Introduction

Designed for the Ethereum Virtual Machine, Premia is a peer-to-peer options exchange and settlement engine. With an emphasis on options trading, the protocol’s goal is to produce a set of smart contracts that prioritize security, self-custody, and autonomous execution without the need for a trusted middleman.

Premia has gone through multiple iterations, upgrading itself since launching in early 2021. It is currently operating both the v2 (live only for LPs to access their liquidity and for migration purposes) and the v3 version.

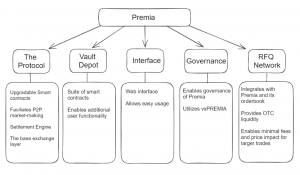

There are currently 5 different areas of Premia, which are the following:

- The Premia Protocol: A suite of upgradable smart contracts that together facilitate peer-to-peer market making and trading of options on ERC-20 tokens available on the Ethereum blockchain along with a settlement engine. This can be thought of as the “base” exchange layer.

- Premia Vault Depot: A suite of in-house and third-party smart contracts composed on top of The Premia Protocol, that enables additional user functionality such as participation in automated strategies, leverage, and risk management on the EVM.

- The Premia Interface: A web interface that allows for easy interaction with the Premia protocol. The interface is only one of many ways one may interact with the Premia protocol, and is actively maintained by the Premia governing body.

- Premia Governance: A governance system for governing the Premia Protocol, enabled by staking PREMIA tokens and receiving vxPREMIA.

- Premia RFQ Network: An RFQ system that seamlessly integrates with the Premia Protocol, and its orderbook, and provides Over-The-Counter (OTC) liquidity, enabling direct trading between two parties. This results in minimal fees and price impact for larger trades, making it an ideal solution for high-volume or specific order requirements.

Premia: History and Background

Premia V1

Launched in 2021, Premia V1 predated L2s and operated as a peer-to-peer options trading platform, featuring an OTC market for on-demand and on-match trading.

Premia V2

In 2022, Premia v2 transitioned to a peer-to-pool model, primarily targeting retail traders. However, this version lacked the flexibility to parametrize the options being sold, limiting customization and making it less appealing for more professional users.

With the launch of Premia Blue (v3) on Arbitrum, v2 would undergo a deprecation on all chains other than Optimism, with the following changes:

- Deposits and trades will be disabled, but withdrawals will be available until the last non-Optimism v2 option expires.

- All liquidity mining rewards have now been redirected from Premia v2 pools to Premia Blue vaults in the form of Options Liquidity Mining (OLM).

Essentially, v2 would only be kept available for the purposes of accessing already existing liquidity and migrating to Premia Blue.

Optimal Pricing Algorithm (V2 C-level Vaults)

Premia’s pricing algorithm is designed to address the unique challenges presented by the cryptocurrency options market. Unlike traditional financial markets, crypto options trading operates in a distinct microstructure, and conventional pricing models like the Black-Scholes or Binomial Options Pricing Model (BOPM) are not well-suited due to various deviations from their underlying assumptions.

- Traditional options pricing models assume market efficiency, zero transaction costs, known and constant risk-free rates and volatility, and normally distributed returns on the underlying asset.

- These assumptions don’t hold in the crypto market, making traditional models ineffective and potentially leading to significant losses for liquidity providers (LPs) or unrealistically high option prices for buyers.

Instead of relying on traditional models, Premia’s pricing model is liquidity-sensitive and incorporates market adjustment mechanisms. This way, The price of options is determined by the relative supply and demand of capital within each pool, allowing market forces to converge toward the true market price. This approach leads to higher capital utilization within pools, potentially reaching 100% utilization, resulting in better returns for LPs without increasing prices for buyers.

- Market supply and demand dynamics are central to determining option prices through a risk-adjusted model.

- The pricing model ensures that, even under volatile user behavior, option prices converge to the true market price.

- In equilibrium, capital utilization within pools is influenced by market returns, typically ranging from 85% to 95% in simulated models, depending on user behavior.

- Higher pool utilization benefits LPs with improved returns while maintaining competitive pricing for buyers.

The Pricing Model

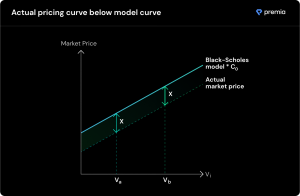

Premia employs a liquidity-sensitive pricing model based on the Black-Scholes framework, adapted to the unique characteristics of the crypto options market. This pricing model is designed to find an equilibrium between option prices, taking into account various market factors.

Inputs Required:

- Strike price.

- Spot price.

- Option maturity.

- Implied volatility.

- Risk-free rate of return.

- Position size

In addition to the input parameters that are used in Black-Scholes, Premia also takes into account the position size.

This results in a 5-dimensional input vector denoted as Vi.

The traditional Black-Scholes model is used as a starting point, but Premia assumes the existence of a theoretical market pricing curve that reflects the true market clearing prices for options based on various input vectors (Vi).

Deviations from the traditional model’s assumptions are expected but are not assumed to significantly alter the shape of the equilibrium pricing curve when compared to the Black-Scholes dynamic-hedge-based model.

Linear Relationship Assumption

Premia assumes a linear relationship between the actual market pricing curve and the Black-Scholes suggested curve. This relationship is assumed to be consistent across different values of Vi.

For instance, if one option is underpriced by 10% according to the Black-Scholes model, another option with different parameters should also be underpriced by the same percentage.

Letting Market Forces Demonstrate the Relationship

The key to understanding this relationship is to allow market forces to quickly converge towards it. For that reason, Premia’s pricing mechanism involves three main parts:

- Original Black-Scholes Model.

- Current pool price level, adjusted for the impact of option size.

- Discrete liquidity adjustment coefficient to update the price level.

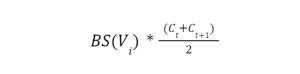

The Formula

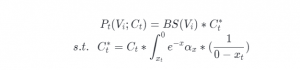

- The price quoted by the pool for an option at a given time t (Pt) is calculated as the product of the Black-Scholes model output (BS(Vi)), and a liquidity adjustment coefficient (C*t).

- The liquidity adjustment coefficient accounts for the impact of option size and is adjusted based on the pool’s size and the size change caused by a purchase. This adjustment is performed with the help of trade-specific steepness parameters (ax).

- The model can result in option prices that are lower than the intrinsic (exercise) value when the liquidity level is very low.

- To protect liquidity providers (LPs), Premia implements a Minimum Return model, ensuring that the final option price offered by a pool is always at least as high as the intrinsic value of the option plus a minimum annualized return, even if the standard model suggests a lower price.

This pricing mechanism aims to strike a balance between the Black-Scholes model and real market dynamics, considering liquidity and trade-specific parameters to provide competitive and LP-friendly option prices.

- Pt: Price quoted by the pool for an option at time t.

- BS(Vi): Black-Scholes model output for the selected option, based on a 5-dimensional input vector Vi (spot price, strike price, maturity, implied volatility, risk-free rate).

- Ct: Pool price level (liquidity adjustment coefficient) at time t (current period).

- (C*t): Pool price level adjusted for the price impact of option size.

- St: Pool size at time t (current period).

- St+1: Pool size after purchase (at time t+1).

- (ax): Trade-specific steepness parameter, currently defaulted to 1 for all trades (no effect).

- Pt is calculated by multiplying the Black-Scholes model output BS(Vi) by a liquidity adjustment coefficient (C*t).

- (C*t) is determined by multiplying Ct by an integral term.

- The integral term involves an exponential function with a parameter x and a multiplier (ax). The denominator of the fraction within the integral term calculates the price impact of the option size change, taking into account the maximum of either St+1 or St.

- Additionally, Ct+1 is calculated based on the current Ct and the price impact factor with ax as an exponent.

How Price Converges

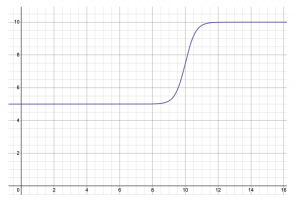

Premia’s pricing model employs a continuous, on-chain reinforcement learning mechanism to achieve price convergence towards the optimal market price and liquidity utilization rate over time.

This is achieved by taking the following assumptions:

- Market participants collectively know the market clearing price for any option.

- If the pool’s quoted price is higher than the true market clearing price, option buyers purchase fewer options, and LPs provide more capital.

- If the pool’s quoted price is lower than the true market clearing price, option buyers purchase more options, and LPs provide less capital.

