- The YAMM borrows an equivalent amount of pTokens from the liquidity pool vault

- The yTokens and pTokens are merged to form and redeem cTokens

- The seller receives cTokens (which can also be converted to any major token)

- The borrowed pTokens are repaid by selling a portion of the cTokens to the pool.

Yield Tokenization and Trading: Users can tokenize future yields of their assets, separating them into principal (pAssets) and yield (yAssets), which can be traded on Pryzm’s DEX.

Liquidity Providing: Supply liquidity to various pools on Pryzm’s DEX and earn trading fees from all maturities for that asset.

Additionally, you can restake your LP positions to earn extra yields on top of the trading fees from L1 fees and $PRYZM emissions.

Participating in Governance: Use $PRYZM tokens to vote on proposals, influencing the future direction and parameters of the Pryzm blockchain. Users can also use cTokens or pTokens to participate in governance of the underlying assets without locking up those assets, maintaining liquidity while still having a say in network decisions.

Utilizing PulseTrade for Reduced Market Impact Trades: Place large orders that are executed incrementally to reduce market impact.

Engaging in FlowTrade for Special Auctions: Participate in auctions where tokens are swapped gradually over time, optimizing for liquidity and pricing.

Investing Strategies

Below we outline some strategies and ways to interact with Pryzm:

Fixed Yield Lock-In Strategy:

Tokenize yield-bearing assets into pTokens and yTokens. Sell the yTokens to lock in the current yield rate, securing a fixed return on your principal amount. Works best as a hedging method to remove the volatility aspect of yield-bearing assets. Hold onto pTokens until maturity to reclaim the original principal amount.

Yield Maximization Strategy:

Purchase additional yTokens in the market to gain exposure to higher yields. This strategy is beneficial if you believe the yield of the underlying asset will exceed the current expectations implied by the market prices of yTokens. You are essentially taking a long position on yields.

Liquidity Provision:

Provide liquidity to pools on Pryzm’s DEX to earn trading fees. Optionally stake the received LP tokens in restaking pools to secure the L1 and earn L1 fees and token emissions.

Arbitrage Opportunities:

These opportunities may arise between the prices of yAssets representing future yield on Pryzm and the actual yield or perceived value of those same assets on other platforms or within different components of the same ecosystem. For example, an investor notices yATOM tokens, representing the future yield on staked $ATOM, are trading at a discount on Pryzm compared to the expected yield or similar products on another platform. The investor buys yATOM on Pryzm at a price that undervalues the expected yield based on current market rates for staking $ATOM.

The investor then either sells the equivalent staking position on another platform where the yield is valued higher, directly profiting from the higher market rate for the yield, or waits until the yield matures, collecting the higher-than-purchased yield directly, if they have correctly predicted an increase in yield rates.

Long Fixed Yield:

Longing fixed yield involves locking in a guaranteed yield rate by purchasing pTokens, which represent the principal amount of the deposited asset that can be redeemed at maturity with a fixed return. Purchase pTokens when interest rates are high or expected to rise, ensuring that the yield at the time of purchase remains advantageous over time.

Hold these pTokens until maturity to benefit from the fixed yield that was locked in at the time of purchase. This is essentially betting that the rates won’t significantly increase beyond your locked rate. At maturity, redeem the principal to realize the fixed yield, which can be reinvested or used as needed.

Leveraged Governance Monetisation:

This is a form of arbitrage on Governance tokens in the context of Pryzm involves capitalizing on the varying values of governance rights across different platforms. In some cases, governance tokens might be undervalued on Pryzm compared to other platforms where the demand for such governance influence is higher.

- Identify undervalued governance tokens on Pryzm that grant voting rights or influence over the network. This might involve analyzing the potential impact of upcoming proposals and the current sentiment towards governance participation.

- Purchase or acquire these governance tokens at a lower price on Pryzm.

- Leverage voting rights for strategic proposals to increase the value of these tokens by demonstrating active and impactful governance.

- Sell the voting rights to larger stakeholders who are looking to secure outcomes favorable to their interests but may not have sufficient voting power.

- Arbitrage the difference by either selling the governance tokens at a premium after influential votes or by renting out your voting capacity to others for a fee.

Relative value between pASSET yield and cASSET yield:

This strategy involves trading between pTokens (fixed yield) and cTokens (floating yield) based on their relative yields to capitalize on inefficiencies or expected changes in yield dynamics. The key is identifying when the fixed yield on pTokens diverges favorably from the expected floating yield on cTokens.

Buy pTokens when the fixed yield becomes relatively attractive compared to the floating yield on cTokens – suggesting that fixed yields are high or expected to rise. Sell cTokens when their floating yields are lower than the yields available from pTokens, or when floating yields are expected to decrease. Vice versa.

Business Model

Pryzm’s business model is anchored in its governance token, $PRYZM, and its unique position as a vertically integrated blockchain ecosystem.. The platform’s revenue streams are diverse and not solely dependent on transaction gas fees, typical of many Layer 1 blockchains. Instead, Pryzm derives income from several innovative features and offerings that enhance its economic model and community engagement.

Yield from Staked Assets: Pryzm collects a portion of the yield generated by assets staked on its platform, including both collateral tokens (cAssets, e.g., cATOM) and yield tokens (yAssets, e.g., yATOM). This mechanism creates a continuous revenue stream, as Pryzm supports staking of various tokens from other blockchains, such as $ATOM, $INJ, $OSMO, and $TIA. This diverse staking model not only enhances liquidity but also provides Pryzm with a steady income from the underlying yield of these assets. Pryzm also receives 100% of the yield of unstaked YTs.

