Overview

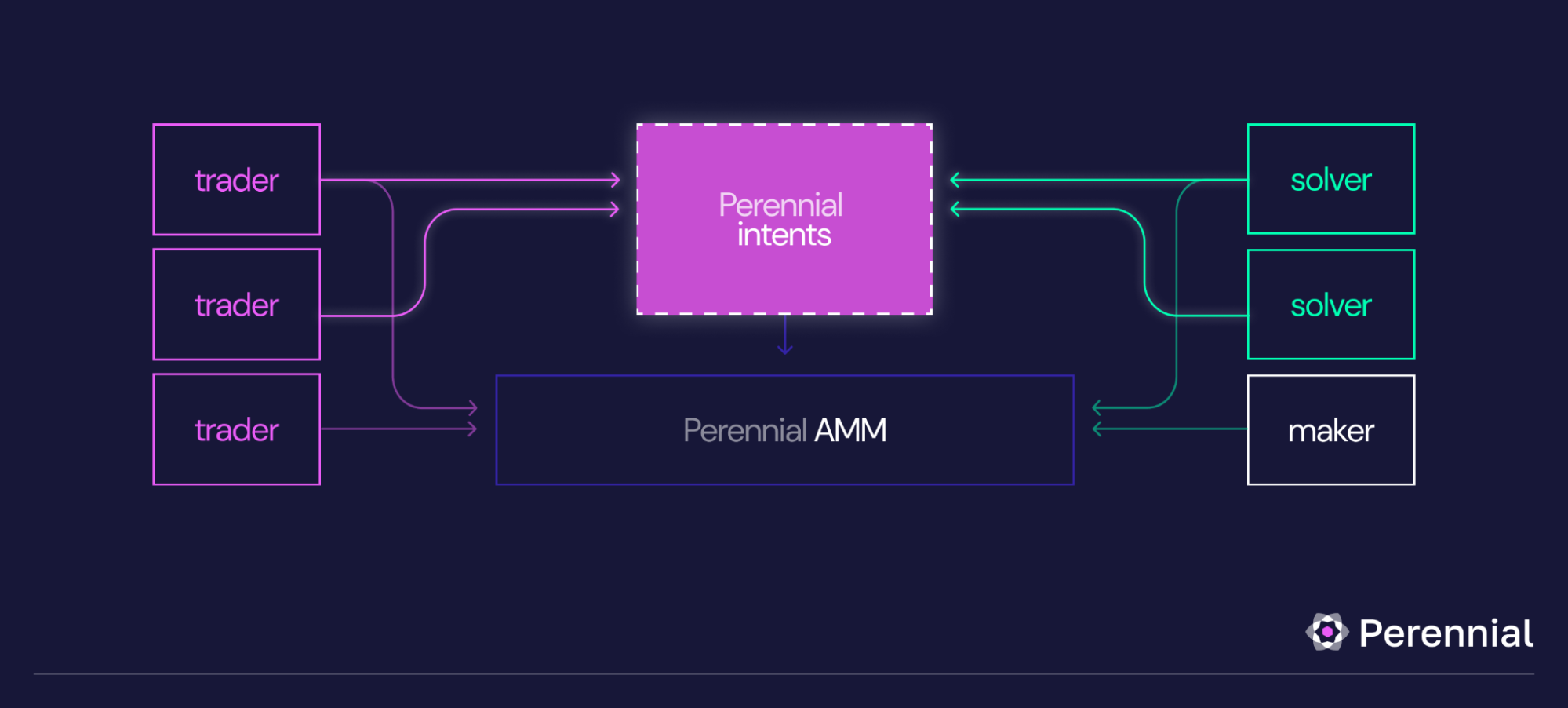

Perennial is a hybrid intent-based and Automated Market Maker (AMM) derivatives protocol designed to provide users with capital-efficient exposure to underlying oracle price feeds. By operating three-sided markets incorporating takers, makers, and the AMM, Perennial facilitates seamless trading and liquidity provision. The protocol combines off-chain order matching through intents with on-chain AMM settlement, unifying liquidity and optimizing execution for traders while maintaining flexibility for market creators and participants.

Perennial distinguishes itself as an intent-powered perpetuals protocol that combines off-chain order matching with on-chain Automated Market Maker (AMM) settlement. By leveraging intent-based trading mechanisms, users can specify their desired trade parameters, which are matched off-chain through a network of solvers before settling on-chain. This hybrid approach enhances capital efficiency and offers users precise control over trade execution.

The protocol’s vision is to serve as a unified liquidity layer, enabling a network of trading interfaces to share order flow and liquidity. By consolidating fragmented liquidity pools, Perennial seeks to address inefficiencies in DeFi related to liquidity fragmentation and capital utilization. This approach is intended to improve the market depth and execution quality for participants across the network.

How Perennial Works

Perennial operates as a peer-to-pool derivatives AMM, continuously offering quotes that take the opposite side of any trader’s position directly at the oracle price with synthetic price impact. The exchange of funding and interest rates is based on market skew and utilization, ensuring that the market remains balanced and efficient. Takers and Makers settle their positions continuously, with the losing side compensating the winning side.

- Takers (Traders): Takers deposit collateral to gain leveraged exposure to various price feeds, whether going long, short or pursuing exotic payoffs. Their positions are matched against those in the opposite direction within the market.

- Makers (Liquidity Providers): When there is a shortfall between Takers in a market, Makers supply the necessary capital and take the net exposure to fill the gap, earning fees in return. They assume exposure relative to the amount required to balance the mismatch between Takers.

Moreover, Perennial’s functionality is built upon a two-layer system designed to enhance capital efficiency and improve users’ trading experience. This design combines off-chain order matching with on-chain settlement, integrating the strengths of both approaches.

- Intent Layer (Order Matching)

In the Intent Layer, traders submit intents that specify their desired trades. These intents can take the form of Market Orders, which allow instant execution at the best available price, or Limit Orders, which target specific execution prices.

Acting as market makers, solvers monitor these intents and provide real-time quotes. They dynamically manage orders to ensure competitive pricing and efficient matching. By operating off-chain, the Intent Layer allows quick and flexible order matching without the constraints of blockchain transaction times and fees.

- AMM Settlement

Once an intent is matched in the Intent Layer, it is routed to Perennial’s Automated Market Maker (AMM) for on-chain settlement. The AMM combines all trades, including intent-based and direct AMM trades, into a shared liquidity pool. It also allows solvers to fulfill orders without long-term collateral commitments or being tied to trades for their entire lifecycle.

Unlike traditional peer-to-peer intent systems, this approach enables Solvers to manage their positions flexibly and efficiently. They can enter and exit positions without locking up significant capital for extended periods, which improves overall market liquidity and reduces barriers to participation.

Features of Perennial

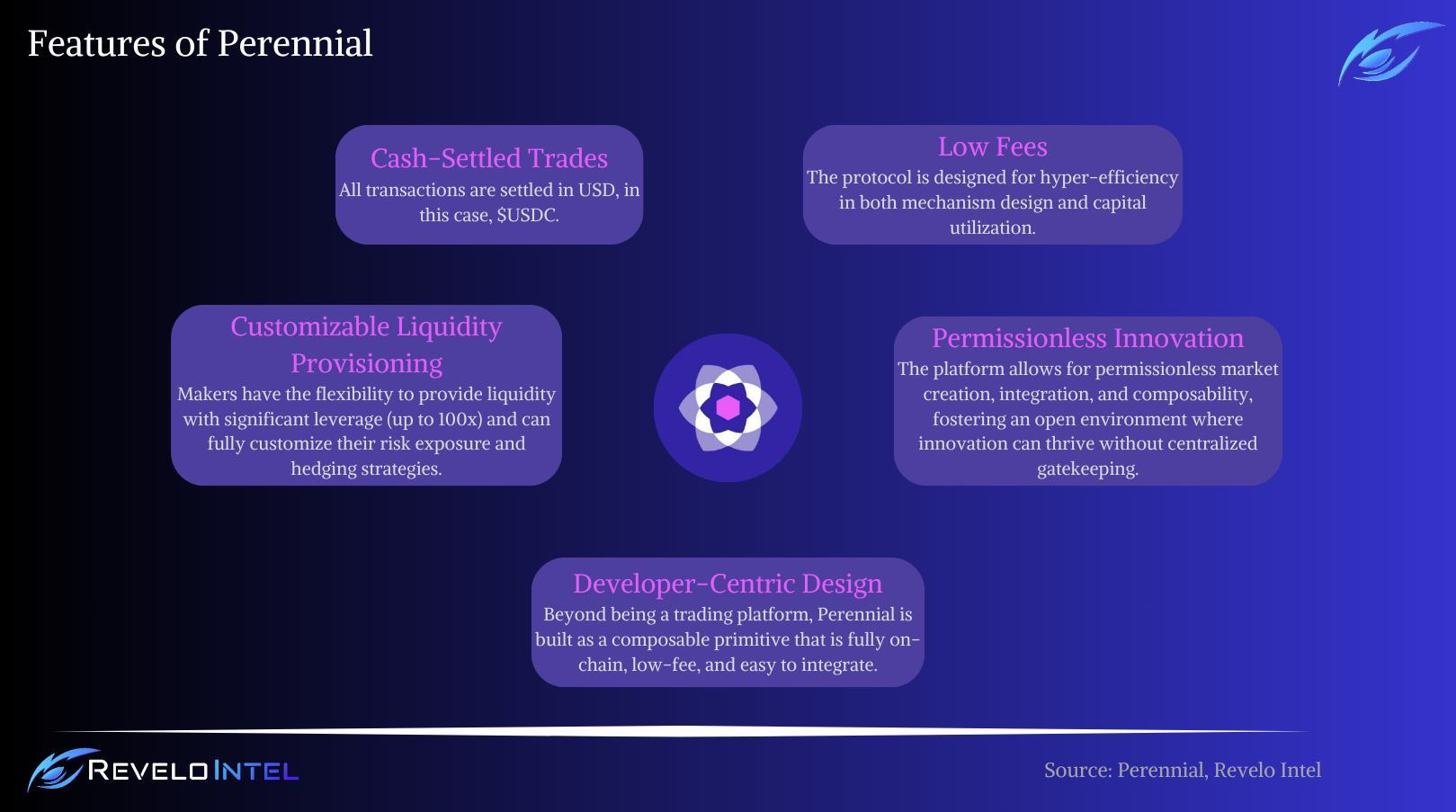

Perennial offers several key features:

Perennial’s integration of intent-based trading brings several new benefits to users, enhancing both the trading experience and the platform’s efficiency.

- Guaranteed Price Execution: Traders can now specify the exact price at which they want to execute their trades, whether they are market orders for immediate execution or limit orders targeting specific prices. Solvers who act as market makers fill these intents and settle them atomically into the AMM. This mechanism ensures traders receive the expected execution price without slippage, providing greater certainty and control over their transactions.

- Deeper Liquidity Access: Solvers source liquidity from both on-chain and off-chain venues. By tapping into a wider network of liquidity sources, they can offer consistently competitive and reliable prices across all Perennial markets. This access to deeper liquidity pools helps minimize price impact and enhances users’ overall trading efficiency.

- Active Maker Control: Solvers manage their exposure by offering quotes across all Perennial markets from a single collateral pool. This approach allows them to avoid long-term collateral lock-in or passive exposure associated with traditional AMMs. By dynamically adjusting their positions, solvers can optimize their capital utilization and risk management, leading to more competitive pricing for traders.

- Always-On Liquidity: Perennial’s AMM serves as a dependable fallback for liquidity, ensuring that trading can continue uninterrupted even when solvers are quoting suboptimal prices or are temporarily unavailable. This means users can consistently execute trades directly through the AMM, maintaining market accessibility under various conditions.

By supporting intent-based trading, Perennial enhances precision in trade execution, broadens liquidity access, and offers greater flexibility for traders and providers. These improvements contribute to a more efficient and user-friendly trading environment, addressing critical challenges in decentralized finance and perpetual markets.

Origins of Perennial

Perennial was conceived in response to the limitations of the emerging DeFi derivatives market, dominated by one-size-fits-all products employing simple yet inefficient mechanisms. During its bootstrapping phase, the market relied heavily on incentivization to demonstrate fundamental demand and validate early use cases. However, initial approaches lacked scalability and were inadequate for supporting the next wave of growth and innovation anticipated in the DeFi derivatives space.

Recognizing the need for a foundational shift, Perennial’s founding team sought to rethink the design of DeFi derivative mechanisms from first principles. Their objective was to unlock the full potential of DeFi derivatives by enabling trading volumes that could surpass spot markets, fostering liquid long-tail derivatives, and cultivating a rich ecosystem in which other protocols and financial money legos can be constructed. Perennial adds differentiation beyond replicating off-chain capabilities and moving beyond rigid, one-size-fits-all solutions to a more flexible and efficient framework.

Perennial adopts a minimalist and unopinionated design philosophy inspired by protocols like Uniswap. Instead of prescribing a specific product model, it empowers market participants to make critical market structure and design decisions. This approach allows Perennial to meet the diverse needs of a broad user base, including novice traders, sophisticated investors, liquidity providers, developers, and other protocols that may build upon its flexible infrastructure.

A key aspect of Perennial’s creation was combining the best elements of decentralized and centralized finance, delivering a simple and scalable trading experience. The platform offers a DeFi-native trading model characterized by the absence of order books, permissionless leverage, and the ability to engage in composable positions. These features simplify the trading process, making it more accessible and efficient for all users.

Another fundamental reason behind Perennial’s development was to unlock the composability of DeFi derivatives. By providing comprehensive integration points and a trading model resistant to miner extractable value (MEV), free from price slippage, and characterized by low fees, Perennial eliminates many of the complexities and risks traditionally associated with managing derivative exposure. This makes composability practical and paves the way for new innovative financial products to be built on top.