- Option buyer demand can only be observed when a purchase is made and capital within a pool is locked as “booked.”

- Participants act rationally, but some bursts of random behavior are tolerated, as long as they do not significantly exceed the variance of the rational behavior model.

This results in the following convergence process:

- Initialization: At the start, there are zero assets in the pool, and an initial guess, C0, which is used as a multiplier to adjust the Black-Scholes model output (BS(Vi)) to produce the option quote provided to buyers. For example, suppose C0=5.

- Step 0: Since the pool intentionally overprices options at initialization, LPs are motivated to provide capital, expecting above-market returns. For example, an LP provides 100 ETH. At this point, the pool doesn’t adjust the C-value.

- Step 1: Options are still overpriced, attracting more LPs to provide liquidity. Suppose another LP joins with an additional 100 ETH. Now, the pool observes that market pressures favor the supply of liquidity.

- The “step size” is calculated as the relative change in available liquidity compared to the previous state, which is 0.5 in this case.

- The step size is used as input to an exponential decay function, resulting in a multiplier (0.6065 in this example).

- This multiplier is applied to the initial guess (C0) to update the belief about the market clearing C-value.

- The improved guess after step 1 is now C1=5*0.6065=30325, which is much closer to the market clearing C-value of 2.

- Repeat Steps 0-1: The process continues, with LPs providing more capital as the pool’s quoted prices become closer to the market clearing price.

- The C-value goes up and down, eventually converging to within a small percentage error of the market clearing conditions.

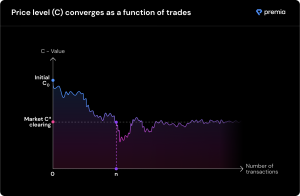

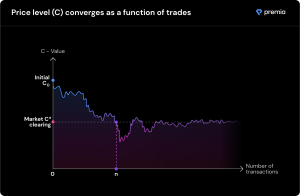

This results in the following convergence characteristics:

- The price level steadily trends towards the market-clearing C-level over time.

- Despite the volatility in user behavior, option purchases continue even if the buying price has not yet reached market equilibrium, leading to fluctuations in the C-value.

- The convergence process is conditional on the initial guess C0 being set above the market clearing level.

Therefore, the initial C0 value significantly influences convergence dynamics. Higher initial values increase the likelihood of asymptotic convergence, but this relationship may change for models with a limited step count.

Similarly, the exponent base in the model impacts the convergence profile, and finding the ideal characteristics of a healthy market convergence process is an ongoing exploration.

Further exploration may involve alternative base pricing models to Black-Scholes and the possibility of using multi-dimensional C-values tailored to option strike price and maturity for more optimal pricing.

C-Level – Capital Pricing and Initial Liquidity

Every pool has a C-level (price level) at any given time.

- The C-level is a dynamic multiplier applied to the base Black-Scholes model to adjust option prices.

- When the C-level is high, options are more expensive, leading to higher premiums earned by Liquidity Providers (LPs) on their capital.

- LPs are incentivized to provide liquidity to pools with high C-levels.

- Each pool is initialized with a high C-value, offering early LPs the potential for above-market risk-adjusted returns.

When a pool is created, it is initialized with a high C-level value. This high initial C-level is set intentionally to ensure that options within the pool are overpriced at the beginning. This initial overpricing benefits LPs.

As an LP, you are motivated to provide liquidity to pools with high C-levels because these pools offer the potential for above-market returns. Buyers may be willing to overpay for options in such pools due to irrational behavior or a strong desire for those options.

For instance, suppose a pool is initialized with C0=5. This means that initial pool prices are set to 5 * BlackScholesPrice.

Next, the C-level dynamically adjusts after every trade within the pool. As LPs deposit more capital into the pool, the C-level decreases. Conversely, when options are purchased (removing free liquidity from the pool), the C-level increases.

Over time and after a certain number of transactions (represented as “n”), the pool’s C-level converges to a market-clearing C-value (not observable). Once this convergence occurs, LPs will earn market-competitive returns on their liquidity.

- Before the C-level reaches its market-clearing value, there are likely to be buyers willing to pay a premium for options. This early stage of the pool’s existence provides LPs with above-market, risk-adjusted returns on the capital they deploy.

- Due to Premia’s pricing mechanics, each pool is designed to converge towards a theoretical 100% utilization. This means that none of the LPs’ capital should sit idle; it will be incentivized to be utilized at the best market return.

The Liquidity Buffer is created by the initial overpricing (high C-level) before convergence to the market clearing C-value. It represents excess liquidity available in the pool. However, not all of this capital will be utilized initially, as it’s assumed to be overpriced. Over time, this buffer may decrease in proportion to the total pool size as the C-level approaches the market-clearing value.

C-level recovery

C-level recovery is a mechanism within Premia’s pricing model that enables pools to recognize and correct themselves when they enter unstable states. These unstable states are characterized by a mismatch between the pool’s C-level and its utilization rate, leading to fewer trades and deposits compared to equilibrium. There are two specific situations that can be considered unstable:

- High Relative Pool C-level with Low Pool Utilization Rate:

- In this scenario, the C-level is relatively high compared to the pool’s utilization rate.

- This results in fewer trades being made than what would be expected at market equilibrium, and it does not incentivize additional deposits.

- Low Relative Pool C-level with High Pool Utilization Rate:

- Conversely, when the C-level is relatively low compared to the pool’s utilization rate, it can also lead to instability.

- In this case, the pool is highly utilized, but the low C-level does not encourage further deposits.

C-level recovery is designed to mathematically identify when a pool enters one of these unstable states and gradually corrects itself to return to a more stable state over time.

- Identifying Unstable States: When the C-level is in an unstable state, such as a high C-level with low utilization or a low C-level with high utilization, the system recognizes it as an unstable condition.

- Automatic Convergence: The C-level then starts to naturally converge back to a more stable level, as long as there are no new interactions with the system for a certain period. In other words, if no trades or deposits occur for a while, the C-level will automatically adjust to incentivize further activity and restore stability.

For example, if a pool has a very high C-level but low utilization (perhaps after the initial deposit), and there are no buyers for some time, the C-level will automatically decrease to encourage the next buyer and rectify the unstable state. The same principle applies in the opposite situation, where a very low C-level exists, and there is minimal free liquidity.

Price Impact by Size

Premia’s pricing model includes a mechanism to account for price impact per size, which helps disincentivize highly disruptive trades, especially those made by large traders. The goal is to maintain market stability and ensure that all traders, regardless of size, are treated fairly.

After every transaction, the pool’s price level is updated from Ct (the current price level) to Ct+1 (the next price level). This update is based on the size and direction of the trade and results in either an increased or decreased price for the next buyer or underwriter.

Premia’s pricing model takes into account the potential for large traders (“whales”) to disrupt the pool’s price level. For example, if a whale intends to make a massive purchase when the C-level falls below their perceived market equilibrium, it could significantly disrupt the pool’s price.

To mitigate such disruptions and ensure that large traders do not have an unfair advantage, a price impact penalty is imposed on the whale. If the starting price level is Ct, and after the whale’s trade, it becomes Ct+1, where Ct+1 > Ct, the price impact penalty is calculated as follows:

- In discrete form, the whale would end up paying:

- In differential form, a more accurate representation is used to calculate the price impact penalty:

Implied Volatility

Implied Volatility (IVOL) is the annualized volatility implied by an option’s price. It represents the market’s expectation of an asset’s future volatility based on the option’s current price. In mathematical terms, IVOL can be determined by plugging the final option price into the original Black-Scholes equation and solving for σ, which is the volatility parameter implied by the price.

The challenge with IVOL is that it creates a chicken-and-egg problem. In modern Black-Scholes models, option prices are often determined by plugging in an implied volatility value (IVOL) into the model instead of σ. This means that IVOL is used to calculate option prices, but option prices are needed to calculate IVOL. This creates a circular dependency.

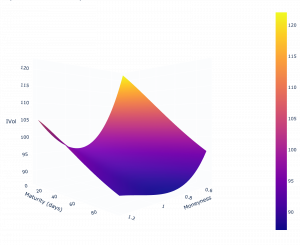

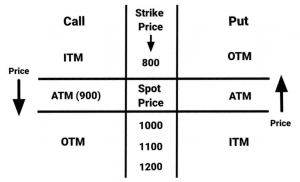

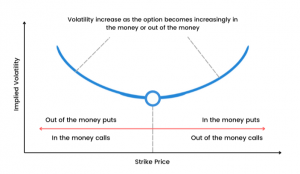

Also, IVOL is not a single value but a three-dimensional concept. It depends on three factors: the option’s maturity date, whether it’s “in-the-money” or “out-of-the-money,” and the strike price of the option. This complexity is why IVOL is often referred to as the IVOL surface or Volatility Surface.