Swap Fees on the DEX: Transaction fees generated from token swaps on Pryzm’s Decentralized Exchange (DEX) represent a significant revenue source. The DEX is optimized for capital efficiency and high liquidity trades across a broad spectrum of supported tokens, with Pryzm taking a small fee from each transaction.

Maximal Extractable Value (MEV): MEV revenue is extracted by Pryzm’s validators through the strategic ordering or censoring of transactions. By utilizing a transparent and fair mechanism via Skip Protocol’s Block SDK, Pryzm captures MEV without compromising network security or user experience.

The Block SDK allows for the creation of customized blocks, each with distinct “lanes” that can serve varied purposes and follow unique sets of rules. This innovation aims to address several issues associated with traditional block construction, such as susceptibility to MEV exploits like front-running and sandwich attacks, and the one-size-fits-all approach that can lead to inefficiencies in transaction processing. Create lanes for different types of transactions, improving efficiency and potentially reducing the negative impacts of MEV. The use of the Block SDK allows Pryzm to:

- Customize Transaction Processing: Create lanes for different types of transactions, improving efficiency and potentially reducing the negative impacts of MEV.

- Transparent and Governable MEV Recapture: Design lanes specifically for mitigating MEV-related issues, enabling the protocol to recapture MEV in a transparent manner and redistribute it back to the network participants, rather than allowing it to be extracted by miners/validators as in traditional settings like on Ethereum.

- Enhance Security and Fairness: Implement lanes with specific rules for transaction ordering and validation, reducing the risk of front-running and other MEV-related exploitations.

- Diversify Revenue Streams: Pryzm can leverage the Block SDK to create innovative fee models and MEV capture mechanisms, diversifying its revenue beyond traditional gas fees and transaction fees.

Staking Take Rate: Pryzm imposes a tax, known as the “take rate,” on tokens other than $PRYZM that are restaked to secure the network. This tax applies to delegated tokens, such as yTokens for $ATOM, $INJ, $OSMO, $TIA, etc. This mechanism incentivizes network participation and generates revenue from the broader ecosystem of staked assets.

Governance and Staking Rewards: By holding and delegating $PRYZM, users participate in the governance of the network, influencing decisions on network parameters and the allocation of the community pool and Treasury funds. This governance model ensures community engagement and allows PRYZM holders to benefit directly from the network’s success through staking rewards. This aligns user incentives with the long-term health and growth of Pryzm.

Governance

Governance helps to make various decisions for the protocol, including choosing which assets get enabled for yield trading, which assets can be restaked, and making Treasury decisionsAll of this is facilitated by the $PRYZM token

For restaking, Pryzm governance controls (1) which assets can be restaked, and (2) how much Pryzm rewards they will get. This could create a dynamic market, where different chains and protocols vie for Pryzm tokens, so they can influence the amount of Pryzm rewards allocated to their assets.

The Pryzm governance also plays a role in making decisions for the Treasury Module, where the module’s operations and parameters can be adjusted through governance proposals.

Setting the Protocol Fees: Governance can decide on the types and amounts of fees levied by different modules within Pryzm. Each fee collection operation must specify an amount and a fee type, allowing for granular control over fee structures.

Determining Fee Collection Ratios: Decisions can be made regarding the ratio of transaction amounts that will be collected as fees. This ratio is critical for balancing the incentive structures for validators and users, ensuring the network remains economically viable.

Allocating Collected Fees: Governance has the authority to schedule the execution of specific actions on the collected fees. These actions can include holding the fees, burning tokens to reduce supply, distributing tokens to stakers as rewards, or allocating funds to the community pool for ecosystem development projects.

Flow-Trade Configuration for Non-PRYZM Tokens: For fees collected in tokens other than PRYZM, governance decisions can outline how these are to be exchanged for PRYZM tokens through FlowTrade. This includes setting the start delay, duration, distribution interval, limit price, and exit window duration for the flow trades.

Exclusion of Tokens from Actions: Governance can decide on specific tokens to be excluded from treasury actions, ensuring that critical assets or tokens are not inadvertently impacted by automated processes.

Action Scheduling: Detailed scheduling of treasury actions, including their occurrence, expiration, and periodicity. Governance can define when specific actions should be executed, how long they should remain active, and at what intervals they should recur.

Update Module Parameters: Through governance proposals, the parameters of the Treasury module itself can be updated. This includes adjusting settings that impact how fees are collected, managed, and utilized within the ecosystem.

Risks and Preventive Measures

Pryzm employs several security mechanisms to safeguard the integrity and stability of its LPs, like Circuit Breakers, which are designed to mitigate extreme price volatility in the AMM pools. Circuit breakers halt operations if the token prices move outside predefined boundaries, ensuring that prices remain within realistic limits. Pools also have Pause mode to temporarily disable key pool functionalities in case of an emergency or Recovery mode which provides a mechanism to safely exit pools during non-functional states or emergencies.

Circuit Breakers

Circuit breakers in Pryzm’s AMM play a pivotal role in stabilizing token prices within liquidity pools by ensuring that movements stay within predefined limits. These mechanisms protect the ecosystem from extreme volatility and potential market manipulation.

Circuit Breakers utilize two main parameters, a boundary (upper and lower limits) and a reference LPT price, which are predefined for each token within a pool. The LPT Price for a pool token is determined by the formula: LPT(token i )= LPT supply ×wi /Bi where Bi is the token’s balance in the pool, and wi is the token’s weight, ensuring prices reflect the token’s proportionate value in the pool.

The circuit breaker boundaries are calculated with lower,upper=CB(wi, bi, bu, LPTref) which considers the token’s weight (wi), the lower and upper boundary parameters (bi, bu), and the reference LPT price (LPTref). The outcome of this calculation provides the lower and upper bounds within which the token’s LPT price must remain for operations to proceed.