Architecture

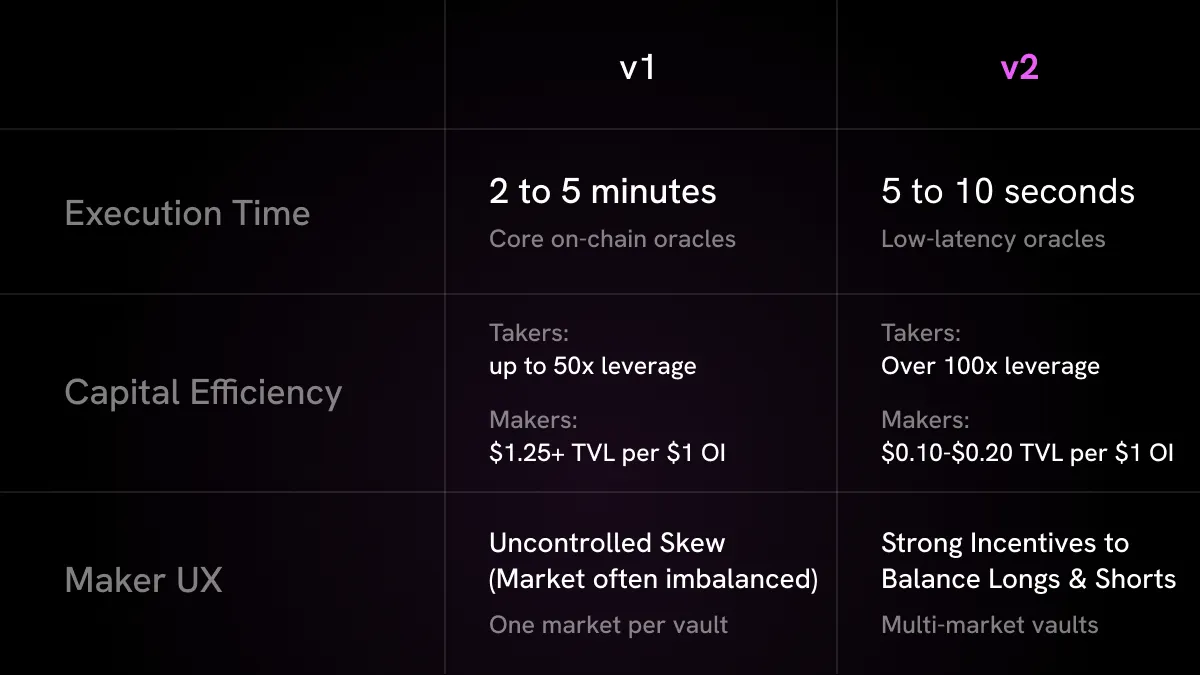

Perennial’s architecture has evolved significantly since inception, aiming to create a scalable and efficient decentralized derivatives platform. The protocol has progressed through multiple versions—V1, V2, and V2.3—each introducing significant improvements to its core functionalities, including market creation, liquidity management, and user experience.

The initial version, Perennial V1, reimagined derivatives as a true DeFi primitive. It established a system that enabled permissionless market creation, offered best-in-class composability, and provided a fully customizable liquidity provider (LP) experience on a shared liquidity layer. While V1 successfully laid the foundational infrastructure, it faced limitations that impeded further scalability and widespread adoption, such as long execution times, higher fees, and poor incentives for makers.

To address the challenges of V1, Perennial V2 was developed as a comprehensive reimagining of what an on-chain derivatives protocol can achieve. Significant improvements were made in critical areas: Oracles, Fee Mechanisms, Liquidity Management, Risk Management, and more. These enhancements made Perennial V2 faster, more cost-efficient, and provided deeper liquidity, effectively addressing the scalability issues of its predecessor.

Continuing its commitment to innovation, Perennial V2.3 introduced several updates and a radical shift towards intent-trading to improve functionality and UX for all users and platform participants. Intents are user-defined instructions within Perennial that specify how trades should be executed under certain conditions. When a user submits an intent—for example, to open or close a position at a particular price, this intent is broadcast to a network of solvers (market makers) who can fulfill it by providing the necessary liquidity. This mechanism is capital efficient because it nets positions and ensures that actual on-chain settlement only occurs when a solver decides to fill an order. By allowing users to directly match with liquidity providers rather than relying on large liquidity pools or traditional order books, Perennial reduces the capital required to support trades.

Perennial’s intent-based trading improves capital efficiency by allowing makers to fill offsetting long and short positions, returning to neutrality while pocketing the spread. This mirrors traditional market-making on a CLOB, enabling makers to recycle capital efficiently. Unlike simpler peer-to-peer intent models, Perennial offers a fully developed market-making experience, increasing liquidity and creating a more dynamic trading environment.

This capital efficiency means users can open and close positions with less collateral tied up, often resulting in more favorable pricing and zero slippage. It also fosters a more competitive environment among solvers to provide better execution, benefiting traders through potentially improved prices and faster transaction times. Overall, intents allow for a more flexible, cost-effective, and user-friendly trading experience on the Perennial platform.

Looking ahead, Perennial is planning the release of V3, which aims to introduce significant upgrades to the AMM. The V3 update is expected to enhance further the protocol’s performance, scalability, and user experience.

Perennial V2

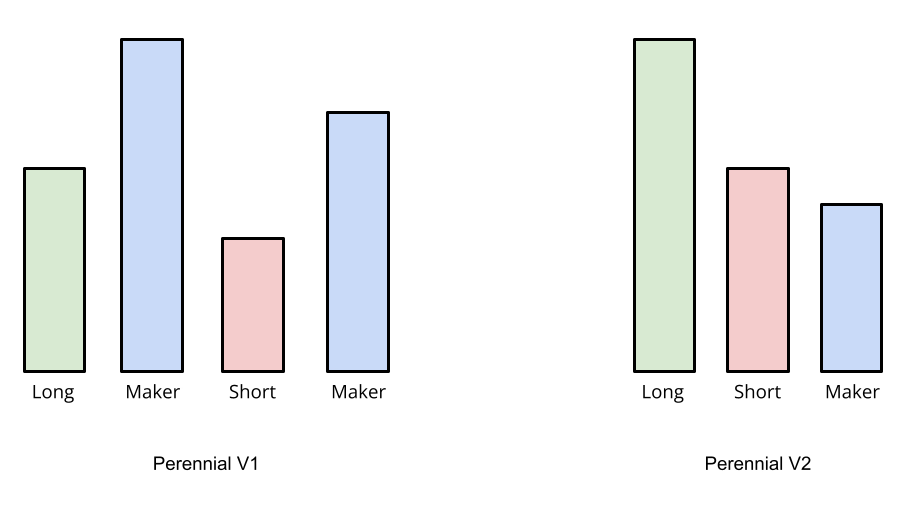

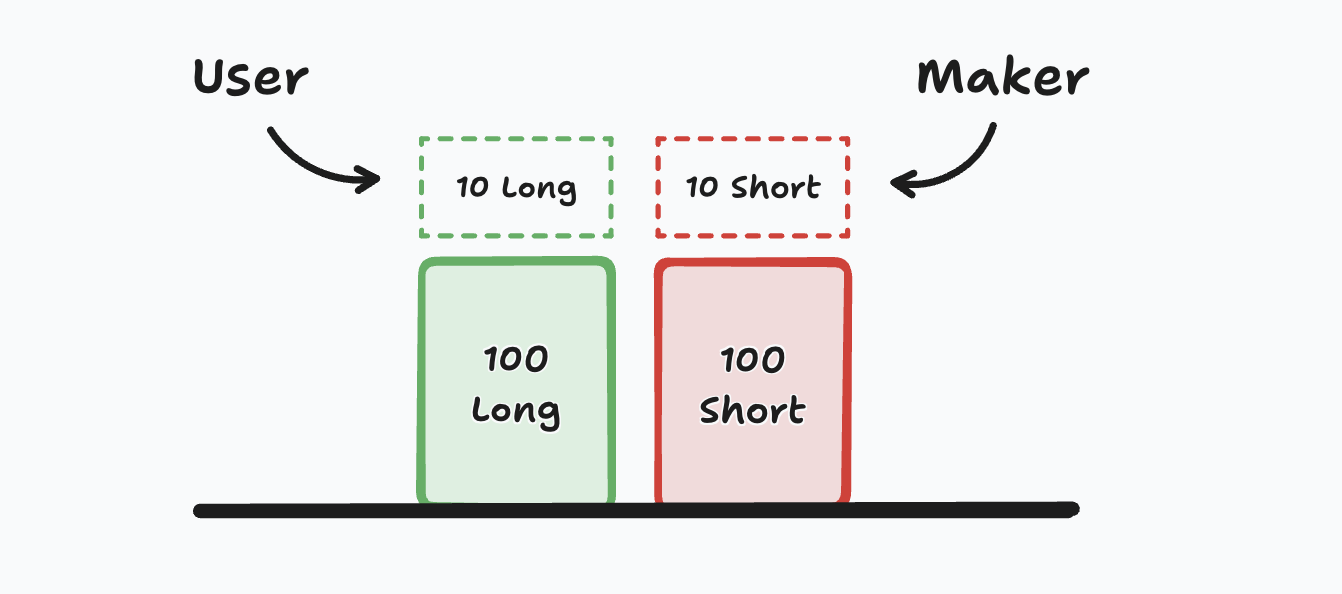

Perennial V2 introduced significant advancements in the protocol’s design, focusing on enhancing capital efficiency and optimizing the utilization of maker liquidity. This version reimagined how markets handle long and short positions by netting them against each other and involving makers (actual suppliers of capital to the liquidity pool) only to cover any resulting imbalances. This approach leads to markets that are up to an order of magnitude more efficient concerning open interest relative to the required maker liquidity.

In traditional derivatives markets, liquidity providers often need to cover the total exposure of all open positions, both long and short. Perennial V2 changed this paradigm by natively netting long positions against short positions within each market.

In Perennial V2, makers (LPs) must supply liquidity only for the net exposure resulting from the imbalance between long and short-taker positions. Instead of backing the entire volume of open positions, makers cover just the residual difference after long and short positions are netted out. This net exposure is then allocated to the maker pool on a pro-rata basis, meaning each maker contributes in proportion to their share of the total liquidity pool.

This protocol version improves capital efficiency by requiring makers to supply liquidity only for the net exposure, reducing the capital needed and optimizing utilization across the platform. It enhances market scalability by allowing larger volumes of open interest without necessitating a proportional increase in maker liquidity, supporting growth and attracting more participants. It mitigates risk for makers by limiting their exposure to net imbalances rather than total market exposure, making liquidity provision more attractive and sustainable.

Perennial V2.3

Perennial now supports Intent-Based Trading, allowing traders to specify the exact price at which they wish to execute their trades, like a limit order. These intent orders are filled by solvers and settled atomically into the AMM. This feature grants traders greater control over their transactions, ensuring execution at desired price points without slippage.

While Perennial enables Solvers to fill intent-based trades, users always retain the option to submit orders directly on-chain through the Automated Market Maker (AMM). There are several reasons why a user might choose to interact directly with the AMM:

- Better Pricing: The AMM may offer more favorable prices when Solver liquidity is lacking.

- Infrastructure Availability: If the infrastructure managed by Solvers or the Solver API becomes unavailable, users can continue trading by submitting orders directly to the AMM.

- Liquidations: In events where Solvers are unable or unwilling to liquidate positions, the AMM remains accessible for users to perform necessary liquidations.

- Composability for Advanced Trades: Users looking to compose complex trades—such as structured products or vaults—may prefer direct interaction with the AMM to fully leverage Perennial’s composability features.

With the introduction of Collateral Accounts, Intent Trigger Orders, and intent orders mentioned above, traders can utilize Signed Message Trading. This enables traders to authorize keepers to execute trades and manage collateral updates using signed messages. By combining this capability with embedded signers, integrators can optionally support one-click trading for their users, streamlining the trading process and enhancing user experience.

In addition to new features, Perennial V2.3 includes several improvements to existing functionalities:

- Oracle Fee Improvements: The settlement fee is dynamic and adjusts based on current chain gas prices. This ensures the system maintains equilibrium when charging and rewarding keeper fees. Additionally, the market’s oracle fee is passed to the SubOracle Factory, allowing the oracle provider to claim the fee separately from the keeper fee.

- Market Fee Improvements: Calculations for trading fees and price impact have been more clearly separated within the market’s parameters and settlement flow. This refinement makes it easier to break down the fees and price impact amounts incurred during a trade, providing greater transparency for users.

- Unwrapping Fees: An approved operator can now claim market fees for an account. This feature allows users to batch and unwrap their fee claims from $DSU (see Collateral section) to $USDC atomically using the MultiInvoker, simplifying the fee claim process.

- Improved On-Chain Metadata: Previously, off-chain sources were required to fully map a market to its name, oracle ID, and sub-oracle addresses. With V2.3, these mappings are now fully connected through on-chain metadata, allowing for more secure linking and lookup. This improvement enhances the integrity and accessibility of market data within the protocol.

This update brings Perennial closer to its vision for a complete capital-efficient trading platform.

Intent Mechanisms

Perennial’s Intent Mechanisms enable makers and takers to match orders at agreed-upon prices through a solving service that matches orders off-chain but settles all trades on-chain through the Perennial Automated Market Maker (AMM). This approach allows market makers to participate in any Perennial market without allocating collateral across multiple markets simultaneously. Taker orders are matched with equal and opposite maker orders, similar to how a CLOB (Central Limit Order Book) operates, where buy and sell orders are queued and matched based on price or time priority.

For example, a taker placing an order for “10 long OPEN” can be matched with a maker’s order for “10 long CLOSE” or “10 short OPEN.”

- Taker: 10 Long OPEN <Match> Maker: 10 Long CLOSE or 10 Short OPEN.

This mechanism enhances liquidity and efficiency by directly connecting counterparties with complementary trading intents within the Perennial protocol.

Intent Order-Book

Market makers continuously post arrays of order sizes and corresponding prices to the Solver API, including all fees, to ensure users receive guaranteed execution. This approach reduces latency by eliminating the need for a round trip to makers when users enter their order size. The aggregated data can also be relayed to integrators, allowing them to display quasi-order books on their user interfaces. This setup mimics traditional order book functionality, enhancing transparency and responsiveness for users. It lets traders see available depths and prices in real time, improving their decision-making process.