For any asset, there exists a theoretical market IVOL surface that is known only to market participants and cannot be directly observed or derived from external data. Until this true IVOL surface is known, there will always be an approximation error in IVOL calculations, which can skew the prices of options in favor of either the Liquidity Providers (LPs) or option buyers.

Due to the decision-making nature of option buying, option buyers are more likely to engage in trades they perceive as favorable, shifting the inefficiency onto the LPs who underwrite the options.

The approach to dealing with this challenge has two main objectives:

- Propose a Starting Point for IVOL: To propose the best possible starting point for IVOL, even in the absence of knowledge of the true IVOL surface.

- Minimize Adjustment Costs: To minimize the cost of adjustments required to converge to the true market IVOL when it becomes known.

Volatility Surface Research

Given the constraints imposed by the underlying blockchain technology, Premia’s approach to solving the volatility surface problem must be not only innovative but also practical.

- Initial “Best Guess” for Volatility Surface: Premia starts with an initial “best guess” for the volatility surface. This initial estimate covers a limited range of inputs, including maturities ranging from 90 days and moneyness (the ratio of the option’s strike price to the current asset price) between 0.8 and 2.0. These inputs represent the most often traded strikes and maturities. The central area of the volatility surface, where these inputs lie, is more consistent and stable compared to the less-traded edges.

- Pinching the Volatility Surface: Any trade, weighted by its magnitude, has the effect of “pinching” the volatility surface. This is analogous to pinching and pulling a bedsheet. The point where the pinch occurs has the most significant effect, but the areas around it are also affected to varying degrees, depending on their proximity to the pinch point. The key design decision is to minimize the amount of trading required to move from the initial best guess IVOL to the theoretical market IVOL by continuously pinching the surface.

- “Pinch” Event Selection: Certain events, such as the purchase of an option, are observable and cause upward pressure on the volatility surface at the corresponding maturity and strike price. However, the opposite pressures, such as LP deposits, are not as straightforward to observe in a pool-to-peer architecture like Premia. Identifying the complete set of pinch events is an ongoing research challenge for Premia.

- Objective of the Initial Best Guess Surface: The goal of the initial best guess surface is to minimize the total error from the theoretical market-clearing volatility surface. The key design decision is to approximate the order of magnitude of this error. For example, if the initial surface is expected to differ by no more than 10% from the theoretical surface, the maximum discount that can be imposed on LPs will correspond to the price decrease resulting from a 10% lower volatility input in the Black Scholes model. This allows for the design of incentive mechanisms that provide fair value to both LPs and option buyers.

- Exploration of Various Directions: Premia’s research into solving the Volatility Surface problem has explored multiple directions, including:

- Inferring dynamic IVOL surface from centralized finance (CeFi) platform data like Deribit and Binance Options.

- Inferring the initial best guess surface from historical pricing data using techniques such as static and dynamic replication models and Monte Carlo simulations.

- Inferring signals from primary and secondary DeFi market transactions, including those on the Premia platform itself.

Premia utilizes Chainlink to solve their need for a volatility surface oracle. Similar to existing Price Feed oracles, this oracle allows smart contracts to access on-chain data. Specifically, it provides a 3-dimensional volatility surface, a crucial component for accurate option pricing and risk assessment.

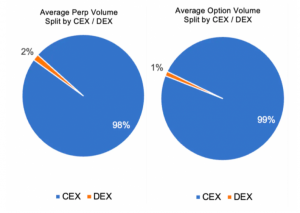

Due to Ethereum’s low-compute constraints, the volatility surface oracle calculates the ideal volatility surface off-chain. It uses a volume-weighted combination of data from the most liquid centralized exchange (CEX) options and trades executed on the Premia platform to create this off-chain volatility surface. This surface is then parameterized for on-chain representation as a simple polynomial, ensuring accurate pricing for any specific option.

Users and smart contracts can then interact with the Volatility Surface Oracle by calling specific functions. For pricing an option, the getBlackScholesPrice function is used, where users provide the token pair, option type (call or put), spot price, strike price, and maturity of the option. This function returns the Black-Scholes price with the volatility surface value applied to the σ parameter in the original Black-Scholes equation.

The volatility surface data isn’t limited to option pricing. Users can retrieve the entire surface by calling getVolatilitySurface with the token pair as a parameter. Alternatively, they can use getAnnualizedVolatility64x64 with the same option parameters to obtain a 64×64 fixed decimal representation of volatility for a specific option.

Trade Execution and Clearing

The Premia ecosystem of smart contracts offers non-custodial protections for liquidity providers and traders alike. Combining the distributed ledger equivalents of clearing houses and trading facilities, Premia offers best-in-class prices for shallow liquidity pools that scale with increasing deposits.

Being the first protocol to bring on-chain implied volatility oracles to EVM networks, Premia is able to properly map the implied volatility surface for mature crypto asset markets, as well as utilize a novel correlation approach to immature crypto asset derivative markets.

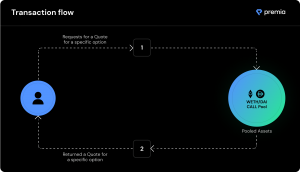

Transaction Flow

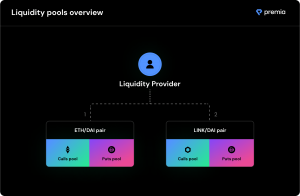

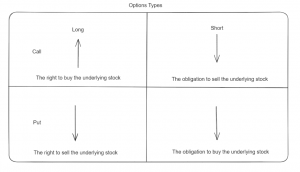

There are 2 pools for each asset pair on Premia: a Call pool and a Put pool. This allows both liquidity providers to granularly decide which pool they’d like to underwrite and option buyers to select which direction they’d like to trade.

When a user wants to purchase an option from the pool, they can simply send the details of the option they’d like to purchase to the pool, and the pool will return a quoted price for the user’s selected size, strike price, and maturity date. If the user agrees with the price, they can execute the trade with an on-chain transaction.

The option is then owned by the purchaser and represented as an ERC-1155 token in their wallet, allowing the user to transfer the option or exercise it at a future time.

Exercising and Settlement

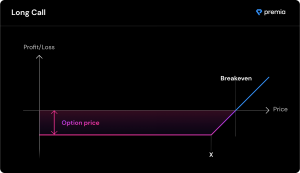

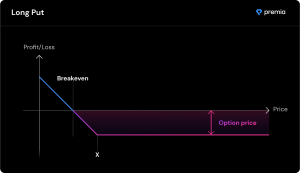

When a user buys an option, they can exercise their option at any time after purchase. Options can be exercised in full or in partial amounts over time. If at the time of maturity, an option is In The Money, the payoff is locked in and can be claimed at any time post maturity by the owner of the option. There is no penalty for late exercising.

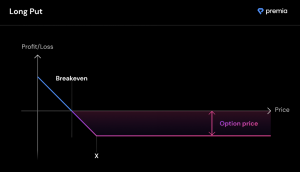

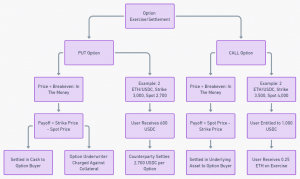

Exercising and settlement of a PUT option

If at the time of exercise, the price of the underlying asset is lower than the breakeven price, the put option is considered In The Money. In this case, the user is entitled to the payoff, which is equal to the strike price of the underlying minus the spot price. This difference is calculated automatically and settled in cash (the base token) to the option buyer.

Exercising and settlement of a CALL option

If at the time of exercise, the price of the underlying asset is higher than the breakeven price, the call option is considered In The Money. In this case, the user is entitled to the payoff, which is equal to the strike price of the underlying minus the spot price. This difference is calculated automatically and settled in the underlying asset (the quote token) to the option buyer.

Providing Liquidity

Each asset pair has 2 pools: a Call pool and a Put pool. Calls pools are underwritten in the underlying asset ($WBTC, $ETH, $LINK), and puts pools are currently underwritten in $DAI. This allows both liquidity providers to granularly decide which pool they’d like to underwrite and option buyers to select which direction they’d like to trade.

Each pool is described by the following parameters:

- Asset pair

- Total amount of assets

- Utilization ratio

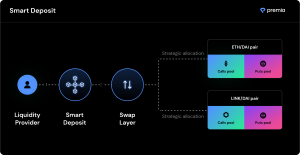

Smart Deposit Router

The Smart Deposit feature is based on a standard mathematical procedure called portfolio optimization.

The user submits a total amount for the deposit and market sentiment, and the Smart Deposit computes the fraction of the deposit to be swapped and allocated per pool. Once determined, these allocations are recommended to the user.

The user is prompted to select a series of assets that they own and is then prompted to select their market sentiment. The market sentiment selection has one of three settings: “bullish”, “bearish”, and “neutral”. These settings determine which pools will be considered for deposit: calls, puts, or both.

The total value of their assets is then summed into a single nominal amount. The fractional pool allocations are then determined based on the “mean-variance” criterion with respect to the aggregate pool c-values.

The allocations recommended to the user simultaneously maximize the mean c-value and minimize the variance of the c-value across the selected pools, hence they are said to satisfy the “mean-variance” criterion. The c-value is a Premia-specific pool metric that summarizes the utility value of deposits in each pool. Because each c-value summarizes the utility value of its respective pool, the smart deposit recommends an allocation that maximizes the mean c-value across pools, hence maximizing the average utility of the user’s deposit.

Severe fluctuations in the c-value are assumed a priori to be undesirable, hence the smart deposit feature recommends an allocation that minimizes the statistical variance of the c-value across pools.

Pool Accounting and LP Returns

This is the first fair pool accounting mechanism on the market, developed by Premia, ensuring fair accounting for LPs, depending on when they got in the pool and how long their capital has been deployed.

Deposits

Deposits are sequenced on a first-in, first-out (FIFO) basis to ensure fairness.

Depositing (adding liquidity to a pool)

- Select pool

- Select Amount

- [optional] Select swap asset

- Confirm transaction

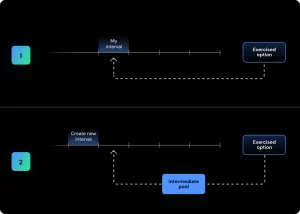

All of the available liquidity (Free Capital) in the pool, is sequenced in terms of intervals.

Each interval is defined by 3 parameters:

- LP wallet address

- Interval number

- Interval size

Underwriting Options

Liquidity providers automatically underwrite options purchased by users of the Premia pools.

When an option is purchased, the following steps happen in a transaction:

- Scans intervals required to underwrite position

- Mints tokens for interval owners

- Calculates option expiration date

- Places purchased option in ordered list, by expiration date

- Updates starting point of Free Capital

Options Expiration and Exercise

An option can complete its lifecycle in one of two ways: either be exercised or expire worthless. Liquidity providers can still withdraw their liquidity from their intermediate pool at any time.

For that, Premia utilizes automated tools such as Chainlink Keepers to process expired options daily, to ensure maximal capital efficiency and the best user experience for users of the protocol.

When an option is exercised, the same transaction settles the position – the option holder receives the payoff, and the newly freed capital is returned to the pool.

If an option expires without being exercised, the value of the option at expiration is locked in the option, allowing the option to be processed by any user of the pool. Users (or Chainlink Keepers) can then call processExpired on the pool to automatically free capital in the next expired option and send the exercise reward to the option holder. This ensures the pools stay maximally capital efficient and users always receive the best returns possible.

Liquidity providers’ capital is organized on deposit into Free Capital intervals, to ensure the fair sequencing of underwritten options. When an option is settled, for the newly freed capital to be returned to a Free Capital interval, it either has to exceed the minimum interval requirement for a new interval to be created, or the LP needs to have an existing Free Capital interval.

If the LP has an existing Free Capital interval, the newly freed capital is added to this interval (the amount is increased). If the LP has no existing Free Capital intervals, then should the newly freed capital exceed the minimum interval requirement, it is added at the back of the queue.

However, if the LP does not have an existing Free Capital interval, and the newly freed capital is below the minimum interval requirement, it will be placed in an intermediate pool until enough capital is accumulated to meet the minimum interval requirement. The reason behind imposing a minimum interval requirement is to avoid unbounded capital fragmentation (think an option buyer having to scan 1,000 intervals worth 1 $DAI each, to buy a single option). This ensures gas prices stay optimal for users of the protocol.

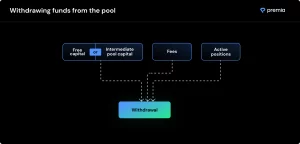

Withdrawal

LPs can withdraw their free capital at any time and have a few options for withdrawing their active capital.

Liquidity providers can withdraw their unutilized free capital in a pool at any moment in time (including unused premiums). If an LP would like to remove active (underwritten option) capital from a pool, they have two choices. They can either pay the pool price to sell the option to another underwriter in the pool, or they can use the Gradual Withdrawal feature to prevent their capital from being used to underwrite future options after expiration.

At any given time of withdrawal, an LP can have up to 3 components to consider:

- Free capital (or intermediate pool capital).

- Accumulated premiums.

- Active positions underwritten.

At the time of withdrawal request, the amount available for withdrawal is calculated as follows:

- WithdrawalAmount: FreeCapital + PremiumsEarned + AvailableActiveCapitalWithdrawalAmount

- FreeCapital: Amount of free/intermediate capital available

- PremiumsEarned: Total premiums accumulated from option sales

- AvailableActiveCapital: Sum(OptionSize∗(1−OutstandingExposure)

- OutstandingExposure: Outstanding pool value of underwritten options

Alternatively to the complete withdrawal of active funds (at cost), an LP can select a gradual withdrawal. This will prevent the user’s capital from being used to underwrite future option sales. As soon as capital is released from unwound positions, it is blocked from re-converting to free capital and can be withdrawn by the user.

Meta-Vaults: Aggregated Pool Strategies

Meta-Vaults were initially designed to embed various LP strategies into new pools of liquidity that implement the strategies automatically. This is made possible by the Premia base pool architecture.

As an LP, on several other platforms, you are forced to take a universal “short volatility” position (i.e. underwrite calls and puts simultaneously), which can often be a losing bet in crypto. This is not the case on Premia, which enables asset and direction-specific option pools.

Using the Premia option pools you could embed strategies such as:

- Optimizing for $PREMIA token farming.

- Deploying capital on momentum (when a C-level within a pool changes).

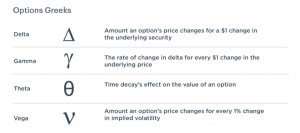

- Delta-hedging and other hedging strategies involving Greeks or spreads.

- Shorting volatility for specific assets.

- Options arbitrage between different platforms.

Most of these meta-vault strategies will only be possible on Layer-2’s with highly decreased gas costs compared to Ethereum mainnet. The current cost of gas on Ethereum mainnet makes most of these strategies unviable in a capital-efficient manner (the strategies lose money due to gas costs or cannot efficiently run the strategy due to capital requirements).

The initial research and vision for the meta-vaults lives on inside Premia Blue (V3) as Strategy Vaults.

Knox Vaults (V2)

Knox Vaults offers DeFi Option Vaults (DOVs) designed with a focus on risk management and yield generation. They are benchmarked on simplicity and outperforming HODL strategies.

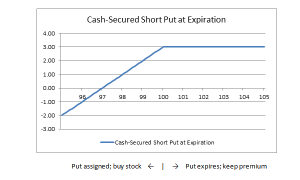

These vaults are automated platforms that facilitate the process of selling options via auction to generate consistent and low-risk yield on crypto assets such as $USDC, $BTC, and $ETH.This is achieved by underwriting options, which involves selling call or put options depending on market sentiment.

With Knox Vaults Premia primarily offers two types of DOVs:

- Covered Call Vaults: These vaults involve selling covered call options. In a covered call strategy, the seller (the vault) owns the underlying asset and sells call options on that asset. This strategy aims to generate income while still maintaining exposure to the asset’s potential price appreciation.

- Cash-Secured Put Vaults: These vaults focus on selling cash-secured put options. A cash-secured put involves selling put options while setting aside enough cash (or collateral) to purchase the underlying asset if the option is exercised. This strategy aims to generate income while also having the potential to acquire the asset at a lower price.

This is achieved using American options issued as ERC-1155 tokens by Premia. These tokens offer the holder the rights (but not the obligation) to buy or sell the underlying token by a specified date.