Collateral Accounts

Collateral Accounts streamline collateral movement between markets by abstracting the required multi-step deposit and withdrawal processes. Users and makers can shift collateral to different markets using signed intents, which can be batched for efficiency. While Collateral Accounts are not mandatory for using intents, they provide a seamless experience. This simplification allows participants to manage their collateral more flexibly, reducing operational complexity within the protocol.

Each user, operating through their Externally Owned Account (EOA), can deploy only one collateral account, with its address being deterministic—meaning it is uniquely predictable based on the user’s EOA.

Actions within collateral accounts are executed using EIP-712 message payloads submitted to keepers through a relayer. Users can self-sign these messages or delegate one or more signers to act on their behalf. Additionally, users can relay requests through this extension to compensate keepers directly from their collateral account, simplifying the process of rewarding those who assist in maintaining the system’s functionality.

Trigger Orders

Trigger Orders in Perennial allow users to set up orders that automatically increase or decrease their positions when the market price reaches a user-specified limit. This mechanism is achieved by storing the trigger orders on-chain, enabling keepers to execute them once the predefined conditions are met. Users integrate this feature by adding a Manager contract as an operator for their account and an OrderVerifier contract to handle signed messages. Each Perennial deployment has a single Manager, and trigger orders are compatible only with markets that use $DSU as collateral.

Market Order Intent Execution Flow

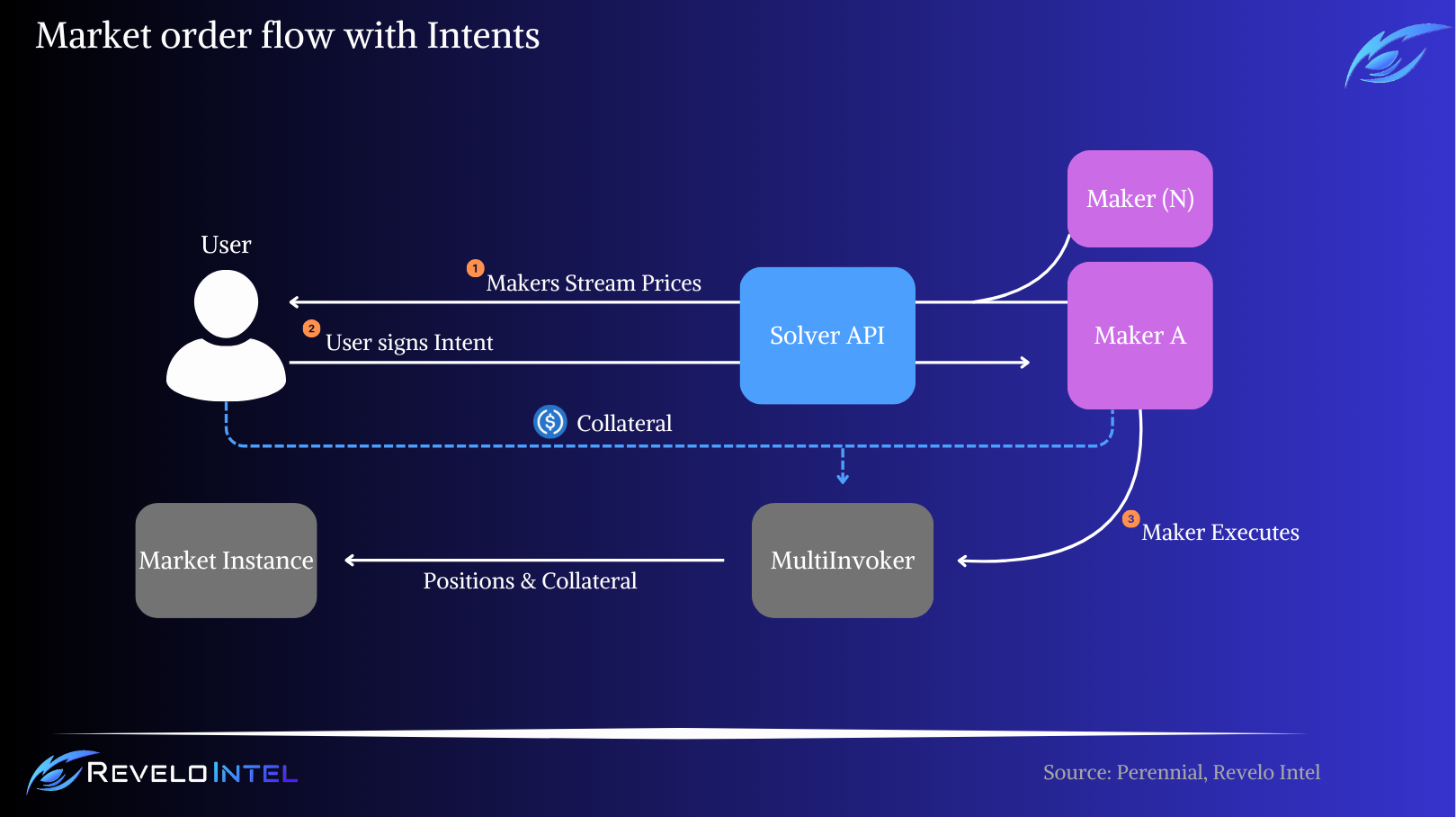

To maintain simplicity while delivering an excellent user experience, Perennial’s market order intent execution flow consists of two main components.

- Continuous Pricing

Market makers continuously post arrays of order sizes and corresponding prices to the Solver API. These quotes are valid for 30 seconds and include all fees accrued by the maker, ensuring that users receive guaranteed execution at the quoted price. This continuous updating of prices allows users to access real-time market data, reducing latency and enhancing decision-making. By incorporating fees into the quoted prices, users can trust that the price they see is the price they will pay upon execution.

- Aggregation and Relaying

The Solver API aggregates the pricing information from all market makers and disseminates it to subscribed users. When a user inputs the size of their desired transaction, the system displays the corresponding price for that specific order size. The user then signs the order and returns it to the Solver API, which relays it to the maker for execution. This streamlined process facilitates efficient communication between users and makers, ensuring timely trade execution and a seamless trading experience.

Fill Rate & Execution Timeliness

Through the Request for Quote (RFQ) flow, users can always access an up-to-date price and depth book for their positions on user interfaces, making the trading experience more responsive. After a user signs an order, the message is relayed to the Solver API and the maker who provided that price. Next, the maker executes the transaction that settles on the AMM. If no prices are available or the expected price is significantly worse than the AMM’s, the trading interface may send the order as a traditional direct-to-AMM trade. However, makers are expected to maintain a minimum fill rate (e.g., 90%) to ensure a good trading experience, allowing some flexibility during extreme price movements. If makers fail to maintain the minimum fill rate (e.g., 90%), it can harm their reliability and reputation, leading to fewer trade opportunities and deprioritization within the network. Users and the platform may bypass inconsistent makers, opting for those who provide dependable execution.

Filling Orders

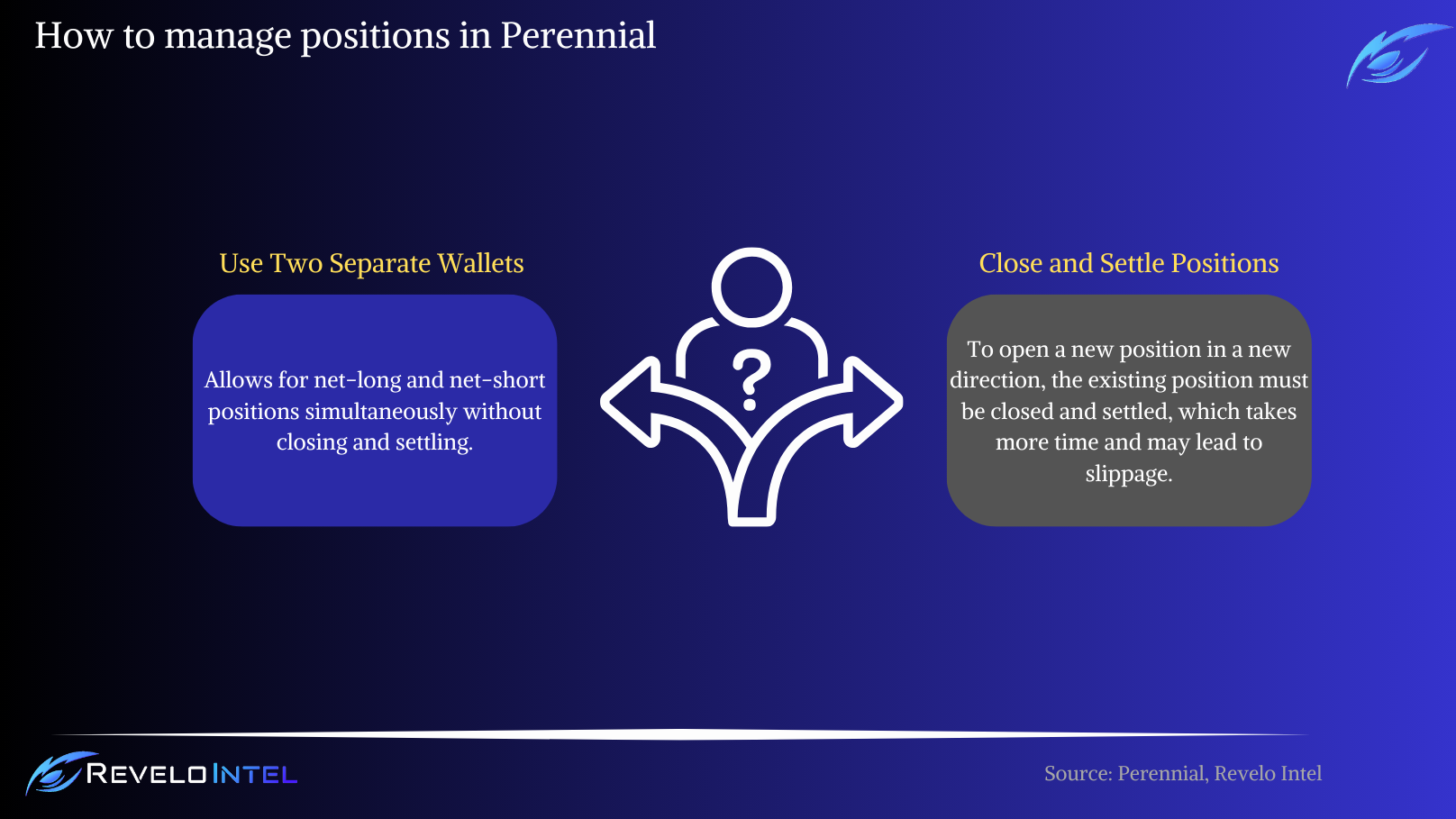

Perennial aims to offer a trading experience similar to traditional Central Limit Order Book (CLOB) market-making. However, users should be aware that certain limitations exist in the initial version of Perennial Intents.

Firstly, a single wallet can hold only one position per market in Perennial. Users cannot simultaneously have long and short positions in the same market using the same wallet; they can only increase or decrease their existing position. This intentional protocol feature is expected to persist in future versions.

Secondly, users cannot “flip” their position without fully closing their existing position and settling it to zero. For example, if a user has an open long position of 10 units, they cannot directly close 20 units to switch to a 10-unit short position. They must first close the 10-unit long position, settle it, and then open a new 10-unit short position. Due to this limitation, market makers may need to use two separate wallets in the current version of Perennial—one that maintains net-long positions and another that maintains net-short positions. This only applies to makers and not takers.

Lastly, both wallets can facilitate long and short trades if they do not cross the zero-value threshold. This means each wallet should avoid switching from a net-long to a net-short position without first settling. This limitation is not an intended feature, and the development team plans to address it in future versions to allow for more seamless position management.

Limit Order Flow with Intents

- Trader Action: The trader publishes a signed intent specifying the direction, size, and desired execution price to the API.

- Maker Response: Market makers periodically poll the API and, upon finding an intent with a desirable price, grab the intent and fill the transaction.

- Order Cancellation: To cancel an order, the user publishes an on-chain nonce cancellation; the nonce is derived from a hash of the signed order.

This flow allows traders to execute their limit orders efficiently when market conditions meet their specified criteria. It will enable makers to fulfill orders that align with their market-making strategies, enhancing overall liquidity and market depth.

Collateral

Perennial uses the stablecoin Digital Standard Unit ($DSU) as its collateral asset. $DSU can be considered an enhanced version of $USDC, offering all the properties of $USDC with additional censorship-resistance features that safeguard both users and the protocols built upon it. Fully collateralized and 100% backed by $USDC, $DSU maintains a 1:1 redeemable ratio, effectively serving as a trust-minimized version of $USDC.

Technically, $DSU is a wrapped version of $USDC; users can deposit 1 $USDC to receive 1 $DSU, an ERC-20 token usable across DeFi platforms and redeemable anytime for $USDC.

In practical terms, most Perennial users interact with $USDC as collateral, and the platform automatically handles the wrapping and unwrapping of $DSU behind the scenes. When a user deposits $USDC via the Perennial frontend, the system wraps it into $DSU and deposits it into the protocol; upon withdrawal, $DSU is unwrapped, and $USDC is returned to the user’s wallet. For users interacting directly with Perennial’s smart contracts, obtaining $DSU is necessary to open maker or taker positions. This can be achieved by wrapping or unwrapping $USDC directly through the $DSU smart contracts. Alternatively, developers can use the Batcher contract to handle these operations for greater gas efficiency.

Liquidations

In Perennial, an account becomes eligible for liquidation when its collateral falls below the maintenance requirement for its position. When a liquidation is initiated, it enters a pending state until the next oracle update. During this period, a special lock is placed on the account to prevent interference with the liquidation process. The user cannot open or close new positions or undergo additional liquidations until the current process is fully settled and the lock is cleared.

For makers (liquidity providers), the maintenance requirement is calculated assuming 100% utilization of their exposure. For example, suppose a maker has a position size of 10, even if the net exposure is only 1 due to netting with opposing positions. In that case, the calculation still uses the full position size of 10. This conservative approach accounts for instantaneous changes in utilization, ensuring a worst-case scenario is always considered.

The maintenance requirement is calculated using the formula: maintenanceRequirement = max (position × price × maintenance, minMaintenance)

Here, minMaintenance serves as a floor on the collateral to ensure that any non-zero position has sufficient incentive for liquidation in case of under-collateralization. This prevents scenarios where the collateral is too low to motivate liquidators to act.

The liquidator can withdraw up to a specified liquidation fee from the account’s collateral upon successful liquidation.

liquidationFee = min (maintenance, maxMaintenance)

The liquidationFee represents a percentage of the maintenance requirement of the position at the time of liquidation. It is a multiple of the settlementFee which is now dynamic based on gas and does not have a cap.

Perennial Chain

Perennial Labs launched the Perennial rollup on Base on February 25, 2025, to advance its derivatives protocol. The rollup operates as a custom Layer-2 scaling solution integrated with Base. In contrast to Perennial’s previous Ethereum mainnet (released December 2022) and Arbitrum (active in 2024) deployments, this deployment prioritizes transaction efficiency and ecosystem compatibility.

The Perennial rollup enables fast and cost-effective perpetual futures trading. It enhances features such as Perennial Intents, which are designed to boost liquidity matching. The rollup’s custom sequencer and integration with Base’s low-fee environment aim to reduce latency and gas costs, tackling common issues in DeFi trading platforms. The launch happened alongside Season 2 of the Petals Program, which aims to boost trader participation, but specific reward details are not publicly available.

The Perennial Chain employs a modular architecture:

- Settlement: Transactions are settled on Base, leveraging its security and connectivity to Ethereum.

- Data Availability: Data storage is outsourced to Celestia, a Layer-1 blockchain designed for this purpose, which aims to reduce costs and improve scalability by separating data management from execution.

- Chain Infrastructure: The rollup operates with a public RPC endpoint (rpc.perennial.foundation), a block explorer (explorer.perennial.foundation), and a subgraph (api.perennial.foundation/subgraphs/perennial) for data querying.

To power the chain, Perennial has partnered with numerous ecosystem protocols, each specializing in a different task.

Further information on the Perennial Chain is stated here.

Using the Protocol

Perennial is deployed on Arbitrum, making it an ideal trading platform due to its low fees and speed. Users can trade on Perennial or provide liquidity and earn platform fees.

Trade on Perennial

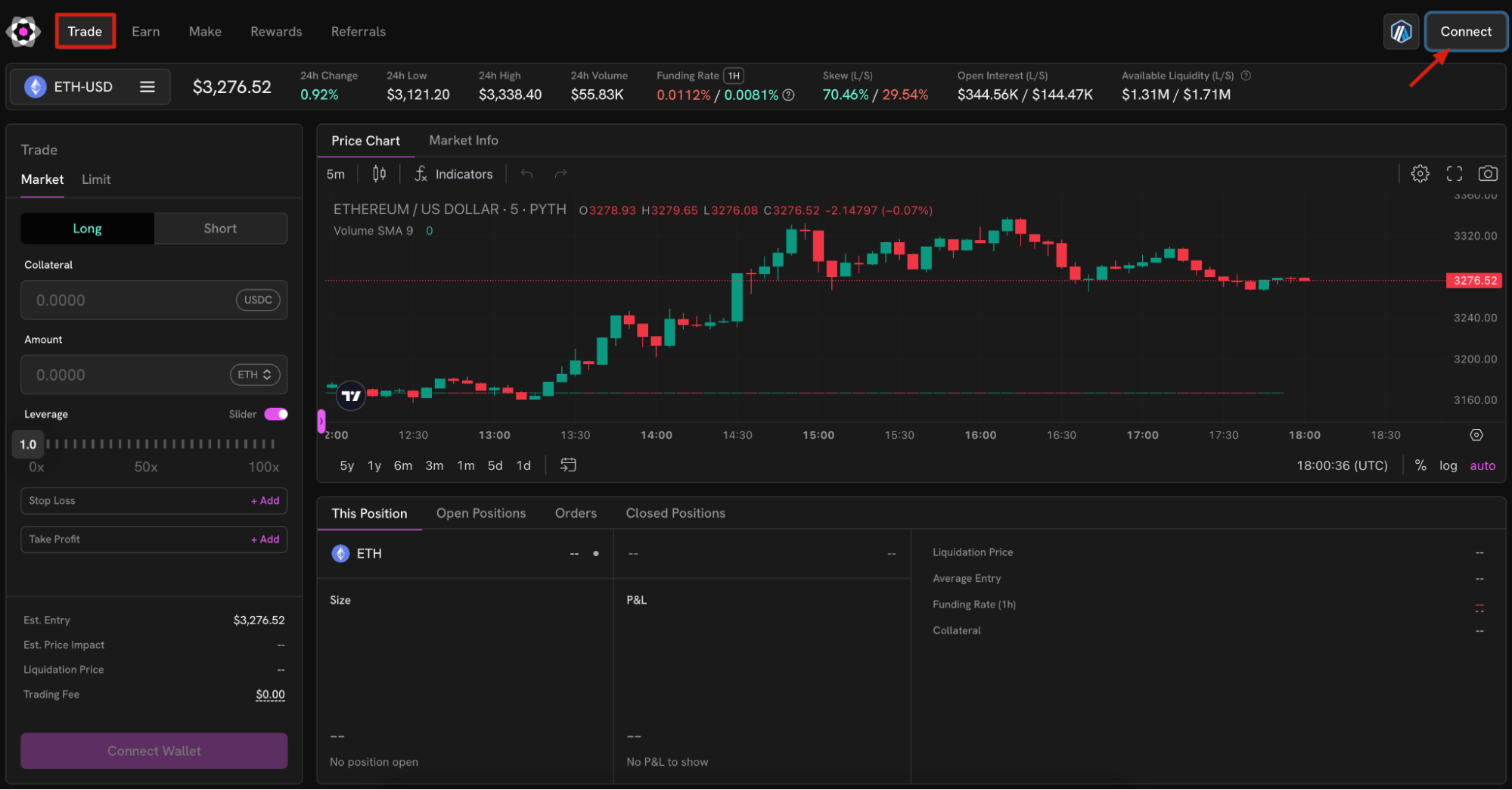

Trading on Perennial is straightforward. You will need $USDC for collateral and $ETH on Arbitrum for gas.

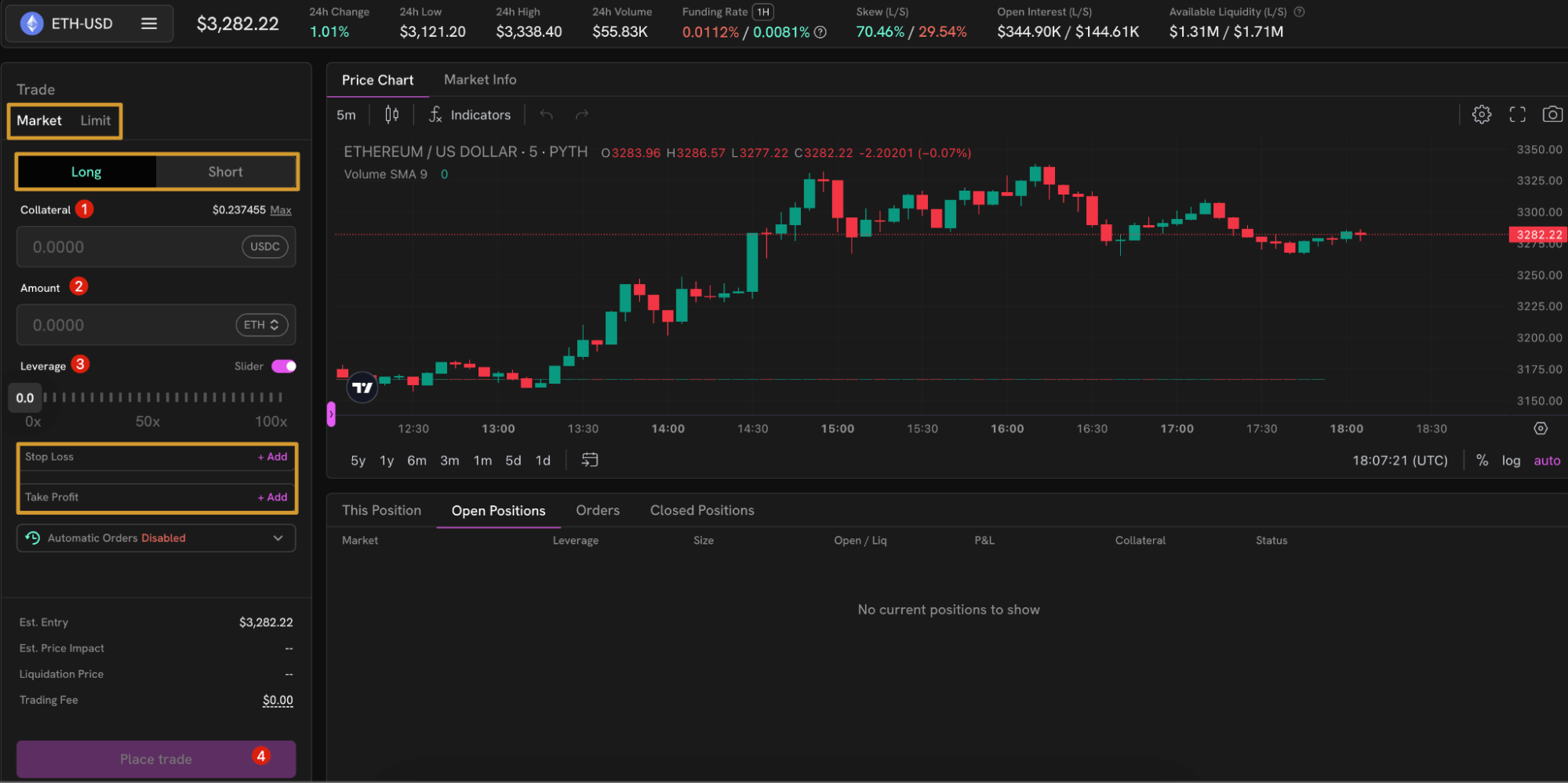

1. Go to the Perennial’s app page here. You’ll be on the Trade tab. Connect your wallet in the top right corner.

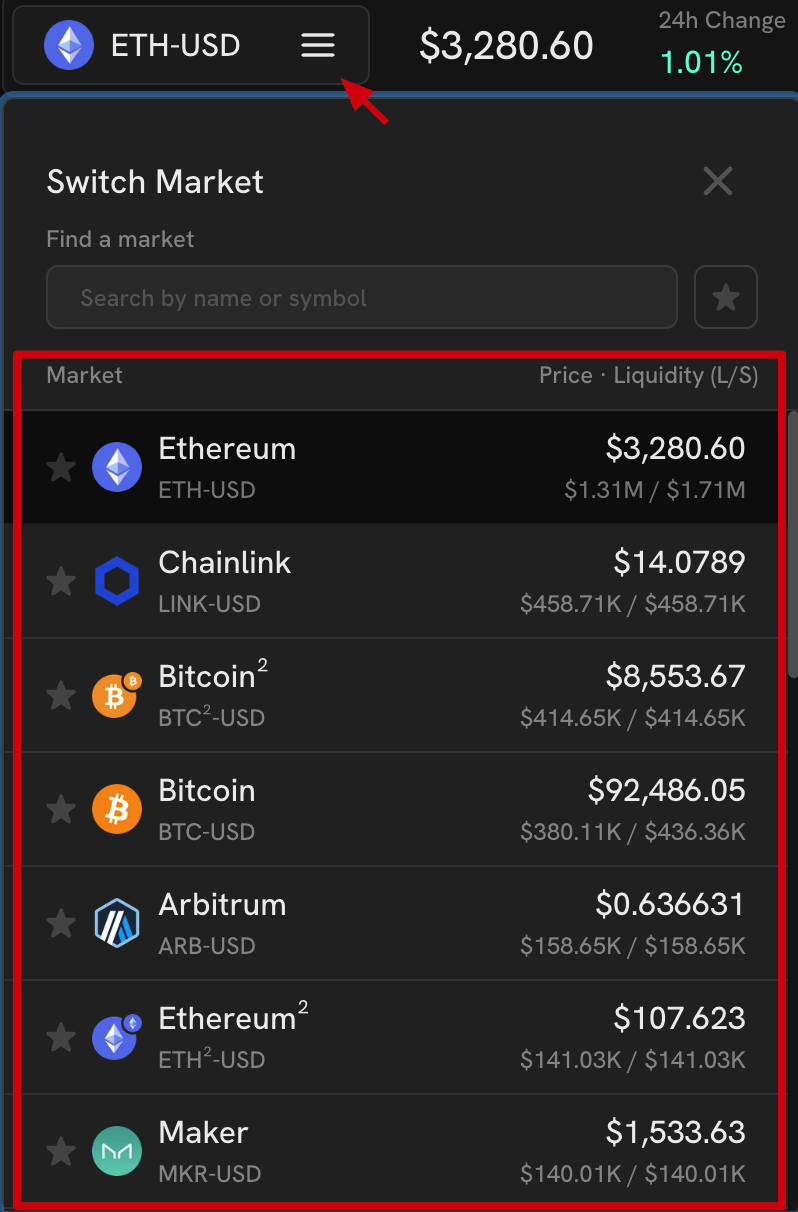

2. Pick the market you want to trade.

3. Choose whether to long or short and if you want to place a market or limit order. Input the collateral needed and the amount you want to long or short. You can choose your leverage by moving the slider. Finally, place your trade and confirm the transaction in your wallet.

4. Your order will show up on the Open Positions tab.

Trading FAQ

Why can’t I open a position?

There are several possible reasons you may be unable to open a position:

1. Existing Position: Perennial allows only one open position per market. Check that you don’t have an existing position in the selected market.