While traditional stock option contracts usually represent 100 shares of the underlying stock, options on Premia represent the same number of tokens as described.

The option strike prices are determined once per epoch using the Delta Strike Formula.

Once pricing is determined, the options are sold via Dutch auction. The premium paid by the option buyers represents the weekly yield for depositors.

Knox Vaults also provides risk management tools within the vaults. For instance, an immediate withdrawal feature offers users the flexibility to exit their positions at any time during an epoch.

Users can initiate a transaction to receive their share of assets held within the vault. Typically, users receive short tokens representing the collateral held by the vault. Once users have these short tokens, they have two options:

- Hold Until Expiration: Users can hold these tokens until the options they represent expire.

- Sell Back to the Pool: Users can go to Premia’s position page and sell their position back to the pool, provided there is sufficient liquidity.

This results in the following advantages:

- Immediate Liquidation: Users can liquidate their assets instantly if needed, providing them with flexibility and liquidity.

- Early Profit Realization: If the options they underwrote (sold) are moving in their favor, users can choose to take profits earlier in the epoch, though the amount may be less than the full potential profit.

- Risk Reduction: If the options they underwrote are moving in an unfavorable direction, users can reduce their risk by exiting the vault.

Covered Calls

Covered calls are a popular options strategy that involves selling call options on an underlying asset while simultaneously holding an equivalent spot position in that asset. This strategy is often used to generate additional yield on an existing asset position while maintaining exposure to potential price appreciation.

- Naked Calls: Writing call options without holding the underlying asset. Naked calls have unlimited downside risk for the option writer because they may need to purchase the asset at a higher price to fulfill the contract if the price rises significantly.

- Covered Calls: Writing call options while already holding an equivalent spot position in the asset. Covered calls are considered less risky because the option writer can fulfill the contract with their existing spot position, even if the asset’s price increases significantly.

As an example:

- Suppose Ethereum ($ETH) is trading at $1,500.

- An investor writes 10 call options with a strike price of $1,600, which means they are willing to sell their ETH at $1,600 if the options are exercised.

- In a covered call scenario, the option writer holds 10 $ETH as collateral.

- If the price of $ETH increases to $2,200 before the options expire, the covered call writer can fulfill the calls using their existing 10 $ETH and still make a profit equivalent to the premiums received when writing the options.

| Benefits of Covered Calls | Risks of Covered Calls |

| Generate Yield: Covered calls provide a way to generate yield on spot positions while maintaining a bullish outlook on the asset. | Asset Value Decrease: If the value of the underlying asset decreases, the dollar value of the spot position also decreases, potentially resulting in a loss. |

| Reduced Downside Risk: Compared to naked calls, covered calls have substantially less downside risk because the option writer holds the underlying asset to fulfill the contract. | Missed Appreciation: If the asset’s price significantly exceeds the strike price, the options are likely to be exercised, and the option writer may miss out on additional price appreciation above the strike price |

Vault System

Vaults are distinguished by their collateral asset ($wETH, $wBTC, $DAI, etc) and delta (bullish or bearish), and are accompanied by three other design components:

- Queues act as liquidity buffers for vaults, holding user funds until they can be deposited

- Pricers determine the strike price for options and auction pricing parameters

- Auctions sell options using a Dutch auction format

Epochs

Vaults work on a 7-day schedule (epochs) and start and end every Friday, 8AM UTC.

The epoch timeline is as follows:

- 24 hours before the start of a new epoch, on Thursday at 8AM UTC*, the strike price for that epoch’s auction is determined and the auction is initialized.

- The epoch starts on Friday at 8AM UTC*.

- The auction starts on Friday at 4PM UTC and lasts 30 minutes.

- The auction ends on Friday at 4:30PM UTC* and options are written. Note, the auction may end earlier if all available option contracts have been sold within the allotted time.

- Options expire at the end of the epoch, i.e. on Friday at 8AM UTC.

Selection Methodology

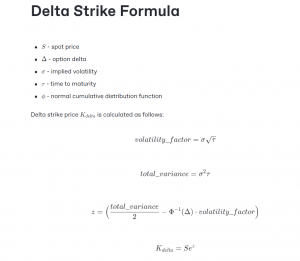

There are 2 methodologies to be aware of, the Option Delta and the Delta Strike Selection.

Option Delta:

Each vault has an option delta, which is defined as the amount an option price is expected to move based on a $1 change in the underlying.

If a call option has a $0.1 delta, the price of the option will increase or decrease $0.1 for every $1 change in the underlying. Calls have a range of delta values between 0-1, puts have a range between -1-0. As the option approaches expiration the delta for ITM options will approach 1 for calls and -1 for puts, while the delta for OTM options will approach 0.

For calls an exercised option represents “stock” purchased by the option buyer, likewise puts represent “stock” sold by the option buyer. For both calls and puts an OTM option after expiration has no intrinsic value. Keep in mind that the option delta is relative to the position of the strike price compared to the spot price of the underlying. In other words, an option further ITM will always have a higher delta than an option further OTM.

Delta Strike Selection:

Under the delta strike formula, we determine a strike price Kdelta at a specific option delta as a function of implied volatility σ. In other words, if we know σ, we can obtain Kdelta, provided that the spot price, time to expiration, and option delta are constants. We can therefore create vaults with varying levels of relative risk and return.

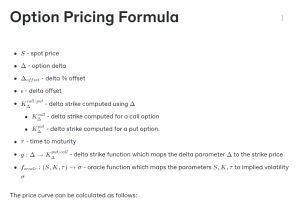

Options Pricing

Knox Finance will offer a certain quantity of options to be sold at a pre-specified time and pre-determined strike. The vaults enable price discovery to occur on-chain via a Linear Gradual Dutch Auction (LGDA).

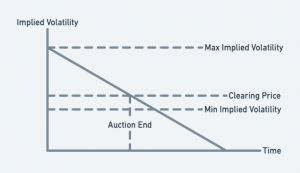

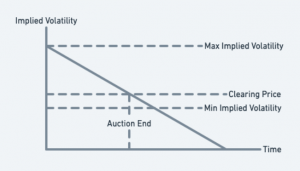

During the allotted time period, options will be written at a price specified by a linear curve. The implied volatility of the option will start at a maximum value (σmax ) and it will be gradually decremented according to the remaining time in the auction to a minimum reserve implied volatility (σmin). A bidder will have the chance to secure this price for a given lot size, depending on how much capital has been utilized prior to their bid.

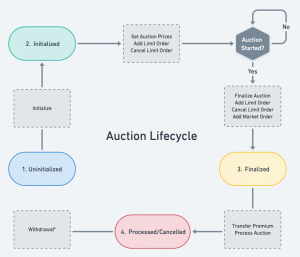

Options Auction

Knox Finance Vaults sell options every epoch using a Dutch auction format. Since the auction determines the price at which options are sold, it also determines the premiums that the vault’s depositors will earn for that epoch.

Dutch auctions are a type of auction whereby the price of an asset starts high and is gradually decreased as the auction progresses. The auction ends when there are enough bidders at or above a certain price, such that the entire lot of the asset can be sold at that price. Importantly, all successful bidders in a Dutch auction pay the auction clearing price.

Auctions last 30 minutes, with prices decreasing along a linear price schedule. The offset delta strike represents the further-OTM option strike, it’s calculated using a fixed percent offset from the delta strike.

Options cannot be sold below the minimum price:

- In case there are not enough bids at or above the minimum price to sell the entire lot of options, the auction will be completed partially and proportionally fewer options will be written that epoch.

- In case there are no bids at or above the minimum price, the auction will be canceled and no options will be written for that epoch.

An auction may be canceled if one of the following happens:

- The auction is initialized with an invalid configuration.

- The auction prices have not been set before the auction starts.

- The auction prices are initialized with an invalid configuration.

- The auction is not processed within 24 hours of the auction end time.

In the event an auction is canceled, the option buyers will be refunded the full amount paid.

Liquidity Providers

Liquidity providers in the vaults can take 3 actions, being depositing and withdrawing collateral, and redeeming claim tokens.

Depositing Collateral

Collateral ($wETH, $wBTC, $DAI, etc) is deposited into the queue where it remains until the epoch is processed once per week.

Knox Finance uses two types of vault tokens to keep track of new and existing deposits:

- ERC1155 claim tokens represent assets deposited into the queue that have not yet been moved to the vault, at a 1:1 rate

- ERC4626 vault shares represent shares of the vault assets

At the beginning of every new epoch, ERC1155 claim tokens are converted into ERC4626 vault token shares based on the vault’s current price per share.