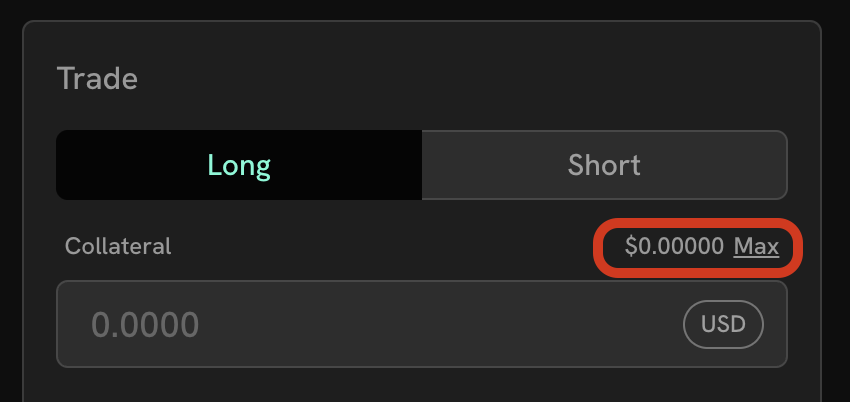

2. Insufficient Collateral: Ensure that you have added sufficient collateral to the protocol before attempting to open a position.

3. Market Utilization: The market may be at 100% utilization, meaning all maker liquidity is currently in use. Full utilization incentivizes new liquidity, so check back later for availability.

Why is the entry price different from when I clicked the “Place Trade” button?

The entry price you receive is based on the next oracle update, not the moment you click the button. This approach prevents bots from exploiting timing inefficiencies across markets. Oracle updates typically occur every 10-15 seconds, so minor discrepancies can happen between the clicked and the entry prices.

I reduced my position. Why didn’t I get any USDC back?

When you decrease your position size, the collateral remains in the protocol. To retrieve it, click the “Withdraw Collateral” button and follow the on-screen instructions to transfer the funds back to your wallet.

Why does my order show a “Pending” state?

Perennial uses delayed settlement to maintain consistency across the market. After submitting your order, it takes one oracle update to process and enter it into the system. This pending period helps ensure fair execution.

I’ve had my position open for X minutes; why hasn’t funding accrued?

Unlike centralized exchanges, Perennial updates markets only when someone actively updates their position (e.g., opens, closes, or makes a trade). As a result, funding values and other metrics may appear stale between updates. You can refer to the UI to check the latest unrealized values, which will be updated with the next market interaction.

Provide Liquidity on Perennial

Here’s how to provide liquidity on Perennial in a few steps using $USDC.

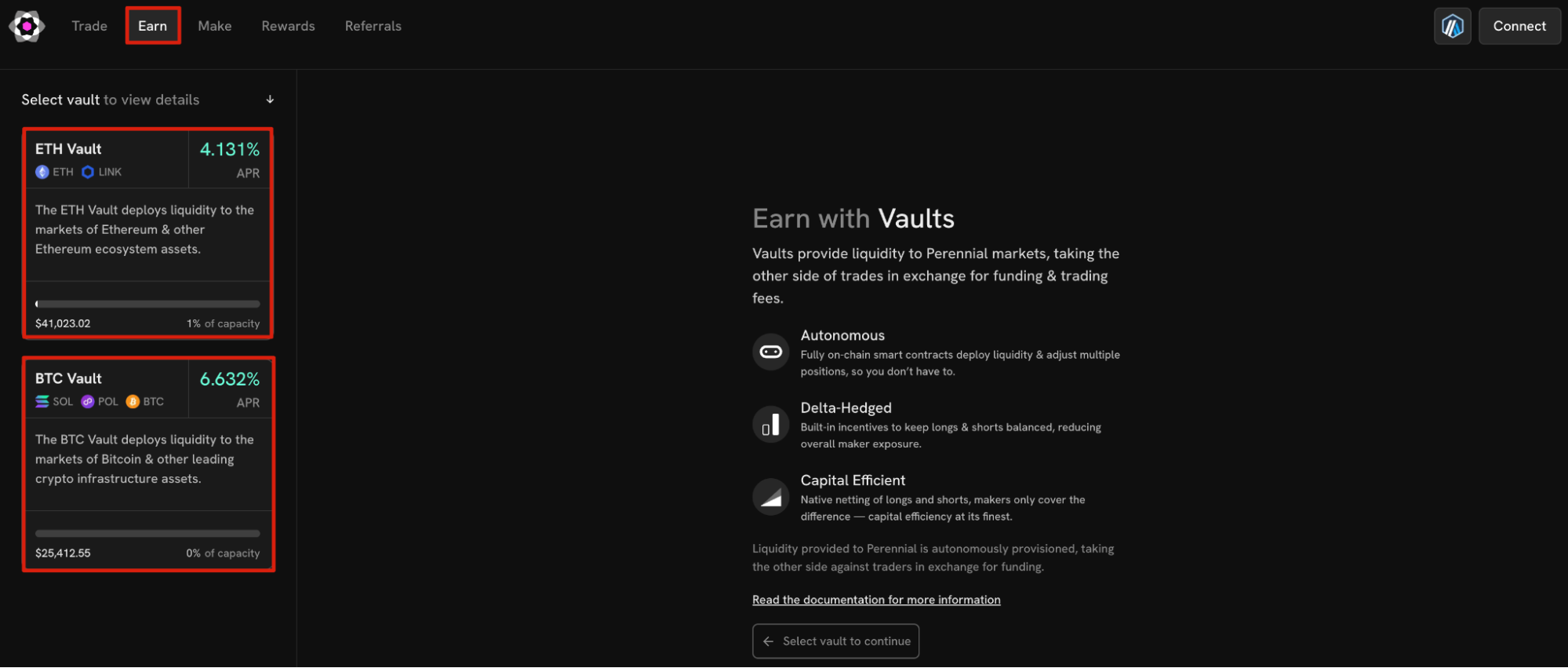

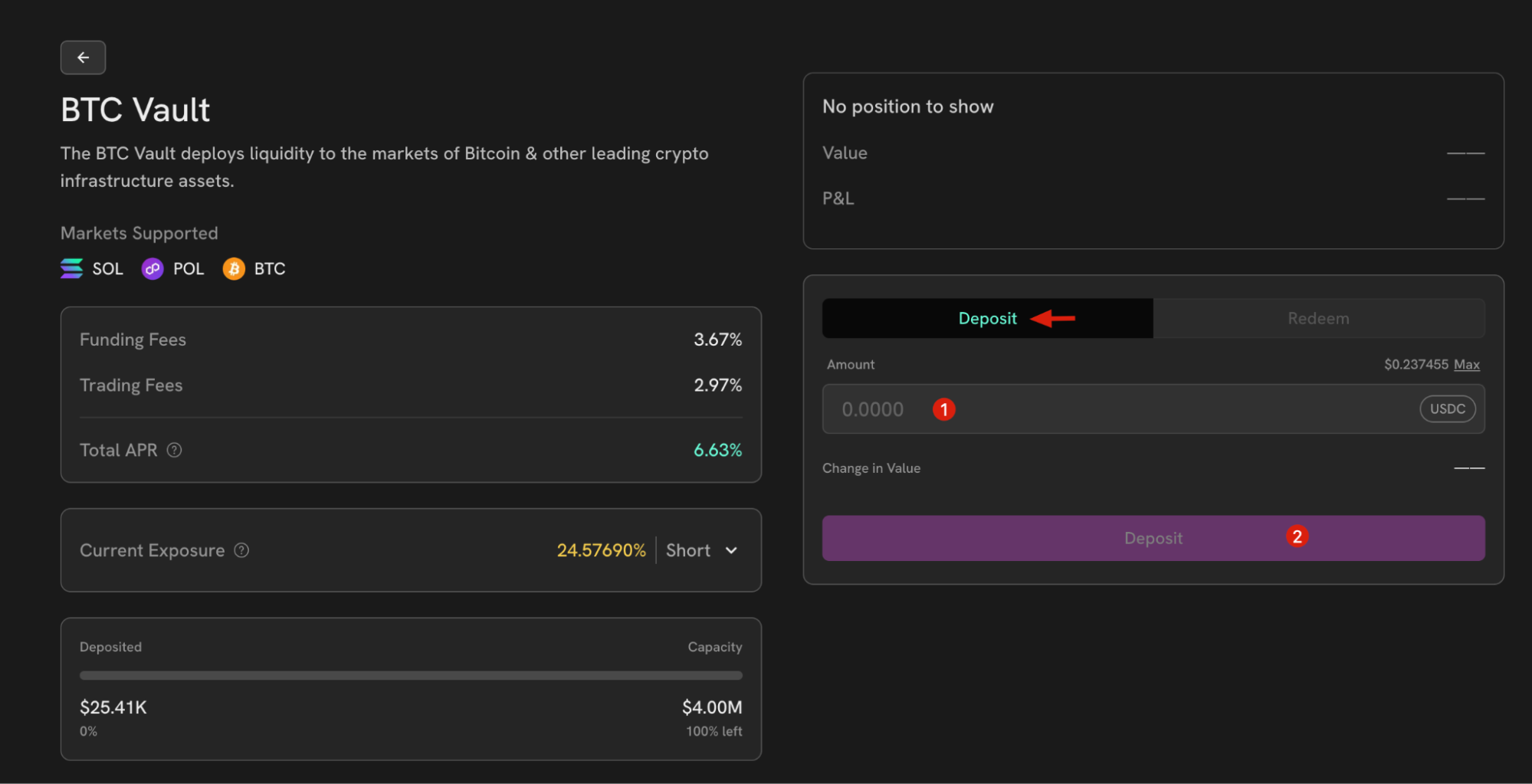

1. Head over to the app page here. This time, you’ll be on the Earn tab. Connect your wallet in the top right corner.

2. The available vaults are the ETH Vault and the BTC Vault. Choose which one you want to provide liquidity on.

3. On this page, select the amount of $USDC you want to deposit into the vault. Click Deposit and confirm the transaction in your wallet. You can redeem your deposit anytime you want to.

4. You can check your position in the same tab.

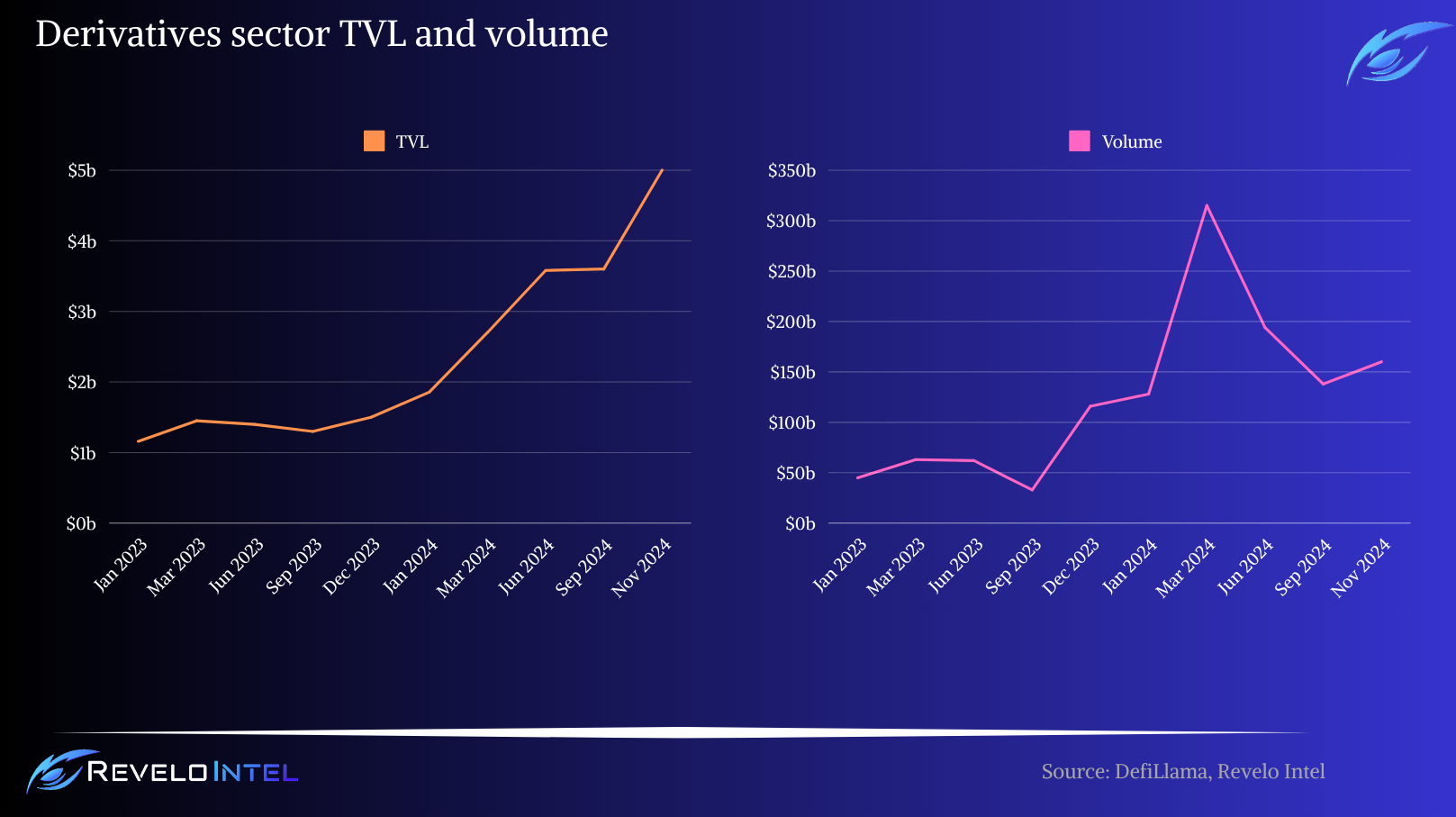

Sector Outlook

The decentralized derivatives sector is experiencing significant growth, driven by the inherent volatility of crypto assets and the demand for greater exposure and leverage among traders. Derivatives markets naturally evolve as financial markets mature, and as crypto enters its next adoption phase, there is an increasing need for a more robust derivatives infrastructure. The 24/7 trading environment, coupled with a demographic skewed toward younger investors with higher risk appetites, makes expanding derivatives in crypto almost inevitable. Factors such as the shift toward self-custody, the outflow from centralized exchanges because of the associated risks, and the enhanced execution performance offered by appchains and L2 solutions have laid the groundwork for the rise of on-chain leveraged trading.