Withdrawing Collateral

Newly deposited collateral is held in the queue until the start of a new epoch. During this window, you can always withdraw collateral, without restrictions, penalties, or fees.

Upon withdrawal, your ERC1155 claim tokens will be exchanged for collateral at the same 1:1 rate applied at the deposit. Remember that at the end of the epoch, any collateral in the queue will be moved to the vault, and different rules for withdrawal apply.

Once funds have been moved from the queue to the vault, they only can be withdrawn without taking any exposure to a short position after a new epoch starts (Friday at 8AM UTC) and before the auction starts (Friday 4PM UTC).

While the auction takes place, you cannot withdraw from the vault until the auction has been processed.

After the withdrawal lock is cleared, you can again withdraw funds, but you will take on exposure to any short positions assumed by the vault during the auction.

Redeeming Claim Tokens

When a deposit is made, claim tokens are minted in a 1:1 ratio to the amount of collateral deposited. At the beginning of every new epoch, ERC1155 claim tokens are converted into ERC4626 vault shares in an amount determined by the vault’s current price per share.

A vault share represents a proportional amount of collateral assets and option contracts underwritten by the vault. Claim tokens minted in a given epoch may be exchanged for vault shares in any subsequent epoch.

Claim tokens are automatically converted to vault shares on behalf of the user each time a user interacts with the vault (i.e. deposits, withdraws, or redeems). This prevents the accumulation of a large number of claim tokens (which by design are temporary).

Options Buyers

Option buyers can take 3 actions: buying, withdrawing, or exercising options.

Buying Options

You can place orders to buy options before or during the options auction. Both market and limit orders are supported. Knox uses a Dutch auction system, so no matter what type of order you use, you will always pay the clearing price.

The platform supports both Market and Limit Orders

- With a market order, you only specify the number of options you wish to buy and the maximum cost you are willing to pay. The amount paid by the buyer will be determined by the quantity of options being purchased and the price established by the linear price curve. Market orders may only be placed during the auction (Friday 4pm – 4:30pm UTC).

- With a limit order, you specify the number of options you wish to buy and the maximum price you are willing to pay per option. The amount paid by the buyer will be determined by the quantity of options being purchased and the price specified by the buyer. Limit orders may be placed once the auction has been initialized (Thursday 8am – Friday 4:30pm UTC), and may be canceled anytime before an auction has been finalized.

Orders are only filled if the order price is greater than or equal to the clearing price and there is sufficient liquidity to fill the order (utilization < 100%). Assuming sufficient liquidity, your order is filled at the clearing price reached at the end of the auction.

The difference between the amount paid and the cost and/or any unfilled amount is refunded to the buyer when they withdraw from the contract.

An order may also be partially filled if there is not enough collateral to meet the amount specified. In this case the difference between remaining collateral and the amount will be used instead, any unspent funds will be refunded to the buyer when they withdraw from the contract.

Withdrawing Options

You can withdraw options from Knox as ERC-1155 options tokens 24 hours after the auction has been processed. Withdrawals may be made at any time if the auction has been canceled.

- If you let in-the-money options expire before withdrawing them, they are automatically exercised. Upon withdrawal, you will receive the proceeds of the options (their intrinsic value) instead of ERC-1155 options tokens.

- When withdrawing options or proceeds from expired options, you also receive a refund for any unspent funds that were deposited when placing the orders to buy those options.

Here is a table of the most common scenarios and their outcomes when withdrawing:

| Expired | Scenario | Outcome |

| No | Your order was filled at the exact price you deposited | You only receive your fill |

| No | Your order was filled at a lower price than you deposited | You receive your fill and a refund for unspent funds |

| No | Your order was not filled | You only receive a refund |

| Yes | Your order was filled at the exact price you deposited | You only receive the proceeds of the options, if any |

| Yes | Your order was filled at a lower price than you deposited | You receive the proceeds of the options, if any, and a refund for unspent funds |

| Yes | Your order was not filled | You only receive a refund |

Exercising Options

Options purchased on Knox Finance are issued by Premia, which means they are automatically exercised upon expiry. Since they are American options, they can also be exercised manually any time before expiry.

With Premia’s design, options are settled in the underlying asset. When exercised or upon expiry, the intrinsic value of the option is paid directly to the option holder:

Premia Blue: Overview

Premia Blue, also referred to as Premia v3, is the latest upgrade of the Premia protocol, designed to simplify and democratize options trading within the DeFi space. Premia Blue marks a groundbreaking shift from the well-known DOV model with a hybrid approach. It’s the first protocol to successfully combine an on-chain orderbook, settlement engine, vaults, and concentrated liquidity pools into a non-custodial options exchange with the accessibility of trading APIs for programmatic traders.

This innovative blend caters to a wider audience, including experienced traders from platforms like Deribit, who prioritize low fees and precise options pricing.

This version of the protocol introduces significant advancements that enhance capital efficiency and composability. Most importantly, the protocol offers benefits for all types of users, regardless of their level of expertise (retail users, passive LPs, active market makers, protail (pro-retail, trading firms, arbitrageurs, etc.).

The Base Layer (The Exchange)

The base layer of Premia Blue is a complete rework of the protocol, focusing on capital efficiency with features such as:

- Concentrated Liquidity:

- Allows liquidity providers (LPs) to create positions in specific option pools with defined price bounds.

- Maximizes fee collection and capital efficiency for both active and passive traders.

- Partial Collateralization:

- Introduces margin architecture, enabling partial collateralization of options for select payoffs like spread strategies.

- Increases liquidity and efficiently-priced assets while maintaining solvency and eliminating counterparty risk.

- Transaction Fees & Revenue Share:

- Traders pay fees, with a portion going to LPs and protocol stakeholders.

- Users can stake $PREMIA tokens to collect fees and participate in protocol governance.

- Vaults & OTC Liquidity:

- Addresses challenges in granular options markets, enhancing accessibility and usability.

- Modular and Layered Protocol:

- Designed for maximum composability and upgradability on top of the base exchange layer.

- European-style Options Markets:

- Enables the creation of European-style options markets for any asset pair with an on-chain spot price oracle.

- Range Orders:

- Supports various types of range orders, each with specific functionalities to cater to different trading strategies.

- Margin System:

- Utilizes a risk-based model to assess user positions, incorporating attributes from traditional Reg-T and Portfolio Margin systems.

- Establishes lending markets to provide capital to option underwriters. (To be enabled later)

In order to minimize counterparty risk, options on Premia are fully collateralized. However, lending pools will be introduced in the future to increase capital efficiency and enable partially-collateralized positions.

| Option Type | Collateralization | Price Quoting | Price Range |

| Call | Fully collateralized by the underlying asset. | Quoted in the underlying asset | Range-bound to price range |

| Put | Fully collateralized by the strike amount in the quote asset | Quoted in the quote asset | Range-bound from 0 to strike price |

Although pairs can be deployed using any quote asset with a valid spot price oracle, most often the quote asset will be a stablecoin, such as $USDCe.

Premia relies on a hybrid exchange that integrates vaults, a concentrated liquidity AMM, and an orderbook. Trades in the orderbook are settled on Arbitrum One, but the quotes are provided on Arbitrum Nova in order to speed up transactions and increase efficiency.

While all options settle within their respective pools, it’s possible to interact with multiple sources of liquidity for the same option. Users of the Premia Interface or Premia v3 SDK will have easy access to the best quotes from each source.

To be exact, for each given option, there could be up to 4 liquidity sources:

- AMM – Range Orders.

- Orderbook / RFQ System.

- Vaults.

- External Protocols / Third Parties.

Premia also offers an API and SDK for systematic traders, allowing them to plug and play their existing strategies and leverage them on-chain without even noticing that they are interacting with underlying smart contracts.

The determination of the settlement price is provided by an oracle feed that relies on spot price oracles, ideally corresponding at 8 a.m. UTC. In Premia Blue, pools can be created out of the box with:

- Chainlink VWAP Price Feeds

- RedStone Oracles (TBA)

- Third-party oracles that implement the IOracleAdapter smart contract interface.

- The UI will only display well-established price feeds.