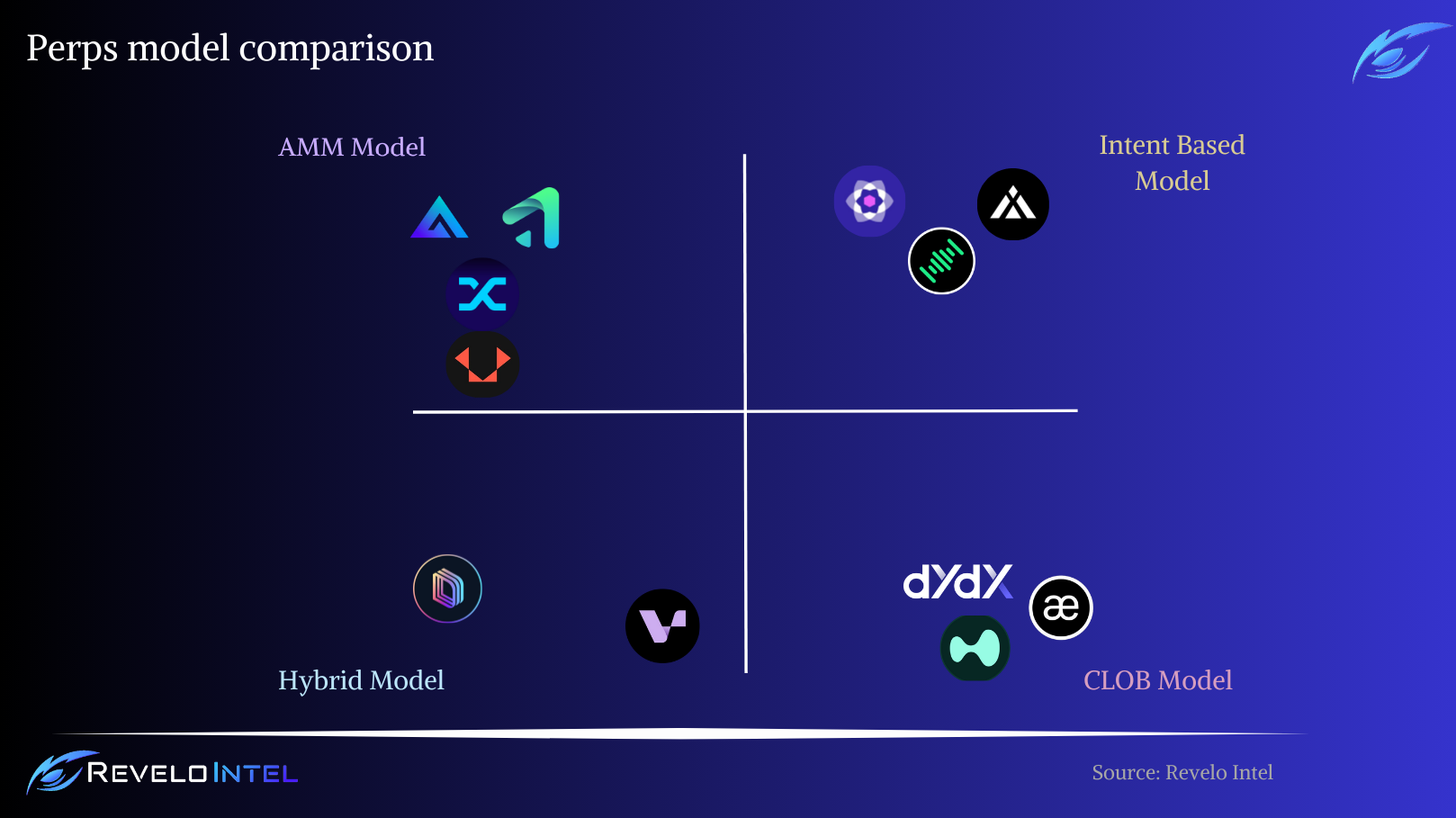

Various models have emerged to pursue the optimal DEX for derivatives trading. The Oracle model provides trading services based on price data from leading exchanges, eliminating the costs associated with aligning DEX prices with market prices but introducing risks of oracle price manipulation or downtime caused by off-chain systems. AMM-based, like vAMMs, facilitate perpetual contracts without actual spot exchanges, inspired by Uniswap’s success in spot markets. Off-chain order books with on-chain settlement address on-chain order matching limitations by conducting trade matching off-chain while keeping execution and asset custody on-chain, maintaining self-custody advantages while mitigating risks like Miner Extractable Value (MEV). Fully on-chain order books aim to maintain trading integrity but face challenges due to blockchain latency and throughput limitations, prompting solutions like Hyperliquid to develop custom L1 chains and consensus mechanisms to scale beyond these constraints.

A newer model gaining traction is intent-based trading. This model allows users to submit intents for opening positions broadcast to market makers (MMs), effectively creating a decentralized over-the-counter (OTC) environment with bilateral trading agreements. When an MM fulfills an intent, an on-chain agreement is established with collateral locked by both parties. This approach offers advantages over AMMs and CLOBs by leveraging MMs who can source liquidity globally, providing users with better asset exposure, and reducing the need for high-throughput on-chain interactions since MMs interact only when fulfilling intents.

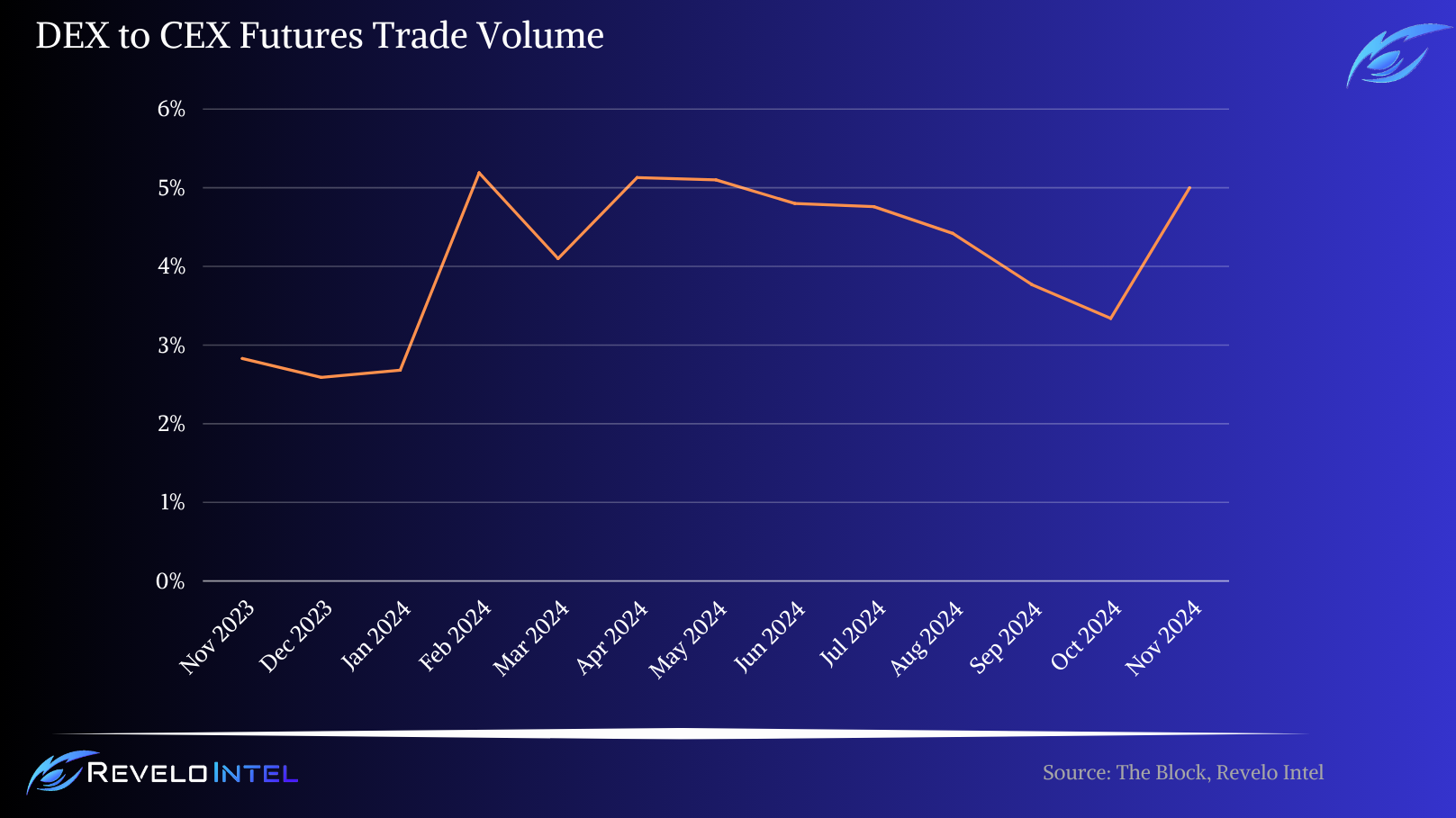

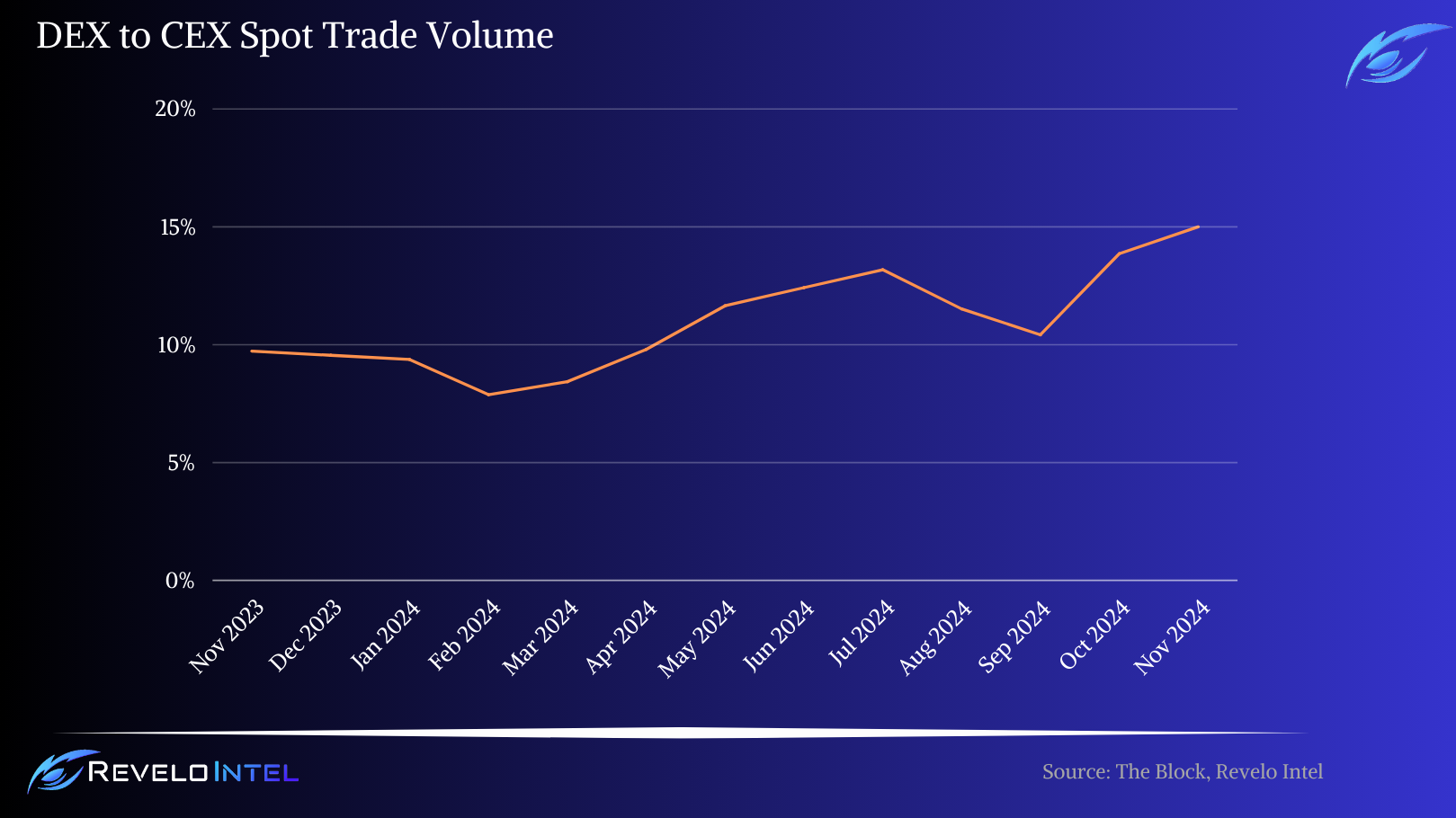

DEXs and CEXs are becoming increasingly competitive. While CEXs currently handle the majority of trading volume, there’s a clear trend toward on-chain trading, with volumes rising and some perpetual DEXs outperforming certain CEXs. The substantial growth of perpetual futures DEXs indicates a shift in trader preference, especially as market sentiment turns risk-on. The central question is whether community liquidity can support increased volumes and trading activity during a bull market and if liquidity providers can remain profitable. Perpetual DEXs have thrived in bear markets; their resilience and scalability will be tested in more volatile, high-volume conditions.

Derivative DEXs leverage the composability of on-chain environments to unlock use cases and functionalities that centralized exchanges cannot offer. By integrating seamlessly with other DeFi protocols, they can develop novel products, automated strategies, and unique financial services that go beyond simply replicating existing CEX features.