The AMM

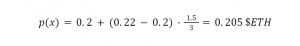

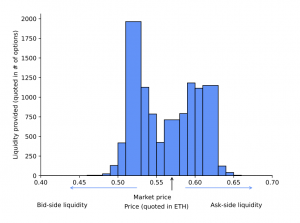

In DeFi, most Automated Market Makers (AMMs) operate using Constant Function Market Makers (CFMMs), where a trading function governs the exchange of assets. However, Premia takes a different approach. Instead of employing a trading function, Premia’s AMM relies on a linear relationship between price and liquidity. This unique approach is made possible due to the range-bound nature of option prices.

Option prices inherently have a defined price range, typically from ‘a’ to ‘b’, and this range is divided into active tick ranges with associated liquidity ‘L’. For example, if the current price ‘p’ is at the lower bound ‘a’, the AMM’s price formula is used to determine the price for any trade size ‘x’ within the active range.

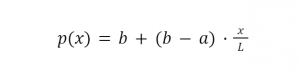

The price of an option is calculated using the following formula:

- ‘x’ represents the trade size.

- ‘a’ and ‘b’ define the lower and upper bounds of the price range.

- ‘L’ is the available liquidity within that price range.

As an example, assume the following:

- There’s 3 units of liquidity deposited in the price range of 0.2 $ETH to 0.22 $ETH.

- The current market price is at 0.2 $ETH.

- An individual liquidity taker (LT) wants to buy 1.5 long contracts.

According to AMM’s formula, when the LT buys 1.5 long contracts, the market price will move to 0.21 ETH because half of the order is filled, and the formula guides the price change.

Now, the quoted price per option is calculated as follows:

So, the LT will receive 1.5 long contracts in return for 1.5 * 0.205 = 0.3075 $ETH.

Concentrated Liquidity

Premia’s AMM is a Concentrated Liquidity AMM (CLAMM), allowing LPs to deploy capital to a specific price range, maximizing utilization, and increasing the amount of fees that can be generated per unit of liquidity. This feature is relevant for the most sophisticated users and offers benefits such as:

- Enhanced capital efficiency: LPs can manually set the range at which their liquidity will earn the most fees.

- Maximize liquidity utilization & trading fees: As LPs are incentivized to provide liquidity to the optimal range, capital is used to its maximum efficiency.

When done effectively, LPs get the best fees, while traders get the most liquid markets possible. However, there is a degree of complexity associated with optimally managing positions.

- The most sophisticated traders will be able to maximize the amount of fees they can collect with more concentrated orders.

- Passive LPs with less conviction trades can still earn fees by selecting a wider and less capital-efficient range.

Options positions are represented as fungible and transferable ERC-1155 tokens.

Range Orders

Premia’s concentrated liquidity system offers a unique approach to range orders, providing liquidity providers (LPs) with the ability to calibrate their exposure and define upper and lower bounds for premiums. Unlike Uniswap v3, where a single range order suffices, Premia’s options market requires two distinct range orders to manage exposure effectively: Collateral-Short (CS) and Long-Collateral (LC).

CS and LC range orders in Premia enable traders to fine-tune their exposure to short and long positions within defined price ranges. These orders are adaptable to the current market price and provide flexibility for risk management and trading strategies.

The Premia team recently made public an open-source Range Order Bot for programmatic traders, which can be found here.

Collateral-Short (CS) Range Orders

CS range orders allow traders to manage their short exposure within a specified price range.

Traders can deposit both collateral and short contracts into the range order, and the composition depends on the current market price.

- When liquidity is deposited above the market price (p), the entire deposit consists of collateral. This collateral is used to underwrite options, serving as liquidity for traders buying long contracts. As liquidity takers (LTs) buy long contracts, the market price increases and the CS order is traversed. This means that the deposited collateral is gradually used to cover the increasing market price due to long contract purchases.

- Conversely, if liquidity is deposited below the market price, the deposit comprises short contracts. These short contracts will be bought-to-close as the market price moves upward. This process unlocks the remaining stored collateral.

- A CS range order that straddles the market price will have a mix of collateral and short contracts, optimizing exposure management.

For instance, let’s examine a scenario involving a range order’s liquidity profile placed above the current market price. As liquidity takers (LTs) engage by purchasing long options, the market price progresses through the range order, leading to specific outcomes. In the illustration below, you can observe that once the market price reaches the upper tick price (0.22 $ETH), the entire range order becomes filled.

A full withdrawal would result in the LP obtaining 0.63 $ETH and 3 short positions.

Long-Collateral (LC) Range Orders

LC range orders serve a similar purpose but are used to manage long exposure within a specified price range. The composition of LC orders also depends on the market price:

- Liquidity deposited above the market price consists entirely of long contracts, which are sold to reduce long exposure.

- In contrast, liquidity deposited below the market price is composed entirely of collateral, which is used to buy-to-open long contracts.

- A market order that straddles the market price will include a mix of both assets, facilitating balanced exposure management.

As an example, consider a range order within a put option pool, where liquidity is deposited above the prevailing market price. As the market price interacts with this range order, long contracts are sold to LTs, resulting in the transfer of premiums. Upon the completion of this movement, where the entire range is traversed, the liquidity within the position will consist entirely of the quote asset.

Custom LP positions

In Premia Blue, LPs have full control over their exposure: LPs can customize the underlying token, strike price, price range, and expiration date of the option they wish to market-make. If a pool doesn’t exist for the option, the LP can freely seed the liquidity to create one.

This unlocks unique opportunities for LPs, who will be able to use their capital efficiently while defining their own risk and setting the exact parameters that they want to underwrite for.

It is important to note that, In order to prevent excessive liquidity fragmentation and ensure maximum composability with other options markets, pools can only be created for common strikes and expirations.

- Strikes are algorithmically limited to common values (log-rounded)

- The maximum expiration is 1 year out.

- All options will expire at 8 a.m. UTC.

- All options with over 7 days to maturity expiring on a Friday

- All options past 30 days must expire on the last Friday of the month.

The Orderbook / RFQ System

The orderbook facilitates the intermediation between makers and takers.

| Market Makers | Market Takers |

| Provide quotes – either through the orderbook off-chain API or on-chain. | Obtain quotes off-chain through the orderbook API to fill the orders on-chain |

| When market makers submit quotes on-chain, an on-chain event is generated, recording the details of each order. | Once a taker selects a quote they wish to execute, the order details must be conveyed on-chain. |

| Each quote includes various parameters, including a deadline, which specifies the validity period of the quote. If necessary, orders can be canceled before the deadline (can only be performed on-chain) | Traders can verify the validity of a quote in the Orderbook |

The orderbook architecture is also unique in the sense that two separate chains are used:

- Arbitrum One acts as the primary chain where all orders are filled/canceled, and positions are settled/exercised.

- Arbitrum Nova is used for providing quotes in a decentralized yet low-cost and fast manner. Quotes are simply events that emit the order details by the maker of a transaction that will ultimately be processed on Arbitrum One.

There are two ways to emit quotes, either directly through the contract on Arbitrum Nova or through a rate-limited and tiered API.

Smart Liquidity Management

To solve the problem of liquidity management Premia offers a Smart Liquidity Management solution for its Range Orders system. One of the most notable features of this system is that range orders are one-sided and can automatically flip their directional exposure. This represents a massive improvement in terms of user experience.

- Range orders are “one-sided” which means that they can either be long or short orders.

- For long orders, the liquidity is used to underwrite long positions on that option.

- For short orders, the liquidity is used to underwrite short positions on that option.

- Range orders flip automatically, meaning that as the price moves along the LP’s range, the position will collect trading fees and the exposure will be updated. In practice, this means that LPs gain both short and long exposure to a given option automatically.

- Fees are collected both ways.

- Lower risk for LPs.

This provides an unparalleled degree of flexibility. As an LP, all you have to do is choose the underlying asset, the option type (call or put), the type of the range order (long or short), the strike price, the maturity date, and the size of the position along with the upper and lower price range.

From the point of view of an LP, the process is simplified as follows:

- Choose the underlying token.

- Choose the option type (call or put) and side of the range order (long or short).

- Enter the strike price, maturity date, and deposit amount.

- Define the upper and lower bounds of the range order.

- Provide liquidity and accept the transaction.

Exercise and Settlement

When a user is long (or short) an option, they can exercise (or settle) their option from the IPool interface at any time after the option’s maturity date. If at the time of maturity, an option is In The Money, the payoff is locked to the intrinsic value and can be claimed at any time post-maturity by the owner of the long option. Short option holders can also claim the remaining value of collateral at any time after expiration. There is no penalty for late exercising or settlement.