The higher proportion of DEX spot volume relative to CEXs (averaging around 15% compared to 5% for futures) indicates user trust and familiarity with decentralized platforms for straightforward transactions. Spot trading is inherently simpler, involving direct asset swaps without the complexities of leverage, margin calls, or liquidation risks inherent in futures trading. Users have become more comfortable using DEXs for spot trades due to the emphasis on self-custody, transparency, and the desire to avoid centralized exchange risks highlighted by past security breaches and regulatory issues. This comfort has not yet fully extended to derivatives trading on DEXs, where users prefer the experience of CEXs due to lower UX friction, better liquidity, and prices.

This disparity suggests substantial growth potential for DEX futures volume to reach or surpass the levels seen in spot trading. Perp DEXs are developing fast, closing the gap to CEXs in interface, speed, cost, and liquidity.

The success of spot DEXs demonstrates a market willingness to embrace decentralized solutions. As trust and technological capabilities expand in favorable markets, it is plausible that futures volume on DEXs could climb to 15% of CEX volumes and beyond, reflecting a broader shift in users’ trading preferences.

Competitive Landscape

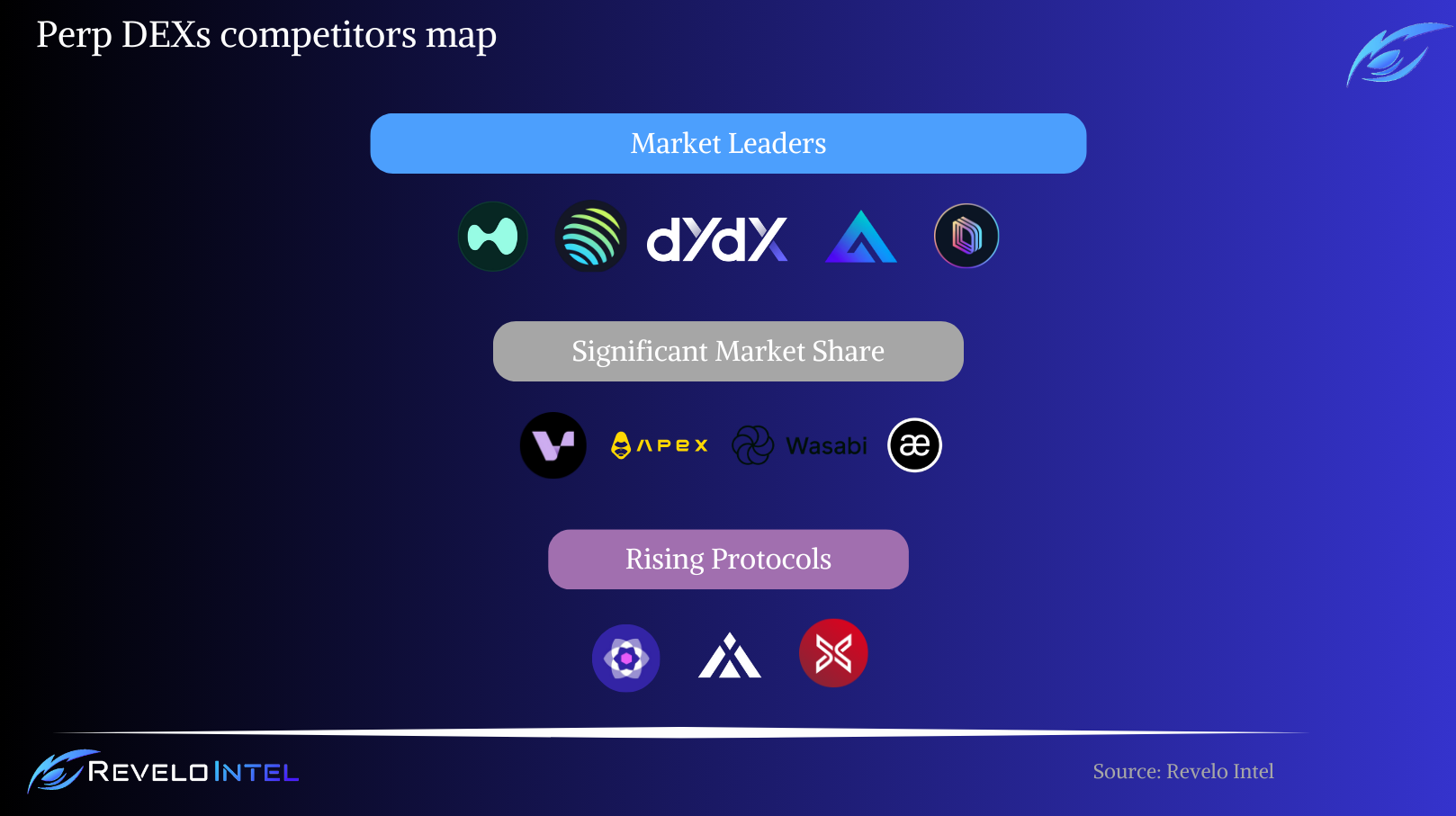

The on-chain derivatives sector is one of the most competitive in the crypto space. Each chain has numerous derivatives protocols offering different features and approaches. User preference comes down to many factors, including features, markets, tools, and other related protocol mechanics. In addition, many users prefer trading on one chain and one protocol, showing loyalty and hesitating to change their preferred platform.

Perennial must penetrate a large market with established protocols that dominate and capture the majority of market share. Protocols such as Hyperliquid, dYdX, Jupiter, GMX, and Drift have separated themselves as market leaders and compete on a different level than the rest of the market, each within its audience niche and ecosystem. Note that this does not mean product superiority in all cases. Someone can claim that a smaller competitor offers a better solution than the protocols mentioned. As stated above, preferences vary and don’t always have to do with which is the better platform to trade.

Perennial has shifted its focus to an intent-based trading platform in combination with a traditional AMM for settlement. This approach aligns with the overall shift of the crypto ecosystem towards intents, where solvers play a vital role by filling trading orders and accessing on-chain and off-chain liquidity. This solves a significant issue in the current ecosystem: liquidity fragmentation. Perpetual exchanges require deep liquidity to operate optimally and handle trading activity. The professionalization of order flow through solvers helps make markets more efficient by enabling dynamic and competitive pricing. Unlike static price curves used in traditional AMMs, market makers in an intent-based system actively assess market conditions and provide tailored pricing based on real-time liquidity and demand.

The mission of Perennial is to become the most capital-efficient perpetual DEX platform bulletproof by liquidity constraints and compete with the major players in this category while empowering use cases that other platforms cannot build. Since V1, Perennial has taken huge steps toward this vision by understanding its limitations and continuously refining them. The V2.3 update brings significant upgrades to Perennial by stepping into the success of V2 but with a more sophisticated approach. Moreover, the V3 update is a step closer to this vision through several developments, such as cross-margin, multi-collateral, and an enhanced AMM.

On the intent-based front, some competitors are offering intent-based trading. Symmio is the most notable example, acting as the infrastructure for permissionless intent-based derivatives to be built on top. Symmio includes several frontends, such as Thena ALPHA, IntentX, and Based. All these solutions operate on top of Symmio. Perennial has done the same with Kwenta and Rage Trade, allowing them to leverage Perennial’s technological infrastructure.

Potential Adoption

Perennial sets a strong adoption case as a decentralized perpetual exchange that appeals to traders and developers through its minimalist and unopinionated design philosophy. Unlike platforms that offer rigid, one-size-fits-all solutions, Perennial provides a flexible infrastructure that allows market participants to define and optimize market structures according to their specific needs. This approach caters to a broad spectrum of users, from novice traders to sophisticated liquidity providers and developers, enabling them to develop trading solutions on top of the protocol.

A key differentiator for Perennial is its capital-efficient mechanism for offsetting long and short positions among takers before involving maker liquidity. By requiring makers (LPs) to cover only the net exposure resulting from the imbalance between longs and shorts, the protocol significantly reduces the capital required from makers. This efficiency can lead to markets that are up to an order of magnitude more capital-efficient in terms of open interest relative to required maker liquidity. Such an approach not only lowers barriers to entry for liquidity providers but also enhances market scalability and depth.

Perennial also introduces advanced features like intent-based trading and signed message trading. Intent-based trading allows traders to specify exact execution prices, filled by solvers and settled atomically into the AMM, minimizing slippage and improving execution precision. Signed message trading enables traders to authorize keepers to execute trades and manage collateral on their behalf, streamlining the trading process.

However, adopting Perennial will ultimately depend on how these differentiators translate into tangible user benefits compared to established competitors. User experience, liquidity availability, security measures, and community support are crucial. While Perennial’s innovative features and flexible architecture are compelling, its success in attracting users will hinge on demonstrating superior performance, reliability, and value in the competitive DeFi derivatives landscape.

Business Model

Perennial captures value by collecting optional fees from various sources, including trading, funding rates, and interest. This fee structure, combined with increased trading volumes driven by the platform’s efficiency, forms the core of Perennial’s revenue plan, balancing user satisfaction with long-term sustainability.

The platform creates value by combining intent-based trading with efficient liquidity provision. By netting long and short positions among traders before involving liquidity providers, Perennial significantly reduces the capital required from makers, enhancing capital efficiency. Market makers benefit from not having to spread collateral across multiple markets, as intent-based trading allows them to participate in any market seamlessly.

Perennial’s revenue model is centered on creating the most efficient trading platform possible, with low fees emerging as a natural byproduct rather than the primary objective. The protocol aims to incentivize increased trading volume by prioritizing market efficiency and attracting more users to the platform. This higher user engagement leads to greater revenue generation as the volume of transactions and economic activities on the platform grows.

The value of Perennial’s intent-based trading mechanism is significantly enhanced by the size and competitiveness of its solver network. Just as a large liquidity pool in a DEX offers better prices to traders, a robust network of solvers provides superior execution to intent users in terms of price and speed. This system thrives on network effects: as more solvers participate, execution quality improves, attracting increased order flow from users seeking efficient and cost-effective trades. The influx of user activity then incentivizes more solvers to join the network, further enhancing execution performance. This positive feedback loop not only improves the trading experience but also strengthens the overall health and appeal of the platform, driving growth and adoption of Perennial’s protocol.

Perennial also delivers value through its user-centric features and developer-friendly architecture. The introduction of collateral accounts and trigger orders complements intent-based trading by streamlining collateral management and enabling automated trading strategies. Users can manage their positions more effectively, while developers can build new financial products on top of the protocol thanks to its composability and permissionless market creation. Effectively, this creates a flywheel where more integrations attract more use cases, where more uses attract more users, and, as a result, more fees.

The protocol can collect fees from various economic activities, including trades, funding rates, and interest. It can turn on or off the fee switch at any time, and fees can be adjusted based on governance decisions or team objectives. By balancing efficiency with a sustainable fee structure, Perennial wants to ensure long-term viability and profitability while being the most capital-efficient trading platform.

Fee Breakdown

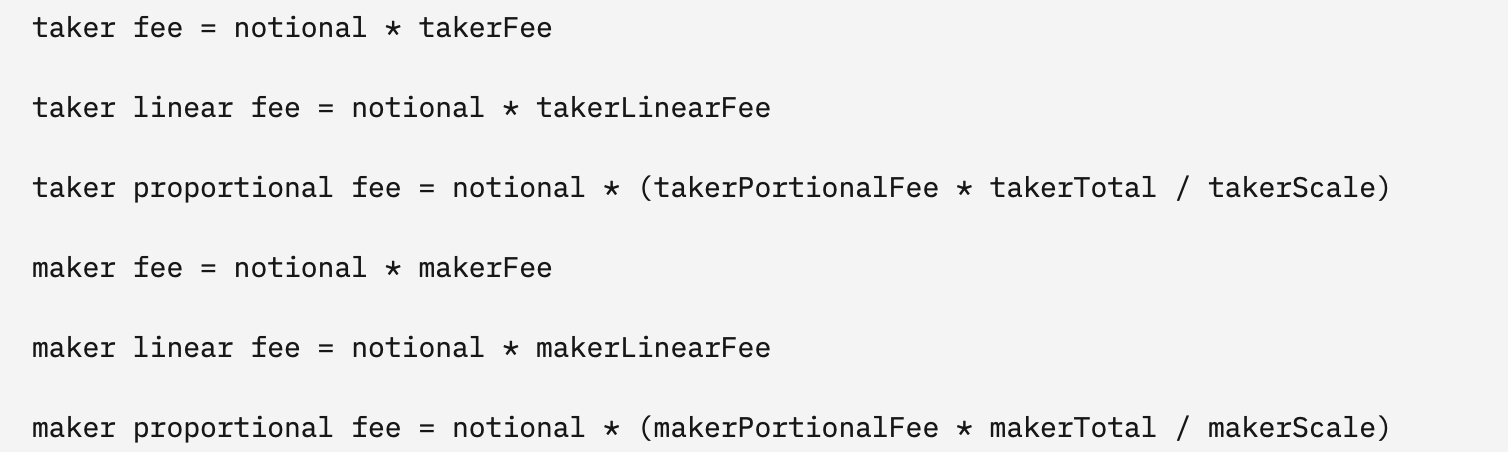

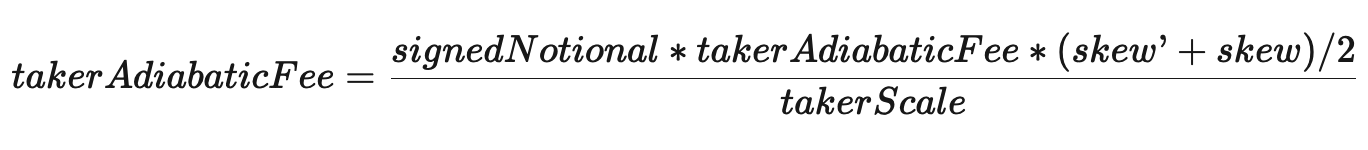

Perennial’s fee structure is designed to manage costs associated with changing positions within the protocol. A combination of fees is incurred whenever an account’s position changes, whether opening, closing, increasing, or decreasing.

Settlement Fee

The Settlement Fee is a fixed charge applied every time a position changes. This fee is determined by the settlementFee parameter and is used to cover the costs associated with oracle keeper services. By ensuring that the oracle fees are met, the protocol maintains accurate and reliable price feeds essential for market operations. The settlement fee is consistent across transactions, providing predictability for users when adjusting their positions.

settlementFee = settlementFee

Taker & Maker Fees

In version 2.3, trade fees have been separated from linear fees to streamline the fee logic and enhance transparency. This section outlines the components of the fees for both takers and makers, explains how they are calculated, and illustrates how they impact the execution price.

Adiabatic fees are calculated in aggregate per trading direction, with the market skew updating at each step. The assessment follows this order:

- Positive Skew Orders: Trades that involve opening long positions or closing short positions.

- Negative Skew Orders: Trades that involve opening short positions or closing long positions.

Price Impact vs Fee

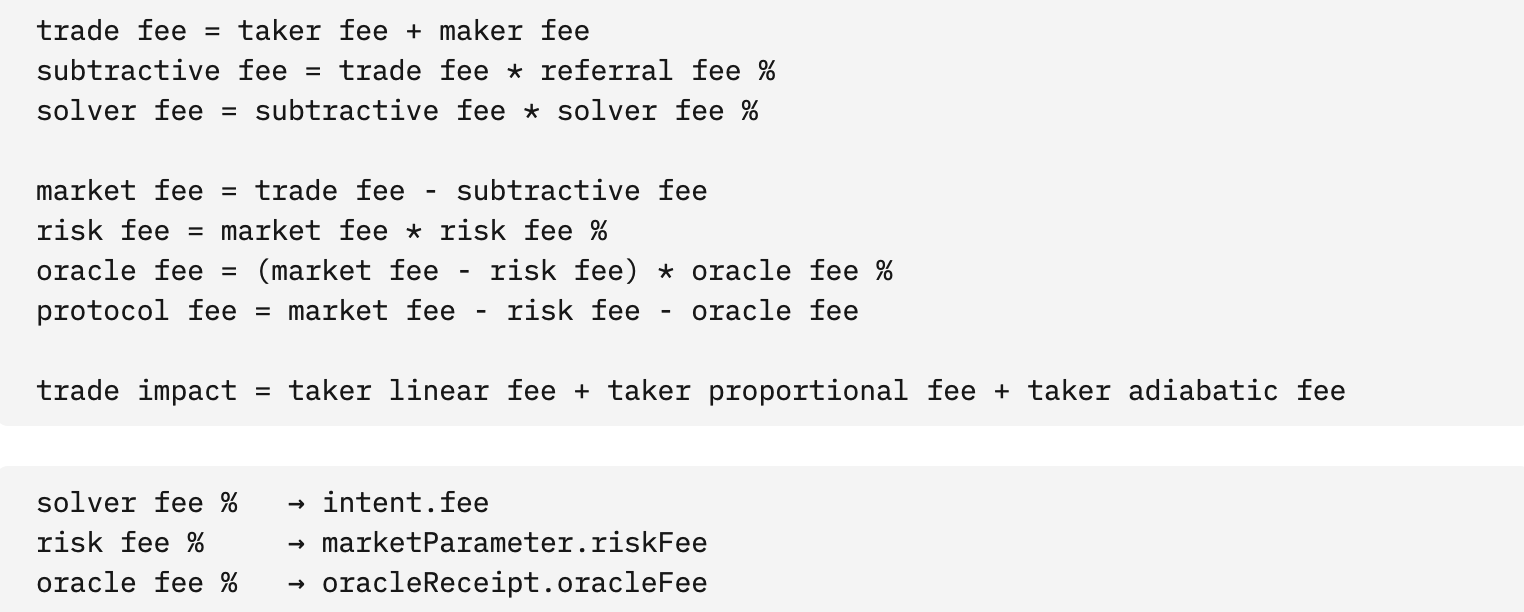

The calculation of market fees has been adjusted to separate risk fees and oracle fees, with oracle fees now determined by the oracle rather than market parameters. The fee distribution is calculated as follows:

Estimated Execution Price

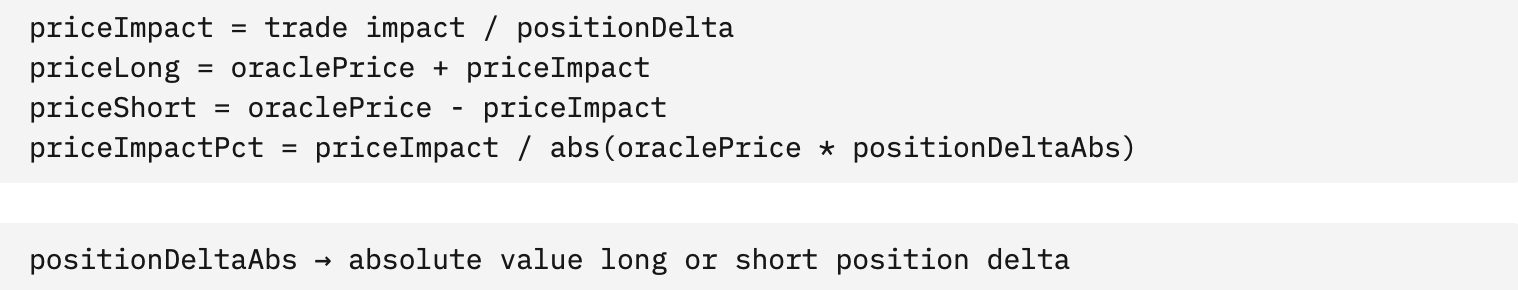

For AMM market orders, the execution price accounts for the price impact caused by the trade. Intents always execute at a pre-specified price. The calculations are as follows:

Fee Split

All collected fees are distributed among various stakeholders to align incentives within the ecosystem. The fees are split between:

- Makers: Rewarding them for providing liquidity and facilitating trades.

- Perennial Treasury: Supporting the ongoing development and maintenance of the protocol.

- Product Owner’s Treasury: Allowing market owners, such as individual organizations, decentralized autonomous organizations (DAOs), or other protocols, to earn revenue directly from their markets.

This fee distribution model enables market owners to monetize their products and manage their parameters effectively.

Risks

Smart Contract Risk

Like all DeFi platforms, Perennial relies on smart contracts. If these contracts contain bugs or vulnerabilities, they could be exploited by malicious actors to manipulate the protocol or steal funds. Rigorous code audits, formal verification, and continuous security assessments are essential to mitigate this risk. However, even audited protocols have been compromised, so the risk cannot be entirely eliminated.

Oracle Risk

Oracles can affect a protocol if they are compromised. Perennial depends on oracles to provide accurate price feeds for underlying assets. If an oracle is compromised or manipulated, attackers could feed incorrect pricing data into the system. This could trigger erroneous liquidations, allow for trades at unfair prices, or distort funding rates.

Solvers Risk

The effectiveness of Perennial’s intent-based trading mechanism hinges on a robust and competitive network of Solvers responsible for fulfilling trade intents. When there are not enough Solvers competing to execute trades swiftly and at low cost, the network risks becoming centralized, leading to increased costs and slower execution times for users. This centralization reduces competitive pressure, potentially resulting in less favorable pricing and diminished trading efficiency. Just as a large liquidity pool in a DEX offers better prices to traders, a sizable and competitive Solver network enhances execution quality for intent users in terms of both price and speed. The system operates on network effects: more Solvers improve execution, attracting more users and increasing order flow, incentivizing additional Solvers to join. Conversely, a limited Solver network can create a negative feedback loop, where subpar execution discourages user participation and deters new Solvers, posing a significant risk to the protocol’s adoption and overall functionality.

However, this does not pose a significant risk to the protocol’s adoption or overall functionality because trades can always fall back on the AMM. In such cases, a larger percentage of the order flow is routed directly to the AMM, which provides consistent liquidity and uninterrupted trading. Therefore, the Solver network is purely additive: it enhances execution quality when active but does not compromise the system when its performance degrades. This design mitigates the risks associated with Solver centralization, as the AMM ensures that users can continue to trade effectively regardless of the Solver network’s state.

Opacity Risk

Implementing intent-based architectures and permissioned mempools can create an opacity risk, making the system impenetrable and lacking transparency. Users may surrender significant control over their on-chain assets without clear insight into how their intents are processed or whether their expectations are met, which may lead to the centralization of order flow in a few concentrated parties.

This opacity makes it challenging to detect threats, abuses, or inefficiencies within the ecosystem, even for knowledgeable observers.

Such a lack of transparency is particularly concerning when users outsource critical decisions like order routing. The negative impacts of Miner Extractable Value (MEV) often arise when users give executors high degrees of freedom, leading to unfavorable execution outcomes. Intent-based applications that require users to relinquish more control heighten this risk, necessitating greater caution in system design to protect users.

In the worst-case scenario, users sign intents that effectively disappear into an opaque system, resulting in transactions without clarity on how or by whom they were executed. This undermines the foundational principles of transparency and trustlessness in blockchain systems.

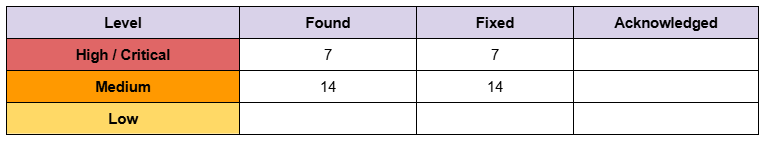

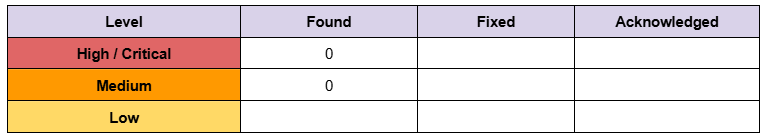

Security

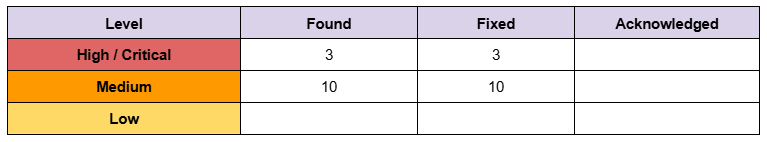

Perennial’s smart contracts have been audited by third-party security firms.

There’s also a bug bounty program run by Immunefi with a maximum reward of $500,000.

Audits

Dependencies and Access Controls

The protocol’s intent-based trading mechanism relies on external parties called Solvers and Keepers to execute trades and manage collateral accounts. If these entities act maliciously, fail to perform their duties, or become centralized points of failure, it could disrupt trading activities. For example, Solvers might front-run orders or manipulate execution timing. Ensuring a decentralized and trustworthy network of Solvers and Keepers is critical, but reliance on external agents introduces uncertainty.

Team

Perennial Labs is the team behind the protocol founded by Arjun Rao and Kevin Britz. Both have engineering backgrounds and have worked for companies like Coinbase and Airbnb. Before Perennial, the two founded Astro Wallet, which was acquired by Coinbase in 2020.

The rest of the team brings extensive expertise in blockchain technology, decentralized finance, and product development. Members have held leadership roles in prominent projects such as MakerDAO and Ajna Protocol, a permissionless peer-to-pool lending system. The team also includes professionals from organizations like Tracer DAO, Pier Two, and SafeBase with significant experience in business development and product design.

Project Investors

Perennial raised $12 million in a seed round in 2023. The round was led by well-known funds such as Polychain and Variant, with several other groups and prominent investors participating.

FAQ

What is Perennial Finance?

Perennial Finance is a DeFi derivatives protocol that enables users to create two-sided markets, allowing traders to gain exposure to underlying price feeds in a capital-efficient way. Designed to operate as a fundamental DeFi primitive, Perennial allows for the creation of various leveraged and hedging products with minimized capital requirements.

How is Perennial different from other derivative protocols?

Perennial is distinct for its focus on simplicity, modularity, and capital efficiency. Key features include USD-based collateral, high leverage (up to 100x), and a position netting system that matches opposing trades to increase liquidity efficiency. Additionally, the protocol offers maker vaults to simplify liquidity provision and supports permissionless market creation, allowing for flexible integration and composability.

Does Perennial charge a platform fee?

Currently, Perennial has set the platform fee to 0, meaning there are no charges for users. While the protocol has the option to apply a fee in the future, there are no immediate plans to implement or increase fees at this time.

Does Perennial have plans for a token?

At this time, Perennial has no plans to release a native token. The team is focused on refining the protocol and ensuring its efficiency and scalability without introducing a tokenized element.

How does Perennial achieve capital efficiency?

Perennial’s capital efficiency comes from its position netting system, which matches long and short positions against each other, reducing the need for excess collateral. This netting allows maker liquidity to cover a greater volume of trades, maximizing the protocol’s capital utilization and allowing users to take larger positions with less collateral.

What collateral is used in Perennial?

Trades on Perennial are collateralized in USD through the $DSU, a stable, fully collateralized digital asset that simplifies trade settlements and improves the protocol’s resilience. This USD collateral approach minimizes volatility and aligns Perennial’s mechanism with traditional financial standards.

What are Maker Vaults, and how do they work?

Maker Vaults are liquidity pools that allow makers (liquidity providers) to supply liquidity either directly through the protocol or through a vault. Maker Vaults simplify the liquidity provision process, making it accessible to users who may be less familiar with traditional liquidity provision. Vaults help manage risk and optimize returns for makers.

Is Perennial permissionless?

Yes, Perennial is fully permissionless, allowing users to create markets, integrate with other protocols, and utilize the protocol’s composability features without any centralized control. This open framework encourages innovation and allows developers to build freely on top of Perennial.

How does settlement work in Perennial?

Perennial uses delayed settlement, with trades being executed at the next oracle update, typically every 10-15 seconds. This approach prevents timing abuse by bots and aligns trade settlements with accurate price feeds, ensuring fairness and consistency in the market.