PUT option

If at the time of maturity, the price of the underlying asset is lower than the breakeven price, a put option is considered In The Money. In this case, the option owner (long the option) is entitled to the payoff, which is equal to the strike price of the underlying minus the spot price. This difference is calculated automatically and settled in cash (the quote token) to the option buyer. The option underwriter (short the option) is charged against the collateral held.

CALL option

If at the time of maturity, the price of the underlying asset is higher than the breakeven price, a call option is considered In The Money. In this case, the user is entitled to the payoff, which is equal to the strike price of the underlying minus the spot price. This difference is calculated automatically and settled in the underlying asset (the base token) to the option buyer.

Settlement Price (Oracle Feed)

Determining the settlement price is done via spot price oracles.

Margin

At a technical level, the margin system is a type of vault, and it is built on top of the base layer. This segregation from the base layer ensures solvency and the ability to guarantee payout as a settlement engine. Users who choose to utilize margin must do so through the margin vault. This experience is simplified for users of the Premia Interface or Premia v3 SDK. One of the major differences between using the margin and using the base layer is that positions held by users on the base layer can be withdrawn and freely moved. Conversely, positions that utilize margin can not be withdrawn.

The margin vault contains a blend of attributes from traditional Reg-T and Portfolio Margin systems that provide sell-side leverage. A risk-based model is used to assess user positions in an isolated fashion (per-position). In order for the base layer to always remain solvent, margin users must borrow capital from pool lenders, which is then used to fully collateralize the exposure on the base layer.

Borrowers are in a “first-loss” position relative to the lender. This means all losses incurred on a position are debited from a borrower before the lender takes on any risk. All profit is retained by the user borrowing capital, less capital usage fees (interest).

Providing Liquidity as a Lender

Lending markets are established exclusively for the purpose of providing capital to option underwriters, where each collateral type (eg. $ETH, $WBTC, $USDC) has its own margin lending pool.

When depositing capital into a margin pool, each lender must select a deadline on which their capital is to be returned. A lender’s capital can be borrowed at any time before the deadline (or indefinitely if no deadline is set). For example, if a lender’s deadline is 30 days from now, this implies the lender’s capital will be available for up to the next 30 days, and will only be used for options that expire between the current time and the deadline.

Any lender capital utilized in an option position is locked for up to the expiration of the position. Upon borrowing, a borrower pays an upfront interest-based commitment fee based on the utilization of the total available capital in the pool, up to the option’s expiration. When a borrower successfully closes a position, each lender’s capital is unlocked and immediately made available for further lending or withdrawal. At any time, lenders may withdraw any of their capital that is not being utilized in the pool.

A lender’s capital may be utilized for multiple options, so long as each expiration date is prior to the lender’s deadline. All lenders for a specific expiration share in lending fees pro-rata. Additionally, lenders split the principal risk of liquidated option positions, if and only if the Reserve Fund cannot fully cover losses. When a lender’s deadline is passed, their capital will be reserved for withdrawal and will no longer be available to be borrowed for margin.

If a borrower closes a position before maturity, they will be rebated with commitment fee claim tokens, enabling the user to claim any potential commitment fees generated by the returned capital, if borrowed again by another user prior to maturity.

Selling on Margin

- Lending Fee

In order to sell on margin, a user must borrow funds so that the position is fully collateralized. Borrowing these funds requires paying interest, which is paid up-front when a trade is opened. Any interest left over (i.e. a position is closed before expiration) is credited back to the trader upon closing the trade in the form or rebate claim tokens, which do not affect lender returns. The lending fee sits between the prevailing risk-free rate, R and R + .05. The amount of reserves relative to the amount of margined open interest determines where the interest rate will be. In other words, the more risk the lenders are potentially exposed to, the higher the interest rate charged up to 5% over the risk-free rate.

For example, if there is $100 ETH in the $ETH Reserve Fund, the first 100 short option positions opened on margin will borrow at the risk free rate. This is because there is no risk of loss to the lenders as any loss will be covered by the reserve fund. As the risk of loss to lenders becomes non-zero (the reserve fund capital becomes exposed), the interest rate will traverse to 10% to cover the risk of potential loss of their funds (as risk is transferred to lenders).

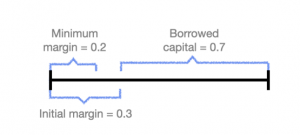

- Min Margin

Minimum Margin is the least amount of collateral a position needs to maintain before it will be liquidated. It is important to know that this is a dynamic number and will change over the life of a margined position based on several factors.

- Dynamics of Min Margin

The following are important terms related to dynamics of Min Margin.

- Time: As a function of time (all else equal), the Min Margin will decrease as an option gets closer to expiration.

- IV: As a function of IV (all else equal), the Min Margin will increase when an option’s IV increases.

- Price: As a function of price (all else equal), the Min Margin will increase when an option’s price increases.

At all times a user can monitor the Minimum Margin requirement for a given position and in the future, users will be able to set alerts directly on the Premia Interface to avoid liquidation.

Initial Margin: The minimum amount of collateral that must be provided by a user in order to open a new short option position using margin. It is set to 1.5x the Min Margin. This ensures users have a substantial risk buffer before a position can be liquidated, once it is opened.

Liquidation

Liquidations do not instantly occur automatically on-chain. One of the of the major challenges with on-chain liquidation is price distortion, which is a function of liquidity. The less liquidity there is in a given market, the more it will be impacted by a liquidation event creating negative feedback loops. To solve this, Premia will implement a Reserve Fund structure, which will help prevent negative feedback loops and can offset risk exposures for lenders as it grows.

- Liquidation Trigger

Anyone can liquidate an at-risk position on-chain and collect a liquidation fee for doing so. The liquidator does not take on position exposure. They merely act as a keeper, monitoring for positions that can be liquidated, and invoking the liquidate_position function for LP exposures and liquidate_trade for taker positions.

- Liquidation Fee

The fee that is rewarded to a liquidator is 0.3% of the total position value (capped at $10k USDC equivalent).

- Liquidated Positions

Liquidation events merely transfer ownership from the trader to the reserve fund. The position is then held by the reserve fund until expiration. Traders who are liquidated lose their collateral (Minimum Margin) upon liquidation. Funds forfeited by the trader are then used to offset any potential loss.

- Determining Market Value

Liquidations are determined based on an IV oracle which seeks to establish the fair market value of an option at any given point. This means that liquidations are not affected by pool prices. This has the added benefit of not triggering erroneous liquidations due to price wicks on the exchange. For further details on the IV Oracle, please see here.

Reserve Fund

Collateral in the Reserve Fund is meant to absorb the profit-or-loss of liquidated positions. Since lenders only provide capital to option positions that have times to maturity less than their deadline, the margin system is able to settle positions and abstract profit-or-loss variance from lenders before they are able to request a withdrawal. Simply stated, the Reserve Fund is in a first-loss position against lenders’ principle. Additionally, it is capable of distributing excess reserves as supplementary yield to lenders, akin to dividend payouts. If the Reserve Fund were to ever be insolvent, lenders’ principle could be exposed pro-rata to loss on liquidated positions.

In the event that reserve funds can not completely cover all (potential) losses, they are utilized in order of option expiration first. For options that have the same expiration, options are settled with reserve assets on a first-come, first-settle basis.

Oracles

In order to create an options market for a given token pair, a valid oracle must be available to determine the value of an option (based on spot price) at expiration. Premia v3 pools can be established out-of-the-box with Chainlink VWAP Price feeds or RedStone Classic TWAP price feeds (TBA). Additionally, any Price Oracle implementing the IOracleAdapter interface can be used to initialize a new option pool.

By default, options will be automatically settled by an address maintained by the protocol, but option holders can at any time designate an autoSettleAddress and an autoMaxSettleFee. Once set, the autoSettleAddress can exercise or settle options for the user after expiration, and be given a credit to compensate for the gas fees associated with making the call.

For convenience, a keeper bot is then used to hydrate each pool with its corresponding settlement price if the option has expired. However, this value can also be populated within each pool by any user who calls the exercise or settle functions.

Chainlink

Chainlink has many available feeds which can be found here. If a direct pair is not available when a pair is inserted to the ChainlinkAdapter, an attempt will be made to combine multiple price paths to create a valid price feed.

To initialize a pool, Chainlink is queried with the selected pair, and if a valid market exists, a VWAP price is returned to help determine the initializationFee.

RedStone

RedStone is a Modular Oracle delivering token pricing by fetching price feeds from off-chain sources (CEXes, aggregators) and on-chain sources (DEXes).